|

|

Dreyfus Stock Index Fund, Inc. | |||||

|

Summary Prospectus May 1, 2018 |

||||||

|

Initial Shares | ||||||

Before you invest, you may want to review the fund's prospectus, which contains more information about the fund and its risks. You can find the fund's prospectus and other information about the fund, including the statement of additional information and most recent reports to shareholders, online at www.im.bnymellon.com/variable. You can also get this information at no cost by calling 1-800-DREYFUS (inside the U.S. only) or by sending an e-mail request to info@dreyfus.com. The fund's prospectus and statement of additional information, dated May 1, 2018 (each as revised or supplemented), are incorporated by reference into this summary prospectus.

The fund seeks to match the total return of the S&P 500® Index.

This table describes the fees and expenses that you may pay if you buy and hold shares of the fund. These figures do not reflect any fees or charges imposed by participating insurance companies under their Variable Annuity contracts (VA contracts) or Variable Life Insurance policies (VLI policies), and if such fees and/or charges were included, the fees and expenses would be higher.

|

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | ||

|

Initial Shares |

Service Shares | |

|

Management fees |

.25 |

.25 |

|

Distribution and/or service (12b-1) fees |

none |

.25 |

|

Other expenses (including shareholder services fees) |

.02 |

.02 |

|

Total annual fund operating expenses |

.27 |

.52 |

Example

The Example is intended to help you compare the cost of investing in the fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the fund for the time periods indicated and then hold or redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the fund's operating expenses remain the same. The Example does not reflect fees and expenses incurred under VA contracts and VLI policies; if they were reflected, the figures in the Example would be higher. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

1 Year |

3 Years |

5 Years |

10 Years | |

|

Initial Shares |

$28 |

$87 |

$152 |

$343 |

|

Service Shares |

$53 |

$167 |

$291 |

$653 |

Portfolio Turnover

The fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover may indicate higher transaction costs. These costs, which are not reflected in annual fund operating expenses or in the Example, affect the fund's performance. During the most recent fiscal year, the fund's portfolio turnover rate was 2.90% of the average value of its portfolio.

|

|

|

To pursue its goal, the fund generally is fully invested in stocks included in the S&P 500® Index. The fund generally invests in all 500 stocks in the S&P 500 Index in proportion to their weighting in the index.

The S&P 500 Index is an unmanaged index of 500 common stocks chosen to reflect the industries of the U.S. economy and is often considered a proxy for the stock market in general. S&P weights each company's stock in the index by its market capitalization (i.e., the share price times the number of shares outstanding), adjusted by the number of available float shares (i.e., those shares available to public investors). Companies included in the S&P 500 Index generally must have market capitalizations in excess of $5.3 billion, to the extent consistent with market conditions.

"Standard & Poor's®," "S&P®," "Standard & Poor's® 500" and "S&P 500®" are trademarks of Standard & Poor's Financial Services LLC (Standard & Poor's) and have been licensed for use by the fund. The fund is not sponsored, endorsed, sold or promoted by Standard & Poor's and Standard & Poor's makes no representation regarding the advisability of investing in the fund.

An investment in the fund is not a bank deposit. It is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. It is not a complete investment program. The fund's share price fluctuates, sometimes dramatically, which means you could lose money.

· Risks of stock investing. Stocks generally fluctuate more in value than bonds and may decline significantly over short time periods. There is the chance that stock prices overall will decline because stock markets tend to move in cycles, with periods of rising prices and falling prices. The market value of a stock may decline due to general market conditions or because of factors that affect the particular company or the company's industry.

· Indexing strategy risk. The fund uses an indexing strategy. It does not attempt to manage market volatility, use defensive strategies or reduce the effects of any long-term periods of poor index performance. The correlation between fund and index performance may be affected by the fund's expenses, changes in securities markets, changes in the composition of the index and the timing of purchases and redemptions of fund shares.

· Non-diversification risk. The fund is non-diversified, which means that the fund may invest a relatively high percentage of its assets in a limited number of issuers. Therefore, the fund's performance may be more vulnerable to changes in the market value of a single issuer or group of issuers and more susceptible to risks associated with a single economic, political or regulatory occurrence than a diversified fund.

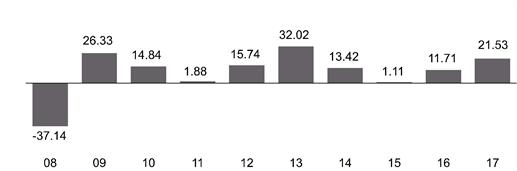

The following bar chart and table provide some indication of the risks of investing in the fund. The bar chart shows changes in the performance of the fund's Initial shares from year to year. The table compares the average annual total returns of the fund's shares to those of a broad measure of market performance. The fund's past performance is not necessarily an indication of how the fund will perform in the future. More recent performance information may be available at www.dreyfus.com.

Performance information reflects the fund's expenses only and does not reflect the fees and charges imposed by participating insurance companies under their VA contracts or VLI policies. Because these fees and charges will reduce total return, policyowners should consider them when evaluating and comparing the fund's performance. Policyowners should consult the prospectus for their contract or policy for more information.

|

Year-by-Year Total Returns as of 12/31 each year (%) Initial Shares | |

|

|

Best Quarter Worst Quarter |

|

Dreyfus Stock Index Fund Summary |

2 |

|

Average Annual Total Returns (as of 12/31/17) | |||

|

1 Year |

5 Years |

10 Years | |

|

Initial Shares |

21.53% |

15.50% |

8.26% |

|

Service Shares |

21.22% |

15.21% |

7.98% |

|

S&P 500® Index reflects no deductions for fees, expenses or taxes |

21.82% |

15.78% |

8.49% |

The fund's investment adviser is The Dreyfus Corporation (Dreyfus). Dreyfus has engaged its affiliate, BNY Mellon Asset Management North America Corporation (BNY Mellon AMNA), to serve as the fund's index manager.

Thomas J. Durante, Karen Q. Wong and Richard A. Brown are the fund's primary portfolio managers. Mr. Durante has been a primary portfolio manager of the fund since March 2000. Mr. Durante is a managing director and co-head of equity index portfolio management at BNY Mellon AMNA. Ms. Wong and Mr. Brown have been primary portfolio managers of the fund since June 2010. Ms. Wong is a managing director and head of index portfolio management at BNY Mellon AMNA, and Mr. Brown is a managing director and co-head of equity index portfolio management at BNY Mellon AMNA.

Fund shares are offered only to separate accounts established by insurance companies to fund VA contracts and VLI policies. Individuals may not purchase shares directly from, or place sell orders directly with, the fund. The VA contracts and the VLI policies are described in the separate prospectuses issued by the participating insurance companies, over which the fund assumes no responsibility. Policyowners should consult the prospectus of the separate account of the participating insurance company for more information about buying, selling (redeeming), or exchanging fund shares.

The fund's distributions are taxable as ordinary income or capital gains. Since the fund's shareholders are the participating insurance companies and their separate accounts, the tax treatment of dividends and distributions will depend on the tax status of the participating insurance company. Accordingly, no discussion is included as to the federal personal income tax consequences to policyowners. For this information, policyowners should consult the prospectus of the separate account of the participating insurance company or their tax advisers.

If you purchase shares through a broker-dealer or other financial intermediary (such as an insurance company), the fund and its related companies may pay the intermediary for the sale of fund shares and related services. To the extent that the intermediary may receive lesser or no payments in connection with the sale of other investments, the payments from the fund and its related companies may create a potential conflict of interest by influencing the broker-dealer or other intermediary and your financial representative to recommend the fund over the other investments. This potential conflict of interest may be addressed by policies, procedures or practices adopted by the financial intermediary. As there may be many different policies, procedures or practices adopted by different intermediaries to address the manner in which compensation is earned through the sale of investments or the provision of related services, the compensation rates and other payment arrangements that may apply to a financial intermediary and its representatives may vary by intermediary. Ask your financial representative or visit your financial intermediary's website for more information.

This prospectus does not constitute an offer or solicitation in any state or jurisdiction in which, or to any person to whom, such offering or solicitation may not lawfully be made.

|

Dreyfus Stock Index Fund Summary |

3 |

|

Dreyfus Stock Index Fund Summary |

4 |