| FREE WRITING PROSPECTUS | ||

| FILED PURSUANT TO RULE 433 | ||

| REGISTRATION FILE NO.: 333-195164-12 | ||

|

|

Free Writing Prospectus

Structural and Collateral Term Sheet

$716,328,406

(Approximate

Aggregate Cut-off Date Balance of Mortgage Pool)

$659,022,000

(Approximate

Aggregate Principal Balance of Offered Certificates)

Wells

Fargo Commercial Mortgage Trust 2015-SG1

as Issuing Entity

Wells Fargo Commercial Mortgage Securities, Inc.

as Depositor

Société Générale

Liberty Island Group I LLC

Basis Real Estate Capital II, LLC

Natixis Real Estate Capital LLC

Wells Fargo Bank, National Association

as Sponsors and Mortgage Loan Sellers

Commercial

Mortgage Pass-Through Certificates

Series 2015-SG1

August 3, 2015

| WELLS FARGO SECURITIES | SOCIETE GENERALE | |

| Co-Lead Manager and | Co-Lead Manager and | |

| Co-Bookrunner | Co-Bookrunner | |

| Citigroup Co-Manager |

Morgan Stanley Co-Manager |

Natixis Securities Americas LLC Co-Manager |

STATEMENT REGARDING THIS FREE WRITING PROSPECTUS

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (’’SEC’’) (SEC File No. 333-195164) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the depositor, any underwriter, or any dealer participating in the offering will arrange to send you the prospectus after filing if you request it by calling toll free 1-800-745-2063 (8 a.m. – 5 p.m. EST) or by emailing wfs.cmbs@wellsfargo.com.

Nothing in this document constitutes an offer of securities for sale in any jurisdiction where the offer or sale is not permitted. The information contained herein is preliminary as of the date hereof, supersedes any such information previously delivered to you and will be superseded by any such information subsequently delivered and ultimately by the final prospectus relating to the securities. These materials are subject to change, completion, supplement or amendment from time to time.

This free writing prospectus has been prepared by the Underwriters for information purposes only and does not constitute, in whole or in part, a prospectus for the purposes of Directive 2003/71/EC (as amended) and/or Part VI of the Financial Services and Markets Act 2000 as amended or other offering document.

STATEMENT REGARDING ASSUMPTIONS AS TO SECURITIES, PRICING ESTIMATES AND OTHER INFORMATION

The attached information contains certain tables and other statistical analyses (the “Computational Materials”) which have been prepared in reliance upon information furnished by the Mortgage Loan Sellers. Numerous assumptions were used in preparing the Computational Materials, which may or may not be reflected herein. As such, no assurance can be given as to the Computational Materials’ accuracy, appropriateness or completeness in any particular context; or as to whether the Computational Materials and/or the assumptions upon which they are based reflect present market conditions or future market performance. The Computational Materials should not be construed as either projections or predictions or as legal, tax, financial or accounting advice. You should consult your own counsel, accountant and other advisors as to the legal, tax, business, financial and related aspects of a purchase of these securities. Any weighted average lives, yields and principal payment periods shown in the Computational Materials are based on prepayment and/or loss assumptions, and changes in such prepayment and/or loss assumptions may dramatically affect such weighted average lives, yields and principal payment periods. In addition, it is possible that prepayments or losses on the underlying assets will occur at rates higher or lower than the rates shown in the attached Computational Materials. The specific characteristics of the securities may differ from those shown in the Computational Materials due to differences between the final underlying assets and the preliminary underlying assets used in preparing the Computational Materials. The principal amount and designation of any security described in the Computational Materials are subject to change prior to issuance. None of Wells Fargo Securities, LLC, SG Americas Securities, LLC, Citigroup Global Markets, Inc., Morgan Stanley & Co. LLC or Natixis Securities Americas LLC or any of their respective affiliates, make any representation or warranty as to the actual rate or timing of payments or losses on any of the underlying assets or the payments or yield on the securities. The information in this presentation is based upon management forecasts and reflects prevailing conditions and management’s views as of this date, all of which are subject to change. In preparing this presentation, we have relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources or which was provided to us by or on behalf of the Mortgage Loan Sellers or which was otherwise reviewed by us.

This free writing prospectus contains certain forward-looking statements. If and when included in this free writing prospectus, the words “expects”, “intends”, “anticipates”, “estimates” and analogous expressions and all statements that are not historical facts, including statements about our beliefs or expectations, are intended to identify forward-looking statements. Any forward-looking statements are made subject to risks and uncertainties which could cause actual results to differ materially from those stated. Those risks and uncertainties include, among other things, declines in general economic and business conditions, increased competition, changes in demographics, changes in political and social conditions, regulatory initiatives and changes in customer preferences, many of which are beyond our control and the control of any other person or entity related to this offering. The forward-looking statements made in this free writing prospectus are made as of the date stated on the cover. We have no obligation to update or revise any forward-looking statement.

Wells Fargo Securities is the trade name for the capital markets and investment banking services of Wells Fargo & Company and its subsidiaries, including but not limited to Wells Fargo Securities, LLC, a member of NYSE, FINRA, NFA and SIPC, Wells Fargo Prime Services, LLC, a member of FINRA, NFA and SIPC, and Wells Fargo Bank, N.A. Wells Fargo Securities, LLC and Wells Fargo Prime Services, LLC are distinct entities from affiliated banks and thrifts.

IMPORTANT NOTICE REGARDING THE OFFERED CERTIFICATES

The Offered Certificates referred to in these materials and the asset pool backing them are subject to modification or revision (including the possibility that one or more classes of certificates may be split, combined or eliminated at any time prior to issuance or availability of a final prospectus) and are offered on a “when, as and if issued” basis. Prospective investors should understand that, when considering the purchase of the Offered Certificates, a contract of sale will come into being no sooner than the date on which the relevant class of certificates has been priced and the underwriters have confirmed the allocation of certificates to be made to investors; any “indications of interest” expressed by any prospective investor, and any “soft circles” generated by the underwriters, will not create binding contractual obligations for such prospective investors, on the one hand, or the underwriters, the depositor or any of their respective agents or affiliates, on the other hand.

As a result of the foregoing, a prospective investor may commit to purchase certificates that have characteristics that may change, and each prospective investor is advised that all or a portion of the certificates referred to in these materials may be issued without all or certain of the characteristics described in these materials. The underwriters’ obligation to sell certificates to any prospective investor is conditioned on the certificates and the transaction having the characteristics described in these materials. If the underwriters determine that a condition is not satisfied in any material respect, such prospective investor will be notified, and neither the depositor nor the underwriters will have any obligation to such prospective investor to deliver any portion of the Offered Certificates which such prospective investor has committed to purchase, and there will be no liability between the underwriters, the depositor or any of their respective agents or affiliates, on the one hand, and such prospective investor, on the other hand, as a consequence of the non-delivery.

Each prospective investor has requested that the underwriters provide to such prospective investor information in connection with such prospective investor’s consideration of the purchase of the certificates described in these materials. These materials are being provided to each prospective investor for informative purposes only in response to such prospective investor’s specific request. The underwriters described in these materials may from time to time perform investment banking services for, or solicit investment banking business from, any company named in these materials. The underwriters and/or their affiliates or respective employees may from time to time have a long or short position in any security or contract discussed in these materials.

The information contained herein supersedes any previous such information delivered to any prospective investor and will be superseded by information delivered to such prospective investor prior to the time of sale.

IMPORTANT NOTICE RELATING TO AUTOMATICALLY-GENERATED EMAIL DISCLAIMERS

Any legends, disclaimers or other notices that may appear at the bottom of any email communication to which this free writing prospectus is attached relating to (1) these materials not constituting an offer (or a solicitation of an offer), (2) no representation that these materials are accurate or complete and may not be updated or (3) these materials possibly being confidential, are not applicable to these materials and should be disregarded. Such legends, disclaimers or other notices have been automatically generated as a result of these materials having been sent via Bloomberg or another system.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 2 |

| Wells Fargo Commercial Mortgage Trust 2015-SG1 | Certificate Structure |

I. Certificate Structure

| Class | Expected Ratings (Fitch/Moody’s/Morningstar)(1) |

Approximate Initial Certificate Principal Balance or Notional Amount(2) |

Approx. Initial Credit Support(3) |

Pass-Through Rate Description |

Weighted Average Life (Years)(4) |

Expected Principal Window(4) |

Certificate Principal to Value Ratio(5) |

Certificate Principal U/W NOI Debt Yield(6) | |

| Offered Certificates | |||||||||

| A-1 | AAAsf/Aaa(sf)/AAA | $30,306,000 | 30.000% | (7) | 2.32 | 9/15 - 10/19 | 46.2% | 15.4% | |

| A-2 | AAAsf/Aaa(sf)/AAA | $17,909,000 | 30.000% | (7) | 4.56 | 10/19 - 8/20 | 46.2% | 15.4% | |

| A-3 | AAAsf/Aaa(sf)/AAA | $6,600,000 | 30.000% | (7) | 6.97 | 8/22 - 8/22 | 46.2% | 15.4% | |

| A-4 | AAAsf/Aaa(sf)/AAA | $391,844,000 (8) | 30.000% | (7) | 9.79 | 12/24 - 8/25 | 46.2% | 15.4% | |

| A-SB | AAAsf/Aaa(sf)/AAA | $54,770,000 | 30.000% | (7) | 7.19 | 8/20 - 12/24 | 46.2% | 15.4% | |

| A-S(9) | AAAsf/Aa2(sf)/AAA | $41,189,000 | 24.250% | (7) | 9.97 | 8/25 - 8/25 | 50.0% | 14.2% | |

| X-A | AAAsf/NR/AAA | $542,618,000 (10) | N/A | Variable(11) | N/A | N/A | N/A | N/A | |

| X-B | NR/NR/AAA | $77,901,000 (12) | N/A | Variable(13) | N/A | N/A | N/A | N/A | |

| B(9) | AA-sf/NR/AA | $44,771,000 | 18.000% | (7) | 9.97 | 8/25 - 8/25 | 54.2% | 13.2% | |

| C(9) | A-sf/NR/A- | $33,130,000 | 13.375% | (7) | 9.97 | 8/25 - 8/25 | 57.2% | 12.5% | |

| PEX(9) | A-sf/NR/A- | $119,090,000 | 13.375% | (7) | 9.97 | 8/25 - 8/25 | 57.2% | 12.5% | |

| D | BBB-sf/NR/BBB | $38,503,000 | 8.000% | (7) | 9.97 | 8/25 - 8/25 | 60.8% | 11.7% | |

| Non-Offered Certificates | |||||||||

| X-E | BB-sf/NR/AAA | $17,908,000(14) | N/A | Variable(15) | N/A | N/A | N/A | N/A | |

| X-F | B-sf/NR/AAA | $8,059,000(16) | N/A | Variable(17) | N/A | N/A | N/A | N/A | |

| X-G | NR/NR/AAA | $31,339,406(18) | N/A | Variable(19) | N/A | N/A | N/A | N/A | |

| A-4FL | AAAsf/Aaa(sf)/AAA(20) | $391,844,000 (21)(22) | 30.000% | LIBOR plus [ ](23) | 9.79 | 12/24 - 8/25 | 46.2% | 15.4% | |

| A-4FX | AAAsf/Aaa(sf)/AAA | $0(21)(22) | 30.000% | (7) | 9.79 | 12/24 - 8/25 | 46.2% | 15.4% | |

| E | BB-sf/NR/BB- | $17,908,000 | 5.500% | (7) | 9.97 | 8/25 - 8/25 | 62.4% | 11.4% | |

| F | B-sf/NR/B+ | $8,059,000 | 4.375% | (7) | 9.97 | 8/25 - 8/25 | 63.2% | 11.3% | |

| G | NR/NR/NR | $31,339,406 | 0.000% | (7) | 9.97 | 8/25 - 8/25 | 66.1% | 10.8% |

| Notes: | |

| (1) | The expected ratings presented are those of Fitch Ratings, Inc. (“Fitch”), Moody’s Investors Service, Inc. (“Moody’s”) and Morningstar Credit Ratings, LLC (“Morningstar”) which the depositor hired to rate the offered certificates. One or more other nationally recognized statistical rating organizations that were not hired by the depositor may use information they receive pursuant to Rule 17g-5 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise, to rate or provide market reports and/or published commentary related to the offered certificates. We cannot assure you as to what ratings a non-hired nationally recognized statistical rating organization would assign or that its reports will not express differing, possibly negative, views of the mortgage loans and/or the offered certificates. The ratings of each class of offered certificates address the likelihood of the timely distribution of interest and, except in the case of the Class X-A and Class X-B certificates, the ultimate distribution of principal due on those classes on or before the Rated Final Distribution Date. See “Risk Factors—Risks Related to the Offered Certificates—Ratings of the Certificates Have Substantial Limitations” and “Ratings” in the free writing prospectus, dated August 3, 2015 (the “Free Writing Prospectus”). Fitch and Moody’s have informed us that the “sf” designation in their ratings represents an identifier for structured finance product ratings. |

| (2) | The principal balances and notional amounts set forth in the table are approximate. The actual initial principal balances and notional amounts may be larger or smaller depending on the aggregate cut-off date principal balance of the mortgage loans definitively included in the pool of mortgage loans, which aggregate cut-off date principal balance may be as much as 5% larger or smaller than the amount presented in the Free Writing Prospectus. |

| (3) | The approximate initial credit support with respect to the Class A-1, A-2, A-3, A-4, A-4FL, A-4FX and A-SB Certificates represents the approximate credit enhancement for the Class A-1, A-2, A-3, A-4, A-4FL, A-4FX and A-SB Certificates in the aggregate. The percentage indicated under the column “Approx. Initial Credit Support” with respect to the Class C Certificates and the Class PEX Certificates represents the approximate credit support for the Class C regular interest. |

| (4) | Weighted Average Lives and Expected Principal Windows are calculated based on an assumed prepayment rate of 0% CPR and the “Structuring Assumptions” described on Annex B to the Free Writing Prospectus. |

| (5) | The Certificate Principal to Value Ratio for each Class of Certificates (other than the Class A-1, A-2, A-3, A-4, A-4FL, A-4FX, A-SB and PEX Certificates) is calculated as the product of (a) the weighted average Cut-off Date LTV Ratio for the mortgage loans and (b) a fraction, the numerator of which is the total initial Certificate Balance of such Class of Certificates and all Classes of Principal Balance Certificates (other than the Class PEX Certificates) senior to such Class of Certificates and the denominator of which is the total initial Certificate Balance of all of the Principal Balance Certificates (other than the Class PEX Certificates). The Certificate Principal to Value Ratios for each of the Class A-1, A-2, A-3, A-4, A-4FL, A-4FX and A-SB Certificates are calculated in the aggregate for those Classes as if they were a single Class and is calculated as the product of (a) the weighted average Cut-off Date LTV Ratio for the mortgage loans and (b) a fraction, the numerator of which is the total initial aggregate Certificate Balances of such Classes of Certificates and the denominator of which is the total initial Certificate Balance of all of the Principal Balance Certificates (other than the Class PEX Certificates). The Certificate Principal to Value Ratio of the Class PEX Certificates is equal to the Certificate Principal to Value Ratio of the Class C Certificates. In any event, however, excess mortgaged property value associated with a mortgage loan will not be available to offset losses on any other mortgage loan. |

| (6) | The Certificate Principal U/W NOI Debt Yield for each Class of Certificates (other than the Class A-1, A-2, A-3, A-4, A-4FL, A-4FX, A-SB and PEX Certificates) is calculated as the product of (a) the weighted average U/W NOI Debt Yield for the mortgage loans and (b) a fraction, the numerator of which is the total initial Certificate Balance of all of the Classes of Principal Balance Certificates (other than the Class PEX Certificates) and the denominator of which is the total initial Certificate Balance for such Class of Certificates and all Classes of Principal Balance Certificates (other than the Class PEX Certificates) senior to such Class of Certificates. The Certificate Principal U/W NOI Debt Yield for each of the Class A-1, A-2, A-3, A-4, A-4FL, A-4FX and A-SB Certificates is calculated in the aggregate for those Classes as if they were a single Class and is calculated as the product of (a) the weighted average U/W NOI Debt Yield for the mortgage loans and (b) a fraction, the numerator of which is the total initial Certificate Balance of all of the Classes of Principal Balance Certificates (other than the Class PEX Certificates) and the denominator of which is the total aggregate initial Certificate Balances for the Class A-1, A-2, A-3, A-4, A-4FL, A-4FX and A-SB Certificates. The Certificate Principal U/W NOI Debt Yield of the Class PEX Certificates is equal to the Certificate Principal U/W NOI Debt Yield for the Class C Certificates. In any event, however, cash flow from each mortgaged property supports only the related mortgage loan and will not be available to support any other mortgage loan. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 3 |

| Wells Fargo Commercial Mortgage Trust 2015-SG1 | Certificate Structure |

| (7) | The pass-through rates for the Class A-1, A-2, A-3, A-4, A-4FX, A-SB, D, E, F and G Certificates and the Class A-4FX, A-S, B and C regular interests in each case will be one of the following: (i) a fixed rate per annum, (ii) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date, (iii) a variable rate per annum equal to the lesser of (a) a fixed rate and (b) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date or (iv) a variable rate per annum equal to the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date minus a specified percentage. For purposes of the calculation of the weighted average of the net mortgage interest rates on the mortgage loans for each distribution date, the mortgage interest rates will be adjusted as necessary to a 30/360 basis. The Class PEX Certificates will not have a pass-through rate, but will be entitled to receive the sum of the interest distributable on the Class PEX Components. The pass-through rate for the Class A-S Certificates, the Class A-S regular interest and the Class PEX Component A-S will, at all times, be the same. The pass-through rate for the Class B Certificates, the Class B regular interest and the Class PEX Component B will, at all times, be the same. The pass-through rate for the Class C Certificates, the Class C regular interest and the Class PEX Component C will, at all times, be the same. |

| (8) | Represents the maximum initial principal balance of the Class A-4 Certificates that will be issued on the closing date. The aggregate initial principal balance of the Class A-4, A-4FL and A-4FX Certificates will be $391,844,000. |

| (9) | The Class A-S, B, C and PEX Certificates are “Exchangeable Certificates”. On the closing date, the upper-tier REMIC of the issuing entity will issue the Class A-S, B and C regular interests (each a “regular interest”) which will have outstanding principal balances on the closing date of $41,189,000, $44,771,000 and $33,130,000, respectively. The regular interests will be held in a grantor trust for the benefit of the holders of the Class A-S, B, C and PEX Certificates. The Class A-S, B, C and PEX Certificates will, at all times, represent undivided beneficial ownership interests in a grantor trust that will hold those regular interests. Each class of the Class A-S, B and C Certificates will, at all times, represent an undivided beneficial ownership interest in a percentage of the outstanding certificate principal balance of the regular interest with the same alphabetical class designation. The Class PEX Certificates will, at all times, represent an undivided beneficial ownership interest in the remaining percentages of the outstanding certificate principal balances of the Class A-S, B and C regular interests and which portions of those regular interests are referred to in this Term Sheet as the Class PEX Component A-S, Class PEX Component B and Class PEX Component C (collectively, the “Class PEX Components”). Following any exchange of Class A-S, B and C Certificates for Class PEX Certificates or any exchange of Class PEX Certificates for Class A-S, B and C Certificates as described in the Free Writing Prospectus, the percentage interest of the outstanding certificate principal balances of the Class A-S, B and C regular interests that is represented by the Class A-S, B, C and PEX Certificates will be increased or decreased accordingly. The initial certificate principal balance of each of the Class A-S, B and C Certificates shown in the table represents the maximum certificate principal balance of such class without giving effect to any exchange. The initial certificate principal balance of the Class PEX Certificates is equal to the aggregate of the initial certificate principal balance of the Class A-S, B and C Certificates and represents the maximum certificate principal balance of the Class PEX Certificates that could be issued in an exchange. The certificate principal balances of the Class A-S, B and C Certificates to be issued on the closing date will be reduced, in required proportions, by an amount equal to the certificate principal balance of the Class PEX Certificates issued on the closing date. Distributions and allocations of payments and losses with respect to the Exchangeable Certificates are described in this Term Sheet under “Allocations and Distributions on the Class A-S, B, C and PEX Certificates” and under “Description of the Offered Certificates—Distributions” in the Free Writing Prospectus. The maximum certificate principal balance of the Class PEX Certificates is set forth in the table but is not included in the certificate principal balance of the certificates set forth on the cover page of this Term Sheet or on the top of the cover page of the Free Writing Prospectus. |

| (10) | The Class X-A Certificates are notional amount certificates. The Notional Amount of the Class X-A Certificates will be equal to the aggregate principal balance of the Class A-1, A-2, A-3, A-4 and A-SB Certificates and the Class A-4FX and A-S regular interests outstanding from time to time (without regard to any exchange of the Class A-S, B and C Certificates for the Class PEX Certificates). The Class X-A Certificates will not be entitled to distributions of principal. |

| (11) | The pass-through rate for the Class X-A Certificates for any distribution date will be a per annum rate equal to the excess, if any, of (a) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date, over (b) the weighted average of the pass-through rates on the Class A-1, A-2, A-3, A-4 and A-SB Certificates and the Class A-4FX and A-S regular interests for the related distribution date, weighted on the basis of their respective aggregate principal balances outstanding immediately prior to that distribution date. For purposes of the calculation of the weighted average of the net mortgage interest rates on the mortgage loans for each distribution date, the mortgage interest rates will be adjusted as necessary to a 30/360 basis. |

| (12) | The Class X-B Certificates are notional amount certificates. The Notional Amount of the Class X-B Certificates will be equal to the aggregate principal balance of the Class B and C regular interests outstanding from time to time (without regard to any exchange of the Class A-S, B and C Certificates for the Class PEX Certificates). The Class X-B Certificates will not be entitled to distributions of principal. |

| (13) | The pass-through rate for the Class X-B Certificates for any distribution date will be a per annum rate equal to the excess, if any, of (a) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date, over (b) the weighted average of the pass-through rates on the Class B and C regular interests for the related distribution date, weighted on the basis of their respective aggregate principal balances outstanding immediately prior to that distribution date. For purposes of the calculation of the weighted average of the net mortgage interest rates on the mortgage loans for each distribution date, the mortgage interest rates will be adjusted as necessary to a 30/360 basis. |

| (14) | The Class X-E Certificates are notional amount certificates. The Notional Amount of the Class X-E Certificates will be equal to the principal balance of the Class E Certificates outstanding from time to time. The Class X-E Certificates will not be entitled to distributions of principal. |

| (15) | The pass-through rate for the Class X-E Certificates for any distribution date will be a per annum rate equal to the excess, if any, of (a) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date, over (b) the pass-through rate on the Class E Certificates for the related distribution date. For purposes of the calculation of the weighted average of the net mortgage interest rates on the mortgage loans for each distribution date, the mortgage interest rates will be adjusted as necessary to a 30/360 basis. |

| (16) | The Class X-F Certificates are notional amount certificates. The Notional Amount of the Class X-F Certificates will be equal to the principal balance of the Class F Certificates outstanding from time to time. The Class X-F Certificates will not be entitled to distributions of principal. |

| (17) | The pass-through rate for the Class X-F Certificates for any distribution date will be a per annum rate equal to the excess, if any, of (a) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date, over (b) the pass-through rate on the Class F Certificates for the related distribution date. For purposes of the calculation of the weighted average of the net mortgage interest rates on the mortgage loans for each distribution date, the mortgage interest rates will be adjusted as necessary to a 30/360 basis. |

| (18) | The Class X-G Certificates are notional amount certificates. The Notional Amount of the Class X-G Certificates will be equal to the principal balance of the Class G Certificates outstanding from time to time. The Class X-G Certificates will not be entitled to distributions of principal. |

| (19) | The pass-through rate for the Class X-G Certificates for any distribution date will be a per annum rate equal to the excess, if any, of (a) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date, over (b) the pass-through rate on the Class G Certificates for the related distribution date. For purposes of the calculation of the weighted average of the net mortgage interest rates on the mortgage loans for each distribution date, the mortgage interest rates will be adjusted as necessary to a 30/360 basis. |

| (20) | The ratings assigned to the Class A-4FL Certificates reflect only the receipt of up to the fixed rate of interest at a rate equal to the pass-through rate for the Class A-4FX regular interest. The ratings of Fitch, Moody’s and Morningstar do not address any shortfalls or delays in payment that investors in the Class A-4FL Certificates may experience as a result of the conversion of the pass-through rate on Class A-4FL Certificates from a floating interest rate to a fixed rate following a default under the swap agreement. See “Ratings” in the Private Placement Memorandum. |

| (21) | The aggregate initial principal balance of the Class A-4, A-4FL and A-4FX Certificates will be $391,844,000. The aggregate principal balance of the Class A-4FL and A-4FX Certificates will at all times equal the principal balance of the Class A-4FX regular interest. The maximum initial principal balance of the Class A-4FL certificates is $391,844,000. The principal balance of the Class A-4FX certificates will initially be $0. The maximum initial principal balance of the Class A-4FX regular interest is $391,844,000. |

| (22) | The Class A-4FL Certificates will evidence a beneficial interest in a grantor trust that includes the Class A-4FX regular interest and an interest rate swap contract. Under some circumstances, holders of the Class A-4FL Certificates may exchange all or a portion of their certificates for a like principal amount of Class A-4FX Certificates having the same pass-through rate as the Class A-4FX regular interest. The aggregate principal balance of the Class A-4FL Certificates may be adjusted from time to time as a result of such an exchange. |

| (23) | The pass-through rate applicable to the Class A-4FL Certificates on each distribution date will be a per annum rate equal to LIBOR plus a specified percentage; provided, however, that under certain circumstances (generally involving a default or termination under the related interest rate swap contract), the pass-through rate applicable to the Class A-4FL Certificates may convert to a fixed rate equal to the pass-through rate on the Class A-4FX regular interest. The initial LIBOR rate will be determined two LIBOR business days prior to the Closing Date, and subsequent LIBOR rates for the Class A-4FL Certificates will be determined two LIBOR business days before the start of the related interest accrual period. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 4 |

| Wells Fargo Commercial Mortgage Trust 2015-SG1 | Issue Characteristics |

II. Transaction Highlights

Mortgage Loan Sellers:

| Mortgage Loan Seller | Number

of Mortgage Loans |

Number

of Mortgaged Properties |

Aggregate

Cut- off Date Balance |

%

of Cut-off Date Pool Balance | ||||

| Société Générale | 27 | 28 | $256,004,972 | 35.7% | ||||

| Liberty Island Group I LLC | 19 | 20 | 174,200,455 | 24.3 | ||||

| Basis Real Estate Capital II, LLC | 10 | 10 | 80,016,579 | 11.2 | ||||

| Liberty Island Group I LLC / Société Générale(1) | 1 | 1 | 69,414,394 | 9.7 | ||||

| Natixis Real Estate Capital LLC | 8 | 11 | 68,698,568 | 9.6 | ||||

| Wells Fargo Bank, National Association | 7 | 7 | 67,993,438 | 9.5 | ||||

| Total | 72 | 77 | $716,328,406 | 100.0% |

| (1) | One mortgage loan, identified on Annex A-1 as the Patrick Henry Mall, was co-originated by Prudential Mortgage Capital Company, LLC and Société Générale and is part of a pari passu loan combination. Liberty Island Group I LLC is holder of the controlling note A-1, which had an original principal balance of $48,100,000. Société Générale is the holder of note A-2 and note A-3 which had original principal balances of $21,400,000 and $26,700,000, respectively. Note A-1 and note A-2 are being contributed to the securitization, while note A-3 is expected to be contributed to one or more future securitizations. |

Loan Pool:

| Cut-off Date Balance: | $716,328,406 |

| Number of Mortgage Loans: | 72 |

| Average Cut-off Date Balance per Mortgage Loan: | $9,949,006 |

| Number of Mortgaged Properties: | 77 |

| Average Cut-off Date Balance per Mortgaged Property(1): | $9,302,966 |

| Weighted Average Mortgage Interest Rate: | 4.523% |

| Ten Largest Mortgage Loans as % of Cut-off Date Pool Balance: | 40.4% |

| Weighted Average Original Term to Maturity or ARD (months): | 119 |

| Weighted Average Remaining Term to Maturity or ARD (months): | 118 |

| Weighted Average Original Amortization Term (months)(2): | 352 |

| Weighted Average Remaining Amortization Term (months)(2): | 351 |

| Weighted Average Seasoning (months): | 1 |

| (1) | Information regarding mortgage loans secured by multiple properties is based on an allocation according to relative appraised values or the allocated loan amounts or property-specific release prices set forth in the related loan documents or such other allocation as the related mortgage loan seller deemed appropriate. |

| (2) | Excludes any mortgage loan that does not amortize. |

Credit Statistics:

| Weighted Average U/W Net Cash Flow DSCR(1): | 1.66x |

| Weighted Average U/W Net Operating Income Debt Yield(1): | 10.8% |

| Weighted Average Cut-off Date Loan-to-Value Ratio(1): | 66.1% |

| Weighted Average Balloon or ARD Loan-to-Value Ratio(1): | 56.4% |

| % of Mortgage Loans with Additional Subordinate Debt(2): | 3.5% |

| % of Mortgage Loans with Single Tenants(3): | 8.3% |

| (1) | With respect to the Patrick Henry Mall mortgage loan and the Patriots Park mortgage loan (collectively, the “Pari Passu Mortgage Loans”), each of which is part of a pari passu loan combination, loan-to-value ratio, debt service coverage ratio and debt yield calculations include the related pari passu companion loan(s) (unless otherwise stated). With respect to each mortgage loan, debt service coverage ratio, debt yield and loan-to-value ratio information takes no account of subordinate debt (whether or not secured by the related mortgaged property), if any, that is allowed under the terms of such mortgage loan. See Annex A-1 and Annex B to the Free Writing Prospectus. |

| (2) | The percentage figure expressed as “% of Mortgage Loans with Additional Subordinate Debt” is determined as a percentage of cut-off date principal balance and does not take into account future subordinate debt (whether or not secured by the mortgaged property), if any, that may be permitted under the terms of any mortgage loan or the pooling and servicing agreement. See “Description of the Mortgage Pool—Subordinate and/or Other Financing” in the Free Writing Prospectus. |

| (3) | Excludes mortgage loans that are secured by multiple single tenant properties and includes mortgage loans secured by multiple single tenant properties where each property is occupied by the same tenant or tenants that are affiliates of one another. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 5 |

| Wells Fargo Commercial Mortgage Trust 2015-SG1 | Issue Characteristics |

Loan Structural Features:

Amortization: Based on the Cut-off Date Pool Balance, 88.1% of the mortgage pool (59 mortgage loans) has scheduled amortization, as follows:

45.6% (36 mortgage loans) requires amortization during the entire loan term; and

42.5% (23 mortgage loans) provides for an interest-only period followed by an amortization period.

Interest-Only: Based on the Cut-off Date Pool Balance, 11.9% of the mortgage pool (13 mortgage loans) provides for interest-only payments during the entire loan term. The Weighted Average Cut-off Date Loan-to-Value Ratio and Weighted Average U/W Net Cash Flow DSCR for those mortgage loans are 60.6% and 2.13x, respectively.

Hard Lockboxes: Based on the Cut-off Date Pool Balance, 61.7% of the mortgage pool (36 mortgage loans) has hard lockboxes in place.

Reserves: The mortgage loans require amounts to be escrowed monthly as follows (excluding any mortgage loans with springing provisions):

| Real Estate Taxes: | 74.7% of the pool |

| Insurance: | 63.6% of the pool |

| Capital Replacements: | 71.2% of the pool |

| TI/LC: | 57.3% of the pool(1) |

| (1) | The percentage of Cut-off Date Balance for mortgage loans with TI/LC reserves is based on the aggregate principal balance allocable to loans that include retail, office, industrial and mixed use properties. |

Call Protection/Defeasance: Based on the Cut-off Date Pool Balance, the mortgage pool had the following call protection and defeasance features:

93.4% of the mortgage pool (67 mortgage loans) features a lockout period, then defeasance only until an open period;

3.8% of the mortgage pool (3 mortgage loans) features a lockout period, then the greater of a prepayment premium or yield maintenance until an open period;

2.2% of the mortgage pool (1 mortgage loan) features a lockout period, then the greater of a prepayment premium or yield maintenance or defeasance, then defeasance, until an open period; and

0.6% of the mortgage pool (1 mortgage loan) features no lockout period, but requires the greater of a prepayment premium or yield maintenance, then the greater of a prepayment premium or yield maintenance or defeasance until an open period.

Please refer to Annex A-1 to the Free Writing Prospectus for further information regarding individual loan call protection.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 6 |

| Wells Fargo Commercial Mortgage Trust 2015-SG1 | Issue Characteristics |

III. Issue Characteristics

| Securities Offered: | $659,022,000 approximate monthly pay, multi-class, commercial mortgage REMIC pass-through certificates consisting of twelve classes (Classes A-1, A-2, A-3, A-4, A-SB, A-S, B, C, D, PEX, X-A and X-B), which are offered pursuant to a registration statement filed with the SEC. | |

| Mortgage Loan Sellers: | Société Générale (“SG”); Liberty Island Group I LLC (“LIG I”); Basis Real Estate Capital II, LLC (“Basis”); Natixis Real Estate Capital LLC (“Natixis”); and Wells Fargo Bank, National Association (“WFB”) | |

| Co-Lead Bookrunning Managers: | Wells Fargo Securities, LLC and SG Americas Securities, LLC | |

| Co-Managers: | Citigroup Global Markets Inc., Morgan Stanley & Co. LLC and Natixis Securities Americas LLC | |

| Rating Agencies: | Fitch Ratings, Inc., Moody’s Investors Service, Inc. and Morningstar Credit Ratings, LLC | |

| Master Servicer: | Wells Fargo Bank, National Association | |

| Special Servicer: | Rialto Capital Advisors, LLC | |

| Certificate Administrator: | Wells Fargo Bank, National Association | |

| Trustee: | Wilmington Trust, National Association | |

| Trust Advisor: | Trimont Real Estate Advisors, Inc. | |

| Initial Majority Subordinate Certificateholder: | RREF II CMBS AIV, LP or another affiliate of Rialto Capital Advisors, LLC | |

| Cut-off Date: | The Cut-off Date with respect to each mortgage loan is the due date for the monthly debt service payment that is due in August 2015 (or, in the case of any mortgage loan that has its first due date in September 2015, the date that would have been its due date in August 2015 under the terms of that mortgage loan if a monthly debt service payment were scheduled to be due in that month). | |

| Expected Closing Date: | On or about August 27, 2015. | |

| Determination Dates: | The 11th day of each month (or if that day is not a business day, the next succeeding business day), commencing in September 2015. | |

| Distribution Dates: | The fourth business day following the Determination Date in each month, commencing in September 2015. | |

| Rated Final Distribution Date: | The Distribution Date in December 2047. | |

| Interest Accrual Period: | With respect to any Distribution Date, the calendar month immediately preceding the month in which such Distribution Date occurs. | |

| Day Count: | The Offered Certificates will accrue interest on a 30/360 basis. | |

| Minimum Denominations: | $10,000 for each Class of Offered Certificates (other than the Class X-A and X-B Certificates) and $1,000,000 for the Class X-A and X-B Certificates. Investments may also be made in any whole dollar denomination in excess of the applicable minimum denomination. | |

| Clean-up Call: | 1% | |

| Delivery: | DTC, Euroclear and Clearstream Banking | |

| ERISA/SMMEA Status: | Each Class of Offered Certificates is expected to be eligible for exemptive relief under ERISA. No Class of Offered Certificates will be SMMEA eligible. | |

| Risk Factors: | THE CERTIFICATES INVOLVE CERTAIN RISKS AND MAY NOT BE SUITABLE FOR ALL INVESTORS. SEE THE “RISK FACTORS” SECTION OF THE FREE WRITING PROSPECTUS. | |

| Bond Analytics Information: | The Certificate Administrator will be authorized to make distribution date settlements, CREFC® reports and certain supplemental reports (other than confidential information) available to certain financial modeling and data provision services, including Bloomberg, L.P., Trepp, LLC, Intex Solutions, Inc., Markit Group Limited, Interactive Data Corp., BlackRock Financial Management, Inc., CMBS.com, Inc. and Thomson Reuters Corporation. | |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 7 |

| Wells Fargo Commercial Mortgage Trust 2015-SG1 | Characteristics of the Mortgage Pool |

IV. Characteristics of the Mortgage Pool(1)

A. Ten Largest Mortgage Loans

| Mortgage

Loan Seller |

Mortgage Loan Name | City | State | Number of Mortgage Loans / Mortgaged Properties | Mortgage Loan Cut-off Date Balance ($) | % of Cut-off Date Pool Balance (%) | Property Type |

Number of SF or Rooms | Cut-off

Date Balance Per SF or Room ($) |

Cut-off

Date LTV Ratio (%) |

Balloon

or ARD LTV Ratio (%) |

U/W NCF DSCR (x) | U/W NOI Debt Yield (%) |

| LIG I/SG | Patrick Henry Mall(2) | Newport News | VA | 1 / 1 | $69,414,394 | 9.7% | Retail | 432,401 | $222 | 62.0% | 49.9% | 1.66x | 11.0% |

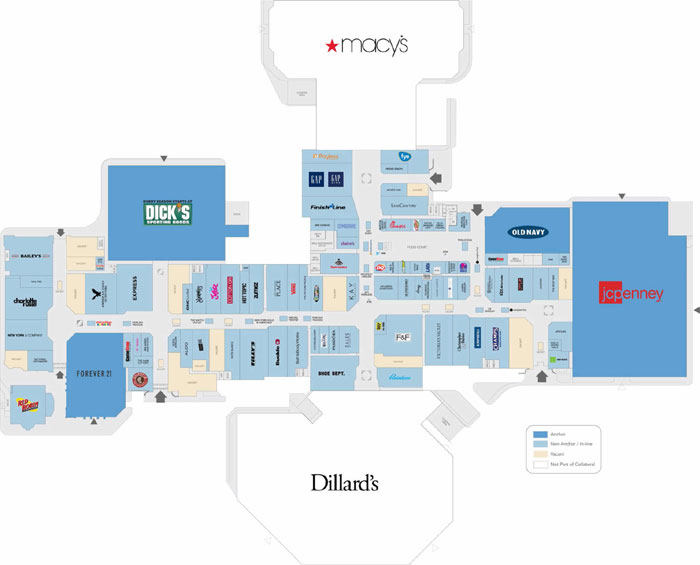

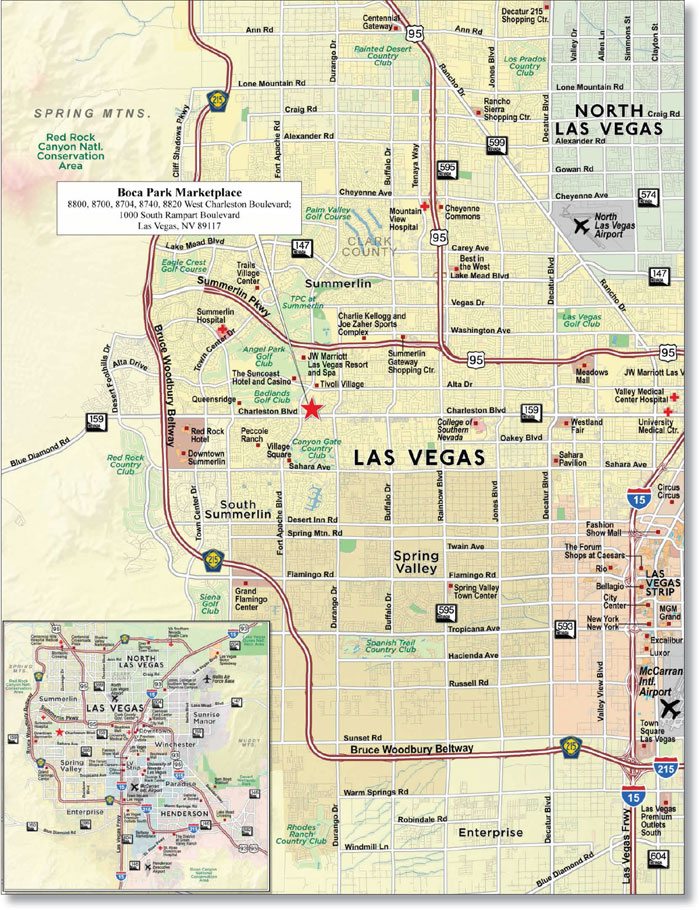

| WFB | Boca Park Marketplace | Las Vegas | NV | 1 / 1 | 46,500,000 | 6.5 | Retail | 148,095 | 314 | 75.0 | 64.4 | 1.27 | 8.3 |

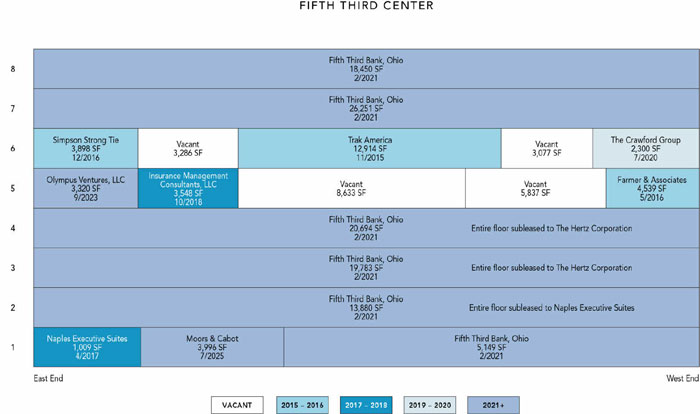

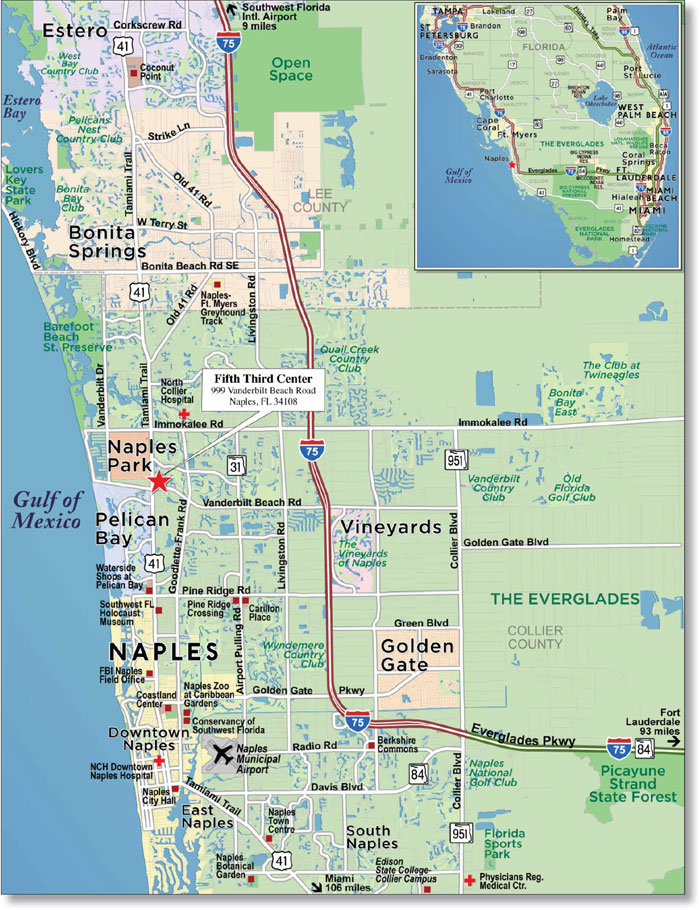

| LIG I | Fifth Third Center | Naples | FL | 1 / 1 | 38,450,000 | 5.4 | Office | 160,565 | 239 | 67.5 | 57.8 | 1.52 | 9.5 |

| SG | Hilton - Harrisburg | Harrisburg | PA | 1 / 1 | 31,500,000 | 4.4 | Hospitality | 341 | 92,375 | 63.0 | 55.1 | 1.64 | 13.4 |

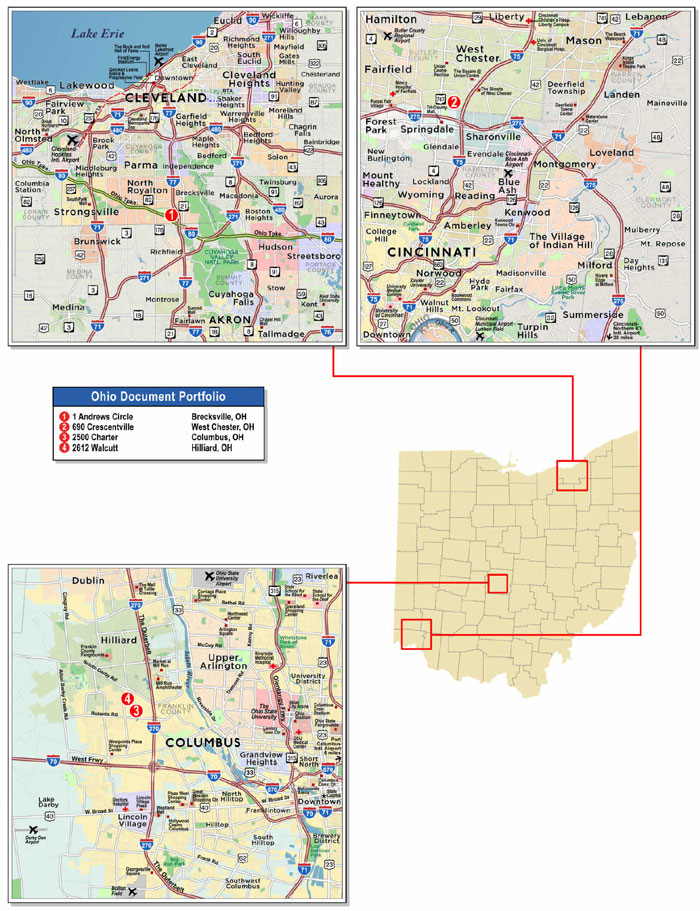

| Natixis | Ohio Document Portfolio | Various | OH | 1 / 4 | 19,926,207 | 2.8 | Industrial | 569,224 | 35 | 74.6 | 60.4 | 1.47 | 10.0 |

| Natixis | DoubleTree DFW | Irving | TX | 1 / 1 | 18,400,000 | 2.6 | Hospitality | 282 | 65,248 | 72.2 | 63.6 | 1.80 | 13.2 |

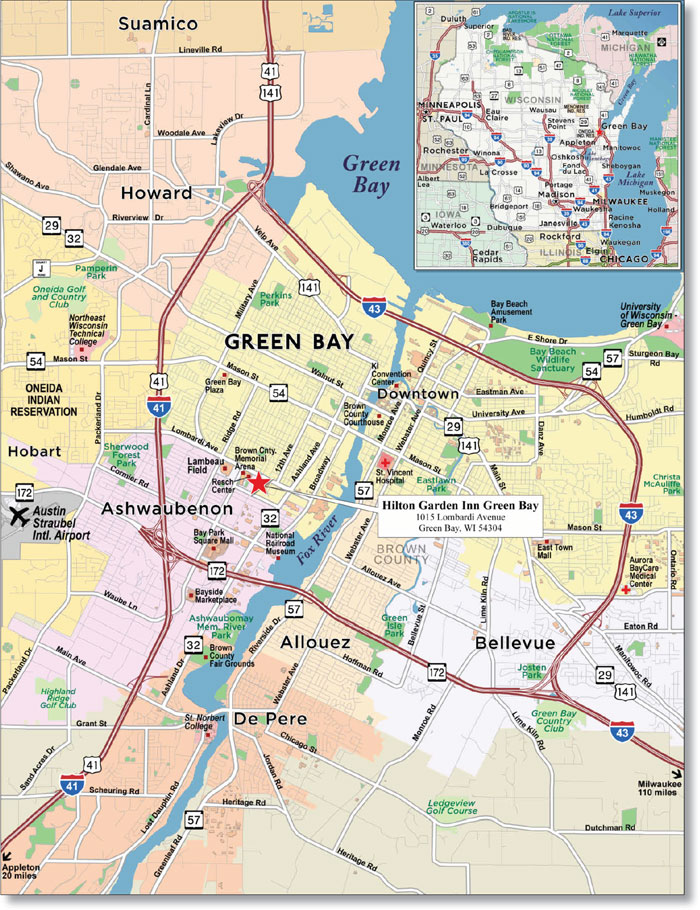

| SG | Hilton Garden Inn Green Bay | Green Bay | WI | 1 / 1 | 16,700,000 | 2.3 | Hospitality | 125 | 133,600 | 63.3 | 57.9 | 1.91 | 13.0 |

| SG | The Fairfax Building | Richmond | VA | 1 / 1 | 16,500,000 | 2.3 | Office | 155,335 | 106 | 75.0 | 65.3 | 1.57 | 10.5 |

| SG | Landmark Center | Indianapolis | IN | 1 / 1 | 16,125,000 | 2.3 | Office | 306,074 | 53 | 73.3 | 64.2 | 1.62 | 12.3 |

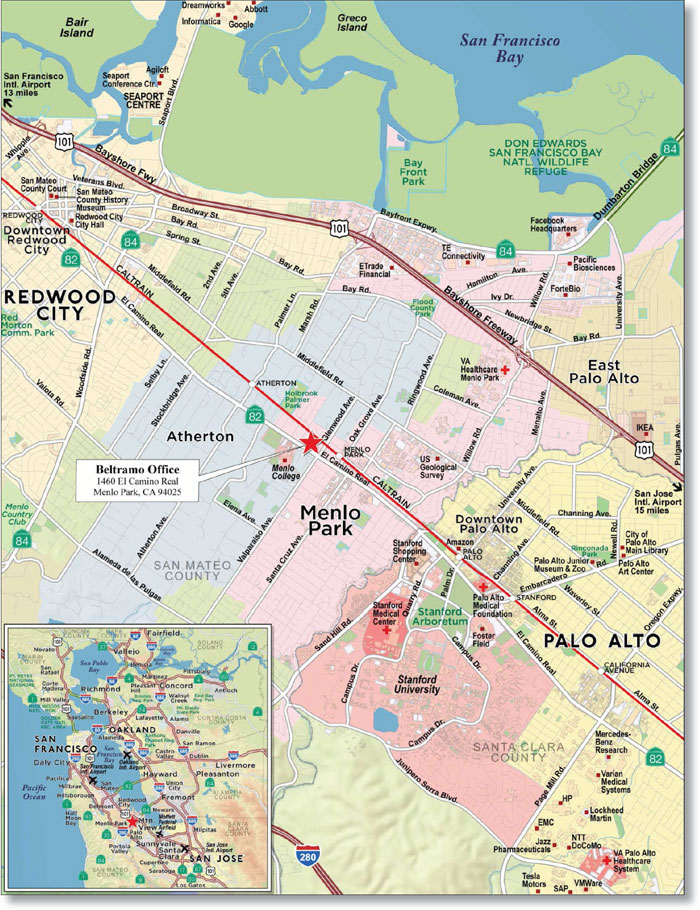

| SG | Beltramo Office | Menlo Park | CA | 1 / 1 | 16,000,000 | 2.2 | Office | 26,927 | 594 | 56.3 | 51.3 | 1.66 | 10.2 |

| Top Three Total/Weighted Average | 3 / 3 | $154,364,394 | 21.5% | 67.3% | 56.2% | 1.51x | 9.8% | ||||||

| Top Five Total/Weighted Average | 5 / 8 | $205,790,601 | 28.7% | 67.3% | 56.5% | 1.52x | 10.4% | ||||||

| Top Ten Total/Weighted Average | 10 / 13 | $289,515,601 | 40.4% | 67.6% | 57.7% | 1.58x | 10.8% | ||||||

| Non-Top Ten Total/Weighted Average | 62 / 64 | $426,812,806 | 59.6% | 65.0% | 55.5% | 1.71x | 10.8% | ||||||

| (1) | With respect to the Pari Passu Mortgage Loans, each of which is part of a pari passu loan combination, Cut-off Date Balance per square foot, loan-to-value ratio, debt service coverage ratio and debt yield calculations include the related pari passu companion loan(s) (unless otherwise stated). With respect to each mortgage loan, debt service coverage ratio, debt yield and loan-to-value ratio information takes no account of subordinate debt (whether or not secured by the related mortgaged property), if any, that is allowed under the terms of such mortgage loan. |

| (2) | One mortgage loan, identified on Annex A-1 as the Patrick Henry Mall, was co-originated Prudential Mortgage Capital Company, LLC and Société Générale and is part of a pari passu loan combination. Liberty Island Group I LLC is holder of the controlling note A-1, which had an original principal balance of $48,100,000. Société Générale is the holder of note A-2 and note A-3 which had original principal balances of $21,400,000 and $26,700,000, respectively. Note A-1 and note A-2 are being contributed to the securitization, while note A-3 is expected to be contributed to one or more future securitizations. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 8 |

| Wells Fargo Commercial Mortgage Trust 2015-SG1 | Characteristics of the Mortgage Pool |

B. Summary of Pari Passu Loan Combinations

| Property Name | Mortgage Loan Seller | Related Notes in Loan Group (Original Balance) | Holder of Note | Lead Servicer for the Entire Loan Combination | Current Master Servicer Under Related Securitization Servicing Agreement |

Current Special Servicer Under Related Securitization Servicing Agreement |

| Patrick Henry Mall | LIG I | $48,100,000 | WFCM 2015-SG1 | Yes | Wells Fargo Bank, National Association | Rialto Capital Advisors, LLC |

| SG | $21,400,000 | WFCM 2015-SG1 | Yes | Wells Fargo Bank, National Association | Rialto Capital Advisors, LLC | |

| SG | $26,700,000 | (1) | No | TBD | TBD | |

| Patriots Park | Natixis | $95,000,000 | WFCM 2015-NXS1 | Yes | Wells Fargo Bank, National Association | Rialto Capital Advisors, LLC |

| Natixis | $90,000,000 | WFCM 2015-NXS2 | No | Wells Fargo Bank, National Association | Rialto Capital Advisors, LLC | |

| Natixis | $26,000,000 | COMM 2015-CCRE22 | No | Wells Fargo Bank, National Association | LNR Partners, LLC | |

| Natixis | $4,070,000 | WFCM 2015-SG1 | No | Wells Fargo Bank, National Association | Rialto Capital Advisors, LLC |

| (1) | The related pari passu companion loan (Note A-3) is currently held by SG and is expected to be contributed to one or more future securitizations. |

C. Mortgage Loans with Additional Secured and Mezzanine Financing

| Loan No. | Mortgage Loan Seller | Mortgage Loan Name | Mortgage Loan Cut-off Date Balance ($) |

% of Cut-off Date Balance (%) | Sub Debt Cut-off Date Balance ($) | Mezzanine Debt Cut-off Date Balance ($) | Total Debt Interest Rate (%)(1) | Mortgage Loan U/W NCF DSCR (x) | Total Debt U/W NCF DSCR (x) | Mortgage Loan Cut- off Date U/W NOI Debt Yield (%) |

Total Debt Cut-off Date U/W NOI Debt Yield (%) | Mortgage Loan Cut-off Date LTV Ratio (%) |

Total Debt Cut-off Date LTV Ratio (%) |

| 6 | Natixis | DoubleTree DFW | $18,400,000 | 2.6% | NAP | $4,515,000 | 5.744% | 1.80x | 1.25x | 13.2% | 10.6% | 72.2% | 89.9% |

| Total/Weighted Average | $18,400,000 | 2.6% | NAP | $4,515,000 | 5.744% | 1.80x | 1.25x | 13.2% | 10.6% | 72.2% | 89.9% | ||

| (1) | Total Debt Interest Rate for any specified mortgage loan reflects the weighted average of the interest rates on the respective components of the total debt. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 9 |

| Wells Fargo Commercial Mortgage Trust 2015-SG1 | Characteristics of the Mortgage Pool |

| D. | Previous Securitization History(1) |

| Loan No. |

Mortgage Loan Seller |

Mortgage Loan or Mortgaged Property Name |

City | State | Property Type |

Mortgage

Loan or Mortgaged Property Cut-off Date Balance ($) |

%

of Cut-off Date Pool Balance (%) |

Previous Securitization | ||||||||

| 2 | WFB | Boca Park Marketplace | Las Vegas | NV | Retail | $46,500,000 | 6.5% | MSC 2005-HQ6 | ||||||||

| 3 | LIG I | Fifth Third Center | Naples | FL | Office | 38,450,000 | 5.4 | BACM 2006-5 | ||||||||

| 4 | SG | Hilton - Harrisburg | Harrisburg | PA | Hospitality | 31,500,000 | 4.4 | WFRBS 2012-C10 | ||||||||

| 7 | SG | Hilton Garden Inn Green Bay | Green Bay | WI | Hospitality | 16,700,000 | 2.3 | BSCMS 2006-PW13 | ||||||||

| 8 | SG | The Fairfax Building | Richmond | VA | Office | 16,500,000 | 2.3 | GCCFC 2006-GG7 | ||||||||

| 9 | SG | Landmark Center | Indianapolis | IN | Office | 16,125,000 | 2.3 | JPMCC 2007-C1 | ||||||||

| 11 | SG | 580 Market | San Francisco | CA | Mixed Use | 15,700,000 | 2.2 | RSO 2013-CRE1 | ||||||||

| 13 | LIG I | Glendale Plaza | New Castle Hundred | DE | Retail | 14,000,000 | 2.0 | BSCMS 2005-PWR8 | ||||||||

| 14 | LIG I | Regency Square Apartments | Yuma | AZ | Multifamily | 13,334,827 | 1.9 | FNA 2014-M3 | ||||||||

| 17 | SG | Skillman Abrams Shopping Center | Dallas | TX | Retail | 12,167,953 | 1.7 | GCCFC 2005-GG5 | ||||||||

| 20 | SG | Hilton Garden Inn Grand Forks | Grand Forks | ND | Hospitality | 10,920,000 | 1.5 | BSCMS 2006-PW14 | ||||||||

| 21 | SG | Hilton Garden Inn Appleton/Kimberly | Kimberly | WI | Hospitality | 10,855,000 | 1.5 | BSCMS 2006-PW13 | ||||||||

| 22 | LIG I | Hampton Inn & Applebee’s, Westampton | Westampton | NJ | Hospitality | 10,484,491 | 1.5 | LBUBS 2007-C2 | ||||||||

| 27 | Natixis | One Corporate Exchange | Beachwood | OH | Office | 8,500,000 | 1.2 | LBUBS 2007-C2 | ||||||||

| 32 | WFB | Lohman Plaza | Las Cruces | NM | Retail | 7,700,000 | 1.1 | CSFB 2005-C5 | ||||||||

| 42 | WFB | San Montego Apartments | El Paso | TX | Multifamily | 6,038,217 | 0.8 | GECMC 2005-C3 | ||||||||

| 43 | Natixis | 1505 Ferguson Lane | Austin | TX | Office | 6,000,000 | 0.8 | JPMCC 2010-C2 | ||||||||

| 53 | LIG I | Powell Plaza | Powell | OH | Retail | 5,073,289 | 0.7 | CSFB 2005-C4 | ||||||||

| 54 | SG | Shoppes at Corporate Park | Fort Lauderdale | FL | Retail | 4,972,220 | 0.7 | GECMC 2005-C3 | ||||||||

| 58 | LIG I | Wilmington Self Storage I | Wilmington | NC | Self Storage | 4,350,000 | 0.6 | BACM 2004-6 | ||||||||

| 61 | SG | 4747 Viewridge | San Diego | CA | Office | 3,900,000 | 0.5 | JPMCC 2006-CB15 | ||||||||

| 63 | SG | Your Extra Attic Suwanee | Sugar Hill | GA | Self Storage | 3,496,361 | 0.5 | BACM 2005-3 | ||||||||

| 64 | SG | Your Extra Attic John’s Creek | Cumming | GA | Self Storage | 3,237,371 | 0.5 | BACM 2005-3 | ||||||||

| 66 | WFB | La Mirada Apartments | El Paso | TX | Multifamily | 2,827,700 | 0.4 | GECMC 2005-C3 | ||||||||

| 68 | SG | Atria | San Diego | CA | Retail | 2,640,000 | 0.4 | CSFB 2005-C6 | ||||||||

| 71 | WFB | Villas del Valle Apartments | El Paso | TX | Multifamily | 1,720,646 | 0.2 | MLMT 2005-CIP1 | ||||||||

| Total | $313,693,075 | 43.8% |

| (1) | The table above represents the most recent securitization with respect to the mortgaged property securing the related mortgage loan, based on information provided by the related borrower or obtained through searches of a third-party database. While the above mortgage loans may have been securitized multiple times in prior transactions, mortgage loans are only listed in the above chart if the mortgage loan in this securitization paid off a mortgage loan in another securitization. The information has not otherwise been confirmed by the mortgage loan sellers. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 10 |

| Wells Fargo Commercial Mortgage Trust 2015-SG1 | Characteristics of the Mortgage Pool |

| E. | Mortgage Loans with Scheduled Balloon Payments and Related Classes |

| Class A-2(1) | ||||||||||||||||||||||||||||||||

| Loan No. |

Mortgage Loan Seller |

Mortgage Loan Name | State | Property Type |

Mortgage

Loan Cut-off Date Balance ($) |

%

of Cut-off Date Pool Balance (%) |

Mortgage

Loan Balance at Maturity ($) |

%

of Class A-2 Certificate Principal Balance (%)(2) |

SF | Loan

per SF ($) |

U/W

NCF DSCR (x) |

U/W

NOI Debt Yield (%) |

Cut-off Date LTV Ratio (%) |

Balloon or ARD LTV Ratio (%) |

Rem.

IO Period (mos.) |

Rem. Term to Maturity (mos.) | ||||||||||||||||

| 55 | SG | 4800 211th Street | IL | Retail | $4,600,000 | 0.6% | $4,221,551 | 23.6% | 11,904 | $386 | 1.69x | 10.9% | 74.8% | 68.6% | 0 | 60 | ||||||||||||||||

| 60 | Natixis | Patriots Park | VA | Office | $4,070,000 | 0.6 | $4,070,000 | 22.7 | 723,667 | $297 | 2.18 | 8.2 | 66.8 | 66.8 | 50 | 50 | ||||||||||||||||

| Total/Weighted Average | $8,670,000 | 1.2% | $8,291,551 | 46.3% | 1.92x | 9.6% | 71.0% | 67.8% | 23 | 55 | ||||||||||||||||||||||

| (1) | The table above presents the mortgage loan(s) whose balloon payments would be applied to pay down the principal balance of the Class A-2 Certificates, assuming a 0% CPR and applying the “Structuring Assumptions” described in the Free Writing Prospectus, including the assumptions that (i) none of the mortgage loans in the pool experience prepayments prior to maturity (or, in the case of an ARD loan, its anticipated repayment date), defaults or losses; (ii) there are no extensions of maturity dates of any mortgage loans in the pool; and (iii) each mortgage loan in the pool is paid in full on its stated maturity date (or, in the case of an ARD loan, its anticipated repayment date). Each Class of Certificates, including the Class A-2 Certificates, evidences undivided ownership interests in the entire pool of mortgage loans. Debt service coverage ratio, debt yield and loan-to-value ratio information takes no account of subordinate debt (whether or not secured by the mortgaged property), if any, that is allowed under the terms of any mortgage loan. See Annex A-1 to the Free Writing Prospectus. |

| (2) | Reflects the percentage equal to the Mortgage Loan Balance at Maturity divided by the initial Class A-2 Certificate Principal Balance. |

| Class A-3(1) | ||||||||||||||||||||||||||||||||

| Loan No. |

Mortgage Loan Seller |

Mortgage Loan Name | State | Property Type |

Mortgage

Loan Cut-off Date Balance ($) |

%

of Cut-off Date Pool Balance (%) |

Mortgage

Loan Balance at Maturity ($) |

%

of Class A-3 Certificate Principal Balance (%)(2) |

SF | Loan

per SF ($) |

U/W

NCF DSCR (x) |

U/W

NOI Debt Yield (%) |

Cut-off Date LTV Ratio (%) |

Balloon or ARD LTV Ratio (%) |

Rem.

IO Period (mos.) |

Rem. Term to Maturity (mos.) | ||||||||||||||||

| 34 | LIG I | 1025 Virginia Ave | GA | Office | $7,540,000 | 1.1% | $6,605,195 | 100.1% | 78,151 | $96 | 1.74x | 12.1% | 56.9% | 49.9% | 0 | 84 | ||||||||||||||||

| Total/Weighted Average | $7,540,000 | 1.1% | $6,605,195 | 100.1% | 1.74x | 12.1% | 56.9% | 49.9% | 0 | 84 | ||||||||||||||||||||||

| (1) | The table above presents the mortgage loan(s) whose balloon payments would be applied to pay down the principal balance of the Class A-3 Certificates, assuming a 0% CPR and applying the “Structuring Assumptions” described in the Free Writing Prospectus, including the assumptions that (i) none of the mortgage loans in the pool experience prepayments prior to maturity (or, in the case of an ARD loan, its anticipated repayment date), defaults or losses; (ii) there are no extensions of maturity dates of any mortgage loans in the pool; and (iii) each mortgage loan in the pool is paid in full on its stated maturity date (or, in the case of an ARD loan, its anticipated repayment date). Each Class of Certificates, including the Class A-3 Certificates, evidences undivided ownership interests in the entire pool of mortgage loans. Debt service coverage ratio, debt yield and loan-to-value ratio information takes no account of subordinate debt (whether or not secured by the mortgaged property), if any, that is allowed under the terms of any mortgage loan. See Annex A-1 to the Free Writing Prospectus. |

| (2) | Reflects the percentage equal to the Mortgage Loan Balance at Maturity divided by the initial Class A-3 Certificate Principal Balance. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 11 |

| Wells Fargo Commercial Mortgage Trust 2015-SG1 | Characteristics of the Mortgage Pool |

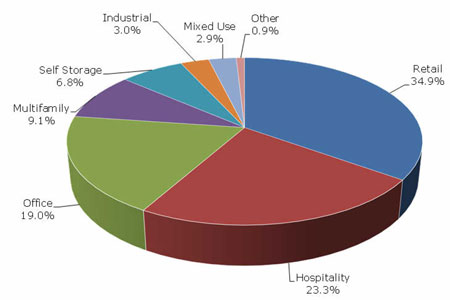

| F. | Property Type Distribution(1) |

| Property Type | Number

of Mortgaged Properties |

Aggregate Cut-off Date Balance ($) |

%

of Cut-off Date Balance (%) |

Weighted Average Cut-off Date LTV Ratio (%) |

Weighted Average Balloon or ARD LTV Ratio (%) |

Weighted Average U/W NCF DSCR (x) |

Weighted Average U/W NOI Debt Yield (%) |

Weighted Average U/W NCF Debt Yield (%) |

Weighted Average Mortgage Rate (%) | |||||||||

| Retail | 23 | $250,021,224 | 34.9% | 66.1% | 56.4% | 1.61x | 10.1% | 9.3% | 4.437% | |||||||||

| Anchored | 8 | 112,073,742 | 15.6 | 70.3 | 59.5 | 1.43 | 9.5 | 8.7 | 4.494 | |||||||||

| Regional Mall | 1 | 69,414,394 | 9.7 | 62.0 | 49.9 | 1.66 | 11.0 | 9.9 | 4.352 | |||||||||

| Unanchored | 8 | 35,940,726 | 5.0 | 66.3 | 58.3 | 1.72 | 10.7 | 10.1 | 4.583 | |||||||||

| Single Tenant | 5 | 29,877,362 | 4.2 | 58.7 | 57.0 | 2.08 | 9.7 | 9.2 | 4.233 | |||||||||

| Shadow Anchored | 1 | 2,715,000 | 0.4 | 75.0 | 65.7 | 1.44 | 9.7 | 8.8 | 4.540 | |||||||||

| Hospitality | 16 | 166,870,175 | 23.3 | 64.8 | 53.6 | 1.75 | 13.2 | 11.3 | 4.765 | |||||||||

| Limited Service | 11 | 90,831,096 | 12.7 | 65.2 | 52.5 | 1.72 | 12.8 | 11.5 | 4.821 | |||||||||

| Full Service | 4 | 63,039,079 | 8.8 | 63.1 | 54.5 | 1.73 | 13.7 | 10.8 | 4.730 | |||||||||

| Extended Stay | 1 | 13,000,000 | 1.8 | 69.5 | 56.3 | 1.99 | 13.5 | 12.2 | 4.540 | |||||||||

| Office | 13 | 136,265,000 | 19.0 | 67.4 | 59.4 | 1.64 | 10.3 | 9.5 | 4.466 | |||||||||

| Suburban | 8 | 102,650,000 | 14.3 | 67.2 | 59.4 | 1.66 | 10.0 | 9.4 | 4.433 | |||||||||

| CBD | 1 | 16,125,000 | 2.3 | 73.3 | 64.2 | 1.62 | 12.3 | 9.8 | 4.490 | |||||||||

| Medical | 3 | 9,950,000 | 1.4 | 67.9 | 59.9 | 1.47 | 9.7 | 9.2 | 4.723 | |||||||||

| Single Tenant | 1 | 7,540,000 | 1.1 | 56.9 | 49.9 | 1.74 | 12.1 | 10.6 | 4.530 | |||||||||

| Multifamily | 9 | 65,471,390 | 9.1 | 70.1 | 57.2 | 1.45 | 9.6 | 9.0 | 4.647 | |||||||||

| Garden | 9 | 65,471,390 | 9.1 | 70.1 | 57.2 | 1.45 | 9.6 | 9.0 | 4.647 | |||||||||

| Self Storage | 8 | 48,624,411 | 6.8 | 59.2 | 50.7 | 1.90 | 10.8 | 10.5 | 4.303 | |||||||||

| Self Storage | 8 | 48,624,411 | 6.8 | 59.2 | 50.7 | 1.90 | 10.8 | 10.5 | 4.303 | |||||||||

| Industrial | 5 | 21,676,207 | 3.0 | 73.2 | 59.1 | 1.50 | 10.7 | 9.4 | 4.621 | |||||||||

| Warehouse | 4 | 19,926,207 | 2.8 | 74.6 | 60.4 | 1.47 | 10.0 | 9.0 | 4.497 | |||||||||

| Flex | 1 | 1,750,000 | 0.2 | 57.6 | 44.6 | 1.84 | 18.5 | 14.3 | 6.031 | |||||||||

| Mixed Use | 2 | 21,050,000 | 2.9 | 63.7 | 63.7 | 1.88 | 8.4 | 7.9 | 4.102 | |||||||||

| Office/Retail | 2 | 21,050,000 | 2.9 | 63.7 | 63.7 | 1.88 | 8.4 | 7.9 | 4.102 | |||||||||

| Other | 1 | 6,350,000 | 0.9 | 62.3 | 62.3 | 1.55 | 6.7 | 6.7 | 4.220 | |||||||||

| Leased Fee | 1 | 6,350,000 | 0.9 | 62.3 | 62.3 | 1.55 | 6.7 | 6.7 | 4.220 | |||||||||

| Total/Weighted Average: | 77 | $716,328,406 | 100.0% | 66.1% | 56.4% | 1.66x | 10.8% | 9.8% | 4.523% |

| (1) | Because this table presents information relating to the mortgaged properties and not the mortgage loans, the information for mortgage loans secured by more than one mortgaged property is based on allocated amounts (allocating the mortgage loan principal balance to each of those properties according to the relative appraised values of the mortgaged properties or the allocated loan amounts or property-specific release prices set forth in the related mortgage loan documents or such other allocation as the related mortgage loan seller deemed appropriate). With respect to the Pari Passu Mortgage Loans, each of which is part of a pari passu loan combination, loan-to-value ratio, debt service coverage ratio and debt yield calculations include the related pari passu companion loan(s) (unless otherwise stated). With respect to each mortgage loan, debt service coverage ratio, debt yield and loan-to-value ratio information takes no account of subordinate debt (whether or not secured by the related mortgaged property) that is allowed under the terms of such mortgage loan. See Annex A-1 to the Free Writing Prospectus. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 12 |

| Wells Fargo Commercial Mortgage Trust 2015-SG1 | Characteristics of the Mortgage Pool |

| G. | Geographic Distribution(1)(2) |

| Location | Number

of Mortgaged Properties |

Aggregate

Cut- off Date Balance ($) |

%

of Cut-off Date Balance (%) |

Weighted Average Cut-off Date LTV Ratio (%) |

Weighted Average Balloon or ARD LTV Ratio (%) |

Weighted Average U/W NCF DSCR (x) |

Weighted Average U/W NOI Debt Yield (%) |

Weighted Average U/W NCF Debt Yield (%) |

Weighted Average Mortgage Rate (%) | |||||||||

| Virginia | 4 | $98,034,394 | 13.7% | 64.9% | 53.7% | 1.66x | 10.8% | 9.7% | 4.344% | |||||||||

| Texas | 8 | 70,918,951 | 9.9 | 69.7 | 57.4 | 1.52 | 10.5 | 9.3 | 4.615 | |||||||||

| California | 8 | 67,266,244 | 9.4 | 59.1 | 55.2 | 1.93 | 9.9 | 9.5 | 4.181 | |||||||||

| Northern | 4 | 45,676,244 | 6.4 | 57.9 | 54.8 | 1.93 | 9.9 | 9.5 | 4.134 | |||||||||

| Southern | 4 | 21,590,000 | 3.0 | 61.7 | 56.1 | 1.92 | 10.0 | 9.5 | 4.282 | |||||||||

| Georgia | 10 | 64,198,733 | 9.0 | 64.3 | 52.0 | 1.63 | 11.5 | 10.5 | 4.835 | |||||||||

| Florida | 5 | 63,212,824 | 8.8 | 66.5 | 55.4 | 1.53 | 9.8 | 9.5 | 4.537 | |||||||||

| Nevada | 3 | 53,721,631 | 7.5 | 74.0 | 64.1 | 1.35 | 8.6 | 8.1 | 4.670 | |||||||||

| Ohio | 9 | 50,113,861 | 7.0 | 71.0 | 56.9 | 1.59 | 11.0 | 9.8 | 4.588 | |||||||||

| Other(4) | 30 | 248,861,769 | 34.7 | 65.0 | 57.1 | 1.74 | 11.6 | 10.3 | 4.530 | |||||||||

| Total/Weighted Average | 77 | $716,328,406 | 100.0% | 66.1% | 56.4% | 1.66x | 10.8% | 9.8% | 4.523% |

| (1) | The mortgaged properties are located in 28 states. |

| (2) | Because this table presents information relating to the mortgaged properties and not the mortgage loans, the information for mortgage loans secured by more than one mortgaged property is based on allocated amounts (allocating the mortgage loan principal balance to each of those properties according to the relative appraised values of the mortgaged properties or the allocated loan amounts or property-specific release prices set forth in the related mortgage loan documents or such other allocation as the related mortgage loan seller deemed appropriate). With respect to the Pari Passu Mortgage Loans, each of which is part of a pari passu loan combination, loan-to-value ratio, debt service coverage ratio and debt yield calculations include the related pari passu companion loan(s) (unless otherwise stated). With respect to each mortgage loan, debt service coverage ratio, debt yield and loan-to-value ratio information takes no account of subordinate debt (whether or not secured by the related mortgaged property), if any, that is allowed under the terms of such mortgage loan. See Annex A-1 to the Free Writing Prospectus. |

| (3) | For purposes of determining whether a mortgaged property is in Northern California or Southern California, Northern California includes areas with zip codes above 93600 and Southern California includes areas with zip codes of 93600 and below. |

| (4) | Includes 21 other states. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 13 |

| Wells Fargo Commercial Mortgage Trust 2015-SG1 | Characteristics of the Mortgage Pool |

H. Characteristics of the Mortgage Pool(1)

| CUT-OFF DATE BALANCE | ||||||

| Range of Cut-off Date Balances ($) |

Number of Mortgage Loans |

Aggregate Cut- off Date Balance |

% of Cut-off Date Balance | |||

| 1,300,000 - 2,000,000 | 4 | $6,677,521 | 0.9% | |||

| 2,000,001 - 3,000,000 | 4 | 11,179,331 | 1.6 | |||

| 3,000,001 - 4,000,000 | 4 | 14,486,094 | 2.0 | |||

| 4,000,001 - 5,000,000 | 7 | 31,067,220 | 4.3 | |||

| 5,000,001 - 6,000,000 | 11 | 59,728,668 | 8.3 | |||

| 6,000,001 - 7,000,000 | 8 | 51,997,296 | 7.3 | |||

| 7,000,001 - 8,000,000 | 5 | 38,880,604 | 5.4 | |||

| 8,000,001 - 9,000,000 | 4 | 33,589,365 | 4.7 | |||

| 9,000,001 - 10,000,000 | 3 | 28,394,435 | 4.0 | |||

| 10,000,001 - 15,000,000 | 11 | 135,112,271 | 18.9 | |||

| 15,000,001 - 20,000,000 | 7 | 119,351,207 | 16.7 | |||

| 30,000,001 - 50,000,000 | 3 | 116,450,000 | 16.3 | |||

| 50,000,001 – 69,414,394 | 1 | 69,414,394 | 9.7 | |||

| Total: | 72 | $716,328,406 | 100.0% | |||

| Average: | $9,949,006 | |||||

| UNDERWRITTEN NOI DEBT SERVICE COVERAGE RATIO | ||||||

| Range of U/W NOI DSCRs (x) |

Number of Mortgage Loans |

Aggregate Cut- off Date Balance |

% of Cut-off Date Balance | |||

| 1.27 - 1.30 | 1 | $6,000,000 | 0.8% | |||

| 1.31 - 1.40 | 1 | 46,500,000 | 6.5 | |||

| 1.41 - 1.50 | 7 | 60,838,217 | 8.5 | |||

| 1.51 - 1.60 | 13 | 105,997,246 | 14.8 | |||

| 1.61 - 1.70 | 7 | 56,415,561 | 7.9 | |||

| 1.71 - 1.80 | 13 | 114,217,794 | 15.9 | |||

| 1.81 - 1.90 | 5 | 98,814,394 | 13.8 | |||

| 1.91 - 2.00 | 2 | 13,202,500 | 1.8 | |||

| 2.01 - 2.25 | 13 | 148,866,244 | 20.8 | |||

| 2.26 - 2.50 | 6 | 35,957,371 | 5.0 | |||

| 2.51 - 2.75 | 2 | 12,289,079 | 1.7 | |||

| 2.76 – 2.97 | 2 | 17,230,000 | 2.4 | |||

| Total: | 72 | $716,328,406 | 100.0% | |||

| Weighted Average: | 1.82x | |||||

| UNDERWRITTEN NCF DEBT SERVICE COVERAGE RATIO | ||||||

| Range of U/W NCF DSCRs (x) |

Number of Mortgage Loans |

Aggregate Cut- off Date Balance |

% of Cut-off Date Balance | |||

| 1.25 - 1.30 | 3 | $58,538,217 | 8.2% | |||

| 1.31 - 1.40 | 6 | 50,943,289 | 7.1 | |||

| 1.41 - 1.50 | 17 | 121,000,817 | 16.9 | |||

| 1.51 - 1.60 | 10 | 110,933,259 | 15.5 | |||

| 1.61 - 1.70 | 13 | 194,992,630 | 27.2 | |||

| 1.71 - 1.80 | 3 | 31,602,500 | 4.4 | |||

| 1.81 - 1.90 | 2 | 15,750,000 | 2.2 | |||

| 1.91 - 2.00 | 4 | 41,076,244 | 5.7 | |||

| 2.01 - 2.25 | 10 | 60,786,450 | 8.5 | |||

| 2.26 - 2.75 | 3 | 22,705,000 | 3.2 | |||

| 2.76 – 2.91 | 1 | 8,000,000 | 1.1 | |||

| Total: | 72 | $716,328,406 | 100.0% | |||

| Weighted Average: | 1.66x | |||||

| LOAN PURPOSE | |||

| Loan Purpose | Number of Mortgage Loans |

Aggregate Cut- off Date Balance |

% of Cut-off Date Balance |

| Refinance | 48 | $536,418,832 | 74.9% |

| Acquisition | 24 | 179,909,575 | 25.1 |

| Total: | 72 | $716,328,406 | 100.0% |

| MORTGAGE RATE | |||

| Range of Mortgage Rates (%) |

Number of Mortgage Loans |

Aggregate Cut- off Date Balance |

% of Cut-off Date Balance |

| 3.658 - 3.750 | 1 | $4,070,000 | 0.6% |

| 3.751 - 4.000 | 2 | 22,125,000 | 3.1 |

| 4.001 - 4.250 | 11 | 91,478,464 | 12.8 |

| 4.251 - 4.500 | 23 | 265,739,500 | 37.1 |

| 4.501 - 4.750 | 21 | 230,514,241 | 32.2 |

| 4.751 - 5.000 | 7 | 60,060,997 | 8.4 |

| 5.001 - 5.250 | 3 | 22,865,205 | 3.2 |

| 5.251 - 5.500 | 2 | 11,525,000 | 1.6 |

| 5.501 - 6.031 | 2 | 7,950,000 | 1.1 |

| Total: | 72 | $716,328,406 | 100.0% |

| Weighted Average: | 4.523% | ||

| UNDERWRITTEN NOI DEBT YIELD | |||

| Range of U/W NOI Debt Yields (%) |

Number of Mortgage Loans |

Aggregate Cut- off Date Balance |

% of Cut-off Date Balance |

| 6.7 - 8.0 | 2 | $22,050,000 | 3.1% |

| 8.1 - 9.0 | 7 | 83,320,000 | 11.6 |

| 9.1 - 10.0 | 22 | 182,961,025 | 25.5 |

| 10.1 - 11.0 | 14 | 174,406,092 | 24.3 |

| 11.1 - 12.0 | 9 | 69,603,235 | 9.7 |

| 12.1 - 13.0 | 8 | 70,531,635 | 9.8 |

| 13.1 - 14.0 | 8 | 104,767,341 | 14.6 |

| 14.1 – 18.5 | 2 | 8,689,079 | 1.2 |

| Total: | 72 | $716,328,406 | 100.0% |

| Weighted Average: | 10.8% | ||

| UNDERWRITTEN NCF DEBT YIELD | |||

| Range of U/W NCF Debt Yields (%) |

Number of Mortgage Loans |

Aggregate Cut- off Date Balance |

% of Cut-off Date Balance |

| 6.7 - 8.0 | 5 | $78,450,000 | 11.0% |

| 8.1 - 9.0 | 20 | 146,462,912 | 20.4 |

| 9.1 - 10.0 | 20 | 270,699,205 | 37.8 |

| 10.1 - 11.0 | 15 | 121,083,626 | 16.9 |

| 11.1 - 12.0 | 3 | 30,676,244 | 4.3 |

| 12.1 - 13.0 | 6 | 57,029,969 | 8.0 |

| 13.1 - 14.0 | 1 | 3,237,371 | 0.5 |

| 14.1 – 14.6 | 2 | 8,689,079 | 1.2 |

| Total: | 72 | $716,328,406 | 100.0% |

| Weighted Average: | 9.8% | ||

|

(1) With respect to the Pari Passu Mortgage Loans, each of which is part of a pari passu loan combination, loan-to-value ratio, debt service coverage ratio and debt yield calculations include the related pari passu companion loan(s) (unless otherwise stated). With respect to each mortgage loan, debt service coverage ratio, debt yield and loan-to-value ratio information takes no account of subordinate debt (whether or not secured by the related mortgaged property), if any, that is allowed under the terms of such mortgage loan. See Annex A-1 to the Free Writing Prospectus. Prepayment provisions for each mortgage loan reflects the entire life of the loan (from origination to maturity or ARD). |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 14 |

| Wells Fargo Commercial Mortgage Trust 2015-SG1 | Characteristics of the Mortgage Pool |

| ORIGINAL TERM TO MATURITY OR ARD | |||

| Original Terms to Maturity or ARD (months) |

Number of Mortgage Loans |

Aggregate Cut- off Date Balance |

% of Cut-off Date Balance |

| 60 | 2 | $8,670,000 | 1.2% |

| 84 | 1 | 7,540,000 | 1.1 |

| 120 | 69 | 700,118,406 | 97.7 |

| Total: | 72 | $716,328,406 | 100.0% |

| Weighted Average: | 119 months | ||

| REMAINING TERM TO MATURITY OR ARD | |||

| Range of Remaining Terms to Maturity or ARD (months) |

Number of Mortgage Loans |

Aggregate Cut- off Date Balance |

% of Cut-off Date Balance |

| 50 - 60 | 2 | $8,670,000 | 1.2% |

| 61 - 84 | 1 | 7,540,000 | 1.1 |

| 85 - 120 | 69 | 700,118,406 | 97.7 |

| Total: | 72 | $716,328,406 | 100.0% |

| Weighted Average: | 118 months | ||

| ORIGINAL AMORTIZATION TERM(2) | |||

| Range of Original Amortization Terms (months) |

Number of Mortgage Loans |

Aggregate Cut- off Date Balance |

% of Cut-off Date Balance |

| Non-Amortizing | 13 | $85,490,000 | 11.9% |

| 240 | 2 | 16,854,969 | 2.4 |

| 241 - 300 | 9 | 51,484,852 | 7.2 |

| 301 - 360 | 48 | 562,498,585 | 78.5 |

| Total: | 72 | $716,328,406 | 100.0% |

| Weighted Average(3): | 352 months | ||

|

(2) The original amortization term shown for any mortgage loan that is interest-only for part of its term does not include the number of months in its interest-only period and reflects only the number of months as of the commencement of amortization remaining from the end of such interest-only period. (3) Excludes the non-amortizing mortgage loans. | |||

| REMAINING AMORTIZATION TERM(4) | |||

| Range of Remaining Amortization Terms (months) |

Number of Mortgage Loans |

Aggregate Cut- off Date Balance |

% of Cut-off Date Balance |

| Non-Amortizing | 13 | $85,490,000 | 11.9% |

| 236 - 240 | 2 | 16,854,969 | 2.4 |

| 241 - 300 | 9 | 51,484,852 | 7.2 |

| 301 - 360 | 48 | 562,498,585 | 78.5 |

| Total: | 72 | $716,328,406 | 100.0% |

| Weighted Average(5): | 351 months | ||

|

(4) The remaining amortization term shown for any mortgage loan that is interest-only for part of its term does not include the number of months in its interest-only period and reflects only the number of months as of the commencement of amortization remaining from the end of such interest-only period. (5) Excludes the non-amortizing mortgage loans. | |||

| LOCKBOXES | |||

| Type of Lockbox | Number of Mortgage Loans |

Aggregate Cut- off Date Balance |

% of Cut-off Date Balance |

| Hard/Springing Cash Management | 32 | $363,764,379 | 50.8% |

| Springing (Without Established Account) | 20 | 156,485,457 | 21.8 |

| None | 13 | 88,731,244 | 12.4 |

| Hard/Upfront Cash Management | 4 | 78,262,500 | 10.9 |

| Soft/Springing Cash Management | 3 | 29,084,827 | 4.1 |

| Total: | 72 | $716,328,406 | 100.0% |

| PREPAYMENT PROVISION SUMMARY | |||

| Prepayment Provision | Number of Mortgage Loans |

Aggregate Cut- off Date Balance |

% of Cut-off Date Balance |

| Lockout/Defeasance/Open | 67 | $668,908,406 | 93.4% |

| Lockout/GTR

YM or 1%/ Open |

3 | 27,350,000 | 3.8 |

| Lockout/GTR

YM or 1% or Defeasance/Defeasance/ Open |

1 | 16,000,000 | 2.2 |

| GTR YM or 1% / GTR YM or 1% or Defeasance / Open | 1 | 4,070,000 | 0.6 |

| Total: | 72 | $716,328,406 | 100.0% |

| CUT-OFF DATE LOAN-TO-VALUE RATIO | |||

| Range of Cut-off Date LTV Ratios (%) |

Number of Mortgage Loans |

Aggregate Cut- off Date Balance |

% of Cut-off Date Balance |

| 44.5 - 50.0 | 2 | $10,176,450 | 1.4% |

| 50.1 - 55.0 | 5 | 32,601,244 | 4.6 |

| 55.1 - 60.0 | 10 | 57,273,581 | 8.0 |

| 60.1 - 65.0 | 19 | 239,662,698 | 33.5 |

| 65.1 - 70.0 | 21 | 208,619,443 | 29.1 |

| 70.1 - 75.0 | 14 | 160,994,990 | 22.5 |

| 75.1 – 81.4 | 1 | 7,000,000 | 1.0 |

| Total: | 72 | $716,328,406 | 100.0% |

| Weighted Average | 66.1% | ||

| BALLOON OR ARD LOAN-TO-VALUE RATIO | |||

| Range of Balloon LTV Ratios (%) | Number of Mortgage Loans |

Aggregate Cut- off Date Balance |

% of Cut-off Date Balance |

| 36.7 - 40.0 | 2 | $10,176,450 | 1.4% |