| T. Rowe Price Institutional Africa & Middle East Fund | ||||||||||||||||||||||||||||||||||||||||||||

| SUMMARY T. Rowe Price Institutional Africa & Middle East Fund | ||||||||||||||||||||||||||||||||||||||||||||

| Investment Objective | ||||||||||||||||||||||||||||||||||||||||||||

| The fund seeks long-term growth of capital by investing primarily in the common stocks of companies located (or with primary operations) in Africa and the Middle East. | ||||||||||||||||||||||||||||||||||||||||||||

| Fees and Expenses | ||||||||||||||||||||||||||||||||||||||||||||

| This table describes the fees and expenses that you may pay if you buy and hold shares of the fund. | ||||||||||||||||||||||||||||||||||||||||||||

| Fees and Expenses of the Fund Shareholder fees (fees paid directly from your investment) | ||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||

| Annual fund operating expenses (expenses that you pay each year as a percentage of the value of your investment) | ||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||

| Example | ||||||||||||||||||||||||||||||||||||||||||||

| This example is intended to help you compare the cost of investing in the fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the fund for the time periods indicated and then redeem all of your shares at the end of those periods. The example also assumes that your investment has a 5% return each year and the fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be: | ||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||

| Portfolio Turnover | ||||||||||||||||||||||||||||||||||||||||||||

| The fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the fund’s performance. During the most recent fiscal year, the fund’s portfolio turnover rate was 60.3% of the average value of its portfolio. | ||||||||||||||||||||||||||||||||||||||||||||

| Investments, Risks, and Performance Principal Investment Strategies | ||||||||||||||||||||||||||||||||||||||||||||

The fund will normally invest at least 80% of its net assets (including any borrowings for investment purposes) in African and Middle Eastern companies. For purposes of determining whether the fund invests at least 80% of its net assets in African and Middle Eastern companies, the fund relies on the country assigned to a security by MSCI, Inc. or another unaffiliated data provider. The fund expects to primarily invest in common stocks, and participation notes (P-notes) linked to common stocks of companies located (or with primary operations) in the countries listed below, as well as others as their markets develop:

While the adviser invests with an awareness of the outlook for certain industry sectors and individual countries within the region, the adviser’s decision-making process focuses on bottom-up stock selection. Country allocation is driven largely by stock selection, though the adviser may limit investments in markets or industries that appear to have poor overall prospects. Security selection reflects a growth style. The fund relies on a global team of investment analysts dedicated to in-depth fundamental research in an effort to identify companies capable of achieving and sustaining above-average, long-term earnings growth. The adviser seeks to purchase stocks of companies at reasonable prices in relation to present or anticipated earnings, cash flow, or book value. In selecting investments, the fund generally favors companies with one or more of the following characteristics:

| ||||||||||||||||||||||||||||||||||||||||||||

| Principal Risks | ||||||||||||||||||||||||||||||||||||||||||||

| As with any mutual fund, there is no guarantee that the fund will achieve its objective. The fund’s share price fluctuates, which means you could lose money by investing in the fund. The principal risks of investing in this fund are summarized as follows: Active management risk The fund is subject to the risk that the investment adviser’s judgments about the attractiveness, value, or potential appreciation of the fund’s investments may prove to be incorrect. If the investments selected and strategies employed by the fund fail to produce the intended results, the fund could underperform in comparison to other funds with similar objectives and investment strategies. Risks of stock investing Stocks generally fluctuate in value more than bonds and may decline significantly over short time periods. There is a chance that stock prices overall will decline because stock markets tend to move in cycles, with periods of rising and falling prices. The value of a stock in which the fund invests may decline due to general weakness in the stock market, or because of factors that affect a particular company or industry. International investing risk Investing in the securities of non-U.S. issuers involves special risks not typically associated with investing in U.S. issuers. International securities tend to be more volatile and less liquid than investments in U.S. securities and may lose value because of adverse local, political, social, or economic developments overseas, or due to changes in the exchange rates between foreign currencies and the U.S. dollar. In addition, international investments are subject to settlement practices and regulatory and financial reporting standards that differ from those of the U.S. Emerging markets risk The risks of international investing are heightened for securities of issuers in emerging market countries. Emerging market countries tend to have economic structures that are less diverse and mature, and political systems that are less stable, than those of developed countries. In addition to all of the risks of investing in international developed markets, emerging markets are more susceptible to governmental interference, local taxes being imposed on international investments, restrictions on gaining access to sales proceeds, and less liquid and less efficient trading markets. Frontier markets generally have smaller economies and less mature capital markets than emerging markets. As a result, the risks of investing in emerging market countries are magnified in frontier market countries. Frontier markets are more susceptible to abrupt changes in currency values, less mature markets and settlement practices, and lower trading volumes that could lead to greater price volatility and illiquidity. P-note risks To the extent the fund invests in P-notes, it is subject to certain risks in addition to the risks normally associated with a direct investment in the underlying foreign securities the P-note seeks to replicate. As the purchaser of a P-note, the fund is relying on the creditworthiness of the counterparty issuing the P-note and does not have the same rights under a P-note as it would as a shareholder of the underlying issuer. Therefore, if a counterparty becomes insolvent, the fund could lose the total value of its investment in the P-note. In addition, there is no assurance that there will be a trading market for a P-note or that the trading price of a P-note will equal the value of the underlying security. Geographic concentration risk Because the fund concentrates its investments in a particular geographic region, the fund’s performance is closely tied to the social, political, and economic conditions within that region. Political developments and changes in regulatory, tax, or economic policy in particular countries within the region could significantly affect the markets in those countries as well as the entire region. As a result, the fund is likely to be more volatile than more geographically diverse international funds. Many African and Middle Eastern countries have histories of dictatorships, political and military unrest, and financial troubles, and their markets should be considered extremely volatile even when compared to those of other emerging market countries. Many of these countries tend to be highly reliant on the exportation of oil and other commodities so their economies can be significantly impacted by fluctuations in commodity prices and the global demand for certain commodities. Industry risk Because the fund may invest significantly in telecommunications and banking companies, the fund is more susceptible to adverse developments affecting such companies and may perform poorly during a downturn in one or more of the industries that heavily impact telecommunications and banking companies. Telecommunications companies can be adversely affected by, among other things, changes in government regulation, intense competition, and rapid obsolescence of products and services due to technological innovations or changing consumer preferences. Banks and other financial services companies can be adversely affected by, among other things, regulatory changes, interest rate movements, the availability of capital and cost to borrow, and the rate of debt defaults. Nondiversification risk As a nondiversified fund, the fund has the ability to invest a larger percentage of its assets in the securities of a smaller number of issuers than a diversified fund. As a result, poor performance by a single issuer could adversely affect fund performance more than if the fund were invested in a larger number of issuers. The fund’s share price can be expected to fluctuate more than that of a comparable diversified fund. Investment style risk Different investment styles tend to shift in and out of favor depending on market conditions and investor sentiment. The fund’s growth approach to investing could cause it to underperform when compared to other stock funds that employ a different investment style. Growth stocks tend to be more volatile than certain other types of stocks, and their prices may fluctuate more dramatically than the overall stock market. A stock with growth characteristics can have sharp price declines due to decreases in current or expected earnings and may lack dividends that can help cushion its share price in a declining market. Market capitalization risk Because the fund may invest in companies of any size, its share price could be more volatile than a fund that invests only in large companies. Small- and medium-sized companies often have less experienced management, narrower product lines, more limited financial resources, and less publicly available information than larger companies. Larger companies may not be able to attain the high growth rates of successful smaller companies, especially during strong economic periods, and they may be less capable of responding quickly to competitive challenges and industry changes. | ||||||||||||||||||||||||||||||||||||||||||||

| Performance | ||||||||||||||||||||||||||||||||||||||||||||

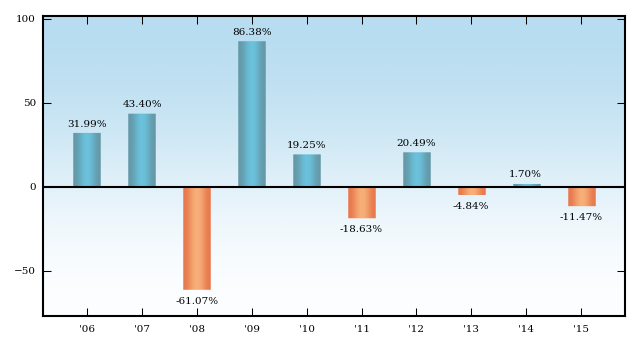

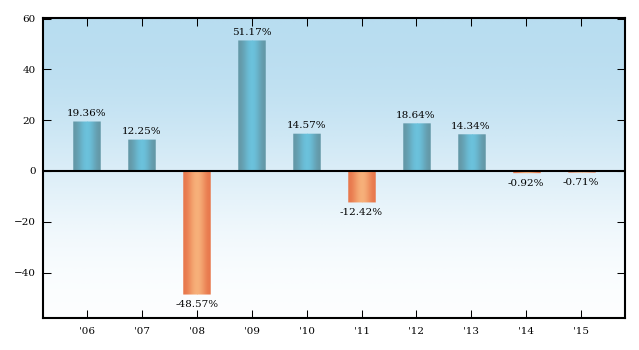

| The bar chart showing calendar year returns and the average annual total returns table provide some indications of the risks of investing in the fund by showing how much returns can differ from year to year and how the fund’s average annual returns for certain periods compare with the returns of a relevant broad-based market index, as well as with the returns of other comparative indexes that have investment characteristics similar to those of the fund. The fund’s performance information represents only past performance (before and after taxes) and is not necessarily an indication of future results. The fund can also experience short-term performance swings, as shown by the best and worst calendar quarter returns during the years depicted. | ||||||||||||||||||||||||||||||||||||||||||||

| Institutional Africa & Middle East Fund Calendar Year Returns | ||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||

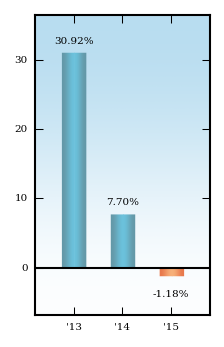

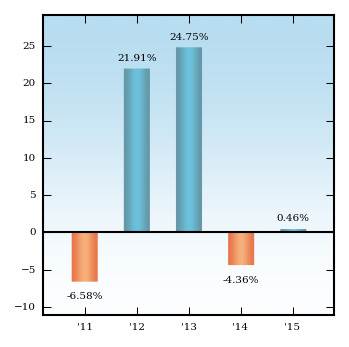

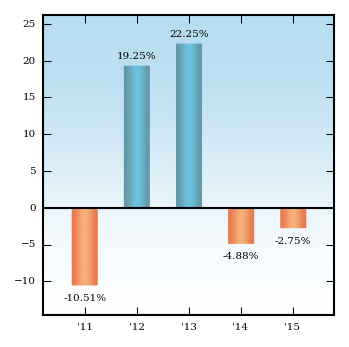

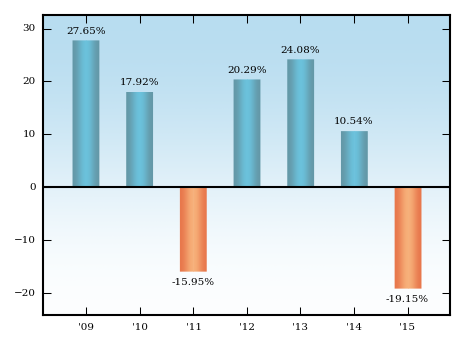

| In addition, the average annual total returns table shows hypothetical after-tax returns to demonstrate how taxes paid by a shareholder may influence returns. After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their fund shares through tax-deferred arrangements, such as a 401(k) account or individual retirement account. In some cases, the figure shown for “returns after taxes on distributions and sale of fund shares” may be higher than the figure shown for “returns before taxes” because the calculations assume the investor received a tax deduction for any loss incurred on the sale of shares. | ||||||||||||||||||||||||||||||||||||||||||||

| Average Annual Total Returns Periods ended December 31, 2015 | ||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||

| Updated performance information is available through troweprice.com or may be obtained by calling 1-800-638-8790. | ||||||||||||||||||||||||||||||||||||||||||||