|

SELECTED FUNDS

|

Table of Contents

|

|

2

|

|

|

Management's Discussion of Fund Performance:

|

|

|

3

|

|

|

5

|

|

|

Fund Overview:

|

|

|

7

|

|

|

8

|

|

|

|

9

|

|

Schedule of Investments:

|

|

|

10

|

|

|

13

|

|

|

|

16

|

|

|

17

|

|

|

18

|

|

|

20

|

|

|

29

|

|

|

31

|

|

|

34

|

|

|

35

|

|

SELECTED FUNDS

|

|

|

|

|

James J. McMonagle

|

Christopher C. Davis

|

Danton G. Goei

|

|

Chairman

|

President & Portfolio Manager

|

Portfolio Manager

|

|

August 6, 2018

|

|

SELECTED FUNDS

|

|

|

SELECTED AMERICAN SHARES, INC.

|

|

1

|

The companies included in the Standard & Poor's 500® Index are divided into eleven sectors. One or more industry groups make up a sector. For purposes of measuring concentration, the Fund generally classifies companies at the industry group or industry level. See the SAI for additional information regarding the Fund's concentration policy.

|

|

2

|

A company's or sector's contribution to or detraction from the Fund's performance is a product both of its appreciation or depreciation and its weighting within the Fund. For example, a 5% holding that rises 20% has twice as much impact as a 1% holding that rises 50%.

|

|

3

|

This Management Discussion of Fund Performance discusses a number of individual companies. The information provided in this report does not provide information reasonably sufficient upon which to base an investment decision and should not be considered a recommendation to purchase, sell, or hold any particular security. The Schedule of Investments lists the Fund's holdings of each company discussed.

|

|

SELECTED FUNDS

|

Management's Discussion of Fund Performance

|

|

SELECTED AMERICAN SHARES, INC. – (CONTINUED)

|

|

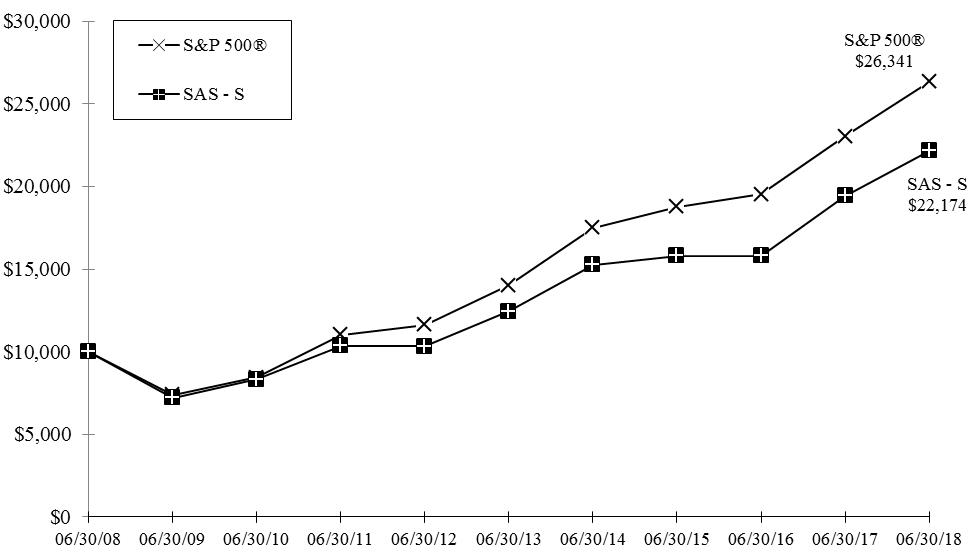

Fund & Benchmark Index

|

1-Year

|

5-Year

|

10-Year

|

Since Class D's

Inception

(May 3, 2004)

|

Gross

Expense

Ratio

|

Net

Expense

Ratio

|

|

Class S

|

14.11%

|

12.24%

|

8.28%

|

N/A

|

0.97%

|

0.97%

|

|

Class D

|

14.48%

|

12.61%

|

8.65%

|

8.01%

|

0.65%

|

0.65%

|

|

Standard & Poor's 500® Index

|

14.37%

|

13.42%

|

10.17%

|

8.71%

|

|

SELECTED FUNDS

|

|

|

SELECTED INTERNATIONAL FUND, INC.

|

|

1

|

The companies included in the Morgan Stanley Capital International All Country World Index ex USA are divided into eleven sectors. One or more industry groups make up a sector. For purposes of measuring concentration, the Fund generally classifies companies at the industry group or industry level. See the SAI for additional information regarding the Fund's concentration policy.

|

|

2

|

A company's or sector's contribution to or detraction from the Fund's performance is a product both of its appreciation or depreciation and its weighting within the Fund. For example, a 5% holding that rises 20% has twice as much impact as a 1% holding that rises 50%.

|

|

3

|

This Management Discussion of Fund Performance discusses a number of individual companies. The information provided in this report does not provide information reasonably sufficient upon which to base an investment decision and should not be considered a recommendation to purchase, sell, or hold any particular security. The Schedule of Investments lists the Fund's holdings of each company discussed.

|

|

SELECTED FUNDS

|

Management's Discussion of Fund Performance

|

|

SELECTED INTERNATIONAL FUND, INC. – (CONTINUED)

|

|

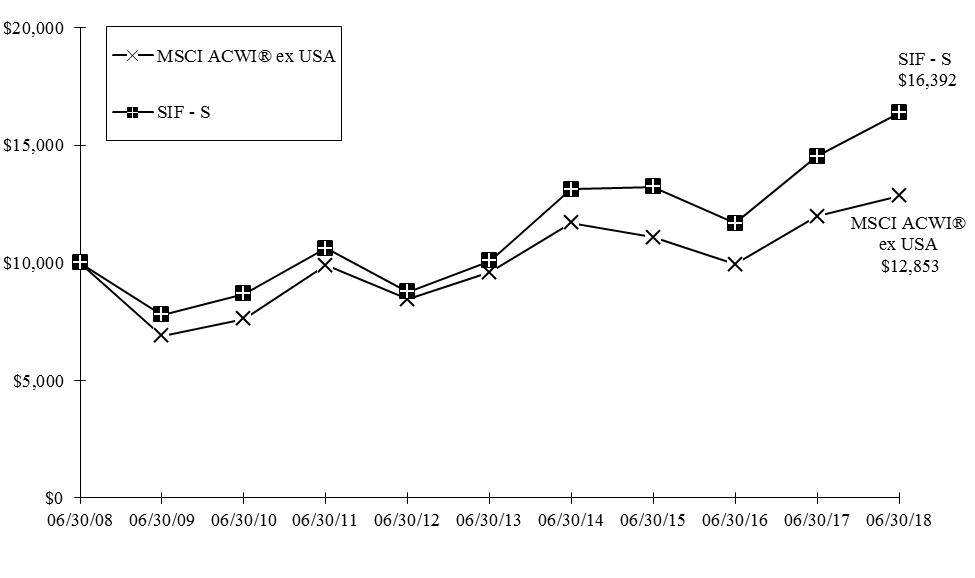

Fund & Benchmark Index

|

1-Year

|

5-Year

|

10-Year

|

Since Class D's

Inception

(May 3, 2004)

|

Gross

Expense

Ratio

|

Net

Expense

Ratio

|

|

Class S

|

12.82%

|

10.19%

|

5.07%

|

N/A

|

1.25%

|

1.25%

|

|

Class D

|

13.28%

|

10.66%

|

5.59%

|

4.98%

|

0.85%

|

0.85%

|

|

MSCI ACWI® ex USA

|

7.28%

|

5.99%

|

2.54%

|

6.28%

|

|

SELECTED FUNDS

|

|

|

SELECTED AMERICAN SHARES, INC.

|

June 30, 2018 (Unaudited)

|

|

Portfolio Composition

|

Industry Weightings

|

|||||

|

(% of Fund's 06/30/18 Net Assets)

|

(% of 06/30/18 Stock Holdings)

|

|||||

|

Fund

|

S&P 500®

|

|||||

|

Common Stock (U.S.)

|

78.53%

|

Information Technology

|

20.27%

|

25.96%

|

||

|

Common Stock (Foreign)

|

17.84%

|

Diversified Financials

|

18.25%

|

5.32%

|

||

|

Preferred Stock (Foreign)

|

2.97%

|

Banks

|

13.24%

|

6.14%

|

||

|

Short-Term Investments

|

0.47%

|

Capital Goods

|

12.95%

|

6.82%

|

||

|

Other Assets & Liabilities

|

0.19%

|

Retailing

|

10.16%

|

7.15%

|

||

|

100.00%

|

Energy

|

9.23%

|

6.34%

|

|||

|

Health Care

|

3.69%

|

14.08%

|

||||

|

Media

|

2.82%

|

2.26%

|

||||

|

Materials

|

2.80%

|

2.61%

|

||||

|

Insurance

|

2.40%

|

2.39%

|

||||

|

Automobiles & Components

|

1.96%

|

0.60%

|

||||

|

Consumer Services

|

1.75%

|

1.66%

|

||||

|

Consumer Durables & Apparel

|

0.48%

|

1.25%

|

||||

|

Food, Beverage & Tobacco

|

–

|

3.91%

|

||||

|

Utilities

|

–

|

2.95%

|

||||

|

Other

|

–

|

10.56%

|

||||

|

100.00%

|

100.00%

|

|||||

|

Top 10 Long-Term Holdings

|

|||||

|

(% of Fund's 06/30/18 Net Assets)

|

|||||

|

Alphabet Inc.*

|

Software & Services

|

8.76%

|

|||

|

Amazon.com, Inc.

|

Retailing

|

5.83%

|

|||

|

Wells Fargo & Co.

|

Banks

|

5.61%

|

|||

|

Berkshire Hathaway Inc., Class A

|

Diversified Financial Services

|

5.50%

|

|||

|

JPMorgan Chase & Co.

|

Banks

|

5.12%

|

|||

|

Bank of New York Mellon Corp.

|

Capital Markets

|

4.77%

|

|||

|

Apache Corp.

|

Energy

|

4.72%

|

|||

|

Capital One Financial Corp.

|

Consumer Finance

|

4.54%

|

|||

|

United Technologies Corp.

|

Capital Goods

|

4.19%

|

|||

|

Facebook, Inc., Class A

|

Software & Services

|

4.08%

|

|||

|

SELECTED FUNDS

|

|

|

SELECTED INTERNATIONAL FUND, INC.

|

June 30, 2018 (Unaudited)

|

|

Portfolio Composition

|

Industry Weightings

|

|||||

|

(% of Fund's 06/30/18 Net Assets)

|

(% of 06/30/18 Stock Holdings)

|

|||||

|

Fund

|

MSCI ACWI® EX USA

|

|||||

|

Common Stock (Foreign)

|

89.39%

|

Information Technology

|

18.86%

|

11.92%

|

||

|

Preferred Stock (Foreign)

|

8.69%

|

Capital Goods

|

15.46%

|

7.87%

|

||

|

Short-Term Investments

|

1.37%

|

Retailing

|

15.10%

|

1.52%

|

||

|

Other Assets & Liabilities

|

0.55%

|

Banks

|

8.70%

|

13.71%

|

||

|

100.00%

|

Media

|

7.76%

|

1.48%

|

|||

|

Consumer Services

|

7.45%

|

1.47%

|

||||

|

Energy

|

5.88%

|

7.43%

|

||||

|

Diversified Financials

|

5.10%

|

3.18%

|

||||

|

Materials

|

5.02%

|

8.19%

|

||||

|

Transportation

|

4.57%

|

2.53%

|

||||

|

Insurance

|

2.54%

|

5.01%

|

||||

|

Health Care

|

1.95%

|

8.12%

|

||||

|

Consumer Durables & Apparel

|

1.61%

|

2.83%

|

||||

|

Food, Beverage & Tobacco

|

–

|

5.46%

|

||||

|

Automobiles & Components

|

–

|

3.94%

|

||||

|

Telecommunication Services

|

–

|

3.70%

|

||||

|

Other

|

–

|

11.64%

|

||||

|

100.00%

|

100.00%

|

|||||

|

Country Diversification

|

Top 10 Long-Term Holdings

|

|||

|

(% of 06/30/18 Stock Holdings)

|

(% of Fund's 06/30/18 Net Assets)

|

|||

|

China

|

45.00%

|

Naspers Ltd. - N

|

7.61%

|

|

|

United Kingdom

|

8.86%

|

Alibaba Group Holding Ltd., ADR

|

6.67%

|

|

|

South Africa

|

7.76%

|

Didi Chuxing Joint Co., Series A, Pfd.

|

6.12%

|

|

|

France

|

7.61%

|

Hollysys Automation Technologies Ltd.

|

5.93%

|

|

|

Canada

|

5.89%

|

Ferguson PLC

|

5.80%

|

|

|

Singapore

|

4.85%

|

New Oriental Education & Technology Group, Inc., ADR

|

5.63%

|

|

|

Switzerland

|

4.28%

|

JD.com Inc., Class A, ADR

|

4.71%

|

|

|

Germany

|

3.27%

|

Safran S.A.

|

4.34%

|

|

|

India

|

3.02%

|

Encana Corp.

|

4.28%

|

|

|

Bermuda

|

3.01%

|

DBS Group Holdings Ltd.

|

3.32%

|

|

|

Brazil

|

2.54%

|

|||

|

Norway

|

2.30%

|

|||

|

Netherlands

|

1.61%

|

|||

|

100.00%

|

||||

|

Beginning

|

Ending

|

Expenses Paid

|

|

|

Account Value

|

Account Value

|

During Period*

|

|

|

(01/01/18)

|

(06/30/18)

|

(01/01/18-06/30/18)

|

|

|

Selected American Shares

|

|||

|

Class S (annualized expense ratio 0.97%**)

|

|||

|

Actual

|

$1,000.00

|

$1,019.03

|

$4.86

|

|

Hypothetical

|

$1,000.00

|

$1,019.98

|

$4.86

|

|

Class D (annualized expense ratio 0.65%**)

|

|||

|

Actual

|

$1,000.00

|

$1,020.66

|

$3.26

|

|

Hypothetical

|

$1,000.00

|

$1,021.57

|

$3.26

|

|

Selected International Fund

|

|||

|

Class S (annualized expense ratio 1.25%**)

|

|||

|

Actual

|

$1,000.00

|

$989.61

|

$6.17

|

|

Hypothetical

|

$1,000.00

|

$1,018.60

|

$6.26

|

|

Class D (annualized expense ratio 0.85%**)

|

|||

|

Actual

|

$1,000.00

|

$991.05

|

$4.20

|

|

Hypothetical

|

$1,000.00

|

$1,020.58

|

$4.26

|

|

Hypothetical assumes 5% annual return before expenses.

|

|

*Expenses are equal to each Class's annualized operating expense ratio, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period).

|

|

**The expense ratios reflect the impact, if any, of certain reimbursements from the Adviser.

|

|

Shares

|

Value

(Note 1) |

|||||||||||

|

COMMON STOCK – (96.37%)

|

||||||||||||

|

CONSUMER DISCRETIONARY – (14.10%)

|

||||||||||||

|

Automobiles & Components – (1.95%)

|

||||||||||||

|

Adient PLC

|

860,345

|

$

|

42,320,370

|

|||||||||

|

Consumer Durables & Apparel – (0.48%)

|

||||||||||||

|

Hunter Douglas N.V. (Netherlands)

|

141,546

|

10,413,737

|

||||||||||

|

Consumer Services – (1.75%)

|

||||||||||||

|

New Oriental Education & Technology Group, Inc., ADR (China)

|

400,300

|

37,892,398

|

||||||||||

|

Media – (2.80%)

|

||||||||||||

|

GCI Liberty, Inc. *

|

73,536

|

3,315,003

|

||||||||||

|

Liberty Global PLC, Series C *

|

617,480

|

16,431,143

|

||||||||||

|

Liberty Latin America Ltd., Class C *

|

156,049

|

3,024,230

|

||||||||||

|

Naspers Ltd. - N (South Africa)

|

149,989

|

38,105,461

|

||||||||||

|

60,875,837

|

||||||||||||

|

Retailing – (7.12%)

|

||||||||||||

|

Amazon.com, Inc. *

|

74,516

|

126,662,297

|

||||||||||

|

Booking Holdings Inc. *

|

9,742

|

19,747,911

|

||||||||||

|

Liberty Expedia Holdings, Inc., Series A *

|

49,080

|

2,156,575

|

||||||||||

|

Liberty TripAdvisor Holdings Inc., Series A *

|

68,033

|

1,095,331

|

||||||||||

|

Qurate Retail, Inc. Series A*

|

240,125

|

5,095,453

|

||||||||||

|

154,757,567

|

||||||||||||

|

Total Consumer Discretionary

|

306,259,909

|

|||||||||||

|

ENERGY – (9.17%)

|

||||||||||||

|

Apache Corp.

|

2,194,967

|

102,614,707

|

||||||||||

|

Cabot Oil & Gas Corp.

|

400,442

|

9,530,520

|

||||||||||

|

Encana Corp. (Canada)

|

4,624,823

|

60,353,940

|

||||||||||

|

Occidental Petroleum Corp.

|

319,300

|

26,719,024

|

||||||||||

|

Total Energy

|

199,218,191

|

|||||||||||

|

FINANCIALS – (33.66%)

|

||||||||||||

|

Banks – (13.15%)

|

||||||||||||

|

DBS Group Holdings Ltd. (Singapore)

|

1,019,500

|

19,911,116

|

||||||||||

|

JPMorgan Chase & Co.

|

1,066,836

|

111,164,311

|

||||||||||

|

U.S. Bancorp

|

652,630

|

32,644,552

|

||||||||||

|

Wells Fargo & Co.

|

2,199,620

|

121,946,933

|

||||||||||

|

285,666,912

|

||||||||||||

|

Diversified Financials – (18.13%)

|

||||||||||||

|

Capital Markets – (4.77%)

|

||||||||||||

|

Bank of New York Mellon Corp.

|

1,922,355

|

103,672,605

|

||||||||||

|

Consumer Finance – (7.86%)

|

||||||||||||

|

American Express Co.

|

734,548

|

71,985,704

|

||||||||||

|

Capital One Financial Corp.

|

1,073,525

|

98,656,948

|

||||||||||

|

170,642,652

|

||||||||||||

|

Diversified Financial Services – (5.50%)

|

||||||||||||

|

Berkshire Hathaway Inc., Class A *

|

424

|

119,584,964

|

||||||||||

|

393,900,221

|

||||||||||||

|

Insurance – (2.38%)

|

||||||||||||

|

Multi-line Insurance – (0.93%)

|

||||||||||||

|

Loews Corp.

|

417,964

|

20,179,302

|

||||||||||

|

SELECTED FUNDS

|

Schedule of Investments

|

|

SELECTED AMERICAN SHARES, INC. - (CONTINUED)

|

June 30, 2018 (Unaudited)

|

|

Shares/Units

|

Value

(Note 1) |

||||||||||||

|

COMMON STOCK – (CONTINUED)

|

|||||||||||||

|

FINANCIALS – (CONTINUED)

|

|||||||||||||

|

Insurance – (Continued)

|

|||||||||||||

|

Property & Casualty Insurance – (1.45%)

|

|||||||||||||

|

Chubb Ltd.

|

170,801

|

$

|

21,695,143

|

||||||||||

|

Markel Corp. *

|

9,108

|

9,876,260

|

|||||||||||

|

31,571,403

|

|||||||||||||

|

51,750,705

|

|||||||||||||

|

Total Financials

|

731,317,838

|

||||||||||||

|

HEALTH CARE – (3.66%)

|

|||||||||||||

|

Health Care Equipment & Services – (3.66%)

|

|||||||||||||

|

Aetna Inc.

|

433,747

|

79,592,574

|

|||||||||||

|

Total Health Care

|

79,592,574

|

||||||||||||

|

INDUSTRIALS – (12.86%)

|

|||||||||||||

|

Capital Goods – (12.86%)

|

|||||||||||||

|

Ferguson PLC (United Kingdom)

|

576,190

|

46,766,262

|

|||||||||||

|

Johnson Controls International PLC

|

2,446,972

|

81,851,213

|

|||||||||||

|

Orascom Construction Ltd. (United Arab Emirates)

|

576,605

|

4,526,349

|

|||||||||||

|

Safran S.A. (France)

|

455,224

|

55,314,082

|

|||||||||||

|

United Technologies Corp.

|

727,190

|

90,920,566

|

|||||||||||

|

Total Industrials

|

279,378,472

|

||||||||||||

|

INFORMATION TECHNOLOGY – (20.14%)

|

|||||||||||||

|

Semiconductors & Semiconductor Equipment – (2.70%)

|

|||||||||||||

|

Texas Instruments Inc.

|

531,083

|

58,551,901

|

|||||||||||

|

Software & Services – (17.44%)

|

|||||||||||||

|

Alibaba Group Holding Ltd., ADR (China)*

|

290,277

|

53,855,092

|

|||||||||||

|

Alphabet Inc., Class A *

|

67,734

|

76,484,555

|

|||||||||||

|

Alphabet Inc., Class C *

|

102,010

|

113,807,457

|

|||||||||||

|

ASAC II L.P. *(a)(b)

|

1,174,606

|

1,147,002

|

|||||||||||

|

Facebook, Inc., Class A *

|

456,318

|

88,671,714

|

|||||||||||

|

Microsoft Corp.

|

312,280

|

30,793,931

|

|||||||||||

|

Oracle Corp.

|

322,735

|

14,219,704

|

|||||||||||

|

378,979,455

|

|||||||||||||

|

Total Information Technology

|

437,531,356

|

||||||||||||

|

MATERIALS – (2.78%)

|

|||||||||||||

|

LafargeHolcim Ltd. (Switzerland)

|

776,789

|

37,673,284

|

|||||||||||

|

OCI N.V. (Netherlands)*

|

839,580

|

22,678,075

|

|||||||||||

|

Total Materials

|

60,351,359

|

||||||||||||

|

TOTAL COMMON STOCK – (Identified cost $1,292,323,824)

|

2,093,649,699

|

||||||||||||

|

PREFERRED STOCK – (2.97%)

|

|||||||||||||

|

CONSUMER DISCRETIONARY – (2.97%)

|

|||||||||||||

|

Retailing – (2.97%)

|

|||||||||||||

|

Didi Chuxing Joint Co., Series A (China)*(a)(b)

|

1,161,716

|

55,245,753

|

|||||||||||

|

Didi Chuxing Joint Co., Series B (China)*(a)(b)

|

195,204

|

9,282,985

|

|||||||||||

|

Total Consumer Discretionary

|

64,528,738

|

||||||||||||

|

TOTAL PREFERRED STOCK – (Identified cost $42,180,624)

|

64,528,738

|

||||||||||||

|

SELECTED FUNDS

|

Schedule of Investments

|

|

SELECTED AMERICAN SHARES, INC. - (CONTINUED)

|

June 30, 2018 (Unaudited)

|

|

Principal

|

Value

(Note 1) |

||||||||||

|

SHORT-TERM INVESTMENTS – (0.47%)

|

|||||||||||

|

INTL FCStone Financial Inc. Joint Repurchase Agreement, 2.12%,

07/02/18, dated 06/29/18, repurchase value of $3,248,574 (collateralized

by: U.S. Government agency mortgages and obligation in a pooled cash

account, 2.00%-10.00%, 08/01/18-07/01/48, total market value

$3,312,960)

|

$

|

3,248,000

|

$

|

3,248,000

|

|||||||

|

Mizuho Securities USA Inc. Joint Repurchase Agreement, 2.10%,

07/02/18, dated 06/29/18, repurchase value of $1,107,194 (collateralized

by: U.S. Government agency mortgages in a pooled cash account,

3.379%-5.00%, 04/01/27-02/01/48, total market value $1,129,140)

|

1,107,000

|

1,107,000

|

|||||||||

|

Nomura Securities International, Inc. Joint Repurchase Agreement,

2.12%, 07/02/18, dated 06/29/18, repurchase value of $1,949,344

(collateralized by: U.S. Government agency obligations in a pooled cash

account, 0.00%, 11/01/18-12/06/18, total market value $1,987,980)

|

1,949,000

|

1,949,000

|

|||||||||

|

SunTrust Robinson Humphrey, Inc. Joint Repurchase Agreement,

2.11%, 07/02/18, dated 06/29/18, repurchase value of $3,897,685

(collateralized by: U.S. Government agency mortgages in a pooled cash

account, 2.50%-5.50%, 12/01/24-08/01/47, total market value

$3,974,940)

|

3,897,000

|

3,897,000

|

|||||||||

|

TOTAL SHORT-TERM INVESTMENTS – (Identified cost $10,201,000)

|

10,201,000

|

||||||||||

|

Total Investments – (99.81%) – (Identified cost $1,344,705,448)

|

2,168,379,437

|

||||||||||

|

Other Assets Less Liabilities – (0.19%)

|

4,151,267

|

||||||||||

|

Net Assets – (100.00%)

|

$

|

2,172,530,704

|

|||||||||

|

ADR: American Depositary Receipt

|

|||||||||||

|

*

|

Non-income producing security.

|

||||||||||

|

(a)

|

Restricted Security – See Note 7 of the Notes to Financial Statements.

|

||||||||||

|

(b)

|

The value of this security was determined using significant unobservable inputs. See Note 1 of the Notes to Financial Statements.

|

||||||||||

|

See Notes to Financial Statements

|

|||||||||||

|

SELECTED FUNDS

|

|

|

SELECTED INTERNATIONAL FUND, INC.

|

June 30, 2018 (Unaudited)

|

|

Shares/Units

|

Value

(Note 1) |

|||||||||||

|

COMMON STOCK – (89.39%)

|

||||||||||||

|

CONSUMER DISCRETIONARY – (22.61%)

|

||||||||||||

|

Consumer Durables & Apparel – (1.57%)

|

||||||||||||

|

Hunter Douglas N.V. (Netherlands)

|

17,712

|

$

|

1,303,097

|

|||||||||

|

Consumer Services – (7.30%)

|

||||||||||||

|

New Oriental Education & Technology Group, Inc., ADR (China)

|

49,226

|

4,659,733

|

||||||||||

|

Tarena International, Inc., Class A, ADR (China)

|

182,630

|

1,382,509

|

||||||||||

|

6,042,242

|

||||||||||||

|

Media – (7.61%)

|

||||||||||||

|

Naspers Ltd. - N (South Africa)

|

24,784

|

6,296,500

|

||||||||||

|

Retailing – (6.13%)

|

||||||||||||

|

Ctrip.com International, Ltd., ADR (China)*

|

24,687

|

1,175,842

|

||||||||||

|

JD.com Inc., Class A, ADR (China)*

|

99,965

|

3,893,637

|

||||||||||

|

5,069,479

|

||||||||||||

|

Total Consumer Discretionary

|

18,711,318

|

|||||||||||

|

ENERGY – (5.77%)

|

||||||||||||

|

Encana Corp. (Canada)

|

271,545

|

3,543,662

|

||||||||||

|

Paramount Resources Ltd., Class A (Canada)*

|

56,450

|

639,364

|

||||||||||

|

Seven Generations Energy Ltd., Class A (Canada)*

|

53,800

|

592,981

|

||||||||||

|

Total Energy

|

4,776,007

|

|||||||||||

|

FINANCIALS – (16.03%)

|

||||||||||||

|

Banks – (8.53%)

|

||||||||||||

|

Bank of N.T. Butterfield & Son Ltd. (Bermuda)

|

53,410

|

2,441,905

|

||||||||||

|

DBS Group Holdings Ltd. (Singapore)

|

140,770

|

2,749,277

|

||||||||||

|

DNB ASA (Norway)

|

95,600

|

1,869,895

|

||||||||||

|

7,061,077

|

||||||||||||

|

Diversified Financials – (5.01%)

|

||||||||||||

|

Capital Markets – (3.62%)

|

||||||||||||

|

Julius Baer Group Ltd. (Switzerland)

|

21,980

|

1,293,542

|

||||||||||

|

Noah Holdings Ltd., ADS (China)*

|

32,614

|

1,700,820

|

||||||||||

|

2,994,362

|

||||||||||||

|

Consumer Finance – (1.39%)

|

||||||||||||

|

Yirendai Ltd., ADR (China)

|

54,010

|

1,146,092

|

||||||||||

|

4,140,454

|

||||||||||||

|

Insurance – (2.49%)

|

||||||||||||

|

Multi-line Insurance – (2.49%)

|

||||||||||||

|

Sul America S.A. (Brazil)

|

436,537

|

2,058,930

|

||||||||||

|

Total Financials

|

13,260,461

|

|||||||||||

|

HEALTH CARE – (1.91%)

|

||||||||||||

|

Pharmaceuticals, Biotechnology & Life Sciences – (1.91%)

|

||||||||||||

|

Shire PLC, ADR (United Kingdom)

|

9,360

|

1,579,968

|

||||||||||

|

Total Health Care

|

1,579,968

|

|||||||||||

|

INDUSTRIALS – (19.65%)

|

||||||||||||

|

Capital Goods – (15.17%)

|

||||||||||||

|

Brenntag AG (Germany)

|

13,594

|

757,559

|

||||||||||

|

Ferguson PLC (United Kingdom)

|

59,142

|

4,800,240

|

||||||||||

|

Meggitt PLC (United Kingdom)

|

124,767

|

812,274

|

||||||||||

|

Safran S.A. (France)

|

29,541

|

3,589,515

|

||||||||||

|

SELECTED FUNDS

|

Schedule of Investments

|

|

SELECTED INTERNATIONAL FUND, INC. - (CONTINUED)

|

June 30, 2018 (Unaudited)

|

|

Shares/Principal

|

Value

(Note 1) |

|||||||||||

|

COMMON STOCK – (CONTINUED)

|

||||||||||||

|

INDUSTRIALS – (CONTINUED)

|

||||||||||||

|

Capital Goods – (Continued)

|

||||||||||||

|

Schneider Electric SE (France)

|

31,044

|

$

|

2,589,202

|

|||||||||

|

12,548,790

|

||||||||||||

|

Transportation – (4.48%)

|

||||||||||||

|

CAR Inc. (China)*

|

1,258,781

|

1,257,882

|

||||||||||

|

InterGlobe Aviation Ltd. (India)

|

154,217

|

2,453,427

|

||||||||||

|

3,711,309

|

||||||||||||

|

Total Industrials

|

16,260,099

|

|||||||||||

|

INFORMATION TECHNOLOGY – (18.50%)

|

||||||||||||

|

Software & Services – (12.57%)

|

||||||||||||

|

58.com Inc., Class A, ADR (China)*

|

1,746

|

121,068

|

||||||||||

|

Alibaba Group Holding Ltd., ADR (China)*

|

29,750

|

5,519,517

|

||||||||||

|

Baidu, Inc., Class A, ADR (China)*

|

4,347

|

1,056,321

|

||||||||||

|

Fang Holdings Ltd., Class A, ADR (China)*

|

342,791

|

1,330,029

|

||||||||||

|

iQIYI, Inc., Class A, ADR (China)*

|

73,390

|

2,370,497

|

||||||||||

|

10,397,432

|

||||||||||||

|

Technology Hardware & Equipment – (5.93%)

|

||||||||||||

|

Hollysys Automation Technologies Ltd. (China)

|

221,800

|

4,910,652

|

||||||||||

|

Total Information Technology

|

15,308,084

|

|||||||||||

|

MATERIALS – (4.92%)

|

||||||||||||

|

LafargeHolcim Ltd. (Switzerland)

|

44,903

|

2,177,739

|

||||||||||

|

Linde AG (Germany)

|

7,942

|

1,895,742

|

||||||||||

|

Total Materials

|

4,073,481

|

|||||||||||

|

TOTAL COMMON STOCK – (Identified cost $58,662,171)

|

73,969,418

|

|||||||||||

|

PREFERRED STOCK – (8.69%)

|

||||||||||||

|

CONSUMER DISCRETIONARY – (8.69%)

|

||||||||||||

|

Retailing – (8.69%)

|

||||||||||||

|

Didi Chuxing Joint Co., Series A (China)*(a)(b)

|

106,435

|

5,061,548

|

||||||||||

|

Grab Holdings Inc., Series G (Singapore)*(a)(b)

|

214,779

|

1,190,286

|

||||||||||

|

Internet Plus Holdings Ltd., Series A-12 (China)*(a)(b)

|

167,387

|

935,536

|

||||||||||

|

Total Consumer Discretionary

|

7,187,370

|

|||||||||||

|

TOTAL PREFERRED STOCK – (Identified cost $5,079,470)

|

7,187,370

|

|||||||||||

|

SHORT-TERM INVESTMENTS – (1.37%)

|

||||||||||||

|

INTL FCStone Financial Inc. Joint Repurchase Agreement, 2.12%,

07/02/18, dated 06/29/18, repurchase value of $361,064 (collateralized

by: U.S. Government agency mortgages and obligation in a pooled cash

account, 2.00%-10.00%, 08/01/18-07/01/48, total market value

$368,220)

|

$

|

361,000

|

361,000

|

|||||||||

|

Mizuho Securities USA Inc. Joint Repurchase Agreement, 2.10%,

07/02/18, dated 06/29/18, repurchase value of $123,022 (collateralized

by: U.S. Government agency mortgages in a pooled cash account,

3.379%-5.00%, 04/01/27-02/01/48, total market value $125,460)

|

123,000

|

123,000

|

||||||||||

|

SELECTED FUNDS

|

Schedule of Investments

|

|

SELECTED INTERNATIONAL FUND, INC. - (CONTINUED)

|

June 30, 2018 (Unaudited)

|

|

Principal

|

Value

(Note 1) |

||||||||||

|

SHORT-TERM INVESTMENTS – (CONTINUED)

|

|||||||||||

|

Nomura Securities International, Inc. Joint Repurchase Agreement,

2.12%, 07/02/18, dated 06/29/18, repurchase value of $217,038

(collateralized by: U.S. Government agency obligations in a pooled cash

account, 0.00%-1.75%, 05/23/19-11/30/19, total market value $221,340)

|

$

|

217,000

|

$

|

217,000

|

|||||||

|

SunTrust Robinson Humphrey, Inc. Joint Repurchase Agreement,

2.11%, 07/02/18, dated 06/29/18, repurchase value of $434,076

(collateralized by: U.S. Government agency mortgages in a pooled cash

account, 3.127%-7.00%, 12/01/24-07/01/37, total market value

$442,680)

|

434,000

|

434,000

|

|||||||||

|

TOTAL SHORT-TERM INVESTMENTS – (Identified cost $1,135,000)

|

1,135,000

|

||||||||||

|

Total Investments – (99.45%) – (Identified cost $64,876,641)

|

82,291,788

|

||||||||||

|

Other Assets Less Liabilities – (0.55%)

|

453,557

|

||||||||||

|

Net Assets – (100.00%)

|

$

|

82,745,345

|

|||||||||

|

ADR: American Depositary Receipt

|

|||||||||||

|

ADS: American Depositary Share

|

|||||||||||

|

*

|

Non-income producing security.

|

||||||||||

|

(a)

|

Restricted Security – See Note 7 of the Notes to Financial Statements.

|

||||||||||

|

(b)

|

The value of this security was determined using significant unobservable inputs. See Note 1 of the Notes to Financial Statements.

|

||||||||||

|

See Notes to Financial Statements

|

|||||||||||

|

Selected

American Shares

|

Selected

International Fund

|

|||||||||

|

ASSETS:

|

||||||||||

|

Investments in securities at value* (see accompanying Schedules of

Investments)

|

$

|

2,168,379,437

|

$

|

82,291,788

|

||||||

|

Cash

|

411

|

455

|

||||||||

|

Receivables:

|

||||||||||

|

Capital stock sold

|

710,194

|

44,643

|

||||||||

|

Dividends and interest

|

3,618,428

|

594,848

|

||||||||

|

Investment securities sold

|

3,516,406

|

–

|

||||||||

|

Prepaid expenses

|

32,759

|

1,293

|

||||||||

|

Total assets

|

2,176,257,635

|

82,933,027

|

||||||||

|

LIABILITIES:

|

||||||||||

|

Payables:

|

||||||||||

|

Capital stock redeemed

|

619,364

|

93,337

|

||||||||

|

Investment securities purchased

|

1,480,235

|

–

|

||||||||

|

Accrued custodian fees

|

87,000

|

21,804

|

||||||||

|

Accrued distribution service fees

|

190,444

|

4,095

|

||||||||

|

Accrued investment advisory fees

|

1,052,173

|

41,124

|

||||||||

|

Accrued transfer agent fees

|

278,735

|

16,976

|

||||||||

|

Other accrued expenses

|

18,980

|

10,346

|

||||||||

|

Total liabilities

|

3,726,931

|

187,682

|

||||||||

|

NET ASSETS

|

$

|

2,172,530,704

|

$

|

82,745,345

|

||||||

|

NET ASSETS CONSIST OF:

|

||||||||||

|

Par value of shares of capital stock

|

$

|

69,902,948

|

$

|

1,438,831

|

||||||

|

Additional paid-in capital

|

1,187,812,497

|

60,850,775

|

||||||||

|

Undistributed net investment income (loss)

|

(897,706)

|

561,008

|

||||||||

|

Accumulated net realized gains from investments and foreign currency

transactions

|

92,072,821

|

2,482,999

|

||||||||

|

Net unrealized appreciation on investments and foreign currency transactions

|

823,640,144

|

17,411,732

|

||||||||

|

Net Assets

|

$

|

2,172,530,704

|

$

|

82,745,345

|

||||||

|

CLASS S SHARES:

|

||||||||||

|

Net assets

|

$

|

864,256,388

|

$

|

15,719,420

|

||||||

|

Shares outstanding

|

22,267,342

|

1,100,410

|

||||||||

|

Net asset value, offering, and redemption price per share (Net assets ÷ Shares

outstanding)

|

$

|

38.81

|

$

|

14.29

|

||||||

|

CLASS D SHARES:

|

||||||||||

|

Net assets

|

$

|

1,308,274,316

|

$

|

67,025,925

|

||||||

|

Shares outstanding

|

33,655,016

|

4,654,912

|

||||||||

|

Net asset value, offering, and redemption price per share (Net assets ÷ Shares

outstanding)

|

$

|

38.87

|

$

|

14.40

|

||||||

|

*Including:

|

||||||

|

Cost of investments

|

$ |

|

1,344,705,448

|

$ |

|

64,876,641

|

|

See Notes to Financial Statements

|

|

SELECTED FUNDS

|

|

|

For the six months ended June 30, 2018 (Unaudited)

|

|

Selected

American Shares

|

Selected

International Fund

|

||||||||

|

INVESTMENT INCOME:

|

|||||||||

|

Income:

|

|||||||||

|

Dividends*

|

$

|

17,477,506

|

$

|

1,051,817

|

|||||

|

Interest

|

286,937

|

11,018

|

|||||||

|

Total income

|

17,764,443

|

1,062,835

|

|||||||

|

Expenses:

|

|||||||||

|

Investment advisory fees (Note 3)

|

6,100,909

|

271,112

|

|||||||

|

Custodian fees

|

179,093

|

43,990

|

|||||||

|

Transfer agent fees:

|

|||||||||

|

Class S

|

526,400

|

30,810

|

|||||||

|

Class D

|

318,633

|

22,671

|

|||||||

|

Audit fees

|

32,430

|

11,750

|

|||||||

|

Legal fees

|

18,701

|

4,083

|

|||||||

|

Reports to shareholders

|

47,500

|

2,700

|

|||||||

|

Directors' fees and expenses

|

212,615

|

12,485

|

|||||||

|

Registration and filing fees

|

28,500

|

27,000

|

|||||||

|

Interest expense (Note 5)

|

–

|

2,751

|

|||||||

|

Miscellaneous

|

53,204

|

10,624

|

|||||||

|

Distribution service fees (Note 3):

|

|||||||||

|

Class S

|

1,109,234

|

36,358

|

|||||||

|

Total expenses

|

8,627,219

|

476,334

|

|||||||

|

Net investment income

|

9,137,224

|

586,501

|

|||||||

|

REALIZED & UNREALIZED GAIN (LOSS) ON INVESTMENTS AND

FOREIGN CURRENCY TRANSACTIONS:

|

|||||||||

|

Net realized gain (loss) from:

|

|||||||||

|

Investment transactions**

|

116,747,961

|

6,359,106

|

|||||||

|

Foreign currency transactions

|

(25,227)

|

(9,129)

|

|||||||

|

Net realized gain

|

116,722,734

|

6,349,977

|

|||||||

|

Net decrease in unrealized appreciation***

|

(81,193,218)

|

(7,555,813)

|

|||||||

|

Net realized and unrealized gain (loss) on investments and foreign

currency transactions

|

35,529,516

|

(1,205,836)

|

|||||||

|

Net increase (decrease) in net assets resulting from operations

|

$

|

44,666,740

|

$

|

(619,335)

|

|||||

|

*Net of foreign taxes withheld of

|

$

|

193,368

|

$

|

64,750

|

|||||

|

**Net of foreign taxes of

|

–

|

3,218

|

|||||||

|

***Net of deferred foreign taxes of

|

–

|

(9,791)

|

|||||||

|

See Notes to Financial Statements

|

|||||||||

|

SELECTED FUNDS

|

|

|

For the six months ended June 30, 2018 (Unaudited)

|

|

Selected

American Shares

|

Selected

International Fund

|

||||||||

|

OPERATIONS:

|

|||||||||

|

Net investment income

|

$

|

9,137,224

|

$

|

586,501

|

|||||

|

Net realized gain from investments and foreign currency transactions

|

116,722,734

|

6,349,977

|

|||||||

|

Net decrease in unrealized appreciation on investments and foreign currency

transactions

|

(81,193,218)

|

(7,555,813)

|

|||||||

|

Net increase (decrease) in net assets resulting from operations

|

44,666,740

|

(619,335)

|

|||||||

|

DIVIDENDS AND DISTRIBUTIONS TO SHAREHOLDERS FROM:

|

|||||||||

|

Net investment income:

|

|||||||||

|

Class S

|

(2,531,277)

|

–

|

|||||||

|

Class D

|

(5,976,546)

|

–

|

|||||||

|

Realized gains from investment transactions:

|

|||||||||

|

Class S

|

(49,570,837)

|

–

|

|||||||

|

Class D

|

(75,106,321)

|

–

|

|||||||

|

CAPITAL SHARE TRANSACTIONS:

|

|||||||||

|

Net increase (decrease) in net assets resulting from capital share transactions

(Note 4):

|

|||||||||

|

Class S

|

(12,374,550)

|

(17,939,064)

|

|||||||

|

Class D

|

17,596,006

|

(1,519,554)

|

|||||||

|

Total decrease in net assets

|

(83,296,785)

|

(20,077,953)

|

|||||||

|

NET ASSETS:

|

|||||||||

|

Beginning of period

|

2,255,827,489

|

102,823,298

|

|||||||

|

End of period*

|

$

|

2,172,530,704

|

$

|

82,745,345

|

|||||

|

*Including undistributed net investment income (loss) of

|

$

|

(897,706)

|

$

|

561,008

|

|||||

|

See Notes to Financial Statements

|

|||||||||

|

SELECTED FUNDS

|

Statements of Changes in Net Assets

|

|

For the year ended December 31, 2017

|

|

Selected

American Shares

|

Selected

International Fund

|

||||||||

|

OPERATIONS:

|

|||||||||

|

Net investment income

|

$

|

13,716,312

|

$

|

173,330

|

|||||

|

Net realized gain (loss) from investments and foreign currency transactions

|

282,401,088

|

(1,895,036)

|

|||||||

|

Net change in unrealized appreciation (depreciation) on investments and

foreign currency transactions

|

167,396,203

|

27,154,903

|

|||||||

|

Net increase in net assets resulting from operations

|

463,513,603

|

25,433,197

|

|||||||

|

DIVIDENDS AND DISTRIBUTIONS TO SHAREHOLDERS FROM:

|

|||||||||

|

Net investment income:

|

|||||||||

|

Class S

|

(3,398,563)

|

(9,523)

|

|||||||

|

Class D

|

(9,745,383)

|

(245,809)

|

|||||||

|

Realized gains from investment transactions:

|

|||||||||

|

Class S

|

(59,977,241)

|

–

|

|||||||

|

Class D

|

(95,463,152)

|

–

|

|||||||

|

CAPITAL SHARE TRANSACTIONS:

|

|||||||||

|

Net increase (decrease) in net assets resulting from capital share transactions

(Note 4):

|

|||||||||

|

Class S

|

(197,211,527)

|

19,411,760

|

|||||||

|

Class D

|

(226,279,028)

|

(2,203,170)

|

|||||||

|

Total increase (decrease) in net assets

|

(128,561,291)

|

42,386,455

|

|||||||

|

NET ASSETS:

|

|||||||||

|

Beginning of year

|

2,384,388,780

|

60,436,843

|

|||||||

|

End of year*

|

$

|

2,255,827,489

|

$

|

102,823,298

|

|||||

|

*Including distributions in excess of net investment income

|

$

|

(1,527,107)

|

$

|

(25,493)

|

|||||

|

See Notes to Financial Statements

|

|

SELECTED FUNDS

|

|

|

June 30, 2018 (Unaudited)

|

|

SELECTED FUNDS

|

Notes to Financial Statements – (Continued)

|

|

June 30, 2018 (Unaudited)

|

|

Investments in Securities at Value

|

|||||

|

Selected

|

Selected

|

||||

|

American

Shares

|

International

Fund

|

||||

|

Valuation inputs

|

|||||

|

Level 1 – Quoted Prices:

|

|||||

|

Equity securities:

|

|||||

|

Consumer Discretionary

|

$

|

306,259,909

|

$

|

18,711,318

|

|

|

Energy

|

199,218,191

|

4,776,007

|

|||

|

Financials

|

731,317,838

|

13,260,461

|

|||

|

Health Care

|

79,592,574

|

1,579,968

|

|||

|

Industrials

|

279,378,472

|

16,260,099

|

|||

|

Information Technology

|

436,384,354

|

15,308,084

|

|||

|

Materials

|

60,351,359

|

4,073,481

|

|||

|

Total Level 1

|

2,092,502,697

|

73,969,418

|

|||

|

Level 2 – Other Significant Observable Inputs:

|

|||||

|

Short-term securities

|

10,201,000

|

1,135,000

|

|||

|

Total Level 2

|

10,201,000

|

1,135,000

|

|||

|

Level 3 – Significant Unobservable Inputs:

|

|||||

|

Equity securities:

|

|||||

|

Consumer Discretionary

|

64,528,738

|

7,187,370

|

|||

|

Information Technology

|

1,147,002

|

–

|

|||

|

Total Level 3

|

65,675,740

|

7,187,370

|

|||

|

Total Investments

|

$

|

2,168,379,437

|

$

|

82,291,788

|

|

|

SELECTED FUNDS

|

Notes to Financial Statements – (Continued)

|

|

June 30, 2018 (Unaudited)

|

|

Beginning

Balance

January 1, 2018

|

Cost of

Purchases

|

Net Change in

Unrealized

Appreciation

(Depreciation)

|

Net Realized

Gain (Loss)

|

Proceeds

from Sales

|

Ending

Balance

June 30, 2018

|

|||||||||||||

|

Selected American Shares

|

||||||||||||||||||

|

Investments in Securities:

|

||||||||||||||||||

|

Common Stock

|

$

|

1,129,149

|

$

|

–

|

$

|

17,853

|

$

|

–

|

$

|

–

|

$

|

1,147,002

|

||||||

|

Preferred Stock

|

69,110,785

|

–

|

(4,582,047)

|

–

|

–

|

64,528,738

|

||||||||||||

|

Total Level 3

|

$

|

70,239,934

|

$

|

–

|

$

|

(4,564,194)

|

$

|

–

|

$

|

–

|

$

|

65,675,740

|

||||||

|

Selected International Fund

|

||||||||||||||||||

|

Investments in Securities:

|

||||||||||||||||||

|

Preferred Stock

|

$

|

6,611,244

|

$

|

2,790,012

|

$

|

(359,410)

|

$

|

(106,623)

|

$

|

(1,747,853)

|

$

|

7,187,370

|

||||||

|

Total Level 3

|

$

|

6,611,244

|

$

|

2,790,012

|

$

|

(359,410)

|

$

|

(106,623)

|

$

|

(1,747,853)

|

$

|

7,187,370

|

||||||

|

Fair Value at

|

Valuation

|

Unobservable

|

Amount(s) or

|

Impact to

Valuation from

|

|||||||

|

June 30, 2018

|

Technique

|

Input(s)

|

Range

|

an Increase in Input

|

|||||||

|

Selected American Shares

|

|||||||||||

|

Investments in Securities:

|

|||||||||||

|

Common Stock

|

$

|

1,147,002

|

Discounted Cash Flow

|

Annualized Yield

|

3.497%

|

Decrease

|

|||||

|

Preferred Stock

|

64,528,738

|

Market Approach

|

Volume-Weighted

Transaction Price

|

$46.50-$48.36

|

Increase

|

||||||

|

Total Level 3

|

$

|

65,675,740

|

|||||||||

|

Selected International Fund

|

|||||||||||

|

Investments in Securities:

|

|||||||||||

|

Preferred Stock

|

$

|

5,061,548

|

Market Approach

|

Volume-Weighted

Transaction Price

|

$46.50-$48.36

|

Increase

|

|||||

|

Preferred Stock

|

1,190,286

|

Market Approach

|

Transaction Price

|

$5.54191

|

Increase

|

||||||

|

Preferred Stock

|

935,536

|

Market Approach

|

Transaction Price

|

$5.58906

|

Increase

|

||||||

|

Total Level 3

|

$

|

7,187,370

|

|||||||||

|

SELECTED FUNDS

|

Notes to Financial Statements – (Continued)

|

|

June 30, 2018 (Unaudited)

|

|

Capital Loss Carryforwards

(No expiration)

|

||

|

Short-term

|

$

|

–

|

|

Long-term

|

2,326,641

|

|

|

Total

|

$

|

2,326,641

|

|

SELECTED FUNDS

|

Notes to Financial Statements – (Continued)

|

|

June 30, 2018 (Unaudited)

|

|

Selected

|

Selected

|

|||||

|

American Shares

|

International Fund

|

|||||

|

Cost

|

$

|

1,354,171,893

|

$

|

66,060,852

|

||

|

Unrealized appreciation

|

864,687,668

|

20,448,033

|

||||

|

Unrealized depreciation

|

(50,480,124)

|

(4,217,097)

|

||||

|

Net unrealized appreciation

|

$

|

814,207,544

|

$

|

16,230,936

|

||

|

SELECTED FUNDS

|

Notes to Financial Statements – (Continued)

|

|

June 30, 2018 (Unaudited)

|

|

Selected

American Shares

|

Selected

International Fund

|

|||||

|

Cost of purchases

|

$

|

223,792,349

|

$

|

22,015,561

|

||

|

Proceeds from sales

|

301,305,009

|

39,857,756

|

||||

|

SELECTED FUNDS

|

Notes to Financial Statements – (Continued)

|

|

June 30, 2018 (Unaudited)

|

|

Six months ended June 30, 2018 (Unaudited)

|

|||||||||||

|

Sold

|

Reinvestment of

Distributions

|

Redeemed*

|

Net Increase

(Decrease)

|

||||||||

|

Selected American Shares

|

|||||||||||

|

Shares: Class S

|

198,620

|

1,336,361

|

(1,756,601)

|

(221,620)

|

|||||||

|

Class D

|

869,718

|

1,914,892

|

(2,250,021)

|

534,589

|

|||||||

|

Value: Class S

|

$

|

8,167,901

|

$

|

51,423,188

|

$

|

(71,965,639)

|

$

|

(12,374,550)

|

|||

|

Class D

|

36,216,213

|

73,799,935

|

(92,420,142)

|

17,596,006

|

|||||||

|

Selected International Fund

|

|||||||||||

|

Shares: Class S

|

290,961

|

–

|

(1,525,154)

|

(1,234,193)

|

|||||||

|

Class D

|

53,542

|

–

|

(155,441)

|

(101,899)

|

|||||||

|

Value: Class S

|

$

|

4,291,683

|

$

|

–

|

$

|

(22,230,747)

|

$

|

(17,939,064)

|

|||

|

Class D

|

796,461

|

–

|

(2,316,015)

|

(1,519,554)

|

|||||||

|

Year ended December 31, 2017

|

|||||||||||

|

Sold

|

Reinvestment of

Distributions

|

Redeemed*

|

Net Increase

(Decrease)

|

||||||||

|

Selected American Shares

|

|||||||||||

|

Shares: Class S

|

364,073

|

1,611,408

|

(7,268,015)

|

(5,292,534)

|

|||||||

|

Class D

|

1,644,628

|

2,493,544

|

(9,871,561)

|

†

|

(5,733,389)

|

||||||

|

Value: Class S

|

$

|

13,884,366

|

$

|

62,574,615

|

$

|

(273,670,508)

|

$

|

(197,211,527)

|

|||

|

Class D

|

62,491,861

|

97,000,829

|

(385,771,718)

|

†

|

(226,279,028)

|

||||||

|

Selected International Fund

|

|||||||||||

|

Shares: Class S

|

2,123,750

|

686

|

(596,472)

|

1,527,964

|

|||||||

|

Class D

|

862,075

|

16,209

|

(1,073,754)

|

(195,470)

|

|||||||

|

Value: Class S

|

$

|

27,445,309

|

$

|

9,482

|

$

|

(8,043,031)

|

$

|

19,411,760

|

|||

|

Class D

|

11,510,777

|

225,301

|

(13,939,248)

|

(2,203,170)

|

|||||||

|

SELECTED FUNDS

|

Notes to Financial Statements – (Continued)

|

|

June 30, 2018 (Unaudited)

|

|

Fund

|

Security

|

Initial

Acquisition

Date

|

Units/

Shares

|

Cost per

Unit/

Share

|

Valuation per Unit/

Share as of

June 30, 2018

|

||||||||

|

Selected American Shares

|

ASAC II L.P.

|

10/10/13

|

1,174,606

|

$

|

1.00

|

$

|

0.9765

|

||||||

|

Didi Chuxing Joint Co.,

Series A, Pfd.

|

07/27/15

|

1,161,716

|

$

|

27.7507

|

$

|

47.5553

|

|||||||

|

Didi Chuxing Joint Co.,

Series B, Pfd.

|

05/16/17

|

195,204

|

$

|

50.9321

|

$

|

47.5553

|

|||||||

|

Selected International Fund

|

Didi Chuxing Joint Co.,

Series A, Pfd.

|

07/27/15

|

106,435

|

$

|

27.7507

|

$

|

47.5553

|

||||||

|

Grab Holdings Inc., Series G, Pfd.

|

08/02/17

|

214,779

|

$

|

5.5419

|

$

|

5.5419

|

|||||||

|

Internet Plus Holdings Ltd., Series A-12, Pfd.

|

04/13/18

|

167,387

|

$

|

5.5891

|

$

|

5.5891

|

|||||||

|

SELECTED FUNDS

|

Notes to Financial Statements – (Continued)

|

|

June 30, 2018 (Unaudited)

|

|

The following financial information represents selected data for each share of capital stock outstanding throughout each period:

|

||||

|

Income (Loss) from Investment Operations

|

||||

|

Net Asset Value,

Beginning of

Period

|

Net Investment

Incomea

|

Net Realized and

Unrealized Gains

(Losses)

|

Total from

Investment

Operations

|

|

|

Selected American Shares Class S:

|

||||

|

Six months ended June 30, 2018e

|

$40.53

|

$0.13

|

$0.62

|

$0.75

|

|

Year ended December 31, 2017

|

$35.76

|

$0.15

|

$7.46

|

$7.61

|

|

Year ended December 31, 2016

|

$36.93

|

$0.13

|

$4.06

|

$4.19

|

|

Year ended December 31, 2015

|

$43.16

|

$0.20

|

$1.37

|

$1.57

|

|

Year ended December 31, 2014

|

$50.29

|

$0.24

|

$2.54

|

$2.78

|

|

Year ended December 31, 2013

|

$41.71

|

$0.23

|

$13.11

|

$13.34

|

|

Selected American Shares Class D:

|

||||

|

Six months ended June 30, 2018e

|

$40.59

|

$0.19

|

$0.63

|

$0.82

|

|

Year ended December 31, 2017

|

$35.80

|

$0.28

|

$7.47

|

$7.75

|

|

Year ended December 31, 2016

|

$36.97

|

$0.25

|

$4.06

|

$4.31

|

|

Year ended December 31, 2015

|

$43.13

|

$0.36

|

$1.36

|

$1.72

|

|

Year ended December 31, 2014

|

$50.26

|

$0.39

|

$2.56

|

$2.95

|

|

Year ended December 31, 2013

|

$41.68

|

$0.39

|

$13.11

|

$13.50

|

|

Selected International Fund Class S:

|

||||

|

Six months ended June 30, 2018e

|

$14.44

|

$0.05

|

$(0.20)

|

$(0.15)

|

|

Year ended December 31, 2017

|

$10.45

|

$(0.03)

|

$4.02

|

$3.99

|

|

Year ended December 31, 2016

|

$10.48

|

$(0.01)

|

$(0.02)

|

$(0.03)

|

|

Year ended December 31, 2015

|

$11.12

|

$0.04

|

$(0.11)

|

$(0.07)

|

|

Year ended December 31, 2014

|

$11.21

|

$0.03

|

$(0.10)

|

$(0.07)

|

|

Year ended December 31, 2013

|

$9.24

|

$0.04

|

$1.97

|

$2.01

|

|

Selected International Fund Class D:

|

||||

|

Six months ended June 30, 2018e

|

$14.53

|

$0.10

|

$(0.23)

|

$(0.13)

|

|

Year ended December 31, 2017

|

$10.50

|

$0.05

|

$4.03

|

$4.08

|

|

Year ended December 31, 2016

|

$10.53

|

$0.04

|

$(0.03)

|

$0.01

|

|

Year ended December 31, 2015

|

$11.17

|

$0.09

|

$(0.10)

|

$(0.01)

|

|

Year ended December 31, 2014

|

$11.27

|

$0.08

|

$(0.11)

|

$(0.03)

|

|

Year ended December 31, 2013

|

$9.28

|

$0.10

|

$1.99

|

$2.09

|

|

a

|

Per share calculations were based on average shares outstanding for the period.

|

|

b

|

Assumes hypothetical initial investment on the business day before the first day of the fiscal period, with all dividends and distributions reinvested in additional shares on the reinvestment date, and redemption at the net asset value calculated on the last business day of the fiscal period. Total returns are not annualized for periods of less than one year.

|

|

c

|

The ratios in this column reflect the impact, if any, of certain reimbursements.

|

|

d

|

The lesser of purchases or sales of portfolio securities for a period, divided by the monthly average of the market value of portfolio securities owned during the period. Securities with a maturity or expiration date at the time of acquisition of one year or less are excluded from the calculation.

|

|

Financial Highlights

|

|

Dividends and Distributions

|

Ratios to Average Net Assets

|

|||||||||

|

Dividends

from Net

Investment

Income

|

Distributions

from

Realized

Gains

|

Return of

Capital

|

Total

Distributions

|

Net Asset

Value, End

of Period

|

Total

Returnb

|

Net Assets,

End of

Period (in

millions)

|

Gross

Expense

Ratio

|

Net Expense

Ratioc

|

Net

Investment

Income

(Loss) Ratio

|

Portfolio

Turnoverd

|

|

$(0.12)

|

$(2.35)

|

$–

|

$(2.47)

|

$38.81

|

1.90%

|

$864

|

0.97%f

|

0.97%f

|

0.63%f

|

10%

|

|

$(0.15)

|

$(2.69)

|

$–

|

$(2.84)

|

$40.53

|

21.77%

|

$911

|

0.97%

|

0.97%

|

0.39%

|

13%

|

|

$(0.27)

|

$(5.09)

|

$–

|

$(5.36)

|

$35.76

|

12.50%

|

$993

|

0.97%

|

0.97%

|

0.39%

|

19%

|

|

$(0.28)

|

$(7.52)

|

$–

|

$(7.80)

|

$36.93

|

3.59%

|

$1,181

|

0.95%

|

0.95%

|

0.50%

|

27%

|

|

$(0.23)

|

$(9.68)

|

$–

|

$(9.91)

|

$43.16

|

5.60%

|

$1,571

|

0.94%

|

0.94%

|

0.47%

|

26%

|

|

$(0.27)

|

$(4.49)

|

$–

|

$(4.76)

|

$50.29

|

33.16%

|

$2,067

|

0.94%

|

0.94%

|

0.49%

|

12%

|

|

$(0.19)

|

$(2.35)

|

$–

|

$(2.54)

|

$38.87

|

2.07%

|

$1,308

|

0.65%f

|

0.65%f

|

0.95%f

|

10%

|

|

$(0.27)

|

$(2.69)

|

$–

|

$(2.96)

|

$40.59

|

22.18%

|

$1,344

|

0.65%

|

0.65%

|

0.71%

|

13%

|

|

$(0.39)

|

$(5.09)

|

$–

|

$(5.48)

|

$35.80

|

12.83%

|

$1,391

|

0.65%

|

0.64%

|

0.72%

|

19%

|

|

$(0.36)

|

$(7.52)

|

$–

|

$(7.88)

|

$36.97

|

3.96%

|

$2,131

|

0.61%

|

0.61%

|

0.84%

|

27%

|

|

$(0.40)

|

$(9.68)

|

$–

|

$(10.08)

|

$43.13

|

5.96%

|

$3,674

|

0.60%

|

0.60%

|

0.81%

|

26%

|

|

$(0.43)

|

$(4.49)

|

$–

|

$(4.92)

|

$50.26

|

33.62%

|

$3,946

|

0.61%

|

0.61%

|

0.82%

|

12%

|

|

$ –

|

$–

|

$–

|

$ –

|

$14.29

|

(1.04)%

|

$16

|

1.25%f

|

1.25%f

|

0.64%f

|

23%

|

|

$–g

|

$–

|

$–

|

$–g

|

$14.44

|

38.22%

|

$34

|

1.28%

|

1.25%

|

(0.07)%

|

12%

|

|

$ –

|

$–

|

$–

|

$ –

|

$10.45

|

(0.29)%

|

$8

|

1.51%

|

1.30%

|

(0.09)%

|

49%

|

|

$(0.04)

|

$(0.53)

|

$–

|

$(0.57)

|

$10.48

|

(0.70)%

|

$9

|

1.41%

|

1.30%

|

0.28%

|

43%

|

|

$(0.02)

|

$–

|

$–

|

$(0.02)

|

$11.12

|

(0.66)%h

|

$11

|

1.38%

|

1.30%

|

0.23%

|

49%

|

|

$(0.04)

|

$–

|

$–

|

$(0.04)

|

$11.21

|

21.78%

|

$11

|

1.44%

|

1.40%

|

0.39%

|

16%

|

|

$ –

|

$ –

|

$–

|

$ –

|

$14.40

|

(0.89)%

|

$67

|

0.85%f

|

0.85%f

|

1.42%f

|

23%

|

|

$(0.05)

|

$ –

|

$–

|

$(0.05)

|

$14.53

|

38.90%

|

$69

|

0.87%

|

0.87%

|

0.31%

|

12%

|

|

$(0.04)

|

$ –

|

$–

|

$(0.04)

|

$10.50

|

0.10%

|

$52

|

0.87%

|

0.83%

|

0.38%

|

49%

|

|

$(0.10)

|

$(0.53)

|

$–

|

$(0.63)

|

$10.53

|

(0.20)%

|

$74

|

0.83%

|

0.83%

|

0.75%

|

43%

|

|

$(0.07)

|

$ –

|

$–

|

$(0.07)

|

$11.17

|

(0.26)%h

|

$89

|

0.83%

|

0.83%

|

0.70%

|

49%

|

|

$(0.10)

|

$ –

|

$–

|

$(0.10)

|

$11.27

|

22.56%

|

$66

|

0.83%

|

0.83%

|

0.96%

|

16%

|

|

e

|

Unaudited.

|

|

f

|

Annualized.

|

|

g

|

Less than $0.005 per share.

|

|

h

|

Selected International Fund's performance benefited from IPO purchases in 2014, adding approximately 2% to the Fund's total return. After purchase, the IPOs rapidly increased in value. The Adviser purchases shares intending to benefit from long-term growth of the underlying company; the rapid appreciation of the IPOs were unusual occurrences. Such performance may not continue in the future.

|

|

See Notes to Financial Statements

|

|

|

SELECTED FUNDS

|

|

1.

|

Achieves satisfactory investment results over the long-term, after all costs;

|

|

2.

|

Efficiently and effectively handles shareholder transactions, inquiries, requests and records, provides quality accounting, legal and compliance services, and oversees third-party service providers; and

|

|

3.

|

Fosters healthy investor behavior.

|

|

SELECTED FUNDS

|

Director Approval of Advisory Agreements (Unaudited) – (Continued)

|

|

SELECTED FUNDS