UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05812

Legg Mason Partners Premium Money Market Trust

(Exact name of registrant as specified in charter)

620 Eighth Avenue, 49th Floor, New York, NY 10018

(Address of principal executive offices) (Zip code)

Robert I. Frenkel, Esq.

Legg Mason & Co., LLC

100 First Stamford Place

Stamford, CT 06902

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-877-721-1926

Date of fiscal year end: August 31

Date of reporting period: August 31, 2015

| ITEM 1. | REPORT TO STOCKHOLDERS. |

The Annual Report to Stockholders is filed herewith.

| Annual Report | August 31, 2015 |

WESTERN ASSET

PREMIUM LIQUID

RESERVES

| INVESTMENT PRODUCTS: NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE |

| What’s inside | ||||

| Letter from the president | II | |||

| Investment commentary | III | |||

| Fund overview | 1 | |||

| Portfolio at a glance — Liquid Reserves Portfolio | 4 | |||

| Fund expenses | 5 | |||

| Western Asset Premium Liquid Reserves |

||||

| Statement of assets and liabilities | 6 | |||

| Statement of operations | 7 | |||

| Statements of changes in net assets | 8 | |||

| Financial highlights | 9 | |||

| Notes to financial statements | 10 | |||

| Report of independent registered public accounting firm | 14 | |||

| Additional information | 15 | |||

| Important tax information | 21 | |||

| Liquid Reserves Portfolio | ||||

| Schedule of investments | 22 | |||

| Statement of assets and liabilities | 30 | |||

| Statement of operations | 31 | |||

| Statements of changes in net assets | 32 | |||

| Financial highlights | 33 | |||

| Notes to financial statements | 34 | |||

| Report of independent registered public accounting firm | 38 | |||

| Additional information | 39 | |||

Fund objective

The Fund’s investment objective is to provide shareholders with liquidity and as high a level of current income as is consistent with preservation of capital.

Dear Shareholder,

We are pleased to provide the annual report of Western Asset Premium Liquid Reserves for the twelve-month reporting period ended August 31, 2015. Please read on for a detailed look at prevailing economic and market conditions during the Fund’s reporting period and to learn how those conditions have affected Fund performance.

I am pleased to introduce myself as the new President and Chief Executive Officer of the Fund, succeeding Kenneth D. Fuller. I am honored to have been appointed to my new role. During my 27 year career with Legg Mason, I have seen the investment management industry evolve and expand. Throughout these changes, maintaining an unwavering focus on our shareholders and their needs has remained paramount.

As always, we remain committed to providing you with excellent service and a full spectrum of investment choices. We also remain committed to supplementing the support you receive from your financial advisor. One way we accomplish this is through our website, www.leggmason.com/individualinvestors. Here you can gain immediate access to market and investment information, including:

| • | Fund prices and performance, |

| • | Market insights and commentaries from our portfolio managers, and |

| • | A host of educational resources. |

We look forward to helping you meet your financial goals.

Sincerely,

Jane Trust, CFA

President and Chief Executive Officer

September 25, 2015

| II | Western Asset Premium Liquid Reserves |

Economic review

The pace of U.S. economic activity expanded moderately during the twelve months ended August 31, 2015 (the “reporting period”). Looking back, the U.S. Department of Commerce’s revised figures showed that third and fourth quarter 2014 U.S. gross domestic product (“GDP”)i growth was 4.3% and 2.1%, respectively. First quarter 2015 GDP growth then moderated to 0.6%. This was attributed to a number of factors, including a deceleration in personal consumption expenditures (“PCE”), along with negative contributions from exports, nonresidential fixed investment, and state and local government spending. However, economic activity then accelerated, as the U.S. Department of Commerce’s final reading for second quarter 2015 GDP growth — released after the reporting period ended — was 3.9%. The upturn was driven by increasing exports, accelerating PCE, declining imports, expanding state and local government spending, and rising nonresidential fixed investment.

The labor market was a tailwind for the economy during the reporting period. When the period began, unemployment was 5.9%, as reported by the U.S. Department of Labor. By August 2015, unemployment was 5.1%, its lowest level since April 2008.

The Federal Reserve Board (“Fed”)ii took a number of actions as it sought to meet its dual mandate of fostering maximum employment and price stability. As it has since December 2008, the Fed maintained the federal funds rateiii at a historically low range between zero and 0.25% during the twelve months ended August 31, 2015. However, in October 2014 the Fed ended its asset purchase program that was announced in December 2012. In December 2014, the Fed said that “it can be patient in beginning to normalize the stance of monetary policy.” At its meeting that concluded on July 29, 2015, the Fed said “The Committee currently anticipates that, even after employment and inflation are near mandate-consistent levels, economic conditions may, for some time, warrant keeping the target federal funds rate below levels the Committee views as normal in the longer run.” Finally, at its meeting that ended on September 17, 2015, after the close of the reporting period, the Fed decided to maintain the target between zero and 0.25%.

As always, thank you for your confidence in our stewardship of your assets.

Sincerely,

Jane Trust, CFA

President and Chief Executive Officer

September 25, 2015

All investments are subject to risk including the possible loss of principal. Past performance is no guarantee of future results.

| i | Gross domestic product (“GDP”) is the market value of all final goods and services produced within a country in a given period of time. |

| ii | The Federal Reserve Board (“Fed”) is responsible for the formulation of policies designed to promote economic growth, full employment, stable prices and a sustainable pattern of international trade and payments. |

| iii | The federal funds rate is the rate charged by one depository institution on an overnight sale of immediately available funds (balances at the Federal Reserve) to another depository institution; the rate may vary from depository institution to depository institution and from day to day. |

| Western Asset Premium Liquid Reserves | III |

Q. What is the Fund’s investment strategy?

A. The Fund seeks to provide shareholders with liquidity and as high a level of current income as is consistent with preservation of capital. The Fund is a money market fund that invests in securities through an underlying mutual fund, Liquid Reserves Portfolio (the “Portfolio”), which has the same goals and strategies as the Fund. The Portfolio invests in high-quality, U.S. dollar-denominated short-term debt securities that, at the time of purchase, are rated by one or more rating agencies in the highest short-term rating category or, if not rated, that we determined to be of equivalent quality.

The Portfolio may invest in all types of money market instruments, including bank obligations, commercial paper and asset-backed securities, structured investments, repurchase agreements and other short-term debt securities. These instruments may be issued or guaranteed by all types of issuers, including U.S. and foreign banks and other private issuers, the U.S. government or any of its agencies or instrumentalities, U.S. states and municipalities, or foreign governments.

The Portfolio may invest without limit in bank obligations, such as certificates of deposit, fixed time deposits and bankers’ acceptances. The Portfolio generally limits its investments in foreign securities to U.S. dollar denominated obligations of issuers, including banks and foreign governments, located in the major industrialized countries, although with respect to bank obligations, the branches of the banks issuing the obligations may be located in The Bahamas or the Cayman Islands.

As a money market fund, the Fund tries to maintain a share price of $1.00 and must follow strict rules as to the credit quality, liquidity, diversification and maturity of its investments.

At Western Asset Management Company (“Western Asset”), the Fund’s and Portfolio’s subadviser, we utilize a fixed-income team approach, with decisions derived from interaction among various investment management sector specialists. The sector teams are comprised of Western Asset’s senior portfolio management personnel, research analysts and an in-house economist. Under this team approach, management of client fixed-income portfolios will reflect a consensus of interdisciplinary views within the Western Asset organization.

Q. What were the overall market conditions during the Fund’s reporting period?

A. Short-term Treasury yields moved higher, whereas longer-term Treasury yields declined during the reporting period. Two-year Treasury yields rose from 0.48% at the beginning of the period to 0.74% at the end of the period. Ten-year Treasury yields were 2.35% at the beginning of the period and ended the period at 2.21%.

The Federal Reserve Board (“Fed”)i kept the federal funds rateii at a historically low range between zero and 0.25% during the twelve months ended August 31, 2015. As a result, short-term yields remained very low during the reporting period. At its July 2015 meeting the Fed said when it “…decides to begin to remove policy accommodation, it will take a balanced approach consistent with its longer-run goals of maximum employment and inflation of 2 percent. The Committee currently anticipates that, even after employment and inflation are near

| Western Asset Premium Liquid Reserves 2015 Annual Report | 1 |

Fund overview (cont’d)

mandate-consistent levels, economic conditions may, for some time, warrant keeping the target federal funds rate below levels the Committee views as normal in the longer run.” Then, on September 17, 2015, after the reporting period ended, the Fed decided to maintain the federal funds rate between zero and 0.25%.

Q. How did we respond to these changing market conditions?

A. At the beginning of the reporting period we maintained an extended average maturity. As the fiscal year progressed and as the economic outlook continued to improve, particularly domestically, we gradually moved to shorten our stance. We have added floating rate securities at attractive spreads that we believe may provide some interest rate protection when the Fed raises interest rates — an event considered likely prior to the end of the calendar year.

Performance review

As of August 31, 2015, the seven-day current yield for Western Asset Premium Liquid Reserves was 0.01% and the seven-day effective yield, which reflects compounding, was 0.01%.1

The Fund does not invest directly in securities but instead invests all of its investable assets in an underlying mutual fund, the Portfolio, which has the same goals and strategies as the Fund. Unless otherwise indicated, references to the Fund include the underlying mutual fund, the Portfolio.

| Western Asset Premium Liquid Reserves Yields as of August 31, 2015 (unaudited) |

||||

| Seven-Day Current Yield1 | 0.01 | % | ||

| Seven-Day Effective Yield1 | 0.01 | % | ||

The performance shown represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above. Yields will fluctuate. To obtain performance data current to the most recent month-end, please visit our website at www.leggmason.com/individualinvestors.

Absent fee waivers and/or expense reimbursements, the seven-day current yield and the seven-day effective yield would have been -0.26%.

The manager has voluntarily undertaken to limit Fund expenses. Such expense limitations may fluctuate daily and are voluntary and temporary and may be terminated by the manager at any time without notice.

An investment in the Fund is neither insured nor guaranteed by the Federal Deposit Insurance Corporation (“FDIC”) or any other government agency. Although the Fund seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in the Fund.

Q. What were the most significant factors affecting Fund performance?

A. Over the reporting period, the economy averaged modest economic growth. Although the federal funds rate remained on hold, short-term money market yields moved gradually higher in response to the improving

| 1 | The seven-day current yield reflects the amount of income generated by the investment during that seven-day period and assumes that the income is generated each week over a 365-day period. The yield is shown as a percentage of the investment. The seven-day effective yield is calculated similarly to the seven-day current yield but, when annualized, the income earned by an investment in the Fund is assumed to be reinvested. The effective yield typically will be slightly higher than the current yield because of the compounding effect of the assumed reinvestment. |

| 2 | Western Asset Premium Liquid Reserves 2015 Annual Report |

economy and the expectation of potential Fed tightening. The Fund’s performance was positively influenced by a number of factors, including yield curveiii roll down as well as our ability to reinvest maturities at higher yields.

Q. Were there any regulatory updates during the Fund’s reporting period?

A. On July 23, 2014, the U.S. Securities and Exchange Commission (“SEC”)iv adopted changes to the rules that govern the operation of money market funds (“MMFs”). The rules require institutional prime and institutional municipal MMFs to have a floating net asset value (“NAV”)v per share, similar to non-money market mutual funds, while permitting government MMFs and retail MMFs the continued ability to maintain a constant dollar price. In addition, the SEC has empowered a fund’s board of trustees to temporarily impose fees on redemptions (liquidity fees) or to temporarily suspend redemptions (redemption gates) if a fund’s liquid assets fall below certain levels. The compliance date for most of these changes is October 14, 2016.

Thank you for your investment in Western Asset Premium Liquid Reserves. As always, we appreciate that you have chosen us to manage your assets and we remain focused on seeking to achieve the Fund’s investment goals.

Sincerely,

Western Asset Management Company

September 15, 2015

RISKS: An investment in a money market fund is neither insured nor guaranteed by the FDIC or any other government agency. Although the Fund seeks to preserve the value of your investment at one dollar per share, it is still possible to lose money by investing in the Fund. The Fund will be more susceptible to negative events affecting the worldwide financial services sector as a significant portion of its assets may be invested in obligations that are issued or backed by U.S. and non-U.S. banks and other financial services companies. Please see the Fund’s prospectus for a more complete discussion of these and other risks, and the Fund’s investment strategies.

All investments are subject to risk including the possible loss of principal. Past performance is no guarantee of future results.

The information provided is not intended to be a forecast of future events, a guarantee of future results or investment advice. Views expressed may differ from those of the firm as a whole.

| i | The Federal Reserve Board (“Fed”) is responsible for the formulation of policies designed to promote economic growth, full employment, stable prices, and a sustainable pattern of international trade and payments. |

| ii | The federal funds rate is the rate charged by one depository institution on an overnight sale of immediately available funds (balances at the Federal Reserve) to another depository institution; the rate may vary from depository institution to depository institution and from day to day. |

| iii | The yield curve is the graphical depiction of the relationship, at a given time, between interest rates and securities that have similar characteristics, but differing maturity dates. |

| iv | The U.S. Securities and Exchange Commission (“SEC”) is an agency of the U.S. government. It holds primary responsibility for enforcing the federal securities laws and regulating the securities industry, the nation’s stock and options exchanges, and other activities and organizations, including the electronic securities markets in the U.S. |

| v | Net asset value (“NAV”) is the dollar value of a single mutual fund share, based on the value of the underlying assets of the fund minus its liabilities, divided by the number of shares outstanding. NAV is calculated at the end of each business day. |

| Western Asset Premium Liquid Reserves 2015 Annual Report | 3 |

Portfolio at a glance† (unaudited)

Liquid Reserves Portfolio

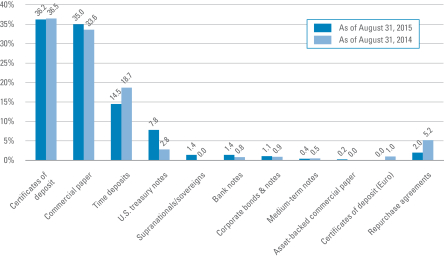

The Fund invests all of its investable assets in Liquid Reserves Portfolio, the investment breakdown of which is shown below.

Investment breakdown (%) as a percent of total investments

| † | The bar graph above represents the composition of the Portfolio’s investments as of August 31, 2015 and August 31, 2014. The Portfolio is actively managed. As a result, the composition of the Portfolio’s investments is subject to change at any time. |

| 4 | Western Asset Premium Liquid Reserves 2015 Annual Report |

Example

As a shareholder of the Fund, you may incur two types of costs: (1) transaction costs and (2) ongoing costs, including management fees, service and/or distribution (12b-1) fees and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

This example is based on an investment of $1,000 invested on March 1, 2015 and held for the six months ended August 31, 2015.

Actual expenses

The table below titled “Based on Actual Total Return” provides information about actual account values and actual expenses. You may use the information provided in this table, together with the amount you invested, to estimate the expenses that you paid over the period. To estimate the expenses you paid on your account, divide your ending account value by $1,000 (for example, an $8,600 ending account value divided by $1,000 = 8.6), then multiply the result by the number under the heading entitled “Expenses Paid During the Period”.

Hypothetical example for comparison purposes

The table below titled “Based on Hypothetical Total Return” provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio and an assumed rate of return of 5.00% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use the information provided in this table to compare the ongoing costs of investing in the Fund and other funds. To do so, compare the 5.00% hypothetical example relating to the Fund with the 5.00% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table below are meant to highlight your ongoing costs only and do not reflect any transactional costs. Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

| Based on actual total return1 | Based on hypothetical total return1 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Actual Total Return2 |

Beginning Account Value |

Ending Account Value |

Annualized Expense Ratio3 |

Expenses Paid During the Period4 |

Hypothetical Annualized Total Return |

Beginning Account Value |

Ending Account Value |

Annualized Expense Ratio3 |

Expenses Paid During the Period4 | |||||||||||||||||||||||||||||||||||||||||

| 0.01% | $ | 1,000.00 | $ | 1,000.10 | 0.24 | % | $ | 1.21 | 5.00 | % | $1,000.00 | $ | 1,024.00 | 0.24 | % | $ | 1.22 | |||||||||||||||||||||||||||||||||

| 1 | For the six months ended August 31, 2015. |

| 2 | Assumes the reinvestment of all distributions, including returns of capital, if any, at net asset value. Total return is not annualized, as it may not be representative of the total return for the year. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of fee waivers and/or expense reimbursements, the total return would have been lower. Past performance is no guarantee of future results. |

| 3 | Includes the Fund’s share of Liquid Reserves Portfolio’s allocated expenses. |

| 4 | Expenses (net of fee waivers and/or expense reimbursements) are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (184), then divided by 365. |

| Western Asset Premium Liquid Reserves 2015 Annual Report | 5 |

Statement of assets and liabilities

August 31, 2015

| Assets: | ||||

| Investment in Liquid Reserves Portfolio, at value |

$ | 318,499,735 | ||

| Receivable for Fund shares sold |

29,973 | |||

| Prepaid expenses |

18,324 | |||

| Total Assets |

318,548,032 | |||

| Liabilities: | ||||

| Investment management fee payable |

76,811 | |||

| Payable for Fund shares repurchased |

18,457 | |||

| Distributions payable |

2,937 | |||

| Trustees’ fees payable |

466 | |||

| Accrued expenses |

50,341 | |||

| Total Liabilities |

149,012 | |||

| Total Net Assets | $ | 318,399,020 | ||

| Net Assets: | ||||

| Par value (Note 3) |

$ | 3,184 | ||

| Paid-in capital in excess of par value |

318,543,142 | |||

| Undistributed net investment income |

1,842 | |||

| Accumulated net realized loss on investments allocated from Liquid Reserves Portfolio |

(149,148) | |||

| Total Net Assets | $ | 318,399,020 | ||

| Shares Outstanding | 318,359,469 | |||

| Net Asset Value | $1.00 | |||

See Notes to Financial Statements.

| 6 | Western Asset Premium Liquid Reserves 2015 Annual Report |

For the Year Ended August 31, 2015

| Investment Income: | ||||

| Income from Liquid Reserves Portfolio |

$ | 726,905 | ||

| Allocated expenses from Liquid Reserves Portfolio |

(349,764) | |||

| Allocated waiver from Liquid Reserves Portfolio |

323,434 | |||

| Total Investment Income |

700,575 | |||

| Expenses: | ||||

| Investment management fee (Note 2) |

1,131,637 | |||

| Service and/or distribution fees (Note 2) |

323,325 | |||

| Transfer agent fees |

40,251 | |||

| Shareholder reports |

31,215 | |||

| Legal fees |

25,859 | |||

| Registration fees |

22,571 | |||

| Audit and tax fees |

22,160 | |||

| Fund accounting fees |

6,300 | |||

| Trustees’ fees |

5,254 | |||

| Insurance |

3,157 | |||

| Miscellaneous expenses |

2,212 | |||

| Total Expenses |

1,613,941 | |||

| Less: Fee waivers and/or expense reimbursements (Note 2) |

(945,701) | |||

| Net Expenses |

668,240 | |||

| Net Investment Income | 32,335 | |||

| Net Realized Gain on Investments from Liquid Reserves Portfolio | 27,025 | |||

| Increase in Net Assets from Operations | $ | 59,360 | ||

See Notes to Financial Statements.

| Western Asset Premium Liquid Reserves 2015 Annual Report | 7 |

Statements of changes in net assets

| For the Years Ended August 31, | 2015 | 2014 | ||||||

| Operations: | ||||||||

| Net investment income |

$ | 32,335 | $ | 28,495 | ||||

| Net realized gain (loss) |

27,025 | (1,315) | ||||||

| Increase in Net Assets from Operations |

59,360 | 27,180 | ||||||

| Distributions to Shareholders From (Note 1): | ||||||||

| Net investment income |

(32,294) | (28,442) | ||||||

| Decrease in Net Assets from Distributions to Shareholders |

(32,294) | (28,442) | ||||||

| Fund Share Transactions (Note 3): | ||||||||

| Net proceeds from sale of shares |

2,521,619,124 | 2,423,126,355 | ||||||

| Reinvestment of distributions |

10,089 | 11,567 | ||||||

| Cost of shares repurchased |

(2,404,183,990) | (2,640,925,551) | ||||||

| Increase (Decrease) in Net Assets from Fund Share Transactions |

117,445,223 | (217,787,629) | ||||||

| Increase (Decrease) in Net Assets |

117,472,289 | (217,788,891) | ||||||

| Net Assets: | ||||||||

| Beginning of year |

200,926,731 | 418,715,622 | ||||||

| End of year* |

$ | 318,399,020 | $ | 200,926,731 | ||||

| *Includesundistributed net investment income of: |

$1,842 | $1,801 | ||||||

See Notes to Financial Statements.

| 8 | Western Asset Premium Liquid Reserves 2015 Annual Report |

| For a share of beneficial interest outstanding throughout each year ended August 31: | ||||||||||||||||||||

| 20151 | 20141 | 20131 | 2012 | 2011 | ||||||||||||||||

| Net asset value, beginning of year | $1.000 | $1.000 | $1.000 | $1.000 | $1.000 | |||||||||||||||

| Income (loss) from operations: | ||||||||||||||||||||

| Net investment income2 |

0.000 | 0.000 | 0.000 | 0.000 | 0.000 | |||||||||||||||

| Net realized gain (loss)2 |

0.000 | (0.000) | (0.000) | 0.000 | 0.000 | |||||||||||||||

| Total income from operations2 |

0.000 | 0.000 | 0.000 | 0.000 | 0.000 | |||||||||||||||

| Less distributions from: | ||||||||||||||||||||

| Net investment income2 |

(0.000) | (0.000) | (0.000) | (0.000) | (0.000) | |||||||||||||||

| Total distributions2 |

(0.000) | (0.000) | (0.000) | (0.000) | (0.000) | |||||||||||||||

| Net asset value, end of year | $1.000 | $1.000 | $1.000 | $1.000 | $1.000 | |||||||||||||||

| Total return3 |

0.01 | % | 0.01 | % | 0.01 | % | 0.01 | % | 0.01 | % | ||||||||||

| Net assets, end of year (millions) | $318 | $201 | $419 | $445 | $435 | |||||||||||||||

| Ratios to average net assets: | ||||||||||||||||||||

| Gross expenses4 |

0.61 | %5 | 0.61 | %5 | 0.60 | %5 | 0.50 | % | 0.48 | % | ||||||||||

| Net expenses4,6,7 |

0.21 | 0.19 | 0.26 | 0.32 | 0.36 | |||||||||||||||

| Net investment income |

0.01 | 0.01 | 0.01 | 0.01 | 0.01 | |||||||||||||||

| 1 | Per share amounts have been calculated using the average shares method. |

| 2 | Amount represents less than $0.0005 per share. |

| 3 | Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of fee waivers and/or expense reimbursements, the total return would have been lower. Past performance is no guarantee of future results. |

| 4 | Includes the Fund’s share of Liquid Reserves Portfolio’s allocated expenses. |

| 5 | The gross expenses do not reflect the reduction in the Fund’s management fee by the amount paid by the Fund for its allocable share of the management fee paid by Liquid Reserves Portfolio. |

| 6 | As a result of an expense limitation arrangement, the ratio of expenses, other than interest, brokerage, taxes, extraordinary expenses and acquired fund fees and expenses, to average net assets of the Fund did not exceed 0.45%. This expense limitation arrangement cannot be terminated prior to December 31, 2016 without the Board of Trustees’ consent. Prior to December 31, 2010, the expense limitation was 0.40%. Additional amounts may be voluntarily waived and/or reimbursed from time to time. |

| 7 | Reflects fee waivers and/or expense reimbursements. |

See Notes to Financial Statements.

| Western Asset Premium Liquid Reserves 2015 Annual Report | 9 |

1. Organization and significant accounting policies

Western Asset Premium Liquid Reserves (the “Fund”) is a separate diversified investment series of Legg Mason Partners Premium Money Market Trust (the “Trust”). The Trust, a Maryland statutory trust, is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company. The Fund invests all of its investable assets in Liquid Reserves Portfolio (the “Portfolio”), a separate investment series of Master Portfolio Trust, that has the same investment objective as the Fund.

The financial statements of the Portfolio, including the schedule of investments, are contained elsewhere in this report and should be read in conjunction with the Fund’s financial statements.

The following are significant accounting policies consistently followed by the Fund and are in conformity with U.S. generally accepted accounting principles (“GAAP”). Estimates and assumptions are required to be made regarding assets, liabilities and changes in net assets resulting from operations when financial statements are prepared. Changes in the economic environment, financial markets and any other parameters used in determining these estimates could cause actual results to differ. Subsequent events have been evaluated through the date the financial statements were issued.

(a) Investment valuation. The Fund records its investment in the Portfolio at value. The value of such investment in the Portfolio reflects the Fund’s proportionate interest (0.5% at August 31, 2015) in the net assets of the Portfolio.

GAAP establishes a disclosure hierarchy that categorizes the inputs to valuation techniques used to value assets and liabilities at measurement date. The disclosure and valuation of securities held by the Portfolio are discussed in Note 1(a) of the Portfolio’s Notes to Financial Statements, which are included elsewhere in this report.

(b) Investment transactions and investment income. Net investment income of the Portfolio is allocated pro rata, based on respective ownership interests, among the Fund and other investors in the Portfolio (the “Holders”) at the time of such determination. Gross realized gains and/or losses of the Portfolio are allocated to the Holders in a manner such that, the net asset values per share of each Holder, after each such allocation is closer to the total of all Holders’ net asset values divided by the aggregate number of shares outstanding for all Holders. The Fund also pays certain other expenses which can be directly attributed to the Fund.

(c) Distributions to shareholders. Distributions from net investment income on the shares of the Fund are declared each business day and are paid monthly. Distributions of net realized gains, if any, are declared at least annually. Distributions to shareholders of the Fund are recorded on the ex-dividend date and are determined in accordance with income tax regulations, which may differ from GAAP.

| 10 | Western Asset Premium Liquid Reserves 2015 Annual Report |

(d) Federal and other taxes. It is the Fund’s policy to comply with the federal income and excise tax requirements of the Internal Revenue Code of 1986 (the “Code”), as amended, applicable to regulated investment companies. Accordingly, the Fund intends to distribute its taxable income and net realized gains, if any, to shareholders in accordance with timing requirements imposed by the Code. Therefore, no federal or state income tax provision is required in the Fund’s financial statements.

Management has analyzed the Fund’s tax positions taken on income tax returns for all open tax years and has concluded that as of August 31, 2015, no provision for income tax is required in the Fund’s financial statements. The Fund’s federal and state income and federal excise tax returns for tax years for which the applicable statutes of limitations have not expired are subject to examination by the Internal Revenue Service and state departments of revenue.

(e) Reclassification. GAAP requires that certain components of net assets be reclassified to reflect permanent differences between financial and tax reporting. These reclassifications have no effect on net assets or net asset value per share. During the current year, the Fund had no reclassifications.

2. Investment management agreement and other transactions with affiliates

Legg Mason Partners Fund Advisor, LLC (“LMPFA”) is the Fund’s and the Portfolio’s investment manager. Western Asset Management Company (“Western Asset”) is the Fund’s and the Portfolio’s subadviser. LMPFA and Western Asset are wholly-owned subsidiaries of Legg Mason, Inc. (“Legg Mason”).

Under the investment management agreement, the Fund pays an investment management fee, calculated daily and paid monthly, at an annual rate of 0.35% of the Fund’s average daily net assets.

Since the Fund invests all of its investable assets in Liquid Reserves Portfolio, the investment management fee of the Fund will be reduced by the investment management fee allocated to the Fund by Liquid Reserves Portfolio.

LMPFA provides administrative and certain oversight services to the Fund. LMPFA delegates to the subadviser the day-to-day portfolio management of the Fund. For its services, LMPFA pays Western Asset 70% of the net management fee it receives from the Fund.

As a result of an expense limitation arrangement between the Fund and LMPFA, the ratio of expenses, other than interest, brokerage, taxes, extraordinary expenses and acquired fund fees and expenses, to average net assets of the Fund did not exceed 0.45%. This expense limitation arrangement cannot be terminated prior to December 31, 2016 without the Board of Trustees’ consent. Additional amounts may be voluntarily waived and/or reimbursed from time to time.

During the year ended August 31, 2015, fees waived and/or expenses reimbursed amounted to $945,701.

| Western Asset Premium Liquid Reserves 2015 Annual Report | 11 |

Notes to financial statements (cont’d)

LMPFA is permitted to recapture amounts waived and/or reimbursed to the Fund during the same fiscal year if the Fund’s total annual operating expenses have fallen to a level below the expense limitation (“expense cap”) in effect at the time the fees were earned or the expenses incurred. In no case will LMPFA recapture any amount that would result, on any particular business day of the Fund, in the Fund’s total annual operating expenses exceeding the expense cap or any other lower limit then in effect.

Legg Mason Investor Services, LLC, a wholly-owned broker-dealer subsidiary of Legg Mason, serves as the Fund’s sole and exclusive distributor.

The Fund has adopted a Rule 12b-1 shareholder services and distribution plan and under that plan the Fund pays service and/or distribution fees calculated at the annual rate not to exceed 0.10% of the Fund’s average daily net assets. Service and/or distribution fees are accrued daily and paid monthly. For the year ended August 31, 2015, service and/or distribution fees paid amounted to $323,325, of which $59,970 was voluntarily waived. Such waiver may be reduced or terminated at any time.

All officers and one Trustee of the Trust are employees of Legg Mason or its affiliates and do not receive compensation from the Trust.

3. Shares of beneficial interest

At August 31, 2015, the Trust had an unlimited number of shares of beneficial interest authorized with a par value of $0.00001 per share.

Because the Fund has maintained a $1.00 net asset value per share from inception, the number of shares sold, shares issued on reinvestment of dividends declared, and shares repurchased, is equal to the dollar amount shown in the Statements of Changes in Net Assets for the corresponding fund share transactions.

4. Income tax information and distributions to shareholders

The tax character of distributions paid during the fiscal years ended August 31, was as follows:

| 2015 | 2014 | |||||||

| Distributions paid from: | ||||||||

| Ordinary income | $ | 32,294 | $ | 28,442 | ||||

As of August 31, 2015, there were no significant differences between the book and tax components of net assets.

During the taxable year ended August 31, 2015, the Fund utilized $15,675 of its deferred capital losses and $11,350 of its capital loss carryforward available from prior years.

Additionally, as of August 31, 2015, the Fund had the following net capital loss carryforward remaining:

| Year of Expiration | Amount | |||

| 8/31/2017 | $ | (149,148 | ) | |

This amount will be available to offset any future taxable capital gains.

| 12 | Western Asset Premium Liquid Reserves 2015 Annual Report |

5. Money market fund reform

In July 2014, the U.S. Securities and Exchange Commission adopted money market fund reform to address potential systemic risks associated with money market funds and to improve transparency for money market fund investors. The reforms require institutional prime and institutional municipal money market funds to sell and redeem shares at prices based on their market value (a floating net asset value). The reforms also allow money market funds to impose liquidity fees and suspend redemptions temporarily, and impose new requirements related to diversification, stress testing, and disclosure. As a result, the Fund may be required to implement changes that will impact and may adversely affect the Fund and its shareholders. The compliance date for most of these changes is October 14, 2016.

| Western Asset Premium Liquid Reserves 2015 Annual Report | 13 |

Report of independent registered public accounting firm

The Board of Trustees and Shareholders

Legg Mason Partners Premium Money Market Trust:

We have audited the accompanying statement of assets and liabilities of Western Asset Premium Liquid Reserves (the “Fund”), a series of Legg Mason Partners Premium Money Market Trust, as of August 31, 2015, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the years in the two-year period then ended, and the financial highlights for each of the years in the five-year period then ended. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of August 31, 2015, by examination of the underlying Liquid Reserves Portfolio. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Western Asset Premium Liquid Reserves Fund as of August 31, 2015, and the results of its operations for the year then ended, the changes in its net assets for each of the years in the two-year period then ended, and the financial highlights for each of the years in the five-year period then ended, in conformity with U.S. generally accepted accounting principles.

New York, New York

October 15, 2015

| 14 | Western Asset Premium Liquid Reserves 2015 Annual Report |

Additional information (unaudited)

Information about Trustees and Officers

The business and affairs of Western Asset Premium Liquid Reserves (the “Fund”) are conducted by management under the supervision and subject to the direction of its Board of Trustees. The business address of each Trustee is c/o Jane Trust, Legg Mason, 100 International Drive, 11th Floor, Baltimore, Maryland 21202. Information pertaining to the Trustees and officers of the Fund is set forth below.

The Statement of Additional Information includes additional information about Trustees and is available, without charge, upon request by calling the Fund at 1-877-721-1926 or 1-203-703-6002.

| Independent Trustees†: | ||

| Elliott J. Berv | ||

| Year of birth | 1943 | |

| Position(s) with Trust | Trustee | |

| Term of office1 and length of time served2 | Since 1989 | |

| Principal occupation(s) during past five years | President and Chief Executive Officer, Catalyst (consulting) (since 1984); formerly, Chief Executive Officer, Rocket City Enterprises (media) (2000 to 2005) | |

| Number of funds in fund complex overseen by Trustee | 53 | |

| Other board memberships held by Trustee during past five years | None | |

| Jane F. Dasher | ||

| Year of birth | 1949 | |

| Position(s) with Trust | Trustee | |

| Term of office1 and length of time served2 | Since 1999 | |

| Principal occupation(s) during past five years | Chief Financial Officer, Long Light Capital, LLC, formerly known as Korsant Partners, LLC (a family investment company) (since 1997) | |

| Number of funds in fund complex overseen by Trustee | 53 | |

| Other board memberships held by Trustee during past five years | None | |

| Mark T. Finn | ||

| Year of birth | 1943 | |

| Position(s) with Trust | Trustee | |

| Term of office1 and length of time served2 | Since 1989 | |

| Principal occupation(s) during past five years | Adjunct Professor, College of William & Mary (since 2002); Chairman, Chief Executive Officer and Owner, Vantage Consulting Group, Inc. (investment management) (since 1988); Principal/Member, Balvan Partners (investment management) (2002 to 2009) | |

| Number of funds in fund complex overseen by Trustee | 53 | |

| Other board memberships held by Trustee during past five years | None | |

| Western Asset Premium Liquid Reserves | 15 |

Additional information (unaudited) (cont’d)

Information about Trustees and Officers

| Independent Trustees cont’d | ||

| Stephen R. Gross | ||

| Year of birth | 1947 | |

| Position(s) with Trust | Trustee | |

| Term of office1 and length of time served2 | Since 1986 | |

| Principal occupation(s) during past five years | Chairman Emeritus (since 2011) and formerly Chairman, HLB Gross Collins, P.C. (accounting and consulting firm) (1974 to 2011); Executive Director of Business Builders Team, LLC (since 2005); Principal, Gross Consulting Group, LLC (since 2011); CEO, Gross Capital Advisors, LLC (since 2011); CEO, Trusted CFO Solutions, LLC (since 2011) | |

| Number of funds in fund complex overseen by Trustee | 53 | |

| Other board memberships held by Trustee during past five years | None | |

| Richard E. Hanson, Jr. | ||

| Year of birth | 1941 | |

| Position(s) with Trust | Trustee | |

| Term of office1 and length of time served2 | Since 1985 | |

| Principal occupation(s) during past five years | Retired; formerly Headmaster, The New Atlanta Jewish Community High School, Atlanta, Georgia (1996 to 2000) | |

| Number of funds in fund complex overseen by Trustee | 53 | |

| Other board memberships held by Trustee during past five years | None | |

| Diana R. Harrington | ||

| Year of birth | 1940 | |

| Position(s) with Trust | Trustee and Chair | |

| Term of office1 and length of time served2 | Since 1992 (Chair of the Board since 2013) | |

| Principal occupation(s) during past five years | Babson Distinguished Professor of Finance, Babson College (since 1992) | |

| Number of funds in fund complex overseen by Trustee | 53 | |

| Other board memberships held by Trustee during past five years | None | |

| Susan M. Heilbron | ||

| Year of birth | 1945 | |

| Position(s) with Trust | Trustee | |

| Term of office1 and length of time served2 | Since 1994 | |

| Principal occupation(s) during past five years | Retired; formerly, President, Lacey & Heilbron (communications consulting) (1990 to 2002); formerly, General Counsel and Executive Vice President, The Trump Organization (1986 to 1990); formerly, Senior Vice President, New York State Urban Development Corporation (1984 to 1986); formerly, Associate, Cravath, Swaine & Moore (1980 to 1984) and (1977 to 1979) | |

| Number of funds in fund complex overseen by Trustee | 53 | |

| Other board memberships held by Trustee during past five years | Formerly, Director, Lincoln Savings Bank, FSB (1991 to 1994); formerly, Director, Trump Shuttle, Inc. (air transportation) (1989 to 1990); formerly, Director, Alexander’s Inc. (department store) (1987 to 1990) | |

| 16 | Western Asset Premium Liquid Reserves |

| Independent Trustees cont’d | ||

| Susan B. Kerley | ||

| Year of birth | 1951 | |

| Position(s) with Trust | Trustee | |

| Term of office1 and length of time served2 | Since 1992 | |

| Principal occupation(s) during past five years | Investment Consulting Partner, Strategic Management Advisors, LLC (investment consulting) (since 1990) | |

| Number of funds in fund complex overseen by Trustee | 53 | |

| Other board memberships held by Trustee during past five years | Director and Trustee (since 1990) and formerly, Chairman (2005 to 2012) of various series of MainStay Family of Funds (66 funds); Investment Company Institute (ICI) Board of Governors (2006 to 2014); ICI Executive Committee (2011 to 2014); Chairman of the Independent Directors Council (2012 to 2014) | |

| Alan G. Merten | ||

| Year of birth | 1941 | |

| Position(s) with Trust | Trustee | |

| Term of office1 and length of time served2 | Since 1990 | |

| Principal occupation(s) during past five years | President Emeritus (since 2012) and formerly, President, George Mason University (1996 to 2012) | |

| Number of funds in fund complex overseen by Trustee | 53 | |

| Other board memberships held by Trustee during past five years | Director Emeritus (since 2012) and formerly, Director, Cardinal Financial Corporation (2006 to 2012); Trustee, First Potomac Realty Trust (since 2005); Director, DeVry Inc. (educational services) (since 2012); formerly, Director, Xybernaut Corporation (information technology) (2004 to 2006); formerly, Director, Digital Net Holdings, Inc. (2003 to 2004); formerly, Director, Comshare, Inc. (information technology) (1985 to 2003) | |

| R. Richardson Pettit | ||

| Year of birth | 1942 | |

| Position(s) with Trust | Trustee | |

| Term of office1 and length of time served2 | Since 1990 | |

| Principal occupation(s) during past five years | Retired; Duncan Professor of Finance Emeritus, University of Houston (1977 to 2006); previous academic or management positions include: University of Washington, University of Pennsylvania and Purdue University | |

| Number of funds in fund complex overseen by Trustee | 53 | |

| Other board memberships held by Trustee during past five years | None | |

| Western Asset Premium Liquid Reserves | 17 |

Additional information (unaudited) (cont’d)

Information about Trustees and Officers

| Interested Trustee and Officer: | ||

| Jane Trust, CFA3 | ||

| Year of birth | 1962 | |

| Position(s) with Trust | Trustee, President, and Chief Executive Officer | |

| Term of office1 and length of time served2 | Since 2015 | |

| Principal occupation(s) during past five years | Managing Director of Legg Mason & Co., LLC (“Legg Mason & Co.”) (since 2015); Officer and/or Trustee/Director of 156 funds associated with LMPFA or its affiliates (since 2015); President and Chief Executive Officer of LMPFA (since 2015); formerly, Senior Vice President of LMPFA (2015); formerly, Director of ClearBridge, LLC (formerly, Legg Mason Capital Management, LLC) (2007 to 2014); formerly, Managing Director of Legg Mason Investment Counsel & Trust Co. (2000 to 2007) | |

| Number of funds in fund complex overseen by Trustee | 147 | |

| Other board memberships held by Trustee during past five years | None | |

| Additional Officers: | ||

| Ted P. Becker Legg Mason 620 Eighth Avenue, 49th Floor, New York, NY 10018 | ||

| Year of birth | 1951 | |

| Position(s) with Trust | Chief Compliance Officer | |

| Term of office1 and length of time served2 | Since 2007 | |

| Principal occupation(s) during past five years | Director of Global Compliance at Legg Mason (since 2006); Chief Compliance Officer of LMPFA (since 2006); Managing Director of Compliance of Legg Mason & Co. (since 2005); Chief Compliance Officer of certain mutual funds associated with Legg Mason & Co. or its affiliates (since 2006) | |

| Susan Kerr Legg Mason 620 Eighth Avenue, 49th Floor, New York, NY 10018 |

||

| Year of birth | 1949 | |

| Position(s) with Trust | Chief Anti-Money Laundering Compliance Officer | |

| Term of office1 and length of time served2 | Since 2013 | |

| Principal occupation(s) during past five years | Assistant Vice President of Legg Mason & Co. and Legg Mason Investor Services, LLC (“LMIS”) (since 2010); Chief Anti-Money Laundering Compliance Officer of certain mutual funds associated with Legg Mason & Co. or its affiliates (since 2013) and Anti-Money Laundering Compliance Officer of LMIS (since 2012); Senior Compliance Officer of LMIS (since 2011); formerly, AML Consultant, DTCC (2010); formerly, AML Consultant, Rabobank Netherlands, (2009); formerly, First Vice President, Director of Marketing & Advertising Compliance and Manager of Communications Review Group at Citigroup Inc. (1996 to 2008) | |

| 18 | Western Asset Premium Liquid Reserves |

| Additional Officers cont’d | ||

| Vanessa A. Williams Legg Mason 100 First Stamford Place, 6th Floor, Stamford, CT 06902 |

||

| Year of birth | 1979 | |

| Position(s) with Trust | Identity Theft Prevention Officer | |

| Term of office1 and length of time served2 | Since 2011 | |

| Principal occupation(s) during past five years | Vice President of Legg Mason & Co. (since 2012); Identity Theft Prevention Officer of certain mutual funds associated with Legg Mason & Co. or its affiliates (since 2011); formerly, Chief Anti-Money Laundering Compliance Officer of certain mutual funds associated with Legg Mason & Co. or its affiliates (2011 to 2013); formerly, Senior Compliance Officer of Legg Mason & Co. (2008 to 2011); formerly, Compliance Analyst of Legg Mason & Co. (2006 to 2008) and Legg Mason & Co. predecessors (prior to 2006) | |

| Robert I. Frenkel Legg Mason 100 First Stamford Place, 6th Floor, Stamford, CT 06902 | ||

| Year of birth | 1954 | |

| Position(s) with Trust | Secretary and Chief Legal Officer | |

| Term of office1 and length of time served2 | Since 2007 | |

| Principal occupation(s) during past five years | Vice President and Deputy General Counsel of Legg Mason (since 2006); Managing Director and General Counsel — U.S. Mutual Funds for Legg Mason & Co. (since 2006) and Legg Mason & Co. predecessors (since 1994); Secretary and Chief Legal Officer of certain mutual funds associated with Legg Mason & Co. or its affiliates (since 2006) and Legg Mason & Co. predecessors (prior to 2006) | |

| Thomas C. Mandia Legg Mason 100 First Stamford Place, 6th Floor, Stamford, CT 06902 | ||

| Year of birth | 1962 | |

| Position(s) with Trust | Assistant Secretary | |

| Term of office1 and length of time served2 | Since 2007 | |

| Principal occupation(s) during past five years | Managing Director and Deputy General Counsel of Legg Mason & Co. (since 2005) and Legg Mason & Co. predecessors (prior to 2005); Secretary of LMPFA (since 2006); Assistant Secretary of certain mutual funds associated with Legg Mason & Co. or its affiliates (since 2006) and Legg Mason & Co. predecessors (prior to 2006); Secretary of LM Asset Services, LLC (“LMAS”) (since 2002) and Legg Mason Fund Asset Management, Inc. (“LMFAM”) (since 2013) (formerly registered investment advisers) | |

| Western Asset Premium Liquid Reserves | 19 |

Additional information (unaudited) (cont’d)

Information about Trustees and Officers

| Additional Officers cont’d | ||

| Richard F. Sennett Legg Mason 100 International Drive, 7th Floor, Baltimore, MD 21202 | ||

| Year of birth | 1970 | |

| Position(s) with Trust | Principal Financial Officer | |

| Term of office1 and length of time served2 | Since 2011 | |

| Principal occupation(s) during past five years | Principal Financial Officer and Treasurer of certain mutual funds associated with Legg Mason & Co. or its affiliates (since 2011 and since 2013); Managing Director of Legg Mason & Co. and Senior Manager of the Treasury Policy group for Legg Mason & Co.’s Global Fiduciary Platform (since 2011); formerly, Chief Accountant within the SEC’s Division of Investment Management (2007 to 2011); formerly, Assistant Chief Accountant within the SEC’s Division of Investment Management (2002 to 2007) | |

| Steven Frank 620 Eighth Avenue, 49th Floor, New York, NY 10018 | ||

| Year of birth | 1967 | |

| Position(s) with Trust | Treasurer | |

| Term of office1 and length of time served2 | Since 2014 | |

| Principal occupation(s) during past five years | Vice President of Legg Mason & Co. and Legg Mason & Co. predecessors (since 2002); Treasurer of certain mutual funds associated with Legg Mason & Co. or its affiliates (since 2010); formerly, Controller of certain mutual funds associated with Legg Mason & Co. or its affiliates (prior to 2010); formerly, Assistant Controller of certain mutual funds associated with Legg Mason & Co. predecessors (prior to 2005) | |

| Jeanne M. Kelly Legg Mason 620 Eighth Avenue, 49th Floor, New York, NY 10018 | ||

| Year of birth | 1951 | |

| Position(s) with Trust | Senior Vice President | |

| Term of office1 and length of time served2 | Since 2007 | |

| Principal occupation(s) during past five years | Senior Vice President of certain mutual funds associated with Legg Mason & Co. or its affiliates (since 2007); Senior Vice President of LMPFA (since 2006); President and Chief Executive Officer of LMAS and LMFAM (since 2015); Managing Director of Legg Mason & Co. (since 2005) and Legg Mason & Co. predecessors (prior to 2005); formerly, Senior Vice President of LMFAM (2013 to 2015) | |

| † | Trustees who are not “interested persons” of the Fund within the meaning of section 2(a)(19) of the 1940 Act. |

| 1 | Each Trustee and officer serves until his or her respective successor has been duly elected and qualified or until his or her earlier death, resignation, retirement or removal. |

| 2 | Indicates the earliest year in which the Trustee became a board member for a fund in the Legg Mason fund complex or the officer took such office. |

| 3 | Effective June 1, 2015, Ms. Trust became a Trustee. Ms. Trust is an “interested person” of the Fund, as defined in the 1940 Act, because of her position with LMPFA and/or certain of its affiliates. |

| 20 | Western Asset Premium Liquid Reserves |

Important tax information (unaudited)

The following information is provided with respect to the distributions paid during the taxable year ended August 31, 2015:

| Record date: | Daily | Daily | ||

| Payable date: | September 2014 - December 2014 |

January 2015 - August 2015 | ||

| Interest from Federal obligations | 1.28% | 2.59% |

The law varies in each state as to whether and what percentage of dividend income attributable to Federal obligations is exempt from state income tax. We recommend that you consult with your tax adviser to determine if any portion of the dividends you received is exempt from state income taxes.

The following information is applicable to non-U.S. resident shareholders:

50% of the ordinary income distributions paid monthly by the Fund represent Qualified Net Interest Income and Qualified Short-Term Capital Gains eligible for exemption from U.S. withholding tax for nonresident aliens and foreign corporations.

Please retain this information for your records.

| Western Asset Premium Liquid Reserves | 21 |

August 31, 2015

Liquid Reserves Portfolio

| Security | Rate | Maturity Date |

Face Amount |

Value | ||||||||||||

| Short-Term Investments — 100.4% | ||||||||||||||||

| Asset-Backed Commercial Paper — 0.2% |

||||||||||||||||

| Old Line Funding LLC |

0.260 | % | 10/21/15 | $ | 100,000,000 | $ | 99,963,889 | (a)(b) | ||||||||

| Bank Notes — 1.4% |

||||||||||||||||

| Bank of America N.A. |

0.280 | % | 10/9/15 | 292,500,000 | 292,500,000 | |||||||||||

| Bank of America N.A. |

0.400 | % | 1/11/16 | 350,000,000 | 350,000,000 | |||||||||||

| Wells Fargo Bank N.A. |

0.401 | % | 7/19/16 | 250,000,000 | 250,000,000 | (c) | ||||||||||

| Total Bank Notes |

892,500,000 | |||||||||||||||

| Certificates of Deposit — 36.3% |

||||||||||||||||

| Bank of Montreal |

0.310 | % | 11/4/15 | 245,000,000 | 245,000,000 | |||||||||||

| Bank of Montreal |

0.310 | % | 11/9/15 | 160,000,000 | 160,000,000 | |||||||||||

| Bank of Montreal |

0.310 | % | 11/10/15 | 489,500,000 | 489,499,999 | |||||||||||

| Bank of Montreal |

0.348 | % | 1/15/16 | 100,000,000 | 100,000,000 | (c) | ||||||||||

| Bank of Montreal |

0.363 | % | 1/20/16 | 374,850,000 | 374,850,000 | (c) | ||||||||||

| Bank of Montreal |

0.510 | % | 2/16/16 | 140,000,000 | 140,000,000 | |||||||||||

| Bank of Nova Scotia |

0.318 | % | 12/29/15 | 400,000,000 | 400,000,000 | (c) | ||||||||||

| Bank of Nova Scotia |

0.324 | % | 3/7/16 | 250,000,000 | 250,000,000 | (c) | ||||||||||

| Bank of Tokyo-Mitsubishi UFJ NY |

0.350 | % | 10/26/15 | 325,000,000 | 325,000,000 | |||||||||||

| Bank of Tokyo-Mitsubishi UFJ NY |

0.350 | % | 11/12/15 | 150,000,000 | 150,000,000 | |||||||||||

| Bank of Tokyo-Mitsubishi UFJ NY |

0.394 | % | 1/14/16 | 100,000,000 | 100,000,000 | (c) | ||||||||||

| BNP Paribas NY Branch |

0.390 | % | 11/2/15 | 95,000,000 | 95,000,000 | |||||||||||

| BNP Paribas NY Branch |

0.400 | % | 11/2/15 | 200,000,000 | 200,000,000 | |||||||||||

| BNP Paribas NY Branch |

0.400 | % | 11/3/15 | 100,000,000 | 100,000,000 | |||||||||||

| BNP Paribas NY Branch |

0.430 | % | 1/8/16 | 420,000,000 | 420,000,000 | |||||||||||

| BNP Paribas NY Branch |

0.500 | % | 2/12/16 | 370,000,000 | 370,000,000 | |||||||||||

| BNP Paribas NY Branch |

0.400 | % | 2/17/16 | 275,000,000 | 275,000,000 | (c) | ||||||||||

| Canadian Imperial Bank of Commerce |

0.130 | % | 9/4/15 | 730,000,000 | 730,000,000 | |||||||||||

| Canadian Imperial Bank of Commerce |

0.342 | % | 1/8/16 | 95,000,000 | 95,000,000 | (c) | ||||||||||

| Canadian Imperial Bank of Commerce |

0.368 | % | 2/8/16 | 376,700,000 | 376,700,000 | (c) | ||||||||||

| Citibank N.A. |

0.404 | % | 10/2/15 | 100,000,000 | 100,000,000 | (c) | ||||||||||

| Citibank N.A. |

0.240 | % | 10/13/15 | 95,000,000 | 95,000,000 | |||||||||||

| Citibank N.A. |

0.300 | % | 11/24/15 | 395,000,000 | 395,000,000 | |||||||||||

| Citibank N.A. |

0.300 | % | 11/24/15 | 80,000,000 | 80,000,000 | |||||||||||

| Credit Agricole Corp. |

0.180 | % | 9/8/15 | 600,000,000 | 600,000,000 | |||||||||||

| Credit Agricole Corp. |

0.180 | % | 9/14/15 | 440,000,000 | 440,000,000 | |||||||||||

| Credit Agricole Corp. |

0.180 | % | 9/14/15 | 350,000,000 | 350,000,000 | |||||||||||

| Credit Suisse NY |

0.391 | % | 1/11/16 | 200,000,000 | 200,000,000 | (c) | ||||||||||

| Credit Suisse NY |

0.440 | % | 2/17/16 | 350,000,000 | 350,000,000 | (c) | ||||||||||

| DnB NOR Bank ASA |

0.130 | % | 9/3/15 | 195,000,000 | 195,000,000 | |||||||||||

See Notes to Financial Statements.

| 22 | Liquid Reserves Portfolio 2015 Annual Report |

Liquid Reserves Portfolio

| Security | Rate | Maturity Date |

Face Amount |

Value | ||||||||||||

| Certificates of Deposit — continued |

||||||||||||||||

| HSBC Bank USA |

0.265 | % | 9/1/15 | $ | 350,000,000 | $ | 350,000,000 | |||||||||

| HSBC Bank USA |

0.320 | % | 10/20/15 | 93,000,000 | 93,000,000 | |||||||||||

| HSBC Bank USA |

0.320 | % | 10/23/15 | 197,000,000 | 197,000,000 | |||||||||||

| HSBC Bank USA |

0.342 | % | 1/4/16 | 100,000,000 | 100,000,000 | (c) | ||||||||||

| Landesbank Hessen-Thuringen |

0.180 | % | 9/25/15 | 90,000,000 | 90,000,000 | |||||||||||

| Landesbank Hessen-Thuringen |

0.180 | % | 9/28/15 | 100,000,000 | 100,000,000 | |||||||||||

| Landesbank Hessen-Thuringen |

0.330 | % | 11/19/15 | 135,000,000 | 135,000,000 | |||||||||||

| Mitsubishi UFJ Trust & Banking NY |

0.270 | % | 9/3/15 | 160,000,000 | 160,000,000 | |||||||||||

| Mitsubishi UFJ Trust & Banking NY |

0.190 | % | 9/25/15 | 175,000,000 | 175,000,000 | |||||||||||

| Mitsubishi UFJ Trust & Banking NY |

0.360 | % | 10/27/15 | 100,000,000 | 100,000,000 | |||||||||||

| Mitsubishi UFJ Trust & Banking NY |

0.410 | % | 1/4/16 | 335,000,000 | 335,000,000 | |||||||||||

| Mizuho Bank Ltd. |

0.270 | % | 9/14/15 | 81,000,000 | 81,000,000 | |||||||||||

| Mizuho Bank Ltd. |

0.350 | % | 10/26/15 | 450,000,000 | 450,000,000 | |||||||||||

| Mizuho Bank Ltd. |

0.350 | % | 11/16/15 | 499,700,000 | 499,700,000 | |||||||||||

| Mizuho Bank Ltd. |

0.398 | % | 1/29/16 | 250,000,000 | 250,000,000 | (c) | ||||||||||

| Mizuho Bank Ltd. |

0.510 | % | 2/24/16 | 185,000,000 | 185,000,000 | |||||||||||

| Natixis NY |

0.380 | % | 9/1/15 | 50,000,000 | 50,000,000 | |||||||||||

| Nordea Bank Finland PLC |

0.330 | % | 11/18/15 | 87,000,000 | 87,000,000 | |||||||||||

| Norinchukin Bank |

0.180 | % | 9/17/15 | 150,000,000 | 150,000,000 | |||||||||||

| Norinchukin Bank |

0.170 | % | 9/24/15 | 135,000,000 | 135,000,000 | |||||||||||

| Norinchukin Bank |

0.190 | % | 9/25/15 | 215,000,000 | 215,000,000 | |||||||||||

| Norinchukin Bank |

0.350 | % | 10/23/15 | 240,000,000 | 239,998,270 | |||||||||||

| Norinchukin Bank |

0.350 | % | 10/26/15 | 499,480,000 | 499,480,000 | |||||||||||

| Norinchukin Bank |

0.350 | % | 10/27/15 | 150,000,000 | 150,000,000 | |||||||||||

| Norinchukin Bank |

0.360 | % | 11/2/15 | 80,000,000 | 80,000,000 | |||||||||||

| Norinchukin Bank |

0.360 | % | 11/13/15 | 125,000,000 | 124,998,735 | |||||||||||

| Oversea-Chinese Banking Corp. Ltd. |

0.273 | % | 11/20/15 | 394,000,000 | 394,000,000 | (c) | ||||||||||

| Oversea-Chinese Banking Corp. Ltd. |

0.359 | % | 1/25/16 | 200,000,000 | 200,000,000 | (c) | ||||||||||

| Royal Bank of Canada |

0.344 | % | 1/7/16 | 729,600,000 | 729,600,000 | (c) | ||||||||||

| Royal Bank of Canada |

0.515 | % | 2/10/16 | 150,000,000 | 150,000,000 | |||||||||||

| Royal Bank of Canada |

0.357 | % | 3/10/16 | 78,500,000 | 78,519,027 | (c) | ||||||||||

| Royal Bank of Canada |

0.354 | % | 5/13/16 | 50,000,000 | 50,003,898 | (c) | ||||||||||

| Skandinaviska Enskilda Banken AB |

0.641 | % | 11/16/15 | 96,000,000 | 96,051,322 | (c) | ||||||||||

| Skandinaviska Enskilda Banken AB |

0.308 | % | 12/15/15 | 350,000,000 | 350,000,000 | (c) | ||||||||||

| Skandinaviska Enskilda Banken AB |

0.400 | % | 1/5/16 | 250,000,000 | 250,000,000 | |||||||||||

| Standard Chartered Bank NY |

0.370 | % | 9/18/15 | 25,000,000 | 25,000,000 | |||||||||||

| Standard Chartered Bank NY |

0.380 | % | 11/6/15 | 50,000,000 | 50,000,000 | |||||||||||

| Standard Chartered Bank NY |

0.430 | % | 1/4/16 | 257,750,000 | 257,750,000 | |||||||||||

See Notes to Financial Statements.

| Liquid Reserves Portfolio 2015 Annual Report | 23 |

Schedule of investments (cont’d)

August 31, 2015

Liquid Reserves Portfolio

| Security | Rate | Maturity Date |

Face Amount |

Value | ||||||||||||

| Certificates of Deposit — continued |

||||||||||||||||

| Standard Chartered Bank NY |

0.430 | % | 1/5/16 | $ | 150,000,000 | $ | 150,000,000 | |||||||||

| Standard Chartered Bank NY |

0.430 | % | 1/8/16 | 100,000,000 | 100,000,000 | |||||||||||

| Standard Chartered Bank NY |

0.360 | % | 1/22/16 | 493,000,000 | 493,000,000 | (c) | ||||||||||

| State Street Bank & Trust Co. |

0.335 | % | 10/22/15 | 425,000,000 | 425,000,000 | |||||||||||

| State Street Bank & Trust Co. |

0.361 | % | 2/11/16 | 380,000,000 | 380,009,910 | (c) | ||||||||||

| Sumitomo Mitsui Banking Corp. |

0.190 | % | 9/16/15 | 100,000,000 | 100,000,000 | |||||||||||

| Sumitomo Mitsui Banking Corp. |

0.190 | % | 9/17/15 | 280,000,000 | 280,000,000 | |||||||||||

| Sumitomo Mitsui Banking Corp. |

0.350 | % | 9/25/15 | 380,000,000 | 380,000,000 | |||||||||||

| Sumitomo Mitsui Banking Corp. |

0.300 | % | 10/9/15 | 300,000,000 | 300,000,000 | |||||||||||

| Sumitomo Mitsui Banking Corp. |

0.398 | % | 1/12/16 | 384,450,000 | 384,450,000 | (c) | ||||||||||

| Sumitomo Mitsui Banking Corp. |

0.400 | % | 1/22/16 | 105,000,000 | 105,000,000 | (c) | ||||||||||

| Sumitomo Mitsui Trust & Banking Co., Ltd. |

0.260 | % | 9/9/15 | 37,000,000 | 37,000,000 | |||||||||||

| Sumitomo Mitsui Trust & Banking Co., Ltd. |

0.190 | % | 9/28/15 | 200,000,000 | 200,000,000 | |||||||||||

| Sumitomo Mitsui Trust & Banking Co., Ltd. |

0.300 | % | 10/13/15 | 150,000,000 | 150,000,000 | |||||||||||

| Sumitomo Mitsui Trust & Banking Co., Ltd. |

0.350 | % | 10/15/15 | 166,400,000 | 166,399,994 | |||||||||||

| Sumitomo Mitsui Trust & Banking Co., Ltd. |

0.350 | % | 10/26/15 | 72,500,000 | 72,500,000 | |||||||||||

| Sumitomo Mitsui Trust & Banking Co., Ltd. |

0.350 | % | 10/27/15 | 100,000,000 | 100,000,000 | |||||||||||

| Sumitomo Mitsui Trust & Banking Co., Ltd. |

0.350 | % | 11/2/15 | 120,000,000 | 120,000,000 | |||||||||||

| Sumitomo Mitsui Trust & Banking Co., Ltd. |

0.398 | % | 1/19/16 | 300,000,000 | 300,000,000 | (c) | ||||||||||

| Sumitomo Mitsui Trust & Banking Co., Ltd. |

0.400 | % | 1/22/16 | 65,000,000 | 65,000,000 | (c) | ||||||||||

| Sumitomo Mitsui Trust & Banking Co., Ltd. |

0.398 | % | 1/29/16 | 100,000,000 | 100,000,000 | (c) | ||||||||||

| Svenska Handelsbanken NY |

0.290 | % | 9/21/15 | 250,000,000 | 250,000,000 | |||||||||||

| Svenska Handelsbanken NY |

0.315 | % | 11/12/15 | 495,000,000 | 495,004,943 | |||||||||||

| Swedbank AB |

0.130 | % | 9/4/15 | 100,000,000 | 100,000,000 | |||||||||||

| Toronto Dominion Bank NY |

0.342 | % | 1/8/16 | 320,000,000 | 320,000,000 | (c) | ||||||||||

| Toronto Dominion Bank NY |

0.500 | % | 1/27/16 | 100,000,000 | 100,000,000 | |||||||||||

| Toronto Dominion Bank NY |

0.500 | % | 1/27/16 | 100,000,000 | 100,000,000 | |||||||||||

| UBS AG Stamford Branch |

0.408 | % | 2/17/16 | 350,000,000 | 350,000,000 | (c) | ||||||||||

| UBS AG Stamford Branch |

0.433 | % | 2/19/16 | 400,000,000 | 400,000,000 | (c) | ||||||||||

| Wells Fargo Bank N.A. |

0.344 | % | 1/13/16 | 450,000,000 | 450,000,000 | (c) | ||||||||||

| Wells Fargo Bank N.A. |

0.328 | % | 2/16/16 | 247,250,000 | 247,250,000 | (c) | ||||||||||

| Total Certificates of Deposit |

23,084,766,098 | |||||||||||||||

| Commercial Paper — 35.1% |

||||||||||||||||

| 3M Co. |

0.050 | % | 9/1/15 | 70,000,000 | 70,000,000 | (a)(b) | ||||||||||

| ANZ National International Ltd. |

0.312 | % | 9/8/15 | 100,000,000 | 100,002,991 | (b)(c) | ||||||||||

| ANZ National International Ltd. |

0.310 | % | 11/12/15 | 95,000,000 | 94,941,100 | (a)(b) | ||||||||||

| ANZ National International Ltd. |

0.411 | % | 12/22/15 | 214,350,000 | 214,076,585 | (a)(b) | ||||||||||

| ASB Finance Ltd. |

0.285 | % | 9/25/15 | 92,000,000 | 91,982,520 | (a)(b) | ||||||||||

See Notes to Financial Statements.

| 24 | Liquid Reserves Portfolio 2015 Annual Report |

Liquid Reserves Portfolio

| Security | Rate | Maturity Date |

Face Amount |

Value | ||||||||||||

| Commercial Paper — continued |

||||||||||||||||

| Bank Nederlandse Gemeenten NV |

0.305 | % | 12/1/15 | $ | 260,000,000 | $ | 259,799,548 | (a)(b) | ||||||||

| Bank of Nova Scotia |

0.316 | % | 11/2/15 | 93,400,000 | 93,349,330 | (a)(b) | ||||||||||

| Bank of Nova Scotia |

0.310 | % | 11/6/15 | 497,000,000 | 496,717,538 | (a)(b) | ||||||||||

| Bank of Nova Scotia |

0.331 | % | 4/4/16 | 195,000,000 | 195,000,000 | (c) | ||||||||||

| BNP Paribas Fortis Funding |

0.060 | % | 9/1/15 | 485,000,000 | 485,000,000 | (a) | ||||||||||

| BNZ International Funding Ltd. |

0.300 | % | 10/23/15 | 95,000,000 | 94,958,833 | (a)(b) | ||||||||||

| BNZ International Funding Ltd. |

0.310 | % | 11/12/15 | 100,000,000 | 99,938,000 | (a)(b) | ||||||||||

| BNZ International Funding Ltd. |

0.300 | % | 11/16/15 | 100,000,000 | 99,936,667 | (a)(b) | ||||||||||

| Caisse des Depots et Consignations |

0.160 | % | 9/18/15 | 355,000,000 | 354,973,178 | (a)(d) | ||||||||||

| Caisse des Depots et Consignations |

0.300 | % | 10/1/15 | 496,500,000 | 496,375,875 | (a)(d) | ||||||||||

| Caisse des Depots et Consignations |

0.240 | % | 10/5/15 | 388,749,000 | 388,660,884 | (a)(d) | ||||||||||

| Coca-Cola Co. |

0.421 | % | 1/26/16 | 50,000,000 | 49,914,250 | (a)(b) | ||||||||||

| Coca-Cola Co. |

0.421 | % | 1/27/16 | 75,000,000 | 74,870,500 | (a)(b) | ||||||||||

| Colgate-Palmolive Co. |

0.050 | % | 9/1/15 | 75,000,000 | 75,000,000 | (a)(b) | ||||||||||

| Commonwealth Bank of Australia |

0.100 | % | 9/1/15 | 36,000,000 | 36,000,000 | (a)(b) | ||||||||||

| Commonwealth Bank of Australia |

0.215 | % | 9/22/15 | 180,000,000 | 179,977,425 | (a)(b) | ||||||||||

| Commonwealth Bank of Australia |

0.230 | % | 9/29/15 | 68,500,000 | 68,487,746 | (a)(b) | ||||||||||

| Credit Agricole Corporate and Investment Bank |

0.070 | % | 9/1/15 | 550,839,000 | 550,839,000 | (a) | ||||||||||

| Credit Suisse NY |

0.300 | % | 10/20/15 | 197,000,000 | 196,919,558 | (a) | ||||||||||

| Credit Suisse NY |

0.451 | % | 1/4/16 | 454,900,000 | 454,189,219 | (a) | ||||||||||

| Credit Suisse NY |

0.451 | % | 1/4/16 | 314,965,000 | 314,472,867 | (a) | ||||||||||

| Danske Corp. |

0.265 | % | 10/19/15 | 100,000,000 | 99,964,666 | (a)(b) | ||||||||||

| Danske Corp. |

0.265 | % | 10/22/15 | 100,000,000 | 99,962,458 | (a)(b) | ||||||||||

| Danske Corp. |

0.265 | % | 10/26/15 | 47,250,000 | 47,230,870 | (a)(b) | ||||||||||

| DBS Bank Ltd. |

0.210 | % | 9/1/15 | 100,000,000 | 100,000,000 | (a)(b) | ||||||||||

| DBS Bank Ltd. |

0.210 | % | 9/2/15 | 90,000,000 | 89,999,475 | (a)(b) | ||||||||||

| DBS Bank Ltd. |

0.220 | % | 9/8/15 | 200,000,000 | 199,991,444 | (a)(b) | ||||||||||

| DBS Bank Ltd. |

0.220 | % | 9/9/15 | 100,000,000 | 99,995,111 | (a)(b) | ||||||||||

| DBS Bank Ltd. |

0.290 | % | 11/2/15 | 100,000,000 | 99,950,056 | (a)(b) | ||||||||||

| DBS Bank Ltd. |

0.290 | % | 11/3/15 | 97,550,000 | 97,500,493 | (a)(b) | ||||||||||

| DBS Bank Ltd. |

0.280 | % | 11/4/15 | 82,274,000 | 82,233,046 | (a)(b) | ||||||||||

| DBS Bank Ltd. |

0.401 | % | 1/4/16 | 200,000,000 | 199,722,222 | (a)(b) | ||||||||||

| DBS Bank Ltd. |

0.401 | % | 1/7/16 | 100,000,000 | 99,857,778 | (a)(b) | ||||||||||

| DnB NOR Bank ASA |

0.326 | % | 10/20/15 | 142,000,000 | 141,937,185 | (a)(b) | ||||||||||

| DnB NOR Bank ASA |

0.326 | % | 10/20/15 | 100,000,000 | 99,955,764 | (a)(b) | ||||||||||

| DnB NOR Bank ASA |

0.326 | % | 10/28/15 | 100,000,000 | 99,948,542 | (a)(b) | ||||||||||

| DnB NOR Bank ASA |

0.321 | % | 11/10/15 | 50,000,000 | 49,968,889 | (a)(b) | ||||||||||

| HSBC Bank PLC |

0.300 | % | 9/22/15 | 91,400,000 | 91,384,005 | (a)(b) | ||||||||||

See Notes to Financial Statements.

| Liquid Reserves Portfolio 2015 Annual Report | 25 |

Schedule of investments (cont’d)

August 31, 2015

Liquid Reserves Portfolio

| Security | Rate | Maturity Date |

Face Amount |

Value | ||||||||||||

| Commercial Paper — continued |

||||||||||||||||

| HSBC Bank PLC |

0.321 | % | 10/29/15 | $ | 220,000,000 | $ | 219,886,578 | (a)(b) | ||||||||

| HSBC Bank PLC |

0.346 | % | 1/12/16 | 270,000,000 | 270,000,000 | (b)(c) | ||||||||||

| HSBC USA Inc. |

0.336 | % | 10/28/15 | 150,000,000 | 149,920,438 | (a) | ||||||||||

| ING U.S. Funding LLC |

0.320 | % | 10/6/15 | 130,000,000 | 129,959,556 | (a) | ||||||||||

| ING U.S. Funding LLC |

0.320 | % | 10/14/15 | 350,000,000 | 349,866,223 | (a) | ||||||||||

| ING U.S. Funding LLC |

0.421 | % | 12/28/15 | 327,500,000 | 327,049,142 | (a) | ||||||||||

| JPMorgan Securities LLC |

0.321 | % | 11/2/15 | 442,000,000 | 441,756,408 | (a) | ||||||||||

| JPMorgan Securities LLC |

0.350 | % | 11/23/15 | 395,000,000 | 395,000,000 | (c) | ||||||||||

| JPMorgan Securities LLC |

0.401 | % | 12/4/15 | 370,000,000 | 369,613,556 | (a) | ||||||||||

| Landesbank Hessen-Thuringen |

0.180 | % | 9/18/15 | 175,000,000 | 174,985,125 | (a)(b) | ||||||||||

| Landesbank Hessen-Thuringen |

0.180 | % | 9/25/15 | 90,000,000 | 89,989,200 | (a)(b) | ||||||||||

| Lloyds Bank PLC |

0.411 | % | 12/24/15 | 50,000,000 | 49,935,083 | (a) | ||||||||||

| Lloyds Bank PLC |

0.401-0.411 | % | 12/30/15 | 550,000,000 | 549,248,334 | (a) | ||||||||||

| Lloyds Bank PLC |

0.401-0.411 | % | 12/30/15 | 249,825,000 | 249,491,900 | (a) | ||||||||||

| Lloyds Bank PLC |

0.501 | % | 2/12/16 | 350,000,000 | 349,202,777 | (a) | ||||||||||

| Lloyds Bank PLC |

0.501 | % | 2/23/16 | 300,000,000 | 299,270,833 | (a) | ||||||||||

| Natixis NY |

0.070 | % | 9/1/15 | 1,420,000,000 | 1,420,000,000 | (a) | ||||||||||

| Nordea Bank AB |

0.205 | % | 9/1/15 | 200,000,000 | 200,000,000 | (a)(b) | ||||||||||

| Nordea Bank AB |

0.255 | % | 10/5/15 | 25,000,000 | 24,993,979 | (a)(b) | ||||||||||

| Nordea Bank AB |

0.300 | % | 10/21/15 | 200,000,000 | 199,916,667 | (a)(b) | ||||||||||

| Nordea Bank AB |

0.316 | % | 11/10/15 | 415,000,000 | 414,745,812 | (a)(b) | ||||||||||

| NRW Bank |

0.130 | % | 9/2/15 | 415,000,000 | 414,998,501 | (a)(b) | ||||||||||

| NRW Bank |

0.195 | % | 9/14/15 | 500,000,000 | 499,964,792 | (a)(b) | ||||||||||

| NRW Bank |

0.195 | % | 9/14/15 | 100,000,000 | 99,992,958 | (a)(b) | ||||||||||

| NRW Bank |

0.185 | % | 9/21/15 | 150,000,000 | 149,984,583 | (a)(b) | ||||||||||

| NRW Bank |

0.205 | % | 10/1/15 | 220,000,000 | 219,962,417 | (a)(b) | ||||||||||

| NRW Bank |

0.205 | % | 10/2/15 | 150,000,000 | 149,973,521 | (a)(b) | ||||||||||

| Oversea-Chinese Banking Corp. Ltd. |

0.210 | % | 9/3/15 | 200,000,000 | 199,997,667 | (a) | ||||||||||

| Oversea-Chinese Banking Corp. Ltd. |

0.130 | % | 9/4/15 | 90,000,000 | 89,999,025 | (a) | ||||||||||

| Oversea-Chinese Banking Corp. Ltd. |

0.220 | % | 9/16/15 | 95,000,000 | 94,991,292 | (a) | ||||||||||

| Oversea-Chinese Banking Corp. Ltd. |

0.401 | % | 1/5/16 | 150,000,000 | 149,790,000 | (a) | ||||||||||

| Oversea-Chinese Banking Corp. Ltd. |

0.359 | % | 1/25/16 | 200,000,000 | 200,000,000 | (c) | ||||||||||

| PNC Bank NA |

0.411 | % | 10/14/15 | 144,000,000 | 143,929,480 | (a) | ||||||||||

| PNC Bank NA |

0.411 | % | 10/14/15 | 5,350,000 | 5,347,380 | (a) | ||||||||||

| PNC Bank NA |

0.381-0.391 | % | 11/2/15 | 272,000,000 | 271,819,890 | (a) | ||||||||||

| PNC Bank NA |

0.381-0.391 | % | 11/2/15 | 41,250,000 | 41,223,004 | (a) | ||||||||||

| PNC Bank NA |

0.401 | % | 11/9/15 | 143,000,000 | 142,890,367 | (a) | ||||||||||

| Rabobank Nederland |

0.310 | % | 11/5/15 | 345,000,000 | 344,806,896 | (a) | ||||||||||

See Notes to Financial Statements.

| 26 | Liquid Reserves Portfolio 2015 Annual Report |

Liquid Reserves Portfolio

| Security | Rate | Maturity Date |

Face Amount |

Value | ||||||||||||