FTEK-2014.12.31-10K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________________

Form 10-K

______________________________(Mark One)

|

| |

ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended: December 31, 2014

OR

|

| |

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 001-33059

______________________________

Fuel Tech, Inc.

(Exact name of registrant as specified in its charter)

______________________________

|

| | |

Delaware | | 20-5657551 |

(State of Incorporation) | | (I.R.S. ID) |

Fuel Tech, Inc.

27601 Bella Vista Parkway

Warrenville, IL 60555-1617

(630) 845-4500

www.ftek.com

Securities registered pursuant to Section 12(b) of the Act:

|

| | |

COMMON STOCK, $0.01 par value per share | | NASDAQ |

Securities registered pursuant to Section 12(g) of the Act: NONE

______________________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ¨ No ý

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large" accelerated filer, "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

|

| | | | | |

Large Accelerated Filer | | ¨ | | Accelerated Filer | ý |

| | | |

Non-accelerated Filer | | ¨ (Do not check if a smaller reporting company) | | Smaller reporting company | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No ý

As of June 30, 2014, the aggregate market value of the registrant's common stock held by non-affiliates of the registrant was approximately $116,302,000 based on the closing sale price as reported on the NASDAQ National Market System.

As of March 16, 2015, there were 22,860,398 shares of common stock outstanding.

Documents incorporated by reference:

Portions of the definitive Proxy Statement to be delivered to shareholders in connection with the Annual Meeting of Shareholders to be held on May 21, 2015 are incorporated by reference into Part III.

TABLE OF CONTENTS

|

| | |

| | Page |

| | |

| | |

| | |

Item 1. | | |

Item 1A. | | |

Item 1B. | | |

Item 2. | | |

Item 3. | | |

Item 4. | | |

| | |

| | |

| | |

Item 5. | | |

Item 6. | | |

Item 7. | | |

Item 7A. | | |

Item 8. | | |

Item 9. | | |

Item 9A. | | |

Item 9B. | | |

| | |

| | |

| | |

Item 10. | | |

Item 11. | | |

Item 12. | | |

Item 13. | | |

Item 14. | | |

| | |

| | |

| | |

Item 15. | | |

| |

| |

TABLE OF DEFINED TERMS

|

| | |

Term | | Definition |

| |

ABC | | American Bailey Corporation |

| |

AIG | | Ammonia Injection Grid |

| |

ASCR™ | | A trademark used to describe our Advanced Selective Catalytic Reduction process |

| |

CAIR | | Clean Air Interstate Rule |

| |

CAVR | | Clean Air Visibility Rule |

| |

CSAPR | | Cross-State Air Pollution Rule |

| | |

CFD | | Computational Fluid Dynamics |

| |

Common Shares | | Shares of the Common Stock of Fuel Tech |

| |

EPA | | The U.S. Environmental Protection Agency |

| |

ESP | | Electrostatic Precipitator |

| | |

FGC | | Flue Gas Conditioning |

| |

FUEL CHEM® | | A trademark used to describe our fuel and flue gas treatment processes, including its TIFI® Targeted In-Furnace Injection™ technology to control slagging, fouling, corrosion and a variety of sulfur trioxide-related issues |

| |

GSG™ | | Graduated Straightening Grid |

| |

HERT™ High Energy Reagent Technology™ | | A trademark used to describe one of our SNCR processes for the reduction of NOx |

| |

Loan Notes | | Nil-coupon, non-redeemable convertible unsecured loan notes of Fuel Tech |

| |

NOx | | Oxides of nitrogen |

| |

NOxOUT® | | A trademark used to describe one of our SNCR processes for the reduction of NOx |

| |

NOxOUT-SCR® | | A trademark used to describe our direct injection of urea as a catalyst reagent |

| |

NOxOUT CASCADE® | | A trademark used to describe our process for the combination of SNCR and SCR technologies |

| |

SCR | | Selective Catalytic Reduction |

| |

SNCR | | Selective Non-Catalytic Reduction |

| |

TCI® Targeted Corrosion Inhibition™ | | A trademark used to describe the FUEL CHEM program designed for high-temperature slag and corrosion control, principally in waste-to-energy boilers |

| |

TIFI® Targeted In-Furnace Injection™ | | A trademark used to describe our proprietary technology that enables the precise injection of a chemical reagent into a boiler or furnace as part of a FUEL CHEM program |

| |

ULTRA™ | | A trademark used to describe our process for generating ammonia for use as a Selective Catalytic Reduction reagent |

PART I

Forward-Looking Statements

This Annual Report on Form 10-K contains “forward-looking statements,” as defined in Section 21E of the Securities Exchange Act of 1934, as amended, that are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and reflect our current expectations regarding our future growth, results of operations, cash flows, performance and business prospects, and opportunities, as well as assumptions made by, and information currently available to, our management. We have tried to identify forward-looking statements by using words such as “anticipate,” “believe,” “plan,” “expect,” “intend,” “will,” and similar expressions, but these words are not the exclusive means of identifying forward-looking statements. These statements are based on information currently available to us and are subject to various risks, uncertainties, and other factors, including, but not limited to, those discussed herein under the caption “Risk Factors” that could cause our actual growth, results of operations, financial condition, cash flows, performance and business prospects and opportunities to differ materially from those expressed in, or implied by, these statements. Except as expressly required by the federal securities laws, we undertake no obligation to update such factors or to publicly announce the results of any of the forward-looking statements contained herein to reflect future events, developments, or changed circumstances or for any other reason. Investors are cautioned that all forward-looking statements involve risks and uncertainties, including those detailed in our filings with the Securities and Exchange Commission. See “Risk Factors” in Item 1A.

ITEM 1 - BUSINESS

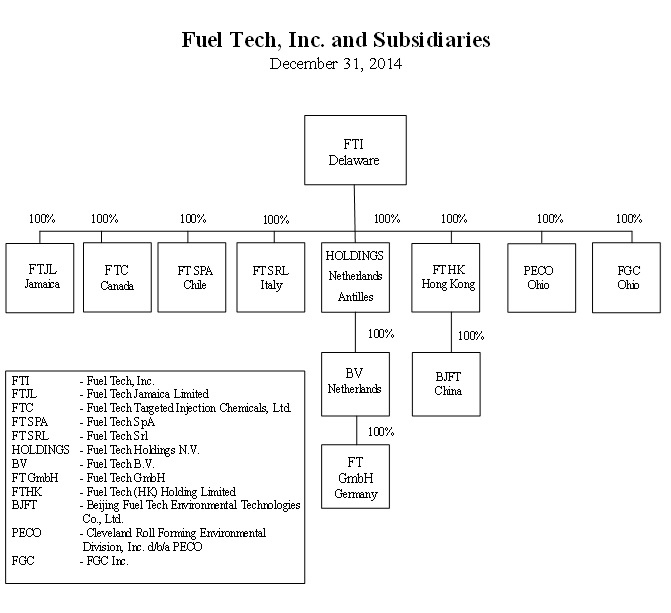

As used in this Annual Report on Form 10-K, the terms “we,” “us,” or “our,” refer to Fuel Tech, Inc. and our wholly-owned subsidiaries.

GENERAL

We are a leading technology company engaged in the worldwide development, commercialization and application of state-of-the-art proprietary technologies for air pollution control, process optimization, combustion efficiency and advanced engineering services. These technologies enable our customers to operate efficiently in a cost-effective and environmentally sustainable manner. We operate as a fully integrated company with a capital projects business to leverage our Air Pollution Control (APC) technologies and a specialty chemicals business which builds upon our proprietary FUEL CHEM® processes. Both segments rely heavily on our unique ability to inject chemical slurries into combustion units, in precise concentrations and locations, to achieve a desired outcome.

| |

• | Our APC technologies include advanced combustion modification techniques including low NOx burners and over fire air systems, along with post-combustion nitrogen oxide (NOx) control approaches, including NOxOUT® and HERT™ Selective Non-Catalytic Reduction (SNCR), Advanced Selective Catalytic Reduction (ASCR) system and I-NOxTM Integrated NOx Reduction Systems, which utilize various combined proprietary technologies to provide a cost effective alternative to high capital cost, standalone conventional SCR systems. Our patented ULTRA™ system generates ammonia on-site for SCR systems using safe urea reagent. Our SCR group provides process design optimization, performance testing and improvement, and catalyst selection services for SCR systems on coal-fired boilers. These technologies have established us as a leader in NOx reduction, with installations on over 1,000 units worldwide, where coal, fuel oil, natural gas, municipal waste, biomass, and other fuels are utilized. Our technologies for particulate control include Electrostatic Precipitator (ESP) products and services including ESP inspection services, performance modeling, and performance and efficiency upgrades, along with complete turnkey capability for ESP retrofits, with more than 60 major rebuilds on units up to 700 MW. Our flue gas conditioning (FGC) systems involve sulfur trioxide (SO3) and ammonia (NH3) conditioning to improve the performance of ESPs by modifying the properties of the fly ash particle. FGC systems offer a lower capital cost approach to improving ash particulate capture versus the alternative of installing larger ESPs or utilizing fabric filter technology to meet targeted emissions and opacity limits. Our particulate control technologies have been installed on more than 125 units worldwide. |

APC technology service offerings include a range of combustion optimization services, including airflow testing, coal flow testing and boiler tuning, as well as services to help optimize SCR system performance, including catalyst management services and ammonia injection grid tuning. In addition, flow corrective devices and physical and computational modeling services are available to optimize flue gas distribution and mixing in both power plant and industrial applications.

| |

• | Our FUEL CHEM technologies revolve around the unique application of chemical injection programs which improve the efficiency, reliability, fuel flexibility and environmental status of combustion units by controlling slagging, fouling, corrosion, opacity and acid plume, as well as the formation of sulfur trioxide (SO3), ammonium bisulfate, particulate matter (PM2.5), and carbon dioxide (CO2). We use our patented TIFI® Targeted In-Furnace Injection™ processes to apply sp |

ecialty chemical programs to units burning a wide variety of fuels including coal, heavy oil, biomass, and municipal waste. These TIFI programs incorporate design, modeling, equipment, reagent, and service to provide complete customized on-site programs designed to improve plant operations and provide a return on investment in addition to helping meet emission regulatory requirements.

Many of our products and services rely heavily on our computational fluid dynamics and chemical kinetics modeling capabilities, which are enhanced by internally developed, high-end visualization software. These capabilities, coupled with our innovative technologies and multi-disciplined team approach, enable us to provide practical solutions to some of our customers' most challenging issues.

Air Pollution Control

Regulations and Markets: Domestic

The continued growth of our APC technology segment is dependent upon the adoption and enforcement of increasingly stringent environmental regulations in the U.S. and globally. In the U.S., federal and state laws regulating the emission of NOx are the primary driver in our APC technology segment. The principal regulatory drivers currently in effect are as follows:

Clean Air Act: The Clean Air Act (CAA) requires the U.S. Environmental Protection Agency (EPA) to establish national ambient air quality standards (NAAQS) at levels that are protective of public health with an adequate margin of safety. The six pollutants specified include: Ozone (O3), Particulate Matter (PM), Nitrogen Dioxide (NO2), Sulfur Dioxide (SO2), Lead, and Carbon Monoxide (CO). The NAAQS provisions require that states comply with ozone and particulate emissions standards. NOx emissions are a precursor to ozone formation and also contribute to fine particulate emissions (PM2.5), which has been the recent regulatory driver through the Cross-State Air Pollution Rule (CSAPR). NOx emissions were targeted as contributors to fine particulate emissions and ozone emissions. Since 1990, programs have been established by the EPA at the regional and federal level to help states in their mission to define and meet their State Implementation Plans (SIPs) for attainment. NAAQS PM standards were issued in 1997, with more stringent standards issued in 2006 and 2012. The NAAQS ozone standards issued in 1997 were made more stringent in 2008. The EPA has stated it plans to revise the 2008 ozone NAAQS during 2015.

Cross-State Air Pollution Rule: On July 7, 2011, the Environmental Protection Agency passed the Cross-State Air Pollution Rule under the “good neighbor” provision of the Clean Air Act to reduce emissions of SO2 and NOx from power plants in the eastern half of the United States. This rule replaces the Clean Air Interstate Rule (CAIR) and focuses on reducing air emissions contributing to fine particle (PM2.5) and ozone nonattainment that often travel across state lines; including SO2 and NOx which contribute to PM2.5 transport. CSAPR affected 27 states, with compliance for the first phase in 2012, with additional reductions required in the second phase by 2014. Under CSAPR, state emission caps were designated to mitigate the emission impact on downwind states by controlling emissions from upwind states. If sources within a state caused the state to exceed its assurance limit, severe penalties including a two-for-one reduction based on each source’s contribution percentage of the state overage would be applied. The DC Circuit Court vacated CSAPR on August 21, 2012, with a 2-1 vote. The Supreme Court overturned the DC Circuit Court decision on April 29, 2014, which reinstated CSAPR on a 6-2 vote. Subsequently, the EPA revised the implementation dates from the original 2011 CSAPR plan, with Phase 1 of CSAPR starting on January 1, 2015, and Phase 2 to commence on January 1, 2017.

Industrial Boiler MACT: In December 2011, the EPA re-proposed its new emissions rule for industrial, commercial and institutional boilers and process heaters, known as the Industrial Boiler Maximum Achievable Control Technology (MACT) standard. The EPA proposed the final rule on January 31, 2013, with compliance scheduled for January 2016. Emissions regulated include acid gas emissions including hydrochloric acid (HCl), carbon monoxide (CO), mercury, PM, and dioxins.

Clean Air Visibility Rule: Also known as the Regional Haze rule, the Clean Air Visibility Rule (CAVR) is part of the Clean Air Act and was finalized in 2005. Under CAVR, certain States are required to submit implementation plans to the EPA to comply with the Regional Haze requirements, and updates are required every five years. The overall obligation of CAVR is to return the U.S. scenic areas to “active” visibility by 2064.

Consent Decrees: Consent decree activity through the U.S. Department of Justice or EPA may require emission sources to meet individual requirements. Sources may also agree to specific air pollution requirements with states or environmental groups.

Regulations and Markets: International

We also sell NOx control systems outside the United States, specifically in Europe, Latin America, South America, and the Pacific Rim, including the People’s Republic of China (China). Under European Union Directives and new regulations in Chile, certain power plants must come into compliance with specified NOx reduction targets by 2016.

China continues to represent an attractive opportunity for us as the government set pollution control and energy conservation and efficiency improvements as top priorities as part of tightened standards that were issued in 2012. We have viable technologies to help achieve these objectives. China’s dominant reliance on coal as an energy resource is not expected to change in the foreseeable future. China alone is forecasted to account for 76% of the projected increase in world coal use through 2035. Clean air will continue to be a pressing issue, especially given China’s robust economic growth, expected growth in thermal power production, and an increasingly expanded role in international events and organizations.

China’s Ministry of Environmental Protection issued regulations to be implemented as part of the Twelfth Five-Year Plan, running from 2011 to 2015, in support of reducing harmful pollutants and further defining the technologies recommended to achieve the reductions. The regulations for NOx apply to all thermal power units that have a steaming rate of 65 tons per hour (155 megawatts (MW) or larger. Newly constructed units and existing units that were approved subsequent to December 31, 2013, must meet the same stringent emission standard, while certain existing units approved prior to December 31, 2013 must meet a standard that is less stringent. In addition, all units that are in Key Regions must achieve the same standard as the newly constructed units. Key Regions are defined as those areas that are highly developed or highly populated and are sensitive to environmental overloading.

In addition, the regulation noted that NOx reduction should be achieved via the use of low NOx burners and over-fire air systems in combination with SNCR or SCR, where appropriate, to achieve required emissions levels. The combination of SNCR and SCR technologies in tandem is also considered as a viable technology choice.

While the current regulations do not specifically comment on the use of urea as the preferred reducing reagent in the NOx control process in high population density areas, we believe that technologies to convert urea to ammonia will be deployed in Key Regions in support of safety objectives, and this practice has already been implemented in major cities such as Beijing, Guangzhou and Shanghai.

Products

Our NOx reduction and particulate control technologies are installed worldwide on over 1000 combustion units, including utility, industrial and municipal solid waste applications. Our products include customized NOx control systems and our patented ULTRA™ technology, which converts urea-to-ammonia on site and provides safe reagent for use in Selective Catalytic Reduction (SCR) systems.

| |

• | Burner Systems: Low NOx Burners and Ultra Low NOx Burners (LNB and ULNB) are available for coal-, oil-, and gas-fired industrial and utility units. Each system application is specifically designed to maximize NOx reduction. Computational fluid dynamics combustion modeling is used to validate the design prior to fabrication of equipment. NOx reductions can range from 40%-60% depending on the fuel type. Over-Fire Air (OFA) systems stage combustion for enhanced NOx reduction. Additional NOx reductions, beyond Low NOx Burners, of 35% - 50% are possible on different boiler configurations on a range of fuel types. Combined overall reductions range from 50% - 70%, with overall capital costs ranging from $10 - $20/kW and total costs ranging from $300 - $1,500/ton of NOx removed, depending on the scope. |

| |

• | SNCR Systems: Our NOxOUT® and HERT™ SNCR processes use non-hazardous urea as the reagent rather than ammonia. Both the NOxOUT® and HERT™ processes on their own are capable of reducing NOx by up to 25% - 50% for utilities and by potentially significantly greater amounts for industrial units in many types of plants with capital costs ranging from $5 - $20/kW for utility boilers and with total annualized operating costs ranging from $1,000 - $2,000/ton of NOx removed. |

| |

• | Combined Systems: Our Advanced Selective Catalytic Reduction (ASCR™) systems include LNB, OFA, and SNCR components, along with a downsized SCR catalyst, Ammonia Injection Grid (AIG), and Graduated Straightening Grid (GSG™) system. Together, these systems provide up to 90% NOx reduction at significantly lower capital and operating costs than conventional SCR systems while providing greater operational flexibility to plant operators. The capital costs for ASCR systems can range from $30 - $150/kW depending on boiler size and configuration, which is significantly less than that of conventional SCRs, which can cost $300/kW or more, while operating costs are competitive with those experienced by SCR systems. The NOxOUT CASCADE® and NOxOUT-SCR® processes are basic types of ASCR systems which use just SNCR and SCR catalyst components. The NOxOUT CASCADE® systems can achieve 60% - 70% NOx reduction, with capital costs being a portion of the ASCR values defined above. Our NOxOUT-SCR® process utilizes urea as the SCR catalyst reagent to achieve NOx reductions of up to 85% from smaller stationary combustion sources with capital and operating costs competitive with equivalently sized, standard SCR systems. |

| |

• | ULTRA Technology: Our ULTRA™ process is designed to convert urea to ammonia safely and economically for use as a reagent in the SCR process for NOx reduction. Recent local objections in the ammonia permitting process have raised concerns regarding the safety of ammonia shipment and storage in quantities sufficient to supply SCR. In addition, the Department of Homeland Security has characterized anhydrous ammonia as a Toxic Inhalation Hazard commodity. Overse |

as, new coal-fired power plants incorporating SCR systems are expected to be constructed at a rapid rate in China, and our ULTRA™ process is believed to be a market leader for the safe conversion of urea to ammonia just prior to injection into the flue gas duct, which is particularly important near densely populated cities, major waterways, harbors or islands, or where the transport of anhydrous or aqueous ammonia is a safety concern.

| |

• | SCR Processes and Services: Our SCR group provides SCR systems for industrial applications, managing all aspects of the process from application analysis through implementation in order to maximize SCR performance and minimize its impact on plant operations. Our SCR group also provides process design optimization, performance testing and improvement, and catalyst selection services for SCR systems on coal-fired boilers. In addition, other related services, including start-ups, maintenance support and general consulting services for SCR systems, Ammonia Injection Grid design and tuning to help optimize catalyst performance, and catalyst management services to help optimize catalyst life, are now offered to customers around the world. We also specialize in both physical experimental models, which involve construction of scale models through which flows are tested, and computational fluid dynamics models, which simulate fluid flow by generating a virtual replication of real-world geometry and operating inputs. We design flow corrective devices, such as turning vanes, ash screens, static mixers and our patent pending Graduated Straightening Grid (GSG™). Our models help clients optimize performance in flow critical equipment, such as selective catalytic reactors in SCR systems, where the effectiveness and longevity of catalysts are of utmost concern. Our modeling capabilities are also applied to other power plant systems where proper flow distribution and mixing are important for performance, such as flue gas desulphurization scrubbers, electrostatic precipitators, air heaters, exhaust stacks and carbon injection systems for mercury removal. |

| |

• | ESP Processes and Services: ESP technologies for particulate control include Electrostatic Precipitator (ESP) products and services including ESP Inspection Services, Performance Modeling, and Performance and Efficiency Upgrades, along with complete turnkey capability for ESP retrofits. Flue gas conditioning (FGC) systems include treatment using sulfur trioxide (SO3) and ammonia (NH3) based conditioning to improve the performance of ESPs by modifying the properties of the fly ash particle. Our ULTRA technology can provide the ammonia system feed requirements for FGC applications as a safe alternative to ammonia reagent based systems. FGC systems offer a lower capital cost approach to improving ash particulate capture versus the alternative of installing larger ESPs or utilizing fabric filter technology to meet targeted emissions and opacity limits. Fuel Tech’s particulate control technologies have been installed on more than 125 units worldwide. |

The key market dynamic for the APC product line is the continued use of coal as the principal fuel source for global electricity production. Coal currently accounts for approximately 37% of all U.S. electricity generation and roughly 80% of Chinese electricity generation. Major coal consumers include China, the United States and India.

Sales of APC products were $42.0 million, $72.6 million, and $62.4 million for the years ended December 31, 2014, 2013 and 2012, respectively.

NOx Reduction Competition

Competition with our NOx reduction suite of products may be expected from companies supplying urea SNCR systems, combustion modification products, SCR systems and ammonia SNCR systems. In addition, we experience competition in the urea-to-ammonia conversion market.

Combustion modifications, including Low NOx Burners and Over-Fire Air systems, can be fitted to most types of boilers with cost and effectiveness varying with specific boilers. Combustion modifications may yield up to 20% - 60% NOx reduction economically with capital costs ranging from $10 - $20/kW and total costs ranging from $300 - $1,500/ton of NOx removed. The modifications are designed to reduce the formation of NOx and are typically the first NOx reduction efforts employed. Companies such as Alstom, Babcock Power, Inc., The Babcock & Wilcox Burner Business, Peerless Manufacturing Company, Foster Wheeler Corporation, and Siemens are active competitors in the Low NOx Burner business. Once NOx is formed, then the SCR process is an effective and proven method of control for removal of NOx up to 90%. SCR systems have a high capital cost of $300+/kW on retrofit coal applications. Such companies as Alstom, Babcock Power, The Babcock & Wilcox Company, AMEC through their acquisition of Foster Wheeler Corporation, Peerless Manufacturing Company, Mitsubishi Hitachi Power Systems, Cormetech and Johnson Matthey, are active SCR system providers, or providers of the catalyst itself.

The use of ammonia as the reagent for the SNCR process can reduce NOx by 30% - 70% on incinerators, but has limited applicability in the utility industry. Ammonia system capital costs range from $5 - $20/kW, with annualized operating costs ranging from $1,000 - $3,000/ton of NOx removed. These systems require the use of either anhydrous or aqueous ammonia, both of which are hazardous substances.

In addition to or in lieu of using the foregoing processes, certain customers may elect to close or de-rate plants, purchase electricity from third-party sources, switch from higher to lower NOx-emitting fuels or purchase NOx emission allowances.

Lastly, with respect to urea-to-ammonia conversion technologies, a competitive approach to our controlled urea decomposition system competes with Wahlco, Inc., which manufactures a system that hydrolyzes urea under high temperature and pressure.

APC BACKLOG

Consolidated APC segment backlog at December 31, 2014 was $18.0 million versus backlog at December 31, 2013 of $22.4 million. A substantial portion of the backlog as of December 31, 2014 should be recognized as revenue in fiscal 2015, although the timing of such revenue recognition in 2015 is subject to the timing of the expenses incurred on existing projects.

FUEL CHEM

Product and Markets

The FUEL CHEM® technology segment revolves around the unique application of specialty chemicals to improve the efficiency, reliability and environmental status of plants operating in the electric utility, industrial, pulp and paper, waste-to-energy, and university and district heating markets. FUEL CHEM programs are currently in place on combustion units in North America, Mexico and Europe, treating a wide variety of solid and liquid fuels, including coal, heavy oil, black liquor, biomass and municipal waste.

Central to the FUEL CHEM approach is the introduction of chemical reagents, such as magnesium hydroxide, to combustion units via in-body fuel application (pre-combustion) or via direct injection (post-combustion) utilizing our proprietary TIFI® technology. By attacking performance-hindering problems, such as slagging, fouling and corrosion, as well as the formation of sulfur trioxide (SO3), ammonium bisulfate (ABS), particulate matter (PM2.5), carbon dioxide (CO2), and unburned carbon in fly ash, our programs offer numerous operational, financial and environmental benefits to owners of boilers, furnaces and other combustion units.

The key market dynamic for this product line is the continued use of coal as the principal fuel source for global electricity production. Coal currently accounts for approximately 37% of all U.S. electricity generation and roughly 80% of Chinese electricity generation. Major coal consumers include the United States, China and India. Additional market dynamics include a growing, worldwide utilization of biomass for both steam and electrical production, as well as the strengthening of the pulp and paper industry worldwide, resulting in black liquor recovery boilers needing to maximize throughput.

The principal markets for this product line are electric power plants burning coals with slag-forming constituents such as sodium, iron and high levels of sulfur. Sodium is typically found in the Powder River Basin coals of Wyoming and Montana. Iron is typically found in coals produced in the Illinois Basin region. High sulfur content is typical of Illinois Basin coals and certain Appalachian coals. High sulfur content can give rise to unacceptable levels of SO3 formation especially in plants with SCR systems and flue gas desulphurization units (scrubbers).

The combination of slagging coals and SO3-related issues, such as “blue plume” formation, air pre-heater fouling and corrosion, SCR fouling and the proclivity to suppress certain mercury removal processes, represents an attractive market potential for Fuel Tech.

A potentially large fuel treatment market exists in Mexico, where high-sulfur, low-grade fuel oil containing vanadium and nickel is a major source for electricity production and refinery steam production. The presence of these metallic constituents and high sulfur promotes slag build-up and high and low temperature corrosion of combustion units, and releases acid gas emissions from the stack. We have successfully treated such units with our TIFI and in-fuel technologies. To capitalize on this market opportunity, we have a license implementation agreement that expires in 2015 with options for renewal with a Mexican company to implement our TIFI program for utility and industrial end user customers in Mexico. Since 2011, our TIFI program has been in continuous use on three boilers located at a power plant in Mexico (110 MW generating capacity). In addition, we have installed TIFI equipment on three boilers at a separate power plant (610 MW) in connection with the implementation agreement.

Sales of the FUEL CHEM products were $37.0 million, $36.8 million, and $35.2 million for the years ended December 31, 2014, 2013 and 2012, respectively.

Competition

Competition for our FUEL CHEM product line includes chemicals sold by specialty chemical and combustion engineering companies, such as Nalco (Ecolab), Environmental Energy Services, Inc., and GE Infrastructure.

INTELLECTUAL PROPERTY

The majority of our products are protected by U.S. and non-U.S. patents. We own 93 granted patents worldwide and nine allowed utility model patents in China. We have 119 patent applications pending; including 13 in the United States and 106 in non-U.S. jurisdictions, as well as 6 pending utility models in China. These patents and applications cover some 31 inventions, 16 associated with our NOx reduction business, 12 associated with the FUEL CHEM business and three associated with non-commercialized technologies. Our granted patents have expiration dates ranging from August 14, 2015 to April 1, 2033. We have one patent due to expire in 2015 which is for a non-commercialized technology in Taiwan.

Management believes that the protection provided by the numerous claims in the above referenced patents or patent applications is substantial, and afford us a significant competitive advantage in our business. Accordingly, any significant reduction in the protection afforded by these patents or any significant development in competing technologies could have a material adverse effect on our business.

EMPLOYEES

At December 31, 2014, we had 198 employees, 148 in North America, 38 in China, six in Europe and six in Chile. We enjoy good relations with our employees and are not a party to any labor management agreement.

RELATED PARTIES

Douglas G. Bailey, a member of our executive team, is a stockholder of American Bailey Corporation (ABC), which is a related party. Please refer to Note 11 to the consolidated financial statements in this document for information about our transactions with ABC. Additionally, see the more detailed information relating to this subject under the caption “Certain Relationships and Related Transactions” in our definitive Proxy Statement to be distributed in connection with our 2015 Annual Meeting of Stockholders, which information is incorporated by reference.

AVAILABLE INFORMATION

We are a fully integrated company using a suite of advanced technologies to provide boiler optimization, efficiency improvement and air pollution reduction and control solutions to utility and industrial customers worldwide. Originally incorporated in 1987 under the laws of the Netherlands Antilles as Fuel-Tech N.V., we were domesticated in the United States on September 30, 2006, and continue as a Delaware corporation with our corporate headquarters at 27601 Bella Vista Parkway, Warrenville, Illinois, 60555-1617. Fuel Tech maintains an Internet website at www.ftek.com. Our Annual Report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and any amendments to those reports filed or furnished pursuant to Section 13(a) of the Exchange Act are made available through our website as soon as reasonably practical after we electronically file or furnish the reports to the Securities and Exchange Commission. Our website also contains our Corporate Governance Guidelines and Code of Ethics and Business Conduct, as well as the charters of the Audit, Compensation, and Nominating and Corporate Governance committees of the Board of Directors. All of these documents are available in print without charge to stockholders who request them. Information on our website is not incorporated into this report.

ITEM 1A - RISK FACTORS

Investors in our Common Shares should be mindful of the following risk factors relative to our business.

Our Product Portfolio Lacks Diversification

We have two broad technology segments that provide advanced engineering solutions to meet the pollution control, efficiency improvement, and operational optimization needs of coal-fired energy-related facilities worldwide. They are as follows:

| |

• | The Air Pollution Control technology segment includes technologies to reduce NOx emissions in flue gas from boilers, incinerators, furnaces and other stationary combustion sources. These include Low and Ultra Low NOx Burners (LNB and ULNB), Over-Fire Air (OFA) systems, NOxOUT® and HERT™ Selective Non-Catalytic Reduction (SNCR) systems, and Advanced Selective Catalytic Reduction (ASCR™) systems. The ASCR system includes ULNB, OFA, and SNCR components, along with a downsized SCR catalyst, Ammonia Injection Grid (AIG), and Graduated Straightening Grid (GSG™) systems to provide high NOx reductions at significantly lower capital and operating costs than conventional SCR systems. The NOxOUT CASCADE® and NOxOUT-SCR® processes are basic types of ASCR systems, using just SNCR and SCR catalyst components. ULTRA™ technology creates ammonia at a plant site using safe urea for use with any SCR application. ESP technologies make use of electrostatic precipitator products and services to reduce particulate matter. Flue Gas Conditioning systems are chemical injection systems offered in markets outside the U.S. and Canada to enhance electrostatic precipitator and fabric filter performance in controlling particulate emissions. |

| |

• | The FUEL CHEM® technology segment which uses chemical processes in combination with advanced Computational Fluid Dynamics (CFD) and Chemical Kinetics Modeling (CKM) boiler modeling for the control of slagging, fouling, corrosion, opacity and other sulfur trioxide-related issues in furnaces and boilers through the addition of chemicals into the furnace using TIFI® Targeted In-Furnace Injection™ technology. |

An adverse development in our advanced engineering solution business as a result of competition, technological change, government regulation, customers converting to use natural gas or other fuels, or any other factor could have a significantly greater impact than if we maintained more diverse operations.

We Face Substantial Competition

Competition in the Air Pollution Control market comes from competitors utilizing their own NOx reduction processes, including SNCR systems, Low NOx Burners, Over-Fire Air systems, flue gas recirculation, ammonia SNCR and SCR, which do not infringe our patented technologies. Indirect competition will also arise from business practices such as the purchase rather than the generation of electricity, fuel switching, closure or de-rating of units, and sale or trade of pollution credits and emission allowances. Utilization by customers of such processes or business practices or combinations thereof may adversely affect our pricing and participation in the NOx control market if customers elect to comply with regulations by methods other than the purchase of our Air Pollution Control products. See Item 1 “Products” and “NOx Reduction Competition” in the Air Pollution Control segment overview.

Competition in the FUEL CHEM markets includes chemicals sold by specialty chemical and combustion engineering companies, such as NALCO (Ecolab), GE Infrastructure, and Environmental Energy Services, Inc.

Our Business Is Dependent on Continuing Air Pollution Control Regulations and Enforcement

Our business is significantly impacted by and dependent upon the regulatory environment surrounding the electricity generation market. Our business will be adversely impacted to the extent that regulations are repealed or amended to significantly reduce the level of required NOx reduction, or to the extent that regulatory authorities delay or otherwise minimize enforcement of existing laws. Additionally, long-term changes in environmental regulation that threaten or preclude the use of coal or other fossil fuels as a primary fuel source for electricity production which result in the reduction or closure of a significant number of fossil fuel-fired power plants may adversely affect our business, financial condition and results of operations. See Item 1 above under the caption “Regulations and Markets” in the Air Pollution Control segment overview.

We May Not Be Able to Successfully Protect our Patents and Proprietary Rights

We hold licenses to or own a number of patents for our products and processes. In addition, we also have numerous patent applications pending both in the U.S. and abroad. There can be no assurance that any of our pending patent applications will be granted or that our outstanding patents will not be challenged, overturned or otherwise circumvented by competitors. In foreign markets, the absence of harmonized patent laws makes it more difficult to ensure consistent respect for our patent rights in emergi

ng markets. In addition, certain critical technical information relating to our products which is not patented is held as trade secret, and protected by trade secret laws and restrictions on disclosure contained in our confidentiality and licensing agreements. There can be no assurance that such protections will prove adequate or that we will have adequate remedies against contractual counterparties for disclosure of our trade secrets or other violations of our intellectual property rights. See Item 1 above under the caption “Intellectual Property.”

Our Results May Be Affected By Foreign Operations

In 2007, we expanded our operations in China by establishing a wholly-owned subsidiary in Beijing. Our management believes that the Asia-Pacific region, particularly China, offers significant market opportunities as nations in this region look to establish and implement regulatory policies for improving their environment and utilizing fossil fuels, especially coal, efficiently and effectively. In 2012, we expanded our operations in Latin and South America by establishing a wholly-owned subsidiary in Chile. The future business opportunities in these markets are dependent on the continued implementation and enforcement of regulatory policies that will benefit our technologies, the acceptance of our engineering solutions in such markets, the ability of potential customers to utilize our technologies on a competitive, cost-effective basis, and our ability to protect and enforce our intellectual property rights.

Our Operating Results May Be Adversely Affected by Product Pricing

The onset of significant competition for either of the technology segments might require us to lower our product prices in order to remain competitive and have a corresponding adverse impact on our realized gross margins and operating profitability. See the risk factor entitled “We Face Substantial Competition” above.

We May Not Be Able to Purchase Raw Materials on Commercially Advantageous Terms

Our FUEL CHEM technology segment is dependent, in part, upon a supply of magnesium hydroxide. Any adverse changes in the availability of this chemical will likely have an adverse impact on ongoing operation of our FUEL CHEM programs. On March 4, 2009, we entered into a Restated Product Supply Agreement (“PSA”) with Martin Marietta Magnesia Specialties, LLC (MMMS) in order to assure the continuance of a stable supply from MMMS of magnesium hydroxide products for our requirements in the United States and Canada. On October 31, 2013, we agreed to extend the term of the PSA to December 31, 2016. Pursuant to the PSA, MMMS supplies us with magnesium hydroxide products manufactured pursuant to our specifications and we have agreed to purchase from MMMS, and MMMS has agreed to supply, 100% of our requirements for such magnesium hydroxide products for our customers who purchase such products for delivery in the United States and Canada. There can be no assurance that we will be able to obtain a stable source of magnesium hydroxide in markets outside the United States.

Our Customer Base Is Highly Concentrated

A small number of customers have historically accounted for a significant portion of our revenues. There can be no assurance that our current customers will continue to place orders, that orders by existing customers will continue at the levels of previous periods, or that we will be able to obtain orders from new customers. The loss of one or more of our customers could have a material adverse effect on our sales and operating results.

We May Borrow Funds Pursuant to our Credit Facilities

We are party to a $15 million domestic revolving credit agreement with JPMorgan Chase Bank, N.A. As of December 31, 2014, there were no outstanding borrowings on this facility and Fuel Tech was in compliance with all financial covenants contained in the agreement. In addition, our Chinese subsidiary, Beijing Fuel Tech Environmental Technologies Company, Ltd., has a RMB 35 million (approximately $5.688 million) revolving credit facility with JPMorgan Chase Bank (China) Company Limited. As of December 31, 2014, the outstanding borrowings under this facility were approximately $1,625. In the event of any default on our part under either of these agreements, the lender is entitled to accelerate payment of any amounts outstanding and may, under certain circumstances, cancel the facilities. If we were unable to obtain a waiver for a breach of covenant and the lender accelerated the payment of any outstanding amounts, such acceleration may cause our cash position to significantly deteriorate or, if cash on hand were insufficient to satisfy the payment due, may require us to obtain alternate financing.

ITEM 1B - UNRESOLVED STAFF COMMENTS

None

ITEM 2 - PROPERTIES

We own an office building in Warrenville, Illinois, which has served as our corporate headquarters since June 23, 2008. This facility, with approximately 40,000 square feet of office space, will meet our growth requirements for the foreseeable future.

We also operate from leased office facilities in Stamford, Connecticut; Durham, North Carolina; Gallarate, Italy and Beijing, China. We do not segregate any of our leased facilities by operating business segment. The terms of our four material lease arrangements are as follows:

| |

• | The Stamford, Connecticut building lease, for approximately 6,440 square feet, runs from February 1, 2010 to December 31, 2019. The facility houses certain administrative functions such as Investor Relations and certain APC sales functions. |

| |

• | The Beijing, China building lease, for approximately 8,000 square feet, runs from September 1, 2014 to August 31, 2017. This facility serves as the operating headquarters for our Beijing Fuel Tech operation. |

| |

• | The Durham, North Carolina building lease, for approximately 16,000 square feet, runs from May 1, 2014 to April 30, 2017. This facility houses engineering operations. |

| |

• | The Gallarate, Italy building lease, for approximately 1,300 square feet, runs from May 1, 2013 to April 30, 2019. This facility serves as the operating headquarters for our European operations. |

| |

• | The Westlake, Ohio building lease, for approximately 5,000 square feet, runs from May 1, 2014 to April 30, 2017. This facility houses engineering operations. |

ITEM 3 - LEGAL PROCEEDINGS

We are from time to time involved in litigation incidental to our business. We are not currently involved in any litigation in which we believe an adverse outcome would have a material effect on our business, financial condition, results of operations, or prospects.

ITEM 4 – MINE SAFETY DISCLOSURES

Not Applicable

PART II

ITEM 5 - MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASE OF EQUITY SECURITIES

Market

Our Common Shares have been traded since September 1993 on The NASDAQ Stock Market, Inc. The trading symbol is FTEK.

Prices

The table below sets forth the high and low sales prices during each calendar quarter since January 2013.

|

| | | | | | | | |

2014 | | High | | Low |

Fourth Quarter | | $ | 4.45 |

| | $ | 3.61 |

|

Third Quarter | | 5.68 |

| | 4.10 |

|

Second Quarter | | 6.77 |

| | 4.96 |

|

First Quarter | | 8.50 |

| | 4.90 |

|

|

| | | | | | | | |

2013 | | High | | Low |

Fourth Quarter | | $ | 9.63 |

| | $ | 4.19 |

|

Third Quarter | | 4.78 |

| | 3.63 |

|

Second Quarter | | 4.42 |

| | 3.55 |

|

First Quarter | | 5.20 |

| | 4.00 |

|

Dividends

We have never paid cash dividends on the Common Shares and have no current plan to do so in the foreseeable future. The declaration and payment of dividends on the Common Shares are subject to the discretion of our Board of Directors. The decision of the Board of Directors to pay future dividends will depend on general business conditions, the effect of a dividend payment on our financial condition, and other factors the Board of Directors may consider relevant. The current policy of the Board of Directors is to reinvest earnings in operations to promote future growth.

Share Repurchase Program

In August 2011, our Board of Directors authorized the repurchase of up to $6 million of our outstanding common shares through December 31, 2012. This initial program was completed in the quarter ended March 31, 2012. In May 2012, the Board of Directors authorized a second repurchase program allowing us to repurchase up to an additional $6 million of our outstanding common shares through June 30, 2013 and this repurchase program was completed in the quarter ended September 30, 2012. The share repurchase programs were funded through our existing cash on hand. Purchases made pursuant to the programs were made in the open market. The timing, manner, price and amount of any those repurchases were determined in our discretion and were subject to economic and market conditions, stock price, applicable legal requirements, and other factors.

During the course of the share repurchase programs, we repurchased an aggregate of 2,306,590 common shares for a total cost of approximately $12,000 including commissions of approximately $76. These acquired shares have been retired and are no longer shown as issued or outstanding shares.

The following table summarizes our share repurchase programs since their inception:

|

| | | | | | | | | | | | | | | |

Period | | Total Number of Shares Purchased | | Average Price Paid Per Share | | Total Cost | | Maximum Dollar Value of Shares That May Yet Be Purchased Under the Program |

Phase One Program | | | | | | | | |

August 25, 2011 through September 30, 2011 | | 571,554 |

| | $ | 5.89 |

| | $ | 3,367 |

| | $ | 2,633 |

|

October 1, 2011 through December 31, 2011 | | 130,160 |

| | 5.71 |

| | 744 |

| | 1,889 |

|

January 1, 2012 through March 31, 2012 | | 334,636 |

| | 5.64 |

| | 1,889 |

| | — |

|

Phase Two Program | | | | | | | | |

April 1, 2012 through June 30, 2012 | | 1,124,797 |

| | 4.70 |

| | 5,290 |

| | 710 |

|

July 1, 2012 through September 30, 2012 | | 145,443 |

| | 4.88 |

| | 710 |

| | — |

|

Total | | 2,306,590 |

| | $ | 5.20 |

| | $ | 12,000 |

| | $ | — |

|

Holders

Based on information from our transfer agent and from banks and brokers, we estimate that, as of March 5, 2015, there were approximately 156 registered stockholders and 11,500 beneficial holders of our common shares.

Transfer Agent

The transfer agent and registrar for our common shares is Computershare Shareowner Services LLP, 480 Washington Boulevard, Jersey City, New Jersey 07310-1900.

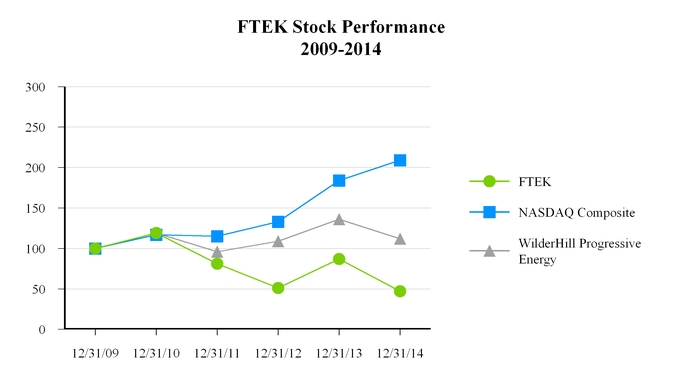

Performance Graph

The following line graph compares our total return to stockholders per common share for the five years ended December 31, 2014 to that of the NASDAQ Composite Index and the WilderHill Progressive Energy Index for the period December 31, 2009 through December 31, 2014.

ITEM 6 - SELECTED FINANCIAL DATA

Selected financial data are presented below as of the end of and for each of the fiscal years in the five-year period ended December 31, 2014. The selected financial data should be read in conjunction with the audited consolidated financial statements as of and for the year ended December 31, 2014, and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included elsewhere in this report and the schedules thereto.

|

| | | | | | | | | | | | | | | | | | | | |

| | For the years ended December 31 |

CONSOLIDATED STATEMENT of OPERATIONS DATA | | 2014 | | 2013 | | 2012 | | 2011 | | 2010 |

(in thousands of dollars, except for share and per-share data) | | | | | | | | | | |

Revenues | | $ | 79,017 |

| | $ | 109,338 |

| | $ | 97,644 |

| | $ | 93,668 |

| | $ | 81,795 |

|

Cost of sales | | 43,889 |

| | 62,521 |

| | 56,899 |

| | 49,857 |

| | 46,821 |

|

Selling, general and administrative and other costs and expenses | | 36,891 |

| | 36,375 |

| | 35,545 |

| | 34,162 |

| | 31,037 |

|

Goodwill impairment | | 23,400 |

| | — |

| | — |

| | — |

| | — |

|

Operating (loss) income | | (25,163 | ) | | 8,000 |

| | 5,200 |

| | 9,649 |

| | 3,937 |

|

Net (loss) income | | (17,725 | ) | | 5,101 |

| | 2,776 |

| | 6,148 |

| | 1,753 |

|

Basic (loss) income per common share | | $ | (0.78 | ) | | $ | 0.23 |

| | $ | 0.12 |

| | $ | 0.26 |

| | $ | 0.07 |

|

Diluted (loss) income per common share | | $ | (0.78 | ) | | $ | 0.23 |

| | $ | 0.12 |

| | $ | 0.25 |

| | $ | 0.07 |

|

Weighted-average basic shares outstanding | | 22,782,000 |

| | 22,286,000 |

| | 22,709,000 |

| | 24,095,000 |

| | 24,213,000 |

|

Weighted-average diluted shares outstanding | | 22,782,000 |

| | 22,579,000 |

| | 23,535,000 |

| | 24,633,000 |

| | 24,405,000 |

|

|

| | | | | | | | | | | | | | | | | | | | |

| | December 31 |

CONSOLIDATED BALANCE SHEET DATA | | 2014 | | 2013 | | 2012 | | 2011 | | 2010 |

(in thousands of dollars) | | | | | | | | | | |

Working capital | | $ | 39,688 |

| | $ | 48,619 |

| | $ | 38,918 |

| | $ | 43,626 |

| | $ | 36,645 |

|

Total assets | | 91,471 |

| | 110,058 |

| | 105,897 |

| | 112,990 |

| | 103,203 |

|

Long-term obligations | | 520 |

| | 789 |

| | 715 |

| | 1,347 |

| | 1,482 |

|

Total liabilities | | 19,170 |

| | 21,435 |

| | 21,661 |

| | 23,977 |

| | 19,293 |

|

Stockholders’ equity (1) | | 72,301 |

| | 88,623 |

| | 84,236 |

| | 89,013 |

| | 83,910 |

|

Notes:

| |

(1) | Stockholders’ equity includes the principal amount of nil coupon non-redeemable perpetual loan notes. See Note 7 to the consolidated financial statements. |

ITEM 7 - MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS (amounts in thousands of dollars)

Background

We have two broad technology segments that provide advanced engineered solutions to meet the pollution control, efficiency improvement and operational optimization needs of energy-related facilities worldwide. They are as follows:

Air Pollution Control Technologies

The Air Pollution Control technology segment includes technologies to reduce NOx emissions in flue gas from boilers, incinerators, furnaces and other stationary combustion sources. These include Low and Ultra Low NOx Burners (LNB and ULNB), OFA systems, NOxOUT and HERT SNCR systems, and ASCR systems. The ASCR system includes ULNB, OFA, and SNCR components, along with a downsized SCR catalyst, AIG, and GSG systems to provide high NOx reductions at significantly lower capital and operating costs than conventional SCR systems. The NOxOUT CASCADE and NOxOUT-SCR processes are basic types of ASCR systems, using just SNCR and SCR catalyst components. ULTRA technology creates ammonia at a plant site using safe urea for use with any SCR application. Our ESP products and services include complete turnkey ESP retrofits and related services. Flue Gas Conditioning systems are chemical injection systems offered in markets outside the U.S. and Canada to enhance electrostatic precipitator and fabric filter performance in controlling particulate emissions. We distribute our products through our direct sales force and third-party sales agents.

FUEL CHEM Technologies

The FUEL CHEM technology segment, which uses chemical processes in combination with advanced CFD and CKM boiler modeling, for the control of slagging, fouling, corrosion, opacity and other sulfur trioxide-related issues in furnaces and boilers through the addition of chemicals into the furnace using TIFI Targeted In-Furnace Injection technology. Fuel Tech sells its FUEL CHEM program through its direct sales force and agents to industrial and utility power-generation facilities. FUEL CHEM programs have been installed on combustion units in North America, Europe, China, and India, treating a wide variety of solid and liquid fuels, including coal, heavy oil, biomass and municipal waste. The FUEL CHEM program improves the efficiency, reliability and environmental status of plants operating in the electric utility, industrial, pulp and paper, waste-to-energy, university and district heating markets and offers numerous operational, financial and environmental benefits to owners of boilers, furnaces and other combustion units.

The key market dynamic for both technology segments is the continued use of fossil fuels, especially coal, as the principal fuel source for global electricity production. Coal currently accounts for approximately 37% of all U.S. electricity generation and roughly 80% of Chinese electricity generation. Major coal consumers include China, the United States and India.

Critical Accounting Policies and Estimates

The consolidated financial statements are prepared in accordance with accounting principles generally accepted in the United States of America, which require us to make estimates and assumptions. We believe that of our accounting policies (see Note 1 to the consolidated financial statements), the following involve a higher degree of judgment and complexity and are deemed critical. We routinely discuss our critical accounting policies with the Audit Committee of the Board of Directors.

Revenue Recognition

Revenues from the sales of chemical products are recorded when title transfers, either at the point of shipment or at the point of destination, depending on the contract with the customer.

We use the percentage of completion method of accounting for equipment construction, equipment supply and license contracts that are sold within the Air Pollution Control technology segment. Under the percentage of completion method, revenues are recognized as work is performed based on the relationship between actual construction costs incurred and total estimated costs at completion. Construction costs include all direct costs such as materials, labor, and subcontracting costs, and indirect costs allocable to the particular contract such as indirect labor, tools and equipment, and supplies. Revisions in completion estimates and contract values are made in the period in which the facts giving rise to the revisions become known and can influence the timing of when revenues are recognized under the percentage of completion method of accounting. Such revisions have historically not had a material effect on the amount of revenue recognized. Provisions are made for estimated losses on uncompleted contracts in the period in which such losses are determined. As of December 31, 2014, we had one construction contract in progress that was identified as loss contracts and a provision for losses in the amount of $4 was recorded in other accrued liabilities on the consolidated balance sheets. As of December 31, 2013, we had three construction contracts in progress that were identified as loss contracts and a provision for losses in the amount of $68 was recorded in other accrued liabilities on the consolidated balance sheets.

Typically, our APC contracts are eight to sixteen months in length. A typical contract will have three or four critical operational measurements that, when achieved, serve as the basis for us to invoice the customer via progress billings. At a minimum, these measurements will include the generation of engineering drawings, the shipment of equipment and the completion of a system performance test.

As part of most of our contractual APC project agreements, we contractually commit to customer-specific acceptance criteria that relate to the operational performance of the system that is being sold. These criteria are determined based on mathematical modeling that is performed by our personnel, which is in turn based on operational inputs that are provided by the customer. Our customer is solely responsible for the accuracy of the operating condition information; all performance guarantees and equipment warranties granted by us are void if the operating condition information is inaccurate or is not met.

Accounts receivable includes unbilled receivables, representing revenues recognized in excess of billings on uncompleted contracts under the percentage of completion method of accounting. At December 31, 2014 and December 31, 2013, unbilled receivables were approximately $9,904 and $12,599, respectively, and are included in accounts receivable on the consolidated balance sheet. Billings in excess of costs and estimated earnings on uncompleted contracts were $2,994 and $1,206 at December 31, 2014 and December 31, 2013, respectively, and are included in other accrued liabilities on the consolidated balance sheet.

We have installed over 1000 units with APC technology and normally provide performance guarantees to our customers based on the operating conditions for the project. As part of the project implementation process, we perform system start-up and optimization services that effectively serve as a test of actual project performance. We believe that this test, combined with the accuracy of the modeling that is performed, enables revenue to be recognized prior to the receipt of formal customer acceptance.

Allowance for Doubtful Accounts

The allowance for doubtful accounts is management’s best estimate of the amount of credit losses in accounts receivable. In order to control and monitor the credit risk associated with our customer base, we review the credit worthiness of customers on a recurring basis. Factors influencing the level of scrutiny include the level of business the customer has with us, the customer’s payment history and the customer’s financial stability. Receivables are considered past due if payment is not received by the date agreed upon with the customer, which is normally 30 days. Representatives of our management team review all past due accounts on a weekly basis to assess collectability. At the end of each reporting period, the allowance for doubtful accounts balance is reviewed relative to management’s collectability assessment and is adjusted if deemed necessary through a corresponding charge or credit to bad debts expense, which is included in selling, general, and administrative expenses in the consolidated statements of operations. Bad debt write-offs are made when management believes it is probable a receivable will not be recovered.

Assessment of Potential Impairments of Goodwill and Intangible Assets

Goodwill and indefinite-lived intangible assets are not amortized, but rather are reviewed annually (in the fourth quarter) or more frequently if indicators arise, for impairment. We do not have any indefinite-lived intangible assets other than goodwill. Such indicators include a decline in expected cash flows, a significant adverse change in legal factors or in the business climate, unanticipated competition, a decrease in our market capitalization to an amount less than the carrying value of our assets, or slower growth rates, among others.

Goodwill is allocated among and evaluated for impairment at the reporting unit level, which is defined as an operating segment or one level below an operating segment. We have two reporting units: the FUEL CHEM segment and the APC technology segment.

Our evaluation of goodwill impairment involves first assessing qualitative factors to determine whether it is more likely than not that the fair value of a reporting unit is less than its carrying amount. We may bypass this qualitative assessment, or determine that based on our qualitative assessment considering the totality of events and circumstances including macroeconomic factors, industry and market considerations, current and projected financial performance, a sustained decrease in our share price, or other factors, that additional impairment analysis is necessary. This additional analysis involves comparing the current fair value of a reporting unit to its carrying value. Fuel Tech uses a discounted cash flow (DCF) model to determine the current fair value of its two reporting units as this methodology was deemed to best quantify the present values of our expected future cash flows and yield a fair value that should be in line with the aggregate market value placed on the outstanding number of Common Shares as reflected by the current stock price multiplied by the outstanding common shares. A number of significant assumptions and estimates are involved in the application of the DCF model to forecast operating cash flows, including markets and market share, sales volumes and prices, costs to produce and working capital changes. Events outside our control, specifically market conditions that impact revenue growth assumptions, could significantly impact the fair value calculated. Management considers historical experience and all available information at the time the fair values of its reporting units are estimated. However, actual fair values that could be realized in an actual transaction may differ from those used to evaluate the impairment of goodwill.

The application of our DCF model in estimating the fair value of each reporting segment is based on the ‘income’ approach to business valuation. In using this approach for each reportable segment, we forecast segment revenues and expenses out to perpetuity and then discount the resulting cash flows to their present value using an appropriate discount rate. The forecast considers, among other items, the current and expected business environment, expected changes in the fixed and variable cost structure as the business grows, and a revenue growth rate that we feel is both achievable and sustainable. The discount rate used is composed of a number of identifiable risk factors, including equity risk, company size, and certain company specific risk factors such as our debt-to-equity ratio, among other factors, that when added together, results in a total return that a prudent investor would demand for an investment in our company.

In the event the estimated fair value of a reporting unit per the DCF model is less than the carrying value, additional analysis would be required. The additional analysis would compare the carrying amount of the reporting unit’s goodwill with the implied fair value of that goodwill. The implied fair value of goodwill is the excess of the fair value of the reporting unit over the fair values assigned to all of the assets and liabilities of that unit as if the reporting unit was acquired in a business combination and the fair value of the reporting unit represented the purchase price. If the carrying value of goodwill exceeds its implied fair value, an impairment loss equal to such excess would be recognized.

Fuel Tech performed its annual goodwill impairment analysis for each of its reporting units as of October 1, 2014 and determined that no impairment of goodwill existed within the FUEL CHEM technology segment. It determined that its APC technology reporting unit failed the first step test because the estimated fair value of the reporting unit was less than its carrying value, a result significantly affected by Fuel Tech's market capitalization, and thus requiring additional analysis of the segment. Based on this additional analysis, Fuel Tech determined that the current fair value of the APC technology reporting unit was less than the fair value of the assets and liabilities of the unit, resulting in an implied fair value of goodwill of zero, and accordingly recorded a non-cash goodwill impairment charge of $23.4 million related to this segment.

The APC segment encompasses the integrated operations of the Company's acquisitions of Advanced Combustion Technology, Inc. (ACT) in 2009 and PECO in 2014. While goodwill impairment is tested for the segment as a whole, the changes in estimates that led to the goodwill impairment charge were most significantly related to the ACT acquisition. The impairment primarily resulted from the lower estimates of revenues and margins in the segment in the assessment forecast period. These lower estimates derive from (1) lower natural gas prices that allow utility operators to switch to natural gas from coal and increase the amount of power generated from natural gas plants, (2) slower sales and smaller margins in the China market and (3) continued delays in investment in environmental remediation, particularly with respect to NOx technologies due to the regulatory environment.

Impairment of Long-Lived Assets and Amortizable Intangible Assets

Long-lived assets, including property, plant and equipment (PP&E) and intangible assets, are reviewed for impairment when events and circumstances indicate that the carrying amount of the assets (or asset group) may not be recoverable. If impairment indicators exist, we perform a more detailed analysis and an impairment loss is recognized when estimated future undiscounted cash flows expected to result from the use of the asset (or asset group) and its eventual disposition are less than the carrying amount. This process of analyzing impairment involves examining the operating condition of individual assets (or asset group) and estimating a fair value based upon current condition, relevant market factors and remaining estimated operational life compared to the asset’s remaining depreciable life. Quoted market prices and other valuation techniques are used to determine expected cash flows. Due to the existence of impairment indicators as more fully described in Note 1 to our consolidated financial statements, we performed a more detailed analysis of potential long-lived and intangible asset impairment in the APC technology asset group during the fourth quarter of 2014 using the aforementioned undiscounted cash flows analysis and concluded that no impairment of these assets exists. A significant portion of our property and equipment is comprised of assets deployed at customer locations relating to our FUEL CHEM technology asset group, and due to the shorter-term duration over which this equipment is depreciated, the likelihood of impairment is mitigated. The discontinuation of a FUEL CHEM program at a customer site would most likely result in the re-deployment of all or most of the affected assets to another customer location rather than an impairment.

Valuation Allowance for Deferred Income Taxes

Deferred tax assets represent deductible temporary differences and net operating loss and tax credit carryforwards. A valuation allowance is recognized if it is more likely than not that some portion of the deferred tax asset will not be realized. At the end of each reporting period, management reviews the realizability of the deferred tax assets. As part of this review, we consider if there are taxable temporary differences that could generate taxable income in the future, if there is the ability to carry back the net operating losses or credits, if there is a projection of future taxable income, and if there are any tax planning strategies that can be readily implemented.

Stock-Based Compensation

We recognize compensation expense for employee equity awards ratably over the requisite service period of the award, adjusted for estimated forfeitures.

We utilize the Black-Scholes option-pricing model to estimate the fair value of stock option awards. Determining the fair value of stock options using the Black-Scholes model requires judgment, including estimates for (1) risk-free interest rate - an estimate based on the yield of zero-coupon treasury securities with a maturity equal to the expected life of the option; (2) expected volatility - an estimate based on the historical volatility of our Common Shares for a period equal to the expected life of the option; and (3) expected life of the option - an estimate based on historical experience including the effect of employee terminations.

In addition, we utilize a Monte Carlo valuation pricing model to determine the fair value of certain restricted stock units (RSUs) that contain market conditions. Determining the fair value of these RSUs requires judgment and involves simulating potential future stock prices based on estimates for the risk-free interest rate, stock volatility, and correlations between our stock price and the stock prices of a peer group of companies.

If any of these assumptions differ significantly from actual results, stock-based compensation expense could be impacted.

Recently Adopted Accounting Standards

On January 1, 2014, Fuel Tech adopted changes issued by the FASB to a parent entity’s accounting for the cumulative translation adjustment upon derecognition of certain subsidiaries or groups of assets within a foreign entity or of an investment in a foreign entity. A parent entity is required to release any related cumulative foreign currency translation adjustment from accumulated other comprehensive income into net income in the following circumstances: (i) a parent entity ceases to have a controlling financial interest in a subsidiary or group of assets that is a business within a foreign entity if the sale or transfer results in the complete or substantially complete liquidation of the foreign entity in which the subsidiary or group of assets had resided; (ii) a partial sale of an equity method investment that is a foreign entity; (iii) a partial sale of an equity method investment that is not a foreign entity whereby the partial sale represents a complete or substantially complete liquidation of the foreign entity that held the equity method investment; and (iv) the sale of an investment in a foreign entity. The adoption of these changes had no impact on the Consolidated Financial Statements. This guidance will need to be considered in the event Fuel Tech initiates any of the transactions described above.

On January 1, 2014, Fuel Tech adopted changes issued by the FASB to the presentation of an unrecognized tax benefit when a net operating loss carryforward, a similar tax loss, or a tax credit carryforward exists. These changes require an entity to present an unrecognized tax benefit as a liability in the financial statements if (i) a net operating loss carryforward, a similar tax loss, or a tax credit carryforward is not available at the reporting date under the tax law of the applicable jurisdiction to settle any additional income taxes that would result from the disallowance of a tax position, or (ii) the tax law of the applicable jurisdiction does not require the entity to use, and the entity does not intend to use, the deferred tax asset to settle any additional income taxes that would result from the disallowance of a tax position. Otherwise, an unrecognized tax benefit is required to be presented in the financial statements as a reduction to a deferred tax asset for a net operating loss carryforward, a similar tax loss, or a tax credit carryforward. Previously, there was diversity in practice as no explicit guidance existed. The adoption of these changes did not result in a significant impact on the Consolidated Financial Statements.

Recently Issued Accounting Standards