| FREE WRITING PROSPECTUS | ||

| FILED PURSUANT TO RULE 433 | ||

| REGISTRATION FILE NO.: 333-206677-04 | ||

Free Writing Prospectus

Structural and Collateral Term Sheet

$712,219,087

(Approximate Aggregate Cut-off Date Balance of Mortgage Pool)

Wells Fargo Commercial Mortgage Trust 2016-C33

as Issuing Entity

Wells Fargo Commercial Mortgage Securities, Inc.

as Depositor

Wells Fargo Bank, National Association

Ladder Capital Finance LLC

Rialto Mortgage Finance, LLC

Natixis Real Estate Capital LLC

C-III Commercial Mortgage LLC

National Cooperative Bank, N.A.

as Sponsors and Mortgage Loan Sellers

Commercial

Mortgage Pass-Through Certificates

Series 2016-C33

March 9, 2016

| WELLS FARGO SECURITIES | ||

| Lead Manager and Sole Bookrunner | ||

Academy Securities Co-Manager |

Deutsche Bank Securities Co-Manager |

Natixis Securities Americas LLC Co-Manager |

| Wells Fargo Commercial Mortgage Trust 2016-C33 | Certain Terms and Conditions |

STATEMENT REGARDING THIS FREE WRITING PROSPECTUS

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (‘‘SEC’’) (SEC File No. 333-206677) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the depositor, any underwriter, or any dealer participating in the offering will arrange to send you the prospectus after filing if you request it by calling toll free 1-800-745-2063 (8 a.m. – 5 p.m. EST) or by emailing wfs.cmbs@wellsfargo.com.

Nothing in this document constitutes an offer of securities for sale in any jurisdiction where the offer or sale is not permitted. The information contained herein is preliminary as of the date hereof, supersedes any such information previously delivered to you and will be superseded by any such information subsequently delivered and ultimately by the final prospectus relating to the securities. These materials are subject to change, completion, supplement or amendment from time to time.

STATEMENT REGARDING ASSUMPTIONS AS TO SECURITIES, PRICING ESTIMATES AND OTHER INFORMATION

This free writing prospectus contains certain forward-looking statements. If and when included in this free writing prospectus, the words “expects”, “intends”, “anticipates”, “estimates” and analogous expressions and all statements that are not historical facts, including statements about our beliefs or expectations, are intended to identify forward-looking statements. Any forward-looking statements are made subject to risks and uncertainties which could cause actual results to differ materially from those stated. Those risks and uncertainties include, among other things, declines in general economic and business conditions, increased competition, changes in demographics, changes in political and social conditions, regulatory initiatives and changes in customer preferences, many of which are beyond our control and the control of any other person or entity related to this offering. The forward-looking statements made in this free writing prospectus are made as of the date stated on the cover. We have no obligation to update or revise any forward-looking statement.

Wells Fargo Securities is the trade name for the capital markets and investment banking services of Wells Fargo & Company and its subsidiaries, including but not limited to Wells Fargo Securities, LLC, a member of NYSE, FINRA, NFA and SIPC, Wells Fargo Prime Services, LLC, a member of FINRA, NFA and SIPC, and Wells Fargo Bank, N.A. Wells Fargo Securities, LLC and Wells Fargo Prime Services, LLC are distinct entities from affiliated banks and thrifts.

IMPORTANT NOTICE REGARDING THE OFFERED CERTIFICATES

The information herein is preliminary and may be supplemented or amended prior to the time of sale. Prospective investors should understand that, when considering the purchase of the Offered Certificates, a contract of sale will come into being no sooner than the date on which the relevant class of certificates has been priced and the investor has otherwise taken all actions the investor must take to become committed to purchase the Offered Certificates, and the investor has therefore entered into a contract of sale. Any “indications of interest” expressed by any prospective investor, and any “soft circles” generated by the underwriters, prior to the time of sale, will not create binding contractual obligations for such prospective investors, on the one hand, or the underwriters, the depositor or any of their respective agents or affiliates, on the other hand.

In addition, the Offered Certificates referred to in these materials and the asset pool backing them are subject to modification or revision (including the possibility that one or more classes of certificates may be split, combined or eliminated at any time prior to issuance or availability of a final prospectus) and are offered on a “when, as and if issued” basis. As a result of the foregoing, a prospective investor may commit to purchase certificates that have characteristics that may change, and each prospective investor is advised that all or a portion of the certificates referred to in these materials may be issued without all or certain of the characteristics described in these materials. The underwriters’ obligation to sell certificates to any prospective investor is conditioned on the certificates and the transaction having the characteristics described in these materials. If the underwriters determine that a condition is not satisfied in any material respect, such prospective investor will be notified, and neither the depositor nor the underwriters will have any obligation to such prospective investor to deliver any portion of the Offered Certificates which such prospective investor has committed to purchase, and there will be no liability between the underwriters, the depositor or any of their respective agents or affiliates, on the one hand, and such prospective investor, on the other hand, as a consequence of the non-delivery.

The underwriters described in these materials may from time to time perform investment banking services for, or solicit investment banking business from, any company named in these materials. The underwriters and/or their affiliates or respective employees may from time to time have a long or short position in any security or contract discussed in these materials.

The information contained herein supersedes any previous such information delivered to any prospective investor and will be superseded by information delivered to such prospective investor prior to the time of sale.

IMPORTANT NOTICE RELATING TO AUTOMATICALLY-GENERATED EMAIL DISCLAIMERS

Any legends, disclaimers or other notices that may appear at the bottom of any email communication to which this free writing prospectus is attached relating to (1) these materials not constituting an offer (or a solicitation of an offer), (2) no representation that these materials are accurate or complete and may not be updated or (3) these materials possibly being confidential, are not applicable to these materials and should be disregarded. Such legends, disclaimers or other notices have been automatically generated as a result of these materials having been sent via Bloomberg or another system.

| No. 1 – Sanofi Office Complex | ||||||

| Loan Information | Property Information | |||||

| Mortgage Loan Seller: | Ladder Capital Finance LLC | Single Asset/Portfolio: | Single Asset | |||

Credit Assessment (DBRS/Fitch/Moody’s): |

NR/NR/NR | Property Type: | Office | |||

| Original Principal Balance(1): | $65,000,000 | Specific Property Type: | Suburban | |||

| Cut-off Date Principal Balance(1): | $65,000,000 | Location: | Bridgewater, NJ | |||

| % of Initial Pool Balance: | 9.1% | Size: | 674,325 SF | |||

| Loan Purpose: | Refinance | Cut-off Date Principal Balance Per SF(1): |

$185.37 | |||

| Borrower Name: | ARC HR5SNFI001 SPE, LLC | Year Built/Renovated: | 1987/2006 | |||

| Sponsor: | American Finance Trust, Inc. | Title Vesting: | Fee | |||

| Mortgage Rate: | 5.093% | Property Manager: | Self-managed | |||

| Note Date: | December 11, 2015 | 4th Most Recent Occupancy (As of): | 100.0% (12/31/2012) | |||

| Anticipated Repayment Date: | January 6, 2021 | 3rd Most Recent Occupancy (As of): | 100.0% (12/31/2013) | |||

| Maturity Date: | July 31, 2026 | 2nd Most Recent Occupancy (As of): | 100.0% (12/31/2014) | |||

| IO Period: | 60 months | Most Recent Occupancy (As of): | 100.0% (12/31/2015) | |||

| Loan Term (Original): | 60 months | Current Occupancy (As of): | 100.0% (3/1/2016) | |||

| Seasoning: | 2 months | |||||

| Amortization Term (Original): | NAP | Underwriting and Financial Information: | ||||

| Loan Amortization Type: | Interest-only, ARD | 4th Most Recent NOI(3): | NAV | |||

| Interest Accrual Method: | Actual/360 | 3rd Most Recent NOI(3): | NAV | |||

| Call Protection: | L(26),D(30),O(4) | 2nd Most Recent NOI (As of): | $18,214,079 (Annualized 9 12/31/2014) | |||

| Lockbox Type: | Hard/Upfront Cash Management | Most Recent NOI (As of): | $18,214,983 (TTM 9/30/2015) | |||

| Additional Debt(1): | Yes | |||||

| Additional Debt Type(1): | Pari Passu | |||||

| U/W Revenues: | $17,336,962 | |||||

| U/W Expenses: | $520,109 | |||||

| U/W NOI: | $16,816,853 | |||||

| U/W NCF: | $16,769,651 | |||||

| U/W NOI DSCR(1): | 2.61x | |||||

| Escrows and Reserves(2): | U/W NCF DSCR(1): | 2.60x | ||||

| Type: | Initial | Monthly | Cap (If Any) | U/W NOI Debt Yield(1): | 13.5% | |

| Taxes | $0 | Springing | NAP | U/W NCF Debt Yield(1): | 13.4% | |

| Insurance | $0 | Springing | NAP | As-Is Appraised Value: | $272,800,000 | |

| Replacement Reserves | $0 | Springing | NAP | As-Is Appraisal Valuation Date: | November 24, 2015 | |

| TI/LC Reserve | $0 | $0 | NAP | Cut-off Date LTV Ratio(1): | 45.8% | |

| Condominium Reserves | $0 | Springing | NAP | LTV Ratio at Maturity or ARD(1): | 45.8% | |

| (1) | The Sanofi Office Complex Whole Loan (as defined below), with an original principal balance of $125,000,000, is comprised of eight pari passu notes (Notes A-1-A, A-1-B, A-2-A, A-2-B, A-3-A, A-3-B, A-4-A and A-4-B). The controlling Note A-1-A and non-controlling Notes A-1-B, A-2-A, and A-2-B have an aggregate original balance of $65,000,000, have an aggregate outstanding principal balance as of the Cut-off Date of $65,000,000 and will be contributed to the WFCM 2016-C33 Trust. The non-controlling Notes A-3-A, A-3-B, A-4-A and Note A-4-B had an aggregate original principal balance of $60,000,000 and are expected to be contributed to one or more future trusts. All statistical information related to balances per square foot, loan-to-value ratios, debt service coverage ratios and debt yields are based on the Sanofi Office Complex Whole Loan. |

| (2) | See “Escrows” section. |

| (3) | See “Cash Flow Analysis” section. |

The Mortgage Loan. The mortgage loan is part of a whole loan (the “Sanofi Office Complex Whole Loan”) that is evidenced by eight pari passu promissory notes (Notes A-1-A, A-1-B, A-2-A, A-2-B, A-3-A, A-3-B, A-4-A and A-4-B) secured by a first mortgage encumbering an office complex located in Bridgewater, New Jersey (the “Sanofi Office Complex Property”). The Sanofi Office Complex Whole Loan was originated on December 11, 2015 by Ladder Capital Finance LLC. The Sanofi Office Complex Whole Loan had an original principal balance of $125,000,000, has an outstanding principal balance as of the Cut-off Date of $125,000,000 and accrues interest at an interest rate of 5.093% per annum (the “Initial Interest Rate”). The Sanofi Office Complex Whole Loan had an initial term of 60 months, has a remaining term of 58 months as of the Cut-off Date and requires interest-only payments through the anticipated repayment date (“ARD”). The ARD is January 6, 2021 and the final maturity date is July 31, 2026. In the event the Sanofi Office Complex Whole Loan is not paid off in full on or before the ARD, the interest rate will increase to the sum of 3.500% and the greater of (i) 5.093% and (ii) the sum of (a) the greater of the five-year offered side swap rate and the five-year treasury rate, plus (b) 3.500% (the “Adjusted Interest Rate”). The payment of interest accrued at the excess of the Adjusted Interest Rate over the Initial Interest Rate will be deferred until the maturity date, to the extent not paid sooner pursuant to the Sanofi Office Complex Whole Loan documents, and in any event will not be paid until the principal balance of the Sanofi Office Complex Whole

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 1 |

| SANOFI OFFICE COMPLEX |

Loan is paid to zero. If the Sanofi Office Complex Whole Loan is not repaid in full on or prior to the ARD, on and after the ARD, all excess cash flow will be used to pay down the principal balance of the Sanofi Office Complex Whole Loan. See “Description of the Mortgage Pool—Certain Terms of the Mortgage Loans-ARD Loans” and “Description of the Mortgage Pool—The Whole Loans—The Serviced Pari Passu Whole Loans—The Sanofi Office Complex Whole Loan” in the Preliminary Prospectus.

The controlling Note A-1-A and non-controlling Notes A-1-B, A-2-A, and A-2-B, which will be contributed to the WFCM 2016-C33 Trust, had an aggregate original principal balance of $65,000,000 and an aggregate outstanding principal balance of $65,000,000 as of the Cut-off Date. The non-controlling Notes A-3-A, Note A-3-B, Note A-4-A and Note A-4-B, with an aggregate original principal balance of $60,000,000, are each expected to be contributed to one or more future trusts. Each of the mortgage loans evidenced by Notes A-3-A, A-3-B, A-4-A and A-4-B are referred to herein as the “Sanofi Office Complex Companion Loans”. The lender provides no assurances that any non-securitized pari-passu note will not be split further. See “Description of the Mortgage Pool—The Whole Loans—The Serviced Pari Passu Whole Loan—Sanofi Office Complex Whole Loan” in the Preliminary Prospectus.

Pari Passu Note Summary

| Original Balance | Note Holder | Controlling Piece | ||

| Note A-1-A | $23,333,333 | WFCM 2016-C33 | Yes | |

| Note A-1-B | $11,666,667 | WFCM 2016-C33 | No | |

| Note A-2-A | $20,000,000 | WFCM 2016-C33 | No | |

| Note A-2-B | $10,000,000 | WFCM 2016-C33 | No | |

| Note A-3-A | $20,000,000 | Ladder Capital Finance, LLC(1) | No | |

| Note A-3-B | $10,000,000 | JPMorgan Chase Bank, National Association(1)(2) | No | |

| Note A-4-A | $20,000,000 | Ladder Capital Finance, LLC(1) | No | |

| Note A-4-B | $10,000,000 | JPMorgan Chase Bank, National Association(1)(2) | No | |

| Total | $125,000,000 |

| (1) | Notes A-3-A, A-3-B, A-4-A and A-4-B are expected to be contributed to a future trust or trusts. |

| (2) | Subsequent to the origination of the Sanofi Office Complex Whole Loan, JPMorgan Chase Bank, National Association purchased the Notes A-1-B, A-2-B, A-3-B and A-4-B from Ladder Capital Finance, LLC. Prior to the closing of the WFCM 2016-C33 Trust, JPMorgan Chase Bank, National Association sold the Notes A-1-B and A-2-B to Ladder Capital Finance, LLC. |

Following the lockout period, the borrower has the right to defease the Sanofi Office Complex Whole Loan in whole, but not in part, on any date prior to October 6, 2020. In addition, the Sanofi Office Complex Whole Loan is prepayable without penalty on or after October 6, 2020.

Sources and Uses

| Sources | Uses | |||||||

| Original whole loan amount | $125,000,000 | 64.6% | Loan payoff(1) | $191,281,433 | 98.9% | |||

| Sponsor’s new cash contribution | 68,375,158 | 35.4 | Closing costs | 2,093,726 | 1.1% | |||

| Total Sources | $193,375,158 | 100.0% | Total Uses | $193,375,158 | 100.0% | |||

| (1) | The Sanofi Office Complex Property was previously securitized in the GCCFC 2006-GG7 transaction. The borrower acquired the Sanofi Office Complex Property in March 2014 for a total purchase price of $251,100,000 and assumed the prior debt. |

The

Property. The Sanofi Office Complex Property is a class A, single-tenant office building containing 674,325 square feet located

in Bridgewater, New Jersey, approximately 34.3 miles southwest of Manhattan. Originally constructed in 1987 for AT&T and renovated

in 2006, the Sanofi Office Complex Property serves as the United States headquarters for Sanofi-Aventis U.S. Inc. (“Sanofi-Aventis”).

The Sanofi Office Complex Property contains two, four-story buildings and one, five-story building all connected by a walkway.

The Sanofi Office Complex Property has been 100.0% leased to Sanofi-Aventis since 2006. Amenities at the Sanofi Office Complex

Property include open floor plans, a fitness center, 500-seat auditorium, 500-seat full-service cafeteria, a company store, credit

union, executive area with a boardroom, and two large tiered conference rooms with full audio-visual capability. Sanofi-Aventis

is a subsidiary of Sanofi S.A., a French multinational pharmaceutical company headquartered in Paris, France, which is ranked

241 on the 2015 Fortune Global 500 and is the world’s fifth-largest pharmaceutical company based on sales. Globally, Sanofi

S.A. has over 110,000 employees, 20 research and development sites and 107 industrial locations. Sanofi-Aventis’s United

States operations include 18 facilities located in nine states, Washington D.C. and Puerto Rico which house approximately 17,000

employees. In 2014, United States sales of approximately €11.0 billion euros represented one-third of 2014 global sales

for Sanofi S.A. Sanofi, S.A. (NYSE: SNY) is rated AA-, A1 and AA by Fitch, Moody’s and S&P, respectively, and had a

market capitalization of approximately $104.0 billion as of February 5, 2016. The Sanofi Office Complex Property is subject to

a condominium regime. The Sanofi Office Complex Property consists of units I, II, and III of a commercial condominium known as

the Sanofi office complex condominium. At origination, there were no units other than the Sanofi Office Complex Property owned

by the borrower. The remaining unit in the condominium, unit IV, is not owned by the Sanofi Office Complex Property borrower and

is not collateral for the Sanofi Office Complex Whole Loan. The Sanofi Office Complex Property currently comprises a total of

76.7% of the condominium with unit IV comprising the remaining 23.4%. At origination, the condominium board consisted of 3 members,

2 of whom were appointed by the borrower. The Sanofi Office Complex Property features 3,344 surface parking spaces resulting in

a parking ratio of 5.0 spaces per 1,000 square feet of net rentable area. As of March 1, 2016, the Sanofi Office Complex Property

was 100.0% occupied by Sanofi-Aventis.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 2 |

| SANOFI OFFICE COMPLEX |

The following table presents certain information relating to the tenant at the Sanofi Office Complex Property:

Major Tenant

| Tenant Name | Credit

Rating (Fitch/ Moody’s/S&P) |

Tenant NRSF |

%

of NRSF |

Annual

U/W Base Rent PSF(1) |

Annual U/W Base Rent(1) |

%

of Total Annual U/W Base Rent |

Lease Expiration Date |

| Major Tenant | |||||||

| Sanofi-Aventis | AA-/A1/AA | 674,325 | 100.0% | $27.06 | $18,249,434 | 100.0% | 7/31/2026(2) |

| Total Major Tenant | 674,325 | 100.0% | $27.06 | $18,249,434 | 100.0% | ||

| Vacant Space | 0 | 0.0% | |||||

| Collateral Total | 674,325 | 100.0% | |||||

| (1) | The Annual U/W Base Rent and Annual U/W Base Rent PSF include contractual rent steps through July 1, 2016, totaling $1,841,686. The tenant’s current base rent is $16,407,748 ($24.33 per square foot). |

| (2) | Sanofi-Aventis has three, five-year lease renewal options. |

The following table presents certain information relating to the lease rollover schedule at the Sanofi Office Complex Property:

Lease Expiration Schedule(1)

| Year

Ending December 31, |

No.

of Leases Expiring |

Expiring NRSF |

%

of Total NRSF |

Cumulative Expiring NRSF |

Cumulative % of Total NRSF |

Annual U/W Base Rent |

%

of Total Annual U/W Base Rent |

Annual U/W Base Rent PSF |

| MTM | 0 | 0 | 0.0% | 0 | 0.0% | $0 | 0.0% | $0.00 |

| 2016 | 0 | 0 | 0.0% | 0 | 0.0% | $0 | 0.0% | $0.00 |

| 2017 | 0 | 0 | 0.0% | 0 | 0.0% | $0 | 0.0% | $0.00 |

| 2018 | 0 | 0 | 0.0% | 0 | 0.0% | $0 | 0.0% | $0.00 |

| 2019 | 0 | 0 | 0.0% | 0 | 0.0% | $0 | 0.0% | $0.00 |

| 2020 | 0 | 0 | 0.0% | 0 | 0.0% | $0 | 0.0% | $0.00 |

| 2021 | 0 | 0 | 0.0% | 0 | 0.0% | $0 | 0.0% | $0.00 |

| 2022 | 0 | 0 | 0.0% | 0 | 0.0% | $0 | 0.0% | $0.00 |

| 2023 | 0 | 0 | 0.0% | 0 | 0.0% | $0 | 0.0% | $0.00 |

| 2024 | 0 | 0 | 0.0% | 0 | 0.0% | $0 | 0.0% | $0.00 |

| 2025 | 0 | 0 | 0.0% | 0 | 0.0% | $0 | 0.0% | $0.00 |

| 2026 | 1 | 674,325 | 100.0% | 674,325 | 100.0% | $18,249,434 | 100.0% | $27.06 |

| Thereafter | 0 | 0 | 0.0% | 674,325 | 100.0% | $0 | 0.0% | $0.00 |

| Vacant | 0 | 0 | 0.0% | 674,325 | 100.0% | $0 | 0.0% | $0.00 |

| Total/Weighted Average | 1 | 674,325 | 100.0% | $18,249,434 | 100.0% | $27.06 |

| (1) | Information obtained from the underwritten rent roll. |

The following table presents historical occupancy percentages at the Sanofi Office Complex Property:

Historical Occupancy

12/31/2012(1) |

12/31/2013(1) |

12/31/2014(1) |

12/31/2015(1) |

3/1/2016(2) |

| 100.0% | 100.0% | 100.0% | 100.0% | 100.0% |

| (1) | Information based on the lease. |

| (2) | Information obtained from the underwritten rent roll. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 3 |

| SANOFI OFFICE COMPLEX |

Operating History and Underwritten Net Cash Flow. The following table presents certain information relating to the historical operating performance and underwritten net cash flow at the Sanofi Office Complex Property:

Cash Flow Analysis(1)

Annualized 9 9/30/2014 | TTM 9/30/2015 | U/W | % of U/W Effective Gross Income | U/W $ per SF | ||||||

| Base Rent | $18,777,401(2) | $18,778,333(2) | $18,249,434(3) | 105.3% | $27.06(3) | |||||

| Grossed Up Vacant Space | 0 | 0 | 0 | 0.00 | 0.00 | |||||

| Total Reimbursables | 0 | 0 | 0 | 0.00 | 0.00 | |||||

| Other Income | 0 | 0 | 0 | 0.00 | 0.00 | |||||

| Less Vacancy & Credit Loss | 0 | 0 | (912,472)(4) | (5.3) | (1.35) | |||||

| Effective Gross Income | $18,777,401 | $18,778,333 | $17,336,962 | 100.0% | $25.71 | |||||

| Total Operating Expenses | $563,322 | $563,350 | $520,109(5) | 3.0% | $0.77 | |||||

| Net Operating Income | $18,214,079 | $18,214,983 | $16,816,853 | 97.0% | $24.94 | |||||

| TI/LC | 0 | 0 | 0 | 0.0 | 0.00 | |||||

| Capital Expenditures | 0 | 0 | 47,203 | 0.3 | 0.07 | |||||

| Net Cash Flow | $18,214,079 | $18,214,983 | $16,769,651 | 96.7% | $24.87 | |||||

| NOI DSCR(6) | 2.82x | 2.82x | 2.61x | |||||||

| NCF DSCR(6) | 2.82x | 2.82x | 2.60x | |||||||

| NOI DY(6) | 14.6% | 14.6% | 13.5% | |||||||

| NCF DY(6) | 14.6% | 14.6% | 13.4% |

| (1) | Historical financial statements are not available as the borrower acquired the Sanofi Office Complex Property in March 2014. |

| (2) | Historical financials are based on the borrower’s reported financial statements which straightlined the tenant’s rent for accounting purposes. |

| (2) | The U/W Base Rent and U/W Base Rent PSF include contractual rent steps through July 1, 2016, totaling $1,841,686. The tenant’s current base rent is $16,407,748 ($24.33 per square foot). |

| (3) | The underwritten economic vacancy is 5.0%. The Sanofi Office Complex Property was 100.0% physically occupied as of March 1, 2016. |

| (4) | The lease with Sanofi-Aventis is fully NNN and the tenant is responsible for all operating expenses. Historical operating expenses represent a management fee. |

| (5) | The debt service coverage ratios and debt yields are based on the Sanofi Office Complex Whole Loan. |

Appraisal. As of the appraisal valuation date of November 24, 2015, the Sanofi Office Complex Property had an “as-is” appraised value of $272,800,000.

Environmental Matters. According to the Phase I environmental assessment dated November 24, 2015, there was no evidence of any recognized environmental conditions at the Sanofi Office Complex Property.

Market Overview and Competition. The Sanofi Office Complex Property is located in Bridgewater, New Jersey approximately 34.3 miles southeast of downtown Manhattan. Primary access to the area is provided by both Interstate-78 and Interstate-287, major arterials that cross the Bridgewater area in an east-west and north-south direction, respectively. Access to the Sanofi Office Complex Property from Interstate-78 and Interstate-287 is provided by US-202/206, located directly adjacent to the Sanofi Office Complex Property. The Sanofi Office Complex Property has access to the Raritan Valley line on New Jersey Transit via the Finderne and Somerville stations, located six and eight miles, respectively, from the Sanofi Office Complex Property. The Sanofi Office Complex Property is also located approximately 40.0 miles southwest of Newark Liberty International Airport. The estimated 2015 population within a one-, three- and five-mile radius of the Sanofi Office Complex Property was 4,002, 27,265 and 75,977, respectively; the estimated 2015 median household income within the same radius was $95,135, $121,917 and $108,121, respectively.

According to the appraisal, the Sanofi Office Complex Property is located in the Branchburg/Bridgewater office submarket, which is part of the Central New Jersey Metro Area office market. As of the third quarter of 2015, the Branchburg/Bridgewater office submarket reported a 28.4% vacancy rate for all office space and an average asking rental rate of $22.63 per square foot, triple-net, while class A properties reported a 25.3% vacancy rate and an average asking rental rate of $30.51, triple-net. The appraiser determined there were 14 competitive properties within the area with a current vacancy rate of 13.7% and an average asking rent of $31.74 per square foot, triple-net.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 4 |

| SANOFI OFFICE COMPLEX |

The following table presents certain information relating to comparable office leases to the Sanofi Office Complex Property:

Comparable Leases(1)

| Property Name/Location | Year

Built/ Renovated |

Stories | Total

GLA (SF) |

Total Occupancy |

Distance from Subject |

Tenant Name |

Lease Date/Term |

Lease Area (SF) |

Annual Base Rent PSF |

Lease Type |

Giralda Farms Madison, NJ |

2000/NAP | 3 | 147,419 | 100% | 13.9 miles | Merck & Company, Inc. | April 2014 / 11 Yrs | 147,419 | $21.50 | NNN |

1 Giralda Farms Madison, NJ |

1985/NAP | 4 | 160,000 | 100% | 14.1 miles | Pfizer | January 2013 / 11 Yrs | 116,000 | $34.75 | FSG |

175 Park Avenue Madison, NJ |

1971/2011 | 3 | 270,000 | 100% | 14.4 miles | Realogy Operations LLC | January 2013 / 17 Yrs | 270,000 | $26.05 | NNN |

Siemens Metropark Iselin, NJ |

2003/NAP | 8 | 239,452 | 100% | 17.1 miles | Siemens Corporation | January 2013 / 10 Yrs | 239,452 | $20.00 | NNN |

Forrestal Greene Plainsboro, NJ |

2000/NAP | 3 | 154,101 | 100% | 19.8 miles | Sandoz | March 2014 / 10 Yrs | 154,101 | $32.50 | FSG |

Novo Nordisk HQ Plainsboro, NJ |

1985/2013 | 3 | 731,104 | 68.1% | 20.9 miles | Novo Nordisk | April 2013 / 15 Yrs | 498,115 | $28.00 | NNN |

| (1) | Information obtained from the appraisal. |

The Borrower. The borrower is ARC HR5SNFI001 SPE, LLC, a Delaware limited liability company and single purpose entity with two independent directors. Legal counsel to the borrower delivered a non-consolidation opinion in connection with the origination of the Sanofi Office Complex Whole Loan. American Finance Trust, Inc. is the guarantor of certain nonrecourse carveouts under the Sanofi Office Complex Whole Loan.

The Sponsor. The sponsor is American Finance Trust, Inc. (“American Finance Trust”). As of September 30, 2015, American Finance Trust owned 463 properties located in 37 states comprising 13.1 million square feet. All of American Finance Trust’s properties are freestanding, single-tenant properties which are 100.0% leased. As of September 30, 2014, American Finance Trust reported total assets of approximately $2.4 billion, and a net worth of approximately $1.2 billion. In addition, the company reported total cash and cash equivalents of $172.0 million.

The external advisor and sponsor of American Finance Trust, and the owner of American Finance Special Limited Partner, LLC (which holds a 0.1% ownership interest in American Finance Trust), is an affiliate of AR Global Investments, LLC (“AR Global”). In addition, the Sanofi Office Complex Property is subject to operating management agreements with wholly-owned subsidiaries of AR Global (the “Operators”) pursuant to which the Operators are responsible for the management of the Sanofi Office Complex Property. Certain principals and affiliates of AR Global as well as the previous external advisor and sponsor of American Finance Trust are subject to litigation and governmental proceedings. See “Description of the Mortgage Pool—Loan Purpose; Default History, Bankruptcy Issues and Other Proceedings” in the Preliminary Prospectus.

Escrows. Upon the T&I Conditions Precedent (as defined below) no longer being in effect, the Sanofi Office Complex Whole Loan documents require monthly real estate tax and insurance premium reserve deposits in amounts equal to one-twelfth of the amount that the lender reasonably estimates will be necessary to pay real estate taxes and insurance premiums over the then succeeding 12-month period. Monthly replacement reserves of $14,048 are waived unless (i) an event of default under the Sanofi Office Complex Whole Loan exists; (ii) the borrower has defaulted in its obligation to perform capital expenditure work at the Sanofi Office Complex Property in accordance with the terms of the Sole Tenant (as defined below) lease; and/or (iii) the Sole Tenant lease and/or the guaranty of the Sole Tenant lease (the “Sole Tenant Lease Guaranty”) fail to be in full force and effect and/or either the landlord or tenant is in default of any of their respective obligations thereunder beyond applicable notice and cure periods. Monthly deposits into the condominium common charges account are waived until the lender has determined, in its sole discretion, that condominium common charges are required to become payable under the condominium documents governing the Sanofi Office Complex Property.

“T&I Conditions Precedent” means (i) no event of default has occurred and is continuing; (ii) tax bills for the Sanofi Office Complex Property are being delivered directly to the Sole Tenant; (iii) the Sole Tenant is obligated to pay, and is actually paying, taxes directly to the appropriate public office; (iv) the Sole Tenant is obligated to maintain, and is actually maintaining, the insurance in respect of the Sanofi Office Complex Property in accordance with the terms of the Sole Tenant’s lease, or self-insuring if permitted to do so under the terms of the Sole Tenant lease; (v) the Sole Tenant is paying insurance premiums directly to the respective insurer or agent (unless the Sole Tenant is self-insuring if permitted to do so under the terms of the Sole Tenant lease); (vi) the Sole Tenant lease and the Sole Tenant Lease Guaranty Cap are in full force and effect and neither the borrower nor the Sole Tenant is in default of the respective obligations thereunder beyond applicable notice and cure periods and (vii) unless and to the extent the borrower is maintaining a blanket insurance policy satisfying the requirements of the Sanofi Office Complex Whole Loan documents, Sanofi-Aventis or, the guarantor under the Sole Tenant Lease Guaranty including any successor guarantor pursuant to the terms of the Sole Tenant lease (the “Sole Tenant Lease Guarantor”) has a senior unsecured debt rating of at least “BBB-” by S&P (or the equivalent of such rating by Moody’s).

A “Sole Tenant” means (i) Sanofi-Aventis or (ii) any successor of Sole Tenant pursuant to the terms of such Sole Tenant lease.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 5 |

| SANOFI OFFICE COMPLEX |

Lockbox and Cash Management. The Sanofi Office Complex Whole Loan requires a lender-controlled lockbox account, which is already in place, and that the borrower direct the tenants to pay their rents directly into such lockbox account. The loan documents also require that all rents received by the borrower or property manager will be deposited into the lockbox account within two business days of receipt. Funds deposited into the lockbox account are required to be swept on a daily basis into a cash management account controlled by the lender and applied and disbursed in accordance with the loan documents. Upon the occurrence of an Excess Cash Flow Sweep Trigger Event (as defined below) and prior to the ARD, all excess cash flow will be held as additional collateral for the Sanofi Office Complex Whole Loan. Notwithstanding the foregoing, on and after the ARD, all excess cash flow is required to be used to (i) pay down the principal balance of the Sanofi Office Complex Whole Loan until such time as the principal balance is reduced to zero and (ii) pay down all unpaid accrued interest since the ARD. Such interest in an amount equal to the excess of the Adjusted Interest Rate over the Initial Interest Rate will be deferred until the maturity date, to the extent not paid sooner pursuant to the Sanofi Office Complex Whole Loan documents.

An “Excess Cash Flow Sweep Trigger Event” will commence upon the earliest of (i) the date on which the Sole Tenant or any other Significant Tenant (as defined below) goes dark; (ii) the Sole Tenant Lease Guarantor has its senior debt rating downgraded below a rating of “BBB-” by S&P (or below the Moody’s equivalent of such S&P rating); (iii) the Sole Tenant or the Sole Tenant Lease Guarantor becomes insolvent or a debtor in any bankruptcy action; (iv) the borrower or the sponsor becomes insolvent or a debtor in any bankruptcy action; (v) the occurrence of an event of default under the Sanofi Office Complex Whole Loan documents; (vi) the Sole Tenant Lease Guaranty is no longer in full force and effect or the limitation of liability thereunder has been reduced; (vii) the trailing 12-month debt service coverage ratio is less than 2.25x; or (viii) the Sole Tenant or any other Significant Tenant is in monetary default under its lease.

An “Excess Cash Flow Sweep Trigger Event Cure” means with regard to clause (i) of the definition of “Excess Cash Flow Sweep Trigger Event”, the date on which (a) a re-tenanting event occurs pursuant to the terms of the Sanofi Office Complex Whole Loan documents or (b) the Sole Tenant or Significant Tenant has reopened for business and is conducting normal business operations at substantially all of its demised premises; with regard to clause (ii) of the definition of “Excess Cash Flow Sweep Trigger Event”, the date on which the senior unsecured debt rating of the Sole Tenant Lease Guarantor has been restored to at least “BBB-” by S&P (or the Moody’s equivalent of such S&P rating) and such rating has have been maintained for six consecutive months; with regard to clause (iii) of the definition of “Excess Cash Flow Sweep Trigger Event”, the date on which the Sole Tenant and/or the Sole Tenant Lease Guarantor, as applicable, (I) becomes solvent to the lender’s satisfaction for three consecutive months or is no longer a debtor in any bankruptcy action and (II) has affirmed the Sole Tenant lease and/or Sole Tenant Lease Guaranty pursuant to a final non-appealable order of a court of competent jurisdiction; with regard to clause (iv) of the definition of “Excess Cash Flow Sweep Trigger Event”, the date on which the borrower or the sponsor, as the case may be, becomes solvent to the lender’s satisfaction for three consecutive months or is no longer a debtor in any bankruptcy action; with regard to clause (v) of the definition of “Excess Cash Flow Sweep Trigger Event”, upon the cure of such event of default; with regard to clause (vi), the date on which the Sole Tenant Lease Guaranty is again in full force and effect and/or the limitation on liability under the Sole Tenant Lease Guaranty has been increased or reset such that not less than $250,000,000 remains available thereunder; with regard to clause (vii) of the definition of “Excess Cash Flow Sweep Trigger Event”, the date on which the debt service coverage ratio is at least 2.40x for six consecutive calendar months; and with regard to clause (viii) of the definition of “Excess Cash Flow Sweep Trigger Event”, the date on which the Sole Tenant or such other Significant Tenant is no longer in monetary default under its lease or a re-tenanting event has occurred with respect to the applicable lease after expiration of applicable notice and cure periods.

A “Significant Tenant” means any tenant occupying 25.0% or more of the Sanofi Office Complex Property as measured by aggregate square footage or aggregate rent.

Property Management. The Sanofi Office Complex Property is managed by affiliates of the borrower.

Assumption. The borrower has the right to transfer the Sanofi Office Complex Property provided that certain conditions are satisfied including (i) no event of default has occurred and is continuing; (ii) the lender has reasonably determined that the proposed transferee and any successor guarantor satisfy the lender’s credit review and underwriting standards, taking into consideration such transferee’s experience, financial strength and general business standing; and (iii) if required by the lender, a rating agency confirmation from DBRS, Fitch and Moody’s stating that such assumption will not result in a downgrade, withdrawal or qualification of the respective ratings to the Series 2016-C33 Certificates and similar confirmations with respect to the ratings of any securities backed by any of the Sanofi Office Complex Companion Loans.

Right of First Offer. Sanofi-Aventis has a right of first offer (“ROFO”) to purchase the Sanofi Office Complex Property. The ROFO is not extinguished by a foreclosure of the Sanofi Office Complex Property; however the ROFO does not apply to a foreclosure or deed-in-lieu thereof.

Partial Release. Not Permitted.

Real Estate Substitution. Not Permitted.

Subordinate and Mezzanine Indebtedness. Not permitted.

Ground Lease. None.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 6 |

| SANOFI OFFICE COMPLEX |

Terrorism Insurance. The loan documents require that the “all risk” insurance policy required to be maintained by the borrower provides coverage for terrorism in an amount equal to the full replacement cost of the Sanofi Office Complex Property. The loan documents also require business interruption insurance covering no less than the 18-month period following the occurrence of a casualty event, together with a 12-month extended period of indemnity.

Windstorm Insurance. The loan documents require windstorm insurance covering the full replacement cost of Sanofi Office Complex Property during the loan term. At the time of closing, the Sanofi Office Complex Property has windstorm insurance coverage.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 7 |

| No. 2 – WPC Self Storage IX | ||||||

| Loan Information | Property Information | |||||

| Mortgage Loan Seller: | Wells Fargo Bank, National Association | Single Asset/Portfolio: | Portfolio | |||

| Credit Assessment (DBRS/Fitch/ Moody’s): | NR/NR/NR | Property Type: | Self Storage | |||

| Original Principal Balance: | $49,000,000 | Specific Property Type: | Self Storage | |||

| Cut-off Date Principal Balance: | $49,000,000 | Location: | Various – See Table | |||

| % of Initial Pool Balance: | 6.9% | Size: | 938,219 SF | |||

| Loan Purpose: | Acquisition | Cut-off Date Principal Balance Per SF: |

$52.23 | |||

| Borrower Names(1): | Various | Year Built/Renovated: | Various – See Table | |||

| Sponsor: | Corporate Property Associates 18 Global Incorporated | Title Vesting: | Fee | |||

| Mortgage Rate: | 4.880% | Property Manager(3): | Various | |||

| Note Date: | February 2, 2016 | 4th Most Recent Occupancy(4): | NAV | |||

| Anticipated Repayment Date: | NAP | 3rd Most Recent Occupancy(4): | NAV | |||

| Maturity Date: | February 11, 2026 | 2nd Most Recent Occupancy (As of): | 81.5% (12/31/2013) | |||

| IO Period: | 120 months | Most Recent Occupancy (As of): | 82.3% (12/31/2014) | |||

| Loan Term (Original): | 120 months | Current Occupancy (As of)(4): | 83.0% (Various) | |||

| Seasoning: | 1 months | |||||

| Amortization Term (Original): | NAP | Underwriting and Financial Information: | ||||

| Loan Amortization Type: | Interest-only, Balloon | |||||

| Interest Accrual Method: | Actual/360 | 4th Most Recent NOI(5): | NAV | |||

| Call Protection: | L(25),D(91),O(4) | 3rd Most Recent NOI (As of) (5): | $4,269,630 (12/31/2013) | |||

| Lockbox Type: | Springing | 2nd Most Recent NOI (As of): | $4,834,587 (12/31/2014) | |||

| Additional Debt: | None | Most Recent NOI (As of)(5): | $5,187,463 (Various) | |||

| Additional Debt Type: | NAP | |||||

| U/W Revenues: | $7,822,383 | |||||

| U/W Expenses: | $3,403,617 | |||||

| U/W NOI: | $4,418,766 | |||||

| U/W NCF: | $4,278,033 | |||||

| Escrows and Reserves(2): | U/W NOI DSCR: | 1.82x | ||||

| U/W NCF DSCR: | 1.76x | |||||

| Type: | Initial | Monthly | Cap (If Any) | U/W NOI Debt Yield: | 9.0% | |

| Taxes | $0 | Springing | NAP | U/W NCF Debt Yield: | 8.7% | |

| Insurance | $0 | Springing | NAP | As-Is Appraised Value(6): | $74,880,000 | |

| Replacement Reserves | $0 | Springing | NAP | As-Is Appraisal Valuation Date(6): | Various | |

| Amortization Reserves | $0 | Springing | NAP | Cut-off Date LTV Ratio(6): | 65.4% | |

| Deferred Maintenance | $1,090,975 | $0 | NAP | LTV Ratio at Maturity or ARD(6): | 65.4% | |

| (1) | See “The Borrowers” section. |

| (2) | See “Escrows” section. |

| (3) | See “Property Management” section. |

| (4) | See “Historical Occupancy” section. |

| (5) | See “Cash Flow Analysis” section. Historical cash flow information was not available for all of the WPC Self Storage IX Properties. |

| (6) | See “Appraisal” section. |

The Mortgage Loan. The mortgage loan (the “WPC Self Storage IX Mortgage Loan”) is evidenced by a single promissory note that is secured by first mortgages encumbering a portfolio of 13 self storage properties located in five states (the “WPC Self Storage IX Properties”). The WPC Self Storage IX Mortgage Loan was originated on February 2, 2016 by Wells Fargo Bank, National Association. The WPC Self Storage IX Mortgage Loan had an original principal balance of $49,000,000, has an outstanding principal balance as of the Cut-off Date of $49,000,000 and accrues interest at an interest rate of 4.880% per annum. The WPC Self Storage IX Mortgage Loan had an initial term of 120 months, has a remaining term of 119 months as of the Cut-off Date and requires interest-only payments through the term on the WPC Self Storage IX Mortgage Loan. The WPC Self Storage IX Mortgage Loan matures on February 11, 2026.

Following the lockout period, the borrower has the right to defease the WPC Self Storage IX Mortgage Loan in whole or in part (see “Partial Release” section), on any day before November 11, 2025. In addition, the WPC Self Storage IX Mortgage Loan is prepayable without penalty on or after November 11, 2025.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 8 |

| WPC SELF STORAGE IX |

Sources and Uses

| Sources | Uses | |||||||

| Original loan amount | $49,000,000 | 64.6% | Purchase price | $74,350,000 | 98.0% | |||

| Sponsor’s new cash contribution | 26,850,830 | 35.4% | Upfront reserves | 1,090,975 | 1.4 | |||

| Closing costs | 409,855 | 0.5 | ||||||

| Total Sources | $75,850,830 | 100.0% | Total Uses | $75,850,830 | 100.0% |

The Properties. The WPC Self Storage IX Mortgage Loan is secured by the fee interest in a portfolio of 13 self storage properties totaling 938,219 rentable square feet or 7,527 units (including 70 parking/RV spaces) located in five states: Texas (8), Florida (2), North Carolina (1), Oregon (1) and Louisiana (1). The WPC Self Storage IX Properties range in size from 36,827 square feet to 141,423 square feet and as of dates ranging from October 31, 2015 to January 19, 2016, the WPC Self Storage IX Properties were 83.0% occupied.

The following table presents certain information relating to the WPC Self Storage IX Properties:

| Property Name – Location | Allocated Cut-off Date Principal Balance | % of Portfolio Cut-off Date Principal Balance | Occupancy | Year

Built/ Renovated |

Net Rentable Area (SF) | Appraised Value | Allocated LTV | |

| CubeSmart - Fernandina Beach - Fernandina Beach, FL | $7,288,000 | 14.9% | 79.5% | 1986/NAP | 141,423 | 10,700,000 | 68.1% | |

| Extra Space - Portland - Portland, OR | $6,365,000 | 13.0% | 97.3% | 2000/NAP | 37,716 | 10,760,000 | 59.2% | |

| Extra Space - Greensboro - Greensboro, NC | $4,047,000 | 8.3% | 61.2% | 1953/1996 | 119,041 | 5,900,000 | 68.6% | |

| CubeSmart - Lomaland Drive - El Paso, TX | $3,728,000 | 7.6% | 88.5% | 1980/NAP | 60,115 | 5,000,000 | 74.6% | |

| CubeSmart - Mesa Street - El Paso, TX | $3,714,000 | 7.6% | 95.5% | 1980/NAP | 67,135 | 5,400,000 | 68.8% | |

| CubeSmart - Clark Drive - El Paso, TX | $3,638,000 | 7.4% | 79.5% | 1986/NAP | 97,113 | 4,860,000 | 74.9% | |

| CubeSmart - Diana Drive - El Paso, TX | $3,621,000 | 7.4% | 91.2% | 1980/NAP | 71,302 | 5,450,000 | 66.4% | |

| CubeSmart - Kissimmee - Kissimmee, FL | $3,457,000 | 7.1% | 92.5% | 1981/NAP | 74,581 | 5,100,000 | 67.8% | |

| CubeSmart - Avondale - Avondale, LA | $3,431,000 | 7.0% | 77.9% | 2003/NAP | 59,414 | 5,600,000 | 61.3% | |

| Extra Space - Beechnut - Houston, TX | $2,965,000 | 6.1% | 84.7% | 2001/NAP | 64,595 | 5,200,000 | 57.0% | |

| CubeSmart - Rankin Road - Houston, TX | $2,765,000 | 5.6% | 85.4% | 1998/NAP | 59,900 | 4,810,000 | 57.5% | |

| CubeSmart - Montana Ave - El Paso, TX | $2,549,000 | 5.2% | 92.3% | 1980/NAP | 49,057 | 4,000,000 | 63.7% | |

| CubeSmart - James Watt Drive - El Paso, TX | $1,432,000 | 2.9% | 83.4% | 1985/NAP | 36,827 | 2,100,000 | 68.2% | |

| Total/Weighted Average | $49,000,000 | 100.0% | 83.0% | 938,219 | 74,880,000 | 65.4% | ||

The following table presents historical occupancy percentages at the WPC Self Storage IX Properties:

Historical Occupancy

| 12/31/2011 | 12/31/2012 | 12/31/2013(1) | 12/31/2014(1) | Various(2) | ||||

| NAV | NAV | 81.5% | 82.3% | 83.0% |

| (1) | Information obtained from the borrower. |

| (2) | Information obtained from the underwritten rent roll. Occupancy shown is as of dates ranging from October 31, 2015 to January 19, 2016. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 9 |

| WPC SELF STORAGE IX |

Operating History and Underwritten Net Cash Flow. The following table presents certain information relating to the historical operating performance and the underwritten net cash flow at the WPC Self Storage IX Properties:

Cash Flow Analysis

2013(1) |

2014 | Various(3) | U/W | % of Effective Gross Income | U/W $ per SF | ||||||||

| Base Rent | $6,852,018 | $7,078,211 | $7,462,475 | $7,247,540 | 92.7% | $7.72 | |||||||

| Grossed Up Vacant Space | 588,336(2) | 543,229(2) | 540,847(2) | 2,211,852 | 28.3 | 2.36 | |||||||

| Less Concessions | (347,118) | (293,781) | (280,860) | 0 | 0 | 0.00 | |||||||

| Other Income | 707,146 | 824,202 | 879,011 | 574,843 | 7.3 | 0.61 | |||||||

| Less Vacancy & Credit Loss | (588,336) | (543,229) | (540,847) | (2,211,852)(4) | (28.3) | (2.36) | |||||||

| Effective Gross Income | $7,212,046 | $7,608,632 | $8,060,626 | $7,822,383 | 100.0% | $8.34 | |||||||

| Total Operating Expenses | $2,942,416 | $2,774,045 | $2,873,164 | $3,403,617 | 43.5% | $3.63 | |||||||

| Net Operating Income | $4,269,630 | $4,834,587 | $5,187,463 | $4,418,766 | 56.5% | $4.71 | |||||||

| Capital Expenditures | 0 | 0 | 0 | 140,733 | 1.8 | 0.15 | |||||||

| Net Cash Flow | $4,269,630 | $4,834,587 | $5,187,463 | $4,278,033 | 54.7% | $4.56 | |||||||

| NOI DSCR | 1.76x | 1.99x | 2.14x | 1.82x | |||||||||

| NCF DSCR | 1.76x | 1.99x | 2.14x | 1.76x | |||||||||

| NOI DY | 8.7% | 9.9% | 10.6% | 9.0% | |||||||||

| NCF DY | 8.7% | 9.9% | 10.6% | 8.7% |

| (1) | The 2013 financials represent the six-month annualized period ending December 31, 2013 for seven of the WPC Self Storage IX Properties and the trailing 12-month period ending December 31, 2013 for six of the WPC Self Storage IX Properties. |

| (2) | Seven of the WPC Self Storage IX Properties, representing approximately 53.0% of the allocated Cut-off Date Principal Balance, historically grossed up vacant space. See “Historical Occupancy” section for 2013, 2014 and the trailing 12-month period vacancies. See “Historical Occupancy” section for the 2013, 2014, and trailing 12-month period vacancies. |

| (3) | The most recent financials represent the trailing 12-month period ending August 31, 2015 for one of the WPC Self Storage IX Properties, ending September 30, 2015 for three of the WPC Self Storage IX Properties, and ending October 31, 2015 for nine of the WPC Self Storage IX Properties. |

| (4) | The underwritten economic vacancy is 23.4%. As of dates ranging from October 31, 2015 to January 19, 2016, the WPC Self Storage IX Properties were 83.0% physically occupied. |

Appraisal. As of the appraisal valuation dates ranging from November 12, 2015 to December 11, 2015, the WPC Self Storage IX Properties had an aggregate “as-is” appraised value of $74,880,000.

Environmental Matters. According to Phase I environmental assessments dated August 28, 2015 through November 23, 2015, there was no evidence of any recognized environmental conditions at 12 of the WPC Self Storage IX Properties.

According to a Phase I environmental assessment dated October 20, 2015, there was a soil vapor encroachment concern at the CubeSmart - Rankin Road (Houston, TX) property related to an adjoining property that conducted on-site dry cleaning. Due to the recognized environmental condition being related to the adjoining property and not the CubeSmart - Rankin Road (Houston, TX) property, no further action was required.

Market Overview and Competition. Six of the WPC Self Storage IX Properties (“El Paso Properties”), representing approximately 38.1% of the allocated Cut-off Date Principal Balance, are located in El Paso, Texas. El Paso is the largest metro area along the Texas-Mexico border, and as the sixth-largest city in Texas, is a top 20% U.S. performing economy that is ranked 2nd in the Top 25 Foreign Trade Zones. As of 2014, El Paso had the lowest crime rate among all U.S. cities with at least a 500,000 population for the 4th year in a row. According to the appraisals, the El Paso Properties’ comparable market vacancy rates ranged from 11.3% to 15.4%, with a weighted average of 13.3%. No other market has more than two of the WPC Self Storage IX Properties or represents more than approximately 14.9% of the allocated Cut-off Date Principal Balance.

The Borrower. The borrower structure comprises eight separate Delaware limited liability companies and partnerships, each of which is a single purpose entity with one independent director. Legal counsel to the borrower provided a non-consolidation opinion in connection with the origination of the WPC Self Storage IX Mortgage Loan. Corporate Property Associates 18 – Global Incorporated (“CPA 18”) is the guarantor of certain nonrecourse carveouts under the WPC Self Storage IX Mortgage Loan.

The Sponsor. The sponsor is CPA 18, a non-traded real estate investment trust. CPA 18 is managed by W.P. Carey (NYSE:WPC), an investment management company that provides long-term sale-leaseback and build-to-suit financing for companies worldwide. As of December 31, 2015, W.P. Carey managed a global investment portfolio comprising 869 commercial properties totaling 90.1 million square feet with an average occupancy rate of 98.8%.

Escrows. The loan documents provide for upfront reserves in the amount of $1,090,975 for deferred maintenance. The loan documents do not require monthly escrows for real estate taxes provided the following conditions are met: (i) no event of default has occurred and is continuing and (ii) the borrower has provided the lender with timely proof of full payment prior to delinquency. The loan documents do not require monthly escrows for insurance provided the following conditions are met: (i) no event of default has occurred and is continuing; (ii) the WPC Self Storage IX Properties are insured via an acceptable blanket insurance policy; and (iii) the borrower provides the lender with evidence of renewal of the policies and timely proof of payment of the insurance premiums. The loan documents do not require monthly reserves for replacement reserves except upon the occurrence and

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 10 |

| WPC SELF STORAGE IX |

continuance of an event of default, at which a time the borrower will be required to deposit $14,073 monthly into a replacement reserve escrow.

The WPC Self Storage IX Mortgage Loan is also structured with an amortization reserve account. During an Amortization Deposit Period (as defined below), the borrower is required to make monthly deposits into the amortization reserve account, as outlined in the amortization schedule in the loan agreement. The scheduled payments outlined in the amortization schedule are equivalent to the hypothetical principal payments assuming the WPC Self Storage IX Mortgage Loan had a 30-year amortization period (with the same 4.880% per annum interest rate).

An “Amortization Deposit Period” is defined as any period on or after January 11, 2021, commencing upon the debt yield being less than or equal to 10.5% at the end of any calendar quarter. An Amortization Deposit Period will end when the debt yield is equal to or greater than 11.0% for one calendar quarter and any deposits in the amortization reserve account will be held in escrow until the debt yield is greater than or equal to 11.0% for two consecutive calendar quarters provided that there is no event of default.

Lockbox and Cash Management. Upon the occurrence of a Cash Trap Event Period (as defined below), the borrower will be required to establish a lender-controlled lockbox account and direct all tenants to deposit all rents directly into such lockbox account. Additionally, all revenues and other monies received by the borrower or property manager relating to the WPC Self Storage IX Properties will be deposited into the lockbox account. During a Cash Trap Event Period, all excess funds on deposit in the lockbox account are swept to a lender-controlled subaccount on a monthly basis.

A “Cash Trap Event Period” will commence upon the earlier of (i) the occurrence and continuance of an event of default; and (ii) the amortizing debt service coverage ratio for the trailing 12-month period falling below 1.15x at the end of any calendar month. A Cash Trap Event Period will expire, with regard to clause (i), upon the cure of such event of default; and with regard to clause (ii), upon the amortizing debt service coverage ratio being equal to or greater than 1.25x for two consecutive calendar quarters.

Property Management. The WPC Self Storage IX Properties are managed by CubeSmart Asset Management, LLC and Extra Space Management, Inc.

Assumption. The borrower has a two-time right to transfer the WPC Self Storage IX Properties in whole, provided that no event of default has occurred and is continuing and certain other conditions are satisfied, including (i) the lender’s reasonable determination that the proposed transferee and guarantor satisfy the lender’s credit review and underwriting standards, taking into consideration transferee experience, financial strength and general business standing; (ii) execution of a recourse guaranty and an environmental indemnity by an affiliate of the transferee; and (iii) if requested by the lender, rating agency confirmation from DBRS, Fitch and Moody’s that the transfer will not result in a downgrade, withdrawal or qualification of the respective ratings assigned to the Series 2016-C33 Certificates.

The borrower also has a two-time right to transfer any individual property (provided that any given property can only be transferred once) along with the allocated loan amount of such a transferred property in the WPC Self Storage IX Mortgage Loan (“Partial Assumption”), provided that no event of default has occurred and is continuing and certain other conditions are satisfied, including (i) the portion of the WPC Self Storage IX Mortgage Loan relating to the transferred property shall no longer be cross-collateralized and/or cross-defaulted with the remaining properties of the WPC Self Storage IX Mortgage Loan; (ii) the loan-to-value ratio of both the property proposed to be transferred and the properties that would be remaining if such transfer occurred must be no greater than 65.0%; (iii) the amortizing debt service coverage ratio of both the property proposed to be transferred and the properties that would be remaining if such transfer occurred must be greater than 1.35x; and clauses (i) through (iii) outlined in the paragraph above.

Partial Release. Following the lockout period, the borrower is permitted to partially release any constituent properties in connection with a partial defeasance, subject to certain conditions including (i) no event of default has occurred and is continuing; (ii) partial defeasance of 125% of the released property’s allocated loan balance; (iii) the loan-to-value with respect to the remaining properties will be no greater than the lesser of 65.4% and the loan-to-value immediately prior to the release; (iv) the amortizing debt service coverage ratio with respect to the remaining properties will be no less than the greater of the debt service coverage ratio at closing and the debt service coverage ratio immediately prior to the release; and (v) the lender receives rating agency confirmation from DBRS, Fitch and Moody’s that the release will not result in a downgrade, withdrawal or qualification of the respective ratings assigned to the Series 2016-C33 Certificates.

Real Estate Substitution. The borrower may obtain a release of any individual WPC Self Storage IX Properties from the lien of the mortgage in connection with a substitution of a different property subject to the satisfaction of certain conditions, including without limitation (i) no event of default has occurred and is continuing; (ii) the substituted property must have a current appraised value equal to or greater than that of the released property, and the loan-to-value of the properties remaining following the substitution must be no greater than the lesser of 65.4% and the loan-to-value immediately prior to the substitution; (iii) the substituted property shall be equal or superior to that of the release property as to physical condition, building use and quality, lease terms favorable to the borrower and market attributes as determined by the lender; (iv) the trailing 12-month amortizing debt service coverage ratio for the properties remaining following the substitution must be no less than the greater of debt service coverage ratio at closing and the debt service coverage ratio for the 12 months preceding the substitution; (v) the lender receives a legal opinion that the substitution satisfies REMIC requirements; and (vi) the lender receives rating agency confirmation from DBRS, Fitch and Moody’s that the substitution will not result in a downgrade, withdrawal or qualification of the respective ratings assigned to the Series 2016-C33 Certificates.

Subordinate and Mezzanine Indebtedness. Not permitted.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 11 |

| WPC SELF STORAGE IX |

Ground Lease. None.

Terrorism Insurance. The loan documents require that the “all risk” insurance policy required to be maintained by the borrower provide coverage for terrorism in an amount equal to the full replacement cost of the WPC Self Storage IX Properties, as well as business interruption insurance covering no less than the 18-month period following the occurrence of a casualty event, together with a six-month extended period of indemnity.

Windstorm Insurance. The loan documents require windstorm insurance covering the full replacement cost of the WPC Self Storage IX Properties during the loan term. At the time of closing, the WPC Self Storage Properties had insurance coverage for windstorm.

Earthquake Insurance. The loan documents do not require earthquake insurance. A seismic report was required for the Barbur Storage (Portland, OR) property and indicated a probable maximum loss of 9.0%.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 12 |

| No. 3 – 225 Liberty Street | ||||||||

| Loan Information | Property Information | |||||||

| Mortgage Loan Seller: | Wells Fargo Bank, National Association | Single Asset/Portfolio: | Single Asset | |||||

| Credit Assessment (DBRS/Fitch/Moody’s): | [AA(low)/AAA/A2 (sca.pd] | Property Type: | Office | |||||

| Original Principal Balance(1): | $40,500,000 | Specific Property Type: | CBD | |||||

| Cut-off Date Principal Balance(1): | $40,500,000 | Location: | New York, NY | |||||

| % of Initial Pool Balance: | 5.7% | Size(1): | 2,427,515 SF | |||||

| Loan Purpose: | Refinance | Cut-off Date Principal Balance Per SF(1): |

$189.08 | |||||

| Borrower Name: | WFP Tower B Co. L.P. | Year Built/Renovated: | 1987/2015 | |||||

| Sponsor: | Brookfield Financial Properties, L.P. | Title Vesting: | Leasehold | |||||

| Mortgage Rate: | 4.657% | Property Manager: | Self-managed | |||||

| Note Date: | January 22, 2016 | 4th Most Recent Occupancy(6): | NAV | |||||

| Anticipated Repayment Date: | NAP | 3rd Most Recent Occupancy(6): | NAV | |||||

| Maturity Date: | February 6, 2026 | 2nd Most Recent Occupancy(6): | NAV | |||||

| IO Period: | 120 months | Most Recent Occupancy(6): | NAV | |||||

| Loan Term (Original): | 120 months | Current Occupancy (As of)(6): | 93.5% (1/31/2016) | |||||

| Seasoning: | 1 month | |||||||

| Amortization Term (Original): | NAP | Underwriting and Financial Information: | ||||||

| Loan Amortization Type: | Interest-only, Balloon | |||||||

| Interest Accrual Method: | Actual/360 | 4th Most Recent NOI(7): | NAV | |||||

| Call Protection(2): | L(25),D(89),O(6) | 3rd Most Recent NOI(7): | NAV | |||||

| Lockbox Type: | Hard/Springing Cash Management | 2nd Most Recent NOI(7): | NAV | |||||

| Additional Debt(1)(3): | Yes | Most Recent NOI(7): | NAV | |||||

| Additional Debt Type(1)(3): | Pari Passu and junior notes; Future Mezzanine | |||||||

| Escrows and Reserves(4): | U/W Revenues: | $132,184,800 | ||||||

| U/W Expenses: | $58,709,263 | |||||||

| Type: | Initial | Monthly | Cap (If Any) | U/W NOI(1)(7): | $73,475,537 | |||

| Taxes | $0 | Springing | NAP | U/W NCF(1)(7): | $67,846,470 | |||

| Insurance | $0 | Springing | NAP | U/W NOI DSCR(1): | 3.39x | |||

| Replacement Reserve | $0 | Springing | NAP | U/W NCF DSCR(1): | 3.13x | |||

| TI/LC Reserve | $0 | $0 | NAP | U/W NOI Debt Yield(1): | 16.0% | |||

| Unfunded Obligations/Rollover Guaranty(5) | $72,789,685 | $0 | NAP | U/W NCF Debt Yield(1): | 14.8% | |||

| Free Rent Reserve | $80,810,295 | $0 | NAP | As-Is Appraised Value(1)(8): | $1,400,000,000 | |||

| Ground Rent Reserve | $0 | Springing | NAP | As-Is Appraisal Valuation Date(8): | October 20, 2015 | |||

| Cash Collateral Reserve | $0 | Springing | NAP | Cut-off Date LTV Ratio(1)(8): | 32.8% | |||

| Master Retail Lease Funds | $0 | Springing | NAP | LTV Ratio at Maturity or ARD(1)(8): | 32.8% | |||

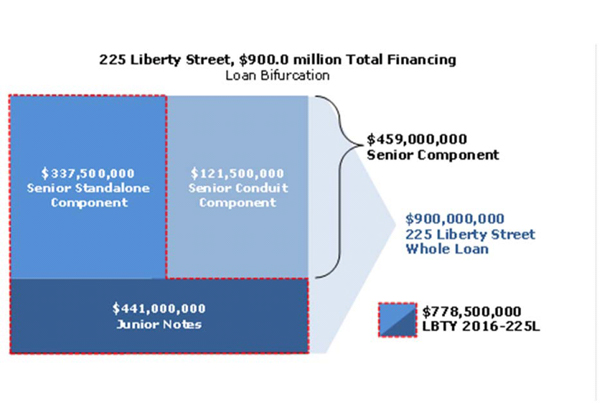

| (1) | The 225 Liberty Street Whole Loan (as defined below), totaling $900,000,000, is comprised of six pari passu senior notes with an aggregate balance of $459,000,000 (Notes A-1A through A-1F) and three junior notes with an aggregate balance of $441,000,000 (Notes A-2A through A-2C). The non-controlling senior Note A-1F had an original balance of $40,500,000, has an outstanding principal balance of $40,500,000 as of the Cut-off Date and will be contributed to the WFCM 2016-C33 Trust. Three of the senior notes with a combined outstanding principal balance of $337,500,000 and the three subordinate notes with a combined outstanding principal balance of $441,000,000 were contributed to the LBTY 2016-225L transaction. The remaining two non-controlling notes, which had an aggregate original principal balance of $81,000,000, are expected to be contributed to future trusts. All statistical information related to balances per square foot, loan-to-value ratios, debt service coverage ratios and debt yields are based on the six senior notes. The Cut-off Date LTV Ratio, U/W NCF DSCR and U/W NCF DY based on the combined senior notes and junior notes totaling $900,000,000 are 64.3%, 1.60x and 7.5%, respectively. Further, unless otherwise specifically noted, all numerical information, including references to square footage, height, occupancy, leases, net rentable area, appraised value, loan-to-value ratios, underwritten net operating income, underwritten net cash flow or similar terms with respect to the 225 Liberty Street Property or the tenants therein excludes the approximately 220,925 square feet of retail space and associated mechanical and storage space located on multiple lower floors at the 225 Liberty Street building (the “Retail Component”) and the related leases and retail tenants. See “Retail Component” section. |

| (2) | The lockout period will be at least 25 payment dates beginning with and including the first payment date of March 6, 2016. Defeasance of the 225 Liberty Street Whole Loan is permitted on or after the date that is the earlier to occur of (i) two years after the closing date of the securitization that includes the last note to be securitized, and (ii) January 22, 2019. The assumed lockout period of 25 payments is based on the expected WFCM 2016-C33 Trust closing date in March 2016. |

| (3) | See “Subordinate and Mezzanine Indebtedness” and “Other Indebtedness” sections. |

| (4) | See “Escrows” section. |

| (5) | A guaranty has been provided by Brookfield Financial Properties, L.P. See “Escrows” section. |

| (6) | See “Historical Occupancy” section. |

| (7) | See “Cash Flow Analysis” section. |

| (8) | See “Appraisal” section. The appraiser also concluded to an “as-stabilized” value of $1,650,000,000 based on an “as-stabilized” valuation date of November 1, 2017, which results in an “as-stabilized” Cut-off Date LTV Ratio and LTV Ratio at Maturity or ARD of 27.8% based on the senior debt. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 13 |

| 225 LIBERTY STREET |

The Mortgage Loan. The mortgage loan (the “225 Liberty Street Mortgage Loan”) is part of a Whole Loan (the “225 Liberty Street Whole Loan”) evidenced by six pari passu senior promissory notes (Notes A-1A through A-1F) and three junior notes (Notes A-2A through A-2C) secured by the leasehold interest in an office building located in New York, New York (the “225 Liberty Street Property”). The 225 Liberty Street Whole Loan was co-originated on January 22, 2016 by Wells Fargo Bank, National Association, Citigroup Global Markets Realty Corp. and German American Capital Corporation. The 225 Liberty Street Whole Loan had an original principal balance of $900,000,000, has an outstanding principal balance as of the Cut-off Date of $900,000,000 and accrues interest at an interest rate of 4.657% per annum. The 225 Liberty Street Whole Loan had an initial term of 120 months, has a remaining term of 119 months as of the Cut-off Date and requires interest-only payments through the term of the 225 Liberty Street Whole Loan. The 225 Liberty Street Whole Loan matures on February 6, 2026. See “Description of the Mortgage Pool—Additional Indebtedness—Whole Loans—The 225 Liberty Street Whole Loan” and “Servicing of the Mortgage Loans and Administration of the Trust Fund” in the Preliminary Prospectus.

The 225 Liberty Street Mortgage Loan, evidenced by Note A-1F, which will be contributed to the WFCM 2016-C33 Trust, had an original principal balance of $40,500,000, has an outstanding principal balance as of the Cut-off Date of $40,500,000 and represents a senior pari passu non-controlling interest in the 225 Liberty Street Whole Loan. Three of the senior pari passu notes (Notes A-1A through A-1C) and all of the junior notes, which were contributed to the LBTY 2016-225L Trust, had an original aggregate principal balance of $778,500,000 and will represent the controlling interest in the 225 Liberty Street Whole Loan. The remaining non-controlling notes, which had an aggregate original principal balance of $81,000,000, are expected to be contributed to future trusts. The lender provides no assurances that any non-securitized notes will not be split further.

Note Summary

| Notes | Original Balance | Note Holder | Controlling Interest | |

| A-1F | $40,500,000 | WFCM 2016-C33 | No | |

| A-1A, A-1B, A-1C(1) | $337,500,000 | LBTY 2016-225L | Yes(2) | |

| A-2A, A-2B, A-2C(1) | $441,000,000 | LBTY 2016-225L | Yes(2) | |

| A-1D | $40,500,000 | CGMRC(3) | No | |

| A-1E | $40,500,000 | GACC(3) | No | |

| Total | $900,000,000 |

| (1) | Contributed to the LBTY 2016-225L Trust. The notes were originally held by CGMRC, GACC and Wells Fargo Bank, N.A. |

| (2) | The 225 Liberty Street Whole Loan is serviced and administered according to the LBTY 2016-225L Trust and Servicing Agreement. |

| (3) | CGMRC – “Citigroup Global Markets Realty Corp.” and GACC – “German American Capital Corporation”. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 14 |

| 225 LIBERTY STREET |

Following the lockout period, the borrower has the right to defease the 225 Liberty Street Whole Loan in whole, but not in part, on any date before August 6, 2025. In addition, the 225 Liberty Street Whole Loan is prepayable without penalty on or after August 6, 2025. The lockout period will expire on the earlier to occur of (i) two years after the closing date of the securitization that includes the last note to be securitized and (ii) January 22, 2019.

Sources and Uses

| Sources | Uses | |||||||

| Original Whole Loan amount | $900,000,000 | 100.0% | Loan payoff(1) | $801,958,400 | 89.1% | |||

| Reserves(2) | 80,810,295 | 9.0 | ||||||

| Closing costs | 5,548,715 | 0.6 | ||||||

| Return of equity | 11,682,590 | 1.3 | ||||||

| Total Sources | $900,000,000 | 100.0% | Total Uses | $900,000,000 | 100.0% |

| (1) | Approximately $800.0 million, including accrued interest, was used to repay an existing bank loan having an outstanding principal balance of approximately $802.0 million encumbering both the 225 Liberty Street Property and the Retail Component (as defined below). Simultaneous with the repayment, the Retail Component, along with the retail components of 200 Vesey Street and 250 Vesey Street (both part of the Brookfield Place Complex, as defined below), were financed separately via a $325.0 million bank loan, which was effectuated as a loan amendment to the existing facility. |

| (2) | Brookfield Financial Properties, L.P. executed a guaranty for approximately $72.8 million of outstanding tenant improvements and the borrower funded a cash reserve of approximately $80.8 million for free rent. |

The Property. The 225 Liberty Street Property consists of the leasehold interest in a 44-story, approximate 2.4 million square foot class A office tower located in the Brookfield Place Complex (as defined below) along the Hudson River in Lower Manhattan. The 225 Liberty Street Property is the largest of four office towers within Brookfield Place Complex (formerly known as the World Financial Center), a mixed-use complex featuring approximately 7.1 million aggregate square feet of office space and approximately 340,000 aggregate square feet of retail space along with extensive public spaces (the “Brookfield Place Complex”). Formerly known as Two World Financial Center, the 225 Liberty Street Property, designed by renowned architect Cesar Pelli, was completed in 1987, and is the domed shape tower that includes as part of the 225 Liberty Street Property, the Winter Garden and is adjacent to West Street.

The office space in the 225 Liberty Street Property was 100.0% net leased to a subsidiary of Merrill Lynch from the 225 Liberty Street Property’s delivery in 1987 through September 30, 2013. Subsequent to Merrill Lynch’s subsidiary’s lease expiration (following its acquisition by Bank of America) and concurrent with a $210.9 million retail redevelopment at the Brookfield Place Complex, the 225 Liberty Street Property underwent a $71.6 million (as of January 15, 2016) renovation which included a new façade, elevator modernizations, fire alarm and building management systems upgrades, and two new lobbies. Over the last three years, the borrower has executed approximately 1.9 million square feet (79.9% of net rentable area (“NRA”)) of new office and storage leases, in addition to a 330,755 square feet (13.6% of NRA) lease renewal with Bank of America.