Document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________________

FORM 10‑K

_______________________________

|

| |

þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2018

or |

| |

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _______________ to _______________

Commission file number 1-4347

_______________________________

ROGERS CORPORATION

(Exact Name of Registrant as Specified in its Charter)

_______________________________

|

| |

Massachusetts | 06-0513860 |

(State or Other Jurisdiction of Incorporation or Organization) | (I. R. S. Employer Identification No.) |

| |

2225 W. Chandler Blvd., Chandler, Arizona | 85224-6155 |

(Address of Principal Executive Offices) | (Zip Code) |

Registrant’s telephone number, including area code: (480) 917-6000

|

| | |

Securities registered pursuant to Section 12(b) of the Act: |

| | |

Title of Each Class | | Name of Each Exchange on Which Registered |

Common Stock, $1 Par Value | | New York Stock Exchange |

| | |

Securities registered pursuant to Section 12(g) of the Act: None |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ý No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company”, and “emerging growth company” in Rule 12b-2 of the Exchange Act. |

| | |

Large accelerated filer ý | Accelerated filer o | Non-accelerated filer o |

Smaller reporting company o | Emerging growth company o | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act) Yes ¨ No ý

The aggregate market value of the voting common equity held by non-affiliates as of June 30, 2018, the last business day of the registrant’s most recently completed second fiscal quarter, was approximately $2,026,896,605. Rogers has no non-voting common equity. The number of shares outstanding of common stock as of February 15, 2019 was 18,438,502.

Documents Incorporated by Reference:

Portions of Rogers’ Definitive Proxy Statement for its 2019 Annual Meeting of Shareholders, currently scheduled for May 9, 2019, are incorporated by reference into Part III of this Form 10-K.

ROGERS CORPORATION

FORM 10-K

December 31, 2018

|

| | |

TABLE OF CONTENTS |

Part I |

Item 1. | Business | |

Item 1A. | Risk Factors | |

Item 1B. | Unresolved Staff Comments | |

Item 2. | Properties | |

Item 3. | Legal Proceedings | |

Item 4. | Mine Safety Disclosures | |

Part II |

Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | |

Item 6. | Selected Financial Data | |

Item 7. | Management’s Discussion and Analysis of Results of Operations and Financial Position | |

Item 7A. | Quantitative and Qualitative Disclosures About Market Risk | |

Item 8. | Financial Statements and Supplementary Data | |

Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | |

Item 9A. | Controls and Procedures | |

Item 9B. | Other Information | |

Part III |

Item 10. | Directors, Executive Officers and Corporate Governance | |

Item 11. | Executive Compensation | |

Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | |

Item 13. | Certain Relationships and Related Transactions, and Director Independence | |

Item 14. | Principal Accountant Fees and Services | |

Part IV |

Item 15. | Exhibits, Financial Statement Schedules | |

Item 16. | Form 10-K Summary | |

| Signatures | |

Part I

Item 1. Business

As used herein, the “Company,” “Rogers,” “we,” “us,” “our” and similar terms include Rogers Corporation and its subsidiaries, unless the context indicates otherwise.

Forward-Looking Statements

This Annual Report on Form 10-K includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such statements are generally accompanied by words such as “anticipate,” “assume,” “believe,” “could,” “estimate,” “expect,” “foresee,” “goal,” “intend,” “may,” “might,” “plan,” “potential,” “predict,” “project,” “should,” “seek,” “target” or similar expressions that convey uncertainty as to future events or outcomes. Forward-looking statements are based on assumptions and beliefs that we believe to be reasonable; however, assumed facts almost always vary from actual results, and the differences between assumed facts and actual results could be material depending upon the circumstances. Where we express an expectation or belief as to future results, that expectation or belief is expressed in good faith and based on assumptions believed to have a reasonable basis. We cannot assure you, however, that the stated expectation or belief will occur or be achieved or accomplished. Among the factors that could cause our results to differ materially from those indicated by forward-looking statements are risks and uncertainties inherent in our business including, without limitation:

| |

• | failure to capitalize on, volatility within, or other adverse changes with respect to the Company’s growth drivers, including advanced mobility and advanced connectivity, such as delays in adoption or implementation of new technologies; |

| |

• | uncertain business, economic and political conditions in the United States and abroad, particularly in China, South Korea, Germany, Hungary and Belgium, where we maintain significant manufacturing, sales or administrative operations; |

| |

• | the ongoing trade policy dispute between the United States and China, as well as adverse changes in trade policy, tariff regulation or other trade restrictions; |

| |

• | fluctuations in foreign currency exchange rates; |

| |

• | our ability to develop innovative products and have them incorporated into end-user products and systems; |

| |

• | the extent to which end-user products and systems incorporating our products achieve commercial success; |

| |

• | the ability of our sole or limited source suppliers to deliver certain key raw materials, including commodities, to us in a timely manner; |

| |

• | intense global competition affecting both our existing products and products currently under development; |

| |

• | failure to realize, or delays in the realization of, anticipated benefits of acquisitions and divestitures due to, among other things, the existence of unknown liabilities or difficulty integrating acquired businesses; |

| |

• | our ability to attract and retain management and skilled technical personnel; |

| |

• | our ability to protect our proprietary technology from infringement by third parties and/or allegations that our technology infringes third party rights; |

| |

• | changes in effective tax rates or tax laws and regulations in the jurisdictions in which we operate; |

| |

• | failure to comply with financial and restrictive covenants in our credit agreement or restrictions on our operational and financial flexibility due to such covenants; |

| |

• | the outcome of ongoing and future litigation, including our asbestos-related product liability litigation; |

| |

• | changes in environmental laws and regulations applicable to our business; and |

| |

• | disruptions in, or breaches of, our information technology systems. |

Our forward-looking statements are expressly qualified by these cautionary statements, which you should consider carefully, along with the risks discussed under the headings “Item 1A. Risk Factors” and “Item 7. Management’s Discussion and Analysis of Results of Operations and Financial Position” and elsewhere in this report, any of which could cause actual results to differ materially from historical results or anticipated results. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, unless required by law.

Overview

Rogers Corporation designs, develops, manufactures and sells high-quality and high-reliability engineered materials and components for mission critical applications. We operate three strategic operating segments: Advanced Connectivity Solutions (ACS), Elastomeric Material Solutions (EMS) and Power Electronics Solutions (PES). The remaining operations, which represent our non-core businesses, are reported in the Other operating segment. We have a history of innovation and have established Innovation Centers for our research and development activities in Chandler, Arizona; Burlington, Massachusetts; Eschenbach, Germany; and Suzhou, China. We are headquartered in Chandler, Arizona.

Growth Strategy and Recent Acquisitions

Our growth strategy is based upon the following principles: (1) market-driven organization, (2) innovation leadership, (3) synergistic mergers and acquisitions, and (4) operational excellence. As a market-driven organization, we are focused on growth drivers, including advanced mobility and advanced connectivity. More specifically, the key trends currently affecting our business include the increasing use of advanced driver assistance systems and adoption of electric and hybrid electric vehicles in the automotive industry and new technology adoption in the telecommunications industry, including next generation wireless infrastructure. In addition to our focus on advanced mobility and advanced connectivity in the automotive and telecommunications industries, we sell into a variety of other end markets including renewable energy, consumer electronics, aerospace and defense and diverse general industrial applications.

Our sales and marketing approach is based on addressing these trends, while our strategy focuses on factors for success as a manufacturer of engineered materials and components: quality, service, cost, efficiency, innovation and technology. We have expanded our capabilities through organic investment and acquisitions, and we strive to ensure high quality solutions for our customers. We continue to review and re-align our manufacturing and engineering footprint in an effort to attain a leading competitive position globally. We have established or expanded our capabilities in various locations in support of our customers’ growth initiatives.

We seek to enhance our operational and financial performance by investing in research and development, manufacturing and materials efficiencies, and new product initiatives that respond to the needs of our customers. We strive to evaluate operational and strategic alternatives to improve our business structure and align our business with the changing needs of our customers and major industry trends affecting our business.

In executing on our growth strategy, we have completed three strategic acquisitions in the last three fiscal years: (1) in July 2018, we acquired Griswold LLC (Griswold), a manufacturer of a wide range of high-performance engineered cellular elastomer and microcellular polyurethane products and solutions, (2) in January 2017, we acquired the principal operating assets of Diversified Silicone Products, Inc. (DSP), a custom silicone product development and manufacturing business serving a wide range of high reliability applications, and (3) in November 2016, we acquired DeWAL Industries LLC (DeWAL), a manufacturer of polytetrafluoroethylene and ultra-high molecular weight polyethylene films, pressure sensitive tapes and specialty products for the industrial, aerospace, automotive and electronics markets. Additionally, in August 2018, we acquired a production facility and related machinery and equipment located in Chandler, Arizona from Isola USA Corp (Isola).

Operating Segments

Advanced Connectivity Solutions

Our ACS operating segment designs, develops, manufactures and sells circuit materials and solutions enabling high-performance and high-reliability connectivity for applications in wireless infrastructure (e.g., power amplifiers, antennas, small cells and distributed antenna systems), automotive (e.g., active safety, advanced driver assistance systems, telematics and thermal management), aerospace and defense, connected devices (e.g., mobile internet devices and Internet of Things), wired infrastructure (e.g., computing and IP infrastructure) and consumer electronics. We believe these products have characteristics that offer performance and other functional advantages in many market applications that serve to differentiate our products from other commonly available materials. These products are sold principally to independent and captive printed circuit board fabricators that convert our laminates to custom printed circuits. Trade names for our ACS products include: RO3000®, RO4000®, RT/duroid®, TMM®, AD SeriesTM and CLTE SeriesTM. As of December 31, 2018, our ACS operating segment had manufacturing and administrative facilities in Chandler, Arizona; Rogers, Connecticut; Bear, Delaware; Evergem, Belgium; and Suzhou, China.

Elastomeric Material Solutions

Our EMS operating segment designs, develops, manufactures and sells engineered material solutions for a wide variety of applications and end markets. These include polyurethane and silicone materials used in critical cushioning, sealing and vibration management applications for portable electronics (e.g., smart phones), automotive, aerospace, rail, footwear and printing end markets; customized silicones used in flex heater and semiconductor thermal applications; polytetrafluoroethylene and ultra-high molecular weight polyethylene materials used in wire and cable, pressure-sensitive tapes and automotive applications. We believe these materials have characteristics that offer functional advantages in many market applications which serve to differentiate Rogers’ products from other commonly available materials. EMS products are sold globally to converters, fabricators, distributors and original equipment manufacturers (OEMs). Trade names for our EMS products include: PORON®, BISCO®, DeWAL®, ARLON®, DSP®, Griswold®, eSORBA®, XRD®, HeatSORB™ and R/bak®.

As of December 31, 2018, our EMS operating segment had administrative and manufacturing facilities in Moosup, Connecticut; Rogers, Connecticut; Woodstock, Connecticut; Bear, Delaware; Carol Stream, Illinois; Narragansett, Rhode Island; Santa Fe Springs, California; Ansan, South Korea; and Suzhou, China. We also own 50% of: (1) Rogers Inoac Corporation (RIC), a joint venture established in Japan to design, develop, manufacture and sell PORON products predominantly for the Japanese market and (2) Rogers INOAC Suzhou Corporation (RIS), a joint venture established in China to design, develop, manufacture and sell PORON products primarily for RIC customers in various Asian countries. INOAC Corporation owns the remaining 50% of both

RIC and RIS. RIC has manufacturing facilities at the INOAC facilities in Nagoya and Mie, Japan, and RIS has manufacturing facilities at Rogers’ facilities in Suzhou, China.

Power Electronics Solutions

Our PES operating segment designs, develops, manufactures and sells ceramic substrate materials for power module applications (e.g., variable frequency drives, vehicle electrification and renewable energy), laminated busbars for power inverter and high power interconnect applications (e.g., mass transit, hybrid-electric and electric vehicles, renewable energy and variable frequency drives) and micro-channel coolers (e.g., laser cutting equipment). We sell our ceramic substrate materials and micro-channel coolers under the curamik® trade name, and our busbars under the ROLINX® trade name. As of December 31, 2018, our PES operating segment had manufacturing and administrative facilities in Evergem, Belgium; Eschenbach, Germany; Budapest, Hungary; and Suzhou, China.

Other

Our Other operating segment consists of elastomer components for applications in ground transportation, office equipment, consumer and other markets; elastomer floats for level sensing in fuel tanks, motors, and storage tanks; and inverters for portable communications and automotive markets. Trade names for our elastomer components include: NITROPHYL® floats for level sensing in fuel tanks, motors, and storage tanks and ENDUR® elastomer rollers.

Sales and Competition

We sell our materials and components primarily through direct sales channels positioned near major concentrations of our customers in North America, Europe and Asia. We sold to over 5,000 customers worldwide in 2018, primarily OEMs and component suppliers. No individual customer represented more than 10% of our total net sales for 2018; however, there are concentrations of OEM customers in our ACS (Chinese telecommunications equipment manufacturers) and PES (semiconductor and automotive manufacturers) operating segments. Although the loss of any one of our larger customers would require a period of adjustment, during which the results of operations could be materially adversely impacted, we believe that such events could be successfully mitigated over a period of time due to the diversity of our customer base.

We employ a technical sales and marketing approach pursuant to which we work collaboratively to provide design engineering, testing, product development and other technical support services to OEMs that incorporate our engineered materials and components in their products. Component suppliers convert, modify or otherwise incorporate our engineered materials and components into their components for these OEMs in accordance with their specifications. Accordingly, we provide similar technical support services to component suppliers.

We compete primarily with manufacturers of high-end materials, some of which are large, multi-national companies, principally on the basis of innovation, historical customer relationships, product quality, reliability, performance and price, technical and engineering service and support, breadth of product line, and manufacturing capabilities. We also compete with manufacturers of commodity materials, including smaller regional producers with lower overhead costs and profit requirements located in Asia that attempt to upsell their products based principally upon price, particularly for products that have matured in their life cycle. We believe that we have a competitive advantage because of our reputation for innovation, the quality and reliability of our materials and components, and our commitment to technical support and customer service.

Research and Development

We have a history of innovation, and innovation leadership is a key component of our overall business strategy. The markets we serve are typically characterized by rapid technological changes and advances. Accordingly, the success of our strategy is in part dependent on our ability to develop market-leading products, which is primarily driven by efforts in research and development. We are focused on identifying technologies and innovations related to both our current product portfolio as well as initiatives targeted at further diversifying and growing our business. As part of this technology commitment, we have Rogers Innovation Centers at Northeastern University in Burlington, Massachusetts, as well as at our facilities in Chandler, Arizona, Eschenbach, Germany and Suzhou, China. Our Innovation Centers focus on early stages of technical and commercial development of new high-tech materials solutions in an effort to align with market direction and needs.

Patents and Other Intellectual Property

We have many domestic and foreign patents, licenses and have additional patent applications pending related to technology in each of our operating segments. These patents and licenses vary in duration and provide some protection from competition. We also own a number of registered and unregistered trademarks and have acquired and developed certain confidential and proprietary technology, including trade secrets that we believe to be of some importance to our business.

While we believe our patents and other intellectual property provide a competitive advantage to our operating segments, we believe that a significant part of our competitive position and future success will be determined by factors such as the innovative skills, systems and process knowledge, and technological expertise of our personnel; the range of new products we develop; and our customer service and support.

Manufacturing and Raw Materials

The key raw materials used in our business are as follows: for our ACS operating segment, copper, polymer and polytetraflouroethylene materials; for our EMS operating segment, polyurethane, polytetraflouroethylene, polyethylene, silicone and natural rubber materials; and for our PES operating segment, copper, ceramic and brazing paste materials.

Some of the raw materials used in our business are available through sole or limited-source suppliers. While we have undertaken strategies to mitigate the risks associated with sole or limited source suppliers, these strategies may not be effective in all cases, and price increases or disruptions in our supply of raw materials could have a material adverse impact on our business. For additional information, refer to “Item 1A. Risk Factors.”

Seasonality

Except for some minor seasonality for consumer products, which often aligns with year-end holidays and product launch cycles, the operations of our segments have not been seasonal.

Our Employees

As of December 31, 2018, we employed approximately 3,700 people.

Backlog

Our backlog of firm orders was $152.8 million as of December 31, 2018, compared to $122.8 million as of December 31, 2017. The year-over-year increase in backlog was mainly comprised of a $24.1 million increase in the backlog for our PES operating segment, primarily due to overall sales growth in 2018 compared to 2017 and favorable foreign currency fluctuations, in addition to $4.2 million of backlog related to Griswold. The backlog of firm orders is expected to be filled within the next 12 months.

Executive Officers

Our executive officers as of February 20, 2019 were as follows:

|

| | | | |

Name | Age | Present Position | Year Appointed to Present Position | Other Relevant Positions Held |

Bruce D. Hoechner | 59 | President and Chief Executive Officer, Director, Principal Executive Officer | 2011 | |

Michael M. Ludwig | 57 | Senior Vice President, Chief Financial Officer and Treasurer, Principal Financial Officer | 2018 | Senior Vice President and Chief Financial Officer, FormFactor, Inc., from May 2011 to March 2018. |

Marc J. Beulque | 54 | Vice President, Global Operations | 2016 | Vice President, Power Electronics Solutions Operations and Research and Development, Rogers, from June 2013 to April 2016; General Manager, Power Distribution Systems from December 2011 to May 2013. Mr. Beulque was promoted to Vice President, Global Operations in April 2016 and was appointed as an executive officer in February 2018 as a result of an expansion of his responsibility to oversee all global operations of the Company. |

Benjamin M. Buckley | 46 | Vice President and Chief Human Resources Officer

| 2019 | Associate General Counsel and Director of Global Compliance and Integrity, Rogers, from October 2014 to January 2019. President and Chief Executive Officer, Verge America Ltd., from May 2013 to October 2014. |

Robert C. Daigle | 55 | Senior Vice President and Chief Technology Officer | 2009 | |

Jeffrey M. Grudzien | 57 | Senior Vice President and General Manager, Advanced Connectivity Solutions | 2017 | Vice President, Advanced Connectivity Solutions, Rogers, from February 2012 to February 2017. |

Jay B. Knoll | 55 | Senior Vice President, Corporate Development, General Counsel and Secretary

| 2017 | Vice President and General Counsel, Rogers, from November 2014 to February 2017; Senior Vice President, General Counsel PKC Group Oyj - North America from June 2012 to November 2014. |

Helen Zhang | 55 | Senior Vice President and General Manager, Power Electronics Solutions and President, Rogers Asia | 2017 | Vice President, Power Electronics Solutions and President, Rogers Asia, Rogers, from May 2012 to February 2017. |

Available Information

We make available on our website (http://www.rogerscorp.com), or through a link posted on our website, free of charge, our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, reports filed by our executive officers and directors pursuant to Section 16 of the Securities Exchange Act of 1934, as amended (the Exchange Act), and amendments to those reports filed pursuant to Section 13(a) or 15(d) of the Exchange Act as soon as reasonably practicable after we electronically file such material with, or furnish it to, the Securities and Exchange Commission (SEC). In addition, the SEC maintains an internet site that contains these reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC (http://www.sec.gov).

We also make available on our website, in a printable format, the charters for our Audit Committee, Compensation and Organization Committee, and Nominating and Governance Committee, in addition to our Corporate Governance Guidelines, Bylaws, Code of Business Ethics, Related Party Transactions Policy and Compensation Recovery Policy. Our website is not incorporated into or a part of this Form 10-K.

Item 1A. Risk Factors

Our business, results of operations and financial position are subject to various risks, including those discussed below, which may affect the value of our capital stock. The risks discussed below are those that we believe are currently the most significant, although additional risks not presently known to us or that we currently deem less significant may also impact our business, results of operations and financial position, perhaps materially.

Failure to capitalize on, volatility within, or other adverse changes with respect to the Company’s growth drivers, including advanced connectivity and advanced mobility, may adversely affect our business.

We derived approximately 25% and 27% of our net sales for the year ended December 31, 2018 from sales relating to the key market growth drivers of advanced connectivity and advanced mobility, respectively. These growth drivers are served by our direct and indirect customers in a variety of end markets, including transportation (specifically including the advanced driver assistance systems and electric and hybrid electric vehicles markets), communications, wireless infrastructure and portable electronics. These growth drivers, as well as specific market and industry trends within them, may be volatile, cyclical and sensitive to a variety of factors, including general economic conditions, technology disruptions, consumer preferences and political priorities. Adverse or cyclical changes to and within these growth drivers, such as delays in adoption or implementation of new technologies, has resulted in, and may continue to result in, reduced demand for certain of our products, production overcapacity, increased inventory levels and related risks of obsolescence, as well as price erosion, ultimately leading to a decline in our operating results. Acceleration within these growth drivers and corresponding rapid increases in demand for certain products may also require us to make significant capital investments or acquisitions in order to increase production levels and to maintain customer relationships and market positions. However, we may not be able to increase our production levels with sufficient speed or efficiency to capitalize on such increases in demand.

We have extensive international operations, and events and circumstances that have general international consequence or specific impact in the countries in which we operate may materially adversely affect our business.

For the year ended December 31, 2018, approximately 72% of our net sales resulted from sales in foreign markets, with approximately 47% and 22% of such net sales occurring in Asia and Europe, respectively. We expect our net sales in foreign markets to continue to represent a substantial majority of our consolidated net sales. We maintain significant manufacturing and administrative operations in China, South Korea, Germany, Hungary and Belgium, and approximately 62% of our employees are located outside the United States. Risks related to our extensive international operations include the following:

| |

• | foreign currency fluctuations, particularly in the value of the Euro, the Hungarian forint, the Japanese yen, the Chinese yuan and the South Korean won against the U.S. dollar; |

| |

• | economic and political instability, due to regional or country-specific events or changes in relations between the United States and the countries in which we operate; |

| |

• | accounts receivable practices across countries, including longer payment cycles; |

| |

• | export control or customs matters, the ongoing trade policy dispute between the United States and China and adverse changes in trade policy, tariff regulations or other trade restrictions; |

| |

• | complications in complying, and failure to comply, with a variety of foreign laws, including due to unexpected changes in the laws or regulations of the countries in which we operate; |

| |

• | failure to comply with the Foreign Corrupt Practices Act or other applicable anti-corruption laws; |

| |

• | greater difficulty protecting our intellectual property; |

| |

• | compliance with foreign employment regulations, as well as work stoppages and labor and union disputes. |

The foregoing risks may be particularly acute in emerging markets such as China and India, where our operations are subject to greater uncertainty due to increased volatility associated with the developing nature of the economic, legal and governmental systems of these countries, changes in bilateral and multilateral arrangements with the United States and other governments, and challenges that some multinational customers that are headquartered in emerging markets may have complying fully with United States and other developed market extraterritorial regulations. In addition, our business has been, and may continue to be, adversely affected by the lack of development, or disruptions, of transportation or other critical infrastructure in emerging markets. If we are unable to successfully manage the risks associated with expanding our global business, or to adequately manage operational fluctuations, it may materially adversely affect our business, results of operations and financial position.

Our business is dependent upon our development of innovative products and our customers’ incorporation of those products into end user products and systems that achieve commercial success.

As a manufacturer and supplier of engineered materials and components, our business depends upon our ability to innovate and sell our materials and components for inclusion in other products that are developed, manufactured and sold by our customers. We strive to differentiate our products and secure long-term demand through our engagement with our customers to design in our materials and components as part of their product development processes. The value of any design-in largely depends upon the decision of our customers to manufacture their products or systems in sufficient production quantities, the commercial success of the end product and the extent to which the design of our customers’ products or systems could accommodate substitution of

competitor products. A consistent failure to introduce new products in a timely manner, achieve design-ins or achieve market acceptance on commercially reasonable terms could materially adversely affect our business, results of operations and financial position. The introduction of new products presents particularly significant business challenges in our business because product development commitments and expenditures must be made well in advance of product sales.

Our dependence on sole or limited source suppliers for certain of our raw materials could materially adversely affect our ability to manufacture products and materially increase our costs.

We rely on sole and limited source suppliers for certain of the raw materials that are critical to the manufacturing of our products. This reliance subjects us to risks related to our potential inability to obtain an adequate supply of required raw materials, particularly given our use of lean manufacturing and just-in-time inventory techniques, and our reduced control over pricing and timing of delivery of raw materials. Our operating results could be materially adversely affected if we were unable to obtain adequate supplies of these materials in a timely manner or if their cost increased significantly.

While we believe we could obtain and qualify alternative sources for most sole and limited source supplier materials if necessary, the transition time could be long, particularly if the change requires us to redesign our systems. Ultimately, we may be unable to redesign our systems, which could further increase delays or prevent us from manufacturing our products at all. Even if a system redesign is feasible, increased costs associated with such a redesign would decrease our profit margins, perhaps materially, if we could not effectively pass such costs along to our customers. Further, it would likely result in production and delivery delays, which could lead to lost sales and damage to our relationships with current and potential customers.

We face intense global competition, which could reduce demand for our products or create additional pricing pressure on our products.

We operate in a highly competitive global environment and compete with domestic and international companies principally on the basis of the following:

| |

• | historical customer relationships; |

| |

• | product quality, reliability, performance and price; |

| |

• | technical and engineering service and support; |

| |

• | breadth of product line; and |

| |

• | manufacturing capabilities. |

Our competitors include commodity materials suppliers, which offer product substitutions based mostly on price, and suppliers of alternate solutions, which offer product substitutions or eliminations based mostly on disruptive technology. Furthermore, our customers may engage in internal manufacturing of products that may result in reduced demand for our products. Certain of these competitors have greater financial and other resources than we have and, in some cases, these competitors are well established in specific product niches. We expect that our competitors will continue to improve the design and performance of their products, which could result in the development of products that offer price or performance features superior to our products. If we are unable to maintain our competitive advantage for any reason, demand for our products may be materially reduced, which may adversely affect our business, results of operations and financial position.

We may acquire or dispose of businesses, or engage in other transactions, which expose us to a variety of risks that could materially adversely affect our business operating results and financial position.

From time to time, we have explored and pursued transaction opportunities that we believe complement our core businesses, and we expect to do so again in the future. We have divested and may again consider divesting businesses or assets that we do not regard as part of our core businesses. These transaction opportunities may come in the form of acquisitions, joint ventures, investments, divestitures or other structures. There are risks associated with such transactions, including, without limitation, general business risk, technology risk, market acceptance risk, litigation risk, environmental risk, regulatory approval risk and risks associated with the failure to complete announced transactions. In addition, if we are unsuccessful in integrating any acquired company or business into our operations or if integration is more difficult than anticipated, we may experience disruptions that could harm our business and result in our failure to realize the anticipated benefits of the acquisitions. In the case of acquisitions, we may not be able to discover, during the due diligence process or otherwise, all known and unknown risks associated with the business we are acquiring, including the existence of liabilities. We may spend a significant portion of available cash, incur substantial debt or issue equity securities, which would dilute current shareholders’ equity ownership, to pay for the acquisitions. In the case of divestitures, we may agree to indemnify acquiring parties for known or unknown liabilities arising from the businesses we are divesting. We have incurred, and may in the future incur, significant costs in the pursuit and evaluation of transactions that we do not consummate for a variety of reasons.

As a result, these transactions may not ultimately create value for us or our shareholders and may harm our reputation and materially adversely affect our business, results of operations and financial position.

Our business may be materially adversely affected if we cannot protect our proprietary technology or if we infringe the proprietary rights of others.

Our proprietary technology supports our ability to compete effectively with other companies, and we seek to protect our intellectual property rights by obtaining domestic and foreign patents, trademarks and copyrights, and maintaining trade secrets for our manufacturing processes. It is possible, however, that our efforts to obtain such protection in the United States and abroad will be unsuccessful or that the protection afforded will not be sufficiently broad to protect our technology.

Even if domestic and foreign laws do grant initial protection to our technology, our competitors or other third parties may subsequently obtain and unlawfully copy, use or disclose our technologies, products, and processes. We believe that the risk of piracy of our technology is particularly acute in the foreign countries in which we operate. In circumstances in which we conclude that our proprietary technology has been infringed, we have pursued, and may again pursue, litigation to enforce our rights. The defense and prosecution of intellectual property infringement suits are both costly and time consuming, even if the outcome is favorable to us. If we are not successful in protecting our proprietary technology or if the protection afforded to us is not sufficiently broad, our competitors may be able to manufacture and offer products substantially similar to our own, thereby reducing demand for our products and adversely affecting our results of operations and financial position. We may also be adversely affected by, and subject to increased competition as a result of, the normal expiration of our issued patents.

Our competitors or other third parties may also assert infringement or invalidity claims against us in the future. In addition to the significant costs associated with such suits, as noted above, an adverse outcome could subject us to significant liabilities to third parties and require us to license rights from third parties or cease selling our products. Any of these events may have a material adverse effect on our business, results of operations and financial position.

The failure to attract and retain specialized technical and management personnel could impair our expected growth and future success.

We depend upon the continued services and performance of key executives, senior management and skilled technical personnel, particularly our sales engineers and other professionals with significant experience in the key industries we serve. Competition for these personnel from other companies, academic institutions and government entities is intense, and our expected growth and future success will depend, in large part, upon our ability to attract and retain these individuals.

As a multinational corporation doing business in the United States and various foreign jurisdictions, changes in tax laws or exposures to additional tax liability could negatively impact our operating results.

As a result of the variability and uncertainty in global taxation, we are subject to a wide variety of tax-related risks, any of which could provoke changes in our global structure, international operations or intercompany agreements, which could materially reduce our net income in future periods or result in restructuring costs, increased effective tax rates and other expenses. Given the global nature of our business, a number of factors may increase our effective tax rates, including:

| |

• | decisions to redeploy foreign earnings outside of their country of origin for which we have not previously provided for income taxes; |

| |

• | increased scrutiny of our transactions by taxing authorities; |

| |

• | changes in the geographic mix of our profits among jurisdictions with differing statutory income tax rates; |

| |

• | ability to utilize, or changes in the valuation of, deferred tax assets; and |

| |

• | changes in tax laws and regulations or issuance of new interpretations of the law applicable to us. |

For instance, on December 22, 2017, the Tax Cuts and Jobs Act of 2017 (U.S. Tax Reform) was signed into law, making significant changes to the Internal Revenue Code. As a result, we recognized an income tax expense in 2017 and made adjustments to the original estimate in 2018. This tax expense is related to the transition tax on our previously untaxed foreign earnings and the remeasurement of deferred income taxes. For additional information regarding U.S. Tax Reform, refer to “Note 14 – Income Taxes” to “Item 8. Financial Statements and Supplementary Data.”

The terms of our credit agreement subject us to risks, including potential acceleration of our outstanding indebtedness if we fail to satisfy financial ratios and comply with numerous covenants.

Our credit agreement contains, and any future debt agreements into which we enter may contain, certain financial ratios and certain restrictive covenants that, among other things, limit our ability to incur indebtedness or liens, acquire other businesses, dispose of assets, or make investments. Our ability to make scheduled payments on these borrowings and to satisfy financial ratios may be adversely affected by changes in economic or business conditions beyond our control, while the restrictive covenants to which we are subject may limit our ability to take advantage of potential business opportunities as they arise. Failure to satisfy these financial ratios or to comply with the covenants in our credit agreement would constitute a default. An uncured default with respect to one or more of our covenants could result in outstanding borrowings thereunder being declared immediately due and payable, which may also trigger an obligation to repay other outstanding indebtedness. Any such acceleration of our indebtedness would have a material adverse effect on our cash flows, financial position and results of operations.

Our credit agreement currently permits us to borrow euro-currency loans that bear interest based on the London interbank offered rate (LIBOR), plus a specified spread. In July 2017, the United Kingdom’s Financial Conduct Authority, which regulates LIBOR, announced that it intends to phase out LIBOR by the end of 2021. LIBOR borrowings may become unavailable before that date, and it is unclear what reference rate might replace it. If LIBOR becomes unavailable, the credit agreement presently provides for the interest rate on our loans to convert to a higher base reference rate plus a spread. Even if we agree with our lenders to amend the credit agreement to identify a new reference rate for borrowings thereunder, this rate may be higher than our present interest rate, thereby causing the cost of our borrowings to increase.

We may be adversely affected by litigation stemming from product liability and other claims.

Our products may contain defects that we do not detect before sale, which may lead to warranty or damage claims against us or product recalls. We are involved in various unresolved legal matters that arise in the ordinary course of our operations, including asbestos-related product liability claims related to our operations before the 1990s. For additional information, refer to “Item 3. Legal Proceedings” and “Note 13 – Commitments and Contingencies” to “Item 8. Financial Statements and Supplementary Data.” We maintain insurance coverage with respect to certain claims, but the policy coverage limits may not be adequate or cover a particular loss. Costs associated with, among other things, the defense of, or settlements or judgments relating to, claims against us that are not covered by insurance or that result in recoveries in excess of insurance coverage may adversely affect our business, results of operations and financial position. Irrespective of insurance coverage, claims against us could divert the attention of our senior management and/or result in reputational damage, thereby adversely affecting our business.

Our projections on the potential exposure and expected insurance coverage relating to our asbestos-related product liability claims are based on a number of assumptions, including the number of new claims to be filed each year, the average cost of disposing of such claims, the length of time it takes to dispose of such claims, coverage issues among insurers and the continuing solvency of various insurance companies, as well as the numerous uncertainties surrounding asbestos litigation in the United States. To the extent such assumptions are inaccurate, the net liabilities that we have recorded in our financial statements may fail to approximate the losses we could suffer in connection with such claims.

We are subject to many environmental laws and regulations as well as potential environmental liabilities that could adversely affect our business.

We are subject to a variety of federal, state, local and foreign laws, rules and regulations related to the use, storage, handling, discharge or disposal of certain toxic, volatile or otherwise hazardous chemicals, gases and other substances used in manufacturing our products. Some of these laws in the United States include the Federal Clean Water Act, Clean Air Act, Resource Conservation and Recovery Act, Comprehensive Environmental Response, Compensation, and Liability Act, Toxic Substances Control Act, and similar state statutes and regulations. In the European Union (EU) we are subject to the EU regulation on Registration, Evaluation, Authorization and Restriction of Chemicals. Compliance with these laws and regulations could require us to incur substantial expenses, including in connection with the acquisition of new equipment. Any failure to comply with present or future environmental laws, rules and regulations could result in criminal and civil liabilities, fines, suspension of production or cessation of certain operations, any of which could have a material adverse effect on our business, results of operations and financial position.

In addition, some environmental laws impose liability, sometimes without fault, for investigating and/or cleaning up contamination on, or emanating from, properties currently or formerly owned, leased or operated by us, as well as for damages to property or natural resources and for personal injury arising out of such contamination. Such liability may be joint and several, meaning that we could be held responsible for more than our share of the liability involved, or even the entire liability. For additional information, refer to “Note 13 – Commitments and Contingencies” to “Item 8. Financial Statements and Supplementary Data.”

A significant disruption in, or breach in security of, our information technology systems or violations of data protection laws could materially adversely affect our business and reputation.

In the ordinary course of business, we collect and store confidential information, including proprietary business information belonging to us, our customers, suppliers, business partners and other third parties and personally identifiable information of our employees. We rely on information technology systems to protect this information and to keep financial records, process orders, manage inventory, coordinate shipments to customers, and operate other critical functions. Our information technology systems may be susceptible to damage, disruptions or shutdowns due to power outages, hardware failures, telecommunication failures and user errors. If we experience a disruption in our information technology systems, it could result in the loss of sales and customers and significant incremental costs, which could materially adversely affect our business.

We may also be subject to security breaches caused by computer viruses, illegal break-ins or hacking, sabotage, or acts of vandalism by disgruntled employees or third parties. The risk of a security breach or disruption, particularly through cyberattack or cyber intrusion, including by computer hackers, foreign governments and cyber terrorists, has increased as the number, intensity and sophistication of attempted attacks and intrusions from around the world have increased. Our information technology network and systems have been and, we believe, continue to be under constant attack. Accordingly, despite our security measures or those of our third party service providers, a security breach may occur, including breaches that we may not be able to detect. Security breaches of our information technology systems could result in the misappropriation or unauthorized disclosure of confidential

information belonging to us or to our customers, suppliers, business partners, employees or other third parties, which could result in our suffering significant financial and reputational damage. If we are unable to protect sensitive information, our customers or governmental authorities could question the adequacy of our security processes and procedures and our compliance with evolving government cyber security requirements for government contractors.

In addition, the processing and storage of certain information is increasingly subject to privacy and data security regulations, and many such regulations are country-specific. The interpretation and application of data protection laws in the United States, Europe, and elsewhere, including the EU General Data Protection Regulation and the California Consumer Privacy Act, are uncertain, evolving and may be inconsistent among jurisdictions. Compliance with these various laws may be onerous and require us to incur substantial costs or to change our business practices in a manner that adversely affects our business, while failure to comply with such laws may subject us to substantial penalties.

Employee benefit cost increases and costs associated with the proposed termination of certain of our pension plans could reduce our profitability.

Our profitability is affected by employee benefit costs, particularly medical, pension and other employee benefits. In recent years, employee medical costs have increased due to factors such as the increase in health care costs in the United States. These factors will continue to put pressure on our business and financial performance, as employee benefit costs continue to escalate. We may not succeed in limiting future cost increases. Continued employee benefit cost increases could have an adverse effect on our results of operations, cash flows and financial position.

We also sponsor various defined benefit pension plans that cover certain employees. Our costs of providing defined benefit pension plans have risen dramatically in recent years, and are dependent upon a number of factors and assumptions that drive our projected liabilities and annual expenses, such as discount rates, the actual and projected rates of return on the plans’ assets, governmental regulation, global equity prices, portfolio composition, mortality rates and required or voluntary contributions to the plans. Changes in assumptions, the inability to grow our pension investments over time to increase the value of the plans’ assets, and other factors relating to worldwide and domestic economic trends and financial market conditions, could all have a negative impact on our pension plans, which could result in an increase in our pension liabilities, a reduction in the funded status of our plan, increases in annual expense recognized related to the plans, and requirements to increase funding for some or all of our defined benefit pension plans, among other factors, all of which could negatively impact our results of operations and financial position.

In October 2017, the Company merged two of its qualified noncontributory defined benefit pension plans (the Merged Plan). The Company currently intends to terminate the Merged Plan and has requested a determination letter from the IRS. The termination of the Merged Plan remains subject to final approval by both management and the IRS. We expect the settlement process to be completed in 2019, but the process for finalizing the termination of the Merged Plan includes compliance with a regulatory review by the IRS and the timing of the resolution of the compliance process may be delayed. Following receipt of approval from the IRS and upon the effectiveness of the termination of the Merged Plan, we plan to distribute the benefits remaining in the Merged Plan. This distribution could have an adverse effect on our results of operations, cash flows and financial position.

Item 1B. Unresolved Staff Comments

None.

Item 2. Properties

We operate various general offices and manufacturing facilities throughout the United States, Europe and Asia. The following table provides certain information about the principal general offices and manufacturing facilities used by our operating segments:

|

| | | | | | | | |

Location | | Floor Space (Square Feet) | | Type of Facility | | Leased / Owned | | Operating Segment |

United States | | | | | | | | |

Chandler, Arizona | | 147,000 | | Manufacturing | | Owned | | ACS |

Chandler, Arizona | | 105,100 | | Manufacturing | | Owned | | ACS |

Chandler, Arizona | | 100,000 | | Manufacturing | | Owned | | ACS |

Chandler, Arizona | | 75,000 | | Administrative Offices | | Owned | | All |

Chandler, Arizona | | 17,000 | | Warehouse / Administrative Offices | | Leased through 3/2020 | | ACS |

Rogers, Connecticut | | 388,100 | | Manufacturing / Administrative Offices | | Owned | | All |

Moosup, Connecticut | | 185,500 | | Manufacturing | | Owned | | EMS |

Woodstock, Connecticut | | 150,600 | | Manufacturing | | Owned | | EMS |

Carol Stream, Illinois | | 216,600 | | Manufacturing | | Owned | | EMS |

Bear, Delaware | | 125,000 | | Manufacturing / Administrative Offices | | Owned | | ACS & EMS |

Burlington, Massachusetts | | 6,000 | | R&D Lab / Administrative Offices | | Leased through 2/2021 | | All |

Narragansett, Rhode Island | | 84,600 | | Manufacturing | | Owned | | EMS |

North Kingston, Rhode Island | | 10,000 | | Warehouse | | Leased through 3/2020 | | EMS |

Santa Fe Springs, California | | 42,000 | | Manufacturing / Administrative Offices | | Leased through 3/2019 | | EMS |

Europe | | | | | | | | |

Eschenbach, Germany | | 149,000 | | Manufacturing / Administrative Offices | | Leased through 6/2021 | | PES |

Eschenbach, Germany | | 24,100 | | Warehouse / Administrative Offices | | Leased through 3/2020 | | PES |

Eschenbach, Germany | | 1,050 | | Warehouse | | Leased through 3/2020 | | PES |

Evergem, Belgium | | 122,000 | | Manufacturing / Administrative Offices | | Owned | | ACS & PES |

Evergem, Belgium | | 55,700 | | Warehouse / Administrative Offices | | Leased through 5/2021 | | ACS & PES |

Ghent, Belgium | | 45,000 | | Warehouse | | Leased through 3/2020 | | ACS & EMS |

Budapest, Hungary | | 64,000 | | Manufacturing | | Leased through 2/2023 | | PES |

Asia | | | | | | | | |

Suzhou, China | | 821,000 | | Manufacturing / Administrative Offices | | Owned | | All |

Ansan, South Korea | | 40,000 | | Manufacturing | | Leased through 10/2021 | | EMS |

Item 3. Legal Proceedings

Asbestos Products Litigation

We, like many other industrial companies, have been named as a defendant in a number of lawsuits filed in courts across the country by persons alleging personal injury from exposure to products containing asbestos. We were a defendant in 745 asbestos-related product liability cases as of December 31, 2018, compared to 687 cases as of December 31, 2017, with the change reflecting new cases, dismissals, settlements and other dispositions. We have never mined, milled, manufactured or marketed asbestos; rather, we made and provided to industrial users a limited number of products that contained encapsulated asbestos, but we stopped manufacturing these products in the late 1980s. In virtually all of the cases against us, the plaintiffs are seeking unspecified damages above a jurisdictional minimum against multiple defendants who may have manufactured, sold or used asbestos-containing products to which the plaintiffs were allegedly exposed and from which they purportedly suffered injury. Most of these cases are being litigated in Illinois, Maryland, Missouri and New York; however, we are also defending cases in other states. We intend to vigorously defend these cases, primarily on the basis of the plaintiffs’ inability to establish compensable loss as a result of exposure to our products. As of December 31, 2018, the estimated liability and estimated insurance recovery for all current and future claims projected through 2058 was $70.3 million and $63.8 million, respectively.

The defense and settlement costs of our asbestos-related product liability litigation to date have been substantially covered by insurance. As of December 31, 2018, our consolidated statements of financial position include approximately $6.5 million of estimated asbestos-related expenses that exceed asbestos-related insurance coverage for all current and future claims projected through 2058. For additional information regarding our asbestos-related product liability litigation, refer to “Note 13 – Commitments and Contingencies” to “Item 8. Financial Statements and Supplementary Data.”

Other Matters

We are currently involved in a variety of other legal proceedings that we view as ordinary routine litigation incidental to our business, including commercial disputes, intellectual property matters, personal injury claims, tax claims and employment matters. Although the outcome of no legal matter can be predicted with certainty, we do not believe that the outcome of any of these legal proceedings, either individually or in the aggregate, will have a material adverse effect on our business, results of operations, cash flows or financial position. In addition, we are involved in certain environmental matters, principally investigations, which we do not view as material legal proceedings, either pending or known to be contemplated. For additional information regarding these matters, refer to “Note 13 – Commitments and Contingencies” to “Item 8. Financial Statements and Supplementary Data.”

Item 4. Mine Safety Disclosures

Not applicable.

Part II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Capital Stock Market Prices and Dividend Policy

Our capital stock is traded on the New York Stock Exchange under the symbol “ROG”. As of the end of business on February 15, 2019, we had 312 shareholders of record. On the same date, the trading price of our capital stock closed at $136.05 per share.

We expect to maintain a policy of emphasizing longer-term growth of capital rather than immediate dividend income and do not anticipate paying cash dividends in the foreseeable future.

Performance Graph

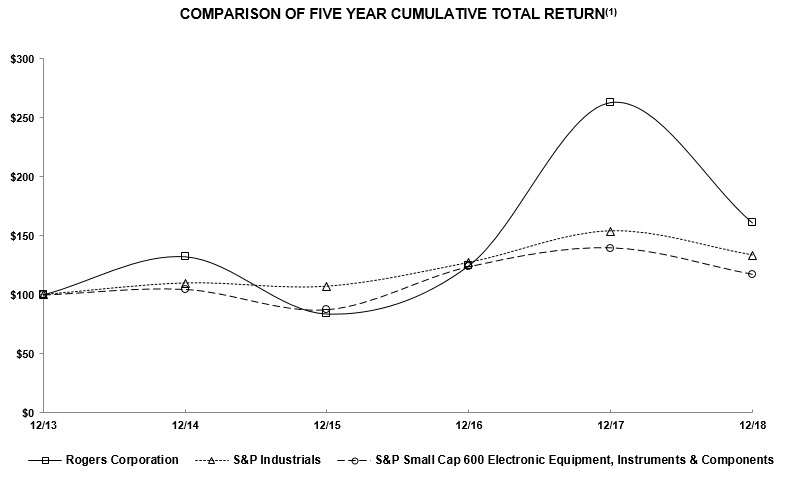

The following graph compares the cumulative total return on Rogers’ capital stock over the past five fiscal years with the cumulative total return on the Standard & Poor’s Industrials Index (S&P Industrials) and the S&P Small Cap 600 Electronic Equipment, Instruments & Components Index. The graph tracks the performance of a $100 investment in the Company’s common stock and in each of the indexes (with the reinvestment of all dividends) on the date specified.

Issuer Purchases of Equity Securities

In 2015, we initiated a share repurchase program (the Program) of up to $100.0 million of the Company’s capital stock. We initiated the Program to mitigate dilutive effects of stock option exercises and vesting of restricted stock units granted by the Company, in addition to enhancing shareholder value. The Program has no expiration date, and may be suspended or discontinued at any time without notice.

During the year ended December 31, 2018, we made $3.0 million of repurchases using cash from operations and cash on hand. As of December 31, 2018, $49.0 million remained available to purchase under the Program. For additional information regarding share repurchases, refer to “Note 21 – Share Repurchases” to “Item 8. Financial Statements and Supplementary Data.”

Item 6. Selected Financial Data

|

| | | | | | | | | | | | | | | | | | | |

(Dollars in thousands, except per share amounts) | 2018 | | 2017 | | 2016 | | 2015 | | 2014 |

Financial Results | | | | | | | | | |

Net sales | $ | 879,091 |

| | $ | 821,043 |

| | $ | 656,314 |

| | $ | 641,443 |

| | $ | 610,911 |

|

Income before income tax expense | $ | 110,589 |

| | $ | 132,925 |

| | $ | 82,280 |

| | $ | 66,173 |

| | $ | 81,224 |

|

Net income | $ | 87,651 |

| | $ | 80,459 |

| | $ | 48,283 |

| | $ | 46,320 |

| | $ | 53,412 |

|

Per Share Data |

|

|

|

|

|

|

|

| | | | |

Basic earnings per share | $ | 4.77 |

| | $ | 4.43 |

| | $ | 2.68 |

| | $ | 2.52 |

| | $ | 2.94 |

|

Diluted earnings per share | $ | 4.70 |

| | $ | 4.34 |

| | $ | 2.65 |

| | $ | 2.48 |

| | $ | 2.86 |

|

Book value | $ | 46.12 |

| | $ | 41.99 |

| | $ | 35.28 |

| | $ | 32.55 |

| | $ | 31.91 |

|

Financial Position |

|

|

|

|

|

|

|

| | | | |

Current assets | $ | 485,786 |

| | $ | 454,523 |

| | $ | 458,401 |

| | $ | 428,665 |

| | $ | 438,174 |

|

Current liabilities | $ | 107,180 |

| | $ | 113,808 |

| | $ | 101,185 |

| | $ | 78,648 |

| | $ | 120,445 |

|

Ratio of current assets to current liabilities | 4.5 to 1 | | 4.0 to 1 | | 4.5 to 1 | | 5.5 to 1 | | 3.6 to 1 |

Cash and cash equivalents | $ | 167,738 |

| | $ | 181,159 |

| | $ | 227,767 |

| | $ | 204,586 |

| | $ | 237,375 |

|

Net working capital | $ | 378,606 |

| | $ | 340,715 |

| | $ | 357,216 |

| | $ | 350,017 |

| | $ | 317,729 |

|

Property, plant and equipment, net | $ | 242,759 |

| | $ | 179,611 |

| | $ | 176,916 |

| | $ | 178,661 |

| | $ | 150,420 |

|

Total assets | $ | 1,279,344 |

| | $ | 1,125,134 |

| | $ | 1,056,500 |

| | $ | 930,355 |

| | $ | 840,435 |

|

Borrowings under revolving credit facility | $ | 228,482 |

| | $ | 130,982 |

| | $ | 235,877 |

| | $ | 173,557 |

| | $ | 25,000 |

|

Shareholders’ equity | $ | 848,324 |

| | $ | 766,573 |

| | $ | 635,786 |

| | $ | 584,582 |

| | $ | 587,281 |

|

Borrowings under revolving credit facility as a percentage of shareholders’ equity | 26.9 | % | | 17.1 | % | | 37.1 | % | | 29.7 | % | | 4.3 | % |

Other Data |

|

|

|

|

|

|

|

| | | | |

Depreciation and amortization | $ | 50,073 |

| | $ | 44,099 |

| | $ | 37,847 |

| | $ | 34,054 |

| | $ | 26,268 |

|

Research and development expenses | $ | 33,075 |

| | $ | 29,547 |

| | $ | 28,582 |

| | $ | 27,644 |

| | $ | 22,878 |

|

Capital expenditures | $ | 90,549 |

| | $ | 27,215 |

| | $ | 18,136 |

| | $ | 24,837 |

| | $ | 28,755 |

|

Number of employees (approximate) | 3,700 |

| | 3,400 |

| | 3,100 |

| | 2,800 |

| | 2,800 |

|

Net sales per employee | $ | 238 |

| | $ | 241 |

| | $ | 212 |

| | $ | 229 |

| | $ | 218 |

|

Number of shares outstanding at year end | 18,395 |

| | 18,255 |

| | 18,021 |

| | 17,957 |

| | 18,403 |

|

Amounts disclosed above for 2014 have been adjusted for our 2015 change in accounting principle from the last in, first out (LIFO) cost method to the first in, first out (FIFO) cost method for valuing inventory for all operations that were using the LIFO cost method. The financial data included within the preceding table should be read in conjunction with our Management’s Discussion and Analysis of Results of Operations and Financial Position as well as the Financial Statements and Supplementary Data included in Items 7 and 8, respectively, of this Form 10-K, and with our previously filed Forms 10-K.

Item 7. Management’s Discussion and Analysis of Results of Operations and Financial Position

The following discussion and analysis of our results of operations and financial position should be read together with the Selected Financial Data and our Consolidated Financial Statements and the related notes that appear elsewhere in this Form 10-K.

Business Overview

Rogers Corporation designs, develops, manufactures and sells high-quality and high-reliability engineered materials and components for mission critical applications. We operate three strategic operating segments: Advanced Connectivity Solutions (ACS), Elastomeric Material Solutions (EMS) and Power Electronics Solutions (PES). The remaining operations, which represent our non-core businesses, are reported in the Other operating segment. We have a history of innovation and have established Innovation Centers for our research and development activities in Chandler, Arizona; Burlington, Massachusetts; Eschenbach, Germany and Suzhou, China. We are headquartered in Chandler, Arizona.

Growth Strategy and Recent Acquisitions

Our growth strategy is based upon the following principles: (1) market-driven organization, (2) innovation leadership, (3) synergistic mergers and acquisitions, and (4) operational excellence. As a market-driven organization, we are focused on growth drivers, including advanced mobility and advanced connectivity. More specifically, the key trends currently affecting our business include the increasing use of advanced driver assistance systems and adoption of electric and hybrid electric vehicles in the automotive industry and new technology adoption in the telecommunications industry, including next generation wireless infrastructure. In addition to our focus on advanced mobility and advanced connectivity in the automotive and telecommunications industries, we sell into a variety of other end markets including renewable energy, consumer electronics, aerospace and defense and diverse general industrial applications.

Our sales and marketing approach is based on addressing these trends, while our strategy focuses on factors for success as a manufacturer of engineered materials and components: quality, service, cost, efficiency, innovation and technology. We have expanded our capabilities through organic investment and acquisitions, and we strive to ensure high quality solutions for our customers. We continue to review and re-align our manufacturing and engineering footprint in an effort to attain a leading competitive position globally. We have established or expanded our capabilities in various locations in support of our customers’ growth initiatives.

We seek to enhance our operational and financial performance by investing in research and development, manufacturing and materials efficiencies, and new product initiatives that respond to the needs of our customers. We strive to evaluate operational and strategic alternatives to improve our business structure and align our business with the changing needs of our customers and major industry trends affecting our business.

In executing on our growth strategy, we have completed three strategic acquisitions in the last three fiscal years: (1) in July 2018, we acquired Griswold LLC (Griswold), a manufacturer of a wide range of high-performance engineered cellular elastomer and microcellular polyurethane products and solutions, (2) in January 2017, we acquired the principal operating assets of Diversified Silicone Products, Inc. (DSP), a custom silicone product development and manufacturing business serving a wide range of high reliability applications, and (3) in November 2016, we acquired DeWAL Industries LLC (DeWAL), a manufacturer of polytetrafluoroethylene and ultra-high molecular weight polyethylene films, pressure sensitive tapes and specialty products for the industrial, aerospace, automotive and electronics markets. Additionally, in August 2018, we acquired a production facility and related machinery and equipment located in Chandler Arizona from Isola USA Corp (Isola).

2018 Executive Summary

In 2018 as compared to 2017, our net sales increased 7.1% to $879.1 million, gross margin decreased approximately 340 basis points to 35.4%, and operating income as a percentage of net sales decreased approximately 290 basis points to 12.8%. The following key factors should be considered when reviewing our results of operations, financial position and liquidity for the periods discussed:

| |

• | Our net sales increase in 2018 was attributable to increases in net sales in our EMS and PES strategic operating segments. Net sales were favorably impacted by higher net sales in electric and hybrid electric vehicle and micro-channel cooler applications in our PES operating segment and higher net sales in portable electronics and automotive applications in our EMS operating segment, partially offset by lower net sales in wireless 4G LTE and portable electronics applications in our ACS operating segment. The increase in net sales was also driven in part by net sales of $13.7 million, or 1.7%, related to our acquisition of Griswold, as well as $15.5 million, or 1.9%, of favorable impacts from appreciation in value of the Euro and Renminbi relative to the U.S. dollar. The adoption of new accounting guidance for revenue recognition favorably impacted net sales in 2018 by $4.6 million, or 0.6%. |

| |

• | Our gross margin decreased approximately 340 basis points to 35.4% in 2018 from 38.8% in 2017. Gross margin was unfavorably impacted as a result of strategic investments in capacity optimization and infrastructure to support future growth initiatives, increased costs for raw materials, facility consolidation and new product launch, as well as unfavorable |

absorption of fixed costs. The adoption of new accounting guidance for revenue recognition favorably impacted gross margin in 2018 by $1.5 million, or 0.5%.

| |

• | Our operating income decreased 12.7% to $112.7 million in 2018, as compared to $129.1 million in 2017. The decrease was primarily due to a decrease in gross margin, as well as a $2.4 million increase in selling, general & administrative (SG&A) expenses and a $3.5 million increase in research and development (R&D) expenses, furthered by a decrease in other operating income of $2.2 million. The increase in SG&A expenses was driven by increases in acquisition expenses as well as other intangible assets amortization related to Griswold. SG&A expenses decreased as a percentage of net sales from 19.7% in 2017 to 18.7% in 2018. The decrease in other operating income was primarily due to the $3.5 million of depreciation expense on leased assets netted against the $0.9 million of imputed income related to the Isola asset acquisition. |

| |

• | We are an innovation company, and in 2018 we continued our investment in R&D, with R&D expenses comprising 3.8% of net sales, an increase of approximately 20 basis points from 2017. R&D expenses were $33.1 million in 2018, as compared to $29.5 million in 2017. We have made concerted efforts to realign our R&D organization to better fit the expected future direction of our Company, including dedicating resources to focus on current product extensions and enhancements to meet our expected short-term and long-term technology needs. |

| |

• | We acquired Griswold in July 2018, as we continue to execute on our synergistic acquisition strategy. Acquisitions are a core part of our growth strategy, and the Griswold acquisition extends the product portfolio and technology capabilities of our EMS operating segment. We financed our acquisition of Griswold with $82.5 million in borrowings under our revolving credit facility. As a result, borrowings under our revolving credit facility increased in 2018. |

| |

• | In preparation for expected demand in advanced connectivity and advanced mobility, we acquired a production facility and related machinery and equipment from Isola in August 2018. We intend to use the purchased assets for capacity expansion within our ACS operating segment in contemplation of expected future demand from our 5G customers. We financed the asset acquisition with $43.4 million in cash on hand. |

Results of Operations

The following table sets forth, for the periods indicated, selected operations data expressed as a percentage of net sales.

|

| | | | | | | | |

| 2018 | | 2017 | | 2016 |

Net sales | 100.0 | % | | 100.0 | % | | 100.0 | % |

Gross margin | 35.4 | % | | 38.8 | % | | 38.0 | % |

| | | | | |

Selling, general and administrative expenses | 18.7 | % | | 19.7 | % | | 21.2 | % |

Research and development expenses | 3.8 | % | | 3.6 | % | | 4.4 | % |

Restructuring and impairment charges | 0.5 | % | | 0.4 | % | | 0.1 | % |

Other operating (income) expense, net | (0.4 | )% | | (0.6 | )% | | — | % |

Operating income | 12.8 | % | | 15.7 | % | | 12.3 | % |

| | | | | |

Equity income in unconsolidated joint ventures | 0.6 | % | | 0.6 | % | | 0.6 | % |

Other income (expense), net | (0.1 | )% | | 0.6 | % | | 0.2 | % |

Interest expense, net | (0.7 | )% | | (0.7 | )% | | (0.6 | )% |

Income before income tax expense | 12.6 | % | | 16.2 | % | | 12.5 | % |

Income tax expense | 2.6 | % | | 6.4 | % | | 5.1 | % |

Net income | 10.0 | % | | 9.8 | % | | 7.4 | % |

2018 vs. 2017

|

| | | | | | | | | | |

Net Sales | | | | | | |

(Dollars in thousands) | | 2018 | | 2017 | | Percent Change |

Net sales | | $ | 879,091 |

| | $ | 821,043 |

| | 7.1% |

Net sales increased by 7.1% in 2018 compared to 2017. Our EMS and PES operating segments had net sales increases of 9.2% and 20.8%, respectively, while our ACS operating segment had a net sales decrease of 2.3%. The increase in net sales was favorably impacted by higher net sales in electric and hybrid electric vehicles and micro-channel cooler applications in our PES operating segment and higher net sales in portable electronics and automotive applications in our EMS operating segment, partially offset by lower net sales in wireless 4G LTE and portable electronics applications in our ACS operating segment. The increase in net sales was also driven in part by net sales of $13.7 million, or 1.7%, related to our acquisition of Griswold, as well as $15.5 million, or 1.9%, of favorable currency fluctuations due to the appreciation in value of the Euro and Renminbi relative to the U.S. dollar. The adoption of new accounting guidance for revenue recognition favorably impacted net sales in 2018 by $4.6 million, or 0.6%. For additional information regarding the impacts of adoption of new accounting guidance for revenue recognition, refer to “Note 16 – Revenue from Contracts with Customers,” as well as “Note 15 – Operating Segment and Geographic Information” to “Item 8. Financial Statements and Supplementary Data.”

|

| | | | | | | | | | |