Exhibit 10.3

PARK MEADOWS CORPORATE CENTER III AND IV OFFICE

LEASE BETWEEN

PUBLIC SERVICE CREDIT UNION

(LANDLORD) AND

ZYNEX MEDICAL, INC. (TENANT)

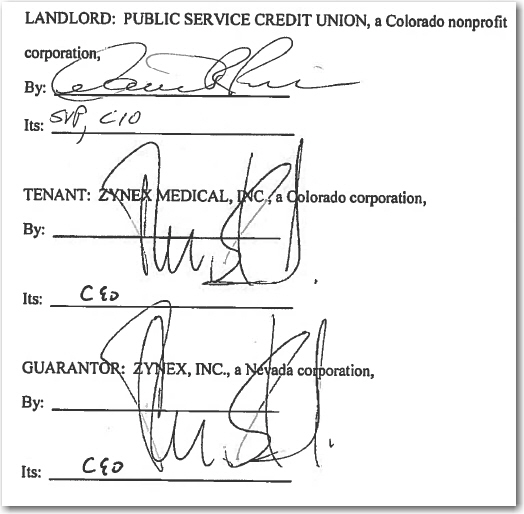

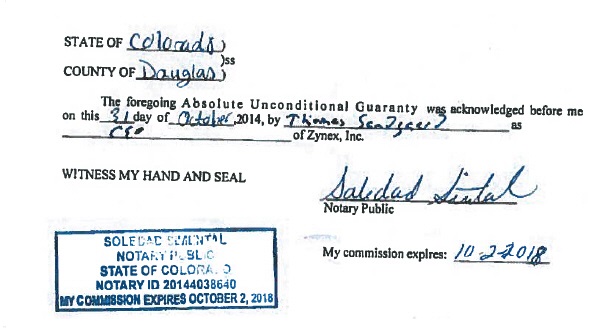

THIS LEASE (Lease) is made this 31st day of October, 2014, by and between PUBLIC SERVICE CREDIT UNION, a Colorado nonprofit corporation (“Landlord”) and ZYNEX MEDICAL, INC., a Colorado corporation (“Tenant”).

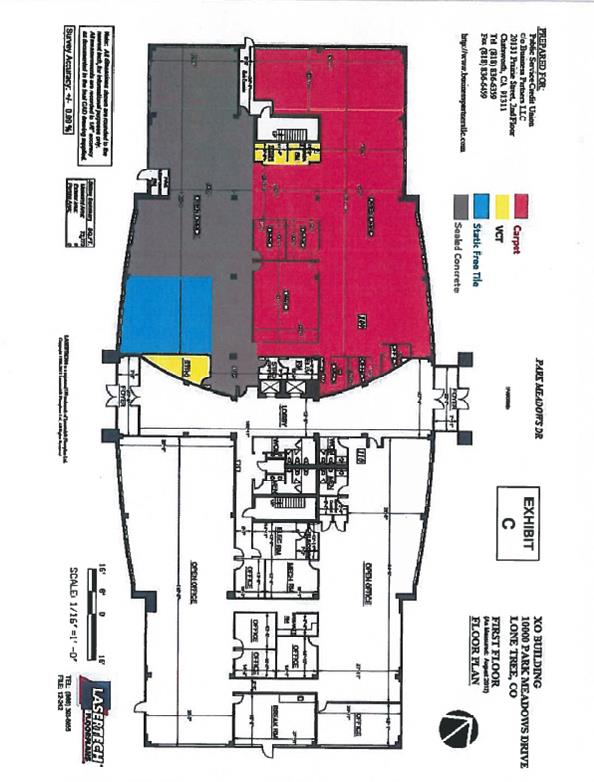

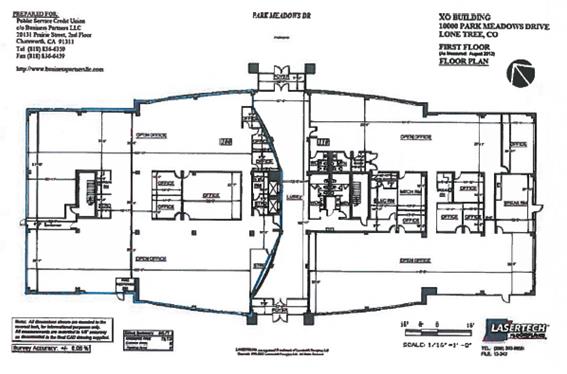

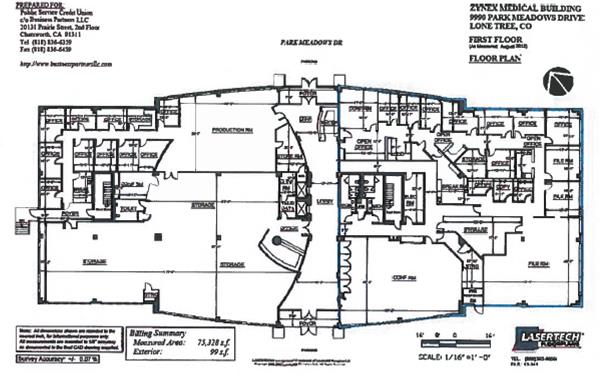

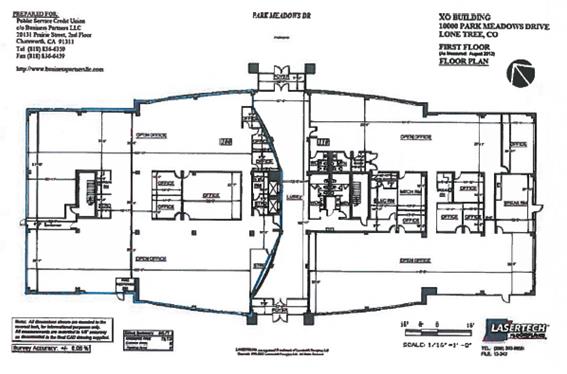

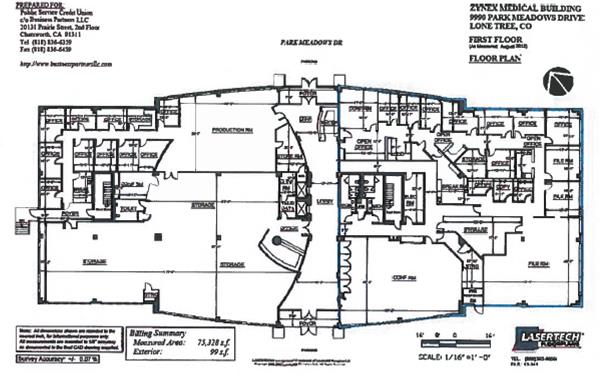

1. Premises: Landlord hereby leases to Tenant those certain premises on the first (1st) floor of Building III (hereinafter defined) as depicted in Exhibit A-1 attached hereto and incorporated herein by this reference and those certain premises on the first (1st) floor of Building IV (hereinafter defined) as depicted in Exhibit A-2 attached hereto and incorporated herein by this reference consisting of a total of 22,000 rentable square feet of space (the “Premises”) located on the real property more particularly described on Exhibit B attached hereto and incorporated herein by this reference, together with a non- exclusive right, subject to the provisions hereof, to use all appurtenances thereunto, including, but not limited to, any areas designated by Landlord for use by tenants of Building III and Building IV (Building III, Building IV, the real property on which the same are situated, and appurtenances are hereinafter collectively sometimes called the “Building Complex”). Building III is commonly known as Park Meadows Corporate Center Ill and is located at 10000 Park Meadows Drive, Lone Tree, Colorado 80124 (“Building III”). Building IV is commonly known as Park Meadows Corporate Center IV and is located at 9990 Park Meadows Drive, Lone Tree, Colorado 80124 (“Building IV”). (Building III and Building IV are hereinafter collectively sometimes called the “Buildings”.) This Lease is subject to the terms, covenants and conditions set forth herein and Tenant and Landlord each covenant as a material part of the consideration for this Lease to keep and perform each and all of said terms, covenants and conditions to be kept and performed by them.

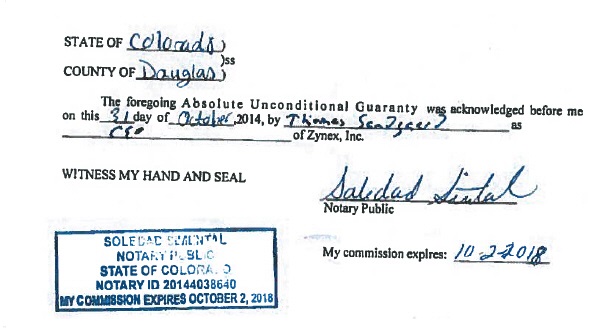

This Lease is conditioned upon Tenant’s full and timely performance of all contingencies, conditions, covenants and agreements in that certain Lease Termination Agreement by and between Landlord and Tenant dated October 31, 2014 concerning that certain Office Lease by and between Landlord and Tenant dated May 1, 2013, as amended by that certain First Amendment to Office Lease dated January 2, 2014, (collectively, the “Original Lease”), for the real property described as follows: 9990 Park Meadows Drive, Lone Tree, CO 80124, as more fully described in the Original Lease (the “Termination Agreement”). If Tenant does not fully and timely perform all contingencies, conditions, covenants and agreements in the Termination Agreement or otherwise is in breach of the Termination Agreement, this Lease shall be voidable at the sole and unfettered discretion of Landlord, and if voided Landlord shall not be liable to Tenant for any loss or damage resulting from the voiding of this Lease nor the failure to deliver possession of the Premises to Tenant, its servants, agents or independent contractors.

2. Term and Possession:

(a) The Term of this Lease shall be two (2) years to commence on January 1, 2015 (the “Commencement Date”) and to end, unless sooner terminated, at midnight on December 31, 2016.

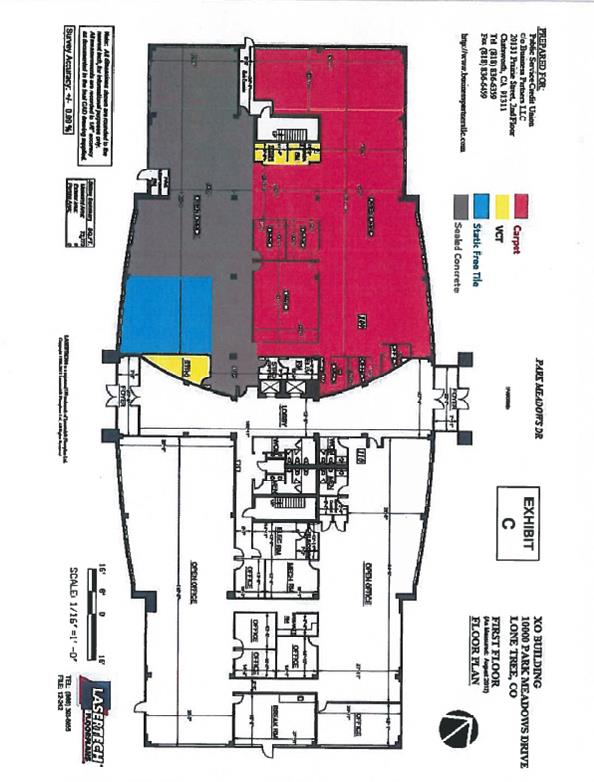

(b) Tenant is currently in possession of the portion of the Premises located in Building IV and accepts that portion of the Premises in its “as is” condition. Landlord will deliver possession of the portion of the Premises located in Building III on the Commencement Date. Prior to the Commencement Date, Landlord will paint the interior of and place new flooring in the portion of the Premises located in Building III with paint and flooring as depicted on Exhibit C (“Landlord’s Work). Other than Landlord’s Work, Landlord shall have no obligation for the completion of the Premises, and Tenant shall accept the Premises in its “as is” condition on the Commencement Date. Landlord shall not have any obligation for the repair or replacement of any portions of the interior of the Premises, including but not limited to carpeting, draperies, window coverings, wall coverings or painting, which are damaged or wear out during the term hereof, unless such damage is caused by Landlord or its agents or employees.

(c) If Tenant occupies or begins to conduct business in all or any portion of the Premises located in Building Ill before the Commencement Date, such occupancy and conducting of its business by Tenant shall be subject to all provisions of this Lease which reasonably and logically apply thereto. Taking possession of all or any portion of the Premises by Tenant shall constitute Tenant’s acceptance of the Premises as being in satisfactory condition without any further work by Landlord.

(d) This Lease shall not be void or voidable nor shall Landlord be liable to Tenant for any loss or damage resulting from any delay in delivering possession of the Premises to Tenant, its servants, agents or independent contractors.

1

3. Rent: Tenant shall pay to Landlord, rent for the Premises (“Base Rent”) in accordance with the following schedule:

|

|

|

|

|

|

|

|

|

|

|

|

|

MONTHLY |

|

ANNUAL |

|

ANNUAL PRICE |

|

PERIOD |

|

BASE RENT |

|

BASE RENT |

|

PER SQUARE FOOT |

|

Month 1-12 |

|

$ |

48,583.00 |

|

$ |

583,000.00 |

|

$ |

26.50 |

|

Months 13-24 |

|

$ |

48,583.00 |

|

$ |

583,000.00 |

|

$ |

26.50 |

Tenant and Landlord agree that Base Rent is based on the measurement of the Premises equaling 22,000 square feet and that the Premises is not subject to remeasurement except as specifically provided herein. All installments of Base Rent shall be payable in advance, on the first (1st) day of each calendar month during the term hereof. Base Rent for any partial month during the term hereof shall be prorated based upon the number of days during each of said months that the Lease term was in effect. All Base Rent shall be paid without notice, demand, deduction or offset, at the office of Landlord or to such other person or at such other place as Landlord may designate in writing. Tenant shall pay to Landlord as “Additional Rent” all other sums due under this Lease. Late payments shall be subject to Interest and penalties as set forth in Section 16 hereof.

4. Character of Occupancy:

(a) The Premises are to be used for general office, compound pharmacy operations, storage, light assembly and testing, and uses incidental to such purposes, not inconsistent with the character and type of tenancy found in comparable first-class office buildings in the Denver metropolitan area and for no other purpose without the prior written consent of Landlord, which consent shall not be unreasonably withheld. Tenant shall be entitled to access to the Premises 24 hours per each day of the calendar year.

(b) Tenant shall not suffer nor permit the Premises nor any part thereof to be used in any manner, nor anything to be done therein, nor suffer or permit anything to be brought into or kept therein, which would in any way (i) make void or voldable any fire or liability insurance policy then in force with respect to the Building Complex, (ii) make unobtainable from insurance companies authorized to do business in Colorado any fire insurance with extended coverage, or liability, elevator, boiler or other insurance required to be furnished by Landlord under the terms of any lease or mortgage to which this Lease is subordinate at standard rates, (iii) cause or in Landlord’s reasonable opinion be likely to cause physical damage to the Building Complex or any part thereof, (iv) constitute a public or private nuisance, (v) impair, in the reasonable opinion of Landlord, the appearance, character or reputation of the Building Complex, (vi) discharge objectionable fumes, vapors or odors into the Buildings air conditioning system or into the Buildings flues or vents not designed to receive them or otherwise in such manner as may unreasonably offend other occupants of the Buildings, (vii) impair or interfere with any of the Buildings services or impair or interfere with or tend to impair or interfere with the use of any of the other areas of the Buildings by, or occasion discomfort, or annoyance to Landlord or any of the other tenants or occupants of the Building Complex, any such impairment or interference to be based upon the judgment of Landlord, (viii) create waste in, on or around the Premises, Buildings, or Building Complex, or (ix) make any noise or set up any vibration which will disturb other tenants, except in the course of permitted repairs or alterations at times permitted by Landlord.

(c) Tenant shall not use the Premises nor permit anything to be done in or about the Premises or Building Complex which will in any way conflict with any law, statute, ordinance, protective covenants affecting the Building Complex or governmental or quasi-governmental rules or regulations now in force or which may hereafter be enacted or promulgated. Tenant shall give written notice within five (5) days from receipt thereof to Landlord of any notice it receives of the violation of any law or requirement of any public authority with respect to the Premises or the use or occupation thereof. Landlord shall give written notice to Tenant within five (5) days from receipt thereof of any notice it receives relative to the violation by Tenant of any law or requirement of any public authority with respect to the Premises or the use or occupation thereof.

5. Services and Utilities:

(a) Landlord agrees, without charge except as provided herein, to furnish; (i) Hot and cold tap water for drinking and toilet purposes. Tenant shall pay Landlord for water furnished for any other purpose as Additional Rent at rates reasonably fixed by Landlord. Tenant shall not permit water to be wasted; (ii) During Ordinary Business Hours (hereinafter defined) to furnish such heated or cooled air to the Premises as may, in the reasonable judgment of Landlord, be required for the comfortable use and occupancy of the Premises provided that Tenant complies with the recommendations of Landlord’s engineer or other duly authorized representative, regarding occupancy and use of the Premises; (iii) During Ordinary Business Hours to cause electric current to be supplied for lighting the Premises and public halls; and, (iv) To furnish such snow removal services to the Building Complex as may, in the judgment of Landlord, be reasonably required for safe access to the Building Complex.

2

(b) Landlord shall have no obligation to provide janitorial services for the Premises. Tenant shall provide its own janitorial services for the Premises and shall keep the Premises in a clean and neat condition and, at a minimum, follow the cleaning specifications adopted by the Landlord for the Building Complex.

(c) Landlord shall provide sufficient electricity to operate normal office lighting and equipment. This does not include special lighting in excess of building standard, or any other item of electrical equipment that singularly requires a voltage that exceeds other than one hundred twenty (120) volts (plus/minus ten percent) single phase. Tenant shall not install or operate in the Premises any electrically operated equipment or other machinery, other than business machines and equipment normally employed for general office use which do not require high electricity consumption for operation, without obtaining the prior written consent of Landlord. If any or all of Tenant’s equipment requires electricity consumption in excess of that which is necessary to operate normal office equipment, such consumption shall be submetered by Landlord or otherwise reasonably estimated, at Tenant’s expense, and Tenant shall reimburse Landlord as Additional Rent for the cost of its submetered or estimated consumption based upon Landlord’s average cost of electricity. Tenant shall not, without the prior written consent of Landlord, use any apparatus or device in or about the Premises which shall cause any substantial noise or vibration or which will increase the amount of electricity or water, if any, usually furnished or supplied for use of the Premises as general office space. Tenant shall not connect with electric current or water pipes, except through existing electrical or water outlets already in the Premises, any apparatus or device for the purposes of using electric current or water, except Tenant is permitted to arrange for a licensed electrician to install, at Tenant’s expense, 220-volt service for Tenant’s Xerox machine.

(d) Tenant agrees that Landlord shall not be liable for failure to supply any heating, air conditioning, elevator, electrical, janitorial, lighting or other services during any period when Landlord uses reasonable diligence to supply such services, or during any period Landlord is required to reduce or curtail such services pursuant to any applicable laws, rules or regulations, now or hereafter in force or effect, it being understood and agreed to by Tenant that Landlord may discontinue, reduce or curtail such services, or any of them at such times as it may be necessary by reason of accident, repairs, alterations, improvements, strikes, lockouts, riots, acts of God, application of applicable laws, statutes, rules and regulations, or due to any other happening beyond the reasonable control of Landlord and not due to an act or omission of Landlord or its agents or employees. In the event of any such interruption, reduction or discontinuance of Landlord’s services. Landlord shall not be liable for damages to persons or property as a result thereof, nor shall the occurrence of any such event in any way be construed as an eviction of Tenant or cause or permit an abatement, reduction or setoff of rent, or operate to release Tenant from any of Tenant’s obligations hereunder. Notwithstanding anything to the contrary contained in this Section 5(d) if: (i) Landlord ceases to furnish any service in the Building for a period in excess of ten (10) consecutive business days after Tenant notifies Landlord of such cessation; (ii) such cessation does not arise as a result of act or omission of Tenant; (iii) such cessation is not caused by a fire or other casualty (in which case Section 13 shall control); (iv) the restoration of such service is reasonably within the control of Landlord; and (v) as a result of such cessation, the Premises, or a material portion thereof, is rendered untenantable (meaning that Tenant is unable to use the Premises or such portion in the normal course of its business) and Tenant in fact ceases to use the Premises, or material portion thereof, then Tenant, as its sole remedy, shall be entitled to receive an abatement of Base Rent payable hereunder during the period beginning on the eleventh (11th) consecutive business day of such cessation and ending on the day when the service in question has been restored. In the event the entire Premises has not been rendered untenantable by the cessation in service, the amount of abatement that Tenant is entitled to receive shall be prorated based upon the percentage of the Premises so rendered untenantable and not used by Tenant.

(e) Whenever heat generating machines or equipment are used by Tenant in the Premises which affect the temperature otherwise maintained by the air conditioning system, Landlord reserves the right to install supplementary air conditioning units in the Premises in the event Landlord’s independent consulting engineer determines same are necessary as a result of Tenant’s use of lights or equipment which generate heat loads in excess of those for which the HVAC system is designed and the cost therefor, including the cost of installation, operation and maintenance thereof, shall be paid by Tenant to Landlord upon demand by Landlord.

(f) In the event that Tenant has any special or additional electrical or mechanical requirements related to its use of the Premises, any such electrical or mechanical equipment must be located within the Premises. Such electrical or mechanical requirements, for the purposes hereof, shall include by way of example, but not limitation, any internal telephone system. The foregoing shall in no way be construed as granting to Tenant additional rights to use any such special or additional electrical or mechanical equipment in its Premises without the prior written consent of Landlord. Any additional cost or expense related to or resulting from such electrical or mechanical requirements shall be the sole obligation of Tenant.

(g) If Tenant requires HVAC service beyond Ordinary Business Hours (hereafter “After Hours Usage”), such service shall be metered and Tenant shall reimburse Landlord on a monthly basis, as Additional Rent, for all costs and expenses for Tenant’s After Hours Usage including Landlord’s actual cost for electric service without markup. Ordinary Business Hours shall mean 6:00 A.M. to 6:00 P.M., Monday through Friday and 8:00 A.M. to 1:00 P.M. on Saturday, except Holidays.

3

6. Quiet Enjoyment: Subject to the provisions of this Lease, Landlord covenants that Tenant, on paying the rent and performing the covenants of this Lease on its part to be performed, shall and may peacefully and quietly have, hold and enjoy the Premises for the term of this Lease. Landlord shall not be responsible for the acts or omissions of any other tenant or third party which may interfere with Tenant’s use and enjoyment of the Premises.

7. Maintenance and Repairs:

(a) Notwithstanding any other provisions of this Lease, Landlord shall repair and maintain the structural portions of the Buildings, including the elevators, plumbing, air conditioning, heating and electrical systems installed or furnished by Landlord, unless such maintenance and repairs are caused in part or in whole by the act, neglect, fault or omission of Tenant, its agents, servants, employees, licensees or invitees, in which case Tenant shall pay to Landlord, on demand, the cost of such maintenance and repairs less the amount of any Insurance proceeds received by Landlord on account thereof, if applicable. Landlord shall also maintain and keep in good order and repair the Building exterior and roof; all exterior doors, including any exterior plate glass within the Building; the Building ventilating systems; and public portions of the Building or Building Complex, including but not limited to the parking areas (including maintaining parking space line striping on an ongoing basis as necessary) landscaping and interior portions of the Building above and below grade which are not covered by leases and are otherwise under the control of Landlord.

(b) Tenant, at Tenant’s sole cost and expense, except for services furnished by Landlord pursuant to Section 5 hereof, shall maintain, in good order, condition and repair, the Premises in their condition as of date or dates of Tenant’s actual possession of the Premises including, without limitation, the interior surfaces of the ceiling (if damaged or discolored due in whole or in part to the act, neglect, omission or fault of Tenant), walls and floors, subject to the provisions of Section 12 hereof. In the event Tenant fails to so maintain the Premises in good order, condition and repair, Landlord shall give Tenant notice to do such acts as are reasonably required to maintain the Premises. In the event Tenant fails to promptly commence such work and diligently pursue it to completion, then Landlord shall have the right, but shall not be required, to do such acts and expend such funds at the expense of the Tenant as are reasonably required to perform such work. Landlord shall have no liability to Tenant for any damage, inconvenience or interference with the use of the Premises by Tenant as a result of performing any such work.

(c) Tenant shall do all acts required to comply with all applicable laws, ordinances, regulations, rules and orders of any public authority relating directly to Tenant’s operations.

(d) Whenever a special HVAC System is installed in all or part of the Premises, Tenant shall enter into a regularly scheduled preventative maintenance and service contract, at Tenant’s sole cost and expense, with an experienced maintenance and service contractor for servicing all such heating, air conditioning and ventilation systems and equipment, and shall provide Landlord with a copy of the same. The contractor and contract are both subject to Landlord’s prior approval, which approval will not be unreasonably withheld or delayed. Such contract shall include, at a minimum, all services recommended by the equipment manufacturer and must be effective within thirty (30) days of the Commencement Date hereof. Landlord shall retain all manufacturers’ warranty information, if any, and will cooperate with the Tenant to the extent warranty repairs are required.

8. Alterations and Additions:

(a) Tenant shall make no alterations, additions or improvements to the Premises or any part thereof without obtaining the prior written consent of Landlord, which consent may be withheld in Landlord’s sole discretion. Landlord may impose, as a condition to such consent, such requirements as Landlord may deem necessary in its reasonable judgment, including without limitation, the manner in which the work is done, a right of approval of the contractor by whom the work is to be performed and the times during which the work is to be accomplished, approval of all plans and specifications and the procurement of all licenses and permits. Landlord shall be entitled to post notices on and about Premises with respect to Landlord’s non-liability for mechanics’ liens and Tenant shall not permit such notices to be defaced or removed. Tenant further agrees not to connect any apparatus, machinery or device to the Building systems, including electric wires, water pipes, fire safety, heating and mechanical systems, without the prior written consent of Landlord, may be withheld in Landlord’s sole discretion. Upon completion Tenant shall furnish Landlord “as-built” plans, contractor’s affidavits and full and final lien waivers and receipted bills covering all labor and materials. Tenant shall reimburse Landlord upon demand as Additional Rent for all reasonable sums, if any, incurred by Landlord for examination of Tenant’s architectural, mechanical, electrical and plumbing plans and construction supervision for any such alterations, additions or improvements.

All alterations, improvements and additions to the Premises by Tenant, including, by way of illustration but not by limitation, all counters, screens, grilles, special cabinetry work, partitions, paneling, carpeting, drapes or other window coverings and light fixtures, shall be deemed a part of the real estate and the property of Landlord and shall remain upon and be surrendered with the Premises as a part thereof without molestation, disturbance or injury at the end of the Lease term, whether by lapse of time or otherwise. Any installation of equipment by Tenant on the roof (along with the use of any spare riser space) including, but not limited

4

to, satellite dish(es) and related equipment, shall be removed by Tenant at the end of the Lease term, whether by lapse of time or otherwise, and the areas of removal on the roof shall be returned to their condition prior to such installation or installations, ordinary wear and tear excepted, all at Tenants own cost and expense.

(b) All movable partitions, machines and equipment which are installed in the Premises by or for Tenant, without expense to Landlord, and can be removed without structural damage to or defacement of the Buildings or the Premises, and all furniture, furnishings and other articles of personal property owned by Tenant and located in the Premises (all of which are herein called “Tenant’s Property”) shall be and remain the property of Tenant and may be removed by it at any time during the term of this Lease. However, if any of Tenant’s Property is removed, Tenant shall repair or pay the cost of repairing any damage to the Buildings or the Premises resulting from such removal, including any holes or damages to the drywall. All additions or improvements which are to be surrendered with the Premises shall be surrendered with the Premises, as a part thereof, at the end of the term or the earlier termination of this Lease.

(c) If Landlord permits persons requested by Tenant to perform any alterations, repairs, modifications or additions to the Premises, then prior to the commencement of any such work, Tenant shall deliver to Landlord certificates issued by insurance companies qualified to do business in the State of Colorado evidencing that worker’s compensation, commercial general public liability insurance and property damage insurance, all in amounts, with companies and on forms satisfactory to Landlord, are in force and maintained by all such contractors and subcontractors engaged by Tenant to perform such work. All such policies shall name Landlord as an additional Insured and shall provide that the same may not be canceled or modified without thirty (30) days prior written notice to Landlord.

(d) Tenant, at its sole cost and expense, shall cause any permitted alterations, decorations, installations, additions or improvements in or about the Premises to be performed in compliance with all applicable codes, ordinances, laws (including the Americans with Disabilities Act), regulations and requirements of governmental bodies having jurisdiction and insurance companies insuring the Building, and in such manner as not to interfere with, delay, or impose any additional expense upon Landlord in the construction, maintenance or operation of the Buildings, and so as to maintain harmonious labor relations in the Buildings.

Entry by Landlord: Landlord and its agents shall have the right to enter the Premises during business hours upon reasonable notice to Tenant (except in the case of an emergency), for the purpose of examining or inspecting the same, to supply any services to be provided by Landlord hereunder, to show the same to prospective purchasers of the Buildings, to make such alterations, repairs, improvements or additions to the Premises or to the Buildings as Landlord may deem necessary or desirable, so long as such activities do not interfere with Tenant’s or Tenant’s guests and invitee’s access to the Premises, and to show the Premises to prospective tenants of the Premises. Landlord and its agent may enter the Premises at all times and without advance notice for the purpose of responding to an actual or apparent emergency. Landlord may in the case of an emergency enter the Premises by means of a master key without liability to Tenant and without affecting this Lease. If, during the last sixty (60) days of the term hereof, Tenant shall have removed substantially all of its property from the Premises and stopped operating its business in the Premises, Landlord may immediately enter and alter, renovate and redecorate the Premises without elimination or abatement of rent or incurring liability to Tenant for any compensation.

9. Mechanic’s Liens: Tenant shall pay or cause to be paid all costs for work done by or on behalf of Tenant or caused to be done by or on behalf of Tenant on the Premises of a character which will or may result in liens against Landlord’s interest in the Premises, Buildings or Building Complex and Tenant will keep the Premises, Buildings and Building Complex free and clear of all mechanic’s liens and other liens on account of work done for or on behalf of Tenant or persons claiming under Tenant. Tenant hereby agrees to indemnify, defend and save Landlord harmless of and from all liability, loss, damages, costs or expenses, including attorneys’ fees, incurred in connection with any claims of any nature whatsoever for work authorized by Tenant and performed for, or materials or supplies furnished to, Tenant, including lien claims of laborers, materialmen or others. Should any such liens be filed or recorded against the Premises, Buildings or Building Complex with respect to work done for or materials supplied to or on behalf of Tenant or should any action affecting the title thereto be commenced, Tenant shall cause such liens to be released of record within five (5) days after notice thereof. If Tenant desires to contest any such claim of lien, Tenant shall nonetheless cause such lien to be released of record by the posting of adequate security within said five (5) day period with a court of competent jurisdiction as may be provided by Colorado’s mechanic lien statutes. If Tenant shall be in default in paying any charge for which such a mechanic’s lien or suit to foreclose such a lien has been recorded or filed and shall not have caused the lien to be released as aforesaid, Landlord may (but without being required to do so) pay such lien or claim and any costs associated therewith, and the amount so paid, together with reasonable attorneys’ fees incurred in connection therewith, shall be immediately due from Tenant to Landlord as Additional Rent.

Nothing in this section 9. is intended to, nor shall be construed to, create any obligation or liability on the part of Tenant with respect to work performed, or labor or materials furnished, which was authorized by Landlord whether such work is performed or the labor or materials are supplied in the Premises, in the Building, or on the Building Complex, unless such work, labor provided or materials supplied was expressly authorized by Tenant.

5

10. Damage to Property, Injury to Persons:

(a) Tenant, as a material part of the consideration to be rendered to Landlord under this Lease, hereby waives all claims of liability that Tenant or Tenant’s legal representatives, successors or assigns may have against Landlord, and Tenant hereby indemnifies and agrees to hold Landlord harmless from any and all claims of liability for any injury or damage to any person or property whatsoever: (1) occurring in, on or about the Premises or any part thereof; and (2) occurring in, on or about the Building Complex, when such injury or damage is caused in part or in whole by the act, neglect, fault or omission of Tenant, its agents, contractors, employees, licensees or invitees. Tenant further agrees to indemnify and to hold Landlord harmless from and against any and all claims arising from any breach or default in the performance of any obligation on Tenant’s part to be performed under the terms of this Lease, or arising from any act or negligence of Tenant, or any of its agents, contractors, employees, licensees or invitees. Such Indemnities shall include by way of example, but not limitation, all costs, reasonable attorneys’ fees, expenses and liabilities incurred in or about any such claim, action or proceeding.

(b) Landlord shall not be liable to Tenant for any damage by or from any act or negligence of any co-tenant or other occupant of the Building Complex, or by any owner or occupant of adjoining or contiguous property. Landlord shall not be liable for any injury or damage to persons or property resulting in whole or in part from the criminal activities of others besides Landlord, Its agents or employees. To the extent not covered by normal fire and extended coverage insurance, Tenant agrees to pay for all damage to the Building Complex, as well as all damage to persons or property of other tenants or occupants thereof, caused by the misuse, neglect, act, omission or negligence of Tenant or any of its agents, contractors, employees, licensees or invitees.

(c) Neither Landlord nor its agents or employees shall be liable for any damage to property entrusted to Landlord, its agents or employees, or employees of the building manager, if any, nor for the loss or damage to any property occurring by theft or otherwise, nor for any injury or damage to persons or property resulting from fire, explosion, falling plaster, steam, gas, electricity, water of rain which may leak from any part of the Building Complex or from the pipes, appliances or plumbing works therein or from the roof, street or subsurface or from any other place or resulting from dampness, or any other cause whatsoever, provided, however, nothing contained herein shall be construed to relieve Landlord from liability for any personal injury resulting from its or its agents’ or employees’ gross negligence or willful misconduct. Neither Landlord nor its agents or employees shall be liable for interference with the lights, view or other incorporeal hereditament, nor shall Landlord be liable for any latent defect in the Premises or in the Buildings or Building Complex. Tenant shall give prompt notice to Landlord in case of fire or accidents in or about the Premises or the Buildings or of defects therein or in the fixtures or equipment located therein.

(d) In case any claim, demand, action or proceeding is made or brought against Landlord, its agents or employees, by reason of any obligation on Tenant’s part to be performed under the terms of this Lease, or arising from any act or negligence of Tenant, its agents or employees, or which gives rise to Tenant’s obligation to indemnify Landlord, Tenant shall be responsible for all costs and expenses, including but not limited to reasonable attorneys’ fees incurred in defending or prosecution of the same, as applicable.

11. Insurance:

(a) Landlord agrees to secure and maintain the following insurance during the term of this Lease and any extension hereof: commercial general public liability insurance against claims for bodily injury, personal injury and property damage in or about the Premises, the Buildings and the Building Complex (excluding Tenant’s Property), such insurance to be in amounts sufficient to provide reasonable protection for the Building Complex. Landlord shall also secure and maintain “all risk” property insurance on the Buildings and Building Complex. Such insurance may expressly exclude property paid for by tenants or paid for by Landlord for which tenants have reimbursed Landlord located in or in, or constituting a part of the Building or the Building Complex. All such insurance shall be procured from a responsible insurance company or companies authorized to do business in Colorado and may be obtained by Landlord by endorsement on its blanket insurance policies.

(b) Upon execution of this Lease, Tenant (with respect to the Premises, the Buildings and the Building Complex) shall secure and maintain, at its own expense, a policy or policies of commercial general liability insurance, protecting Tenant and naming Landlord, Its property manager and their respective agents as additional insured against claims for bodily injury, personal injury, advertising injury and property damaged based upon, involving or arising out of the Tenant’s use, occupancy or maintenance of the Premises, the Buildings and the Building Complex. Such insurance shall afford a combined single limit of not less than One Million Dollars ($1,000,000) per occurrence and aggregate of Two Million Dollars ($2,000,000). The coverage required to be carried shall include blanket contractual liability, personal injury liability (libei, slander, false arrest and wrongful eviction), and broad form property damage liability and the policy shall contain an exception to any pollution exclusion which insures damage or injury arising out of heat, smoke or fumes from a hostile fire. Such insurance shall be written on an occurrence basis and contain a standard separation of insureds provision. In addition, Tenant shall secure and maintain workers’ compensation and employer’s liability insurance with limits as may be required by applicable law. Tenant shall provide Landlord with a certificate evidencing such insurance

6

coverage. The certificate shall indicate that the insurance provided specifically recognizes the liability assumed by Tenant under this Lease and that Tenant’s insurance is primary to and not contributory with any other insurance available to Landlord, whose insurance shall be considered excess insurance only. Not more frequently than every three (3) years, if, in the reasonable opinion of any mortgagee of Landlord or of the insurance broker retained by Landlord, the amount of liability insurance coverage at that time is not adequate, then Tenant shall increase its liability insurance coverage as required by either any mortgagee of Landlord or Landlord’s insurance broker.

(c) Tenant shall secure and maintain, at Tenant’s expense, special form fire and extended coverage insurance on all of Tenant’s fixtures and personal property in the Premises and on any improvements or alterations, additions or improvements made by Tenant, upon the Premises, all for the full replacement cost thereof (or such other form of property insurance then available in the insurance market that is most comparable or equivalent to “all risk”). Tenant shall use the proceeds from such insurance for the replacement of fixtures and personal property and for the restoration of tenant improvements or alterations, additions or improvements to the Premises. Landlord shall be named as loss payee as its interests may appear. Tenant shall provide Landlord with certificates of all such insurance. Tenant shall, at least thirty (30) days prior to the expiration of any policy of insurance required to be maintained by Tenant under this Lease, furnish Landlord with an “insurance binder” or other satisfactory evidence of renewal thereof.

(d) All policies required to be carried by Tenant hereunder shall be issued by and binding upon an insurance company licensed to do business in the State of Colorado with a rating of at least A-:VIII, or such other rating as may be required by a lender having a lien on the Building as set forth in the then most current issue of “Best’s Insurance Reports.” Tenant shall not do or permit anything to be done that would invalidate the insurance policies referred to in this Section II. Evidence of insurance provided to Landlord shall include an endorsement showing that Landlord and its representatives are included as additional insureds on general liability insurance, and as loss payees for property insurance, and an endorsement whereby the insurer agrees not to cancel, non-renew or reduce coverage of the policy without at least thirty (30) days prior written notice to Landlord and its representatives.

(e) In the event that Tenant fails to provide evidence of insurance required to be provided by Tenant hereunder, prior to commencement of the Term, and thereafter during the Term, within ten (10) days following Landlord’s request therefor, and thirty (30) days prior to the expiration date of any such coverage, Landlord shall be authorized (but not required) to procure such coverage in the amounts stated with all costs thereof (plus a fifteen percent [15%] administrative fee) to be chargeable to Tenant and payable upon written invoice therefor.

(f) The limits of insurance required by this Lease, or as carried by Tenant, shall not limit the liability of Tenant nor relieve Tenant of any obligation hereunder.

(g) Anything in this Lease to the contrary notwithstanding, Landlord and Tenant each waives all rights of recovery, claim, action or cause of action against the other, its agents (including partners, both general and limited), trustees, officers, directors, and employees, for any loss or damage that may occur to the Premises, or any improvements thereto, or the Building or any personal property of such party therein, by reason of any cause required to be insured against under this Lease, regardless of cause or origin, including negligence of the other party hereto; and each party covenants that, to the fullest extent permitted by law, no insurer shall hold any right to subrogation against such other party. Tenant shall advise its insurers of the foregoing and such waiver shall be a part of each policy maintained by Tenant which applies to the Premises, any part of the Building or Tenant’s use and occupancy of any part thereof.

(h) Any Building employee to whom property shall be entrusted by or on behalf of Tenant shall be deemed to be acting as Tenant’s agent with respect to such property and neither Landlord, the Building manager, if any, nor their respective agents shall be liable for any damage to the property of Tenant or others entrusted to employees of the Building, nor for the loss of or damage to any property of Tenant by theft or otherwise and Tenant shall indemnify Landlord of and from any loss or damages, costs or actions Landlord may suffer or incur as a result of such loss or damage to Property.

12. Damage or Destruction to Building:

(a) In the event that the Premises or the Building are damaged by fire or other insured casualty and the insurance proceeds have been made available therefor by the holder or holders of any mortgages or deeds of trust covering the Building, the damage shall be repaired by and at the expense of Landlord to the extent of such insurance proceeds available therefor, provided such repairs and restoration can, in Landlord’s reasonable opinion, be made within one hundred eighty (180) days after the occurrence of such damage without the payment of overtime or other premiums, and until such repairs and restoration are completed, the Base Rent shall be abated in proportion to the part of the Premises which is unusable by Tenant in the conduct of its business, as may be reasonably determined by Landlord, (but there shall be no abatement of Base Rent by reason of any portion of the Premises being unusable for a period equal to one day or less). Landlord agrees to notify Tenant within sixty (60) days after such casualty if it estimates that it will be unable to repair and restore the Premises within said one hundred eighty (180) day period. Such notice shall

7

set forth the approximate length of time Landlord estimates will be required to complete such repairs and restoration. Notwithstanding anything to the contrary contained herein, if Landlord cannot or estimates it cannot make such repairs and restoration within said one hundred eighty (180) day period, then Tenant may, by written notice to Landlord cancel this Lease, provided such notice is given to Landlord within fifteen (15) days after Landlord notifies Tenant in writing of the estimated time for completion of such repairs and restoration. Notwithstanding the preceding sentence, Tenant may not cancel this Lease as hereinabove stated if the damage to the Premises or the Building is in whole or in part the result of the act, omission, fault or gross negligence of Tenant, its agents, contractors, employees, licensees or invitees. Except as provided in this Section 12 there shall be no abatement of rent and no liability of Landlord by reason of any injury to or interference with Tenant’s business or property arising from the making of any such repairs, alterations or improvements in or to the Building, Premises or fixtures, appurtenances and equipment. Tenant understands that Landlord will not carry insurance of any kind on Tenant’s property, including furniture and furnishings, or on any fixtures or equipment removable by Tenant under the provisions of this Lease, or any improvement installed in the Premises by or on behalf of Tenant, and that Landlord shall not be obligated to repair any damage thereto or replace the same.

(b) In case the Building Complex throughout shall be so injured or damaged, whether by fire or otherwise (though the Premises may not be affected, or if affected, can be repaired within said one hundred eighty (180) days) that Landlord, within sixty (60) days after the happening of such injury, shall decide not to reconstruct or rebuild, then notwithstanding anything contained herein to the contrary, upon notice in writing to that effect given by Landlord to Tenant within said sixty (60) days, this Lease shall terminate from the date Tenant was unable to occupy the Premises, and both parties hereto shall be released and discharged from all further obligations hereunder (except those obligations which expressly survive termination of the Lease term). If Landlord terminates the Lease in accordance with this Section 12, Tenant shall pay the rent, properly apportioned up to date of such casualty. A total destruction of the Buildings shall automatically terminate this Lease effective on the date of such total destruction.

13. Condemnation:

(a) If more than 20% of the Premises shall be taken under power of eminent domain or transferred under threat thereof, then this Lease, at the option of either Landlord or Tenant exercised by either party giving notice to the other of such election within thirty (30) days after such conveyance or taking possession, whichever is earlier, shall forthwith cease and terminate and the rent shall be duly apportioned as of the date of such taking or conveyance. No award for any partial or entire taking shall be apportioned and Tenant hereby assigns to Landlord any award which may be made in such taking or condemnation, together with any and all rights of Tenant now or hereafter arising in or to the same or any part thereof. Notwithstanding the foregoing, Tenant shall be entitled to seek, directly from the condemning authority, an award for its removable trade fixtures, equipment and personal property and relocation expenses, if any, to the extent Landlord’s award is not diminished. In the event of a partial taking which does not result in a termination of this Lease, Base Rent shall be reduced in proportion to the reduction in the size of the Premises so taken and this Lease shall be modified accordingly. Promptly after obtaining knowledge thereof, Landlord or Tenant, as the case may be, shall notify the other of any pending or threatened condemnation or taking affecting the Premises or Buildings.

(b) If during the Term part of Building III of Building IV is so taken or purchased as set out in Section 13(a), then:

(1) If in the reasonable opinion of Landlord, substantial alteration or reconstruction of the Building is necessary or desirable as a result thereof, whether or not the Premises are or may be affected, Landlord shall have the right to terminate this Lease by giving the Tenant at least ninety (90) days’ written notice of such termination; and

(2) If more than one-third (1/3) of the number of square feet in the Premises is included in such taking or purchase and such reduction in square footage of the Premises renders the Premises unusable, in the reasonable estimation of Landlord, for the permitted use hereunder as conducted by Tenant, Landlord and Tenant shall each have, the right to terminate this Lease by giving the other at least ninety (90) days’ written notice thereof.

If either party exercises Its right to termination hereunder, this Lease shall terminate on the date stated in the notice; provided, however, that no termination pursuant to notice hereunder may occur later than one hundred and twenty (120) days after the date of such taking.

14. Prohibition on Assignment and Subletting:

(a) Tenant shall not voluntarily, by operation of law, or otherwise, assign, transfer, sublease or encumber this Lease or any interest herein or part with possession of all or any part of the Premises (any and all of which shall hereinafter be referred to as “Transfer”). Any Transfer and resulting subletting or assignment shall not relieve Tenant of its primary obligations hereunder, including the obligation for payment of all rents due hereunder. Any Transfer shall constitute a default hereunder and shall be void and shall confer no rights upon any third party, notwithstanding Landlord’s acceptance of rent payments from any purported transferee.

8

(b) In the event of any Transfer of this Lease or any portion thereof, Landlord shall have the following remedies, in addition to any other remedies hereunder or at law or equity: (I) to give Tenant written notice of Landlord’s intention to terminate this Lease on the date such notice is given or on any later date specified therein, whereupon, on the date specified in such notice, Tenant’s right to possession of the Premises shall cease and this Lease shall thereupon be terminated, except as to any uncompleted obligations of Tenant; (2) to re-enter and take possession of the Premises or the part thereof subject to such Transfer, and to enforce all rights of Tenant, and receive and collect all rents and other payments due to Tenant, in accordance with such sublet or assignment of the Premises, or any part thereof, as if Landlord was the subiessor or assignor, and to do whatever Tenant is permitted to do pursuant to the terms of such sublease or assignment; or, (3) Landlord, at its option and from time to time, may collect the rent from the subtenant or assignee, and apply the net amount collected to the rent herein reserved without any obligation to pay over to or credit Tenant for any amounts so collected by Landlord.

15. Estoppel Certificate: Tenant further agrees at any time and from time to time on or before ten (10) days after written request by Landlord, to execute, acknowledge and deliver to Landlord an estoppel certificate certifying (to the extent it believes the same to be true) that this Lease is unmodified and in full force and effect (or if there have been modifications, that the same is in full force and effect as modified, and stating the modifications), that to the knowledge of Tenant there have been no defaults thereunder by Landlord or Tenant (or if there have been defaults, setting forth the nature thereof), the date to which the rent and other charges have been paid, if any, Tenant claims no present charge, lien, claim or offset against rent, the rent is not prepaid for more than one month in advance and such other matters as may be reasonably required by Landlord, Landlord’s mortgagee, or any potential purchaser of the Building, it being intended that any such statement delivered pursuant to this section may be relied upon by any prospective purchaser of all or any portion of Landlord’s interest herein, or a holder of any mortgage or deed of trust encumbering any portion of the Building Complex. Tenant’s failure to deliver such statement within such time shall be a default under this Lease. Notwithstanding the foregoing, in the event that Tenant does not execute the statement required by this Section, Tenant hereby grants to Landlord a power of attorney coupled with an interest to act as Tenant’s attorney In fact for the purpose of executing such statement or statements required by this Section.

16. Default:

(a) The following events (herein referred to as an “event of default”) shall constitute a default by Tenant hereunder;

(1) Tenant shall fail to pay within five (5) business days after the date due of any installment of Base Rent, Additional Rent or any other amounts payable hereunder, however Tenant shall have the opportunity to cure the foregoing non-payment twice in any twelve month rolling time period by making payment within five (5) business days of written notice from Landlord notifying Tenant of non-receipt such Base Rent, Additional Rent or any other amounts payable hereunder;

(2) Tenant shall fail to perform any of the other non-monetary agreements, terms, covenants or conditions hereof on Tenant’s part to be performed, and such nonperformance shall continue for a period of thirty (30) days after written notice thereof by Landlord to Tenant; provided, however, that if Tenant cannot reasonably cure such nonperformance within thirty (30) days, Tenant shall not be in default if it commences cure within said thirty (30) days and diligently and continuously pursues the same to completion;

(3) This Lease or the estate of Tenant hereunder shall be transferred to or shall pass to or devolve upon any other person or party in violation of the provisions of this Lease

(4) This Lease or the Premises or any part thereof shall be taken upon execution or by other process of law directed against Tenant, or shall be taken upon or subject to any attachment at the instance of any creditor or claimant against Tenant, and said attachment shall not be discharged or disposed of within fifteen (15) days after the levy thereof;

(5) Tenant shall file a petition in bankruptcy or insolvency or for reorganization or arrangement under the bankruptcy laws of the United States or under any Insolvency act of any state, or shall voluntarily take advantage of any such law or act by answer or otherwise, or shall be dissolved or shali make an assignment for the benefit of creditors;

(6) Involuntary proceeding under any such bankruptcy law or insolvency act or for the dissolution of Tenant shall be instituted against Tenant, or a receiver or trustee shall be appointed of all or substantially all of the property of Tenant, and such proceedings shall not be dismissed or such receivership or trusteeship vacated within sixty (60) days after such institution or appointment;

(7) Tenant shall fail to occupy the Premises within thirty (30) days of the Commencement Date;

9

(8) Tenant shall fail to continuously operate it business within the Premises for a period of thirty (30) consecutive days;

(9) Tenant shall fail to obtain a release of any mechanic’s lien or post a bond, as required herein;

(10) A guarantor of this Lease, if any, or a general partner of Tenant (if Tenant is a general or limited partnership), becomes a debtor under any state or federal bankruptcy proceedings, or becomes subject to receivership or trusteeship proceedings, whether voluntary or involuntary; except in the case of a guarantor, Tenant shall not be In default if a substitute guarantor, with acceptable creditworthiness and financial abilities in light of the responsibilities of Tenant hereunder, and otherwise acceptable to Landlord, is provided to Landlord within fifteen (15) days; and

(11) All or a substantial part of the personal property of Tenant is seized, subject to levy or attachment, or similarly repossessed or removed from the Premises, or a receiver is appointed for all or substantially all of Tenant’s assets.

(b) Upon the occurrence of an event of default, Landlord shall have the right, at its election, then or at any time thereafter and while any such event of default shall continue, to pursue any one or more of the following remedies without notice or demand whatsoever:

(1) Except as otherwise provided in C.R.S. § 13-40-104(1)(e) and (e.5), as amended, give Tenant written notice of Landlord’s intent to terminate this Lease on the date of such notice or on any later date as may be specified herein, whereupon, Tenant’s right to possession of the Premises shall cease and this Lease, except as to Tenant’s liability, shall be terminated.

In the event this Lease is terminated in accordance with the provisions of this Section, Tenant shall remain liable to Landlord for damages in an amount equal to the Base Rent, Additional Rent and other sums which would have been owing by Tenant hereunder for the balance of the Term had this Lease not been terminated, less the net proceeds, if any, of any reletting of the Premises by Landlord subsequent to such termination, deducting from such proceeds all Landlord’s expenses including, without limitations, all repossession costs, brokerage commissions, legal expenses, attorneys’ fees, expenses of employees, alteration and repair costs and expenses of preparation for such reletting. Landlord shall be entitled to collect such damages from Tenant monthly on the days on which the Base Rent and other charges would have been payable hereunder if this Lease had not been terminated. Alternatively, at the option of the Landlord, in the event this Lease is so terminated, Landlord shall be entitled to recover forthwith against Tenant as damages for loss of the bargain and not as a penalty an aggregate sum, which at the time of such termination of this Lease, represents the excess, if any, of the aggregate of the Base Rent, Additional Rent and all other charges payable by Tenant hereunder that would have accrued for the balance of the Term over the aggregate fair market rental value of the Premises (such rental value to be computed on the basis of Tenant paying not only a Base Rent and Additional Rent to Landlord for the use and occupation of the Premises, but also such other charges as are required to be paid by Tenant under the terms of this Lease) for the balance of such Term, both discounted to present worth at the rate of four percent (4%) per annum.

(2) Reenter and take possession of the Premises or any part thereof, and repossess the same as of Landlord’s former estate and expel Tenant and those claiming through and under Tenant, and remove the effects of both or either, using such force for such purposes as may be necessary, without being liable for prosecution thereof, without being deemed guilty of any manner of trespass, and without prejudice to any remedies for arrears of Base Rent, Additional Rent and other charges payable or preceding breach of covenants or conditions. Should Landlord elect to reenter as provided in this subsection, or should Landlord take possession pursuant to legal proceedings or pursuant to any notice provided for by law, Landlord from time to time, without terminating this Lease, relet the Premises or any part thereof in Landlord’s or Tenant’s name, but for the account of Tenant, for such term or terms (which may be greater or less than the period which would otherwise have constituted the balance of the Term of this Lease) and on such conditions and upon other terms (which may include concessions of free Base Rent and alteration and repair of the Premises) as Landlord, in its sole discretion, may determine, and Landlord may collect and receive the Base Rents therefor. Landlord shall in no way be responsible or liable for any failure to relet the Premises, or any part thereof, or forany failure to collect any Base Rent due upon such reletting. No such reentry or taking possession of the Premises by Landlord shall be construed as an election on Landlord’s part to terminate this Lease unless a written notice of such intention is given to Tenant. No notice from Landlord hereunder or under a forcible entry and detainer statute or similar law shall constitute an election by Landlord to terminate this Lease unless such notice specifically so states. Landlord reserves the right following any such reentry and/or reletting to exercise its right to terminate this Lease by giving Tenant such written notice, in which event the Lease will terminate as specified in said notice.

10

In the event that Landlord does not elect to terminate this Lease but takes possession as provided for in this subsection, Tenant shall pay to Landlord (i) the Base Rent, Additional Rent and other charges as herein provided which would be payable hereunder if such repossession had not occurred, less (ii) the net proceeds, if any, of any reletting of the Premises after deducting all Landlord’s reasonable expenses including, without limitation, all repossession costs, brokerage commissions, legal expenses, attorneys’ fees, expenses of employees, alteration and repair costs and expense of preparation for such reletting. Tenant shall pay such Base Rent, Additional Rent and other sums to Landlord monthly on the days on which the Base Rent would have been payable hereunder if possession had not been retaken.

Landlord acknowledges that regardless of which remedy Is selected, it shall have a duty to mitigate the damages in accordance with Colorado law,

(c) No failure by Landlord to insist upon the strict performance of any agreement, term, covenant or condition hereof or to exercise any right or remedy consequent upon a breach thereof, and no acceptance of full or partial rent during the continuance of any such breach, shall constitute a waiver of any such breach of such agreement, term, covenant or condition. No agreement, term, covenant or condition hereof to be performed or complied with by Tenant, and no breach thereof, shall be waived, altered or modified except by written instrument executed by Landlord. No waiver of any breach shall affect or alter this Lease, but each and every agreement, term, covenant and condition hereof shall continue in full force and effect with respect to any other then existing or subsequent breach thereof. Notwithstanding any unilateral termination of this Lease, this Lease shall continue in force and effect as to any provisions hereof which require observance or performance of Landlord or Tenant subsequent to termination.

(d) Any rents or other amounts owing to Landlord hereunder which are not paid within ten (10) days of the date they are due, shall thereafter bear interest from the due date at the rate of eighteen percent (18%) per annum (“Interest Rate”) until paid. Similarly, any amounts paid by Landlord to cure any default of Tenant or to perform any obligation of Tenant, shall, if not repaid by the Tenant within five (5) days of demand by Landlord, thereafter bear interest from the date paid by Landlord at the interest Rate until paid. In addition to the foregoing, Tenant shall pay to Landlord whenever any Base Rent, Additional Rent or any other sums due hereunder at the time of default remain unpaid more than ten (10) days after the due date thereof, a late charge equal to ten percent (10%) of the amount due. Further, in the event of default by Tenant, in addition to all other rights and remedies, Landlord shall be entitled to receive from Tenant all sums, the payment of which may previously have been waived or abated by Landlord, or which may have been paid by Landlord pursuant to any agreement to grant Tenant a rental abatement or other monetary inducement or concession, including but not limited to any tenant finish allowance, moving allowance, and leasing commissions, together with interest thereon from the date or dates such amounts were paid by Landlord or would have been due from Tenant but for the abatement, at the Interest Rate, until paid; it being understood and agreed that such concession or abatement was made on the condition and basis that Tenant fully perform all obligations and covenants under the Lease for the entire term.

Notwithstanding anything in this Section 16 to the contrary, it is Landlord’s and Tenant’s understanding that in the event of default, Landlord should be made whole for any loss or damage it sustains as a result of the event of default, but that it should not be entitled to recover amounts for which it will otherwise be paid.

(e) Each right and remedy provided for in this Lease shall be cumulative and shall be in addition to every other right or remedy provided for in this Lease now or hereafter existing at law or in equity or by statute or otherwise, including, but not limited to, suits for injunctive or declaratory relief and specific performance. The exercise or commencement of the exercise by Landlord of any one or more of the rights or remedies provided for in this Lease now or hereafter existing at law or in equity or by statute or otherwise shall not preclude the simultaneous or subsequent exercise by Landlord of any or all other rights or remedies provided for in this Lease or now or hereafter existing at law or in equity or by statue or otherwise. All costs incurred by Landlord in connection with collecting any amounts and damages owing by Tenant pursuant to the provisions of this Lease or to enforce any provision of this Lease, including by way of example, but not limitation, reasonable attorneys’ fees from the date any such matter is turned over to an attorney, shall also be recoverable by Landlord from Tenant.

(f) The Tenant and Landlord each hereby expressly, irrevocably, fully and forever release, waive and relinquish any and all right to trial by jury and all right to receive punitive, exemplary and consequential damages from the other (or any past, present or future director, officer, member, partner, employee, agent, representative, or advisor of the other) In any claim, demand, action, suit, proceeding or cause of action in which the Tenant and Landlord are parties, which In any way (directly or Indirectly) arises out of, results from, or relates to, any of the following, in each case whether now existing or hereafter arising and whether based on contract or tort or any other legal basis; this Lease; any past, present or future act, omission, conduct or activity with respect to this Lease; any transactions, event or occurrence contemplated by this Lease; the performance of any obligation or the exercise of any right under this Lease; or the enforcement of this Lease. The Tenant and Landlord each agree that this Agreement constitutes written consent that trial by jury shall be waived in any such claim, demand, action, suit, proceeding or other cause of action and agree that the Tenant and Landlord each shall have the right at any time to file this Lease with the clerk or judge of any court in which any such claim, demand, action, suit, proceeding or other cause of action may be pending as written consent to waiver of trial by jury.

11

17. Security Deposit. Tenant, no later than the Commencement Date will deposit with Landlord the sum of $55,208.33 as security for the payment by Tenant of the Base Rent and all other sums herein agreed to be paid and for the faithful performance of all the terms, conditions and covenants of this Lease. If, at any time during the term hereof, Tenant shall be in default in the performance of any provisions of this Lease, then without limiting Landlord’s other remedies for such default, Landlord shall have the right, but not the obligation, to use said deposit, or so much thereof as necessary, in payment of any rent in default, reimbursement of any expense Incurred by Landlord, (including without limitation reasonable attorney’s fees), and in payment of any damages incurred by Landlord by reason of Tenant’s default. In such event, Tenant shall, on written demand of Landlord, forthwith remit to Landlord a sufficient amount in cash to restore said deposit to its original amount. In the event said deposit has not been utilized as aforesaid, said deposit, or as much thereof as has not been utilized for such purposes, shall be refunded to Tenant, without interest, within sixty (60) days after the termination of this Lease upon full performance of this Lease by Tenant and vacation of the Premises by Tenant. Landlord shall have the right to commingle said deposit with other funds of Landlord. Landlord may deliver the funds deposited herein by Tenant to any purchaser or transferee of Landlord’s Interest in the Premises in the event such interest is sold or transferred, and thereupon Landlord shall be discharged from further liability with respect to such deposit. If the claims of Landlord exceed the amount of said deposit, Tenant shall remain liable for the balance of such claims.

18. Removal of Tenant’s Property: All movable furniture and personal effects of Tenant not removed from the Premises upon the vacation or abandonment thereof or upon the termination of this Lease for any cause whatsoever shall conclusively be deemed to have been abandoned and may be appropriated, sold, stored, destroyed or otherwise disposed of by Landlord without notice to Tenant and without obligation to account therefor, and Tenant shall reimburse Landlord for all expenses incurred in connection with the disposition of such property.

19. Holdover: Should Tenant, without Landlord’s consent, holdover after the termination of this Lease and continue to pay rent, Tenant shall become a tenant from month to month only upon each and all of the terms herein provided as may be applicable to such month to month tenancy and any such holdover shall not constitute an extension of this Lease. During such holdover, without Landlord’s consent, Tenant shall pay monthly Base Rent equal to one hundred fifty percent (150%) of the Base Rent and Additional Rent due for the last month of the Term of the Lease, plus the other monetary charges as provided herein. In the event of Tenant holdover after the termination of this Lease with Landlord’s consent all other terms of this Section 20 shall apply, however, Tenant shall pay Landlord monthly Base Rent equal to one hundred fifty percent (150%) of the Base Rent and Additional Rent due for the last month of the Term of the Lease. Such tenancy (whether with or without Landlord’s consent) shall continue until terminated by Landlord, as provided by law, or until Tenant shall have given to Landlord at least thirty (30) days written notice prior to the last day of the calendar month intended as the date of termination of such month to month tenancy.

20. Common Areas and Management: Except the Premises and as otherwise specifically provided herein, all access roads, other areas of the Building Complex and the facilities or improvements furnished by Landlord are for the general and nonexclusive use in common of all tenants of the Building, and those persons invited upon the land upon which the Buildings are situated and shall be subject to the exclusive control and management of Landlord, and Landlord shall have the right, without obligation to establish, modify and enforce such rules and regulations, which the Landlord may deem reasonable and/or necessary. An affiliate of Landlord or an institutional quality third party management company (“Manager”) shall manage the Buildings. The Manager shall have a local representative whose office Is in reasonably close proximity to the Buildings, The Manager shall operate the Buildings in a first- class institutional quality manner.

21. Surrender and Notice: Upon the expiration or earlier termination of this Lease, Tenant shall promptly quit and surrender to Landlord the Premises broom clean, in good order and condition, ordinary wear and tear and loss by fire or other casualty excepted, and Tenant shall remove all of its movable furniture and other effects and such alterations, additions and improvements as Landlord shall require Tenant to remove pursuant to Section 8 hereof. In the event Tenant fails to so vacate the Premises on a timely basis as required, Tenant shall be responsible to Landlord for all Costs and damages, including but not limited to any amounts required to be paid to third parties who were to have occupied the Premises, incurred by Landlord as a result of such failure, plus interest thereon at the Interest Rate on all amounts not paid by Tenant within five (5) days of demand, until paid in full.

22. Sales. Conveyance and Assignment: Nothing In this Lease shall restrict the right of Landlord to sell, convey, assign or otherwise deal with its interest in the Buildings subject only to the rights of Tenant under this Lease. In the event Landlord conveys Its interest In the Buildings, Tenant shall, if requested by Landlord, execute an Estoppel Certificate for the benefit of the new owner.

23. Subordination and Attornment:

(a) Conditioned upon any current or future mortgagee entering into a nondisturbance agreement with Tenant In a form satisfactory to Tenant, based upon Tenant’s exercise of commercially reasonable discretion, this Lease is and shall be subject and subordinate in all respects to any and all mortgages and deeds of trust now or hereafter placed on the Buildings, the Building Complex or the land on which it is situated, and to all renewals, modifications, consolidations, replacements and extensions thereof.

12

(b) Subject to subsection (c), if the interest of Landlord is transferred to any person (herein called (“Purchaser”) by reason of foreclosure or other proceedings for enforcement of any mortgage or deed of trust, or by delivery of a deed in lieu of such foreclosure or other proceedings, Tenant shall immediately and automatically attorn to Purchaser.

(c) Upon attornment under subsection (b), this Lease shall continue in full force and effect as a direct Lease between Purchaser and Tenant, upon all of the same terms, conditions and covenants as are set forth in this Lease except that, after such attornment, Purchaser shall not be liable for any act of omission of any previous Landlord.

(d) The subordination and attornment provisions of this Section 23 shall be self- operating and except as set out in subsection (a), no further instrument shall be required. Nevertheless Tenant, on request by and without cost to Landlord or any successor in interest, shall execute and deliver any and all reasonable instruments further evidencing such subordination and (where applicable hereunder) attornment. Tenant hereby irrevocably appoints Landlord as attorney-In-fact of Tenant to execute, delivery and record any such documents and instruments in the name and on behalf of Tenant if Tenant fails to do so.

24. Payments After Termination: No payments of money by Tenant to Landlord after the termination of this Lease, in any manner, or after giving of any notice (other than a demand for payment of money) by Landlord to Tenant, shall reinstate, continue or extend the term of this Lease or affect any notice given to Tenant prior to the payment of such money, it being agreed that after the service of notice of the commencement of a suit or other final judgment granting Landlord possession of the Premises, Landlord may receive and collect any sums of rent due, or any other sums of money due under the terms of this Lease or otherwise exercise its rights and remedies hereunder. The payment of such sums of money, whether as rent or otherwise, shall not waive said notice or in any manner affect any pending suit or judgment theretofore obtained.

25. Authorities for Action and Notice:

(a) Except as otherwise provided herein, Landlord may, for any matter pertaining to this Lease, act by and through its building manager or any other person designated in writing from time to time.

(b) All notices or demands required or permitted to be given hereunder shall be in writing, and shall be deemed delivered when received by the addressee, if hand delivered or delivered by overnight courier, or three (3) days after the same is deposited in the United States mail, with proper postage prepaid, certified or registered mail, return receipt requested, addressed to Landlord or Tenant, as applicable, at the following addresses:

|

Landlord: |

|

Public Service Credit Union |

|

|

|

7055 East Evans Avenue |

|

|

|

Denver, CC 80224 |

|

|

|

Att: Facilities Manager |

|

|

|

|

|

cc: |

|

Hensley & Kennedy, P.C. |

|

|

|

1790 30th St., Suite 435 |

|

|

|

Boulder, CO 80301 |

|

|

|

Att: John F. |

|

|

|

Hensley |

|

Tenant: |

|

Zynex Medical, Inc. |

|

|

|

9990 Park Meadows |

|

|

|

Drive Lone Tree, |

|

|

|

Colorado 80124 Att: |

|

|

|

Thomas Sandgaard |

Either party shall have the right to designate in writing served as above provided, a different address to which notice is to be provided, which address change shall be effective thirty (30) days after delivery of notice of the same. The foregoing shall in no event prohibit notice from being given as provided in Rule 4 of the Colorado Rules of Civil Procedure, as the same may be amended from time to time. The failure to provide a courtesy copy of any notice required to be given hereunder shall not vitiate an otherwise validly given notice

13

26. Liability of Landlord: Landlord’s liability under this Lease shall be limited to Landlord’s estate and interest in the Buildings (or to the proceeds thereof) and no other property or other assets of Landlord shall be subject to levy, execution or other enforcement procedure for the satisfaction of Tenant’s remedies under or with respect to this Lease, the relationship of Landlord and Tenant hereunder or Tenant’s use and occupancy of the Premises. Nothing contained in this section shall be construed to permit Tenant to offset against rents due a successor landlord, a judgment (or other judicial process) requiring the payment of money by reason of any default of a prior landlord, except as otherwise specifically set forth herein.

27. Brokerage: Tenant represents and warrants that it has dealt with no brokers and agrees to defend, hold harmless and indemnity Landlord against any and all claims by any other person or entity claiming entitlement to any commission or other compensation as a result of a claim that such person or entity assisted Tenant in any manner with respect to the Lease. Additionally, Tenant acknowledges and agrees that Landlord shall have no obligation for payment of any brokerage fee or similar compensation to any person with whom Tenant has dealt or may in the future deal with respect to leasing of any additional or expansion space in the Buildings or renewals or extensions of this Lease.

28. Tenant’s Taxes: