UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________

FORM

_________________

| (Mark One) |

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended |

or

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number:

_____________________

(Exact name of registrant as specified in its charter)

_____________________

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| (Address of principal executive offices) | (Zip Code) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Symbol | Name of each exchange on which registered | |||

Securities registered pursuant to Section 12(g) of the Act: None

_________________

Indicate by check mark if the registrant is

a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [_]

Indicate by check mark if the registrant is

not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [_]

Indicate by check mark whether the registrant

(1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months

(or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements

for the past 90 days.

Indicate by check mark whether the registrant

has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405

of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

| 1 |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [_] | Accelerated filer [_] | |

| Smaller reporting company | ||

| Emerging growth company | ||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [_]

Indicate by check mark whether the registrant

has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial

reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or

issued its audit report.

If securities are registered pursuant to Section

12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction

of an error to previously issued financial statements.

Indicate by check mark whether any of those

error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s

executive officers during the relevant recovery period pursuant to §240.10D-1(b).

Indicate by check mark whether the registrant

is a shell company (as defined in Rule 12b-2 of the Act). Yes [_]

The number of shares of the registrant’s

common stock outstanding as of March 17, 2024 was . The aggregate market value of the shares of Common Stock held by non-affiliates

of the registrant as of June 30, 2023, the last day of business of our most recently completed second fiscal quarter, was $

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the FRP Holdings, Inc. 2023 Annual Report to Shareholders are incorporated by reference in Parts I and II.

Portions of the FRP Holdings, Inc. Proxy Statement which will be filed with the Securities and Exchange Commission not later than March 31, 2024 are incorporated by reference in Part III.

| 2 |

FRP HOLDINGS, INC.

FORM 10-K

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2023

TABLE OF CONTENTS

| Page | ||||||

| PART I | ||||||

| Item 1. | Business | 5 | ||||

| Item 1A. | Risk Factors | 6 | ||||

| Item 1B. | Unresolved Staff Comments | 11 | ||||

| Item 1C. | Cybersecurity | 11 | ||||

| Item 2. | Properties | 12 | ||||

| Item 3. | Legal Proceedings | 16 | ||||

| Item 4. | Mine Safety Disclosures | 16 | ||||

| PART II | ||||||

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 17 | ||||

| Item 6. | [Reserved] | 17 | ||||

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 17 | ||||

| Item 7A. | Quantitative and Qualitative Disclosures about Market Risk | 18 | ||||

| Item 8. | Financial Statements and Supplementary Data | 18 | ||||

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 18 | ||||

| Item 9A. | Controls and Procedures | 18 | ||||

| Item 9B. | Other Information | 19 | ||||

| Item 9C. | Disclosure Regarding Foreign Jurisdictions that Prevent Inspections | 19 | ||||

| PART III | ||||||

| Item 10. | Directors, Executive Officers and Corporate Governance | 20 | ||||

| Item 11. | Executive Compensation | 20 | ||||

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 20 | ||||

| Item 13. | Certain Relationships and Related Transactions, and Director Independence | 21 | ||||

| Item 14. | Principal Accounting Fees and Services | 21 | ||||

| PART IV | ||||||

| Item 15. | Exhibits and Financial Statement Schedules | 21 | ||||

| Item 16. | Form 10-K Summary | 21 | ||||

| Signatures | 22 | |||||

| 3 |

Preliminary Note Regarding Forward-Looking Statements.

Certain matters discussed in the report contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The words or phrases “anticipate,” “estimate,” “believe,” “budget,” “continue,” “could,” “intend,” “may,” “plan,” “potential,” “predict,” “seek,” “should,” “will,” “would,” “expect,” “objective,” “projection,” “forecast,” “goal,” “guidance,” “outlook,” “effort,” “target” and similar expressions identify forward-looking statements. Such statements reflect management’s current views with respect to financial results related to future events and are based on assumptions and expectations that may not be realized and are inherently subject to risks and uncertainties, many of which cannot be predicted with accuracy and some of which might not even be anticipated. Future events and actual results, financial or otherwise, may differ, perhaps materially, from the results discussed in the forward-looking statements. Risk factors discussed in Item 1A of this Form 10-K and other factors that might cause differences, some of which could be material, include, but are not limited to: the possibility that we may be unable to find appropriate investment opportunities; levels of construction activity in the markets served by our mining properties; demand for flexible industrial and commercial facilities in the Baltimore-Washington-Northern Virginia area; demand for apartments in Washington D.C and Greenville, SC; our ability to obtain zoning and entitlements necessary for property development; the impact of lending and capital market conditions on our liquidity, our ability to finance projects or repay our debt; general real estate investment and development risks; vacancies in our properties; risks associated with developing and managing properties in partnership with others; competition; our ability to renew leases or re-lease spaces as leases expire; illiquidity of real estate investments; bankruptcy or defaults of tenants; the impact of restrictions imposed by our credit facility; the level and volatility of interest rates; environmental liabilities; inflation risks; cyber security risks; as well as other risks listed from time to time in our SEC filings, including but not limited to, our annual and quarterly reports. We have no obligation to revise or update any forward-looking statements, other than as imposed by law, as a result of future events or new information. Readers are cautioned not to place undue reliance on such forward-looking statements. Additional information regarding these and other risk factors may be found in the Company’s other filings made from time to time with the Securities and Exchange Commission.

| 4 |

PART I

Item 1. BUSINESS.

FRP Holdings, Inc., a Florida corporation (the “Company”) was incorporated on April 22, 2014 in connection with a corporate reorganization that preceded the Spin-off of Patriot Transportation Holding, Inc. The Company’s predecessor issuer was formed on July 20, 1998. The business of the Company is conducted through our wholly-owned subsidiaries FRP Development Corp., a Maryland corporation, and Florida Rock Properties, Inc., a Florida corporation, and the various subsidiaries and joint ventures of each.

Our Business. The Company is a holding company engaged in various real estate businesses. Our business segments are: (i) leasing and management of industrial and commercial properties (the “Industrial and Commercial Segment” previously named “Asset Management Segment”), (ii) leasing and management of mining royalty land owned by the Company (the “Mining Royalty Lands Segment”), (iii) real property acquisition, entitlement, development and construction primarily for multifamily, industrial and commercial, or residential either alone or through joint ventures (the “Development Segment”), (iv) ownership, leasing and management of apartment buildings through joint ventures (the “Multifamily Segment” previously named “Stabilized Joint Venture Segment”).

The Industrial and Commercial Segment owns, leases and manages in-service commercial properties wholly owned by the Company or through joint ventures. Currently this includes eight warehouses in two business parks, an office building partially occupied by the Company, and two ground leases.

Our Mining Royalty Lands Segment owns several properties totaling approximately 16,650 acres currently under lease for mining rents or royalties and an additional 4,280 acres through our Brooksville joint venture with Vulcan Materials. Other than one location in Virginia, all of our mining properties are located in Florida and Georgia.

Our Development Segment owns and continuously monitors the highest and best use of parcels of land that are in various stages of development. The overall strategy for this segment is to convert all of our non-income producing property into income-producing property through (i) an orderly process of constructing new apartment, retail, warehouse, and office buildings to be operated by the Company or (ii) a sale to, or joint venture with, third parties. Additionally, our Development Segment will form joint ventures on new developments of land not previously owned by the Company.

The Multifamily Segment includes joint ventures which own, lease and manage buildings that have met our initial lease-up criteria. We intend to transfer additional joint ventures from our Development Segment into this segment as they reach stabilization. Stabilization occurs when a minimum occupancy threshold has been achieved for a certain period of time.

Competition. As a developer, we compete with numerous developers, owners and operators of real estate, many of whom own properties similar to ours in the same submarkets in which our properties are located. Price, location, rental space availability, flexibility of design and property management services are the major factors that affect competition.

Customers. In the Mining Royalty Lands Segment, we have a total of five tenants currently leasing our mining locations, and Vulcan Materials Company (“Vulcan” or “Vulcan Materials”) accounted for 24% of the Company’s consolidated revenues in 2023. An event affecting Vulcan’s ability to perform under its lease agreements could materially impact the Company’s results.

Sales and Marketing. We use national brokerage firms to assist us in marketing our vacant properties. Our hands-on in-house management team focuses on tenant satisfaction during the life of the lease which we have found to be very beneficial with respect to our tenant renewal success rate over the years.

| 5 |

Financial Information. Financial information is discussed by industry segment in Note 10 to the consolidated financial statements included in the accompanying 2023 Annual Report to Shareholders, which is incorporated herein by reference.

Environmental Matters. The Company incurs costs from time to time to investigate and remediate environmental contamination on its real estate, in particular, in connection with our Development Segment. The Company's mining leases contain provisions under which the lessee is responsible for environmental liabilities and reclamation of mining sites at least to the extent required by law.

Human Capital. The Company employed 15 people and was provided services by three executive officers under a related party agreement at December 31, 2023. Our small but dedicated workforce has extraordinarily low turnover, and the average tenure of our employee is 12.3 years. We are committed to an inclusive and diverse culture and do not tolerate any sort of discrimination. We maintain a whistleblower hotline allowing employees to report complaints on an anonymous basis.

Company Website. The Company’s website may be accessed at www.frpdev.com. All of our filings with the Securities and Exchange Commission are accessible through our website promptly after filing. This includes annual reports on Form 10-K, proxy statements, quarterly reports on Form 10-Q, current reports filed or furnished on Form 8-K and all related amendments.

Item 1A. RISK FACTORS.

Our future results may be affected by a number of factors over which we have little or no control. The following issues, uncertainties, and risks, among others, should be considered in evaluating our business and outlook. Also, note that additional risks not currently identified or known to us could also negatively impact our business or financial results.

Risks Relating to our Business

A decline in the economic conditions in Baltimore and Washington, D.C. markets could adversely affect our business.

Nearly all of our residential/mixed-use and commercial properties are located in the Baltimore area and Washington, D.C. We are, therefore, subject to increased exposure to (positive or negative) economic factors and other competitive factors specific to markets in confined geographic areas. Our operations may also be affected if too many competing properties are built in these markets. An economic downturn in these markets resulting from factors outside of our control could adversely affect our operation. Such a downturn could be triggered by such factors as the downsizing or relocation of government jobs, crime or acts of terrorism. We cannot be sure that these markets will continue to grow or demand the type of assets in our portfolio.

We conduct a significant portion of our operations through joint ventures, which may lead to disagreements with our joint venture partners and adversely affect our interests in the joint ventures.

We currently are a party to several joint ventures and we may enter into additional joint ventures in the future. In each of our existing joint ventures, the consent of our joint venture partner is required to take certain actions, and in some cases will share equal voting control. Our joint venture partners, as well as future partners, may have interests that are different from ours which may result in conflicting views as to the conduct of the joint ventures. In the event that we have a disagreement with a joint venture partner as to the resolution of a particular issue to come before the joint venture, or as to the conduct or management of the joint venture generally, we may not be able to resolve such disagreement in our favor and such a disagreement could have a material adverse effect on our interest in the joint venture or on the business of the joint venture generally.

Our business may be adversely affected by seasonal factors and harsh weather conditions.

| 6 |

The Mining Royalty Lands Segment and the Development Segment could be adversely affected by reduced construction and mining activity during periods of inclement weather. These factors could cause our operating results to fluctuate from quarter to quarter. An occurrence of unusually harsh or long-lasting inclement weather such as hurricanes, tornadoes and heavy snowfalls could have an adverse effect on our operations and profitability.

Our business could be negatively impacted by cyberattacks targeting our computer and telecommunications systems and infrastructure, or targeting those of our third-party service providers.

Our business, like other companies in our industry, has become increasingly dependent on digital technologies, including technologies that are managed by third-party service providers on whom we rely to help us collect, host or process information. Such technologies are integrated into our business operations. Use of the internet and other public networks for communications, services, and storage, including "cloud" computing, exposes all users (including our business) to cybersecurity risks.

While we and our third-party service providers commit resources to the design, implementation, and monitoring of our information systems, there is no guarantee that our security measures will provide absolute security. Despite these security measures, we may not be able to anticipate, detect, or prevent cyberattacks, particularly because the methodologies used by attackers change frequently or may not be recognized until launched, and because attackers are increasingly using techniques designed to circumvent controls and avoid detection. We and our third-party service providers may therefore be vulnerable to security events that are beyond our control, and we may be the target of cyber-attacks, as well as physical attacks, which could result in information security breaches and significant disruption to our business.

Our revenues depend in part on construction sector activity, which tends to be cyclical.

Our Mining Royalty Lands Segment revenues are derived from royalties on construction aggregates mined on our properties. Thus, our results depend in part on residential, commercial and infrastructure construction activity and spending levels. The construction industry in our markets tends to be cyclical. Construction activity and spending levels vary across our markets and are influenced by interest rates, inflation, consumer spending habits, demographic shifts, environmental laws and regulations, employment levels and the availability of funds for public infrastructure projects. Economic downturns may lead to recessions in the construction industry, either in individual markets or nationally.

Our operations are subject to various environmental laws and regulations, the violation of which could result in substantial fines or penalties.

Liability for environmental contamination on real property owned by the Company may include the following costs, without limitation: investigation and feasibility study costs, remediation costs, litigation costs, oversight costs, monitoring costs, institutional control costs, penalties from state and federal agencies and third-party claims. These costs could be substantial and in extreme cases could exceed the value of the contaminated property. Moreover, on-site operations may be suspended until certain environmental contamination is remediated and/or permits are received, and governmental agencies can impose permanent restrictions on the manner in which a property may be used depending on the extent and nature of the contamination. This may result in a breach of the terms of the lease entered into with our tenants. Governmental agencies also may create liens on contaminated sites for damages it incurred to address such contamination. In addition, the presence of hazardous substances at, on, under or from a property may adversely affect our ability to sell the property or borrow funds using the property as collateral, thus harming our financial condition.

The presence of contaminated material at our Riverfront on the Anacostia development site will subject us to substantial environmental liability and costs as construction proceeds.

With respect to Phases III and IV of the Riverfront on the Anacostia site in Washington, D.C., preliminary environmental testing has indicated the presence of contaminated material that will have to be specially handled in excavation in conjunction with construction. While we have recovered partial reimbursement for these costs from neighboring property owners, we still expect to incur significant environmental costs in

| 7 |

connection with construction.

The Company has no obligation to remediate this contamination on Phases III and IV of the development until such time as it makes a commitment to commence construction on each phase. The Company's actual expense to address this issue may be materially higher or lower than the expense previously recorded depending upon the actual costs incurred.

The geographic concentration of our properties makes our business more vulnerable to severe weather conditions, natural disasters and climate change.

Climate change presents an array of risks to real estate companies due to sea level rise, flooding, extreme weather, stronger storms and human migration. A significant number of our properties are located in areas that are susceptible to hurricanes, tropical storms, flooding, sea level rise and other natural disasters. We have accounted for the risk of flooding and sea level rise in the design of our Riverfront on the Anacostia development. Future developments, including potential “second life” uses of our mining properties, could be impacted by these factors and the impacts that they have on human behavior. Weather conditions could disrupt the business of our tenants, which may affect the ability of some tenants to pay rent and/or their willingness to remain in or move to affected areas. [Additionally, the cost of insurance associated with our properties has increased, and future weather conditions may cause premiums to increase in the future.]

Uninsured losses could significantly reduce our earnings.

We self-insure for a portion of our claims exposure resulting from workers’ compensation, auto liability, general liability and employees’ health insurance. We also are responsible for our legal expenses relating to such claims. We maintain insurance above the amounts for which we self-insure with licensed insurance carriers. Although we believe the aggregate insurance limits should be sufficient to cover reasonably expected claims, it is possible that one or more claims could exceed our aggregate coverage limits. Additionally, there are certain losses, such as losses from hurricanes, terrorism, wars or earthquakes, where insurance is limited or not economically justifiable. If the Company experiences an uninsured loss of real property, we could lose both the invested capital and anticipated revenues associated with such property. We accrue currently for estimated incurred losses and expenses and periodically evaluate and adjust our claims’ accrued liability to reflect our experience. However, ultimate results may differ from our estimates, which could result in losses greater than accrued amounts.

We may be unable to renew leases or re-lease properties as leases expire.

When a lease expires, a tenant may elect not to renew it. If that occurs, we may not be able to lease the property on similar terms. The terms of renewal or re-lease (including the cost of required renovations and concessions to tenants) may be less favorable than the prior lease. If we are unable to lease all or substantially all of our properties, or if the rental rates upon such re-leasing are significantly lower than expected rates, our cash generated before debt repayments and capital expenditures may be adversely affected.

We may be unable to lease currently vacant properties.

If we are unable to obtain leases sufficient to cover carrying costs, then our cash flows may be adversely affected.

The bankruptcy or insolvency of significant tenants with long-term leases may adversely affect income produced by our properties.

Should tenants default on their obligations, our cash flow would be adversely affected, and we may not be able to find another tenant to occupy the space under similar terms or may have to make expenditures to retrofit or divide the space. Additionally, we may have to incur a non-cash expense for a significant amount of deferred rent revenue generated from the accounting requirement to straight-line rental revenues. The bankruptcy or insolvency of a major tenant may also adversely affect the income produced by a property. If any of our tenants become a debtor in a case under the U.S. Bankruptcy Code, we cannot evict that tenant

| 8 |

solely because of its bankruptcy. The bankruptcy court may authorize the tenant to reject and terminate its lease with the Company. Our claim against such a tenant for unpaid future rent would be subject to a statutory limitation that may be substantially less than the remaining rent actually owed to us under the tenant’s lease. Any shortfall in rent payments could adversely affect our cash flow.

Our inability to obtain necessary approvals for property development could adversely affect our profitability.

We may be unable to obtain, or incur delays in obtaining, necessary zoning, land-use, building, occupancy and other required governmental permits and authorizations, which could result in increased costs or abandonment of certain projects. Before we can develop a property, we must obtain a variety of approvals from local and state governments with respect to such matters as zoning, density, parking, subdivision, site planning and environmental issues. Legislation could impose moratoriums on new real estate development or land-use conversions from mining to development. These factors may reduce our profit or growth and may limit the value of these properties.

Real estate investments are not as liquid as other types of assets.

The illiquid nature of real estate investments may limit our ability to react promptly to changes in economic or other conditions. In addition, significant expenditures associated with real estate investments, such as mortgage payments, real estate taxes and maintenance costs, are generally not reduced when circumstances cause a reduction in income from the investments. Thus, the illiquid nature of our real estate investments could adversely affect our profitability under certain economic conditions.

Our debt service obligations may have adverse consequences on our business operations.

We use debt to finance our operations, including acquisitions of properties. As of December 31, 2023, we had outstanding non-recourse mortgage indebtedness of $180,070,000, secured by developed real estate properties having a carrying value of $246,804,000. Our use of debt may have adverse consequences, including the following:

| · | Our cash flows from operations may not be sufficient to meet required payments of principal and interest. |

| · | We may be forced to dispose of one or more of our properties, possibly on disadvantageous terms, to make payments on our debt. |

| · | We may default on our debt obligations, and the lenders may foreclose on our properties that collateralize those loans. |

| · | A foreclosure on one of our properties could create taxable income without any accompanying cash proceeds to pay the tax. |

| · | We may not be able to refinance or extend our existing debt. |

| · | The terms of any refinancing or extension may not be as favorable as the terms of our existing debt. |

| · | We may not be able to issue debt on unencumbered properties under reasonable terms to finance growth of our portfolio of properties. |

| · | We may be subject to a significant increase in the variable interest rates on our unsecured and secured lines of credit, which could adversely impact our operations. |

| · | Our debt agreements have yield maintenance requirements that result in a penalty if we prepay loans. |

Our uncollateralized revolving credit agreement restricts our ability to engage in some business activities.

Our uncollateralized revolving credit agreement contains customary negative covenants and other financial and operating covenants that, among other things:

| 9 |

| · | restricts our ability to incur certain additional indebtedness; |

| · | restricts our ability to make certain investments; |

| · | restricts our ability to merge with another company; |

| · | restricts our ability to pay dividends; |

| · | requires us to maintain financial coverage ratios; and |

| · | requires us to not encumber certain assets except as approved by the lenders. |

These restrictions could cause us to default on our unsecured line of credit or negatively affect our operations.

Fluctuations in value of our U.S. Treasury debt investments.

As of December 31, 2023, the Company had total investments of $128,795,000 in U.S. Treasury Notes which mature through mid-2024. The Company measures the fair value of these investments on a quarterly basis and recognizes the unrealized gain or loss in its comprehensive income. As a result, the Company’s comprehensive income will be impacted by factors outside our control such as fluctuations in interest rates that impact the value of our investment portfolio. The Company could incur losses should it sell the Notes prior to maturity.

We face competition from numerous sources.

As a developer of apartments, retail, flexible warehouse and office space, we compete with numerous developers, owners and operators of real estate, many of whom own properties similar to ours in the same submarkets in which our properties are located. If our competitors offer space at rental rates below current market rates, or below the rental rates we currently charge our tenants, we may lose potential tenants and we may be pressured to reduce our rental rates to an amount lower than we currently charge in order to retain tenants when our tenants’ leases expire. As a result, our financial condition, results of operations, cash flow and ability to satisfy our debt service obligations could be materially adversely affected.

Construction costs may be higher than anticipated.

Our long-term business plan includes a number of construction projects. The construction costs of these projects may exceed original estimates and possibly make the completion of a property uneconomical. Building material commodity shortages, supply chain disruptions, construction delays or stoppages or rapidly escalating construction costs may out-pace market rents, which would adversely affect our profits. The market environment and existing lease commitments may not allow us to raise rents to cover these higher costs.

Risks Relating to our Common Stock

Certain shareholders have effective control of a significant percentage of FRP's common stock and would have significant influence on the outcome of any shareholder vote.

As of December 31, 2023, our Chief Executive Officer, John D. Baker, II beneficially owned approximately 15.8% of the outstanding shares of our common stock (79.4% of which are held in trusts under which voting power is shared with other family members) and members of his family who are (i) officers or directors of the company, (ii) required to report their beneficial ownership on Schedule 13D or Schedule 13G, or (iii) are members of his immediate family beneficially own, collectively, an additional 21.2% of the outstanding shares of our common stock. As a result, these individuals effectively may have the ability to direct the election of all members of our board of directors and to exercise a controlling influence over its business and affairs, including any determinations with respect to mergers or other business combinations involving the Company, its acquisition or disposition of assets, its borrowing of monies, its issuance of any additional securities, its repurchase of common stock and its payment of dividends.

Provisions in our articles of incorporation and bylaws and certain provisions of Florida law could delay or prevent a change in control of FRP.

The existence of some provisions of our articles of incorporation and bylaws and Florida law could

| 10 |

discourage, delay or prevent a change in control of FRP that a shareholder may consider favorable. These include provisions:

- providing that directors may be removed by our shareholders only for cause;

- authorizing a large number of shares of stock that are not yet issued, which would allow FRP’s board of directors to issue shares to persons friendly to current management, thereby protecting the continuity of its management, or which could be used to dilute the stock ownership of persons seeking to obtain control of FRP;

- requiring the written demand of 50% of all votes entitled to be cast on a particular issue in order for shareholders to call a special meeting;

- prohibiting shareholders from taking action by written consent; and

- imposing advance notice requirements for nominations of candidates for election to our board of directors at the annual shareholder meetings.

These provisions apply even if a takeover offer may be considered beneficial by some shareholders and could delay or prevent an acquisition that our board of directors determines is not in the Company’s or the shareholders’ best interests.

FRP may issue preferred stock with terms that could dilute the voting power or reduce the value of our common stock.

Our articles of incorporation authorize us to issue, without the approval of our shareholders, one or more classes or series of preferred stock having such designations, powers, preferences and relative, participating, optional and other rights, and such qualifications, limitations or restrictions as our board of directors generally may determine. The terms of one or more classes or series of preferred stock could dilute the voting power or reduce the value of FRP's common stock. For example, FRP could grant holders of preferred stock the right to elect some number of its directors in all events or on the happening of specified events or the right to veto specified transactions. Similarly, the repurchase or redemption rights or dividend, distribution or liquidation preferences FRP could assign to holders of preferred stock could affect the residual value of the common stock.

Institutional investor focus on environmental, social and governance issues may impact our stock price.

Many large institutional investors focus on sustainability in managing investment risks, portfolio design and dealing with companies in which they invest. This focus extends to climate change and the plan for transitioning to a net-zero economy, diversity and inclusion and other human resource matters, and social and governance issues and corporate social responsibility. While we are proud of the returns to shareholders and our sustainable practices in construction and environmental management, we recognize our responsibility to focus on these key issues that impact our long-term sustainability. Our failure to demonstrate this commitment could dissuade institutional investors from holding our stock, which would result in downward pressure on our stock price.

Item 1B. UNRESOLVED STAFF COMMENTS.

None.

Item 1C. CYBERSECURITY.

We have processes in place for assessing, identifying, and managing material risks from cybersecurity threats which could result in information security breaches and significant disruption to our business. We have a multi-layer security approach including specialized hardware/software, access protocols, third-party

| 11 |

assessments, and regular training. Our servers are hosted by a third-party that provides Service Organization Control (SOC) Type 1 and 2 reports annually with monthly bridge letters and hosts a separate disaster recovery site. Our Firewall, Virtual Private Network, Multifactor Authentication, Email Gateway, Antivirus software, file storage protection software, and other software applications help mitigate cybersecurity risks. Our IT Steering committee reviews our access protocols and systems biannually. Our third-party internal auditing firm provided an assessment of our system design and performed testing. Our IT consultant participates in our weekly operations meetings, requires cybersecurity training, and monitors the results of test phishing and credential harvesting emails.

Our board of directors has oversight of our strategic and business risk management and has delegated cybersecurity risk management oversight to the Audit Committee of our board of directors. Our Audit Committee is responsible for ensuring that management has processes in place designed to identify and evaluate cybersecurity risks to which the company is exposed and to implement processes and programs to manage cybersecurity risks and mitigate cybersecurity incidents.

Management is responsible for identifying, assessing, and managing material cybersecurity risks on an ongoing basis, establishing processes to ensure that such potential cybersecurity risk exposures are monitored, putting in place appropriate mitigation measures, maintaining our business continuity plans, IT security policies and procedures, and providing regular reports to our board of directors, including through the Audit Committee. Our IT consultant monitors the prevention, detection, mitigation, and remediation of cybersecurity incidents through a variety of software tools, and regularly reports to management.

In 2023, we did not identify any cybersecurity events that have materially affected or are reasonably likely to materially affect our business, results of operations, or financial condition. However, despite our efforts, we cannot eliminate all risks from cybersecurity threats, or provide assurances that we have not experienced undetected cybersecurity incidents. For additional information about these risks, see Part I, Item 1A, "Risk Factors" in this Annual Report on Form 10-K.

Item 2. PROPERTIES.

The Company owns (predominately in fee simple but also through ownership of interests in joint ventures) approximately 21,000 acres of land in Florida, Georgia, Maryland, Virginia, South Carolina, and the District of Columbia. This land is held by the Company in four distinct segments: (i) Industrial and Commercial Segment (land owned and operated as income producing rental properties in the form of commercial properties), (ii) Mining Royalty Lands Segment (land owned and leased to mining companies for royalties or rents), (iii) Development Segment (land owned and held for investment to be further developed for future income production or sales to third parties), and (iv) Multifamily Segment (ownership, leasing and management of buildings through joint ventures).

Industrial and Commercial Segment. As of December 31, 2023, the Industrial and Commercial Segment includes nine buildings at four commercial properties owned by the Company in fee simple as follows:

1) 34 Loveton Circle in suburban Baltimore County, MD consists of one office building totaling 33,708 square feet which is 90.8% occupied (16% of the space is occupied by the Company for use as our Baltimore headquarters). The property is subject to commercial leases with various tenants.

2) 155 E. 21st Street in Duval County, FL was an office building property that remains under lease through March 2026. We permitted the tenant to demolish all structures on the property during 2018.

3) Cranberry Run Business Park in Harford County, MD consists of five industrial buildings totaling 267,737 square feet which are 92.1% leased and occupied. The property is subject to commercial leases with various tenants.

4) Hollander 95 Business Park in Baltimore City, MD consists of three industrial buildings totaling 247,340 square feet that are 100.0% leased and 100.0% occupied

| 12 |

Mining Royalty Lands Segment.

Introduction.

Pursuant to amendments to Regulation S-K of the Securities Act of 1933 (“Regulation S-K”) adopted by the Securities and Exchange Commission in 2018, effective for fiscal years beginning on or after January 1, 2021, registrants with material mining operations must disclose certain information in their Securities and Exchange Act filings concerning mineral resources and mineral reserves, in accordance with to Subpart 1300 of Regulation S-K. This section of Item 2 provides summary information about our overall portfolio of mining royalty properties.

Our mining leases do not require tenants to furnish technical report summaries that meet the requirements of Rule 1302, and the Company does not otherwise have access to the technical data required to determine precise amounts of each class of mineral resource or probable or proven resources. In accordance with Rule 1303(a)(3), the Company is providing all required information in its possession or which it can obtain without incurring an unreasonable burden or expense.

The Company periodically engages consultants to examine remaining sand and stone deposit estimates and geological studies conducted by tenants and their industry professionals.

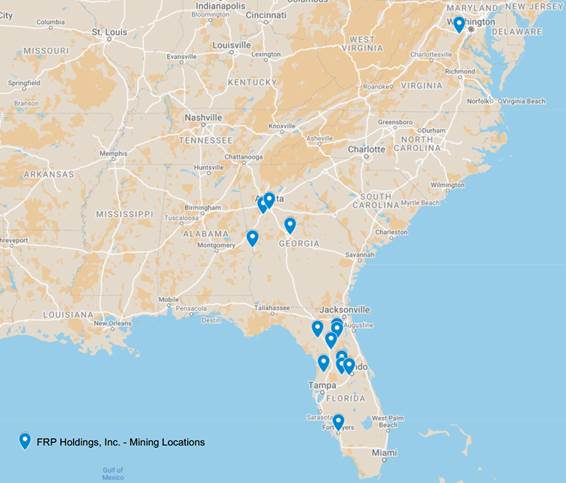

Locations. The following map presents the locations of the Company’s mining properties, which are discussed by segment (as reported in the Company’s financial statements) below:

| 13 |

Mining Properties. The Company owns a fee simple interest in 14 open pit aggregates quarries located in Florida, Georgia and Virginia, which comprise approximately 16,650 total acres. The Company’s quarries are subject to mining leases with Vulcan Materials, Martin Marietta, Cemex, Argos, and The Concrete Company. Aggregates consist of crushed stone, sand, gravel, fill dirt, limestone and calcium and are used primarily in construction applications.

Nine of the Company’s quarries (located in Grandin, FL, Fort Myers, FL, Keuka, FL, Newberry, FL, Astatula, FL, Columbus, GA, Macon, GA, Tyrone, GA, and Manassas, VA; totaling 13,876 acres) are currently being mined, and five of the Company’s quarries (located in Marion County, FL, Lake Louisa, FL, Astatula, FL and Lake Sand, FL and Forest Park, GA; totaling 2,778 acres) are leased but are not currently being mined. Our typical mining lease requires the tenant to pay the Company a royalty based on the number of tons of mined materials sold from our mining property during a given fiscal year multiplied by a percentage of the average annual sales price per ton sold. In certain locations, typically where the sand and stone deposits on the property have been depleted but the tenant still has a need for the leased land, we collect a minimum annual rental amount. In the fiscal years ended December 31, 2023, 2022 and 2021, aggregate tons sold with respect to the Company’s mining properties were approximately 9,569,000, 9,525,000 and 7,575,000, respectively.

In May 2014, the Company entered into an amendment to our lease with Vulcan for our Fort Myers location requiring that the mining be accelerated and that the mining plan be conformed to accommodate the future construction of up to 105 residential dwelling units around the mined lakes. In return, the Company granted Lee County an option to purchase a right of way for a connector road that would benefit the residential area on our property and to place a conservation easement on part of the property, which the County exercised in 2020. Mining activity commenced in 2017 following Lee County’s issuance of a mine operating permit allowing Vulcan to begin production.

In November 2017, Lake County commissioners voted to approve a permit to Cemex to mine the Company’s land in Lake Louisa, Florida. The county issued the permit in July 2019. Cemex expects to begin mining in late 2024 after completing the work necessary to prepare this site to become an active sand mine.

Brooksville Joint Venture. Additionally, through a joint venture with Vulcan Materials, the Company owns a 50% interest in 4,280 acres of mixed-use property in Brooksville, Florida, a portion of which comprises a ground calcium mine that is mined by Vulcan Materials. The Company entered into the joint venture in 2006 for the purpose of jointly owning and developing the land as a mixed-use community. In April 2011, the Florida Department of Community Affairs issued its final order approving the development of the project consisting of 5,800 residential dwelling units and over 600,000 square feet of commercial and 850,000 of light industrial uses. Zoning for the project was approved by the County in August 2012. Vulcan Materials still mines on the property and the Company receives 100% of the royalty on all tons sold at the Brooksville property. In the fiscal years ended December 31, 2023, 2022, and 2021, aggregate tons sold were approximately 259,000, 244,000 and 280,000, respectively.

Other Properties. The Company also owns an additional 36 acres of investment property in Brooksville, Florida.

Development Segment – Industrial and Commercial Land.

At December 31, 2023, this segment owned the following future development parcels:

| 1) | 54 acres of land that will be capable of supporting over 690,000 square feet of industrial product located at 1001 Old Philadelphia Road in Aberdeen, MD. |

| 2) | 17 acres of land in Harford County, MD with a 259,200 square foot speculative warehouse project on Chelsea Road under construction due to be complete in the third quarter of 2024. |

| 3) | 170 acres of land in Cecil County, MD that can accommodate 900,000 square feet of industrial development. |

Development Segment – Land Held for Development or Sale.

| 14 |

At December 31, 2023, this segment was invested in the following development parcels:

| 1) | Riverfront on the Anacostia: The Riverfront on the Anacostia property is a 5.8-acre parcel of real estate in Washington, D.C. that fronts the Anacostia River and is adjacent to the Washington Nationals Baseball Park. A revised Planned Unit Development (PUD) plan was approved in 2012 and permits the Company to develop, in four phases, a four-building, mixed-use project, containing approximately 1,161,050 square feet. The approved development includes numerous publicly accessible open spaces and a waterfront esplanade along the Anacostia River. The first phase (now known as Dock 79), which was completed through a joint venture with MRP Realty, and which consisted of a single building with residential and retail uses, became our fourth business segment in July 2017, now known as the Multifamily Segment. The second phase (now known as The Maren), also completed through a joint venture with MRP Realty and consists of a single building with residential and retail uses, was added to the Multifamily Segment effective March 31, 2021. The final two phases, Phase 3 and Phase 4 remain under a first-stage PUD approval expiring March 30, 2025, permitting 571,671 square feet of development. |

| 2) | Hampstead Trade Center: The Hampstead Trade Center property in Carroll County, MD is a 118-acre parcel located adjacent to the State Route 30 bypass. The parcel was previously zoned for industrial use, but our request for rezoning for residential use was approved in December 2018. Management believes this to be a higher and better use of the property. We are fully engaged in the formal process of seeking PUD entitlements for this tract, which is now known as “Hampstead Overlook”. |

| 3) | Bryant Street: On December 24, 2018 the Company and MRP Realty formed four partnerships to purchase and develop approximately five acres of land at 500 Rhode Island Ave NE, Washington, D.C. This property is the first phase of the Bryant Street Master Plan. The property is located in an Opportunity Zone, which provides tax benefits in the new communities development program as established by Congress in the Tax Cuts and Jobs Act of 2017. This first phase is a mixed-use development which supports 487 residential units and 91,607 square feet of first floor and stand-alone retail on approximately five acres of the roughly 12-acre site. Construction is complete and leasing efforts are nearing completion. |

| 4) | The Verge: On December 20, 2019 the Company and MRP formed a joint venture to acquire and develop a mixed-use project located at 1800 Half Street, Washington, D.C. This property is located in the Buzzard Point area of Washington, DC, less than half a mile downriver from Dock 79 and The Maren. It lies directly between our two acres on the Anacostia currently under lease by Vulcan and Audi Field, the home stadium of the DC United. The project is located in an Opportunity Zone, which provides tax benefits in the new communities’ development program as established by Congress in the Tax Cuts and Jobs Act of 2017. The eleven-story structure has 344 apartments and 8,536 square feet of ground floor retail. Construction is complete and leasing is nearing completion. |

| 5) | Square 664E: The Company’s Square 664E property is approximately two acres situated on the Anacostia River at the base of South Capitol Street less than half a mile down river from our Riverfront on the Anacostia property. This property is currently under lease to Vulcan Materials for use as a concrete batch plant through 2026. In March 2017, reconstruction of the bulkhead was completed at a cost of $4.2 million in anticipation of future high-rise development. |

| 6) | .408 Jackson: In December 2019, the Company entered into a joint venture with Woodfield Development for the acquisition and development of a mixed-use project known as “.408 Jackson” in Greenville, SC. Woodfield specializes in Class-A multifamily, mixed-use developments primarily in the Carolinas and DC. The project is located across the street from Greenville’s minor league baseball stadium and holds 227 multifamily units and 4,539 square feet of retail space. It is located in an Opportunity Zone, which provides tax benefits in the new communities’ development program as established by Congress in the Tax Cuts and Jobs Act of 2017. The temporary certificate of occupancy was received in December 2022. Leasing began in the fourth quarter of 2022 with residential units 95.2% leased and 93.4% occupied at quarter end. Retail at this location is 100% leased. The Company owns 40% of the development. |

| 15 |

| 7) | Windlass Run: In March 2016, the Company entered into an agreement with St. Johns Properties Inc., a Baltimore development company, to jointly develop the remaining lands of our Windlass Run Business Park, located in Middle River, MD, into a multi-building business park consisting of approximately 329,000 square feet of single-story office space. The project will take place in several phases. Construction of the first phase, which includes two office buildings and two retail buildings totaling 100,030-square-feet (inclusive of 27,950 retail), commenced in the fourth quarter of 2017 and was completed in January 2019. At December 31, 2023 Phase I was 73.4% leased and 62.8% occupied, the subsequent phases will follow as each phase is stabilized. |

| 8) | Estero: In August 2022, the Company invested $3.6 million for a minority interest in a joint venture with Woodfield Development to purchase and develop 46 acres in Estero, FL into a mixed-use project with 554 multifamily units, 72,000 square feet of commercial space, 41,000 square feet of office space and a boutique 170-key hotel. While the joint venture attempts to rezone the property, the Company will receive a preferred return of 8% with an option to roll its investment into equity in the vertical development or exit at that point. |

| 9) | Buzzard Point: In November 2022, the Company entered into a contribution agreement with MRP and Steuart Investment Company (SIC) regarding potential development of an estimated 1,200 multifamily units in four phases on land owned by SIC. The Company entered into a separate agreement with MRP to perform pre-development obligations for the contribution agreement. The company owns 50% of the partnership with MRP. |

| 10) | Woven: In August 2023, the Company entered into an agreement with Woodfield Development for the acquisition and development of a mixed-use project known as “Woven” in Greenville, SC, to consist of an estimated 214 multifamily units and 10,000 square feet of retail space. The joint venture is in the pre-development and pre-closing phase in pursuit of vertical construction closing conditions. The Company owns 50% at this time with final ownership to be determined based upon contributions by the partners, land contributors, and other investors. |

Multifamily Segment.

At December 31, 2023, this segment was invested in the following stabilized multifamily joint ventures:

| 1) | Dock 79: Dock 79 (Phase I of the Riverfront on the Anacostia development) is a 305-unit residential apartment building with approximately 14,430 square feet of first floor retail space. The property is situated on approximately 2.1 acres of land located on Potomac Avenue in Washington, DC, across the street from the Nationals Park. |

| 2) | The Maren: The Maren (Phase II of the Riverfront on the Anacostia development) is a 264-unit residential apartment building with 6,811 square feet of retail space located on Potomac Avenue in Washington, DC, across the street from the Nationals Park |

| 3) | Riverside: Riverside Joint Venture in Greenville, SC is a joint venture with Woodfield Development which includes a 200-unit residential apartment building. The Company owns 40% of the venture. |

Item 3. LEGAL PROCEEDINGS.

None.

Item 4. MINE SAFETY DISCLOSURES.

None.

| 16 |

PART II

Item 5. MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

There were approximately 315 holders of record of FRP Holdings, Inc. common stock, $.10 par value, as of December 31, 2023. The Company's common stock is traded on the Nasdaq Stock Market (Symbol FRPH).

Price Range of Common Stock. Information concerning stock prices is included under the caption "Quarterly Results" on page 9 of the Company's 2023 Annual Report to Shareholders, and such information is incorporated herein by reference.

Dividends. The Company has not paid a cash dividend in the past and it is the present policy of the Board of Directors not to pay cash dividends. Information concerning restrictions on the payment of cash dividends is included in Note 4 to the consolidated financial statements included in the accompanying 2023 Annual Report to Shareholders, and such information is incorporated herein by reference.

Securities Authorized for Issuance Under Equity Compensation Plans. Information regarding securities authorized for issuance under equity compensation plans is included in Item 12 of Part III of this Annual Report on Form 10-K, and such information is incorporated herein by reference.

Purchases of Equity Securities by the Issuer and Affiliated Purchasers

| Total | ||||||||||||||||||

| Number of | ||||||||||||||||||

| Shares | ||||||||||||||||||

| Purchased | Approximate | |||||||||||||||||

| As Part of | Dollar Value of | |||||||||||||||||

| Total | Publicly | Shares that May | ||||||||||||||||

| Number of | Average | Announced | Yet Be Purchased | |||||||||||||||

| Shares | Price Paid | Plans or | Under the Plans | |||||||||||||||

| Period | Purchased | per Share | Programs | or Programs (1) | ||||||||||||||

| October 1 through October 31 | — | $ | — | — | $ | 7,363,000 | ||||||||||||

| November 1 through November 30 | — | $ | — | — | $ | 7,363,000 | ||||||||||||

| December 1 through December 31 | — | $ | — | — | $ | 7,363,000 | ||||||||||||

| Total | — | $ | — | — | ||||||||||||||

(1) On February 4, 2015, the Board of Directors authorized management to expend up to $5,000,000 to repurchase shares of the Company’s common stock from time to time as opportunities arise. On December 5, 2018, the Board of Directors approved a $10,000,000 increase in the Company’s stock repurchase authorization. On August 5, 2019, the Board of Directors approved a $10,000,000 increase in the Company’s stock repurchase authorization. On May 6, 2020, the Board of Directors approved a $10,000,000 increase in the Company’s stock repurchase authorization. On August 26, 2020, the Board of Directors approved a $10,000,000 increase in the Company’s stock repurchase authorization.

Item 6. [RESERVED]

Item 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION.

Information required in response to Item 7 is included under the caption "Management’s Discussion and Analysis of Financial Condition and Results of Operation" on pages 10 through 21 of the Company’s 2023 Annual Report to Shareholders, and such information is incorporated herein by reference.

| 17 |

Item 7.A QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK.

Interest Rate Risk - We are exposed to the impact of interest rate changes through our variable-rate borrowings under our Credit Agreement with Wells Fargo.

Under the Wells Fargo Credit Agreement, the applicable margin for borrowings at December 31, 2023 was Daily Simple SOFR plus 2.25%.

The Company did not have any variable rate debt outstanding at December 31, 2023, so a sensitivity analysis was not performed to determine the impact of hypothetical changes in interest rates on the Company’s results of operations and cash flows.

For our debt instruments with variable interest rates, changes in interest rates affect the amount of interest expense incurred. The following table presents the principal cash flow payments associated with our outstanding debt by year, weighted average interest rates on debt outstanding each year-end, and fair value of total debt as of December 31, 2023 (dollars in thousands):

| 2024 | 2025 | 2026 | 2027 | 2028 | Thereafter | Total | Fair Value | ||||||||||||||||||||||||

| Fixed rate debt | $ | — | $ | — | $ | — | $ | — | $ | — | $ | 180,070 | $ | 180,070 | $ | 145,678 | |||||||||||||||

| Average interest for fixed rate debt | 3.03 | % | 3.03 | % | 3.03 | % | 3.03 | % | 3.03 | % | 3.03 | % | 3.03 | % | |||||||||||||||||

Item 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA.

Information required in response to this Item 8 is included under the caption "Quarterly Results" on page 9 and on pages 22 through 41 of the Company's 2023 Annual Report to Shareholders. Such information is incorporated herein by reference.

Item 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE.

None.

Item 9A. CONTROLS AND PROCEDURES.

CONCLUSION REGARDING THE EFFECTIVENESS OF DISCLOSURE CONTROLS AND PROCEDURES

Under the supervision and with the participation of our management, including our principal executive officer, principal financial officer and chief accounting officer, we conducted an evaluation of our disclosure controls and procedures, as such terms are defined under Rule 13a-15(e) promulgated under the Exchange Act. Based on this evaluation, our principal executive officer, our principal financial officer and our principal accounting officer concluded that our disclosure controls and procedures were effective as of the end of the period covered by this Annual Report.

MANAGEMENT’S REPORT ON INTERNAL CONTROL OVER FINANCIAL REPORTING

Our management is responsible for establishing and maintaining adequate internal control over financial reporting, as such term is defined in Exchange Act Rule 13a-15(f). Under the supervision and with the participation of our management, including our principal executive officer, principal financial officer and principal accounting officer, we conducted an evaluation of the effectiveness of our internal control over financial reporting based on the framework in the Internal Control-Integrated Framework (2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO). Based on our evaluation

| 18 |

under the framework in the Internal Control-Integrated Framework (2013), our management concluded that our internal control over financial reporting was effective as of December 31, 2023.

This Annual Report does not include an attestation report of our Independent Registered Public Accounting Firm, Hancock Askew & Co., LLP, regarding internal control over financial reporting. Management’s report was not subject to attestation by our Independent Registered Public Accounting Firm pursuant to rules of the Securities and Exchange Commission that permit the Company to provide only management’s report in this Annual Report.

CHANGE IN INTERNAL CONTROL OVER FINANCIAL REPORTING

During the fourth quarter of 2023, there were no changes in our internal control over financial reporting that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

INHERENT LIMITATIONS OVER INTERNAL CONTROLS

Our internal control over financial reporting is designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of consolidated financial statements for external purposes in accordance with generally accepted accounting principles. Our internal control over financial reporting includes those policies and procedures that:

| i. | pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of our assets; |

| ii. | provide reasonable assurance that transactions are recorded as necessary to permit preparation of consolidated financial statements in accordance with generally accepted accounting principles, and that our receipts and expenditures are being made only in accordance with authorizations of our management and directors; and |

| iii. | provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of our assets that could have a material effect on the consolidated financial statements. |

Internal control over financial reporting cannot provide absolute assurance of achieving financial reporting objectives because of its inherent limitations, including the possibility of human error and circumvention by collusion or overriding of controls. Accordingly, even an effective internal control system may not prevent or detect material misstatements on a timely basis. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions or that the degree of compliance with the policies or procedures may deteriorate.

ITEM 9B. OTHER INFORMATION.

None.

ITEM 9C. DISCLOSURE REGARDING FOREIGN JURISDICTIONS THAT PREVENT INSPECTIONS.

Not applicable.

| 19 |

PART III

Item 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE.

The Company has adopted a Financial Code of Ethical Conduct applicable to its principal executive officers, principal financial officers and principal accounting officers. A copy of this Financial Code of Ethical Conduct is filed as Exhibit 14 to this Form 10-K. The Financial Code of Ethical Conduct is also available on our web site at www.frpdev.com/investor-relations/corporate-governance/.

The rest of the information required in response to this Item 10 is included under the captions “Our Board of Directors”, “Corporate Governance, ESG and Our Approach to Risk Management”, “Our Executive Officers”, “Securities Ownership” in the Company's Proxy Statement, and such information is incorporated herein by reference. The Proxy Statement will be filed with the Securities and Exchange Commission not later than March 31, 2024.

Item 11. EXECUTIVE COMPENSATION.

Information required in response to this Item 11 is included under the caption “Executive Compensation” in the Company's Proxy Statement, and such information is incorporated herein by reference. The Proxy Statement will be filed with the Securities and Exchange Commission not later than March 31, 2024.

Item 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS.

Equity Compensation Plan Information

| Number of Securities | ||||||||

| remaining available | ||||||||

| Number of Securities | for future issuance | |||||||

| to be issued upon | Weighted average | under equity | ||||||

| exercise of | exercise price of | compensation plans | ||||||

| outstanding options, | outstanding options, | (excluding securities | ||||||

| warrants and rights | warrants and rights | reflected in column (a)) | ||||||

| Plan Category | (a) | (b) | (c) | |||||

| Equity compensation plans | ||||||||

| approved by security holders | 124,866 | (1) | $ | 39.99 | (2) | 344,077 | (1) | |

| Equity compensation plans | ||||||||

| not approved by security holders | 0 | 0 | 0 | |||||

| Total | 124,866 | $ | 39.99 | 344,077 |

| 1. | Column (a) includes 118,167 stock options granted under our 2016 Equity Incentive Plan and 2006 Stock Incentive Plan and 6,699 performance share awards granted under our 2016 Equity Incentive Plan. Each performance share award shown in the table represents a right to receive, subject to the satisfaction of certain performance criteria and the recipient’s continued service to the Company, a number of shares of restricted stock, which number will be calculated after the applicable performance period by dividing the pre-determined value of each award by the closing price of our common stock on the date the restricted stock is issued. The aggregate value of the performance share awards shown in table is $405,356. For illustrative purposes, the maximum |

| 20 |

payout of the performance share awards has been assumed, and the number of performance share awards has been calculated using our closing stock price on March 6, 2024 ($60.51). The performance share awards are subject to partial or complete forfeiture if the vesting criteria are not met. Because some or all of the performance share awards may not vest, and because the number of shares of restricted stock to be issued thereunder is dependent on future stock prices, columns (a) and (c) may overstate or understate expected dilution.

| 2. | Because there is no exercise price associated with the performance share awards, the weighted-average exercise price does not take the performance share awards into account. |

The remainder of the information required in response to this Item 12 is included under the caption “Securities Ownership” in the Company's Proxy Statement, and such information is incorporated herein by reference. The Proxy Statement will be filed with the Securities and Exchange Commission not later than March 31, 2024.

Item 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE.

Information required in response to this Item 13 is included under the captions “Corporate Governance, ESG and Our Approach to Risk Management” and “Our Board of Directors” in the Company's Proxy Statement, and such information is incorporated herein by reference. The Proxy Statement will be filed with the Securities and Exchange Commission not later than March 31, 2024.

Item 14. PRINCIPAL ACCOUNTING FEES AND SERVICES.

Our independent registered accounting firm is

PART IV

Item 15. EXHIBITS, FINANCIAL STATEMENT SCHEDULE.

(a) (1) Financial Statements.

The response to this item is submitted as a separate section. See Index to Financial Statements on page 26 of this Form 10-K.

(3) Exhibits.

The response to this item is submitted as a separate section. See Exhibit Index on pages 24 through 25 of this Form 10-K.

Item 16. FORM 10-K SUMMARY.

| 21 |

None.

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| FRP Holdings, Inc. | ||||

|

Date: March 26, 2024 |

By | JOHN D. BAKER II | ||

| John D. Baker II | ||||

| Chief Executive Officer | ||||

| (Principal Executive Officer) | ||||

| By | JOHN D. BAKER, III | |||

| John D. Baker, III | ||||

| Treasurer and Chief Financial Officer | ||||

| (Principal Financial Officer) | ||||

| By | JOHN D. KLOPFENSTEIN | |||

| John D. Klopfenstein | ||||

| Controller and Chief Accounting | ||||

| Officer (Principal Accounting Officer) | ||||

| 22 |

Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of the registrant and in the capacities indicated on March 26, 2024.

|

/s/ John D. Baker II John D. Baker II Executive Chairman and Chief Executive Officer |

/s/ David H. deVilliers, Jr. David H. deVilliers, Jr. President and Vice-Chair Director |

| (Principal Executive Officer) |

/s/ Matthew S. McAfee Matthew S. McAfee Director |

|

/s/ John D. Baker, III John D. Baker, III Treasurer and Chief Financial Officer (Principal Financial Officer) |

s/ Martin E. Stein, Jr. Martin E. Stein, Jr. Director |

|

/s/ John D. Klopfenstein John D. Klopfenstein Controller and Chief Accounting Officer (Principal Accounting Officer) |

/s/ John S. Surface John S. Surface Director |

|

/s/ Nicole B. Thomas Nicole B. Thomas Director | |

|

/ s/ William H. Walton William H. Walton Director

/s/ Margaret Wetherbee Margaret Wetherbee Director

|

| 23 |

FRP HOLDINGS, INC.

FORM 10-K FOR THE FISCAL YEAR ENDED DECEMBER 31, 2023

EXHIBIT INDEX

| Item 15(a)(3) |

| 24 |

| 101.INS | XBRL Instance Document Taxonomy Extension Schema |

| 101.SCH | XBRL Taxonomy Extension Schema Document |

| 101.CAL | XBRL Taxonomy Extension Calculation Linkbase |

| 101.DEF | XBRL Taxonomy Extension Definition Linkbase |

| 101.LAB | XBRL Taxonomy Extension Label Linkbase |

| 101.PRE | XBRL Taxonomy Extension Presentation Linkbase |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document and contained in Exhibit 101). |

| 25 |

FRP HOLDINGS, INC.

INDEX TO FINANCIAL STATEMENTS

(Item 15(a) (1) and 2))

| Page | ||||

| Consolidated Financial Statements: | ||||

| Consolidated balance sheets at December 31, 2023 and 2022 | 54 | |||

| For the years ended December 31, 2023, 2022 and 2021 | ||||

| Consolidated statements of income | 52 | |||

| Consolidated statements of comprehensive income | 53 | |||

| Consolidated statements of cash flows | 55 | |||

| Consolidated statements of shareholders' equity | 56 | |||

| Notes to consolidated financial statements | 57-75 | |||

| Report of Independent Registered Public Accounting Firm | 77-78 | |||

| Selected quarterly financial data (unaudited) | 36-37 | |||

| Consent of Independent Registered Public Accounting Firm | 27 | |||

All schedules have been omitted, as they are not required under the related instructions, are inapplicable, or because the information required is included in the consolidated financial statements.

| 26 |

Exhibit 23

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

FRP Holdings, Inc.

Jacksonville, Florida

We hereby consent to the incorporation by reference in the Registration Statements on Form S-8 (No. 333- 125099, 333-131475 and 333-216025) of FRP Holdings, Inc. of our report dated March 26, 2024, relating to the consolidated financial statements which appear in the Annual Report to Shareholders incorporated by reference herein.

Respectfully submitted,

Hancock Askew & Co., LLP

Jacksonville, Florida

March 26, 2024

| 27 |

Annual Report 2023

CONSOLIDATED FINANCIAL HIGHLIGHTS

Years ended December 31

(Amounts in thousands except per share amounts)

| % | ||||||||||||

| 2023 | 2022 | Change | ||||||||||

| Revenues | $ | 41,506 | 37,481 | 10.7 | ||||||||

| Operating profit | $ | 11,700 | 7,996 | 46.3 | ||||||||

| Net investment income | $ | 10,897 | 5,473 | 99.1 | ||||||||

| Interest Expense | $ | (4,315 | ) | (3,045 | ) | 41.7 | ||||||

| Equity in loss of joint ventures | $ | (11,937 | ) | (5,721 | ) | 108.7 | ||||||

| Gain on sale of real estate and other income | $ | 53 | 874 | (93.9 | ) | |||||||

| Loss attributable to noncontrolling interest | $ | (420 | ) | (518 | ) | (18.9 | ) | |||||

| Net income attributable to the Company | $ | 5,302 | 4,565 | 16.1 | ||||||||

| Per common share: | ||||||||||||

| Net income attributable to the Company: | ||||||||||||

| Basic | $ | 0.56 | 0.49 | 14.3 | ||||||||

| Diluted | $ | 0.56 | 0.48 | 16.7 | ||||||||

| Total Assets | $ | 709,166 | 701,084 | 1.2 | ||||||||

| Total Debt | $ | 178,705 | 178,557 | — | ||||||||

| Shareholders' Equity | $ | 414,520 | 407,145 | 1.8 | ||||||||

| Common Shares Outstanding | 9,484 | 9,460 | .3 | |||||||||

| Book Value Per Common Share | $ | 43.71 | 43.04 | 1.6 | ||||||||

BUSINESS. FRP Holdings, Inc. is a holding company engaged in the real estate business, namely (i) leasing and management of commercial properties owned by the Company, (ii) leasing and management of mining royalty land owned by the Company, (iii) real property acquisition, entitlement, development and construction primarily for apartment, retail, warehouse, and office buildings either alone or through joint ventures, (iv) ownership, leasing and management of buildings through joint ventures. The Company’s operating subsidiaries are FRP Development Corp. and Florida Rock Properties, Inc.

STRATEGY. Our strategy consists of the re-deployment of cash from asset sales, real estate operations, and mining royalties, into new assets that allow management to exploit its knowledge and expertise. The asset classes of choice are mixed-use, industrial, raw land, existing buildings, and repeatable strategic partnerships located in core markets with growth potential. Emphasis will be placed on generating returns through opportunistic disposition, as well as cash-flow and long-term appreciation.

OBJECTIVE. We strive to improve shareholder value through (1) active engagement with properties and partners to grow asset value, (2) contributing our operating expertise and connections to maximize value and NOI growth, and (3) manage our capital structure in an efficient and responsible manner, with a watchful eye on projected future market conditions and trends to facilitate timely disposition of selected assets, (4) diligent, sustainable growth.

| 28 |

To Our Shareholders,

It is a truth universally acknowledged, at least in the investment world, that diversification on the company level is unnecessary if not out-and-out a bad thing. The heyday of the conglomerates like Gulf & Western or GE at its Jack Welch peak, with their hands in multiple assets and industries and global markets, is over. Investor bias towards asset concentration makes sense on a number of levels: it prevents empire building; it is hard enough to “get smart” on one industry, let alone a multitude of unrelated industries; investors don’t need companies to diversify for them when they can do it themselves as they see fit. The biggest argument against diversification on the company level is that it complicates things. Valuing one type of asset is easier than valuing multiple asset types.

This Company is not simple. Though far from a conglomerate, we have several business segments in different and unrelated facets of the real estate industry. We have our in-house projects and a multitude of joint ventures. The investor who knows the apartment business might not want to take the time to get to know the industrial space and almost certainly has limited exposure to the aggregates business. That surface level complexity and lack of concentration in one particular asset type is probably off-putting to some investors, especially for a company our size. We are arguably the corporate version of what Scott Fitzgerald referred to as “that most limited of all specialists—the well-rounded man.”

Our complexity is also part of the heritage of this Company, and we believe we have made it into an asset. Our mining royalties are the sole reason for this Company’s existence and have been an instrumental component of the cashflow engine that has fueled our debt-free industrial development. We could have sold our land on the Anacostia River in DC, and deemed multifamily development outside of our focus, and we would have closed the door on owning some of the best assets in one of the greatest cities in the world. When we sold our industrial portfolio in 2018, we could have solely concentrated on multi-family projects, and in doing so, we would have written off decades of industrial real estate experience, not to mention the recent boom in industrial real estate values.