DEF 14ATETRA TECHNOLOGIES, INC.000084496500008449652023-01-012023-12-3100008449652020-01-012023-12-31iso4217:USD00008449652022-01-012022-12-3100008449652021-01-012021-12-3100008449652020-01-012020-12-310000844965tti:DeductionForAmountsReportedUnderTheStockAwardsColumnInTheSummaryCompensationTableForTheCurrentYearMemberecd:PeoMember2023-01-012023-12-310000844965tti:DeductionForAmountsReportedUnderTheStockAwardsColumnInTheSummaryCompensationTableForTheCurrentYearMemberecd:NonPeoNeoMember2023-01-012023-12-310000844965tti:IncreasedeductionBasedOnASC718FairValueOfAwardsGrantedDuringCurrentYearThatRemainUnvestedAsOfYearEndDeterminedAsOfYearEndMemberecd:PeoMember2023-01-012023-12-310000844965ecd:NonPeoNeoMembertti:IncreasedeductionBasedOnASC718FairValueOfAwardsGrantedDuringCurrentYearThatRemainUnvestedAsOfYearEndDeterminedAsOfYearEndMember2023-01-012023-12-310000844965tti:IncreasedeductionForAwardsGrantedDuringPriorFiscalYearsThatWereOutstandingAndUnvestedAsOfYearEndDeterminedBasedOnChangeInASC718FairValueFromPriorYearEndMemberecd:PeoMember2023-01-012023-12-310000844965ecd:NonPeoNeoMembertti:IncreasedeductionForAwardsGrantedDuringPriorFiscalYearsThatWereOutstandingAndUnvestedAsOfYearEndDeterminedBasedOnChangeInASC718FairValueFromPriorYearEndMember2023-01-012023-12-310000844965tti:IncreasedeductionForAwardsGrantedDuringPriorFiscalYearsThatVestedDuringCurrentYearDeterminedBasedOnChangeInASC718FairValueFromPriorYearEndToVestingDateMemberecd:PeoMember2023-01-012023-12-310000844965ecd:NonPeoNeoMembertti:IncreasedeductionForAwardsGrantedDuringPriorFiscalYearsThatVestedDuringCurrentYearDeterminedBasedOnChangeInASC718FairValueFromPriorYearEndToVestingDateMember2023-01-012023-12-310000844965tti:DeductionOfASC718FairValueOfAwardsGrantedDuringPriorYearsThatWereForfeitedDuringCurrentYearDeterminedAsOfPriorYearEndMemberecd:PeoMember2023-01-012023-12-310000844965ecd:NonPeoNeoMembertti:DeductionOfASC718FairValueOfAwardsGrantedDuringPriorYearsThatWereForfeitedDuringCurrentYearDeterminedAsOfPriorYearEndMember2023-01-012023-12-310000844965ecd:PeoMember2023-01-012023-12-310000844965ecd:NonPeoNeoMember2023-01-012023-12-310000844965tti:DeductionForAmountsReportedUnderTheStockAwardsColumnInTheSummaryCompensationTableForTheCurrentYearMemberecd:PeoMember2022-01-012022-12-310000844965tti:DeductionForAmountsReportedUnderTheStockAwardsColumnInTheSummaryCompensationTableForTheCurrentYearMemberecd:NonPeoNeoMember2022-01-012022-12-310000844965tti:IncreasedeductionBasedOnASC718FairValueOfAwardsGrantedDuringCurrentYearThatRemainUnvestedAsOfYearEndDeterminedAsOfYearEndMemberecd:PeoMember2022-01-012022-12-310000844965ecd:NonPeoNeoMembertti:IncreasedeductionBasedOnASC718FairValueOfAwardsGrantedDuringCurrentYearThatRemainUnvestedAsOfYearEndDeterminedAsOfYearEndMember2022-01-012022-12-310000844965tti:IncreasedeductionForAwardsGrantedDuringPriorFiscalYearsThatWereOutstandingAndUnvestedAsOfYearEndDeterminedBasedOnChangeInASC718FairValueFromPriorYearEndMemberecd:PeoMember2022-01-012022-12-310000844965ecd:NonPeoNeoMembertti:IncreasedeductionForAwardsGrantedDuringPriorFiscalYearsThatWereOutstandingAndUnvestedAsOfYearEndDeterminedBasedOnChangeInASC718FairValueFromPriorYearEndMember2022-01-012022-12-310000844965tti:IncreasedeductionForAwardsGrantedDuringPriorFiscalYearsThatVestedDuringCurrentYearDeterminedBasedOnChangeInASC718FairValueFromPriorYearEndToVestingDateMemberecd:PeoMember2022-01-012022-12-310000844965ecd:NonPeoNeoMembertti:IncreasedeductionForAwardsGrantedDuringPriorFiscalYearsThatVestedDuringCurrentYearDeterminedBasedOnChangeInASC718FairValueFromPriorYearEndToVestingDateMember2022-01-012022-12-310000844965tti:DeductionOfASC718FairValueOfAwardsGrantedDuringPriorYearsThatWereForfeitedDuringCurrentYearDeterminedAsOfPriorYearEndMemberecd:PeoMember2022-01-012022-12-310000844965ecd:NonPeoNeoMembertti:DeductionOfASC718FairValueOfAwardsGrantedDuringPriorYearsThatWereForfeitedDuringCurrentYearDeterminedAsOfPriorYearEndMember2022-01-012022-12-310000844965ecd:PeoMember2022-01-012022-12-310000844965ecd:NonPeoNeoMember2022-01-012022-12-310000844965tti:DeductionForAmountsReportedUnderTheStockAwardsColumnInTheSummaryCompensationTableForTheCurrentYearMemberecd:PeoMember2021-01-012021-12-310000844965tti:DeductionForAmountsReportedUnderTheStockAwardsColumnInTheSummaryCompensationTableForTheCurrentYearMemberecd:NonPeoNeoMember2021-01-012021-12-310000844965tti:IncreasedeductionBasedOnASC718FairValueOfAwardsGrantedDuringCurrentYearThatRemainUnvestedAsOfYearEndDeterminedAsOfYearEndMemberecd:PeoMember2021-01-012021-12-310000844965ecd:NonPeoNeoMembertti:IncreasedeductionBasedOnASC718FairValueOfAwardsGrantedDuringCurrentYearThatRemainUnvestedAsOfYearEndDeterminedAsOfYearEndMember2021-01-012021-12-310000844965tti:IncreasedeductionForAwardsGrantedDuringPriorFiscalYearsThatWereOutstandingAndUnvestedAsOfYearEndDeterminedBasedOnChangeInASC718FairValueFromPriorYearEndMemberecd:PeoMember2021-01-012021-12-310000844965ecd:NonPeoNeoMembertti:IncreasedeductionForAwardsGrantedDuringPriorFiscalYearsThatWereOutstandingAndUnvestedAsOfYearEndDeterminedBasedOnChangeInASC718FairValueFromPriorYearEndMember2021-01-012021-12-310000844965tti:IncreasedeductionForAwardsGrantedDuringPriorFiscalYearsThatVestedDuringCurrentYearDeterminedBasedOnChangeInASC718FairValueFromPriorYearEndToVestingDateMemberecd:PeoMember2021-01-012021-12-310000844965ecd:NonPeoNeoMembertti:IncreasedeductionForAwardsGrantedDuringPriorFiscalYearsThatVestedDuringCurrentYearDeterminedBasedOnChangeInASC718FairValueFromPriorYearEndToVestingDateMember2021-01-012021-12-310000844965tti:DeductionOfASC718FairValueOfAwardsGrantedDuringPriorYearsThatWereForfeitedDuringCurrentYearDeterminedAsOfPriorYearEndMemberecd:PeoMember2021-01-012021-12-310000844965ecd:NonPeoNeoMembertti:DeductionOfASC718FairValueOfAwardsGrantedDuringPriorYearsThatWereForfeitedDuringCurrentYearDeterminedAsOfPriorYearEndMember2021-01-012021-12-310000844965ecd:PeoMember2021-01-012021-12-310000844965ecd:NonPeoNeoMember2021-01-012021-12-310000844965tti:DeductionForAmountsReportedUnderTheStockAwardsColumnInTheSummaryCompensationTableForTheCurrentYearMemberecd:PeoMember2020-01-012020-12-310000844965tti:DeductionForAmountsReportedUnderTheStockAwardsColumnInTheSummaryCompensationTableForTheCurrentYearMemberecd:NonPeoNeoMember2020-01-012020-12-310000844965tti:IncreasedeductionBasedOnASC718FairValueOfAwardsGrantedDuringCurrentYearThatRemainUnvestedAsOfYearEndDeterminedAsOfYearEndMemberecd:PeoMember2020-01-012020-12-310000844965ecd:NonPeoNeoMembertti:IncreasedeductionBasedOnASC718FairValueOfAwardsGrantedDuringCurrentYearThatRemainUnvestedAsOfYearEndDeterminedAsOfYearEndMember2020-01-012020-12-310000844965tti:IncreasedeductionForAwardsGrantedDuringPriorFiscalYearsThatWereOutstandingAndUnvestedAsOfYearEndDeterminedBasedOnChangeInASC718FairValueFromPriorYearEndMemberecd:PeoMember2020-01-012020-12-310000844965ecd:NonPeoNeoMembertti:IncreasedeductionForAwardsGrantedDuringPriorFiscalYearsThatWereOutstandingAndUnvestedAsOfYearEndDeterminedBasedOnChangeInASC718FairValueFromPriorYearEndMember2020-01-012020-12-310000844965tti:IncreasedeductionForAwardsGrantedDuringPriorFiscalYearsThatVestedDuringCurrentYearDeterminedBasedOnChangeInASC718FairValueFromPriorYearEndToVestingDateMemberecd:PeoMember2020-01-012020-12-310000844965ecd:NonPeoNeoMembertti:IncreasedeductionForAwardsGrantedDuringPriorFiscalYearsThatVestedDuringCurrentYearDeterminedBasedOnChangeInASC718FairValueFromPriorYearEndToVestingDateMember2020-01-012020-12-310000844965tti:DeductionOfASC718FairValueOfAwardsGrantedDuringPriorYearsThatWereForfeitedDuringCurrentYearDeterminedAsOfPriorYearEndMemberecd:PeoMember2020-01-012020-12-310000844965ecd:NonPeoNeoMembertti:DeductionOfASC718FairValueOfAwardsGrantedDuringPriorYearsThatWereForfeitedDuringCurrentYearDeterminedAsOfPriorYearEndMember2020-01-012020-12-310000844965ecd:PeoMember2020-01-012020-12-310000844965ecd:NonPeoNeoMember2020-01-012020-12-31

| | |

Notice of 2024 Annual Meeting of Stockholders |

To our Stockholders:

The 2024 Annual Meeting of Stockholders (the "Annual Meeting") of TETRA Technologies, Inc. (“TETRA” or the “Company”) will be held as follows:

| | | | | | | | | | | |

| When: Tuesday, May 21, 2024, at 11:00 a.m. local time | | Where: TETRA Technologies, Inc. Corporate Headquarters 24955 Interstate 45 North The Woodlands, Texas 77380 |

At the Annual Meeting, you will be asked to consider and take action on the following:

1.Election of eight directors to serve on TETRA's Board of Directors (the "Board of Directors" or the “Board”) for one-year terms ending at the 2025 Annual Meeting of Stockholders (the "2025 Annual Meeting"), or until their respective successors have been duly elected or appointed;

2.Advisory vote to approve executive compensation;

3.Ratification of the appointment of Grant Thornton LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024; and

4.Vote on a stockholder proposal entitled, “Proposal 4 – Shareholder Right to Act by Written Consent,” if properly presented at the Annual Meeting.

Additionally, if needed, the stockholders may act upon any other matters that may properly come before the Annual Meeting or any adjournments.

Only stockholders of record at the close of business on March 25, 2024 will be entitled to notice of and to vote at the Annual Meeting. The proxy statement, form of proxy, and voting instructions are first being made available to stockholders on or about April 8, 2024 at www.envisionreports.com/TTI for registered holders and at www.proxyvote.com for beneficial holders.

| | |

Your vote is important! Please promptly vote your shares by telephone, the internet, or, if the proxy statement was mailed to you, by marking, signing, dating, and returning the enclosed proxy card as soon as possible, regardless of whether you plan to attend the Annual Meeting. You may revoke your proxy at any time before it is voted. |

| | | | | |

By Order of the Board Of Directors |

|

|

Kimberly M. O'Brien |

Corporate Secretary |

|

| April 8, 2024 |

The Woodlands, Texas |

| | | | | | | | | | | | | | | | | | | | |

| PROXY STATEMENT SUMMARY | | | | Board and Committee Self-Evaluation Process | |

| | | | | Executive Sessions of the Board of Directors | |

| Proposal No. 1: Election of Directors | | | | Communications with Directors | |

| Board Recommendation | | | | Executive Succession Planning | |

| Vote Required | | | | Insider Trading Policy (Including Hedging) | |

| Nominees for Director | | | | Certain Transactions | |

| | | | | | |

| Proposal No. 2: Advisory Vote to Approve Executive | | | AUDIT COMMITTEE REPORT | |

| Compensation | | | | Fees Paid to Principal Accounting Firm | |

| Board Recommendation | | | | Audit Committee Preapproval Policies | |

| Vote Required | | | | and Procedures | |

| | | | | | |

| Proposal No. 3: Ratification of Selection of | | | EXECUTIVE OFFICERS | |

| Independent Registered Public Accounting Firm | | | | | |

| Independence of our Independent Auditor | | | COMPENSATION DISCUSSION & ANALYSIS | |

| Audit Partner Rotation | | | I. | Executive Summary | |

| Considerations Regarding Appointment | | | | Company Operations and Performance | |

| Board Recommendation | | | | Positive 2023 Say-on-Pay Vote Outcome and | |

| Vote Required | | | | Stockholder Engagement | |

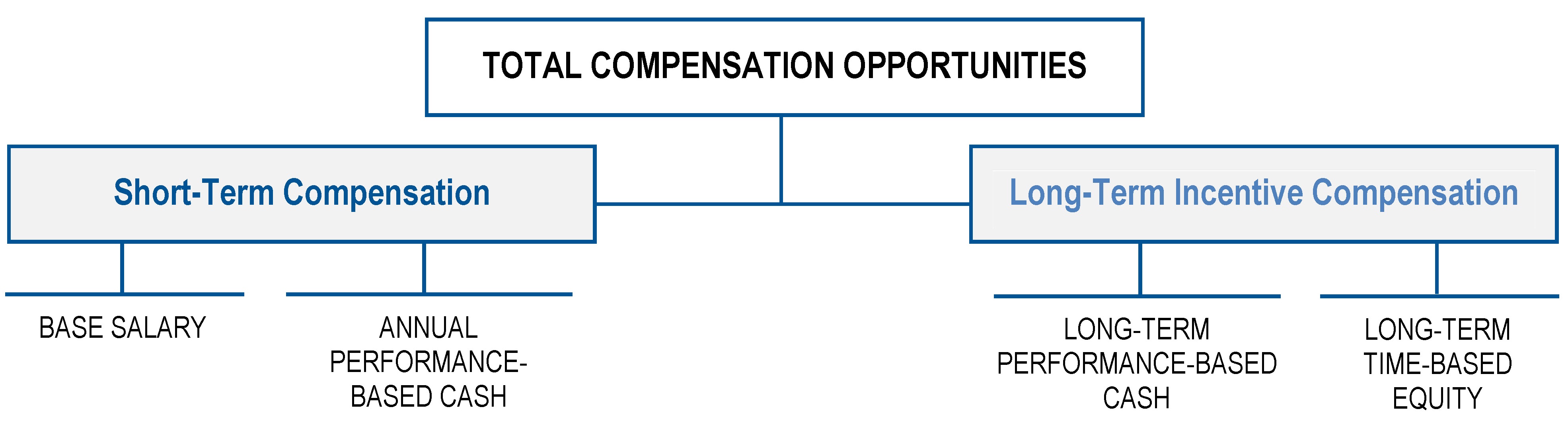

| | | | | Overall Compensation Structure | |

| Proposal No. 4: Stockholder Proposal | | | | Key Compensation Practices and Policies | |

| Background of the Proposal | | | II. | Compensation Philosophy | |

| Statement of the Board of Directors | | | | Overview of Compensation Philosophy | |

| Board Recommendation | | | III. | Roles and Processes | |

| Vote Required | | | IV. | Compensation Elements | |

| | | | | Base Salary | |

| CORPORATE GOVERNANCE | | | | Annual Cash Incentives | |

| Corporate Governance Guidelines | | | | Long-Term Incentives | |

| Plurality Plus Vote Policy | | | | Retirement, Health, and Welfare Benefits | |

| Corporate Governance Documents | | | | Perquisites | |

| Director Independence and Transactions | | | | Clawback Policy | |

| Board Leadership Structure; Separation of | | | | Severance Plan and Termination Payments | |

| Positions of Chairman and Chief Executive Officer | | | | Employment Agreements | |

| Board Oversight of TETRA | | | | Double Trigger Change of Control Agreements | |

| Stockholder Engagement | | | | Indemnification Agreements | |

| Sustainability | | | | Stock Ownership Guidelines | |

| Stock Ownership Guidelines | | | | Tax and Accounting Implications of Executive | |

| Board Committees and Meetings | | | | Compensation | |

| Board and Committee Succession Planning | | | | | |

| Director Nominations by the Nominating, | | | COMPENSATION COMMITTEE REPORT | |

| Governance, and Sustainability Committee | | | | |

| Minimum Qualities and Skills | | | COMPENSATION OF EXECUTIVE OFFICERS | |

| Director Nominations Submitted by Stockholders | | | | Summary Compensation | |

| Director Tenure | | | | Grants of Plan Based Awards | |

| Director Orientation and Continuing Education | | | | Outstanding Equity Awards at Fiscal Year End | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| Option Exercises and Stock Vested | | | | | |

| Nonqualified Deferred Compensation | | | | | |

| Potential Payments upon Termination or Change of | | | | | |

| Control | | | | | |

| CEO Pay Ratio | | | | | |

| Pay vs. Performance | | | | | |

| | | | | | |

| COMPENSATION RISK | | | | | |

| | | | | | |

| DIRECTOR COMPENSATION | | | | | |

| | | | | | |

| BENEFICIAL STOCK OWNERSHIP OF CERTAIN | | | | | |

| STOCKHOLDERS AND MANAGEMENT | | | | | |

| Delinquent Section 16(a) Reports | | | | | |

| 2025 Proposals of Stockholders | | | | | |

| Additional Financial Information | | | | | |

| Other Matters | | | | | |

| | | | | | |

| GENERAL INFORMATION ABOUT THE MEETING | | | | | |

| AND VOTING | | | | | |

| Internet and Electronic Availability of Proxy | | | | | |

| General Voting Instructions | | | | | |

| Voting Rules | | | | | |

| Householding of Annual Meeting Materials | | | | | |

| | | | | | |

| APPENDIX A - INFORMATION REGARDING | | | | | |

| NON-GAAP FINANCIAL MEASURES | | | | | |

This summary provides an overview of selected information contained elsewhere in the Proxy Statement and does not contain all the information you should consider. You should refer to the remainder of the Proxy Statement for more information about us and the proposals you are being asked to consider.

Annual Meeting of Stockholders

| | | | | | | | | | | | | | | | | |

| Date & Time

Tuesday, May 21, 2024 11:00 a.m. local time | | Location

24955 Interstate 45 North The Woodlands, TX 77380 | | Record Date

Monday, March 25, 2024 |

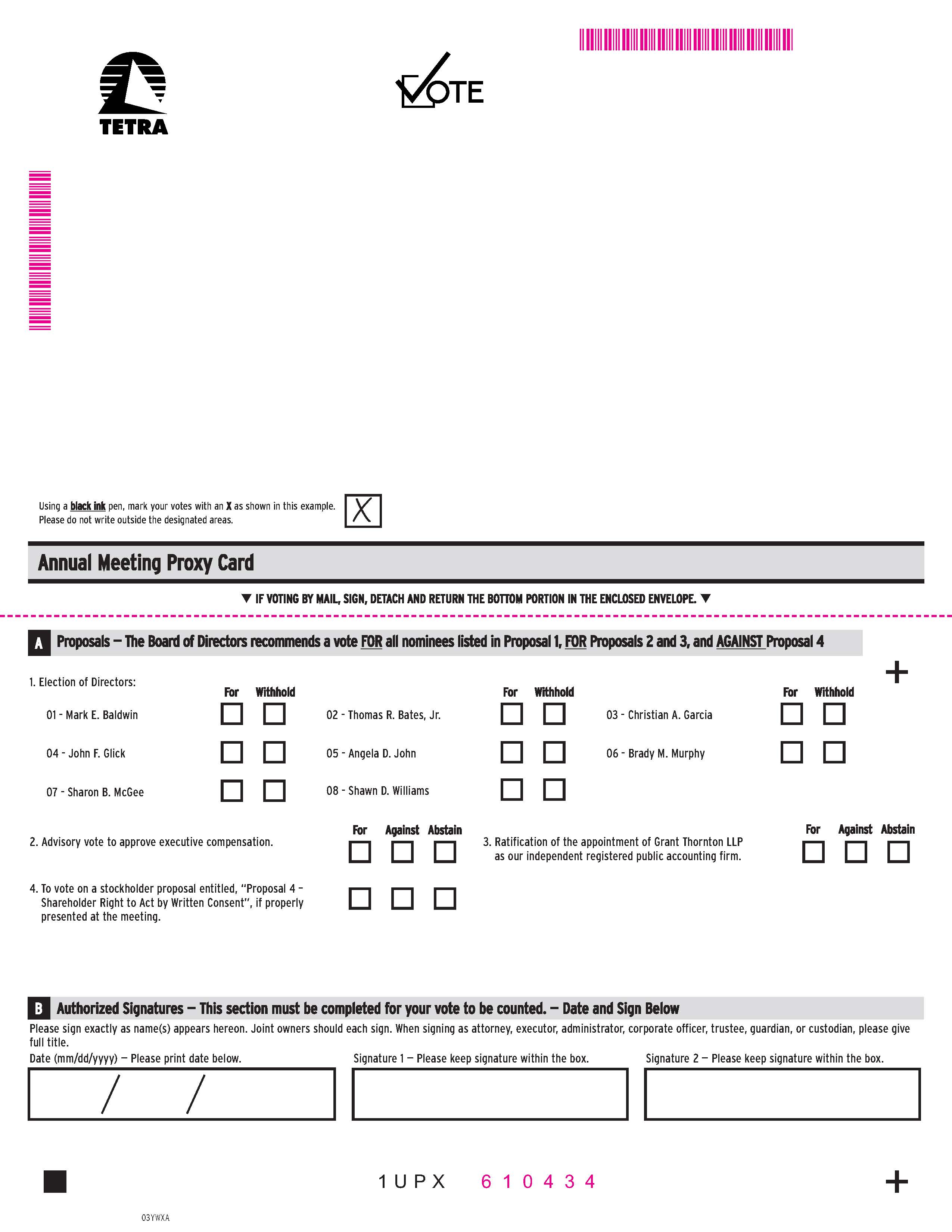

Voting Matters

Stockholders will be asked to vote on the following matters at the Annual Meeting:

| | | | | | | | | | | |

| Board Recommendation | Page Reference |

Management Proposals | | |

1 - | Election of Directors | Vote FOR each director nominee

| |

2 - | Advisory vote to approve executive compensation | Vote FOR

| |

3 - | Ratification of the appointment of Grant Thornton LLP as our independent registered public accounting firm | Vote FOR | |

Stockholder Proposal | | |

4 - | Vote on a stockholder proposal adopting a shareholder right to act by written consent, if properly presented | Vote AGAINST | |

TETRA Technologies, Inc. | 4

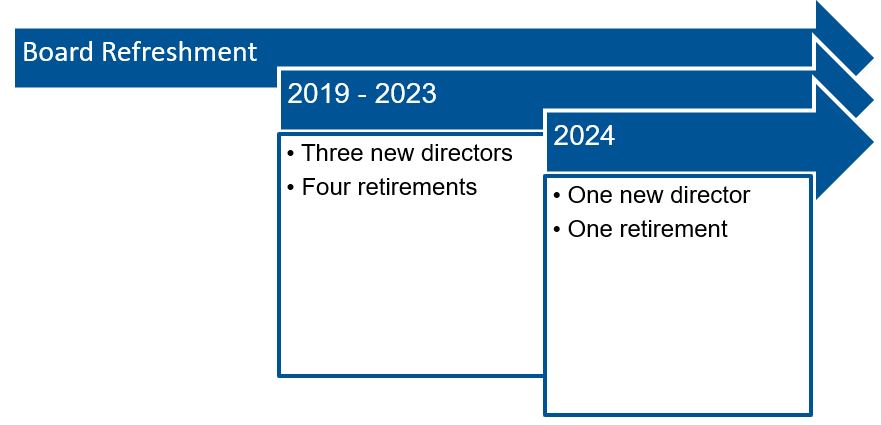

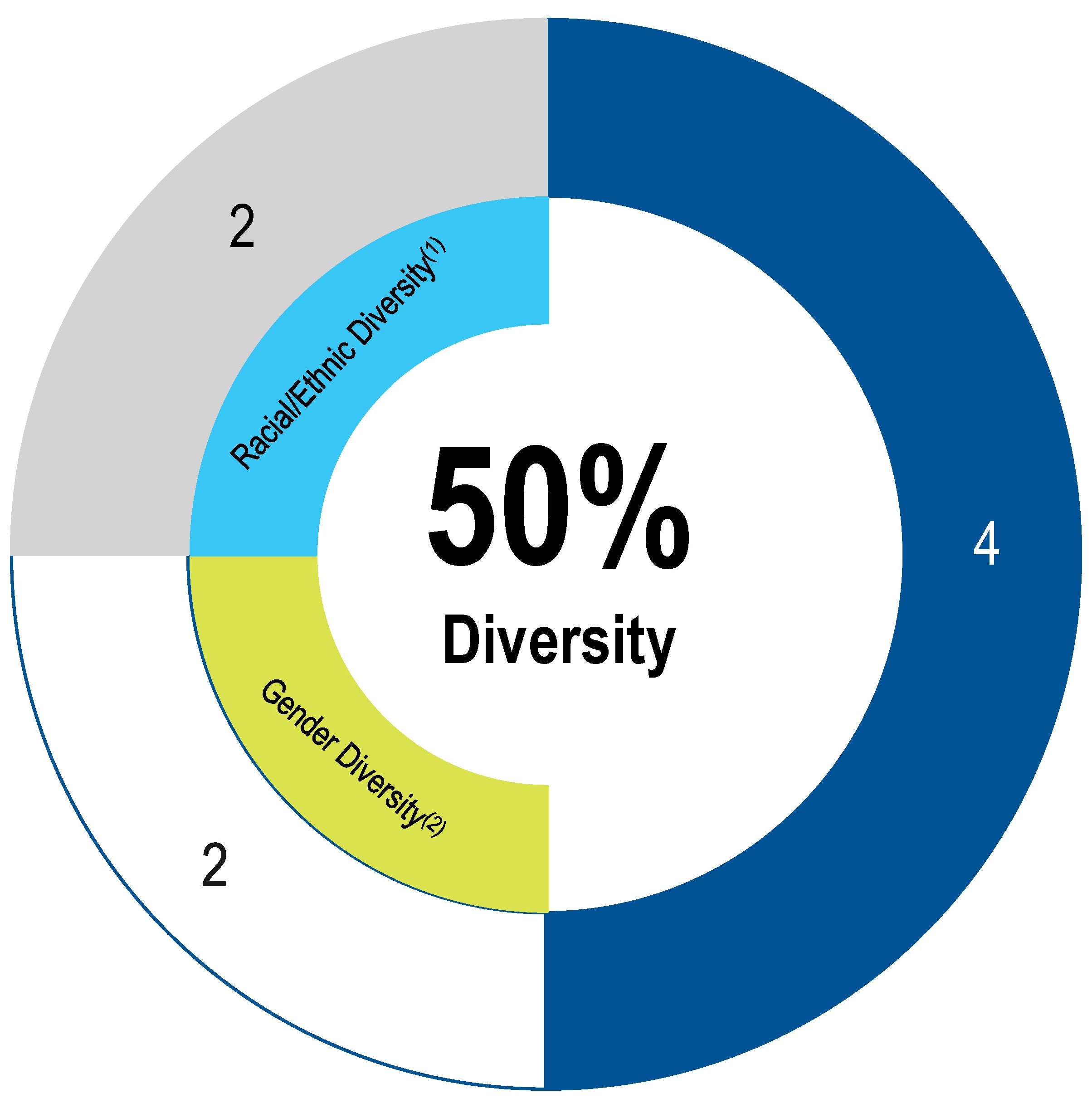

Snapshot of 2024 Director Nominees

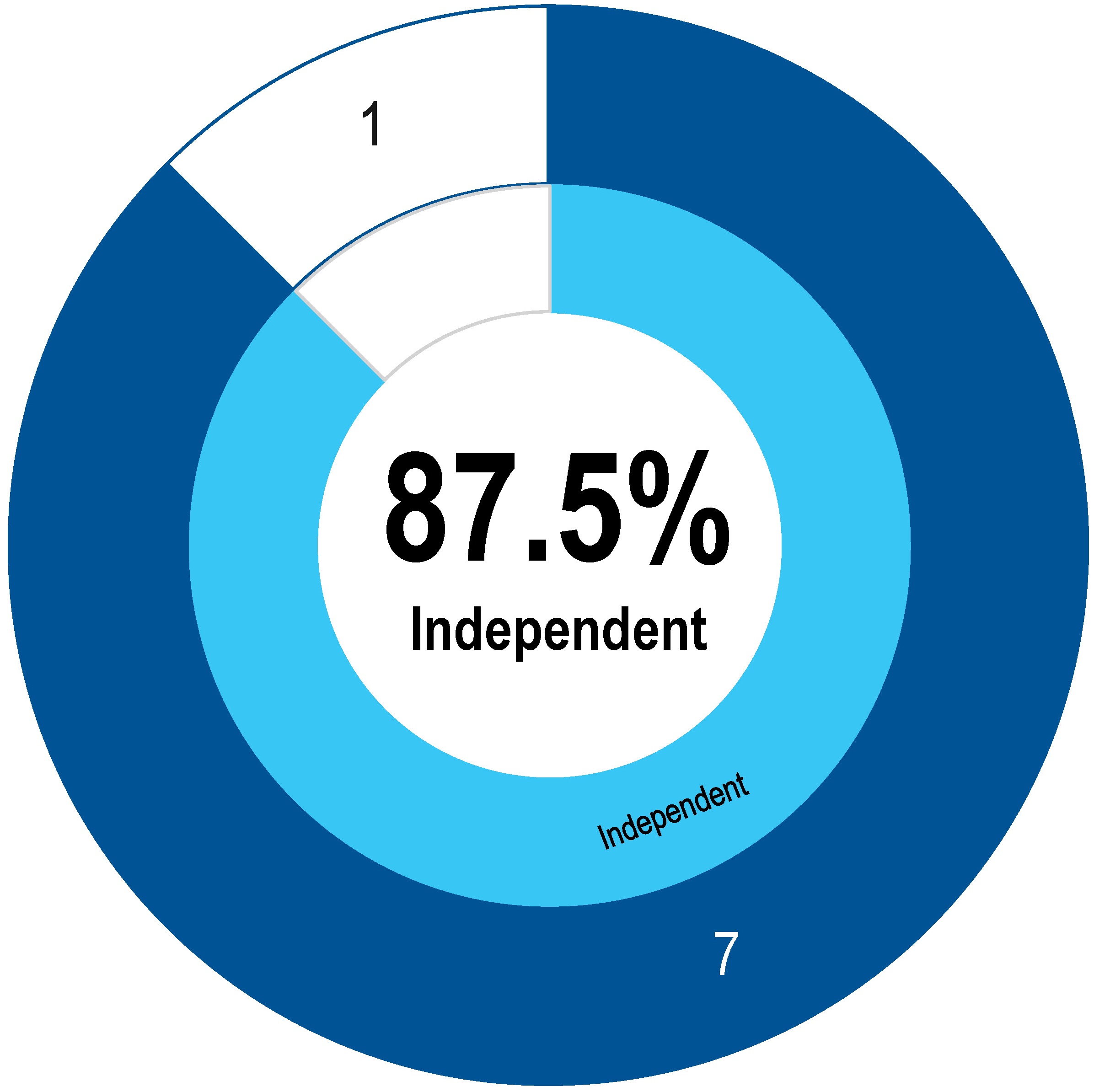

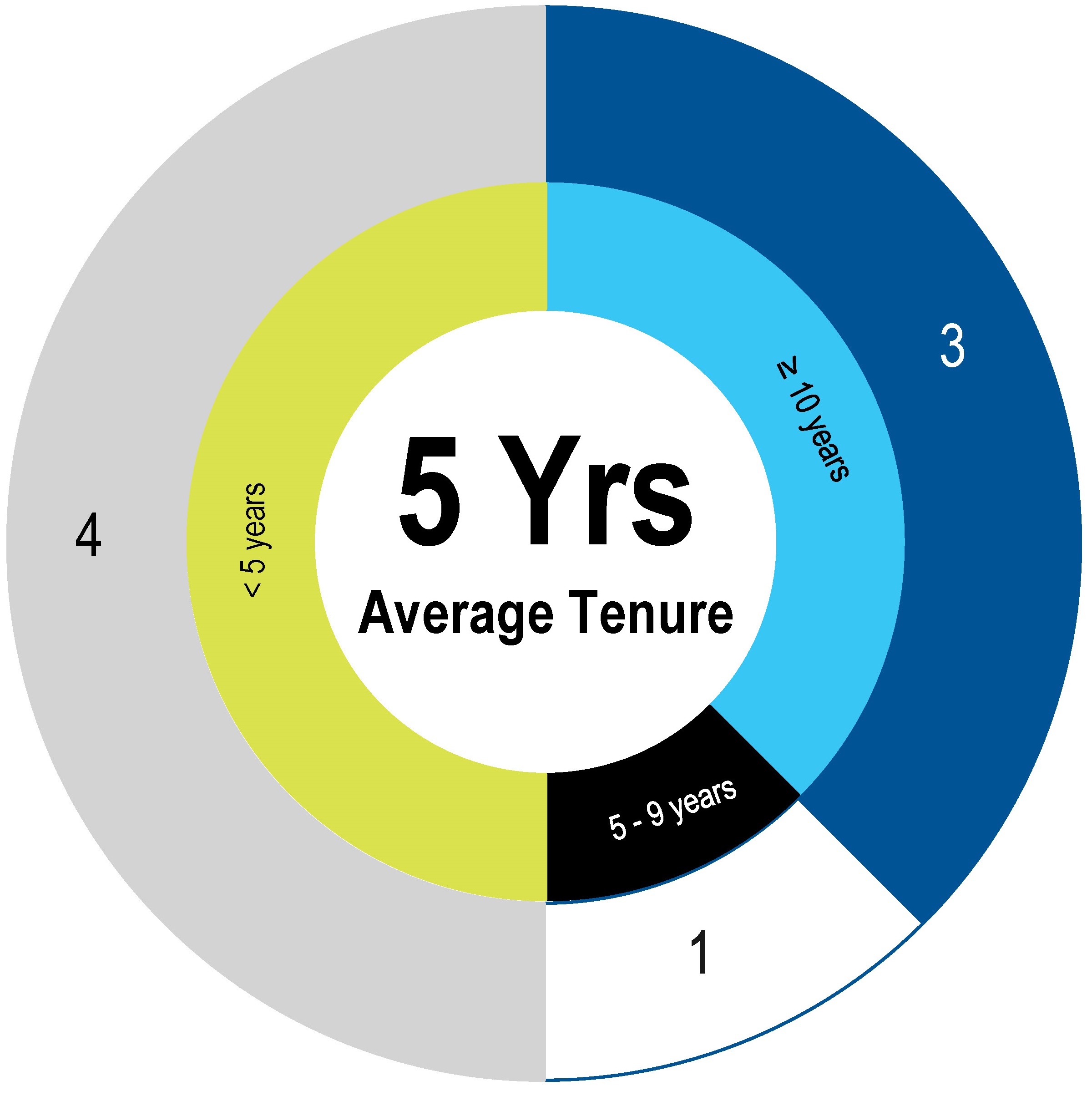

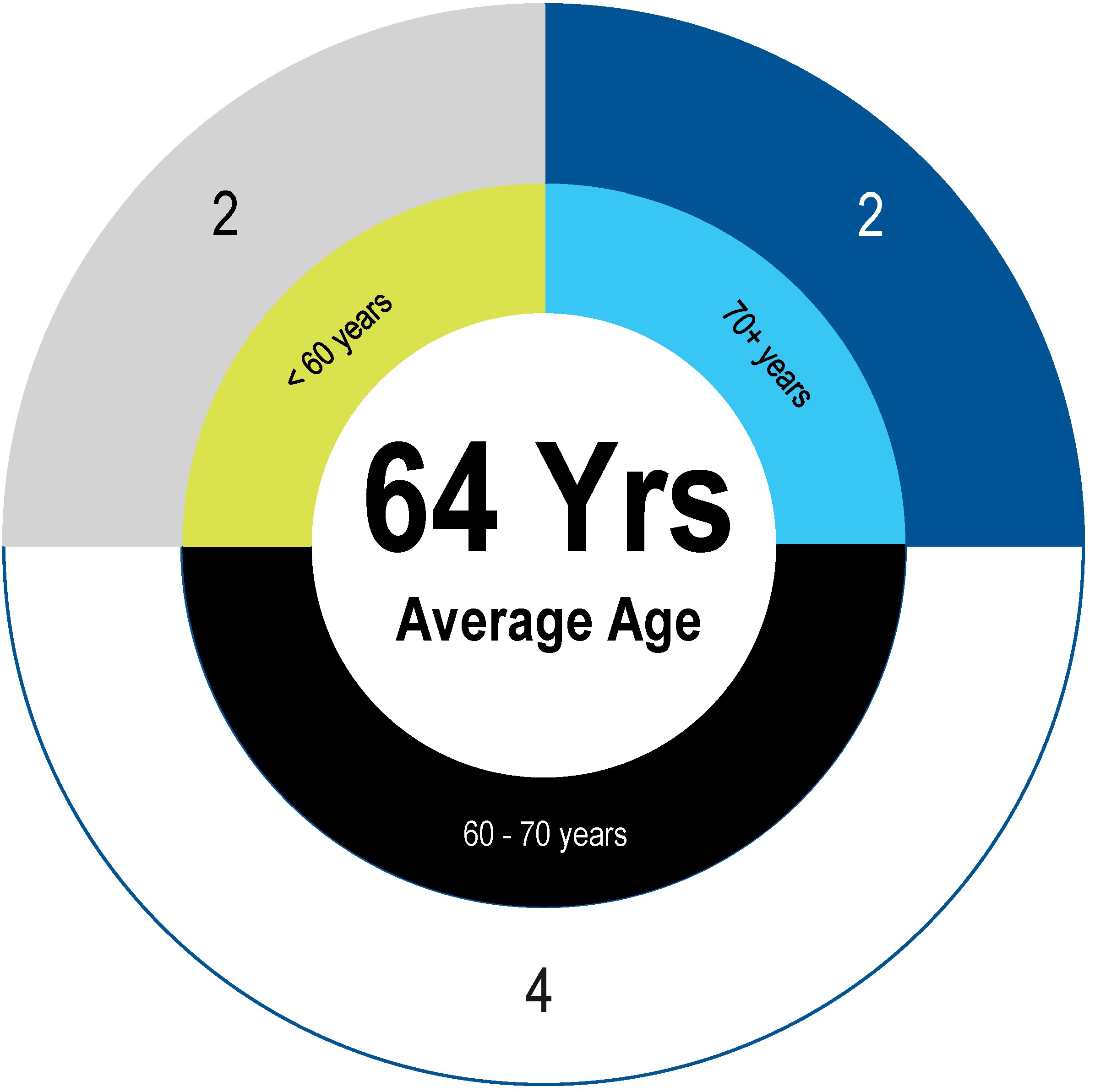

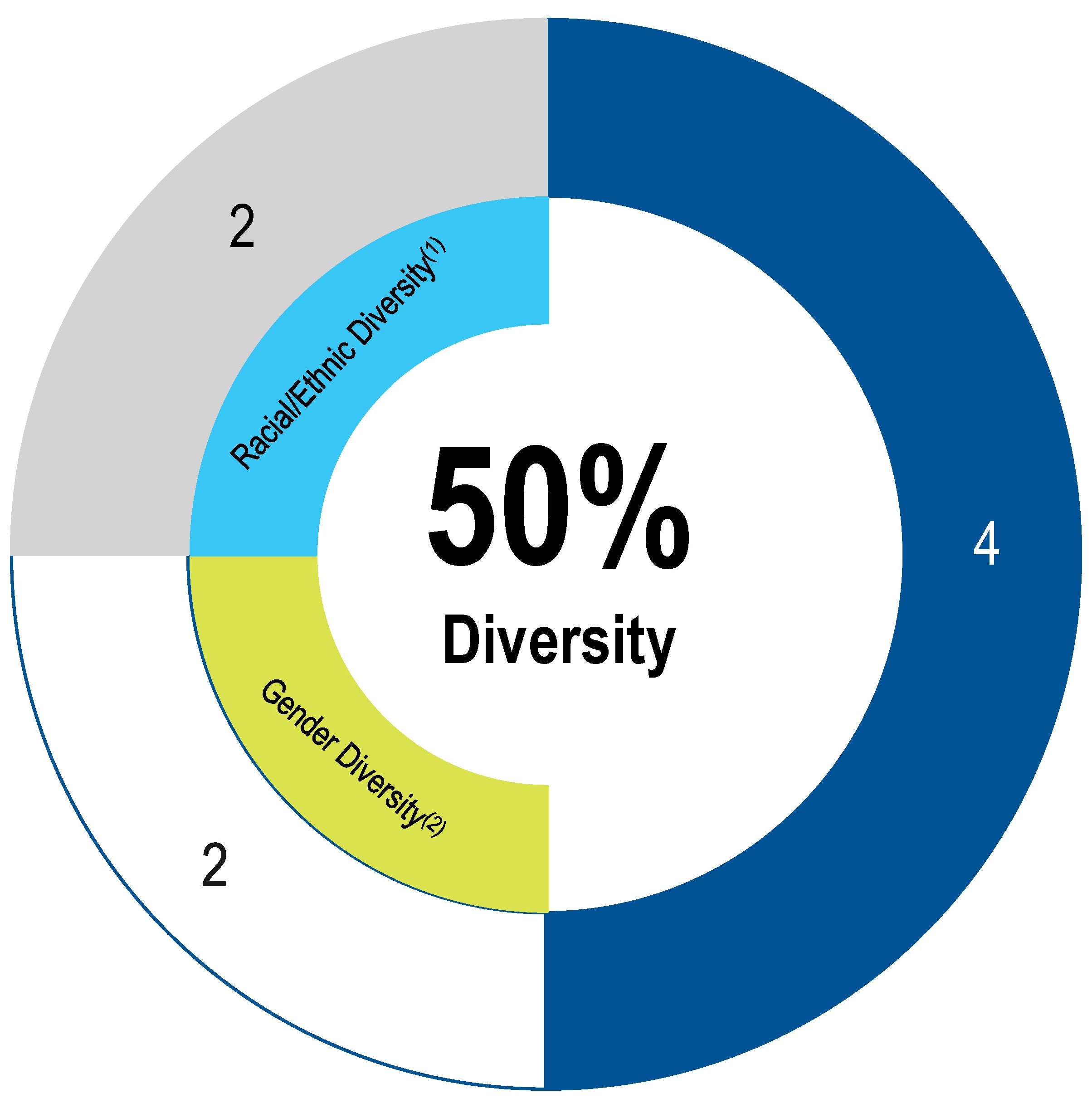

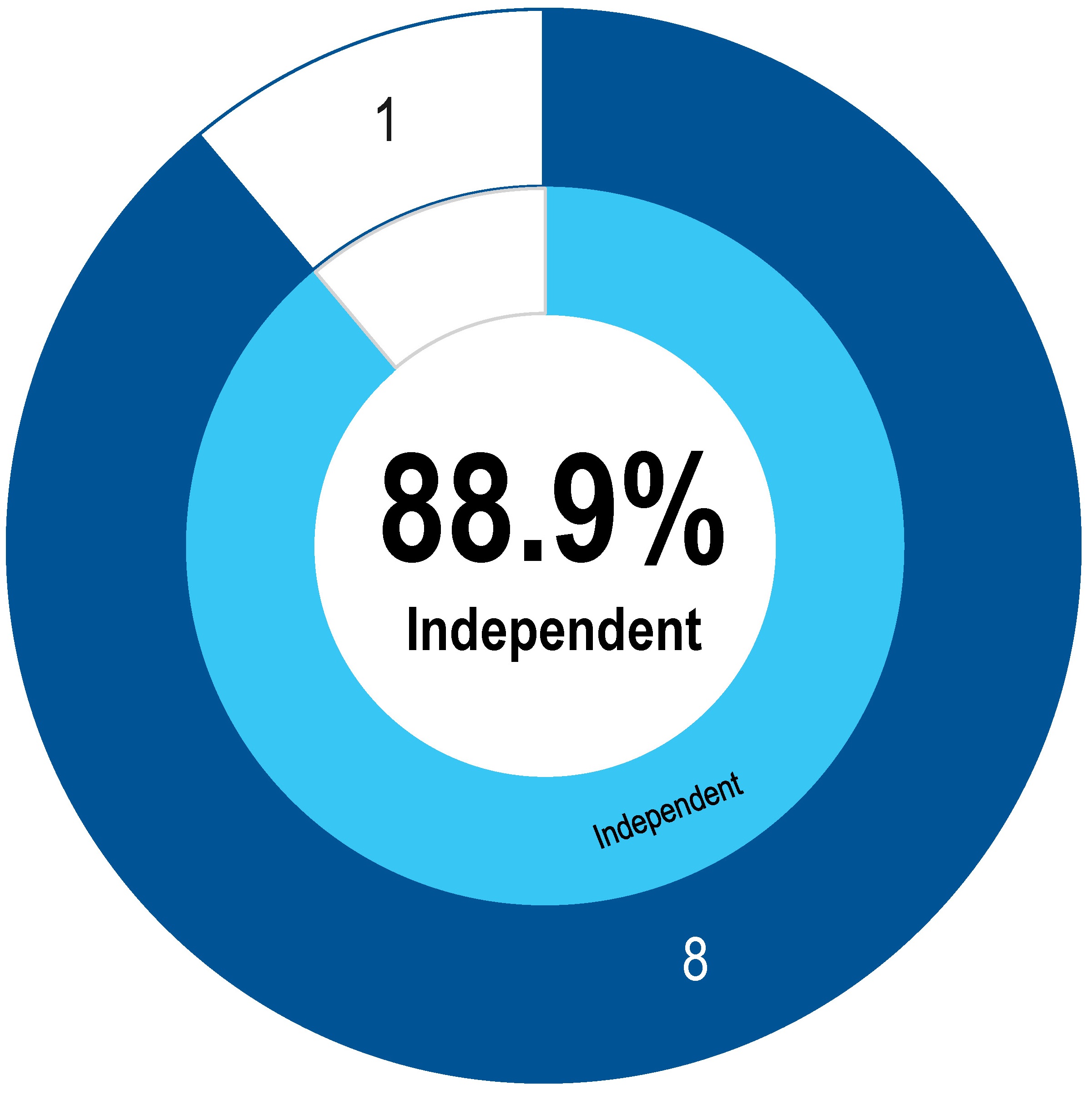

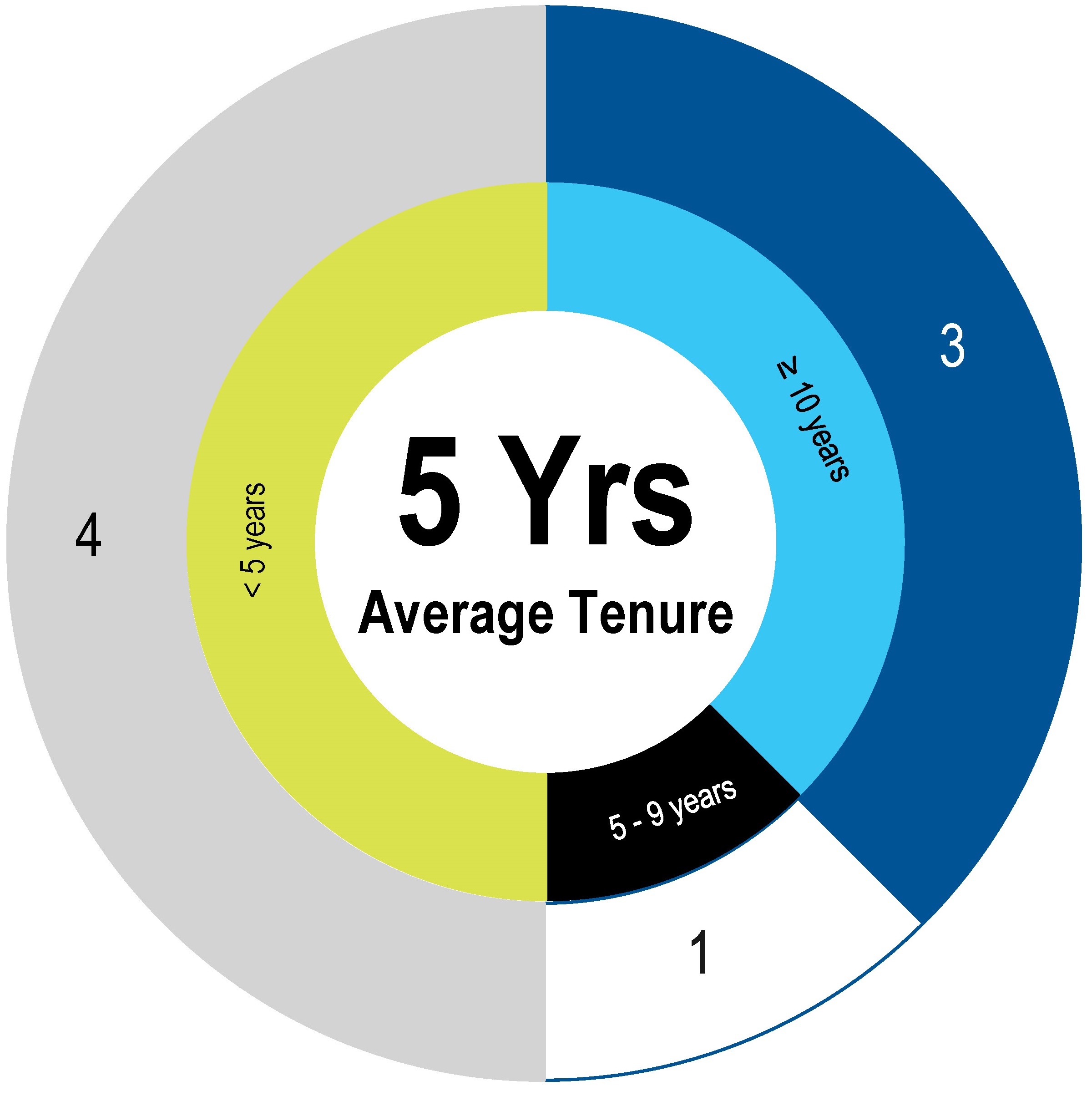

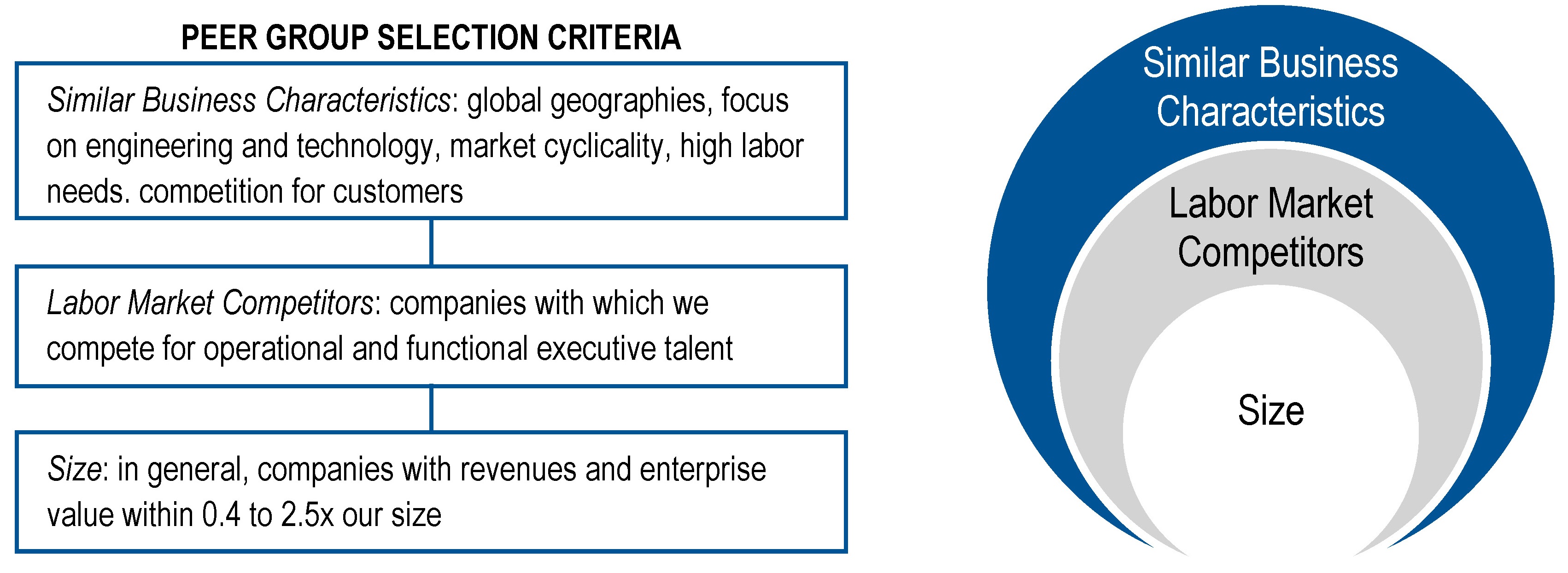

Our director nominees exhibit an effective mix of diversity, experience and perspective. The following chart summarizes the independence, tenure, age and diversity of our director nominees.

| | | | | |

| Independence | Tenure |

| |

| Age | Diversity |

| (1) Christian Garcia and Shawn Williams (2) Sharon McGee and Angela John |

TETRA Technologies, Inc. | 5

| | | | | | | | | | | |

| | | |

| Mark. E. Baldwin | Thomas R. Bates, Jr. | Christian A. Garcia | John F. Glick Chairman of the Board |

| | | |

| Angela D. John | Brady M. Murphy Chief Executive Officer | Sharon B. McGee | Shawn D. Williams |

| | | | | | | | | | | | | | | | | | | | |

| 2024 Nominees | Tenure | Independent | Committee Memberships | Public |

| (years) | | Audit | HCMCC | NGSC | Directorships |

| Mark E. Baldwin * | 10 | a | C | | | 3 |

| Thomas R. Bates, Jr. | 12 | a | | C | | 3 |

| Christian A. Garcia * | <1 | a | | | | 1 |

| John F. Glick | 10 | a | Ex-Officio Member of all committees | 2 |

| Angela D. John | <1 | a | | | | 2 |

| Brady M. Murphy | 5 | CEO | | | | 1 |

Sharon B. McGee (1) | 2 | a | | | | 1 |

| Shawn D. Williams | 3 | a | | | | 3 |

| | | | | |

| HCMCC = Human Capital Management & Compensation Committee | C = Chair |

| NGSC = Nominating, Governance, and Sustainability Committee |  = Member = Member |

| *= Audit Committee Financial Expert | |

(1) Chair of the NGSC following the Annual Meeting | |

Corporate Governance Highlights

We continuously monitor developments and best practices in corporate governance and enhance our practices as warranted and based on stockholder feedback. Our practices include policies and structures that we believe are sound and effective corporate governance practices, including:

| | | | | |

● | Plurality voting standard with a director resignation policy ("plurality plus") in the election of directors |

● | Annual election of all directors |

● | Separation of Chairman of the Board and Chief Executive Officer positions |

● | Regular meetings of our non-employee independent directors |

● | Thoughtful board evaluation process |

● | Director and executive succession planning |

● | Formal onboarding program for new directors |

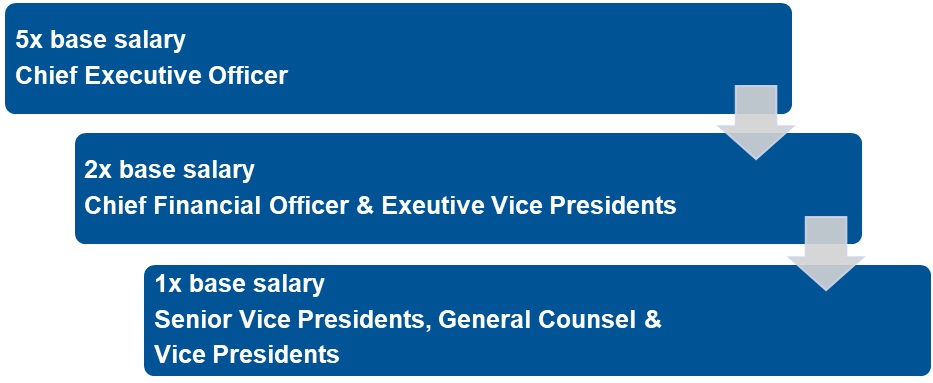

● | Rigorous stock ownership guidelines applicable to directors and executive officers |

TETRA Technologies, Inc. | 6

| | | | | |

● | A prohibition against directors, executive officers and employees holding our securities in margin accounts or pledging our securities, absent company approval |

● | A prohibition against directors, executive officers and employees engaging in certain hedging transactions with respect to our securities |

● | Executive Officer change in control benefits that are subject to “double trigger” |

● | An independent compensation consultant hired by and reporting to the Human Capital Management and Compensation Committee |

● | Compensation clawback policy that provides us with a mechanism to recover incentive compensation paid to our executive officers in certain circumstances |

● | Written Human Rights Standards |

● | No supermajority voting provisions in either our Amended and Restated Certificate of Incorporation (as may be amended or restated from time to time, our “Certificate of Incorporation”) or our Second Amended and Restated Bylaws (as may be amended from time to time, our “Bylaws”) |

● | Stockholders have the right to request a special meeting |

Executive Compensation Highlights

Below is a list of our 2023 Named Executive Officers, or “NEOs,” and select 2023 compensation highlights. Our executive compensation program reflects a fundamental belief that compensation should be competitive with the broad market in which we compete for executive talent, and commensurate with the performance of the individual executives and the Company. For additional information on the 2023 compensation of our NEOs, please refer to the Compensation Discussion and Analysis (“CD&A”), beginning on page 43. 2022 NEOs

| | | | | | | | | | | | | | |

| | | | |

Brady M. Murphy President & Chief Executive Officer | Elijio V. Serrano Sr. Vice President & Chief Financial Officer | Matthew J. Sanderson Exec. Vice President & Chief Commercial Officer | Timothy C. Moeller Sr. Vice President | Roy E. McNiven Sr. Vice President |

| | | | | | | | | | | |

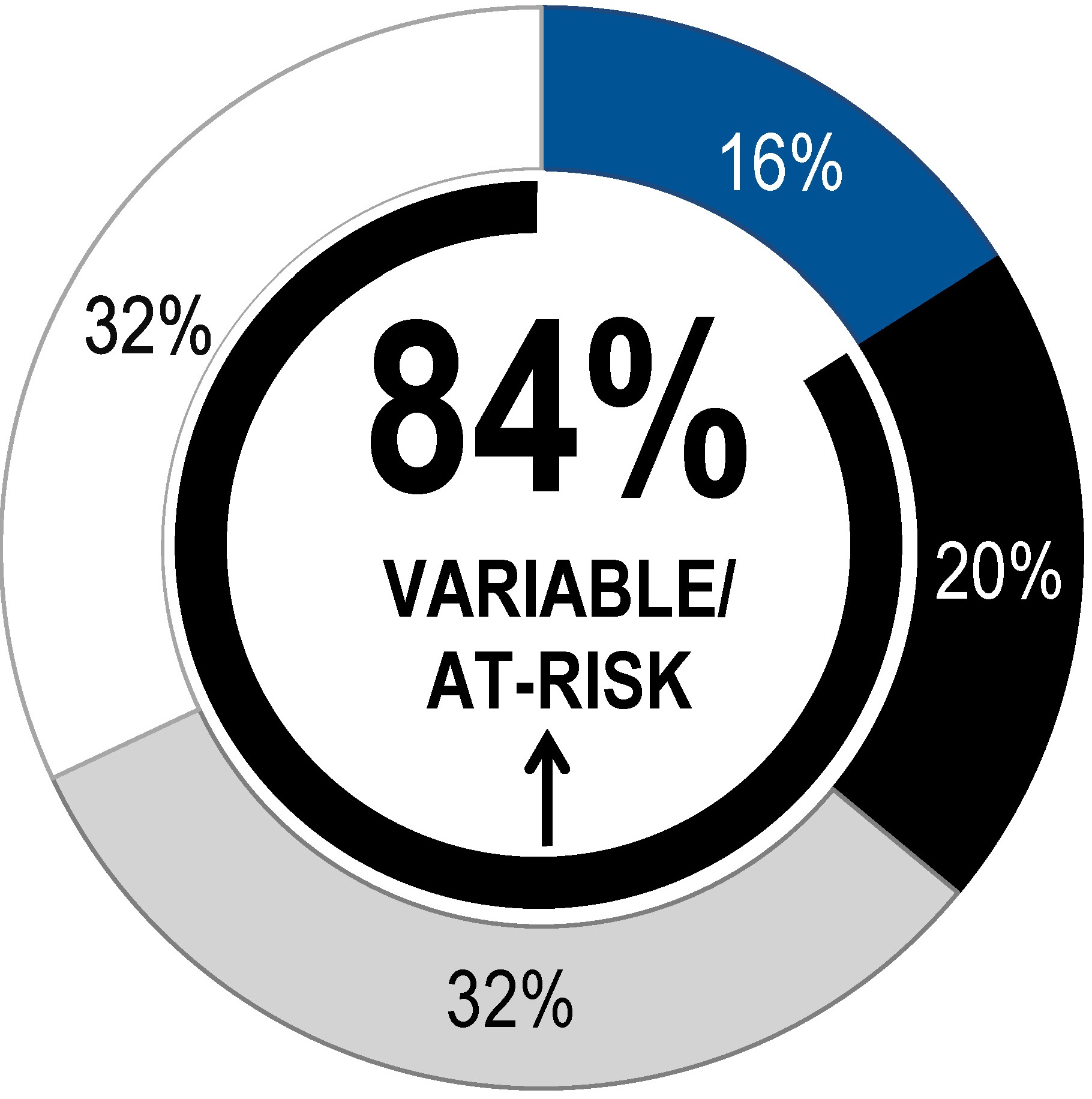

| 2023 NEOs | Change in Annual Base Salary (2022 to 2023) | Change in Target Annual Bonus (2022 to 2023) | Percentage of 2023 Total Target Direct Compensation that is Variable or Performance-Based |

| Brady M. Murphy | 6.1% | no change | 83.6% |

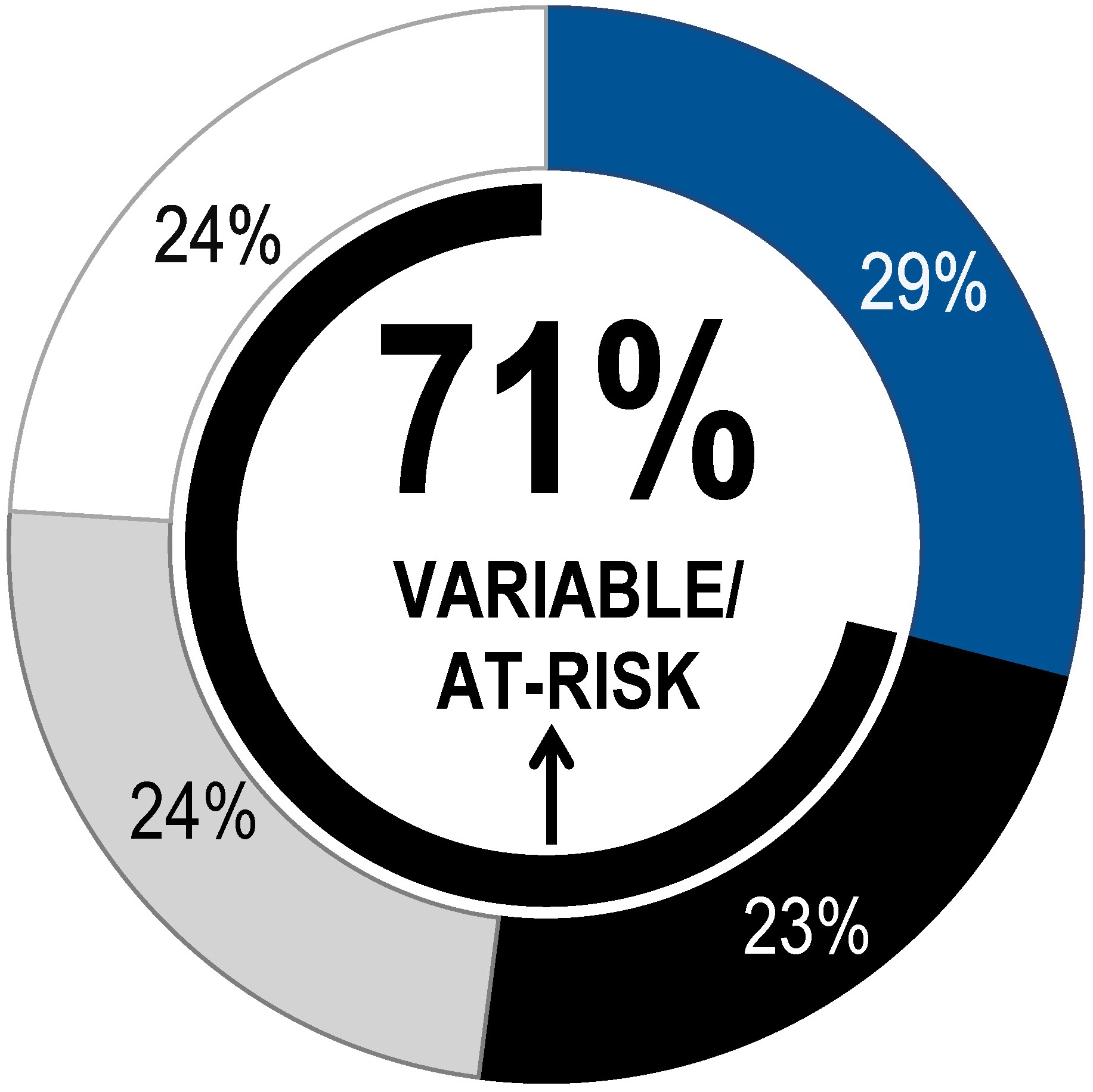

| Elijio V. Serrano | 3.6% | no change | 76.7% |

| Matthew J. Sanderson | 2.3% | no change | 71.2% |

| Timothy C. Moeller | 3.6% | no change | 67.7% |

| Roy E. McNiven | 5.0% | no change | 68.6% |

Business Highlights

| | | | | |

● | Strong financial and operational performance in 2023 with improved earnings, cash flow, liquidity, and leverage metrics |

● | Industrial calcium chloride business performed at record levels |

● | Well-timed investments to expand our offshore capacity to meet the growing deepwater market demand |

● | Water and Flowback Services expanded the production side of the onshore business while introducing automation and new technologies |

● | Completed the engineering design for our first commercial produced water beneficial reuse project with a large oil & gas producer with a planned deployment later in 2024 |

● | Achieved several key milestones necessary to develop our brine leases in Arkansas for future lithium and bromine production |

● | Expanded into the stationary energy storage markets with our high purity zinc bromide solution |

● | Strong culture of QHS&E drives product and service delivery |

TETRA Technologies, Inc. | 7

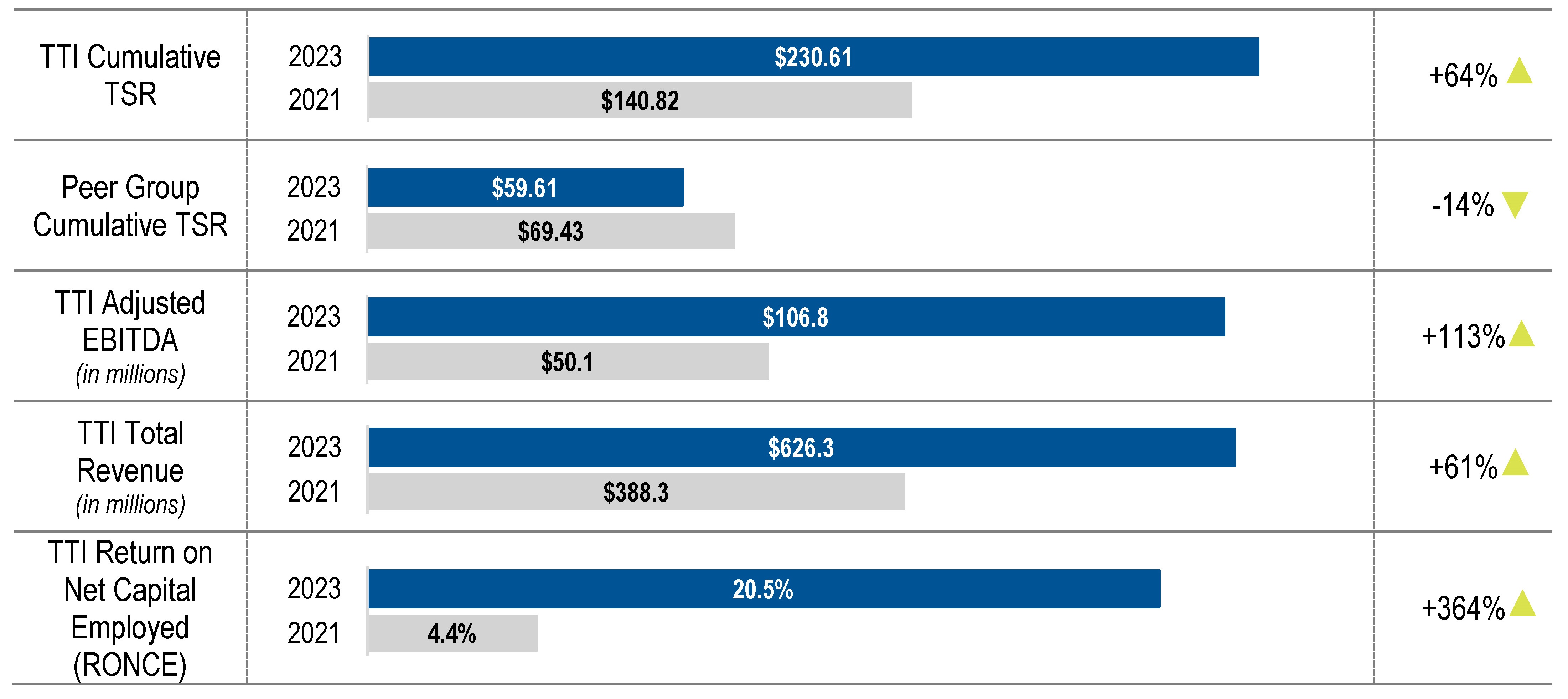

Financial Results – Delivering on our Commitments to Stockholders

In 2023, TETRA drove improvements in key financial metrics by:

| | | | | |

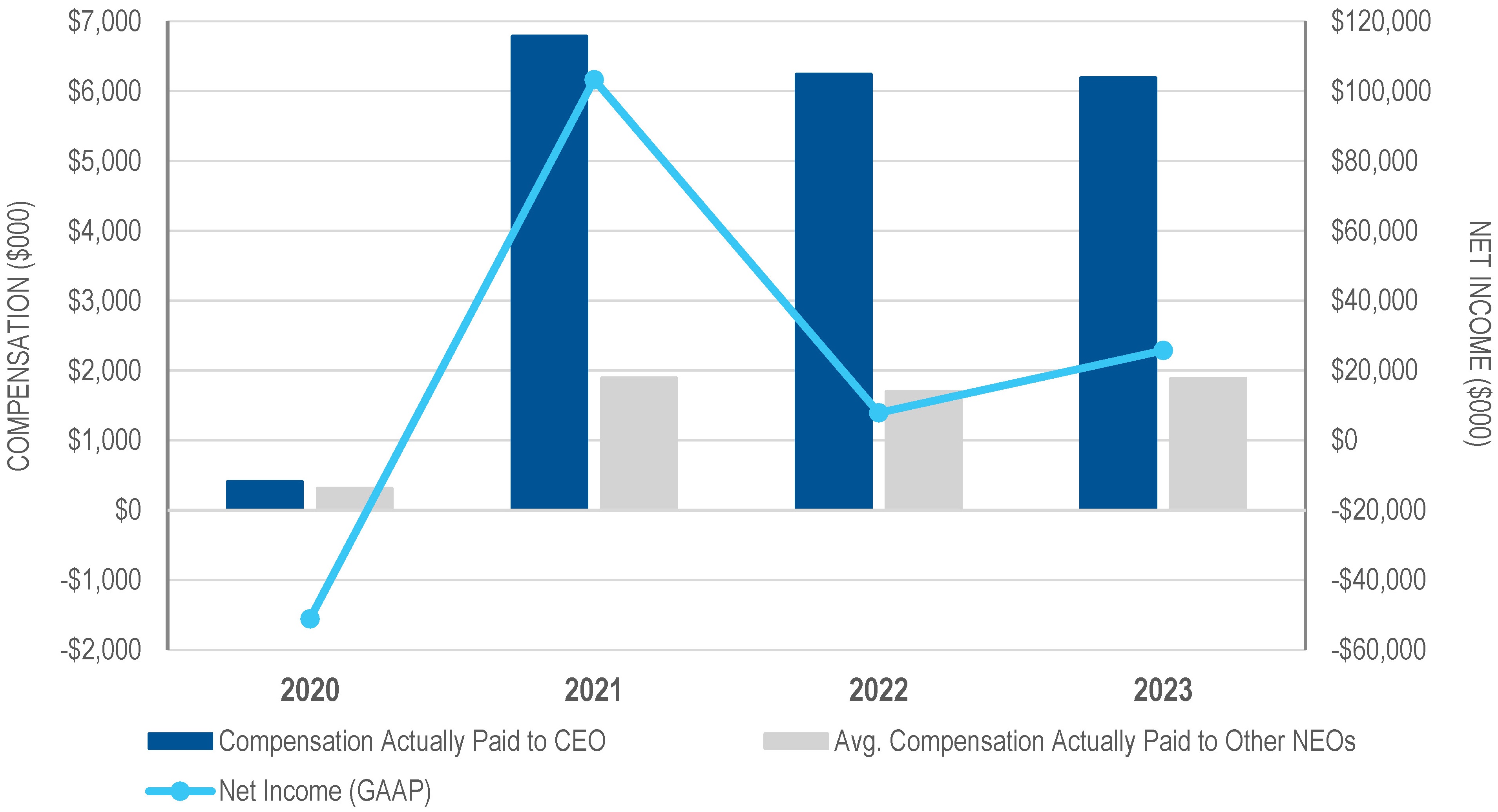

● | Increasing GAAP net income to $25.8 million, a 229% increase over 2022 |

● | Increasing revenue to $626 million, a 13% increase over 2022 and a 61% increase over 2021 |

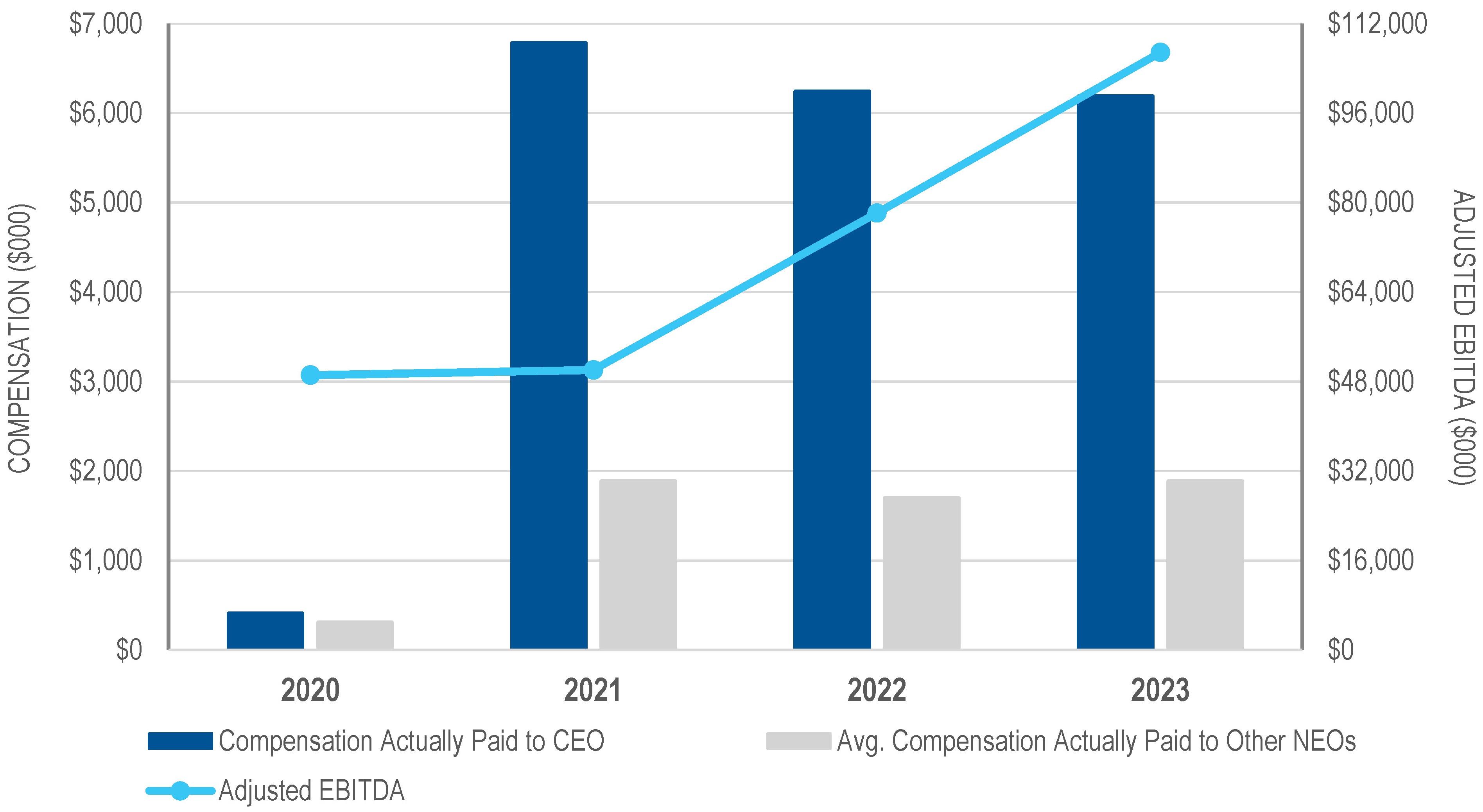

● | Improving adjusted EBITDA* to $106.8 million, a 37% increase over 2022 and a 113% increase over 2021 |

● | Improving our Return on Net Capital Employed (RONCE)* to 20.5%, a 52% increase over 2022 and a 364% increase over 2021 |

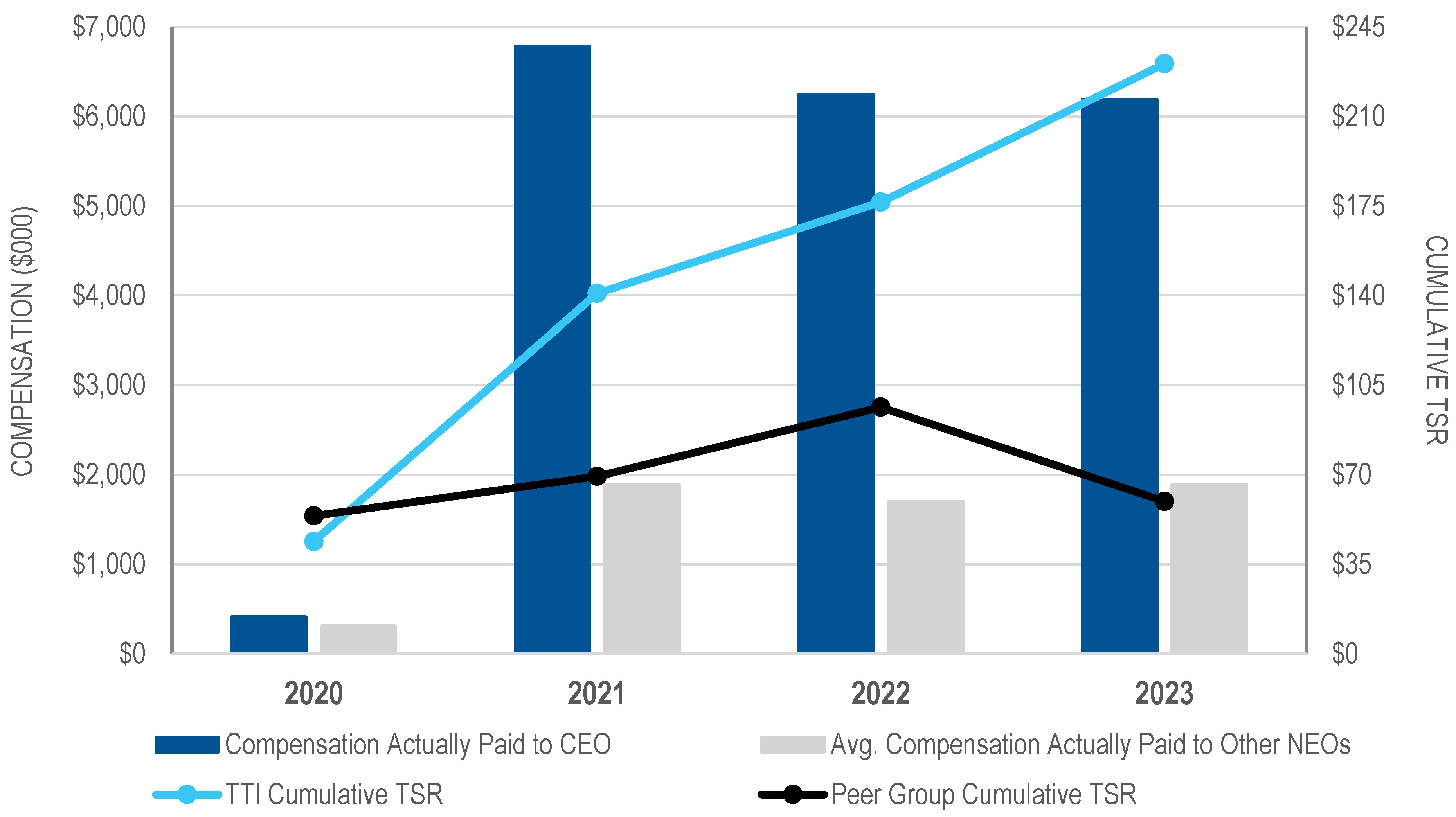

● | Over the 3-year period of 2021 through 2023, increasing our total stockholder return ("TSR") by 64% |

* adjusted EBITDA and RONCE are not presented in accordance with generally accepted accounting principles in the United States (“GAAP”). Please see Appendix A – Information Regarding Non-GAAP Financial Measures - for reconciliations of these non-GAAP financial measures to the most directly comparable GAAP measures

Three Year Performance Highlights

TETRA Technologies, Inc. | 8

PROPOSAL NO. 1 - ELECTION OF DIRECTORS

Proposal No. 1 — Election of Directors

| | | | | | | | |

| The Board recommends a vote FOR the election of each nominee | |

Departure of Current Board Member

Gina A. Luna, a current member of our Board of Directors, will let her current term expire to enable her to focus on her other commitments. She will remain on the board until the end of her term at the Annual Meeting and, as such, Ms. Luna is not standing for election at the Annual Meeting.

Our Board of Directors determined that Sharon B. McGee would succeed Ms. Luna as Chairman of the Nominating, Governance and Sustainability Committee (“NGSC”) immediately following the Annual Meeting. Also immediately following the Annual Meeting, the Board of Directors expects to set the size of the Board at eight directors. Proxies solicited hereby cannot be voted for a greater number of persons than the nominees for director set forth below.

Board Recommendation

Our Board of Directors believes that each director nominee for election at the Annual Meeting is highly qualified. The director nominees’ biographies (below) describe the specific experience, qualifications, attributes, and skills that have been considered by the Nominating, Governance and Sustainability Committee and contributed to such individuals’ being nominated for our Board of Directors. As their biographies indicate, all the director nominees possess significant leadership and professional experience, knowledge, including energy and specialty chemicals industry knowledge, and skills that qualify them for service on our Board of Directors. Each nominee, other than Mr. Murphy, our President and Chief Executive Officer, satisfies the independence requirements under the listing standards of the New York Stock Exchange (“NYSE”). All nominees satisfy the criteria stated in our Corporate Governance Guidelines and possess the personal characteristics essential for the proper and effective functioning of our Board of Directors.

The terms of office of each of the nine current directors will expire at the time of the Annual Meeting. The Nominating, Governance and Sustainability Committee of the Board of Directors has recommended, and the Board of Directors has nominated and urges you to vote “FOR”, the election of the eight persons listed below who have been nominated to serve one-year terms as directors. Each of the nominees has consented to be named in this Proxy Statement and to serve as a director, if elected.

Vote Required

A plurality vote is required for the election of directors in Proposal No. 1. This means that, if a quorum is present at the Annual Meeting, the eight nominees receiving the greatest numbers of “FOR” votes will be elected to serve as directors. Please see the "General Information About the Meeting and Voting" section in this Proxy Statement for additional information.

It is intended that the proxies solicited hereby will be voted “FOR” the election of such nominees, unless the authority to do so has been withheld by you. A ballot for a nominee that is marked "WITHHOLD" will not be counted as a vote cast. If, at the time of the Annual Meeting, any of the nominees should be unable or decline to serve, the discretionary authority provided in the proxy will enable the proxy holder to vote for a substitute nominee of the Board of Directors. The Board of Directors has no reason to believe that any substitute nominee will be required.

Plurality Plus Voting Policy: Our Corporate Governance Guidelines provide that in an uncontested election (that is, an election where the number of nominees is not greater than the number of directors to be elected), any nominee who receives a greater number of votes WITHHELD for his or her election than votes FOR such election shall, following certification of the stockholder vote, unless such nominee has previously submitted an irrevocable resignation in accordance with the director resignation policy, promptly tender his or her resignation to the Chairman of the Board of Directors. The Nominating, Governance and Sustainability Committee is required to recommend to the Board of Directors whether such tendered resignation should be accepted or rejected. The Board of Directors will then determine whether to accept or reject the tendered resignation. Following the Board of Director’s decision on the Nominating, Governance and

TETRA Technologies, Inc. | 9

PROPOSAL NO. 1 - ELECTION OF DIRECTORS

Sustainability Committee’s recommendation, we will promptly disclose the Board of Director’s decision and decision-making process regarding a tendered resignation in a document filed with the Securities and Exchange Commission (the “SEC”). Each of the director nominees has previously submitted an irrevocable resignation letter in accordance with the director resignation policy. Please read our Corporate Governance Guidelines posted in the Corporate Governance section of the Investor Relations area of our website at www.tetratec.com for more information regarding our plurality plus vote policy.

Nominees for Director

The nominees for election as directors are as follows:

| | | | | | | | | | | | | | | | | | | | |

Name | | Age | | Position with Us | Tenure (years) | Public Directorships |

Mark E. Baldwin | | 70 | | Independent Director | 10 | 3 |

Thomas R. Bates, Jr. | | 74 | | Independent Director | 12 | 3 |

Christian A. Garcia | | 60 | | Independent Director | <1 | 1 |

John F. Glick | | 71 | | Independent Director | 10 | 2 |

Angela D. John | | 53 | | Independent Director | <1 | 2 |

Sharon B. McGee | | 59 | | Independent Director | 2 | 1 |

Brady M. Murphy | | 64 | | Director, President and CEO | 5 | 1 |

Shawn D. Williams | | 61 | | Independent Director | 3 | 3 |

See “Beneficial Stock Ownership of Certain Stockholders and Management” on page 104 for information regarding the number of shares of the Company's common stock, par value $0.01 per share (the "common stock") owned by each nominee.

| | | | | | | | |

| Mark E. Baldwin |

| |

| •Independent Director since 2014 |

| Board Committees |

•Audit Committee (Chairman) |

Skills and Experience •Executive Leadership •Governance/Risk Management •Operations Management •Industry Experience |

•Finance/Accounting/Capital Markets •Strategic Planning and Management •Public Company Experience |

Mr. Baldwin was selected to serve as a director due to his extensive knowledge of the energy industry and his financial management and operations experience which provides a significant contribution to our Board of Director’s mix of backgrounds and skills. |

Mr. Baldwin has served as a member of our Board of Directors since January 2014 and as Chairman of our Audit Committee since May 2014. Mr. Baldwin served as the executive vice president and chief financial officer of Dresser-Rand Group, Inc., a public company subject to the reporting requirements of the Securities Exchange Act of 1934, from August 2007 until his retirement in May 2013. Prior to joining Dresser-Rand, he served as the executive vice president, chief financial officer, and treasurer of Veritas DGC Inc., a public company, from August 2004 through February 2007, and operating partner at First Reserve Corporation from April 2003 through July 2004. Mr. Baldwin served as executive vice president and chief financial officer for NextiraOne from October 2001 through August 2002, and as chairman of the board and chief executive officer for Pentacon Inc. from 1997 through 2001. From 1980 through 1997, Mr. Baldwin served in a variety of finance and operations positions with Keystone International Inc., including treasurer, chief financial officer, and president of the Industrial Valves and Controls Group. Mr. Baldwin currently serves as a director and as a member of the audit committee of KBR, Inc. (NYSE: KBR) and as a director and as a member of the audit committee of Nine Energy Service, Inc. (NYSE: NINE). He previously served as a director of Seahawk Drilling Inc. from August 2009 until February 2011. Mr. Baldwin has a B.S. in Mechanical Engineering from Duke University and an MBA from Tulane University.

TETRA Technologies, Inc. | 10

PROPOSAL NO. 1 - ELECTION OF DIRECTORS

| | | | | | | | |

| Thomas R. Bates, Jr., Ph.D. |

| •Independent Director since 2014 |

| Board Committees |

•Human Capital Management and Compensation Committee (Chairman) |

Skills and Experience •Executive Leadership •Human Capital Management/DEI •Governance/Risk Management •Operations Management •Cybersecurity Oversight | •Strategic Planning and Management •Public Company Experience •International/Industry Experience •Private Equity

|

Dr. Bates was selected to serve as a director due to his extensive international oil and gas services industry experience, human capital management experience, his past management of a private equity firm, which provides valuable entrepreneurial and capital markets insight, and his experience serving as a director of other public companies, which provides cross-board experience and perspective. |

Dr. Bates served as a member of our Board of Directors since November 2011, as Chairman of our Human Capital Management and Compensation Committee since May 2014, and as a member of that committee since May 2012. Dr. Bates is a private investor and currently an adjunct professor in the Finance Department at Texas Christian University where he teaches in the MBA program at the Neeley School of Business and serves on the board of the Ralph Lowe Energy Institute. Dr. Bates joined Lime Rock Management LP, an energy-focused private equity firm, as a managing director in 2001 and became a senior advisor of the firm in 2010 before retiring in 2013. Dr. Bates had 25 years of experience in oil service management and operations before joining Lime Rock. He served from 1998 through 2000 as president of the Discovery Group of Baker Hughes and was responsible for the integration of Western Atlas into Baker Hughes. Earlier, he served as president and chief executive officer of Weatherford Enterra. Previously, Dr. Bates spent 15 years with Schlumberger in both domestic and international locations and was responsible for the Anadrill business unit when early MWD and LWD tools were commercialized. Dr. Bates began his career with Shell Oil Company, where he conducted drilling research. Dr. Bates has been a personal investor and/or a corporate investor in more than a dozen oil service technology startups. Dr. Bates also serves on the board of directors and as chairman of the compensation and leadership development committee and member of the audit committee of SSR Mining, Inc. (NASDAQ/TSX: SSRM), a Canadian company, and as chairman of the board of directors and a member of the audit committee of Vantage Drilling International (OTC: VTDRF). Dr. Bates previously served on the boards of Independence Contract Drilling, Inc. from August, 2014 through June, 2020, Weatherford International, plc from December 2019 until June 2020, and Tidewater Inc. from July 2017 to October 2019. Dr. Bates is a graduate of the University of Michigan with a Ph.D. in Mechanical Engineering.

| | | | | | | | |

| Christian A. Garcia |

| •Independent Director since 2023 |

| Board Committees |

•Audit Committee |

•Nominating, Governance and Sustainability Committee |

Skills and Experience •Executive Leadership •Governance/Risk Management •Information Technology •Investor Relations | •International/Industry Experience •Public Company Experience •Strategic Planning and Management •Finance/Accounting/Capital Markets |

Mr. Garcia was selected to serve as a director due to his broad experience in financial management, information technology, and global business processes for a number of energy-related companies which provides valuable insight to our Board of Directors from a financial, operational and strategic planning perspective. |

Mr. Garcia has served as a member of our Board of Directors and as a member of the Audit Committee and the Nominating, Governance and Sustainability Committee since May 2023. Mr. Garcia served as executive vice president and chief financial officer at BrandSafway, a provider of industrial services solutions to commercial, industrial, and infrastructure markets from October 2020 to May 2023. Prior to joining BrandSafway, from January 2020 to August 2020, Mr. Garcia served as the executive vice president and chief financial officer of Weatherford International (NASDAQ: WFRD), an oil services company. Prior to joining Weatherford, from October 2016 to October 2019, he served as

TETRA Technologies, Inc. | 11

PROPOSAL NO. 1 - ELECTION OF DIRECTORS

executive vice president and chief financial officer of Visteon Corporation (NSADAQ: VC), a provider of automotive cockpit electronics. Previously, Mr. Garcia served as acting chief financial officer of Halliburton Company (NYSE: HAL), an energy company, where he progressed through a variety of leadership positions including chief accounting officer, treasurer and senior vice president of investor relations. For the periods August 2020 to October 2020 and October 2019 to January 2020, Mr. Garcia was self-employed. From May 2017 to October 2019, he served as a board director and chairman of the audit committee of Keane Group, Inc. (NYSE: FRAC), a provider of integrated well completions. Mr. Garcia received his Bachelor of Science from the University of the Philippines and his master’s degree in business from Purdue University.

| | | | | | | | |

| John F. Glick |

| •Independent Director since 2014 |

•Chairman of the Board |

| Board Committees |

•As Chairman of the Board, Mr. Glick is an Ex-Officio member of the Audit Committee, the Human Capital Management and Compensation Committee, and the Nominating, Governance and Sustainability Committee |

Skills and Experience •Executive Leadership •Operations Management •Governance/Risk Management •Public Company Experience | •International/Industry Experience •Human Capital Management/DEI •Strategic Planning and Management |

Mr. Glick was selected to serve as a director due to his broad experience in manufacturing and servicing a variety of oilfield drilling and completion products, both domestically and internationally, which provides valuable insight to our Board of Directors from an operational and strategic planning perspective. |

Mr. Glick has served as a member of our Board of Directors since January 2014, as Chairman of the Board since May 2022, as a member of our Nominating, Governance and Sustainability Committee from May 2015 until May 2023, including chairman of that committee from May 2015 to May 2022, and as a member Human Capital Management and Compensation Committee from May 2014 to May 2022. Mr. Glick served as the chief executive officer and a director of Lufkin Industries, Inc., a public company, from March 2008 until his retirement in July 2013 and served as Lufkin’s president and a director since August 2007. During his tenure, Mr. Glick oversaw the growth of Lufkin and, ultimately, the sale of the company to General Electric in July 2013. From September 1994 through August 2007, Mr. Glick served as the vice president and general manager of Lufkin’s Power Transmission Division. He served as vice president and general manager of Lufkin’s Oilfield Division from August 2007 through August 2008. Prior to joining Lufkin, from 1974 through 1994, Mr. Glick held several senior management level positions with Cameron Iron Works, Inc. Mr. Glick currently serves as the non-executive chairman of the board of directors, chairman of the nominating and governance committee, and an ex-officio member of the audit and remuneration committees of Hunting PLC (LSE: HTG.L) and also serves as chairman of Baylor St. Luke’s Hospital board of trustees and sits on its executive committee. Mr. Glick previously served on the board of Weatherford International plc from December 2019 until June 2020. Mr. Glick received a B.S. in Journalism from the University of Kansas and graduated from the Harvard Graduate School of Business Program for Management Development.

TETRA Technologies, Inc. | 12

PROPOSAL NO. 1 - ELECTION OF DIRECTORS

| | | | | | | | |

| Angela D. John |

| •Independent Director since 2024 |

| Board Committees |

•Audit Committee |

•Nominating, Governance and Sustainability Committee |

Skills and Experience •Executive Leadership •Trading and Marketing •Renewables and Low-Carbon •Business Development |

•Governance/Risk Management •Strategic Planning and Management •Industry Experience •Public Company Experience |

Ms. John was selected to serve as a director due to her broad experience in the energy industry, including experience creating structures to support financing of renewable and low carbon projects. Her chemical engineering background also provides valuable insight to our Board of Directors regarding our aqueous chemistry solutions. |

Ms. John has served as a member of our Board of Directors and as a member of our Audit Committee and our Nominating, Governance and Sustainability Committee since March 2024. Since October 2020, Ms. John has been providing advisory services in the energy industry, primarily focused on clean energy business development and commercialization strategies. Ms. John was the director of innovation and strategy for New Energy Ventures with The Williams Companies, Inc. (NYSE: WMB) from January 2021 to September 2022. Prior to that Ms. John held a number of leadership roles within BP p.l.c. (NYSE/LSE: BP) over a 27-year period, including vice president, marketing and supply, NGLs, from 2009 to 2011, senior vice president marketing and origination, from 2011 to 2017, and most recently, from 2017 to September 2020, as director of structured products where she focused on renewable fuels development. Ms. John has served on the board of Parkland Corporation (TSX: PKI) since August 2021 and serves on its environmental, safety, and sustainability committee and its human resources and compensation committee. Ms. John earned a Master of Business Administration from Northwestern University’s Kellogg School of Management, and a Bachelor of Science in Chemical Engineering from the University of Houston. Ms. John has also earned an NACD Directorship Certification through the NACD Directorship Certification program and is in the process of completing certification requirements for the NACD CERT Certificate in Cyber-Risk Oversight.

| | | | | | | | |

| Sharon B. McGee |

| •Independent Director since 2022 |

| Board Committees |

•Human Capital Management and Compensation Committee |

•Nominating, Governance and Sustainability Committee |

Skills and Experience •Executive Leadership •Corporate Development •R&D/Innovation •Investor Relations |

•Strategic Planning and Management •Sales/Marketing •Manufacturing Operations •Specialty Chemicals Industry |

Ms. McGee was selected to serve as a director due to her broad range of experience in the global specialty chemicals industry and her expertise provides valuable insight to our Board of Directors regarding our aqueous chemistry solutions and low carbon energy initiatives. |

Ms. McGee has served as a member of our Board of Directors and as a member of our Nominating, Governance and Sustainability Committee and our Human Capital Management and Compensation Committee since February 2022. Ms. McGee founded SDBM Executive and Strategic Advisory, LLC in May, 2021, an independent advisory service to the new energy, chemicals, materials, mining, and oil and gas industries. Prior to that, Ms. McGee served at Albemarle Corporation (NYSE: ALB) for 33 years, holding several senior management level positions, most recently as vice president of investor relations and corporate development from 2016 through January, 2021, vice president, Asia Pacific region and global fire safety sales from 2014-2016, vice president, sales – Americas from 2013-2014, division vice president, performance chemicals from 2008-2013, and global business director, industrial bromides from 2005-2008. Albemarle is one of the largest global producers of lithium and lithium derivatives, and bromine and bromine derivatives, of which Ms. McGee participated in many of the strategic discussions with respect to Albemarle’s lithium and bromine operations. Ms. McGee earned an Executive MBA Certificate from Louisiana State University and MS and BS degrees in Chemical Engineering

TETRA Technologies, Inc. | 13

PROPOSAL NO. 1 - ELECTION OF DIRECTORS

from the University of Arkansas. She also earned an NACD Directorship Certification through the NACD Directorship Certification program.

| | | | | | | | |

| Brady M. Murphy |

| •President and Chief Executive Officer |

•Director since 2018 |

| Board Committees |

•No Committee Memberships |

Skills and Experience •Executive Leadership •Operations Management •Public Company Experience •International/Industry Experience | •Human Capital Management/DEI •Governance/Risk Management •Strategic Planning and Management |

Mr. Murphy has more than 35 years of global operations, engineering, manufacturing and business development experience in a variety of areas within the energy industry, including deepwater, mature fields and unconventional assets. Mr. Murphy’s service as our President and Chief Executive Officer provides our Board of Directors with an in-depth source of knowledge regarding our operations, customers, competitors, markets in which we operate, business strategy, safety leadership, executive management team, and the effectiveness of our compensation programs. |

Mr. Murphy has served as our President and Chief Executive Officer since May 2019, as our President and Chief Operating Officer from February 2018 until his promotion to Chief Executive Officer in May 2019, and as a director since December 2018. From May 2019 to January 2021, Mr. Murphy also served as President and chairman of the board of directors of CSI Compressco GP LLC, the general partner of CSI Compressco LP (NASDAQ: CCLP), formerly one of our consolidated subsidiaries. Mr. Murphy served as a director of CSI Compressco GP LLC from February 2018 to January 2021. Prior to joining TETRA, Mr. Murphy served as chief executive officer of Paradigm Group B.V., a private company focused on strategic technologies for the upstream energy industry, from January 2016 until February 2018. Mr. Murphy previously served at Halliburton Company (NYSE: HAL) and its affiliated companies for 26 years and held numerous international and North America positions, most recently as senior vice president - global business development and marketing from 2012 to December 2015, as senior vice president - business development Eastern Hemisphere from 2011 to 2012, and as senior vice president - Europe/Sub–Saharan Africa region from 2008 to 2011. Earlier in his career, from 1981 until 1989, Mr. Murphy held several positions with increasing responsibility at Gerhart Industries. Mr. Murphy received his B.S. degree in Chemical Engineering from Pennsylvania State University and is an alumnus of Harvard Business School’s Advanced Management Program.

| | | | | | | | |

| Shawn D. Williams |

| •Independent Director since 2021 |

| Board Committees |

•Audit Committee |

•Human Capital Management and Compensation Committee |

Skills and Experience •Executive Leadership •Public Company Experience •Specialty Chemicals Industry •International Experience •Cybersecurity Oversight | •Human Capital Management/DEI •Governance/Risk Management •Strategic Planning and Management •Operations Management

|

Mr. Williams was selected to serve as a director due his extensive experience in various industrial markets, including the plastics and specialty chemicals industry, his service in senior executive leadership positions with both financial sponsored and strategic owned global enterprises, and experience with strategic talent development and succession planning which provides a significant contribution to our Board of Director’s mix of backgrounds and skills. |

Mr. Williams has served as a member of our Board of Directors since March 2021 and as a member of our Audit Committee and Human Capital Management and Compensation Committee since April 2021. Most recently, Mr. Williams served as the Chief Executive Officer of Nexeo Plastics Holdings, Inc., a global plastics distributor, from April 2019 until

TETRA Technologies, Inc. | 14

PROPOSAL NO. 1 - ELECTION OF DIRECTORS

June of 2020 and from September 2012 to March of 2019, as Executive Vice President of Nexeo Solutions, Inc. Mr. Williams has been retired since June 2020. Prior to joining Nexeo Solutions, from 2007 to 2012 Mr. Williams served as President of Momentive Global Sealants, a global specialty sealants business, and President of Momentive Performance Materials, a silicone specialty materials business. Earlier in his career, Mr. Williams spent 22 years serving in industrial and material business leadership roles at General Electric Company and led businesses globally in the Americas, Europe, and Asia across a broad sector of markets. Since January 1, 2022, Mr. Williams has served as the executive chairman of the board of managers of Covia Holdings, LLC, a provider of minerals-based solutions serving the industrial and energy markets, has served as a member of its audit committee and compensation committee since December 2020, and served as chairman of the board of managers from December 2020 to December 2021. He served as interim chief executive officer of Covia Holdings from June to December 2020. Mr. Williams has also served on the board of directors of Kirby Corporation (NYSE: KEX) since July 2021 and as a member of its ESG and nominating committee since January 2022 and on the board of directors of Marathon Oil Corporation (NYSE: MRO) since February 2023 and as a member of its audit and finance committee and its corporate governance and nominating committee. Mr. Williams earned his MBA from the Haas School of Business at the University of California, Berkeley, and a B.S. in electrical engineering from Purdue University. Mr. Williams also earned an NACD CERT Certificate in Cyber-Risk Oversight.

More details on our Board of Directors and corporate governance documents can be found starting on page 22.

TETRA Technologies, Inc. | 15

PROPOSAL NO. 2 - ADVISORY VOTE TO APPROVE EXECUTIVE COMPENSATION

Proposal No. 2 — Advisory Vote to Approve Executive Compensation

| | | | | | | | |

| The Board recommends a vote FOR this Proposal | |

In Proposal No. 2, we are asking our stockholders to approve, on an advisory basis, the compensation of our named executive officers (collectively, the “Named Executive Officers” or “NEOs”) pursuant to Section 14A of the Exchange Act, as disclosed in this Proxy Statement in accordance with SEC rules. While this vote is not binding on our Company, the results of the votes on this proposal will be carefully considered by the Board of Directors and the Human Capital Management and Compensation Committee (“HCMCC”) of our Board of Directors when making future executive compensation decisions. The next such vote will occur at the 2025 Annual Meeting.

| | | | | | | | |

| As discussed in the Compensation Discussion and Analysis (“CD&A”) section of this Proxy Statement, our compensation philosophy is designed to enable us to recruit and retain the highly qualified and competent executives that are crucial to our long-term success while ensuring that a significant portion of the compensation opportunities available to them are tied to performance; thus aligning their interests with the interests of our stockholders. | |

The following are some of the key topics discussed in greater detail in the CD&A and in other sections of this Proxy Statement, and stockholders are encouraged to read these other sections.

| | | | | |

| • | Every member of our HCMCC is independent, as independence is defined in the listing standards of the NYSE (page 23). |

| • | We maintain an Incentive-Based Compensation Recoupment Policy that provides a mechanism for us to recover incentive-based compensation paid to our executive officers (page 57). |

| • | Our HCMCC has established a thorough process for the review and approval of our compensation programs and practices and it has retained and directed an independent compensation consultant to assist in the discharge of its duties (page 46). |

| • | Our Board of Directors has adopted stock ownership guidelines that apply to our directors and executive officers (pages 28 and 58). |

| • | We employ our executive officers “at will” under employment agreements similar to those executed by all our employees (page 57). |

| • | Our insider trading policy prohibits transactions involving short sales, the buying and selling of puts, calls, or other derivative instruments, and certain forms of hedging or monetization transactions involving our securities (page 36). |

| • | On an annual basis, our HCMCC awards performance-based, long-term cash incentives to certain of our executive officers to supplement the long-term performance-based incentive and retention value provided by time-vesting equity awards. |

| • | A significant portion of our executive officers’ compensation is in the form of long-term incentive awards that are tied to the long-term performance of our stock and certain key measures that drive stockholder returns. The process by which the HCMCC determines the structure of these long-term incentive awards takes into account TETRA’s performance relative to our peers and internal budgeted expectations, market compensation and the need to retain executive talent over the long-term, and alignment with the experience of our long-term stockholders. |

| • | We believe that providing both short- and long-term incentive compensation awards also helps reduce risks to us or our stockholders that could arise from excessive focus on short-term performance (page 73). |

TETRA Technologies, Inc. | 16

PROPOSAL NO. 2 - ADVISORY VOTE TO APPROVE EXECUTIVE COMPENSATION

Our Board of Directors believes that our compensation program is effective in implementing our compensation philosophy and furthering our strategic goals and objectives. Pursuant to SEC rules, we are asking our stockholders to approve the compensation of our NEOs as disclosed in the CD&A (beginning on page 43), the compensation tables (beginning on page 60) and the narrative discussion following the compensation tables. This advisory stockholder vote, commonly known as “say-on-pay,” gives you as a stockholder the opportunity to approve or not approve our executive compensation program and policies through the following resolution:

“RESOLVED, that the stockholders of TETRA Technologies, Inc. approve, on an advisory basis, the compensation of its named executive officers as disclosed in the Company’s 2024 Proxy Statement pursuant to the executive compensation disclosure rules of the Securities and Exchange Commission, which disclosure includes the Compensation Discussion and Analysis, the compensation tables and related narrative disclosure contained in this Proxy Statement.”

Board Recommendation

The Board of Directors recommends that you vote “FOR” approval of the named executive officer compensation as disclosed pursuant to the executive compensation disclosure rules of the SEC, including in the Compensation Discussion and Analysis, the compensation tables and related narrative discussion as contained in this Proxy Statement. Proxies returned will be so voted unless contrary instructions are indicated thereon.

Vote Required

Approval of Proposal No. 2, on an advisory basis, requires the affirmative vote of a majority of the common shares represented in person or by proxy and entitled to vote on the proposal at the Annual Meeting. Brokers do not have discretionary authority to vote on the advisory vote to approve executive compensation. Consequently, broker non-votes will not be considered in the vote totals for this proposal and will have no effect on the vote. For the purpose of determining whether the proposal has received a majority vote, abstentions will be included in the vote totals with the result that an abstention will have the same effect as a vote against the proposal. Please see the "General Information About the Meeting and Voting" section in this Proxy Statement for additional information.

TETRA Technologies, Inc. | 17

PROPOSAL NO. 3 - RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Proposal No. 3 — Ratification of Selection of Independent Registered Public Accounting Firm

| | | | | | | | |

| The Board recommends a vote FOR this Proposal | |

Proposal No. 3 requests stockholder approval of the Audit Committee’s selection of the firm of Grant Thornton LLP (“GT”) as our independent registered public accounting firm, or “independent auditors”, for the year ending December 31, 2024.

Independence of our Independent Auditor

The Audit Committee evaluates the selection of the independent auditors each year and has selected GT for the current year. GT has served as our independent auditors since June 2020. The Audit Committee concluded that many factors contribute to the continued support of GT’s independence, such as the oversight of the Public Company Accounting Oversight Board (“PCAOB”) through the establishment of audit, quality, ethics, and independence standards, in addition to conducting audit inspections, the mandating of reports on internal control over financial reporting, PCAOB requirements for audit partner rotation, and limitations imposed by regulation and by our Audit Committee on non-audit services provided by GT. The Audit Committee reviews and pre-approves all audit and non-audit services to be performed by GT as well as reviews and approves the fees charged by GT for such services. The Audit Committee pre-approved all audit and non-audit services performed by GT during the last two fiscal years. In its review and pre-approval of non-audit service fees, the Audit Committee considers, among other factors, the possible impact of the performance of such services on the auditors’ independence. In addition, under the auditor independence rules, GT reviews its independence each year and delivers to the Audit Committee a letter addressing matters prescribed in those rules. Please see the Audit Committee Report on page 37 for additional information regarding the Audit Committee’s evaluation of GT.

Audit Partner Rotation

In accordance with SEC rules, audit partners for independent registered public accounting firms are also subject to rotation requirements that limit the number of consecutive years an individual partner may serve in certain roles. For lead and concurring audit partners, the maximum is five consecutive years of service. We select the lead partner from our independent registered public accounting firm pursuant to this rotation policy following meetings with potential candidates and discussions between the Audit Committee and management.

Considerations Regarding Appointment

The Audit Committee considers, among other factors, the fact that we require global, standardized, and well-coordinated services, not only for audit purposes, but for other non-audit service items, including statutory audits and various regulatory certification items. Some of these services are provided to us by multinational audit and accounting firms other than GT. A change in our independent auditor may require us to replace one or more of these other multinational service providers and could significantly disrupt our business due to a loss of cumulative knowledge in such service providers’ areas of expertise.

Board Recommendation

The Board of Directors recommends that you vote “FOR” ratification and approval of the appointment of GT as our independent registered public accounting firm for the 2024 fiscal year, and proxies returned will be so voted unless contrary instructions are indicated thereon.

As a matter of good corporate governance, the Board of Directors submits the selection of the independent registered public accounting firm to our stockholders for ratification. If our stockholders do not ratify the appointment, the Audit Committee may reconsider its selection of the firm as our independent registered public accounting firm for the year ending December 31, 2024, but the Audit Committee may also elect to retain the firm. Even if the selection is ratified, the Audit Committee in its discretion may appoint a different independent registered public accounting firm at any time during the year if the committee determines that such change would be appropriate. Representatives of GT are expected to be present at the Annual Meeting and will have the opportunity to make a statement if they desire to do so and to respond to appropriate questions from stockholders.

TETRA Technologies, Inc. | 18

PROPOSAL NO. 3 - RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Vote Required

Approval of Proposal No. 3 requires the affirmative vote of a majority of the common shares represented in person or by proxy and entitled to vote on the proposal at the Annual Meeting. Proposal No. 3 is considered to be "routine" under NYSE rules. As such, brokers who have not received voting instructions from the beneficial owner have the discretionary authority to vote on this matter. Therefore, there will be no broker non-votes for this proposal. For the purpose of determining whether the proposal has received a majority vote, abstentions will be included in the vote totals with the result that an abstention will have the same effect as a vote against the proposal. Please see the "General Information About the Meeting and Voting" section in this Proxy Statement for additional information.

TETRA Technologies, Inc. | 19

PROPOSAL NO. 4 - STOCKHOLDER PROPOSAL

Proposal No. 4 — Stockholder Proposal

| | | | | | | | |

| The Board recommends a vote AGAINST this Proposal | |

Background of the Proposal

In accordance with SEC rules, we have set forth below a stockholder proposal and supporting statement from Kenneth Steiner of 14 Stoner Ave., 2M, Great Neck, NY 11021-2100, who has indicated he is the beneficial owner of at least 500 shares of our common stock since at least October 15, 2020 and intends for the following proposal to be presented at the Annual Meeting. In accordance with Rule 14a-8 of the Exchange Act, the stockholder proposal is required to be voted on at the Annual Meeting only if properly presented by the stockholder proponent or his qualified representative at the meeting. The text of the stockholder’s resolution and the statement that the stockholder furnished to us in support thereof appear below, exactly as submitted, and we are not responsible for inaccuracies or omissions therein.

Proposal 4 – Shareholder Right to Act by Written Consent

Shareholders request that our board of directors take such steps as may be necessary to permit written consent by the shareholders entitled to cast the minimum number of votes that would be necessary to authorize an action at a meeting at which all shareholders entitled to vote thereon were present and voting. This includes shareholder ability to initiate any appropriate topic for written consent.

It is important for shareholders to have a right to act by written consent due to the current restricted right for shareholders to call for a special shareholder meeting. All TETRA Technologies, shares not owned for one continuous year are prohibited from participating in calling for a special shareholder meeting.

Thus the shareholders, who own the 25% of all TETRA Technologies shares outstanding that are needed to call for a special shareholder meeting, could determine that they own 40% of all shares outstanding when the length of their TTI stock ownership is factored out. A potential in-practice requirement to own 40% of all shares outstanding to call for a special shareholder meeting is not much of a shareholder right. Thus it is reasonable that shareholders have the related right to act by written consent to help make up for the current restricted shareholder right to call for a special shareholder meeting.

Please vote yes:

Shareholder Right to Act by Written Consent — Proposal 4

Statement of the Board of Directors

The Board of Directors has carefully considered this proposal and has concluded that its adoption is not in the best interests of the Company’s stockholders. Accordingly, the Board of Directors unanimously recommends a vote AGAINST this proposal for the reasons outlined below:

•The Board of Directors is already highly accountable to stockholders.

•The Board of Directors recognizes the importance of corporate governance to the effective management of the Company and is committed to maintaining policies and practices that serve the best interests of all stockholders. Delivering on this commitment, the Board of Directors unanimously approved and recommended to the stockholders an amendment to our Certificate of Incorporation to provide a right for stockholders to request a special meeting. Following last year’s annual meeting, our Certificate of Incorporation now permits stockholders who hold, in the aggregate, at least 25% of our common stock, and satisfy a minimum holding requirement that such stockholder has continuously owned all such common stock throughout the one-year period preceding, and including, the date of submission of such stockholder’s demand, as well as certain other procedures and requirements, to request a special meeting of stockholders. In addition to this newly implemented special meeting right, the Company has

TETRA Technologies, Inc. | 20

PROPOSAL NO. 4 - STOCKHOLDER PROPOSAL

many other governance provisions that demonstrate our Board of Directors’ commitment to good corporate governance, including:

•Majority-Independent Board. Currently, eight out of our nine directors are independent. Following the Annual Meeting, assuming the stockholders elect to the Board of Directors the director nominees set forth in Proposal No. 1, seven out of our eight directors will be independent.

•No Supermajority Voting Provisions. We have no supermajority voting provisions in either our Certificate of Incorporation or our Bylaws.

•Stock Ownership Guidelines. The Board of Directors believes that equity ownership by the Company’s directors and executive officers is important for the Company. Our directors and executive officers are subject to stock ownership guidelines to align their interests with those of our stockholders.

•Encourage Stockholder Engagement. We value our stockholders’ opinions and actively solicit input through our stockholder engagement program. We are responsive to stockholders and believe in maintaining active stockholder engagement.

•The Board of Directors believes that stockholders’ right to request a special meeting strikes the appropriate balance between enhancing stockholder rights and protecting the long-term interests of the Company and our stockholders. We believe that the ability to act by written consent, as set forth in this Proposal No. 4, is not only unnecessary given the existing right to request a special meeting, but that it lacks appropriate safeguards and fails to serve the best interests of our stockholders as a whole.

•The existing special meeting right provides an intentional, informed and equitable forum for all stockholders to discuss proposals, because the date, time and place of a meeting must be provided to all stockholders in advance. Moreover, the Board of Directors, who are bound by fiduciary duties to all stockholders, have the opportunity to review the merits of a proposal and to provide a recommendation for consideration.

•The Board of Directors believes that when our stockholders are asked to act on a matter, ALL stockholders – rather than a select few – deserve to have their votes solicited and an opportunity to consider the matter in an open forum at a regular or special meeting of stockholders, which provides our stockholders with important protections and procedural safeguards.

•A written consent need not be distributed to all stockholders or to the Board of Directors. Instead, the ability to act by written consent, as set forth in this Proposal No. 4, would provide the opportunity for a limited group of stockholders to act in favor of their own interests at any time, with any frequency. We believe that this could disenfranchise stockholders by depriving them of the important opportunity to receive notice of, discuss and vote on proposed actions.

•The ability to act by written consent could also lead to confusion among stockholders and disruption to the Company. Groups of stockholders could solicit duplicative or conflicting written consents at the same time. Proposals could require the expenditure of significant administrative and financial Company resources, with potentially little to no corresponding benefit to stockholders.

The Board of Directors believes that our existing practices strike the appropriate balance in ensuring that stockholder voices are heard and that procedural safeguards exist to protect all stockholders. Accordingly, the Board of Directors believes the adoption of this Proposal No. 4 is unnecessary and not in the best interests of the Company and our stockholders.

Board Recommendation

The Board of Directors has carefully considered this stockholder proposal and believes that it is not in the best interests of our stockholders for the reasons outlined above. Accordingly, the Board of Directors unanimously recommends that stockholders vote “AGAINST” this Proposal No. 4.

Vote Required

Approval of this Proposal No. 4 requires the affirmative vote of a majority of the common shares represented in person or by proxy and entitled to vote on the proposal at the Annual Meeting. Abstentions will be counted as present and entitled to vote on the proposal and will therefore have the same effect as a vote against the proposal. Brokers do not have discretionary authority to vote on this proposal. Consequently, broker non-votes will have no effect on the vote. Please see the “General Information About the Meeting and Voting” section in this Proxy Statement for additional information.

TETRA Technologies, Inc. | 21

CORPORATE GOVERNANCE

CORPORATE GOVERNANCE

Corporate Governance Guidelines

The Board of Directors has adopted Corporate Governance Guidelines that address applicable NYSE corporate governance listing requirements and various other corporate governance matters. The Board of Directors believes the Corporate Governance Guidelines assist in ensuring that:

•the Board of Directors is independent from management;

•the Board of Directors adequately performs its function as the overseer of management; and

•the interests of management and the Board of Directors align with the interests of our stockholders.

Plurality Plus Vote Policy

Our Corporate Governance Guidelines provide for a plurality vote standard with a director resignation policy in connection with the election of our directors. This means that in an uncontested election (that is, an election where the number of nominees is not greater than the number of directors to be elected), any nominee who receives a greater number of votes “withheld” from his or her election than votes “for” his or her election must promptly tender his or her resignation to the Chairman of the Board unless such nominee has previously submitted an irrevocable letter of resignation in accordance with our Corporate Governance Guidelines. The Corporate Governance Guidelines also provide that the Board of Directors may require, in order for any incumbent director to become a nominee for further service on the Board of Directors, that such incumbent director submit to the Board of Directors an irrevocable letter of resignation. The irrevocable letter of resignation is conditioned upon, and will not become effective until (i) that nominee has been elected a director in an upcoming contested election of directors, (ii) that nominee fails to receive more votes “for” his or her election than votes “withheld” from his or her election in any uncontested election of directors and (iii) acceptance of the resignation by the Board of Directors. In the event a director receives a greater number of votes “withheld” from his or her election than “for” his or her election, the Nominating, Governance and Sustainability Committee will make a recommendation to the Board of Directors regarding the action to be taken with respect to the tendered resignation. A director whose resignation is being considered will not participate in any committee or Board of Directors meetings where his or her resignation is being considered. The Board of Directors will consider the Nominating, Governance and Sustainability Committee’s recommendation and decide whether to accept the tendered resignation no later than 90 days following the certification of the stockholder vote, and the Board of Directors will promptly and publicly disclose its decision. Each of the nominees for election to the Board of Directors has submitted an irrevocable letter of resignation in accordance with our Corporate Governance Guidelines.

Corporate Governance Documents

The following governance documents are available in the Corporate Governance section of the Investor Relations area of our website at www.tetratec.com and are also available upon written request addressed to Corporate Secretary, TETRA Technologies, Inc., 24955 Interstate 45 North, The Woodlands, Texas 77380:

•Corporate Governance Guidelines, which govern the qualifications and conduct of the Board of Directors.

•Audit Committee Charter.

•Human Capital Management and Compensation Committee Charter.

•Nominating, Governance and Sustainability Committee Charter.

•Code of Business Conduct for directors, officers, and employees. The key principles of this code are honesty, loyalty, fairness, and accountability.

•Code of Ethics for Senior Financial Officers. The key principles of this code include acting legally and ethically, promoting honest business conduct, and providing timely and meaningful public disclosures to our stockholders.

TETRA Technologies, Inc. | 22

CORPORATE GOVERNANCE

•Supplier Code of Business Conduct, which provides guidance on our expectations from our suppliers, vendors, contractors, and others with whom we do business.

•Anti-Corruption Policy, which provides targeted guidance in the very important areas of anti-corruption and anti-bribery compliance.

•Policy on Trading in Company Securities, which is applicable to all members of the Board of Directors, officers, and other employees of the Company.

•Conflict Minerals Policy Statement evidencing our commitment to responsible sourcing of materials for our products and to sourcing products from suppliers that share TETRA's values regarding ethics, integrity, and respect for human rights.

•Stock Ownership Guidelines for Directors and Executive Officers, which are designed to align the interests of our executive officers and directors with the interests of our stockholders.

•Policy and Procedures for Receipt and Treatment of Complaints Related to Accounting and Compliance Matters (Whistleblower Policy), which provides for the receipt, retention, and treatment of complaints received by us regarding accounting, internal accounting controls, auditing matters, or possible violations of laws, rules, or regulations applicable to us and the confidential, anonymous submission of concerns regarding those matters.

•Human Rights Standards, which set forth our commitment to supporting international principles aimed at protecting and promoting universal human rights.

If any substantive amendments are made to the Code of Ethics for Senior Financial Officers, the nature of such amendment will be disclosed on our website. In addition, if a waiver from either the Code of Business Conduct or the Code of Ethics for Senior Financial Officers is granted to an executive officer, director, or principal accounting officer, the nature of such waiver will be disclosed on our website.

Director Independence and Transactions Considered in Independence Determinations

Director Independence. The NYSE listing standards and our Corporate Governance Guidelines require our Board of Directors to be comprised of at least a majority of independent directors. Our Board of Directors determines independence in accordance with the listing requirements of the NYSE, taking into consideration such facts and circumstances as it considers relevant. In order to assist the Board of Directors in making its determination of whether directors are independent, each director completed and delivered to us a questionnaire designed to solicit accurate and complete information that may be relevant in making such independence determinations. The Board of Directors, with the assistance of the Nominating, Governance and Sustainability Committee, reviewed summaries of responses to such questionnaires and such other information considered relevant with respect to the existence of any relationships between a director and us. All of the directors who serve as members of the Audit Committee, Human Capital Management and Compensation Committee and the Nominating, Governance and Sustainability Committee are independent as required by the NYSE corporate governance rules. Under these rules, Audit Committee members also satisfy the separate SEC independence requirements, and the Human Capital Management and Compensation Committee members satisfy the additional NYSE independence requirements.

The Board of Directors has affirmatively determined that the following directors and director nominees are independent:

| | | | | |

Mark E. Baldwin

Thomas R. Bates, Jr.

Christian A. Garcia

John F. Glick

Angela D. John

Gina A. Luna

Sharon B. McGee

Shawn D. Williams | |

TETRA Technologies, Inc. | 23

CORPORATE GOVERNANCE

Transactions Considered in Independence Determinations. In making its independence determinations, our Board of Directors considered transactions that occurred between us and entities associated with the independent directors and their immediate family members.

Shawn Williams is a director of Marathon Oil Corporation. Marathon Oil Corporation or its affiliates is a customer of TETRA, although Mr. Williams’ interest in these transactions was not considered to be material and therefore did not impact his independence. We have considered the foregoing and have concluded that these transactions and relationships did not disqualify Mr. Williams from being considered independent under the rules of the NYSE. Our Board of Directors has also determined that Mr. Williams does not have a material interest in these transactions and that he is independent.

Based upon his ongoing employment with us, the Board of Directors has determined that Mr. Murphy is not independent.

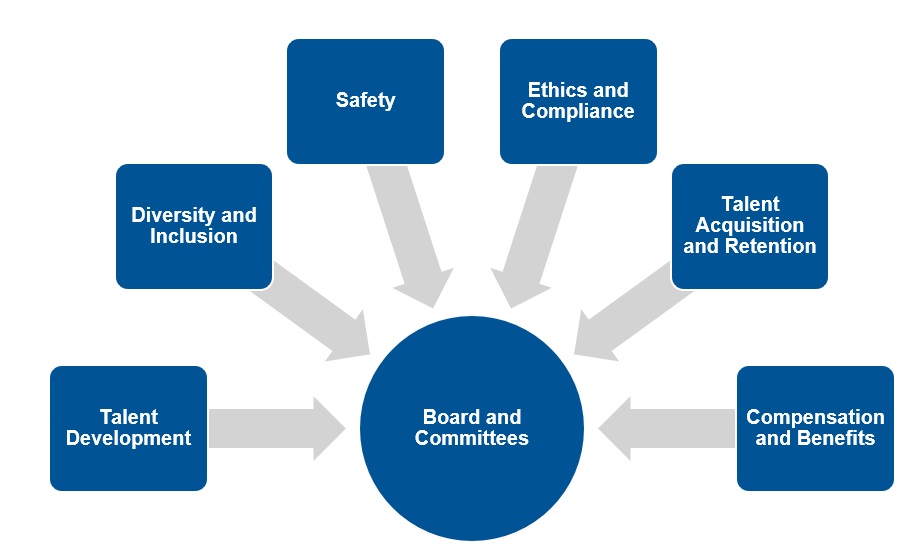

Board Leadership Structure; Separation of Positions of Chairman and Chief Executive Officer