|

NOVEMBER 30, 2012

Annual Report

to Shareholders

|

| |

|

DWS Multi-Market Income Trust

Ticker Symbol: KMM

|

|

|

Contents

4 Portfolio Management Review

40 Statement of Assets and Liabilities

42 Statement of Operations

43 Statement of Cash Flows

44 Statement of Changes in Net Assets

46 Notes to Financial Statements

58 Report of Independent Registered Public Accounting Firm

60 Shareholder Meeting Results

61 Dividend Reinvestment Plan

63 Investment Management Agreement Approval

67 Board Members and Officers

72 Additional Information

|

The fund's investment objective is to provide high current income consistent with prudent total return asset management.

Closed-end funds, unlike open-end funds, are not continuously offered. There is a one time public offering and once issued, shares of closed-end funds are sold in the open market through a stock exchange. Shares of closed-end funds frequently trade at a discount to net asset value. The price of the fund's shares is determined by a number of factors, several of which are beyond the control of the fund. Therefore, the fund cannot predict whether its shares will trade at, below or above net asset value.

Bond investments are subject to interest-rate and credit risks. When interest rates rise, bond prices generally fall. Credit risk refers to the ability of an issuer to make timely payments of principal and interest. Investments in lower-quality ("junk bonds") and non-rated securities present greater risk of loss than investments in higher-quality securities. Investing in derivatives entails special risks relating to liquidity, leverage and credit that may reduce returns and/or increase volatility. Leverage results in additional risks and can magnify the effect of any gains or losses. Investing in foreign securities, particularly those of emerging markets, presents certain risks, such as currency fluctuations, political and economic changes, and market risks.

DWS Investments is part of the Asset & Wealth Management division of Deutsche Bank AG.

NOT FDIC/NCUA INSURED NO BANK GUARANTEE MAY LOSE VALUE NOT A DEPOSIT NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

Portfolio Management Review (Unaudited)

Market Overview and Fund Performance

All performance information below is historical and does not guarantee future results. Investment return and principal fluctuate, so your shares may be worth more or less when redeemed. Current performance may differ from performance data shown. Please visit www.dws-investments.com for the fund's most recent month-end performance. Fund performance includes reinvestment of all distributions. Please refer to pages 12 through 13 for more complete performance information.

DWS Multi-Market Income Trust returned 20.20% based on net asset value (NAV) for the one-year period ended November 30, 2012. For the same period, the fund's return based on the market price of its shares quoted on the New York Stock Exchange was 15.39%. The fund began the period trading at a 6.4% premium to net asset value, and it finished the period at a 2.1% premium.

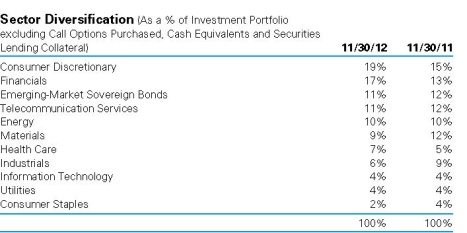

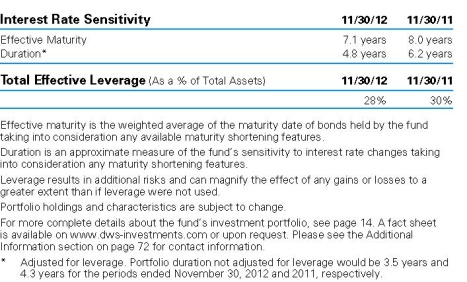

The fund maintained a leverage position throughout the period, meaning that the fund borrowed money as permitted by its loan agreement. The portfolio was approximately 28% leveraged at the close of the period. The fund held a leverage position throughout the year, but we reduced net leverage from June through mid-September 2012. At that point, we added leverage again in order to add exposure to senior loans, where we believed there were opportunities to pick up incremental yield at acceptable risk.

|

Investment Strategy

The fund's investment objective is to provide high current income, consistent with prudent total return asset management. The fund seeks to achieve its objective by investing its assets in a broad range of income producing securities, such as (1) U.S. corporate fixed-income securities, (2) debt obligations of foreign government and their agencies and instrumentalities, (3) debt obligations of the U.S. government and its agencies and instrumentalities and (4) other income producing securities.

|

High-yield bonds returned 15.82% during the annual period as measured by the Credit Suisse High Yield Index. The asset class continued to benefit from strong investor demand at a time of extremely low yields on government bonds and other low-risk investments. While events in Europe caused periodic bouts of elevated investor risk aversion, the backdrop was favorable enough to encourage investors to take on more risk in order to pick up extra yield. U.S. economic data exhibited a gradual improvement and the U.S. Federal Reserve Board's (the Fed's) policy — highlighted by its September 2012 decision to begin a new round of its stimulative quantitative easing — was highly supportive. Overseas, the news flow out of Europe improved due to the European Central Bank's effort to contain the region's crisis via a series of aggressive policy responses. Investors were also encouraged by the improving fundamentals of the high-yield asset class, as seen in the default rate of 0.92% for the Moody's trailing 12-month U.S. speculative bond default rate as of November 30, 2012 (which was down from 1.92% and 1.57% as of October 31, 2012 and September 30, 2012, respectively, and low by historical measures); issuers' rising cash balances and reduced debt; and the ability of high-yield companies to refinance existing debt at more attractive rates. Taken together, these factors created a strong backdrop for the high-yield market during the past year.

The stimulative policies of the Fed, together with its pledge to keep short-term interest rates near zero through 2015, caused U.S. Treasuries to trade near all-time low yield levels during the past year. This low-yield environment boosted the non-Treasury, higher-yielding "spread sectors" of the bond market — a positive for higher-risk asset classes. With this as the backdrop, the 15.82% return of the Credit Suisse High Yield Index compared favorably with the 5.51% return of the Barclays U.S. Aggregate Bond Index, a measure of U.S. investment-grade bond market performance.

Emerging-markets bonds returned 17.65% during the annual period as gauged by the JPMorgan EMBI Global Diversified Index. Issuer fundamentals remained robust despite slowing global economic growth, as governments in the asset class generally feature healthy finances and relatively low levels of debt. The majority of emerging-markets countries are now in fact rated investment-grade, a vast improvement from the low issuer quality that characterized the boom-bust cycle of the 1990s. The rise of the corporate bond market in emerging nations has also added depth to the asset class by providing investors with a wider range of options. The total value of the corporate bond market in the developing countries now exceeds $1 trillion, which is 10 times larger than it was in 2000. This positive backdrop enabled the emerging markets, which came into the period with attractive valuations compared to most other segments of the bond market, to post strong gains amid investors' elevated risk appetites and thirst for yield.

Performance Attribution

The largest contributor to fund performance during the past year was our use of leverage, which enabled us to take full advantage of the rising market. Additionally, our overweight in the wireless telecommunications sector assisted performance as the sector benefited from a high level of merger and acquisition activity.

With regard to security selection, our relative performance compared to the fund's benchmark was helped both by bonds we owned and by those we decided to avoid. In terms of what we held, our overweight in Cricket Communications, Inc. — a subsidiary of Leap Wireless International — assisted performance as the bonds received a credit rating upgrade. Our overweight in the junior part of the capital structure of the satellite provider Intelsat Luxembourg SA helped performance during the past year ended November 30, 2012. The company filed for a potential initial public offering, which, together with strong investor risk appetites, may allow for an early partial refinancing of these bonds. The fund's overweight in the wireline and wireless telecommunications provider Cincinnati Bell, Inc. also provided outperformance as the company filed for an initial public offering of a subsidiary in order to repay debt.

Among individual securities, our largest detractors included an overweight in the natural gas producer Chesapeake Energy Corp. and an underweight in the junior bonds of the electronic payment processor First Data Corp. The overweight in Chesapeake detracted from relative performance as the company struggled to fund its cash flow shortfall, while the underweight in First Data detracted as the company beat consensus cash flow expectations earlier in the year. In addition, strong investor risk appetites fueled demand for lower-rated, higher-risk bonds, such as those issued by First Data. Our underweights in the bonds of Chrysler* and the natural gas producer Range Resources Corp.* also detracted from performance.

* Not held in the portfolio as of November 30, 2012.

In the emerging-markets segment, the fund's performance was helped by our positions in the longer-term debt of Croatia, the Dominican Republic, El Salvador, Lithuania, Poland, Serbia and Uruguay. Investors anticipation of Croatia's joining the European Union in 2013, plus the continued decline in Treasury yields during the fund year, led to strong moves in the longest-term, most interest-rate-sensitive bonds of emerging-markets issuers with healthy underlying fundamentals.

Outlook and Positioning

We maintain a cautiously optimistic outlook on high-yield bonds and other credit-sensitive asset classes, such as emerging-markets bonds and senior loans, as we believe yield spreads continue to look reasonably attractive relative to global growth risks and the risk of contagion out of Europe. Having said this, we believe that market volatility could reassert itself given the ongoing European debt problems, slow global growth and the ongoing developments in the U.S. While global central banks continue to provide liquidity, these underlying issues still need to be addressed. In this context, we remain true to our rigorous bottom-up credit research and security selection processes given that individual defaults are likely to have an amplified impact on performance.

In high yield, the Moody's trailing 12-month U.S. speculative bond par default rate was 0.92% at year-end, yet the spread between high-yield bonds and U.S. Treasuries stood at 583 basis points (5.83 percentage points) at the end of November 2012, down from 759 basis points one year ago. At this level, the yield spread is not meaningfully below the long-run average, and it continues to price in a higher default rate than we expect to materialize over the near term. We therefore continue to believe the asset class offers investors a reasonable trade-off of risk and return via the combination of its current spread and a low default rate.

|

"We seek to manage the fund from a long-term perspective and look to avoid excessive risk to boost short-term returns."

|

In the emerging markets, the yield spread of the JPMorgan EMBI Global Diversified Index relative to Treasuries was 275 basis points (or 2.75 percentage points), which is low on a historical basis but we believe that leaves room for yields to fall further. In addition, yields on emerging-markets corporate fixed-income securities reflect the political risk of their underlying sovereigns and yet, in many cases, that risk has declined given that emerging markets exhibit stronger growth, leverage critical to commodities and better overall debt profiles than many developed nations.

Our investment process remains focused on using credit research to identify compelling investment opportunities for the portfolio. We seek to manage the fund from a long-term perspective and look to avoid excessive risk to boost short-term returns.

Portfolio Management

Gary Russell, CFA, Managing Director

Lead Portfolio Manager of the fund. Joined the fund in 2006.

• Joined Deutsche Asset Management in 1996. Served as the head of the High Yield group in Europe and as an Emerging Markets portfolio manager.

• Prior to that, four years at Citicorp as a research analyst and structurer of collateralized mortgage obligations. Prior to Citicorp, served as an officer in the U.S. Army from 1988 to 1991.

• Head of U.S. High Yield Bonds: New York.

• BS, United States Military Academy (West Point); MBA, New York University, Stern School of Business.

The views expressed reflect those of the portfolio management team only through the end of the period of the report as stated on the cover. The management team's views are subject to change at any time based on market and other conditions and should not be construed as a recommendation. Past performance is no guarantee of future results. Current and future portfolio holdings are subject to risk.

Terms to Know

Yield (or current yield) is the income generated by an investment, divided by its current price.

The Credit Suisse High Yield Index is an unmanaged, unleveraged, trader-priced portfolio constructed to mirror the global high-yield debt market.

Index returns do not reflect any fees or expenses and it is not possible to invest directly into an index.

Quantitative easing is a government monetary policy often used when interest rates are at or near zero. With this policy, government or other securities are purchased from the market in an effort to increase monetary supply and to produce the desired effect of raising interest rates.

The Moody's trailing 12-month dollar-weighted global speculative-grade default rate calculates the dollar value of defaults divided by the total value of the rated high-yield bond market. The ratings of Moody's Investors Service, Inc. (Moody's) represent the company's opinions as to the quality of the securities it rates. Ratings are relative and subjective and are not absolute standards of quality. The fund's credit quality does not remove market risk.

Spread refers to the excess yield various bond sectors offer over financial instruments with similar maturities. When spreads widen, yield differences are increasing between bonds in the two sectors being compared. When spreads narrow, the opposite is true.

The Barclays U.S. Aggregate Bond Index is an unmanaged, unleveraged, index representing domestic taxable investment-grade bonds, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities with an average maturity of one year or more.

The JPMorgan EMBI Global Diversified Index is an unmanaged, unleveraged, index that tracks total returns for U.S.-dollar-denominated debt instruments issued by emerging-markets sovereign entities, including Brady bonds, loans and Eurobonds, and quasi-sovereign entities. The index limits exposure to any one country.

Index returns do not reflect any fees or expenses and it is not possible to invest directly into an index.

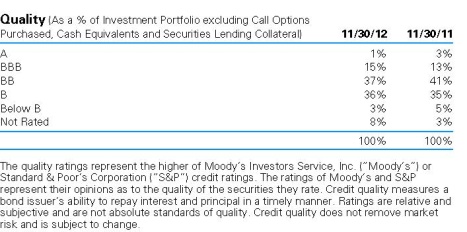

Credit quality measures a bond issuer's ability to repay interest and principal in a timely manner. Rating agencies assign letter designations, such as AAA, AA and so forth. The lower the rating, the higher the probability of default. Credit quality does not remove market risk and is subject to change.

Underweight means the fund holds a lower weighting in a given sector or security than the benchmark. Overweight means it holds a higher weighting.

Sovereign debt is debt that is issued by a national government.

Performance Summary November 30, 2012 (Unaudited)

Performance is historical, assumes reinvestment of all dividend and capital gain distributions, and does not guarantee future results. Investment return and principal value fluctuate with changing market conditions so that, when sold, shares may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Please visit www.dws-investments.com for the Fund's most recent month-end performance.

Fund specific data and performance are provided for informational purposes only and are not intended for trading purposes.

|

Average Annual Total Returns as of 11/30/12

|

|

|

DWS Multi-Market Income Trust

|

|

1-Year

|

|

|

3-Year

|

|

|

5-Year

|

|

|

10-Year

|

|

|

Based on Net Asset Value(a)

|

|

|

20.20 |

% |

|

|

14.66 |

% |

|

|

11.91 |

% |

|

|

13.04 |

% |

|

Based on Market Price(a)

|

|

|

15.39 |

% |

|

|

18.68 |

% |

|

|

15.31 |

% |

|

|

13.57 |

% |

|

Credit Suisse High Yield Index(b)

|

|

|

15.82 |

% |

|

|

11.96 |

% |

|

|

9.21 |

% |

|

|

10.21 |

% |

|

Morningstar Closed-End Multisector Bond Funds Category (based on Net Asset Value)(c)

|

|

|

20.54 |

% |

|

|

12.49 |

% |

|

|

8.26 |

% |

|

|

9.24 |

% |

(a) Total return based on net asset value reflects changes in the Fund's net asset value during each period. Total return based on market price reflects changes in market price. Each figure assumes that dividend and capital gain distributions, if any, were reinvested. These figures will differ depending upon the level of any discount from or premium to NAV at which the Fund's shares traded during the period.

(b) The Credit Suisse High Yield Index is an unmanaged, unleveraged, trader-priced portfolio constructed to mirror the global high-yield debt market. Index returns do not reflect any fees or expenses and it is not possible to invest directly into an index.

(c) Morningstar's Closed-End Multisector Bond Funds category represents multisector-bond portfolios that seek income by diversifying their assets among several fixed-income sectors, usually U.S. government obligations, U.S. corporate bonds, foreign bonds and high-yield U.S. debt securities. These portfolios typically hold 35% to 65% of bond assets in securities that are not rated or are rated by a major agency such as Standard & Poor's or Moody's at the level of BB (considered speculative for taxable bonds). Morningstar figures represent the average of the total returns based on net asset value reported by all of the closed-end funds designated by Morningstar, Inc. as falling into the Closed-End Multisector Bond Funds category. Category returns assume reinvestment of all distributions. It is not possible to invest directly in a Morningstar category.

|

Net Asset Value and Market Price

|

|

| |

|

As of 11/30/12

|

|

|

As of 11/30/11

|

|

|

Net Asset Value

|

|

$ |

10.29 |

|

|

$ |

9.38 |

|

|

Market Price

|

|

$ |

10.51 |

|

|

$ |

9.98 |

|

Prices and net asset value fluctuate and are not guaranteed.

|

Distribution Information

|

|

|

Twelve Months as of 11/30/12:

Income Dividends

|

|

$ |

.92 |

|

|

November Income Dividend

|

|

$ |

.0770 |

|

|

Current Annualized Distribution Rate (based on Net Asset Value) as of 11/30/12†

|

|

|

8.98 |

% |

|

Current Annualized Distribution Rate (based on Market Price) as of 11/30/12†

|

|

|

8.79 |

% |

† Current annualized distribution rate is the latest monthly dividend shown as an annualized percentage of net asset value/market price on November 30, 2012. Distribution rate simply measures the level of dividends and is not a complete measure of performance. Distribution rates are historical, not guaranteed and will fluctuate.

|

Morningstar Rankings — Closed-End Multisector Bond Funds Category as of 11/30/12

|

|

Period

|

Rank

|

|

Number of Funds Tracked

|

Percentile Ranking (%)

|

|

1-Year

|

11

|

of

|

25

|

42

|

|

3-Year

|

6

|

of

|

23

|

23

|

|

5-Year

|

3

|

of

|

21

|

10

|

|

10-Year

|

2

|

of

|

14

|

8

|

Source: Morningstar, Inc. Rankings are historical and do not guarantee future results. Rankings are based on net asset value total return with distributions reinvested.

Investment Portfolio as of November 30, 2012

| |

|

Principal Amount ($)(a)

|

|

|

Value ($)

|

|

| |

|

|

|

|

Corporate Bonds 100.8%

|

|

|

Consumer Discretionary 19.3%

|

|

|

313 Group, Inc., 144A, 6.375%, 12/1/2019

|

|

|

|

295,000 |

|

|

|

290,575 |

|

|

AMC Entertainment, Inc., 8.75%, 6/1/2019

|

|

|

|

735,000 |

|

|

|

808,500 |

|

|

AMC Networks, Inc., 7.75%, 7/15/2021

|

|

|

|

130,000 |

|

|

|

147,550 |

|

|

Asbury Automotive Group, Inc.:

|

|

|

7.625%, 3/15/2017

|

|

|

|

255,000 |

|

|

|

263,925 |

|

|

8.375%, 11/15/2020

|

|

|

|

300,000 |

|

|

|

333,750 |

|

|

AutoNation, Inc., 6.75%, 4/15/2018

|

|

|

|

370,000 |

|

|

|

418,562 |

|

|

Avis Budget Car Rental LLC:

|

|

|

8.25%, 1/15/2019

|

|

|

|

365,000 |

|

|

|

403,781 |

|

|

9.625%, 3/15/2018

|

|

|

|

160,000 |

|

|

|

178,000 |

|

|

Block Communications, Inc., 144A, 7.25%, 2/1/2020

|

|

|

|

580,000 |

|

|

|

614,800 |

|

|

Bresnan Broadband Holdings LLC, 144A, 8.0%, 12/15/2018

|

|

|

|

695,000 |

|

|

|

750,600 |

|

|

Cablevision Systems Corp.:

|

|

|

7.75%, 4/15/2018

|

|

|

|

1,030,000 |

|

|

|

1,125,275 |

|

|

8.0%, 4/15/2020

|

|

|

|

85,000 |

|

|

|

93,925 |

|

|

Caesar's Entertainment Operating Co., Inc.:

|

|

|

144A, 8.5%, 2/15/2020

|

|

|

|

575,000 |

|

|

|

563,500 |

|

|

10.0%, 12/15/2018

|

|

|

|

295,000 |

|

|

|

188,063 |

|

|

11.25%, 6/1/2017

|

|

|

|

1,745,000 |

|

|

|

1,874,784 |

|

|

Carlson Wagonlit BV, 144A, 6.875%, 6/15/2019

|

|

|

|

320,000 |

|

|

|

334,400 |

|

|

CCO Holdings LLC:

|

|

|

5.25%, 9/30/2022

|

|

|

|

2,035,000 |

|

|

|

2,050,262 |

|

|

6.625%, 1/31/2022

|

|

|

|

675,000 |

|

|

|

734,062 |

|

|

7.0%, 1/15/2019

|

|

|

|

165,000 |

|

|

|

178,613 |

|

|

7.25%, 10/30/2017

|

|

|

|

1,575,000 |

|

|

|

1,718,719 |

|

|

7.375%, 6/1/2020

|

|

|

|

85,000 |

|

|

|

94,563 |

|

|

7.875%, 4/30/2018

|

|

|

|

4,645,000 |

|

|

|

5,016,600 |

|

|

8.125%, 4/30/2020

|

|

|

|

95,000 |

|

|

|

106,875 |

|

|

CDR DB Sub, Inc., 144A, 7.75%, 10/15/2020

|

|

|

|

165,000 |

|

|

|

162,525 |

|

|

Cequel Communications Holdings I LLC, 144A, 8.625%, 11/15/2017

|

|

|

|

2,500,000 |

|

|

|

2,668,750 |

|

|

Chester Downs & Marina LLC, 144A, 9.25%, 2/1/2020

|

|

|

|

110,000 |

|

|

|

108,625 |

|

|

Clear Channel Worldwide Holdings, Inc.:

|

|

|

Series A, 144A, 6.5%, 11/15/2022

|

|

|

|

195,000 |

|

|

|

194,025 |

|

|

Series B, 144A, 6.5%, 11/15/2022

|

|

|

|

525,000 |

|

|

|

527,625 |

|

|

Series A, 7.625%, 3/15/2020

|

|

|

|

85,000 |

|

|

|

82,025 |

|

|

Series B, 7.625%, 3/15/2020

|

|

|

|

865,000 |

|

|

|

847,700 |

|

|

Crown Media Holdings, Inc., 10.5%, 7/15/2019

|

|

|

|

215,000 |

|

|

|

240,800 |

|

|

Cumulus Media Holdings, Inc., 7.75%, 5/1/2019

|

|

|

|

185,000 |

|

|

|

178,988 |

|

|

DineEquity, Inc., 9.5%, 10/30/2018

|

|

|

|

415,000 |

|

|

|

469,469 |

|

|

DISH DBS Corp.:

|

|

|

4.625%, 7/15/2017

|

|

|

|

1,160,000 |

|

|

|

1,197,700 |

|

|

6.75%, 6/1/2021

|

|

|

|

110,000 |

|

|

|

124,300 |

|

|

7.125%, 2/1/2016

|

|

|

|

345,000 |

|

|

|

386,831 |

|

|

Fontainebleau Las Vegas Holdings LLC, 144A, 11.0%, 6/15/2015*

|

|

|

|

290,000 |

|

|

|

181 |

|

|

Griffey Intermediate, Inc., 144A, 7.0%, 10/15/2020

|

|

|

|

290,000 |

|

|

|

294,350 |

|

|

Harron Communications LP, 144A, 9.125%, 4/1/2020

|

|

|

|

425,000 |

|

|

|

462,187 |

|

|

Hertz Corp.:

|

|

|

6.75%, 4/15/2019

|

|

|

|

120,000 |

|

|

|

129,600 |

|

|

144A, 6.75%, 4/15/2019

|

|

|

|

330,000 |

|

|

|

356,400 |

|

|

7.5%, 10/15/2018

|

|

|

|

1,195,000 |

|

|

|

1,308,525 |

|

|

Jo-Ann Stores Holdings, Inc., 144A, 9.75%, 10/15/2019 (PIK)

|

|

|

|

165,000 |

|

|

|

161,288 |

|

|

Lear Corp., 8.125%, 3/15/2020

|

|

|

|

135,000 |

|

|

|

150,863 |

|

|

Levi Strauss & Co., 7.625%, 5/15/2020

|

|

|

|

480,000 |

|

|

|

521,400 |

|

|

Libbey Glass, Inc., 144A, 6.875%, 5/15/2020

|

|

|

|

190,000 |

|

|

|

203,300 |

|

|

Limited Brands, Inc., 7.0%, 5/1/2020

|

|

|

|

230,000 |

|

|

|

262,200 |

|

|

Lions Gate Entertainment, Inc., 144A, 10.25%, 11/1/2016

|

|

|

|

390,000 |

|

|

|

433,875 |

|

|

Mediacom Broadband LLC, 144A, 6.375%, 4/1/2023

|

|

|

|

610,000 |

|

|

|

616,100 |

|

|

Mediacom LLC:

|

|

|

7.25%, 2/15/2022

|

|

|

|

165,000 |

|

|

|

176,963 |

|

|

9.125%, 8/15/2019

|

|

|

|

530,000 |

|

|

|

585,650 |

|

|

MGM Resorts International:

|

|

|

144A, 6.75%, 10/1/2020

|

|

|

|

125,000 |

|

|

|

125,938 |

|

|

7.5%, 6/1/2016

|

|

|

|

140,000 |

|

|

|

148,750 |

|

|

7.625%, 1/15/2017

|

|

|

|

390,000 |

|

|

|

414,375 |

|

|

144A, 8.625%, 2/1/2019

|

|

|

|

1,285,000 |

|

|

|

1,407,075 |

|

|

9.0%, 3/15/2020

|

|

|

|

590,000 |

|

|

|

656,375 |

|

|

10.0%, 11/1/2016

|

|

|

|

160,000 |

|

|

|

182,800 |

|

|

10.375%, 5/15/2014

|

|

|

|

275,000 |

|

|

|

307,312 |

|

|

11.125%, 11/15/2017

|

|

|

|

345,000 |

|

|

|

378,637 |

|

|

National CineMedia LLC:

|

|

|

6.0%, 4/15/2022

|

|

|

|

320,000 |

|

|

|

338,400 |

|

|

7.875%, 7/15/2021

|

|

|

|

360,000 |

|

|

|

397,800 |

|

|

Norcraft Companies LP, 10.5%, 12/15/2015

|

|

|

|

620,000 |

|

|

|

620,000 |

|

|

Palace Entertainment Holdings LLC, 144A, 8.875%, 4/15/2017

|

|

|

|

285,000 |

|

|

|

301,387 |

|

|

Penske Automotive Group, Inc., 144A, 5.75%, 10/1/2022

|

|

|

|

440,000 |

|

|

|

447,700 |

|

|

PETCO Animal Supplies, Inc., 144A, 9.25%, 12/1/2018

|

|

|

|

225,000 |

|

|

|

249,750 |

|

|

Petco Holdings, Inc., 144A, 8.5%, 10/15/2017 (PIK)

|

|

|

|

85,000 |

|

|

|

86,913 |

|

|

Quebecor Media, Inc., 144A, 5.75%, 1/15/2023

|

|

|

|

295,000 |

|

|

|

306,062 |

|

|

Regal Entertainment Group, 9.125%, 8/15/2018

|

|

|

|

250,000 |

|

|

|

276,875 |

|

|

Royal Caribbean Cruises Ltd., 5.25%, 11/15/2022

|

|

|

|

220,000 |

|

|

|

230,450 |

|

|

Seminole Indian Tribe of Florida:

|

|

|

144A, 7.75%, 10/1/2017

|

|

|

|

330,000 |

|

|

|

359,700 |

|

|

144A, 7.804%, 10/1/2020

|

|

|

|

455,000 |

|

|

|

467,226 |

|

|

Sirius XM Radio, Inc., 144A, 8.75%, 4/1/2015

|

|

|

|

425,000 |

|

|

|

481,844 |

|

|

Sonic Automotive, Inc.:

|

|

|

144A, 7.0%, 7/15/2022

|

|

|

|

150,000 |

|

|

|

162,375 |

|

|

Series B, 9.0%, 3/15/2018

|

|

|

|

350,000 |

|

|

|

384,562 |

|

|

Sotheby's, 144A, 5.25%, 10/1/2022

|

|

|

|

285,000 |

|

|

|

287,850 |

|

|

Toys "R" Us-Delaware, Inc., 144A, 7.375%, 9/1/2016

|

|

|

|

260,000 |

|

|

|

266,500 |

|

|

UCI International, Inc., 8.625%, 2/15/2019

|

|

|

|

165,000 |

|

|

|

159,431 |

|

|

Unitymedia Hessen GmbH & Co., KG:

|

|

|

144A, 5.5%, 1/15/2023 (b)

|

|

|

|

1,120,000 |

|

|

|

1,120,000 |

|

|

144A, 7.5%, 3/15/2019

|

|

|

|

300,000 |

|

|

|

330,000 |

|

|

144A, 8.125%, 12/1/2017

|

|

|

|

1,545,000 |

|

|

|

1,676,325 |

|

|

Unitymedia KabelBW GmbH, 144A, 9.625%, 12/1/2019

|

EUR

|

|

|

610,000 |

|

|

|

886,632 |

|

|

Univision Communications, Inc.:

|

|

|

144A, 6.875%, 5/15/2019

|

|

|

|

85,000 |

|

|

|

87,550 |

|

|

144A, 7.875%, 11/1/2020

|

|

|

|

185,000 |

|

|

|

197,488 |

|

|

144A, 8.5%, 5/15/2021

|

|

|

|

105,000 |

|

|

|

108,150 |

|

|

UPC Holding BV:

|

|

|

144A, 8.375%, 8/15/2020

|

EUR

|

|

|

715,000 |

|

|

|

1,022,883 |

|

|

144A, 9.75%, 4/15/2018

|

EUR

|

|

|

595,000 |

|

|

|

825,249 |

|

|

Videotron Ltd., 9.125%, 4/15/2018

|

|

|

|

310,000 |

|

|

|

331,700 |

|

|

Viking Cruises Ltd., 144A, 8.5%, 10/15/2022

|

|

|

|

295,000 |

|

|

|

312,700 |

|

|

Visant Corp., 10.0%, 10/1/2017

|

|

|

|

305,000 |

|

|

|

265,350 |

|

|

Visteon Corp., 6.75%, 4/15/2019

|

|

|

|

549,000 |

|

|

|

579,195 |

|

|

Yonkers Racing Corp., 144A, 11.375%, 7/15/2016

|

|

|

|

240,000 |

|

|

|

258,600 |

|

| |

|

|

|

48,589,838 |

|

|

Consumer Staples 2.4%

|

|

|

Alliance One International, Inc., 10.0%, 7/15/2016

|

|

|

|

195,000 |

|

|

|

202,069 |

|

|

Constellation Brands, Inc.:

|

|

|

6.0%, 5/1/2022

|

|

|

|

150,000 |

|

|

|

171,562 |

|

|

8.375%, 12/15/2014

|

|

|

|

810,000 |

|

|

|

905,175 |

|

|

Darling International, Inc., 8.5%, 12/15/2018

|

|

|

|

620,000 |

|

|

|

710,675 |

|

|

Del Monte Corp., 7.625%, 2/15/2019

|

|

|

|

580,000 |

|

|

|

595,950 |

|

|

Dole Food Co., Inc., 144A, 8.0%, 10/1/2016

|

|

|

|

135,000 |

|

|

|

140,738 |

|

|

FAGE Dairy Industry SA, 144A, 9.875%, 2/1/2020

|

|

|

|

330,000 |

|

|

|

333,300 |

|

|

JBS U.S.A. LLC, 144A, 8.25%, 2/1/2020

|

|

|

|

240,000 |

|

|

|

249,000 |

|

|

NBTY, Inc., 9.0%, 10/1/2018

|

|

|

|

185,000 |

|

|

|

208,125 |

|

|

Pilgrim's Pride Corp., 7.875%, 12/15/2018

|

|

|

|

220,000 |

|

|

|

220,000 |

|

|

Rite Aid Corp., 9.25%, 3/15/2020

|

|

|

|

85,000 |

|

|

|

86,700 |

|

|

Smithfield Foods, Inc.:

|

|

|

6.625%, 8/15/2022

|

|

|

|

375,000 |

|

|

|

397,500 |

|

|

7.75%, 7/1/2017

|

|

|

|

590,000 |

|

|

|

671,125 |

|

|

Tops Holding Corp., 10.125%, 10/15/2015

|

|

|

|

440,000 |

|

|

|

464,200 |

|

|

TreeHouse Foods, Inc., 7.75%, 3/1/2018

|

|

|

|

370,000 |

|

|

|

405,150 |

|

|

U.S. Foods, Inc., 144A, 8.5%, 6/30/2019

|

|

|

|

290,000 |

|

|

|

292,900 |

|

| |

|

|

|

6,054,169 |

|

|

Energy 11.9%

|

|

|

Access Midstream Partners LP, 6.125%, 7/15/2022

|

|

|

|

500,000 |

|

|

|

530,000 |

|

|

Alpha Natural Resources, Inc., 6.0%, 6/1/2019

|

|

|

|

500,000 |

|

|

|

445,000 |

|

|

Arch Coal, Inc.:

|

|

|

7.0%, 6/15/2019

|

|

|

|

165,000 |

|

|

|

148,088 |

|

|

7.25%, 10/1/2020

|

|

|

|

150,000 |

|

|

|

134,625 |

|

|

7.25%, 6/15/2021

|

|

|

|

265,000 |

|

|

|

237,175 |

|

|

Berry Petroleum Co.:

|

|

|

6.75%, 11/1/2020

|

|

|

|

330,000 |

|

|

|

353,100 |

|

|

10.25%, 6/1/2014

|

|

|

|

325,000 |

|

|

|

360,750 |

|

|

BreitBurn Energy Partners LP:

|

|

|

144A, 7.875%, 4/15/2022

|

|

|

|

285,000 |

|

|

|

292,838 |

|

|

8.625%, 10/15/2020

|

|

|

|

150,000 |

|

|

|

161,625 |

|

|

Chaparral Energy, Inc., 144A, 7.625%, 11/15/2022

|

|

|

|

165,000 |

|

|

|

167,888 |

|

|

Chesapeake Energy Corp.:

|

|

|

7.25%, 12/15/2018

|

|

|

|

1,975,000 |

|

|

|

2,123,125 |

|

|

9.5%, 2/15/2015

|

|

|

|

620,000 |

|

|

|

695,950 |

|

|

Chesapeake Oilfield Operating LLC, 144A, 6.625%, 11/15/2019

|

|

|

|

315,000 |

|

|

|

296,100 |

|

|

CITGO Petroleum Corp., 144A, 11.5%, 7/1/2017

|

|

|

|

375,000 |

|

|

|

434,531 |

|

|

Cloud Peak Energy Resources LLC:

|

|

|

8.25%, 12/15/2017

|

|

|

|

165,000 |

|

|

|

177,375 |

|

|

8.5%, 12/15/2019

|

|

|

|

80,000 |

|

|

|

86,800 |

|

|

Continental Resources, Inc.:

|

|

|

5.0%, 9/15/2022

|

|

|

|

255,000 |

|

|

|

270,300 |

|

|

7.125%, 4/1/2021

|

|

|

|

230,000 |

|

|

|

259,325 |

|

|

7.375%, 10/1/2020

|

|

|

|

245,000 |

|

|

|

275,625 |

|

|

8.25%, 10/1/2019

|

|

|

|

110,000 |

|

|

|

123,750 |

|

|

Crestwood Midstream Partners LP, 7.75%, 4/1/2019

|

|

|

|

860,000 |

|

|

|

877,200 |

|

|

Crosstex Energy LP:

|

|

|

144A, 7.125%, 6/1/2022

|

|

|

|

155,000 |

|

|

|

158,100 |

|

|

8.875%, 2/15/2018

|

|

|

|

425,000 |

|

|

|

461,125 |

|

|

Dresser-Rand Group, Inc., 6.5%, 5/1/2021

|

|

|

|

585,000 |

|

|

|

614,250 |

|

|

Eagle Rock Energy Partners LP, 8.375%, 6/1/2019

|

|

|

|

390,000 |

|

|

|

395,850 |

|

|

El Paso LLC, 7.25%, 6/1/2018

|

|

|

|

405,000 |

|

|

|

468,146 |

|

|

EP Energy LLC:

|

|

|

6.875%, 5/1/2019

|

|

|

|

520,000 |

|

|

|

562,900 |

|

|

7.75%, 9/1/2022

|

|

|

|

125,000 |

|

|

|

129,688 |

|

|

9.375%, 5/1/2020

|

|

|

|

120,000 |

|

|

|

132,900 |

|

|

EV Energy Partners LP, 8.0%, 4/15/2019

|

|

|

|

1,280,000 |

|

|

|

1,344,000 |

|

|

Frontier Oil Corp., 6.875%, 11/15/2018

|

|

|

|

270,000 |

|

|

|

287,550 |

|

|

Global Geophysical Services, Inc., 10.5%, 5/1/2017

|

|

|

|

475,000 |

|

|

|

435,812 |

|

|

Halcon Resources Corp., 144A, 9.75%, 7/15/2020

|

|

|

|

230,000 |

|

|

|

243,800 |

|

|

Holly Energy Partners LP:

|

|

|

144A, 6.5%, 3/1/2020

|

|

|

|

165,000 |

|

|

|

173,250 |

|

|

8.25%, 3/15/2018

|

|

|

|

410,000 |

|

|

|

438,700 |

|

|

HollyFrontier Corp., 9.875%, 6/15/2017

|

|

|

|

620,000 |

|

|

|

676,575 |

|

|

Linn Energy LLC:

|

|

|

144A, 6.25%, 11/1/2019

|

|

|

|

855,000 |

|

|

|

858,206 |

|

|

6.5%, 5/15/2019

|

|

|

|

185,000 |

|

|

|

187,775 |

|

|

MarkWest Energy Partners LP, 5.5%, 2/15/2023

|

|

|

|

375,000 |

|

|

|

394,688 |

|

|

MEG Energy Corp.:

|

|

|

144A, 6.375%, 1/30/2023

|

|

|

|

595,000 |

|

|

|

617,312 |

|

|

144A, 6.5%, 3/15/2021

|

|

|

|

325,000 |

|

|

|

339,219 |

|

|

Midstates Petroleum Co., Inc., 144A, 10.75%, 10/1/2020

|

|

|

|

165,000 |

|

|

|

174,075 |

|

|

Newfield Exploration Co.:

|

|

|

5.75%, 1/30/2022

|

|

|

|

615,000 |

|

|

|

668,812 |

|

|

7.125%, 5/15/2018

|

|

|

|

955,000 |

|

|

|

1,007,525 |

|

|

Northern Oil & Gas, Inc., 8.0%, 6/1/2020

|

|

|

|

805,000 |

|

|

|

829,150 |

|

|

Oasis Petroleum, Inc.:

|

|

|

6.5%, 11/1/2021

|

|

|

|

240,000 |

|

|

|

252,600 |

|

|

7.25%, 2/1/2019

|

|

|

|

750,000 |

|

|

|

798,750 |

|

|

Offshore Group Investment Ltd.:

|

|

|

144A, 7.5%, 11/1/2019

|

|

|

|

420,000 |

|

|

|

422,100 |

|

|

11.5%, 8/1/2015

|

|

|

|

43,000 |

|

|

|

47,300 |

|

|

OGX Austria GmbH, 144A, 8.375%, 4/1/2022

|

|

|

|

220,000 |

|

|

|

179,300 |

|

|

Plains Exploration & Production Co.:

|

|

|

6.125%, 6/15/2019

|

|

|

|

345,000 |

|

|

|

351,038 |

|

|

6.75%, 2/1/2022

|

|

|

|

760,000 |

|

|

|

782,800 |

|

|

6.875%, 2/15/2023

|

|

|

|

740,000 |

|

|

|

762,200 |

|

|

7.625%, 6/1/2018

|

|

|

|

465,000 |

|

|

|

492,900 |

|

|

Quicksilver Resources, Inc., 11.75%, 1/1/2016

|

|

|

|

565,000 |

|

|

|

560,762 |

|

|

Sabine Pass LNG LP, 7.5%, 11/30/2016

|

|

|

|

145,000 |

|

|

|

156,600 |

|

|

SandRidge Energy, Inc., 7.5%, 3/15/2021

|

|

|

|

180,000 |

|

|

|

187,650 |

|

|

SESI LLC:

|

|

|

6.375%, 5/1/2019

|

|

|

|

335,000 |

|

|

|

356,775 |

|

|

7.125%, 12/15/2021

|

|

|

|

1,050,000 |

|

|

|

1,168,125 |

|

|

Shelf Drilling Holdings Ltd., 144A, 8.625%, 11/1/2018

|

|

|

|

210,000 |

|

|

|

211,050 |

|

|

Swift Energy Co.:

|

|

|

7.875%, 3/1/2022

|

|

|

|

625,000 |

|

|

|

646,875 |

|

|

144A, 7.875%, 3/1/2022

|

|

|

|

370,000 |

|

|

|

382,950 |

|

|

Tesoro Corp.:

|

|

|

4.25%, 10/1/2017

|

|

|

|

310,000 |

|

|

|

317,750 |

|

|

5.375%, 10/1/2022

|

|

|

|

215,000 |

|

|

|

223,600 |

|

|

Venoco, Inc., 8.875%, 2/15/2019

|

|

|

|

410,000 |

|

|

|

361,825 |

|

|

WPX Energy, Inc.:

|

|

|

5.25%, 1/15/2017

|

|

|

|

670,000 |

|

|

|

708,525 |

|

|

6.0%, 1/15/2022

|

|

|

|

490,000 |

|

|

|

524,300 |

|

| |

|

|

|

29,946,353 |

|

|

Financials 18.3%

|

|

|

Abengoa Finance SAU, 144A, 8.875%, 11/1/2017

|

|

|

|

360,000 |

|

|

|

320,400 |

|

|

AerCap Aviation Solutions BV, 6.375%, 5/30/2017

|

|

|

|

1,040,000 |

|

|

|

1,086,800 |

|

|

Akbank TAS, 144A, 5.125%, 7/22/2015

|

|

|

|

480,000 |

|

|

|

506,400 |

|

|

Ally Financial, Inc.:

|

|

|

4.625%, 6/26/2015

|

|

|

|

1,400,000 |

|

|

|

1,459,500 |

|

|

5.5%, 2/15/2017

|

|

|

|

580,000 |

|

|

|

617,700 |

|

|

6.25%, 12/1/2017

|

|

|

|

740,000 |

|

|

|

817,356 |

|

|

8.0%, 3/15/2020

|

|

|

|

870,000 |

|

|

|

1,070,100 |

|

|

8.3%, 2/12/2015

|

|

|

|

280,000 |

|

|

|

312,900 |

|

|

Alphabet Holding Co., Inc., 144A, 7.75%, 11/1/2017 (PIK)

|

|

|

|

145,000 |

|

|

|

147,900 |

|

|

AmeriGas Finance LLC:

|

|

|

6.75%, 5/20/2020

|

|

|

|

165,000 |

|

|

|

179,850 |

|

|

7.0%, 5/20/2022

|

|

|

|

165,000 |

|

|

|

179,850 |

|

|

Antero Resources Finance Corp.:

|

|

|

7.25%, 8/1/2019

|

|

|

|

415,000 |

|

|

|

448,200 |

|

|

9.375%, 12/1/2017

|

|

|

|

560,000 |

|

|

|

616,000 |

|

|

AWAS Aviation Capital Ltd., 144A, 7.0%, 10/17/2016

|

|

|

|

642,360 |

|

|

|

677,690 |

|

|

Banco Bradesco SA, 144A, 5.75%, 3/1/2022

|

|

|

|

1,420,000 |

|

|

|

1,519,400 |

|

|

BOE Merger Corp., 144A, 9.5%, 11/1/2017 (PIK)

|

|

|

|

295,000 |

|

|

|

289,100 |

|

|

Calpine Construction Finance Co., LP, 144A, 8.0%, 6/1/2016

|

|

|

|

420,000 |

|

|

|

448,350 |

|

|

Case New Holland, Inc., 7.875%, 12/1/2017

|

|

|

|

830,000 |

|

|

|

977,325 |

|

|

Cequel Communications Escrow 1 LLC, 144A, 6.375%, 9/15/2020

|

|

|

|

215,000 |

|

|

|

220,913 |

|

|

CIT Group, Inc.:

|

|

|

4.25%, 8/15/2017

|

|

|

|

1,850,000 |

|

|

|

1,890,752 |

|

|

144A, 4.75%, 2/15/2015

|

|

|

|

2,455,000 |

|

|

|

2,547,062 |

|

|

5.0%, 5/15/2017

|

|

|

|

300,000 |

|

|

|

314,250 |

|

|

5.25%, 3/15/2018

|

|

|

|

835,000 |

|

|

|

886,144 |

|

|

CNH Capital LLC, 144A, 3.875%, 11/1/2015

|

|

|

|

540,000 |

|

|

|

554,175 |

|

|

DuPont Fabros Technology LP, (REIT), 8.5%, 12/15/2017

|

|

|

|

495,000 |

|

|

|

543,262 |

|

|

E*TRADE Financial Corp.:

|

|

|

6.375%, 11/15/2019

|

|

|

|

420,000 |

|

|

|

423,675 |

|

|

6.75%, 6/1/2016

|

|

|

|

520,000 |

|

|

|

546,000 |

|

|

12.5%, 11/30/2017

|

|

|

|

963,000 |

|

|

|

1,083,712 |

|

|

Fibria Overseas Finance Ltd., 144A, 6.75%, 3/3/2021

|

|

|

|

160,000 |

|

|

|

174,400 |

|

|

Ford Motor Credit Co., LLC:

|

|

|

5.0%, 5/15/2018

|

|

|

|

585,000 |

|

|

|

641,417 |

|

|

5.875%, 8/2/2021

|

|

|

|

430,000 |

|

|

|

492,758 |

|

|

6.625%, 8/15/2017

|

|

|

|

465,000 |

|

|

|

541,529 |

|

|

8.125%, 1/15/2020

|

|

|

|

1,410,000 |

|

|

|

1,791,911 |

|

|

Fresenius Medical Care U.S. Finance II, Inc.:

|

|

|

144A, 5.625%, 7/31/2019

|

|

|

|

330,000 |

|

|

|

352,275 |

|

|

144A, 5.875%, 1/31/2022

|

|

|

|

285,000 |

|

|

|

305,662 |

|

|

Fresenius Medical Care U.S. Finance, Inc.:

|

|

|

144A, 5.75%, 2/15/2021

|

|

|

|

255,000 |

|

|

|

271,894 |

|

|

144A, 6.5%, 9/15/2018

|

|

|

|

170,000 |

|

|

|

190,825 |

|

|

Fresenius U.S. Finance II, Inc., 144A, 9.0%, 7/15/2015

|

|

|

|

300,000 |

|

|

|

345,750 |

|

|

Hellas Telecommunications Finance SCA, 144A, 8.21%**, 7/15/2015 (PIK)*

|

EUR

|

|

|

278,431 |

|

|

|

0 |

|

|

Hexion U.S. Finance Corp.:

|

|

|

6.625%, 4/15/2020

|

|

|

|

145,000 |

|

|

|

144,638 |

|

|

8.875%, 2/1/2018

|

|

|

|

2,020,000 |

|

|

|

2,040,200 |

|

|

International Lease Finance Corp.:

|

|

|

5.75%, 5/15/2016

|

|

|

|

155,000 |

|

|

|

162,030 |

|

|

6.25%, 5/15/2019

|

|

|

|

465,000 |

|

|

|

491,737 |

|

|

8.625%, 9/15/2015

|

|

|

|

300,000 |

|

|

|

334,125 |

|

|

8.625%, 1/15/2022

|

|

|

|

460,000 |

|

|

|

548,550 |

|

|

8.75%, 3/15/2017

|

|

|

|

1,365,000 |

|

|

|

1,561,219 |

|

|

Kinder Morgan Finance Co., LLC, 144A, 6.0%, 1/15/2018

|

|

|

|

610,000 |

|

|

|

667,247 |

|

|

Kinder Morgan Finance Co., ULC, 5.7%, 1/5/2016

|

|

|

|

910,000 |

|

|

|

992,960 |

|

|

Level 3 Financing, Inc.:

|

|

|

144A, 7.0%, 6/1/2020

|

|

|

|

550,000 |

|

|

|

559,625 |

|

|

8.125%, 7/1/2019

|

|

|

|

290,000 |

|

|

|

310,300 |

|

|

8.625%, 7/15/2020

|

|

|

|

240,000 |

|

|

|

261,000 |

|

|

Momentive Performance Materials, Inc., 144A, 8.875%, 10/15/2020

|

|

|

|

205,000 |

|

|

|

203,463 |

|

|

MPT Operating Partnership LP:

|

|

|

(REIT), 6.375%, 2/15/2022

|

|

|

|

270,000 |

|

|

|

282,150 |

|

|

(REIT), 6.875%, 5/1/2021

|

|

|

|

415,000 |

|

|

|

450,275 |

|

|

National Money Mart Co., 10.375%, 12/15/2016

|

|

|

|

450,000 |

|

|

|

498,375 |

|

|

Neuberger Berman Group LLC:

|

|

|

144A, 5.625%, 3/15/2020

|

|

|

|

245,000 |

|

|

|

255,413 |

|

|

144A, 5.875%, 3/15/2022

|

|

|

|

405,000 |

|

|

|

422,212 |

|

|

Nielsen Finance LLC, 144A, 4.5%, 10/1/2020

|

|

|

|

215,000 |

|

|

|

214,463 |

|

|

NII Capital Corp., 7.625%, 4/1/2021

|

|

|

|

285,000 |

|

|

|

196,650 |

|

|

Pinnacle Foods Finance LLC:

|

|

|

8.25%, 9/1/2017

|

|

|

|

700,000 |

|

|

|

735,000 |

|

|

9.25%, 4/1/2015

|

|

|

|

291,000 |

|

|

|

296,092 |

|

|

Reynolds Group Issuer, Inc.:

|

|

|

144A, 5.75%, 10/15/2020

|

|

|

|

575,000 |

|

|

|

587,937 |

|

|

6.875%, 2/15/2021

|

|

|

|

760,000 |

|

|

|

818,900 |

|

|

7.125%, 4/15/2019

|

|

|

|

1,355,000 |

|

|

|

1,463,400 |

|

|

8.25%, 2/15/2021

|

|

|

|

155,000 |

|

|

|

153,838 |

|

|

8.5%, 5/15/2018

|

|

|

|

100,000 |

|

|

|

101,750 |

|

|

9.875%, 8/15/2019

|

|

|

|

100,000 |

|

|

|

106,000 |

|

|

Schaeffler Finance BV:

|

|

|

144A, 7.75%, 2/15/2017

|

|

|

|

610,000 |

|

|

|

667,950 |

|

|

144A, 8.5%, 2/15/2019

|

|

|

|

255,000 |

|

|

|

283,687 |

|

|

Serta Simmons Holdings LLC, 144A, 8.125%, 10/1/2020

|

|

|

|

165,000 |

|

|

|

166,031 |

|

|

Sky Growth Acquisition Corp., 144A, 7.375%, 10/15/2020

|

|

|

|

250,000 |

|

|

|

246,563 |

|

|

Toys "R" Us Property Co. I, LLC, 10.75%, 7/15/2017

|

|

|

|

360,000 |

|

|

|

392,400 |

|

|

Tronox Finance LLC, 144A, 6.375%, 8/15/2020

|

|

|

|

365,000 |

|

|

|

359,525 |

|

|

UPCB Finance III Ltd., 144A, 6.625%, 7/1/2020

|

|

|

|

255,000 |

|

|

|

273,488 |

|

|

UPCB Finance V Ltd., 144A, 7.25%, 11/15/2021

|

|

|

|

320,000 |

|

|

|

350,400 |

|

|

Virgin Media Finance PLC, 4.875%, 2/15/2022

|

|

|

|

370,000 |

|

|

|

380,175 |

|

|

Virgin Media Secured Finance PLC, 6.5%, 1/15/2018

|

|

|

|

1,645,000 |

|

|

|

1,784,825 |

|

|

Wind Acquisition Finance SA, 144A, 7.25%, 2/15/2018

|

|

|

|

365,000 |

|

|

|

361,350 |

|

|

WMG Acquisition Corp., 144A, 6.0%, 1/15/2021

|

|

|

|

145,000 |

|

|

|

148,625 |

|

| |

|

|

|

46,067,755 |

|

|

Health Care 8.4%

|

|

|

Aviv Healthcare Properties LP, 7.75%, 2/15/2019

|

|

|

|

730,000 |

|

|

|

766,500 |

|

|

Biomet, Inc.:

|

|

|

144A, 6.5%, 8/1/2020

|

|

|

|

500,000 |

|

|

|

522,500 |

|

|

144A, 6.5%, 10/1/2020

|

|

|

|

145,000 |

|

|

|

143,550 |

|

|

Community Health Systems, Inc.:

|

|

|

5.125%, 8/15/2018

|

|

|

|

1,660,000 |

|

|

|

1,747,150 |

|

|

7.125%, 7/15/2020

|

|

|

|

965,000 |

|

|

|

1,020,487 |

|

|

HCA Holdings, Inc., 7.75%, 5/15/2021

|

|

|

|

805,000 |

|

|

|

873,425 |

|

|

HCA, Inc.:

|

|

|

5.875%, 3/15/2022

|

|

|

|

415,000 |

|

|

|

451,313 |

|

|

6.5%, 2/15/2020

|

|

|

|

2,865,000 |

|

|

|

3,215,962 |

|

|

7.5%, 2/15/2022

|

|

|

|

1,245,000 |

|

|

|

1,416,187 |

|

|

7.875%, 2/15/2020

|

|

|

|

3,805,000 |

|

|

|

4,275,869 |

|

|

8.5%, 4/15/2019

|

|

|

|

270,000 |

|

|

|

303,075 |

|

|

9.875%, 2/15/2017

|

|

|

|

328,000 |

|

|

|

348,910 |

|

|

Hologic, Inc., 144A, 6.25%, 8/1/2020

|

|

|

|

300,000 |

|

|

|

318,750 |

|

|

IMS Health, Inc., 144A, 6.0%, 11/1/2020

|

|

|

|

365,000 |

|

|

|

376,863 |

|

|

Mylan, Inc.:

|

|

|

144A, 7.625%, 7/15/2017

|

|

|

|

1,945,000 |

|

|

|

2,185,694 |

|

|

144A, 7.875%, 7/15/2020

|

|

|

|

385,000 |

|

|

|

454,781 |

|

|

Physio-Control International, Inc., 144A, 9.875%, 1/15/2019

|

|

|

|

240,000 |

|

|

|

262,200 |

|

|

STHI Holding Corp., 144A, 8.0%, 3/15/2018

|

|

|

|

240,000 |

|

|

|

261,000 |

|

|

Tenet Healthcare Corp., 6.25%, 11/1/2018

|

|

|

|

1,550,000 |

|

|

|

1,705,000 |

|

|

Warner Chilcott Co., LLC, 7.75%, 9/15/2018

|

|

|

|

545,000 |

|

|

|

576,338 |

|

| |

|

|

|

21,225,554 |

|

|

Industrials 7.0%

|

|

|

Accuride Corp., 9.5%, 8/1/2018

|

|

|

|

310,000 |

|

|

|

292,950 |

|

|

Aguila 3 SA, 144A, 7.875%, 1/31/2018

|

|

|

|

685,000 |

|

|

|

726,100 |

|

|

Air Lease Corp., 5.625%, 4/1/2017

|

|

|

|

685,000 |

|

|

|

715,825 |

|

|

BE Aerospace, Inc., 6.875%, 10/1/2020

|

|

|

|

235,000 |

|

|

|

262,025 |

|

|

Belden, Inc., 144A, 5.5%, 9/1/2022

|

|

|

|

505,000 |

|

|

|

511,312 |

|

|

Bombardier, Inc.:

|

|

|

144A, 5.75%, 3/15/2022

|

|

|

|

650,000 |

|

|

|

663,000 |

|

|

144A, 7.75%, 3/15/2020

|

|

|

|

1,700,000 |

|

|

|

1,908,250 |

|

|

Briggs & Stratton Corp., 6.875%, 12/15/2020

|

|

|

|

225,000 |

|

|

|

249,188 |

|

|

Casella Waste Systems, Inc., 7.75%, 2/15/2019

|

|

|

|

785,000 |

|

|

|

755,562 |

|

|

CHC Helicopter SA, 9.25%, 10/15/2020

|

|

|

|

475,000 |

|

|

|

482,125 |

|

|

Clean Harbors, Inc., 144A, 5.125%, 6/1/2021 (b)

|

|

|

|

375,000 |

|

|

|

383,438 |

|

|

Ducommun, Inc., 9.75%, 7/15/2018

|

|

|

|

250,000 |

|

|

|

265,625 |

|

|

DynCorp International, Inc., 10.375%, 7/1/2017

|

|

|

|

635,000 |

|

|

|

560,387 |

|

|

Florida East Coast Railway Corp., 8.125%, 2/1/2017

|

|

|

|

155,000 |

|

|

|

164,106 |

|

|

FTI Consulting, Inc.:

|

|

|

144A, 6.0%, 11/15/2022

|

|

|

|

295,000 |

|

|

|

301,638 |

|

|

6.75%, 10/1/2020

|

|

|

|

1,095,000 |

|

|

|

1,163,437 |

|

|

Garda World Security Corp., 144A, 9.75%, 3/15/2017

|

|

|

|

235,000 |

|

|

|

247,338 |

|

|

Huntington Ingalls Industries, Inc.:

|

|

|

6.875%, 3/15/2018

|

|

|

|

410,000 |

|

|

|

439,725 |

|

|

7.125%, 3/15/2021

|

|

|

|

85,000 |

|

|

|

91,906 |

|

|

Interline Brands, Inc., 7.5%, 11/15/2018

|

|

|

|

395,000 |

|

|

|

427,588 |

|

|

Iron Mountain, Inc., 5.75%, 8/15/2024

|

|

|

|

515,000 |

|

|

|

513,712 |

|

|

Meritor, Inc.:

|

|

|

8.125%, 9/15/2015

|

|

|

|

205,000 |

|

|

|

217,300 |

|

|

10.625%, 3/15/2018

|

|

|

|

225,000 |

|

|

|

233,438 |

|

|

Navios Maritime Holdings, Inc.:

|

|

|

8.125%, 2/15/2019

|

|

|

|

530,000 |

|

|

|

466,400 |

|

|

8.875%, 11/1/2017

|

|

|

|

175,000 |

|

|

|

178,063 |

|

|

Navios South American Logistics, Inc., 9.25%, 4/15/2019

|

|

|

|

205,000 |

|

|

|

195,775 |

|

|

Nortek, Inc., 8.5%, 4/15/2021

|

|

|

|

315,000 |

|

|

|

342,563 |

|

|

Ply Gem Industries, Inc., 144A, 9.375%, 4/15/2017

|

|

|

|

120,000 |

|

|

|

126,600 |

|

|

RBS Global, Inc. & Rexnord Corp., 8.5%, 5/1/2018

|

|

|

|

885,000 |

|

|

|

960,225 |

|

|

Spirit AeroSystems, Inc.:

|

|

|

6.75%, 12/15/2020

|

|

|

|

330,000 |

|

|

|

349,800 |

|

|

7.5%, 10/1/2017

|

|

|

|

230,000 |

|

|

|

246,100 |

|

|

Titan International, Inc., 7.875%, 10/1/2017

|

|

|

|

685,000 |

|

|

|

720,962 |

|

|

TransDigm, Inc., 7.75%, 12/15/2018

|

|

|

|

500,000 |

|

|

|

552,500 |

|

|

United Rentals North America, Inc.:

|

|

|

144A, 5.75%, 7/15/2018

|

|

|

|

550,000 |

|

|

|

592,625 |

|

|

6.125%, 6/15/2023

|

|

|

|

35,000 |

|

|

|

35,963 |

|

|

144A, 7.375%, 5/15/2020

|

|

|

|

455,000 |

|

|

|

497,087 |

|

|

144A, 7.625%, 4/15/2022

|

|

|

|

455,000 |

|

|

|

503,912 |

|

|

Welltec A/S, 144A, 8.0%, 2/1/2019

|

|

|

|

200,000 |

|

|

|

210,000 |

|

| |

|

|

|

17,554,550 |

|

|

Information Technology 4.6%

|

|

|

Alliance Data Systems Corp., 144A, 5.25%, 12/1/2017

|

|

|

|

370,000 |

|

|

|

373,700 |

|

|

Aspect Software, Inc., 10.625%, 5/15/2017

|

|

|

|

180,000 |

|

|

|

163,800 |

|

|

Avaya, Inc., 144A, 7.0%, 4/1/2019

|

|

|

|

1,150,000 |

|

|

|

1,032,125 |

|

|

CDW LLC, 8.5%, 4/1/2019

|

|

|

|

625,000 |

|

|

|

673,437 |

|

|

CommScope, Inc., 144A, 8.25%, 1/15/2019

|

|

|

|

665,000 |

|

|

|

723,187 |

|

|

CyrusOne LP, 144A, 6.375%, 11/15/2022

|

|

|

|

145,000 |

|

|

|

150,075 |

|

|

eAccess Ltd., 144A, 8.25%, 4/1/2018

|

|

|

|

235,000 |

|

|

|

260,850 |

|

|

Equinix, Inc.:

|

|

|

7.0%, 7/15/2021

|

|

|

|

335,000 |

|

|

|

368,500 |

|

|

8.125%, 3/1/2018

|

|

|

|

1,100,000 |

|

|

|

1,210,000 |

|

|

Fidelity National Information Services, Inc.:

|

|

|

5.0%, 3/15/2022

|

|

|

|

165,000 |

|

|

|

172,425 |

|

|

7.625%, 7/15/2017

|

|

|

|

85,000 |

|

|

|

92,650 |

|

|

First Data Corp.:

|

|

|

144A, 6.75%, 11/1/2020

|

|

|

|

1,010,000 |

|

|

|

1,017,575 |

|

|

144A, 7.375%, 6/15/2019

|

|

|

|

365,000 |

|

|

|

375,038 |

|

|

144A, 8.875%, 8/15/2020

|

|

|

|

635,000 |

|

|

|

695,325 |

|

|

Freescale Semiconductor, Inc., 144A, 9.25%, 4/15/2018

|

|

|

|

1,520,000 |

|

|

|

1,635,900 |

|

|

Hughes Satellite Systems Corp.:

|

|

|

6.5%, 6/15/2019

|

|

|

|

700,000 |

|

|

|

752,500 |

|

|

7.625%, 6/15/2021

|

|

|

|

335,000 |

|

|

|

373,525 |

|

|

Jabil Circuit, Inc.:

|

|

|

5.625%, 12/15/2020

|

|

|

|

400,000 |

|

|

|

423,000 |

|

|

7.75%, 7/15/2016

|

|

|

|

135,000 |

|

|

|

156,263 |

|

|

Sensata Technologies BV, 144A, 6.5%, 5/15/2019

|

|

|

|

420,000 |

|

|

|

443,100 |

|

|

SunGard Data Systems, Inc., 144A, 6.625%, 11/1/2019

|

|

|

|

370,000 |

|

|

|

377,400 |

|

| |

|

|

|

11,470,375 |

|

|

Materials 11.8%

|

|

|

Aleris International, Inc.:

|

|

|

7.625%, 2/15/2018

|

|

|

|

155,000 |

|

|

|

155,775 |

|

|

144A, 7.875%, 11/1/2020

|

|

|

|

40,000 |

|

|

|

39,500 |

|

|

APERAM:

|

|

|

144A, 7.375%, 4/1/2016

|

|

|

|

305,000 |

|

|

|

277,550 |

|

|

144A, 7.75%, 4/1/2018

|

|

|

|

365,000 |

|

|

|

312,075 |

|

|

Ball Corp., 7.375%, 9/1/2019

|

|

|

|

170,000 |

|

|

|

189,125 |

|

|

Berry Plastics Corp.:

|

|

|

5.09%**, 2/15/2015

|

|

|

|

1,965,000 |

|

|

|

1,965,982 |

|

|

9.5%, 5/15/2018

|

|

|

|

235,000 |

|

|

|

257,325 |

|

|

9.75%, 1/15/2021

|

|

|

|

305,000 |

|

|

|

346,938 |

|

|

Clearwater Paper Corp., 7.125%, 11/1/2018

|

|

|

|

515,000 |

|

|

|

558,775 |

|

|

Compass Minerals International, Inc., 8.0%, 6/1/2019

|

|

|

|

325,000 |

|

|

|

349,375 |

|

|

Continental Rubber of America Corp., 144A, 4.5%, 9/15/2019

|

|

|

|

230,000 |

|

|

|

232,300 |

|

|

Crown Americas LLC:

|

|

|

6.25%, 2/1/2021

|

|

|

|

70,000 |

|

|

|

76,650 |

|

|

7.625%, 5/15/2017

|

|

|

|

1,590,000 |

|

|

|

1,687,387 |

|

|

CSN Resources SA, 144A, 6.5%, 7/21/2020

|

|

|

|

2,190,000 |

|

|

|

2,427,615 |

|

|

Essar Steel Algoma, Inc.:

|

|

|

144A, 9.375%, 3/15/2015

|

|

|

|

1,770,000 |

|

|

|

1,601,850 |

|

|

144A, 9.875%, 6/15/2015

|

|

|

|

150,000 |

|

|

|

97,500 |

|

|

Exopack Holding Corp., 10.0%, 6/1/2018

|

|

|

|

335,000 |

|

|

|

304,850 |

|

|

FMG Resources (August 2006) Pty Ltd.:

|

|

|

144A, 6.0%, 4/1/2017

|

|

|

|

490,000 |

|

|

|

476,525 |

|

|

144A, 6.875%, 4/1/2022

|

|

|

|