| FREE WRITING PROSPECTUS | ||

| FILED PURSUANT TO RULE 433 | ||

| REGISTRATION FILE NO.: 333-226486-11 | ||

|

|

Free Writing Prospectus

Structural and Collateral Term Sheet

$669,827,472

(Approximate Initial Pool Balance)

Wells Fargo Commercial Mortgage Trust 2019-C54

as Issuing Entity

Wells Fargo Commercial Mortgage Securities, Inc.

as Depositor

Argentic Real Estate Finance LLC

Wells Fargo Bank, National Association

Rialto Mortgage Finance, LLC

BSPRT CMBS Finance, LLC

UBS AG

as Sponsors and Mortgage Loan Sellers

Commercial

Mortgage Pass-Through Certificates

Series 2019-C54

October 30, 2019

WELLS FARGO SECURITIES Co-Lead Manager and Joint Bookrunner |

UBS SECURITIES LLC Co-Lead Manager and Joint Bookrunner | |

Academy Securities Co-Manager |

Drexel Hamilton Co-Manager |

STATEMENT REGARDING THIS FREE WRITING PROSPECTUS

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (‘‘SEC’’) (SEC File No. 333-226486) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the depositor, any underwriter, or any dealer participating in the offering will arrange to send you the prospectus after filing if you request it by calling toll free 1-800-745-2063 (8 a.m. – 5 p.m. EST) or by emailing wfs.cmbs@wellsfargo.com.

Nothing in this document constitutes an offer of securities for sale in any jurisdiction where the offer or sale is not permitted. The information contained herein is preliminary as of the date hereof, supersedes any such information previously delivered to you and will be superseded by any such information subsequently delivered and ultimately by the final prospectus relating to the securities. These materials are subject to change, completion, supplement or amendment from time to time.

This free writing prospectus has been prepared by the underwriters for information purposes only and does not constitute, in whole or in part, a prospectus for the purposes of Directive 2003/71/EC (as amended) and/or Part VI of the Financial Services and Markets Act 2000, as amended, or other offering document.

STATEMENT REGARDING ASSUMPTIONS AS TO SECURITIES, PRICING ESTIMATES AND OTHER INFORMATION

The attached information contains certain tables and other statistical analyses (the “Computational Materials”) which have been prepared in reliance upon information furnished by the Mortgage Loan Sellers. Numerous assumptions were used in preparing the Computational Materials, which may or may not be reflected herein. As such, no assurance can be given as to the Computational Materials’ accuracy, appropriateness or completeness in any particular context; or as to whether the Computational Materials and/or the assumptions upon which they are based reflect present market conditions or future market performance. The Computational Materials should not be construed as either projections or predictions or as legal, tax, financial or accounting advice. You should consult your own counsel, accountant and other advisors as to the legal, tax, business, financial and related aspects of a purchase of these securities. Any weighted average lives, yields and principal payment periods shown in the Computational Materials are based on prepayment and/or loss assumptions, and changes in such prepayment and/or loss assumptions may dramatically affect such weighted average lives, yields and principal payment periods. In addition, it is possible that prepayments or losses on the underlying assets will occur at rates higher or lower than the rates shown in the attached Computational Materials. The specific characteristics of the securities may differ from those shown in the Computational Materials due to differences between the final underlying assets and the preliminary underlying assets used in preparing the Computational Materials. The principal amount and designation of any security described in the Computational Materials are subject to change prior to issuance. None of Wells Fargo Securities, LLC, UBS Securities LLC, Academy Securities, Inc., Drexel Hamilton, LLC, or any of their respective affiliates, make any representation or warranty as to the actual rate or timing of payments or losses on any of the underlying assets or the payments or yield on the securities. The information in this presentation is based upon management forecasts and reflects prevailing conditions and management’s views as of this date, all of which are subject to change. In preparing this presentation, we have relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources or which was provided to us by or on behalf of the Mortgage Loan Sellers or which was otherwise reviewed by us.

This free writing prospectus contains certain forward-looking statements. If and when included in this free writing prospectus, the words “expects”, “intends”, “anticipates”, “estimates” and analogous expressions and all statements that are not historical facts, including statements about our beliefs or expectations, are intended to identify forward-looking statements. Any forward-looking statements are made subject to risks and uncertainties which could cause actual results to differ materially from those stated. Those risks and uncertainties include, among other things, declines in general economic and business conditions, increased competition, changes in demographics, changes in political and social conditions, regulatory initiatives and changes in customer preferences, many of which are beyond our control and the control of any other person or entity related to this offering. The forward-looking statements made in this free writing prospectus are made as of the date stated on the cover. We have no obligation to update or revise any forward-looking statement.

Wells Fargo Securities is the trade name for the capital markets and investment banking services of Wells Fargo & Company and its subsidiaries, including but not limited to Wells Fargo Securities, LLC, a member of NYSE, FINRA, NFA and SIPC, Wells Fargo Prime Services, LLC, a member of FINRA, NFA and SIPC, and Wells Fargo Bank, N.A. Wells Fargo Securities, LLC and Wells Fargo Prime Services, LLC are distinct entities from affiliated banks and thrifts.

IMPORTANT NOTICE REGARDING THE OFFERED CERTIFICATES

The information herein is preliminary and may be supplemented or amended prior to the time of sale. In addition, the Offered Certificates referred to in these materials and the asset pool backing them are subject to modification or revision (including the possibility that one or more classes of certificates may be split, combined or eliminated at any time prior to issuance or availability of a final prospectus) and are offered on a “when, as and if issued” basis.

The underwriters described in these materials may from time to time perform investment banking services for, or solicit investment banking business from, any company named in these materials. The underwriters and/or their affiliates or respective employees may from time to time have a long or short position in any security or contract discussed in these materials.

The information contained herein supersedes any previous such information delivered to any prospective investor and will be superseded by information delivered to such prospective investor prior to the time of sale.

IMPORTANT NOTICE RELATING TO AUTOMATICALLY-GENERATED EMAIL DISCLAIMERS

Any legends, disclaimers or other notices that may appear at the bottom of any email communication to which this free writing prospectus is attached relating to (1) these materials not constituting an offer (or a solicitation of an offer), (2) any representation that these materials are accurate or complete and may not be updated or (3) these materials possibly being confidential, are not applicable to these materials and should be disregarded. Such legends, disclaimers or other notices have been automatically generated as a result of these materials having been sent via Bloomberg or another system.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

2

| Wells Fargo Commercial Mortgage Trust 2019-C54 | Transaction Highlights |

A. Transaction Highlights

Mortgage Loan Sellers:

Mortgage Loan Seller |

Number

|

Number

of |

Aggregate

Cut- |

%

of Initial |

| Argentic Real Estate Finance LLC | 11 | 16 | $177,079,177 | 26.4% |

| Wells Fargo Bank, National Association | 11 | 12 | 173,893,603 | 26.0 |

| Rialto Mortgage Finance, LLC | 9 | 20 | 158,376,246 | 23.6 |

| BSPRT CMBS Finance, LLC | 7 | 19 | 105,722,940 | 15.8 |

| UBS AG | 6 | 21 | 54,755,506 | 8.2 |

Total |

44 |

88 |

$669,827,472 |

100.0% |

Loan Pool:

| Initial Pool Balance: | $669,827,472 |

| Number of Mortgage Loans: | 44 |

| Average Cut-off Date Balance per Mortgage Loan: | $15,223,352 |

| Number of Mortgaged Properties: | 88 |

| Average Cut-off Date Balance per Mortgaged Property(1): | $7,611,676 |

| Weighted Average Mortgage Interest Rate: | 3.887% |

| Ten Largest Mortgage Loans as % of Initial Pool Balance: | 45.9% |

| Weighted Average Original Term to Maturity or ARD (months): | 118 |

| Weighted Average Remaining Term to Maturity or ARD (months): | 116 |

| Weighted Average Original Amortization Term (months)(2): | 358 |

| Weighted Average Remaining Amortization Term (months)(2): | 357 |

| Weighted Average Seasoning (months): | 2 |

| (1) | Information regarding mortgage loans secured by multiple properties is based on an allocation according to relative appraised values or the allocated loan amounts or property-specific release prices set forth in the related loan documents or such other allocation as the related mortgage loan seller deemed appropriate. |

| (2) | Excludes any mortgage loan that does not amortize. |

Credit Statistics:

| Weighted Average U/W Net Cash Flow DSCR(1): | 2.21x |

| Weighted Average U/W Net Operating Income Debt Yield(1): | 10.0% |

| Weighted Average Cut-off Date Loan-to-Value Ratio(1): | 63.4% |

| Weighted Average Balloon or ARD Loan-to-Value Ratio(1): | 59.7% |

| % of Mortgage Loans with Additional Subordinate Debt(2): | 7.4% |

| % of Mortgage Loans with Single Tenants(3): | 10.8% |

| (1) | With respect to any mortgage loan that is part of a whole loan, loan-to-value ratio, debt service coverage ratio and debt yield calculations include the related pari passu companion loan(s) but exclude any related subordinate companion loans (unless otherwise stated). The debt service coverage ratio, debt yield and loan-to-value ratio information do not take into account any subordinate debt (whether or not secured by the related mortgaged property), that currently exists or is allowed under the terms of any mortgage loan. See “Description of the Mortgage Pool—Mortgage Pool Characteristics” in the Preliminary Prospectus and Annex A-1 to the Preliminary Prospectus. |

| (2) | The percentage figure expressed as “% of Mortgage Loans with Additional Subordinate Debt” is determined as a percentage of the initial pool balance and does not take into account any future subordinate debt (whether or not secured by the mortgaged property), if any, that may be permitted under the terms of any mortgage loan or the pooling and servicing agreement. See “Description of the Mortgage Pool—Additional Indebtedness—Other Unsecured Indebtedness” in the Preliminary Prospectus. |

| (3) | Excludes mortgage loans that are secured by multiple single tenant properties. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

3

| Wells Fargo Commercial Mortgage Trust 2019-C54 | Characteristics of the Mortgage Pool |

B. Summary of the Whole Loans

| Property Name | Mortgage Loan Seller in WFCM 2019-C54 |

Note(s)(1) | Original Balance | Holder of Note(1) | Lead Servicer for Whole Loan | Master Servicer Under Lead Securitization Servicing Agreement |

Special Servicer Under Lead Securitization Servicing Agreement |

| The Tower at Burbank | WFB | A-1 | $100,000,000 | BANK 2019-BNK20 | Yes | Wells Fargo Bank, National Association | Midland Loan Services |

| A-2 | $70,000,000 | BANK 2019-BNK21 | No | ||||

| A-3 | $25,000,000 | WFCM 2019-C54 | No | ||||

| Planet Self Storage Portfolio | RMF | A-1, A-3 | $45,000,000 | WFCM 2019-C53(2) | Yes | Wells Fargo Bank, National Association | Midland Loan Services |

| A-2, A-4 | $25,000,000 | WFCM 2019-C54 | No | ||||

| Phoenix Industrial Portfolio II | UBS AG | A-1, A-2, A-5 | $40,000,000 | UBS 2019-C17 | Yes | Wells Fargo Bank, National Association | Rialto Capital Advisors, LLC |

| A-3, A-4 | $20,000,000 | WFCM 2019-C54 | No | ||||

| A-6 | $8,000,000 | UBS AG | No | ||||

| Global Payments, Inc. | BSPRT | A-1 | $19,167,000 | WFCM 2019-C54 | Yes | Wells Fargo Bank, National Association | LNR Partners, LLC |

| A-2 | $10,000,000 | BSPRT CMBS Finance, LLC | No | ||||

| NMR Pharmacy Portfolio | BSPRT | A-1 | $17,500,000 | WFCM 2019-C54 | Yes | Wells Fargo Bank, National Association | LNR Partners, LLC |

| A-2 | $14,300,000 | BBCMS 2019-C5(3) | No | ||||

| Washington Avenue Portfolio | AREF | A-1 | $26,000,000 | GSMS 2019-GSA1(4) | Yes | Midland Loan Services | LNR Partners, LLC |

| A-2 | $13,000,000 | WFCM 2019-C54 | No | ||||

| CIRE Equity Retail & Industrial Portfolio | UBS AG | A-1, A-2-1 | $50,000,000 | BMARK 2019-B12 | Yes | Midland Loan Services | Midland Loan Services |

| A-2-2, A-3 | $27,160,000 | CGCMT 2019-GC41 | No | ||||

| A-4 | $22,000,000 | WFCM 2019-C51 | No | ||||

| A-5-1 | $15,000,000 | UBS 2019-C17 | No | ||||

| A-5-2 | $5,000,000 | WFCM 2019-C54 | No | ||||

| A-6 | $9,440,000 | BBCMS 2019-C4 | No |

| (1) | Unless otherwise indicated, each note not currently held by a securitization trust is expected to be contributed to a future securitization. No assurance can be provided that any such note will not be split further. |

| (2) | The WFCM 2019-C53 transaction is expected to close on or about November 7, 2019. |

| (3) | The BBCMS 2019-C5 transaction is expected to close on or about November 26, 2019. |

| (4) | The GSMS 2019-GSA1 transaction is expected to close on or about November 8, 2019. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

4

| Wells Fargo Commercial Mortgage Trust 2019-C54 | Characteristics of the Mortgage Pool |

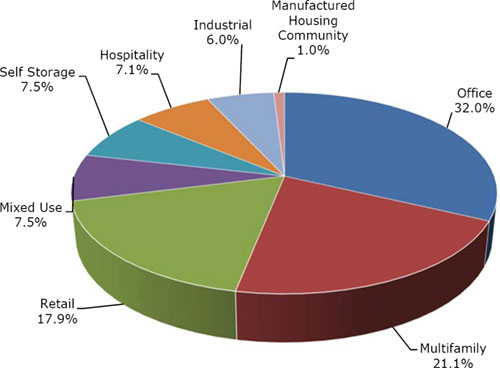

C. Property Type Distribution(1)

| Property Type | Number of Mortgaged Properties | Aggregate

Cut-off Date Balance ($) |

%

of Initial Pool Balance (%) |

Weighted Average Cut-off Date LTV Ratio (%) | Weighted

Average Balloon or ARD LTV Ratio (%) |

Weighted

Average U/W NCF DSCR (x) |

Weighted Average U/W NOI Debt Yield (%) | Weighted Average U/W NCF Debt Yield (%) | Weighted Average Mortgage Rate (%) |

| Office | 10 | $214,372,940 | 32.0% | 60.0% | 58.2% | 2.45x | 10.0% | 9.6% | 3.726% |

| Suburban | 6 | 128,472,940 | 19.2 | 60.4 | 57.4 | 2.52 | 10.6 | 10.1 | 3.673 |

| CBD | 3 | 55,500,000 | 8.3 | 62.2 | 62.2 | 2.44 | 9.3 | 9.0 | 3.778 |

| Urban | 1 | 30,400,000 | 4.5 | 54.3 | 54.3 | 2.19 | 8.9 | 8.6 | 3.850 |

| Multifamily | 11 | 141,383,488 | 21.1 | 65.3 | 61.9 | 2.05 | 9.3 | 8.9 | 3.983 |

| Garden | 7 | 114,083,488 | 17.0 | 67.4 | 63.3 | 1.93 | 9.0 | 8.7 | 3.997 |

| Mid Rise | 2 | 11,000,000 | 1.6 | 59.5 | 59.5 | 2.37 | 8.5 | 8.3 | 3.440 |

| Student Housing | 1 | 8,300,000 | 1.2 | 46.6 | 46.6 | 3.20 | 12.2 | 11.8 | 3.625 |

| High Rise | 1 | 8,000,000 | 1.2 | 61.5 | 61.5 | 2.11 | 10.9 | 10.5 | 4.910 |

| Retail | 28 | 120,218,271 | 17.9 | 62.2 | 59.5 | 2.29 | 10.4 | 9.9 | 3.908 |

| Anchored | 12 | 73,493,271 | 11.0 | 61.7 | 58.7 | 2.48 | 11.4 | 10.7 | 3.856 |

| Unanchored | 2 | 26,450,000 | 3.9 | 62.5 | 59.5 | 2.03 | 8.7 | 8.3 | 3.745 |

| Single Tenant | 13 | 17,500,000 | 2.6 | 62.7 | 62.7 | 1.96 | 8.9 | 8.6 | 4.316 |

| Shadow Anchored | 1 | 2,775,000 | 0.4 | 71.8 | 59.3 | 1.61 | 10.3 | 9.5 | 4.250 |

| Mixed Use | 4 | 50,240,032 | 7.5 | 66.6 | 66.6 | 2.41 | 10.0 | 9.4 | 3.866 |

| Flex/Office/Retail | 1 | 27,600,000 | 4.1 | 69.7 | 69.7 | 2.33 | 9.7 | 9.0 | 3.790 |

| Retail/Office | 3 | 22,640,032 | 3.4 | 62.7 | 62.7 | 2.52 | 10.3 | 9.9 | 3.960 |

| Self Storage | 15 | 49,993,267 | 7.5 | 67.2 | 61.7 | 2.01 | 8.7 | 8.5 | 3.588 |

| Self Storage | 15 | 49,993,267 | 7.5 | 67.2 | 61.7 | 2.01 | 8.7 | 8.5 | 3.588 |

| Hospitality | 6 | 47,262,070 | 7.1 | 61.4 | 49.5 | 1.98 | 13.3 | 11.8 | 4.366 |

| Select Service | 2 | 26,395,332 | 3.9 | 63.5 | 50.9 | 2.03 | 13.3 | 11.9 | 4.218 |

| Limited Service | 3 | 15,407,012 | 2.3 | 58.9 | 47.7 | 1.96 | 13.4 | 11.9 | 4.502 |

| Extended Stay | 1 | 5,459,726 | 0.8 | 57.9 | 47.2 | 1.79 | 12.6 | 11.2 | 4.700 |

| Industrial | 12 | 39,857,403 | 6.0 | 73.2 | 63.2 | 1.58 | 9.6 | 8.7 | 4.029 |

| Flex | 2 | 17,390,144 | 2.6 | 73.3 | 61.2 | 1.60 | 9.2 | 8.7 | 3.618 |

| Warehouse | 8 | 15,511,939 | 2.3 | 74.0 | 64.8 | 1.43 | 9.8 | 8.5 | 4.442 |

| Manufacturing | 1 | 4,885,496 | 0.7 | 74.2 | 64.8 | 1.41 | 9.8 | 8.5 | 4.450 |

| Warehouse Distribution | 1 | 2,069,823 | 0.3 | 64.7 | 64.7 | 2.94 | 10.5 | 10.2 | 3.400 |

| Manufactured Housing Community | 2 | 6,500,000 | 1.0 | 54.1 | 46.5 | 1.41 | 9.0 | 8.8 | 4.800 |

| Manufactured Housing Community | 2 | 6,500,000 | 1.0 | 54.1 | 46.5 | 1.41 | 9.0 | 8.8 | 4.800 |

| Total/Weighted Average: | 88 | $669,827,472 | 100.0% | 63.4% | 59.7% | 2.21x | 10.0% | 9.5% | 3.887% |

| (1) | Because this table presents information relating to the mortgaged properties and not the mortgage loans, the information for mortgage loans secured by more than one mortgaged property is based on allocated amounts (allocating the principal balance of the mortgage loan to each of those properties according to the relative appraised values of the mortgaged properties or the allocated loan amounts or property-specific release prices set forth in the related mortgage loan documents or such other allocation as the related mortgage loan seller deemed appropriate). With respect to any mortgage loan that is part of a whole loan, the loan-to-value ratio, debt service coverage ratio and debt yield calculations include the related pari passu companion loan(s) but exclude any related subordinate companion loans (unless otherwise stated). With respect to each mortgage loan, debt service coverage ratio, debt yield and loan-to-value ratio information do not take into account any subordinate debt (whether or not secured by the related mortgaged property) that currently exists or is allowed under the terms of such mortgage loan. See Annex A-1 to the Preliminary Prospectus. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

5

| Wells Fargo Commercial Mortgage Trust 2019-C54 | Certain Terms and Conditions |

D. Large Loan Summaries

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

6

| No. 1 – Continental Park – Rosecrans Douglas | ||||||

| Mortgage Loan Information | Mortgaged Property Information | |||||

| Mortgage Loan Seller: | Rialto Mortgage Finance, LLC | Single Asset/Portfolio: | Single Asset | |||

Credit Assessment (Fitch/KBRA/S&P): |

NR/NR/NR | Property Type – Subtype: | Office – Suburban | |||

| Original Principal Balance: | $55,000,000 | Location: | El Segundo, CA | |||

| Cut-off Date Balance: | $55,000,000 | Size: | 206,012 SF | |||

| % of Initial Pool Balance: | 8.2% | Cut-off Date Balance Per SF: | $266.97 | |||

| Loan Purpose: | Refinance | Maturity Date Balance Per SF: | $266.97 | |||

| Borrower Sponsor: | Continental Development Corporation | Year Built/Renovated: | 1965/2017 | |||

| Guarantor: | Continental Development Corporation | Title Vesting: | Fee | |||

| Mortgage Rate: | 3.3400% | Property Manager: | Self-managed | |||

| Note Date: | October 18, 2019 | Current Occupancy (As of): | 100.0% (9/9/2019) | |||

| Seasoning: | 1 month | YE 2018 Occupancy: | 100.0% | |||

| Maturity Date: | November 6, 2029 | YE 2017 Occupancy: | 100.0% | |||

| IO Period: | 120 months | YE 2016 Occupancy: | NAV | |||

| Loan Term (Original): | 120 months | As-Is Appraised Value: | $104,000,000 | |||

| Amortization Term (Original): | NAP | As-Is Appraised Value Per SF: | $504.82 | |||

| Loan Amortization Type: | Interest-only, Balloon | As-Is Appraisal Valuation Date: | September 15, 2019 | |||

| Call Protection: | L(23),GRTR 1% or YM(90),O(7) | |||||

| Lockbox Type: | Springing | Underwriting and Financial Information | ||||

| Additional Debt: | No | TTM NOI (8/31/2019): | $6,138,874 | |||

| Additional Debt Type (Balance): | N/A | YE 2018 NOI: | $5,967,074 | |||

| YE 2017 NOI: | $5,639,026 | |||||

| YE 2016 NOI: | NAV | |||||

| U/W Revenues: | $7,523,684 | |||||

| U/W Expenses: | $1,563,060 | |||||

| Escrows and Reserves(1) | U/W NOI: | $5,960,625 | ||||

| Initial | Monthly | Cap | U/W NCF: | $5,713,410 | ||

| Taxes | $48,798 | $23,237 | NAP | U/W DSCR based on NOI/NCF: | 3.19x / 3.06x | |

| Insurance | $8,218 | $3,913 | NAP | U/W Debt Yield based on NOI/NCF: | 10.8% / 10.4% | |

| Replacement Reserve | $0 | $3,434 | $206,102 | U/W Debt Yield at Maturity based on NOI/NCF: | 10.8% / 10.4% | |

| TI/LC Reserve(2) | $6,500,000 | $17,168 | $500,000 | Cut-off Date LTV Ratio: | 52.9% | |

| LTV Ratio at Maturity: | 52.9% | |||||

| Sources and Uses | ||||||

| Sources | Uses | |||||

| Original whole loan amount | $55,000,000 | 100.0% | Loan payoff | $31,634,989 | 57.5% | |

| Upfront reserves | 6,557,016 | 1.9 | ||||

| Closing costs | 764,744 | 1.4 | ||||

| Return of equity | 16,043,251 | 29.2 | ||||

| Total Sources | $55,000,000 | 100.0% | Total Uses | $55,000,000 | 100.0% | |

| (1) | See “Escrows” section for a full description of Escrows and Reserves. |

| (2) | The Initial TI/LC Reserve is for general TI/LC, including re-leasing the Carlisle space. The TI/LC Cap does not take into account the initial TI/LC amount collected. |

The Mortgage Loan. The mortgage loan (the “Continental Park - Rosecrans Douglas Mortgage Loan”) is evidenced by single promissory note secured by a first mortgage encumbering the fee interest in a 206,012 square foot mixed use property located in El Segundo, California (the “Continental Park - Rosecrans Douglas Property”).

The Borrower and Borrower Sponsor. The borrower is Continental Rose-Doug LLC (the “Continental Park - Rosecrans Douglas Borrower”), a Delaware limited liability company and single purpose entity with one independent director. Legal counsel to the Continental Park - Rosecrans Douglas Borrower delivered a non-consolidation opinion in connection with the origination of the Continental Park - Rosecrans Douglas Mortgage Loan. The borrower sponsor and nonrecourse carve-out guarantor of the Continental Park - Rosecrans Douglas Mortgage Loan is Continental Development Corporation (“CDC”).

CDC is wholly by owned Richard C. Lundquist and Melanie F. Lundquist, as Trustees of the Richard and Melanie Lundquist Family Trust, established August 20, 2001. Mr. Lundquist serves as the President of CDC, which is privately held and has had the same Lundquist family ownership since its inception. CDC is one of California’s largest commercial real estate developers and owners, and the company is primarily involved in the development of prime income-producing commercial properties designed for long-term investment. CDC has owned or developed more than 6.0 million square feet of office and commercial space in Southern and Northern California,

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

7

| Office - Suburban | Loan # 1 | Cut-off Date Balance: | $55,000,000 | |

| 831 Douglas Street & 2201, | Continental Park – Rosecrans Douglas | Cut-off Date LTV: | 52.9% | |

| 2221 & 2231 Rosecrans Avenue | U/W NCF DSCR: | 3.06x | ||

| El Segundo, CA 90245 | U/W NOI Debt Yield: | 10.8% |

comprised of Class-A office, medical/dental, research and development, commercial, retail, restaurant, entertainment, hospitality and mixed-use properties.

The Property. The Continental Park - Rosecrans Douglas Property is a 260,012 square foot office property, that includes 6,287 square feet of retail space, located on the northwest corner of the intersection of South Douglas Street and Rosecrans Avenue in El Segundo, California. The Continental Park - Rosecrans Douglas Property is situated on 8.6 acres of land and is comprised of two, two-story office buildings, a one-story office building and a one-story retail building. The Continental Park - Rosecrans Douglas Borrower developed the Continental Park - Rosecrans Douglas Property in phases in 1965, 1967, 1974 & 1996, and most recently renovated in 2011 and 2017. The three office buildings (two of which are occupied by single-tenants) contain 180,429 square feet of office space and 19,296 square feet of warehouse/studio space. The Continental Park - Rosecrans Douglas Property is 100% occupied by six national tenants and one regional tenant as of the September 9, 2019 rent roll. Investment-grade rated tenants occupy 59.7% of the Continental Park - Rosecrans Douglas Property’s net rentable area and contribute 72.4% of the UW base and straight-line rent. There is on-site parking for 870 vehicles (4.22 spaces per 1,000 square feet) at the Continental Park - Rosecrans Douglas Property, which includes 379 covered spaces located within an above-ground four-story parking structure and 491 surface spaces located throughout the Continental Park - Rosecrans Douglas Property.

Major Tenants.

Largest Tenant: Motor Trend (41.6% of underwritten base rent; 59,908 SF on 3/31/2029 and 22,438 SF on 11/30/2025 lease expiration) – Motor Trend is a subsidiary of Discovery Inc., a global leader in real life entertainment and delivers over 8,000 hours of original programming each year. Discovery’s portfolio of premium brands includes Discover Channel, HGTV, Food Network, TLC, Travel Channel, Turbo/Velocity, Animal Planet, Science Channel, OWN: Oprah Winfrey Network, Discovery Kids in Latin America, Eurosport and Motor Trend OnDemand. Motor Trend is an American automobile magazine that first appeared in September 1949, issued by Petersen Publishing Company in Los Angeles. It has a monthly circulation of over one million readers. The magazines feature road tests, vehicle comparisons and car of the year sectionals. Motor Trend has been a tenant at the Continental Park – Rosecrans Douglas Property since 2009, occupying 4 suites: Suite 150, Suite 175, Suite 195, and Suite 195A. Motor Trend has one, three year renewal option for its 150 – 831 Douglas space (suite 150), and two, 5-year renewal options remaining for other suites at the 2221 Rosecrans location.

2nd Largest Tenant: Carlisle Interconnect Technologies (26.5% of underwritten base rent; 2/29/2020 lease expiration) – Carlisle Interconnect Technologies is a diversified global company with a portfolio of businesses focused on the manufacture and distribution of highly engineered products for both original equipment and aftermarket channels. Carlisle is a division of Carlisle Companies Inc., which operates through its four segments, Carlisle Construction Materials, Carlisle Interconnect Technologies, Carlisle Fluid Technologies and Carlisle Brake & Friction. Carlisle has been a tenant at the Continental Park – Rosecrans Douglas Property since 1991 and has given notice of its intention to vacate upon the conclusion of its lease. The borrower sponsor has provided a letter of intent from a confidential tenant to backfill Carlisle’s space. The letter of intent outlines a ten-year lease with a rental rate starting at $41.40 per sq. ft. with 2.5% annual escalations. This proposed lease will have Proposition 13 protection for the first five years of the lease term, will include six months of free rent and an improvement allowance of $85 per sq. ft. The lease commencement date is projected to occur in December 2020. The Continental Park - Rosecrans Douglas Mortgage Loan is structured with a $6.5 million ($85 per sq. ft.) leasing reserve to lease the space.

3rd Largest Tenant: CBRE (19.0% of underwritten base rent; 11/30/2021 lease expiration) – CBRE was incorporated in February 2001 and had $105.5 billion of asset under management, more than 480 offices and more than 90,000 employees as of December 31, 2018. CBRE has been included on the Fortune 500 since 2006, ranking #146 in 2019, has been voted the most recognized commercial real estate brand in the Lipsey Company survey for 18 consecutive years (including 2019), has also been rated a World’s Most Ethical Company by the Ethisphere Institute for six consecutive years, and has been named one of Fortune’s “Most Admired Companies” for seven years in a row, including being ranked number one in the real estate sector in 2019. Revenue and adjusted EBITDA for 2018 reached new all-time highs of $21.3 billion and $1.9 billion, respectively. CBRE has been a tenant at the Continental Park – Rosecrans Douglas Property since 2011 and has two, 5-year renewal options remaining.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

8

| Office - Suburban | Loan # 1 | Cut-off Date Balance: | $55,000,000 | |

| 831 Douglas Street & 2201, | Continental Park – Rosecrans Douglas | Cut-off Date LTV: | 52.9% | |

| 2221 & 2231 Rosecrans Avenue | U/W NCF DSCR: | 3.06x | ||

| El Segundo, CA 90245 | U/W NOI Debt Yield: | 10.8% |

The following table presents certain information relating to the tenancy at the Continental Park – Rosecrans Douglas Property:

Major Tenants

| Tenant Name | Credit

Rating (Fitch/Moody’s/ S&P)(1) |

Tenant NRSF | %

of NRSF |

Annual U/W Base Rent PSF(2) | Annual U/W Base Rent(2) |

% of Total Annual U/W Base Rent | Lease

Expiration Date |

Extension Options | Termination Option (Y/N) |

| Major Tenants | |||||||||

| Motor Trend(3) | BBB-/Baa3/BBB- | 82,346 | 40.0% | $31.53 | $2,596,533 | 41.6% | Various(4) | Various(5) | Y(6) |

| Carlisle Interconnect Technology(7) | NR/NR/NR | 81,300 | 39.5% | $20.35 | $1,654,818 | 26.5% | 2/29/2020 | None | N |

| CBRE | NR/Baa1/BBB+ | 30,794 | 14.9% | $38.53 | $1,186,524 | 19.0% | 11/30/2021 | 2, 5-year | N |

| Total Major Tenants | 194,440 | 94.4% | $27.97 | $5,437,874 | 87.0% | ||||

| Non-Major Tenant(5)(6) | 11,572 | 5.6% | $69.96 | $809,619 | 13.0% | ||||

| Vacant Space | 0 | 0.0% | |||||||

| Collateral Total | 206,012 | 100.0% | $30.33 | $6,247,494 | 100.0% | ||||

| (1) | Certain ratings are those of the parent company or affiliates whether or not the parent company guarantees the lease. |

| (2) | Annual U/W Base Rent PSF and Annual U/W Base Rent include contractual rent steps through April 30, 2020 totaling $307,004, of which $281,137 belongs to Motor Trend and $25,867 to CBRE. |

| (3) | Motor Trend has rent abatement for Suite 175 from December 2020 through April 2021. |

| (4) | Motor Trend has 59,908 SF expiring on 3/31/2029 (Suite 150) and 22,438 SF expiring on 11/30/2025 (Suite 175, 195, and 195A). |

| (5) | Motor Trend has one, three-year option for its 831 Douglas Street space (Suite 175), and two, five-year option terms for other suites at 2221 Rosecrans. |

| (6) | Motor Trend has a one-time right to terminate its lease for its 831 Douglas Street space (Suite 175) on April 30, 2027 with ten months’ prior notice and payment of a termination fee equal to 22.49% of the tenant improvement allowance ($47.50 per SF.; $2,845,630) and commissions ($300,000), which equates to $707,452. |

| (7) | Carlisle Interconnect Technology has given notice to leave its space at the end of its lease. |

The following table presents certain information relating to the lease rollover schedule at the Continental Park – Rosecrans Douglas Property:

Lease Expiration Schedule(1)(2)

| Year

Ending December 31, |

No.

of Leases Expiring |

Expiring

NRSF |

%

of Total NRSF |

Cumulative

Expiring NRSF |

Cumulative

% of Total NRSF |

Annual U/W Base Rent |

%

of Total Annual U/W Base Rent |

Annual U/W Base Rent PSF |

| MTM | 0 | 0 | 0.0% | 0 | 0.0% | $0 | 0.0% | $0.00 |

| 2019 | 0 | 0 | 0.0% | 0 | 0.0% | $0 | 0.0% | $0.00 |

| 2020 | 1 | 81,300 | 39.5% | 81,300 | 39.5% | $1,654,818 | 26.5% | $20.35 |

| 2021 | 2 | 30,794 | 14.9% | 112,094 | 54.4% | $1,186,524 | 19.0% | $38.53 |

| 2022 | 3 | 8,474 | 4.1% | 120,568 | 58.5% | $567,975 | 9.1% | $67.03 |

| 2023 | 1 | 3,098 | 1.5% | 123,666 | 60.0% | $241,644 | 3.9% | $78.00 |

| 2024 | 0 | 0 | 0.0% | 123,666 | 60.0% | $0 | 0.0% | $0.00 |

| 2025 | 3 | 22,438 | 10.9% | 146,104 | 70.9% | $815,937 | 13.1% | $36.36 |

| 2026 | 0 | 0 | 0.0% | 146,104 | 70.9% | $0 | 0.0% | $0.00 |

| 2027 | 0 | 0 | 0.0% | 146,104 | 70.9% | $0 | 0.0% | $0.00 |

| 2028 | 0 | 0 | 0.0% | 146,104 | 70.9% | $0 | 0.0% | $0.00 |

| 2029 | 1 | 59,908 | 29.1% | 206,012 | 100.0% | $1,780,596 | 28.5% | $29.72 |

| Thereafter | 0 | 0 | 0.0% | 206,012 | 100.0% | $0 | 0.0% | $0.00 |

| Vacant | 0 | 0 | 0.0% | 206,012 | 100.0% | $0 | 0.0% | $0.00 |

| Total/Weighted Average | 11 | 206,012 | 100.0% | $6,247,494 | 100.0% | $30.33 |

| (1) | Information obtained from the underwritten rent roll. |

| (2) | Certain tenants may have lease termination options that are exercisable prior to the originally stated expiration date of the subject lease and that are not considered in the Lease Expiration Schedule. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

9

| Office - Suburban | Loan # 1 | Cut-off Date Balance: | $55,000,000 | |

| 831 Douglas Street & 2201, | Continental Park – Rosecrans Douglas | Cut-off Date LTV: | 52.9% | |

| 2221 & 2231 Rosecrans Avenue | U/W NCF DSCR: | 3.06x | ||

| El Segundo, CA 90245 | U/W NOI Debt Yield: | 10.8% |

The following table presents historical occupancy percentages at the Continental Park – Rosecrans Douglas Property:

Historical Occupancy

12/31/2016 |

12/31/2017(1) |

12/31/2018(1) |

9/9/2019(2) |

| NAV | 100.0% | 100.0% | 100.0% |

| (1) | Information provided by the borrower. |

| (2) | Information obtained from the underwritten rent roll. |

Operating History and Underwritten Net Cash Flow. The following table presents certain information relating to the underwritten net cash flow at the Continental Park – Rosecrans Douglas Property:

Cash Flow Analysis

| 2017 | 2018 | TTM 8/31/2019 | U/W | %(1) | U/W $ per SF | |

| Rents in Place | $5,706,683 | $5,984,020 | $6,072,932 | $6,142,084 | 77.8% | $29.81 |

| Contractual Rent Steps(2) | 0 | 0 | 0 | 412,413 | 5.2 | 2.00 |

| Grossed Up Vacant Space | 0 |

0 |

0 |

0 |

0.0 |

0.00 |

| Gross Potential Rent | $5,706,683 | $5,984,020 | $6,072,932 | $6,554,498 | 83.0% | $31.82 |

| Other Income | 329,580 | 350,301 | 374,707 | 402,672 | 5.1 | 1.95 |

| Total Recoveries | 477,703 |

486,692 |

549,346 |

941,305 |

11.9 |

4.57 |

| Net Rental Income | $6,513,966 | $6,821,013 | $6,996,985 | $7,898,475 | 100.0% | $38.34 |

| (Vacancy & Credit Loss) | 0 |

0 |

0 |

(374,790)(3) |

(5.7) |

(1.82) |

| Effective Gross Income | $6,513,966 | $6,821,013 | $6,996,985 | $7,523,684 | 95.3% | $36.52 |

| Real Estate Taxes | $132,136 | $139,398 | $146,781 | $735,441 | 9.8 | 3.57 |

| Insurance | $36,234 | $38,506 | $40,448 | $46,959 | 0.6 | 0.23 |

| Management Fee | $30,746 | $36,266 | $40,696 | $150,474 | 2.0 | 0.73 |

| Other Operating Expenses | $675,824 |

$639,769 |

$630,186 |

$630,186 |

8.4 |

3.06 |

| Total Operating Expenses | $874,940 | $853,939 | $858,111 | $1,563,060 | 20.8% | $7.59 |

| Net Operating Income | $5,639,026 | $5,967,074 | $6,138,874 | $5,960,625 | 79.2% | $28.93 |

| Replacement Reserves | 0 | 0 | 0 | 41,202 | 0.5 | 0.20 |

| TI/LC | 0 |

0 |

0 |

206,012 |

2.7 |

1.00 |

| Net Cash Flow | $5,639,026 | $5,967,074 | $6,138,874 | $5,713,410 | 71.9% | $27.73 |

| NOI DSCR(5) | 3.02x | 3.20x | 3.29x | 3.20x | ||

| NCF DSCR(5) | 3.02x | 3.20x | 3.29x | 3.07x | ||

| NOI Debt Yield(5) | 10.3% | 10.8% | 11.2% | 10.8% | ||

| NCF Debt Yield(5) | 10.3% | 10.8% | 11.2% | 10.4% |

| (1) | Represents (i) percent of Net Rental Income for all revenue fields, (ii) percent of Gross Potential Rent for Vacancy & Credit Loss and (iii) percent of Effective Gross Income for all other fields. |

| (2) | Represents contractual rent steps through April, 2020 for Motor Trend, CBRE and Noah’s bagels, and straight line rent for Motor Trend and CBRE. |

| (3) | The underwritten economic vacancy is 5.0%. The Continental Park – Rosecrans Douglas Property was 100.0% leased as of September 9, 2019. |

Appraisal. The appraiser concluded to an “As Is” for the Continental Park – Rosecrans Douglas Property of $104,000,000 as of September 15, 2019. The appraisal assumed that new tenant took the space of Carlisle Interconnect Technologies and paid an annual rent of $41.4 PSF, which matched the concluded market rent for office space in the area that the appraisal determined. Carlisle Interconnect Technologies is currently paying $20.35 PSF annually.

Environmental Matters. According to a Phase I environmental site assessment dated September 23, 2019, there was no evidence of any recognized environmental conditions at the Continental Park – Rosecrans Douglas Property. However, it was noted that suspect ACM should be managed under an ACM O&M Program.

Market Overview and Competition. The Continental Park – Rosecrans Douglas Property is located in El Segundo, California within the South Bay area of Los Angeles County. Significant industries in the South Bay include defense, aerospace, technology, automotive, international trade, oil & gas, entertainment, media and telecommunication. The largest concentrations of office space are located in the cities of Long Beach, El Segundo, the Los Angeles International Airport area and the 190th Street Corridor in Torrance. Companies headquartered in the South Bay include Mattel, Honda USA, Cetera, Epson, and DIRECTV. Office development in El Segundo is primarily located along Sepulveda Boulevard, Imperial Highway, El Segundo Boulevard, and Rosecrans Avenue. The Continental Park – Rosecrans

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

10

| Office - Suburban | Loan # 1 | Cut-off Date Balance: | $55,000,000 | |

| 831 Douglas Street & 2201, | Continental Park – Rosecrans Douglas | Cut-off Date LTV: | 52.9% | |

| 2221 & 2231 Rosecrans Avenue | U/W NCF DSCR: | 3.06x | ||

| El Segundo, CA 90245 | U/W NOI Debt Yield: | 10.8% |

Douglas Property is located 1.5 miles east of San Diego (405) Freeway, and 6.4 miles south of the Century (105) Freeway which provide regional access for El Segundo.

Submarket Information – According to a third-party market research report, the Continental Park – Rosecrans Douglas Property is situated within the El Segundo office submarket and the South Bay retail submarket. As of second quarter 2019, the El Segundo office submarket reported a total inventory of 17.9 million square feet with a 11.7% vacancy rate, representing a year-over-year increase of 2.98%. As of second quarter 2019, the South Bay retail submarket reported a total inventory of 70.1 million square feet with a 4.97% vacancy rate, representing a year-over-year decrease of 0.11%.

Appraiser’s Comp Set – The appraiser identified eight primary competitive office properties for the Continental Park – Rosecrans Douglas Property totaling approximately 1.5 million square feet, which reported an average occupancy rate of approximately 72.3%. The appraiser also identified four competitive retail properties for Continental Park – Rosecrans Douglas Property totaling approximately 625,232 square feet, which reported an average occupancy rate of approximately 99%. The appraiser concluded to net market rents for the Continental Park – Rosecrans Douglas Property of $41.40 per square foot, for office tenants and $72.00 per square foot gross for the retail tenants.

The following table presents certain information relating to the appraiser’s market rent conclusion for the Continental Park – Rosecrans Douglas Property:

Market Rent Summary(1)

| Large Office | Small/Mid Office | Retail | |

| Market Rent (PSF) | $41.40 | $41.40 | $72.00 |

| Lease Term (Years) | 10 | 5 | 5 |

| Lease Type (Reimbursements) | MG (Net Utilities) | MG (Net Utilities) | NNN |

| Rent Increase Projection | 10.0% after Yr. 5 | 3.0% per annum | 3.0% per annum |

| (1) | Information obtained from the appraisal. |

The table below presents certain information relating to comparable sales for the Continental Park – Rosecrans Douglas Property identified by the appraiser:

Comparable Sales(1)

| Property Name | Location | Rentable Area (SF) | Sale Date | Sale Price | Sale Price (PSF) |

| 777 Aviation Boulevard | El Segundo, CA | 318,182 | Jun-19 | $170,000,000 | $534 |

| Westwood Terrace | Los Angeles, CA | 164,682 | Aug-18 | $92,500,000 | $562 |

| Campus 2100 | El Segundo, CA | 203,946 | Dec-17 | $117,100,000 | $574 |

| 800 Corporate Pointe | Culver City, CA | 245,786 | Sep-17 | $148,000,000 | $602 |

| Ocean Park Plaza | Santa Monica, CA | 100,983 | Sep-17 | $63,500,000 | $629 |

| Apollo at Rosecrans | El Segundo, CA | 546,833 | May-16 | $317,300,000 | $580 |

| (1) | Information obtained from the appraisal. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

11

| Office - Suburban | Loan # 1 | Cut-off Date Balance: | $55,000,000 | |

| 831 Douglas Street & 2201, | Continental Park – Rosecrans Douglas | Cut-off Date LTV: | 52.9% | |

| 2221 & 2231 Rosecrans Avenue | U/W NCF DSCR: | 3.06x | ||

| El Segundo, CA 90245 | U/W NOI Debt Yield: | 10.8% |

The table below presents certain information relating to comparable office properties to the Continental Park – Rosecrans Douglas Property identified by the appraiser:

Competitive Set(1)

| Property Name | Location | Distance from Subject | Property Type | Year Built | Anchors | Total GLA | Total Occupancy |

| 840 Apollo | El Segundo, CA | 1.9 miles | Office | 1980 | Marcus & Millichap | 75,337 | 100.0% |

| 2221 Park Place | El Segundo, CA | 1.7 miles | Office | 1966 | WeWork | 90,000 | 100.0% |

| 777 Aviation Boulevard | El Segundo, CA | 1.8 miles | Office | 1968 | FAA | 318,182 | 70.0% |

| 555 Aviation Boulevard | El Segundo, CA | 1.6 miles | Office | 1966 | Publicis | 259,106 | 33.0% |

Ascend at Utah Avenue Campus |

El Segundo, CA | 1.3 miles | Office | 2018 | Radiology Partners | 80,000 | 85.0% |

| Campus 2100 | El Segundo, CA | 1.2 miles | Office | 1977 | Chicken of the Sea | 203,946 | 95.0% |

| Gateway El Segundo | El Segundo, CA | 1.2 miles | Office/Retail | 1980 | Spaces | 336,527 | 65.0% |

| INSITE | El Segundo, CA | 0.5 miles | Office | 1953 | Go Guardian | 101,874 | 30.0% |

| (1) | Information obtained from the appraisal. |

The following table presents certain information relating to comparable leases to those at the Continental Park-Rosecrans Douglas Property:

Comparable Office Leases

| Property Name/Location | Year Built/ Renovated | Total GLA (SF) | Distance from Subject | Occupancy | Lease Term | Tenant Size | Annual Base Rent PSF | Reimbursement Amount PSF | Lease Type |

840 Apollo 840 Apollo Street El Segundo, CA |

1980/2004 | 75,337 | 0.5 miles | 100.0% | 7.3 Yrs | 12,500 SF | $43.20 | $38.40 | MG |

2221 Park Place 2221 Park Place El Segundo, CA |

1966/2019 | 90,000 | 0.2 miles | 100.0% | 10.0 Yrs | 90,000 SF | $54.00 | $49.20 | MG |

777 Aviation Blvd 777 Aviation Blvd El Segundo, CA |

1968/N/A | 318,182 | 0.8 miles | 70.0% | 6.0 Yrs 6.0 Yrs 10.9 Yrs 15.0 Yrs |

7,174 SF 20,000 SF 43,728 SF 155,000 SF |

$46.20 $44.40 $43.20 $48.00 |

$41.40 $39.60 $38.40 $37.80 |

MG MG MG FS |

555 Aviation Blvd 555 Aviation Blvd El Segundo, CA |

1966/2017 | 259,106 | 0.8 miles | 33.0% | 10.0 Yrs | 85,000 SF | $42.60 | $37.80 | MG |

Ascend Utah Ave Campus 2330 Utah Ave El Segundo, CA |

2018/N/A | 80,000 | 0.5 miles | 85.0% | 11.0 Yrs | 63,820 SF | $37.20 | $37.20 | NNN |

Campus 2100 2100, 2120 & 2150 E. Grand Ave El Segundo, CA |

1977/2005 | 203,946 | 1.6 miles | 95.0% | 5.3 Yrs 5.3 Yrs 7.3 Yrs |

4,180 SF 3,014 SF 33,085 SF |

$50.40 $49.80 $33.00 |

$40.20 $39.60 $33.00 |

FS FS NNN |

Gateway El Segundo 300, 360 & 390 N. Sepulveda Blvd El Segundo, CA |

1980/2018 | 336,527 | 2.3 miles | 65.0% | 11.0 Yrs | 37,373 SF | $39.60 | $29.40 | FS |

INSITE 2030 E. Maple Ave El Segundo, CA |

1953/2016 | 101,874 | 2.2 miles | 30.0% | 8.5 Yrs | 30,000 SF | $45.60 | $40.80 | MG |

| (1) | Information obtained from the appraisal. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

12

| Office - Suburban | Loan # 1 | Cut-off Date Balance: | $55,000,000 | |

| 831 Douglas Street & 2201, | Continental Park – Rosecrans Douglas | Cut-off Date LTV: | 52.9% | |

| 2221 & 2231 Rosecrans Avenue | U/W NCF DSCR: | 3.06x | ||

| El Segundo, CA 90245 | U/W NOI Debt Yield: | 10.8% |

Comparable Retail Leases

| Property Name/Location | Year Built/ Renovated | Total GLA (SF) | Distance from Subject | Occupancy | Lease Term | Tenant Size | Annual Base Rent PSF | Reimbursement Amount PSF | Lease Type |

Apollo Landing 2171 Rosecrans Ave El Segundo, CA |

2017 / NAV | 13,500 | 0.2 miles | 100.0% | 10.0 Yrs 10.0 Yrs 0.0 Yrs 10.0 Yrs |

2,000 SF 1,200 SF 2,084 SF 4,058 SF |

$75.00 $84.00 $84.00 $69.96 |

$15.00 | NNN |

Manhattan Marketplace 1570 Rosecrans Ave Manhattan Beach, CA |

1990 / NAV | 113,175 | 0.4 miles | 97.0% | 5.0 Yrs 5.0 Yrs |

1,000 SF 1,500 SF |

$64.80 $63.00 |

$7.80 | NNN |

The Point 850 S. Sepulveda Blvd El Segundo, CA |

2015 / NAV | 118,000 | 1.3 miles | 100.0% | 5.0 Yrs 10.0 Yrs 5.0 Yrs 5.0 Yrs |

6,919 SF 3,057 SF 6,501 SF 3,000 SF |

$47.40 $60.00 $54.96 $60.00 |

N/A | NNN |

Plaza El Segundo NEC Rosecrans Ave & Sepulveda Blvd El Segundo, CA |

2007 / NAV | 380,557 | 1.6 miles | 100.0% | 5.0 Yrs 5.0 Yrs |

5,409 SF 902 SF |

$58.56 $88.68 |

$11.40 | NNN |

| (1) | Information obtained from the appraisal. |

Escrows.

Real Estate Taxes – The Continental Park – Rosecrans Douglas Mortgage Loan documents require an upfront real estate tax reserve of $48,798 and ongoing monthly real estate tax reserves in an amount equal to one-twelfth of the real estate taxes that the lender estimates will be payable during the next twelve months (initially $23,237).

Insurance – The Continental Park – Rosecrans Douglas Mortgage Loan documents require an upfront insurance reserve of $8,218 and ongoing monthly insurance reserves in an amount equal to one-twelfth of the insurance premiums that the lender estimates will be payable during the next twelve months (initially $3,913). However, if insurance coverage required per the Continental Park – Rosecrans Douglas Mortgage Loan documents is provided through an approved blanket insurance policy, the Continental Park – Rosecrans Douglas Mortgage Borrower will not be obligated to make the ongoing monthly insurance deposit so long as Continental Park – Rosecrans Douglas Borrower maintains the insurance coverage required by the Continental Park – Rosecrans Douglas Mortgage Loan documents and delivers to lender, not less than fifteen (15) days prior to the expiration date of any such blanket insurance policy, certificates of insurance evidencing such policy.

Replacement Reserves – The Continental Park – Rosecrans Douglas Mortgage Loan documents require ongoing monthly replacement reserves of $3,434. However, ongoing monthly replacement reserve deposits will not be required so long as the balance in the replacement reserve exceeds $206,012.

Existing TI/LC Reserve – The Continental Park – Rosecrans Douglas Mortgage Loan documents require an upfront reserve of $6,500,000 and ongoing monthly TI/LC reserves of $17,168 into the Rollover Account. However, ongoing monthly TI/LC reserves will not be required so long as the TI/LC reserve balance exceeds $500,000 (the “Rollover Cap”), the calculation of which does not include any portion of the $6,500,000 upfront reserve amount. In addition to the required deposits, the Continental Park – Rosecrans Douglas Borrower is required to deposit all Extraordinary Lease Payments (as defined below), net of reasonable, out-of-pocket costs and expenses, if any, incurred by Continental Park – Rosecrans Douglas Borrower. Extraordinary Lease Payments deposited into the Rollover Account will not be counted towards the balance in the Rollover Account that is subject to the Rollover Cap. Notwithstanding the foregoing, in the event Continental Park – Rosecrans Douglas Borrower receives an Extraordinary Lease Payment from a future tenant occupying all of the 2201 Rosecrans Space, the required to deposit amount will be equal to $85.00 per rentable square foot of the 2201 Rosecrans Space, and the Continental Park – Rosecrans Douglas Borrower will be entitled to retain any amount of the Extraordinary Lease Payment in excess of such amount.

Extraordinary Lease Payments represent any amounts paid to Continental Park – Rosecrans Douglas Borrower in connection with a termination, cancellation, surrender, modification, sale or other disposition of any lease or any portion thereof, other than amounts paid for rent and other charges in respect of periods prior to the date of such termination, cancellation, surrender, modification, sale or other disposition.

Lockbox and Cash Management. The Continental Park – Rosecrans Douglas Mortgage Loan requires a springing lockbox and a springing cash management. Upon the occurrence and continuance of a Cash Management Trigger Event (as defined below) the borrower is required to establish a lender-controlled lockbox account and instruct tenants to deposit rents into such lockbox account. The Continental Park – Rosecrans Douglas Mortgage Loan documents also require that all rents received by the Continental Park – Rosecrans Douglas Borrower or the property manager be deposited into the lockbox account within one business day of receipt. Pursuant to the Continental Park – Rosecrans Douglas Mortgage Loan documents, all excess funds on deposit are required to be applied as follows (a) if a Cash Sweep Event (as defined below) is not in effect, to the Continental Park – Rosecrans Douglas Borrower; and (b) if a Cash Sweep Event is in effect due to the existence of a Critical Tenant Trigger Event (as defined below) to the Critical Tenant

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

13

| Office - Suburban | Loan # 1 | Cut-off Date Balance: | $55,000,000 | |

| 831 Douglas Street & 2201, | Continental Park – Rosecrans Douglas | Cut-off Date LTV: | 52.9% | |

| 2221 & 2231 Rosecrans Avenue | U/W NCF DSCR: | 3.06x | ||

| El Segundo, CA 90245 | U/W NOI Debt Yield: | 10.8% |

TI/LC account until the applicable Critical Tenant Trigger Event cure has occurred. If a Cash Sweep Event is in effect but a Critical Tenant Trigger Event is not in effect, then funds will be applied to the excess cash flow account.

A “Cash Management Trigger Event” will commence upon the earliest to occur of the following:

| (i) | an event of default; |

| (ii) | the Continental Park – Rosecrans Douglas Borrower’s second late debt service payment within a 12-month period; |

| (iii) | a bankruptcy action of the Continental Park – Rosecrans Douglas Borrower, guarantor or manager; |

| (iv) | a Cash Management DSCR Trigger Event; or |

| (v) | a Critical Tenant Trigger Event (as defined below). |

A “Cash Management Trigger Event” will end upon the occurrence of:

| ● | with regard to clause (i) above, the cure of such event of default has been accepted or waived by the lender; |

| ● | with regard to clause (ii) above, the timely payment of monthly debt service on six consecutive payment dates; |

| ● | with regard to clause (iii) above, when such bankruptcy action petition has been discharged, stayed, or dismissed within 60 days of such filing among other conditions for the Continental Park – Rosecrans Douglas Borrower or guarantor (or, with respect to the guarantor, if Continental Park – Rosecrans Douglas Borrower replaces such guarantor with an approved replacement guarantor) and within 120 days for the property manager, with respect to the manager, the Continental Park – Rosecrans Douglas Borrower replacing the manager with a qualified manager acceptable to the lender; |

| ● | with regard to clause (iv) above, the date the amortizing debt service coverage ratio based on the trailing 12-month period immediately preceding the date of such determination is greater than 1.20x for two consecutive quarters. |

| ● | with regard to clause (v) above, the date on which the Critical Tenant Trigger Event Cure (as defined below) has occurred. |

A “Cash Management DSCR Trigger Event” will occur on any day the debt service coverage ratio, based on the trailing 12-month period immediately preceding the date of determination, is less than 1.20x for the Continental Park – Rosecrans Douglas Mortgage Loan.

A “Cash Sweep Event” will commence upon the occurrence of the following:

| (i) | an event of default; |

| (ii) | a bankruptcy action of the Continental Park – Rosecrans Douglas Borrower, guarantor or manager; |

| (iii) | a Cash Sweep DSCR Trigger Event (as defined below); or |

| (iv) | a Critical Tenant Trigger Event (as defined below). |

A Cash Sweep Event will end upon the occurrence of:

| ● | with regard to clause (i) above, the cure of such event of default has been accepted or waived by the lender; |

| ● | with regard to clause (ii) above, when such bankruptcy action petition has been discharged, stayed, or dismissed within 90 days of such filing among other conditions for the Continental Park – Rosecrans Douglas Borrower or guarantor and within 120 days for the property manager, with respect to the manager, the Continental Park – Rosecrans Douglas Borrower replacing the manager with a qualified manager acceptable to the lender; |

| ● | with regard to clause (iii) above, the date the amortizing debt service coverage ratio based on the trailing 12-month period immediately preceding the date of such determination is greater than 1.20x for two consecutive quarters; and |

| ● | with regard to clause (iv) above, the date on which the Critical Tenant Trigger Event Cure (as defined below) has occurred. |

A “Cash Sweep DSCR Trigger Event” will occur on any day the debt service coverage ratio, based on the trailing 12-month period immediately preceding the date of determination, is less than 1.15x for the Continental Park – Rosecrans Douglas Mortgage Loan.

A “Critical Tenant Trigger Event” will commence, with respect to Extreme Ventures, CBRE and any other tenant occupying 30,000 or more square feet of a critical tenant space (“Critical Tenant”), upon the earlier to occur of the following:

| (i) | upon the earlier to occur of the following: |

| a. | the date that the related Critical Tenant gives notice of its intention to not extend or renew its Lease or to terminate its lease or lease is otherwise terminated; |

| b. | on the date that is nine months prior to the related lease expiration date if the Critical Tenant has failed to give notice of its election to renew its lease; |

| c. | on or prior to the date on which the Critical Tenant is required under its lease to notify the Continental Park – Rosecrans Douglas Borrower of its election to renew its lease, and the Critical Tenant fails to give such notice; however, that no Critical Tenant Trigger Event will be deemed to have occurred pursuant to this clause (i) in the event that Borrower immediately, upon each occurrence of clauses (a), (b) and/or (c) above with respect to any Critical Tenant, deposits with Lender an amount equal to $50.00 per rentable square foot of the applicable Critical Tenant space or commences making monthly deposits of $300,000 into the Critical Tenant TI/LC Account until such time as the Critical Tenant TI/LC Funds on deposit equals or exceeds an amount equal to $50.00 per rentable square foot of the applicable Critical Tenant space; |

| (ii) | an event of default under the Critical Tenant Lease occurs or is continuing; and |

| (iii) | if a bankruptcy action with respect to the Critical Tenant or any Critical Tenant guarantor occurs. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

14

| Office - Suburban | Loan # 1 | Cut-off Date Balance: | $55,000,000 | |

| 831 Douglas Street & 2201, | Continental Park – Rosecrans Douglas | Cut-off Date LTV: | 52.9% | |

| 2221 & 2231 Rosecrans Avenue | U/W NCF DSCR: | 3.06x | ||

| El Segundo, CA 90245 | U/W NOI Debt Yield: | 10.8% |

A “Critical Tenant Trigger Event Cure” will occur upon:

| ● | with regard to clause (i), above, (x) the date that (1) (x) the Critical Tenant lease extension is executed and delivered by the Continental Park – Rosecrans Douglas Borrower and the related Critical Tenant; (y) the amount of Critical Tenant TI/LC Funds on deposit in the Critical Tenant TI/LC Account as a result of the related Cash Sweep Event Period equals or exceeds an amount equal to $50.00 per rentable square foot of the applicable Critical Tenant space or (z) Continental Park – Rosecrans Douglas Borrower delivers an acceptable letter of credit to the lender ender in an amount equal to $50.00 per rentable square foot of the applicable Critical Tenant space, or (2) a Critical Tenant Space Re-Tenanting Event (as defined below) has occurred; |

| ● | with regard to clause (ii) above, after a cure of the applicable default; and |

| ● | with regard to clause (iii) above, after an affirmation that the Critical Tenant is actually paying all rents and other amounts under the lease. |

A “Critical Tenant Space Re-tenanting Event” will occur on the date each of the following conditions has been satisfied: (i) the Critical Tenant space is leased to one or more replacement tenants for a term of at least five years and on terms that are acceptable to the lender; (ii) all tenant improvement costs, leasing commissions and other material costs and expenses relating to the re-letting of the space have been paid in full; and (iii) the replacement tenant(s) has accepted possession and is in actual, physical occupancy of, and is conducting normal business operations at the related Critical Tenant space and is paying full, unabated rent without offset in accordance with its lease, and (iv) the lender has received a fully-executed copy of each replacement lease, an officer’s certificate and a duly-executed estoppel certificate from each replacement tenant.

Property Management. The Continental Park-Rosecrans Douglas Property is managed by an affiliate of the Continental Park-Rosecrans Douglas Borrower.

Partial Release. Not permitted.

Real Estate Substitution. The Continental Park-Rosecrans Douglas has the right to release an outparcel for the purpose of road widening so long as, among other conditions, (i) no event of default has occurred or is continuing, and (ii) such partial release will occur with the transfer of fee title to the outparcel to the City of El Segundo, California.

Terrorism Insurance. The Continental Park-Rosecrans Douglas Mortgage Loan documents require that the “all risk” insurance policy required to be maintained by the Continental Park-Rosecrans Douglas Borrower provides coverage for terrorism in an amount equal to the full replacement cost of the Continental Park-Rosecrans Douglas Property, as well as business interruption insurance covering no less than the 18-month period following the occurrence of a casualty event, together with a 12-month extended period of indemnity. The Continental Park-Rosecrans Douglas Property is located in seismic Zone 4. There was no requirement for seismic insurance.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

15

| No. 2 – West Bountiful Commons | |||||||

| Mortgage Loan Information | Mortgaged Property Information | ||||||

| Mortgage Loan Seller: | Rialto Mortgage Finance, LLC | Single Asset/Portfolio: | Single Asset | ||||

Credit Assessment (Fitch/KBRA/S&P): |

NR/NR/NR | Property Type – Subtype: | Retail – Anchored | ||||

| Original Principal Balance: | $34,750,000 | Location: | West Bountiful, UT | ||||

| Cut-off Date Balance: | $34,750,000 | Size: | 324,349 SF | ||||

| % of Initial Pool Balance: | 5.2% | Cut-off Date Balance Per SF: | $107.14 | ||||

| Loan Purpose: | Refinance | Maturity Date Balance Per SF: | $107.14 | ||||

| Borrower Sponsors: | John R. Thackeray and Armand D. Johansen | Year Built/Renovated: | 1993/2017 | ||||

| Guarantors: | John R. Thackeray and Armand D. Johansen | Title Vesting: | Fee | ||||

| Mortgage Rate: | 3.8400% | Property Manager: | Self-managed | ||||

| Note Date: | October 18, 2019 | Current Occupancy (As of): | 99.2% (9/12/2019) | ||||

| Seasoning: | 1 month | YE 2018 Occupancy: | 97.3% | ||||

| Maturity Date: | November 6, 2029 | YE 2017 Occupancy: | 97.4% | ||||

| IO Period: | 120 months | YE 2016 Occupancy: | 98.8% | ||||

| Loan Term (Original): | 120 months | YE 2015 Occupancy: | NAV | ||||

| Amortization Term (Original): | NAP | As-Is Appraised Value: | $53,700,000 | ||||

| Loan Amortization Type: | Interest-only, Balloon | As-Is Appraised Value Per SF: | $165.56 | ||||

| Call Protection | L(25),D(91),O(4) | As-Is Appraisal Valuation Date: | September 20, 2019 | ||||

| Lockbox Type: | Springing | Underwriting and Financial Information | |||||

| Additional Debt: | No | TTM NOI (8/31/2019): | $3,227,658 | ||||

| Additional Debt Type (Balance): | NAP | YE 2018 NOI: | $3,267,825 | ||||

| YE 2017 NOI: | $3,339,093 | ||||||

| YE 2016 NOI: | $3,046,193 | ||||||

| U/W Revenues: | $3,968,218 | ||||||

| U/W Expenses: | $549,945 | ||||||

| Escrows and Reserves(2) | U/W NOI: | $3,418,273 | |||||

| Initial | Monthly | Cap | U/W NCF: | $3,261,882 | |||

| Taxes | $18,302 | $17,431 | NAP | U/W DSCR based on NOI/NCF: | 2.52x / 2.40x | ||

| Insurance | $19,214 | $1,664 | NAP | U/W Debt Yield based on NOI/NCF: | 9.8% / 9.4% | ||

| Replacement Reserve | $0 | $2,367 | NAP | U/W Debt Yield at Maturity based on NOI/NCF: | 9.8% / 9.4% | ||

| TI/LC Reserve | $0 | $13,244 | NAP | Cut-off Date LTV Ratio: | 64.7% | ||

| Unfunded TI/LC Reserve | $77,025(2) | $99,250(3) | NAP | LTV Ratio at Maturity: | 64.7% | ||

| Sources and Uses | ||||||

| Sources | Uses | |||||

| Original loan amount | $34,750,000 | 99.3% | Purchase Price | $34,098,177 | 97.4% | |

| Equity Contribution | 241,437 | 0.7 | Closing Costs | 778,718 | 2.2 | |

| Upfront Reserves | 114,541 | 0.3 | ||||

| Total Sources | $34,991,437 | 100.0% | Total Uses | $34,991,437 | 100.0% | |

| (1) | See “Escrows” section for a full description of Escrows and Reserves. |

| (2) | The Initial Unfunded TI/LC Reserve represents the tenant improvement amount for the 18th largest tenant, Nothing Bundt Cakes. |

| (3) | The monthly Unfunded TI/LC Reserve is for the 2nd largest tenant, At Home; the West Bountiful Commons Borrower (as defined below) is required to collect on each payment date from December 2019 through March 2020. |

The Mortgage Loan. The mortgage loan (the “West Bountiful Commons Mortgage Loan”) is evidenced by a single promissory note secured by a first mortgage encumbering the fee interest in a 324,349 square foot anchored retail center located in West Bountiful, Utah (the “West Bountiful Commons Property”).

The Borrower and Borrower Sponsors. The borrower is WBC Partners Delaware, LLC (the “West Bountiful Commons Borrower”), a Delaware limited liability company and single purpose entity with two independent directors. Legal counsel to the West Bountiful Commons Borrower delivered a non-consolidation opinion in connection with the origination of the West Bountiful Commons Mortgage Loan. The borrower sponsors and nonrecourse carve-out guarantors of the West Bountiful Commons Mortgage Loan are John R. Thackeray and Armand D. Johansen, on a joint and several basis.

John R. Thackeray is a broker and principal of The Thackeray Company, a Salt Lake City based commercial real estate firm that develops, leases and manages commercial real estate. Mr. Thackeray has over 40 years of experience developing retail shopping centers, multifamily housing, single family subdivisions, and office projects and has historically overseen construction and management

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

16

| Retail - Anchored | Loan # 2 | Cut-off Date Balance: | $34,750,000 | |

| 100 North 500 West | West Bountiful Commons | Cut-off Date LTV: | 64.7% | |

| West Bountiful, UT 84010 | U/W NCF DSCR: | 2.40x | ||

| U/W NOI Debt Yield: | 9.8% |

of the projects. Prior to founding The Thackeray Company, Mr. Thackeray spent time as a lawyer with an emphasis in real estate development, consulting, leasing and zoning. Mr. Thackeray is a current member of the Utah State Bar, the Salt Lake Board of Realtors, and ICSC. Mr. Thackeray reported ownership interests in a portfolio of properties, which include 15 retail properties with over 1.5 million square feet, four multifamily properties, 13 hotel properties, two industrial properties, one mixed use property and 143 acres of land.

Armand Johansen is a manager and co-founder of The Thackeray Company. Mr. Johansen has 35 years of experience in real estate development, construction, and management with an emphasis in financing, lease negotiations, option and purchase agreements. Prior to his time at The Thackeray Company, Mr. Johansen spent time as a lawyer focusing on real estate development, consulting, leasing, and zoning. Mr. Johansen is a current member of the Utah State Bar. Mr. Johansen reported ownership interests in a portfolio of properties, which include 15 retail properties with over 1.3 million square feet and 143 acres of land.

The Property. The West Bountiful Commons Property is a 324,349 square foot, anchored retail center located in West Bountiful, Utah, approximately 11.4 miles north of Salt Lake City, Utah. The improvements consist of one, single-story, 135,000 square foot Costco wholesale center, one, single-story 101,581 square foot At Home store, and seven single-story retail outparcel buildings, including five multi-tenant strip buildings, one single-tenant commercial building and a bank branch. The improvements were developed in phases between 1980 and 2006 and are situated on a 29.33 acre site with 965 parking spaces (2.98 spaces per 1,000 square feet of NRA). The At Home store (collateral) is attached to a portion of another retail center, Gateway Crossing, which is not included in the West Bountiful Commons Property. The West Bountiful Commons Property is anchored by Costco and At Home and is junior anchored by Office Depot and Petco. As of September 12, 2019, the West Bountiful Commons Property was 99.2% occupied by 25 national and regional tenants.

Major Tenants.

Largest Tenant: Costco Wholesale Corporation (22.1% of underwritten base rent; 11/21/2035 lease expiration) – Costco Wholesale Corporation (“Costco”) operates an international chain of membership warehouses, that carry quality, brand-name merchandise at substantially lower prices than are typically offered by conventional wholesale or retail sources. Costco’s merchandise includes groceries, candy, appliances, television and media, automotive supplies, tires, toys, hardware, sporting goods, jewelry, watches, cameras, books, housewares, apparel, health and beauty aids, furniture, office supplies and office equipment. Costco is open only to members and offers three types of membership: Executive, Business and Gold Star, with the membership cost ranging between $60 and $120 annually. As of September 5, 2019, Costco reported $149.4 billion in annual revenues, 98.5 million membership cardholders served by 783 locations worldwide, 544 of which are in the United States and Puerto Rico, 163,000 employees in the United States and 243,000 employees worldwide. Costco owns its own building and improvements and is operating on a 30-year ground lease with nine, 5-year renewal options.

2nd Largest Tenant: At Home (21.8% of underwritten base rent; 12/31/2025 lease expiration) – At Home is a home décor superstore providing customers with more than 50,000 unique items across broad product categories including furniture, garden, home textiles, housewares, patio, rugs, seasonal décor, tabletop décor and wall décor. As of July 27, 2019, At Home reported 204 stores across 39 states, averaging 105,000 square feet per store. The company benefits from a fully integrated supply chain driven by distribution centers in Plano, Texas and Carlisle, Pennsylvania, respectively, that are able to support more than 350 total stores. At Home was founded in 1979 and maintains its headquarters in Plano, Texas. Per its annual statement dated January 26, 2019, At Home recorded $1.16 billion in net sales, a year-over-year growth of 23%, marking five consecutive years and 19 straight quarters of at least 20% sales growth. Comparable store sales increased 2.7% and culminated in the company’s 20th consecutive quarter of growth. At Home has been a tenant at the West Bountiful Commons Property since 2016 and has three, 5-year renewal options remaining.

3rd Largest Tenant: Office Depot, Inc. (9.3% of underwritten base rent; 3/31/2027 lease expiration) – Office Depot, Inc. ("Office Depot") is a leading provider of business services and supplies, products and technology solutions through its fully integrated omni-channel platform of supply stores, online presence, and dedicated sales professionals and technicians to small, medium and enterprise businesses. Office Depot offers its products under various banners, including Office Depot, OfficeMax, CompuCom, and Grand & Toy. Headquartered in Boca Raton, Florida, the company reported having approximately 44,000 employees as of January 2019. For the fiscal year ending December 29, 2018, Office Depot operated 1,361 retail supply stores. Net sales were approximately $11.0 billion, up 7.6% from the previous fiscal year of approximately $10.2 billion. The current average retail store footprint is 20,000 square feet Office Depot has been a tenant at the West Bountiful Commons Property since 2007 and has two, 5-year renewal options remaining.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

17

| Retail - Anchored | Loan # 2 | Cut-off Date Balance: | $34,750,000 | |

| 100 North 500 West | West Bountiful Commons | Cut-off Date LTV: | 64.7% | |

| West Bountiful, UT 84010 | U/W NCF DSCR: | 2.40x | ||

| U/W NOI Debt Yield: | 9.8% |

The following table presents certain information relating to the tenancy at the West Bountiful Commons Property:

Major Tenants

| Tenant Name | Credit

Rating (Fitch/Moody’s/ S&P)(1) |

Tenant NRSF | %

of NRSF |

Annual U/W Base Rent PSF(2) | Annual U/W Base Rent(2) |

% of Total Annual U/W Base Rent | Lease

Expiration Date |

Extension Options | Termination Option (Y/N) |

| Anchor Tenants | |||||||||

| Costco(3) | NR/Aa3/A+ | 135,000 | 41.6% | $5.91 | $797,500 | 22.1% | 11/21/2035 | 9, 5-year | N |

| At Home | NR/NR/B+ | 101,581 | 31.3% | $7.74 | $786,237 | 21.8% | 12/31/2025 | 3, 5-year | N |

| Total Anchor Tenants | 236,581 | 72.9% | $6.69 | $1,583,737 | 43.9% | ||||

| Major Tenants | |||||||||

| Office Depot | NR/Ba3/B | 21,008 | 6.5% | $15.90 | $334,027 | 9.3% | 3/31/2027 | 2, 5-year | N |

| Petco | NR/NR/NR | 15,000 | 4.6% | $19.80 | $297,000 | 8.2% | 1/31/2027 | 1, 5-year | N |

| Total Anchor Tenants | 36,008 | 11.1% | $17.52 | $631,027 | 17.5% | ||||

| Non-Major Tenants | 49,263 | 15.2% | $28.30 | $1,390,607 | 38.6% | ||||

| Vacant Space | 2,497 | 0.8% | |||||||

| Collateral Total | 324,349 | 100.0% | $11.20 | $3,605,372 | 100.0% | ||||

| (1) | Certain ratings are those of the parent company whether or not the parent company guarantees the lease. |

| (2) | Annual U/W Base Rent PSF and Annual U/W Base Rent include contractual rent steps through January 2021 totaling $35,462. |

| (3) | Costco has a right of first refusal to purchase the Costco parcel from the West Bountiful Commons Borrower. Straight line rent was under written for Costco from 2020 to 2030. |

The following table presents certain information relating to tenant sales at the West Bountiful Commons Property:

Tenant Sales (PSF)

| Major Tenant Name | % of Total Annual U/W Base Rent | 2016 | 2017 | 2018 | Anchor Tenant Occupancy Cost |

| In-Line Sales PSF(1) | $264 | $271 | $251 | ||

| In-Line Occupancy Cost | 13.0% | 12.7% | 14.1% |

| (1) | Above in-line sales represent sales reported for Go Wireless Verizon, GNC and Sports Clips. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.