|

OMB APPROVAL

|

|

OMB Number: 3235-0570

Expires: January 31, 2014

Estimated average burden hours per response: 20.6

|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05685

Williamsburg Investment Trust

(Exact name of registrant as specified in charter)

|

225 Pictoria Drive, Suite 450 Cincinnati, Ohio

|

45246

|

|

(Address of principal executive offices)

|

(Zip code)

|

W. Lee H. Dunham, Esq.

Sullivan & Worcester LLP One Post Office Square Boston, Massachusetts 02109

(Name and address of agent for service)

Registrant's telephone number, including area code: (513) 587-3400

Date of fiscal year end: March 31, 2013

Date of reporting period: September 30, 2012

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

|

Item 1.

|

Reports to Stockholders.

|

SEMI-ANNUAL REPORT

September 30, 2012

(Unaudited)

|

|

THE DAVENPORT FUNDS

LETTER TO SHAREHOLDERS

|

October 24, 2012

|

Dear Shareholders,

The third quarter of 2012 treated equity investors well. The S&P 500 Index advanced 6.35% and is now up 16.44% year-to-date, while the Russell 2000 Index advanced 5.25% and finished the quarter up 14.23% year-to-date. The S&P 500 Index has now rallied 12.71% since early June and, perhaps even more impressive, is up 31.06% from the low we saw last October when Eurozone worries peaked. Most domestic indices are near multi-year highs if not all-time highs. Suffice it to say, market strength has confounded the many naysayers in the investment community. In fact, this may be one of the most doubted, distrusted and disliked rallies we have seen. Not surprisingly, those who are either under-invested or short the market seem the most troubled by recent action.

Market strength has mainly been a function of risk premiums abating. That is, stocks have advanced without improvement in the economic picture or earnings outlook. In fact, a recent Bloomberg survey found that market strategists had recently reduced their earnings forecasts for next year. Further, Bloomberg shows that Gross Domestic Product (“GDP”) is expected to grow only 2.1% next year, down from expectations for 2.5% growth when the year began. What does all this mean? Growth expectations may remain subdued, but investors have been willing to pay more for stocks as fear of economic calamity in Europe or some other “fat tail” event has diminished. As the year began, we discussed the prospect of stocks “climbing a wall of worry” and this certainly seems to be happening.

We’ve also been aided by a fresh dose of easy monetary policy. The Federal Reserve System recently unveiled the latest iteration of quantitative easing (“QE3”), which entails buying $40 billion worth of mortgage-backed securities per month in an effort to drive down interest rates. The end goal is to make borrowing more affordable (i.e. make money “cheap”) in order to improve economic conditions, namely employment. The program is open-ended, meaning the Fed is willing to throw money at the problem for as long as it takes. By effectively going “all in,” Chairman Ben Bernanke and his colleagues are clearly prioritizing job growth over inflation concerns. In addition to keeping rates low, the Fed hopes to drive up the value of assets such as stocks, real estate and homes by decreasing the appeal of cash and interest-bearing securities. It certainly appears to have impacted stocks, which experienced somewhat of a buying panic after the news.

Will it work? We are in uncharted waters and the efficacy of such unprecedented monetary stimulus remains to be seen. We and many others have some doubts about the Fed’s ability to translate QE3 into job growth and worry about the long-term side effects of their efforts, particularly the chance of rising inflation. We also can’t help but wonder what else the Fed could possibly have in its quiver after seemingly putting all its cards on the table. However, we admit to having no better solution and will operate under the assumption the Fed can tactfully withdraw stimulus as the economy finds more solid footing. What we do know is that the Fed can’t engineer economic growth without help. Government leaders will have to enact sensible fiscal policy or the economy will likely remain stuck in the mud and the American public’s confidence will remain shaken. Chairman Bernanke overtly called upon Capitol Hill when he recently noted, “We can’t solve this problem by ourselves.”

2

This brings us to the “fiscal cliff,” which has become the new most popular thing to worry about. If you watch the news, you may think our economy is scheduled to fly off the side of a mountain and explode into a fiery ball in the valley below. True, our economy will experience a significant slowdown if higher taxes and spending cuts go into effect, as are currently scheduled. However, it seems logical to anticipate some form of compromise that avoids an extreme scenario while also imposing some fiscal discipline (i.e. more modest tax increases and spending cuts than are currently planned). Such a compromise may be pushed into 2013 given election year politics and we are sure to see some intense bickering, media hysteria, and market volatility in the mean time. Still, a compromise shouldn’t prevent our domestic recovery from continuing, even if at a modest pace.

What about the Presidential election? This is the most polarized political landscape many have ever seen and the election’s impact on financial markets is a hot topic. At the moment, an Obama victory coupled with status quo in Congress seems likely and appears to be priced into financial markets. Many contend a Romney victory would be better for the economy and financial markets given the Republican party’s friendlier stance on both taxes and regulation. This thinking seems logical, but one could also argue Republican efforts to curtail the federal deficit could be a drag in the near term. Ultimately, the outcome may matter less than many think given the fact that either administration would be forced to deal with deficit issues. Also of interest, markets have historically performed better under Democratic presidents as compared to Republican. We can’t predict the outcome, but we do think the conclusion of the election process will remove another layer of uncertainty and give investors some indication of policy going into the next four years.

To conclude, we are pleased to be enjoying a solid year and glad to see our vanilla approach outperforming many of the exotic strategies that have gained popularity over the last decade. Given the market’s recent run, one could easily argue a measure of caution is warranted in the short term. However, we note that stocks have generally been out of favor for well over a decade and still seem both reasonably valued and relatively under-owned. Further, moderate economic growth and decreasing event risk (European debt crisis, fiscal cliff, etc.) could allow valuations to keep expanding.

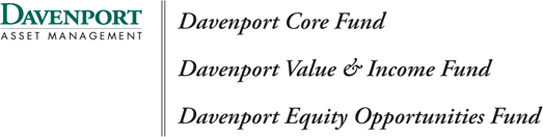

Davenport Core Fund

The following chart represents the Davenport Core Fund (the “Fund”) performance and the performance of the S&P 500 Index*, the Fund’s primary benchmark, for the periods ended September 30, 2012.

|

|

Q3 2012

|

1 Year

|

3 Years**

|

5 Years**

|

10 Years**

|

Since

Inception**

1/15/98

|

Expense

Ratio+

|

Prospectus Expense

Ratio

|

|

Core Fund

|

5.62%

|

28.68%

|

12.77%

|

1.33%

|

7.83%

|

4.73%

|

0.95%

|

0.96%

|

|

S&P 500 Index*

|

6.35%

|

30.20%

|

13.20%

|

1.05%

|

8.01%

|

4.74%

|

—

|

—

|

Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data, current to the most recent month end, may be obtained by calling 1-800-281-3217.

|

*

|

The S&P 500 Index is comprised of 500 U.S. stocks and is an indicator of the performance of the overall U.S. stock market. An investor cannot invest in an index and its returns are not indicative of the performance of any specific investment.

|

|

**

|

Annualized.

|

|

+

|

Annualized as of September 30, 2012.

|

3

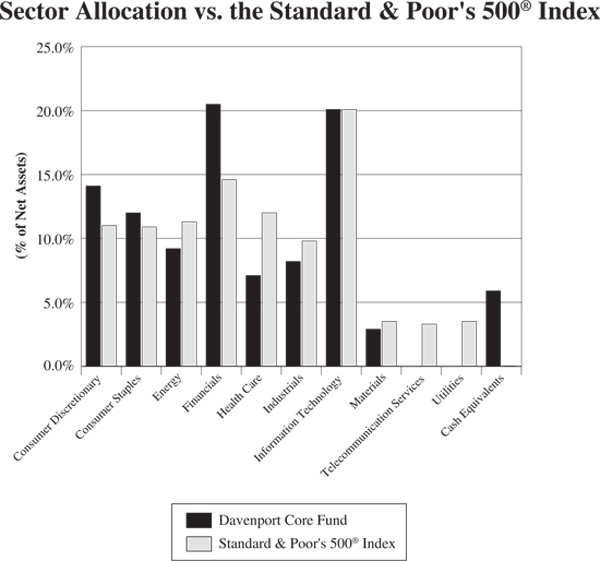

The Davenport Core Fund gained 5.62% during the third quarter, slightly lagging the 6.35% advance for the S&P 500 Index (the “S&P 500”). Year-to-date, the Fund is up 14.97% relative to the 16.44% gain for the S&P 500. As has been the case throughout much of the year, large caps continued to outperform small caps. In fact, the S&P 500 is one of the best performing indices year-to-date, finishing the quarter ahead of smaller cap indices such as the Russell 2000 Index and the Russell Midcap Index. Though we did not capture all of the market’s advances during the quarter, we are pleased to have managed solid year-to-date gains.

Weakness across a few key names in the Health Care and Materials sectors weighed on results during the quarter. Within Health Care, WellPoint (WLP) reacted negatively to a disappointing earnings release, which piled on to fresh concerns surrounding the impact of the recent upholding of provisions of the Patient Protection and Affordable Care Act. Albemarle (ALB) was a source of weakness in Materials due to renewed concerns about profitability in the second half of the year. Relative strength during the quarter came from the Industrials and Consumer Staples sectors, where holdings such as Stanley Black & Decker (SWK), Illinois Tool Works (ITW) and recently purchased J.M. Smucker (SJM), recorded nice gains. The Information Technology sector produced strong results as well, with Google (GOOG), Accenture (ACN), and Amazon.com (AMZN) hitting new highs.

Apple (AAPL) and QUALCOMM (QCOM) also performed nicely during the quarter; however, our underweight stance in AAPL led to some relative underperformance. Though it hurt performance during the most recent period, we recently elected to chip both of these names. In the case of AAPL, the stock is up more than five-fold since 2009 and has come to represent roughly 5% of the S&P 500. Though we believe this distinction is well deserved given the company’s impressive track record of innovation and profitability, we have grown a bit concerned that AAPL’s incredible competitive edge may be difficult to maintain. Furthermore, we worry that the company’s unprecedented margins and pricing power may come under pressure as the competition refines its approach. With respect to QCOM, we are concerned that the explosive growth in smartphone adoption may begin to decelerate sooner than many investors would like to admit. This, coupled with a decline in average selling prices (ASPs) of these devices (QCOM’s royalty revenues are based on price), could lead to compression in the company’s valuation multiples over time. To be clear, we continue to believe that QCOM is a great way to play the proliferation of wireless devices for years to come; we just felt like owning a little less given the aforementioned concerns.

During the quarter, we initiated positions in General Motors (GM) and Goldman Sachs (GS). Though these companies’ business activities differ greatly, we found similarities in the two, given their cheap valuations and powerful franchises that have been neglected by investors. In the case of GM, we acknowledge it is a bit more “rugged” than the average Fund holding due to its well publicized pension issues and high level of government ownership following the company’s reorganization under Chapter 11 in 2009. That said, we felt the shares offer a very attractive risk/reward opportunity considering the stock’s dirt cheap valuation and many opportunities to improve results. GS has had its own struggles, as the company’s transition from a pure investment bank to a bank holding company has limited the firm’s ability to use leverage to enhance returns in a recovering credit environment. Though pre-crisis returns on equity of 25%+ are likely a thing of the past, we believe results can improve significantly from current levels as the market environment recovers, regulatory uncertainty dissipates, and management continues to focus on capital allocation and controlling costs. Clearly, much has changed for the company from a

4

structural, regulatory and environmental perspective; however, we believe key attributes, such as its world renowned franchises and ability to recruit and retain world class talent, should enable the company to generate attractive returns even amid a tepid economic recovery. With the stock out of favor and trading at historically cheap levels, we felt the risk/reward profile was attractive.

In summary, we are pleased to be having such a strong year. Though some of our more “against the grain” actions have led to some relative underperformance amid a strong market environment, we feel comfortable with the Fund’s positioning. Sometimes zigging while others are zagging can lead to short term headaches; however, this approach can also yield strong returns over extended periods.

New Positions

Aon plc (AON) is a leading global provider of risk management services, insurance and reinsurance brokerage, and human resources consulting and outsourcing.

General Motors Company (GM) is the world’s largest light vehicle manufacturer, with operations in 120 countries, selling around 9 million vehicles annually.

Goldman Sachs Group, Inc. (GS) is one of the world’s leading investment banking franchises.

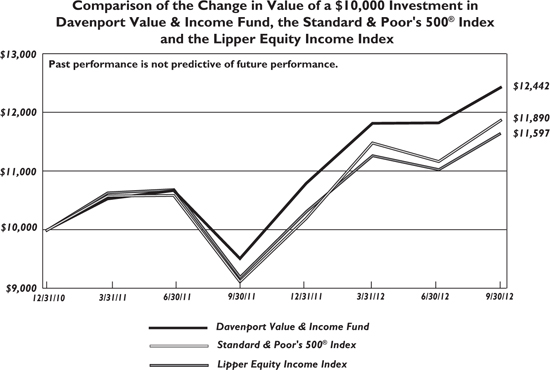

Davenport Value & Income Fund

The following chart represents the Davenport Value & Income Fund (the “Fund”) performance and the performance of the S&P 500 Index*, the Fund’s primary benchmark, and the Lipper Equity Income Index for the periods ended September 30, 2012.

|

|

Q3 2012

|

1 Year

|

Since

Inception** 12/31/2010

|

Expense

Ratio+

|

Prospectus Expense

Ratio

|

30 Day

SEC Yield

|

|

Value & Income Fund

|

5.17%

|

30.73%

|

13.32%

|

0.99%

|

1.24%

|

2.14%

|

|

S&P 500 Index*

|

6.35%

|

30.20%

|

10.41%

|

—

|

—

|

—

|

|

Lipper Equity Income Index*

|

5.60%

|

26.79%

|

8.85%

|

—

|

—

|

—

|

Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data, current to the most recent month end, may be obtained by calling 1-800-281-3217.

|

*

|

The S&P 500 Index is comprised of 500 U.S. stocks and is an indicator of the performance of the overall U.S. stock market. The Lipper Equity Income Fund Index is an unmanaged index of the 30 largest funds, based on total year-end net asset value, in the Lipper Equity Income Fund Index. An investor cannot invest in an index and its returns are not indicative of the performance of any specific investment.

|

|

**

|

Annualized.

|

|

+

|

Annualized as of September 30, 2012.

|

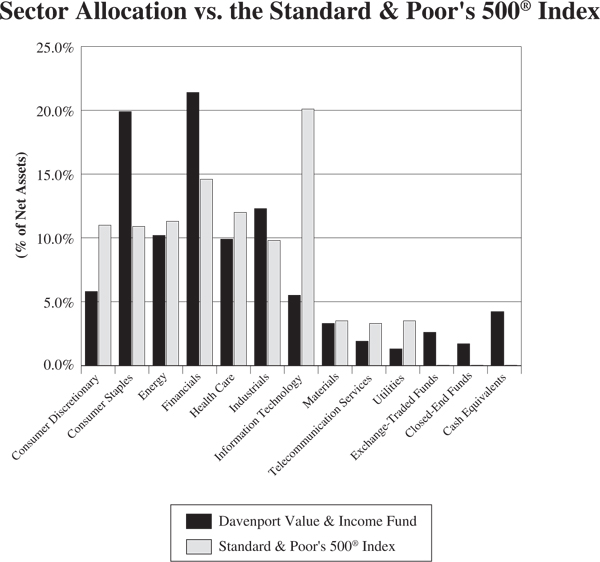

The Davenport Value & Income Fund advanced 5.17% during the third quarter, just under the 6.35% and 5.60% gains for the S&P 500 Index and the Lipper Equity Income Fund Index, respectively. Year-to-date, the Fund was up 15.20% relative to the 16.44% and the 12.97% gains for the S&P 500 Index and the Lipper Equity Income Fund Index, respectively. Clearly, dividend stocks have not lost their luster. In fact, many low growth companies with above average yields

5

continue to shine, despite fairly expensive valuations. In other words, many stocks that have traditionally been perceived as value situations are now looking quite expensive. As you will read below, we have begun to move away from certain low growth, high payout companies (such as utilities) in search of stocks that may have lower yields, but better earnings and dividend growth potential.

Housing related companies exhibited strong performance during the quarter, as improving industry data coupled with the Federal Reserve System’s announcement of QE3 fueled gains across the group. More direct plays, such as Weyerhaeuser (WY), Plum Creek Timber (PCL), and Fidelity National Financial (FNF), were top performers; however, bank holdings, such as JPMorgan Chase (JPM) and SunTrust (STI), also benefitted. Marathon Petroleum (MPC) was the Fund’s top contributor for the quarter. The earnings picture continues to improve for this domestic refiner, who’s flexible asset base and geographic positioning allow the company to take advantage of high gas prices by using cheap domestic crude from areas of the country where transportation capacity is constrained. Performance suffered in the Health Care and Materials sectors where WellPoint (WLP) and Dow Chemical (DOW) weighed on results. Norfolk Southern (NSC) and Intel (INTC) were also detractors following earnings announcements that fell well below street estimates.

In keeping with the theme mentioned above, we elected to sell our position in The Southern Company (SO) and add to positions in Johnson & Johnson (JNJ) and JPM. SO has benefitted from the “yield bid” along with the rest of the Utilities sector, as investors rotated into defensive sectors with high yields. As such, we felt the valuation was a bit full relative to the company’s growth prospects and ability to raise the dividend. On the other hand, both JPM and JNJ trade at discounts to historical averages, pay solid dividends, and seem poised to generate attractive earnings growth following periods of reputational and operational setbacks. In the case of JNJ, we believe the shares offer an attractive risk/reward profile given the company’s strong balance sheet, attractive dividend (yield: 3.5%), and increasing earnings visibility from new product launches and recent acquisitions. Though JPM suffered a reputational “black eye” with its Q2 trading loss, we felt the financial ramifications of the loss had been reflected in the shares and that further downside risk was limited. Going forward, we believe JPM is well-positioned relative to many of its global competitors and seems likely to generate superior industry returns over the long term. The stock pays a solid dividend, yielding approximately 3.0%, and trades at a modest premium to its tangible book value.

Early on in the quarter, we initiated a position in leading pharmacy retailer Walgreen (WAG). At the time of the purchase, this was a contrarian move given the well publicized headwinds that have hurt earnings and bludgeoned investor sentiment through the first half of this year (contract loss with Express Scripts (ESRX), potential for further losses from Medco Health Solutions, large acquisition of European drugstore chain). Though we clearly had some luck with timing, as the ESRX/Medco dispute was resolved the day after our purchase, we continue to believe the shares can work higher from here. WAG generates solid cash flows, has a strong balance sheet, and pays a healthy dividend (yields 3.0%). Though we have already benefitted from a major catalyst, we think earnings, cash flows, and the stock’s multiple can improve as the company benefits from an aging population whose consumption of prescription drugs is set to accelerate. Furthermore, though criticized for its timing, price and strategic fit, we believe the Alliance Boots acquisition could be value accretive beyond management’s initial projections, providing incremental support to earnings down the road.

6

To close, we are encouraged to have generated such solid results up to this point in the year. Just as diamonds are a girl’s best friend, dividends may be an investor’s best friend for years to come and should continue to make up a meaningful component of the market’s total return. That said, we acknowledge the fact that dividend strategies have become quite crowded, which may make it difficult to replicate the strong relative performance of the past couple of years. As this occurs, it will be incumbent upon us to continue to find areas where we see value.

New Positions

Darden Restaurants, Inc. (DRI) is the largest casual dining restaurant company in the world, with over 2,000 units comprised of flagship brands such as Red Lobster, Olive Garden and Longhorn Steakhouse. Current yield: 3.6%.

Walgreen Company (WAG) is a leading pharmacy retailer. Current yield: 3.0%.

Increased Positions

Johnson & Johnson (JNJ) is a leading worldwide diversified health care corporation, operating over 250 companies in 57 different countries. Currently yields 3.5%.

JPMorgan Chase & Company (JPM) is a leading retail and investment banking franchise. Current yield: 3.0%.

There is no guarantee that a company will continue to pay a dividend.

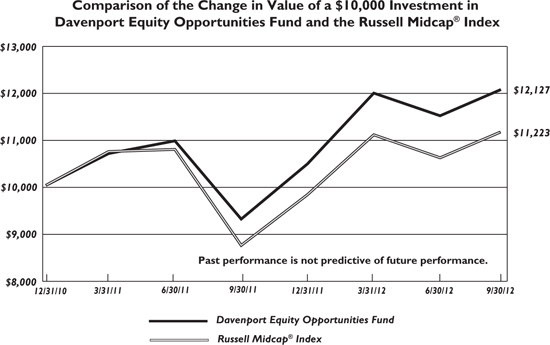

Davenport Equity Opportunities Fund

The following chart represents the Davenport Equity Opportunities Fund (the “Fund”) performance and the performance of the Russell Midcap Index*, the Fund’s primary benchmark, and the S&P 500 Index for the periods ended September 30, 2012.

|

|

Q3 2012

|

1 Year

|

Since

Inception** 12/31/2010

|

Expense

Ratio+

|

Prospectus Expense Ratio

|

|

Equity Opportunities Fund

|

5.23%

|

30.03%

|

11.66%

|

1.04%

|

1.10%

|

|

Russell Midcap Index*

|

5.59%

|

28.03%

|

6.83%

|

—

|

—

|

|

S&P 500 Index*

|

6.35%

|

30.20%

|

10.41%

|

—

|

—

|

Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data, current to the most recent month end, may be obtained by calling 1-800-281-3217.

|

*

|

The Russell Midcap Index measures the performance of the 800 smallest companies in the Russell 1000, which represent approximately 25% of the total market capitalization of the Russell 1000. The S&P 500 Index is comprised of 500 U.S. stocks and is an indicator of the performance of the overall U.S. stock market. An investor cannot invest in an index and its returns are not indicative of the performance of any specific investment.

|

|

**

|

Annualized.

|

|

+

|

Annualized as of September 30, 2012.

|

7

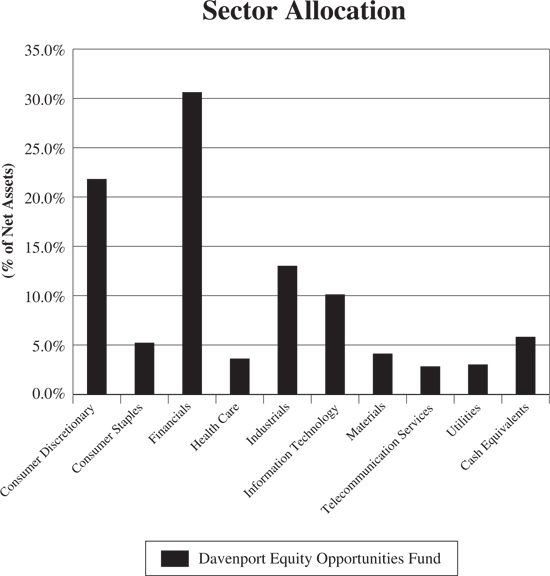

The Davenport Equity Opportunities Fund enjoyed a 5.23% gain for the third quarter. This compared to advances of 5.59% and 6.35% for the Russell Midcap Index (the “Russell Midcap”) and S&P 500 Index (the “S&P 500”), respectively. Year-to-date, the Fund was up 15.49% at period end versus gains of 14.00% and 16.44% for the Russell Midcap and S&P 500, respectively. As another point of reference, the small cap-oriented Russell 2000 Index finished the quarter up 14.23%, year-to-date. While we have fared well versus the aforementioned Russell indices, investors’ preference for large cap dividend payers has recently made it more difficult to keep up with the S&P 500. In fact, we are probably fortunate to have come this far without owning juggernauts such as Apple (AAPL) and Wal-Mart (WMT).

A number of companies in the Consumer Discretionary and Financials sectors were standouts this past quarter. Brookfield Residential (BRP) and SunTrust (STI) were up sharply given ongoing enthusiasm for housing-related plays. STI also benefited from efforts to further de-risk its balance sheet and provide greater earnings visibility. Lamar Advertising (LAMR) posted outsized gains as the billboard operator announced its intent to convert to a Real Estate Investment Trust (REIT), which could provide a tax shield and ultimately result in a meaningful dividend. While we still have a meaningful overweight stance in both consumer and finance, we’ve used recent strength in these stocks to reduce positions. The domestic recovery story seems intact, but the stocks definitely incorporate more enthusiasm than they did a few months ago. International Game Technology (IGT) was our biggest laggard during the quarter. Shares of the slot machine manufacturer have been disappointing for a couple of reasons. One, investors have questioned the company’s capital allocation after the purchase of online game provider DoubleDown. Two, the industry has become more competitive and the machine makers appear to be getting more aggressive on pricing. While the name has been frustrating, we bought more with the shares trading at a 52-week low and commanding the lowest P/E multiple we recalled ever seeing for the stock (less than 10x 2013 estimates). The stock has recovered some ground since then, but the risk/reward still seems attractive. We think management is very aware of investor concerns and is focused on improving returns on capital. We believe any improvement in sales trends and/or management credibility could yield another 20% -25% upside.

Penn National Gaming (PENN), which operates 19 regional casinos, represents another situation where we took advantage of weakness to build our position. The stock had declined from its highs due to the threat of increased competition at PENN’s flagship property in Charles Town, WV. Though we acknowledge the headwind of new competition and the potential cannibalization of existing PENN properties, we note this company is now very diversified and adept at adjusting its cost structure. We also point out that PENN has an underleveraged balance sheet and a penchant for finding new growth opportunities via development or acquisition. In addition, the company will be generating a huge amount of free cash flow following the opening of its new Ohio properties, which further supports the company’s ability to create value via deals or share repurchases. At less than 7x 2013 Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA) and 13x an Earnings Per Share (EPS) figure that understates free cash flow, the stock was cheaper than we’ve seen it in a while and we decided to increase our position.

We added to a couple of names we haven’t discussed in recent years. One of these was Rockwell Collins (COL). We have always admired this company for its strong balance sheet (net debt free), well above average returns on capital, and free cash flow generation. The stock has remained sluggish amid the market’s rally due to disappointing results and concerns regarding the company’s exposure to the defense budget. While 2013 will be somewhat of a transition year

8

for the company given slowing defense spending, we think this headwind is well-documented and 2014 earnings growth could be substantial as business jet activity improves and commercial orders associated with Boeing’s 787 program pick up steam.

Elsewhere, we added to our position in ITC Holdings (ITC), the nation’s largest independent electric transmission company. This business has tremendous barriers to entry and attractive returns that are regulated by the Federal Energy Regulatory Commission (FERC). It also has visible earnings growth associated with efforts to upgrade and provide new power sources to the electric grid. While the stock has performed very well since our initial purchase, it has stalled in the last year due to regulatory concerns and uncertainty surrounding a complex merger announced in December of 2011. We believe these concerns have presented us an opportunity to add to a quality defensive name.

In sum, we are very pleased to be enjoying such robust gains this year. While stocks in general have become more fully valued, we are still finding reasonable deals in a number of areas that haven’t been focal points for investors recently. An ongoing appetite for household names may favor large cap stocks at the moment, but we will continue leaning primarily towards small-to-medium sized companies with significant growth potential. Over time, we think a collection of superior business models run by exceptional management could yield above average returns.

Increased Positions

Aon plc (AON) is a leading global provider of risk management services, insurance and reinsurance brokerage, and human resources consulting and outsourcing.

ITC Holdings Corporation (ITC) is the nation’s largest independent electric transmission company.

International Game Technology (IGT) is the world’s leading maker of slot machines.

Penn National Gaming, Inc. (PENN) is a regional casino operator with an attractive portfolio of 19 casinos throughout the United States.

Rockwell Collins, Inc. (COL) is a leading provider of communications equipment and aviation electronics for military and commercial aerospace customers.

The P/E Ratio is a valuation ratio of a company’s current share price compared to its per share earnings.

Sincerely,

John P. Ackerly, IV

President, The Davenport Funds

9

|

DAVENPORT CORE FUND

PERFORMANCE INFORMATION (Unaudited)

|

|

Average Annual Total Returns(a)

(for periods ended September 30, 2012)

|

||||

|

1 Year

|

5 Years

|

10 Years

|

||

|

Davenport Core Fund

|

28.68%

|

1.33%

|

7.83%

|

|

|

Standard & Poor’s 500® Index

|

30.20%

|

1.05%

|

8.01%

|

|

|

(a) The total returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

|

10

|

DAVENPORT VALUE & INCOME FUND

PERFORMANCE INFORMATION (Unaudited)

|

|

Average Annual Total Returns(a)

(for periods ended September 30, 2012)

|

|||

|

1 Year

|

Since Inception(b)

|

||

|

Davenport Value & Income Fund

|

30.73%

|

13.32%

|

|

|

Standard & Poor’s 500® Index

|

30.20%

|

10.41%

|

|

|

Lipper Equity Income Index

|

26.79%

|

8.85%

|

|

|

(a) The total returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

|

|

(b) Commencement of operations was December 31, 2010.

|

11

|

DAVENPORT EQUITY OPPORTUNITIES FUND

PERFORMANCE INFORMATION (Unaudited)

|

|

Average Annual Total Returns(a)

(for periods ended September 30, 2012)

|

|||

|

1 Year

|

Since Inception(b)

|

||

|

Davenport Equity Opportunities Fund

|

30.03%

|

11.66%

|

|

|

Russell Midcap® Index

|

28.03%

|

6.83%

|

|

|

(a) The total returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

|

|

(b) Commencement of operations was December 31, 2010.

|

12

|

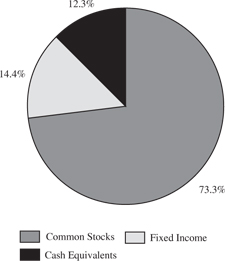

DAVENPORT CORE FUND

PORTFOLIO INFORMATION

September 30, 2012 (Unaudited)

|

Top Ten Equity Holdings

|

Security Description

|

% of

Net Assets

|

|

Brookfield Asset Management, Inc. - Class A

|

2.7%

|

|

Exxon Mobil Corporation

|

2.6%

|

|

Berkshire Hathaway, Inc. - Class B

|

2.4%

|

|

Wells Fargo & Company

|

2.4%

|

|

Apple, Inc.

|

2.4%

|

|

International Business Machines Corporation

|

2.4%

|

|

Johnson & Johnson

|

2.3%

|

|

Markel Corporation

|

2.3%

|

|

Chevron Corporation

|

2.2%

|

|

J.M. Smucker Company (The)

|

2.2%

|

13

|

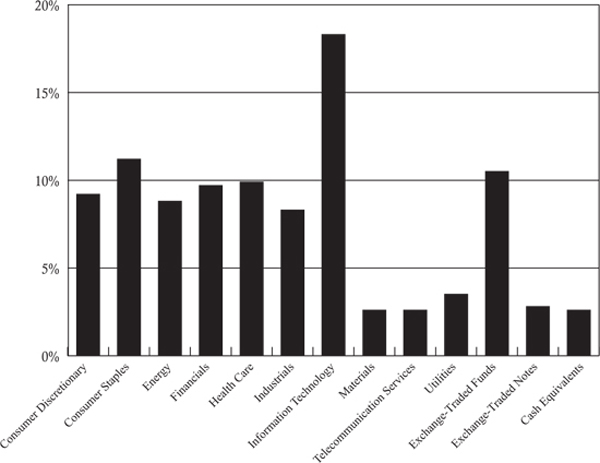

DAVENPORT VALUE & INCOME FUND

PORTFOLIO INFORMATION

September 30, 2012 (Unaudited)

|

Top Ten Equity Holdings

|

Security Description

|

% of

Net Assets

|

|

Fidelity National Financial, Inc. - Class A

|

2.8%

|

|

JPMorgan Chase & Company

|

2.7%

|

|

SPDR EURO STOXX 50 ETF

|

2.6%

|

|

Wells Fargo & Company

|

2.6%

|

|

Johnson & Johnson

|

2.5%

|

|

Royal Dutch Shell plc - Class B - ADR

|

2.5%

|

|

Sun Communities, Inc.

|

2.4%

|

|

Travelers Companies, Inc. (The)

|

2.4%

|

|

Chevron Corporation

|

2.4%

|

|

GlaxoSmithKline plc - ADR

|

2.3%

|

14

|

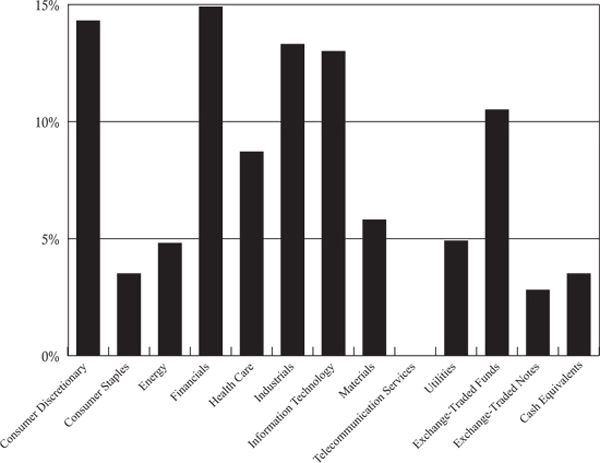

DAVENPORT EQUITY OPPORTUNITIES FUND

PORTFOLIO INFORMATION

September 30, 2012 (Unaudited)

|

Top Ten Equity Holdings

|

Security Description

|

% of

Net Assets

|

|

Markel Corporation

|

4.8%

|

|

Penn National Gaming, Inc.

|

4.6%

|

|

CarMax, Inc.

|

4.3%

|

|

Aon plc

|

3.9%

|

|

Capital One Financial Corporation

|

3.9%

|

|

O'Reilly Automotive, Inc.

|

3.9%

|

|

Colfax Corporation

|

3.7%

|

|

Brookfield Asset Management, Inc. - Class A

|

3.4%

|

|

NCR Corporation

|

3.3%

|

|

SunTrust Banks, Inc.

|

3.3%

|

15

|

DAVENPORT CORE FUND

SCHEDULE OF INVESTMENTS

September 30, 2012 (Unaudited)

|

|

COMMON STOCKS — 94.1%

|

Shares

|

Value

|

||||||

|

Consumer Discretionary — 14.1%

|

||||||||

|

Amazon.com, Inc. (a)

|

14,733 | $ | 3,746,896 | |||||

|

CarMax, Inc. (a)

|

145,122 | 4,106,953 | ||||||

|

General Motors Company (a)

|

124,015 | 2,821,341 | ||||||

|

Lowe's Companies, Inc.

|

93,816 | 2,836,996 | ||||||

|

McDonald's Corporation

|

29,076 | 2,667,723 | ||||||

|

News Corporation - Class A

|

125,841 | 3,086,880 | ||||||

|

Starwood Hotels & Resorts Worldwide, Inc.

|

52,613 | 3,049,449 | ||||||

|

Walt Disney Company (The)

|

69,238 | 3,619,763 | ||||||

| 25,936,001 | ||||||||

|

Consumer Staples — 12.0%

|

||||||||

|

Anheuser-Busch InBev SA/NV - ADR

|

34,245 | 2,941,988 | ||||||

|

Dr. Pepper Snapple Group, Inc.

|

64,100 | 2,854,373 | ||||||

|

J.M. Smucker Company (The)

|

47,947 | 4,139,264 | ||||||

|

Nestle SA - ADR

|

39,018 | 2,466,328 | ||||||

|

PepsiCo, Inc.

|

46,101 | 3,262,568 | ||||||

|

Procter & Gamble Company (The)

|

37,814 | 2,622,779 | ||||||

|

Wal-Mart Stores, Inc.

|

53,372 | 3,938,854 | ||||||

| 22,226,154 | ||||||||

|

Energy — 9.2%

|

||||||||

|

Chevron Corporation

|

35,547 | 4,143,358 | ||||||

|

Exxon Mobil Corporation

|

53,382 | 4,881,784 | ||||||

|

National Oilwell Varco, Inc.

|

32,395 | 2,595,164 | ||||||

|

Occidental Petroleum Corporation

|

28,296 | 2,435,154 | ||||||

|

Schlumberger Ltd.

|

41,383 | 2,993,232 | ||||||

| 17,048,692 | ||||||||

|

Financials — 20.5%

|

||||||||

|

American Tower Corporation

|

46,748 | 3,337,340 | ||||||

|

Aon plc

|

51,640 | 2,700,255 | ||||||

|

Bank of America Corporation

|

142,096 | 1,254,708 | ||||||

|

Berkshire Hathaway, Inc. - Class B (a)

|

51,126 | 4,509,313 | ||||||

|

Brookfield Asset Management, Inc. - Class A

|

144,424 | 4,984,072 | ||||||

|

Capital One Financial Corporation

|

68,407 | 3,899,883 | ||||||

|

Goldman Sachs Group, Inc. (The)

|

25,085 | 2,851,663 | ||||||

|

JPMorgan Chase & Company

|

68,028 | 2,753,773 | ||||||

|

Markel Corporation (a)

|

9,128 | 4,185,097 | ||||||

|

T. Rowe Price Group, Inc.

|

44,511 | 2,817,546 | ||||||

|

Wells Fargo & Company

|

129,994 | 4,488,693 | ||||||

| 37,782,343 | ||||||||

|

Health Care — 7.1%

|

||||||||

|

Johnson & Johnson

|

60,938 | 4,199,238 | ||||||

|

Laboratory Corporation of America Holdings (a)

|

29,917 | 2,766,425 | ||||||

|

Novo Nordisk A/S - ADR

|

20,050 | 3,164,090 | ||||||

16

|

DAVENPORT CORE FUND

SCHEDULE OF INVESTMENTS (Continued)

|

|

COMMON STOCKS — 94.1% (Continued)

|

Shares

|

Value

|

||||||

|

Health Care — 7.1% (Continued)

|

||||||||

|

WellPoint, Inc.

|

49,485 | $ | 2,870,625 | |||||

| 13,000,378 | ||||||||

|

Industrials — 8.2%

|

||||||||

|

Danaher Corporation

|

67,792 | 3,738,729 | ||||||

|

Illinois Tool Works, Inc.

|

44,174 | 2,627,028 | ||||||

|

Stanley Black & Decker, Inc.

|

38,768 | 2,956,060 | ||||||

|

Union Pacific Corporation

|

22,405 | 2,659,473 | ||||||

|

United Technologies Corporation

|

40,819 | 3,195,720 | ||||||

| 15,177,010 | ||||||||

|

Information Technology — 20.1%

|

||||||||

|

Accenture plc - Class A

|

54,399 | 3,809,562 | ||||||

|

Apple, Inc.

|

6,635 | 4,427,270 | ||||||

|

Automatic Data Processing, Inc.

|

48,265 | 2,831,225 | ||||||

|

Check Point Software Technologies Ltd. (a)

|

52,510 | 2,528,882 | ||||||

|

Fiserv, Inc. (a)

|

52,408 | 3,879,764 | ||||||

|

Google, Inc. - Class A (a)

|

4,279 | 3,228,505 | ||||||

|

Intel Corporation

|

107,647 | 2,441,434 | ||||||

|

International Business Machines Corporation

|

21,152 | 4,387,982 | ||||||

|

Microsoft Corporation

|

101,853 | 3,033,182 | ||||||

|

QUALCOMM, Inc.

|

47,820 | 2,988,272 | ||||||

|

Visa, Inc. - Class A

|

25,788 | 3,462,813 | ||||||

| 37,018,891 | ||||||||

|

Materials — 2.9%

|

||||||||

|

Albemarle Corporation

|

52,693 | 2,775,867 | ||||||

|

Praxair, Inc.

|

25,291 | 2,627,229 | ||||||

| 5,403,096 | ||||||||

|

Total Common Stocks (Cost $127,696,331)

|

$ | 173,592,565 | ||||||

|

MONEY MARKET FUNDS — 4.9%

|

Shares

|

Value

|

||||||

|

First American Treasury Obligations Fund - Class Z, 0.00% (b) (Cost $9,088,235)

|

9,088,235 | $ | 9,088,235 | |||||

|

Total Investments at Value — 99.0% (Cost $136,784,566)

|

$ | 182,680,800 | ||||||

|

Other Assets in Excess of Liabilities — 1.0%

|

1,851,756 | |||||||

|

Net Assets — 100.0%

|

$ | 184,532,556 | ||||||

ADR - American Depositary Receipt.

|

(a)

|

Non-income producing security.

|

|

(b)

|

Variable rate security. The rate shown is the 7-day effective yield as of September 30, 2012.

|

See accompanying notes to financial statements.

17

|

DAVENPORT VALUE & INCOME FUND

SCHEDULE OF INVESTMENTS

September 30, 2012 (Unaudited)

|

|

COMMON STOCKS — 91.5%

|

Shares

|

Value

|

||||||

|

Consumer Discretionary — 5.8%

|

||||||||

|

Cracker Barrel Old Country Store, Inc.

|

29,590 | $ | 1,985,785 | |||||

|

Darden Restaurants, Inc.

|

40,545 | 2,260,384 | ||||||

|

McDonald's Corporation

|

22,155 | 2,032,721 | ||||||

|

VF Corporation

|

13,030 | 2,076,461 | ||||||

| 8,355,351 | ||||||||

|

Consumer Staples — 19.9%

|

||||||||

|

Altria Group, Inc.

|

64,941 | 2,168,380 | ||||||

|

Anheuser-Busch InBev SA/NV - ADR

|

30,025 | 2,579,448 | ||||||

|

Coca-Cola Company (The)

|

77,925 | 2,955,695 | ||||||

|

Diageo plc - ADR

|

19,115 | 2,154,834 | ||||||

|

Dr. Pepper Snapple Group, Inc.

|

48,517 | 2,160,462 | ||||||

|

H.J. Heinz Company

|

32,735 | 1,831,523 | ||||||

|

PepsiCo, Inc.

|

41,040 | 2,904,401 | ||||||

|

Philip Morris International, Inc.

|

32,345 | 2,909,109 | ||||||

|

Procter & Gamble Company (The)

|

32,155 | 2,230,271 | ||||||

|

Walgreen Company

|

88,740 | 3,233,686 | ||||||

|

Wal-Mart Stores, Inc.

|

44,512 | 3,284,985 | ||||||

| 28,412,794 | ||||||||

|

Energy — 10.2%

|

||||||||

|

BP plc - ADR

|

50,160 | 2,124,778 | ||||||

|

Chevron Corporation

|

29,016 | 3,382,105 | ||||||

|

Marathon Petroleum Corporation

|

52,430 | 2,862,154 | ||||||

|

Royal Dutch Shell plc - Class B - ADR

|

49,435 | 3,524,715 | ||||||

|

Teekay Shipping Corporation

|

88,970 | 2,775,864 | ||||||

| 14,669,616 | ||||||||

|

Financials — 21.4%

|

||||||||

|

Federated Investors, Inc. - Class B

|

103,502 | 2,141,456 | ||||||

|

Fidelity National Financial, Inc. - Class A

|

189,485 | 4,053,084 | ||||||

|

JPMorgan Chase & Company

|

94,185 | 3,812,609 | ||||||

|

Plum Creek Timber Company, Inc.

|

66,060 | 2,896,071 | ||||||

|

Sun Communities, Inc.

|

79,093 | 3,489,583 | ||||||

|

SunTrust Banks, Inc.

|

100,070 | 2,828,979 | ||||||

|

Travelers Companies, Inc. (The)

|

50,600 | 3,453,956 | ||||||

|

W.P. Carey & Company, LLC

|

30,034 | 1,471,666 | ||||||

|

Wells Fargo & Company

|

106,895 | 3,691,084 | ||||||

|

Weyerhaeuser Company

|

107,774 | 2,817,212 | ||||||

| 30,655,700 | ||||||||

|

Health Care — 9.9%

|

||||||||

|

Abbott Laboratories

|

34,520 | 2,366,691 | ||||||

|

GlaxoSmithKline plc - ADR

|

71,140 | 3,289,514 | ||||||

|

Johnson & Johnson

|

51,905 | 3,576,774 | ||||||

|

Merck & Company, Inc.

|

58,565 | 2,641,281 | ||||||

18

|

DAVENPORT VALUE & INCOME FUND

SCHEDULE OF INVESTMENTS (Continued)

|

|

COMMON STOCKS — 91.5% (Continued)

|

Shares

|

Value

|

||||||

|

Health Care — 9.9% (Continued)

|

||||||||

|

WellPoint, Inc.

|

39,830 | $ | 2,310,538 | |||||

| 14,184,798 | ||||||||

|

Industrials — 12.3%

|

||||||||

|

3M Company

|

25,830 | 2,387,209 | ||||||

|

Eaton Corporation

|

53,400 | 2,523,684 | ||||||

|

General Electric Company

|

128,040 | 2,907,788 | ||||||

|

Illinois Tool Works, Inc.

|

34,525 | 2,053,202 | ||||||

|

Norfolk Southern Corporation

|

37,180 | 2,365,763 | ||||||

|

Raytheon Company

|

47,656 | 2,724,017 | ||||||

|

Watsco, Inc.

|

33,945 | 2,572,692 | ||||||

| 17,534,355 | ||||||||

|

Information Technology — 5.5%

|

||||||||

|

Automatic Data Processing, Inc.

|

48,095 | 2,821,253 | ||||||

|

Intel Corporation

|

108,450 | 2,459,646 | ||||||

|

Microsoft Corporation

|

87,980 | 2,620,044 | ||||||

| 7,900,943 | ||||||||

|

Materials — 3.3%

|

||||||||

|

Dow Chemical Company (The)

|

81,170 | 2,350,683 | ||||||

|

E.I. du Pont de Nemours and Company

|

46,785 | 2,351,882 | ||||||

| 4,702,565 | ||||||||

|

Telecommunication Services — 1.9%

|

||||||||

|

Vodafone Group plc - ADR

|

95,220 | 2,713,294 | ||||||

|

Utilities — 1.3%

|

||||||||

|

Dominion Resources, Inc.

|

34,720 | 1,838,077 | ||||||

|

Total Common Stocks (Cost $116,900,927)

|

$ | 130,967,493 | ||||||

|

EXCHANGE-TRADED FUNDS — 2.6%

|

Shares

|

Value

|

||||||

|

SPDR EURO STOXX 50 ETF (Cost $3,657,597)

|

121,170 | $ | 3,759,905 | |||||

|

CLOSED-END FUNDS — 1.7%

|

Shares

|

Value

|

||||||

|

Tortoise Energy Infrastructure Corporation (Cost $2,323,509)

|

58,800 | $ | 2,380,224 | |||||

19

|

DAVENPORT VALUE & INCOME FUND

SCHEDULE OF INVESTMENTS (Continued)

|

|

MONEY MARKET FUNDS — 2.9%

|

Shares

|

Value

|

||||||

|

First American Treasury Obligations Fund - Class Z, 0.00% (a) (Cost $4,142,587)

|

4,142,587 | $ | 4,142,587 | |||||

|

Total Investments at Value — 98.7% (Cost $127,024,620)

|

$ | 141,250,209 | ||||||

|

Other Assets in Excess of Liabilities — 1.3%

|

1,891,522 | |||||||

|

Net Assets — 100.0%

|

$ | 143,141,731 | ||||||

ADR - American Depositary Receipt.

|

(a)

|

Variable rate security. The rate shown is the 7-day effective yield as of September 30, 2012.

|

See accompanying notes to financial statements.

20

|

DAVENPORT EQUITY OPPORTUNITIES FUND

SCHEDULE OF INVESTMENTS

September 30, 2012 (Unaudited)

|

|

COMMON STOCKS — 94.2%

|

Shares

|

Value

|

||||||

|

Consumer Discretionary — 21.8%

|

||||||||

|

Brookfield Residential Properties, Inc. (a)

|

61,540 | $ | 860,329 | |||||

|

CarMax, Inc. (a)

|

107,970 | 3,055,551 | ||||||

|

Hanesbrands, Inc. (a)

|

49,365 | 1,573,756 | ||||||

|

International Game Technology

|

164,015 | 2,146,957 | ||||||

|

Lamar Advertising Company - Class A (a)

|

48,200 | 1,786,292 | ||||||

|

O'Reilly Automotive, Inc. (a)

|

32,760 | 2,739,391 | ||||||

|

Penn National Gaming, Inc. (a)

|

75,370 | 3,248,447 | ||||||

| 15,410,723 | ||||||||

|

Consumer Staples — 5.2%

|

||||||||

|

Church & Dwight Company, Inc.

|

26,640 | 1,438,294 | ||||||

|

J.M. Smucker Company (The)

|

25,685 | 2,217,386 | ||||||

| 3,655,680 | ||||||||

|

Financials — 30.6%

|

||||||||

|

American Tower Corporation

|

27,220 | 1,943,236 | ||||||

|

Aon plc

|

53,370 | 2,790,717 | ||||||

|

Brookfield Asset Management, Inc. - Class A

|

70,480 | 2,432,265 | ||||||

|

Capital One Financial Corporation

|

48,571 | 2,769,033 | ||||||

|

Fidelity National Financial, Inc. - Class A

|

96,885 | 2,072,370 | ||||||

|

Markel Corporation (a)

|

7,410 | 3,397,411 | ||||||

|

Safety Insurance Group, Inc.

|

40,330 | 1,850,340 | ||||||

|

Sun Communities, Inc.

|

47,665 | 2,102,980 | ||||||

|

SunTrust Banks, Inc.

|

81,640 | 2,307,963 | ||||||

| 21,666,315 | ||||||||

|

Health Care — 3.6%

|

||||||||

|

Henry Schein, Inc. (a)

|

18,185 | 1,441,525 | ||||||

|

Laboratory Corporation of America Holdings (a)

|

11,805 | 1,091,608 | ||||||

| 2,533,133 | ||||||||

|

Industrials — 13.0%

|

||||||||

|

Babcock & Wilcox Company (a)

|

45,414 | 1,156,694 | ||||||

|

Colfax Corporation (a)

|

72,300 | 2,651,241 | ||||||

|

Delta Air Lines, Inc. (a)

|

123,480 | 1,131,077 | ||||||

|

Rockwell Collins, Inc.

|

40,400 | 2,167,056 | ||||||

|

Watsco, Inc.

|

27,800 | 2,106,962 | ||||||

| 9,213,030 | ||||||||

|

Information Technology — 10.1%

|

||||||||

|

Check Point Software Technologies Ltd. (a)

|

25,545 | 1,230,247 | ||||||

|

Fiserv, Inc. (a)

|

24,355 | 1,803,001 | ||||||

|

Intuit, Inc.

|

29,965 | 1,764,339 | ||||||

|

NCR Corporation (a)

|

100,611 | 2,345,242 | ||||||

| 7,142,829 | ||||||||

21

|

DAVENPORT EQUITY OPPORTUNITIES FUND

SCHEDULE OF INVESTMENTS (Continued)

|

|

COMMON STOCKS — 94.2% (Continued)

|

Shares

|

Value

|

||||||

|

Materials — 4.1%

|

||||||||

|

Albemarle Corporation

|

30,015 | $ | 1,581,190 | |||||

|

NewMarket Corporation

|

5,469 | 1,347,999 | ||||||

| 2,929,189 | ||||||||

|

Telecommunication Services — 2.8%

|

||||||||

|

Millicom International Cellular S.A.

|

21,630 | 2,009,211 | ||||||

|

Utilities — 3.0%

|

||||||||

|

ITC Holdings Corporation

|

28,100 | 2,123,798 | ||||||

|

Total Common Stocks (Cost $58,864,117)

|

$ | 66,683,908 | ||||||

|

MONEY MARKET FUNDS — 2.7%

|

Shares

|

Value

|

||||||

|

First American Treasury Obligations Fund - Class Z, 0.00% (b) (Cost $1,945,790)

|

1,945,790 | $ | 1,945,790 | |||||

|

Total Investments at Value — 96.9% (Cost $60,809,907)

|

$ | 68,629,698 | ||||||

|

Other Assets in Excess of Liabilities — 3.1%

|

2,197,905 | |||||||

|

Net Assets — 100.0%

|

$ | 70,827,603 | ||||||

|

(a)

|

Non-income producing security.

|

|

(b)

|

Variable rate security. The rate shown is the 7-day effective yield as of September 30, 2012.

|

See accompanying notes to financial statements.

22

|

THE DAVENPORT FUNDS

STATEMENTS OF ASSETS AND LIABILITIES

September 30, 2012 (Unaudited)

|

|

|

Davenport

Core

Fund

|

Davenport

Value &

Income

Fund

|

Davenport

Equity

Opportunities

Fund

|

|||||||||

|

ASSETS

|

||||||||||||

|

Investments in securities:

|

||||||||||||

|

At acquisition cost

|

$ | 136,784,566 | $ | 127,024,620 | $ | 60,809,907 | ||||||

|

At market value (Note 2)

|

$ | 182,680,800 | $ | 141,250,209 | $ | 68,629,698 | ||||||

|

Cash

|

1,957,366 | 3,727,184 | 2,811,608 | |||||||||

|

Dividends receivable

|

131,430 | 306,798 | 26,206 | |||||||||

|

Receivable for capital shares sold

|

297,401 | 717,662 | 138,314 | |||||||||

|

Other assets

|

20,001 | 15,983 | 13,697 | |||||||||

|

TOTAL ASSETS

|

185,086,998 | 146,017,836 | 71,619,523 | |||||||||

|

LIABILITIES

|

||||||||||||

|

Payable for capital shares redeemed

|

405,244 | 332,890 | — | |||||||||

|

Payable for investment securities purchased

|

— | 2,429,299 | 732,412 | |||||||||

|

Accrued investment advisory fees (Note 4)

|

126,325 | 87,081 | 45,171 | |||||||||

|

Payable to administrator (Note 4)

|

21,850 | 16,925 | 9,650 | |||||||||

|

Other accrued expenses

|

1,023 | 9,910 | 4,687 | |||||||||

|

TOTAL LIABILITIES

|

554,442 | 2,876,105 | 791,920 | |||||||||

|

NET ASSETS

|

$ | 184,532,556 | $ | 143,141,731 | $ | 70,827,603 | ||||||

|

Net assets consist of:

|

||||||||||||

|

Paid-in capital

|

$ | 143,616,360 | $ | 127,882,465 | $ | 62,233,239 | ||||||

|

Accumulated net investment income

|

14,848 | 19,745 | 12,450 | |||||||||

|

Accumulated net realized gains (losses)

from security transactions

|

(4,994,886 | ) | 1,013,932 | 762,123 | ||||||||

|

Net unrealized appreciation on investments

|

45,896,234 | 14,225,589 | 7,819,791 | |||||||||

|

Net assets

|

$ | 184,532,556 | $ | 143,141,731 | $ | 70,827,603 | ||||||

|

Shares of beneficial interest outstanding

(unlimited number of shares authorized,

$0.01 par value)

|

12,177,019 | 11,943,440 | 5,863,035 | |||||||||

|

Net asset value, offering price and redemption

price per share (Note 2)

|

$ | 15.15 | $ | 11.98 | $ | 12.08 | ||||||

See accompanying notes to financial statements.

23

|

THE DAVENPORT FUNDS

STATEMENTS OF OPERATIONS

Six Months Ended September 30, 2012 (Unaudited)

|

|

|

Davenport

Core

Fund

|

Davenport

Value &

Income

Fund

|

Davenport

Equity

Opportunities

Fund

|

|||||||||

|

INVESTMENT INCOME

|

||||||||||||

|

Dividends

|

$ | 1,500,617 | $ | 1,926,470 | $ | 349,511 | ||||||

|

Foreign withholding taxes on dividends

|

(31,322 | ) | (1,503 | ) | (9,635 | ) | ||||||

|

Interest

|

60 | — | — | |||||||||

|

TOTAL INVESTMENT INCOME

|

1,469,355 | 1,924,967 | 339,876 | |||||||||

|

EXPENSES

|

||||||||||||

|

Investment advisory fees (Note 4)

|

653,626 | 430,428 | 236,187 | |||||||||

|

Administration fees (Note 4)

|

117,591 | 80,319 | 48,389 | |||||||||

|

Custodian and bank service fees

|

9,210 | 12,700 | 5,766 | |||||||||

|

Professional fees

|

8,826 | 7,716 | 7,716 | |||||||||

|

Registration and filing fees

|

9,134 | 7,265 | 6,700 | |||||||||

|

Compliance service fees (Note 4)

|

9,479 | 7,259 | 5,421 | |||||||||

|

Printing of shareholder reports

|

7,476 | 5,060 | 3,868 | |||||||||

|

Trustees’ fees and expenses

|

4,102 | 4,102 | 4,102 | |||||||||

|

Insurance expense

|

5,855 | 3,415 | 2,260 | |||||||||

|

Other expenses

|

3,391 | 9,357 | 7,017 | |||||||||

|

TOTAL EXPENSES

|

828,690 | 567,621 | 327,426 | |||||||||

|

NET INVESTMENT INCOME

|

640,665 | 1,357,346 | 12,450 | |||||||||

|

REALIZED AND UNREALIZED

GAINS (LOSSES) ON INVESTMENTS

|

||||||||||||

|

Net realized gains from security transactions

|

3,557,533 | 2,002,998 | 1,246,803 | |||||||||

|

Net change in unrealized appreciation/

depreciation on investments

|

(1,435,826 | ) | 3,617,236 | (189,194 | ) | |||||||

|

NET REALIZED AND UNREALIZED

GAINS ON INVESTMENTS

|

2,121,707 | 5,620,234 | 1,057,609 | |||||||||

|

NET INCREASE IN NET ASSETS

FROM OPERATIONS

|

$ | 2,762,372 | $ | 6,977,580 | $ | 1,070,059 | ||||||

See accompanying notes to financial statements.

24

|

DAVENPORT CORE FUND

STATEMENTS OF CHANGES IN NET ASSETS

|

|

|

Six Months

Ended

September 30,

2012

(Unaudited)

|

Year

Ended

March 31,

2012

|

||||||

|

FROM OPERATIONS

|

||||||||

|

Net investment income

|

$ | 640,665 | $ | 1,034,589 | ||||

|

Net realized gains from security transactions

|

3,557,533 | 2,194,465 | ||||||

|

Net change in unrealized appreciation/

depreciation on investments

|

(1,435,826 | ) | 12,450,152 | |||||

|

Net increase in net assets from operations

|

2,762,372 | 15,679,206 | ||||||

|

DISTRIBUTIONS TO SHAREHOLDERS

|

||||||||

|

From net investment income

|

(646,214 | ) | (1,036,002 | ) | ||||

|

FROM CAPITAL SHARE TRANSACTIONS

|

||||||||

|

Proceeds from shares sold

|

15,903,385 | 17,735,914 | ||||||

|

Net asset value of shares issued in reinvestment

of distributions to shareholders

|

610,875 | 972,757 | ||||||

|

Payments for shares redeemed

|

(8,995,568 | ) | (18,348,617 | ) | ||||

|

Net increase in net assets from capital share transactions

|

7,518,692 | 360,054 | ||||||

|

TOTAL INCREASE IN NET ASSETS

|

9,634,850 | 15,003,258 | ||||||

|

NET ASSETS

|

||||||||

|

Beginning of period

|

174,897,706 | 159,894,448 | ||||||

|

End of period

|

$ | 184,532,556 | $ | 174,897,706 | ||||

|

ACCUMULATED NET INVESTMENT INCOME

|

$ | 14,848 | $ | 20,397 | ||||

|

CAPITAL SHARE ACTIVITY

|

||||||||

|

Shares sold

|

1,091,694 | 1,299,210 | ||||||

|

Shares reinvested

|

41,973 | 73,427 | ||||||

|

Shares redeemed

|

(612,680 | ) | (1,362,591 | ) | ||||

|

Net increase in shares outstanding

|

520,987 | 10,046 | ||||||

|

Shares outstanding at beginning of period

|

11,656,032 | 11,645,986 | ||||||

|

Shares outstanding at end of period

|

12,177,019 | 11,656,032 | ||||||

See accompanying notes to financial statements.

25

|

DAVENPORT VALUE & INCOME FUND

STATEMENTS OF CHANGES IN NET ASSETS

|

|

|

Six Months

Ended

September 30,

2012

(Unaudited)

|

Year

Ended

March 31,

2012

|

||||||

|

FROM OPERATIONS

|

||||||||

|

Net investment income

|

$ | 1,357,346 | $ | 1,533,671 | ||||

|

Net realized gains (losses) from security transactions

|

2,002,998 | (989,066 | ) | |||||

|

Net change in unrealized appreciation/

depreciation on investments

|

3,617,236 | 9,378,913 | ||||||

|

Net increase in net assets from operations

|

6,977,580 | 9,923,518 | ||||||

|

DISTRIBUTIONS TO SHAREHOLDERS

|

||||||||

|

From net investment income

|

(1,358,204 | ) | (1,522,098 | ) | ||||

|

From net realized gains from security transactions

|

— | (71,734 | ) | |||||

|

Decrease in net assets from distributions to shareholders

|

(1,358,204 | ) | (1,593,832 | ) | ||||

|

FROM CAPITAL SHARE TRANSACTIONS

|

||||||||

|

Proceeds from shares sold

|

44,499,551 | 44,865,899 | ||||||

|

Net asset value of shares issued in reinvestment

of distributions to shareholders

|

1,185,785 | 1,359,339 | ||||||

|

Payments for shares redeemed

|

(6,920,388 | ) | (4,628,047 | ) | ||||

|

Net increase in net assets from capital share transactions

|

38,764,948 | 41,597,191 | ||||||

|

TOTAL INCREASE IN NET ASSETS

|

44,384,324 | 49,926,877 | ||||||

|

NET ASSETS

|

||||||||

|

Beginning of period

|

98,757,407 | 48,830,530 | ||||||

|

End of period

|

$ | 143,141,731 | $ | 98,757,407 | ||||

|

ACCUMULATED NET INVESTMENT INCOME

|

$ | 19,745 | $ | 20,603 | ||||

|

CAPITAL SHARE ACTIVITY

|

||||||||

|

Shares sold

|

3,862,417 | 4,240,900 | ||||||

|

Shares reinvested

|

101,390 | 130,856 | ||||||

|

Shares redeemed

|

(599,226 | ) | (444,451 | ) | ||||

|

Net increase in shares outstanding

|

3,364,581 | 3,927,305 | ||||||

|

Shares outstanding at beginning of period

|

8,578,859 | 4,651,554 | ||||||

|

Shares outstanding at end of period

|

11,943,440 | 8,578,859 | ||||||

See accompanying notes to financial statements.

26

|

DAVENPORT EQUITY OPPORTUNITIES FUND

STATEMENTS OF CHANGES IN NET ASSETS

|

|

|

Six Months

Ended

September 30,

2012

(Unaudited)

|

Year

Ended

March 31,

2012

|

||||||

|

FROM OPERATIONS

|

||||||||

|

Net investment income (loss)

|

$ | 12,450 | $ | (99,423 | ) | |||

|

Net realized gains (losses) from security transactions

|

1,246,803 | (469,701 | ) | |||||

|

Net change in unrealized appreciation/

depreciation on investments

|

(189,194 | ) | 6,678,341 | |||||

|

Net increase in net assets from operations

|

1,070,059 | 6,109,217 | ||||||

|

DISTRIBUTIONS TO SHAREHOLDERS

|

||||||||

|

From net realized gains from security transactions

|

— | (163,030 | ) | |||||

|

FROM CAPITAL SHARE TRANSACTIONS

|

||||||||

|

Proceeds from shares sold

|

12,829,396 | 23,587,122 | ||||||

|

Net asset value of shares issued in reinvestment

of distributions to shareholders

|

— | 157,487 | ||||||

|

Payments for shares redeemed

|

(2,206,543 | ) | (4,931,526 | ) | ||||

|

Net increase in net assets from capital share transactions

|

10,622,853 | 18,813,083 | ||||||

|

TOTAL INCREASE IN NET ASSETS

|

11,692,912 | 24,759,270 | ||||||

|

NET ASSETS

|

||||||||

|

Beginning of period

|

59,134,691 | 34,375,421 | ||||||

|

End of period

|

$ | 70,827,603 | $ | 59,134,691 | ||||

|

ACCUMULATED NET INVESTMENT INCOME

|

$ | 12,450 | $ | — | ||||

|

CAPITAL SHARE ACTIVITY

|

||||||||

|

Shares sold

|

1,108,162 | 2,186,580 | ||||||

|

Shares reinvested

|

— | 15,593 | ||||||

|

Shares redeemed

|

(190,183 | ) | (464,812 | ) | ||||

|

Net increase in shares outstanding

|

917,979 | 1,737,361 | ||||||

|

Shares outstanding at beginning of period

|

4,945,056 | 3,207,695 | ||||||

|

Shares outstanding at end of period

|

5,863,035 | 4,945,056 | ||||||

See accompanying notes to financial statements.

27

|

DAVENPORT CORE FUND

FINANCIAL HIGHLIGHTS

|

|

Selected Per Share Data and Ratios for a Share Outstanding Throughout Each Period

|

||||||||||||||||||||||||

|

Six Months

Ended

Sept. 30,

2012

(Unaudited)

|

Years Ended March 31,

|

|||||||||||||||||||||||

|

|

2012 | 2011 | 2010 | 2009 | 2008 | |||||||||||||||||||

|

Net asset value at

beginning of period

|

$ | 15.00 | $ | 13.73 | $ | 12.05 | $ | 8.36 | $ | 13.82 | $ | 14.75 | ||||||||||||

|

Income (loss) from

investment operations:

|

||||||||||||||||||||||||

|

Net investment income

|

0.05 | 0.09 | 0.07 | 0.08 | 0.11 | 0.10 | ||||||||||||||||||

|

Net realized and unrealized gains

(losses) on investments

|

0.15 | 1.27 | 1.68 | 3.69 | (5.17 | ) | 0.53 | |||||||||||||||||

|

Total from investment operations

|

0.20 | 1.36 | 1.75 | 3.77 | (5.06 | ) | 0.63 | |||||||||||||||||

|

Less distributions:

|

||||||||||||||||||||||||

|

Dividends from net

investment income

|

(0.05 | ) | (0.09 | ) | (0.07 | ) | (0.08 | ) | (0.11 | ) | (0.10 | ) | ||||||||||||

|

Distributions from net

realized gains

|

— | — | — | — | (0.29 | ) | (1.46 | ) | ||||||||||||||||

|

Total distributions

|

(0.05 | ) | (0.09 | ) | (0.07 | ) | (0.08 | ) | (0.40 | ) | (1.56 | ) | ||||||||||||

|

Net asset value at end of period

|

$ | 15.15 | $ | 15.00 | $ | 13.73 | $ | 12.05 | $ | 8.36 | $ | 13.82 | ||||||||||||

|

Total return (a)

|

1.37% | (b) | 9.99% | 14.61% | 45.20% | (36.85% | ) | 3.44% | ||||||||||||||||

|

Net assets at end of period (000’s)

|

$ | 184,533 | $ | 174,898 | $ | 159,894 | $ | 132,662 | $ | 92,358 | $ | 155,799 | ||||||||||||

|

Ratio of total expenses to

average net assets

|

0.95% | (c) | 0.96% | 0.99% | 1.00% | 1.00% | 0.96% | |||||||||||||||||

|

Ratio of net investment income

to average net assets

|

0.73% | (c) | 0.66% | 0.58% | 0.75% | 0.98% | 0.60% | |||||||||||||||||

|

Portfolio turnover rate

|

12% | (b) | 19% | 34% | 25% | 39% | 37% | |||||||||||||||||

|

(a)

|

Total return is a measure of the change in value of an investment in the Fund over the periods covered, which assumes any dividends or capital gains distributions are reinvested in shares of the Fund. Returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares.

|

|

(b)

|

Not annualized.

|

|

(c)

|

Annualized.

|

See accompanying notes to financial statements.

28

|

DAVENPORT VALUE & INCOME FUND

FINANCIAL HIGHLIGHTS

|

|

Selected Per Share Data and Ratios for a Share Outstanding Throughout Each Period

|

||||||||||||

|

|

Six Months

Ended

Sept. 30,

2012

(Unaudited)

|

Year

Ended

March 31,

2012

|

Period

Ended

March 31,

2011 (a)

|

|||||||||

|

Net asset value at beginning of period

|

$ | 11.51 | $ | 10.50 | $ | 10.00 | ||||||

|

Income from investment operations:

|

||||||||||||

|

Net investment income

|

0.13 | 0.23 | 0.04 | |||||||||

|

Net realized and unrealized gains on investments

|

0.47 | 1.02 | 0.49 | |||||||||

|

Total from investment operations

|

0.60 | 1.25 | 0.53 | |||||||||

|

Less distributions:

|

||||||||||||

|

Dividends from net investment income

|

(0.13 | ) | (0.23 | ) | (0.03 | ) | ||||||

|

Distributions from net realized gains

|

— | (0.01 | ) | — | ||||||||

|

Total distributions

|

(0.13 | ) | (0.24 | ) | (0.03 | ) | ||||||

|

Net asset value at end of period

|

$ | 11.98 | $ | 11.51 | $ | 10.50 | ||||||

|

Total return (b)

|

5.23% | (c) | 12.23% | 5.35% | (c) | |||||||

|

Net assets at end of period (000’s)

|

$ | 143,142 | $ | 98,757 | $ | 48,831 | ||||||

|

Ratio of total expenses to average net assets

|

0.99% | (d) | 1.04% | 1.25% | (d) | |||||||

|

Ratio of net investment income to average net assets

|

2.36% | (d) | 2.30% | 1.99% | (d) | |||||||

|

Portfolio turnover rate

|

11% | (c) | 27% | 10% | (c) | |||||||

|

(a)

|

Represents the period from commencement of operations (December 31, 2010) through March 31, 2011.

|

|

(b)

|

Total return is a measure of the change in value of an investment in the Fund over the periods covered, which assumes any dividends or capital gains distributions are reinvested in shares of the Fund. Returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares.

|

|

(c)

|

Not annualized.

|

|

(d)

|

Annualized.

|

See accompanying notes to financial statements.

29

|

DAVENPORT EQUITY OPPORTUNITIES FUND

FINANCIAL HIGHLIGHTS

|

|

Selected Per Share Data and Ratios for a Share Outstanding Throughout Each Period

|

||||||||||||

|

|

Six Months

Ended

Sept. 30,

2012

(Unaudited)

|

Year

Ended

March 31,

2012

|

Period

Ended

March 31,

2011 (a)

|

|||||||||

|

Net asset value at beginning of period

|

$ | 11.96 | $ | 10.72 | $ | 10.00 | ||||||

|

Income (loss) from investment operations:

|

||||||||||||

|

Net investment income (loss)

|

0.00 | (b) | (0.02 | ) | (0.01 | ) | ||||||

|

Net realized and unrealized gains on investments

|

0.12 | 1.30 | 0.73 | |||||||||

|

Total from investment operations

|

0.12 | 1.28 | 0.72 | |||||||||

|

Less distributions:

|

||||||||||||

|

Distributions from net realized gains

|

— | (0.04 | ) | — | ||||||||

|

Net asset value at end of period

|

$ | 12.08 | $ | 11.96 | $ | 10.72 | ||||||

|

Total return (c)

|

1.00% | (d) | 12.00% | 7.20% | (d) | |||||||

|

Net assets at end of period (000’s)

|

$ | 70,828 | $ | 59,135 | $ | 34,375 | ||||||

|

Ratio of total expenses to average net assets

|

1.04% | (e) | 1.10% | 1.25% | (e) | |||||||

|

Ratio of net investment income (loss) to average net assets

|

0.04% | (e) | (0.22% | ) | (0.40% | )(e) | ||||||

|

Portfolio turnover rate

|

16% | (d) | 35% | 6% | (d) | |||||||

|

(a)

|

Represents the period from commencement of operations (December 31, 2010) through March 31, 2011.

|

|

(b)

|

Amount rounds to less than a penny per share.

|

|

(c)

|

Total return is a measure of the change in value of an investment in the Fund over the periods covered, which assumes any dividends or capital gains distributions are reinvested in shares of the Fund. Returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares.

|

|

(d)

|

Not annualized.

|

|

(e)

|

Annualized.

|

See accompanying notes to financial statements.

30

|

THE DAVENPORT FUNDS

NOTES TO FINANCIAL STATEMENTS

September 30, 2012 (Unaudited)

|

1. Organization

Davenport Core Fund, Davenport Value & Income Fund and Davenport Equity Opportunities Fund (individually, a “Fund,” and, collectively, the “Funds”) are each a no-load, diversified series of the Williamsburg Investment Trust (the “Trust”), an open-end management investment company registered under the Investment Company Act of 1940. The Trust was organized as a Massachusetts business trust on July 18, 1988. Other series of the Trust are not incorporated in this report. Davenport Core Fund began operations on January 15, 1998. Davenport Value & Income Fund and Davenport Equity Opportunities Fund each began operations on December 31, 2010.

Davenport Core Fund’s investment objective is long term growth of capital.

Davenport Value & Income Fund’s investment objective is to achieve long term growth while generating current income through dividend payments on portfolio securities.

Davenport Equity Opportunities Fund’s investment objective is long term capital appreciation.

2. Significant Accounting Policies

The following is a summary of the Funds’ significant accounting policies. The policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”).

Securities valuation — The Funds’ portfolio securities are valued as of the close of business of the regular session of the New York Stock Exchange (normally 4:00 p.m., Eastern time). Securities traded on a national stock exchange are valued based upon the closing price on the principal exchange where the security is traded. Securities which are quoted by NASDAQ are valued at the NASDAQ Official Closing Price. Securities which are traded over-the-counter are valued at the last sales price, if available, otherwise, at the last quoted bid price. Fixed income securities will ordinarily be traded in the over-the-counter market and common stocks will ordinarily be traded on a national securities exchange, but may also be traded in the over-the-counter market.