Table of Contents

| OMB APPROVAL | ||

| OMB Number: |

3235-0570 | |

| Expires: |

Nov. 30, 2005 | |

| Estimated average burden | ||

| hours per response: |

5.0 | |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number: 811-5687

Strong Common Stock Fund, Inc., on behalf of Strong Advisor Common Stock Fund,

Strong Advisor Endeavor Large Cap Fund, Strong Advisor Focus Fund

and Strong Advisor Technology Fund

(Exact name of registrant as specified in charter)

| P.O. Box 2936 Milwaukee, WI | 53201 | |

| (Address of principal executive offices) | (Zip code) |

Richard Smirl, Strong Capital Management, Inc.

P.O. Box 2936 Milwaukee, WI 53201

(Name and address of agent for service)

Registrant’s telephone number, including area code: (414) 359-3400

Date of fiscal year end: December 31

Date of reporting period: December 31, 2003

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. (S) 3507.

Table of Contents

Item 1. Reports to Stockholders

ANNUAL REPORT | December 31, 2003

Strong

ADVISOR EQUITY

Funds

|

| ||

| Strong Advisor Common Stock Fund | ||

| Strong Advisor Mid Cap Growth Fund | ||

| Strong Advisor Small Cap Value Fund | ||

| Strong Advisor U.S. Value Fund | ||

| Strong Advisor Endeavor Large Cap Fund | ||

| Strong Advisor Focus Fund | ||

| Strong Advisor International Core Fund | ||

| Strong Advisor Select Fund | ||

| Strong Advisor Technology Fund | ||

| Strong Advisor U.S. Small/Mid Cap Growth Fund | ||

| Strong Advisor Utilities and Energy Fund | ||

| Strong Advisor Large Company Core Fund | ||

| ||

Table of Contents

ANNUAL REPORT | December 31, 2003

Strong

Advisor Equity

Funds

| Investment Reviews |

||

| 2 | ||

| 4 | ||

| 6 | ||

| 8 | ||

| 10 | ||

| 12 | ||

| 14 | ||

| 16 | ||

| 18 | ||

| 20 | ||

| 22 | ||

| 24 | ||

| Financial Information |

||

| Schedules of Investments in Securities |

||

| 26 | ||

| 27 | ||

| 29 | ||

| 34 | ||

| 36 | ||

| 38 | ||

| 39 | ||

| 40 | ||

| 41 | ||

| 42 | ||

| 43 | ||

| 44 | ||

| 46 | ||

| 54 | ||

| 60 | ||

| 65 | ||

| 86 | ||

| 110 | ||

| 111 | ||

Table of Contents

A Few Words From Dick Weiss

Market Update — January 1, 2003, to December 31, 2003

One of the great strengths of Strong Capital Management, Inc. (“Strong”), is the autonomy of its different investment teams. Unlike so many institutions where a single investment philosophy predominates and stock selection is done by committee, Strong is comprised of highly independent investment teams with individual philosophies and practices.

This independence notwithstanding, the investment teams share a common objective — adding value for shareholders.

Despite the turmoil surrounding the mutual fund industry and our firm during the last quarter of 2003, Strong’s investment teams performed admirably. According to Lipper, 74 percent of the Strong Funds beat their respective peer indices since their inception.*

Indeed, 2003 turned out to be a better year than anticipated by the investment world. In October of 2002, the market bottomed, and then began a steady advance upward into 2003. Troubled by the prospect of military conflict with Iraq, the market turned down in January and bottomed again in March. Once the outcome in Iraq

Economic Growth Rebounded in 2003

| * | Results are based on total returns. 110 of 149 funds, including separate share classes, outperformed their Lipper Peer Indices since the funds’ inception through 12-31-03. Investment values fluctuate. Results will vary for other time periods. Does not include effect of any loads (as applicable). |

(Continued on next page)

Table of Contents

became clear, the market anticipated the major business recovery that materialized in the third and fourth quarters, and resumed its forward march. The S&P 500 Index, Dow Jones Industrial Average, and Nasdaq moved up smartly for the remainder of the year.

It was, in effect, a rising tide that lifted many boats. Stocks that had been especially battered by the three-year bear market — either because the market assumed their business models were broken or because they had been pushed to the edge of bankruptcy — enjoyed dramatic recoveries. Once it became clear that the economy had bottomed, many of the most downtrodden stocks rebounded like coiled springs and rose appreciably in the second half of 2003. This is a phenomenon that has typically occurred after tough bear markets and has generally lasted around 6-8 months. I believe we are approaching the end of this phase.

In some instances, I believe going against conventional wisdom in 2004 will spell the difference between average and exceptional performance. For example:

| • | Popular opinion has it that manufacturing — a sector which has suffered for roughly 30 years — will continue to falter in 2004. I disagree. It appears that 2004 may shape up to be the first synchronized global economic recovery in years. That, combined with a weak dollar, should make U.S. manufacturing goods increasingly competitive around the world and bolster the sector’s overall results. |

| • | The energy sector, which significantly underperformed in 2003, looks promising as well. While it participated in the fourth quarter rally, it lagged for the year and was nearing an all-time low, as a percentage of the S&P 500 Index. Energy prices were stronger than most observers expected in 2003. Given the likely increase in demand as the global economy expands, energy prices should remain at the upper end of their normal trading range. This scenario would allow individual energy stocks to play catch-up. |

Table of Contents

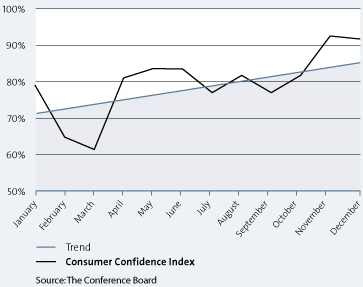

Here at home, the U.S. economy shows unmistakable signs of strengthening. Job growth is gaining momentum. Consumer confidence quite clearly is on the rise. All in all, it’s an encouraging combination.

If you accept the premise that there will be a wider divergence of performance this year, diversification becomes essential. It’s going to be harder to make money in 2004 than it was in 2003. But in a market environment where a rising tide will not lift all issues indiscriminately, diversified mutual funds can be a sound and sensible investment option.

Consumer Confidence Increased in 2003

Thank you for investing with Strong.

Richard T. Weiss

Vice Chairman

Strong Financial Corporation

Table of Contents

Strong Advisor Common Stock Fund

Following three consecutive years of declines, the U.S. equity markets staged a strong recovery in 2003. The Strong Advisor Common Stock Fund Class A gained 30.52% for the year (38.50% when excluding the initial sales charge), while the Fund’s broad-based benchmark, the Russell Midcap Index, returned 40.06% for the same period.

Improving economic conditions

This year’s rally was driven by a material improvement in the nation’s economic outlook. Specifically, low interest rates from the Federal Reserve and tax cuts from Washington set the stage for economic recovery. As investors began to anticipate the resurgence of the economy, they regained confidence in investing in various stocks, which helped to drive some of the initial improvements in the market.

By the middle of the year, the continued strengthening of the economy led investors to focus on lower-quality stocks — specifically those with little or no earnings. This hurt the Fund’s relative performance, as we have historically invested in attractively priced companies with higher-quality characteristics and strong, long-term potential. We believe the trend favoring lower-quality, speculative stocks has now reached its conclusion.

Considering private market value

Our analysis of individual companies takes a close look at their competitive strengths, assets, and financial position. We then use that information to gauge a company’s private market value — the price a buyer would be willing to pay for the entire company. Companies that meet our standards and whose stocks are selling at prices lower than their private market value are candidates for inclusion in the Fund.

This process served us relatively well in 2003, as it attracted us to many stocks with strong qualities whose prices had been beaten down to very attractive levels. One example of a stock we identified through our disciplined process is Continental Airlines. Following the terrorist attacks of 9/11, the U.S. airline industry was hit by one of its worst down-turns ever. Many companies were pushed into bankruptcy. We thoroughly evaluated the remaining airlines and added Continental to the portfolio based on its relative strength. It proved to be one of our strongest stocks during the year.

Our analysis of beaten-down segments also helped us add trucking company Ryder Systems and metals company Alcoa to the portfolio during the year. In the technology sector, pessimism about the industry outlook early in the year allowed us to add companies positioned to benefit from improving corporate spending. Among the companies we were able to buy at a discount to private market value was Unisys Corporation. That holding, as well as existing positions in software and semiconductor stocks, performed strongly during the year.

As the economy improved in the second half of the year, most of the market’s performance came from lower-quality companies. This was particularly true in the technology area, where the long bear market had driven many companies to near-bankruptcy level. Given our stock selection criteria, the Fund had an underrepresentation in these stocks compared to the benchmark, which hurt our relative performance for the year. In addition, non-cyclical consumer stocks, such as food and beverage companies, did not fully participate in the market’s rally. Our holdings in this segment also hurt relative performance.

Our overweight position, relative to our benchmark, in energy stocks also hurt the Fund’s performance despite an extremely strong year for commodity prices. While oil prices hovered around $30 per barrel, and natural gas stayed above $5 per cubic foot for most of the year, the performance of energy stocks did not match these high levels. We continue to believe the stocks are attractively valued and that strong underlying fundamentals will in time attract more investors to the sector. Our holdings in the sector remain tilted toward natural gas and energy-service stocks, which we believe are in the best position to benefit from higher commodity prices.

Further improvement in 2004

We believe the market will continue to post positive returns in the coming year, though not at the levels seen in 2003. The economic picture continues to improve, with the employment picture likely stabilizing at year-end. Given both low inventory levels and improving corporate spending, we believe the progress is sustainable. Much of this positive news has already been reflected in stock prices, but in our assessment, stock valuations remain reasonable for this stage of the economic recovery. We therefore anticipate that stocks should continue to appreciate as long as earnings continue to rise.

Thank you for your investment in the Strong Advisor Common Stock Fund.

|

| Richard T. Weiss |

| Portfolio Co-Manager |

|

| Ann M. Miletti |

| Portfolio Co-Manager |

2

Table of Contents

Fund Highlights

Your Fund’s Approach

The Fund invests in common stocks of small- and medium-capitalization companies that the Fund’s managers believe are underpriced yet have attractive growth prospects. The managers base their analysis on a company’s “private market value” — the price an investor would be willing to pay for the entire company given its management, financial health, and growth potential.

Average Annual Total Returns

As of 12-31-03

| Class A1 |

|||

| 1-year |

30.52 | % | |

| 5-year |

7.23 | % | |

| 10-year |

11.32 | % | |

| Since Fund Inception (12-29-89) |

14.80 | % |

| Class A, excluding sales load |

|||

| 1-year |

38.50 | % | |

| 5-year |

— | ||

| 10-year |

— | ||

| Since Fund Inception (12-29-89) |

— |

| Class B1 |

|||

| 1-year |

32.40 | % | |

| 5-year |

7.56 | % | |

| 10-year |

11.57 | % | |

| Since Fund Inception (12-29-89) |

14.98 | % |

| Class C1 |

|||

| 1-year |

36.31 | % | |

| 5-year |

7.86 | % | |

| 10-year |

11.39 | % | |

| Since Fund Inception (12-29-89) |

14.70 | % |

| Class Z2 |

|||

| 1-year |

38.70 | % | |

| 5-year |

8.83 | % | |

| 10-year |

12.35 | % | |

| Since Fund Inception (12-29-89) |

15.67 | % |

Equity funds are volatile investments and should only be considered for long-term goals.

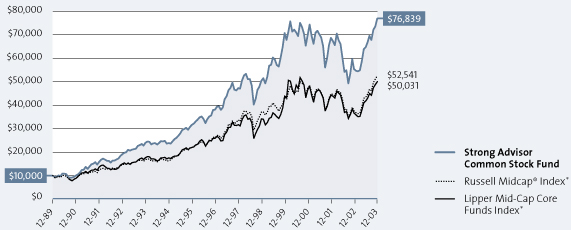

Growth of an Assumed $10,000 Investment†

From 12-29-89 to 12-31-03

Mention of specific securities in this report is not indicative of whether the Fund may make additional purchases of, sell all or a portion of, or continue to hold those securities.

| † | This graph, provided in accordance with SEC regulations, compares a $10,000 investment in the Fund, made at its inception, with the performance of the Russell Midcap® Index and the Lipper Mid-Cap Core Funds Index. Results include the reinvestment of all dividends and capital gains distributions. Performance is historical and does not represent future results. Investment returns and principal value vary, and you may have a gain or loss when you sell shares. Current performance may be lower or higher than the quoted performance. Call us or visit www.Strong.com for the most current performance information. The graph and the Average Annual Total Returns table do not reflect the deduction of taxes, if any, that a shareholder would pay on Fund distributions or the redemption of Fund shares. This graph is based on Class Z shares only; performance for other classes will vary due to differences in fee structures. |

The Fund’s prospectus and statement of additional information may describe restrictions on the percentage of a particular type or quality of security in which the Fund may invest (“Percentage Restrictions”). Percentage Restrictions apply at the time the Fund purchases a security. Circumstances subsequent to the purchase of the security, such as a change in: (1) the Fund’s assets (e.g., due to cash inflows and redemptions); (2) the market value of the security; or (3) the pricing, liquidity, or rating of the security, may cause the Fund to exceed or fall short of the Percentage Restriction. If this happens, the Fund’s continued holding of the security will not constitute a violation of the Percentage Restriction.

From time to time, the Fund’s advisor and/or administrator has waived its fees and/or absorbed Fund expenses, which has resulted in higher returns.

| 1 | Load-adjusted performance reflects the effect of the maximum sales charge of 5.75% for Class A, the applicable contingent deferred sales charge of 5.00% in year 1 and eliminated after year 6 for Class B, and the applicable contingent deferred sales charge of 1.00% and eliminated after 12 months for Class C. The performance of the Class A, B, and C shares is based on the performance of the Fund’s Class Z shares (formerly Retail Class shares) prior to 11-30-00. The performance of the Class A shares is restated to reflect the load and the different expenses of the Class A shares, as applicable. The performance of the Class B shares is restated to reflect the contingent deferred sales charge, the different expenses of the Class B shares, and the conversion to Class A shares after eight years, as applicable. The performance of the Class C shares is restated to reflect the contingent deferred sales charge and the different expenses of the Class C shares, as applicable. |

| 2 | Performance information is for Class Z shares (formerly Retail Class shares). The Strong Advisor Common Stock Fund Class Z shares are closed to new accounts, though the Fund may continue to offer its shares to certain company-sponsored retirement plans, institutional investors meeting specific eligibility requirements, and other limited groups as described in the prospectus. Please consult a prospectus for information about all share classes. |

Because smaller companies often have narrower markets and limited financial resources, investments in these stocks present more risk than investments in those of larger, more established companies.

| * | The Russell Midcap® Index measures the performance of the 800 smallest companies in the Russell 1000 Index, which represent approximately 26% of the total market capitalization of the Russell 1000 Index. The Lipper Mid-Cap Core Funds Index is the average of the 30 largest funds in the Lipper Mid-Cap Core Funds Category. Source of the Russell index data is Standard & Poor’s Micropal. Source of the Lipper index data is Lipper Inc. |

3

Table of Contents

Strong Advisor Mid Cap Growth Fund

After withstanding a fierce bear market, equity investors were generally rewarded with strong positive returns in 2003. For the year ended December 31, 2003, the Strong Advisor Mid Cap Growth Fund Class A recorded a solid return of 26.84% (34.56% when excluding the initial sales charge). This figure did, however, lag the broad-based Russell Midcap Index’s return of 40.06% over the same period.

Many factors drove performance

During the year, several factors combined to create a very favorable investing climate. Among these factors were economic stimulus from new tax cuts, reduction of geopolitical uncertainties, and continued low interest rates and inflation. The positive impact was felt in both growth and value stocks and across nearly all sectors of the economy.

The stocks that were the top contributors to the Fund’s performance over the year came from the consumer sector of the market. As the economy strengthened throughout the year, this area experienced above-average growth. Holdings that were weaker for the Fund came primarily from the technology, healthcare, and energy sectors.

Our investment process

Research drives our process of selecting stocks for the Strong Advisor Mid Cap Growth Fund. For a stock to be chosen, it must display — or have solid prospects for displaying — above-average growth trends in revenue, earnings, or both. Identifying stocks that are experiencing this growth is important. But what matters the most in our investment process is seeking to discern growth trends that are sustainable, as opposed to those that are likely to be short-lived.

In order for a company to make the most of its growth opportunities, it must also have a solid management team in place. For that reason, we analyze management’s track record of execution and often take time to get to know a company’s managers before buying its stock. Through our thorough, hands-on research, we also seek to determine whether their business plan is sensible and offers opportunities for future expansion. Finally, before we add a stock to the portfolio, we consider whether it fits in with our overall economic view, as well as one or more of the important investment themes that guide our market outlook. These trends include the aging of the overall population and the changes technological innovation can bring to virtually every part of the economy.

Ultra Petroleum Corporation is a company that met the above criteria and proved to be an excellent holding for the Fund during the year. Ultra is an energy company, engaged in the exploration and production of crude oil and natural gas. We were attracted to Ultra because we recognized it was growing its natural gas production at an industry-leading rate, and more importantly, because its high production growth rate was likely to continue for several more years, driven by the strength of its drilling prospects and management’s solid track record of execution. Finally, an investment in Ultra made sense given the team’s positive overall outlook for crude oil and natural gas prices.

Our decision to sell a stock is generally based on criteria that are essentially the opposite of our buying criteria. We may sell a stock when we see a deterioration in fundamentals that threatens the sustainability of a company’s existing or prospective growth. Conditions that could cause this may include, but are not limited to, changes we see in the economy, a new competitive threat, or a change in management personnel or direction.

Maintaining a positive outlook

Our outlook for the next few months remains positive, as we expect the economy to continue to benefit from continued low interest rates and inflation. This environment should allow for solid growth in corporate profits, which is beneficial to stock prices.

We will continue to seek out the fastest-growing companies we can identify that fit within the framework of our time-tested investment process.

We thank you for your continued investment in the Strong Advisor Mid Cap Growth Fund.

Brandon Nelson

Portfolio Manager

4

Table of Contents

Fund Highlights

Your Fund’s Approach

The Fund invests in stocks of medium-capitalization companies that the Fund’s manager believes have favorable prospects for growth of earnings and capital appreciation. Although the Fund may invest in stocks of any economic sector, at times it may emphasize one or more particular sectors.

Average Annual Total Returns

As of 12-31-03

| Class A1 |

|||

| 1-year |

26.84 | % | |

| 3-year |

-18.24 | % | |

| 5-year |

-0.92 | % | |

| Since Fund Inception (12-31-96) |

3.07 | % | |

| Class A, excluding sales load |

|||

| 1-year |

34.56 | % | |

| 3-year |

— | ||

| 5-year |

— | ||

| Since Fund Inception (12-31-96) |

— | ||

| Class B1 |

|||

| 1-year |

28.41 | % | |

| 3-year |

-19.21 | % | |

| 5-year |

-0.76 | % | |

| Since Fund Inception (12-31-96) |

3.38 | % | |

| Class C1 |

|||

| 1-year |

32.41 | % | |

| 3-year |

-17.21 | % | |

| 5-year |

-0.36 | % | |

| Since Fund Inception (12-31-96) |

3.38 | % | |

| Class Z2 |

|||

| 1-year |

34.25 | % | |

| 3-year |

-16.70 | % | |

| 5-year |

0.32 | % | |

| Since Fund Inception (12-31-96) |

4.10 | % | |

Equity funds are volatile investments and should only be considered for long-term goals.

Growth of an Assumed $10,000 Investment†

From 12-31-96 to 12-31-03

Mention of specific securities in this report is not indicative of whether the Fund may make additional purchases of, sell all or a portion of, or continue to hold those securities.

| † | This graph, provided in accordance with SEC regulations, compares a $10,000 investment in the Fund, made at its inception, with the performance of the Russell Midcap® Index and the Lipper Mid-Cap Growth Funds Index. Results include the reinvestment of all dividends and capital gains distributions. Performance is historical and does not represent future results. Investment returns and principal value vary, and you may have a gain or loss when you sell shares. Current performance may be lower or higher than the quoted performance. Call us or visit www.Strong.com for the most current performance information. The graph and the Average Annual Total Returns table do not reflect the deduction of taxes, if any, that a shareholder would pay on Fund distributions or the redemption of Fund shares. This graph is based on Class Z shares only; performance for other classes will vary due to differences in fee structures. |

The Fund’s prospectus and statement of additional information may describe restrictions on the percentage of a particular type or quality of security in which the Fund may invest (“Percentage Restrictions”). Percentage Restrictions apply at the time the Fund purchases a security. Circumstances subsequent to the purchase of the security, such as a change in: (1) the Fund’s assets (e.g., due to cash inflows and redemptions); (2) the market value of the security; or (3) the pricing, liquidity, or rating of the security, may cause the Fund to exceed or fall short of the Percentage Restriction. If this happens, the Fund’s continued holding of the security will not constitute a violation of the Percentage Restriction.

From time to time, the Fund’s advisor and/or administrator has waived its fees and/or absorbed Fund expenses, which has resulted in higher returns.

| 1 | Load-adjusted performance reflects the effect of the maximum sales charge of 5.75% for Class A, the applicable contingent deferred sales charge of 5.00% in year 1 and eliminated after year 6 for Class B, and the applicable contingent deferred sales charge of 1.00% and eliminated after 12 months for Class C. The performance of the Class A, B, and C shares is based on the performance of the Fund’s Class Z shares (formerly Retail Class shares) prior to 11-30-00. The performance of Class A shares is restated to reflect the load and the different expenses of the Class A shares, as applicable. The performance of the Class B shares is restated to reflect the contingent deferred sales charge and the different expenses of the Class B shares, as applicable. The performance of the Class C shares is restated to reflect the contingent deferred sales charge and the different expenses of the Class C shares, as applicable. |

| 2 | Performance information is for Class Z shares (formerly Retail Class shares). The Strong Advisor Mid Cap Growth Fund Class Z shares are closed to new accounts, though the Fund may continue to offer its shares to certain company-sponsored retirement plans, institutional investors meeting specific eligibility requirements, and other limited groups as described in the prospectus. Please consult a prospectus for information about all share classes. |

| * | The Russell Midcap® Index measures the performance of the 800 smallest companies in the Russell 1000 Index, which represent approximately 26% of the total market capitalization of the Russell 1000 Index. The Lipper Mid-Cap Growth Funds Index is the average of the 30 largest funds in the Lipper Mid-Cap Growth Funds Category. Source of the Russell index data is Standard & Poor’s Micropal. Source of the Lipper index data is Lipper Inc. |

5

Table of Contents

Strong Advisor Small Cap Value Fund

The Strong Advisor Small Cap Value Fund had a very good year in 2003, both in absolute terms and relative to its broad-based benchmark. The Fund’s Class A shares returned 39.98% or 48.49% when excluding the initial sales charge, placing it just ahead of the broad-based Russell 2000 Index, which returned 47.25%.

A strong year for equities

The past year witnessed a broad and substantial rally for all areas of the equity market. The growth and value styles of investing both performed well. While large-cap stocks, especially those in the technology sector, performed well, small-cap stocks had a very good year. Although the market in 2003 was generally perceived to have been growth-dominated, small-cap stocks in the value style performed exceptionally well.

The Fund’s holdings in stocks from such sectors as materials, industrials, and energy made significant positive contributions to its returns. Also, many of our mining and metals stocks added to the Fund’s returns. These stocks benefited from a favorable supply/demand relationship — that is, demand is good while supply is relatively tight — for silver and gold.

Furthermore, this past year saw a significant weakening of the U.S. dollar, which also aided many of the names in the metals and mining industries. When the dollar loses value relative to foreign currencies, investors tend to favor precious metals, helping to drive the value of these stocks upward. Energy stocks in the portfolio also benefited from a good supply/demand environment. The situation is particularly favorable for companies in the natural gas area.

We kept the Fund’s exposure to technology stocks near to, or slightly lower than, their representation in our benchmark index. Technology stocks performed very strongly over the year, so this positioning could have hurt performance. However, our individual stock selections in this sector were strong and added significant value to the portfolio.

Looking for catalysts

The Fund employs a relative value approach to investing. This means that we look for stocks in all sectors of the marketplace that are attractively priced and have positive fundamental catalysts that could drive their stock price upward in the future. These catalyst qualities can include new products, strong management teams, or favorable dynamics within the company’s industry.

We use a multidimensional, bottom-up stock-selection process. We employ both quantitative analysis (objective number-crunching) and fundamental research (careful, but more subjective study of the company’s specific qualities). For the most part, we use quantitative analysis to narrow down the pool of stocks we consider for the portfolio and then spend most of our time on the hands-on, fundamental research that guides our final selections. We contend that a stock that is attractive from a quantitative basis may not be a good investment if it lacks a catalyst to drive future growth.

The Fund’s allocations to different industries and sectors are driven primarily by our individual stock selections. We generally don’t seek to capitalize on potential market trends by deliberately overweighting or underweighting the portfolio in different market sectors.

United States Steel provides an excellent example of how our stock selection process works. This company’s reasonable valuation and other factors allowed it to pass through our initial quantitative screening process. Then we engaged in closer research and evaluation. What we found was a preeminent steel company with a seasoned, forward-thinking management team and successful operations in eastern Europe. Additionally, the company merged with National Steel in May 2003. The resulting synergies have been a key driving force for success and earnings growth. The stock has been a holding in our portfolio for some time, typifying our long-term approach to most of our holdings.

Possible challenges in 2004

In the past year, stocks moved upward across the market, but in 2004 we believe individual stock selection will become increasingly critical to success. It is our opinion that small-cap stocks can continue to do well this year, as their prices remain attractive and many investors still have relatively low exposure to this asset class.

Additionally, we believe the dollar may continue to drop (but somewhat less drastically) versus other major currencies, and that prices for such commodities as precious metals, natural gas, and oil will continue their upward trend. We intend to position the Fund to benefit from these expected trends.

Thank you for your investment in the Strong Advisor Small Cap Value Fund.

I. Charles Rinaldi

Portfolio Manager

6

Table of Contents

Fund Highlights

Your Fund’s Approach

The Fund invests in stocks of small-capitalization companies that the Fund’s manager believes are undervalued relative to the market based on earnings, cash flow, or asset value. The manager specifically looks for companies whose stock prices may benefit from a positive dynamic of change, such as a new management team, a new product or service, a corporate restructuring, an improved business plan, or a change in the political, economic, or social environment.

Average Annual Total Returns

As of 12-31-03

| Class A1 |

|||

| 1-year |

39.98 | % | |

| 3-year |

15.60 | % | |

| 5-year |

19.97 | % | |

| Since Fund Inception (12-31-97) |

17.49 | % | |

| Class A, excluding sales load |

|||

| 1-year |

48.49 | % | |

| 3-year |

— | ||

| 5-year |

— | ||

| Since Fund Inception (12-31-97) |

— | ||

| Class B1 |

|||

| 1-year |

42.28 | % | |

| 3-year |

16.09 | % | |

| 5-year |

20.50 | % | |

| Since Fund Inception (12-31-97) |

17.91 | % | |

| Class C1 |

|||

| 1-year |

46.34 | % | |

| 3-year |

17.11 | % | |

| 5-year |

20.72 | % | |

| Since Fund Inception (12-31-97) |

18.01 | % | |

| Class Z2 |

|||

| 1-year |

48.70 | % | |

| 3-year |

18.09 | % | |

| 5-year |

21.66 | % | |

| Since Fund Inception (12-31-97) |

18.92 | % | |

Equity funds are volatile investments and should only be considered for long-term goals.

Growth of an Assumed $10,000 Investment†

From 12-31-97 to 12-31-03

Mention of specific securities in this report is not indicative of whether the Fund may make additional purchases of, sell all or a portion of, or continue to hold those securities.

| † | This graph, provided in accordance with SEC regulations, compares a $10,000 investment in the Fund, made at its inception, with the performance of the Russell 2000® Index and the Lipper Small-Cap Value Funds Index. Results include the reinvestment of all dividends and capital gains distributions. Performance is historical and does not represent future results. Investment returns and principal value vary, and you may have a gain or loss when you sell shares. Current performance may be lower or higher than the quoted performance. Call us or visit www.Strong.com for the most current performance information. The graph and the Average Annual Total Returns table do not reflect the deduction of taxes, if any, that a shareholder would pay on Fund distributions or the redemption of Fund shares. This graph is based on Class Z shares only; performance for other classes will vary due to differences in fee structures. |

The Fund’s prospectus and statement of additional information may describe restrictions on the percentage of a particular type or quality of security in which the Fund may invest (“Percentage Restrictions”). Percentage Restrictions apply at the time the Fund purchases a security. Circumstances subsequent to the purchase of the security, such as a change in: (1) the Fund’s assets (e.g., due to cash inflows and redemptions); (2) the market value of the security; or (3) the pricing, liquidity, or rating of the security, may cause the Fund to exceed or fall short of the Percentage Restriction. If this happens, the Fund’s continued holding of the security will not constitute a violation of the Percentage Restriction.

From time to time, the Fund’s advisor and/or administrator has waived its fees and/or absorbed Fund expenses, which has resulted in higher returns.

| 1 | Load-adjusted performance reflects the effect of the maximum sales charge of 5.75% for Class A, the applicable contingent deferred sales charge of 5.00% in year 1 and eliminated after year 6 for Class B, and the applicable contingent deferred sales charge of 1.00% and eliminated after 12 months for Class C. The performance of the Class A, B, and C shares is based on the performance of the Fund’s Class Z shares (formerly Retail Class shares) prior to 11-30-00. The performance of the Class A shares is restated to reflect the load and the different expenses of the Class A shares, as applicable. The performance of the Class B shares is restated to reflect the contingent deferred sales charge and the different expenses of the Class B shares, as applicable. The performance of the Class C shares is restated to reflect the contingent deferred sales charge and the different expenses of the Class C shares, as applicable. |

| 2 | Performance information is for Class Z shares (formerly Retail Class shares). The Strong Advisor Small Cap Value Fund Class Z shares are closed to new accounts, though the Fund may continue to offer its shares to certain company-sponsored retirement plans, institutional investors meeting specific eligibility requirements, and other limited groups as described in the prospectus. |

Please consult a prospectus for information about all share classes.

Because small companies often have narrower markets and limited financial resources, investments in these stocks present more risk than investments in those of larger, more established companies.

| * | The Russell 2000® Index measures the performance of the 2,000 smallest companies in the Russell 3000 Index, which represents approximately 8% of the total market capitalization of the Russell 3000 Index. The Lipper Small-Cap Value Funds Index is the average of the 30 largest funds in the Lipper Small-Cap Value Funds Category. Source of the Russell index data is Standard & Poor’s Micropal. Source of the Lipper index data is Lipper Inc. |

7

Table of Contents

Strong Advisor U.S. Value Fund

The Strong Advisor U.S. Value Fund outperformed its broad-based index, the S&P 500 Index. The Fund’s Class A shares returned 23.00% or 30.48% when excluding the initial sales charge, while the S&P 500 Index returned 28.67%.

In a departure from the previous three years, all categories of the equity markets delivered positive results — and did so decisively. As is typical in the early stages of an economic recovery, throughout the year small-cap stocks outperformed mid-cap stocks, which in turn outperformed large-cap stocks. Our willingness to hold some mid-cap stocks clearly helped our performance relative to the S&P 500 Index.

Individual stock selection drove outperformance

We spend virtually all of our time and effort on bottom-up, fundamental stock research. We were therefore gratified to find that our outperformance relative to our indices was driven in large part by strength in our individual stock selections, led by stocks in the materials (Georgia-Pacific and Phelps Dodge), healthcare (HCA and McKesson), and consumer discretionary (McDonald’s and Metro-Goldwyn-Mayer) sectors. In keeping with our value discipline, we have substantially reduced our exposure to our strongest materials and consumer discretionary stocks, as they have generally doubled in price from their lows. However, we continue to find value in healthcare stocks.

We are overweighted in food stocks relative to the benchmark level, as we find the steady growth, high dividends, and stable cash flow of these businesses very compelling at this time. In addition, as growth-oriented investors rotated out of this sector in search of faster-growth stocks, there was an unusual opportunity to purchase these businesses when they were out of favor and undervalued.

Some notes about energy and tech stocks

As of December 31, 2003, we were overweight in energy stocks relative to our benchmark. We took this position because energy stocks materially underperformed the broader market in 2003. Although we believed the energy stocks we selected may benefit from company-specific factors, it’s generally oil prices that drive the sector’s returns. Because oil prices are denominated in dollars, we believed that the weakened dollar should bolster prices, driving our decision to increase our position in the sector in the fourth quarter. The market appeared to warm up to this idea toward the end of the year, and energy stocks significantly outperformed the market in December.

We reduced our holdings in technology stocks in 2003. We believe that euphoria has begun to return to this area of the market, making the valuations of many companies excessive, in our assessment. In addition, it appears to us that many investors are not considering that most technology companies’ earnings per share will suffer material, negative impact once stock options are properly accounted for. We also reduced our position in financials, particularly in brokers and other areas sensitive to shifts in the markets.

Outlook for the year ahead

The year saw considerable weakness in the U.S. dollar, a condition that is typically more beneficial to larger companies. (Bigger companies are more likely to be exporters, which generally benefit from stronger currencies abroad.) This was not the case in 2003, however, as small caps outperformed larger stocks, continuing a five-year trend. It may be that large-cap investors can look forward to their stocks’ playing catch-up in 2004, particularly if dollar weakness continues.

We will continue to keep our heads down and our eyes open, seeking out companies with solid assets, manageable debt levels, and credible management teams. We will work to buy these companies at attractive prices — which often come when they are temporarily out of favor with the market. Finally, we hope and expect our valuation discipline and focus on risk management will be of greater importance in 2004 than they were in 2003.

Thank you for your investment in the Strong Advisor U.S. Value Fund.

Robert J. Costomiris

Portfolio Manager

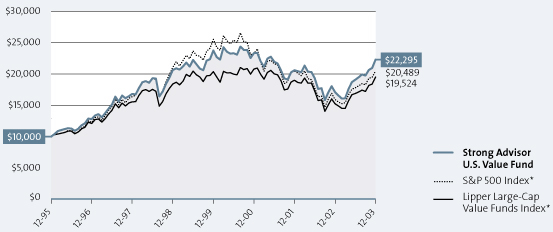

| * | The S&P 500 Index consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market value weighted index (stock price times number of shares outstanding), with each stock’s weight in the Index proportionate to its market value. The Lipper Large-Cap Value Funds Index is the average of the 30 largest funds in the Lipper Large-Cap Value Funds Category. Source of the S&P index data is Standard & Poor’s Micropal. Source of the Lipper index data is Lipper Inc. |

8

Table of Contents

Fund Highlights

Your Fund’s Approach

The Fund invests in stocks of U.S. companies that the Fund’s manager believes are undervalued relative to the market based on discounted cash flows, earnings, and asset value. The manager’s philosophy is that improving returns on invested capital drives improving valuations. The manager selects securities by screening for undervalued securities and utilizing fundamental analysis such as management interviews and financial modeling analysis to select those securities with improving returns on capital.

Average Annual Total Returns

As of 12-31-03

| Class A1 |

|||

| 1-year |

23.00 | % | |

| 3-year |

-3.32 | % | |

| 5-year |

0.29 | % | |

| Since Fund Inception (12-29-95) |

9.51 | % | |

| Class A, excluding sales load |

|||

| 1-year |

30.48 | % | |

| 3-year |

— | ||

| 5-year |

— | ||

| Since Fund Inception (12-29-95) |

— | ||

| Class B1 |

|||

| 1-year |

24.37 | % | |

| 3-year |

-3.51 | % | |

| 5-year |

0.41 | % | |

| Since Fund Inception (12-29-95) |

9.62 | % | |

| Class C1 |

|||

| 1-year |

28.42 | % | |

| 3-year |

-2.08 | % | |

| 5-year |

0.81 | % | |

| Since Fund Inception (12-29-95) |

9.62 | % | |

| Class K1 |

|||

| 1-year |

31.03 | % | |

| 3-year |

-0.95 | % | |

| 5-year |

1.90 | % | |

| Since Fund Inception (12-29-95) |

10.76 | % | |

| Class Z2 |

|||

| 1-year |

30.23 | % | |

| 3-year |

-1.49 | % | |

| 5-year |

1.56 | % | |

| Since Fund Inception (12-29-95) |

10.53 | % | |

Equity funds are volatile investments and should only be considered for long-term goals.

Growth of an Assumed $10,000 Investment†

From 12-29-95 to 12-31-03

Mention of specific securities in this report is not indicative of whether the Fund may make additional purchases of, sell all or a portion of, or continue to hold those securities.

| † | This graph, provided in accordance with SEC regulations, compares a $10,000 investment in the Fund, made at its inception, with the performance of the S&P 500 Index (“S&P 500”) and the Lipper Large-Cap Value Funds Index. Results include the reinvestment of all dividends and capital gains distributions. Performance is historical and does not represent future results. Investment returns and principal value vary, and you may have a gain or loss when you sell shares. Current performance may be lower or higher than the quoted performance. Call us or visit www.Strong.com for the most current performance information. The graph and the Average Annual Total Returns table do not reflect the deduction of taxes, if any, that a shareholder would pay on Fund distributions or the redemption of Fund shares. This graph is based on Class Z shares only; performance for other classes will vary due to differences in fee structures. |

The Fund’s prospectus and statement of additional information may describe restrictions on the percentage of a particular type or quality of security in which the Fund may invest (“Percentage Restrictions”). Percentage Restrictions apply at the time the Fund purchases a security. Circumstances subsequent to the purchase of the security, such as a change in: (1) the Fund’s assets (e.g., due to cash inflows and redemptions); (2) the market value of the security; or (3) the pricing, liquidity, or rating of the security, may cause the Fund to exceed or fall short of the Percentage Restriction. If this happens, the Fund’s continued holding of the security will not constitute a violation of the Percentage Restriction.

From time to time, the Fund’s advisor and/or administrator has waived its fees and/or absorbed Fund expenses, which has resulted in higher returns.

| 1 | Load-adjusted performance reflects the effect of the maximum sales charge of 5.75% for Class A, the applicable contingent deferred sales charge of 5.00% in year 1 and eliminated after year 6 for Class B, and the applicable contingent deferred sales charge of 1.00% and eliminated after 12 months for Class C. The performance of the Class A, B, and C shares is based on the performance of the Fund’s Class Z shares (formerly Retail Class shares) prior to 11-30-00. The performance of the Class A shares is restated to reflect the load and the different expenses of the Class A shares. The performance of the Class B shares is restated to reflect the contingent deferred sales charge and the different expenses of the Class B shares, as applicable. The performance of the Class C shares is restated to reflect the contingent deferred sales charge and the different expenses of the Class C shares, as applicable. The performance of Class K shares prior to December 31, 2001, is based on the Fund’s Class Z shares’ performance. Please consult a prospectus for information about all share classes. |

| 2 | Performance information is for Class Z shares. The Strong Advisor U.S. Value Fund Class Z shares are closed to new accounts, though the Fund may continue to offer its shares to certain company-sponsored retirement plans, institutional investors meeting specific eligibility requirements, and other limited groups as described in the prospectus. Please consult a prospectus for information about all share classes. |

9

Table of Contents

Strong Advisor Endeavor Large Cap Fund

For the year ended December 31, 2003, the Strong Advisor Endeavor Large Cap Fund Class A delivered a very solid return, advancing 25.84% (33.51% when excluding the initial sales charge). The Fund’s broad-based benchmark, the S&P 500 Index, returned 28.67%.

We had positioned the Fund to benefit from overall improvement in economic conditions and investor confidence. We were surprised, however, that high-volatility stocks experienced the strongest performance over the past year. This may have hindered our performance relative to the benchmark.

An investigative approach

Our team of portfolio managers and analysts worked diligently in 2003 to research investment opportunities for new and existing holdings for the Fund. Our research process is based on the idea of surrounding a company. This can be likened to the work of investigative journalists, tapping into an extensive network of sources to develop an original investment opinion. We begin surrounding a company by thoroughly analyzing its financial statements, looking for companies that can produce strong earnings growth relative to the investment required to grow their businesses. One of the companies this research led us toward in 2003 was Cisco Systems, the manufacturer of a broad array of networking and communications products.

We then seek to gain perspectives from many key individuals who directly affect the particular company or industry that is the subject of our research. We hold extensive conversations with senior management, but also interview middle managers, sales personnel, and product or channel managers who can provide valuable insights into sales trends, customer interests, and the competitive landscape. These relationships help us to gain an understanding of the effectiveness of new product and customer initiatives. Information from competitors, suppliers, and customers helps to round out our understanding.

In Cisco’s case, our research among component suppliers indicated that business trends were improving across most of the company’s customer base. Indeed, Cisco was able to announce an important new contract with the U.S. Defense Department to build a high-speed data network. Cisco’s solid operating leverage, improving business trends, and reduced product backlog and lead times were all positive for the company’s stock.

Healthy performers for the Fund

Semiconductor manufacturer Intel Corporation was also a solid holding during the period. The semiconductor industry fared well this year, and Intel’s stock rose on the strength in demand as it witnessed a solid push in the markets for servers, desktop computers, and mobile devices. Also, the company continued to benefit from high expectations that its Centrino chipset will allow it to build considerable market share in the growing laptop market.

Finally, as demand for leisure travel improved this year, our carefully researched holdings in the travel sector contributed positively to returns. For example, Royal Caribbean, one of the world’s largest cruise lines, benefited from improved bookings and its strong position among its competitors. As the economy strengthened, we detected improving leisure travel as trends returned to normal after three years of below-average results.

We believe that our research of companies of all sizes is a key advantage even when investing in larger-cap companies. Many large companies compete, form partnerships, or do business with smaller and midsize companies. With research that spans the market capitalization spectrum, we get unusual insights that enhance our ability to build a differentiated portfolio of growth stocks.

A positive outlook overall

We expect economic and corporate earnings growth to continue at a moderate pace in the coming year. Inflation appears to be at a sustainably low level, with strong productivity gains and job growth appearing to pick up. These factors should provide a solid foundation for the equity markets next year.

There is, however, potential for rising interest rates due to a weaker dollar and improving economy, which could hamper stock returns somewhat. In this environment, we intend to continue to maintain a balance of core growth holdings and developing growth stocks in the portfolio. Our aim is to take advantage of the opportunities that may present themselves in 2004, while prudently managing risk.

Thank you for your investment in the Strong Advisor Endeavor Large Cap Fund.

|

|

| Thomas J. Pence |

| Portfolio Co-Manager |

|

| D. Paul Berg |

| Portfolio Co-Manager |

10

Table of Contents

Fund Highlights

Your Fund’s Approach

The Fund invests in stocks of large-cap companies that its managers believe offer the potential for capital growth. The Fund’s managers seek to identify companies that have the prospect of improving sales and earnings growth rates, enjoy a competitive advantage, and have effective management with a history of making investments that are in the best interests of shareholders.

Average Annual Total Returns

As of 12-31-03

| Class A1 |

|||

| 1-year |

25.84 | % | |

| Since Fund Inception (9-28-01) |

-1.21 | % | |

| Class A, excluding sales load |

|||

| 1-year |

33.51 | % | |

| Since Fund Inception (9-28-01) |

— | ||

| Class B1 |

|||

| 1-year |

27.76 | % | |

| Since Fund Inception (9-28-01) |

-0.84 | % | |

| Class C1 |

|||

| 1-year |

31.76 | % | |

| Since Fund Inception (9-28-01) |

0.93 | % | |

Equity funds are volatile investments and should only be considered for long-term goals.

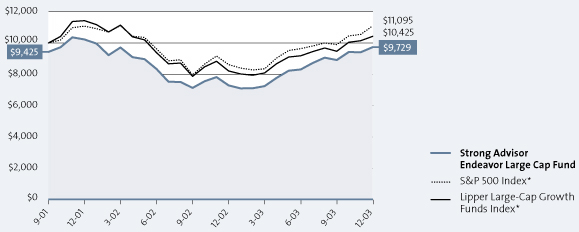

Growth of an Assumed $10,000 Investment†

From 9-28-01 to 12-31-03

Mention of specific securities in this report is not indicative of whether the Fund may make additional purchases of, sell all or a portion of, or continue to hold those securities.

| † | This graph, provided in accordance with SEC regulations, compares a $10,000 investment in the Fund, made at its inception, with the performance of the S&P 500 Index (“S&P 500”) and the Lipper Large-Cap Growth Funds Index. Results include the reinvestment of all dividends and capital gains distributions. Performance is historical and does not represent future results. Investment returns and principal value of the Fund vary, and you may have a gain or loss when you sell shares. Current performance may be lower or higher than the quoted performance. Call us or visit www.Strong.com for the most current performance information. The graph and the Average Annual Total Returns table do not reflect the deduction of taxes, if any, that a shareholder would pay on Fund distributions or the redemption of Fund shares. This graph is based on Class A shares only and reflects the effect of the maximum sales charge of 5.75%; performance for other share classes will vary due to differences in fee structures and sales charges. |

The Fund’s prospectus and statement of additional information may describe restrictions on the percentage of a particular type or quality of security in which the Fund may invest (“Percentage Restrictions”). Percentage Restrictions apply at the time the Fund purchases a security. Circumstances subsequent to the purchase of the security, such as a change in: (1) the Fund’s assets (e.g., due to cash inflows and redemptions); (2) the market value of the security; or (3) the pricing, liquidity, or rating of the security, may cause the Fund to exceed or fall short of the Percentage Restriction. If this happens, the Fund’s continued holding of the security will not constitute a violation of the Percentage Restriction.

From time to time, the Fund’s advisor and/or administrator has waived its fees and/or absorbed Fund expenses, which has resulted in higher returns.

| 1 | Load-adjusted performance reflects the effect of the maximum sales charge of 5.75% for Class A, the applicable contingent sales charge of 5.00% in year 1 and eliminated after year 6 for Class B, and the applicable contingent deferred sales charge of 1.00% and eliminated after 12 months for Class C. |

| * | The S&P 500 Index consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market value weighted index (stock price times number of shares outstanding), with each stock’s weight in the Index proportionate to its market value. The Lipper Large-Cap Growth Funds Index is the average of the 30 largest funds in the Lipper Large-Cap Growth Funds Category. Source of the S&P 500 index data is Standard & Poor’s Micropal. Source of the Lipper index data is Lipper Inc. |

11

Table of Contents

Emerging from a three-year bear market, the Strong Advisor Focus Fund Class A posted a solid return of 17.91% for the year (25.05% when excluding the initial sales charge). The Fund’s broad-based benchmark, the S&P 500 Index, returned 28.67% for the same period.

The stock market in 2003 was driven by three major trends. First, the newly enacted tax cuts offered the potential for stimulus to the economy and provided a boost to investors’ anticipated after-tax returns. Second, the economy displayed solid improvement through the year, accelerating in the second half. Third, the credit and capital markets opened up dramatically, giving companies the opportunity to repair troubled balance sheets.

Overall, this environment favored the lowest-quality stocks the most, as the market appeared to understand that it had less reason to worry about these companies’ long-term viability. Our focus and research tends to steer us away from such companies, which accounts for much of our underperformance this past year.

Seeking out fast-growing companies

Our process for selecting individual stocks has proprietary research at its core. The underlying theme to our process is the continual search for companies with superior business models that can achieve earnings growth by increasing their revenues and gaining market share.

Apollo Group is a good example that demonstrates our investment process. The company offers higher education both on campuses and via the Internet through its University of Phoenix operations. The company fits into an important investment theme that we follow, the dramatic economic growth associated with the very large echo boomer generation (that is, the children of the original baby boomers). This generation is now moving into its post-secondary-education years, providing a generous tailwind for the University of Phoenix’s growth.

The company gained market share, strongly outpacing most of the post-secondary education market. Furthermore, it met our criteria for revenue growth, positive earnings surprises, return on invested capital, and consistency of performance. We have supplemented our quantitative research with regular visits to the company to evaluate whether our growth expectations remain reasonable or need to be revised upward or downward.

Choosing when to sell a stock

With Apollo Group we observed times where the price of the stock was near our valuation targets — that is, the price we believed fully reflected its intrinsic value. As we do with other stocks in the portfolio, we took the opportunity to reduce our position in the stock. Because we invest in fast-growing companies, this sell discipline — that is, devising and employing the criteria we use to determine when a stock is no longer appropriate for the Fund — is a vital part of our management process.

Performance ultimately is driven not only by how well we buy a stock, but also by how well we sell it. Our decisions to sell stocks are driven by signs that the stock’s price has risen too high relative to its earnings and growth prospects, and by indications that the growth rates we sought when we bought the stock may not come to fruition. (Similarly, we may choose to increase our position in a company if its stock price dips while its prospects remain good.) Our process has served us well with respect to Apollo Group, and we believe it is a good formula for evaluating, selecting, and eventually selling a wide range of growth stocks over the long term.

Thoughts about 2004

For the near future, we anticipate continued economic strength, with the Federal Reserve taking a benign stance on interest rates through the first half of 2004. We believe that corporate profitability will continue to experience an above-average rate of growth, driven by rebounding domestic and international economies. We believe this should present a reasonable environment for growth-stock investing.

The stock market is dynamic. Among the factors we expect to be paying close attention to in the coming months will be the direction of long-bond rates, the recent weakness in the U.S. dollar relative to major foreign currencies, the environment for corporate credit, and the evolving demand for healthcare services.

We thank you for your investment in the Strong Advisor Focus Fund, and we appreciate the confidence you’ve continued to place in us.

|

| Thomas C. Ognar |

| Portfolio Manager |

12

Table of Contents

Fund Highlights

Your Fund’s Approach

The Fund focuses on stocks of 30 to 40 companies that its manager believes have favorable prospects for accelerating growth of earnings but are selling at reasonable valuations based on earnings, cash flow, or asset value. The portfolio can include stocks of small-, medium-, or large-capitalization companies.

Average Annual Total Returns

As of 12-31-03

| Class A1 |

|||

| 1-year |

17.91 | % | |

| 3-year |

-18.07 | % | |

| Since Fund Inception (11-30-00) |

-16.92 | % | |

| Class A, excluding sales load |

|||

| 1-year |

25.05 | % | |

| 3-year |

— | ||

| Since Fund Inception (11-30-00) |

— | ||

| Class B1 |

|||

| 1-year |

19.10 | % | |

| 3-year |

-18.88 | % | |

| Since Fund Inception (11-30-00) |

-17.28 | % | |

| Class C1 |

|||

| 1-year |

23.10 | % | |

| 3-year |

-16.90 | % | |

| Since Fund Inception (11-30-00) |

-15.86 | % | |

Equity funds are volatile investments and should only be considered for long-term goals.

Growth of an Assumed $10,000 Investment†

From 11-30-00 to 12-31-03

Mention of specific securities in this report is not indicative of whether the Fund may make additional purchases of, sell all or a portion of, or continue to hold those securities.

| † | This graph, provided in accordance with SEC regulations, compares a $10,000 investment in the Fund, made at its inception, with the performance of the S&P 500 Index (“S&P 500”) and the Lipper Multi-Cap Growth Funds Index. Results include the reinvestment of all dividends and capital gains distributions. Performance is historical and does not represent future results. Investment returns and principal value vary, and you may have a gain or loss when you sell shares. Current performance may be lower or higher than the quoted performance. Call us or visit www.Strong.com for the most current performance information. The graph and the Average Annual Total Returns table do not reflect the deduction of taxes, if any, that a shareholder would pay on Fund distributions or the redemption of Fund shares. This graph is based on Class A shares only and reflects the effect of the maximum sales charge of 5.75%; performance for other classes will vary due to differences in fee structures and sales charges. |

The Fund’s prospectus and statement of additional information may describe restrictions on the percentage of a particular type or quality of security in which the Fund may invest (“Percentage Restrictions”). Percentage Restrictions apply at the time the Fund purchases a security. Circumstances subsequent to the purchase of the security, such as a change in: (1) the Fund’s assets (e.g., due to cash inflows and redemptions); (2) the market value of the security; or (3) the pricing, liquidity, or rating of the security, may cause the Fund to exceed or fall short of the Percentage Restriction. If this happens, the Fund’s continued holding of the security will not constitute a violation of the Percentage Restriction.

From time to time, the Fund’s advisor and/or administrator has waived its fees and/or absorbed Fund expenses, which has resulted in higher returns.

The Fund is nondiversified, meaning it may concentrate its assets in fewer individual holdings than a diversified fund. Therefore, the Fund is more exposed to individual stock volatility and market pressure than a fully diversified fund.

| 1 | Load-adjusted performance reflects the effect of the maximum sales charge of 5.75% for Class A, the applicable contingent deferred sales charge of 5.00% in year 1 and eliminated after year 6 for Class B, and the applicable contingent deferred sales charge of 1.00% and eliminated after 12 months for Class C. |

| * | The S&P 500 Index consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market value weighted index (stock price times number of shares outstanding), with each stock’s weight in the Index proportionate to its market value. The Lipper Multi-Cap Growth Funds Index is the average of the 30 largest funds in the Lipper Multi-Cap Growth Funds Category. Source of the S&P index data is Standard & Poor’s Micropal. Source of the Lipper index data is Lipper Inc. |

13

Table of Contents

Strong Advisor International Core Fund

The Strong Advisor International Core Fund Class A rose 23.82% for the year ended December 31, 2003 (31.38% when excluding the initial sales charge). While a solid return for the year, the Fund’s performance lagged the total return of its international benchmark, the MSCI EAFE Index, which gained 38.59% for the year.

Small-cap stocks and lower-quality stocks dominated the global market rally over the past year. Our investment discipline emphasizes higher-quality, large-cap companies, which limited the Fund’s participation in the market’s recovery.

Solid gains around the world

As the global economic recovery gained momentum through the year, all major international equity markets and global sectors enjoyed double-digit gains in U.S. dollar terms. Performance was best in emerging markets, where falling interest rates, attractive share prices, and accelerating growth prospects sparked investor sentiment. The Fund’s investments in Brazil and Mexico were particular beneficiaries of this trend. Asian markets also posted strong returns, especially in the second half of the year.

European markets had less dramatic performance in local currency terms, reflecting the struggling nature of that region’s economy. Germany was a notable exception in Europe. We increased our investment in Germany during the year, emphasizing companies poised for a significant earnings recovery in spite of the strong euro.

A major factor in the Fund’s results was the strength of key foreign currencies compared with the U.S. dollar. For example, the yen rose in value by 10% relative to the dollar, and the euro appreciated by 20%. Differences between the Fund’s currency exposures and those of the MSCI EAFE Index contributed to the Fund’s below-benchmark return.

Lower-quality stocks outperformed

As we have noted, in 2003 the stocks that experienced the greatest returns around the world and across economic sectors were small-capitalization stocks and low-quality stocks sharing such traits as highly leveraged balance sheets, a history of poor acquisition strategies, and volatile earnings results.

The difference in relative performance of small vs. large capitalization stocks was striking around the world. For example, the MSCI Europe Small Cap Index rose 35% in the year, while the MSCI Europe Index climbed just 17%. A similar relationship existed in Asia, where the MSCI Far East Small Cap Index increased 45%, nearly twice the return of the MSCI Far East Index, up 23%. (All returns are based in local currencies.) While some smaller-cap holdings, such as Puma of Germany, did very well for the year, the Fund is generally concentrated on large-cap stocks as part of our long-standing investment process.

The performance gap between low- and high-quality stocks also had an impact on the Fund’s relative performance. Eye-popping increases were experienced by some of the world’s most troubled financial, technology, and industrial stocks. Nevertheless, we remained true to our discipline, eschewing high-risk stocks with questionable fundamentals and favoring instead those that fit key criteria such as solid balance sheets, consistent earnings growth, proven business development strategies, and attractive relative valuations. We intend to maintain our focus on quality, as we believe such an approach is essential to identifying stocks that can survive and prosper over the longer term.

The year did have significant bright spots for the Fund. We identified rising materials prices as a key new trend early in the year, and therefore chose to emphasize that sector within the portfolio. Commodity prices rose on the back of the weaker dollar, reduced production capacity, and renewed demand — especially from China. Three Fund holdings from the sector, Anglo American, Gold Fields, and BHP are among the world’s largest metals and mining firms and were clear beneficiaries of the solid pricing environment for their products. Companhia Vale do Rio Doce, one of the Fund’s best performing stocks in 2003, has the added benefit of very low production costs following the devaluation of Brazil’s currency in January 1999.

Keeping our focus on high quality

Major issues facing global stock markets in 2004 include questions about the durability of the current global economic recovery, the negative effects of a weak U.S. dollar, the potential for rising interest rates across regions, and the ability of China’s expansion to serve as an engine of growth for the world economy and not just the Asian region.

In this environment, we believe investors will once again turn to the large-cap, high-quality stocks this Fund favors.

Thank you for your investment in the Strong Advisor International Core Fund.

Stacy Ho

Portfolio Co-Manager

Katherine Schapiro

Portfolio Co-Manager

14

Table of Contents

Fund Highlights

Your Fund’s Approach

The Fund invests in stocks of any size from any country, including emerging markets, that appear to have strong growth potential and good relative value based on valuation measures such as earnings, cash flow, or asset value. The strategy is comprised of three parts that continually interact: trend identification, stock selection, and risk management.

Average Annual Total Returns

As of 12-31-03

| Class A1 |

|||

| 1-year |

23.82 | % | |

| Since Fund Inception (9-28-01) |

4.09 | % | |

| Class A, excluding sales load |

|||

| 1-year |

31.38 | % | |

| Since Fund Inception (9-28-01) |

— | ||

| Class B1 |

|||

| 1-year |

26.58 | % | |

| Since Fund Inception (9-28-01) |

5.17 | % | |

| Class C1 |

|||

| 1-year |

30.52 | % | |

| Since Fund Inception (9-28-01) |

6.79 | % | |

Equity funds are volatile investments and should only be considered for long-term goals.

Growth of an Assumed $10,000 Investment†

From 9-28-01 to 12-31-03

Mention of specific securities in this report is not indicative of whether the Fund may make additional purchases of, sell all or a portion of, or continue to hold those securities.

| † | This graph, provided in accordance with SEC regulations, compares a $10,000 investment in the Fund, made at its inception, with the performance of the Morgan Stanley Capital International Europe, Australasia, and Far East Index (“MSCI EAFE”) and the Lipper International Funds Index. Results include the reinvestment of all dividends and capital gains distributions. Performance is historical and does not represent future results. Investment returns and principal value of the Fund vary, and you may have a gain or loss when you sell shares. Current performance may be lower or higher than the quoted performance. Call us or visit www.Strong.com for the most current performance information. The graph and the Average Annual Total Returns table do not reflect the deduction of taxes, if any, that a shareholder would pay on Fund distributions or the redemption of Fund shares. This graph is based on Class A shares only and reflects the effect of the maximum sales charge of 5.75%; performance for other share classes will vary due to differences in fee structures and sales charges. |

The Fund’s prospectus and statement of additional information may describe restrictions on the percentage of a particular type or quality of security in which the Fund may invest (“Percentage Restrictions”). Percentage Restrictions apply at the time the Fund purchases a security. Circumstances subsequent to the purchase of the security, such as a change in: (1) the Fund’s assets (e.g., due to cash inflows and redemptions); (2) the market value of the security; or (3) the pricing, liquidity, or rating of the security, may cause the Fund to exceed or fall short of the Percentage Restriction. If this happens, the Fund’s continued holding of the security will not constitute a violation of the Percentage Restriction.

From time to time, the Fund’s advisor and/or administrator has waived its fees and/or absorbed Fund expenses, which has resulted in higher returns.

An investment in this Fund entails the special risks of international investing, including currency exchange fluctuation, government regulations, and the potential for political and economic instability. The Fund’s share price is expected to be more volatile than that of a U.S.-only fund. These risks are generally intensified for investments in emerging markets.

| 1 | Load-adjusted performance reflects the effect of the maximum sales charge of 5.75% for Class A, the applicable contingent sales charge of 5.00% in year 1 and eliminated after year 6 for Class B, and the applicable contingent deferred sales charge of 1.00% and eliminated after 12 months for Class C. |

| * | The MSCI EAFE® Index (Europe, Australasia, Far East) is a free float-adjusted market capitalization index that is designed to measure developed market equity performance, excluding the U.S. and Canada. The Lipper International Funds Index is the average of the 30 largest funds in the Lipper International Funds Category. These funds invest assets in securities with primary trading markets outside of the United States. Source of the MSCI EAFE index data is Standard & Poor’s Micropal. Source of the Lipper index data is Lipper Inc. |

15

Table of Contents

The Strong Advisor Select Fund Class A posted a strong return in 2003. For the year ended December 31, 2003, the Fund returned 29.21% (37.05% when excluding the initial sales charge), outperforming its broad-based benchmark, the S&P 500 Index, which returned 28.67% for the same period.

In an environment that saw virtually every sector of the equity market post solid returns, the Fund’s outperformance relative to the S&P 500 Index was driven by strong individual stock selection.

Investigative approach to investing

Our investment process for the Strong Advisor Select Fund is based on the idea of surrounding a company with research. This can be likened to the work of investigative journalists, tapping into an extensive network of sources to develop an original investment opinion. We begin surrounding a company by thoroughly analyzing its financial statements, looking for companies that can produce strong earnings growth relative to the investment required to grow their businesses. We require each holding in the Fund to display strong barriers to new competitors, which should help support strong or improving returns on capital.

One company this approach led us to was Royal Caribbean Cruises, one of the world’s largest cruise lines. The very nature of the large cruise-line business helps to limit the potential for new entrants to the market. Among the factors that drew us to this company were increased bookings, which resulted from the strengthening economy and receding fears of terrorism. Royal Caribbean Cruises also had a strong position among its competitors. We expect to continue to closely monitor pricing, competition, and demand trends in the travel industry.

Among the most useful elements of our research process is seeking out perspectives from many key individuals who directly affect the particular company or industry that is the subject of our research. We hold extensive conversations with senior management, but we also interview middle managers, sales personnel, and product or channel managers who can provide valuable insights into sales trends, customer interests, and the competitive landscape. These relationships help us to gain an understanding of the effectiveness of new product and customer initiatives. Information from competitors, suppliers, and customers helps to round out our understanding of a company.

Eclectic stock picking

This research helps us to uncover opportunities in a wide range of sectors. For example, another strong performer we identified for the Fund was Harman International Industries, which designs and markets high-fidelity audio products and electronic systems. We were able to determine that Harman was benefiting from rolling out its Harman Infotainment system to higher-end auto manufacturers. That system also helps auto manufacturers decrease costs by simplifying the assembly process. We believed Harman’s customer base should allow it to generate solid long-term revenue and earnings growth.