Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended: December 31, 2012

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 000-52228

SORRENTO THERAPEUTICS, INC.

(Exact Name of Registrant as Specified in Its Charter)

| Delaware | 33-0344842 | |

| (State or Other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification No.) | |

| 6042 Cornerstone Ct. West, Suite B San Diego, California |

92121 | |

| (Address of Principal Executive Offices) | (Zip Code) |

(858) 210-3700

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, par value $0.0001 per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ¨ Yes x No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. ¨ Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to the filing requirements for at least the past 90 days. x Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (Section 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). x Yes ¨ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). ¨ Yes x No

The aggregate market value of voting stock held by non-affiliates of the registrant is calculated based upon the closing sale price of the common stock on June 30, 2012 (the last trading day of the registrant’s second fiscal quarter of 2012), as reported on the Over-the-Counter Bulletin Board, and such aggregate market value was approximately $33,667,189.

At March 22, 2013, the registrant had 336,075,440 shares of common stock outstanding.

Table of Contents

SORRENTO THERAPEUTICS, INC.

ANNUAL REPORT ON FORM 10-K

FISCAL YEAR ENDED DECEMBER 31, 2012

| Page No. | ||||||

| 1 | ||||||

| Item 1. |

1 | |||||

| Item 1A. |

11 | |||||

| Item 1B. |

24 | |||||

| Item 2. |

24 | |||||

| Item 3. |

24 | |||||

| Item 4. |

24 | |||||

| 24 | ||||||

| Item 5. |

24 | |||||

| Item 6. |

25 | |||||

| Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

26 | ||||

| Item 7A. |

32 | |||||

| Item 8. |

32 | |||||

| Item 9. |

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

32 | ||||

| Item 9A. |

32 | |||||

| Item 9B. |

33 | |||||

| 33 | ||||||

| Item 10. |

33 | |||||

| Item 11. |

41 | |||||

| Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

46 | ||||

| Item 13. |

Certain Relationships, Related Transactions and Director Independence |

48 | ||||

| Item 14. |

50 | |||||

| Item 15. |

51 | |||||

i

Table of Contents

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K, or Form 10-K, contains “forward-looking statements” that involve risks and uncertainties, as well as assumptions that, if they never materialize or prove incorrect, could cause our results to differ materially and adversely from those expressed or implied by such forward-looking statements. The forward-looking statements are contained principally in Item 1—“Business,” Item 1.A—“Risk Factors” and Item 7—“Management’s Discussion and Analysis of Financial Condition and Results of Operations” but appear throughout the Form 10-K. Examples of forward-looking statements include, but are not limited to our expectations, beliefs or intentions regarding our potential product offerings, business, financial condition, results of operations, strategies or prospects and other matters that do not relate strictly to historical facts or statements of assumptions underlying any of the foregoing. These statements are often identified by the use of words such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “ongoing,” “opportunity,” “plan,” “potential,” “predicts,” “seek,” “should,” “will,” or “would,” and similar expressions and variations or negatives of these words. These forward-looking statements are based on the expectations, estimates, projections, beliefs and assumptions of our management based on information currently available to management, all of which are subject to change. Such forward-looking statements are subject to risks, uncertainties and other factors that are difficult to predict and could cause our actual results and the timing of certain events to differ materially and adversely from future results expressed or implied by such forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those identified below, and those discussed under Item 1.A—“Risk Factors” in this Form 10-K. Furthermore, such forward-looking statements speak only as of the date of this Form 10-K. We undertake no obligation to update or revise publicly any forward-looking statements to reflect events or circumstances after the date of such statements for any reason, except as otherwise required by law.

| Item 1. | Business. |

Overview

We are a development stage biopharmaceutical company engaged in the discovery, development and commercialization of novel, proprietary drug candidates for the treatment of patients suffering from a variety of conditions, including cancer, inflammation, metabolic and infectious diseases. In 2012, we identified and advanced a number of potential drug candidates with the goal of selecting multiple lead products to progress into preclinical development activities in 2013. It is too early to assess which of these candidates, if any, will merit further evaluation in clinical trials. Our proprietary G-MAB® fully-human antibody library platform was designed to facilitate the rapid identification and isolation of highly specific antibody therapeutic product candidates that bind to disease targets appropriate for antibody therapy. Our initial investment in antibody expression and production capabilities enables us to make the product material necessary to conduct preclinical safety and efficacy testing in animal models.

Our therapeutic objective is to develop two classes of antibody drug products: (i) First in Class, or FIC, and/or (ii) Best in Class, or BIC, which may offer greater efficacy and/or fewer adverse events or side effects as compared to existing drugs. Although we intend to retain ownership and control of some product candidates by advancing them further into preclinical development, we will also consider partnerships with pharmaceutical or biopharmaceutical companies in order to balance the risks associated with drug discovery and development and maximize our stockholders’ returns. Our partnering objectives include generating revenue through license fees, milestone-related development fees and royalties by licensing rights to our product candidates.

Recent Development - IgDraSol Transactions

On March 7, 2013, we entered into an exclusive option agreement with IgDraSol, Inc., or IgDraSol, a private company focused on the development of oncologic agents for the treatment of metastatic breast cancer,

1

Table of Contents

which we refer to as MBC, non-small cell lung cancer, which we refer to as NSCLC, and other cancers. Pursuant to the option agreement, IgDraSol granted us an irrevocable option to acquire IgDraSol by means of an agreement and plan of merger. In consideration for entering into the option agreement, IgDraSol is to receive a non-refundable lump sum payment of $200,000. The close of the transaction and the lump sum payment are expected to occur within 51 days of the signing of the option agreement. If we exercise our option to acquire IgDraSol, we will, pursuant to the merger agreement, issue 76,199,198 shares of common stock to IgDraSol stockholders and, upon the achievement of a specified regulatory milestone, we will issue an additional 32,656,799 shares of common stock to former IgDraSol stockholders. If we do not exercise our option to acquire IgDraSol, we will be required to invest $500,000 in IgDraSol pari passu with other new investors of IgDraSol.

IgDraSol’s lead compound, Cynviloq™, is a micellar diblock copolymeric paclitaxel formulation drug product. Cynviloq™ is currently approved and marketed in several countries, including South Korea for MBC and NSCLC under the trade name Genexol-PM®, and has completed Phase 2 testing for potential advancement into registration trials in the U.S. IgDraSol has the exclusive U.S. distribution rights to Cynviloq™ from Samyang Biopharmaceuticals Corporation, a South Korean corporation.

Contemporaneously with the execution of the IgDraSol option agreement, on March 7, 2013, we and IgDraSol entered into an asset purchase agreement pursuant to which we agreed to purchase all documentation, equipment, information and other know-how related to the micellar nanoparticle technology encompassing Tocosol® and related technologies for a purchase price of $1,210,000. The transaction is expected to close within 45 days of the signing of the asset purchase agreement. Upon payment of such purchase price, we and IgDraSol intend to enter into a development services agreement pursuant to which approximately $3,000,000 in development services may be provided by IgDraSol for the development of Tocosol® and related technologies.

We and IgDraSol also entered into an initial services agreement dated March 7, 2013, pursuant to which IgDraSol is to provide certain product development and technology services related to our antibody platform in exchange for a payment of $1,000,000, which was paid to IgDraSol upon signing.

Collectively, the option agreement, asset purchase agreement, initial services agreement and development services agreement are referred to as the “IgDraSol Transactions”.

Corporate Information

On September 21, 2009, QuikByte Software, Inc., a Colorado corporation and shell company, or QuikByte, consummated its acquisition of Sorrento Therapeutics, Inc., a Delaware corporation and private concern, or STI, in a reverse merger, or the Merger. Pursuant to the Merger, all of the issued and outstanding shares of STI common stock were converted into an aggregate of 169,375,807 shares of QuikByte common stock and STI became a wholly owned subsidiary of QuikByte. The holders of QuikByte’s common stock immediately prior to the Merger held an aggregate of 55,708,320 shares of QuikByte’s common stock immediately following the Merger.

STI was originally incorporated as San Diego Antibody Company in California in 2006 and was renamed “Sorrento Therapeutics, Inc.” and reincorporated in Delaware in 2009, prior to the Merger. QuikByte was originally incorporated in Colorado in 1989. Following the Merger, on December 4, 2009, QuikByte reincorporated under the laws of the State of Delaware, or the Reincorporation. Immediately following the Reincorporation, on December 4, 2009, STI merged with and into QuikByte, the separate corporate existence of STI ceased and QuikByte continued as the surviving corporation, or the Roll-Up Merger. Pursuant to the certificate of merger filed in connection with the Roll-Up Merger, QuikByte’s name was changed from “QuikByte Software, Inc.” to “Sorrento Therapeutics, Inc.” We formed Sorrento Therapeutics, Inc. Hong Kong Limited effective December 4, 2012. Sorrento Hong Kong had no operations in 2012.

2

Table of Contents

Background to Antibodies

The Function of Antibodies

The human immune system protects the body against a variety of infections and other illnesses. Specialized cells work together with the other components of the immune system to recognize, neutralize and eliminate from the body numerous foreign substances, infectious organisms and malignant cells.

Antibodies are part of the body’s principal defense mechanism against disease-causing organisms, other foreign molecules and toxins. Antibodies are protein molecules capable of specifically recognizing substances potentially harmful to the human body, known as antigens, and binding to those antigens to neutralize or block them from interacting with and causing damage to the body. Antibodies are capable of recognizing and distinguishing between the subtlest of molecular differences in antigens. Antibodies that bind tightly to antigens are said to have “high affinity.”

Antibodies are naturally present in the blood and circulate for extended periods in order to perform their surveillance and defense functions. Antibodies are made in the immune system by human white blood cells, called leukocytes. Human leukocytes produce millions of different types of antibodies, all with varying shapes that allow them to specifically attach to and, as a result, neutralize different disease targets. For example, certain antibodies seek out and attach to viruses, bacteria and diseased cells, marking them for destruction by the human immune system. Others attach to specific disease targets and block their interaction with other molecules or can be used to deliver toxic agents to directly kill cancer cells.

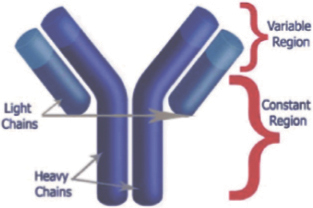

As depicted below, the basic structure of an antibody comprises four polypeptides of two different sizes, two identical light chains and two identical heavy chains, named according to their relative size. The heavy and light chains are assembled within the white blood cell to form an antibody molecule. Each chain has a variable region, which contains the binding site for an antigen and gives the antibody its high specificity, and a constant region, which interacts with other parts of the immune system to facilitate the removal of the pathogen or foreign molecule. The genetic code determining the structure of a given variable region is referred to as immunoglobulin variable domain sequence.

The repertoire of antibodies the body uses to defend itself is produced, in part, through random recombination of genes for the variable regions, as well as random pairing of the heavy and light chains. As a result, the immune system is able to adapt and produce antibodies against virtually any antigen. When an antibody encounters an antigen to which it binds, the white blood cell which produces this specific antibody proliferates to generate more antibodies against the target antigen. White blood cells that have differentiated to produce a specific antibody are called B lymphocytes.

3

Table of Contents

Antibodies as Products

Recent advances in the technologies for creating and producing antibody products, coupled with a better understanding of how antibodies and the immune system function, have further increased the already significant interest in the commercial development of antibodies as therapeutic products in key disease states.

We believe that, as products, antibodies have several potential clinical and commercial advantages over traditional therapies, including small molecule drugs and surgery. These advantages may include the following:

| • | fewer unwanted and uncomfortable side effects as a result of high specificity for the disease target; |

| • | greater patient compliance (use) as a result of more favorable pharmacokinetics over traditional therapies, including better absorption, distribution, metabolism and excretion; |

| • | enhanced ability to deliver various payloads, including drugs, radiation and toxins, to specific disease sites while avoiding surrounding (healthy) tissues; |

| • | reduced risk of failure while developing biobetter antibody therapeutics, since these antibodies target the same antigens as the existing, approved antibodies, yet are designed to deliver significant improvements, such as better dosing, fewer side effects and increased efficacy; and |

| • | overall lower cost of clinical development for the biobetter antibody therapeutic candidates. |

Monoclonal and Chimeric/Humanized Antibodies

The therapeutic antibodies marketed today generally belong to a class of molecules known as “monoclonal antibodies”, or mAbs. This term is used to refer to a homogeneous population of antibody molecules that are identical in their structure and functional characteristics. Historically, the approach to generating monoclonal antibodies has been to immortalize single antibody-producing white blood cells from mice, so that the cells are capable of reproducing over an indefinite period of time. Any of these immortalized, fused cells, known as hybridomas, can be made to produce one specific antibody with desired binding characteristics. The hybridomas can then be selected, cloned and expanded, allowing the large scale production of a murine mAb, or mouse antibody.

However, mouse antibodies are wholly composed of mouse protein sequences and tend to be recognized as “foreign” by the human immune system. When patients are repeatedly treated with mouse antibodies, they will begin to produce antibodies that effectively neutralize the mouse antibody, a reaction referred to as a Human Anti-Mouse Antibody, or HAMA, response. In many cases, the HAMA response prevents the mouse antibodies from having the desired therapeutic effect and may cause the patient to have an allergic reaction.

Recognizing the limitations of mouse mAbs, researchers have developed a number of approaches to make them appear more “human-like” to a patient’s immune system. For example, improved forms of mouse antibodies, referred to as “chimeric” and “humanized” antibodies, are genetically engineered and assembled from portions of mouse and human antibody gene fragments. While these chimeric and humanized antibodies are more human-like, they still retain a varying amount of the mouse antibody protein sequence, and accordingly may continue to trigger a HAMA response. Additionally, the chimeric/humanization process can be expensive and time-consuming, often requiring additional weeks or months of secondary manipulation after the initial generation of the mouse mAbs.

Human Antibodies

The probability of inducing a HAMA response can be reduced through the generation of antibody therapeutic products with fully-human protein sequences. Researchers have developed several antibody technologies to produce antibodies with 100% or fully-human protein sequences. One approach to generating human antibodies, known as “antibody display” technology, involves cloning and expressing human antibody

4

Table of Contents

genes in novel contexts, such as bacteriophages, which are viruses that infect bacteria, yeast or ribosome/mRNA complexes, in order to display libraries of antibody fragments for subsequent in vitro selection against antigens. Ribosomes are intracellular organelles that synthesize proteins. The information for the sequence of amino acids used to synthesize a given protein comes from the mRNA sequence, which is “read” by the ribosome. A ribosome/mRNA complex is mRNA attached to a ribosome for translation into a protein. Our proprietary technology, or the STI Technology, and the Winter II Technology discussed below are both antibody display technologies.

Another approach to develop human antibodies, called “human mouse technology”, is based on genetically-engineered strains of mice in which the attempt has been made to inactivate mouse antibody gene expression and to functionally replace it with human antibody gene expression. The so-called human mouse can be immunized with an antigen of interest, and if, after some time, which is often many months, a sufficient immune response has taken place, human antibody candidates may be obtained.

An additional approach involves the clonal isolation and expansion of human B-lymphocytes. This approach is generally limited to creating antibodies only to non-human antigens or antigens to which the lymphocyte donor had previously responded. Accordingly, it may not be suitable for targeting many key diseases, such as cancer and inflammatory and autoimmune disorders, for which appropriate therapy might require antibodies to human antigens.

Proprietary Human Antibody Library Technology

We believe the STI Technology is a significant improvement over traditional technologies used to construct large human antibody libraries. STI has the ability to produce fully-human antibody libraries of far greater diversity (that is, the number of different antibody species) and single-class libraries, such as Immunoglobulin G (IgG) for therapeutic antibodies or Immunoglobulin A (IgA) for anti-infective secretory antibodies. It is this dual advantage of high diversity and single class libraries that provides STI with what we believe is the premier antibody library asset in the industry. The fact that STI has generated a proprietary portfolio of fully-human antibody preclinical candidates, as both FIC and biobetters, provides evidence that the STI Technology is a formidable tool for discovering proprietary preclinical candidates.

The STI Technology was initially invented by Henry Ji, Ph.D., STI’s co-founder, Chief Executive Officer and President. A U.S. patent covering the STI Technology was issued in July 2008 and additional patent application families for the generation, display and screening of antibody libraries are pending. We also recently filed a group of patent applications covering significant improvements to the initial STI Technology, with the key improvements relating to what we believe is our ability to achieve greater library diversity and single-class libraries.

A traditional technology for the construction of human antibody libraries is the so-called “Winter II Technology”, developed by the Medical Research Council, at Cambridge, UK, The Scripps Research Institute in La Jolla, CA, or TSRI, and Stratagene, Inc. in La Jolla, CA. The Winter II Technology is a process to generate human antibody libraries via amplification of the variable regions of the heavy and light chains of human immunoglobulin genes obtained from human blood samples, followed by cloning and expression in a display system. The Winter II Technology process is covered by U.S. patents that begin to expire in 2018. We believe that the STI proprietary libraries do not follow the Winter II patents.

Our Technology Advantages

We believe the STI Technology may offer the following advantages over competing technologies:

| • | The STI Technology has been designed to provide the full spectrum of human immunoglobulin gene recombination in fully-human mAb libraries. Unlike chimeric and humanization technologies, the STI Technology has allowed the generation of antibodies with fully-human protein sequences without the challenges and limitations of animal-to-human gene transfer procedures. |

5

Table of Contents

| • | Because the STI Technology represents an in vitro human mAb library technology, it enables fast and cost-effective in vitro screening of a large number of antigens. The STI Technology is designed so that any antigen of interest can be investigated, without dependence on the successful induction of a host immune response against the antigen. As opposed to the human-mouse technology, the STI Technology does not require the establishment and maintenance of large animal facilities, which are quite costly to establish and maintain. In addition, a given human antigen may not induce an immune response in mice. In such cases, the “human-mouse” technology appears to be less suitable for delivering human antibody development candidates. |

In addition, we believe that our platform offers advantages over competing platforms, as we are an independent, development stage biotechnology company and, except for our limited license agreement with OPKO Health, Inc., or OPKO, as detailed below, we are not a party to agreements that restrict our right to enter into collaborative arrangements with third parties.

Competition

We compete in an industry characterized by intense competition and rapid technological change. We face, and will continue to face, competition in both the discovery and development of any of our product candidates. New discoveries and developments occur and are expected to continue to occur at a rapid pace. There are many companies, including major pharmaceutical and specialized biotechnology companies, engaged in activities similar to ours. Universities, governmental agencies and other public and private research organizations also conduct research and may market commercial products on their own or through joint ventures.

Many of these entities are significantly larger and have greater financial resources, technical staff, manufacturing, research and development resources, including personnel and technology, expertise in prosecution and enforcement of intellectual property rights and marketing capabilities than us, and many have significant experience in preclinical testing, human clinical trials, product manufacturing, marketing, sales and distribution and other regulatory approval and commercial procedures. They may also have a greater number of patents and greater legal resources to seek remedies for cases of alleged infringement of their patents, which may have the effect of blocking, delaying or compromising our own drug development process.

A number of biotechnology and pharmaceutical companies are developing new products for the treatment of the same diseases being targeted by us; in some instances, these products have already entered clinical trials or are already being marketed. Discoveries or commercial developments by our competitors may render some or all of our technologies or potential products obsolete or non-competitive.

Our Strategy

Our objective is to, either independently or through one or more partnerships with pharmaceutical or biopharmaceutical organizations, identify drug development candidates derived from our antibody libraries. In the event we are successful in identifying drug development candidates, we intend to actively seek partners with experience and expertise in antibody drug development for clinical development of these candidates. Our partnering objectives include generating revenue through license fees, milestone-related development fees and royalties by licensing rights to our development candidates. Key elements of our strategy are:

| • | Screening therapeutically/commercially attractive antigens. Utilizing the STI Technology, we have been and intend to continue screening clinically attractive antigens in the areas of infectious diseases, cancer, cardiovascular, or autoimmune and inflammatory diseases against our antibody libraries with the goal of identifying high quality, functional antibodies. We believe these antibodies represent potential novel and/or proprietary drug development candidates. The isolated human antibodies selected for respective antigens have been and will be subjected to further biochemical characterization and functional testing, such as binding affinity, specificity and kinetics, cellular functionality and |

6

Table of Contents

| animal model testing. The majority of the isolated human antibodies have and may undergo further optimization, applying for example in vitro maturation or molecular evolution to improve their affinity and specificity. |

| • | Establishing partnerships to enhance development efficiency. We intend to minimize technology risk and optimize development efficiency. For biobetter product candidates, the clinical development program established by the FIC provider is a significant advantage, as it represents a development strategy that has been shown to be successful. For FIC products, we expect to seek partnerships with biopharmaceutical companies with experience and expertise in the clinical indications under consideration for any drug candidates we develop. |

See the section entitled “Risk Factors” in this Form 10-K for a discussion of some of the risks relating to the execution of our business strategy.

Intellectual Property

The STI Technology is an antibody library generation technology that we believe represents a significant improvement over the traditional Winter II Technology. The STI Technology was initially invented by Henry Ji, Ph.D., STI’s co-founder and our Chief Executive Officer and President, and assigned to us by Dr. Ji.

A U.S. patent covering the STI Technology was issued in July 2008 and additional patent application families for the generation, display and screening of antibody libraries are pending. We also recently filed a group of patent applications covering significant improvements to the initial STI Technology, with the key improvements relating to what we believe is our ability to achieve greater library diversity and single-class libraries.

We rely on patents, trade secrets and proprietary know-how to protect our intellectual property rights. We plan to diligently prosecute and defend our patents and proprietary technology.

License Agreement with OPKO Health, Inc.

In June 2009, we entered into a limited license agreement, or the OPKO License, with OPKO pursuant to which we granted OPKO an exclusive, royalty-free, worldwide license under all U.S. and foreign patents and patent applications owned or controlled by us or any of our affiliates, or the STI Patents, to (i) develop, manufacture, use, market, sell, offer to sell, import and export certain products related to the development, manufacture, marketing and sale of drugs for ophthalmological indications, or the OPKO Field, and (ii) use and screen any population of distinct molecules covered by any claim of the STI Patents or which is derived by use of any process or method covered by any claim of the STI Patents to identify, select and commercialize certain products within the OPKO Field. Subject to certain limitations, OPKO will have the right to sublicense the foregoing rights granted under the OPKO License. Additionally, pursuant to the OPKO License, OPKO has granted us an exclusive, royalty-free, worldwide license to any patent or patent application owned or controlled by OPKO or any of its affiliates, or the OPKO Patents, to develop, use, make, market, sell and distribute certain products in any field of use, other than the OPKO Field, or the STI Field.

We have retained all rights in the STI Patents outside of the OPKO Field and we have agreed not to practice the OPKO Patents or the STI Patents outside the STI Field. Unless otherwise terminated in accordance with its terms, the License Agreement will expire upon the expiration of the last to expire patent within the STI Patents and OPKO Patents on a country-by-country basis.

License Agreement with The Scripps Research Institute

In January 2010, we entered into a license agreement, or the TSRI License, with TSRI. Under the TSRI License, TSRI granted us an exclusive, worldwide license to certain TSRI patent rights and materials based on

7

Table of Contents

quorum sensing for the prevention and treatment of Staphylococcus aureus, or Staph, infections, including Methicillin-resistant Staph, or MRSA. In consideration for the license, we issued TSRI a warrant for the purchase of common stock, and agreed to pay TSRI a nominal annual royalty, a running royalty based on any sales of licensed products by us or our affiliates and a royalty for any revenues generated by us through our sublicense of patent rights and materials licensed from TSRI under the TSRI License. The TSRI License requires us to indemnify TSRI for certain breaches of the agreement and other matters customary for license agreements. The parties may terminate the TSRI License at any time by mutual agreement. In addition, we may terminate the TSRI License by giving 60 days notice to TSRI and TSRI may terminate the TSRI License immediately in the event of certain breaches of the agreement by us or upon our failure to undertake certain activities in furtherance of commercial development goals. Unless terminated by us or TSRI, the term of the TSRI License will continue until the final expiration of all claims covered by the patent rights licensed by us under the agreement.

Collaboration Agreement

In July 2010, we entered into a feasibility study agreement, or the Collaboration Agreement, with a third party. Under the terms of the Collaboration Agreement, we provided certain antibody screening services for an upfront cash fee of $200,000 and were reimbursed $23,453 for certain costs and expenses associated with providing the services. We completed the screening services in March 2011.

Clinical Development

We currently focus our efforts primarily in the identification and isolation of human antibody drug candidates and further characterize these antibody candidates in in vitro and in vivo functional testing. Due to our limited financial resources, we intend to actively seek product development and commercialization partners from the biopharmaceuticals industry to help us advance in the clinical development of select product candidates.

Manufacturing, Marketing and Sales

We currently do not have any clinical or commercial manufacturing or sales capabilities. We may or may not manufacture the products we develop, if any. We intend to license to, or enter into strategic alliances with, larger companies in the biopharmaceutical businesses, which are equipped to manufacture, market and/or sell our products, if any, through their well-developed manufacturing capabilities and distribution networks. We intend to license some or all of our worldwide patent rights to more than one third party to achieve the fullest development, marketing and distribution of any products we develop.

Government Regulation

U.S. Regulations

We are further developing our internally discovered product candidates. The U.S. Food and Drug Administration, or FDA, regulates, among other things, the development, testing, manufacture, safety, efficacy, record-keeping, labeling, storage, approval, advertising, promotion, sale and distribution of biopharmaceutical products. Specifically, government authorities in the U.S., at the federal, state, and local level, and foreign countries extensively regulate, among other things, the following areas relating to products and product candidates labeled for use in humans:

| • | research and development; |

| • | testing, manufacture, labeling and distribution; |

| • | advertising, promotion, sampling and marketing; and |

| • | import and export. |

In particular, human therapeutic products are subject to rigorous preclinical and clinical trials to demonstrate safety and efficacy and other approval procedures of the FDA and similar regulatory authorities in foreign

8

Table of Contents

countries. Clinical trial programs in humans generally follow a three-phase process. Various federal, state, local, and foreign statutes and regulations also govern testing, manufacturing, labeling, distribution, storage and record-keeping related to such products and their promotion and marketing. The process of obtaining these approvals and the compliance with federal, state, local, and foreign statutes and regulations require the expenditure of substantial time and financial resources. In addition, the current regulatory and political environment at FDA could lead to increased testing and data requirements which could impact regulatory timelines and costs.

Clinical trials involve the administration of the investigational product to healthy volunteers or to patients, under the supervision of qualified principal investigators. Each clinical study at each clinical site must be reviewed and approved by an independent institutional review board prior to the recruitment of subjects.

Clinical trials are typically conducted in three sequential phases, but the phases may overlap and different trials may be initiated with the same drug candidate within the same phase of development in similar or differing patient populations. Phase 1 studies may be conducted in a limited number of patients, but are usually conducted in healthy volunteer subjects. The drug is usually tested for safety and, as appropriate, for absorption, metabolism, distribution, excretion, pharmaco-dynamics and pharmaco-kinetics.

Phase 2 usually involves studies in a larger, but still limited patient population to evaluate preliminarily the efficacy of the drug candidate for specific, targeted indications, to determine dosage tolerance and optimal dosage and to identify possible short-term adverse effects and safety risks.

Phase 3 trials are undertaken to further evaluate clinical efficacy of a specific endpoint and to test further for safety within an expanded patient population at geographically dispersed clinical study sites.

The results generated from the preclinical studies and clinical trials, together with other detailed information, including information on the manufacture and composition of the product, are submitted to the FDA as part of a Biologics License Application, or BLA, requesting approval to market the product candidate. Under the Prescription Drug User Fee Act, as amended, the fees payable to the FDA for reviewing a BLA, as well as annual fees for commercial manufacturing establishments and for approved products, can be substantial. Each BLA submitted to the FDA for approval is typically reviewed for administrative completeness and reviewability within 45 to 60 days following submission of the application. If determined to be complete, the FDA will “file” the BLA, thus triggering a full review of the application. The FDA may refuse to file any BLA that it deems incomplete or not properly reviewable. The FDA’s established goals for the review of a BLA are six months for Priority applications and 10 months for Standard applications, whereupon a review decision is to be made. The FDA, however, may not approve a drug within these established goals and its review goals are subject to change from time to time. Further, the outcome of the review, even if generally favorable, may not be an actual approval but an “action letter” that describes additional work that must be done before the application can be approved.

Before approving a BLA, the FDA may inspect the facilities at which the product is manufactured and will not approve the product unless current Good Manufacturing Practices, or cGMP, compliance is satisfactory. The FDA may deny approval of a BLA if applicable statutory or regulatory criteria are not satisfied, or may require additional testing or information, which can delay the approval process. FDA approval of any application may include many delays or never be granted. If a product is approved, the approval will impose limitations on the indicated uses for which the product may be marketed, may require that warning statements be included in the product labeling, and may require that additional studies be conducted following approval as a condition of the approval, may impose restrictions and conditions on product distribution, prescribing or dispensing in the form of a risk management plan, or otherwise limit the scope of any approval. To market a product for other indicated uses, or to make certain manufacturing or other changes, requires FDA review and approval of a BLA Supplement or new BLA. Further post-marketing testing and surveillance to monitor the safety or efficacy of a product is required. Also, product approvals may be withdrawn if compliance with regulatory standards is not maintained or if safety or manufacturing problems occur following initial marketing. In addition, new government requirements may be established that could delay or prevent regulatory approval of our product candidates under development.

9

Table of Contents

Both before and after the FDA approves a product, the manufacturer and the holder or holders of the BLA for the product are subject to comprehensive regulatory oversight. For example, quality control and manufacturing procedures must conform to cGMP requirements, and the FDA periodically inspects manufacturing facilities to assess compliance with cGMP. Accordingly, manufacturers must continue to spend time, money and effort to maintain cGMP compliance.

Foreign Regulations

In addition to regulations in the U.S., we are subject to a variety of foreign regulatory requirements governing human clinical trials and marketing approval for drug products. The foreign regulatory approval process includes substantially all of the risks associated with FDA approval set forth above, as well as additional country-specific regulations. Whether or not we obtain FDA approval for a product, we must obtain approval of a product by the comparable regulatory authorities of foreign countries before we can commence clinical trials or marketing of the product in those countries. The approval process varies from country to country, and the time may be longer or shorter than that required for FDA approval. The requirements governing the conduct of clinical trials, product licensing, pricing and reimbursement vary greatly from country to country.

There can be no assurance that in the event we seek to develop any product candidate, we or any of our partners would be able to satisfy one or more of these requirements to conduct preclinical or clinical trials or receive any regulatory approvals.

Third-Party Reimbursement and Pricing Controls

In order to raise sufficient financial resources to continue to advance our product candidates, we will need to address pricing pressures and potential third-party reimbursement coverage for our product candidates. In the U.S. and elsewhere, sales of pharmaceutical products depend in significant part on the availability of reimbursement to the consumer from third-party payors, such as government and private insurance plans. Third-party payors are increasingly challenging the prices charged for medical products and services. It is and will continue to be time-consuming and expensive for us or our strategic collaborators to go through the process of seeking reimbursement from Medicare and private payors. Our products may not be considered cost effective, and coverage and reimbursement may not be available or sufficient to allow us to sell our products on a competitive and profitable basis.

In many foreign markets, including the countries in the European Union, pricing of pharmaceutical products is subject to governmental control. In the U.S., there have been, and we expect that there will continue to be, a number of federal and state proposals to implement similar governmental pricing control.

Employees

As of December 31, 2012, we had 18 employees and 13 consultants and advisors. A significant number of our management and our other employees and consultants have worked or consulted with pharmaceutical, biotechnology or medical product companies. While we have been successful in attracting skilled and experienced scientific personnel, there can be no assurance that we will be able to attract or retain the necessary qualified employees and/or consultants in the future. None of our employees are covered by collective bargaining agreements and we consider relations with our employees to be good.

Research and Development

Our research and development expenses totaled $3,830,404 and $2,570,406 in the years ended December 31, 2012 and 2011, respectively.

Address

Our principal executive offices are located at 6042 Cornerstone Ct. West, Suite B, San Diego, CA 92121, and our telephone number at that address is (858) 210-3700. Our website is www.sorrentotherapeutics.com. The contents of our website are not part of this Form 10-K.

10

Table of Contents

Available Information

We file electronically with the U.S. Securities and Exchange Commission, or SEC, our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to reports filed pursuant to Section 13(a) and 15(d) of the Securities Exchange Act of 1934, as amended. We make available on our website at www.sorrentotherapeutics.com, free of charge, copies of these reports, as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. Copies of our annual report will also be made available, free of charge, upon written request.

The public may read and copy any materials filed by us with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC at http://www.sec.gov. The contents of these websites are not incorporated into this filing. Further, our references to the URLs for these websites are intended to be inactive textual references only.

| Item 1A. | Risk Factors. |

Risks Related to Our Business

We are a development stage company subject to all of the risks and uncertainties of a new business, including the risk that we or our partners may never develop or market any products or generate product related revenues. We have incurred significant losses since our inception and anticipate that we will continue to incur losses for the foreseeable future. We are currently unprofitable and cannot assure you that we will ever become or remain profitable.

We are a development-stage biopharmaceutical company that began operating and commenced research and development activities in 2009. Biopharmaceutical product development is a highly speculative undertaking and involves a substantial degree of risk. There is no assurance that our libraries of fully-human mAbs will be suitable for research, diagnostic or therapeutic use, or that we will be able to identify and isolate therapeutics product candidates, or develop, market and commercialize these candidates. We do not expect any of our product candidates to be commercially available for a number of years, if at all. Even if we are able to commercialize our product candidates, there is no assurance that these candidates would generate revenues or that any revenues generated would be sufficient for us to become profitable or thereafter maintain profitability.

We have not generated any product related revenues to date, and we do not expect to generate any such revenues for a number of years. Additionally, we have incurred operating losses since our inception and we expect to continue to incur significant operating losses for the foreseeable future. For the years ended December 31, 2012 and 2011, we had net losses of $4.8 million and $3.2 million, respectively. As of December 31, 2012, we had an accumulated deficit of $11.0 million. We also expect to continue to incur significant operating expenditures in the foreseeable future as we expand our research and development activities and seek to develop our technologies and product candidates. In the event that our operating losses are greater than anticipated or continue for longer than anticipated, we will need to raise significant additional capital sooner, or in greater amounts, than otherwise anticipated in order to be able to continue development of our technologies and maintain our operations. We cannot be certain that additional funding will be available on acceptable terms, or at all. If we are unable to raise additional capital in sufficient amounts or on terms acceptable to us we may have to significantly delay, scale back or discontinue the ongoing discovery and development of our product candidates. Any of these events could significantly harm our business, financial condition and prospects.

11

Table of Contents

We expect that we will require additional financing, and an inability to raise the necessary capital or to do so on acceptable terms would threaten the success of our business.

We believe that our current cash and cash equivalents balances will not be sufficient to meet our operating and capital requirements, as currently planned, for at least one year. Our future capital requirements will depend on many factors, including:

| • | the progress of the development of our core technology and product candidates; |

| • | the number of product candidates we pursue; |

| • | the time and costs involved in obtaining regulatory approvals; |

| • | the costs involved in filing and prosecuting patent applications and enforcing or defending patent claims; |

| • | our plans to establish sales, marketing and/or manufacturing capabilities; |

| • | our ability to establish, enforce and maintain selected strategic alliances and activities required for product commercialization; and |

| • | our revenues, if any, from successful development and commercialization of our product candidates. |

In order to carry out our business plan and implement our strategy, including the continued development of antibody libraries and the continued development of our pipeline of product candidates in both the FIC and biobetter market segments, we anticipate that we will need to obtain additional financing from time to time and may choose to raise additional funds through strategic collaborations, licensing arrangements, public or private equity or debt financing, a bank line of credit, asset sales, government grants, or other arrangements. We cannot be sure that any additional funding, if needed, will be available on terms favorable to us or at all. Furthermore, any additional equity or equity-related financing may be dilutive to our stockholders, and debt or equity financing, if available, may subject us to restrictive covenants and significant interest costs. If we obtain funding through a strategic collaboration or licensing arrangement, we may be required to relinquish our rights to certain of our product candidates or marketing territories.

In its report on our consolidated financial statements for the year ended December 31, 2012, our independent registered public accounting firm included an explanatory paragraph expressing substantial doubt regarding our ability to continue as a going concern. A “going concern” opinion means, in general, that our independent registered public accounting firm has substantial doubt about our ability to continue our operations without continuing infusions of capital from external sources and this opinion could impair our ability to finance our operations through the sale of debt or equity securities or commercial bank loans.

Further, the NIH has notified all grant recipients that due to the current Congressional budget sequestration, the NIH may not be able to issue continuation awards, or it may be required to negotiate a reduction in the scope of existing awards to meet the constraints imposed. Additionally, plans for new grants or cooperative agreements may be re-scoped, delayed, or canceled depending on the nature of the work and the availability of resources. As a result, we cannot assure you that we will receive the funding under our existing NIH grants, and we may not be successful in securing additional grants from the NIH in the future.

In addition, certain investors, including institutional investors, may be unwilling to invest in our securities since we are traded on the Over-the-Counter Bulletin Board, or OTCBB, and not on a national securities exchange. Our inability to raise capital when needed would harm our business, financial condition and results of operations, and could cause our stock price to decline or require that we wind down our operations altogether.

We have a limited operating history upon which to base an investment decision and we may be unable to successfully develop our technology or any product candidates.

We are a development stage company and have not demonstrated our ability to perform the functions necessary for the successful development or commercialization of the technology we are seeking to develop.

12

Table of Contents

Because we only recently commenced operations, we have a limited operating history upon which you can evaluate our business and prospects. In addition, as an early stage company, we have limited experience and have not yet demonstrated an ability to successfully overcome many of the risks and uncertainties frequently encountered by companies in new and rapidly evolving fields, particularly in the biopharmaceutical area.

The successful development, and any commercialization, of our technology and any product candidates would require us to successfully perform a variety of functions, including:

| • | developing our technology platform; |

| • | identifying, developing, manufacturing and commercializing product candidates; |

| • | entering into successful licensing and other arrangements with product development partners; |

| • | participating in regulatory approval processes; |

| • | formulating and manufacturing products; and |

| • | conducting sales and marketing activities. |

Our operations have been limited to organizing our company, acquiring, developing and securing our proprietary technology and identifying and obtaining early preclinical data for various product candidates. These operations provide a limited basis for you to assess our ability to continue to develop our technology, identify product candidates, develop and commercialize any product candidates we are able to identify and enter into successful collaborative arrangements with other companies, as well as for you to assess the advisability of investing in our securities. Each of these requirements will require substantial time, effort and financial resources.

Our potential product candidates are in early stages of development and any product candidates that we develop will require extensive preclinical and clinical testing before they are approved by the appropriate regulatory agency, if at all.

The FDA regulates, among other things, the development, testing, manufacture, safety, efficacy, record-keeping, labeling, storage, approval, advertising, promotion, sale and distribution of biopharmaceutical products. We are in the early stages of developing potential product candidates, and any candidates that we develop will require extensive preclinical and clinical testing before they will be approved by the FDA or another regulatory authority in a jurisdiction outside the U.S., if at all. We have not yet developed any product candidate; if we were to do so there are a number of requirements that we would be required to satisfy in order to begin conducting preclinical trials and there can be no assurance that we will develop product candidates or complete the steps necessary to allow us to commence these trials. We cannot predict with any certainty the results of preclinical testing or whether such trials would yield sufficient data to permit us, or those with whom we collaborate, to proceed with clinical development and ultimately submit an application for regulatory approval of our product candidates in the U.S. or abroad, or whether such applications would be approved by the appropriate regulatory agency. Further, our product candidates may not receive regulatory approval even if they are successful in clinical trials. If we do not receive regulatory approvals for our product candidates, we may not be able to continue our operations.

Our product development efforts may not be successful.

Our product development efforts for our FIC therapeutic antibodies are designed to focus on novel therapeutic approaches and technologies that have not been widely studied. We are applying these approaches and technologies in our attempt to discover new treatments for conditions that are also the subject of research and development efforts of many other companies. These approaches and technologies may never be successful.

13

Table of Contents

Our failure to find third party collaborators to assist or share in the costs of product development could materially harm our business, financial condition and results of operations.

Our strategy for the development and commercialization of our proprietary product candidates may include the formation of collaborative arrangements with third parties. Potential third parties include biopharmaceutical, pharmaceutical and biotechnology companies, academic institutions and other entities. Third-party collaborators may assist us in:

| • | funding research, preclinical development, clinical trials and manufacturing; |

| • | seeking and obtaining regulatory approvals; and |

| • | successfully commercializing any future product candidates. |

If we are not able to establish further collaboration agreements, we may be required to undertake product development and commercialization at our own expense. Such an undertaking may limit the number of product candidates that we will be able to develop, significantly increase our capital requirements and place additional strain on our internal resources. Our failure to enter into additional collaborations could materially harm our business, financial condition and results of operations.

In addition, our dependence on licensing, collaboration and other agreements with third parties may subject us to a number of risks. These agreements may not be on terms that prove favorable to us and may require us to relinquish certain rights in our product candidates. To the extent we agree to work exclusively with one collaborator in a given area, our opportunities to collaborate with other entities could be curtailed. Lengthy negotiations with potential new collaborators may lead to delays in the research, development or commercialization of product candidates. The decision by our collaborators to pursue alternative technologies or the failure of our collaborators to develop or commercialize successfully any product candidate to which they have obtained rights from us could materially harm our business, financial condition and results of operations.

We expect to rely on third parties to gain access to certain antigens.

We expect to gain access to antigens through contractual arrangements with leading academic researchers, through companies involved in supplying antigens, by isolating them ourselves, or from publicly available sources. In the event we are unable to access antigens in sufficient quantities, or at all, we may not be able to perform antibody discovery activities for certain antigens, which may have an adverse impact on our business and financial condition.

We expect to rely on third parties to conduct any clinical trials for any product candidates we develop, and if they do not properly and successfully perform their legal and regulatory obligations, as well as their contractual obligations to us, we may not be able to obtain regulatory approvals for any product candidates we develop.

In the event we develop product candidates, we expect to rely on contract research organizations and other third parties to assist us in managing, monitoring and otherwise carrying out these trials, including with respect to site selection, contract negotiation and data management. Because we would not control these third parties, they may not treat our clinical studies as their highest priority, or in the manner in which we would prefer, which could result in delays. Moreover, if third parties did not successfully carry out their duties under their agreements with us, if the quality or accuracy of the data they obtain is compromised due to failure to adhere to our clinical protocols or regulatory requirements, or if they otherwise failed to comply with clinical trial protocols or meet expected deadlines, the clinical trials conducted on our behalf may not meet regulatory requirements. If our clinical trials do not meet regulatory requirements or if these third parties need to be replaced, our clinical trials may be extended, delayed, suspended or terminated, and we may not be able to obtain regulatory approval of some or all of the product candidates we may develop.

14

Table of Contents

If we cannot compete successfully against other biopharmaceutical companies, we may not be successful in developing and commercializing our technology and our business will suffer.

The biopharmaceutical space is characterized by intense competition and rapid technological advances. Even if we are able to develop our proprietary platform technology and additional antibody libraries, each will compete with a number of existing and future technologies and product candidates developed, manufactured and marketed by others. Specifically, we will compete against fully integrated pharmaceutical companies and smaller companies that are collaborating with larger pharmaceutical companies, academic institutions, government agencies and other public and private research organizations. Many of these competitors have validated technologies with products already FDA-approved or in various stages of development. In addition, many of these competitors, either alone or together with their collaborative partners, operate larger research and development programs and have substantially greater financial resources than we do, as well as significantly greater experience in:

| • | developing product candidates and technologies generally; |

| • | undertaking preclinical testing and clinical trials; |

| • | obtaining FDA and other regulatory approvals of product candidates; |

| • | formulating and manufacturing product candidates; and |

| • | launching, marketing and selling product candidates. |

If our technology fails to compete effectively against third party technologies, our business will be adversely impacted.

Because our development activities are expected to rely heavily on sensitive and personal information, an area which is highly regulated by privacy laws, we may not be able to generate, maintain or access essential patient samples or data to continue our research and development efforts in the future on reasonable terms and conditions, which may adversely affect our business.

We may have access to very sensitive data regarding patients whose tissue samples are used in our studies. This data will contain information that is personal in nature. The maintenance of this data is subject to certain privacy-related laws, which impose upon us administrative and financial burdens, and litigation risks. For instance, the rules promulgated by the Department of Health and Human Services under the Health Insurance Portability and Accountability Act, or HIPAA, create national standards to protect patients’ medical records and other personal information in the U.S. These rules require that healthcare providers and other covered entities obtain written authorizations from patients prior to disclosing protected health care information of the patient to companies. If the patient fails to execute an authorization or the authorization fails to contain all required provisions, then we will not be allowed access to the patient’s information and our research efforts can be substantially delayed. Furthermore, use of protected health information that is provided to us pursuant to a valid patient authorization is subject to the limits set forth in the authorization (i.e., for use in research and in submissions to regulatory authorities for product approvals). As such, we are required to implement policies, procedures and reasonable and appropriate security measures to protect individually identifiable health information we receive from covered entities, and to ensure such information is used only as authorized by the patient. Any violations of these rules by us could subject us to civil and criminal penalties and adverse publicity, and could harm our ability to initiate and complete clinical studies required to support regulatory applications for our proposed products. In addition, HIPAA does not replace federal, state, or other laws that may grant individuals even greater privacy protections. We can provide no assurance that future legislation will not prevent us from generating or maintaining personal data or that patients will consent to the use of their personal information, either of which may prevent us from undertaking or publishing essential research. These burdens or risks may prove too great for us to reasonably bear, and may adversely affect our ability to achieve profitability or maintain profitably in the future.

We may be exposed to liability claims associated with the use of hazardous materials and chemicals.

Our research and development activities may involve the controlled use of hazardous materials and chemicals. Although we believe that our safety procedures for using, storing, handling and disposing of these

15

Table of Contents

materials comply with federal, state and local laws and regulations, we cannot completely eliminate the risk of accidental injury or contamination from these materials. In the event of such an accident, we could be held liable for any resulting damages and any liability could materially adversely affect our business, financial condition and results of operations. We do not currently maintain hazardous materials insurance coverage. In addition, the federal, state and local laws and regulations governing the use, manufacture, storage, handling and disposal of hazardous or radioactive materials and waste products may require us to incur substantial compliance costs that could materially harm our business.

If we are unable to retain and recruit qualified scientists and advisors, or if any of our key executives, key employees or key consultants discontinues his or her employment or consulting relationship with us, it may delay our development efforts or otherwise harm our business.

We may not be able to attract or retain qualified management and scientific and clinical personnel in the future due to the intense competition for qualified personnel among biotechnology, pharmaceutical and other businesses, particularly in the San Diego, California area. Our industry has experienced a high rate of turnover of management personnel in recent years. If we are not able to attract, retain and motivate necessary personnel to accomplish our business objectives, we may experience constraints that will significantly impede the successful development of any product candidates, our ability to raise additional capital and our ability to implement our overall business strategy.

We are highly dependent on the key members of our management and scientific staff, especially our Chief Executive Officer and President, Henry Ji, Ph.D. The loss of any of our key employees or key consultants could impede the achievement of our research and development objectives. Furthermore, recruiting and retaining qualified scientific personnel to perform research and development work in the future is critical to our success. We may be unable to attract and retain personnel on acceptable terms given the competition among biotechnology, biopharmaceutical and health care companies, universities and non-profit research institutions for experienced scientists. Certain of our current officers, directors, scientific advisors and/or consultants or certain of the officers, directors, scientific advisors and/or consultants hereafter appointed may from time to time serve as officers, directors, scientific advisors and/or consultants of other biopharmaceutical or biotechnology companies. We do not maintain “key man” insurance policies on any of our officers or employees. All of our employees are employed “at will” and, therefore, each employee may leave our employment at any time.

We plan to grant stock options or other forms of equity awards in the future as a method of attracting and retaining employees, motivating performance and aligning the interests of employees with those of our stockholders. If we are unable to implement and maintain equity compensation arrangements that provide sufficient incentives, we may be unable to retain our existing employees and attract additional qualified candidates. If we are unable to retain our existing employees, including qualified scientific personnel, and attract additional qualified candidates, our business and results of operations could be adversely affected.

We will need to increase the size of our company and may not effectively manage our growth.

Our success will depend upon growing our business and our employee base. Over the next 12 months, we plan to add additional employees to assist us with research and development. Our future growth, if any, may cause a significant strain on our management, and our operational, financial and other resources. Our ability to manage our growth effectively will require us to implement and improve our operational, financial and management systems and to expand, train, manage and motivate our employees. These demands may require the hiring of additional management personnel and the development of additional expertise by management. Any increase in resources devoted to research and product development without a corresponding increase in our operational, financial and management systems could have a material adverse effect on our business, financial condition, and results of operations.

Any disruption in our research and development facilities could adversely affect our business, financial condition and results of operations.

Our principal executive offices, which house our research and development programs, are located in San Diego, California. Our facilities may be affected by natural or man-made disasters. Earthquakes are of particular

16

Table of Contents

significance since our facilities are located in an earthquake-prone area. We are also vulnerable to damage from other types of disasters, including power loss, attacks from extremist organizations, fire, floods and similar events. In the event that our facilities were affected by a natural or man-made disaster, we may be forced to curtail our operations and/or rely on third-parties to perform some or all of our research and development activities. Although we believe we possess adequate insurance for damage to our property and the disruption of our business from casualties, such insurance may not be sufficient to cover all of our potential losses and may not continue to be available to us on acceptable terms, or at all. In the future, we may choose to expand our operations in either our existing facilities or in new facilities. If we expand our worldwide manufacturing locations, there can be no assurance that this expansion will occur without implementation difficulties, or at all.

International operations may expose us to foreign currency exchange rate fluctuations for all foreign currencies in which we do business and we may be materially adversely affected by these fluctuations.

We formed Sorrento Hong Kong effective December 4, 2012. Sorrento Hong Kong had no operations in 2012. In the event Sorrento Hong Kong becomes operational, we may have an international subsidiary that operates in a foreign currency which would expose us to foreign currency exchange rate fluctuations. We intend to hedge any foreign currency risks associated with potential transactions by entering into forward contracts. Although we may enter into such forward contracts, they may not be adequate to eliminate the risk of foreign currency exchange rate exposures. International operations may also expose us to currency fluctuations as we translate the financial statements of our international subsidiary to U.S. Dollars.

If we acquire companies or technologies in the future, they could prove difficult to integrate, disrupt our business, dilute stockholder value, and adversely affect our operating results and the value of our common stock.

As part of our business strategy, we may acquire, enter into joint ventures with, or make investments in complementary or synergistic companies, services, and technologies in the future. Acquisitions and investments involve numerous risks, including:

| • | difficulties in identifying and acquiring products, technologies, or businesses that will help our business; |

| • | difficulties in integrating operations, technologies, services, and personnel; |

| • | diversion of financial and managerial resources from existing operations; |

| • | the risk of entering new development activities and markets in which we have little to no experience; |

| • | risks related to the assumption of known and unknown liabilities; and |

| • | risks related to our ability to raise sufficient capital to fund additional operating activities. |

As a result, if we fail to properly evaluate acquisitions or investments, we may not achieve the anticipated benefits of any such acquisitions, we may incur costs in excess of what we anticipate, and management resources and attention may be diverted from other necessary or valuable activities.

Risks Related to the Proposed Acquisition of IgDraSol and the IgDraSol Transactions.

Completion of the proposed acquisition of Igdrasol and the related IgDraSol Transactions is subject to various closing conditions, involves significant costs, will require raising additional capital and will require considerable attention from our management. Failure to complete the acquisition could adversely affect our stock price and our future business and operations.

As more fully described above under Item 1, Recent Developments, on March 7, 2013, we entered into the IgDraSol Transactions. IgDraSol’s lead compound, Cynviloq™, is a micellar diblock copolymeric paclitaxel formulation drug product. Cynviloq™ has completed Phase 2 testing for potential advancement into registration

17

Table of Contents

trials in the U.S. IgDraSol is preparing for an “End of Phase 2” meeting with the FDA regarding Cynviloq™ targeted for the first half of 2013. As a formulation of paclitaxel, Cynviloq™ is potentially eligible for approval via FDA’s 505(b)(2) bioequivalence regulatory pathway versus albumin-bound paclitaxel (Abraxane®) in its currently approved MBC and NSCLC indications. However, there can be no assurance that Cynviloq™ is eligible for approval via FDA’s 505(b)(2) bioequivalence regulatory pathway or any other pathway acceptable to the Sorrento board of directors or shareholders.

The completion of the proposed acquisition of IgDraSol and activities under the IgDraSol Transactions are subject to the satisfaction of various closing conditions, and we cannot assure you that such conditions will be satisfied and that the acquisition will be successfully completed. In the event that the acquisition is not consummated, we will have spent considerable time and resources, and incurred substantial costs, including costs related to the acquisition, many of which must be paid even if the acquisition is not completed. If the acquisition is not consummated, our reputation in our industry and in the investment community could be damaged and, as a result, the market price of our common stock could decline.

We may fail to realize the anticipated benefits of the acquisition of IgDraSol and IgDraSol Transactions.

The success of the acquisition of IgDraSol and IgDraSol Transactions will depend on, among other things, our ability to combine our business with IgDraSol in a manner that does not materially disrupt existing relationships and that allows us to achieve development and operational synergies. If we are unable to achieve these objectives, the anticipated benefits of the acquisition may not be realized fully or at all or may take longer to realize than expected. In particular, the acquisition may not be accretive to our stock value or development pipeline in the near or long term.