File No. 33-27172

811-5719

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-1A

| REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 | [X] |

| Pre-Effective Amendment No. | [__] |

| Post-Effective Amendment No. 27 | [X] |

and/or

| REGISTRATION STATEMENT UNDER THE INVESTMENT COMPANY ACT OF 1940 | [X] |

| Amendment No. 27 | [X] |

(Check appropriate box or boxes.)

DREYFUS STOCK INDEX FUND, INC.

(Exact Name of Registrant as Specified in Charter)

c/o The Dreyfus Corporation

200 Park Avenue, New York, New York 10166

(Address of Principal Executive Offices) (Zip Code)

Registrant's Telephone Number, including Area Code: (212) 922-6000

Michael A. Rosenberg, Esq.

200 Park Avenue

New York, New York 10166

(Name and Address of Agent for Service)

Approximate Date of Proposed Public Offering May 1, 2010

It is proposed that this filing will become effective (check appropriate box)

___ immediately upon filing pursuant to paragraph (b)

_X_ on April 13,2010 pursuant to paragraph (b)

___ 60 days after filing pursuant to paragraph (a)(1)

___ on (date) pursuant to paragraph (a)(1)

___ 75 days after filing pursuant to paragraph (a)(2)

___ on (date) pursuant to paragraph (a)(2) of Rule 485

If appropriate, check the following box:

| this post-effective amendment designates a new effective date for a previously filed post-effective |

| ____ amendment. |

Dreyfus Stock Index Fund, Inc.

PROSPECTUS May 1, 2010

Initial Shares

Service Shares

Contents

| Fund Summary | |

| Fund Summary | 1 |

| Fund Details | |

| Introduction | 4 |

| Goal and Approach | 4 |

| Investment Risks | 5 |

| Management | 6 |

| Shareholder Guide | |

| Your Investment | 8 |

| General Policies | 9 |

| Distributions and Taxes | 11 |

| Exchange Privilege | 11 |

| Financial Highlights | 12 |

| For More Information |

| See back cover. |

Fund Summary

INVESTMENT OBJECTIVE

The fund seeks to match the total return of the Standard & Poor's® 500 Composite Stock Price Index.

FEES AND EXPENSES

This table describes the fees and expenses that you may pay if you buy and hold shares of the fund. These figures do not reflect any fees or charges imposed by participating insurance companies under their Variable Annuity contracts (VA contracts) or Variable Life Insurance policies (VLI policies).

| Annual fund operating expenses (expenses that you pay each | ||

| year as a percentage of the value of your investment) | ||

| Initial | Service | |

| shares | shares | |

| Management fees | .25 | .25 |

| Distribution (12b-1) fees | none | .25 |

| Other expenses (including shareholder services fees) | .04 | .04 |

| Total annual fund operating expenses | .29 | .54 |

EXAMPLE

The Example below is intended to help you compare the cost of investing in the fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the fund for the time periods indicated. The Example also assumes that your investment has a 5% return each year and that the fund’s operating expenses remain the same. The Example does not reflect fees and expenses incurred under VA contracts and VLI policies; if they were reflected, the figures in the Example would be higher. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |

| Initial Shares | $30 | $93 | $163 | $368 |

| Service Shares | $55 | $173 | $302 | $677 |

PORTFOLIO TURNOVER

The fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover may indicate higher transaction costs. These costs, which are not reflected in annual fund operating expenses or in the example, affect the fund’s performance. During the most recent fiscal year, the fund’s portfolio turnover rate was 5.42% of the average value of its portfolio.

PRINCIPAL INVESTMENT STRATEGY

To pursue its goal, the fund generally is fully invested in stocks included in the S&P 500® Index and in futures whose performance is tied to the index. The fund generally invests in all 500 stocks in the S&P 500 Index in proportion to their weighting in the index. The S&P 500 Index is an unmanaged index of 500 common stocks chosen to reflect the industries of the U.S. economy and is often considered a proxy for the stock market in general. S&P weights each company’s stock in the index by its market capitalization, adjusted by the number of available float shares divided by the company’s total shares outstanding, which means larger companies with more available float shares have greater representation in the index than smaller ones. The fund attempts to have a correlation between its performance and that

1

of the S&P 500 Index of at least .95 before expenses. A correlation of 1.00 would mean that the fund and the index were perfectly correlated.

PRINCIPAL RISKS

An investment in the fund is not a bank deposit. It is not insured or guaranteed by the FDIC or any other government agency. It is not a complete investment program. The fund’s share price fluctuates, sometimes dramatically, which means you could lose money.

-

Market risk. The market value of a security may decline due to general market conditions that are not specifically related to a particular company, such as real or perceived adverse economic conditions, changes in the outlook for corporate earnings, changes in interest or currency rates or adverse investor sentiment generally. A security’s market value also may decline because of factors that affect a particular industry or industries, such as labor shortages or increased production costs and competitive conditions within an industry.

-

Issuer risk. The value of a security may decline for a number of reasons which directly relate to the issuer, such as management performance, financial leverage and reduced demand for the issuer’s products or services.

-

Indexing strategy risk. The fund uses an indexing strategy. It does not attempt to manage market volatility, use defensive strategies or reduce the effects of any long-term periods of poor index performance. The correlation between fund and index performance may be affected by the fund’s expenses, changes in securities markets, changes in the composition of the index and the timing of purchases and redemptions of fund shares.

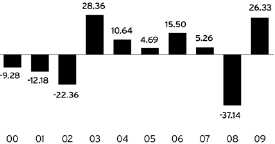

PERFORMANCE

The following bar chart and table provide some indication of the risks of investing in the fund. The bar chart shows changes in the performance of the fund’s Initial shares from year to year. The table compares the average annual total returns of the fund’s shares to those of a broad measure of market performance. The fund’s past performance is no guarantee of future results. More recent performance information may be available at www.dreyfus.com.

Performance information reflects the fund’s expenses only and does not reflect the fees and charges imposed by participating insurance companies under their VA contracts or VLI policies. Because these fees and charges will reduce total return, policyowners should consider them when evaluating and comparing the fund’s performance. Policyowners should consult the prospectus for their contract or policy for more information.

Year-by-year total returns as of 12/31 each year (%)

Initial Shares

Best Quarter (Q2, 2009) 15.87%. Worst Quarter (Q4, 2008) -22.00%

2

| Average annual total returns as of 12/31/09 | |||

| 1 Year | 5 Years | 10 Years | |

| Initial Shares | 26.33% | 0.21% | -1.18% |

| Service Shares* | 26.05% | -0.04% | -1.41% |

| S&P 500® Index (reflects no | 26.46% | 0.42% | -0.95% |

| deduction for fees, expenses or taxes) | |||

| * The average annual total returns for the fund’s Service shares for periods prior to 12/31/00 |

| (commencement of initial offering of Service shares) reflect the performance of the fund’s Initial shares. |

| Such performance figures have not been adjusted to reflect the higher operating expenses of the Service |

| shares; if these expenses had been reflected, such performance would have been lower. |

PORTFOLIO MANAGEMENT

The fund’s investment adviser is The Dreyfus Corporation (Dreyfus). The fund’s index fund manager is Mellon Capital Management Corporation (Mellon Capital), an affiliate of Dreyfus. Thomas Durante, CFA, has been the fund’s primary portfolio manager since March 2000. Mr. Durante is a portfolio manager with Mellon Capital, where he has been employed since January 2000.

PURCHASE AND SALE OF FUND SHARES

Fund shares are offered only to separate accounts established by insurance companies to fund VA contracts and VLI policies. Individuals may not purchase shares directly from, or place sell orders directly with, the fund. The VA contracts and the VLI policies are described in the separate prospectuses issued by the participating insurance companies, over which the fund assumes no responsibility. Policyowners should consult the prospectus of the separate account of the participating insurance company for more information about buying, selling, or exchanging fund shares.

TAX INFORMATION

The fund’s distributions are taxable as ordinary income or capital gains, except when your investment is through an IRA, 401(k) plan or other tax-advantaged investment plan. Since the fund’s shareholders are the participating insurance companies and their separate accounts, the tax treatment of dividends and distributions will depend on the tax status of the participating insurance company. Accordingly, no discussion is included as to the federal personal income tax consequences to policyowners. For this information, policyowners should consult the prospectus of the separate account of the participating insurance company or their tax advisers.

PAYMENTS TO BROKER-DEALERS AND OTHER FINANCIAL INTERMEDIARIES

If you purchase shares through a broker-dealer or other financial intermediary (such as an insurance company), the fund and its related companies may pay the intermediary for the sale of fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

3

Fund Details

INTRODUCTION

Fund shares are offered only to separate accounts established by insurance companies to fund VA contracts and VLI policies. Individuals may not purchase shares directly from, or place sell orders directly with, the fund. The VA contracts and the VLI policies are described in the separate prospectuses issued by the participating insurance companies, over which the fund assumes no responsibility. Conflicts may arise between the interests of VA contract holders and VLI policyholders (collectively, policyowners). The board will monitor events to identify any material conflicts and, if such conflicts arise, determine what action, if any, should be taken.

The fund currently offers two classes of shares: Initial shares and Service shares. Policyowners should consult the applicable prospectus of the separate account of the participating insurance company to determine which class of fund shares may be purchased by the separate account.

While the fund’s investment objectives and policies may be similar to those of other funds managed by the investment adviser(s), the fund’s investment results may be higher or lower than, and may not be comparable to, those of the other funds.

GOAL AND APPROACH

The fund seeks to match the total return of the Standard & Poor’s® 500 Composite Stock Price Index. To pursue this goal, the fund generally is fully invested in stocks included in the S&P 500® Index and in futures whose performance is tied to the index.

The fund attempts to have a correlation between its performance and that of the S&P 500 Index of at least .95 before expenses. A correlation of 1.00 would mean that the fund and the index were perfectly correlated.

The fund generally invests in all 500 stocks in the S&P 500 Index in proportion to their weighting in the index. The S&P 500 Index is an unmanaged index of 500 common stocks chosen to reflect the industries of the U.S. economy and is often considered a proxy for the stock market in general. S&P weights each company’s stock in the index by its market capitalization (i.e., the share price times the number of shares outstanding), adjusted by the number of available float shares (i.e., those shares available to public investors) divided by the company’s total shares outstanding, which means larger companies with more available float shares have greater representation in the index than small companies. The fund also may use stock index futures as a substitute for the sale or purchase of securities. Under normal circumstances, the fund will invest at least 80% of its net assets in stocks included in the S&P 500 Index; the fund will provide its shareholders with 60 days’ prior notice of any change in this policy.

4

INVESTMENT RISKS

The fund’s principal risks are discussed below. An investment in the fund is not a bank deposit. It is not insured or guaranteed by the FDIC or any other government agency. It is not a complete investment program. The value of your investment in the fund will fluctuate, sometimes dramatically, which means you could lose money.

-

Market risk. The market value of a security may decline due to general market conditions that are not specifically related to a particular company, such as real or perceived adverse economic conditions, changes in the outlook for corporate earnings, changes in interest or currency rates or adverse investor sentiment generally. A security’s market value also may decline because of factors that affect a particular industry or industries, such as labor shortages or increased production costs and competitive conditions within an industry.

-

Issuer risk. The value of a security may decline for a number of reasons which directly relate to the issuer, such as management performance, financial leverage and reduced demand for the issuer’s products or services.

-

Indexing strategy risk. The fund uses an indexing strategy. It does not attempt to manage market volatility, use defensive strategies or reduce the effects of any long-term periods of poor index performance. The correlation between fund and index performance may be affected by the fund’s expenses, changes in securities markets, changes in the composition of the index and the timing of purchases and redemptions of fund shares.

In addition to the principal risks described above, the fund is subject to the following additional risks.

-

Other potential risks. The fund may lend its portfolio securities to brokers, dealers and other financial institutions. In connection with such loans, the fund will receive collateral from the borrower equal to at least 100% of the value of loaned securities. If the borrower of the securities fails financially, there could be delays in recovering the loaned securities or exercising rights to the collateral.

The fund may invest in stock index futures contracts whose performance is tied to the S&P 500 Index. While used primarily as a substitute for the sale or purchase of securities, such investments can increase the fund’s volatility and lower its return. Derivatives, such as futures contracts, can be illiquid, and a small investment in certain derivatives could have a potentially large impact on the fund’s performance.

The participating insurance companies and their separate accounts are the shareholders of the fund. From time to time, a shareholder may own a substantial number of fund shares. The sale of a large number of shares could hurt the fund’s net asset value.

5

MANAGEMENT

The investment adviser for the fund is The Dreyfus Corporation (Dreyfus), 200 Park Avenue, New York, New York 10166. Founded in 1947, Dreyfus manages approximately $290 billion in 190 mutual fund portfolios. For the past fiscal year, the fund paid Dreyfus a management fee at the annual rate of 0.245% of the fund’s average daily net assets. A discussion regarding the basis for the board’s approving the fund’s management agreement with Dreyfus is available in the fund’s semi-annual report for the six-month period ended June 30, 2009.

Service class shares are subject to an ongoing Rule 12b-1 fee of 0.25% for distribution, advertising and marketing, and servicing and/or maintaining accounts of Service class shares. Because these fees are paid out of the fund’s assets on an ongoing basis, over time these fees will increase the cost of your investment and may cost you more than paying other types of sales charges. Dreyfus is the primary mutual fund business of The Bank of New York Mellon Corporation (BNY Mellon), a global financial services company focused on helping clients move and manage their financial assets, operating in 34 countries and serving more than 100 markets. BNY Mellon is a leading provider of financial services for institutions, corporations and high-net-worth individuals, providing asset and wealth management, asset servicing, issuer services, and treasury services through a worldwide client-focused team. BNY Mellon has more than $22.3 trillion in assets under custody and administration and $1.1 trillion in assets under management, and it services more than $12.0 trillion in outstanding debt. Additional information is available at www.bnymellon.com.

The Dreyfus asset management philosophy is based on the belief that discipline and consistency are important to investment success. For each fund, Dreyfus seeks to establish clear guidelines for portfolio management and to be systematic in making decisions. This approach is designed to provide each fund with a distinct, stable identity.

Dreyfus has engaged its affiliate, Mellon Capital Management Corporation (Mellon Capital), to serve as the fund’s index fund manager. As of February 28, 2010, Mellon Capital, located at 500 Grant Street, Pittsburgh, Pennsylvania 15258, managed approximately $175.4 billion in assets (including $9.6 billion in overlay assets) and provided investment advisory services for four other investment companies.

Thomas Durante, CFA, is the fund’s primary portfolio manager. He has managed the fund since March 2000. Mr. Durante is a portfolio manager with Mellon Capital, where he has been employed since January 2000. He also has been employed by Dreyfus since August 1982.

The fund’s Statement of Additional Information (SAI) provides additional portfolio manager information, including compensation, other accounts managed and ownership of fund shares.

MBSC Securities Corporation (MBSC), a wholly owned subsidiary of Dreyfus, serves as distributor of the fund and for the other funds in the Dreyfus Family of Funds. Rule 12b-1 fees and shareholder services fees, as applicable, are paid to MBSC for financing the sale and distribution of fund share and for providing shareholder account service and maintenance, respectively. Dreyfus or MBSC may provide cash payments out of its own resources to financial intermediaries that sell shares of funds in the Dreyfus Family of Funds or provide other services. Such payments are separate from any sales charges, 12b-1 fees and/or shareholder services fees or other expenses that may be paid by a fund to those intermediaries. Because those payments are not made by fund shareholders or the fund, the fund’s total expense ratio will not be affected by any such payments. These payments may be made to intermediaries, including affiliates, that provide shareholder servicing, sub-administration, recordkeeping and/or sub-transfer agency services, marketing support and/or access to sales meetings, sales representatives and management representatives of the financial intermediary. Cash compensation also may be paid from Dreyfus’ or MBSC’s own resources to intermediaries for inclusion of a fund on a sales list, including a preferred or select sales list or in other sales programs. These payments sometimes are referred to as “revenue sharing.” From time to time, Dreyfus or MBSC also may provide cash or non-cash compensation to financial intermediaries or their representatives in the form of occasional gifts; occasional meals, tickets

6

or other entertainment; support for due diligence trips; educational conference sponsorships; support for recognition programs; and other forms of cash or non-cash compensation permissible under broker-dealer regulations. In some cases, these payments or compensation may create an incentive for a financial intermediary or its employees to recommend or sell shares of the fund to you. Please contact your financial representative for details about any payments they or their firm may receive in connection with the sale of fund shares or the provision of services to the fund.

The fund, Dreyfus, Mellon Capital, and MBSC have each adopted a code of ethics that permits its personnel, subject to such code, to invest in securities, including securities that may be purchased or held by the fund. Each code of ethics restricts the personal securities transactions of employees, and requires portfolio managers and other investment personnel to comply with the code’s preclearance and disclosure procedures. The primary purpose of the respective codes is to ensure that personal trading by employees does not disadvantage any fund managed by Dreyfus or its affiliates.

7

Shareholder Guide

YOUR INVESTMENT

Fund shares may be purchased or sold (redeemed) by separate accounts of participating insurance companies. Policyowners should consult the prospectus of the separate account of the participating insurance company for more information about buying or selling fund shares.

Dreyfus generally calculates fund NAVs as of the close of trading on the New York Stock Exchange (NYSE) (usually 4:00 p.m. Eastern time) on days the NYSE is open for regular business. Your order will be priced at the next NAV calculated after your order is received in proper form by the fund’s transfer agent or other authorized entity. When calculating NAVs, Dreyfus values equity investments on the basis of market quotations or official closing prices. Dreyfus generally values fixed income investments based on values supplied by an independent pricing service approved by the fund’s board. The pricing service’s procedures are reviewed under the general supervision of the board. If market quotations or prices from a pricing service are not readily available, or are determined not to reflect accurately fair value, the fund may value those investments at fair value as determined in accordance with procedures approved by the fund’s board. Fair value of investments may be determined by the fund’s board, its pricing committee or its valuation committee in good faith using such information as it deems appropriate under the circumstances. Under certain circumstances, the fair value of foreign equity securities will be provided by an independent pricing service. Using fair value to price investments may result in a value that is different from a security’s most recent closing price and from the prices used by other mutual funds to calculate their net asset values. Funds that seek tax-exempt income are not recommended for purchase in IRAs or other qualified retirement plans. Foreign securities held by a fund may trade on days when the fund does not calculate its NAV and thus may affect the fund’s NAV on days when investors have no access to the fund.

Investments in certain types of thinly traded securities may provide short-term traders arbitrage opportunities with respect to the fund’s shares. For example, arbitrage opportunities may exist when trading in a portfolio security or securities is halted and does not resume, or the market on which such securities are traded closes before the fund calculates its NAV. If short-term investors of the fund were able to take advantage of these arbitrage opportunities, they could dilute the NAV of fund shares held by long-term investors. Portfolio valuation policies can serve to reduce arbitrage opportunities available to short-term traders, but there is no assurance that such valuation policies will prevent dilution of the fund’s NAV by short-term traders. While the fund has a policy regarding frequent trading, it too may not be completely effective to prevent short-term NAV arbitrage trading, particularly in regard to omnibus accounts. Please see “Shareholder Guide — General Policies” for further information about the fund’s frequent trading policy.

8

GENERAL POLICIES

The fund is designed for long-term investors. Frequent purchases, redemptions and exchanges may disrupt portfolio management strategies and harm fund performance by diluting the value of fund shares and increasing brokerage and administrative costs. As a result, Dreyfus and the fund’s board have adopted a policy of discouraging excessive trading, short-term market timing and other abusive trading practices (frequent trading) that could adversely affect the fund or its operations. Dreyfus and the fund will not enter into arrangements with any person or group to permit frequent trading.

The fund also reserves the right to:

-

change its minimum or maximum investment amounts

-

delay sending out redemption proceeds for up to seven days (generally applies only during unusual market conditions or in cases of very large redemptions or excessive trading)

-

“redeem in kind,” or make payments in securities rather than cash, if the amount redeemed is large enough to affect fund operations (for example, if it exceeds 1% of the fund’s assets)

-

refuse any purchase or exchange request, including those from any participating insurance company, individual or group who, in Dreyfus’ view, is likely to engage in frequent trading

Transactions in fund shares are processed by the participating insurance companies using omnibus accounts that aggregate the trades of multiple policyowners. Dreyfus’ ability to monitor the trading activity of these policyowners is limited because their individual transactions in fund shares are not disclosed to the fund. Accordingly, Dreyfus relies to a significant degree on the participating insurance company to detect and deter frequent trading. The agreement with the participating insurance company includes obligations to comply with all applicable federal and state laws. All participating insurance companies have been sent written reminders of their obligations under the agreements, specifically highlighting rules relating to trading fund shares. Further, all participating insurance companies have been requested in writing to notify Dreyfus immediately if, for any reason, they cannot meet their commitment to make fund shares available in accordance with the terms of the prospectus and relevant rules and regulations.

Dreyfus supplements the surveillance processes in place at participating insurance companies by monitoring total purchases and redemptions of fund shares on a periodic basis. If Dreyfus identifies patterns that may be indicative of frequent trading of large amounts, Dreyfus contacts the participating insurance company for assistance in disaggregating selected omnibus trades into their component parts. When this process identifies multiple roundtrips (i.e., an investment that is substantially liquidated within 60 days), Dreyfus instructs the participating insurance company to temporarily or permanently bar such policyowner’s future purchases of fund shares if Dreyfus concludes the policyowner is likely to engage in frequent trading. Dreyfus also may instruct the participating insurance company to apply these restrictions across all accounts under common ownership, control or perceived affiliation. In all instances, Dreyfus seeks to make these determinations to the best of its abilities in a manner that it believes is consistent with shareholder interests.

In addition to applying restrictions on future purchases or exchanges, Dreyfus or the participating insurance company may cancel or reverse the purchase or exchange on the business day following the transaction if the participating insurance company’s surveillance system identifies the account as one that is likely to engage in frequent trading. Dreyfus may also instruct the participating insurance company to cancel or reverse the purchase or exchange on the following business day if the trade represents a significant amount of the fund’s assets and Dreyfus has concluded that the account is likely to engage in frequent trading.

To the extent the fund significantly invests in foreign securities traded on markets that close before the fund calculates its NAV, events that influence the value of these foreign securities may occur after the

9

close of these foreign markets and before the fund calculates its NAV. As a result, certain policyowners may seek to trade fund shares in an effort to benefit from their understanding of the value of these foreign securities at the time the fund calculates its NAV (referred to as price arbitrage). This type of frequent trading may dilute the value of fund shares held by other policyowners. The fund has adopted procedures designed to adjust closing market prices of foreign equity securities under certain circumstances to reflect what it believes to be their fair value.

Although the fund’s frequent trading and fair valuation policies and procedures are designed to discourage market timing and excessive trading, none of these tools alone, nor all of them together, completely eliminates the potential for frequent trading.

10

DISTRIBUTIONS AND TAXES

The fund earns dividends, interest and other income from its investments, and distributes this income (less expenses) to shareholders as dividends. The fund also realizes capital gains from its investments, and distributes these gains (less any losses) to shareholders as capital gain distributions. The fund normally pays dividends quarterly and capital gains distributions annually. Fund dividends and capital gain distributions will be reinvested in the fund unless the participating insurance company instructs otherwise.

Since the fund’s shareholders are the participating insurance companies and their separate accounts, the tax treatment of dividends and distributions will depend on the tax status of the participating insurance company. Accordingly, no discussion is included as to the federal personal income tax consequences to policyowners. For this information, policyowners should consult the prospectus of the separate account of the participating insurance company or their tax advisers.

Participating insurance companies should consult their tax advisers about federal, state and local tax consequences.

EXCHANGE PRIVILEGE

Policyowners may exchange shares of a class for shares of other funds offered by the VA contracts or VLI policies through the insurance company separate accounts subject to the terms and conditions set forth in the prospectuses of such VA contracts or VLI policies. Policyowners should refer to the applicable insurance company prospectus for more information on exchanging fund shares.

11

FINANCIAL HIGHLIGHTS

These financial highlights describe the performance of the fund’s shares for the fiscal periods indicated. “Total return” shows how much your investment in the fund would have increased (or decreased) during each period, assuming you had reinvested all dividends and distributions. The financial highlights for the fiscal years ended December 31, 2007, 2008 and 2009 have been audited by Ernst & Young LLP, an independent registered public accounting firm, whose report, along with the fund’s financial statements, is included in the annual report, which is available upon request. Information for each of the fiscal years ended through December 31, 2006 was audited by the fund’s former independent registered public accounting firm. Keep in mind that fees and charges imposed by participating insurance companies, which are not reflected in the tables, would reduce the investment returns that are shown.

| Year Ended December 31, | |||||

| Initial Shares | 2009 | 2008 | 2007 | 2006 | 2005 |

| Per Share Data ($): | |||||

| Net asset value, beginning of period | 22.98 | 37.40 | 36.15 | 31.82 | 30.89 |

| Investment Operations: | |||||

| Investment income--neta | .48 | .64 | .64 | .56 | .49 |

| Net realized and unrealized gain (loss) on investments | 4.85 | (14.40) | 1.26 | 4.33 | .94 |

| Total from Investment Operations | 5.33 | (13.76) | 1.90 | 4.89 | 1.43 |

| Distributions: | |||||

| Dividends from investment income--net | (.48) | (.66) | (.65) | (.56) | (.50) |

| Dividends from net realized gain on investments | (1.52) | - | - | - | (.00)b |

| Total Distributions | (2.00) | (.66) | (.65) | (.56) | (.50) |

| Net asset value, end of period | 26.31 | 22.98 | 37.40 | 36.15 | 31.82 |

| Total Return (%) | 26.33 | (37.14) | 5.26 | 15.50 | 4.69 |

| Ratios/Supplemental Data (%): | |||||

| Ratio of total expenses to average net assets | .29 | .28 | .27 | .27 | .27 |

| Ratio of net expenses to average net assets | .29c | .28c | .27 | .27 | .27 |

| Ratio of net investment income to average net assets | 2.12 | 2.04 | 1.70 | 1.67 | 1.60 |

| Portfolio Turnover Rate | 5.42 | 4.69 | 4.54 | 4.91 | 6.09 |

| Net Assets, end of period ($ x 1,000) | 1,593,165 | 1,464,344 | 2,702,209 | 3,594,085 | 3,616,211 |

| a Based on average shares outstanding at each month end. |

| b Amount represents less than $.01 per share. |

| c Expense waivers and/or reimbursements amounted to less than .01%. |

12

| Year Ended December 31, | |||||

| Service Shares | 2009 | 2008 | 2007 | 2006 | 2005 |

| Per Share Data ($): | |||||

| Net asset value, beginning of period | 23.00 | 37.41 | 36.16 | 31.82 | 30.90 |

| Investment Operations: | |||||

| Investment income—neta | .43 | .57 | .55 | .47 | .42 |

| Net realized and unrealized gain (loss) on investments | 4.85 | (14.42) | 1.26 | 4.35 | .93 |

| Total from Investment Operations | 5.28 | (13.85) | 1.81 | 4.82 | 1.35 |

| Distributions: | |||||

| Dividends from investment income--net | (.42) | (.56) | (.56) | (.48) | (.43) |

| Dividends from net realized gain on investments | (1.52) | - | - | - | (.00)b |

| Total Distributions | (1.94) | (.56) | (.56) | (.48) | (.43) |

| Net asset value, end of period | 26.34 | 23.00 | 37.41 | 36.16 | 31.82 |

| Total Return (%) | 26.05 | (37.32) | 4.99 | 15.21 | 4.43 |

| Ratios/Supplemental Data (%): | |||||

| Ratio of total expenses to average net assets | .54 | .53 | .52 | .52 | .52 |

| Ratio of net expenses to average net assets | .54c | .53c | .52 | .52 | .52 |

| Ratio of net investment income to average net assets | 1.86 | 1.72 | 1.45 | 1.43 | 1.35 |

| Portfolio Turnover Rate | 5.42 | 4.69 | 4.54 | 4.91 | 6.09 |

| Net Assets, end of period ($ x 1,000) | 150,369 | 124,614 | 532,711 | 590,965 | 530,037 |

| a Based on average shares outstanding at each month end. |

| b Amount represents less than $.01 per share. |

| c Expense waivers and/or reimbursements amounted to less than .01%. |

13

For More Information

Dreyfus Stock Index Fund, Inc.

More information on this fund is available free upon request, including the following:

Annual/Semiannual Report

Describes the fund’s performance, lists portfolio holdings and contains a letter from the fund’s manager discussing recent market conditions, economic trends and fund strategies that significantly affected the fund’s performance during the last fiscal year.The fund’s most recent annual and semiannual reports are available at www.dreyfus.com.

Statement of Additional Information (SAI)

Provides more details about the fund and its policies. A current SAI is available at www.dreyfus.com and is on file with the Securities and Exchange Commission (SEC). The SAI is incorporated by reference (is legally considered part of this prospectus).

Portfolio Holdings

Dreyfus funds generally disclose their complete schedule of portfolio holdings monthly with a 30-day lag at www.dreyfus.com under Mutual Fund Center – Dreyfus Mutual Funds – Mutual Fund Total Holdings. Complete holdings as of the end of the calendar quarter are disclosed 15 days after the end of such quarter. Dreyfus money market funds generally disclose their complete schedule of holdings daily. The schedule of holdings for a fund will remain on the website until the fund files its Form N-Q or Form N-CSR for the period that includes the dates of the posted holdings.

A complete description of the fund’s policies and procedures with respect to the disclosure of the fund’s portfolio securities is available in the fund’s SAI.

To obtain information:

By telephone Call 1-800-554-4611 or 516-338-3300

| By mail Write to: |

| The Dreyfus Family of Funds |

| 144 Glenn Curtiss Boulevard |

| Uniondale, NY 11556-0144 |

| Attn: Institutional Services Department |

On the Internet Text-only versions of certain fund documents can be viewed online or downloaded from:

| SEC http://www.sec.gov |

| Dreyfus http://www.dreyfus.com |

You can also obtain copies, after paying a duplicating fee, by visiting the SEC’s Public Reference Room in Washington, DC (for information, call 1-202-551-8090) or by E-mail request to publicinfo@sec.gov, or by writing to the SEC’s Public Reference Section, Washington, DC 20549-0102.

DREYFUS STOCK INDEX FUND, INC.

INITIAL SHARES AND SERVICE SHARES

STATEMENT OF ADDITIONAL INFORMATION

MAY 1, 2010

This Statement of Additional Information, which is not a prospectus, supplements and should be read in conjunction with the current Prospectus of Dreyfus Stock Index Fund, Inc. (the “Fund”), dated May 1, 2010, as the Prospectus may be revised from time to time. To obtain a copy of the Fund’s Prospectus, please call your financial adviser, write to the Fund at 144 Glenn Curtiss Boulevard, Uniondale, New York 11556-0144, visit www.dreyfus.com, or call 1-800-554-4611 or 516-338-3300.

Fund shares are offered only to variable annuity and variable life insurance separate accounts established by insurance companies (“Participating Insurance Companies”) to fund variable annuity contracts (“VA contracts”) and variable life insurance policies (“VLI policies,” and together with VA contracts, the “Policies”). Individuals may not purchase shares directly from the Fund. The Policies are described in the separate prospectuses issued by the Participating Insurance Companies.

The Fund currently offers two classes of shares: Initial shares and Service shares. VA contract holders and VLI policyholders should consult the applicable prospectus of the separate account of the Participating Insurance Company to determine which class of Fund shares may be purchased by the separate account.

The Fund’s most recent Annual Report and Semi-Annual Report to Shareholders are separate documents supplied with this Statement of Additional Information, and the financial statements, accompanying notes and report of the independent registered public accounting firm appearing in the Annual Report are incorporated by reference into this Statement of Additional Information.

TABLE OF CONTENTS

| Page | |

| Description of the Fund | B-2 |

| Management of the Fund | B-8 |

| Management Arrangements | B-17 |

| How to Buy Shares | B-24 |

| Distribution Plan (Service Shares Only) | B-25 |

| Shareholder Services Plan (Initial Shares Only) | B-26 |

| How to Redeem Shares | B-26 |

| Exchange Privilege | B-27 |

| Determination of Net Asset Value | B-28 |

| Dividends, Distributions and Taxes | B-29 |

| Portfolio Transactions | B-30 |

| Summary of the Proxy Voting Policy, Procedures and Guidelines of the Dreyfus Family | |

| of Funds | B-33 |

| Information About the Fund | B-35 |

| Counsel and Independent Registered Public Accounting Firm | B-38 |

DESCRIPTION OF THE FUND

The Fund is a Maryland corporation formed on January 24, 1989 that commenced operations on September 29, 1989 under the name Dreyfus Life and Annuity Index Fund, Inc. On April 23, 2002, the Fund’s name was changed to Dreyfus Stock Index Fund, Inc.

The Dreyfus Corporation (“Dreyfus” or the “Manager”) serves as the Fund’s manager. Dreyfus has engaged its affiliate, Mellon Capital Management Corporation (“Mellon Capital”), to serve as the Fund’s index fund manager and provide day-to-day management of the Fund’s investments. Dreyfus and Mellon Capital are referred to collectively as the “Advisers.”

MBSC Securities Corporation (the “Distributor”) serves as the distributor of the Fund’s shares.

Certain Portfolio Securities

The following information supplements and should be read in conjunction with the Fund’s Prospectus. When the Fund has cash reserves or as otherwise described below, it may invest in the following securities.

U.S. Government Securities. Securities issued or guaranteed by the U.S. Government or its agencies or instrumentalities include U.S. Treasury securities that differ in their interest rates, maturities and times of issuance. Some obligations issued or guaranteed by U.S. Government agencies and instrumentalities are supported by the full faith and credit of the U.S. Treasury; others by the right of the issuer to borrow from the Treasury; others by discretionary authority of the U.S. Government to purchase certain obligations from the agency or instrumentality; and others only by the credit of the agency or instrumentality. These securities bear fixed, floating or variable rates of interest. While the U.S. Government provides financial support for such U.S. Government-sponsored agencies and instrumentalities, no assurance can be given that it will always do so since it is not so obligated by law.

Repurchase Agreements. In a repurchase agreement, the Fund buys, and the seller agrees to repurchase, a security at a mutually agreed upon time and price. The repurchase agreement thereby determines the yield during the purchaser’s holding period, while the seller’s obligation to repurchase is secured by the value of the underlying security. The Fund’s custodian or sub-custodian will have custody of, and will hold in a segregated account, securities acquired by the Fund under a repurchase agreement. Repurchase agreements are considered by the staff of the Securities and Exchange Commission (the “SEC”) to be loans by the Fund. Repurchase agreements could involve risks in the event of a default or insolvency of the other party to the agreement, including possible delays or restrictions upon the Fund’s ability to dispose of the underlying securities. In an attempt to reduce the risk of incurring a loss on a repurchase agreement, the Fund will require that additional securities be deposited with it if the value of the securities purchased should decrease below resale price.

Bank Obligations. The Fund may purchase certificates of deposit, time deposits, bankers' acceptances and other short-term obligations issued by domestic banks, foreign subsidiaries or foreign branches of domestic banks, domestic and foreign branches of foreign banks, domestic

savings and loan associations and other banking institutions. With respect to such securities issued by foreign subsidiaries or foreign branches of domestic banks, and domestic and foreign branches of foreign banks, the Fund may be subject to additional investment risks that are different in some respects from those incurred by a fund which invests only in debt obligations of U.S. domestic issuers.

Certificates of deposit are negotiable certificates evidencing the obligation of a bank to repay funds deposited with it for a specified period of time.

Time deposits are non-negotiable deposits maintained in a banking institution for a specified period of time (in no event longer than seven days) at a stated interest rate.

Bankers' acceptances are credit instruments evidencing the obligation of a bank to pay a draft drawn on it by a customer. These instruments reflect the obligation both of the bank and the drawer to pay the face amount of the instruments upon maturity. The other short-term obligations may include uninsured, direct obligations bearing fixed, floating or variable interest rates.

Commercial Paper. Commercial paper consists of short-term, unsecured promissory notes issued to finance short-term credit needs. The commercial paper purchased by the Fund will consist only of direct obligations which, at the time of their purchase, are (a) rated at least Prime-1 by Moody’s Investors Service, Inc. (“Moody’s”) or A-1 by Standard & Poor’s Ratings Services (“S&P”), (b) issued by companies having an outstanding unsecured debt issue currently rated at least Aa by Moody’s or at least AA- by S&P, or (c) if unrated, determined by the Advisers to be of comparable quality to those rated obligations which may be purchased by the Fund.

Investment Companies. The Fund may invest in securities issued by other investment companies. Under the Investment Company Act of 1940, as amended (the “1940 Act”), the Fund’s investment in such securities, subject to certain exceptions, currently is limited to (i) 3% of the total voting stock of any one investment company, (ii) 5% of the Fund’s total assets with respect to any one investment company and (iii) 10% of the Fund’s total assets in the aggregate. As a shareholder of another investment company, the Fund would bear, along with other shareholders, its pro rata portion of the other investment company’s expenses, including advisory fees. These expenses would be in addition to the advisory fees and other expenses that the Fund bears directly in connection with its own operations. The Fund also may invest its uninvested cash reserves or cash it receives as collateral from borrowers of its portfolio securities in connection with the Fund’s securities lending program in shares of one or more money market funds advised by Dreyfus. Such investments will not be subject to the limitations described above. See “Lending Portfolio Securities.”

Investment Techniques

The following information supplements and should be read in conjunction with the Fund’s Prospectus.

General. The Fund seeks to match the total return of the Standard & Poor’s 500 Composite Stock Price Index (the “Index”). The Index is composed of 500 common stocks, most of which are traded on the New York Stock Exchange (“NYSE”), chosen by S&P to best capture the price performance of a large cross-section of the U.S. publicly traded stock market. The Index is structured to approximate the general distribution of industries in the U.S. economy. The 500 securities represent approximately 75% of the market value of all U.S. common stocks. Component stocks included in the Index are chosen with the aim of achieving a distribution at the index level representative of the various components of the U.S. economy and therefore do not represent the 500 largest companies. Aggregate market value and trading activity are also considered in the selection process. A limited percentage of the Index may include foreign securities and real estate investment trusts (“REITs”).

The Fund will attempt to achieve a correlation between the performance of its portfolio and that of the Index of at least 0.95, without taking into account expenses. A correlation of 1.00 would indicate perfect correlation, which would be achieved when the Fund’s net asset value, including the value of its dividends and capital gains distributions, increases or decreases in exact proportion to changes in the Index. The Fund’s ability to correlate its performance with the Index, however, may be affected by, among other things, changes in securities markets, the manner in which the Index is calculated by S&P and the timing of purchases and redemptions. In the future, the Fund’s Board, subject to the approval of shareholders, may select another index if such a standard of comparison is deemed to be more representative of the performance of common stocks.

The Fund’s ability to duplicate the performance of the Index also depends to some extent on the size of the Fund’s portfolio and the size of cash flows into and out of the Fund. Investment changes to accommodate these cash flows are made to maintain the similarity of the Fund’s portfolio to the Index to the maximum practicable extent.

Borrowing Money. The Fund is permitted to borrow money only for temporary or emergency (not leveraging) purposes, in an amount up to 5% of the value of its total assets (including the amount borrowed) valued at the lesser of cost or market, less liabilities (not including the amount borrowed) at the time the borrowing is made.

Lending Portfolio Securities. The Fund may lend securities from its portfolio to brokers, dealers and other financial institutions needing to borrow securities to complete certain transactions. In connection with such loans, the Fund remains the owner of the loaned securities and continues to be entitled to payments in amounts equal to the interest, dividends or other distributions payable on the loaned securities. The Fund also has the right to terminate a loan at any time. The Fund may call the loan to vote proxies if a material issue affecting the Fund’s investment is to be voted upon. Loans of portfolio securities may not exceed 33-1/3% of the value of the Fund’s total assets (including the value of all assets received as collateral for the loan). The Fund will receive collateral consisting of cash, U.S. Government securities or irrevocable letters of credit which will be maintained at all times in an amount equal to at least 100% of the current market value of the loaned securities. If the collateral consists of a letter of credit or securities, the borrower will pay the Fund a loan premium fee. If the collateral consists of cash, the Fund will reinvest the cash and pay the borrower a pre-negotiated fee or “rebate” from any return earned on the investment. The Fund may participate in a securities lending

program operated by The Bank of New York Mellon, as lending agent (the “Lending Agent”). The Lending Agent will receive a percentage of the total earnings of the Fund derived from lending its portfolio securities. Should the borrower of the securities fail financially, the Fund may experience delays in recovering the loaned securities or exercising its rights in the collateral. Loans are made only to borrowers that are deemed by Dreyfus to be of good financial standing. In a loan transaction, the Fund will also bear the risk of any decline in value of securities acquired with cash collateral. The Fund will minimize this risk by limiting the investment of cash collateral to money market funds advised by Dreyfus, repurchase agreements or other high quality instruments with short maturities.

Derivatives. The Fund may invest in, or enter into, derivatives, such as stock index futures, in anticipation of taking a market position when, in the opinion of the Advisers, available cash balances do not permit an economically efficient trade in the cash market, to hedge dividend accruals or to meet liquidity needs. Derivatives may provide a cheaper, quicker or more specifically focused way for the Fund to invest than “traditional” securities would.

Derivatives can be volatile and involve various types and degrees of risk, depending upon the characteristics of the particular derivative and the portfolio as a whole. Derivatives permit the Fund to increase or decrease the level of risk, or change the character of the risk, to which its portfolio is exposed in much the same way as the Fund can increase or decrease the level of risk, or change the character of the risk, of its portfolio by making investments in specific securities. However, derivatives may entail investment exposures that are greater than their cost would suggest, meaning that a small investment in derivatives could have a large potential impact on the Fund’s performance.

If the Fund invests in derivatives at inopportune times or judges market conditions incorrectly, such investments may lower the Fund’s return or result in a loss. The Fund also could experience losses if its derivatives were poorly correlated with the underlying instruments or the fund’s other investments, or if the Fund were unable to liquidate its position because of an illiquid secondary market. The market for many derivatives is, or suddenly can become, illiquid. Changes in liquidity may result in significant, rapid and unpredictable changes in the prices for derivatives.

Derivatives may be purchased on established exchanges or through privately negotiated transactions referred to as over-the-counter derivatives. Exchange-traded derivatives generally are guaranteed by the clearing agency that is the issuer or counterparty to such derivatives. This guarantee usually is supported by a variation margin payment system operated by the clearing agency in order to reduce overall credit risk. As a result, unless the clearing agency defaults, there is relatively little counterparty credit risk associated with derivatives purchased on an exchange. In contrast, no clearing agency guarantees over-the-counter derivatives. Therefore, each party to an over-the-counter derivative bears the risk that the counterparty will default. Accordingly, the Advisers will consider the creditworthiness of counterparties to over-the-counter derivatives in the same manner as it would review the credit quality of a security to be purchased by the Fund. Over-the-counter derivatives are less liquid than exchange-traded derivatives since the other party to the transaction may be the only investor with sufficient understanding of the derivative to be interested in bidding for it.

Pursuant to regulations and/or published positions of the SEC, the Fund may be required to segregate permissible liquid assets, or engage in other measure approved by the SEC or its staff, to “cover” the Fund’s obligations relating to its transactions in derivatives. For example, in the case of futures contracts that are not contractually required to cash settle, the Fund must set aside liquid assets equal to such contracts’ full notional value (generally, the total numerical value of the asset underlying a futures contract at the time of valuation) while the positions are open. With respect to futures contracts that are contractually required to cash settle, however, the Fund is permitted to set aside liquid assets in an amount equal to the Fund’s daily marked to market net obligations (i.e., the Fund’s daily net liability) under the contracts, if any, rather than such contracts’ full notional value. By setting aside assets equal to only its net obligations under cash-settled futures contracts, the Fund may employ leverage to greater extent than if the Fund were required to segregate assets equal to the full notional value of such contracts.

The Fund will not be a commodity pool. The Fund has filed notice with the Commodity Futures Trading Commission and National Futures Association of its eligibility as a registered investment company for an exclusion from the definition of commodity pool operator and that the Fund is not subject to registration or regulation as a commodity pool operator under the Commodity Exchange Act.

Futures Transactions--In General. A futures contract is an agreement between two parties to buy and sell a security for a set price on a future date. These contracts are traded on exchanges, so that, in most cases, either party can close out its position on the exchange for cash, without delivering the security. The Fund may enter into futures contracts in U.S. domestic markets.

Although some futures contracts call for making or taking delivery of the underlying securities, generally these obligations are closed out before delivery by offsetting purchases or sales of matching futures contracts (same exchange, underlying security or index, and delivery month). Closing out a futures contract sale is effected by purchasing a futures contract for the same aggregate amount of the specific type of financial instrument with the same delivery date. If an offsetting purchase price is less than the original sale price, the Fund realizes a capital gain, or if it is more, the Fund realizes a capital loss. Conversely, if an offsetting sale price is more than the original purchase price, the Fund realizes a capital gain, or if it is less, the Fund realizes a capital loss. Transaction costs also are included in these calculations.

Engaging in these transactions involves risk of loss to the Fund which could adversely affect the value of the Fund's net assets. Although the Fund intends to purchase or sell futures contracts only if there is an active market for such contracts, no assurance can be given that a liquid market will exist for any particular contract at any particular time. Many futures exchanges and boards of trade limit the amount of fluctuation permitted in futures contract prices during a single trading day. Once the daily limit has been reached in a particular contract, no trades may be made that day at a price beyond that limit or trading may be suspended for specified periods during the trading day. Futures contract prices could move to the limit for several consecutive trading days with little or no trading, thereby preventing prompt liquidation of futures positions and potentially subjecting the Fund to substantial losses.

Specific Futures Transactions. The Fund may purchase and sell stock index futures contracts. A stock index future obligates the Fund to pay or receive an amount of cash equal to a fixed dollar

amount specified in the futures contract multiplied by the difference between the settlement price of the contract on the contract's last trading day and the value of the index based on the prices of the securities that comprise the index at the opening of trading in such securities on the next business day.

Investment Restrictions

The Fund’s investment objective is a fundamental policy, which cannot be changed without approval by the holders of a majority (as defined in the 1940 Act) of the Fund’s outstanding voting shares. In addition, the Fund has adopted investment restrictions numbered 1 through 9 as fundamental policies. The Fund may not:

1. Purchase securities of any company having less than three years' continuous operations (including operations of any predecessors) if such purchase would cause the value of the Fund’s investments in all such companies to exceed 5% of the value of its total assets.

2. Invest in commodities, except that the Fund may invest in futures contracts as described in the Prospectus and Statement of Additional Information.

3. Purchase, hold or deal in real estate, or oil and gas interests, but the Fund may purchase and sell securities that are secured by real estate or issued by companies that invest or deal in real estate.

4. Borrow money or pledge, mortgage or hypothecate its assets, except as described in the Fund’s Prospectus and the Statement of Additional Information and in connection with entering into futures contracts. Collateral arrangements with respect to initial or variation margin for futures contracts will not be deemed to be pledges of the Fund’s assets.

5. Lend any securities or make loans to others, except to the extent permitted under the 1940 Act (which currently limits such loans to no more than 33-1/3% of the value of the Fund’s total assets) or as otherwise permitted by the SEC. For purposes of this Investment Restriction, the purchase of debt obligations (including acquisitions of loans, loan participations or other forms of debt instruments) and the entry into repurchase agreements shall not constitute loans by the Fund. Any loans of portfolio securities will be made according to guidelines established by the SEC and the Fund’s Board.

6. Act as an underwriter of securities of other issuers or purchase securities subject to restrictions on disposition under the Securities Act of 1933 (so-called “restricted securities”). The Fund may not enter into repurchase agreements providing for settlement in more than seven days after notice or purchase securities which are not readily marketable, if, in the aggregate, more than 10% of the value of the Fund’s net assets would be so invested. The Fund will not enter into time deposits maturing in more than seven days and time deposits maturing from two business days through seven calendar days will not exceed 10% of the Fund’s total assets.

7. Invest in the securities of a company for the purpose of exercising management or control, but the Fund will vote the securities it owns in its portfolio as a shareholder in accordance with its views.

8. Purchase, sell or write puts, calls or combinations thereof.

9. Invest more than 25% of its assets in investments in any particular industry or industries (including banking), except to the extent the Index also is so concentrated, provided that, when the Fund has adopted a temporary defensive posture, there shall be no limitation on the purchase of obligations issued or guaranteed by the U.S. Government, its agencies or instrumentalities.

In addition to the investment restrictions adopted as set forth above, the Fund has adopted certain additional non-fundamental policies which may be changed by vote of a majority of the Board members at any time. The Fund may not: (i) engage in arbitrage transactions, (ii) purchase warrants (other than those acquired by the Fund in units or attached to securities), (iii) sell securities short, but reserves the right to sell securities short against the box, (iv) invest more than 10% of its total assets in the securities of any single issuer or hold more than 10% of the voting securities of any single issuer, or (iv) purchase securities of other investment companies, except to the extent permitted under the 1940 Act. In addition, the Fund intends to: (i) comply with the diversification requirements under Section 817(h) of the Internal Revenue Code of 1986, as amended (the “Code”), and (ii) comply in all material respects with relevant insurance laws and regulations applicable to investments of separate accounts of Participating Insurance Companies.

If a percentage restriction is adhered to at the time of investment, a later change in percentage resulting from changes in values or assets will not constitute a violation of such restriction.

MANAGEMENT OF THE FUND

Board of the Company

Board's Oversight Role in Management. The Board's role in management of the Company is oversight. As is the case with virtually all investment companies (as distinguished from operating companies), service providers to the Company, primarily the Manager and its affiliates, have responsibility for the day-to-day management of the Fund, which includes responsibility for risk management (including management of investment performance and investment risk, valuation risk, issuer and counterparty credit risk, compliance risk and operational risk). As part of its oversight, the Board, acting at its scheduled meetings, or the Chairman, acting between Board meetings, regularly interacts with and receives reports from senior personnel of service providers, including the Manager's Chief Investment Officer (or a senior representative of his office), the Company's and the Manager's Chief Compliance Officer and portfolio management personnel. The Board's audit committee (which consists of all Board members) meets during its scheduled meetings, and between meetings the audit committee chair maintains contact, with the Company's independent registered public accounting firm and the Company's Chief Financial Officer. The Board also receives periodic presentations from senior personnel of the Manager or its affiliates regarding risk management generally, as well as periodic presentations regarding specific operational, compliance or investment areas, such as business continuity, anti-money laundering, personal trading, valuation, credit, investment research and securities lending. The Board has adopted policies and procedures designed to

address certain risks to the Fund. In addition, the Manager and other service providers to the Company have adopted a variety of policies, procedures and controls designed to address particular risks to the Fund. Different processes, procedures and controls are employed with respect to different types of risks. However, it is not possible to eliminate all of the risks applicable to the Fund. The Board also receives reports from counsel to the Manager and the Board's own independent legal counsel regarding regulatory compliance and governance matters. The Board's oversight role does not make the Board a guarantor of the Fund's investments or activities.

Board Composition and Leadership Structure. The 1940 Act requires that at least 40% of the Company's Board members not be "interested persons" (as defined in the 1940 Act) of the Company and as such are not affiliated with the Manager ("Independent Board members"). To rely on certain exemptive rules under the 1940 Act, a majority of the Company's Board members must be Independent Board members, and for certain important matters, such as the approval of investment advisory agreements or transactions with affiliates, the 1940 Act or the rules thereunder require the approval of a majority of the Independent Board members. Currently, all of the Company's Board members, including the Chairman of the Board, are Independent Board members, although the Board could in the future determine to add Board members who are not Independent Board members. The Board has determined that its leadership structure, in which the Chairman of the Board is not affiliated with the Manager, is appropriate in light of the services that the Manager and its affiliates provide to the Company and potential conflicts of interest that could arise from these relationships.

Information About Each Board Member's Experience, Qualifications, Attributes or Skills. Board members of the Company, together with information as to their positions with the Company, principal occupations and other board memberships for the past five years, are shown below.

| Name (Age) | Principal Occupation | Other Public Company Board Memberships |

| Position with Company (Since) | During Past 5 Years | During Past 5 Years |

| Joseph S. DiMartino (66) | Corporate Director and | CBIZ (formerly, Century Business Services, |

| Chairman of the Board | Trustee | Inc.), a provider of outsourcing functions for |

| (1999) | small and medium size companies, Director | |

| (1997 - present) | ||

| The Newark Group, a provider of a national | ||

| market of paper recovery facilities, paperboard | ||

| mills and paperboard converting plants, | ||

| Director (2000 - present) | ||

| Sunair Services Corporation, a provider of | ||

| certain outdoor-related services to homes and | ||

| business, Director (2005 - 2009) | ||

| Name (Age) | Principal Occupation | Other Public Company Board Memberships |

| Position with Company (Since) | During Past 5 Years | During Past 5 Years |

| Peggy C. Davis (67) | Shad Professor of Law, New | N/A |

| Board Member | York University School of | |

| (2006) | Law | |

| Writer and teacher in the | ||

| fields of evidence, | ||

| constitutional theory, family | ||

| law, social sciences and the | ||

| law, legal process and | ||

| professional methodology | ||

| and training | ||

| David P. Feldman (70) | Corporate Director and | BBH Mutual Funds Group (4 registered mutual |

| Board Member | Trustee | funds), Director (1992 - present) |

| (1994) | ||

| QMed, Inc., a healthcare company, Director | ||

| (1999 - 2007) | ||

| James F. Henry (79) | Director, advisor and | N/A |

| Board Member | mediator involved in several | |

| (1968) | non-profit organizations, | |

| primarily engaged in | ||

| domestic and international | ||

| dispute resolution, and | ||

| historic preservation | ||

| Ehud Houminer (69) | Executive-in-Residence at the | Avnet, Inc., an electronics distributor, Director |

| Board Member | Columbia Business School, | (1993 - present) |

| (2006) | Columbia University | |

| Dr. Martin Peretz (70) | Editor-in-Chief of The New | N/A |

| Board Member | Republic Magazine (1974 - | |

| (2006) | present) | |

| Director of TheStreet.com, a | ||

| financial information | ||

| service on the web (1996 - | ||

| present) | ||

Each Board member has been a Board member of other Dreyfus mutual funds for over ten years. Additional information about each Board member follows (supplementing the information provided in the table above) that describes some of the specific experiences, qualifications, attributes or skills that each Board member possesses which the Board believes has prepared them to be effective Board members. The Board believes that the significance of each Board member's experience, qualifications, attributes or skills is an individual matter (meaning that experience that is important for one Board member may not have the same value for another) and that these factors are best evaluated at the board level, with no single Board member, or particular factor, being indicative of board effectiveness. However, the Board believes that Board members need to have the ability to critically review, evaluate, question and discuss information provided to them, and to interact effectively with Company management, service providers and counsel, in order to exercise effective business judgment in the

performance of their duties; the Board believes that its members satisfy this standard. Experience relevant to having this ability may be achieved through a Board member's educational background; business, professional training or practice (e.g., medicine, accounting or law), public service or academic positions; experience from service as a board member (including the Board of the Company) or as an executive of investment funds, public companies or significant private or not-for-profit entities or other organizations; and/or other life experiences. The charter for the Board's Nominating Committee contains certain other factors considered by the Committee in identifying and evaluating potential Board member nominees. To assist them in evaluating matters under federal and state law, the Board members are counseled by their own independent legal counsel, who participates in Board meetings and interacts with the Manager, and also may benefit from information provided by the Manager's counsel; counsel to the Company and to the Board have significant experience advising funds and fund board members. The Board and its committees have the ability to engage other experts as appropriate. The Board evaluates its performance on an annual basis.

-

Joseph S. DiMartino - Mr. DiMartino has been the Chairman of the Board of the funds in the Dreyfus Family of Funds for over 15 years. From 1971 through 1994, Mr. DiMartino served in various roles as an employee of Dreyfus (prior to its acquisition by a predecessor of BNY Mellon in August 1994 and related management changes), including portfolio manager, President, Chief Operating Officer and a Director. He ceased being an employee or Director of Dreyfus by the end of 1994. From July 1995 to November 1997, Mr. DiMartino served as Chairman of the Board of The Noel Group, a public buyout firm; in that capacity, he helped manage, acquire, take public and liquidate a number of operating companies. Mr. DiMartino has been a Director of The Muscular Dystrophy Association since 1986.

-

Peggy C. Davis – Ms. Davis currently serves as the John S. R. Shad Professor of Lawyering and Ethics at New York University School of Law. Prior to joining the university's faculty in 1983, Ms. Davis served as a Judge of the Family Court of the State of New York. Before her appointment to the bench, she practiced law for ten years in both the commercial and public interest sectors. Ms. Davis has also served as Chair of the Board of the Russell Sage Foundation.

-

David P. Feldman – Mr. Feldman is the former Chairman and Chief Executive Officer of AT&T Investment Management Corp., from which he retired in 1997, responsible for $70 billion in pension assets. Mr. Feldman has served as Chairman of the Financial Executives Institute's Committee on Investment of Employee Benefits Assets. Mr. Feldman currently serves as a member of the Pension Managers Advisory Committee of the New York Stock Exchange Inc.

-

James F. Henry – Mr. Henry is the former President of The International Institute for Conflict Prevention and Resolution, a non-profit organization principally engaged in the development of alternatives to business litigation. He also serves as an Advisor to the Elaw Forum, which provides consulting services with respect to managing corporate legal costs, and as an Advisor to John Jay Homestead (the restored home of the first U.S. Chief Justice).

-

Ehud Houminer - Mr. Houminer currently serves on Columbia Business School's Board of Overseers. Prior to his association with Columbia Business School beginning in 1991, Mr.

- Houminer held various senior financial, strategic and management positions at Philip Morris Companies Inc., including serving as Senior Corporate Vice President for Corporate Planning, and as President and Chief Executive Officer of Philip Morris USA, Inc (now part of Altria Group, Inc.). Mr. Houminer is Chairman of the Business School Board and a Trustee of Ben Gurion University. He has an MBA from the Wharton School of the University of Pennsylvania.

-

Dr. Martin Peretz – Dr. Peretz has been the editor-in-chief of The New Republic since 1974. Dr. Peretz is also the co-founder and a director of TheStreet.com. Previously, Dr. Peretz was a member of the faculty of Harvard University from 1966 through 2002. He currently serves on the boards of a number of significant non-profit organizations.

Additional Information about the Board and its Committees. Board members are elected to serve for an indefinite term. The Fund has standing audit, nominating and compensation committees, each comprised of its Board members who are not “interested persons” of the Fund, as defined in the 1940 Act. The function of the audit committee is to (i) oversee the Fund’s accounting and financial reporting processes and the audit of the Fund's financial statements and (ii) to assist in the Board's oversight of the integrity of the Fund's financial statements, the Fund's compliance with legal and regulatory requirements and the independent registered public accounting firm’s qualifications, independence and performance. The Fund's nominating committee is responsible for selecting and nominating persons as members of the Board for election or appointment by the Board and for election by shareholders. The nominating committee will consider recommendations for nominees from shareholders submitted to the Secretary of the Fund, c/o The Dreyfus Corporation Legal Department, 200 Park Avenue, 8th Floor East, New York, New York 10166, which includes information regarding the recommended nominee as specified in the nominating committee charter. The function of the compensation committee is to establish the appropriate compensation for serving on the Board. The Fund also has a standing pricing committee comprised of any one Board member. The function of the pricing committee is to assist in valuing the Fund’s investments. The audit committee met four times and the compensation, nominating and pricing committees did not meet during the fiscal year ended December 31, 2009.

The table below indicates the dollar range of each Board member’s ownership of Fund shares and shares of other funds in the Dreyfus Family of Funds for which he or she is a Board member, in each case as of December 31, 2009.

| Aggregate Holding of Funds in the Dreyfus | ||

| Dreyfus Stock | Family of Funds for which Responsible as a | |

| Name of Board Member | Index Fund | Board Member |

| Joseph S. DiMartino | None | Over $100,000 |

| Peggy C. Davis | None | Over $100,000 |

| David P. Feldman | None | Over $100,000 |

| James F. Henry | None | Over $100,000 |

| Ehud Houminer | None | Over $100,000 |

| Dr. Martin Peretz | None | $50,000 - $100,000 |

As of December 31, 2009, none of the Board members or their immediate family members owned securities of Dreyfus, Mellon Capital, the Distributor or any person (other than

a registered investment company) directly or indirectly controlling, controlled by or under common control with Dreyfus, Mellon Capital or the Distributor.