UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

|

☒ |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2018

OR

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 0-17973

Heritage Global Inc.

(Exact name of registrant as specified in its charter)

|

FLORIDA |

59-2291344 |

|

(State or Other Jurisdiction of |

(I.R.S. Employer Identification No.) |

12625 High Bluff Drive, Suite 305, San Diego, CA 92130

(Address of Principal Executive Offices)

(858) 847-0656

(Registrant’s Telephone Number)

N/A

(Registrant’s Former Name)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large Accelerated Filer |

☐ |

|

Accelerated Filer |

☐ |

|

Non-Accelerated Filer |

☐ |

|

Smaller reporting company |

☒ |

|

Emerging growth company |

☐ |

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of November 1, 2018, there were 29,253,278 shares of common stock, $0.01 par value, outstanding.

|

Part I. |

3 |

|

|

|

|

|

|

Item 1. |

3 |

|

|

|

|

|

|

|

Condensed Consolidated Balance Sheets as of September 30, 2018 (unaudited) and December 31, 2017 |

3 |

|

|

|

|

|

|

4 |

|

|

|

|

|

|

|

5 |

|

|

|

|

|

|

|

6 |

|

|

|

|

|

|

|

7 |

|

|

|

|

|

|

Item 2. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

15 |

|

|

|

|

|

Item 3. |

22 |

|

|

|

|

|

|

Item 4. |

22 |

|

|

|

|

|

|

Part II. |

23 |

|

|

|

|

|

|

Item 1. |

23 |

|

|

|

|

|

|

Item 1A. |

23 |

|

|

|

|

|

|

Item 2. |

23 |

|

|

|

|

|

|

Item 3. |

23 |

|

|

|

|

|

|

Item 4. |

23 |

|

|

|

|

|

|

Item 5. |

23 |

|

|

|

|

|

|

Item 6. |

24 |

2

PART I – FINANCIAL INFORMATION

Item 1 – Financial Statements.

HERITAGE GLOBAL INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands of US dollars, except share and per share amounts)

|

|

|

September 30, 2018 |

|

|

December 31, 2017 |

|

||

|

|

|

(unaudited) |

|

|

|

|

|

|

|

ASSETS |

|

|

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

3,228 |

|

|

$ |

2,109 |

|

|

Accounts receivable (net of allowance for doubtful accounts of $0 in 2018; $110 in 2017) |

|

|

720 |

|

|

|

384 |

|

|

Inventory – equipment |

|

|

114 |

|

|

|

170 |

|

|

Other current assets |

|

|

693 |

|

|

|

357 |

|

|

Total current assets |

|

|

4,755 |

|

|

|

3,020 |

|

|

Property and equipment, net |

|

|

177 |

|

|

|

145 |

|

|

Identifiable intangible assets, net |

|

|

3,691 |

|

|

|

3,877 |

|

|

Goodwill |

|

|

6,158 |

|

|

|

6,158 |

|

|

Other assets |

|

|

251 |

|

|

|

250 |

|

|

Total assets |

|

$ |

15,032 |

|

|

$ |

13,450 |

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

|

|

Accounts payable and accrued liabilities |

|

$ |

6,407 |

|

|

$ |

5,019 |

|

|

Related party debt |

|

|

— |

|

|

|

382 |

|

|

Current portion of third party debt |

|

|

372 |

|

|

|

356 |

|

|

Contingent consideration |

|

|

— |

|

|

|

2,774 |

|

|

Other current liabilities |

|

|

84 |

|

|

|

133 |

|

|

Total current liabilities |

|

|

6,863 |

|

|

|

8,664 |

|

|

Non-current portion of third party debt |

|

|

535 |

|

|

|

786 |

|

|

Deferred tax liabilities |

|

|

512 |

|

|

|

512 |

|

|

Total liabilities |

|

|

7,910 |

|

|

|

9,962 |

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders’ equity: |

|

|

|

|

|

|

|

|

|

Preferred stock, $10.00 par value, authorized 10,000,000 shares; issued and outstanding 569 Class N shares at September 30, 2018 and December 31, 2017 |

|

|

6 |

|

|

|

6 |

|

|

Common stock, $0.01 par value, authorized 300,000,000 shares; issued and outstanding 29,253,278 shares at September 30, 2018 and 28,480,148 shares at December 31, 2017 |

|

|

293 |

|

|

|

285 |

|

|

Additional paid-in capital |

|

|

284,681 |

|

|

|

284,396 |

|

|

Accumulated deficit |

|

|

(277,781 |

) |

|

|

(281,124 |

) |

|

Accumulated other comprehensive loss |

|

|

(77 |

) |

|

|

(75 |

) |

|

Total stockholders’ equity |

|

|

7,122 |

|

|

|

3,488 |

|

|

Total liabilities and stockholders’ equity |

|

$ |

15,032 |

|

|

$ |

13,450 |

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

3

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

AND COMPREHENSIVE INCOME

(In thousands of US dollars, except share and per share amounts)

(unaudited)

|

|

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

||||||||||

|

|

|

2018 |

|

|

2017 |

|

|

2018 |

|

|

2017 |

|

||||

|

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Services revenue |

|

$ |

4,897 |

|

|

$ |

4,231 |

|

|

$ |

16,407 |

|

|

$ |

12,637 |

|

|

Asset sales |

|

|

231 |

|

|

|

506 |

|

|

|

1,351 |

|

|

|

1,915 |

|

|

Total revenues |

|

|

5,128 |

|

|

|

4,737 |

|

|

|

17,758 |

|

|

|

14,552 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating costs and expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of services revenue |

|

|

710 |

|

|

|

522 |

|

|

|

2,001 |

|

|

|

2,291 |

|

|

Cost of asset sales |

|

|

189 |

|

|

|

282 |

|

|

|

752 |

|

|

|

1,541 |

|

|

Selling, general and administrative |

|

|

3,734 |

|

|

|

3,539 |

|

|

|

11,315 |

|

|

|

9,751 |

|

|

Depreciation and amortization |

|

|

79 |

|

|

|

78 |

|

|

|

239 |

|

|

|

233 |

|

|

Total operating costs and expenses |

|

|

4,712 |

|

|

|

4,421 |

|

|

|

14,307 |

|

|

|

13,816 |

|

|

Operating income |

|

|

416 |

|

|

|

316 |

|

|

|

3,451 |

|

|

|

736 |

|

|

Fair value adjustment of contingent consideration |

|

|

— |

|

|

|

(246 |

) |

|

|

157 |

|

|

|

(536 |

) |

|

Interest and other expense, net |

|

|

(47 |

) |

|

|

3 |

|

|

|

(201 |

) |

|

|

(44 |

) |

|

Income before income tax expense |

|

|

369 |

|

|

|

73 |

|

|

|

3,407 |

|

|

|

156 |

|

|

Income tax expense |

|

|

— |

|

|

|

(10 |

) |

|

|

64 |

|

|

|

18 |

|

|

Net income |

|

$ |

369 |

|

|

$ |

83 |

|

|

$ |

3,343 |

|

|

$ |

138 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average common shares outstanding – basic |

|

|

28,653,278 |

|

|

|

28,480,148 |

|

|

|

28,557,517 |

|

|

|

28,464,635 |

|

|

Weighted average common shares outstanding – diluted |

|

|

28,823,918 |

|

|

|

28,481,296 |

|

|

|

28,902,499 |

|

|

|

28,474,997 |

|

|

Net income per share – basic |

|

$ |

0.01 |

|

|

$ |

0.00 |

|

|

$ |

0.12 |

|

|

$ |

0.00 |

|

|

Net income per share – diluted |

|

$ |

0.01 |

|

|

$ |

0.00 |

|

|

$ |

0.12 |

|

|

$ |

0.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Comprehensive income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income |

|

$ |

369 |

|

|

$ |

83 |

|

|

$ |

3,343 |

|

|

$ |

138 |

|

|

Other comprehensive income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign currency translation adjustment |

|

|

(6 |

) |

|

|

(2 |

) |

|

|

(2 |

) |

|

|

(3 |

) |

|

Comprehensive income |

|

$ |

363 |

|

|

$ |

81 |

|

|

$ |

3,341 |

|

|

$ |

135 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

4

CONDENSED CONSOLIDATED STATEMENT OF STOCKHOLDERS’ EQUITY

(In thousands of US dollars, except share amounts)

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Additional |

|

|

|

|

|

|

Accumulated other |

|

|

|

|

|

|||||||

|

|

|

Preferred stock |

|

|

Common stock |

|

|

paid-in |

|

|

Accumulated |

|

|

comprehensive |

|

|

|

|

|

|||||||||||||

|

|

|

Shares |

|

|

Amount |

|

|

Shares |

|

|

Amount |

|

|

capital |

|

|

deficit |

|

|

loss |

|

|

Total |

|

||||||||

|

Balance at December 31, 2017 |

|

|

569 |

|

|

$ |

6 |

|

|

|

28,480,148 |

|

|

$ |

285 |

|

|

$ |

284,396 |

|

|

$ |

(281,124 |

) |

|

$ |

(75 |

) |

|

$ |

3,488 |

|

|

Stock-based compensation expense |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

219 |

|

|

|

— |

|

|

|

— |

|

|

|

219 |

|

|

Issuance of restricted common stock |

|

|

— |

|

|

|

— |

|

|

|

600,000 |

|

|

|

6 |

|

|

|

(6 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Issuance of common stock from exercise of stock options |

|

|

— |

|

|

|

— |

|

|

|

173,130 |

|

|

|

2 |

|

|

|

72 |

|

|

|

— |

|

|

|

— |

|

|

|

74 |

|

|

Net income |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

3,343 |

|

|

|

— |

|

|

|

3,343 |

|

|

Foreign currency translation adjustment |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(2 |

) |

|

|

(2 |

) |

|

Balance at September 30, 2018 |

|

|

569 |

|

|

$ |

6 |

|

|

|

29,253,278 |

|

|

$ |

293 |

|

|

$ |

284,681 |

|

|

$ |

(277,781 |

) |

|

$ |

(77 |

) |

|

$ |

7,122 |

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

5

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands of US dollars)

(unaudited)

|

|

|

Nine Months Ended September 30, |

|

|||||

|

|

|

2018 |

|

|

2017 |

|

||

|

Cash flows provided by operating activities: |

|

|

|

|

|

|

|

|

|

Net income |

|

$ |

3,343 |

|

|

$ |

138 |

|

|

Adjustments to reconcile net income to net cash provided by operating activities: |

|

|

|

|

|

|

|

|

|

Accrued interest added to principal of related party debt |

|

|

8 |

|

|

|

27 |

|

|

Fair value adjustment of contingent consideration |

|

|

(157 |

) |

|

|

536 |

|

|

Stock-based compensation expense |

|

|

219 |

|

|

|

186 |

|

|

Depreciation and amortization |

|

|

239 |

|

|

|

233 |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

|

Accounts receivable |

|

|

(336 |

) |

|

|

593 |

|

|

Inventory |

|

|

56 |

|

|

|

121 |

|

|

Other assets |

|

|

(337 |

) |

|

|

(24 |

) |

|

Accounts payable and accrued liabilities |

|

|

1,337 |

|

|

|

29 |

|

|

Net cash provided by operating activities |

|

|

4,372 |

|

|

|

1,839 |

|

|

|

|

|

|

|

|

|

|

|

|

Cash flows used in investing activities: |

|

|

|

|

|

|

|

|

|

Purchase of property and equipment |

|

|

(85 |

) |

|

|

(16 |

) |

|

Net cash used in investing activities |

|

|

(85 |

) |

|

|

(16 |

) |

|

|

|

|

|

|

|

|

|

|

|

Cash flows used in financing activities: |

|

|

|

|

|

|

|

|

|

Repayment of debt payable to third party |

|

|

(235 |

) |

|

|

— |

|

|

Payment of contingent consideration |

|

|

(2,617 |

) |

|

|

(897 |

) |

|

Repayment of debt payable to related party |

|

|

(390 |

) |

|

|

(498 |

) |

|

Proceeds from exercise of options to purchase common shares |

|

|

74 |

|

|

|

1 |

|

|

Net cash used in financing activities |

|

|

(3,168 |

) |

|

|

(1,394 |

) |

|

Net increase in cash and cash equivalents |

|

|

1,119 |

|

|

|

429 |

|

|

Cash and cash equivalents at beginning of period |

|

|

2,109 |

|

|

|

2,530 |

|

|

Cash and cash equivalents at end of period |

|

$ |

3,228 |

|

|

$ |

2,959 |

|

|

|

|

|

|

|

|

|

|

|

|

Supplemental cash flow information: |

|

|

|

|

|

|

|

|

|

Cash paid for taxes |

|

$ |

86 |

|

|

$ |

19 |

|

|

Cash paid for interest |

|

$ |

92 |

|

|

$ |

3 |

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

6

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

Note 1 –Basis of Presentation

These unaudited condensed consolidated interim financial statements include the accounts of Heritage Global Inc. (“HGI”) together with its subsidiaries, including Heritage Global Partners, Inc. (“HGP”), Heritage Global LLC (“HG LLC”), Equity Partners HG LLC (“Equity Partners”) and National Loan Exchange, Inc. (“NLEX”). These entities, collectively, are referred to as the “Company” in these financial statements. The Company’s unaudited condensed consolidated interim financial statements were prepared in conformity with generally accepted accounting principles in the United States of America (“GAAP”), as outlined in the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”), and include the assets, liabilities, revenues, and expenses of all subsidiaries over which HGI exercises control. All significant intercompany accounts and transactions have been eliminated upon consolidation. The Company’s sole operating segment is its asset liquidation business. The Company provides an array of value-added capital and financial asset solutions: auction and appraisal services, traditional asset disposition sales, and financial solutions for businesses and properties in transition.

The Company has prepared the condensed consolidated interim financial statements included herein pursuant to the rules and regulations of the United States Securities and Exchange Commission (the “SEC”). In the opinion of management, these financial statements reflect all adjustments that are necessary to present fairly the results for the interim periods included herein. Certain information and footnote disclosures normally included in financial statements prepared in accordance with GAAP have been condensed or omitted pursuant to such rules and regulations; however, the Company believes that the disclosures are appropriate. These unaudited condensed consolidated interim financial statements should be read in conjunction with the audited consolidated financial statements and the notes thereto included in the Company’s annual report on Form 10-K for the year ended December 31, 2017, filed with the SEC on March 13, 2018.

The results of operations for the nine month period ended September 30, 2018 are not necessarily indicative of those operating results to be expected for any subsequent interim period or for the entire year ending December 31, 2018. The accompanying condensed consolidated balance sheet at December 31, 2017 has been derived from the audited consolidated balance sheet at December 31, 2017, contained in the above referenced Form 10-K.

Note 2 – Summary of Significant Accounting Policies

Use of Estimates

The preparation of the Company’s consolidated financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements, as well as the reported amounts of revenues and expenses during the reporting period. Management bases its estimates and judgments on historical experience and various other factors that are believed to be reasonable under the circumstances. Actual results could differ from those estimates.

Significant estimates include the assessment of collectability of revenue recognized, and the valuation of accounts receivable, inventory, other assets, goodwill and intangible assets, liabilities, contingent consideration, deferred income tax assets and liabilities, and stock-based compensation. These estimates have the potential to significantly impact the Company’s consolidated financial statements, either because of the significance of the financial statement item to which they relate, or because they require judgment and estimation due to the uncertainty involved in measuring, at a specific point in time, events that are continuous in nature.

Foreign Currency

The functional currency of foreign operations is deemed to be the local country’s currency. Assets and liabilities of operations outside of the United States are generally translated into U.S. dollars, and the effects of foreign currency translation adjustments are included as a component of accumulated other comprehensive income.

Reclassifications

Certain prior year balances within the condensed consolidated financial statements have been reclassified to conform to the current year presentation.

7

On January 1, 2018, the Company adopted the new accounting standard FASB ASC Topic 606, Revenue from Contracts with Customers (“ASC 606”) to all contracts using the modified retrospective method. Based on the Company’s analysis of contracts with customers in prior periods, there was no cumulative effect adjustment to the opening balance of the Company’s accumulated deficit as a result of the adoption of this new standard. We expect the impact of the adoption of the new standard to be immaterial to the consolidated financial statements on an ongoing basis.

Services revenue generally consists of commissions and fees from providing auction services, appraisals, brokering of sales transactions and providing merger and acquisition advisory services. Asset sales revenue generally consists of proceeds obtained through sales of purchased assets. Revenue is recognized for both services revenue and asset sales revenue based on the ASC 606 standard recognition model, which consists of the following: (1) an agreement exists between two or more parties that creates enforceable rights and obligations, (2) the performance obligations are clearly identified, (3) the transaction price has been determined, (4) the transaction price has been properly allocated to each performance obligation, and (5) the entity satisfies a performance obligation by transferring a promised good or service to a customer for each of the entities.

All services and asset sales revenue from contracts with customers is considered to be one reporting segment – the asset liquidation business. Although the Company provides various services within the asset liquidation business, it does not disaggregate revenue streams further than that in its statement of operations, services revenue and asset sales. Generally, revenue is recognized in the asset liquidation business at the point in time in which the performance obligation has been satisfied and full consideration is received. The exception to recognition at a point in time occurs when certain contracts provide for advance payments recognized over a period of time. Services revenue recognized over a period of time is not material in comparison to total revenues (4% of total revenues for the nine month period ended September 30, 2018), and therefore not reported on a disaggregated basis. Further, as certain contracts stipulate that the customer make advance payments, amounts not recognized within the reporting period are considered deferred revenue and the Company’s “contract liability”. As of September 30, 2018, the deferred revenue balance was approximately $10,000. The Company records receivables related to asset liquidation in certain situations based on timing of payments for asset liquidation transactions held at the end of the reporting period; however, revenue is generally recognized in the period that the Company satisfies the performance obligation and cash is collected. The Company does not record a “contract asset” for partially satisfied performance obligations.

We evaluate revenue from asset liquidation transactions in accordance with the accounting guidance to determine whether to report such revenue on a gross or net basis. We have determined that we act as an agent for our fee based asset liquidation transactions and therefore we report the revenue from transactions in which we act as an agent on a net basis.

The Company also earns asset liquidation income through asset liquidation transactions that involve the Company acting jointly with one or more additional purchasers, pursuant to a partnership, joint venture or limited liability company (“LLC”) agreement (collectively, “Joint Ventures”). For these transactions, the Company does not record asset liquidation revenue or expense. Instead, the Company’s proportionate share of the net income (loss) is reported as earnings of equity method investments. In general, the Joint Ventures apply the same revenue recognition and other accounting policies as the Company.

The critical accounting policies used in the preparation of the Company’s audited consolidated financial statements are discussed in the Company’s Annual Report on Form 10-K for the year ended December 31, 2017. There have been no changes to these policies in the nine months ended September 30, 2018, except for the adoption of ASC 606 as described above.

Recent Accounting Pronouncements

In 2016, the FASB issued ASU 2016-02, Leases, (“ASU 2016-02”). ASU 2016-02 changes the accounting for leases previously classified as operating leases under GAAP by, among other things, requiring a Company to recognize the lease on the balance sheet with a right-of-use asset and a lease liability. ASU 2016-02 will be effective for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2018. The Company has not yet adopted ASU 2016-02 nor completed its assessment of the potential impact of this new guidance on its consolidated financial statements.

In 2014, the FASB issued new guidance related to revenue recognition (ASU 2014-09 Revenue from Contracts with Customers (Topic 606)). Subsequently the FASB has issued additional guidance (ASUs 2015-14; 2016-08; 2016-10; 2016-12; 2016-13; 2016-20). The guidance establishes principles for reporting information about the nature, amount, timing, and uncertainty of revenue and cash flows arising from an entity’s contracts with customers. The above stated updates became effective January 1, 2018 and did not have a material impact on the Company’s consolidated financial statements, except for more comprehensive disclosure requirements (see Note 2 – Revenue Recognition for further detail).

8

In 2016, the FASB issued ASU 2016-15, Statement of Cash Flows (“ASU 2016-15”), which clarifies the classification of certain cash receipts and payments. The specific cash flow issues addressed by ASU 2016-15, with the objective of reducing the existing diversity in practice, are as follows: (1) Debt prepayment or debt extinguishment costs; (2) Settlement of zero-coupon debt instruments or other debt instruments with insignificant coupon interest rates; (3) Contingent consideration payments made after a business combination; (4) Proceeds from the settlement of insurance claims; (5) Proceeds from the settlement of corporate-owned life insurance policies; (6) Distributions received from equity method investees; (7) Beneficial interest in securitization transactions; and (8) Separately identifiable cash flows and application of the predominance in principle. ASU 2016-15 became effective January 1, 2018 and did not have a material impact on the Company’s consolidated financial statements.

In 2017, the FASB issued ASU 2017-01, Business Combinations (“ASU 2017-01”), which clarifies the definition of a business under ASC 805. The main provisions of ASU 2017-01 provide a screen to determine when an integrated set of assets and activities is not a business. The screen requires that when substantially all of the fair value of the gross assets acquired (or disposed of) is concentrated in a single identifiable asset or group of similar identifiable assets, the set is not a business. ASU 2017-01 became effective January 1, 2018 and did not have a material impact on the Company’s consolidated financial statements.

In 2017, the FASB issued ASU 2017-04, Intangibles – Goodwill and Other (“ASU 2017-04”), which simplifies the test for goodwill impairment. The main provisions of ASU 2017-04 eliminate the second step of the goodwill impairment test which previously was performed to determine the goodwill impairment loss for an entity by calculating the difference between the implied fair value of the entity’s goodwill and its carrying value. Under ASU 2017-04, if a reporting unit’s carrying value exceeds its fair value, an entity will record an impairment charge based on that difference. The impairment charge will be limited to the amount of goodwill which is allocated to that reporting unit. ASU 2017-04 will be effective for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2019. Early adoption is permitted for annual and interim goodwill impairment testing dates after January 1, 2017. The Company is still assessing the impact of ASU 2017-04 on its consolidated financial statements.

In 2018, the FASB issued ASU 2018-07, Compensation – Stock Compensation (“ASU 2018-07”), which expands the scope of Topic 718 to include share based payment transactions for acquiring goods and services from nonemployees. The amendments in this update are effective for public business entities for fiscal years beginning after December 15, 2018, including interim periods within that fiscal year. The Company is still evaluating the impact of ASU 2018-07 on the consolidated financial statements.

Note 3 – Stock-based Compensation

Options

At September 30, 2018 the Company had four stock-based compensation plans, which are described more fully in Note 15 to the audited consolidated financial statements for the year ended December 31, 2017, contained in the Company’s most recently filed Annual Report on Form 10-K.

During the nine months ended September 30, 2018, the Company issued options to purchase 441,500 shares of common stock to the Company’s employees and options to purchase 85,000 shares of common stock to the Company’s non-employee directors as part of their annual compensation. During the same period, the Company cancelled options to purchase 1,058,420 shares of common stock as a result of employee resignations and natural expiration.

On June 1, 2018, the Company issued options to purchase 300,000 shares of common stock to the employees of NLEX, in connection with the Addendum to the Employment Agreements of David Ludwig and Tom Ludwig. As of September 30, 2018, 173,130 shares of common stock were issued pursuant to the exercise of these common stock options. The remaining 126,870 shares expired as of July 31, 2018.

The following summarizes the changes in common stock options for the nine months ended September 30, 2018:

9

|

|

|

Options |

|

|

Weighted Average Exercise Price |

|

||

|

Outstanding at December 31, 2017 |

|

|

5,040,450 |

|

|

$ |

0.97 |

|

|

Granted |

|

|

526,500 |

|

|

$ |

0.43 |

|

|

Exercised |

|

|

(173,130 |

) |

|

$ |

0.43 |

|

|

Forfeited |

|

|

(1,058,420 |

) |

|

$ |

1.71 |

|

|

Outstanding at September 30, 2018 |

|

|

4,335,400 |

|

|

$ |

0.59 |

|

|

|

|

|

|

|

|

|

|

|

|

Options exercisable at September 30, 2018 |

|

|

1,800,975 |

|

|

$ |

1.17 |

|

The Company recognized stock-based compensation expense related to stock options of $0.1 million and $0.2 million, respectively, for the three and nine months ended September 30, 2018. As of September 30, 2018, there is approximately $0.8 million of unrecognized stock-based compensation expense related to unvested option awards outstanding, which is expected to be recognized over a weighted average period of 3.0 years.

Restricted Stock

Restricted stock awards represent a right to receive shares of common stock at a future date determined in accordance with the participant’s award agreement. There is no exercise price and no monetary payment required for receipt of restricted stock awards or the shares issued in settlement of the award. Instead, consideration is furnished in the form of the participant’s services to the Company. Compensation cost for these awards is based on the fair value on the date of grant and recognized as compensation expense on a straight-line basis over the requisite service period.

On June 1, 2018, the Company granted 600,000 shares of Company restricted common stock in connection with the Addendum to the Employment Agreements of David Ludwig and Tom Ludwig. The shares are subject to certain restrictions on transfer and a right of repurchase over five years, ending May 31, 2023, and require a continued term of service to the Company. Stock-based compensation expense related to the restricted stock awards, calculated by using the grant date fair value of $0.43 per share, was $12,900 and $17,200 for the three and nine months ended September 30, 2018, respectively. The unrecognized stock-based compensation expense as of September 30, 2018 was approximately $0.2 million.

Note 4 – Earnings Per Share

The Company is required in periods in which it has net income to calculate basic earnings per share (“basic EPS”) using the two-class method. The two-class method is required because the Company’s Class N preferred shares, each of which is convertible to 40 common shares, have the right to receive dividends or dividend equivalents should the Company declare dividends on its common stock. Under the two-class method, earnings for the period are allocated on a pro-rata basis to the common and preferred stockholders. The weighted-average number of common and preferred shares outstanding during the period is then used to calculate basic EPS for each class of shares.

In periods in which the Company has a net loss, basic loss per share is calculated by dividing the loss attributable to common stockholders by the weighted-average number of common shares outstanding during the period. The two-class method is not used in periods in which the Company has a net loss because the preferred stock does not participate in losses.

Stock options and other potential common shares are included in the calculation of diluted earnings per share (“diluted EPS”), since they are assumed to be exercised or converted, except when their effect would be anti-dilutive. The table below shows the calculation of the shares used in computing diluted EPS.

10

|

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

|||||||||||

|

Weighted Average Shares Calculation: |

|

2018 |

|

|

2017 |

|

|

2018 |

|

|

2017 |

|

||||

|

Basic weighted average shares outstanding |

|

|

28,653,278 |

|

|

|

28,480,148 |

|

|

|

28,557,517 |

|

|

|

28,464,635 |

|

|

Treasury stock effect of common stock options and restricted stock awards |

|

|

170,640 |

|

|

|

1,148 |

|

|

|

344,982 |

|

|

|

10,362 |

|

|

Diluted weighted average common shares outstanding |

|

|

28,823,918 |

|

|

|

28,481,296 |

|

|

|

28,902,499 |

|

|

|

28,474,997 |

|

For the nine months ended September 30, 2018 and 2017 there were potential common shares totaling approximately 1.0 million and 5.0 million, respectively, that were excluded from the computation of diluted EPS as the inclusion of such shares would have been anti-dilutive. For the three months ended September 30, 2018 and 2017 there were potential common shares totaling approximately 1.0 million and 5.0 million, respectively, that were excluded.

Note 5 – Intangible Assets and Goodwill

Identifiable intangible assets

The Company’s identifiable intangible assets are associated with its acquisitions of HGP in 2012 and NLEX in 2014, as shown in the table below (in thousands), and are amortized using the straight-line method over their remaining estimated useful lives of one to eight years. The Company’s tradename acquired as part of the acquisition of NLEX in 2014 has an indefinite life and therefore is not amortized.

|

|

|

Carrying Value |

|

|

|

|

|

|

Carrying Value |

|

||

|

|

|

December 31, |

|

|

|

|

|

|

September 30, |

|

||

|

Amortized Intangible Assets |

|

2017 |

|

|

Amortization |

|

|

2018 |

|

|||

|

Customer Network (HGP) |

|

$ |

136 |

|

|

$ |

(17 |

) |

|

$ |

119 |

|

|

Trade Name (HGP) |

|

|

850 |

|

|

|

(78 |

) |

|

|

772 |

|

|

Customer Relationships (NLEX) |

|

|

440 |

|

|

|

(82 |

) |

|

|

358 |

|

|

Website (NLEX) |

|

|

14 |

|

|

|

(9 |

) |

|

|

5 |

|

|

Total |

|

|

1,440 |

|

|

|

(186 |

) |

|

|

1,254 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Unamortized Intangible Assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

Trade Name (NLEX) |

|

|

2,437 |

|

|

|

— |

|

|

|

2,437 |

|

|

Total |

|

$ |

3,877 |

|

|

$ |

(186 |

) |

|

$ |

3,691 |

|

Amortization expense during the nine months ended September 30, 2018 and 2017 was $0.2 million.

The estimated amortization expense as of September 30, 2018 during the next five fiscal years and thereafter is shown below (in thousands):

|

Year |

|

Amount |

|

|

|

2018 (remainder of year from October 1, 2018 to December 31, 2018) |

|

$ |

63 |

|

|

2019 |

|

|

236 |

|

|

2020 |

|

|

236 |

|

|

2021 |

|

|

236 |

|

|

2022 |

|

|

128 |

|

|

Thereafter |

|

|

355 |

|

|

Total |

|

$ |

1,254 |

|

11

The Company’s goodwill is related to its asset liquidation business, and is comprised of goodwill from three acquisitions, as shown in the table below (in thousands). There were no additions to goodwill and no impairment losses to the carrying amount of goodwill during the three or nine months ended September 30, 2018 and 2017.

|

Acquisition |

|

September 30, 2018 |

|

|

December 31, 2017 |

|

||

|

Equity Partners |

|

$ |

573 |

|

|

$ |

573 |

|

|

HGP |

|

|

2,040 |

|

|

|

2,040 |

|

|

NLEX |

|

|

3,545 |

|

|

|

3,545 |

|

|

Total goodwill |

|

$ |

6,158 |

|

|

$ |

6,158 |

|

Note 6 – Debt

Outstanding debt at September 30, 2018 and December 31, 2017 is summarized as follows (in thousands):

|

|

|

September 30, 2018 |

|

|

December 31, 2017 |

|

||

|

Current: |

|

|

|

|

|

|

|

|

|

Related party debt |

|

$ |

- |

|

|

$ |

382 |

|

|

Third party debt |

|

|

372 |

|

|

|

356 |

|

|

Non-current: |

|

|

|

|

|

|

|

|

|

Third party debt |

|

|

535 |

|

|

|

786 |

|

|

Total debt |

|

$ |

907 |

|

|

$ |

1,524 |

|

In 2016, following an amendment, the Company’s related party debt with Street Capital (the “Street Capital Loan”) began accruing interest at a rate per annum equal to the Wall Street Journal prime rate + 1.0%. During the period ending September 30, 2018, the Company terminated the existing Street Capital Loan with repayment of all principal and interest outstanding. Please see Note 9 for further discussion of transactions with Street Capital.

In 2016, the Company entered into a related party secured promissory note with an entity owned by certain executive officers of the Company (the “Entity”) for a revolving line of credit (the “Line of Credit”). Under the terms of the Line of Credit, the Company received a revolving line of credit with an aggregate borrowing capacity of $1.5 million. Interest under the Line of Credit was charged at a variable rate, and the Entity was eligible to participate in the net profits and net losses of certain industrial auction principal and guarantee transactions entered into by the Company on or after January 1, 2017, and consummated on or prior to the maturity date. In connection with the Company entering into a new credit facility with a third party bank on September 27, 2018, the Company terminated the related party secured promissory note with the Entity.

On September 27, 2018, Heritage Global, Inc. entered into a secured promissory note and business loan agreement (the “Credit Facility”) with First Choice Bank, for a $1.5 million revolving line of credit. The Credit Facility matures on October 5, 2019 and replaced the Line of Credit. The Company is permitted to use the proceeds of the loan solely for its business operations. The Credit Facility accrues at a variable interest rate, which is equal to the rate of interest last quoted by The Wall Street Journal as the “prime rate,” not to be less than 5.25% per annum, with a minimum interest charge of $100.00 per month. The Company will pay interest on the Credit Facility in regular monthly payments, beginning on November 5, 2018. The Company may prepay the Credit Facility without penalty, subject to the minimum monthly interest charge. The Company is the borrower, with certain of the subsidiaries of the Company as guarantors under the Credit Facility. The Credit Facility is secured by a first priority security interest in all of the Company’s and its certain subsidiaries’ current and future tangible and intangible assets, inventory, chattel paper, accounts, equipment and general intangibles. The availability of draws under the Credit Facility is conditioned, among other things, on the compliance with certain customary representations and warranties, including the preparation of timely financial statements, payment of taxes and disclosure of all material legal or administrative proceedings. The agreement governing the Credit Facility also contains customary affirmative covenants regarding, among other things, the maintenance of records, compliance with governmental requirements, timely submission of all filings with the Securities and Exchange Commission and payment of taxes. The Credit Facility contains certain customary financial covenants and negative covenants that, among other things, include restrictions on the Company’s ability to create, incur or assume indebtedness for borrowed money, including capital leases or to sell, transfer, mortgage, assign, pledge, lease, grant a security interest in, or encumber any of the Company’s assets. As of September 30, 2018, the Company had not drawn on the line of credit.

12

On January 30, 2018, HG LLC, a wholly owned subsidiary of HGI, settled a long-standing litigation matter that was commenced against the predecessor in interest of HG LLC. The settlement, which also involved several other co-defendant parties, included a complete release of HG LLC’s predecessor in interest and its successors and affiliates by the plaintiffs from all claims arising from or relating to the facts and circumstances underlying the litigation. The portion of the settlement attributable to HG LLC’s predecessor in interest was paid on behalf of HG LLC by 54 Finance, LLC (“54 Finance”) (an affiliate of a co-defendant in the litigation) in consideration of a Promissory Note dated January 30, 2018 (the “Note”) from HG LLC in the amount of $1,260,000. Pursuant to a Guaranty dated January 30, 2018, HGI has guaranteed the obligations of HG LLC under the Note, which are required to be paid in 36 equal installments of $35,000, with any remaining outstanding balance due and payable in full on January 30, 2021. As of December 31, 2017, the Company accrued the present value of the Note based on the payment terms noted above and at an interest rate of 6.5%. The Note was recorded as this was determined to be a recognized subsequent event pursuant to ASC 855, Subsequent Events. Upon the occurrence of any Event of Default (as defined below), in the sole discretion of 54 Finance, the outstanding principal balance of the Note will bear interest at a rate per annum (computed on the basis of a 360-day year, actual days elapsed) equal to 12%. An “Event of Default” means: (a) any failure of HG LLC to pay when due any amount thereunder, when and as due, (b) any failure on the part of HG LLC to pay upon 54 Finance’s demand any fees, costs, expenses or other charges hereunder or otherwise due to HG LLC under the Note or the Guaranty, (c) any breach, failure or default under the Guaranty, (d) HG LLC or HGI repudiates or revokes, or purports to repudiate or revoke, any obligation under the Note or the Guaranty, or the obligation of HGI under the Guaranty is limited or terminated by operation of law or by HGI, or (e) HG LLC or HGI are insolvent or admit in writing its inability to pay debts as they mature, or make a general assignment for the benefit of its creditors, or institute any bankruptcy, insolvency or similar proceeding under the laws of any jurisdiction, or take any action to authorize such proceeding. During the nine months ended September 30, 2018, the Company made the scheduled payments on the Note totaling $280,000. The outstanding balance on the Note as of September 30, 2018 was $907,000.

Note 7 – Fair Value Measurements

In accordance with the authoritative guidance for financial assets and liabilities measured at fair value on a recurring basis, the Company prioritizes the inputs used to measure fair value from market-based assumptions to entity specific assumptions:

|

|

• |

Level 1 – Inputs based on quoted market prices for identical assets or liabilities in active markets at the measurement date. |

|

|

• |

Level 2 – Observable inputs other than quoted prices included in Level 1, such as quoted prices for similar assets and liabilities in active markets; quoted prices for identical or similar liabilities in markets that are not active; or other inputs that are observable or can be corroborated by observable market data. |

|

|

• |

Level 3 – Inputs which reflect management’s best estimate of what market participants would use in pricing the asset or liability at the measurement date. The inputs are unobservable in the market and significant to the instruments valuation. |

As of September 30, 2018 and December 31, 2017, the Company had no Level 1 or Level 2 assets or liabilities measured at fair value. As of December 31, 2017, the Company’s contingent consideration from the 2014 acquisition of NLEX was the only Level 3 liability measured at fair value on a recurring basis which had a fair value of $2,774,000. The fair value of the Company’s contingent consideration was determined using a discounted cash flow analysis, which is based on significant inputs that are not observable in the market. As of September 30, 2018, the contingent consideration had been fully satisfied in accordance with terms stated within the NLEX stock purchase agreement.

When valuing its Level 3 liabilities, the Company gives consideration to operating results, financial condition, economic and/or market events, and other pertinent information that would impact its estimate of the expected contingent consideration payments. The valuation of the liability is primarily based on management’s estimate of the Net Profits of NLEX (as defined in the NLEX stock purchase agreement). Given the short term nature of the contingent consideration periods, changes in the discount rate did not have a material impact on the fair value of the liability.

The following table summarizes the changes in the fair value of the liability during the nine months ended September 30, 2018 (in thousands):

|

Balance at December 31, 2017 |

|

$ |

2,774 |

|

|

Payment of contingent consideration |

|

|

(2,618 |

) |

|

Fair value adjustment of contingent consideration |

|

|

(157 |

) |

|

Balance at September 30, 2018 |

|

$ |

- |

|

13

At September 30, 2018 the Company has aggregate tax net operating loss carry forwards of approximately $73.0 million ($57.8 million of unrestricted net operating tax losses and approximately $15.2 million of restricted net operating tax losses) and unused minimum tax credit carry forwards of $0.5 million. Substantially all of the net operating loss carry forwards and unused minimum tax credit carry forwards expire between 2024 and 2036. The Company’s utilization of restricted net operating tax loss carry forwards against future income for tax purposes is restricted pursuant to the “change in ownership” rules in Section 382 of the Internal Revenue Code.

The reported tax expense varies from the amount that would be provided by applying the statutory U.S. Federal income tax rate to the income from operations before taxes primarily as a result of the change in the deferred tax asset valuation allowance.

The Company records net deferred tax assets to the extent that it believes such assets will more likely than not be realized. As a result of cumulative losses and uncertainty with respect to future taxable income, the Company has provided a full valuation allowance against its net deferred tax assets as of September 30, 2018 and December 31, 2017.

Note 9 – Related Party Transactions

Debt with Street Capital

During the period ending September 30, 2018, the Company terminated the existing Street Capital Loan with repayment of all principal and interest outstanding. The Company’s loan from Street Capital was previously classified as related party debt because Allan Silber, an affiliate of Street Capital, is the Company’s chairman of the board and a significant shareholder of the Company.

Transactions with Other Related Parties

As part of the operations of NLEX, the Company leases office space in Edwardsville, IL that is owned by the President of NLEX, David Ludwig. The total amount paid to the related party was approximately $78,000 and $75,000 for the nine months ended September 30, 2018 and 2017, respectively, and is included in selling, general and administrative expenses in the consolidated financial statements. All of the payments in both 2018 and 2017 were made to David Ludwig. On June 1, 2018, the Company amended its lease agreement with David Ludwig, whereby the term of the agreement extends to May 31, 2023 and the rent amounts were agreed upon for the new term.

In 2016 the Company entered into a secured related party loan agreement with certain executive officers of the Company which is more fully described in Note 6. Both Ross Dove and Kirk Dove, who were parties to the related party loan, share equally in all payments made by the Company to satisfy obligations under the loan agreement. During the nine months ended September 30, 2018, the Company made payment of approximately $34,000 to the respective parties based on the profit share provision for principal and guarantee transactions that occurred in 2017. Additionally, the Company has accrued as interest expense approximately $150,000 profit share for principal and guarantee transactions that occurred in the nine months ended September 30, 2018. In connection with the Company entering into a new credit facility with a third party bank on September 27, 2018, the Company terminated the related party loan agreement.

Note 10 – Subsequent Events

The Company has evaluated events subsequent to September 30, 2018 for potential recognition or disclosure in its condensed consolidated financial statements. There have been no material subsequent events requiring recognition or disclosure in this Quarterly Report on Form 10-Q.

14

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

The following discussion and analysis should be read in conjunction with the information contained in the unaudited condensed consolidated interim financial statements of Heritage Global Inc. (together with its consolidated subsidiaries, “we”, “us”, “our” or the “Company”) and the related notes thereto for the three and nine month periods ended September 30, 2018 and 2017, appearing elsewhere herein, and in conjunction with the Management’s Discussion and Analysis of Financial Condition and Results of Operations set forth in the Company’s Annual Report on Form 10-K for the year ended December 31, 2017, filed with the Securities and Exchange Commission (“SEC”).

Forward Looking Information

This Quarterly Report on Form 10-Q (the “Report”) contains certain “forward-looking statements” as defined by the Private Securities Litigation Reform Act of 1995 that are based on management’s exercise of business judgment as well as assumptions made by, and information currently available to, management. When used in this document, the words “may,” "will,” “anticipate,” “believe,” “estimate,” “expect,” “intend,” and words of similar import, are intended to identify any forward-looking statements. You should not place undue reliance on these forward-looking statements. These statements reflect our current view of future events and are subject to certain risks and uncertainties, as noted in our Annual Report on Form 10-K, filed with the SEC, and as noted below. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, our actual results could differ materially from those anticipated in these forward-looking statements. We undertake no obligation, and do not intend, to update, revise or otherwise publicly release any revisions to these forward-looking statements to reflect events or circumstances after the date hereof, or to reflect the occurrence of any unanticipated events. Although we believe that our expectations are based on reasonable assumptions, we can give no assurance that our expectations will materialize.

Overview, History and Recent Developments

Heritage Global Inc. (“HGI”) was incorporated in the State of Florida in 1983 under the name “MedCross, Inc.” The Company’s name was changed to “I-Link Incorporated” in 1997, to “Acceris Communications Inc.” in 2003, to “C2 Global Technologies Inc.” in 2005, to “Counsel RB Capital Inc.” in 2011, and to Heritage Global Inc. effective in 2013. The most recent name change more closely identifies the Company with its core auction business, Heritage Global Partners, Inc. (“HGP”).

In 2014, HGI acquired all of the issued and outstanding capital stock in National Loan Exchange, Inc. (“NLEX”), a broker of charged-off receivables in the United States and Canada. As a result of this acquisition, NLEX now operates as one of our wholly owned divisions.

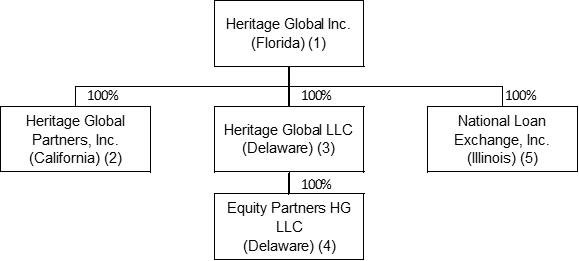

The organization chart below outlines our basic domestic corporate structure as of September 30, 2018.

|

(1) |

Registrant. |

|

(2) |

Full service, global auction, appraisal and asset advisory company. |

|

(3) |

Asset liquidation company which acquires and monetizes distressed and surplus assets. |

15

|

(4) |

Mergers and acquisitions (M&A) advisory firm specializing in financially distressed businesses and properties. |

|

(5) |

Broker of charged-off receivables. |

Asset liquidation

We are a value-driven, innovative leader in corporate and financial asset liquidation transactions, valuations and advisory services. We specialize both in acting as an adviser, as well as in acquiring or brokering turnkey manufacturing facilities, surplus industrial machinery and equipment, industrial inventories, real estate, accounts receivable portfolios, intellectual property, and entire business enterprises.

Our asset liquidation business began operations in 2009 with the establishment of Heritage Global LLC (“HG LLC”). In addition to acquiring turnkey manufacturing facilities and used industrial machinery and equipment, HG LLC arranges traditional asset disposition sales, including liquidation and auction sales. In 2011, HG LLC acquired 100% of the business of EP USA, LLC (“Equity Partners”), thereby expanding our operations. Equity Partners is a boutique M&A advisory firm and provider of financial solutions for businesses and properties in transition.

In 2012, we increased our in-house asset liquidation expertise with our acquisition of 100% of the outstanding equity of HGP, a global full-service auction, appraisal and asset advisory firm, and launched Heritage Global Partners Europe (“HGP Europe”). Through our wholly-owned subsidiary Heritage Global Partners UK Limited, we opened three European-based offices, one each in the United Kingdom, Germany and Spain.

In 2014, we again expanded our asset liquidation operations with the acquisition of 100% of the outstanding equity of NLEX. NLEX is the largest volume broker of charged-off receivables in the United States and Canada, and its offerings include national, state and regional portfolios on behalf of many of the world’s top financial institutions. The NLEX acquisition is consistent with our strategy to expand and diversify the services provided by its asset liquidation business.

As a result of the events and acquisitions outlined above, management believes that our expanded global platform will allow us to achieve our long term industry leadership goals.

Industry and Competition

Our asset liquidation business consists primarily of the auction, appraisal and asset advisory services provided by HGP, mergers and acquisitions advisory services provided by Equity Partners, and the accounts receivable brokerage services provided by NLEX. It also includes the purchase and sale, including at auction, of industrial machinery and equipment, real estate, inventories, accounts receivable and distressed debt. The market for these services and assets is highly fragmented. To acquire auction or appraisal contracts, or assets for resale, the Company competes with other liquidators, auction companies, dealers and brokers. It also competes with them for potential purchasers, as well as with equipment manufacturers, distributors, dealers and equipment rental companies. Some competitors have significantly greater financial and marketing resources and name recognition.

Our business strategy includes the option of partnering with one or more additional purchasers, pursuant to a partnership, joint venture or limited liability company agreement (collectively, “Joint Ventures”). These Joint Ventures give us access to more opportunities, helping to mitigate some of the competition from the market’s larger participants and contribute to our objective to be the leading resource for clients requiring capital and financial asset solutions.

Government Regulation

We are subject to federal, state and local consumer protection laws, including laws protecting the privacy of customer non-public information and regulations prohibiting unfair and deceptive trade practices. Many jurisdictions also regulate “auctions” and “auctioneers” and may regulate online auction services. These consumer protection laws and regulations could result in substantial compliance costs and could interfere with the conduct of our business.

Legislation in the United States, including the Sarbanes-Oxley Act of 2002 and the Dodd-Frank Act of 2010, has increased public companies’ regulatory and compliance costs as well as the scope and cost of work provided by independent registered public accountants and legal advisors. The mandatory adoption of XBRL reporting in 2011 has also increased the Company’s costs paid to third party service providers. As regulatory and compliance guidelines continue to evolve, we expect to continue to incur costs, which may or may not be material, in order to comply with legislative requirements or rules, pronouncements and guidelines by regulatory bodies.

16

Management’s Discussion and Analysis of Financial Condition and Results of Operations references our unaudited condensed consolidated interim financial statements, which have been prepared in accordance with generally accepted accounting principles in the United States of America (“GAAP”). This requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements, as well as the reported amounts of revenue and expenses during the reporting period. Management bases its estimates and judgments on historical experience and various other factors that are considered to be reasonable under the circumstances. Actual results could differ from those estimates.

Significant estimates required in the preparation of the unaudited condensed consolidated interim financial statements included in this Report include the assessment of collectability of revenue recognized, and the valuation of accounts receivable, inventory, other assets, goodwill, intangible assets, liabilities, contingent consideration, deferred income tax assets and liabilities and stock-based compensation. These estimates are considered significant either because of the significance of the financial statement items to which they relate, or because they require judgment and estimation due to the uncertainty involved in measuring, at a specific point in time, events that are continuous in nature.

We have no off-balance sheet arrangements.

We have not paid any dividends, and do not expect to pay any dividends in the future.

The critical accounting policies used in the preparation of our audited consolidated financial statements are discussed in our Annual Report on Form 10-K for the year ended December 31, 2017. There have been no changes to these policies in the nine months ended September 30, 2018, except for the changes to revenue recognition accounting standards (see Note 2-Revenue Recognition for further detail).

Management’s Discussion of Financial Condition

Liquidity and Capital Resources

Liquidity

At September 30, 2018 we had a working capital deficit of $2.1 million, as compared to a working capital deficit of $5.6 million at December 31, 2017, a decrease of approximately $3.5 million primarily as a result of our net income of $3.3 million during the first three quarters of 2018.

Our current assets at September 30, 2018 increased to $4.8 million compared to $3.0 million at December 31, 2017. The most significant change was an approximate $1.1 million increase in cash and cash equivalents primarily as a result of our net income of $3.3 million during the first three quarters of 2018. Our current liabilities at September 30, 2018 decreased to $6.9 million compared to $8.7 million at December 31, 2017. The most significant change was an approximate $3.4 million decrease in debt (including the contingent consideration), partially offset by an approximate $1.4 million increase in accounts payable and accrued liabilities primarily the result of timing of certain auction settlement liabilities during the nine months ended September 30, 2018.

During the nine months ended September 30, 2018, our primary source of cash was the cash on hand plus the cash provided by operations of our asset liquidation business. Cash disbursements other than those related to debt repayment (including the contingent consideration payment) of $3.2 million were primarily related to operating expenses.

We expect that our asset liquidation business will continue to be the primary source of cash required for ongoing operations for the foreseeable future.

Ownership Structure and Capital Resources

|

|

• |

At September 30, 2018 the Company had stockholders’ equity of $7.1 million, as compared to $3.5 million at December 31, 2017. |

17

|

|

facility provides for aggregate loans of up to $1.5 million. Refer to Note 6 to the condensed consolidated financial statements for further information. |

|

|

• |

We determine our future capital and operating requirements based upon our current and projected operating performance and the extent of our contractual commitments. We expect to be able to finance our future operations through cash flows from our asset liquidation business and draws on the line of credit, as needed. Capital requirements are generally limited to repayment of our debt obligations and our purchases of surplus and distressed assets. We believe that our current capital resources are sufficient for these requirements. In the event additional capital is needed, we will draw on the line of credit. |

Cash Position and Cash Flows

Cash and cash equivalents at September 30, 2018 were $3.2 million as compared to $2.1 million at December 31, 2017, an increase of approximately $1.1 million.

Cash provided by operating activities. Cash provided by operating activities was $4.4 million during the nine months ended September 30, 2018 as compared to $1.8 million cash provided during the same period in 2017. The approximate $2.6 million increase was primarily attributable to a favorable change in the net income adjusted for noncash items, which was $2.5 million better during the nine months ended September 30, 2018 compared to the same period in 2017.

The significant changes in operating assets and liabilities during the nine months ended September 30, 2018 as compared to 2017 are primarily due to the nature of our operations. We earn revenue from discrete asset liquidation deals that vary considerably with respect to their magnitude and timing, and that can consist of fees, commissions, asset sale proceeds, or a combination of these. The operating assets and liabilities associated with these deals are therefore subject to the same variability and can be quite different at the end of any given period.

Cash used in investing activities. Cash used in investing activities during the nine months ended September 30, 2018 was $0.1 million, as compared to $16,000 used during the nine months ended September 30, 2017.

Cash used in financing activities. Cash used in financing activities was $3.2 million during the nine months ended September 30, 2018, as compared to $1.4 million used during the same period in 2017. The 2018 activity consisted of repayments to Street Capital ($0.4 million), repayments to an unrelated third party ($0.2 million), and the final contingent consideration payment of $2.6 million to the former owner of NLEX. The 2017 activity consisted of repayments to Street Capital ($0.5 million) and an advance contingent consideration payment of $0.9 million to the former owner of NLEX.

18

Our significant contractual obligations, are our third party loan(s) and lease obligations. The loan and lease obligations are fully described in the notes to the financial statements including in our 2017 Form 10-K filed with the SEC on March 13, 2018. We previously had an earn-out obligation owed to the former owner (and current president) of NLEX; however the final earn-out payment was made during the quarter ended September 30, 2018.

Management’s Discussion of Results of Operations

The following table sets out the Company’s condensed consolidated results of operations for the three and nine months ended September 30, 2018 and 2017 (dollars in thousands).

|

|

|

Three Months Ended September 30, |

|

|

Change |

|

|

Nine Months Ended September 30, |

|

|

Change |

|

||||||||||||||||||||

|

|

|

2018 |

|

|

2017 |

|

|

Dollars |

|

|

Percent |

|

|

2018 |

|

|

2017 |

|

|

Dollars |

|

|

Percent |

|

||||||||

|

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Services revenue |

|

$ |

4,897 |

|

|

$ |

4,231 |

|

|

$ |

666 |

|

|

|

16 |

% |

|

$ |

16,407 |

|

|

$ |

12,637 |

|

|

$ |

3,770 |

|

|

|

30 |

% |

|

Asset sales |

|

|

231 |

|

|

|

506 |

|

|

|

(275 |

) |

|

|

(54 |

)% |

|

|

1,351 |

|

|

|

1,915 |

|

|

|

(564 |

) |

|

|

(29 |

)% |

|

Total revenues |

|

|

5,128 |

|

|

|

4,737 |

|

|

|

391 |

|

|

|

8 |

% |

|

|

17,758 |

|

|

|

14,552 |

|

|

|

3,206 |

|

|

|

22 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating costs and expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of services revenue |

|

|

710 |

|

|

|

522 |

|

|

|