0000084748DEF 14Afalse00000847482022-01-012022-12-31iso4217:USD00000847482021-01-012021-12-3100000847482020-01-012020-12-31000008474812022-01-012022-12-310000084748rog:ChangeInAccumulatedBenefitsUnderDefinedBenefitAndActuarialPensionPlansMemberecd:PeoMember2022-01-012022-12-310000084748rog:PlusServiceCostsUnderDefinedBenefitAndActuarialPensionPlanMemberecd:PeoMember2022-01-012022-12-310000084748rog:GrantDateFairValueOfStockAwardsGrantedInFiscalYearMemberecd:PeoMember2022-01-012022-12-310000084748ecd:PeoMemberrog:FairValueAtFiscalYearEndOfOutstandingAndUnvestedStockAwardsGrantedInFiscalYearMember2022-01-012022-12-310000084748ecd:PeoMemberrog:ChangeInFairValueOfOutstandingAndUnvestedStockAwardsGrantedInPriorFiscalMember2022-01-012022-12-310000084748ecd:PeoMemberrog:FairValueAtVestingOfStockAwardsGrantedInFiscalYearThatVestedDuringFiscalYearMember2022-01-012022-12-310000084748rog:ChangeInFairValueAsOfVestingDateOfStockAwardsGrantedInPriorYearsForWhichApplicableVestingConditionsWereSatisfiedDuringFiscalMemberecd:PeoMember2022-01-012022-12-310000084748rog:FairValueAsOfPriorFiscalYearEndOfStockAwardsGrantedInPriorFiscalYearsThatFailedToMeetApplicableVestingConditionsDuringFiscalMemberecd:PeoMember2022-01-012022-12-310000084748rog:ChangeInAccumulatedBenefitsUnderDefinedBenefitAndActuarialPensionPlansMemberecd:PeoMember2021-01-012021-12-310000084748rog:PlusServiceCostsUnderDefinedBenefitAndActuarialPensionPlanMemberecd:PeoMember2021-01-012021-12-310000084748rog:GrantDateFairValueOfStockAwardsGrantedInFiscalYearMemberecd:PeoMember2021-01-012021-12-310000084748ecd:PeoMemberrog:FairValueAtFiscalYearEndOfOutstandingAndUnvestedStockAwardsGrantedInFiscalYearMember2021-01-012021-12-310000084748ecd:PeoMemberrog:ChangeInFairValueOfOutstandingAndUnvestedStockAwardsGrantedInPriorFiscalMember2021-01-012021-12-310000084748ecd:PeoMemberrog:FairValueAtVestingOfStockAwardsGrantedInFiscalYearThatVestedDuringFiscalYearMember2021-01-012021-12-310000084748rog:ChangeInFairValueAsOfVestingDateOfStockAwardsGrantedInPriorYearsForWhichApplicableVestingConditionsWereSatisfiedDuringFiscalMemberecd:PeoMember2021-01-012021-12-310000084748rog:FairValueAsOfPriorFiscalYearEndOfStockAwardsGrantedInPriorFiscalYearsThatFailedToMeetApplicableVestingConditionsDuringFiscalMemberecd:PeoMember2021-01-012021-12-310000084748rog:ChangeInAccumulatedBenefitsUnderDefinedBenefitAndActuarialPensionPlansMemberecd:PeoMember2020-01-012020-12-310000084748rog:PlusServiceCostsUnderDefinedBenefitAndActuarialPensionPlanMemberecd:PeoMember2020-01-012020-12-310000084748rog:GrantDateFairValueOfStockAwardsGrantedInFiscalYearMemberecd:PeoMember2020-01-012020-12-310000084748ecd:PeoMemberrog:FairValueAtFiscalYearEndOfOutstandingAndUnvestedStockAwardsGrantedInFiscalYearMember2020-01-012020-12-310000084748ecd:PeoMemberrog:ChangeInFairValueOfOutstandingAndUnvestedStockAwardsGrantedInPriorFiscalMember2020-01-012020-12-310000084748ecd:PeoMemberrog:FairValueAtVestingOfStockAwardsGrantedInFiscalYearThatVestedDuringFiscalYearMember2020-01-012020-12-310000084748rog:ChangeInFairValueAsOfVestingDateOfStockAwardsGrantedInPriorYearsForWhichApplicableVestingConditionsWereSatisfiedDuringFiscalMemberecd:PeoMember2020-01-012020-12-310000084748rog:FairValueAsOfPriorFiscalYearEndOfStockAwardsGrantedInPriorFiscalYearsThatFailedToMeetApplicableVestingConditionsDuringFiscalMemberecd:PeoMember2020-01-012020-12-310000084748ecd:NonPeoNeoMemberrog:ChangeInAccumulatedBenefitsUnderDefinedBenefitAndActuarialPensionPlansMember2022-01-012022-12-310000084748ecd:NonPeoNeoMemberrog:PlusServiceCostsUnderDefinedBenefitAndActuarialPensionPlanMember2022-01-012022-12-310000084748ecd:NonPeoNeoMemberrog:GrantDateFairValueOfStockAwardsGrantedInFiscalYearMember2022-01-012022-12-310000084748ecd:NonPeoNeoMemberrog:FairValueAtFiscalYearEndOfOutstandingAndUnvestedStockAwardsGrantedInFiscalYearMember2022-01-012022-12-310000084748ecd:NonPeoNeoMemberrog:ChangeInFairValueOfOutstandingAndUnvestedStockAwardsGrantedInPriorFiscalMember2022-01-012022-12-310000084748ecd:NonPeoNeoMemberrog:FairValueAtVestingOfStockAwardsGrantedInFiscalYearThatVestedDuringFiscalYearMember2022-01-012022-12-310000084748ecd:NonPeoNeoMemberrog:ChangeInFairValueAsOfVestingDateOfStockAwardsGrantedInPriorYearsForWhichApplicableVestingConditionsWereSatisfiedDuringFiscalMember2022-01-012022-12-310000084748ecd:NonPeoNeoMemberrog:FairValueAsOfPriorFiscalYearEndOfStockAwardsGrantedInPriorFiscalYearsThatFailedToMeetApplicableVestingConditionsDuringFiscalMember2022-01-012022-12-310000084748ecd:NonPeoNeoMemberrog:ChangeInAccumulatedBenefitsUnderDefinedBenefitAndActuarialPensionPlansMember2021-01-012021-12-310000084748ecd:NonPeoNeoMemberrog:PlusServiceCostsUnderDefinedBenefitAndActuarialPensionPlanMember2021-01-012021-12-310000084748ecd:NonPeoNeoMemberrog:GrantDateFairValueOfStockAwardsGrantedInFiscalYearMember2021-01-012021-12-310000084748ecd:NonPeoNeoMemberrog:FairValueAtFiscalYearEndOfOutstandingAndUnvestedStockAwardsGrantedInFiscalYearMember2021-01-012021-12-310000084748ecd:NonPeoNeoMemberrog:ChangeInFairValueOfOutstandingAndUnvestedStockAwardsGrantedInPriorFiscalMember2021-01-012021-12-310000084748ecd:NonPeoNeoMemberrog:FairValueAtVestingOfStockAwardsGrantedInFiscalYearThatVestedDuringFiscalYearMember2021-01-012021-12-310000084748ecd:NonPeoNeoMemberrog:ChangeInFairValueAsOfVestingDateOfStockAwardsGrantedInPriorYearsForWhichApplicableVestingConditionsWereSatisfiedDuringFiscalMember2021-01-012021-12-310000084748ecd:NonPeoNeoMemberrog:FairValueAsOfPriorFiscalYearEndOfStockAwardsGrantedInPriorFiscalYearsThatFailedToMeetApplicableVestingConditionsDuringFiscalMember2021-01-012021-12-310000084748ecd:NonPeoNeoMemberrog:ChangeInAccumulatedBenefitsUnderDefinedBenefitAndActuarialPensionPlansMember2020-01-012020-12-310000084748ecd:NonPeoNeoMemberrog:PlusServiceCostsUnderDefinedBenefitAndActuarialPensionPlanMember2020-01-012020-12-310000084748ecd:NonPeoNeoMemberrog:GrantDateFairValueOfStockAwardsGrantedInFiscalYearMember2020-01-012020-12-310000084748ecd:NonPeoNeoMemberrog:FairValueAtFiscalYearEndOfOutstandingAndUnvestedStockAwardsGrantedInFiscalYearMember2020-01-012020-12-310000084748ecd:NonPeoNeoMemberrog:ChangeInFairValueOfOutstandingAndUnvestedStockAwardsGrantedInPriorFiscalMember2020-01-012020-12-310000084748ecd:NonPeoNeoMemberrog:FairValueAtVestingOfStockAwardsGrantedInFiscalYearThatVestedDuringFiscalYearMember2020-01-012020-12-310000084748ecd:NonPeoNeoMemberrog:ChangeInFairValueAsOfVestingDateOfStockAwardsGrantedInPriorYearsForWhichApplicableVestingConditionsWereSatisfiedDuringFiscalMember2020-01-012020-12-310000084748ecd:NonPeoNeoMemberrog:FairValueAsOfPriorFiscalYearEndOfStockAwardsGrantedInPriorFiscalYearsThatFailedToMeetApplicableVestingConditionsDuringFiscalMember2020-01-012020-12-31000008474822022-01-012022-12-31000008474832022-01-012022-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant o

Check the appropriate box:

| | | | | |

| o | Preliminary Proxy Statement |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material under §240.14a-12 |

ROGERS CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | | | | | |

| x | No fee required. |

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| | |

| (2) | Aggregate number of securities to which transaction applies: |

| | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| (4) | Proposed maximum aggregate value of transaction: |

| | |

| (5) | Total fee paid: |

| | |

o | Fee paid previously with preliminary materials. |

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| | |

| (2) | Form, Schedule or Registration Statement No.: |

| | |

| (3) | Filing Party: |

| | |

| (4) | Date Filed: |

| | |

2023 Proxy Statement

Annual Meeting of Shareholders

to be held on May 4, 2023 Rogers Corporation

Rogers Corporation

Notice of 2023 Annual Meeting of Shareholders

| | | | | |

Date: | May 4, 2023 |

| |

Time: | 8:30 a.m., Local Time |

| |

Location: | In person at Rogers’ Global Headquarters, located at 2225 W. Chandler Blvd., Chandler, Arizona 85224; and virtually via webcast at: www.virtualshareholdermeeting.com/ROG2023 |

| |

Record date: | March 3, 2023. Only shareholders of record at the close of business on the record date are entitled to receive notice of, and to vote at, the Annual Meeting. |

| |

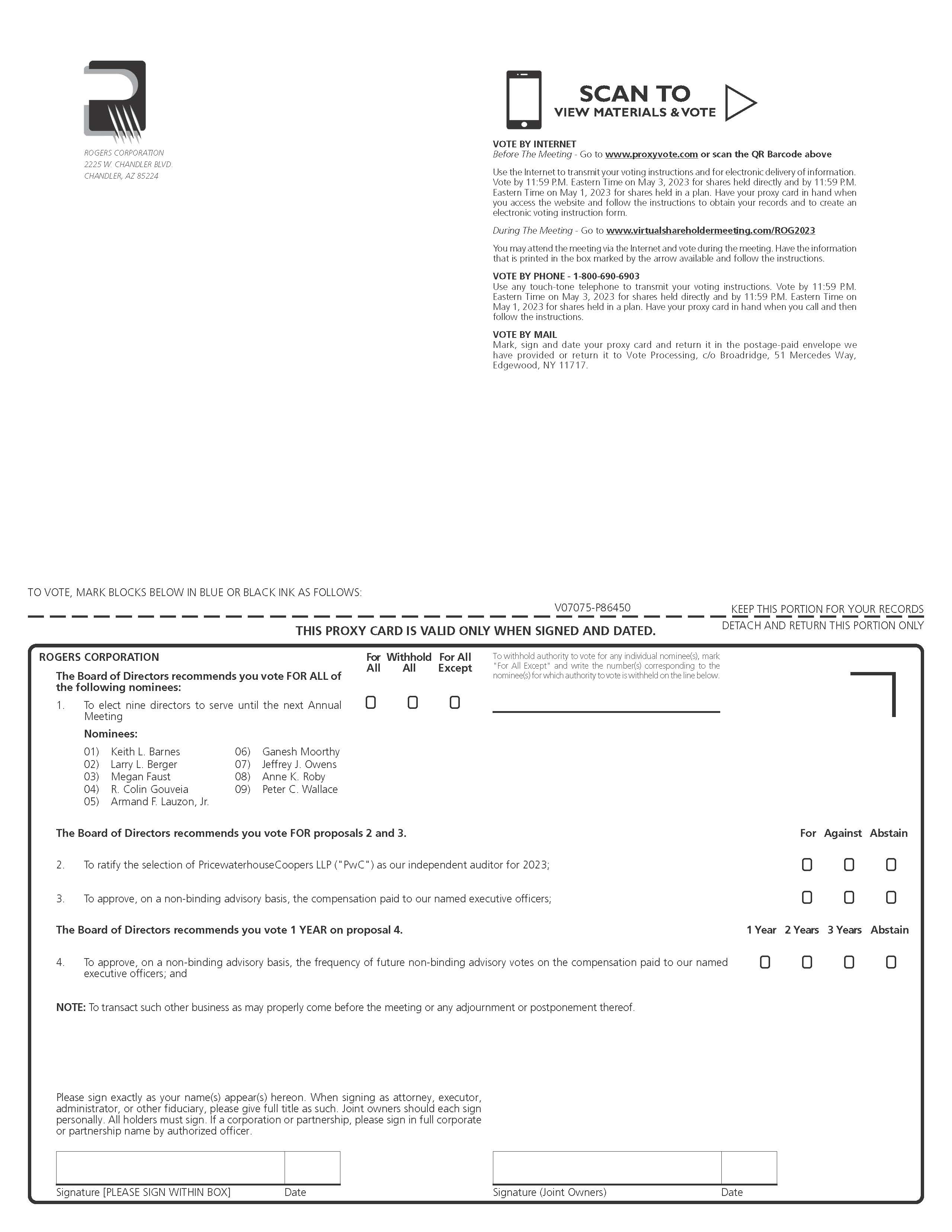

Items of business: | •To elect nine directors to serve until the next annual meeting; |

| •To ratify the selection of PricewaterhouseCoopers LLP ("PwC") as our independent auditor for 2023; |

| •To approve, on a non-binding advisory basis, the compensation paid to our named executive officers; |

| •To approve, on a non-binding advisory basis, the frequency of future non-binding advisory votes on the compensation paid to our named executive officers; and |

| •To transact such other business as may properly come before the meeting or any adjournment or postponement thereof. |

All shareholders as of the Record Date and properly appointed proxy holders may attend the 2023 Annual Meeting of Shareholders (the “Annual Meeting”) over the Internet at www.virtualshareholdermeeting.com/ROG2023 or in person at Rogers’ Global Headquarters, 2225 W. Chandler Blvd., Chandler, Arizona 85224. Shareholders who plan to attend virtually must have access to the control number we have provided to you to join the Annual Meeting. Instructions on how to attend and participate via the Internet, including how to demonstrate proof of stock ownership, are posted at https://materials.proxyvote.com/775133. Shareholders of record will be verified against an official list available electronically at the Annual Meeting. Rogers Corporation (the “Company”) reserves the right to deny admittance to anyone who cannot adequately show proof of share ownership as of the Record Date (or demonstrate that the person holds a valid proxy from a shareholder as of the Record Date).

Your vote is important. Regardless of whether you plan to attend the meeting, please promptly vote electronically over the Internet or by telephone or by returning your completed proxy card in the pre-addressed, postage-paid return envelope (which will be provided to those shareholders who request to receive paper copies of these materials by mail) or, if your shares are held in a street name, by returning your completed voting instruction card to your broker. If, for any reason, you desire to revoke or change your proxy, you may do so at any time before it is exercised. The proxy is solicited by the Board of Directors of Rogers Corporation.

By order of the Board of Directors:

Robert J. McCard

Interim General Counsel & Corporate Secretary

2225 W. Chandler Blvd.

Chandler, AZ 85224

March 24, 2023

This proxy statement and form of proxy were first sent to security holders on March 24, 2023.

This proxy statement and our 2022 Form 10-K for the fiscal year ended December 31, 2022, as filed with the SEC, are available at https://materials.proxyvote.com/775133

Proxy Summary

This summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all of the information you should consider, and you should read the entire Proxy Statement carefully before voting.

Annual Meeting of Shareholders

| | | | | |

Date: | May 4, 2023 |

| |

Time: | 8:30 a.m., Local Time |

| |

Location: | In person at Rogers’ Global Headquarters, located at 2225 W. Chandler Blvd., Chandler, Arizona 85224; and virtually via webcast at: www.virtualshareholdermeeting.com/ROG2023 |

| |

Record date: | March 3, 2023 |

| |

Voting: | Shareholders as of the record date are entitled to vote. Each share of common stock is entitled to one vote for each director nominee and one vote for each of the proposals to be voted on. |

Meeting agenda:

•Election of nine directors

•Ratification of PwC as our independent auditor for 2023

•Advisory vote on named executive officer compensation

•Advisory vote on the frequency of future advisory votes on named executive officer compensation

•To transact such other business as may properly come before the meeting or any adjournment or postponement thereof

Voting Matters and Vote Recommendation

| | | | | | | | |

| Matter | Board vote recommendation | Page Reference |

| Election of directors | FOR each director nominee | Page 8-9 |

| Ratification of PwC as our independent auditor for 2023 | FOR | Page 14-15 |

| Advisory vote on named executive officer compensation | FOR | Page 16 |

| Advisory vote on the frequency of future advisory votes on named executive officer compensation | FOR | Page 17 |

Our Director Nominees

The following table provides summary information about each director nominee. Each director is elected annually by the affirmative vote of the holders of a plurality of the votes cast.

| | | | | | | | | | | | | | | | | |

| Name | Age | Director Since(1) | Principal Occupation | Directorships | Independence |

| Keith L. Barnes | 71 | 2015 | Retired Chairman and CEO of Verigy Pte Ltd. | Knowles Corporation; Viavi Solutions Inc. | ü |

| Larry L. Berger | 62 | | Executive Vice President and CTO of Ecolab, Inc. | | ü |

| Megan Faust | 49 | 2020 | Executive Vice President and CFO of Amkor Technology, Inc. | | ü |

| R. Colin Gouveia | 59 | 2023 | President and CEO of Rogers Corporation | | |

| Armand F. Lauzon, Jr. | 66 | 2023 | Retired President, CEO and director of C&D Technologies, Inc. | Zekelman Industries Inc.; Northwest Hardwoods Inc. | ü |

| Ganesh Moorthy | 63 | 2013 | CEO and President of Microchip Technology Incorporated | Microchip Technology Incorporated | ü |

| Jeffrey J. Owens | 68 | 2017 | Retired EVP and CTO of Delphi Automotive PLC | indie Semiconductor | ü |

| Anne K. Roby | 58 | 2023 | Retired Executive Vice President of Linde plc. | Nuvance Health Network | ü |

| Peter C. Wallace | 68 | 2010 | Retired CEO of Gardner Denver Inc. | Curtiss-Wright Corporation; Applied Industrial Technologies, Inc. | ü |

(1) As previously disclosed on the Current Report on Form 8-K dated March 15, 2023, the Company nominated Mr. Berger on March 14 for election to the Board for a term commencing immediately after the conclusion of the 2023 Annual Meeting.

Principal Accountant Fees and Services

As a matter of good corporate governance, we ask that our shareholders ratify the selection of PwC as our independent auditor for 2023. Set forth below is summary information with respect to 2022 auditor fees paid to PwC.

| | | | | |

| 2022 |

| Audit Fees | $2,835,500 | |

| Audit Related Fees | $10,150 | |

| Tax Fees | $52,375 | |

| All Other Fees | $7,900 | |

| Total Fees | $2,905,925 | |

Executive Compensation

We ask that our shareholders annually approve on an advisory basis our named executive officer (“NEO”) compensation. Our Board of Directors (the “Board”) recommends a FOR vote because it believes that our compensation policies and practices are effective in achieving the Company’s goals of rewarding sustained financial and operating performance and leadership excellence, aligning the executives’ long-term interest with those of our shareholders and motivating our executives to remain with the Company for long and productive careers. At our most recent regularly held annual meeting, over 99% of the votes cast by our shareholders approved our executive compensation.

The Board recommends a vote for ONE YEAR on the frequency of future advisory votes to approve the compensation of our NEOs. The Board believes that annual advisory votes to approve the compensation of our NEOs will continue to be an effective way to gather frequent and timely feedback from shareholders on our executive compensation philosophy and policies. Receiving feedback from shareholders on our executive compensation philosophy, policies and procedures is important to us, and we believe that an annual vote on NEO compensation is a meaningful way, together with our other forms of shareholder engagement, to hear from shareholders on this issue.

Corporate Governance Highlights

We believe that our commitment to good corporate governance is illustrated by the following practices (see page 10 for additional information):

| | | | | | | | | | | |

| ü | Strong corporate governance guidelines/policies | ü | Board oversight of succession planning |

| ü | Diversity of board skills and experience | ü | All directors stand for election annually |

| ü | Board independence (8 of 9 directors) | ü | Board access to management |

| ü | Annual Board/Committee self-evaluations | ü | Director training and education |

| ü | Separate CEO and Independent Board Chair | ü | Retirement policy for directors |

| ü | Annual board review of Strategic plan | ü | Six Audit Committee Financial Experts |

| ü | Majority vote policy for uncontested elections with accompanying resignation policy | ü | 98% Director attendance at meetings |

| ü | Board and committee oversight of ESG | ü | 40% of directors are gender or ethnically diverse |

Proxy Statement Table of Contents

Proposal 1 - Election of Directors

The first proposal to be voted on at the Annual Meeting will be the election of nine director nominees. If elected, each director will serve until the next annual meeting of shareholders and thereafter until their successors are chosen and qualified. The Board has been advised that each nominee will serve if elected. All of the nominees, with the exception of Mr. Berger, are currently directors of Rogers and all directors, with the exception of Mr. Gouveia, Mr. Lauzon and Dr. Roby, were elected to their present term at the 2021 Annual Meeting of Shareholders. Rogers did not hold an annual meeting of shareholders in 2022 due to the then-pending merger with DuPont de Nemours, Inc. (“DuPont”). Mr. Gouveia was appointed to the Board in January 2023 in connection with his appointment as President and Chief Executive Officer (“CEO”) of Rogers. Mr. Lauzon and Dr. Roby were appointed to the Board in February 2023 in connection with the Company’s entry into a settlement agreement (the “Starboard Agreement”) with Starboard Value LP (Starboard”). As previously disclosed, on February 26, 2023, the Company entered into the Starboard Agreement, pursuant to which Starboard agreed to withdraw its shareholder nomination of six director candidates and the Company agreed to, among other things, appoint Mr. Lauzon and Dr. Roby to the Board as new independent directors. Effective as of that date, Mr. Lauzon was appointed to the Audit Committee and the Compensation & Organization Committee, and Dr. Roby was appointed to the Audit Committee and the Nominating, Governance & Sustainability Committee. Additional detail regarding the Starboard Agreement can be found in the Company’s Current Report on Form 8-K as filed with the SEC on February 27, 2023. As previously disclosed on the Current Report on Form 8-K dated March 15, 2023, the Company nominated Mr. Berger on March 14 for election to the Board for a term commencing immediately after the conclusion of the 2023 Annual Meeting.

Vote Required

To be elected, each director requires the affirmative vote of the holders of a plurality of the votes cast. This means that the nominees who receive the highest number of affirmative votes cast will be elected irrespective of how small the number of affirmative votes is in comparison to the total number of shares voted. Our Board, however, has adopted a majority vote policy, under which any director nominee in an uncontested election who receives a greater number of votes “withheld” for his or her election than votes “for” such election must submit his or her resignation for consideration by our Nominating, Governance & Sustainability Committee and our Board. Abstentions and “broker non-votes” do not constitute votes properly cast favoring or opposing director elections and, accordingly, will not have any effect on the outcome of this vote.

OUR BOARD RECOMMENDS A VOTE “FOR” THE ELECTION OF EACH OF THE DIRECTOR NOMINEES LISTED BELOW.

Nominees for Director: Qualifications and Experience

The biographical information below identifies the primary experience, qualifications, attributes and skills of the nine nominees for director at our Annual Meeting. We believe each director is knowledgeable in these areas and also possesses numerous skills and competencies that are valuable to the governance and oversight responsibilities of the Board and its committees.

Our Board Recommends a Vote “FOR” Each of the Following Nominees:

| | | | | |

| Name, Age as of March 3, 2023, and Positions with the Company | Principal Occupation, Business Experience, Directorships and Qualifications |

Keith L. Barnes Age 71 Director since 2015 Compensation & Organization Committee - Chair Nominating, Governance & Sustainability Committee | Keith Barnes served as Chairman and CEO of Verigy Pte Ltd. from 2006 until his retirement in 2011. Previously, Mr. Barnes was Chairman and CEO of Electroglas, Inc. (2003 – 2006) and Chairman and CEO of Integrated Measurement Systems (1995 – 2001). Mr. Barnes has also been a director of Knowles Corporation since 2014 and Viavi Solutions Inc. since 2011. Director Qualifications: Mr. Barnes brings to the Board experience as a chief executive of global technology manufacturing companies, as well as experience in corporate governance. |

Larry L. Berger Age 62 | Larry L. Berger has served as Chief Technical Officer of food safety and water treatment company Ecolab (NYSE: ECL) since 2008, and as Executive Vice President of Ecolab since 2011. Prior to joining Ecolab, Mr. Berger served in a variety of research, management and leadership roles at DuPont de Nemours, Inc. (NYSE: DD) from 1986 through 2008, most recently as CTO of DuPont Nonwovens, which makes fabrics for durable clothing.

Director Qualifications: Mr. Berger brings to the Board more than three decades of experience as a senior executive in the chemical industries. |

Megan Faust Age 49 Director since 2020 Audit Committee Compensation & Organization Committee | Megan Faust is currently Executive Vice President and CFO of Amkor Technology, Inc., a leading provider of outsourced semiconductor packaging and test services. She joined Amkor in 2005 and became CFO in 2016, after serving six years as its Corporate Controller. Before that, Ms. Faust served as an auditor with KPMG LLP for 10 years. Director Qualifications: Ms. Faust brings to the Board experience as an active senior finance executive in a global technology manufacturing company. |

| | | | | |

R. Colin Gouveia Age 59 Director since 2023 President and Chief Executive Officer | Colin Gouveia has served as Rogers’ President and CEO since January 2023. Mr. Gouveia previously served as Senior Vice President and General Manager of Rogers’ Elastomeric Material Solutions (EMS) business unit since June 2019. Prior to joining Rogers in June 2019, Mr. Gouveia served as Vice President and General Manager of Eastman Chemical’s global Chemical Intermediates business unit from December 2014. Mr. Gouveia has also held global leadership positions with Dow Chemical Company, The Rohm and Haas Company and Imperial Chemical Industries (ICI). Mr. Gouveia served as an officer in the U.S. Army for five years. Director Qualifications: In addition to his perspectives as the CEO of Rogers, Mr. Gouveia brings to the Board more than three decades of cross-functional experience in the specialty chemical and materials manufacturing industries. |

Armand F. Lauzon, Jr. Age 66 Director since 2023 Audit Committee Compensation & Organization Committee | Armand Lauzon served as President, Chief Executive Officer and as a director of C&D Technologies, Inc., a power conversion systems and electrical power storage company, from March 2015 to January 2020. Prior to that, Mr. Lauzon served as a chief executive officer and board member for three portfolio companies of The Carlyle Group Inc., a private equity firm, from 2002 to 2014. Earlier in his career, Mr. Lauzon served as President of Wyman Gordon, a subsidiary of Precision Castparts Corporation, which was acquired by Berkshire Hathaway Inc., from 1999 to 2002. He began his career in a variety of operations positions in the Aircraft Engine Division of General Electric Company, from 1979 to 1985. Mr. Lauzon currently serves on the board of directors of Zekelman Industries Inc., since 2005, and Northwest Hardwoods Inc., since 2021. He previously served on the board of directors of GCP Applied Technologies Inc., from May 2020 until its acquisition by Compagnie de Saint-Gobain S.A. in September 2022.

Director Qualifications: Mr. Lauzon brings to the Board experience as a chief executive and senior executive of manufacturing and energy companies. |

Ganesh Moorthy Age 63 Director since 2013 Audit Committee Nominating, Governance & Sustainability Committee - Chair | Ganesh Moorthy is currently President and CEO, and a member of the Board of Directors, of Microchip Technology Incorporated, a leading manufacturer of smart, connected and secure embedded control solutions. Before his appointment as Microchip’s President and CEO in 2021, Mr. Moorthy served as Microchip’s President and COO (2016 – 2021), COO (2009 – 2016), Executive Vice President (2006 – 2009) and Vice President of several Microchip divisions (2001 – 2006). Director Qualifications: Mr. Moorthy brings to the Board experience as an active senior executive in a global technology manufacturing company, with particular experience in manufacturing and innovation. |

Jeffrey J. Owens Age 68 Director since 2017 Audit Committee Compensation & Organization Committee | Jeffrey Owens served as Executive Vice President and CTO of Delphi Automotive PLC until his retirement in 2017. During his over 40-year career at Delphi, Mr. Owens served in a variety of technology, engineering and operating leadership roles, including as President of Delphi’s Electronics and Safety Division and as President of Delphi Asia Pacific. Mr. Owens served as a director of Cypress Semiconductor Corporation from 2017 until 2020. Mr. Owens currently serves as a director on the board of indie Semiconductor. Director Qualifications: Mr. Owens brings to the Board experience as a chief technology executive of a global manufacturing company, with particular experience in technology operations and innovation. |

Anne K. Roby Age 58 Director since 2023 Audit Committee Nominating, Governance & Sustainability Committee | Anne Roby served as Executive Vice President at Linde plc. until her retirement in 2020. She was a member of Linde’s executive leadership team subsequent to Linde AG’s merger with Praxair and was responsible for global technology, market development, operational excellence, digitalization, procurement, strategic sales, sustainability, and safety, health & environment, as well as the Praxair Surface Technologies, Electronic Materials and Helium/Rare Gases businesses. Previously, she oversaw Praxair’s engineering, product line development, and project execution. Dr. Roby currently serves on the Board of Trustees for Villanova University. She is also the Chair of the Board for Nuvance Health Network and previously served on the Board of CMC Materials, Inc. Dr. Roby holds four patents for industrial gas applications.

Director Qualifications: Dr. Roby brings to the Board experience as a senior executive in global technology and operations. |

Peter C. Wallace Age 68 Director since 2010 Board Chair Compensation & Organization Committee Nominating, Governance & Sustainability Committee | Peter Wallace served as CEO and a director of Gardner Denver Inc. from 2013 until his retirement in 2016. Previously, Mr. Wallace served as President and CEO and a director of Robbins & Myers, Inc. (2004 – 2013) and President and CEO of IMI Norgren Group (2001 – 2004). Mr. Wallace has also been a director of Curtiss-Wright Corporation since 2016 and a director of Applied Industrial Technologies, Inc. since 2005 (Chairman of the Board since 2014). Director Qualifications: Mr. Wallace brings to the Board experience as a chief executive of global manufacturing companies, as well as experience in corporate governance. |

Other than pursuant to the Starboard Agreement as discussed above, none of the nominees for director are subject to any arrangement pursuant to which directors will be elected, nor are there any family relationships between any directors and any of the Company’s executive officers. To the best of our knowledge, there are no pending material legal proceedings in which any of our directors or nominees for director, or any of their associates, is a party adverse to us or any of our affiliates, or in which the persons have a material interest adverse to us or any of our affiliates. Additionally, to the best of our knowledge, there have been no events under any bankruptcy act, no criminal proceedings and no adverse findings or orders, judgments, sanctions, or injunctions during the last 10 years that are material to the evaluation of the ability or integrity of any of our directors or nominees for director.

Our Corporate Governance

The Board has adopted Corporate Governance Guidelines, provisions of our bylaws and other formal policies that establish a framework for our corporate governance practices. In addition to practices described below, our corporate governance practices include the following:

| | | | | | | | | | | |

| ü | Strong corporate governance guidelines/policies | ü | Board and committee oversight of ESG and sustainability |

| ü | Board independence (8 of 9 directors) | ü | Stock ownership guidelines |

| ü | All directors stand for election annually | ü | Annual Board/Committee self-evaluations |

| ü | Majority vote policy for uncontested elections with accompanying resignation policy | ü | Confidential company hotline for reporting legal and ethical violations |

| ü | Separate CEO and Independent Board Chair | ü | Retirement policy for directors |

| ü | Annual board review of company strategic plan | ü | Related party transaction policy |

| ü | Six Audit Committee Financial Experts | ü | No shareholder rights plan currently in place |

| ü | Regular executive sessions of independent directors | ü | No supermajority shareholder voting requirements in bylaws |

| ü | Diversity of board skills and experience | ü | No dual class structure |

| ü | Board ethnic/gender diversity | ü | Director training and education |

| ü | 98% Director attendance at meetings in 2022 | ü | Board oversight of succession planning |

| ü | Robust insider trading policy(1) | ü | Clawback policy |

(1)Our Insider Trading Policy includes provisions prohibiting directors and executive officers from engaging in (i) hedging transactions with respect to our securities, including the sale of covered calls and the use of collars, and (ii) purchasing or holding our securities in a margin account or pledging our securities as collateral for a loan.

Board Committees

Our Board has three standing committees: the Audit Committee, the Compensation & Organization Committee, and the Nominating, Governance & Sustainability Committee. Each of these committees is comprised solely of independent directors, with each of the three committees having a separate chair who participates in the development of committee agendas. Charters for the Audit, Compensation & Organization, and Nominating, Governance & Sustainability committees are available on our website, http://www.rogerscorp.com/investors/corporate-governance.

| | | | | | | | | | | |

| Current Directors | Audit Committee | Compensation & Organization

Committee | Nominating, Governance, & Sustainability

Committee |

| Keith L. Barnes | | Chair | • |

| Megan Faust | • | • |

|

| R. Colin Gouveia | |

| |

Bruce D. Hoechner(1) | |

| |

| Carol R. Jensen | • | | • |

| Keith Larson | • | | |

| Armand F. Lauzon, Jr. | • | • | |

| Ganesh Moorthy | • | | Chair |

| Jeffrey J. Owens | • | • | |

| Anne K. Roby | • | | • |

| Helene Simonet | Chair | • | |

| Peter C. Wallace |

| • | • |

| Number of Meetings in 2022 | 9 | 5 | 5 |

(1)As previously disclosed, Messrs. Hoechner and Larson and Mses. Jensen and Simonet are not standing for reelection as directors.

During 2022, the Board held 12 meetings, and the committees of the Board collectively held 15 meetings, for a total of 27 meetings. Each director serving during 2022 attended more than 75% of the aggregate meetings of the Board and the committees on which they served, with average attendance of 98% among directors. Our Corporate Governance Guidelines provide that all directors are expected to attend the Annual Meeting of Shareholders absent an unavoidable conflict. Rogers did not hold an annual meeting of shareholders in 2022 due to the then-pending merger with DuPont.

Committee Member Qualifications. Each of the members of our Audit, Compensation & Organization Committee, and the Nominating, Governance & Sustainability Committees are independent under New York Stock Exchange (“NYSE”) guidelines and “non-employee directors” for purposes of Rule 16b-3 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Board has determined that all of the Audit Committee members are financially literate in accordance with NYSE listing standards and that committee members Ms. Faust, Mr. Larson, Mr. Lauzon, Mr. Moorthy, and Ms. Simonet are “audit committee financial experts” in accordance with SEC regulations.

The Audit Committee’s authority and responsibilities include:

•oversight of the Company’s financial reporting function

•oversight of the Company’s internal audit function and internal controls

•selection, evaluation, and oversight of the Company’s independent auditor

•assessment and review of compliance, investigations and legal matters

The Compensation & Organization Committee’s authority and responsibilities include:

•review and evaluation of the Company’s compensation philosophy

•establishment of the compensation of our CEO and other executive officers

•oversight with respect to the Company’s equity incentive and stock-based plans and material employee benefit plans

•review of succession plans for the CEO and other senior leadership positions

The Nominating, Governance & Sustainability Committee’s authority and responsibilities include:

•developing and recommending to the Board criteria for board and committee membership

•evaluating and presenting to the Board its determinations with respect to director independence and satisfaction of other regulatory requirements

•overseeing Rogers’ corporate governance policies and practices

•developing and recommending to the Board an annual Board and committee evaluation process

•overseeing our compliance with legal and regulatory requirements

•overseeing director orientation and training programs

•overseeing the company's engagement with ESG considerations, including in its overall business strategy

•leading the search for board members and identifying potential directors

Board Structure and Board Chair. In February 2021, the Board replaced its Lead Director role with a Board Chair to better align with best governance practices. Our Board Chair is Peter C. Wallace. The role of Board Chair, unlike the previous role of Lead Director, is defined under the Company’s Bylaws, and the responsibilities of the two roles are intended to be consistent, except that, under the Company's Bylaws, the Board Chair presides over Board and shareholder meetings. Additional duties of the Board Chair include:

•calling meetings of independent directors

•presiding at executive sessions of non-management directors

•providing feedback to the CEO

•reviewing board agendas

•serving as the principal point of contact for shareholders who wish to communicate with the Board

Meetings of Non-Management Directors. Our non-management directors (all of whom the Board has determined to be independent) hold executive sessions without management present as frequently as they deem appropriate, and generally such an executive session is held at each in-person, regularly scheduled board meeting. Non-management directors may hold executive sessions as determined by the Board Chair.

Appropriateness of Leadership Structure. We believe that this leadership structure works well for the Company. This structure creates an environment in which there are candid disclosures by management about the Company’s performance and a culture in which directors can regularly engage management and each other in active and meaningful discussions about various corporate matters. As reflected by the recent appointment of an independent Board Chair, the Board periodically reviews its leadership structure and developments in corporate governance to ensure that this approach continues to strike the appropriate balance for the Company and our shareholders.

Director Independence. The Board, in compliance with NYSE listing standards, determines annually whether each of its directors is independent based on the absence of any direct or indirect material relationship between the Company and the director. To evaluate the materiality of any such relationship, the Board has adopted categorical independence standards consistent with the NYSE listing standards. In addition, the Board has adopted the following categorical standards, contained in the Rogers Corporation Corporate Governance Guidelines, which identify certain relationships deemed by the Board to be immaterial provided that they satisfy the criteria below:

•if a Rogers director receives direct or indirect annual compensation or other benefits (other than board and committee fees) from Rogers, the amount of such compensation must not exceed $30,000. This immateriality standard is not applicable to Audit Committee members, who may not accept any consulting, advisory or other compensatory fee from Rogers;

•if a Rogers director is an executive officer of another company that does business with Rogers, that company’s annual sales to, or purchases from, Rogers must be less than 1% of the revenues of that company;

•if a Rogers director is an executive officer of another company which is indebted to Rogers, or to which Rogers is indebted, the total amount of either company’s indebtedness to the other must be less than 1% of the total consolidated assets of the company for which he or she serves as an executive officer; and

•if a Rogers director serves as an officer, director or trustee of a charitable organization, Rogers’ discretionary charitable contributions to the organization must be less than 1% of that organization’s total annual charitable receipts (Rogers’ matching of employee charitable contributions will not be included in the calculation of the amount of Rogers’ contributions for this purpose).

The Board has determined that all of the nominees standing for election, other than Mr. Gouveia, due to his position as President and Chief Executive Officer, satisfy these independence standards and do not have any direct or indirect material relationship with Rogers.

Compensation & Organization Committee Interlocks and Insider Participation. None of the Compensation & Organization Committee members (Keith L. Barnes, Megan Faust, Armand F. Lauzon, Jr., Jeffrey J. Owens, Helene Simonet, or Peter C. Wallace):

•Has ever been an officer or employee of the Company;

•Is or has been a participant in a related party transaction with the Company (see “Corporate Governance - Related Party Transactions” for a description of our policy on related party transactions); or

•Has any other interlocking relationships requiring disclosure under applicable SEC rules.

Board Diversity. The Nominating, Governance & Sustainability Committee does not have a formal policy with respect to diversity in identifying or selecting nominees for Rogers’ Board, but in evaluating nominees, the committee assesses the background of each candidate in several different ways, including how the individual’s qualifications complement, strengthen and enhance those of existing board members as well as the future needs of the Board. Currently, our Board includes three female members and one ethnically diverse member.

ESG Oversight. Our Board takes into account a range of ESG considerations in connection with its oversight of Company strategy. In support of the Board’s ESG oversight, our Board has delegated oversight of our ESG practices and reporting to our Nominating, Governance & Sustainability Committee. The committee’s responsibilities include reviewing and discussing with management the company’s:

•implementation of procedures for identifying, assessing, monitoring and managing ESG and sustainability risks related to the company's business

•integration of ESG and sustainability policies, practices and goals into its business strategy and decision making

•voluntary ESG and sustainability reporting

During 2022, the Board and Nominating, Governance & Sustainability Committee engaged with management on a variety of ESG topics, including Rogers’ ESG Program structure and future ESG reporting plans.

Risk Management. The Board has an active role as a whole and at the committee level in overseeing management of the Company’s risks. The entire Board receives regular reports from management concerning areas of material risk to the Company, considers the Company’s general risk management strategy and evaluates risks to be taken by the Company based on the Company’s strategy and the current business environment. Although the Board as a whole is responsible for overseeing the Company’s risk management, each Board committee is responsible for evaluating the risks associated with its area of responsibility and making recommendations to the Board related to the management of those risks. While the Board oversees the Company’s risk management, the Company’s senior management is responsible for the day-to-day risk management processes. We believe this division of responsibilities is the most effective approach for addressing the risks facing our Company.

Insider Trading Policy. Our Insider Trading Policy includes provisions prohibiting directors and executive officers from engaging in hedging transactions with respect to our securities, including the sale of covered calls and the use of collars, and purchasing or holding our securities in a margin account or pledging our securities as collateral for a loan.

Location of Corporate Governance Documents. Our Bylaws, Corporate Governance Guidelines, Code of Business Ethics, Related Party Transactions Policy, Audit Committee Charter, Compensation & Organization Committee Charter, and Nominating, Governance & Sustainability Committee Charter are each available at http://www.rogerscorp.com/investors/corporate-governance. Rogers' website is not incorporated into or a part of this proxy statement.

Shareholder Director Nominations and Proposals for 2024. The Nominating, Governance & Sustainability Committee will consider director nominees recommended by shareholders. To be considered for inclusion in Rogers’ proxy statement and form of proxy in connection with the 2024 Annual Meeting of Shareholders, shareholder proposals submitted pursuant to Rule 14a-8 of the Exchange Act must be received by Rogers on or before November 25, 2023. These proposals must also meet other requirements of the rules of the SEC relating to shareholder proposals, the SEC’s proxy rules and the Exchange Act. Under the company’s bylaws, in order for a shareholder to present a proposal or directly nominate a director candidate at the 2024 Annual Meeting of Shareholders, Rogers must receive written notice no earlier than November 7, 2023, and no later than December 7, 2023, and the written notice must comply with the requirements of the Company’s bylaws, the SEC’s proxy rules, including Rule 14a-19, and the Exchange Act. All shareholder proposals or notices of an intention to nominate a director or present other business at the 2024 Annual Meeting of Shareholders should be marked for the attention of the Office of the Corporate Secretary, Rogers Corporation, 2225 W. Chandler Blvd., Chandler, AZ 85224.

Communications with Members of the Board. The Board has not formally adopted a process by which shareholders may communicate directly with directors because it believes the procedures currently in place continue to serve the needs of the Board and shareholders, any shareholder communications should be sent to the Board of Directors, Rogers Corporation, 2225 W. Chandler Blvd., Chandler, AZ 85224, c/o Office of the Corporate Secretary of the Company. At present, all such communications sent by shareholders to the above address are forwarded to the Board Chair for consideration.

Environmental, Social and Governance (ESG) Practices

Rogers has had a consistent, ongoing commitment to responsible corporate citizenship. We have a culture of respect built on the ethical foundation of our Code of Business Ethics and our commitment to “Results, but Results the Right Way.”

The Company and our people—globally and locally, through company-wide programs and individual initiatives—have pursued the highest standards of business ethics and stewardship as part of our business operations and strategy. Over the years, we have implemented numerous programs aligned with these goals, including regulatory compliance, employee development and support for our local communities. As a global technology leader in specialty engineered materials, we have placed particular emphasis on product responsibility and how our business contributes to the low-carbon economy.

In 2022, our oversight and implementation of ESG practices benefited from the following:

•ESG Governance: In 2021, the Nominating, Governance and Sustainability (NG&S) Committee of the Board continued to exercise its ESG oversight responsibilities by receiving regular updates from management on ESG topics, including refining Rogers' ESG Program structure, quantifying Rogers' sustainability enablement, establishing of environmental goals and metrics, obtaining stakeholder feedback from customers, shareholders, and employees, development of the ESG portion of Rogers' public-facing website, engaging ESG ratings agencies, and preparing an ESG Report for the following year. During 2022, the Board and the NG&S Committee engaged with management on a variety of ESG topics, including Rogers' ESG Program structure and future ESG reporting plans.

•ESG Reporting: Rogers did not release an ESG Report in 2022 due to the pending merger with DuPont de Nemours. Rogers’ 2023 ESG Report will be released in Q2 of 2023.

•COVID-19 Response: We responded to the pandemic with the health and safety of our employees as a first priority, as we continued to supply our customers with products, including for their critical infrastructure and health applications. We implemented additional hygienic and social distancing protocols in our manufacturing and administrative facilities. We also recognized our responsibility to provide greater support for our employees’ overall well-being for their particular circumstances and responded with benefit enhancements, including expanded work-from-home policies, incentive pay for essential employees and adjusted pay, sick time, vacation and dependent care policies allowing our employees more flexibility to address the particular care needs within their households.

•Diversity, Equity & Inclusion (DE&I): The DE&I Council, established in 2021, continues to oversee the progression of various initiatives in support of improving the maturity of our enterprise-wide DE&I practices. Some of these initiatives include the addition of new Employee Relation Groups (ERGs), supporting diverse hiring practices for our more senior positions, and the establishment of a set of baseline metrics against which we will measure ourselves. We plan to reassess ourselves in 2023 against the Global Diversity and Inclusion Benchmarks (GDIB) to gauge progress and identify additional focus areas for our DE&I activities.

As we move forward on our ESG journey, we intend to regularly evaluate our ESG program and prioritize topics with the intent to focus on the areas that are most important to our business and our stakeholders and where we can have the greatest impact.

More information regarding Rogers’ ESG initiatives can be found in Rogers’ 2021 and 2023 (to be released in Q2 of 2023) ESG reports located on our website at https://www.rogerscorp.com/. Rogers’ ESG reports are not incorporated into or a part of this proxy statement.

Proposal 2 - Ratification of the Selection of Our Independent Auditor

We are asking our shareholders to ratify the selection of PwC as our independent registered public accounting firm for 2023, even though it is not required by our bylaws or otherwise. If the selection is not ratified, the Audit Committee will consider whether it is appropriate to select another independent auditor. Even if the selection is ratified, the Audit Committee may select a different independent auditor at any time during the year if it determines that doing so would be in the best interests of Rogers and our shareholders. Rogers expects representatives of PwC to attend the Annual Meeting. They will have an opportunity to make a statement if they wish and will be available to respond to appropriate questions.

Vote Required

The affirmative vote of a majority of the votes properly cast on this proposal will constitute approval of the ratification of the appointment of PwC as Rogers’ independent registered public accounting firm for 2023. Abstentions will not have any effect on the outcome of the proposal. If shares are held in street name by a nominee, that nominee has discretionary authority to vote shares held through it in the absence of instructions regarding how such shares should be voted.

OUR BOARD RECOMMENDS A VOTE “FOR” RATIFICATION OF PWC AS OUR INDEPENDENT AUDITOR

AUDIT COMMITTEE REPORT

The Audit Committee oversees and monitors the Company’s financial reporting process and systems of internal accounting and financial controls on behalf of the Board of Directors. In fulfilling these responsibilities, the Audit Committee reviewed and discussed with management the audited financial statements included in the Annual Report on Form 10-K for the year ended December 31, 2022 (the “2022 Form 10-K”). The Audit Committee discussed with PwC, Rogers’ independent registered public accounting firm, the matters required to be discussed with the independent registered public accounting firm under generally accepted auditing standards, including Auditing Standard No. 1301. In addition, the Audit Committee has received the written disclosures and the letter from PwC required by the Public Company Accounting Oversight Board regarding PwC’s communications with the Audit Committee concerning independence, and has discussed its independence with PwC.

Based on the reviews and discussions referred to above, the Audit Committee recommended to the Board of Directors, and the Board approved, the inclusion of the audited financial statements in the 2022 Form 10-K for filing with the SEC.

The Audit Committee’s responsibility is one of oversight, and it recognizes that management is responsible for preparing the Company’s financial statements and that the Company’s independent registered public accounting firm is responsible for auditing those financial statements. Consequently, in carrying out its oversight responsibilities, the Audit Committee is not providing any expert or special assurance as to the Company’s financial statements or any professional certification as to the work of the Company’s independent registered public accounting firm. In giving its recommendation to the Board, the Audit Committee has relied on (i) management’s representation that such financial statements have been prepared with integrity and objectivity and in conformity with accounting principles generally accepted in the United States, and (ii) the report of the Company’s independent registered public accounting firm with respect to such financial statements.

The Audit Committee of the Board of Directors

| | | | | |

| Helene Simonet (Chair) | Megan Faust |

| Carol R. Jensen | Keith Larson |

| Ganesh Moorthy | Jeffrey J. Owens |

February 24, 2023

INDEPENDENT AUDITING FIRM FEES

PwC is our principal independent registered public accounting firm. We paid PwC the fees described below in 2022 and 2021, all of which services were approved by our Audit Committee:

| | | | | | | | |

| 2022 | 2021 |

Audit Fees(1) | $2,835,500 | | $3,078,500 | |

Audit Related Fees(2) | $10,150 | | $18,550 | |

Tax Fees(3) | $52,375 | | $63,803 | |

All Other Fees(4) | $7,900 | | $7,900 | |

| Total Fees | $2,905,925 | | $3,168,753 | |

(1)Audit fees consist of fees billed for professional services rendered for the audit of the Company's consolidated annual financial statements and review of the interim consolidated financial statements included in quarterly reports and services that are normally provided by the independent auditor in connection with statutory and regulatory filings or other services to comply with GAAS. Amounts also include fees for the required audit of the Company's internal control over financial reporting.

(2)Audit-related fees consist of fees billed for assurance and related services that are reasonably related to the performance of the audit or review of the Company's consolidated financial statements that are not reported under "Audit Fees." This category includes fees related primarily to regulatory filings.

(3)Tax fees consist of fees billed for professional services rendered for tax compliance, tax advice and tax planning (domestic and international).

(4)All other fees consist of fees for products and services other than the services reported above, including subscription services to PwC's online resources for accounting and auditing technical research and disclosure requirements.

Pre-approval Policy. The Audit Committee’s policy is to pre-approve all audit and non-audit services provided by the independent auditor. These services may include audit services, audit-related services, tax services and other services. Pre-approval is generally provided for up to one year and any pre-approval is detailed as to the particular service or category of services and is generally subject to a specific budget. The Audit Committee has delegated pre-approval authority to its chair when expedition of services is necessary. The independent auditor and management are required to periodically report to the full Audit Committee regarding the extent of services provided by the independent auditor in accordance with this pre-approval, and the fees for the services performed to date.

Proposal 3 - Advisory Vote on Executive Compensation

In accordance with Section 14A of the Exchange Act, we annually request shareholder approval, on a non-binding advisory basis, of the compensation of our NEOs during 2022, as described under the heading “Compensation Discussion and Analysis” in this proxy. Although the advisory vote (‘say-on-pay”) is non-binding, our Compensation & Organization Committee will review the results and consider the outcome of this vote in making future determinations regarding our executive compensation program. We annually seek a non-binding advisory vote on our executive compensation and will seek a shareholder advisory vote at our 2023 annual meeting of shareholders.

Executive compensation is an important matter for Rogers and our shareholders. We believe that our executive compensation program provides an appropriate balance between salary and incentive compensation as well as an appropriate balance between risk and reward so that such compensation practices are strongly aligned with the long-term interests of our shareholders. We urge you to carefully read the Compensation Discussion and Analysis section of this proxy statement for additional details on Rogers’ executive compensation, including Rogers’ compensation philosophy and the 2022 compensation of our NEOs. Our Board believes that our executive compensation program is effective in implementing our compensation philosophy.

Vote Required

The advisory vote on the compensation of our NEOs will be approved by the affirmative vote of the majority of votes properly cast (i.e., the number of shares voted “FOR” the proposal must exceed the number of shares voted “AGAINST” the proposal). Abstentions and “broker non-votes” will have no effect on the outcome of the vote.

OUR BOARD RECOMMENDS A VOTE “FOR” THE APPROVAL, ON A NON-BINDING ADVISORY BASIS, OF THE 2022 COMPENSATION OF OUR NEOS

Proposal 4 - Advisory Vote on Frequency of Advisory Votes on Executive Compensation

As required by Section 14A of the Exchange Act, we are seeking your advisory vote on how often Rogers should hold a say-on-pay vote. You may specify whether you prefer the vote to occur every year, two years, or three years. Shareholders will have an opportunity to cast an advisory vote on the frequency of the say-on-pay vote at least every six years.

Our Board recommends that future say-on-pay votes occur every year. We believe holding an advisory vote each year is consistent with best corporate governance practices. We believe an annual vote promotes accountability and transparency.

Although the vote is non-binding, our Board will consider the vote results in determining the frequency of future say-on-pay votes. Rogers will announce its decision on the frequency of say-on-pay votes in a Form 8-K filed with the SEC no later than 150 days after the Annual Meeting. Our Board may change the vote frequency based on the nature of our compensation programs, input from our shareholders, and our Board’s views.

Vote Required

Shareholders have the choice of voting for the frequency of advisory votes on executive compensation to occur once every one, two or three years. The choice receiving the highest number of votes will be given due regard by, but will not be binding on, the Board. Abstentions and “broker non-votes” will not have any effect on the outcome of this vote.

OUR BOARD RECOMMENDS A VOTE, ON AN ADVISORY BASIS, “FOR” FUTURE SHAREHOLDER ADVISORY VOTES ON EXECUTIVE COMPENSATION TO BE HELD EVERY YEAR

Compensation & Organization Committee Report

The Compensation & Organization Committee of the Board of Directors of Rogers Corporation reviewed and discussed the Compensation Discussion and Analysis set forth in this proxy with management and, based upon such review and discussion, recommended to the Board of Directors that the Compensation Discussion and Analysis be included in this proxy statement and incorporated by reference into the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022.

March 14, 2023

The Compensation & Organization Committee of the Board of Directors

| | | | | |

| Keith L. Barnes (Chair) | Megan Faust |

| Armand F. Lauzon, Jr. | Jeffrey J. Owens |

| Helene Simonet | Peter C. Wallace |

Named Executive Officers for Fiscal Year 2022

| | | | | |

Name | Title |

Bruce D. Hoechner | President and Chief Executive Officer(1) |

Ram Mayampurath | Senior Vice President, Chief Financial Officer and Treasurer |

Robert C. Daigle | Senior Vice President and Chief Technology Officer(2) |

Jay B. Knoll | Senior Vice President, Corporate Development, General Counsel and Corporate Secretary(3) |

R. Colin Gouveia | Senior Vice President and General Manager Elastomeric Material Solutions(1) |

(1)Mr. Hoechner retired as President and Chief Executive Officer, effective as of December 31, 2022, and Mr. Gouveia assumed the roles of President and Chief Executive Officer, effective as of January 1, 2023. Mr. Hoechner will continue to serve as a member of the Board and act in an advisory capacity to the Company until March 31, 2023. Please see the “Management Transition” section below for a discussion of the compensation arrangements made in connection with this management transition.

(2)Mr. Daigle will be departing the Company, effective as of March 31, 2023.

(3)Mr. Knoll departed the Company, effective as of December 31, 2022.

Compensation Discussion and Analysis

Compensation Philosophy. The Company’s executive compensation philosophy is to attract, retain, and motivate the most talented and experienced executives possible to achieve outstanding business performance and shareholder value at a reasonable cost. The Company’s approach to executive compensation considers the various industries in which the Company operates, including the technology industry. We believe that our executive compensation program provides an appropriate balance between industry competitive base salary and incentive compensation as well as between risk and reward so that our compensation practices are strongly aligned with the long-term interests of our shareholders.

Role of Compensation & Organization Committee and the Decision-Making Process. The Compensation & Organization Committee (the “Committee” for purposes of this section) establishes the compensation of the Company’s CEO and executive officers. The Committee began its consideration of 2022 executive compensation by evaluating our compensation philosophy and affirmed our existing philosophy. In line with our compensation philosophy, the Committee seeks to provide competitive base salaries for our NEOs, and to leverage short-term and long-term variable compensation in line with performance to reward our NEOs for the value they create. To achieve these goals, we seek to:

•provide opportunity for our executive officers and other senior managers to earn compensation that is competitive with other comparable technology companies

•emphasize a culture of pay for performance

•use a combination of salary, bonuses, long-term incentives, and/or benefits to directly incentivize performance

•measure employee performance by pre-defined metrics or qualitative evaluations (performance appraisals) in order to reward and align accountability for our executive officers and other senior managers in working toward the achievement of our financial, strategic and operational objectives

Accordingly, the Committee considers market compensation (overall and by element), Company performance, and individual performance, along with cost reasonableness, in setting executive compensation levels.

Role of Management. The Committee, in making executive compensation decisions, solicits input from management, as appropriate, with respect to individual and Company performance. The Committee receives recommendations and evaluations with respect to NEO compensation and performance from the CEO (other than with respect to his own compensation). While the CEO does not make a recommendation to the Committee with respect to his own compensation, he provides the Committee with a summary of his annual performance. The Committee considers this assessment in conjunction with materials provided by the Company’s Chief Human Resources Officer regarding the CEO’s performance and recommended compensation. The Committee evaluates this input, as well as the compensation data provided by its compensation consultant, as it independently makes its assessments and compensation decisions.

Role of Compensation Consultants. The Committee is authorized to select and retain its own independent compensation consultant, and since 2017 has retained Compensia, Inc. (“Compensia” or “Consultant”). During its engagement, Compensia has advised the Committee on evolving best pay practices and compensation disclosure and provided competitive market data on executive officer compensation. The Committee annually reviews the independence of the Consultant as part of its standard governance practices and has determined that the Consultant is independent and that its work does not raise any conflict of interest.

Use of Peer Group Data. We believe that the Committee's use of peer group data demonstrates our focus on efficient recruitment and retention of executives who will help drive our business performance and enhance shareholder value at a reasonable cost, while maintaining a competitive market position. The Committee regularly reviews the peer groups it uses to set NEO compensation.

In 2022, the Committee, in consultation with Compensia, determined that four companies in the 2021 peer group (Azenta (formerly Brooks Automation, Inc.), CMC Materials, Inc., Ferro Corporation, and GCP Applied Technologies, Inc.) would be removed and replaced by five new companies (Chart Industries Inc., Helios Technologies, Inc., Livent Corp., Power Integrations Inc., and Synaptics Inc.) for our 2022 NEO compensation analysis, due to the recent acquisitions in the 2020 peer group and changes in revenue and market capitalization of the companies in that peer group. The companies comprising the new peer group, which were selected in consultation with Compensia, are listed below.

| | | | | | | | | | | |

| 2022 NEO Compensation Peer Group |

| Advanced Energy Industries Inc. | Helios Technologies, Inc. | Livent Corp. | Power Integrations Inc. |

| Chart Industries Inc. | Ingevity Corporation | MACOM Technology Solutions Holdings, Inc. | Quaker Chemical Corporation |

| Diodes Incorporated | Knowles Corp. | Materion Corporation | Semtech Corporation |

| ESCO Technologies Inc. | Kulicke and Soffa Industries, Inc. | Methode Electronics, Inc. | Silicon Laboratories Inc. |

| FormFactor, Inc. | Littelfuse, Inc. | Novanta Inc. | Synaptics Inc. |

The Committee considered compensation data from the 2020 and 2021 proxy statements of these companies, with slight cost-of-living adjustments, when setting 2022 NEO compensation. Specifically, the Committee considered this peer group data when establishing the overall compensation packages for our NEOs and each element of compensation within those packages for 2022 and, as part of that process, evaluating target total cash compensation for each NEO (defined as base salary and target payments under our AICP) and target total direct compensation for each NEO (defined as base salary and target payments under our AICP and LTIP). In general, the Committee

aims to set overall executive compensation, as well as each element of executive compensation, for each NEO around the median of the peer group. While the Committee considers relevant market pay practices when setting executive compensation, it does not believe it is appropriate to establish compensation levels based only on market practices. The Committee believes that compensation decisions are complex and require a deliberate review of Company and individual performance, peer compensation levels, as well as other factors, such as tenure, experience, performance, responsibilities and expected contribution.

Addressing Risk. The Committee believes that our compensation programs do not encourage risks that are reasonably likely to have a material adverse effect on the Company. This belief is based on the following:

•Our compensation philosophy and strategy are reviewed by the Committee on an annual basis

•At-risk pay comprises a substantial portion of our executives’ target total direct compensation and performance has a meaningful effect on payouts to our NEOs

•Performance of the CEO and the other NEOs are evaluated by the Committee each year, and that evaluation is used as the basis for future compensation decisions

•Equity awards for our executives are earned or vest over a three-year period, which the Committee believes discourages undue short-term risk-taking

•Equity represents a significant component of our executives’ target total direct compensation, and payouts with respect to at least 50% of our equity awards are contingent on Company performance

•Our stock ownership guidelines seek to encourage a long-term perspective by our executives

•The Committee engages an independent compensation consultant

•The Committee reserves negative discretion to lower compensation plan payouts

•We have a compensation recovery policy in place to recover any compensation earned by or paid to an executive officer based on any financial result or operating objective that was impacted by the officer’s misconduct

Compensation Recovery Policy. The Company has a compensation recovery policy in place to recover any compensation earned by or paid to an executive officer based on any financial result or operating objective that was impacted by the officer’s misconduct. The Company continues to monitor the policy to ensure that it is consistent with applicable laws and will review and modify the policy as necessary to reflect the final NYSE listing rules adopted to implement the compensation recovery requirements under the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”).

Stock Ownership Guidelines. In order to align our executives’ interests with those of our shareholders and to assure that our executives own meaningful levels of Company stock throughout their tenure with the Company, the Company maintains stock ownership guidelines which provide as follows: CEO stock ownership should reach three times base salary within five years of service as CEO, while NEOs other than the CEO are expected to own Company stock valued at least two times base salary no later than the completion of five years of service as an executive officer. As of the record date, each of our continuing NEOs were either in compliance with the applicable stock ownership guidelines or were within the five-year transition period.

Shareholder Engagement. We actively engage with our shareholders in a variety of forums. Our executives meet frequently with individual shareholders at investor conferences, on telephone calls, virtual meetings, and scheduled on-site visits. While these meetings typically focus on investment matters, there is also active engagement on topical governance issues, including executive compensation and ESG matters. In addition, we regularly reach out to our larger shareholders to engage on these topical governance issues.

As noted above, in its compensation review process, the Committee considers whether the Company’s executive compensation program is aligned with the interests of the Company’s shareholders. As part of its review of the Company’s executive compensation program, the Committee considered the approval by approximately 99% of the votes cast for the Company’s say-on-pay vote at our last regular annual meeting held in 2021. The Committee determined that the Company’s executive compensation philosophies and objectives and compensation elements continued to be appropriate and did not make any changes to the Company’s executive compensation program in response to the 2021 say-on-pay vote.

Finally, we encourage our shareholders to provide feedback directly via mail and our website (https://rogerscorp.com/investors/contact-investor-relations). Rogers' website is not incorporated into or made a part of this proxy statement.

Our Compensation Program. In 2022, our compensation program was modified from prior years by the arrangements described below under “Merger-Related Compensation Matters.” However, in 2022, we designed a program consistent with the restrictions included in the since-terminated merger agreement (the “Merger Agreement”) between the Company and DuPont and in a way that we believe maintained our commitment to the use of at-risk compensation (awards under our Long-Term Incentive Program (“LTIP”) and Annual Incentive Compensation Plan (“AICP”)), pay for performance, compensation transparency, and the pursuit of pay practices competitive with those of our peers. Our compensation program primarily consists of four elements:

•Base Salary: Base salaries are targeted around the median of our peer group but will take into account experience and performance.

•At-risk Compensation: At-risk compensation made up approximately 83.3% of our CEO's target total direct compensation in 2022, approximately the same as in 2021. For our remaining NEOs, at-risk compensation in 2022 made up approximately 67.6% of their target total direct compensation, approximately the same as in 2021.

•Performance-based Pay: Performance-based pay made up approximately 56.7% of our CEO's target compensation in 2022, lower than 57% in 2021 given the limitations on the use of performance-based restricted stock units (“PSUs”) under the terms of the Merger Agreement, and made up approximately 44.5% of target compensation in 2022 for our remaining NEOs, on average, compared to 43% in 2021.

•Pay for Performance Measures: In 2022, we continued to employ multiple performance measures to balance short-term and long-term objectives. With respect to longer-term incentives, restrictions under the Merger Agreement prevented us from granting new PSUs, but PSUs granted in prior years remained in effect and with vesting tied to the Company's three-year total shareholder return ("TSR") measured relative to the TSR of a pre-established group of peer companies.

Merger-Related Compensation Matters. The Merger Agreement imposed certain limitations and prompted certain modifications to our executive compensation arrangements during the pendency of the merger. Termination of the Merger Agreement also resulted in additional compensation actions. These arrangements and actions were largely focused on providing adequate retention incentives for our executive officers and other key personnel during and following the pendency of the Merger Agreement. We describe these matters below.

Limitations and Modifications to Equity Awards. Covenants in the Merger Agreement prohibited the Company from granting new equity awards other than “Post-Signing Company RSUs” with a grant date fair value not in excess of equity awards granted in the ordinary course of business consistent with prior practice. As prescribed by the Merger Agreement, the terms of Post-Signing Company RSUs were substantially the same as our other outstanding restricted stock units (“RSUs”) except that the Post-Signing Company RSUs provided for vesting of one-third of the underlying shares upon a qualifying termination following closing of the merger and within one year of the grant date. Accordingly, in February 2022, the Committee granted no PSUs, but instead granted Post-Signing Company RSUs with a grant date fair value equal to the aggregate grant date fair value of RSUs and PSUs previously awarded in the ordinary course of business consistent with prior practice. In addition, the Merger Agreement provided that then-existing RSUs and PSUs would accelerate and vest at the time of the completion of the merger with DuPont. As a result of the termination of the Merger Agreement, the RSUs and PSUs that were outstanding in 2022 now will vest pursuant to their original terms and, after the first anniversary of the date of grant, the Post-Signing Company RSUs will vest on the same basis as our other RSUs.

Key Employee Retention Plan. As permitted by the Merger Agreement, the Company established the Rogers Corporation Key Employee Retention Plan (“KERP”), which was designed to incentivize the retention of key talent through the pendency of the merger in order to promote continuity of Company operations. Benefits under the KERP included cash-based retention awards payable 50% upon closing of the merger and 50% on December 31, 2022 (or 100% if the merger had not closed by that date), which the Chief Executive Officer was permitted to grant in an aggregate amount for all participants not to exceed $10 million. The KERP also provided for payment of a 50% benefit to a participant who incurred a Qualifying Termination (as defined in the KERP) on or prior to December 31, 2022. Non-NEO executives, as well as other key Company employees, were eligible to participate in the KERP. $9.5 million in awards or benefits were allocated or granted under the KERP to non-NEO executives and key Company employees.