UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ⌧

Filed by a Party other than the Registrant ◻

Check the appropriate box:

◻ | Preliminary Proxy Statement |

◻ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

⌧ | Definitive Proxy Statement |

◻ | Definitive Additional Materials |

◻ | Soliciting Material Pursuant to §240.14a-12 |

Dime Community Bancshares, Inc. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

⌧ | No fee required. |

◻ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

◻ Fee paid previously with preliminary materials.

◻ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

April 16, 2021

Dear Shareholder,

You are cordially invited to attend the Annual Meeting of Shareholders (the “Annual Meeting”) of Dime Community Bancshares, Inc. (the “Company”), which will be held on May 27, 2021 at 10:00 a.m. Eastern Time. This year’s Annual Meeting will be a virtual meeting of shareholders, which will be conducted via live webcast. Shareholders will only be able to participate in the Annual Meeting online, vote shares electronically and submit questions during the Annual Meeting by visiting www.virtualshareholdermeeting.com/DCOM2021. Instructions on how to attend the Annual Meeting online and vote shares are described in the accompanying Proxy Statement.

The attached Notice of the Annual Meeting of Shareholders and Proxy Statement describe the business to be transacted at the Annual Meeting. The Company's Board of Directors has determined that an affirmative vote on each matter to be considered at the Annual Meeting is in the best interests of the Company and its shareholders and unanimously recommends a vote “FOR” each of these matters. The directors and executive officers of the Company, as well as a representative of Crowe LLP, the accounting firm appointed by the Audit Committee of the Board of Directors to be the Company's independent registered public accounting firm for the year ending December 31, 2021, will be available during the Annual Meeting.

2020 was a transformational year for the Company. We entered into a merger of equals agreement between Bridge Bancorp, Inc. (“Bridge”) and Dime Community Bancshares, Inc. (“Legacy Dime”) on July 1, 2020. During the year, we were both able to successfully balance planning for and launching our merger integration roadmap and continuing to maintain the momentum in our core businesses.

On February 1, 2021, we completed the merger transaction and we are especially proud of the people within our organization that have made the success of this merger possible. The merger brought together two high-performing banks with complementary strengths to create the greater New York’s Premier Business Bank with size, scale, and product offerings to compete and win in an evolving market. Our leadership begins with a strong and diverse Board of Directors which brings a mix of complementary strengths and deep expertise from both Legacy Dime and Bridge. In addition to the Board, we have a seasoned management team with the key attributes needed to lead the Company into the future.

As we turn our attention to 2021, our focus is on completing the merger integration, including executing on our committed cost savings and the remaining online banking systems conversions later this year, as well as leveraging business synergy opportunities to drive sustained organic growth. By bringing together the best of both banks, we believe we have several unique catalysts in place to create a differentiated story in today’s banking environment.

On behalf of our Board of Directors and employees, we thank you for your continued support and hope you participate in our virtual Annual Meeting.

Sincerely yours,

|

|

Kenneth J. Mahon | Kevin M. O’Connor |

Executive Chairman of the Board | Chief Executive Officer |

DIME COMMUNITY BANCSHARES, INC

898 Veterans Memorial Highway

Hauppauge, NY 11788

(631) 537-1000

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held on May 27, 2021

To the Shareholders of Dime Community Bancshares, Inc.:

NOTICE IS HEREBY GIVEN that the Annual Meeting of Shareholders (the “Annual Meeting”) of Dime Community Bancshares, Inc. (the “Company”) will be held virtually on Thursday, May 27, 2021 at 10:00 a.m. Eastern Time, to consider and vote upon the following:

| 1) | The election of 12 directors to the Company’s Board of Directors, to hold office for a term of one year, and until their successors are elected and qualified; |

| 2) | The ratification of the appointment of Crowe LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2021; |

| 3) | Approval, by a non-binding advisory vote, of the compensation of the Company’s Named Executive Officers; |

| 4) | Approval of the Dime Community Bancshares, Inc. 2021 Equity Incentive Plan; and |

5) Transaction of such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof. As of the date hereof, management is not aware of any other such business. |

This year’s Annual Meeting will be a completely virtual meeting of shareholders, You will only be able to participate in the Annual Meeting, vote shares and submit questions during the Annual Meeting by visiting www.virtualshareholdermeeting.com/DCOM2021.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” EACH OF THESE ITEMS FOR THE REASONS DESCRIBED IN THE PROXY STATEMENT. |

The Board of Directors has fixed April 1, 2021 as the record date for the Annual Meeting and any adjournment or postponement thereof. Only shareholders of record at the close of business on that date will be entitled to notice of, and to vote at, the Annual Meeting and any adjournment or postponement thereof. A list of such shareholders will be available for inspection by any shareholder for any lawful purpose germane to the Annual Meeting during the 10 days prior to the Annual Meeting and during the Annual Meeting. Shareholders may access the list at www.virtualshareholdermeeting.com/DCOM2021.

By Order of the Board of Directors

Patricia M. Schaubeck

Corporate Secretary

Hauppauge, New York

April 16, 2021

YOU ARE CORDIALLY INVITED TO ATTEND THE VIRTUAL ANNUAL MEETING. IT IS IMPORTANT THAT YOUR SHARES BE REPRESENTED REGARDLESS OF THE NUMBER OF SHARES YOU OWN. THE BOARD OF DIRECTORS URGES YOU TO VOTE BY INTERNET, TELEPHONE OR MAIL AS SOON AS POSSIBLE. VOTING IN ADVANCE OF THE MEETING WILL NOT PREVENT YOU FROM ATTENDING AND VOTING ELECTRONICALLY DURING THE ANNUAL MEETING IF YOU CHOOSE TO DO SO.

DIME COMMUNITY BANCSHARES, INC.

PROXY STATEMENT FOR THE

ANNUAL MEETING OF SHAREHOLDERS

To Be Held on May 27, 2021

NOTICE OF INTERNET AVAILABILITY OF PROXY MATERIALS

We are relying upon a U.S. Securities and Exchange Commission rule that allows us to furnish proxy materials to shareholders over the Internet. As a result, beginning on or about April 16, 2021, we sent by mail or e-mail a Notice of Internet Availability of Proxy Materials to certain shareholders, containing instructions on how to access our proxy materials, including our Proxy Statement and annual report to shareholders, over the Internet and how to attend and vote at the Annual Meeting. Other shareholders received paper copies of our proxy materials. If you received your proxy materials by mail, the Notice of Annual Meeting, Proxy Statement, proxy card and annual report to shareholders are enclosed.

Internet availability of our proxy materials is designed to expedite receipt by shareholders and lower the cost and environmental impact of the Annual Meeting. However, if you received such a Notice of Internet Availability of Proxy Materials and would prefer to receive paper copies of our proxy materials, please follow the instructions included in the Notice of Internet Availability of Proxy Materials to request paper copies.

If you hold our common stock through more than one account, you may receive multiple copies of these proxy materials and will have to follow the instructions for each in order to vote all of your shares of our common stock.

The notice of meeting, Proxy Statement, annual report to shareholders and sample proxy card are available for review at www.ProxyVote.com. The notice of meeting, Proxy Statement and annual report are also available on the Company’s website at www.dime.com. Information on our website is not a part of this Proxy Statement or accompanying materials.

IMPACT OF MERGER OF BRIDGE BANCORP, INC. AND DIME COMMUNITY BANCSHARES, INC.

On February 1, 2021, Bridge Bancorp Inc. (“Bridge”) and Dime Community Bancshares, Inc. (“Legacy Dime”) announced the closing of the merger of equals between the respective companies, with Bridge as the surviving legal entity. Pursuant to the terms of the merger agreement dated July 1, 2020, each share of Legacy Dime was converted into 0.648 common shares of Bridge and the combined company was renamed Dime Community Bancshares, Inc. (the “Company”). The common stock of the Company began trading on The Nasdaq Global Select Market under the ticker “DCOM” on February 1, 2021. The information provided in this Proxy Statement as of December 31, 2020 (unless stated otherwise) reflects the Bridge-only information prior to the closing of the merger.

In connection with the merger, the Company amended its bylaws to establish certain corporate governance provisions, including those set forth below.

Board of Directors

The Board of Directors of the Company currently consists of 12 directors, with 6 directors designated by Bridge and 6 directors designated by Legacy Dime. For a period of 36 months following the closing of the merger on February 1, 2021 (the “Specified Period”), the Board will consist of six Bridge directors, which are directors initially designated by Bridge and their successors as designated by Bridge, and six Legacy Dime directors, which are directors initially designated by Legacy Dime and their successors as designated by Legacy Dime. From Bridge, the six initial directors are Marcia Z. Hefter, Lead Director, Matthew Lindenbaum, Albert E. McCoy, Jr., Raymond A. Nielsen, Kevin M. O’Connor, and Dennis A. Suskind. From Legacy Dime, the six initial directors are Kenneth J. Mahon, Executive Chairman, Rosemarie Chen, Michael P. Devine, Vincent F. Palagiano, Joseph J. Perry, and Kevin Stein. Following the termination of the Specified Period, the Board of Directors shall consist of a number of directors as designated by resolution of the Board from time to time.

1

Annual Election of Directors

Prior to the merger, Bridge and Legacy Dime each had staggered boards of directors whereby approximately one-third of each board was elected by shareholders every three years, and directors were elected to serve three-year terms. The amended bylaws of the Company provide for the annual election of directors. Following the merger, the Company’s Board was de-classified. At this Annual Meeting, all directors will stand for election and, if elected, will serve a one-year term to expire at the next annual meeting of shareholders.

Committees of the Board of Directors

During the Specified Period, each of the Audit Committee, the Compensation and Human Resources Committee, and the Corporate Governance and Nominating Committee will consist of at least four members and will be comprised of 50% Legacy Dime directors and 50% Bridge directors.

Executive Management

The senior executive officers of the Company are (i) the previous Bridge President and Chief Executive Officer, Kevin M. O’Connor, who serves as Chief Executive Officer (and also a director) of the Company, (ii) Legacy Dime President, Stuart H. Lubow, who serves as President and Chief Operating Officer of the Company, (iii) John M. McCaffery, the previous Executive Vice President and Chief Financial Officer of Bridge, who serves as Senior Executive Vice President and Chief Risk Officer of the Company, and (iv) Avinash Reddy, the previous Senior Executive Vice President and Chief Financial Officer of Legacy Dime, who serves in the same positions with the Company. During the Specified Period, the affirmative vote of 75% of the Board of Directors of the Company will be needed to remove any of those individuals from serving in the aforementioned capacities, terminate them without cause, modify their duties or amend their employment or other agreements with the Company.

Corporate Name and Headquarters

In connection with the merger, Bridge changed its name to “Dime Community Bancshares, Inc.” The Company’s corporate headquarters will remain in Hauppauge, New York and a corporate office will be maintained in New York, New York. The Company remains incorporated in the State of New York. The Company’s common stock trades on The Nasdaq Global Select Market under the symbol “DCOM.”

GENERAL INFORMATION

General

This Proxy Statement is being furnished to the shareholders of Dime Community Bancshares, Inc. (the “Company”, “we”, “our” or “us”) in connection with the solicitation of proxies by the Company's Board of Directors from holders of the shares of the Company's issued and outstanding common stock, par value $0.01 per share (the “Common Stock”), for use at the virtual Annual Meeting of Shareholders to be held on May 27, 2021 (the “Annual Meeting”) at 10:00 a.m. Eastern Time, and at any adjournment or postponement thereof. This Proxy Statement and/or a Notice of Internet Availability of Proxy Materials is first being sent to shareholders on or about April 16, 2021.

Record Date

The Company's Board of Directors has fixed the close of business on April 1, 2021 as the record date for the determination of shareholders entitled to notice of, and to vote at, the Annual Meeting (the “Record Date”). Accordingly, only shareholders of record at the close of business on April 1, 2021 will be entitled to vote at the Annual Meeting. There were 41,558,698 shares of Common Stock outstanding on the Record Date.

2

Why A Virtual Meeting

We are pleased to conduct the Annual Meeting solely online via the Internet through a live webcast and online shareholder tools. Given the ongoing health concerns related to COVID-19, we believe it important for the safety of shareholders and all of our constituents to participate fully from a remote location. We have designed the virtual format for ease of shareholder access and participation. Shareholders may vote and submit questions online during the meeting by following the instructions below.

Annual Meeting Admission and Participation

You are entitled to attend and participate in the Annual Meeting only if you were a Company shareholder as of the Record Date or if you hold a valid proxy for the Annual Meeting. If you plan to attend the Annual Meeting online, please be aware of what you will need to gain admission as described herein. If you do not comply with the procedures described herein for attending the Annual Meeting online, you will not be able to participate in the Annual Meeting. Shareholders may participate in the Annual Meeting by visiting www.virtualshareholdermeeting.com/DCOM2021. To attend online and participate in the Annual Meeting, shareholders of record will need to use their control number on their Notice of Internet Availability of Proxy Materials or proxy card. Beneficial shareholders who do not have a control number may gain access to the Annual Meeting by logging into their brokerage firm’s website and selecting the shareholder communications mailbox to link through to the Annual Meeting; instructions should also be provided on the voting instruction card provided by their broker, bank, or other nominee.

We encourage you to access the meeting prior to the start time. Please allow ample time for online check-in, which will begin at 9:45 a.m. Eastern Time. If you encounter any difficulties accessing the virtual meeting during the check-in or meeting time, please call the technical support number that will be posted on the virtual shareholder meeting log-in page. Shareholders may submit questions live during the meeting. Shareholders can also access copies of the Proxy Statement and annual report on the website.

SOLICITATION AND VOTING OF PROXIES

Voting During the Meeting

Whether you are a shareholder of record or a beneficial shareholder, you may direct how your shares are voted without participating in the Annual Meeting. We encourage shareholders to vote well before the Annual Meeting, even if they plan to attend the Annual Meeting, by completing proxies online or by telephone, or, if they received printed copies of these materials, by mailing their proxy cards. Shareholders can vote via the internet in advance of or during the Annual Meeting. Shareholders who attend the virtual Annual Meeting can vote during the meeting while the polls are open by clicking on the “Vote” button at www.virtualshareholdermeeting.com/DCOM2021 or submit questions during the Annual Meeting in the text box. Even if you plan to participate in the meeting, we recommend that you vote in advance by proxy, in case you later change your mind and determine not to participate in the meeting.

Voting Rights

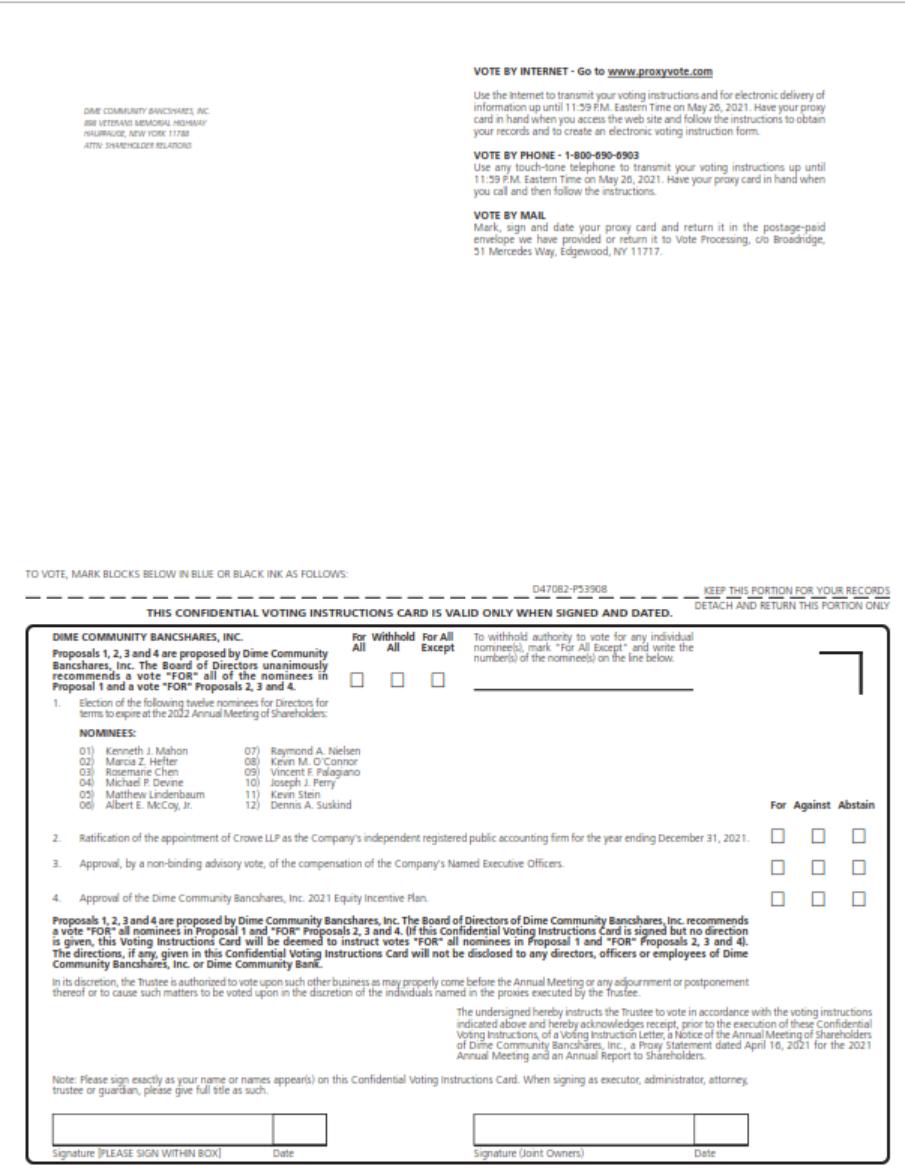

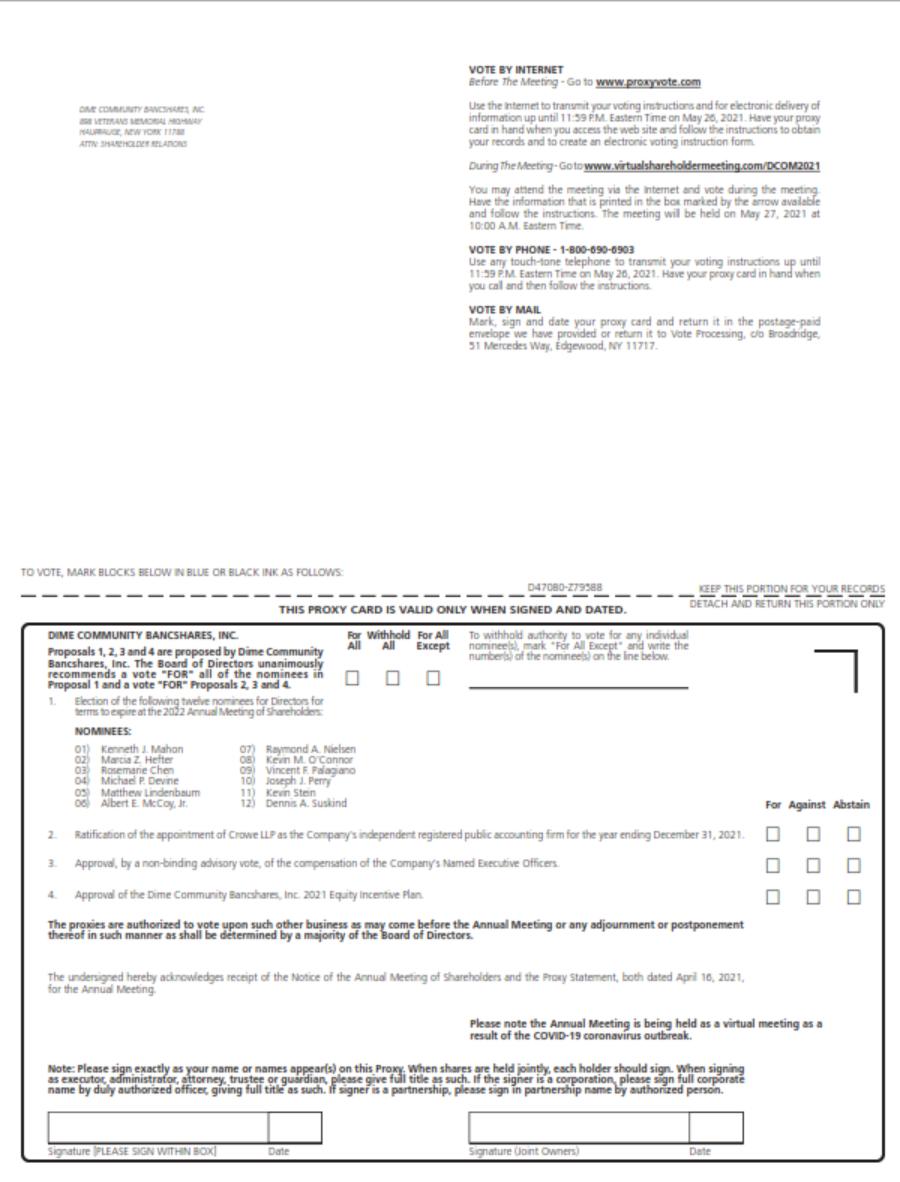

Each holder of Common Stock on the Record Date will be entitled to one vote at the Annual Meeting for each share held on the Record Date. You may vote your shares of Common Stock in advance of the meeting by marking and signing your Proxy Card and returning it in the enclosed postage-paid envelope, by telephone or internet by following the instructions stated on your Notice of Internet Availability of Proxy Materials or Proxy Card or by attending and voting via the internet during the Annual Meeting. All properly executed proxies received by the Company on or before 11:59 p.m. Eastern Time on May 26, 2021 will be voted in accordance with the instructions indicated thereon. If no instructions are given, executed proxies will be voted FOR the election of each of the nominees for director, FOR the ratification of the appointment of Crowe LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2021, FOR the approval of compensation of the Company’s Named Executive Officers (as defined herein), and FOR the approval of the Dime Community Bancshares, Inc. 2021 Equity Incentive Plan.

3

Management is not aware of any matters other than those set forth in the Notice of the Annual Meeting of Shareholders that may be brought before the Annual Meeting. If any other matters properly come before the Annual Meeting, the person named in the proxy will vote the shares represented by all properly executed proxies on such matters in such manner as shall be determined by a majority of the Company's Board of Directors.

Quorum and Vote Required

If you hold your shares in street name, it is critical that you cast your vote if you want it to count in the election of directors and with respect to the advisory proposal regarding the compensation of our Named Executive Officers and with respect to the approval of the Company’s 2021 Equity Incentive Plan. Current regulations restrict the ability of your bank or broker to vote your uninstructed shares in the election of directors and other matters on a discretionary basis. Thus, if you hold your shares in street name and you do not instruct your bank or broker how to vote with respect to the election of directors, the advisory vote regarding the compensation of our Named Executive Officers, or with respect to the Company’s 2021 Equity Incentive Plan, no votes will be cast on your behalf. These are referred to as “broker non-votes”. Your bank or broker does, however, continue to have discretion to vote any uninstructed shares on the ratification of the appointment of our independent registered public accounting firm.

The presence by proxy or attendance via webcast at the Annual Meeting of the holders of at least a majority of the total number of shares of Common Stock entitled to vote at the Annual Meeting is necessary to constitute a quorum. Abstentions and broker non-votes will be counted as present for the purpose of determining whether a quorum is present.

Directors are elected by a plurality of the votes cast at the Annual Meeting, without regard to broker non-votes or proxies as to which authority to vote for a nominee is marked “WITHHOLD.” Shareholders may not vote their shares cumulatively for the election of directors.

Proposals 2, 3 and 4 require the affirmative vote of a majority of the votes cast at the Annual Meeting, without regard to broker non-votes or proxies marked “ABSTAIN.”

Although the advisory vote on the compensation of Named Executive Officers (Proposal 3) is non-binding as provided by law, the Company’s Board of Directors will review the results of the vote and consider them in making future determinations concerning executive compensation.

Revocability of Proxies

A proxy may be revoked at any time before it is voted by filing a written revocation of the proxy with the Company's Corporate Secretary at 898 Veterans Memorial Highway, Suite 560, Hauppauge, New York 11788 or by submitting a duly executed proxy bearing a later date. A proxy also may be revoked by voting at the Annual Meeting.

Solicitation of Proxies

The Company will bear the costs of soliciting proxies from its shareholders. In addition to the use of mail, proxies may be solicited by officers, directors or employees of the Company or Dime Community Bank (the “Bank”) by telephone or other forms of communication. The Company will also request persons, firms and corporations holding shares in their names or in the names of their nominees, which are beneficially owned by others, to send proxy materials to, and obtain proxies from, such beneficial owners, and will reimburse such holders for reasonable expenses incurred in connection therewith. The Company has hired Equiniti (US) Services LLC to assist us in soliciting proxies and has agreed to pay a fee of $7,500 for their services.

Interests of Directors and Management in Certain Proposals

Shareholders will be asked to cast a non-binding advisory vote on Proposal 3 regarding compensation to the Company's Named Executive Officers and to cast a vote on Proposal 4 for the approval of the Dime Community Bancshares, Inc. 2021 Equity Incentive Plan. The results of such votes may influence future compensation decisions. As a result, the Company's senior executives have personal interests in the outcome of these proposals that are different from the interests

4

of the Company's other shareholders. The Board was aware of these interests and took them into account in recommending that the shareholders vote in favor of Proposal 3 and Proposal 4.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

Principal Shareholders of the Company

Persons and groups who beneficially own in excess of five percent of the Common Stock are required to file certain reports with the Company and the Securities and Exchange Commission (“SEC”) regarding such beneficial ownership. The following table sets forth, as of the Record Date, certain information as to the shares of Common Stock owned by persons who beneficially own more than five percent of the issued and outstanding shares of Common Stock. We know of no persons, except as listed below, who beneficially owned more than five percent of the outstanding shares of Common Stock as of the Record Date. Except for the column titled “Percent of Outstanding Shares,” and as otherwise indicated, the information provided in the table was obtained from filings with the SEC pursuant to the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Addresses provided are those listed in the filings as the address of the person authorized to receive notices and communications As used herein, “voting power” includes the power to vote, or direct the voting of, Common Stock and “investment power” includes the power to dispose, or direct the disposition, of such shares. Unless otherwise noted, each beneficial owner has sole voting and sole investment power over the shares beneficially owned.

| | Number of Shares Owned | | Percent of |

|

Name and Address | | and Nature of Beneficial | | Outstanding |

|

of Beneficial Owner |

| Ownership |

| Shares |

|

| | | | | |

BlackRock, Inc. |

| | | | |

55 East 52nd Street | | 5,906,926 | (1) | 14.2 | % |

New York, NY 10055 | | | | | |

| | | | | |

Basswood Capital Management L.L.C. |

| | | | |

645 Madison Avenue, 10th Floor | | 3,979,003 | (2) | 9.6 | % |

New York, NY 10022 | | | | | |

| | | | | |

T. Rowe Price Associates, Inc. |

| | | | |

100 E. Pratt Street | | 2,310,596 | (3) | 5.6 | % |

Baltimore, MD 21202 | | | | | |

| (1) | Represents the total shares of Common Stock beneficially owned by Blackrock, Inc. as described in the Schedule 13G/A filed on March 10, 2021 with the SEC. |

| (2) | Represents the total shares of Common Stock collectively beneficially owned by Basswood Capital Management, L.L.C., Matthew Lindenbaum, Bennett Lindenbaum and certain other persons as disclosed in the Schedule 13D/A filed on February 8, 2021 with the SEC and as otherwise disclosed to the Company. |

| (3) | Represents the total shares of Common Stock beneficially owned by T. Rowe Price Associates, Inc. as described in the Schedule 13G/A filed on March 10, 2021 with the SEC. |

Security Ownership of Management

The following table sets forth information as of the Record Date with respect to the shares of Common Stock beneficially owned by each of the Company’s directors and the principal executive officer, principal financial officer and three most highly compensated executive officers (other than the principal executive and principal financial officer) of the Company (the “Named Executive Officers” or “NEOs”), certain other executive officers, and all of the Company’s directors and executive officers as a group. Except as otherwise indicated, each person and each group shown in the table has sole voting and investment power with respect to the shares of Common Stock indicated. For purposes of the table below, in

5

accordance with Rule 13d-3 under the Exchange Act, a person is deemed to be the beneficial owner of any shares of Common Stock: (1) over which he or she has or shares, directly or indirectly, voting or investment power, and (2) of which he or she has the right to acquire beneficial ownership at any time within 60 days after April 1, 2021.

The Company’s Insider Trading and Confidentiality of Information Policy prohibits directors and executive officers from pledging Common Stock as collateral for any loan.

| | | | Number of Shares | | |

| Vested Stock | |

| | | | Owned and | | | | Options Included | |

| | | | Nature of | | Percent of | | in Beneficial | |

| | | | Beneficial | | Outstanding | | Ownership | |

Name of Beneficial Owner |

| Position |

| Ownership(1) |

| Shares |

| Total(2) |

|

Kenneth J. Mahon |

| Director, Executive Chairman of the Board |

| 346,357 | (3) | * | % | — | |

Marcia Z. Hefter |

| Director, Lead Director of the Board |

| 123,278 | (4) | * | | | |

Rosemarie Chen |

| Director |

| 8,640 | (5) | * | | | |

Michael P. Devine |

| Director |

| 440,154 | (6) | 1.1% | | — | |

Matthew A. Lindenbaum | | Director | | 3,840,720 | (7) | 9.2% | | — | |

Albert E. McCoy, Jr. |

| Director |

| 175,147 | (8) | * | | — | |

Raymond A. Nielsen |

| Director |

| 33,771 | (9) | * | | — | |

Kevin M. O'Connor |

| Director, Chief Executive Officer |

| 326,102 | (10) | * | | 65,142 | |

Vincent F. Palagiano |

| Director |

| 590,547 | (11) | 1.4% | | | |

Joseph J. Perry |

| Director |

| 50,474 | (12) | * | | — | |

Kevin Stein |

| Director |

| 16,425 | (13) | * | | | |

Dennis A. Suskind |

| Director |

| 85,384 | (14) | * | | | |

Stuart H. Lubow | | President and Chief Operating Officer |

| 253,617 | (15) | * | | — | |

Avinash Reddy |

| Senior Executive Vice President and Chief Financial Officer | | 43,560 | (16) | * | | — | |

John M. McCaffery |

| Senior Executive Vice President and Chief Risk Officer | | 92,653 | (17) | * | | 29,421 | |

Conrad J. Gunther |

| Executive Vice President and Chief Lending Officer | | 69,222 | (18) | * | | — | |

Howard H. Nolan | | Former Senior Executive Vice President, Chief Operating Officer and Corporate Secretary | | 94,511 | (19) | * | | 29,346 | |

Kevin L. Santacroce | | Executive Vice President and Deputy Chief Lending Officer | | 97,678 | (20) | * | | 29,116 | |

James J. Manseau | | Executive Vice President and Chief Retail Banking Officer | | 92,748 | (21) | * | | 26,995 | |

All directors and executive officers as a group (21 persons) | | | | 6,815,166 | (22) | 16.40% | | 180,020 | |

* | Represents less than 1% |

(1) | Includes shares as to which a person (or his/her spouse) directly or indirectly has or shares voting power and/or investment power (which includes the power to dispose). |

(2) | All vested stock options are exercisable. |

(3) | Includes 2,608 time-vested restricted stock awards over which Mr. Mahon has voting power. |

(4) | Includes 2,333 time-vested restricted stock awards over which Ms. Hefter has voting power. |

(5) | Includes 2,127 time-vested restricted stock awards over which Ms. Chen has voting power. |

(6) | Includes 1,784 time-vested restricted stock awards over which Mr. Devine has voting power. |

(7) | Includes the total shares of Common Stock collectively beneficially owned by Matthew Lindenbaum and Basswood Capital Management, LLC, with respect to which Mr. Lindenbaum serves as Principal Managing Member and Portfolio Manager. As described in the in the Schedule 13D/A filed on February 8, 2021 with the SEC with respect to the Company’s Common Stock, each of Basswood Capital Management, L.L.C., Matthew Lindenbaum and Bennett Lindenbaum may be deemed to be part of a “group” with such other reporting persons. Includes 1,784 time-vested restricted stock awards over which Mr. Lindenbaum has voting power. |

(8) | Includes 1,990 time-vested restricted stock awards over which Mr. McCoy, Jr. has voting power. |

(9) | Includes 1,990 time-vested restricted stock awards over which Mr. Nielsen has voting power. |

(10) | Includes 92,881 time-vested restricted stock awards over which Mr. O’Connor has voting power. |

(11) | Includes 1,784 time-vested restricted stock awards over which Mr. Palagiano has voting power. |

(12) | Includes 2,127 time-vested restricted stock awards over which Mr. Perry has voting power. |

(13) | Includes 2,127 time-vested restricted stock awards over which Mr. Stein has voting power. |

(14) | Includes 1,990 time-vested restricted stock awards over which Mr. Suskind has voting power. |

6

(15) | Includes 47,225 time-vested restricted stock awards over which Mr. Lubow has voting power. |

(16) | Includes 23,612 time-vested restricted stock awards over which Mr. Reddy has voting power. |

(17) | Includes 31,117 time-vested restricted stock awards over which Mr. McCaffery has voting power. |

(18) | Includes 23,612 time-vested restricted stock awards over which Mr. Gunther has voting power. |

(19) | Mr. Nolan currently serves as a consultant to the Company. Prior to the merger on February 1, 2021, Mr. Nolan served as Senior Executive Vice President, Chief Operating Officer, and Corporate Secretary of Bridge. |

(20) | Includes 30,925 time-vested restricted stock awards over which Mr. Santacroce has voting power. |

(21) | Includes 22,184 time-vested restricted stock awards over which Mr. Manseau has voting power. |

(22) | Includes 312,301 shares of time-vested restricted stock awards over which the directors/executive officers have voting power. |

PROPOSAL 1. - ELECTION OF DIRECTORS

General

The Company’s Board of Directors currently consists of twelve (12) members. Each year each director is elected to serve for a one year term and until their respective successors shall have been elected and qualified.

The Board of Directors has nominated the following directors to serve on the Board for a term to expire at the 2022 annual meeting of shareholders.

The business experience of each of the Company’s directors nominated to be elected as directors, as well as the qualifications, attributes and skills that led the Board of Directors to conclude that each director should serve on the Board are as follows:

Directors

Kenneth J. Mahon. Age 70; Director since 2021

Mr. Mahon was appointed to the Board of Directors of the Company and as Executive Chairman of the Board of Directors simultaneously with the closing of the merger with Legacy Dime on February 1, 2021. He previously served as a director of Legacy Dime since 2002 and as Chief Executive Officer of Legacy Dime since 2017. He joined the legacy Dime Community Bank (“DCB”) in 1980, where he was a director since 1998. Mr. Mahon was elected to serve on the board of the Federal Home Loan Bank of New York in 2017. He currently serves as a board member of the Committee for Hispanic Children and Families, and was formerly a director of Southside United HDFC (“Los Sures”), a community support organization in Williamsburg, Brooklyn, and Brooklyn Legal Services Corporation A, a non-profit which provides legal services for low income families in Brooklyn. Mr. Mahon is a member of the Financial Managers Society, the National Investor Relations Institute and the National Association of Corporate Directors. Mr. Mahon’s extensive knowledge of the community banking industry, as well as his experience with Legacy Dime and DCB, provide valuable resources to the Company.

Marcia Z. Hefter. Age 77; Director since 1989

Ms. Hefter was appointed Lead Director of the Board of Directors effective with the closing of the merger with Legacy Dime on February 1, 2021. Ms. Hefter has been a director of the Company since 1989 and served as Bridge’s Board Chairperson since 2008. She is senior counsel in the law firm Esseks, Hefter, Angel, Di Talia & Pasca, LLP located in Riverhead, New York. Ms. Hefter’s background as a lawyer and long standing service as a director provides the Board of Directors with a unique perspective and counsel in its oversight of the Company.

Rosemarie Chen. Age 54; Director since 2021

Ms. Chen was appointed a director of the Company effective with the closing of the merger with Legacy Dime on February 1, 2021. She previously served as a director of Legacy Dime and DCB since 2017. Ms. Chen is currently the Global Financial Services Practice Leader at Willis Towers Watson, a global advisory, broker, and solutions company where she advises companies on strategic human capital issues along with leading initiatives relating to Fintech since 2016. Prior to joining Willis Towers Watson, Ms. Chen held senior executive roles with Deloitte Consulting (Senior Manager - 2013 to 2016) and Aon Hewitt/McLagan Partners (Head of US Infrastructure Services and Support - 2003 to 2016). Ms. Chen’s

7

more than 20 years of experience in working across human capital management and technology in support of aligning business strategies with talent solutions are valuable resources to the Board.

Michael P. Devine. Age 74; Director since 2021

Mr. Devine was appointed a director of the Company effective with the closing of the merger with Legacy Dime on February 1, 2021. He previously served as a director of Legacy Dime since 1995, a director of DCB since 1980 and as Vice Chairman of the Boards of both Legacy Dime and DCB since 2014. Mr. Devine served as President of Legacy Dime and DCB from 1997 to his retirement in 2015, after serving as Chief Operating Officer of Legacy Dime from its inception in 1995 to 2014, and of DCB from 1989 to 2014. Mr. Devine previously served on the Board of Trustees of Long Island University and as the Chairman of its Audit Committee, and the Board of the Pentegra Retirement Trust and its predecessor, the Retirement Systems Group. Mr. Devine’s in-depth knowledge of the banking industry and Legacy Dime, obtained from his lifelong career in the industry, make him qualified to serve on the Board.

Matthew Lindenbaum. Age 58; Director since 2018

Mr. Lindenbaum is Principal, Managing Member and Portfolio Manager of Basswood Capital Management, LLC. He has been a director of the Company since 2018. Mr. Lindenbaum previously served as Vice Chairman of Community National Bank (“CNB”) and was a director at CNB from 2005 to 2015. He has also served as a director of Hudson Valley Holding Corp from 2014 to 2015. Mr. Lindenbaum is an experienced investor in community banks and his investor background and experience along with his service on the Board of Directors of other community banks are considered valuable attributes for service on the Board.

Albert E. McCoy, Jr. Age 57; Director since 2008

Mr. McCoy is President of W. F. McCoy Petroleum Products Inc. and the McCoy Bus Company located in Bridgehampton, New York. He has been a director of the Company since 2008. Mr. McCoy brings to the Board of Directors an extensive knowledge of local markets and the communities served by the Company which gives him unique insights into the Company’s lending challenges and opportunities.

Raymond A. Nielsen. Age 70; Director since 2013

Mr. Nielsen is a director of CVD Equipment Corp. and has been a director of the Company since 2013. He previously served as the Director of Finance for the Beechwood Organization, responsible for Project and Corporate Finance including Strategic Planning Initiatives. Mr. Nielsen is the former Chief Executive Officer of Reliance Federal Savings Bank and Herald National Bank, and a 45 year veteran of the banking industry. Mr. Nielsen also served as a director of North Fork Bancorporation and its subsidiary, North Fork Bank, for 6 years where he chaired the Compensation and Audit Committees and also served as lead independent director. Mr. Nielsen’s extensive banking and real estate development experience and knowledge of the communities served by the Company, provides a valuable resource to the Board of Directors.

Kevin M. O’Connor. Age 58; Director since 2007

Mr. O’Connor is Chief Executive Officer of the Company. Prior to the merger on February 1, 2021, Mr. O’Connor was President and Chief Executive Officer of Bridge. He joined Bridge in October 2007 as President and Chief Executive Officer Designee and director. In 2008, he became President and Chief Executive Officer. Prior to joining Bridge, Mr. O’Connor served as Executive Vice President and Treasurer of North Fork Bancorporation, Inc. from 1997 through 2007. Mr. O’Connor’s background and extensive banking experience provides a valuable resource to the Board of Directors.

Vincent F. Palagiano. Age 80; Director since 2021

Mr. Palagiano was appointed a director of the Company effective with the closing of the merger with Legacy Dime on February 1, 2021. Mr. Palagiano previously served as Chairman of the Board of Legacy Dime since its formation in 1995 and of DCB since 1989. He served as Chief Executive Officer of both Legacy Dime and DCB from 1989 to his retirement in 2016. Prior to Mr. Palagiano’s appointment as Chief Executive Officer, he served as President of both Legacy Dime and DCB. Mr. Palagiano’s knowledge of Legacy Dime and its markets, obtained from his lifelong career with DCB, provide the Company with valuable insights.

8

Joseph J. Perry. Age 54; Director since 2021

Mr. Perry was appointed a director of the Company effective with the closing of the merger with Legacy Dime on February 1, 2021. He previously served as a director of Legacy Dime and DCB since 2005. Mr. Perry is currently a partner at Marcum LLP, a public accounting and consulting firm headquartered in New York, New York, where he has served as the Tax and Business Services Leader since 2006 and is a member of the Firm’s Executive Committee. Prior to joining Marcum LLP, Mr. Perry was a tax partner at one of the leading "Big 5" accounting firms and provided services to several financial services companies throughout the New York metropolitan area. Mr. Perry is a member of the American Institute of Certified Public Accountants and the New York State Society of Public Accountants. Mr. Perry’s more than 30 years of tax and accounting experience in the financial services industry are valuable resources to the Board.

Kevin Stein. Age 59; Director since 2021

Mr. Stein was appointed as a director of the Company effective with the closing of the merger with Legacy Dime on February 1, 2021. Mr. Stein is currently Chief Executive Officer of EJF Acquisition Corp. and a Senior Managing Director of EJF Capital LLC. Prior to joining EJF Capital, Mr. Stein was CEO of Resolution Analytica Corporation since co-founding the business in 2017. Mr. Stein was a Senior Managing Director of KCK-US, Inc., a family-controlled private equity firm from 2016 through 2017, Managing Director of Financial Institutions Investment Banking with Barclays from 2011 through 2016, and Partner and Head of Depository Investment Banking at FBR & Co. from 2004 through 2011. From 1994 to 2004, Mr. Stein served as an executive of Greenpoint Financial Corporation, a $25 billion bank holding company, and prior thereto was an Associate Director of the Federal Deposit Insurance Corporation, Division of Resolutions. Since February 2019, Mr. Stein is a member of the Board of Directors of Ocwen Financial Corporation and, from 2017 to 2018, prior to its acquisition by Ocwen Financial Corporation, was a director of PHH Corporation. Director Stein is Audit Committee Chairman and, since 1996, a Director of Bedford Stuyvesant Restoration Corporation. Mr. Stein’s more than 30 years of experience in finance and banking, and his banking regulatory knowledge, make him qualified to serve as a director.

Dennis A. Suskind. Age 78; Director since 2002

Mr. Suskind is a retired General Partner of Goldman Sachs & Co. and has been a director of the Company since 2002. Mr. Suskind is a director of the Chicago Mercantile Exchange and serves as a member on its Audit, Nominating and Governance, and Executive Committees, and is Chairperson of its Risk Committee. Mr. Suskind is also a board member of Driven by Stem, as well as Navistar Corporation and the Chairperson of its Compensation Committee. His considerable experience in investment banking, capital markets and his service on the Board of Directors of another large publicly traded company are valuable to the Board of Directors in many ways, including its assessment of the Company’s sources and uses of capital.

It is intended that the proxies solicited on behalf of the Board of Directors will be voted at the Annual Meeting for the election of each of these nominees (other than proxies in which the vote is withheld as to any nominee). Each nominee has consented to being named in this Proxy Statement and to serve, if elected. If a nominee is unable to serve, the shares represented by all such proxies will be voted for the election of such substitute as the Board of Directors may recommend. At this time, the Board of Directors knows of no reason why a nominee would be unable to serve, if elected.

Information as to Nominees

The Board has determined that, except as to Mr. Mahon and Mr. O’Connor, each member of the Board is an “independent director” within the meaning of the corporate governance listing standards of the Nasdaq Stock Market. Mr. Mahon is not independent because he is a party to an Executive Chairman and Separation Agreement with the Company. Mr. O’Connor is not independent because he is an employee of the Company. In reaching independence determinations of other directors, the Board considered loans outstanding that were made on the same terms as available to others.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” EACH OF THE NOMINEES LISTED IN THIS PROXY STATEMENT.

9

DIRECTOR NOMINATIONS

The Board of Directors has established a Corporate Governance and Nominating Committee (the “Corporate Governance Committee”) for the selection of directors to be elected by the shareholders. Nominations of directors to the Board are recommended by the Corporate Governance Committee and determined by the full Board of Directors. The Board believes that it is appropriate to have the input of all directors with respect to the candidates to be considered for election to the Board by the shareholders. In this regard, the Board believes that each individual director has a unique insight into the operations of the Company and the Bank, the communities in which we operate, and the needs of the Company with respect to Board membership.

The Company’s Bylaws, along with the Company’s Corporate Governance Committee Charter and Corporate Governance Guidelines which are available on the Company’s website www.dime.com, outline the director nomination process. During the Specified Period, all responsibilities for the evaluation and nomination of directors to the Board are vested exclusively in (i) the Bridge directors of the Corporate Governance Committee with respect to Bridge directors, and (ii) the Legacy Dime directors of the Corporate Governance Committee with respect to Legacy Dime directors. During the Specified Period, vacancies resulting from the cessation of service by any Bridge director for any reason, or vacancies resulting from the cessation of service by any Legacy Dime director for any reason, shall be filled as selected by the Corporate Governance Committee in accordance with the immediately preceding sentence.

The Corporate Governance Committee identifies nominees by first evaluating the current members of the Board willing to continue in service. Current members of the Board with skills and experience that are relevant to the Company’s business and who are willing to continue in service are first considered for re-nomination, balancing the value of continuity of service by existing members of the Board with that of gaining new perspectives. The Corporate Governance Committee coordinates annual performance evaluations for the Board of Directors. All nominees for director currently serve on the Board. Subject to the preceding paragraph, if any member of the Board does not wish to continue in service, or if the Committee decides not to re-nominate a member for re-election, or if the size of the Board is increased, the Committee would solicit suggestions for director candidates from all Board members. The Corporate Governance Committee is authorized to retain search firm(s) to assist in the identification of candidates for director nominees. The Corporate Governance Committee is not limited to a specific process in identifying candidates and will consider potential nominees from various sources, including recommendations from shareholders as well as directors and officers of the Company. Individuals recommended by shareholders are evaluated in a manner identical to other potential nominees. The Corporate Governance Committee seeks a diverse group of candidates who possess the background, skills, and expertise to make a significant contribution to the Board, and to the Company and its shareholders. The Corporate Governance Committee shall select individuals as director nominees who shall have the highest personal and professional integrity, who shall have demonstrated exceptional ability and judgment and who shall be most effective, in conjunction with the other nominees to the Board, in collectively serving the long-term interests of the Company’s shareholders.

The charter of the Corporate Governance Committee provides that diversity, inclusive of gender, race, and ethnicity shall be part of the selection criteria for determining the individuals to be considered for election and re-election to the Board. Further, the Charter provides that the Corporate Governance Committee shall endeavor in good faith to include women and people of color in each candidate pool for a position on the Board. There are currently two women on the Board of Directors and one person of color.

PROCEDURES FOR THE NOMINATION OF DIRECTORS BY SHAREHOLDERS

The Company’s Bylaws set forth the procedures for the submission of director nominees by shareholders. Shareholders can submit nominations for director by writing to our Corporate Secretary, Dime Community Bancshares, Inc., 898 Veterans Memorial Highway, Suite 560, Hauppauge, New York 11788. The Corporate Secretary must receive a submission not less than ninety (90) days prior to the date of the Company’s proxy materials for the preceding year’s annual meeting. As more fully set forth in the Company’s Bylaws, the submission must include the following information:

| ● | A statement that the writer is a shareholder and is proposing a candidate for consideration by the Board or is proposing business for the consideration by the shareholders of the Company; |

10

| ● | The name and address of the shareholder as they appear on the Company’s books, and number of shares of Common Stock that are owned beneficially by such shareholder (if the shareholder is not a holder of record, appropriate evidence of the shareholder’s ownership will be required); |

| ● | The name, address and contact information for the candidate, and the number of shares of Common Stock that are owned by the candidate (if the candidate is not a holder of record, appropriate evidence of the candidate’s ownership should be provided); |

| ● | A statement of the candidate’s business and educational experience, detailed information about any relationship or understanding between the proposing shareholder and the candidate, and a statement that the candidate is willing to be considered and willing to serve as a director if nominated and elected; |

| ● | Such other information regarding the candidate as would be required to be included in the proxy statement pursuant to SEC Regulation 14A; |

| ● | A statement detailing any relationship between the proposing shareholder, the candidate and any customer, supplier or competitor of the Company or its affiliates; and |

| ● | A statement as to whether the shareholder intends to deliver a proxy statement and form of proxy to holders of a sufficient number of holders of the Company’s voting shares to elect such nominee or nominees. |

In order to be eligible for inclusion in the proxy materials for the Annual Meeting, shareholder nominations must comply with the proxy rules adopted under the Exchange Act. See “Shareholder Proposals Under SEC Rule 14a-8” below.

SHAREHOLDER COMMUNICATIONS WITH THE BOARD

A shareholder of the Company who wants to communicate with the Board of Directors or with any individual director can write to the Corporate Secretary, Dime Community Bancshares, Inc., 898 Veterans Memorial Highway, Suite 560, Hauppauge, New York 11788.

The letter should indicate that the author is a shareholder and if shares are not held of record, should include appropriate evidence of stock ownership. Depending on the subject matter, the Corporate Secretary will:

| ● | Forward the communication to the director or directors to whom it is addressed; |

| ● | Attempt to handle the inquiry directly, for example where it is a request for information about the Company or it is a stock-related matter; or |

| ● | Not forward the communication if it is primarily commercial in nature, relates to an improper or irrelevant topic, or is unduly hostile, threatening, illegal or otherwise inappropriate. |

At each Board meeting, the Corporate Secretary shall present a summary of all communications received since the last meeting that were not forwarded and make those communications available to the directors.

CODE OF ETHICS

The Board has adopted a Code of Ethics that is applicable to the officers, directors and employees of the Company, including the Company’s principal executive officer, principal financial officer, and principal accounting officer or controller, or persons performing similar functions. The Code of Ethics is available on the Company’s website, www.dime.com. Amendments to and waivers from the Code of Ethics will also be disclosed on the Company’s website.

11

BOARD MEETINGS AND COMMITTEES

The following three standing committees facilitate and assist the Board in executing its responsibilities: the Audit Committee, the Compensation and Human Resources Committee (“Compensation Committee”) and the Corporate Governance Committee. The table below shows current membership for each of the standing Board committees.

Audit |

| Compensation |

| Corporate Governance Committee |

|

Kevin Stein* | | Rosemarie Chen* | | Dennis A. Suskind* | |

Raymond A. Nielsen | | Michael P. Devine | | Michael P. Devine | |

Joseph J. Perry | | Matthew Lindenbaum | | Matthew Lindenbaum | |

Dennis A. Suskind | | Albert E. McCoy, Jr. | | Kevin Stein | |

* Committee Chairperson

In addition, the Company has a Compliance Risk, a Credit Risk, an Enterprise Risk and a Strategic Planning Committee. All of the Committees of the Board are comprised solely of independent directors.

The business of the Board of Directors of the Company and the Bank is conducted through meetings and activities of the Boards and their Committees. The Board of Directors of the Company and the Bank generally hold ten regular meetings during the course of a year, but will meet more often as may be necessary. The Board of Directors of Bridge and the Bank met 20 times during 2020. No director attended fewer than 75% in the aggregate of the total number of Board meetings held and the total number of Committee meetings on which he or she served during 2020, including Board and Committee meetings of the Bank and Bridge. Although it has no official policy, the Board strongly encourages each of its members to attend the Annual Meeting of Shareholders. Due to the pandemic, all persons serving on the Board of Directors at the time of the Annual Meeting of Shareholders held on June 2, 2020 attended the meeting via teleconference.

BOARD LEADERSHIP AND RISK OVERSIGHT

Board Leadership Structure

Commencing with the closing of the merger with Legacy Dime on February 1, 2021, the Company elected an Executive Chairman of the Board and elected an independent Lead Director. The Executive Chairman is Kenneth J. Mahon, former director and Chief Executive Officer of Legacy Dime, and the Lead Director of the Company is Marcia Z. Hefter, who was the Chairperson of the Board of Directors of Bridge. The Executive Chairman provides overall leadership to enhance the effectiveness and performance of the Board of Directors and acts as the primary spokesperson for the Board of Directors and, among other things, confers with the Chief Executive Officer on reviewing and developing strategic initiatives for the Company and on succession planning and key hiring and firing decisions. The Lead Director must qualify as an independent director under Nasdaq exchange rules. The Lead Director chairs any meeting of independent directors in executive session and, among other things, serves as a liaison between the Executive Chairman and the other independent directors and consults with the Executive Chairman on matters pertinent to the Board.

The Company believes that the current separation of the Executive Chairman and Chief Executive Officer roles, along with an independent Lead Director, is good governance policy and enhances Board independence and oversight.

The Role of the Board in Risk Oversight

In the ordinary course of business, the Company faces various strategic, operating, compliance, reputational, technological and financial risks. Management is responsible for the day-to-day management of risk, while the Board, as a whole and through its Committees, is responsible for the oversight of risk management. In its risk oversight role, the Board has the responsibility of satisfying itself that the risk management processes designed and implemented by management are adequate and functioning as designed. The Enterprise Risk and Audit Committees assist the Board of Directors in its oversight of the Company’s corporate-wide risk management and in identifying, measuring, monitoring, and managing risks, and as to the Audit Committee in particular, material financial risks. The Company’s Enterprise Risk Committee receives regular reports from the Compensation, Compliance Risk, Credit Risk, and Strategic Planning Committees of the Board.

12

The Compliance Risk Committee of the Board assists the Board in fulfilling its compliance oversight responsibilities regarding consumer protection and fair lending, the Community Reinvestment Act, and BSA/AML compliance by, among other things, approving and reviewing the effectiveness of the Bank’s compliance management system and overseeing the assessment and monitoring of the risks associated with the Bank’s consumer compliance and BSA/AML activities. The Credit Risk Committee of the Board assists the Board in fulfilling its credit risk management functions by, among other things, setting acceptable levels of credit risk and reviewing the effectiveness of management’s administration and monitoring of credit risk. The Strategic Planning Committee of the Board assists the Board in its oversight of the capital planning of the Company, which includes the operating expense budget and key business plan objectives. In addition, management has established management ALCO, Compensation and Benefits, Credit Risk, Enterprise Risk, Loan Approval, Regulatory Compliance Risk, Strategic Planning, and Technology committees to provide regular reports as to the actions taken by management to adequately address those risks.

THE AUDIT COMMITTEE

Effective with the closing of the merger with Legacy Dime on February 1, 2021, the Audit Committee consists of Directors Stein (Chairperson), Nielsen, Perry and Suskind. Prior thereto, the Audit Committee was comprised of Messrs. Santoro (Chairperson), Massoud, Nielsen, Rubin and Suskind. Each member of the Audit Committee is considered “independent” as defined in the Nasdaq corporate governance listing standards and under SEC Rule 10A-3. The duties and responsibilities of the Audit Committee include, among other things:

| ● | Retain, oversee and evaluate the independent registered public accounting firm to audit the annual consolidated financial statements of the Company; |

| ● | In consultation with the independent registered public accounting firm and the internal audit function, review the integrity of the Company’s financial reporting processes, both internal and external; |

| ● | Review the annual audited consolidated financial statements, quarterly financial statements and the independent registered public accounting firm’s report with management and the independent registered public accounting firm and recommend inclusion of the annual audited consolidated financial statements in the Company’s annual report on Form 10-K; |

| ● | Review and discuss with the independent registered public accounting firm all significant relationships the independent registered public accounting firm has with the Company to determine and assess independence, qualification and performance; |

| ● | Review the internal audit function of the Company and the annual audit plan and ensure that the internal audit function adheres to the Institute of Internal Audit’s International Professions Practice Framework; |

| ● | Approve all engagements for audit and non-audit services by the independent registered public accounting firm; and |

| ● | Review the adequacy of the Audit Committee charter. |

The Audit Committee of Bridge met nine times during 2020. The Audit Committee reports to the Board on its activities and findings. The Board of Directors has determined that Directors Stein, Nielsen, and Perry are “Audit Committee Financial Experts” as that term is used in the rules and regulations of the SEC.

AUDIT COMMITTEE REPORT

The Audit Committee operates under a written charter adopted by the Board of Directors. A copy of the charter of the Audit Committee is available on the Company’s website, www.dime.com.

Management is responsible for the preparation of the Company’s consolidated financial statements and their assessment of the design and effectiveness of the Company’s internal control over financial reporting. The Independent Registered Public Accounting Firm is responsible for performing an independent audit of the Company’s consolidated financial statements and opining on the effectiveness of the Company’s internal control over financial reporting in accordance with the standards of the Public Company Accounting Oversight Board (United States) (“PCAOB”) and issuing their reports thereon. As provided in its charter, the Audit Committee’s responsibilities include monitoring and overseeing these processes.

13

In discharging its responsibilities, the Audit Committee has:

| ● | Reviewed and discussed with management, and the Independent Registered Public Accounting Firm, the Company’s audited consolidated financial statements for the year ended December 31, 2020; |

| ● | Reviewed and discussed with the Independent Registered Public Accounting Firm all matters required to be discussed under the applicable requirements of the PCAOB; and |

| ● | Received the written disclosures and the letter from the Independent Registered Public Accounting Firm required by applicable requirements of the PCAOB regarding the Independent Registered Public Accounting Firm’s communications with the audit committee concerning independence, and has discussed with the Independent Registered Public Accounting Firm its independence from the Company. |

Based on the reviews and discussions referred to above, the Audit Committee recommended to the Board of Directors that the audited consolidated financial statements be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2020 and filed with the SEC. In addition, the Audit Committee selected Crowe LLP to be the Company’s Independent Registered Public Accounting Firm for the year ending December 31, 2021, subject to the ratification of this appointment by the shareholders.

This report shall not be deemed incorporated by reference by any general statement incorporating by reference this Proxy Statement into any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except to the extent that the Company specifically incorporates this information by reference, and shall not otherwise be deemed filed under such Acts.

The foregoing report has been furnished by Audit Committee members:

Kevin Stein, Chairperson

Raymond A. Nielsen

Joseph J. Perry

Dennis A. Suskind | |

THE COMPENSATION COMMITTEE

The Compensation Committee is appointed by the Board of Directors to assist the Board in fulfilling its responsibilities relating to the compensation and benefits provided to the Company’s executive management and to review, administer, evaluate and recommend the benefit plans and overall compensation for the Company. The Compensation Committee of Bridge met twelve times during 2020. Effective with the closing of the merger with Legacy Dime on February 1, 2021, the Compensation Committee consists of Directors Chen (Chairperson), Devine, Lindenbaum and McCoy Jr. Prior thereto, the Compensation Committee was comprised of Messrs. Arturi (Chairperson), McCoy, Jr., Nielsen and Lindenbaum and Ms. Hefter. Each member is considered independent as defined in the Nasdaq corporate governance listing standards. The Board has adopted a charter for the Compensation Committee, which is available on the Company’s website, www.dime.com.

The Compensation Committee’s responsibilities include, among other duties, the responsibility to:

| ● | Establish, review, and modify from time to time as appropriate the overall compensation philosophy of the Company; |

| ● | Review, evaluate and recommend Company objectives relevant to the compensation of the Chief Executive Officer (“CEO”); review and evaluate CEO performance relative to established goals; and review, evaluate and recommend to the full Board of Directors, the CEO’s compensation, employment and severance agreement, including any change of control and indemnification provisions; |

| ● | Review, evaluate and recommend Company objectives relevant to the compensation of the Company’s other executive officers; review and evaluate such officers’ performance relative to established goals; and review, evaluate and determine such officers’ compensation, employment and severance agreements, including any change of control and indemnification provisions; |

14

| ● | Review, evaluate and recommend, in consultation with the Corporate Governance Committee, the compensation to be paid to directors of the Company and of affiliates of the Company for their service on the Board; |

| ● | Administer the Company’s stock benefit plans; and |

| ● | Review and oversee incentive compensation arrangements of the Bank to ensure they are balanced relative to incentives and risk objectives. |

Compensation recommendations for the CEO, President and Chief Operating Officer (“President”), Chief Financial Officer (“CFO”), Chief Risk Officer (“CRO”), and the Chief Lending Officer (“CLO”) are made by the Compensation Committee to the Board of Directors. Decisions regarding non-equity compensation for the other officers are made under the authority of the Company’s CEO. The Compensation Committee has engaged McLagan, an outside and independent national compensation consulting firm, to assist in the annual review of its incentive compensation arrangements for the NEOs and all other employee groups of the Bank. McLagan also assisted the Compensation Committee of Bridge in its merger related compensation actions, as described below under “Executive Compensation.”

At the request of the Compensation Committee, Compensation Committee meetings are regularly attended by the CEO and President. At each meeting, the Compensation Committee meets in executive session, which excludes executive management. The Compensation Committee’s Chairperson reports the Committee’s recommendations on executive compensation to the Board.

In addition, in 2020, in accordance with best practices, the Compensation Committee of Bridge engaged McLagan to assist in the review of potential risks stemming from the Company’s compensation programs. McLagan conducted a comprehensive review and evaluation of incentive plans covering all employees of the Company. The review included an evaluation of the design features of each plan, the governance and oversight aspects of each plan, the mix of cash and equity incentives opportunities, the use of performance metrics, the performance periods and time horizon of each plan, the various termination provisions associated with the plans, and other dimensions of the plans deemed relevant for the risk review process. McLagan reviewed the results of its assessment with the Committee and with management. Based on the results of the independent assessment by McLagan and the assessment of risks by the Committee, the Board has determined that the Company’s compensation policies, practices and programs do not promote excessive risk taking or pose risks that are reasonably likely to have a material adverse effect on the Company.

The Compensation Committee of Bridge considered the independence of McLagan, in light of SEC rules and Nasdaq listing standards. The Committee requested and received a report from McLagan addressing the independence of McLagan and its consultants, including the following factors: (1) other services provided to us by McLagan; (2) fees paid by us as a percentage of McLagan’s total revenue; (3) policies or procedures maintained by McLagan that are designed to prevent a conflict of interest; (4) any business or personal relationships between the consultants and a member of the Committee; (5) any company stock owned by the consultants; and (6) any business or personal relationships between our executive officers and the consultants. The Committee discussed these considerations and concluded that the work performed by McLagan and its consultants involved in the engagements did not raise any conflict of interest and that McLagan has served as an independent compensation consultant.

Compensation Committee Interlocks and Insider Participation

None of the current Compensation Committee members or members of the Compensation Committee of Bridge during 2020 was, during 2020, or is formerly, an officer of the Company. During the year ended December 31, 2020, the Company had no “interlocking” relationships in which any executive officer of the Company is a member of the board of directors or compensation committee of another entity, one of whose executive officers is a member of the Company’s Board of Directors or Compensation Committee.

THE CORPORATE GOVERNANCE COMMITTEE

The Corporate Governance Committee is appointed by the Board of Directors to assist the Board in developing corporate governance principles applicable to the Company and to recommend nominees for directorships and committee memberships to the Board. The Corporate Governance Committee of Bridge met three times during 2020. Effective with the closing of the merger with Legacy Dime on February 1, 2021, the Corporate Governance Committee consists of Directors Suskind (Chairperson), Devine, Lindenbaum and Stein. Prior thereto, the Governance Committee was comprised

15

of Messrs. Suskind (Chairperson), Massoud, Nielsen, Lindenbaum and Santoro. Each member is considered independent as defined in the Nasdaq corporate governance listing standards. The Board has adopted a charter for the Corporate Governance Committee, which is available on the Company’s website, www.dime.com.

The Corporate Governance Committee’s responsibilities include, among other duties, the responsibility to:

| ● | Review the size and composition of the Board from time to time and make recommendations to the Board regarding such assessments; |

| ● | Develop, adopt and recommend to the Board criteria for the selection of individuals to be considered for election or re-election to the Board; |

| ● | Recommend to the Board nominees to stand for election by the shareholders at the annual meeting; |

| ● | Review status and independence of a director if there is change in such Director’s employment or third-party responsibilities; |

| ● | Review Board committees and recommend to the Board the number, identity and responsibilities of Board committees and the Chairperson of such committees, as well as the directors designated to serve as members of such committees; and |

| ● | Review and approve all related-party transactions, including transactions between the Company and a related person as defined in Item 404 of Regulation S-K. |

16

Governance and Social Highlights

The Company is committed to strong corporate governance and social responsibility. We believe that this commitment is essential to the success of the Company and promotes the interests of all of the Company’s stakeholders, such as its shareholders, employees, customers and community. The table below highlights various ways the Company invests in corporate governance and social responsibility.

GOVERNANCE AND SOCIAL HIGHLIGHTS |

Diversity and Inclusion•2 out of 12 directors are women

| • | 1 director is a person of color |

•Established Women’s Internal Network of employees

Board•Lead Independent Director

•Separation of Executive Chairman and CEO roles

•Committees comprised of independent directors

| • | Non-classified Board (annual election of directors) |

•Annual Board self-evaluation

Community Impact•Conducted 75 Financial Literacy, Small Business and Elder Abuse seminars

in 2020

| • | Over 100 employees volunteered to distribute food at 14 events after the onset of COVID-19 |

• | Charitable contributions of $2 million in 2020, including $250,000 directly to small businesses impacted by COVID-19 |

• | Made $43 million in Community Development investments to spur affordable housing and economic development |

•Originated $874 million of Community Development loans in 2020

• | Through the Record Date, originated 9,795 Paycheck Protection Program loans with an original principal balance of approximately $1.9 billion |

• | In 2020, purchased approximately $23 million of investments in mortgage-backed securities, where the underlying collateral is affordable housing properties |

• | Purchased approximately $6 million of investments in municipal securities in 2020, where the use of the proceeds is to provide and encourage the investment of capital in safe and sanitary housing within the financial reach of families and individuals of low income |

• | Purchased $3 million of securities issued by a certified Community Development Financial Institution (“CDFI”) in 2020. The investment will aid the CDFI to continue lending to high-quality underbanked and underserved niche customers |

Business Conduct•Code of Ethics

• | Business integrity hotline for anonymous reporting of violations of Code of Ethics |

•Corporate Governance Guidelines

Work Environment•Employee training on appropriate workplace conduct

Privacy and Data Security•Robust data security environment policies and procedures

17

EXECUTIVE OFFICERS

The following individuals are executive officers of the Company, holding the offices set forth opposite their names as of the Record Date:

Name Position Held

Kevin M. O’ConnorChief Executive Officer

Stuart H. LubowPresident and Chief Operating Officer

Avinash ReddySEVP and Chief Financial Officer

John M. McCafferySEVP and Chief Risk Officer

Conrad J. GuntherSEVP and Chief Lending Officer

James J. ManseauEVP and Chief Retail Banking Officer

Kevin L. SantacroceEVP and Deputy Chief Lending Officer

Patricia M. SchaubeckEVP and General Counsel

Leslie VeluswamySVP and Chief Accounting Officer

The executive officers are elected annually and hold office until their respective successors have been elected and qualified, or until death, resignation or removal by the Board of Directors.

Biographical information of the executive officers who are not directors of the Company or Bank is set forth below.

Stuart H. Lubow, age 63, is President and Chief Operating Officer of the Company and the Bank. Mr. Lubow has been a banking executive for over 38 years. He joined Legacy Dime and DCB in 2017 and was most recently President of Legacy Dime and DCB prior to the merger on February 1, 2021. From its inception in 2005 until its sale to the Bank in June 2015, Mr. Lubow was a founder, Chairman, President, and CEO of Community National Bank. Prior to that, he was founder, President, and CEO of Community State Bank, EVP and COO of Garden State Bank, and Chief Operating Officer at Dry Dock Bank. Prior to Dry Dock Bank, Mr. Lubow held senior positions at Peoples Bank N.A., First Fidelity Bank, and Chase Manhattan Bank, N.A.

Avinash Reddy, age 37, is Senior Executive Vice President and Chief Financial Officer of the Company and the Bank. Prior to the merger on February 1, 2021, Mr. Reddy served as Senior Executive Vice President and Chief Financial Officer of Legacy Dime and DCB. Prior to joining Legacy Dime and DCB in 2017, Mr. Reddy held several investment banking roles with firms including Evercore Partners, from 2011 to 2014, Barclays Capital, from 2008 to 2011 and Lehman Brothers, from 2005 to 2008.

John M. McCaffery, age 56 is Senior Executive Vice President and Chief Risk Officer of the Company and the Bank. Prior to the merger on February 1, 2021, Mr. McCaffery was Executive Vice President, Chief Financial Officer and Treasurer of Bridge and the Bank. Mr. McCaffery joined Bridge in 2012 as Senior Vice President and Treasurer, was promoted to Executive Vice President in 2014 and appointed Chief Financial Officer in 2016. Prior to his service at Bridge, Mr. McCaffery was the Treasurer of State Bank of Long Island.