UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D. C. 20549

FORM N-CSRS

Investment Company Act file number: 811-05689

Deutsche Multi-Market Income Trust

(Exact Name of Registrant as Specified in Charter)

345 Park Avenue

New York, NY 10154-0004

(Address of Principal Executive Offices) (Zip Code)

Registrant’s Telephone Number, including Area Code: (212) 250-3220

Paul Schubert

60 Wall Street

New York, NY 10005

(Name and Address of Agent for Service)

| Date of fiscal year end: | 11/30 |

| Date of reporting period: | 5/31/2016 |

| ITEM 1. | REPORT TO STOCKHOLDERS |

May 31, 2016

Semiannual

Report

to Shareholders

Deutsche Multi-Market Income Trust

Ticker Symbol: KMM

Contents

|

3 Performance Summary 4 Important Notice 5 Portfolio Management Team 5 Portfolio Summary 8 Investment Portfolio 31 Statement of Assets and Liabilities 33 Statement of Operations 34 Statement of Cash Flows 35 Statement of Changes in Net Assets 36 Financial Highlights 37 Notes to Financial Statements 51 Dividend Reinvestment and Cash Purchase Plan 54 Additional Information 56 Privacy Statement |

The fund's investment objective is to provide high current income consistent with prudent total return asset management.

Closed-end funds, unlike open-end funds, are not continuously offered. There is a one time public offering and once issued, shares of closed-end funds are sold in the open market through a stock exchange. Shares of closed-end funds frequently trade at a discount to net asset value. The price of the fund's shares is determined by a number of factors, several of which are beyond the control of the fund. Therefore, the fund cannot predict whether its shares will trade at, below or above net asset value.

Bond investments are subject to interest-rate, credit, liquidity and market risks to varying degrees. When interest rates rise, bond prices generally fall. Credit risk refers to the ability of an issuer to make timely payments of principal and interest. Investments in lower-quality ("junk bonds") and non-rated securities present greater risk of loss than investments in higher-quality securities. Investing in derivatives entails special risks relating to liquidity, leverage and credit that may reduce returns and/or increase volatility. Leverage results in additional risks and can magnify the effect of any gains or losses. Emerging markets tend to be more volatile and less liquid than the markets of more mature economies, and generally have less diverse and less mature economic structures and less stable political systems than those of developed countries. Investing in foreign securities presents certain risks, such as currency fluctuations, political and economic changes, and market risks.

Deutsche Asset Management represents the asset management activities conducted by Deutsche Bank AG or any of its subsidiaries.

NOT FDIC/NCUA INSURED NO BANK GUARANTEE MAY LOSE VALUE NOT A DEPOSIT NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

Performance Summary May 31, 2016 (Unaudited)

Performance is historical, assumes reinvestment of all dividend and capital gain distributions, and does not guarantee future results. Investment return and principal value fluctuate with changing market conditions so that, when sold, shares may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Please visit deutschefunds.com for the Fund's most recent month-end performance.

Fund specific data and performance are provided for informational purposes only and are not intended for trading purposes.

| Average Annual Total Returns as of 5/31/16 | ||||

| Deutsche Multi-Market Income Trust | 6-Month‡ | 1-Year | 5-Year | 10-Year |

| Based on Net Asset Value(a) | 4.10% | –0.22% | 5.82% | 8.32% |

| Based on Market Price(a) | 15.49% | 3.76% | 2.30% | 7.15% |

| Credit Suisse High Yield Index(b) | 4.74% | –1.67% | 5.17% | 6.93% |

| JPMorgan Emerging Markets Bond Global Diversified Index(c) | 5.22% | 4.55% | 5.94% | 7.57% |

| Blended Index(d) | 5.00% | 1.42% | 5.59% | 7.31% |

| Bank of America Merrill Lynch US High Yield Master II Constrained Index(e) | 5.36% | –0.92% | 5.26% | 7.28% |

| Morningstar Closed-End High Yield Bond Funds Category (based on Net Asset Value)(f) | 3.58% | –2.69% | 6.03% | 6.36% |

‡ Total returns shown for periods less than one year are not annualized.

(a) Total return based on net asset value reflects changes in the Fund's net asset value during each period. Total return based on market price reflects changes in market price. Each figure assumes that dividend and capital gain distributions, if any, were reinvested. These figures will differ depending upon the level of any discount from or premium to NAV at which the Fund's shares traded during the period. Expenses of the Fund include management fee, interest expense and other fund expenses. Total returns shown take into account these fees and expenses. The expense ratio of the Fund for the six months ended May 31, 2016 was 1.67% (1.03% excluding interest expense).

(b) The Credit Suisse High Yield Index is an unmanaged, unleveraged, trader-priced portfolio constructed to mirror the global high-yield debt market.

(c) The JPMorgan Emerging Markets Bond Global Diversified Index is an unmanaged, unleveraged index that tracks total returns for U.S.-dollar-denominated debt instruments issued by emerging-market sovereign entities, including Brady bonds, loans and Eurobonds, and quasi-sovereign entities. The index limits exposure to any one country.

(d) The Blended Index consists of 50% in the Credit Suisse High Yield Index and 50% in the JPMorgan Emerging Markets Bond Global Diversified Index.

(e) The Bank of America Merrill Lynch US High Yield Master II Constrained Index is a market value-weighted index of all domestic and Yankee high-yield bonds, including deferred interest bonds and payment-in-kind securities.

Index returns do not reflect any fees or expenses and it is not possible to invest directly into an index.

On June 1, 2016, the Bank of America Merrill Lynch US High Yield Master II Constrained Index replaced the Credit Suisse High Yield Index as the fund’s comparative broad-based securities market index because the Advisor believes the Bank of America Merrill Lynch US High Yield Master II Constrained Index more closely reflects the fund’s investment strategies.

(f) Morningstar's Closed-End High Yield Bond Funds category represents high-yield bond portfolios that concentrate on lower-quality bonds, which are riskier than those of higher-quality companies. These portfolios generally offer higher yields than other types of portfolios, but they are also more vulnerable to economic and credit risk. These portfolios primarily invest in U.S. high-income debt securities where at least 65% or more of bond assets are not rated or are rated by a major agency such as Standard & Poor's or Moody's at the level of BB (considered speculative for taxable bonds) and below. Morningstar figures represent the average of the total returns based on net asset value reported by all of the closed-end funds designated by Morningstar, Inc. as falling into the Closed-End High Yield Bond Funds category. Category returns assume reinvestment of all distributions. It is not possible to invest directly in a Morningstar category.

| Net Asset Value and Market Price | ||

| As of 5/31/16 | As of 11/30/15 | |

| Net Asset Value | $ 8.94 | $ 8.87 |

| Market Price | $ 8.23 | $ 7.36 |

Prices and net asset value fluctuate and are not guaranteed.

| Distribution Information | |

|

Six Months as of 5/31/16: Income Dividends |

$ .26 |

| May Income Dividend | $ .0425 |

| Current Annualized Distribution Rate (based on Net Asset Value) as of 5/31/16† | 5.70% |

| Current Annualized Distribution Rate (based on Market Price) as of 5/31/16† | 6.20% |

† Current annualized distribution rate is the latest monthly dividend shown as an annualized percentage of net asset value/market price on May 31, 2016. Distribution rate simply measures the level of dividends and is not a complete measure of performance. Distribution rates are historical, not guaranteed and will fluctuate. Distributions do not include return of capital or other non-income sources.

Important Notice

On July 13, 2016 the Board of Trustees approved the termination of the Fund, pursuant to which the Fund will make a liquidating distribution to shareholders no later than December 31, 2018.

Portfolio Management Team

Gary Russell, CFA, Managing Director

Portfolio Manager of the fund. Began managing the fund in 2006.

— Joined Deutsche Asset Management in 1996. Served as the head of the High Yield group in Europe and as an Emerging Markets portfolio manager.

— Prior to that, he spent four years at Citicorp as a research analyst and structurer of collateralized mortgage obligations. Prior to Citicorp, he served as an officer in the US Army from 1988 to 1991.

— Head of US High Yield Bonds: New York.

— BS, United States Military Academy (West Point); MBA, New York University, Stern School of Business.

Thomas R. Bouchard, Director

Portfolio Manager of the fund. Began managjng the fund in 2016.

— Joined Deutsche Asset Management in 2006 with six years of industry experience. Prior to joining, served as a High Yield Investment Analyst at Flagship Capital Management. He also served as an officer in the US Army from 1989 to 1997.

— Portfolio Manager for High Yield Strategies: New York.

— BS, University of Wisconsin — Madison; MBA in Finance, Boston College; MA in Strategic Studies from US Army War College.

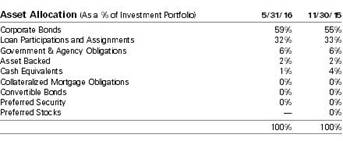

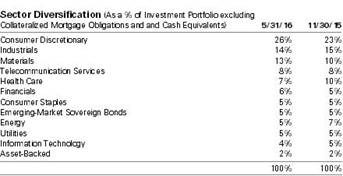

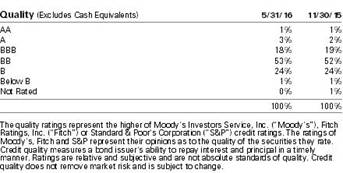

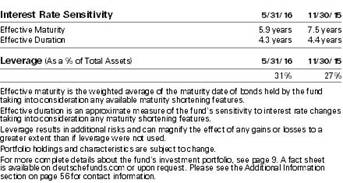

Portfolio Summary (Unaudited)

Investment Portfolio as of May 31, 2016 (Unaudited)

| Principal Amount ($)(a) | Value ($) | |||

| Corporate Bonds 86.0% | ||||

| Consumer Discretionary 24.9% | ||||

| 1011778 B.C. Unlimited Liability Co., 144A, 4.625%, 1/15/2022 | 140,000 | 142,975 | ||

| Ally Financial, Inc.: | ||||

| 3.25%, 2/13/2018 | 935,000 | 932,662 | ||

| 4.125%, 3/30/2020 | 1,810,000 | 1,819,050 | ||

| 4.25%, 4/15/2021 | 575,000 | 576,437 | ||

| 5.75%, 11/20/2025 | 710,000 | 718,875 | ||

| Altice Financing SA: | ||||

| 144A, 6.5%, 1/15/2022 | 240,000 | 244,200 | ||

| 144A, 7.5%, 5/15/2026 | 755,000 | 753,112 | ||

| Altice Finco SA, 144A, 9.875%, 12/15/2020 | 335,000 | 362,638 | ||

| Altice U.S. Finance I Corp., 144A, 5.5%, 5/15/2026 | 755,000 | 770,100 | ||

| AMC Entertainment, Inc., 5.875%, 2/15/2022 | 295,000 | 297,950 | ||

| AMC Networks, Inc., 5.0%, 4/1/2024 | 1,000,000 | 1,002,500 | ||

| AmeriGas Finance LLC: | ||||

| 6.75%, 5/20/2020 | 625,000 | 646,094 | ||

| 7.0%, 5/20/2022 | 485,000 | 511,069 | ||

| APX Group, Inc., 6.375%, 12/1/2019 | 295,000 | 292,050 | ||

| Asbury Automotive Group, Inc., 6.0%, 12/15/2024 | 1,050,000 | 1,071,000 | ||

| Ashtead Capital, Inc., 144A, 6.5%, 7/15/2022 | 455,000 | 476,612 | ||

| Ashton Woods U.S.A. LLC, 144A, 6.875%, 2/15/2021 | 480,000 | 423,600 | ||

| Avis Budget Car Rental LLC, 5.5%, 4/1/2023 | 770,000 | 714,175 | ||

| Beacon Roofing Supply, Inc., 6.375%, 10/1/2023 | 200,000 | 212,000 | ||

| Block Communications, Inc., 144A, 7.25%, 2/1/2020 | 580,000 | 585,800 | ||

| Boyd Gaming Corp., 6.875%, 5/15/2023 | 165,000 | 173,003 | ||

| CalAtlantic Group, Inc., 5.25%, 6/1/2026 | 1,084,000 | 1,069,772 | ||

| Caleres, Inc., 6.25%, 8/15/2023 | 140,000 | 142,800 | ||

| CCO Holdings LLC: | ||||

| 144A, 5.125%, 5/1/2023 | 445,000 | 450,562 | ||

| 144A, 5.5%, 5/1/2026 | 1,850,000 | 1,868,500 | ||

| 144A, 5.875%, 4/1/2024 | 385,000 | 401,362 | ||

| 144A, 5.875%, 5/1/2027 | 550,000 | 563,062 | ||

| Cequel Communications Holdings I LLC: | ||||

| 144A, 5.125%, 12/15/2021 | 815,000 | 778,325 | ||

| 144A, 6.375%, 9/15/2020 | 810,000 | 824,588 | ||

| Churchill Downs, Inc., 144A, 5.375%, 12/15/2021 | 187,000 | 192,610 | ||

| Clear Channel Worldwide Holdings, Inc.: | ||||

| Series A, 7.625%, 3/15/2020 | 85,000 | 78,200 | ||

| Series B, 7.625%, 3/15/2020 | 215,000 | 206,400 | ||

| Cogeco Communications, Inc., 144A, 4.875%, 5/1/2020 | 35,000 | 35,831 | ||

| CSC Holdings LLC, 5.25%, 6/1/2024 | 305,000 | 274,500 | ||

| Dana Financing Luxembourg Sarl, 144A, 6.5%, 6/1/2026 | 585,000 | 583,537 | ||

| Dana Holding Corp.: | ||||

| 5.375%, 9/15/2021 | 2,000,000 | 2,057,500 | ||

| 5.5%, 12/15/2024 | 195,000 | 187,688 | ||

| DISH DBS Corp., 6.75%, 6/1/2021 | 110,000 | 113,938 | ||

| Dollar Tree, Inc.: | ||||

| 144A, 5.25%, 3/1/2020 | 1,110,000 | 1,157,175 | ||

| 144A, 5.75%, 3/1/2023 | 350,000 | 369,687 | ||

| Fiat Chrysler Automobiles NV: | ||||

| 4.5%, 4/15/2020 | 400,000 | 404,000 | ||

| 5.25%, 4/15/2023 | 600,000 | 597,000 | ||

| Global Partners LP, 7.0%, 6/15/2023 | 270,000 | 220,725 | ||

| GLP Capital LP: | ||||

| 4.375%, 4/15/2021 | 155,000 | 158,875 | ||

| 5.375%, 4/15/2026 | 500,000 | 521,250 | ||

| Goodyear Tire & Rubber Co.: | ||||

| 5.0%, 5/31/2026 | 925,000 | 935,406 | ||

| 5.125%, 11/15/2023 | 210,000 | 214,725 | ||

| 6.5%, 3/1/2021 | 1,000,000 | 1,048,750 | ||

| Group 1 Automotive, Inc.: | ||||

| 5.0%, 6/1/2022 | 545,000 | 542,275 | ||

| 144A, 5.25%, 12/15/2023 | 755,000 | 743,675 | ||

| Hanesbrands, Inc., 144A, 4.625%, 5/15/2024 | 390,000 | 390,000 | ||

| HD Supply, Inc.: | ||||

| 144A, 5.25%, 12/15/2021 | 290,000 | 305,225 | ||

| 144A, 5.75%, 4/15/2024 | 185,000 | 192,400 | ||

| 7.5%, 7/15/2020 | 105,000 | 110,775 | ||

| Hot Topic, Inc., 144A, 9.25%, 6/15/2021 | 110,000 | 110,825 | ||

| Jaguar Land Rover Automotive PLC, 144A, 3.5%, 3/15/2020 | 1,060,000 | 1,070,600 | ||

| Lennar Corp., 4.75%, 11/15/2022 | 500,000 | 496,250 | ||

| Live Nation Entertainment, Inc.: | ||||

| 144A, 5.375%, 6/15/2022 | 70,000 | 72,450 | ||

| 144A, 7.0%, 9/1/2020 | 470,000 | 493,082 | ||

| MDC Partners, Inc., 144A, 6.5%, 5/1/2024 | 170,000 | 164,475 | ||

| Mediacom Broadband LLC: | ||||

| 5.5%, 4/15/2021 | 70,000 | 72,100 | ||

| 6.375%, 4/1/2023 | 610,000 | 632,875 | ||

| Mediacom LLC, 7.25%, 2/15/2022 | 165,000 | 174,488 | ||

| MGM Growth Properties Operating Partnership LP, 144A, 5.625%, 5/1/2024 | 380,000 | 399,000 | ||

| NCL Corp., Ltd., 144A, 4.625%, 11/15/2020 | 305,000 | 311,100 | ||

| Neptune Finco Corp.: | ||||

| 144A, 6.625%, 10/15/2025 | 200,000 | 213,602 | ||

| 144A, 10.125%, 1/15/2023 | 600,000 | 672,000 | ||

| 144A, 10.875%, 10/15/2025 | 630,000 | 716,625 | ||

| Nielsen Finance LLC, 144A, 5.0%, 4/15/2022 | 155,000 | 158,488 | ||

| Numericable-SFR: | ||||

| 144A, 6.0%, 5/15/2022 | 1,070,000 | 1,065,185 | ||

| 144A, 7.375%, 5/1/2026 | 1,155,000 | 1,165,106 | ||

| Penske Automotive Group, Inc.: | ||||

| 5.375%, 12/1/2024 | 700,000 | 700,000 | ||

| 5.5%, 5/15/2026 | 330,000 | 327,525 | ||

| Quebecor Media, Inc., 5.75%, 1/15/2023 | 295,000 | 302,375 | ||

| Sabre GLBL, Inc.: | ||||

| 144A, 5.25%, 11/15/2023 | 70,000 | 71,488 | ||

| 144A, 5.375%, 4/15/2023 | 25,000 | 25,563 | ||

| Sally Holdings LLC, 5.625%, 12/1/2025 | 535,000 | 559,744 | ||

| Schaeffler Finance BV, 144A, 4.75%, 5/15/2023 | 400,000 | 409,750 | ||

| Seminole Hard Rock Entertainment, Inc., 144A, 5.875%, 5/15/2021 | 180,000 | 181,800 | ||

| Serta Simmons Bedding LLC, 144A, 8.125%, 10/1/2020 | 165,000 | 174,075 | ||

| Sirius XM Radio, Inc.: | ||||

| 144A, 5.375%, 7/15/2026 | 530,000 | 527,350 | ||

| 144A, 5.875%, 10/1/2020 | 310,000 | 320,463 | ||

| Springs Industries, Inc., 6.25%, 6/1/2021 | 415,000 | 420,187 | ||

| Starz LLC, 5.0%, 9/15/2019 | 230,000 | 234,025 | ||

| Suburban Propane Partners LP, 5.75%, 3/1/2025 | 150,000 | 147,375 | ||

| Toll Brothers Finance Corp., 4.875%, 11/15/2025 | 345,000 | 349,313 | ||

| TRI Pointe Group, Inc.: | ||||

| 4.375%, 6/15/2019 | 185,000 | 185,000 | ||

| 4.875%, 7/1/2021 | 2,215,000 | 2,217,769 | ||

| Unitymedia Hessen GmbH & Co., KG, 144A, 5.5%, 1/15/2023 | 1,320,000 | 1,361,250 | ||

| UPCB Finance IV Ltd., 144A, 5.375%, 1/15/2025 | 1,075,000 | 1,095,715 | ||

| UPCB Finance V Ltd., 144A, 7.25%, 11/15/2021 | 144,000 | 151,560 | ||

| UPCB Finance VI Ltd., 144A, 6.875%, 1/15/2022 | 445,500 | 470,002 | ||

| Viking Cruises Ltd.: | ||||

| 144A, 6.25%, 5/15/2025 | 275,000 | 216,563 | ||

| 144A, 8.5%, 10/15/2022 | 295,000 | 262,550 | ||

| Virgin Media Secured Finance PLC: | ||||

| 144A, 5.25%, 1/15/2026 | 390,000 | 390,000 | ||

| 144A, 5.5%, 8/15/2026 | 350,000 | 353,500 | ||

| 49,910,213 | ||||

| Consumer Staples 2.7% | ||||

| Aramark Services, Inc.: | ||||

| 144A, 4.75%, 6/1/2026 | 1,105,000 | 1,099,475 | ||

| 5.125%, 1/15/2024 | 220,000 | 228,250 | ||

| Cott Beverages, Inc.: | ||||

| 5.375%, 7/1/2022 | 515,000 | 516,931 | ||

| 6.75%, 1/1/2020 | 195,000 | 203,775 | ||

| FAGE Dairy Industry SA, 144A, 9.875%, 2/1/2020 | 500,000 | 518,750 | ||

| JBS Investments GmbH, 144A, 7.25%, 4/3/2024 | 360,000 | 368,100 | ||

| JBS U.S.A. LLC: | ||||

| 144A, 5.75%, 6/15/2025 | 220,000 | 210,100 | ||

| 144A, 7.25%, 6/1/2021 | 775,000 | 798,250 | ||

| 144A, 8.25%, 2/1/2020 | 240,000 | 249,600 | ||

| Performance Food Group, Inc., 144A, 5.5%, 6/1/2024 | 315,000 | 318,938 | ||

| Pilgrim's Pride Corp., 144A, 5.75%, 3/15/2025 | 205,000 | 206,667 | ||

| Pinnacle Foods Finance LLC, 144A, 5.875%, 1/15/2024 | 65,000 | 68,250 | ||

| Post Holdings, Inc., 144A, 6.75%, 12/1/2021 | 155,000 | 163,525 | ||

| Smithfield Foods, Inc., 6.625%, 8/15/2022 | 15,000 | 15,750 | ||

| The WhiteWave Foods Co., 5.375%, 10/1/2022 | 410,000 | 438,187 | ||

| 5,404,548 | ||||

| Energy 6.9% | ||||

| Antero Resources Corp.: | ||||

| 5.125%, 12/1/2022 | 365,000 | 349,487 | ||

| 5.375%, 11/1/2021 | 320,000 | 312,000 | ||

| 5.625%, 6/1/2023 | 210,000 | 204,750 | ||

| Blue Racer Midstream LLC, 144A, 6.125%, 11/15/2022 | 235,000 | 211,500 | ||

| Carrizo Oil & Gas, Inc., 6.25%, 4/15/2023 | 275,000 | 268,813 | ||

| Cheniere Corpus Christi Holdings LLC, 144A, 7.0%, 6/30/2024 | 510,000 | 522,750 | ||

| Concho Resources, Inc., 5.5%, 4/1/2023 | 575,000 | 575,000 | ||

| Continental Resources, Inc.: | ||||

| 4.5%, 4/15/2023 | 200,000 | 182,125 | ||

| 5.0%, 9/15/2022 | 1,515,000 | 1,431,675 | ||

| DCP Midstream Operating LP, 2.7%, 4/1/2019 | 700,000 | 655,587 | ||

| Delek & Avner Tamar Bond Ltd., 144A, 5.082%, 12/30/2023 | 500,000 | 514,225 | ||

| Freeport-McMoran Oil & Gas LLC, 6.5%, 11/15/2020 | 500,000 | 480,000 | ||

| Gulfport Energy Corp., 6.625%, 5/1/2023 | 110,000 | 108,075 | ||

| Hilcorp Energy I LP, 144A, 5.75%, 10/1/2025 | 385,000 | 371,525 | ||

| Holly Energy Partners LP, 6.5%, 3/1/2020 | 165,000 | 166,650 | ||

| Ithaca Energy, Inc., 144A, 8.125%, 7/1/2019 | 215,000 | 169,850 | ||

| Laredo Petroleum, Inc., 6.25%, 3/15/2023 | 310,000 | 292,950 | ||

| Memorial Resource Development Corp., 5.875%, 7/1/2022 | 245,000 | 244,081 | ||

| Newfield Exploration Co.: | ||||

| 5.375%, 1/1/2026 | 155,000 | 151,173 | ||

| 5.75%, 1/30/2022 | 305,000 | 307,288 | ||

| Oasis Petroleum, Inc.: | ||||

| 6.875%, 3/15/2022 | 110,000 | 101,200 | ||

| 6.875%, 1/15/2023 | 65,000 | 58,663 | ||

| Pertamina Persero PT, 144A, 5.25%, 5/23/2021 | 410,000 | 431,485 | ||

| Range Resources Corp., 4.875%, 5/15/2025 | 440,000 | 415,800 | ||

| Ras Laffan Liquefied Natural Gas Co., Ltd. II, 144A, 5.298%, 9/30/2020 | 1,072,350 | 1,136,691 | ||

| Reliance Industries Ltd., 144A, 4.125%, 1/28/2025 | 1,250,000 | 1,271,860 | ||

| Rice Energy, Inc., 7.25%, 5/1/2023 | 50,000 | 50,500 | ||

| RSP Permian, Inc., 6.625%, 10/1/2022 | 310,000 | 320,075 | ||

| Sabine Pass Liquefaction LLC, 5.625%, 2/1/2021 | 980,000 | 1,000,825 | ||

| Sunoco LP: | ||||

| 144A, 5.5%, 8/1/2020 | 170,000 | 168,725 | ||

| 144A, 6.375%, 4/1/2023 | 155,000 | 153,450 | ||

| Tesoro Logistics LP: | ||||

| 6.125%, 10/15/2021 | 120,000 | 123,900 | ||

| 6.375%, 5/1/2024 | 270,000 | 278,100 | ||

| Whiting Petroleum Corp., 6.25%, 4/1/2023 | 235,000 | 193,875 | ||

| WPX Energy, Inc., 7.5%, 8/1/2020 | 545,000 | 534,100 | ||

| 13,758,753 | ||||

| Financials 7.0% | ||||

| AerCap Ireland Capital Ltd.: | ||||

| 3.95%, 2/1/2022 | 790,000 | 789,210 | ||

| 4.625%, 10/30/2020 | 2,375,000 | 2,458,125 | ||

| Alliance Data Systems Corp., 144A, 5.25%, 12/1/2017 | 370,000 | 375,550 | ||

| CIT Group, Inc., 3.875%, 2/19/2019 | 1,475,000 | 1,481,918 | ||

| CNO Financial Group, Inc.: | ||||

| 4.5%, 5/30/2020 | 520,000 | 536,900 | ||

| 5.25%, 5/30/2025 | 165,000 | 169,950 | ||

| Commonwealth Bank of Australia, 144A, 4.5%, 12/9/2025 | 2,105,000 | 2,168,367 | ||

| Corp. Financiera de Desarrollo SA, 144A, 4.75%, 2/8/2022 | 500,000 | 528,600 | ||

| E*TRADE Financial Corp.: | ||||

| 4.625%, 9/15/2023 | 205,000 | 205,513 | ||

| 5.375%, 11/15/2022 | 180,000 | 188,100 | ||

| Equinix, Inc.: | ||||

| (REIT), 5.375%, 1/1/2022 | 240,000 | 247,200 | ||

| (REIT), 5.375%, 4/1/2023 | 995,000 | 1,023,606 | ||

| (REIT), 5.75%, 1/1/2025 | 180,000 | 187,200 | ||

| (REIT), 5.875%, 1/15/2026 | 180,000 | 187,650 | ||

| Iron Mountain, Inc., 144A, (REIT), 4.375%, 6/1/2021 | 220,000 | 219,450 | ||

| Lincoln Finance Ltd., 144A, 7.375%, 4/15/2021 | 140,000 | 149,800 | ||

| MPT Operating Partnership LP: | ||||

| (REIT), 6.375%, 2/15/2022 | 415,000 | 434,758 | ||

| (REIT), 6.375%, 3/1/2024 | 390,000 | 417,300 | ||

| (REIT), 6.875%, 5/1/2021 | 415,000 | 430,882 | ||

| National Savings Bank, 144A, 5.15%, 9/10/2019 | 500,000 | 480,140 | ||

| Neuberger Berman Group LLC, 144A, 5.875%, 3/15/2022 | 405,000 | 421,706 | ||

| The Goldman Sachs Group, Inc., Series L, 5.7%, 12/29/2049 | 360,000 | 358,650 | ||

| VEREIT Operating Partnership LP: | ||||

| (REIT), 4.125%, 6/1/2021 (b) | 455,000 | 459,550 | ||

| (REIT), 4.875%, 6/1/2026 (b) | 165,000 | 168,506 | ||

| 14,088,631 | ||||

| Health Care 5.3% | ||||

| Alere, Inc., 144A, 6.375%, 7/1/2023 | 220,000 | 229,434 | ||

| Community Health Systems, Inc.: | ||||

| 5.125%, 8/1/2021 | 75,000 | 74,906 | ||

| 7.125%, 7/15/2020 | 1,090,000 | 1,010,975 | ||

| Concordia Healthcare Corp., 144A, 7.0%, 4/15/2023 | 110,000 | 102,163 | ||

| Endo Finance LLC: | ||||

| 144A, 5.75%, 1/15/2022 | 305,000 | 273,737 | ||

| 144A, 5.875%, 1/15/2023 | 285,000 | 245,813 | ||

| Endo Ltd.: | ||||

| 144A, 6.0%, 7/15/2023 | 240,000 | 210,098 | ||

| 144A, 6.0%, 2/1/2025 | 150,000 | 130,125 | ||

| Fresenius Medical Care U.S. Finance II, Inc., 144A, 6.5%, 9/15/2018 | 170,000 | 184,450 | ||

| HCA, Inc.: | ||||

| 5.25%, 6/15/2026 | 610,000 | 626,775 | ||

| 6.5%, 2/15/2020 | 1,700,000 | 1,870,000 | ||

| 7.5%, 2/15/2022 | 620,000 | 702,925 | ||

| Hologic, Inc., 144A, 5.25%, 7/15/2022 | 110,000 | 115,088 | ||

| IMS Health, Inc., 144A, 6.0%, 11/1/2020 | 365,000 | 373,796 | ||

| LifePoint Health, Inc.: | ||||

| 144A, 5.375%, 5/1/2024 | 435,000 | 436,631 | ||

| 5.5%, 12/1/2021 | 385,000 | 400,400 | ||

| 5.875%, 12/1/2023 | 310,000 | 320,075 | ||

| Mallinckrodt International Finance SA: | ||||

| 144A, 4.875%, 4/15/2020 | 90,000 | 87,300 | ||

| 144A, 5.625%, 10/15/2023 | 165,000 | 155,100 | ||

| Tenet Healthcare Corp., 144A, 4.134%**, 6/15/2020 | 205,000 | 203,975 | ||

| Valeant Pharmaceuticals International, Inc.: | ||||

| 144A, 5.375%, 3/15/2020 | 390,000 | 344,175 | ||

| 144A, 5.875%, 5/15/2023 | 360,000 | 303,300 | ||

| 144A, 6.125%, 4/15/2025 | 1,100,000 | 919,875 | ||

| 144A, 7.5%, 7/15/2021 | 1,455,000 | 1,316,775 | ||

| 10,637,891 | ||||

| Industrials 9.6% | ||||

| ADT Corp.: | ||||

| 3.5%, 7/15/2022 | 190,000 | 174,325 | ||

| 5.25%, 3/15/2020 | 320,000 | 337,200 | ||

| 6.25%, 10/15/2021 | 580,000 | 607,550 | ||

| Aerojet Rocketdyne Holdings, Inc., 7.125%, 3/15/2021 | 690,000 | 726,225 | ||

| Air Lease Corp., 4.75%, 3/1/2020 | 3,915,000 | 4,179,262 | ||

| Allegion PLC, 5.875%, 9/15/2023 | 110,000 | 116,325 | ||

| Artesyn Embedded Technologies, Inc., 144A, 9.75%, 10/15/2020 | 395,000 | 346,613 | ||

| Belden, Inc., 144A, 5.5%, 9/1/2022 | 505,000 | 510,050 | ||

| Bombardier, Inc.: | ||||

| 144A, 5.75%, 3/15/2022 | 480,000 | 408,000 | ||

| 144A, 6.0%, 10/15/2022 | 355,000 | 303,525 | ||

| Carlson Travel Holdings, Inc., 144A, 7.5%, 8/15/2019 | 165,000 | 159,638 | ||

| Casella Waste Systems, Inc., 7.75%, 2/15/2019 | 540,000 | 551,475 | ||

| CNH Industrial Capital LLC, 3.875%, 7/16/2018 | 400,000 | 401,000 | ||

| Covanta Holding Corp., 5.875%, 3/1/2024 | 295,000 | 293,525 | ||

| CTP Transportation Products LLC, 144A, 8.25%, 12/15/2019 | 385,000 | 371,525 | ||

| DigitalGlobe, Inc., 144A, 5.25%, 2/1/2021 | 210,000 | 192,675 | ||

| DR Horton, Inc., 4.0%, 2/15/2020 | 100,000 | 103,250 | ||

| EnerSys, 144A, 5.0%, 4/30/2023 | 55,000 | 54,656 | ||

| Florida East Coast Holdings Corp., 144A, 6.75%, 5/1/2019 | 300,000 | 298,500 | ||

| FTI Consulting, Inc., 6.0%, 11/15/2022 | 295,000 | 311,225 | ||

| Garda World Security Corp., 144A, 7.25%, 11/15/2021 | 400,000 | 325,000 | ||

| Gates Global LLC, 144A, 6.0%, 7/15/2022 | 245,000 | 214,926 | ||

| Huntington Ingalls Industries, Inc.: | ||||

| 144A, 5.0%, 12/15/2021 | 415,000 | 436,787 | ||

| 144A, 5.0%, 11/15/2025 | 213,000 | 223,650 | ||

| Manitowoc Foodservice, Inc., 144A, 9.5%, 2/15/2024 | 155,000 | 170,500 | ||

| Masonite International Corp., 144A, 5.625%, 3/15/2023 | 230,000 | 240,350 | ||

| Meritor, Inc.: | ||||

| 6.25%, 2/15/2024 | 285,000 | 248,663 | ||

| 6.75%, 6/15/2021 | 400,000 | 375,000 | ||

| Moog, Inc., 144A, 5.25%, 12/1/2022 | 175,000 | 177,844 | ||

| Nortek, Inc., 8.5%, 4/15/2021 | 315,000 | 328,781 | ||

| OPE KAG Finance Sub, Inc., 144A, 7.875%, 7/31/2023 | 280,000 | 281,400 | ||

| Oshkosh Corp.: | ||||

| 5.375%, 3/1/2022 | 217,500 | 224,569 | ||

| 5.375%, 3/1/2025 | 803,000 | 825,082 | ||

| Ply Gem Industries, Inc., 6.5% , 2/1/2022 | 525,000 | 520,125 | ||

| Prime Security Services Borrower LLC, 144A, 9.25%, 5/15/2023 | 40,000 | 41,700 | ||

| SBA Communications Corp., 5.625%, 10/1/2019 | 285,000 | 295,331 | ||

| Spirit AeroSystems, Inc., 5.25%, 3/15/2022 | 390,000 | 411,450 | ||

| Summit Materials LLC: | ||||

| 6.125%, 7/15/2023 | 355,000 | 356,775 | ||

| 144A, 8.5%, 4/15/2022 | 155,000 | 165,075 | ||

| Titan International, Inc., 6.875%, 10/1/2020 | 335,000 | 282,238 | ||

| TransDigm, Inc., 144A, 6.375%, 6/15/2026 (b) | 315,000 | 315,394 | ||

| Triumph Group, Inc., 5.25%, 6/1/2022 | 175,000 | 160,125 | ||

| United Rentals North America, Inc.: | ||||

| 6.125%, 6/15/2023 | 35,000 | 36,138 | ||

| 7.625%, 4/15/2022 | 455,000 | 484,006 | ||

| USG Corp., 144A, 5.5%, 3/1/2025 | 10,000 | 10,625 | ||

| ZF North America Capital, Inc.: | ||||

| 144A, 4.0%, 4/29/2020 | 439,000 | 453,816 | ||

| 144A, 4.5%, 4/29/2022 | 610,000 | 613,355 | ||

| 144A, 4.75%, 4/29/2025 | 470,000 | 470,000 | ||

| 19,135,249 | ||||

| Information Technology 4.9% | ||||

| ACI Worldwide, Inc., 144A, 6.375%, 8/15/2020 | 140,000 | 144,725 | ||

| Cardtronics, Inc., 5.125%, 8/1/2022 | 175,000 | 173,688 | ||

| CDW LLC: | ||||

| 5.5%, 12/1/2024 | 355,000 | 364,763 | ||

| 6.0%, 8/15/2022 | 160,000 | 168,000 | ||

| Denali International LLC, 144A, 5.625%, 10/15/2020 | 300,000 | 315,450 | ||

| Diamond 1 Finance Corp.: | ||||

| 144A, 4.42%, 6/15/2021 (b) | 735,000 | 749,676 | ||

| 144A, 6.02%, 6/15/2026 (b) | 470,000 | 475,115 | ||

| EarthLink Holdings Corp., 7.375%, 6/1/2020 | 345,000 | 362,681 | ||

| EMC Corp., 1.875%, 6/1/2018 | 1,200,000 | 1,170,403 | ||

| Entegris, Inc., 144A, 6.0%, 4/1/2022 | 215,000 | 221,988 | ||

| First Data Corp.: | ||||

| 144A, 6.75%, 11/1/2020 | 1,579,000 | 1,661,897 | ||

| 144A, 7.0%, 12/1/2023 | 355,000 | 359,881 | ||

| Freescale Semiconductor, Inc., 144A, 6.0%, 1/15/2022 | 380,000 | 403,066 | ||

| Jabil Circuit, Inc., 5.625%, 12/15/2020 | 400,000 | 424,000 | ||

| Match Group, Inc., 144A, 6.375%, 6/1/2024 (b) | 180,000 | 183,600 | ||

| Micron Technology, Inc.: | ||||

| 144A, 5.25%, 8/1/2023 | 250,000 | 211,875 | ||

| 144A, 7.5%, 9/15/2023 | 600,000 | 630,000 | ||

| NCR Corp.: | ||||

| 5.875%, 12/15/2021 | 75,000 | 76,125 | ||

| 6.375%, 12/15/2023 | 190,000 | 192,998 | ||

| NXP BV: | ||||

| 144A, 4.125%, 6/1/2021 | 625,000 | 629,688 | ||

| 144A, 4.625%, 6/1/2023 | 300,000 | 301,503 | ||

| Riverbed Technology, Inc., 144A, 8.875%, 3/1/2023 | 155,000 | 159,650 | ||

| Sanmina Corp., 144A, 4.375%, 6/1/2019 | 35,000 | 35,700 | ||

| Western Digital Corp.: | ||||

| 144A, 7.375%, 4/1/2023 | 155,000 | 161,200 | ||

| 144A, 10.5%, 4/1/2024 | 275,000 | 284,625 | ||

| 9,862,297 | ||||

| Materials 13.0% | ||||

| Ardagh Packaging Finance PLC: | ||||

| 144A, 3.634%**, 12/15/2019 | 490,000 | 491,225 | ||

| 144A, 4.625%, 5/15/2023 | 245,000 | 243,775 | ||

| 144A, 6.75%, 1/31/2021 | 340,000 | 342,550 | ||

| 144A, 7.25%, 5/15/2024 | 435,000 | 443,700 | ||

| Ball Corp.: | ||||

| 4.375%, 12/15/2020 | 155,000 | 161,975 | ||

| 5.25%, 7/1/2025 | 275,000 | 286,344 | ||

| Berry Plastics Corp., 5.5%, 5/15/2022 | 600,000 | 616,500 | ||

| Cascades, Inc., 144A, 5.5%, 7/15/2022 | 185,000 | 180,375 | ||

| Celanese U.S. Holdings LLC, 4.625%, 11/15/2022 | 1,500,000 | 1,537,500 | ||

| Cemex SAB de CV, 144A, 6.5%, 12/10/2019 | 1,300,000 | 1,371,630 | ||

| Chemours Co.: | ||||

| 6.625%, 5/15/2023 | 205,000 | 183,988 | ||

| 7.0%, 5/15/2025 | 95,000 | 83,303 | ||

| Clearwater Paper Corp., 144A, 5.375%, 2/1/2025 | 215,000 | 214,463 | ||

| Constellium NV, 144A, 7.875%, 4/1/2021 | 950,000 | 964,250 | ||

| Coveris Holding Corp., 144A, 10.0%, 6/1/2018 | 335,000 | 340,025 | ||

| Coveris Holdings SA, 144A, 7.875%, 11/1/2019 | 230,000 | 225,400 | ||

| First Quantum Minerals Ltd.: | ||||

| 144A, 6.75%, 2/15/2020 | 200,000 | 160,000 | ||

| 144A, 7.0%, 2/15/2021 | 630,000 | 497,306 | ||

| Freeport-McMoRan, Inc.: | ||||

| 2.3%, 11/14/2017 | 800,000 | 780,000 | ||

| 2.375%, 3/15/2018 | 1,990,000 | 1,930,300 | ||

| Greif, Inc., 7.75%, 8/1/2019 | 870,000 | 973,312 | ||

| Hexion, Inc., 6.625%, 4/15/2020 | 190,000 | 161,500 | ||

| Kaiser Aluminum Corp.: | ||||

| 144A, 5.875%, 5/15/2024 | 295,000 | 302,788 | ||

| 8.25%, 6/1/2020 | 25,000 | 26,031 | ||

| Novelis, Inc., 8.75%, 12/15/2020 | 1,820,000 | 1,888,250 | ||

| Perstorp Holding AB, 144A, 8.75%, 5/15/2017 | 400,000 | 400,000 | ||

| Plastipak Holdings, Inc., 144A, 6.5%, 10/1/2021 | 390,000 | 400,238 | ||

| Platform Specialty Products Corp.: | ||||

| 144A, 6.5%, 2/1/2022 | 235,000 | 208,709 | ||

| 144A, 10.375%, 5/1/2021 | 200,000 | 204,000 | ||

| Reynolds Group Issuer, Inc.: | ||||

| 5.75%, 10/15/2020 | 3,720,000 | 3,836,250 | ||

| 6.875%, 2/15/2021 | 760,000 | 788,500 | ||

| Sealed Air Corp.: | ||||

| 144A, 4.875%, 12/1/2022 | 120,000 | 122,700 | ||

| 144A, 5.125%, 12/1/2024 | 60,000 | 61,650 | ||

| Teck Resources Ltd.: | ||||

| 2.5%, 2/1/2018 | 2,100,000 | 2,115,750 | ||

| 144A, 8.0%, 6/1/2021 (b) | 520,000 | 530,400 | ||

| 144A, 8.5%, 6/1/2024 (b) | 115,000 | 117,875 | ||

| Tronox Finance LLC: | ||||

| 6.375%, 8/15/2020 | 275,000 | 211,750 | ||

| 144A, 7.5%, 3/15/2022 | 250,000 | 186,250 | ||

| United States Steel Corp., 144A, 8.375%, 7/1/2021 | 805,000 | 831,163 | ||

| Volcan Cia Minera SAA, 144A, 5.375%, 2/2/2022 | 1,565,000 | 1,353,255 | ||

| WR Grace & Co-Conn: | ||||

| 144A, 5.125%, 10/1/2021 | 105,000 | 108,871 | ||

| 144A, 5.625%, 10/1/2024 | 55,000 | 58,163 | ||

| 25,942,014 | ||||

| Telecommunication Services 9.9% | ||||

| America Movil SAB de CV, 7.125%, 12/9/2024 | MXN | 7,000,000 | 364,512 | |

| B Communications Ltd., 144A, 7.375%, 2/15/2021 | 370,000 | 395,900 | ||

| Bharti Airtel International Netherlands BV, 144A, 5.125%, 3/11/2023 | 1,400,000 | 1,500,883 | ||

| CenturyLink, Inc.: | ||||

| Series V, 5.625%, 4/1/2020 | 145,000 | 148,625 | ||

| Series T, 5.8%, 3/15/2022 | 550,000 | 530,750 | ||

| Series S, 6.45%, 6/15/2021 | 600,000 | 609,000 | ||

| Series W, 6.75%, 12/1/2023 | 705,000 | 687,375 | ||

| Series Y, 7.5%, 4/1/2024 | 590,000 | 583,731 | ||

| CommScope, Inc.: | ||||

| 144A, 4.375%, 6/15/2020 | 135,000 | 139,050 | ||

| 144A, 5.0%, 6/15/2021 | 350,000 | 355,250 | ||

| CyrusOne LP, 6.375%, 11/15/2022 | 395,000 | 418,700 | ||

| Digicel Group Ltd.: | ||||

| 144A, 7.125%, 4/1/2022 | 355,000 | 273,812 | ||

| 144A, 8.25%, 9/30/2020 | 633,000 | 549,127 | ||

| Digicel Ltd.: | ||||

| 144A, 6.75%, 3/1/2023 | 390,000 | 343,200 | ||

| 144A, 7.0%, 2/15/2020 | 200,000 | 185,500 | ||

| Frontier Communications Corp.: | ||||

| 6.25%, 9/15/2021 | 160,000 | 149,200 | ||

| 7.125%, 1/15/2023 | 870,000 | 776,475 | ||

| 8.5%, 4/15/2020 | 130,000 | 137,638 | ||

| 144A, 10.5%, 9/15/2022 | 730,000 | 760,112 | ||

| 144A, 11.0%, 9/15/2025 | 200,000 | 203,500 | ||

| Hughes Satellite Systems Corp., 7.625%, 6/15/2021 | 335,000 | 362,637 | ||

| Intelsat Jackson Holdings SA, 144A, 8.0%, 2/15/2024 | 725,000 | 738,594 | ||

| Level 3 Financing, Inc.: | ||||

| 144A, 5.25%, 3/15/2026 | 270,000 | 269,325 | ||

| 5.375%, 8/15/2022 | 750,000 | 761,250 | ||

| 5.375%, 1/15/2024 | 210,000 | 213,717 | ||

| 5.375%, 5/1/2025 | 225,000 | 228,983 | ||

| 6.125%, 1/15/2021 | 230,000 | 240,350 | ||

| Millicom International Cellular SA, 144A, 6.0%, 3/15/2025 | 500,000 | 462,500 | ||

| Plantronics, Inc., 144A, 5.5%, 5/31/2023 | 110,000 | 109,450 | ||

| Sprint Communications, Inc., 144A, 7.0%, 3/1/2020 | 320,000 | 330,237 | ||

| Sprint Corp., 7.125%, 6/15/2024 | 1,325,000 | 997,062 | ||

| T-Mobile U.S.A., Inc.: | ||||

| 6.0%, 4/15/2024 | 1,075,000 | 1,120,257 | ||

| 6.125%, 1/15/2022 | 155,000 | 163,525 | ||

| 6.375%, 3/1/2025 | 542,000 | 567,745 | ||

| 6.5%, 1/15/2026 | 20,000 | 21,150 | ||

| 6.625%, 11/15/2020 | 600,000 | 619,620 | ||

| Turk Telekomunikasyon AS, 144A, 3.75%, 6/19/2019 | 2,000,000 | 2,015,500 | ||

| Wind Acquisition Finance SA, 144A, 6.5%, 4/30/2020 | 290,000 | 297,975 | ||

| Windstream Services LLC, 7.75%, 10/15/2020 | 115,000 | 107,525 | ||

| Zayo Group LLC: | ||||

| 6.0%, 4/1/2023 | 590,000 | 606,225 | ||

| 6.375%, 5/15/2025 | 500,000 | 520,000 | ||

| 19,865,967 | ||||

| Utilities 1.8% | ||||

| Calpine Corp.: | ||||

| 5.375%, 1/15/2023 | 290,000 | 283,385 | ||

| 5.75%, 1/15/2025 | 290,000 | 280,575 | ||

| Dynegy, Inc.: | ||||

| 7.375%, 11/1/2022 | 275,000 | 265,375 | ||

| 7.625%, 11/1/2024 | 485,000 | 465,600 | ||

| Energy Future Holdings Corp., Series Q, 6.5%, 11/15/2024* | 400,000 | 220,000 | ||

| NGL Energy Partners LP, 5.125%, 7/15/2019 | 245,000 | 220,500 | ||

| NRG Energy, Inc.: | ||||

| 6.25%, 5/1/2024 | 1,050,000 | 1,020,797 | ||

| 144A, 7.25%, 5/15/2026 | 570,000 | 568,575 | ||

| 7.875%, 5/15/2021 | 169,000 | 175,338 | ||

| Talen Energy Supply LLC, 144A, 4.625%, 7/15/2019 | 125,000 | 115,000 | ||

| 3,615,145 | ||||

| Total Corporate Bonds (Cost $171,580,350) | 172,220,708 | |||

| Asset-Backed 3.5% | ||||

| Miscellaneous | ||||

| Apidos CLO XXI, "C", Series 2015-21A, 144A, 4.17%**, 7/18/2027 | 1,125,000 | 1,014,073 | ||

| Babson CLO Ltd., "D", Series 2015-2A, 144A, 4.424%**, 7/20/2027 | 2,000,000 | 1,867,942 | ||

| Cumberland Park CLO Ltd., "D", Series 2015-2A, 144A, 4.024%**, 7/20/2026 | 1,500,000 | 1,353,057 | ||

| Marea CLO Ltd., "DR", Series 2012-1A, 144A, 4.372%**, 10/15/2023 | 1,500,000 | 1,384,183 | ||

| Neuberger Berman CLO XVIII Ltd., "C", Series 2014-18A, 144A, 4.368%**, 11/14/2025 | 1,500,000 | 1,368,500 | ||

| Total Asset-Backed (Cost $7,449,232) | 6,987,755 | |||

| Collateralized Mortgage Obligation 0.4% | ||||

| Federal National Mortgage Association, "PZ", Series 2010-129, 4.5%, 11/25/2040 (Cost $856,521) | 818,104 | 869,724 | ||

| Government & Agency Obligations 8.0% | ||||

| Other Government Related (c) 0.5% | ||||

| VTB Bank OJSC, 144A, 6.315%, 2/22/2018 | 985,000 | 1,034,132 | ||

| Sovereign Bonds 7.5% | ||||

| Dominican Republic, 144A, 6.875%, 1/29/2026 | 300,000 | 323,250 | ||

| KazAgro National Management Holding JSC, 144A, 4.625%, 5/24/2023 | 1,250,000 | 1,079,938 | ||

| Perusahaan Penerbit SBSN, 144A, 4.325%, 5/28/2025 | 700,000 | 707,875 | ||

| Republic of Argentina-Inflation Linked Bond, 5.83%, 12/31/2033 | ARS | 654 | 261 | |

| Republic of Armenia, 144A, 7.15%, 3/26/2025 | 500,000 | 487,100 | ||

| Republic of Costa Rica, 144A, 7.158%, 3/12/2045 | 400,000 | 368,000 | ||

| Republic of Hungary: | ||||

| 4.0%, 3/25/2019 | 800,000 | 831,000 | ||

| Series 19/A, 6.5%, 6/24/2019 | HUF | 51,600,000 | 208,412 | |

| Republic of Panama: | ||||

| 3.75%, 3/16/2025 | 1,030,000 | 1,048,025 | ||

| 9.375%, 1/16/2023 | 2,610,000 | 3,447,810 | ||

| Republic of Paraguay, 144A, 6.1%, 8/11/2044 | 200,000 | 204,000 | ||

| Republic of Peru, 4.125%, 8/25/2027 | 500,000 | 526,875 | ||

| Republic of Slovenia: | ||||

| 144A, 4.75%, 5/10/2018 | 800,000 | 844,080 | ||

| 144A, 5.5%, 10/26/2022 | 2,200,000 | 2,490,400 | ||

| Republic of Sri Lanka, 144A, 5.125%, 4/11/2019 | 1,000,000 | 998,434 | ||

| Republic of Uruguay, 5.1%, 6/18/2050 | 120,000 | 111,900 | ||

| United Mexican States: | ||||

| 3.6%, 1/30/2025 | 375,000 | 378,281 | ||

| 4.6%, 1/23/2046 | 800,000 | 776,000 | ||

| ZAR Sovereign Capital Fund Propriety Ltd., 144A, 3.903%, 6/24/2020 | 185,000 | 185,039 | ||

| 15,016,680 | ||||

| Total Government & Agency Obligations (Cost $15,841,346) | 16,050,812 | |||

| Loan Participations and Assignments 47.4% | ||||

| Senior Loans** | ||||

| Consumer Discretionary 12.6% | ||||

| 1011778 B.C. Unlimited Liability Co., Term Loan B2, 3.75%, 12/10/2021 | 1,548,073 | 1,555,232 | ||

| Altice U.S. Finance I Corp., Term Loan, 4.25%, 12/14/2022 | 1,494,647 | 1,499,878 | ||

| Atlantic Broadband Finance LLC, Term Loan B, 3.25%, 11/30/2019 | 3,508,271 | 3,516,305 | ||

| Avis Budget Car Rental LLC, Term Loan, 3.25%, 3/15/2022 | 1,325,829 | 1,329,144 | ||

| CSC Holdings, Inc., Term Loan B, 2.955%, 4/17/2020 | 3,499,365 | 3,531,087 | ||

| Goodyear Tire & Rubber Co., Second Lien Term Loan, 3.75%, 4/30/2019 | 1,760,000 | 1,765,773 | ||

| Hilton Worldwide Finance LLC, Term Loan B2, 3.5%, 10/26/2020 | 3,199,326 | 3,213,499 | ||

| Quebecor Media, Inc., Term Loan B1, 3.25%, 8/17/2020 | 3,217,392 | 3,205,326 | ||

| Seminole Tribe of Florida, Term Loan, 3.0%, 4/29/2020 | 3,112,600 | 3,120,397 | ||

| Visteon Corp., Term Delay Draw B, 3.5%, 4/9/2021 | 2,500,000 | 2,506,250 | ||

| 25,242,891 | ||||

| Consumer Staples 5.0% | ||||

| Albertson's LLC, Term Loan B2, 5.5%, 3/21/2019 | 2,637,128 | 2,642,996 | ||

| Pinnacle Foods Finance LLC: | ||||

| Term Loan H, 3.25%, 4/29/2020 | 2,528,141 | 2,534,284 | ||

| Term Loan G, 3.25%, 4/29/2020 | 1,136,077 | 1,138,918 | ||

| U.S. Foods, Inc., Term Loan, 4.5%, 3/31/2019 | 2,984,655 | 2,989,833 | ||

| Vogue International, Inc., Term Loan, 5.75%, 2/14/2020 | 602,700 | 606,090 | ||

| 9,912,121 | ||||

| Energy 0.6% | ||||

| MEG Energy Corp., Term Loan, 3.75%, 3/31/2020 | 1,276,708 | 1,142,654 | ||

| Financials 0.8% | ||||

| Delos Finance Sarl, Term Loan B, 3.5%, 3/6/2021 | 1,575,000 | 1,582,481 | ||

| Health Care 5.0% | ||||

| AmSurg Corp., First Lien Term Loan B, 3.5%, 7/16/2021 | 790,913 | 793,942 | ||

| Community Health Systems, Inc.: | ||||

| Term Loan G, 3.75%, 12/31/2019 | 279,536 | 274,540 | ||

| Term Loan H, 4.0%, 1/27/2021 | 514,340 | 507,560 | ||

| Convatec, Inc., Term Loan, 4.25%, 6/15/2020 | 2,460,740 | 2,468,429 | ||

| DaVita HealthCare Partners, Inc., Term Loan B, 3.5%, 6/24/2021 | 3,933,930 | 3,970,319 | ||

| Valeant Pharmaceuticals International, Inc.: | ||||

| Term Loan B, 4.5%, 2/13/2019 | 1,076,528 | 1,065,763 | ||

| Term Loan B, 4.75%, 12/11/2019 | 1,004,403 | 994,108 | ||

| 10,074,661 | ||||

| Industrials 10.2% | ||||

| BE Aerospace, Inc., Term Loan B, 4.0%, 12/16/2021 | 3,344,364 | 3,366,520 | ||

| Booz Allen Hamilton, Inc., Term Loan, 3.75%, 7/31/2019 | 2,500,000 | 2,514,375 | ||

| Hertz Corp., Term Loan B, 3.75%, 3/11/2018 | 1,492,288 | 1,494,736 | ||

| Ply Gem Industries, Inc., Term Loan, 4.0%, 2/1/2021 | 3,207,942 | 3,212,626 | ||

| Quikrete Holdings, Inc., First Lien Term Loan, 4.0%, 9/28/2020 | 3,000,000 | 3,011,565 | ||

| Sabre, Inc., Term Loan B, 4.0%, 2/19/2019 | 1,989,717 | 1,996,353 | ||

| TransDigm, Inc., Term Loan C, 3.75%, 2/28/2020 | 1,778,532 | 1,782,614 | ||

| Waste Industries U.S.A., Inc., Term Loan B, 4.25%, 2/27/2020 | 2,984,925 | 3,002,655 | ||

| 20,381,444 | ||||

| Information Technology 1.5% | ||||

| First Data Corp., Term Loan, 4.443%, 3/24/2021 | 2,985,925 | 3,003,348 | ||

| Materials 5.4% | ||||

| American Rock Salt Holdings LLC, First Lien Term Loan, 4.75%, 5/20/2021 | 2,716,613 | 2,600,599 | ||

| Axalta Coating Systems U.S. Holdings, Inc., Term Loan, 3.75%, 2/1/2020 | 1,605,281 | 1,611,413 | ||

| Berry Plastics Holding Corp.: | ||||

| Term Loan D, 3.5%, 2/8/2020 | 2,917,293 | 2,923,463 | ||

| Term Loan E, 3.75%, 1/6/2021 | 1,098,075 | 1,103,088 | ||

| MacDermid, Inc.: | ||||

| Term Loan B2, 5.5%, 6/7/2020 | 1,262,218 | 1,262,060 | ||

| First Lien Term Loan, 5.5%, 6/7/2020 | 802,313 | 802,064 | ||

| PolyOne Corp., Term Loan B, 3.75%, 11/11/2022 | 583,538 | 586,820 | ||

| 10,889,507 | ||||

| Telecommunication Services 1.2% | ||||

| DigitalGlobe, Inc., Term Loan B, 4.75%, 1/31/2020 | 53,350 | 53,833 | ||

| Level 3 Financing, Inc.: | ||||

| Term Loan B2, 3.5%, 5/31/2022 | 620,000 | 620,645 | ||

| Term Loan B, 4.0%, 1/15/2020 | 1,670,000 | 1,678,350 | ||

| 2,352,828 | ||||

| Utilities 5.1% | ||||

| Calpine Corp., Term Loan B5, 3.5%, 5/27/2022 | 6,297,413 | 6,263,721 | ||

| NRG Energy, Inc., Term Loan B, 2.75%, 7/2/2018 | 3,955,983 | 3,958,970 | ||

| 10,222,691 | ||||

| Total Loan Participations and Assignments (Cost $94,833,537) | 94,804,626 | |||

| Convertible Bond 0.2% | ||||

| Materials | ||||

| GEO Specialty Chemicals, Inc., 144A, 7.5% Cash, 7.5% PIK, 10/30/2018 (Cost $440,795) | 444,912 | 444,111 | ||

| Preferred Security 0.3% | ||||

| Materials | ||||

| Hercules, Inc., 6.5%, 6/30/2029 (Cost $470,183) | 675,000 | 555,187 | ||

Shares |

Value ($) | |||

| Common Stocks 0.0% | ||||

| Consumer Discretionary 0.0% | ||||

| Dawn Holdings, Inc.* (d) | 7 | 15,592 | ||

| Industrials 0.0% | ||||

| Congoleum Corp.* | 7,900 | 0 | ||

| Quad Graphics, Inc. | 115 | 2,209 | ||

| 2,209 | ||||

| Materials 0.0% | ||||

| GEO Specialty Chemicals, Inc.* | 46,639 | 16,794 | ||

| GEO Specialty Chemicals, Inc. 144A* | 649 | 234 | ||

| 17,028 | ||||

| Total Common Stocks (Cost $114,610) | 34,829 | |||

| Warrant 0.0% | ||||

| Materials | ||||

| Hercules Trust II, Expiration Date 3/31/2029* (Cost $87,876) | 400 | 2,108 | ||

| Cash Equivalents 0.7% | ||||

| Deutsche Central Cash Management Government Fund, 0.39% (e) (Cost $1,368,758) | 1,368,758 | 1,368,758 | ||

| % of Net Assets | Value ($) | |

| Total Investment Portfolio (Cost $293,043,208)† | 146.5 | 293,338,618 |

| Other Assets and Liabilities, Net | (0.0) | (150,227) |

| Notes Payable | (46.5) | (93,000,000) |

| Net Assets | 100.0 | 200,188,391 |

The following table represents bonds that are in default:

| Security | Coupon | Maturity Date | Principal Amount | Cost ($) | Value ($) | |

| Energy Future Holdings Corp.* | 6.5% | 11/15/2024 | USD | 400,000 | 249,537 | 220,000 |

* Non-income producing security.

** Floating rate securities' yields vary with a designated market index or market rate, such as the coupon-equivalent of the U.S. Treasury Bill rate. These securities are shown at their current rate as of May 31, 2016.

† The cost for federal income tax purposes was $293,884,997. At May 31, 2016, net unrealized depreciation for all securities based on tax cost was $546,379. This consisted of aggregate gross unrealized appreciation for all securities in which there was an excess of value over tax cost of $4,709,838 and aggregate gross unrealized depreciation for all securities in which there was an excess of tax cost over value of $5,256,217.

(a) Principal amount stated in U.S. dollars unless otherwise noted.

(b) When-issued security.

(c) Government-backed debt issued by financial companies or government sponsored enterprises.

(d) The Fund may purchase securities that are subject to legal or contractual restrictions on resale ("restricted securities"). Restricted securities are securities which have not been registered with the Securities and Exchange Commission under the Securities Act of 1933. The Fund may be unable to sell a restricted security and it may be more difficult to determine a market value for a restricted security. Moreover, if adverse market conditions were to develop during the period between the Fund's decision to sell a restricted security and the point at which the Fund is permitted or able to sell such security, the Fund might obtain a price less favorable than the price that prevailed when it decided to sell. This investment practice, therefore, could have the effect of increasing the level of illiquidity of the Fund. The future value of these securities is uncertain and there may be changes in the estimated value of these securities.

| Schedule of Restricted Securities | Acquisition Date | Cost ($) | Value ($) | Value as % of Net Assets |

| Dawn Holdings, Inc.* | August 2013 | 26,381 | 15,592 | .01 |

(e) Affiliated fund managed by Deutsche Investment Management Americas Inc. The rate shown is the annualized seven-day yield at period end.

144A: Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers.

CLO: Collateralized Loan Obligation

OJSC: Open Joint Stock Company

PIK: Denotes that all or a portion of the income is paid in-kind in the form of additional principal.

REIT: Real Estate Investment Trust

SBSN: Surat Berharga Syariah Negara (Islamic Based Government Securities)

At May 31, 2016, the Fund had the following open forward foreign currency exchange contracts:

| Contracts to Deliver | In Exchange For | Settlement Date | Unrealized Appreciation ($) | Counterparty | ||||

| MXN | 7,194,700 | USD | 406,607 | 8/5/2016 | 19,534 | Citigroup, Inc. | ||

| Currency Abbreviations |

|

ARS Argentine Peso HUF Hungarian Forint MXN Mexican Peso USD United States Dollar ZAR South African Rand |

For information on the Fund's policy and additional disclosures regarding forward foreign currency exchange contracts, please refer to Note B in the accompanying Notes to Financial Statements.

Fair Value Measurements

Various inputs are used in determining the value of the Fund's investments. These inputs are summarized in three broad levels. Level 1 includes quoted prices in active markets for identical securities. Level 2 includes other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds and credit risk). Level 3 includes significant unobservable inputs (including the Fund's own assumptions in determining the fair value of investments). The level assigned to the securities valuations may not be an indication of the risk or liquidity associated with investing in those securities.

The following is a summary of the inputs used as of May 31, 2016 in valuing the Fund's investments. For information on the Fund's policy regarding the valuation of investments, please refer to Note A in the accompanying Notes to Financial Statements.

| Assets | Level 1 | Level 2 | Level 3 | Total | |

| Fixed Income Investments (f) | |||||

| Corporate Bonds | $ — | $ 172,220,708 | $ — | $ 172,220,708 | |

| Asset-Backed | — | 6,987,755 | — | 6,987,755 | |

| Collateralized Mortgage Obligation | — | 869,724 | — | 869,724 | |

| Government & Agency Obligations | — | 16,050,812 | — | 16,050,812 | |

| Loan Participations and Assignments | — | 94,804,626 | — | 94,804,626 | |

| Convertible Bond | — | — | 444,111 | 444,111 | |

| Preferred Security | — | 555,187 | — | 555,187 | |

| Common Stocks | 2,209 | — | 32,620 | 34,829 | |

| Warrants | — | — | 2,108 | 2,108 | |

| Short-Term Investment | 1,368,758 | — | — | 1,368,758 | |

| Derivatives (f) | |||||

| Forward Foreign Currency Exchange Contracts | — | 19,534 | — | 19,534 | |

| Total | $ 1,370,967 | $ 291,508,346 | $ 478,839 | $ 293,358,152 | |

There have been no transfers between fair value measurement levels during the period ended May 31, 2016.

(f) Derivatives include unrealized appreciation (depreciation) on forward foreign currency exchange contracts.

The accompanying notes are an integral part of the financial statements.

Statement of Assets and Liabilities

| as of May 31, 2016 (Unaudited) | |

| Assets | |

|

Investments: Investments in non-affiliated securities, at value (cost $291,674,450) |

$ 291,969,860 |

| Investment in Deutsche Central Cash Management Government Fund (cost $1,368,758) | 1,368,758 |

| Total investments in securities, at value (cost $293,043,208) | 293,338,618 |

| Cash | 241,369 |

| Foreign currency, at value (cost $103,951) | 96,965 |

| Receivable for investments sold — when-issued/delayed delivery securities | 628,956 |

| Interest receivable | 3,017,768 |

| Unrealized appreciation on forward foreign currency exchange contracts | 19,534 |

| Foreign taxes recoverable | 2,044 |

| Other assets | 3,305 |

| Total assets | 297,348,559 |

| Liabilities | |

| Payable for investments purchased | 175,457 |

| Payable for investments purchased — when-issued/delayed delivery securities | 3,582,061 |

| Notes payable | 93,000,000 |

| Interest on notes payable | 95,628 |

| Accrued management fee | 143,956 |

| Accrued Trustees' fees | 4,257 |

| Other accrued expenses and payables | 158,809 |

| Total liabilities | 97,160,168 |

| Net assets, at value | $ 200,188,391 |

| Net Assets Consist of | |

| Distributions in excess of net investment income | (160,395) |

|

Net unrealized appreciation (depreciation) on: Investments |

295,410 |

| Foreign currency | 11,938 |

| Accumulated net realized gain (loss) | (29,541,446) |

| Paid-in capital | 229,582,884 |

| Net assets, at value | $ 200,188,391 |

| Net Asset Value | |

| Net Asset Value per share ($200,188,391 ÷ 22,403,562 outstanding shares of beneficial interest, $.01 par value, unlimited shares authorized) | $ 8.94 |

The accompanying notes are an integral part of the financial statements.

Statement of Operations

| for the six months ended May 31, 2016 (Unaudited) | |

| Investment Income | |

|

Income: Interest |

$ 7,254,319 |

| Dividends | 2,592 |

| Income distributions — Deutsche Central Cash Management Government Fund | 6,063 |

| Total income | 7,262,974 |

|

Expenses: Management fee |

829,875 |

| Services to shareholders | 10,632 |

| Custodian fee | 33,982 |

| Professional fees | 48,123 |

| Reports to shareholders | 37,918 |

| Interest expense | 624,428 |

| Trustees' fees and expenses | 7,777 |

| Stock exchange listing fees | 11,345 |

| Other | 26,513 |

| Total expenses | 1,630,593 |

| Net investment income | 5,632,381 |

| Realized and Unrealized Gain (Loss) | |

|

Net realized gain (loss) from: Investments |

(6,133,454) |

| Swap contracts | 17,165 |

| Written options | 32,085 |

| Foreign currency | 1,194 |

| (6,083,010) | |

|

Change in net unrealized appreciation (depreciation) on: Investments |

7,030,431 |

| Swap contracts | (14,859) |

| Written options | (32,078) |

| Foreign currency | 22,875 |

| 7,006,369 | |

| Net gain (loss) | 923,359 |

| Net increase (decrease) in net assets resulting from operations | $ 6,555,740 |

The accompanying notes are an integral part of the financial statements.

Statement of Cash Flows

| for the six months ended May 31, 2016 (Unaudited) | |

|

Increase (Decrease) in Cash: Cash Flows from Operating Activities | |

| Net increase (decrease) in net assets resulting from operations | $ 6,555,740 |

|

Adjustments to reconcile net increase (decrease) in net assets resulting from operations to net cash provided (used) by operating activities: Purchases of long-term investments |

(51,820,904) |

| Net purchases, sales and maturities of short-term investments | 10,306,946 |

| Net amortization of premium/(accretion of discount) | 86,399 |

| Proceeds from sales and maturities of long-term investments | 53,772,774 |

| (Increase) decrease in interest receivable | 319,353 |

| (Increase) decrease in other assets | 4,140 |

| (Increase) decrease in receivable for investments sold | 1,252,854 |

| (Increase) decrease in receivable for investments sold — when issued | (628,956) |

| (Increase) decrease in upfront payments paid/received on credit swap contracts | 24,508 |

| (Increase) decrease in written options, at value | (7) |

| Increase (decrease) in interest on notes payable | (7,372) |

| Increase (decrease) in payable for investments purchased | (22,822,466) |

| Increase (decrease) in payable for investments purchased — when-issued securities | 2,464,248 |

| Increase (decrease) in other accrued expenses and payables | 67,429 |

| Change in unrealized (appreciation) depreciation on investments | (7,030,431) |

| Change in unrealized (appreciation) depreciation on swap contracts | 14,859 |

| Change in unrealized (appreciation) depreciation on forward foreign currency exchange contracts | (25,791) |

| Net realized (gain) loss from investments | 6,133,454 |

| Cash provided (used) by operating activities | $ (1,333,223) |

| Cash Flows from Financing Activities | |

| Net increase (decrease) in notes payable | 10,000,000 |

| Payment for shares repurchased | (3,006,005) |

| Distributions paid (net of reinvestment of distributions) | (5,730,942) |

| Cash provided (used) by financing activities | 1,263,053 |

| Increase (decrease) in cash | (70,170) |

| Cash at beginning of period (including foreign currency) | 408,504 |

| Cash at end of period (including foreign currency) | $ 338,334 |

| Supplemental Disclosure | |

| Interest paid on notes | $ 631,800 |

The accompanying notes are an integral part of the financial statements.

Statement of Changes in Net Assets

| Six Months Ended May 31, 2016 (Unaudited) | Year Ended November 30, 2015 | |

| Increase (Decrease) in Net Assets | ||

|

Operations: Net investment income |

$ 5,632,381 | $ 12,519,898 |

| Net realized gain (loss) | (6,083,010) | (14,798,957) |

| Change in net unrealized appreciation (depreciation) | 7,006,369 | (6,413,325) |

| Net increase (decrease) in net assets resulting from operations | 6,555,740 | (8,692,384) |

|

Distributions to shareholders from: Net investment income |

(5,730,942) | (13,502,459) |

| Return of capital | — | (589,269) |

| Total distributions | (5,730,942) | (14,091,728) |

|

Fund share transactions: Cost of shares repurchased |

(2,983,927) | (12,546,417) |

| Increase (decrease) in net assets | (2,159,129) | (35,330,529) |

| Net assets at beginning of period | 202,347,520 | 237,678,049 |

| Net assets at end of period (including distributions in excess of net investment income of $160,395 and $61,834, respectively) | $ 200,188,391 | $ 202,347,520 |

| Other Information | ||

| Shares outstanding at beginning of period | 22,803,076 | 24,286,599 |

| Shares repurchased | (399,514) | (1,483,523) |

| Shares outstanding at end of period | 22,403,562 | 22,803,076 |

The accompanying notes are an integral part of the financial statements.

Financial Highlights

| Six Months Ended 5/31/16 (Unaudited) | Years Ended November 30, | ||||||

| 2015 | 2014 | 2013 | 2012 | 2011 | |||

| Selected Per Share Data | |||||||

| Net asset value, beginning of period | $ 8.87 | $ 9.79 | $ 9.98 | $ 10.29 | $ 9.38 | $ 9.75 | |

|

Income (loss) from investment operations: Net investment incomea |

.25 | .54 | .64 | .70 | .81 | .87 | |

| Net realized and unrealized gain (loss) | .06 | (.92) | (.16) | (.13) | 1.02 | (.33) | |

| Total from investment operations | .31 | (.38) | .48 | .57 | 1.83 | .54 | |

|

Less distributions from: Net investment income |

(.26) | (.58) | (.68) | (.88) | (.92) | (.91) | |

| Return of capital | — | (.03) | — | — | — | — | |

| Total distributions | (.26) | (.61) | (.68) | (.88) | (.92) | (.91) | |

| NAV accretion resulting from repurchases of shares at a discount to NAVa | .02 | .07 | .01 | — | — | — | |

| Net asset value, end of period | $ 8.94** | $ 8.87 | $ 9.79 | $ 9.98 | $ 10.29 | $ 9.38 | |

| Market price, end of period | $ 8.23** | $ 7.36 | $ 8.79 | $ 9.41 | $ 10.51 | $ 9.98 | |

| Total Return | |||||||

| Based on net asset value (%)b | 4.10 | (2.42) | 5.53 | 5.58 | 20.20 | 5.64 | |

| Based on market price (%)b | 15.49 | (9.82) | .49 | (2.53) | 15.39 | 7.65 | |

| Ratios to Average Net Assets and Supplemental Data | |||||||

| Net assets, end of period ($ millions) | 200 | 202 | 238 | 245 | 252 | 228 | |

| Ratio of expenses (including interest expense) (%) | 1.67* | 1.51 | 1.52 | 1.60 | 1.66 | 1.49 | |

| Ratio of expenses (excluding interest expense) (%) | 1.03* | 1.02 | 1.01 | 1.00 | 1.00 | 1.02 | |

| Ratio of net investment income (%) | 5.77* | 5.77 | 6.37 | 6.89 | 8.09 | 8.84 | |

| Portfolio turnover rate (%) | 19** | 50 | 82 | 76 | 45 | 55 | |

| Total debt outstanding end of period ($ thousands) | 93,000 | 83,000 | 99,000 | 109,000 | 103,000 | 98,247 | |

| Asset coverage per $1,000 of debtc | 3,153 | 3,438 | 3,401 | 3,244 | 3,442 | 3,324 | |

|

a Based on average shares outstanding during the period. b Total return based on net asset value reflects changes in the Fund's net asset value during each period. Total return based on market price reflects changes in market price. Each figure assumes that dividend and capital gain distributions, if any, were reinvested. These figures will differ depending upon the level of any discount from or premium to NAV at which the Fund's shares trade during the period. c Asset coverage equals the total net assets plus borrowings of the Fund divided by the borrowings outstanding at period end. * Annualized ** Not annualized | |||||||

Notes to Financial Statements (Unaudited)

A. Organization and Significant Accounting Policies

Deutsche Multi-Market Income Trust (the "Fund") is registered under the Investment Company Act of 1940, as amended (the "1940 Act"), as a closed-end, diversified management investment company organized as a Massachusetts business trust.

On July 13, 2016 the Board of Trustees approved the termination of the Fund, pursuant to which the Fund will make a liquidating distribution to shareholders no later than December 31, 2018.

The Fund's financial statements are prepared in accordance with accounting principles generally accepted in the United States of America which require the use of management estimates. Actual results could differ from those estimates. The policies described below are followed consistently by the Fund in the preparation of its financial statements.

Security Valuation. Investments are stated at value determined as of the close of regular trading on the New York Stock Exchange on each day the exchange is open for trading.

Various inputs are used in determining the value of the Fund's investments. These inputs are summarized in three broad levels. Level 1 includes quoted prices in active markets for identical securities. Level 2 includes other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds and credit risk). Level 3 includes significant unobservable inputs (including the Fund's own assumptions in determining the fair value of investments). The level assigned to the securities valuations may not be an indication of the risk or liquidity associated with investing in those securities.

Debt securities and loan participations and assignments are valued at prices supplied by independent pricing services approved by the Fund's Board. Such services may use various pricing techniques which take into account appropriate factors such as yield, quality, coupon rate, maturity, type of issue, trading characteristics, prepayment speeds and other data, as well as broker quotes. If the pricing services are unable to provide valuations, debt securities are valued at the average of the most recent reliable bid quotations or evaluated prices, as applicable, obtained from broker-dealers and loan participations and assignments are valued at the mean of the most recent bid and ask quotations or evaluated prices, as applicable, obtained from broker-dealers. Certain securities may be valued on the basis of a price provided by a single source or broker-dealer. No active trading market may exist for some senior loans and they may be subject to restrictions on resale. The inability to dispose of senior loans in a timely fashion could result in losses. These securities are generally categorized as Level 2.

Equity securities are valued at the most recent sale price or official closing price reported on the exchange (U.S. or foreign) or over-the-counter market on which they trade. Securities for which no sales are reported are valued at the calculated mean between the most recent bid and asked quotations on the relevant market or, if a mean cannot be determined, at the most recent bid quotation. Equity securities are generally categorized as Level 1 securities.

Investments in open-end investment companies are valued at their net asset value each business day and are categorized as Level 1.

Forward currency contracts are valued at the prevailing forward exchange rate of the underlying currencies and are categorized as Level 2.

Swap contracts are valued daily based upon prices supplied by a Board approved pricing vendor, if available, and otherwise are valued at the price provided by the broker-dealer. Swap contracts are generally categorized as Level 2.

Exchange-traded options are valued at the last sale price or, in the absence of a sale, the mean between the closing bid and asked prices or at the most recent asked price (bid for purchased options) if no bid or asked price are available. Exchange-traded options are categorized as Level 1. Over-the-counter written or purchased options are valued at prices supplied by a Board approved pricing vendor, if available, and otherwise are valued at the price provided by the broker-dealer with which the option was traded. Over-the-counter written or purchased options are generally categorized as Level 2.

Securities and other assets for which market quotations are not readily available or for which the above valuation procedures are deemed not to reflect fair value are valued in a manner that is intended to reflect their fair value as determined in accordance with procedures approved by the Board and are generally categorized as Level 3. In accordance with the Fund's valuation procedures, factors considered in determining value may include, but are not limited to, the type of the security; the size of the holding; the initial cost of the security; the existence of any contractual restrictions on the security's disposition; the price and extent of public trading in similar securities of the issuer or of comparable companies; quotations or evaluated prices from broker-dealers and/or pricing services; information obtained from the issuer, analysts, and/or the appropriate stock exchange (for exchange-traded securities); an analysis of the company's or issuer's financial statements; an evaluation of the forces that influence the issuer and the market(s) in which the security is purchased and sold; and with respect to debt securities, the maturity, coupon, creditworthiness, currency denomination and the movement of the market in which the security is normally traded. The value determined under these procedures may differ from published values for the same securities.

Disclosure about the classification of fair value measurements is included in a table following the Fund's Investment Portfolio.

Securities Lending. The Fund is approved to participate in securities lending, but had no securities on loan during the six months ended May 31, 2016. Deutsche Bank AG, as lending agent, lends securities of the Fund to certain financial institutions under the terms of the Security Lending Agreement. The Fund retains the benefits of owning the securities it has loaned and continues to receive interest and dividends generated by the securities and to participate in any changes in their market price. The Fund requires the borrowers of the securities to maintain collateral with the Fund consisting of either cash or liquid, unencumbered assets having a value at least equal to the value of the securities loaned. When the collateral falls below specified amounts, the lending agent will use its best efforts to obtain additional collateral on the next business day to meet required amounts under the security lending agreement. The Fund may invest the cash collateral into a joint trading account in an affiliated money market fund. Deutsche Investment Management Americas Inc. receives a management/administration fee (0.10% annualized effective rate as of May 31, 2016) on the cash collateral invested in Daily Assets Fund. The Fund receives compensation for lending its securities either in the form of fees or by earning interest on invested cash collateral net of borrower rebates and fees paid to a lending agent. Either the Fund or the borrower may terminate the loan. There may be risks of delay and costs in recovery of securities or even loss of rights in the collateral should the borrower of the securities fail financially. If the Fund is not able to recover securities lent, the Fund may sell the collateral and purchase a replacement investment in the market, incurring the risk that the value of the replacement security is greater than the value of the collateral. The Fund is also subject to all investment risks associated with the reinvestment of any cash collateral received, including, but not limited to, interest rate, credit and liquidity risk associated with such investments.

Foreign Currency Translations. The books and records of the Fund are maintained in U.S. dollars. Investment securities and other assets and liabilities denominated in a foreign currency are translated into U.S. dollars at the prevailing exchange rates at period end. Purchases and sales of investment securities, income and expenses are translated into U.S. dollars at the prevailing exchange rates on the respective dates of the transactions.

Net realized and unrealized gains and losses on foreign currency transactions represent net gains and losses between trade and settlement dates on securities transactions, the acquisition and disposition of foreign currencies, and the difference between the amount of net investment income accrued and the U.S. dollar amount actually received. The portion of both realized and unrealized gains and losses on investments that results from fluctuations in foreign currency exchange rates is not separately disclosed, but is included with net realized and unrealized gain/appreciation and loss/depreciation on investments.

When-Issued/Delayed Delivery Securities. The Fund may purchase or sell securities with delivery or payment to occur at a later date beyond the normal settlement period. At the time the Fund enters into a commitment to purchase or sell a security, the transaction is recorded and the value of the transaction is reflected in the net asset value. The price of such security and the date when the security will be delivered and paid for are fixed at the time the transaction is negotiated. The value of the security may vary with market fluctuations. At the time the Fund enters into a purchase transaction, it is required to segregate cash or other liquid assets at least equal to the amount of the commitment. Additionally, the Fund may be required to post securities and/or cash collateral in accordance with the terms of the commitment.

Certain risks may arise upon entering into when-issued or delayed delivery transactions from the potential inability of counterparties to meet the terms of their contracts or if the issuer does not issue the securities due to political, economic, or other factors. Additionally, losses may arise due to changes in the value of the underlying securities.

Loan Participations and Assignments. Loan Participations and Assignments are portions of loans originated by banks and sold in pieces to investors. Floating-rate loans ("Loans") in which the Fund invests are arranged between the borrower and one or more financial institutions ("Lenders"). These Loans may take the form of Senior Loans, which are corporate obligations often issued in connection with recapitalizations, acquisitions, leveraged buy outs and refinancing. The Fund invests in such Loans in the form of participations in Loans ("Participations") or assignments of all or a portion of Loans from third parties ("Assignments"). Participations typically result in the Fund having a contractual relationship with only the Lender, not with the borrower. The Fund has the right to receive payments of principal, interest and any fees to which it is entitled from the Lender selling the Participation and only upon receipt by the Lender of the payments from the borrower. In connection with purchasing Participations, the Fund generally has no right to enforce compliance by the borrower with the terms of the loan agreement relating to the Loan, or any rights of set off against the borrower, and the Fund will not benefit directly from any collateral supporting the Loan in which it has purchased the Participation. As a result, the Fund assumes the credit risk of both the borrower and the Lender that is selling the Participation. Assignments typically result in the Fund having a direct contractual relationship with the borrower, and the Fund may enforce compliance by the borrower with the terms of the loan agreement. Loans held by the Fund are generally in the form of Assignments, but the Fund may also invest in Participations. If affiliates of the Advisor participate in the primary and secondary market for senior loans, legal limitations may restrict the Fund's ability to participate in restructuring or acquiring some senior loans. All Loans involve interest rate risk, liquidity risk and credit risk, including the potential default or insolvency of the borrower.

Federal Income Taxes. The Fund's policy is to comply with the requirements of the Internal Revenue Code, as amended, which are applicable to regulated investment companies, and to distribute all of its taxable income to its shareholders.

Under the Regulated Investment Company Modernization Act of 2010, net capital losses incurred post-enactment may be carried forward indefinitely, and their character is retained as short-term and/or long-term. Previously, net capital losses were carried forward for eight years and treated as short-term losses. As a transition rule, the Act requires that post-enactment net capital losses be used before pre-enactment net capital losses.

At November 30, 2015, the Fund had a net tax basis capital loss carryforward of approximately $22,527,000, including $6,932,000 of pre-enactment losses, which may be applied against any realized net taxable capital gains of each succeeding year until fully utilized or until November 30, 2017, the respective expiration date, whichever occurs first; and approximately $15,595,000 of post-enactment losses, which may be applied against realized net taxable capital gains indefinitely, including short-term losses ($5,653,000) and long-term losses ($9,942,000).

The Fund has reviewed the tax positions for the open tax years as of November 30, 2015 and has determined that no provision for income tax and/or uncertain tax provisions is required in the Fund's financial statements. The Fund's federal tax returns for the prior three fiscal years remain open subject to examination by the Internal Revenue Service.

Distribution of Income and Gains. Distributions from net investment income of the Fund are declared and distributed to shareholders monthly. Net realized gains from investment transactions, in excess of available capital loss carryforwards, would be taxable to the Fund if not distributed, and, therefore, will be distributed to shareholders at least annually. The Fund may also make additional distributions for tax purposes if necessary.

The timing and characterization of certain income and capital gain distributions are determined annually in accordance with federal tax regulations which may differ from accounting principles generally accepted in the United States of America. These differences primarily relate to forward currency contracts, swap contracts, certain securities sold at a loss and premium amortization on debt securities. As a result, net investment income (loss) and net realized gain (loss) on investment transactions for a reporting period may differ significantly from distributions during such period. Accordingly, the Fund may periodically make reclassifications among certain of its capital accounts without impacting the net asset value of the Fund.

The tax character of current year distributions will be determined at the end of the current fiscal year.

Statement of Cash Flows. Information on financial transactions which have been settled through the receipt and disbursement of cash is presented in the Statement of Cash Flows. The cash amount shown in the Statement of Cash Flows represents the cash and foreign currency position at the Fund's custodian bank at May 31, 2016.

Contingencies. In the normal course of business, the Fund may enter into contracts with service providers that contain general indemnification clauses. The Fund's maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet been made. However, based on experience, the Fund expects the risk of loss to be remote.

Other. Investment transactions are accounted for on a trade date plus one basis for daily net asset value calculations. However, for financial reporting purposes, investment transactions are reported on trade date. Interest income is recorded on the accrual basis net of foreign withholding taxes. Dividend income is recorded on the ex-dividend date net of foreign withholding taxes. Realized gains and losses from investment transactions are recorded on an identified cost basis. Proceeds from litigation payments, if any, are included in net realized gain (loss) from investments. All premiums and discounts are amortized/accreted for financial reporting purposes, with the exception of securities in default of principal.

B. Derivative Instruments

Swaps. A swap is a contract between two parties to exchange future cash flows at periodic intervals based on the notional amount of the swap. A bilateral swap is a transaction between the fund and a counterparty where cash flows are exchanged between the two parties. A centrally cleared swap is a transaction executed between the fund and a counterparty, then cleared by a clearing member through a central clearinghouse. The central clearinghouse serves as the counterparty, with whom the fund exchanges cash flows.