UNITED STATES

SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05822

MFS CHARTER INCOME TRUST

(Exact name of registrant as specified in charter)

111 Huntington Avenue, Boston, Massachusetts 02199 (Address of principal executive offices) (Zip code)

Christopher R. Bohane

Massachusetts Financial Services Company

111Huntington Avenue Boston, Massachusetts 02199

(Name and address of agents for service)

Registrant’s telephone number, including area code: (617) 954-5000

Date of fiscal year end: November 30

Date of reporting period: May 31, 2024

ITEM 1. REPORTS TO STOCKHOLDERS.

Item 1(a):

| 1 | |

| 4 | |

| 4 | |

| 6 | |

| 42 | |

| 44 | |

| 46 | |

| 47 | |

| 48 | |

| 50 | |

| 66 | |

| 67 | |

| 67 | |

| 67 | |

| 67 |

| back cover |

| High Yield Corporates | 62.0% |

| Emerging Markets Bonds | 20.1% |

| Investment Grade Corporates | 7.5% |

| Non-U.S. Government Bonds | 4.8% |

| U.S. Treasury Securities | 4.8% |

| Mortgage-Backed Securities | 3.0% |

| Commercial Mortgage-Backed Securities | 1.9% |

| Collateralized Debt Obligations | 1.2% |

| Asset-Backed Securities | 0.7% |

| Municipal Bonds | 0.4% |

| Residential Mortgage-Backed Securities | 0.3% |

| Average Duration (d) | 5.8 |

| Average Effective Maturity (m) | 7.8 yrs. |

| AAA | 6.8% |

| AA | 3.0% |

| A | 7.4% |

| BBB | 12.3% |

| BB | 35.4% |

| B | 29.7% |

| CCC | 9.4% |

| CC | 0.2% |

| C | 0.1% |

| D | 0.1% |

| U.S. Government | 21.4% |

| Federal Agencies | 3.0% |

| Not Rated | (22.1)% |

| Non-Fixed Income | 1.2% |

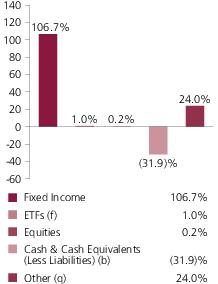

| Cash & Cash Equivalents (Less Liabilities) (b) | (31.9)% |

| Other (q) | 24.0% |

| (a) | For all securities other than those specifically described below, ratings are assigned to underlying securities utilizing ratings from Moody’s, Fitch, and Standard & Poor’s rating agencies and applying the following hierarchy: If all three agencies provide a rating, the middle rating (after dropping the highest and lowest ratings) is assigned; if two of the three agencies rate a security, the lower of the two is assigned. If none of the 3 rating agencies above assign a rating, but the security is rated by DBRS Morningstar, then the DBRS Morningstar rating is assigned. If none of the 4 rating agencies listed above rate the security, but the security is rated by the Kroll Bond Rating Agency (KBRA), then the KBRA rating is assigned. Ratings are shown in the S&P and Fitch scale (e.g., AAA). Securities rated BBB or higher are considered investment grade. All ratings are subject to change. U.S. Government includes securities issued by the U.S. Department of the Treasury. Federal Agencies includes rated and unrated U.S. Agency fixed-income securities, U.S. Agency mortgage-backed securities, and collateralized mortgage obligations of U.S. Agency mortgage-backed securities. |

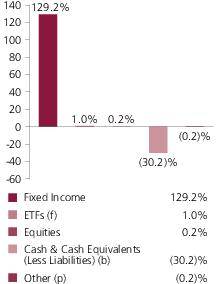

| (b) | Cash & Cash Equivalents (Less Liabilities) includes any cash, investments in money market funds, short-term securities, and other assets less liabilities. Liabilities include the value of outstanding borrowings made by the fund for leverage transactions. Cash & Cash Equivalents (Less Liabilities) is negative due to these borrowings. Please see the Statement of Assets and Liabilities for additional information related to the fund’s cash position and other assets and liabilities. Please see Note 6 in the Notes to Financial Statements for more information on the fund's outstanding borrowings. |

| (d) | Duration is a measure of how much a bond’s price is likely to fluctuate with general changes in interest rates, e.g., if rates rise 1.00%, a bond with a 5-year duration is likely to lose about 5.00% of its value due to the interest rate move. The Average Duration calculation reflects the impact of the equivalent exposure of derivative positions, if any. |

| (f) | The fund invests a portion of its assets in Exchange-Traded Funds (ETFs) or Options on ETFs to gain fixed income exposure. Percentages include the direct exposure from investing in ETFs or Options on ETFs and not the indirect exposure to the underlying holdings. |

| (i) | For purposes of this presentation, the components include the value of securities, and reflect the impact of the equivalent exposure of derivative positions, if any. These amounts may be negative from time to time. Equivalent exposure is a calculated amount that translates the derivative position into a reasonable approximation of the amount of the underlying asset that the portfolio would have to hold at a given point in time to have the same price sensitivity that results from the portfolio’s ownership of the derivative contract. When dealing with derivatives, equivalent exposure is a more representative measure of the potential impact of a position on portfolio performance than value. The bond component will include any accrued interest amounts. |

| (m) | In determining each instrument’s effective maturity for purposes of calculating the fund’s dollar-weighted average effective maturity, MFS uses the instrument’s stated maturity or, if applicable, an earlier date on which MFS believes it is probable that a maturity-shortening feature (such as a put, pre-refunding or prepayment) will cause the instrument to be repaid. Such an earlier date can be substantially shorter than the instrument’s stated maturity. |

| (p) | For purposes of the presentation of Portfolio structure at value, Other includes market value from currency derivatives and may be negative. |

| (q) | For purposes of this presentation, Other includes equivalent exposure from currency derivatives and/or any offsets to derivative positions and may be negative. |

| (v) | For purposes of this presentation, market value of fixed income and/or equity derivatives, if any, is included in Cash & Cash Equivalents (Less Liabilities). |

| Portfolio Manager | Primary Role | Since | Title and Five Year History |

| Robert Spector | Lead and Debt Instruments Portfolio Manager | 2015 | Investment Officer of MFS; employed in the investment management area of MFS since 2011. |

| Neeraj Arora | Emerging Markets Debt Instruments Portfolio Manager | 2023 | Investment Officer of MFS; employed in the investment management area of MFS since 2011. |

| Ward Brown | Emerging Markets Debt Instruments Portfolio Manager | 2012 | Investment Officer of MFS; employed in the investment management area of MFS since 2005. |

| Philipp Burgener | Structured Securities Portfolio Manager | 2019 | Investment Officer of MFS; employed in the investment management area of MFS since 2003. |

| David Cole | Below Investment Grade Debt Instruments Portfolio Manager | 2006 | Investment Officer of MFS; employed in the investment management area of MFS since 2004. |

| Pilar Gomez-Bravo | Debt Instruments Portfolio Manager | 2013 | Co-Chief Investment Officer-Global Fixed Income of MFS; employed in the investment management area of MFS since 2013. |

| Andy Li | Investment Grade Debt Instruments Portfolio Manager | 2019 | Investment Officer of MFS; employed in the investment management area of MFS since 2018. |

| John Mitchell | Investment Grade Debt Instruments Portfolio Manager | 2023 | Investment Officer of MFS; employed in the investment management area of MFS since 2003. |

| Michael Skatrud | Below Investment Grade Debt Instruments Portfolio Manager | 2018 | Investment Officer of MFS; employed in the investment management area of MFS since 2013. |

| Erik Weisman | Sovereign Debt Instruments Portfolio Manager | 2012 | Investment Officer of MFS; employed in the investment management area of MFS since 2002. |

| Issuer | Shares/Par | Value ($) | ||

| Bonds – 129.2% | ||||

| Aerospace & Defense – 3.1% | ||||

| Boeing Co., 6.298%, 5/01/2029 (n) | $ | 613,000 | $617,968 | |

| Boeing Co., 6.388%, 5/01/2031 (n) | 29,000 | 29,335 | ||

| Boeing Co., 5.805%, 5/01/2050 | 138,000 | 123,569 | ||

| Bombardier, Inc., 7.5%, 2/01/2029 (n) | 481,000 | 497,575 | ||

| Bombardier, Inc., 8.75%, 11/15/2030 (n) | 202,000 | 216,744 | ||

| Bombardier, Inc., 7.25%, 7/01/2031 (n) | 278,000 | 283,799 | ||

| Bombardier, Inc., 7%, 6/01/2032 (n) | 406,000 | 407,480 | ||

| F-Brasile S.p.A./F-Brasile U.S. LLC, 7.375%, 8/15/2026 (n) | 525,000 | 525,063 | ||

| Moog, Inc., 4.25%, 12/15/2027 (n) | 848,000 | 793,994 | ||

| Spirit AeroSystems, Inc., 9.75%, 11/15/2030 (n) | 1,015,000 | 1,108,916 | ||

| TransDigm, Inc., 5.5%, 11/15/2027 | 1,235,000 | 1,205,693 | ||

| TransDigm, Inc., 6.75%, 8/15/2028 (n) | 498,000 | 503,648 | ||

| TransDigm, Inc., 4.625%, 1/15/2029 | 566,000 | 521,210 | ||

| TransDigm, Inc., 6.375%, 3/01/2029 (n) | 459,000 | 458,004 | ||

| TransDigm, Inc., 6.875%, 12/15/2030 (n) | 1,129,000 | 1,143,209 | ||

| Triumph Group, Inc., 9%, 3/15/2028 (n) | 289,000 | 298,336 | ||

| $8,734,543 | ||||

| Airlines – 0.7% | ||||

| Air Canada, 3.875%, 8/15/2026 (n) | $ | 941,000 | $893,294 | |

| American Airlines, Inc./AAdvantage Loyalty IP Ltd., 5.75%, 4/20/2029 (n) | 759,080 | 734,080 | ||

| easyJet PLC, 3.75%, 3/20/2031 | EUR | 100,000 | 105,871 | |

| Hawaiian Brand Intellectual Property Ltd., 5.75%, 1/20/2026 (n) | $ | 289,000 | 266,488 | |

| $1,999,733 | ||||

| Apparel Manufacturers – 0.2% | ||||

| Tapestry, Inc., 3.05%, 3/15/2032 | $ | 57,000 | $45,830 | |

| Wolverine World Wide, Inc., 4%, 8/15/2029 (n) | 460,000 | 383,097 | ||

| $428,927 | ||||

| Asset-Backed & Securitized – 4.1% | ||||

| 3650R Commercial Mortgage Trust, 2021-PF1, “XA”, 1.013%, 11/15/2054 (i) | $ | 3,745,206 | $170,800 | |

| ACREC 2021-FL1 Ltd., “C”, FLR, 7.585% ((SOFR - 1mo. + 0.11448%) + 2.15%), 10/16/2036 (n) | 229,500 | 222,335 | ||

| AmeriCredit Automobile Receivables Trust, 2024-1, “A”, 5.61%, 1/12/2027 (n) | 114,751 | 114,577 | ||

| Issuer | Shares/Par | Value ($) | ||

| Bonds – continued | ||||

| Asset-Backed & Securitized – continued | ||||

| Arbor Realty Trust, Inc., CLO, 2021-FL1, “C”, FLR, 7.431% ((SOFR - 1mo. + 0.11448%) + 2%), 12/15/2035 (n) | $ | 200,000 | $195,172 | |

| Arbor Realty Trust, Inc., CLO, 2021-FL2, “B”, FLR, 7.031% ((SOFR - 1mo. + 0.11448%) + 1.6%), 5/15/2036 (n) | 100,000 | 98,770 | ||

| Arbor Realty Trust, Inc., CLO, 2021-FL2, “C”, FLR, 7.381% ((SOFR - 1mo. + 0.11448%) + 1.95%), 5/15/2036 (n) | 275,500 | 270,986 | ||

| Arbor Realty Trust, Inc., CLO, 2022-FL1, “C”, FLR, 7.623% (SOFR - 30 day + 2.3%), 1/15/2037 (n) | 327,000 | 321,517 | ||

| Arbor Realty Trust, Inc., CLO, 2022-FL1, “D”, FLR, 8.324% (SOFR - 30 day + 3%), 1/15/2037 (n) | 208,000 | 196,332 | ||

| AREIT 2022-CRE6 Trust, “C”, FLR, 7.473% (SOFR - 30 day + 2.15%), 1/20/2037 (n) | 100,000 | 95,922 | ||

| AREIT 2022-CRE6 Trust, “D”, FLR, 8.173% (SOFR - 30 day + 2.85%), 1/20/2037 (n) | 100,000 | 94,849 | ||

| ARI Fleet Lease Trust, 2023-B, “A2”, 6.05%, 7/15/2032 (n) | 100,000 | 100,329 | ||

| Bayview Financial Revolving Mortgage Loan Trust, FLR, 7.039% ((SOFR - 1mo. + 0.11448%) + 1.6%), 12/28/2040 (n) | 85,181 | 131,655 | ||

| BBCMS Mortgage Trust, 2020-C7, “XA”, 1.611%, 4/15/2053 (i) | 1,959,688 | 112,811 | ||

| BBCMS Mortgage Trust, 2021-C10, “XA”, 1.402%, 7/15/2054 (i) | 981,168 | 61,163 | ||

| BBCMS Mortgage Trust, 2021-C9, “XA”, 1.601%, 2/15/2054 (i) | 2,248,065 | 175,100 | ||

| Benchmark 2020-B18 Mortgage Trust, “XA”, 1.783%, 7/15/2053 (i) | 3,264,418 | 194,695 | ||

| Benchmark 2021-B23 Mortgage Trust, “XA”, 1.264%, 2/15/2054 (i) | 3,597,195 | 204,605 | ||

| Benchmark 2021-B24 Mortgage Trust, “XA”, 1.144%, 3/15/2054 (i) | 1,988,710 | 100,072 | ||

| Benchmark 2021-B26 Mortgage Trust, “XA”, 0.996%, 6/15/2054 (i) | 5,519,876 | 228,251 | ||

| Benchmark 2021-B27 Mortgage Trust, “XA”, 1.257%, 7/15/2054 (i) | 6,911,144 | 395,756 | ||

| Benchmark 2021-B28 Mortgage Trust, “XA”, 1.268%, 8/15/2054 (i) | 2,319,144 | 143,773 | ||

| Benchmark 2022-B36 Mortgage Trust, “XA”, 0.809%, 7/15/2055 (i) | 8,926,377 | 396,921 | ||

| BMP Commercial Mortgage Trust, 2024-MF23, “C”, 7.161% (SOFR - 1mo. + 1.8413%), 6/15/2041 (n)(w) | 100,000 | 99,781 | ||

| BMP Commercial Mortgage Trust, 2024-MF23, “D”, 7.71% (SOFR - 1mo. + 2.3905%), 6/15/2041 (n)(w) | 100,000 | 99,781 | ||

| Issuer | Shares/Par | Value ($) | ||

| Bonds – continued | ||||

| Asset-Backed & Securitized – continued | ||||

| BSPRT 2021-FL7 Issuer Ltd., “B”, FLR, 7.481% ((SOFR - 1mo. + 0.11448%) + 2.05%), 12/15/2038 (n) | $ | 100,000 | $98,235 | |

| BSPRT 2021-FL7 Issuer Ltd., “C”, FLR, 7.731% ((SOFR - 1mo. + 0.11448%) + 2.3%), 12/15/2038 (n) | 100,000 | 97,938 | ||

| Business Jet Securities LLC, 2024-1A, “A”, 6.197%, 5/15/2039 (n) | 97,917 | 98,327 | ||

| Business Jet Securities LLC, 2024-1A, “B”, 6.924%, 5/15/2039 (n) | 97,917 | 98,673 | ||

| BXMT 2021-FL4 Ltd., “B”, FLR, 6.985% ((SOFR - 1mo. + 0.11448%) + 1.55%), 5/15/2038 (n) | 549,000 | 484,063 | ||

| Capital Automotive, 2020-1A, “A4”, REIT, 3.19%, 2/15/2050 (n) | 143,298 | 139,474 | ||

| Capital Automotive, 2020-1A, “B1”, REIT, 4.17%, 2/15/2050 (n) | 437,500 | 426,092 | ||

| CF Hippolyta Issuer LLC, 2020-1, “A1”, 1.69%, 7/15/2060 (n) | 89,945 | 84,851 | ||

| CF Hippolyta Issuer LLC, 2020-1, “B1”, 2.28%, 7/15/2060 (n) | 89,945 | 83,439 | ||

| Chesapeake Funding II LLC, 2023-1A, “A1”, 5.65%, 5/15/2035 (n) | 99,444 | 99,395 | ||

| CNH Equipment Trust 2023-A, “A2”, 5.34%, 9/15/2026 | 36,553 | 36,487 | ||

| Colt Funding LLC, 2024-1, “A1”, 5.835%, 2/25/2069 (n) | 147,955 | 147,002 | ||

| Commercial Mortgage Pass-Through Certificates, 2021-BN32, “XA”, 0.771%, 4/15/2054 (i) | 1,570,723 | 57,103 | ||

| Commercial Mortgage Pass-Through Certificates, 2021-BN34, “XA”, 1.082%, 6/15/2063 (i) | 996,295 | 47,448 | ||

| Commercial Mortgage Pass-Through Certificates, 2021-BN35, “XA”, 1.143%, 6/15/2064 (i) | 1,293,896 | 66,132 | ||

| Commercial Mortgage Pass-Through Certificates, 2022-BNK41, “AS”, 3.79%, 4/15/2065 | 257,000 | 223,189 | ||

| Crest Ltd., CDO, 7% (0.001% Cash or 7% PIK), 1/28/2040 (a)(p) | 4,586,320 | 46 | ||

| DT Auto Owner Trust, 2023-1A, “A”, 5.48%, 4/15/2027 (n) | 37,407 | 37,373 | ||

| ELM Trust, 2024-ELM, “B10”, 5.995%, 6/10/2027 (n)(w) | 100,000 | 100,000 | ||

| ELM Trust, 2024-ELM, “C10”, 1%, 6/10/2027 (n)(w) | 100,000 | 100,000 | ||

| ELM Trust, 2024-ELM, “D10”, 6.626%, 6/10/2027 (n)(w) | 100,000 | 100,000 | ||

| Empire District Bondco LLC, 4.943%, 1/01/2033 | 165,000 | 162,384 | ||

| Fortress CBO Investments Ltd., 2022-FL3, “AS”, FLR, 7.574% (SOFR - 30 day + 2.25%), 2/23/2039 (n) | 114,000 | 110,968 | ||

| FS Rialto 2021-FL2 Issuer Ltd., “AS”, FLR, 6.984% ((SOFR - 1mo. + 0.11448%) + 1.55%), 5/16/2038 (n) | 297,500 | 288,830 | ||

| GreatAmerica Leasing Receivables Funding LLC, 2023-1, “A2”, 5.35%, 2/16/2026 (n) | 52,593 | 52,583 | ||

| Issuer | Shares/Par | Value ($) | ||

| Bonds – continued | ||||

| Asset-Backed & Securitized – continued | ||||

| LoanCore 2021-CRE5 Ltd., “B”, FLR, 7.431% ((SOFR - 1mo. + 0.11448%) + 2.0%), 7/15/2036 (n) | $ | 100,000 | $97,750 | |

| MF1 2021-FL5 Ltd., “C”, FLR, 7.134% ((SOFR - 1mo. + 0.11448%) + 1.7%), 7/15/2036 (n) | 213,000 | 209,626 | ||

| MF1 2021-FL5 Ltd., “D”, FLR, 7.934% ((SOFR - 1mo. + 0.11448%) + 2.5%), 7/15/2036 (n) | 755,000 | 730,409 | ||

| MF1 2022-FL8 Ltd., “C”, FLR, 7.519% (SOFR - 30 day + 2.2%), 2/19/2037 (n) | 110,841 | 106,948 | ||

| MF1 2024-FL14 LLC, “A”, FLR, 7.057% (SOFR - 1mo. + 1.737%), 3/19/2039 (n) | 229,000 | 228,921 | ||

| MF1 2024-FL14 LLC, “AS”, FLR, 7.56% (SOFR - 1mo. + 2.24%), 3/19/2039 (n) | 100,000 | 99,806 | ||

| MF1 2024-FL14 LLC, “B”, FLR, 8.009% (SOFR - 1mo. + 2.689%), 3/19/2039 (n) | 349,917 | 349,789 | ||

| Morgan Stanley Capital I Trust, 2021-L5, “XA”, 1.287%, 5/15/2054 (i) | 1,027,288 | 59,520 | ||

| Morgan Stanley Capital I Trust, 2021-L6, “XA”, 1.317%, 6/15/2054 (i) | 3,063,796 | 159,871 | ||

| Navistar Financial Dealer Note Master Owner Trust, 2023-1, “A”, 6.18%, 8/25/2028 (n) | 244,000 | 245,416 | ||

| Navistar Financial Dealer Note Master Owner Trust, 2023-1, “B”, 6.48%, 8/25/2028 (n) | 57,000 | 56,988 | ||

| OBX Trust, 2024-NQM1, “A1”, 5.928%, 11/25/2063 (n) | 120,567 | 119,875 | ||

| OBX Trust, 2024-NQM1, “A2”, 6.253%, 11/25/2063 (n) | 95,288 | 94,701 | ||

| OBX Trust, 2024-NQM2, “A1”, 5.878%, 12/25/2063 (n) | 283,174 | 281,644 | ||

| RAC Bond Co. PLC, 4.87%, 5/06/2026 | GBP | 100,000 | 124,646 | |

| Shelter Growth CRE 2021-FL3 Ltd., “C”, FLR, 7.581% ((SOFR - 1mo. + 0.11448%) + 2.15%), 9/15/2036 (n) | $ | 157,500 | 151,627 | |

| Starwood Commercial Mortgage, 2021-FL2, “B”, FLR, 7.235% ((SOFR - 1mo. + 0.11448%) + 1.8%), 4/18/2038 (n) | 190,000 | 179,890 | ||

| Starwood Commercial Mortgage, 2021-FL2, “C”, FLR, 7.535% ((SOFR - 1mo. + 0.11448)% + 2.1%), 4/18/2038 (n) | 100,000 | 91,220 | ||

| TPG Real Estate Finance, 2021-FL4, “AS”, FLR, 6.835% ((SOFR - 1mo. + 0.11448%) + 1.4%), 3/15/2038 (n) | 150,000 | 146,602 | ||

| TPG Real Estate Finance, 2021-FL4, “B”, FLR, 7.285% ((SOFR - 1mo. + 0.11448%) + 1.85%), 3/15/2038 (n) | 310,000 | 295,546 | ||

| Verus Securitization Trust, 2014-1, “A1”, 5.712%, 1/25/2069 (n) | 161,164 | 159,790 | ||

| Wells Fargo Commercial Mortgage Trust, 2021-C60, “XA”, 1.52%, 8/15/2054 (i) | 1,951,958 | 141,455 | ||

| Westlake Automobile Receivables Trust, 2023-1A, “A2B”, FLR, 6.173% (SOFR - 30 day + 0.85%), 6/15/2026 (n) | 18,622 | 18,637 | ||

| $11,616,662 | ||||

| Issuer | Shares/Par | Value ($) | ||

| Bonds – continued | ||||

| Automotive – 0.9% | ||||

| Clarios Global LP/Clarios U.S. Finance Co., 8.5%, 5/15/2027 (n) | $ | 621,000 | $624,979 | |

| Clarios Global LP/Clarios U.S. Finance Co., 6.75%, 5/15/2028 (n) | 290,000 | 293,049 | ||

| Dornoch Debt Merger Sub, Inc., 6.625%, 10/15/2029 (n) | 631,000 | 545,069 | ||

| Ferrari N.V., 3.625%, 5/21/2030 | EUR | 130,000 | 140,273 | |

| Garrett Motion Holdings, Inc./Garrett LX I S.à r.l., 7.75%, 5/31/2032 (n) | $ | 406,000 | 408,664 | |

| Hyundai Capital America, 6.375%, 4/08/2030 (n) | 72,000 | 74,748 | ||

| LKQ Corp., 6.25%, 6/15/2033 | 34,000 | 34,938 | ||

| Real Hero Merger Sub 2, Inc., 6.25%, 2/01/2029 (n) | 480,000 | 413,500 | ||

| Volkswagen Leasing GmbH, 4%, 4/11/2031 | EUR | 70,000 | 75,665 | |

| $2,610,885 | ||||

| Broadcasting – 0.7% | ||||

| AMC Networks, Inc., 10.25%, 1/15/2029 (n) | $ | 232,000 | $231,478 | |

| Banijay Group S.A.S., 8.125%, 5/01/2029 (n) | 600,000 | 613,373 | ||

| Discovery Communications LLC, 4.125%, 5/15/2029 | 32,000 | 29,502 | ||

| Midas OpCo Holdings LLC, 5.625%, 8/15/2029 (n) | 584,000 | 534,563 | ||

| Prosus N.V., 3.061%, 7/13/2031 (n) | 329,000 | 266,623 | ||

| Ubisoft Entertainment S.A., 0.878%, 11/24/2027 | EUR | 200,000 | 184,932 | |

| WarnerMedia Holdings, Inc., 4.279%, 3/15/2032 | $ | 34,000 | 29,757 | |

| $1,890,228 | ||||

| Brokerage & Asset Managers – 1.0% | ||||

| AG TTMT Escrow Issuer LLC, 8.625%, 9/30/2027 (n) | $ | 704,000 | $731,661 | |

| Aretec Escrow Issuer 2, Inc., 10%, 8/15/2030 (n) | 585,000 | 639,869 | ||

| Aretec Escrow Issuer, Inc., 7.5%, 4/01/2029 (n) | 274,000 | 264,708 | ||

| Charles Schwab Corp., 5.643% to 5/19/2028, FLR (SOFR - 1 day + 2.210%) to 5/19/2029 | 43,000 | 43,407 | ||

| Charles Schwab Corp., 6.136% to 8/24/2033, FLR (SOFR - 1 day + 2.01%) to 8/24/2034 | 42,000 | 43,438 | ||

| Hightower Holding LLC, 6.75%, 4/15/2029 (n) | 343,000 | 321,558 | ||

| LPL Holdings, Inc., 4%, 3/15/2029 (n) | 375,000 | 347,637 | ||

| LPL Holdings, Inc., 4.375%, 5/15/2031 (n) | 388,000 | 353,482 | ||

| LSEG Netherlands B.V., 4.231%, 9/29/2030 | EUR | 100,000 | 111,409 | |

| $2,857,169 | ||||

| Building – 2.9% | ||||

| ABC Supply Co., Inc., 3.875%, 11/15/2029 (n) | $ | 572,000 | $505,186 | |

| Cornerstone Building Brands, Inc., 6.125%, 1/15/2029 (n) | 405,000 | 329,408 | ||

| CRH SMW Finance DAC, 4%, 7/11/2031 | EUR | 110,000 | 120,543 | |

| Foundation Building Materials LLC, 6%, 3/01/2029 (n) | $ | 812,000 | 719,720 | |

| GYP Holding III Corp., 4.625%, 5/01/2029 (n) | 871,000 | 804,724 | ||

| Issuer | Shares/Par | Value ($) | ||

| Bonds – continued | ||||

| Building – continued | ||||

| Holcim Sterling Finance (Netherlands) B.V., 2.25%, 4/04/2034 | GBP | 100,000 | $96,071 | |

| LBM Acquisition LLC, 6.25%, 1/15/2029 (n) | $ | 289,000 | 260,962 | |

| Miter Brands Acquisition Holdco, Inc., 6.75%, 4/01/2032 (n) | 171,000 | 169,865 | ||

| MIWD Holdco II LLC/MIWD Finance Co., 5.5%, 2/01/2030 (n) | 716,000 | 652,601 | ||

| New Enterprise Stone & Lime Co., Inc., 5.25%, 7/15/2028 (n) | 726,000 | 682,427 | ||

| New Enterprise Stone & Lime Co., Inc., 9.75%, 7/15/2028 (n) | 240,000 | 245,705 | ||

| Patrick Industries, Inc., 7.5%, 10/15/2027 (n) | 767,000 | 778,085 | ||

| SRM Concrete, 8.875%, 11/15/2031 (n) | 853,000 | 898,144 | ||

| Standard Industries, Inc., 4.75%, 1/15/2028 (n) | 522,000 | 497,281 | ||

| Standard Industries, Inc., 4.375%, 7/15/2030 (n) | 871,000 | 777,264 | ||

| Vulcan Materials Co., 3.5%, 6/01/2030 | 75,000 | 68,044 | ||

| White Cap Buyer LLC, 6.875%, 10/15/2028 (n) | 779,000 | 743,171 | ||

| $8,349,201 | ||||

| Business Services – 0.7% | ||||

| Euronet Worldwide, Inc., 1.375%, 5/22/2026 | EUR | 100,000 | $102,658 | |

| Fiserv, Inc., 4.4%, 7/01/2049 | $ | 84,000 | 68,398 | |

| Iron Mountain, Inc., 4.875%, 9/15/2027 (n) | 454,000 | 437,911 | ||

| Iron Mountain, Inc., 5.25%, 3/15/2028 (n) | 530,000 | 510,226 | ||

| Mastercard, Inc., 3.3%, 3/26/2027 | 45,000 | 43,095 | ||

| Mastercard, Inc., 3.85%, 3/26/2050 | 77,000 | 60,861 | ||

| Tencent Holdings Ltd., 3.8%, 2/11/2025 | 700,000 | 691,177 | ||

| Visa, Inc., 3.65%, 9/15/2047 | 118,000 | 91,514 | ||

| Wolters Kluwer N.V., 3.25%, 3/18/2029 | EUR | 100,000 | 106,882 | |

| $2,112,722 | ||||

| Cable TV – 4.6% | ||||

| Cable One, Inc., 4%, 11/15/2030 (n) | $ | 1,184,000 | $883,440 | |

| CCO Holdings LLC/CCO Holdings Capital Corp., 5.125%, 5/01/2027 (n) | 570,000 | 544,777 | ||

| CCO Holdings LLC/CCO Holdings Capital Corp., 4.75%, 3/01/2030 (n) | 1,852,000 | 1,577,634 | ||

| CCO Holdings LLC/CCO Holdings Capital Corp., 4.5%, 8/15/2030 (n) | 1,143,000 | 949,725 | ||

| CCO Holdings LLC/CCO Holdings Capital Corp., 4.25%, 1/15/2034 (n) | 535,000 | 398,623 | ||

| Charter Communications Operating LLC/Charter Communications Operating Capital Corp., 6.1%, 6/01/2029 | 110,000 | 110,120 | ||

| Charter Communications Operating LLC/Charter Communications Operating Capital Corp., 4.8%, 3/01/2050 | 27,000 | 19,910 | ||

| Issuer | Shares/Par | Value ($) | ||

| Bonds – continued | ||||

| Cable TV – continued | ||||

| CSC Holdings LLC, 5.375%, 2/01/2028 (n) | $ | 800,000 | $561,838 | |

| CSC Holdings LLC, 7.5%, 4/01/2028 (n) | 250,000 | 139,565 | ||

| CSC Holdings LLC, 11.75%, 1/31/2029 (n) | 417,000 | 331,393 | ||

| CSC Holdings LLC, 5.75%, 1/15/2030 (n) | 825,000 | 356,488 | ||

| CSC Holdings LLC, 4.125%, 12/01/2030 (n) | 250,000 | 154,165 | ||

| DIRECTV Financing LLC, 8.875%, 2/01/2030 (n) | 253,000 | 243,756 | ||

| DISH DBS Corp., 7.75%, 7/01/2026 | 392,000 | 249,279 | ||

| DISH DBS Corp., 5.25%, 12/01/2026 (n) | 488,000 | 388,608 | ||

| DISH DBS Corp., 5.125%, 6/01/2029 | 370,000 | 147,338 | ||

| DISH Network Corp., 11.75%, 11/15/2027 (n) | 255,000 | 255,845 | ||

| LCPR Senior Secured Financing DAC, 6.75%, 10/15/2027 (n) | 893,000 | 845,854 | ||

| SES S.A., 3.5%, 1/14/2029 | EUR | 100,000 | 104,056 | |

| Sirius XM Radio, Inc., 4%, 7/15/2028 (n) | $ | 571,000 | 511,138 | |

| Sirius XM Radio, Inc., 5.5%, 7/01/2029 (n) | 738,000 | 685,429 | ||

| Summer BidCo B.V., 10% (10% Cash or 10.75% PIK), 2/15/2029 (p) | EUR | 123,584 | 135,599 | |

| Videotron Ltd., 5.125%, 4/15/2027 (n) | $ | 406,000 | 396,939 | |

| Virgin Media Finance PLC, 5%, 7/15/2030 (n) | 600,000 | 498,509 | ||

| Virgin Media Vendor Financing Notes IV DAC, 5%, 7/15/2028 (n) | 891,000 | 803,518 | ||

| Ziggo Bond Finance B.V., 3.375%, 2/28/2030 | EUR | 170,000 | 153,792 | |

| Ziggo Bond Finance B.V., 5.125%, 2/28/2030 (n) | $ | 1,715,000 | 1,464,777 | |

| $12,912,115 | ||||

| Chemicals – 1.8% | ||||

| Chemours Co., 4.625%, 11/15/2029 (n) | $ | 722,000 | $615,723 | |

| Consolidated Energy Finance S.A., 5.625%, 10/15/2028 (n) | 447,000 | 384,693 | ||

| Element Solutions, Inc., 3.875%, 9/01/2028 (n) | 900,000 | 818,967 | ||

| LSF11 A5 HoldCo LLC, 6.625%, 10/15/2029 (n) | 691,000 | 651,498 | ||

| Sasol Financing (USA) LLC, 5.5%, 3/18/2031 | 550,000 | 453,848 | ||

| SCIH Salt Holdings, Inc., 6.625%, 5/01/2029 (n) | 766,000 | 721,453 | ||

| SNF Group SACA, 3.375%, 3/15/2030 (n) | 1,105,000 | 950,438 | ||

| Windsor Holdings III, LLC, 8.5%, 6/15/2030 (n) | 502,000 | 524,493 | ||

| $5,121,113 | ||||

| Computer Software – 0.6% | ||||

| Central Parent LLC/CDK Global II LLC/CDK Financing Co., Inc., 8%, 6/15/2029 (n) | $ | 568,000 | $583,136 | |

| Dun & Bradstreet Corp., 5%, 12/15/2029 (n) | 606,000 | 563,559 | ||

| Microsoft Corp., 2.525%, 6/01/2050 | 101,000 | 63,417 | ||

| Neptune Bidco U.S., Inc., 9.29%, 4/15/2029 (n) | 407,000 | 388,743 | ||

| Oracle Corp., 4%, 7/15/2046 | 62,000 | 47,433 | ||

| $1,646,288 | ||||

| Issuer | Shares/Par | Value ($) | ||

| Bonds – continued | ||||

| Computer Software - Systems – 0.7% | ||||

| Sabre GLBL, Inc., 8.625%, 6/01/2027 (n) | $ | 337,000 | $310,253 | |

| Sabre GLBL, Inc., 11.25%, 12/15/2027 (n) | 180,000 | 174,967 | ||

| SS&C Technologies Holdings, Inc., 5.5%, 9/30/2027 (n) | 1,213,000 | 1,187,962 | ||

| Virtusa Corp., 7.125%, 12/15/2028 (n) | 361,000 | 328,319 | ||

| $2,001,501 | ||||

| Conglomerates – 2.2% | ||||

| BWX Technologies, Inc., 4.125%, 6/30/2028 (n) | $ | 500,000 | $460,740 | |

| BWX Technologies, Inc., 4.125%, 4/15/2029 (n) | 1,098,000 | 1,004,831 | ||

| Chart Industries, Inc., 9.5%, 1/01/2031 (n) | 549,000 | 592,817 | ||

| Emerald Debt Merger, 6.625%, 12/15/2030 (n) | 1,046,000 | 1,047,822 | ||

| Gates Corp., 6.875%, 7/01/2029 (n) | 230,000 | 232,209 | ||

| Gates Global LLC, 6.25%, 1/15/2026 (n) | 484,000 | 483,722 | ||

| Illinois Tool Works, Inc., 3.375%, 5/17/2032 | EUR | 100,000 | 106,847 | |

| Madison IAQ LLC, 5.875%, 6/30/2029 (n) | $ | 657,000 | 608,959 | |

| nVent Finance S.à r.l., 5.65%, 5/15/2033 | 69,000 | 68,776 | ||

| Regal Rexnord Corp., 6.05%, 4/15/2028 | 138,000 | 140,091 | ||

| TriMas Corp., 4.125%, 4/15/2029 (n) | 1,442,000 | 1,305,145 | ||

| Veralto Corp., 4.15%, 9/19/2031 | EUR | 100,000 | 108,733 | |

| Westinghouse Air Brake Technologies Corp., 4.7%, 9/15/2028 | $ | 75,000 | 73,352 | |

| Westinghouse Air Brake Technologies Corp., 5.611%, 3/11/2034 | 39,000 | 39,119 | ||

| $6,273,163 | ||||

| Construction – 0.9% | ||||

| Beazer Homes USA, Inc., 7.5%, 3/15/2031 (n) | $ | 693,000 | $691,773 | |

| Empire Communities Corp., 9.75%, 5/01/2029 (n) | 464,000 | 473,340 | ||

| Mattamy Group Corp., 5.25%, 12/15/2027 (n) | 249,000 | 240,863 | ||

| Mattamy Group Corp., 4.625%, 3/01/2030 (n) | 516,000 | 471,519 | ||

| Weekley Homes LLC/Weekley Finance Corp., 4.875%, 9/15/2028 (n) | 684,000 | 626,443 | ||

| $2,503,938 | ||||

| Consumer Products – 1.2% | ||||

| Amer Sports Co., 6.75%, 2/16/2031 (n) | $ | 803,000 | $800,017 | |

| Energizer Holdings, Inc., 4.375%, 3/31/2029 (n) | 382,000 | 339,577 | ||

| HFC Prestige Products, Inc./HFC Prestige International US LLC, 6.625%, 7/15/2030 (n) | 974,000 | 980,919 | ||

| Kenvue, Inc., 5.05%, 3/22/2053 | 100,000 | 93,999 | ||

| Prestige Consumer Healthcare, Inc., 5.125%, 1/15/2028 (n) | 857,000 | 825,699 | ||

| Prestige Consumer Healthcare, Inc., 3.75%, 4/01/2031 (n) | 415,000 | 355,842 | ||

| $3,396,053 | ||||

| Issuer | Shares/Par | Value ($) | ||

| Bonds – continued | ||||

| Consumer Services – 2.9% | ||||

| Allied Universal Holdco LLC, 9.75%, 7/15/2027 (n) | $ | 1,062,000 | $1,052,991 | |

| Allied Universal Holdco LLC, 6%, 6/01/2029 (n) | 400,000 | 341,413 | ||

| Arches Buyer, Inc., 6.125%, 12/01/2028 (n) | 659,000 | 530,862 | ||

| Compass Group PLC, 3.25%, 2/06/2031 | EUR | 100,000 | 106,087 | |

| Cushman & Wakefield PLC, 6.75%, 5/15/2028 (n) | $ | 350,000 | 348,034 | |

| GoDaddy, Inc., 3.5%, 3/01/2029 (n) | 1,013,000 | 905,031 | ||

| GW B-CR Security Corp., 9.5%, 11/01/2027 (n) | 804,000 | 804,680 | ||

| Match Group Holdings II LLC, 5%, 12/15/2027 (n) | 584,000 | 553,026 | ||

| Match Group Holdings II LLC, 4.625%, 6/01/2028 (n) | 704,000 | 654,748 | ||

| Pachelbel Bidco Spa, 7.125%, 5/17/2031 (n) | EUR | 100,000 | 111,218 | |

| Pluxee N.V., 3.75%, 9/04/2032 | 100,000 | 106,154 | ||

| Realogy Group LLC/Realogy Co-Issuer Corp., 5.75%, 1/15/2029 (n) | $ | 665,000 | 456,308 | |

| Realogy Group LLC/Realogy Co-Issuer Corp., 5.25%, 4/15/2030 (n) | 436,000 | 284,538 | ||

| TriNet Group, Inc., 3.5%, 3/01/2029 (n) | 1,125,000 | 993,026 | ||

| Velocity Vehicle Group LLC, 8%, 6/01/2029 (n)(w) | 174,000 | 176,828 | ||

| Verisure Midholding AB, 5.25%, 2/15/2029 | EUR | 100,000 | 105,358 | |

| WASH Multi-Family Acquisition, Inc., 5.75%, 4/15/2026 (n) | $ | 595,000 | 578,398 | |

| $8,108,700 | ||||

| Containers – 1.5% | ||||

| ARD Finance S.A., 6.5% (6.5% Cash or 7.25% PIK), 6/30/2027 (n)(p) | $ | 238,000 | $55,330 | |

| Ardagh Metal Packaging Finance USA LLC, 3.25%, 9/01/2028 (n) | 765,000 | 670,832 | ||

| Can-Pack S.A./Eastern PA Land Investment Holding LLC, 3.875%, 11/15/2029 (n) | 1,069,000 | 938,734 | ||

| Crown Americas LLC, 5.25%, 4/01/2030 | 342,000 | 328,722 | ||

| Crown Americas LLC/Crown Americas Capital Corp. V, 4.25%, 9/30/2026 | 604,000 | 580,480 | ||

| Crown Americas LLC/Crown Americas Capital Corp. VI, 4.75%, 2/01/2026 | 490,000 | 480,983 | ||

| Titan Holdings II B.V., 5.125%, 7/15/2029 | EUR | 531,000 | 521,048 | |

| Trivium Packaging Finance B.V., 8.5%, 8/15/2027 (n) | $ | 601,000 | 599,659 | |

| $4,175,788 | ||||

| Electrical Equipment – 0.0% | ||||

| Arrow Electronics, Inc., 2.95%, 2/15/2032 | $ | 48,000 | $40,110 | |

| Arrow Electronics, Inc., 5.875%, 4/10/2034 | 88,000 | 86,374 | ||

| $126,484 | ||||

| Issuer | Shares/Par | Value ($) | ||

| Bonds – continued | ||||

| Electronics – 1.0% | ||||

| Entegris Escrow Corp., 5.95%, 6/15/2030 (n) | $ | 418,000 | $411,455 | |

| Entegris, Inc., 4.375%, 4/15/2028 (n) | 430,000 | 402,231 | ||

| Entegris, Inc., 3.625%, 5/01/2029 (n) | 499,000 | 443,367 | ||

| Intel Corp., 5.7%, 2/10/2053 | 70,000 | 68,482 | ||

| NXP B.V./NXP Funding LLC/NXP USA, Inc., 3.4%, 5/01/2030 | 36,000 | 32,467 | ||

| NXP B.V./NXP Funding LLC/NXP USA, Inc., 5%, 1/15/2033 | 17,000 | 16,502 | ||

| Sensata Technologies B.V., 5%, 10/01/2025 (n) | 847,000 | 853,164 | ||

| Sensata Technologies B.V., 5.875%, 9/01/2030 (n) | 385,000 | 374,221 | ||

| Sensata Technologies, Inc., 4.375%, 2/15/2030 (n) | 209,000 | 190,646 | ||

| $2,792,535 | ||||

| Emerging Market Quasi-Sovereign – 4.0% | ||||

| Abu Dhabi Development Holding Co. PJSC, 5.5%, 5/08/2034 (n) | $ | 855,000 | $866,773 | |

| Dua Capital Ltd. (Federation of Malaysia), 2.78%, 5/11/2031 | 404,000 | 342,590 | ||

| Empresa Nacional del Petroleo (Republic of Chile), 3.75%, 8/05/2026 | 600,000 | 574,511 | ||

| Empresa Nacional del Petroleo (Republic of Chile), 5.25%, 11/06/2029 | 400,000 | 390,304 | ||

| EQUATE Petrochemical B.V. (State of Kuwait), 4.25%, 11/03/2026 | 522,000 | 500,484 | ||

| Eskom Holdings SOC Ltd. (Republic of South Africa), 6.35%, 8/10/2028 | 624,000 | 596,100 | ||

| Eustream A.S. (Slovak Republic), 1.625%, 6/25/2027 | EUR | 146,000 | 138,429 | |

| Indian Railway Finance Corp., 2.8%, 2/10/2031 (n) | $ | 299,000 | 252,685 | |

| Indian Railway Finance Corp., 2.8%, 2/10/2031 | 800,000 | 676,080 | ||

| Ipoteka Bank (Republic of Uzbekistan), 5.5%, 11/19/2025 | 700,000 | 672,000 | ||

| Korea Development Bank, 4.25%, 9/08/2032 | 531,000 | 501,130 | ||

| Magyar Export-Import Bank PLC (Republic of Hungary), 6.125%, 12/04/2027 (n) | 200,000 | 200,542 | ||

| NBK SPC Ltd. (State of Kuwait), 5.5% to 6/06/2029, FLR (SOFR - 1 day + 1.16%) to 6/06/2030 (n)(w) | 642,000 | 642,565 | ||

| Office Cherifien des Phosphates S.A. (Kingdom of Morocco), 6.75%, 5/02/2034 (n) | 493,000 | 496,867 | ||

| Office Cherifien des Phosphates S.A. (Kingdom of Morocco), 5.125%, 6/23/2051 (n) | 650,000 | 479,960 | ||

| Oryx Funding Ltd. (Sultanate of Oman), 5.8%, 2/03/2031 (n) | 200,000 | 196,610 | ||

| Petroleos Mexicanos, 6.49%, 1/23/2027 | 904,000 | 859,373 | ||

| Petroleos Mexicanos, 5.95%, 1/28/2031 | 100,000 | 81,155 | ||

| Petroleos Mexicanos, 10%, 2/07/2033 | 60,000 | 60,556 | ||

| Petroleos Mexicanos, 6.75%, 9/21/2047 | 866,000 | 581,664 | ||

| QNB Finance Ltd. (State of Qatar), 2.75%, 2/12/2027 | 352,000 | 327,888 | ||

| Issuer | Shares/Par | Value ($) | ||

| Bonds – continued | ||||

| Emerging Market Quasi-Sovereign – continued | ||||

| Southern Gas Corridor CJSC (Republic of Azerbaijan), 6.875%, 3/24/2026 | $ | 1,065,000 | $1,069,154 | |

| SPP-Distribucia A.S. (Republic of Slovakia), 1%, 6/09/2031 | EUR | 180,000 | 149,167 | |

| State Oil Company of the Azerbaijan Republic, 6.95%, 3/18/2030 | $ | 500,000 | 509,930 | |

| Turkiye Ihracat Kredi Bankasi A.S., 7.5%, 2/06/2028 (n) | 200,000 | 200,500 | ||

| $11,367,017 | ||||

| Emerging Market Sovereign – 9.6% | ||||

| Republic of India, 7.18%, 8/14/2033 | INR | 51,100,000 | $616,633 | |

| Arab Republic of Egypt, 8.5%, 1/31/2047 | $ | 965,000 | 752,023 | |

| Dominican Republic, 5.5%, 2/22/2029 (n) | 761,000 | 732,001 | ||

| Dominican Republic, 7.05%, 2/03/2031 (n) | 150,000 | 154,121 | ||

| Dominican Republic, 5.3%, 1/21/2041 (n) | 181,000 | 153,029 | ||

| Dominican Republic, 5.875%, 1/30/2060 (n) | 1,360,000 | 1,149,968 | ||

| Federal Republic of Nigeria, 8.747%, 1/21/2031 (n) | 519,000 | 488,057 | ||

| Federative Republic of Brazil, 10%, 1/01/2027 | BRL | 1,375,000 | 255,723 | |

| Federative Republic of Brazil, 10%, 1/01/2029 | 16,500,000 | 2,981,176 | ||

| Hellenic Republic (Republic of Greece), 3.375%, 6/15/2034 | EUR | 385,000 | 407,727 | |

| Kingdom of Morocco, 1.375%, 3/30/2026 | 428,000 | 438,593 | ||

| Kingdom of Morocco, 3%, 12/15/2032 (n) | $ | 459,000 | 365,594 | |

| Kingdom of Saudi Arabia, 5%, 1/18/2053 | 200,000 | 174,580 | ||

| Oriental Republic of Uruguay, 8.25%, 5/21/2031 | UYU | 23,377,000 | 570,383 | |

| Oriental Republic of Uruguay, 9.75%, 7/20/2033 | 8,914,000 | 237,197 | ||

| People's Republic of China, 3.13%, 11/21/2029 | CNY | 3,100,000 | 451,214 | |

| People's Republic of China, 2.88%, 2/25/2033 | 8,520,000 | 1,228,279 | ||

| Republic of Albania, 5.9%, 6/09/2028 | EUR | 682,000 | 765,048 | |

| Republic of Angola, 9.375%, 5/08/2048 | $ | 870,000 | 741,943 | |

| Republic of Angola, 9.125%, 11/26/2049 | 200,000 | 166,500 | ||

| Republic of Argentina, 3.625%, 7/09/2035 | 768,494 | 337,265 | ||

| Republic of Benin, 6.875%, 1/19/2052 (n) | EUR | 114,000 | 99,437 | |

| Republic of Benin, 6.875%, 1/19/2052 | 400,000 | 348,902 | ||

| Republic of Costa Rica, 7.3%, 11/13/2054 | $ | 600,000 | 621,356 | |

| Republic of Cote d'Ivoire, 5.25%, 3/22/2030 | EUR | 929,000 | 921,312 | |

| Republic of Cote d'Ivoire, 6.875%, 10/17/2040 | 200,000 | 183,786 | ||

| Republic of Guatemala, 6.125%, 6/01/2050 (n) | $ | 382,000 | 343,322 | |

| Republic of Hungary, 5.5%, 6/16/2034 (n) | 650,000 | 625,764 | ||

| Republic of Korea, 2.375%, 12/10/2027 | KRW | 325,000,000 | 226,312 | |

| Republic of Korea, 1.875%, 6/10/2029 | 3,174,250,000 | 2,122,088 | ||

| Republic of Korea, 1.375%, 6/10/2030 | 2,721,670,000 | 1,738,833 | ||

| Republic of Paraguay, 6%, 2/09/2036 (n) | $ | 200,000 | 198,260 | |

| Republic of Paraguay, 5.4%, 3/30/2050 (n) | 1,150,000 | 985,256 | ||

| Republic of Philippines, 3.556%, 9/29/2032 | 334,000 | 293,748 | ||

| Issuer | Shares/Par | Value ($) | ||

| Bonds – continued | ||||

| Emerging Market Sovereign – continued | ||||

| Republic of Poland, 5.125%, 9/18/2034 | $ | 379,000 | $368,577 | |

| Republic of Romania, 1.75%, 7/13/2030 (n) | EUR | 247,000 | 219,268 | |

| Republic of Romania, 2%, 1/28/2032 | 350,000 | 299,067 | ||

| Republic of Romania, 2%, 4/14/2033 | 250,000 | 205,904 | ||

| Republic of Serbia, 1.65%, 3/03/2033 | 428,000 | 347,948 | ||

| Republic of Serbia, 2.05%, 9/23/2036 (n) | 452,000 | 348,091 | ||

| Republic of Sri Lanka, 7.55%, 3/28/2030 (a)(d)(n) | $ | 446,000 | 257,569 | |

| Republic of Turkey, 7.625%, 5/15/2034 | 566,000 | 567,551 | ||

| Sultanate of Oman, 7%, 1/25/2051 | 800,000 | 830,200 | ||

| United Mexican States, 7.75%, 5/29/2031 | MXN | 5,900,000 | 310,828 | |

| United Mexican States, 4.75%, 4/27/2032 | $ | 727,000 | 674,292 | |

| United Mexican States, 4.875%, 5/19/2033 | 441,000 | 408,623 | ||

| United Mexican States, 3.771%, 5/24/2061 | 774,000 | 479,932 | ||

| $27,193,280 | ||||

| Energy - Independent – 3.3% | ||||

| Civitas Resources, Inc., 8.375%, 7/01/2028 (n) | $ | 526,000 | $552,030 | |

| Civitas Resources, Inc., 8.625%, 11/01/2030 (n) | 173,000 | 185,055 | ||

| Civitas Resources, Inc., 8.75%, 7/01/2031 (n) | 349,000 | 372,597 | ||

| Comstock Resources, Inc., 6.75%, 3/01/2029 (n) | 1,167,000 | 1,128,822 | ||

| CrownRock LP/CrownRock Finance, Inc., “F”, 5%, 5/01/2029 (n) | 651,000 | 642,049 | ||

| Diamondback Energy, Inc., 5.75%, 4/18/2054 | 77,000 | 74,231 | ||

| Encino Acquisition partners Holdings LLC, 8.75%, 5/01/2031 (n) | 464,000 | 479,840 | ||

| Matador Resources Co., 6.875%, 4/15/2028 (n) | 635,000 | 640,789 | ||

| Matador Resources Co., 6.5%, 4/15/2032 (n) | 228,000 | 227,556 | ||

| Medco Bell Pte. Ltd., 6.375%, 1/30/2027 (n) | 492,000 | 481,211 | ||

| Occidental Petroleum Corp., 6.45%, 9/15/2036 | 103,000 | 107,289 | ||

| Permian Resources Operating LLC, 7.75%, 2/15/2026 (n) | 110,000 | 110,954 | ||

| Permian Resources Operating LLC, 5.875%, 7/01/2029 (n) | 886,000 | 868,261 | ||

| Permian Resources Operating LLC, 7%, 1/15/2032 (n) | 463,000 | 473,005 | ||

| Pioneer Natural Resources Co., 2.15%, 1/15/2031 | 95,000 | 79,743 | ||

| Santos Finance Ltd., 6.875%, 9/19/2033 (n) | 82,000 | 85,846 | ||

| Sitio Royalties Operating Partnership, LP, 7.875%, 11/01/2028 (n) | 841,000 | 872,558 | ||

| SM Energy Co., 6.5%, 7/15/2028 | 664,000 | 661,795 | ||

| Tengizchevroil Finance Co. International Ltd., 4%, 8/15/2026 | 987,000 | 940,019 | ||

| Vital Energy, Inc., 7.875%, 4/15/2032 (n) | 457,000 | 464,018 | ||

| $9,447,668 | ||||

| Issuer | Shares/Par | Value ($) | ||

| Bonds – continued | ||||

| Energy - Integrated – 0.3% | ||||

| BP Capital Markets America, Inc., 4.812%, 2/13/2033 | $ | 54,000 | $52,228 | |

| BP Capital Markets B.V., 4.323%, 5/12/2035 | EUR | 100,000 | 111,549 | |

| Citgo Petroleum Corp., 8.375%, 1/15/2029 (n) | $ | 585,000 | 605,568 | |

| Eni S.p.A., 3.875%, 1/15/2034 | EUR | 100,000 | 107,052 | |

| Exxon Mobil Corp., 1.408%, 6/26/2039 | 100,000 | 76,479 | ||

| $952,876 | ||||

| Entertainment – 2.4% | ||||

| Carnival Corp. PLC, 7.625%, 3/01/2026 (n) | $ | 642,000 | $645,481 | |

| Carnival Corp. PLC, 5.75%, 3/01/2027 (n) | 989,000 | 970,785 | ||

| Carnival Corp. PLC, 4%, 8/01/2028 (n) | 366,000 | 337,823 | ||

| Carnival Corp. PLC, 6%, 5/01/2029 (n) | 367,000 | 358,688 | ||

| Carnival Corp. PLC, 5.75%, 1/15/2030 (n) | EUR | 260,000 | 286,683 | |

| Merlin Entertainments, 7.375%, 2/15/2031 (n) | $ | 734,000 | 743,924 | |

| NCL Corp. Ltd., 5.875%, 3/15/2026 (n) | 659,000 | 647,950 | ||

| Royal Caribbean Cruises Ltd., 5.375%, 7/15/2027 (n) | 566,000 | 554,557 | ||

| Royal Caribbean Cruises Ltd., 5.5%, 4/01/2028 (n) | 360,000 | 351,689 | ||

| SeaWorld Parks & Entertainment, 5.25%, 8/15/2029 (n) | 403,000 | 376,847 | ||

| Six Flags Entertainment Corp., 6.625%, 5/01/2032 (n) | 747,000 | 747,544 | ||

| Viking Cruises Ltd. Co., 5.875%, 9/15/2027 (n) | 228,000 | 222,617 | ||

| Viking Ocean Cruises Ship VII Ltd., 5.625%, 2/15/2029 (n) | 625,000 | 599,388 | ||

| $6,843,976 | ||||

| Financial Institutions – 3.7% | ||||

| Avation Capital S.A., 8.25% (8.25% Cash or 9% PIK), 10/31/2026 (n)(p) | $ | 574,138 | $506,625 | |

| Avolon Holdings Funding Ltd., 4.375%, 5/01/2026 (n) | 69,000 | 67,014 | ||

| Citycon Treasury B.V., 6.5%, 3/08/2029 | EUR | 100,000 | 108,184 | |

| Credit Acceptance Corp., 9.25%, 12/15/2028 (n) | $ | 690,000 | 728,452 | |

| Encore Capital Group, Inc., 9.25%, 4/01/2029 (n) | 558,000 | 580,707 | ||

| Freedom Mortgage Corp., 7.625%, 5/01/2026 (n) | 570,000 | 566,351 | ||

| Freedom Mortgage Holdings LLC, 9.25%, 2/01/2029 (n) | 143,000 | 144,442 | ||

| FTAI Aviation Ltd., 5.5%, 5/01/2028 (n) | 657,000 | 634,993 | ||

| FTAI Aviation Ltd., 7.875%, 12/01/2030 (n) | 407,000 | 425,296 | ||

| Global Aircraft Leasing Co. Ltd., 6.5% (6.5% Cash or 7.25% PIK), 9/15/2024 (n)(p) | 1,590,325 | 1,512,827 | ||

| Heimstaden Bostad Treasury B.V., 1%, 4/13/2028 | EUR | 100,000 | 87,581 | |

| Jefferson Capital Holdings LLC, 9.5%, 2/15/2029 (n) | $ | 509,000 | 523,488 | |

| Macquarie AirFinance Holdings Ltd., 8.375%, 5/01/2028 (n) | 762,000 | 801,282 | ||

| Macquarie AirFinance Holdings Ltd., 6.4%, 3/26/2029 (n) | 107,000 | 108,125 | ||

| Macquarie AirFinance Holdings Ltd., 8.125%, 3/30/2029 (n) | 126,000 | 132,674 | ||

| Muthoot Finance Ltd., 7.125%, 2/14/2028 (n) | 231,000 | 232,000 | ||

| Nationstar Mortgage Holdings, Inc., 6%, 1/15/2027 (n) | 991,000 | 977,444 | ||

| OneMain Finance Corp., 6.875%, 3/15/2025 | 566,000 | 570,037 | ||

| Issuer | Shares/Par | Value ($) | ||

| Bonds – continued | ||||

| Financial Institutions – continued | ||||

| OneMain Finance Corp., 7.125%, 3/15/2026 | $ | 763,000 | $774,200 | |

| OneMain Finance Corp., 5.375%, 11/15/2029 | 403,000 | 374,796 | ||

| OneMain Finance Corp., 7.5%, 5/15/2031 | 416,000 | 416,135 | ||

| Samhallsbyggnadsbolaget i Norden AB, 3%, 1/14/2025 | EUR | 100,000 | 100,402 | |

| Samhallsbyggnadsbolaget i Norden AB, 2.375%, 9/04/2026 | 100,000 | 83,549 | ||

| Samhallsbyggnadsbolaget i Norden AB, 2.875% to 1/30/2027, FLR (EUR Swap Rate - 5yr. + 3.223%) to 1/30/2032, FLR (EUR Swap Rate - 5yr. + 3.473%) to 1/30/2047, FLR (EUR Swap Rate - 5yr. + 4.473%) to 1/30/2171 | 280,000 | 96,230 | ||

| $10,552,834 | ||||

| Food & Beverages – 2.8% | ||||

| Anheuser-Busch InBev S.A/N.V., 3.95%, 3/22/2044 | EUR | 100,000 | $105,936 | |

| Anheuser-Busch InBev Worldwide, Inc., 4.375%, 4/15/2038 | $ | 144,000 | 130,066 | |

| Anheuser-Busch InBev Worldwide, Inc., 5.55%, 1/23/2049 | 42,000 | 42,067 | ||

| B&G Foods, Inc., 5.25%, 9/15/2027 | 406,000 | 372,607 | ||

| B&G Foods, Inc., 8%, 9/15/2028 (n) | 216,000 | 219,222 | ||

| Bacardi-Martini B.V., 5.4%, 6/15/2033 (n) | 129,000 | 125,296 | ||

| Central American Bottling Corp., 5.25%, 4/27/2029 (n) | 755,000 | 710,062 | ||

| Chobani LLC/Chobani Finance Corp., 7.625%, 7/01/2029 (n) | 285,000 | 290,333 | ||

| Coca-Cola Co., 3.125%, 5/14/2032 | EUR | 100,000 | 105,922 | |

| Constellation Brands, Inc., 3.15%, 8/01/2029 | $ | 32,000 | 28,905 | |

| Constellation Brands, Inc., 2.25%, 8/01/2031 | 53,000 | 43,262 | ||

| Fiesta Purchaser, Inc., 7.875%, 3/01/2031 (n) | 460,000 | 472,641 | ||

| JBS USA Food Co., 6.5%, 12/01/2052 | 43,000 | 43,138 | ||

| JBS USA Lux S.A./JBS USA Food Co./JBS USA Finance, Inc., 3.625%, 1/15/2032 | 781,000 | 669,657 | ||

| Kraft Heinz Foods Co., 4.375%, 6/01/2046 | 94,000 | 77,053 | ||

| Performance Food Group Co., 5.5%, 10/15/2027 (n) | 781,000 | 761,198 | ||

| Pernod Ricard S.A., 3.375%, 11/07/2030 | EUR | 100,000 | 106,346 | |

| Post Holdings, Inc., 5.625%, 1/15/2028 (n) | $ | 555,000 | 542,268 | |

| Post Holdings, Inc., 4.625%, 4/15/2030 (n) | 935,000 | 849,038 | ||

| Primo Water Holding, Inc., 4.375%, 4/30/2029 (n) | 1,014,000 | 929,777 | ||

| TreeHouse Foods, Inc., 4%, 9/01/2028 | 461,000 | 410,521 | ||

| U.S. Foods Holding Corp., 4.75%, 2/15/2029 (n) | 783,000 | 734,956 | ||

| United Natural Foods, Inc., 6.75%, 10/15/2028 (n) | 267,000 | 220,359 | ||

| $7,990,630 | ||||

| Gaming & Lodging – 3.2% | ||||

| Caesars Entertainment, Inc., 4.625%, 10/15/2029 (n) | $ | 310,000 | $280,059 | |

| Caesars Entertainment, Inc., 7%, 2/15/2030 (n) | 643,000 | 649,945 | ||

| Caesars Resort Collection LLC/CRC Finco, Inc., 8.125%, 7/01/2027 (n) | 497,000 | 506,687 | ||

| Issuer | Shares/Par | Value ($) | ||

| Bonds – continued | ||||

| Gaming & Lodging – continued | ||||

| CCM Merger, Inc., 6.375%, 5/01/2026 (n) | $ | 591,000 | $586,640 | |

| CDI Escrow Issuer, Inc., 5.75%, 4/01/2030 (n) | 991,000 | 950,540 | ||

| Flutter Treasury DAC, 5%, 4/29/2029 (n) | EUR | 203,000 | 223,079 | |

| Flutter Treasury DAC, 6.375%, 4/29/2029 (n) | $ | 200,000 | 201,022 | |

| Hilton Domestic Operating Co., Inc., 4.875%, 1/15/2030 | 1,038,000 | 981,397 | ||

| Las Vegas Sands Corp., 3.9%, 8/08/2029 | 89,000 | 80,850 | ||

| Las Vegas Sands Corp., 6.2%, 8/15/2034 | 298,000 | 300,292 | ||

| Marriott International, Inc., 2.85%, 4/15/2031 | 90,000 | 76,473 | ||

| Penn National Gaming, Inc., 4.125%, 7/01/2029 (n) | 509,000 | 424,786 | ||

| Studio City Finance Ltd., 5%, 1/15/2029 (n) | 342,000 | 297,882 | ||

| VICI Properties LP, REIT, 4.95%, 2/15/2030 | 47,000 | 45,025 | ||

| Wyndham Hotels & Resorts, Inc., 4.375%, 8/15/2028 (n) | 1,040,000 | 964,771 | ||

| Wynn Macau Ltd., 5.5%, 10/01/2027 (n) | 705,000 | 670,143 | ||

| Wynn Macau Ltd., 5.625%, 8/26/2028 (n) | 883,000 | 825,161 | ||

| Wynn Resorts Finance LLC/Wynn Resorts Capital Corp., 5.125%, 10/01/2029 (n) | 727,000 | 683,702 | ||

| Wynn Resorts Finance LLC/Wynn Resorts Capital Corp., 7.125%, 2/15/2031 (n) | 286,000 | 293,661 | ||

| $9,042,115 | ||||

| Industrial – 1.1% | ||||

| Albion Financing 1 S.à r.l., 6.125%, 10/15/2026 (n) | $ | 200,000 | $196,793 | |

| Albion Financing 2 S.à r.l., 8.75%, 4/15/2027 (n) | 635,000 | 640,590 | ||

| APi Escrow Corp., 4.75%, 10/15/2029 (n) | 1,016,000 | 931,807 | ||

| Arcadis N.V., 4.875%, 2/28/2028 | EUR | 100,000 | 111,166 | |

| Artera Services LLC, 8.5%, 2/15/2031 (n) | $ | 459,000 | 468,997 | |

| Trustees of the University of Pennsylvania, 2.396%, 10/01/2050 | 35,000 | 20,860 | ||

| Williams Scotsman International, Inc., 4.625%, 8/15/2028 (n) | 887,000 | 828,210 | ||

| $3,198,423 | ||||

| Insurance – 0.1% | ||||

| Corebridge Financial, Inc., 4.35%, 4/05/2042 | $ | 101,000 | $83,265 | |

| Lincoln National Corp., 5.852%, 3/15/2034 | 109,000 | 108,424 | ||

| Sammons Financial Group, Inc., 6.875%, 4/15/2034 (n) | 62,000 | 63,026 | ||

| $254,715 | ||||

| Insurance - Health – 0.1% | ||||

| Elevance Health, Inc., 5.375%, 6/15/2034 | $ | 80,000 | $79,766 | |

| UnitedHealth Group, Inc., 3.25%, 5/15/2051 | 74,000 | 50,694 | ||

| $130,460 | ||||

| Issuer | Shares/Par | Value ($) | ||

| Bonds – continued | ||||

| Insurance - Property & Casualty – 2.7% | ||||

| Acrisure LLC/Acrisure Finance, Inc., 8.25%, 2/01/2029 (n) | $ | 344,000 | $345,661 | |

| Acrisure LLC/Acrisure Finance, Inc., 6%, 8/01/2029 (n) | 116,000 | 105,735 | ||

| Alliant Holdings Intermediate LLC/Alliant Holdings Co-Issuer, 6.75%, 10/15/2027 (n) | 470,000 | 460,671 | ||

| Alliant Holdings Intermediate LLC/Alliant Holdings Co-Issuer, 5.875%, 11/01/2029 (n) | 692,000 | 643,704 | ||

| Alliant Holdings Intermediate LLC/Alliant Holdings Co-Issuer, 7%, 1/15/2031 (n) | 450,000 | 451,176 | ||

| American International Group, Inc., 5.125%, 3/27/2033 | 87,000 | 85,383 | ||

| AmWINS Group Benefits, Inc., 4.875%, 6/30/2029 (n) | 576,000 | 529,455 | ||

| Ardonagh Finco Ltd., 7.75%, 2/15/2031 (n) | 701,000 | 696,124 | ||

| Arthur J. Gallagher & Co., 6.5%, 2/15/2034 | 45,000 | 47,574 | ||

| Arthur J. Gallagher & Co., 6.75%, 2/15/2054 | 60,000 | 66,021 | ||

| AssuredPartners, Inc., 5.625%, 1/15/2029 (n) | 459,000 | 427,138 | ||

| Baldwin Insurance Group Holdings LLC, 7.125%, 5/15/2031 (n) | 637,000 | 643,254 | ||

| Fairfax Financial Holdings Ltd., 4.25%, 12/06/2027 | CAD | 175,000 | 125,307 | |

| Fairfax Financial Holdings Ltd., 6.35%, 3/22/2054 (n) | $ | 71,000 | 71,378 | |

| GTCR (AP) Finance, Inc., 8%, 5/15/2027 (n) | 484,000 | 484,527 | ||

| Hub International Ltd., 5.625%, 12/01/2029 (n) | 287,000 | 266,277 | ||

| Hub International Ltd., 7.25%, 6/15/2030 (n) | 866,000 | 879,881 | ||

| Hub International Ltd., 7.375%, 1/31/2032 (n) | 390,000 | 391,384 | ||

| Panther Escrow Issuer, 7.125%, 6/01/2031 (n) | 836,000 | 842,957 | ||

| QBE Insurance Group Ltd., 2.5% to 9/13/2028, FLR (GBP Government Yield - 5yr. + 2.061%) to 9/13/2038 | GBP | 100,000 | 108,868 | |

| $7,672,475 | ||||

| International Market Quasi-Sovereign – 0.3% | ||||

| Deutsche Bahn Finance GmbH (Federal Republic of Germany), 3.375%, 1/29/2038 | EUR | 20,000 | $21,026 | |

| EnBW International Finance B.V. (Federal Republic of Germany), 3.5%, 7/24/2028 | 90,000 | 97,283 | ||

| La Banque Postale (Republic of France), 3.5%, 6/13/2030 | 100,000 | 106,975 | ||

| Landsbankinn hf. (Republic of Iceland), 5%, 5/13/2028 | 100,000 | 109,809 | ||

| Logicor Financing S.à r.l. (Grand Duchy of Luxembourg), 1.625%, 1/17/2030 | 110,000 | 101,225 | ||

| NBN Co. Ltd. (Commonwealth of Australia), 5.75%, 10/06/2028 (n) | $ | 200,000 | 204,800 | |

| NBN Co. Ltd. (Commonwealth of Australia), 3.75%, 3/22/2034 | EUR | 100,000 | 107,311 | |

| P3 Group S.à r.l. (Grand Duchy of Luxembourg), 1.625%, 1/26/2029 | 100,000 | 95,258 | ||

| Issuer | Shares/Par | Value ($) | ||

| Bonds – continued | ||||

| International Market Quasi-Sovereign – continued | ||||

| Swisscom Finance, 3.5%, 11/29/2031 | EUR | 100,000 | $107,711 | |

| $951,398 | ||||

| International Market Sovereign – 10.6% | ||||

| Commonwealth of Australia, 3.25%, 6/21/2039 | AUD | 14,422,000 | $8,185,910 | |

| Commonwealth of Australia, 2.75%, 5/21/2041 | 960,000 | 494,882 | ||

| Government of Bermuda, 2.375%, 8/20/2030 (n) | $ | 200,000 | 166,400 | |

| Government of Bermuda, 5%, 7/15/2032 (n) | 560,000 | 535,528 | ||

| Government of Canada, 1.25%, 6/01/2030 | CAD | 882,000 | 565,141 | |

| Government of Canada, 1.5%, 6/01/2031 | 2,484,000 | 1,583,968 | ||

| Government of Canada, 2%, 6/01/2032 | 1,037,000 | 674,691 | ||

| Government of Japan, 2.4%, 12/20/2034 | JPY | 407,000,000 | 2,911,021 | |

| Government of Japan, 0.3%, 12/20/2039 | 196,350,000 | 1,027,640 | ||

| Government of Japan, 0.4%, 3/20/2050 | 159,900,000 | 679,355 | ||

| Government of Japan, 0.7%, 12/20/2051 | 308,500,000 | 1,387,205 | ||

| Government of New Zealand, 3.5%, 4/14/2033 | NZD | 372,000 | 207,654 | |

| Kingdom of Belgium, 2.85%, 10/22/2034 (n) | EUR | 375,000 | 394,807 | |

| Kingdom of Belgium, 0.4%, 6/22/2040 | 347,000 | 237,127 | ||

| Kingdom of Spain, 3.25%, 4/30/2034 | 1,075,000 | 1,153,521 | ||

| Kingdom of Spain, 3.45%, 10/31/2034 (n)(w) | 477,000 | 518,771 | ||

| Kingdom of Spain, 3.9%, 7/30/2039 (n) | 1,075,000 | 1,192,680 | ||

| Kingdom of Spain, 1%, 10/31/2050 | 650,000 | 375,676 | ||

| Kingdom of Spain, 4%, 10/31/2054 | 462,000 | 501,854 | ||

| Republic of Italy, 4.1%, 2/01/2029 | 2,571,000 | 2,864,704 | ||

| Republic of Italy, 1.45%, 3/01/2036 | 1,295,000 | 1,070,626 | ||

| Republic of Italy, 4.15%, 10/01/2039 (n) | 1,736,000 | 1,865,676 | ||

| United Kingdom Treasury, 0.375%, 10/22/2030 | GBP | 398,000 | 401,027 | |

| United Kingdom Treasury, 1.25%, 10/22/2041 | 506,000 | 386,927 | ||

| United Kingdom Treasury, 1.5%, 7/22/2047 | 130,000 | 90,993 | ||

| United Kingdom Treasury, 3.75%, 7/22/2052 | 515,000 | 556,491 | ||

| $30,030,275 | ||||

| Local Authorities – 0.0% | ||||

| Province of Alberta, 1.65%, 6/01/2031 | CAD | 95,000 | $59,346 | |

| Province of British Columbia, 2.95%, 6/18/2050 | 115,000 | 64,473 | ||

| $123,819 | ||||

| Machinery & Tools – 0.8% | ||||

| AGCO Corp., 5.8%, 3/21/2034 | $ | 102,000 | $101,821 | |

| CNH Industrial Capital LLC, 5.5%, 1/12/2029 | 71,000 | 71,519 | ||

| Ritchie Bros Holdings, Inc., 7.75%, 3/15/2031 (n) | 1,288,000 | 1,344,412 | ||

| Sarens Finance Co. N.V., 5.75%, 2/21/2027 | EUR | 110,000 | 116,169 | |

| Issuer | Shares/Par | Value ($) | ||

| Bonds – continued | ||||

| Machinery & Tools – continued | ||||

| Terex Corp., 5%, 5/15/2029 (n) | $ | 682,000 | $641,422 | |

| $2,275,343 | ||||

| Major Banks – 1.3% | ||||

| Banca Popolare Sondrio, 4.125%, 6/04/2030 (w) | EUR | 100,000 | $107,711 | |

| Bank of America Corp., 5.202% to 4/25/2028, FLR (SOFR - 1 day + 1.63%) to 4/25/2029 | $ | 100,000 | 99,460 | |

| Bank of America Corp., 2.687% to 4/22/2031, FLR (SOFR - 1 day + 1.32%) to 4/22/2032 | 92,000 | 77,320 | ||

| BPER Banca S.p.A., 4%, 5/22/2031 | EUR | 100,000 | 107,247 | |

| Commonwealth Bank of Australia, 2.688%, 3/11/2031 (n) | $ | 221,000 | 182,317 | |

| ING Groep N.V., 4.375%, 8/15/2034 | EUR | 100,000 | 107,515 | |

| JPMorgan Chase & Co., 1.47% to 9/22/2026, FLR (SOFR - 1 day + 0.765%) to 9/22/2027 | $ | 44,000 | 40,265 | |

| JPMorgan Chase & Co., 5.04% to 1/23/2027, FLR (SOFR - 1 day + 1.19%) to 1/23/2028 | 66,000 | 65,439 | ||

| JPMorgan Chase & Co., 5.581% to 4/22/2029, FLR (SOFR - 1 day + 1.16%) to 4/22/2030 | 59,000 | 59,642 | ||

| JPMorgan Chase & Co., 1.953% to 2/04/2031, FLR (SOFR - 1 day + 1.065%) to 2/04/2032 | 108,000 | 87,423 | ||

| JPMorgan Chase & Co., 3.761% to 3/21/2033, FLR (EURIBOR - 3mo. + 0.98%) to 3/21/2034 | EUR | 100,000 | 107,309 | |

| JPMorgan Chase & Co., 3.328% to 4/22/2051, FLR (SOFR - 1 day + 1.58%) to 4/22/2052 | $ | 28,000 | 19,782 | |

| Lloyds Banking Group PLC, 4.75% to 9/21/2030, FLR (EUR Swap Rate - 1yr. + 1.6%) to 9/21/2031 | EUR | 100,000 | 112,818 | |

| Lloyds Banking Group PLC, 3.875%, 5/14/2032 | 100,000 | 107,418 | ||

| Morgan Stanley, 3.622% to 4/01/2030, FLR (SOFR - 1 day + 3.12%) to 4/01/2031 | $ | 154,000 | 140,570 | |

| Morgan Stanley, 5.424% to 7/21/2033, FLR (SOFR - 1 day + 1.88%) to 7/21/2034 | 43,000 | 42,555 | ||

| Morgan Stanley, 3.955% to 3/21/2034, FLR (EURIBOR - 3mo. + 1.242%) to 3/21/2035 | EUR | 100,000 | 107,629 | |

| Nationwide Building Soceity, 4.015%, 5/02/2027 | 100,000 | 108,559 | ||

| NatWest Group PLC, 8.125% to 5/10/2034, FLR (CMT - 5yr. + 3.752%) to 6/30/2172 | $ | 200,000 | 202,806 | |

| NatWest Markets PLC, 3.625%, 1/09/2029 | EUR | 100,000 | 107,820 | |

| PNC Financial Services Group, Inc., 5.3% to 1/21/2027, FLR (SOFR - 1 day + 1.342%) to 1/21/2028 | $ | 46,000 | 45,868 | |

| PNC Financial Services Group, Inc., 5.676% to 1/22/2034, FLR (SOFR - 1 day + 1.902%) to 1/22/2035 | 55,000 | 55,002 | ||

| Toronto-Dominion Bank, 3.563%, 4/16/2031 | EUR | 100,000 | 106,622 | |

| Issuer | Shares/Par | Value ($) | ||

| Bonds – continued | ||||

| Major Banks – continued | ||||

| Toronto-Dominion Bank, 8.125% to 10/31/2027, FLR (CMT - 5yr. + 4.075%) to 10/31/2082 | $ | 985,000 | $1,020,891 | |

| UBS Group AG, 2.746% to 2/11/2032, FLR (CMT - 1yr. + 1.1%) to 2/11/2033 (n) | 200,000 | 163,457 | ||

| UniCredit S.p.A., 4.3%, 1/23/2031 | EUR | 150,000 | 163,415 | |

| Wells Fargo & Co., 3.526% to 3/24/2027, FLR (SOFR - 1 day + 1.51%) to 3/24/2028 | $ | 45,000 | 42,786 | |

| Wells Fargo & Co., 3.35% to 3/02/2032, FLR (SOFR - 1 day + 1.5%) to 3/02/2033 | 69,000 | 59,501 | ||

| $3,649,147 | ||||

| Medical & Health Technology & Services – 4.2% | ||||

| 180 Medical, Inc., 3.875%, 10/15/2029 (n) | $ | 965,000 | $867,945 | |

| Avantor Funding, Inc., 4.625%, 7/15/2028 (n) | 1,108,000 | 1,042,645 | ||

| Bausch & Lomb Escrow Corp., 8.375%, 10/01/2028 (n) | 486,000 | 494,505 | ||

| CAB SELAS, 3.375%, 2/01/2028 | EUR | 100,000 | 97,540 | |

| Charles River Laboratories International, Inc., 3.75%, 3/15/2029 (n) | $ | 1,070,000 | 967,870 | |

| CHS/Community Health Systems, Inc., 8%, 12/15/2027 (n) | 426,000 | 426,162 | ||

| CHS/Community Health Systems, Inc., 6.125%, 4/01/2030 (n) | 454,000 | 323,738 | ||

| CHS/Community Health Systems, Inc., 5.25%, 5/15/2030 (n) | 1,146,000 | 951,297 | ||

| CVS Health Corp., 5.625%, 2/21/2053 | 16,000 | 14,838 | ||

| Encompass Health Corp., 5.75%, 9/15/2025 | 244,000 | 243,013 | ||

| Encompass Health Corp., 4.75%, 2/01/2030 | 680,000 | 629,371 | ||

| Encompass Health Corp., 4.625%, 4/01/2031 | 120,000 | 108,463 | ||

| HCA, Inc., 5.125%, 6/15/2039 | 54,000 | 50,132 | ||

| ICON Investments Six DAC, 5.809%, 5/08/2027 | 200,000 | 201,535 | ||

| IQVIA, Inc., 5%, 5/15/2027 (n) | 1,010,000 | 981,120 | ||

| IQVIA, Inc., 6.5%, 5/15/2030 (n) | 600,000 | 605,942 | ||

| Lifepoint Health, Inc., 9.875%, 8/15/2030 (n) | 286,000 | 306,016 | ||

| Lifepoint Health, Inc., 11%, 10/15/2030 (n) | 341,000 | 375,661 | ||

| Lifepoint Health, Inc., 10%, 6/01/2032 (n) | 464,000 | 465,684 | ||

| New York Society for the Relief of the Ruptured & Crippled, 2.667%, 10/01/2050 | 179,000 | 111,194 | ||

| ProMedica Toledo Hospital, “B”, AGM, 6.015%, 11/15/2048 | 142,000 | 141,020 | ||

| Surgery Center Holdings, Inc., 7.25%, 4/15/2032 (n) | 512,000 | 515,842 | ||

| Tenet Healthcare Corp., 6.125%, 10/01/2028 | 484,000 | 479,450 | ||

| Tenet Healthcare Corp., 4.375%, 1/15/2030 | 416,000 | 382,553 | ||

| Tenet Healthcare Corp., 6.125%, 6/15/2030 | 726,000 | 719,583 | ||

| U.S. Acute Care Solutions LLC, 9.75%, 5/15/2029 (n) | 465,000 | 448,306 | ||

| $11,951,425 | ||||

| Issuer | Shares/Par | Value ($) | ||

| Bonds – continued | ||||

| Medical Equipment – 0.7% | ||||

| American Medical Systems Europe B.V., 3.5%, 3/08/2032 | EUR | 100,000 | $106,353 | |

| Garden SpinCo Corp., 8.625%, 7/20/2030 (n) | $ | 620,000 | 662,415 | |

| Medline Borrower LP, 3.875%, 4/01/2029 (n) | 290,000 | 263,951 | ||

| Medline Borrower LP, 5.25%, 10/01/2029 (n) | 848,000 | 799,390 | ||

| $1,832,109 | ||||

| Metals & Mining – 2.0% | ||||

| Anglo American Capital PLC, 4.125%, 3/15/2032 | EUR | 100,000 | $107,420 | |

| Baffinland Iron Mines Corp./Baffinland Iron Mines LP, 8.75%, 7/15/2026 (n) | $ | 742,000 | 674,686 | |

| FMG Resources Ltd., 5.875%, 4/15/2030 (n) | 130,000 | 126,097 | ||

| FMG Resources Ltd., 4.375%, 4/01/2031 (n) | 1,766,000 | 1,567,838 | ||

| Glencore Capital Finance DAC, 4.154%, 4/29/2031 | EUR | 110,000 | 118,183 | |

| GrafTech Finance, Inc., 4.625%, 12/15/2028 (n) | $ | 797,000 | 516,116 | |

| Kaiser Aluminum Corp., 4.625%, 3/01/2028 (n) | 514,000 | 478,175 | ||

| Novelis Corp., 3.25%, 11/15/2026 (n) | 486,000 | 453,757 | ||

| Novelis Corp., 4.75%, 1/30/2030 (n) | 784,000 | 724,350 | ||

| Novelis Corp., 3.875%, 8/15/2031 (n) | 248,000 | 212,330 | ||

| Petra Diamonds US$ Treasury PLC, 9.75%, 3/08/2026 (n) | 373,170 | 271,339 | ||

| Taseko Mines Ltd., 8.25%, 5/01/2030 (n) | 457,000 | 468,466 | ||

| $5,718,757 | ||||

| Midstream – 4.0% | ||||

| Columbia Pipelines Operating Co. LLC, 6.036%, 11/15/2033 (n) | $ | 45,000 | $45,868 | |

| Columbia Pipelines Operating Co. LLC, 6.544%, 11/15/2053 (n) | 72,000 | 76,288 | ||

| DT Midstream, Inc., 4.125%, 6/15/2029 (n) | 863,000 | 789,172 | ||

| DT Midstream, Inc., 4.375%, 6/15/2031 (n) | 862,000 | 774,281 | ||

| Enbridge, Inc., 5.7%, 3/08/2033 | 42,000 | 42,146 | ||

| Enbridge, Inc., 8.5% to 1/15/2034, FLR (CMT - 5yr. + 4.431%) to 1/15/2054, FLR (CMT - 5yr. + 5.181%) to 1/15/2084 | 74,000 | 79,528 | ||

| Energy Transfer LP, 5.95%, 5/15/2054 | 60,000 | 57,726 | ||

| EQM Midstream Partners LP, 5.5%, 7/15/2028 | 961,000 | 942,317 | ||

| EQM Midstream Partners LP, 6.375%, 4/01/2029 (n) | 229,000 | 228,578 | ||

| Kinetik Holdings, Inc., 5.875%, 6/15/2030 (n) | 793,000 | 772,769 | ||

| NuStar Logistics, LP, 6.375%, 10/01/2030 | 683,000 | 680,929 | ||

| Peru LNG, 5.375%, 3/22/2030 | 518,000 | 438,415 | ||

| Prairie Acquiror LP, 9%, 8/01/2029 (n) | 290,000 | 298,025 | ||

| Sunoco LP, 7.25%, 5/01/2032 (n) | 580,000 | 593,795 | ||

| Tallgrass Energy Partners LP, 5.5%, 1/15/2028 (n) | 953,000 | 908,986 | ||

| Tallgrass Energy Partners LP, 7.375%, 2/15/2029 (n) | 444,000 | 445,179 | ||

| Targa Resources Corp., 4.2%, 2/01/2033 | 11,000 | 9,871 | ||

| Issuer | Shares/Par | Value ($) | ||

| Bonds – continued | ||||

| Midstream – continued | ||||

| Targa Resources Corp., 4.95%, 4/15/2052 | $ | 79,000 | $67,191 | |

| Venture Global Calcasieu Pass LLC, 3.875%, 8/15/2029 (n) | 632,000 | 569,183 | ||

| Venture Global Calcasieu Pass LLC, 6.25%, 1/15/2030 (n) | 410,000 | 410,986 | ||

| Venture Global Calcasieu Pass LLC, 4.125%, 8/15/2031 (n) | 627,000 | 553,747 | ||

| Venture Global LNG, Inc., 8.125%, 6/01/2028 (n) | 833,000 | 851,321 | ||

| Venture Global LNG, Inc., 9.5%, 2/01/2029 (n) | 706,000 | 765,672 | ||

| Venture Global LNG, Inc., 8.375%, 6/01/2031 (n) | 886,000 | 913,643 | ||

| $11,315,616 | ||||

| Mortgage-Backed – 3.0% | ||||

| Fannie Mae, 6.5%, 4/01/2032 - 1/01/2033 | $ | 11,891 | $12,122 | |

| Fannie Mae, 5.5%, 7/01/2033 - 7/01/2035 | 47,642 | 47,854 | ||

| Fannie Mae, 6%, 8/01/2034 - 2/01/2037 | 23,252 | 23,716 | ||

| Fannie Mae, 3.5%, 12/01/2047 | 36,727 | 33,172 | ||

| Fannie Mae, UMBS, 2%, 4/01/2042 - 5/01/2052 | 531,340 | 419,506 | ||

| Fannie Mae, UMBS, 6.5%, 2/01/2043 | 38,486 | 39,119 | ||

| Fannie Mae, UMBS, 3.5%, 5/01/2049 - 7/01/2050 | 116,489 | 104,200 | ||

| Fannie Mae, UMBS, 2.5%, 1/01/2050 - 4/01/2052 | 797,161 | 646,362 | ||

| Fannie Mae, UMBS, 3%, 12/01/2051 | 19,560 | 16,660 | ||

| Fannie Mae, UMBS, 5%, 8/01/2052 | 167,968 | 161,908 | ||

| Fannie Mae, UMBS, 4%, 10/01/2052 | 470,443 | 427,493 | ||

| Fannie Mae, UMBS, 5.5%, 11/01/2052 | 111,920 | 110,434 | ||

| Fannie Mae, UMBS, 6%, 11/01/2053 | 95,462 | 95,608 | ||

| Freddie Mac, 0.181%, 2/25/2025 (i) | 38,000,000 | 46,793 | ||

| Freddie Mac, 1.366%, 3/25/2027 (i) | 448,000 | 15,127 | ||

| Freddie Mac, 0.124%, 2/25/2028 (i) | 36,576,000 | 194,742 | ||

| Freddie Mac, 0.293%, 2/25/2028 (i) | 15,572,000 | 170,521 | ||

| Freddie Mac, 0.107%, 4/25/2028 (i) | 15,983,000 | 86,065 | ||

| Freddie Mac, 5.972%, 3/25/2029 | 175,747 | 176,501 | ||

| Freddie Mac, 1.09%, 7/25/2029 (i) | 1,875,185 | 85,401 | ||

| Freddie Mac, 5.961%, 7/25/2029 - 9/25/2029 | 321,010 | 321,858 | ||

| Freddie Mac, 5.962%, 8/25/2029 | 159,221 | 159,577 | ||

| Freddie Mac, 1.798%, 4/25/2030 (i) | 845,640 | 75,034 | ||

| Freddie Mac, 1.868%, 4/25/2030 (i) | 731,897 | 67,058 | ||

| Freddie Mac, 1.666%, 5/25/2030 (i) | 896,340 | 75,761 | ||

| Freddie Mac, 1.797%, 5/25/2030 (i) | 2,034,877 | 182,732 | ||

| Freddie Mac, 1.341%, 6/25/2030 (i) | 821,458 | 55,841 | ||

| Freddie Mac, 1.599%, 8/25/2030 (i) | 719,995 | 59,305 | ||

| Freddie Mac, 1.169%, 9/25/2030 (i) | 455,646 | 27,846 | ||

| Freddie Mac, 1.081%, 11/25/2030 (i) | 901,677 | 52,187 | ||

| Freddie Mac, 4.94%, 11/25/2030 | 227,690 | 227,582 | ||

| Freddie Mac, 0.326%, 1/25/2031 (i) | 3,177,178 | 52,343 | ||

| Freddie Mac, 0.514%, 3/25/2031 (i) | 3,727,599 | 100,848 | ||

| Issuer | Shares/Par | Value ($) | ||

| Bonds – continued | ||||

| Mortgage-Backed – continued | ||||

| Freddie Mac, 0.938%, 7/25/2031 (i) | $ | 670,491 | $37,558 | |

| Freddie Mac, 0.536%, 9/25/2031 (i) | 2,699,427 | 85,845 | ||

| Freddie Mac, 0.568%, 12/25/2031 (i) | 659,754 | 22,651 | ||

| Freddie Mac, 6%, 8/01/2034 | 18,559 | 18,937 | ||

| Freddie Mac, UMBS, 4.5%, 7/01/2038 - 11/01/2053 | 207,272 | 197,412 | ||

| Freddie Mac, UMBS, 2.5%, 4/01/2051 - 7/01/2051 | 542,017 | 438,863 | ||

| Freddie Mac, UMBS, 2%, 8/01/2051 - 9/01/2051 | 68,500 | 53,258 | ||

| Freddie Mac, UMBS, 3%, 4/01/2052 | 22,273 | 18,793 | ||

| Freddie Mac, UMBS, 5%, 11/01/2052 | 211,881 | 204,163 | ||

| Freddie Mac, UMBS, 6%, 8/01/2053 | 68,505 | 68,990 | ||

| Freddie Mac, UMBS, 5.5%, 11/01/2053 | 96,619 | 95,106 | ||

| Ginnie Mae, 2.5%, 8/20/2051 - 10/20/2052 | 424,058 | 353,624 | ||

| Ginnie Mae, 2%, 3/20/2052 | 29,968 | 24,044 | ||

| Ginnie Mae, 3%, 6/20/2052 - 11/20/2052 | 66,823 | 57,760 | ||

| Ginnie Mae, 3.5%, 7/20/2052 | 76,625 | 68,385 | ||

| Ginnie Mae, 4%, 7/20/2052 - 11/20/2052 | 102,652 | 94,367 | ||

| Ginnie Mae, 5.5%, 2/20/2053 | 68,252 | 67,758 | ||

| Ginnie Mae, 5%, 3/20/2053 - 4/20/2053 | 189,276 | 183,780 | ||

| Ginnie Mae, 6.473%, 3/20/2064 | 149,298 | 149,743 | ||

| Ginnie Mae, TBA, 2%, 6/15/2054 - 7/15/2054 | 75,000 | 60,132 | ||

| Ginnie Mae, TBA, 3%, 6/15/2054 | 50,000 | 43,187 | ||

| Ginnie Mae, TBA, 5.5%, 6/15/2054 | 25,000 | 24,798 | ||

| Ginnie Mae, TBA, 6%, 6/15/2054 | 50,000 | 50,306 | ||

| Ginnie Mae, TBA, 6.5%, 6/15/2054 | 75,000 | 76,129 | ||

| UMBS, TBA, 4.5%, 6/15/2039 | 75,000 | 73,151 | ||

| UMBS, TBA, 3%, 6/25/2054 - 7/25/2054 | 775,000 | 651,833 | ||

| UMBS, TBA, 2%, 7/25/2054 | 1,275,000 | 984,472 | ||

| $8,576,321 | ||||

| Municipals – 0.4% | ||||

| Iowa Student Loan Liquidity Corp. Rev., Taxable, “A”, 5.08%, 12/01/2039 | $ | 100,000 | $96,228 | |

| Massachusetts Educational Financing Authority, Education Loan Rev., Taxable, Issue M, “A”, 2.641%, 7/01/2037 | 145,000 | 129,419 | ||

| Massachusetts Educational Financing Authority, Education Loan Rev., Taxable, Issue M, “A”, 4.949%, 7/01/2038 | 185,000 | 176,055 | ||

| Massachusetts Housing Finance Agency, Single Family Housing Rev., Taxable, “226”, 5.562%, 12/01/2052 | 150,000 | 148,568 | ||

| Michigan Finance Authority Hospital Rev., Taxable (Trinity Health Credit Group), 3.384%, 12/01/2040 | 70,000 | 56,468 | ||

| Minnesota Housing Finance Agency, Residential Housing, Taxable, “G”, 4.337%, 1/01/2047 | 190,000 | 181,142 | ||

| Issuer | Shares/Par | Value ($) | ||

| Bonds – continued | ||||

| Municipals – continued | ||||

| Oklahoma Development Finance Authority, Health System Rev., Taxable (OU Medicine Project), “C”, 5.45%, 8/15/2028 | $ | 246,000 | $231,309 | |

| Oklahoma Development Finance Authority, Health System Rev., Taxable (OU Medicine Project), “C”, AGM, 4.65%, 8/15/2030 | 221,000 | 206,578 | ||

| $1,225,767 | ||||

| Natural Gas - Distribution – 0.1% | ||||

| ENGIE S.A., 3.875%, 3/06/2036 | EUR | 100,000 | $107,577 | |

| ENGIE S.A., 4.25%, 1/11/2043 | 100,000 | 107,436 | ||

| $215,013 | ||||

| Natural Gas - Pipeline – 0.1% | ||||

| APA Infrastructure Ltd., 3.125%, 7/18/2031 | GBP | 100,000 | $107,727 | |

| APA Infrastructure Ltd., 2.5%, 3/15/2036 | 100,000 | 89,471 | ||

| $197,198 | ||||

| Network & Telecom – 0.5% | ||||

| Iliad Holding S.A.S., 7%, 10/15/2028 (n) | $ | 1,012,000 | $1,002,163 | |

| Iliad Holding S.A.S., 6.875%, 4/15/2031 (n) | EUR | 366,000 | 403,701 | |

| TDC Net A/S, 5.186%, 8/02/2029 | 100,000 | 108,728 | ||

| $1,514,592 | ||||

| Oil Services – 0.5% | ||||

| Nabors Industries Ltd., 7.25%, 1/15/2026 (n) | $ | 346,000 | $346,849 | |

| Nabors Industries Ltd., 7.5%, 1/15/2028 (n) | 172,000 | 163,666 | ||

| Nabors Industries Ltd., 9.125%, 1/31/2030 (n) | 275,000 | 283,963 | ||

| U.S.A. Compression Partners LP/Finance Co., 7.125%, 3/15/2029 (n) | 557,000 | 557,630 | ||

| $1,352,108 | ||||

| Oils – 0.5% | ||||

| FS Luxembourg S.à r.l., 8.875%, 2/12/2031 (n) | $ | 200,000 | $195,448 | |

| PBF Holding Co. LLC/PBF Finance Corp., 6%, 2/15/2028 | 766,000 | 748,493 | ||

| Thaioil Treasury Center Co. Ltd., 5.375%, 11/20/2048 (n) | 355,000 | 323,372 | ||

| $1,267,313 | ||||

| Issuer | Shares/Par | Value ($) | ||

| Bonds – continued | ||||

| Other Banks & Diversified Financials – 0.7% | ||||

| AIB Group PLC, 6.608% to 9/13/2028, FLR (SOFR - 1 day + 2.33%) to 9/13/2029 (n) | $ | 200,000 | $205,633 | |

| Banque Federative du Credit Mutuel S.A., 4.375%, 1/11/2034 | EUR | 100,000 | 107,126 | |

| Banque Federative du Credit Mutuel S.A., 3.75%, 2/03/2034 | 100,000 | 108,221 | ||

| BBVA Bancomer S.A. (Texas), 8.125%, 1/08/2039 (n) | $ | 200,000 | 205,107 | |

| BPCE S.A., 4.5%, 3/15/2025 (n) | 250,000 | 246,769 | ||

| BPCE S.A., 4.125%, 3/08/2033 | EUR | 100,000 | 108,762 | |

| Credit Mutuel Arkea S.A., 3.625%, 10/03/2033 | 100,000 | 106,971 | ||

| Deutsche Bank AG, 3.75% to 1/15/2029, FLR (EURIBOR - 3mo. + 1.25%) to 1/15/2030 | 100,000 | 107,991 | ||

| Deutsche Bank AG, 4% to 6/24/2027, FLR (EUR ICE Swap Rate - 5yr. + 3.3%) to 6/24/2032 | 100,000 | 105,450 | ||

| Intesa Sanpaolo S.p.A., 7.2%, 11/28/2033 (n) | $ | 200,000 | 215,062 | |

| KBC Group N.V., 3.75%, 3/27/2032 | EUR | 100,000 | 107,980 | |

| KBC Group N.V., 6.151% to 3/19/2029, FLR (GBP Government Yield - 5yr. + 2.25%) to 3/19/2034 | GBP | 100,000 | 127,279 | |

| M&T Bank Corp., 4.553% to 8/16/2027, FLR (SOFR - 1 day + 1.78%) to 8/16/2028 | $ | 88,000 | 84,104 | |

| M&T Bank Corp., 6.082% to 3/13/2031, FLR (SOFR - 1 day + 2.26%) to 3/13/2032 | 30,000 | 29,755 | ||

| Macquarie Group Ltd., 6.255% to 12/07/2033, FLR (SOFR - 1 day + 2.303%) to 12/07/2034 (n) | 47,000 | 48,566 | ||

| Truist Financial Corp., 5.435% to 1/24/2029, FLR (SOFR - 1 day + 1.62%) to 1/24/2030 | 41,000 | 40,768 | ||

| Truist Financial Corp., 5.711% to 1/24/2034, FLR (SOFR - 1 day + 1.922%) to 1/24/2035 | 49,000 | 48,688 | ||

| $2,004,232 | ||||

| Pharmaceuticals – 0.8% | ||||

| 1375209 B.C. Ltd., 9%, 1/30/2028 (n) | $ | 456,000 | $440,572 | |

| AbbVie, Inc., 5.35%, 3/15/2044 | 41,000 | 40,365 | ||

| AbbVie, Inc., 5.4%, 3/15/2054 | 51,000 | 50,275 | ||

| Bausch Health Co., Inc., 11%, 9/30/2028 (n) | 462,000 | 403,095 | ||

| Bausch Health Co., Inc., 14%, 10/15/2030 (n) | 90,000 | 68,400 | ||

| Bristol-Myers Squibb Co., 5.5%, 2/22/2044 | 34,000 | 33,649 | ||

| Bristol-Myers Squibb Co., 5.55%, 2/22/2054 | 29,000 | 28,552 | ||

| Johnson & Johnson, 3.55%, 6/01/2044 | EUR | 100,000 | 106,649 | |

| Organon Finance 1 LLC, 4.125%, 4/30/2028 (n) | $ | 454,000 | 419,352 | |

| Organon Finance 1 LLC, 5.125%, 4/30/2031 (n) | 625,000 | 552,317 | ||

| Roche Finance Europe B.V., 3.564%, 5/03/2044 | EUR | 100,000 | 105,320 | |

| $2,248,546 | ||||

| Issuer | Shares/Par | Value ($) | ||

| Bonds – continued | ||||

| Pollution Control – 0.8% | ||||

| GFL Environmental, Inc., 4.25%, 6/01/2025 (n) | $ | 54,000 | $53,382 | |

| GFL Environmental, Inc., 4%, 8/01/2028 (n) | 758,000 | 693,115 | ||

| GFL Environmental, Inc., 4.75%, 6/15/2029 (n) | 200,000 | 186,157 | ||

| GFL Environmental, Inc., 4.375%, 8/15/2029 (n) | 345,000 | 314,838 | ||

| GFL Environmental, Inc., 6.75%, 1/15/2031 (n) | 127,000 | 129,542 | ||

| Stericycle, Inc., 3.875%, 1/15/2029 (n) | 888,000 | 806,272 | ||

| Waste Management, Inc., 4.625%, 2/15/2033 | 72,000 | 69,227 | ||

| $2,252,533 | ||||

| Precious Metals & Minerals – 0.6% | ||||

| Eldorado Gold Corp., 6.25%, 9/01/2029 (n) | $ | 707,000 | $673,421 | |

| IAMGOLD Corp., 5.75%, 10/15/2028 (n) | 923,000 | 866,214 | ||

| Northern Star Resources Ltd. Co., 6.125%, 4/11/2033 (n) | 78,000 | 78,365 | ||

| $1,618,000 | ||||

| Printing & Publishing – 0.2% | ||||

| Cimpress PLC, 7%, 6/15/2026 | $ | 468,000 | $466,966 | |

| Real Estate - Office – 0.1% | ||||

| Boston Properties LP, REIT, 3.65%, 2/01/2026 | $ | 71,000 | $68,361 | |

| Corporate Office Property LP, REIT, 2.25%, 3/15/2026 | 149,000 | 140,245 | ||

| Corporate Office Property LP, REIT, 2%, 1/15/2029 | 52,000 | 43,985 | ||

| Corporate Office Property LP, REIT, 2.75%, 4/15/2031 | 39,000 | 32,091 | ||

| $284,682 | ||||

| Real Estate - Other – 0.6% | ||||

| EPR Properties, REIT, 3.6%, 11/15/2031 | $ | 104,000 | $86,357 | |

| Lexington Realty Trust Co., 2.7%, 9/15/2030 | 47,000 | 39,119 | ||

| RHP Hotel Properties, LP/RHP Finance Corp., 7.25%, 7/15/2028 (n) | 1,099,000 | 1,122,744 | ||

| XHR LP, REIT, 4.875%, 6/01/2029 (n) | 597,000 | 550,018 | ||

| $1,798,238 | ||||

| Real Estate - Retail – 0.1% | ||||

| STORE Capital Corp., REIT, 2.75%, 11/18/2030 | $ | 113,000 | $92,250 | |

| STORE Capital Corp., REIT, 2.7%, 12/01/2031 | 18,000 | 14,374 | ||

| WEA Finance LLC, 2.875%, 1/15/2027 (n) | 100,000 | 92,434 | ||

| $199,058 | ||||

| Restaurants – 0.3% | ||||

| 1011778 B.C. ULC / New Red Finance, Inc., 4%, 10/15/2030 (n) | $ | 406,000 | $353,278 | |

| Fertitta Entertainment LLC, 6.75%, 1/15/2030 (n) | 692,000 | 611,653 | ||

| $964,931 | ||||

| Issuer | Shares/Par | Value ($) | ||

| Bonds – continued | ||||

| Retailers – 1.5% | ||||

| Asbury Automotive Group, Inc., 4.625%, 11/15/2029 (n) | $ | 531,000 | $488,529 | |

| Home Depot, Inc., 3.625%, 4/15/2052 | 122,000 | 89,528 | ||

| Lithia Motors, Inc., 3.875%, 6/01/2029 (n) | 626,000 | 557,558 | ||

| Macy's Retail Holdings LLC, 5.875%, 4/01/2029 (n) | 503,000 | 484,341 | ||

| Maxeda DIY Holding B.V., 5.875%, 10/01/2026 | EUR | 345,000 | 301,196 | |

| NMG Holding Co. Inc./Neiman Marcus Group LLC, 7.125%, 4/01/2026 (n) | $ | 487,000 | 484,250 | |

| Parkland Corp., 4.625%, 5/01/2030 (n) | 935,000 | 849,836 | ||

| Penske Automotive Group Co., 3.75%, 6/15/2029 | 809,000 | 719,444 | ||

| Victoria's Secret & Co., 4.625%, 7/15/2029 (n) | 419,000 | 341,691 | ||

| $4,316,373 | ||||

| Specialty Chemicals – 0.1% | ||||

| Covestro AG, 1.375%, 6/12/2030 | EUR | 80,000 | $76,177 | |

| CTEC II GmbH, 5.25%, 2/15/2030 (n) | 100,000 | 100,361 | ||

| International Flavors & Fragrances, Inc., 1.832%, 10/15/2027 (n) | $ | 53,000 | 46,990 | |

| International Flavors & Fragrances, Inc., 4.375%, 6/01/2047 | 62,000 | 47,626 | ||

| International Flavors & Fragrances, Inc., 5%, 9/26/2048 | 35,000 | 29,725 | ||

| $300,879 | ||||

| Specialty Stores – 0.6% | ||||

| DICK'S Sporting Goods, 4.1%, 1/15/2052 | $ | 111,000 | $78,749 | |

| Michael Cos., Inc., 5.25%, 5/01/2028 (n) | 383,000 | 310,659 | ||

| Michael Cos., Inc., 7.875%, 5/01/2029 (n) | 543,000 | 369,292 | ||

| PetSmart, Inc./PetSmart Finance Corp., 7.75%, 2/15/2029 (n) | 870,000 | 832,911 | ||

| Richemont International S.A., 1.5%, 3/26/2030 | EUR | 100,000 | 97,574 | |

| $1,689,185 | ||||

| Supermarkets – 0.7% | ||||

| ELO SACA, 4.875%, 12/08/2028 | EUR | 100,000 | $103,631 | |

| KeHE Distributors LLC/KeHE Finance Corp., 9%, 2/15/2029 (n) | $ | 771,000 | 780,966 | |

| Ocado Group PLC, 3.875%, 10/08/2026 | GBP | 500,000 | 550,317 | |

| Picard Bondco S.A., 5.375%, 7/01/2027 | EUR | 416,000 | 438,403 | |

| Tesco Corporate Treasury Services PLC, 5.125%, 5/22/2034 | GBP | 100,000 | 122,392 | |

| $1,995,709 | ||||

| Supranational – 0.9% | ||||

| European Union, 3.25%, 7/04/2034 | EUR | 675,000 | $741,659 | |

| European Union, 3.375%, 11/04/2042 | 350,000 | 377,941 | ||

| European Union, 2.625%, 2/04/2048 | 475,000 | 451,663 | ||

| Issuer | Shares/Par | Value ($) | ||

| Bonds – continued | ||||

| Supranational – continued | ||||

| European Union, 3%, 3/04/2053 | EUR | 834,000 | $829,749 | |

| European Union, 3.375%, 10/05/2054 | 56,811 | 60,367 | ||

| $2,461,379 | ||||

| Telecommunications - Wireless – 1.0% | ||||

| Altice France S.A., 5.5%, 1/15/2028 (n) | $ | 534,000 | $373,896 | |

| Altice France S.A., 5.125%, 7/15/2029 (n) | 200,000 | 134,131 | ||

| American Tower Corp., 3.9%, 5/16/2030 | EUR | 100,000 | 107,695 | |

| American Tower Corp., 5.45%, 2/15/2034 | $ | 82,000 | 80,979 | |

| Millicom International Cellular S.A., 5.125%, 1/15/2028 | 635,400 | 601,686 | ||

| SBA Communications Corp., 3.875%, 2/15/2027 | 618,000 | 584,945 | ||

| SBA Communications Corp., 3.125%, 2/01/2029 | 1,094,000 | 962,517 | ||

| T-Mobile USA, Inc., 3.875%, 4/15/2030 | 54,000 | 50,191 | ||

| T-Mobile USA, Inc., 5.75%, 1/15/2034 | 26,000 | 26,617 | ||