10-K

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

|

| |

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the fiscal year ended December 31, 2015 |

OR

|

| |

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the transition period from to |

Commission File Number 1-10258

TREDEGAR CORPORATION

(Exact name of registrant as specified in its charter)

|

| | |

Virginia | | 54-1497771 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | |

1100 Boulders Parkway, Richmond, Virginia | | 23225 |

(Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: 804-330-1000

Securities registered pursuant to Section 12(b) of the Act:

|

| | |

Title of Each Class | | Name of Each Exchange on Which Registered |

Common Stock | | New York Stock Exchange |

Preferred Stock Purchase Rights | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for at least the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K ¨.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

| | | |

Large accelerated filer | x | Accelerated filer | ¨ |

| | | |

Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

Aggregate market value of voting and non-voting common equity held by non-affiliates of the registrant as of June 30, 2015 (the last business day of the registrant’s most recently completed second fiscal quarter): $560,178,695*

Number of shares of Common Stock outstanding as of January 30, 2016: 32,682,162 (32,705,198 as of June 30, 2015)

|

| |

* | In determining this figure, an aggregate of 7,369,210 shares of Common Stock beneficially owned by Floyd D. Gottwald, Jr., John D. Gottwald, William M. Gottwald and the members of their immediate families has been excluded because the shares are deemed to be held by affiliates. The aggregate market value has been computed based on the closing price in the New York Stock Exchange on June 30, 2015. |

Documents Incorporated By Reference

Portions of the Tredegar Corporation Proxy Statement for the 2016 Annual Meeting of Shareholders (the “Proxy Statement”) are incorporated by reference into Part III of this Form 10-K.

Index to Annual Report on Form 10-K

Year Ended December 31, 2015

|

| | | |

| | Page |

| | | |

Part I | | | |

Item 1. | Business | | |

Item 1A. | Risk Factors | | |

Item 1B. | Unresolved Staff Comments | | |

Item 2. | Properties | | |

Item 3. | Legal Proceedings | | |

Item 4. | Mine Safety Disclosures | | |

| | | |

Part II | | | |

Item 5. | Market for Tredegar’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | | |

Item 6. | Selected Financial Data | | |

Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | | |

Item 7A. | Quantitative and Qualitative Disclosures About Market Risk | | |

Item 8. | Financial Statements and Supplementary Data | | |

Item 9. | Changes In and Disagreements With Accountants on Accounting and Financial Disclosure | | |

Item 9A. | Controls and Procedures | |

|

Item 9B. | Other Information | | |

| | | |

Part III | | | |

Item 10. | Directors, Executive Officers and Corporate Governance* | | |

Item 11. | Executive Compensation | | |

Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters* | |

|

Item 13. | Certain Relationships and Related Transactions, and Director Independence | | |

Item 14. | Principal Accounting Fees and Services | | |

| | | |

Part IV | | | |

Item 15. | Exhibits and Financial Statement Schedules | | |

|

| |

*Items | 11, 13 and 14 and portions of Items 10 and 12 are incorporated by reference from the Proxy Statement. |

PART I

Description of Business

Tredegar Corporation (“Tredegar”), a Virginia corporation incorporated in 1988, is engaged, through its subsidiaries, in the manufacture of polyethylene (“PE”) plastic films, polyester (“PET”) films and aluminum extrusions. The financial information related to Tredegar’s PE films, PET films and aluminum extrusions segments and related geographical areas included in Note 5 of the Notes to Financial Statements is incorporated herein by reference. Unless the context requires otherwise, all references herein to “Tredegar,” “the Company,” “we,” “us” or “our” are to Tredegar Corporation and its consolidated subsidiaries.

Tredegar has historically reported two business segments: Film Products and Aluminum Extrusions. In the third quarter of 2015, the Company divided Film Products into two separate reportable segments: PE Films and Flexible Packaging Films. As part of its transition to a new executive leadership team, the Company’s management decided to discontinue its efforts to integrate Terphane Holdings, LLC (“Terphane”) with its PE film products operations. In separating PE Films and Flexible Packaging Films, the Company’s management believes that it will be able to more effectively manage the distinct opportunities and challenges that each of these businesses face. Therefore, the Company's reportable business segments are now PE Films, Flexible Packaging Films and Aluminum Extrusions.

PE Films

PE Films manufactures plastic films, elastics and laminate materials primarily utilized in personal care materials, surface protection films and specialty and optical lighting applications. These products are manufactured at facilities in the United States (“U.S.”), The Netherlands, Hungary, China, Brazil and India. PE Films competes in all of its markets on the basis of product innovation, quality, price and service.

Personal Care Materials. PE Films is one of the largest global suppliers of apertured, breathable, elastic and embossed films, laminate materials, and polyethylene and polypropylene overwrap films for personal care markets, including:

| |

• | Apertured film and laminate materials for use as topsheet in feminine hygiene products, baby diapers and adult incontinence products (including materials sold under the ComfortAire™, ComfortFeel™ and FreshFeel™ brand names); |

| |

• | Breathable, embossed and elastic materials for use as components for baby diapers, adult incontinence products and feminine hygiene products (including elastic components sold under the ExtraFlex™, FabriFlex™, FlexAire™ and FlexFeel™ brand names); |

| |

• | Absorbent transfer layers for baby diapers and adult incontinence products sold under the AquiDry® and AquiDry Plus™ brand names; |

| |

• | Thin-gauge films that are readily printable and convertible on conventional processing equipment for overwrap for bathroom tissue and paper towels; and |

| |

• | Polypropylene films for various industrial applications, including tape and automotive protection. |

In 2015, 2014 and 2013, personal care materials accounted for approximately 33%, 40% and 43% of Tredegar’s consolidated net sales (sales less freight) from continuing operations, respectively.

Surface Protection Films. PE Films produces single- and multi-layer surface protection films sold under the UltraMask®, ForceField™ and ForceField PEARL™ brand names. These films are used in high-technology applications, most notably protecting high-value components of flat panel displays used in televisions, monitors, notebooks, smart phones, tablets, e-readers and digital signage, during the manufacturing and transportation process. In 2015, 2014 and 2013, surface protection films accounted for approximately 10% of Tredegar’s consolidated net sales (sales less freight) from continuing operations.

Engineered Polymer Solutions. PE Films also makes a variety of specialty films and film-based products that provide tailored functionality for the illumination market as well as various other markets. Bright View Technologies Corporation (“Bright View”), a wholly owned subsidiary of Tredegar, is a developer and producer of advanced optical management products for the LED (light-emitting diode) and fluorescent lighting markets. By leveraging multiple technology platforms, including film capabilities and its patented microstructure technology, Bright View offers engineered solutions for a wide range of applications.

PE Films’ net sales by market segment over the last three years is shown below:

|

| | | | | | | | |

% of PE Films Net Sales by Market Segment * |

| 2015 | | 2014 | | 2013 |

Personal care materials | 75 | % | | 79 | % | | 81 | % |

Surface protection films | 23 | % | | 19 | % | | 18 | % |

Engineered polymer solutions | 2 | % | | 2 | % | | 1 | % |

Total | 100 | % | | 100 | % | | 100 | % |

| | | | | |

* See previous discussion by market segment for comparison of net sales to the Company’s consolidated net sales (sales less freight) from continuing operations for significant market segments for each of the years presented. |

Raw Materials. The primary raw materials used by PE Films in polyethylene and polypropylene films are low density, linear low density and high density polyethylene and polypropylene resins. All of these raw materials are obtained from domestic and foreign suppliers at competitive prices, and PE Films believes that there will be an adequate supply of polyethylene and polypropylene resins in the foreseeable future. PE Films also buys polypropylene-based nonwoven fabrics based on the resins previously noted and styrenic block copolymers, and it believes there will be an adequate supply of these raw materials in the foreseeable future.

Customers. PE Films sells to many branded product producers throughout the world, with the top five customers comprising 73%, 76% and 82% of its net sales in 2015, 2014 and 2013, respectively. Its largest customer is The Procter & Gamble Company (“P&G”). Net sales to P&G totaled $164 million in 2015, $221 million in 2014 and $262 million in 2013 (these amounts include film sold to third parties that converted the film into materials used with products manufactured by P&G). P&G and Tredegar have a successful long-term relationship based on cooperation, product innovation and continuous process improvement. For additional information, see “Item 1A. Risk Factors” beginning on page 5.

Flexible Packaging Films

Flexible Packaging Films is comprised of Terphane, which was acquired in October 2011. Flexible Packaging Films produces polyester-based films for use in packaging applications that have specialized properties, such as heat resistance, strength, barrier protection and the ability to accept high-quality print graphics. These differentiated, high-value films are primarily sold in Latin America and the U.S. under the Terphane® and Sealphane® brand names. Major end uses include food packaging and industrial applications. In 2015, 2014 and 2013, Flexible Packaging Films accounted for approximately 12%, 12% and 14%, respectively, of Tredegar’s consolidated net sales (sales less freight) from continuing operations. Flexible Packaging Films competes in all of its markets on the basis of product quality, price and service.

Raw Materials. The primary raw materials used by Flexible Packaging Films in polyester films are purified terephthalic acid (“PTA”) and monoethylene glycol (“MEG”) to produce the polyester resins. Flexible Packaging Films also purchases additional polyester resins directly from suppliers. All of these raw materials are obtained from domestic and foreign suppliers at competitive prices, and Flexible Packaging Films believes that there will be an adequate supply of polyester resins as well as PTA and MEG in the foreseeable future.

Aluminum Extrusions

The William L. Bonnell Company, Inc., known in the industry as Bonnell Aluminum, and AACOA, Inc., a division of Bonnell Aluminum (together, “Aluminum Extrusions”), produce high-quality, soft-alloy and medium-strength aluminum extrusions primarily for building and construction, automotive, consumer durables, machinery and equipment, electrical and distribution markets. Aluminum Extrusions manufactures mill (unfinished), anodized (coated) and painted and fabricated aluminum extrusions for sale directly to fabricators and distributors, and it competes primarily on the basis of product quality, service and price. Sales are made predominantly in the U.S.

The end-uses in each of Aluminum Extrusions’ primary market segments include:

|

| | |

Major Markets | | End-Uses |

| | |

Building & construction -nonresidential | | Commercial windows and doors, curtain walls, storefronts and entrances, walkway covers, ducts, louvers and vents, office wall panels, partitions and interior enclosures, acoustical walls and ceilings, point of purchase displays and pre-engineered structures |

| | |

Building & construction -residential | | Shower and tub enclosures, railing and support systems, venetian blinds, swimming pools and storm shutters |

| | |

Consumer durables | | Furniture, pleasure boats, refrigerators and freezers, appliances and sporting goods |

| | |

Machinery & equipment | | Material handling equipment, conveyors and conveying systems, industrial modular assemblies and medical equipment |

| | |

Automotive | | Automotive and light truck structural components, spare parts, after-market automotive accessories, travel trailers and recreation vehicles |

| | |

Distribution (metal service centers specializing in stock and release programs and custom fabrications to small manufacturers) | | Various custom profiles including storm shutters, pleasure boat accessories, theater set structures and various standard profiles (including rod, bar, tube and pipe) |

| | |

Electrical | | Lighting fixtures, solar panels, electronic apparatus and rigid and flexible conduits |

Aluminum Extrusions’ sales volume from continuing operations by market segment over the last three years is shown below:

|

| | | | | | | | | |

% of Aluminum Extrusions Sales Volume by Market Segment (Continuing Operations) |

| 2015 | | 2014 | | 2013 |

Building and construction: | | | | | |

Nonresidential | 58 | % | | 59 | % | | 60 | % |

Residential | 6 | % | | 6 | % | | 7 | % |

Specialty: | | | | | |

Consumer durables | 10 | % | | 12 | % | | 12 | % |

Machinery & equipment | 7 | % | | 7 | % | | 7 | % |

Distribution | 5 | % | | 5 | % | | 4 | % |

Electrical | 4 | % | | 4 | % | | 4 | % |

Automotive | 10 | % | | 7 | % | | 6 | % |

Total | 100 | % | | 100 | % | | 100 | % |

| |

In 2015, 2014 and 2013, nonresidential building and construction accounted for approximately 26%, 22% and 19% of Tredegar’s consolidated net sales (sales less freight) from continuing operations, respectively.

Raw Materials. The primary raw materials used by Aluminum Extrusions consist of aluminum ingot, aluminum scrap and various alloys, which are purchased from domestic and foreign producers in open-market purchases and under short-term contracts. Aluminum Extrusions believes that it has adequate long-term supply agreements for aluminum and other required raw materials and supplies in the foreseeable future.

General

Intellectual Property. Tredegar considers patents, licenses and trademarks to be significant to PE Films. As of December 31, 2015, PE Films held 280 issued patents (81 of which are issued in the U.S.) and 107 trademarks (10 of which are issued in the

U.S.). Flexible Packaging Films held 1 patent, which is issued in the U.S. and 14 trademarks (2 of which are issued in the U.S.). Aluminum Extrusions held no U.S. patents and three U.S. trademark registrations. These patents have remaining terms ranging from 1 to 20 years. Tredegar also has licenses under patents owned by third parties.

Research and Development. Tredegar’s spending for research and development (“R&D”) activities in 2015, 2014 and 2013 was primarily related to PE Films. PE Films has technical centers in Durham, North Carolina; Richmond, Virginia; and Terre Haute, Indiana. Flexible Packaging has a technical center in Bloomfield, New York. R&D spending by the Company was approximately $16.2 million, $12.1 million and $12.7 million in 2015, 2014 and 2013, respectively.

Backlog. Backlogs are not material to the operations in PE Films or Flexible Packaging Films. Overall backlog for continuing operations in Aluminum Extrusions was approximately 11.8 million pounds at December 31, 2015 compared to approximately 17.0 million pounds at December 31, 2014, a decrease of 5.2 million pounds, or approximately 30%. Volume for Aluminum Extrusions, which it believes is cyclical in nature, was 170.0 million pounds in 2015, 153.8 million pounds in 2014 and 143.7 million pounds in 2013.

Government Regulation. U.S. laws concerning the environment to which the Company’s domestic operations are or may be subject include, among others, the Clean Water Act, the Clean Air Act, the Resource Conservation and Recovery Act, the Occupational Safety and Health Act, the National Environmental Policy Act, the Toxic Substances Control Act, the Comprehensive Environmental Response, Compensation and Liability Act (“CERCLA”), all as amended, regulations promulgated under these acts, and any other federal, state or local laws or regulations governing environmental matters. Compliance with these laws is an important consideration because Tredegar uses hazardous materials in some of its operations, is a generator of hazardous waste, and wastewater from the Company’s operations is discharged to various types of wastewater management systems. Under CERCLA and other laws, Tredegar may be subject to financial exposure for costs associated with waste management and disposal, even if the Company fully complies with applicable environmental laws.

The U.S. Environmental Protection Agency has adopted regulations under the Clean Air Act relating to emissions of carbon dioxide and other greenhouse gases (“GHG”), including mandatory reporting and permitting requirements. Additional regulations are anticipated. Several of the Company’s manufacturing operations result in emissions or GHG and are subject to the current GHG regulations. The Company’s compliance with these regulations has yet to require significant expenditures. The cost of compliance with any future GHG legislation or regulations is not presently determinable, but Tredegar does not anticipate compliance to have a material adverse effect on its consolidated financial condition, results of operations and cash flows based on information currently available.

Tredegar is also subject to the governmental regulations in the countries where it conducts business.

At December 31, 2015, the Company believes that it was in substantial compliance with all applicable environmental laws, regulations and permits in the U.S. and other countries where it conducts business. Environmental standards tend to become more stringent over time. In order to maintain substantial compliance with such standards, the Company may be required to incur additional expenditures, the amounts and timing of which are not presently determinable but which could be significant, in constructing new facilities or in modifying existing facilities. Furthermore, failure to comply with current or future laws and regulations could subject Tredegar to substantial penalties, fines, costs and expenses.

Employees. Tredegar employed approximately 2,800 people at December 31, 2015.

Available Information and Corporate Governance Documents. Tredegar’s Internet address is www.tredegar.com. The Company makes available, free of charge through its website, its annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, as soon as reasonably practicable after such documents are electronically filed with, or furnished to, the Securities and Exchange Commission (“SEC”). Information filed electronically with the SEC can be accessed on its website at www.sec.gov. In addition, the Company’s Corporate Governance Guidelines, Code of Conduct and the charters of the Audit, Executive Compensation, and Nominating and Governance Committees are available on Tredegar’s website and are available in print, without charge, to any shareholder upon request by contacting Tredegar’s Corporate Secretary at 1100 Boulders Parkway, Richmond, Virginia 23225. The information on or that can be accessed through the Company’s website is not, and shall not be deemed to be, a part of this report or incorporated into other filings it makes with the SEC.

There are a number of risks and uncertainties that could have a material adverse effect on the Company’s consolidated financial condition, results of operations, or cash flows. The following risk factors should be considered, in addition to the other information included in this Annual Report on Form 10-K for the year ended December 31, 2015 (“Form 10-K”), when evaluating Tredegar and its businesses:

General

| |

• | Tredegar has an underfunded defined benefit (pension) plan. Tredegar sponsors a pension plan that covers certain hourly and salaried employees in the U.S. The plan was substantially frozen to new participants in 2007, and frozen to benefit accruals for active participants in 2014. As of December 31, 2015, the plan was underfunded under U.S. GAAP measures by $93.2 million. Tredegar expects that it will be required to make a cash contribution of approximately $6.1 million to its underfunded pension plan in 2016, and may be required to make higher cash contributions in future periods depending on the level of interest rates and investment returns on plan assets. |

| |

• | U.S. and global economic conditions could have an adverse effect on the consolidated financial condition, results of operations and cash flows of some or all of Tredegar’s operations. As a global entity, the consolidated financial condition, results of operations and cash flows for Tredegar could become more sensitive to changes in macroeconomic conditions, including fluctuations in exchange rates. Sales associated with new products and regions tend to more closely follow the cycles within the economy. Cost reductions and productivity improvements may not be sufficient to offset the adverse effects on profitability from lower customer demand in an economic downturn. Therefore, as such product offerings become a greater part of the Company’s business, its consolidated financial condition, results of operations and cash flows may be adversely impacted by seasonal slowdowns, cyclical downturns in the economy or changes in foreign currency rates. |

| |

• | Noncompliance with any of the covenants in the Company’s $350 million credit facility could result in all debt under the agreement outstanding at such time becoming due and limiting its borrowing capacity, which could have a material adverse effect on consolidated financial condition and liquidity. The credit agreement governing Tredegar’s revolving credit facility contains restrictions and financial covenants that could restrict the Company’s operational and financial flexibility. Failure to comply with these covenants could result in an event of default, which if not cured or waived, would result in all outstanding debt under the credit facility at such time becoming due, which could have a material adverse effect on the Company’s consolidated financial condition and liquidity. Renegotiation of the covenant(s) through an amendment to the revolving credit facility may effectively cure the noncompliance, but may have a negative effect on the Company’s consolidated financial condition or liquidity depending upon how the amended covenant is renegotiated. |

| |

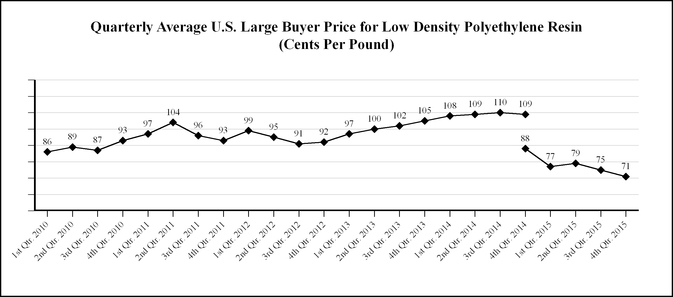

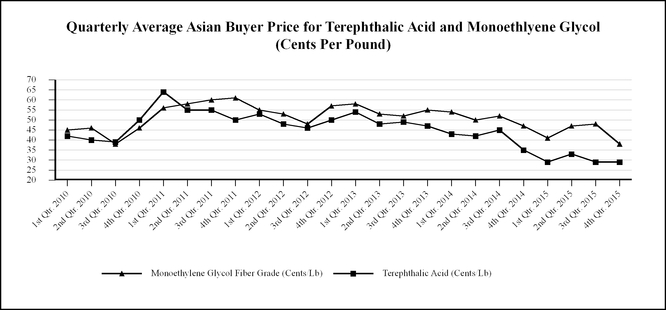

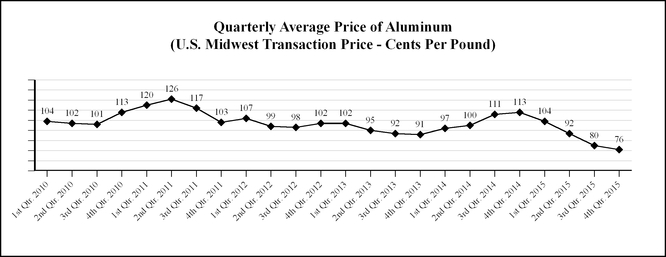

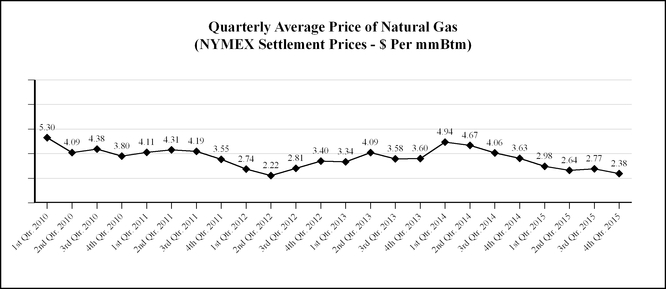

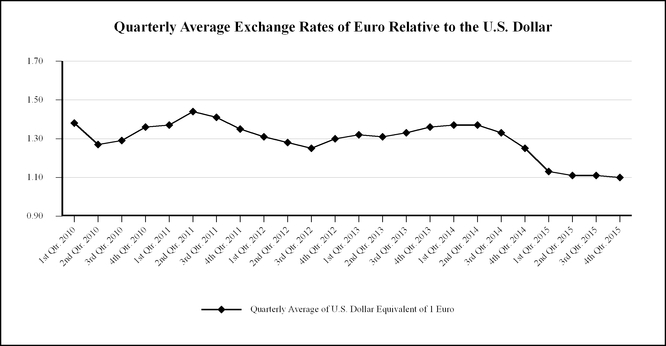

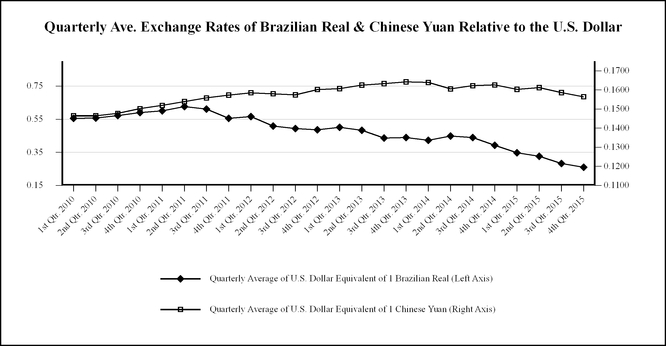

• | Tredegar’s performance is influenced by costs incurred by its operating companies, including, for example, the cost of raw materials and energy. These costs include, without limitation, the cost of resin (the raw material on which PE Films primarily depends), PTA and MEG (the raw materials on which Flexible Packaging Films primarily depends), aluminum (the raw material on which Aluminum Extrusions primarily depends), natural gas (the principal fuel necessary for Aluminum Extrusions’ plants to operate), electricity and diesel fuel. Resin, aluminum and natural gas prices are extremely volatile as shown in the charts in the Quantitative and Qualitative Disclosures section on pages 36-37. The Company attempts to mitigate the effects of increased costs through price increases and contractual pass-through provisions, but there are no assurances that higher prices can effectively be passed through to customers or that Tredegar will be able to offset fully or on a timely basis the effects of higher raw material and energy costs through price increases or pass-through arrangements. Further, the Company’s cost control efforts may not be sufficient to offset any additional future declines in revenue or increases in raw material, energy or other costs. |

| |

• | Substantial international operations subject the Company to risks of doing business in countries outside the U.S., which could adversely affect its consolidated financial condition, results of operations and cash flows. Risks inherent in international operations include the following, by way of example: changes in general economic conditions or governmental policies, potential difficulty enforcing agreements and intellectual property rights, modifications in foreign tax laws and incentives, staffing and managing widespread operations and the challenges of complying with a wide variety of laws and regulations, restrictions on international trade or investment, restrictions on the repatriation of income, imposition of additional taxes on income generated outside the U.S., nationalization of private enterprises, unexpected adverse changes in international laws and regulatory requirements and fluctuations in exchange rates. In the countries where Tredegar conducts its operations, significant fluctuations in the foreign currencies relative to the U.S. dollar could have a material impact on its consolidated financial condition, results of operations and cash flows. In addition, while expanding operations into emerging markets provides greater opportunities for growth, there are certain operating risks, as previously noted. |

| |

• | Tredegar may not be able to successfully identify, complete or integrate strategic acquisitions. From time to time, the Company evaluates acquisition candidates that fit its business objectives. Acquisitions involve special risks, including, without limitation, meeting revenue, margin, working capital and capital expenditure expectations that substantially drive valuation, diversion of management’s time and attention from existing businesses, the potential assumption of unanticipated liabilities and contingencies and potential difficulties in integrating acquired businesses and achieving anticipated operational improvements. Acquired businesses may not achieve expected results. |

| |

• | Failure to continue to attract, develop and retain certain senior executive officers, operating company management or other key employees could adversely affect Tredegar’s businesses. The Company depends on its senior executive officers, operating company management and other key personnel to run the businesses. The loss of key personnel could have a material adverse effect on operations. Competition for qualified employees among companies that rely heavily on engineering and technology expertise is intense, and the loss of qualified employees or an inability to attract, retain and motivate highly skilled employees required for the operation and expansion of Tredegar’s businesses could hinder its ability to improve manufacturing operations, conduct research activities successfully and develop marketable products. |

| |

• | Tredegar is subject to various environmental laws and regulations and could become exposed to material liabilities and costs associated with such laws. The Company is subject to various environmental obligations and could become subject to additional obligations in the future. In the case of known potential liabilities, it is management’s judgment that the resolution of ongoing and/or pending environmental remediation obligations is not expected to have a material adverse effect on the Company’s consolidated financial condition or liquidity. In any given period(s), however, it is possible such obligations or matters could have a material adverse effect on the results of operations. Changes in environmental laws and regulations, or their application, including, but not limited to, those relating to global climate change, could subject Tredegar to significant additional capital expenditures and operating expenses. Moreover, future developments in federal, state, local and international environmental laws and regulations are difficult to predict. Environmental laws have become and are expected to continue to become increasingly strict. As a result, Tredegar expects to be subject to new environmental laws and regulations. However, any such changes are uncertain and, therefore, it is not possible for the Company to predict with certainty the amount of additional capital expenditures or operating expenses that could be necessary for compliance with respect to any such changes. See Government Regulation on page 4 for a further discussion of this risk factor. |

| |

• | Material disruptions at one of the Company’s major manufacturing facilities could negatively impact financial results. Tredegar believes its facilities are operated in compliance with applicable local laws and regulations and that the Company has implemented measures to minimize the risks of disruption at its facilities. Such a disruption could be a result of any number of events, including but not limited to: an equipment failure with repairs requiring long lead times, labor stoppages or shortages, utility disruptions, constraints on the supply or delivery of critical raw materials, and severe weather conditions. A material disruption in one of the Company’s operating locations could negatively impact production and its consolidated financial condition, results of operations and cash flows. |

| |

• | An information technology system failure may adversely affect the business. Tredegar relies on information technology systems to help manage business processes, collect and interpret business data and communicate internally and externally with employees, investors, suppliers, customers and others. Some of these information systems are managed by third-party service providers. The Company has backup systems and business continuity plans in place, and takes care to protect its systems and data from unauthorized access. To date, interruptions of our information systems have been infrequent and have not had a material impact on our operations. Nevertheless, an information technology system failure due to computer viruses, internal or external security breaches, power interruptions, hardware failures, fire, natural disasters, human error, or other causes could disrupt operations and prevent the Company from being able to process transactions with its customers, operate its manufacturing facilities, and properly report those transactions in a timely manner. A significant, protracted information technology system failure or cyber attacks or security breaches by parties intent on extracting or corrupting information or otherwise disrupting business processes may result in the loss of revenue, assets or personal or other sensitive data, cause damage to the reputation of the Company and result in legal challenges and significant remediation and other costs to the Company. |

| |

• | Tredegar is subject to credit risk that is inherent with efforts to increase market share as the Company attempts to broaden its customer base. In the event of the deterioration of operating cash flows or diminished borrowing capacity of Tredegar’s customers, the collection of trade receivable balances may be delayed or deemed unlikely. The Company’s credit risk exposure could increase as business is expanded, including on export sales which have payment terms in excess of domestic sales. In addition, the operations of the customers for Aluminum Extrusions generally follow the cycles within the economy, resulting in greater credit risk from diminished operating cash flows and higher bankruptcy rates when the economy is deteriorating or in recession. |

| |

• | An inability to renegotiate the Company’s collective bargaining agreements could adversely impact its consolidated financial condition, results of operations and cash flows. Some of the Company’s employees are represented by labor unions under various collective bargaining agreements with varying durations and expiration dates. Tredegar may not be able to satisfactorily renegotiate collective bargaining agreements when they expire, which could result in strikes or work stoppages or higher labor costs. In addition, existing collective bargaining agreements may not prevent a strike or work stoppage at the Company’s facilities in the future. Any such work stoppages (or potential work stoppages) could negatively impact Tredegar’s ability to manufacture its products and adversely affect its consolidated financial condition, results of operations and cash flows. |

| |

• | Tredegar’s valuation of its $7.5 million cost-basis investment in kaléo is volatile and uncertain. Tredegar uses the fair value method to account for its 19% ownership interest and investment in kaleo, Inc. (“kaléo”), a private specialty pharmaceutical company. There is no active secondary market for buying or selling ownership interests in kaléo. The Company’s fair value estimates can fluctuate materially between reporting periods, primarily due to variances in performance versus expectations, and kaléo’s ability to meet developmental and commercialization milestones within an anticipated time frame. Commercial sales of kaléo’s first licensed product, an epinephrine auto-injector, commenced in the first quarter of 2013, and commercial sales of its second product, a naloxone auto-injector, commenced in the third quarter of 2014. |

In 2009, kaléo licensed exclusive rights to sanofi-aventis U.S. LLC (“Sanofi”) to commercialize the epinephrine auto-injector in the U.S. and Canada. Sanofi began manufacturing and distributing the epinephrine auto-injector, under the names Auvi-Q® in the U.S. and Allerject® in Canada, in 2013. Sanofi announced on October 28, 2015, a voluntary recall of all Auvi-Q and Allerject epinephrine auto-injectors that were previously on the market. As a result of this recall and its adverse impact on kaléo’s expected future prospects, the Company’s estimated fair value of its investment decreased $20.5 million, or 52%, in the fourth quarter of 2015.

Kaléo may need additional financing as it addresses this recall, attempts to correct the issues with its epinephrine auto-injector that resulted in the recall, and continues to invest in its product pipeline. Whether or not kaléo could be successful in raising additional funds is uncertain. Moreover, significant dilution could occur to existing investors in any new round of financing that does occur. Even with additional financing, kaléo may not be able to resolve the recall issue or bring new technology to market.

The estimated fair value of the Company’s investment in kaléo was $18.6 million at December 31, 2015 (included in “Other assets and deferred charges” in the consolidated balance sheets).

PE Films

| |

• | PE Films is highly dependent on sales associated with its top five customers, the largest of which is P&G. PE Films’ top five customers comprised approximately 32%, 38% and 44% of Tredegar’s consolidated net sales (sales less freight) from continuing operations, in 2015, 2014 and 2013, respectively, with net sales to P&G alone comprising approximately 19%, 24% and 28% in 2015, 2014 and 2013, respectively. The loss or significant reduction of sales associated with one or more of these customers could have a material adverse effect on the Company’s business. Other factors that could adversely affect the business include, by way of example, (i) failure by a key customer to achieve success or maintain share in markets in which they sell products containing PE Films’ materials, (ii) key customers rolling out products utilizing technologies developed by others that replace PE Films’ business with such customer, (iii) delays in a key customer rolling out products utilizing new technologies developed by PE Films and (iv) operational decisions by a key customer that result in component substitution, inventory reductions and similar changes. While PE Films has undertaken efforts to expand its customer base, there can be no assurance that such efforts will be successful, or that they will offset any delay or loss of sales and profits associated with these large customers. |

In recent years, PE Films lost substantial sales volume due to product transitions and suffered other losses associated with various customers (see further discussion in the Executive Summary, PE Films section on page 20).

PE Films anticipates further exposure to product transitions and lost business in certain personal care materials that could negatively affect future operating profit from ongoing operations by approximately $10 million annually, likely beginning after 2017. While it continues to identify new business opportunities with its existing customers, PE Films is also working to expand its customer base in order to create long-term growth and profitability by actively competing for new business with various customers across its full product portfolio and introducing new products and/or improvements to existing applications. There is no assurance that these efforts to expand the revenue base and mitigate this or any future loss of sales and profits from significant customers will be successful.

| |

• | PE Films and its customers operate in highly competitive markets. PE Films competes on product innovation, quality, price and service, and its businesses and their customers operate in highly competitive markets. Global market conditions continue to exacerbate the Company’s exposure to margin compression due to competitive forces, especially as certain products move into the later stages of their product life cycles. While PE Films continually works to identify new business opportunities with existing and new customers, primarily through the development of new products with improved performance and/or cost characteristics, there can be no assurances that such efforts will be successful, or that they will offset business lost from competitive dynamics or customer product transitions. |

| |

• | Growth of PE Films depends on its ability to develop and deliver new products at competitive prices. Personal care materials, surface protection films and engineered polymer solutions applications are now being made with a variety of new innovative materials and the overall cycle for bringing new films products to market has accelerated. While PE Films has substantial technological resources, there can be no assurance that its new products can be brought to market successfully, or if brought to market successfully, at the same level of profitability and market share of replaced films. A shift in customer preferences away from PE Films’ technologies, its inability to develop and deliver new profitable products, or delayed acceptance of its new products in domestic or foreign markets, could have a material adverse effect on its consolidated financial condition, results of operations and cash flows. In the long term, growth will depend on PE Films’ ability to provide innovative products at a price that meets the customers’ needs. |

| |

• | Failure of PE Films’ customers, who are subject to cyclical downturns, to achieve success or maintain market share could adversely impact its sales and operating margins. PE Films’ plastic films serve as components for various consumer products sold worldwide. A customer’s ability to successfully develop, manufacture and market their products is integral to PE Films’ success. In addition, many customers are in industries that are cyclical in nature and sensitive to changes in general economic conditions. During weak economic cycles, consumers of premium products made with or using PE Films’ components may shift to less premium, less expensive products, reducing the demand for PE Films’ plastic films. Cycle downturns may negatively affect businesses that use PE Films’ plastic film products, which could adversely affect sales and operating margins. |

| |

• | The Company’s inability to protect its intellectual property rights or its infringement of the intellectual property rights of others could have a material adverse impact on PE Films. PE Films operates in an industry where its significant customers and competitors have substantial intellectual property portfolios. The continued success of its business depends on its ability not only to protect its own technologies and trade secrets, but also to develop and sell new products that do not infringe upon existing patents or threaten existing customer relationships. Intellectual property litigation is very costly and could result in substantial expense and diversions of Company resources, both of which could adversely affect its consolidated financial condition, results of operations and cash flows. In addition, there may be no effective legal recourse against infringement of the Company’s intellectual property by third parties, whether due to limitations on enforcement of rights in foreign jurisdictions or as a result of other factors. An unfavorable outcome in any intellectual property litigation or similar proceeding could have a material adverse effect on the consolidated financial condition, results of operations and cash flows of PE Films. |

| |

• | An unstable economic environment could have a disruptive impact on PE Films’ supply chain. Certain raw materials used in manufacturing PE Films’ products are sourced from single suppliers, and PE Films may not be able to quickly or inexpensively re-source from other suppliers. The risk of damage or disruption to its supply chain may increase if and when different suppliers consolidate their product portfolios or experience financial distress. Failure to take adequate steps to effectively manage such events, which are intensified when a product is procured from a single supplier or location, could adversely affect PE Films’ consolidated financial condition, results of operations and cash flows, as well as require additional resources to restore its supply chain. |

Flexible Packaging Films

| |

• | Uncertain economic conditions in Brazil could adversely impact the financial condition, results of operations and cash flows of Flexible Packaging Films. Flexible Packaging Films and its customers operate in a highly competitive global market for PET films. In addition, its operations have been adversely impacted by ongoing unfavorable economic conditions in Brazil, its primary market, which accounted for approximately 46% of its overall sales in 2015. These combined factors have resulted in significant competitive pricing pressures and margin compression. Tredegar has attempted to mitigate these impacts through new product offerings, cost saving measures and manufacturing efficiency initiatives, but these efforts to-date have not been sufficient, resulting in a significant decline in the operating profit for Flexible Packaging Films since its acquisition in October 2011 and further efforts may not be successful, which could adversely impact Flexible Packaging Films’ financial condition, results of operations and cash flows. |

| |

• | Governmental failure to extend anti-dumping duties in Brazil on imported products or prevent competitors from circumventing such duties could adversely impact Flexible Packaging Films. In recent years, excess global capacity in the industry has led to increased competitive pressures from imports into Brazil, the Company’s primary market for flexible packaging films. The Company believes that these conditions have shifted the competitive environment from a regional to a global landscape and have driven price convergence and lower product margins for Flexible Packaging Films. In addition to previous actions taken against UAE, Mexico and Turkey, the Brazilian government recently extended anti-dumping duties on PET films imported from China, Egypt and India, and authorities have initiated new investigations of dumping against Peru and Bahrain. Competitors not currently subject to anti-dumping duties may choose to utilize their excess capacity by selling product in Brazil, which may result in pricing pressures thereby creating margin compression that Flexible Packaging Films may not be able to offset with cost savings measures and/or manufacturing efficiency initiatives. |

Aluminum Extrusions

| |

• | Sales volume and profitability of Aluminum Extrusions is seasonal and cyclical and highly dependent on economic conditions of end-use markets in the U.S., particularly in the construction sector. Aluminum Extrusions’ end-use markets can be subject to seasonality as well as large cyclical swings in volume. Because of capital intensive nature and level of fixed costs inherent in the aluminum extrusions business, the percentage drop in operating profits in a cyclical downturn will likely exceed the percentage drop in volume. Any benefits associated with cost reductions and productivity improvements may not be sufficient to offset the adverse effects on profitability from pricing and margin pressure and higher bad debts (including a greater chance of loss associated with customers defaulting on fixed-price forward sales contracts) that usually accompany a downturn. In addition, higher energy costs can further reduce profits unless offset by price increases or cost reductions and productivity improvements. |

| |

• | The markets for Aluminum Extrusions’ products are highly competitive with product quality, service, delivery performance and price being the principal competitive factors. Aluminum Extrusions has approximately 1,500 customers that are in a variety of end-use markets within the broad categories of building and construction, distribution, automotive and other transportation, machinery and equipment, electrical and consumer durables. No single customer exceeds 3% of Aluminum Extrusions’ net sales. Future success and prospects depend on its ability to provide superior service and high quality products to retain existing customers and participate in overall industry cross-cycle growth. In recent years, increased demand, primarily from the nonresidential building and construction sector, has pushed Aluminum Extrusions’ average capacity utilization in excess of 90%. Aluminum Extrusions’ ability to grow and service existing customers is closely tied to having sufficient capacity. |

During improving economic conditions, excess industry capacity is absorbed and pricing pressure becomes less of a factor in many of its end-use markets. Conversely, during an economic slowdown, excess industry capacity often drives increased pricing pressure in many end-use markets as competitors protect their position with key customers. Because the business is susceptible to these changing economic conditions, Aluminum Extrusions targets complex, customized, service-intensive business with more challenging requirements in order to differentiate itself from competitors that focus on higher volume, standard extrusion applications.

| |

• | Aluminum Extrusions’ efforts to expand the Company’s presence in the automotive market may not be successful. Aluminum Extrusions has made significant capital investments in recent years to increase sales to automotive and light truck tier suppliers. Efforts to expand product offerings and broaden the customer base are tied to successfully substituting the Company’s aluminum extrusions for current market alternatives. New Corporate Average Fuel Economy (CAFE) standards requiring material improvements in the automotive and light truck MPG (miles per gallon) by 2025, are expected to increase demand for lighter materials used in the vehicle’s body, some of which can be supplied by Aluminum Extrusions. If the demand does not increase and/or the alternative products offered by Aluminum Extrusions are not accepted by its customers, Aluminum Extrusions may not generate expected returns on its capital investments, which could have a material adverse effect on its consolidated financial condition, results of operations and cash flows. |

| |

• | Failure to extend duties on imported products or prevent competitors from circumventing such duties could adversely impact Aluminum Extrusions. In previous years, imports into the U.S., primarily from China, represented an increasing portion of the U.S. aluminum extrusion market. However, due to an affirmative determination by the U.S. International Trade Commission in April 2011 that asserted that dumped and subsidized imports of aluminum extrusion from China unfairly and negatively impacted the domestic industry, the U.S. Department of Commerce has applied duties to these imported products. As a result, aluminum extrusion imports from China have decreased significantly. While the risk to the domestic industry has been abated for the time being, these protective duties are scheduled to expire in 2016. There are ongoing efforts within the U.S. aluminum extrusions industry to extend these protective duties. An unfavorable outcome could have a material adverse effect on the consolidated financial condition, results of operations and cash flows of Aluminum Extrusions. |

| |

Item 1B. | UNRESOLVED STAFF COMMENTS |

None.

General

Most of the improved real property and the other assets used in the Company’s operations are owned, and none of the owned property is subject to an encumbrance that is considered to be material to its consolidated operations. Tredegar considers the manufacturing facilities, warehouses and other properties and assets that it owns or leases to be in generally good condition. Capacity utilization at its various manufacturing facilities can vary with product mix and normal fluctuations in sales levels. The Company believes that its PE Films and Flexible Packaging Films manufacturing facilities have sufficient capacity to meet its current production requirements. Increased demand, primarily from the nonresidential building and construction sector, pushed Aluminum Extrusions’ average capacity utilization in excess of 90% in 2015. Tredegar’s corporate headquarters, which is leased, is located at 1100 Boulders Parkway, Richmond, Virginia 23225.

The Company’s principal manufacturing plants and facilities are listed below:

PE Films

|

| | | | |

Locations in the U.S. | | Locations Outside the U.S. | | Principal Operations |

Lake Zurich, Illinois Durham, North Carolina (technical center and production facility) (leased) Pottsville, Pennsylvania Richmond, Virginia (technical center) (leased) Terre Haute, Indiana (technical center and production facility) | | Guangzhou, China Kerkrade, The Netherlands Pune, India Rétság, Hungary São Paulo, Brazil Shanghai, China | | Production of plastic films and laminate materials |

Flexible Packaging Films

|

| | | | |

Locations in the U.S. | | Locations Outside the U.S. | | Principal Operations |

Bloomfield, New York (technical center and production facility)

| | Cabo de Santo Agostinho, Brazil | | Production of polyester films |

Aluminum Extrusions

|

| | | | |

Locations in the U.S. | | | | Principal Operations |

Carthage, Tennessee Elkhart, Indiana Newnan, Georgia Niles, Michigan | | | | Production of aluminum extrusions, fabrication and finishing |

| | | | |

None.

| |

Item 4. | MINE SAFETY DISCLOSURES |

None.

PART II

| |

Item 5. | MARKET FOR TREDEGAR’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Market Prices of Common Stock and Shareholder Data

Tredegar’s common stock is traded on the New York Stock Exchange (“NYSE”) under the ticker symbol TG. The Company has no preferred stock outstanding. There were 32,682,162 shares of common stock held by 2,188 shareholders of record on December 31, 2015.

The following table shows the reported high and low closing prices of Tredegar’s common stock by quarter for the past two years.

|

| | | | | | | | | | | | | | | |

| 2015 | | 2014 |

| High | | Low | | High | | Low |

First quarter | $ | 23.07 |

| | $ | 18.87 |

| | $ | 28.45 |

| | $ | 22.48 |

|

Second quarter | 23.16 |

| | 19.75 |

| | 25.08 |

| | 19.65 |

|

Third quarter | 23.76 |

| | 12.63 |

| | 24.07 |

| | 18.41 |

|

Fourth quarter | 16.17 |

| | 13.09 |

| | 22.49 |

| | 16.76 |

|

The closing price of Tredegar’s common stock on February 20, 2016 was $12.19.

Dividend Information

Tredegar has paid a dividend every quarter since becoming a public company in July 1989. During the past three years, the Company paid quarterly dividends as follows:

•11 cents per share in the last three quarters of 2015

•9 cents per share in each of the final three quarters of 2014 and first quarter of 2015;

•7 cents per share in the first quarter of 2014 and each of the quarters of 2013;

All decisions with respect to the declaration and payment of dividends will be made by the Board of Directors in its sole discretion based upon earnings, financial condition, anticipated cash needs, restrictions in the Company’s revolving credit agreement and other such considerations as the Board deems relevant. See Note 11 of the Notes to Financial Statements beginning on page 70 for the restrictions on the payment of dividends contained in the Company’s revolving credit agreement related to aggregate dividends permitted.

Issuer Purchases of Equity Securities

On January 7, 2008, Tredegar announced that its Board of Directors approved a share repurchase program whereby management is authorized at its discretion to purchase, in the open market or in privately negotiated transactions, up to 5 million shares of the Company’s outstanding common stock. The authorization has no time limit. Tredegar did not repurchase any shares in the open market or otherwise in 2015, 2014 and 2013 under this standing authorization. The maximum number of shares remaining under this standing authorization was 1,732,003 at December 31, 2015.

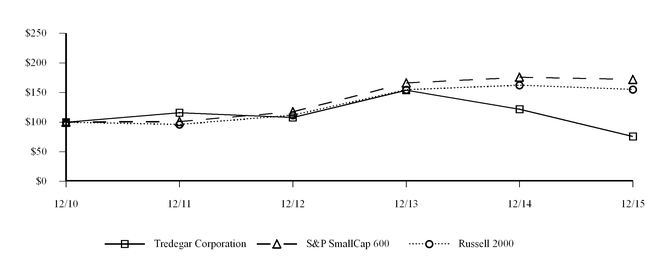

Comparative Tredegar Common Stock Performance

The following graph compares cumulative total shareholder returns for Tredegar, the S&P SmallCap 600 Stock Index (an index comprised of companies with market capitalizations similar to Tredegar) and the Russell 2000 Index for the five years ended December 31, 2015. Tredegar is part of both the S&P SmallCap 600 Index and Russell 2000 Index.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

Among Tredegar Corporation, the S&P SmallCap 600 Index, and the Russell 2000 Index

|

|

*$100 invested on 12/31/10 in stock or index, including reinvestment of dividends. Fiscal year ending December 31.

Copyright© 2016 S&P, a division of The McGraw-Hill Companies Inc. All rights reserved.

Copyright© 2016 Russell Investment Group. All rights reserved.

|

Inquiries

Inquiries concerning stock transfers, dividends, dividend reinvestment, consolidating accounts, changes of address, or lost or stolen stock certificates should be directed to Computershare Investor Services, the transfer agent and registrar for the Company’s common stock:

Computershare Investor Services

P.O. Box 30170

College Station, TX 77842-3170

Phone: 800-622-6757

www.computershare.com/us/contact

All other inquiries should be directed to:

Tredegar Corporation

Investor Relations Department

1100 Boulders Parkway

Richmond, Virginia 23225

Phone: 800-411-7441

E-mail: invest@tredegar.com

Website: www.tredegar.com

Quarterly Information

Tredegar does not generate or distribute quarterly reports to its shareholders. Information on quarterly results can be obtained from the Company’s website. In addition, Tredegar files quarterly, annual and other information electronically with the SEC, which can be accessed on its website at www.sec.gov.

| |

Item 6. | SELECTED FINANCIAL DATA |

The tables that follow on pages 13-18 present certain selected financial and segment information for the five years ended December 31, 2015.

FIVE-YEAR SUMMARY

Tredegar Corporation and Subsidiaries

|

| | | | | | | | | | | | | | | | | | | | | | | | |

Years Ended December 31 | 2015 | | | 2014 | | | 2013 | | | 2012 | | | 2011 | |

(In Thousands, Except Per-Share Data) | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Results of Operations (g): | | | | | | | | | | | | | | |

Sales | $ | 896,177 |

| | | $ | 951,826 |

| | | $ | 959,346 |

| | | $ | 882,188 |

| | | $ | 794,420 |

| |

Other income (expense), net | (20,113 | ) | (b) | | (6,697 | ) | (c) | | 1,776 |

| (d) | | 18,119 |

| (e) | | 3,213 |

| (f) |

| 876,064 |

| | | 945,129 |

| | | 961,122 |

| | | 900,307 |

| | | 797,633 |

| |

Cost of goods sold | 725,459 |

| (b) | | 778,113 |

| (c) | | 784,675 |

| (d) | | 712,660 |

| (e) | | 654,087 |

| (f) |

Freight | 29,838 |

| | | 28,793 |

| | | 28,625 |

| | | 24,846 |

| | | 18,488 |

| |

Selling, general & administrative expenses | 71,911 |

| (b) | | 69,526 |

| (c) | | 71,195 |

| (d) | | 73,717 |

| (e) | | 67,808 |

| (f) |

Research and development expenses | 16,173 |

| | | 12,147 |

| | | 12,669 |

| | | 13,162 |

| | | 13,219 |

| |

Amortization of intangibles | 4,073 |

| | | 5,395 |

| | | 6,744 |

| | | 5,806 |

| | | 1,399 |

| |

Interest expense | 3,502 |

| | | 2,713 |

| | | 2,870 |

| | | 3,590 |

| | | 1,926 |

| |

Asset impairments and costs associated with exit and disposal activities | 3,850 |

| (b) | | 3,026 |

| (c) | | 1,412 |

| (d) | | 5,022 |

| (e) | | 1,917 |

| (f) |

Goodwill impairment charge | 44,465 |

| (a) | | — |

| | | — |

| | | — |

| | | — |

| |

| 899,271 |

| | | 899,713 |

| | | 908,190 |

| | | 838,803 |

| | | 758,844 |

| |

Income (loss) from continuing operations before income taxes | (23,207 | ) | | | 45,416 |

| | | 52,932 |

| | | 61,504 |

| | | 38,789 |

| |

Income taxes | 8,928 |

| (b) | | 9,387 |

| (c) | | 16,995 |

| (d) | | 18,319 |

| (e) | | 10,244 |

| (f) |

Income (loss) from continuing operations (g) | (32,135 | ) | | | 36,029 |

| | | 35,937 |

| | | 43,185 |

| | | 28,545 |

| |

Income (loss) from discontinued operations, net of tax (g) | — |

| | | 850 |

| (g) | | (13,990 | ) | (g) | | (14,934 | ) | (g) | | (3,690 | ) | (g) |

Net income | $ | (32,135 | ) | | | $ | 36,879 |

| | | $ | 21,947 |

| | | $ | 28,251 |

| | | $ | 24,855 |

| |

Diluted earnings (loss) per share (g): | | | | | | | | | | | | | | |

Continuing operations | $ | (0.99 | ) | | | $ | 1.11 |

| | | $ | 1.10 |

| | | $ | 1.34 |

| | | $ | 0.89 |

| |

Discontinued operations | — |

| | | 0.02 |

| (g) | | (0.43 | ) | (g) | | (0.46 | ) | (g) | | (0.12 | ) | |

Net income | $ | (0.99 | ) | | | $ | 1.13 |

| | | $ | 0.67 |

| | | $ | 0.88 |

| | | $ | 0.77 |

| |

Refer to Notes to Financial Tables on page 18.

FIVE-YEAR SUMMARY

Tredegar Corporation and Subsidiaries

|

| | | | | | | | | | | | | | | | | | | | |

Years Ended December 31 | 2015 | | 2014 | | 2013 | | 2012 | | | 2011 |

(In Thousands, Except Per-Share Data) | | | | | | | | | | |

| | | | | | | | | | |

Share Data: | | | | | | | | | | |

Equity per share (m) | $ | 8.35 |

| | $ | 11.47 |

| | $ | 12.46 |

| | $ | 11.61 |

| | | $ | 12.38 |

|

Cash dividends declared per share | $ | 0.42 |

| | $ | 0.34 |

| | $ | 0.28 |

| | $ | 0.96 |

| (k) | | $ | 0.18 |

|

Weighted average common shares outstanding during the period | 32,578 |

| | 32,302 |

| | 32,172 |

| | 32,032 |

| | | 31,932 |

|

Shares used to compute diluted earnings (loss) per share during the period | 32,578 |

| | 32,554 |

| | 32,599 |

| | 32,193 |

| | | 32,213 |

|

Shares outstanding at end of period | 32,682 |

| | 32,422 |

| | 32,305 |

| | 32,069 |

| | | 32,057 |

|

Closing market price per share: | | | | | | | | | | |

High | $ | 23.76 |

| | $ | 28.45 |

| | $ | 30.73 |

| | $ | 26.29 |

| | | $ | 23.00 |

|

Low | $ | 12.63 |

| | $ | 16.76 |

| | $ | 21.06 |

| | $ | 13.49 |

| | | $ | 13.92 |

|

End of year | $ | 13.62 |

| | $ | 22.49 |

| | $ | 28.81 |

| | $ | 20.42 |

| | | $ | 22.22 |

|

Total return to shareholders (h) | (37.6 | )% | | (20.8 | )% | | 42.5 | % | | (3.8 | )% | | | 15.6 | % |

Financial Position: | | | | | | | | | | |

Total assets (l) | $ | 623,260 |

| | $ | 788,626 |

| | $ | 793,008 |

| | $ | 783,165 |

| | | $ | 780,610 |

|

Cash and cash equivalents | $ | 44,156 |

| | $ | 50,056 |

| | $ | 52,617 |

| | $ | 48,822 |

| | | $ | 68,939 |

|

Debt | $ | 104,000 |

| | $ | 137,250 |

| | $ | 139,000 |

| | $ | 128,000 |

| | | $ | 125,000 |

|

Shareholders’ equity (net book value) | $ | 272,748 |

| | $ | 372,029 |

| | $ | 402,664 |

| | $ | 372,252 |

| | | $ | 396,907 |

|

Equity market capitalization (i) | $ | 445,131 |

| | $ | 729,173 |

| | $ | 930,711 |

| | $ | 654,857 |

| | | $ | 712,307 |

|

Refer to Notes to Financial Tables on page 18.

SEGMENT TABLES

Tredegar Corporation and Subsidiaries

|

| | | | | | | | | | | | | | | | | | | |

Net Sales (j) | | | | | | | | | |

| 2015 | | 2014 | | 2013 | | 2012 | | 2011 |

(In Thousands) | | | | | | | | | |

PE Films | $ | 385,550 |

| | $ | 464,339 |

| | $ | 495,386 |

| | $ | 473,849 |

| | $ | 507,284 |

|

Flexible Packaging Films | 105,332 |

| | 114,348 |

| | 125,853 |

| | 138,028 |

| | 28,256 |

|

Aluminum Extrusions | 375,457 |

| | 344,346 |

| | 309,482 |

| | 245,465 |

| | 240,392 |

|

Total net sales | 866,339 |

| | 923,033 |

| | 930,721 |

| | 857,342 |

| | 775,932 |

|

Add back freight | 29,838 |

| | 28,793 |

| | 28,625 |

| | 24,846 |

| | 18,488 |

|

Sales as shown in Consolidated Statements of Income | $ | 896,177 |

| | $ | 951,826 |

| | $ | 959,346 |

| | $ | 882,188 |

| | $ | 794,420 |

|

| | | | | | | | | |

Identifiable Assets | | | | | | | | | |

| 2015 | | 2014 | | 2013 | | 2012 | | 2011 |

(In Thousands) | | | | | | | | | |

PE Films | $ | 270,236 |

| | $ | 283,606 |

| | $ | 291,377 |

| | $ | 301,175 |

| | $ | 329,961 |

|

Flexible Packaging Films | 146,253 |

| | 262,604 |

| | 265,496 |

| | 250,667 |

| | 244,610 |

|

Aluminum Extrusions | 136,935 |

| | 143,328 |

| | 134,928 |

| | 129,279 |

| | 78,661 |

|

Subtotal | 553,424 |

| | 689,538 |

| | 691,801 |

| | 681,121 |

| | 653,232 |

|

General corporate | 25,680 |

| | 49,032 |

| | 48,590 |

| | 53,222 |

| | 40,917 |

|

Cash and cash equivalents | 44,156 |

| | 50,056 |

| | 52,617 |

| | 48,822 |

| | 68,939 |

|

Identifiable assets from continuing operations | 623,260 |

| | 788,626 |

| | 793,008 |

| | 783,165 |

| | 763,088 |

|

Discontinued operations (g) | — |

| | — |

| | — |

| | — |

| | 17,522 |

|

Total | $ | 623,260 |

| | $ | 788,626 |

| | $ | 793,008 |

| | $ | 783,165 |

| | $ | 780,610 |

|

Refer to Notes to Financial Tables on page 18.

SEGMENT TABLES

Tredegar Corporation and Subsidiaries

|

| | | | | | | | | | | | | | | | | | | | | | | | |

Operating Profit | | | | | | | | | | | | | | |

| 2015 | | | 2014 | | | 2013 | | | 2012 | | | 2011 | |

(In Thousands) | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

PE Films: | | | | | | | | | | | | | | |

Ongoing operations | $ | 48,275 |

| | | $ | 60,971 |

| | | $ | 61,866 |

| | | $ | 76,003 |

| | | $ | 58,067 |

| |

Plant shutdowns, asset impairments, restructurings and other | (4,180 | ) | (b) | | (12,236 | ) | (c) | | (671 | ) | (d) | | 1,011 |

| (e) | | (901 | ) | (f) |

Flexible Packaging Films: | | | | | | | | | | | | | | |

Ongoing operations | 5,453 |

| | | (2,917 | ) | | | 9,100 |

| | | (6,053 | ) | | | 1,426 |

| |

Plant shutdowns, asset impairments, restructurings and other | (185 | ) | | | (591 | ) | | | — |

| | | (1,120 | ) | | | (5,906 | ) | |

Goodwill impairment charge | (44,465 | ) | (a) | | — |

| | | — |

| | | — |

| | | — |

| |

Aluminum Extrusions: | | | | | | | | | | | | | | |

Ongoing operations | 30,432 |

| | | 25,664 |

| | | 18,291 |

| | | 9,037 |

| | | 3,457 |

| |

Plant shutdowns, asset impairments, restructurings and other | (708 | ) | (b) | | (976 | ) | (c) | | (2,748 | ) | (d) | | (5,427 | ) | (e) | | 58 |

| (f) |

Total | 34,622 |

| | | 69,915 |

| | | 85,838 |

| | | 73,451 |

| | | 56,201 |

| |

Interest income | 294 |

| | | 588 |

| | | 594 |

| | | 418 |

| | | 1,023 |

| |

Interest expense | 3,502 |

| | | 2,713 |

| | | 2,870 |

| | | 3,590 |

| | | 1,926 |

| |

Gain (loss) on investment accounted for under the fair value method | (20,500 | ) | | | 2,000 |

| (c) | | 3,400 |

| (d) | | 16,100 |

| (e) | | 1,600 |

| (f) |

Gain on sale of investment property | — |

| | | 1,208 |

| (c) | | — |

| | | — |

| | | — |

| |

Unrealized loss on investment property | — |

| | | — |

| | | 1,018 |

| (d) | | — |

| | | — |

| |

Stock option-based compensation expense | 483 |

| | | 1,272 |

| | | 1,155 |

| | | 1,432 |

| | | 1,940 |

| |

Corporate expenses, net | 33,638 |

| (b) | | 24,310 |

| (c) | | 31,857 |

| (d) | | 23,443 |

| (e) | | 16,169 |

| (f) |

Income (loss) from continuing operations before income taxes | (23,207 | ) | | | 45,416 |

| | | 52,932 |

| | | 61,504 |

| | | 38,789 |

| |

Income taxes | 8,928 |

| (b) | | 9,387 |

| (c) | | 16,995 |

| (d) | | 18,319 |

| (e) | | 10,244 |

| (f) |

Income (loss) from continuing operations | (32,135 | ) | | | 36,029 |

| | | 35,937 |

| | | 43,185 |

| | | 28,545 |

| |

Income (loss) from discontinued operations, net of tax (g) | — |

| | | 850 |

| (g) | | (13,990 | ) | (g) | | (14,934 | ) | (g) | | (3,690 | ) | (g) |

Net income | $ | (32,135 | ) | | | $ | 36,879 |

| | | $ | 21,947 |

| | | $ | 28,251 |

| | | $ | 24,855 |

| |

Refer to Notes to Financial Tables on page 18.

SEGMENT TABLES

Tredegar Corporation and Subsidiaries

|

| | | | | | | | | | | | | | | | | | | |

Depreciation and Amortization

| | | | | | | | | |

| 2015 | | 2014 | | 2013 | | 2012 | | 2011 |

(In Thousands) | | | | | | | | | |

PE Films | $ | 15,480 |

| | $ | 21,399 |

| | $ | 25,656 |

| | $ | 28,962 |

| | $ | 34,201 |

|

Flexible Packaging Films | 9,697 |

| | 9,331 |

| | 9,676 |

| | 10,240 |

| | 2,114 |

|

Aluminum Extrusions | 9,698 |

| | 9,974 |

| | 9,202 |

| | 9,984 |

| | 8,333 |

|

Subtotal | 34,875 |

| | 40,704 |

| | 44,534 |

| | 49,186 |

| | 44,648 |

|

General corporate | 107 |

| | 114 |

| | 121 |

| | 73 |

| | 75 |

|

Total continuing operations | 34,982 |

| | 40,818 |

| | 44,655 |

| | 49,259 |

| | 44,723 |

|

Discontinued operations (g) | — |

| | — |

| | — |

| | 10 |

| | 12 |

|

Total depreciation and amortization expense | $ | 34,982 |

| | $ | 40,818 |

| | $ | 44,655 |

| | $ | 49,269 |

| | $ | 44,735 |

|

| | | | | | | | | |

Capital Expenditures | | | | | | | | | |

| 2015 | | 2014 | | 2013 | | 2012 | | 2011 |

(In Thousands) | | | | | | | | | |

PE Films | $ | 21,218 |

| | $ | 17,000 |

| | $ | 15,615 |

| | $ | 5,965 |

| | $ | 10,783 |

|

Flexible Packaging Films | 3,489 |

| | 21,806 |

| | 49,252 |

| | 24,519 |

| | 2,324 |

|

Aluminum Extrusions | 8,124 |

| | 6,092 |

| | 14,742 |

| | 2,332 |

| | 2,697 |

|

Subtotal | 32,831 |

| | 44,898 |

| | 79,609 |

| | 32,816 |

| | 15,804 |

|

General corporate | — |

| | — |

| | 52 |

| | 436 |

| | 76 |

|

Capital expenditures for continuing operations | 32,831 |

| | 44,898 |

| | 79,661 |

| | 33,252 |

| | 15,880 |

|

Discontinued operations | — |

| | — |

| | — |

| | — |

| | — |

|

Total capital expenditures | $ | 32,831 |

| | $ | 44,898 |

| | $ | 79,661 |

| | 33,252 |

| | 15,880 |

|

Refer to Notes to Financial Tables on page 18.

NOTES TO FINANCIAL TABLES

| |

(a) | Results for 2015 included a goodwill impairment charge of $44.5 million ($44.5 million after taxes) recognized in Flexible Packaging Films in the third quarter of 2015 upon completion of an impairment analysis performed as of September 30, 2015. See further discussion in Executive Summary beginning on page 19. |

| |

(b) | Plant shutdowns, asset impairments, restructurings and other charges for 2015 include charges of $3.9 million (included in “Selling, general and administrative” in the consolidated statements of income) for severance and other employee-related costs associated with the resignation of the Company’s former chief executive and chief financial officers; charges of $2.2 million associated with the consolidation of domestic PE Films manufacturing facilities, which includes severance and other employee-related costs of $0.8 million, asset impairments of $0.4 million, accelerated depreciation of $0.4 million (included in “Cost of goods sold” in the consolidated statements of income) and other facility consolidation-related expenses of $0.6 million ($0.1 million is included in “Cost of goods sold” in the consolidated statements of income); charge of $2.2 million for severance and other employee-related costs associated with restructurings in PE Films ($2.0 million) ($0.4 million included in “Selling, general and administrative expense” in the consolidated statement of income), Flexible Packaging Films ($0.2 million), Aluminum Extrusions ($35,000) and Corporate ($26,000); charges of $1.0 million associated with a non-recurring business development project (included in “Cost of goods sold” in the consolidated statements of income); charges of $0.4 million associated with the shutdown of the aluminum extrusions manufacturing facility in Kentland, Indiana; and charges of $0.3 million related to expected future environmental costs at the Company’s aluminum extrusions manufacturing facility in Newnan, Georgia (included in “Cost of goods sold” in the consolidated statements of income). The unrealized loss on the Company’s investment in kaléo of $20.5 million is included in “Other income (expense), net” in the consolidated statements of income. |

| |

(c) | Plant shutdowns, asset impairments, restructurings and other for 2014 include a charge of $10.0 million (included in “Other income (expense), net” in the consolidated statements of income) associated with the one-time, lump sum license payment to 3M Company (“3M”) after the Company settled all litigation issues associated with a patent infringement complaint; charges of $2.3 million for severance and other employee-related costs in connection with restructurings in PE Films ($1.7 million), Flexible Packaging Films ($0.6 million) and Aluminum Extrusions ($31,000); charges of $0.9 million related to expected future environmental costs at the aluminum extrusions manufacturing facility in Newnan, Georgia (included in “Cost of goods sold” in the consolidated statement of income); charges of $0.7 million associated with the shutdown of the film products manufacturing facility in Red Springs, North Carolina, which includes severance and other employee-related costs of $0.4 million and asset impairment and other shutdown-related charges of $0.3 million; gain of $0.1 million related to the sale of previously shutdown film products manufacturing facility in LaGrange, Georgia (included in “Other income (expense), net” in the consolidated statements of income); and charges of $54,000 associated with the shutdown of the aluminum extrusions manufacturing facility in Kentland, Indiana. The unrealized gain on the Company’s investment in kaléo of $2.0 million; the unrealized loss on the Company’s investment in Harbinger Capital Partners Special Situations Fund L.P. (“Harbinger”) of $0.8 million and the gain on sale on a portion the Company’s investment property in Alleghany and Bath County, Virginia was $1.2 million in 2014 are included in “Other income (expense), net” in the consolidated statements of income. Income taxes from continuing operations in 2014 includes the recognition of a tax benefit for a portion of the Company’s capital loss carryforwards of $4.9 million. These capital loss carryforwards were previously offset by a valuation allowance associated with expected limitations on the utilization of these assumed capital losses. As a result of changes in the underlying basis of certain foreign subsidiaries, income taxes from continuing operations in 2014 also included an adjustment of $2.2 million to reverse previously accrued deferred tax liabilities arising from foreign currency translation adjustments. |

| |