| [MHM, December 28, 2011] | |

| [Translation] | |

| SECURITIES REGISTRATION STATEMENT | |

| (For NAV Sale) | |

| PUTNAM EUROPE EQUITY FUND |

| SECURITIES REGISTRATION STATEMENT |

| (For NAV Sale) |

| To: Director of Kanto Local Finance Bureau |

| Filing Date: December 28, 2011 | |

| Name of the Registrant Trust: | PUTNAM EUROPE EQUITY FUND |

| Name and Official Title of | Jonathan S. Horwitz |

| Representative of Trustees: | Executive Vice President, Treasurer, Principal |

| Executive Officer and Compliance Liaison | |

| Address of Principal Office: | One Post Office Square |

| Boston, Massachusetts 02109 | |

| U.S.A. | |

| Name and Title of Registration Agent: | Harume Nakano |

| Attorney-at-Law | |

| Ken Miura | |

| Attorney-at-Law | |

| Address or Place of Business: | Marunouchi Park Building, |

| 6-1, Marunouchi 2-chome | |

| Chiyoda-ku, Tokyo | |

| Name of Liaison Contact: | Harume Nakano |

| Ken Miura | |

| Attorneys-at-Law | |

| Place of Liaison Contact: | Mori Hamada & Matsumoto |

| Marunouchi Park Building, | |

| 6-1, Marunouchi 2-chome | |

| Chiyoda-ku, Tokyo | |

| Phone Number: | 03-6212-8316 |

| - ii - |

| Public Offering or Sale for Registration |

Name of the Fund Making Public Offering or Sale of Foreign Investment Fund Securities:

PUTNAM EUROPE EQUITY FUND

Aggregate Amount of Foreign Investment Fund Securities to be Publicly Offered or Sold:

Up to 898 million U.S. Dollars (USD) (Japanese Yen (JPY) 69.8 billion.)

Note : U.S. dollar amounts are translated into Japanese Yen at the rate of 1 USD=JPY 77.75, the mean of the exchange rate quotations by The Bank of Tokyo-Mitsubishi UFJ, Ltd. for buying and selling spot dollars by telegraphic transfer against Japanese Yen on October 31, 2011.

| Places where a copy of this Securities Registration |

| Statement is available for Public Inspection |

| Not applicable. |

| - 1 - |

PART I. INFORMATION CONCERNING SECURITIES

1. NAME OF FUND:

PUTNAM EUROPE EQUITY FUND (hereinafter referred to as the "Fund")

2. NATURE OF FOREIGN INVESTMENT FUND SECURITIES CERTIFICATES:

Six classes of shares (Class A shares, Class B shares, Class C shares, Class M shares, Class R shares and Class Y shares) being all registered without par value. In Japan, only Class M shares (all hereinafter referred to as the "Shares") are available for public offering. As to the Shares, there are no credit ratings that have been provided or made available for inspection by any credit-rating firm due to a request from the issuer of the Fund, or that are to be provided or made available for inspection by any credit-rating firm due to a request from the issuer of the Fund. The Shares are an additional offering type.

3. TOTAL AMOUNT OF OFFERING PRICE:

Up to 898 million U.S. Dollars (JPY 69.8 billion).

Note 1: For convenience, U.S. Dollar amounts are converted into Japanese Yen at the rate of USD 1.00 = JPY 77.75 (the mean of the exchange rate quotations by The Bank of Tokyo-Mitsubishi UFJ, Ltd. for buying and selling spot dollars by telegraphic transfer against Japanese Yen on October 31, 2011). The same rate applies hereinafter.

Note 2: In this document, money amounts and percentages ending in the numeral 5 or higher have been rounded up to 10 and otherwise rounded down. Therefore, there are cases in which the amount for the "total” column is not equal to the aggregate amount. Also, conversion into other currencies is done by simply multiplying the corresponding amount by the conversion rate specified and rounding the resulting number up to 10 if the amount ends in the numeral 5 or higher and otherwise rounding down when necessary. As a result, in this document, there are cases in which Japanese Yen figures for the same information differ from each other.

4. ISSUE PRICE:

The Net Asset Value per share is calculated on a Fund Business Day after the application for purchase is received by the Fund. Note: A “Fund Business Day” means a day on which the New York Stock Exchange (the “NYSE”) is open for business. Investors can inquire of SMBC Friend Securities Co., Ltd., described in Item 8 below, about the issue price.

5. SALES CHARGE:

Class M Shares:

The sales charge (in Japan) is 3.675% (3.50% without a consumption tax) of the net asset value of the Fund’s class M shares (Net Asset Value).

| - 2 - |

Note: 0.50% of the amount calculated by dividing the Net Asset Value by (1-0.035) and rounding to three decimal places will be retained by Putnam Retail Management Limited Partnership, principal underwriter of the Fund (the “Principal Underwriter”).

6. MINIMUM AMOUNT OR NUMBER OF SHARES FOR SUBSCRIPTION:

The minimum amount for purchase of Shares is 100 Shares. Shares may be purchased in integral multiples of 10 Shares.

7. PERIOD OF SUBSCRIPTION:

From December 29, 2011 (Thursday) to December 28, 2012 (Friday) (the “Subscription Period”) provided that the subscription is handled only on a day that is both a Fund Business Day and a business day when securities companies are open for business in Japan.

8. PLACE OF SUBSCRIPTION:

SMBC Friend Securities Co., Ltd. (hereinafter referred to as "SMBC Friend" or the "Distributor")

7-12, Nihonbashi-kabutocho, Chuo-ku, Tokyo

Note: The subscription is handled at the head office and the branch offices in Japan of the above-mentioned securities company.

9. DATE OF PAYMENT:

Investors shall pay the Issue Price and Sales Charge to SMBC Friend within 4 business days in Japan from the day when SMBC Friend confirms the execution of the order (the "Trade Day"). The total issue price for each date of subscription (the “Application Day”) will be transferred by SMBC Friend to the account of the Fund’s underwriter within 4 Fund Business Days (hereinafter referred to as "Payment Date") from (and including) the Application Day.

10. PLACE OF PAYMENT:

SMBC Friend

11. MATTERS REGARDING TRANSFER AGENT:

Not applicable.

12. MISCELLANEOUS:

(A) DEPOSIT FOR SUBSCRIPTION:

None

| - 3 - |

(B) Method of Subscription:

Investors who subscribe to Shares shall enter into an agreement with a Sales Handling Company concerning transactions of foreign securities. A Sales Handling Company shall provide to the investors a Contract Concerning a Foreign Securities Transactions Account and other prescribed contracts (the "Contracts"), and the investors shall submit to the Sales Handling Company an application requesting the opening of a transactions account under the Contracts. The subscription amount shall be paid in Yen in principle and the Yen exchange rate shall be the foreign exchange rate quoted in the Tokyo Foreign Exchange Market on the Trade Day of each subscription, which shall be determined by such Sales Handling Company.

The payment may be made in U.S. Dollars to the extent that the Sales Handling Company can agree.

Note: A "Sales Handling Company" means a financial instruments agent company and/or registration agent financial institution which shall conclude the agreement with a Distributor concerning agency business of shares of the Fund, act as agent for a Distributor for subscription or repurchase of shares of the Fund from investors, and handle the business, etc. concerning receipt of subscription money from investors or payment of repurchase proceeds to investors, etc.

SMBC Friend shall pay the subscription amount in U.S. Dollars to the account of the Fund’s underwriter for the Fund on the Payment Date.

(C) PAST PERFORMANCE

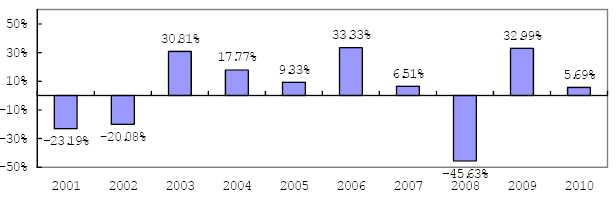

The performance information below gives some indication of the risks associated with an investment in the Fund by showing the Fund’s performance year to year and over time. The bar chart shows calendar year returns and the average annual total return over the past 10 years for the Fund’s class M shares.

The bar chart does not reflect the impact of sales charges. If it did, performance would be lower. Please remember that past performance is not necessarily an indication of future results. Monthly performance figures for the Fund are available at Putnam.com.

Annual total returns for Class M shares before sales charges

| - 4 - |

- Year-to-date performance through 9/30/11: -18.18%.

| - Best calendar quarter | |

| Q2 2009 | 24.67% |

| - Worst calendar quarter | |

| Q3 2002 | -23.51% |

Average annual total returns after sales charges (for periods ending 12/31/10)

| Past 1 year | Past 5 years | Past 10 years | |

|

| |||

| Class M before taxes | 2.00% | 0.93% | 0.80% |

|

| |||

| MSCI Europe Index | |||

| (ND) (no deduction | |||

| for fees, expenses or | |||

| taxes other than | 3.88% | 2.85% | 3.27% |

| withholding taxes on | |||

| reinvested dividends) | |||

|

| |||

This table compares the Fund’s performance to that of a broad measure of market performance. Unlike the bar chart, this performance information reflects the impact of sales charges. (See (D) FEES AND EXPENSES in Part I of the SRS for details.) Class M share performance reflects the current maximum initial sales charge of 3.50%. The Fund’s performance for portions of the period benefited from Putnam Investment Management, LLC’s (the “Investment Management Company”) agreement to limit the Fund’s expenses.

| - 5 - |

The Fund's performance is compared to the MSCI Europe Index (Net Dividends), an unmanaged index of Western European equity securities.

(D) FEES AND EXPENSES

The following table describes the fees and expenses an investor may pay if the investor buys and holds shares of the Fund. An investor may qualify for sales charge discounts if the investor and the investor’s family invest, or agree to invest in the future, at least $50,000 in Putnam funds.

Shareholder Fees (fees paid directly from an investor’s investment)

| Class M Shares | |

|

| |

| Maximum Sales Charge (Load) Imposed on Purchases | 3.50% |

| (as a percentage of offering price) | |

|

| |

| Maximum Deferred Sales Charge (Load) (as a percentage of | 0.65* |

| original purchase price or redemption proceeds, whichever is lower) | |

|

| |

| Redemption Fee (as a percentage of total redemption proceeds) | 1.00% |

* Applies only to certain redemptions of shares bought with no initial sales charge.

Annual Fund Operating Expenses

(expenses an investor pays each year as a percentage of the value of the investor’s investment)

| Management | Distribution | Other | Total Annual | |

| Fees* | and Service | Expenses | Fund Operating | |

| (12b-1) Fees | Expenses | |||

|

| ||||

| Class M | 0.72% | 0.75% | 0.46% | 1.93% |

|

| ||||

* Management fees are subject to a performance adjustment.

(E) EXAMPLE:

The following hypothetical example is intended to help investors compare the cost of investing in the Fund with the cost of investing in other funds. It assumes that an investor invests $10,000 in the Fund for the time periods indicated and then, except as indicated, redeems all of the investor’s shares at the end of those periods. It assumes a 5% return on an investor’s investment each year and

| - 6 - |

that the Fund’s operating expenses remain the same. An investor’s actual costs may be higher or lower.

| 1 year | 3 years | 5 years | 10 years | |

|

| ||||

| Class M | $539 | $935 | $1,355 | $2,525 |

(F) PORTFOLIO TURNOVER:

The Fund pays transaction-related costs when it buys and sells securities (or “turns over” its portfolio). A higher turnover rate may indicate higher transaction costs and may result in higher taxes when the Fund’s shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or the above example, affect Fund performance. The Fund’s turnover rate in the most recent fiscal year was 70%.

(G) Offerings other than in Japan:

Shares are simultaneously offered in the United States of America.

(H) OUTLINE OF UNDERWRITING, ETC.:

(1) SMBC Friend undertakes to make a public offering of Shares in accordance with an agreement dated June 22, 1998 with the Principal Underwriter in connection with the sale of the Shares in Japan.

(2) SMBC Friend will execute or forward purchase orders and repurchase requests relating to the Shares received directly or indirectly through other Sales Handling Companies to the Fund.

(3) The Fund has appointed SMBC Friend as the Agent Company in Japan.

Note: The "Agent Company" shall mean the company which, under a contract made with a foreign issuer of investment securities, makes public the Fund’s Net Asset Value per Share and submits or forwards the financial reports or other documents to the Japan Securities Dealers Association ("JSDA") or other Sales Handling Companies.

PART II. INFORMATION CONCERNING THE FUND

I. DESCRIPTION OF THE FUND

1. NATURE OF THE FUND

(A) Objectives and Basic Nature of the Fund:

| - 7 - |

GOAL

The Fund seeks capital appreciation.

INVESTMENTS and RISKS

Investments

The Investment Management Company invests mainly in common stocks (growth or value stocks or both) of large and midsize European companies that it believes have favorable investment potential. The Investment Management Company may purchase stocks of companies with stock prices that reflect a value lower than that which it places on the company. The Investment Management Company also considers other factors it believes will cause the stock price to rise. The Investment Management Company invests mainly in developed countries, but may invest in emerging markets, such as those in Eastern Europe. The Investment Management Company may consider, among other factors, a company’s valuation, financial strength, growth potential, competitive position in its industry, projected future earnings, cash flows and dividends when deciding whether to buy or sell investments. The Investment Management Company may also use derivatives, such as futures, options, certain foreign currency transactions, warrants and swap contracts, for both hedging and non-hedging purposes.

Risks

It is important to understand that you can lose money by investing in the Fund.

The prices of stocks in the Fund’s portfolio may fall or fail to rise over extended periods of time for a variety of reasons, including both general financial market conditions and factors related to a specific company or industry. Growth stocks may be more susceptible to earnings disappointments, and value stocks may fail to rebound. The value of international investments traded in foreign currencies may be adversely impacted by fluctuations in exchange rates. International investments may carry risks associated with potentially less stable economies or governments, such as the risk of seizure by a foreign government, the imposition of currency or other restrictions, or high levels of inflation or deflation. International investments, particularly emerging-market investments, can be illiquid. Investments in a single region may

| - 8 - |

be affected by common economic forces and other factors. In addition, events in any one country within the region may impact the other countries or the region as a whole. The Investment Management Company’s use of derivatives may increase these risks by, for example, increasing investment exposure or, in the case of many over-the-counter instruments, because of the potential inability to terminate or sell derivatives positions.

The Fund may not achieve its goal, and it is not intended to be a complete investment program. An investment in the Fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

LIMITATION TO THE AMOUNT OF THE TRUST MONEY

No limitation is set to the amount of the trust money.

| (B) | HISTORY OF THE FUND: | |

| November 10, 1988: | Organization of the Fund as a Massachusetts business | |

| trust. Adoption of the Agreement and Declaration of | ||

| Trust. | ||

| July 13, 1990: | Adoption of the Amended and Restated Agreement and | |

| Declaration of Trust | ||

| April 30, 2003: | Adoption of the Amended and Restated Agreement and | |

| Declaration of Trust |

(C) Structure of the Fund:

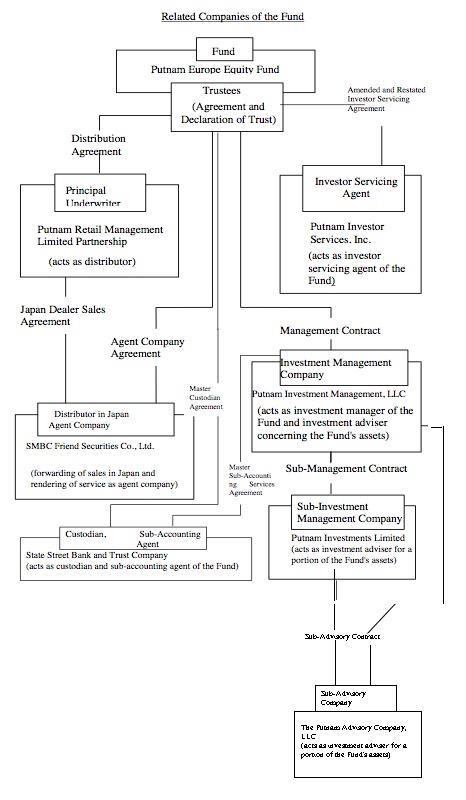

(1) Affiliated Companies of the Fund:

Names of the affiliated companies of the Fund and their roles in the operation of the Fund are as follows:

a. The Investment Management Company renders investment management services to the Fund. It is responsible for making investments decisions for the Fund and managing the Fund’s other affairs and business.

b. Putnam Investments Limited (the “Sub-Investment Management Company”) manages a separate portion of the assets of the Fund as determined by the Investment Management Company from time to time. Subject to the supervision of the Investment Management Company, the Sub-Investment Management Company is responsible for making investment decisions for the portion of the assets of the Fund that it manages.

| - 9 - |

c. The Putnam Advisory Company, LLC (the Sub-Advisory Company”) manages a separate portion of the assets of the Fund as determined by the Investment Management Company or the Sub-Investment Management Company from time to time. Subject to the supervision of the Investment Management Company or the Sub-Investment Management Company, as applicable, the Sub-Advisory Company is responsible for making investment decisions for the portion of the assets of the Fund that it manages.

d. Putnam Investor Services, Inc. (the “Investor Servicing Agent”) acts as Investor Servicing Agent.

e. State Street Bank and Trust Company (the “Custodian” and “Sub-Accounting Agent”) acts as Custodian and Sub-Accounting Agent.

f. The Principal Underwriter provides marketing services to the Fund.

g. SMBC Friend Securities Co., Ltd. ("Distributor in Japan" and "Agent Company") engages in forwarding the purchase or repurchase orders for the Shares in Japan and also acts as the Agent Company.

| - 10 - |

| - 12 - |

(2) Outline of Agreements concluded between related parties of the Fund

| Role in Operation | Related Party | Agreement | Outline |

| of Fund | |||

|

| |||

| Investment | Putnam Investment | Management Contract | An agreement entered into on January 1, |

| Management | Management, LLC | (Note 1) | 2010, in which the Investment |

| Company | Management Company agrees to act as | ||

| investment manager of the Fund and as | |||

| investment adviser concerning the Fund's | |||

| assets. | |||

|

| |||

| Sub-Advisory | The Putnam Advisory | Sub-Advisory | An agreement entered into on May 15, |

| Company | Company, LLC | Contract (Note 2) | 2008, in which the Sub-Advisory |

| Company agrees to act as a sub-advisor for | |||

| a portion of the Fund’s assets. | |||

|

| |||

| Sub-Investment | Putnam Investments | Sub-Management | An agreement entered into on May 15, |

| Management | Limited | Contract | 2008, in which the Sub-Investment |

| Company | (Note 3) | Management Company agrees to act as | |

| sub-investment manager for a portion of | |||

| the Fund’s assets. | |||

|

| |||

| Investor | Servicing Putnam Investor Services, | Amended and | An agreement entered into on January 1, |

| Agent | Inc. | Restated Investor | 2009 relating to the Investor Servicing |

| Servicing Agreement | Agent’s acting as investor servicing agent | ||

| (Note 4) | of the Fund. | ||

|

| |||

| Custodian | and State Street Bank and Trust | Master Custodian | An agreement entered into on January 1, |

| Sub-Accounting | Company | Agreement (Note 5) | 2007 relating to the Custodian acting as |

| Agent | custodian of the Fund’s assets. | ||

| Master | An agreement entered into on January 1, | ||

| Sub-Accounting | 2007 relating to the Custodian providing | ||

| Services Agreement | certain administrative, pricing, and | ||

| (Note 6) | bookkeeping services for the Fund. | ||

|

| |||

| Principal | Putnam Retail | Distribution Plan and | A plan and agreement concluded on |

| Underwriter | Management Limited | Agreement | November 28, 1994 relating to the |

| Partnership | distribution of Class M shares. | ||

|

| |||

| Agent Company | SMBC Friend Securities | Agent Company | An agreement concluded June 5, 1998, in |

| Co., Ltd. | Agreement (Note 7) | which the Agent Company agrees to | |

| render services as agent company in Japan. | |||

|

| |||

| Distributor in Japan | SMBC Friend Securities | Japan Dealer Sales | An agreement concluded June 22, 1998, in |

| - 13 - |

| Co., Ltd. | Agreement (Note 8) | which the Distributor agrees to sell shares | |

| of the Fund in Japan. | |||

|

| |||

(Note 1) The Management Contract is an agreement by which the Investment Management Company agrees to provide investment management services for the Fund and investment advisory services for the Fund’s assets.

(Note 2) The Sub-Advisory Contract is an agreement by which the Sub-Advisory Company agrees to provide discretionary investment management services for a portion of the Fund’s assets as determined from time to time by the Investment Management Company or the Sub-Investment Management Company.

(Note 3) The Sub-Management Contract is an agreement by which the Sub-Investment Management Company agrees to provide investment advisory services for a portion of the Fund’s assets as determined from time to time by the Investment Management Company.

(Note 4) The Amended and Restated Investor Servicing Agreement is an agreement in which the Investor Servicing Agent agrees to provide investor servicing agent functions to the Fund.

(Note 5) The Master Custodian Agreement is an agreement by which the Custodian agrees to provide custody services for the Fund’s assets.

(Note 6) The Master Sub-Accounting Services Agreement is an agreement under which the Investment Management Company has delegated to the Sub-Accounting Agent responsibility for providing certain administrative, pricing, and bookkeeping services for the Fund.

(Note 7) The Agent Company Agreement is an agreement by which the Agent Company, appointed by Fund, agrees to distribute prospectuses relating to Shares, to make public the daily Net Asset Value per Share of the Fund and to distribute management reports and other documents, etc. required to be prepared in accordance with the applicable laws and regulations of Japan and/or the Rules of the Japan Securities Dealers Association.

(Note 8) The Japan Dealer Sales Agreement is an agreement by which the Distributor in Japan agrees to sell Shares delivered by Principal Underwriter for the purpose of public offering in Japan in accordance with the provisions of the applicable laws and regulations of Japan and the prospectus in Japan.

(3) Outline of the Fund

1. Fund

a. Law of Place of Incorporation

The Fund is a Massachusetts business trust organized in Massachusetts, U.S.A. on November 10, 1988.

Chapter 182 of the Massachusetts General Laws prescribes the fundamental matters in regard to the operations of certain business trusts constituting voluntary associations under that chapter.

The Fund is an open-end, diversified management company under the Investment Company Act of 1940, as amended (the “1940 Act”).

| - 14 - |

b. Purpose of the Fund

The purpose of the Fund is to provide investors with a managed investment primarily in securities, debt instruments and other instruments and rights of a financial nature.

| c. | History of the Fund | |

| Organization of the Fund as a Massachusetts business trust. | ||

| Adoption of the Agreement and Declaration of Trust. | November 10, 1988 | |

| Adoption of the Amended and Restated Agreement | ||

| and Declaration of Trust | July 13, 1990 | |

| Adoption of the Amended and Restated Agreement | ||

| and Declaration of Trust | April 30, 2003 |

d. Amount of Capital Stock

Not applicable.

e. Information Concerning Major Shareholders

Not applicable.

2. Putnam Investment Management, LLC (the Investment Management Company)

a. Law of Place of Incorporation The Investment Management Company is a limited liability company organized under the law of the State of Delaware on November 29, 2000. Its investment advisory business is regulated under the Investment Advisers Act of 1940.

Under the Investment Advisers Act of 1940, an investment adviser means, with certain exceptions, any person who, for compensation, engages in the business of advising others, either directly or through publications or writings, as to the value of securities or as to the advisability of investing in, purchasing or selling securities, or who, for compensation and as part of a regular business, issues or promulgates analyses or reports concerning securities. Investment advisers under the Investment Advisers Act of 1940 generally may not conduct their business unless they are registered with the United States Securities and Exchange Commission (“SEC”).

b. Purpose of the Company

The Investment Management Company’s primary business is investment management, which includes the buying, selling, exchanging and trading of securities of all descriptions on behalf of mutual funds in any part of the world.

c. History of the Company

The Investment Management Company is one of America's oldest and largest money management firms. The Investment Management Company’s staff of experienced portfolio

| - 15 - |

managers and research analysts selects securities and constantly manages the Fund's portfolio. By pooling an investor's money with that of other investors, a greater variety of securities can be purchased than would be the case individually; the resulting diversification helps reduce investment risk. The Investment Management Company has been managing mutual funds since 1937. Today, the firm serves as the Investment Management Company for the funds in the Putnam family, with over $61 billion in aggregate net asset value in nearly 5 million shareholder accounts as of June 30, 2011. An affiliate of the Investment Management Company, Putnam Investments Limited, provides a full range of international investment advisory services to institutional and retail clients. Another affiliate, The Putnam Advisory Company, LLC, provides financial services to institutions and individuals through separately managed accounts and pooled investment vehicles. Another affiliate, Putnam Fiduciary Trust Company, provides investment advice to institutional clients under its banking and fiduciary responsibilities.

Total assets under management of Putnam entities, including assets managed for mutual funds and other clients are over $121 billion as of the end of October 2011.

The Investment Management Company, the Principal Underwriter, the Sub-Investment Management Company, the Sub-Advisory Company and the Investor Servicing Agent are indirect subsidiaries of Putnam Investments, LLC, which is located at One Post Office Square, Boston, Massachusetts 02109 and is an indirect subsidiary of Great-West Lifeco Inc., which is a financial services holding company with operations in Canada, the United States and Europe and is a member of the Power Financial Corporation group of companies. Power Financial Corporation, a global company with interests in the financial services industry, is a subsidiary of Power Corporation of Canada, a financial, industrial, and communications holding company, of which the Honorable Paul Desmarais, Sr., through a group of private holding companies which he controls, has voting control.

d. Amount of Capital Stock

(1) Amount of Member’s Equity

1. Amount of Member’s Equity (as of the end of October, 2011):

$123,280,085 *(approximately JPY9,585million)

2. Record of Amount of Member’s Equity (for the latest 5 years):

| Year | Member’s Equity |

| End of 2006 | $65,683,062 |

| End of 2007 | $116,796,876 |

| End of 2008 | $58,526,939 |

| - 16 - |

| End of 2009 | $69,079,977 |

| End of 2010 | $82,851,104 |

| *unaudited | |

e. Information Concerning Major Stockholders

As of October 31, 2011, all the outstanding interests of the Investment Management Company were indirectly owned by Putnam Investments, LLC. See subsection c. above.

(D) OUTLINE OF LAWS REGULATING THE FUND IN THE JURISDICTION WHERE ESTABLISHED:

(1) Form of the Fund

Putnam Europe Equity Fund is a Massachusetts business trust organized on November 10, 1988. A copy of the Agreement and Declaration of Trust, which is governed by Massachusetts law, is on file with the Secretary of The Commonwealth of Massachusetts.

The Fund is an open-end management investment company with an unlimited number of authorized shares of beneficial interest. The Trustees of the Fund (the “Trustees”) may, without shareholder approval, create two or more series of shares representing separate investment portfolios. Any such series of shares may be divided without shareholder approval into two or more classes of shares having such preferences and special or relative rights and privileges as the Trustees determine. The Fund's shares are not currently divided into series. Only the Fund's Class M shares are currently offered in Japan. Sales charges in the United States may differ. Japanese investors should rely on this Securities Registration Statement, and not any sales literature information provided for use by U.S. investors. The Fund also offers in the United States of America other classes of shares with different sales charges and expenses. Because of these different sales charges and expenses, the investment performance of the classes (and of class M shares offered in Japan and the United States) will vary.

Each share has one vote, with fractional shares voting proportionally. Shares of all classes will vote together as a single class except when otherwise required by law or as determined by the Trustees. Shares are freely transferable, are entitled to dividends as declared by the Trustees, and, if the Fund were liquidated, would receive the net assets of the Fund.

The Fund may suspend the sale of shares at any time and may refuse any order to purchase shares. Although the Fund is not required to hold annual meetings of its shareholders, shareholders holding at least 10% of the outstanding shares entitled to vote have the right to call a meeting to elect or remove Trustees, or to take other actions as provided in the Agreement and Declaration of Trust. The Fund has voluntarily undertaken to hold a shareholder meeting at least

| - 17 - | |

every five years. The most recent shareholder meeting was in 2009.

The Fund is a “diversified” investment company under the 1940 Act. This means that, among other things, with respect to 75% of its total assets, the Fund may not invest more than 5% of its total assets in the securities of any one issuer (except U.S. government securities and securities issued by other investment companies). The remaining 25% of its total assets is not subject to this restriction. To the extent the Fund invests a significant portion of its assets in the securities of a particular issuer, it will be subject to an increased risk of loss if the market value of such issuer’s securities declines.

If a shareholder owns fewer shares than the minimum set by the Trustees (presently 20 shares), the Fund may redeem the shareholders’ shares without the shareholder’s permission and send the shareholder the proceeds after providing the shareholder with at least 60 days’ notice to attain the minimum. To the extent permitted by applicable law, the Fund may also redeem shares if shareholders own shares above a maximum amount set by the Trustees. There is presently no maximum, but the Trustees could set a maximum that would apply to both present and future shareholders.

(2) Governing Laws

The Fund was created under, and is subject to, the laws of The Commonwealth of Massachusetts. The sale of the Fund’s shares is subject to, among other things, the Securities Act of 1933, as amended (the “1933 Act”), and certain state securities laws. The Fund also attempts to qualify each year and elect to be taxed as a regulated investment company under the United States Internal Revenue Code of 1986, as amended (the “Code”).

The following is a broad outline of certain of the principal statutes regulating the operations of the Fund in the United States:

a. Massachusetts General Laws, Chapter 182 - Voluntary Associations and Certain Trusts

Chapter 182 provides in part as follows:

A copy of the declaration of trust must be filed with the Secretary of State of The Commonwealth of Massachusetts and with the Clerk of the City of Boston. Any amendment of the declaration of trust must be filed with the Secretary and the Clerk within thirty days after the adoption of such amendment.

A trust must annually file with the Secretary of State on or before June 1 a report providing the name of the trust, its address, number of shares outstanding and the names and addresses of its trustees.

Penalties may be assessed against the trust for failure to comply with certain of the provisions of Chapter 182.

| - 18 - |

b. Investment Company Act of 1940

The 1940 Act, in general, requires investment companies to register as such with the SEC, and to comply with a number of substantive regulations of their operations. The 1940 Act requires an investment company, among other things, to provide periodic reports to its shareholders.

c. Securities Act of 1933

The 1933 Act, regulates many sales of securities. The 1933 Act, among other things, imposes various registration requirements upon sellers of securities and provides for various liabilities for failures to comply with its provisions or in respect of other specified matters.

d. Securities Exchange Act of 1934

The Securities Exchange Act of 1934, as amended (the "1934 Act"), regulates a variety of matters involving, among other things, the secondary trading of securities, periodic reporting by the issuers of securities, and certain of the activities of transfer agents and brokers and dealers.

e. The Internal Revenue Code

The Fund intends to qualify as a "regulated investment company" for United States federal income tax purposes and to meet all other requirements necessary for it to be relieved of federal taxes on income and gains it distributes to shareholders.

f. Other laws

The Fund is subject to the provisions of other laws, rules, and regulations applicable to the Fund or its operations, such as, for example, various state laws regarding the sale of the Fund’s shares.

(E) OUTLINE OF DISCLOSURE SYSTEM:

(1) Disclosure in United States:

(i) Disclosure to shareholders

In accordance with the 1940 Act, the Fund is required to send to its shareholders annual and semi-annual reports containing financial information.

(ii) Disclosure to the SEC

The Fund has filed a registration statement with the SEC on Form N-1A; the Fund updates that registration statement annually in accordance with the 1940 Act. The Fund also files certain additional information periodically with the SEC on Forms N-Q, N-PX, N-CSR and N-SAR.

(2) Disclosure in Japan:

a. Disclosure to the Supervisory Authority:

| - 19 - |

(i) Disclosure Required under the Financial Instruments and Exchange Law:

When the Fund intends to offer the Shares amounting to more than 100 million yen in Japan, it shall submit to the Director of Kanto Local Finance Bureau of the Ministry of Finance of Japan securities registration statements. The said documents are made available for public inspection for investors and any other persons who desire on the electronic disclosure system concerning the disclosure documents of the Annual Securities Report, etc. under the Financial Instruments and Exchange Law of Japan (EDINET), etc.

The Sales Handling Company of the Shares shall deliver to the investors Mandatory Prospectuses” (Kofu-Mokuromisho in Japanese), which should be delivered to the investors before or at the same time as their application for subscription in accordance with the stipulation of the Financial Instruments and Exchange Law. In addition, the Sales Handling Company of the Shares shall deliver to the investors Prospectuses on Request” (Seikyu-Mokuromisho in Japanese), which should be delivered to the investors, if they request them, in accordance with the stipulation of the Financial Instruments and Exchange Law. For the purpose of disclosure of the financial conditions, etc., the Trustees shall submit to the Director of Kanto Local Finance Bureau of the Ministry of Finance of Japan securities reports within 6 months of the end of each fiscal year, semi-annual reports within 3 months of the end of each semi-annual period and extraordinary reports from time to time when changes occur as to material subjects of the Fund. These documents are available for public inspection for the investors and any other persons who so desire on EDINET, etc.

(ii) Notifications, etc. under the Law Concerning Investment Trusts and Investment Companies

If the Investment Management Company conducts the business of offering for sale of shares of the Fund, it must file in advance certain information relating to the Fund with the Commissioner of Financial Services Agency under the Law Concerning Investment Trusts and Investment Companies (the Law No. 198, 1951, as amended) (hereinafter referred to the "Investment Trusts Law"). In addition, if the Investment Management Company amends the Agreement and Declaration of Trust of the Fund, etc., it must file in advance the details of such amendment and the reasons for the amendment, etc. with the Commissioner of Financial Services Agency. Further, the Investment Management Company must prepare the Management Report on the prescribed matters concerning the assets of the Fund under the Investment Trusts Law immediately after the end of each calculation period of the Fund and must file such Report with the Commissioner of Financial Services Agency.

b. Disclosure to Japanese Shareholders:

| - 20 - |

In the case where the Agreement and Declaration of Trust is to be amended and the amendment is significant, etc., the Fund shall notify in writing the shareholders known in Japan of contents of the amendment and reasons therefore, etc. before such amendment.

The Japanese shareholders will be notified of changes in material facts which would change their position, including notices from the Trustees, through the Sales Handling Companies.

The above-described Management Report on the Fund will be sent to the shareholders known in Japan.

(F) OUTLINE OF THE SUPERVISORY AUTHORITY:

Among the regulatory authorities having jurisdiction over the Fund or certain of its operations are the SEC and state regulatory agencies or authorities.

a. The SEC has broad authority to oversee the application and enforcement of the federal securities laws, including the 1940 Act, the 1933 Act, and the 1934 Act, among others, to the Fund. The 1940 Act provides the SEC broad authority to inspect the records of investment companies, to exempt investment companies or certain practices from the provisions of the Act, and otherwise to enforce the provisions of the Act.

b. State authorities typically have broad authority to regulate the activities of broker, dealers, or other persons directly or indirectly engaged in activities relating to the offering and sale of securities to their residents or within their jurisdictions.

2. INVESTMENT POLICY

(A) Basic Policy for Investment:

This section contains greater detail on the Fund’s main investment strategies and the related risks an investor would face as a Fund shareholder. It is important to keep in mind that risk and reward generally go hand in hand; the higher the potential reward, the greater the risk. The Investment Management Company pursues the Fund’s goal by investing mainly in common stocks issued by European companies. Under normal circumstances, the Investment Management Company invests at least 85% of the Fund’s net assets in European companies and at least 80% of the Fund’s net assets in equity investments. This policy may be changed only after 60 days’ notice to shareholders. To determine whether a company is European, the Investment Management Company looks at the following factors: where the company's securities trade, where the company is located or organized, or where the company derives a majority of its revenues or profits.

(B) Objectives in which Investment is made:

| - 21 - |

The Investment Management Company invests mainly in common stocks (growth or value or both) of large and midsize European companies that are believed to have favorable investment potential. The Investment Management Company may purchase stocks of companies with stock prices that reflect a lower value than that which the Investment Management Company places on the company. Also considered are other factors the Investment Management Company believes will cause the stock price to rise. The Fund invests mainly in developed countries, but may invest in emerging markets, such as those in Eastern Europe. The Investment Management Company may consider, among other factors, a company’s valuation, financial strength, growth potential, competitive position in its industry, projected future earnings, cash flows and dividends when deciding whether to buy or sell investments. The Investment Management Company may also use derivatives, such as futures, options, certain foreign currency transactions, warrants and swap contracts, for both hedging and non-hedging purposes.

(C) Management Structure of the Fund:

The Investment Management Company is ultimately managed by its managing member. The Sub-Investment Management Company is ultimately managed by its Board of Directors, which is elected by its shareholders. The Sub-Advisory Company is ultimately managed by its managing members.

The investment performance and portfolio of the Fund is overseen by its Board of Trustees, a majority of whom are not affiliated with the Investment Management Company. The Trustees periodically review the performance of the Fund with its manager. The basis for the Trustees’ approval of the Management Contract, Sub-Management Contract and Sub-Advisory Contract is discussed in the Fund’s annual report to shareholders dated 6/30/11 and filed with the SEC.

The Investment Management Company has retained its affiliate Putnam Investments Limited, the Sub-Investment Management Company, to make investment decisions for such Fund assets as may be designated from time to time for its management by the Investment Management Company. The Investment Management Company (and not the Fund) will pay a quarterly sub-management fee to the Sub-Investment Management Company for its services at the annual rate of 0.35% of the average aggregate net asset value of any Fund assets managed by the Sub-Investment Management Company. The Sub-Investment Management Company, which provides a full range of international investment advisory services to institutional clients, is located at Cassini House, 57-59 St James’s Street, London, England, SW1A 1LD.

The Investment Management Company and the Sub-Investment Management Company have retained their affiliate The Putnam Advisory Company, LLC (the Sub-

| - 22 - |

Advisory Company to make investment decisions for such Fund assets as may be designated from time to time for its management by the Investment Management Company or the Sub-Investment Management Company, as applicable The Investment Management Company or the Sub-Investment Management Company, as applicable (and not the Fund), will pay a quarterly sub-advisory fee to the Sub-Advisory Company for its services at the annual rate of 0.35% of the average aggregate net asset value of any Fund assets managed by the Sub-Advisory Company. The Sub-Advisory Company, which provides financial services to institutions and individuals through separately-managed accounts and pooled investment vehicles, has its headquarters at One Post Office Square, Boston, MA 02109, with additional investment management personnel located in Singapore.

Pursuant to these arrangements, professionals of the Investment Management Company who are based in foreign jurisdictions may serve as portfolio managers of the Fund or provide other investment services, consistent with local regulations.

In selecting portfolio securities for the Fund, the Investment Management Company looks for securities that represent attractive values based on careful issue-by-issue credit analysis and hundreds of onsite visits and other contacts with issuers every year.

The officer of the Investment Management Company identified below is primarily responsible for the day-to-day management of the Fund's portfolio.

| Portfolio Manager | Joined | Employer | Positions Over Past Five Years |

| Fund | |||

|

| |||

| Simon Davis | 2006 | Putnam Investments Limited | Co-Head of International Equities |

| Previously, Head of International Large Cap | |||

| 2000- Present | Equities and Chief Investment Officer, | ||

| International Core Team. | |||

Compensation of investment professionals.

The Investment Management Company’s goal for its products and investors is to deliver strong performance versus peers or performance ahead of the applicable benchmark, depending on the product, over a rolling 3-year period. Portfolio managers are evaluated and compensated, in part, based on their performance relative to this goal across the products they manage. In addition to their individual performance, evaluations take into account the performance of their group and a subjective component.

| - 23 - |

Each portfolio manager is assigned an industry competitive incentive compensation target consistent with this goal and evaluation framework. Actual incentive compensation may be higher or lower than the target, based on individual, group, and subjective performance, and may also reflect the performance of the Investment Management Company as a firm. Typically, performance is measured over the lesser of three years or the length of time a portfolio manager has managed a product.

Incentive compensation includes a cash bonus and may also include grants of deferred cash, stock or options. In addition to incentive compensation, portfolio managers receive fixed annual salaries typically based on level of responsibility and experience.

For this Fund, the Investment Management Company evaluates performance based on the Fund's peer ranking in the Lipper European Region Funds Category, which is based on pre-tax performance.

Ownership of securities

The dollar range of shares of the Fund owned by the portfolio manager at the end of the Fund’s last fiscal year, including investments by immediate family members and amounts invested through retirement and deferred compensation plans, was $10,001 - $50,000.

Structure of Fund Management:

As described above, the Fund will invest mainly in stocks issued by European companies. The Investment Management Company shall faithfully carry out the stated investment objectives of the Fund. In accordance with the 1940 Act, the Fund has “fundamental” investment restrictions governing certain of its investment practices, as described on page [32].

(a) Investment Team

Simon Davis is co-Head of International Equities and Portfolio Manager for the European Core Equity portfolios. Mr. Davis is supported by the Investment Management Company’s Large Cap Equity research team. The Investment Management Company employs

| - 24 - |

a hybrid research structure where coverage is determined through a combination of region and sector. Some companies are more sensitive to global industry trends (materials, technology, energy, and health care) while others require a greater degree of localized analysis (consumer staples, consumer discretionary, financials, industrials, telecommunication service, and utilities). Mr. Davis and the Investment Management Company’s team of dedicated European equity research analysts are based in London. In addition, Mr. Davis can leverage the expertise of the Investment Management Company’s Quantitative team, Dedicated Emerging Markets team, European High Yield team, International Economists, International Growth & Value teams, Global Equity team, Global Asset Allocation team, and Currency Management team. These teams provide valuable macroeconomic insights to the portfolio manager. As lead portfolio manager, Mr. Davis has ultimate decision-making authority over the European Core Equity portfolios.

| - 25 - |

(b) Investment Process

The portfolio manager seeks to achieve an attractive absolute rate of return through an actively managed portfolio of European companies. Investment is sought primarily in companies domiciled in the developed economies within Europe, but limited investments may be made in emerging markets. The portfolio manager/the Investment Management Company utilizes a bottom-up stock selection driven process which seeks to identify significantly mispriced companies using a number of proprietary valuation tools, with a focus on understanding downside risk. The portfolio manager/the Investment Management Company integrates qualitative and quantitative techniques to attempt to achieve maximum return potential within clients' risk parameters.

As mentioned above, the Investment Management Company selects stocks through a bottom-up process, utilizing our valuation approach to identify significantly mispriced companies. The portfolio manager/the Investment Management Company believes that price discrepancies occur between the underlying worth of a company (which tends to change slowly over time) and the company's stock price (which tends to fluctuate frequently over the shorter term). Our expertise is in identifying stocks selling for less than their real or relative

| - 26 - |

worth regardless of the type of company (i.e., growth, cyclical, or mature), which may potentially generate excess returns regardless of the current market environment. Our "valuation" is the hallmark of the Investment Management Company’s core approach, allowing us to set a target price for each stock, purchase the security at a discount if one exists, and enforce our sell discipline.

The Investment Management Company utilizes a risk-controlled approach in constructing portfolios. The overall objective of portfolio construction is to build a portfolio of 50-80 stocks with significant valuation upside as well as to reflect the attractiveness of both sectors and countries. The portfolio manager continually reviews the weighting and risk position of each stock in the portfolio and confirms that it is consistent with stock conviction. "What-if" analysis is also conducted on newly rated or recently reviewed stocks, to assess whether potential trades will enhance returns in the portfolio. In this manner, the portfolio manager compares potential new high conviction ideas to existing holdings in order to ensure that the portfolio contains the Investment Management Company's best European stock ideas. The portfolio manager/the Investment Management Company aims to take the most risk where The portfolio manager/the Investment Management Company has the greatest alpha insight –generally this means at the stock selection level. Sector and country positioning are an outcome of this.

| - 27 - |

(c) Management of Fund Business

Performance & Analytics Team

Independently from the Investment Division, the Performance & Analytics Team executes performance measurement of the Fund, and reports up to Chief of Operations.

Legal and Compliance Division

Independently from the Investment Division, the Legal and Compliance Division monitors portfolio holdings, trading compliance and Fund investment restriction compliance. These matters are monitored and resolved according to the Investment Management Company’s broad-based compliance policies and procedures and applicable legal requirements. The Legal and Compliance Division reports directly to senior management, and not to the Investment Division or other business divisions.

Risk & Portfolio Analysis Group

The Investment Management Company has also established an independent Risk & Portfolio Analysis Group (“RPAG”). RPAG is part of the Investment Division and is charged with identifying, monitoring, and assessing risk factors and contracts across the Investment Management Company’s investment activities. RPAG and its head do not have direct

| - 28 - | |

responsibility for the management of client portfolios. This organizational structure facilitates an unbiased assessment of risk.

Internal and external inspections

Various aspects of the operations of the Investment Management Company, including its management of the Fund, are included in the scope of internal audits performed by the Investment Management Company’s internal audit function, which conducts a broad spectrum of audits developed using a risk-based approach. The internal audit function tracks and tests the remediation of its recommendations, and provides reports to senior management. In addition, various aspects of the internal control environment of the Investment Management Company and its affiliates are subject to review by a third-party audit firm on a periodic basis.

As noted above, the Investment Management Company’s business operations (including not only investment compliance, but also other key areas such as distribution/sales and operations) are subject to ongoing monitoring by the Investment Management Company’s Legal and Compliance Division, which consists of a variety of sub-groups covering different areas of the business. The Investment Management Company is further subject to regulation and inspection by the SEC.

All employees of the Investment Management Company are bound by the Investment Management Company’s Code of Ethics, which includes certain restrictions on personal investing and disclosure requirements. Additional requirements under the Code of Ethics apply to investment professionals of the Investment Management Company. Compliance with the Code of Ethics is monitored on an ongoing basis by the Legal and Compliance Division.

Oversight of third parties

Service providers of the Fund (including the Investor Servicing Agent, Custodian and Sub-Accounting Agent, and Principal Underwriter) are monitored by the Investment Management Company, through each contract with the relevant third-party provider. These contracts may be terminated under certain circumstances. (Because the Principal Underwriter and Investor Servicing Agent are affiliates of the Investment Management Company, they are

| - 29 - |

subject to the same control and compliance environment as the Investment Management Company and are not third-party service providers.)

The Investment Management Company seeks to monitor the level of service provided to the Fund by third-party providers in the first instance through ongoing contacts between Operations professionals of the Investment Management Company and the relevant service providers.

(D) Distribution Policy:

The Fund normally distributes any net investment income and any net realized capital gains annually. Distributions from net investment income, if any, are expected to be small. Distributions from capital gains are made after applying any available capital loss carryovers. The payment to Japanese investors may be made, in principle, in accordance with the record date in December each year by SMBC Friend.

(Note) The above statement will not guarantee the payment of future distributions, if any, or the amount thereof.

(E) Restrictions on Investment:

Except as otherwise specifically designated, the investment restrictions described in this document are not fundamental investment restrictions.

The Trustees may change any non-fundamental restrictions without shareholder approval.

As fundamental investment restrictions, which may not be changed without a vote of a majority of the outstanding voting securities, the Fund may not and will not:

(1) Borrow money in excess of 33 1/3% of the value of its total assets (not including the amount borrowed) at the time the borrowing is made.

(2) Underwrite securities issued by other persons except to the extent that, in connection with the disposition of its portfolio investments, it may be deemed to be an underwriter under certain U.S. federal securities laws.

| - 30 - |

(3) Purchase or sell real estate, although it may purchase securities of issuers which deal in real estate, securities which are secured by interests in real estate, and securities representing interests in real estate, and it may acquire and dispose of real estate or interests in real estate acquired through the exercise of its rights as a holder of debt obligations secured by real estate or interests therein.

(4) Purchase or sell commodities or commodity contracts, except that the Fund may purchase and sell financial futures contracts and options and may enter into foreign (non-U.S.) exchange contracts and other financial transactions not involving physical commodities.

(5) Make loans, except by purchase of debt obligations in which the Fund may invest consistent with its investment policies (including without limitation debt obligations issued by other Putnam funds), by entering into repurchase agreements, or by lending its portfolio securities.

(6) With respect to 75% of its total assets, invest in securities of any issuer if, immediately after such investment, more than 5% of the total assets of the Fund (taken at current value) would be invested in the securities of such issuer; provided that this limitation does not apply to obligations issued or guaranteed as to interest or principal by the U.S. government or its agencies or instrumentalities or to securities issued by other investment companies.

(7) With respect to 75% of its total assets, acquire more than 10% of the outstanding voting securities of any issuer.

(8) Purchase securities (other than securities of the U.S. government) if, as a result of such purchase, more than 25% of the Fund's total assets would be invested in any one industry.

(9) Issue any class of securities which is senior to the Fund's shares of beneficial interest, except for permitted borrowings.

| - 31 - |

The 1940 Act provides that a "vote of a majority of the outstanding voting securities" of the Fund means the affirmative vote of the lesser of (1) more than 50% of the outstanding Fund shares, or (2) 67% or more of the shares present at a meeting if more than 50% of the outstanding Fund shares are represented at the meeting in person or by proxy.

For purposes of the Fund’s fundamental policy on industry concentration (#8 above), the Investment Management Company determines the appropriate industry categories and assigns issuers to them. Industry categories and issuer assignments may change over time in the Investment Management Company’s discretion and may differ from those shown in shareholder reports and other communications.

The following non-fundamental investment policies may be changed by the Trustees without shareholder approval:

(1) The Fund will not invest in (a) securities which are not readily marketable, (b) securities restricted as to resale (excluding securities determined by the Trustees of the Fund (or the person designated by the Trustees of the Fund to make such determinations) to be readily marketable), and (c) repurchase agreements maturing in more than seven days, if, as a result, more than 15% of the Fund's net assets (taken at current value) would be invested in securities described in (a), (b) and (c).

(2) In addition, the Fund will, so long as shares of the Fund are being offered for sale by the Fund in Japan and such standards are required as a condition of such offer for sale, comply with the following standards of selection of the Japan Securities Dealers Association:

(a) The Fund will not invest more than 15% of its net assets in securities that are not traded on an official exchange or other regulated market, including, without limitation, the National Association of Securities Dealers Automated Quotation System (this restriction shall not be applicable to bonds determined by the Investment Management Company to be liquid and for which a market price (including a dealer quotation) is generally obtainable or determinable;

(b) The Fund will not borrow money in excess of 10% of the value of its total assets;

(c) The Fund will not make short sales of securities in excess of the Fund’s net asset value; and

| - 32 - |

(d) The Fund will not together with other mutual funds managed by the Investment Management Company, acquire more than 50% of the outstanding voting securities of any issuer.

If the undertaking is violated, the Fund will, promptly after discovery, take such action as may be necessary to cause the violation to cease, which shall be the only obligation of the Fund and the only remedy in respect of the violation. This undertaking will remain in effect as long as shares of the Fund are qualified for offer or sale in Japan and such undertaking is required by the Japanese Securities Dealers Association as a condition of such qualification.

All percentage limitations on investments (other than pursuant to non-fundamental restriction (1)) will apply at the time of the making of an investment and shall not be considered violated unless an excess or deficiency occurs or exists immediately after and as a result of such investment.

3. INVESTMENT RISKS

(A) INVESTMENT RISKS:

This section contains greater detail on the Fund’s main investment strategies and the related risks an investor would face as a Fund shareholder. It is important to keep in mind that risk and reward generally go hand in hand; the higher the potential reward, the greater the risk. The Investment Management Company pursues the Fund's goal by investing mainly in common stocks issued by European companies. Under normal circumstances, the Investment Management Company invests at least 85% of the Fund’s net assets in European companies and at least 80% of the Fund’s net assets in equity investments. This policy may be changed only after 60 days’ notice to shareholders. To determine whether a company is European, the following factors are looked at: where the company's securities trade, where the company is located or organized, or where the company derives a majority of its revenues or profits.

Common stocks. Common stock represents an ownership interest in a company. The value of a company’s stock may fall as a result of factors directly relating to that company, such as decisions made by its management or lower demand for the company’s products or services. A stock's value may also fall because of factors affecting not just the company, but

| - 33 - |

also other companies in the same industry or in a number of different industries, such as increases in production costs. From time to time, the Fund may invest a significant portion of its assets in companies in one or more related industries or sectors, which would make the Fund more vulnerable to adverse developments affecting those industries or sectors. The value of a company’s stock may also be affected by changes in financial markets that are relatively unrelated to the company or its industry, such as changes in interest rates or currency exchange rates. In addition, a company's stock generally pays dividends only after the company invests in its own business and makes required payments to holders of its bonds and other debt. For this reason, the value of a company's stock will usually react more strongly than its bonds and other debt to actual or perceived changes in the company's financial condition or prospects. Stocks of smaller companies may be more vulnerable to adverse developments than those of larger companies.

Growth stocks – Stocks of companies the Investment Management Company believes are fast-growing may trade at a higher multiple of current earnings than other stocks. The values of these stocks may be more sensitive to changes in current or expected earnings than the values of other stocks. If the Investment Management Company’s assessment of the prospects for a company’s earnings growth is wrong, or if the Investment Management Company’s judgment of how other investors will value the company’s earnings growth is wrong, then the price of the company’s stock may fall or may not approach the value that the Investment Management Company has placed on it.

Value stocks – Companies whose stocks the Investment Management Company believes are undervalued by the market may have experienced adverse business developments or may be subject to special risks that have caused their stocks to be out of favor. If the Investment Management Company’s assessment of a company's prospects is wrong, or if other investors do not similarly recognize the value of the company, then the price of the company's stock may fall or may not approach the value that the Investment Management Company has placed on it.

Non-U.S. investments. Non-U.S. investments involve certain special risks, including:

| - 34 - | |

- Unfavorable changes in currency exchange rates: Non-U.S. investments are typically issued and traded in non-U.S. currencies. As a result, their values may be affected by changes in exchange rates between non-U.S. currencies and the U.S. Dollar.

- Political and economic developments: Non-U.S. investments may be subject to the risks of seizure by a non-U.S. government, direct or indirect impact of sovereign debt default, imposition of restrictions on the exchange or export of non-U.S. currency, and tax increases.

- Unreliable or untimely information: There may be less information publicly available about a non-U.S. company than about most publicly-traded U.S. companies, and non-U.S. companies are usually not subject to accounting, auditing and financial reporting standards and practices as stringent as those in the United States.

- Limited legal recourse: Legal remedies for investors may be more limited than the remedies available in the United States.

- Limited markets: Certain non-U.S. investments may be less liquid (harder to buy and sell) and more volatile than U.S. investments which means we may at times be unable to sell these non-U.S. investments at desirable prices. For the same reason, we may at times find it difficult to value the Fund's non-U.S. investments.

- Trading practices: Brokerage commissions and other fees are generally higher for non-U.S. investments than for U.S. investments. The procedures and rules governing non-U.S. transactions and custody may also involve delays in payment, delivery or recovery of money or investments.

The risks of non-U.S. investments are typically increased in less developed countries, which are sometimes referred to as emerging markets. Emerging markets countries may have less developed markets and legal and regulatory systems and may be susceptible to greater political and economic instability than developed markets. These countries are also more

| - 35 - |

likely to experience high levels of inflation, deflation or currency devaluation, and investments in emerging markets countries may be more volatile and less liquid than U.S. investments. For these and other reasons, investments in emerging markets are often considered speculative.

Certain of these risks may also apply to some extent to U.S.-traded investments that are denominated in non-U.S. currencies, investments in U.S. companies that are traded in non-U.S. markets or investments in U.S. companies that have significant non-U.S. operations. Special U.S. tax considerations may apply to the Fund's non-U.S. investments.

Geographic focus. Developments in European economies will generally have a greater effect on the Fund than they would on a more geographically diversified fund, which may result in greater losses and volatility. This risk may be heightened by efforts of the member countries of the European Union to continue to unify their economic and monetary policies, which may increase the potential for similarities in the movements of European markets and reduce the benefit of diversification within the region.

Derivatives. The Fund may engage in a variety of transactions involving derivatives, such as futures, certain non-U.S. currency transactions, options, warrants and swap contracts. Derivatives are financial instruments whose value depends upon, or is derived from, the value of something else, such as one or more underlying investments, pools of investments, indexes or currencies. The Fund may make use of “short” derivatives positions, the values of which move in the opposite direction from the price of the underlying investment, pool of investments, index or currency. The Fund may use derivatives both for hedging and non-hedging purposes. For example, the Fund may use foreign currency transactions to increase or decrease the Fund’s exposure to a particular currency or group of currencies. The Fund may also use derivatives as a substitute for a direct investment in the securities of one or more issuers. However, the Fund may also choose not to use derivatives, based on the Investment Management Company’s evaluation of market conditions or the availability of suitable derivatives. Investments in derivatives may be applied toward meeting a requirement to invest in a particular kind of investment if the derivatives have economic characteristics similar to that investment.

| - 36 - |

Derivatives involve special risks and may result in losses. The successful use of derivatives depends on the Fund’s ability to manage these sophisticated instruments. Some derivatives are “leveraged,” which means that they provide the Fund with investment exposure greater than the value of the Fund’s investment in the derivatives. As a result, these derivatives may magnify or otherwise increase investment losses to the Fund. The risk of loss from certain short derivatives positions is theoretically unlimited. The prices of derivatives may move in unexpected ways due to the use of leverage or other factors, especially in unusual market conditions, and may result in increased volatility.

Other risks arise from the Fund’s potential inability to terminate or sell derivatives positions. A liquid secondary market may not always exist for the Fund's derivatives positions at any time. In fact, many over-the-counter instruments (investments not traded on an exchange) will not be liquid. Over-the-counter instruments also involve the risk that the other party to the derivatives transaction will not meet its obligations.

Risks of investing in Europe. Investing in Europe involves risks not typically associated with investments in the United States.

A majority of western European countries and a number of eastern European countries are members of the European Union (EU), an intergovernmental union aimed at developing economic and political coordination and cooperation among its member states. European countries that are members of the Economic and Monetary Union of the European Union (EMU) (the European Union members that have adopted the euro currency) are subject to restrictions on inflation rates, interest rates, deficits, and debt levels. As a condition to adopting the euro, EU member states must also relinquish control of their monetary policies to the European Central Bank and become subject to certain monetary and fiscal controls imposed by the EMU. As economic conditions across member states may vary widely, it is possible that these controls may not adequately address the needs of all EMU member states from time to time. These controls remove EMU member states’ flexibility in implementing monetary policy measures to address regional economic conditions, which may impair their economic strength.

Investing in euro-denominated securities risks exposure to a currency that may not fully reflect the strengths and weaknesses of disparate European economies. Many EU economies rely heavily upon export-related businesses and the exchange rate between the euro and the U.S. dollar or other foreign currencies may positively or negatively impact corporate profits and the performance of EU investments. While many countries in western Europe are considered to have developed markets, many eastern European countries are less developed and investments in eastern European countries, even if denominated in euros, may involve special risks associated with investments in emerging markets. Securities markets of emerging

| - 37 - |

market economies may be less efficient and may have lower trading volume, lower liquidity, and higher volatility than more developed markets. Many eastern European economies remain particularly sensitive to social, political, and economic conditions within the region and may, in particular, be adversely affected by events in Russia, including changes to the Russian economy or currency. Many eastern European countries are also highly dependent on exports to western Europe, making them particularly vulnerable to demand in western Europe.

The impact of the global economic crisis of 2008–2009 was significant in Europe, and a renewed recession in Europe or in other parts of the world could have a substantial impact on access to credit, export levels, and consumer demand in the region. Although Europe has recently shown limited signs of recovery, any recovery, if sustained, may be gradual. Despite modest recovery among some developed European economies, European countries with less-developed economies are generally less stable, may have been more impacted by the global economic crisis, and may recover less quickly. Several economies—including those of Greece, Italy, Spain, Portugal, and the Republic of Ireland— have recently experienced large public budget deficits and large levels of public debt, which has undermined investor confidence in European sovereign debt and which may further slow the recovery of the region as a whole. Several countries have sought and may continue to seek financial assistance from other European governments or private institutions, and any such assistance may be conditioned on a country meeting certain objectives. A country’s inability to procure adequate financial assistance or failure to meet the objectives upon which such assistance is conditioned could impair the country’s economic recovery, which could significantly affect the value of a fund’s European investments.

In response to the crisis, many countries in Europe have increased regulation of financial markets. As a condition of receiving financial assistance, some European countries have imposed strict austerity measures and comprehensive financial and labor market reforms. Additional regulation is expected in the near future and may be substantial, although the exact nature, duration and effect of this regulation remains unknown. It is possible that such regulation could negatively impact the European economies and the performance of a fund’s European investments.

Some European countries have experienced and may continue to experience protests and other forms of political or social unrest as a result of public dissatisfaction with high unemployment rates, newly-imposed austerity measures and other lingering effects of the global economic crisis. Continued political or social unrest in the region may decrease tourism, lower consumer confidence, or otherwise impede financial recovery in Europe, which may in turn affect the Fund’s investments in the region.

Other investments. In addition to the main investment strategies described above, the Fund may make other types of investments, such as investments in U.S. companies, preferred stocks, convertible securities and debt instruments. The Fund may also loan its portfolio securities to earn income. These practices may be subject to other risks.

| - 38 - |

Alternative strategies. At times the Fund may judge that market conditions make pursuing the Fund's usual investment strategies inconsistent with the best interests of its shareholders. The Fund then may temporarily invest some or all of the Fund’s assets using alternative strategies that are mainly designed to limit losses, including investing solely in the United States. However, the Fund may choose not to use these strategies for a variety of reasons, even in very volatile market conditions. These strategies may cause the Fund to miss out on investment opportunities, and may prevent the Fund from achieving its goal.

Changes in policies. The Fund’s Trustees may change the Fund’s goal, investment strategies and other policies without shareholder approval, except as otherwise indicated.

Portfolio turnover rate. The Fund's portfolio turnover rate measures how frequently the Fund buys and sells investments. A portfolio turnover rate of 100%, for example, would mean that the Fund sold and replaced securities valued at 100% of the Fund’s assets within a one-year period. From time to time the Fund may engage in frequent trading. Funds with high turnover may be more likely to realize capital gains that must be distributed to shareholders as taxable income. High turnover may also cause a fund to pay more brokerage commissions and other transaction costs, which may detract from performance. The Fund’s portfolio turnover rate and the amount of brokerage commissions it pays will vary over time based on market conditions.

(B) MANAGEMENT STRUCTURE FOR INVESTMENT RISKS:

The risks associated with the Fund described above are monitored by the Investment Management Company and, from time to time, by the Sub-Investment Management Company and the Sub-Advisory Company.

Risk & Portfolio Analysis Group