| FREE WRITING PROSPECTUS | ||

| FILED PURSUANT TO RULE 433 | ||

| REGISTRATION FILE NO.: 333-257991-08 | ||

|

|

|

|

Free Writing Prospectus

Structural and Collateral Term Sheet

$ 748,248,334

(Approximate Initial Pool Balance)

BANK5 2023-5YR4

as Issuing Entity

Wells Fargo Commercial Mortgage Securities, Inc.

as Depositor

Morgan Stanley Mortgage Capital Holdings LLC

Wells Fargo Bank, National Association

Bank of America, National Association

JPMorgan Chase Bank, National Association

as Sponsors and Mortgage Loan Sellers

Commercial

Mortgage Pass-Through Certificates

Series 2023-5YR4

November 15, 2023

| WELLS FARGO SECURITIES | BOFA SECURITIES | J.P. MORGAN | MORGAN STANLEY |

Co-Lead Manager and Joint Bookrunner |

Co-Lead Manager and Joint Bookrunner |

Co-Lead Manager and Joint Bookrunner |

Co-Lead Manager and Joint Bookrunner |

Academy Securities, Inc. Co-Manager |

Drexel Hamilton Co-Manager |

Siebert Williams Shank Co-Manager |

STATEMENT REGARDING THIS FREE WRITING PROSPECTUS

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-257991) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the depositor, any underwriter, or any dealer participating in the offering will arrange to send you the prospectus after filing if you request it by calling toll free 1-800-745-2063 (8 a.m. – 5 p.m. EST) or by emailing wfs.cmbs@wellsfargo.com.

Nothing in this document constitutes an offer of securities for sale in any jurisdiction where the offer or sale is not permitted. The information contained herein is preliminary as of the date hereof, supersedes any such information previously delivered to you and will be superseded by any such information subsequently delivered and ultimately by the final prospectus relating to the securities. These materials are subject to change, completion, supplement or amendment from time to time.

This free writing prospectus has been prepared by the underwriters for information purposes only and does not constitute, in whole or in part, a prospectus for the purposes of (i) Regulation (EU) 2017/1129 (as amended), (ii) such Regulation as it forms part of UK domestic law, or (iii) Part VI of the UK Financial Services and Markets Act 2000, as amended; and does not constitute an offering document for any other purpose.

STATEMENT REGARDING ASSUMPTIONS AS TO SECURITIES, PRICING ESTIMATES AND OTHER INFORMATION

The attached information contains certain tables and other statistical analyses (the “Computational Materials”) which have been prepared in reliance upon information furnished by the Mortgage Loan Sellers. Numerous assumptions were used in preparing the Computational Materials, which may or may not be reflected herein. As such, no assurance can be given as to the Computational Materials’ accuracy, appropriateness or completeness in any particular context; or as to whether the Computational Materials and/or the assumptions upon which they are based reflect present market conditions or future market performance. The Computational Materials should not be construed as either projections or predictions or as legal, tax, financial or accounting advice. You should consult your own counsel, accountant and other advisors as to the legal, tax, business, financial and related aspects of a purchase of these securities. Any weighted average lives, yields and principal payment periods shown in the Computational Materials are based on prepayment and/or loss assumptions, and changes in such prepayment and/or loss assumptions may dramatically affect such weighted average lives, yields and principal payment periods. In addition, it is possible that prepayments or losses on the underlying assets will occur at rates higher or lower than the rates shown in the attached Computational Materials. The specific characteristics of the securities may differ from those shown in the Computational Materials due to differences between the final underlying assets and the preliminary underlying assets used in preparing the Computational Materials. The principal amount and designation of any security described in the Computational Materials are subject to change prior to issuance. None of Wells Fargo Securities, LLC, Morgan Stanley & Co. LLC, BofA Securities, Inc., J.P. Morgan Securities LLC, Academy Securities, Inc., Drexel Hamilton, LLC, Siebert Williams Shank & Co., LLC or any of their respective affiliates, make any representation or warranty as to the actual rate or timing of payments or losses on any of the underlying assets or the payments or yield on the securities. The information in this presentation is based upon management forecasts and reflects prevailing conditions and management’s views as of this date, all of which are subject to change. In preparing this presentation, we have relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources or which was provided to us by or on behalf of the Mortgage Loan Sellers or which was otherwise reviewed by us.

This free writing prospectus contains certain forward-looking statements. If and when included in this free writing prospectus, the words “expects”, “intends”, “anticipates”, “estimates” and analogous expressions and all statements that are not historical facts, including statements about our beliefs or expectations, are intended to identify forward-looking statements. Any forward-looking statements are made subject to risks and uncertainties which could cause actual results to differ materially from those stated. Those risks and uncertainties include, among other things, declines in general economic and business conditions, increased competition, changes in demographics, changes in political and social conditions, regulatory initiatives and changes in customer preferences, many of which are beyond our control and the control of any other person or entity related to this offering. The forward-looking statements made in this free writing prospectus are made as of the date stated on the cover. We have no obligation to update or revise any forward-looking statement.

Wells Fargo Securities is the trade name for the capital markets and investment banking services of Wells Fargo & Company and its subsidiaries, including but not limited to Wells Fargo Securities, LLC, a member of NYSE, FINRA, NFA and SIPC, Wells Fargo Prime Services, LLC, a member of FINRA, NFA and SIPC, and Wells Fargo Bank, N.A. Wells Fargo Securities, LLC and Wells Fargo Prime Services, LLC are distinct entities from affiliated banks and thrifts.

“BofA Securities” is the marketing name for the global banking and global markets businesses of Bank of America Corporation. Lending, derivatives, and other commercial banking activities are performed globally by banking affiliates of Bank of America Corporation, including Bank of America, N.A., member FDIC. Securities, strategic advisory, and other investment banking activities are performed globally by investment banking affiliates of Bank of America Corporation, including, in the United States, BofA Securities, Inc., which is a registered broker-dealer and member of FINRA and SIPC, and, in other jurisdictions, locally registered entities.

J.P. Morgan is the marketing name for the investment banking businesses of JPMorgan Chase & Co. and its subsidiaries worldwide. Securities, syndicated loan arranging, financial advisory and other investment banking activities are performed by JPMS and its securities affiliates, and lending, derivatives and other commercial banking activities are performed by JPMorgan Chase Bank, National Association and its banking affiliates. JPMS is a member of SIPC and the NYSE.

IMPORTANT NOTICE REGARDING THE OFFERED CERTIFICATES

The information herein is preliminary and may be supplemented or amended prior to the time of sale. In addition, the Offered Certificates referred to in these materials and the asset pool backing them are subject to modification or revision (including the possibility that one or more classes of certificates may be split, combined or eliminated at any time prior to issuance or availability of a final prospectus) and are offered on a “when, as and if issued” basis.

The underwriters described in these materials may from time to time perform investment banking services for, or solicit investment banking business from, any company named in these materials. The underwriters and/or their affiliates or respective employees may from time to time have a long or short position in any security or contract discussed in these materials.

The information contained herein supersedes any previous such information delivered to any prospective investor and will be superseded by information delivered to such prospective investor prior to the time of sale.

IMPORTANT NOTICE RELATING TO AUTOMATICALLY-GENERATED EMAIL DISCLAIMERS

Any legends, disclaimers or other notices that may appear at the bottom of any email communication to which this free writing prospectus is attached relating to (1) these materials not constituting an offer (or a solicitation of an offer), (2) any representation that these materials are accurate or complete and may not be updated or (3) these materials possibly being confidential, are not applicable to these materials and should be disregarded. Such legends, disclaimers or other notices have been automatically generated as a result of these materials having been sent via Bloomberg or another system.

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. | ||

| 2 | ||

| BANK5 2023-5YR4 | Transaction Highlights |

| I. | Transaction Highlights |

Mortgage Loan Sellers:

|

Mortgage Loan Seller |

Number of |

Number of |

Aggregate Cut-off Date Balance |

Approx. %

of Initial Pool | ||||

| Morgan Stanley Mortgage Capital Holdings LLC | 12 | 12 | $313,075,000 | 41.8 | % | |||

| Wells Fargo Bank, National Association | 5 | 17 | 153,390,000 | 20.5 | ||||

| Bank of America, National Association | 7 | 31 | 139,783,334 | 18.7 | ||||

| JPMorgan Chase Bank, National Association | 3 | 3 | 122,000,000 | 16.3 | ||||

| Wells Fargo Bank, National Association/JPMorgan Chase Bank, National Association |

1 | 1 | 20,000,000 | 2.7 | ||||

|

Total |

28 |

|

64 |

|

$748,248,334 |

|

100.0 |

% |

Loan Pool:

| Initial Pool Balance: | $748,248,334 |

| Number of Mortgage Loans: | 28 |

| Average Cut-off Date Balance per Mortgage Loan: | $26,723,155 |

| Number of Mortgaged Properties: | 64 |

| Average Cut-off Date Balance per Mortgaged Property(1): | $11,691,380 |

| Weighted Average Interest Rate: | 7.5531% |

| Ten Largest Mortgage Loans as % of Initial Pool Balance: | 66.1% |

| Weighted Average Original Term to Maturity (months): | 60 |

| Weighted Average Remaining Term to Maturity (months): | 58 |

| Weighted Average Original Amortization Term (months)(2): | NAP |

| Weighted Average Remaining Amortization Term (months)(2): | NAP |

| Weighted Average Seasoning (months): | 2 |

|

(1) |

Information regarding mortgage loans secured by multiple properties is based on an allocation according to relative appraised values or the allocated loan amounts or property-specific release prices set forth in the related loan documents or such other allocation as the related mortgage loan seller deemed appropriate. |

| (2) | Excludes any mortgage loan that does not amortize. |

Credit Statistics:

| Weighted Average U/W Net Cash Flow DSCR(1): | 1.63x |

| Weighted Average U/W Net Operating Income Debt Yield(1): | 13.5% |

| Weighted Average Cut-off Date Loan-to-Value Ratio(1): | 53.5% |

| Weighted Average Balloon Loan-to-Value Ratio(1): | 53.5% |

| % of Mortgage Loans with Additional Subordinate Debt(2): | 13.5% |

| % of Mortgage Loans with Single Tenants(3): | 14.0% |

| (1) | With respect to any mortgage loan that is part of a whole loan, loan-to-value ratio, debt service coverage ratio and debt yield calculations include the related pari passu companion loan(s) but exclude any related subordinate companion loan(s) (unless otherwise stated). The debt service coverage ratio, debt yield and loan-to-value ratio information do not take into account any subordinate debt (whether or not secured by the related mortgaged property), that currently exists or is allowed under the terms of any mortgage loan. See “Description of the Mortgage Pool—Mortgage Pool Characteristics” in the Preliminary Prospectus and Annex A-1 to the Preliminary Prospectus. |

| (2) | The percentage figure expressed as “% of Mortgage Loans with Additional Subordinate Debt” is determined as a percentage of the initial pool balance and does not take into account any future subordinate debt (whether or not secured by the mortgaged property), if any, that may be permitted under the terms of any mortgage loan or the pooling and servicing agreement. See “Description of the Mortgage Pool—Additional Indebtedness—Other Unsecured Indebtedness” in the Preliminary Prospectus. |

| (3) | Excludes mortgage loans that are secured by multiple single tenant properties. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. | ||

| 3 | ||

| BANK5 2023-5YR4 | Characteristics of the Mortgage Pool |

| II. | Characteristics of the Mortgage Pool(1) |

Ten Largest Mortgage Loans

| Mortgage Loan Seller |

Mortgage Loan Name | City | State | Number of Mortgage Loans / Mortgaged Properties | Mortgage Loan Cut-off Date Balance ($) | % of Initial Pool Balance(%) | Property Type |

Number of SF/Rooms |

Cut-off Date Balance Per SF/Room ($) |

Cut-off Date LTV Ratio (%) |

Balloon LTV Ratio (%) |

U/W NCF DSCR (x) |

U/W NOI Debt Yield (%) | |||||

| WFB | Westfarms | West Hartford | CT | 1 / 1 | $74,000,000 | 9.9 | % | Retail | 501,990 | $482 | 44.2 | % | 44.2 | % | 1.76 | x | 14.4 | % |

| MSMCH | Renaissance Dallas Addison Hotel | Addison | TX | 1 / 1 | 72,000,000 | 9.6 | Hospitality | 528 | 136,364 | 63.4 | 63.4 | 1.60 | 14.7 | |||||

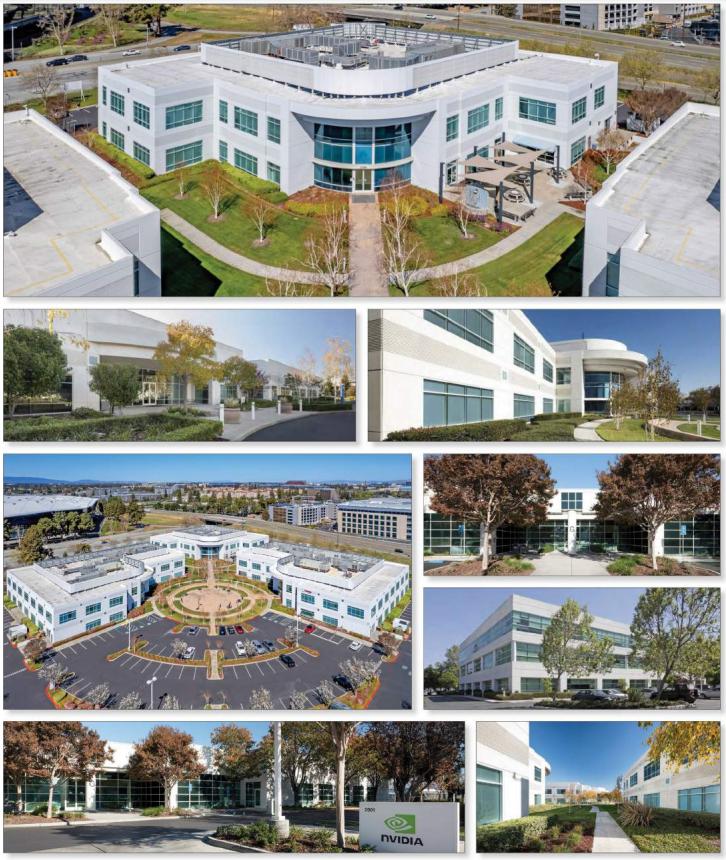

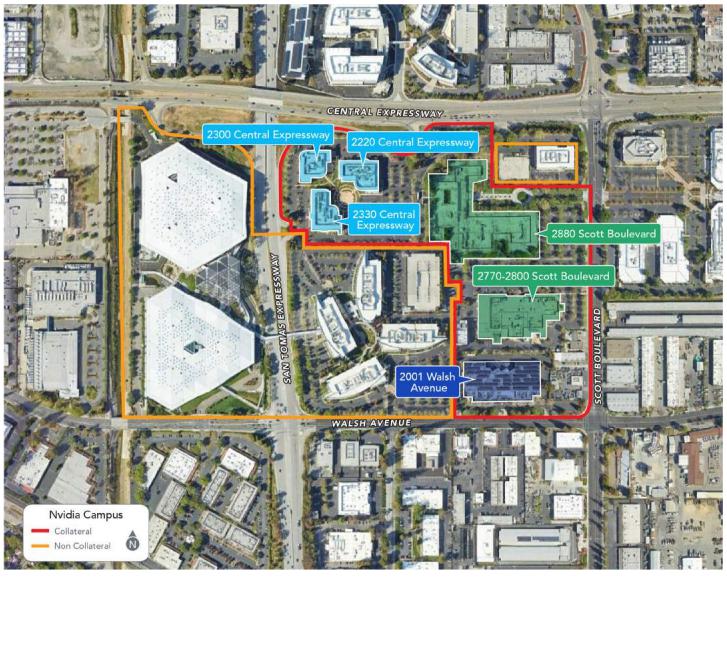

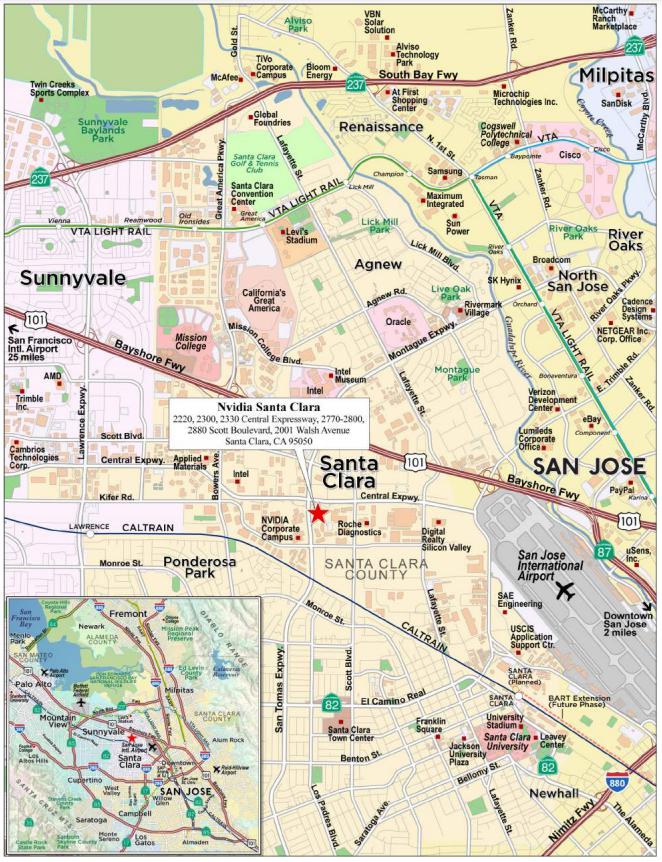

| JPMCB | Nvidia Santa Clara | Santa Clara | CA | 1 / 1 | 70,000,000 | 9.4 | Mixed Use | 551,233 | 236 | 41.5 | 41.5 | 2.01 | 14.1 | |||||

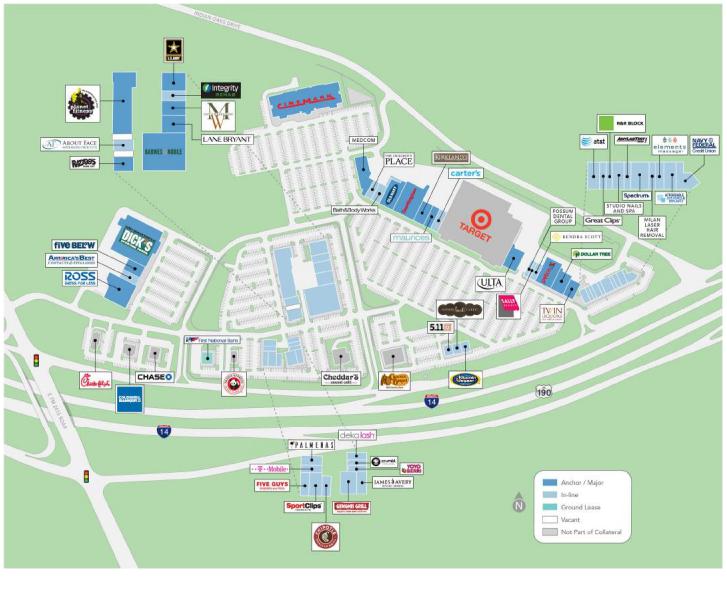

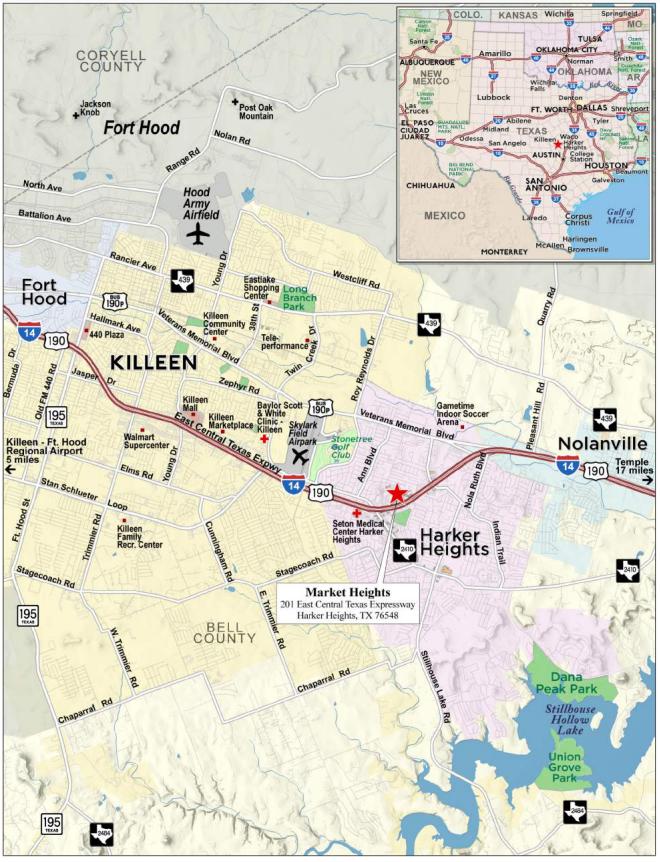

| MSMCH | Market Heights | Harker Heights | TX | 1 / 1 | 55,000,000 | 7.4 | Retail | 418,693 | 131 | 62.9 | 62.9 | 1.35 | 11.8 | |||||

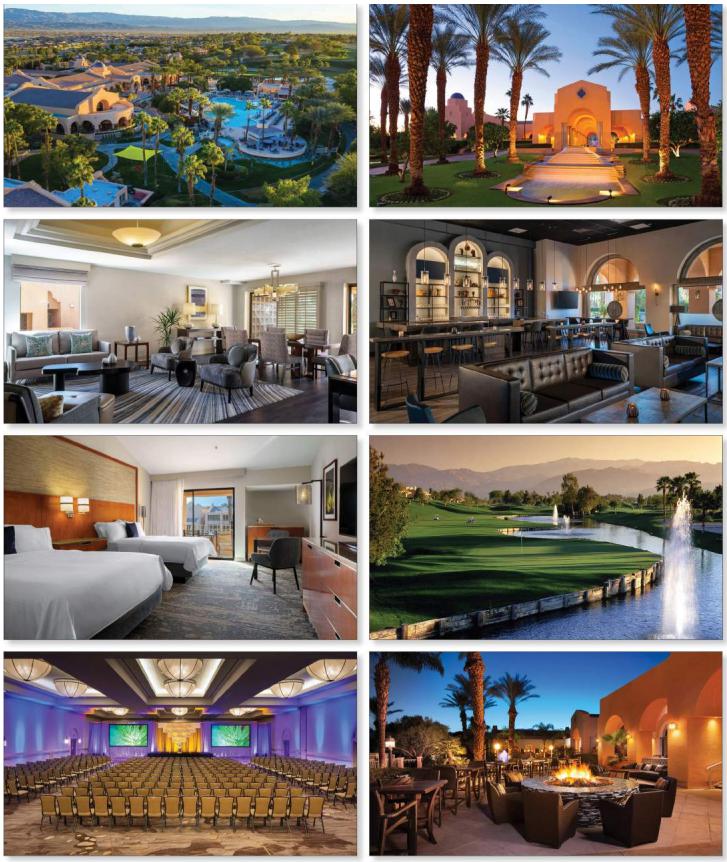

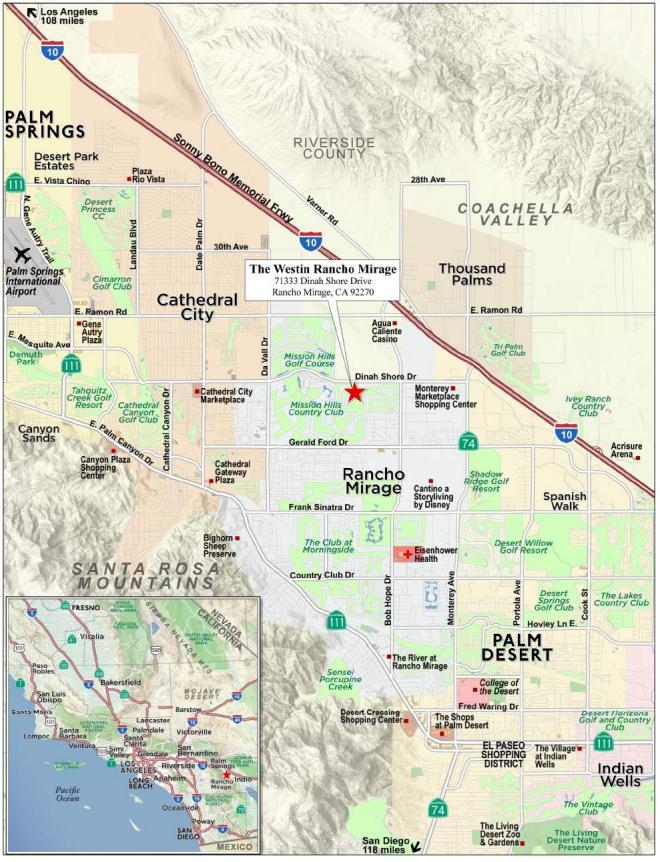

| WFB | The Westin Rancho Mirage | Rancho Mirage | CA | 1 / 1 | 50,000,000 | 6.7 | Hospitality | 512 | 97,656 | 56.1 | 56.1 | 1.68 | 18.7 | |||||

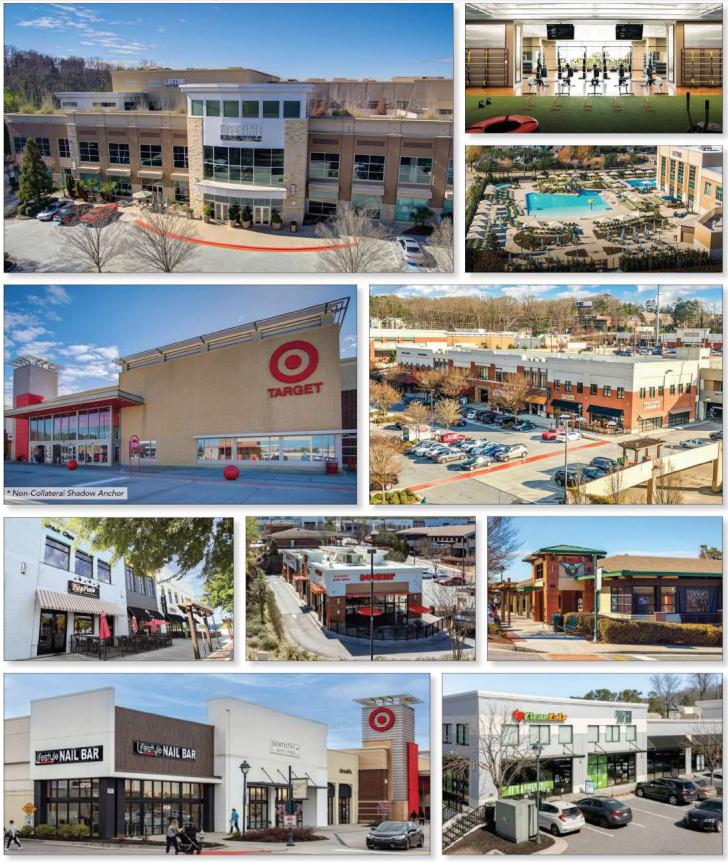

| JPMCB | The Prado | Sandy Springs | GA | 1 / 1 | 42,000,000 | 5.6 | Retail | 302,541 | 139 | 62.6 | 62.6 | 1.36 | 13.1 | |||||

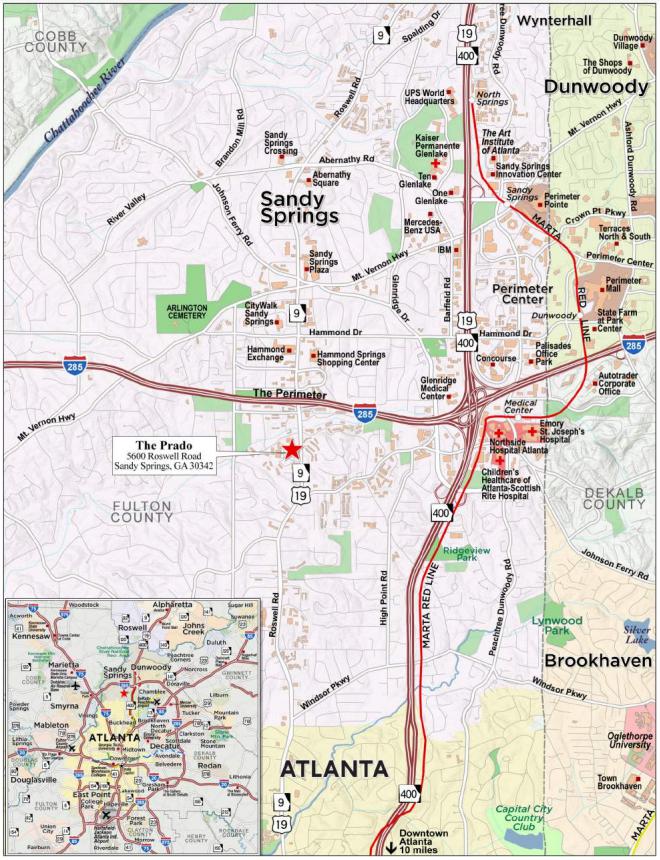

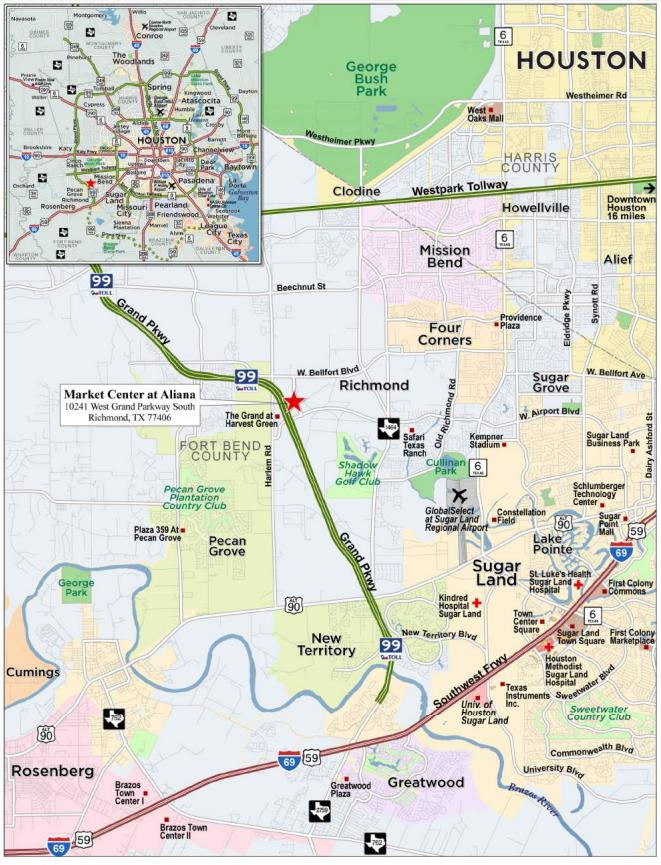

| MSMCH | Market Center at Aliana | Richmond | TX | 1 / 1 | 37,000,000 | 4.9 | Retail | 176,933 | 209 | 60.5 | 60.5 | 1.33 | 10.3 | |||||

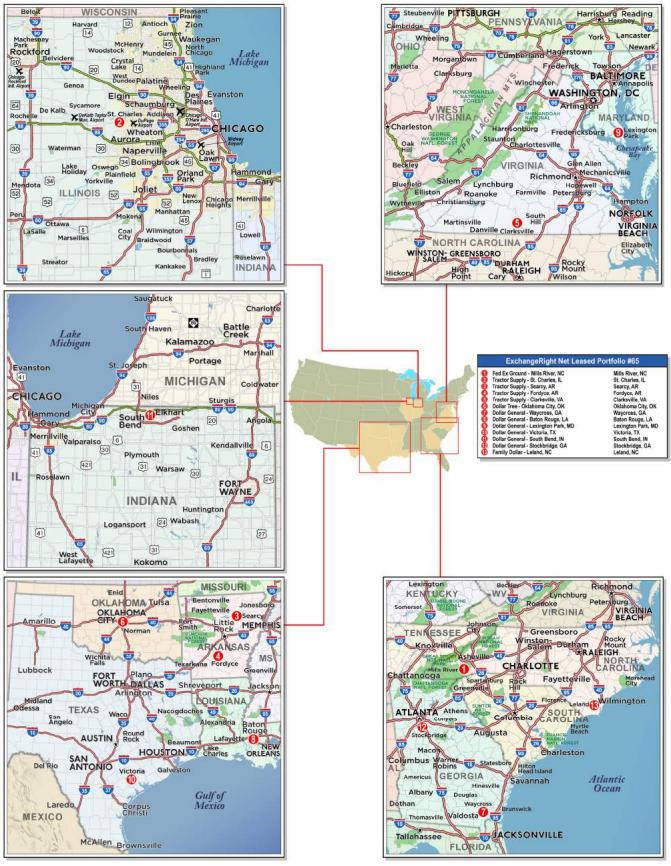

| BANA | ExchangeRight Net Leased Portfolio #65 | Various | Various | 1 / 13 | 33,100,000 | 4.4 | Various | 412,363 | 80 | 45.0 | 45.0 | 2.01 | 12.5 | |||||

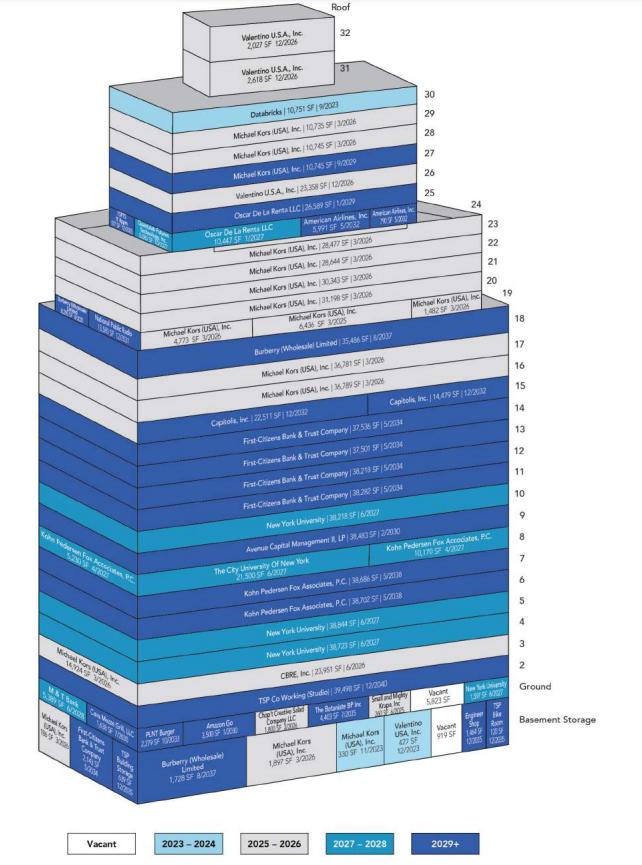

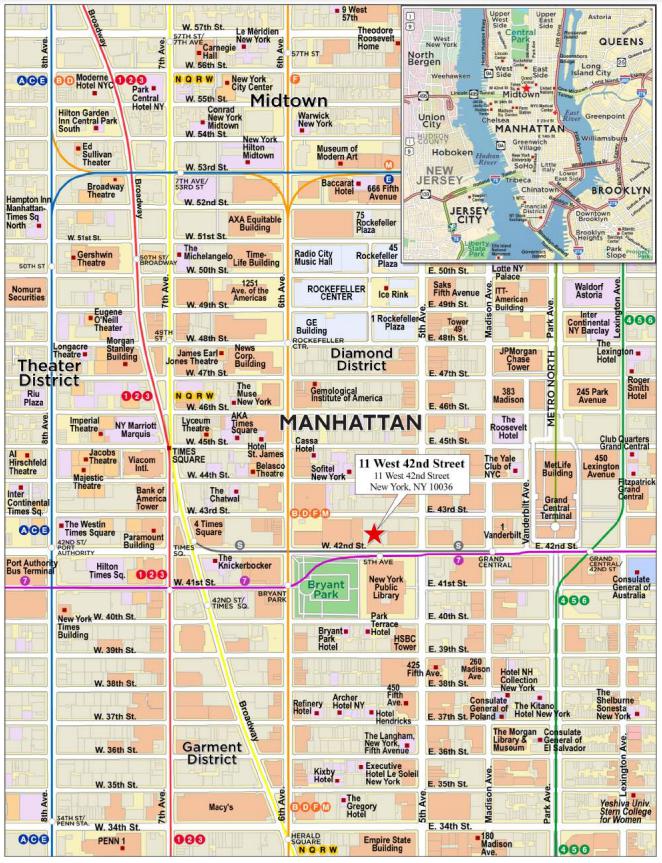

| BANA | 11 West 42nd Street | New York | NY | 1 / 1 | 31,333,334 | 4.2 | Office | 960,568 | 285 | 49.4 | 49.4 | 1.39 | 11.6 | |||||

| BANA | Stirling Hotel Portfolio | Various | Various | 1 / 4 | 30,200,000 | 4.0 | Hospitality | 405 | 74,568 | 45.6 | 45.6 | 1.71 | 17.4 | |||||

| Top Three Total/Weighted Average | 3 / 3 | $216,000,000 | 28.9 | % | 49.7 | % | 49.7 | % | 1.79 | x | 14.4 | % | ||||||

| Top Five Total/Weighted Average | 5 / 5 | $321,000,000 | 42.9 | % | 53.0 | % | 53.0 | % | 1.70 | x | 14.6 | % | ||||||

| Top Ten Total/Weighted Average | 10 / 25 | $494,633,334 | 66.1 | % | 53.1 | % | 53.1 | % | 1.64 | x | 14.0 | % | ||||||

| Non-Top Ten Total/Weighted Average | 18 / 39 | $253,615,000 | 33.9 | % | 54.3 | % | 54.3 | % | 1.60 | x | 12.5 | % | ||||||

| (1) | With respect to any mortgage loan that is part of a whole loan, Cut-off Date Balance Per SF or Room ($) loan-to-value ratio, debt service coverage ratio and debt yield calculations include the related pari passu companion loan(s) but exclude any related subordinate companion loan(s) (unless otherwise stated). With respect to each mortgage loan, debt service coverage ratio, debt yield and loan-to-value ratio information do not take into account subordinate debt (whether or not secured by the related mortgaged property), if any, that currently exists or is allowed under the terms of such mortgage loan. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. | ||

| 4 | ||

| BANK5 2023-5YR4 | Characteristics of the Mortgage Pool |

| III. | Summary of the Whole Loans |

| Loan No. | Property Name | Mortgage Loan Seller in BANK5 2023-5YR4 | Trust Cut-off Date Balance | Aggregate Pari-Passu Companion Loan Cut-off Date Balance (1) | Controlling Pooling/Trust & Servicing Agreement | Master Servicer | Special Servicer | Related Pari Passu Companion Loan(s) Securitizations | Related Pari Passu Companion Loan(s) Original Balance |

| 1 | Westfarms | WFB | $74,000,000 | $242,000,000 | BMO 2023-5C2 | KeyBank, National Association | Greystone Servicing Company LLC | BANK5 2023-5YR3, BMO 2023-5C2 | $168,000,000 |

| 3 | Nvidia Santa Clara | JPMCB | $70,000,000 | $130,000,000 | BANK5 2023-5YR4 | Wells Fargo Bank, National Association | KeyBank, National Association | Future Securitization | $60,000,000 |

| 9 | 11 West 42nd Street | BANA | $31,333,334 | $274,000,000 | BANK5 2023-5YR3 | Wells Fargo Bank, National Association | Greystone Servicing Company LLC | BANK5 2023-5YR3, BMO 2023-C6, BMO 2023-5C1, BMO 2023-5C2 | $242,666,666 |

| 11 | Mckesson Phase II | MSMCH | $30,000,000 | $76,700,000 | BANK5 2023-5YR1 | Wells Fargo Bank, National Association | CWCapital Asset Management, LLC | BANK5 2023-5YR1 | $46,700,000 |

| 14 | Merit Hill Self Storage | WFB | $21,250,000 | $85,000,000 | BMARK 2023-V4 | Midland Loan Services | K-Star Asset Management | BMO 2023-5C2, BMARK 2023-V4 | $63,750,000 |

| 15 | Short Pump Town Center | BANA | $20,000,000 | $180,000,000 | BANK5 2023-5YR3 | Wells Fargo Bank, National Association | Greystone Servicing Company LLC | BANK5 2023-5YR3, BMO 2023-5C1, BMO 2023-5C2 | $160,000,000 |

| 16 | 1201 Third Avenue | MSMCH | $20,000,000 | $170,000,000 | BANK 2023-BNK46 | Wells Fargo Bank, National Association | CWCapital Asset Management, LLC | BMARK 2023-V2, BMARK 2023-B38, BANK5 2023-5YR1, BANK5 2023-5YR2, BANK 2023-BNK46 | $150,000,000 |

| 17 | Philadelphia Marriott Downtown | WFB/JPMCB | $20,000,000 | $215,000,000 | BMARK 2023-V4(2) | Midland Loan Services | K-Star Asset Management | BMARK 2023-V4 | $195,000,000 |

| 21 | 1825 K Street NW | JPMCB | $10,000,000 | $42,000,000 | BANK 2023-BNK46 | Wells Fargo Bank, National Association | LNR Partners LLC | BANK 2023-BNK46 | $32,000,000 |

| (1) | The Aggregate Pari Passu Companion Loan Cut-off Date Balance excludes the related Subordinate Companion Loans. |

| (2) | Philadelphia Marriott Downtown is currently serviced under BMARK 2023-V4 and is anticipated to be placed into their next transaction. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. | ||

| 5 | ||

| BANK5 2023-5YR4 | Characteristics of the Mortgage Pool |

| IV. | Previous Securitization History(1) |

| Loan No. | Mortgage Loan Seller | Mortgage Loan or Mortgaged Property Name |

City | State | Property Type | Mortgage Loan or Mortgaged Property Cut-off Date Balance ($) |

% of Cut-off Date Pool Balance (%) | Previous Securitization | |

| 3.00 | JPMCB | Nvidia Santa Clara | Santa Clara | CA | Mixed Use | $70,000,000 | 9.4 | % | NCMS 2018-TECH |

| 9.00 | BANA | 11 West 42nd Street | New York | NY | Office | 31,333,334 | 4.2 | GSMS 2013-GC13, GSMS 2013-GC14 | |

| 14.02 | WFB | Parkglenn Self-Storage | Parker | CO | Self Storage | 2,266,250 | 0.3 | WFRBS 2014-C19, MERIT 2020-HILL | |

| 14.06 | WFB | 3803 N Navarro St | Victoria | TX | Self Storage | 1,568,500 | 0.2 | CSAIL 2015-C1 | |

| 14.07 | WFB | 2102 NW Stallings Dr | Nacogdoches | TX | Self Storage | 1,254,750 | 0.2 | CSAIL 2015-C1 | |

| 14.08 | WFB | 2005 W Wheeler Ave | Aransas Pass | TX | Self Storage | 1,199,750 | 0.2 | CSAIL 2015-C1 | |

| 14.09 | WFB | 3817 Gulf Freeway | Dickinson | TX | Self Storage | 1,113,500 | 0.1 | CSAIL 2015-C1 | |

| 14.10 | WFB | 1600 E General Cavazos Blvd | Kingsville | TX | Self Storage | 1,066,500 | 0.1 | CSAIL 2015-C1 | |

| 17.00 | WFB/JPMCB | Philadelphia Marriott Downtown | Philadelphia | PA | Hospitality | 20,000,000 | 2.7 | MSBAM 2014-C15, MSBAM 2014-C16, MSBAM 2014-C17 | |

| Total | $129,802,584 | 17.3 | % | ||||||

| (1) | The table above represents the most recent securitization with respect to the mortgaged property securing the related mortgage loan, based on information provided by the related borrower or obtained through searches of a third-party database. While loans secured by the above mortgaged properties may have been securitized multiple times in prior transactions, mortgage loans in this securitization are only listed in the above chart if the mortgage loan paid off a loan in another securitization. The information has not otherwise been confirmed by the mortgage loan sellers. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. | ||

| 6 | ||

| BANK5 2023-5YR4 | Characteristics of the Mortgage Pool |

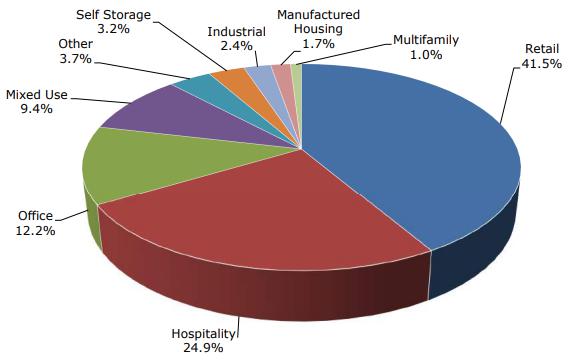

| V. | Property Type Distribution(1) |

| Property Type | Number of Mortgaged Properties | Aggregate Cut-off Date Balance ($) | % of Cut-off Date Balance (%) | Weighted Average Cut-off Date LTV Ratio (%) | Weighted Average Balloon LTV Ratio (%) | Weighted Average U/W NCF DSCR (x) | Weighted Average U/W NOI Debt Yield (%) | Weighted Average U/W NCF Debt Yield (%) | Weighted Average Interest Rate (%) |

| Retail | 23 | $310,765,498 | 41.5% | 54.6% | 54.6% | 1.53x | 12.8% | 12.0% | 7.7481% |

| Anchored | 7 | 141,350,000 | 18.9 | 59.2 | 59.2 | 1.42 | 12.3 | 11.2 | 7.8126 |

| Super Regional Mall | 1 | 74,000,000 | 9.9 | 44.2 | 44.2 | 1.76 | 14.4 | 13.9 | 7.7950 |

| Power Center | 1 | 55,000,000 | 7.4 | 62.9 | 62.9 | 1.35 | 11.8 | 10.9 | 7.9600 |

| Single Tenant | 13 | 20,415,498 | 2.7 | 45.2 | 45.2 | 1.94 | 12.3 | 11.7 | 6.0175 |

| Lifestyle Center | 1 | 20,000,000 | 2.7 | 47.6 | 47.6 | 1.61 | 14.3 | 13.5 | 8.3030 |

| Hospitality | 8 | 186,400,000 | 24.9 | 56.5 | 56.5 | 1.66 | 16.6 | 13.7 | 8.1717 |

| Full Service | 3 | 142,000,000 | 19.0 | 59.6 | 59.6 | 1.62 | 16.3 | 13.3 | 8.0915 |

| Limited Service | 3 | 28,200,000 | 3.8 | 47.3 | 47.3 | 1.82 | 17.4 | 15.3 | 8.3179 |

| Extended Stay | 2 | 16,200,000 | 2.2 | 45.6 | 45.6 | 1.71 | 17.4 | 14.9 | 8.6200 |

| Office | 4 | 91,333,334 | 12.2 | 51.6 | 51.6 | 1.79 | 11.9 | 11.1 | 6.2900 |

| CBD | 4 | 91,333,334 | 12.2 | 51.6 | 51.6 | 1.79 | 11.9 | 11.1 | 6.2900 |

| Mixed Use | 1 | 70,000,000 | 9.4 | 41.5 | 41.5 | 2.01 | 14.1 | 14.0 | 6.8761 |

| Office/Lab | 1 | 70,000,000 | 9.4 | 41.5 | 41.5 | 2.01 | 14.1 | 14.0 | 6.8761 |

| Other | 1 | 28,000,000 | 3.7 | 43.8 | 43.8 | 1.31 | 11.6 | 11.3 | 8.5500 |

| RV/Boat Storage | 1 | 28,000,000 | 3.7 | 43.8 | 43.8 | 1.31 | 11.6 | 11.3 | 8.5500 |

| Self Storage | 14 | 23,800,000 | 3.2 | 60.5 | 60.5 | 1.22 | 8.9 | 8.8 | 7.1415 |

| Self Storage | 14 | 23,800,000 | 3.2 | 60.5 | 60.5 | 1.22 | 8.9 | 8.8 | 7.1415 |

| Industrial | 1 | 17,724,502 | 2.4 | 45.0 | 45.0 | 2.01 | 12.5 | 11.8 | 5.8200 |

| Warehouse/Distribution | 1 | 17,724,502 | 2.4 | 45.0 | 45.0 | 2.01 | 12.5 | 11.8 | 5.8200 |

| Manufactured Housing | 10 | 13,000,000 | 1.7 | 72.6 | 72.6 | 1.25 | 9.9 | 9.7 | 7.6690 |

| Manufactured Housing | 10 | 13,000,000 | 1.7 | 72.6 | 72.6 | 1.25 | 9.9 | 9.7 | 7.6690 |

| Multifamily | 2 | 7,225,000 | 1.0 | 74.2 | 74.2 | 1.45 | 10.6 | 10.5 | 7.2654 |

| Mid Rise | 1 | 4,125,000 | 0.6 | 86.8 | 86.8 | 1.62 | 10.8 | 10.7 | 6.5300 |

| Garden | 1 | 3,100,000 | 0.4 | 57.4 | 57.4 | 1.22 | 10.4 | 10.2 | 8.2440 |

| Total/Weighted Average | 64 | $748,248,334 | 100.0% | 53.5% | 53.5% | 1.63x | 13.5% | 12.3% | 7.5531% |

| (1) | Because this table presents information relating to the mortgaged properties and not the mortgage loans, the information for mortgage loans secured by more than one mortgaged property is based on allocated loan amounts (allocating the principal balance of the mortgage loan to each of those properties according to the relative appraised values of the mortgaged properties or the allocated loan amounts or property-specific release prices set forth in the related mortgage loan documents or such other allocation as the related mortgage loan seller deemed appropriate). With respect to any mortgage loan that is part of a whole loan, the loan-to-value ratio, debt service coverage ratio and debt yield calculations include the related pari passu companion loan(s) but exclude any related subordinate companion loan(s) (unless otherwise stated). With respect to each mortgage loan, debt service coverage ratio, debt yield and loan-to-value ratio information do not take into account any subordinate debt (whether or not secured by the related mortgaged property) that currently exists or is allowed under the terms of such mortgage loan. See Annex A-1 to the Preliminary Prospectus. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. | ||

| 7 | ||

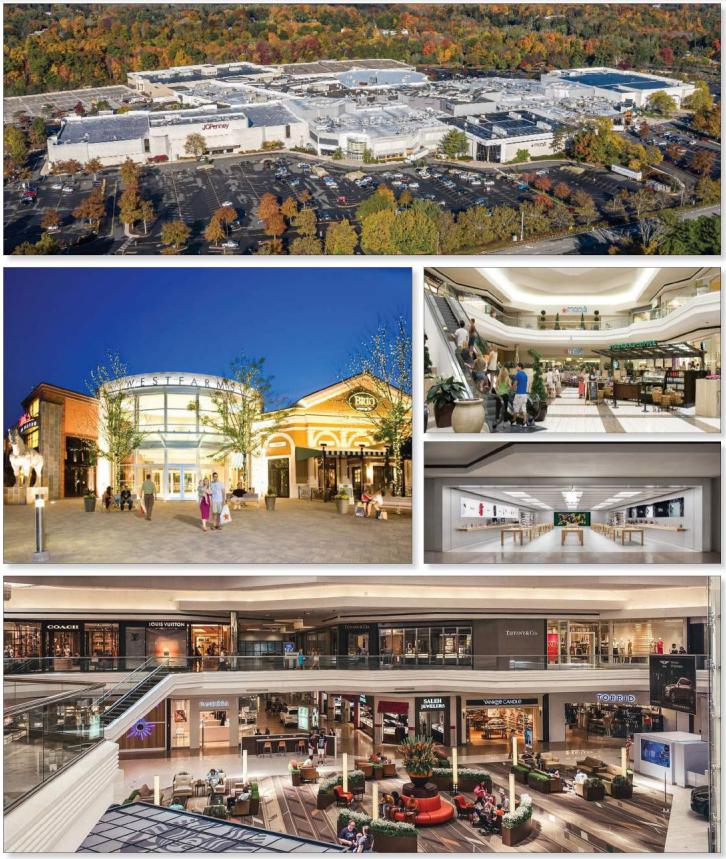

| Retail – Super Regional Mall | Loan #1 | Cut-off Date Balance: | $74,000,000 | |

| 1500 New Britain Avenue | Westfarms | Cut-off Date LTV: | 44.2% | |

| West Hartford, CT 06110 | U/W NCF DSCR: | 1.76x | ||

| U/W NOI Debt Yield: | 14.4% |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. | ||

| 8 | ||

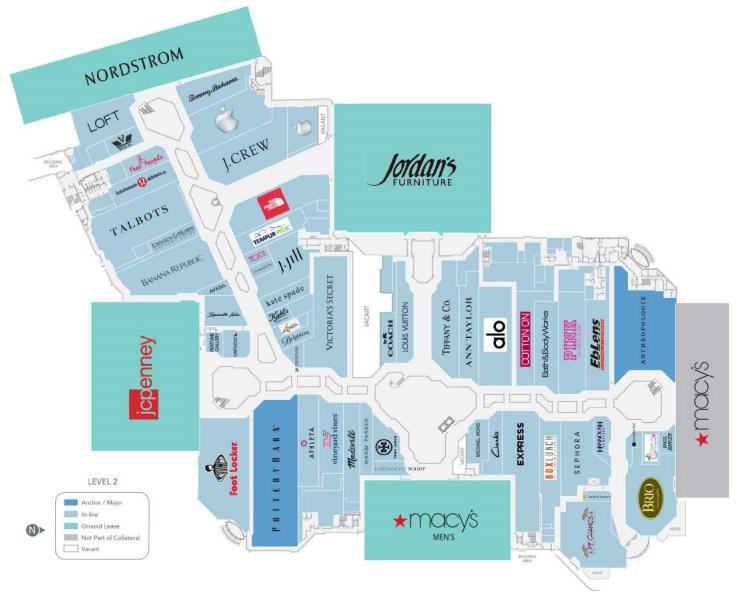

| Retail – Super Regional Mall | Loan #1 | Cut-off Date Balance: | $74,000,000 | |

| 1500 New Britain Avenue | Westfarms | Cut-off Date LTV: | 44.2% | |

| West Hartford, CT 06110 | U/W NCF DSCR: | 1.76x | ||

| U/W NOI Debt Yield: | 14.4% |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. | ||

| 9 | ||

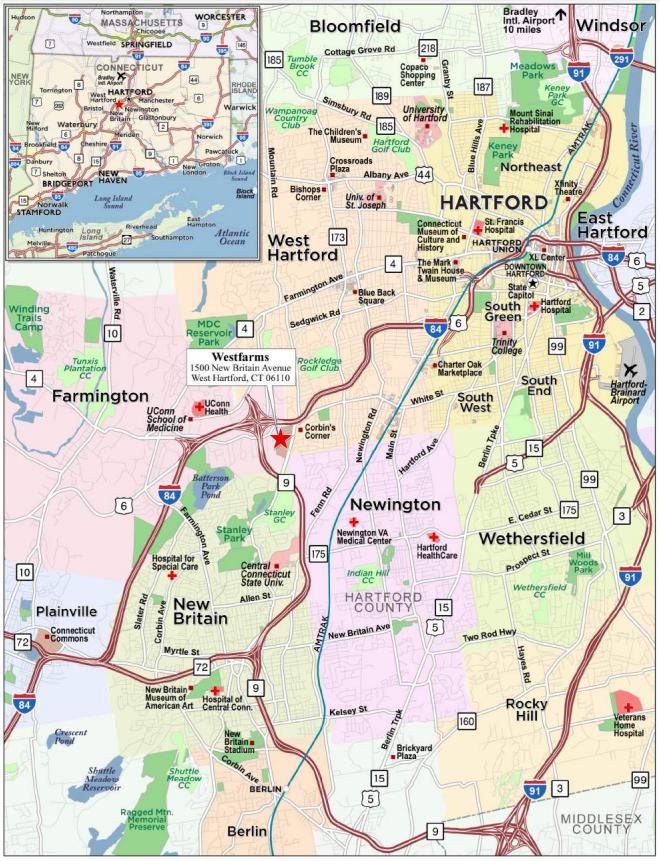

| Retail – Super Regional Mall | Loan #1 | Cut-off Date Balance: | $74,000,000 | |

| 1500 New Britain Avenue | Westfarms | Cut-off Date LTV: | 44.2% | |

| West Hartford, CT 06110 | U/W NCF DSCR: | 1.76x | ||

| U/W NOI Debt Yield: | 14.4% |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. | ||

| 10 | ||

| Retail – Super Regional Mall | Loan #1 | Cut-off Date Balance: | $74,000,000 | |

| 1500 New Britain Avenue | Westfarms | Cut-off Date LTV: | 44.2% | |

| West Hartford, CT 06110 | U/W NCF DSCR: | 1.76x | ||

| U/W NOI Debt Yield: | 14.4% |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. | ||

| 11 | ||

| No. 1 – Westfarms |

| Mortgage Loan Information | Mortgaged Property Information | ||||||

| Mortgage Loan Seller: | Wells Fargo Bank, National Association | Single Asset/Portfolio: | Single Asset | ||||

|

Credit Assessment (Fitch/KBRA/S&P): |

NR/BBB-/NR | Property Type – Subtype: | Retail – Super Regional Mall | ||||

| Original Principal Balance(1): | $74,000,000 | Location: | West Hartford, CT | ||||

| Cut-off Date Balance(1): | $74,000,000 | Size(4): | 501,990 SF | ||||

| % of Initial Pool Balance: | 9.9% | Cut-off Date Balance Per SF(1): | $482.08 | ||||

| Loan Purpose: | Refinance | Maturity Date Balance Per SF(1): | $482.08 | ||||

| Borrower Sponsor: | The Taubman Realty Group LLC | Year Built/Renovated: | 1974/2013 | ||||

| Guarantor: | The Taubman Realty Group LLC | Title Vesting: | Fee | ||||

| Mortgage Rate: | 7.7950% | Property Manager: | The Taubman Company LLC (borrower-related) | ||||

| Note Date: | August 31, 2023 | Current Occupancy (As of)(5): | 95.9% (8/25/2023) | ||||

| Seasoning: | 3 months | YE 2022 Occupancy(5): | 93.0% | ||||

| Maturity Date: | September 6, 2028 | YE 2021 Occupancy(5): | 92.6% | ||||

| IO Period: | 60 months | YE 2020 Occupancy: | 91.7% | ||||

| Loan Term (Original): | 60 months | YE 2019 Occupancy: | 92.4% | ||||

| Amortization Term (Original): | NAP | As-Is Appraised Value: | $547,800,000 | ||||

| Loan Amortization Type: | Interest Only | As-Is Appraised Value Per SF: | $1,091.26 | ||||

| Call Protection: | L(27),D(26),O(7) | As-Is Appraisal Valuation Date: | July 6, 2023 | ||||

| Lockbox Type: | Hard/Springing Cash Management | Underwriting and Financial Information | |||||

| Additional Debt(1)(2): | Yes | TTM NOI (6/30/2023)(6): | $30,911,416 | ||||

| Additional Debt Type (Balance)(1)(2): | Pari Passu ($168,000,000) | YE 2022 NOI: | $28,924,568 | ||||

| YE 2021 NOI: | $29,775,349 | ||||||

| YE 2020 NOI: | $26,506,171 | ||||||

| Escrows and Reserves(3) | U/W Revenues: | $51,139,577 | |||||

| Initial | Monthly | Cap | U/W Expenses: | $16,217,012 | |||

| Taxes | $0 | Springing | NAP | U/W NOI(6): | $34,922,565 | ||

| Insurance | $0 | Springing | NAP | U/W NCF: | $33,648,313 | ||

| Replacement Reserve | $0 | $20,916 | NAP | U/W DSCR based on NOI/NCF(1): | 1.83x / 1.76x | ||

| TI/LC Reserve: | $0 | $41,833 | NAP | U/W Debt Yield based on NOI/NCF(1): | 14.4% /13.9% | ||

| Gap Rent/Free Rent Reserve: | $298,225 | $0 | NAP | U/W Debt Yield at Maturity based on NOI/NCF(1): | 14.4% /13.9% | ||

| Outstanding TI/LC Reserve: | $3,103,791 | $0 | NAP | Cut-off Date LTV Ratio(1): | 44.2% | ||

| LTV Ratio at Maturity(1): | 44.2% | ||||||

| Sources and Uses | ||||||||

| Sources | Uses | |||||||

| Whole Loan Amount(1): | $242,000,000 | 98.6 | % | Loan Payoff | $240,789,383 | 98.2 | % | |

| Sponsor Equity: | 3,317,606 | 1.4 | Upfront reserves | 3,402,016 | 1.4 | |||

| Closing costs | 1,126,207 | 0.5 | ||||||

| Total Sources | $245,317,606 | 100.0 | % | Total Uses | $245,317,606 | 100.0 | % | |

| (1) | The Westfarms Mortgage Loan (as defined below) is part of the Westfarms Whole Loan (as defined below), which is comprised of nine pari passu senior promissory notes with an aggregate original principal balance of $242,000,000. The Cut-off Date Balance Per SF, Maturity Date Balance Per SF, U/W DSCR based on NOI/NCF, U/W Debt Yield based on NOI/NCF, U/W Debt Yield at Maturity based on NOI/NCF, Cut-off Date LTV Ratio and LTV Ratio at Maturity presented above are based on the aggregate Cut-off Date principal balance of the Westfarms Whole Loan. |

| (2) | See “The Mortgage Loan” section below for further discussion of additional mortgage debt. |

| (3) | See “Escrows” section below for further discussion of reserve requirements. |

| (4) | The Westfarms Property (as defined below) is part of a larger mall which consists of 501,990 SF of owned improvements, 560,820 SF of leased fee improvements, and a 208,790 SF non-collateral Macys. |

| (5) | Occupancy represents the occupancy based on the owned SF totaling 501,990. Occupancy based on total SF of 1,062,810, which includes the four leased fee anchor tenant’s square footage, is 98.0%, 96.7%, and 96.5% for the Most Recent, 2nd Most Recent and 3rd Most Recent periods, respectively. |

| (6) | The increase from the TTM NOI to the U/W NOI is driven by 11 leases signed being signed in 2023 totaling 29,630 SF (5.9% of owned SF), and 6.8% of underwritten rent. Additional drivers include rent steps of $506,056, and a decrease in both the management fee and real estate taxes. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. | ||

| 12 | ||

| Retail – Super Regional Mall | Loan #1 | Cut-off Date Balance: | $74,000,000 | |

| 1500 New Britain Avenue | Westfarms | Cut-off Date LTV: | 44.2% | |

| West Hartford, CT 06110 | U/W NCF DSCR: | 1.76x | ||

| U/W NOI Debt Yield: | 14.4% |

The Mortgage Loan. The largest mortgage loan (the “Westfarms Mortgage Loan”) is part of a whole loan (the “Westfarms Whole Loan”) evidenced by nine pari passu notes with an aggregate outstanding principal balance as of the Cut-off Date of $242,000,000. The Westfarms Whole Loan is secured by a first mortgage lien on the borrower’s fee interest in a 501,990 SF portion of a 1,271,600 SF super regional mall anchored by a JC Penney, Lord & Taylor (subleased by Jordan’s Furniture), Macys (non-collateral), Macys Men and Furniture Gallery, and Nordstrom located in West Hartford, Connecticut (the “Westfarms Property”). The Westfarms Mortgage Loan is evidenced by the non-controlling Notes A-2-2 and A-2-3 with an aggregate outstanding principal balance as of the Cut-off Date of $74,000,000. The Westfarms Whole Loan was co-originated by Goldman Sachs Bank USA (“GS”) and Wells Fargo Bank, National Association (“WFB”) on August 31, 2023. The Westfarms Whole Loan pari passu notes other than those evidencing the Westfarms Mortgage Loan are referred to herein as the “Westfarms Pari Passu Companion Loans.” The Westfarms Whole Loan is being serviced pursuant to the trust and servicing agreement for the BMO 2023-5C2 securitization trust. The relationship between the holders of the Westfarms Whole Loan is governed by a co-lender agreement as described under “Description of the Mortgage Pool—The Whole Loans—The Non-Serviced Pari Passu Whole Loans” in the prospectus.

Whole Loan Note Summary

| Note | Original Balance | Cut-off Date Balance | Note Holder | Controlling Piece |

| A-1 | $40,000,000 | $40,000,000 | BMO 2023-5C2 | Yes |

| A-2-1 | $45,000,000 | $45,000,000 | BANK5 2023-5YR3 | No |

| A-2-2 | $50,000,000 | $50,000,000 | BANK5 2023-5YR4 | No |

| A-2-3 | $24,000,000 | $24,000,000 | BANK5 2023-5YR4 | No |

| A-2-4 | $2,000,000 | $2,000,000 | WFB | No |

| A-3 | $20,000,000 | $20,000,000 | BMO 2023-5C2 | No |

| A-4 | $30,000,000 | $30,000,000 | UBS AG | No |

| A-5 | $16,000,000 | $16,000,000 | GSBI | No |

| A-6 | $10,000,000 | $10,000,000 | UBS AG | No |

| A-7 | $5,000,000 | $5,000,000 | BMO 2023-5C2 | No |

| Total (Whole Loan) | $242,000,000 | $242,000,000 |

The Borrower and Borrower Sponsor. The borrower is West Farms Mall, LLC, a Delaware limited liability company with two independent managers. The borrower is a joint venture between The Taubman Realty Group LLC (78.9%) and Victor J. Dowling Jr. (20.9%). The borrower sponsors and non-recourse carveout guarantor of the Westfarms Whole Loan is The Taubman Realty Group LLC (“The Taubman Company”).

The Taubman Company was founded in 1950 and has developed enclosed regional malls across the United States and Asia and the company has a portfolio of 24 regional, super-regional, and outlet shopping malls located in major markets.

The Property. The Westfarms Property is part of a two-story, Class A super regional mall. The Westfarms Property portion of the super regional mall totals 501,990 owned SF, and is located in West Hartford, Connecticut. The mall as a whole, which includes the Westfarms Property, totals 1,271,600 SF, and is anchored by JC Penney, Lord & Taylor (subleased by Jordan’s Furniture), Macys, Macys Men’s and Furniture, and Nordstrom. Macys owns its own store (208,790 SF) and underlying land and is not part of the collateral. The remaining anchors own their stores and ground lease the land from the borrower. The Westfarms Property is an enclosed mall with multiple wings and entrances, containing a food court and the leased fee department store anchors. Built in 1974 and most recently renovated in 2013, the entire mall is situated on a 111.0-acre parcel and contains 6,555 parking spaces (5.2/1,000 SF). The collateral tenancy, outside of the anchors, is granular with no tenant making up more than 4.5% of the owned SF. Notable tenants include Talbots, The North Face, Apple Inc., lululemon athletica, Pottery Barn, Victorias Secret, and Louis Vuitton. As of August 25, 2023, the Westfarms Property was 95.9% leased based on the owned improvements, and 98.0% leased including the four leased fee anchors.

The Westfarms Property is rated A+ by Greenstreet. Year-end 2022 in-line sales PSF are $888 PSF, representing a 13.1% and 19.1% increase since 2021 and 2019, respectively. Excluding Apple, 2022 in-line sales PSF are $713 PSF, representing a 11.7% and 19.8% increase since 2021 and 2019, respectively. As of year-end 2022, the in-line occupancy cost ratio is 11.5% including Apple and 14.2% excluding Apple. The table below provides an overview of the sales by tenancy type.

| Sales by Tenancy Type(1) | ||||||||

| Tenancy Type | 2019 Sales | 2019 PSF |

2020 Sales | 2020 PSF |

2021 Sales | 2021 PSF |

2022 Sales | 2022 PSF |

| Inline (< 10,000 SF) | $247,469,700 | $746 | $161,469,160 | $509 | $250,393,896 | $786 | $265,663,994 | $888 |

| Occupancy Cost | 14.9% | 18.6% | 12.2% | 11.5% | ||||

| Inline (< 10,000 SF) excluding Apple | $193,280,891 | $595 | $128,259,329 | $413 | $199,111,246 | $638 | $208,344,455 | $713 |

| Occupancy Cost | 18.7% | 22.7% | 14.9% | 14.2% | ||||

| (1) | Based on the underwritten rent roll dated August 25, 2023. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. | ||

| 13 | ||

| Retail – Super Regional Mall | Loan #1 | Cut-off Date Balance: | $74,000,000 | |

| 1500 New Britain Avenue | Westfarms | Cut-off Date LTV: | 44.2% | |

| West Hartford, CT 06110 | U/W NCF DSCR: | 1.76x | ||

| U/W NOI Debt Yield: | 14.4% |

Major Tenants.

Forever 21 (Fitch/Moody’s/S&P: NR/NR/NR; 22,512 square feet; 4.5% of net rentable area; 2.5% of underwritten base rent; MTM). Forever 21 is a fast fashion retailer specializing in the latest trends. Today, the company operates in more than 540 locations globally. Forever 21 has been a tenant since August 2013. Its lease expired in January 31, 2023 and they are currently operating on a month to month basis. Forever 21 is currently in negotiations to execute a new lease. However, we cannot assure you when or if Forever 21 will enter into a new lease. Additionally, the tenant is paying percentage in lieu of base rent of 13.5% of its trailing twelve month sales, which equates to $31.13 PSF in rent.

H&M (Fitch/Moody’s/S&P: NR/NR/BBB; 15,121 square feet; 3.0% of net rentable area; 1.6% of underwritten base rent; 1/31/2032 lease expiration). H&M is part of the H&M Group, which is a family of brands and businesses offering fashion, design and services. Today, the company operates approximately 4,399 stores in 77 markets and 60 online markets. H&M has been a tenant at the property since 2008 and most recently renewed for 10 years in February 2022. The tenant has no remaining extension options and no termination options.

Pottery Barn (Fitch/Moody’s/S&P: NR/NR/NR; 14,187 square feet; 2.8% of net rentable area; 0.8% of underwritten base rent; 1/31/2027 lease expiration). Pottery Barn is a member of the Williams-Sonoma Inc. (NYSE: WSM), family of brands, headquartered in San Francisco, California. Pottery Barn offers home décor including furniture, bedding, bath, lighting art and mirrors and rugs. Pottery Barn has been a tenant at the property since 2005 and has no remaining extension options and no termination options.

The following table presents a summary regarding the major tenants at the Westfarms Property:

Major Tenants

| Tenant Name |

Credit Rating (Fitch/Moody’s/ S&P)(1) |

Tenant NRSF | % of NRSF | Annual U/W Rent(2)(3) | % of Total Annual U/W Rent | Annual U/W Rent PSF(2)(3) | Lease Expiration Date | Ext. Options | Term. Option (Y/N) |

| Anchor Tenants(leased fee)(4) | |||||||||

| JC Penney | NR/NR/NR | 190,713 | NAP | $125,000 | NAP | $0.66 | 9/30/2032 | 5 x 5 Yr | N |

| Nordstrom | BB+/Ba1/BB+ | 175,415 | NAP | $140,000 | NAP | $0.80 | 2/1/2025 | 7 x 10 Yr | N |

| Lord & Taylor(5) | NR/NR/NR | 114,700 | NAP | $202,735 | NAP | $1.77 | 2/3/2034 | 6 x 5 Yr | N |

| Macys Mens and Furniture Gallery | BBB-/Ba1/BB+ | 79,992 | NAP | $0 | NAP | $0.00 | 5/31/2025 | 7 x 10 Yr | N |

| Total/Wtd. Avg. | 560,820 | NAP | $467,735 | NAP | $0.83 | ||||

| Major Tenants | |||||||||

| Forever 21(6) | NR/NR/NR | 22,512 | 4.5% | $700,785 | 2.5% | $31.13 | MTM | None | N |

| H&M | NRNR/BBB | 15,121 | 3.0% | $450,000 | 1.6% | $29.76 | 1/31/2032 | None | N |

| Pottery Barn | NR/NR/NR | 14,187 | 2.8% | $223,440 | 0.8% | $15.75 | 1/31/2027 | None | N |

| Gap Gap Kids | NR/NR/NR | 13,093 | 2.6% | $321,174 | 1.2% | $24.53 | 1/31/2025 | None | N |

| Anthropologie(6) | NR/NR/NR | 11,673 | 2.3% | $255,200 | 0.9% | $21.86 | 1/31/2027 | 1 x 5 Yr | N |

| Arhaus(7) | NR/NR/NR | 11,155 | 2.2% | $624,680 | 2.2% | $56.00 | 9/30/2033 | 1 x 5 Yr | N |

| Foot Locker | NR/Ba1/BB+ | 11,122 | 2.2% | $591,690 | 2.1% | $53.20 | 6/30/2025 | None | N |

| Urban Outfitters | NR/NR/NR | 10,958 | 2.2% | $650,000 | 2.3% | $59.32 | 1/31/2027 | None | N |

| Brooks Brothers(6) | NR/NR/NR | 10,644 | 2.1% | $311,760 | 1.1% | $29.29 | 1/31/2024 | None | N |

| Total/Wtd. Avg. | 120,465 | 24.0% | $4,128,729 | 14.9% | $34.27 | ||||

| Non-Major Tenants(8) | 360,737 | 71.9% | $23,673,122 | 85.1% | $65.62 | ||||

| Occupied Collateral Total(9) | 481,202 | 95.9% | $27,801,851 | 100.0% | $57.78 | ||||

| Vacant Space | 20,788 | 4.1% | |||||||

| Total/Wtd. Avg. | 501,990 | 100.0% |

| (1) | Certain ratings are those of the parent company whether or not the parent guarantees the lease. |

| (2) | Annual UW Rent and Annual UW Rent PSF includes percentage in-lieu of rents totaling $1,536,455. |

| (3) | Annual UW Rent and Annual UW Rent PSF includes $506,056 of rent steps through September 2024. |

| (4) | The anchor tenants own their own improvements and ground lease the land from the borrower. The SF of leased fee improvements is not included in the owned SF total. |

| (5) | Jordan’s Furniture is subleasing the former Lord & Taylor box and is expected to open in February 2024. Gap rent for the tenant was reserved upfront. |

| (6) | Forever 21, Anthropologie, and Brooks Brothers Annual UW Rent and Annual UW Rent PSF represent percentage in-lieu of rent based on the tenants’ TTM sales. |

| (7) | Arhaus has a lease start date of 10/1/2023. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. | ||

| 14 | ||

| Retail – Super Regional Mall | Loan #1 | Cut-off Date Balance: | $74,000,000 | |

| 1500 New Britain Avenue | Westfarms | Cut-off Date LTV: | 44.2% | |

| West Hartford, CT 06110 | U/W NCF DSCR: | 1.76x | ||

| U/W NOI Debt Yield: | 14.4% |

| (8) | Non-Major Tenants includes two tenants, Francesca’s Collection and Alo Yoga, totaling 6,998 SF (1.4% of owned SF) with lease start dates in November 2023 and September 2023, respectively. |

| (9) | Occupied Collateral Total does not include the SF or underwritten rent from the leased fee anchor tenants. |

The following table presents a summary of sales and occupancy costs for certain tenants at the Westfarms Property:

Sales and Occupancy Cost Summary(1)

| 2020 Sales (PSF) | 2021 Sales (PSF) | 2022 Sales (PSF) | |

| Forever 21 | $170 | $317 | $255 |

| H&M | $227 | $372 | $365 |

| Pottery Barn | $252 | $375 | $442 |

| Gap Gap Kids | $69 | $192 | $191 |

| Anthropologie | $76 | $225 | $257 |

| Arhaus(2) | NAV | NAV | NAV |

| Foot Locker | $512 | $620 | $677 |

| Urban Outfitters | $207 | $335 | $306 |

| Brooks Brothers | $47 | $187 | $239 |

| (1) | Information obtained from the borrower. |

| (2) | Arhaus lease began on October 1, 2023. |

The following table presents certain information relating to the lease rollover schedule at the Westfarms Property:

Lease Expiration Schedule(1)(2)(3)

| Year Ending December 31, |

No. of Leases Expiring | Expiring NRSF | % of Total NRSF | Cumulative Expiring NRSF | Cumulative % of Total NRSF | Annual U/W Base Rent |

% of Total Annual U/W Base Rent | Annual U/W Base Rent PSF |

| MTM | 5 | 35,656 | 7.1% | 35,656 | 7.1% | $1,328,478 | 4.8% | $37.26 |

| 2023 | 2 | 5,957 | 1.2% | 41,613 | 8.3% | $293,500 | 1.1% | $49.27 |

| 2024 | 50 | 119,908 | 23.9% | 161,521 | 32.2% | $7,758,635 | 27.9% | $64.70 |

| 2025 | 20 | 77,670 | 15.5% | 239,191 | 47.6% | $4,436,677 | 16.0% | $57.12 |

| 2026 | 12 | 31,740 | 6.3% | 270,931 | 54.0% | $2,526,862 | 9.1% | $79.61 |

| 2027 | 13 | 68,411 | 13.6% | 339,342 | 67.6% | $3,473,652 | 12.5% | $50.78 |

| 2028 | 12 | 45,166 | 9.0% | 384,508 | 76.6% | $2,576,028 | 9.3% | $57.03 |

| 2029 | 11 | 40,569 | 8.1% | 425,077 | 84.7% | $2,555,772 | 9.2% | $63.00 |

| 2030 | 10 | 23,348 | 4.7% | 448,425 | 89.3% | $1,365,972 | 4.9% | $58.50 |

| 2031 | 1 | 1,626 | 0.3% | 450,051 | 89.7% | $123,202 | 0.4% | $75.77 |

| 2032 | 2 | 16,296 | 3.2% | 466,347 | 92.9% | $528,000 | 1.9% | $32.40 |

| 2033 | 2 | 11,826 | 2.4% | 478,173 | 95.3% | $682,769 | 2.5% | $57.73 |

| 2034 & Beyond | 2 | 3,029 | 0.6% | 481,202 | 95.9% | $152,303 | 0.5% | $50.28 |

| Vacant | 0 | 20,788 | 4.1% | 501,990 | 100.0% | $0 | 0.0% | $0.00 |

| Total/Weighted Average(4) | 142 | 501,990 | 100.0% | $27,801,851 | 100.0% | $57.78 |

| (1) | Information is based on the underwritten rent roll as of August 25, 2023. |

| (2) | Certain tenants may have lease termination options that are exercisable prior to the stated expiration date of the subject lease or leases which are not considered in the lease rollover schedule. |

| (3) | The Lease Rollover Schedule excludes the square footage and underwritten rent from the leased fee anchor tenants. |

| (4) | Total/Weighted Avgerage Annual U/W Rent PSF Rolling excludes vacant space. |

The following table presents historical occupancy percentages at the Westfarms Property:

Historical Occupancy

|

12/31/2019(1) |

12/31/2020(1) |

12/31/2021(1) |

12/31/2022(1) |

6/30/2023(2) |

| 92.4% | 91.7% | 92.6% | 93.0% | 95.9% |

| (1) | Information obtained from the Westfarms Borrower. |

| (2) | Information obtained from the underwritten rent roll. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. | ||

| 15 | ||

| Retail – Super Regional Mall | Loan #1 | Cut-off Date Balance: | $74,000,000 | |

| 1500 New Britain Avenue | Westfarms | Cut-off Date LTV: | 44.2% | |

| West Hartford, CT 06110 | U/W NCF DSCR: | 1.76x | ||

| U/W NOI Debt Yield: | 14.4% |

Operating History and Underwritten Net Cash Flow. The following table presents certain information relating to the historical operating performance and underwritten net cash flow at the Westfarms Property:

Cash Flow Analysis

| 2019 | 2020 | 2021 | 2022 | TTM 6/30/2023 |

U/W | %(1) | U/W $ per SF(2) | |

| Base Rent | $27,282,519 | $22,983,686 | $23,234,186 | $24,713,923 | $25,823,273 | $28,269,586(3)(4) | 53.3% | $26.60 |

| Grossed Up Vacant Space |

$0 |

$0 |

$0 |

$0 |

$0 |

$1,902,406 |

3.6 |

$1.79 |

| Gross Potential Rent | $27,282,519 | $22,983,686 | $23,234,186 | $24,713,923 | $25,823,273 | $30,171,992 | 56.9% | $28.39 |

| Overage/Percentage Rent | $570,349 | $394,858 | $2,874,076 | $2,662,752 | $2,728,906 | $2,365,780 | 4.5 | $2.23 |

| Other Rental Revenue(5) | $2,239,692 | $1,644,375 | $1,977,439 | $2,000,578 | $1,994,711 | $2,088,324 | 3.9 | $1.96 |

| Reimbursement Revenue | $18,019,080 | $15,510,718 | $12,847,320 | $12,464,487 | $12,128,300 | $11,891,421 | 22.4 | $11.19 |

| Promotion Revenue | $1,434,317 | $1,161,019 | $814,395 | $789,287 | $757,717 | $710,484 | 1.3 | $0.67 |

| Electric/Central Plan/Tenant Services | $3,897,946 | $3,291,931 | $3,047,835 | $3,439,866 | $3,985,459 | $4,791,051 | 9.0 | $4.51 |

| Other Revenue |

$1,083,628 |

$879,228 |

$749,294 |

$1,089,098 |

$1,118,917 |

$1,022,931 |

1.9 |

$0.96 |

| Net Rental Income | $54,527,531 | $45,865,814 | $45,544,545 | $47,159,991 | $48,537,283 | $53,041,983 | 100.0% | $49.91 |

| Less Free Rent & Credit Loss | ($226,548) | ($3,406,378) | $2,090,563 | ($20,141) | ($8,386) | $0 | 0.0 | $0.00 |

| Less Vacancy |

$0 |

$0 |

$0 |

$0 |

$0 |

($1,902,406) |

(3.6) |

($1.79) |

| Effective Gross Income | $54,300,983 | $42,459,436 | $47,635,108 | $47,139,850 | $48,528,897 | $51,139,577 | 96.4% | $48.12 |

| Real Estate Taxes | $6,626,200 | $6,617,128 | $6,773,226 | $6,493,587 | $6,310,496 | $5,365,568 | 10.5 | $5.05 |

| Insurance | $302,092 | $301,031 | $321,564 | $395,847 | $382,436 | $304,114 | 0.6 | $0.29 |

| Management Fee | $1,853,841 | $1,467,975 | $1,893,556 | $1,935,175 | $2,025,709 | $1,000,000 | 2.0 | $0.94 |

| Other Expenses |

$7,699,981 |

$7,567,131 |

$8,871,413 |

$9,390,673 |

$8,898,840 |

$9,547,330 |

18.7 |

$8.98 |

| Total Expenses | $16,482,114 | $15,953,265 | $17,859,759 | $18,215,282 | $17,617,481 | $16,217,012 | 31.7% | $15.26 |

| Net Operating Income | $37,818,869 | $26,506,171 | $29,775,349 | $28,924,568 | $30,911,416(6) | $34,922,565(6) | 68.3% | $32.86 |

| TI/LC | $0 | $0 | $0 | $0 | $0 | $968,038 | 1.9 | $0.91 |

| Capital Expenditures |

$0 |

$0 |

$0 |

$0 |

$0 |

$306,214 |

0.6 |

$0.29 |

| Net Cash Flow | $37,818,869 | $26,506,171 | $29,775,349 | $28,924,568 | $30,911,416 | $33,648,313 | 65.8% | $31.66 |

| NOI DSCR(7) | 1.98x | 1.39x | 1.56x | 1.51x | 1.62x | 1.83x | ||

| NCF DSCR(7) | 1.98x | 1.39x | 1.56x | 1.51x | 1.62x | 1.76x | ||

| NOI Debt Yield(7) | 15.6% | 11.0% | 12.3% | 12.0% | 12.8% | 14.4% | ||

| NCF Debt Yield(7) | 15.6% | 11.0% | 12.3% | 12.0% | 12.8% | 13.9% |

| (1) | Represents (i) percent of Net Rental Income for all revenue fields and Vacancy, (ii) percent of Gross Potential Rent for Free Rent & Credit Loss and (iii) percent of Effective Gross Income for all other fields. |

| (2) | UW PSF is based on the total collateral SF of 1,062,810. |

| (3) | Base Rent includes percentage in-lieu of rents totaling $1,536,455 and includes $506,056 of rent steps through September 2024. |

| (4) | Base Rent includes $467,735 of underwritten rent attributed to the four leased fee tenants. |

| (5) | Other Rental Revenue includes kiosks/temporary/specialty and temporary tenant revenue. |

| (6) | The increase from the TTM 6/30/2023 NOI to the U/W NOI is driven by 11 leases being signed in 2023 totaling 29,630 SF (5.9% of owned SF), and 6.8% of underwritten rent. Additional drivers include rent steps of $506,056, and a decrease in both the management fee and real estate taxes. |

| (7) | Debt service coverage ratios and debt yields are based on the Westfarms Whole Loan. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. | ||

| 16 | ||

| Retail – Super Regional Mall | Loan #1 | Cut-off Date Balance: | $74,000,000 | |

| 1500 New Britain Avenue | Westfarms | Cut-off Date LTV: | 44.2% | |

| West Hartford, CT 06110 | U/W NCF DSCR: | 1.76x | ||

| U/W NOI Debt Yield: | 14.4% |

Appraisal. The appraiser concluded to an “As-is” value for the Westfarms Property of $547,8000,000 as of July 6, 2023.

Environmental Matters. According to the Phase I environmental site assessment dated July 17, 2023, there was no evidence of any recognized environmental conditions at the Westfarms Property.

Market Overview and Competition. The Westfarms Property is located in West Hartford, Connecticut, approximately 6.8 miles southwest of the Hartford central business district. The property is located at the intersection of New Britain Avenue (Route 71) and South Road. The property is located in an area that benefits from a convergence of highway infrastructure that includes Route 71, Route 4, Route 173/218 and Interstate 84, which provides access to the center of West Hartford. According to the appraisal, the area is seen as one of the main focuses of retail development on the west side of the Hartford CBSA, and the Westfarms Property was the catalyst for significant commercial development in the area. According to the appraisal, the top five employers in the surrounding area are Arch Parent, Inc., Mount Sinai Rehabilitation Hospital, Inc., Pratt & Whitney Engine Services, Inc., Hartford Healthcare Corporation and the City of Hartford.

Within a five-, ten- and fifteen-mile radius of the Westfarms Property, the 2022 average household income was approximately $90,496, $99,948, and $103,767, respectively; and within the same radii, the 2022 estimated population was 252,943, 606,771, and 944,379, respectively.

According to a third-party market research report, the property is situated within the Farmington retail submarket. As of August 2023, the submarket reported total inventory of approximately 2.29 million SF with a 1.0% vacancy rate and average rents of $20.31 PSF.

The following table presents certain information relating to the appraiser’s market rent conclusions for the Westfarms Property:

Market Rent Summary(1)

| Market Rent (PSF) | Lease Term (Yrs.) | Rent Increase Projections | New Tenant Improvements PSF | |

| Shops/Inline 0-1,000 SF | $115.00 | 7 | 2.5% | $35.00 |

| Shops/Inline 1,001-2,000 SF | $62.00 | 7 | 2.5% | $35.00 |

| Shops/Inline 2,001-3,500 SF | $70.00 | 7 | 2.5% | $35.00 |

| Shops/Inline 3,501-5,000 SF | $54.00 | 7 | 2.5% | $35.00 |

| Shops/Inline 5,001-10,000SF | $53.00 | 7 | 2.5% | $35.00 |

| 10,000 SF+ | $25.00 | 7 | 2.5% | $35.00 |

| Restaurant | $33.00 | 7 | 2.5% | $50.00 |

| Jewelry | $120.00 | 7 | 2.5% | $35.00 |

| Kiosk | $600.00 | 5 | Flat | $0.00 |

| (1) | Information obtained from the appraisal. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. | ||

| 17 | ||

| Retail – Super Regional Mall | Loan #1 | Cut-off Date Balance: | $74,000,000 | |

| 1500 New Britain Avenue | Westfarms | Cut-off Date LTV: | 44.2% | |

| West Hartford, CT 06110 | U/W NCF DSCR: | 1.76x | ||

| U/W NOI Debt Yield: | 14.4% |

The table below presents certain information relating to comparable retail centers pertaining to the Westfarms Property identified by the appraiser:

Competitive Set(1)

|

Property Name |

Year Built/Renovated |

Total NRA |

Total Occupancy(2) |

Anchor / Major Tenants |

Distance to Westfarms Property | |

| Westfarms | 1974/2013 | 1,062,810(3) | 98.0 | %(3) | JC Penney, Jordan’s Furniture, Macys Men’s and Furniture Gallery, Macys, Nordstrom | |

| The Shoppes at Buckland Hills | 1990/2003 | 1,048,198 | 96% | JC Penney, Macy’s | 12.0 miles | |

| Meriden Mall | 1971/1999 | 893,052 | 70% | Best Buy, Dick’s Sporting Goods, Boscov’s | 12.0 miles | |

| Brass Mill Center | 1997/NAP | 1,179,405 | 86% | JC Penney, Burlington | 18.0 miles | |

| Holyoke Mall at Ingleside | 1979/1995 | 1,557,138 | 92% | JC Penney, Macy’s, Target, Best Buy, Burlington, Christmas Tree Shop | 31.0 miles | |

| Blue Back Square | 2006/NAP | 448,211 | 96% | Barnes & Noble, Cinepolis Cinema, Crate & Barrel | 2.5 miles | |

| The Shoppes at Farmington Valley | 1990/NAP | 426,925 | 95% | Barnes & Noble, Dick’s Sporting Goods, Kohl’s, Old Navy, Shop Rite | 9.3 miles | |

| The Promenade Shops at Evergreen Walk | 2004/NAP | 374,979 | 93% | Old Navy, LL Bean | 12.3 miles | |

| Weighted Average | 91% | |||||

| (1) | Information obtained from the appraisal, unless otherwise specified. |

| (2) | Based on a third party market research report, unless otherwise specified. |

| (3) | Based on the underwritten rent roll as of August 25, 2023, and includes the leased fee anchor tenants improved square footage. |

Escrows.

Real Estate Taxes – During a Lockbox Event Period (as defined below), or at any time (x) any property taxes are not paid by the borrower prior to the assessment of a penalty, or (y) upon request of the lender the borrower fails to promptly provide evidence that property taxes have been paid prior to a penalty, the loan documents require the borrower to make monthly payments into the real estate tax reserve in an amount equal to 1/12th of the property taxes that the lender reasonably estimates will be payable during the ensuing 12 months.

Insurance – During the Lockbox Event Period, if the borrower has not provided satisfactory evidence to the lender that the property is covered by policies that are being maintained as part of a reasonably acceptable blanket insurance policy, the loan documents require the borrower to make ongoing monthly deposits in an amount equal to 1/12th of the insurance premiums that the lender reasonably estimates will be payable for the renewal of the coverage afforded by the policy in order to accumulate sufficient funds to pay the premiums at least 30 days prior to expiration.

Replacement Reserve – The loan documents require ongoing monthly deposits of $20,916 for replacement reserves.

TI/LC Reserve – The loan documents require ongoing monthly deposits of $41,833 for tenant improvements and leasing commissions reserves.

Gap Rent/Free Rent Reserve – The loan documents require an upfront deposit of $298,225 for gap and free rent related to Lord & Taylor(subleased by Jordan’s Furniture), Francesca’s Collection, Alo Yoga, and Arhaus.

Outstanding TI/LC Reserve – The loan documents require an upfront deposit of $3,103,791 for outstanding tenant improvements and leasing commissions related to 11 tenants.

Lockbox and Cash Management. The Westfarms Whole Loan is structured with a hard lockbox and springing cash management. The borrower is required to deposit all rents into a lender controlled lockbox account within two business days of receipt, and to direct all tenants to make direct rent deposits into the lockbox account. As long as a Lockbox Event Period is not in effect, all funds in the lockbox account are required to be distributed to the borrower. During the continuance of a Lockbox Event Period, all funds in the lockbox will be transferred to a lender controlled cash management account to be disbursed in accordance with the cash management waterfall set forth in the loan documents, with any excess funds required to be held as additional security in an excess cash flow subaccount controlled by the lender for so long as the Lockbox Event Period continues.

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. | ||

| 18 | ||

| Retail – Super Regional Mall | Loan #1 | Cut-off Date Balance: | $74,000,000 | |

| 1500 New Britain Avenue | Westfarms | Cut-off Date LTV: | 44.2% | |

| West Hartford, CT 06110 | U/W NCF DSCR: | 1.76x | ||

| U/W NOI Debt Yield: | 14.4% |

A “Lockbox Event Period” will commence upon the earlier of the following:

| (i) | the occurrence of an event of default; |

| (ii) | any bankruptcy action of the borrower; |

| (iii) | a bankruptcy action of the manager if the manager is an affiliate of the borrower, and provided the manager is not replaced within 60 days; or |

| (iv) | the net operating income debt yield, based on the trailing four calendar quarter period, is below 10.5%, for two consecutive quarters. |

A Lockbox Event Period will end upon the occurrence of the following:

| ● | with regard to clause (i), the cure of such event of default; |

| ● | with regard to clause (ii) and (iii), the borrower replaces the manager with a qualified manager under a replacement management agreement within 60 days, or the bankruptcy proceeding is discharged or dismissed within 90 days without any adverse consequences to the property or loan; or |

| ● | with regard to clause (iv), the net operating income debt yield, based on the trailing four calendar quarter period, is 10.5% or greater, for two consecutive quarters. |

Additional Secured Indebtedness (not including trade debts). The Westfarms Property also secures the Westfarms Serviced Pari Passu Companion Loans, which have an aggregate Cut-off Date principal balance of $168,000,000. The Westfarms Serviced Pari Passu Companion Loans accrue interest at the same rate as the Westfarms Mortgage Loan. The Westfarms Mortgage Loan is entitled to payments of principal and interest on a pro rata and pari passu basis with the Westfarms Serviced Pari Passu Companion Loans. The holders of the Westfarms Mortgage Loan and the Westfarms Serviced Pari Passu Companion Loans have entered into a co-lender agreement which sets forth the allocation of collections on the Westfarms Whole Loan. See “Description of the Mortgage Pool—The Whole Loans—The Serviced Pari Passu Whole Loans” in the prospectus.

Real Estate Substitution. Not permitted.

Property Management. The Westfarms Property is managed by The Taubman Company LLC, an affiliate of the borrower.

Subordinate and Mezzanine Indebtedness. None.

Ground Lease. None.

Rights of First Offer / Rights of First Refusal. None.

Letter of Credit. None.

Terrorism Insurance. The loan documents require that the “all risk” insurance policy required to be maintained by the borrower provides coverage for terrorism in an amount equal to the full replacement cost of the property, as well as business interruption insurance covering no less than the 18-month period following the occurrence of a casualty event, together with a 12-month extended period of indemnity (provided that if TRIPRA or a similar statute is not in effect, the borrower will not be obligated to pay terrorism insurance premiums in excess of two times the annual premium for the property and business interruption/rental loss insurance coverage). See “Risk Factors—Risks Relating to the Mortgage Loans—Terrorism Insurance May Not Be Available for All Mortgaged Properties” in the prospectus.

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. | ||

| 19 | ||

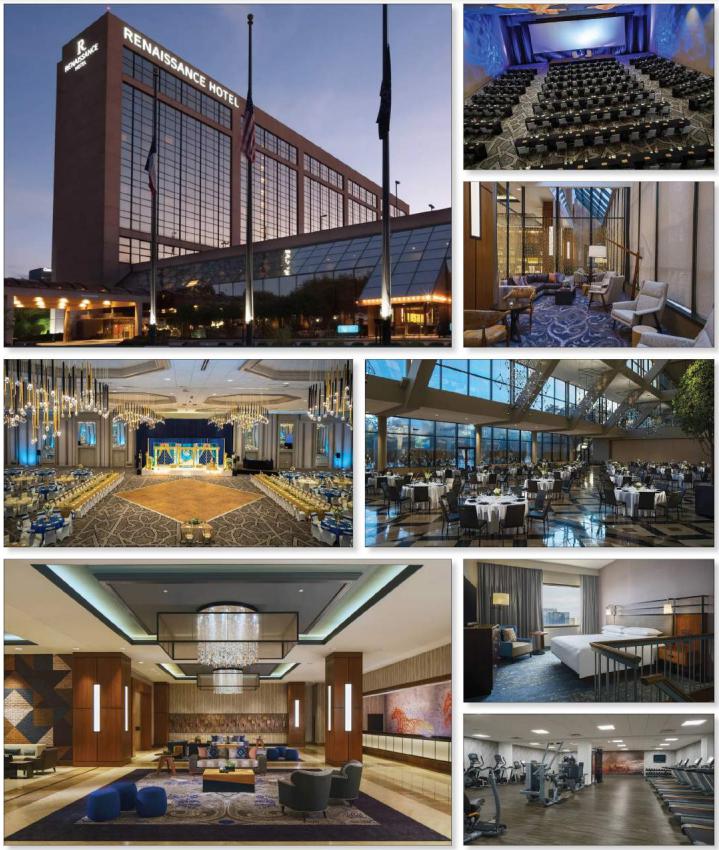

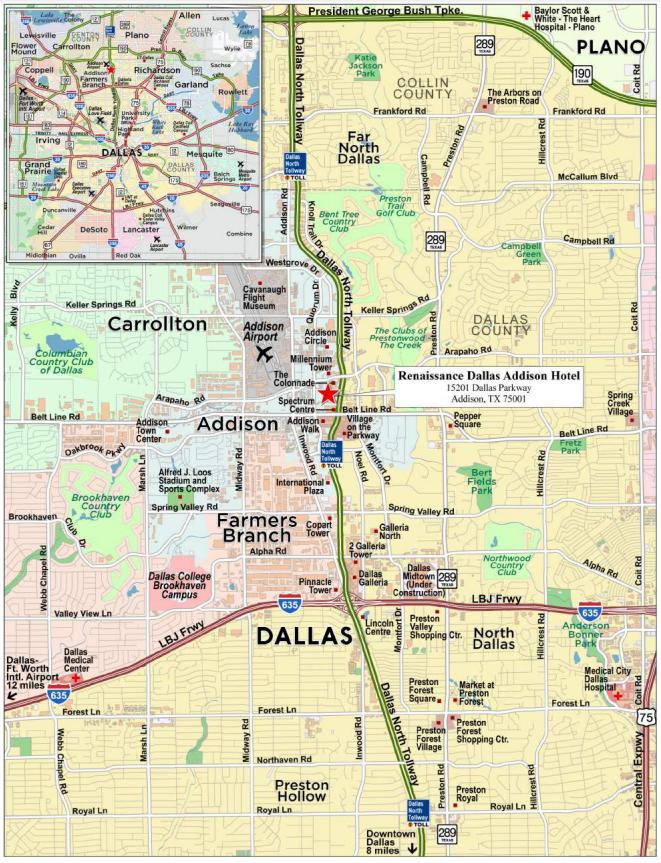

| Hospitality – Full Service | Loan #2 | Cut-off Date Balance: | $72,000,000 | |

| 15201 Dallas Parkway | Renaissance Dallas Addison Hotel | Cut-off Date LTV: | 63.4% | |

| Addison, TX 75001 | U/W NCF DSCR: | 1.60x | ||

| U/W NOI Debt Yield: | 14.7% |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. | ||

| 20 | ||

| Hospitality – Full Service | Loan #2 | Cut-off Date Balance: | $72,000,000 | |

| 15201 Dallas Parkway | Renaissance Dallas Addison Hotel | Cut-off Date LTV: | 63.4% | |

| Addison, TX 75001 | U/W NCF DSCR: | 1.60x | ||

| U/W NOI Debt Yield: | 14.7% |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. | ||

| 21 | ||

| No. 2 – Renaissance Dallas Addison Hotel |

| Mortgage Loan Information | Mortgaged Property Information | ||||||

| Mortgage Loan Seller: | Morgan Stanley Mortgage Capital Holdings LLC | Single Asset/Portfolio: | Single Asset | ||||

| Credit Assessment | NR/NR/NR | Property Type – Subtype: | Hospitality – Full Service | ||||

| (Fitch/KBRA/S&P): | Location: | Addison, TX | |||||

| Original Principal Balance: | $72,000,000 | Size: | 528 Rooms | ||||

| Cut-off Date Balance: | $72,000,000 | Cut-off Date Balance Per Room: | $136,364 | ||||

| % of Initial Pool Balance: | 9.6% | Maturity Date Balance Per Room: | $136,364 | ||||

| Loan Purpose: | Refinance | Year Built/Renovated: | 1983 / 2018-2021 | ||||

| Borrower Sponsor: | Columbia Sussex Corporation | Title Vesting: | Fee | ||||

| Guarantor: | CSC Holdings, LLC | Property Manager: | Crestview Management, LLC | ||||

| Mortgage Rate: | 7.8250% | (borrower-related) | |||||

| Note Date: | September 21, 2023 | Current Occupancy (As of)(2): | 50.2% (8/31/2023) | ||||

| Seasoning: | 2 months | YE 2022 Occupancy(2) | 40.1% | ||||

| Maturity Date: | October 1, 2028 | YE 2021 Occupancy(2): | 18.7% | ||||

| IO Period: | 60 months | YE 2020 Occupancy(2): | 10.8% | ||||

| Loan Term (Original): | 60 months | YE 2019 Occupancy(2): | 40.7% | ||||

| Amortization Term (Original): | NAP | As-Is Appraised Value: | $113,500,000 | ||||

| Loan Amortization Type: | Interest Only | As-Is Appraised Value Per Room: | $214,962 | ||||

| Call Protection: | L(26),D(27),O(7) | As-Is Appraisal Valuation Date: | July 21, 2023 | ||||

| Lockbox Type: | Hard/Springing Cash Management | ||||||

| Additional Debt: | None | Underwriting and Financial Information | |||||

| Additional Debt Type | NAP | TTM 8/31/2023 NOI(2): | $10,929,849 | ||||

| (Balance): | YE 2022 NOI(2): | $8,078,067 | |||||

| YE 2021 NOI(2): | $1,118,718 | ||||||

| Escrows and Reserves(1) | YE 2020 NOI(2): | ($470,360) | |||||

| Initial | Monthly | Cap | YE 2019 NOI(2): | $7,104,094 | |||

| Taxes: | $578,761 | $64,307 | NAP | U/W Revenues: | $28,306,100 | ||

| Insurance: | $0 | Springing | NAP | U/W Expenses: | $17,733,770 | ||

| Deferred Maintenance: | $6,215 | $0 | NAP | U/W NOI: | $10,572,330 | ||

| FF&E Reserve: | $0 | $117,942 | NAP | U/W NCF: | $9,157,025 | ||

| PIP Reserve | $0 | Springing | NAP | U/W DSCR based on NOI/NCF: | 1.85x / 1.60x | ||

| U/W Debt Yield based on NOI/NCF: | 14.7% / 12.7% | ||||||

| U/W Debt Yield at Maturity based on | |||||||

| NOI/NCF: | 14.7% / 12.7% | ||||||

| Cut-off Date LTV Ratio: | 63.4% | ||||||

| LTV Ratio at Maturity: | 63.4% | ||||||

| Sources and Uses | |||||||

| Sources | Uses | ||||||

| Mortgage Loan Amount | $72,000,000 | 100.0% | Loan Payoff | $52,348,142 | 72.7 | % | |

| Return of Equity | 18,672,967 | 25.9 | |||||

| Reserves | 584,976 | 0.8 | |||||

| Closing Costs | 393,916 | 0.5 | |||||

| Total Sources | $72,000,000 | 100.0% | Total Uses | $72,000,000 | 100.0 | % | |

| (1) | See “Escrows” below for further discussion of reserve requirements. |

| (2) | The decrease in Occupancy and NOI from 2019 to 2020, and the increase in Occupancy and NOI from 2020 to 2021, 2021 to 2022 and from 2022 to 8/31/2023 TTM was primarily due to the effect of the novel coronavirus on the hospitality industry in 2020, and the continued recovery in 2021 and 2022. |

The Mortgage Loan. The second largest mortgage loan (the “Renaissance Dallas Addison Hotel Mortgage Loan”) is evidenced by a promissory note in the original principal amount of $72,000,000 and secured by a fee mortgage encumbering a full-service hospitality property located in Addison, Texas (the “Renaissance Dallas Addison Hotel Property”).

The Borrower and Borrower Sponsor. The borrower for the Renaissance Dallas Addison Hotel Mortgage Loan is CP Addison II, LLC, a single-purpose, Delaware limited liability company with two independent directors in its organizational structure. Legal counsel to the borrower delivered a non-consolidation opinion in connection with the origination of the Renaissance Dallas Addison Hotel Mortgage Loan. CP Addison II, LLC is wholly owned by the non-recourse carve-out guarantor, CSC Holdings, LLC, which is 99% owned by The 1998 William J. Yung and Martha A. Yung Family Trust and 1% owned by its managing member, Columbia Sussex Corporation (the borrower sponsor), which in turn is owned 51% by William J. Yung, III, with the remainder owned by family trusts of the William J. Yung III family. Columbia Sussex Corporation is a private family-owned company based in Crestview Hills, Kentucky, with over 40 hotels in its portfolio, encompassing over 14,000 keys under various Marriott, Hilton, and Hyatt brands, all of which are managed by

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. | ||

| 22 | ||

| Hospitality – Full Service | Loan #2 | Cut-off Date Balance: | $72,000,000 | |

| 15201 Dallas Parkway | Renaissance Dallas Addison Hotel | Cut-off Date LTV: | 63.4% | |

| Addison, TX 75001 | U/W NCF DSCR: | 1.60x | ||

| U/W NOI Debt Yield: | 14.7% |

affiliates of the borrower sponsor. William J. Yung III is the founder, president, and Chief Executive Officer of Columbia Sussex Corporation. The borrower sponsor has experienced prior defaults and foreclosures. See “Description of the Mortgage Pool—Loan Purpose; Default History, Bankruptcy Issues and Other Proceedings” in the prospectus.

The Property. The Renaissance Dallas Addison Hotel Property is a 528-room, full-service hospitality property built on a 10.7-acre site in Addison, Texas. The Renaissance Dallas Addison Hotel Property was constructed in 1983 as the Registry Hotel, was rebranded as a Kempinksi Hotel in 1987, and was rebranded again in 1997 as an InterContinental Hotel. A franchise agreement was executed in November 2017, and in March 2018, the Renaissance Dallas Addison Hotel Property was reflagged to the current Renaissance brand following the issuance of a $34.1 million property improvement plan (“PIP”), which was completed in 2021. The PIP renovations included reconditioning of the exterior and new signage, renovation and upgrade of all lobby and common areas, reconfiguration of restaurant spaces, expansion and refitting of the fitness center, repairs and resurfacing of pool and terrace areas, reconceptualization of retail premises, refurbishment of meeting, conference center, and ballroom areas, upgrades of all back-of-house spaces, kitchens, telecommunications, and HVAC systems, and completion of fire and life safety upgrades. The PIP also included renovation of guest rooms, including replacement of case and soft goods and finishes, and refitting and refinishing of guest bathrooms. The Renaissance Dallas Addison Hotel Property features an outdoor swimming pool, a business center, fitness center, the restaurants Noell JCT and Noell Lounge (which are both operated internally), room service, and five retail tenant spaces that are currently 100.0% occupied. The Renaissance Dallas Addison Hotel Property also has approximately 95,007 square feet of dedicated meeting and event space, and 848 parking spaces, comprised of 315 surface spaces and 533 spaces located in a three-level garage that is attached to the Renaissance Dallas Addison Hotel Property.

The guestroom mix at the Renaissance Dallas Addison Hotel Property is comprised of 351 bedrooms with two queen beds and 177 king bedrooms, including 24 suites. Guestrooms are accessible via six passenger elevators, and room amenities feature a work area, nightstand, dresser, sofa chair, 55-inch high-definition flat screen television, internet, iron and ironing board, coffee maker, and a mini refrigerator. The 84-seat Noell JCT restaurant serves breakfast and lunch and features contemporary American-style cuisine. The 98-seat Noell Lounge serves lunch and dinner, featuring the same American-style cuisine as the Noell JCT restaurant. Noell Lounge features a full-service bar including craft cocktails, draft and bottled beers, and an extensive wine list for purchase. Room service is also available for breakfast, lunch and dinner, offering items from the full Noell JCT restaurant and Noell Lounge menus.

The Renaissance Dallas Addison Hotel Property is currently subject to a franchise agreement with Marriott International, Inc., which expires on March 15, 2039.

According to the appraisal, the property segmentation at the Renaissance Dallas Addison Hotel Property is estimated at 30% commercial, 10% leisure and 60% meeting and group.

The following table presents certain information relating to the Occupancy, ADR and RevPAR of the Renaissance Dallas Addison Hotel Property and its competitive set:

Historical Occupancy, ADR, RevPAR(1)(2)

| Competitive Set | Renaissance Dallas Addison Hotel Property | Penetration Factor | |||||||

| Year | Occupancy | ADR | RevPAR | Occupancy | ADR | RevPAR | Occupancy | ADR | RevPAR |

| 12/31/2020 | 26.6% | $109.18 | $29.06 | 10.8% | $156.23 | $16.89 | 40.6% | 143.1% | 58.1% |

| 12/31/2021 | 36.1% | $102.16 | $36.84 | 18.7% | $149.09 | $27.93 | 52.0% | 145.9% | 75.8% |

| 12/31/2022 | 63.6% | $112.50 | $71.57 | 40.1% | $154.94 | $62.09 | 63.0% | 137.7% | 86.8% |

| 7/31/2023 TTM | 62.3% | $121.15 | $75.46 | 46.9% | $150.19 | $70.51 | 75.4% | 124.0% | 93.4% |

Source: Industry Report.

| (1) | The competitive set for 7/31/2023 TTM and 12/31/2022 includes Marriott Dallas/Addison Quorum by the Galleria, Hyatt House Dallas Addison, Radisson Hotel Dallas North – Addison, and Home2 Suites by Hilton Dallas Addison. The competitive set for 12/31/2021 includes Dallas/Addison Marriott Quorum by the Galleria, Hilton Dallas Lincoln Centre, Crowne Plaza Dallas Near Galleria Addison and Hilton Richardson Dallas. The competitive set for 12/31/2020 includes Marriott Dallas/Addison Quorm by the Galleria, Hilton Dallas Lincoln Centre, Crowne Plaza Dallas Near Galleria Addison and Hyatt Regency North Dallas Richardson. |