Table of Contents

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

| (Mark One) | WASHINGTON, D.C. 20549 |

FORM 20-F

¨ REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

X ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended: December 31, 2015

OR

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

OR

¨ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of event requiring this shell company report

Commission file number: 001-32846

CRH public limited company

(Exact name of Registrant as specified in its charter)

Republic of Ireland

(Jurisdiction of incorporation or organisation)

Belgard Castle, Clondalkin, Dublin 22, Ireland

(Address of principal executive offices)

Senan Murphy

Tel: +353 1 404 1000

Fax: +353 1 404 1007

Belgard Castle, Clondalkin, Dublin 22, Ireland

(Name, Telephone, Email and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

| Title of Each Class | Name of Each Exchange On Which Registered | |

| CRH plc | ||

| Ordinary Shares/Income Shares of €0.34 each | The New York Stock Exchange* | |

| American Depositary Shares, each representing the right to receive one | The New York Stock Exchange | |

| Ordinary Share | ||

| CRH America Inc. | ||

| 4.125% Notes due 2016 guaranteed by CRH plc | The New York Stock Exchange | |

| 6.000% Notes due 2016 guaranteed by CRH plc | The New York Stock Exchange | |

| 8.125% Notes due 2018 guaranteed by CRH plc | The New York Stock Exchange | |

| 5.750% Notes due 2021 guaranteed by CRH plc | The New York Stock Exchange | |

–

| * | Not for trading but only in connection with the registration of American Depositary Shares, pursuant to the requirements of the Securities and Exchange Commission. |

Securities registered or to be registered pursuant to Section 12(g) of the Act. None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act. None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

| Ordinary Shares/Income Shares of €0.34 each ** |

823,911,253 | |||

| 5% Cumulative Preference Shares of €1.27 each |

50,000 | |||

| 7% ‘A’ Cumulative Preference Shares of €1.27 each |

872,000 |

–

| ** | Each Income Share is tied to an Ordinary Share and may only be transferred or otherwise dealt with in conjunction with such Ordinary Share. |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes X No ¨

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes ¨ No X

Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes X No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).*** Yes ¨ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer X Accelerated filer ¨ Non-accelerated filer ¨

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP ¨ | International Financial Reporting Standards as issued by the | Other ¨ | ||

| International Accounting Standards Board X |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. Item 17 ¨ Item 18 ¨

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No X

*** This requirement does not yet apply to the registrant.

Table of Contents

CRH Annual Report on Form 20-F | 2015

CRH plc Annual Report on Form 20-F

in respect of the year ended 31 December 2015

Table of Contents

CRH Annual Report on Form 20-F | 2015

Cross Reference to Form 20-F Requirements

This table has been provided as a cross reference from the information included in this Annual Report to the requirements of this 20-F.

| 1 |

Table of Contents

CRH Annual Report on Form 20-F | 2015

| Our business

CRH creates value by maintaining a balanced portfolio. Our product mix spans the breadth of building materials demand and sectoral end-use, thereby minimising exposure to any one single demand driver. In addition, the Group offsets cyclical economic risk by maintaining a geographically diversified portfolio across its key regions of North America and Europe, as well as in the emerging regions of Asia and South America. |

| Heavyside Materials

|

||||

|

• Aggregates – crushed stone

• Cement – primary binding agent

• Asphalt – road and highway surfaces

• Readymixed Concrete – pourable pre-mixed, aggregates, cement and water based compound

• Precast Concrete – structural floors, beams, vaults

• Architectural Concrete – blocks, bricks, pavers |

|||

| Lightside Products

|

||||

|

• Glass & Glazing Systems – engineered products for external and internal use

• Construction Accessories – engineered fixing, connecting and anchoring solutions

• Shutters & Awnings – solar shading, terrace roof and window protection solutions

• Fencing & Security – outdoor security and protection systems

• Cubis – composite access chambers |

|||

| Building Materials Distribution

|

||||

|

• Builders Merchants – channel for distribution of building materials to the professional contractor

• SHAP – specialist distribution of sanitary, heating and plumbing products

• DIY – providing decorative and home improvement products to the consumer |

|||

| 2 |

Table of Contents

CRH Annual Report on Form 20-F | 2015

| CRH at a glance

CRH plc is a leading global diversified building materials group, employing 89,000 people at over 3,900 operating locations in 31 countries worldwide.

CRH is a top two building materials company globally and the largest in North America. The Group has leadership positions in Europe as well as established strategic positions in the emerging economic regions of Asia and South America.

CRH is committed to improving the built environment through the delivery of superior materials and products for the construction and maintenance of infrastructure, residential and commercial projects.

A Fortune 500 company, CRH is listed in London and Dublin and is a constituent member of the FTSE100 and the ISEQ 20 indices. CRH’s American Depositary Shares are listed on the New York Stock Exchange. CRH’s market capitalisation at 31 December 2015 was approximately €22 billion.

|

||

|

Our vision:

To be the leading building materials business in the world

|

||

| 2015 Performance highlights

|

||

|

€23.6 billion |

|

€1.0 billion | |||||

| Sales | Profit Before Tax | |||||||

|

€2.2 billion |

|

89.1 cent | |||||

| EBITDA (as defined)* | Earnings Per Share | |||||||

|

€1.3 billion |

|

62.5 cent | |||||

| Operating Profit | Dividend Per Share | |||||||

| * Defined as earnings before interest, taxes, depreciation, amortisation, asset impairment charges, profit on disposals and the Group’s share of equity accounted investments’ result after tax. |

||||||||

| 3 |

Table of Contents

| 4 |

Table of Contents

CRH Annual Report on Form 20-F | 2015

| 5 |

Table of Contents

| 6 |

Table of Contents

| 7 |

Table of Contents

CRH Annual Report on Form 20-F | 2015

Introduction and Performance Measures

|

Reconciliation of EBITDA (as defined)* and Operating Profit (by segment) to Group Profit

|

| |||||||||||||||||||||||||||||||||||

| Year ended 31 December | ||||||||||||||||||||||||||||||||||||

| Group operating profit before | ||||||||||||||||||||||||||||||||||||

| depreciation and amortisation | Depreciation, amortisation | |||||||||||||||||||||||||||||||||||

| (EBITDA (as defined)*) | and impairment | Group operating profit(i) | ||||||||||||||||||||||||||||||||||

| 2015 | 2014 | 2013 | 2015 | 2014 | 2013 | 2015 | 2014 | 2013 | ||||||||||||||||||||||||||||

| €m | €m | €m | €m | €m | €m | €m | €m | €m | ||||||||||||||||||||||||||||

| Europe Heavyside | 334 | 380 | 326 | 199 | 229 | 721 | 135 | 151 | (395) | |||||||||||||||||||||||||||

| Europe Lightside | 100 | 94 | 71 | 25 | 23 | 43 | 75 | 71 | 28 | |||||||||||||||||||||||||||

| Europe Distribution | 171 | 190 | 186 | 77 | 78 | 80 | 94 | 112 | 106 | |||||||||||||||||||||||||||

| Europe | 605 | 664 | 583 | 301 | 330 | 844 | 304 | 334 | (261) | |||||||||||||||||||||||||||

| Americas Materials | 912 | 609 | 557 | 301 | 254 | 331 | 611 | 355 | 226 | |||||||||||||||||||||||||||

| Americas Products | 391 | 263 | 246 | 142 | 118 | 178 | 249 | 145 | 68 | |||||||||||||||||||||||||||

| Americas Distribution | 140 | 105 | 89 | 29 | 22 | 22 | 111 | 83 | 67 | |||||||||||||||||||||||||||

| Americas | 1,443 | 977 | 892 | 472 | 394 | 531 | 971 | 583 | 361 | |||||||||||||||||||||||||||

| LH Assets | 171 | - | - | 169 | - | - | 2 | - | - | |||||||||||||||||||||||||||

| Total Group | 2,219 | 1,641 | 1,475 | 942 | 724 | 1,375 | 1,277 | 917 | 100 | |||||||||||||||||||||||||||

| Profit on disposals | 101 | 77 | 26 | |||||||||||||||||||||||||||||||||

| Finance costs less income | (295) | (246) | (249) | |||||||||||||||||||||||||||||||||

| Other financial expense | (94) | (42) | (48) | |||||||||||||||||||||||||||||||||

| Share of equity accounted investments’ profit/(loss) | 44 | 55 | (44) | |||||||||||||||||||||||||||||||||

| Profit/(loss) before tax | 1,033 | 761 | (215) | |||||||||||||||||||||||||||||||||

| Income tax expense | (304) | (177) | (80) | |||||||||||||||||||||||||||||||||

| Group profit/(loss) for the financial year | 729 | 584 | (295) | |||||||||||||||||||||||||||||||||

|

(i) Throughout this document, Group operating profit as shown in the Consolidated Financial Statements excludes profit on disposals.

|

| |||||||||||||||||||||||||||||||||||

|

Calculation of EBITDA (as defined)* Net Interest Cover

|

| |||||||||||||||||||||||||||||||||||

| 2015 | 2014 | 2013 | ||||||||||||||||||||||||||||||||||

| €m | €m | €m | ||||||||||||||||||||||||||||||||||

| Interest | ||||||||||||||||||||||||||||||||||||

| Finance costs(i) | 303 | 254 | 262 | |||||||||||||||||||||||||||||||||

| Finance income(i) | (8) | (8) | (13) | |||||||||||||||||||||||||||||||||

| Net interest | 295 | 246 | 249 | |||||||||||||||||||||||||||||||||

| EBITDA (as defined)* | 2,219 | 1,641 | 1,475 | |||||||||||||||||||||||||||||||||

| Times | ||||||||||||||||||||||||||||||||||||

| EBITDA (as defined)* net interest cover (EBITDA (as defined)* divided by net interest) | 7.5 | 6.7 | 5.9 | |||||||||||||||||||||||||||||||||

| (i) | These items appear on the Consolidated Income Statement on page 156. |

| * | Defined as earnings before interest, taxes, depreciation, amortisation, asset impairment charges, profit on disposals and the Group’s share of equity accounted investments’ result after tax. |

| 8 |

Table of Contents

CRH Annual Report on Form 20-F | 2015

| Sales and EBITDA (as defined)* from continuing operations | ||||||||||||||||||||||||||||||||||||||||

| Sales | 2014 | 2015 |

||||||||||||||||||||||||||||||||||||||

| As €bn |

Exclude €bn |

Exclude €bn |

Continuing €bn |

As €bn |

Exclude €bn |

Exclude €bn |

Continuing €bn |

% change continuing operations |

||||||||||||||||||||||||||||||||

| Europe | 8.8 | (0.5) | – | 8.3 | 8.7 | (0.1) | – | 8.6 | 3% | |||||||||||||||||||||||||||||||

| Americas | 10.1 | (0.6) | – | 9.5 | 12.5 | (0.2) | – | 12.3 | 30% | |||||||||||||||||||||||||||||||

| Subtotal |

18.9 | (1.1) | – | 17.8 | 21.2 | (0.3) | – | 20.9 | 17% | |||||||||||||||||||||||||||||||

| LH Assets |

– | 2.4 | ||||||||||||||||||||||||||||||||||||||

| Total Group |

18.9 | 23.6 | ||||||||||||||||||||||||||||||||||||||

| EBITDA (as defined)* |

2014 | 2015 |

||||||||||||||||||||||||||||||||||||||

| As €m |

Exclude €m |

Exclude €m |

Continuing €m |

As €m |

Exclude €m |

Exclude €m |

Continuing €m |

% change continuing operations |

||||||||||||||||||||||||||||||||

| Europe |

664 | (70) | 15 | 609 | 605 | (11) | 41 | 635 | 4% | |||||||||||||||||||||||||||||||

| Americas |

977 | (38) | 27 | 966 | 1,443 | (1) | 14 | 1,456 | 51% | |||||||||||||||||||||||||||||||

| Subtotal |

1,641 | (108) | 42 | 1,575 | 2,048 | (12) | 55 | 2,091 | 33% | |||||||||||||||||||||||||||||||

| LH Assets |

– | 171 | ||||||||||||||||||||||||||||||||||||||

| Total Group |

1,641 | 2,219 | ||||||||||||||||||||||||||||||||||||||

| * | Defined as earnings before interest, taxes, depreciation, amortisation, asset impairment charges, profit on disposals and the Group’s share of equity accounted investments’ result after tax. |

| 9 |

Table of Contents

CRH Annual Report on Form 20-F | 2015

Introduction and Performance Measures | continued

| 10 |

Table of Contents

CRH Annual Report on Form 20-F | 2015

|

|

||||||||||||||||||||

| Year ended 31 December (amounts in millions, except per share data and ratios)

|

|

|||||||||||||||||||

| 2015 | 2014 | 2013(i) | 2012(ii) | 2011(ii) | ||||||||||||||||

| €m | €m | €m | €m | €m | ||||||||||||||||

| Consolidated Income Statement Data | ||||||||||||||||||||

| Revenue | 23,635 | 18,912 | 18,031 | 18,084 | 18,081 | |||||||||||||||

| Group operating profit | 1,277 | 917 | 100 | 805 | 871 | |||||||||||||||

| Profit/(loss) attributable to equity holders of the Company | 724 | 582 | (296) | 538 | 580 | |||||||||||||||

| Basic earnings/(loss) per Ordinary Share | 89.1c | 78.9c | (40.6c) | 74.6c | 81.2c | |||||||||||||||

| Diluted earnings/(loss) per Ordinary Share | 88.7c | 78.8c | (40.6c) | 74.5c | 81.2c | |||||||||||||||

| Dividends paid during calendar year per Ordinary Share | 62.5c | 62.5c | 62.5c | 62.5c | 62.5c | |||||||||||||||

| Average number of Ordinary Shares outstanding(iii) | 812.3 | 737.6 | 729.2 | 721.9 | 714.4 | |||||||||||||||

| Ratio of earnings to fixed charges (times)(iv) | 2.9 | 2.6 | 0.7(v) | 2.6 | 2.4 | |||||||||||||||

| All data relates to continuing operations | ||||||||||||||||||||

| Consolidated Balance Sheet Data | ||||||||||||||||||||

| Total assets | 32,007 | 22,017 | 20,429 | 20,900 | 21,384 | |||||||||||||||

| Net assets(vi) | 13,544 | 10,198 | 9,686 | 10,589 | 10,593 | |||||||||||||||

| Ordinary shareholders’ equity | 13,014 | 10,176 | 9,661 | 10,552 | 10,518 | |||||||||||||||

| Equity share capital | 281 | 253 | 251 | 249 | 247 | |||||||||||||||

| Number of Ordinary Shares(iii) | 823.9 | 744.5 | 739.2 | 733.8 | 727.9 | |||||||||||||||

| Number of Treasury Shares and own shares(iii) | 1.3 | 3.8 | 6.0 | 7.4 | 8.9 | |||||||||||||||

| Number of Ordinary Shares net of Treasury Shares and own shares(iii) | 822.6 | 740.7 | 733.2 | 726.4 | 719.0 | |||||||||||||||

| (i) | Group operating profit includes asset impairment charges of €650 million in 2013, with an additional €105 million impairment charge included in loss attributable to equity holders of the Company in respect of equity accounted investments. Details are contained in note 2 to the Consolidated Financial Statements. |

| (ii) | On 1 January 2013, the Group adopted IFRS 11 Joint Arrangements and IAS 19 Employee Benefits (revised). As a result, the prior year comparatives were restated as required by IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors. |

| (iii) | All share numbers are shown in millions of shares. |

| (iv) | For the purposes of calculating the ratio of earnings to fixed charges, in accordance with Item 503 of Regulation S-K, earnings have been calculated by adding: profit/(loss) before tax adjusted to exclude the Group’s share of equity accounted investments’ result after tax, fixed charges and dividends received from equity accounted investments; and the fixed charges were calculated by adding interest expensed and capitalised, amortised premiums, discounts and capitalised expenses related to indebtedness, an estimate of the interest within rental expense and preference security dividend requirements of consolidated subsidiaries. |

| (v) | The amount of the deficiency in 2013 was US$183 million. |

| (vi) | Net assets is calculated as the sum of total assets less total liabilities. |

| 11 |

Table of Contents

CRH Annual Report on Form 20-F | 2015

Introduction and Performance Measures | continued

| * | Defined as earnings before interest, taxes, depreciation, amortisation, asset impairment charges, profit on disposals and the Group’s share of equity accounted investments’ result after tax. |

| 12 |

Table of Contents

CRH Annual Report on Form 20-F | 2015

|

Exchange Rates |

||||||||||||||||

| US Dollar/euro exchange rate

|

|

|||||||||||||||

| Years ended 31 December | Period End | Average Rate(i) | High | Low | ||||||||||||

| 2011 | 1.30 | 1.40 | 1.49 | 1.29 | ||||||||||||

| 2012 | 1.32 | 1.29 | 1.35 | 1.21 | ||||||||||||

| 2013 | 1.38 | 1.33 | 1.38 | 1.28 | ||||||||||||

| 2014 | 1.21 | 1.32 | 1.39 | 1.21 | ||||||||||||

| 2015 | 1.09 | 1.10 | 1.20 | 1.05 | ||||||||||||

| 2016 (through 11 March 2016) | 1.12 | 1.10 | 1.14 | 1.07 | ||||||||||||

| Months ended |

||||||||||||||||

| September 2015 | 1.12 | 1.12 | 1.14 | 1.11 | ||||||||||||

| October 2015 | 1.10 | 1.12 | 1.14 | 1.10 | ||||||||||||

| November 2015 | 1.06 | 1.07 | 1.10 | 1.06 | ||||||||||||

| December 2015 | 1.09 | 1.09 | 1.10 | 1.06 | ||||||||||||

| January 2016 | 1.08 | 1.09 | 1.10 | 1.07 | ||||||||||||

| February 2016 | 1.09 | 1.11 | 1.14 | 1.09 | ||||||||||||

| March 2016 (through 11 March 2016) | 1.12 | 1.10 | 1.12 | 1.08 | ||||||||||||

| (i) | The average of the US Dollar/euro exchange rate on the last day of each month during the period or in the case of monthly averages, the average of all days in the month, in each case using the FRB Noon Buying Rate. |

| 13 |

Table of Contents

CRH Annual Report on Form 20-F | 2015

History, Development and Organisational Structure of the Company

| 14 |

Table of Contents

CRH Annual Report on Form 20-F | 2015

The percentage of Group revenue and operating profit for each of the seven reporting segments for 2015, 2014 and 2013 is as follows:

|

Business Overview

|

|

|||||||||||||||||||||||

| 2015 | 2014 | 2013 | ||||||||||||||||||||||

| Revenue | Operating profit | Revenue | Operating profit | Revenue | Operating profit | |||||||||||||||||||

| Share of revenue and operating profit |

||||||||||||||||||||||||

| Europe Heavyside(i) | 15% | 11% | 21% | 16% | 21% | (395%) | ||||||||||||||||||

| Europe Lightside | 4% | 6% | 5% | 8% | 5% | 28% | ||||||||||||||||||

| Europe Distribution | 18% | 7% | 21% | 12% | 22% | 106% | ||||||||||||||||||

| Americas Materials | 27% | 48% | 27% | 39% | 26% | 226% | ||||||||||||||||||

| Americas Products | 16% | 19% | 17% | 16% | 17% | 68% | ||||||||||||||||||

| Americas Distribution | 10% | 9% | 9% | 9% | 9% | 67% | ||||||||||||||||||

| LH Assets(ii) | 10% | 0% | - | - | - | - | ||||||||||||||||||

| Total | 100% | 100% | 100% | 100% | 100% | 100% | ||||||||||||||||||

| (i) | See “Business Operations in Europe” on page 20 for details of non-European countries grouped with Europe for reporting purposes. |

| (ii) | The post-acquisition operating profit for LH Assets reported by CRH in 2015 is stated after charging transaction costs of €144 million (see note 30) and other one-off costs of €53 million. |

| A cement kiln at CRH Serbia’s Novi Popovac production plant, which produced 520,000 tonnes of cement and 360,000 tonnes of clinker in 2015. |

|

| 15 |

Table of Contents

CRH Annual Report on Form 20-F | 2015

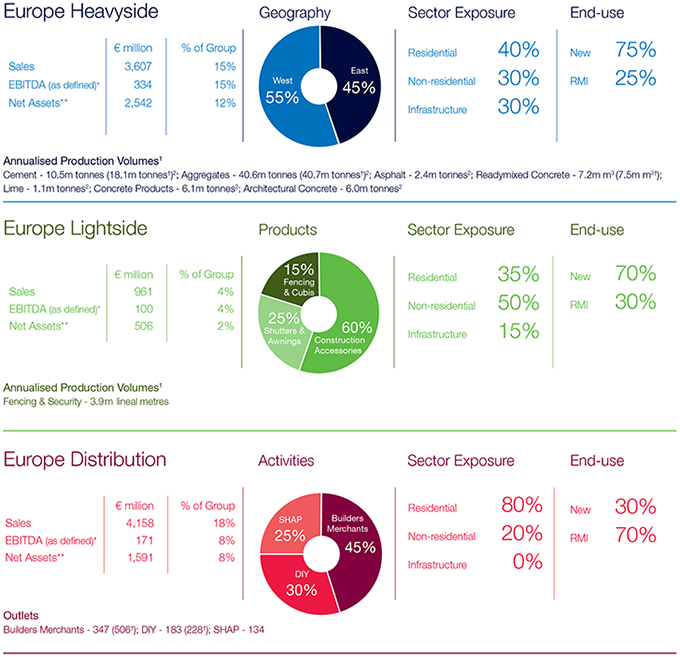

Sector exposure and end-use based on 2015 annualised EBITDA (as defined)*

| * | Defined as earnings before interest, taxes, depreciation, amortisation, asset impairment charges, profit on disposals and the Group’s share of equity accounted investments’ result after tax. |

| ** | Net Assets at 31 December 2015 comprise segment assets less segment liabilities as disclosed in note 1 to the Consolidated Financial Statements. |

| 16 |

Table of Contents

CRH Annual Report on Form 20-F | 2015

| 1 | Throughout this document annualised volumes have been used which reflect the full-year impact of acquisitions made during the year and may vary from actual volumes produced. |

| 2 | Throughout this document tonnes denote metric tonnes (i.e. 1,000 kilogrammes). |

| † | Including equity accounted investments; the volumes quoted above for Europe Heavyside also include the Group’s share of production volumes in the businesses in China and India in which CRH has equity accounted investments. |

| 17 |

Table of Contents

| 18 |

Table of Contents

CRH Annual Report on Form 20-F | 2015

CRH in Europe*

| CRH is a regional leader in the manufacture and supply of building materials to construction markets in Europe and strives to maintain No. 1 and No. 2 market positions in its various product segments across a range of European countries.

|

||||||||||||

| The European operations are comprised of three divisions: Heavyside, Lightside and Distribution. The Heavyside operations produce cement, aggregates, asphalt, readymixed concrete, precast concrete and concrete landscaping. Our Lightside operations manufacture construction accessories, shutters and

|

awnings, fencing and composite access chambers. In Distribution, we are a leading player in builders merchanting, DIY and sanitary, heating and plumbing.

Operating across Western and Eastern Europe, more than 32,000 people are employed by our businesses at approximately 1,500 locations. |

|||||||||||

|

|

| ||||||||||

| The limestone quarry at Trzuskawica’s plant at Sitkówka. The plant is located near the city of Kielce, an area rich in limestone. This is one of the biggest quarries in Poland, with yearly extraction of up to 6m tonnes of high quality limestone in peak years. | Metal Inert Gas (MIG) welding of a stainless steel brick cladding support system at Ancon’s 6,500m2 manufacturing facility in Sheffield, UK. Ancon, part of Europe Lightside, is a two-time winner of the Queen’s Award for Enterprise. | Raboni, a general builders merchant, supplies a wide range of building materials to professional contractors in the Normandy and Paris regions of France. | ||||||||||

| * | A map showing the countries, including in Europe, where the newly acquired LH Assets are located is shown on page 32. |

| 19 |

Table of Contents

CRH Annual Report on Form 20-F | 2015

Business Operations in Europe

| 20 |

Table of Contents

CRH Annual Report on Form 20-F | 2015

| 21 |

Table of Contents

CRH Annual Report on Form 20-F | 2015

Business Operations in Europe | continued

| 22 |

Table of Contents

CRH Annual Report on Form 20-F | 2015

| 23 |

Table of Contents

| 24 |

Table of Contents

CRH Annual Report on Form 20-F | 2015

CRH in the Americas

| CRH is the largest building materials company in North America. We operate in all 50 US states and in six Canadian provinces.

|

||||||||||||

| Our Americas operations comprise Materials, Products and Distribution divisions. In Materials, we are the largest producer of asphalt and third largest producer of aggregates and readymixed concrete in the United States. Our Products operations, with their national footprint and broad product range, are the leading supplier of concrete products and

|

architectural glazing systems in North America. In Distribution, we are a leading supplier of product to the specialist Exterior roofing/siding contractor and also the Interior ceilings/walls demand segments.

Close to 40,000 people are employed by CRH in the Americas, with operations at over 1,700 locations. |

|||||||||||

|

|

| ||||||||||

| The Shelly Company’s Smith Concrete, supplied 35,000 cubic yards of concrete for the US$45 million Bridge of Honor. The bridge is a cast-in-place segmental concrete edge girder system with transverse floor beams. The bridge, which has a span of 675-feet, connects the cities of Pomeroy, Ohio, and Mason, West Virginia, across the Ohio River. | A rigorous quality assurance process at the Anjou Plant in Quebec, Canada, ensures that our customers receive world-class quality products and service. For more than 60 years, Oldcastle Architectural has been Canada’s leader in concrete products, offeringing leading-edge design options for residential and commercial applications. | Tri-Built Materials Group, the private-label division of Allied Building Products, has been well received and now includes more than 30 residential and commercial accessory products. | ||||||||||

| 25 |

Table of Contents

CRH Annual Report on Form 20-F | 2015

Business Operations in the Americas

| 26 |

Table of Contents

| 27 |

Table of Contents

CRH Annual Report on Form 20-F | 2015

Business Operations in the Americas | continued

| 28 |

Table of Contents

CRH Annual Report on Form 20-F | 2015

| 29 |

Table of Contents

CRH Annual Report on Form 20-F | 2015

Business Operations in the Americas | continued

| 30 |

Table of Contents

| 31 |

Table of Contents

CRH Annual Report on Form 20-F | 2015

| 32 |

Table of Contents

CRH Annual Report on Form 20-F | 2015

LH Assets

| 33 |

Table of Contents

| 34 |

Table of Contents

CRH Annual Report on Form 20-F | 2015

CRH in China & India

Equity Accounted Investments

CRH has established strategic footholds in China and India over the last eight years. Our strategy is to build select leading regional positions to enable us to benefit from industrialisation, urbanisation and population growth in these developing economies over the coming decades.

|

Products and Services - Locations

Cement

China, India

Aggregates

China, India

Readymixed Concrete

China, India

Precast Concrete

China

Commissioned in 2009, this 3.7km conveyor belt feeds crushed limestone to two 5,000 tonne per day kilns in Shuangyang Cement Plant which is located in the northeast of China. |

|

| 35 |

Table of Contents

CRH Annual Report on Form 20-F | 2015

Activities with Reserves Backing(i)

| Property acreage | % of mineral | |||||||||||||||||||||||||||||||||||||

| (hectares)(ii) | reserves by rock type | |||||||||||||||||||||||||||||||||||||

| No. of | Proven & | 2015 | ||||||||||||||||||||||||||||||||||||

| Physical | quarries/ | probable | Years to | Hard | Sand & | Annualised | ||||||||||||||||||||||||||||||||

| Location | pits | Owned | Leased | Reserves(iii) | Depletion(iv) | rock | gravel | Other | Extraction(v) | |||||||||||||||||||||||||||||

| Europe Heavyside |

||||||||||||||||||||||||||||||||||||||

| Ireland | 2 | 249 | - | 215 | 109 | 100% | - | - | 2.4 | |||||||||||||||||||||||||||||

| Poland | 2 | 293 | - | 185 | 46 | 93% | 6% | 1% | 4.2 | |||||||||||||||||||||||||||||

| Cement |

Spain | 1 | 33 | - | 85 | 366 | 100% | - | - | 0.4 | ||||||||||||||||||||||||||||

| Switzerland | 3 | 93 | 6 | 31 | 21 | 91% | - | 9% | 1.4 | |||||||||||||||||||||||||||||

| Ukraine | 3 | 279 | - | 158 | 51 | 81% | - | 19% | 3.0 | |||||||||||||||||||||||||||||

| Finland | 151 | 640 | 436 | 192 | 17 | 70% | 30% | - | 11.0 | |||||||||||||||||||||||||||||

| Ireland | 125 | 5,110 | 70 | 1,073 | 94 | 88% | 12% | - | 12.9 | |||||||||||||||||||||||||||||

| Aggregates |

Poland | 4 | 273 | - | 182 | 40 | 96% | 4% | - | 4.6 | ||||||||||||||||||||||||||||

| Spain | 11 | 138 | 167 | 96 | 44 | 99% | 1% | - | 1.8 | |||||||||||||||||||||||||||||

| Other | 36 | 214 | 559 | 172 | 23 | 76% | 24% | - | 7.9 | |||||||||||||||||||||||||||||

| Lime |

Ireland, Poland | 3 | 105 | - | 161 | 160 | 100% | - | - | 1.4 | ||||||||||||||||||||||||||||

| Clay |

Poland | 13 | 1,851 | 28 | 32 | 115 | - | 17% | 83% | 0.3 | ||||||||||||||||||||||||||||

| Subtotals |

354 | 9,278 | 1,266 | 2,582 | 88% | 10% | 2% | |||||||||||||||||||||||||||||||

| Americas Materials |

||||||||||||||||||||||||||||||||||||||

| Aggregates |

East | 287 | 25,823 | 5,633 | 9,286 | 120 | 87% | 13% | - | 84.6 | ||||||||||||||||||||||||||||

| West | 452 | 19,517 | 15,256 | 3,888 | 69 | 45% | 55% | - | 57.4 | |||||||||||||||||||||||||||||

| Subtotals |

739 | 45,340 | 20,889 | 13,174 | 75% | 25% | - | |||||||||||||||||||||||||||||||

| LH Assets |

||||||||||||||||||||||||||||||||||||||

| Brazil | 3 | 1,072 | - | 169 | 89 | 100% | - | - | 2.2 | |||||||||||||||||||||||||||||

| Canada | 2 | 691 | - | 300 | 106 | 100% | - | - | 3.0 | |||||||||||||||||||||||||||||

| France | 3 | 376 | - | 155 | 81 | 100% | - | - | 1.9 | |||||||||||||||||||||||||||||

| Germany | 3 | 321 | - | 164 | 54 | 100% | - | - | 3.0 | |||||||||||||||||||||||||||||

| Philippines | 11 | 2,061 | 17 | 189 | 31 | 100% | - | - | 6.6 | |||||||||||||||||||||||||||||

| Cement |

Romania | 5 | - | 881 | 241 | 79 | 73% | - | 27% | 3.7 | ||||||||||||||||||||||||||||

| Serbia | 2 | 81 | 42 | 109 | 185 | 100% | - | - | 0.6 | |||||||||||||||||||||||||||||

| Slovakia | 5 | 193 | 318 | 307 | 113 | 92% | - | 8% | 2.1 | |||||||||||||||||||||||||||||

| UK | 7 | 1,498 | 150 | 251 | 63 | 100% | - | - | 4.0 | |||||||||||||||||||||||||||||

| United States | 4 | 527 | 19 | 31 | 76 | 100% | - | - | 0.4 | |||||||||||||||||||||||||||||

| Canada | 23 | 3,035 | 94 | 481 | 29 | 81% | 19% | - | 16.8 | |||||||||||||||||||||||||||||

| France | 47 | 552 | 1,017 | 250 | 24 | 67% | 33% | - | 10.3 | |||||||||||||||||||||||||||||

| La Reunion | 3 | - | 54 | 4 | 4 | - | 100% | - | 1.0 | |||||||||||||||||||||||||||||

| Aggregates |

Romania | 24 | - | 922 | 121 | 50 | 94% | 6% | - | 2.4 | ||||||||||||||||||||||||||||

| Slovakia | 4 | 554 | - | 19 | 25 | - | 100% | - | 0.8 | |||||||||||||||||||||||||||||

| UK | 177 | 11,223 | 6,407 | 1,438 | 33 | 89% | 11% | - | 43.6 | |||||||||||||||||||||||||||||

| Lime |

UK | 1 | 209 | 3 | 39 | 36 | 100% | - | - | 1.1 | ||||||||||||||||||||||||||||

| Subtotals |

324 | 22,393 | 9,924 | 4,268 | 90% | 8% | 2% | |||||||||||||||||||||||||||||||

| Group totals |

1,417 | 77,011 | 32,079 | 20,024 | 79% | 20% | 1% | |||||||||||||||||||||||||||||||

| (i) | The disclosures made in this category refer to those facilities which are engaged in on-site processing of reserves in the various forms. |

| (ii) | 1 hectare equals approximately 2.47 acres. |

| (iii) | Where reserves are leased, the data presented above is restricted to include only that material which can be produced over the life of the contractual commitment inherent in the lease; the totals shown pertain only to amounts which are proven and probable. All of the proven and probable reserves are permitted and are quoted in millions of tonnes. |

| (iv) | Years to depletion is based on the average of the most recent three years annualised production. |

| (v) | Annualised extraction is quoted in millions of tonnes. |

| 36 |

Table of Contents

CRH Annual Report on Form 20-F | 2015

| Pennsy Supply’s Prescott Quarry in Lebanon, Pennsylvania, was recognised by Oldcastle Materials Group’s Aggregates National Performance Committee as Most Improved in the National Large Quarry Category in 2015. Local management successfully adjusted its operations plan to achieve higher volumes while reducing cost. |

|

| 37 |

Table of Contents

CRH Annual Report on Form 20-F | 2015

| 38 |

Table of Contents

CRH Annual Report on Form 20-F | 2015

| 39 |

Table of Contents

CRH Annual Report on Form 20-F | 2015

The Environment and Government Regulations

| 40 |

Table of Contents

CRH Annual Report on Form 20-F | 2015

| 41 |

Table of Contents

| 42 |

Table of Contents

| 43 |

Table of Contents

CRH Annual Report on Form 20-F | 2015

| (i) | See cautionary statement regarding forward-looking statements on page 12. |

| * | Defined as earnings before interest, taxes, depreciation, amortisation, asset impairment charges, profit on disposals and the Group’s share of equity accounted investments’ result after tax. |

| 44 |

Table of Contents

CRH Annual Report on Form 20-F | 2015

| * | Defined as earnings before interest, taxes, depreciation, amortisation, asset impairment charges, profit on disposals and the Group’s share of equity accounted investments’ result after tax. |

| 45 |

Table of Contents

CRH Annual Report on Form 20-F | 2015

Becoming the global leader

in building materials

CRH’s vision is to be the leading building materials business in the

world and in doing so to create value and deliver superior returns for

all our stakeholders.

| 46 |

Table of Contents

CRH Annual Report on Form 20-F | 2015

| Continuous Business Improvement | Our relentless focus on operational and commercial performance in all of our businesses in 2015 helped deliver improved returns.

In financial terms this resulted in Return on Net Assets (RONA) of 7.6% in 2015. This reflects improved margins, on a continuing operations basis, in each of our six legacy divisions. When adjusted to take account of non-recurring costs (€197 million) relating to the acquisition of our newly acquired LH Assets, Group RONA in 2015 was 8.8%, ahead of 2014 (7.4%).

| |

|

Disciplined and Focused Growth |

Portfolio management, and in particular the recycling of capital from lower growth areas into core businesses for growth, is a cornerstone of our value creation model. In 2015, we continued to manage our portfolio carefully, recording total disposal proceeds of approximately €1 billion.

While net debt levels of €6.6 billion at year-end 2015 reflect the significant €8 billion acquisition spend during the year, we continued to maintain financial discipline through careful working capital management and capital expenditure controls. The Group is committed to restoring its debt metrics to normalised levels in 2016.

| |

|

Leadership Development |

2015 was an active year for talent injection and promotion throughout the Group. This ensures that CRH is attracting the very best talent in the market and promoting talented individuals from within.

The Group also maintained its focus on leadership development with high performers selected to participate in a range of leadership development programmes.

Mobility opportunities continue to expand as the Group seeks to offer rewarding career and personal development experiences at different operating locations worldwide.

| |

|

Extracting the Benefits of Scale |

In 2015, the newly acquired LH Assets more than doubled the Group’s cement production volumes and made CRH the second largest building materials player globally and the world No. 2 in aggregates. The transaction enabled the Group to establish new leadership positions in certain heavyside materials markets globally. For example, CRH is now the market leader in the UK, has regional leadership positions in Canada, Germany and the Philippines, and has established top three positions in Romania, Slovakia, Hungary and Serbia. |

| 47 |

Table of Contents

CRH Annual Report on Form 20-F | 2015

Creating value and growth

CRH delivers on its strategy through the execution of a dynamic business model which is focused on value creation and growth. This has allowed CRH to deliver an industry-leading Total Shareholder Return of 16.1% since 1970. €100 invested in CRH shares in 1970, with dividends reinvested, would now be worth €83,000.

| 48 |

Table of Contents

CRH Annual Report on Form 20-F | 2015

| Balanced Portfolio | CRH creates value by maintaining a balanced portfolio. Our product mix spans the breadth of building materials demand and sectoral end-use, thereby reducing exposure to any one single demand driver. The Group also offsets cyclical economic risk by maintaining a geographically diversified portfolio across its key regions of North America and Europe, as well as the emerging regions of Asia and South America.

In 2015 the Group’s sector exposure was split 35% residential, 35% non-residential and 30% infrastructure. End-use was balanced equally between New Build and RMI.

|

| ||

|

Making Businesses Better |

CRH’s emphasis on making better businesses is a key component of its focus on value creation and growth. We have a proven track record in acquiring new businesses and bringing the Group’s collective knowledge and experience to bear in working with the local management teams of those businesses to deliver improvements in performance.

The Group supports the delivery of such improvements through targeted investment in measures that improve capacity, quality and efficiency.

Over time these improvements help us build better businesses that deliver stronger returns on capital invested.

|

| ||

|

Proven Acquisition Model |

CRH creates value and growth by identifying and acquiring strong businesses that complement our existing portfolio of operations. Typically we specialise in acquiring small and mid-sized companies, releasing value through synergies and network optimisation. From time to time the Group also evaluates and concludes larger transactions where the strategic rationale is compelling.

We excel at integrating businesses and ensuring that they are appropriately positioned and resourced to succeed as part of the CRH Group.

|

| ||

|

Dynamic Capital Management |

CRH constantly strives to ensure that capital is recycled from low growth areas into core parts of our business that offer the potential for stronger growth and returns.

With a portfolio which is diversified across many products, geographies and end-uses, we allocate capital to the areas best positioned to take advantage of developing growth cycles and new areas that offer improved value creation and growth potential. |

| ||

|

Financial Strength |

The Group maintains a constant focus on financial discipline and strong cash generation which in turn supports our ability to fund new value creating acquisitions and returns for shareholders.

Our strong financial position reduces the cost of capital. In 2015, we raised over €2.5 billion at historically low interest rates for the Group; with an eight-year bond for €600 million at 1.875%, a ten-year bond for $1.25 billion at 3.875%, a 14-year bond of £400 million at 4.125% and a 30-year bond for $500 million at 5.125%. |

|

| 49 |

Table of Contents

CRH Annual Report on Form 20-F | 2015

Building a sustainable business

| Corporate Social Responsibility and Sustainability concepts are embedded in the heart of our business and are fundamental to achieving our vision of becoming the leading building materials business in the world. |

| |||

|

Our Approach

CRH is committed to delivering a built environment that is sustainable and of value to the communities we serve. Our extensive global presence and industry leadership puts the Group in a strong position to influence transformative innovation that improves the sustainability of the built environment. Applying a strategic approach to deriving tangible long-term business value from sustainability, we collaborate with stakeholders to ensure our medium-term objectives and long-term ambitions are achieved. The Group does this while also being sensitive and responsive to our stakeholders as well as to the environment in which we operate.

CRH has formal structures in place to identify, evaluate and manage potential risks and opportunities in sustainability areas. Group performance and effectiveness is reviewed regularly by the Board of Directors.

We are committed to reporting on the breadth of our sustainability performance in a comprehensive and transparent manner and to publishing performance indicators and ambitions in key identified sustainability areas. |

CRH continues to be ranked among sector leaders by leading Sustainable and Responsible Investment (SRI) rating agencies and continues as a constituent member of several sustainability indices including the FTSE4Good Index, the STOXX® Global ESG Leaders Indices and the Vigeo World 120 Index. In addition, many Group locations have won high-ranking accolades for excellence in sustainability achievements. |

|||

|

| ||||

| 50 |

Table of Contents

CRH Annual Report on Form 20-F | 2015

| 51 |

Table of Contents

CRH Annual Report on Form 20-F | 2015

Creating value through Risk Governance

The aim of Enterprise Risk Management is to deliver increased shareholder value for CRH. Effective governance, which is considered fundamental in CRH, is critical to success, supporting management in executing strategy, managing costs, responding to risks, attracting investment, achieving regulatory compliance and in promoting effective decision making.

| 52 |

Table of Contents

CRH Annual Report on Form 20-F | 2015

| 53 |

Table of Contents

CRH Annual Report on Form 20-F | 2015

Key Strategic, Operational and Compliance Risk Factors

Industry cyclicality: strategic

| Risk Factor

|

Discussion

| |

| Description:

The level of construction activity in local and national markets is inherently cyclical being influenced by a wide variety of factors including global and national economic circumstances, ongoing austerity programmes in the developed world, governments’ ability to fund infrastructure projects, consumer sentiment and weather conditions. Financial performance may also be negatively impacted by unfavourable swings in fuel and other commodity/raw material prices. |

The Group’s operating and financial performance is influenced by general economic conditions and the state of the residential, industrial and commercial and infrastructure construction markets in the countries in which it operates, particularly in Europe and North America.

In general, economic uncertainty exacerbates negative trends in construction activity leading to postponement in orders. Construction markets are inherently cyclical and are affected by many factors that are beyond the Group’s control, including: | |

| Impact:

Failure of the Group to respond on a timely basis and/or adequately to unfavourable events beyond its control may adversely affect financial performance. |

• the price of fuel and principal energy-related raw materials such as bitumen and steel (which accounted for approximately 8% of annual Group sales revenues in 2015);

• the performance of the national economies in the 31 countries in which the Group operates;

• monetary policies in the countries in which the Group operates — for example, an increase in interest rates typically reduces the volume of mortgage borrowings thus impacting residential construction activity;

• the allocation of government funding for public infrastructure programmes, such as the development of highways in the United States under the Fixing Americas Surface Transportation Act (FAST Act); and

• the level of demand for construction materials and services, with sustained adverse weather conditions leading to potential disruptions or curtailments in outdoor construction activity.

While economic conditions appear to be improving in the United States, a prolongation of or further deterioration in economic performance in Europe may result in further general reductions in construction activity in that area. Against this backdrop, the adequacy and timeliness of the actions taken by the Group’s management team are of critical importance in maintaining financial performance at appropriate levels.

Each of the above factors could have a material adverse effect on the Group’s operating results and the market price of CRH plc’s Ordinary Shares.

| |

| 54 |

Table of Contents

CRH Annual Report on Form 20-F | 2015

Political and economic uncertainty: strategic

| Risk Factor

|

Discussion

| |

| Description:

As an international business, the Group operates in many countries with differing, and in some cases, potentially fast-changing economic, social and political conditions. These conditions could include political unrest, currency disintegration, strikes, civil disturbance and other forms of instability including natural disasters, epidemics, widespread transmission of diseases and terrorist attacks. These factors are of particular relevance in developing/emerging markets.

Impact:

Changes in these conditions, or in the governmental or regulatory requirements in any of the countries in which the Group operates, may adversely affect the Group’s business, results of operations, financial condition or prospects thus leading to possible impairment of financial performance and/or restrictions on future growth opportunities. |

The adverse developments in eurozone economic performance in recent years, together with ongoing austerity programmes in various countries in Europe and the growth of international terrorism, have contributed to heightened global uncertainty. While various actions have been taken by central banks and other institutions to stabilise the economic situation, the success of these actions cannot be guaranteed.

The Group currently operates mainly in Western Europe and North America as well as, to a lesser degree, in developing countries/emerging markets in Eastern Europe, the Philippines, Brazil, China and India. The economies of these countries are at varying stages of socioeconomic and macroeconomic development which could give rise to a number of risks, uncertainties and challenges and could include the following:

• changes in political, social or economic conditions;

• trade protection measures and import or export licensing requirements;

• potentially negative consequences from changes in tax laws;

• labour practices and differing labour regulations;

• procurement which contravenes ethical considerations;

• unexpected changes in regulatory requirements;

• state-imposed restrictions on repatriation of funds; and

• the outbreak of armed conflict.

With regard to Ukraine, where the Group has significant business interests, the outlook remains uncertain and the implications for construction activity in 2016 and beyond are unclear. | |

Commodity products and substitution: strategic

| Risk Factor

|

Discussion

| |

| Description:

The Group faces strong volume and price competition across its product lines. In addition, existing products may be replaced by substitute products which the Group does not produce or distribute.

Impact:

Against this backdrop, if the Group fails to generate competitive advantage through differentiation and innovation across the value chain (for example, through superior product quality, engendering customer loyalty or excellence in logistics), market share, and thus financial performance, may decline. |

The competitive environment in which the Group operates can be significantly impacted by general economic conditions in combination with local factors including the number of competitors, the degree of utilisation of production capacity and the specifics of product demand. Across the multitude of largely local markets in which the Group conducts business, downward pricing pressure is experienced from time to time, and the Group may not always be in a position to recover increased operating expenses (caused by factors such as increased fuel and raw material prices) through higher sale prices.

A number of the products sold by the Group (both those manufactured internally and those distributed) compete with other building products that do not feature in the existing product range. Any significant shift in demand preference from the Group’s existing products to substitute products, which the Group does not produce or distribute, could adversely impact market share and results of operations. | |

| 55 |

Table of Contents

CRH Annual Report on Form 20-F | 2015

Key Strategic, Operational and Compliance Risk Factors | continued

Acquisition activity: strategic

| Risk Factor

|

Discussion

| |

| Description:

Growth through acquisition and active management of the Group’s business portfolio are key elements of the Group’s strategy with the Group’s balanced portfolio growing year on year through bolt-on activity occasionally supplemented by larger and/or step-change transactions. In 2015, the Group completed the largest transaction in its history, namely the acquisition of the LH Assets across 11 countries. In addition, the Group may be liable for the past acts, omissions or liabilities of companies or businesses it has acquired.

Impact:

The Group may not be able to continue to grow as contemplated in its business plans if it is unable to identify attractive targets (including potential new platforms for growth), execute full and proper due diligence, raise funds on acceptable terms, complete such acquisition transactions, integrate the operations of the acquired businesses and realise anticipated levels of profitability and cash flows. If the Group is held liable for the past acts, omissions or liabilities of companies or businesses it has acquired, those liabilities may either be unforeseen or greater than anticipated at the time of the relevant acquisition. |

The Group’s acquisition strategy focuses on value-enhancing mid-sized acquisitions supplemented from time to time by larger strategic acquisitions into new markets or new building products.

The realisation of the Group’s acquisition strategy is dependent on the ability to identify and acquire suitable assets at appropriate prices thus satisfying the stringent cash flow and return on investment criteria underpinning such activities. The Group may not be able to identify such companies, and, even if identified, may not be able to acquire them because of a variety of factors including the outcome of due diligence processes, the ability to raise funds (as required) on acceptable terms, the need for competition authority approval in certain instances and competition for transactions from peers and other entities exploring acquisition opportunities in the building materials sector. In addition, situations may arise where the Group may be liable for the past acts or omissions or liabilities of companies acquired; for example, the potential environmental liabilities addressed under the “Sustainability” Risk Factor below. The Group’s ability to realise the expected benefits from acquisition activity depends, in large part, on its ability to integrate newly-acquired businesses in a timely and effective manner. Even if the Group is able to acquire suitable companies, it still may not be able to incorporate them successfully into the relevant legacy businesses and, accordingly, may be deprived of the expected benefits thus leading to potential dissipation and diversion of management resources and constraints on financial performance. | |

Joint ventures and associates: strategic

| Risk Factor

|

Discussion

| |

| Description:

The Group does not have a controlling interest in certain of the businesses (i.e. joint ventures and associates) in which it has invested and may invest. The absence of a controlling interest gives rise to increased governance complexity and a need for proactive relationship management, which may restrict the Group’s ability to generate adequate returns and to develop and grow these businesses.

Impact:

These limitations could impair the Group’s ability to manage joint ventures and associates effectively and/or realise the strategic goals for these businesses. In addition, improper management or ineffective policies, procedures or controls for non-controlled entities could adversely affect the business, results of operations or financial condition of the relevant investment. |

Due to the absence of full control of joint ventures and associates, important decisions such as the approval of business plans and the timing and amount of cash distributions and capital expenditures, for example, may require the consent of partners or may be approved without the Group’s consent.

These limitations could impair the Group’s ability to manage joint ventures and associates effectively and/or realise the strategic goals for these businesses. In addition, improper management or ineffective policies, procedures or controls for non-controlled entities could adversely affect the business, results of operations or financial condition of the relevant investment and, by corollary, the Group. | |

| 56 |

Table of Contents

CRH Annual Report on Form 20-F | 2015

Human resources: strategic

| Risk Factor

|

Discussion

| |

| Description:

Existing processes to recruit, develop and retain talented individuals and promote their mobility may be inadequate thus giving rise to employee/management attrition, difficulties in succession planning and inadequate “bench strength”, potentially impeding the continued realisation of the core strategy of performance and growth. In addition, the Group is exposed to various risks associated with collective representation of employees in certain jurisdictions, these risks could include strikes and increased wage demands with possible reputational consequences.

Impact:

In the longer term, failure to manage talent and plan for leadership and succession could impede the realisation of core strategic objectives around performance and growth. |

The identification and subsequent assessment, management, development and deployment of talented individuals is of major importance in continuing to deliver on the Group’s core strategy of performance and growth and in ensuring that succession planning objectives for key executive roles throughout its international operations are satisfied. Programmes designed to focus on performance management skills and leadership development may not achieve their desired objectives.

The maintenance of positive employee and trade/labour union relations is key to the successful operation of the Group. Some of the Group’s employees are represented by trade/labour unions under various collective agreements. For unionised employees, the Group may not be able to renegotiate satisfactorily the relevant collective agreements upon expiration and may face tougher negotiations and higher wage demands than would be the case for non-unionised employees. In addition, existing labour agreements may not prevent a strike or work stoppage with any such activity creating reputational risk and potentially having a material adverse effect on the results of operations and financial condition of the Group. | |

Corporate communications: strategic

| Risk Factor

|

Discussion

| |

| Description:

As a publicly-listed company, the Group undertakes regular communications with its stakeholders. Given that these communications may contain forward-looking statements, which by their nature involve uncertainty, actual results and developments may differ from those communicated due to a variety of external and internal factors giving rise to reputational risk.

Impact:

Failure to deliver on performance indications and non-financial commitments communicated to the Group’s variety of stakeholders could result in a reduction in share price, reduced earnings and reputational damage. |

The Group places great emphasis on timely and relevant corporate communications with overall responsibility for these matters being vested in senior management at the Group Head Office (largely the Chief Executive, the Finance Director, the Group Transformation Director, the Head of Investor Relations and the Group Director, Corporate Affairs) supported by engagement with highly experienced external advisors, where appropriate. The strategic, operational and financial performance of the Group and of its constituent entities, is reported to the Board on a monthly basis with all results announcements and other externally-issued documentation (e.g. the Annual Report on Form 20-F) being discussed by the Board/Audit Committee prior to release. | |

| 57 |

Table of Contents

CRH Annual Report on Form 20-F | 2015

Key Strategic, Operational and Compliance Risk Factors | continued

| Sustainability: operational

| ||

| Risk Factor

|

Discussion

| |

| Description:

The Group is subject to stringent and evolving laws, regulations, standards and best practices in the area of sustainability (comprising corporate governance, environmental management and climate change (specifically capping of emissions), health and safety management and social performance).

Impact:

Non-adherence to such laws, regulations, standards and best practices may give rise to increased ongoing remediation and/or other compliance costs and may adversely affect the Group’s business, results of operations, financial condition and/or prospects. |

The Group is subject to a broad and increasingly stringent range of existing and evolving laws, regulations, standards and best practices with respect to governance, the environment, health and safety and social performance in each of the jurisdictions in which it operates giving rise to significant compliance costs, potential legal liability exposure and potential limitations on the development of its operations. These laws, regulations, standards and best practices relate to, amongst other things, climate change, noise, emissions to air, water and soil, the use and handling of hazardous materials and waste disposal practices. Given the above, the risk of increased environmental and other compliance costs and unplanned capital expenditure is inherent in conducting business in the building materials sector and the impact of future developments in these respects on the Group’s activities, products, operations, profitability and cash flow cannot be estimated; there can therefore be no assurance that material liabilities and costs will not be incurred in the future or that material limitations on the development of its operations will not arise.

Environmental and health and safety and other laws, regulations, standards and best practices may expose the Group to the risk of substantial costs and liabilities, including liabilities associated with assets that have been sold or acquired and activities that have been discontinued. In addition, many of the Group’s manufacturing sites have a history of industrial use and, while strict environmental operating standards are applied and extensive environmental due diligence is undertaken in acquisition activity, some soil and groundwater contamination has occurred in the past at a limited number of sites. Although the associated remediation costs incurred to date have not been material, they may become more significant in the future. Despite the Group’s policy and efforts to comply with all applicable environmental and health and safety laws, it may face increased remediation liabilities and legal proceedings concerning environmental and health and safety matters in the future.

Based on information currently available, the Group has budgeted capital and revenue expenditures for environmental improvement projects and has established reserves for known environmental remediation liabilities that are probable and reasonably capable of estimation. However, the Group cannot predict environmental and health and safety matters with certainty, and budgeted amounts and established reserves may not be adequate for all purposes. In addition, the development or discovery of new facts, events, circumstances or conditions, including future decisions to close plants, which may trigger remediation liabilities, and other developments such as changes in laws or increasingly strict enforcement by governmental authorities, could result in increased costs and liabilities or prevent or restrict some of the operations of the Group, which in turn could have a material adverse effect on the reputation, business, results of operations and overall financial condition of the Group.

For additional information see also “Introduction – The Environment and Government Regulations”. | |

| 58 |

Table of Contents

CRH Annual Report on Form 20-F | 2015

|

Cyber and information technology: operational

| ||

| Risk Factor

|

Discussion

| |

| Description:

As a result of the proliferation of information technology in the world today, the Group is dependent on the employment of advanced information systems and is exposed to risks of failure in the operation of these systems. Further, the Group is exposed to security threats to its digital infrastructure through cyber-crime. Such attacks are by their nature technologically sophisticated and may be difficult to detect and defend in a timely fashion.

Impact:

Should a threat materialise, it might lead to interference with production processes, manipulation of financial data, the theft of private data or misrepresentation of information via digital media. In addition to potential irretrievability or corruption of critical data, the Group could suffer reputational losses, regulatory penalties and incur significant financial costs in remediation.

|

Security and cyber threats are becoming increasingly sophisticated and are continually evolving. Such attacks may result in interference with production software, corruption or theft of sensitive data, manipulation of financial data accessible through digital infrastructure, or reputational losses as a result of misrepresentation via social media and other websites. While the Group has made a significant investment in upgrading its digital infrastructure and governance processes with the overall objective of further enhancing system security, there can be no assurance that future attacks will not be successful due to their increasing sophistication and the difficulties in detecting and defending against them in a timely fashion. | |

|

Laws and regulations: compliance

| ||

| Risk Factor

|

Discussion

| |

| Description:

The Group is subject to many local and international laws and regulations, including those relating to competition law, corruption and fraud, across many jurisdictions of operation and is therefore exposed to changes in those laws and regulations and to the outcome of any investigations conducted by governmental, international or other regulatory authorities.

Impact:

Potential breaches of local and international laws and regulations in the areas of competition law, corruption and fraud, among others, could result in the imposition of significant fines and/or sanctions for non-compliance, and may inflict reputational damage. |

The Group is subject to various statutes, regulations and laws applicable to businesses generally in the countries and markets in which it operates. These include statutes, regulations and laws affecting land usage, zoning, labour and employment practices, competition, financial reporting, taxation, anti-bribery, anti-corruption, governance and other matters. The Group mandates that its employees comply with its Code of Business Conduct which stipulates best practices in relation to regulatory matters. The Group cannot guarantee that its employees will at all times successfully comply with all demands of regulatory agencies in a manner which will not materially adversely affect its business, results of operations, financial condition or prospects.

While the Group has put in place significant internal controls and compliance policies and procedures (including with respect to the Foreign Corrupt Practices Act in the United States and the Bribery Act in the United Kingdom), there can be no assurance that such established policies and procedures will afford adequate protection against fraudulent and/or corrupt activity and any such activity could have a material adverse effect on the Group’s business, results of operations, financial condition or prospects. | |

| 59 |

Table of Contents

CRH Annual Report on Form 20-F | 2015

Key Financial and Reporting Risk Factors

| Financial instruments |

||

| (interest rate and leverage, foreign currency, counterparty, credit ratings and liquidity)

| ||

|

Risk Factor

|

Discussion

| |

| Description:

The Group uses financial instruments throughout its businesses giving rise to interest rate and leverage, foreign currency, counterparty, credit rating and liquidity risks. A significant portion of the cash generated by the Group from operational activity is currently dedicated to the payment of principal and interest on indebtedness. In addition, the Group has entered into certain financing agreements containing restrictive covenants requiring it to maintain a certain minimum interest coverage ratio and a certain minimum net worth.

Impact:

A downgrade of the Group’s credit ratings may give rise to increases in funding costs in respect of future debt and may impair the Group’s ability to raise funds on acceptable terms. In addition, insolvency of the financial institutions with which the Group conducts business (or a downgrade in their credit ratings) may lead to losses in derivative assets and cash and cash equivalents balances or render it more difficult either to utilise existing debt capacity or otherwise obtain financing for operations. |

Interest rate and leverage risks: The Group’s exposures to changes in interest rates result from investing and borrowing activities undertaken to manage liquidity and capital requirements and stem predominantly from long-term debt obligations. Borrowing costs are managed through employing a mix of fixed and floating rate debt and interest rate swaps, where appropriate. As at 31 December 2015, the Group had outstanding net indebtedness of approximately €6.6 billion (2014: €2.5 billion). On foot of acquisition activity in 2015, the Group has significantly greater outstanding indebtedness, which may impair its operating and financial flexibility over the longer term and could adversely affect its business, results of operations and financial position. This high level of indebtedness could give rise to the Group dedicating a substantial portion of its cash flow to debt service thereby reducing the funds available in the longer term for working capital, capital expenditure, acquisitions, distributions to shareholders and other general corporate purposes and limiting its ability to borrow additional funds and to respond to competitive pressures. In addition, the increased level of indebtedness may give rise to a general increase in interest rates borne and there can be no assurance that the Group will not be adversely impacted by increases in borrowing costs in the future.

For the year ended 31 December 2015, PBITDA/net interest (all as defined in the relevant agreements as discussed in note 23 to the Consolidated Financial Statements), which is the Group’s principal financial covenant, was 8.5 times (2014: 7.0 times). The prescribed minimum PBITDA/net interest cover ratio under such agreements is 4.5 times and the prescribed minimum net worth is €5.6 billion.

Foreign currency risks: If the euro, which is the Group’s reporting currency, weakens relative to the basket of foreign currencies in which net debt is denominated (principally the US Dollar, Canadian Dollar, Swiss Franc, Philippine Peso and Pound Sterling), the net debt balance would increase; the converse would apply if the euro was to strengthen. The Group’s established policy to spread its net worth across the currencies of its operations, with the objective of limiting its exposure to individual currencies and thus promoting consistency with geographical balance, may not be successful.

Counterparty risks: Insolvency of the financial institutions with which the Group conducts business, or a downgrade in their credit ratings, may lead to losses in derivative assets and cash and cash equivalents balances or render it more difficult either to utilise existing debt capacity or otherwise obtain financing for operations. The maximum exposure arising in the event of default on the part of the counterparty (including insolvency) is the carrying amount of the relevant financial instrument.

The Group holds significant cash balances on deposit with a variety of highly-rated financial institutions (typically invested on a short-term basis) which, together with cash and cash equivalents at 31 December 2015, totalled €2.5 billion (2014: €3.3 billion). In addition to the above, the Group enters into derivative transactions with a variety of highly-rated financial institutions giving rise to derivative assets and derivative liabilities; the relevant balances as at 31 December 2015 were €109 million and €24 million respectively (2014: €102 million and €23 million respectively). The counterparty risks inherent in these exposures may give rise to losses in the event that the relevant financial institutions suffer a ratings downgrade or become insolvent. In addition, certain of the Group’s activities (e.g. highway paving in the United States) give rise to significant amounts receivable from counterparties at the balance sheet date; at year-end 2015, this balance was €0.7 billion (2014: €0.5 billion). In the current business environment, there is increased exposure to counterparty default, particularly as regards bad debts.

| |

| 60 |

Table of Contents

CRH Annual Report on Form 20-F | 2015

|

Financial instruments | continued |

||

| (interest rate and leverage, foreign currency, counterparty, credit ratings and liquidity)

| ||

|

Risk Factor

|

Discussion

| |

| Credit rating risks: A downgrade of the Group’s credit ratings may give rise to increases in funding costs in respect of future debt and may, among other concerns, impair its ability to access debt markets or otherwise raise funds or enter into letters of credit, for example, on acceptable terms. Such a downgrade may result from factors specific to the Group, including increased indebtedness stemming from acquisition activity, or from other factors such as general economic or sector-specific weakness or sovereign credit rating ceilings.

Liquidity risks: The principal liquidity risks stem from the maturation of debt obligations and derivative transactions. The Group aims to achieve flexibility in funding sources through a variety of means including (i) maintaining cash and cash equivalents with a number of highly-rated counterparties; (ii) limiting the maturity of such balances; (iii) meeting the bulk of debt requirements through committed bank lines or other term financing; and (iv) having surplus committed lines of credit. However, market or economic conditions may make it difficult at times to realise this objective.

For additional information on the above risks see note 21 to the Consolidated Financial Statements.

| ||

|

Defined benefit pension schemes and related obligations

| ||

|

Risk Factor

|

Discussion

| |

|

Description:

The Group operates a number of defined benefit pension schemes and related obligations (for example, termination indemnities and jubilee/long-term service benefits, which are accounted for as defined benefit) in certain of its operating jurisdictions. The assets and liabilities of defined benefit pension schemes may exhibit significant period-on-period volatility attributable primarily to asset values, changes in bond yields/discount rates and anticipated longevity.

Impact:

In addition to the contributions required for the ongoing service of participating employees, significant cash contributions may be required to remediate deficits applicable to past service. Further, fluctuations in the accounting surplus/deficit may adversely impact credit metrics thus harming the Group’s ability to raise funds. |

The assumptions used in the recognition of pension assets, liabilities, income and expenses (including discount rates, rate of increase in future compensation levels, mortality rates and healthcare cost trend rates) are updated based on market and economic conditions at the respective balance sheet date and for any relevant changes to the terms and conditions of the pension and post-retirement plans. These assumptions can be affected by (i) for the discount rate, changes in the rates of return on high-quality fixed income investments; (ii) for future compensation levels, future labour market conditions and anticipated inflation; (iii) for mortality rates, changes in the relevant actuarial funding valuations or changes in best practice; and (iv) for healthcare cost trend rates, the rate of medical cost inflation in the relevant regions. The weighted average actuarial assumptions used and sensitivity analysis in relation to the significant assumptions employed in the determination of pension and other post-retirement liabilities are disclosed on pages 214 to 223. A prolonged period of financial market instability or other adverse changes in the assumption mentioned above would have an adverse impact on the valuations of pension scheme assets.

In addition, a number of the defined benefit pension schemes in operation throughout the Group have reported material funding deficits thus necessitating remediation either in accordance with legislative requirements or as agreed with the relevant regulators. These obligations are reflected in the contracted payments disclosure on page 69. The extent of such contributions may be exacerbated over time as a result of a prolonged period of instability in worldwide financial markets or other adverse changes in the assumption mentioned above.

| |

| 61 |

Table of Contents

CRH Annual Report on Form 20-F | 2015

Key Financial and Reporting Risk Factors | continued

|

Adequacy of insurance arrangements and related counterparty exposures

| ||

|

Risk Factor

|

Discussion

| |

|

Description:

The building materials sector is subject to a wide range of operating risks and hazards, not all of which can be covered, adequately or at all, by insurance; these risks and hazards include climatic conditions such as floods and hurricanes/cyclones, seismic activity, technical failures, interruptions to power supplies, industrial accidents and disputes, environmental hazards, fire and crime. In its worldwide insurance programme, the Group provides coverage for its operations at a level believed to be commensurate with the associated risks.

Impact:

In the event of failure of one or more of the Group’s counterparties, the Group could be impacted by losses where recovery from such counterparties is not possible. In addition, losses may materialise in respect of uninsured events or may exceed insured amounts. |