SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

| Filed by the Registrant x | Filed by a Party other than the Registrant ¨ | |

| Check the appropriate box: | ||

|

x Preliminary Proxy Statement.

|

||

|

¨ Confidential, for use of the Commission Only (as permitted by Rule 14a-6(e)(2)).

| ||

|

¨ Definitive Proxy Statement.

|

||

|

¨ Definitive Additional Materials.

|

||

| ¨ Soliciting Material Pursuant to Sec. 240.14a-12. | ||

Oppenheimer Global Strategic Income Fund

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

| Payment | Of Filing Fee (Check the appropriate box): |

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| 1) | Title of each class of securities to which transaction applies: |

| 2) | Aggregate number of securities to which transaction applies: |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4) | Proposed maximum aggregate value of transaction: |

| 5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| 1) | Amount Previously Paid: |

| 2) | Form, Schedule or Registration Statement No.: |

| 3) | Filing Party: |

| 4) | Date Filed: |

Important Proxy Materials

PLEASE CAST YOUR VOTE NOW

OPPENHEIMER GLOBAL STRATEGIC INCOME FUND

Dear Shareholder:

A Special Meeting of Shareholders (the “Meeting”) of Oppenheimer Global Strategic Income Fund (the “Fund”) will be held at [1:00 p.m. Mountain Time] on May 1, 2015, as may be adjourned or postponed, at the offices of the Fund located at 6803 South Tucson Way, Centennial, Colorado 80112. A formal notice of the Meeting appears on the next page and is followed by a proxy statement for the Meeting.

The Meeting is being held for the purpose of seeking shareholder approval on proposals approved by the Fund’s Board of Trustees (the “Board”). As described further in the enclosed proxy statement, these proposals include:

| (1) | To elect Arthur P. Steinmetz as a Trustee of the Fund. In July 2014, Mr. Steinmetz was appointed Chief Executive Officer and Chairman of OFI Global Asset Management, Inc. (the “Manager”), which currently serves as manager of the Oppenheimer family of funds, including the Fund. In January 2015, Mr. Steinmetz was also appointed Chairman of OppenheimerFunds, Inc. (the “Sub-Adviser”), which currently serves as sub-adviser for the Oppenheimer family of funds. As such, Mr. Steinmetz is uniquely positioned to serve as a Trustee. |

| (2) | To approve a new investment sub-sub-advisory agreement between OppenheimerFunds, Inc. and Apollo Credit Management, LLC. On January 22, 2015, the Board approved, subject to shareholder approval, a new investment sub-sub-advisory agreement between the Sub-Adviser and Apollo Credit Management, LLC (“ACM”) (the “Apollo Agreement”). |

| (3) | To approve implementation of a manager of managers arrangement with respect to the Fund. On November 11, 2014 and January 22, 2015, the Board approved, subject to shareholder approval, the implementation of a manager of managers arrangement for the Fund that will permit each of the Manager and the Sub-Adviser, subject to the prior approval of the Board, to enter into and materially amend agreements with sub-advisers without obtaining prior approval of the Fund’s shareholders (the “Manager of Managers Arrangement”). |

If the proposals are approved at the Meeting it is expected that the Apollo Agreement and the Manager of Managers Arrangement will become effective as soon as reasonably practicable.

After careful consideration, the Board recommends that you vote FOR each Proposal.

YOU CAN VOTE ON THE INTERNET, BY TELEPHONE OR BY MAIL.

WE URGE YOU TO VOTE PROMPTLY.

YOUR VOTE IS IMPORTANT.

Dated: February [27], 2015

By Order of the Board of Trustees

Arthur Gabinet, Secretary

____________________________________________________________________________________

PLEASE HELP YOUR FUND AVOID THE EXPENSES OF ADDITIONAL SOLICITATIONS BY VOTING TODAY

QUESTIONS AND ANSWERS:

What proposals am I being asked to vote on?

You are being asked to vote on the following proposals:

| (1) | To elect Arthur P. Steinmetz as a Trustee of the Fund. In July 2014, Mr. Steinmetz was appointed Chief Executive Officer and Chairman of OFI Global Asset Management, Inc. (the “Manager”), which currently serves as manager of the Oppenheimer family of funds, including the Fund. In January 2015, Mr. Steinmetz was also appointed Chairman of OppenheimerFunds, Inc. (the “Sub-Adviser”), which currently serves as sub-adviser for the Oppenheimer family of funds. As such, Mr. Steinmetz is uniquely positioned to serve as a Trustee. |

| (2) | To approve a new investment sub-sub-advisory agreement between OppenheimerFunds, Inc. and Apollo Credit Management, LLC. On January 22, 2015, the Board approved, subject to shareholder approval, a new investment sub-sub-advisory agreement between the Sub-Adviser and Apollo Credit Management, LLC (“ACM”) (the “Apollo Agreement”). |

| (3) | To approve implementation of a manager of managers arrangement with respect to the Fund. On November 11, 2014 and January 22, 2015, the Board approved, subject to shareholder approval, the implementation of a manager of managers arrangement for the Fund that will permit each of the Manager and the Sub-Adviser, subject to the prior approval of the Board, to enter into and materially amend agreements with sub-advisers without obtaining prior approval of the Fund’s shareholders (the “Manager of Managers Arrangement”). |

Has my Fund’s Board approved the Proposals?

Yes. These proposals were approved by the Fund’s Board, including a majority of the Independent Trustees, and the Board and recommends that you vote to approve each proposal.

Why am I being asked to elect Arthur P. Steinmetz as a Trustee?

In July 2014, Mr. Steinmetz was appointed Chief Executive Officer and Chairman of the Manager, which currently serves as manager of the Oppenheimer family of funds. In January 2015, Mr. Steinmetz was also appointed Chairman of the Sub-Adviser, which currently serves as sub-adviser for the Oppenheimer family of funds. In addition, Mr. Steinmetz has served as President and Principal Executive Officer of the Fund and other funds in the Oppenheimer fund complex since September 2014 and is a former Vice President and portfolio manager of the Fund. As such, Mr. Steinmetz is uniquely positioned to serve as a Trustee. The Board has reviewed Mr. Steinmetz’s qualifications and background and believes that he is experienced in overseeing investment companies and is familiar with the Fund, the Oppenheimer fund complex and the Manager.

Why am I being asked to approve the Apollo Agreement?

The Fund is an investment company registered under the Investment Company Act of 1940, as amended (the “Investment Company Act”), which requires that a new investment advisory agreement or sub-advisory agreement (including sub-sub-advisory agreements) be approved by a majority of the Fund’s outstanding voting securities (as defined in the Investment Company Act) absent special exemptive relief from the SEC. At present, all of the Fund’s assets are managed by the Fund’s sub-adviser, OppenheimerFunds, Inc. (the “Sub-Adviser”) pursuant to a sub-advisory agreement between the Sub-Adviser and the Manager. The Manager and the Sub-Adviser have concluded that the selection of ACM to manage a certain portion of the Fund’s assets allocated to it by the Sub-Adviser (the “Allocated Assets”) serves the interests of the Fund’s shareholders better than the current arrangement because they believe ACM is uniquely positioned to provide the Fund with access to diversified credit strategies not otherwise used by the Sub-Adviser. Because the Manager of Managers Arrangement that would otherwise apply to allow the Sub-Adviser to appoint ACM without shareholder approval has not yet been implemented, the Apollo Agreement must be submitted to shareholders of the Fund for their vote. The provisions of the Investment Company Act relating to the approval of investment advisory agreements are designed to ensure that shareholders of registered investment companies are able to participate in the decision as to which investment adviser, sub-adviser or sub-sub-adviser manages the investment company.

If approved, how will the Apollo Agreement affect my Fund?

The approval of the Apollo Agreement should have very little effect on your experience as a shareholder of the Fund. The proposal, if approved, will not result in increased fees to shareholders as the Sub-Adviser, not the Fund, will pay ACM an annual fee under the Apollo Agreement. Further, the approval of the Apollo Agreement is not anticipated to result in any change to the Fund’s investment objective or investment policies. Apollo, subject to oversight by the Manager, the Sub-Adviser and the Board, will manage the “Allocated Assets” in a manner that is consistent with the Fund’s current investment objective.

Why am I being asked to approve implementation of the Manager of Managers Arrangement?

Shareholders of the Fund are being asked to vote on implementation of the manager of managers arrangement available to the Fund, the Manager, and the Sub-Adviser, which allows each of the Manager and the Sub-Adviser to hire, and materially amend sub-advisory agreements with, sub-advisers to manage the Fund’s assets without shareholder approval, but subject to prior approval by the Board.

Will my vote make a difference?

Your vote is very important no matter how many shares you own and can make a difference in the management of the Fund. You vote can help ensure that the proposals recommended by the Board can be implemented. Voting your shares early will eliminate the need for follow-up mail and telephone solicitation.

Who is paying for preparation, printing and mailing of the Proxy Statement?

The costs associated with the Proxy Statement, including the mailing and proxy solicitation costs, will be borne by the Manager.

When will the Meeting be held?

The Meeting will be held at [1:00 p.m. Mountain Time] on May 1, 2015, unless it is adjourned or postponed.

Will the Fund’s Board attend the Meeting?

No. Members of the Fund’s Board are not required to attend the meeting and do not plan to attend the Meeting.

How do I vote my shares?

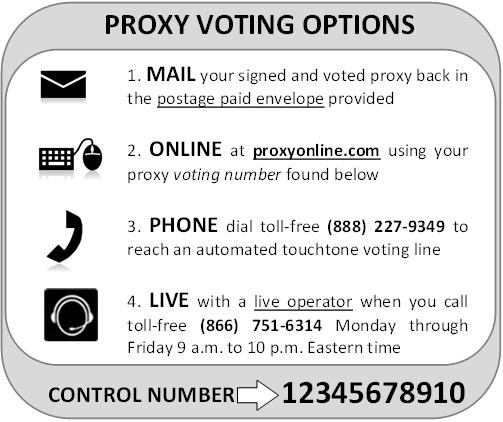

You can vote your shares by completing and signing the enclosed proxy ballot, and mailing the proxy ballot in the enclosed postage paid envelope. You also may vote your shares by telephone or via the internet by following the instructions on the attached proxy ballot and accompanying materials. If you need assistance, or have any questions regarding the proposals or how to vote your shares, please call our proxy information line toll-free at 1-866-751-6314.

NOTICE OF A SPECIAL MEETING OF SHAREHOLDERS

_________________________

OPPENHEIMER GLOBAL STRATEGIC INCOME FUND

_________________________

A Special Meeting of Shareholders of Oppenheimer Global Strategic Income Fund (“Fund”) will be held at [1:00 p.m. Mountain Time] on May 1, 2015, as may be adjourned or postponed from time to time (the “Meeting”), at the offices of the Fund located at 6803 South Tucson Way, Centennial, Colorado 80112. The purpose of the Meeting is to seek shareholder approval of three proposals recently approved by the Fund’s Board of Trustees (the “Board”). At the Meeting, shareholders will be asked to vote on the following proposals (each, a “Proposal” and collectively, the “Proposals”):

| (1) | To elect Arthur P. Steinmetz (the “Nominee”) as a Trustee of the Fund. | |

| (2) | To approve a new sub-sub-advisory agreement between OppenheimerFunds, Inc. (the “Sub-Adviser”) and Apollo Credit Management, LLC (“ACM”). |

| (3) | To approve the implementation of a manager of managers arrangement with respect to the Fund (the “Manager of Managers Arrangement”). |

Shareholders will also be asked to transact any other business as may properly come before the Meeting.

The Proposals referenced above are discussed in the Proxy Statement attached to this Notice. Only shareholders of record who owned shares of the Fund at the close of business on January 15, 2015 (the “Record Date”) are entitled to vote at the Meeting or any adjournment or postponement of the Meeting. Please be certain to sign, date and return each proxy card you receive. Please read the full text of the enclosed Proxy Statement for a complete understanding of the Proposals.

After careful consideration, the Board recommends that you vote FOR each Proposal.

YOU CAN VOTE ON THE INTERNET, BY TELEPHONE OR BY MAIL.

WE URGE YOU TO VOTE PROMPTLY.

YOUR VOTE IS IMPORTANT.

Dated: February [27], 2015

By Order of the Board of Trustees

Arthur Gabinet, Secretary

____________________________________________________________________________________

PLEASE HELP YOUR FUND AVOID THE EXPENSES OF ADDITIONAL SOLICITATIONS BY VOTING TODAY

TABLE OF CONTENTS

| NOTICE OF A SPECIAL MEETING OF SHAREHOLDERS | |

| PROXY STATEMENT | |

| Proposal 1: To elect Arthur P. Steinmetz as a Trustee of the Fund | |

| Proposal 2: To approve a new investment sub-sub-advisory agreement between OppenheimerFunds, Inc. and Apollo Credit Management, LLC | |

| Proposal 3: To approve the implementation of a manager of managers arrangement with respect to the Fund | |

|

Information Regarding the Fund |

|

| Appendix A: Form of Sub-Sub-Advisory Agreement Between Sub-Adviser and Apollo Credit Management, LLC | |

| Appendix B: Governance Committee Charter | |

_______________________________________________________

OPPENHEIMER GLOBAL STRATEGIC INCOME FUND

___________________________________________________

Special Meeting of Shareholders to be Held on May 1, 2015

This is a Proxy Statement for Oppenheimer Global Strategic Income Fund (the “Fund”). The Fund’s Board of Trustees (the “Board”) is soliciting proxies for a Special Meeting of Shareholders of the Fund to approve proposals that have already been approved by the Board.

The Board has sent you this Proxy Statement to ask for your vote on three proposals affecting your Fund. The Fund will hold a Special Meeting of Shareholders on May 1, 2015 at [1:00 p.m. Mountain Time], as may be adjourned or postponed from time to time (the “Meeting”). The Meeting will be held at the offices of the Fund located at 6803 South Tucson Way, Centennial, Colorado 80112 in order to consider the proposals described in this Proxy Statement.

Shareholders of record who owned shares of the Fund at the close of business on January 15, 2015 (the “Record Date”) are entitled to vote at the Meeting or any adjournment or postponement of the meeting. Please be certain to sign, date and return the proxy card you receive. Shareholders are entitled to cast one vote for each full share and fractional vote for each fractional share they owned on the Record Date.

You should read the entire Proxy Statement before voting. If you have any questions, please call our proxy information line toll-free at 1-866-751-6314. The Fund expects to mail the Notice of Special Meeting, this Proxy Statement and proxy ballot to shareholders on or about [February 27, 2015].

The Fund, which is organized as a Delaware statutory trust, is an open-end, diversified management investment company registered under the Investment Company Act. OFI Global Asset Management, Inc. (the “Manager”), 225 Liberty Street, New York, New York 10281, serves as the Fund's investment adviser. OppenheimerFunds, Inc. (the "Sub-Adviser"), 225 Liberty Street, New York, New York 10281, serves as its sub-adviser.

The Fund is required by federal law to file reports, proxy statements and other information with the Securities and Exchange Commission (the “SEC”). The SEC maintains a website that contains information about the Fund (www.sec.gov). You can inspect and copy the proxy material, reports and other information at the public reference facilities of the SEC, 100 F Street NE, Washington, D.C. 20549. You can also obtain copies of these materials from the Public Reference Branch, Office of Consumer Affairs and Information Services of the SEC at 100 F Street NE, Washington, D.C., 20549, at prescribed rates.

The Annual Report to Shareholders of the Fund has previously been sent to shareholders. Upon request, the Fund’s most recent annual and subsequent semi-annual report (if available) is available at no cost. To request a report, please call the Fund toll-free at 1-800-CALL OPP (1-800-225-5677), or write to the Fund at OppenheimerFunds Services, P.O. Box 5270, Denver, Colorado 80217-5270.

| PROPOSAL 1: To elect Arthur P. Steinmetz as a Trustee of the Fund |

|

PROPOSAL 2: To approve the Apollo Agreement PROPOSAL 3: To approve implementation of the Manager of Managers Arrangement |

PROPOSAL 1

TO ELECT ARTHUR P. STEINMETZ AS A TRUSTEE OF THE FUND

The purpose of this Proposal 1 is to elect Arthur P. Steinmetz (“Nominee”) as a Trustee of the Fund. In July 2014, Mr. Steinmetz was appointed Chief Executive Officer and Chairman of OFI Global Asset Management, Inc. (the “Manager”), which currently serves as manager of the Oppenheimer family of funds. In January 2015, Mr. Steinmetz was also appointed Chairman of OppenheimerFunds, Inc , (the “Sub-Adviser”), which currently serves as subadviser to the Oppenheimer family of funds. Mr. Steinmetz has served as President and Principal Executive Officer of the Fund and other funds in the Oppenheimer fund complex since September 2014 and is a former Vice President and portfolio manager of the Fund. As such, Mr. Steinmetz is uniquely positioned to serve as a Trustee. The Board has reviewed Mr. Steinmetz’s qualifications and background and believes that he is experienced in overseeing investment companies and is familiar with the Fund, the Oppenheimer fund complex and the Manager.

The Fund is not required, and does not intend, to hold annual shareholder meetings for the purpose of electing Trustees. As a result, if elected, the Nominee will serve an indefinite term or until his resignation, retirement, death or removal. If elected, the Nominee will begin his term as Board Member as soon as practicable. If the Nominee should be unable to accept election, serve his term or resign, the Board may, subject to the Investment Company Act, in its discretion, select another person to fill the vacant position. The Nominee has consented to be named as such in this Proxy Statement and to serve as Trustee if elected.

The Nominee does not currently serve as a Trustee of the Fund. Mr. Steinmetz is an “interested person” of the Fund (as that term is defined in the Investment Company Act) because he is affiliated with the Manager and the Sub-Adviser by virtue of his positions as an officer and director of the Manager, as a director of the Sub-Adviser, and as a shareholder of the parent company of the Sub-Adviser. As an interested person, Mr. Steinmetz will not receive a salary or fee from the Fund.

The Board has determined that the Nominee nominated for election as a Trustee, along with the Trustees currently serving on the Board, is appropriate to oversee the Fund. Proxies cannot be voted for a greater number of persons than the number of Nominees.

After due consideration, the members of the Board selected and nominated the Nominee and recommended to shareholders the election of the Nominee. In making the recommendation, the Board took into consideration a number of factors, including the knowledge, background, and experience of the Nominee in overseeing the Fund.

If shareholders approve the election of the Nominee as Trustee, the Fund will continue to be overseen by the same individuals who currently constitute the Board, with the addition of Mr. Steinmetz, as of the effective date he joins the Board. The Board is responsible for protecting the interests of shareholders. The Trustees meet periodically throughout the year to oversee the Fund’s activities, review its performance and review the actions of the Manager and the Sub-Adviser, which is responsible for the Fund’s day-to-day operations. The Board met in person 7 times during the Fund’s most recent fiscal year.

Interested Nominee

Mr. Steinmetz is an “Interested Nominee” because he is affiliated with the Manager and Sub-Adviser by virtue of his positions as an officer and director of the Manager, director of the Sub-Adviser and as a shareholder of the Sub-Adviser’s parent company. Both as a Trustee and as an officer, he will serve for an indefinite term, or until his resignation, retirement, death or removal. Mr. Steinmetz’s address is 225 Liberty Street, 11th Floor, New York, New York 10281-1008.

Below is a brief discussion of the specific experience, qualifications, attributes and skills of the Nominee that led the Board to conclude that he should serves as a Trustee of the Fund. During the course of his association with the Manager and Sub-Adviser, Mr. Steinmetz has become familiar with the Fund’s (and other Oppenheimer funds’) financial, accounting, regulatory and investment matters. As such, he will contribute significantly to the Board’s deliberations. The Nominee’s professional experience is outlined in the table below.

Name, Year of Birth, Position(s) Held with Fund, Length of Service, |

Principal Occupation(s) During the Past 5 Years |

|

Arthur P. Steinmetz (1958) President and Principal Executive Officer of the Fund since September 16, 2014.

Not currently serving as a Trustee |

Chairman of the Sub-Adviser (since January 2015). CEO and Chairman of the Manager (since July 2014), President of the Manager (since May 2013), a Director of the Manager (since January 2013), Director of the Sub-Adviser (since July 2014), President, Management Director and CEO of Oppenheimer Acquisition Corp. (the Sub-Adviser's parent holding company) (since July 2014), and President and Director of OFI SteelPath, Inc. (since January 2013). Chief Investment Officer of the OppenheimerFunds advisory entities from (January 2013-December 2013); Executive Vice President of the Manager (January 2013-May 2013); Chief Investment Officer of the Sub-Adviser (October 2010-December 2012); Chief Investment Officer, Fixed-Income, of the Sub-Adviser (April 2009-October 2010); Executive Vice President of the Sub-Adviser (October 2009-December 2012); Director of Fixed Income of the Sub-Adviser (January 2009-April 2009); and a Senior Vice President of the Sub-Adviser (March 1993-September 2009). |

General Information Regarding the Board

Each current Trustee, their position with the Fund (if any), length of service in such position(s) and principal occupations and business affiliations during at the past five years, are listed in the charts below. The address of each Independent Trustee (not an “interested person” as that term is defined in the Investment Company Act) in the chart below is 6803 S. Tucson Way, Centennial, Colorado 80112-3924. Each Independent Trustee serves for an indefinite term, or until his or her resignation, retirement, death or removal.

| Name, Year of Birth, Position(s), Length of Service | Principal Occupation(s) During the Past 5 Years; Other Trusteeships/Directorships Held |

| Sam Freedman (1940), Chairman of the Board of Trustees, Trustee since 1996 | Director of Colorado UpLIFT (charitable organization) (since September 1984). Mr. Freedman held several positions with the Sub-Adviser and with subsidiary or affiliated companies of the Sub-Adviser (until October 1994). Mr. Freedman has served on the Boards of certain Oppenheimer funds since 1996, during which time he has become familiar with the Fund's (and other Oppenheimer funds') financial, accounting, regulatory and investment matters and has contributed to the Boards' deliberations. |

| Jon S. Fossel (1942), Trustee, Trustee since 1990 |

Chairman of the Board of Jack Creek Preserve Foundation (non-profit organization) (since 2005); Chairman of the Board (2006-December 2011) and Director (June 2002-December 2011) of UNUMProvident (insurance company); Director of Northwestern Energy Corp. (public utility corporation) (November 2004-December 2009); Director of P.R. Pharmaceuticals (October 1999-October 2003); Director of Rocky Mountain Elk Foundation (non-profit organization) (February 1998-February 2003 and February 2005-February 2007); Chairman and Director (until October 1996) and President and Chief Executive Officer (until October 1995) of the Sub-Adviser; President, Chief Executive Officer and Director of the following: Oppenheimer Acquisition Corp. (“OAC”) (parent holding company of the Sub- Adviser), Shareholders Services, Inc. and Shareholder Financial Services, Inc. (until October 1995). Mr. Fossel has served on the Boards of certain Oppenheimer funds since 1990, during which time he has become familiar with the Fund’s (and other Oppenheimer funds’) financial, accounting, regulatory and investment matters and has contributed to the Boards’ deliberations. |

| Richard F. Grabish (1948), Trustee, Trustee since 2002 | Formerly Senior Vice President and Assistant Director of Sales and Marketing (March 1997-December 2007), Director (March 1987-December 2007) and Manager of Private Client Services (June 1985-June 2005) of A.G. Edwards & Sons, Inc. (broker/dealer and investment firm); Chairman and Chief Executive Officer of A.G. Edwards Trust Company, FSB (March 2001-December 2007); President and Vice Chairman of A.G. Edwards Trust Company, FSB (investment adviser) (April 1987-March 2001); President of A.G. Edwards Trust Company, FSB (investment adviser) (June 2005-December 2007). Mr. Grabish has served on the Boards of certain Oppenheimer funds since 2001, during which time he has become familiar with the Fund's (and other Oppenheimer funds') financial, accounting, regulatory and investment matters and has contributed to the Boards' deliberations. |

| Beverly L. Hamilton (1946), Trustee, Trustee since 2002 | Trustee of Monterey Institute for International Studies (educational organization) (since February 2000); Board Member of Middlebury College (educational organization) (December 2005-June 2011); Chairman (since 2010) of American Funds' Emerging Markets Growth Fund, Inc. (mutual fund); Director of The California Endowment (philanthropic organization) (April 2002-April 2008); Director (February 2002-2005) and Chairman of Trustees (2006-2007) of the Community Hospital of Monterey Peninsula; Director (October 1991-2005); Vice Chairman (2006-2009) of American Funds' Emerging Markets Growth Fund, Inc. (mutual fund); President of ARCO Investment Management Company (February 1991-April 2000); Member of the investment committees of The Rockefeller Foundation (2001-2006) and The University of Michigan (since 2000); Advisor at Credit Suisse First Boston's Sprout venture capital unit (venture capital fund) (1994-January 2005); Trustee of MassMutual Institutional Funds (investment company) (1996-June 2004); Trustee of MML Series Investment Fund (investment company) (April 1989-June 2004); Member of the investment committee of Hartford Hospital (2000-2003); and Advisor to Unilever (Holland) pension fund (2000-2003). Ms. Hamilton has served on the Boards of certain Oppenheimer funds since 2002, during which time she has become familiar with the Fund's (and other Oppenheimer funds') financial, accounting, regulatory and investment matters and has contributed to the Boards' deliberations. |

|

Victoria J. Herget (1951), Trustee, Trustee since 2012, Bo |

Board Chair (2008-Present) and Director (2004-Present), United Educators (insurance company); Trustee (since 2000) and Chair (since 2010), Newberry Library (independent research library); Trustee, Mather LifeWays (senior living organization) (since 2001); Independent Director of the First American Funds (mutual fund family) (2003-2011); former Managing Director (1993-2001), Principal (1985-1993), Vice President (1978-1985) and Assistant Vice President (1973-1978) of Zurich Scudder Investments (investment adviser) (and its predecessor firms); Trustee (1992-2007), Chair of the Board of Trustees (1999-2007), Investment Committee Chair (1994-1999) and Investment Committee member (2007-2010) of Wellesley College; Trustee, BoardSource (non-profit organization) (2006-2009) and Chicago City Day School (K-8 School) (1994-2005). Ms. Herget has served on the Boards of certain Oppenheimer funds since 2012, during which time she has become familiar with the Fund's (and other Oppenheimer funds') financial, accounting, regulatory and investment matters and has contributed to the Boards' deliberations. |

| Robert J. Malone (1944), Trustee, Trustee since 2002, | Chairman of the Board (since 2012) and Director (since August 2005) of Jones International University (educational organization) (since August 2005); Chairman, Chief Executive Officer and Director of Steele Street Bank Trust (commercial banking) (since August 2003); Trustee of the Gallagher Family Foundation (non-profit organization) (since 2000); Board of Directors of Opera Colorado Foundation (non-profit organization) (2008-2012); Director of Colorado UpLIFT (charitable organization) (1986-2010); Director of Jones Knowledge, Inc. (2006-2010); Former Chairman of U.S. Bank-Colorado (subsidiary of U.S. Bancorp and formerly Colorado National Bank) (July 1996-April 1999); Director of Commercial Assets, Inc. (real estate investment trust) (1993-2000); Director of U.S. Exploration, Inc. (oil and gas exploration) (1997-February 2004); Chairman of the Board (1991-1994) and Trustee (1985-1994) of Regis University; and Chairman of the Board (1990-1991 and Trustee (1984-1999) of Young Presidents Organization. Mr. Malone has served on the Boards of certain Oppenheimer funds since 2002, during which time he has become familiar with the Fund's (and other Oppenheimer funds') financial, accounting, regulatory and investment matters and has contributed to the Board's deliberations. |

| F. William Marshall, Jr. (1942), Trustee, Trustee since 2000 | Trustee Emeritus of Worcester Polytech Institute (WPI) (private university) (since 2009); Trustee of MassMutual Select Funds (formerly MassMutual Institutional Funds) (investment company) (since 1996), MML Series Investment Fund (investment company) (since 1996) and Mass Mutual Premier Funds (investment company) (since January 2012); President and Treasurer of the SIS Funds (private charitable fund) (January 1999-March 2011); Former Trustee of WPI (1985-2008); Former Chairman of the Board (2004-2006) and Former Chairman of the Investment Committee of WPI (1994-2008); Chairman of SIS Family Bank, F.S.B. (formerly SIS Bank) (commercial bank) (January 1999-July 1999); Executive Vice President of Peoples Heritage Financial Group, Inc. (commercial bank) (January 1999-July 1999); and Former President and Chief Executive Officer of SIS Bancorp. (1993-1999). Mr. Marshall has served on the Boards of certain Oppenheimer funds since 2000, during which time he has become familiar with the Fund's (and other Oppenheimer funds') financial, accounting, regulatory and investment matters and has contributed to the Boards' deliberations. |

|

Karen L. Stuckey (1953), Trustee, Trustee since 2012 |

Partner (1990-2012) of PricewaterhouseCoopers LLP (professional services firm) (held various positions 1975-1990); Trustee (1992-2006) and member of Executive, Nominating and Audit Committees and Chair of Finance Committee of Lehigh University; and member, Women’s Investment Management Forum (professional organization) since inception. Ms. Stuckey has served on the Boards of certain Oppenheimer funds since 2012, during which time she has become familiar with the Fund's (and other Oppenheimer funds') financial, accounting, regulatory and investment matters and has contributed to the Boards' deliberations. |

|

James D. Vaughn (1945), Trustee, Trustee since 2012 |

Retired; former managing partner (1994-2001) of Denver office of Deloitte & Touche LLP, (held various positions 1969-1993); Trustee and Chairman of the Audit Committee of Schroder Funds (2003-2012); Board member and Chairman of Audit Committee of AMG National Trust Bank (since 2005); Trustee, and Investment Committee member, University of South Dakota Foundation (since 1996); Board member, Audit Committee Member and past Board Chair, Junior Achievement (since 1993); former Board member, Mile High United Way, Boys and Girls Clubs, Boy Scouts, Colorado Business Committee for the Arts, Economic Club of Colorado and Metro Denver Network. Mr. Vaughn has served on the Boards of certain Oppenheimer funds since 2012, during which time he has become familiar with the Fund's (and other Oppenheimer funds') financial, accounting, regulatory and investment matters and has contributed to the Boards' deliberations. |

Mr. Glavin is an “Interested Trustee” because his is affiliated with the Manager and Sub-Adviser by virtue of his positions as a director of the Sub-Adviser and shareholder of the Sub-Adviser’s parent company. Both as a Trustee and as an officer, he serves for an indefinite term, or until his resignation, retirement, death or removal. Mr. Glavin’s address is 225 Liberty Street, 11th Floor, New York, New York 10281-1008.

| Name, Age, Position(s), Length of Service | Principal Occupation(s) During the Past 5 Years; Other Trusteeships/Directorships Held |

| William F. Glavin, Jr (1958) Trustee, Trustee since 2009 | Chairman of the Sub-Adviser (July 2014 – December 2014 and December 2009-December 2012) and Director of the Sub-Adviser (since January 2009); Chairman, Director and Chief Executive Officer (January 2013-June 2014) of the Manager; President of the Manager (January 2013-May 2013); Chief Executive Officer (January 2009-December 2012); President of the Sub-Adviser (May 2009-December 2012); Management Director (June 2009-June 2014), President (December 2009-June 2014) and Chief Executive Officer (January 2011-June 2014) of Oppenheimer Acquisition Corp. ("OAC") (the Sub-Adviser's parent holding company); Director of Oppenheimer Real Asset Management, Inc. (March 2010-June 2014); Executive Vice President (March 2006-February 2009) and Chief Operating Officer (July 2007-February 2009) of Massachusetts Mutual Life Insurance Company (OAC's parent company); Director (May 2004-March 2006) and Chief Operating Officer and Chief Compliance Officer (May 2004-January 2005), President (January 2005-March 2006) and Chief Executive Officer (June 2005-March 2006) of Babson Capital Management LLC; Director (March 2005-March 2006), President (May 2003-March 2006) and Chief Compliance Officer (July 2005-March 2006) of Babson Capital Securities, Inc. (a broker-dealer); President (May 2003-March 2006) of Babson Investment Company, Inc.; Director (May 2004-August 2006) of Babson Capital Europe Limited; Director (May 2004-October 2006) of Babson Capital Guernsey Limited; Director (May 2004-March 2006) of Babson Capital Management LLC; Non-Executive Director (March 2005-March 2007) of Baring Asset Management Limited; Director (February 2005-June 2006) Baring Pension Trustees Limited; Director and Treasurer (December 2003-November 2006) of Charter Oak Capital Management, Inc.; Director (May 2006-September 2006) of C.M. Benefit Insurance Company; Director (May 2008-June 2009) and Executive Vice President (June 2007-July 2009) of C.M. Life Insurance Company; President (March 2006-May 2007) of MassMutual Assignment Company; Director (January 2005-December 2006), Deputy Chairman (March 2005-December 2006) and President (February 2005-March 2005) of MassMutual Holdings (Bermuda) Limited; Director (May 2008-June 2009) and Executive Vice President (June 2007-July 2009) of MML Bay State Life Insurance Company; Chief Executive Officer and President (April 2007-January 2009) of MML Distributors, LLC; and Chairman (March 2006-December 2008) and Chief Executive Officer (May 2007-December 2008) of MML Investors Services, Inc. Mr. Glavin has served on the Boards of certain Oppenheimer funds since December 2009, during which time he has become familiar with the Fund's (and other Oppenheimer funds') financial, accounting, regulatory and investment matters and has contributed to the Boards' deliberations. |

Equity Securities Owned by the Nominee and Trustees. Information relating to the amount of equity securities owned by the Nominee and Trustees, in the Fund, as well as other funds in the fund complex, as of [___________] is set forth in below.

| Interested Trustee/Interested Nominee |

Dollar Range of Equity Securities Owned in the Fund

|

Aggregate Dollar Range of Equity Securities Held in All Registered Investment Companies Overseen by Interested Trustee/Interested Nominee in the Oppenheimer Family of Investment Companies As of [ ], 2014 | |

| William F. Glavin, Jr. | |||

| Arthur P. Steinmetz | |||

| Independent Trustees |

Dollar Range of Equity Securities Owned in the Fund

|

Aggregate Dollar Range of Equity Securities Held in All Registered Investment Companies Overseen by Trustee in the Oppenheimer Family of Investment Companies As of [ ], 2014 | |

| Sam Freedman | |||

| Jon S. Fossel | |||

| Richard F. Grabish | |||

| Beverly L. Hamilton | |||

| Victoria J. Herget | |||

| Robert J. Malone | |||

| F. William Marshall, Jr. | |||

| Karen L. Stuckey | |||

| James D. Vaughn | |||

Compensation.

The Independent Trustees receive compensation for services as Trustees and as a Committee member (if applicable) and are reimbursed for expenses incurred in connection with attending such Board and Committee meetings. Each fund, including the Fund, for which an Independent Trustee serves, pays a share of these expenses. The officers and the Interested Trustee of the Fund, Mr. Glavin, who is affiliated with the Manager and the Sub-Adviser, receive no salary or fee from the Fund. The Independent Trustees’ total compensation from the Fund during the most recent fiscal year, and from the fund complex during the calendar year ended December 31, 2014 represents compensation, including accrued retirement benefits, for serving as a Trustee and member of a committee (if applicable) of the Board of the Fund and of other funds in the OppenheimerFunds complex. The compensation paid to each Independent Trustee is set forth below.

|

Independent Trustees/Independent Nominees

|

Aggregate Compensation From the Fund for Fiscal Year Ended September 30, 20141

|

Total Compensation From the Fund and Fund Complex for the Year Ended December 31, 20142

| |

|

Sam Freedman Chairman of the Board |

$21,523 | $336,000 | |

|

Jon S. Fossel Audit Committee Member |

$14,349 | $224,000 | |

|

Richard F. Grabish Review Committee Chairman and Governance Committee Member |

$15,536 | $241,500 | |

|

Beverly L. Hamilton Governance Committee Chairman and Review Committee Member |

$16,5013 | $257,600 | |

|

Victoria J. Herget Review Committee Member and Governance Committee Member |

$14,349 | $224,000 | |

|

Robert J. Malone Governance Committee Member and Review Committee Member |

$14,349 | $224,000 | |

|

F. William Marshall, Jr. Audit Committee Chairman and Governance Committee Member |

$17,219 | $449,2564 | |

|

Karen L. Stuckey Audit Committee Member and Governance Committee Member |

$14,349 | $224,000 | |

|

James D. Vaughn Audit Committee Member and Governance Committee Member |

$14,349 | $224,000 | |

| 1. | Aggregate Compensation from the Fund” includes fees and deferred compensation, if any. |

| 2. | In accordance with SEC regulations, for purposes of this section only, “Fund Complex” includes the Oppenheimer Funds, the MassMutual Institutional Funds, the MassMutual Select Funds and the MML Series Investment Fund, the investment adviser for which is the indirect parent company of the Fund’s Manager. The Manager also serves as the Sub-Adviser to the following: MassMutual Premier International Equity Fund, MassMutual Premier Main Street Fund, MassMutual Premier Strategic Income Fund, MassMutual Premier Capital Appreciation Fund, and MassMutual Premier Global Fund. The Manager does not consider MassMutual Institutional Funds, MassMutual Select Funds and MML Series Investment Fund to be part of the Oppenheimer Funds’ “Fund Complex” as that term may be otherwise interpreted. |

| 3. | Includes $16,501 deferred by Ms. Hamilton under the “Compensation Deferral Plan” described below. |

| 4. | Includes $180,456 compensation paid to Mr. Marshall for serving as a Trustee for MassMutual Select Funds and MML Series Investment Fund. |

Compensation Deferral Plan for Trustees

The Board of Trustees has adopted a Compensation Deferral Plan for Independent Trustees that enables them to elect to defer receipt of all or a portion of the annual fees they are entitled to receive from certain funds. Under the plan, the compensation deferred by a Trustee is periodically adjusted as though an equivalent amount had been invested in shares of one or more Oppenheimer funds selected by the Trustee. The amount paid to the Trustee under the plan will be determined based on the amount of compensation deferred and the performance of the selected funds.

Deferral of the Trustees’ fees under the plan will not materially affect a Fund’s assets, liabilities or net income per share. The plan will not obligate a fund to retain the services of any Trustee or to pay any particular level of compensation to any Trustee.

Board Meetings

The Fund is governed by a Board of Trustees, which is responsible for overseeing the Fund. The Board is led by Sam Freedman, an independent trustee, who is not an "interested person" of the Fund, as that term is defined in the Investment Company Act. The Board meets periodically throughout the year to oversee the Fund's activities, including to review its performance, oversee potential conflicts that could affect the Fund, and review the actions of the Manager and Sub-Adviser. With respect to its oversight of risk, the Board, through its committees, relies on reports and information received from various parties, including the Manager and Sub-Adviser, internal auditors, the Manager’s Chief Risk Officer, the Fund's Chief Compliance Officer, the Fund's outside auditors and Fund counsel. It is important to note that, despite the efforts of the Board and of the various parties that play a role in the oversight of risk, it is likely that not all risks will be identified or mitigated.

Committees of the Board

The Board has an Audit Committee, a Review Committee and a Governance Committee. Each of the Committees is comprised solely of Trustees who are not "interested persons" under the Investment Company Act (the "Independent Trustees"). The Board has determined that its leadership structure is appropriate in light of the characteristics and circumstances of the Fund because it allocates areas of responsibility among the committees in a manner that enhances the Board's oversight.

The Audit Committee is comprised solely of Independent Trustees. The members of the Audit Committee are F. William Marshall, Jr. (Chairman), Jon S. Fossel, Karen L. Stuckey and James D. Vaughn. The Audit Committee selects the Fund's independent registered public accounting firm (also referred to as the "independent Auditors"). Other main functions of the Audit Committee, outlined in the Audit Committee Charter, include, but are not limited to: (i) reviewing the scope and results of financial statement audits and the audit fees charged; (ii) reviewing reports from the Fund's independent Auditors regarding the Fund's internal accounting procedures and controls; (iii) reviewing reports from the Manager's Internal Audit Department; (iv) maintaining a separate line of communication between the Fund's independent Auditors and the Independent Trustees; (v) reviewing the independence of the Fund's independent Auditors; and (vi) approving in advance the provision of any audit or non-audit services by the Fund's independent Auditors, including tax services, that are not prohibited by the Sarbanes-Oxley Act, to the Fund, the Manager and certain affiliates of the Manager. The Audit Committee also reviews reports concerning the valuation on certain investments. The Audit Committee held 5 meetings during the Fund’s most recent fiscal year.

The Review Committee is comprised solely of Independent Trustees. The members of the Review Committee are Richard F. Grabish (Chairman), Beverly L. Hamilton, Victoria J. Herget and Robert J. Malone. Among other duties, as set forth in the Review Committee's Charter, the Review Committee reviews Fund performance and expenses as well as oversees several of the Fund's principal service providers and certain policies and procedures of the Fund. The Review Committee also reviews certain reports from and meets regularly with the Fund's Chief Compliance Officer. The Review Committee held 5 meetings during the Fund’s most recent fiscal year.

The Governance Committee is comprised solely of Independent Trustees. The members of the Governance Committee are Beverly L. Hamilton (Chairman), Richard F. Grabish, Victoria J. Herget, Robert J. Malone, F. William Marshall, Jr., Karen L. Stuckey and James D. Vaughn. The Governance Committee has adopted a charter setting forth its duties and responsibilities. Among other duties, the Governance Committee reviews and oversees Fund governance and the nomination of the Independent Trustees. The Governance Committee has adopted a process for shareholder submission of nominees for board positions. Shareholders may submit names of individuals, accompanied by complete and properly supported resumes, for the Governance Committee's consideration by mailing such information to the Governance Committee in care of the Fund. The Governance Committee has not established specific qualifications that it believes must be met by a nominee. In evaluating nominees, the Governance Committee considers, among other things, an individual's background, skills, and experience; whether the individual is an "interested person" as defined in the Investment Company Act; and whether the individual would be deemed an "audit committee financial expert" within the meaning of applicable SEC rules. The Governance Committee also considers whether the individual's background, skills, and experience will complement the background, skills, and experience of other Trustees and will contribute to the Board's diversity. The Governance Committee may consider such persons at such time as it meets to consider possible nominees. The Governance Committee, however, reserves sole discretion to determine which candidates for Trustee it will recommend to the Board and the shareholders and it may identify candidates other than those submitted by shareholders. The Governance Committee may, but need not, consider the advice and recommendation of the Manager or its affiliates in selecting nominees. New Trustees may be elected by the full Board or by a shareholder vote. The Governance Committee held 3 meetings during the Fund’s most recent fiscal year.

Shareholders who desire to communicate with the Board should address correspondence to the Board or an individual Trustee and may submit correspondence electronically at www.oppenheimerfunds.com under the caption "contact us" or by mail to the Fund at OppenheimerFunds, Inc., 6803 South Tucson Way, Centennial CO, 80112-3924.

Officers of the Fund. Information is given below about the officers who are not Trustees of the Fund or Nominees, including their business experience during the past five years. All such officers of the Fund, with the exception of portfolio managers, hold the same offices with the other Oppenheimer funds in the OppenheimerFunds family of funds. The address for Messrs. Edwards, Gabinet and Mss. Bloomberg, Kantesaria, Picciotto and Sexton is 225 Liberty Street, New York, NY 10281-1008. The address for Messrs. Kennedy, Legg, O’Donnell and Wixted and Mss. Burley, La Fond and Miller is 6803 S. Tucson Way, Centennial, CO 80112-3924.

All officers serve at the pleasure of the Board. Each officer serves for an indefinite term or until his or her earlier resignation, retirement, death or removal.

| Name, Year of Birth, Position(s), Length of Service | Principal Occupation(s) During the Past 5 Years |

|

Mary Ann Picciotto (1973)

|

Senior Vice President and Chief Compliance Officer of the Manager (since March 2014); Chief Compliance Officer of the Sub-Adviser, OFI SteelPath, Inc., OFI Global Trust Company, OFI Global Institutional, Inc., Oppenheimer Real Asset Management, Inc., OFI Private Investments, Inc., Harborview Asset Management Corporation, Trinity Investment Management Corporation, and Shareholder Services, Inc. (since March 2014); Managing Director of Morgan Stanley Investment Management Inc. and certain of its various affiliated entities; Chief Compliance Officer of various Morgan Stanley Funds (May 2010-January 2014); Chief Compliance Officer of Morgan Stanley Investment Management Inc. (April 2007-January 2014). |

|

Jennifer Sexton (1969)

|

Senior Vice President of OppenheimerFunds Distributor, Inc. (since June 2014); Vice President of OppenheimerFunds Distributor, Inc. (April 2006-June 2014); Vice President of the Sub-Adviser (January 1998-March 2006); Assistant Vice President of the Sub-Adviser (October 1991-December 1998). |

|

Brian W. Wixted (1959)

|

Senior Vice President of the Manager (since January 2013); Treasurer of the Sub-Adviser, HarbourView Asset Management Corporation, Shareholder Financial Services, Inc., Shareholder Services, Inc., and Oppenheimer Real Asset Management, Inc. (March 1999-June 2008), OFI Private Investments, Inc. (March 2000-June 2008), OppenheimerFunds International Ltd. and OppenheimerFunds plc (since May 2000), OFI Global Institutional, Inc. (November 2000-June 2008), and OppenheimerFunds Legacy Program (charitable trust program established by the Sub-Adviser) (June 2003-December 2011); Treasurer and Chief Financial Officer of OFI Global Trust Company (since May 2000); Assistant Treasurer of Oppenheimer Acquisition Corporation (March 1999-June 2008). |

|

Julie Burley (1981)

|

Vice President of the Manager (since October 2013). Previously held the following positions at Deloitte & Touche: Senior Manager (September 2010-October 2013), Manager (September 2008-August 2010), and Audit Senior (September 2005-August 2008). |

|

James A. Kennedy (1958)

|

Senior Vice President of the Manager (since January 2013); Senior Vice President of the Sub-Adviser (September 2006-December 2012.) |

|

Jan Miller (1963)

|

Assistant Vice President of the Manager (since 2013); Assistant Vice President of the Sub-Adviser (2005-December 2012); Assistant Vice President in the Sub-Adviser's Fund Accounting department (November 2004 to March 2006). |

|

Mathew O'Donnell (1967)

|

Vice President of the Manager (since January 2013); Vice President of the Sub-Adviser (January 2008-December 2012); Accounting Policy Director of the Sub-Adviser (May 2007-March 2012). |

|

Arthur S. Gabinet (1958)

|

Executive Vice President, Secretary and General Counsel of the Manager (since January 2013); General Counsel OFI SteelPath, Inc. (since January 2013); Executive Vice President (May 2010-December 2012) and General Counsel (since January 2011) of the Sub-Adviser; General Counsel of the Distributor (since January 2011); General Counsel of Centennial Asset Management Corporation (January 2011-December 2012); Executive Vice President (January 2011-December 2012) and General Counsel of HarbourView Asset Management Corporation (since January 2011); Assistant Secretary (since January 2011) and Director (since January 2011) of OppenheimerFunds International Ltd. and OppenheimerFunds plc; Director of Oppenheimer Real Asset Management, Inc. (January 2011-December 2012) and General Counsel (since January 2011); Executive Vice President (January 2011-December 2011) and General Counsel of Shareholder Financial Services, Inc. and Shareholder Services, Inc. (since January 2011); Executive Vice President (January 2011-December 2012) and General Counsel of OFI Private Investments Inc. (since January 2011); Vice President of OppenheimerFunds Legacy Program (January 2011-December 2011); Executive Vice President (January 2011-December 2012) and General Counsel of OFI Global Institutional, Inc. (since January 2011); General Counsel, Asset Management of the Sub-Adviser (May 2010-December 2010); Principal, The Vanguard Group (November 2005-April 2010); District Administrator, U.S. Securities and Exchange Commission (January 2003-October 2005). |

|

Lisa I. Bloomberg (1968)

|

Senior Vice President and Deputy General Counsel of the Manager (since January 2013); Senior Vice President (February 2010-December 2012) and Deputy General Counsel (May 2008-December 2012) of the Sub-Adviser; Vice President (May 2004-January 2010) and Associate Counsel of the Sub-Adviser (May 2004-May 2008). |

|

Randy G. Legg (1965)

|

Vice President and Senior Counsel of the Manager (since January 2013); Vice President (June 2005-December 2012) and Senior Counsel (March 2011-December 2012) of the Sub-Adviser; Associate Counsel (January 2007-March 2011) of the Sub-Adviser. |

|

Taylor V. Edwards (1967)

|

Vice President and Senior Counsel of the Manager (since January 2013); Vice President (February 2007-December 2012) and Senior Counsel (February 2012-December 2012) of the Sub-Adviser; Associate Counsel (May 2009-January 2012); Assistant Vice President (January 2006-January 2007) and Assistant Counsel (January 2006-April 2009) of the Sub-Adviser. |

|

Amee Kantesaria (1980)

|

Vice President and Associate Counsel of the Manager (since January 2014); Vice President and Assistant Counsel of the Manager (January 2013-January 2014); Vice President (May 2009-December 2012) and Assistant Counsel (December 2006-December 2012) of the Sub-Adviser; Assistant Vice President (December 2006-May 2009) of the Sub-Adviser; Assistant Secretary (since January 2011) of the Sub-Adviser and Oppenheimer Acquisition Corp. |

|

Gloria J. LaFond (1945)

|

Assistant Vice President of the Manager (since January 2013); Assistant Vice President (January 2006-December 2012) of the Sub-Adviser. |

| Name, Year of Birth, Position(s), Length of Service | Principal Occupation(s) During the Last 5 Years |

|

Michael Mata (1963) Vice President (since 2014) |

Senior Vice President of the Sub-Adviser and the Head of Multi-Sector Fixed Income (since July 2014). Portfolio manager with ING Investment Management and Head of Multi-Sector Fixed-Income (August 2004-December 2013), managing the Global Bond and Core Plus strategies and the macro and quantitative research teams, along with the emerging markets sovereign team. Senior Vice President and Senior Risk Manager at Putnam Investments (March 2000-August 2004) and a Vice President and Risk Manager for Fixed Income Trading at Lehman Brothers (September 1994-March 2000). |

|

Krishna Memani (1960) Vice President (since 2009) |

President of the Sub-Adviser (since January 2013); Executive Vice President of the Manager (since January 2014) and Chief Investment Officer of the OppenheimerFunds advisory entities (since January 2014). Chief Investment Officer, Fixed Income of the Sub-Adviser (January 2013-December 2013); Head of the Investment Grade Fixed Income Team of the Sub-Adviser (March 2009-January 2014); Director of Fixed Income of the Sub-Adviser (October 2010-December 2012); Senior Vice President of the Sub-Adviser (March 2009-December 2012) and Senior Vice President of OFI Global Institutional, Inc. (April 2009-December 2012). Managing Director and Head of the U.S. and European Credit Analyst Team at Deutsche Bank Securities (June 2006-January 2009). Chief Credit Strategist at Credit Suisse Securities (August 2002-March 2006). Managing Director and Senior Portfolio Manager at Putnam Investments (September 1998-June 2002). |

|

Jack Brown, CFA (1973) Vice President (since 2013) |

Vice President of the Sub-Adviser (since May 2009) and was a senior analyst for the High Yield Corporate Debt team (from 2000-2012). He joined the Sub-Adviser (in 1995) and has held numerous positions including fixed income liaison, analyst and senior analyst. |

|

Sara J. Zervos, PhD. (1969) Vice President (since 2010) |

Senior Vice President of the Sub-Adviser (since January 2011); Head of the Global Debt Team (since October 2010) and the team’s Director of International Research. Ms. Zervos serves on the Board of the Emerging Market Trade Association (EMTA) (since January 2014) and is a member of the Federal Reserve Bank of New York Foreign Exchange Committee (since January 2014). Vice President of the Sub-Adviser (April 2008-December 2010). Portfolio manager with Sailfish Capital Management (May 2007-February 2008) and a portfolio manager for emerging market debt at Dillon Read Capital Management and OTA Asset Management (June 2004-April 2007).

|

All officers serve at the pleasure of the Board. As of [_______], the Nominee, continuing Trustees and officers of the Fund, individually and as a group, beneficially owned less than 1% of any class of shares of the Fund beneficially or of record.

The foregoing statement does not reflect ownership of shares held of record by an employee benefit plan for employees of the Manager, other than the shares beneficially owned under that plan by the officers of the Fund. In addition, none of the Independent Trustees (nor any of their immediate family members) owns securities of either the Manager or the OppenheimerFunds Distributor, Inc. (the Fund’s principal underwriter, referred to herein as the “Distributor”) or of any entity directly or indirectly controlling, controlled by or under common control with the Manager or the Distributor.

Investment Manager, Administrator and Distributor

OFI Global Asset Management, Inc. (the “Manager”), 225 Liberty Street, New York, New York 10281, serves as the Fund's investment adviser and also acts as the Fund’s Transfer Agent. OppenheimerFunds, Inc. (the "Sub-Adviser"), 225 Liberty Street, New York, New York 1028, serves as its sub-adviser. OppenheimerFunds Distributor, Inc., located at 225 Liberty Street, 11th Floor, New York, New York 10281, serves as the Fund’s distributor. Shareholder Services, Inc. doing business as OppenheimerFunds Services, serves as the Fund’s sub-transfer agent and is located at P.O. Box 5270 Denver, Colorado 80217.

Independent Registered Public Accounting Firm Fees and Services

The Fund selected KPMG LLP as its Independent Registered Public Accounting Firm (“Principal Accountant” or “KPMG”) for each of its 2013 and 2014 fiscal years as well as the current fiscal year. Representatives of KPMG are not expected to be present at the Meeting but will be available should any matter arise requiring their presence.

Set forth below, for the Fund’s two most recent fiscal years, are the fees billed by the Fund’s independent registered public accounting firm for all audit and non-audit services provided directly to the Fund.

Audit Fees. KPMG billed the Fund the following amounts for professional services that are normally provided by KPMG in connection with statutory and regulatory filings or engagements for those fiscal years: $60,900 for the fiscal year ended September 30, 2013 and $62,100 for the fiscal year ended September 30, 2014.

Audit-Related Fees. Audit-related fees are for assurance and related services by KPMG that are reasonably related to the performance of the auditor’s review of the Fund’s financial statements and are not reported under the prior category. Audit-related fees would include, among others: due diligence related to mergers and acquisitions, accounting consultations and audits in connection with acquisitions, internal control reviews and consultation concerning financial accounting and reporting standards. KPMG received the following amounts in audit-related fees from the Fund: $0 for the fiscal year ended September 30, 2013 and $0 for the fiscal year ended September 30, 2014. KPMG received the following amounts in audit-related fees from the Fund’s investment adviser or any entity controlling, controlled by, or under common control with the adviser that provides ongoing services to the Fund: $500,945 for the fiscal year ended September 30, 2013 and $1,042,959 for the fiscal year ended September 30, 2014.

Tax Fees. Tax Fees include fees for tax compliance, tax planning and tax advice. Tax compliance generally involves preparation of original and amended tax returns, claims for a refund and tax payment-planning services. Tax planning and tax advice includes assistance with tax audits and appeals, tax advice related to mergers and acquisitions and requests for rulings or technical advice from taxing authorities. KPMG received the following amounts in tax fees from the Fund: $0 for the fiscal year ended September 30, 2013 and $1,450 for the fiscal year ended September 30, 2014.KPMG received the following amounts in tax fees from the Fund’s investment adviser or any entity controlling, controlled by, or under common control with the adviser that provides ongoing services to the Fund: $653,930 for the fiscal year ended September 30, 2013 and $467,462 for the fiscal year ended September 30, 2014.

All Other Fees. All other fees include fees for products and services provided by KPMG other than the services reported under the prior three categories. Such fees would include the cost to KPMG of attending audit committee meetings. KPMG received no such fees from the Fund or from the Fund’s investment adviser or any entity controlling, controlled by, or under common control with the adviser that provides ongoing services to the Fund, during the Fund’s fiscal years ended September 30, 2013 and September 30, 2014.

During its regularly scheduled periodic meetings, the Fund’s Audit Committee will pre-approve all audit, audit-related, tax and other services to be provided by the principal accountants of the Fund.

The Audit Committee has delegated pre-approval authority to its Chairman for any subsequent new engagements that arise between regularly scheduled meeting dates provided that any fees so pre-approved are presented to the Audit Committee at its next regularly scheduled meeting. Pre-approval of non-audit services may be waived provided that: 1) the aggregate amount of all such services provided constitutes no more than five percent of the total amount of fees paid by the Fund to its principal accountant during the Fund’s fiscal year in which services are provided; 2) such services were not recognized by the Fund at the time of engagement as non-audit services; and 3) such services are promptly brought to the attention of the Audit Committee of the Fund and approved prior to the completion of the audit. All services described in “Audit-Related Fees”, “Tax Fees” and “All Other Fees” were pre-approved by the Fund’s current Audit Committee.

Aggregate Non-Audit Services Fees. KPMG received the following aggregate non-audit services fees from the Fund and the Fund’s investment adviser or any entity controlling, controlled by, or under common control with the adviser that provides ongoing services to the Fund: $1,154,875 for the fiscal year ended September 30, 2013 and $1,511,871 for the fiscal year ended September 30, 2014. Those billings did not include any prohibited non-audit services as defined by the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

The Fund’s current Audit Committee has considered whether the provision of non-audit services that were rendered to the Fund’s investment adviser, and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the Fund that were not pre-approved pursuant to paragraph (c)(7)(ii) of Rule 2-01 of Regulation S-X was compatible with maintaining the principal accountant’s independence. No such services were rendered.

THE BOARD RECOMMENDS THAT SHAREHOLDERS OF THE FUND VOTE “FOR” THE ELECTION OF ARTHUR P. STEINMETZ AS A TRUSTEE OF THE FUND.

PROPOSAL 2

TO APPROVE THE APOLLO AGREEMENT

The purpose of this Proposal 2 is to approve a new investment sub-sub-advisory agreement for the Fund (the “Apollo Agreement”) between the OppenheimerFunds, Inc. (the “Sub-Adviser”) and Apollo Credit Management, LLC (“ACM”), a subsidiary of Apollo Global Management, LLC (together with its consolidated subsidiaries including ACM, “Apollo”). Pursuant to the Apollo Agreement, ACM will manage the portion of the Fund's assets allocated to it by the Sub-Adviser (the “Allocated Assets”) using a contrarian, value-oriented approach focused on diversified credit strategies intended to take advantage of the ACM credit platform in accordance with the Fund's investment objective and strategies as described in its registration statement.

In general, the Investment Company Act requires all new investment advisory agreements, including sub-sub-advisory agreements, to be approved by both the Board and the vote of a “majority of the outstanding voting securities” (as defined in the Investment Company Act) of a registered investment company. Under the Investment Company Act, the vote of a "majority of the outstanding voting securities" of the Fund means the affirmative vote of the lesser of: (a) 67% or more of the voting securities present at the Meeting or represented by proxy if the holders of more than 50% of the outstanding voting securities are present or represented by proxy; or (b) more than 50% of the outstanding voting securities (an "Investment Company Act Majority"). Approval of the Proposal requires the affirmative vote of an Investment Company Majority of the Fund’s shares.

As described in more detail below, at its meeting held on January 22, 2015 (the "Board Meeting"), the Board, including a majority of the Independent Trustees, approved (a) the appointment of ACM as a sub-sub-adviser to the Fund and (b) the Apollo Agreement. In addition, the Board, including a majority of the Independent Trustees, recommended the approval of the Apollo Agreement to the Fund's shareholders.

The Sub-Adviser believes that the investment strategy employed by ACM provides the Fund with access to diversified credit strategies that are currently not utilized by the Sub-Adviser, and is consistent with the Fund's investment objective. Apollo is a leading global alternative investment manager. Apollo is a contrarian, value-oriented investor in private equity, credit and real estate, with significant distressed credit expertise. Apollo operates its businesses in an integrated manner which it believes distinguishes it from other alternative investment managers. Apollo has applied this investment philosophy over its 24-year history, deploying capital across the balance sheet of industry leading businesses, and seeking to create value for investors throughout economic cycles.

Current Advisory Arrangements

The Manager oversees the Fund's investments and its business operations, subject to the policies established by the Fund’s Board, under an investment advisory agreement dated November 1, 2013 with the Fund that describes the Manager’s responsibilities (the “Agreement”). The Agreement sets the fees the Fund pays to the Manager and describes the expenses that the Fund is responsible to pay to conduct its business. Under the Agreement, the Fund pays the Manager an advisory fee at an annual rate that declines on additional assets as the Fund grows: 0.75% of the first $200 million of average annual net assets of the Fund, 0.72% of the next $200 million, 0.69% of the next $200 million, 0.66% of the next $200 million, 0.60% of the next $200 million, 0.50% of the next $4 billion, 0.48% of the next $5 billion, and 0.46% in excess of $10 billion, calculated on the daily net assets of the Fund. The aggregate advisory fee paid to the Manager for the fiscal year ended September 30, 2014 was 0.52%.

Material Terms of the Agreement

The Board most recently approved the Agreement at an in-person meeting held on August 19, 2014.

The Manager has served as the Fund’s Manager pursuant to the Agreement since January 1, 2013. Prior to that date, the Sub-Adviser served as the Fund’s investment adviser. Shareholder approval of the Agreement was not required since the restructuring of the advisory arrangements did not constitute an “assignment” for purposes of Section 15(a)(4) of the Investment Company Act.

Set forth below is a general description of the material terms of the Agreement.

Investment Advisory Services. In accordance with the terms of the Agreement, the Manager, subject to the supervision of the Board and the stated investment policies and restrictions of the Fund as set forth in the Fund’s prospectus and Statement of Additional Information will (i) regularly provide investment advice and recommendations to the Fund with respect to its investments, investment policies and the purchase and sale of securities; (ii) supervise continuously the investment program of the Fund and the composition of its portfolio and determine what securities shall be purchased or sold by the Fund; and (iii) arrange, subject to the provisions of the Agreement, for the purchase of securities and other investments for the Fund and the sale of securities and other investments held in the portfolio of the Fund.

The Agreement require the Manager to, at its own expense, provide and supervise the activities of all administrative and clerical personnel as shall be required to provide effective corporate administration for the Fund, including the compilation and maintenance of such records with respect to its operations as may reasonably be required; the preparation and filing of such reports with respect thereto as shall be required by the SEC; composition of periodic reports with respect to its operations for the shareholders of the Fund; composition of proxy materials for meetings of the Fund's shareholders and the composition of such registration statements as may be required by federal securities laws for continuous public sale of shares of the Fund. The Agreement requires the Manager, at its own cost and expense, to also provide the Fund with adequate office space, facilities and equipment.

Advisory Fees. The Agreement describes the expenses that the Fund is responsible for paying to conduct its business. Under the Agreement, the Fund will pay the Manager an advisory fee at an annual rate that declines on additional assets as the Fund grows: the Fund pays the Manager an advisory fee at an annual rate that declines on additional assets as the Fund grows: 0.75% of the first $200 million of average annual net assets of the Fund, 0.72% of the next $200 million, 0.69% of the next $200 million, 0.66% of the next $200 million, 0.60% of the next $200 million, 0.50% of the next $4 billion, 0.48% of the next $5 billion, and 0.46% in excess of $10 billion, calculated on the daily net assets of the Fund. Expenses not expressly assumed by the Manager under the Agreement, or by the distributor of the Fund’s shares, are paid by the Fund, such as interest, taxes, brokerage commissions, fees to certain Trustees, legal and audit expenses, custodian and transfer agent expenses, certain printing and registration costs and non-recurring expenses, including litigation.

Liability. The Agreement states that, provided that nothing in the Agreement shall be deemed to protect the Manager from willful misfeasance, bad faith or gross negligence in the performance of its duties, or reckless disregard of its obligations and duties under the Agreement, the Manager shall not be liable for any loss sustained by reason of good faith errors or omissions in connection with any matters to which the Agreement relates.

Term. The Agreement states that unless earlier terminated, the Agreement shall remain in effect until two years from the date of execution, and thereafter will continue in effect from year to year, so long as such continuance shall be approved at least annually by the Fund's Board of Trustees, including the vote of the majority of the trustees of the Fund who are not parties to the Agreement or "interested persons" (as defined in the Investment Company Act) of any such party, cast in person at a meeting called for the purpose of voting on such approval, or by the holders of a "majority" (as defined in the Investment Company Act) of the outstanding voting securities of the Fund and by such a vote of the Fund's Board of Trustees.

Termination. The Agreement states that it may be terminated (i) by the Manager at any time without penalty upon giving the Fund sixty days' written notice (which notice may be waived by the Fund); or (ii) by the Fund at any time without penalty upon sixty days' written notice to the Manager (which notice may be waived by the Manager) provided that such termination by the Fund shall be directed or approved by the vote of a majority of all of the Trustees of the Fund then in office or by the vote of the holders of a "majority" (as defined in the Investment Company Act) of the outstanding voting securities of the Fund. The Agreement also states that it shall automatically and immediately terminate in the event of its "assignment," as defined in the Investment Company Act.

Use of “Oppenheimer” Name. The Agreement permits the Manager to act as an investment adviser for any other person, firm or corporation and to use the name "Oppenheimer" in connection with other investment companies for which it may act as investment adviser or general distributor. If the Manager shall no longer act as investment adviser to the Fund, the Manager may withdraw the right of the Fund to use the name "Oppenheimer" as part of its name.

Material Terms of the Sub-Advisory Agreement

The Board most recently approved the sub-advisory agreement (the “Sub-Advisory Agreement”) at an in-person meeting held on August 19, 2014. The Sub-Adviser has served as the Fund’s Sub-Adviser pursuant to the Sub-Advisory Agreement since January 1, 2013. Prior to that date, the Sub-Adviser served as the Fund’s investment adviser. Shareholder approval of the Sub-Advisory Agreement was not required since the restructuring of the advisory arrangements did not constitute an “assignment” for purposes of Section 15(a)(4) of the Investment Company Act.

Set forth below is a general description of the material terms of the Sub-Advisory Agreement.

The Sub-Adviser has a Sub-Advisory Agreement with the Manager and is paid by the Manager. The Sub-Adviser, chooses the Fund's investments and provides related advisory services. Under the Sub-Advisory Agreement, the Manager pays the Sub-Adviser a percentage of the net investment advisory fee (after all applicable waivers) that it receives from the Fund as compensation for the provision of the investment advisory services.

Under the Sub-Advisory Agreement between the Manager and the Sub-Adviser, the Sub-Adviser shall regularly provide investment advice with respect to the Fund and invest and reinvest cash, securities, commodity interests and the property comprising the assets of the Fund. The Sub-Adviser selects securities and/or commodity interests for the Fund's portfolio and provides related advisory services. The portfolio manager(s) of the Fund is employed by the Sub-Adviser and is principally responsible for the provision of advisory services to the Fund's portfolio. Other members of the Sub-Adviser's investment teams provide the portfolio manager(s) with counsel and support in managing the Fund's portfolio.

Under the Sub-Advisory Agreement, the Manager pays the Sub-Adviser a percentage of the net investment advisory fee (after all applicable waivers) that it receives from the Fund as compensation for the provision of investment advisory services. The fee paid to the Sub-Adviser under the Sub-Advisory Agreement is paid by the Manager, not by the Fund.

The Sub-Advisory Agreement states that in the absence of willful misfeasance, bad faith, negligence or reckless disregard of its duties or obligations, the Sub-Adviser shall not be liable to the Manager for any act or omission in the course of or connected with rendering services under the Sub-Advisory Agreement or for any losses that may be sustained in the purchase, holding or sale of any security.

Description of the Material Terms of the Apollo Agreement

General Information. The following description of the material terms of the Apollo Agreement is qualified in its entirety by reference to the form of the sub-sub-advisory agreement between the Sub-Adviser and ACM, attached hereto as Appendix A.