UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-05749

_________________________________________

the China FUND, INC.

________________________________________

(Exact name of registrant as specified in charter)

C/O BROWN BROTHERS HARRIMAN & CO.

50 POST OFFICE SQ.

BOSTON, MA 02110

ATTENTION SUZAN BARRON

(Address of principal executive offices)(Zip code)

__________________________________________

Copy to:

| Suzan Barron | Laura E. Flores, Esq. |

| Brown Brothers Harriman & Co. | Morgan, Lewis & Bockius LLP |

| 50 Post Office Sq. | 1111 Pennsylvania Avenue, NW |

| Boston, MA 02110 | Washington, DC 20004-2541 |

| (Name and Address of Agent for Service) |

_________________________________________

Registrant’s telephone number, including area code: (888) 246-2255

Date of fiscal year end: October 31, 2024

Date of reporting period: April 30, 2024

Item 1. Report to Stockholders.

The China Fund, Inc. |

SEMI-ANNUAL REPORT

April 30, 2024 (Unaudited)

The China Fund, Inc.

Table of Contents

Page |

|

Key Highlights |

1 |

Asset Allocation |

2 |

Industry Allocation |

3 |

Chairman’s Statement |

4 |

Investment Manager’s Statement |

6 |

Performance |

8 |

Portfolio Management |

9 |

Schedule of Investments |

10 |

Financial Statements |

16 |

Notes to Financial Statements |

21 |

Other Information |

29 |

Dividends and Distributions: Summary of Dividend Reinvestment and Cash Purchase Plan |

33 |

THE CHINA FUND, INC.

Key Highlights (unaudited)

FUND DATA |

|

NYSE Stock Symbol |

CHN |

Listing Date |

July 10, 1992 |

Shares Outstanding |

9,924,983 |

Total Net Assets (4/30/24) |

$121,526,301 |

Net Asset Value Per Share (4/30/24) |

$12.24 |

Market Price Per Share (4/30/24) |

$10.42 |

TOTAL RETURN(1) |

|||

Performance as of 4/30/24: |

Net Asset Value(2) |

Market Price |

MSCI China All-Shares Index |

1-Year Cumulative |

-11.65% |

-11.23% |

-8.96% |

3-Year Cumulative |

-45.27% |

-48.74% |

-39.15% |

3-Year Annualized |

-18.20% |

-19.97% |

-15.26% |

5-Year Cumulative |

-13.20% |

-17.56% |

-15.55% |

5-Year Annualized |

-2.79% |

-3.79% |

-3.32% |

10-Year Cumulative |

31.46% |

26.46% |

38.76% |

10-Year Annualized |

2.77% |

2.37% |

3.33% |

DIVIDEND HISTORY |

||||||||

Record Date |

Income |

Capital Gains |

||||||

12/28/23 |

0.0185 | — | ||||||

12/28/22 |

— | $ | 0.6748 | |||||

12/28/21 |

$ | 0.0421 | $ | 7.2248 | ||||

12/28/20 |

$ | 0.1502 | $ | 2.1621 | ||||

12/30/19 |

$ | 0.1320 | $ | 1.2523 | ||||

12/21/18 |

$ | 0.1689 | $ | 0.3712 | ||||

12/19/17 |

$ | 0.5493 | — | |||||

12/19/16 |

$ | 0.4678 | — | |||||

12/28/15 |

$ | 0.2133 | $ | 1.2825 | ||||

12/22/14 |

$ | 0.2982 | $ | 3.4669 | ||||

12/23/13 |

$ | 0.4387 | $ | 2.8753 | ||||

(1) Total investment returns reflect changes in net asset value or market price, as the case may be, during each period and assumes that dividends and capital gains distributions, if any, were reinvested in accordance with the dividend reinvestment plan. The net asset value returns are not an indication of the performance of a stockholder’s investment in the Fund, which is based on market price. Total investment returns do not reflect the deduction of taxes that a stockholder would pay on Fund distributions or the sale of Fund shares. Total investment returns are historical and do not guarantee future results. Market price returns do not reflect broker commissions in connection with the purchase or sale of Fund shares.

(2) Performance results do not include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles and may differ from what is reported in the Financial Highlights.

1

THE CHINA FUND, INC.

Asset Allocation AS OF April 30, 2024 (unaudited)

Ten Largest Listed Equity Investments* |

||||

Tencent Holdings, Ltd. |

9.9 | % | ||

China Merchants Bank Co., Ltd. |

5.4 | % | ||

Alibaba Group Holding, Ltd. |

4.0 | % | ||

Meituan |

3.7 | % | ||

Wuliangye Yibin Co., Ltd. |

3.6 | % | ||

PetroChina Co., Ltd. |

3.3 | % | ||

Ping An Insurance Group Co. of China, Ltd. |

3.3 | % | ||

China Construction Bank Corp. |

3.0 | % | ||

KE Holdings, Inc. |

2.9 | % | ||

JD.com, Inc. |

2.7 | % | ||

* Percentages based on net assets.

2

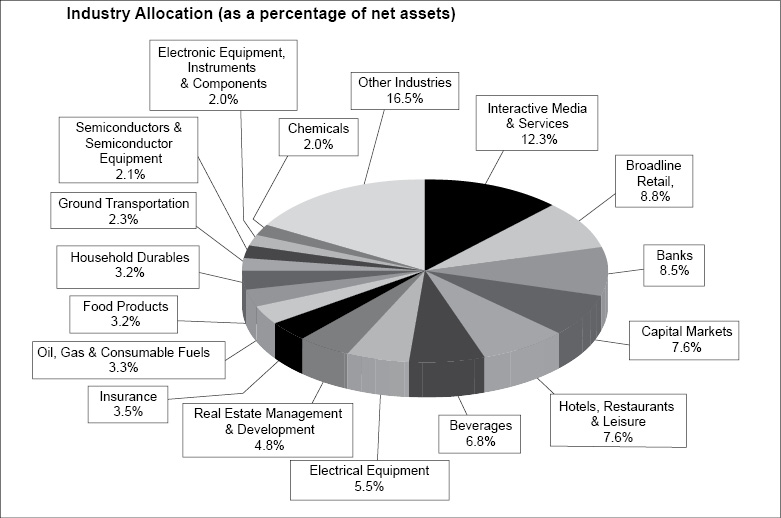

Industry Allocation (unaudited) |

Fund holdings are subject to change and percentages shown above are based on net assets at April 30, 2024. A complete list of holdings at April 30, 2024 is contained in the Schedule of Investments included in this report. The most current available data regarding portfolio holdings can be found on our website, www.chinafundinc.com. You may also obtain holdings by calling 1-888-246-2255.

3

THE CHINA FUND, INC.

Chairman’s Statement (unaudited)

Dear fellow Stockholders,

We have pleasure in providing you the semi-annual report for The China Fund, Inc. (“the Fund”) covering the first half of its fiscal year, November 1, 2023 to April 30, 2024 (the “Period”).

The Stock Market and Fund Performance

As investors into mainland China are aware, the Chinese stock market has been under increasingly intense downward pressure following its high point in February 2021. Whilst a market low was recorded in late 2023, both stock and investor sentiment levels have remained depressed driven primarily by the negative sentiment within the domestic property sector and overall weak consumer consumption. Recent events, however, point to a possible exciting change of government policy within the sector. In mid-May, Vice President He Lifeng, joined by senior government officials and members of the banking sector, announced an important stimulus program for the property sector. In particular, the stimulus measures address both the logjam of incomplete property projects that have been fully paid for by purchasers, as well as rising inventory levels. Whilst these measures are by no means a complete solution to China’s property development problems, they are an important and pragmatic first step that, if continued, should provide for the conditions precedent to revitalise the country’s entrepreneurs and consumers and, hence, the conditions to develop a buoyant stock market within the short to medium term.

In summary, during the Period, the Chinese stock market regained in the second quarter of the Period what it lost in the first quarter of the Period, providing the Fund’s benchmark, the MSCI China All Shares Index, a gain of 3.66% for the first half of the Period. Over the same timeframe, the Fund gained 3.23%, based on the Fund’s net asset value (“NAV”). With regard to the Fund’s five-year Tender Offer Period, established by your Board of Directors effective January 1, 2023, the Fund lags its benchmark by 887 basis points.

Throughout the Period, your investment manager has slowly repositioned the Fund’s portfolio away from past winners, particularly, within the consumer discretionary sector and into, amongst others, the financials sector to better position it for the future. However, patience will be required to permit the economic fundamentals to improve before the true signs of a bull market emerge.

Share Price Discount

The share price discount to the Fund’s NAV has remained stubbornly high throughout the Period, ranging from 11.78% to 18.53%, and closing at 14.87%. Your Board has continued the Fund’s discount management program subject to careful monitoring with the intention of maximizing the return for any spend.

Expenses

Your Board closely monitors the Fund’s expenses and whilst they are currently running at the lowest level experienced in many years, the Fund’s total expense ratio is forecast to rise for its 2024 fiscal year, due solely to the Fund’s decline in assets under management.

4

THE CHINA FUND, INC.

Chairman’s Statement (unaudited) (continued)

We appreciate that the recent years in the Chinese stock market have been most frustrating but, if the Chinese government’s recent moves to support the property sector are maintained, we strongly believe the start of a recovery could be underway.

We thank all stockholders for your continued support.

Yours very sincerely,

For and on behalf of The China Fund, Inc.

Julian Reid,

Chairman

Past performance is not indicative of future results. You should consider the Fund’s investment objectives, risks, and charges and expenses carefully before you invest.

5

THE CHINA FUND, INC.

Investment Manager’s Statement (unaudited)

Market Environment

Chinese equities experienced a contrast in narratives during the six months ended April 30, 2024. In the three months through January, Chinese equities were the primary weak spot among major emerging markets. Policy announcements to support the economy and a dovish pivot in the U.S. Fed’s interest rate outlook weren’t enough to offset disappointment over China’s recovery and worries over deflation, as well as concerns over its struggling housing market. During the rest of the period, Chinese equities staged a recovery and led major emerging and developed markets higher as government initiatives, including a program to buy up stocks and cuts in mortgage lending rates, started to gain traction. A meeting by Chinese leadership in April to review the “economic roadmap for 2024” was also interpreted positively by markets in hopes that economic policy would remain a priority for the government.

Performance Contributors and Detractors

For the six months ended April 30, 2024, China Fund, Inc. returned 3.23% while its benchmark, the MSCI China All Shares Index, returned 3.66%. From a sector perspective, the portfolio’s stock selection in consumer discretionary, its allocation and stock selection in communications services, and its stock selection in industrials contributed the most to relative performance in the period. On the other hand, stock selection in financials, and allocation to utilities and materials detracted the most from relative performance.

Turning to individual stocks, PDD Holdings, operator of Pinduoduo, one of China’s largest e-commerce platforms, was the largest contributor to both absolute and relative performance in the period, aided by stronger-than-expected earnings. The platform has been growing faster than peers and has also experienced continued strong momentum delivering monetization of the business model. Tencent Holdings was also a top contributor to absolute returns given its large weight of almost 10% in the portfolio and returning slightly over 18% in the period. Attractive valuations, better-than-expected growth recovery in its advertising business and steady performance in its gaming business have led to positive returns. PetroChina, a leading oil and gas company, was also a top contributor to total and relative returns. It has benefitted from positive oil price movements, a growing gas distribution business and was viewed as a defensive stock in a volatile environment. In contrast, Wuxi Biologics, a pharmaceutical company, was the biggest detractor to absolute and relative returns. Continued geopolitical headlines affected the stock and the market also became concerned over whether it can continue to grow successfully among its U.S. and global clients. China International Capital Corp., an investment bank, and Wingtech Technology, a mobile communications equipment manufacturer, were also big detractors. CICC’s earnings were under pressure as underwriting profits suffered in weak equity market environments. Wingtech was a detractor amid softer growth in its semiconductor component business. The overall chip manufacturing industry domestically has been under pricing pressure due to weaker than expected demand.

Outlook

Looking ahead, the question remains as to whether China’s equity markets are charting a sustainable path of recovery. Notwithstanding the well-known concerns, investor sentiment is improving toward China based upon perceived risk/

6

THE CHINA FUND, INC.

Investment Manager’s Statement (unaudited) (continued)

reward. Marginal year-over-year improvement in earnings expectations combined with stock multiples trading at roughly a 50% discount to February 2021 highs is giving investors confidence that current valuations provide an adequate cushion for unforeseen risks. The calculus suggests that even with little to no improvement in sentiment or stock multiples, consensus estimates in year-over-year earnings growth could lead to attractive equity returns. We remain, however, in a cautious frame of mind. China has still to work through its real estate problems and, as ever, as active managers we have to contend with geopolitics, particularly with the U.S. election approaching. But an improving economy and improving earnings growth are positive signs. In 2023, we think Chinese government policy over promised and underachieved; this year we think the government is seeking to under promise and overachieve.

7

THE CHINA FUND, INC.

Performance (unaudited)

Average Annual Total Returns(1) as of 4/30/24

1-Year |

5-Year |

10-Year |

|

Net Asset Value (“NAV”) |

-11.65% |

-2.79% |

2.77% |

Market Price |

-11.23% |

-3.79% |

2.37% |

MSCI China All-Shares Index |

-8.96% |

-3.32% |

3.33% |

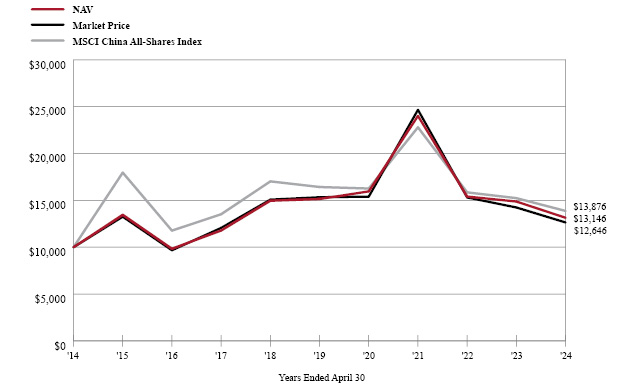

Growth of a Hypothetical $10,000 Investment(2)

|

(1) |

Past performance is not indicative of future returns. Investment returns are historical and do not guarantee future results. Investment returns reflect changes in NAV and market price per share during each period and assumes that dividends and capital gains distributions, if any, were reinvested in accordance with the dividend reinvestment plan. The NAV percentages are not an indication of the performance of a stockholders investment in the Fund, which is based on market price. NAV performance includes the deduction of management fees and other expenses. Performance results do not include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles and may differ from what is reported in the Financial Highlights. Market price performance does not include the deduction of brokerage commissions and other expenses of trading shares and would be lower had such commissions and expenses been deducted. Indexes are unmanaged and it is not possible to invest directly in an index. The MSCI China All Shares Index captures large and mid-cap representation across China A shares, B shares, H shares, Red Chips, P chips and foreign listings (e.g. ADRs). The index aims to reflect the opportunity set of China share classes listed in Hong Kong, Shanghai, Shenzhen and outside of China. |

|

(2) |

The graph represents historical performance of a hypothetical investment of $10,000 in the Fund over ten years. The graph and table do not reflect the deduction of taxes that a stockholder would pay on Fund distributions or the sale of Fund shares. |

Matthews International Capital Management, LLC was appointed as Investment Manager on January 1, 2019. Prior to that date the Fund had different Investment Management arrangements.

8

THE CHINA FUND, INC.

Portfolio Management (unaudited)

Matthews International Capital Management, LLC (“Matthews Asia”), the largest dedicated Asia investment specialist in the United States, is an independent, privately owned firm with a focus on long-term investment performance.

Andrew Mattock serves as the Lead Manager for the Fund’s portfolio of listed securities. Prior to joining Matthews Asia in 2015, he was a Fund Manager at Henderson Global Investors for 15 years, first in London and then in Singapore, managing Asia Pacific equities. Andrew holds a Bachelor of Business majoring in Accounting from ACU. He began his career at PricewaterhouseCoopers and qualified as a Chartered Accountant.

Winnie Chwang serves as the co-manager for the Fund’s portfolio of listed securities. She joined the firm in 2004 and has built her investment career at the firm. Winnie earned an MBA from the Haas School of Business and received her B.A. in Economics with a minor in Business Administration from the University of California, Berkeley. She is fluent in Mandarin and conversational in Cantonese.

Effective June 13, 2024, Sherwood Zhang serves as the co-manager for the Fund’s portfolio of listed securities. Prior to joining Matthews in 2011, Sherwood was an analyst at Passport Capital from 2007 to 2010, where he focused on such industries as property and basic materials in China as well as consumer-related sectors. Before earning his MBA in 2007, Sherwood served as a Senior Treasury Officer for Hang Seng Bank in Shanghai and Hong Kong, and worked as a Foreign Exchange Trader at Shanghai Pudong Development Bank in Shanghai. He received his MBA from the University of Maryland and his Bachelor of Economics in Finance from Shanghai University. Sherwood is fluent in Mandarin and speaks conversational Cantonese.

Effective June 13, 2024, Hardy Zhu serves as the co-manager for the Fund’s portfolio of listed securities. Prior to joining the firm in 2011, Hardy was an Equity Analyst with Delaware Investments researching Chinese equities. Before earning his MBA from Duke University in 2007, Hardy was a senior accountant at PNC Global Investment Servicing from 2000 to 2005. Hardy began his career at China National Nonferrous Metals Import & Export Co., one of the largest state-owned international trading companies in China. He received a Master of Accounting degree from the Virginia Polytechnic Institute and State University and a B.S. in Industrial Foreign Trade from Shenyang Polytechnic University in China. Hardy is fluent in Mandarin.

9

THE CHINA FUND, INC.

Schedule of Investments

April 30, 2024 (unaudited)

Name of Issuer and Title of Issue |

Shares |

Value (Note A) |

||||||||||

COMMON STOCK |

||||||||||||

CHINA — “A” SHARES |

||||||||||||

Banks — 4.1% |

||||||||||||

China Merchants Bank Co., Ltd. — A |

1,053,247 | $ | 4,956,842 | |||||||||

Beverages — 5.4% |

||||||||||||

Shanxi Xinghuacun Fen Wine Factory Co., Ltd. — A |

58,200 | 2,091,566 | ||||||||||

Wuliangye Yibin Co., Ltd. — A |

214,296 | 4,418,574 | ||||||||||

| 6,510,140 | ||||||||||||

Capital Markets — 1.5% |

||||||||||||

East Money Information Co., Ltd. — A |

435,480 | 779,482 | ||||||||||

Hithink RoyalFlush Information Network Co., Ltd. — A |

59,600 | 984,103 | ||||||||||

| 1,763,585 | ||||||||||||

Chemicals — 2.0% |

||||||||||||

Wanhua Chemical Group Co., Ltd. — A |

199,900 | 2,446,651 | ||||||||||

Communications Equipment — 0.6% |

||||||||||||

Suzhou TFC Optical Communication Co., Ltd. — A |

33,100 | 721,535 | ||||||||||

Electrical Equipment — 5.5% |

||||||||||||

Contemporary Amperex Technology Co., Ltd. — A |

100,640 | 2,798,583 | ||||||||||

Hongfa Technology Co., Ltd. — A |

392,600 | 1,541,067 | ||||||||||

Sichuan Injet Electric Co., Ltd. — A |

186,300 | 1,288,538 | ||||||||||

Sungrow Power Supply Co., Ltd. — A |

69,000 | 977,938 | ||||||||||

| 6,606,126 | ||||||||||||

Electronic Equipment, Instruments & Components — 2.0% |

||||||||||||

SUPCON Technology Co., Ltd. — A |

196,380 | 1,282,702 | ||||||||||

Wingtech Technology Co., Ltd. — A* |

279,554 | 1,205,320 | ||||||||||

| 2,488,022 | ||||||||||||

Food Products — 3.2% |

||||||||||||

Anjoy Foods Group Co., Ltd. — A |

188,500 | 2,391,641 | ||||||||||

Guangdong Haid Group Co., Ltd. — A |

219,900 | 1,509,296 | ||||||||||

| 3,900,937 | ||||||||||||

Health Care Equipment & Supplies — 1.8% |

||||||||||||

Shenzhen Mindray Bio-Medical Electronics Co., Ltd. — A |

51,200 | 2,144,041 | ||||||||||

Health Care Providers & Services — 0.8% |

||||||||||||

Aier Eye Hospital Group Co., Ltd. — A |

562,600 | 994,142 | ||||||||||

See notes to financial statements.

10

THE CHINA FUND, INC.

SCHEDULE oF INVESTMENTS (continued)

April 30, 2024 (unaudited)

Name of Issuer and Title of Issue |

Shares |

Value (Note A) |

||||||||||

COMMON STOCK (continued) |

||||||||||||

CHINA — “A” SHARES (continued) |

||||||||||||

Household Durables — 1.6% |

||||||||||||

Midea Group Co., Ltd. — A |

200,229 | $ | 1,920,770 | |||||||||

Insurance — 1.3% |

||||||||||||

Ping An Insurance Group Co., of China Ltd. — A |

287,600 | 1,628,752 | ||||||||||

Machinery — 1.8% |

||||||||||||

Neway Valve Suzhou Co., Ltd. — A |

477,800 | 1,228,473 | ||||||||||

Shenzhen Inovance Technology Co., Ltd. — A |

40,604 | 331,693 | ||||||||||

Yutong Bus Co., Ltd. — A |

171,500 | 605,994 | ||||||||||

| 2,166,160 | ||||||||||||

Media — 0.9% |

||||||||||||

Focus Media Information Technology Co., Ltd. — A |

1,279,600 | 1,143,867 | ||||||||||

Semiconductors & Semiconductor Equipment — 2.1% |

||||||||||||

NAURA Technology Group Co., Ltd. — A |

18,902 | 825,734 | ||||||||||

Will Semiconductor Co., Ltd. Shanghai — A |

88,000 | 1,228,432 | ||||||||||

Zhejiang Jingsheng Mechanical & Electrical Co., Ltd. — A |

116,200 | 541,091 | ||||||||||

| 2,595,257 | ||||||||||||

Software — 0.4% |

||||||||||||

Shanghai Baosight Software Co., Ltd. — A |

89,396 | 503,786 | ||||||||||

Specialty Retail — 0.8% |

||||||||||||

China Tourism Group Duty Free Corp., Ltd. — A |

99,700 | 1,021,241 | ||||||||||

Transportation Infrastructure — 1.2% |

||||||||||||

Shanghai International Airport Co., Ltd. — A* |

272,100 | 1,408,476 | ||||||||||

TOTAL CHINA — “A” SHARES — (Cost $49,726,970) |

37.0 | % | 44,920,330 | |||||||||

HONG KONG |

||||||||||||

Air Freight & Logistics — 1.0% |

||||||||||||

JD Logistics, Inc. 144A* |

1,169,100 | 1,268,825 | ||||||||||

Biotechnology — 0.9% |

||||||||||||

Innovent Biologics, Inc. 144A* |

235,500 | 1,145,740 | ||||||||||

Broadline Retail — 8.8% |

||||||||||||

Alibaba Group Holding, Ltd. |

518,408 | 4,837,659 | ||||||||||

JD.com, Inc. |

227,704 | 3,263,145 | ||||||||||

See notes to financial statements.

11

THE CHINA FUND, INC.

SCHEDULE oF INVESTMENTS (continued)

April 30, 2024 (unaudited)

Name of Issuer and Title of Issue |

Shares |

Value (Note A) |

||||||||||

COMMON STOCK (continued) |

||||||||||||

HONG KONG (continued) |

||||||||||||

Broadline Retail (continued) |

||||||||||||

PDD Holdings, Inc. ADR* |

20,799 | $ | 2,603,619 | |||||||||

| 10,704,423 | ||||||||||||

Capital Markets — 1.1% |

||||||||||||

Hong Kong Exchanges & Clearing, Ltd. |

43,600 | 1,383,560 | ||||||||||

Diversified Consumer Services — 0.2% |

||||||||||||

China Education Group Holdings, Ltd. |

436,000 | 247,169 | ||||||||||

Entertainment — 1.6% |

||||||||||||

NetEase, Inc. |

54,100 | 1,017,039 | ||||||||||

Tencent Music Entertainment Group ADR* |

70,958 | 890,523 | ||||||||||

| 1,907,562 | ||||||||||||

Ground Transportation — 2.3% |

||||||||||||

DiDi Global, Inc. ADR* |

574,147 | 2,836,286 | ||||||||||

Hotels, Restaurants & Leisure — 7.6% |

||||||||||||

Galaxy Entertainment Group, Ltd. |

397,000 | 1,783,157 | ||||||||||

Luckin Coffee, Inc. ADR* |

19,955 | 419,055 | ||||||||||

Meituan 144A* |

330,750 | 4,525,461 | ||||||||||

Trip.com Group, Ltd. ADR* |

29,414 | 1,419,520 | ||||||||||

Yum China Holdings, Inc. |

29,678 | 1,083,544 | ||||||||||

| 9,230,737 | ||||||||||||

Household Durables — 1.6% |

||||||||||||

Man Wah Holdings, Ltd. |

2,622,800 | 1,909,288 | ||||||||||

Interactive Media & Services — 12.3% |

||||||||||||

Baidu, Inc.* |

82,150 | 1,075,558 | ||||||||||

Kuaishou Technology 144A* |

260,900 | 1,837,340 | ||||||||||

Tencent Holdings, Ltd. |

273,800 | 11,994,087 | ||||||||||

| 14,906,985 | ||||||||||||

Life Sciences Tools & Services — 0.6% |

||||||||||||

Wuxi Biologics Cayman, Inc. 144A* |

445,500 | 767,780 | ||||||||||

Metals & Mining — 0.9% |

||||||||||||

MMG, Ltd.(1)* |

2,396,000 | 1,089,702 | ||||||||||

See notes to financial statements.

12

THE CHINA FUND, INC.

SCHEDULE oF INVESTMENTS (continued)

April 30, 2024 (unaudited)

Name of Issuer and Title of Issue |

Shares |

Value (Note A) |

||||||||||

COMMON STOCK (continued) |

||||||||||||

HONG KONG (continued) |

||||||||||||

Real Estate Management & Development — 4.8% |

||||||||||||

CIFI Holdings Group Co., Ltd.* |

21,016,968 | $ | 958,731 | |||||||||

KE Holdings, Inc. ADR |

230,754 | 3,489,000 | ||||||||||

Longfor Group Holdings, Ltd. 144A |

764,000 | 1,132,685 | ||||||||||

Times China Holdings, Ltd.* |

8,477,000 | 228,963 | ||||||||||

| 5,809,379 | ||||||||||||

Textiles, Apparel & Luxury Goods — 1.1% |

||||||||||||

ANTA Sports Products, Ltd. |

119,400 | 1,350,490 | ||||||||||

TOTAL HONG KONG — (Cost $65,185,710) |

44.8 | % | 54,557,926 | |||||||||

HONG KONG — “H” SHARES |

||||||||||||

Banks — 4.4% |

||||||||||||

China Construction Bank Corp. |

5,662,000 | 3,665,568 | ||||||||||

China Merchants Bank Co., Ltd. |

377,000 | 1,631,803 | ||||||||||

| 5,297,371 | ||||||||||||

Beverages — 1.4% |

||||||||||||

Tsingtao Brewery Co., Ltd. |

238,000 | 1,716,741 | ||||||||||

Capital Markets — 5.0% |

||||||||||||

China International Capital Corp., Ltd. 144A |

1,992,800 | 2,406,160 | ||||||||||

China Merchants Securities Co., Ltd. 144A |

2,194,600 | 1,824,345 | ||||||||||

CITIC Securities Co., Ltd. |

1,188,125 | 1,893,390 | ||||||||||

| 6,123,895 | ||||||||||||

Health Care Providers & Services — 0.6% |

||||||||||||

Sinopharm Group Co., Ltd. |

300,400 | 757,179 | ||||||||||

Insurance — 2.2% |

||||||||||||

PICC Property & Casualty Co., Ltd. |

278,000 | 344,891 | ||||||||||

Ping An Insurance Group Co., of China Ltd. |

518,500 | 2,343,689 | ||||||||||

| 2,688,580 | ||||||||||||

See notes to financial statements.

13

THE CHINA FUND, INC.

SCHEDULE oF INVESTMENTS (continued)

April 30, 2024 (unaudited)

Name of Issuer and Title of Issue |

Shares |

Value (Note A) |

||||||||||

COMMON STOCK (continued) |

||||||||||||

HONG KONG — “H” SHARES (continued) |

||||||||||||

Oil, Gas & Consumable Fuels — 3.3% |

||||||||||||

PetroChina Co., Ltd. |

4,278,000 | $ | 3,996,906 | |||||||||

TOTAL HONG KONG — “H” SHARES — (Cost $22,746,153) |

16.9 | % | 20,580,672 | |||||||||

TOTAL HONG KONG (INCLUDING “H” SHARES) — (Cost $87,931,863) |

61.7 | % | 75,138,598 | |||||||||

TOTAL COMMON STOCK — (Cost $137,658,833) |

98.7 | % | 120,058,928 | |||||||||

COLLATERAL FOR SECURITIES ON LOAN |

||||||||||||

Money Market Funds — 0.8% |

||||||||||||

Fidelity Investments Money Market Government Portfolio, 5.24%∞ (Cost $939,232) |

939,232 | 939,232 | ||||||||||

TOTAL COLLATERAL FOR SECURITIES ON LOAN — (Cost $939,232) |

0.8 | % | 939,232 | |||||||||

See notes to financial statements.

14

THE CHINA FUND, INC.

SCHEDULE oF INVESTMENTS (continued)

April 30, 2024 (unaudited)

Name of Issuer and Title of Issue |

Principal |

Value (Note A) |

||||||||||

SHORT TERM INVESTMENTS |

||||||||||||

Time Deposits — 1.1% |

||||||||||||

JPMorgan Chase & Co. - New York, 4.67%, 5/1/2024 |

USD 1,298,328 | $ | 1,298,328 | |||||||||

TOTAL SHORT TERM INVESTMENTS — (Cost $1,298,328) |

1.1 | % | 1,298,328 | |||||||||

TOTAL INVESTMENTS — (Cost $139,896,393) |

100.6 | % | 122,296,488 | |||||||||

OTHER ASSETS AND LIABILITIES |

(0.6 | )% | (770,187 | ) | ||||||||

NET ASSETS |

100.0 | % | $ | 121,526,301 | ||||||||

Footnotes to Schedule of Investments

|

* |

Denotes non-income producing security. |

|

∞ |

Rate shown is the 7-day yield as of April 30, 2024. |

|

(1) |

A security (or a portion of the security) is on loan. As of April 30, 2024, the market value of securities loaned was $871,762. The loaned securities were secured with cash collateral of $939,232. Collateral is calculated based on prior day’s prices. |

144A Securities exempt from registration under Rule 144a of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At April 30, 2024, these restricted securities amounted to $14,908,336, which represented 12.27% of net assets.

ADR — American Depositary Receipt

USD — U.S. dollar

See notes to financial statements.

15

THE CHINA FUND, INC.

Statement of Assets and Liabilities

April 30, 2024 (unaudited)

ASSETS |

||||

Investments in securities, at value (cost $139,896,393) (including securities on loan, at value, $871,762) (Note A) |

$ | 122,296,488 | ||

Cash |

3,628 | |||

Foreign currency, at value (cost $62,898) |

62,898 | |||

Receivable for investments sold |

240,778 | |||

Prepaid expenses |

120,172 | |||

TOTAL ASSETS |

122,723,964 | |||

LIABILITIES |

||||

Payable upon return of collateral for securities on loan |

939,232 | |||

Payable for shares redeemed |

12,695 | |||

Investment management fee payable (Note B) |

71,688 | |||

Administration and custodian fees payable (Note B) |

20,738 | |||

Chief Compliance Officer fees payable |

5,105 | |||

Directors’ fees payable (Note B) |

5,932 | |||

Other accrued expenses |

142,273 | |||

TOTAL LIABILITIES |

1,197,663 | |||

TOTAL NET ASSETS |

$ | 121,526,301 | ||

COMPOSITION OF NET ASSETS: |

||||

Par value, 100,000,000 shares authorized, 9,924,983 shares outstanding (Note C) |

99,249 | |||

Paid in capital in excess of par |

175,236,647 | |||

Distributable earnings |

(53,809,595 | ) | ||

TOTAL NET ASSETS |

$ | 121,526,301 | ||

NET ASSET VALUE PER SHARE |

||||

($121,526,301/9,924,983 shares of common stock outstanding) |

$ | 12.24 |

See notes to financial statements.

16

THE CHINA FUND, INC.

Statement of Operations

Six Months Ended April 30, 2024 (unaudited)

INVESTMENT INCOME: |

||||

Dividend income (net of tax withheld of $18,147) |

$ | 591,562 | ||

Securities lending income |

7,380 | |||

Interest income |

30,557 | |||

TOTAL INVESTMENT INCOME |

629,499 | |||

EXPENSES |

||||

Investment Management fees (Note B) |

460,699 | |||

Directors’ fees and expenses |

134,581 | |||

Insurance |

73,429 | |||

Legal fees (Note B) |

66,835 | |||

Administration fees (Note B) |

36,103 | |||

Principal Financial Officer fee |

32,620 | |||

Chief Compliance Officer fee |

32,605 | |||

Audit and tax service fees |

27,374 | |||

Custodian fees (Note B) |

25,119 | |||

Stockholder service fees |

16,260 | |||

Stock exchange listing fee |

13,140 | |||

Transfer agent fees |

13,124 | |||

Fund accounting fees |

11,983 | |||

Printing and postage |

9,678 | |||

Fund Secretary fee |

4,978 | |||

Miscellaneous expenses |

24,681 | |||

TOTAL EXPENSES |

983,209 | |||

Less: Expense waiver |

(14,052 | ) | ||

Net Expenses |

969,157 | |||

NET INVESTMENT LOSS |

(339,658 | ) |

See notes to financial statements.

17

THE CHINA FUND, INC.

Statement of Operations (continued)

Six Months Ended April 30, 2024 (unaudited)

NET REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS AND FOREIGN CURRENCY TRANSACTIONS |

||||

Net realized loss on investments |

$ | (15,639,431 | ) | |

Net realized loss on foreign currency transactions |

(5,297 | ) | ||

| (15,644,728 | ) | |||

Net change in unrealized appreciation/(depreciation) on investments |

19,583,459 | |||

Net change in unrealized appreciation/(depreciation) on foreign currency translations |

(52 | ) | ||

| 19,583,407 | ||||

NET REALIZED AND UNREALIZED GAIN ON INVESTMENTS AND FOREIGN CURRENCY TRANSACTIONS |

3,938,679 | |||

NET INCREASE IN NET ASSETS FROM OPERATIONS |

$ | 3,599,021 |

See notes to financial statements.

18

THE CHINA FUND, INC.

Statements of Changes In Net Assets

Six Months |

Year Ended |

|||||||

(unaudited) |

||||||||

INCREASE (DECREASE) IN NET ASSETS FROM OPERATIONS |

||||||||

Net investment income (loss) |

$ | (339,658 | ) | $ | 213,743 | |||

Net realized loss on investments and foreign currency transactions |

(15,644,728 | ) | (17,424,458 | ) | ||||

Net change in unrealized appreciation on investments and foreign currency translations |

19,583,407 | 27,313,330 | ||||||

Net increase in net assets from operations |

3,599,021 | 10,102,615 | ||||||

DISTRIBUTIONS TO STOCKHOLDERS FROM: |

||||||||

Distributable earnings |

(184,891 | ) | (6,875,397 | ) | ||||

Total distributions to stockholders |

(184,891 | ) | (6,875,397 | ) | ||||

CAPITAL SHARE TRANSACTIONS: |

||||||||

Cost of shares repurchased (Note D) |

(1,036,928 | ) | (2,843,434 | ) | ||||

Net increase (decrease) in net assets from capital share transactions |

(1,036,928 | ) | (2,843,434 | ) | ||||

NET INCREASE (DECREASE) IN NET ASSETS |

2,377,202 | 383,784 | ||||||

NET ASSETS: |

||||||||

Beginning of Period |

119,149,099 | 118,765,315 | ||||||

End of Period |

$ | 121,526,301 | $ | 119,149,099 | ||||

See notes to financial statements.

19

THE CHINA FUND, INC.

Financial Highlights

Selected data for a share of common stock outstanding for the periods indicated

Six Months |

Year Ended October 31, |

|||||||||||||||||||||||

(unaudited) |

2023 |

2022 |

2021 |

2020 |

2019(1) |

|||||||||||||||||||

Per Share Operating Performance |

||||||||||||||||||||||||

Net asset value, beginning of period |

$ | 11.88 | $ | 11.58 | $ | 30.32 | $ | 31.52 | $ | 22.80 | $ | 18.98 | ||||||||||||

Net investment income (loss)* |

(0.03 | ) | 0.02 | (0.06 | ) | 0.06 | 0.06 | 0.13 | ||||||||||||||||

Net realized and unrealized gain (loss) on investments and foreign currency transactions |

0.39 | 0.91 | (11.43 | )(2) | 1.02 | 9.98 | 4.09 | |||||||||||||||||

Total from investment operations |

0.36 | 0.93 | (11.49 | ) | 1.08 | 10.04 | 4.22 | |||||||||||||||||

Less dividends and distributions: |

||||||||||||||||||||||||

Dividends from net investment income |

(0.02 | ) | — | (0.04 | ) | (0.15 | ) | (0.13 | ) | (0.17 | ) | |||||||||||||

Distributions from net realized gains |

— | (0.67 | ) | (7.23 | ) | (2.16 | ) | (1.25 | ) | (0.37 | ) | |||||||||||||

Total dividends and distributions |

(0.02 | ) | (0.67 | ) | (7.27 | ) | (2.31 | ) | (1.38 | ) | (0.54 | ) | ||||||||||||

Capital Share Transactions: |

||||||||||||||||||||||||

Accretion (Dilution) to net asset value resulting from share repurchase program |

0.02 | 0.04 | 0.02 | 0.03 | 0.06 | 0.14 | ||||||||||||||||||

Net asset value, end of period |

$ | 12.24 | $ | 11.88 | $ | 11.58 | $ | 30.32 | $ | 31.52 | $ | 22.80 | ||||||||||||

Market price, end of period |

$ | 10.42 | $ | 9.74 | $ | 9.80 | $ | 26.06 | $ | 27.93 | $ | 20.08 | ||||||||||||

Total Investment Return (Based on Market Price)(3) |

7.18 | % | 3.91 | % | (47.48 | )% | 0.54 | % | 47.84 | % | 21.86 | % | ||||||||||||

Total Investment Return (Based on Net Asset Value)(4) |

3.23 | % | 7.26 | % | (46.66 | )%(2) | 3.65 | % | 46.94 | % | 23.79 | % | ||||||||||||

Ratios and Supplemental Data |

||||||||||||||||||||||||

Net assets, end of period (000’s) |

$ | 121,526 | $ | 119,149 | $ | 118,765 | $ | 314,302 | $ | 329,412 | $ | 242,937 | ||||||||||||

Ratio of gross expenses to average net assets |

1.71 | % | 1.56 | % | 1.25 | % | 1.00 | % | 1.08 | % | 1.41 | % | ||||||||||||

Ratio of net expenses to average net assets |

1.68 | % | 1.56 | % | 1.25 | % | 1.00 | % | 1.08 | % | 1.41 | % | ||||||||||||

Ratio of net investment income to average net assets |

(0.59 | )% | 0.15 | % | (0.30 | )% | 0.20 | % | 0.25 | % | 0.61 | % | ||||||||||||

Portfolio turnover rate |

37 | % | 51 | % | 74 | % | 76 | % | 60 | % | 132 | % | ||||||||||||

|

* |

Per share amounts have been calculated using the average share method. |

|

(1) |

Effective January 1, 2019, Matthews International Capital Management, LLC became the investment manager. Prior to January 1, 2019, the Fund’s investment manager was Allianz Global Investors. |

|

(2) |

Includes proceeds from a class action settlement payment related to foreign exchange transactions from prior years. Without this, net realized and unrealized gain (loss) on investments and foreign currency transactions would have been $(11.44) and the Total Investment Return (Based on Net Asset Value) would have been (46.70)%. |

|

(3) |

Based on changes in the share market price and assumes that dividend and capital gain distributions, if any, were reinvested in accordance with the Dividend Reinvestment and Cash Purchase Plan. |

|

(4) |

Based on changes in the share net asset value and assumes that dividend and capital gain distributions, if any, were reinvested in accordance with the Dividend Reinvestment and Cash Purchase Plan. |

See notes to financial statements.

20

THE CHINA FUND, INC.

Notes to Financial Statements

April 30, 2024 (unaudited)

NOTE A — SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The China Fund, Inc. (the “Fund”) was incorporated under the laws of the State of Maryland on April 28, 1992, and is a non-diversified, closed-end management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”). The Fund’s investment objective is long-term capital appreciation which it seeks to achieve by investing primarily in equity securities (i) of companies for which the principal securities trading market is in the People’s Republic of China (“China”), (ii) of companies for which the principal securities trading market is outside of China, or constituting direct equity investments in companies organized outside of China, that in both cases derive at least 50% of their revenues from goods or services sold or produced, or have at least 50% of their assets, in China and (iii) constituting direct equity investments in companies organized in China (“Direct Investments”). The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. The Fund’s investment manager is Matthews International Capital Management, LLC (“Matthews Asia” or the “Investment Manager”).

The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board Accounting Standard Codification Topic 946 “Financial Services — Investment Companies.”

The financial statements are prepared in accordance with U.S. generally accepted accounting principles (“GAAP”), which require management to make estimates and assumptions that affect the reported amounts of assets and liabilities. Actual results could differ from those estimates. The following summarizes the significant accounting policies of the Fund:

Security Valuation: Portfolio securities listed on recognized U.S. or foreign security exchanges are valued at the last quoted sales price in the principal market where they are traded. Listed securities with no such sales price and unlisted securities are valued at the mean between the current bid and asked prices, if any, from brokers. Short-term investments having maturities of sixty days or less are valued at amortized cost (original purchase cost as adjusted for amortization of premium or accretion of discount) which when combined with accrued interest approximates market value. Securities for which market quotations are not readily available or are deemed unreliable are valued at fair value in good faith by or at the direction of the Board of Directors (the “Board”) in accordance with the Fund’s Valuation Procedures. For securities listed on non-North American exchanges, the Fund fair values those securities daily using fair value factors provided by a third-party pricing service if certain thresholds determined by the Board are met. Direct Investments and derivatives investments, if any, are valued at fair value as determined by or at the direction of the Board based on financial and other information supplied by the Direct Investment Manager or a third-party pricing service.

Factors used in determining fair value may include, but are not limited to, the type of security, the size of the holding, the initial cost of the security, the existence of any contractual restrictions on the security’s disposition, the price and extent of public trading in similar securities of the issuer or of comparable companies, the availability of quotations from broker-dealers, the availability of values of third parties other than the Investment Manager, information obtained from the issuer, analysts, and/or the appropriate stock exchange (if available), an analysis of the company’s financial statements, an evaluation of the forces that influence the issuer and the market(s) in which the security is purchased

21

Notes To Financial Statements (unaudited) (continued)

and sold and with respect to debt securities, the maturity, coupon, creditworthiness, currency denomination, and the movement of the market in which they trade.

Securities Lending: The Fund may lend up to 33 1/3% of the Fund’s total assets held by Brown Brothers Harriman & Co. (“BBH”) as custodian to certain qualified brokers, except those securities which the Fund specifically identifies as not being available. By lending its investment securities, the Fund attempts to increase its net investment income through the receipt of interest on the loan. Any gain or loss in the market price of the securities loaned that might occur and any interest or dividends declared during the term of the loan would accrue to the account of the Fund. Risks of delay in recovery of the securities or even loss of rights in the collateral may occur should the borrower of the securities fail financially. Upon entering into a securities lending transaction, the Fund receives cash as collateral in an amount equal to or exceeding 100% of the current market value of the loaned securities with respect to securities of the U.S. government or its agencies, 102% of the current market value of the loaned securities with respect to U.S. securities and 105% of the current market value of the loaned securities with respect to foreign securities. Any cash received as collateral is generally invested by BBH, acting in its capacity as securities lending agent (the “Agent”), in the Fidelity Investments Money Market Government Portfolio. A portion of the dividends received on the collateral may be rebated to the borrower of the securities and the remainder is split between the Agent and the Fund.

Remaining Contractual Maturity of the Agreements |

||||||||||||||||||||

Overnight and |

<30 days |

Between |

>90 days |

Total |

||||||||||||||||

Securities Lending Transactions |

||||||||||||||||||||

Money Market Fund |

$ | 939,232 | $ | — | $ | — | $ | — | $ | 939,232 | ||||||||||

Total Borrowings |

$ | 939,232 | $ | — | $ | — | $ | — | $ | 939,232 | ||||||||||

Gross amount of recognized liabilities for securities lending transactions |

$ | 939,232 | ||||||||||||||||||

As of April 30, 2024, the Fund had loaned securities which were collateralized by cash. The value of the securities on loan and the value of the related collateral were as follows:

Value of |

Value of Cash |

Value of |

Total |

||||||||||||

| $871,762 | $939,232 | $— | $939,232 | ||||||||||||

|

* |

Fund cannot repledge or dispose of this collateral, nor does the Fund earn any income or receive dividends with respect to this collateral. |

Gross Amounts Not Offset in the Statement of Assets and Liabilities |

|||||||||||||||

Gross Asset Amounts |

Financial |

Collateral |

Net Amount |

||||||||||||

| $939,232 | $— | $(939,232) | $0 | ||||||||||||

22

Notes To Financial Statements (unaudited) (continued)

Time Deposits: The Fund places excess cash balances into overnight time deposits with one or more eligible deposit institutions that meet credit and risk standards approved by the Fund. These are classified as short-term investments in the Schedule of Investments.

Foreign Currency Translations: The records of the Fund are maintained in U.S. dollars. Foreign currencies, investments and other assets and liabilities are translated into U.S. dollars at the current exchange rates. Purchases and sales of investment securities and income and expenses are translated on the respective dates of such transactions. Net realized gains and losses on foreign currency transactions represent net gains and losses from the disposition of foreign currencies, currency gains and losses realized between the trade dates and settlement dates of security transactions, and the difference between the amount of net investment income accrued and the U.S. dollar amount actually received. The effects of changes in foreign currency exchange rates on investments in securities are not segregated in the Statement of Operations from the effects of changes in market prices of those securities, but are included in realized and unrealized gain or loss on investments. Net unrealized foreign currency gains and losses arise from changes in the value of assets and liabilities, other than investments in securities, as a result of changes in exchange rates.

Forward Foreign Currency Contracts: The Fund may enter into forward foreign currency contracts to hedge against foreign currency exchange rate risks. A forward currency contract is an agreement between two parties to buy or sell currency at a set price on a future date. Upon entering into these contracts, risks may arise from the potential inability of counterparties to meet the terms of their contracts and from unanticipated movements in the value of the foreign currency relative to the U.S. dollar. The U.S. dollar value of forward currency contracts is determined using forward exchange rates provided by quotation services. Daily fluctuations in the value of such contracts are recorded as unrealized gain or loss and included in the distributable earnings in the Statement of Assets and Liabilities. When the contract is closed, the Fund records a realized gain or loss equal to the difference between the value at the time it was opened and the value at the time it was closed. Such gain or loss is disclosed in the realized and unrealized gain or loss on foreign currency transactions in the Fund’s accompanying Statement of Operations. On April 30, 2024, the Fund did not hold forward foreign currency transactions contracts.

Option Contracts: The Fund may purchase and write (sell) call options and put options provided the transactions are for hedging purposes and the initial margin and premiums do not exceed 5% of total assets. Option contracts are valued daily and unrealized gains or losses are recorded on the Statement of Assets and Liabilities based upon the last sales price on the principal exchange on which the options are traded. The Fund will realize a gain or loss upon the expiration or closing of the option contract. Such gain or loss is disclosed in the realized and unrealized gain or loss on options in the Fund’s accompanying Statement of Operations. When an option is exercised, the proceeds on sales of the underlying security for a written call option, the purchase cost of the security for a written put option, or the cost of the security for a purchased put or call option is adjusted by the amount of premium received or paid.

The risk in writing a call option is that the Fund gives up the opportunity for profit if the market price of the security increases and the option is exercised. The risk in writing a put option is that the Fund may incur a loss if the market price of the security decreases and the option is exercised. The risk in buying an option is that the Fund pays a premium whether or not the option is exercised. Risks may also arise from an illiquid secondary market or from the inability of a counterparty to meet the terms of the contract. At April 30, 2024, the Fund did not hold any option contracts.

23

Notes To Financial Statements (unaudited) (continued)

Equity-Linked Securities: The Fund may invest in equity-linked securities such as linked participation notes, equity swaps and zero-strike options and securities warrants. Equity-linked securities may be used by the Fund to gain exposure to countries that place restrictions on investments by foreigners. To the extent that the Fund invests in equity-linked securities whose return corresponds to the performance of a foreign securities index or one or more foreign stocks, investing in equity-linked securities will involve risks similar to the risks of investing in foreign securities. In addition, the Fund bears the risk that the issuer of any equity-linked securities may default on its obligation under the terms of the arrangement with the counterparty. Equity-linked securities are often used for many of the same purposes as, and share many of the same risks with, derivative instruments. In addition, equity-linked securities may be considered illiquid. At April 30, 2024, the Fund did not hold equity-linked securities.

Direct Investments: The Fund may invest up to 25% of the net proceeds from its offering of its outstanding common stock in Direct Investments; however, the Board of the Fund has suspended additional investments in Direct Investments. Direct Investments are generally restricted and do not have a readily available resale market. Because of the absence of any public trading market for these investments, the Fund may take longer to liquidate these positions than would be the case for publicly traded securities. Although these securities may be resold in privately negotiated transactions, the prices on these sales could be less than those originally paid by the Fund. Issuers whose securities are not publicly traded may not be subject to public disclosure and other investor protections requirements applicable to publicly traded securities. At April 30, 2024, the Fund did not hold Direct Investments.

Indemnification Obligations: Under the Fund’s organizational documents, its Officers and Directors are indemnified against certain liabilities arising out of the performance of their duties to the Fund. In addition, in the normal course of business the Fund enters into contracts that provide general indemnifications to other parties. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred.

Security Transactions and Investment Income: Security transactions are recorded as of the trade date. Realized gains and losses from securities sold are recorded on the identified cost basis. Dividend income is recorded on the ex-dividend date, or, in the case of dividend income on foreign securities, on the ex-dividend date or when the Fund becomes aware of its declaration. Interest income is recorded on the accrual basis. All premiums and discounts are amortized/accreted for both financial reporting and federal income tax purposes.

Dividends and Distributions: The Fund intends to distribute to its stockholders, at least annually, substantially all of its net investment income and any net realized capital gains. Distributions to stockholders are recorded on the ex-dividend date. Income and capital gains distributions are determined in accordance with federal income tax regulations, which may differ from GAAP. Certain capital accounts in the financial statements are periodically adjusted for permanent differences in order to reflect their tax character. These adjustments have no impact on net assets or net asset value per share. Temporary differences which arise from recognizing certain items of income, expense, gain or loss in different periods for financial statement and tax purposes will reverse at some time in the future. Unless the Board elects to make distributions in shares of the Fund’s common stock, the distributions will be paid in cash, except with respect to stockholders who have elected to participate in the Fund’s Dividend Reinvestment and Cash Purchase Plan.

24

Notes To Financial Statements (unaudited) (continued)

Federal Taxes: It is the Fund’s policy to qualify each year as a regulated investment company under Subchapter M of the Internal Revenue Code, as amended (“Code”) and to distribute to stockholders each year substantially all of its income. Accordingly, no provision for federal income tax is necessary. As of and during the period ended April 30, 2024, the Fund did not have a liability for any uncertain tax positions. The Fund recognizes interest and penalties, if any, related to tax liabilities as income tax expense in the Statement of Operations. For the previous three years the Fund remains subject to examination by the Fund’s major tax jurisdictions, which include the United States of America and the State of Maryland. The Fund may be subject to taxes imposed by governments of countries in which it invests. Such taxes are generally based on either income or gains earned or repatriated. The Fund accrues and applies such taxes to net investment income, net realized gains and net unrealized gains as income and/or gains are earned.

At April 30, 2024, the cost of investments for federal income tax purposes was $139,896,393. Gross unrealized appreciation of investments was $11,418,395 while gross unrealized depreciation of investments was $29,018,300, resulting in net unrealized depreciation of investments of $17,599,905.

NOTE B — ADVISORY FEE AND OTHER TRANSACTIONS

Matthews Asia is the investment manager for the Fund’s listed assets (“Listed Assets”). Matthews Asia receives a fee, computed and accrued daily and paid monthly at an annual rate of 0.70% if assets exceed $150 million and 0.80% if assets do not exceed $150 million. Effective for one year from February 1, 2024, the Investment Manager has agreed to voluntarily waive a portion of the fee it receives from the Fund by reducing the management fee rate applied when the Fund’s monthly average assets are less than $150 million from 0.80% to 0.75%. After the one year period the fee waiver will terminate without further notice, unless the Investment Manager, in its sole discretion, agrees to continue the waiver. For the period ended April 30, 2024, the investment management fee rate was equivalent to an annual effective rate of 0.77% of the Fund’s average daily net assets. For the six months ended April 30, 2024, no fees were paid for Direct Investments as the Fund held no such investments during the period.

An officer of the Fund is affiliated with Matthews Asia. He does not receive any compensation from the Fund for serving as an officer of the Fund.

BBH provides, or arranges for the provision of certain administrative services for the Fund, including preparing certain reports and other documents required by federal and/or state laws and regulations. For these services, the Fund pays BBH a fee that is calculated daily and paid monthly at an annual rate based on aggregate average daily assets of the Fund, subject to a monthly minimum fee. The Fund also pays BBH an annual fee for certain legal administration services, including corporate secretarial services and preparing regulatory filings.

The Fund has also contracted with BBH to provide custody and fund accounting services to the Fund. For these services, the Fund pays BBH asset-based fees, subject to a minimum fee, that vary according to the number of positions and transactions plus out-of-pocket expenses.

25

Notes To Financial Statements (unaudited) (continued)

NOTE C — FUND SHARES

At April 30, 2024, there were 100,000,000 shares of $0.01 par value capital stock authorized, of which 9,924,983 were issued and outstanding.

For the period ended April 30, 2024, the Fund repurchased 104,972 shares of its common stock, valued at $1,036,928 from stockholders participating in the repurchases under the Fund’s discount management program.

For Period Ended |

For Year Ended |

|||||||

Shares outstanding at beginning of period |

10,029,955 | 10,258,595 | ||||||

Shares repurchased |

(104,972 | ) | (228,640 | ) | ||||

Shares outstanding at end of period |

9,924,983 | 10,029,955 | ||||||

NOTE D — DISCOUNT MANAGEMENT PROGRAM

On February 6, 2019, the Fund announced that its Board approved a Discount Management Program (the “Program”) which authorizes management to make open market purchases in an aggregate amount up to 10% of the Fund’s common shares outstanding as of the close of business on October 31 of the prior year. This limit may be increased or decreased by the Board at any time. Under the Program, the Fund expects to repurchase its common shares in the open market on any trading day that the Fund’s shares are trading above the discount threshold. On each day that shares are repurchased, the Fund repurchases its shares within the limits permitted by law. The Program is intended to enhance stockholder value, as repurchases made at a discount may have the effect of increasing the per share NAV of the Fund’s remaining shares. There is no assurance, however, that the market price of the Fund’s shares, either absolutely or relative to NAV, will increase as a result of any share repurchases. These repurchases may be commenced or suspended at any time or from time to time without any notice. Any repurchases will be disclosed in the Fund’s stockholder reports for the relevant fiscal periods.

For the period ended April 30, 2024, the Fund repurchased 104,972 (October 31, 2023: 228,640) of its shares at an average price of $9.88 (October 31, 2023: $12.44) per share (including brokerage commissions) at an average discount of 15.84% (October 31, 2023: 13.43%). These repurchases had a total cost of $1,036,928 (October 31, 2023: $2,843,434). The Board will continue to review the Program and its effectiveness, and, as appropriate, may make further enhancements as it believes are necessary.

NOTE E — CONDITIONAL PERFORMANCE TENDER OFFER POLICY

On January 24, 2023 the Board announced the adoption of a policy pursuant to which the Fund intends to conduct a performance tender offer for up to twenty-five percent (25%) of the Fund’s then-issued and outstanding shares of common stock on or before March 31, 2028, and on each fifth-year anniversary thereafter, if the Fund’s investment performance does not equal or exceed that of the Fund’s performance benchmark, the MSCI China All Shares Index, for the period commencing on January 1, 2023 and ending on December 31, 2027 (and for each five-year performance

26

Notes To Financial Statements (unaudited) (continued)

period thereafter) (the “Performance Policy”). The offer size, price at which shares are to be tendered, and other terms and conditions of such performance tender offer would be determined by the Board in its discretion based on its review and consideration of market conditions at that time and any other factors it deems relevant. The Board would proceed with a performance tender offer pursuant to the Performance Policy only to the extent it would be consistent with the best interests of the Fund and its stockholders under then-current circumstances. The Board will not eliminate or materially modify the Performance Policy without first notifying the Fund’s stockholders.

NOTE F — INVESTMENT TRANSACTIONS

For the six months ended April 30, 2024, the Fund’s cost of purchases and proceeds from sales of investment securities, other than short-term securities, were $42,186,112 and $44,521,399, respectively.

NOTE G — INVESTMENTS IN CHINA

The Fund’s investments in Chinese companies involve certain risks not typically associated with investments in securities of U.S. companies or the U.S. Government, including risks relating to (1) social, economic and political uncertainty; (2) price volatility, lesser liquidity and smaller market capitalization of securities markets in which securities of Chinese companies trade; (3) currency exchange fluctuations, currency blockage and higher rates of inflation; (4) controls on foreign investment and limitations on repatriation of invested capital and on the Fund’s ability to exchange local currencies for U.S. dollars; (5) governmental involvement in and control over the economy; (6) risk of nationalization or expropriation of assets; (7) the nature of the smaller, less seasoned and newly organized Chinese companies, particularly in China; and (8) the absence of uniform accounting, auditing and financial reporting standards, practices and disclosure requirements and less government supervision and regulation.

In June 2021, the President of the United States issued an Executive Order (the “Order”) to prohibit, among other things, any transaction by any U.S. person in publicly traded securities of certain companies determined to be involved with China’s surveillance technology sector. The Order, which took effect on August 2, 2021, expands the scope of a previously issued Executive Order that prohibited U.S. persons’ transactions in companies determined to be affiliated with China’s military. The Order, and any similar future actions by the United States government, may limit the securities in which the Fund may invest, and adversely affect the Fund’s performance.

The Chinese government plays a major role in the country’s economic policies regarding foreign investments. Foreign investors are subject to the risk of loss from expropriation or nationalization of their investment assets and property, governmental restrictions on foreign investments and the repatriation of capital invested. The Chinese government may intervene or seek to control the operations, structure, or ownership of Chinese companies, including with respect to foreign investors of such companies. For example, the Fund may invest to a significant extent in variable interest entity (“VIE”) structures. VIE structures can vary, but generally consist of a U.S.-listed company with contractual arrangements, through one or more wholly-owned special purpose vehicles, with a Chinese company that ultimately provides the U.S.-listed company with contractual rights to exercise control over and obtain economic benefits from the Chinese company. The VIE structure enables foreign investors, such as the Fund, to obtain investment

27

Notes To Financial Statements (unaudited) (continued)

exposure similar to that of an equity owner in a Chinese company in situations in which the Chinese government has restricted or prohibited the ownership of such company by foreign investors. As a result, an investment in a VIE structure subjects the Fund to the risks associated with the underlying Chinese company. Intervention by the Chinese government into the operation or ownership of VIE structures could significantly and adversely affect the Chinese company’s performance and thus, the value of the Fund’s investment in the VIE, as well as the enforceability of the VIE contractual arrangements with the underlying Chinese company. In the event of such an occurrence, the Fund, as a foreign investor, may have little or no legal recourse. The Fund’s investment in a VIE structure is also subject to the risk that the underlying Chinese company (or its officers, directors, or Chinese equity owners) may breach its contractual arrangements with the other entities in the VIE structure, or Chinese law changes in a way that adversely affects the enforceability of these arrangements, or those contracts are otherwise not enforceable under Chinese law, in which case the Fund may suffer significant losses on its VIE investments with little or no recourse available.

NOTE H — FAIR VALUE MEASUREMENT

The Fund has adopted fair valuation accounting standards which establish a definition of fair value and set out a hierarchy for measuring fair value. These standards require additional disclosures about the various inputs and valuation techniques used to develop the measurements of fair value and a discussion of changes in valuation techniques and related inputs during the period. These inputs are summarized in the three broad levels listed below:

|

● |

Level 1 — Inputs that reflect unadjusted quoted prices in active markets for identical assets or liabilities that the Fund has the ability to access at the measurement date; |

|

● |

Level 2 — Inputs other than quoted prices that are observable for the asset or liability either directly or indirectly, including inputs in markets that are not considered to be active; |

|

● |

Level 3 — Inputs that are unobservable. |

The following is a summary of the inputs used as of April 30, 2024 in valuing the Fund’s investments carried at value:

ASSETS VALUATION INPUT

Description* |

Level 1 |

Level 2 |

Level 3 |

Total |

||||||||||||

Common Stock |

$ | 15,258,557 | $ | 104,800,371 | $ | — | $ | 120,058,928 | ||||||||

Collateral For Securities On Loan |

939,232 | — | — | 939,232 | ||||||||||||

Short Term Investments |

1,298,328 | — | — | 1,298,328 | ||||||||||||

TOTAL INVESTMENTS |

$ | 17,496,117 | $ | 104,800,371 | $ | — | $ | 122,296,488 | ||||||||

* Please refer to the Schedule of Investments for additional security details.

NOTE I — DERIVATIVE INSTRUMENTS AND HEDGING ACTIVITIES

The Fund did not enter into any derivatives transactions or hedging activities for the six months ended April 30, 2024.

28

THE CHINA FUND, INC.

Other Information (unaudited)

Board Deliberations Regarding Approval of Continuance of Investment Advisory and Management Agreement

The Investment Company Act of 1940 (the “1940 Act”) requires that an investment advisory agreement be approved initially, as well as annually after an initial two-year term, by a vote of both the full board of directors and a majority of the directors who are not “interested persons” of any party to the agreement, as defined in the 1940 Act (the “Independent Directors”). In connection with their consideration of the approval of an investment advisory agreement, the Independent Directors must request and evaluate such information as may reasonably be necessary to make a reasonable business judgment with respect to the approval of the investment advisory agreement, and the adviser is required to provide such information.

In considering the approval of the Investment Advisory and Management Agreement (the “Agreement”) between the China Fund, Inc. (the “Fund”) and Matthews International Capital Management, LLC (“Matthews Asia”), the investment adviser to the Fund, the Board of Directors (the “Board”), all of whom are Independent Directors, took into account all the materials provided prior to and during a meeting of the Board held on November 30, 2023 (the “Meeting”). The materials included, among other things, comparative fee and expense data, the presentations made by Matthews Asia during the Meeting, and the comprehensive discussions had during the Meeting. The Board also requested and received assistance and advice regarding applicable legal standards from counsel to the Fund.

The information prepared specifically for the review of the Agreement supplemented the information provided to the Board throughout the year. The Board met regularly during the year and the information provided and topics discussed at such meetings were relevant to the review of the Agreement. Some of these reports and other data included, among other things, materials that outlined the Fund’s investment performance; compliance, regulatory, and risk management matters; the trading practices of Matthews Asia; valuation of securities; Fund expenses; and overall market and regulatory developments. The Independent Directors considered the review of the Agreement to be an ongoing process and employed the accumulated information, knowledge, and experience they had gained during their tenure on the Board governing the Fund and working with Matthews Asia in their review of the Agreement.

The conclusions that the Independent Directors reached were based on a comprehensive evaluation of all information presented to and requested by the Board and were not the result of any single factor; rather, the Board based its determination on the total mix of information available to it and each Independent Director may have afforded different weight to the various factors in reaching his or her conclusions with respect to the Agreement.

In evaluating the Agreement, the Board received and considered information, during the Meeting and throughout the year, regarding: (i) the nature, extent and quality of services provided to the Fund by Matthews Asia; (ii) the Fund’s performance, including as compared to relevant benchmarks and peer funds; (iii) Matthews Asia’s costs of and profits realized from providing advisory services to the Fund, including any fall-out benefits enjoyed by Matthews Asia; (iv) comparative fee and expense data; (v) the extent to which the management fee for the Fund reflects any economies of scale shared with Fund stockholders; and (vi) other factors the Board deemed to be relevant. The Board specifically noted that the materials included information with respect to the management fee, comparative fees and expense information, performance figures and profitability analysis with respect to the Fund, and the services provided by Matthews Asia. The Board also considered brokerage policies and practices, the standards applied in seeking best execution, and policies and practices regarding soft dollars.

29

THE CHINA FUND, INC.

Other Information (unaudited) (continued)

Nature, Extent and Quality of the Services Provided. In considering the nature and quality of the services provided to the Fund, the Board considered Matthews Asia’s specific responsibilities in all aspects of the day-to-day management of the Fund. The Board noted that Matthews Asia’s responsibilities include making investment decisions, supervising the acquisition and disposition of investments and supervising the selection of brokers or dealers to execute these transactions in accordance with the Fund’s investment objective and policies and within the guidelines and directions established by the Board, quarterly reporting to the Board, and implementing Board directives as they relate to the Fund. The Board considered the qualifications, experience, and responsibilities of Matthews Asia’s investment personnel, the quality of Matthews Asia’s compliance infrastructure, and the determination of the Fund’s Chief Compliance Officer that Matthews Asia has appropriate compliance policies and procedures in place. The Board noted that it was provided with Matthews Asia’s current Form ADV, as well as responses to a detailed series of questions, which included a description of its operations, service offerings, personnel, compliance program, risk management program, and financial condition. The Board considered Matthews Asia’s experience working with registered investment companies, including the Fund, and the Fund’s performance.

Based on the factors discussed above, as well as those discussed below, the Board concluded that it was satisfied with the nature, extent, and quality of the services provided to the Fund by Matthews Asia.

Performance. The Board received and considered performance information for the Fund. The Board considered the short-term and long-term performance of the Fund on both an absolute basis and in comparison to appropriate peer funds and benchmark indices for various time periods. In evaluating the performance of the Fund, the Board considered risk expectations for the Fund, the impact of relevant market or regulatory factors, as well as the level of Fund performance in the context of its review of Fund expenses and Matthews Asia’s profitability. In addition to the information received by the Board at the Meeting, the Board received detailed performance information for the Fund at each regular Board meeting during the year. The Board concluded that the Fund’s overall performance was satisfactory when viewed in the context of its investment style and was consistent with the Fund’s investment approach regularly communicated to investors.

Cost of Advisory Services and Profitability. The Board considered the management fee rate paid by the Fund to Matthews Asia in light of the nature, extent and quality of the services provided to the Fund and in comparison to the management fees of other funds in the Fund’s relevant peer group. The Board considered that the Fund’s management fee was toward the lower end of the range of fees paid by funds in the peer group. The Board also considered the depth and range of services provided under the Agreement.

The Board reviewed Matthews’ profitability data for the Fund using data as of June 30, 2023. The Board also reviewed the allocation methods used in preparing the profitability data. In considering profitability information, the Board considered the effect of fall-out benefits on Matthews Asia’s expenses, such as the increased visibility of Matthews Asia’s investment management business due to the availability of the Fund through various broker-dealer platforms as well as the research services acquired by Matthews Asia through soft dollars. The Board focused on the profitability of Matthews Asia’s relationship with the Fund before taxes and distribution expenses. The Board noted that Matthews Asia’s commitment of resources to the Fund resulted in it assuming entrepreneurial and other risks, for which it may

30

THE CHINA FUND, INC.

Other Information (unaudited) (continued)

reasonably seek to be compensated. The Board concluded that Matthews Asia’s profitability was not excessive in light of the nature, extent and quality of services provided to the Fund.

Economies of Scale. The Board considered the potential benefits from economies of scale that the Fund’s stockholders could be afforded. The Board noted that the Fund’s management fee includes breakpoints, which allows for economies of scale to be shared through reductions in the management fee as Fund assets grow. Based on its consideration of this factor and the factors above, the Board determined that there was a reasonable sharing of any realized economies of scale under the Agreement.

Conclusion. After considering and weighing all of the above factors and having requested and received such information from Matthews Asia as the Board believed to be reasonably necessary to evaluate the terms of the Agreement, and as assisted by the advice of counsel, the Board concluded that it would be in the best interest of the Fund and its stockholders to approve the continuance of the Agreement.

Results of Annual Stockholder Meeting held on March 14, 2024

1. Election of Director – the stockholders of the Fund elected the following Director to serve for a three year term expiring on the date of which the annual meeting of stockholder is held in 2027.

Description* |

Votes |

Votes |

Julian Reid |

8,044,022 |

350,783 |

PRIVACY POLICY

Privacy Notice

The China Fund, Inc. collects nonpublic personal information about its stockholders from the following sources:

■ Information it receives from stockholders on applications or other forms; and

■ Information about stockholder transactions with the Fund.

The Fund’s policy is to not disclose nonpublic personal information about its stockholders to nonaffiliated third parties (other than disclosures permitted by law).