| Label |

Element |

Value |

| BNY Mellon Stock Index Fund, Inc. |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Risk/Return [Heading] |

rr_RiskReturnHeading |

Fund Summary

|

|

| Objective [Heading] |

rr_ObjectiveHeading |

Investment Objective

|

|

| Objective, Primary [Text Block] |

rr_ObjectivePrimaryTextBlock |

The fund seeks to match the total return of the S&P 500® Index.

|

|

| Expense [Heading] |

rr_ExpenseHeading |

Fees and Expenses

|

|

| Expense Narrative [Text Block] |

rr_ExpenseNarrativeTextBlock |

This table describes the fees and expenses that you may pay if you buy and hold shares of the fund. These figures do not reflect any fees or charges imposed by participating insurance companies under their Variable Annuity contracts (VA contracts) or Variable Life Insurance policies (VLI policies), and if such fees and/or charges were included, the fees and expenses would be higher.

|

|

| Operating Expenses Caption [Text] |

rr_OperatingExpensesCaption |

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment)

|

|

| Portfolio Turnover [Heading] |

rr_PortfolioTurnoverHeading |

Portfolio Turnover

|

|

| Portfolio Turnover [Text Block] |

rr_PortfolioTurnoverTextBlock |

The fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover may indicate higher transaction costs. These costs, which are not reflected in annual fund operating expenses or in the Example, affect the fund's performance. During the most recent fiscal year, the fund's portfolio turnover rate was 2.94% of the average value of its portfolio.

|

|

| Portfolio Turnover, Rate |

rr_PortfolioTurnoverRate |

2.94%

|

|

| Expense Example [Heading] |

rr_ExpenseExampleHeading |

Example

|

|

| Expense Example Narrative [Text Block] |

rr_ExpenseExampleNarrativeTextBlock |

The Example is intended to help you compare the cost of investing in the fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the fund for the time periods indicated and then hold or redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the fund's operating expenses remain the same. The Example does not reflect fees and expenses incurred under VA contracts and VLI policies; if they were reflected, the figures in the Example would be higher. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

|

| Strategy [Heading] |

rr_StrategyHeading |

Principal Investment Strategy

|

|

| Strategy Narrative [Text Block] |

rr_StrategyNarrativeTextBlock |

To pursue its goal, the fund generally is fully invested in stocks included in the S&P 500® Index. The fund generally invests in all 500 stocks in the S&P 500 Index in proportion to their weighting in the index.

The S&P 500 Index is an unmanaged index of 500 common stocks chosen to reflect the industries of the U.S. economy and is often considered a proxy for the stock market in general. S&P weights each company's stock in the index by its market capitalization (i.e., the share price times the number of shares outstanding), adjusted by the number of available float shares (i.e., those shares available to public investors). Companies included in the S&P 500 Index generally must have market capitalizations in excess of $8.2 billion, to the extent consistent with market conditions.

"Standard & Poor's®," "S&P®," "Standard & Poor's® 500" and "S&P 500®" are trademarks of Standard & Poor's Financial Services LLC (Standard & Poor's) and have been licensed for use by the fund. The fund is not sponsored, endorsed, sold or promoted by Standard & Poor's and Standard & Poor's makes no representation regarding the advisability of investing in the fund.

|

|

| Risk [Heading] |

rr_RiskHeading |

Principal Risks

|

|

| Risk Narrative [Text Block] |

rr_RiskNarrativeTextBlock |

An investment in the fund is not a bank deposit. It is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. It is not a complete investment program. The fund's share price fluctuates, sometimes dramatically, which means you could lose money.

· Risks of stock investing. Stocks generally fluctuate more in value than bonds and may decline significantly over short time periods. There is the chance that stock prices overall will decline because stock markets tend to move in cycles, with periods of rising prices and falling prices. The market value of a stock may decline due to general market conditions or because of factors that affect the particular company or the company's industry.

· Indexing strategy risk. The fund uses an indexing strategy. It does not attempt to manage market volatility, use defensive strategies or reduce the effects of any long-term periods of poor index performance. The correlation between fund and index performance may be affected by the fund's expenses, changes in securities markets, changes in the composition of the index and the timing of purchases and redemptions of fund shares.

· Market risk. The value of the securities in which the fund invests may be affected by political, regulatory, economic and social developments, and developments that impact specific economic sectors, industries or segments of the market. In addition, turbulence in financial markets and reduced liquidity in equity, credit and/or fixed income markets may negatively affect many issuers, which could adversely affect the fund. Global economies and financial markets are becoming increasingly interconnected, and conditions and events in one country, region or financial market may adversely impact issuers in a different country, region or financial market. These risks may be magnified if certain events or developments adversely interrupt the global supply chain; in these and other circumstances, such risks might affect companies world-wide. Recent examples include pandemic risks related to COVID-19 and aggressive measures taken world-wide in response by governments, including closing borders, restricting international and domestic travel, and the imposition of prolonged quarantines of large populations, and by businesses, including changes to operations and reducing staff. To the extent the fund may overweight its investments in certain countries, companies, industries or market sectors, such positions will increase the fund's exposure to risk of loss from adverse developments affecting those countries, companies, industries or sectors.

· Non-diversification risk. The fund is non-diversified, which means that the fund may invest a relatively high percentage of its assets in a limited number of issuers. Therefore, the fund's performance may be more vulnerable to changes in the market value of a single issuer or group of issuers and more susceptible to risks associated with a single economic, political or regulatory occurrence than a diversified fund.

|

|

| Risk Lose Money [Text] |

rr_RiskLoseMoney |

The fund's share price fluctuates, sometimes dramatically, which means you could lose money.

|

|

| Risk Nondiversified Status [Text] |

rr_RiskNondiversifiedStatus |

The fund is non-diversified, which means that the fund may invest a relatively high percentage of its assets in a limited number of issuers. Therefore, the fund's performance may be more vulnerable to changes in the market value of a single issuer or group of issuers and more susceptible to risks associated with a single economic, political or regulatory occurrence than a diversified fund.

|

|

| Risk Not Insured Depository Institution [Text] |

rr_RiskNotInsuredDepositoryInstitution |

An investment in the fund is not a bank deposit. It is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency.

|

|

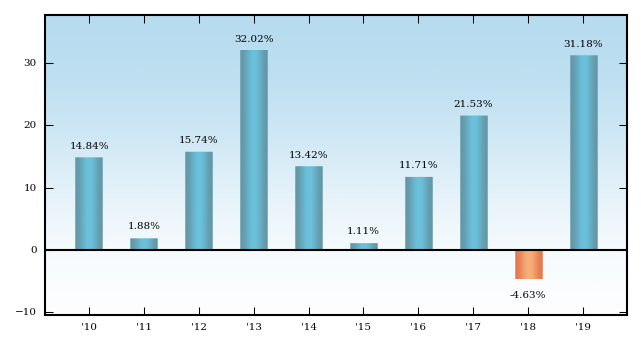

| Bar Chart and Performance Table [Heading] |

rr_BarChartAndPerformanceTableHeading |

Performance

|

|

| Performance Narrative [Text Block] |

rr_PerformanceNarrativeTextBlock |

The following bar chart and table provide some indication of the risks of investing in the fund. The bar chart shows changes in the performance of the fund's Initial shares from year to year. The table compares the average annual total returns of the fund's shares to those of a broad measure of market performance. The fund's past performance is not necessarily an indication of how the fund will perform in the future. More recent performance information may be available at www.bnymellonim.com/us.

Performance information reflects the fund's expenses only and does not reflect the fees and charges imposed by participating insurance companies under their VA contracts or VLI policies. Because these fees and charges will reduce total return, policyowners should consider them when evaluating and comparing the fund's performance. Policyowners should consult the prospectus for their contract or policy for more information.

|

|

| Performance Information Illustrates Variability of Returns [Text] |

rr_PerformanceInformationIllustratesVariabilityOfReturns |

The following bar chart and table provide some indication of the risks of investing in the fund.

|

|

| Performance Availability Website Address [Text] |

rr_PerformanceAvailabilityWebSiteAddress |

www.bnymellonim.com/us

|

|

| Performance Past Does Not Indicate Future [Text] |

rr_PerformancePastDoesNotIndicateFuture |

The fund's past performance is not necessarily an indication of how the fund will perform in the future.

|

|

| Bar Chart [Heading] |

rr_BarChartHeading |

Year-by-Year Total Returns as of 12/31 each year (%) Initial Shares

|

|

| Bar Chart Does Not Reflect Sales Loads [Text] |

rr_BarChartDoesNotReflectSalesLoads |

Performance information reflects the fund's expenses only and does not reflect the fees and charges imposed by participating insurance companies under their VA contracts or VLI policies.

|

|

| Bar Chart Closing [Text Block] |

rr_BarChartClosingTextBlock |

| Best Quarter

Q1, 2019: 13.59% Worst Quarter

Q3, 2011: -13.95% |

|

|

| Highest Quarterly Return, Label |

rr_HighestQuarterlyReturnLabel |

Best Quarter

|

|

| Highest Quarterly Return, Date |

rr_BarChartHighestQuarterlyReturnDate |

Mar. 31, 2019

|

|

| Highest Quarterly Return |

rr_BarChartHighestQuarterlyReturn |

13.59%

|

|

| Lowest Quarterly Return, Label |

rr_LowestQuarterlyReturnLabel |

Worst Quarter

|

|

| Lowest Quarterly Return, Date |

rr_BarChartLowestQuarterlyReturnDate |

Sep. 30, 2011

|

|

| Lowest Quarterly Return |

rr_BarChartLowestQuarterlyReturn |

(13.95%)

|

|

| Index No Deduction for Fees, Expenses, Taxes [Text] |

rr_IndexNoDeductionForFeesExpensesTaxes |

reflects no deductions for fees, expenses or taxes

|

|

| Average Annual Return, Caption |

rr_AverageAnnualReturnCaption |

Average Annual Total Returns (as of 12/31/19)

|

|

| BNY Mellon Stock Index Fund, Inc. | S&P 500® Index reflects no deductions for fees, expenses or taxes |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Average Annual Returns, 1 Year |

rr_AverageAnnualReturnYear01 |

31.46%

|

|

| Average Annual Returns, 5 Years |

rr_AverageAnnualReturnYear05 |

11.69%

|

|

| Average Annual Returns, 10 Years |

rr_AverageAnnualReturnYear10 |

13.55%

|

|

| BNY Mellon Stock Index Fund, Inc. | BNY Mellon Stock Index Fund, Inc. - Initial Shares |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Management fees |

rr_ManagementFeesOverAssets |

0.25%

|

|

| Distribution and/or service (12b-1) fees |

rr_DistributionAndService12b1FeesOverAssets |

none

|

|

| Other expenses: Shareholder services fee |

rr_Component1OtherExpensesOverAssets |

none

|

[1] |

| Other expenses: Miscellaneous other expenses |

rr_Component3OtherExpensesOverAssets |

0.02%

|

|

| Total other expenses |

rr_OtherExpensesOverAssets |

0.02%

|

|

| Total annual fund operating expenses |

rr_ExpensesOverAssets |

0.27%

|

|

| Expense Example, with Redemption, 1 Year |

rr_ExpenseExampleYear01 |

$ 28

|

|

| Expense Example, with Redemption, 3 Years |

rr_ExpenseExampleYear03 |

87

|

|

| Expense Example, with Redemption, 5 Years |

rr_ExpenseExampleYear05 |

152

|

|

| Expense Example, with Redemption, 10 Years |

rr_ExpenseExampleYear10 |

343

|

|

| Expense Example, No Redemption, 1 Year |

rr_ExpenseExampleNoRedemptionYear01 |

28

|

|

| Expense Example, No Redemption, 3 Years |

rr_ExpenseExampleNoRedemptionYear03 |

87

|

|

| Expense Example, No Redemption, 5 Years |

rr_ExpenseExampleNoRedemptionYear05 |

152

|

|

| Expense Example, No Redemption, 10 Years |

rr_ExpenseExampleNoRedemptionYear10 |

$ 343

|

|

| Annual Return 2010 |

rr_AnnualReturn2010 |

14.84%

|

|

| Annual Return 2011 |

rr_AnnualReturn2011 |

1.88%

|

|

| Annual Return 2012 |

rr_AnnualReturn2012 |

15.74%

|

|

| Annual Return 2013 |

rr_AnnualReturn2013 |

32.02%

|

|

| Annual Return 2014 |

rr_AnnualReturn2014 |

13.42%

|

|

| Annual Return 2015 |

rr_AnnualReturn2015 |

1.11%

|

|

| Annual Return 2016 |

rr_AnnualReturn2016 |

11.71%

|

|

| Annual Return 2017 |

rr_AnnualReturn2017 |

21.53%

|

|

| Annual Return 2018 |

rr_AnnualReturn2018 |

(4.63%)

|

|

| Annual Return 2019 |

rr_AnnualReturn2019 |

31.18%

|

|

| Average Annual Returns, 1 Year |

rr_AverageAnnualReturnYear01 |

31.18%

|

|

| Average Annual Returns, 5 Years |

rr_AverageAnnualReturnYear05 |

11.42%

|

|

| Average Annual Returns, 10 Years |

rr_AverageAnnualReturnYear10 |

13.29%

|

|

| BNY Mellon Stock Index Fund, Inc. | BNY Mellon Stock Index Fund, Inc. - Service Shares |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Management fees |

rr_ManagementFeesOverAssets |

0.25%

|

|

| Distribution and/or service (12b-1) fees |

rr_DistributionAndService12b1FeesOverAssets |

0.25%

|

|

| Other expenses: Shareholder services fee |

rr_Component1OtherExpensesOverAssets |

none

|

|

| Other expenses: Miscellaneous other expenses |

rr_Component3OtherExpensesOverAssets |

0.02%

|

|

| Total other expenses |

rr_OtherExpensesOverAssets |

0.02%

|

|

| Total annual fund operating expenses |

rr_ExpensesOverAssets |

0.52%

|

|

| Expense Example, with Redemption, 1 Year |

rr_ExpenseExampleYear01 |

$ 53

|

|

| Expense Example, with Redemption, 3 Years |

rr_ExpenseExampleYear03 |

167

|

|

| Expense Example, with Redemption, 5 Years |

rr_ExpenseExampleYear05 |

291

|

|

| Expense Example, with Redemption, 10 Years |

rr_ExpenseExampleYear10 |

653

|

|

| Expense Example, No Redemption, 1 Year |

rr_ExpenseExampleNoRedemptionYear01 |

53

|

|

| Expense Example, No Redemption, 3 Years |

rr_ExpenseExampleNoRedemptionYear03 |

167

|

|

| Expense Example, No Redemption, 5 Years |

rr_ExpenseExampleNoRedemptionYear05 |

291

|

|

| Expense Example, No Redemption, 10 Years |

rr_ExpenseExampleNoRedemptionYear10 |

$ 653

|

|

| Average Annual Returns, 1 Year |

rr_AverageAnnualReturnYear01 |

30.84%

|

|

| Average Annual Returns, 5 Years |

rr_AverageAnnualReturnYear05 |

11.15%

|

|

| Average Annual Returns, 10 Years |

rr_AverageAnnualReturnYear10 |

13.01%

|

|

|

|