| FREE WRITING PROSPECTUS | ||

| FILED PURSUANT TO RULE 433 | ||

| REGISTRATION FILE NO.: 333-257991-04 | ||

|

|

Free Writing Prospectus

Structural and Collateral Term Sheet

$531,901,217

(Approximate Initial Pool Balance)

Wells Fargo Commercial Mortgage Trust 2022-C62

as Issuing Entity

Wells Fargo Commercial Mortgage Securities, Inc.

as Depositor

LMF Commercial, LLC

Argentic Real Estate Finance LLC

BSPRT CMBS Finance, LLC

UBS AG

Wells Fargo Bank, National Association

as Sponsors and Mortgage Loan Sellers

Commercial

Mortgage Pass-Through Certificates

Series 2022-C62

March 23, 2022

WELLS

FARGO

Co-Lead Manager and Joint Bookrunner |

UBS SECURITIES LLC

Co-Lead Manager and Joint Bookrunner | |

Academy Securities Co-Manager |

Drexel Hamilton Co-Manager |

Siebert Williams Shank Co-Manager

|

STATEMENT REGARDING THIS FREE WRITING PROSPECTUS

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-257991) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the depositor, any underwriter, or any dealer participating in the offering will arrange to send you the prospectus after filing if you request it by calling toll free 1-800-745-2063 (8 a.m. – 5 p.m. EST) or by emailing wfs.cmbs@wellsfargo.com.

Nothing in this document constitutes an offer of securities for sale in any jurisdiction where the offer or sale is not permitted. The information contained herein is preliminary as of the date hereof, supersedes any such information previously delivered to you and will be superseded by any such information subsequently delivered and ultimately by the final prospectus relating to the securities. These materials are subject to change, completion, supplement or amendment from time to time.

This free writing prospectus has been prepared by the underwriters for information purposes only and does not constitute, in whole or in part, a prospectus for the purposes of (i) Regulation (EU) 2017/1129 (as amended), (ii) such Regulation as it forms part of UK domestic law, or (iii) Part VI of the UK Financial Services and Markets Act 2000, as amended; and does not constitute an offering document for any other purpose.

STATEMENT REGARDING ASSUMPTIONS AS TO SECURITIES, PRICING ESTIMATES AND OTHER INFORMATION

The attached information contains certain tables and other statistical analyses (the “Computational Materials”) which have been prepared in reliance upon information furnished by the Mortgage Loan Sellers. Numerous assumptions were used in preparing the Computational Materials, which may or may not be reflected herein. As such, no assurance can be given as to the Computational Materials’ accuracy, appropriateness or completeness in any particular context; or as to whether the Computational Materials and/or the assumptions upon which they are based reflect present market conditions or future market performance. The Computational Materials should not be construed as either projections or predictions or as legal, tax, financial or accounting advice. You should consult your own counsel, accountant and other advisors as to the legal, tax, business, financial and related aspects of a purchase of these securities. Any weighted average lives, yields and principal payment periods shown in the Computational Materials are based on prepayment and/or loss assumptions, and changes in such prepayment and/or loss assumptions may dramatically affect such weighted average lives, yields and principal payment periods. In addition, it is possible that prepayments or losses on the underlying assets will occur at rates higher or lower than the rates shown in the attached Computational Materials. The specific characteristics of the securities may differ from those shown in the Computational Materials due to differences between the final underlying assets and the preliminary underlying assets used in preparing the Computational Materials. The principal amount and designation of any security described in the Computational Materials are subject to change prior to issuance. None of Wells Fargo Securities, LLC, UBS Securities, LLC, Academy Securities, Inc., Drexel Hamilton, LLC, Siebert Williams Shank & Co., LLC or any of their respective affiliates, make any representation or warranty as to the actual rate or timing of payments or losses on any of the underlying assets or the payments or yield on the securities. The information in this presentation is based upon management forecasts and reflects prevailing conditions and management’s views as of this date, all of which are subject to change. In preparing this presentation, we have relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources or which was provided to us by or on behalf of the Mortgage Loan Sellers or which was otherwise reviewed by us.

This free writing prospectus contains certain forward-looking statements. If and when included in this free writing prospectus, the words “expects”, “intends”, “anticipates”, “estimates” and analogous expressions and all statements that are not historical facts, including statements about our beliefs or expectations, are intended to identify forward-looking statements. Any forward-looking statements are made subject to risks and uncertainties which could cause actual results to differ materially from those stated. Those risks and uncertainties include, among other things, declines in general economic and business conditions, increased competition, changes in demographics, changes in political and social conditions, regulatory initiatives and changes in customer preferences, many of which are beyond our control and the control of any other person or entity related to this offering. The forward-looking statements made in this free writing prospectus are made as of the date stated on the cover. We have no obligation to update or revise any forward-looking statement.

Wells Fargo Securities is the trade name for the capital markets and investment banking services of Wells Fargo & Company and its subsidiaries, including but not limited to Wells Fargo Securities, LLC, a member of NYSE, FINRA, NFA and SIPC, Wells Fargo Prime Services, LLC, a member of FINRA, NFA and SIPC, and Wells Fargo Bank, N.A. Wells Fargo Securities, LLC and Wells Fargo Prime Services, LLC are distinct entities from affiliated banks and thrifts.

IMPORTANT NOTICE REGARDING THE OFFERED CERTIFICATES

The information herein is preliminary and may be supplemented or amended prior to the time of sale. In addition, the Offered Certificates referred to in these materials and the asset pool backing them are subject to modification or revision (including the possibility that one or more classes of certificates may be split, combined or eliminated at any time prior to issuance or availability of a final prospectus) and are offered on a “when, as and if issued” basis.

The underwriters described in these materials may from time to time perform investment banking services for, or solicit investment banking business from, any company named in these materials. The underwriters and/or their affiliates or respective employees may from time to time have a long or short position in any security or contract discussed in these materials.

The information contained herein supersedes any previous such information delivered to any prospective investor and will be superseded by information delivered to such prospective investor prior to the time of sale.

IMPORTANT NOTICE RELATING TO AUTOMATICALLY-GENERATED EMAIL DISCLAIMERS

Any legends, disclaimers or other notices that may appear at the bottom of any email communication to which this free writing prospectus is attached relating to (1) these materials not constituting an offer (or a solicitation of an offer), (2) any representation that these materials are accurate or complete and may not be updated or (3) these materials possibly being confidential, are not applicable to these materials and should be disregarded. Such legends, disclaimers or other notices have been automatically generated as a result of these materials having been sent via Bloomberg or another system.

THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

2

| Wells Fargo Commercial Mortgage Trust 2022-C62 | Transaction Highlights |

| I. | Transaction Highlights |

Mortgage Loan Sellers:

| Mortgage Loan Seller | Number

of Mortgage Loans | Number

of Mortgaged Properties | Aggregate Cut-off Date Balance | %

of Initial Pool Balance | ||||||||

| LMF Commercial, LLC | 16 | 19 | $145,385,000 | 27.3 | % | |||||||

| Argentic Real Estate Finance LLC | 11 | 14 | 140,378,871 | 26.4 | ||||||||

| BSPRT CMBS Finance, LLC | 7 | 7 | 85,299,134 | 16.0 | ||||||||

| UBS AG | 7 | 32 | 84,175,000 | 15.8 | ||||||||

| Wells Fargo Bank, National Association | 5 | 10 | 76,663,212 | 14.4 | ||||||||

| Total | 46 | 82 | $531,901,217 | 100.0 | % | |||||||

Loan Pool:

| Initial Pool Balance: | $531,901,217 |

| Number of Mortgage Loans: | 46 |

| Average Cut-off Date Balance per Mortgage Loan: | $11,563,070 |

| Number of Mortgaged Properties: | 82 |

| Average Cut-off Date Balance per Mortgaged Property(1): | $6,486,600 |

| Weighted Average Mortgage Interest Rate: | 4.3758% |

| Ten Largest Mortgage Loans as % of Initial Pool Balance: | 48.6% |

| Weighted Average Original Term to Maturity or ARD (months): | 116 |

| Weighted Average Remaining Term to Maturity or ARD (months): | 114 |

| Weighted Average Original Amortization Term (months)(2): | 360 |

| Weighted Average Remaining Amortization Term (months)(2): | 359 |

| Weighted Average Seasoning (months): | 1 |

| (1) | Information regarding mortgage loans secured by multiple properties is based on an allocation according to relative appraised values or the allocated loan amounts or property-specific release prices set forth in the related loan documents or such other allocation as the related mortgage loan seller deemed appropriate. |

| (2) | Excludes any mortgage loan that does not amortize. |

Credit Statistics:

| Weighted Average U/W Net Cash Flow DSCR(1)(2): | 2.23x |

| Weighted Average U/W Net Operating Income Debt Yield(1)(2): | 11.1% |

| Weighted Average Cut-off Date Loan-to-Value Ratio(1)(2): | 58.2% |

| Weighted Average Balloon or ARD Loan-to-Value Ratio(1)(2): | 56.1% |

| % of Mortgage Loans with Additional Subordinate Debt(3): | 2.8% |

| % of Mortgage Loans with Single Tenants(4): | 6.2% |

| (1) | With respect to any mortgage loan that is part of a whole loan, loan-to-value ratio, debt service coverage ratio and debt yield calculations include the related pari passu companion loan(s) but exclude any related subordinate companion loan(s) (unless otherwise stated). The debt service coverage ratio, debt yield and loan-to-value ratio information do not take into account any subordinate debt (whether or not secured by the related mortgaged property), that currently exists or is allowed under the terms of any mortgage loan. See “Description of the Mortgage Pool—Mortgage Pool Characteristics” in the Preliminary Prospectus and Annex A-1 to the Preliminary Prospectus. |

| (2) | For certain of the mortgage loans, underwritten net cash flow, underwritten net operating income and appraised values of the related mortgaged properties were determined, or were calculated based on information as of a date, prior to the emergence of the novel coronavirus pandemic and the economic disruption resulting from measures to combat the pandemic, and the loan-to-value, debt service coverage and debt yield metrics presented in this term sheet may not reflect current market conditions. |

| (3) | The percentage figure expressed as “% of Mortgage Loans with Additional Subordinate Debt” is determined as a percentage of the initial pool balance and does not take into account any future subordinate debt (whether or not secured by the mortgaged property), if any, that may be permitted under the terms of any mortgage loan or the pooling and servicing agreement. See “Description of the Mortgage Pool—Additional Indebtedness” in the Preliminary Prospectus. |

| (4) | Excludes mortgage loans that are secured by multiple single tenant properties. |

THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

3

| Wells Fargo Commercial Mortgage Trust 2022-C62 | Characteristics of the Mortgage Pool |

| II. | Summary of the Whole Loans |

| No. | Loan Name | Mortgage Loan Seller in WFCM 2022-C62 | Trust Cut-off Date Balance | Aggregate Pari Passu Companion Loan Cut-off Date Balance(1) | Controlling Pooling/Trust & Servicing Agreement | Master Servicer | Special Servicer | Related Pari Passu Companion Loan(s) Securitizations | Related Pari Passu Companion Loan(s) Original Balance |

| 1 | Pacific Castle Portfolio | AREF | $44,700,000 | $64,700,000 | WFCM 2022-C62 | Wells Fargo Bank, National Association | Argentic Services Company, LP | Future Securitizations | $20,000,000 |

| 9 | GS Foods Portfolio | WFB | $17,520,000 | $57,520,000 | BANK 2022-BNK40 | Wells Fargo Bank, National Association | CWCapital Asset Management LLC | BANK 2022-BNK40 | $40,000,000 |

| 13 | ILPT Logistics Portfolio | UBS AG | $15,000,000 | $341,140,000 | ILPT 2022-LPFX | Berkadia Commercial Mortgage, LLC | Situs Holdings, LLC | ILPT 2022-LPFX | $326,140,000 |

| 17 | The Hallmark | BSPRT | $12,175,118 | $34,040,636 | BBCMS 2022-C14 | Midland Loan Services, a Division of PNC Bank National Association | Midland Loan Services, a Division of PNC Bank National Association | BBCMS 2022-C14 | $21,865,518 |

| (1) | The Aggregate Pari Passu Companion Loan Cut-off Date Balance excludes any related Subordinate Companion Loans. |

THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

4

| Wells Fargo Commercial Mortgage Trust 2022-C62 | Characteristics of the Mortgage Pool |

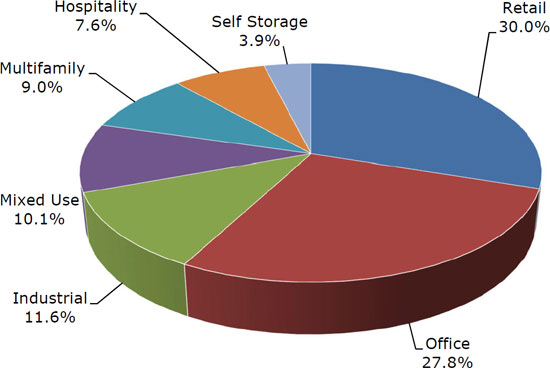

| III. | Property Type Distribution(1) |

| Property Type | Number

of Mortgaged Properties | Aggregate

Cut-off Date Balance ($) | %

of Initial Pool Balance (%) | Weighted Average Cut-off Date LTV Ratio (%) | Weighted Average Balloon LTV Ratio (%) | Weighted Average U/W NCF DSCR (x) | Weighted Average U/W NOI Debt Yield (%) | Weighted Average U/W NCF Debt Yield (%) | Weighted Average Mortgage Rate (%) | ||||||||||||||||||

| Retail | 20 | $159,653,064 | 30.0 | % | 62.5 | % | 61.2 | % | 2.16 | x | 10.1 | % | 9.5 | % | 4.2741 | % | |||||||||||

| Anchored | 8 | 118,488,064 | 22.3 | 63.4 | 61.6 | 2.23 | 10.5 | 9.8 | 4.2280 | ||||||||||||||||||

| Single Tenant | 12 | 41,165,000 | 7.7 | 59.8 | 59.8 | 1.96 | 8.9 | 8.7 | 4.4067 | ||||||||||||||||||

| Office | 8 | 147,725,118 | 27.8 | 56.0 | 54.1 | 2.34 | 12.0 | 11.2 | 4.5587 | ||||||||||||||||||

| Suburban | 5 | 82,425,118 | 15.5 | 58.1 | 54.6 | 2.16 | 11.4 | 10.6 | 4.4002 | ||||||||||||||||||

| CBD | 2 | 55,500,000 | 10.4 | 51.8 | 51.8 | 2.76 | 13.5 | 12.6 | 4.6333 | ||||||||||||||||||

| Medical | 1 | 9,800,000 | 1.8 | 62.9 | 62.9 | 1.49 | 8.3 | 8.2 | 5.4700 | ||||||||||||||||||

| Industrial | 26 | 61,870,000 | 11.6 | 49.8 | 48.0 | 2.25 | 10.5 | 9.8 | 3.9717 | ||||||||||||||||||

| Flex | 3 | 29,350,000 | 5.5 | 50.1 | 50.1 | 2.28 | 10.3 | 9.6 | 4.1350 | ||||||||||||||||||

| Warehouse/Distribution | 14 | 13,984,071 | 2.6 | 29.0 | 29.0 | 3.12 | 13.2 | 12.2 | 3.8647 | ||||||||||||||||||

| Cold Storage | 2 | 10,363,713 | 1.9 | 67.2 | 60.9 | 1.45 | 8.6 | 8.1 | 3.7900 | ||||||||||||||||||

| Warehouse/Cold Storage | 2 | 5,159,327 | 1.0 | 67.2 | 60.9 | 1.45 | 8.6 | 8.1 | 3.7900 | ||||||||||||||||||

| Cold Storage/Warehouse/Distribution | 1 | 1,495,160 | 0.3 | 67.2 | 60.9 | 1.45 | 8.6 | 8.1 | 3.7900 | ||||||||||||||||||

| Manufacturing/Warehouse | 3 | 1,015,929 | 0.2 | 29.0 | 29.0 | 3.12 | 13.2 | 12.2 | 3.8647 | ||||||||||||||||||

| Manufacturing/Cold Storage/Warehouse | 1 | 501,800 | 0.1 | 67.2 | 60.9 | 1.45 | 8.6 | 8.1 | 3.7900 | ||||||||||||||||||

| Mixed Use | 10 | 53,745,000 | 10.1 | 63.1 | 62.6 | 1.94 | 9.2 | 8.9 | 4.5762 | ||||||||||||||||||

| Multifamily/Retail | 5 | 31,895,000 | 6.0 | 67.1 | 67.1 | 1.75 | 8.1 | 8.0 | 4.6656 | ||||||||||||||||||

| Multifamily/Office/Retail | 1 | 6,200,000 | 1.2 | 57.9 | 57.9 | 2.51 | 11.6 | 10.7 | 4.2250 | ||||||||||||||||||

| Self Storage/Industrial | 1 | 6,150,000 | 1.2 | 56.6 | 56.6 | 2.28 | 9.4 | 9.2 | 3.9710 | ||||||||||||||||||

| Retail/Multifamily | 1 | 4,750,000 | 0.9 | 64.2 | 64.2 | 1.71 | 8.4 | 8.2 | 4.7500 | ||||||||||||||||||

| Self Storage/Recreational Vehicle Community | 1 | 2,750,000 | 0.5 | 51.9 | 43.4 | 1.99 | 13.7 | 13.4 | 5.4400 | ||||||||||||||||||

| Office/Retail | 1 | 2,000,000 | 0.4 | 47.6 | 47.6 | 2.74 | 13.7 | 12.5 | 4.5000 | ||||||||||||||||||

| Multifamily | 6 | 47,692,442 | 9.0 | 59.9 | 57.0 | 1.89 | 9.8 | 9.4 | 4.2746 | ||||||||||||||||||

| Mid Rise | 2 | 19,500,000 | 3.7 | 65.6 | 65.6 | 1.97 | 9.3 | 9.0 | 4.5336 | ||||||||||||||||||

| Garden | 2 | 18,850,000 | 3.5 | 56.6 | 52.6 | 1.85 | 9.7 | 9.4 | 3.8420 | ||||||||||||||||||

| Student Housing | 1 | 6,492,442 | 1.2 | 50.7 | 41.3 | 1.92 | 12.3 | 11.8 | 4.6100 | ||||||||||||||||||

| Low Rise | 1 | 2,850,000 | 0.5 | 63.6 | 63.6 | 1.62 | 7.7 | 7.6 | 4.6000 | ||||||||||||||||||

| Hospitality | 5 | 40,615,593 | 7.6 | 54.4 | 45.7 | 2.96 | 18.4 | 16.8 | 4.4557 | ||||||||||||||||||

| Limited Service | 3 | 18,926,656 | 3.6 | 56.7 | 50.0 | 2.93 | 18.7 | 16.9 | 5.0191 | ||||||||||||||||||

| Extended Stay | 1 | 12,936,722 | 2.4 | 43.9 | 34.2 | 3.68 | 21.1 | 19.5 | 3.3410 | ||||||||||||||||||

| Full Service | 1 | 8,752,214 | 1.6 | 64.8 | 53.3 | 1.97 | 13.8 | 12.6 | 4.8850 | ||||||||||||||||||

| Self Storage | 7 | 20,600,000 | 3.9 | 57.2 | 57.2 | 1.98 | 9.4 | 9.2 | 4.6197 | ||||||||||||||||||

| Self Storage | 7 | 20,600,000 | 3.9 | 57.2 | 57.2 | 1.98 | 9.4 | 9.2 | 4.6197 | ||||||||||||||||||

| Total | 82 | $531,901,217 | 100.0 | % | 58.2 | % | 56.1 | % | 2.23 | x | 11.1 | % | 10.5 | % | 4.3758 | % | |||||||||||

| (1) | Because this table presents information relating to the mortgaged properties and not the mortgage loans, the information for mortgage loans secured by more than one mortgaged property is based on allocated loan amounts (allocating the principal balance of the mortgage loan to each of those properties according to the relative appraised values of the mortgaged properties or the allocated loan amounts or property-specific release prices set forth in the related mortgage loan documents or such other allocation as the related mortgage loan seller deemed appropriate). With respect to any mortgage loan that is part of a whole loan, the loan-to-value ratio, debt service coverage ratio and debt yield calculations include the related pari passu companion loan(s) but exclude any related subordinate secured loan(s) (unless otherwise stated). With respect to each mortgage loan, debt service coverage ratio, debt yield and loan-to-value ratio information do not take into account any subordinate debt (whether or not secured by the related mortgaged property) that currently exists or is allowed under the terms of such mortgage loan. See Annex A-1 to the Preliminary Prospectus. |

THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

5

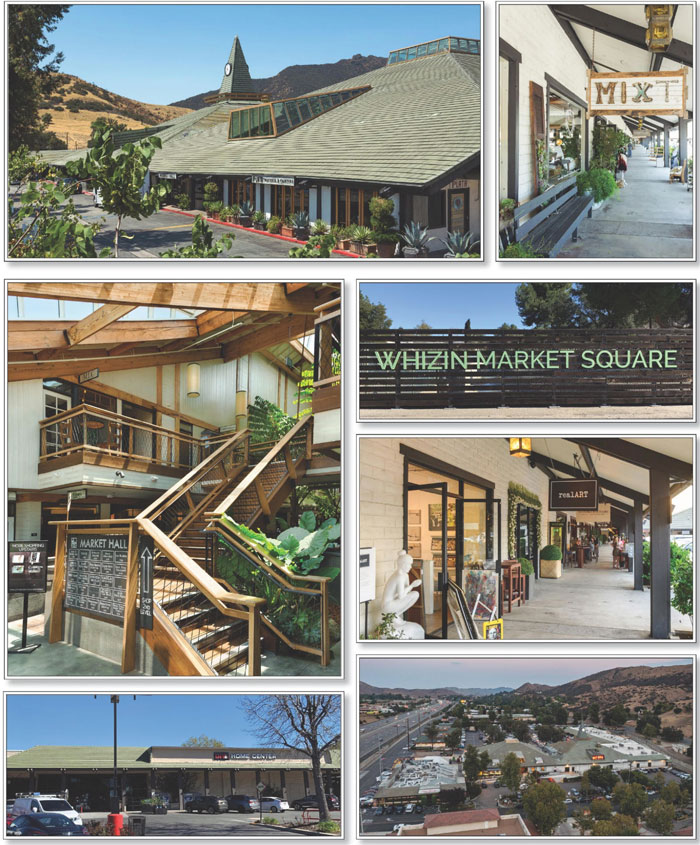

| Retail – Anchored | Loan #1 | Cut-off Date Balance: | $44,700,000 | |

| Property Addresses - Various | Pacific Castle Portfolio | Cut-off Date LTV: | 60.0% | |

| U/W NCF DSCR: | 2.43x | |||

| U/W NOI Debt Yield: | 10.2% |

THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

6

| No. 1 – Pacific Castle Portfolio | ||||||

| Mortgage Loan Information | Mortgaged Property Information | |||||

| Mortgage Loan Seller: | AREF | Single Asset/Portfolio: | Portfolio | |||

Credit Assessment (Fitch/KBRA/Moody’s): |

NR/NR/NR | Property Type – Subtype: | Retail - Anchored | |||

| Original Principal Balance(1): | $44,700,000 | Location: | Various | |||

| Cut-off Date Balance(1): | $44,700,000 | Size: | 465,115 SF | |||

| % of Initial Pool Balance: | 8.4% | Cut-off Date Balance Per SF(1): | $139.11 | |||

| Loan Purpose(2): | Acquisition/Refinance | Maturity Date Balance Per SF(1): | $139.11 | |||

| Borrower Sponsors: | Wayne Cheng and Cheng Family Trust, dated December 21, 2001 | Year Built/Renovated: | Various/Various | |||

| Guarantors: | Wayne Cheng and Cheng Family Trust, dated December 21, 2001 | Title Vesting: | Fee | |||

| Mortgage Rate: | 3.8850% | Property Manager: | Pacific Castle Management, Inc. | |||

| Note Date: | February 2, 2022 | Current Occupancy (As of): | 92.0% (1/1/2022) | |||

| Seasoning: | 2 months | YE 2020 Occupancy: | 86.0% | |||

| Maturity Date: | February 6, 2032 | YE 2019 Occupancy(4): | 91.4% | |||

| IO Period: | 120 months | YE 2018 Occupancy(4): | 90.7% | |||

| Loan Term (Original): | 120 months | As-Is Appraised Value(5): | $107,800,000 | |||

| Amortization Term (Original): | NAP | As-Is Appraised Value Per SF(5): | $231.77 | |||

| Loan Amortization Type: | Interest Only | As-Is Appraisal Valuation Date(5): | December 28, 2021 | |||

| Call Protection: | L(26),D(89),O(5) | |||||

| Lockbox Type: | Hard/Springing Cash Management | Underwriting and Financial Information(6) | ||||

| Additional Debt(1): | Yes | TTM NOI (9/30/2021)(7): | $5,675,258 | |||

| Additional Debt Type (Balance)(1): | Pari Passu ($20,000,000) | YE 2020 NOI: | $5,089,684 | |||

| YE 2019 NOI(8): | $5,607,506 | |||||

| YE 2018 NOI: | $5,234,513 | |||||

| U/W Revenues: | $9,182,898 | |||||

| U/W Expenses: | $2,601,302 | |||||

| Escrows and Reserves(3) | U/W NOI(7): | $6,581,596 | ||||

| Initial | Monthly | Cap | U/W NCF: | $6,192,992 | ||

| Taxes | $373,548 | $74,710 | NAP | U/W DSCR based on NOI/NCF(1): | 2.58x / 2.43x | |

| Insurance | $106,062 | $11,785 | NAP | U/W Debt Yield based on NOI/NCF(1): | 10.2% / 9.6% | |

| Replacement Reserve | $0 | $5,814 | $348,836 | U/W Debt Yield at Maturity based on NOI/NCF(1): | 10.2% / 9.6% | |

| TI/LC Reserve | $300,000 | $29,070 | $1,046,509 | Cut-off Date LTV Ratio(1)(5): | 60.0% | |

| Immediate Repairs | $40,063 | $0 | NAP | LTV Ratio at Maturity(1)(5): | 60.0% | |

| Sources and Uses | |||||||

| Sources | Uses | ||||||

| Original whole loan amount | $64,700,000 | 83.6% | Purchase price(2) | $50,847,934 | 65.7% | ||

| Equity contribution | 12,719,130 | 16.4 | Loan payoff(2) | 24,582,758 | 31.8 | ||

| Closing costs | 1,168,766 | 1.5 | |||||

| Reserves | 819,673 | 1.1 | |||||

| Total Sources | $77,419,130 | 100.0% | Total Uses | $77,419,130 | 100.0% | ||

| (1) | The Pacific Castle Portfolio Mortgage Loan (as defined below) is part of the Pacific Castle Portfolio Whole Loan (as defined below) with an original aggregate principal balance of $64,700,000. The Cut-off Date Balance Per SF, Maturity Date Balance Per SF, U/W DSCR based on NOI/NCF, U/W Debt Yield based on NOI/NCF, U/W Debt Yield at Maturity based on NOI/NCF, Cut-off Date LTV Ratio and LTV Ratio at Maturity numbers presented above are based on the Pacific Castle Portfolio Whole Loan. |

| (2) | The Pacific Castle Portfolio Whole Loan facilitated the acquisition of the Sandstone Village Property (as defined below) for approximately $18.3 million and the Rancho Cordova Town Center Property (as defined below) for $32.5 million, and the refinance of the Prune Tree Center Property (as defined below) and Rimrock Plaza Property (as defined below). |

| (3) | See “Escrows” section below. |

| (4) | The Rimrock Plaza Property was acquired in 2020 and the prior owner did not provide historical occupancy statistics. The occupancy figures used in the calculation were obtained from the appraisal. |

| (5) | The As-Is Appraised Value represents the portfolio market value of the Pacific Castle Portfolio Properties (as defined below) as of December 28, 2021, if the entire property portfolio is marketed to a single purchaser. Based on the sum of the appraised values of the individual properties which equals $101,350,000, the As-Is Appraised Value Per SF, Cut-off Date LTV Ratio and LTV Ratio at Maturity are $217.90, 63.8% and 63.8%, respectively. |

| (6) | While the Pacific Castle Portfolio Mortgage Loan was originated after the emergence of the novel coronavirus pandemic and the economic disruption resulting from measures to combat the pandemic, the pandemic is an evolving situation and could impact the Pacific Castle Portfolio Mortgage Loan more severely than assumed in the underwriting and could adversely affect the NOI, NCF and occupancy information, as well as the appraised value and the DSCR, LTV and Debt Yield metrics presented above. See “Risk Factors—Risks Related to Market Conditions and Other External Factors— |

THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

7

| Retail – Anchored | Loan #1 | Cut-off Date Balance: | $44,700,000 | |

| Property Addresses - Various | Pacific Castle Portfolio | Cut-off Date LTV: | 60.0% | |

| U/W NCF DSCR: | 2.43x | |||

| U/W NOI Debt Yield: | 10.2% |

Coronavirus Pandemic Has Adversely Affected the Global Economy and Will Likely Adversely Affect the Performance of the Mortgage Loans” in the Preliminary Prospectus.

| (7) | The difference between UW NOI and TTM NOI is primarily attributed to (i) $124,146 of rent steps, (ii) an increase in recoveries, and (iii) recent leasing resulting in an increase in occupancy from 87.2% as of September 30, 2021 to 92.0% as of January 1, 2022. |

| (8) | Represents 2019 NOI for the Sandstone Village Property, Rancho Cordova Town Center Property, and Prune Tree Center Property. Represents the 6/30/2019 T6 annualized NOI for the Rimrock Plaza Property. The Rimrock Plaza Property was acquired in 2020 and the prior owner did not provide full year 2019 operating statements. |

The Mortgage Loan. The mortgage loan (the “Pacific Castle Portfolio Mortgage Loan”) is part of a whole loan (the “Pacific Castle Portfolio Whole Loan”) that is evidenced by four promissory notes secured by a first priority fee mortgage encumbering a 465,115 square foot portfolio of four anchored retail properties located in California and Utah (the “Rancho Cordova Town Center Property”, “Prune Tree Center Property”, “Rimrock Plaza Property”, and “Sandstone Village Property”, and collectively, the “Pacific Castle Portfolio Properties”). Proceeds from the Pacific Castle Portfolio Whole Loan were used to facilitate the refinance and acquisition of the Pacific Castle Portfolio Properties, fund reserve accounts, and pay closing costs.

Note Summary

| Notes | Original Principal Balance | Cut-off Date Balance | Note Holder | Controlling Interest |

| A-1 | $30,000,000 | $30,000,000 | WFCM 2022-C62 | Yes |

| A-2 | $20,000,000 | $20,000,000 | MSC 2022-L8 | No |

| A-3 | $10,000,000 | $10,000,000 | WFCM 2022-C62 | No |

| A-4 | $4,700,000 | $4,700,000 | WFCM 2022-C62 | No |

| Total | $64,700,000 | $64,700,000 |

The Borrowers and Borrower Sponsors. The borrowers are PC Prunetree, LLC, Pacific Castle Rimrock, LLC, Pacific Castle Sandstone, LLC, and Pacific Castle Rancho, LLC, each a Delaware limited liability company and single purpose entity with one independent director. Each borrower owns one individual Pacific Castle Portfolio Property. Legal counsel to the borrowers delivered a non-consolidation opinion in connection with the origination of the Pacific Castle Portfolio Whole Loan.

The borrower sponsors and non-recourse carveout guarantors of the Pacific Castle Portfolio Whole Loan are Wayne Cheng and the Cheng Family Trust, dated December 21, 2001. Wayne Cheng is the founder and CEO of Pacific Castle, a real estate investment company founded in 1993 that has executed over $1.0 billion in transactions since its founding. Affiliates of Pacific Castle currently own and/or manage a portfolio of shopping centers in the western United States. The total portfolio is comprised of nearly 2.0 million square feet.

The Properties. The Pacific Castle Portfolio Whole Loan is secured by four anchored retail properties totaling 465,115 square feet located in California (81.0% of NRA) and Utah (19.0% of NRA). The Pacific Castle Portfolio Properties were 92.0% occupied by 85 tenants as of January 1, 2022. Ten tenants occupying approximately 31.3% of the NRA are investment grade tenants. Thirty-nine tenants occupying approximately 61.6% of the NRA have renewed their respective leases one or more times.

The following table presents certain information relating to the Pacific Castle Portfolio Properties:

Portfolio Summary

| Property Name | City, State(1) | Net Rentable Area (SF)(2) | Year Built/ Renovated(1) |

Occupancy %(2) | Allocated Cut-off Date Balance(3) | % of ALA | “As-Is” Appraised Value(1) | U/W NCF |

| Rancho Cordova Town Center | Rancho Cordova, CA | 148,656 | 1988/NAP | 94.2% | $21,704,983 | 33.5% | $34,000,000 | $2,592,361 |

| Prune Tree Center | Prunedale, CA | 131,655 | 1989/2016 | 93.7% | $17,906,611 | 27.7% | $28,050,000 | $1,637,749 |

| Rimrock Plaza | Palm Springs, CA | 96,348 | 1982/NAP | 81.0% | $13,086,828 | 20.2% | $20,500,000 | $934,939 |

| Sandstone Village | St. George, UT | 88,456 | 2004-2005/NAP | 97.7% | $12,001,579 | 18.5% | $18,800,000 | $1,027,943 |

| Total/Wtd. Avg. | 465,115 | 92.0% | $64,700,000 | 100.0% | $107,800,000(4) | $6,192,992 | ||

| (1) | Information obtained from the appraisals. |

| (2) | Information obtained from the underwritten rent roll as of January 1, 2022. |

| (3) | Based on the Pacific Castle Portfolio Whole Loan. |

| (4) | The Total As-Is Appraised Value represents the portfolio market value of the Pacific Castle Portfolio Properties as of December 28, 2021, if the entire property portfolio is marketed to a single purchaser. The sum of the appraised values of the individual properties equals $101,350,000. |

THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

8

| Retail – Anchored | Loan #1 | Cut-off Date Balance: | $44,700,000 | |

| Property Addresses - Various | Pacific Castle Portfolio | Cut-off Date LTV: | 60.0% | |

| U/W NCF DSCR: | 2.43x | |||

| U/W NOI Debt Yield: | 10.2% |

Rancho Cordova Town Center Property (32.0% of NRA; 33.5% of Allocated Loan Amount (“ALA”)): The Rancho Cordova Town Center Property is a 148,656 square foot anchored retail shopping center located in a commercial hub in Rancho Cordova, California, north of Highway 50. The improvements were constructed in 1988 and are situated on an approximately 12.2-acre site. The Rancho Cordova Town Center Property is anchored by Ross, Marshall’s, and Michael’s Stores, Inc. Both Ross and Marshall’s have been in occupancy since 2012 and have a lease expiration in January 2027 with three, five-year renewals remaining and August 2027 with three, five-year renewals remaining, respectively. Marshall’s recently executed a five-year extension in February 2022. Michael’s Stores, Inc has been in occupancy since 1988 and has a lease expiration in June 2024. The Rancho Cordova Town Center Property is also shadow anchored by a Super Target store which is not part of the collateral for the Pacific Castle Portfolio Whole Loan. As of January 1, 2022, the Rancho Cordova Town Center Property was 94.2% occupied by 30 tenants. The Rancho Cordova Town Center Property features 690 surface parking spaces (4.6 per 1,000 SF).

Prune Tree Center Property (28.3% of NRA; 27.7% of ALA): The Prune Tree Center Property is a 131,655 square foot anchored retail shopping center located in Prunedale, California, approximately five miles north of Salinas and approximately 21 miles northeast of Monterey. The improvements consist of five retail buildings situated on an 18.85-acre site and were constructed in 1989 and most recently renovated in 2016. The Prune Tree Center Property contains 121,849 square feet of retail space and 9,806 square feet of office space (on the second floor of one of the five buildings). The Prune Tree Center Property also features 561 surface parking spaces (4.3 per 1,000 SF). The Prune Tree Center Property is anchored by Safeway and CVS. Safeway has been in occupancy since 1989 and has a lease expiration in May 2024 with six, five-year renewal options remaining. CVS has been in occupancy since 1989 and has a lease expiration in June 2024 with five, five-year renewal options remaining. Safeway and CVS have in place rents that are 14.9% and 29.8% below market rents concluded in the appraisal. Three of the five buildings are pad buildings that are currently ground leased to McDonald’s, Starbucks, and Taco Bell. As of January 1, 2022, the Prune Tree Center Property was 93.7% occupied by 30 tenants.

Rimrock Plaza Property (20.7% of NRA; 20.2% of ALA): The Rimrock Plaza Property is a 96,348 square foot anchored retail shopping center located in Palm Springs, California, on the southeast corner of East Palm Canyon Drive and Matthew Drive. The improvements consist of four buildings that were constructed in 1982. The Rimrock Plaza Property is situated on an approximately 9.4-acre site with 437 surface parking spaces (4.5 per 1,000 SF). The Rimrock Plaza Property is anchored by Vons supermarket. Vons has been in occupancy since 1981 and has a lease expiration in May 2026 with one, five-year renewal option remaining. Furthermore, Vons’ current rent is approximately 48.7% below the market rents concluded in the appraisal. According to the appraisal, the Rimrock Plaza Property reached 100% occupancy in late 2013 and remained fully occupied from 2014 to 2019. The borrower sponsor acquired the Rimrock Plaza Property in 2020 and began converting leases from modified gross to triple net as leases expired causing the occupancy to gradually decreased in first quarter of 2020 and dropping below 80% in 2021. Occupancy has increased to 81.0% as of January 1, 2022 across 18 tenants and the borrower sponsor currently has several letters of intent under negotiation. The appraisal concluded to a stabilized occupancy of 92.5% for the Rimrock Plaza Property.

Sandstone Village Property (19.0% of NRA; 18.5% of ALA): The Sandstone Village Property is an 88,456 square foot anchored retail shopping center located in St. George, Utah, at the southeast quadrant of the St. George Boulevard exit on Interstate 15. The improvements consist of three buildings that were constructed in 2004-2005. The Sandstone Village Property is situated on a 6.8-acre site with 365 surface parking spaces (4.1 per 1,000 SF and is anchored by TJ Maxx. TJ Maxx has been a tenant at the Sandstone Village Property since 2004 and has a lease expiration in May 2024 with two, five-year renewal options remaining. As of January 1, 2022, the Sandstone Village Property was 97.7% occupied by nine tenants.

Major Tenants.

Largest Tenant: TJ Maxx (48,067 square feet; 10.3% of net rentable area; 8.3% of underwritten base rent; May 31, 2024 lease expiration; Sandstone Village Property) – TJ Maxx is a leading off-price retailer founded in 1977, with more than 1,200 stores spanning 49 states and Puerto Rico. The lease is signed by The TJX Companies, Inc. (NYSE: TJX, rated A2/A by Moody’s/S&P), the parent company of TJ Maxx. TJX operates more than 4,500 stores in nine countries across three continents, as well as four e-commerce businesses. TJ Maxx has been a tenant at the Sandstone Village Property since 2004 when it commenced a ten-year lease. The tenant has renewed its lease on two separate occasions, most recently for five years commencing in June 2019. TJ Maxx has two, five-year renewal options remaining. TJ Maxx has the right to terminate its lease if occupancy (excluding the TJ Maxx space) at Sandstone Village Property remains below 22,000 SF for 180 consecutive days. TJ Maxx reported sales of $409 PSF and $331 PSF for 2019 and 2020, respectively.

Second Largest Tenant: Vons (41,330 square feet; 8.9% of net rentable area; 4.6% of underwritten base rent; May 31, 2026 lease expiration; Rimrock Plaza Property) – Vons is a Southern California and Southern Nevada supermarket chain owned by Albertsons (NYSE: ACI, rated Ba3/BB by Moody’s/S&P). Vons is headquartered in Fullerton, California and operates stores under the Vons and Pavilions banners. Vons stores offer a bakery, deli, seafood counter, liquor store, floral department, pharmacy and various other services. Vons has been a tenant at the Rimrock Plaza Property for over 40 years and has exercised four renewal options since the original lease expired. Vons has one, five-year renewal option remaining and no termination options. Vons reported sales of $596 PSF, $703 PSF and $701 PSF for 2019, 2020 and 2021, respectively.

Third Largest Tenant: Safeway (35,722 square feet; 7.7% of net rentable area; 4.7% of underwritten base rent; May 31, 2024 lease expiration; Prune Tree Center Property) – Safeway (rated Ba3/BB by Moody’s/S&P) is an American supermarket chain founded in 1915 in American Falls, Idaho. The chain provides grocery items, food and general merchandise and features a variety of specialty departments, such as bakery, delicatessen, floral department and pharmacy, as well as coffee shops and fuel centers. It has been a

THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

9

| Retail – Anchored | Loan #1 | Cut-off Date Balance: | $44,700,000 | |

| Property Addresses - Various | Pacific Castle Portfolio | Cut-off Date LTV: | 60.0% | |

| U/W NCF DSCR: | 2.43x | |||

| U/W NOI Debt Yield: | 10.2% |

subsidiary of Albertsons since January 2015 after being acquired by private equity investors led by Cerberus Capital Management. Safeway is headquartered in Pleasanton, California, with its parent company, Albertsons, headquartered in Boise, Idaho. Safeway has been a tenant at the Prune Tree Center Property since June 1989 when it commenced a 25-year lease. The tenant has exercised two, five-year renewal options since the original lease term expired. The most recent renewal commenced in June 2019 and expires in May 2024. Safeway has six, five-year renewal options remaining that will be automatically exercised unless the tenant gives landlord notice to terminate the lease at least 180 days prior to expiration. Safeway has no termination options. Safeway reported sales of $801 PSF, $906 PSF, and $827 PSF for 2019, 2020, and 2021, respectively.

The following table presents certain information relating to the tenancy at the Pacific Castle Portfolio Properties:

Major Tenants

| Tenant Name | Credit

Rating (Fitch/ Moody’s/ S&P)(1) |

Property Name | Tenant NRSF |

%

of NRSF |

Annual U/W Base Rent PSF(2) | Annual U/W Base Rent(2) |

% of Total Annual U/W Base Rent | Lease Expiration | Extension Options | Term. Option (Y/N) |

| TJ Maxx | NR/A2/A | Sandstone Village | 48,067 | 10.3% | $12.00 | $576,804 | 8.3% | 5/31/2024 | 2, 5-year | N(3) |

| Vons | NR/Ba3/BB | Rimrock Plaza | 41,330 | 8.9% | $7.70 | $318,260 | 4.6% | 5/31/2026 | 1, 5-year | N |

| Safeway | NR/Ba3/BB | Prune Tree Center | 35,722 | 7.7% | $9.19 | $328,296 | 4.7% | 5/31/2024 | 6, 5-year | N |

| CVS | NR/Baa2/BBB | Prune Tree Center | 31,472 | 6.8% | $7.58 | $238,558 | 3.4% | 6/30/2024 | 5, 5-year | N |

| Ross | NR/A2/BBB+ | Rancho Cordova Town Center | 26,968 | 5.8% | $11.28 | $304,202 | 4.4% | 1/31/2027 | 3, 5-year | N(4) |

| Marshall's | NR/A2/A | Rancho Cordova Town Center | 25,252 | 5.4% | $10.50 | $265,146 | 3.8% | 8/31/2027 | 3, 5-year | N(5) |

| Michael's Stores, Inc | NR/NR/NR | Rancho Cordova Town Center | 20,800 | 4.5% | $16.20 | $336,960 | 4.8% | 6/30/2024 | None | N |

| Eisenhower Medical Center | NR/NR/NR | Rimrock Plaza | 14,895 | 3.2% | $19.84 | $295,538 | 4.3% | Various(6) | None | N |

| Hive | NR/NR/NR | Sandstone Village | 13,488 | 2.9% | $10.76 | $145,075 | 2.1% | 10/31/2025 | 1, 5-year | N |

| Minky Couture | NR/NR/NR | Sandstone Village | 9,250 | 2.0% | $15.50 | $143,375 | 2.1% | 6/30/2027 | 3, 5-year | N |

| Total Major Tenants | 267,244 | 57.5% | $11.05 | $2,952,213 | 42.5% | |||||

| Other Tenants | 160,747 | 34.6% | $24.86 | $3,996,262 | 57.5% | |||||

| Occupied Space | 427,991 | 92.0% | $16.24 | $6,948,475 | 100.0% | |||||

| Vacant Space | 37,124 | 8.0% | ||||||||

| Collateral Total | 465,115 | 100.0% | ||||||||

| (1) | Certain ratings are those of the parent company, regardless of whether or not the parent guarantees the lease. |

| (2) | Based on the underwritten rent roll, including rent increases occurring through November 2022. |

| (3) | No unilateral termination options; however, TJ Maxx has the right to terminate its lease if occupancy at the other retail spaces at the Sandstone Village Property stays below 22,000 SF for 180 consecutive days. |

| (4) | No unilateral termination options; however, Ross has the right to terminate its lease if, for 12 consecutive months, (a)(i) the required co-tenants (defined as Target, Michael’s Stores, Inc and (ii) one anchor tenant (greater than or equal to 20,000 SF) or, (b) two soft goods anchor tenants (greater than 20,000 SF)) are not open and operating for business, or (c) the retail tenants, including the required co-tenants, are not open and operating in at least 70% of the leasable floor area of the Rancho Cordova Town Center Property. |

| (5) | No unilateral termination options; however, Marshall’s has the right to terminate its lease if, for any period of more than 745 consecutive days, (i) either of the inducement tenants (Target and a retail store of at least 25,000 SF that is part of a national chain of not less than 75 store locations, or a regional chain of not less than 50 store locations) are not open for business or (ii) less than 50% of the gross leasable area in the shopping center is occupied. |

| (6) | Eisenhower Medical Center has 9,790 SF expiring on October 31, 2025 and 5,105 SF expiring on December 31, 2025. |

THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

10

| Retail – Anchored | Loan #1 | Cut-off Date Balance: | $44,700,000 | |

| Property Addresses - Various | Pacific Castle Portfolio | Cut-off Date LTV: | 60.0% | |

| U/W NCF DSCR: | 2.43x | |||

| U/W NOI Debt Yield: | 10.2% |

Major Tenants Sales(1)

| Tenant Name | Property Name | Tenant NRSF |

2019 Sales PSF | 2020 Sales PSF | 2021 Sales PSF |

Occupancy Cost(2) |

| TJ Maxx | Sandstone Village | 48,067 | $409 | $331 | N/A | 4.2% |

| Vons | Rimrock Plaza | 41,330 | $596 | $703 | $701 | 1.9% |

| Safeway | Prune Tree Center | 35,722 | $801 | $906 | $827 | 1.4% |

| CVS | Prune Tree Center | 31,472 | $254 | $283 | $277 | 3.3% |

| Ross | Rancho Cordova Town Center | 26,968 | N/A | N/A | $337(3) | 4.2% |

| Marshall's | Rancho Cordova Town Center | 25,252 | N/A | N/A | $309(3) | 4.3% |

| Michael's Stores, Inc | Rancho Cordova Town Center | 20,800 | $143 | $136 | $147(4) | 15.9% |

| Target (Non-owned) | Rancho Cordova Town Center | NAP | N/A | N/A | $444(3) | 0.2% |

| (1) | Information obtained from the underwritten rent roll. |

| (2) | Represents the occupancy cost of latest available sales figures to underwritten gross rents which include any applicable rent increases occurring through November 2022. |

| (3) | Represent estimated sales as per third party market reports. |

| (4) | Represents trailing twelve months ending September 2021 sales for Michael’s Stores, Inc. |

The following table presents certain information relating to the lease rollover schedule at the Pacific Castle Portfolio Properties:

Lease Expiration Schedule(1)(2)

| Year Ending December 31, | No. of Leases Expiring |

Expiring NRSF | %

of Total NRSF |

Cumulative Expiring NRSF | Cumulative % of Total NRSF | Annual U/W Base Rent |

% of Total Annual U/W Base Rent | Annual U/W Base Rent PSF |

| MTM | 2 | 4,060 | 0.9% | 4,060 | 0.9% | $93,734 | 1.3% | $23.09 |

| 2022 | 11 | 16,183 | 3.5% | 20,243 | 4.4% | $323,246 | 4.7% | $19.97 |

| 2023 | 10 | 15,217 | 3.3% | 35,460 | 7.6% | $402,244 | 5.8% | $26.43 |

| 2024 | 20 | 165,404 | 35.6% | 200,864 | 43.2% | $2,220,309 | 32.0% | $13.42 |

| 2025 | 12 | 48,223 | 10.4% | 249,087 | 53.6% | $1,003,519 | 14.4% | $20.81 |

| 2026 | 10 | 55,951 | 12.0% | 305,038 | 65.6% | $694,632 | 10.0% | $12.42 |

| 2027 | 9 | 77,081 | 16.6% | 382,119 | 82.2% | $1,066,444 | 15.3% | $13.84 |

| 2028 | 4 | 8,118 | 1.7% | 390,237 | 83.9% | $221,164 | 3.2% | $27.24 |

| 2029 | 3 | 7,700 | 1.7% | 397,937 | 85.6% | $176,760 | 2.5% | $22.96 |

| 2030 | 1 | 2,044 | 0.4% | 399,981 | 86.0% | $44,212 | 0.6% | $21.63 |

| 2031 | 3 | 16,744 | 3.6% | 416,725 | 89.6% | $351,225 | 5.1% | $20.98 |

| 2032 | 0 | 0 | 0.0% | 416,725 | 89.6% | $0 | 0.0% | $0.00 |

| Thereafter | 4 | 11,266 | 2.4% | 427,991 | 92.0% | $350,986 | 5.1% | $31.15 |

| Vacant | 0 | 37,124 | 8.0% | 465,115 | 100.0% | $0 | 0.0% | $0.00 |

| Total/Wtd. Avg. | 89 | 465,115 | 100.0% | $6,948,475 | 100.0% | $16.24(3) |

| (1) | Based on the underwritten rent roll, including rent increases occurring through November 2022. |

| (2) | Certain tenants may have lease termination options that are exercisable prior to the originally stated expiration date that are not reflected in the Lease Expiration Schedule. |

| (3) | Excludes NRA of underwritten vacant space. |

The following table presents historical occupancy percentages at the Pacific Castle Portfolio Properties:

Historical Occupancy

| Property Name | 12/31/2018(1) | 12/31/2019(1) | 12/31/2020(1) | 1/1/2022(3) |

| Rancho Cordova Town Center | 82.1% | 85.5% | 83.0% | 94.2% |

| Prune Tree Center | 87.5% | 89.9% | 90.0% | 93.7% |

| Rimrock Plaza | 100.0%(2) | 100.0%(2) | 83.4% | 81.0% |

| Sandstone Village | 100.0% | 93.9% | 88.1% | 97.7% |

| Wtd. Avg. Occupancy | 90.7% | 91.4% | 86.0% | 92.0% |

| (1) | Occupancy figures were calculated using leases and historical rent rolls. |

| (2) | The Rimrock Plaza Property was acquired in 2020 and the prior owner did not provide historical occupancy statistics. The figures shown were obtained from the appraisal. |

| (3) | Information obtained from the underwritten rent roll dated January 1, 2022. |

THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

11

| Retail – Anchored | Loan #1 | Cut-off Date Balance: | $44,700,000 | |

| Property Addresses - Various | Pacific Castle Portfolio | Cut-off Date LTV: | 60.0% | |

| U/W NCF DSCR: | 2.43x | |||

| U/W NOI Debt Yield: | 10.2% |

COVID-19 Update. As of March 9, 2022, the Pacific Castle Portfolio Properties were open and operating. The borrower sponsors reported that 11 tenants representing 29.3% of the total NRA across the Pacific Castle Portfolio Properties received rent relief as a result of the pandemic. The rent relief provided came in the form of partial rent abatements and rent deferrals. All deferred rents have since been paid back. Based on an account receivables report dated March 9, 2022, approximately $46,129 consisting primarily of CAM reimbursements were over 30 days delinquent and $8,526 of accounts receivables were over 60 days delinquent, representing a collection rate (over underwritten in-place gross rents) of 93.9% and 98.9% for February and January 2022, respectively. As of March 9, 2022, the Pacific Castle Portfolio Whole Loan is current on its debt service payment and is not subject to any modification or forbearance request.

Operating History and Underwritten Net Cash Flow. The following table presents certain information relating to the historical operating performance and underwritten net cash flow at the Pacific Castle Portfolio Properties:

Cash Flow Analysis

| 2018 | 2019(1) | 2020 | TTM 9/30/2021 | U/W | %(2) | U/W $ per SF | ||||||||

| Base Rent | $6,021,406 | $6,265,442 | $5,642,871 | $6,346,990 | $6,824,329 | 67.7% | $14.67 | |||||||

| Contractual Rent Steps(3) | 0 | 0 | 0 | 0 | 124,146 | 1.2 | 0.27 | |||||||

| Grossed Up Vacant Space | 0 | 0 | 0 | 0 | 870,959 | 8.6 | 1.87 | |||||||

| Gross Potential Rent | $6,021,406 | $6,265,442 | $5,642,871 | $6,346,990 | $7,819,434 | 77.5% | $16.81 | |||||||

| Other Income(4) | 3,366 | 146,132 | 86,967 | 39,436 | 39,436 | 0.4 | 0.08 | |||||||

| Total Recoveries | 1,667,462 | 1,787,126 | 1,703,113 | 1,771,598 | 2,227,293 | 22.1 | 4.79 | |||||||

| Net Rental Income | $7,692,234 | $8,198,699 | $7,432,951 | $8,158,024 | $10,086,163 | 100.0% | $21.69 | |||||||

| (Vacancy & Credit Loss) | 0 | 0 | 0 | 0 | (903,265)(5) | (11.6) | (1.94) | |||||||

| Effective Gross Income | $7,692,234 | $8,198,699 | $7,432,951 | $8,158,024 | $9,182,898 | 91.0% | $19.74 | |||||||

| Real Estate Taxes | 693,199 | 708,787 | 792,827 | 809,338 | 870,735 | 9.5 | 1.87 | |||||||

| Insurance | 124,260 | 135,393 | 116,776 | 127,203 | 141,417 | 1.5 | 0.30 | |||||||

| Management Fee | 438,456 | 445,980 | 277,442 | 323,822 | 366,747 | 4.0 | 0.79 | |||||||

| Other Operating Expenses | 1,201,806 | 1,301,034 | 1,156,224 | 1,222,403 | 1,222,403 | 13.3 | 2.63 | |||||||

| Total Operating Expenses | $2,457,721 | $2,591,194 | $2,343,268 | $2,482,766 | $2,601,302 | 28.3% | $5.59 | |||||||

| Net Operating Income(6) | $5,234,513 | $5,607,506 | $5,089,684 | $5,675,258 | $6,581,596 | 71.7% | $14.15 | |||||||

| Capital Expenditures | 0 | 0 | 0 | 12,863 | 69,767 | 0.8 | 0.15 | |||||||

| TI/LC | 0 | 0 | 0 | 0 | 318,836 | 3.5 | 0.69 | |||||||

| Net Cash Flow | $5,234,513 | $5,607,506 | $5,089,684 | $5,662,394 | $6,192,992 | 67.4% | $13.31 | |||||||

| NOI DSCR(7) | 2.05x | 2.20x | 2.00x | 2.23x | 2.58x | |||||||||

| NCF DSCR(7) | 2.05x | 2.20x | 2.00x | 2.22x | 2.43x | |||||||||

| NOI Debt Yield(7) | 8.1% | 8.7% | 7.9% | 8.8% | 10.2% | |||||||||

| NCF Debt Yield(7) | 8.1% | 8.7% | 7.9% | 8.8% | 9.6% |

| (1) | Based on the full year 2019 operating statements for the Sandstone Village Property, Rancho Cordova Town Center Property, and Prune Tree Center Property. Based on the 6/30/2019 T6 annualized financials for the Rimrock Plaza Property. The Rimrock Plaza Property was acquired in 2020 and the prior owner did not provide full year 2019 operating statements. |

| (2) | Represents (i) percent of Net Rental Income for all revenue fields, (ii) percent of Gross Potential Rent for Vacancy & Credit Loss and (iii) percent of Effective Gross Income for all other fields. |

| (3) | Contractual Rent Steps are through November 2022. |

| (4) | Other Income consists of miscellaneous charges such as lease termination fees. |

| (5) | The underwritten economic vacancy is 9.0%. The Pacific Castle Portfolio Properties were 92.0% leased as of January 1, 2022. |

| (6) | The increase in U/W Net Operating Income from TTM 9/30/2021 Net Operating Income is primarily attributed to (i) $124,146 of rent steps, (ii) an increase in recoveries, and (iii) recent leasing resulting in an increase in occupancy from 87.2% as of September 30, 2021 to 92.0% as of January 1, 2022. |

| (7) | Debt service coverage ratios and debt yields are based on the Pacific Castle Portfolio Whole Loan. |

Appraisals. According to the appraisal, the Pacific Castle Portfolio Properties had an “as-is” appraised value of $107,800,000 as of December 28, 2021. The as-is appraised value represents the portfolio market value of the Pacific Castle Portfolio Properties as if the entire property portfolio is marketed to a single purchaser. The sum of the appraised values of the individual properties is $101,350,000 when excluding the portfolio premium.

Environmental Matters. According to the Phase I environmental reports dated September 24, 2021 through December 8, 2021, there are no recognized environmental conditions or recommendations for further action at the Pacific Castle Portfolio Properties. However, the environmental reports indicated that there is a controlled recognized environmental condition (“CREC”) related to

THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

12

| Retail – Anchored | Loan #1 | Cut-off Date Balance: | $44,700,000 | |

| Property Addresses - Various | Pacific Castle Portfolio | Cut-off Date LTV: | 60.0% | |

| U/W NCF DSCR: | 2.43x | |||

| U/W NOI Debt Yield: | 10.2% |

elevated concentrations of perchloroethylene in soil vapor and indoor air at the Rimrock Plaza Property. See “Description of the Mortgage Pool—Environmental Considerations” in the Preliminary Prospectus.

Market Overview and Competition. The Pacific Castle Portfolio Properties are located in California (81.5% of ALA) and Utah (18.5% of ALA).

The table below presents certain market information with respect to the Pacific Castle Portfolio Properties:

Market Overview(1)

| Property Name | City, State | Estimated 2021 Population (5-mile Radius) |

Estimated 2021 Average Household Income (5-mile Radius) | Submarket Inventory (SF) | Submarket Vacancy | Appraisal Concluded Vacancy | Appraisal Market Rent PSF - Anchor | Appraisal Market Rent PSF – Inline |

| Rancho Cordova Town Center | Rancho Cordova, CA | 220,273 | $106,692 | 5,638,213 | 9.7% | 10.0% | $11.40 | $27.00 |

| Prune Tree Center | Prunedale, CA | 135,187 | $82,874 | 3,692,087 | 2.9% | 7.0% | $10.80 | $12.00 - $21.00 |

| Rimrock Plaza | Palm Springs, CA | 105,259 | $94,358 | 26,927,952 | 9.2% | 7.5% | $15.00 | $12.00 - $30.00 |

| Sandstone Village | St. George, UT | 116,424 | $85,132 | 8,927,867 | 2.6% | 5.0% | $12.00 | $18.00 |

| Weighted Average(2) | 152,614 | $93,295 | 6.3% | 7.7% |

| (1) | Information obtained from the appraisals. |

| (2) | Information as of third quarter 2021 for the Rancho Cordova Town Center Property and Prune Tree Center Property and as of second quarter 2021 for the Rimrock Plaza Property and Sandstone Village Property. |

| (3) | Weighted Averages are based on NRA. |

Rancho Cordova Town Center (32.0% of NRA; 33.5% of ALA): The Rancho Cordova Town Center Property is located approximately 13.7 miles east of downtown Sacramento, California. Primary access to the area is provided by US Highway 50 and Folsom Boulevard, which are both approximately 0.5 miles from the Rancho Cordova Town Center Property. According to the appraisal, the Rancho Cordova Town Center Property is located in the Highway 50 Corridor Retail submarket within the Sacramento Metropolitan Statistical Area (“MSA”). The Sacramento MSA is representative of a typical state capital economy with high levels of government employment and healthcare workers. The top three employers in the Sacramento MSA are the University of California Davis Health System, Sutter/California Health Services, and Dignity/Mercy Healthcare. As of the third quarter of 2021, the Highway 50 Corridor Retail submarket had approximately 5.6 million square feet of inventory and a vacancy rate of 9.7% with an average asking rent of $16.08 PSF. The appraisal concluded to market rents of $11.40 PSF, $27.00 PSF, $33.00 PSF, $21.00 PSF and $24.00 PSF for the anchor, inline retail, pad, junior anchor, and large inline retail on a triple-net basis, respectively.

The following tables present certain information relating to retail rental and sales comparables to the Rancho Cordova Town Center Property:

Rancho Cordova Town Center – Comparable Leases Summary(1)

| Property Name | Location | Market Rent (PSF/Yr) | Square Footage | Lease Term (Yrs) | Lease Type | Rent Increase Projection | Tenant Name | Type of Space |

| Zinfandel Place | Rancho Cordova, CA | $28.20 | 3,685 | 9 | NNN | 3.0% per annum | CDC Dental Management Co, LLC | Inline |

| Manzanita Plaza | Carmichael, CA | $29.88 | 1,166 | 5 | NNN | 3.0% per annum | Halal Pizza | Inline |

| Commercial Retail Property | Elk Grove, CA | $34.80 | 1,636 | 7 | NNN | 3.0% per annum | Nash and Proper | Inline |

| Antique Plaza | Rancho Cordova, CA | $10.20 | 20,088 | 5 | NNN | 3.0% per annum | Cali Quilt Co | Anchor |

| Florin Square | Sacramento, CA | $10.32 | 12,329 | 7 | NNN | 2.0% per annum | Bargain World | Anchor |

| Walerga Plaza | Antelope, CA | $11.40 | 54,502 | 15 | NNN | 2.0% per annum | California Family Fitness | Anchor |

| (1) | Information obtained from the appraisal. |

THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

13

| Retail – Anchored | Loan #1 | Cut-off Date Balance: | $44,700,000 | |

| Property Addresses - Various | Pacific Castle Portfolio | Cut-off Date LTV: | 60.0% | |

| U/W NCF DSCR: | 2.43x | |||

| U/W NOI Debt Yield: | 10.2% |

Rancho Cordova Town Center – Comparable Sales Summary(1)

| Property Name | Location | Rentable Area (SF) | Sale Date | Sale Price | Sales Price (PSF) | Cap Rate |

| Town & Country Village | Sacramento, CA | 216,320 | Nov-21 | $62,150,000 | $287.31 | 6.3% |

| Mitchell Plaza | Ceres, CA | 43,200 | Apr-21 | $9,650,000 | $223.38 | 6.9% |

| Promenade at Sacramento Gateway | Sacramento, CA | 283,341 | Oct-19 | $56,042,000 | $197.79 | 7.3% |

| Nut Tree Plaza | Vacaville, CA | 241,452 | Nov-21 | $69,116,000 | $286.25 | 6.7% |

| Summerhill Plaza | Citrus Heights, CA | 108,081 | Dec-21 | $18,750,000 | $173.48 | 5.8% |

| Rio Linda Plaza | Rio Linda, CA | 77,080 | Jun-20 | $15,515,000 | $201.28 | 7.4% |

| (1) | Information obtained from the appraisal. |

Prune Tree Center (28.3% of NRA; 27.7% of ALA): The Prune Tree Center Property is located in northeast Monterey County, California, approximately five miles north of Salinas. Primary access to the area is provided by US Highway 101, a major north-south route connecting San Francisco with Los Angeles. The surrounding neighborhood consists primarily of residential properties, with commercial uses located near Highway 101. According to the appraisal, the Prune Tree Center property is located in the North Monterey County retail submarket within the Salinas MSA. The top three industries within the area are Agric/Forestry/Fishing/Hunting, Health Care/Social Assistance and Retail Trade, which represent a combined total of 39% of the population. As of the third quarter of 2021, the North Monterey County retail submarket had approximately 3.7 million square feet of inventory and a vacancy rate of 2.9%, with an average asking rent of $20.37 PSF. The appraisal concluded to market rents of $10.80 PSF, $21.00 PSF, $18.00 PSF, $33.00 PSF, and $12.00 PSF for anchor, high end retail, low end retail, ground lease pad, and office space, respectively.

The following tables present certain information relating to retail rental and sales comparables to the Prune Tree Center Property:

Prune Tree Center – Comparable Leases Summary(1)

| Property Name | Location | Market Rent (PSF/Yr) | Square Footage | Lease Term (Yrs) | Lease Type | Rent Increase Projection | Tenant Name | Type of Space |

| Westgate Shopping Center | Woodland, CA | $7.56 | 60,115 | 10 | NNN | None | Raley's | Anchor |

| Pacific Town Center | Stockton, CA | $12.00 | 30,037 | 10 | NNN | 10% / Yr. 5 | Smart & Final | Anchor |

| 99 Cents Only and Smart & Final Extra Stores | Hanford, CA | $11.04 | 23,154 | 9 | NNN | 10% / Yr. 6 | 99 Cents Only Stores | Anchor |

| Cypress Plaza | Marina, CA | $21.00 | 1,500 | 2 | NNN | 3.0% per annum | Doctor (Family Practice) | Inline |

| Pajaro Hills Retail Center | Watsonville, CA | $23.40 | 6,559 | 10 | NNN | 3.0% per annum | Confidential | Inline |

| Mountain Valley Center | Salinas, CA | $24.00 | 1,500 | 5 | NNN | None | Piara Pizza | Inline |

| (1) | Information obtained from the appraisal. |

Prune Tree Center – Comparable Sales Summary(1)

| Property Name | Location | Rentable Area (SF) | Sale Date | Sale Price | Sales Price (PSF) | Cap Rate |

| Rio Linda Plaza | Rio Linda, CA | 77,080 | Jun-20 | $15,515,000 | $201.28 | 8.2% |

| Pacheco Pass Center | Gilroy, CA | 78,215 | Nov-19 | $22,000,000 | $281.28 | 5.5% |

| Antioch Crossings | Antioch, CA | 120,667 | Sep-19 | $25,983,207 | $215.33 | 6.6% |

| Morada Ranch | Stockton, CA | 101,842 | Apr-19 | $30,000,000 | $294.57 | 6.8% |

| The Dunes at Monterey Bay | Marina, CA | 233,892 | Sep-18 | $45,000,000 | $192.40 | 7.1% |

| (1) | Information obtained from the appraisal. |

Rimrock Plaza (20.7% of NRA; 20.2% of ALA): The Rimrock Plaza Property is located in the Coachella Valley region of Riverside County, California, approximately 61 miles east of San Bernardino. Primary access to the area is provided by the 10 Freeway, which is located approximately five miles north of the Rimrock Plaza Property. The surrounding neighborhood consists primarily of resort residential developments and country club/golf course facilities. The Coachella Valley’s largest industry is tourism, which generates approximately $1 billion in revenue annually. There are over 100 golf courses in the Coachella Valley, with several major tournaments being hosted

THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

14

| Retail – Anchored | Loan #1 | Cut-off Date Balance: | $44,700,000 | |

| Property Addresses - Various | Pacific Castle Portfolio | Cut-off Date LTV: | 60.0% | |

| U/W NCF DSCR: | 2.43x | |||

| U/W NOI Debt Yield: | 10.2% |

at these courses each year. According to the appraisal, the Rimrock Plaza Property is located in the Coachella Valley Retail Submarket within the broader Inland Empire Market. The Coachella Valley Retail Submarket had approximately 26.9 million square feet of inventory and a vacancy rate of 9.2% as of the second quarter of 2021, with an average asking rent of $23.04 PSF annually. The appraisal concluded to market rents of $15.00 PSF and $12.00 PSF to $30.00 PSF for grocery and shop spaces, respectively.

The following tables present certain information relating to retail rental and sales comparables to the Rimrock Plaza Property:

Rimrock Plaza – Comparable Leases Summary(1)

| Property Name | Location | Market Rent (PSF/Yr) | Square Footage | Lease Term (Yrs) | Lease Type | Tenant Name | Type of Space |

| Smoke Tree Village | Palm Springs, CA | $17.40 | 906 | 3 | NNN | Palm Springs Holistic | Inline |

| Gene Autry Plaza | Palm Springs, CA | $36.00 | 1,508 | 5 | NNN | Retail Tenant | Inline |

| Sun Center | Palm Springs, CA | $9.96 | 6,000 | 5 | NNN | Desert Rose Playhouse | Inline |

| Crossley Plaza | Palm Springs, CA | $12.00 | 1,458 | 5 | NNN | Retail Tenant | Inline |

| Shops at Palm Springs Marketplace | Palm Springs, CA | $10.80 | 2,070 | 5 | NNN | Bones N Scones | Inline |

| The Springs | Palm Springs, CA | $32.40 | 3,360 | 10 | NNN | America's Best Eyeglasses | Inline |

| (1) | Information obtained from the appraisal. |

Rimrock Plaza – Comparable Sales Summary(1)

| Property Name | Location | Rentable Area (SF) | Sale Date | Sale Price | Sales Price (PSF) | Cap Rate |

| Magnolia Tyler Center | Riverside, CA | 182,653 | Apr-21 | $39,400,000 | $215.71 | 6.5% |

| Gene Autry Plaza | Palm Springs, CA | 69,652 | Mar-21 | $23,400,000 | $335.96 | 6.8% |

| Arlington Plaza | Riverside, CA | 126,067 | Jan-20 | $27,100,000 | $214.97 | 6.5% |

| Menifee Town Center | Menifee, CA | 124,431 | Jul-19 | $25,350,000 | $203.73 | 7.4% |

| Palms to Pines West | Palm Desert, CA | 82,180 | May-19 | $10,606,500 | $129.06 | 7.5% |

| Heritage Plaza | Riverside, CA | 124,550 | Sep-18 | $26,250,000 | $210.76 | 7.6% |

| (1) | Information obtained from the appraisal. |

Sandstone Village (19.0% of NRA; 18.5% of ALA): The Sandstone Village Property is located in Washington County, Utah, approximately 120 miles northeast of Las Vegas. Primary access to the area is provided by Interstate 15 via the St. George Boulevard exit. The immediate area surrounding the Sandstone Village Property consists primarily of commercial development centered around Interstate 15. According to the appraisal, the Sandstone Village Property’s neighborhood is heavily influenced by tourism due to its proximity to Zion National Park, Grand Canyon National Park, Bryce Canyon National Park, and Lake Powell National Recreation Area. As of the second quarter of 2021, the St. George retail market had approximately 8.9 million square feet of inventory and a vacancy rate of 2.6% with an average asking rent of $16.62 PSF. The appraisal concluded to market rents of $12.00 PSF, $18.00 PSF, and $36.00 PSF for anchor, inline shops, and pad shop spaces, respectively.

THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

15

| Retail – Anchored | Loan #1 | Cut-off Date Balance: | $44,700,000 | |

| Property Addresses - Various | Pacific Castle Portfolio | Cut-off Date LTV: | 60.0% | |

| U/W NCF DSCR: | 2.43x | |||

| U/W NOI Debt Yield: | 10.2% |

The following tables present certain information relating to retail rental and sales comparables to the Sandstone Village Property:

Sandstone Village – Comparable Leases Summary(1)

| Property Name | Location | Market Rent (PSF/Yr) | Square Footage | Lease Term (Yrs) | Lease Type | Rent Increase Projection | Tenant Name | Type of Space |

| Dinosaur Crossing | St. George, UT | $33.50 | 1,500 | 7 | NNN | NAV | Swig | Inline |

| Lin's Anchored Retail | St. George, UT | $29.64 | 1,466 | 5 | NNN | NAV | Fortify Physical Therapy | Inline |

| Green Springs Shopping Center | Washington, UT | $14.00 | 2,500 | 6 | NNN | NAV | Desert Haven Spa | Inline |

| Pineview Plaza | St. George, UT | $14.00 | 2,208 | 2 | NNN | NAV | Photo Pop | Inline |

| Cotton Mill Center | Washington, UT | $28.00 | 2,666 | 5 | NNN | NAV | Red Rock Hot Tubs | Inline |

| Retail Center | Washington, UT | $19.08 | 1,400 | 5 | NNN | NAV | The Crepe Station | Inline |

| (1) | Information obtained from the appraisal. |

Sandstone Village – Comparable Sales Summary(1)

| Property Name | Location | Rentable Area (SF) | Sale Date | Sale Price | Sales Price (PSF) | Cap Rate |

| Foothill Village | Salt Lake City, UT | 271,823 | Aug-21 | $51,000,000 | $187.62 | 5.5% |

| Parkway Village | Provo, UT | 102,298 | Jun-21 | $26,200,000 | $256.11 | 5.0% |

| The Center @ Dinosaur Crossing | St. George, UT | 21,403 | Mar-20 | $4,600,000 | $214.92 | 6.8% |

| Jordan Square | West Jordan, UT | 108,627 | Mar-20 | $17,000,000 | $156.50 | 7.2% |

| Interpointe Shopping Center | South Salt Lake, UT | 99,809 | Feb-20 | $20,660,000 | $207.00 | 6.9% |

| Promenade at Red Cliffs | St. George, UT | 95,304 | Jan-19 | $22,750,000 | $238.71 | 7.5% |

| (1) | Information obtained from the appraisal |

Escrows.

Real Estate Taxes – The Pacific Castle Portfolio Whole Loan documents require an upfront real estate tax reserve of approximately $373,548 and ongoing monthly tax reserves in an amount equal to one-twelfth of the real estate taxes that the lender estimates will be payable during the next 12 months (initially $74,710).

Insurance – The Pacific Castle Portfolio Whole Loan documents require an upfront insurance reserve of approximately $106,062 and ongoing monthly insurance reserves in an amount equal to one-twelfth of the insurance premiums that the lender estimates will be payable for the renewal of the coverage during the next 12 months (initially $11,785).

Replacement Reserve – The Pacific Castle Portfolio Whole Loan documents require ongoing monthly replacement reserves of approximately $5,814, subject to a cap of $348,836.

TI/LC Reserve – The Pacific Castle Portfolio Whole Loan documents require an upfront TI/LC reserve of approximately $300,000 and monthly deposits of $29,070, subject to a cap of $1,046,509.

Immediate Repairs – The Pacific Castle Portfolio Whole Loan documents require an upfront immediate repairs reserve of approximately $40,063.

Lockbox and Cash Management. The Pacific Castle Portfolio Whole Loan is structured with a hard lockbox and springing cash management upon the occurrence and continuance of a Cash Management Period (as defined below). Revenues from the Pacific Castle Portfolio Properties are required to be deposited directly into the lockbox account or, if received by the borrowers or the property manager, deposited into the lockbox account within three business days of receipt. During the continuance of a Cash Management Period, all funds in the lockbox account are required to be swept each business day to a lender-controlled cash management account and disbursed in accordance with the Pacific Castle Portfolio Whole Loan documents, and all excess funds on deposit in the cash management account (after payment of required monthly reserve deposits, debt service payment on the Pacific Castle Portfolio Whole Loan, and operating expenses) are required to be held as additional collateral for the Pacific Castle Portfolio Whole Loan.

THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

16

| Retail – Anchored | Loan #1 | Cut-off Date Balance: | $44,700,000 | |

| Property Addresses - Various | Pacific Castle Portfolio | Cut-off Date LTV: | 60.0% | |

| U/W NCF DSCR: | 2.43x | |||

| U/W NOI Debt Yield: | 10.2% |

A “Cash Management Period” will commence upon the earliest of the following:

| (i) | The maturity date has occurred; |

| (ii) | a default or an event of default; |

| (iii) | the trailing 12-month period debt service coverage ratio falling below 1.30x as of the last day of any calendar quarter; or |

| (iv) | the commencement of a Lease Sweep Period (as defined below). |

A Cash Management Period will end upon the occurrence of the following:

| • | if (1) the Pacific Castle Portfolio Whole Loan and all other obligations under the Pacific Castle Portfolio Whole Loan documents have been repaid in full or (2) the maturity date has not occurred and |

| • | with regard to clause (ii) above, the cure of such default or event of default and no other default or event of default has occurred and is continuing; |

| • | with regard to clause (iii) above, the trailing 12-month debt service coverage ratio for the Pacific Castle Portfolio Properties in the aggregate being at least 1.35x for two consecutive calendar quarters; or |

| • | with regard to clause (iv) above, the Lease Sweep Period being cured as set forth in the definition of such term below. |

A “Lease Sweep Period” will commence upon the occurrence of:

| (i) | the earlier of (a) the date that is nine months prior to the end of the term of the Lease Sweep Lease (as defined below) (including any renewal terms) (or six months with respect to Vons), or (b) the date the applicable tenant under a Lease Sweep Lease actually gives such written notice of its intention not to renew or extend; |

| (ii) | the date required under a Lease Sweep Lease by which the applicable tenant is required to give notice of its exercise of a renewal option (and such renewal has not been exercised) or the date that any tenant under a Lease Sweep Lease gives written notice of its intention not to renew or extend; |

| (iii) | any Lease Sweep Lease (or any material portion thereof) is surrendered, cancelled or terminated prior to its then current expiration date or any tenant under a Lease Sweep Lease gives written notice of its intention to terminate, surrender or cancel its Lease Sweep Lease (or any material portion thereof); |

| (iv) | any tenant under a Lease Sweep Lease discontinues its business in any material portion of its premises (i.e., “goes dark”) or gives written notice that it intends to do the same; |

| (v) | the occurrence and continuance (beyond any applicable notice and cure periods) of a monetary or non-monetary default under any Lease Sweep Lease by the applicable tenant; or |

| (vi) | any tenant under a Lease Sweep Lease becomes subject to an insolvency proceeding. |

A Lease Sweep Period will end upon the earlier to occur of (a) the date on which the amount in the special rollover reserve account is equal to $25.00 per square foot for each Lease Sweep Lease space that gave rise to the Lease Sweep Period, or (b) the occurrence of any of the following:

| • | with respect to a Lease Sweep Period caused by a matter described in clauses (i), (ii), (iii) or (iv) above, upon the earlier to occur of (A) the date on which the tenant under the Lease Sweep Lease irrevocably exercises its renewal or extension option with respect to all of the space demised under its Lease Sweep Lease, and in the lender’s reasonable judgment, sufficient funds have been accumulated in the special rollover reserve to pay for all anticipated leasing expenses for such Lease Sweep Lease and any other anticipated expenses in connection with such renewal or extension, or (B) the date on which all of the space demised under the subject Lease Sweep Lease that gave rise to the subject Lease Sweep Period has been fully leased pursuant to a replacement lease or replacement leases approved by the lender, and entered into in accordance with the Pacific Castle Portfolio Whole Loan documents, and all approved leasing expenses for such Lease Sweep Lease (and any other expenses in connection with the re-tenanting of such space) have been paid in full; |

| • | with regard to clause (v) above, the default under the Lease Sweep Lease has been cured and no other default under a Lease Sweep Lease has occurred for a period of three consecutive months following such cure; |

| • | with regard to clause (vi) above, the applicable insolvency proceeding has terminated and the applicable Lease Sweep Lease has been affirmed, assumed or assigned in a manner reasonably satisfactory to the lender. |

A “Lease Sweep Lease” means Safeway, CVS, Michael’s, TJ Maxx, Vons, and any other lease (leased by such tenant and/or its affiliates) that covers 27,000 or more rentable square feet at an individual Pacific Castle Portfolio Property.

Property Management. The Pacific Castle Portfolio Properties are currently managed by Pacific Castle Management, Inc., an affiliate of the borrowers.