TG-2015.06.30-10Q

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

|

| |

x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2015

OR

|

| |

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 1-10258

Tredegar Corporation

(Exact Name of Registrant as Specified in Its Charter)

|

| | |

Virginia | | 54-1497771 |

(State or Other Jurisdiction of Incorporation or Organization) | | (I.R.S. Employer Identification No.) |

|

| | |

1100 Boulders Parkway Richmond, Virginia | | 23225 |

(Address of Principal Executive Offices) | | (Zip Code) |

Registrant’s Telephone Number, Including Area Code: (804) 330-1000

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

| | | | | |

Large accelerated filer | | x | Accelerated filer | | ¨ |

| | | |

Non-accelerated filer | | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The number of shares of Common Stock, no par value, outstanding as of July 27, 2015: 32,674,891.

PART I - FINANCIAL INFORMATION

| |

Item 1. | Financial Statements. |

Tredegar Corporation

Consolidated Balance Sheets

(In Thousands, Except Share Data)

(Unaudited)

|

| | | | | | | |

| June 30, | | December 31, |

| 2015 | | 2014 |

Assets | | | |

Current assets: | | | |

Cash and cash equivalents | $ | 47,405 |

| | $ | 50,056 |

|

Accounts and other receivables, net of allowance for doubtful accounts and sales returns of $2,830 in 2015 and $2,610 in 2014 | 112,471 |

| | 113,341 |

|

Income taxes recoverable | 3,679 |

| | 877 |

|

Inventories | 73,400 |

| | 74,308 |

|

Deferred income taxes | 8,431 |

| | 8,877 |

|

Prepaid expenses and other | 8,017 |

| | 8,283 |

|

Total current assets | 253,403 |

| | 255,742 |

|

Property, plant and equipment, at cost | 772,414 |

| | 790,622 |

|

Less accumulated depreciation | (521,955 | ) | | (520,665 | ) |

Net property, plant and equipment | 250,459 |

| | 269,957 |

|

Goodwill and other intangibles, net | 206,844 |

| | 215,129 |

|

Other assets and deferred charges | 47,283 |

| | 47,798 |

|

Total assets | $ | 757,989 |

| | $ | 788,626 |

|

Liabilities and Shareholders’ Equity | | | |

Current liabilities: | | | |

Accounts payable | $ | 84,817 |

| | $ | 94,131 |

|

Accrued expenses | 36,211 |

| | 32,049 |

|

Total current liabilities | 121,028 |

| | 126,180 |

|

Long-term debt | 135,000 |

| | 137,250 |

|

Deferred income taxes | 32,953 |

| | 39,255 |

|

Other noncurrent liabilities | 113,153 |

| | 113,912 |

|

Total liabilities | 402,134 |

| | 416,597 |

|

Commitments and contingencies (Notes 1 and 13) |

| |

|

Shareholders’ equity: | | | |

Common stock, no par value (issued and outstanding - 32,705,198 at June 30, 2015 and 32,422,082 at December 31, 2014) | 29,954 |

| | 24,364 |

|

Common stock held in trust for savings restoration plan (66,823 shares at June 30, 2015 and 66,255 shares at December 31, 2014) | (1,452 | ) | | (1,440 | ) |

Accumulated other comprehensive income (loss): | | | |

Foreign currency translation adjustment | (76,366 | ) | | (47,270 | ) |

Gain (loss) on derivative financial instruments | (985 | ) | | 656 |

|

Pension and other post-retirement benefit adjustments | (98,536 | ) | | (103,581 | ) |

Retained earnings | 503,240 |

| | 499,300 |

|

Total shareholders’ equity | 355,855 |

| | 372,029 |

|

Total liabilities and shareholders’ equity | $ | 757,989 |

| | $ | 788,626 |

|

See accompanying notes to financial statements.

Tredegar Corporation

Consolidated Statements of Income

(In Thousands, Except Per Share Data)

(Unaudited)

|

| | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2015 | | 2014 | | 2015 | | 2014 |

Revenues and other items: | | | | | | | |

Sales | $ | 221,245 |

| | $ | 236,965 |

| | $ | 455,416 |

| | $ | 472,178 |

|

Other income (expense), net | 124 |

| | (10,136 | ) | | 232 |

| | (10,230 | ) |

| 221,369 |

| | 226,829 |

| | 455,648 |

| | 461,948 |

|

Costs and expenses: | | | | | | | |

Cost of goods sold | 183,754 |

| | 192,084 |

| | 373,185 |

| | 382,778 |

|

Freight | 7,743 |

| | 6,401 |

| | 15,068 |

| | 13,171 |

|

Selling, general and administrative | 21,898 |

| | 16,512 |

| | 38,971 |

| | 34,831 |

|

Research and development | 4,267 |

| | 3,012 |

| | 8,152 |

| | 5,991 |

|

Amortization of intangibles | 1,040 |

| | 1,427 |

| | 2,123 |

| | 2,822 |

|

Interest expense | 893 |

| | 531 |

| | 1,778 |

| | 1,161 |

|

Asset impairments and costs associated with exit and disposal activities, net of adjustments | 277 |

| | 946 |

| | 225 |

| | 2,191 |

|

Total | 219,872 |

| | 220,913 |

| | 439,502 |

| | 442,945 |

|

Income before income taxes | 1,497 |

| | 5,916 |

| | 16,146 |

| | 19,003 |

|

Income taxes | 903 |

| | 2,164 |

| | 5,682 |

| | 6,772 |

|

Net income | $ | 594 |

| | $ | 3,752 |

| | $ | 10,464 |

| | $ | 12,231 |

|

| | | | | | | |

Earnings per share: | | | | | | | |

Basic | $ | 0.02 |

| | $ | 0.12 |

| | $ | 0.32 |

| | $ | 0.38 |

|

Diluted | $ | 0.02 |

| | $ | 0.11 |

| | $ | 0.32 |

| | $ | 0.37 |

|

Shares used to compute earnings per share: | | | | | | | |

Basic | 32,609 |

| | 32,312 |

| | 32,546 |

| | 32,277 |

|

Diluted | 32,746 |

| | 32,641 |

| | 32,687 |

| | 32,631 |

|

Dividends per share | $ | 0.11 |

| | $ | 0.09 |

| | $ | 0.20 |

| | $ | 0.16 |

|

See accompanying notes to financial statements.

Tredegar Corporation

Consolidated Statements of Comprehensive Income (Loss)

(In Thousands)

(Unaudited)

|

| | | | | | | |

| Three Months Ended June 30, |

| 2015 | | 2014 |

Net income | $ | 594 |

| | $ | 3,752 |

|

Other comprehensive income (loss): | | | |

Foreign currency translation adjustment (net of tax of $225 in 2015 and tax of $125 in 2014) | 5,557 |

| | 4,145 |

|

Derivative financial instruments adjustment (net of tax benefit of $591 in 2015 and tax of $50 in 2014) | (979 | ) | | 81 |

|

Amortization of prior service costs and net gains or losses (net of tax of $1,462 in 2015 and $997 in 2014) | 2,523 |

| | 1,740 |

|

Other comprehensive income (loss) | 7,101 |

| | 5,966 |

|

Comprehensive income (loss) | $ | 7,695 |

| | $ | 9,718 |

|

| | | |

| Six Months Ended June 30, |

| 2015 | | 2014 |

Net income | $ | 10,464 |

| | $ | 12,231 |

|

Other comprehensive income (loss): | | | |

Foreign currency translation adjustment (net of tax benefit of $1,384 in 2015 and tax of $250 in 2014) | (29,096 | ) | | 9,240 |

|

Derivative financial instruments adjustment (net of tax benefit of $990 in 2015 and tax of $167 in 2014) | (1,641 | ) | | 273 |

|

Amortization of prior service costs and net gains or losses (net of tax of $2,924 in 2015 and $1,994 in 2014) | 5,045 |

| | 3,480 |

|

Other comprehensive income (loss) | (25,692 | ) | | 12,993 |

|

Comprehensive income (loss) | $ | (15,228 | ) | | $ | 25,224 |

|

See accompanying notes to financial statements.

Tredegar Corporation

Consolidated Statements of Cash Flows

(In Thousands)

(Unaudited)

|

| | | | | | | |

| Six Months Ended June 30, |

| 2015 | | 2014 |

Cash flows from operating activities: | | | |

Net income | $ | 10,464 |

| | $ | 12,231 |

|

Adjustments for noncash items: | | | |

Depreciation | 15,872 |

| | 18,163 |

|

Amortization of intangibles | 2,123 |

| | 2,822 |

|

Deferred income taxes | (3,990 | ) | | (5,318 | ) |

Accrued pension and post-retirement benefits | 6,258 |

| | 3,983 |

|

Loss on investment accounted for under the fair value method | — |

| | 1,100 |

|

Loss on asset impairments and divestitures | — |

| | 799 |

|

Net gain on disposal of assets | — |

| | (837 | ) |

Changes in assets and liabilities, net of effects of acquisitions and divestitures: | | | |

Accounts and other receivables | (3,627 | ) | | (13,399 | ) |

Inventories | (2,956 | ) | | 906 |

|

Income taxes recoverable/payable | (3,046 | ) | | (2,477 | ) |

Prepaid expenses and other | (847 | ) | | 1,124 |

|

Accounts payable and accrued expenses | (3,938 | ) | | (3,623 | ) |

Other, net | 3,050 |

| | 1,340 |

|

Net cash provided by operating activities | 19,363 |

| | 16,814 |

|

Cash flows from investing activities: | | | |

Capital expenditures | (14,358 | ) | | (22,884 | ) |

Proceeds from the sale of assets and other | 585 |

| | 4,723 |

|

Net cash used in investing activities | (13,773 | ) | | (18,161 | ) |

Cash flows from financing activities: | | | |

Borrowings | 59,000 |

| | 32,000 |

|

Debt principal payments and financing costs | (61,328 | ) | | (34,250 | ) |

Dividends paid | (6,536 | ) | | (5,176 | ) |

Proceeds from exercise of stock options and other | 2,794 |

| | (106 | ) |

Net cash used in financing activities | (6,070 | ) | | (7,532 | ) |

Effect of exchange rate changes on cash | (2,171 | ) | | 270 |

|

Increase (decrease) in cash and cash equivalents | (2,651 | ) | | (8,609 | ) |

Cash and cash equivalents at beginning of period | 50,056 |

| | 52,617 |

|

Cash and cash equivalents at end of period | $ | 47,405 |

| | $ | 44,008 |

|

See accompanying notes to financial statements.

Tredegar Corporation

Consolidated Statement of Shareholders’ Equity

(In Thousands, Except Share and Per Share Data)

(Unaudited)

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Accumulated Other Comprehensive Income (Loss) | | |

| Common Stock | | Retained Earnings | | Trust for Savings Restoration Plan | | Foreign Currency Translation | | Gain (Loss) on Derivative Financial Instruments | | Pension & Other Post-retirement Benefit Adjust. | | Total Shareholders’ Equity |

Balance at January 1, 2015 | $ | 24,364 |

| | $ | 499,300 |

| | $ | (1,440 | ) | | $ | (47,270 | ) | | $ | 656 |

| | $ | (103,581 | ) | | $ | 372,029 |

|

Net income | — |

| | 10,464 |

| | — |

| | — |

| | — |

| | — |

| | 10,464 |

|

Other comprehensive income (loss): | | | | | | | | | | | | | |

Foreign currency translation adjustment (net of tax benefit of $1,384) | — |

| | — |

| | — |

| | (29,096 | ) | | — |

| | — |

| | (29,096 | ) |

Derivative financial instruments adjustment (net of tax benefit of $990) | — |

| | — |

| | — |

| | — |

| | (1,641 | ) | | — |

| | (1,641 | ) |

Amortization of prior service costs and net gains or losses (net of tax of $2,924) | — |

| | — |

| | — |

| | — |

| | — |

| | 5,045 |

| | 5,045 |

|

Cash dividends declared ($0.20 per share) | — |

| | (6,536 | ) | | — |

| | — |

| | — |

| | — |

| | (6,536 | ) |

Stock-based compensation expense | 3,129 |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 3,129 |

|

Issued upon exercise of stock options & other | 2,461 |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 2,461 |

|

Tredegar common stock purchased by trust for savings restoration plan | — |

| | 12 |

| | (12 | ) | | — |

| | — |

| | — |

| | — |

|

Balance at June 30, 2015 | $ | 29,954 |

| | $ | 503,240 |

| | $ | (1,452 | ) | | $ | (76,366 | ) | | $ | (985 | ) | | $ | (98,536 | ) | | $ | 355,855 |

|

See accompanying notes to financial statements.

TREDEGAR CORPORATION

NOTES TO THE CONSOLIDATED INTERIM FINANCIAL STATEMENTS

(Unaudited)

| |

1. | In the opinion of management, the accompanying consolidated financial statements of Tredegar Corporation and its subsidiaries (“Tredegar,” “the Company,” “we,” “us” or “our”) contain all adjustments necessary to state fairly, in all material respects, Tredegar’s consolidated financial position as of June 30, 2015, the consolidated results of operations for the three and six months ended June 30, 2015 and 2014, the consolidated cash flows for the six months ended June 30, 2015 and 2014, and the consolidated changes in shareholders’ equity for the six months ended June 30, 2015. All such adjustments, unless otherwise detailed in the notes to the consolidated interim financial statements, are deemed to be of a normal, recurring nature. The financial position data as of December 31, 2014 that is included herein was derived from the audited consolidated financial statements provided in the Company’s Annual Report on Form 10-K for the year ended December 31, 2014 (“2014 Form 10-K”) but does not include all disclosures required by United States generally accepted accounting principles (“U.S. GAAP”). These financial statements should be read in conjunction with the consolidated financial statements and related notes included in the Company’s 2014 Form 10-K. The results of operations for the three and six months ended June 30, 2015, are not necessarily indicative of the results to be expected for the full year. |

| |

2. | Plant shutdowns, asset impairments, restructurings and other charges are shown in the net sales and operating profit by segment table in Note 9, and unless otherwise noted below, are also included in “Asset impairments and costs associated with exit and disposal activities, net of adjustments” in the consolidated statements of income. |

Plant shutdowns, asset impairments, restructurings and other charges in the second quarter of 2015 include:

| |

• | Pretax charges of $3.9 million (included in “Selling, general and administrative expense” in the consolidated statements of income and “Corporate expenses, net” in the statement of net sales and operating profit by segment included in Note 9) for severance and other employee-related costs associated with the resignation of the Company’s former chief executive and chief financial officers; |

| |

• | Pretax charges of $0.3 million for severance and other-employee-related costs associated with restructurings in Film Products; and |

| |

• | Pretax charges of $18,000 associated with the shutdown of the aluminum extrusions manufacturing facility in Kentland, Indiana. |

Plant shutdowns, asset impairments, restructurings and other charges in the first six months of 2015 include:

| |

• | Pretax charges of $3.9 million (included in “Selling, general and administrative expense” in the consolidated statements of income and “Corporate expenses, net” in the statement of net sales and operating profit by segment included in Note 9) for severance and other employee-related costs associated with the resignation of the Company’s former chief executive and chief financial officers; |

| |

• | Pretax charge of $0.2 million for severance and other employee-related costs associated with restructurings in Film Products; and |

| |

• | Pretax charges of $33,000 associated with the shutdown of the aluminum extrusions manufacturing facility in Kentland, Indiana. |

Plant shutdowns, asset impairments, restructurings and other charges in the second quarter of 2014 include:

| |

• | Pretax charge of $10 million (included in “Other income (expense), net” in the consolidated statements of income) associated with a one-time, lump sum license payment to the 3M Company (“3M”) after the Company settled all litigation issues associated with a patent infringement complaint (see Note 13 for additional detail on this legal matter); |

| |

• | Pretax charges of $0.6 million associated with severance and other employee-related costs associated with restructurings in Film Products; |

| |

• | Pretax charges of $0.3 million associated with the shutdown of the film products manufacturing facility in Red Springs, North Carolina, which includes severance and other employee-related costs of $0.2 million and asset impairment and other shutdown-related charges of $0.1 million; |

| |

• | Pretax charges of $0.2 million related to expected future environmental costs at the Company’s aluminum extrusions manufacturing facility in Newnan, Georgia (included in “Cost of goods sold” in the consolidated statements of income); and |

| |

• | Pretax charges of $24,000 associated with the shutdown of the aluminum extrusions manufacturing facility in Kentland, Indiana. |

Plant shutdowns, asset impairments, restructurings and other charges in the first six months of 2014 include:

| |

• | Pretax charge of $10 million associated with a one-time, lump sum license payment to 3M after the Company settled all litigation issues associated with a patent infringement complaint (see Note 13 for additional detail on this legal matter); |

| |

• | Pretax charges of $1.4 million associated with severance and other employee-related costs associated with restructurings in Film Products; |

| |

• | Pretax charges of $0.7 million associated with the shutdown of the film products manufacturing facility in Red Springs, North Carolina, which includes severance and other employee-related costs of $0.4 million and asset impairment and other shutdown-related charges of $0.3 million; |

| |

• | Pretax charges of $0.2 million related to expected future environmental costs at the Company’s aluminum extrusions manufacturing facility in Newnan, Georgia (included in “Cost of goods sold” in the consolidated statements of income); and |

| |

• | Pretax charges of $24,000 associated with the shutdown of the aluminum extrusions manufacturing facility in Kentland, Indiana. |

Results in the second quarter and first six months of 2014 include unrealized gains on the Company’s investment in kaleo, Inc (“kaléo”), which is accounted for under the fair value method (included in “Other income (expense), net” in the consolidated statements of income), of $1.1 million ($0.7 million after taxes). Unrealized losses (included in “Other income (expense), net” in the consolidated statements of income and “Corporate expenses, net” in the statement of net sales and operating profit by segment) on the Company’s investment in the Harbinger Capital Partners Special Situations Fund, L.P. (“Harbinger Fund”), which is accounted for under the cost method, of $0.3 million ($0.2 million after taxes) and $0.6 million ($0.4 million after taxes) in the second quarter and first six months of 2014, respectively, as a result of a reduction in the value of the investment that is not expected to be temporary. The Company realized a gain (included in “Other income (expense), net” in the consolidated statements of income) of $1.2 million ($0.8 million after taxes) on the sale of a portion of its investment property in Alleghany and Bath counties in Virginia in the second quarter of 2014. See Note 6 for additional information on investments.

A reconciliation of the beginning and ending balances of accrued expenses associated with “Asset impairments and costs associated with exit and disposal activities, net of adjustments” in the consolidated statements of income for the six months ended June 30, 2015 is as follows:

|

| | | | | | | | | | | |

(In Thousands) | Severance | | Other (a) | | Total |

Balance at January 1, 2015 | $ | 246 |

| | $ | 201 |

| | $ | 447 |

|

Changes in 2015: | | | | | |

Charges | 192 |

| | 33 |

| | 225 |

|

Cash spent | (361 | ) | | (91 | ) | | (452 | ) |

Balance at June 30, 2015 | $ | 77 |

| | $ | 143 |

| | $ | 220 |

|

| |

(a) | Other includes other shutdown-related costs associated with the shutdown of the Company’s aluminum extrusions manufacturing facility in Kentland, Indiana. |

In July 2015, the Company announced its intention to consolidate its domestic production for film products by restructuring its manufacturing facility in Lake Zurich, Illinois. Efforts to transition domestic production from the Lake Zurich manufacturing facility will require various machinery upgrades and equipment transfers to its other manufacturing facilities. Given Film Products’ focus on maintaining product quality and customer satisfaction, the Company anticipates that these activities will require 21-24 months to execute.

The Company expects to recognize costs associated with the exit and disposal activities of approximately $4-5 million over the next 21-24 months. Exit and disposal costs include severance charges and other employee-related expenses arising from the termination of employees of approximately $2-3 million and equipment transfers, asset impairments and other shutdown-related costs of approximately $2 million. During the same period of time, operating expenses will include the acceleration of approximately $3 million of non-cash depreciation expense for certain machinery and equipment at the Lake Zurich manufacturing facility.

Total estimated cash expenditures of $13-14 million over the next 21-24 months include the following:

| |

• | Cash outlays associated with previously discussed exit and disposal expenses of approximately $4 million; |

| |

• | Capital expenditures associated with equipment upgrades at other film products manufacturing facilities in the United States of approximately $8 million; |

| |

• | Cash incentives of approximately $1 million in connection with meeting safety and quality standards while production ramps down at the Lake Zurich manufacturing facility; and |

| |

• | Additional operating expenses of approximately $1 million associated with customer product qualifications on upgraded and transferred production lines. |

| |

3. | The components of inventories are as follows: |

|

| | | | | | | | |

| | June 30, | | December 31, |

(In Thousands) | 2015 | | 2014 |

Finished goods | $ | 15,526 |

| | $ | 17,559 |

|

Work-in-process | 10,586 |

| | 10,089 |

|

Raw materials | 25,644 |

| | 25,227 |

|

Stores, supplies and other | 21,644 |

| | 21,433 |

|

Total | $ | 73,400 |

| | $ | 74,308 |

|

| |

4. | Basic earnings per share is computed by dividing net income by the weighted average number of shares of common stock outstanding. Diluted earnings per share is computed by dividing net income by the weighted average common and potentially dilutive common equivalent shares outstanding, determined as follows: |

|

| | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

| June 30, | | June 30, |

(In Thousands) | 2015 | | 2014 | | 2015 | | 2014 |

Weighted average shares outstanding used to compute basic earnings per share | 32,609 |

| | 32,312 |

| | 32,546 |

| | 32,277 |

|

Incremental dilutive shares attributable to stock options and restricted stock | 137 |

| | 329 |

| | 141 |

| | 354 |

|

Shares used to compute diluted earnings per share | 32,746 |

| | 32,641 |

| | 32,687 |

| | 32,631 |

|

Incremental shares attributable to stock options and restricted stock are computed under the treasury stock method using the average market price during the related period. For the three and six months ended June 30, 2015, average out-of-the-money options to purchase shares that were excluded from the calculation of incremental shares attributable to stock options and restricted stock were 327,697 and 356,228, respectively. For the three and six months ended June 30, 2014, average out-of-the-money options to purchase shares that were excluded from the calculation of incremental shares attributable to stock options and restricted stock were 227,094 and 170,972, respectively.

| |

5. | The following table summarizes the after-tax changes in accumulated other comprehensive income (loss) for the six months ended June 30, 2015: |

|

| | | | | | | | | | | | | | | |

(In Thousands) | Foreign currency translation adjustment | | Gain (loss) on derivative financial instruments | | Pension and other post-retirement benefit adjustments | | Total |

Beginning balance, January 1, 2015 | $ | (47,270 | ) | | $ | 656 |

| | $ | (103,581 | ) | | $ | (150,195 | ) |

Other comprehensive income (loss) before reclassifications | (29,096 | ) | | (1,950 | ) | | — |

| | (31,046 | ) |

Amounts reclassified from accumulated other comprehensive income (loss) | — |

| | 309 |

| | 5,045 |

| | 5,354 |

|

Net other comprehensive income (loss) - current period | (29,096 | ) | | (1,641 | ) | | 5,045 |

| | (25,692 | ) |

Ending balance, June 30, 2015 | $ | (76,366 | ) | | $ | (985 | ) | | $ | (98,536 | ) | | $ | (175,887 | ) |

The following table summarizes the after-tax changes in accumulated other comprehensive income (loss) for the six months ended June 30, 2014:

|

| | | | | | | | | | | | | | | |

(In Thousands) | Foreign

currency

translation

adjustment | | Gain (loss) on

derivative

financial

instruments | | Pension and

other

post-retirement

benefit

adjustments | | Total |

Beginning balance, January 1, 2014 | $ | (19,205 | ) | | $ | 765 |

| | $ | (71,848 | ) | | $ | (90,288 | ) |

Other comprehensive income (loss) before reclassifications | 9,240 |

| | 302 |

| | — |

| | 9,542 |

|

Amounts reclassified from accumulated other comprehensive income (loss) | — |

| | (29 | ) | | 3,480 |

| | 3,451 |

|

Net other comprehensive income (loss) - current period | 9,240 |

| | 273 |

| | 3,480 |

| | 12,993 |

|

Ending balance, June 30, 2014 | $ | (9,965 | ) | | $ | 1,038 |

| | $ | (68,368 | ) | | $ | (77,295 | ) |

Reclassifications of balances out of accumulated other comprehensive income (loss) into net income for the three months June 30, 2015 are summarized as follows:

|

| | | | | |

(In Thousands) | Amount

reclassified from

other

comprehensive

income | | Location of gain

(loss) reclassified

from accumulated

other

comprehensive

income to net

income |

Gain (loss) on derivative financial instruments: | | | |

Aluminum future contracts, before taxes | $ | (481 | ) | | Cost of sales |

Foreign currency forward contracts, before taxes | 16 |

| | Cost of sales |

Total, before taxes | (465 | ) | | |

Income tax expense (benefit) | (176 | ) | | Income taxes |

Total, net of tax | $ | (289 | ) | | |

Amortization of pension and other post-retirement benefits: | | | |

Actuarial gain (loss) and prior service costs, before taxes | $ | (3,985 | ) | | (a) |

Income tax expense (benefit) | (1,462 | ) | | Income taxes |

Total, net of tax | $ | (2,523 | ) | | |

| |

(a) | This component of accumulated other comprehensive income is included in the computation of net periodic pension cost (see Note 8 for additional detail). |

Reclassifications of balances out of accumulated other comprehensive income (loss) into net income for the six months ended June 30, 2015 are summarized as follows:

: |

| | | | | |

(In Thousands) | Amount reclassified from other comprehensive income | | Location of gain (loss) reclassified from accumulated other comprehensive income to net income |

Gain (loss) on derivative financial instruments: | | | |

Aluminum future contracts, before taxes | $ | (529 | ) | | Cost of sales |

Foreign currency forward contracts, before taxes | 31 |

| | Cost of sales |

Total, before taxes | (498 | ) | | |

Income tax expense (benefit) | (189 | ) | | Income taxes |

Total, net of tax | $ | (309 | ) | | |

Amortization of pension and other post-retirement benefits: | | | |

Actuarial gain (loss) and prior service costs, before taxes | $ | (7,969 | ) | | (a) |

Income tax expense (benefit) | (2,924 | ) | | Income taxes |

Total, net of tax | $ | (5,045 | ) | | |

| |

(a) | This component of accumulated other comprehensive income is included in the computation of net periodic pension cost (see Note 8 for additional detail). |

Reclassifications of balances out of accumulated other comprehensive income (loss) into net income for the three months June 30, 2014 are summarized as follows:

|

| | | | | |

(In Thousands) | Amount

reclassified from

other

comprehensive

income | | Location of gain

(loss) reclassified

from accumulated

other

comprehensive

income to net

income |

Gain (loss) on derivative financial instruments: | | | |

Aluminum future contracts, before taxes | $ | 83 |

| | Cost of sales |

Foreign currency forward contracts, before taxes | — |

| | |

Total, before taxes | 83 |

| | |

Income tax expense (benefit) | 31 |

| | Income taxes |

Total, net of tax | $ | 52 |

| | |

Amortization of pension and other post-retirement benefits: | | | |

Actuarial gain (loss) and prior service costs, before taxes | $ | (2,737 | ) | | (a) |

Income tax expense (benefit) | (997 | ) | | Income taxes |

Total, net of tax | $ | (1,740 | ) | | |

| |

(a) | This component of accumulated other comprehensive income is included in the computation of net periodic pension cost (see Note 8 for additional detail). |

Reclassifications of balances out of accumulated other comprehensive income (loss) into net income for the six months ended June 30, 2014 are summarized as follows:

|

| | | | | |

(In Thousands) | Amount

reclassified from

other

comprehensive

income | | Location of gain

(loss) reclassified

from accumulated

other

comprehensive

income to net

income |

Gain (loss) on derivative financial instruments: | | | |

Aluminum future contracts, before taxes | $ | 46 |

| | Cost of sales |

Foreign currency forward contracts, before taxes | — |

| | |

Total, before taxes | 46 |

| | |

Income tax expense (benefit) | 17 |

| | Income taxes |

Total, net of tax | $ | 29 |

| | |

Amortization of pension and other post-retirement benefits: | | | |

Actuarial gain (loss) and prior service costs, before taxes | $ | (5,474 | ) | | (a) |

Income tax expense (benefit) | (1,994 | ) | | Income taxes |

Total, net of tax | $ | (3,480 | ) | | |

| |

(a) | This component of accumulated other comprehensive income is included in the computation of net periodic pension cost (see Note 8 for additional detail). |

| |

6. | In August 2007 and December 2008, the Company made an aggregate investment of $7.5 million in kaléo, a privately held specialty pharmaceutical company. The mission of kaléo is to set a new standard in life-saving personal medical products designed to enable superior treatment outcomes, improved cost effectiveness and intuitive patient administration. Tredegar’s ownership interest on a fully diluted basis is approximately 20%, and the investment is accounted for under the fair value method. At the time of the initial investment, the Company elected the fair value option over the equity method of accounting since its investment objectives were similar to those of venture capitalists, which typically do not have controlling financial interests. |

The estimated fair value of the investment in kaléo (also the carrying value, which is included in “Other assets and deferred charges” in the consolidated balance sheet) was $39.1 million at June 30, 2015 and December 31, 2014, respectively. The fair value estimates are based upon significant unobservable (Level 3) inputs since there is no secondary market for our ownership interest. Accordingly, until the next round of financing or other significant financial transaction, value estimates will primarily be based on assumptions relating to meeting product development and commercialization milestones, corresponding cash flow projections (projections of sales, costs, expenses, capital expenditures and working capital investment) and discounting of these factors for the high degree of risk. Adjustments to the estimated fair value of the Company’s investment in kaléo will be made in the period during which changes can be quantified.

The Company recognized an unrealized loss on its investment in kaléo (included in “Other income (expense), net” in the consolidated statements of income) of $1.1 million in the second quarter and first six months of 2014 (none in the second quarter and first six months of 2015). The unrealized loss in the second quarter of 2014 was primarily attributed to adjustments in the timing of cash flows associated with achieving product development and commercialization milestones.

The fair market valuation of the Company’s interest in kaléo is sensitive to changes in the weighted average cost of capital used to discount cash flow projections for the high degree of risk associated with meeting development and commercialization milestones as anticipated. The weighted average cost of capital used in the fair market valuation of Tredegar’s interest in kaléo was 45% at June 30, 2015 and December 31, 2014. At June 30, 2015, the effect of a 500 basis point decrease in the weighted average cost of capital assumption would have increased the fair value of the interest in kaléo by approximately $7 million, and a 500 basis point increase in the weighted average cost of capital assumption would have decreased the fair value of the interest by approximately $5 million.

Had the Company not elected to account for its investment under the fair value method, it would have been required to use the equity method of accounting. The condensed balance sheets for kaléo at June 30, 2015 and December 31, 2014 and condensed statement of operations for the three and six months ended June 30, 2015 and 2014, as reported to the Company by kaléo, are provided below:

|

| | | | | | | | | | | | | | | | |

(In Thousands) | June 30, 2015 | | December 31, 2014 | | | June 30, 2015 | | December 31, 2014 |

Assets: | | | | | Liabilities & Equity: | | | |

Cash & short-term investments | $ | 101,407 |

| | $ | 117,589 |

| | | | | |

Restricted cash | 8,289 |

| | 14,498 |

| | Other current liabilities | $ | 6,792 |

| | $ | 8,123 |

|

Other current assets | 21,609 |

| | 17,916 |

| | Other noncurrent liabilities | 1,182 |

| | 1,247 |

|

Property & equipment | 9,526 |

| | 10,824 |

| | Long term debt, net (b) | 146,984 |

| | 146,629 |

|

Patents | 2,749 |

| | 2,702 |

| | Redeemable preferred stock | 23,430 |

| | 22,946 |

|

Other long-term assets (b) | 669 |

| | 15 |

| | Equity | (34,139 | ) | | (15,401 | ) |

Total assets | $ | 144,249 |

| | $ | 163,544 |

| | Total liabilities & equity | $ | 144,249 |

| | $ | 163,544 |

|

|

| | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2015 | | 2014 | | 2015 | | 2014 |

Revenues & Expenses: | | | | | | | |

Revenues | $ | 10,068 |

| | $ | 4,410 |

| | $ | 14,918 |

| | $ | 6,968 |

|

Cost of goods sold | (2,807 | ) | | — |

| | (5,137 | ) | | — |

|

Expenses and other, net (a) | (14,006 | ) | | (14,658 | ) | | (28,390 | ) | | (22,974 | ) |

Income tax benefit (expense) | — |

| | 3,892 |

| | (4 | ) | | 6,131 |

|

Net income (loss) | $ | (6,745 | ) | | $ | (6,356 | ) | | $ | (18,613 | ) | | $ | (9,875 | ) |

(a) “Expenses and other, net” includes selling, general and administrative expense, research and development expense, interest expense and other income (expense), net.

(b) Certain prior year balances have been reclassified to conform with current year presentation.

The Company’s investment in the Harbinger Fund had a carrying value (included in “Other assets and deferred charges”) of $1.8 million at June 30, 2015 and December 31, 2014, respectively. The carrying value at June 30, 2015 reflected Tredegar’s cost basis in its investment in the Harbinger Fund, net of total withdrawal proceeds received and unrealized losses. The Company recorded unrealized losses of $0.3 million and $0.6 million in the second quarter and first six months of 2014, respectively, on its investment in the Harbinger Fund (included in “Other income (expense), net” in the consolidated statements of income) as a result of a reduction in the value of the investment that is not expected to be temporary (none in the second quarter and first six months of 2015). Withdrawal proceeds were $0.2 million in the first six months of 2014 (none in the first six months of 2015). The timing and amount of future installments of withdrawal proceeds, which commenced in August 2010, were not known as of June 30, 2015. Gains on the Company’s investment in the Harbinger Fund will be recognized when the amounts expected to be collected from any withdrawal from the investment are known, which will likely be when cash in excess of the remaining carrying value is received. Losses will be recognized when management believes it is probable that future withdrawal proceeds will not exceed the remaining carrying value.

Tredegar has investment property in Alleghany and Bath Counties, Virginia. The Company realized a gain (included in “Other income (expense), net” in the consolidated statements of income) of $1.2 million ($0.8 million after taxes) on the sale of a portion of this investment property in the second quarter of 2014. The carrying value in this investment property (included in “Other assets and deferred charges” on the consolidated balance sheets) was $2.6 million at June 30, 2015 and December 31, 2014.

| |

7. | The Company uses derivative financial instruments for the purpose of hedging margin exposure from fixed-price forward sales contracts in Aluminum Extrusions and currency exchange rate exposures that exist due to specified transactions. When possible, derivative financial instruments utilized by Tredegar are designated as and qualify as cash flow hedges and are recognized in the balance sheet at fair value. A change in the fair value of derivatives that are highly effective and that are designated and qualify as cash flow hedges is recorded in other comprehensive income |

(loss). Gains and losses reported in other comprehensive income (loss) are reclassified to earnings in the periods in which earnings are affected by the variability of cash flows of the hedged transaction. Such gains and losses are reported on the same line as the underlying hedged item. Any hedge ineffectiveness (which represents the amount by which the changes in the fair value of the derivative exceed the variability in the cash flows of the forecasted transaction) is recorded in current period earnings. The amount of gains and losses recognized for hedge ineffectiveness was not material to the three and six month periods ended June 30, 2015 and 2014.

The fair value of derivative instruments recorded on the consolidated balance sheets is based upon Level 2 inputs within the corresponding commodity or foreign currency markets. If individual derivative instruments with the same counterparty can be settled on a net basis, the Company records the corresponding derivative fair values as a net asset or net liability.

In the normal course of business, the Company enters into fixed-price forward sales contracts with certain customers for the future sale of fixed quantities of aluminum extrusions at scheduled intervals. In order to hedge the margin exposure created from the fixing of future sales prices relative to volatile raw material (aluminum) costs, the Company enters into a combination of forward purchase commitments and futures contracts to acquire or hedge aluminum, based on the scheduled purchases for the firm sales commitments. The fixed-price firm sales commitments and related hedging instruments generally have durations of not more than 12 months, and the notional amount of aluminum futures contracts that hedged future purchases of aluminum to meet fixed-price forward sales contract obligations was $23.3 million (23.8 million pounds of aluminum) at June 30, 2015 and $8.6 million (7.8 million pounds of aluminum) at December 31, 2014.

The table below summarizes the location and gross amounts of aluminum futures contract fair values in the consolidated balance sheets as of June 30, 2015 and December 31, 2014:

|

| | | | | | | | | | | |

| June 30, 2015 | | December 31, 2014 |

(In Thousands) | Balance Sheet Account | | Fair Value | | Balance Sheet Account | | Fair Value |

Derivatives Designated as Hedging Instruments | | | | | | | |

Asset derivatives:

Aluminum futures contracts | Accrued expenses | | $ | — |

| | Accrued expenses | | $ | 82 |

|

Liability derivatives:

Aluminum futures contracts | Accrued expenses | | $ | (2,836 | ) | | Accrued expenses | | $ | (318 | ) |

| | | | | | | |

Derivatives Not Designated as Hedging Instruments | | | | | | |

Asset derivatives:

Aluminum futures contracts | Accrued expenses | | $ | 29 |

| | Accrued expenses | | $ | 7 |

|

Liability derivatives:

Aluminum futures contracts | Accrued expenses | | $ | (29 | ) | | Accrued expenses | | $ | (7 | ) |

Net asset (liability) | | | $ | (2,836 | ) | | | | $ | (236 | ) |

In the event that the counterparty to an aluminum fixed-price forward sales contract chooses to not take delivery of its aluminum extrusions, the customer is contractually obligated to compensate us for any losses on the related aluminum futures and/or forward purchase contracts through the date of cancellation. The offsetting asset and liability positions for derivatives not designated as hedging instruments are associated with the unwinding of aluminum futures contracts that relate to such cancellations.

Film Products utilized future fixed Euro-denominated contractual payments for equipment being purchased as part of our multi-year capacity expansion project at our film products manufacturing facility in Cabo de Santo Agostinho, Brazil. The Company used fixed-rate Euro forward contracts with various settlement dates to hedge exchange rate exposure on these obligations. The Company did not have any fixed-rate forward contracts with outstanding notional amounts as of June 30, 2015 or December 31, 2014.

These derivative contracts involve elements of market risk that are not reflected on the consolidated balance sheet, including the risk of dealing with counterparties and their ability to meet the terms of the contracts. The counterparties to any forward purchase commitments are major aluminum brokers and suppliers, and the counterparties to any aluminum futures contracts are major financial institutions. Fixed-price forward sales contracts are only made available to the best and most credit-worthy customers. The counterparties to our foreign currency futures and zero-cost collar contracts are major financial institutions.

The effect on net income and other comprehensive income (loss) of derivative instruments classified as cash flow hedges and described in the previous paragraphs for the three and six month periods ended June 30, 2015 and 2014 is summarized in the table below:

|

| | | | | | | | | | | | | | | |

(In Thousands) | Cash Flow Derivative Hedges |

| Aluminum Futures Contracts | | Foreign Currency Forwards |

| Three Months Ended June 30, |

| 2015 | | 2014 | | 2015 | | 2014 |

Amount of pre-tax gain (loss) recognized in other comprehensive income | $ | (2,035 | ) | | $ | 233 |

| | $ | — |

| | $ | (13 | ) |

Location of gain (loss) reclassified from accumulated other comprehensive income into net income (effective portion) | Cost of

sales |

| | Cost of

sales |

| | Cost of

sales |

| | |

Amount of pre-tax gain (loss) reclassified from accumulated other comprehensive income to net income (effective portion) | $ | (481 | ) | | $ | 83 |

| | $ | 16 |

| | $ | — |

|

| Aluminum Futures Contracts | | Foreign Currency Forwards |

| Six Months Ended June 30, |

| 2015 | | 2014 | | 2015 | | 2014 |

Amount of pre-tax gain (loss) recognized in other comprehensive income | $ | (3,129 | ) | | $ | 497 |

| | $ | — |

| | $ | (5 | ) |

Location of gain (loss) reclassified from accumulated other comprehensive income into net income (effective portion) | Cost of

sales |

| | Cost of

sales |

| | Cost of

sales |

| | |

Amount of pre-tax gain (loss) reclassified from accumulated other comprehensive income to net income (effective portion) | $ | (529 | ) | | $ | 46 |

| | $ | 31 |

| | $ | — |

|

As of June 30, 2015, the Company expects $1.8 million of unrealized after-tax losses on derivative instruments reported in accumulated other comprehensive income (loss) to be reclassified to earnings within the next 12 months. For the three and six month periods ended June 30, 2015 and 2014, net gains or losses realized on previously unrealized net gains or losses from hedges that had been discontinued were not significant.

| |

8. | The Company sponsors noncontributory defined benefit (pension) plans covering most employees. The plans for salaried and hourly employees currently in effect are based on a formula using the participant’s years of service and compensation or using the participant’s years of service and a dollar amount. The plan is closed to new participants, and based on plan changes announced in 2006, pay for active plan participants was frozen as of December 31, 2007. Beginning in the first quarter of 2014, with the exception of plan participants at two of Tredegar’s U.S. manufacturing facilities, the plan no longer accrued benefits associated with crediting employees for service, thereby freezing future benefits under the plan. |

The components of net periodic benefit cost for our pension and other post-retirement benefit programs reflected in consolidated results are shown below:

|

| | | | | | | | | | | | | | | |

| Pension Benefits | | Other Post-Retirement Benefits |

| Three Months Ended June 30, | | Three Months Ended June 30, |

(In Thousands) | 2015 | | 2014 | | 2015 | | 2014 |

Service cost | $ | 144 |

| | $ | 105 |

| | $ | 12 |

| | $ | 13 |

|

Interest cost | 3,313 |

| | 3,342 |

| | 83 |

| | 93 |

|

Expected return on plan assets | (4,407 | ) | | (4,558 | ) | | — |

| | — |

|

Amortization of prior service costs, gains or losses and net transition asset | 4,024 |

| | 2,814 |

| | (40 | ) | | (77 | ) |

Net periodic benefit cost | $ | 3,074 |

| | $ | 1,703 |

| | $ | 55 |

| | $ | 29 |

|

| Pension Benefits | | Other Post-Retirement Benefits |

| Six Months Ended June 30, | | Six Months Ended June 30, |

| 2015 | | 2014 | | 2015 | | 2014 |

Service cost | $ | 288 |

| | $ | 649 |

| | $ | 24 |

| | $ | 26 |

|

Interest cost | 6,625 |

| | 6,683 |

| | 167 |

| | 186 |

|

Expected return on plan assets | (8,814 | ) | | (9,116 | ) | | — |

| | — |

|

Amortization of prior service costs, (gains) losses and net transition asset | 8,048 |

| | 5,628 |

| | (80 | ) | | (154 | ) |

Curtailment charge | — |

| | 81 |

| | — |

| | — |

|

Net periodic benefit cost | $ | 6,147 |

| | $ | 3,925 |

| | $ | 111 |

| | $ | 58 |

|

Pension and other post-retirement liabilities were $102.8 million and $104.8 million at June 30, 2015 and December 31, 2014, respectively ($0.6 million included in “Accrued expenses” at June 30, 2015 and December 31, 2014, with the remainder included in “Other noncurrent liabilities” in the consolidated balance sheets). The Company’s required contributions are expected to be approximately $2.4 million in 2015. Tredegar funds its other post-retirement benefits (life insurance and health benefits) on a claims-made basis, which the Company anticipates will be consistent with amounts paid for the year ended December 31, 2014, or $0.3 million.

| |

9. | The Company's business segments are Film Products and Aluminum Extrusions. Information by business segment is reported below. There are no accounting transactions between segments and no allocations to segments. Net sales (sales less freight) and operating profit from ongoing operations are the measures of sales and operating profit used by the chief operating decision maker for purposes of assessing performance. The following table presents net sales and operating profit by segment for the three and six month periods ended June 30, 2015 and 2014: |

|

| | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

(In Thousands) | 2015 | | 2014 | | 2015 | | 2014 |

Net Sales | | | | | | | |

Film Products | $ | 115,299 |

| | $ | 146,016 |

| | $ | 248,500 |

| | $ | 295,176 |

|

Aluminum Extrusions | 98,203 |

| | 84,548 |

| | 191,848 |

| | 163,831 |

|

Total net sales | 213,502 |

| | 230,564 |

| | 440,348 |

| | 459,007 |

|

Add back freight | 7,743 |

| | 6,401 |

| | 15,068 |

| | 13,171 |

|

Sales as shown in the Consolidated Statements of Income | 221,245 |

| | 236,965 |

| | 455,416 |

| | 472,178 |

|

Operating Profit | | | | | | | |

Film Products: | | | | | | | |

Ongoing operations | 6,178 |

| | 14,963 |

| | 23,795 |

| | 31,685 |

|

Plant shutdowns, asset impairments, restructurings and other | (259 | ) | | (10,923 | ) | | (192 | ) | | (12,168 | ) |

Aluminum Extrusions: | | | | | | | |

Ongoing operations | 8,299 |

| | 8,050 |

| | 13,591 |

| | 12,811 |

|

Plant shutdowns, asset impairments, restructurings and other | (18 | ) | | (174 | ) | | (33 | ) | | (174 | ) |

Total | 14,200 |

| | 11,916 |

| | 37,161 |

| | 32,154 |

|

Interest income | 82 |

| | 107 |

| | 171 |

| | 302 |

|

Interest expense | 893 |

| | 531 |

| | 1,778 |

| | 1,161 |

|

Gain (loss) on investment accounted for under fair value method | — |

| | (1,100 | ) | | — |

| | (1,100 | ) |

Gain on sale of investment property | — |

| | 1,208 |

| | — |

| | 1,208 |

|

Stock option-based compensation costs | 198 |

| | 345 |

| | 498 |

| | 586 |

|

Corporate expenses, net | 11,694 |

| | 5,339 |

| | 18,910 |

| | 11,814 |

|

Income before income taxes | 1,497 |

| | 5,916 |

| | 16,146 |

| | 19,003 |

|

Income taxes | 903 |

| | 2,164 |

| | 5,682 |

| | 6,772 |

|

Net income | $ | 594 |

| | $ | 3,752 |

| | $ | 10,464 |

| | $ | 12,231 |

|

The following table presents identifiable assets by segment at June 30, 2015 and December 31, 2014:

|

| | | | | | | |

(In Thousands) | June 30, 2015 | | December 31, 2014 |

Film Products | $ | 506,707 |

| | $ | 546,210 |

|

Aluminum Extrusions | 152,277 |

| | 143,328 |

|

Subtotal | 658,984 |

| | 689,538 |

|

General corporate | 51,600 |

| | 49,032 |

|

Cash and cash equivalents | 47,405 |

| | 50,056 |

|

Total | $ | 757,989 |

| | $ | 788,626 |

|

| |

10. | The effective tax rate in the first six months of 2015 was 35.2% compared to 35.6% in the first six months of 2014. The significant differences between the U.S. federal statutory rate and the effective income tax rate for the six months ended June 30, 2015 and 2014 are as follows: |

|

| | | | | |

| Percent of Income Before Income Taxes |

Six Months Ended June 30, | 2015 | | 2014 |

Income tax expense at federal statutory rate | 35.0 |

| | 35.0 |

|

State taxes, net of federal income tax benefit | 2.1 |

| | 2.0 |

|

Income tax contingency accruals and tax settlements | 2.1 |

| | 1.7 |

|

Non-deductible expenses | 1.0 |

| | 0.2 |

|

Valuation allowance for foreign operating loss carry-forwards | 1.0 |

| | — |

|

Unremitted earnings from foreign operations | 0.5 |

| | 1.0 |

|

Foreign tax incentives | — |

| | (0.5 | ) |

Changes in estimates related to prior year tax provision | (0.4 | ) | | 0.3 |

|

Foreign rate differences | (0.5 | ) | | (0.4 | ) |

Valuation allowance for capital loss carry-forwards | (1.9 | ) | | (1.3 | ) |

Domestic production activities deduction | (3.7 | ) | | (2.3 | ) |

Other | — |

| | (0.1 | ) |

Effective income tax rate | 35.2 |

| | 35.6 |

|

In 2014, the Brazilian federal statutory income tax rate was a composite of 34.0% (25.0% of income tax and 9.0% of social contribution on income). Terphane Holdings, LLC’s (“Terphane”) manufacturing facility in Brazil is the beneficiary of certain income tax incentives that allow for a reduction in the statutory Brazilian federal income tax rate levied on the operating profit of its products. These incentives produced a current effective tax rate of 15.25% for Terphane Ltda. (6.25% of income tax and 9.0% social contribution on income). These incentives expired at the end of 2014. The Company anticipates that it will qualify for additional incentives that extend beyond 2014, but the future benefit will not be recorded until the amount and extent of these incentives are more fully known. The benefit from tax incentives was $0.1 million ($0.00 per share) in the first six months of 2014.

In connection with its capacity expansion project in Brazil, the Company has paid certain social taxes associated with the purchase of machinery and equipment and construction of buildings and other long-term assets. Payments of these taxes in Brazil were included in “Net cash used in investing activities” given the nature of the underlying use of cash (e.g. the purchase of property, plant and equipment). The Company can recover tax credits associated with the purchase of machinery and equipment at different points over a period up to 24 months. Once the machinery and equipment was placed into service, the Company started applying these tax credits against various other taxes due in Brazil, with their recovery being reflected as cash received from investing activities, consistent with the classification of the original payments.

Income taxes in 2015 included a partial reversal of a valuation allowance of $0.3 million related to the expected limitations on the utilization of assumed capital losses on certain investments that were recognized in prior years. Income taxes in 2014 included the partial reversal of a valuation allowance of $0.2 million related to the expected limitations on the utilization of assumed capital losses on certain investments. The Company has a valuation allowance for excess capital losses from investments and other related items of $11.1 million at June 30, 2015. Tredegar continues to evaluate opportunities to utilize these loss carryforwards prior to their expiration at various dates in the future. As events and circumstances warrant, allowances will be reversed when it is more likely than not that future taxable income will exceed deductible amounts, thereby resulting in the realization of deferred tax assets.

Tredegar and its subsidiaries file income tax returns in the U.S., various states and jurisdictions outside the U.S. With few exceptions, Tredegar and its subsidiaries are no longer subject to U.S. federal, state or non-U.S. income tax examinations by tax authorities for years before 2011.

| |

11. | On March 31, 2015, Tredegar entered into Amendment No. 2 (the “Amendment”) to its $350 million five-year, unsecured revolving credit facility (as amended, the “Credit Agreement”) dated as of April 23, 2012. The Amendment removes the negative covenant prohibiting Consolidated Stockholders’ Equity, at any time, to be less than $320 million increased on a cumulative basis at the end of each fiscal quarter, beginning with the fiscal quarter ending March 31, 2012, by an amount equal to 50% of Consolidated Net Income (to the extent positive) for the fiscal quarter then ended. |

| |

12. | Pursuant to the Second Amended and Restated Rights Agreement (the “Rights Agreement”), dated as of November 18, 2013, with Computershare Trust Company, N.A., as Rights Agent, one purchase right (a “Right”) was attached to each outstanding share of the Company’s Common Stock. Each Right entitled the registered holder to purchase from Tredegar one one-hundredth of a share of our Series A Participating Cumulative Preferred Stock (the “Preferred Stock”) at an exercise price of $150, subject to adjustment (the “Purchase Price”). Unless otherwise noted in the Rights Agreement, the Rights would have become exercisable, if not earlier redeemed, only if a person or group (i) acquired beneficial ownership of 20% or more of the outstanding shares of our Common Stock or (ii) commenced, or publicly disclosed an intention to commence, a tender offer or exchange offer that would have resulted in beneficial ownership by a person or group of 20% or more of the outstanding shares of our Common Stock. |

On February 19, 2014, the Company’s Board of Directors authorized the termination of the Rights Agreement and the redemption of all of the outstanding Rights, at a redemption price of $.01 per Right to be paid in cash to shareholders of record as of the close of business on March 3, 2014. The corresponding redemption payment of $0.3 million was made in the first quarter of 2014.

| |

13. | In November 2009, 3M filed a patent infringement complaint in the United States District Court for the District of Minnesota (“Minnesota District Court”) against the Company’s film products business. The complaint alleged infringement upon elastic film technology patents held by 3M and sought unspecified compensatory and enhanced damages associated with our sales of certain elastic film product lines, which include our FabriFlex™ and FlexFeel™ family of products. |

The Company and 3M settled all pending matters between the parties related to the patent infringement lawsuits filed by 3M. While the Company is confident in its position on the issues, because of the inherent risks associated with litigating patent lawsuits and the significant legal expenses expected to be incurred, the Company, without any admission of wrongdoing or fault of any kind, entered into a non-exclusive worldwide license agreement with 3M on June 26, 2014 for certain elastic film products, and on June 30, 2014, made a one-time, lump-sum payment of $10 million to 3M.

In 2011, Tredegar was notified by U.S. Customs and Border Protection (“U.S. Customs”) that certain film products exported by Terphane to the U.S. since November 6, 2008 could be subject to duties associated with an antidumping duty order on imported PET films from Brazil. The Company contested the applicability of these antidumping duties to the films exported by Terphane, and it filed a request with the U.S. Department of Commerce (“Commerce”) for clarification about whether the film products at issue are within the scope of the antidumping duty order. On January 8, 2013, Commerce issued a scope ruling confirming that the films are not subject to the order, provided that Terphane can establish to the satisfaction of U.S. Customs that the performance enhancing layer on those films is greater than 0.00001 inches thick. The films at issue are manufactured to specifications that exceed that threshold. On February 6, 2013, certain U.S. producers of PET film filed a summons with the U.S. Court of International Trade to appeal the scope ruling from Commerce. If U.S. Customs ultimately were to require the collection of anti-dumping duties because Commerce’s scope ruling was overturned on appeal, or otherwise, indemnifications for related liabilities are specifically provided for under the purchase agreement pursuant to which the Company acquired Terphane. In December 2014, the U.S. International Trade Commission voted to revoke the anti-dumping duty order on imported PET films from Brazil. The revocation, as a result of the vote by the U.S. International Trade Commission, was effective as of November 2013. On February 20, 2015, certain U.S. producers of PET Film filed a summons with the U.S. Court of International Trade to appeal the determination by the U.S. International Trade Commission.

| |

14. | In May 2014, the Financial Accounting Standards Board (“FASB”) and International Accounting Standards Board (“IASB”) issued their converged standard on revenue recognition. The revised revenue standard contains principles that an entity will apply to direct the measurement of revenue and timing of when it is recognized. The core principle of the guidance is that the recognition of revenue should depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which an entity expects to be entitled in exchange for those goods and services. To achieve that core principle, an entity will utilize a principle-based five-step approach model. The converged standard also includes more robust disclosure requirements which will require entities to provide sufficient information to enable users of financial statements to understand the nature, amount, timing and uncertainty of revenue and cash flows arising from contracts with customers. In July 2015, the FASB delayed the effective date of this revised standard to annual reporting periods beginning after December 15, 2017, including interim periods within that reporting period. Early application is permitted as of annual reporting periods beginning after December 15, 2016, including interim reporting periods within that annual reporting period. The converged standard can be adopted either retrospectively or through the use of a practical expedient. The Company is still assessing the impact of this new guidance. |

In June 2014, the FASB issued a new standard to eliminate the concept of development stage entities and all related specified presentation and reporting requirements under U.S. GAAP. In addition, the amended standard eliminated the scope exception for development stage entities when evaluating the sufficiency of equity at risk for a variable interest entity (“VIE”), thereby changing consolidation conclusions in some situations. Except for the elimination of the scope exception for development stage entities when evaluating the sufficiency of equity at risk for a VIE, the revised guidance is effective for annual reporting periods beginning after December 15, 2014, including interim periods within that reporting period. The amendments to the consolidation guidance are effective for annual reporting periods beginning after December 15, 2015, including interim periods within that reporting period. The new standard is not expected to impact the Company.

In April 2015, the FASB issued new guidance requiring that debt issuance costs related to a recognized debt liability be presented in the balance sheet as a direct reduction from the carrying amount of that corresponding debt liability, consistent with debt discounts, rather than as a deferred charge (e.g. an asset). The new guidance will be effective for annual reporting periods beginning after December 15, 2015, including interim periods within that reporting period. The guidance requires that all prior period balance sheets be adjusted retrospectively, and early adoption is permitted. The Company expects to adopt the guidance by the first quarter of 2016. Deferred debt issuance costs associated with the Company’s Credit Agreement were $1.0 million and $1.1 million (included in “Other assets and deferred charges” in the consolidated balance sheet) at June 30, 2015 and December 31, 2014, respectively.

In May 2015, the FASB issued new guidance for investments measured at net asset value (“NAV”). Under the new guidance, investments measured at NAV, as a practical expedient for fair value, are excluded from the fair value hierarchy. Removing investments measured using the practical expedient from the fair value hierarchy is intended to eliminate diversity in practice that currently exists with respect to the categorization of these investments. The new guidance is effective for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2015 for public business entities. Early adoption is permitted, including for financial statement periods that have not yet been issued. The Company is currently assessing the impact of this new guidance on its disclosures.

| |

Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations. |

Forward-looking and Cautionary Statements

Some of the information contained in this Quarterly Report on Form 10-Q (“Form 10-Q”) may constitute “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. When using the words “believe,” “estimate,” “anticipate,” “expect,” “project,” “likely,” “may” and similar expressions, Tredegar does so to identify forward-looking statements. Such statements are based on then current expectations and are subject to a number of risks and uncertainties that could cause actual results to differ materially from those addressed in the forward-looking statements. It is possible that actual results and financial condition may differ, possibly materially, from the anticipated results and financial condition indicated in or implied by these forward-looking statements. Accordingly, you should not place undue reliance on these forward-looking statements. Factors that could cause actual results to differ from expectations include, without limitation: acquired businesses, including Terphane Holdings LLC (“Terphane”) and AACOA, Inc. (“AACOA”), may not achieve expected levels of revenue, profit, productivity or otherwise perform as expected; acquisitions, including the acquisitions of Terphane and AACOA, involve special risks, including without limitation, diversion of management’s time and attention to the Company’s existing businesses, the potential assumption of unanticipated liabilities and contingencies and potential difficulties in integrating acquired businesses and achieving anticipated operational improvements; Film Products is highly dependent on sales to one customer — The Procter & Gamble Company (“P&G”) and Film Products may not be able to mitigate the impact of the expected decline in net sales to P&G on operating profit from ongoing operations; growth of Film Products depends on its ability to develop and deliver new products at competitive prices; sales volume and profitability of Aluminum Extrusions are cyclical and highly dependent on economic conditions of end-use markets in the U.S., particularly in the building and construction sector, and are also subject to seasonal slowdowns; Aluminum Extrusions’ efforts to expand product offerings and broaden its customer base may not be successful; substantial international operations subject Tredegar to risks of doing business in countries outside the U.S., which could adversely affect Tredegar’s business, financial condition and results of operations; future performance is influenced by costs incurred by Tredegar’s operating companies, including, for example, the cost of energy and raw materials; and the other factors discussed in the reports Tredegar files with or furnishes to the Securities and Exchange Commission (the “SEC”) from time to time, including the risks and important factors set forth in additional detail in “Risk Factors” in Part I, Item 1A of Tredegar’s 2014 Annual Report on Form 10-K (the “2014 Form 10-K”) filed with the SEC. Readers are urged to review and carefully consider the disclosures Tredegar makes in its filings with the SEC, including the 2014 Form 10-K. Tredegar does not undertake, and expressly disclaims any duty, to update any forward-looking statement to reflect any change in management’s expectations or any change in conditions, assumptions or circumstances on which such statements are based, except as required by applicable law.

References herein to “Tredegar,” “the Company,” “we,” “us” and “our” are to Tredegar Corporation and its subsidiaries, collectively, unless the context otherwise indicates or requires.

Executive Summary

Second-quarter 2015 net income was $0.6 million (2 cents per share) compared with $3.8 million (11 cents per share) in the second quarter of 2014. Net income from continuing operation was $10.5 million (32 cents per share) in first six months of 2015 and $12.2 million (37 cents per share) in the first six months of 2014. Losses related to plant shutdowns, asset impairments, restructurings and other items are described in Note 2 on page 7. Net sales (sales less freight) and operating profit (loss) from ongoing operations are the measures of sales and operating profit used by the chief operating decision maker of each segment for purposes of assessing performance.

On June 26, 2015, Tredegar announced changes in its chief executive and chief financial officers. Prior management had disclosed and updated performance targets for volume, adjusted EBITDA (earnings before interest, taxes, depreciation and amortization) and return on invested capital. Given recent performance, such targets are no longer considered appropriate guidance for future performance. Current management has no immediate plans to provide updated or new performance targets.

The following table presents Tredegar’s net sales and operating profit by segment for the three and six months ended June 30, 2015 and 2014:

|

| | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

(In Thousands) | 2015 | | 2014 | | 2015 | | 2014 |

Net Sales | | | | | | | |

Film Products | $ | 115,299 |

| | $ | 146,016 |

| | $ | 248,500 |

| | $ | 295,176 |

|

Aluminum Extrusions | 98,203 |

| | 84,548 |

| | 191,848 |

| | 163,831 |

|

Total net sales | 213,502 |

| | 230,564 |

| | 440,348 |

| | 459,007 |

|

Add back freight | 7,743 |

| | 6,401 |

| | 15,068 |

| | 13,171 |

|

Sales as shown in the Consolidated Statements of Income | 221,245 |

| | 236,965 |

| | 455,416 |

| | 472,178 |

|

Operating Profit | | | | | | | |

Film Products: | | | | | | | |

Ongoing operations | 6,178 |

| | 14,963 |

| | 23,795 |

| | 31,685 |

|

Plant shutdowns, asset impairments, restructurings and other | (259 | ) | | (10,923 | ) | | (192 | ) | | (12,168 | ) |

Aluminum Extrusions: | | | | | | | |

Ongoing operations | 8,299 |

| | 8,050 |

| | 13,591 |

| | 12,811 |

|

Plant shutdowns, asset impairments, restructurings and other | (18 | ) | | (174 | ) | | (33 | ) | | (174 | ) |

Total | 14,200 |

| | 11,916 |

| | 37,161 |

| | 32,154 |

|

Interest income | 82 |

| | 107 |

| | 171 |

| | 302 |

|

Interest expense | 893 |

| | 531 |

| | 1,778 |

| | 1,161 |

|

Gain (loss) on investment accounted for under fair value method | — |

| | (1,100 | ) | | — |

| | (1,100 | ) |

Gain on sale of investment property | — |

| | 1,208 |

| | — |

| | 1,208 |

|

Stock option-based compensation costs | 198 |

| | 345 |

| | 498 |

| | 586 |

|

Corporate expenses, net | 11,694 |

| | 5,339 |

| | 18,910 |

| | 11,814 |

|

Income before income taxes | 1,497 |

| | 5,916 |

| | 16,146 |

| | 19,003 |

|

Income taxes | 903 |

| | 2,164 |

| | 5,682 |

| | 6,772 |

|

Net income | $ | 594 |

| | $ | 3,752 |

| | $ | 10,464 |

| | $ | 12,231 |

|

Film Products

A summary of operating results from ongoing operations for Film Products is provided below:

|

| | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Favorable/

(Unfavorable)

% Change | | Six Months Ended | | Favorable/

(Unfavorable)

% Change |

| June 30, | | June 30, | |

(In Thousands, Except Percentages) | 2015 | | 2014 | | 2015 | | 2014 | |

Sales volume (pounds) | 56,613 |

| | 60,729 |

| | (6.8 | )% | | 119,316 |

| | 123,352 |

| | (3.3 | )% |

Net sales | $ | 115,299 |

| | $ | 146,016 |

| | (21.0 | )% | | $ | 248,500 |

| | $ | 295,176 |

| | (15.8 | )% |

Operating profit from ongoing operations | $ | 6,178 |

| | $ | 14,963 |

| | (58.7 | )% | | $ | 23,795 |

| | $ | 31,685 |

| | (24.9 | )% |

Second-Quarter Results vs. Prior Year Second Quarter

Net sales (sales less freight) in the second quarter of 2015 decreased by $30.7 million versus 2014 primarily due to:

| |

• | The loss of business to Film Products’ largest customer related to certain babycare elastic laminate films sold in North America (approximately $8.1 million) and to the unfavorable impact of various product transitions in personal care materials (approximately $4.4 million); |

| |

• | Lower net sales for flexible packaging films of approximately $4.0 million, or 14.7%, (despite an increase in volume of 5.5%) due to changes in product mix and competitive pricing pressures driven by continued unfavorable economic conditions in its primary market of Brazil and excess global capacity in the industry; |

| |

• | The unfavorable impact of approximately $7.0 million from the change in the U.S. dollar value of currencies for polyethylene film operations outside of the U.S.; and |

| |

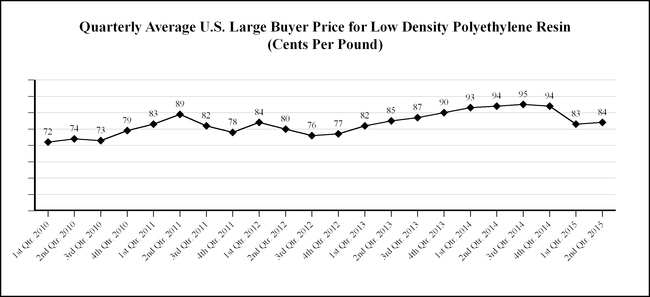

• | Estimated reductions in average selling prices in polyethylene films of approximately $4.3 million primarily due to the contractual pass-through of lower average resin prices. |

Operating profit from ongoing operations in the second quarter of 2015 decreased by $8.8 million in versus 2014 primarily due to:

| |

• | Lower volumes in polyethylene films, primarily in personal care materials from the previously referenced lost business and various product transitions for Film Products’ largest customer, which had an adverse impact of approximately $4.3 million; |

| |

• | An increase in the operating loss from ongoing operations for flexible packaging films to $3.1 million in the second quarter of 2015 versus $1.1 million in 2014; |

| |

• | The estimated unfavorable impact in polyethylene films from the quarterly lag in the pass-through of average resin costs of approximately $1.6 million; and |

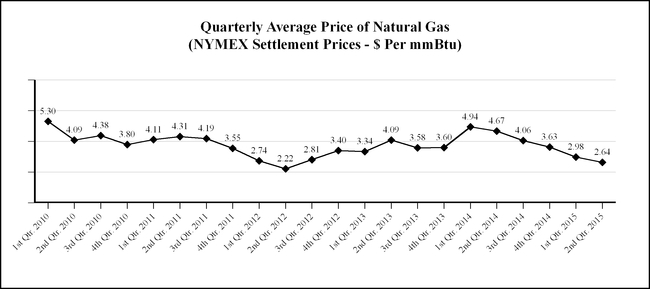

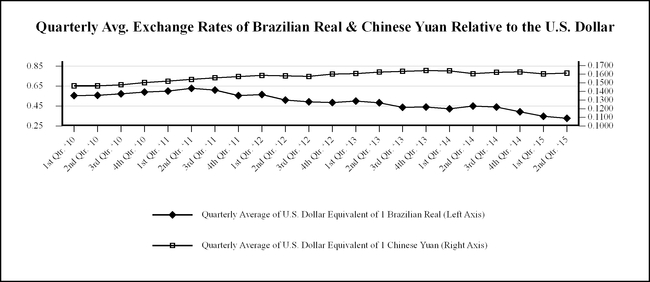

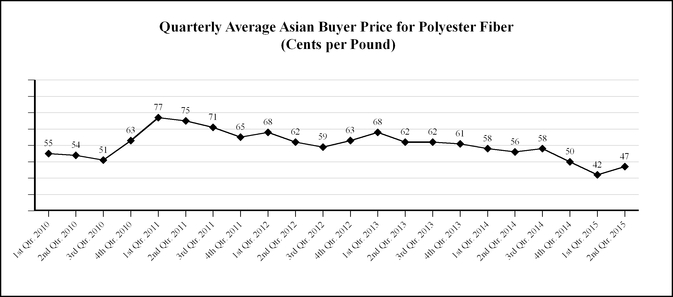

| |