SECTION 6.9

Information about this report

Unreasonable prejudice

As permitted by sections 299(3) and 299A(3) of the Corporations Act 2001, we have omitted certain information from our operating and financial review in relation to our business strategy, future prospects and likely developments in our operations and the expected results of those operations in future financial years. We have done this on the basis that such information, if disclosed, would be likely to result in unreasonable prejudice to Woodside (for example, because the information is premature, commercially sensitive, confidential or could give a third-party a commercial advantage). The omitted information relates to our internal budgets, forecasts and estimates, details of our business strategy, and LNG contractual pricing.

Forward-looking statements

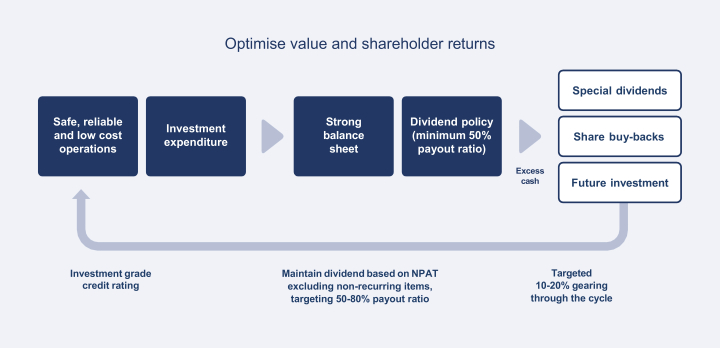

This report may contain forward-looking statements with respect to Woodside’s business and operations, market conditions, results of operations and financial condition, including, for example, but not limited to, statements about expectations regarding long-term demand for Woodside’s products, timing of completion of Woodside’s projects, expected synergies from the merger with BHP’s petroleum business, expectations regarding growth opportunities, Woodside’s strategic framework, Woodside’s dividend policy, future results of projects, operating activities, and new energy products, and expectations regarding the achievement of Woodside’s Scope 1 and 2 net equity emissions reduction and new energy investment target and other climate, sustainability and ESG goals. All forward-looking statements contained in this report reflect Woodside’s views held as at the date of this report. All statements, other than statements of historical or present facts, are forward-looking statements and generally may be identified by the use of forward-looking words such as ‘guidance’, ‘foresee’, ‘likely’, ‘potential’, ‘anticipate’, ‘believe’, ‘aim’, ‘estimate’, ‘expect’, ‘intend’, ‘may’, ‘target’, ‘plan’, ‘forecast’, ‘project’, ‘schedule’, ‘will’, ‘should’, ‘seek’ and other similar words or expressions. Similarly, statements that describe the objectives, plans, goals or expectations of Woodside are or may be forward- looking statements.

The information and statements in this report about Woodside’s future strategy and other forward-looking statements are not guidance, forecasts, guarantees or predictions of future events or performance, but are in the nature of aspirational targets that Woodside has set for itself and its management of the business.

Those statements and any assumptions on which they are based are only opinions and are subject to change without notice and are subject to inherent known and unknown risks, uncertainties, assumptions and other factors, many of which are beyond the control of Woodside, its related bodies corporate and their respective beneficiaries.

Important factors that could cause actual results to differ materially from those in the forward-looking statements include, but are not limited to, fluctuations in commodity prices, actual demand, currency fluctuations, geotechnical factors, drilling and production results, gas commercialisation, development progress, operating results, engineering estimates, reserve estimates, loss of market, industry competition, environmental risks, climate related risks, physical risks, legislative, fiscal and regulatory developments, changes in accounting standards, economic and financial markets conditions in various countries and regions, political risks, project delay or advancement, approvals, cost estimates and the effect of future regulatory or legislative actions on Woodside or the industries in which it operates, including potential changes to tax laws, as well as general economic conditions, prevailing exchange rates and interest rates and conditions in financial markets.

Details of the key risks relating to Woodside and its business can be found in the section 3.8 - Risk factors. You should review and have regard to these risks when considering the information contained in this report.

If any of the assumptions on which a forward-looking statement is based were to change or be found to be incorrect, this would likely cause outcomes to differ from the statements made in this report.

Investors are strongly cautioned not to place undue reliance on any forward-looking statements. Actual results or performance may vary materially from those expressed in, or implied by, any forward-looking statements. None of Woodside nor any of its related bodies corporate, nor any of their respective beneficiaries, nor any person named in this report or involved in the preparation of the information in this report, makes any representation, assurance, guarantee or warranty (either express or implied) as to the accuracy or likelihood of fulfilment of any forward-looking statement, or any outcomes, events or results expressed or implied in any forward-looking statement in this report.

Past performance (including historical financial information and pro forma information) is given for illustrative purposes only. It should not be relied on and is not necessarily a reliable indicator of future performance, including future security prices.

A-43