Year |

Summary compensation table total for CEO (1) |

Compensation actually paid to CEO (1)(2)(3) |

Average summary compensation table total for non-CEO named executive officers (NEOs) (4) |

Average compensation actually paid for non-CEO NEOs (3)(4)(5) |

Value of initial fixed $100 investment based on: |

|||||||||||||||||||||||||

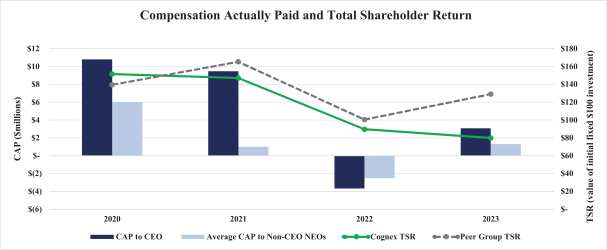

Total shareholder return (TSR) (6) |

Peer group TSR (6) |

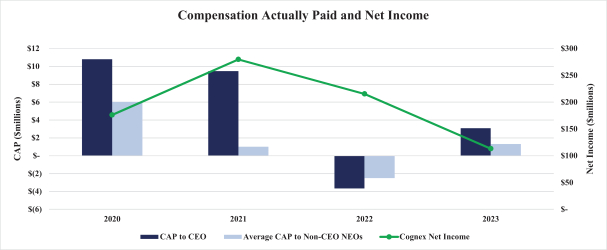

Net Income |

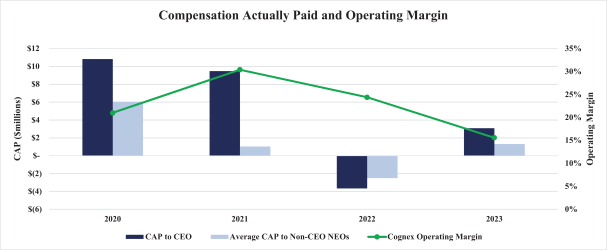

Operating Margin (7) | |||||||||||||||||||||||||||

2023 |

$ | $ | $ | $ | $ | $ | $ | |||||||||||||||||||||||

2022 |

$ | $ | ( |

) | $ | $ | ( |

) | $ | $ | $ | |||||||||||||||||||

2021 |

$ | $ | $ | $ | $ | $ | $ | |||||||||||||||||||||||

2020 |

$ | $ | $ | $ | $ | $ | $ | |||||||||||||||||||||||

| (1) | Our CEO in all of 2020, 2021, 2022 and 2023 was |

| (2) | Mr. Willett’s compensation “actually paid” as presented above is calculated by deducting and adding the following amounts, in each case in accordance with Item 402(v)(2)(C) of Regulation S-K: |

CEO Compensation “Actually Paid” |

2023 |

2022 |

2021 |

2020 |

||||||||||||

Summary Compensation Table total for the covered fiscal year |

$ | $ | $ | $ | ||||||||||||

Less, Grant date fair value of awards reported in the Summary Compensation Table for the covered fiscal year |

$ | $ | $ | $ | ||||||||||||

Plus, Year-end fair value of awards granted for the covered fiscal year that were outstanding and unvested as of the end of the covered fiscal year |

$ | $ | $ | $ | ||||||||||||

Plus, Change in fair value of awards granted in prior years that were outstanding and unvested as of the end of the covered fiscal year (from prior fiscal year-end to covered fiscal year-end) |

$ | ( |

) | $ | ( |

) | $ | ( |

) | $ | ||||||

Plus, Change in fair value of awards granted in prior years that vested in the covered fiscal year (from prior fiscal year-end to vesting date) |

$ | $ | ( |

) | $ | $ | ( |

) | ||||||||

Total Adjustments |

$ | ( |

) | $ | ( |

) | $ | ( |

) | $ | ||||||

| (3) | In 2020, 2021, 2022 and 2023, neither our CEO nor any non-CEO NEO had any awards that vested in the same year that they were granted, any awards granted in prior years that failed to meet the applicable vesting conditions, or any dividends or other earnings paid on equity awards in the covered fiscal year prior to vesting that are not reflected in total compensation for the applicable year, and therefore, no adjustments for those items were included in calculating compensation “actually paid.” Further, in 2020, 2021, 2022 and 2023, neither our CEO nor any non-CEO NEO received any benefit under any defined benefit and actuarial plans and therefore, no adjustments for those items were included in calculating compensation “actually paid.” |

| (4) | Our non-CEO NEOs for each of the fiscal years presented above were: |

| • | 2023: Paul D. Todgham, Carl W. Gerst III, Sheila M. DiPalma and Joerg Kuechen |

| • | 2022: Paul D. Todgham, Carl W. Gerst III, Sheila M. DiPalma and Joerg Kuechen |

| • | 2021: Robert J. Shillman, Paul D. Todgham, Carl W. Gerst III and Sheila M. DiPalma |

| • | 2020: Robert J. Shillman, Paul D. Todgham, Carl W. Gerst III, Sheila M. DiPalma and Laura A. MacDonald |

| (5) | Average non-CEO NEO compensation “actually paid” as presented above is calculated by deducting and adding the following amounts, in each case in accordance with Item 402(v)(2)(C) of Regulation S-K: |

Average Non-CEO Compensation “Actually Paid” |

2023 |

2022 |

2021 |

2020 |

||||||||||||

Summary Compensation Table total for the covered fiscal year |

$ | $ | $ | $ | ||||||||||||

Less, Grant date fair value of awards reported in the Summary Compensation Table for the covered fiscal year |

$ | $ | $ | $ | ||||||||||||

Plus, Year-end fair value of awards granted for the covered fiscal year that were outstanding and unvested as of the end of the covered fiscal year |

$ | $ | $ | $ | ||||||||||||

Plus, Change in fair value of awards granted in prior years that were outstanding and unvested as of the end of the covered fiscal year (from prior fiscal year-end to covered fiscal year-end) |

$ | ( |

) | $ | ( |

) | $ | ( |

) | $ | ||||||

Plus, Change in fair value of awards granted in prior years that vested in the covered fiscal year (from prior fiscal year-end to vesting date) |

$ | $ | ( |

) | $ | $ | ( |

) | ||||||||

Total Adjustments |

$ | ( |

) | $ | ( |

) | $ | $ | ||||||||

| (6) | Total shareholder return (“TSR”) of Cognex and the peer group are calculated by assuming that an investment of $100 was made in each of our common stock and in the Nasdaq Lab Apparatus & Analytical, Optical, Measuring & Controlling Instrument (SIC 3820-3829 US Companies) Index (“Peer Index”) starting from the market close on December 31, 2019, which is the last trading day before our fiscal year 2020, through and including the end of each fiscal year shown. Total shareholder return includes reinvestment of dividends into shares of common stock of the applicable company. Data for the Peer Index was provided to Cognex by Research Data Group, Inc. |

| (7) | non-financial performance measures for the purpose of evaluating and determining executive compensation, we consider operating margin, which is a primary factor used to determine annual cash incentive compensation for our NEOs, to be the most important performance measure used to link compensation “actually paid” to the NEOs to company performance. |

| • |

| • |

| • |

| • |

| • |

| • |

| • |