UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2012

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 1-10258

Tredegar Corporation

(Exact Name of Registrant as Specified in Its Charter)

| Virginia | 54-1497771 | |

| (State or Other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification No.) | |

| 1100 Boulders Parkway Richmond, Virginia |

23225 | |

| (Address of Principal Executive Offices) | (Zip Code) | |

Registrant’s Telephone Number, Including Area Code: (804) 330-1000

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | x | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The number of shares of Common Stock, no par value, outstanding as of July 27, 2012: 32,113,983.

PART I – FINANCIAL INFORMATION

| Item 1. | Financial Statements. |

Tredegar Corporation

Consolidated Balance Sheets

(In Thousands, Except Share Data)

(Unaudited)

| June 30, | December 31, | |||||||

| 2012 | 2011 | |||||||

| Assets |

||||||||

| Current assets: |

||||||||

| Cash and cash equivalents |

$ | 52,559 | $ | 68,939 | ||||

| Accounts and other receivables, net of allowance for doubtful accounts and sales returns of $3,319 in 2012 and $3,539 in 2011 |

101,280 | 98,027 | ||||||

| Income taxes recoverable |

1,695 | 2,592 | ||||||

| Inventories |

69,688 | 61,290 | ||||||

| Deferred income taxes |

6,912 | 7,135 | ||||||

| Prepaid expenses and other |

5,916 | 7,880 | ||||||

|

|

|

|

|

|||||

| Total current assets |

238,050 | 245,863 | ||||||

|

|

|

|

|

|||||

| Property, plant and equipment, at cost |

743,225 | 745,762 | ||||||

| Less accumulated depreciation |

508,214 | 488,488 | ||||||

|

|

|

|

|

|||||

| Net property, plant and equipment |

235,011 | 257,274 | ||||||

|

|

|

|

|

|||||

| Goodwill and other intangibles, net |

216,074 | 223,432 | ||||||

| Other assets and deferred charges |

65,279 | 54,041 | ||||||

|

|

|

|

|

|||||

| Total assets |

$ | 754,414 | $ | 780,610 | ||||

|

|

|

|

|

|||||

| Liabilities and Shareholders’ Equity |

||||||||

| Current liabilities: |

||||||||

| Accounts payable |

$ | 80,006 | $ | 73,742 | ||||

| Accrued expenses |

39,193 | 41,997 | ||||||

|

|

|

|

|

|||||

| Total current liabilities |

119,199 | 115,739 | ||||||

|

|

|

|

|

|||||

| Long-term debt |

98,000 | 125,000 | ||||||

| Deferred income taxes |

69,796 | 70,754 | ||||||

| Other noncurrent liabilities |

70,243 | 72,210 | ||||||

|

|

|

|

|

|||||

| Total liabilities |

357,238 | 383,703 | ||||||

|

|

|

|

|

|||||

| Commitments and contingencies (Notes 1, 3 and 12) |

||||||||

| Shareholders’ equity: |

||||||||

| Common stock, no par value (issued and outstanding – 32,113,983 at June 30, 2012 and 32,057,281 at December 31, 2011) |

15,445 | 14,357 | ||||||

| Common stock held in trust for savings restoration plan |

(1,348 | ) | (1,343 | ) | ||||

| Foreign currency translation adjustment |

398 | 11,693 | ||||||

| Gain (loss) on derivative financial instruments |

(653 | ) | (406 | ) | ||||

| Pension and other postretirement benefit adjustments |

(87,410 | ) | (90,672 | ) | ||||

| Retained earnings |

470,744 | 463,278 | ||||||

|

|

|

|

|

|||||

| Total shareholders’ equity |

397,176 | 396,907 | ||||||

|

|

|

|

|

|||||

| Total liabilities and shareholders’ equity |

$ | 754,414 | $ | 780,610 | ||||

|

|

|

|

|

|||||

See accompanying notes to financial statements.

2

Tredegar Corporation

Consolidated Statements of Income

(In Thousands, Except Per Share Data)

(Unaudited)

| Three Months Ended June 30 |

Six Months Ended June 30 |

|||||||||||||||

| 2012 | 2011 | 2012 | 2011 | |||||||||||||

| Revenues and other items: |

||||||||||||||||

| Sales |

$ | 216,113 | $ | 200,966 | $ | 433,311 | $ | 392,490 | ||||||||

| Other income (expense), net |

2,650 | 429 | 5,215 | 623 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| 218,763 | 201,395 | 438,526 | 393,113 | |||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Costs and expenses: |

||||||||||||||||

| Cost of goods sold |

176,600 | 167,125 | 352,657 | 324,983 | ||||||||||||

| Freight |

5,938 | 4,742 | 11,274 | 8,741 | ||||||||||||

| Selling, general and administrative |

19,428 | 15,247 | 38,875 | 31,409 | ||||||||||||

| Research and development |

3,088 | 3,187 | 6,734 | 6,744 | ||||||||||||

| Amortization of intangibles |

1,330 | 129 | 2,742 | 258 | ||||||||||||

| Interest expense |

1,017 | 361 | 2,024 | 716 | ||||||||||||

| Asset impairments and costs associated with exit and disposal activities |

1,321 | 1,084 | 2,214 | 1,084 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total |

208,722 | 191,875 | 416,520 | 373,935 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Income from continuing operations before income taxes |

10,041 | 9,520 | 22,006 | 19,178 | ||||||||||||

| Income taxes from continuing operations |

2,688 | 3,472 | 6,855 | 6,462 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Income from continuing operations |

7,353 | 6,048 | 15,151 | 12,716 | ||||||||||||

| Loss from discontinued operations |

— | (345 | ) | (4,800 | ) | (345 | ) | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income |

$ | 7,353 | $ | 5,703 | $ | 10,351 | $ | 12,371 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Earnings (loss) per share: |

||||||||||||||||

| Basic |

||||||||||||||||

| Continuing operations |

$ | .23 | $ | .19 | $ | .47 | $ | .40 | ||||||||

| Discontinued operations |

— | (.01 | ) | (.15 | ) | (.01 | ) | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income |

$ | .23 | $ | .18 | $ | .32 | $ | .39 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Diluted |

||||||||||||||||

| Continuing operations |

$ | .23 | $ | .19 | $ | .47 | $ | .39 | ||||||||

| Discontinued operations |

— | (.01 | ) | (.15 | ) | (.01 | ) | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income |

$ | .23 | $ | .18 | $ | .32 | $ | .38 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Shares used to compute earnings per share: |

||||||||||||||||

| Basic |

32,051 | 31,946 | 32,031 | 31,900 | ||||||||||||

| Diluted |

32,101 | 32,205 | 32,247 | 32,233 | ||||||||||||

| Dividends per share |

$ | .045 | $ | .045 | $ | .090 | $ | .090 | ||||||||

See accompanying notes to financial statements.

3

Tredegar Corporation

Consolidated Statements of Comprehensive Income (Loss)

(In Thousands)

(Unaudited)

| Three Months Ended June 30 |

||||||||

| 2012 | 2011 | |||||||

| Net income |

$ | 7,353 | $ | 5,703 | ||||

| Other comprehensive income (loss): |

||||||||

| Foreign currency translation adjustment (net of tax benefit of $1,361 in 2012 and a tax of $908 in 2011) |

(16,268 | ) | 1,687 | |||||

| Derivative financial instruments adjustment (net of tax benefit of $441 in 2012 and $182 in 2011) |

(718 | ) | (294 | ) | ||||

| Amortization of prior service costs and net gains or losses (net of tax of $942 in 2012 and $569 in 2011) |

1,631 | 1,010 | ||||||

|

|

|

|

|

|||||

| Other comprehensive income (loss) |

(15,355 | ) | 2,403 | |||||

|

|

|

|

|

|||||

| Comprehensive income (loss) |

$ | (8,002 | ) | $ | 8,106 | |||

|

|

|

|

|

|||||

| Six Months Ended June 30 |

||||||||

| 2012 | 2011 | |||||||

| Net income |

$ | 10,351 | $ | 12,371 | ||||

| Other comprehensive income (loss): |

||||||||

| Foreign currency translation adjustment (net of tax benefit of $328 in 2012 and a tax of $2,867 in 2011) |

(11,295 | ) | 5,308 | |||||

| Derivative financial instruments adjustment (net of tax benefit of $152 in 2012 and $134 in 2011) |

(247 | ) | (216 | ) | ||||

| Amortization of prior service costs and net gains or losses (net of tax of $1,885 in 2012 and $1,137 in 2011) |

3,262 | 2,020 | ||||||

|

|

|

|

|

|||||

| Other comprehensive income (loss) |

(8,280 | ) | 7,112 | |||||

|

|

|

|

|

|||||

| Comprehensive income |

$ | 2,071 | $ | 19,483 | ||||

|

|

|

|

|

|||||

See accompanying notes to financial statements.

4

Tredegar Corporation

Consolidated Statements of Cash Flows

(In Thousands)

(Unaudited)

| Six Months Ended June 30 |

||||||||

| 2012 | 2011 | |||||||

| Cash flows from operating activities: |

||||||||

| Net income |

$ | 10,351 | $ | 12,371 | ||||

| Adjustments for noncash items: |

||||||||

| Depreciation |

24,334 | 21,731 | ||||||

| Amortization of intangibles |

2,742 | 258 | ||||||

| Deferred income taxes |

(245 | ) | 229 | |||||

| Accrued pension and postretirement benefits |

4,044 | 1,196 | ||||||

| Gain on investment accounted for under the fair value method |

(6,300 | ) | — | |||||

| Loss on asset impairments and divestitures |

1,942 | 798 | ||||||

| (Gain) loss on disposal of assets |

— | (188 | ) | |||||

| Changes in assets and liabilities, net of effects of acquisitions and divestitures: |

||||||||

| Accounts and other receivables |

(4,750 | ) | (14,776 | ) | ||||

| Inventories |

(11,052 | ) | 8,346 | |||||

| Income taxes recoverable/payable |

575 | 324 | ||||||

| Prepaid expenses and other |

1,814 | 1,066 | ||||||

| Accounts payable and accrued expenses |

7,775 | (709 | ) | |||||

| Other, net |

(3,716 | ) | (2,475 | ) | ||||

|

|

|

|

|

|||||

| Net cash provided by operating activities |

27,514 | 28,171 | ||||||

|

|

|

|

|

|||||

| Cash flows from investing activities: |

||||||||

| Capital expenditures |

(8,933 | ) | (8,504 | ) | ||||

| Acquisition, net of cash acquired |

(3,311 | ) | — | |||||

| Proceeds from the sale of assets and property disposals |

75 | 960 | ||||||

|

|

|

|

|

|||||

| Net cash used in investing activities |

(12,169 | ) | (7,544 | ) | ||||

|

|

|

|

|

|||||

| Cash flows from financing activities: |

||||||||

| Debt principal payments and financing costs |

(28,354 | ) | (81 | ) | ||||

| Dividends paid |

(2,890 | ) | (2,878 | ) | ||||

| Proceeds from exercise of stock options |

125 | 709 | ||||||

|

|

|

|

|

|||||

| Net cash used in financing activities |

(31,119 | ) | (2,250 | ) | ||||

|

|

|

|

|

|||||

| Effect of exchange rate changes on cash |

(606 | ) | 2,216 | |||||

|

|

|

|

|

|||||

| Increase (decrease) in cash and cash equivalents |

(16,380 | ) | 20,593 | |||||

| Cash and cash equivalents at beginning of period |

68,939 | 73,191 | ||||||

|

|

|

|

|

|||||

| Cash and cash equivalents at end of period |

$ | 52,559 | $ | 93,784 | ||||

|

|

|

|

|

|||||

See accompanying notes to financial statements.

5

Tredegar Corporation

Consolidated Statement of Shareholders’ Equity

(In Thousands, Except Share and Per Share Data)

(Unaudited)

| Accumulated Other Comprehensive Income (Loss) |

||||||||||||||||||||||||||||

| Common Stock |

Retained Earnings |

Trust for Savings Restoration Plan |

Foreign Currency Translation |

Gain (Loss) on Derivative Financial Instruments |

Pension & Other Post-retirement Benefit Adjust. |

Total Shareholders Equity |

||||||||||||||||||||||

| Balance December 31, 2011 |

$ | 14,357 | $ | 463,278 | $ | (1,343 | ) | $ | 11,693 | $ | (406 | ) | $ | (90,672 | ) | $ | 396,907 | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Comprehensive income (loss): |

||||||||||||||||||||||||||||

| Net income |

— | 10,351 | — | — | — | — | 10,351 | |||||||||||||||||||||

| Foreign currency translation adjustment (net of tax benefit of $328) |

— | — | — | (11,295 | ) | — | — | (11,295 | ) | |||||||||||||||||||

| Derivative financial instruments adjustment (net of tax benefit of $152) |

— | — | — | — | (247 | ) | — | (247 | ) | |||||||||||||||||||

| Amortization of prior service costs and net gains or losses (net of tax of $1,885) |

— | — | — | — | — | 3,262 | 3,262 | |||||||||||||||||||||

| Cash dividends declared ($.090 per share) |

— | (2,890 | ) | — | — | — | — | (2,890 | ) | |||||||||||||||||||

| Stock-based compensation expense |

1,317 | — | — | — | — | — | 1,317 | |||||||||||||||||||||

| Issued upon exercise of stock options (including related income tax benefits of $83) & other |

(229 | ) | — | — | — | — | — | (229 | ) | |||||||||||||||||||

| Tredegar common stock purchased by trust for savings restoration plan |

— | 5 | (5 | ) | — | — | — | — | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Balance June 30, 2012 |

$ | 15,445 | $ | 470,744 | $ | (1,348 | ) | $ | 398 | $ | (653 | ) | $ | (87,410 | ) | $ | 397,176 | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

See accompanying notes to financial statements.

6

TREDEGAR CORPORATION

NOTES TO THE CONSOLIDATED INTERIM FINANCIAL STATEMENTS

(Unaudited)

| 1. | In the opinion of management, the accompanying consolidated financial statements of Tredegar Corporation and Subsidiaries (“Tredegar,” “we,” “us” or “our”) contain all adjustments necessary to state fairly, in all material respects, Tredegar’s consolidated financial position as of June 30, 2012, the consolidated results of operations for the three and six months ended June 30, 2012 and 2011, the consolidated cash flows for the six months ended June 30, 2012 and 2011, and the consolidated changes in shareholders’ equity for the six months ended June 30, 2012. All such adjustments, unless otherwise detailed in the notes to the consolidated interim financial statements, are deemed to be of a normal, recurring nature. The financial position data as of December 31, 2011 that is included herein was derived from the audited consolidated financial statements provided in our Annual Report on Form 10-K (“2011 Form 10-K”) for the year ended December 31, 2011 but does not include all disclosures required by United States generally accepted accounting principles. These financial statements should be read in conjunction with the consolidated financial statements and related notes included in our 2011 Form 10-K. The results of operations for the three and six months ended June 30, 2012, are not necessarily indicative of the results to be expected for the full year. |

| 2. | On October 14, 2011, TAC Holdings, LLC (the “Buyer”) and Tredegar Film Products Corporation, which are indirect and direct, respectively, wholly-owned subsidiaries of Tredegar, entered into a Membership Interest Purchase Agreement (the “Purchase Agreement”) with Gaucho Holdings, B.V. (the “Seller”), an indirect, wholly-owned subsidiary of Vision Capital Partners VII LP (“Vision Capital”). On October 24, 2011, under the terms of the Purchase Agreement, the Buyer acquired from the Seller 100% of the outstanding equity interests of Terphane Holdings LLC (“Terphane”). |

Terphane is headquartered in São Paulo, Brazil and operates manufacturing facilities in Cabo de Santo Agostinho, Brazil and Bloomfield, New York. It is a market leading producer of thin polyester films in Latin America with a growing presence in strategic niches in the U.S. Polyester films have specialized properties, such as heat resistance and barrier protection, that make them uniquely suited for the fast-growing flexible packaging market. We expect that the acquisition of Terphane will allow us to extend our product offerings into adjacent specialty films markets and to expand in Latin America.

As of December 31, 2011, the purchase price allocation was preliminary, subject to adjustments for certain terms and conditions under the Purchase Agreement. In the first quarter of 2012, all post-closing adjustments to the purchase price were resolved. Adjustments to the purchase price were made retrospectively as if the accounting had been completed on the acquisition date.

Upon completing these post-closing adjustments, which were primarily related to working capital transferred, the total purchase price (net of cash acquired) was $182.7 million, $3.3 million of which was paid during the first quarter of 2012. The purchase price was funded using available cash (net of cash received) of approximately $57.7 million and financing of $125 million secured from Tredegar’s revolving credit facility.

7

Based upon management’s valuation of the fair value of tangible and intangible assets acquired (net of cash acquired) and liabilities assumed, the purchase price has been allocated as follows:

| (In Thousands) |

||||

| Accounts receivable |

$ | 14,321 | ||

| Inventories |

23,437 | |||

| Property, plant & equipment |

86,963 | |||

| Identifiable intangible assets: |

||||

| Customer relationships |

32,600 | |||

| Proprietary technology |

14,700 | |||

| Trade names |

9,400 | |||

| Noncompete agreements |

2,300 | |||

| Other assets (current & noncurrent) |

3,680 | |||

| Trade payables |

(17,471 | ) | ||

| Other liabilities (current & noncurrent) |

(12,216 | ) | ||

| Deferred taxes |

(38,167 | ) | ||

|

|

|

|||

| Total identifiable net assets |

119,547 | |||

| Purchase price, net of cash received |

182,761 | |||

|

|

|

|||

| Goodwill |

$ | 63,214 | ||

|

|

|

|||

None of the goodwill or other intangible assets will be deductible for tax purposes. Intangible assets acquired in the purchase of Terphane are being amortized over the following periods:

| Identifiable Intangible Asset |

Useful Life (Yrs) | |

| Customer relationships |

12 | |

| Proprietary technology |

10 | |

| Trade names |

Indefinite | |

| Noncompete agreements |

2 |

The financial position and results of operations for Terphane have been consolidated with Tredegar subsequent to October 24, 2011. For the three and six month periods ended June 30, 2012, the consolidated results of operations included sales of $36.0 million and $69.4 million, respectively, and net income of $3.8 million and $6.1 million, respectively, related to Terphane. The following unaudited supplemental pro forma data presents our consolidated revenues and earnings as if the acquisition of Terphane had been consummated on January 1, 2011. The pro forma results are not necessarily indicative of our consolidated revenues and earnings if the acquisition and related borrowing had been consummated on January 1, 2011. Unaudited results for the three and six month periods ended June 30, 2012 and supplemental unaudited pro forma results for the three and six month ended June 30, 2011 are as follows:

| Three Months Ended June 30 |

Six Months Ended June 30 |

|||||||||||||||

| (In Thousands, Except Per Share Data) |

2012 | 2011 | 2012 | 2011 | ||||||||||||

| Sales |

$ | 216,113 | $ | 247,555 | $ | 433,311 | $ | 480,842 | ||||||||

| Income from continuing operations |

7,353 | 11,178 | 15,151 | 26,281 | ||||||||||||

| Earnings per share from continuing operations: |

||||||||||||||||

| Basic |

$ | .23 | $ | .35 | $ | .47 | $ | .82 | ||||||||

| Diluted |

.23 | .35 | .47 | .82 | ||||||||||||

8

The supplemental unaudited pro forma amounts reflect the application of the following adjustments in order to present the consolidated results as if the acquisition and related borrowing had occurred on January 1, 2011:

| • | Adjustment for additional depreciation and amortization expense associated with the adjustments to property, plant and equipment, and intangible assets associated with purchase accounting; |

| • | Additional interest expense and financing fees associated with borrowing arrangements used to fund the acquisition of Terphane and the elimination of historical interest expense associated with historical borrowings of Terphane that were not assumed by Tredegar; |

| • | Adjustments related to the elimination of foreign currency remeasurement gains associated with long-term borrowings that were not assumed by Tredegar; and |

| • | Adjustments for the estimated net income tax benefit associated with the previously described adjustments. |

| 3. | Plant shutdowns, asset impairments, restructurings and other charges are shown in the net sales and operating profit by segment table in Note 10, and unless otherwise noted below, are also included in “Asset impairments and costs associated with exit and disposal activities” in the consolidated statements of income. |

Plant shutdowns, asset impairments, restructurings and other charges in the second quarter of 2012 include:

| • | Net pretax charge of $1.0 million associated with the shutdown of the aluminum extrusions manufacturing facility in Kentland, Indiana, which includes accelerated depreciation for property, plant and equipment of $1.2 million (included in “Cost of goods sold” in the consolidated statements of income), severance and other employee related expenses of $0.4 million and other shutdown-related charges of $70,000, partially offset by adjustments to inventories accounted for under the last-in, first-out (“LIFO”) method of $0.5 million (included in “Cost of goods sold” in the consolidated statements of income); |

| • | Pretax loss of $0.8 million for asset impairments associated with a previously shutdown film products manufacturing facility in LaGrange, Georgia; |

| • | Pretax charges of $0.6 million for integration-related expenses and other non-recurring transactions (included in “Selling, general and administrative expenses” in the consolidated statements of income) associated with the acquisition of Terphane by Film Products; and |

| • | Pretax charges of $71,000 for severance and other employee-related costs in connection with restructurings in Film Products. |

Plant shutdowns, asset impairments, restructurings and other charges in the first six months of 2012 include:

| • | Net pretax charge of $1.9 million associated with the shutdown of the aluminum extrusions manufacturing facility in Kentland, Indiana, which includes accelerated depreciation for property, plant and equipment of $1.9 million (included in “Cost of goods sold” in the consolidated statements of income), severance and other employee related expenses of $1.0 million and other shutdown-related charges of $0.1 million, partially offset by adjustments to inventories accounted for under the last-in, first-out (“LIFO”) method of $1.0 million (included in “Cost of goods sold” in the consolidated statements of income); |

| • | Pretax charges of $0.9 million for integration-related expenses and other non-recurring transactions (included in “Selling, general and administrative expenses” in the consolidated statements of income) associated with the acquisition of Terphane by Film Products; |

| • | Pretax loss of $0.8 million for asset impairments associated with a previously shutdown film products manufacturing facility in LaGrange, Georgia; and |

| • | Pretax charges of $0.3 million for severance and other employee-related costs in connection with restructurings in Film Products ($71,000) and Aluminum Extrusions ($0.2 million). |

9

Results in the second quarter and first six months of 2012 include an unrealized gain from the write-up of an investment accounted for under the fair value method (included in “Other income (expense), net” in the consolidated statements of income) of $2.7 million ($1.7 million after taxes) and $6.3 million ($4.0 million after taxes), respectively. An unrealized loss (included in “Other income (expense), net” in the consolidated statements of income and “Corporate expenses, net” in the statement of net sales and operating profit by segment) on our investment in Harbinger Capital Partners Special Situations Fund, L.P. (“Harbinger”) of $1.1 million ($0.7 million after tax) was recorded in the first quarter of 2012 as a result of a reduction in the fair value of our investment that is not expected to be temporary. See Note 7 for additional information on investments.

Plant shutdowns, asset impairments, restructurings and other items in the second quarter of 2011 include:

| • | Pretax charges of $0.8 million for asset impairments in Film Products; |

| • | Pretax charges of $0.3 million for severance and other employee-related costs in connection with restructurings in Film Products; and |

| • | Pretax gains of $94,000 for timing differences between the recognition of realized losses on aluminum futures contracts and related revenues from the delayed fulfillment by customers of fixed-price forward purchase commitments (included in “Cost of goods sold” in the consolidated statements of income). |

Plant shutdowns, asset impairments, restructurings and other items in the first six months of 2011 include:

| • | Pretax charges of $0.8 million for asset impairments in Film Products; |

| • | Pretax charges of $0.3 million for severance and other employee-related costs in connection with restructurings in Film Products; and |

| • | Pretax gains of $62,000 for timing differences between the recognition of realized losses on aluminum futures contracts and related revenues from the delayed fulfillment by customers of fixed-price forward purchase commitments (included in “Cost of goods sold” in the consolidated statements of income). |

On February 12, 2008, we sold our aluminum extrusions business in Canada for approximately $25.0 million to an affiliate of H.I.G. Capital. All historical results for this business have been reflected as discontinued operations; however, cash flows for discontinued operations have not been separately disclosed in the consolidated statements of cash flows. In the first quarter of 2012, an accrual of $4.8 million ($4.8 million net of tax) was made for indemnifications under the purchase agreement related to environmental matters. Accruals of $4.4 million ($4.4 million after tax) were made in 2011 ($0.3 million in the second quarter of 2011) for indemnifications under the purchase agreement related to environmental matters.

10

A reconciliation of the beginning and ending balances of accrued expenses associated with asset impairments and exit and disposal activities for the six months ended June 30, 2012 is as follows:

| (In Thousands) |

Severance | Long-Lived Asset Impairments |

Other | Total | ||||||||||||

| Balance at December 31, 2011 |

$ | 197 | $ | — | $ | — | $ | 197 | ||||||||

| Changes in 2012: |

||||||||||||||||

| Charges |

1,296 | 834 | 131 | 2,261 | ||||||||||||

| Cash spent |

(675 | ) | — | (131 | ) | (806 | ) | |||||||||

| Charged against assets |

— | (834 | ) | — | (834 | ) | ||||||||||

| Reversed to income |

(46 | ) | — | — | (46 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Balance at June 30, 2012 |

$ | 772 | $ | — | $ | — | $ | 772 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| 4. | On April 23, 2012, we entered into a $350 million five-year, unsecured revolving credit facility (the “Credit Agreement”), with an option to increase that amount by an additional $75 million. The Credit Agreement replaces our previous $300 million four-year, unsecured revolving credit facility that was due to expire on June 21, 2014. In connection with the refinancing, we borrowed $102 million under the Credit Agreement, which was used, together with available cash on hand, to repay all indebtedness under our previous revolving credit facility. |

Borrowings under the Credit Agreement bear an interest rate of LIBOR plus a credit spread and commitment fees charged on the unused amount under the Credit Agreement at various indebtedness-to-adjusted EBITDA levels as follows:

| Pricing Under Revolving Credit Agreement (Basis Points) |

||||||||

| Indebtedness-to-Adjusted EBITDA Ratio |

Credit Spread Over LIBOR |

Commitment Fee |

||||||

| > 2.0x but <= 3.0x |

200 | 35 | ||||||

| > 1.0x but <=2.0x |

175 | 30 | ||||||

| <= 1.0x |

150 | 25 | ||||||

The most restrictive covenants in the Credit Agreement include:

| • | Maximum indebtedness-to-adjusted EBITDA of 3.0x; |

| • | Minimum adjusted EBIT-to-interest expense of 2.5x; |

| • | Maximum aggregate distributions to shareholders over the term of the Credit Agreement of $100 million plus, beginning with the fiscal quarter ended March 31, 2012, 50% of net income; and |

| • | Minimum shareholders’ equity at any point during the term of the Credit Agreement of at least $320 million increased on a cumulative basis at the end of each fiscal quarter, beginning with the fiscal quarter ended March 31, 2012, by an amount equal to 50% of net income (to the extent positive). |

11

| 5. | The components of inventories are as follows: |

| June 30, | December 31, | |||||||

| (In Thousands) |

2012 | 2011 | ||||||

| Finished goods |

$ | 14,630 | $ | 11,103 | ||||

| Work-in-process |

7,187 | 6,874 | ||||||

| Raw materials |

26,948 | 24,148 | ||||||

| Stores, supplies and other |

20,923 | 19,165 | ||||||

|

|

|

|

|

|||||

| Total |

$ | 69,688 | $ | 61,290 | ||||

|

|

|

|

|

|||||

During the first six months of 2012, certain inventories accounted for on a LIFO basis declined permanently, which resulted in cost of goods sold being stated at below current replacement costs by approximately $1.0 million in Aluminum Extrusions.

| 6. | Basic earnings per share is computed by dividing net income by the weighted average number of shares of common stock outstanding. Diluted earnings per share is computed by dividing net income by the weighted average common and potentially dilutive common equivalent shares outstanding, determined as follows: |

| Three Months Ended June 30 |

Six Months Ended June 30 |

|||||||||||||||

| (In Thousands) |

2012 | 2011 | 2012 | 2011 | ||||||||||||

| Weighted average shares outstanding used to compute basic earnings per share |

32,051 | 31,946 | 32,031 | 31,900 | ||||||||||||

| Incremental dilutive shares attributable to stock options and restricted stock |

50 | 259 | 216 | 333 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Shares used to compute diluted earnings per share |

32,101 | 32,205 | 32,247 | 32,233 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

Incremental shares attributable to stock options and restricted stock are computed using the average market price during the related period. During the three and six months ended June 30, 2012 and the three and six months ended June 30, 2011, 1,054,067, 527,033, 235,867 and 157,317, respectively, of average out-of-the-money options to purchase shares were excluded from the calculation of incremental shares attributable to stock options and restricted stock.

| 7. | We invested $7.5 million in a privately held specialty pharmaceutical company in 2007 and 2008. The company is developing and commercializing state of the art drug delivery systems designed to improve patient compliance and outcomes, and our ownership interest on a fully diluted basis is approximately 20%. The investment is accounted for under the fair value method. We elected the fair value option over the equity method of accounting since our investment objectives are similar to those of venture capitalists. |

At June 30, 2012 and December 31, 2011, the estimated fair value of our investment (also the carrying value included in “Other assets and deferred charges” in our balance sheet) was $23.9 million and $17.6 million, respectively. The fair value estimates are based upon significant unobservable (Level 3) inputs since there is no secondary market for our ownership interest. Accordingly, until the next round of financing or other significant financial transaction, value estimates will primarily be based on assumptions relating to meeting product development and commercialization milestones, corresponding cash flow projections (projections of sales, costs, expenses, capital expenditures and working capital investment) and discounting of these factors for the high degree of risk. Adjustments to the estimated fair value of our investment will be made in the period during which changes can be quantified.

12

We recognized an unrealized gain on the investment accounted for under the fair value method (included in “Other income (expense), net” in the consolidated statements of income) of $2.7 million and $6.3 million in the second quarter and first six months of 2012, respectively (none in the first six months 2011). The unrealized gain in the second quarter of 2012 is primarily attributed to the appreciation of our ownership interest to reflect insights from a new marketing study for its first product, which resulted in a favorable adjustment to the timing and amount of anticipated cash flows from an upcoming product introduction and achieving related milestones. The unrealized gain in the first quarter of 2012 was primarily attributed to the appreciation of our ownership interest after the weighted average cost of capital used to discount cash flows in our valuation of the specialty pharmaceutical company was reduced to reflect the completion of certain process testing and a reassessment of the risk associated with the timing for obtaining final marketing approval from the U.S. Food and Drug Administration for its first product.

The fair market valuation of our interest in the specialty pharmaceutical company is sensitive to changes in the weighted average cost of capital used to discount cash flow projections for the high degree of risk associated with meeting development and commercialization milestones as anticipated. The weighted average cost of capital used in the fair market valuation of our interest in the specialty pharmaceutical company was 55% at June 30, 2012 and 60% at December 31, 2011. At June 30, 2012, the effect of a 500 basis point decrease in the weighted average cost of capital assumption would have further increased the fair value of our interest in the specialty pharmaceutical company by approximately $4.6 million, and a 500 basis point increase in the weighted average cost of capital assumption would have decreased the fair value of our interest by approximately $3.5 million.

Had we not elected to account for our investment under the fair value method, we would have been required to use the equity method of accounting. For the three and six months ended June 30, 2012, net income (loss) recorded by the specialty pharmaceutical company, as reported to us by the investee, was a net loss of $1.5 million and $3.0 million, respectively, compared to net income of $0.2 million and $0.6 million for the three and six months ended June 30, 2011, respectively. Operating results included $3.3 million and $6.6 million in licensing revenues in the second quarter and first six months 2011, respectively (none in 2012). Total assets (which included cash and cash equivalents of $22.8 million at June 30, 2012 and $9.6 million at December 31, 2011) were $29.2 million and $17.1 million at June 30, 2012 and December 31, 2011, respectively.

Our investment in Harbinger had a carrying value (included in “Other assets and deferred charges”) of $4.0 million at June 30, 2012, compared with $5.2 million at December 31, 2011. We recorded an unrealized loss of $1.1 million ($0.7 million after taxes) on our investment in Harbinger in the first quarter of 2012 (included in “Other income (expense), net” in the consolidated statements of income) as a result of a reduction in the estimated fair value of our investment that is not expected to be temporary.

The carrying value at June 30, 2012 reflected Tredegar’s cost basis in its investment in the Harbinger Fund, net of total withdrawal proceeds received ($0.1 million in the first half of 2012) and unrealized losses. The timing and amount of future installments of withdrawal proceeds, which commenced in August 2010, were not known as of June 30, 2012. Gains on our investment in Harbinger will be recognized when the amounts expected to be collected from our withdrawal from the investment are known, which will likely be when cash in excess of our remaining carrying value is received. Losses will be recognized when management believes it is probable that future withdrawal proceeds will not exceed the remaining carrying value.

13

| 8. | We use derivative financial instruments for the purpose of hedging margin exposure from fixed-price forward sales contracts in Aluminum Extrusions and currency exchange rate exposures that exist due to specified transactions. When possible, our derivative financial instruments are designated as and qualify as cash flow hedges and are recognized in the balance sheet at fair value. A change in the fair value of derivatives that are highly effective and that are designated and qualify as cash flow hedges is recorded in other comprehensive income (loss). Gains and losses reported in other comprehensive income (loss) are reclassified to earnings in the periods in which earnings are affected by the variability of cash flows of the hedged transaction. Such gains and losses are reported on the same line as the underlying hedged item. Any hedge ineffectiveness (which represents the amount by which the changes in the fair value of the derivative exceed the variability in the cash flows of the forecasted transaction) is recorded in current period earnings. The amount of gains and losses recognized for hedge ineffectiveness was not material to the second quarter and first six months of 2012 and 2011. |

The fair value of derivative instruments recorded on the consolidated balance sheets are based upon Level 2 inputs within the corresponding commodity or foreign currency markets. If individual derivative instruments with the same counterparty can be settled on a net basis, we record the corresponding derivative fair values as a net asset or net liability.

In the normal course of business, we enter into fixed-price forward sales contracts with certain customers for the future sale of fixed quantities of aluminum extrusions at scheduled intervals. In order to hedge our margin exposure created from the fixing of future sales prices relative to volatile raw material (aluminum) costs, we enter into a combination of forward purchase commitments and futures contracts to acquire or hedge aluminum, based on the scheduled purchases for the firm sales commitments. The fixed-price firm sales commitments and related hedging instruments generally have durations of not more than 12 months, and the notional amount of aluminum futures contracts that hedged future purchases of aluminum to meet fixed-price forward sales contract obligations was $8.9 million (9.1 million pounds of aluminum) at June 30, 2012 and $10.8 million (11.0 million pounds of aluminum) at December 31, 2011.

The table below summarizes the location and gross amounts of aluminum futures contract fair values in the consolidated balance sheets as of June 30, 2012 and December 31, 2011:

| June 30, 2012 |

December 31, 2011 |

|||||||||||

| Balance Sheet | Fair | Balance Sheet | Fair | |||||||||

| (In Thousands) |

Account |

Value | Account |

Value | ||||||||

| Derivatives Designated as Hedging Instruments |

||||||||||||

| Asset derivatives: |

||||||||||||

| Aluminum futures contracts |

$ | — | Accrued expenses | $ | 21 | |||||||

| Liability derivatives: |

||||||||||||

| Aluminum futures contracts |

Accrued expenses | $ | 1,054 | Accrued expenses | $ | 677 | ||||||

| Derivatives Not Designated as Hedging Instruments |

||||||||||||

| Asset derivatives: |

||||||||||||

| Aluminum futures contracts |

Accrued expenses | $ | 63 | Accrued expenses | $ | 18 | ||||||

| Liability derivatives: |

||||||||||||

| Aluminum futures contracts |

Accrued expenses | $ | 63 | Accrued expenses | $ | 18 | ||||||

In the event that the counterparty to an aluminum fixed-price forward sales contract chooses to not take delivery of its aluminum extrusions, the customer is contractually obligated to compensate us for any losses on the related aluminum futures and/or forward purchase contracts through the date of cancellation. The offsetting asset and liability positions for derivatives not designated as hedging instruments included in the table above are associated with the unwinding of aluminum futures contracts that relate to such cancellations.

14

These derivative contracts involve elements of market risk that are not reflected on our consolidated balance sheet, including the risk of dealing with counterparties and their ability to meet the terms of the contracts. The counterparties to our forward purchase commitments are major aluminum brokers and suppliers, and the counterparties to our aluminum futures contracts are major financial institutions. Fixed-price forward sales contracts are only made available to our best and most credit-worthy customers. The counterparties to our foreign currency futures and zero-cost collar contracts are major financial institutions.

The effect on net income and other comprehensive income (loss) of derivative instruments classified as cash flow hedges and described in the previous paragraphs for the three and six month periods ended June 30, 2012 and 2011 is summarized in the table below:

| (In Thousands) | Three Months Ended June 30 |

|||||||

| Aluminum Futures Contracts |

2012 | 2011 | ||||||

| Amount of pre-tax gain (loss) recognized in other comprehensive income |

$ | (1,289 | ) | $ | (169 | ) | ||

|

|

|

|

|

|||||

| Location of gain (loss) reclassified from accumulated other comprehensive income into net income (effective portion) |

|

Cost of sales |

|

|

Cost of sales |

| ||

| Amount of pre-tax gain (loss) reclassified from accumulated other comprehensive income to net income (effective portion) |

$ | (131 | ) | $ | 307 | |||

| Six Months Ended June 30 |

||||||||

| 2012 | 2011 | |||||||

| Amount of pre-tax gain (loss) recognized in other comprehensive income |

$ | (700 | ) | $ | 236 | |||

|

|

|

|

|

|||||

| Location of gain (loss) reclassified from accumulated other comprehensive income into net income (effective portion) |

|

Cost of sales |

|

|

Cost of sales |

| ||

| Amount of pre-tax gain (loss) reclassified from accumulated other comprehensive income to net income (effective portion) |

$ | (302 | ) | $ | 586 | |||

As of June 30, 2012, we expect $0.6 million of unrealized after-tax losses on derivative instruments reported in accumulated other comprehensive income (loss) to be reclassified to earnings within the next twelve months. For the three and six month periods ended June 30, 2012 and 2011, net gains or losses realized on previously unrealized net gains or losses from hedges that had been discontinued were not material.

15

| 9. | The components of net periodic benefit cost for our pension and other post-retirement benefit programs reflected in consolidated results are shown below: |

| Pension Benefits for Three Months Ended June 30 |

Other Post-Retirement Benefits for Three Months Ended June 30 |

|||||||||||||||

| (In Thousands) |

2012 | 2011 | 2012 | 2011 | ||||||||||||

| Service cost |

$ | (857 | ) | $ | (801 | ) | $ | (13 | ) | $ | (13 | ) | ||||

| Interest cost |

(3,288 | ) | (3,283 | ) | (101 | ) | (95 | ) | ||||||||

| Expected return on plan assets |

4,811 | 5,107 | — | — | ||||||||||||

| Amortization of prior service costs, gains or losses and net transition asset |

(2,627 | ) | (1,579 | ) | 53 | 66 | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net periodic benefit cost |

$ | (1,961 | ) | $ | (556 | ) | $ | (61 | ) | $ | (42 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

| Pension Benefits for Six Months Ended June 30 |

Other Post-Retirement Benefits for Six Months Ended June 30 |

|||||||||||||||

| 2012 | 2011 | 2012 | 2011 | |||||||||||||

| Service cost |

$ | (1,715 | ) | $ | (1,602 | ) | $ | (26 | ) | $ | (26 | ) | ||||

| Interest cost |

(6,577 | ) | (6,566 | ) | (201 | ) | (191 | ) | ||||||||

| Expected return on plan assets |

9,622 | 10,213 | — | — | ||||||||||||

| Amortization of prior service costs, gains or losses and net transition asset |

(5,253 | ) | (3,157 | ) | 106 | 133 | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net periodic benefit cost |

$ | (3,923 | ) | $ | (1,112 | ) | $ | (121 | ) | $ | (84 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

We contributed $0.2 million to our pension plans for continuing operations in 2011, and our required contributions are expected to be approximately $5.3 million in 2012. We fund our other post-retirement benefits (life insurance and health benefits) on a claims-made basis, which were $0.3 million for the year ended December 31, 2011.

| 10. | We have four reportable segments, which include Film Products, Aluminum Extrusions, AFBS (formerly Therics, Inc.) and Other. There was no activity related to AFBS in the first six months of 2012 or 2011. Effective January 1, 2012, the operations of Bright View Technologies Corporation (“Bright View”) were incorporated into Film Products to leverage research and development efforts and accelerate new product development. Prior year balances for Bright View have been reclassified to Film Products to conform with the current year presentation. The Other segment is now solely comprised of the operations of Falling Springs, LLC. |

Information by business segment is reported below. There are no accounting transactions between segments and no allocations to segments. Net sales (sales less freight) and operating profit from ongoing operations are the measures of sales and operating profit used by the chief operating decision maker for purposes of assessing performance.

16

The following table presents net sales and operating profit by segment for the three and six month periods ended June 30, 2012 and 2011:

| Three Months Ended June 30 |

Six Months Ended June 30 |

|||||||||||||||

| (In Thousands) |

2012 | 2011 | 2012 | 2011 | ||||||||||||

| Net Sales |

||||||||||||||||

| Film Products |

$ | 150,226 | $ | 132,035 | $ | 303,925 | $ | 263,556 | ||||||||

| Aluminum Extrusions |

59,695 | 63,896 | 117,303 | 119,897 | ||||||||||||

| Other |

254 | 293 | 809 | 296 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total net sales |

210,175 | 196,224 | 422,037 | 383,749 | ||||||||||||

| Add back freight |

5,938 | 4,742 | 11,274 | 8,741 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Sales as shown in the Consolidated Statements of Income |

$ | 216,113 | $ | 200,966 | $ | 433,311 | $ | 392,490 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Operating Profit (Loss) |

||||||||||||||||

| Film Products: |

||||||||||||||||

| Ongoing operations |

$ | 13,441 | $ | 12,794 | $ | 28,907 | $ | 28,387 | ||||||||

| Plant shutdowns, asset impairments, restructurings and other |

(1,508 | ) | (1,084 | ) | (1,792 | ) | (1,084 | ) | ||||||||

| Aluminum Extrusions: |

||||||||||||||||

| Ongoing operations |

3,800 | 1,467 | 5,503 | 238 | ||||||||||||

| Plant shutdowns, asset impairments, restructurings and other |

(1,086 | ) | 94 | (2,147 | ) | 62 | ||||||||||

| Other: |

||||||||||||||||

| Ongoing operations |

8 | 34 | 184 | (168 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total |

14,655 | 13,305 | 30,655 | 27,435 | ||||||||||||

| Interest income |

83 | 270 | 253 | 500 | ||||||||||||

| Interest expense |

1,017 | 361 | 2,024 | 716 | ||||||||||||

| Gain on investment accounted for under fair value method |

2,700 | — | 6,300 | — | ||||||||||||

| Stock option-based compensation costs |

315 | 516 | 761 | 1,007 | ||||||||||||

| Corporate expenses, net |

6,065 | 3,178 | 12,417 | 7,034 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Income from continuining operations before income taxes |

10,041 | 9,520 | 22,006 | 19,178 | ||||||||||||

| Income taxes from continuing operations |

2,688 | 3,472 | 6,855 | 6,462 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Income from continuing operations |

7,353 | 6,048 | 15,151 | 12,716 | ||||||||||||

| Loss from discontinued operations |

— | (345 | ) | (4,800 | ) | (345 | ) | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income |

$ | 7,353 | $ | 5,703 | $ | 10,351 | $ | 12,371 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

The following table presents identifiable assets by segment at June 30, 2012 and December 31, 2011:

| June 30, | December 31, | |||||||

| (In Thousands) |

2012 | 2011 | ||||||

| Film Products |

$ | 554,592 | $ | 574,571 | ||||

| Aluminum Extrusions |

79,160 | 78,661 | ||||||

| Other |

21,168 | 17,520 | ||||||

|

|

|

|

|

|||||

| Subtotal |

654,920 | 670,752 | ||||||

| General corporate |

46,935 | 40,919 | ||||||

| Cash and cash equivalents |

52,559 | 68,939 | ||||||

|

|

|

|

|

|||||

| Total |

$ | 754,414 | $ | 780,610 | ||||

|

|

|

|

|

|||||

17

| 11. | The effective tax rate for income from continuing operations the first six months of 2012 was 31.2% compared to 33.7% in first six months of 2011. The significant differences between the U.S. federal statutory rate and the effective income tax rate for continuing operations for the six months ended June 30, 2012 and 2011 are as follows: |

| Percent of Income Before Income Taxes |

||||||||

| Six Months Ended June 30 |

2012 | 2011 | ||||||

| Income tax expense at federal statutory rate |

35.0 | 35.0 | ||||||

| Valuation allowance for capital loss carry-forwards |

6.1 | .3 | ||||||

| Unremitted earnings from foreign operations |

1.1 | 1.4 | ||||||

| State taxes, net of federal income tax benefit |

1.0 | 1.6 | ||||||

| Non-deductible expenses |

.2 | .7 | ||||||

| Income tax contingency accruals/reversals |

— | .6 | ||||||

| Research and development tax credit |

— | (.7 | ) | |||||

| Domestic production activities deduction |

(.3 | ) | (.5 | ) | ||||

| Valuation allowance for foreign operating loss carry-forwards |

(.4 | ) | (1.1 | ) | ||||

| Foreign rate differences |

(3.6 | ) | (3.7 | ) | ||||

| Foreign tax incentives |

(7.4 | ) | — | |||||

| Other |

(.5 | ) | .1 | |||||

|

|

|

|

|

|||||

| Effective income tax rate for income from continuing operations |

31.2 | 33.7 | ||||||

|

|

|

|

|

|||||

The Brazilian federal statutory income tax rate is a composite of 34.0% (25.0% of income tax and 9.0% of social contribution on income). Terphane’s manufacturing facility in Brazil is the beneficiary of certain income tax incentives that allow for a reduction in the statutory Brazilian federal income tax rate levied on the operating profit of its products. These incentives produce a current effective tax rate of 15.25% for Terphane Ltda. (6.25% of income tax and 9.0% social contribution on income). The current incentives will expire at the end of 2014, but we anticipate that we will qualify for additional incentives that will extend beyond 2014.

Income taxes for the first six months of 2012 and 2011 include the recognition of an additional valuation allowance of $1.3 million and $61,000, respectively, related to expected limitations on the utilization of assumed capital losses on certain investments recognized in previous years.

We claimed an ordinary loss on the write-off of our investment in our aluminum extrusions operations in Canada (sold in February 2008) on our 2008 consolidated tax return (included in discontinued operations in the consolidated statement of income in 2007). During an audit, the Internal Revenue Service (“IRS”) challenged the ordinary nature of the loss, asserting that the loss should be re-characterized as capital in nature. Had the IRS prevailed in final, non-appealable determinations, it is possible that the matter would have resulted in additional tax payments of up to $12 million, plus any interest and penalties. Prior to issuing a Notice of Deficiency, however, the IRS revised their audit report to allow the ordinary loss treatment to stand. The audit findings are subject to IRS Joint Committee review, and, while we expect no further challenge on this issue, if challenged, we will vigorously defend our position and believe that we will prevail but there can be no assurance of such a result.

Tredegar and its subsidiaries file income tax returns in the U.S., various states and jurisdictions outside the U.S. Generally, except for refund claims and amended returns, Tredegar is no longer subject to U.S. federal income tax examinations by tax authorities for years before 2008.

18

| 12. | We have been notified by U.S. Customs that certain film products exported by Terphane to the U.S. since November 6, 2008 are subject to duties associated with an antidumping duty order on imported PET films. We contest the applicability of these antidumping duties to the films exported by Terphane, which we believe are outside the scope of the antidumping order, and we intend to defend our position vigorously. For shipments through June 30, 2012, we have not received final demand from U.S. Customs, but we estimate that antidumping duties related to this matter could be approximately $8.6 million, none of which is recorded in the accompanying consolidated balance sheet. If unsuccessful, there are indemnifications for these liabilities that are specifically provided for under the Purchase Agreement, and we believe that we will recover all antidumping duty payments made to U.S. Customs from the Seller, subject to the terms of the indemnifications within the Purchase Agreement. |

19

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations. |

Forward-looking and Cautionary Statements

Some of the information contained in this Quarterly Report on Form 10-Q may constitute “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. When we use the words “believe,” “estimate,” “anticipate,” “expect,” “project,” “likely,” “may” and similar expressions, we do so to identify forward-looking statements. Such statements are based on our then current expectations and are subject to a number of risks and uncertainties that could cause actual results to differ materially from those addressed in the forward-looking statements. It is possible that our actual results and financial condition may differ, possibly materially, from the anticipated results and financial condition indicated in these forward-looking statements. Accordingly, you should not place undue reliance on these forward-looking statements. Factors that could cause actual results to differ from expectations include, without limitation: acquired businesses, including Terphane, may not achieve the levels of revenue, profit, productivity or otherwise perform as we expect; acquisitions, including our acquisition of Terphane, involve special risks, including without limitation, diversion of management’s time and attention to our existing businesses, the potential assumption of unanticipated liabilities and contingencies and potential difficulties in integrating acquired businesses and achieving anticipated operational improvements; Film Products is highly dependent on sales to one customer – The Procter & Gamble Company; growth of Film Products depends on its ability to develop and deliver new products at competitive prices; sales volume and profitability of Aluminum Extrusions are cyclical and highly dependent on economic conditions of end-use markets in the U.S., particularly in the construction sector, and are also subject to seasonal slowdowns; our substantial international operations subject us to risks of doing business in foreign countries, which could adversely affect our business, financial condition and results of operations; our future performance is influenced by costs incurred by our operating companies including, for example, the cost of energy and raw materials; and the other factors discussed in the reports Tredegar files with or furnishes to the Securities and Exchange Commission (the “SEC”) from time-to-time, including the risks and important factors set forth in additional detail in “Risk Factors” in Part I, Item 1A of Tredegar’s 2011 Annual Report on Form 10-K (the “2011 Form 10-K”) filed with the SEC. Readers are urged to review and carefully consider the disclosures Tredegar makes in its filings with the SEC, which include the 2011 Form 10-K. Tredegar does not undertake, and expressly disclaims any duty, to update any forward-looking statement to reflect any change in management’s expectations or any change in conditions, assumptions or circumstances on which such statements are based.

Executive Summary

Second-quarter 2012 net income from continuing operations was $7.4 million (23 cents per share) compared with $6.0 million (19 cents per share) in the second quarter of 2011. Net income from continuing operations for the first six months of 2012 was $15.2 million (47 cents per share) compared with $12.7 million (39 cents per share) in the first six months of 2011. Losses related to plant shutdowns, asset impairments, restructurings and other items are described in Note 3 on page 9. Net sales (sales less freight) and operating profit (loss) from ongoing operations are the measures of sales and operating profit used by the chief operating decision maker of each segment for purposes of assessing performance.

20

The following table presents Tredegar’s net sales and operating profit by segment for the three and six month periods ended June 30, 2012 and 2011:

| Three Months Ended June 30 |

Six Months Ended June 30 |

|||||||||||||||

| (In Thousands) |

2012 | 2011 | 2012 | 2011 | ||||||||||||

| Net Sales |

||||||||||||||||

| Film Products |

$ | 150,226 | $ | 132,035 | $ | 303,925 | $ | 263,556 | ||||||||

| Aluminum Extrusions |

59,695 | 63,896 | 117,303 | 119,897 | ||||||||||||

| Other |

254 | 293 | 809 | 296 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total net sales |

210,175 | 196,224 | 422,037 | 383,749 | ||||||||||||

| Add back freight |

5,938 | 4,742 | 11,274 | 8,741 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Sales as shown in the Consolidated Statements of Income |

$ | 216,113 | $ | 200,966 | $ | 433,311 | $ | 392,490 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Operating Profit (Loss) |

||||||||||||||||

| Film Products: |

||||||||||||||||

| Ongoing operations |

$ | 13,441 | $ | 12,794 | $ | 28,907 | $ | 28,387 | ||||||||

| Plant shutdowns, asset impairments, restructurings and other |

(1,508 | ) | (1,084 | ) | (1,792 | ) | (1,084 | ) | ||||||||

| Aluminum Extrusions: |

||||||||||||||||

| Ongoing operations |

3,800 | 1,467 | 5,503 | 238 | ||||||||||||

| Plant shutdowns, asset impairments, restructurings and other |

(1,086 | ) | 94 | (2,147 | ) | 62 | ||||||||||

| Other: |

||||||||||||||||

| Ongoing operations |

8 | 34 | 184 | (168 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total |

14,655 | 13,305 | 30,655 | 27,435 | ||||||||||||

| Interest income |

83 | 270 | 253 | 500 | ||||||||||||

| Interest expense |

1,017 | 361 | 2,024 | 716 | ||||||||||||

| Gain on investment accounted for under fair value method |

2,700 | — | 6,300 | — | ||||||||||||

| Stock option-based compensation costs |

315 | 516 | 761 | 1,007 | ||||||||||||

| Corporate expenses, net |

6,065 | 3,178 | 12,417 | 7,034 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Income from continuing operations before income taxes |

10,041 | 9,520 | 22,006 | 19,178 | ||||||||||||

| Income taxes from continuing operations |

2,688 | 3,472 | 6,855 | 6,462 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Income from continuing operations |

7,353 | 6,048 | 15,151 | 12,716 | ||||||||||||

| Loss from discontinued operations |

— | (345 | ) | (4,800 | ) | (345 | ) | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income |

$ | 7,353 | $ | 5,703 | $ | 10,351 | $ | 12,371 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

Film Products

A summary of operating results for Film Products is provided below:

| Favorable/ | Favorable/ | |||||||||||||||||||||||

| Quarter Ended June 30 | (Unfavorable) | Six Months Ended June 30 | (Unfavorable) | |||||||||||||||||||||

| (In Thousands, Except Percentages) |

2012 | 2011 | % Change | 2012 | 2011 | % Change | ||||||||||||||||||

| Sales volume (pounds) |

67,949 | 53,309 | 27.5 | % | 134,921 | 106,456 | 26.7 | % | ||||||||||||||||

| Net sales |

$ | 150,226 | $ | 132,035 | 13.8 | % | $ | 303,925 | $ | 263,556 | 15.3 | % | ||||||||||||

| Operating profit from ongoing operations |

$ | 13,441 | $ | 12,794 | 5.1 | % | $ | 28,907 | $ | 28,387 | 1.8 | % | ||||||||||||

Net sales (sales less freight) in the second quarter and first six months of 2012 increased in comparison to the same periods of the prior year, due to the addition of Terphane, partially offset by lower volumes in the remainder of our Film Products business. Terphane, which was acquired in the fourth quarter of 2011, generated net sales of $34.6 million in the second quarter of 2012 and $66.8 million in the first six months of 2012.

21

Operating profit from ongoing operations in 2012 was higher compared to the second quarter and first six months of the prior year as a result of operating profit generated by the addition of Terphane and a reduction in the unfavorable impact of the lag in the pass-through of higher resin costs, partially offset by the lower volumes noted above and margin compression for surface protection and personal care products. Consumer trends toward value segment products and low growth rates in developed markets are adversely affecting the demand for our customers’ products that utilize our materials for these markets. Consequently, we are experiencing margin compression in our efforts to address these market dynamics.

Terphane had operating profit of $4.0 million and $6.6 million in the second quarter and first six months of 2012, respectively, which included amortization expense of $1.3 million and $2.6 million, respectively. During the second quarter, Terphane made significant progress in resolving production efficiency issues associated with the upgrade of an existing production line. Although production has been stabilized, further effort to increase production output on the line will continue throughout the rest of the year. As anticipated, Terphane’s margins were below those of the prior year, as we believe the first half of 2011 was near the peak of an industry cycle.

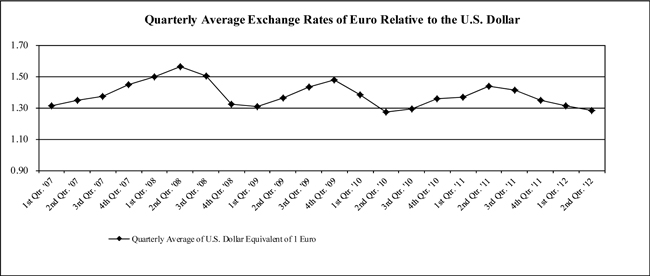

The estimated impact on operating profit from ongoing operations of the quarterly lag in the pass-through of average resin costs was a negative $1.1 million in the second quarter of 2012 compared to a negative $2.6 million in the second quarter of 2011. The change in the U.S. dollar value of currencies for operations outside the U.S. had an unfavorable impact of approximately $0.3 million in the second quarter of 2012 compared to the second quarter of 2011. The estimated impact on operating profit from ongoing operations of the quarterly lag in the pass-through of average resin costs was a negative $1.6 million for the first six months of 2012 compared to a negative $4.3 million for the first six months of 2011. The change in the U.S. dollar value of currencies for operations outside the U.S. had an unfavorable impact of approximately $0.5 million in the first six months of 2012 compared to the first six months of 2011.

Effective January 1, 2012, the operations of Bright View Technologies Corporation (“Bright View”) were incorporated into Film Products to leverage research and development efforts and accelerate new product development. Prior year balances for Bright View have been reclassified to Film Products to conform with the current year presentation. Operating losses for Bright View in the first half of 2012 were $2.0 million, which were consistent with the first half of 2011.

Capital expenditures in Film Products were $7.3 million in the first six months of 2012 compared with $7.1 million in the first six months of 2011. Film Products currently projects that capital expenditures will be approximately $44 million in 2012, which includes approximately $24 million in capital expenditures for a project that will expand capacity at our manufacturing facility in Cabo de Santo Agostinho, Brazil. This multi-year project will significantly increase capacity in Brazil and will primarily serve polyester films customers in Latin America. Depreciation expense was $18.8 million in the first six months of 2012 and $17.3 million in the first six months of 2011, and is projected to be approximately $38 million in 2012.

22

Aluminum Extrusions

A summary of operating results for Aluminum Extrusions is provided below:

| Favorable/ | Favorable/ | |||||||||||||||||||||||

| Quarter Ended June 30 | (Unfavorable) | Six Months Ended June 30 | (Unfavorable) | |||||||||||||||||||||

| (In Thousands, Except Percentages) |

2012 | 2011 | % Change | 2012 | 2011 | % Change | ||||||||||||||||||

| Sales volume (pounds) |

27,776 | 27,733 | 0.2 | % | 54,686 | 53,195 | 2.8 | % | ||||||||||||||||

| Net sales |

$ | 59,695 | $ | 63,896 | (6.6 | )% | $ | 117,303 | $ | 119,897 | (2.2 | )% | ||||||||||||

| Operating profit from ongoing operations |

$ | 3,800 | $ | 1,467 | 159.0 | % | $ | 5,503 | $ | 238 | 2,212.2 | % | ||||||||||||

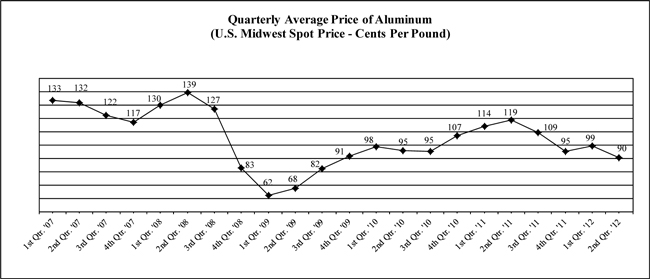

Despite a modest increase in sales volume, net sales in the second quarter and first half of 2012 decreased in comparison to the same periods of the prior year due to lower average selling prices as a result of a decrease in aluminum prices. The favorable change in the operating profit from ongoing operations versus the second quarter and first six months of 2011 was primarily driven by margin improvements resulting from favorable product mix, improved pricing and lower energy costs.

In February 2012, we announced that Aluminum Extrusions would be closing its manufacturing facility in Kentland, Indiana. The plant, which employed 146 people and whose core market was residential construction, is scheduled to close during the third quarter of 2012. We estimate that charges incurred related to the shutdown will be approximately $6 million, and include accelerated depreciation on property, plant and equipment of approximately $2.5 million, severance charges of approximately $1.2 million and other shutdown-related costs of approximately $2 million. Other shutdown-related costs are primarily comprised of equipment transfers and plant shutdown charges. Most of these charges, which include cash expenditures of approximately $4 million, are expected to be recognized over the next 18 months. Starting in 2013, we estimate that the closure of Kentland will have a positive impact on an annual basis of approximately $2-3 million on segment operating profit from ongoing operations in future periods.

Capital expenditures for Aluminum Extrusions were $1.5 million in the first six months of 2012 and $1.3 million in the first six months of 2011. Capital expenditures are projected to be approximately $4 million in 2012. Depreciation expense was $5.5 million in the first six months of 2012 compared with $4.2 million in first six months of 2011, and is projected to be approximately $9 million in 2012. Higher depreciation expense in 2012 is primarily related to approximately $2.5 million in accelerated depreciation on fixed assets at the Kentland manufacturing facility.

Other

The Other segment includes the mitigation banking business, which is also referred to as Falling Springs. Net sales for this business can fluctuate from quarter-to-quarter as Falling Springs’ revenue varies based upon the timing of development projects within its markets. Operating profit from ongoing operations was $0.2 million in the first six months of 2012 compared to an operating loss from ongoing operations of $0.2 million in the first six months of 2011.

Corporate Expenses, Interest and Taxes

Pension expense was $3.9 million in the first six months of 2012, an unfavorable change of $2.8 million from the first six months of 2011. Most of the impact of pensions on earnings is reflected in “Corporate expenses, net” in the net sales and operating profit by segment table. We contributed $0.2 million to our pension plans for continuing operations in 2011, and our required contributions are expected to be approximately $5.3 million in 2012. Corporate expenses, net increased in 2012 versus 2011 primarily due to the higher pension expenses noted above, an unrealized loss on our investment in the Harbinger Capital Partners Special Situations Fund, L.P. (“Harbinger”), and the timing of certain non-recurring corporate-related expenses.

23

Interest expense, which includes the amortization of debt issue costs, was $2.0 million in the first six months of 2012 in comparison to $0.7 million in the first six months of last year as a result of an increase in the average borrowings under our revolving credit facility, which were used to finance a portion of the purchase price for the acquisition of Terphane.

The effective tax rate used to compute income taxes from continuing operations for the first six months of 2012 was 31.2% compared to 33.7% in the first six months of 2011. The significant differences between the U.S. federal statutory rate and the effective tax rate for the first six months of 2012 and 2011 is shown in the table provided in Note 11 on page 18.

Net capitalization and other credit measures are provided in the liquidity and capital resources section beginning on page 28.

Critical Accounting Policies