UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________

FORM

_____________________

For the quarterly period ended:

or

For the transition period from: _____________ to _____________

(Exact name of registrant as specified in its charter) |

_____________________

|

| |||

(State or Other Jurisdiction of Incorporation) |

| (Commission File Number) |

| (I.R.S. Employer Identification No.) |

(Address of Principal Executive Office) (Zip Code)

(

(Registrant’s telephone number, including area code)

N/A

(Former name, former address and former fiscal year, if changed since last report)

_____________________

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

| Trading Symbol(s) |

| Name of each exchange on which registered |

|

|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and "emerging growth company" in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer | ☐ | Accelerated filer | ☐ |

☐(Do not check if a smaller reporting company) | Smaller reporting company | ||

|

| Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act) Yes

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date

TABLE OF CONTENTS

PART I – FINANCIAL INFORMATION

|

|

| ||

| 27 |

| ||

| 27 |

| ||

Unregistered Sales of Equity Securities and Use of Proceeds. |

| 27 |

| |

| 27 |

| ||

| 27 |

| ||

| 27 |

| ||

| 28 |

| ||

|

| 29 |

| |

| 2 |

| Table of Contents |

PART I – FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

ISSUER DIRECT CORPORATION AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(in thousands, except share and per share amounts)

|

| March 31, |

|

| December 31, |

| ||

|

| 2024 |

|

| 2023 |

| ||

ASSETS |

| (unaudited) |

|

|

| |||

Current assets: |

|

|

|

|

|

| ||

Cash and cash equivalents |

| $ |

|

| $ |

| ||

Accounts receivable (net of allowance for credit losses of $ |

|

|

|

|

|

| ||

Income tax receivable |

|

|

|

|

|

| ||

Other current assets |

|

|

|

|

|

| ||

Total current assets |

|

|

|

|

|

| ||

Capitalized software (net of accumulated amortization of $ |

|

|

|

|

|

| ||

Fixed assets (net of accumulated depreciation of $ |

|

|

|

|

|

| ||

Right-of-use asset – leases |

|

|

|

|

|

| ||

Other long-term assets |

|

|

|

|

|

| ||

Goodwill |

|

|

|

|

|

| ||

Intangible assets (net of accumulated amortization of $ |

|

|

|

|

|

| ||

Total assets |

| $ |

|

| $ |

| ||

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

|

Accounts payable |

| $ |

|

| $ |

| ||

Accrued expenses |

|

|

|

|

|

| ||

Current portion of long-term debt |

|

|

|

|

|

| ||

Deferred revenue |

|

|

|

|

|

| ||

Total current liabilities |

|

|

|

|

|

| ||

Long-term debt (net of debt discount of $ |

|

|

|

|

|

| ||

Deferred income tax liability |

|

|

|

|

|

| ||

Lease liabilities – long-term |

|

|

|

|

|

| ||

Other long-term liabilities |

|

|

|

|

|

| ||

Total liabilities |

|

|

|

|

|

| ||

Commitments and contingencies |

|

|

|

|

|

|

|

|

Stockholders' equity: |

|

|

|

|

|

|

|

|

Preferred stock, $ |

|

|

|

|

|

| ||

Common stock $ |

|

|

|

|

|

| ||

Additional paid-in capital |

|

|

|

|

|

| ||

Other accumulated comprehensive loss |

|

| ( | ) |

|

| ( | ) |

Retained earnings |

|

|

|

|

|

| ||

Total stockholders' equity |

|

|

|

|

|

| ||

Total liabilities and stockholders’ equity |

| $ |

|

| $ |

| ||

The accompanying notes are an integral part of these unaudited financial statements.

| 3 |

| Table of Contents |

ISSUER DIRECT CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

(UNAUDITED)

(in thousands, except share and per share amounts)

|

| For the Three Months Ended |

| |||||

|

| March 31, |

|

| March 31, |

| ||

|

| 2024 |

|

| 2023 |

| ||

|

|

|

|

|

|

| ||

Revenues |

| $ |

|

| $ |

| ||

Cost of revenues |

|

|

|

|

|

| ||

Gross profit |

|

|

|

|

|

| ||

Operating costs and expenses: |

|

|

|

|

|

|

|

|

General and administrative |

|

|

|

|

|

| ||

Sales and marketing |

|

|

|

|

|

| ||

Product development |

|

|

|

|

|

| ||

Depreciation and amortization |

|

|

|

|

|

| ||

Total operating costs and expenses |

|

|

|

|

|

| ||

Operating (loss) income |

|

| ( | ) |

|

|

| |

Interest expense, net |

|

| ( | ) |

|

| ( | ) |

Other income (expense) |

|

|

|

|

| ( | ) | |

Loss before taxes |

|

| ( | ) |

|

| ( | ) |

Income tax expense (benefit) |

|

|

|

|

| ( | ) | |

Net loss |

| $ | ( | ) |

| $ | ( | ) |

Loss per share – basic |

| $ | ( | ) |

| $ | ( | ) |

Loss per share – fully diluted |

| $ | ( | ) |

| $ | ( | ) |

Weighted average number of common shares outstanding – basic |

|

|

|

|

|

| ||

Weighted average number of common shares outstanding – fully diluted |

|

|

|

|

|

| ||

The accompanying notes are an integral part of these unaudited financial statements.

| 4 |

| Table of Contents |

ISSUER DIRECT CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF COMPREHENSIVE LOSS

(UNAUDITED)

(in thousands)

|

| For the Three Months Ended |

| |||||

|

| March 31, |

|

| March 31, |

| ||

|

| 2024 |

|

| 2023 |

| ||

Net loss |

| $ | ( | ) |

| $ | ( | ) |

Foreign currency translation adjustment |

|

| ( | ) |

|

|

| |

Comprehensive loss |

| $ | ( | ) |

| $ | ( | ) |

The accompanying notes are an integral part of these unaudited financial statements.

| 5 |

| Table of Contents |

ISSUER DIRECT CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

(UNAUDITED)

(in thousands, except share and per share amounts)

|

| Common Stock |

|

| Additional Paid-in |

|

| Accumulated Other Comprehensive |

|

| Retained |

|

| Total Stockholders’ |

| |||||||||

|

| Shares |

|

| Amount |

|

| Capital |

|

| Loss |

|

| Earnings |

|

| Equity |

| ||||||

Balance at December 31, 2022 |

|

|

|

| $ |

|

| $ |

|

| $ | ( | ) |

| $ |

|

| $ |

| |||||

Stock-based compensation expense |

|

| — |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

Foreign currency translation |

|

| — |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

Net loss |

|

| — |

|

|

|

|

|

|

|

|

|

|

|

| ( | ) |

|

| ( | ) | |||

Balance at March 31, 2023 |

|

|

|

| $ |

|

| $ |

|

| $ | ( | ) |

| $ |

|

| $ |

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance at December 31, 2023 |

|

|

|

| $ |

|

| $ |

|

| $ | ( | ) |

| $ |

|

| $ |

| |||||

Stock-based compensation expense |

|

| — |

|

|

|

|

|

| ( | ) |

|

|

|

|

|

|

|

| ( | ) | |||

Exercise of stock awards, net of tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Foreign currency translation |

|

| — |

|

|

|

|

|

|

|

|

| ( | ) |

|

|

|

|

| ( | ) | |||

Net loss |

|

| — |

|

|

|

|

|

|

|

|

|

|

|

| ( | ) |

|

| ( | ) | |||

Balance at March 31, 2024 |

|

|

|

| $ |

|

| $ |

|

| $ | ( | ) |

| $ |

|

| $ |

| |||||

The accompanying notes are an integral part of these unaudited financial statements.

| 6 |

| Table of Contents |

ISSUER DIRECT CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)

(in thousands)

|

| For the Three Months Ended |

| |||||

|

| March 31, |

|

| March 31, |

| ||

|

| 2024 |

|

| 2023 |

| ||

Cash flows from operating activities: |

|

|

|

|

|

| ||

Net loss |

| $ | ( | ) |

| $ | ( | ) |

Adjustments to reconcile net income to net cash provided by operating activities: |

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

|

|

|

| ||

Provision for credit losses |

|

|

|

|

|

| ||

Deferred income taxes |

|

| ( | ) |

|

|

| |

Stock-based compensation expense |

|

| ( | ) |

|

|

| |

Non-cash interest expense |

|

|

|

|

|

| ||

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

Decrease (increase) in accounts receivable |

|

| ( | ) |

|

| ( | ) |

Decrease (increase) in other assets |

|

| ( | ) |

|

| ( | ) |

Increase (decrease) in accounts payable |

|

|

|

|

|

| ||

Increase (decrease) in accrued expenses and other liabilities |

|

|

|

|

|

| ||

Increase (decrease) in deferred revenue |

|

|

|

|

| ( | ) | |

Net cash provided by operating activities |

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

Cash flows from investing activities: |

|

|

|

|

|

|

|

|

Purchase of acquired business, net of cash received |

|

|

|

|

|

| ||

Purchase of fixed assets |

|

| ( | ) |

|

| ( | ) |

Capitalized software |

|

| ( | ) |

|

|

| |

Net cash (used in) provided by investing activities |

|

| ( | ) |

|

|

| |

|

|

|

|

|

|

|

|

|

Cash flows from financing activities: |

|

|

|

|

|

|

|

|

Payment of long-term debt |

|

| ( | ) |

|

| ( | ) |

Proceeds from issuance of term loan |

|

|

|

|

|

| ||

Payments for capitalized debt issuance costs |

|

|

|

|

| ( | ) | |

Net cash used in financing activities |

|

| ( | ) |

|

| ( | ) |

|

|

|

|

|

|

|

|

|

Net change in cash and cash equivalents |

|

| ( | ) |

|

| ( | ) |

Cash and cash equivalents – beginning |

|

|

|

|

|

| ||

Currency translation adjustment |

|

| ( | ) |

|

|

| |

Cash and cash equivalents – ending |

| $ |

|

| $ |

| ||

|

|

|

|

|

|

|

|

|

Supplemental disclosures: |

|

|

|

|

|

|

|

|

Cash paid for interest |

| $ |

|

| $ |

| ||

The accompanying notes are an integral part of these unaudited financial statements.

| 7 |

| Table of Contents |

ISSUER DIRECT CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

Note 1. Basis of Presentation

The unaudited interim consolidated balance sheet as of March 31, 2024 and consolidated statements of operations, comprehensive loss, stockholders’ equity and cash flows for the three-month periods ended March 31, 2024 and 2023 included herein, have been prepared in accordance with the instructions for Form 10-Q under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and Article 10 of Regulation S-X under the Exchange Act. In the opinion of management, they include all normal recurring adjustments necessary for a fair presentation of the financial statements. Results of operations reported for the interim periods are not necessarily indicative of results for the entire year. Certain information and footnote disclosures normally included in financial statements prepared in accordance with accounting principles generally accepted in the United States ("US GAAP") have been condensed or omitted pursuant to such rules and regulations relating to interim financial statements. The interim financial information should be read in conjunction with the 2023 audited financial statements of Issuer Direct Corporation (the “Company”, “We”, or “Our”) filed on Form 10-K for the year ended December 31, 2023.

Note 2. Summary of Significant Accounting Policies

The consolidated financial statements include the accounts of the Company and its wholly owned subsidiaries. Significant intercompany accounts and transactions are eliminated in consolidation.

Earnings Per Share (EPS)

Earnings per share accounting guidance requires that basic net income per common share be computed by dividing net income for the period by the weighted average number of common shares outstanding during the period. Diluted net income per share is computed by dividing the net income for the period by the weighted average number of common and dilutive common equivalent shares outstanding during the period. Shares issuable upon the exercise of stock options totaling

Revenue Recognition

Substantially all the Company’s revenue comes from contracts with customers for subscriptions to its cloud-based products or contracts for Communications and Compliance products and services. Customers consist of public corporate issuers and professional firms, such as investor and public relations firms. In the case of news distribution and webcasting offerings, customers also include private companies. The Company accounts for a contract with a customer when there is an enforceable contract between the Company and the customer, the rights of the parties are identified, the contract has economic substance, and collectability of the contract consideration is probable. The Company's revenues are measured based on consideration specified in the contract with each customer.

The Company's contracts include either a subscription to its entire platform, certain modules within the platform or to its Press Release Optimizer Plan (“PRO”), or an agreement to perform services, or any combination thereof, and often contain multiple subscriptions and services. For these bundled contracts, the Company accounts for individual subscriptions and services as separate performance obligations if they are distinct, which is when a product or service is separately identifiable from other items in the bundled package, and a customer can benefit from it on its own or with other resources that are readily available to the customer. The Company separates revenue from its contracts into two revenue streams: i) Communications and ii) Compliance. Performance obligations of Communications contracts include providing subscriptions to certain modules or our entire Communications platform, distributing press releases on a per release basis or conducting webcasts, virtual annual meetings, or other events on a per event basis. PRO subscription contracts contain two performance obligations of which the first is a series of distinct services that include, but are not limited to, developing specific media plans, and creating content to be distributed and the second performance obligation being access to the PRO platform along with distribution of press releases, ongoing support, and assessment of performance as a stand-ready obligation. Performance obligations of Compliance contracts include providing subscriptions to certain Compliance modules or other stand-ready obligations to deliver services and annual report printing and distribution. Additionally, services are provided on a per project basis. Set up fees for disclosure services are considered a separate performance obligation and are satisfied upfront. Set up fees for the transfer agent module and investor relations content management module are immaterial. The Company’s subscription and service contracts are generally for one year, with automatic renewal clauses included in the contract until the contract is cancelled. The contracts do not contain any rights of returns, guarantees, or warranties. Since contracts are generally for one year, all the revenue is expected to be recognized within one year from the contract start date. As such, the Company has elected the optional exemption that allows the Company not to disclose the transaction price allocated to performance obligations that are unsatisfied or partially satisfied at the end of each reporting period.

| 8 |

| Table of Contents |

The Company recognizes revenue for subscriptions evenly over the contract period, upon distribution for per release contracts and upon event completion for webcasting and virtual annual meeting events. For service contracts that include stand ready obligations, revenue is recognized evenly over the contract period. For all other services delivered on a per project or event basis, the revenue is recognized at the completion of the event. The Company believes recognizing revenue for subscriptions and stand ready obligations using a time-based measure of progress, best reflects the Company’s performance in satisfying the obligations.

For bundled contracts, revenue is allocated to each performance obligation based on its relative standalone selling price. Standalone selling prices are based on observable prices at which the Company separately sells the subscription or service. If a standalone selling price is not directly observable, the Company uses the residual method to allocate any remaining price to that subscription or service. The Company reviews standalone selling prices, at least annually, and updates these estimates if necessary.

The Company invoices its customers based on the billing schedules designated in its contracts, typically upfront on either a monthly, quarterly or annual basis or per transaction at the completion of the performance obligation. Deferred revenue for the periods presented was primarily related to press release packages which have been prepaid, however the releases have not yet been disseminated, as well as, subscription and service contracts, which are billed upfront, quarterly, or annually, however the revenue has not yet been recognized. The associated deferred revenue is generally recognized as press releases are disseminated for press release packages and ratably over the billing period for subscriptions. Deferred revenue as of March 31, 2024 and December 31, 2023, was $

Costs to obtain contracts with customers consist primarily of sales commissions. As of March 31, 2024 and December 31, 2023, the Company has capitalized $

Cash Equivalents

For purposes of the Company’s financial statements, the Company considers all highly liquid investments purchased with an original maturity date of three months or less to be cash equivalents.

Accounts Receivable and Allowance for Credit Losses

The Company adopted Financial Accounting Standards Board Accounting Standards Codification (“ASC”) Topic 326, Financial Statements – Credit Losses (“Topic 326”) with an adoption date of January 1, 2023. As a result, the Company changed its accounting policy for allowance for credit losses using an expected losses model rather than using incurred losses. The new model is based on the credit losses expected to arise over the life of the asset based on the Company’s expectations as of the balance sheet date through analyzing historical customer data as well as taking into consideration current economic trends. The Company adopted Topic 326 and determined it did not have a material financial impact.

The roll forward of the allowance for credit losses for the three-months ended March 31, 2024 and 2023 was as follows:

|

| Three months ended March 31, 2024 |

|

| Three months ended March 31, 2023 |

| ||

Beginning balance |

| $ |

|

| $ |

| ||

Provision for credit losses |

|

|

|

|

|

| ||

Write-offs |

|

| ( | ) |

|

| ( | ) |

Ending balance |

| $ |

|

| $ |

| ||

Concentration of Credit Risk

Financial instruments and related items which potentially subject the Company to concentrations of credit risk consist primarily of cash, cash equivalents and accounts receivables. The Company places its cash and temporary cash investments with credit quality institutions. Such cash balances are currently in excess of the FDIC insurance limit of $

| 9 |

| Table of Contents |

The Company believes it did not have any financial instruments that could have potentially subjected us to significant concentrations of credit risk for any relevant period.

Use of Estimates

The preparation of financial statements in conformity with US GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Significant estimates include the allowance for doubtful accounts and the valuation of goodwill, intangible assets, deferred tax assets, and stock-based compensation. Actual results could differ from those estimates.

Income Taxes

Deferred income tax assets and liabilities are computed for differences between the financial statement and tax bases of assets and liabilities that will result in future taxable or deductible amounts based on enacted tax laws and rates applicable to the periods in which the differences are expected to affect taxable income. Valuation allowances are established, when necessary, to reduce deferred income tax assets to the amounts expected to be realized. For any uncertain tax positions, the Company recognizes the impact of a tax position, only if it is more likely than not of being sustained upon examination, based on the technical merits of the position. The Company’s policy regarding the classification of interest and penalties is to classify them as income tax expense in the financial statements, if applicable.

Capitalized Software

Costs incurred to develop the Company’s cloud-based platform products are capitalized when the preliminary project phase is complete, management commits to fund the project and it is probable the project will be completed and used for its intended purposes. Once the software is substantially complete and ready for its intended use, the software is amortized over its estimated useful life, which is typically four years. Costs related to design or maintenance of the software are expensed as incurred. Amortization for the three-month periods ended March 31, 2024 and 2023, is as follows (in thousands):

|

| March 31, |

| |||||

|

| 2024 |

|

| 2023 |

| ||

Capitalized software development costs |

| $ |

|

| $ |

| ||

Amortization included in cost of revenues |

|

|

|

|

|

| ||

Impairment of Long-lived Assets

In accordance with the authoritative guidance for accounting for long-lived assets, assets such as property and equipment, trademarks, and intangible assets subject to amortization, are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset group may not be recoverable. Recoverability of asset groups to be held and used is measured by a comparison of the carrying amount of an asset group to estimated undiscounted future cash flows expected to be generated by the asset group. If the carrying amount of an asset group exceeds its estimated future cash flows, an impairment charge is recognized by the amount by which the carrying amount of an asset group exceeds fair value of the asset group.

Lease Accounting

The Company determines if an arrangement is a lease at inception. Operating lease agreements are primarily for office space and are included within lease right-of-use (“ROU”) assets and lease liabilities on the consolidated balance sheet.

ROU assets represent the right to use an underlying asset for the lease term and lease liabilities represent the obligation to make lease payments arising from the lease. ROU assets and lease liabilities are recognized at the commencement date based on the present value of lease payments over the lease term. Variable lease payments consist of non-lease services related to the lease and payments under operating leases classified as short-term. Variable lease payments are excluded from the ROU assets and lease liabilities and are recognized in the period in which the obligation for those payments is incurred. As most leases do not provide an implicit rate, the Company uses its incremental borrowing rate based on the information available at commencement date in determining the present value of lease payments. ROU assets include any lease payments due and exclude lease incentives. Rental expense for lease payments related to operating leases is recognized on a straight-line basis over the lease term.

| 10 |

| Table of Contents |

Fair Value Measurements

ASC Topic 820 establishes a fair value hierarchy that requires an entity to maximize the use of observable inputs and minimize the use of unobservable inputs when measuring fair value. Assets and liabilities recorded at fair value in the financial statements are categorized based upon the hierarchy of levels of judgment associated with the inputs used to measure their fair value. Hierarchical levels directly related to the amount of subjectivity associated with the inputs to fair valuation of these assets and liabilities, are as follows:

| · | Level 1 - Quoted prices are available in active markets for identical assets or liabilities at the reporting date. Generally, this includes debt and equity securities that are traded in an active market. Cash and cash equivalents are quoted at Level 1. |

| · | Level 2 - Observable inputs other than Level 1 prices such as quoted prices for similar assets or liabilities; quoted prices in markets that are not active; or other inputs that are observable or can be corroborated by observable market data for substantially the full term of the assets or liabilities. The fair value of the Company’s long-term debt and interest rate swap are quoted at Level 2. |

|

|

|

| · | Level 3 - Unobservable inputs that are supported by little or no market activity and that are significant to the fair value of the assets or liabilities. Level 3 assets and liabilities include financial instruments whose value is determined using pricing models, discounted cash flow methodologies, or other valuation techniques, as well as instruments for which the determination of fair value requires significant management judgment or estimation. |

As of March 31, 2024 and December 31, 2023, the Company believes the fair value of its financial instruments, such as, accounts receivable, long-term debt, interest rate swap, the line of credit, and accounts payable approximate their carrying amounts.

Translation of Foreign Financial Statements

The financial statements of the foreign subsidiaries of the Company have been translated into U.S. dollars. All assets and liabilities have been translated at current rates of exchange in effect at the end of the period. Income and expense items have been translated at the average exchange rates for the year or the applicable interim period. The gains or losses that result from this process are recorded as a separate component of other accumulated comprehensive income until the entity is sold or substantially liquidated.

Business Combinations, Goodwill, and Intangible Assets

The authoritative guidance for business combinations specifies the criteria for recognizing and reporting intangible assets apart from goodwill. The Company records the assets acquired and liabilities assumed in business combinations at their respective fair values at the date of acquisition, with any excess purchase price recorded as goodwill. Goodwill is an asset representing the future economic benefits arising from other assets acquired in a business combination that are not individually identified and separately recognized. Intangible assets consist of client relationships, customer lists, distribution partner relationships, software, technology, non-compete agreements and trademarks that are initially measured at fair value. At the time of the business combination, trademarks may be considered an indefinite-lived asset and, as such, are not amortized as there may be no foreseeable limit to cash flows generated from them. For the Newswire acquisition the Company determined the trademarks acquired were considered a definite lived asset which will be amortized over a period of

Comprehensive Loss

Comprehensive loss consists of net loss and other comprehensive income related to changes in the cumulative foreign currency translation adjustment.

Advertising

The Company expenses advertising as incurred. During the three-month periods ended March 31, 2024 and 2023, advertising expense was $

Stock-based Compensation

The authoritative guidance for stock compensation requires that companies estimate the fair value of share-based payment awards on the date of the grant using an option-pricing model. The associated cost is recognized over the period during which an employee or director is required to provide service in exchange for the award.

| 11 |

| Table of Contents |

Note 3: Equity

Dividends

The Company did not pay any dividends during the three-month periods ended March 31, 2024 and 2023.

Preferred stock and common stock

There were no issuances of preferred stock or common stock during the three-month periods ended March 31, 2024 and 2023, other than stock awarded to employees and the Board of Directors.

2014 and 2023 Equity Incentive Plan

On May 23, 2014, the shareholders of the Company approved the 2014 Equity Incentive Plan, as amended (the “2014 Plan”). Under the terms of the 2014 Plan, the Company is authorized to issue incentive awards for common stock up to

On June 7, 2023, the shareholders of the Company approved the 2023 Equity Incentive Plan (the “2023 Plan”). Under the terms of the 2023 Plan, the Company is authorized to issue incentive awards for common stock up to

The following table summarizes information about stock options outstanding and exercisable at March 31, 2024:

|

| Options Outstanding |

|

| Options Exercisable |

| |||||||||||

Exercise Price Range |

| Number |

|

| Weighted Average Remaining Contractual Life (in Years) |

|

| Weighted Average Exercise Price |

|

| Number |

| |||||

$ |

|

|

|

|

|

|

| $ |

|

|

|

| |||||

$ |

|

|

|

|

|

|

| $ |

|

|

|

| |||||

$ |

|

|

|

|

|

|

| $ |

|

|

|

| |||||

$ |

|

|

|

|

|

|

| $ |

|

|

|

| |||||

$ |

|

|

|

|

|

|

| $ |

|

|

|

| |||||

| Total |

|

|

|

|

|

|

| $ |

|

|

|

| ||||

As of March 31, 2024, the Company had unrecognized stock compensation related to the options of $

During the three months ended March 31, 2024, the Company granted

Note 4: Income Taxes

The Company recognized income tax expense of $

| 12 |

| Table of Contents |

Note 5: Leases

Leasing activity generally consists of office leases. In March 2019, a new lease was signed to move the corporate headquarters to Raleigh, North Carolina. The new lease, which had a lease commencement date of October 2, 2019, expires

Lease liabilities totaled $

|

| Three months ended |

| |||||

|

| March 31, |

| |||||

|

| 2024 |

|

| 2023 |

| ||

Lease expense |

|

|

|

|

|

| ||

Operating lease expense |

| $ |

|

| $ |

| ||

Variable lease expense |

|

|

|

|

|

| ||

Rent expense |

| $ |

|

| $ |

| ||

The weighted-average remaining non-cancelable lease term for our operating leases was

Year Ended December 31: |

|

|

| |

2024 |

| $ |

| |

2025 |

|

|

| |

2026 |

|

|

| |

2027 |

|

|

| |

Total lease payments |

| $ |

| |

Present value adjustment |

|

| ( | ) |

Lease liability |

|

|

| |

We have performed an evaluation of our other contracts with customers and suppliers in accordance with Topic 842 and have determined that, except for the leases described above, none of our contracts contain a lease.

Note 6: Revenue

The Company considers itself to be a single reportable segment under the authoritative guidance for segment reporting, specifically a communications and compliance company for publicly traded and private companies. The following tables present revenue disaggregated by revenue stream in (000’s):

|

| Three months ended March 31, |

| |||||||||||||

Revenue Streams |

| 2024 |

|

| 2023 |

| ||||||||||

Communications |

| $ |

|

|

| % |

| $ |

|

|

| % | ||||

Compliance |

|

|

|

|

| % |

|

|

|

|

| % | ||||

Total |

| $ |

|

|

| % |

| $ |

|

|

| % | ||||

The Company did not have any customers during the three-month periods ended March 31, 2024 or 2023 that accounted for more than

| 13 |

| Table of Contents |

Note 7: Credit Agreement

On March 20, 2023 (the “Closing Date”), the Company entered into a $

Pursuant to the terms of the Credit Agreement,

The Company began making monthly interest only payments on the Term Loan beginning on April 1, 2023. On January 1, 2024, the Company began making monthly principal payments of $

The proceeds of the Term Loan along with certain cash on hand of the Company were used to repay in its entirety the one-year Secured Promissory Note (the “Seller Note”) issued to Lead Capital, LLC (“the Seller”) in connection with the Company’s November 1, 2022 acquisition of iNewswire.com LLC (“Newswire”) for a lump sum payment of $

The Company currently has no plans to utilize the Revolving LOC but may do so in the future. If the Company does utilize any funds under the Revolving LOC, the funds will bear interest at a per annum rate equal to the then current SOFR plus 2.05%. Pinnacle’s commitment to fund under the Revolving LOC terminates on September 1, 2024, unless terminated earlier pursuant to the terms of the Credit Agreement. The Company terminated its existing $

The Credit Agreement contains the following financial covenants, which commenced with fiscal quarter ending June 30, 2023: a fixed charge coverage ratio of no less than 1.20:1.00 and a leverage ratio requiring that, for each fiscal quarter of the Company ending on or after June 30, 2023 through September 30, 2023, the leverage ratio shall not exceed 2.75:1.00 and for each fiscal quarter of the Company ending after December 31, 2023, the leverage ratio shall not exceed 2.50:1.00.

The Credit Agreement also contains customary affirmative covenants for a transaction of this nature, including among other things, covenants relating to: maintenance of adequate financial and accounting books and records, delivery of financial statements and other information, preservation of existence of the Company and subsidiaries, payment of taxes and claims, compliance with laws, maintenance of insurance, foreign qualification, use of proceeds, cash management system, maintenance of properties, and conduct of business.

The Credit Agreement also contains customary negative covenants for a transaction of this nature, including, among other things, covenants relating to debt, liens, investments, negative pledges, dividends and other debt payments, restriction on fundamental changes, sale of assets, transactions with affiliates, restrictive agreements, and changes in fiscal year.

The Credit Agreement also contains various Events of Default (subject to certain grace periods, to the extent applicable), including among other things, Events of Default for the nonpayment of principal, interest or fees; breach of certain covenants; inaccuracy of the representations or warranties in any material respect; bankruptcy or insolvency; dissolution or change of control; certain unsatisfied judgments; defaults under material agreements; certain unfunded liabilities under employee benefit plans; certain unsatisfied judgments; certain ERISA violations; and the invalidity or unenforceability of the Credit Agreement. If an Event of Default occurs, the Company may be required to repay all amounts outstanding under the Credit Agreement. The Term Loan and any advances under the Revolving LOC are secured by a first priority lien and security interest to the benefit of Pinnacle in the Event of Default on all of the Company’s current or future assets and each of the Guarantor’s current or future assets.

| 14 |

| Table of Contents |

Note 8: Interest Rate Swap

The Company entered into an interest rate swap agreement to convert its interest rate exposure from variable rate to fixed rate to control cash outflows related to interest on its variable rate debt. The Company has $

The carrying amount for the Company’s derivative financial instrument is the estimated fair value of the financial instrument. The Company’s derivative is not exchange listed and therefore the fair value is estimated under a mark-to-market approach using an analytics model that is a readily observable market input. This model reflects the contractual terms of the derivative, such as notional value and expiration date, as well as market-based observables including interest rates, yield curves, and the credit quality of the counterparty. The model also incorporates the Company’s creditworthiness in order to appropriately reflect non-performance risk. Inputs to the derivative pricing model are generally observable and do not contain a high level of subjectivity, and accordingly, the Company’s derivative is classified within Level 2 of the fair value hierarchy. While the Company believes its estimate results in a reasonable reflection of the fair value of the instrument, the estimated value may not be representative of actual value that could have been realized or that will be realized in the near future.

In accounting for the interest rate swap, the Company has determined it does not qualify for hedge accounting. The fair value of the swap agreement as of March 31, 2024 and December 31, 2023 was a net asset of $

| 15 |

| Table of Contents |

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

The discussion of the financial condition and results of operations of the Company set forth below should be read in conjunction with the consolidated financial statements and related notes thereto included elsewhere in this Form10-Q. This Form10-Q contains forward-looking statements that involve risks and uncertainties. The statements contained in this Form10-Q that are not purely historical are forward-looking statements within the meaning of Section 27a of the Securities Act and Section 21e of the Exchange Act. When used in this Form10-Q, or in the documents incorporated by reference into this Form 10-Q, the words “anticipate,” “believe,” “estimate,” “intend” and “expect” and similar expressions are intended to identify such forward-looking statements. Such forward-looking statements include, without limitation, the statements regarding the Company’s strategy, future sales, future expenses, future liquidity, and capital resources. All forward-looking statements in this Form10-Q are based upon information available to the Company on the date of this Form10-Q, and the Company assumes no obligation to update any such forward-looking statements. The Company’s actual results could differ materially from those discussed in this Form10-Q for many reasons. Factors that could cause or contribute to such differences (“Cautionary Statements”) include, but are not limited to, those discussed in Item 1. Business — “Risk Factors” and elsewhere in the Company’s Annual Report on Form10-K for the year ended December 31, 2023, which are incorporated by reference into this Form 10-Q. All subsequent written and oral forward-looking statements attributable to the Company, or persons acting on the Company’s behalf, are expressly qualified in their entirety by the Cautionary Statements.

Overview

Issuer Direct Corporation and its subsidiaries are hereinafter collectively referred to as “Issuer Direct”, the “Company”, “We” or “Our” unless otherwise noted. Our corporate headquarters are located at One Glenwood Ave., Suite 1001, Raleigh, North Carolina, 27603.

We announce material financial information to our investors using our investor relations website, SEC filings, investor events, news and earnings releases, public conference calls, webcasts, and social media. We use these channels to communicate with our investors and the public about our company, our products and services and other related matters. It is possible that information we post on some of these channels could be deemed to be material information. Therefore, we encourage investors, the media and others interested in Issuer Direct to review the information we post to all our channels, including our social media accounts.

We are a leading communications and compliance company, providing solutions for both public relations and investor relations professionals. Our comprehensive solutions are used by thousands of customers from emerging startups to multi-billion-dollar global brands, ensuring their most important moments are reaching the right audiences, via our industry leading newswire, IR website solutions, events technology and compliance solutions. Our platform efficiently and effectively helps our customers manage their events when seeking to distribute their messaging to key constituents, investors, markets and regulatory systems around the globe.

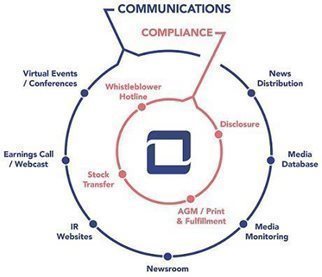

Our platform consists of several related but distinct Communications and Compliance modules that companies and customers utilize every quarter. As such, we disclose our revenue in the following two main categories: (i) Communications and (ii) Compliance. Set forth below is an infographic depicting the products included in each of these two main categories we provide today:

| 16 |

| Table of Contents |

In the future, we expect the Communications portion of our business to continue to increase, both in terms of overall revenue and as compared to the Compliance portion of our business. Therefore, we plan to continue to invest in offerings we intend to incorporate into and complement our Communications product lineup. Within most of our target markets, customers require several individual services and/or software providers to meet their communications and investor relations needs. We believe our platform can address all these needs in a single, secure, cloud-based platform - one that offers a customer control, increases efficiencies, demonstrates clear value and, most importantly, delivers consistent and compliant messaging from one centralized platform.

We work with a diverse customer base, which includes not only corporate issuers and private companies, but also investment banks, professional firms, such as investor relations and public relations firms, as well as the accounting and legal communities. Our customers and their service providers utilize our platform and related solutions from document creation all the way to dissemination to regulatory bodies, news outlets, financial platforms, and our customers’ shareholders. Private companies primarily use our news distribution, newsroom and webcasting products and services to disseminate their message globally.

We also work with several select stock exchanges by making available certain parts of our platform under agreements to integrate our offerings within their products. We believe such partnerships will continue to yield increased exposure to a targeted customer base that could impact our revenue and overall brand in the market.

Communications

Our Communications platform consists of our press release distribution businesses branded as ACCESSWIRE and Newswire, our webcasting and events business, professional conference and events software, as well as our investor relations website technology. Our ACCESSWIRE and Newswire news distribution platforms have been integrated into one dissemination platform that will give our customers all the distribution benefits of our global distribution footprint. These products are sold as the leading part of our Communications subscription, as well as individually to customers around the globe and are further described below. Like other newswires globally, ours are dependent upon several key partners for its news distribution. Disruption in any of our partnerships could have a materially adverse impact on our overall business.

ACCESSWIRE

Our leading press release offering, which is marketed under the brand ACCESSWIRE, is a news dissemination and media outreach service. The ACCESSWIRE product offering focuses on press release distribution for both private and public companies globally. We believe ACCESSWIRE is becoming a competitive alternative in the newswire industry because we have been able to use our technological advancements to allow customers to self-edit releases or use our editorial staff as desired to edit releases. We continue to expand our distribution points, improve our targeting and enhance our analytics reporting. We also offer an e-commerce element to our ACCESSWIRE product, whereby customers can self-select their distribution, register, and then upload their press release for editorial review in minutes. We believe these enhancements have helped increase ACCESSWIRE revenues each year compared to the prior year, a trend we expect to continue over the next several years. We have also been able to maintain high gross margins while providing our customer flexible pricing, with options to pay per release or enter longer-term agreements for a designated package of releases.

Newswire

The Newswire brand was acquired on November 1, 2022, as part of the iNewswire, LLC transaction. Today we continue to operate this brand independently as a stand-alone front-end marketing and news distribution brand option for private companies. Its distribution was fully integrated into the company’s main newswire brand ACCESSWIRE in early 2023. Newswire began in 2016 as an ecommerce news distribution platform, that has evolved over the years to serve thousands of customers globally. Additionally, the brand added new products to complement its news distribution services, such as media database, media rooms and PR Optimizer (”PRO”).

Our PRO offering, formally Media Advantage Platform, automates media and marketing communications for businesses seeking to deliver the right message to the right audience at the right time for the right purpose. Through the PRO offering, we provide content and media communications services that provide customers the opportunity to optimize their content and increase their media visibility, therefore building their brand awareness and engaging a larger audience. With the flexibility of these offerings, customers have the ability to choose between support with content optimization, increased media visibility, or both for optimal results. We believe the PRO product offering provides the most effective and efficient integrated media and content communication program available in the market today.

We believe for the near term, we will operate the newswire brand (newswire.com) platform separate from ACCESSWIRE as there are clear customer segmentation differentiation and offerings surrounding both the Investor Relations and Public Relations Community. However, as the market changes, we could move the brands together and alter the offerings to remain competitive in the market.

| 17 |

| Table of Contents |

Media Suite

As part of the iNewswire acquisition, we acquired certain assets that with further development resulted in our ability to release a subscription add-on to our Newswire and ACCESSWIRE brands, which we call Media Suite. Media Suite includes three new products: Media Database, Media Pitching, and Media Monitoring, all of which are further described below.

The Media Suite offering provides communication professionals with the opportunity to build their story, incorporate artificial intelligence (AI) if desired, effectively pitch the media, and monitor their internal brand as well as their competitors. This is all accomplished with a blend of human curation and an advanced AI engine that ultimately serves as the foundation of an easy-to-use workflow we branded as our Media Suite. Media Suite is a recurring subscription product, with three subscription options available: Media Suite Starter, Media Suite Plus, and Media Suite Enterprise, each providing different combinations of our solutions to help our customers reach their goals.

Media Database – Our media database is based on the idea that pitching the media should be a targeted endeavor. Our dataset includes only the journalists that are actively writing and publishing articles. We built this component in reverse, looking at the tens of millions of articles published annually and sorted articles by industry, publication and journalist, then curated the most accurate data of each contact and made it available within our media database. Additionally, within the interface we made it easy to see each article published by every journalist a user may want to connect with, making Media Suite a compelling combination of the right features and intelligence between database, pitching, and monitoring.

Media Pitching – Pitching is a critical part of the Media Suite because it allows the user to contact and connect with the most active journalists in their industry. Media Suite not only gives the user the professionals to pitch, it also offers AIMee, our AI writing and recommendation engine, to enhance the user’s message, write a new message and highlight engageable content to help bring their pitch to the forefront.

Media Monitoring – a brand Monitoring solution is extremely important, and every company should consider monitoring not only their brands, but their products, executives and competitors mentioned in all mediums – print, broadcast media and television, web, radio, video, blogs and social media. Our monitoring solution offers many of these mediums and we will continue to undergo expansion in each of these mediums with a goal of being a comprehensive media monitoring solution within the next year. Our media monitoring solution ties together our journalist contacts and mention analytics into and with a customer’s dashboard of daily activity.

Media Room

A natural addition to our ACCESSWIRE and investor relations website business is our corporate Media Room. This product offering can be an add-on to any customer’s ACCESSWIRE or Communications subscription account. The Media Room suite includes a custom newsroom page builder, a brand asset manager and contact manager.

Our Media Room suite addresses the needs of our customers looking to build connections with media, journalists, customers and if applicable the investment community. According to a survey from TekGroup, a majority of journalists and media professionals indicated the importance of newsrooms that include digital media, press kits and video. We believe our Media Room suite accomplishes this by making it a part of our new Media Suite, giving us a further competitive advantage in the market. This also allows our customers to have one media platform to manage all their assets, brands and outreach.

Webcasting & Events

Our webcasting and events business is comprised of our earnings call webcasting solutions and our virtual meeting and events software (such as annual meetings, deal/non-deal road shows, analyst days and shareholder days).

Our Webcasting Platform is a cloud-based webcast, webinar and virtual meeting platform that delivers live and on-demand streaming of events to audiences of all sizes. Our solution allows customers to create, produce and deliver events, which we feel has significantly strengthened our webcasting product and Communications offering. The platform architecture gives us the ability to host thousands of webcasts each year, expanding and diversifying our webcast business from our historical earnings-based events to include any type of virtual event.

Traditional earnings calls and webcasts are a highly competitive market with the majority of the business being driven from practitioners in investor relations and communications firms. We estimate there are approximately 5,000 companies in North America conducting earnings events each quarter that include a teleconference, webcast or both as part of their events. Our platform incorporates other elements of the earnings event, including earnings date/call announcement, earnings press release and SEC Form 8-K filings. There are a handful of our competitors that can offer this integrated full-service solution today, however, we believe our real-time event setup and integrated approach offers a more effective way to manage the process. As we expand our platform, it is vital for us to have solutions that service both our core public companies but also a growing segment of private customers.

| 18 |

| Table of Contents |

Professional Conference and Events Software

Our professional conference and events software is a subscription offering we currently license to investor conference organizers. This software, which is also available as a native mobile app, offers organizers, issuers and investors the ability to register, request and approve one-on-one meetings, manage schedules, perform event promotion and sponsorship, print attendee badges and manage lodging. This cloud-based product can be used in a virtual or in person conference setting and is integrated within our Communications subscription offerings of newswire, newsrooms, webcasting and shareholder targeting. We believe this integration gives us a unique offering for professional conference organizers that is not available elsewhere in the market.

Investor Relations Websites

Our investor relations content network is another component of our Communications offering, which is used to create the investor relations’ tab of a company’s website. This investor relations content network is a robust series of data feeds including news feeds, stock feeds, fundamentals, regulatory filings, corporate governance and many other components which are aggregated from most of the major exchanges and news distribution outlets around the world. Customers can subscribe to one or more of these data feeds or as a component of a fully designed and hosted website for pre-IPO companies, SEC reporting companies and partners seeking to display our content on their corporate sites. The clear benefit to our investor relations content network is its integration with our other Communications offerings. As such, companies can produce content for public distribution and it is automatically linked to their corporate website, distributed to targeted groups and placed into our data feed partners.

During 2023 we released significant upgrades to our investor relations website, that included ADA Compliance (Americans with Disabilities Act) which ensures that people with disabilities have the same access to all areas of a business's premises. Specifically, this module addresses electronic information and technology, such as our customers’ websites. This add-on requires a recurring annual subscription and is delivered fully integrated into and with our investor relations website offering.

Compliance

Our Compliance offerings consist of our disclosure software for financial reporting, stock transfer services, whistleblower hotline and related annual meeting, print and shareholder distribution services. Some of these products are sold as part of a Compliance subscription as well as individually to customers around the globe.

Disclosure Software and Services

Our disclosure reporting module is a document conversion, editing and filing offering which is designed for reporting companies and professionals seeking to insource the document drafting, editing and filing processes to the SEC’s EDGAR system. Our disclosure business also offers companies the ability to use our in-house staff to assist in the conversion, tagging and filing of their documents. We generate revenues in disclosure both from software and services and, in most cases, customers have both components within their annual agreements, while others pay for services as they are completed.

Whistleblower Hotline

Our whistleblower hotline is an add-on product within our platform. This system delivers secure notifications and basic incident workflow management processes that align with a company’s corporate governance whistleblower policy. As a supported and subsidized bundle product of the New York Stock Exchange (“NYSE”) offerings, we are introduced to new IPO customers and other larger cap customers listed on the NYSE. Since 2014, we have been a named NYSE subsidy provider of this Whistleblower solution. Recently, we have been working on upgrading the incident response and management component of the workflow, which is expected to be deployed this year.

Stock Transfer Module

A valued subscription module in our Compliance offering is the ability for our customers to gain access to real-time information about their shareholders, stock ledgers and reports and to issue new shares from our cloud-based stock transfer module. Managing the capitalization table of a public company or pre-IPO company is a cornerstone of corporate governance and transparency, and as such companies and community banks have chosen us to assist with their stock transfer needs, including bond offerings and dividend management. This is an industry which has experienced declining overall revenues as it was affected by the replacement of paper certificates with digital certificates. However, we have been focused on selling subscriptions of the stock transfer component of our platform, allowing customers to gain access to our cloud-based system in order to move shares or query shareholders, which we believe has resulted in a more efficient process for both our customers and us.

| 19 |

| Table of Contents |

Annual Meeting / Proxy Voting Platform

Our proxy module is marketed as a fully integrated, real-time voting platform for our customers and their shareholders of record. This module is utilized for every annual meeting or special meeting we manage for our customers and offers both full-set mailing and notice of internet availability options.

This module has been incorporated within our webcasting offering to enable our customers the ability to conduct their annual meetings in-person or fully virtual. Our solution incorporates shareholder and guest registration, voting integration, real-time statistics on attendance, audio video and presentation features as well as fully managed meeting managers and inspector of elections. We believe a virtual component to an annual meeting is both a benefit to all shareholders and a corporate governance advantage.

Shareholder Distribution

In the past, we have worked on refining the model of digital distribution of our customers’ message to the investment community and beyond. This was accomplished by integrating our shareholder outreach module, Investor Network, into and with our Compliance offerings. Most of the customers subscribing to this module today are historical PrecisionIR (“PIR”) – Annual Report Service (“ARS”) users, as well as new customers purchasing the entire platform subscription. We migrated some of the customers from the traditional ARS business into this new digital subscription business, however, we continue to operate a portion of this legacy physical hard copy delivery of annual reports and prospectuses for customers who opt to take advantage of it. We continue to see customer attrition for customers who subscribe to both the electronic and physical distribution of reports as a stand-alone product.

Results of Operations

Comparison of results of operations for the three months ended March 31, 2024 and 2023 (in 000’s):

|

| Three Months Ended March 31, |

|

| Percentage of Revenue(1) |

| ||||||||||

|

| 2024 |

|

| 2023 |

|

| 2024 |

|

| 2023 |

| ||||

Revenue: |

|

|

|

|

|

|

|

|

|

|

|

| ||||

Communications revenue |

| $ | 5,459 |

|

| $ | 6,566 |

|

|

| 78 | % |

|

| 76 | % |

Compliance revenue |

|

| 1,503 |

|

|

| 2,053 |

|

|

| 22 | % |

|

| 24 | % |

Total revenue |

|

| 6,962 |

|

|

| 8,619 |

|

|

| 100 | % |

|

| 100 | % |

Cost of revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Communications cost of revenue |

|

| 1,342 |

|

|

| 1,384 |

|

|

| 25 | % |

|

| 21 | % |

Compliance cost of revenue |

|

| 379 |

|

|

| 445 |

|

|

| 25 | % |

|

| 22 | % |

Total cost of revenue |

|

| 1,721 |

|

|

| 1,829 |

|

|

| 25 | % |

|

| 21 | % |

Gross Margin: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Communications gross margin |

|

| 4,117 |

|

|

| 5,182 |

|

|

| 75 | % |

|

| 79 | % |

Compliance gross margin |

|

| 1,124 |

|

|

| 1,608 |

|

|

| 75 | % |

|

| 78 | % |

Total gross margin |

|

| 5,241 |

|

|

| 6,790 |

|

|

| 75 | % |

|

| 79 | % |

Operating Expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

General and administrative |

|

| 1,819 |

|

|

| 2,332 |

|

|

| 26 | % |

|

| 27 | % |

Sales and marketing |

|

| 2,096 |

|

|

| 2,381 |

|

|

| 30 | % |

|

| 28 | % |

Product development |

|

| 654 |

|

|

| 774 |

|

|

| 9 | % |

|

| 9 | % |

Depreciation and amortization |

|

| 724 |

|

|

| 722 |

|

|

| 10 | % |

|

| 8 | % |

Total expenses |

|

| 5,293 |

|

|

| 6,209 |

|

|

| 76 | % |

|

| 72 | % |

Operating (loss) income |

|

| (52 | ) |

|

| 581 |

|

|

| (1 | )% |

|

| 7 | % |

Interest expense, net |

|

| (276 | ) |

|

| (238 | ) |

|

| (4 | )% |

|

| (3 | )% |

Other income (expense) |

|

| 205 |

|

|

| (535 | ) |

|

| 3 | % |

|

| (6 | )% |

(Loss) income before income taxes |

|

| (123 | ) |

|

| (192 | ) |

|

| (2 | )% |

|

| (2 | )% |

Income tax (benefit) expense |

|

| 16 |

|

|

| (48 | ) |

|

| — |

|

|

| (1 | )% |

Net (loss) income |

| $ | (139 | ) |

| $ | (144 | ) |

|

| (2 | )% |

|

| (2 | )% |

(1) Percentage of revenue is calculated as the relevant revenue, expense, income amount divided by total revenue, except for communications and compliance cost of revenue and communications and compliance gross margin, which are divided by the related component of revenue.

| 20 |

| Table of Contents |

Revenues

Total revenue decreased $1,657,000, or 19%, to $6,962,000 during the three months ended March 31, 2024, as compared to $8,619,000 for the same period in 2023. The decrease is attributable to declines in revenue in both our Communications and Compliance revenue streams.

Communications revenue decreased $1,107,000, or 17%, to $5,459,000 for the three months ended March 31, 2024, as compared to $6,566,000 for the same period of 2023. The decrease in revenue is due to both a decrease in volume in our Newswire business as well as decrease in pricing mix from our ACCESSWIRE business. Additionally, revenue from our events and webcasting business was lower due to a large conference that occurred during the three months ended March 31, 2023, but not during the current year. Communications revenue represented 78% of total revenue during the three months ended March 31, 2024, as compared to 76% for the same period of 2023.

Compliance revenue decreased $550,000, or 27%, to $1,503,000 during the three months ended March 31, 2024, as compared to $2,053,000 during the same period of 2023. The decrease was primarily related to a decrease in revenue from print and proxy fulfillment services due to fewer and smaller transactions than in the prior year. Additionally, we had a decrease in revenue from our transfer agent services due to a decrease in corporate actions and directives during the period. Revenue from these two services tends to fluctuate from quarter to quarter because they are project-based and dependent on market activity.

Revenue Backlog

As of March 31, 2024, our deferred revenue balance was $5,584,000, which we expect to recognize over the next twelve months, compared to $5,412,000 at December 31, 2023, an increase of 3%. Deferred revenue primarily consists of advance billings for pre-paid packages of our news distribution products as well as advance billings for subscriptions of our cloud-based products and annual service contracts.

Cost of Revenues

Communications cost of revenues consists primarily of direct labor costs, newswire distribution costs, teleconferencing costs, and third-party licensing costs. Compliance and other costs of revenue consists primarily of direct labor costs, warehousing, logistics, print production materials and postage. Cost of revenues decreased by $108,000, or 6%, during the three months ended March 31, 2024, as compared to the same period of 2023. Overall gross margin decreased $1,549,000, or 23%, during the three months ended March 31, 2024, compared to the same period of 2023. As a result, overall gross margin percentage decreased to 75% during the three months ended March 31, 2024, as compared to 79% during the same period of 2023.

Cost of revenues associated with our Communications revenue decreased $42,000, or 3%, during the three months ended March 31, 2024 as compared to the same period of 2023. This decrease is primarily due to lower volume noted earlier. Gross margin percentage associated with our Communications revenue was 75% for the three months ended March 31, 2024 compared to 79% for the same period of 2023. The decrease in gross margin percentage is due to lower Communications revenue.

Cost of revenues associated with our Compliance revenue decreased $66,000, or 15%, during the three months ended March 31, 2024 as compared to the same period of 2023. The decrease is primarily the result of lower print and postage costs associated with lower revenue from our print and proxy fulfillment services. As a result, gross margin percentage associated with our Compliance revenue decreased to 75% for the three months ended March 31, 2024, compared to 78% for the same period of 2023.

General and Administrative Expenses

General and administrative expenses consist primarily of salaries, bonuses, stock-based compensation, insurance, fees for professional services, general corporate expenses (including bad debt expense) and facility and equipment expenses. General and administrative expenses were $1,819,000 for the three months ended March 31, 2024, a decrease of $513,000 or 22%, as compared to the same period of 2023. The decrease is primarily driven by a benefit to stock compensation expense as a result of the resignation of an executive officer as well as lower one-time transaction and integration costs, partially offset by an increase in bad debt expense.

As a percentage of revenue, general and administrative expenses were 26% for the three months ended March 31, 2024, as compared to 27% for the same period of 2023.

Sales and Marketing Expenses

Sales and marketing expenses consist primarily of salaries, stock-based compensation, sales commissions, advertising expenses, tradeshow expenses and other marketing expenses. Sales and marketing expenses were $2,096,000 for the three months ended March 31, 2024, a decrease of $285,000, or 12%, as compared to the same period of 2023. This decrease is primarily due to lower employee-related expenses, including commissions.

| 21 |

| Table of Contents |

As a percentage of revenue, sales and marketing expenses were 30% for the three months ended March 31, 2024, as compared to 28% for the same period of 2023.

Product Development Expenses

Product development expenses consist primarily of salaries, stock-based compensation, bonuses, and licenses to develop new products and technology to complement and/or enhance our platform. Product development expenses decreased $120,000, or 16%, to $654,000 during the three months ended March 31, 2024, as compared to 2023. The decrease is primarily due to the capitalization of $245,000 for our Media Suite product as well as enhancements to our ACCESSWIRE system. No costs were capitalized during the three months ended March 31, 2023.

As a percentage of revenue, product development expenses were 9% for both the three months ended March 31, 2024 and 2023.

Interest Income (Expense), Net

We recognized interest expense of $308,000 for the three-month period ended March 31, 2024, compared to $337,000 during the same period of 2023. For the three months ended March 31, 2024, interest expense is related to our long-term credit agreement. For the three months ended March 31, 2023, interest expense primarily represents interest attributed to the $22,000,000 Seller Note, as well as $47,000 of accrued interest related to our long-term credit agreement. These amounts are offset by interest income on deposit and money market accounts of $32,000 and $99,000 for the three months ended March 31, 2024 and 2023, respectively.

Other income (expense)

Other income (expense) represents the change in fair value of our interest rate swap. For the three months ended March 31, 2023, Other income (expense) also includes expense related to $370,000 paid to extinguish the Seller Note.

Income Taxes

We recognized an income tax expense of $16,000 for the three-month period ended March 31, 2024, compared to income tax benefit of $48,000 during the same period of 2023. For the three-month periods ended March 31, 2024 and 2023, the variance between our effective tax rate and the U.S. statutory rate of 21% is primarily attributable to state income tax. For the three months ended March 31, 2024, the effective tax rate was also impacted by additional expense associated with vesting of stock-based compensation awards.

Liquidity and Capital Resources

As of March 31, 2024, we had $5,399,000 in cash and cash equivalents and $4,201,000 in net accounts receivable. Current liabilities as of March 31, 2024, totaled $13,215,000 including our accounts payable, deferred revenue, accrued payroll liabilities, income taxes payable, current portion of long-term debt, current portion of lease liabilities and other accrued expenses. On March 31, 2024, our current liabilities exceeded our current assets by $2,116,000.