UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

RADIANT SYSTEMS, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which the transaction applies: |

| (2) | Aggregate number of securities to which the transaction applies: |

| (3) | Per unit price or other underlying value of the transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of the transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

April 28, 2011

Dear Shareholder:

This year’s annual meeting of shareholders of Radiant Systems, Inc. will be held on Wednesday, June 8, 2011 at 10:00 a.m., local time, at Radiant’s headquarters located at 3925 Brookside Parkway, Alpharetta, Georgia 30022. You are cordially invited to attend.

The notice of annual meeting and a proxy statement, which describe the formal business to be conducted at the annual meeting, follow this letter.

Whether or not you attend the annual meeting, it is important that your shares be represented and voted at the annual meeting. Therefore, I urge you to promptly vote and submit your proxy by phone, via the Internet or by signing, dating and returning a proxy card. If you decide to attend the annual meeting, you will be able to vote in person even if you have previously submitted your proxy. Regardless of the number of shares you own, your careful consideration of, and vote on, the matters before our shareholders are important.

We look forward to seeing you at the annual meeting.

| Very truly yours, |

|

| John Heyman |

| Chief Executive Officer |

RADIANT SYSTEMS, INC.

3925 Brookside Parkway

Alpharetta, Georgia 30022

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD JUNE 8, 2011

The annual meeting of shareholders of Radiant Systems, Inc. will be held on Wednesday, June 8, 2011 at 10:00 a.m., local time, at our headquarters located at 3925 Brookside Parkway, Alpharetta, Georgia 30022, for the following purposes:

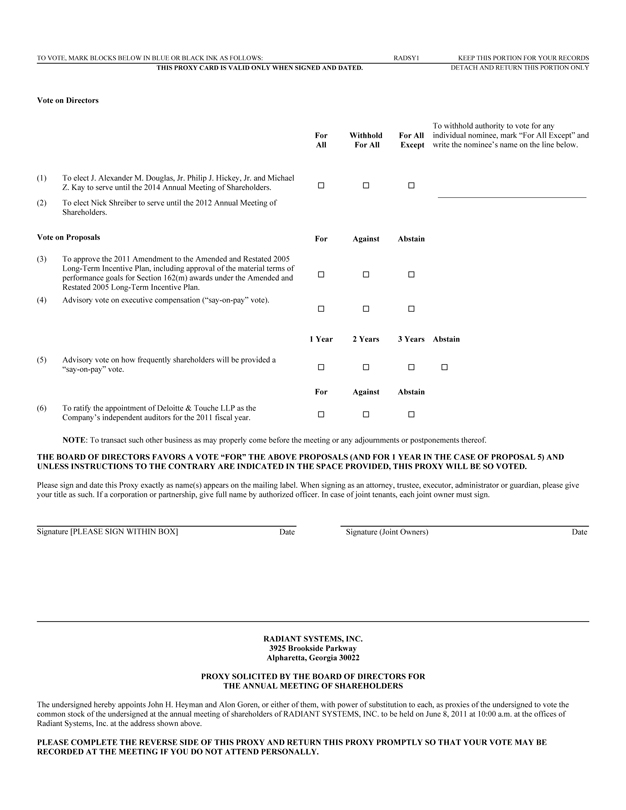

| (1) | To elect three Class III directors to serve until the 2014 annual meeting of shareholders, and until their successors are elected and qualified. The board of directors recommends that shareholders vote for its nominees. |

| (2) | To elect one Class I director to serve until the 2012 annual meeting of shareholders, and until his successor is elected and qualified. The board of directors recommends that shareholders vote for its nominee. |

| (3) | To approve the 2011 Amendment to the Amended and Restated 2005 Long-Term Incentive Plan. |

| (4) | To take a non-binding advisory vote on the compensation program for the Company’s Named Executive Officers, as disclosed in the Compensation Discussion and Analysis section of the proxy statement (a “say-on-pay” vote). The Board recommends that shareholders approve the compensation program, as set forth in the proposal. |

| (5) | To take a non-binding advisory vote on how frequently shareholders will be provided a “say-on-pay” vote. You have the opportunity to request a “say-on-pay” vote ever year, every two years, or every three years, or abstain from voting on the matter completely. The board of directors recommends that shareholders vote in favor of a “say-on-pay” vote every year. |

| (6) | To ratify the appointment of Deloitte & Touche LLP as our independent auditors for the 2011 fiscal year. The board of directors recommends that shareholders vote for the appointment. |

| (7) | To transact such other business as may properly come before the annual meeting or any adjournments or postponements thereof. |

Only shareholders of record at the close of business on April 22, 2011 will be entitled to notice of, and to vote at, the annual meeting or any adjournments or postponements of the annual meeting.

Shareholders are cordially invited to attend the annual meeting of shareholders. Whether or not you expect to attend the meeting in person, we urge you to vote your shares via the toll-free number or over the Internet. If you received a copy of the proxy by mail, you may sign, date and return the proxy in the envelope provided. If you attend the annual meeting, you may, if you wish, withdraw your proxy and vote in person.

| By Order of the Board of Directors, |

|

| John Heyman |

| Chief Executive Officer |

Alpharetta, Georgia

April 28, 2011

PLEASE COMPLETE THE PROXY PROMPTLY SO THAT YOUR VOTE MAY BE RECORDED AT THE MEETING IF YOU DO NOT ATTEND PERSONALLY.

RADIANT SYSTEMS, INC.

3925 Brookside Parkway

Alpharetta, Georgia 30022

ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD

JUNE 8, 2011

PROXY STATEMENT

Unless the context indicates otherwise, all references in this proxy statement to “we,” “us” and “our” refer to Radiant Systems, Inc. and its subsidiaries.

This proxy statement is furnished in connection with the solicitation of proxies by the board of directors of Radiant Systems, Inc. for its annual meeting of shareholders to be held on June 8, 2011, and any adjournments or postponements of such annual meeting, at the time and place and for the purposes set forth in the preceding notice of annual meeting. The expense of this solicitation will be paid by us. In addition, our officers and regular employees, at no additional cost, may assist in soliciting proxies by telephone. In accordance with rules and regulations of the Securities and Exchange Commission, instead of mailing a printed copy of our proxy materials to each shareholder of record, we are furnishing proxy materials to our shareholders on the Internet. If you have received a Notice of Internet Availability of Proxy Materials by mail, you will not receive a printed copy of the proxy materials other than as described below. Instead, the Notice of Internet Availability of Proxy Materials will instruct you as to how you may access and review all of the important information contained in the proxy materials. If you received a Notice of Internet Availability of Proxy Materials by mail and would like to receive a printed copy of our proxy materials, you should follow the instructions for requesting such materials included in the Notice of Internet Availability of Proxy Materials. The Notice of Internet Availability of Proxy Materials is first being sent to shareholders on or about April 28, 2011. The proxy statement and the accompanying proxy are first being made available to shareholders on or about April 28, 2011. The address of our principal executive offices is 3925 Brookside Parkway, Alpharetta, Georgia 30022.

Our board of directors has designated Alon Goren and John H. Heyman, and each or either of them, as proxies to vote the shares of our common stock solicited on behalf of our board of directors. Any proxy given pursuant to this solicitation may be revoked by any shareholder who attends the annual meeting and gives oral notice of his election to vote in person, without compliance with any other formalities. In addition, any proxy given pursuant to this solicitation may be revoked prior to the annual meeting by delivering to our Corporate Secretary an instrument revoking it or a duly executed proxy for the same shares bearing a later date. Proxies that are returned properly executed and not revoked will be voted in accordance with the shareholder’s directions specified in such proxy. If you hold your shares in a bank or brokerage account and do not provide voting instructions on a “non-routine” proposal, including the election of directors, within ten days of the annual meeting, the bank or broker may not vote your shares on such proposal. Abstentions and broker non-votes will not be counted as votes either in favor of or against the matter with respect to which the abstention or broker non-vote relates, but will be counted as present for the purpose of determining the presence of a quorum for the transaction of business. If a quorum is present, under applicable state law and our bylaws, abstentions and broker non-votes will have no effect on the outcome of the voting for any matters described in this proxy statement. A majority of our outstanding shares of common stock will constitute a quorum for the transaction of business at the annual meeting.

The record of shareholders entitled to notice of, and to vote at, the annual meeting was taken on April 22, 2011. On that date, we had outstanding and entitled to vote 40,159,610 shares of common stock. Each outstanding share of common stock entitled to vote is entitled to one vote upon each matter submitted to a vote at any meeting of shareholders. All elections shall be determined by a plurality of the votes cast. The 2011 Amendment to our Amended and Restated 2005 Long-Term Incentive Plan, which provides for the re-approval of the material terms, as amended, of the Amended and Restated 2005 Long-Term Incentive Plan with respect to the material terms of performance goals for awards made pursuant to Section 162(m), will be approved if a quorum exists and a majority of the total votes cast on the proposal are voted in favor of it. The ratification of the appointment of Deloitte & Touche LLP as our independent auditors for the 2011 fiscal year will be approved if a quorum exists and the number of votes cast in favor of such proposal exceeds the number of votes cast against such proposal.

2

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information regarding the beneficial ownership of our common stock as of April 22, 2011 by each person known by us to be the beneficial owner of more than 5% of our outstanding common stock, each of our directors, each of our director nominees, each of our named executive officers, and all of our directors and executive officers as a group.

| Name of Beneficial Owner | Number of Shares Beneficially Owned (1) |

Percent of Shares Outstanding |

||||||

| Alon Goren (2) |

2,952,442 | (3) | 7.35 | % | ||||

| John H. Heyman |

640,279 | (4) | 1.59 | % | ||||

| Andrew S. Heyman |

468,557 | (5) | 1.17 | % | ||||

| Mark E. Haidet |

138,232 | (6) | * | |||||

| Carlyle Taylor |

154,486 | (7) | * | |||||

| James S. Balloun |

103,372 | (8) | * | |||||

| William A. Clement, Jr. |

84,925 | (9) | * | |||||

| J. Alexander M. Douglas, Jr. |

103,325 | (10) | * | |||||

| Philip J. Hickey, Jr. |

0 | (11) | * | |||||

| Michael Z. Kay |

125,800 | (12) | * | |||||

| Donna A. Lee |

64,925 | (13) | * | |||||

| Nick Shreiber |

0 | (14) | * | |||||

| AllianceBernstein L.P. |

2,206,307 | (15) | 5.49 | % | ||||

| BlackRock, Inc. |

3,975,755 | (16) | 9.90 | % | ||||

| Eagle Asset Management, Inc. |

2,578,198 | (17) | 6.42 | % | ||||

| All directors and executive officers as a group (12 persons) |

4,836,343 | (18) | 12.04 | % | ||||

| * | Less than 1% of outstanding shares. |

| (1) | “Beneficial ownership” includes shares for which an individual, directly or indirectly, has or shares voting or investment power, or both, and also includes options that are exercisable within 60 days of April 22, 2011. Unless otherwise indicated, all of the listed persons have sole voting and investment power over the shares listed opposite their names. Beneficial ownership as reported in the above table has been determined in accordance with Rule 13d-3 of the Securities Exchange Act of 1934, as amended, referred to in this proxy statement as the Exchange Act. Pursuant to the rules of the Securities and Exchange Commission, referred to in this proxy statement as the SEC, certain shares of our common stock that a beneficial owner has the right to acquire within 60 days pursuant to the exercise of stock options or warrants are deemed to be outstanding for the purpose of computing the percentage ownership of such owner, but are not deemed outstanding for the purpose of computing the percentage ownership of any other person. |

| (2) | The business address of Alon Goren is 3925 Brookside Parkway, Alpharetta, Georgia 30022. |

| (3) | Includes 148,675 shares subject to stock options that are currently exercisable. Includes 150,000 shares pledged as security. |

| (4) | Includes 371,875 shares subject to stock options that are currently exercisable. |

| (5) | Includes 308,401 shares subject to stock options that are currently exercisable. |

| (6) | Includes 72,578 shares subject to stock options that are currently exercisable. |

| (7) | Includes 92,778 shares subject to stock options that are currently exercisable. |

| (8) | Includes 79,436 shares subject to stock options that are currently exercisable. |

| (9) | Includes 66,036 shares subject to stock options that are currently exercisable. |

| (10) | Includes 84,436 shares subject to stock options that are currently exercisable. |

| (11) | Includes 0 shares subject to stock options that are currently exercisable. Mr. Hickey was elected as a director on February 25, 2011. |

| (12) | Includes 104,436 shares subject to stock options that are currently exercisable. |

| (13) | Includes 46,036 shares subject to stock options that are currently exercisable. |

| (14) | Includes 0 shares subject to stock options that are currently exercisable. Mr. Shreiber was elected as a director on March 23, 2011. |

| (15) | Based on a Schedule 13G filed with the SEC on February 9, 2011 by AllianceBernstein L.P. We make no representation as to the accuracy or completeness of the information reported. The address of AllianceBernstein L.P. is 1345 Avenue of the Americas, New York, New York 10105. |

| (16) | Based on a Schedule 13G/A filed with the SEC on March 11, 2011 by BlackRock, Inc. We make no representation as to the accuracy or completeness of the information reported. The address of BlackRock, Inc. is 40 East 52nd Street, New York, New York 10022. |

| (17) | Based on a Schedule 13G filed with the SEC on January 27, 2011 by Eagle Asset Management, Inc. We make no representation as to the accuracy or completeness of the information reported. The address of Eagle Asset Management, Inc. is 880 Carillon Parkway, St. Petersburg, Florida 33716. |

| (18) | Includes 1,374,687 shares subject to stock options that are currently exercisable. |

3

ELECTION OF DIRECTORS

Our board of directors consists of nine directors, divided into three classes, with the members of each class serving for staggered three-year terms. The terms of the three Class III directors, J. Alexander M. Douglas, Jr., Philip J. Hickey, Jr. and Michael Z. Kay, will expire at the annual meeting, and each of these directors has been nominated for reelection for a term expiring at our 2014 annual meeting of shareholders. Philip J. Hickey was elected as a Class III director by the board of directors on February 25, 2011.

In addition, the interim term of one of our Class I directors, Nick Shreiber, is expiring at the annual meeting, and he has been nominated for reelection for a term expiring at our 2012 annual meeting of shareholders. Nick Shreiber was elected as a Class I director by the board of directors on March 23, 2011.

Our board of directors recommends that you vote “for” the election of these nominees.

Each of the nominees has consented to being named in this proxy statement and to serve as one of our directors if elected. In the event that any director nominee withdraws or for any reason is not able to serve as a director, the proxy will be voted for such other person as may be designated by our board of directors, but in no event will the proxy be voted for more than four nominees. The affirmative vote of a plurality of all votes cast at the meeting is required for the election of the four director nominees standing for election. We have no reason to believe that any director nominee will not serve if elected.

PROPOSAL 1

The following persons have been nominated for election to our board of directors as Class III directors to succeed themselves for a term of three years, expiring at the 2014 annual meeting of shareholders, and until their successors are elected and qualified:

J. Alexander M. Douglas, Jr., age 49, has served as President of Coca-Cola North America – The Coca-Cola Company since September 2006 and is a member of its Executive Committee. Mr. Douglas was, from January 2003 until September 2006, the Chief Customer & Commercial Officer and a Senior Vice President of The Coca-Cola Company. He joined the Coca-Cola Company in January 1988 as district sales manager in Coca-Cola Fountain, USA and held a variety of positions with increasing responsibility. In 1994, he was named Vice President for CCE Sales & Marketing Group, and in 1998 his responsibilities expanded to include the entire North American Field Sales & Marketing Groups. Mr. Douglas graduated from the University of Virginia in 1983 and began his career at The Procter & Gamble Company where he worked in a variety of sales and sales management positions. Mr. Douglas has been one of our directors since August 2001.

As a member of our board of directors, Mr. Douglas’s extensive career with The Coca-Cola Company makes Mr. Douglas an expert in all aspects of the convenience store and restaurant industries. Mr. Douglas has broad and in-depth knowledge of the trends, top management and customer base in these industries, which is very valuable to us in our business development, customer relations and strategic planning.

Philip J. Hickey, Jr., age 56, was elected to our board of directors on February 25, 2011. Mr. Hickey has served as chairman of the board of O’Charley’s, Inc., a multi-brand public restaurant company based in Nashville, Tennessee, since 2009. Prior to 2009, he served as CEO of RARE Hospitality International, Inc., owner of Longhorn Steakhouse and The Capital Grille, from 2001 to 2007 when it was acquired by Darden Restaurants. During that time, Mr. Hickey and his team grew the company to more

4

than 300 restaurants and over 20,000 employees, and increased annual revenues from $90 million to $1.3 billion. Mr. Hickey’s past professional experience also includes President and COO of Rio Bravo, International, Inc. and President and COO of Innovative Restaurant Concepts. He also serves on the board of directors for the National Restaurant Association (NRA) and will assume the role as chairman of that organization in 2013.

As a member of our board of directors, Mr. Hickey’s extensive management experience in the restaurant and hospitality industries serves to provide insight into the needs and desires of a core market for the Company’s products and services. Mr. Hickey also has financial expertise in fields in which the Company markets its products, which brings a greater understanding to the board of competitive strategies for winning market share in such industries.

Michael Z. Kay, age 71, served as Chairman of the Board of Magnatrax Corporation, a supplier of engineered products for construction industries, from September 2001 to 2004, and is now retired. From September 1991 to September 2001, Mr. Kay served as President and Chief Executive Officer of LSG Sky Chefs, the world’s largest in-flight catering alliance. Mr. Kay served as Executive Vice President and Management Consultant of Charter Medical Corporation from May 1990 to May 1991. From 1964 to 1991, Mr. Kay held management positions within the hotel and hospitality industry with several organizations, including Portman Hotel Company, Omni International Hotels, Ltd., and Americana Hotels, Inc. Mr. Kay has been one of our directors since April 2002.

As a member of our board of directors, Mr. Kay, through his senior executive positions in the hospitality and food service industries, brings extensive experience, knowledge and skills in operations management which are very valuable to us as we strive to continually improve our operations and profitability. Mr. Kay is also very experienced in understanding and implementing strategic growth, both organically and through acquisitions.

5

PROPOSAL 2

The following person has been nominated for election to our board of directors as a Class I director to succeed himself for a term of one year, expiring at the 2012 annual meeting of shareholders, and until his successor is elected and qualified:

Nick Shreiber, age 62, was elected to our board of directors on March 25, 2011. Since 2006, Mr. Shreiber has advised and coached executives of international companies on issues relating to strategy, organization and operations. In 2005, he completed an 18-year international career at the Tetra Pak Group, a world leader in packaging and processing solutions for food, during the last five of which he served as President and Chief Executive Officer. He previously was a partner with McKinsey & Co., where he spent eight years with engagement responsibility for major clients in Europe and Latin America in diverse industrial and service sectors.

As a member of our board of directors, Mr. Shreiber brings strong international and operational experience to the board of directors, with more than 30 years of senior leadership experience in both line management and management consulting. Mr. Shreiber’s extensive international experience assists us in the development and implementation of strategies in the global marketplace.

Each of the following persons is a member of the board of directors who is not standing for election to the board of directors this year and whose term will continue after the 2011 annual meeting of shareholders.

Class I Directors, serving for a term expiring at the 2012 annual meeting of shareholders:

William A. Clement, Jr., age 68, was elected President and CEO of the Atlanta Life Financial Group, Inc. in June 2008, and stepped down from that position on March 31, 2011. Founded in 1905, Atlanta Life Financial Group, Inc. is a privately-held financial services company. Mr. Clement served as the Chairman and CEO of DOBBS, RAM & Company from 1988 to 2008, and now serves as its non-Executive Chairman of the Board of Directors. Appointed by President Carter, Mr. Clement served as the Associate Administrator of the U.S. Small Business Administration in Washington, D.C. during the Carter Administration. Mr. Clement also served as the Vice President and Senior Loan Officer of the Citizens Trust Bank, Atlanta, Georgia. Mr. Clement received his BA from Morehouse College and his MBA from the Wharton Business School at the University of Pennsylvania. He is a board member of TRX, Inc. and a former board member of the National Cooperative Bank, Washington, D.C. Mr. Clement has served as one of our directors since April 2005.

As a member of our board of directors, Mr. Clement’s extensive professional experience in banking, investment banking and finance are very valuable to us, particularly with respect to his service as Chairman of our audit committee and in assisting us with our financial compliance and corporate governance matters.

Alon Goren, age 45, has served as Chairman of our board of directors and as our Chief Technology Officer since our inception in 1985. Mr. Goren became sole Chairman of our board of directors in January 2004. Mr. Goren has a B.S. in Computer Systems Engineering from Rensselaer Polytechnic Institute.

As a member of our board of directors, Mr. Goren, as our Chairman and Chief Technology Officer, one of our Company’s founders and our second largest shareholder, possesses essential technical knowledge, strategic vision and vast understanding of our industry. Mr. Goren also has the greatest historical knowledge of our Company’s business and the ability to apply our technology to advance our business.

6

Class II Directors, serving for a term expiring at the 2013 annual meeting of shareholders:

James S. Balloun, age 72, retired as Chairman and Chief Executive Officer of Acuity Brands, Inc. on September 1, 2004, having served in those positions since November 2001. He is the former Chairman, President and Chief Executive Officer of National Service Industries, where he led the company for five years prior to the spin-off of Acuity Brands, Inc. in November 2001. Acuity Brands was a $2 billion manufacturer of lighting fixtures and cleaning chemicals. Mr. Balloun served as a Director of McKinsey & Company, Inc. from 1976 until 1996. Mr. Balloun received an M.B.A. from Harvard Business School in 1965. He also holds a B.S. degree in industrial engineering from Iowa State University, 1960. Mr. Balloun is a director of Invesco Mortgage Capital Inc. and Enzymatic Deinking Technologies, and a former director of Georgia-Pacific Corporation and Wachovia Corporation. Mr. Balloun has been one of our directors since April 1997.

As a member of our board of directors, Mr. Balloun brings extensive experience by virtue of his senior executive positions across a variety of industries and geographic areas, and possesses comprehensive knowledge, experience and skills that are particularly valuable to us in connection with our strategic planning and acquisitions, including assisting us with the successful integration of acquisitions.

John H. Heyman, age 49, has served as our Chief Executive Officer since January 2002 and as one of our directors since June 1996. Mr. Heyman served as our Chief Financial Officer from September 1995 to January 2003 and as our Executive Vice President from September 1995 to December 2001. Mr. Heyman served as Vice President and Chief Financial Officer of Phoenix Communications, Inc., a commercial printer, from March 1991 to August 1995. From 1989 to 1991, Mr. Heyman served as Vice President—Acquisitions of Forsch Corporation, a diversified manufacturing company. From 1983 to 1987, Mr. Heyman served in a variety of capacities with Arthur Andersen LLP, where he worked primarily with middle market companies and technology firms. Mr. Heyman received an MBA from Harvard Business School and a BBA degree in accounting from the University of Georgia. He is the brother of Andrew S. Heyman, one of our executive officers.

As a member of our board of directors, Mr. Heyman, as our Chief Executive Officer, has first hand knowledge of all aspects of our business and daily operations; thus Mr. Heyman is essential to the board’s management of our Company. Mr. Heyman brings the strategic vision for the Company to the board, which serves as a framework for and enriches our board of director discussions, and is an insightful and constructive leader capable of effectively synthesizing and responding to the board’s guidance and directions.

Donna A. Lee, age 56, retired as Chief Marketing Officer, Business Markets of BellSouth Corp. in January 2007, having served in that position since December 2000, where she was responsible for marketing, product management, strategic pricing, sales operation and information technology for business markets. Ms. Lee began her career with AT&T Inc. in June 1976 and held a variety of engineering, operations and sales/marketing assignments until being named a company officer in 1993. Ms. Lee holds an M.B.A. from Georgia State University and a B.S. in mathematics from Mary Washington College, and has completed the Advanced Management Program at Harvard University. Ms. Lee has been one of our directors since March 2007.

As a member of our board of directors, Ms. Lee, through her long career with Bell South and AT&T, possesses extensive marketing and operational experience, knowledge and skills that are particularly valuable to us in the development and implementation of our sales and marketing efforts, as well as our strategic planning.

7

PROPOSAL 3

APPROVAL OF THE 2011 AMENDMENT TO THE

AMENDED AND RESTATED 2005 LONG-TERM INCENTIVE PLAN

Our 2005 Long-Term Incentive Plan was originally approved by the Compensation Committee of the Company’s board of directors on May 6, 2005, and was subsequently approved by shareholders on August 8, 2005. The 2005 Long-Term Incentive Plan was later amended and restated, effective July 14, 2008, as approved by shareholders on October 1, 2008. The Plan was later amended effective May 29, 2009, and was again amended effective as of March 25, 2010 and subsequently approved by shareholders May 27, 2010. The Amended and Restated 2005 Long-Term Incentive Plan is referred to in this proxy statement as the 2005 Plan, and is attached hereto as Appendix B.

On March 23, 2011, our board of directors adopted an amendment to the 2005 Plan (the “2011 Amendment”), subject to shareholder approval. The 2011 Amendment, which is attached hereto as Appendix A and is described in greater detail below, will become effective upon shareholder approval. Our board adopted the 2011 Amendment, subject to shareholder approval, to ensure that all awards can be made under the 2005 Plan that comply with the “performance-based” requirements under Section 162(m) of the United States Internal Revenue Code (“Code Section 162(m)”) for tax deductibility of amounts paid to certain executive officers, to remove the single trigger automatic vesting of awards under the 2005 Plan upon a Change in Control, and to eliminate certain methods of paying the Option Price of Options awarded under the 2005 Plan. Code Section 162(m) generally does not allow publicly held companies to deduct more than $1 million in any year for compensation paid to certain executive officers unless that compensation satisfies certain exceptions, one of which is performance-based compensation.

One requirement for performance-based compensation under Code Section 162(m) is that the “material terms” of a performance goal under which the compensation is to be paid must be disclosed to and re-approved by shareholders every five years. The material terms of a performance goal include: (i) the employees eligible to receive compensation, (ii) a description of the business criteria on which the performance goal is based, and (iii) the maximum amount of compensation that could be paid to any employee. The 2011 Amendment amends in full each of such material terms of the performance goals under the 2005 Plan; accordingly, shareholder approval of the 2011 Amendment will constitute shareholder re-approval of the material terms of the performance goals under the 2005 Plan for Code Section 162(m) purposes. The material terms of the performance goals under the 2005 Plan, giving effect to the 2011 Amendment, are described below, followed by a description of other relevant provisions of the 2005 Plan, giving effect to the 2011 Amendment. Our board of directors recommends that you vote “for” the 2011 Amendment to the 2005 Plan.

2011 Amendment of the 2005 Plan

On March 23, 2011, our board of directors approved the 2011 Amendment to the 2005 Plan to make the following changes:

| • | to limit employee eligibility under the 2005 Plan to “key employees,” as determined by the Compensation Committee; |

| • | to add additional types of performance criteria that can be used while meeting the performance-based requirements of Code Section 162(m); |

| • | to require that the Compensation Committee certify that any performance goals have been met before payment can be made to an employee (to include language that ensures the Compensation Committee complies with the performance-based requirements of Code Section 162(m)); |

8

| • | to limit the number of Performance Units, shares of Restricted Stock, and Phantom Stock that can be issued to an employee to 250,000 each year so that these types of grants can be made as performance-based under Code Section 162(m); |

| • | to remove the payment methods “by offset against compensation due” and “through a ‘margin’ commitment” as methods of paying the Option Price of Stock Options and Stock Appreciation Rights; and |

| • | to eliminate an automatic vesting of an award upon a Change in Control and add a “double trigger,” or the requirement that there be a termination of employment by the Company (other than for Cause) or by the Participant for Good Reason within one year following a Change in Control, for the 2005 Plan’s Change in Control vesting provisions to be operable. |

Material Terms of the Performance Goals Under the 2005 Plan Incorporating Changes Made by the 2011 Amendment

Persons Eligible to Participate in the 2005 Plan

Awards may be granted to our key employees and directors and key employees and directors of our subsidiaries. Only our key employees, however, are eligible to receive Incentive Stock Options. The Compensation Committee will determine which of our employees are key employees. In making awards to participants, our Compensation Committee takes into account the duties of the respective participants and such other factors as our Compensation Committee deems relevant in connection with accomplishing the purposes of the 2005 Plan. All of our key employees and directors are eligible for awards under the 2005 Plan; however, other than awards previously granted (including those awards described below), it is not possible at this time to predict the types or amounts of awards that will be granted or the individuals that will receive such awards in the future.

Shares Subject to the 2005 Plan

The 2005 Plan currently provides that the maximum number of shares of our common stock available for awards is 5,900,000. The maximum number of shares subject to any award to an employee in any calendar year is 250,000. For information on the current shares available for grant and options and awards outstanding under the 2005 Plan, see “Executive Compensation – Securities Authorized for Issuance Under Equity Compensation Plans” on page 44.

Performance-Based Award Determinations

The 2005 Plan provides the Compensation Committee with the discretionary authority to structure one or more stock issuances or Performance Unit awards so that the shares subject to those particular awards will only be issued and/or vest upon the achievement of certain predetermined performance criteria. The goals can be based on one or more of the following criteria: earnings per share, economic value created, market share (actual or targeted growth), net income (before or after taxes), operating income, adjusted operating income (excluding amortization and stock-based compensation expense), adjusted net income after capital charge, return on assets (actual or targeted growth), return on capital (actual or targeted growth), return on equity (actual or targeted growth), return on investment (actual or targeted growth), revenue (actual or targeted growth), cash flow, operating margin, share price, share price growth, total shareholder return, earnings before interest, taxes, depreciation, and amortization (EBITDA), earnings before interest and taxes (EBIT), costs, expense reduction or expense management, overall sales growth, net operating profit, net operating profit after tax, shareholder value added, economic profit, and strategic business criteria consisting of one or more objectives based on meeting specified market penetration goals, productivity measures, geographic business expansion goals, cost targets, customer satisfaction or employee satisfaction goals, goals relating to merger synergies,

9

management of employment practices or employee benefits, or supervision of litigation and information technology, and goals relating to acquisitions or divestures of Subsidiaries and/or other affiliates or joint ventures. Such performance criteria may be determined solely by reference to the performance of Radiant, a subsidiary, or a division or unit of either of the foregoing, or based on comparisons of any of the performance measures relative to other companies. These criteria may have a minimum performance standard below which no amount will be paid, a target performance standard and a maximum performance standard above which no additional payments will be made. In all cases, such measures will be on a reported basis, adjusted at the Compensation Committee’s sole discretion, as permitted by the terms of the 2005 Plan. All performance goals shall be subject to the requirement that the Compensation Committee certify that the performance goal(s) and all other material terms of an award have been met before any payment shall be made.

Other Relevant Provisions of the 2005 Plan Incorporating Changes Made by the 2011 Amendment

Types of Awards Under the 2005 Plan

The 2005 Plan provides for the grant of Incentive Stock Options, Non-Qualified Stock Options, Stock Appreciation Rights, Restricted Stock, Performance Units and Phantom Stock.

Administration of the 2005 Plan

The 2005 Plan is administered by the Compensation Committee of our board of directors. Subject to the provisions of the 2005 Plan, our Compensation Committee has the authority to determine, among other things, the individuals to whom awards shall be granted and to determine exercise prices, vesting requirements, the term of and the number of shares covered by each award, and the form of the award to be granted.

Incentive Awards

All Awards. Each award granted under the 2005 Plan will be represented by an agreement in a form approved by our Compensation Committee. The award agreement will be subject to and will incorporate the terms and conditions required under the 2005 Plan or as required by our Compensation Committee for the form of the award granted and such other terms and conditions as our Compensation Committee may specify.

Stock Options. The 2005 Plan authorizes our Compensation Committee to grant options to purchase shares of common stock to our eligible employees and non-employee directors and to eligible employees and non-employee directors of our subsidiaries, and to grant Incentive Stock Options to purchase shares of common stock to our eligible employees.

The exercise price of stock options granted under the 2005 Plan will be determined by our Compensation Committee, but may not be less than the fair market value (as defined in the 2005 Plan) per share of our common stock on the date of the grant of the option (or, in the case of certain Incentive Stock Options as described below, 110% of fair market value).

Stock options may be exercised in whole or in part by the option holder, but in no event later than seven years from the date of the grant. Any Incentive Stock Option granted under the 2005 Plan to a participant who owns directly or indirectly (under applicable ownership attribution rules) more than 10% of the total combined voting power of all classes of our stock or the stock of any of our subsidiaries may not be purchased at a price less than 110% of the market price on the day the option is granted, and no such option may be exercised more than five years from the date of grant.

10

The purchase price for the shares may be paid in cash, shares of our common stock owned by the participant for more than six months, by withholding shares of common stock issuable upon exercise of the stock option, by a same-day sale commitment, by a combination of the above or by another method acceptable to our Compensation Committee, in each case, as determined by our Compensation Committee and set forth in the applicable award agreement.

Stock options granted under the 2005 Plan are exercisable during the lifetime of the participant only by the participant. All stock options granted under the 2005 Plan are non-transferable except by will or under the laws of descent and distribution.

Stock Appreciation Rights. Upon exercise of a Stock Appreciation Right, a participant will be entitled to receive an amount in cash or shares of common stock or a combination thereof equal in value to the excess of the fair market value of one share of common stock on the date of exercise over the fair market value of one share of common stock on the date of grant (as set forth in the applicable award agreement), multiplied by the number of shares in respect of which the Stock Appreciation Right is exercised. Any shares of stock reserved but not required for such exercise will be cancelled and will not be added back into the total shares available for awards under the 2005 Plan. Stock Appreciation Rights may be exercised in whole or in part by a participant, but in no event later than seven years from the date of grant.

Performance Units. In granting Performance Units, our Compensation Committee will determine a performance period of one or more years and will determine the performance objectives for grants of Performance Units. Performance objectives may vary from participant to participant and between groups of participants and may be based upon such criteria or combination of factors as our Compensation Committee may deem appropriate and which are set forth in the “Performance-Based Award Determinations” section above. Performance Units may be paid in cash or shares of common stock or a combination thereof.

At the beginning of a performance period, our Compensation Committee will determine for each participant eligible for Performance Units the amount of the award (which may be fixed or may vary in accordance with the applicable performance goals) that will be paid as an award if the relevant measure of performance for the performance period is met.

Restricted Stock. Restricted Stock granted under the 2005 Plan will be subject to a restriction period (after which restrictions shall lapse) commencing on the date of grant of the award and ending on such date or upon the achievement of such performance or other criteria as our Compensation Committee shall determine.

Except as otherwise provided in the 2005 Plan, no shares of Restricted Stock may be sold, exchanged, transferred, pledged or otherwise disposed of during the restriction period. Our Compensation Committee may require certificates for Restricted Stock delivered under the 2005 Plan to be held in custody by a bank or other institution or by us until the restriction period expires or the restrictions thereon otherwise lapse. In addition, our Compensation Committee may require the recipient to deliver a stock power of attorney endorsed in blank relating to the Restricted Stock as a condition of receipt of Restricted Stock. If the participant ceases to be employed by or to provide services to us before the end of the restriction period, the Restricted Stock may be forfeited.

Phantom Stock. For each share of Phantom Stock awarded under the 2005 Plan, a participant is entitled to receive an amount in cash and/or shares of common stock equal in value to the fair market value of one share of common stock at the applicable date or upon the occurrence of an applicable event as specified in the award agreement.

11

Effects of a Change in Control

Under the 2005 Plan, special vesting rules apply upon the occurrence within one year following a Change in Control Event, as defined in the 2005 Plan, of (i) a Termination by the Company, other than for Cause, or (ii) a Termination by the Participant for Good Reason. If these rules are applicable, (A) Stock Appreciation Rights and Options not previously exercisable and vested shall become fully exercisable and vested, (B) the restrictions and deferral limitations upon any Restricted Stock Award shall lapse and such shares and awards shall be deemed fully vested, and (C) the rights to receive any Performance Units shall become fully vested.

Amendment and Termination of the 2005 Plan

With respect to any shares of common stock at the time not subject to an award, our board of directors may at any time terminate, modify or amend the 2005 Plan in any respect, provided always that no such termination, modification or amendment shall terminate any outstanding award previously granted under the 2005 Plan (unless we are liquidated or dissolved) and no modification or amendment shall be made absent the approval of our shareholders to: (1) increase the total number of shares which may be issued or delivered under the 2005 Plan; (2) make any change in the class of individuals eligible to receive awards; (3) extend the period set forth in the 2005 Plan during which awards may be granted; or (4) make any changes that require shareholder approval under the rules and regulations of any securities exchange on which our common stock is traded. Our board of directors may also suspend the granting of awards pursuant to the 2005 Plan at any time and may terminate the 2005 Plan at any time; provided, however, no such suspension or termination shall modify or amend any award granted before such suspension or termination unless the affected participant consents in writing to such modification or amendment or we are dissolved or liquidated. Except in connection with a corporate transaction involving us (including, without limitation, any stock dividend, stock split, extraordinary cash dividend, recapitalization, reorganization, merger, consolidation, split-up, spin-off, combination or exchange of shares), the terms of outstanding awards may not be amended to reduce the exercise price of outstanding options or Stock Appreciation Rights or cancel outstanding options or Stock Appreciation Rights in exchange for cash, other awards or options or Stock Appreciation Rights with an exercise price that is less than the exercise price of the original options or Stock Appreciation Rights without shareholder approval.

Federal Income Tax Consequences

Incentive Stock Options. All Incentive Stock Options granted or to be granted under the 2005 Plan are intended to be Incentive Stock Options as defined in Section 422 of the Internal Revenue Code of 1986, as amended and referred to in this proxy statement as the Code.

Under the provisions of Section 422 of the Code, neither the holder of an Incentive Stock Option nor the issuer of such option will recognize income, gain, deduction or loss upon the grant or exercise of an Incentive Stock Option. An optionee will be taxed only when the common stock acquired upon exercise of his or her Incentive Stock Option is sold or otherwise disposed of in a taxable transaction. If at the time of such sale or disposition the optionee has held the shares for the required holding period (two years from the date the option was granted and one year from the date of the transfer of the shares to the optionee), the optionee will recognize long-term capital gain or loss, as the case may be, based upon the difference between his or her exercise price and the net proceeds of the sale. However, if the optionee disposes of the shares before the end of such holding period, the optionee will recognize ordinary income on such disposition in an amount generally equal to the lesser of: (1) gain on the sale or other disposition; or (2) the amount by which the fair market value of the shares on the date of exercise exceeded the option exercise price, with any excess gain being capital gain, long-term or short-term, depending on whether or not the shares had previously been held for more than one year on the date of sale or other taxable

12

disposition. In addition, the exercise of an Incentive Stock Option may subject the optionee to alternative minimum tax.

The foregoing discussion and the reference to capital gain or loss treatment assume that the option shares are a capital asset in the hands of the optionee. A sale or other disposition which results in the recognition of ordinary income to the optionee will also result in a corresponding income tax deduction for us.

The 2005 Plan permits an optionee to pay all or part of the purchase price for shares acquired pursuant to exercise of an Incentive Stock Option by transferring to us other shares of our common stock owned by the optionee, and Section 422 of the Code provides that an option will continue to be treated as an Incentive Stock Option if it is exercised in such manner. Accordingly, except as noted below with respect to certain “statutory option stock,” an optionee who exercises an Incentive Stock Option in whole or in part in such manner will not recognize any gain or loss upon such exercise. The optionee’s basis in the number of new shares so acquired that is equal to the number of shares surrendered will be equal to the optionee’s cost basis in the shares surrendered. The optionee’s basis in the additional number of new shares received will be zero plus, in the case of payment of the purchase price in a combination of cash and surrendered shares, the amount of any cash paid.

Section 424(c)(3) of the Code provides that if “statutory option stock” is transferred in connection with the exercise of an Incentive Stock Option, and if the holding period requirements under Section 422(a)(1) of the Code are not met with respect to such statutory option stock before such transfer, then ordinary income will be recognized as a result of the transfer of statutory option stock. The optionee’s basis in the number of new shares so acquired that is equal to the number of shares surrendered will be equal to the optionee’s cost basis in the shares surrendered plus the amount of ordinary income recognized. The optionee’s basis in the additional number of new shares received will be zero plus, in the case of payment of the purchase price in a combination of cash and surrendered shares, the amount of any cash paid. However, the Incentive Stock Option stock acquired through the exchange of statutory option stock will still qualify for favorable tax treatment under Section 422 of the Code.

In general, an option granted under the 2005 Plan which is designated as an Incentive Stock Option will be taxed as described above. However, in some circumstances an option which is designated as an Incentive Stock Option will be treated as a Non-Qualified Stock Option and the holder taxed accordingly. For example, a change in the terms of an option which gives the employee additional benefits may be treated as the grant of a new option. Unless all the criteria for treatment as an Incentive Stock Option are met on the date the “new option” is considered granted (such as the requirement that the exercise price of the option be not less than the fair market value of the stock as of the date of the grant), the option will be treated and taxed as a Non-Qualified Stock Option. In addition, the aggregate fair market value (determined at the time the option was granted) of the shares with respect to which Incentive Stock Options granted under the 2005 Plan are exercisable for the first time by an optionee during any calendar year may not exceed $100,000. Any excess over such amount will be deemed to be related to and part of a Non-Qualified Stock Option.

Non-Qualified Stock Options. All options granted under the 2005 Plan that do not qualify as Incentive Stock Options are Non-Qualified Stock Options not entitled to special tax treatment under Section 422 of the Code. A participant in the 2005 Plan will recognize taxable income upon the grant of a Non-Qualified Stock Option only if such option has a readily ascertainable fair market value as of the date of the grant. However, under the applicable Treasury Regulations, the Non-Qualified Stock Options issued under the 2005 Plan will not have a readily ascertainable fair market value unless, at the time such options are granted, similar options of the company are actively traded on an established market. We will not have any such actively traded options in the foreseeable future.

13

Upon the exercise of a Non-Qualified Stock Option not having a readily ascertainable fair market value, the optionee recognizes ordinary income in an amount equal to the excess of the fair market value of the shares on the date of exercise over the option exercise price for those shares. The optionee’s basis for determination of gain or loss upon the subsequent disposition of shares acquired upon the exercise of a Non-Qualified Stock Option will be the amount paid for such shares plus any ordinary income recognized as a result of the exercise of such option. Upon disposition of any shares acquired pursuant to the exercise of a Non-Qualified Stock Option, the difference between the sale price and the optionee’s basis in the shares will be treated as a capital gain or loss and generally will be characterized as long-term capital gain or loss if the shares have been held for more than one year at the time of their disposition. We will not be entitled to an income tax deduction with respect to the grant of a Non-Qualified Stock Option or the sale of stock acquired pursuant to such grant. We generally will be permitted a deduction equal to the amount of ordinary income the optionee is required to recognize as a result of the exercise of a Non-Qualified Stock Option.

The 2005 Plan permits our Compensation Committee to allow an optionee to pay all or part of the purchase price for shares acquired pursuant to an exercise of a non-statutory option by transferring to us other shares of our common stock owned by the optionee. If an optionee exchanges previously acquired common stock pursuant to the exercise of a Non-Qualified Stock Option, the Internal Revenue Service has ruled that the optionee will not be taxed on the unrealized appreciation of the shares surrendered in the exchange. In other words, the optionee is not taxed on the difference between his or her cost basis for the old shares and their fair market value on the date of the exchange, even though the previously acquired shares are valued at the current market price for purposes of paying all or part of the option price. Thus, the optionee’s basis in the number of new shares so acquired that is equal to the number of shares surrendered will be equal to the optionee’s cost basis in the shares surrendered. The optionee’s basis in the additional number of new shares received will be equal to the amount of ordinary compensation income recognized as the result of the exercise of the option plus, in the case of payment of the purchase price in a combination of cash and surrendered shares, the amount of any cash paid.

Stock Appreciation Rights, Performance Units and Phantom Stock. On the exercise of a Stock Appreciation Right or upon the receipt of cash or common stock with respect to a Performance Unit or a share of Phantom Stock, the participant will recognize taxable ordinary income in an amount equal to the sum of the cash and the fair market value of the stock (determined as of the date of exercise of the Stock Appreciation Right or the date of receipt of cash or common stock with respect to the Performance Unit or Phantom Stock, whichever is applicable), if any, received. A 2005 Plan participant will not recognize a loss on the termination of an unexercised Stock Appreciation Right, Performance Unit or share of Phantom Stock received under the 2005 Plan.

Restricted Stock. Generally, and except as noted below, the grant of Restricted Stock is not taxable at the time of the grant. Instead, at the time Restricted Stock vests or becomes transferable free of a substantial risk of forfeiture, a participant will recognize ordinary income equal to (1) the excess of the fair market value of such Restricted Stock on the date the shares vest or become transferrable over (2) the price, if any, paid for such Restricted Stock. An employee may, however, if permitted by the award agreement, elect to recognize income as of the date of grant of the Restricted Stock, in an amount equal to (1) the excess of the fair market value of the Restricted Stock on the date of grant over (2) the price, if any, paid for the Restricted Stock. If such an election is made, no additional income will be recognized at the time the stock vests or becomes transferable. In the event of a subsequent forfeiture of the shares, an employee making such an election may be able to recognize a capital loss with respect to the amount, if any, paid for such Restricted Stock, but only to the extent such amount exceeds the amount realized by such employee on such forfeiture. The employee will not be able to recognize a loss for tax purposes with respect to the excess of fair market value over the purchase price which was previously included in income. Dividends paid on the shares of Restricted Stock before they vest will be taxed to the participant

14

either as additional compensation or, if the participant has made the election described above, as dividend income.

In most cases, the basis in shares acquired upon exercise of a Non-Qualified Stock Option or Stock Appreciation Right, upon an award of Restricted Stock or upon payment with respect to shares of Phantom Stock will be equal to the fair market value of the shares on the employee’s income recognition date, and the holding period for determining gains and losses on a subsequent disposition of such shares will begin on such date.

As a general rule, we will be entitled to a deduction for federal income tax purposes at the same time and in the same amount that an employee recognizes ordinary income from awards granted under the 2005 Plan (including the recognition of ordinary income as the result of a holder of stock obtained through exercise of an Incentive Stock Option disposing of such stock prior to the expiration of the required holding period), to the extent such income is considered reasonable compensation under the Code and generally provided that we comply with the reporting requirements applicable to the ordinary income recognized by the employee. We will not, however, be entitled to a deduction with respect to payments to employees that are contingent upon a change of control if such payments are deemed to constitute “excess parachute payments” pursuant to Section 280G of the Code and do not qualify as reasonable compensation pursuant to that Section. In addition, such payment will subject the recipient to a 20% excise tax. We also may not be entitled to a deduction with respect to payments to certain employees to the extent that the total remuneration of such employee is found to be excessive under Section 162(m) of the Code.

General. The 2005 Plan is not qualified under Section 401(a) of the Code and is not subject to the provisions of the Employee Retirement Income Security Act of 1974.

The preceding discussion is based upon federal tax laws and regulations in effect on the date of this document, which are subject to change, and upon an interpretation of the statutory provisions of the Code, its legislative history and related income tax regulations. Furthermore, the foregoing is only a general discussion of the federal income tax consequences of the Plan and does not purport to be a complete description of all federal income tax aspects of the Plan. Plan participants may also be subject to state and local taxes in connection with the grant or exercise of Options, Stock Appreciation Rights, Performance Units, Restricted Stock, Phantom Stock, or any combination thereof granted under the Plan and the sale or other disposition of shares acquired upon exercise of the Options or otherwise received pursuant to the Plan. Individuals receiving a grant of Options, Stock Appreciation Rights, Performance Units, Restricted Stock, Phantom Stock, or any combination thereof should consult with their personal tax advisor regarding federal, state and local consequences to them of participating in the Plan.

Impact of Section 409A of the Internal Revenue Code

The tax consequences described above under “Federal Income Tax Consequences” may be impacted by the Congress’ adoption of Section 409A of the Code, which became effective January 1, 2005 and generally applies to (1) all awards granted after December 31, 2004, and (2) the portion of any awards granted prior to January 1, 2005 which had not yet vested as of December 31, 2004. If an award violates Section 409A of the Code, the affected participant’s award and all similar awards of the affected participant made under our other similar plans or arrangements, plus related earnings on such awards, for that year and all preceding years, will be includible in the participant’s gross income to the extent the amounts are not subject to a substantial risk of forfeiture. In addition, the participant will be charged interest (generally from the date that the award vests) at the Internal Revenue Service underpayment rate plus one percent, plus an additional tax equal to 20% of the compensation that is required to be included in gross income. As of December 31, 2008 plans were required to be amended to comply with

15

Section 409A of the Code.

The terms of the 2005 Plan are intended to comply with the requirements of Section 409A of the Code. However, the statutory language of Section 409A of the Code is somewhat ambiguous, and the proper application of certain of its provisions is currently unclear despite the issuance of final regulations by the Treasury. The Treasury has indicated that it intends to issue additional guidance in the future to further clarify the application of Section 409A of the Code. We intend to amend the 2005 Plan, if and as necessary, to conform its provisions to the requirements of Section 409A of the Code as clarified in such additional guidance.

Awards Subject to Shareholder Approval

The following awards of performance-based Restricted Stock were granted on March 23, 2011 and the performance measure is based on the two-year cumulative adjusted operating income goal of the Company for the 2011-2012 fiscal years, and are subject to shareholder approval of the 2011 Amendment to the 2005 Plan. This means that these awards will be voided and all shares transferred will be returned to the Company for no consideration if the 2011 Amendment is not approved. Shareholder approval of the 2011 Amendment to the 2005 Plan will allow our Compensation Committee to grant awards under the 2005 Plan that will be considered performance-based compensation under Code Section 162(m).

NEW PLAN BENEFITS

2005 Long-Term Incentive Plan

| Name and Position |

Dollar Value ($)1 | Number of Shares2 | Maximum Number of Shares2 |

|||||||||

| John H. Heyman |

1,068,750 | 63,342 | 79,178 | |||||||||

| Alon Goren |

270,000 | 16,002 | 20,003 | |||||||||

| Andrew S. Heyman |

600,000 | 35,560 | 44,450 | |||||||||

| Mark E. Haidet |

393,750 | 23,337 | 29,171 | |||||||||

| Carlyle Taylor |

225,000 | 13,335 | 16,669 | |||||||||

| Executive Group |

2,557,500 | 151,576 | 189,471 | |||||||||

| Non-Executive Director Group |

— | — | — | |||||||||

| Non-Executive Officer Employee Group |

1,639,125 | 97,147 | 121,434 | |||||||||

| 1 | The dollar value reflected in this column is the dollar value for performance-based awards only. These awards are subject to rescission if the 2011 Amendment is not approved by the shareholders. Each of individuals and groups listed in the table above has also been granted time-based awards under the 2005 Plan, and such awards are not subject to rescission. The dollar value of the time-based awards that have been granted are as follows: John H. Heyman – $356,250, Alon Goren – $90,000, Andrew S. Heyman –$200,000, Mark E. Haidet – $131,250, Carlyle Taylor – $75,000, Executive Group – $852,500, Non-Executive Director Group – $0 and Non-Executive Officer Employee Group – $1,061,625. |

| 2 | With respect to these awards, 100% of the respective performance-based awards shall be earned if the two-year Cumulative Operating Income Budget is achieved; 50% of the awards will be earned if 75% of the two-year Cumulative Operating Income Budget is achieved; and 125% of the awards will be earned if the two-year Cumulative Operating Income Target is achieved; provided that payment between these performance levels will be calculated proportionately between Budget and Target. |

16

If the 2011 Amendment to the 2005 Plan is not approved, our Compensation Committee will explore available alternatives, including granting awards under the 2005 Plan that are not considered performance-based compensation under Code Section 162(m).

THE FOREGOING DESCRIPTION ADDRESSES ONLY CERTAIN FEATURES OF THE 2005 PLAN, AS AMENDED, AND IS QUALIFIED BY THE FULL TEXT OF THE 2005 PLAN. THE 2011 AMENDMENT TO THE 2005 PLAN IS ATTACHED HERETO AS APPENDIX A. A COPY OF THE 2005 PLAN (PRIOR TO THE 2011 AMENDMENT) IS ATTACHED HERETO AS APPENDIX B.

17

PROPOSAL 4

ADVISORY VOTE ON EXECUTIVE COMPENSATION

We are requesting your advisory approval of the compensation of our named executive officers as disclosed in the Compensation Discussion and Analysis, the compensation tables, and the narrative discussion set forth on pages 26 to 49 of this Proxy Statement. This non-binding advisory vote is commonly referred to as a “say on pay” vote.

Our Compensation Committee, which is responsible for designing and administering our executive compensation program, has designed our executive compensation program to provide a competitive and internally equitable compensation and benefits package that reflects Company performance, job complexity and strategic value of the position, while ensuring long-term retention, motivation and alignment with the long-term interests of the Company’s shareholders. The Company has maintained profitability and we believe the compensation program for our named executive officers has been instrumental in helping the Company achieve strong financial performance in the challenging macroeconomic environment over the past few years. We encourage you to carefully review the “Compensation Discussion and Analysis” beginning on page 26 of this Proxy Statement for additional details on the Company’s executive compensation, including the Company’s compensation philosophy and objectives, as well as the processes our Compensation Committee used to determine the structure and amounts of the compensation of our named executive officers in the fiscal year ended December 31, 2010.

We are asking you to indicate your support for the compensation of our named executive officers as described in this Proxy Statement. This vote is not intended to address any specific item of compensation, but rather the overall compensation of our named executive officers and the philosophy, policies and practices described in this Proxy Statement. Accordingly, we are asking you to vote, on an advisory basis, “For” the following resolution at the Annual Meeting:

“RESOLVED, that the compensation paid to Radiant Systems, Inc.’s named executive officers, as disclosed pursuant to the Securities and Exchange Commission’s compensation disclosure rules, including the Compensation Discussion and Analysis, compensation tables and narrative discussion set forth on pages 26 to 49 of this Proxy Statement, is hereby approved.”

While the results of this advisory vote are not binding, the Compensation Committee will consider the outcome of the vote in deciding whether to take any action as a result of the vote and when making future compensation decisions for our named executive officers. Our board of directors recommends that you vote “for” the compensation of our named executive officers as disclosed in this Proxy Statement.

18

PROPOSAL 5

ADVISORY VOTE ON THE FREQUENCY OF THE

VOTE ON EXECUTIVE COMPENSATION

The Company is presenting this proposal, which gives you as a shareholder the opportunity to inform the Company as to how often you wish the Company to include a “say-on-pay” proposal, similar to Proposal Four, in our proxy statement (a “say-on-frequency” vote). While this say on frequency vote is advisory in nature and therefore will not bind us to adopt any particular frequency, our board of directors intends to carefully consider the shareholder vote resulting from the proposal in determining how frequently we will hold “say-on-pay” votes.

Please note that as a shareholder you have the choice to vote for one of the following choices, as indicated on the proxy card: to hold the advisory vote on executive compensation every year, every other year, every third year, or to abstain from voting.

The board of directors values constructive dialogue on executive compensation and other important governance topics with our shareholders. The board of directors believes an advisory vote every year will provide an effective way to obtain information on shareholder sentiment about our executive compensation program and respond to shareholders’ feedback and the vote results.

Required Vote of Shareholders

Shareholders are not voting to approve or disapprove the recommendation of the board of directors that the non-binding advisory vote on the compensation of the Company’s Named Executive Officers (as set forth in Proposal Four) be held every year. For the purposes of the non-binding advisory vote on this Proposal Five, the Company will take into consideration the shareholder vote on each of the alternatives set forth in the proxy card with respect to this Proposal.

The board of directors recommends that shareholders vote “for” the “1 Year” alternative set out in the proxy card.

19

PROPOSAL 6

RATIFICATION OF APPOINTMENT OF DELOITTE & TOUCHE LLP

Deloitte & Touche LLP served as our independent auditors for the fiscal year ended December 31, 2010 and has been selected to serve as our independent auditors for the 2011 fiscal year. Our audit committee proposes that shareholders ratify this selection at the annual meeting of shareholders. Management is not aware that such firm nor any of its members or associates has or has had during the past year any financial interest in us, direct or indirect, or any relationship with us other than in connection with their professional engagement.

Shareholder ratification of this appointment is not required. Management has submitted this matter to the shareholders because it believes the shareholders’ views on the matter should be considered, and if the proposal is not approved, management may reconsider the appointment. Representatives of Deloitte & Touche LLP are not expected to be present at the annual meeting. Our board of directors recommends that you vote “for” the ratification of the appointment of Deloitte & Touche LLP as our independent auditors for the 2011 fiscal year.

Principal Accountant Fees and Services

The following table shows the aggregate fees for professional services rendered to us by our independent auditors, Deloitte & Touche LLP, for the years ended December 31, 2010 and 2009. No fees were paid for tax services or any other services except as described below.

| 2010 | 2009 | |||||||

| Audit Fees (1) |

$ | 698,902 | $ | 536,717 | ||||

| Audit-Related Fees (2) |

$ | 118,755 | $ | 25,200 | ||||

| Tax Fees (3) |

$ | 503,110 | $ | 30,083 | ||||

| All Other Fees (4) |

$ | — | $ | — | ||||

| Total |

$ | 1,320,767 | $ | 592,000 | ||||

| (1) | Primarily includes fees related to audits of our financial statements; reviews of financial statements and disclosures in SEC filings; and comfort letters and consents. |

| (2) | Primarily includes fees related to accounting consultations and reviews of reports on Form 8-K. |

| (3) | Primarily includes fees related to research and development tax credit work and tax structure work. |

| (4) | Primarily includes fees related to transaction services. |

Audit Committee Pre-Approval Policy

The services performed by our independent accountants in 2010 were pre-approved by our audit committee. Any requests for audit, audit-related, tax and other services must be submitted to our audit committee for specific pre-approval. Normally, pre-approval is considered at regularly scheduled meetings.

20

CORPORATE GOVERNANCE AND BOARD MATTERS

Leadership Structure of the Board of Directors

Our board of directors is led by our Chairman, Alon Goren, who is one of our founders and also serves as our Chief Technology Officer. Although we have not formally designated a lead independent director, James S. Balloun acts as our lead independent director. Mr. Balloun conducts the executive sessions of the independent directors, and thereafter meets with our Chief Executive Officer to report on relevant discussions. Mr. Balloun also arranges for our Chief Executive Officer to meet periodically with our full board of directors to respond to board direction and guidance. Given Alon Goren’s long history with us, the length of time that Mr. Balloun has served on our board of directors and the relatively small size of our board of directors, we believe this board leadership structure best serves our needs and the needs of our shareholders.

Meetings of the Board of Directors

Our board of directors held five meetings during the fiscal year ended December 31, 2010. Each director attended at least 75% or more of the aggregate number of meetings held by our board of directors and the committees on which he or she served, with the following exceptions: Michael Z. Kay attended 73%. We do not have a policy regarding attendance of directors at annual meetings; however, no members of our board of directors attended our 2010 annual meeting of shareholders.

Board Independence

Our board of directors has determined that James S. Balloun, William Clement, Jr., J. Alexander M. Douglas, Jr., Philip J. Hickey, Michael Z. Kay, Donna A. Lee and Nick Shreiber qualify as independent directors under the rules applicable to companies listed on The NASDAQ Stock Market, referred to in this proxy statement as NASDAQ.

Shareholder Communications with the Board of Directors

Our board of directors has implemented a process for shareholders to send communications to our board of directors, and to specific individual directors. Any shareholder desiring to communicate with our board of directors, or with specific individual directors, may do so by writing to our Corporate Secretary at 3925 Brookside Parkway, Alpharetta, Georgia 30022. Our Corporate Secretary will promptly forward all such communications to our board of directors or such individual directors, as applicable.

Committees of the Board of Directors

Our board of directors has three standing committees – the audit committee, the compensation committee, and the nominating and corporate governance committee. Each of our committees operates pursuant to a written charter which, as in effect from time to time, may be found on our website at www.radiantsystems.com. Each of the committees is composed solely of independent directors, consistent with the independence standards defined by the SEC and NASDAQ. Each committee has the right to retain its own legal and other advisors.

Audit Committee

Our audit committee presently consists of William A. Clement, Jr., as Chairman, Michael Z. Kay, Donna A. Lee and Philip J. Hickey, Jr. Our audit committee has been assigned the principal function of

21

reviewing our internal and external financial reporting, reviewing the scope of the independent audit, and considering comments by the auditors regarding internal controls and accounting procedures and management’s response to these comments. Our audit committee held five meetings during 2010. Our board of directors has determined that William A. Clement, Jr. and Michael Z. Kay qualify as “audit committee financial experts,” as defined in the applicable rules of the SEC.

Compensation Committee

Our compensation committee presently consists of Michael Z. Kay, as Chairman, J. Alexander M. Douglas, Jr., Donna A. Lee and Nick Shreiber. Our compensation committee has been assigned the functions of approving and monitoring the remuneration arrangements for senior management, and administering and granting awards under our equity incentive plans. Our compensation committee held five meetings during 2010. Our compensation committee is responsible for reviewing salary recommendations for our executives and then approving such recommendations with any modifications it deems appropriate. The independent members of our board of directors are then responsible for approving such salary recommendations with any modifications they deem appropriate. The annual salary recommendations for our named executive officers are initially made by our Executive Vice President of Human Resources. Our compensation committee also has the sole authority to retain and terminate any compensation consultant used to assist in the development and/or analysis of our compensation programs and to approve such consultant’s fees and other retention terms. See “Compensation Discussion and Analysis,” the “Compensation Committee Report,” and our compensation committee charter available on our website at www.radiantsystems.com for further information with respect to our compensation committee.

Nominating and Corporate Governance Committee