| UNITED STATES | |||

| SECURITIES AND EXCHANGE COMMISSION | |||

| Washington, D.C. 20549 | |||

| FORM N-CSR | |||

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED | |||

| MANAGEMENT INVESTMENT COMPANIES | |||

| Investment Company Act file number: (811-05740) | |||

| Exact name of registrant as specified in charter: | Putnam Managed Municipal Income Trust | ||

| Address of principal executive offices: One Post Office Square, Boston, Massachusetts 02109 | |||

| Name and address of agent for service: | Beth S. Mazor, Vice President | ||

| One Post Office Square | |||

| Boston, Massachusetts 02109 | |||

| Copy to: | John W. Gerstmayr, Esq. | ||

| Ropes & Gray LLP | |||

| 800 Boylston Street | |||

| Boston, Massachusetts 02199-3600 | |||

| Registrant’s telephone number, including area code: | (617) 292-1000 | ||

| Date of fiscal year end: October 31, 2011 | |||

| Date of reporting period: November 1, 2010 - October 31, 2011 | |||

Item 1. Report to Stockholders:

The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940:

Putnam

Managed Municipal

Income Trust

Annual report

10 | 31 | 11

| Message from the Trustees | 1 | ||

|

|

|||

| About the fund | 2 | ||

|

|

|||

| Performance snapshot | 4 | ||

|

|

|||

| Interview with your fund’s portfolio manager | 5 | ||

|

|

|||

| Your fund’s performance | 10 | ||

|

|

|||

| Terms and definitions | 12 | ||

|

|

|||

| Other information for shareholders | 13 | ||

|

|

|||

| Trustee approval of management contract | 14 | ||

|

|

|||

| Financial statements | 18 | ||

|

|

|||

| Federal tax information | 48 | ||

|

|

|||

| Shareholder meeting results | 49 | ||

|

|

|||

| About the Trustees | 50 | ||

|

|

|||

| Officers | 52 | ||

|

|

|||

Message from the Trustees

Dear Fellow Shareholder:

As we move toward the end of 2011, we have seen markets experience heightened levels of volatility because of global economic uncertainty. Following a solid October rebound, U.S. markets are holding on to modest gains.

Volatility will likely remain a dominant characteristic of the markets as the U.S. economy continues to battle high unemployment and a weak housing market, and Europe seeks a lasting resolution to its debt woes. While volatility is unsettling, long-term investors should understand that it has also created opportunities for active managers. Putnam’s team of investment professionals is working to identify attractive investments while also guarding against downside risk.

We would like to thank John A. Hill, who has served as Chairman of the Trustees since 2000 and who continues on as a Trustee, for his service. We are pleased to announce that Jameson A. Baxter is the new Chair, having served as Vice Chair since 2005 and a Trustee since 1994.

Ms. Baxter is President of Baxter Associates, Inc., a private investment firm, and Chair of the Mutual Fund Directors Forum. In addition, she serves as Chair Emeritus of the Board of Trustees of Mount Holyoke College, Director of the Adirondack Land Trust, and Trustee of the Nature Conservancy’s Adirondack Chapter.

Lastly, we would like to take this opportunity to welcome new shareholders to the fund and to thank all of our investors for your continued confidence in Putnam.

About the fund

Potential for income exempt from federal income tax

Municipal bonds can help investors keep more of their investment income while also financing important public projects such as schools, roads, and hospitals. The bonds are typically issued by states and local municipalities to raise funds for building and maintaining public facilities, and they offer income that is generally exempt from federal, state, and local income tax.

Putnam Managed Municipal Income Trust has the flexibility to invest in municipal bonds issued by any state in the country. The bonds are backed by the issuing city or town or by revenues collected from usage fees, and have varying degrees of credit risk — the risk that the issuer would not be able to repay the bond.

The fund also combines bonds of differing credit quality. In addition to investing in high-quality bonds, the fund’s managers allocate a portion of the portfolio to lower-rated bonds, which may offer higher income in return for more risk. When deciding whether to invest in a bond, the managers consider factors such as credit risk, interest-rate risk, and the risk that the bond will be prepaid.

The managers are backed by Putnam’s fixed-income organization, where municipal bond analysts are grouped into sector teams and conduct ongoing research. Once a bond has been purchased, the managers continue to monitor developments that affect the bond market, the sector, and the issuer of the bond.

The goal of this research and active management is to stay a step ahead of the industry and pinpoint opportunities for investors.

Consider these risks before investing: Lower-rated bonds may offer higher yields in return for more risk. Funds that invest in bonds are subject to certain risks including interest-rate risk, credit risk, and inflation risk. As interest rates rise, the prices of bonds fall. Long-term bonds are more exposed to interest-rate risk than short-term bonds. Unlike bonds, bond funds have ongoing fees and expenses. The fund’s shares trade on a stock exchange at market prices, which may be lower than the fund’s net asset value.

How do closed-end funds differ from open-end funds?

More assets at work While open-end funds need to maintain a cash position to meet redemptions, closed-end funds are not subject to redemptions and can keep more of their assets invested in the market.

Traded like stocks Closed-end fund shares are traded on stock exchanges, and their market prices fluctuate in response to supply and demand, among other factors.

Net asset value vs. market price Like an open-end fund’s net asset value (NAV) per share, the NAV of a closed-end fund share is equal to the current value of the fund’s assets, minus its liabilities, divided by the number of shares outstanding. However, when buying or selling closed-end fund shares, the price you pay or receive is the market price. Market price reflects current market supply and demand and may be higher or lower than the NAV.

Data are historical. Past performance does not guarantee future results. More recent returns may be less or more than those shown. Investment return and net asset value will fluctuate, and you may have a gain or a loss when you sell your shares. Performance assumes reinvestment of distributions and does not account for taxes. Fund returns in the bar chart are at NAV. See pages 5 and 10–11 for additional performance information, including fund returns at market price. Index and Lipper results should be compared with fund performance at NAV. Lipper calculates performance differently than the closed-end funds it ranks, due to varying methods for determining a fund’s monthly reinvestment NAV.

4

Interview with your fund’s portfolio manager

Paul M. Drury, CFA

Municipal bonds were frequently in the news during the past 12 months. How would you describe the investment environment?

Although the end result for shareholders was positive, the past year was one of the more volatile periods for municipal bonds in recent memory, beginning in November 2010, when a number of factors combined to create significant headwinds for the market.

First, the Federal Reserve announced it would purchase $600 billion in Treasury bonds over a period of several months in a second round of quantitative easing measures, known as “QE2,” designed in part to keep yields low and encourage investor risk taking. In theory, this move should have caused government bond yields to fall. But, in fact, the widely anticipated QE2 announcement had already been priced in, and investors responded by selling their positions in Treasuries. This sent yields higher and, in turn, pressured interest rates in the municipal bond market.

Second, as the end of 2010 approached, investor uncertainty grew over the possibility of pending tax-rate increases and the anticipated expiration of the Build America Bonds, or “BABs,” program, which for two years had played a key stabilizing role in the municipal bond market. This uncertainty, coupled with dire media coverage of state budget challenges and predictions of widespread defaults, led to a broad sell-off in municipal bonds as investors pulled money out of the asset class.

As 2011 progressed, however, the municipal bond market gained back a good deal of what it had lost in the fourth quarter of 2010. Widespread defaults did not materialize, and through October were in line with their historical average. States continued to face challenges in balancing their budgets, but by late in the period, all state legislatures that were slated to enact budgets had done so, including California, which passed its budget on time for the first time in years. Income tax receipts also generally began to

This comparison shows your fund’s performance in the context of broad market indexes for the 12 months ended 10/31/11. See pages 4 and 10–11 for additional fund performance information. Index descriptions can be found on page 12.

5

improve slightly versus last year. As investors ultimately realized that municipal credit conditions were not nearly as bleak as some feared, they re-entered the municipal market.

Against this backdrop, for the 12 months ended October 31, 2011, I am pleased to report that the fund modestly outpaced its benchmark and the average return of its Lipper peer group.

In August, Standard & Poor’s downgraded its credit rating for U.S. Treasuries and a number of municipal bonds. What impact did that have on the market?

On the heels of its August 5 downgrade of U.S. sovereign debt, Standard & Poor’s [S&P] lowered its ratings from AAA to AA+ for more than 11,000 municipal securities, including taxable and tax-exempt securities. While this number does seem large, it covers less than 1% of the $3 trillion municipal bond market. These securities all had links to the federal government, and, according to S&P, the affected issues fall into four broad categories: municipal housing bonds backed by the federal government or invested in U.S. government securities; bonds of certain government-related entities in the housing and public power sectors; bonds backed by federal leases; and defeased bonds secured by U.S. Treasury and government agency securities held in escrow.

The downgrade was not surprising given the interdependence of state and federal finances, and S&P had been suggesting such a move was imminent for some time. To date, state general obligation, or “G.O.,” bond ratings were unchanged; 13 states continue to hold AAA ratings from S&P. Nonetheless, we believe S&P’s downgrades underscore the importance of performing intensive fundamental research when investing in the municipal bond market. At Putnam, we independently research every bond we hold and assess the credit risk it represents before we add it to the portfolio.

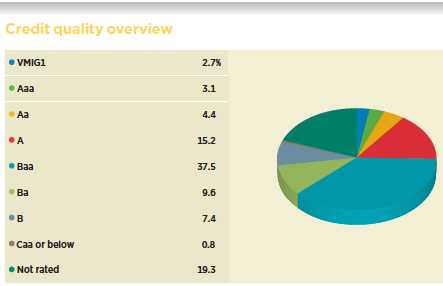

Credit qualities are shown as a percentage of portfolio value as of 10/31/11. A bond rated Baa or higher (MIG3/VMIG3 or higher, for short-term debt) is considered investment grade. The chart reflects Moody’s ratings; percentages may include bonds or derivatives not rated by Moody’s but rated by Standard & Poor’s or, if unrated by S&P, by Fitch, and then included in the closest equivalent Moody’s rating. Ratings will vary over time. Credit qualities are included for portfolio securities and are not included for derivative instruments and cash. The fund itself has not been rated by an independent rating agency.

6

What effect did recent policy debates have on the tax-exempt bond market?

It was an eventful period from a policy perspective. First, the popular BABs program expired. BABs are taxable municipal bonds that carried special tax credits and federal subsidies for the states and local governments that issued them, which resulted in substantial savings on borrowing costs. Despite some speculation that the program might be extended, it was allowed to expire on December 31, 2010.

The anticipated expiration of the BABs program caused a spike in municipal bond supply at the end of 2010. To lock in the federal subsidy BABs offered, many states accelerated issuance originally slated for the first quarter of 2011 into the fourth quarter of 2010. Because excess supply can lead to lower prices when demand fails to keep pace, some investors worried that the unusually high issuance at the end of 2010 would continue in the tax-free market in 2011, undermining price stability. However, tax-free issuance year to date in 2011 has been even lower than expected, which has helped keep prices relatively stable.

More recently, the 12-member “super committee” — created through August’s debt ceiling legislation and tasked with reducing the deficit by at least $1.2 trillion — announced that it was unable to reach an agreement for a debt-reduction plan before its November 23, 2011 deadline. As a result, automatic, across-the-board cuts are slated to be implemented over the next 10 years, beginning in January 2013.

Top ten state allocations are shown as a percentage of the fund’s portfolio value as of 10/31/11. Investments in Puerto Rico represented 2.8% of portfolio value. Holdings will vary over time. State concentrations listed after the portfolio schedule in the Financial Statements section of this shareholder report are inclusive of tender option bonds and exclusive of insured status and any interest accruals, and may differ from the summary information above.

7

Overall, this sequestration of funding is not necessarily a negative for municipal bonds, particularly given the recommendations that the super committee might have made. Some speculation arose that the committee, in an effort to raise revenue, would have recommended limiting the amount of municipal-bond interest that top income earners could exclude from their taxable income. This could have had the dual effect of reducing the demand for municipal bonds and increasing the costs to municipal issuers. Although such a move does not appear imminent, it is likely that a more wide-ranging debate over taxes will continue into the upcoming election year.

We should also point out that the failure of the super committee to come to an agreement has left a number of other issues unresolved, including the future of the annual “alternative minimum tax [AMT] patch,” which sets the income threshold associated with the AMT, and the fate of the Bush-era tax cuts. We believe these issues and others will be debated in Congress in 2012, and we will be closely monitoring these developments.

How did you position the portfolio during the fund’s fiscal year?

We continued to position the portfolio to benefit from improving fundamentals in the municipal bond market. While we felt that the budget challenges faced by many states were significant, we were confident that conditions would improve as long as the broad economy did not stall.

Against this backdrop, we believed that essential service revenue bonds remained attractive, while we continued to limit the fund’s exposure to local G.O.s, which are securities issued at the city or county level. We believe that as the federal government looks to reduce transfer payments to the states — and as states, in turn, seek to close their deficits by reducing spending — these types of bonds are at risk for downgrades or other headline-driven price volatility. And unlike state general obligation bonds, local G.O.s rely more on property tax revenue than on income or sales taxes. With real estate prices still under pressure in many markets, property taxes have been slower to recover than other tax sources.

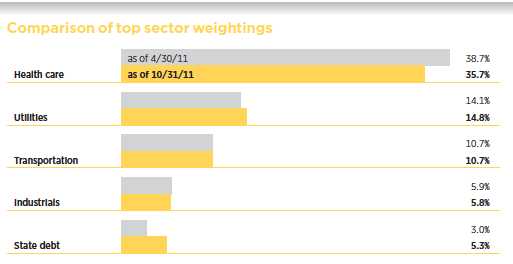

This chart shows how the fund’s top weightings have changed over the past six months. Weightings are shown as a percentage of net assets. Summary information may differ from the portfolio schedule included in the financial statements due to the inclusion of derivative securities and the exclusion of as-of trades, if any. Holdings will vary over time. Sector concentrations listed after the portfolio schedule in the Financial Statements section of this shareholder report are exclusive of insured status and any interest accruals and may differ from the summary information above.

8

From a credit perspective, we held an overweight position in Baa- and Ba-rated securities versus the fund’s benchmark, which contributed positively to relative returns. In terms of sectors, we favored health care — both hospitals and continuing-care retirement communities — transportation, and utilities. We reduced the fund’s allocation to tobacco bonds, and maintained underweighted exposure to non-rated securities.

What is your outlook?

While technical factors in the market have been positive — specifically, lighter supply and stable demand — uncertainty remains. We believe that states will continue to face financial challenges as the nation’s economy struggles to find its footing. For the most part, however, we believe that the fiscal conditions of states and municipalities are showing signs of improvement. Tax receipts are beginning to improve, albeit slowly, and we believe defaults will remain relatively low.

Our concerns remain focused on the economy and Congress’s plans to reduce the deficit. Higher federal income tax rates, a change in the tax status of municipal bonds, or significant cuts in state funding all would have consequences for the municipal bond market. But for investors with longer time horizons, we believe that our actively managed approach remains a prudent way to diversify holdings and generate tax-exempt income in the municipal bond market.

Thank you, Paul, for bringing us up to date.

The views expressed in this report are exclusively those of Putnam Management and are subject to change. They are not meant as investment advice.

Please note that the holdings discussed in this report may not have been held by the fund for the entire period. Portfolio composition is subject to review in accordance with the fund’s investment strategy and may vary in the future. Current and future portfolio holdings are subject to risk.

Portfolio Manager Paul M. Drury has a B.A. from Suffolk University. A CFA charter-holder, Paul has been in the investment industry since he joined Putnam in 1989.

In addition to Paul, your fund’s portfolio managers are Susan McCormack and Thalia Meehan.

IN THE NEWS

The U.S. unemployment picture, dim for many months, showed a glimmer of hope in October. The Labor Department reported that the private sector added 104,000 jobs, which was offset by the reduction of 24,000 government positions for a net increase of 80,000 jobs. The nation’s unemployment rate fell to 9%, the lowest since April. The U.S. economy has regained 2.3 million of the nearly 8.8 million jobs lost during the Great Recession. Employment gains in the private sector were achieved across a number of industries, including health care, manufacturing, mining, and professional services.

9

Your fund’s performance

This section shows your fund’s performance, price, and distribution information for periods ended October 31, 2011, the end of its most recent fiscal year. In accordance with regulatory requirements for mutual funds, we also include performance as of the most recent calendar quarter-end. Performance should always be considered in light of a fund’s investment strategy. Data represent past performance. Past performance does not guarantee future results. More recent returns may be less or more than those shown. Investment return, net asset value, and market price will fluctuate, and you may have a gain or a loss when you sell your shares.

Fund performance Total return for periods ended 10/31/11

| Lipper High Yield | ||||

| Barclays Capital | Municipal Debt | |||

| Municipal Bond | Funds (closed-end) | |||

| NAV | Market price | Index | category average* | |

|

| ||||

| Annual average | ||||

| Life of fund (since 2/24/89) | 6.42% | 6.16% | 6.46% | 5.44% |

|

| ||||

| 10 years | 68.80 | 72.79 | 61.78 | 65.36 |

| Annual average | 5.37 | 5.62 | 4.93 | 5.11 |

|

| ||||

| 5 years | 23.17 | 38.41 | 26.44 | 17.21 |

| Annual average | 4.26 | 6.72 | 4.80 | 3.17 |

|

| ||||

| 3 years | 47.81 | 64.40 | 27.07 | 48.84 |

| Annual average | 13.91 | 18.02 | 8.31 | 14.10 |

|

| ||||

| 1 year | 4.14 | 4.47 | 3.78 | 3.76 |

|

| ||||

Performance assumes reinvestment of distributions and does not account for taxes.

Index and Lipper results should be compared to fund performance at net asset value. Lipper calculates performance differently than the closed-end funds it ranks, due to varying methods for determining a fund’s monthly reinvestment NAV.

* Over the 1-year, 3-year, 5-year, 10-year, and life-of-fund periods ended 10/31/11, there were 14, 14, 13, 10, and 6 funds, respectively, in this Lipper category.

10

Fund price and distribution information For the 12-month period ended 10/31/11

| Distributions | |||||||

|

| |||||||

| Number | 12 | ||||||

|

| |||||||

| Income 1 | $0.528 | ||||||

|

| |||||||

| Capital gains 2 | — | ||||||

|

| |||||||

| Total | $0.528 | ||||||

| Series A | Series C | ||||||

| Distributions — Preferred shares | (245 shares) | (1,980 shares) | |||||

|

| |||||||

| Income 1 | $188.43 | $96.90 | |||||

|

| |||||||

| Capital gains 2 | — | — | |||||

|

| |||||||

| Total | $188.43 | $96.90 | |||||

| Share value | NAV | Market price | |||||

|

| |||||||

| 10/31/10 | $7.62 | $7.73 | |||||

|

| |||||||

| 10/31/11 | 7.37 | 7.50 | |||||

|

| |||||||

| Current yield (end of period) | |||||||

|

| |||||||

| Current dividend rate 3 | 7.16% | 7.04% | |||||

|

| |||||||

| Taxable equivalent 4 | 11.02% | 10.83% | |||||

|

| |||||||

The classification of distributions, if any, is an estimate. Final distribution information will appear on your year-end tax forms.

1 For some investors, investment income may be subject to the federal alternative minimum tax. Income from federally exempt funds may be subject to state and local taxes.

2 Capital gains, if any, are taxable for federal and, in most cases, state purposes.

3 Most recent distribution, excluding capital gains, annualized and divided by NAV or market price at end of period.

4 Assumes maximum 35% federal tax rate for 2011. Results for investors subject to lower tax rates would not be as advantageous.

Fund performance as of most recent calendar quarter

Total return for periods ended 9/30/11

| NAV | Market price | |

|

| ||

| Annual average | ||

| Life of fund (since 2/24/89) | 6.44% | 6.12% |

|

| ||

| 10 years | 70.65 | 70.13 |

| Annual average | 5.49 | 5.46 |

|

| ||

| 5 years | 24.10 | 38.93 |

| Annual average | 4.41 | 6.80 |

|

| ||

| 3 years | 33.61 | 42.15 |

| Annual average | 10.14 | 12.44 |

|

| ||

| 1 year | 4.69 | 2.69 |

|

| ||

11

Terms and definitions

Important terms

Total return shows how the value of the fund’s shares changed over time, assuming you held the shares through the entire period and reinvested all distributions in the fund.

Net asset value (NAV) is the value of all your fund’s assets, minus any liabilities and the net assets allocated to any outstanding preferred shares, divided by the number of outstanding common shares.

Market price is the current trading price of one share of the fund. Market prices are set by transactions between buyers and sellers on exchanges such as the New York Stock Exchange.

Fixed-income terms

Current yield is the annual rate of return earned from dividends or interest of an investment. Current yield is expressed as a percentage of the price of a security, fund share, or principal investment.

Yield curve is a graph that plots the yields of bonds with equal credit quality against their differing maturity dates, ranging from shortest to longest. It is used as a benchmark for other debt, such as mortgage or bank lending rates.

Comparative indexes

Barclays Capital U.S. Aggregate Bond Index is an unmanaged index of U.S. investment-grade fixed-income securities.

Barclays Capital Municipal Bond Index is an unmanaged index of long-term fixed-rate investment-grade tax-exempt bonds.

BofA (Bank of America) Merrill Lynch U.S. 3-Month Treasury Bill Index is an unmanaged index that seeks to measure the performance of U.S. Treasury bills available in the marketplace.

S&P 500 Index is an unmanaged index of common stock performance.

Indexes assume reinvestment of all distributions and do not account for fees. Securities and performance of a fund and an index will differ. You cannot invest directly in an index.

Lipper is a third-party industry-ranking entity that ranks mutual funds. Its rankings do not reflect sales charges. Lipper rankings are based on total return at net asset value relative to other funds that have similar current investment styles or objectives as determined by Lipper. Lipper may change a fund’s category assignment at its discretion. Lipper category averages reflect performance trends for funds within a category.

12

Other information for shareholders

Important notice regarding share repurchase program

In September 2011, the Trustees of your fund approved the renewal of a share repurchase program that had been in effect since 2005. This renewal will allow your fund to repurchase, in the 12 months beginning October 8, 2011, up to 10% of the fund’s common shares outstanding as of October 7, 2011.

Important notice regarding Putnam’s privacy policy

In order to conduct business with our shareholders, we must obtain certain personal information such as account holders’ names, addresses, Social Security numbers, and dates of birth. Using this information, we are able to maintain accurate records of accounts and transactions.

It is our policy to protect the confidentiality of our shareholder information, whether or not a shareholder currently owns shares of our funds. In particular, it is our policy not to sell information about you or your accounts to outside marketing firms. We have safeguards in place designed to prevent unauthorized access to our computer systems and procedures to protect personal information from unauthorized use.

Under certain circumstances, we must share account information with outside vendors who provide services to us, such as mailings and proxy solicitations. In these cases, the service providers enter into confidentiality agreements with us, and we provide only the information necessary to process transactions and perform other services related to your account. Finally, it is our policy to share account information with your financial representative, if you’ve listed one on your Putnam account.

Proxy voting

Putnam is committed to managing our mutual funds in the best interests of our shareholders. The Putnam funds’ proxy voting guidelines and procedures, as well as information regarding how your fund voted proxies relating to portfolio securities during the 12-month period ended June 30, 2011, are available in the Individual Investors section at putnam.com, and on the SEC’s website, www.sec.gov. If you have questions about finding forms on the SEC’s website, you may call the SEC at 1-800-SEC-0330. You may also obtain the Putnam funds’ proxy voting guidelines and procedures at no charge by calling Putnam’s Shareholder Services at 1-800-225-1581.

Fund portfolio holdings

The fund will file a complete schedule of its portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Shareholders may obtain the fund’s Forms N-Q on the SEC’s website at www.sec.gov. In addition, the fund’s Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. You may call the SEC at 1-800-SEC-0330 for information about the SEC’s website or the operation of the Public Reference Room.

Trustee and employee fund ownership

Putnam employees and members of the Board of Trustees place their faith, confidence, and, most importantly, investment dollars in Putnam mutual funds. As of October 31, 2011, Putnam employees had approximately $325,000,000 and the Trustees had approximately $71,000,000 invested in Putnam mutual funds. These amounts include investments by the Trustees’ and employees’ immediate family members as well as investments through retirement and deferred compensation plans.

13

Trustee approval of management contract

General conclusions

The Board of Trustees of the Putnam funds oversees the management of each fund and, as required by law, determines annually whether to approve the continuance of your fund’s management contract with Putnam Investment Management (“Putnam Management”) and the sub-management contract with respect to your fund between Putnam Management and its affiliate, Putnam Investments Limited (“PIL”).

The Board of Trustees, with the assistance of its Contract Committee, which consists solely of Trustees who are not “interested persons” (as this term is defined in the Investment Company Act of 1940, as amended) of the Putnam funds (“Independent Trustees”), requests and evaluates all information it deems reasonably necessary under the circumstances in connection with its annual contract review. Over the course of several months ending in June 2011, the Contract Committee met on a number of occasions with representatives of Putnam Management, and separately in executive session, to consider the information that Putnam Management provided and other information developed with the assistance of the Board’s independent counsel and independent staff. The Contract Committee reviewed and discussed key aspects of this information with all of the Independent Trustees on a number of occasions. At the Trustees’ June 17, 2011 meeting, the Contract Committee recommended, and the Independent Trustees approved, the continuance of your fund’s management and sub-management contracts, effective July 1, 2011. (Because PIL is an affiliate of Putnam Management and Putnam Management remains fully responsible for all services provided by PIL, the Trustees have not evaluated PIL as a separate entity, and all subsequent references to Putnam Management below should be deemed to include reference to PIL as necessary or appropriate in the context.)

The Independent Trustees’ approval was based on the following conclusions:

• That the fee schedule in effect for your fund represented reasonable compensation in light of the nature and quality of the services being provided to the fund, the fees paid by competitive funds, and the costs incurred by Putnam Management in providing services, and

• That the fee schedule represented an appropriate sharing between fund shareholders and Putnam Management of such economies of scale as may exist in the management of the fund at current asset levels.

These conclusions were based on a comprehensive consideration of all information provided to the Trustees and were not the result of any single factor. Some of the factors that figured particularly in the Trustees’ deliberations and how the Trustees considered these factors are described below, although individual Trustees may have evaluated the information presented differently, giving different weights to various factors. It is also important to recognize that the management arrangements for your fund and the other Putnam funds are the result of many years of review and discussion between the Independent Trustees and Putnam Management, that some aspects of the arrangements may receive greater scrutiny in some years than others, and that the Trustees’ conclusions may be based, in part, on their consideration of fee arrangements in previous years.

Management fee schedules and total expenses

The Trustees reviewed the management fee schedules in effect for all Putnam funds, including fee levels and breakpoints. In reviewing management fees, the Trustees

14

generally focus their attention on material changes in circumstances — for example, changes in assets under management or investment style, changes in Putnam Management’s operating costs, or changes in competitive practices in the mutual fund industry — that suggest that consideration of fee changes might be warranted. The Trustees concluded that the circumstances did not warrant changes to the management fee structure of your fund.

Your fund currently has the benefit of breakpoints in its management fee that provide shareholders with significant economies of scale in the form of reduced fee levels as the fund’s assets under management increase. In recent years, the Trustees have examined the operation of the existing breakpoint structure during periods of both growth and decline in asset levels. The Trustees concluded that the fee schedule in effect for your fund represented an appropriate sharing of economies of scale at that time.

The Trustees reviewed comparative fee and expense information for a custom group of competitive funds selected by Lipper Inc. This comparative information included your fund’s percentile ranking for effective management fees and total expenses, which provides a general indication of your fund’s relative standing. In the custom peer group, your fund ranked in the 1st quintile in effective management fees (determined for your fund and the other funds in the custom peer group based on fund asset size and the applicable contractual management fee schedule) and in the 1st quintile in total expenses as of December 31, 2010 (the first quintile representing the least expensive funds and the fifth quintile the most expensive funds). The fee and expense data reported by Lipper as of December 31, 2010 reflected the most recent fiscal year-end data available in Lipper’s database at that time.

In connection with their review of the management fees and total expenses of the Putnam funds, the Trustees also reviewed the costs of the services provided and the profits realized by Putnam Management and its affiliates from their contractual relationships with the funds. This information included trends in revenues, expenses and profitability of Putnam Management and its affiliates relating to the investment management, investor servicing and distribution services provided to the funds. In this regard, the Trustees also reviewed an analysis of Putnam Management’s revenues, expenses and profitability, allocated on a fund-by-fund basis, with respect to the funds’ management, distribution, and investor servicing contracts. For each fund, the analysis presented information about revenues, expenses and profitability for each of the agreements separately and for the agreements taken together on a combined basis. The Trustees concluded that, at current asset levels, the fee schedules in place represented reasonable compensation for the services being provided and represented an appropriate sharing of such economies of scale as may exist in the management of the funds at that time.

The information examined by the Trustees as part of their annual contract review for the Putnam funds has included for many years information regarding fees charged by Putnam Management and its affiliates to institutional clients such as defined benefit pension plans, college endowments, and the like. This information included comparisons of those fees with fees charged to the funds, as well as an assessment of the differences in the services provided to these different types of clients. The Trustees observed that the differences in fee rates between institutional clients and mutual funds are by no means uniform when examined by individual asset sectors, suggesting that differences in the pricing of investment

15

management services to these types of clients may reflect historical competitive forces operating in separate markets. The Trustees considered the fact that in many cases fee rates across different asset classes are higher on average for mutual funds than for institutional clients, as well as the differences between the services that Putnam Management provides to the Putnam funds and those that it provides to its institutional clients. The Trustees did not rely on these comparisons to any significant extent in concluding that the management fees paid by your fund are reasonable.

Investment performance

The quality of the investment process provided by Putnam Management represented a major factor in the Trustees’ evaluation of the quality of services provided by Putnam Management under your fund’s management contract. The Trustees were assisted in their review of the Putnam funds’ investment process and performance by the work of several investment oversight committees of the Trustees, which met on a regular basis with the funds’ portfolio teams and with the Chief Investment Officer and other members of Putnam Management’s Investment Division throughout the year. The Trustees concluded that Putnam Management generally provides a high-quality investment process — based on the experience and skills of the individuals assigned to the management of fund portfolios, the resources made available to them, and in general Putnam Management’s ability to attract and retain high-quality personnel — but also recognized that this does not guarantee favorable investment results for every fund in every time period. The Trustees considered the investment performance of each fund over multiple time periods and considered information comparing each fund’s performance with various benchmarks and with the performance of competitive funds.

The Committee noted the substantial improvement in the performance of most Putnam funds during the 2009–2010 period and Putnam Management’s ongoing efforts to strengthen its investment personnel and processes. The Committee also noted the disappointing investment performance of some funds for periods ended December 31, 2010 and considered information provided by Putnam Management regarding the factors contributing to the underperformance and actions being taken to improve the performance of these particular funds. The Trustees indicated their intention to continue to monitor performance trends to assess the effectiveness of these efforts and to evaluate whether additional actions to address areas of underperformance are warranted.

In the case of your fund, the Trustees considered that its common share cumulative total return performance at net asset value was in the following quartiles of its Lipper Inc. peer group (High Yield Municipal Debt Funds (closed-end)) for the one-year, three-year and five-year periods ended December 31, 2010 (the first quartile representing the best-performing funds and the fourth quartile the worst-performing funds):

| One-year period | 1st | ||

|

|

|||

| Three-year period | 1st | ||

|

|

|||

| Five-year period | 2nd | ||

|

|

|||

Over the one-year, three-year and five-year periods ended December 31, 2010, there were 15, 15 and 14 funds, respectively, in your fund’s Lipper peer group. (When considering performance information, shareholders should be mindful that past performance is not a guarantee of future results.)

Brokerage and soft-dollar allocations; investor servicing

The Trustees considered various potential benefits that Putnam Management may receive in connection with the services it provides under the management contract with your fund. These include benefits related

16

to brokerage allocation and the use of soft dollars, whereby a portion of the commissions paid by a fund for brokerage may be used to acquire research services that are expected to be useful to Putnam Management in managing the assets of the fund and of other clients. Subject to policies established by the Trustees, soft-dollar credits acquired through these means are used primarily to supplement Putnam Management’s internal research efforts. However, the Trustees noted that a portion of available soft-dollar credits continues to be allocated to the payment of fund expenses. The Trustees indicated their continued intent to monitor regulatory developments in this area with the assistance of their Brokerage Committee and also indicated their continued intent to monitor the potential benefits associated with fund brokerage and soft-dollar allocations and trends in industry practices to ensure that the principle of seeking best price and execution remains paramount in the portfolio trading process.

Putnam Management may also receive benefits from payments that the funds make to Putnam Management’s affiliates for investor services. In conjunction with the annual review of your fund’s management contract, the Trustees reviewed your fund’s investor servicing agreement with Putnam Investor Services, Inc. (“PSERV”), an affiliate of Putnam Management. The Trustees concluded that the fees payable by the funds to PSERV for such services are reasonable in relation to the nature and quality of such services.

17

Financial statements

These sections of the report, as well as the accompanying Notes, preceded by the Report of Independent Registered Public Accounting Firm, constitute the fund’s financial statements.

The fund’s portfolio lists all the fund’s investments and their values as of the last day of the reporting period. Holdings are organized by asset type and industry sector, country, or state to show areas of concentration and diversification.

Statement of assets and liabilities shows how the fund’s net assets and share price are determined. All investment and non-investment assets are added together. Any unpaid expenses and other liabilities are subtracted from this total. The result is divided by the number of shares to determine the net asset value per share. (For funds with preferred shares, the amount subtracted from total assets includes the liquidation preference of preferred shares.)

Statement of operations shows the fund’s net investment gain or loss. This is done by first adding up all the fund’s earnings — from dividends and interest income — and subtracting its operating expenses to determine net investment income (or loss). Then, any net gain or loss the fund realized on the sales of its holdings — as well as any unrealized gains or losses over the period — is added to or subtracted from the net investment result to determine the fund’s net gain or loss for the fiscal year.

Statement of changes in net assets shows how the fund’s net assets were affected by the fund’s net investment gain or loss, by distributions to shareholders, and by changes in the number of the fund’s shares. It lists distributions and their sources (net investment income or realized capital gains) over the current reporting period and the most recent fiscal year-end. The distributions listed here may not match the sources listed in the Statement of operations because the distributions are determined on a tax basis and may be paid in a different period from the one in which they were earned.

Financial highlights provide an overview of the fund’s investment results, per-share distributions, expense ratios, net investment income ratios, and portfolio turnover in one summary table, reflecting the five most recent reporting periods. In a semiannual report, the highlights table also includes the current reporting period.

18

Report of Independent Registered Public Accounting Firm

The Board of Trustees and Shareholders

Putnam Managed Municipal Income Trust:

We have audited the accompanying statement of assets and liabilities of Putnam Managed Municipal Income Trust (the fund), including the fund’s portfolio, as of October 31, 2011, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the years in the two-year period then ended and the financial highlights for each of the years in the five-year period then ended. These financial statements and financial highlights are the responsibility of the fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform our audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of October 31, 2011 by correspondence with the custodian and brokers or by other appropriate auditing procedures. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Putnam Managed Municipal Income Trust as of October 31, 2011, the results of its operations for the year then ended, the changes in its net assets for each of the years in the two-year period then ended, and the financial highlights for each of the years in the five-year period then ended, in conformity with U.S. generally accepted accounting principles.

Boston, Massachusetts

December 13, 2011

19

The fund’s portfolio 10/31/11

Key to holding’s abbreviations

| ABAG Association Of Bay Area Governments | FRB Floating Rate Bonds |

| AGM Assured Guaranty Municipal Corporation | G.O. Bonds General Obligation Bonds |

| AMBAC AMBAC Indemnity Corporation | GNMA Coll. Government National Mortgage |

| COP Certificates of Participation | Association Collateralized |

| FGIC Financial Guaranty Insurance Company | NATL National Public Finance Guarantee Corp. |

| FHLMC Coll. Federal Home Loan Mortgage | Radian Insd. Radian Group Insured |

| Corporation Collateralized | U.S. Govt. Coll. U.S. Government Collateralized |

| FNMA Coll. Federal National Mortgage | VRDN Variable Rate Demand Notes |

| Association Collateralized |

| MUNICIPAL BONDS AND NOTES (128.6%)* | Rating** | Principal amount | Value |

|

| |||

| Alabama (1.7%) | |||

| Butler, Indl. Dev. Board Solid Waste Disp. Rev. | |||

| Bonds (GA. Pacific Corp.), 5 3/4s, 9/1/28 | A– | $1,500,000 | $1,505,670 |

|

| |||

| Courtland, Indl. Dev. Board Env. Impt. Rev. Bonds | |||

| (Intl. Paper Co.), Ser. A, 5s, 11/1/13 | BBB | 1,500,000 | 1,590,285 |

|

| |||

| Cullman Cnty., Hlth. Care Auth. Rev. Bonds | |||

| (Cullman Regl. Med. Ctr.), Ser. A, 6 3/4s, 2/1/29 | Ba1 | 3,000,000 | 2,847,600 |

|

| |||

| Selma, Indl. Dev. Board Rev. Bonds (Gulf Opportunity | |||

| Zone Intl. Paper Co.), Ser. A, 6 1/4s, 11/1/33 | BBB | 1,000,000 | 1,055,260 |

|

| |||

| 6,998,815 | |||

| Arizona (3.8%) | |||

| Apache Cnty., Indl. Dev. Auth. Poll. Control Rev. | |||

| Bonds (Tucson Elec. Pwr. Co.) | |||

| Ser. B, 5 7/8s, 3/1/33 | Baa3 | 1,000,000 | 1,000,220 |

| Ser. A, 5.85s, 3/1/28 | Baa3 | 250,000 | 250,130 |

|

| |||

| Calhoun Cnty., Sales & Use Tax Rev. Bonds | |||

| (Georgia-Pacific Corp.), 6 3/8s, 11/1/26 | Baa3 | 830,000 | 835,976 |

|

| |||

| Casa Grande, Indl. Dev. Auth. Rev. Bonds (Casa | |||

| Grande Regl. Med. Ctr.), Ser. A | |||

| 7 5/8s, 12/1/29 | BB–/P | 1,800,000 | 1,797,210 |

| 7 1/4s, 12/1/19 | BB–/P | 1,000,000 | 1,016,560 |

|

| |||

| Cochise Cnty., Indl. Dev. Auth. Rev. Bonds | |||

| (Sierra Vista Regl. Hlth. Ctr.), Ser. A, 6.2s, 12/1/21 | BBB+/P | 425,000 | 453,178 |

|

| |||

| Coconino Cnty., Poll. Control Rev. Bonds (Tucson | |||

| Elec. Pwr. Co. — Navajo), Ser. A, 5 1/8s, 10/1/32 | Baa3 | 2,000,000 | 1,905,000 |

|

| |||

| Maricopa Cnty., Poll. Control Rev. Bonds (El Paso | |||

| Elec. Co.), Ser. A, 7 1/4s, 2/1/40 | Baa2 | 2,200,000 | 2,431,396 |

|

| |||

| Navajo Cnty., Poll. Control Corp. Mandatory Put | |||

| Bonds (6/1/16), Ser. E, 5 3/4s, 6/1/34 | Baa2 | 1,950,000 | 2,194,608 |

|

| |||

| Phoenix, Indl. Dev. Auth. Ed. Rev. Bonds (Career | |||

| Success Schools), 7 1/8s, 1/1/45 | BB+ | 500,000 | 476,520 |

|

| |||

| Pima Cnty., Indl. Dev. Auth. Rev. Bonds | |||

| (Tucson Elec. Pwr.), Ser. A, 6 3/8s, 9/1/29 | Baa3 | 500,000 | 507,655 |

| (Horizon Cmnty. Learning Ctr.), 5.05s, 6/1/25 | BBB | 1,140,000 | 998,879 |

|

| |||

20

| MUNICIPAL BONDS AND NOTES (128.6%)* cont. | Rating** | Principal amount | Value |

|

| |||

| Arizona cont. | |||

| Salt Verde, Fin. Corp. Gas Rev. Bonds, | |||

| 5 1/2s, 12/1/29 | A | $2,000,000 | $2,002,180 |

|

| |||

| Tempe, Indl. Dev. Auth. Sr. Living Rev. Bonds | |||

| (Friendship Village), Ser. A, 5 3/8s, 12/1/13 | BB–/P | 393,000 | 389,601 |

|

| |||

| 16,259,113 | |||

| Arkansas (0.4%) | |||

| Arkadelphia, Pub. Ed. Fac. Board Rev. Bonds | |||

| (Ouachita Baptist U.), 6s, 3/1/33 | BBB–/P | 840,000 | 863,470 |

|

| |||

| Rogers, Rev. Bonds (Sales and Use Tax), | |||

| 3 3/4s, 11/1/34 | AA | 850,000 | 832,023 |

|

| |||

| 1,695,493 | |||

| California (10.5%) | |||

| ABAG Fin. Auth. for Nonprofit Corps. Rev. Bonds | |||

| (Episcopal Sr. Cmnty.), 6s, 7/1/31 | BBB+ | 660,000 | 661,855 |

|

| |||

| CA Edl. Fac. Auth. Rev. Bonds (U. of La Verne), | |||

| Ser. A, 5s, 6/1/35 | Baa2 | 500,000 | 453,090 |

|

| |||

| CA Muni. Fin. Auth. COP (Cmnty. Hosp. Central CA), | |||

| 5 1/4s, 2/1/37 | Baa2 | 1,105,000 | 964,212 |

|

| |||

| CA Muni. Fin. Auth. Rev. Bonds (U. of La Verne), | |||

| Ser. A, 6 1/8s, 6/1/30 | Baa2 | 1,000,000 | 1,044,320 |

|

| |||

| CA Poll. Control Fin. Auth. Rev. Bonds (Pacific | |||

| Gas & Electric Corp.), Class D, FGIC, 4 3/4s, 12/1/23 | A3 | 2,500,000 | 2,618,300 |

|

| |||

| CA Poll. Control Fin. Auth. Solid Waste Disp. FRB | |||

| (Waste Management, Inc.), Ser. C, 5 1/8s, 11/1/23 | A–2 | 2,150,000 | 2,199,493 |

|

| |||

| CA Poll. Control Fin. Auth. Solid Waste Disp. Rev. | |||

| Bonds (Waste Management, Inc.), Ser. A-2, | |||

| 5.4s, 4/1/25 | BBB | 1,760,000 | 1,799,354 |

|

| |||

| CA State G.O. Bonds, 6 1/2s, 4/1/33 | A1 | 5,000,000 | 5,854,100 |

|

| |||

| CA State Pub. Wks. Board Rev. Bonds | |||

| Ser. I-1, 6 5/8s, 11/1/34 | A2 | 5,595,000 | 6,195,903 |

| (Dept. of Corrections), Ser. C, 5 1/4s, 6/1/28 | A2 | 1,000,000 | 1,009,350 |

| (Dept. of Forestry & Fire), Ser. E, 5s, 11/1/32 | A2 | 1,250,000 | 1,205,900 |

|

| |||

| CA Statewide Cmnty. Dev. Auth. COP (The Internext | |||

| Group), 5 3/8s, 4/1/30 | BBB | 3,950,000 | 3,594,935 |

|

| |||

| CA Statewide Cmnty. Dev. Auth. Rev. Bonds | |||

| (Thomas Jefferson School of Law), Ser. A, | |||

| 7 1/4s, 10/1/38 | BB+ | 560,000 | 567,823 |

| (American Baptist Homes West), 5 3/4s, 10/1/25 | BBB | 3,000,000 | 3,005,490 |

|

| |||

| Cathedral City, Impt. Board Act of 1915 Special | |||

| Assmt. Bonds (Cove Impt. Dist.), Ser. 04-02 | |||

| 5.05s, 9/2/35 | BBB–/P | 1,015,000 | 873,966 |

| 5s, 9/2/30 | BBB–/P | 245,000 | 221,142 |

|

| |||

| Chula Vista, Cmnty. Fac. Dist. Special Tax Rev. Bonds | |||

| (No. 06-1 Eastlake Woods Area), 6.1s, 9/1/21 | BBB/P | 1,000,000 | 1,024,420 |

| (No. 07-1 Otay Ranch Village Eleven), 5.8s, 9/1/28 | BB+/P | 275,000 | 274,681 |

|

| |||

| Foothill/Eastern Corridor Agcy. Rev. Bonds | |||

| (Toll Road), 5.85s, 1/15/23 | Baa3 | 500,000 | 503,090 |

| (CA Toll Roads), 5 3/4s, 1/15/40 | Baa3 | 2,745,000 | 2,503,138 |

|

| |||

| M-S-R Energy Auth. Rev. Bonds, Ser. A, | |||

| 6 1/2s, 11/1/39 | A | 750,000 | 852,983 |

|

| |||

21

| MUNICIPAL BONDS AND NOTES (128.6%)* cont. | Rating** | Principal amount | Value |

|

| |||

| California cont. | |||

| Orange Cnty., Cmnty. Fac. Dist. Special Tax Rev. | |||

| Bonds (Ladera Ranch No. 02-1), Ser. A, | |||

| 5.55s, 8/15/33 | BBB–/P | $900,000 | $874,449 |

|

| |||

| Sacramento, Special Tax (North Natomas Cmnty. | |||

| Fac.), Ser. 4-C, 6s, 9/1/33 | BBB–/P | 1,245,000 | 1,246,158 |

|

| |||

| San Francisco, City & Cnty. Redev. Fin. Auth. Tax | |||

| Alloc. Bonds (Mission Bay South), Ser. D, | |||

| 6 5/8s, 8/1/39 | BBB | 250,000 | 259,068 |

|

| |||

| Santaluz, Cmnty. Facs. Dist. No. 2 Special Tax Rev. | |||

| Bonds (Impt. Area No. 1), Ser. B, 6 3/8s, 9/1/30 | BBB/P | 2,730,000 | 2,737,617 |

|

| |||

| Sunnyvale, Special Tax Rev. Bonds (Cmnty. Fac. | |||

| Dist. No. 1), 7 3/4s, 8/1/32 | B+/P | 835,000 | 835,359 |

|

| |||

| Thousand Oaks, Cmnty. Fac. Dist. Special Tax Rev. | |||

| Bonds (Marketplace 94-1), zero %, 9/1/14 | B/P | 1,240,000 | 996,972 |

|

| |||

| 44,377,168 | |||

| Colorado (2.3%) | |||

| CO Hlth. Fac. Auth. Rev. Bonds | |||

| (Christian Living Cmnty.), 6 3/8s, 1/1/41 | BB–/P | 810,000 | 805,132 |

| (Christian Living Cmnty.), Ser. A, 5 3/4s, 1/1/26 | BB–/P | 425,000 | 419,301 |

| (Christian Living Cmnty.), Ser. A, 8 1/4s, 1/1/24 | BB–/P | 375,000 | 397,774 |

| (Evangelical Lutheran), Ser. A, 6 1/8s, 6/1/38 | A3 | 2,045,000 | 2,062,035 |

| (Total Longterm Care National), Ser. A, | |||

| 6 1/4s, 11/15/40 | BBB–/F | 300,000 | 306,843 |

| (Valley View Assn.), 5 1/4s, 5/15/42 | BBB+ | 3,495,000 | 3,240,100 |

|

| |||

| CO Pub. Hwy. Auth. Rev. Bonds | |||

| (E-470 Pub. Hwy.), Ser. C1, NATL, 5 1/2s, 9/1/24 | Baa1 | 1,000,000 | 997,190 |

| (E-470), Ser. C, 5 3/8s, 9/1/26 | Baa2 | 500,000 | 491,195 |

|

| |||

| Denver, City & Cnty. Special Fac. Arpt. Rev. | |||

| Bonds (United Airlines), Ser. A, 5 1/4s, 10/1/32 | B | 325,000 | 272,373 |

|

| |||

| Regl. Trans. Dist. Rev. Bonds (Denver Trans. Partners), | |||

| 6s, 1/15/41 | Baa3 | 750,000 | 759,548 |

|

| |||

| 9,751,491 | |||

| Connecticut (0.4%) | |||

| CT State Dev. Auth. 1st. Mtg. Gross Rev. Hlth. Care | |||

| Rev. Bonds (Elim Street Park Baptist, Inc.), | |||

| 5.85s, 12/1/33 | BBB | 650,000 | 625,066 |

|

| |||

| Hamden, Fac. Rev. Bonds (Whitney Ctr.), Ser. A, | |||

| 7 3/4s, 1/1/43 | BB/P | 1,050,000 | 1,105,503 |

|

| |||

| 1,730,569 | |||

| Delaware (0.7%) | |||

| DE St. Econ. Dev. Auth. Rev. Bonds | |||

| (Delmarva Pwr.), 5.4s, 2/1/31 | BBB+ | 500,000 | 509,020 |

| (Indian River Pwr.), 5 3/8s, 10/1/45 | Baa3 | 2,600,000 | 2,397,148 |

|

| |||

| 2,906,168 | |||

| District of Columbia (1.5%) | |||

| DC Rev. Bonds (Howard U.), Ser. A | |||

| 6 1/2s, 10/1/41 | A3 | 2,500,000 | 2,647,700 |

| 6 1/4s, 10/1/32 | A3 | 1,000,000 | 1,051,470 |

|

| |||

| DC Tobacco Settlement Fin. Corp. Rev. Bonds, | |||

| Ser. A, zero %, 6/15/46 | B+/F | 17,500,000 | 1,109,150 |

|

| |||

| Metro. Washington, Arpt. Auth. Dulles Toll Rd. Rev. | |||

| Bonds (2nd Sr. Lien), Ser. B, zero %, 10/1/40 | Baa1 | 10,000,000 | 1,604,600 |

|

| |||

| 6,412,920 | |||

22

| MUNICIPAL BONDS AND NOTES (128.6%)* cont. | Rating** | Principal amount | Value |

|

| |||

| Florida (6.3%) | |||

| Double Branch Cmnty. Dev. Dist. Rev. Bonds, | |||

| Ser. A, 6.7s, 5/1/34 | BBB | $915,000 | $926,685 |

|

| |||

| Escambia Cnty., Env. Impt. Rev. Bonds (Intl. | |||

| Paper Co.), Ser. A, 5s, 8/1/26 | BBB | 2,000,000 | 1,891,980 |

|

| |||

| Fishhawk, Cmnty. Dev. Dist. II Rev. Bonds | |||

| Ser. B, 7.04s, 11/1/14 | B–/P | 10,000 | 9,900 |

| Ser. A, 6 1/8s, 5/1/34 | B–/P | 435,000 | 427,448 |

|

| |||

| FL Hsg. Fin. Corp. Rev. Bonds, Ser. G, GNMA | |||

| Coll., FNMA Coll., FHLMC Coll., 5 3/4s, 1/1/37 | Aa1 | 785,000 | 837,917 |

|

| |||

| Halifax, Hosp. Med. Ctr. Rev. Bonds, Ser. A, | |||

| 5 3/8s, 6/1/46 | A– | 4,380,000 | 4,242,852 |

|

| |||

| Heritage Harbour Marketplace Cmnty., Dev. Dist. | |||

| Special Assmt., 5.6s, 5/1/36 | B/P | 370,000 | 307,840 |

|

| |||

| Heritage Harbour, South Cmnty. Dev. Distr. Rev. | |||

| Bonds, Ser. A, 6 1/2s, 5/1/34 | BB+/P | 450,000 | 452,250 |

|

| |||

| Hillsborough Cnty., Indl. Dev. Auth. Poll. | |||

| Control Mandatory Put Bonds (9/1/13) (Tampa | |||

| Elec. Co.), Ser. B, 5.15s, 9/1/25 | Baa1 | 400,000 | 424,572 |

|

| |||

| Jacksonville, Econ. Dev. Comm. Hlth. Care Fac. Rev. | |||

| Bonds (Proton Therapy Inst.), Class A, 6s, 9/1/17 | B/P | 450,000 | 478,778 |

|

| |||

| Jacksonville, Econ. Dev. Comm. Indl. Dev. Rev. | |||

| Bonds (Gerdau Ameristeel US, Inc.), 5.3s, 5/1/37 | BBB– | 2,450,000 | 2,121,651 |

|

| |||

| Lakeland, Retirement Cmnty. Rev. Bonds | |||

| (1st Mtge. — Carpenters), 6 3/8s, 1/1/43 | BBB–/F | 840,000 | 774,682 |

|

| |||

| Lee Cnty., Indl. Dev. Auth. Hlth. Care Fac. Rev. Bonds | |||

| (Cypress Cove Hlth. Pk.), Ser. A, 6 3/8s, 10/1/25 | B/P | 1,000,000 | 792,600 |

| (Shell Pt./Alliance Oblig. Group), 5 1/8s, 11/15/36 | BB | 1,075,000 | 853,335 |

| (Shell Pt./Alliance Cmnty.), 5s, 11/15/22 | BB | 1,500,000 | 1,405,500 |

|

| |||

| Miami Beach, Hlth. Fac. Auth. Hosp. Rev. Bonds | |||

| (Mount Sinai Med. Ctr.), Ser. A | |||

| 6.8s, 11/15/31 | Baa3 | 500,000 | 502,845 |

| 6.7s, 11/15/19 | Baa3 | 1,335,000 | 1,349,899 |

|

| |||

| Palm Beach Cnty., Hlth. Fac. Auth. Rev. Bonds | |||

| (Acts Retirement-Life Cmnty.), 5 1/2s, 11/15/33 | BBB+ | 2,000,000 | 1,942,800 |

|

| |||

| Palm Coast Pk. Cmnty. Dev. Dist. Special Assmt. | |||

| Bonds, 5.7s, 5/1/37 | B–/P | 945,000 | 560,527 |

|

| |||

| Six Mile Creek, Cmnty. Dev. Dist. Rev. Bonds, | |||

| 5.65s, 5/1/22 | CCC/P | 1,240,000 | 396,800 |

|

| |||

| South Lake Hosp. Dist. (South Lake Hosp.), | |||

| Ser. A, 6s, 4/1/29 | Baa2 | 1,000,000 | 1,012,450 |

|

| |||

| Tampa Bay, Cmnty. Dev. Dist. Special Assmt. Bonds | |||

| (New Port), Ser. A, 5 7/8s, 5/1/38 (In default) † | D/P | 655,000 | 196,500 |

|

| |||

| Tolomato, Cmnty. Dev. Dist. Special Assmt. Bonds | |||

| (Split Pine Cmnty. Dev. Dist.), Ser. A, | |||

| 5 1/4s, 5/1/39 | B–/P | 1,790,000 | 1,129,186 |

| 6.55s, 5/1/27 | B–/P | 700,000 | 469,623 |

| 5.4s, 5/1/37 | CCC/P | 1,375,000 | 1,065,529 |

|

| |||

| Verandah, West Cmnty. Dev. Dist. Rev. Bonds (Cap. | |||

| Impt.), Ser. A, 6 5/8s, 5/1/33 | BB/P | 445,000 | 428,980 |

|

| |||

23

| MUNICIPAL BONDS AND NOTES (128.6%)* cont. | Rating** | Principal amount | Value |

|

| |||

| Florida cont. | |||

| Verano Ctr. Cmnty. Dev. Dist. Special Assmt. Bonds | |||

| (Cmnty. Infrastructure) | |||

| Ser. A, 5 3/8s, 5/1/37 | B–/P | $980,000 | $639,607 |

| Ser. B, 5s, 11/1/13 | B–/P | 580,000 | 531,814 |

|

| |||

| Village Cmnty. Dev. Dist. No. 8 Special Assmt. | |||

| Bonds (Dist. No. 8 Phase II), 6 1/8s, 5/1/39 | BB–/P | 485,000 | 486,111 |

|

| |||

| 26,660,661 | |||

| Georgia (2.5%) | |||

| Atlanta, Wtr. & Waste Wtr. Rev. Bonds, Ser. A, | |||

| 6 1/4s, 11/1/39 | A1 | 2,500,000 | 2,798,150 |

|

| |||

| Clayton Cnty., Dev. Auth. Special Fac. Rev. Bonds | |||

| (Delta Airlines), Ser. A, 8 3/4s, 6/1/29 | CCC+ | 2,000,000 | 2,306,400 |

|

| |||

| Forsyth Cnty., Hosp. Auth. Rev. Bonds (Baptist | |||

| Hlth. Care Syst.), U.S. Govt. Coll., 6 1/4s, | |||

| 10/1/18 (Prerefunded 12/5/11) | AA+ | 1,520,000 | 1,769,523 |

|

| |||

| Fulton Cnty., Res. Care Fac. Rev. Bonds | |||

| (Canterbury Court), Class A, 6 1/8s, 2/15/34 | BB/P | 600,000 | 542,358 |

|

| |||

| Gainesville & Hall Cnty., Devauth Retirement | |||

| Cmnty. Rev. Bonds (Acts Retirement-Life Cmnty.), | |||

| Ser. A-2, 6 3/8s, 11/15/29 | BBB+ | 700,000 | 733,775 |

|

| |||

| Marietta, Dev. Auth. Rev. Bonds (U. Fac. Life U., Inc.), | |||

| Ser. PJ, 6 1/4s, 6/15/20 | Ba3 | 1,255,000 | 1,229,586 |

|

| |||

| Med. Ctr. Hosp. Auth. Rev. Bonds (Spring Harbor | |||

| Green Island), 5 1/4s, 7/1/27 | B+/P | 575,000 | 513,814 |

|

| |||

| Rockdale Cnty., Dev. Auth. Rev. Bonds (Visy Paper), | |||

| Ser. A, 6 1/8s, 1/1/34 | B–/P | 600,000 | 596,700 |

|

| |||

| 10,490,306 | |||

| Hawaii (1.2%) | |||

| HI Dept. of Trans. Special Fac. Rev. Bonds | |||

| (Continental Airlines, Inc.), 7s, 6/1/20 | B | 1,220,000 | 1,220,305 |

|

| |||

| HI State Dept. Budget & Fin. Rev. Bonds | |||

| (Craigside), Ser. A, 9s, 11/15/44 | B/P | 400,000 | 457,224 |

| (Hawaiian Elec. Co. — Subsidiary), 6 1/2s, 7/1/39 | Baa1 | 3,000,000 | 3,206,490 |

|

| |||

| 4,884,019 | |||

| Illinois (3.6%) | |||

| Chicago, Special Assmt. Bonds (Lake Shore East), | |||

| 6 3/4s, 12/1/32 | BB/P | 2,000,000 | 2,060,020 |

|

| |||

| Du Page Cnty., Special Svc. Area No. 31 Special | |||

| Tax Bonds (Monarch Landing) | |||

| 5 5/8s, 3/1/36 | BB–/P | 350,000 | 276,399 |

| 5.4s, 3/1/16 | BB–/P | 165,000 | 162,121 |

|

| |||

| IL Fin. Auth. Rev. Bonds | |||

| (Provena Hlth.), Ser. A, 7 3/4s, 8/15/34 | Baa1 | 1,500,000 | 1,694,970 |

| (Silver Cross Hosp. & Med. Ctr.), 7s, 8/15/44 | BBB | 2,000,000 | 2,098,620 |

| (IL Rush U. Med Ctr.), Ser. C, 6 5/8s, 11/1/39 | A2 | 1,075,000 | 1,158,710 |

| (Navistar Intl. Recvy. Zone), 6 1/2s, 10/15/40 | BB– | 1,000,000 | 1,032,800 |

| (Roosevelt U.), 6 1/4s, 4/1/29 | Baa2 | 1,500,000 | 1,562,505 |

| (Landing At Plymouth Place), Ser. A, 6s, 5/15/25 | B+/P | 200,000 | 182,032 |

| (Three Crowns Pk. Plaza), Ser. A, 5 7/8s, 2/15/26 | B+/P | 1,000,000 | 975,850 |

| (Landing At Plymouth Place), Ser. A, | |||

| 5.35s, 5/15/15 | B+/P | 600,000 | 594,858 |

| (American Wtr. Cap. Corp.), 5 1/4s, 10/1/39 | BBB+ | 1,575,000 | 1,527,813 |

|

| |||

24

| MUNICIPAL BONDS AND NOTES (128.6%)* cont. | Rating** | Principal amount | Value |

|

| |||

| Illinois cont. | |||

| IL Hlth. Fac. Auth. Rev. Bonds | |||

| (Cmnty. Rehab. Providers Fac.), Ser. A, | |||

| 7 7/8s, 7/1/20 | CCC/P | $120,246 | $85,737 |

| (St. Benedict), Ser. 03A-1, 6.9s, 11/15/33 | |||

| (In default) † | D/P | 500,000 | 155,000 |

| (Elmhurst Memorial Hlth. Care), 5 5/8s, 1/1/28 | Baa1 | 550,000 | 552,376 |

|

| |||

| Railsplitter, Tobacco Settlement Auth. Rev. Bonds, | |||

| 6s, 6/1/28 | A– | 1,050,000 | 1,092,599 |

|

| |||

| 15,212,410 | |||

| Indiana (2.0%) | |||

| IN State Fin. Auth. Edl. Fac. VRDN, Ser. A-1, | |||

| 0.13s, 2/1/37 | VMIG1 | 1,550,000 | 1,550,000 |

|

| |||

| Indianapolis, Arpt. Auth. Rev. Bonds (Federal | |||

| Express Corp.), 5.1s, 1/15/17 | Baa2 | 3,500,000 | 3,892,280 |

|

| |||

| Jasper Cnty., Indl. Poll. Control Rev. Bonds | |||

| AMBAC, 5.7s, 7/1/17 | Baa2 | 1,125,000 | 1,260,248 |

| NATL, 5.6s, 11/1/16 | Baa1 | 700,000 | 782,110 |

| Ser. A, NATL, 5.6s, 11/1/16 | Baa1 | 500,000 | 558,650 |

|

| |||

| St. Joseph Cnty., Econ. Dev. Rev. Bonds (Holy Cross | |||

| Village Notre Dame), Ser. A, 5 3/4s, 5/15/15 | B/P | 455,000 | 464,150 |

|

| |||

| 8,507,438 | |||

| Iowa (1.7%) | |||

| IA Fin. Auth. Hlth. Care Fac. Rev. Bonds (Care | |||

| Initiatives), Ser. A | |||

| 5 1/4s, 7/1/17 | BB+ | 1,040,000 | 1,011,670 |

| 5s, 7/1/19 | BB+ | 2,750,000 | 2,507,010 |

| 5 1/2s, 7/1/25 | BB+ | 950,000 | 810,198 |

|

| |||

| IA Fin. Auth. Retirement Cmnty. Rev. Bonds | |||

| (Friendship Haven), Ser. A | |||

| 6 1/8s, 11/15/32 | BB/P | 750,000 | 751,485 |

| 6s, 11/15/24 | BB/P | 200,000 | 200,386 |

|

| |||

| Orange Cnty., Hosp. Rev. Bonds, 5 1/2s, 9/1/27 | BB–/P | 1,230,000 | 1,120,727 |

|

| |||

| Tobacco Settlement Auth. of IA Rev. Bonds, | |||

| Ser. C, 5 3/8s, 6/1/38 | BBB | 1,250,000 | 932,100 |

|

| |||

| 7,333,576 | |||

| Kansas (0.1%) | |||

| Lenexa, Hlth. Care Fac. Rev. Bonds (LakeView | |||

| Village), 7 1/8s, 5/15/29 | BB/P | 500,000 | 505,335 |

|

| |||

| 505,335 | |||

| Kentucky (0.6%) | |||

| KY Econ. Dev. Fin. Auth. Rev. Bonds | |||

| (First Mtge.), Ser. IA, 8s, 1/1/29 | B+/P | 273,000 | 275,009 |

| (Masonic Home Indpt. Living II), 7 1/4s, 5/15/41 | BB–/P | 500,000 | 503,395 |

| (Masonic Home Indpt. Living II), 7s, 5/15/30 | BB–/P | 500,000 | 510,780 |

|

| |||

| Louisville/Jefferson Cnty., Metro. Govt. College | |||

| Rev. Bonds (Bellarmine U.), Ser. A, 6s, 5/1/28 | Baa3 | 500,000 | 522,365 |

|

| |||

| Owen Cnty., Wtr. Wks. Syst. Rev. Bonds (American | |||

| Wtr. Co.), Ser. A, 6 1/4s, 6/1/39 | BBB+ | 700,000 | 733,467 |

|

| |||

| 2,545,016 | |||

25

| MUNICIPAL BONDS AND NOTES (128.6%)* cont. | Rating** | Principal amount | Value |

|

| |||

| Louisiana (0.8%) | |||

| Rapides, Fin. Auth. FRB (Cleco Pwr.), AMBAC, | |||

| 4.7s, 11/1/36 | Baa2 | $750,000 | $662,528 |

|

| |||

| Tobacco Settlement Fin. Corp. Rev. Bonds, | |||

| Ser. 01-B, 5 7/8s, 5/15/39 | A3 | 2,700,000 | 2,702,808 |

|

| |||

| 3,365,336 | |||

| Maine (0.8%) | |||

| ME Hlth. & Higher Edl. Fac. Auth. Rev. Bonds | |||

| (ME Gen. Med. Ctr.), 7 1/2s, 7/1/32 | Baa3 | 1,000,000 | 1,097,120 |

|

| |||

| Rumford, Solid Waste Disp. Rev. Bonds (Boise | |||

| Cascade Corp.), 6 7/8s, 10/1/26 | B2 | 2,500,000 | 2,225,525 |

|

| |||

| 3,322,645 | |||

| Maryland (1.5%) | |||

| Baltimore Cnty., Rev. Bonds (Oak Crest | |||

| Village, Inc. Fac.), Ser. A, 5s, 1/1/37 | BBB+ | 2,000,000 | 1,813,960 |

|

| |||

| MD Econ. Dev. Corp. Poll. Control Rev. Bonds | |||

| (Potomac Electric Power Co.), 6.2s, 9/1/22 | A | 550,000 | 645,997 |

|

| |||

| MD State Hlth. & Higher Edl. Fac. Auth. Rev. Bonds | |||

| (King Farm Presbyterian Cmnty.), Ser. A, | |||

| 5 1/4s, 1/1/27 | B/P | 710,000 | 591,480 |

|

| |||

| MD State Indl. Dev. Fin. Auth. Rev. Bonds | |||

| (Synagro-Baltimore), Ser. A, 5 3/8s, 12/1/14 | BBB+/F | 1,000,000 | 1,046,790 |

|

| |||

| MD State Indl. Dev. Fin. Auth. Econ. Dev. Rev. Bonds | |||

| (Our Lady of Good Counsel School), Ser. A, | |||

| 6s, 5/1/35 | BB–/P | 400,000 | 402,244 |

|

| |||

| Westminster, Econ. Dev. Rev. Bonds (Carroll | |||

| Lutheran Village), Ser. A | |||

| 6 1/4s, 5/1/34 | BB/P | 600,000 | 519,084 |

| 5 7/8s, 5/1/21 | BB/P | 1,600,000 | 1,483,984 |

|

| |||

| 6,503,539 | |||

| Massachusetts (8.3%) | |||

| Boston, Indl. Dev. Fin. Auth. Rev. Bonds | |||

| (Springhouse, Inc.), 6s, 7/1/28 | BB–/P | 1,600,000 | 1,438,096 |

|

| |||

| MA Dev. Fin. Agcy. Sr. Living Fac. Rev. Bonds, | |||

| Ser. B1, 7 1/4s, 6/1/16 | BB–/P | 2,000,000 | 2,000,400 |

|

| |||

| MA Edl. Fin. Auth. Rev. Bonds, Ser. B, 5 1/2s, 1/1/23 | AA | 915,000 | 944,664 |

|

| |||

| MA State Dev. Fin. Agcy. Rev. Bonds | |||

| (Boston Biomedical Research), 5 3/4s, 2/1/29 | Ba1 | 1,000,000 | 917,940 |

| (First Mtge. — Orchard Cove), 5s, 10/1/19 | BB/P | 550,000 | 511,792 |

| (Linden Ponds, Inc. Fac.), Ser. A-1, | |||

| 6 1/4s, 11/15/26 | CCC/P | 275,400 | 235,384 |

| (Linden Ponds, Inc. Fac.), Ser. A-1, | |||

| 6 1/4s, 11/15/39 | CCC/P | 532,400 | 399,742 |

| (Linden Ponds, Inc. Fac.), Ser. A-1, | |||

| 6 1/4s, 11/15/46 | CCC/P | 850,850 | 625,468 |

| (Linden Ponds, Inc. Fac.), Ser. A-2, | |||

| 5 1/2s, 11/15/46 | CCC/P | 88,265 | 57,640 |

| (Linden Ponds, Inc. Fac.), Ser. B, zero %, 11/15/56 | CCC/P | 439,022 | 4,377 |

| (Sabis Intl.), Ser. A, 8s, 4/15/39 | BBB | 690,000 | 773,897 |

| (Wheelock College), Ser. C, 5 1/4s, 10/1/29 | BBB | 1,700,000 | 1,710,200 |

|

| |||

| MA State Dev. Fin. Agcy. Hlth. Care Fac. Rev. Bonds | |||

| (Adventcare), Ser. A, 6.65s, 10/15/28 | B/P | 1,050,000 | 1,016,831 |

|

| |||

26

| MUNICIPAL BONDS AND NOTES (128.6%)* cont. | Rating** | Principal amount | Value |

|

| |||

| Massachusetts cont. | |||

| MA State Dev. Fin. Agcy. Solid Waste Disp. | |||

| Mandatory Put Bonds (12/1/11) (Dominion Energy | |||

| Brayton 1), Ser. 1, 5 3/4s, 5/1/19 | A– | $1,050,000 | $1,153,005 |

|

| |||

| MA State Hlth. & Edl. Fac. Auth. Rev. Bonds | |||

| (Baystate Med. Ctr.), Ser. F, 5.7s, 7/1/27 | A+ | 1,000,000 | 1,006,040 |

| (Baystate Med. Ctr.), Ser. I, 5 3/4s, 7/1/36 | A+ | 1,500,000 | 1,528,695 |

| (Civic Investments/HPHC), Ser. A, 9s, 12/15/15 | |||

| (Prerefunded 12/15/12) | AAA/P | 1,975,000 | 2,159,268 |

| (Emerson Hosp.), Ser. E, Radian Insd., 5s, 8/15/25 | BB/P | 1,500,000 | 1,323,240 |

| (Fisher College), Ser. A, 5 1/8s, 4/1/37 | BBB– | 250,000 | 217,835 |

| (Jordan Hosp.), Ser. E, 6 3/4s, 10/1/33 | BB– | 2,550,000 | 2,544,008 |

| (Milford Regl. Med.), Ser. E, 5s, 7/15/22 | Baa3 | 2,200,000 | 2,185,436 |

| (Norwood Hosp.), Ser. C, 7s, 7/1/14 (Escrowed | |||

| to maturity) | BB/P | 1,185,000 | 1,316,357 |

| (Quincy Med. Ctr.), Ser. A, 6 1/4s, 1/15/28 | |||

| (In default) † | D/P | 739,544 | 327,248 |

| (Springfield College), 5 1/2s, 10/15/26 | Baa1 | 1,500,000 | 1,538,775 |

| (Springfield College), 5 1/2s, 10/15/31 | Baa1 | 1,100,000 | 1,104,884 |

| (Springfield College), 5 5/8s, 10/15/40 | Baa1 | 450,000 | 444,600 |

| (Suffolk U.), Ser. A, 5 3/4s, 7/1/39 | Baa2 | 950,000 | 975,356 |

| (Suffolk U.), Ser. A, 6 1/4s, 7/1/30 | Baa2 | 1,000,000 | 1,076,690 |

|

| |||

| MA State Indl. Fin. Agcy. Rev. Bonds (1st Mtge. | |||

| Berkshire Retirement), Ser. A, 6 5/8s, 7/1/16 | BBB | 1,560,000 | 1,566,053 |

|

| |||

| MA State Port Auth. Special Fac. Rev. Bonds (Conrac), | |||

| Ser. A, 5 1/8s, 7/1/41 | A | 750,000 | 770,370 |

|

| |||

| Metro. Boston Trans. Pkg. Corp. Rev. Bonds | |||

| (Systemwide Pkg.), 5 1/4s, 7/1/33 | A1 | 1,500,000 | 1,582,455 |

| 5s, 7/1/41 | A1 | 1,500,000 | 1,524,045 |

|

| |||

| 34,980,791 | |||

| Michigan (4.4%) | |||

| Detroit, G.O. Bonds (Cap. Impt.), Ser. A-1, 5s, 4/1/15 | BB | 950,000 | 912,561 |

|

| |||

| Detroit, Wtr. Supply Syst. Rev. Bonds, Ser. B, AGM, | |||

| 6 1/4s, 7/1/36 | AA+ | 1,660,000 | 1,869,260 |

|

| |||

| Flint, Hosp. Bldg. Auth. Rev. Bonds (Hurley Med. Ctr.), | |||

| 6s, 7/1/20 | Ba1 | 1,035,000 | 1,036,677 |

|

| |||

| Garden City, Hosp. Fin. Auth. Rev. Bonds (Garden | |||

| City Hosp.), Ser. A, 5 3/4s, 9/1/17 | Ba3 | 395,000 | 395,028 |

|

| |||

| MI State Hosp. Fin. Auth. Rev. Bonds | |||

| Ser. A, 6 1/8s, 6/1/39 | A1 | 2,000,000 | 2,109,420 |

| (Henry Ford Hlth.), 5 3/4s, 11/15/39 | A1 | 1,600,000 | 1,637,120 |

| (Henry Ford Hlth. Syst.), Ser. A, 5 1/4s, 11/15/46 | A1 | 2,565,000 | 2,504,723 |

| (Chelsea Cmnty. Hosp. Oblig.), 5s, 5/15/25 | |||

| (Prerefunded 5/15/15) | AA+ | 755,000 | 858,737 |

|

| |||

| MI State Strategic Fund Ltd. Oblig. Rev. Bonds | |||

| (Cadillac Place Office Bldg.), 5 1/4s, 10/15/26 | A1 | 1,250,000 | 1,342,138 |

|

| |||

| MI State Strategic Fund, Ltd. Rev. Bonds | |||

| (Worthington Armstrong Venture), U.S. Govt. | |||

| Coll., 5 3/4s, 10/1/22 (Escrowed to maturity) | AAA/P | 1,350,000 | 1,634,405 |

|

| |||

27

| MUNICIPAL BONDS AND NOTES (128.6%)* cont. | Rating** | Principal amount | Value |

|

| |||

| Michigan cont. | |||

| MI Tobacco Settlement Fin. Auth. Rev. Bonds, | |||

| Ser. A, 6s, 6/1/48 | BB | $4,000,000 | $2,813,360 |

|

| |||

| Monroe Cnty., Hosp. Fin. Auth. Rev. Bonds (Mercy | |||

| Memorial Hosp.), 5 1/2s, 6/1/20 | Baa3 | 1,480,000 | 1,493,616 |

|

| |||

| 18,607,045 | |||

| Minnesota (2.3%) | |||

| Douglas Cnty., Gross Hlth. Care Fac. Rev. Bonds | |||

| (Douglas Cnty. Hosp.), Ser. A, 6 1/4s, 7/1/34 | BBB– | 3,000,000 | 3,135,690 |

|

| |||

| Inver Grove Heights, Nursing Home Rev. Bonds | |||

| (Presbyterian Homes Care), 5 3/8s, 10/1/26 | B/P | 700,000 | 667,849 |

|

| |||

| North Oaks, Sr. Hsg. Rev. Bonds (Presbyterian | |||

| Homes North Oaks), 6 1/8s, 10/1/39 | BB/P | 315,000 | 317,070 |

|

| |||

| Northfield, Hosp. Rev. Bonds, 5 3/8s, 11/1/26 | BBB– | 750,000 | 765,615 |

|

| |||

| Rochester, Hlth. Care Fac. Rev. Bonds (Olmsted | |||

| Med. Ctr.), 5 7/8s, 7/1/30 | BBB/F | 1,000,000 | 1,002,930 |

|

| |||

| Sauk Rapids Hlth. Care & Hsg. Fac. Rev. Bonds | |||

| (Good Shepherd Lutheran Home) | |||

| 7 1/2s, 1/1/39 | B+/P | 500,000 | 504,885 |

| 6s, 1/1/34 | B+/P | 400,000 | 350,380 |

|

| |||

| St. Paul, Hsg. & Redev. Auth. Charter School Lease | |||

| Rev. Bonds (Nova Classical Academy), Ser. A | |||

| 6 5/8s, 9/1/42 | BBB– | 250,000 | 250,418 |

| 6 3/8s, 9/1/31 | BBB– | 250,000 | 250,423 |

|

| |||

| St. Paul, Hsg. & Redev. Auth. Hosp. Rev. Bonds | |||

| (Healtheast) | |||

| 6s, 11/15/35 | Ba1 | 1,350,000 | 1,336,406 |

| Ser. B, 5.85s, 11/1/17 | Ba1 | 250,000 | 250,223 |

|

| |||

| St. Paul, Port Auth. Lease Rev. Bonds (Regions | |||

| Hosp. Pkg. Ramp), Ser. 1, 5s, 8/1/36 | BBB+/P | 1,125,000 | 984,746 |

|

| |||

| 9,816,635 | |||

| Mississippi (1.4%) | |||

| MS Bus. Fin. Corp. Poll. Control Rev. Bonds | |||

| (Syst. Energy Resources, Inc.), 5.9s, 5/1/22 | BBB | 3,630,000 | 3,651,962 |

|

| |||

| MS Home Corp. Rev. Bonds (Single Fam. Mtge.), | |||

| Ser. B-2, GNMA Coll., FNMA Coll., 6.45s, 12/1/33 | Aaa | 540,000 | 564,403 |

|

| |||

| Warren Cnty., Gulf Opportunity Zone (Intl. | |||

| Paper Co.), Ser. A, 6 1/2s, 9/1/32 | BBB | 1,600,000 | 1,734,352 |

|

| |||

| 5,950,717 | |||

| Missouri (2.0%) | |||

| Cape Girardeau Cnty., Indl. Dev. Auth. Hlth. Care | |||

| Fac. Rev. Bonds (St. Francis Med. Ctr.), Ser. A, | |||

| 5 1/2s, 6/1/16 | A+ | 1,000,000 | 1,038,690 |

|

| |||

| Kansas City, Indl. Dev. Auth. Hlth. Fac. Rev. | |||

| Bonds (First Mtge. Bishop Spencer), Ser. A, | |||

| 6 1/2s, 1/1/35 | B/P | 2,000,000 | 1,943,880 |

|

| |||

| MO State Hlth. & Edl. Fac. Auth. VRDN (Washington | |||

| U. (The)) | |||

| Ser. C, 0.95s, 9/1/30 | VMIG1 | 2,900,000 | 2,900,000 |

| Ser. A, 0.17s, 9/1/30 | VMIG1 | 1,100,000 | 1,100,000 |

|

| |||

28

| MUNICIPAL BONDS AND NOTES (128.6%)* cont. | Rating** | Principal amount | Value |

|

| |||

| Missouri cont. | |||

| MO State Hsg. Dev. Comm. Mtge. Rev. Bonds (Single | |||

| Fam. Home Ownership Loan), Ser. A-1, GNMA Coll., | |||

| FNMA Coll., 6 3/4s, 3/1/34 | AA+ | $205,000 | $215,599 |

|

| |||

| St. Louis Arpt. Rev. Bonds (Lambert-St. Louis Intl.), | |||

| Ser. A-1, 6 5/8s, 7/1/34 | A– | 1,000,000 | 1,083,760 |

|

| |||

| 8,281,929 | |||

| Montana (1.4%) | |||

| MT Fac. Fin. Auth. Rev. Bonds (Sr. Living St. John’s | |||

| Lutheran), Ser. A, 6s, 5/15/25 | B+/P | 500,000 | 466,630 |

|

| |||

| MT Fac. Fin. Auth. VRDN (Sisters of Charity), | |||

| Ser. A, 0.15s, 12/1/25 | VMIG1 | 5,285,000 | 5,285,000 |

|

| |||

| 5,751,630 | |||

| Nebraska (0.6%) | |||

| Central Plains, Energy Rev. Bonds (NE Gas No. 1), | |||

| Ser. A, 5 1/4s, 12/1/18 | Ba3 | 1,500,000 | 1,524,735 |

|

| |||

| Lancaster Cnty., Hosp. Auth. Rev. Bonds (Immanuel | |||

| Oblig. Group), 5 1/2s, 1/1/30 | A–/F | 1,000,000 | 1,054,330 |

|

| |||

| 2,579,065 | |||

| Nevada (2.2%) | |||