| FREE WRITING PROSPECTUS | ||

| FILED PURSUANT TO RULE 433 | ||

| REGISTRATION FILE NO.: 333-206677-07 | ||

|

|

|

Free Writing Prospectus

Structural and Collateral Term Sheet

$870,557,680

(Approximate Initial Pool Balance)

$729,853,000

(Approximate Aggregate Certificate Balance of Offered Certificates)

Wells Fargo Commercial Mortgage Trust 2016-BNK1

as Issuing Entity

Wells Fargo Commercial Mortgage Securities, Inc.

as Depositor

Wells Fargo Bank, National Association

Bank of America, National Association

Morgan Stanley Mortgage Capital Holdings LLC

as Sponsors and Mortgage Loan Sellers

Commercial

Mortgage Pass-Through Certificates

Series 2016-BNK1

August 1, 2016

| WELLS

FARGO SECURITIES |

BofA MERRILL LYNCH |

MORGAN STANLEY |

|

Co-Lead Manager and Joint Bookrunner |

Co-Lead Manager and Joint Bookrunner |

Co-Lead Manager and Joint Bookrunner |

|

Academy Securities Co-Manager |

Drexel Hamilton Co-Manager |

STATEMENT REGARDING THIS FREE WRITING PROSPECTUS

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (‘‘SEC’’) (SEC File No. 333-206677) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the depositor, any underwriter, or any dealer participating in the offering will arrange to send you the prospectus after filing if you request it by calling toll free 1-800-745-2063 (8 a.m. – 5 p.m. EST) or by emailing wfs.cmbs@wellsfargo.com.

Nothing in this document constitutes an offer of securities for sale in any jurisdiction where the offer or sale is not permitted. The information contained herein is preliminary as of the date hereof, supersedes any such information previously delivered to you and will be superseded by any such information subsequently delivered and ultimately by the final prospectus relating to the securities. These materials are subject to change, completion, supplement or amendment from time to time.

This free writing prospectus has been prepared by the underwriters for information purposes only and does not constitute, in whole or in part, a prospectus for the purposes of Directive 2003/71/EC (as amended) and/or Part VI of the Financial Services and Markets Act 2000, as amended, or other offering document.

STATEMENT REGARDING ASSUMPTIONS AS TO SECURITIES, PRICING ESTIMATES AND OTHER INFORMATION

The attached information contains certain tables and other statistical analyses (the “Computational Materials”) which have been prepared in reliance upon information furnished by the Mortgage Loan Sellers. Numerous assumptions were used in preparing the Computational Materials, which may or may not be reflected herein. As such, no assurance can be given as to the Computational Materials’ accuracy, appropriateness or completeness in any particular context; or as to whether the Computational Materials and/or the assumptions upon which they are based reflect present market conditions or future market performance. The Computational Materials should not be construed as either projections or predictions or as legal, tax, financial or accounting advice. You should consult your own counsel, accountant and other advisors as to the legal, tax, business, financial and related aspects of a purchase of these securities. Any weighted average lives, yields and principal payment periods shown in the Computational Materials are based on prepayment and/or loss assumptions, and changes in such prepayment and/or loss assumptions may dramatically affect such weighted average lives, yields and principal payment periods. In addition, it is possible that prepayments or losses on the underlying assets will occur at rates higher or lower than the rates shown in the attached Computational Materials. The specific characteristics of the securities may differ from those shown in the Computational Materials due to differences between the final underlying assets and the preliminary underlying assets used in preparing the Computational Materials. The principal amount and designation of any security described in the Computational Materials are subject to change prior to issuance. None of Wells Fargo Securities, LLC, Merrill Lynch, Pierce, Fenner & Smith Incorporated, Morgan Stanley & Co. LLC, Academy Securities, Inc., Drexel Hamilton, LLC or any of their respective affiliates, make any representation or warranty as to the actual rate or timing of payments or losses on any of the underlying assets or the payments or yield on the securities. The information in this presentation is based upon management forecasts and reflects prevailing conditions and management’s views as of this date, all of which are subject to change. In preparing this presentation, we have relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources or which was provided to us by or on behalf of the Mortgage Loan Sellers or which was otherwise reviewed by us.

This free writing prospectus contains certain forward-looking statements. If and when included in this free writing prospectus, the words “expects”, “intends”, “anticipates”, “estimates” and analogous expressions and all statements that are not historical facts, including statements about our beliefs or expectations, are intended to identify forward-looking statements. Any forward-looking statements are made subject to risks and uncertainties which could cause actual results to differ materially from those stated. Those risks and uncertainties include, among other things, declines in general economic and business conditions, increased competition, changes in demographics, changes in political and social conditions, regulatory initiatives and changes in customer preferences, many of which are beyond our control and the control of any other person or entity related to this offering. The forward-looking statements made in this free writing prospectus are made as of the date stated on the cover. We have no obligation to update or revise any forward-looking statement.

Wells Fargo Securities is the trade name for the capital markets and investment banking services of Wells Fargo & Company and its subsidiaries, including but not limited to Wells Fargo Securities, LLC, a member of NYSE, FINRA, NFA and SIPC, Wells Fargo Prime Services, LLC, a member of FINRA, NFA and SIPC, and Wells Fargo Bank, N.A. Wells Fargo Securities, LLC and Wells Fargo Prime Services, LLC are distinct entities from affiliated banks and thrifts.

IMPORTANT NOTICE REGARDING THE OFFERED CERTIFICATES

The information herein is preliminary and may be supplemented or amended prior to the time of sale. In addition, the Offered Certificates referred to in these materials and the asset pool backing them are subject to modification or revision (including the possibility that one or more classes of certificates may be split, combined or eliminated at any time prior to issuance or availability of a final prospectus) and are offered on a “when, as and if issued” basis.

The underwriters described in these materials may from time to time perform investment banking services for, or solicit investment banking business from, any company named in these materials. The underwriters and/or their affiliates or respective employees may from time to time have a long or short position in any security or contract discussed in these materials.

The information contained herein supersedes any previous such information delivered to any prospective investor and will be superseded by information delivered to such prospective investor prior to the time of sale.

IMPORTANT NOTICE RELATING TO AUTOMATICALLY-GENERATED EMAIL DISCLAIMERS

Any legends, disclaimers or other notices that may appear at the bottom of any email communication to which this free writing prospectus is attached relating to (1) these materials not constituting an offer (or a solicitation of an offer), (2) any representation that these materials are accurate or complete and may not be updated or (3) these materials possibly being confidential, are not applicable to these materials and should be disregarded. Such legends, disclaimers or other notices have been automatically generated as a result of these materials having been sent via Bloomberg or another system.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

2

|

Wells Fargo Commercial Mortgage Trust 2016-BNK1 |

Certificate Structure |

| I. | Certificate Structure |

| Class | Expected

Ratings (Fitch/KBRA/Moody’s/S&P)(1) |

Approximate Initial Certificate Balance or Notional Amount(2) |

Approx. Initial Credit Support(3) |

Pass-Through Rate Description | Weighted Average Life (Years)(4) | Expected Principal Window(4) | Certificate Principal to Value Ratio(5) | Certificate

Principal U/W NOI Debt Yield(6) | ||||||

| Offered Certificates | ||||||||||||||

| A-1 | AAAsf/AAA(sf)/Aaa(sf)/AAA(sf) | $36,136,000 | 30.000% | (7) | 2.87 | 09/16 – 08/21 | 38.9% | 17.5% | ||||||

| A-2 | AAAsf/AAA(sf)/Aaa(sf)/AAA(sf) | $230,000,000 | 30.000% | (7) | 9.73 | 09/25 – 06/26 | 38.9% | 17.5% | ||||||

| A-3 | AAAsf/AAA(sf)/Aaa(sf)/AAA(sf) | $267,018,000 | 30.000% | (7) | 9.89 | 06/26 – 07/26 | 38.9% | 17.5% | ||||||

| A-SB | AAAsf/AAA(sf)/Aaa(sf)/AAA(sf) | $45,766,000 | 30.000% | (7) | 7.09 | 08/21 – 09/25 | 38.9% | 17.5% | ||||||

| A-S | AAAsf/AAA(sf)/Aa2(sf)/AAA(sf) | $67,197,000 | 21.875% | (7) | 9.92 | 07/26 – 08/26 | 43.4% | 15.7% | ||||||

| X-A | AAAsf/AAA(sf)/Aaa(sf)/AAA(sf) | $578,920,000(8) | N/A | Variable(9) | N/A | N/A | N/A | N/A | ||||||

| X-B | A-sf/AAA(sf)/NR/A-(sf) | $150,933,000(10) | N/A | Variable(11) | N/A | N/A | N/A | N/A | ||||||

| B | AA-sf/AA-(sf)/NR/AA-(sf) | $44,452,000 | 16.500% | (7) | 9.99 | 08/26 – 08/26 | 46.4% | 14.7% | ||||||

| C | A-sf/A-(sf)/NR/A-(sf) | $39,284,000 | 11.750% | (7) | 9.99 | 08/26 – 08/26 | 49.1% | 13.9% | ||||||

| Non-Offered Certificates | ||||||||||||||

| X-D | BBB-sf/BBB-(sf)/NR/NR | $39,284,000(12) | N/A | Variable(13) | N/A | N/A | N/A | N/A | ||||||

| X-E | BB-sf/BB-(sf)/NR/NR | $18,608,000(14) | N/A | Variable(15) | N/A | N/A | N/A | N/A | ||||||

| X-F | B-sf/B-(sf)/NR/NR | $8,271,000(16) | N/A | Variable(17) | N/A | N/A | N/A | N/A | ||||||

| X-G | NR/NR/NR/NR | $31,013,795(18) | N/A | Variable(19) | N/A | N/A | N/A | N/A | ||||||

| D | BBB-sf/BBB-(sf)/NR/NR | $39,284,000 | 7.000% | (7) | 9.99 | 08/26 – 08/26 | 51.7% | 13.2% | ||||||

| E | BB-sf/BB-(sf)/NR/NR | $18,608,000 | 4.750% | (7) | 9.99 | 08/26 – 08/26 | 52.9% | 12.9% | ||||||

| F | B-sf/B-(sf)/NR/NR | $8,271,000 | 3.750% | (7) | 9.99 | 08/26 – 08/26 | 53.5% | 12.7% | ||||||

| G | NR/NR/NR/NR | $31,013,795 | 0.000% | (7) | 10.79 | 08/26 – 07/31 | 55.6% | 12.2% | ||||||

| Non-Offered Eligible Vertical Interest | ||||||||||||||

| RRI Interest | NR/NR/NR/NR | $43,527,883 | N/A | WAC(20) | 9.44 | 09/16 - 07/31 | N/A | N/A | ||||||

| Notes: | |

| (1) | The expected ratings presented are those of Fitch Ratings, Inc. (“Fitch”), Kroll Bond Rating Agency, Inc. (“KBRA”), Moody’s Investors Service, Inc. (“Moody’s”) and S&P Global Ratings (“S&P”), which the depositor hired to rate the Offered Certificates. One or more other nationally recognized statistical rating organizations that were not hired by the depositor may use information they receive pursuant to Rule 17g-5 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise, to rate or provide market reports and/or published commentary related to the Offered Certificates. We cannot assure you as to what ratings a non-hired nationally recognized statistical rating organization would assign or that its reports will not express differing, possibly negative, views of the mortgage loans and/or the Offered Certificates. The ratings of each Class of Offered Certificates address the likelihood of the timely distribution of interest and, except in the case of the Class X-A and X-B certificates, the ultimate distribution of principal due on those Classes on or before the Rated Final Distribution Date. See “Risk Factors—Other Risks Relating to the Certificates—Nationally Recognized Statistical Rating Organizations May Assign Different Ratings to the Certificates; Ratings of the Certificates Reflect Only the Views of the Applicable Rating Agencies as of the Dates Such Ratings Were Issued; Ratings May Affect ERISA Eligibility; Ratings May Be Downgraded” and “Ratings” in the Preliminary Prospectus, expected to be dated August 1, 2016 (the “Preliminary Prospectus”). Fitch, KBRA, Moody’s and S&P have informed us that the “sf” designation in their ratings represents an identifier for structured finance product ratings. |

| (2) | The certificate balances and notional amounts set forth in the table are approximate. The actual initial certificate balances and notional amounts may be larger or smaller depending on the initial pool balance of the mortgage loans definitively included in the pool of mortgage loans, which aggregate cut-off date balance may be as much as 5% larger or smaller than the amount presented in the Preliminary Prospectus. |

| (3) | The approximate initial credit support with respect to the Class A-1, A-2, A-3 and A-SB Certificates represents the approximate credit enhancement for the Class A-1, A-2, A-3 and A-SB Certificates in the aggregate. The RRI Interest only provides credit support to the limited extent that losses incurred on the underlying mortgage loans are allocated to it, on the one hand, and to the Offered Certificates and the Non-Offered Certificates, on the other hand, pro rata, in accordance with their respective Percentage Allocation Entitlements. |

| (4) | Weighted Average Lives and Expected Principal Windows are calculated based on an assumed prepayment rate of 0% CPR and the “Structuring Assumptions” described under “Yield and Maturity Considerations—Weighted Average Life” in the Preliminary Prospectus. |

| (5) | The Certificate Principal to Value Ratio for each Class of Certificates (other than the Class A-1, A-2, A-3 and A-SB Certificates) is calculated as the product of (a) the weighted average Cut-off Date LTV Ratio for the mortgage loans and (b) a fraction, the numerator of which is the total initial Certificate Balance of such Class of Certificates and all Classes of Principal Balance Certificates senior to such Class of Certificates and the denominator of which is the total initial Certificate Balance of all of the Principal Balance Certificates (other than the RRI Interest). The Certificate Principal to Value Ratio for each of the Class A-1, A-2, A-3 and A-SB Certificates is calculated in the aggregate for those Classes as if they were a single Class and is calculated as the product of (a) the weighted average Cut-off Date LTV Ratio for the mortgage loans and (b) a fraction, the numerator of which is the total initial aggregate Certificate Balances of such Classes of Certificates and the denominator of which is the total initial Certificate Balance of all of the Principal Balance Certificates (other than the RRI Interest). In any event, however, excess mortgaged property value associated with a mortgage loan will not be available to offset losses on any other mortgage loan. |

| (6) | The Certificate Principal U/W NOI Debt Yield for each Class of Certificates (other than the Class A-1, A-2, A-3 and A-SB Certificates) is calculated as the product of (a) the weighted average U/W NOI Debt Yield for the mortgage loans and (b) a fraction, the numerator of which is the total initial Certificate Balance of all of the Classes of Principal Balance Certificates (other than the RRI Interest) and the denominator of which is the total initial Certificate Balance for such Class of Certificates and all Classes of Principal Balance Certificates senior to such Class of Certificates. The Certificate Principal U/W NOI Debt Yield for each of the Class A-1, A-2, A-3 and A-SB Certificates is calculated in the aggregate for those Classes as if they were a single Class and is calculated as the product of (a) the weighted average U/W NOI Debt Yield for the mortgage loans and (b) a fraction, the numerator of which is the total initial Certificate Balance of all of the Classes of Principal Balance Certificates (other than the RRI Interest) and the denominator of which is the total aggregate initial Certificate Balances for the Class A-1, A-2, A-3 and A-SB Certificates. In any event, however, cash flow from each mortgaged property supports only the related mortgage loan and will not be available to support any other mortgage loan. |

| (7) | The pass-through rates for the Class A-1, A-2, A-3, A-SB, A-S, B, C, D, E, F and G Certificates in each case will be one of the following: (i) a fixed rate per annum, (ii) a variable rate per annum equal to the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date, (iii) a variable rate per annum equal to the lesser of (a) a fixed rate and (b) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date or (iv) a variable rate per annum equal to the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date minus a specified percentage. For purposes of the calculation of the weighted average of the net mortgage interest rates on the mortgage loans for each distribution date, the mortgage interest rates will be adjusted as necessary to a 30/360 basis. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

3

| Wells Fargo Commercial Mortgage Trust 2016-BNK1 | Certificate Structure |

| (8) | The Class X-A Certificates are notional amount certificates. The Notional Amount of the Class X-A Certificates will be equal to the aggregate Certificate Balance of the Class A-1, A-2, A-3 and A-SB Certificates outstanding from time to time. The Class X-A Certificates will not be entitled to distributions of principal. |

| (9) | The pass-through rate for the Class X-A Certificates for any distribution date will be a per annum rate equal to the excess, if any, of (a) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date, over (b) the weighted average of the pass-through rates on the Class A-1, A-2, A-3 and A-SB Certificates for the related distribution date, weighted on the basis of their respective Certificate Balances outstanding immediately prior to that distribution date. For purposes of the calculation of the weighted average of the net mortgage interest rates on the mortgage loans for each distribution date, the mortgage interest rates will be adjusted as necessary to a 30/360 basis. |

| (10) | The Class X-B Certificates are notional amount certificates. The Notional Amount of the Class X-B Certificates will be equal to the aggregate Certificate Balance of the Class A-S, B and C Certificates outstanding from time to time. The Class X-B Certificates will not be entitled to distributions of principal. |

| (11) | The pass-through rate for the Class X-B Certificates for any distribution date will be a per annum rate equal to the excess, if any, of (a) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date, over (b) the weighted average of the pass-through rates on the Class A-S, B and C Certificates for the related distribution date, weighted on the basis of their respective Certificate Balances outstanding immediately prior to that distribution date. For purposes of the calculation of the weighted average of the net mortgage interest rates on the mortgage loans for each distribution date, the mortgage interest rates will be adjusted as necessary to a 30/360 basis. |

| (12) | The Class X-D Certificates are notional amount certificates. The Notional Amount of the Class X-D Certificates will be equal to the Certificate Balance of the Class D Certificates outstanding from time to time. The Class X-D Certificates will not be entitled to distributions of principal. |

| (13) | The pass-through rate for the Class X-D Certificates for any distribution date will be a per annum rate equal to the excess, if any, of (a) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date, over (b) the pass-through rate on the Class D Certificates for the related distribution date. For purposes of the calculation of the weighted average of the net mortgage interest rates on the mortgage loans for each distribution date, the mortgage interest rates will be adjusted as necessary to a 30/360 basis. |

| (14) | The Class X-E Certificates are notional amount certificates. The Notional Amount of the Class X-E Certificates will be equal to the Certificate Balance of the Class E Certificates outstanding from time to time. The Class X-E Certificates will not be entitled to distributions of principal. |

| (15) | The pass-through rate for the Class X-E Certificates for any distribution date will be a per annum rate equal to the excess, if any, of (a) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date, over (b) the pass-through rate on the Class E Certificates for the related distribution date. For purposes of the calculation of the weighted average of the net mortgage interest rates on the mortgage loans for each distribution date, the mortgage interest rates will be adjusted as necessary to a 30/360 basis. |

| (16) | The Class X-F Certificates are notional amount certificates. The Notional Amount of the Class X-F Certificates will be equal to the Certificate Balance of the Class F Certificates outstanding from time to time. The Class X-F Certificates will not be entitled to distributions of principal. |

| (17) | The pass-through rate for the Class X-F Certificates for any distribution date will be a per annum rate equal to the excess, if any, of (a) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date, over (b) the pass-through rate on the Class F Certificates for the related distribution date. For purposes of the calculation of the weighted average of the net mortgage interest rates on the mortgage loans for each distribution date, the mortgage interest rates will be adjusted as necessary to a 30/360 basis. |

| (18) | The Class X-G Certificates are notional amount certificates. The Notional Amount of the Class X-G Certificates will be equal to the Certificate Balance of the Class G Certificates outstanding from time to time. The Class X-G Certificates will not be entitled to distributions of principal. |

| (19) | The pass-through rate for the Class X-G Certificates for any distribution date will be a per annum rate equal to the excess, if any, of (a) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date, over (b) the pass-through rate on the Class G Certificates for the related distribution date. For purposes of the calculation of the weighted average of the net mortgage interest rates on the mortgage loans for each distribution date, the mortgage interest rates will be adjusted as necessary to a 30/360 basis. |

| (20) | The effective interest rate for the RRI Interest will be the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

4

| Wells Fargo Commercial Mortgage Trust 2016-BNK1 | Transaction Highlights |

| II. | Transaction Highlights |

Mortgage Loan Sellers:

Mortgage Loan Seller |

Number

of |

Number

of |

Aggregate

Cut-off |

%

of Initial | |||||

| Wells Fargo Bank, National Association | 15 | 15 | $302,740,928 | 34.8 | % | ||||

| Bank of America, National Association | 15 | 21 | 268,752,809 | 30.9 | |||||

| Morgan Stanley Mortgage Capital Holdings LLC | 9 | 9 | 219,063,942 | 25.2 | |||||

| Wells Fargo Bank, National Association/Bank of America, National Association(1) | 1 | 1 | 80,000,000 | 9.2 | |||||

Total |

40 |

46 |

$870,557,680 |

100.0 |

% | ||||

| (1) | One mortgage loan identified on Annex A-1 as The Shops at Crystals, representing approximately 9.2% of the aggregate principal balance of the pool of mortgage loans as of the cut-off date, is part of a whole loan that was co-originated by Wells Fargo Bank, National Association, Bank of America, National Association and JPMorgan Chase Bank, National Association. Wells Fargo Bank, National Association is acting as loan seller and originator with respect to Notes A-3-B-2, A-3-B-3, B-3-B-2 and B-3-B-3, with an aggregate outstanding principal balance as of the cut-off date of $40,000,000. Bank of America, National Association is acting as loan seller and originator with respect to Notes A-2-B-2, A-2-B-3, B-2-B-2 and B-2-B-3, with an aggregate outstanding principal balance as of the cut-off date of $40,000,000. |

Loan Pool:

| Initial Pool Balance: | $870,557,680 |

| Number of Mortgage Loans: | 40 |

| Average Cut-off Date Balance per Mortgage Loan: | $21,763,942 |

| Number of Mortgaged Properties: | 46 |

| Average Cut-off Date Balance per Mortgaged Property(1): | $18,925,167 |

| Weighted Average Mortgage Interest Rate: | 4.289% |

| Ten Largest Mortgage Loans as % of Initial Pool Balance: | 58.7% |

| Weighted Average Original Term to Maturity or ARD (months): | 120 |

| Weighted Average Remaining Term to Maturity or ARD (months): | 119 |

| Weighted Average Original Amortization Term (months)(2): | 345 |

| Weighted Average Remaining Amortization Term (months)(2): | 344 |

| Weighted Average Seasoning (months): | 1 |

| (1) | Information regarding mortgage loans secured by multiple properties is based on an allocation according to relative appraised values or the allocated loan amounts or property-specific release prices set forth in the related loan documents or such other allocation as the related mortgage loan seller deemed appropriate. |

| (2) | Excludes any mortgage loan that does not amortize. |

Credit Statistics:

| Weighted Average U/W Net Cash Flow DSCR(1): | 2.35x |

| Weighted Average U/W Net Operating Income Debt Yield(1): | 12.2% |

| Weighted Average Cut-off Date Loan-to-Value Ratio(1): | 55.6% |

| Weighted Average Balloon or ARD Loan-to-Value Ratio(1): | 48.9% |

| % of Mortgage Loans with Additional Subordinate Debt(2): | 18.4% |

| % of Mortgage Loans with Single Tenants(3): | 25.8% |

| (1) | With respect to any mortgage loan that is part of a whole loan, loan-to-value ratio, debt service coverage ratio and debt yield calculations include the related pari passu companion loan(s) but exclude any related subordinate companion loan(s) (unless otherwise stated). The debt service coverage ratio, debt yield and loan-to-value ratio information do not take into account any subordinate debt (whether or not secured by the related mortgaged property), that currently exists or is allowed under the terms of any mortgage loan. The information for each mortgaged property that relates to a mortgage loan that is cross-collateralized or cross-defaulted with one or more other mortgage loans is based upon the principal balance of that mortgage loan, except that the applicable loan-to-value ratio, debt service coverage ratio, and debt yield for each such mortgage loan is based upon the ratio or yield (as applicable) for the aggregate indebtedness evidenced by all loans in the group (without regard to any limitation on the amount of indebtedness secured by any mortgaged property in such cross-collateralized group). On an individual basis, without regard to the cross-collateralization feature, any mortgage loan that is part of a cross-collateralized group of mortgage loans may have a higher loan-to-value ratio, lower debt service coverage ratio and/or lower debt yield than is presented herein. See “Description of the Mortgage Pool—Mortgage Pool Characteristics” in the Preliminary Prospectus and Annex A-1 to the Preliminary Prospectus. |

| (2) | The percentage figure expressed as “% of Mortgage Loans with Additional Subordinate Debt” is determined as a percentage of the initial pool balance and does not take into account any future subordinate debt (whether or not secured by the mortgaged property), if any, that may be permitted under the terms of any mortgage loan or the pooling and servicing agreement. See “Description of the Mortgage Pool—Additional Indebtedness—Other Unsecured Indebtedness”. |

| (3) | Excludes mortgage loans that are secured by multiple single tenant properties. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

5

| Wells Fargo Commercial Mortgage Trust 2016-BNK1 | Transaction Highlights |

Loan Structural Features:

Amortization: Based on the Initial Pool Balance, 62.5% of the mortgage pool (28 mortgage loans) has scheduled amortization, as follows:

33.6% (18 mortgage loans) requires amortization during the entire loan term; and

28.9% (10 mortgage loans) provides for an interest-only period followed by an amortization period.

Interest-Only: Based on the Initial Pool Balance, 37.5% of the mortgage pool (12 mortgage loans) provides for interest-only payments during the entire loan term. The Weighted Average Cut-off Date Loan-to-Value Ratio and Weighted Average U/W Net Cash Flow DSCR for those mortgage loans are 47.2% and 3.38x, respectively.

Hard Lockboxes: Based on the Initial Pool Balance, 57.7% of the mortgage pool (15 mortgage loans) have hard lockboxes in place.

Reserves: The mortgage loans require amounts to be escrowed monthly as follows (excluding any mortgage loans with springing provisions):

| Real Estate Taxes: | 64.2% of the pool |

| Insurance: | 23.1% of the pool |

| Capital Replacements: | 43.9% of the pool |

| TI/LC: | 36.3% of the pool(1) |

| (1) | The percentage of Initial Pool Balance for mortgage loans with TI/LC reserves is based on the aggregate principal balance allocable to loans that include office, retail, industrial and mixed-use properties. |

Call Protection/Defeasance: Based on the Initial Pool Balance, the mortgage pool has the following call protection and defeasance features:

63.7% of the mortgage pool (26 mortgage loans) features a lockout period, then defeasance only until an open period;

18.9% of the mortgage pool (four mortgage loans) features a lockout period, then the greater of a prepayment premium or yield maintenance or defeasance until an open period; and

17.4% of the mortgage pool (10 mortgage loans) features a lockout period, then the greater of a prepayment premium or yield maintenance until an open period.

Please refer to Annex A-1 and the footnotes related thereto to the Preliminary Prospectus for further information regarding individual loan call protection.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

6

| Wells Fargo Commercial Mortgage Trust 2016-BNK1 | Issue Characteristics |

| III. | Issue Characteristics |

| Securities Offered: | $729,853,000 approximate monthly pay, multi-class, commercial mortgage REMIC pass-through certificates consisting of nine classes (Classes A-1, A-2, A-3, A-SB, A-S, B, C, X-A and X-B), which are offered pursuant to a registration statement filed with the SEC (such classes of certificates, the “Offered Certificates”). |

| Mortgage Loan Sellers: | Wells Fargo Bank, National Association (“WFB”), Bank of America, National Association (“BANA”) and Morgan Stanley Mortgage Capital Holdings LLC (“MSMCH”). |

| Joint Bookrunners and Co-Lead Managers: | Wells Fargo Securities, LLC, Merrill Lynch, Pierce, Fenner & Smith Incorporated, Morgan Stanley & Co. LLC |

| Co-Managers: | Academy Securities Inc. and Drexel Hamilton, LLC |

| Rating Agencies: | Fitch Ratings, Inc., Kroll Bond Rating Agency, Inc., Moody’s Investors Service, Inc. and S&P Global Ratings |

| Master Servicer: | Wells Fargo Bank, National Association |

| Special Servicer: | Rialto Capital Advisors, LLC |

| Certificate Administrator: | Wells Fargo Bank, National Association |

| Trustee: | Wilmington Trust, National Association |

| Operating Advisor: | Park Bridge Lender Services LLC |

| Asset Representations Reviewer: | Park Bridge Lender Services LLC |

| U.S. Credit Risk Retention: | For a discussion on the manner in which the credit risk retention requirements, if they were in effect, would be addressed by Wells Fargo Bank, National Association, as the retaining sponsor, see “Credit Risk Retention” in the Preliminary Prospectus. |

| EU Risk Retention: | For a discussion of the manner in which each of Wells Fargo Bank, National Association, Bank of America, National Association and Morgan Stanley Bank, N.A. will covenant and represent to each other, the issuing entity and the trustee to retain a material net economic interest in the securitization for the purpose of the EU risk retention requirements and due diligence requirements, see “EU Securitization Risk Retention Requirements” in the Preliminary Prospectus. |

| Risk Retention Consultation Party: | Wells Fargo Bank, National Association |

| Initial Majority Controlling Class Certificateholder: | RREF III Debt AIV, LP or another affiliate of Rialto Capital Advisors, LLC. |

| Cut-off Date: | The Cut-off Date with respect to each mortgage loan is the due date for the monthly debt service payment that is due in August 2016 (or, in the case of any mortgage loan that has its first due date in September 2016, the date that would have been its due date in August 2016 under the terms of that mortgage loan if a monthly debt service payment were scheduled to be due in that month). |

| Expected Closing Date: | On or about August 18, 2016. |

| Determination Dates: | The 11th day of each month (or if that day is not a business day, the next succeeding business day), commencing in September 2016. |

| Distribution Dates: | The fourth business day following the Determination Date in each month, commencing in September 2016. |

| Rated Final Distribution Date: | The Distribution Date in August 2049. |

| Interest Accrual Period: | With respect to any Distribution Date, the calendar month immediately preceding the month in which such Distribution Date occurs. |

| Day Count: | The Offered Certificates will accrue interest on a 30/360 basis. |

| Minimum Denominations: | $10,000 for each Class of Offered Certificates (other than the Class X-A and X-B Certificates) and $1,000,000 for the Class X-A and X-B Certificates. Investments may also be made in any whole dollar denomination in excess of the applicable minimum denomination. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

7

| Wells Fargo Commercial Mortgage Trust 2016-BNK1 | Issue Characteristics |

| Clean-up Call: | On each Distribution Date occurring after the aggregate unpaid principal balance of the mortgage loans is less than (or in the case of clause (ii) below, less than or equal to) the greater of (i) 1.0% of the principal balance as of the cut-off date or (ii) if the South Main Shopping Center Mortgage Loan is an asset of the trust fund, the sum of the outstanding principal balance of the South Main Shopping Center Mortgage Loan on any date of determination and 1.0% of the principal balance as of the cut-off date, however, this termination right will not be exercisable at the percentage threshold specified in clause (ii) above earlier than the Distribution Date in September 2026. |

| Delivery: | DTC, Euroclear and Clearstream Banking |

| ERISA/SMMEA Status: | Each Class of Offered Certificates is expected to be eligible for exemptive relief under ERISA. No Class of Offered Certificates will be SMMEA eligible. |

| Risk Factors: | THE CERTIFICATES INVOLVE CERTAIN RISKS AND MAY NOT BE SUITABLE FOR ALL INVESTORS. SEE THE “RISK FACTORS” SECTION OF THE PRELIMINARY PROSPECTUS. |

| Bond Analytics Information: | The Certificate Administrator will be authorized to make distribution date statements, CREFC® reports and certain supplemental reports (other than confidential information) available to certain financial modeling and data provision services, including Bloomberg, L.P., Trepp, LLC, Intex Solutions, Inc., Markit Group Limited, Interactive Data Corp., BlackRock Financial Management, Inc., CMBS.com, Inc. and Thomson Reuters Corporation. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

8

| Wells Fargo Commercial Mortgage Trust 2016-BNK1 | Characteristics of the Mortgage Pool |

| IV. | Characteristics of the Mortgage Pool(1) |

| A. | Ten Largest Mortgage Loans |

| Mortgage

Loan Seller |

Mortgage Loan Name | City | State | Number of Mortgage Loans / Mortgaged Properties | Mortgage Loan Cut-off Date Balance ($) | % of Initial Pool Balance (%) | Property Type |

Number of SF/Rooms | Cut-off

Date Balance Per SF/Room |

Cut-off

Date LTV Ratio (%) |

Balloon

or ARD LTV Ratio (%) |

U/W

NCF DSCR (x) |

U/W NOI Debt Yield (%) | |

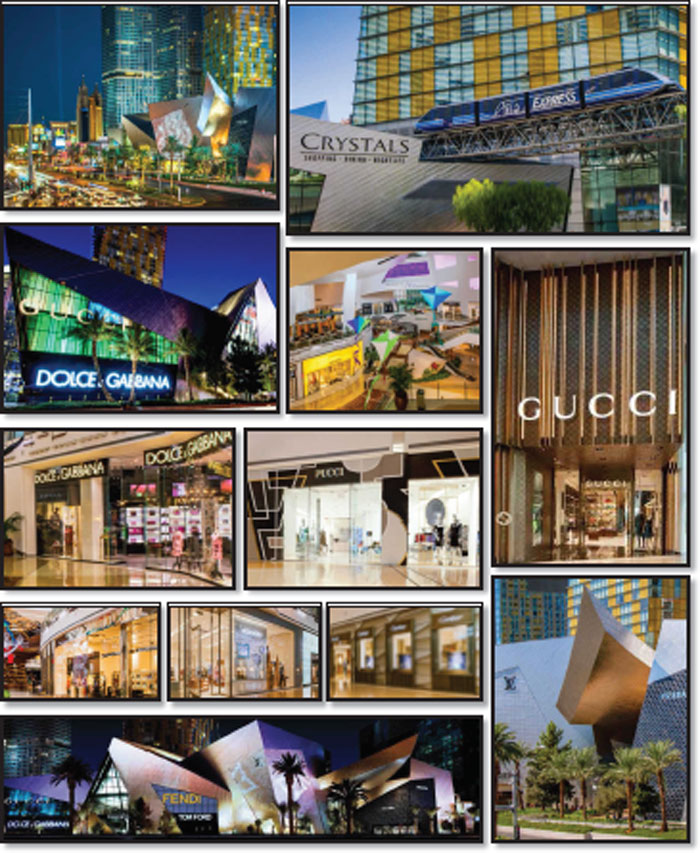

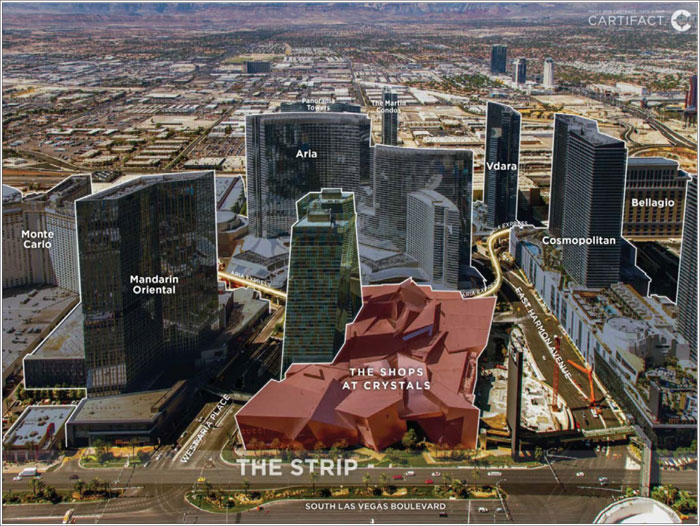

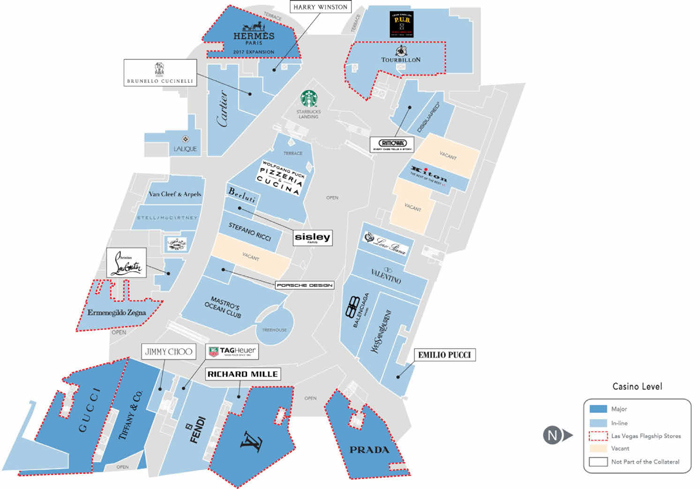

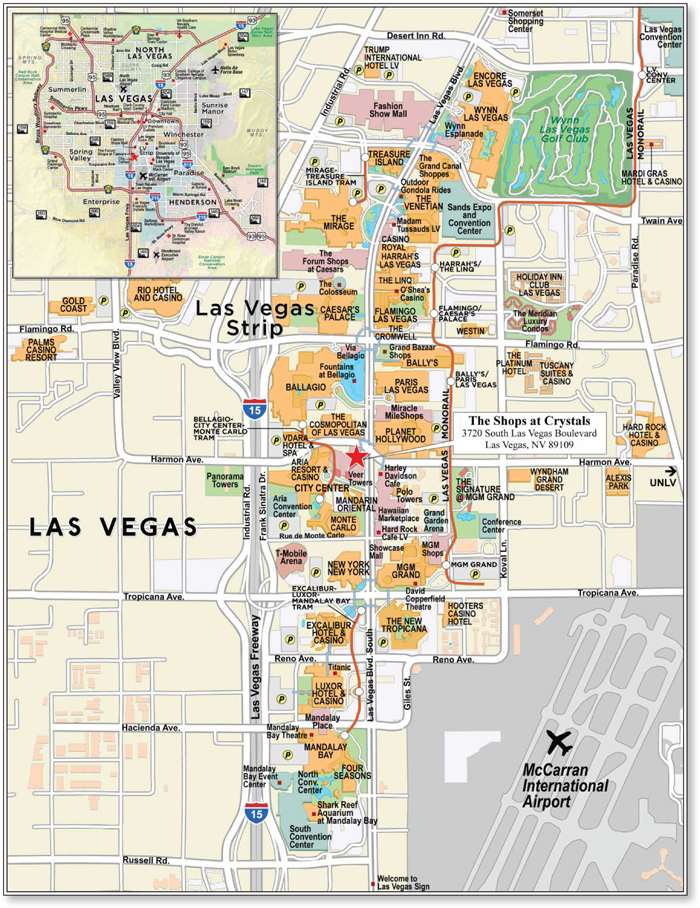

| WFB/BANA | The Shops at Crystals | Las Vegas | NV | 1 / 1 | $80,000,000 | 9.2% | Retail | 262,327 | $1,459 | 34.8% | 34.8% | 3.28x | 12.9 | % |

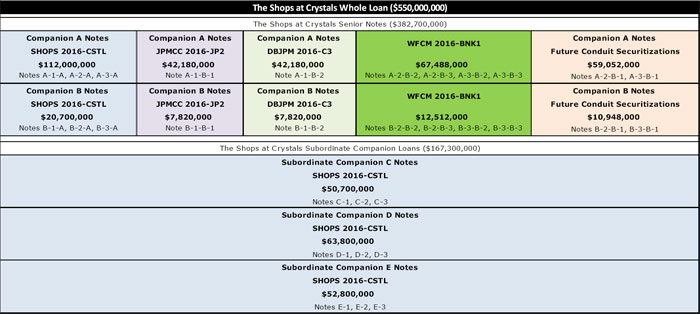

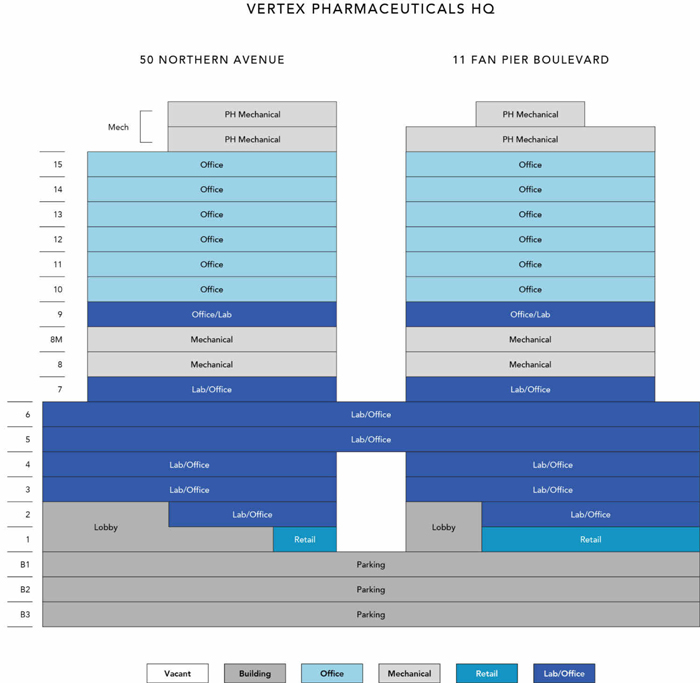

| MSMCH | Vertex Pharmaceuticals HQ | Boston | MA | 1 / 1 | 80,000,000 | 9.2 | Office | 1,133,723 | 375 | 35.5 | 35.5 | 6.28 | 17.9 | |

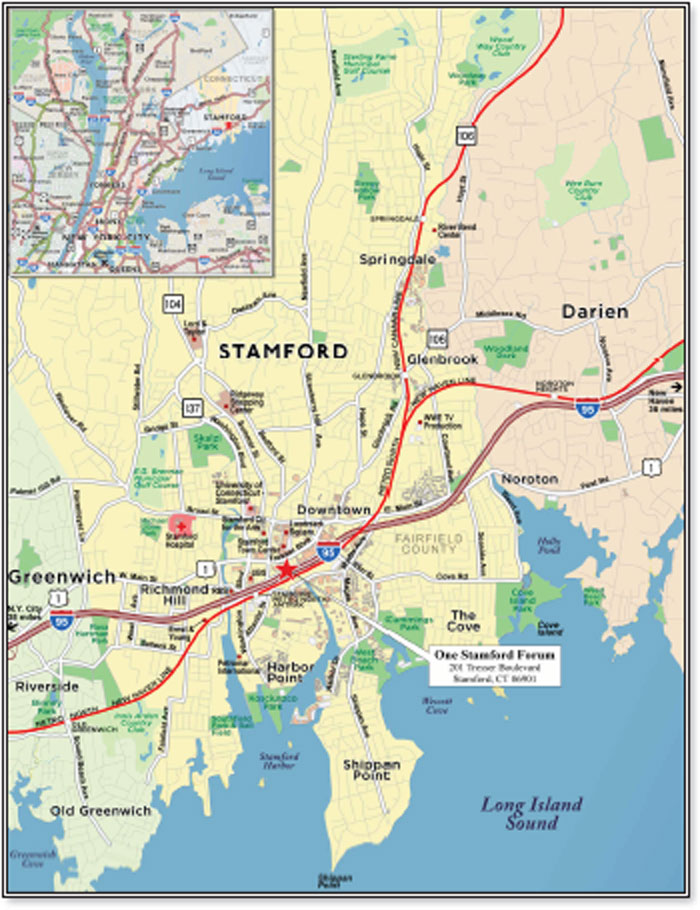

| BANA | One Stamford Forum | Stamford | CT | 1 / 1 | 71,387,864 | 8.2 | Office | 504,471 | 218 | 48.4 | 36.1 | 1.55 | 12.0 | |

| WFB | Renaissance Dallas | Dallas | TX | 1 / 1 | 60,000,000 | 6.9 | Hospitality | 514 | 116,732 | 50.5 | 46.1 | 2.16 | 15.8 | |

| WFB | Pinnacle II | Burbank | CA | 1 / 1 | 40,000,000 | 4.6 | Office | 230,000 | 378 | 61.3 | 61.3 | 1.96 | 9.2 | |

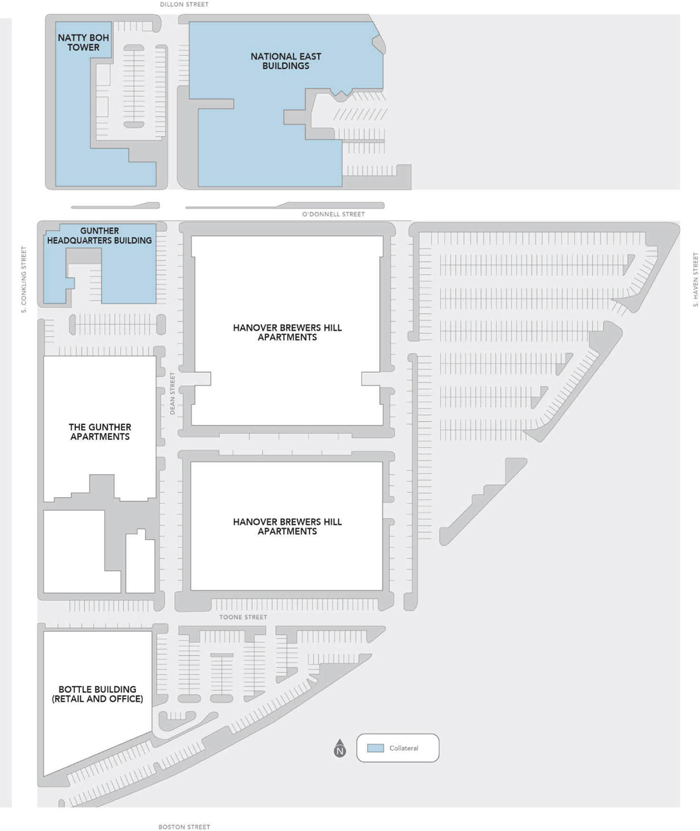

| WFB | Brewers Hill | Baltimore | MD | 1 / 1 | 40,000,000 | 4.6 | Mixed Use | 382,213 | 105 | 69.0 | 60.1 | 1.40 | 9.7 | |

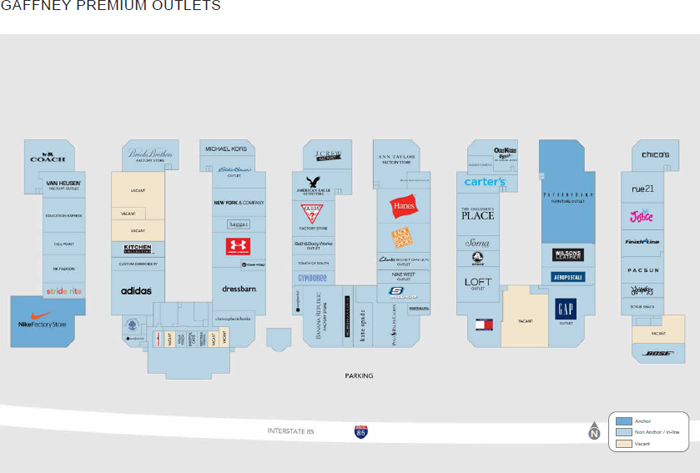

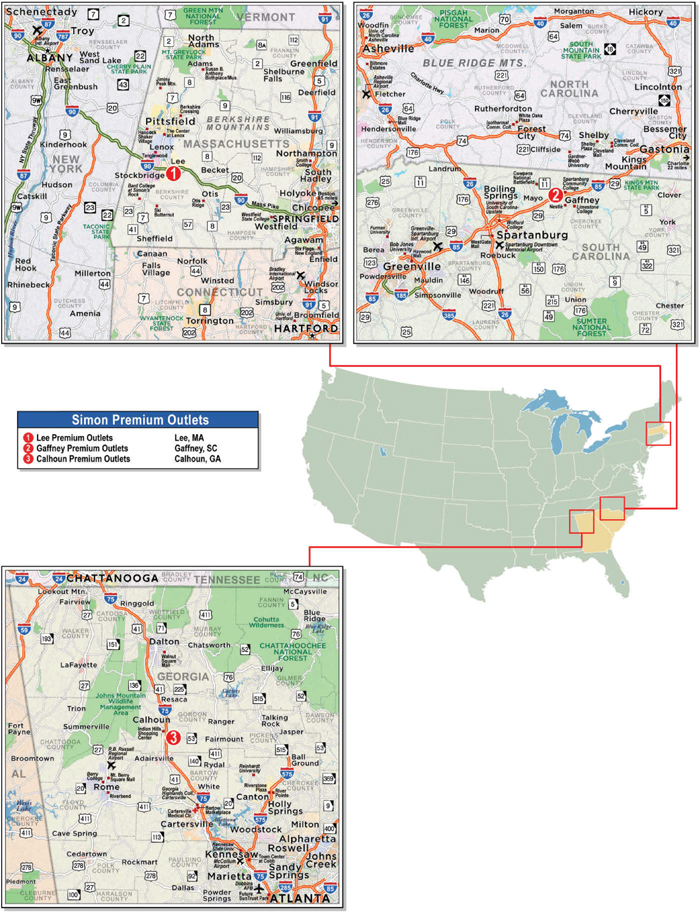

| BANA | Simon Premium Outlets | Various | Various | 1 / 3 | 37,399,290 | 4.3 | Retail | 782,765 | 134 | 46.8 | 37.5 | 2.55 | 16.3 | |

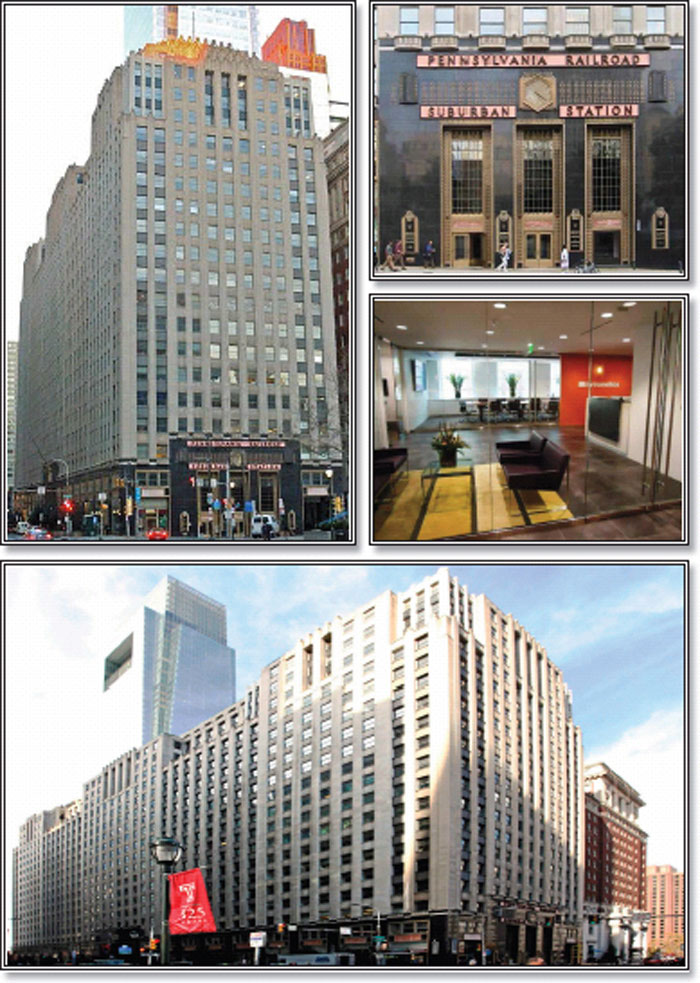

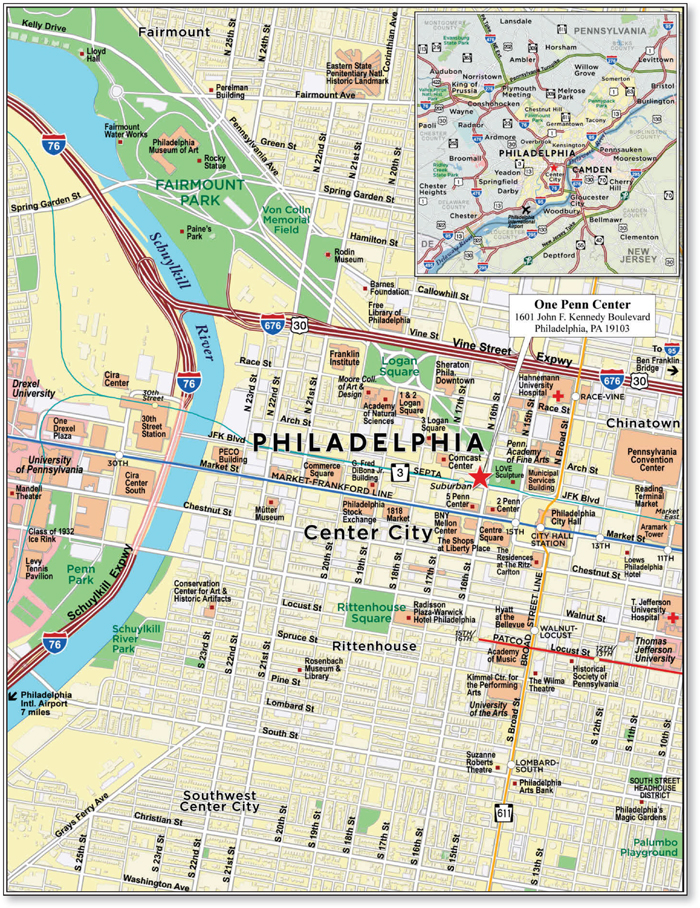

| WFB | One Penn Center | Philadelphia | PA | 1 / 1 | 35,000,000 | 4.0 | Office | 689,966 | 99 | 74.7 | 66.0 | 1.26 | 9.2 | |

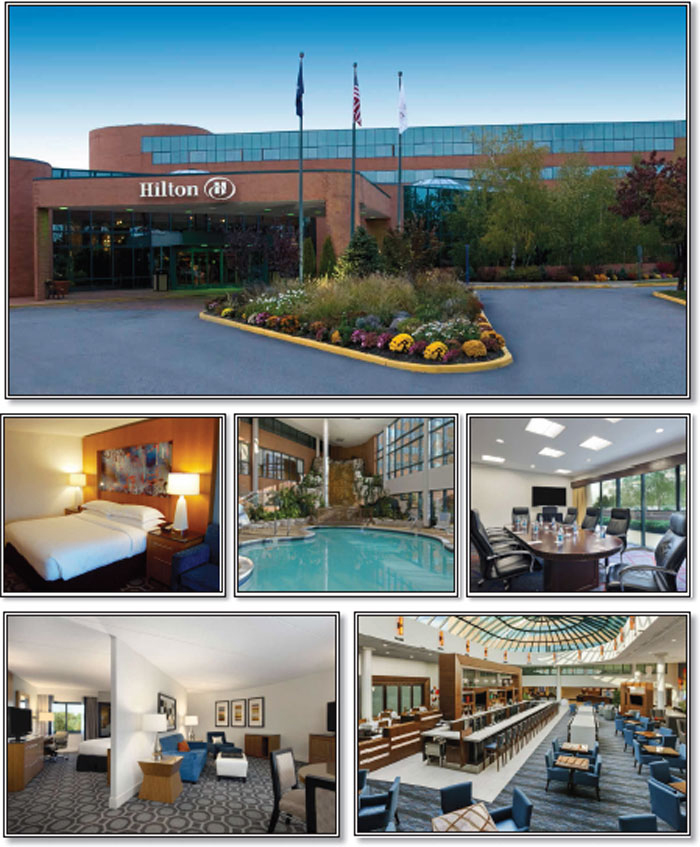

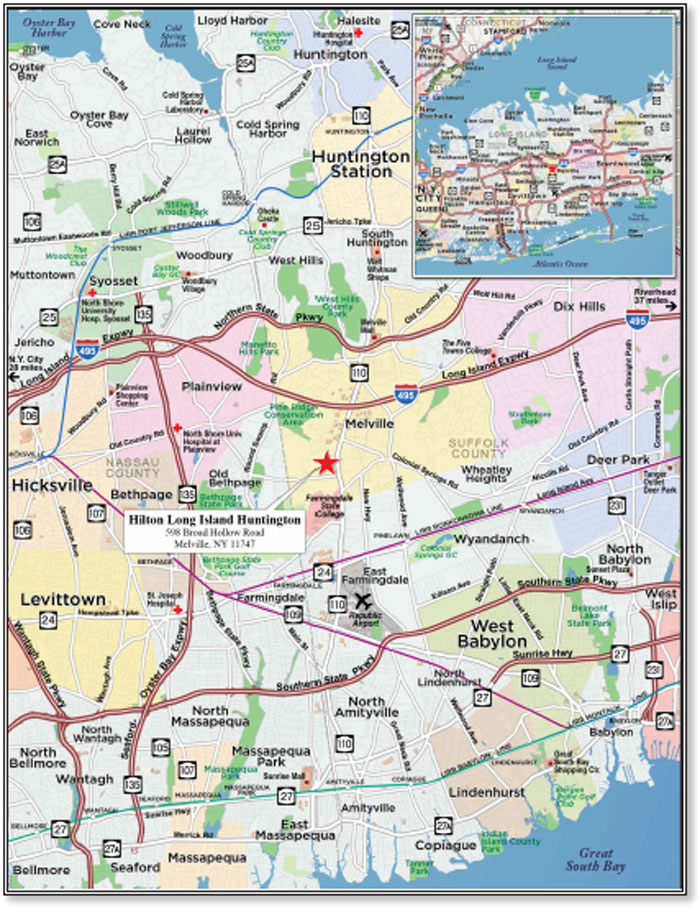

| MSMCH | Hilton Long Island Huntington | Melville | NY | 1 / 1 | 35,000,000 | 4.0 | Hospitality | 305 | 114,754 | 66.9 | 57.2 | 2.08 | 15.0 | |

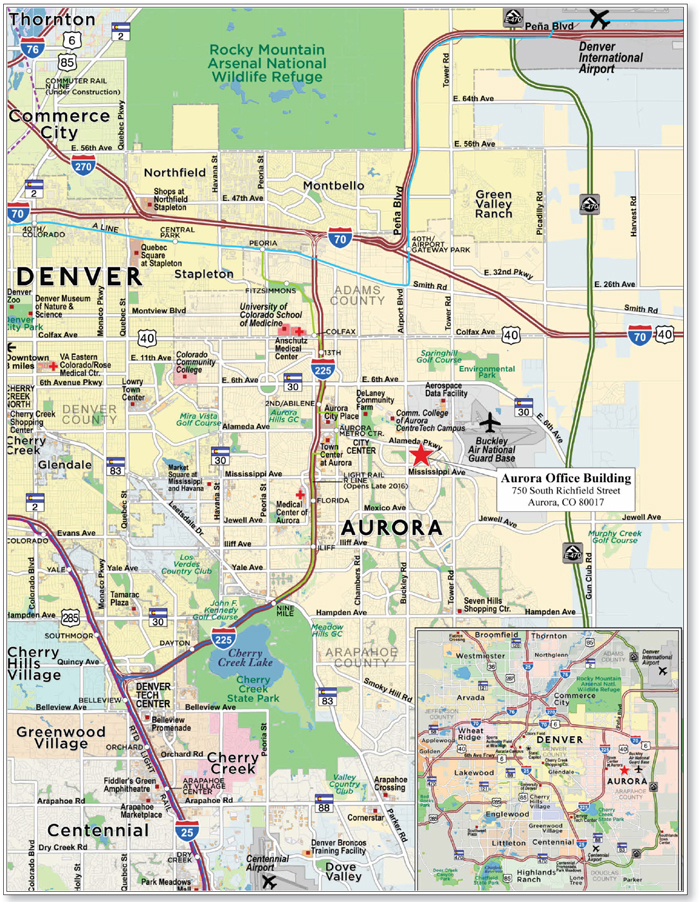

| MSMCH | Aurora Office Building | Aurora | CO | 1 / 1 | 32,600,000 | 3.7 | Office | 183,529 | 178 | 67.4 | 56.9 | 1.80 | 11.3 | |

| Top Three Total/Weighted Average | 3 / 3 | $231,387,864 | 26.6% | 39.2% | 35.4% | 3.78x | 14.4 | % | ||||||

| Top Five Total/Weighted Average | 5 / 5 | $331,387,864 | 38.1% | 43.9% | 40.5% | 3.27x | 14.0 | % | ||||||

| Top Ten Total/Weighted Average | 10 / 12 | $511,387,154 | 58.7% | 51.3% | 45.7% | 2.76x | 13.4 | % | ||||||

| Non-Top Ten Total/Weighted Average | 30 / 34 | $359,170,526 | 41.3% | 61.7% | 53.5% | 1.76x | 10.6 | % | ||||||

| (1) | With respect to any mortgage loan that is part of a whole loan, Cut-off Date Balance Per SF/Room, loan-to-value ratio, debt service coverage ratio and debt yield calculations include the related pari passu companion loan(s) but exclude any related subordinate companion loan(s) (unless otherwise stated). With respect to each mortgage loan, debt service coverage ratio, debt yield and loan-to-value ratio information do not take into account of subordinate debt (whether or not secured by the related mortgaged property), if any, that currently exists or is allowed under the terms of such mortgage loan. The information for each mortgaged property that relates to a mortgage loan that is cross-collateralized or cross-defaulted with other mortgage loans is based upon the principal balance of that mortgage loan, except that the applicable loan-to-value ratio, debt service coverage ratio and debt yield for each such mortgage loan is based upon the ratio or yield (as applicable) for the aggregate indebtedness evidenced by all loans in the group (without regard to any limitation on the amount of indebtedness secured by any mortgaged property in such cross-collateralized group). |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

9

| Wells Fargo Commercial Mortgage Trust 2016-BNK1 | Characteristics of the Mortgage Pool |

| B. | Summary of the Whole Loans |

| Property Name | Related Mortgage Loan Seller | Note(s) | Related Notes in Loan Group (Original Balance) | Holder of Note | Lead Servicer for the Entire Whole loan |

Current Master Servicer Under Related Securitization Servicing Agreement | Current Special Servicer Under Related Securitization Servicing Agreement |

| The Shops at Crystals(1) | JPMCB/BANA/WFB | (2) | $132,700,000 | SHOPS 2016-CSTL | Yes | Key Bank National Association | Aegon USA Realty Advisors, LLC |

| WFB/BANA | (3) | $80,000,000 | WFCM 2016-BNK1 | No | Wells Fargo Bank, National Association | Rialto Capital Advisors, LLC | |

| JPMCB | A-1-B-1 & B-1-B-1 |

$50,000,000 | JPMCC 2016-JP2 | No | Wells Fargo Bank, National Association | LNR Partners, LLC | |

| JPMCB | A-1-B-2 & B-1-B-2 |

$50,000,000 | DBJPM 2016-C3(4) | No | Midland Loan Services, a Division of PNC Bank, National Association | Midland Loan Services, a Division of PNC Bank, National Association | |

| BANA | A-2-B-1 & B-2-B-1 |

$35,000,000 | (5) | No | TBD | TBD | |

| WFB | A-3-B-1 & B-3-B-1 |

$35,000,000 | (6) | No | TBD | TBD | |

| Vertex Pharmaceuticals HQ | MSMCH | A-1 | $80,000,000 | WFCM 2016-BNK1 | Yes | Wells Fargo Bank, National Association | Rialto Capital Advisors, LLC |

| MSMCH | A-2-1 | $40,000,000 | (7) | No | TBD | TBD | |

| MSMCH | A-2-2 | $30,000,000 | (7) | No | TBD | TBD | |

| MSMCH | A-2-3 | $10,000,000 | (7) | No | TBD | TBD | |

| MSMCH | A-3 | $80,000,000 | (7) | No | TBD | TBD | |

| MSMCH | A-4 | $57,500,000 | (7) | No | TBD | TBD | |

| CGMRC | A-5 | $30,000,000 | (7) | No | TBD | TBD | |

| CGMRC | A-6 | $75,000,000 | (7) | No | TBD | TBD | |

| CGMRC | A-7 | $22,500,000 | (7) | No | TBD | TBD | |

| One Stamford Forum | BANA | A-1 | $71,500,000 | WFCM 2016-BNK1 | Yes | Wells Fargo Bank, National Association | Rialto Capital Advisors, LLC |

| BANA | A-2 | $38,500,000 | (8) | No | TBD | TBD | |

| Pinnacle II | WFB | A-1 | $40,000,000 | WFCM 2016-BNK1 | Yes | Wells Fargo Bank, National Association | Rialto Capital Advisors, LLC |

| WFB | A-2 | $20,000,000 | WFCM 2016-C35 | No | Wells Fargo Bank, National Association | CWCapital Asset Management LLC | |

| WFB | A-3 | $27,000,000 | (9) | No | TBD | TBD | |

| Simon Premium Outlets | BANA | A-1 | $37,500,000 | WFCM 2016-BNK1 | Yes | Wells Fargo Bank, National Association | Rialto Capital Advisors, LLC |

| BANA | A-2 | $35,000,000 | (10) | No | TBD | TBD | |

| BANA | A-3 | $32,500,000 | (10) | No | TBD | TBD | |

| One Penn Center | WFB | A-1 | $35,000,000 | WFCM 2016-BNK1 | Yes | Wells Fargo Bank, National Association | Rialto Capital Advisors, LLC |

| WFB | A-2 | $33,000,000 | (11) | No | TBD | TBD | |

| FedEx - Atlanta, GA | BANA | A-1 | $14,200,000 | WFCM 2016-BNK1 | Yes | Wells Fargo Bank, National Association | Rialto Capital Advisors, LLC |

| CGMRC | A-2 | $14,200,000 | CGCMT 2016-P4 | No | Wells Fargo Bank, National Association | CWCapital Asset Management LLC | |

| FedEx - West Palm Beach, FL | BANA | A-1 | $11,837,500 | WFCM 2016-BNK1 | Yes | Wells Fargo Bank, National Association | Rialto Capital Advisors, LLC |

| CGMRC | A-2 | $11,837,500 | CGCMT 2016-P4 | No | Wells Fargo Bank, National Association | CWCapital Asset Management LLC | |

| FedEx - Fife, WA | BANA | A-1 | $20,125,000 | WFCM 2016-BNK1 | Yes | Wells Fargo Bank, National Association | Rialto Capital Advisors, LLC |

| CGMRC | A-2 | $20,125,000 | CGCMT 2016-P4 | No | Wells Fargo Bank, National Association | CWCapital Asset Management LLC | |

| FedEx - Boulder, CO | BANA | A-1 | $9,225,000 | WFCM 2016-BNK1 | Yes | Wells Fargo Bank, National Association | Rialto Capital Advisors, LLC |

| CGMRC | A-2 | $9,225,000 | CGCMT 2016-P4 | No | Wells Fargo Bank, National Association | CWCapital Asset Management LLC |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

10

| Wells Fargo Commercial Mortgage Trust 2016-BNK1 | Characteristics of the Mortgage Pool |

| (1) | The Shops at Crystals whole loan also includes nine junior companion loans with an aggregate original principal balance of $167,300,000, which were contributed to the SHOPS 2016-CSTL securitization. Such junior companion loans are not reflected in the “Related Notes in Loan Group” column. |

| (2) | Consists of two tranches of three pari passu promissory notes each, three subordinate pari passu promissory notes (the “C Notes”), three subordinate pari passu promissory notes (the “D Notes”) and three subordinate pari passu promissory notes (the “E Notes”). The controlling Note A-1-A and non-controlling Note A-2-A and Note A-3-A have an aggregate original balance of $112,000,000 and the subordinate non-controlling Note B-1-A, Note B-2-A and Note B-3-A have an aggregate original balance of $20,700,000 and were contributed to the SHOPS 2016-CSTL Trust. |

| (3) | Consists of four pari passu promissory notes and four subordinate pari passu promissory notes. The non-controlling Note A-2-B-2, Note A-2-B-3, Note A-3-B-2 and Note A-3-B-3 have an aggregate original balance of $67,488,000 and the subordinate non-controlling Note B-2-B-2, Note B-2-B-3, Note B-3-B-2 and Note B-3-B-3 have an aggregate original balance of $12,512,000. |

| (4) | The DBJPM 2016-C3 securitization transaction has not yet closed. However, based on a publicly available preliminary prospectus for the DBJPM 2016-C3 securitization transaction, it is expected that the non-controlling Note A-1-B-2 and the subordinate non-controlling Note B-1-B-2 will be included in that transaction by JPMorgan Chase Bank, National Association (“JPMCB”), and that transaction will close prior to this transaction. |

| (5) | The non-controlling Note A-2-B-1 and the subordinate non-controlling Note B-2-B-1 are held by BANA and are expected to be contributed to one or more future securitizations. No assurance can be provided that the Note A-2-B-1 or Note B-2-B-1 will not be split further. |

| (6) | The non-controlling Note A-3-B-1 and the subordinate non-controlling Note B-3-B-1 are held by WFB and are expected to be contributed to one or more future securitizations. No assurance can be provided that the Note A-3-B-1 or Note B-3-B-1 will not be split further. |

| (7) | The related pari passu Note A-2-1, Note A-2-2, Note A-2-3, Note A-3 and Note A-4 are currently held by an affiliate of MSMCH and are expected to be contributed to one or more future securitization. The related pari passu Note A-5, Note A-6 and Note A-7 are currently held by an affiliate of Citigroup Mortgage Realty Capital (“CGMRC”) or an affiliate and are expected to be contributed to one or more future securitization No assurance can be provided that the Note A-2-1, A-2-2, A-2-3, Note A-3, Note A-4, Note A-5, Note A-6 or Note A-7 will not be split further. |

| (8) | The related pari passu Note A-2 is currently held by BANA and is expected to be contributed to a future securitization. No assurance can be provided that the Note A-2 will not be split further. |

| (9) | The related pari passu Note A-3 is currently held by WFB and is expected to be contributed to a future securitization. No assurance can be provided that the Note A-3 will not be split further. |

| (10) | The related pari passu Note A-2 and Note A-3 are currently held by BANA and are expected to be contributed to a future securitization. No assurance can be provided that the Note A-2 or Note A-3 will not be split further. |

| (11) | The related pari passu Note A-2 is currently held by WFB and is expected to be contributed to a future securitization. No assurance can be provided that the Note A-2 will not be split further. |

| C. Mortgage Loans with Additional Secured and Mezzanine Financing |

| Loan No. | Mortgage Loan Seller | Mortgage Loan Name | Mortgage Loan Cut-off Date Balance ($) |

%

of Initial Pool Balance (%) |

Subordinate Debt Cut-off Date Balance ($) |

Mezzanine Debt Cut-off Date Balance ($) |

Total

Debt Interest Rate (%)(1) |

Mortgage Loan U/W NCF DSCR (x)(2) |

Total

Debt U/W NCF DSCR (x) |

Mortgage Loan Cut-off Date U/W NOI Debt Yield (%)(2) |

Total Debt Cut-off Date U/W NOI Debt Yield (%) | Mortgage Loan Cut-off Date LTV Ratio (%)(2) | Total Debt Cut-off Date LTV Ratio (%) |

| 1 | WFB/BANA | The Shops at Crystals | $80,000,000 | 9.2% | $167,300,000 | NAP | 3.744% | 3.28x | 2.28x | 12.9% | 9.0% | 34.8% | 50.0% |

| 2 | MSMCH | Vertex Pharmaceuticals HQ | 80,000,000 | 9.2 | NAP | $195,000,000 | 3.530% | 6.28 | 3.42 | 17.9 | 12.3 | 35.5 | 51.8 |

| Total/Weighted Average | $160,000,000 | 18.4% | $167,300,000 | $195,000,000 | 3.637% | 4.78x | 2.85x | 15.4% | 10.7% | 35.2% | 50.9% | ||

| (1) | Total Debt Interest Rate for any specified mortgage loan reflects the weighted average of the interest rates on the respective components of the total debt. |

| (2) | With respect to The Shops at Crystals mortgage loan and the Vertex Pharmaceuticals HQ mortgage loan, which are each part of a whole loan, the loan-to-value ratio, debt service coverage ratio and debt yield calculations include the related pari passu companion loan(s). |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

11

| Wells Fargo Commercial Mortgage Trust 2016-BNK1 | Characteristics of the Mortgage Pool |

| D. | Previous Securitization History(1) |

| Loan No. |

Mortgage Loan Seller | Mortgage Loan or Mortgaged Property Name |

City | State | Property Type |

Mortgage

Loan or Mortgaged Property Cut-off Date Balance ($) |

% of Initial Pool Balance (%) |

Previous Securitization |

| 3 | BANA | One Stamford Forum | Stamford | CT | Office | $71,387,864 | 8.2% | BACM 2006-3 |

| 4 | WFB | Renaissance Dallas | Dallas | TX | Hospitality | 60,000,000 | 6.9 | MLCFC 2007-5 |

| 5 | WFB | Pinnacle II | Burbank | CA | Office | 40,000,000 | 4.6 | GSMS 2006-GG8 |

| 6 | WFB | Brewers Hill | Baltimore | MD | Mixed Use | 40,000,000 | 4.6 | JPMCC 2006-CB17 |

| 7 | BANA | Simon Premium Outlets | Various | Various | Retail | 37,399,290 | 4.3 | JPMCC 2006-CB16 |

| 8 | WFB | One Penn Center | Philadelphia | PA | Office | 35,000,000 | 4.0 | LBUBS 2006-C6 |

| 10 | MSMCH | Aurora Office Building | Aurora | CO | Office | 32,600,000 | 3.7 | CD 2006-CD3 |

| 11 | WFB | 633 Third Avenue - Retail Condo | New York | NY | Retail | 32,000,000 | 3.7 | MSC 2006-HQ10 |

| 12 | BANA | Riverside University Village | Riverside | CA | Retail | 29,013,042 | 3.3 | MLMT 2005-CIP1 |

| 16 | MSMCH | 420 East Third Street | Los Angeles | CA | Mixed Use | 19,000,000 | 2.2 | PFP 2014-1 |

| 17 | MSMCH | Courtyard Marriott - Baldwin Park | Baldwin Park | CA | Hospitality | 18,979,809 | 2.2 | MSC 2011-C3 |

| 18 | WFB | Homewood Suites Del Mar | San Diego | CA | Hospitality | 18,736,233 | 2.2 | GCCFC 2006-GG7 |

| 20 | BANA | La Crosse Industrial | La Crosse | WI | Industrial | 15,806,702 | 1.8 | MLCFC 2006-1 |

| 21 | WFB | Southland Terrace Shopping Center | Louisville | KY | Retail | 14,000,000 | 1.6 | JPMCC 2006-LDP8 |

| 27 | BANA | Dallas MHC Portfolio | Various | TX | Manufactured Housing Community | 9,900,000 | 1.1 | CFCRE 2011-C2 |

| 28 | WFB | So Cal Self Storage - Rancho Santa Margarita | Rancho Santa Margarita | CA | Self Storage | 9,500,000 | 1.1 | GSMS 2006-GG8 |

| 30 | BANA | Brewster Business Park | Brewster | NY | Industrial | 8,490,251 | 1.0 | BACM 2006-4 |

| 31 | WFB | Bonanza Square | Las Vegas | NV | Retail | 6,591,503 | 0.8 | MLCFC 2006-3 |

| 32 | BANA | Lakeview and Creek Run Business Park | Columbus | OH | Industrial | 6,542,268 | 0.8 | COMM 2012-CR3 |

| 33 | WFB | So Cal Self Storage - Camarillo | Camarillo | CA | Self Storage | 6,500,000 | 0.7 | GMACC 2002-C2 |

| 36 | WFB | SPS Frederick | Frederick | MD | Self Storage | 5,081,563 | 0.6 | MSC 2006-T23 |

| 40.02 | BANA | North Cannon Storage Center | Kannapolis | NC | Self Storage | 1,402,944 | 0.2 | CMLT 2008-LS1 |

| Total | $517,931,469 | 59.5% |

| (1) | The table above represents the most recent securitization with respect to the mortgaged property securing the related mortgage loan, based on information provided by the related borrower or obtained through searches of a third-party database. While loans secured by the above mortgaged properties may have been securitized multiple times in prior transactions, mortgage loans in this securitization are only listed in the above chart if the mortgage loan paid off a loan in another securitization. The information has not otherwise been confirmed by the mortgage loan sellers. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

12

(THIS PAGE INTENTIONALLY LEFT BLANK)

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

13

| Wells Fargo Commercial Mortgage Trust 2016-BNK1 | Characteristics of the Mortgage Pool |

| E. | Property Type Distribution(1) |

| Property Type | Number of Mortgaged Properties | Aggregate

Cut-off Date Balance ($) |

%

of Initial Pool Balance (%) |

Weighted Average Cut-off Date LTV Ratio (%) | Weighted

Average Balloon or ARD LTV Ratio (%) |

Weighted

Average U/W NCF DSCR (x) |

Weighted Average U/W NOI Debt Yield (%) | Weighted Average U/W NCF Debt Yield (%) | Weighted Average Mortgage Rate (%) | ||

| Office | 6 | $274,817,864 | 31.6% | 53.0% | 47.0% | 2.97x | 12.7% | 12.0% | 4.094% | ||

| CBD | 4 | 226,387,864 | 26.0 | 50.2 | 45.0 | 3.25 | 13.2 | 12.4 | 4.051 | ||

| Suburban | 2 | 48,430,000 | 5.6 | 66.2 | 56.7 | 1.65 | 10.7 | 9.7 | 4.296 | ||

| Retail | 12 | 227,651,163 | 26.2 | 50.1 | 43.6 | 2.30 | 12.0 | 11.2 | 4.214 | ||

| Anchored | 6 | 174,484,545 | 20.0 | 50.1 | 45.4 | 2.34 | 11.1 | 10.5 | 4.164 | ||

| Outlet Center | 3 | 37,399,290 | 4.3 | 46.8 | 37.5 | 2.55 | 16.3 | 15.0 | 4.168 | ||

| Unanchored | 2 | 10,800,000 | 1.2 | 69.3 | 56.4 | 1.28 | 9.0 | 8.4 | 5.103 | ||

| Single Tenant | 1 | 4,967,328 | 0.6 | 36.4 | 0.2 | 1.31 | 18.1 | 16.3 | 4.380 | ||

| Hospitality | 4 | 132,716,042 | 15.2 | 59.6 | 51.7 | 2.04 | 14.8 | 12.5 | 4.587 | ||

| Full Service | 2 | 95,000,000 | 10.9 | 56.5 | 50.2 | 2.13 | 15.5 | 12.9 | 4.437 | ||

| Select Service | 1 | 18,979,809 | 2.2 | 65.4 | 53.9 | 1.83 | 13.3 | 11.8 | 5.000 | ||

| Extended Stay | 1 | 18,736,233 | 2.2 | 69.1 | 56.9 | 1.78 | 12.7 | 11.4 | 4.930 | ||

| Industrial | 9 | 97,726,721 | 11.2 | 60.2 | 55.6 | 2.03 | 10.8 | 10.0 | 4.520 | ||

| Warehouse Distribution | 5 | 66,887,500 | 7.7 | 56.5 | 56.5 | 2.27 | 10.3 | 10.0 | 4.390 | ||

| Flex | 4 | 30,839,221 | 3.5 | 68.1 | 53.7 | 1.51 | 11.9 | 10.0 | 4.802 | ||

| Mixed Use | 2 | 59,000,000 | 6.8 | 64.3 | 54.7 | 1.58 | 10.4 | 9.3 | 4.239 | ||

| Office/Self Storage | 1 | 40,000,000 | 4.6 | 69.0 | 60.1 | 1.40 | 9.7 | 8.3 | 4.300 | ||

| Office/Retail | 1 | 19,000,000 | 2.2 | 54.3 | 43.3 | 1.96 | 12.0 | 11.4 | 4.110 | ||

| Self Storage | 9 | 57,561,757 | 6.6 | 58.1 | 52.2 | 1.88 | 10.1 | 9.9 | 4.553 | ||

| Self Storage | 9 | 57,561,757 | 6.6 | 58.1 | 52.2 | 1.88 | 10.1 | 9.9 | 4.553 | ||

| Multifamily | 1 | 11,184,133 | 1.3 | 67.4 | 53.0 | 1.80 | 10.6 | 9.9 | 3.700 | ||

| Garden | 1 | 11,184,133 | 1.3 | 67.4 | 53.0 | 1.80 | 10.6 | 9.9 | 3.700 | ||

| Manufactured Housing Community | 3 | 9,900,000 | 1.1 | 73.8 | 64.8 | 1.52 | 9.5 | 9.3 | 4.600 | ||

| Manufactured Housing Community | 3 | 9,900,000 | 1.1 | 73.8 | 64.8 | 1.52 | 9.5 | 9.3 | 4.600 | ||

| Total/Weighted Average: | 46 | $870,557,680 | 100.0% | 55.6% | 48.9% | 2.35x | 12.2% | 11.3% | 4.289% | ||

| (1) | Because this table presents information relating to the mortgaged properties and not the mortgage loans, (a) the information for mortgage loans secured by more than one mortgaged property (other than through cross-collateralization with other mortgage loans) is based on allocated amounts (allocating the mortgage loan principal balance to each of those properties according to the relative appraised values of the mortgaged properties or the allocated loan amounts or property-specific release prices set forth in the related mortgage loan documents or such other allocation as the related mortgage loan seller deemed appropriate), and (b) the information for each mortgaged property that relates to a mortgage loan that is cross-collateralized or cross-defaulted with other mortgage loans is based upon the principal balance of that mortgage loan, except that the applicable loan-to-value ratio, debt service coverage ratio and debt yield for each such mortgage loan is based upon the ratio or yield (as applicable) for the aggregate indebtedness evidenced by all loans in the group (without regard to any limitation on the amount of indebtedness secured by any mortgaged property in such cross-collateralized group). On an individual basis, without regard to the cross-collateralization feature, any mortgage loan that is part of a cross-collateralized group of mortgage loans may have a higher loan-to-value ratio, lower debt service coverage ratio and/or lower debt yield than is presented herein. With respect to any mortgage loan that is part of a whole loan, the loan-to-value ratio, debt service coverage ratio and debt yield calculations include the related pari passu companion loan(s) but exclude any related subordinate companion loan(s) (unless otherwise stated). With respect to each mortgage loan, debt service coverage ratio, debt yield and loan-to-value ratio information do not take into account of any subordinate debt (whether or not secured by the related mortgaged property) that currently exists or is allowed under the terms of such mortgage loan. See Annex A-1 to the Preliminary Prospectus. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

14

| Wells Fargo Commercial Mortgage Trust 2016-BNK1 | Characteristics of the Mortgage Pool |

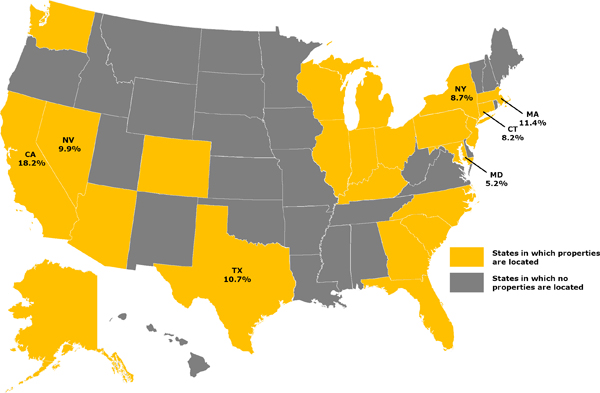

| F. | Geographic Distribution(1)(2) |

| Location | Number of Mortgaged Properties | Aggregate Cut-off Date Balance ($) | %

of Initial Pool Balance (%) |

Weighted Average Cut-off Date LTV Ratio (%) | Weighted Average Balloon or ARD LTV Ratio (%) | Weighted Average U/W NCF DSCR (x) | Weighted Average U/W NOI Debt Yield (%) | Weighted Average U/W NCF Debt Yield (%) | Weighted Average Mortgage Rate (%) | |

| California | 9 | $158,196,412 | 18.2% | 59.9% | 51.8% | 1.82x | 11.0% | 10.2% | 4.584% | |

| Southern | 8 | 153,229,084 | 17.6 | 60.6 | 53.5 | 1.84 | 10.8 | 10.0 | 4.590 | |

| Northern | 1 | 4,967,328 | 0.6 | 36.4 | 0.2 | 1.31 | 18.1 | 16.3 | 4.380 | |

| Massachusetts | 2 | 99,233,921 | 11.4 | 37.7 | 35.9 | 5.56 | 17.6 | 17.3 | 3.064 | |

| Texas | 7 | 93,580,000 | 10.7 | 57.8 | 51.1 | 1.89 | 13.4 | 11.4 | 4.468 | |

| Nevada | 2 | 86,591,503 | 9.9 | 36.3 | 35.5 | 3.19 | 13.0 | 12.4 | 3.775 | |

| New York | 3 | 75,490,251 | 8.7 | 66.3 | 60.3 | 1.79 | 11.1 | 9.9 | 4.477 | |

| Connecticut | 1 | 71,387,864 | 8.2 | 48.4 | 36.1 | 1.55 | 12.0 | 10.8 | 4.900 | |

| Maryland | 2 | 45,081,563 | 5.2 | 67.2 | 58.2 | 1.43 | 9.8 | 8.5 | 4.337 | |

| Other(3) | 20 | 240,996,167 | 27.7 | 62.8 | 55.0 | 1.83 | 11.0 | 10.1 | 4.468 | |

| Total/Weighted Average | 46 | $870,557,680 | 100.0% | 55.6% | 48.9% | 2.35x | 12.2% | 11.3% | 4.289% |

| (1) | The mortgaged properties are located in 23 states. |

| (2) | Because this table presents information relating to the mortgaged properties and not the mortgage loans, (a) the information for mortgage loans secured by more than one mortgaged property (other than through cross-collateralization with other mortgage loans) is based on allocated amounts (allocating the mortgage loan principal balance to each of those properties according to the relative appraised values of the mortgaged properties or the allocated loan amounts or property-specific release prices set forth in the related mortgage loan documents or such other allocation as the related mortgage loan seller deemed appropriate), and (b) the information for each mortgaged property that relates to a mortgage loan that is cross-collateralized or cross-defaulted with other mortgage loans is based upon the principal balance of that mortgage loan, except that the applicable loan-to-value ratio, debt service coverage ratio and debt yield for each such mortgage loan is based upon the ratio or yield (as applicable) for the aggregate indebtedness evidenced by all loans in the group (without regard to any limitation on the amount of indebtedness secured by any mortgaged property in such cross-collateralized group). On an individual basis, without regard to the cross-collateralization feature, any mortgage loan that is part of a cross-collateralized group of mortgage loans may have a higher loan-to-value ratio, lower debt service coverage ratio and/or lower debt yield than is presented herein. With respect to any mortgage loan that is part of a whole loan, the loan-to-value ratio, debt service coverage ratio and debt yield calculations include the related pari passu companion loan(s) but exclude any related subordinate companion loan(s) (unless otherwise stated). With respect to each mortgage loan, debt service coverage ratio, debt yield and loan-to-value ratio information do not take into account of any subordinate debt (whether or not secured by the related mortgaged property) that currently exists or is allowed under the terms of such mortgage loan. See Annex A-1 to the Preliminary Prospectus. |

| (3) | Includes 16 other states. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

15

| Wells Fargo Commercial Mortgage Trust 2016-BNK1 | Characteristics of the Mortgage Pool |

| G. | Characteristics of the Mortgage Pool(1) |

| CUT-OFF DATE BALANCE | |||||

| Range

of Cut-off Date Balances ($) |

Number

of Mortgage Loans |

Aggregate

Cut- off Date Balance |

% of Initial Pool Balance | ||

| 2,884,226 - 3,000,000 | 1 | $2,884,226 | 0.3% | ||

| 3,000,001 - 4,000,000 | 1 | 3,791,577 | 0.4 | ||

| 4,000,001 - 5,000,000 | 2 | 9,467,328 | 1.1 | ||

| 5,000,001 - 6,000,000 | 2 | 11,065,864 | 1.3 | ||

| 6,000,001 - 8,000,000 | 4 | 25,933,771 | 3.0 | ||

| 8,000,001 - 9,000,000 | 1 | 8,490,251 | 1.0 | ||

| 9,000,001 - 10,000,000 | 3 | 28,625,000 | 3.3 | ||

| 10,000,001 - 15,000,000 | 8 | 99,421,722 | 11.4 | ||

| 15,000,001 - 20,000,000 | 5 | 88,352,744 | 10.1 | ||

| 20,000,001 - 30,000,000 | 2 | 49,138,042 | 5.6 | ||

| 30,000,001 - 50,000,000 | 7 | 251,999,290 | 28.9 | ||

| 50,000,001 - 70,000,000 | 1 | 60,000,000 | 6.9 | ||

| 70,000,001 - 80,000,000 | 3 | 231,387,864 | 26.6 | ||

| Total: | 40 | $870,557,680 | 100.0% | ||

| Average: | $21,763,942 | ||||

| UNDERWRITTEN NOI DEBT SERVICE COVERAGE RATIO | |||||

| Range

of U/W NOI DSCRs (x) |

Number

of Mortgage Loans |

Aggregate

Cut- off Date Balance |

% of Initial Pool Balance | ||

| 1.34 - 1.40 | 2 | $18,620,090 | 2.1% | ||

| 1.41 - 1.50 | 5 | 89,310,370 | 10.3 | ||

| 1.51 - 1.60 | 3 | 31,270,251 | 3.6 | ||

| 1.61 - 1.70 | 5 | 104,388,264 | 12.0 | ||

| 1.71 - 1.80 | 2 | 74,272,089 | 8.5 | ||

| 1.81 - 1.90 | 1 | 3,791,577 | 0.4 | ||

| 1.91 - 2.00 | 4 | 76,520,366 | 8.8 | ||

| 2.01 - 2.50 | 13 | 194,860,383 | 22.4 | ||

| 2.51 - 3.00 | 3 | 117,524,290 | 13.5 | ||

| 3.01 - 4.00 | 1 | 80,000,000 | 9.2 | ||

| 4.01 - 6.31 | 1 | 80,000,000 | 9.2 | ||

| Total: | 40 | $870,557,680 | 100.0% | ||

| Weighted Average: | 2.52x | ||||

| UNDERWRITTEN NCF DEBT SERVICE COVERAGE RATIO | |||||

| Range

of U/W NCF DSCRs (x) |

Number

of Mortgage Loans |

Aggregate

Cut- off Date Balance |

% of Initial Pool Balance | ||

| 1.25 - 1.30 | 2 | $41,300,000 | 4.7% | ||

| 1.31 - 1.40 | 7 | 122,437,161 | 14.1 | ||

| 1.41 - 1.50 | 2 | 21,370,251 | 2.5 | ||

| 1.51 - 1.75 | 7 | 146,753,652 | 16.9 | ||

| 1.76 - 2.00 | 8 | 150,834,021 | 17.3 | ||

| 2.01 - 2.25 | 6 | 128,575,805 | 14.8 | ||

| 2.26 - 2.50 | 5 | 61,887,500 | 7.1 | ||

| 2.51 - 3.00 | 1 | 37,399,290 | 4.3 | ||

| 3.01 - 6.28 | 2 | 160,000,000 | 18.4 | ||

| Total: | 40 | $870,557,680 | 100.0% | ||

| Weighted Average: | 2.35x | ||||

| LOAN PURPOSE | |||

| Loan Purpose | Number

of Mortgage Loans |

Aggregate

Cut- off Date Balance |

% of Initial Pool Balance |

| Refinance | 25 | $600,353,316 | 69.0% |

| Acquisition | 14 | 190,204,364 | 21.8 |

| Recapitalization(2) | 1 | 80,000,000 | 9.2 |

| Total: | 40 | $870,557,680 | 100.0% |

| MORTGAGE RATE | |||

| Range

of Mortgage Rates (%) |

Number

of Mortgage Loans |

Aggregate

Cut- off Date Balance |

% of Initial Pool Balance |

| 2.798 - 3.500 | 1 | $80,000,000 | 9.2% |

| 3.501 - 4.000 | 2 | 91,184,133 | 10.5 |

| 4.001 - 4.250 | 10 | 170,358,293 | 19.6 |

| 4.251 - 4.500 | 10 | 252,951,630 | 29.1 |

| 4.501 - 4.750 | 7 | 61,048,397 | 7.0 |

| 4.751 - 5.000 | 7 | 193,423,650 | 22.2 |

| 5.001 - 5.250 | 2 | 15,291,577 | 1.8 |

| 5.251 - 5.320 | 1 | 6,300,000 | 0.7 |

| Total: | 40 | $870,557,680 | 100.0% |

| Weighted Average: | 4.289% | ||

| UNDERWRITTEN NOI DEBT YIELD | |||

| Range

of U/W NOI Debt Yields (%) |

Number

of Mortgage Loans |

Aggregate

Cut- off Date Balance |

% of Initial Pool Balance |

| 7.2 - 8.0 | 1 | $32,000,000 | 3.7% |

| 8.1 - 9.0 | 4 | 43,000,090 | 4.9 |

| 9.1 - 10.0 | 9 | 174,720,251 | 20.1 |

| 10.1 - 11.0 | 9 | 110,050,463 | 12.6 |

| 11.1 - 12.0 | 6 | 156,586,143 | 18.0 |

| 12.1 - 13.0 | 3 | 104,720,535 | 12.0 |

| 13.1 - 14.0 | 1 | 18,979,809 | 2.2 |

| 14.1 - 15.0 | 3 | 48,133,771 | 5.5 |

| 15.1 - 16.0 | 1 | 60,000,000 | 6.9 |

| 16.1 - 17.0 | 1 | 37,399,290 | 4.3 |

| 17.1 - 18.0 | 1 | 80,000,000 | 9.2 |

| 18.1 | 1 | 4,967,328 | 0.6 |

| Total: | 40 | $870,557,680 | 100.0% |

| Weighted Average: | 12.2% | ||

| UNDERWRITTEN NCF DEBT YIELD | |||

| Range

of U/W NCF Debt Yields (%) |

Number

of Mortgage Loans |

Aggregate

Cut- off Date Balance |

% of Initial Pool Balance |

| 7.0 - 8.0 | 2 | $67,000,000 | 7.7% |

| 8.1 - 9.0 | 9 | 151,820,340 | 17.4 |

| 9.1 - 10.0 | 6 | 86,903,877 | 10.0 |

| 10.1 - 11.0 | 10 | 187,841,152 | 21.6 |

| 11.1 - 12.0 | 5 | 67,049,888 | 7.7 |

| 12.1 - 14.0 | 5 | 187,575,805 | 21.5 |

| 14.1 - 16.0 | 1 | 37,399,290 | 4.3 |

| 16.1 - 17.0 | 1 | 4,967,328 | 0.6 |

| 17.1 - 17.8 | 1 | 80,000,000 | 9.2 |

| Total: | 40 | $870,557,680 | 100.0% |

| Weighted Average: | 11.3% | ||

(1) Information regarding mortgage loans that are cross-collateralized or cross-defaulted with other mortgage loans is based upon the individual loan balances, except that the applicable loan-to-value ratio, debt service coverage ratio and debt yield for each such mortgage loan is based upon the ratio or yield (as applicable) for the aggregate indebtedness evidenced by all loans in the group (without regard to any limitation on the amount of indebtedness secured by any mortgaged property in such cross-collateralized group). On an individual basis, without regard to the cross-collateralization feature, any mortgage loan that is part of a cross-collateralized group of mortgage loans may have a higher loan-to-value ratio, lower debt service coverage ratio and/or lower debt yield than is presented herein. With respect to any mortgage loan that is part of a whole loan, the loan-to-value ratio, debt service coverage ratio and debt yield calculations include the related pari passu companion loan(s) but exclude any related subordinate companion loan(s) (unless otherwise stated). With respect to each mortgage loan, debt service coverage ratio, debt yield and loan-to-value ratio information do not take into account any subordinate debt (whether or not secured by the related mortgaged property), that currently exists or is allowed under the terms of such mortgage loan. See Annex A-1 to the Preliminary Prospectus. Prepayment provisions for each mortgage loan reflects the entire life of the loan (from origination to maturity). (2) In April 2016, The Shops at Crytals whole loan sponsor acquired the related mortgaged property in an all-cash transaction for approximately $1.1 billion. In June 2016, the Mortgage Loan proceeds were used to recapitalize the joint venture and return equity to affiliates of The Shops at Crystals mortgage loan sponsors.

|

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

16

| Wells Fargo Commercial Mortgage Trust 2016-BNK1 | Characteristics of the Mortgage Pool |

| ORIGINAL TERM TO MATURITY OR ARD | ||||

| Original

Terms to Maturity or ARD (months) |

Number

of Mortgage Loans |

Aggregate

Cut- off Date Balance |

% of Initial Pool Balance | |

| 120 | 39 | $864,257,680 | 99.3% | |

| 180 | 1 | 6,300,000 | 0.7 | |

| Total: | 40 | $870,557,680 | 100.0% | |

| Weighted Average: | 120 months | |||

| REMAINING TERM TO MATURITY OR ARD | ||||

| Range

of Remaining Terms to Maturity or ARD (months) |

Number

of Mortgage Loans |

Aggregate

Cut- off Date Balance |

% of Initial Pool Balance | |

| 109 - 120 | 39 | $864,257,680 | 99.3% | |

| 121 - 179 | 1 | 6,300,000 | 0.7 | |

| Total: | 40 | $870,557,680 | 100.0% | |

| Weighted Average: | 119 months | |||

| ORIGINAL AMORTIZATION TERM(3) | ||||

| Original Amortization Terms (months) |

Number

of Mortgage Loans |

Aggregate

Cut- off Date Balance |

% of Initial Pool Balance | |

| Non-Amortizing | 12 | $326,387,500 | 37.5% | |

| 120 | 1 | 4,967,328 | 0.6 | |

| 300 | 3 | 116,207,607 | 13.3 | |

| 360 | 24 | 422,995,244 | 48.6 | |

| Total: | 40 | $870,557,680 | 100.0% | |

| Weighted Average(4): | 345 months | |||

(3) The original amortization term shown for any mortgage loan that is interest-only for part of its term does not include the number of months in its interest-only period and reflects only the number of months as of the commencement of amortization remaining from the end of such interest-only period. (4) Excludes the non-amortizing mortgage loans. | ||||

| REMAINING AMORTIZATION TERM(5) | ||||

| Range

of Remaining Amortization Terms (months) |

Number

of Mortgage Loans |

Aggregate

Cut- off Date Balance |

% of Initial Pool Balance | |

| Non-Amortizing | 12 | $326,387,500 | 37.5% | |

| 119 - 120 | 1 | 4,967,328 | 0.6 | |

| 121 - 300 | 3 | 116,207,607 | 13.3 | |

| 301 - 360 | 24 | 422,995,244 | 48.6 | |

| Total: | 40 | $870,557,680 | 100.0% | |

| Weighted Average(6): | 344 months | |||

(5) The remaining amortization term shown for any mortgage loan that is interest-only for part of its term does not include the number of months in its interest-only period and reflects only the number of months as of the commencement of amortization remaining from the end of such interest-only period. (6) Excludes the non-amortizing mortgage loans. | ||||

| LOCKBOXES | ||||

| Type of Lockbox | Number

of Mortgage Loans |

Aggregate

Cut- off Date Balance |

% of Initial Pool Balance | |

| Hard/Springing Cash Management | 11 | $384,244,714 | 44.1% | |

| Springing | 17 | 265,347,101 | 30.5 | |

| Hard/Upfront

Cash Management |

4 | 118,500,000 | 13.6 | |

| Soft/Springing Cash Management | 3 | 63,900,000 | 7.3 | |

| None | 5 | 38,565,864 | 4.4 | |

| Total: | 40 | $870,557,680 | 100.0% | |

| PREPAYMENT PROVISION SUMMARY | ||||

| Prepayment Provision | Number

of Mortgage Loans |

Aggregate

Cut- off Date Balance |

% of Initial Pool Balance | |

| Lockout / Def / Open(7) | 26 | $554,485,965 | 63.7% | |

| Lockout / GRTR 1% or YM / Open | 10 | 151,112,038 | 17.4 | |

| Lockout / GRTR 1% or YM or Def / Open | 3 | 84,959,677 | 9.8 | |

| Lockout / GRTR 0.5% or YM or Def / Open | 1 | 80,000,000 | 9.2 | |

| Total: | 40 | $870,557,680 | 100.0% | |

| (7) With respect to the Aurora Office Building mortgage loan, the mortgage loan documents permit prepayment in part during the lockout period, together with payment of a yield maintenance premium, in order to avoid triggering a cash management event caused by a decline in the debt service coverage ratio or debt yield. | ||||

| CUT-OFF DATE LOAN-TO-VALUE RATIO | ||||

| Range

of Cut-off Date LTV Ratios (%) |

Number

of Mortgage Loans |

Aggregate

Cut- off Date Balance |

% of Initial Pool Balance | |

| 34.8 - 35.0 | 1 | $80,000,000 | 9.2% | |

| 35.1 - 40.0 | 2 | 84,967,328 | 9.8 | |

| 40.1 - 45.0 | 1 | 5,984,302 | 0.7 | |

| 45.1 - 50.0 | 2 | 108,787,154 | 12.5 | |

| 50.1 - 55.0 | 10 | 164,060,566 | 18.8 | |

| 55.1 - 60.0 | 1 | 9,500,000 | 1.1 | |

| 60.1 - 65.0 | 7 | 150,441,321 | 17.3 | |

| 65.1 - 70.0 | 8 | 172,500,175 | 19.8 | |

| 70.1 - 74.7 | 8 | 94,316,834 | 10.8 | |

| Total: | 40 | $870,557,680 | 100.0% | |

| Weighted Average: | 55.6% | |||

| BALLOON OR ARD LOAN-TO-VALUE RATIO | |||

| Range of Balloon or ARD LTV Ratios (%) | Number

of Mortgage Loans |

Aggregate

Cut- off Date Balance |

% of Initial Pool Balance |

| 0.2 - 30.0 | 1 | $4,967,328 | 0.6% |

| 30.1 - 35.0 | 2 | 85,984,302 | 9.9 |

| 35.1 - 40.0 | 3 | 188,787,154 | 21.7 |

| 40.1 - 45.0 | 3 | 30,673,066 | 3.5 |