Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-05749

THE CHINA FUND, INC.

(Exact name of registrant as specified in charter)

C/O BROWN BROTHERS HARRIMAN & CO.

50 POST OFFICE SQ.

BOSTON, MA 02110

ATTENTION SUZAN BARRON

(Address of principal executive offices)(Zip code)

Copy to:

| Suzan Barron Brown Brothers Harriman & Co. 50 Post Office Sq. Boston, MA 02110 |

Laura E. Flores, Esq. Morgan, Lewis & Bockius LLP 1111 Pennsylvania Avenue, NW Washington, DC 20004-2541 | |

| (Name and Address of Agent for Service) |

Registrant’s telephone number, including area code: (888) 246-2255

Date of fiscal year end: October 31

Date of reporting period: April 30, 2020

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Table of Contents

Item 1. Report to Stockholders.

Table of Contents

|

THE CHINA FUND, INC.

|

SEMI-ANNUAL REPORT

April 30, 2020 (unaudited)

Table of Contents

THE CHINA FUND, INC.

| FUND DATA | ||

| NYSE Stock Symbol | CHN | |

| Listing Date | July 10, 1992 | |

| Shares Outstanding | 10,477,422 | |

| Total Net Assets (04/30/20) | $245,537,298 | |

| Net Asset Value Per Share (04/30/20) | $23.43 | |

| Market Price Per Share (04/30/20) | $20.01 | |

| TOTAL RETURN(1) | ||||||||

| Performance as of 04/30/20: |

Net Asset Value | Market Price | ||||||

| 1-Year Cumulative |

5.39% | 0.42% | ||||||

| 3-Year Cumulative |

35.50% | 27.69% | ||||||

| 3-Year Annualized |

10.66% | 8.49% | ||||||

| 5-Year Cumulative |

18.50% | 16.17% | ||||||

| 5-Year Annualized |

3.45% | 3.04% | ||||||

| 10-Year Cumulative |

81.21% | 76.89% | ||||||

| 10-Year Annualized |

6.13% | 5.87% | ||||||

| DIVIDEND HISTORY | ||||||||

| Record Date | Income | Capital Gains | ||||||

| 12/30/19 |

$0.1320 | $1.2523 | ||||||

| 12/21/18 |

$0.1689 | $0.3712 | ||||||

| 12/19/17 |

$0.5493 | — | ||||||

| 12/19/16 |

$0.4678 | — | ||||||

| 12/28/15 |

$0.2133 | $1.2825 | ||||||

| 12/22/14 |

$0.2982 | $3.4669 | ||||||

| 12/23/13 |

$0.4387 | $2.8753 | ||||||

| 12/24/12 |

$0.3473 | $2.9044 | ||||||

| 12/23/11 |

$0.1742 | $2.8222 | ||||||

| 12/24/10 |

$0.3746 | $1.8996 | ||||||

(1) Total investment returns reflect changes in net asset value or market price, as the case may be, during each period and assumes that dividends and capital gains distributions, if any, were reinvested in accordance with the dividend reinvestment plan. The net asset value returns are not an indication of the performance of a stockholder’s investment in the Fund, which is based on market price. Total investment returns do not reflect the deduction of taxes that a stockholder would pay on Fund distributions or the sale of Fund shares. Total investment returns are historical and do not guarantee future results. Market price returns do not reflect broker commissions in connection with the purchase or sale of Fund shares.

1

Table of Contents

THE CHINA FUND, INC.

ASSET ALLOCATION AS OF April 30, 2020 (unaudited)

| Ten Largest Listed Equity Investments * | ||

| AlibabaGroup Holding, Ltd. |

13.4% | |

| TencentHoldings, Ltd. |

12.4% | |

| ChinaMerchants Bank Co., Ltd. |

5.0% | |

| JD.com,Inc. |

4.8% | |

| ChinaConstruction Bank Corp. |

4.5% | |

| WuliangyeYibin Co., Ltd. |

3.4% | |

| AIA Group, Ltd. |

3.3% | |

| Ping An Insurance Group Company of China, Ltd. |

2.8% | |

| MeituanDianping |

2.5% | |

| TimesChina Holdings, Ltd. |

2.3% | |

| * | Percentages based on net assets. |

2

Table of Contents

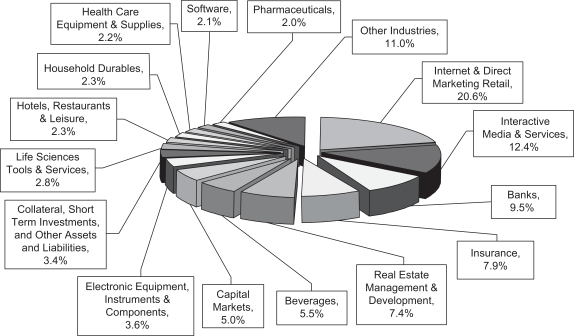

Industry Allocation (as a percentage of net assets)

Fund holdings are subject to change and percentages shown above are based on net assets at April 30, 2020. A complete list of holdings at April 30, 2020 is contained in the Schedule of Investments included in this report. The most current available data regarding portfolio holdings can be found on our website, www.chinafundinc.com. You may also obtain holdings by calling 1-888-246-2255.

3

Table of Contents

THE CHINA FUND, INC.

CHAIRMAN’S STATEMENT (unaudited)

June 9, 2020

Dear Fellow Stockholders,

On behalf of your Board, I am delighted to write to you outlining the activities of your Fund through the first half of its fiscal year, which specifically covers the period from November 1, 2019 to April 30, 2020, and which is otherwise referred to herein as the “Period”.

Investment Performance

During the Period, the Fund’s net asset value (“NAV”) has increased 9.23% whilst the market price increased by 5.92%, this differential is primarily due to the increase in the share discount that occurred particularly in the most recent quarter on the back of the negative effects on global markets caused by the Coronavirus pandemic. Encouragingly, both numbers reflect the Fund’s outperformance of its present and previous benchmarks, the MSCI China All Share Index and the MSCI Golden Dragon Index, which increased 4.76% and 1.94%, respectively, for the Period. The Fund’s performance provided relative alpha of 4.47% and 7.33% in comparison to the Fund’s present and past benchmark indices, respectively.

Coronavirus

Without doubt the discovery of Sars-CoV-2 in Wuhan, Hubei Province, China at the end of the 2019 calendar year has struck the world with absolute horror, and our condolences are extended to everyone who has been affected in any way by this terrible pandemic. Given that this virus is so new it is presenting constant ‘work in progress’ at numerous levels for, including but by no means restricted to, scientists, the medical profession as well as us, as investors. The scientific knowledge of the virus is improving daily and it is of comfort that, at time of writing, signs of a global recovery appear encouraging led by positive health statistics from China.

To better understand the latest news related to, and opportunities arising from, this pandemic, our investment managers have prepared and posted a host of useful information on your Fund’s website (www.chinafundinc.com) under the heading of “Thought Leadership.” Amongst the pandemic-related risks our manager has highlighted is a possible second spike in the virus — as the world resumes normality thereby creating closer human-to-human contact, and the fear of pre-symptomatic transmission. The extent of any economic impact will be harder to gauge in this fast-moving environment as will the impact of the knock-on effect on the levels of employment. However, our manager highlights some benefits in the Chinese economy in that its expansion in each of the past eight years has been led by internal consumption, which now represents some 60% of gross domestic product (“GDP”), whilst exports have diminished as a percentage of GDP to some 17%. As an example of the recent recovery of economic activity, the latest power generation numbers through the initial two months of the 2020 calendar year have held up well, while domestic Chinese opinion polls reflect a high proportion forecasting that earnings will remain largely unchanged for the full 2020 calendar year. Our manager has also highlighted the importance of sustainable profitability in smaller companies given that sector’s significance in China’s growth and, as much, job creation.

4

Table of Contents

THE CHINA FUND, INC.

CHAIRMAN’S STATEMENT (continued) (unaudited)

A detailed report from your Investment Manager follows.

Discount Management Program

The Board of Directors carefully monitors your Fund’s share price relative to its NAV and strives to manage it, within the environment of its global peer group, with the intent of preventing the discount from reaching double figures. Through the early part of the Period the discount ranged from 10% to 12%, but the breakout of Coronavirus in mid-February, was the primary contributor leading to a discount of 21% in mid-March, which was in line with the general market trend and its peer funds. The Fund’s discount slowly recovered to a Period-end level better than the 15%. At the time of writing, the Fund’s discount is 16.00%. In response to the increased volatility in global equity markets since mid-February — when implied volatility (commonly measured by the VIX Index) surged from the top end of the broad historic range of 20 to peak at 85 in mid-March, since when it has returned to the current 30-level, the Board of Directors suspended the operation of the Fund’s Discount Management Program given the perceived limited benefit to be realized by the Fund under the circumstances. The Board of Directors continues to closely monitor global social and market conditions — in the present conditions through a regular virtual meeting to determine how best to manage the Fund’s operations in the best interests of the Fund and its stockholders.

Fund Expenses

In line with the numerous recent actions undertaken, the Board of Directors continues to seek opportunities to reduce the costs incurred by the Fund where possible and its efforts are progressing in a favorable manner.

We thank you for your support through these exceptional and difficult conditions and wish all stockholders good health and stay safe.

Yours very sincerely

Julian Reid

For and on behalf of

The China Fund Inc.

5

Table of Contents

THE CHINA FUND, INC.

INVESTMENT MANAGER’S STATEMENT (unaudited)

Market Environment

Chinese equities were positive, but volatile, for the six months ended April 30, 2020. Key factors driving volatility were the U.S.-China trade war, Hong Kong political protests and the global COVID-19 pandemic. Looking back to November 2019, Chinese equities began to edge higher as positive sentiment surrounding trade was a catalyst for bargain hunting. The severity of protests in Hong Kong escalated mid-November and the U.S. Congress passed a bill in support of Hong Kong protesters, both of which created uncertainty for investors later in the month. Chinese equities continued to be strong performers in December. Protests in Hong Kong continued but at a lesser intensity and trade negotiations narrowed to focus on specific, more achievable objectives -the result of which was a ‘phase one’ agreement of terms. Markets began pricing in a positive trade outcome early in December, which ultimately resulted in a strong rally in China.

In January, the U.S. and China signed phase one of a trade agreement, which was light on specifics but represented an improvement in rhetoric. However, Chinese equities experienced fresh volatility later in the month as investors feared fallout from the coronavirus. A longer than normal incubation period for the virus combined with the mass people movement associated with Chinese New Year complicated the control of the virus early on. Chinese authorities acted decisively, limiting internal travel and controlling its borders while working with world health organizations to control the outbreak. Chinese equities were flat in February but held up better than other parts of Asia. The slowdown in the percentage rise in new virus cases in February along with comprehensive policy action helped stabilize sentiment within Chinese markets, especially A-shares. In addition, policy actions meant to assist small and medium size enterprises were implemented including an increase in loan quotas, lowering of borrowing rates, a delay in loan repayments and value-added tax (“VAT”) tax relief.

Chinese equities were negative in March as market participants tried to gauge the economic damage from the pandemic. The number of new virus cases continued to shrink, as public health measures showed strong progress toward reducing and dramatically slowing the spread of the virus. In April, Chinese equity prices rebounded, creating positive returns for the month. China’s economic recovery continued as factories increased capacity, office buildings opened their doors to workers and retail and restaurants began taking in customers. Supply side production increased but demand has been slower to materialize. In terms of reopening its economy, we estimate China’s economy is now operating at around 80% of its pre-lockdown levels. Unemployment has risen in China, as it has globally, but domestic demand remains resilient and we expect domestic travel could resume toward the second half of this year. Notably, China was the first country to experience the global pandemic and also the first to begin its economic recovery. We believe China’s policy makers have the right policy tools to help restart their economy and the right approach to public health policy to continue to contain the spread of the virus. While we remain concerned about the implication of the pandemic on the global economy, we see China’s economy as having the potential to be more resilient.

6

Table of Contents

THE CHINA FUND, INC.

INVESTMENT MANAGER’S STATEMENT (continued) (unaudited)

Performance, Contributors and Detractors

For the six months ended April 30, 2020, the Fund returned 9.23%, outperforming its benchmark, the MSCI China All Shares Index, which returned 4.76%. From a sector perspective, the Fund’s holdings in consumer discretionary, information technology and real estate contributed to performance. In contrast, the Fund’s holdings in financials, health care and industrials sectors detracted from performance.

A contributor among individual stocks was e-commerce company JD.com, Inc. (“JD.com”), which experienced increased demand for its services during the pandemic. As the second largest e-commerce company in China, JD.com has a broad reach and its profitability is improving. Logistics oriented businesses tend to be very capital intensive in their early years, but with much of JD.com’s logistic infrastructure already in place, we expect that the business may be less capital intensive going forward. China has many metropolitan densities and the complexity of making deliveries to most households is high, creating a competitive moat for an ecommerce player such as JD.com.

A detractor among individual stocks was Momo, a platform for live streaming entertainment. In addition to its live streaming platform, the company is diversifying into subscription-based services, such as a dating app and dating website. However, the competitive landscape for the company’s products is getting more crowded and we decided to exit the position. During the semiannual reporting period, we took advantage of market volatility and dislocations to continue to focus the portfolio and improve the overall quality of our holdings.

Outlook

From a health care and public policy perspective, China remains proactive about minimizing future outbreaks of COVID-19. We also believe China’s policy makers have considerable fiscal and monetary bandwidth to help support a sustained economic recovery. China’s annual National People’s Congress will convene mid-May with the expectation that the government will lower its 2020 economic growth target or abolish it altogether. In response, market participants expect the government to modestly increase fiscal spending and its government deficit while allowing local governments to increase debt financing. Lastly, we expect that announcements from the upcoming National People’s Congress could include additional minor stimulus, potentially pointed towards small businesses and households.

In our view, the larger risks to China’s economy are related not to domestic health concerns or government policy. Rather, they are related to global economic contraction. While China’s economy is primarily driven through domestic consumption, the country remains an export powerhouse and exports continue to represent part of China’s employment engine. A slowdown in global economic activity would present a headwind to China’s near-term growth.

Taking a longer-term view, we remain optimistic about China’s ability to grow its economy over the next three to five years, especially in those sectors driven by services and innovation. As China’s economy has changed and evolved, we find the quality of earnings streams coming out of publically listed companies improving. The breadth and range of companies now available to public equity investors in China has expanded considerably. Consider the

7

Table of Contents

THE CHINA FUND, INC.

INVESTMENT MANAGER’S STATEMENT (continued) (unaudited)

example of the health care sector. There was a time when we could only invest in a handful of health care product distributors. Now we can invest in a broad range of innovative drug makers, contract research organizations (“CROs”) and high-end medical equipment manufacturers and suppliers. The growth of innovative companies and a services-based economy present attractive opportunities for generating alpha through an active, bottom-up stock selection.

8

Table of Contents

THE CHINA FUND, INC.

ABOUT THE PORTFOLIO MANAGER (unaudited)

Matthews International Capital Management, LLC (“Matthews Asia”), the largest dedicated Asia investment specialist in the United States, is an independent, privately owned firm with a focus on long-term investment performance.

Andrew Mattock serves as the portfolio manager for the Fund’s portfolio of listed securities. Prior to joining Matthews Asia in 2015, he was a Fund Manager at Henderson Global Investors for 15 years, first in London and then in Singapore, managing Asia Pacific equities. Andrew holds a Bachelor of Business majoring in Accounting from ACU. He began his career at PricewaterhouseCoopers and qualified as a Chartered Accountant.

9

Table of Contents

THE CHINA FUND, INC.

April 30, 2020 (unaudited)

| Name of Issuer and Title of Issue |

Shares |

Value (Note A) | ||||||||||

| COMMON STOCK | ||||||||||||

| CHINA — “A” SHARES | ||||||||||||

| Banks — 5.0% | ||||||||||||

| China Merchants Bank Co., Ltd. — A |

2,461,547 | $ | 12,203,489 | |||||||||

|

|

|

|||||||||||

| Beverages — 5.5% | ||||||||||||

| Kweichow Moutai Co., Ltd. — A |

29,078 | 5,199,814 | ||||||||||

| Wuliangye Yibin Co., Ltd. — A |

433,396 | 8,313,450 | ||||||||||

|

|

|

|||||||||||

| 13,513,264 | ||||||||||||

|

|

|

|||||||||||

| Chemicals — 1.3% | ||||||||||||

| Wanhua Chemical Group Co., Ltd. — A |

518,243 | 3,294,871 | ||||||||||

|

|

|

|||||||||||

| Construction Materials — 1.0% | ||||||||||||

| Anhui Conch Cement Co., Ltd. — A |

302,071 | 2,558,958 | ||||||||||

|

|

|

|||||||||||

| Electronic Equipment, Instruments & Components — 3.6% | ||||||||||||

| AVIC Jonhon Optronic Technology Co., Ltd. — A |

137,791 | 697,526 | ||||||||||

| Luxshare Precision Industry Co., Ltd. — A |

604,320 | 4,039,359 | ||||||||||

| NAURA Technology Group Co., Ltd. — A |

190,302 | 4,091,333 | ||||||||||

|

|

|

|||||||||||

| 8,828,218 | ||||||||||||

|

|

|

|||||||||||

| Health Care Equipment & Supplies — 2.2% | ||||||||||||

| Lepu Medical Technology Beijing Co., Ltd. — A |

1,001,400 | 5,391,865 | ||||||||||

|

|

|

|||||||||||

| Household Durables — 2.3% | ||||||||||||

| Midea Group Co., Ltd. — A |

733,129 | 5,567,387 | ||||||||||

|

|

|

|||||||||||

| Insurance — 2.8% | ||||||||||||

| Ping An Insurance Group Company of China, Ltd. — A |

653,928 | 6,879,319 | ||||||||||

|

|

|

|||||||||||

| Life Sciences Tools & Services — 1.1% | ||||||||||||

| Hangzhou Tigermed Consulting Co., Ltd. — A |

244,700 | 2,662,056 | ||||||||||

|

|

|

|||||||||||

| Machinery — 0.9% | ||||||||||||

| Estun Automation Co., Ltd. — A |

1,467,400 | 2,154,054 | ||||||||||

|

|

|

|||||||||||

| TOTAL CHINA — “A” SHARES — (Cost $49,134,013) |

25.7 | % | 63,053,481 | |||||||||

|

|

|

|

|

|||||||||

| HONG KONG | ||||||||||||

| Capital Markets — 1.0% | ||||||||||||

| Hong Kong Exchanges & Clearing, Ltd. |

74,800 | 2,431,422 | ||||||||||

|

|

|

|||||||||||

| Diversified Consumer Services — 1.9% | ||||||||||||

| New Oriental Education & Technology Group, Inc. ADR* |

36,300 | 4,634,058 | ||||||||||

|

|

|

|||||||||||

| Hotels, Restaurants & Leisure — 2.3% | ||||||||||||

| Galaxy Entertainment Group, Ltd. |

859,000 | 5,590,010 | ||||||||||

|

|

|

|||||||||||

See notes to financial statements.

10

Table of Contents

THE CHINA FUND, INC.

SCHEDULE OF INVESTMENTS (continued)

April 30, 2020 (unaudited)

| Name of Issuer and Title of Issue |

Shares |

Value (Note A) | ||||||||||

| COMMON STOCK (continued) | ||||||||||||

| HONG KONG (continued) | ||||||||||||

| Insurance — 3.3% | ||||||||||||

| AIA Group, Ltd. |

865,000 | $ | 8,027,959 | |||||||||

|

|

|

|||||||||||

| Interactive Media & Services — 12.4% | ||||||||||||

| Tencent Holdings, Ltd. |

568,900 | 30,600,619 | ||||||||||

|

|

|

|||||||||||

| Internet & Direct Marketing Retail — 20.6% | ||||||||||||

| Alibaba Group Holding, Ltd. ADR* |

161,801 | 32,792,208 | ||||||||||

| JD.com, Inc. ADR* |

272,300 | 11,736,129 | ||||||||||

| Meituan Dianping — B* |

450,800 | 6,035,865 | ||||||||||

|

|

|

|||||||||||

| 50,564,202 | ||||||||||||

|

|

|

|||||||||||

| IT Services — 1.9% | ||||||||||||

| Chinasoft International, Ltd.* |

8,644,000 | 4,571,480 | ||||||||||

|

|

|

|||||||||||

| Life Sciences Tools & Services — 1.7% | ||||||||||||

| Wuxi Biologics Cayman, Inc. 144A* |

267,500 | 4,175,105 | ||||||||||

|

|

|

|||||||||||

| Pharmaceuticals — 2.0% | ||||||||||||

| Sino Biopharmaceutical, Ltd. |

3,413,000 | 4,992,379 | ||||||||||

|

|

|

|||||||||||

| Real Estate Management & Development — 7.4% | ||||||||||||

| China Overseas Property Holdings, Ltd. |

3,140,000 | 3,479,213 | ||||||||||

| China Resources Land, Ltd. |

1,140,000 | 4,676,169 | ||||||||||

| CIFI Holdings Group Co., Ltd. |

5,880,000 | 4,467,359 | ||||||||||

| Times China Holdings, Ltd. |

3,418,000 | 5,722,753 | ||||||||||

|

|

|

|||||||||||

| 18,345,494 | ||||||||||||

|

|

|

|||||||||||

| Software — 2.1% | ||||||||||||

| Kingdee International Software Group Co., Ltd. |

1,772,000 | 2,578,286 | ||||||||||

| Weimob, Inc. 144A(1)* |

3,234,000 | 2,461,219 | ||||||||||

|

|

|

|||||||||||

| 5,039,505 | ||||||||||||

|

|

|

|||||||||||

| Specialty Retail — 1.7% | ||||||||||||

| Zhongsheng Group Holdings, Ltd. |

1,035,500 | 4,180,735 | ||||||||||

|

|

|

|||||||||||

| TOTAL HONG KONG — (Cost $101,392,031) |

58.3 | % | 143,152,968 | |||||||||

|

|

|

|

|

|||||||||

| HONG KONG — “H” SHARES | ||||||||||||

| Banks — 4.5% | ||||||||||||

| China Construction Bank Corp. |

13,348,000 | 10,881,568 | ||||||||||

|

|

|

|||||||||||

| Capital Markets — 4.0% | ||||||||||||

| China International Capital Corp., Ltd. 144A |

3,550,000 | 5,458,369 | ||||||||||

| CITIC Securities Co., Ltd. |

2,209,500 | 4,263,672 | ||||||||||

|

|

|

|||||||||||

| 9,722,041 | ||||||||||||

|

|

|

|||||||||||

See notes to financial statements.

11

Table of Contents

THE CHINA FUND, INC.

SCHEDULE OF INVESTMENTS (continued)

April 30, 2020 (unaudited)

| Name of Issuer and Title of Issue |

Shares |

Value (Note A) | ||||||||||

| COMMON STOCK (continued) | ||||||||||||

| HONG KONG — “H” SHARES (continued) | ||||||||||||

| Health Care Providers & Services — 1.5% | ||||||||||||

| Sinopharm Group Co., Ltd. |

1,404,400 | $ | 3,804,244 | |||||||||

|

|

|

|||||||||||

| Insurance — 1.8% | ||||||||||||

| New China Life Insurance Co., Ltd. |

939,700 | 3,260,617 | ||||||||||

| Ping An Insurance Group Company of China Ltd. |

117,000 | 1,202,825 | ||||||||||

|

|

|

|||||||||||

| 4,463,442 | ||||||||||||

|

|

|

|||||||||||

| Transportation Infrastructure — 0.8% | ||||||||||||

| Beijing Capital International Airport Co., Ltd. |

3,060,000 | 2,060,393 | ||||||||||

|

|

|

|||||||||||

| TOTAL HONG KONG — “H” SHARES — (Cost $32,024,639) |

12.6 | % | 30,931,688 | |||||||||

|

|

|

|

|

|||||||||

| TOTAL HONG KONG (INCLUDING “H” SHARES) — (Cost $133,416,670) |

70.9 | % | 174,084,656 | |||||||||

|

|

|

|

|

|||||||||

| TOTAL COMMON STOCK — (Cost $182,550,683) |

96.6 | % | 237,138,137 | |||||||||

|

|

|

|

|

|||||||||

| COLLATERAL FOR SECURITIES ON LOAN | ||||||||||||

| Money Market Funds — 0.1% | ||||||||||||

| Fidelity Investments Money Market Government Portfolio, 0.20% ¥ — (Cost $350,080) |

350,080 | 350,080 | ||||||||||

|

|

|

|||||||||||

| TOTAL COLLATERAL FOR SECURITIES ON LOAN — (Cost $350,080) |

0.1 | % | 350,080 | |||||||||

|

|

|

|

|

|||||||||

| Principal |

||||||||||||

| SHORT TERM INVESTMENTS | ||||||||||||

| Time Deposits — 3.5% | ||||||||||||

| Brown Brothers Harriman & Co. — Grand Cayman, 0.24%, 5/4/2020 |

HKD 370 | 48 | ||||||||||

| Barclays, London — 0.01%, 5/1/2020 |

USD 2,000,000 | 2,000,000 | ||||||||||

| Citibank N.A. — New York, 0.01%, 5/1/2020 |

USD 4,000,000 | 4,000,000 | ||||||||||

| JPMorgan Chase & Co. — New York, 0.01%, 5/1/2020 |

USD 2,486,677 | 2,486,677 | ||||||||||

|

|

|

|||||||||||

| TOTAL SHORT TERM INVESTMENTS — (Cost $8,486,725) |

3.5 | % | 8,486,725 | |||||||||

|

|

|

|

|

|||||||||

| TOTAL INVESTMENTS — (Cost $191,387,488) |

100.2 | % | 245,974,942 | |||||||||

|

|

|

|

|

|||||||||

| OTHER ASSETS AND LIABILITIES |

(0.2 | )% | (437,644 | ) | ||||||||

|

|

|

|

|

|||||||||

| NET ASSETS |

100.0 | % | $ | 245,537,298 | ||||||||

|

|

|

|

|

|||||||||

See notes to financial statements.

12

Table of Contents

THE CHINA FUND, INC.

SCHEDULE OF INVESTMENTS (continued)

April 30, 2020 (unaudited)

Notes to Schedule of Investments

| * | Denotes non-income producing security. |

| ¥ | Rate shown is the 7-day yield as of April 30, 2020. |

| (1) | A security (or a portion of the security) is on loan. As of April 30, 2020, the market value of the security loaned was $333,033. The loaned security was secured with cash collateral of $350,080. Collateral is calculated based on prior day’s prices. |

144A Securities exempt from registration under Rule 144a of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At April 30, 2020, these restricted securities amounted to $12,094,693, which represented 4.9% of total net assets.

ADR American Depositary Receipt

HKD — Hong Kong dollar

USD — United States dollar

See notes to financial statements.

13

Table of Contents

THE CHINA FUND, INC.

STATEMENT OF ASSETS AND LIABILITIES

April 30, 2020 (unaudited)

| ASSETS |

||||

| Investments in securities, at value (cost $191,387,488) (including securities on loan, at value, $333,033) (Note A) |

$ | 245,974,942 | ||

| Cash |

498 | |||

| Foreign currency, at value (cost $90,956) |

92,268 | |||

| Prepaid expenses and other receivables |

98,542 | |||

|

|

|

|||

| TOTAL ASSETS |

246,166,250 | |||

|

|

|

|||

| LIABILITIES |

||||

| Payable upon return of collateral for securities on loan |

350,080 | |||

| Investment management fee payable (Note B) |

135,394 | |||

| Administration and custodian fees payable (Note B) |

1,056 | |||

| Chief Compliance Officer fees payable |

3,190 | |||

| Other accrued expenses and liabilities |

139,232 | |||

|

|

|

|||

| TOTAL LIABILITIES |

628,952 | |||

|

|

|

|||

| TOTAL NET ASSETS |

$ | 245,537,298 | ||

|

|

|

|||

| COMPOSITION OF NET ASSETS: |

||||

| Par value, 100,000,000 shares authorized, 10,477,422 shares outstanding (Note C) |

104,774 | |||

| Paid in capital in excess of par |

184,442,331 | |||

| Distributable earnings |

60,990,193 | |||

|

|

|

|||

| TOTAL NET ASSETS |

$ | 245,537,298 | ||

|

|

|

|||

| NET ASSET VALUE PER SHARE |

||||

| ($245,537,298/10,477,422 shares of common stock outstanding) |

$ 23.43 | |||

|

|

|

|||

See notes to financial statements.

14

Table of Contents

THE CHINA FUND, INC.

STATEMENT OF OPERATIONS

Six Months Ended April 30, 2020 (unaudited)

| INVESTMENT INCOME: |

||||

| Dividend income |

$ | 99,166 | ||

| Securities lending income |

31,641 | |||

| Interest income |

28,004 | |||

|

|

|

|||

| TOTAL INVESTMENT INCOME |

158,811 | |||

|

|

|

|||

| EXPENSES |

||||

| Investment Management fees (Note B) |

858,901 | |||

| Directors’ fees and expenses |

109,844 | |||

| Insurance |

55,585 | |||

| Legal fees |

48,432 | |||

| Custodian fees (Note B) |

35,155 | |||

| Fund Officer fees |

35,112 | |||

| Chief Compliance Officer fee |

29,856 | |||

| Administration fees (Note B) |

29,049 | |||

| Shareholder service fees |

26,204 | |||

| Audit and tax service fees |

25,562 | |||

| Transfer agent fees |

18,261 | |||

| Printing and postage |

14,115 | |||

| Stock exchange listing fee |

12,494 | |||

| Fund accounting fees |

12,414 | |||

| Miscellaneous expenses |

45,627 | |||

|

|

|

|||

| TOTAL EXPENSES |

1,356,611 | |||

|

|

|

|||

| NET INVESTMENT LOSS |

(1,197,800 | ) | ||

|

|

|

|||

| NET REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS AND FOREIGN CURRENCY TRANSACTIONS |

||||

| Net realized gain on investments |

8,937,771 | |||

| Net realized loss on foreign currency transactions |

(12,948 | ) | ||

|

|

|

|||

| 8,924,823 | ||||

|

|

|

|||

| Net change in unrealized appreciation/depreciation on investments |

13,266,357 | |||

| Net change in unrealized appreciation/depreciation on foreign currency translations |

2,599 | |||

|

|

|

|||

| 13,268,956 | ||||

|

|

|

|||

| NET REALIZED AND UNREALIZED GAIN ON INVESTMENTS AND FOREIGN CURRENCY TRANSACTIONS |

22,193,779 | |||

|

|

|

|||

| NET INCREASE IN NET ASSETS FROM OPERATIONS |

$ | 20,995,979 | ||

|

|

|

|||

See notes to financial statements.

15

Table of Contents

THE CHINA FUND, INC.

STATEMENT OF CHANGES IN NET ASSETS

| Six Months Ended April 30, 2020 |

Year Ended October 31, 2019 |

|||||||

| (unaudited) | ||||||||

| INCREASE (DECREASE) IN NET ASSETS FROM OPERATIONS |

||||||||

| Net investment income (loss) |

$ | (1,197,800) | $ | 1,561,770 | ||||

| Net realized gain on investments and foreign currency transactions |

8,924,823 | 15,181,643 | ||||||

| Net change in unrealized appreciation/depreciation on investments and foreign currency translations |

13,268,956 | 40,411,053 | ||||||

|

|

|

|

|

|||||

| Net increase in net assets from operations |

20,995,979 | 57,154,466 | ||||||

|

|

|

|

|

|||||

| DISTRIBUTIONS TO SHAREHOLDERS FROM: |

||||||||

| Distributable earnings |

(14,642,447 | ) | (8,491,817 | ) | ||||

|

|

|

|

|

|||||

| Total distributions to shareholders |

(14,642,447 | ) | (8,491,817 | ) | ||||

|

|

|

|

|

|||||

| CAPITAL SHARE TRANSACTIONS: |

||||||||

| Cost of shares tendered (Note E) |

— | (97,213,310 | ) | |||||

| Cost of share repurchased (Note D) |

(3,752,951 | ) | (6,981,694 | ) | ||||

|

|

|

|

|

|||||

| Net increase (decrease) in net assets from capital share transactions |

(3,752,951 | ) | (104,195,004 | ) | ||||

|

|

|

|

|

|||||

| NET INCREASE/(DECREASE) IN NET ASSETS |

2,600,581 | (55,532,355 | ) | |||||

|

|

|

|

|

|||||

| NET ASSETS: |

||||||||

| Beginning of Period |

242,936,717 | 298,469,072 | ||||||

|

|

|

|

|

|||||

| End of Period |

$ | 245,537,298 | $ | 242,936,717 | ||||

|

|

|

|

|

|||||

See notes to financial statements.

16

Table of Contents

THE CHINA FUND, INC.

FINANCIAL HIGHLIGHTS

Selected data for a share of common stock outstanding for the periods indicated

| Six

Months ended April 30, 2020 |

Year Ended October 31, | |||||||||||||||||||||||

| 2019(1) | 2018 | 2017 | 2016 | 2015 | ||||||||||||||||||||

| (unaudited) | ||||||||||||||||||||||||

| Per Share Operating Performance |

||||||||||||||||||||||||

| Net asset value, beginning of period |

$ | 22.80 | $ | 18.98 | $ | 23.31 | $ | 18.78 | $ | 19.91 | $ | 24.21 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net investment income (loss)* |

(0.11 | ) | 0.13 | 0.14 | 0.18 | (2) | 0.46 | (2) | 0.26 | |||||||||||||||

| Net realized and unrealized gain (loss) on investments and foreign currency transactions |

2.07 | 4.09 | (3.92 | ) | 4.82 | (0.10 | ) | (0.79 | ) | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total from investment operations |

1.96 | 4.22 | (3.78 | ) | 5.00 | 0.36 | (0.53 | ) | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Less dividends and distributions: |

||||||||||||||||||||||||

| Dividends from net investment income |

(0.13 | ) | (0.17 | ) | (0.55 | ) | (0.47 | ) | (0.21 | ) | (0.30 | ) | ||||||||||||

| Distributions from net realized gains |

(1.25 | ) | (0.37 | ) | — | — | (1.28 | ) | (3.47 | ) | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total dividends and distributions |

(1.38 | ) | (0.54 | ) | (0.55 | ) | (0.47 | ) | (1.49 | ) | (3.77 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Capital Share Transactions: |

||||||||||||||||||||||||

| Accretion (Dilution) to net asset value resulting from share repurchase program, tender offer or issuance of shares in stock dividend |

0.05 | 0.14 | — | — | 0.00 | (3) | — | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net asset value, end of period |

$ | 23.43 | $ | 22.80 | $ | 18.98 | $ | 23.31 | $ | 18.78 | $ | 19.91 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Market price, end of period |

$ | 20.01 | $ | 20.08 | $ | 16.98 | $ | 21.10 | $ | 16.18 | $ | 17.49 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total Investment Return (Based on Market Price) |

5.92 | %(4) | 21.86 | % | (17.53 | )% | 34.38 | %(5) | 1.73 | % | (1.95 | )% | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total Investment Return (Based on Net Asset Value) |

9.23 | %(4) | 23.79 | % | (16.55 | )% | 27.90 | %(5) | 3.73 | % | (1.16 | )% | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Ratios and Supplemental Data |

||||||||||||||||||||||||

| Net assets, end of period (000’s) |

$ | 245,537 | $ | 242,937 | $ | 298,469 | $ | 366,541 | $ | 295,252 | $ | 312,191 | ||||||||||||

| Ratio of gross expenses to average net assets |

1.11 | %(6) | 1.41 | % | 1.91 | % | 1.49 | % | 1.51 | % | 1.34 | % | ||||||||||||

| Ratio of net expenses to average net assets |

1.11 | %(6) | 1.41 | % | 1.91 | % | 1.49 | % | 1.51 | % | 1.34 | % | ||||||||||||

| Ratio of net investment income/(loss) to average net assets |

(0.98 | )%(6) | 0.61 | % | 0.62 | % | 0.92 | %(2) | 2.66 | %(2) | 1.16 | % | ||||||||||||

| Portfolio turnover rate |

35 | %(4) | 132 | % | 50 | % | 31 | % | 52 | % | 64 | % | ||||||||||||

| * | Per share amounts have been calculated using the average share method. |

| (1) | Effective January 1, 2019, Matthews International Capital Management, LLC became the investment manager. Prior to January 1, 2019, the Fund’s investment manager was Allianz Global Investors. |

| (2) | Amount includes a non-recurring receipt of a refund for over-billing of prior years’ custody out of pocket expense which amounted to $0.02 per share and 0.12% of average net assets during 2016 and less than $0.01 per share and less than 0.005% of net assets during 2017. |

| (3) | Amount is less than $0.01. |

| (4) | Not Annualized. |

| (5) | The performance has been restated to reflect an adjustment to the dividend reinvestment price applied in 2016, which had the effect of modestly understating performance for the period. |

| (6) | Annualized. |

See notes to financial statements.

17

Table of Contents

THE CHINA FUND, INC.

April 30, 2020 (unaudited)

NOTE A — SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The China Fund, Inc. (the “Fund”) was incorporated under the laws of the State of Maryland on April 28, 1992, and is a non-diversified, closed-end management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”). The Fund’s investment objective is long-term capital appreciation which it seeks to achieve by investing primarily in equity securities (i) of companies for which the principal securities trading market is the People’s Republic of China (“China”), (ii) of companies for which the principal securities trading market is outside of China, or constituting direct equity investments in companies organized outside of China, that in both cases derive at least 50% of their revenues from goods and services sold or produced, or have at least 50% of their assets, in China and (iii) constituting direct equity investments in companies organized in China (“Direct Investments”). The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. The Fund’s investment manager is Matthews International Capital Management, LLC (“Matthews Asia” or the “Investment Manager”).

The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board Accounting Standard Codification Topic 946 “Financial Services — Investment Companies.”

The financial statements are prepared in accordance with U.S. generally accepted accounting principles (“GAAP”), which require management to make estimates and assumptions that affect the reported amounts of assets and liabilities. Actual results could differ from those estimates. The following summarizes the significant accounting policies of the Fund:

Security Valuation: Portfolio securities listed on recognized U.S. or foreign security exchanges are valued at the last quoted sales price in the principal market where they are traded. Listed securities with no such sales price and unlisted securities are valued at the mean between the current bid and asked prices, if any, from brokers. Short-term investments having maturities of sixty days or less are valued at amortized cost (original purchase cost as adjusted for amortization of premium or accretion of discount) which when combined with accrued interest approximates market value. Securities for which market quotations are not readily available or are deemed unreliable are valued at fair value in good faith by or at the direction of the Board of Directors (the “Board”) considering relevant factors, data and information including, if relevant, the market value of freely tradable securities of the same class in the principal market on which such securities are normally traded. Direct Investments, if any, are valued at fair value as determined by or at the direction of the Board based on financial and other information supplied by the Direct Investment Manager regarding each Direct Investment. Forward currency contracts are valued at the current cost of offsetting the contract. Equity linked securities, if any, are valued at fair value primarily based on the value(s) of the underlying security (or securities), which normally follows the same methodology as the valuation of securities listed on recognized exchanges.

Factors used in determining fair value may include, but are not limited to, the type of security, the size of the holding, the initial cost of the security, the existence of any contractual restrictions on the security’s disposition, the price and extent of public trading in similar securities of the issuer or of comparable companies, the availability of quotations from broker-dealers, the availability of values of third parties other than the Investment Manager,

18

Table of Contents

NOTES TO FINANCIAL STATEMENTS (continued) (unaudited)

information obtained from the issuer, analysts, and/or the appropriate stock exchange (if available), an analysis of the company’s financial statements, an evaluation of the forces that influence the issuer and the market(s) in which the security is purchased and sold and with respect to debt securities, the maturity, coupon, creditworthiness, currency denomination, and the movement of the market in which they trade.

Securities Lending: The Fund may lend up to 33 1/3% of the Fund’s total assets held by Brown Brothers Harriman & Co. (“BBH”) as custodian to certain qualified brokers, except those securities which the Fund or the Investment Manager specifically identifies as not being available. By lending its investment securities, the Fund attempts to increase its net investment income through the receipt of interest on the loan. Any gain or loss in the market price of the securities loaned that might occur and any interest or dividends declared during the term of the loan would accrue to the account of the Fund. Risks of delay in recovery of the securities or even loss of rights in the collateral may occur should the borrower of the securities fail financially. Upon entering into a securities lending transaction, the Fund receives cash as collateral in an amount equal to or exceeding 100% of the current market value of the loaned securities with respect to securities of the U.S. government or its agencies, 102% of the current market value of the loaned securities with respect to U.S. securities and 105% of the current market value of the loaned securities with respect to foreign securities. Any cash received as collateral is generally invested by BBH, acting in its capacity as securities lending agent (the “Agent”), in the Fidelity Investments Money Market Government Portfolio. A portion of the dividends received on the collateral may be rebated to the borrower of the securities and the remainder is split between the Agent and the Fund.

| Remaining Contractual Maturity of the Agreements As of April 30, 2020 |

||||||||||||||||||||

| Overnight

and Continuous |

<30 days | Between 30 & 90 days |

>90 days | Total | ||||||||||||||||

| Securities Lending Transactions |

||||||||||||||||||||

| Money Market Fund |

$ | 350,080 | $ | — | $ | — | $ | — | $ | 350,080 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total Borrowings |

$ | 350,080 | $ | — | $ | — | $ | — | $ | 350,080 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Gross amount of recognized liabilities for securities lending transactions |

$ | 350,080 | ||||||||||||||||||

As of April 30, 2020, the Fund had loaned securities which were collateralized by cash. The value of the security on loan and the value of the related collateral were as follows:

| Value

of Securities |

Value of

Cash Collateral |

Value of Non-Cash Collateral* |

Total Collateral |

|||||||||||

| $333,033 | $ | 350,080 | $ | — | $ | 350,080 | ||||||||

| * | Fund cannot repledge or dispose of this collateral, nor does the Fund earn any income or receive dividends with respect to this collateral. |

19

Table of Contents

NOTES TO FINANCIAL STATEMENTS (continued) (unaudited)

| Gross Amounts Not Offset in the Statement of Assets and Liabilities | ||||||||||||||

| Gross Asset Amounts Presented in Statement of Assets and Liabilities |

Financial Instrument |

Collateral Received |

Net Amount | |||||||||||

| $350,080 | $ | — | $ | (350,080 | ) | $ | 0 | |||||||

Time Deposits: The Fund places excess cash balances into overnight time deposits with one or more eligible deposit institutions that meet credit and risk standards approved by the Fund. These are classified as short term investments in Schedule of Investments.

Foreign currency translations: The records of the Fund are maintained in U.S. dollars. Foreign currencies, investments and other assets and liabilities are translated into U.S. dollars at the current exchange rates. Purchases and sales of investment securities and income and expenses are translated on the respective dates of such transactions. Net realized gains and losses on foreign currency transactions represent net gains and losses from the disposition of foreign currencies, currency gains and losses realized between the trade dates and settlement dates of security transactions, and the difference between the amount of net investment income accrued and the U.S. dollar amount actually received. The effects of changes in foreign currency exchange rates on investments in securities are not segregated in the Statement of Operations from the effects of changes in market prices of those securities, but are included in realized and unrealized gain or loss on investments. Net unrealized foreign currency gains and losses arise from changes in the value of assets and liabilities, other than investments in securities, as a result of changes in exchange rates.

Forward Foreign Currency Contracts: The Fund may enter into forward foreign currency contracts to hedge against foreign currency exchange rate risks. A forward currency contract is an agreement between two parties to buy or sell currency at a set price on a future date. Upon entering into these contracts, risks may arise from the potential inability of counterparties to meet the terms of their contracts and from unanticipated movements in the value of the foreign currency relative to the U.S. dollar. The U.S. dollar value of forward currency contracts is determined using forward exchange rates provided by quotation services. Daily fluctuations in the value of such contracts are recorded as unrealized gain or loss on the Statement of Assets and Liabilities. When the contract is closed, the Fund records a realized gain or loss equal to the difference between the value at the time it was opened and the value at the time it was closed. Such gain or loss is disclosed in the realized and unrealized gain or loss on foreign currency in the Fund’s accompanying Statement of Operations. At April 30, 2020, the Fund did not hold forward foreign currency contracts.

Option Contracts: The Fund may purchase and write (sell) call options and put options provided the transactions are for hedging purposes and the initial margin and premiums do not exceed 5% of total assets. Option contracts are valued daily and unrealized gains or losses are recorded on the Statement of Assets and Liabilities based upon the last sales price on the principal exchange on which the options are traded. The Fund will realize a gain or loss upon the expiration or closing of the option contract. Such gain or loss is disclosed in the realized and unrealized gain or loss on options in the Fund’s accompanying Statement of Operations. When an option is exercised, the proceeds on sales of the underlying security for a written call option, the purchase cost of the security for a written put option, or the cost of the security for a purchased put or call option is adjusted by the amount of premium received or paid.

20

Table of Contents

NOTES TO FINANCIAL STATEMENTS (continued) (unaudited)

The risk in writing a call option is that the Fund gives up the opportunity for profit if the market price of the security increases and the option is exercised. The risk in writing a put option is that the Fund may incur a loss if the market price of the security decreases and the option is exercised. The risk in buying an option is that the Fund pays a premium whether or not the option is exercised. Risks may also arise from an illiquid secondary market or from the inability of a counterparty to meet the terms of the contract. At April 30, 2020, the Fund did not hold any option contracts.

Equity-Linked Securities: The Fund may invest in equity-linked securities such as linked participation notes, equity swaps and zero-strike options and securities warrants. Equity-linked securities may be used by the Fund to gain exposure to countries that place restrictions on investments by foreigners. To the extent that the Fund invests in equity-linked securities whose return corresponds to the performance of a foreign securities index or one or more foreign stocks, investing in equity-linked securities will involve risks similar to the risks of investing in foreign securities. In addition, the Fund bears the risk that the issuer of any equity-linked securities may default on its obligation under the terms of the arrangement with the counterparty. Equity-linked securities are often used for many of the same purposes as, and share many of the same risks with, derivative instruments. In addition, equity-linked securities may be considered illiquid. At April 30, 2020, the Fund did not hold equity-linked securities.

Direct Investments: The Fund may invest up to 25% of the net proceeds from its offering of its outstanding common stock in Direct Investments; however, the Board of the Fund has suspended additional investments in Direct Investments. Direct Investments are generally restricted and do not have a readily available resale market. Because of the absence of any public trading market for these investments, the Fund may take longer to liquidate these positions than would be the case for publicly traded securities. Although these securities may be resold in privately negotiated transactions, the prices on these sales could be less than those originally paid by the Fund. Issuers whose securities are not publicly traded may not be subject to public disclosure and other investor protections requirements applicable to publicly traded securities. At April 30, 2020, the Fund did not hold Direct Investments.

Indemnification Obligations: Under the Fund’s organizational documents, its Officers and Directors are indemnified against certain liabilities arising out of the performance of their duties to the Fund. In addition, in the normal course of business the Fund enters into contracts that provide general indemnifications to other parties. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred.

Security transactions and investment income: Security transactions are recorded as of the trade date. Realized gains and losses from securities sold are recorded on the identified cost basis. Dividend income is recorded on the ex-dividend date, or, in the case of dividend income on foreign securities, on the ex-dividend date or when the Fund becomes aware of its declaration. Interest income is recorded on the accrual basis. All premiums and discounts are amortized/accreted for both financial reporting and federal income tax purposes.

Dividends and distributions: The Fund intends to distribute to its stockholders, at least annually, substantially all of its net investment income and any net realized capital gains. Distributions to stockholders are recorded on the ex-dividend date. Income and capital gains distributions are determined in accordance with federal income tax

21

Table of Contents

NOTES TO FINANCIAL STATEMENTS (continued) (unaudited)

regulations, which may differ from U.S. generally accepted accounting principles. Certain capital accounts in the financial statements are periodically adjusted for permanent differences in order to reflect their tax character. These adjustments have no impact on net assets or net asset value per share. Temporary differences which arise from recognizing certain items of income, expense, gain or loss in different periods for financial statement and tax purposes will reverse at some time in the future. Unless the Board elects to make distributions in shares of the Fund’s common stock, the distributions will be paid in cash, except with respect to stockholders who have elected to participate in the Fund’s Dividend Reinvestment and Cash Purchase Plan.

Federal Taxes: It is the Fund’s policy to qualify each year as a regulated investment company under Subchapter M of the Internal Revenue Code, as amended (“Code”) and to distribute to stockholders each year substantially all of its income. Accordingly, no provision for federal income tax is necessary. As of and during the period ended April 30, 2020, the Fund did not have a liability for any uncertain tax positions. The Fund recognizes interest and penalties, if any, related to tax liabilities as income tax expense in the Statement of Operations. For the previous three years the Fund remains subject to examination by the Fund’s major tax jurisdictions, which include the United States of America and the State of Maryland. The Fund may be subject to taxes imposed by governments of countries in which it invests. Such taxes are generally based on either income or gains earned or repatriated. The Fund accrues and applies such taxes to net investment income, net realized gains and net unrealized gains as income and/or gains are earned.

At April 30, 2020, the cost of investments for federal income tax purposes was $191,387,488. Gross unrealized appreciation of investments was $58,696,044 while gross unrealized depreciation of investments was $4,108,590, resulting in net unrealized appreciation of investments of $54,587,454.

NOTE B — ADVISORY FEE AND OTHER TRANSACTIONS

Effective January 1, 2019, Matthews Asia is the investment manager for the Fund’s listed assets (“Listed Assets”). Matthews Asia receives a fee, computed and accrued daily and paid monthly at a rate of 0.70% if assets exceed $150 million and 0.80% if assets do not exceed $150 million. Prior to January 1, 2019, Allianz Global Investors (“AGI”) was the investment manager for the Fund’s Listed Assets and Direct Investments. AGI received a fee, computed weekly and payable monthly, at the following annual rates: 0.70% of the first US$315 million of the Fund’s average weekly net assets invested in Listed Assets; and 0.50% of the Fund’s average weekly net assets invested in Listed Assets in excess of US$315 million. For the period ended April 30, 2020, the investment management fee rate was equivalent to an annual effective rate of 0.70% of the Fund’s average daily net assets. For the six months ended April 30, 2020, no fees were paid for Direct Investments as the Fund held no such investments during the period.

No director, officer or employee of Matthews Asia, AGI, or any affiliates of those entities receives any compensation from the Fund for serving as an officer or director of the Fund.

BBH provides, or arranges for the provision of certain administrative services for the Fund, including preparing certain reports and other documents required by federal and/or state laws and regulations. The Fund pays BBH a fee that is calculated daily and paid monthly at an annual rate based on aggregate average daily assets of the Fund. The

22

Table of Contents

NOTES TO FINANCIAL STATEMENTS (continued) (unaudited)

Fund also pays BBH an annual fee for certain legal administration services, including corporate secretarial services and preparing regulatory filings.

The Fund has also contracted with BBH to provide custody and fund accounting services to the Fund. For these services, the Fund pays BBH asset-based fees that vary according to the number of positions and transactions plus out-of-pocket expenses.

NOTE C — FUND SHARES

At April 30, 2020, there were 100,000,000 shares of $0.01 par value capital stock authorized, of which 10,477,422 were issued and outstanding.

For the period ended April 30, 2020, the Fund repurchased 177,903 shares of its common stock, valued at $3,752,951, from stockholders participating in the repurchases under the Fund’s discount management program.

| For Period Ended April 30, 2020 |

||||

| Shares outstanding at beginning of period |

10,655,325 | |||

| Shares repurchased |

(177,903 | ) | ||

|

|

|

|||

| Shares outstanding at end of period |

10,477,422 | |||

|

|

|

|||

NOTE D — DISCOUNT MANAGEMENT PROGRAM

On February 6, 2019, the Fund announced that its Board of Directors approved a Discount Management Program (the “Program”) which authorizes management to make open market purchases in an aggregate amount up to 10% of the Fund’s common shares outstanding as of the close of business on October 31 of the prior year. This limit may be increased or decreased by the Board at any time. Under the Program, the Fund will repurchase its common shares in the open market on any trading day that the Fund’s shares are trading above the discount threshold, which is currently 9.5%. On each day that shares are repurchased, the Fund repurchases its shares to the maximum extent permitted by law unless the Board and the Program Manager determine that such repurchase would be detrimental to the Fund and its stockholders. The Program is intended to enhance stockholder value, as repurchases made at a discount may have the effect of increasing the per share NAV of the Fund’s remaining shares. There is no assurance, however, that the market price of the Fund’s shares, either absolutely or relative to NAV, will increase as a result of any share repurchases. These repurchases may be commenced or suspended at any time or from time to time without any notice. On March 16, 2020, in light of the effects of the COVID-19 pandemic on global economies and stock markets and the resulting volatility in stock prices, the Board initiated a temporary suspension of the Program. Subsequent to the reporting period, on June 2, 2020, the Board resumed the operation of the Program. Any repurchases will be disclosed in the Fund’s stockholder reports for the relevant fiscal periods.

For the period ended April 30, 2020, the Fund repurchased 177,903 of its shares at an average price of $21.10 per share (including brokerage commissions) at an average discount of 11.52%. These repurchases had a total cost of $3,752,951. The Board will continue to review the Program and its effectiveness, and, as appropriate, may make further enhancements as it believes are necessary.

23

Table of Contents

NOTES TO FINANCIAL STATEMENTS (continued) (unaudited)

NOTE E — TENDER OFFER

On November 9, 2018, the Fund announced that its Board approved in principle a one-time tender offer (the “Tender Offer”). The Tender Offer commenced on January 4, 2019 and expired on February 5, 2019. The Tender Offer was oversubscribed and, pursuant to the terms of the Tender Offer, tendered shares were accepted for payment on a pro rata basis. The Fund accepted 4,716,803 shares for payment on or about February 12, 2019 at $20.61 per share, which is equal to 99% of the Fund’s NAV per share as of the close of regular trading on the New York Stock Exchange on February 6, 2019. The 4,716,803 shares totaling $97,213,310 represented 30% of the Fund’s outstanding shares. On a pro rata basis, approximately 40.71% of the shares so tendered were accepted for payment.

NOTE F — INVESTMENT TRANSACTIONS

For the six months ended April 30, 2020, the Fund’s cost of purchases and proceeds from sales of investment securities, other than short-term securities, were $82,500,149 and $103,326,606, respectively.

NOTE G — INVESTMENTS IN CHINA

The Fund’s investments in Chinese companies involve certain risks not typically associated with investments in securities of U.S. companies or the U.S. Government, including risks relating to (1) social, economic and political uncertainty; (2) price volatility, lesser liquidity and smaller market capitalization of securities markets in which securities of Chinese companies trade; (3) currency exchange fluctuations, currency blockage and higher rates of inflation; (4) controls on foreign investment and limitations on repatriation of invested capital and on the Fund’s ability to exchange local currencies for U.S. dollars; (5) governmental involvement in and control over the economy; (6) risk of nationalization or expropriation of assets; (7) the nature of the smaller, less seasoned and newly organized Chinese companies, particularly in China; and (8) the absence of uniform accounting, auditing and financial reporting standards, practices and disclosure requirements and less government supervision and regulation.

NOTE H — FAIR VALUE MEASUREMENT

The Fund has adopted fair valuation accounting standards which establish a definition of fair value and set out a hierarchy for measuring fair value. These standards require additional disclosures about the various inputs and valuation techniques used to develop the measurements of fair value and a discussion of changes in valuation techniques and related inputs during the period. These inputs are summarized in the three broad levels listed below:

| • | Level 1 — Inputs that reflect unadjusted quoted prices in active markets for identical assets or liabilities that the Fund has the ability to access at the measurement date; |

| • | Level 2 — Inputs other than quoted prices that are observable for the asset or liability either directly or indirectly, including inputs in markets that are not considered to be active; |

| • | Level 3 — Inputs that are unobservable. |

24

Table of Contents

NOTES TO FINANCIAL STATEMENTS (continued) (unaudited)

The following is a summary of the inputs used as of April 30, 2020 in valuing the Fund’s investments carried at value:

ASSETS VALUATION INPUT

| Description* |

Level 1 | Level 2 | Level 3 | Total | ||||||||||||

| Common Stock |

237,138,137 | — | — | 237,138,137 | ||||||||||||

| Collateral For Securities On Loan |

350,080 | — | — | 350,080 | ||||||||||||

| Short Term Investments |

— | 8,486,725 | — | 8,486,725 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| TOTAL INVESTMENTS |

237,488,217 | 8,486,725 | — | 245,974,942 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| * | Please refer to the Schedule of Investments for additional security details. |

NOTE I — DERIVATIVE INSTRUMENTS AND HEDGING ACTIVITIES

The Fund did not enter into any derivatives transactions or hedging activities for the six months ended April 30, 2020.

NOTE J — SUBSEQUENT EVENT

On March 11, 2020 the COVID-19 outbreak was declared a pandemic by the World Health Organization. The COVID-19 coronavirus pandemic was first detected in China in December 2019 and subsequently spread globally. Containment efforts around the world have halted business and manufacturing operations and restricted people’s movement and travel. The virus and those containment efforts have caused disruptions to global supply chains, consumer demand, business investment and the global financial system, and considerable uncertainty for the global economy and financial markets. The effects of COVID-19 pandemic may persist for an extended period of time and have resulted in substantial market volatility and a significant economic downturn. The ultimate economic fallout from the pandemic, and the long-term impact on economies, markets, industries and individual issuers, are not known. The COVID-19 pandemic could adversely affect the value and liquidity of the Fund’s investments and negatively impact the Fund’s performance. In addition, measures taken to mitigate the effects of the COVID-19 pandemic could result in disruptions to the services provided to the Fund by its service providers. The potential impact to the Funds is uncertain at this time and management continues to monitor and evaluate the situation.

.

25

Table of Contents

THE CHINA FUND, INC.

Results of Annual Stockholder Meeting held on March 12, 2020

1. Election of Director — the stockholders of the Fund elected the following Director to serve for a three year term expiring on the date of which the annual meeting of stockholders is held in 2023.

| Director |

Votes Cast for |

Votes Against/ Withheld |

||||||

| George J. Iwanicki |

5,593,943 | 349,091 | ||||||

PRIVACY POLICY

| Privacy Notice

The China Fund, Inc. collects nonpublic personal information about its stockholders from the following sources:

☐ Information it receives from stockholders on applications or other forms; and

☐ Information about stockholder transactions with the Fund.

The Fund’s policy is to not disclose nonpublic personal information about its stockholders to nonaffiliated third parties (other than disclosures permitted by law).

The Fund restricts access to nonpublic personal information about its stockholders to those agents of the Fund who need to know that information to provide products or services to stockholders. The Fund maintains physical, electronic and procedural safeguards that comply with federal standards to guard its stockholders’ nonpublic personal information. |

QUARTERLY PORTFOLIO OF INVESTMENTS

A Schedule of Investments will be filed as of the end of the first and third quarter of each fiscal year on Form N-Q and will be available on the Securities and Exchange Commission’s website at http://www.sec.gov. Form N-Q was filed as of January 31, 2020 for the first quarter of this fiscal year and is available on the Securities and Exchange Commission’s website at www.sec.gov. Effective May 1, 2020 the Fund will file its complete Schedule of Investments with the Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The Fund’s Form N-PORT reports are available on the SEC’s website at http://www.sec.gov. The quarterly Schedule of Investments will be made available without charge, upon request, by calling 1-888-246-2255.

PROXY VOTING POLICIES & PROCEDURES

A description of the policies and procedures that the Fund has adopted to determine how to vote proxies relating to portfolio securities and information about how the Fund voted proxies relating to portfolio securities held during the

26

Table of Contents

THE CHINA FUND, INC.

Other Information (continued) (unaudited)

most recent twelve month period ended June 30 is available (i) without charge, upon request, by calling the Fund’s stockholder servicing agent at 1-888-245-2255; (ii) on the Fund’s website at www.chinafundinc.com; and (iii) on the Securities and Exchange Commission website at www.sec.gov.

CERTIFICATIONS

The Fund’s chief executive officer has certified to the New York Stock Exchange that, as of April 13, 2020, he was not aware of any violation by the Fund of applicable New York Stock Exchange corporate governance listing standards. The Fund also has included the certifications of the Fund’s chief executive officer and chief financial officer required by Section 302 and Section 906 of the Sarbanes-Oxley Act of 2002 in the Fund’s Form N-CSR filed with the Securities and Exchange Commission, for the period of this report.

27

Table of Contents

SUMMARY OF DIVIDEND REINVESTMENT AND CASH PURCHASE PLAN

The Fund will distribute to stockholders, at least annually, substantially all of its net investment income from dividends and interest earnings and expects to distribute any net realized capital gains annually. Pursuant to the Dividend Reinvestment and Cash Purchase Plan (the “Plan”), adopted by the Fund, each stockholder will automatically be a participant (a “Participant”) in the Plan unless Computershare Trust Company, N.A., the Plan Agent, is otherwise instructed by the stockholder in writing, to have all distributions, net of any applicable U.S. withholding tax, paid in cash. Stockholders who do not participate in the Plan will receive all distributions in cash paid by check in U.S. dollars mailed directly to the stockholder by Computershare Trust Company, N.A., as paying agent. Stockholders who do not wish to have distributions automatically reinvested should notify the Fund by contacting Computershare Trust Company, N.A. c/o The China Fund, Inc. at P.O. Box 505000 Louisville, Kentucky 40233-5000, by telephone at 1-800-426-5523 or via the Internet at www.computershare.com/investor.

Whenever the Directors of the Fund declare a capital gains distribution or an income dividend payable only in shares of the Fund’s common stock (including such a declaration that provides an option to receive cash), Participants will take such distribution or dividend entirely in shares of common stock to be issued by the Fund, and the Plan Agent shall automatically receive such shares of common stock, including fractions, for the Participant’s account.

Whenever a dividend or distribution is declared payable in cash or shares of the Fund’s common stock, the Plan will operate as follows: (i) whenever the market price per share of common stock equals or exceeds the net asset value per share at the time shares of common stock are valued for the purpose of determining the number of shares of common stock equivalent to the dividend or distribution (the “Valuation Date”), Participants will be issued shares of common stock by the Fund valued at net asset value or, if the net asset value is less than 95% of the market price on the Valuation Date, then Participants will be issued shares valued at 95% of the market price; and (ii) whenever the net asset value per share of the common stock on the Valuation Date exceeds the market price of a share of the common stock on the Valuation Date, Participants will receive shares of common stock of the Fund purchased in the open market. The Plan Agent will, as purchasing agent for the Participants, buy shares of common stock in the open market, on the New York Stock Exchange (the “Exchange”) or elsewhere, with the cash in respect of such dividend or distribution for the Participants’ accounts on, or shortly after, the payment date.

If the Fund should declare an income dividend or capital gains distribution payable only in cash, the Plan Agent will, as purchasing agent for the Participants, buy shares of common stock in the open market, on the Exchange or elsewhere, with the cash in respect of such dividend or distribution for the Participants’ accounts on, or shortly after, the payment date.

Participants in the Plan have the option of making additional payments to the Plan Agent annually, in any amount from $100 to $3,000 for investment in the Fund’s Common Stock. The Plan Agent will use all funds received from participants (as well as any dividends and capital gains distributions received in cash) to purchase Fund shares in the open market on January 15 of each year or the next trading day if January 15th is not a trading day. Participants may make voluntary cash payments by sending a check (in U.S. dollars and drawn on a U.S. Bank) made payable to “Computershare” along with a completed transaction form which is attached to each statement a Participant receives. The Plan Agent will not accept cash, traveler’s checks, money orders or third party checks. Any voluntary

28

Table of Contents

DIVIDENDS AND DISTRIBUTIONS:

SUMMARY OF DIVIDEND REINVESTMENT AND CASH PURCHASE PLAN (continued)

cash payments received more than thirty-five days prior to such date will be returned by the Plan Agent, and interest will not be paid on any such amounts. To avoid unnecessary cash accumulations, and also to allow ample time for receipt and processing by the Plan Agent, participants should send in voluntary cash payments to be received by the Plan Agent approximately two days before January 15. A participant may withdraw a voluntary cash payment by written notice, if the notice is received by the Plan Agent not less than 48 hours before such payment is to be invested. In the event that a Participant’s check for a voluntary cash payment is returned unpaid for any reason, the Plan Agent will consider the request for investment of such funds null and void, and shall immediately remove from the Participant’s account those shares, if any, purchased upon the prior credit of such funds. The Plan Agent shall be entitled to sell shares to satisfy any uncollected amount plus any applicable fees. If the net proceeds of the sale of such shares are insufficient to satisfy the balance of such uncollected amounts, the Plan Agent shall be entitled to sell such additional shares from the Participant’s account as may be necessary to satisfy the uncollected balance.

For all purposes of the Plan: (a) the market price of shares of common stock of the Fund on a particular date shall be the last sales price on the Exchange on the close of the previous trading day or, if there is no sale on the Exchange on that date, then the mean between the closing bid and asked quotations for such stock on the Exchange on such date, (b) Valuation Date shall be the dividend or distribution payment date or, if that date is not an Exchange trading day, the next preceding trading day, and (c) net asset value per share of common stock on a particular date shall be as determined by or on behalf of the Fund.