UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

|

☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended June 30, 2017, or

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period

from to

Commission file number 0-17272

BIO-TECHNE CORPORATION

(Exact name of registrant as specified in its charter)

|

Minnesota |

41-1427402 | |

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

|

614 McKinley Place N.E. Minneapolis, MN 55413 |

(612) 379-8854 | |

|

(Address of principal executive offices) (Zip Code) |

(Registrant's telephone number, including area code) | |

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

Name of each exchange on which registered | |

|

Common Stock, $0.01 par value |

The NASDAQ Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer |

|

☒ |

|

Accelerated filer |

|

☐ |

|

|

|

|

| |||

|

Non-accelerated filer |

|

☐ |

|

Smaller reporting company |

|

☐ |

|

Emerging growth company |

☐ | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

As of December 31, 2016 the aggregate market value of the Common Stock held by non-affiliates of the Registrant was $3.8 billion based upon the closing sale price as reported on The Nasdaq Stock Market ($102.83 per share). Shares of Common Stock held by each officer and director and by each person who owns 5% or more of the outstanding Common Stock have been excluded.

As of August 30, 2017, 37,382,025 shares of the Company’s Common Stock ($0.01 par value) were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Company’s Proxy Statement for its 2017 Annual Meeting of Shareholders are incorporated by reference into Part III.

TABLE OF CONTENTS

|

|

|

Page |

|

PART I | ||

|

|

|

|

|

Item 1. |

Business |

1 |

|

|

|

|

|

Item 1A. |

Risk Factors |

10 |

|

|

|

|

|

Item 1B. |

Unresolved Staff Comments |

16 |

|

|

|

|

|

Item 2. |

Properties |

16 |

|

|

|

|

|

Item 3. |

Legal Proceedings |

16 |

|

Item 4. |

Mine Safety Disclosures |

16 |

|

PART II | ||

|

|

|

|

|

Item 5. |

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

17 |

|

|

|

|

|

Item 6. |

Selected Financial Data |

19 |

|

|

|

|

|

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

20 |

|

|

|

|

|

Item 7A. |

Quantitative and Qualitative Disclosures about Market Risk |

32 |

|

|

|

|

|

Item 8. |

Financial Statements and Supplementary Data |

33 |

|

Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

|

|

Item 9A. |

Controls and Procedures |

63 |

|

Item 9B. |

Other Information |

66 |

|

|

|

|

|

PART III | ||

|

|

|

|

|

Item 10. |

Directors, Executive Officers |

66 |

|

|

|

|

|

Item 11. |

Executive Compensation |

66 |

|

|

|

|

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Shareholder Matters |

66 |

|

|

|

|

|

Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

66 |

|

|

|

|

|

Item 14. |

Principal Accounting Fees and Services |

66 |

|

PART IV | ||

|

Item 15. |

Exhibits, Financial Statement Schedules |

67 |

|

SIGNATURES |

67 | |

PART I

ITEM 1. BUSINESS

OVERVIEW

Bio-Techne and its subsidiaries, collectively doing business as Bio-Techne (Bio-Techne, we, our, us or the Company) develop, manufacture and sell biotechnology reagents and instruments for the research and clinical diagnostic markets worldwide. With our deep product portfolio and application expertise, we strive to provide the life sciences community with innovative, high-quality scientific tools to better understand biological processes and drive discovery.

We currently operate with three reporting segments – our Biotechnology, Protein Platforms and Diagnostics Divisions. Our Biotechnology Division is a leader in providing high quality proteins and antibodies, and related immunoassays, as well as biologically active small molecules and other reagents for the research and clinical diagnostics markets, all under the primary brands of R&D Systems, Novus Biologicals and Tocris Bioscience. Through our most recent acquisition, Advanced Cell Diagnostics, we also sell products for RNA in situ hybridization. Our Protein Platforms Division focuses on developing and supplying instrumentation and related consumables designed to simplify protein analysis processes along with single cell protein analysis, all under the ProteinSimple brand. Through our Diagnostics Division, we serve the clinical markets with regulated products such as controls, calibrators, reagents and immunoassays intended for diagnostic uses.

We are a Minnesota corporation with our global headquarters in Minneapolis, Minnesota. We originally were founded over forty years ago, in 1976, as Research and Diagnostic Systems, Inc. We became a publicly traded company in 1985 through a merger with Techne Corporation, now Bio-Techne Corporation. Our common stock is listed on the NASDAQ under the symbol “TECH.” We operate globally, with offices in multiple locations in the United States, Europe, and Asia. Today, our product line extends to over 300,000 manufactured products in state of the art facilities to accommodate many of our manufacturing needs.

Our historical focus was on providing high quality proteins, antibodies and immunoassays to the life science research market and hematology controls for the diagnostics market. Beginning in 2012, and accelerating over the last three years, we implemented a strategy to accelerate growth in part by acquiring businesses and product portfolios that leveraged and diversified our existing product lines, filled portfolio gaps with differentiated high growth businesses, and expanded our geographic scope.

Growth Through Acquisition

|

Acquisition |

Year Acquired (Fiscal) |

Reporting Segment |

Primary Product Portfolios |

|

Tocris |

2012 |

Biotechnology |

Biologically active small molecules |

|

Bionostics |

2014 |

Diagnostics |

Blood chemistry and packaging |

|

PrimeGene |

2014 |

Biotechnology |

Bulk and GMP proteins manufacturing for China |

|

Novus Biologicals |

2015 |

Biotechnology |

Antibodies |

|

ProteinSimple |

2015 |

Protein Platforms |

Protein analysis, including automated western blot, ELISAs and biologics instrumentation |

|

CyVek |

2015 |

Protein Platforms |

Automated ELISA systems |

|

Cliniqa |

2016 |

Diagnostics |

Blood chemistry quality controls and bulk immunochemistry reagents |

|

Zephyrus BioSciences |

2016 |

Protein Platforms |

Single cell western blotting |

|

Space Import-Export |

2017 |

Biotechnology |

Geographic expansion |

|

Advanced Cell Diagnostics |

2017 |

Biotechnology |

Genomic in situ hybridization |

Recognizing the importance of an integrated, global approach to meeting our mission and accomplishing our strategies, we have unified our brands and recent acquisitions under a single global brand, Bio-Techne. In November 2014 we changed the name of the parent corporation from Techne Corporation to Bio-Techne Corporation. The Bio-Techne name solidifies the new strategic direction for the Company, and also unifies all of our brands under one complete corporate umbrella.

We are committed to providing the life sciences community with innovative, high-quality scientific tools to better understand biological processes and drive discovery. Our mission is to “build epic tools for epic science.” We intend to build on Bio-Techne’s past accomplishments, high product quality reputation and sound financial position by executing strategies that position us to serve as the standard for biological content in the research market, and to leverage that leadership position to enter the diagnostics and other adjacent markets. Our strategies include:

Continued innovation in core products. Through collaborations with key opinion leaders, participation in scientific discussions and societies, and leveraging our internal talent we expect to be able to convert our continued significant investment in our research and development activities to be first-to-market with quality products that are at the leading edge of life science researchers’ needs.

Expansion of geographic footprint. We will continue to expand our sales staff and distribution channels globally in order to increase our global presence and make it easier for customers to transact with us.

Realignment of resources. In recognition of the increased size and scale of the organization, we continue to redesign our development and operational processes to create greater efficiencies throughout the organization.

Talent recruitment and retention. We strive to recruit, train and retain the most talented staff to implement all of our strategies effectively.

Targeted acquisitions and investments. We will continue to leverage our strong balance sheet to gain access to new technologies and products that improve our competitiveness in the current market, meet customers’ expanding work flow needs and allow us to enter adjacent markets.

OUR PRODUCTS AND MARKETS

In fiscal 2017, net sales from Bio-Techne’s Biotechnology, Protein Platforms and Diagnostics segments represented 65%, 16%, and 19% of consolidated net sales, respectively. Financial information relating to Bio-Techne’s segments is incorporated herein by reference to Note 11 to the Consolidated Financial Statements included in Item 8 of this Annual Report on Form 10-K.

Biotechnology Segment

Biotechnology Segment Products

Through our Biotechnology segment, we are one of the world's leading suppliers of specialized proteins, such as cytokines and growth factors, immunoassays, antibodies and related reagents, to the biotechnology research community. Our combined chemical and biological reagents portfolio provides high quality tools which customers can use in solving the complexity of important biological pathways and glean knowledge that may lead to a more complete understanding of biological processes, and ultimately to the development of novel strategies to address different pathologies.

The portfolio in this segment includes five main product lines: native and recombinant proteins, monoclonal and polyclonal antibodies, immunoassays, biologically active chemical compounds and, through our most recent acquisition, Advanced Cell Diagnostics, in situ genomic hybridization. As mentioned above, all are useful in a wide variety of important biomedical research activities. In addition, a number of our products have the potential to serve as predictive biomarkers and therapeutic targets for a variety of human diseases and conditions including cancer, autoimmunity, diabetes, hypertension, obesity, inflammation, neurological disorders, and kidney failure. Immunoassays can also be useful in clinical diagnostics. In fact, we have received Food and Drug Administration (FDA) marketing clearance for a few of our immunoassays for use as in vitro diagnostic devices. In addition to being useful research tools, our RNA in situ hybridization assays have diagnostics applications as well, and several are currently being cleared with the FDA in partnership with diagnostics instrument manufacturers and pharmaceutical companies.

Biotechnology Segment Customers and Distribution Methods

We sell our Biotechnology products directly to customers who are primarily located in North America, western Europe and China. We have a sales and marketing partnership agreement with Fisher Scientific in order to bolster our market presence in North America and leverage the transactional efficiencies offered by the large Fisher organization. We also sell through third party distributors in China, Japan, eastern Europe and the rest of the world. Our sales are widely distributed, and no single end-user customer accounted for more than 10% of Biotechnology's net sales during fiscal 2017, 2016 or 2015.

Biotechnology Segment Competitors

A number of companies supply the worldwide market for protein-related and chemically-based research and diagnostic reagents, including GE Healthcare Life Sciences, BD Biosciences, Merck KGaA/EMD Chemicals, Inc., PeproTech, Inc., Abcam plc., and Thermo Fisher Scientific, Inc. Market success is primarily dependent upon product quality, selection, price and reputation. We believe we are one of the leading world-wide suppliers of cytokine related products in the research market. We further believe that the expansion of our product offering, their recognized quality, and the continued demand for protein-related and chemically-based research reagents will allow us to remain competitive in the growing biotechnology research and diagnostic markets.

Biotechnology Manufacturing

We are not dependent on key or sole source suppliers for most of our products in the Biotechnology segment. We develop and manufacture the majority of our proteins using recombinant DNA technology, thus significantly reducing our reliance on outside resources. Our antibodies are produced using a variety of technologies including traditional animal immunization and hybridoma technology as well as recombinant antibody techniques. Our chemical-based small molecule products are synthesized from widely available products. We typically have several outside sources for all critical raw materials necessary for the manufacture of our products.

The majority of our Biotechnology products are shipped within one day of receipt of the customers' orders. Consequently, we had no significant backlog of orders for our Biotechnology segment products as of the date of this Annual Report on Form 10-K or as of a comparable date for fiscal 2016.

Protein Platforms Segment

Proteins are important for understanding disease because they are the functional units that carry out specific tasks in every cell. Altered levels of certain proteins can prevent the cell from performing its intended function, produce the energy it requires, maintain its morphology or survive within the tissue. However, protein analysis is complex given the varied and unique three-dimensional structure of the many proteins of interest. Our Protein Platforms segment develops, manufactures and sells tools to simplify protein analysis while at the same time achieving more quantitative and reproducible results.

Protein Platforms Segment Products

Biologics Platform. Biologics are complex protein-based therapeutics, and are transforming the pharmaceutical industry and treatment of many diseases. Biologic drugs are very effective targeted therapeutics for diseases such as arthritis, cancer and diabetes, and their number in development is increasing because of a variety of advances in biochemistry, immunology and biotechnology. Developers of biologics are required by regulatory agencies, such as FDA, to develop robust processes to ensure that the specific biologic of interest can be identified and characterized accurately and then consistently and reliably produced. Our Biologics tools help researchers interrogate protein purity and identify contaminants during the development and production of biologics. Our Maurice, iCE3 and MFI platforms all measure some elements of protein identity, purity and heterogeneity.

The Simple Western Platform. The Western blot, or Western, is one of the most widely-used assays for protein analysis and identification today. Unchanged since its invention in 1979, the Western assay is used by molecular biologists, biochemists and clinicians to determine if a specific protein is present in a sample. Our Simple Western platform is a fully-automated Western blot analytical technique that can identify and quantify a protein of interest in a more sensitive, automated and less time intensive manner.

SimplePlex Platform. A common assay used in research and clinical diagnostics is the ELISA, or enzyme-linked immunosorbent assay. The SimplePlex platform is a transformative immunoassay technology which integrates an innovatively designed microfluidic cartridge with a state-of-the-art analyzer to deliver a bench-top immunoassay system that is more sensitive than ELISA with none of the traditional challenges of assay design or repeatability. SimplePlex assays are fully automated, multi-analyte immunoassays that permit the customer to run multiple samples while interrogating multiple analytes in approximately one hour while leveraging the large biological content menu that has been developed over 30 years. We believe the SimplePlex technology, along with other immunoassay platforms offered by Bio-Techne, represents the most comprehensive line of immunoassay products to meet customers' complete workflow in their research and clinical protein applications.

Single Cell Western Platform. The Milo platform and related reagents perform western blot assays on individual cells versus an entire cell population. With this tool, customers can elucidate the properties of individual cells to better understand cell behavior that can shape the overall cell population response in a disease or normal state.

Protein Platforms Segment Customers and Distribution Methods

Our customers for this segment include researchers in academia as well as commercial researchers. Our biologics line of products is used primarily by production and quality control departments at biotech and pharmaceutical companies. We sell our Protein Platforms products directly to customers who are primarily located in North America, western Europe and Japan. We also sell through third party distributors in China, southern Europe and the rest of the world. Our sales are widely distributed, and no single end-user customer accounted for more than 10% of Protein Platforms' net sales during fiscal 2017, 2016 or 2015.

Protein Platforms Segment Competitors

Our Simple Western platform is a complete replacement for the traditional Western blot. As a result, we face competition from the vendors that supply instruments and reagents to traditional Western blot users. These competitors include Bio-Rad Laboratories, GE Healthcare, Merck KGaA, PerkinElmer and Thermo Fisher Scientific. Similarly, our SimplePlex platform replaces the traditional ELISA assay as well as some flow-based multiplex assays; competitors include those who supply instruments and reagents for ELISAs, including Meso Scale Discovery, PerkinElmer, Thermo Fisher, Luminex, Millipore, Quanterix, and Bio-Rad Laboratories. The primary competitors for our Biologics instrumentation are Agilent Technologies, Danaher and PerkinElmer, as well as GE Healthcare, Shimadzu, Thermo Fisher and Waters. We believe our competitive position is strong due to the unique aspects of our products and our product quality.

Protein Platforms Segment Manufacturing

We manufacture our products for this division at various locations in the United States and Canada. We manufacture our own components where we believe it adds significant value, but we rely on suppliers for the manufacture of some of the consumables, components, subassemblies and autosamplers used with, or included in, our systems, which are manufactured to our specifications. We are not dependent on any one supplier and are not required to carry significant amounts of inventory to assure ourselves of a continuous allotment of goods from suppliers. We conduct all final testing and inspection of our products. We have established a quality control program, including a set of standard manufacturing and documentation procedures.

There was no significant backlog of orders for our Protein Platforms products as of the date of this Annual Report on Form 10-K or as of a comparable date for fiscal 2016.

Diagnostics Segment (formerly Clinical Controls)

Diagnostics Segment Products

Beginning in the first quarter of fiscal 2017, the Clinical Controls segment has been renamed Diagnostics. Our original business in this segment was focused primarily on controls and calibrators for hematology clinical instruments. With the acquisition of Bionostics in fiscal 2014 and Cliniqa in fiscal 2016, we expanded this segment to include blood chemistry and blood gas quality controls, diagnostic immunoassays, and other bulk and custom reagents for the in vitro diagnostic market. We renamed the operating segment to reflect this expanded portfolio of products.

Our hematology controls and calibrators ensure that hematology instruments are performing accurately and reliably. We believe our products have improved stability and versatility and a longer shelf life than most of those of our competitors. We also offer controls for blood glucose and blood gas devices, as well as coagulation device control products.

We also develop and supply bulk purified proteins, enzymes, disease-state plasmas, infectious disease antigens and processed serums to the clinical diagnostic industry worldwide. Often we manufacture these reagents on a custom basis to optimize their use in a customer's diagnostic assay. We supply these reagents in various formats including liquid, lyophilized and powder form. In fiscal 2017, we launched the Paratest® product, a novel and convenient stool collection and test device for the veterinary market, utilizing our expertise in packaging and reagents from our Devens, Massachusetts site.

Diagnostics Segment Customers and Distribution Methods

Original Equipment Manufacturer (OEM) agreements represent the largest market for our diagnostics products. In fiscal 2017, 2016 and 2015, OEM agreements accounted for $60.7 million, $54.2 million, and $41.1 million, or 57%, 52%, and 53% of division net sales in each fiscal year, respectively. We sell some of our diagnostics products directly to customers and, in Europe and Asia, also through distributors. One OEM customer accounted for approximately 12% and 13% of the Diagnostics Division's net sales during fiscal 2017 and 2015, respectively. This customer did not amount to 10% or more of the Company's consolidated revenue during these years. No customers accounted for more than 10% of the Diagnostics Division’s net sales during fiscal year 2016.

Diagnostics Segment Competitors

We believe we are the third largest supplier of hematology controls in the marketplace behind Beckman Coulter, Inc. and Streck, Inc. For our other control and calibrator products, the principal competitors are Abbott Diagnostics, Beckman Coulter, Inc., Bio-Rad Laboratories, Inc., Siemens Healthcare Diagnostics Inc. and Sysmex Corporation. We compete based primarily on product performance, quality, and price. SeraCare, HyTest Ltd and Thermo Fisher Scientific are additional competitors in the clinical diagnostic manufacturing and reagents markets.

Diagnostics Segment Manufacturing

The primary raw material for our hematology controls products is whole blood. We purchase human blood from commercial blood banks, and porcine and bovine blood from nearby meat processing plants. Although the cost of human blood has increased due to the requirement that it be tested for certain diseases and pathogens prior to use, the higher cost of these materials has not had a material adverse effect on our business thus far. Other controls are derived from various bodily fluids or cells from difference animal species, which are then processed in-house to isolate the product of interest or from other bulk reagent suppliers that specialize in certain products. Our other reagent products are manufactured using a variety of suppliers, with no supplier representing a material portion of our business.

Most of the hematology controls products are shipped based on a preset, recurring schedule. However, the majority of our business in this segment are large orders shipped based on our customers' needs; we are highly dependent on our customers’ demand and inventory controls. Consequently, our revenues can vary significantly from quarter to quarter and year to year. There was no significant backlog of orders for our Diagnostics products as of the date of this Annual Report on Form 10-K or as of a comparable date for fiscal 2016.

Geographic Information

Following is financial information relating to geographic areas (in thousands):

|

Year Ended June 30, |

||||||||||||

|

2017 |

2016 |

2015 |

||||||||||

|

External sales |

||||||||||||

|

United States |

$ | 313,195 | $ | 275,859 | $ | 245,217 | ||||||

|

EMEA, excluding U.K. |

125,126 | 103,060 | 104,178 | |||||||||

|

U.K. |

28,401 | 28,307 | 32,309 | |||||||||

|

APAC, excluding Greater China |

41,463 | 38,137 | 24,015 | |||||||||

|

Greater China |

39,078 | 36,199 | 34,933 | |||||||||

|

Rest of world |

15,740 | 17,461 | 11,594 | |||||||||

|

Total external sales |

$ | 563,003 | $ | 499,023 | $ | 452,246 | ||||||

|

Long-lived assets |

||||||||||||

|

United States and Canada |

$ | 119,859 | $ | 116,830 | $ | 117,224 | ||||||

|

Europe |

14,100 | 14,423 | 11,239 | |||||||||

|

China |

1,165 | 1,109 | 1,286 | |||||||||

|

Total long-lived assets |

$ | 135,124 | $ | 132,362 | $ | 129,749 | ||||||

Net sales are attributed to countries based on the location of the customer or distributor. Long-lived assets are comprised of land, buildings and improvements and equipment, net of accumulated depreciation. See the description of risks associated with the Company's foreign subsidiaries in Item 1A of this Annual Report on Form 10-K.

PRODUCTS UNDER DEVELOPMENT

Bio-Techne is engaged in continuous ongoing research and development in all of our major product lines. We believe that our future success depends, to a large extent, on our ability to keep pace with changing technologies and market needs.

In fiscal 2017, aside from the large number of products added through the acquisition of Advanced Cell Diagnostics, Bio-Techne introduced approximately 1,500 new products. We also expect to significantly expand our portfolio of products through acquisitions as well as continued product development in our existing businesses. However, there is no assurance that any of the products in the research and development phase can be successfully completed or, if completed, can be successfully introduced into the marketplace.

|

Year Ended June 30, |

||||||||||||

|

2017 |

2016 |

2015 |

||||||||||

|

Research and development expense: |

||||||||||||

|

Biotechnology |

$ | 35,507 | $ | 26,981 | $ | 28,201 | ||||||

|

Protein Platforms |

14,424 | 14,610 | 11,024 | |||||||||

|

Diagnostics |

3,583 | 3,596 | 1,628 | |||||||||

|

Total research and development expense |

$ | 53,514 | $ | 45,187 | $ | 40,853 | ||||||

|

Percent of net sales |

10 |

% |

9 |

% |

9 |

% | ||||||

PATENTS AND TRADEMARKS

Our success depends in part upon our ability to protect our core technologies and intellectual property. To accomplish this, we rely on a combination of intellectual property rights, including patents, trade secrets and trademarks, as well as customary contractual protections.

With respect to our Protein Platforms segment and the Biotechnology segment’s genomic in situ hybridization product line, the protection is primarily through pending patent applications and issued patents. As of June 30, 2017, we had rights to 115 granted patents and approximately 100 pending patent applications. Patent protection, if granted, generally has a life of 20 years from the date of the patent application or patent grant. We cannot assure you whether any of our pending patent applications will result in the grant of a patent, whether the examination process will require us to narrow our claims, and whether our claims will provide adequate coverage of our competitors' products or services.

In addition to pursuing patents on our products, we also preserve much of our innovation as trade secrets, particularly in the Biotechnology segment. We have taken steps to protect our intellectual property and proprietary technology by entering into confidentiality agreements and intellectual property assignment agreements with our employees, consultants, corporate partners and, when needed, our advisors. Such agreements may not be enforceable or may not provide meaningful protection for our trade secrets or other proprietary information in the event of unauthorized use or disclosure or other breaches of the agreements, and we may not be able to prevent such unauthorized disclosure. Monitoring unauthorized disclosure is difficult, and we do not know whether the steps we have taken to prevent such disclosure are, or will be, adequate.

No assurance can be given that Bio-Techne's products do not infringe upon patents or proprietary rights owned or claimed by others, particularly for genetically engineered products. Bio-Techne has not conducted a patent infringement study for each of its products. Where we have been contacted by patent holders with certain intellectual property rights, Bio-Techne has entered into licensing agreements with patent holders under which it has the exclusive and/or non-exclusive right to sometimes use patented technology as well as the right to manufacture and sell certain patented products to the research market. In addition, certain of our products are covered by licenses from third parties to supplement our own patent portfolio.

Bio-Techne has obtained federal trademark registration for certain of its brand and product names. Bio-Techne believes it has common law trademark rights to certain marks in addition to those which it has registered.

SEASONALITY OF BUSINESS

Bio-Techne believes there is some seasonality as a result of vacation and academic schedules of its worldwide customer base, particularly for the Biotechnology and Protein Platforms Segments. A majority of Diagnostics segment products are manufactured in large bulk lots and sold on a schedule set by the customer. Consequently, sales for that segment can be unpredictable, although not necessarily based on seasonality. As a result, we can experience material and sometimes unpredictable fluctuations in our revenue for this segment.

EMPLOYEES

Through its subsidiaries, Bio-Techne employed approximately 1,800 full-time and part-time employees as of June 30, 2017.

INVESTOR INFORMATION

We are subject to the information requirements of the Securities Exchange Act of 1934 (the Exchange Act). Therefore, we file periodic reports, proxy statements, and other information with the Securities and Exchange Commission (SEC). Such reports, proxy statements, and other information may be obtained by visiting the Public Reference Room of the SEC at 100 F Street, N.E., Room 1580, Washington, DC 20549 or by calling the SEC at 1-800-SEC-0330. In addition, the SEC maintains an internet site (http://www.sec.gov) that contains reports, proxy and information statements, and other information regarding issuers that file electronically.

Financial and other information about us is available on our web site (http://www.bio-techne.com/investors). We make available on our web site copies of our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13 or 15(d) of the Exchange Act as soon as reasonably practicable after filing such material electronically or otherwise furnishing it to the SEC.

EXECUTIVE OFFICERS OF THE REGISTRANT

Currently, the names, ages, positions and periods of service of each executive officer of the Company are as follows:

|

Name |

|

Age |

|

Position |

|

Officer Since |

|

|

|

|

|

|

|

|

|

Charles Kummeth |

|

57 |

|

President, Chief Executive Officer and Director |

|

2013 |

|

James T. Hippel |

|

46 |

|

Senior Vice President, Chief Financial Officer |

|

2014 |

|

Brenda Furlow |

|

59 |

|

Senior Vice President, General Counsel and Secretary |

|

2014 |

|

J. Fernando Bazan |

|

57 |

|

Chief Technology Officer |

|

2013 |

|

Kevin Gould |

|

53 |

|

Senior Vice President, Diagnostics |

|

2016 |

|

David Eansor |

|

55 |

|

Senior Vice President, Biotechnology |

|

2014 |

|

Robert Gavin |

|

49 |

|

Senior Vice President, Protein Platforms |

|

2014 |

Set forth below is information regarding the business experience of each executive officer. There are no family relationships among any of the officers named, nor is there any arrangement or understanding pursuant to which any person was selected as an officer.

Charles Kummeth has been President and Chief Executive Officer of the Company since April 1, 2013. Prior to joining the Company, he served as President of Mass Spectrometry and Chromatography at Thermo Fisher Scientific Inc. from September 2011. He was President of that company's Laboratory Consumables Division from 2009 to September 2011. Prior to joining Thermo Fisher, Mr. Kummeth served in various roles at 3M Corporation, most recently as the Vice President of the company's Medical Division from 2006 to 2008.

James T. Hippel has been Chief Financial Officer of the Company since April 1, 2014. Prior to joining the Company, Mr. Hippel served as Senior Vice President and Chief Financial Officer for Mirion Technologies, Inc., a $300 million global company that provides radiation detection and identification products. Prior to Mirion, Mr. Hippel served as Vice President, Finance at Thermo Fisher Scientific, Inc., leading finance operations for its Mass Spectrometry & Chromatography division and its Laboratory Consumables division. In addition, Mr. Hippel's experience includes nine years of progressive financial leadership at Honeywell International, within its Aerospace Segment. Mr. Hippel started his career with KPMG LLP.

Brenda Furlow joined the Company as Senior Vice President and General Counsel on August 4, 2014. Most recently, Ms. Furlow was affiliated with Alphatech Counsel, SC and served as general counsel to emerging growth technology companies. Ms. Furlow was General Counsel for TomoTherapy, Inc., a global, publicly traded company that manufactured and sold radiation therapy equipment from 2007 to 2011. From 1998 to 2007, Ms. Furlow served as General Counsel for Promega Corporation, a global life sciences company.

Dr. J. Fernando Bazan was appointed Chief Technical Officer when he joined the Company on August 1, 2013. Dr. Bazan is an adjunct professor at the University of Minnesota School of Medicine and served as Chief Scientific Officer at Neuroscience, Inc., a neuroimmunology startup from 2010 to 2012. From 2003 through 2010, Dr. Bazan served as Senior Scientist at Genentech, Inc. (Roche).

Kevin Gould became Senior Vice President, Diagnostics Division on January 1, 2016. Prior to that, Mr. Gould was President and CEO of Cliniqa prior to its acquisition by Bio-Techne in July 2015. Prior to Cliniqa, Mr. Gould held senior level positions in other diagnostic product business, including Vice President, SeraCare BBI Diagnostics business unit of SeraCare Life Sciences, Inc.; and Vice President, Sales & Marketing for Medical Analysis Systems Inc., now part of Thermo Fisher Scientific Inc.

David Eansor has served as Senior Vice President, Biotechnology Division since April, 2015. Prior to that, Mr. Eansor was Senior Vice President, Novus Biologicals, since the Company completed its acquisition of Novus on July 2, 2014. From January 2013 until the date of the acquisition, Mr. Eansor was the Senior Vice President of Corporate Development of Novus Biologicals. Prior to joining Novus, Mr. Eansor was the President of the Bioscience Division of Thermo Fisher Scientific. Mr. Eansor was promoted to Division President in early 2010 after 5 years as President of Thermo Fisher's Life Science Research business.

Robert Gavin was appointed Senior Vice President of the Protein Platforms Division in December 2014. Mr. Gavin had previously been Vice President of Product Development at ProteinSimple, which was acquired by the Company in July, 2014. Prior to joining ProteinSimple in 2008, Mr. Gavin served as Director of Engineering at MDS Analytical Technologies (previously Molecular Devices, Inc.). Prior to Molecular Devices, Mr. Gavin managed a team of engineers at Affymax Research Institute.

FORWARD-LOOKING INFORMATION AND CAUTIONARY STATEMENTS

This report contains forward-looking statements, which are based on the Company's current assumptions and expectations. The principal forward-looking statements in this report include the Company's expectations regarding product releases and strategy, future financial results, acquisition activity, the competitive environment, currency fluctuation and exchange rates, capital expenditures, the performance of the Company's investments, future dividend declarations, the construction and lease of certain facilities, the adequacy of owned and leased property for future operations, anticipated financial results and sufficiency of capital resources to meet the Company's foreseeable future cash and working capital requirements.

All such forward-looking statements are intended to enjoy the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995, as amended. Although the Company believes there is a reasonable basis for the forward-looking statements, the Company's actual results could be materially different. The most important factors which could cause the Company's actual results to differ from forward-looking statements are set forth in the Company's description of risk factors in Item 1A to this Annual Report on Form 10-K.

Forward-looking statements speak only as of the date they are made, and the Company does not undertake any obligation to update any forward-looking statements.

ITEM 1A. RISK FACTORS

Statements in this Annual Report on Form 10-K and elsewhere that are forward-looking involve risks and uncertainties which may affect the Company's actual results of operations. Certain of these risks and uncertainties which have affected and, in the future, could affect the Company's actual results are discussed below. The Company undertakes no obligation to update or revise any forward-looking statements made due to new information or future events. Investors are cautioned not to place undue emphasis on these statements.

The following risk factors should be read carefully in connection with evaluation of the Company's business and any forward-looking statements made in this Annual Report on Form 10-K and elsewhere. See the section entitled “forward-looking statements” set forth above. Any of the following risks or others discussed in this Annual Report on Form 10-K or the Company's other SEC filings could materially adversely affect the Company's business, operating results and financial condition.

It may be difficult for us to implement our strategies for maintaining organic growth.

Some of the markets in which we compete are experiencing slower growth and we face significant competition across many of our product lines. Competitors include companies ranging from start-up companies, which may be able to more quickly respond to customers' needs, to large multinational companies, which may have greater financial, marketing, operational, and research and development resources than the Company. In addition, consolidation trends in the pharmaceutical and biotechnology and diagnostics industries have served to create fewer customer accounts and to concentrate purchasing decisions for some customers, resulting in increased pricing pressure on the Company. Moreover, customers may believe that consolidated businesses are better able to compete as sole source vendors, and therefore prefer to purchase from such businesses. The entry into the market by manufacturers in China, India and other low-cost manufacturing locations is also creating increased pricing and competitive pressures, particularly in developing markets. Failure to anticipate and respond to competitors' actions may impact the Company's future sales and earnings.

To address this issue, we are pursuing a number of strategies to improve our internal growth, including:

|

|

• |

strengthening our presence in selected geographic markets; |

|

|

• |

allocating research and development funding to products with higher growth prospects; |

|

|

• |

developing new applications for our technologies; |

|

|

• |

continuing key opinion leader initiatives; |

|

|

• |

finding new markets for our products; and |

|

• |

continuing the development of commercial tools and infrastructure to increase and support cross-selling opportunities of products and services to take advantage of our depth in product offerings. |

We may not be able to successfully implement these strategies, and these strategies may not result in the expected growth of our business.

Our acquisition growth strategy pose financial, management and other risks and challenges.

We routinely explore acquiring other businesses and assets, and have completed nine acquisitions and several investments in the last three years. However, we may be unable to identify or complete promising acquisitions for many reasons, including competition among buyers, the high valuations of businesses in our industry, the need for regulatory and other approvals, and availability of capital. When we do identify and consummate acquisitions, we may face financial, managerial and operational challenges, including diversion of management attention, difficulty with integrating acquired businesses, integration of different corporate cultures, increased expenses, assumption of unknown liabilities, indemnities, potential disputes with the sellers, and the need to evaluate the financial systems of and establish internal controls for acquired entities. There can be no assurance that we will engage in any additional acquisitions or that we will be able to do so on terms that will result in any expected benefits. In addition, acquisitions financed with borrowings could make us more vulnerable to business downturns and could negatively affect our earnings due to higher leverage and interest expense.

We may be required to record a significant charge to earnings if our goodwill and other amortizable intangible assets, or other investments become impaired.

We are required under generally accepted accounting principles to test goodwill for impairment at least annually and to review our goodwill, amortizable intangible assets, and other assets acquired through merger and acquisition activity, for impairment when events or changes in circumstance indicate the carrying value may not be recoverable. Factors that could lead to impairment of goodwill, amortizable intangible assets, and other assets acquired via acquisitions include significant adverse changes in the business climate and actual or projected operating results (affecting our company as a whole or affecting any particular segment) and declines in the financial condition of our business. We may be required in the future to record additional charges to earnings if our goodwill, amortizable intangible assets or other investments become impaired. Any such charge would adversely impact our financial results.

In addition, the Company's expansion strategies include collaborations and investments in joint ventures and companies developing new products related to the Company's business. These strategies carry risks that objectives will not be achieved and future earnings will be adversely affected. For example, the Company has an approximate 13% equity investment in publicly traded ChemoCentryx, Inc. (Nasdaq: CCXI) that is valued at $59.6 million as of June 30, 2017. The ownership of CCXI shares is very concentrated, the share price is highly volatile and there is limited trading of the shares. In fiscal 2017, we also invested and hold a minority interest in privately-held Astute Medical, Inc., a diagnostics company developing new diagnostics tests relating to kidney injury. While their initial product is on the market, its adoption and success is highly uncertain, and our initial investment may be significantly impaired if it does not have market success. Any diminution in the value of these investments could result in future dilution of our investments or materially impact our financial statements.

Significant developments stemming from the recent U.S. elections and the U.K.’s referendum on membership in the EU could have an adverse effect on us.

The current Congress is considering significant changes to, or replacement or elimination of the Patient Protection and Affordable Care Act, and government negotiation/regulation of drug prices paid by government programs. The new U.S. administration has called for substantial changes to trade agreements and has raised the possibility of imposing significant increases on tariffs on goods imported into the United States, particularly from China and Mexico. These and other potential shifts in law, regulation and policy could adversely affect operating results and our business.

In a referendum vote held on June 23, 2016, the United Kingdom (UK) voted to leave the European Union (EU). Subsequently, on March 29, 2017, the UK invoked Article 50 of the Lisbon Treaty to formally begin the withdrawal process. The impact of this action has caused and may continue to cause global economic uncertainty and currency exchange rate fluctuations. Although it is unknown what the terms of the UK’s future relationship with the EU will be, it is possible that there will be disruption to the UK and EU economies, as well as greater restrictions on imports and exports between the UK and the EU and increased regulatory and tax complexities. Any of these factors could adversely affect customer demand, our relationships with customers and suppliers, and our business and financial results, particularly since our European headquarters and shipping facilities are currently located in the UK. Additionally, attracting and retaining qualified employees who are citizens of EU countries to our UK facilities may be more difficult given the uncertainties resulting from the UK withdrawal.

We are subject to financial, operating, legal and compliance risk associated with global operations.

We engage in business globally, with approximately 31% of our sales revenue in fiscal 2017 coming from outside the U.S. In addition, one of our strategies is to expand geographically, particularly in China and in developing countries, both through distribution and through direct operations. This subjects us to a number of risks, including international economic, political, and labor conditions; currency fluctuations; tax laws (including U.S. taxes on foreign subsidiaries); increased financial accounting and reporting burdens and complexities; unexpected changes in, or impositions of, legislative or regulatory requirements; failure of laws to protect intellectual property rights adequately; inadequate local infrastructure and difficulties in managing and staffing international operations; delays resulting from difficulty in obtaining export licenses for certain technology; tariffs, quotas and other trade barriers and restrictions; transportation delays; operating in locations with a higher incidence of corruption and fraudulent business practices; and other factors beyond our control, including terrorism, war, natural disasters, climate change and diseases.

The application of laws and regulations implicating global transactions is often unclear and may at times conflict. Compliance with these laws and regulations may involve significant costs or require changes in our business practices that result in reduced revenue and profitability. Non-compliance could also result in fines, damages, criminal sanctions, prohibited business conduct, and damage to our reputation. We incur additional legal compliance costs associated with our global operations and could become subject to legal penalties in foreign countries if it does not comply with local laws and regulations, which may be substantially different from those in the U.S.

We continue to expand our operations in countries with developing economies, where it may be common to engage in business practices that are prohibited by U.S. regulations applicable to the Company, such as the Foreign Corrupt Practices Act. Although we implement policies and procedures designed to ensure compliance with these laws, there can be no assurance that all of our employees, contractors, and agents, as well as those companies to which we outsource certain aspects of our business operations, including those based in foreign countries where practices which violate such U.S. laws may be customary, will comply with our internal policies. Any such non-compliance, even if prohibited by our internal policies, could have an adverse effect on our business and result in significant fines or penalties.

Changes in economic conditions for our customers could negatively impact our revenues and earnings.

Our biotechnology and protein platforms products are sold primarily to research scientists at pharmaceutical and biotechnology companies and at university and government research institutions. Research and development spending by our customers and the availability of government research funding can fluctuate due to changes in available resources, mergers of pharmaceutical and biotechnology companies, spending priorities, general economic conditions and institutional and governmental budgetary policies. Our diagnostics segment products are intended primarily for the medical diagnostics market, which relies largely on government healthcare-related policies and funding. Changes in government reimbursement for certain diagnostic tests or reductions in overall healthcare spending could negatively impact our customers and, correspondingly, our sales to them. The U.S. and global economies recently experienced a period of economic downturn and have been slow to recover in some parts of the world. In Japan, government investment in biotechnology research remains weak. Such downturns, and other reductions or delays in governmental funding, could cause customers to delay or forego purchases of our products. We carry essentially no backlog of orders and changes in the level of orders received and filled daily can cause fluctuations in quarterly revenues and earnings.

We have identified a material weakness in our internal control over financial reporting which could, if not remediated, harm our operating results or cause us to fail to meet our reporting obligations.

Our management is responsible for establishing and maintaining adequate internal control over our financial reporting, as defined in Rule 13a-15(f) under the Securities Exchange Act. As disclosed in Item 9A, at the beginning of fiscal 2017 management identified material weaknesses in our internal control over financial reporting involving the effectiveness of the information and communication, and monitoring processes resulting in a lack of effective controls over general information technology controls (GITC) for certain applications. A material weakness is defined as a deficiency, or combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of our annual or interim financial statements will not be prevented or detected on a timely basis. As a result of these material weaknesses, our management concluded that our internal control over financial reporting was not effective based on criteria set forth by the Committee of Sponsoring Organization of the Treadway Commission in Internal Control-An Integrated Framework (2013 Framework). We have developed and implemented a remediation plan designed to address these material weaknesses, but have not yet had sufficient time to fully and effective implement and test the additional controls established in that plan. Any failure to complete the implementation of effective internal controls could harm our operating results or cause us to fail to meet our reporting obligations. Inadequate internal controls could also cause investors to lose confidence in our reported financial information, which could have a negative effect on the trading price of our common stock, and may require us to incur additional costs to improve our internal control system.

Our success will be dependent on recruiting and retaining highly qualified personnel and creating a new culture that includes the employees joining through acquisition.

Recruiting and retaining qualified scientific, production, sales and marketing, and management personnel are critical to our success. Our anticipated growth and its expected expansion into areas and activities requiring additional expertise will require the addition of new personnel and the development of additional expertise by existing personnel. We also operate in several geographic locations where competition for talent is strong, making employee retention particularly challenging in those locations. Our growth by acquisition also creates challenges in retaining employees. As we integrate past and future acquisitions and evolve our corporate culture to incorporate the new workforces, some employees may not find such integration or cultural changes appealing. The failure to attract and retain such personnel could adversely affect our business.

Cyber security risks and the failure to maintain the confidentiality, integrity, and availability of our computer hardware, software, and Internet applications and related tools and functions could result in damage to our reputation and/or subject us to costs, fines, or lawsuits.

The integrity and protection of our own data, and that of our customers and employees, is critical to our business. The regulatory environment governing information, security and privacy laws is increasingly demanding and continues to evolve. Maintaining compliance with applicable security and privacy regulations may increase our operating costs and/or adversely impact our ability to market our products and services to customers. Although our computer and communications hardware is protected through physical and software safeguards, it is still vulnerable to fire, storm, flood, power loss, earthquakes, telecommunications failures, physical or software break-ins, software viruses, and similar events. These events could lead to the unauthorized access, disclosure and use of non-public information. The techniques used by criminal elements to attack computer systems are sophisticated, change frequently and may originate from less regulated and remote areas of the world. As a result, we may not be able to address these techniques proactively or implement adequate preventative measures. If our computer systems are compromised, we could be subject to fines, damages, litigation, and enforcement actions, customers could curtail or cease using its applications, and we could lose trade secrets, the occurrence of which could harm our business.

We are dependent on maintaining our intellectual property rights.

Our success depends in part on our ability to protect and maintain our intellectual property, including trade secrets. If we fail to protect our intellectual property, third parties may be able to compete more effectively against us, we may lose our technological or competitive advantage, or we may incur substantial litigation costs in our attempts to recover or restrict use of our intellectual property. We attempt to protect trade secrets in part through confidentiality agreements, but those agreements can be breached, and if they are, there may not be an adequate remedy. If trade secrets become publicly known, we could lose our competitive position.

We also attempt to protect and maintain intellectual property through the patent process. As of June 30, 2017, we owned or exclusively licensed 115 granted U.S. patents and approximately 100 pending patent applications. We cannot be confident that any of our currently pending or future patent applications will result in granted patents, and we cannot predict how long it will take for such patents to be granted. It is possible that, if patents are granted to us, others will design around our patented technologies. Further, other parties may challenge any patents granted to us and courts or regulatory agencies may hold our patents to be invalid or unenforceable. We may not be successful in defending challenges made against our patents and patent applications. Any successful third-party challenge to our patents could result in the unenforceability or invalidity of such patents. Our ability to establish or maintain a technological or competitive advantage over our competitors may be diminished because of these uncertainties. To the extent our intellectual property offers inadequate protection, or is found to be invalid or unenforceable, we would be exposed to a greater risk of direct competition. If our intellectual property does not provide adequate coverage of our competitors' products, our competitive position could be adversely affected, as could our business. Both the patent application process and the process of managing patent disputes can be time consuming and expensive.

We may be involved in disputes to determine the scope, coverage and validity of others' proprietary rights, or to defend against third-party claims of intellectual property infringement, any of which could be time-intensive and costly and may adversely impact our business.

Our success depends in part on its ability to operate without infringing the proprietary rights of others, and to obtain licenses where necessary or appropriate. We have obtained and continue to negotiate licenses to produce a number of products claimed to be owned by others. Since we have not conducted a patent infringement study for each of our products, it is possible that some of our products may unintentionally infringe patents of third parties.

We have been and may in the future be sued by third parties alleging that we are infringing their intellectual property rights. These lawsuits are expensive, take significant time, and divert management's focus from other business concerns. If we are found to be infringing the intellectual property of others, we could be required to cease certain activities, alter our products or processes or pay licensing fees. This would cause unexpected costs and delays which may have a material adverse effect on us. If we are unable to obtain a required license on acceptable terms, or unable to design around any third party patent, we may be unable to sell some of our products and services, which could result in reduced revenue. In addition, if we do not prevail, a court may find damages or award other remedies in favor of the opposing party in any of these suits, which may adversely affect our earnings.

The Company relies heavily on internal manufacturing and related operations to produce, package and distribute its products which, if disrupted, could materially impair our business operations.

The Company's internal quality control, packaging and distribution operations support the majority of the Company's sales. Since certain Company products must comply with Food and Drug Administration Quality System Regulations and because in all instances, the Company creates value for its customers through the development of high-quality products, any significant decline in quality or disruption of operations for any reason, particularly at the Minneapolis facility, could adversely affect sales and customer relationships, and therefore adversely affect the business. While the Company has taken certain steps to manage these operational risks, and while insurance coverage may reimburse, in whole or in part, for losses related to such disruptions, the Company's future sales growth and earnings may be adversely affected by perceived disruption risks or actual disruptions.

We have entered into and drawn on a revolving credit facility. The burden of this additional debt could adversely affect us, make us more vulnerable to adverse economic or industry conditions, and prevent us from funding our expansion strategy.

In connection with the acquisition of Advanced Cell Diagnostics on August 1, 2016, we modified our revolving credit facility, governed by a Credit Agreement on July 28, 2016. The Credit Agreement provides for a revolving credit facility of $400 million. Borrowings under the Credit Agreement bear interest at a variable rate. As of August 30, 2017, the Company had drawn $368.5 million under the Credit Agreement.

The terms of the Credit Agreement and the burden of the indebtedness incurred thereunder could have negative consequences for us, such as:

|

• |

limiting our ability to obtain additional financing to fund our working capital, capital expenditures, debt service requirements, expansion strategy, or other needs; |

|

• |

increasing our vulnerability to, and reducing our flexibility in planning for, adverse changes in economic, industry and competitive conditions; and |

|

• |

increasing our vulnerability to increases in interest rates. |

The Credit Agreement also contains negative covenants that limit our ability to engage in specified types of transactions. These covenants limit our ability to, among other things, sell, lease or transfer any properties or assets, with certain exceptions; and enter into certain merger, consolidation or other reorganization transactions, with certain exceptions.

A breach of any of these covenants could result in an event of default under our credit facility. Upon the occurrence of an event of default, the lender could elect to declare all amounts outstanding under such facility to be immediately due and payable and terminate all commitments to extend further credit. In addition, the Company would be subject to additional restrictions if an event of default exists under the Credit Agreement, such as a prohibition on the payment of cash dividends.

Our share price will fluctuate.

Over the last several years, stock markets in general and our common stock in particular have experienced significant price and volume volatility. Both the market price and the daily trading volume of our common stock may continue to be subject to significant fluctuations due not only to general stock market conditions but also to a change in sentiment in the market regarding our operations and business prospects. In addition to the risk factors discussed above, the price and volume volatility of our common stock may be affected by:

|

• |

operating results that vary from our financial guidance or the expectations of securities analysts and investors; |

|

• |

the financial performance of the major end markets that we target; |

|

• |

the operating and securities price performance of companies that investors consider to be comparable to us; |

|

• |

announcements of strategic developments, acquisitions and other material events by us or our competitors; and |

|

• |

changes in global financial markets and global economies and general market conditions, such as interest or foreign exchange rates, commodity and equity prices and the value of financial assets. |

Dividends on our common stock could be reduced or eliminated in the future.

For the past 9 years, our Board has consistently declared quarterly dividends of $0.25 to $0.32 cents per share. In the future, our Board may determine to reduce or eliminate our common stock dividend in order to fund investments for growth, repurchase shares or conserve capital resources.

ITEM 1B. UNRESOLVED STAFF COMMENTS

There are no unresolved staff comments as of the date of this report.

ITEM 2. PROPERTIES

The Company owns the facilities that its headquarters and R&D Systems subsidiary occupy in Minneapolis, Minnesota. The Minneapolis facilities are utilized by both the Company's Biotechnology and Diagnostics segments.

The Minneapolis complex includes approximately 800,000 square feet of space in several adjoining buildings. Bio-Techne uses approximately 625,000 square feet of the complex for administrative, research, manufacturing, shipping and warehousing activities. The Company is currently leasing or plans to lease the remaining space in the complex as retail and office space.

The Company owns the 17,000 square foot facility that its Bio-Techne Europe subsidiary occupies in Abingdon, England. This facility is utilized by the Company's Biotechnology and Protein Platforms segments.

The Company leases the following material facilities, all of which are utilized by the Company's Biotechnology segment with the exception of the locations used by the Company's ProteinSimple and CyVek sites, which support the Protein Platforms segment and the Bionostics and Cliniqa subsidiaries (Diagnostics segment). Certain locations are not named because they were not significant individually or in the aggregate as of the date of this report.

|

Subsidiary |

|

Location |

|

Type |

|

Square Feet |

|

|

|

|

|

|

|

|

|

|

|

Bio-Techne Europe |

|

Langley, United Kingdom |

|

Warehouse |

|

14,300 |

|

|

Bio-Techne China |

|

Shanghai and Beijing, China |

|

Office/warehouse |

|

10,700 |

|

|

Boston Biochem |

|

Cambridge, Massachusetts |

|

Office/lab |

|

7,400 |

|

|

Tocris |

|

Bristol, United Kingdom |

|

Office/manufacturing/lab/warehouse |

|

30,000 |

|

|

PrimeGene |

|

Shanghai, China |

|

Office/manufacturing/lab |

|

20,600 |

|

|

Bionostics |

|

Devens, Massachusetts |

|

Office/manufacturing |

|

48,000 |

|

|

Novus Biologicals |

|

Littleton, Colorado |

|

Office/warehouse |

|

22,500 |

|

|

ProteinSimple |

|

San Jose, California |

|

Office/manufacturing/warehouse |

|

167,000 |

|

|

ProteinSimple Canada |

|

Ottawa and Toronto, Canada |

|

Office/manufacturing/warehouse |

|

13,900 |

|

|

CyVek |

|

Wallingford, Connecticut |

|

Office/manufacturing/warehouse |

|

17,500 |

|

|

Cliniqa |

|

San Marcos, California |

|

Office/manufacturing/warehouse |

|

87,200 |

|

|

Advanced Cell Diagnostics |

Newark, California |

Office/manufacturing/warehouse |

35,100 |

The Company is currently in the process of transitioning into new lease space for its Cliniqa operations. The Company believes the owned and leased properties are adequate to meet its occupancy needs in the foreseeable future.

ITEM 3. LEGAL PROCEEDINGS

As of August 30, 2017, the Company is not a party to any legal proceedings that, individually or in the aggregate, are reasonably expected to have a material adverse effect on the Company's business, results of operations, financial condition or cash flows.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

PART II

ITEM 5. MARKET FOR THE REGISTRANT'S COMMON EQUITY, RELATED SHAREHOLDER

MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Market Price of Common Stock

The Company's common stock trades on the NASDAQ Global Select Market under the symbol "TECH." The following table sets forth for the periods indicated the high and low sales price per share for the Company's common stock as reported by the NASDAQ Global Select Market.

|

Fiscal 2017 Price |

Fiscal 2016 Price |

|||||||||||||||

|

High |

Low |

High |

Low |

|||||||||||||

|

First Quarter |

$ | 117.42 | $ | 103.99 | $ | 114.56 | $ | 87.49 | ||||||||

|

Second Quarter |

112.20 | 98.92 | 96.81 | 83.90 | ||||||||||||

|

Third Quarter |

108.58 | 95.68 | 96.83 | 79.95 | ||||||||||||

|

Fourth Quarter |

119.98 | 98.22 | 114.62 | 91.45 | ||||||||||||

Holders of Common Stock and Dividends Paid

As of August 30, 2017, there were over 29,000 beneficial shareholders of the Company's common stock and over 165 shareholders of record. The Company paid quarterly cash dividends totaling $47.7 million, $47.6 million and $47.1 million in fiscal 2017, 2016 and 2015, respectively. The Board of Directors periodically considers the payment of cash dividends, and there is no guarantee that the Company will pay comparable cash dividends, or any cash dividends, in the future. The Company entered into a revolving line of credit in July 2016, which would prohibit payment of dividends to Company shareholders in the event of a default thereunder. The Credit Agreement that governs the revolving line of credit contains customary events of default.

Issuer Purchases of Equity Securities

There was no share repurchase activity by the Company in fiscal 2017. The maximum approximate dollar value of shares that may yet be purchased under the Company's existing stock repurchase plan is approximately $125 million. The plan does not have an expiration date.

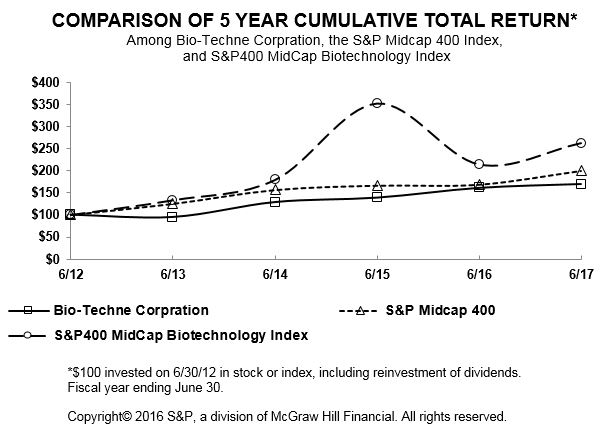

Stock Performance Graph

The following chart compares the cumulative total shareholder return on the Company's common stock with the S&P Midcap 400 Index and the S&P 400 Biotechnology Index. The comparison assumes $100 was invested on the last trading day before July 1, 2012 in the Company's common stock and in each of the foregoing indices and assumes reinvestment of dividends.

|

|

ITEM 6. SELECTED FINANCIAL DATA

(dollars in thousands, except per share data)

|

Income and Share Data: |

2017(1) |

2016(2) |

2015(3) |

2014(4) |

2013 |

|||||||||||||||

|

Net sales |

$ | 563,003 | $ | 499,023 | $ | 452,246 | $ | 357,763 | $ | 310,575 | ||||||||||

|

Operating income |

120,584 | 150,593 | 147,023 | 159,750 | 158,469 | |||||||||||||||

|

Earnings before income taxes (5) |

111,961 | 147,481 | 154,162 | 161,392 | 160,662 | |||||||||||||||

|

Net earnings |

76,086 | 104,476 | 107,735 | 110,948 | 112,561 | |||||||||||||||

|

Diluted earnings per share |

2.03 | 2.80 | 2.89 | 3.00 | 3.05 | |||||||||||||||

|

Average common and common equivalent shares - diluted (in thousands) |

37,500 | 37,326 | 37,231 | 37,005 | 36,900 | |||||||||||||||

|

Balance Sheet Data as of June 30: |

2017 |

2016 |

2015 |

2014 |

2013 |

|||||||||||||||

|

Cash, cash equivalents and short-term available-for-sale investments |

157,714 | $ | 95,835 | $ | 110,921 | $ | 363,354 | $ | 332,937 | |||||||||||

|

Working capital |

212,503 | 199,744 | 208,515 | 443,022 | 377,432 | |||||||||||||||

|

Total assets |

1,558,219 | 1,129,581 | 1,063,360 | 862,491 | 778,098 | |||||||||||||||

|

Total shareholders' equity |

949,627 | 879,280 | 846,935 | 795,265 | 737,541 | |||||||||||||||

|

Cash Flow Data: |

2017 |

2016 |

2015 |

2014 |

2013 |

|||||||||||||||

|

Net cash provided by operating activities |

$ | 143,811 | $ | 143,870 | $ | 139,359 | $ | 136,762 | $ | 123,562 | ||||||||||

|

Capital expenditures |

15,179 | 16,898 | 19,905 | 13,821 | 22,454 | |||||||||||||||

|

Cash dividends declared per share |

1.28 | 1.28 | 1.27 | 1.23 | 1.18 | |||||||||||||||

|

Employee Data as of June 30: |

2017 |

2016 |

2015 |

2014 |

2013 |

|||||||||||||||

|

Employees |

1,789 | 1,560 | 1,356 | 967 | 789 | |||||||||||||||

|

(1) |

The Company acquired Space on July 1, 2016, and Advanced Cell Diagnostics on August 1, 2016. |

|

(2) |

The Company acquired Cliniqa on July 8, 2015, and Zephyrus on March 21, 2016. |

|

(3) |

The Company acquired Novus Biologicals on July 2, 2014, ProteinSimple on July 31, 2014, and CyVek on November 3, 2014. |

|

(4) |

The Company acquired Bionostics on July 22, 2013, and PrimeGene on April 30, 2014. |

|

(5) |

Earnings before income taxes included acquisition related expenses related to amortization of intangibles, costs recognized on sale of acquired inventories and professional fees associated with acquisition activity, as follows: 2017 - $73.2 million; 2016 - $37.6 million; 2015 - $37.6 million; 2014 - $20.0 million; 2013 - $10.2 million. |

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL

CONDITION AND RESULTS OF OPERATIONS

The following management discussion and analysis (“MD&A”) provides information that we believe is useful in understanding our operating results, cash flows and financial condition. We provide quantitative information about the material sales drivers including the effect of acquisitions and changes in foreign currency at the corporate and segment level. We also provide quantitative information about discrete tax items and other significant factors we believe are useful for understanding our results. The MD&A should be read in conjunction with the consolidated financial information and related notes included in this Form 10-K. This discussion contains various “Non-GAAP Financial Measures” and also contains various “Forward-Looking Statements” within the meaning of the Private Securities Litigation Reform Act of 1995. We refer readers to the statements entitled “Non-GAAP Financial Measures” located at the end of this MD&A and “Forward-Looking Information and Cautionary Statements” and “Risk Factors” within Items 1 and 1A of this Form 10-K.

OVERVIEW

Bio-Techne develops, manufactures and sells biotechnology products and clinical diagnostic controls worldwide. With our deep product portfolio and application expertise, Bio-Techne is a leader in providing specialized proteins, including cytokines and growth factors, and related immunoassays, small molecules and other reagents to the research, diagnostics and clinical controls markets.