0000850141DEF 14AFALSE00008501412022-01-012022-12-31iso4217:USD00008501412021-01-012021-12-3100008501412020-01-012020-12-310000850141ecd:PeoMemberhmn:StockAndOptionAwardsMember2022-01-012022-12-310000850141hmn:StockAndOptionAwardsMemberecd:NonPeoNeoMember2022-01-012022-12-310000850141ecd:PeoMemberhmn:StockAndOptionAwardsMember2021-01-012021-12-310000850141hmn:StockAndOptionAwardsMemberecd:NonPeoNeoMember2021-01-012021-12-310000850141ecd:PeoMemberhmn:StockAndOptionAwardsMember2020-01-012020-12-310000850141hmn:StockAndOptionAwardsMemberecd:NonPeoNeoMember2020-01-012020-12-310000850141ecd:PeoMemberhmn:EquityAwardAdjustmentsYearEndFairValueOfEquityAwardsGrantedInTheApplicableYearMember2022-01-012022-12-310000850141hmn:EquityAwardAdjustmentsYearEndFairValueOfEquityAwardsGrantedInTheApplicableYearMemberecd:NonPeoNeoMember2022-01-012022-12-310000850141ecd:PeoMemberhmn:EquityAwardAdjustmentsYearEndFairValueOfEquityAwardsGrantedInTheApplicableYearMember2021-01-012021-12-310000850141hmn:EquityAwardAdjustmentsYearEndFairValueOfEquityAwardsGrantedInTheApplicableYearMemberecd:NonPeoNeoMember2021-01-012021-12-310000850141ecd:PeoMemberhmn:EquityAwardAdjustmentsYearEndFairValueOfEquityAwardsGrantedInTheApplicableYearMember2020-01-012020-12-310000850141hmn:EquityAwardAdjustmentsYearEndFairValueOfEquityAwardsGrantedInTheApplicableYearMemberecd:NonPeoNeoMember2020-01-012020-12-310000850141hmn:EquityAwardAdjustmentsYearOverYearChangeInFairValueOfEquityAwardsGrantedInPriorYearsThatAreUnvestedAtYearEndMemberecd:PeoMember2022-01-012022-12-310000850141hmn:EquityAwardAdjustmentsYearOverYearChangeInFairValueOfEquityAwardsGrantedInPriorYearsThatAreUnvestedAtYearEndMemberecd:NonPeoNeoMember2022-01-012022-12-310000850141hmn:EquityAwardAdjustmentsYearOverYearChangeInFairValueOfEquityAwardsGrantedInPriorYearsThatAreUnvestedAtYearEndMemberecd:PeoMember2021-01-012021-12-310000850141hmn:EquityAwardAdjustmentsYearOverYearChangeInFairValueOfEquityAwardsGrantedInPriorYearsThatAreUnvestedAtYearEndMemberecd:NonPeoNeoMember2021-01-012021-12-310000850141hmn:EquityAwardAdjustmentsYearOverYearChangeInFairValueOfEquityAwardsGrantedInPriorYearsThatAreUnvestedAtYearEndMemberecd:PeoMember2020-01-012020-12-310000850141hmn:EquityAwardAdjustmentsYearOverYearChangeInFairValueOfEquityAwardsGrantedInPriorYearsThatAreUnvestedAtYearEndMemberecd:NonPeoNeoMember2020-01-012020-12-310000850141ecd:PeoMemberhmn:EquityAwardAdjustmentsYearOverYearChangeInFairValueOfEquityAwardsGrantedInPriorYearsThatVestedInTheYearMember2022-01-012022-12-310000850141ecd:NonPeoNeoMemberhmn:EquityAwardAdjustmentsYearOverYearChangeInFairValueOfEquityAwardsGrantedInPriorYearsThatVestedInTheYearMember2022-01-012022-12-310000850141ecd:PeoMemberhmn:EquityAwardAdjustmentsYearOverYearChangeInFairValueOfEquityAwardsGrantedInPriorYearsThatVestedInTheYearMember2021-01-012021-12-310000850141ecd:NonPeoNeoMemberhmn:EquityAwardAdjustmentsYearOverYearChangeInFairValueOfEquityAwardsGrantedInPriorYearsThatVestedInTheYearMember2021-01-012021-12-310000850141ecd:PeoMemberhmn:EquityAwardAdjustmentsYearOverYearChangeInFairValueOfEquityAwardsGrantedInPriorYearsThatVestedInTheYearMember2020-01-012020-12-310000850141ecd:NonPeoNeoMemberhmn:EquityAwardAdjustmentsYearOverYearChangeInFairValueOfEquityAwardsGrantedInPriorYearsThatVestedInTheYearMember2020-01-012020-12-310000850141ecd:PeoMemberhmn:EquityAwardAdjustmentsValueOfDividendsOrOtherEarningsPaidOnStockOrOptionAwardsNotOtherwiseReflectedInFairValueOrTotalCompensationMember2022-01-012022-12-310000850141ecd:NonPeoNeoMemberhmn:EquityAwardAdjustmentsValueOfDividendsOrOtherEarningsPaidOnStockOrOptionAwardsNotOtherwiseReflectedInFairValueOrTotalCompensationMember2022-01-012022-12-310000850141ecd:PeoMemberhmn:EquityAwardAdjustmentsValueOfDividendsOrOtherEarningsPaidOnStockOrOptionAwardsNotOtherwiseReflectedInFairValueOrTotalCompensationMember2021-01-012021-12-310000850141ecd:NonPeoNeoMemberhmn:EquityAwardAdjustmentsValueOfDividendsOrOtherEarningsPaidOnStockOrOptionAwardsNotOtherwiseReflectedInFairValueOrTotalCompensationMember2021-01-012021-12-310000850141ecd:PeoMemberhmn:EquityAwardAdjustmentsValueOfDividendsOrOtherEarningsPaidOnStockOrOptionAwardsNotOtherwiseReflectedInFairValueOrTotalCompensationMember2020-01-012020-12-310000850141ecd:NonPeoNeoMemberhmn:EquityAwardAdjustmentsValueOfDividendsOrOtherEarningsPaidOnStockOrOptionAwardsNotOtherwiseReflectedInFairValueOrTotalCompensationMember2020-01-012020-12-31000085014112022-01-012022-12-31000085014122022-01-012022-12-31000085014132022-01-012022-12-31000085014142022-01-012022-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| | | | | | | | |

| ☐ | | Preliminary Proxy Statement |

| ☐ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

| ☒ | | Definitive Proxy Statement |

| ☐ | | Definitive Additional Materials |

| ☐ | | Soliciting Material Under §240.14a-12 |

Horace Mann Educators Corporation

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | | |

| ☐ | Fee paid previously with preliminary materials |

| | | | | |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Springfield, Illinois

April 5, 2023

Dear Shareholder,

You are cordially invited to virtually attend the Annual Meeting of Horace Mann Educators Corporation to be held at 9:00 a.m. Central Daylight Saving Time on Wednesday, May 24, 2023. We are pleased to announce that this year’s Annual Meeting will be via live webcast on the Internet. Shareholders of record can attend the Annual Meeting, vote and submit questions during the live webcast by visiting www.virtualshareholdermeeting.com/HMN2023 and entering the 16-digit control number, which is included in our Notice of Internet Availability of Proxy Materials or on the proxy card. Beneficial owners should review these proxy materials and the voting instruction form or Notice of Internet Availability of Proxy Materials for how to vote in advance of, and how to participate in, the Annual Meeting.

We encourage you to read the Proxy Statement and vote your shares as soon as possible. You may vote online, by telephone or by completing and returning a proxy card. Specific voting instructions are set forth in the Proxy Statement, the Notice of Internet Availability of Proxy Materials and the proxy card. You may revoke your voted proxy at any time prior to the meeting or by voting again electronically during the virtual meeting.

We look forward to having you join us for the virtual meeting. If you vote by proxy and do not plan to attend, let us know your thoughts about Horace Mann either by letter or by comment on the proxy card.

Sincerely,

| | | | | |

| |

H. Wade Reece |

Chairman of the Board |

| |

Marita Zuraitis |

President & Chief Executive Officer |

Annual Meeting of Shareholders | Meeting Notice

Horace Mann Educators Corporation

1 Horace Mann Plaza

Springfield, Illinois 62715-0001

The approximate availability date of the Proxy Statement and the proxy card is April 5, 2023. Your vote is important. Even if you do not plan to participate in the Annual Meeting, the Board of Directors urges you to vote via the Internet, by telephone or by returning a proxy card. If you vote via the Internet or by telephone, do not return your proxy card. You may revoke your proxy at any time before the vote is taken at the Annual Meeting, provided that you comply with the procedures set forth in the Proxy Statement that accompanies this Notice of Annual Meeting of Shareholders. If you participate in the Annual Meeting, you may vote electronically during the virtual meeting.

Brokers are not permitted to vote on certain proposals and may not vote on any of the proposals unless you provide voting instructions. Voting your shares will help to ensure that your interests are represented at the meeting.

We encourage you to read the Proxy Statement and vote your shares as soon as possible.

By order of the Board of Directors,

Donald M. Carley

Executive Vice President and General Counsel Corporate Secretary

Springfield, Illinois

Meeting Details

Wednesday, May 24, 2023

9:00 a.m. Central Daylight Saving Time

Meeting live via the Internet - Please visit www.virtualshareholdermeeting.com/HMN2023. To join the meeting, Shareholders of record will need the 16-digit control number included on your Notice, or on your proxy card. Beneficial owners should review these proxy materials and the voting instruction form or Notice of Internet Availability of Proxy Materials for how to participate in the Annual Meeting. The following items will be addressed at the Annual Meeting:

•Elect the nine Directors named in the Proxy Statement.

•Approve the advisory resolution to approve Named Executive Officers’ compensation.

•Provide an advisory vote on the frequency of future advisory votes on Named Executive Officers’ compensation.

•Ratify the appointment of KPMG LLP, an independent registered public accounting firm, as the Company’s auditors for the year ending December 31, 2023.

•Conduct other business, if properly raised.

Record Date: March 28, 2023 - Shareholders registered in the records of the Company or its agents as of the close of business on that date are entitled to receive notice of and to vote at the meeting.

2023 Proxy Statement | Summary

This summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all of the information you should consider. You should read the entire Proxy Statement carefully before voting.

How to Vote Before the Meeting(1)

By Internet: Go to www.proxyvote.com

By phone: 800-690-6903

By mail: Request a paper proxy card

How to Vote During the Meeting(1)

The meeting will be available at www.virtualshareholdermeeting.com/HMN2023. To join the meeting, you will need the 16-digit control number included on your Notice, or on your proxy card. Voting will be available during the meeting, but if you have previously voted your shares, you do not need to vote during the meeting.

(1) Beneficial owners should review these proxy materials and the voting instruction form or Notice of Internet Availability of Proxy Materials for how to vote in advance of, and how to participate in, the Annual Meeting.

Voting Matters and Board Vote Recommendation

| | | | | |

Proposal | Board vote recommendation |

Elect nine Directors (page 4) | FOR each director nominee |

Approve Advisory Resolution to Approve Named Executive Officers’ Compensation (page 18) | FOR |

Provide an Advisory Vote on the Frequency of Future Advisory Votes on Named Executive Officers’ Compensation (page 19) | 1 YEAR |

Ratify Independent Registered Public Accounting Firm (page 49) | FOR |

Fiscal Year 2022 Business Highlights

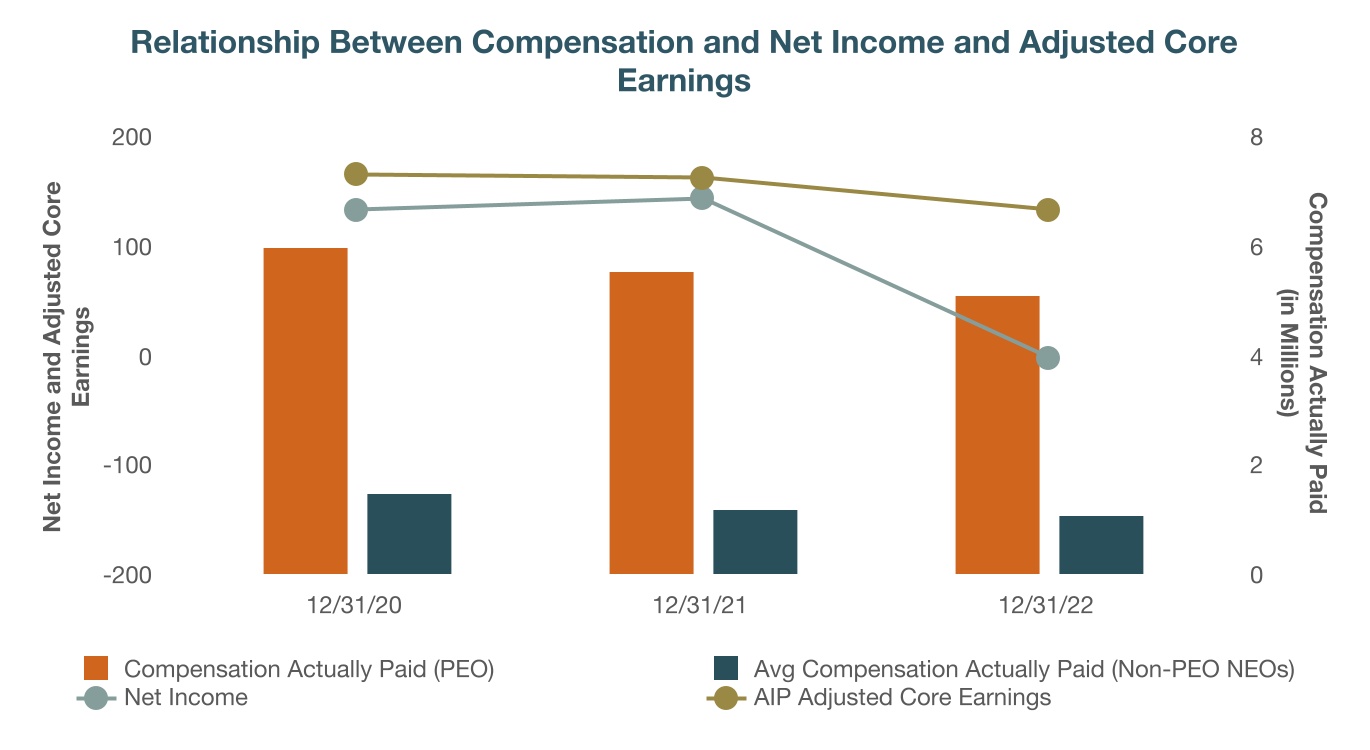

Horace Mann reported a net loss of $2.6 million in 2022, or a loss of $0.06 per share, reflecting realized investment losses largely due to strategic portfolio repositioning, including improved book yield. Core earnings* of $45.7 million, or core earnings per share of $1.09, reflected continued emergence of elevated loss costs across the property and casualty industry, due to inflation, as well as the overall impact of financial market volatility. These factors more than offset a strong contribution from the new Worksite Division, which provides a comprehensive suite of employer-paid and employee-paid benefits, such as group life, disability and specialty health insurance, as well as supplemental products.

Throughout the year, Horace Mann maintained its unwavering commitment to be a trusted partner to the educational community. We made important progress to further diversify the business base and cement our position as the leading provider of education market solutions for both school districts and individual educators, underscoring management’s optimism about the potential for long-term success.

Segment results reflected both the challenges of 2022 as well as progress towards our long-term objectives. Largely due to the impact of inflation on loss costs, the Property & Casualty segment reported a core loss in 2022. Segment earnings in the Life & Retirement segment were below the prior year due to market volatility and the impact of rising interest rates. In the Supplemental & Group Benefits segment, core earnings reflected a strong pretax profit margin and the addition of the employer-sponsored products added at the beginning of 2022 with the acquisition of Madison National Life Insurance Company, Inc. (Madison National). Net investment income was lower than the prior year largely due to the comparison to outsized 2021 returns for the Property & Casualty segment limited partnership fund portfolio.

Please see “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in HMEC’s 2022 Form 10-K for a more detailed description of these financial results.

To determine annual compensation incentive awards, the Compensation Committee makes adjustments to core earnings for items that are highly volatile and outside the control of management. On that basis, core earnings would have increased to $63 million, as discussed in the Compensation Discussion and Analysis beginning on page 20.

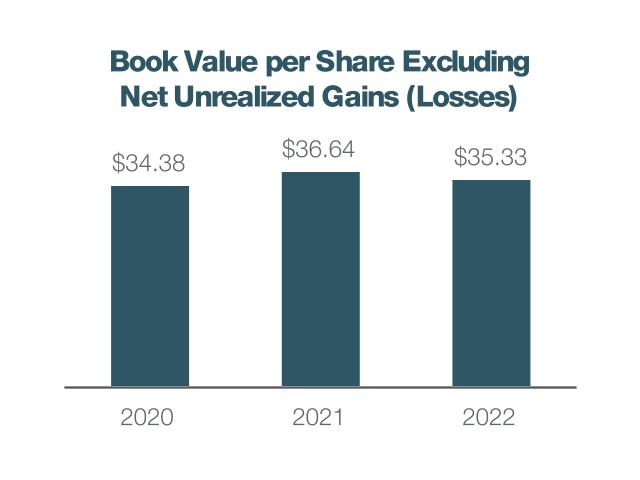

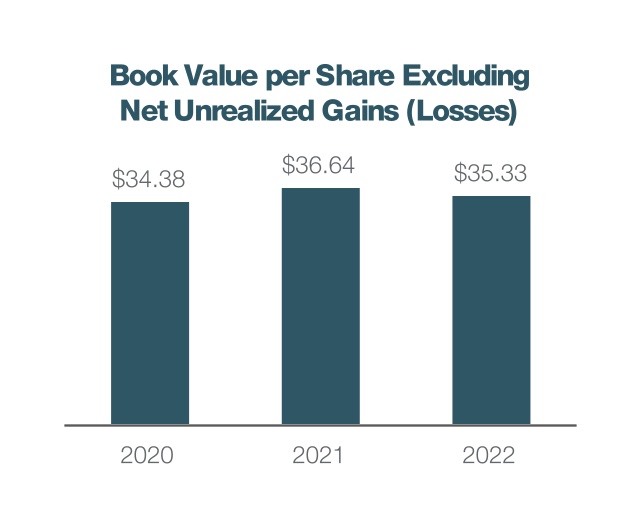

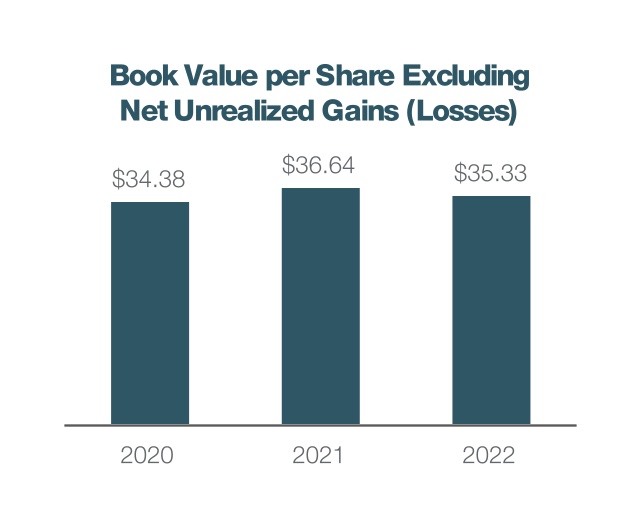

Book value per share excluding net unrealized investment gains (losses) on fixed maturity securities* declined slightly in 2022 after rising in the prior year. Reported book value per share declined for the year as higher interest rates resulted in net unrealized losses on fixed maturity securities. The Company returned $53.7 million to Shareholders in 2022 through dividends. In March 2023, the Board approved a shareholder dividend increase for the 15th consecutive year. In addition, the Company continues to opportunistically repurchase shares, buying 670,816 shares in 2022 and 128,540 shares in the first quarter of 2023. Since 2011, repurchases have totaled $113 million, and there is $37 million remaining on the buyback authorization.

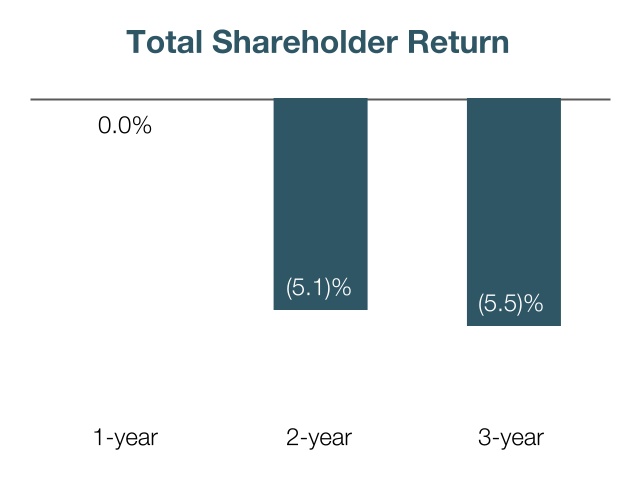

Book value per share excluding net unrealized investment gains (losses) on fixed maturity securities* declined slightly in 2022 after rising in the prior year. Reported book value per share declined for the year as higher interest rates resulted in net unrealized losses on fixed maturity securities. The Company returned $53.7 million to Shareholders in 2022 through dividends. In March 2023, the Board approved a shareholder dividend increase for the 15th consecutive year. In addition, the Company continues to opportunistically repurchase shares, buying 670,816 shares in 2022 and 128,540 shares in the first quarter of 2023. Since 2011, repurchases have totaled $113 million, and there is $37 million remaining on the buyback authorization. Total Shareholder Return (TSR) was flat in 2022 as the broader insurance industry contended with negative impacts from elevated inflation as well as increased market volatility related to concerns about inflation, Federal Reserve interest rate policy and economic growth.

*See General Information, page 1, for a discussion of non-GAAP measures

Horace Mann has been successful for nearly 80 years because our business is centered around the relationships we have with the education community. We understand the issues that educators are facing and we provide solutions. Our business model evolves in tandem with the changing educational environment. Over the course of 2022, we made important progress to leverage our leadership position in the education market to increase sales and build relationships. We expect to expand our share of the education market by growing through all channels in the coming years, while resuming our trajectory toward sustained double digit return on equity.

For example, at the beginning of 2022, we strengthened our value proposition with the acquisition of Madison National Life Insurance Company, Inc. (Madison National), a leading writer of employer-paid and sponsored benefits provided to educators by K-12 school districts. As part of our Worksite Division, Madison National enhances our ability to meet the needs of districts that are increasingly looking to bolster employee benefits packages to attract and retain highly qualified teachers. This ensures that whether educators are buying insurance and financial solutions from a local, trusted advisor; through one of our direct channels; or receiving them through their school district employer, Horace Mann can be the partner to provide it.

In the Worksite Division, 2022 sales rose almost two and a half times over last year for the division, bolstered by the employer-sponsored products added in the Madison National acquisition. Sales of worksite direct supplemental products reflected the improved school access, and in the fourth quarter reached their highest quarterly level since before the pandemic.

In the Retail Division, we made steady progress on our strategic growth initiatives over the course of 2022. Educators continued to respond favorably to the solutions offered by our Life & Retirement business, with annualized Life sales up 7% for the year. Retirement results also remained strong, even as financial market volatility has been a headwind. In the Property & Casualty business, our focus has been on the acceleration of our rate plan, along with implementation of non-rate underwriting actions, so we can remain on track to our longer-term profitability targets for this business. Auto sales were up, largely in states in which we are confident in the outlook for pricing.

Commitment to transparency and dialogue around ESG topics

Horace Mann is committed to being a good corporate citizen and to having a positive impact on America’s educational community, our employees and the communities in which we live and work. Horace Mann demonstrates its commitment to operating responsibly through the security it provides customers, the initiatives and investments the Company deploys in the communities it serves, the claims it pays and the grants it gives in times of need. We view our environmental, social and governance (ESG) commitments as follows:

•Environmental - We are committed to working to reduce our limited carbon footprint, as well as to monitoring and managing climate change risks that affect our business and stakeholders.

•Social - We strive to have a significant positive social impact on America’s educational community, our employees and the communities in which we live and work. We aspire to implement human capital, diversity and inclusion and corporate giving practices that support our corporate mission and strengthen our corporate culture.

•Governance - We endeavor to represent stakeholder interests by following corporate governance best practices to create a financially strong company that operates ethically.

We report on our ESG initiatives through our Corporate Social Responsibility (CSR) website at csr.horacemann.com. In 2022, we expanded our corporate disclosures in the areas of human capital management, climate change, data security and privacy and responsible product offerings to promote corporate transparency.

Environmental

In 2022, we achieved our initial target of a 50% decrease in absolute Scope 1 and Scope 2 carbon emissions — as defined by the Greenhouse Gas Protocol Corporate Accounting and Reporting Standard — far ahead our 2030 deadline. Our carbon-reduction initiative included installing a new, more efficient HVAC system, replacing single-pane windows with double-pane insulated glass, adding LED lighting and motion sensors, and investing in the installation of solar panels, which increased our use of renewable energy at our corporate headquarters. In addition, we now recycle more than 50% of the waste generated at our corporate headquarters. We will continue the work to minimize our carbon footprint, and plan to achieve net-zero by 2050.

Social Responsibility

Horace Mann’s commitment to offering an inclusive work environment — one where diversity of thought is highly valued, and individual differences are recognized, respected and appreciated — continues to be an important factor in the Company’s success. As part of our ongoing employee listening strategy, we regularly solicit employee feedback through pulse surveys on both specific items and broader topics. In 2022, we undertook a comprehensive employee engagement survey, with 74% of employees participating. In addition to our Diversity, Equity and Inclusion (DEI) Council, we host educational events and corporate-wide book studies, with participants including senior leadership and directors. In late 2022, we launched Employee Resource Groups aligned with employee identity, inclusion and wellness.

Within our investment portfolio, we hold $1.5 billion in responsible investments, or 23% of the total portfolio. Responsible investments provide societal and environmental benefits, while also generating a long-term sustainable return to benefit all stakeholders.

The Horace Mann Educators Foundation is an independent charitable organization formed by Horace Mann Educators Corporation to recognize the dedication of educators to helping each student reach their full potential. In 2022, the Foundation gave more than $425,000 to support educators, employees, communities and others in need. This included:

•$185,000 in educator-focused grants

•$171,500 to support strong communities

•$53,500 to support employee giving to charitable organizations, including matching programs open to all employees

•$15,500 in disaster relief and non-focused grants

For the fifth year in a row, Horace Mann was named to the Bloomberg Gender-Equality Index. The index recognizes corporate commitment to transparency in gender reporting and advancing women’s equality. Only 484 companies worldwide are included in the reference index, which measures gender equality across five pillars: female leadership and talent pipeline, equal pay and gender pay parity, inclusive culture, sexual harassment policies, and pro-women brand.

Governance

Our governance and compensation structure reflects an active, engaged, and accountable Board and a number of compensation best practices, including:

Director Term: One year

Director Election Standard: Majority vote

Director Independence: Eight of our nine Directors are independent

Board Meetings in 2022: Seven

Board Committee Meetings in 2022: Audit (12), Compensation (5), Executive (0), Investment & Finance (4), Nominating & Governance (5)

Corporate Governance Materials: Available online at investors.horacemann.com - Governance - Governance Documents

Board Communication: By mail to: Board of Directors, c/o Corporate Secretary, 1 Horace Mann Plaza, Springfield, Illinois 62715. By email to: hmecbofd@horacemann.com

Compensation Governance:

•Hedging transactions and pledging shares are prohibited for all Directors and Executive Officers

•Clawback provisions are applicable to all Executive Officers for both cash and equity awards

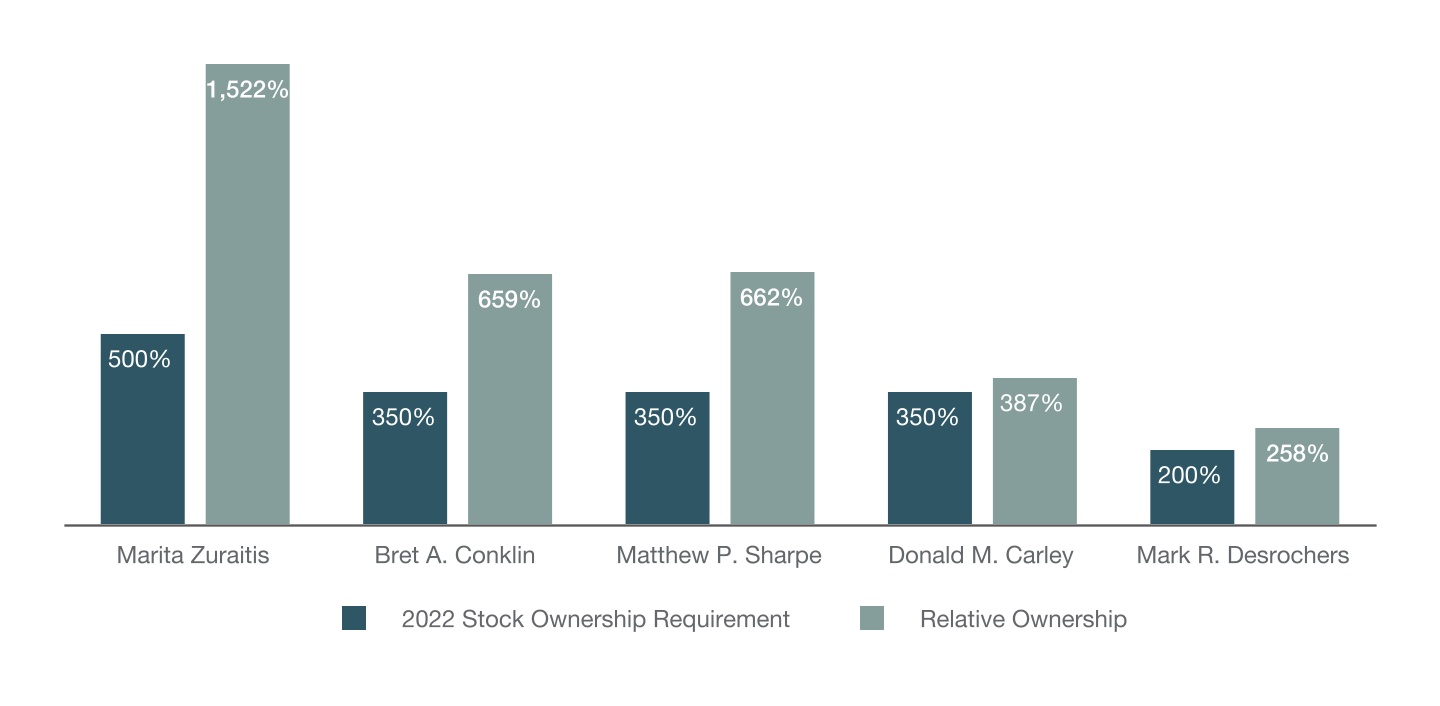

•Stock ownership requirements are applicable to all Directors and Executive Officers

•Stock option holding requirement post-exercise

ESG oversight

The Horace Mann Board of Directors oversees the Company’s ESG strategy and priorities, with various committees responsible for different ESG aspects:

•Nominating & Governance Committee provides general oversight, as well as direction on governance, environmental risks and goals, and social risks and goals.

•Investment & Finance Committee oversees responsible investing strategy.

•Compensation Committee provides DEI oversight and direction on human capital management strategy.

•Audit Committee oversees the Enterprise Risk Management function, including cybersecurity, as well as ethics issues and policies, such as the Code of Conduct.

Horace Mann’s General Counsel is the strategic lead for our ESG/CSR activities and briefs the Board quarterly on the Company’s ESG initiatives and progress.

ESG and Stakeholder Engagement

Horace Mann strives to maintain an open and productive dialogue with all stakeholders regarding ESG topics. We undertook a formal stakeholder engagement survey to update and refine our understanding of potentially relevant issues and their materiality. We chose topics based on our knowledge of stakeholder priorities gained from regular interactions, as well as rating agency factors and peer materiality maps. We solicited input on a list of topics from 10 external and internal stakeholder groups, including educators, investors, employees, company leadership, agents and community leaders. This materiality assessment showed that stakeholders’ top priorities include business ethics, data security and privacy; employee training, development and retention; and DEI.

In addition, we engaged with our stakeholders in multiple ways: We held town hall meetings with agents, surveyed educators and conducted employee pulse surveys. Horace Mann’s management and investor relations team regularly discuss ESG and CSR topics with active investors during ongoing virtual or in-person interactions at conferences and other venues. During 2022, in addition to conversations with potential investors, we had on-going dialogue with existing, active investors representing approximately 32% of our outstanding shares. In those meetings, management covers Horace Mann’s business strategy and performance. Investors react positively to updates on how corporate social responsibility initiatives support the Company’s business strategy.

In addition, in advance of the 2023 Annual Meeting of Shareholders, Horace Mann’s investor relations team reached out to the Company’s top 25 active and passive Shareholders regarding the Company’s most recent CSR reporting. The outreach provides these Shareholders with the opportunity to indicate interest in speaking with Board members or management and to learn more about the Company’s stance on ESG, corporate governance and overall shareholder value creation. Feedback to similar outreach in the past has been positive and Shareholders approved all proposals in the 2022 Proxy Statement by over 96%.

2023 Proxy Statement | Table of Contents

| | | | | |

Content | Page |

| |

| General Information | |

| |

| Your Proxy Vote | |

| How to Vote Before the Meeting | |

| Voting Rules | |

| |

| Proposals and Company Information | |

| PROPOSAL NO. 1 - ELECTION OF NINE DIRECTORS | |

| Board of Directors and Committees | |

| Director Compensation | |

| Corporate Governance | |

| Related Person Transactions | |

| PROPOSAL NO. 2 - ADVISORY RESOLUTION TO APPROVE NAMED EXECUTIVE OFFICERS’ COMPENSATION | |

| PROPOSAL NO. 3 - ADVISORY VOTE ON THE FREQUENCY OF FUTURE ADVISORY VOTES ON NAMED EXECUTIVE OFFICERS’ COMPENSATION | |

| Compensation Discussion and Analysis | |

| Compensation Committee Report | |

| Equity Compensation Plan Information | |

| Executive Officers | |

| Security Ownership of Certain Beneficial Owners and Management | |

| PROPOSAL NO. 4 - RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | |

| Report of the Audit Committee | |

| The Company’s Independent Registered Public Accounting Firm | |

| |

| Other Matters | |

| Delivery of Proxy Materials | |

| Submitting Shareholder Proposals for the 2024 Annual Meeting of Shareholders | |

2023 Proxy Statement | General Information

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to Be Held on Wednesday, May 24, 2023. The Proxy Statement and Annual Report on Form 10-K (Proxy Materials) are available at proxyvote.com.

This Proxy Statement is furnished in connection with the solicitation by the Board of Directors (Board) of Horace Mann Educators Corporation (HMEC, Company or Horace Mann) of proxies (that is, the authority to vote shares) from holders of the Company’s common stock, par value $.001 per share (Common Stock). The proxies will be voted at the Annual Meeting of Shareholders to be held on Wednesday, May 24, 2023 at 9:00 a.m. Central Daylight Saving Time via live webcast at www.virtualshareholdermeeting.com/HMN2023 and at any adjournment or postponement thereof (Annual Meeting).

The mailing address of the Company is 1 Horace Mann Plaza, Springfield, Illinois 62715-0001 (telephone number 217-789-2500). This Proxy Statement, Notice of Internet Availability of Proxy Materials and the proxy card are first being made available to Shareholders of the Company (Shareholders) on or about April 5, 2023.

The Board has fixed the close of business on March 28, 2023 as the record date (Record Date) for determining the Shareholders entitled to receive notice of and to vote at the Annual Meeting. At the close of business on the Record Date, an aggregate of 40,826,549 shares of Common Stock were issued and outstanding, each share entitling the holder thereof to one vote on each matter to be voted upon at the Annual Meeting. The presence, including by proxy, of the holders of a majority of the voting power of such issued and outstanding shares entitled to vote at the Annual Meeting is necessary to constitute a quorum for the transaction of business at the Annual Meeting. The Company, through bankers, brokers or other persons, also intends to make a solicitation of beneficial owners of Common Stock.

At the Annual Meeting, Shareholders will be asked to: (1) elect nine Directors named in the Proxy Statement to hold office for one-year terms continuing until the next Annual Meeting of Shareholders and until their respective successors have been duly elected and qualified; (2) approve the advisory resolution to approve Named Executive Officers’ (as defined on page 26 below) compensation; (3) provide an advisory vote on the frequency of future advisory votes on Named Executive Officers’ compensation; and (4) ratify the appointment of KPMG LLP, an independent registered public accounting firm, as the Company’s auditors for the year ending December 31, 2023.

Shareholders may also be asked to consider and take action with respect to such other matters as may properly come before the Annual Meeting.

Copies of the Annual Report on Form 10-K for the year ended Dec. 31, 2022 (Annual Report), including the Company’s audited consolidated financial statements, were made available to known Shareholders on or about February 28, 2023.

Statements included in this document that are not historical in nature, including statements regarding our environmental and other sustainability plans and goals, are forward-looking within the meaning of the Private Securities Litigation Reform Act of 1995 and are subject to certain risks and uncertainties. Horace Mann is not under any obligation to (and expressly disclaims any such obligation to) update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Please refer to the Company's Annual Report for the year ended December 31, 2022 and the Company's past and future filings and reports filed with the Securities and Exchange Commission (SEC) for information concerning the important factors that could cause actual results to differ materially from those in forward-looking statements. Any standards of measurement and performance made in reference to our environmental, social, governance and other sustainability plans and goals are developing and based on assumptions, and no assurance can be given that any such plan, initiative, projection, goal, commitment, expectation, or prospect can or will be achieved. Website references throughout this document are provided for convenience only, and the content on the referenced websites is not incorporated by reference into this document.

The historical financial information contained in this document is before implementation of Financial Accounting Standards Board’s Accounting Standard Update 2018-12 Financial Services - Insurance: Targeted Improvements to the Accounting for Long-Duration Contracts. Measures marked with * the first time they are presented within this document are not based on accounting principles generally accepted in the U.S. (non-GAAP). An explanation of these measures is contained in the Glossary of Selected Terms included as Exhibit 99.1 in our most recent Annual Report on Form 10-K filed with the SEC and are reconciled to the most directly comparable measures prepared in accordance with accounting principles generally accepted in the U.S. (GAAP) in the Appendix to the Company’s Fourth Quarter 2022 Investor Supplement.

| | | | | | | | |

| Horace Mann Educators Corporation | | 2023 Annual Meeting of Shareholders Meeting Notice & Proxy Statement 1 |

2023 Proxy Statement | Your Proxy Vote

How to Vote Before the Meeting

Shareholders of Record

1.Via Internet: Go to proxyvote.com to vote via the Internet. Follow the instructions on your Notice of Internet Availability of Proxy Materials (Notice) or proxy card and the website. If you vote via the Internet, you may incur Internet access charges.

2.By Telephone: If you received paper copies of the Proxy Materials, call the toll-free telephone number on the proxy card or the website to vote by telephone. You will need to follow the instructions and the voice prompts.

3.By Mail: Request, complete and return a paper proxy card, following the instructions on your Notice.

If you vote via the Internet or by telephone, your electronic vote authorizes the named proxies in the same manner as if you signed, dated and returned your proxy card. If you vote via the Internet or by telephone, you do not need to return your proxy card. Further, shares held in your name as the Shareholder of record or as beneficial owner may be voted electronically during the virtual Annual Meeting (www.virtualshareholdermeeting.com/HMN2023). To join the meeting, including to vote and ask questions, you will need the 16-digit control number included on your Notice, on your proxy card or on the instructions that accompanied your Proxy Materials. If you have previously voted your shares, you do not need to vote during the meeting.

Beneficial Owners

If your shares are held in “street name” (that is, in the name of a bank, broker or other holder of record), you will receive a Notice or voting instruction form containing instructions from the holder of record that you must follow in order for your shares to be voted. If your Notice or voting instruction form indicates that you may vote those shares through the proxyvote.com website, then you may access, participate in, and vote at the Annual Meeting with the 16-digit control access code indicated on that Notice or voting instruction form. Otherwise, Shareholders who hold their shares in street name should contact their bank, broker or other nominee (preferably at least five days before the Annual Meeting) and obtain a “legal proxy” in order to be able to attend, participate in or vote at the Annual Meeting. Internet and/or telephone voting also will be offered to Shareholders owning shares through most banks and brokers.

Participants in the Company’s stock fund within the Horace Mann 401(k) Plan can direct the trustee to vote their shares via the Internet as directed in the Notice, by telephone as provided on the website or proxy card, or by signing and returning a proxy card.

Voting Rules

Solicitation and Revocation

Your proxy is being solicited by and on behalf of the Board. The persons named in the Form of Proxy have been designated as proxies by the Board. Such persons are Directors of the Company.

Shares of Common Stock represented at the Annual Meeting by a properly executed and returned proxy will be voted at the Annual Meeting in accordance with the instructions noted thereon, or if no instructions are noted, the proxy will be voted in favor of the proposals set forth in the Notice of Annual Meeting. A submitted proxy is revocable by a Shareholder at any time prior to it being voted, provided that such Shareholder gives written notice to the Corporate Secretary prior to the Annual Meeting that such Shareholder intends to vote during the meeting or by submitting a subsequently dated proxy. Participation in the Annual Meeting by a Shareholder who has given a proxy shall not in and of itself constitute a revocation of such proxy.

| | | | | | | | |

2 2023 Annual Meeting of Shareholders Meeting Notice & Proxy Statement | | Horace Mann Educators Corporation |

Further solicitation may be made by officers and other employees of the Company personally, by telephone or otherwise, but such persons will not be specifically compensated for such services. Banks, brokers, nominees and other custodians and fiduciaries will be reimbursed for their reasonable out-of-pocket expenses in forwarding soliciting material to their principals, the beneficial owners of Common Stock. The costs of soliciting proxies will be borne by the Company. It is estimated these costs will be nominal.

Shareholder Approval

Shareholders are entitled to one vote per share of Common Stock on all matters submitted for consideration at the Annual Meeting. Under the Company’s Bylaws, the affirmative vote of a majority of the shares of Common Stock present in person or represented by proxy at the Annual Meeting is required for the election of Directors, approval of the advisory resolution to approve Named Executive Officers’ compensation, the advisory vote on the frequency of future advisory votes on Named Executive Officers’ compensation and the ratification of the appointment of KPMG LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2023.

Brokers holding shares must vote according to specific instructions they receive from the beneficial owners of those shares. If brokers do not receive specific instructions, brokers may in some cases vote the shares in their discretion, but are not permitted to vote on certain proposals and may elect not to vote on any of the proposals unless you provide voting instructions. If you do not provide voting instructions and the broker elects to vote your shares on some but not all matters, it will result in a “broker non-vote” for the matters on which the broker does not vote. Abstentions occur when you provide voting instructions but instruct the broker to abstain from voting on a particular matter instead of voting for or against the matter. Abstentions and broker non-votes will be considered as present for quorum purposes. Abstentions have the same effect as a vote “against” approval of the matter. Broker non-votes will have no effect on the outcome of the vote on the election of directors or on any of the other proposals.

Other Matters

Other than the matters set forth below, the Board has not received any shareholder proposals by the deadline prescribed by the rules of the SEC, and otherwise knows of no other matters to be brought before the Annual Meeting. However, should any other matters properly come before the meeting, the persons named in the Form of Proxy will vote or refrain from voting thereon at their discretion.

We are holding a virtual meeting again this year. The virtual Annual Meeting format provides all Shareholders with the same access and ability to participate, regardless of their location.

The Annual Meeting will begin promptly at 9:00 a.m. Central Daylight Saving Time on May 24, 2023. Online check-in will begin approximately 15 minutes before the Annual Meeting. You are encouraged to access the Annual Meeting early and provide sufficient time for online check-in. Technical assistance will be available to assist with any difficulties encountered while accessing the Annual Meeting.

Shareholders may submit questions before and during the Annual Meeting at www.virtualshareholdermeeting.com/HMN2023. We will try to answer as many questions as possible during the time scheduled. Additional information regarding the question and answer process, including the types and number of questions permitted, the time allocated for the question and answer session, and how questions will be addressed and disclosed, will be available in the Annual Meeting Rules of Conduct, which will be posted at the virtual Annual Meeting website during the Annual Meeting.

In the event of a technical malfunction or other situation that the Board Chair determines may affect the ability of the Annual Meeting to satisfy the requirements for a meeting of Shareholders to be held by means of remote communication under Delaware General Corporation Law, or that otherwise makes it advisable to adjourn the Annual Meeting, the Board Chair or Secretary of the Annual Meeting will convene the meeting at 9:30 a.m. Central Daylight Saving Time on May 24, 2023 at the Company’s address specified in the Meeting Notice above solely for the purpose of adjourning the meeting to reconvene at a date, time and physical or virtual location announced by the meeting Chair. Under either of the foregoing circumstances, we will post information regarding the announcement on the Company’s website at investors.horacemann.com.

| | | | | | | | |

| Horace Mann Educators Corporation | | 2023 Annual Meeting of Shareholders Meeting Notice & Proxy Statement 3 |

2023 Proxy Statement | Proposals and Company Information

Proposal No. 1 - Election of Nine Directors

The Bylaws of the Company provide for the Company to have not less than five or more than 15 Directors. The following nine persons currently are serving as Directors of the Company (Directors): Thomas A. Bradley, Mark S. Casady, Daniel A. Domenech, Perry G. Hines, Mark E. Konen, Beverley J. McClure, H. Wade Reece, Elaine A. Sarsynski and Marita Zuraitis. The terms of these Directors expire at the Annual Meeting. Seven of the current Directors are standing for reelection. Both Mr. Casady, in order to focus on his business as General Partner of Vestigo Ventures, and Dr. Domenech, who has reached the mandatory age of retirement under the Company’s retirement policy, were not renominated to stand for reelection to the Board.

In order to ensure the Board has the background skills necessary to support Horace Mann’s continued growth, the Nominating & Governance Committee recommended, and the Board approved, the addition of two new Board nominees, Victor Fetter and Aaliyah Samuel. Mr. Fetter is the Global Chief Information Officer of Fortive, an industrial technology company. He has extensive experience with technology, including cybersecurity and digital transformation. Dr. Samuel is the President and Chief Executive Officer of CASEL, a nonprofit organization dedicated to making evidence-based social and emotional learning an essential part of education. She has extensive experience in public education and educational policy development. She served as the Deputy Assistant Secretary of Local, State and National Engagement at the U.S. Department of Education.

Board Qualifications

The Board of Directors believes it is necessary for each of the Directors to possess a variety of qualities and skills. The Nominating & Governance Committee conducts all necessary and appropriate inquiries into the background and qualifications of Board candidates, including the determination of their independence. In addition, the Nominating & Governance Committee has identified areas of expertise that it believes support the Company’s business strategy in the short- and long-term, enable the Board to exercise its oversight function and contribute to a well-rounded Board.

The matrix below highlights certain key qualifications and experience of the Board Nominees.(1)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Bradley | Fetter | Hines | Konen | McClure | Reece | Samuel | Sarsynski | Zuraitis |

| Education Background | | | X | | | X | X | | |

| Niche Market Experience | X | | | | X | | X | X | X |

| Brand & Marketing | | | X | X | X | | X | X | X |

| Insurance | X | | X | X | X | X | | X | X |

| Agency Management | | | | | | X | | X | X |

| Technology & Innovation | | X | | X | | | | X | X |

| Public Company Board Experience | X | | X | | X | | | X | X |

| Financial Services | X | X | X | X | X | X | | X | X |

| Customer Experience | | X | X | | X | X | X | X | X |

| Senior Leadership Experience | X | X | X | X | X | X | X | X | X |

| Finance & Accounting | X | | | X | | | | X | X |

| Investments | X | X | X | X | | | | X | X |

| Corporate Governance | X | X | X | | X | | | X | X |

| Human Capital / Talent Management | | X | | | | | X | X | X |

| HR / Executive Compensation | | | | | | | X | X | X |

(1) The absence of a particular qualification or skill for a Director does not mean the Director does not possess that attribute.

| | | | | | | | |

4 2023 Annual Meeting of Shareholders Meeting Notice & Proxy Statement | | Horace Mann Educators Corporation |

Board Diversity

The Nominating & Governance Committee believes that it is important that the Board be comprised of individuals with expertise in fields relevant to the Company’s business, experience from different professions, a diversity of age, ethnicity and gender, and a range of tenures.

The Nominating & Governance Committee is responsible for reviewing with the Board, on an annual basis, the requisite skills and characteristics of new Board members as well as the composition of the Board as a whole. This assessment includes consideration of experience, perspective, background, skill sets, age, ethnicity, and gender makeup of the current Board as well as any candidate’s individual qualities in leadership, character judgment and ethical standards. It also assesses the effectiveness of our interest in diverse candidates.

The Nominating & Governance Committee believes our Board Nominees (as identified below) represent a diverse base of perspectives and reflect the diversity of the Company’s employees, customers and Shareholders, as well as an appropriate level of age and tenure, as further illustrated below.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Board nominees(1) | Bradley | Fetter | Hines | Konen | McClure | Reece | Samuel | Sarsynski | Zuraitis |

| Gender | Male | Male | Male | Male | Female | Male | Female | Female | Female |

Age(2) | 65 | 54 | 60 | 64 | 68 | 66 | 44 | 67 | 62 |

| Director Since | 2021 | N/A | 2018 | 2019 | 2013 | 2016 | N/A | 2021 | 2013 |

| Race/Ethnicity | Caucasian/white | Caucasian/white | African American/Black | Caucasian/white | Caucasian/white | Caucasian/white | African American/ Black and Hispanic | Caucasian/white | Caucasian/white |

N/A - Not applicable

(1) No Board nominee identified as a military veteran, person with disabilities, or LGBTQ+.

(2) As of March 15, 2023

Board Refreshment

The Board and Nominating & Governance Committee regularly consider the long-term makeup of the Board and how the members of the Board change over time. The Board and Nominating & Governance Committee understand the importance of Board refreshment and strive to balance the knowledge that comes from longer-term service on the Board with the new experience, ideas and energy that can come from adding directors to the Board. Directors who are 75 years of age or older may not stand for election in the absence of a specific finding by the Board that there are special circumstances to justify an exception, which supports Board refreshment.

| | | | | | | | |

| Horace Mann Educators Corporation | | 2023 Annual Meeting of Shareholders Meeting Notice & Proxy Statement 5 |

Board Nominees

Upon the recommendation of the Nominating & Governance Committee, the Board nominated Mr. Bradley, Mr. Fetter, Mr. Hines, Mr. Konen, Ms. McClure, Mr. Reece, Dr. Samuel, Ms. Sarsynski and Ms. Zuraitis (Board Nominees) to hold office as Directors.

The proxies solicited by and on behalf of the Board will be voted FOR the election of the Board Nominees unless you specify otherwise. The Company has no reason to believe that any of the foregoing Board Nominees is not available to serve or will not serve if elected, although in the unexpected event that any such Board Nominee should become unavailable to serve as a Director, full discretion is reserved to the persons named as proxies to vote for such other persons as may be nominated, or the Board may reduce the size of the Board. Each Director will serve until the next Annual Meeting of Shareholders and until their respective successor is duly elected and qualified.

The following information, as of March 15, 2023, is provided with respect to each Board Nominee:

| | | | | | | | |

| Thomas A. Bradley Age: 65 Director Since: 2021 Horace Mann Committees: Audit (Chair) | Mr. Bradley currently serves as acting Chief Executive Officer and Chairman of the Board of Argo Group International Holdings, Ltd., an international underwriter of specialty insurance and reinsurance products in the property and casualty market. He retired from Allied World Assurance Company Holdings, AG, an insurance holding company, in July 2018 as Executive Vice President and Chief Financial Officer, a position he had held since 2012. He previously served as the Executive Vice President and Chief Financial Officer for both Fair Isaac Corporation and the St. Paul Companies. Mr. Bradley also held senior financial and operational positions at Zurich Insurance Group, including Chief Financial Officer for North America and Chief Executive Officer of the Universal Underwriters Group.

Mr. Bradley has an extensive finance and accounting background and is recognized as a financial expert. His knowledge in these areas assists the Board in its oversight responsibilities. |

| Victor P. Fetter Age: 54 Board Nominee | Mr. Fetter is the Global Chief Information Officer of Fortive, an industrial technology company, a position he has held since January 2020. He previously served as Chief Digital Officer at Vertiv, a critical infrastructure provider, from 2017 to 2019. Prior to that, he served as Chief Information Officer for LPL Financial and Dell’s online division. He is National Association of Corporate Directors (NACD) Directorship Certified and has completed the NACD Cyber-Risk Oversight Program. Mr. Fetter’s extensive experience in digital transformation, cybersecurity and technology risk management will bring a unique perspective and assist the Board with its oversight responsibilities. |

| | | | | | | | |

6 2023 Annual Meeting of Shareholders Meeting Notice & Proxy Statement | | Horace Mann Educators Corporation |

| | | | | | | | |

| Perry G. Hines Age: 60 Director Since: 2018 Horace Mann Committees: Audit Investment & Finance | Mr. Hines is a retired corporate marketing executive and is the President and CEO of The Hines Group, LLC, a firm he formed in 2006 specializing in marketing, communications and strategic planning. He has over 27 years of cross-sector experience in general management, brand, communications and marketing with a specific focus on financial services. Mr. Hines previously served as Senior Vice President, Chief Marketing and Communications Officer for Irwin Mortgage Corporation, a position he held from 2002 to 2007, Senior Vice President, Chief Marketing and Sales Officer of Lincoln Reinsurance Corporation and its subsequent successor Swiss Reinsurance Corporation from 1998 to 2002 and Vice President of Marketing & Communications of Safeco from 1995 to 1998. He has held numerous management roles and stewarded well known household brands.

Mr. Hines’ cross-sector expertise in general management, brand building and strategic marketing brings unique perspective and insight to the Board. |

| Mark E. Konen Age: 64 Director Since: 2019 Horace Mann Committees: Compensation (Chair) Audit Executive | Mr. Konen retired from Lincoln Financial Group, a financial services company, in February 2017 as President of the Insurance and Retirement Solutions division, a position he had held since 2008. He was responsible for all aspects of strategic leadership, product development, and client services, as well as profitability management of the individual life insurance, group protection and retirement plan services businesses. He oversaw Lincoln Financial Group’s individual life and annuity business as President, Individual Markets, from 2006 to 2008. Prior to its merger with Lincoln Financial Group in 2006, he served in various senior management positions with Jefferson Pilot Financial. Mr. Konen is currently a member of the Board of Directors of Lincoln Life & Annuity Company of New York.

Mr. Konen’s 35-year insurance career, extensive background and proven leadership in the life and retirement business provides the Board with a valuable perspective on these topics. |

| Beverley J. McClure Age: 68 Director Since: 2013 Horace Mann Committees: Nominating & Governance (Chair) Compensation | Ms. McClure retired in 2007 after a 35-year career with United Services Automobile Association, a diversified financial services group, as Senior Vice President, Enterprise Operations. In 2007, she founded Fresh Perspectives LLC, an executive coaching and small business consulting firm, which was dissolved in 2019. Ms. McClure previously served as Senior Advisor of Endeavor Management, a consulting firm specializing in service culture creation, leadership coaching, business transformation, operational execution, and customer experience management, a position she held from 2010 to 2013. She holds the Chartered Life Underwriter and Fellow and Life Management Institute designations. Ms. McClure’s broad experience in the areas of service excellence, customer experience, culture creation, employee engagement and quality management provides the Board with a valuable perspective on these topics. |

| | | | | | | | |

| Horace Mann Educators Corporation | | 2023 Annual Meeting of Shareholders Meeting Notice & Proxy Statement 7 |

| | | | | | | | |

| H. Wade Reece Age: 66 Director Since: 2016 Horace Mann Committees: Executive (Chair) Compensation Nominating & Governance | Mr. H. Wade Reece retired in 2015 after a 37-year career with BB&T Corporation, a bank holding company, where he served as the Chairman of the Board and Chief Executive Officer of BB&T Insurance Services, Inc. and BB&T Insurance Holdings, Inc., the sixth largest insurance broker globally. Until his retirement in 2015, Mr. Reece served as Vice Chairman of the Foundation of Agency Management Excellence Board of Directors and a member of the Executive Committee of The Institutes (American Institute for Chartered Property Casualty Underwriters and Insurance Institute of America). He was also a Chairman of the Council of Insurance Agents & Brokers and Chairman of the Board of Trustees of The Institutes. Mr. Reece currently is a member of the Board of Directors of the North Carolina State University Foundation and the Blue Ridge Conservancy.

Mr. Reece’s in-depth knowledge of the insurance industry, leadership skills and broad experience with agency management provides the Board with industry insight and perspective. |

| Aaliyah A. Samuel, EdD Age: 44 Board Nominee | Dr. Samuel is the President and Chief Executive Officer of CASEL, a nonpartisan, nonprofit organization dedicated to making evidence-based social and emotional learning an essential part of education for all students, a position she has held since January 2022. Prior to joining CASEL, she served as Deputy Assistant Secretary, of Local, State and National Engagement at the U.S. Department of Education, a position she held from February 2021 to December 2021. Prior to her role in the Department of Education, she was with NWEA, a research based not-for-profit that creates academic assessments, including service as Executive Vice President of Government Affairs & Partnerships and Vice President, Policy & Advocacy, from January 2019 to February 2021. She served as Director of Education at the National Governors Association from November 2015 to December 2018. Dr. Samuel currently serves as a Senior Fellow at the Center on the Developing Child at Harvard University, a research center to drive innovation in early childhood education practice and policy.

Dr. Samuel’s extensive experience in public education and educational policy development will provide the Board with valuable insight into the Company’s niche market and the challenges and opportunities within that market. |

| | | | | | | | |

8 2023 Annual Meeting of Shareholders Meeting Notice & Proxy Statement | | Horace Mann Educators Corporation |

| | | | | | | | |

| Elaine A. Sarsynski Age: 67 Director Since: 2021 Horace Mann Committees: Investment & Finance (Chair) | Ms. Sarsynski was Chairwoman, Chief Executive Officer and President of Mass Mutual International, an insurance company, until her retirement in 2017. She joined Mass Mutual Life Insurance Company in 2005 as Managing Director at Babson Capital Management LLC, a MassMutual subsidiary. She became Executive Vice President, Chief Administrative Officer, Chief Executive Officer and President of MassMutual International in 2006 and Executive Vice President, member of the Office of the Chief Executive Officer and President of MassMutual Retirement Services, as well as Chairwoman of MassMutual International, in 2008. Prior to joining Babson Capital, she served two elected terms as First Selectman for the town of Suffield, Connecticut. In 1998, she founded Sun Consulting Group LLC, offering consulting services to the real estate industry. Ms. Sarsynski previously spent 17 years at Aetna where she held multiple senior management positions overseeing segments of the company’s Investments Division and leading the Corporate Finance Department. She currently serves on the Board of Directors of Genworth Financial, Inc., TI Fluid Systems PLC and Horizon Technology Finance Corporation. Ms. Sarsynski’s extensive knowledge in managing institutional investments and proven strategic leadership is a valuable asset to the Board. |

| Marita Zuraitis Age: 62 Director Since: 2013 Horace Mann Committees: Executive Investment & Finance | Ms. Zuraitis was appointed to her present position as President and Chief Executive Officer of the Company in September 2013 after joining the Company in May 2013 as President and Chief Executive Officer-Elect. Ms. Zuraitis came to Horace Mann from The Hanover Insurance Group where she was an Executive Vice President and a member of The Hanover’s Executive Leadership Team. From 2004 to 2013, she served as President, Property and Casualty Companies, of The Hanover Insurance Group. Prior to 2004, Ms. Zuraitis was with The St. Paul/Travelers Companies for six years, where she achieved the position of President and Chief Executive Officer, Commercial Lines. She also held a number of increasingly responsible underwriting and field management positions with United States Fidelity and Guaranty Company and Aetna Life and Casualty. She is the Chair of the Board of Trustees of The Institutes, the leading provider of risk management and property-casualty insurance education, whose offerings include the premier CPCU® designation, and a past member of the Board of Directors of LL Global, Inc., a trade association with operating divisions LIMRA and LOMA. She is also a member of the Board of Directors of Citizens Financial Group, Inc. Ms. Zuraitis has over 30 years of experience in the insurance industry.

Ms. Zuraitis’s knowledge of and extensive background in the insurance industry contribute to Board discussion and understanding of issues impacting the Company. |

| | | | | | | | |

| Horace Mann Educators Corporation | | 2023 Annual Meeting of Shareholders Meeting Notice & Proxy Statement 9 |

All of the Board Nominees were elected Directors at the last Annual Meeting of Shareholders of the Company held on May 25, 2022, with the exception of Mr. Fetter and Dr. Samuel. As part of ongoing Board refreshment, the Nominating & Governance committee reviewed a broad pool of candidates. Some candidates were recommended by non-management Directors, including Mr. Fetter and Dr. Samuel. After an extensive interview process, Mr. Fetter and Dr. Samuel were selected and recommended for nomination as Directors by the Company’s Nominating & Governance Committee. The Board recommends that Shareholders vote FOR the election of these nine nominees as Directors.

Board of Directors and Committees

There were nine members on the Board as of March 15, 2023. The Board met seven times during 2022. No incumbent Director of the Company attended fewer than 90% of the Board meetings and the committee meetings to which they were appointed and served during 2022.

The Board Chair presides over all executive sessions of the Board, including executive sessions of non-employee Directors, and may be contacted as described in “Corporate Governance - Communications with Directors.” The members of the Board are expected to be present at the Annual Meeting. The following nine Directors serving on the Board at the time of last year’s Annual Meeting attended the meeting: Mr. Bradley, Mr. Casady, Dr. Domenech, Mr. Hines, Mr. Konen, Ms. McClure, Mr. Reece, Ms. Sarsynski and Ms. Zuraitis.

Committees of the Board

The standing committees of the Board consist of the Executive Committee, Compensation Committee, Nominating & Governance Committee, Investment & Finance Committee and Audit Committee. Each standing committee is governed by a charter that defines its role and responsibilities which are available on the Company’s website at investors.horacemann.com under “Governance - Governance Documents.” A printed copy of these charters may be obtained by Shareholders upon written request addressed to Investor Relations, Horace Mann Educators Corporation, 1 Horace Mann Plaza, C-738, Springfield, Illinois 62715-0001. The Board may also form ad hoc committees from time to time.

The Executive Committee exercises certain powers of the Board during intervals between meetings of the Board and, as requested by the Chief Executive Officer, acts as a sounding board for discussing strategic and operating issues between Board meetings.

The Compensation Committee approves and recommends to the Board the compensation, salaries, bonuses and awards applicable to the Executive Officers and Directors of the Company and oversees the process of Executive Officer leadership development and succession. The Committee also reviews annually the diversity of the Company’s workforce, as well as those activities and initiatives related to diversity. Each of the current members of this Committee are independent under the listing standards of the NYSE applicable to compensation committee members. The Compensation Committee receives recommendations from management regarding compensation matters and has unrestricted access to the Company’s personnel documents and to reports or evaluations of any independent compensation consultants, specialists or advisors who are retained by the Company or the Compensation Committee to analyze the compensation of the Executive Officers and members of the Board. The Compensation Committee also has access to any other resources which it needs to discharge its responsibilities, including selecting, retaining and/or replacing, as needed, compensation consultants and other outside consultants to provide independent advice to the Compensation Committee. Additional information regarding the processes and procedures for the consideration and determination of Executive Officer compensation is provided in the Compensation Discussion and Analysis.

The Nominating & Governance Committee develops and recommends to the Board corporate governance principles applicable to the Company, oversees the Company’s environmental, social and governance (ESG) initiatives, including oversight of actions and establishment of related goals to address environmental, climate and social risks, oversees the Board succession planning process, and recommends Director candidates to the Board. The Nominating & Governance Committee will consider Director candidates recommended by Shareholders. Candidates may be submitted in writing to the Corporate Secretary, Horace Mann Educators Corporation, 1 Horace Mann Plaza, Springfield, Illinois 62715-0001. There are no differences between the evaluation of candidates recommended by Shareholders and the evaluation of candidates recommended by members of the Nominating & Governance Committee.

| | | | | | | | |

10 2023 Annual Meeting of Shareholders Meeting Notice & Proxy Statement | | Horace Mann Educators Corporation |

The Nominating & Governance Committee does not have any specific, minimum qualifications that nominees must meet, but evaluates possible nominees to the Board on the basis of the factors it deems relevant, including the following:

•high standards of personal character, conduct and integrity;

•understanding of the interests of the Company’s Shareholders, clients, employees, agents, suppliers, communities and the general public;

•intention and ability to act in the interest of all Shareholders;

•position of leadership and substantial accomplishment in their field of endeavor, which may include business, government or academia;

•ability to understand and exercise sound judgment on issues related to the goals of the Company;

•willingness and ability to devote the time and effort required to serve effectively on the Board, including preparation for and attendance at Board and committee meetings;

•absence of interests or affiliations that could give rise to a biased approach to directorship responsibilities and/or a conflict of interest, and the absence of any significant business relationship with the Company except for the employment relationship of an employee Director; and

•needs of the Board, including skills, experience, diversity and age.

The Investment & Finance Committee approves investment strategies, monitors the performance of investments made on behalf of the Company and its subsidiaries, and oversees all matters relating to the Company’s capital structure.

The Audit Committee oversees the accounting and financial reporting process, audits of the financial statements, ethical standards policies and compliance with the Code of Conduct, and internal operating controls of the Company, including those related to data privacy and cybersecurity. It meets with both the Company’s management and the Company’s independent registered public accounting firm. Each of the current members of this Committee is independent under the independence standards of the NYSE applicable to audit committee members. No Audit Committee member serves on the audit committee of more than three other publicly traded companies. The Board has determined that Mr. Bradley, the Chair of our Audit Committee, is an “audit committee financial expert” as defined by SEC rules. Mr. Bradley retired in 2018 from Allied World Assurance Company Holdings, AG, an insurance holding company, where he served as Executive Vice President and Chief Financial Officer. He previously served as Chief Financial Officer of Fair Isaac Corporation and the St. Paul Companies and held various senior financial positions at Zurich Insurance Group, including Chief Financial Officer for North America.

Considering the importance of technology advancement, the Board has established a formal Technology Liaison role to focus on cybersecurity and technology issues, which we believe are important to Horace Mann’s ongoing success. The Technology Liaison is a Board member that has experience and expertise with respect to cybersecurity and technology issues. Fundamentally, the Technology Liaison’s role is to support effective Board oversight on cybersecurity and technology issues in light of the increasing costs and risks associated with technology investment and cybersecurity. Mark Casady currently serves as the Board’s designated Technology Liaison.

The following table identifies membership and the Chair of each of the current committees of the Board, as well as the number of times each committee met during 2022.

| | | | | | | | |

| Horace Mann Educators Corporation | | 2023 Annual Meeting of Shareholders Meeting Notice & Proxy Statement 11 |

| | | | | | | | | | | | | | | | | |

Director | Executive

Committee | Compensation Committee | Nominating & Governance

Committee | Investment & Finance

Committee | Audit

Committee |

| Thomas A. Bradley | | | | | Chair |

| Mark S. Casady | X | | | X | |

| Daniel A. Domenech | | | X | | |

Perry G. Hines | | | | X | X |

Mark E. Konen | X | Chair | | | X |

Beverley J. McClure | | X | Chair | | |

H. Wade Reece | Chair | X | X | | |

| Elaine A. Sarsynski | | | | Chair | |

Marita Zuraitis | X | | | X | |

| Meetings in 2022 | 0 | 5 | 5 | 4 | 12 |

Chair - Committee Chair

X - Committee member

Director Compensation

The Compensation Committee (Committee) reviews compensation to be paid to the Company’s non-employee Directors. The Committee retained Compensation Advisory Partners LLC (CAP) as independent compensation consultants to provide information and advice to the Committee regarding non-employee Director compensation. CAP analyzes each element of director compensation for the same peer group of companies that is used to evaluate executive compensation. See “Compensation levels should be market competitive” in the Compensation Discussion & Analysis for a list of these peer companies. CAP also considers non-employee Director compensation in the insurance industry and the broader general industry, as appropriate. The Committee reviews CAP’s report of competitive Director compensation and determines whether to recommend to the Board a change in the Company’s non-employee Director compensation. If such a change is recommended by the Committee, the full Board would then determine whether to ratify the change. The Committee’s current practice is to review non-employee Director compensation every other year. In 2022, the Compensation Committee recommended, and the Board approved, an increase in the Board annual retainers, and an increase in the annual award of Restricted Stock Units, as reflected in the table below.

| | | | | | | | |

12 2023 Annual Meeting of Shareholders Meeting Notice & Proxy Statement | | Horace Mann Educators Corporation |

The compensation program for non-employee Directors is shown in the following table:

| | | | | |

Compensation Element | Non-Employee Director Compensation(1) |

| Board Chair Annual Retainer | $145,000 |

Board Member Annual Retainer

(other than Board Chair) | $75,000 |

| Committee Chair Annual Retainer | $25,000 Audit Committee $15,000 all other Committees(2) |

| Technology Liaison Annual Retainer | $10,000 |

| Share-based Compensation | Fair value on the date of the respective awards is used to determine the number of Restricted Stock Units (RSUs) awarded.

An annual award of $115,000 in RSUs following the Annual Shareholder Meeting. $115,000 in RSUs if joining the Board within six months after the prior Annual Shareholder Meeting, $57,500 in RSUs if joining more than six months after the prior Annual Shareholder Meeting but before the next Annual Shareholder Meeting.

All awards have a 1-year vesting period. |

| Basic Group Term Life Insurance | Premium for $10,000 face amount |

| Business Travel Accident Insurance | Premium for $100,000 coverage |

(1) Annual retainer fees are paid following the Annual Shareholder Meeting each year. The annual retainer fees are prorated to the extent that a non-employee Director joins the Board after the Annual Shareholder Meeting. Non-employee Directors may elect to defer cash compensation into RSUs.

(2) The Executive Committee Chair is not paid an Annual Retainer.

Non-employee Directors are required to hold shares of HMEC Common Stock with a market value equal to five times their annual cash retainer.

Until non-employee Directors meet this ownership requirement, they must retain all RSUs granted as share-based compensation (net of taxes). As of December 31, 2022, all non-employee Directors have met the guidelines with the exception of the following individuals: Mr. Casady, Mr. Konen and Ms. Sarsynski. They have five years to meet this requirement and Mr. Konen and Ms. Sarsynski are on track to do so. Mr. Casady was not nominated to stand for reelection to the Board after four years of service. Employee Directors do not receive compensation for serving on the Board and are subject to separate stock ownership guidelines. See Stock Ownership & Holding Requirements under Compensation Discussion and Analysis.

| | | | | | | | |

| Horace Mann Educators Corporation | | 2023 Annual Meeting of Shareholders Meeting Notice & Proxy Statement 13 |

The following table sets forth information regarding compensation earned by, or paid to, the non-employee Directors during 2022:

| | | | | | | | | | | | | | |

Director | Fees Earned

or Paid in Cash ($) | Stock Awards

($) (1) | All Other

Compensation

($) (2) | Total

($) |

Thomas A. Bradley(3) | 110,425 | 115,000 | 51 | 225,476 |

| Mark S. Casady | 85,000 | 115,000 | 51 | 200,051 |

| Daniel A. Domenech | 75,000 | 115,000 | 204 | 190,204 |

| Perry G. Hines | 75,000 | 115,000 | 51 | 190,051 |

| Mark E. Konen | 90,000 | 115,000 | 51 | 205,051 |

| Beverley J. McClure | 90,000 | 115,000 | 204 | 205,204 |

| H. Wade Reece | 145,000 | 115,000 | 204 | 260,204 |

| Elaine A. Sarsynski | 90,000 | 115,000 | 204 | 205,204 |

(1) Represents fees deferred in 2022 pursuant to the HMEC 2010 Comprehensive Executive Compensation Plan, as well as $115,000 in RSUs (awarded May 25, 2022). As of December 31, 2022, each Director had 2,987 unvested RSUs.

(2) Represents insurance premiums provided by the Company for group term life insurance and business travel accident insurance for each Director. The group term life insurance premiums are age-banded and this is reflected in the lower premiums for Mr. Bradley, Mr. Casady, Mr. Hines and Mr. Konen.

(3) Mr. Bradley was appointed Chairman of the Audit Committee effective January 13, 2022. Mr. Bradley’s Committee Chair annual retainer was pro-rated based on that date.

Corporate Governance

Director Independence

The Company’s Corporate Governance Principles require that the Board consist of a majority of directors who meet the criteria for independence required by the listing standards of the NYSE. Based on the independence requirements of the NYSE and after reviewing any relationships between the Board Nominees and the Company or its management (either directly or indirectly, including as a partner, Shareholder or officer of an organization that has a relationship with the Company or its management) that could impair, or appear to impair, the Director’s ability to make independent judgments, the Board determined that none of its non-employee Board Nominees have a material relationship with the Company, and therefore all of these Directors are independent. These independence determinations are analyzed at least annually in both fact and appearance to promote arms-length oversight. The current non-employee Board Nominees are Mr. Bradley, Mr. Fetter, Mr. Hines, Mr. Konen, Ms. McClure, Mr. Reece, Dr. Samuel and Ms. Sarsynski. In addition, the Board determined that Mr. Casady and Dr. Domenech, who are not standing for reelection to the Board, are independent.

Board Leadership Structure

Our Board’s leadership structure may change over time to reflect the Company’s evolving needs, strategy, and operating environment as well as changes to our Board’s composition and leadership needs. Other factors, including the perspective of shareholders and other stakeholders, will also influence the Company’s leadership structure. The Board is committed to strong, independent Board leadership and believes that objective oversight of management is a critical aspect of effective corporate governance.

The Board has a separate Board Chair and Chief Executive Officer; the position of Board Chair is held by an independent Director. The Board of Directors believes that having an independent Director serve as Board Chair is in the best interest of the Company at this time, as this structure provides a greater role for the independent Directors in the oversight of the Company. As described in the Company’s Corporate Governance Principles, in the future, the Board could deem it to be in the best interests of the Company and its shareholders to permit one individual to hold both positions. If the same person holds the Board Chair and Chief Executive Officer role or if the Board Chair is not

| | | | | | | | |

14 2023 Annual Meeting of Shareholders Meeting Notice & Proxy Statement | | Horace Mann Educators Corporation |

independent, the independent directors of the Board will designate one of the independent directors to serve as the independent Lead Director.

The Board continues to believe it is important to retain flexibility to determine whether the role of Board Chair and Chief Executive Officer should be separate or combined roles, based upon the Board’s assessment of the Company’s needs. The Board recognizes that no single leadership model is right for all companies and at all times and will continue to evaluate whether to split or combine the Board Chair and Chief Executive Officer roles to ensure the Company’s leadership structure is optimized to serve the best interest of the Company and our shareholders.

Board Evaluation

The Nominating & Governance Committee is responsible for overseeing the annual evaluation process designed to measure and improve board and director effectiveness. Each Director annually completes a self-assessment questionnaire. An external law firm compiles the responses and provides a written summary of the data to the Chair of the Nominating & Governance Committee.