Use these links to rapidly review the document

TABLE OF CONTENTS

FINANCIAL STATEMENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE FISCAL YEAR ENDED DECEMBER 31, 2012

Commission file No. 1-4422

ROLLINS, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 51-0068479 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

2170 Piedmont Road, N.E., Atlanta, Georgia |

30324 |

|

| (Address of principal executive offices) | (Zip Code) |

Registrant's telephone number, including area code: (404) 888-2000

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each Exchange on which registered |

|

|---|---|---|

| Common Stock, $1 Par Value | The New York Stock Exchange |

Securities registered pursuant to section 12(g) of the Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ý | Accelerated filer o | Non-accelerated filer o | Smaller Reporting Company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

The aggregate market value of Rollins, Inc. Common Stock held by non-affiliates on June 30, 2012 was $1,412,400,268 based on the reported last sale price of common stock on June 30, 2012, which is the last business day of the registrant's most recently completed second fiscal quarter.

Rollins, Inc. had 146,309,001 shares of Common Stock outstanding as of January 31, 2013.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Proxy Statement for the 2013 Annual Meeting of Stockholders of Rollins, Inc. are incorporated by reference into Part III, Items 10-14.

Rollins, Inc.

Form 10-K

For the Year Ended December 31, 2012

Table of Contents

9

General

Rollins, Inc. (the "Company") was originally incorporated in 1948 under the laws of the state of Delaware as Rollins Broadcasting, Inc.

The Company is an international service company with headquarters located in Atlanta, Georgia, providing pest and termite control services through its wholly-owned subsidiaries to both residential and commercial customers in North America with international franchises in Central America, the Caribbean, the Middle East, Asia, the Mediterranean, Europe, Africa and Mexico. Services are performed through a contract that specifies the pricing arrangement with the customer.

Orkin, LLC. ("Orkin"), a wholly-owned subsidiary of the Company founded in 1901, is the world's largest pest and termite control company. It provides customized services from over 400 locations. Orkin serves customers, either directly or indirectly through franchises, in the United States, Canada, Central America, the Caribbean, the Middle East, Asia, the Mediterranean, Europe, Africa and Mexico providing essential pest control services and protection against termite damage, rodents and insects to homes and businesses, including hotels, food service establishments, food manufacturers, retailers and transportation companies. Orkin operates under the Orkin®, and Orkin Canada® trademarks and the AcuridSM service mark. The Orkin® brand name makes Orkin the most recognized pest and termite company throughout the United States. The Orkin Canada brand name provides similar brand recognition throughout Canada.

Orkin Canada, a wholly-owned subsidiary of Orkin founded in 1952, was acquired by Orkin in 1999. Orkin Canada is Canada's largest pest control provider and a leader in the development of fast, effective and environmentally responsible pest control solutions.

Western Pest Services ("Western"), a wholly-owned subsidiary of the Company founded in 1928, was acquired by Rollins, Inc. in 2004. Western is primarily a commercial pest control service company and its business complements most of the services Orkin offers focusing on the northeastern United States.

The Industrial Fumigant Company ("IFC"), a wholly-owned subsidiary of the Company founded in 1937, was acquired by Rollins, Inc. in 2005. IFC is a leading provider of pest management and sanitation services and products to the food and commodity industries.

HomeTeam Pest Defense ("HomeTeam"), a wholly-owned subsidiary of the Company established in 1996, was acquired by Rollins, Inc. in April 2008. At the time of the acquisition, HomeTeam, with its unique Taexx tubes in the wall pest control system, was recognized as a premier pest control business and ranked as the 4th largest company in the industry. HomeTeam services home builders nationally.

The Company has several smaller wholly-owned subsidiaries that in total make up less than 5% of the Company's total revenues.

The Company has only one reportable segment, its pest and termite control business. Revenue, operating profit and identifiable assets for this segment, which includes the United States, Canada, Central America, the Caribbean, the Middle East, Asia, the Mediterranean, Europe, Africa and Mexico are included in Item 8 of this document, "Financial Statements and Supplementary Data" on pages 34 and 35. The Company's results of operations and its financial condition are not reliant upon any single customer or a few customers or the Company's foreign operations.

Common Stock Repurchase Program

At the July 2012 Board of Directors' meeting, the Board authorized the purchase of 5.0 million shares of the Company's common stock. The authorized share repurchases are in addition to the Company's existing plan of which 298,183 shares remained available for repurchase as of July 24, 2012. During the years ended

10

December 31, 2012 and 2011, the Company repurchased 0.8 million and 1.5 million shares at a weighted average price of $20.93 and $18.68, respectively. In total, there are 5.3 million additional shares authorized to be repurchased under prior Board approval. The repurchase program does not have an expiration date.

Backlog

Backlog services and orders are usually provided within the month following the month of order receipt, except in the area of prepaid pest control and bait monitoring services, which are usually provided within twelve months of order receipt. The Company does not have a material portion of its business that may be subject to renegotiation of profits or termination of contracts at the election of a governmental entity.

| |

|

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| |

At December 31, | |||||||||

| (in thousands) |

2012 |

2011 |

2010 |

|||||||

Backlog |

$ | 2,876 | $ | 2,781 | $ | 2,966 | ||||

Orkin Franchises

The Company continues to expand its growth through Orkin's franchise program. This program is primarily used in smaller markets where it is currently not economically feasible to locate a conventional Orkin branch. Domestic franchisees are subject to a contractual buyback provision at Orkin's option with a pre-determined purchase price using a formula applied to revenues of the franchise. International franchise agreements also contain an optional buyback provision, however, the franchisee has the prior right of renewal of the agreement. The Company through its wholly-owned Orkin subsidiary began its Orkin franchise program in the U.S. in 1994, and established its first international franchise in 2000 and since has expanded to Central America, South America, the Caribbean, the Middle East, Asia, the Mediterranean, Europe, Africa and Mexico.

| |

|

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| |

At December 31, | |||||||||

| Franchises |

2012 |

2011 |

2010 |

|||||||

United States Franchises |

57 | 58 | 56 | |||||||

International Franchises |

22 | 18 | 16 | |||||||

Total Franchises |

79 | 76 | 72 | |||||||

Seasonality

The business of the Company is affected by the seasonal nature of the Company's pest and termite control services. The increase in pest pressure and activity, as well as the metamorphosis of termites in the spring and summer (the occurrence of which is determined by the timing of the change in seasons), has historically resulted in an increase in the revenue of the Company's pest and termite control operations during such periods as evidenced by the following chart.

| |

|

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| |

Total Net Revenues | |||||||||

| (in thousands) |

2012 |

2011 |

2010 |

|||||||

First Quarter |

$ | 289,465 | $ | 271,643 | $ | 253,041 | ||||

Second Quarter |

334,872 | 320,436 | 298,803 | |||||||

Third Quarter |

340,179 | 323,929 | 305,118 | |||||||

Fourth Quarter |

306,393 | 289,056 | 279,928 | |||||||

Year ended December 31, |

$ | 1,270,909 | $ | 1,205,064 | $ | 1,136,890 | ||||

11

Inventories

The Company has relationships with a national pest control product distributor and other vendors for pest and termite control treatment products. Rollins maintains a sufficient level of chemicals, materials and other supplies to fulfill its immediate servicing needs and to alleviate any potential short-term shortage in availability from its national network of suppliers.

Competition

The Company believes that Rollins, through its wholly-owned subsidiaries Orkin, Orkin Canada, HomeTeam Pest Defense, Western Pest Services, The Industrial Fumigant Company, Crane Pest Control, Waltham Services and TruTech competes favorably with competitors as the world's largest pest and termite control company. The Company's competitors include Terminix, Ecolab and Rentokil.

The principal methods of competition in the Company's pest and termite control business are quality of service and guarantees, including money-back guarantees on pest and termite control, and the termite re-treatment and damage repair guarantee to qualified homeowners.

Research and Development

Expenditures by the Company on research activities relating to the development of new products or services are not significant. Some of the new and improved service methods and products are researched, developed and produced by unaffiliated universities and companies. Also, a portion of these methods and products are produced to the specifications provided by the Company.

The Company maintains a close relationship with several universities for research and validation of treatment procedures and material selection.

The Company conducts tests of new products with the specific manufacturers of such products. The Company also works closely with leading entomologists, industry consultants and suppliers to improve service protocols and materials.

Environmental and Regulatory Considerations

The Company's pest control business is subject to various legislative and regulatory enactments that are designed to protect the environment, public health and consumers. Compliance with these requirements has not had a material negative impact on the Company's financial position, results of operations or liquidity.

Federal Insecticide Fungicide and Rodentcide Act ("FIFRA")

This federal law (as amended) grants to the states the responsibility to be the primary agent in enforcement and conditions under which pest control companies operate. Each state must meet certain guidelines of the Environmental Protection Agency in regulating the following: licensing, record keeping, contracts, standards of application, training and registration of products. This allows each state to institute certain features that set their regulatory programs in keeping with special interests of the citizens' wishes in each state. The pest control industry is impacted by these federal and state regulations.

Food Quality Protection Act of 1996 ("FQPA")

The FQPA governs the manufacture, labeling, handling and use of pesticides and does not have a direct impact on how the Company conducts its business.

12

Environmental Remediation

The Comprehensive Environmental Response, Compensation and Liability Act ("CERCLA"), also known as Superfund, is the primary Federal statute regulating the cleanup of inactive hazardous substance sites and imposing liability for cleanup on the responsible parties. Responsibilities governed by this statute include the management of hazardous substances, reporting releases of hazardous substances, and establishing the necessary contracts and agreements to conduct cleanup. Customarily, the parties involved will work with the EPA and under the direction of the responsible state agency to agree and implement a plan for site remediation. Consistent with the Company's responsibilities under these regulations, the Company undertakes environmental assessments and remediation of hazardous substances from time to time as the Company determines its responsibilities for these purposes. As these situations arise, the Company accrues management's best estimate of future costs for these activities. Based on management's current estimates of these costs, management does not believe these costs are material to the Company's financial condition or operating results.

Employees

The number of persons employed by the Company as of January 31, 2013 was approximately 10,500.

| |

|

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| |

At December 31, | |||||||||

| |

2012 |

2011 |

2010 |

|||||||

Employees |

10,470 | 10,112 | 10,088 | |||||||

Available Information

Our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to these reports, are available free of charge on our web site at www.rollins.com as soon as reasonably practicable after those reports are electronically filed with or furnished to the Securities and Exchange Commission.

We may not be able to maintain our competitive position in the competitive pest control industry in the future.

We operate in a highly competitive industry. Our revenues and earnings may be affected by changes in competitive prices, and general economic issues. We compete with other large pest control companies, as well as numerous smaller pest control companies, for a finite number of customers. We believe that the principal competitive factors in the market areas that we serve are service quality and product and availability, terms of guarantees, reputation for safety, technical proficiency and price. Although we believe that our experience and reputation for safety and quality service is excellent, we cannot assure that we will be able to maintain our competitive position.

Economic conditions may adversely affect our business

Pest and termite services represent discretionary expenditures to most of our residential customers. As consumers restrict their discretionary expenditures, we may suffer a decline in revenues from our residential service lines. Economic downturns can also adversely affect our commercial customers, including food service, hospitality and food processing industries whose business levels are particularly sensitive to adverse economies. For example, we may lose commercial customers and related revenues because of consolidation or cessation of commercial businesses or because these businesses switch to a lower cost provider.

13

We may not be able to identify, complete or successfully integrate acquisitions.

Acquisitions have been and may continue to be an important element of our business strategy. We cannot assure that we will be able to identify and acquire acceptable acquisition candidates on terms favorable to us in the future. We cannot assure that we will be able to integrate successfully the operations and assets of any acquired business with our own business. Any inability on our part to integrate and manage the growth from acquired businesses could have a material adverse effect on our results of operations and financial condition.

Our operations are affected by adverse weather conditions.

Our operations are directly impacted by the weather conditions across the United States and Canada. The business of the Company is affected by the seasonal nature of the Company's pest and termite control services. The increase in pest pressure and activity, as well as the metamorphosis of termites in the spring and summer (the occurrence of which is determined by the timing of the change in seasons), has historically resulted in an increase in the revenue and income of the Company's pest and termite control operations during such periods. The business of the Company is also affected by extreme weather such as drought which can greatly reduce the pest population for extended periods.

Our inability to attract and retain skilled workers may impair growth potential and profitability.

Our ability to remain productive and profitable will depend substantially on our ability to attract and retain skilled workers. Our ability to expand our operations is in part impacted by our ability to increase our labor force. The demand for skilled employees is high, and the supply is very limited. A significant increase in the wages paid by competing employers could result in a reduction in our skilled labor force, increases in wage rates paid by us, or both. If either of these events occurred, our capacity and profitability could be diminished, and our growth potential could be impaired.

Our operations could be affected by pending and ongoing litigation.

In the normal course of business, some of the Company's subsidiaries are defendants in a number of lawsuits or arbitrations, which allege that plaintiffs have been damaged. The Company does not believe that any pending claim, proceeding or litigation, either alone or in the aggregate, will have a material adverse effect on the Company's financial position; however, it is possible that an unfavorable outcome of some or all of the matters, however unlikely, could result in a charge that might be material to the results of an individual year.

Our operations may be adversely affected if we are unable to comply with regulatory and environmental laws.

Our business is significantly affected by environmental laws and other regulations relating to the pest control industry and by changes in such laws and the level of enforcement of such laws. We are unable to predict the level of enforcement of existing laws and regulations, how such laws and regulations may be interpreted by enforcement agencies or court rulings, or whether additional laws and regulations will be adopted. We believe our present operations substantially comply with applicable federal and state environmental laws and regulations. We also believe that compliance with such laws has had no material adverse effect on our operations to date. However, such environmental laws are changed frequently. We are unable to predict whether environmental laws will, in the future, materially affect our operations and financial condition. Penalties for noncompliance with these laws may include cancellation of licenses, fines, and other corrective actions, which would negatively affect our future financial results.

14

The Company's Management Has a Substantial Ownership Interest; Public Stockholders May Have No Effective Voice In the Company's Management

The Company has elected the "Controlled Company" exemption under rule 303A of the New York Stock Exchange ("NYSE") Company Guide. The Company is a "Controlled Company" because a group that includes the Company's Chairman of the Board, R. Randall Rollins and his brother, Gary W. Rollins, who is the Vice Chairman and Chief Executive Officer, also a director of the Company and certain companies under their control, controls in excess of fifty percent of the Company's voting power. As a "Controlled Company," the Company need not comply with certain NYSE rules.

Rollins, Inc.'s executive officers, directors and their affiliates hold directly or through indirect beneficial ownership, in the aggregate, approximately 57 percent of the Company's outstanding shares of common stock. As a result, these persons will effectively control the operations of the Company, including the election of directors and approval of significant corporate transactions such as acquisitions and approval of matters requiring stockholder approval. This concentration of ownership could also have the effect of delaying or preventing a third party from acquiring control of the Company at a premium.

Item 1.B. Unresolved Staff Comments

None

The Company's administrative headquarters are owned by the Company, and are located at 2170 Piedmont Road, N.E., Atlanta, Georgia 30324. The Company owns or leases over 500 branch offices and operating facilities used in its business as well as the Rollins Training Center located in Atlanta, Georgia, the Rollins Customer Service Center located in Covington, Georgia, and the Pacific Division Administration and Training Center in Riverside, California. None of the branch offices, individually considered, represents a materially important physical property of the Company. The facilities are suitable and adequate to meet the current and reasonably anticipated future needs of the Company.

In the normal course of business, certain of the Company's subsidiaries are defendants in a number of lawsuits or arbitrations, which allege that plaintiffs have been damaged as a result of the rendering of services by the defendant subsidiary. The subsidiaries are actively contesting these actions. Some lawsuits have been filed (John Maciel v. Orkin, Inc., et al.; Douglas F. Bracho, Jr. v. Orkin, Inc.;Jennifer M. Welsh et al. v. Orkin, LLC, et al.: and Jennifer Thompson and Janet Flood v. Philadelphia Management Company, Parkway Associated, Parkway House Apartments, Barbara Williams, and Western Pest Services) in which the plaintiffs are seeking certification of a class. These cases originate in California (Maciel and Bracho), South Carolina (Welsh), and Pennsylvania (Flood), respectively. The Maciel lawsuit, a wage and hour related matter, was filed in the Superior Court of Los Angeles County, California. The Bracho lawsuit, a matter related to payroll deductions for use of Company vehicles, was filed in the Superior Court of Orange County, California. In Bracho, the Court in early October approved a final resolution of this matter, and on October 15, 2012, it was dismissed. The Welsh lawsuit, a termite service related matter, was filed in the Court of Common Pleas Fourteenth Judicial Circuit, County of Beaufort, South Carolina. The Flood lawsuit, a bed bug service related matter filed by residents of an apartment complex, was filed in the Court of Common Pleas of Philadelphia County, Pennsylvania. On October 26, 2012, the Court approved a settlement of the Flood case, and it was dismissed with prejudice. None of the remaining matters have been scheduled for a class certification hearing. Additionally, the Company and a subsidiary, The Industrial Fumigant Company, LLC, are named defendants in Severn Peanut Co. and Meherrin Agriculture & Chemical Co. v. Industrial Fumigant Co., et al. The Severn lawsuit, a matter related to a fumigation service, has been filed in the Northern Division of the United States District Court for the Eastern District of

15

North Carolina. The plaintiffs are seeking damages for breach of contract and negligence. The Industrial Fumigant Company, LLC is also a named defendant in Insurance Company of the State of Pennsylvania as Subrogee of Archer-Daniels-Midland Company, Agrinational Insurance Company, Inc. as Subrogee of Archer-Daniels-Midland Company, and Archer-Daniels-Midland Company v. The Industrial Fumigant Co., The Industrial Fumigant Company, LLC, and James Miller. The ADM lawsuit, a matter related to a fumigation service, has been filed in the State Court in Lucas County, Ohio. The plaintiffs are seeking damages for breach of contract and negligence. The Company believes these matters are without merit and intends to vigorously contest certification and defend itself through trial or arbitration, if necessary. Management does not believe that any pending claim, proceeding or litigation, either alone or in the aggregate, will have a material adverse effect on the Company's financial position, results of operations or liquidity; however, it is possible that an unfavorable outcome of some or all of the matters, however unlikely, could result in a charge that might be material to the results of an individual quarter or year.

Orkin, LLC is involved in certain environmental matters primarily arising in the normal course of business. In the opinion of management, the Company's liability under any of these matters would not and did not materially affect its financial condition, results of operations or liquidity.

Item 4 Mine Safety Disclosures.

Not applicable.

Item 4.A. Executive Officers of the Registrant.

Each of the executive officers of the Company was elected by the Board of Directors to serve until the Board of Directors' meeting immediately following the next Annual Meeting of Stockholders or until his earlier removal by the Board of Directors or his resignation. The following table lists the executive officers of the Company and their ages, offices within the Company, and the dates from which they have continually served in their present offices with the Company.

| Name |

Age |

Office with Registrant |

Date First Elected to Present Office |

||||||

|---|---|---|---|---|---|---|---|---|---|

| R. Randall Rollins (1) | 81 | Chairman of the Board of Directors | 10/22/1991 | ||||||

| Gary W. Rollins (1) (2) | 68 | Vice Chairman and Chief Executive Officer | 7/24/2001 | ||||||

| Harry J. Cynkus (3) | 63 | Senior Vice President, Chief Financial Officer and Treasurer | 5/28/1998 | ||||||

| John Wilson (4) | 55 | President and Chief Operating Officer | 1/23/2013 | ||||||

| Eugene Iarocci (5) | 66 | Vice President | 2/22/2011 | ||||||

| Bob Wanzer (6) | 59 | Vice President | 2/22/2011 | ||||||

| Tom Luczynski (7) | 56 | Secretary | 5/4/2010 | ||||||

- (1)

- R.

Randall Rollins and Gary W. Rollins are brothers.

- (2)

- Gary

W. Rollins was elevated to Vice Chairman Rollins in January 2013. He was elected to the office of Chief Executive Officer in July 2001. In February

2004, he was named Chairman of Orkin, LLC.

- (3)

- Harry J. Cynkus joined Rollins in 1998 as CFO and corporate treasurer, was named vice president in 2009 and elevated to senior vice president in 2010. He began his career with Arthur Andersen & Co. in Boston and has held various financial and information technology positions with several companies throughout the U.S., including Tyco International, ARAMARK Services, Initial USA, Brach & Brock Confections and Mayer Electric Supply Co, Inc. His professional memberships include the American Institute of Certified Public Accountants and the Financial Executives Institute (FEI). He also previously served on FEI's National Committee on Finance and Information Technology.

16

- (4)

- John

Wilson joined the Company in 1996 and has held various positions of increasing responsibility, serving as a technician, sales inspector, branch

manager, region manager, vice president and division president. His most senior positions have included Southeast Division president, Atlantic Division vice president and Central Commercial region

manager. Mr. Wilson was elected President and Chief Operating Officer in January 2013.

- (5)

- Eugene

Iarocci joined the Company in 2003 and has more than 20 years experience in multi-unit management with a number of service and

manufacturing industries, including Union Carbide Corporation where he worked for 24 years. He has served as Region Manager in Louisiana, Division Vice President and President of Orkin's

Atlantic Division. Mr. Iarocci currently serves as Rollins wholly-owned subsidiary, Orkin's President.

- (6)

- Bob

Wanzer joined the Company with the acquisition of HomeTeam Pest Defense in 2008. He joined HomeTeam Pest Defense as President in 1998, became Chief

Operating Officer in 2003 and CEO in 2007. Prior to joining HomeTeam, Mr. Wanzer served as Regional Vice President and Regional Manager of Tru-Green / Chemlawn. Previously,

Mr. Wanzer was employed as Regional General Manager for Emery Worldwide, a national provider of domestic and international airfreight delivery services. In addition, he has served on the Boards

of Directors for both the Professional Pest Management Alliance and the National Pest Management Association. Mr. Wanzer now serves as Rollins' Vice President of Independent Brands and

Corporate Administration.

- (7)

- Tom Luczynski assumed responsibilities as corporate secretary on May 4, 2010. Currently also serving as vice president of Orkin international development, franchising and support services, Mr. Luczynski joined the company in 1985 as manager of reporting and was promoted to vice president of Orkin finance in 1995. Prior to joining Rollins, Mr. Luczynski held financial positions with Revere Copper and Brass and Keytek-Elco Corporation. Mr. Luczynski is active in the pest control industry and has previously served on various industry board committees. In addition, he has served as president of the Atlanta chapter of FEI and president of the Atlanta chapter of the Institute of Management Accountants.

17

Item 5. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

The Common Stock of the Company is listed on the New York Stock Exchange and is traded on the Philadelphia, Chicago and Boston Exchanges under the symbol ROL. The high and low prices of the Company's common stock and dividends paid for each quarter in the years ended December 31, 2012 and 2011 were as follows:

STOCK PRICES AND DIVIDENDS

Rounded to the nearest $.01

| |

Stock Price | Dividends Paid Per Share |

|

Stock Price | Dividends Paid Per Share |

||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2012 |

High |

Low |

2011 |

High |

Low |

||||||||||||||||

First Quarter |

$ | 23.04 | $ | 19.30 | $ | 0.08 | First Quarter | $ | 20.31 | $ | 18.29 | $ | 0.07 | ||||||||

Second Quarter |

$ | 22.48 | $ | 20.03 | $ | 0.08 | Second Quarter | $ | 21.19 | $ | 18.87 | $ | 0.07 | ||||||||

Third Quarter |

$ | 24.41 | $ | 22.08 | $ | 0.08 | Third Quarter | $ | 21.60 | $ | 16.51 | $ | 0.07 | ||||||||

Fourth Quarter |

$ | 23.80 | $ | 21.42 | $ | 0.20 | Fourth Quarter | $ | 23.74 | $ | 17.30 | $ | 0.07 | ||||||||

As of January 31, 2013, there were 2,056 holders of record of the Company's common stock. However, a large number of our shareholders hold their shares in "street name" in brokerage accounts and, therefore, do not appear on the shareholder list maintained by our transfer agent.

On January 23, 2013 the Board of Directors approved a quarterly cash dividend per common share of $0.09 payable March 8, 2013 to stockholders of record at the close of business February 8, 2013. On October 23, 2012, the Board of Directors declared a special year-end dividend of $0.12 per share payable December 10, 2012 to stockholders of record at the close of business November 09, 2012. The Company expects to continue to pay cash dividends to the common stockholders, subject to the earnings and financial condition of the Company and other relevant factors.

Issuer Purchases of Equity Securities

During the years ended December 31, 2012 and 2011, the Company repurchased 0.8 million and 1.5 million shares at a weighted average price of $20.93 and $18.68, respectively. In total, there are 5.3 million additional shares authorized to be repurchased under prior Board approval. The repurchase program does not have an expiration date.

| Period |

Total Number of Shares Purchased |

Weighted Average Price Paid per Share |

Total Number of Shares Purchased as Part of Publicly Announced Repurchase Plans |

Maximum Number of Shares that May Yet Be Purchased Under the Repurchase Plans |

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

October 1 to 31, 2012 |

— | $ | — | — | 5,298,183 | ||||||||

November 1 to 30, 2012 |

— | $ | — | — | 5,298,183 | ||||||||

December 1 to 31, 2012 |

— | $ | — | — | 5,298,183 | ||||||||

Total |

— | $ | — | — | 5,298,183 | ||||||||

There were no repurchases of the Company's common stock during the fourth quarter ended December 31, 2012.

18

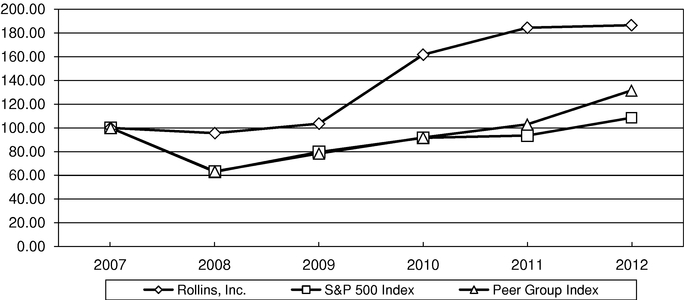

The following graph sets forth a five year comparison of the cumulative total stockholder return based on the performance of the stock of the Company as compared with both a broad equity market index and an industry index. The indices included in the following graph are the S&P 500 Index and the S&P 500 Commercial Services Index.

COMPARISON OF FIVE YEAR CUMULATIVE TOTAL RETURN*

Comparison

of 5 Year Cumulative Total Return

Assumes Initial Investment of $100

December 2012

Rollins, Inc., S&P 500 Index and peer group composite index

| Cumulative Total Shareholder Return $ at Fiscal Year End |

2007 |

2008 |

2009 |

2010 |

2011 |

2012 |

|||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Rollins, Inc. |

100.00 | 95.57 | 103.59 | 161.74 | 184.46 | 186.58 | |||||||||||||

S&P 500 |

100.00 | 62.99 | 79.65 | 91.64 | 93.57 | 108.55 | |||||||||||||

Peer Index |

100.00 | 63.38 | 78.46 | 91.90 | 103.00 | 131.57 | |||||||||||||

ASSUMES

INITIAL INVESTMENT OF $100

*TOTAL RETURN ASSUMES REINVESTMENT OF DIVIDENDS

NOTE: TOTAL RETURNS BASED ON MARKET CAPITALIZATION

19

Item 6. Selected Financial Data.

The following summary financial data of Rollins highlights selected financial data and should be read in conjunction with the financial statements included elsewhere in this document.

FIVE-YEAR FINANCIAL SUMMARY

Rollins, Inc. and Subsidiaries

All earnings per share and dividends per share have been adjusted for the 2010 three-for-two stock split effective December 10, 2010.

STATEMENT OF OPERATIONS DATA:

| |

Years ended December 31, | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (in thousands except per share data) |

||||||||||||||||

| 2012 |

2011 |

2010 |

2009 |

2008 |

||||||||||||

Revenues |

$ | 1,270,909 | $ | 1,205,064 | $ | 1,136,890 | $ | 1,073,958 | $ | 1,020,564 | ||||||

Income Before Income Taxes |

176,642 | 161,096 | 143,545 | 126,291 | 112,954 | |||||||||||

Net Income |

111,332 | 100,711 | 90,002 | 83,984 | 68,934 | |||||||||||

Earnings Per Share – Basic: |

0.76 | 0.69 | 0.61 | 0.56 | 0.46 | |||||||||||

Earnings Per Share – Diluted: |

0.76 | 0.69 | 0.61 | 0.56 | 0.45 | |||||||||||

Dividends paid per share |

0.44 | 0.28 | 0.24 | 0.19 | 0.17 | |||||||||||

OTHER DATA: |

||||||||||||||||

Net cash provided by operating activities |

$ | 141,919 | $ | 154,647 | $ | 124,053 | $ | 110,846 | $ | 90,744 | ||||||

Net cash used in investing activities |

(42,693 | ) | (29,154 | ) | (47,645 | ) | (26,562 | ) | (166,717 | ) | ||||||

Net cash provided by (used in) financing activities |

(80,989 | ) | (99,427 | ) | (65,497 | ) | (89,753 | ) | 21,032 | |||||||

Depreciation |

15,212 | 15,112 | 15,975 | 15,874 | 14,205 | |||||||||||

Amortization of intangible assets |

23,443 | 22,391 | 20,433 | 21,295 | 19,238 | |||||||||||

Capital expenditures |

$ | (19,040 | ) | $ | (18,652 | ) | $ | (13,036 | ) | $ | (15,740 | ) | $ | (14,815 | ) | |

BALANCE SHEET DATA AT END OF YEAR: |

||||||||||||||||

Current assets |

$ | 205,992 | $ | 175,822 | $ | 151,021 | $ | 120,530 | $ | 116,838 | ||||||

Total assets |

692,506 | 645,650 | 619,014 | 566,496 | 572,517 | |||||||||||

Line of credit |

— | — | 26,000 | 30,000 | 65,000 | |||||||||||

Stockholders' equity |

$ | 354,956 | $ | 323,997 | $ | 297,970 | $ | 264,566 | $ | 228,433 | ||||||

Number of shares outstanding at year-end |

146,015 | 146,251 | 147,181 | 148,357 | 150,062 | |||||||||||

20

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations.

You should read the following discussion in conjunction with our audited financial statements and related notes included elsewhere in this document. The following discussion (as well as other discussions in this document) contains forward-looking statements. Please see "Cautionary Statement Regarding Forward-Looking Statements" for a discussion of uncertainties, risks and assumptions associated with these statements.

Overview

The Company

Rollins, Inc. (the "Company") was originally incorporated in 1948 under the laws of the state of Delaware as Rollins Broadcasting, Inc. The Company is an international service company with headquarters located in Atlanta, Georgia, providing pest and termite control services through its wholly-owned subsidiaries to both residential and commercial customers in North America with international franchises in Central America, South America, the Caribbean, the Middle East, Asia, the Mediterranean, Europe, Africa and Mexico. Services are performed through a contract that specifies the treatment specifics and the pricing arrangement with the customer.

RESULTS OF OPERATIONS

| |

|

|||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Years ended December 31, | % better/(worse) as compared to prior year |

||||||||||||||

| (in thousands) |

2012 |

2011 |

2010 |

2012 |

2011 |

|||||||||||

Revenues |

$ | 1,270,909 | $ | 1,205,064 | $ | 1,136,890 | 5.5 | % | 6.0 | % | ||||||

Cost of services provided |

647,578 | 616,842 | 583,089 | (5.0 | ) | (5.8 | ) | |||||||||

Depreciation and amortization |

38,655 | 37,503 | 36,408 | (3.1 | ) | (3.0 | ) | |||||||||

Sales, general and administrative |

407,488 | 388,710 | 373,288 | (4.8 | ) | (4.1 | ) | |||||||||

(Gain)/loss on sales/impairment of assets, net |

(468 | ) | 405 | 123 | 215.6 | 229.3 | ||||||||||

Pension Settlement |

1,000 | — | — | N/M | N/M | |||||||||||

Interest expense |

14 | 508 | 437 | 97.2 | (16.2 | ) | ||||||||||

Income before income taxes |

176,642 | 161,096 | 143,545 | 9.7 | 12.2 | |||||||||||

Provision for income taxes |

65,310 | 60,385 | 53,543 | (8.2 | ) | (12.8 | ) | |||||||||

Net income |

111,332 | 100,711 | 90,002 | 10.5 | 11.9 | |||||||||||

General Operating Comments

2012 marked the Company's 15th consecutive year of reporting improved results, with 2012 concluding with record revenues and profits. Last year (2012) the Company's revenue grew 5.5%, with growth in all lines of service.

Results of Operations—2012 Versus 2011

Overview

The Company's gross margin increased to 49.0% for 2012 from 48.8% in 2011. Sales, general and administrative expense decreased in 2012 to 32.1% of revenue versus 32.3% in 2011. The Company experienced a reduction in its depreciation and amortization margin to 3.0% in 2012 versus 3.1% in 2011. The Company had net income of $111.3 million in 2012 compared to $100.7 million in 2011, a 10.5% increase. Net profit margin improved to 8.8% in 2012 from 8.4% in 2011.

21

Revenues

Revenues for the year ended December 31, 2012 were $1.3 billion, an increase of $65.8 million or 5.5% from 2011 revenues of $1.2 billion. Commercial pest control represented approximately 41.0% of the Company's business in 2012 and grew 3.7% in 2012 due to increases in sales, bed bug revenues and an increase in the average sales price. Residential pest control represented approximately 41.0% of the Company's business and increased 8.0% driven by increased leads, closure and pricing as well as increased capture of TAEXX homebuilder installations and bed bug revenues. The Company's termite business, which represented approximately 18.0% of the Company's revenue, grew 4.0% in 2012 due to increases in ancillary service sales as well as the Company's expanded sales force and price increases.

The Company's foreign operations accounted for approximately 8% of total revenues for the years ended December 31, 2012 and 2011. The Company established new franchises in Mexico, China, Turks and Caicos Islands and Chile for a total of 22 and 18 international franchises at December 31, 2012 and 2011, respectively. Orkin had 79 and 76 total domestic and international franchises at December 31, 2012 and 2011, respectively.

Cost of Services Provided

For the twelve months ended December 31, 2012 cost of services provided increased $30.8 million or 5.0%, compared to the twelve months ended December 31, 2011. Gross margin for the year was 49.0% for 2012 and 48.8% for 2011. While all costs increased during the year due to the Company's early 2012 and late 2011 acquisitions, insurance and claims expense increased but was partially offset by lower termite provision claims and telephone costs were down marginally due to cost controls, partially offset by higher personnel related costs including payroll taxes and group premiums.

Depreciation and Amortization

For the twelve months ended December 31, 2012, depreciation and amortization increased $1.2 million, or 3.1% compared to the twelve months ended December 31, 2011. The increase is due to amortization of intangible assets acquired in late 2011 and early 2012 partially offset by several intangible assets being fully amortized.

Sales, General and Administrative

For the twelve months ended December 31, 2012, sales, general and administrative (SG&A) expenses increased $18.8 million, or 4.8% compared to the twelve months ended December 31, 2011 representing 32.1% of revenues compared to 32.3% of revenues in the prior year. As a percentage of revenues, SG&A decreased due to reductions in professional services due to timing of projects and reduced salaries as a percentage of revenues as the Company continues to maximize efficiency in its workforce.

Interest Expense, Net

Interest expense, net for the year ended December 31, 2012 was $14 thousand, a decrease of $0.5 million compared to $0.5 million in 2011 due to the pay-off of the remainder of the Company's outstanding borrowings in 2011.

Pension Settlement

Management terminated its wholly-owned subsidiary's (Waltham Services, LLC) salaried pension plan and recorded a settlement loss, which resulted in an additional expense of $1.0 million for the year ended December 31, 2012.

22

(Gain)/loss on Sales/Impairment of assets, Net

(Gain)/Loss on Sales/Impairment of assets, net increased to $0.5 million gain for the year ended December 31, 2012 compared to $0.4 million loss in 2011. The Company recognized gains from the sale of owned vehicles and property in Canada in 2012 while recognizing an impairment on software related to terminated projects for approximately $0.5 million in 2011.

Taxes

The Company's effective tax rate was 37.0% in 2012 compared to 37.5% in 2011, due primarily to differences in state tax rates.

Results of Operations—2011 Versus 2010

Overview

The Company's gross margin increased slightly to 48.8% for 2011 from 48.7% in 2010. Sales, general and administrative expense decreased in 2011 to 32.3% of revenue versus 32.8% in 2010. The Company experienced a reduction in its depreciation and amortization margin to 3.1% in 2011 versus 3.2% in 2010 due to several assets being fully depreciated, partially offset by amortization of intangible assets acquired in 2010. The Company had net income of $100.7 million compared to $90.0 million in 2010, an 11.9% increase. Net profit margin improved to 8.4% in 2011 from 7.9% in 2010.

Revenues

Revenues for the year ended December 31, 2011 were $1.2 billion, an increase of $68.2 million or 6.0% from 2010 revenues of $1.1 billion. Commercial pest control represented approximately 42.0% of the Company's business in 2011 and grew 6.0% in 2011 due to increases in sales, bed bug revenues and revenues from 2010 acquisitions. Residential pest control represented approximately 40.0% of the Company's business and increased 7.7% driven by increased leads, closure and pricing. The Company's termite business, which represented approximately 18.0% of the Company's revenue, grew 2.8% in 2011 due to increases in ancillary services sales as well as the Company's expanded sales force and price increases.

The Company's foreign operations accounted for approximately 8% of total revenues for the years ended December 31, 2011 and 2010. The Company established new franchises in China and two locations in Nigeria for a total of 18 and 16 international franchises at December 31, 2011 and 2010, respectively. Orkin had 76 and 72 total domestic and international franchises at December 31, 2011 and 2010, respectively.

Cost of Services Provided

For the twelve months ended December 31, 2011 cost of services provided increased $33.8 million or 5.8%, compared to the twelve months ended December 31, 2010. Gross margin for the year was 48.8% for 2011 and 48.7% for 2010. While all costs increased during the year due to the Company's 2010 acquisitions and fleet expenses were marginally better due to better routing and scheduling.

Depreciation and Amortization

For the twelve months ended December 31, 2011, depreciation and amortization increased $1.1 million, or 3.0% compared to the twelve months ended December 31, 2010. The increase is due to amortization of intangible assets acquired in 2010, partially offset by several assets being fully depreciated.

23

Sales, General and Administrative

For the twelve months ended December 31, 2011, sales, general and administrative (SG&A) expenses increased $15.4 million, or 4.1% compared to the twelve months ended December 31, 2010 representing 32.3% of revenues compared to 32.8% of revenues in the prior year. As a percentage of revenues, SG&A decreased due to reductions in professional services related to the Company's 2010 pricing study and reduced salaries as a percentage of revenues as the Company continues to maximize efficiency in its workforce.

Interest Expense, Net

Interest expense, net for the year ended December 31, 2011 was $0.5 million, an increase of $0.1 million compared to $0.4 million in 2010 due interest on acquisition related payables and outstanding debt during the year.

Loss on Sales/Impairment of assets, Net

Loss on Sales/Impairment of assets, net increased to $0.4 million loss for the year ended December 31, 2011 compared to $0.1 million loss in 2010. The Company recognized an impairment on software related to terminated projects for approximately $0.5 million in 2011.

Taxes

The Company's effective tax rate was 37.5% in 2011 compared to 37.3% in 2010, due primarily to differences in state tax rates.

Liquidity and Capital Resources

Cash and Cash Flow

The Company's cash and cash equivalents at December 31, 2012, 2011, and 2010 were $65.1 million, $46.3 million and $20.9 million, respectively.

| |

|

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| |

Years ended December 31, | |||||||||

| (in thousands) |

2012 |

2011 |

2010 |

|||||||

Net cash provided by operating activities |

$ | 141,919 | $ | 154,647 | $ | 124,053 | ||||

Net cash used in investing activities |

(42,693 | ) | (29,154 | ) | (47,645 | ) | ||||

Net cash provided by (used in) financing activities |

(80,989 | ) | (99,427 | ) | (65,497 | ) | ||||

Effect of exchange rate changes on cash |

570 | (704 | ) | 498 | ||||||

Net increase in cash and cash equivalents |

$ | 18,807 | $ | 25,362 | $ | 11,409 | ||||

Cash Provided by Operating Activities

The Company's operations generated cash of $141.9 million for the year ended December 31, 2012 primarily from net income of $111.3 million, compared with cash provided by operating activities of $154.6 million in 2011 and 124.1 million in 2010. The Company believes its current cash and cash equivalents balances, future cash flows expected to be generated from operating activities and available borrowings under its $175.0 million credit facility will be sufficient to finance its current operations and obligations, and fund expansion of the business for the foreseeable future.

The Company made contributions totaling $5.2 million to the Rollins, Inc. and its wholly-owned subsidiaries' defined benefit retirement plans (the "Plans") during the year ended December 31, 2012 and $4.9 million and $5.2 million during the years ended December 31, 2011 and 2010, respectively, as a result of the Plans' funding status. The Company is considering making contributions to its Plans of

24

approximately $5.0 million during fiscal 2013. In the opinion of management, additional Plan contributions will not have a material effect on the Company's financial position, results of operations or liquidity.

Cash Used in Investing Activities

The Company used $42.7 million on investing activities for the year ended December 31, 2012 compared to $29.2 million and $47.6 million during 2011 and 2010, respectively, and of that, invested approximately $19.0 million in capital expenditures during 2012 compared to $18.7 million and $13.0 million during 2011 and 2010, respectively. Capital expenditures for the year consisted primarily of property purchases, equipment replacements and technology related projects. The Company expects to invest between $15.0 million and $20.0 million in 2013 in capital expenditures. During 2012, the Company's subsidiaries acquired several small companies totaling $25.0 million compared to $11.4 million in acquisitions during 2011 and $34.8 million in 2010. The expenditures for the Company's acquisitions were funded with cash on hand. The Company continues to seek new acquisitions.

Cash Provided by Financing Activities

The Company used cash of $81.0 million on financing activities for the year ended December 31, 2012 compared to $99.4 million and $65.5 million during 2011 and 2010, respectively. A total of $64.3 million was paid in cash dividends ($0.44 per share) during the year ended December 31, 2012 including a special dividend paid in December 2012 of $0.12 per share, compared to $41.1 million ($0.28 per share) during the year ended December 31, 2011 and $35.5 million ($0.24 per share) in 2010. The Company used $19.9 million to repurchase 0.9 million shares of its common stock at a weighted average price of $20.93 per share during 2012 compared to $30.2 million to purchase 1.5 million shares at an average price of $18.68 in 2011 and $29.7 million to purchase 1.9 million shares at a weighted average price of $13.95 in 2010. There are 5.3 million shares authorized remaining to be repurchased under prior Board approval.

The Company's $65.1 million of total cash at December 31, 2012, is primarily cash held at various banking institutions. Approximately $40.9 million is held in cash accounts at international bank institutions and the remaining $24.2 million is primarily held in non-interest-bearing accounts at various domestic banks. In July 2010, President Obama signed into law the Dodd-Frank Act, which again led to changes in FDIC deposit guarantees. Beginning January 1, 2011 and lasting through December 31, 2012, all funds held in noninterest-bearing transaction accounts at insured depository institutions were automatically fully insured, without limit. This temporary unlimited insurance expired at the end of 2012 and has reverted to a $250,000 limit per bank.

On October 31, 2012, the Company entered into a Revolving Credit Agreement with SunTrust Bank and Bank of America, N.A. for an unsecured line of credit of up to $175.0 million, which includes a $75.0 million letter of credit subfacility, and a $25.0 million swingline subfacility. As of December 31, 2012, no borrowings were outstanding under the line of credit or under the swingline subfacility. The Company maintains approximately $33.2 million in letters of credit. These letters of credit are required by the Company's fronting insurance companies and/or certain states, due to the Company's self-insured status, to secure various workers' compensation and casualty insurance contracts coverage. The Company believes that it has adequate liquid assets, funding sources and insurance accruals to accommodate such claims.

25

The Revolving Credit Agreement is guaranteed by certain of Rollins' domestic-subsidiaries. The maturity date of the Credit Agreement is October 31, 2016, subject to optional annual extensions on the first three anniversaries of the Credit Agreement for one year each. Revolving loans under the Revolving Credit Agreement bear interest at one of the following two rates, at the Company's election:

- •

- the Base Rate, which shall mean the highest of (i) the per annum rate which the Administrative Agent publicly

announces from time to time as its prime lending rate, (ii) the Federal Funds rate, plus 0.50% per annum, and (iii) the Adjusted LIBOR

Rate (which equals LIBOR as increased to account for the maximum reserve percentages established by the U.S. Federal Reserve) determined on a daily basis for an Interest Period of one (1), plus 1.0% per

annum.

- •

- with respect to any Eurodollar borrowings, Adjusted LIBOR plus an additional amount, which varies between .75% and 1.00%, based upon Rollins' then-current debt-to-EBITDA ratio. As of December 31, 2012, the additional rate allocated was .75%.

The Revolving Credit Agreement contains customary terms and conditions, including, without limitation, certain financial covenants including covenants restricting the Company's ability to incur certain indebtedness or liens, or to merge or consolidate with or sell substantially all of its assets to another entity. Further, the Revolving Credit Agreement contains financial covenants restricting the Company's ability to permit the ratio of the Company's consolidated debt to EBITDA to exceed certain limits.

The Company remained in compliance with applicable debt covenants at December 31, 2012 and expects to maintain compliance throughout 2013.

Litigation

For discussion on the Company's legal contingencies, see note 12 to the accompanying financial statements.

Off Balance Sheet Arrangements, Contractual Obligations and Contingent Liabilities and Commitments

Other than the operating leases disclosed in the table that follows, the Company has no material off balance sheet arrangements.

The impact that the Company's contractual obligations as of December 31, 2012 are expected to have on our liquidity and cash flow in future periods is as follows:

| |

Payments due by period | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Contractual obligations (in thousands) |

Total |

Less than 1 year |

1 - 3 years |

4 - 5 years |

More than 5 years |

|||||||||||

Business combination related liabilities |

$ | 9,447 | $ | 6,531 | $ | 2,858 | $ | 58 | $ | — | ||||||

Non-cancelable operating leases |

85,501 | 31,265 | 34,921 | 13,420 | 5,895 | |||||||||||

Unrecognized Tax Positions (1) |

901 | 901 | — | — | — | |||||||||||

Total (2) |

$ | 95,849 | $ | 38,697 | $ | 37,779 | $ | 13,478 | $ | 5,895 | ||||||

- (1)

- These

amounts represent expected payments with interest for unrecognized tax benefits as of December 31, 2012. Uncertain tax positions of

$0.7 million are not included due to the uncertainty of the final amount and settlement.

- (2)

- Minimum pension funding requirements are not included as funding will not be required. The Company is considering making contributions to its pension plans of approximately $5.0 million during 2013.

26

Critical Accounting Policies

The Company views critical accounting policies to be those policies that are very important to the portrayal of our financial condition and results of operations, and that require management's most difficult, complex or subjective judgments. The circumstances that make these judgments difficult or complex relate to the need for management to make estimates about the effect of matters that are inherently uncertain. We believe our critical accounting policies to be as follows:

Accrual for Termite Contracts—The Company maintains an accrual for termite claims representing the estimated costs of reapplications, repairs and associated labor and chemicals, settlements, awards and other costs relative to termite control services. Factors that may impact future cost include termiticide life expectancy and government regulation. It is significant that the actual number of claims has decreased in recent years due to changes in the Company's business practices. However, it is not possible to precisely predict future significant claims. Accruals for termite contracts are included in other current liabilities and long-term accrued liabilities on the Company's consolidated statements of financial position.

Accrued Insurance—The Company self-insures, up to specified limits, certain risks related to general liability, workers' compensation and vehicle liability. The estimated costs of existing and future claims under the self-insurance program are accrued based upon historical trends as incidents occur, whether reported or unreported (although actual settlement of the claims may not be made until future periods) and may be subsequently revised based on developments relating to such claims. The Company contracts an independent third party actuary on a semi-annual basis to provide the Company an estimated liability based upon historical claims information. The actuarial study is a major consideration, along with management's knowledge of changes in business practice and existing claims compared to current balances. The reserve is established based on all these factors. Management's judgment is inherently subjective and a number of factors are outside management's knowledge and control. Additionally, historical information is not always an accurate indication of future events. The Company continues to be proactive in risk management to develop and maintain ongoing programs to reduce claims. Initiatives that have been implemented include pre-employment screening and an annual motor vehicle report required on all its drivers, post-offer physicals for new employees, and pre-hire, random and post-accident drug testing. The Company has improved the time required to report a claim by utilizing a "Red Alert" program that provides serious accident assessment twenty four hours a day and seven days a week and has instituted a modified duty program that enables employees to go back to work on a limited-duty basis.

Revenue Recognition—The Company's revenue recognition policies are designed to recognize revenues at the time services are performed. For certain revenue types, because of the timing of billing and the receipt of cash versus the timing of performing services, certain accounting estimates are utilized. Residential and commercial pest control services are primarily recurring in nature on a monthly, bi-monthly or quarterly basis, while certain types of commercial customers may receive multiple treatments within a given month. In general, pest control customers sign an initial one-year contract, and revenues are recognized at the time services are performed. For pest control customers, the Company offers a discount for those customers who prepay for a full year of services. The Company defers recognition of these advance payments and recognizes the revenue as the services are rendered. The Company classifies the discounts related to the advance payments as a reduction in revenues.

Termite baiting revenues are recognized based on the delivery of the individual units of accounting. At the inception of a new baiting services contract upon quality control review of the installation, the Company recognizes revenue for the installation of the monitoring stations, initial directed liquid termiticide treatment and servicing of the monitoring stations. A portion of the contract amount is deferred for the undelivered monitoring element. This portion is recognized as income on a straight-line basis over the remaining contract term, which results in recognition of revenue in a pattern that approximates the timing of performing monitoring visits. The allocation of the purchase price to the two deliverables is based on the relative selling price. There are no contingencies related to the delivery of additional items or meeting

27

other specified performance conditions. Baiting renewal revenue is deferred and recognized over the annual contract period on a straight-line basis that approximates the timing of performing the required monitoring visits.

At inception revenue received for conventional termite renewals is deferred and recognized on a straight-line basis over the remaining contract term; and, the cost of reinspections, reapplications and repairs and associated labor and chemicals are expensed as incurred. For outstanding claims, an estimate is made of the costs to be incurred (including legal costs) based upon current factors and historical information. The performance of reinspections tends to be close to the contract renewal date and while reapplications and repairs involve an insubstantial number of the contracts, these costs are incurred over the contract term. As the revenue is being deferred, the future cost of reinspections, reapplications and repairs and associated labor and chemicals applicable to the deferred revenue are expensed as incurred. The Company accrues for noticed claims. The costs of providing termite services upon renewal are compared to the expected revenue to be received and a provision is made for any expected losses.

All revenues are reported net of sales taxes.

Contingency Accruals—The Company is a party to legal proceedings with respect to matters in the ordinary course of business. In accordance with FASB ASC Topic 450 "Contingencies," Management estimates and accrues for its liability and costs associated with the litigation. Estimates and accruals are determined in consultation with outside counsel. Because it is not possible to accurately predict the ultimate result of the litigation, judgments concerning accruals for liabilities and costs associated with litigation are inherently uncertain and actual liabilities may vary from amounts estimated or accrued. However, in the opinion of management, the outcome of the litigation will not have a material adverse impact on the Company's financial condition or results of operations. Contingency accruals are included in other current liabilities and long-term accrued liabilities on the Company's consolidated statements of financial position.

Defined benefit pension plans—In 2005, the Company ceased all future benefit accruals under the Rollins, Inc. defined benefit plan, although the Company remains obligated to provide employees benefits earned through June 2005. The Company terminated the Waltham Services, LLC Salaried Pension Plan and all benefits have been settled via an annuity purchase or lump sum in December 2012. The Company also includes the Waltham Services, LLC Hourly Employee Pension Plan to the Company's financial statements. The Company accounts for these defined benefit plans in accordance with FASB ASC Topic 715 "Compensation-Retirement Benefits", and engages an outside actuary to calculate its obligations and costs. With the assistance of the actuary, the Company evaluates the significant assumptions used on a periodic basis including the estimated future return on plan assets, the discount rate, and other factors, and makes adjustments to these liabilities as necessary.

The Company chooses an expected rate of return on plan assets based on historical results for similar allocations among asset classes, the investments strategy, and the views of our investment adviser. Differences between the expected long-term return on plan assets and the actual return are amortized over future years. Therefore, the net deferral of past asset gains (losses) ultimately affects future pension expense. The Company's assumption for the expected return on plan assets is 7% which is unchanged from the prior year.

The discount rate reflects the current rate at which the pension liabilities could be effectively settled at the end of the year. In estimating this rate, the Company utilizes a yield curve approach. The approach utilizes an economic model whereby the Company's expected benefit payments over the life of the plans is forecasted and then compared to a portfolio of corporate bonds that will mature at the same time that the benefit payments are due in any given year. The economic model then calculates the one discount rate to apply to all benefit payments over the life of the plan which will result in the same total lump sum as the payments from the corporate bonds. The discount rate was 4.17% as of December 31, 2012 compared to 5.01% in 2011 and 5.51% in 2010. A lower discount rate increases the present value of benefit obligation.

28

As set forth in note 13 to the Company's financial statements, included among the asset categories for the Plan's investments are real estate, tactical composite and alternative investments comprised of investments in real estate and hedge funds. These investments are categorized as level 3 investments and are valued using significant non-observable inputs which do not have a readily determinable fair value. In accordance with ASU No. 2009-12 "Investments In Certain Entities That Calculate Net Asset Value per Share (Or Its Equivalent)," these investments are valued based on the net asset value per share calculated by the funds in which the plan has invested. These valuations are subject to judgments and assumptions of the funds which may prove to be incorrect, resulting in risks of incorrect valuation of these investments. The Company seeks to mitigate against these risks by evaluating the appropriateness of the funds' judgments and assumptions by reviewing the financial data included in the funds' financial statements for reasonableness.

As of December 31, 2012, the defined benefit plans were under-funded and the recorded change within accumulated other comprehensive income decreased stockholders' equity by $15.4 million before tax and $9.5 million after tax.

New Accounting Standards

Recently issued accounting standards to be adopted in 2013

In December 2011, the Financial Accounting Standards Board ("FASB") issued an Accounting Standards Update ("ASU") Disclosures about Offsetting Assets and Liabilities ("ASU 2011-11") to Topic 210, Balance Sheet. The update requires new disclosures about balance sheet offsetting and related arrangements. For derivatives and financial assets and liabilities, the amendments require disclosure of gross asset and liability amounts, amounts offset on the balance sheet, and amounts subject to the offsetting requirements but not offset on the balance sheet. The guidance is effective December 1, 2013 and is to be applied retrospectively. This guidance does not amend the existing guidance on when it is appropriate to offset; as a result, we do not expect this guidance to have a material effect on our financial statements.

In July 2012, the FASB issued ASU No. 2012-02, Testing Indefinite-Lived Intangible Assets for Impairment (ASU 2012-02). This standard provides new accounting guidance that permits an entity to first assess qualitative factors to determine whether it is more likely than not that an indefinite-lived intangible asset is impaired as a basis for determining whether it is necessary to perform a quantitative impairment test. An entity would continue to calculate the fair value of an indefinite-lived intangible asset if the asset fails the qualitative assessment, while no further analysis would be required if it passes. The provisions of the new guidance are effective as of the beginning of our 2013 fiscal year; we do not expect the new guidance to have an impact on the 2013 impairment test results.

In February 2013, the FASB issued ASU No. 2013-02, Reporting of Amounts Reclassified Out of Accumulated Other Comprehensive Income ("ASU 2013-02) to topic 220, Comprehensive Income. The guidance which requires disclosure of significant amounts reclassified out of accumulated other comprehensive income by component and their corresponding effect on the respective line items of net income. This guidance is effective for the Company beginning in the first quarter of 2013; we do not expect the new guidance to have a material effect on our financial statements.

Forward-Looking Statements

This Annual Report contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements include statements regarding the Company's belief that its levels of supplies will alleviate the potential short-term shortage in availability from its suppliers; management's belief that environmental remediation costs estimated to be incurred are not material to the Company's financial condition or operating results; the outcome of litigation, as discussed in the Legal Proceedings section and elsewhere, and the Company's belief that such litigation will not have a material adverse effect on the Company's financial condition, results of operations or liquidity; the Company's expectation to continue its payment of cash dividends; the adequacy of the

29

Company's resources and borrowings to fund operations and obligations; management's belief that any additional pension plan contributions will not have a material effect on the Company's financial position, results of operation or liquidity; the Company's projected 2013 capital expenditures; the Company's expectation to maintain compliance with the covenants contained in its Revolving Credit Agreement throughout 2013; the impact and amount of the Company's contractual obligations; management's expectations regarding termite claims and factors that impact future costs from those claims; the expected cost of termite renewals; the expected collectability of accounts receivable; expected tax consequences; the impact of recent accounting pronouncements; and interest rate risks and foreign exchange currency risk on the Company's financial position, results of operations and liquidity. The actual results of the Company could differ materially from those indicated by the forward-looking statements because of various risks, timing and uncertainties including, without limitation, the possibility of an adverse ruling against the Company in pending litigation; general economic conditions; market risk; changes in industry practices or technologies; the degree of success of the Company's termite process reforms and pest control selling and treatment methods; the Company's ability to identify potential acquisitions; climate and weather trends; competitive factors and pricing practices; potential increases in labor costs; and changes in various government laws and regulations, including environmental regulations. All of the foregoing risks and uncertainties are beyond the ability of the Company to control, and in many cases the Company cannot predict the risks and uncertainties that could cause its actual results to differ materially from those indicated by the forward-looking statements.

Item 7A. Quantitative and Qualitative Disclosures about Market Risk.

Market Risk

The Company maintains an investment portfolio subject to short-term interest rate risk exposure. The Company is also subject to interest rate risk exposure through borrowings on its $175 million credit facility. Currently, the Company has no outstanding borrowings. However, the Company does maintain approximately $33.2 million in Letters of Credit. The Company is also exposed to market risks arising from changes in foreign exchange rates. The Company believes that this foreign exchange rate risk will not have a material effect upon the Company's results of operations or financial position going forward.

30

MANAGEMENT'S REPORT ON INTERNAL CONTROLS OVER FINANCIAL REPORTING

To the Stockholders of Rollins, Inc.:

The management of Rollins, Inc. is responsible for establishing and maintaining adequate internal control over financial reporting for the Company. Rollins, Inc. maintains a system of internal accounting controls designed to provide reasonable assurance, at a reasonable cost, that assets are safeguarded against loss or unauthorized use and that the financial records are adequate and can be relied upon to produce financial statements in accordance with accounting principles generally accepted in the United States of America. The internal control system is augmented by written policies and procedures, an internal audit program and the selection and training of qualified personnel. This system includes policies that require adherence to ethical business standards and compliance with all applicable laws and regulations.

Under the supervision and with the participation of our management, including our principal executive officer and principal financial officer, we conducted an evaluation of the effectiveness of the design and operation of internal controls over financial reporting, as of December 31, 2012 based on criteria established in Internal Control—Integrated framework issued by the Committee of Sponsoring Organizations of the Treadway Commission. Based on this evaluation, management's assessment is that Rollins, Inc. maintained effective internal control over financial reporting as of December 31, 2012.

The independent registered public accounting firm, Grant Thornton LLP has audited the consolidated financial statements as of and for the year ended December 31, 2012, and has also issued their report on the effectiveness of the Company's internal control over financial reporting, included in this report on page 32.

| /s/ GARY W. ROLLINS Gary W. Rollins Vice Chairman and Chief Executive Officer |

/s/ HARRY J. CYNKUS Harry J. Cynkus Senior Vice President, Chief Financial Officer and Treasurer |

Atlanta,

Georgia

February 27, 2013

31

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM ON INTERNAL CONTROL OVER FINANCIAL REPORTING

Board

of Directors and Shareholders

Rollins, Inc.

We have audited the internal control over financial reporting of Rollins, Inc. (a Delaware corporation) and subsidiaries (the "Company") as of December 31, 2012, based on criteria established in Internal Control—Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO). The Company's management is responsible for maintaining effective internal control over financial reporting and for its assessment of the effectiveness of internal control over financial reporting, included in the accompanying Management's Report on Internal Controls over Financial Reporting. Our responsibility is to express an opinion on the Company's internal control over financial reporting based on our audit.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether effective internal control over financial reporting was maintained in all material respects. Our audit included obtaining an understanding of internal control over financial reporting, assessing the risk that a material weakness exists, testing and evaluating the design and operating effectiveness of internal control based on the assessed risk, and performing such other procedures as we considered necessary in the circumstances. We believe that our audit provides a reasonable basis for our opinion.