UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

_________________

| (Mark One) |

|

|

|

|

|

|

| þ |

| Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the fiscal year ended January 31, 2013

or

|

|

|

|

|

|

|

|

| o |

| Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the Transition Period from to

Commission File Number 0-17386

CYCLONE URANIUM CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

| Nevada |

| 88-0227654 |

| (State or Other Jurisdiction of |

| (I.R.S. Employer Identification No.) |

| Incorporation or Organization) |

|

|

|

|

| 2186 S. Holly St. Ste 104 |

| Denver, Colorado 80222 |

| (Address of principal executive offices and zip code) |

Registrant’s telephone number, including area code: (303) 800-0678

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in rule 405 of Securities Act. Yes o No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes þ No o

1

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. Yes þ No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

| Large accelerated filer ¨ |

| Accelerated filer ¨ |

|

|

|

|

| Non-accelerated filer ¨ (Do not check if smaller reporting company) |

| Smaller reporting company x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No þ

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant as of July 31, 2012, based upon the closing price of the common stock as reported by OTCBB on such date was approximately $1,654,773. The total number of shares of Common Stock issued and outstanding as of May 10, 2013 was 141,062,125

2

EXCHANGE RATES

Except as otherwise indicated, all dollar amounts described in this Form 10-K Annual Report are expressed in United States dollars ($US).

CONVERSION TABLE

For ease of reference, the following conversion factors are provided:

|

|

|

| 1 mile = 1.6093 kilometers | 1 metric tonne = 2,204.6 pounds |

| 1 foot = 0.305 meters | 1 ounce (troy) = 31.1035 grams |

| 1 acre = 0.4047 hectare | 1 imperial gallon = 4.5546 liters |

| 1 long ton = 2,240 pounds | 1 imperial gallon = 1.2010 U.S. gallons |

FORWARD LOOKING STATEMENTS

This Form 10-K contains forward-looking statements regarding future events and the Company’s future results that are subject to the safe harbors created under the Securities Act of 1933 (the “Securities Act”) and the Securities Exchange Act of 1934 (the “Exchange Act”). These statements are based on current expectations, estimates, forecasts, and projections about the industry in which the Company operates and the beliefs and assumptions of the Company’s management. Words such as “hopes,” “expects,” “anticipates,” “targets,” “goals,” “projects,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “continues,” “may,” variations of such words, and similar expressions are intended to identify such forward-looking statements. In addition, any statements that refer to projections of the Company’s future financial performance, the continuing development of the Company’s website, the prospects for selling advertising on the website and new visitors and visitor page views related to advertising agreements, the Company’s anticipated growth and potentials in its business, and other characterizations of future events or circumstances are forward-looking statements.

The Company is under no duty to update any of these forward-looking statements after the date of this report. You should not place undue reliance on these forward-looking statements.

4

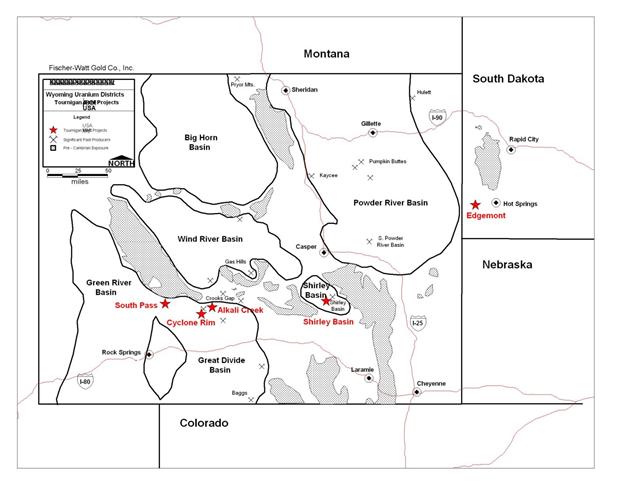

Introduction

Cyclone Uranium Corporation (“Cyclone” or the “Company”) formerly known as Fischer-Watt Gold Company, Inc. is a junior mineral exploration company with a portfolio of uranium properties in Wyoming, South Dakota and Arizona. Cyclone was incorporated in Nevada in 1986. On March 14, 2012, Cyclone acquired the assets of New Fork Uranium Corp. for stock, further strengthening its land position with strategically located claims and leases in the Cyclone Rim area of the Wyoming Red Desert. Cyclone changed its name from Fischer-Watt Gold Company, Inc. in December, 2012.

In 2009 Cyclone acquired a 100% interest in Tournigan Energy Ltd and with the New Fork Uranium Corp. acquisition now holds 30,000 acres of claims in Wyoming (1,376 federal claims and three state leases), South Dakota (51 federal claims) and Arizona (31 federal claims). Between 2006 and 2008 approximately $7.0 million was invested in uranium exploration activities on certain of these claims. The core area of focus is Cyclone Rim of Sweetwater County, Wyoming, where the claims cover roughly 28 miles of land hosting sinuous roll-front. The acquisition of New Fork Uranium Corp. added ten claim blocks containing 521 claims in the heart of the Great Divide Basin, which is one of the focal points of uranium exploration in the United States.

The assets acquired from New Fork Uranium Corp. include 521 federal mining claims (10,500 acres over 16 square miles) in Sweetwater County, Wyoming. Cyclone holds extensive historical data on these claims obtained from the Wyoming Geological Survey. Drill maps of drilling conducted by Kerr McGee is the most complete and show numerous uranium ore holes drilled on New Fork claims. Management believes these claims reflect uranium mineralization through surface work and subsequent drill programs. These claims, which are in close proximity to other operators that are investing heavily in exploration activities, are on trend to uranium mineralization found in the Eocene Battle Springs Formation that is a coarse, arkosic sandstone interbedded with intermittent mudstone, claystone, and siltstone.

Employees

The Company has one full time employee.

Item 1A. Risk Factors.

This 10-K contains statements concerning our future performance, intentions, objectives, plans and expectations that are or may be deemed to be "forward-looking statements". Our ability to do this has been fostered by the Private Securities Litigation Act of 1995, which provides a "safe harbor" for forward-looking statements to encourage companies to provide prospective statements identifying important factors that could cause actual results to differ materially from those discussed in the statement. In addition, the Company's status as an exploration and development company without any present revenue producing operations increases the risks involved in an investment in the Company. These factors affecting us include, but are not limited to, the following:

5

Risks Inherent in the Mining Industry

The Company is subject to all of the risks inherent in the minerals exploration and mining industry and including, without limitation, the following:

• competition from a large number of companies, many of which are significantly larger than the Company, in the acquisition, exploration, and development of mining properties;

• the Company might not be able raise enough money to pay the fees, taxes and perform labor necessary to maintain its concessions in good force;

• exploration for minerals is highly speculative and involves substantial risks, even when conducted on properties known to contain significant quantities of mineralization, our exploration projects may not result in the discovery of commercially mineable deposits of ore;

• the probability of an individual prospect ever having reserves that meet the requirements of Securities Act Industry Guide 7 is extremely remote, or the properties may not contain any reserves, and any funds spent on exploration may be lost;

• our operations are subject to a variety of existing laws and regulations relating to exploration and development, permitting procedures, safety precautions, property reclamation, employee health and safety, air quality standards, pollution and other environmental protection controls and the Company may not be able to comply with these regulations and controls; and

• a large number of factors beyond the control of the Company, including fluctuations in metal prices, inflation, and other economic conditions, will affect the economic feasibility of mining.

THE BUSINESS OF MINERAL EXPLORATION IS SUBJECT TO MANY RISKS:

Fluctuating Price for Metals

The Company’s operations will be greatly influenced by the prices of commodities, particularly the price of uranium but also including gold, zinc, lead, copper, and other metals. These prices fluctuate widely and are affected by numerous factors beyond the Company’s control, including interest rates, expectations for inflation, speculation, currency values, in particular the strength of the United States dollar, global and regional demand, political and economic conditions and production costs in major metal producing regions of the world.

Title to Our Mineral Properties May be Challenged

We attempt to confirm the validity of its rights to title to, or contract rights with respect to, each mineral property in which we have a material interest. However, we cannot guarantee that title to our properties will not be challenged. Title insurance generally is not available, and our ability to ensure that we have obtained secure claim to individual mineral properties or mining concessions may be severely constrained. Our mineral properties may be subject to prior unregistered agreements, transfers or claims, and title may be affected by, among other things, undetected defects. In addition, we may be unable to operate our properties as permitted or to enforce our rights with respect to our properties.

8

Environmental Controls

Compliance with statutory environmental quality requirements may necessitate significant capital outlays, may materially affect the earning power of the Company, or may cause material changes in the Company’s intended activities. Our exploration operations require compliance with local and federal regulations. No assurance can be given that environmental standards imposed by either federal or state governments will not be changed or become more stringent, thereby possibly materially adversely affecting the proposed activities of the Company. In addition, if we are unable to fund fully the cost of remediation of any environmental condition, we may be required to suspend operations or enter into interim compliance measures pending completion of the required remediation.

Availability of Water

Water is essential in all phases of the exploration and development of mineral properties. It is used in such processes as exploration, drilling, leaching, placer mining, dredging, testing, and hydraulic mining. Mining and ore processing requires large volumes of water. Both the lack of available water and the cost of acquisition may make an otherwise viable project economically impossible to complete. Although work completed thus far indicates that an adequate supply of water can probably be developed in the area for an underground mining operation, the Company will need to complete an additional water exploration program to determine if there is sufficient water available for an open pit mining operation.

Shortages of Supplies and Materials

The mineral industry has experienced from time to time shortages of certain supplies and materials necessary in the exploration for and evaluation of mineral deposits. The prices at which such supplies and materials are available have also greatly increased. Our planned operations would likely be subject to delays due to such shortages and that further price escalations will increase the Company’s costs of such supplies and materials. Experience of the Company and of others in the industry is that suppliers are currently often unable to meet contractual obligations for supplies, equipment, materials, and services, and that alternate sources of supply do not exist.

Availability of Outside Engineers and Consultants

The Company is heavily dependent upon outside engineers and other professionals to complete work on its exploration projects. The mining industry has experienced significant growth over the last several years and as a result, many engineering and consulting firms have experienced a shortage of qualified engineering personnel. The Company closely monitors its outside consultants through regular meetings and review of resource allocations and project milestones. However, the lack of qualified personnel combined with increased mining projects could result in delays in completing work on our exploration projects or result in higher costs to keep personnel focused on our project.

9

At the present, the Company employs one full-time employee and two outside consultants in the United States, and relies in large part on the personal efforts of its officers and directors. The success of the Company’s proposed business will depend, in part, upon the ability to attract and retain qualified employees. The Company believes that it will be able to attract competent employees, but no assurance can be given that the Company will be successful in this regard. If the Company is unable to engage and retain the necessary personnel, its business would be materially and adversely affected.

RISKS RELATED TO OUR SECURITIES

There may be future sales or other dilution of our equity which may adversely affect the market price of our common stock.

We are not restricted from issuing additional common stock or preferred stock, including any securities that are convertible into or exchangeable for, or that represent the right to receive, common stock or preferred stock or any substantially similar securities. Our Board of Directors is authorized to issue additional shares of common stock and additional classes or series of preferred stock without any action on the part of the stockholders. Our Board of Directors also has the discretion, without stockholder approval, to set the terms of any such classes or series of preferred stock that may be issued, including voting rights, rights and preferences with respect to dividends or upon the liquidation, or winding up of our business and other terms. If we issue preferred shares in the future that have a preference over our common stock with respect to the payment of dividends or upon liquidation, dissolution or winding up, or if we issue preferred shares with voting rights that dilute the voting power of our common stock, the rights of our common stockholders or the market price of our common stock could be adversely affected.

The Company does not intend to declare any dividends in the foreseeable future.

The Company intends to retain any of its profits to fund the Company’s business operations. Investors who require income from dividends should not purchase our common stock.

The lack of a broker or dealer to create or maintain a market in our stock could adversely impact the price and liquidity of our securities.

The Company has no agreement with any broker or dealer to act as a market maker for its securities and there is no assurance that it will be successful in obtaining any market makers. Thus, no broker or dealer will have an incentive to make a market for our stock. This in part, has resulted in very low trading volume of our common stock. The lack of a market maker for our securities could adversely influence the market for and price of our securities, as well as your ability to dispose of, or to obtain accurate information about, and/or quotations as to the price of, our securities.

As our stock is not listed on a national securities exchange, trading in our shares will be subject to rules governing "penny stocks," which will impair trading activity in our shares.

Our stock is not on a national securities exchange. Therefore, our stock is subject to rules adopted by the Commission regulating broker dealer practices in connection with transactions in "penny stocks." Those disclosure rules applicable to "penny stocks" require a broker dealer, prior to a transaction in a "penny stock" not otherwise exempt from the rules, to deliver a standardized list disclosure document prepared by the Commission. That disclosure document advises an investor that investment in "penny stocks" can be very risky and that the investor's salesperson or broker is not an impartial advisor but rather paid to sell the shares. The disclosure contains further warnings for the investor to exercise caution in connection with an investment in "penny stocks," to independently investigate the security, as well as the salesperson with whom the investor is working and to understand the risky nature of an investment in this security. The broker dealer must also provide the customer with certain other information and must make a special written determination that the "penny stock" is a suitable investment for the purchaser and receive the purchaser's written agreement to the transaction. Further, the rules require that, following the proposed transaction, the broker provide the customer with monthly account statements containing market information about the prices of the securities.

These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for our common stock. Many brokers may be unwilling to engage in transactions in our common stock because of the added disclosure requirements, thereby making it more difficult for shareholders to dispose of their shares. Shareholders will also find it difficult to obtain accurate information about, and/or quotations as to the price of, our common stock. Consequently, the penny stock rules may affect the ability of broker-dealers to make a market in or trade our common stock and may also affect your ability to resell any shares you may purchase in the public markets.

As a company with a class of securities registered pursuant to the 1934 Act the Company has significant obligations under the 1934 Act.

Having a class of securities registered under the 1934 Act is a time consuming and expensive process and subjects the company to increased regulatory scrutiny and extensive and complex regulation. Complying with these regulations would be expensive and could require a significant amount of management’s time. For example, public companies are obligated to institute and maintain financial accounting controls and for the accuracy and completeness of their books and records. These requirements could necessitate additional corporate spending on procedures and personnel requiring us to reallocate funds from other business objectives.

Item 1B. Unresolved Staff Comments.

None.

Item 2. Properties.

Executive Office

Cyclone’s principal executive offices are located at 2186 S. Holly Street, Suite 104, Denver, CO 80222. The lease is in the name of our CEO, James G. Baughman and we sublease the office at a rate of $400 per month on a month-to-month basis.

11

The following is a description of the Company's mineral properties.

Mineral Claims and Leases

The mineral holdings in Tournigan USA, Inc. (“TUSA”) are comprised of 907 federal lode claims covering 18,100 acres in Wyoming, South Dakota and Arizona, along with 3 State leases covering 879 acres in Wyoming. All the claims and leases are 100% controlled in TUSA and there are no further underlying agreements, payments or royalties other than statutory Federal, State and County fees and production royalties. Annual fees and minimum work requirements to hold these properties currently amount to approximately $127,000. The claims were staked by Sweetwater River Resources and Cowboy Explorations of Wyoming who were contracted by TUSA to perform geological services. All the claims and leases are registered in TUSA’s name.

Wyoming

The Wyoming properties consist of 825 Federal claims covering 16,500 acres and 3 State leases covering 879 acres distributed in five areas of prospective uranium bearing geology. Some of the properties are close to former producing uranium mines or in-situ recovery (“ISR”) operations. These areas are Cyclone Rim in Sweetwater County; South Pass in Sublette and Fremont Counties; Alkali Creek and Whiskey Peak in Fremont County; and Shirley Basin in Carbon County.

12

Uranium mineralization in Wyoming is chiefly found in “roll-fronts”. The roll-fronts are crescent-shaped deposits formed in saturated, permeable sandstones. Groundwater flows through these host rocks carrying dissolved uranium and other metals such as iron, molybdenum, vanadium and selenium. These metals precipitate when the groundwater flow crosses the interface from oxidized conditions into reducing conditions in the sandstone and thereby deposit in the crescent-shaped forms.

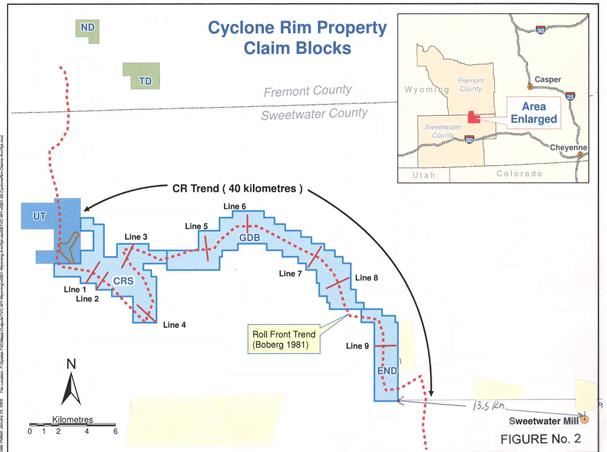

Cyclone Rim.

The largest exploration area in TUSA is in the Cyclone Rim covering 14,200 acres. The claims are located in the northwestern portion of the Great Divide Basin and are located in Township 26 North, Range 96 West and Township 25 North, Range 94 through 96 West. The property extends for 28 miles astride the “CR Trend” roll-front. The area is underlain by rock units of the Wasatch and the Battle Springs Formations, which host uranium mineralization in the eastern Great Divide Basin and at Crooks Gap/Green Mountain located approximately 30 miles west. The general area was explored in the early 1970’s by Union Carbide and Teton Exploration, and in the late 1970’s by Newmont Mining, Rocky Mountain Energy, Western Fuels and Ogle Petroleum. The current claim group was assembled between 2005 and 2008 and it covers an extensive length of potential roll-front mineralization from the UT claims in the west and along the CR trend for a further 25 miles of favorable uranium geology. The east end of these claims is approximately 8 miles west of Rio Tinto’s Sweetwater uranium processing mill. That facility is presently on care and maintenance.

13

The mineralization occurs as typical Wyoming sandstone hosted roll-front uranium mineralization in the Eocene age Battle Springs Formation. The lithology ranges from coarse sands and gravels to yellow and green silty sands and green sandy clay. Thin interbeds of green clay are common. The host unit is underlain by a thick bed of hard, chocolate brown clay shale. The mineralization tends to favor clayey sands.

Alteration, typical of roll-front uranium mineralization, consists of reddish oxidized sands in the barren interior, up-dip from the roll-front, to green and grey reduced sands at the outer, down-dip part of the roll-front. Pyrite grains in the barren interior are corroded, while in the roll-front and in the outer portions the grains are fresh. This can be an important clue for locating drill-hole positions relative to the roll-front.

The mineralization in this area ranges in depth from less than 100 feet to over 500 feet below the surface.

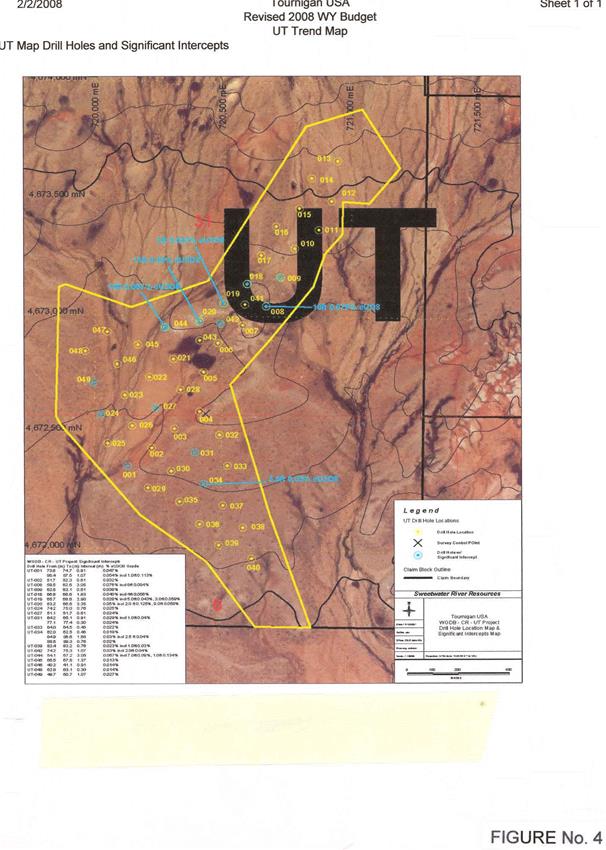

In 2007, TUSA drilled 49 vertical mud rotary holes, each being of 6” diameter, on the UT claims to follow up on reports of uranium mineralization located in the area in historic drilling by Rocky Mountain Energy. Holes were drilled on 400 ft. spacings and uranium mineralization was encountered in 15 of the holes. Additionally, TUSA drilled five core holes in order to twin holes containing the most significant mineralization. From the down-hole radiometric readings it appears that the mineralization is in at least two shallow roll-fronts within about 200 feet below the surface.

14

| Drill Hole | From | To | Thickness | Average Grade |

| (ft.) | (ft.) | (ft.) | (% eU3O8) | |

| UT-001 | 242 | 245 | 3.0 | 0.047% |

|

| 283.5 | 287 | 3.5 | 0.054% |

| Incl’d | 286 | 287 | 1.0 | 0.113% |

| UT-002 | 169.5 | 171.5 | 2.0 | 0.032% |

| UT-008 | 195.2 | 205.2 | 10.0 | 0.076% |

| UT-009 | 205 | 207 | 2.0 | 0.038% |

| UT-018 | 219 | 225 | 6.0 | 0.040% |

| Incl’d | 220.5 | 224.5 | 4.0 | 0.056% |

| UT-019 | 215.5 | 225 | 9.5 | 0.028% |

| Incl’d | 217 | 222 | 5.0 | 0.043% |

| Incl’d | 217.5 | 220.5 | 3.0 | 0.059% |

| UT-020 | 207.5 | 218.5 | 11.0 | 0.050% |

| Incl’d | 216.5 | 218.5 | 2.0 | 0.125% |

| UT-024 | 243.5 | 245.1 | 2.5 | 0.025% |

| UT-027 | 167.7 | 169.6 | 2 | 0.024% |

| UT-031 | 210.6 | 213.6 | 3 | 0.029% |

| UT-034 | 278.6 | 284.1 | 5.5 | 0.030% |

|

| 290.4 | 293 | 2.5 | 0.020% |

| UT-039 | 270.4 | 273 | 2.5 | 0.023% |

| UT-042 | 243.5 | 247.1 | 3.5 | 0.030% |

| UT-044 | 177.5 | 187.7 | 10 | 0.067% |

| UT-049 | 163.1 | 166 | 3.5 | 0.027% |

Note: The uranium grades are reported as % eU3O8 as determined by down-hole radiometric logging equipment. A number of the rotary holes that had the most significant intercepts were twinned with core holes, which were then sampled, analyzed and calibrated with the gamma log readings in order to increase the accuracy of the disequilibrium coefficient. This is a mathematical means of equating gamma log readings to actual % U3O8.

15

In order to carry out an initial test of the 25 mile long CR trend, TUSA carried out a drill program in late 2007/early 2008 where it drilled 33 mud rotary holes and one core hole along nine widely spaced fences of drill-holes to provide cross-sectional information along the trend. Each fence was about 2.5 miles apart and vertical holes were drilled 200 ft. apart on each fence. These holes were designed to test for uranium mineralization along the 26-mile trace of the roll front. Significant uranium mineralization was found in 5 of the holes on three of the section lines. The mineralization was encountered at depths ranging from 50 feet to 750 feet below the surface with the mineralization plunging towards the east.

|

|

|

|

|

|

|

|

| Drill Hole | Section Line | From (ft) | To (ft) | Thickness (ft) | % eU3O8 | Comment |

|

|

|

|

|

|

|

|

| CR-010 | Line 2 | 137.5 | 143.5 | 6.0 | 0.018 | incl 3.0ft 0.024% |

|

|

| 137.5 | 155.5 | 18.0 | 0.016 | incl 1.0ft 0.035% |

|

|

|

|

|

|

|

|

| CR-014 | Line 2 | 208.0 | 234.0 | 26.0 | 0.059 | incl 2.5ft 0.15% |

|

|

|

|

|

|

|

|

| CR-029 | Line 3 | 413.0 | 415.0 | 2.0 | 0.026 |

|

|

|

|

|

|

|

|

|

| CR-032 | Line 9 | 54.0 | 60.5 | 6.5 | 0.030 |

|

|

|

| 502.5 | 509.5 | 7.0 | 0.044 |

|

|

|

| 595.0 | 607.0 | 12.0 | 0.020 |

|

|

|

| 675.5 | 684.0 | 8.5 | 0.023 |

|

|

|

| 704.5 | 708.5 | 4.0 | 0.021 |

|

|

|

| 791.0 | 793.0 | 2.0 | 0.024 |

|

|

|

|

|

|

|

|

|

| CR-033 | Line 9 | 59.5 | 65.5 | 6.0 | 0.030 |

|

|

|

| 548.5 | 557.0 | 8.5 | 0.020 |

|

|

|

| 694.0 | 698.0 | 4.0 | 0.022 |

|

|

|

| 699.5 | 706.0 | 6.5 | 0.022 |

|

|

|

| 710.0 | 723.0 | 13.0 | 0.023 |

|

|

|

| 727.5 | 733.0 | 5.5 | 0.035 |

|

From these results it has been determined that uranium mineralization is present along a significant portion of the roll front trace. Furthermore, the mineralized intercepts appear to represent portions of a series of roll fronts stacked one on top of the other.

17

| U3O8 MINERALIZATION & PRODUCTION ALONG THE ROLL FRONT EAST OF CYCLONE URANIUM’S CYCLONE RIM | ||

|

Property | Mineralization MM Lbs U3O8 |

Comments |

| Lost Creek (Ur-Energy Inc.) | 10.9 |

|

| Lost Soldier (Ur-Energy Inc.) | 14.0 |

|

| JAB (Energy Metals Corp.) | 3.6 |

|

| Sweetwater Mine (Rio Tinto) | 1.3 | historic production |

| Total | 29.8 |

|

Note: Cyclone does not own nor control any of these deposits.

The Alkali Creek and Whiskey Peak claims, totaling about 1,200 acres, lie about 8 miles north of the UT claims and are adjacent to claims held by Energy Metals Corporation. A reclaimed ISR operation that was operated by Ogle Petroleum is in the immediate vicinity. The Alkali Creek claims encompass historic close-spaced drilling patterns of Teton Energy and Newmont Mining.

South Pass

The 36 claims and 2 leases covering about 800 acres at South Pass are located along the southeast flank of the Wind River Mountains in the Green River Basin. Exploration was carried out in this area in the late 1960s by Federal American Partners, Getty Oil and Gulf Resources. In general they identified widespread low-grade mineralization over portions of a 26 mile long roll-front. Two mineralized areas, known as the East Sage and the Brett, were identified at that time. These may be evaluated by Cyclone Uranium for the possible application of ISR.

Shirley Basin

The Shirley Basin uranium district is located in the northeastern part of Carbon County, between Casper and Medicine Bow. Uranium was historically produced from four mines beginning in 1959. Utah Construction and Homestake operated underground mines and Petronomics developed two open pits. Mineralization in the area is hosted in the Wind River Formations of Eocene age.

TUSA holds claims at the southern end of the Middle Shirley Basin Trend in an area of reported uranium mineralization. The MSB block of 21 claims cover an area of approximately 400 acres. No exploration has been carried out by TUSA to date.

18

South Dakota

In South Dakota, TUSA holds three claim blocks totaling 51 claims over 1,000 acres in an area approximately 8 miles north of the town of Edgemont in the southern Black Hills district. The area covered by these claim blocks were initially held by Union Carbide and the Tennessee Valley Authority as part of a larger block known as the Chord claims. The Chord property encompassed more than 40 small open pits as well as a few underground operations. These operations produced uranium intermittently from the early 1950’s till the late 60’s, supplying ore to a former mill at Edgemont.

The three TUSA blocks are known as the Long, RC and DH claims and are located generally within the Long Mountain structural zone. This northeast trending fault zone, running through the area of the historic Chord claims, is approximately two miles wide, with uranium mineralization being hosted in four sandstone formations. Two of these are in the Cretaceous age Lakota Formations and two are in the overlying sandstone sequences.

The Long claims consist of 33 claims covering 650 acres that encompass a 3 mile long by 1 mile wide mineralized trend that includes pre-existing claims controlled by Strathmore Minerals. These cover the historic Viking, Virginia C and Ridge Runner deposits. The eastern portion of the Long claims surrounds the historic Long Mountain deposits, some of which are also covered by Strathmore claims. The US Forest Service has prepared a Draft Environment Assessment covering certain lands in the Craven Canyon and Long Mountain area, which proposes a "Mineral Withdrawal" to protect regional cultural and other resources on National Forest lands. This proposed action would "withdraw" some of our TUSA claims from mineral exploration and future development.

19

Approximately 1 mile east of the Long claims is the 8 claim RC claim block covering 150 acres. This area contains two areas of prospective uranium mineralization as well as the Hot Point mineralized area.

The 10 claim DH claim block covers about 200 acres in an area 1 mile south of the RC claims where in 1971 the US Geological Survey reported “widespread low grade mineralization”. Historic production was won from several small pits and at least two small underground operations where the reported average grade was 0.25% U3O8 and 0.30% vanadium oxide.

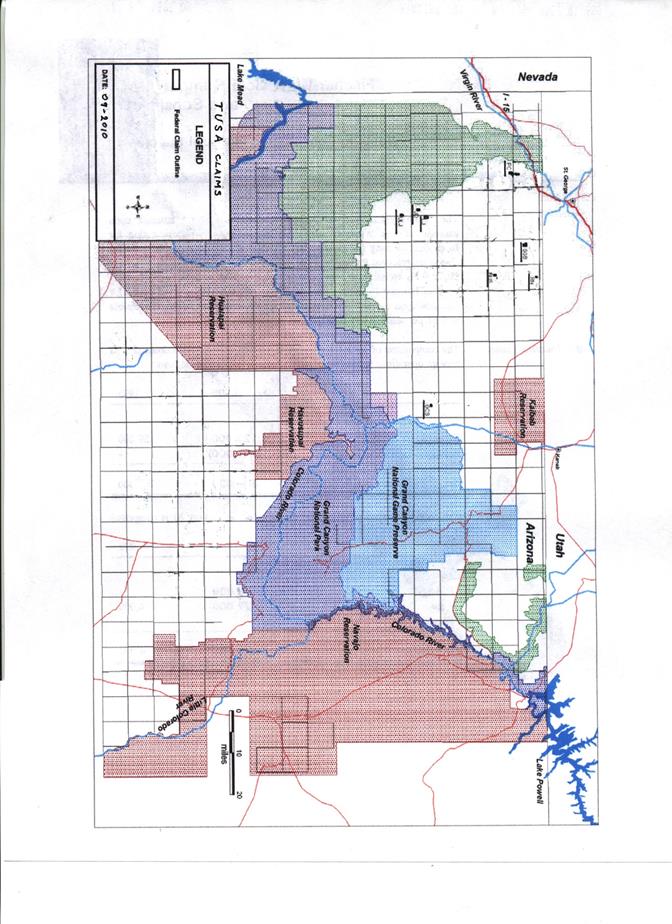

Arizona

TUSA holds 31 federal lode claims on approximately 600 acres in Mohave County , northern Arizona, in the area known as the Arizona Strip immediately south of the Utah border. Uranium mineralization in these areas is hosted in “collapse” breccia pipes caused by the collapse of overlying rock strata into solution cavity caverns in the underlying limestones. Uranium mineralization was realized in the breccia pipes, at specific favorable horizons, by the action of downward migrating ground waters carrying dissolved uranium. The amounts are relatively small horizontal tabular mineralization, but are among the highest grade in the United States.

The breccia pipes are about 300 feet in diameter on average and are recognized as a circular depression on the surface. There are a lot of these structures in northern Arizona and about 1% of them appear to be mineralized. TUSA’s non-contiguous 9 blocks of claims cover about 10 depressions.

TUSA has carried out extensive field work on about 80 of these depression areas in the form of geological mapping along with soil and rock geochemical sampling since geochemical surveys have been shown in the past to be effective in identifying associated uranium mineralization. Based on this work TUSA selected about 20 areas as high priority targets. Several of these targets were followed up with geophysical surveys in order to map out the vertical shape of the breccia pipes. Audio-frequency magnetotelluric surveys, using both natural source and controlled source, as well as limited seismic surveys were carried out on about 10 of the high priority targets. This was followed up with 11 holes being drilled into 4 targeted pipes for a total of 8,421 feet of drilling. Breccias were encountered in several of the holes and down-hole gamma surveys were carried out. The results are being evaluated to determine what follow-up programs should be planned.

20

The TUSA properties currently have no reserves and there is no assurance that the projects will advance from their present exploration stage. All of the exploration on the properties to date has been carried out by Cowboy Explorations of Laramie, Wyoming, a qualified and experienced geological contractor with extensive local geological knowledge.

New Fork Properties

With the acquisition of New Fork on March 14, 2012, Cyclone Uranium increased its claim holding in Wyoming by 519 claims, or approximately 10,000 acres. The claims are located in Sweetwater County, Wyoming. The map below shows the claims.

RCR Claims

This group of sixteen unpatented claims covering an area of approximately 320 acres is located in Sections 1 & 2, T25N, R90W, 6th Principal Meridan, Sweetwater County, Wyoming. The claims were located on Februray 22, 2011 and filed with Sweetwater County on April 14, 2011. The claims were filed with Bureau of Land Management in Cheyenne, Wyoming on May 12, 2011.

22

This group of forty two unpatented claims covering an area of approximately 840 acres is located in Sections 11, 12, 13, & 14, T25N, R9W, 6th Principal Meridan, Sweetwater County, Wyoming. The claims were located on Februray 22, 2011 and filed with Sweetwater County on April 14, 2011. The claims were filed with Bureau of Land Management in Cheyenne, Wyoming on May 12, 2011.

Juliet Claims

This group of eighteen unpatented claims covering an area of approximately 360 acres is located in Section 36 T26N, R91W, Sections 31 & 32 T26N, R90W, and Sections 5 & 6 T25N R90W 6th Principal Meridan, Sweetwater County, Wyoming. The claims were located on Februray 24, 2011 and filed with Sweetwater County on April 14, 2011. The claims were filed with Bureau of Land Management in Cheyenne, Wyoming on May 12, 2011.

CS Claims

This group of thirty unpatented claims covering an area of approximately 600 acres is located in Sections 14, 15, 16, 22, & 23 T25N, R91W, 6th Principal Meridan, Sweetwater County, Wyoming. The claims were located on Febuary 22, 2011 and filed with Sweetwater County on April 14, 2011. The claims were filed with Bureau of Land Management in Cheyenne, Wyoming on May 12, 2011.

EGL Claims

This group of twenty three unpatented claims covering an area of approximately 460 acres is located in Sections 33, 34, 35 T26N, R92W, and Sections 4, 3, & 2 T25N R92W, 6th Principal Meridan, Sweetwater County, Wyoming. The claims were located on Febuary 21, 2011 and filed with Sweetwater County on April 14, 2011. The claims were filed with Bureau of Land Management in Cheyenne, Wyoming on May 12, 2011.

HS Claims

This group of fourteen unpatented claims covering an area of approximately 280 acres is located in Sections 8, 9, 16, & 17 T26N, R91W, 6th Principal Meridan, Sweetwater County, Wyoming. The claims were located on Feburary 23, 2011 and filed with Sweetwater County on April 14, 2011. The claims were filed with Bureau of Land Management in Cheyenne, Wyoming on May 12, 2011.

WO Claims

This group of sixteen unpatented claims covering an area of approximately 320 acres is located in Sections 22 & 27 T26N, R91W, 6th Principal Meridan, Sweetwater County, Wyoming. The claims were located on Feburary 23, 2011 and filed with Sweetwater County on April 14, 2011. The claims were filed with Bureau of Land Management in Cheyenne, Wyoming on May 12, 2011.

GB Claims

This group of ten unpatented claims covering an area of approximately 200 acres is located in Section 21 T26N, R91W, 6th Principal Meridan, Sweetwater County, Wyoming. The claims were located on Feburary 23, 2011 to March 5, 2011 and filed with Sweetwater County on April 14, 2011. The claims were filed with Bureau of Land Management in Cheyenne, Wyoming on May 12, 2011.

23

This group of eighty seven unpatented claims covering an area of approximately 1,740 acres is located in Sections 20, 29, 30, 31, 32 T26N, R90W and Sections 25 & 36 T26N, R91W, 6th Principal Meridan, Sweetwater County, Wyoming. The claims were located on Feburary 23 & 24, 2011 and filed with Sweetwater County on April 14, 2011. The claims were filed with Bureau of Land Management in Cheyenne, Wyoming on May 12, 2011.

OD2 Claims

This group of one hundred and five unpatented claims covering an area of approximately 1,800 acres is located in Sections 13 T26N, R92W and Sections 7, 8, 9, 17, 18, 19 T26N R91W, 6th Principal Meridan, Sweetwater County, Wyoming. Nintey claims were located on Feburary 14, 15, 16, & 23 2011 and filed with Sweetwater County on April 14, 2011. The claims were filed with Bureau of Land Managerment in Cheyenne, Wyoming on May 12, 2011. Fifteen additonal claims were staked on April 23, 2011. These claims were filed with Sweetwater County, Wyoming on May 24, 2011 and with the Bureau of Land Management in Cheyenne, Wyoming on July 14, 2011.

OSB Claims

This group of one hundred sixty unpatented claims covering an area of approximately 3,200 acres is located in Section 13 T26N, R92W and Sections 7, 8, 9, 17, 18, 19 T26N R91W, 6th Principal Meridan, Sweetwater County, Wyoming. The claims were located on Feburary 16, 18, 19, & 21 2011 and filed with Sweetwater County on April 14, 2011. The claims were filed with Bureau of Land Managerment in Cheyenne, Wyoming on May 12, 2011.

The New Fork claim areas were drilled by Kerr McGee and by Conoco in the late 1970s and the 1980s with no further work being carried out until the areas were restaked by New Fork. The New Fork properties currently have no reserves and there is no assurance that the claims will advance from their present exploration stage.

Item 3. Legal Proceedings.

None.

Item 4. (Mine Safety Disclosures)

Not applicable.