|

NOTICE OF DELIVERY OF PROSPECTUSES,

|

|

SEMI-ANNUAL REPORTS AND ANNUAL REPORTS

|

|

In order to reduce expenses of the Fifth Third Funds incurred in connection with the mailing of prospectuses, prospectus supplements, semi-annual reports and annual reports to multiple shareholders at the same address, Fifth Third Funds may in the future deliver one copy of a prospectus, prospectus supplement, semi-annual report or annual report to a single investor sharing a street address or post office box with other investors, provided that all such investors have the same last name or are believed to be members of the same family. If you share an address with another investor and wish to receive your own prospectus, prospectus supplements, semi-annual reports and annual reports, please call the Trust toll-free at 1-800-282-5706.

|

|

Fifth Third Funds, like all mutual funds:

|

|

• are NOT FDIC insured

|

|

• have no bank guarantee

|

|

• may lose value

|

|

FACTS

|

WHAT DOES Fifth Third Funds

DO WITH YOUR PERSONAL INFORMATION?

|

|

Why?

|

Financial companies choose how they share your personal information. Federal law gives consumers the right to limit some but not all sharing. Federal law also requires us to tell you how we collect, share, and protect your personal information. Please read this notice carefully to understand what we do.

|

||||

|

What?

|

The types of personal information we collect and share depend on the product or service you have with us. This information can include:

|

||||

|

■

|

Social Security number and customer names

|

||||

|

■

|

customer addresses

|

and tax identification numbers

|

|||

|

■

|

account numbers

|

and account and transaction history

|

|||

|

When you are no longer our customer, we continue to share your information as described in this notice.

|

|||||

|

How?

|

All financial companies need to share customers’ personal information to run their everyday business. In the section below, we list the reasons financial companies can share their customers’ personal information; the reasons Fifth Third Funds chooses to share; and whether you can limit this sharing.

|

||||

|

Reasons we can share your personal information

|

Does Fifth Third

Funds share?

|

Can you limit this sharing?

|

|

|

For our everyday business purposes –

such as to process your transactions, maintain

your account(s), respond to court orders and legal

investigations, or report to credit bureaus

|

Yes

|

No

|

|

|

For our marketing purposes –

to offer our products and services to you

|

Yes

|

No

|

|

|

For joint marketing with other financial companies

|

No

|

No

|

|

|

For our affiliates’ everyday business purposes –

information about your transactions and experiences

|

Yes

|

No

|

|

|

For our affiliates’ everyday business purposes –

information about your creditworthiness

|

No

|

No

|

|

|

For our affiliates to market to you

|

No

|

No

|

|

|

For nonaffiliates to market to you

|

No

|

No

|

|

Questions?

|

Call 800-282-5706 or go to http://fifththirdfunds.com/

|

||

|

Who we are

|

||||||

|

Who is providing this notice?

|

Fifth Third Funds

|

|||||

|

What we do

|

||||||

|

How does Fifth Third Funds

protect my personal information?

|

To protect your personal information from unauthorized access and use, we use security measures that comply with federal law. These measures include computer safeguards and secured files and buildings.

|

|||||

|

How does Fifth Third Funds

collect my personal information?

|

We collect your personal information, for example, when you

|

|||||

|

|

■

|

open an account or conduct account

|

||||

|

■

|

transactions or request account information or

|

|||||

|

■

|

when our service providers service your account.

|

|||||

|

Why can’t I limit all sharing?

|

Federal law gives you the right to limit only

|

|||||

|

■

|

sharing for affiliates’ everyday business purposes – information about your creditworthiness

|

|||||

|

■

|

affiliates from using your information to market to you

|

|||||

|

■

|

sharing for nonaffiliates to market to you

|

|||||

|

State laws and individual companies may give you additional rights to limit sharing.

|

||||||

|

Definitions

|

||||||

|

Affiliates

|

Companies related by common ownership or control. They can be financial and nonfinancial companies.

|

|||||

|

■

|

Fifth Third Bank, Inc., Fifth Third Securities, Inc., Fifth Third Asset Management, Inc. See www.53.com for a list of all affiliates.

|

|||||

|

Nonaffiliates

|

Companies not related by common ownership or control. They can be financial and nonfinancial companies.

|

|||||

|

■

|

State Street Bank and Trust, Boston Financial Data Services, FTAM Funds Distributor, Inc.

|

|||||

|

Joint marketing

|

A formal agreement between nonaffiliated financial companies that together market financial products or services to you.

|

|||||

|

■

|

None

|

|||||

|

Other important information

|

||||||

|

The Fifth Third Funds require its service providers to maintain technical, physical, and administrative safeguards. Additionally, when customer information is shared, the Fifth Third Funds require third parties to treat and maintain the privacy of customer information with the same degree of diligence and careful attention required by the Fifth Third Funds.

|

||||||

|

Table of Contents

|

||

|

2

|

||

|

4

|

||

|

4

|

||

|

6

|

||

|

8

|

||

|

10

|

||

|

12

|

||

|

14

|

||

|

16

|

||

|

18

|

||

|

20

|

||

|

22

|

||

|

24

|

||

|

26

|

||

|

28

|

||

|

30

|

||

|

32

|

||

|

34

|

||

|

36

|

||

|

72

|

||

|

74

|

||

|

78

|

||

|

82

|

||

|

94

|

||

|

110

|

||

|

111

|

||

|

135

|

||

|

136

|

| 1 |

|

•

|

A 9.13% advance for the S&P 500® Index1 of large cap stocks.

|

|

•

|

A 1.20% advance for the S&P 400® Index1 of mid cap stocks.

|

|

•

|

A 3.99% advance for the S&P 600® Index1 of small cap stocks.

|

|

•

|

A –11.45% decline for the MSCI EAFE Index1 of international stocks.

|

|

•

|

Statistics related to the domestic economy suggest to us that the current recovery is still intact and should grow in the modest 2% range (plus or minus) for now. We are mindful, however, of the fact that conditions did slow during the spring and summer months in 2010 and 2011.

|

|

•

|

Company fundamentals should remain solid and will likely outpace overall economic growth. We see earnings progressing at a 5% to 6% clip in 2012.

|

| 2 |

|

•

|

The Federal Reserve continues to signal nothing but accommodation. Bottom-line, we favor stocks over bonds, cash, and other asset classes. At this stage, market retrenchments should be viewed as an opportunity to buy good stocks.

|

|

•

|

The second half of the year will be consumed by November’s U.S. Presidential election. For the markets, the election outcome will be important and the key issues will center on the tax code: individual income tax rates, investment tax rates on dividends and capital gains, and corporate tax policies. Investors should be aware of these implications and should consider portfolio planning during the year.

|

|

|

Keith Wirtz, CFA®

|

|

Chief Investment Officer

|

|

1Terms and Definitions

|

||

| 3 |

|

Investment Risk Considerations

|

||

|

Average Annual Total Returns as of July 31, 2012

|

||

|

1 Year

|

5 Year

|

10 Year

|

Ending Value2

|

||||||

|

Institutional

|

4.88

|

%

|

2.78%

|

8.22%

|

22,026

|

||||

|

Class A Shares

|

–0.59

|

%

|

1.48%

|

7.39%

|

20,399

|

||||

|

Class B Shares

|

–1.16

|

%

|

1.46%

|

7.27%

|

20,175

|

||||

|

Class C Shares

|

3.90

|

%

|

1.79%

|

7.14%

|

19,931

|

||||

|

Russell Midcap® Growth Index1

|

0.67

|

%

|

2.34%

|

9.57%

|

24,932

|

||||

|

Sector Investment Concentration as of July 31, 2012

|

||

|

as a percentage of total investments

|

||

|

Top Ten Equity Holdings as of July 31, 2012 *

|

||

|

as a percentage of value of investments †

|

||

|

Alexion Pharmaceuticals, Inc.

|

2.68%

|

|

Mellanox Technologies, Ltd.

|

2.30%

|

|

Ross Stores, Inc.

|

2.19%

|

|

TransDigm Group, Inc.

|

2.11%

|

|

FMC Corp.

|

2.00%

|

|

Medivation, Inc.

|

1.94%

|

|

Cirrus Logic, Inc.

|

1.93%

|

|

Teradata Corp.

|

1.90%

|

|

Dollar Tree, Inc.

|

1.84%

|

|

Ecolab, Inc.

|

1.76%

|

|

*

|

Long-term securities.

|

|

†

|

Portfolio composition is subject to change.

|

| 4 |

|

Management Discussion of Fund Performance (Unaudited)

|

|

|

Mid Cap Growth Fund

|

|

|

Growth of a $10,000 Investment

|

|

|

||

|

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. For performance data current to the most recent month end, visit our website at www.fifththirdfunds.com.

|

||

|

1.

|

The Fund’s performance is measured against the Russell Midcap® Growth Index. The Russell Midcap® Growth Index measures the performance of those Russell midcap companies with higher price-to-book ratios and higher forecasted growth values. The stocks are also members of the Russell 1000® Growth Index.

The Russell Midcap® Growth Index is unmanaged and does not reflect the deduction of fees associated with a mutual fund such as investment management and fund accounting fees. However, the Fund’s performance reflects the deduction of fees for these value added services. Investors cannot invest directly in an index, although they can invest in its underlying mutual funds or securities.

|

|

2.

|

The ending value represents the value of a $10,000 investment in the indicated share class for the 10-Year period ended July 31, 2012.

|

| 5 |

|

Investment Risk Considerations

|

||

|

Average Annual Total Returns as of July 31, 2012

|

||

|

1 Year

|

5 Year

|

10 Year

|

Ending Value2

|

||||||

|

Institutional

|

2.58

|

%

|

2.73%

|

5.31%

|

16,782

|

||||

|

Class A Shares

|

–2.76

|

%

|

1.44%

|

4.52%

|

15,556

|

||||

|

Class B Shares

|

–3.42

|

%

|

1.37%

|

4.42%

|

15,410

|

||||

|

Class C Shares

|

1.56

|

%

|

1.70%

|

4.26%

|

15,177

|

||||

|

Russell 1000® Growth Index1

|

8.26

|

%

|

3.46%

|

6.77%

|

19,252

|

||||

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, visit www.fifththirdfunds.com.

|

Sector Investment Concentration as of July 31, 2012

|

||

|

as a percentage of total investments

|

||

|

Top Ten Equity Holdings as of July 31, 2012 *

|

||

|

as a percentage of value of investments †

|

||

|

Apple, Inc.

|

6.72%

|

|

International Business Machines Corp.

|

4.21%

|

|

Exxon Mobil Corp.

|

3.37%

|

|

Coca-Cola Co. (The)

|

3.03%

|

|

Fiserv, Inc.

|

2.16%

|

|

FMC Corp.

|

2.14%

|

|

McDonald’s Corp.

|

2.08%

|

|

Alexion Pharmaceuticals, Inc.

|

2.04%

|

|

Qualcomm, Inc.

|

2.01%

|

|

Valspar Corp.

|

2.00%

|

|

*

|

Long-term securities.

|

|

†

|

Portfolio composition is subject to change.

|

| 6 |

|

Management Discussion of Fund Performance (Unaudited)

|

|

|

Quality Growth Fund

|

|

|

Growth of a $10,000 Investment

|

|

|

||

|

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. For performance data current to the most recent month end, visit our website at www.fifththirdfunds.com.

|

||

|

1.

|

The Fund’s performance is measured against the Russell 1000® Growth Index. The Russell 1000® Growth Index measures the performance of 1,000 securities found in the Russell universe with higher price–to–book ratios and higher forecasted growth values.

|

|

The Russell 1000® Growth Index is unmanaged and does not reflect the deduction of fees associated with a mutual fund such as investment management and fund accounting fees. However, the Fund’s performance reflects the deduction of fees for these value added services. Investors cannot invest directly in an index, although they can invest in its underlying mutual funds or securities.

|

|

|

2.

|

The ending value represents the value of a $10,000 investment in the indicated share class for the 10-Year period ended July 31, 2012.

|

| 7 |

|

Management Discussion of Fund Performance (Unaudited)

|

|

|

Investment Risk Considerations

|

||

|

Average Annual Total Returns as of July 31, 2012

|

||

|

1 Year

|

5 Year

|

10 Year

|

Ending Value2

|

||||||||

|

Institutional

|

0.66

|

%

|

1.70

|

%

|

10.23

|

%

|

26,479

|

||||

|

Class A Shares

|

–4.71

|

%

|

0.41

|

%

|

9.38

|

%

|

24,506

|

||||

|

Class B Shares

|

–5.51

|

%

|

0.41

|

%

|

9.40

|

%

|

24,550

|

||||

|

Class C Shares

|

–0.53

|

%

|

0.69

|

%

|

9.23

|

%

|

24,174

|

||||

|

Russell 2000®

|

|||||||||||

|

Value Index1

|

0.89

|

%

|

0.52

|

%

|

8.11

|

%

|

21,817

|

||||

|

Russell Microcap® Value Index1

|

2.22

|

%

|

–2.06

|

%

|

7.48

|

%3

|

20,577

|

||||

|

Sector Investment Concentration as of July 31, 2012

|

||

|

as a percentage of total investments

|

||

|

Top Ten Equity Holdings as of July 31, 2012 *

|

||

|

as a percentage of value of investments †

|

||

|

ViewPoint Financial Group

|

1.69%

|

|

Unitil Corp.

|

1.62%

|

|

BofI Holding, Inc.

|

1.53%

|

|

Monmouth Real Estate Investment Corp.

|

1.52%

|

|

Chesapeake Utilities Corp.

|

1.50%

|

|

Dime Community Bancshares, Inc.

|

1.47%

|

|

Renasant Corp.

|

1.37%

|

|

PH Glatfelter Co.

|

1.35%

|

|

OfficeMax, Inc.

|

1.35%

|

|

Stage Stores, Inc.

|

1.32%

|

|

*

|

Long-term securities.

|

|

†

|

Portfolio composition is subject to change.

|

| 8 |

|

Management Discussion of Fund Performance (Unaudited)

|

|

|

Micro Cap Value Fund

|

|

|

Growth of a $10,000 Investment

|

|

|

||

|

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. For performance data current to the most recent month end, visit our website at www.fifththirdfunds.com.

|

||

|

1.

|

The Fund’s performance is measured against the Russell 2000® Value Index and the Russell Microcap® Value Index. The Russell 2000® Value Index measures the performance of those Russell 2000® companies with a less-than-average growth orientation. The Russell Microcap® Value Index measures the performance of those Russell Microcap companies with lower price-to-book ratios and lower forecasted growth values.

|

|

The Russell 2000® Value Index and the Russell Microcap® Value Index are unmanaged and do not reflect the deduction of fees associated with a mutual fund such as investment management and fund accounting fees. However, the Fund’s performance reflects the deduction of fees for these value-added services. Investors cannot invest directly in an index, although they can invest in its underlying mutual funds or securities.

|

|

|

2.

|

The ending value represents the value of a $10,000 investment in the indicated share class for the 10-year period ended July 31, 2012.

|

|

3.

|

The average annual total return for the Russell Microcap® Value Index since its inception.

|

| 9 |

|

Management Discussion of Fund Performance (Unaudited)

|

|

Investment Risk Considerations

|

||

|

Average Annual Total Returns as of July 31, 2012

|

||

|

Inception

|

|

|

Since

|

Ending

|

||||||||

|

Date

|

1 Year

|

5 Year

|

Inception

|

Value2

|

||||||||

|

Institutional

|

4/1/03

|

–2.42%

|

2.25%

|

8.83%

|

22,038

|

|||||||

|

Class A Shares

|

4/1/03

|

–7.51%

|

0.94%

|

7.96%

|

20,436

|

|||||||

|

Class B Shares

|

4/1/03

|

–7.91%

|

0.89%

|

7.87%

|

20,272

|

|||||||

|

Class C Shares

|

4/1/03

|

–3.39%

|

1.21%

|

7.73%

|

20,035

|

|||||||

|

Russell 2000® Value Index1

|

|

0.89%

|

0.52%

|

9.68%

|

23,697

|

|||||||

|

Sector Investment Concentration as of July 31, 2012

|

||

|

as a percentage of total investments

|

||

|

Top Ten Equity Holdings as of July 31, 2012 *

|

||

|

as a percentage of value of investments †

|

||

|

Kemper Corp.

|

1.86 | % | ||

|

CubeSmart

|

1.77 | % | ||

|

Lexington Realty Trust

|

1.75 | % | ||

|

W&T Offshore, Inc.

|

1.75 | % | ||

|

Black Hills Corp.

|

1.75 | % | ||

|

OfficeMax, Inc.

|

1.74 | % | ||

|

Avista Corp.

|

1.73 | % | ||

|

American Equity Investment Life Holding Co.

|

1.68 | % | ||

|

MedAssets, Inc.

|

1.67 | % | ||

|

Symmetry Medical, Inc.

|

1.66 | % |

|

*

|

Long-term securities.

|

|

†

|

Portfolio composition is subject to change.

|

| 10 |

|

Management Discussion of Fund Performance (Unaudited)

|

|

Small Cap Value Fund

|

||

|

Growth of a $10,000 Investment

|

|

||

|

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. For performance data current to the most recent month end, visit our website at www.fifththirdfunds.com.

|

|

1.

|

The Fund’s performance is measured against the Russell 2000® Value Index. The Russell 2000® Value Index measures the performance of those Russell 2000® companies with a less–than–average growth orientation. Companies in this index generally have low price-to-book and price-to-earnings ratios.

|

|

The Russell 2000® Value Index is unmanaged and does not reflect the deduction of fees associated with a mutual fund such as investment management and fund accounting fees. However, the Fund’s performance reflects the deduction of fees for these value added services. Investors cannot invest directly in an index, although they can invest in its underlying mutual funds or securities.

|

|

|

2.

|

The ending value represents the value of a $10,000 investment in the indicated share class from its inception to the period ended July 31, 2012.

|

| 11 |

|

Management Discussion of Fund Performance (Unaudited)

|

|

Investment Risk Considerations

|

||

|

Average Annual Total Returns as of July 31, 2012

|

||

|

1 Year

|

5 Year

|

10 Year

|

Ending Value2

|

|||||||||

|

Institutional

|

0.76%

|

–3.37%

|

6.65%

|

19,046

|

||||||||

|

Class A Shares

|

–4.47%

|

–4.57%

|

5.85%

|

17,655

|

||||||||

|

Class B Shares

|

–5.12%

|

–4.61%

|

5.75%

|

17,494

|

||||||||

|

Class C Shares

|

–0.25%

|

–4.33%

|

5.58%

|

17,210

|

||||||||

|

Russell 3000®

|

||||||||||||

|

Value Index1

|

7.09%

|

–0.93%

|

6.54%

|

18,845

|

||||||||

|

Russell Midcap® Value Index1

|

3.81%

|

1.13%

|

9.35%

|

24,456

|

||||||||

|

Sector Investment Concentration as of July 31, 2012

|

||

|

as a percentage of total investments

|

||

|

Top Ten Equity Holdings as of July 31, 2012 *

|

||

|

as a percentage of value of investments †

|

||

|

General Electric Co.

|

3.95 | % | ||

|

AT&T, Inc.

|

3.12 | % | ||

|

Merck & Co., Inc.

|

2.96 | % | ||

|

Amgen, Inc.

|

2.88 | % | ||

|

Intel Corp.

|

2.79 | % | ||

|

Citigroup, Inc.

|

2.78 | % | ||

|

Cisco Systems, Inc.

|

2.72 | % | ||

|

UnitedHealth Group, Inc.

|

2.68 | % | ||

|

Chevron Corp.

|

2.40 | % | ||

|

CIGNA Corp.

|

2.31 | % |

| * |

Long-term securities.

|

| † |

Portfolio composition is subject to change.

|

| 12 |

|

Management Discussion of Fund Performance (Unaudited)

|

|

All Cap Value Fund

|

||

|

Growth of a $10,000 Investment

|

|

||

|

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. For performance data current to the most recent month end, visit our website at www.fifththirdfunds.com.

|

||

|

1.

|

The Fund’s performance is measured against the Russell 3000® Value Index and the Russell Midcap® Value Index. The Russell 3000® Value Index measures the performance of those companies in the Russell 3000® Index with lower price-to-book ratios and lower forecasted growth values. The Russell Midcap® Value Index measures the performance of those Russell mid cap companies with lower price-to-book ratios and lower forecasted growth values.

|

|

The Russell 3000® Value and the Russell Midcap® Value Indices are unmanaged and do not reflect the deduction of fees associated with a mutual fund such as investment management and fund accounting fees. However, the Fund’s performance reflects the deduction of fees for these value-added services. Investors cannot invest directly in an index, although they can invest in its underlying mutual funds or securities.

|

|

|

2.

|

The ending value represents the value of a $10,000 investment in the indicated share class for the 10-year period ended July 31, 2012.

|

| 13 |

|

Management Discussion of Fund Performance (Unaudited)

|

|

Investment Risk Considerations

|

||

|

Average Annual Total Returns as of July 31, 2012

|

||

|

1 Year

|

5 Year

|

10 Year

|

Ending Value2

|

|||||||||

|

Institutional

|

3.25%

|

–1.91%

|

5.88%

|

17,699

|

||||||||

|

Class A Shares

|

–2.19%

|

–3.15%

|

5.07%

|

16,403

|

||||||||

|

Class B Shares

|

–2.73%

|

–3.22%

|

4.98%

|

16,259

|

||||||||

|

Class C Shares

|

2.25%

|

–2.87%

|

4.82%

|

16,018

|

||||||||

|

Russell 1000® Value Index1

|

7.64%

|

–1.06%

|

6.42%

|

18,267

|

||||||||

|

Sector Investment Concentration as of July 31, 2012

|

||

|

as a percentage of total investments

|

||

|

Top Ten Equity Holdings as of July 31, 2012 *

|

||

|

as a percentage of value of investments †

|

||

|

Merck & Co., Inc.

|

4.53 | % | ||

|

General Electric Co.

|

4.44 | % | ||

|

AT&T, Inc.

|

4.35 | % | ||

|

Chevron Corp.

|

4.21 | % | ||

|

BP PLC

|

3.72 | % | ||

|

Cisco Systems, Inc.

|

3.71 | % | ||

|

Citigroup, Inc.

|

3.67 | % | ||

|

Amgen, Inc.

|

2.97 | % | ||

|

Royal Dutch Shell PLC

|

2.86 | % | ||

|

General Dynamics Corp.

|

2.80 | % |

|

*

|

Long-term securities. |

|

†

|

Portfolio composition is subject to change. |

| 14 |

|

Management Discussion of Fund Performance (Unaudited)

|

|

Disciplined Large Cap Value Fund

|

||

|

Growth of a $10,000 Investment

|

|

||

|

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. For performance data current to the most recent month end, visit our website at www.fifththirdfunds.com.

|

||

|

1.

|

The Fund’s performance is measured against the Russell 1000® Value Index. The Russell 1000® Value Index measures the performance of 1,000 securities found in the Russell universe with a less-than-average growth orientation. Companies in this index generally have low price-to-book and price-to-earning ratios, higher dividend yields and lower forecasted growth values.

|

|

The Russell 1000® Value Index is unmanaged and does not reflect the deduction of fees associated with a mutual fund such as investment management and fund accounting fees. However, the Fund’s performance reflects the deduction of fees for these value-added services. Investors cannot invest directly in an index, although they can invest in its underlying mutual funds or securities.

|

|

|

2.

|

The ending value represents the value of a $10,000 investment in the indicated share class for the 10-year period ended July 31, 2012.

|

| 15 |

|

Management Discussion of Fund Performance (Unaudited)

|

|

Investment Risk Considerations

|

||

|

Average Annual Total Returns as of July 31, 2012

|

||

|

1 Year

|

5 Year

|

10 Year

|

Ending Value2

|

||||||||||

|

Institutional

|

–13.47

|

%

|

–7.02

|

%

|

4.65

|

%

|

15,759

|

||||||

|

Class A Shares

|

–17.96

|

%

|

–8.22

|

%

|

3.87

|

%

|

14,620

|

||||||

|

Class B Shares

|

–18.60

|

%

|

–8.18

|

%

|

3.78

|

%

|

14,499

|

||||||

|

Class C Shares

|

–14.37

|

%

|

–7.97

|

%

|

3.59

|

%

|

14,228

|

||||||

|

MSCI EAFE Index, Net1

|

–11.45

|

%

|

–5.61

|

%

|

6.36

|

%

|

18,529

|

||||||

|

Sector Investment Concentration as of July 31, 2012

|

||

|

as a percentage of total investments

|

||

|

Top Ten Equity Holdings as of July 31, 2012 *

|

||

|

as a percentage of value of investments †

|

||

|

Nestle SA

|

2.38

|

%

|

||

|

Novartis AG

|

1.96

|

%

|

||

|

Royal Dutch Shell PLC

|

1.70

|

%

|

||

|

Total SA

|

1.50

|

%

|

||

|

HSBC Holdings PLC

|

1.45

|

%

|

||

|

BHP Billiton, Ltd.

|

1.30

|

%

|

||

|

Vodafone Group PLC

|

1.30

|

%

|

||

|

Commonwealth Bank of Australia

|

1.29

|

%

|

||

|

BASF SE

|

1.24

|

%

|

||

|

Bayer AG

|

1.23

|

%

|

|

*

|

Long-term securities.

|

|

†

|

Portfolio composition is subject to change.

|

| 16 |

|

Management Discussion of Fund Performance (Unaudited)

|

|

International Equity Fund

|

||

|

Growth of a $10,000 Investment

|

|

||

|

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. For performance data current to the most recent month end, visit our website at www.fifththirdfunds.com.

|

||

|

1.

|

The Fund’s performance is measured against the Morgan Stanley Capital International (MSCI) Europe, Australasia and Far East (EAFE) Index, Net. The Morgan Stanley Capital International (MSCI) Europe, Australasia and Far East (EAFE) Index, Net is generally representative of a sample of companies of the market structure of 20 European and Pacific Basin countries.

|

|

The MSCI EAFE Index, Net does not reflect the deduction of fees associated with a mutual fund such as investment management and fund accounting fees. However, the Fund’s performance reflects the deduction of fees for these value-added services. Investors cannot invest directly in an index, although they can invest in its underlying mutual funds or securities.

|

|

|

2.

|

The ending value represents the value of a $10,000 investment in the indicated share class for the 10-year period ended July 31, 2012.

|

| 17 |

|

Management Discussion of Fund Performance (Unaudited)

|

|

Investment Risk Considerations

|

||

|

Average Annual Total Returns as of July 31, 2012

|

||

|

1 Year

|

5 Year

|

10 Year

|

Ending Value2

|

||||||||||

|

Institutional

|

8.21

|

%

|

6.35

|

%

|

6.24

|

%

|

18,316

|

||||||

|

Class A Shares

|

2.48

|

%

|

5.01

|

%

|

5.40

|

%

|

16,923

|

||||||

|

Class B Shares

|

2.07

|

%

|

4.98

|

%

|

5.36

|

%

|

16,860

|

||||||

|

Class C Shares

|

7.16

|

%

|

5.31

|

%

|

5.20

|

%

|

16,603

|

||||||

|

Barclays Capital U.S. Aggregate Bond Index1

|

7.25

|

%

|

6.91

|

%

|

5.65

|

%

|

17,325

|

||||||

|

Fund Holdings as of July 31, 2012

|

||

|

as a percentage of value of investments †

|

||

|

†

|

Portfolio composition is subject to change.

|

| 18 |

|

Management Discussion of Fund Performance (Unaudited)

|

|

Strategic Income Fund

|

||

|

Growth of a $10,000 Investment

|

|

||

|

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. For performance data current to the most recent month end, visit our website at www.fifththirdfunds.com.

|

||

|

1.

|

The Fund’s performance is measured against the Barclays Capital U.S. Aggregate Bond Index. The Barclays Capital U.S. Aggregate Bond Index is a market value-weighted performance benchmark for investment-grade fixed-rate taxable SEC-registered debt issues, including government, corporate, asset-backed and mortgage-backed securities, with maturities of at least one year.

|

|

The Barclays Capital U.S. Aggregate Bond Index is unmanaged and does not reflect the deduction of fees associated with a mutual fund such as investment management and fund accounting fees. However, the Fund’s performance reflects the deduction of fees for these value-added services. Investors cannot invest directly in an index, although they can invest in its underlying mutual funds or securities.

|

|

|

2.

|

The ending value represents the value of a $10,000 investment in the indicated share class for the 10-year period ended July 31, 2012.

|

| 19 |

|

Management Discussion of Fund Performance (Unaudited)

|

|

|

||

|

Investment Risk Considerations

|

||

|

Average Annual Total Returns as of July 31, 2012

|

||

|

Inception

Date

|

1 Year

|

5 Year

|

Since

Inception

|

Ending

Value2

|

||||||||||||

|

Institutional

|

8/1/02

|

0.97

|

%

|

–1.04

|

%

|

5.83

|

%

|

17,628

|

||||||||

|

Class A Shares

|

8/1/02

|

–4.37

|

%

|

–2.32

|

%

|

5.00

|

%

|

16,287

|

||||||||

|

Class B Shares

|

8/1/02

|

–4.98

|

%

|

–2.33

|

%

|

4.90

|

%

|

16,140

|

||||||||

|

Class C Shares

|

8/1/02

|

–0.10

|

%

|

–2.08

|

%

|

4.75

|

%

|

15,899

|

||||||||

|

LifeModel Aggressive Target Neutral 90% Russell 3000® Index/10% Barclays Capital U.S. Intermediate Government/Credit Bond Index Blend1

|

|

7.25

|

%

|

1.94

|

%

|

6.76

|

%

|

19,234

|

||||||||

|

Barclays Capital U.S. Intermediate Government/Credit Bond Index1

|

|

4.94

|

%

|

6.02

|

%

|

5.05

|

%

|

16,373

|

||||||||

|

Russell 3000® Index1

|

7.33

|

%

|

1.29

|

%

|

6.80

|

%

|

19,306

|

|||||||||

|

Fund Holdings as of July 31, 2012

|

||

|

as a percentage of value of investments †

|

||

|

†

|

Portfolio composition is subject to change.

|

| 20 |

|

Management Discussion of Fund Performance (Unaudited)

|

|

LifeModel Aggressive FundSM

|

||

|

Growth of a $10,000 Investment

|

|

||

|

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. For performance data current to the most recent month end, visit our website at www.fifththirdfunds.com.

|

||

|

1.

|

The Fund’s performance is measured against the LifeModel Aggressive Target Neutral 90% Russell 3000® Index/10% Barclays Capital U.S. Intermediate Government/Credit Bond Index Blend, an unmanaged custom-blended index, created by Fifth Third Asset Management, Inc. The LifeModel Aggressive Target Neutral 90% Russell 3000® Index/10% Barclays Capital U.S. Intermediate Government/Credit Bond Index Blend is a hypothetical blend only and does not represent underlying allocations in the Fund.

|

|

The Russell 3000® Index measures the performance of the largest 3000 U.S. companies representing approximately 98% of the investable U.S. equity market. The Barclays Capital U.S. Intermediate Government/Credit Bond Index is composed of investment grade corporate debt issues as well as debt issues of U.S. government agencies and the U.S. Treasury. The debt issues all maintain maturities within a range of one to ten years.

|

|

|

The Russell 3000® Index and the Barclays Capital U.S. Intermediate Government/Credit Bond Index are unmanaged and do not reflect the deduction of fees associated with a mutual fund such as investment management and fund accounting fees. However, the Fund’s performance reflects the deduction of fees for these value-added services. Investors cannot invest directly in an index, although they can invest in its underlying mutual funds or securities.

|

|

|

2.

|

The ending value represents the value of a $10,000 investment in the indicated share class from its inception to the period ended July 31, 2012.

|

| 21 |

|

Management Discussion of Fund Performance (Unaudited)

|

|

Investment Risk Considerations

|

||

|

Average Annual Total Returns as of July 31, 2012

|

||

|

Inception

Date

|

1 Year

|

5 Year

|

Since

Inception |

Ending

Value2

|

||||||||||||

|

Institutional

|

8/1/02

|

2.24

|

%

|

0.32

|

%

|

6.05

|

%

|

17,996

|

||||||||

|

Class A Shares

|

8/1/02

|

–3.11

|

%

|

–0.93

|

%

|

5.25

|

%

|

16,677

|

||||||||

|

Class B Shares

|

8/1/02

|

–3.78

|

%

|

–0.98

|

%

|

5.16

|

%

|

16,539

|

||||||||

|

Class C Shares

|

8/1/02

|

1.22

|

%

|

–0.66

|

%

|

5.01

|

%

|

16,303

|

||||||||

|

LifeModel Moderately Aggressive Target Neutral 70% Russell 3000® Index/ 30% Barclays Capital U.S. Intermediate Government/ Credit Bond Index Blend1

|

|

6.98

|

% |

3.13

|

%

|

6.59

|

%

|

18,927

|

||||||||

|

Barclays Capital U.S. Intermediate Government/ Credit Bond Index1

|

|

4.94

|

%

|

6.02

|

%

|

5.05

|

%

|

16,373

|

||||||||

|

Russell 3000® Index1

|

7.33

|

%

|

1.29

|

%

|

6.80

|

%

|

19,306

|

|||||||||

|

Fund Holdings as of July 31, 2012

|

||

|

as a percentage of value of investments †

|

||

|

†

|

Portfolio composition is subject to change.

|

| 22 |

| Management Discussion of Fund Performance (unaudited) | ||

|

LifeModel Moderately Aggressive FundSM

|

||

|

Growth of a $10,000 Investment |

||

|

||

| Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. For performance data current to the most recent month end, visit our website at www.fifththirdfunds.com. | ||

|

1.

|

The Fund’s performance is measured against the LifeModel Moderately Aggressive Target Neutral 70% Russell 3000® Index/30% Barclays Capital U.S. Intermediate Government/Credit Bond Index Blend, an unmanaged custom-blended index, created by Fifth Third Asset Management, Inc. The LifeModel Moderately Aggressive Target Neutral 70% Russell 3000® Index/30% Barclays Capital U.S. Intermediate Government/Credit Bond Index Blend is a hypothetical blend only and does not represent underlying allocations in the Fund.

The Russell 3000® Index measures the performance of the largest 3000 U.S. companies representing approximately 98% of the investable U.S. equity market. The Barclays Capital U.S. Intermediate Government/Credit Bond Index is composed of investment grade corporate debt issues as well as debt issues of U.S. government agencies and the U.S. Treasury. The debt issues all maintain maturities within a range of one to ten years.

|

|

The Russell 3000® Index and the Barclays Capital U.S. Intermediate Government/Credit Bond Index are unmanaged and do not reflect the deduction of fees associated with a mutual fund such as investment management and fund accounting fees. However, the Fund’s performance reflects the deduction of fees for these value-added services. Investors cannot invest directly in an index, although they can invest in its underlying mutual funds or securities.

|

|

|

2.

|

The ending value represents the value of a $10,000 investment in the indicated share class from its inception to the period ended July 31, 2012.

|

| 23 |

| Management Discussion of Fund Performance (unaudited) | ||

|

For the 12-month period ended July 31, 2012, the Fifth Third LifeModel Moderate Fund (Institutional) gained 3.48% on a net of fee basis, underperforming its benchmark, a blend of the Russell 3000® Index and the Barclays Capital U.S. Intermediate Government/Credit Bond Index, which advanced 6.57%.

|

||

|

Investment Risk Considerations

|

||

|

Average Annual Total Returns as of July 31, 2012

|

||

|

Inception

Date

|

1 Year

|

5 Year

|

Since

Inception

|

Ending

Value2

|

|||||||||||

|

Institutional

|

8/1/02

|

3.48 |

%

|

|

1.69%

|

|

5.43%

|

|

16,972

|

||||||

|

Class A Shares

|

8/1/02

|

–1.84 |

%

|

|

0.41%

|

|

4.63%

|

|

15,729

|

||||||

|

Class B Shares

|

8/1/02

|

–2.56 |

%

|

|

0.35%

|

|

4.54%

|

|

15,593

|

||||||

|

Class C Shares

|

8/1/02

|

2.54 |

%

|

|

0.68%

|

|

4.39%

|

|

15,370

|

||||||

|

LifeModel Moderate Target Neutral 50% Russell 3000® Index/ 50% Barclays Capital U.S. Intermediate Government/ Credit Bond Index Blend1

|

6.57

|

%

|

|

4.15%

|

|

6.30%

|

|

18,414

|

|||||||

|

Barclays Capital U.S. Intermediate Government/ Credit Bond Index1

|

4.94

|

%

|

|

6.02%

|

|

5.05%

|

|

16,373

|

|||||||

|

Russell 3000® Index1

|

7.33 |

%

|

|

1.29%

|

|

6.80%

|

|

19,306

|

|||||||

|

Fund Holdings as of July 31, 2012

|

||

|

as a percentage of value of investments †

|

||

|

†

|

Portfolio composition is subject to change.

|

| 24 |

| Management Discussion of Fund Performance (unaudited) | ||

|

LifeModel Moderate FundSM

|

||

|

Growth of a $10,000 Investment |

||

|

||

|

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. For performance data current to the most recent month end, visit our website at www.fifththirdfunds.com.

|

||

|

1.

|

The Fund’s performance is measured against the LifeModel Moderate Target Neutral 50% Russell 3000® Index/50% Barclays Capital U.S. Intermediate Government/Credit Bond Index Blend, an unmanaged custom-blended index, created by Fifth Third Asset Management, Inc. The LifeModel Moderate Target Neutral 50% Russell 3000® Index/50% Barclays Capital U.S. Intermediate Government/Credit Bond Index blend is a hypothetical blend only and does not represent underlying allocations in the Fund.

|

|

The Russell 3000® Index measures the performance of the largest 3000 U.S. companies representing approximately 98% of the investable U.S. equity market. The Barclays Capital U.S. Intermediate Government/Credit Bond Index is composed of investment grade corporate debt issues as well as debt issues of U.S. government agencies and the U.S. Treasury. The debt issues all maintain maturities within a range of one to ten years.

|

|

|

The Russell 3000® Index and the Barclays Capital U.S. Intermediate Government/Credit Bond Index are unmanaged and do not reflect the deduction of fees associated with a mutual fund such as investment management and fund accounting fees. However, the Fund’s performance reflects the deduction of fees for these value-added services. Investors cannot invest directly in an index, although they can invest in its underlying mutual funds or securities.

|

|

|

2.

|

The ending value represents the value of a $10,000 investment in the indicated share class from its inception to the period ended July 31, 2012.

|

| 25 |

| Management Discussion of Fund Performance (unaudited) | ||

|

For the 12-month period ended July 31, 2012, the Fifth Third LifeModel Moderately Conservative Fund (Institutional) gained 4.03% on a net of fee basis, underperforming its benchmark, a blend of the Russell 3000® Index and the Barclays Capital U.S. Intermediate Government/Credit Bond Index, which advanced 6.32%.

|

||

|

Investment Risk Considerations

|

||

|

Average Annual Total Returns as of July 31, 2012

|

||

|

Inception

Date

|

1 Year

|

5 Year

|

Since

Inception

|

Ending

Value2

|

||||||||||||

|

Institutional

|

8/1/02

|

4.03 |

%

|

|

2.49%

|

|

5.11%

|

|

16,459

|

|||||||

|

Class A Shares

|

8/1/02

|

–1.39 |

%

|

|

1.17%

|

|

4.30%

|

|

15,237

|

|||||||

|

Class B Shares

|

8/1/02

|

–2.05 |

%

|

|

1.12%

|

|

4.22%

|

|

15,124

|

|||||||

|

Class C Shares

|

8/1/02

|

3.01 |

%

|

|

1.46%

|

|

4.06%

|

|

14,890

|

|||||||

|

LifeModel Moderately Conservative Target Neutral 40% Russell 3000® Index/ 60% Barclays Capital U.S. Intermediate Government/ Credit Bond Index Blend1

|

6.32

|

%

|

|

4.61%

|

|

6.11%

|

|

18,087

|

||||||||

|

Barclays Capital U.S. Intermediate Government/ Credit Bond Index1

|

4.94

|

%

|

|

6.02%

|

|

5.05%

|

|

16,373

|

||||||||

|

Russell 3000® Index1

|

7.33 |

%

|

|

1.29%

|

|

6.80%

|

|

19,306

|

||||||||

|

Fund Holdings as of July 31, 2012

|

||

|

as a percentage of value of investments †

|

||

|

†

|

Portfolio composition is subject to change.

|

| 26 |

| Management Discussion of Fund Performance (unaudited) | ||

|

LifeModel Moderately Conservative FundSM

|

||

|

Growth of a $10,000 Investment

|

||

|

||

|

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. For performance data current to the most recent month end, visit our website at www.fifththirdfunds.com.

|

||

|

1.

|

The Fund’s performance is measured against the LifeModel Moderately Conservative Target Neutral 40% Russell 3000® Index/60% Barclays Capital U.S. Intermediate Government/Credit Bond Index Blend, an unmanaged custom-blended index, created by Fifth Third Asset Management, Inc. The LifeModel Moderately Conservative Target Neutral 40% Russell 3000® Index/60% Barclays Capital U.S. Intermediate Government/Credit Bond Index Blend is a hypothetical blend only and does not represent underlying allocations in the Fund.

|

|

The Russell 3000® Index measures the performance of the largest 3000 U.S. companies representing approximately 98% of the investable U.S. equity market. The Barclays Capital U.S. Intermediate Government/Credit Bond Index is composed of investment grade corporate debt issues as well as debt issues of U.S. government agencies and the U.S. Treasury. The debt issues all maintain maturities within a range of one to ten years.

|

|

|

The Russell 3000® Index and the Barclays Capital U.S. Intermediate Government/Credit Bond Index are unmanaged and do not reflect the deduction of fees associated with a mutual fund such as investment management and fund accounting fees. However, the Fund’s performance reflects the deduction of fees for these value-added services. Investors cannot invest directly in an index, although they can invest in its underlying mutual funds or securities.

|

|

|

2.

|

The ending value represents the value of a $10,000 investment in the indicated share class from its inception to the period ended July 31, 2012.

|

| 27 |

|

Management Discussion of Fund Performance (Unaudited)

|

|

Investment Risk Considerations

|

||

|

Average Annual Total Returns as of July 31, 2012

|

||

|

Inception

Date

|

1 Year

|

5 Year

|

Since

Inception

|

Ending

Value2

|

|||||||

|

Institutional

|

8/1/02

|

5.05%

|

3.24%

|

4.69%

|

15,807

|

||||||

|

Class A Shares

|

8/1/02

|

–0.43%

|

1.93%

|

3.88%

|

14,639

|

||||||

|

Class B Shares

|

8/1/02

|

–0.98%

|

1.87%

|

3.80%

|

14,526

|

||||||

|

Class C Shares

|

8/1/02

|

4.02%

|

2.22%

|

3.65%

|

14,316

|

||||||

|

LifeModel Conservative Target Neutral 20% Russell 3000® Index/80% Barclays Capital U.S. Intermediate Government/Credit Bond Index Blend1

|

|

5.70%

|

5.39%

|

5.64%

|

17,304

|

||||||

|

Barclays Capital U.S. Intermediate Government/Credit Bond Index1

|

|

4.94%

|

6.02%

|

5.05%

|

16,373

|

||||||

|

Russell 3000® Index1

|

7.33%

|

1.29%

|

6.80%

|

19,306

|

|||||||

|

Fund Holdings as of July 31, 2012

|

||

|

as a percentage of value of investments †

|

||

|

†

|

Portfolio composition is subject to change.

|

| 28 |

|

Management Discussion of Fund Performance (Unaudited)

|

|

LifeModel Conservative FundSM

|

|

|

Growth of a $10,000 Investment

|

|

||

|

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. For performance data current to the most recent month end, visit our website at www.fifththirdfunds.com.

|

|

1.

|

The Fund’s performance is measured against the LifeModel Conservative Target Neutral 20% Russell 3000® Index/80% Barclays Capital U.S. Intermediate Government/Credit Bond Index Blend, an unmanaged custom-blended index, created by Fifth Third Asset Management, Inc. The LifeModel Conservative Target Neutral 20% Russell 3000® Index/80% Barclays Capital U.S. Intermediate Government/Credit Bond Index Blend is a hypothetical blend only and does not represent underlying allocations in the Fund.

|

|

The Russell 3000® Index measures the performance of the largest 3000 U.S. companies representing approximately 98% of the investable U.S. equity market. The Barclays Capital U.S. Intermediate Government/Credit Bond Index is composed of investment grade corporate debt issues as well as debt issues of U.S. government agencies and the U.S. Treasury. The debt issues all maintain maturities within a range of one to ten years.

|

|

|

The Russell 3000® Index and the Barclays Capital U.S. Intermediate Government/Credit Bond Index are unmanaged and do not reflect the deduction of fees associated with a mutual fund such as investment management and fund accounting fees. However, the Fund’s performance reflects the deduction of fees for these value-added services. Investors cannot invest directly in an index, although they can invest in its underlying mutual funds or securities.

|

|

|

2.

|

The ending value represents the value of a $10,000 investment in the indicated share class from its inception to the period ended July 31, 2012.

|

| 29 |

|

Management Discussion of Fund Performance (Unaudited)

|

|

Investment Risk Considerations

|

||

|

Average Annual Total Returns as of July 31, 2012

|

||

|

Inception

Date

|

1 Year

|

5 Year

|

Since

Inception

|

Ending

Value2

|

|||||

|

Institutional

|

11/29/05

|

6.84%

|

9.26%

|

8.03%

|

16,746

|

||||

|

Class A Shares

|

11/29/05

|

1.59%

|

7.89%

|

6.93%

|

15,642

|

||||

|

Class B Shares

|

11/29/05

|

0.77%

|

7.88%

|

6.96%

|

15,666

|

||||

|

Class C Shares

|

11/29/05

|

5.81%

|

8.20%

|

6.97%

|

15,679

|

||||

|

BofA Merrill Lynch U.S. High Yield, Cash Pay Index1

|

7.37%

|

9.18%

|

8.69%

|

17,447

|

|

Fund Holdings as of July 31, 2012

|

||

|

as a percentage of value of investments †

|

||

| † |

Portfolio composition is subject to change.

|

| 30 |

|

Management Discussion of Fund Performance (Unaudited)

|

|

High Yield Bond Fund

|

|

|

Growth of a $10,000 Investment

|

|

||

|

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. For performance data current to the most recent month end, visit our website at www.fifththirdfunds.com.

|

|

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark, and represents the reinvestment of dividends and capital gains in the Fund. However, the performance does not reflect the deduction of taxes on Fund distributions, or redemption of shares.

|

|

|

1.

|

The Fund’s performance is measured against the BofA Merrill Lynch U.S. High Yield, Cash Pay Index, an unmanaged index which tracks the performance of below investment grade, U.S. dollar-denominated corporate bonds publicly issued in the U.S. domestic market. Qualifying bonds must have at least one year remaining term to maturity, at least $100,000,000 par outstanding, and a fixed coupon schedule. The index does not reflect the deduction of fees associated with a mutual fund such as investment management and fund accounting fees. However, the Fund’s performance reflects the deduction of fees for these value-added services. Investors cannot invest directly in an index, although they can invest in its underlying mutual funds or securities.

|

|

2.

|

The ending value represents the value of a $10,000 investment in the indicated share class from its inception to the period ended July 31, 2012.

|

| 31 |

|

Management Discussion of Fund Performance (Unaudited)

|

|

Investment Risk Considerations

|

||

|

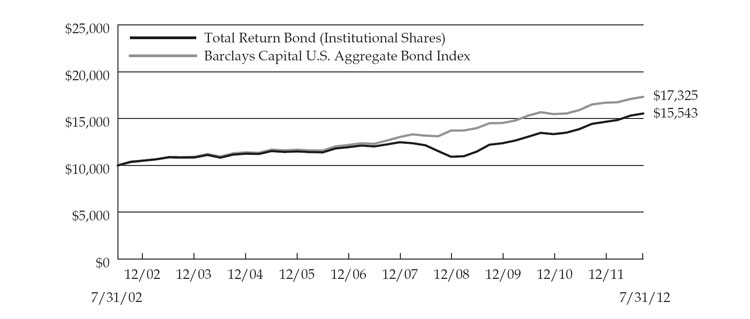

Average Annual Total Returns as of July 31, 2012

|

||

|

1 Year

|

5 Year

|

10 Year

|

Ending Value2

|

||||

|

Institutional

|

8.62%

|

5.13%

|

4.51%

|

15,543

|

|||

|

Class A Shares

|

3.35%

|

3.88%

|

3.76%

|

14,462

|

|||

|

Class B Shares

|

2.49%

|

3.75%

|

3.63%

|

14,286

|

|||

|

Class C Shares

|

7.53%

|

4.10%

|

3.47%

|

14,066

|

|||

|

Barclays Capital U.S. Aggregate Bond Index1

|

7.25%

|

6.91%

|

5.65%

|

17,325

|

|

Fund Holdings as of July 31, 2012

|

||

|

as a percentage of value of investments †

|

||

|

|

|

†

|

Portfolio composition is subject to change.

|

| 32 |

|

Management Discussion of Fund Performance (Unaudited)

|

|

Total Return Bond Fund

|

|

|

Growth of a $10,000 Investment

|

|

||

|

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. For performance data current to the most recent month end, visit our website at www.fifththirdfunds.com.

|

|

1.

|

The Fund’s performance is measured against the Barclays Capital U.S. Aggregate Bond Index. The Barclays Capital U.S. Aggregate Bond Index is a market value-weighted performance benchmark for investment-grade fixed-rate taxable SEC-registered debt issues, including government, corporate, asset-backed, and mortgage-backed securities, with maturities of at least one year.

|

|

The Barclays Capital U.S. Aggregate Bond Index is an unmanaged index and does not reflect the deduction of fees associated with a mutual fund such as investment management and fund accounting fees. However, the Fund’s performance reflects the deduction of fees for these value-added services. Investors cannot invest directly in an index, although they can invest in its underlying mutual funds or securities.

|

|

|

2.

|

The ending value represents the value of a $10,000 investment in the indicated share class for the 10-year period ended July 31, 2012.

|

| 33 |

|

Management Discussion of Fund Performance (Unaudited)

|

|

Investment Risk Considerations

|

||

|

Average Annual Total Returns as of July 31, 2012

|

||

|

1 Year

|

5 Year

|

10 Year

|

Ending Value2

|

|||||

|

Institutional

|

1.52%

|

3.31%

|

3.01%

|

13,458

|

||||

|

Class A Shares

|

–1.70%

|

2.45%

|

2.48%

|

12,773

|

||||

|

Class C Shares

|

0.64%

|

2.32%

|

2.00%

|

12,190

|

||||

|

BofA Merrill Lynch

1-3 Year Government/ |

1.23%

|

3.54%

|

3.32%

|

13,861

|

|

Fund Holdings as of July 31, 2012

|

||

|

as a percentage of value of investments †

|

||

|

†

|

Portfolio composition is subject to change.

|

| 34 |

|

Management Discussion of Fund Performance (Unaudited)

|

|

Short Term Bond Fund

|

||

|

||

|

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. For performance data current to the most recent month end, visit our website at www.fifththirdfunds.com.

|

|

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark, and represents the reinvestment of dividends and capital gains in the Fund. However, the performance does not reflect the deduction of taxes on Fund distributions, or redemption of shares.

|

|

|

1.

|

The Fund’s performance is measured against the BofA Merrill Lynch 1-3 Year Government/Corporate Bond Index. The BofA Merrill Lynch 1-3 Year Government/Corporate Bond Index is composed of U.S. Treasury issues and publicly issued debt of U.S. Government agencies with maturities of one to three years.

|

|

The BofA Merrill Lynch 1-3 Year Government/Corporate Bond Index is unmanaged and does not reflect the deduction of fees associated with a mutual fund such as investment management and fund accounting fees.

|

|

|

However, the Fund’s performance reflects the deduction of fees for these value-added services. Investors cannot invest directly in an index, although they can invest in its underlying mutual funds or securities.

|

|

|

2.

|

The ending value represents the value of a $10,000 investment in the indicated share class for the 10-year period ended July 31, 2012.

|

| 35 |

|

Shares

|

Value

|

|||||||

|

Common Stocks (96.0%)

|

||||||||

|

Aerospace & Defense (2.1%)

|

||||||||

|

TransDigm Group, Inc. *

|

14,000 | $ | 1,727,040 | |||||

|

Beverages-Non-alcoholic (1.7%)

|

||||||||

|

Monster Beverage Corp. *

|

21,000 | 1,395,870 | ||||||

|

Biotechnology * (9.4%)

|

||||||||

|

Alexion Pharmaceuticals, Inc.

|

21,000 | 2,201,850 | ||||||

|

Ariad Pharmaceuticals, Inc.

|

65,000 | 1,243,450 | ||||||

|

Medivation, Inc.

|

16,000 | 1,595,200 | ||||||

|

Onyx Pharmaceuticals, Inc.

|

12,000 | 899,640 | ||||||

|

Regeneron Pharmaceuticals, Inc.

|

9,000 | 1,211,850 | ||||||

|

Vertex Pharmaceuticals, Inc.

|

11,000 | 533,610 | ||||||

| 7,685,600 | ||||||||

|

Capital Markets (1.5%)

|

||||||||

|

Affiliated Managers Group, Inc. *

|

11,000 | 1,227,490 | ||||||

|

Chemicals (7.4%)

|

||||||||

|

Airgas, Inc.

|

11,000 | 872,520 | ||||||

|

CF Industries Holdings, Inc.

|

5,000 | 978,800 | ||||||

|

Ecolab, Inc.

|

22,000 | 1,439,900 | ||||||

|

FMC Corp.

|

30,000 | 1,641,000 | ||||||

|

Valspar Corp.

|

23,000 | 1,154,600 | ||||||

| 6,086,820 | ||||||||

|

Commercial Banks (2.6%)

|

||||||||

|

Comerica, Inc.

|

32,000 | 966,720 | ||||||

|

Texas Capital Bancshares, Inc. *

|

26,000 | 1,120,340 | ||||||

| 2,087,060 | ||||||||

|

Computers & Peripherals (1.4%)

|

||||||||

|

3D Systems Corp. *

|

31,000 | 1,178,000 | ||||||

|

Electrical Equipment (3.3%)

|

||||||||

|

AMETEK, Inc.

|

42,000 | 1,302,000 | ||||||

|

Roper Industries, Inc.

|

14,000 | 1,392,300 | ||||||

| 2,694,300 | ||||||||

|

Energy Equipment & Services (2.5%)

|

||||||||

|

Atwood Oceanics, Inc. *

|

20,000 | 890,600 | ||||||

|

Oceaneering International, Inc.

|

23,000 | 1,188,870 | ||||||

| 2,079,470 | ||||||||

|

Food Products (2.5%)

|

||||||||

|

Hershey Co. (The)

|

16,000 | 1,147,840 | ||||||

|

Mead Johnson Nutrition Co.

|

12,000 | 875,520 | ||||||

| 2,023,360 | ||||||||

|

Health Care Equipment & Supplies (4.1%)

|

||||||||

|

Cooper Cos., Inc. (The)

|

9,000 | 677,340 | ||||||

|

Edwards Lifesciences Corp. *

|

10,000 | 1,012,000 | ||||||

|

Endologix, Inc. *

|

69,000 | 810,750 | ||||||

|

IDEXX Laboratories, Inc. *

|

10,000 | 881,700 | ||||||

| 3,381,790 | ||||||||

|

Health Care Technology (0.9%)

|

||||||||

|

Cerner Corp. *

|

10,000 | 739,200 | ||||||

|

Hotels, Restaurants & Leisure (1.0%)

|

||||||||

|

Marriott Vacations Worldwide Corp. *

|

27,000 | 837,540 | ||||||

|

Household Durables (1.4%)

|

||||||||

|

Lennar Corp., Class A

|

38,000 | 1,109,980 | ||||||

|

Industrial Conglomerates (2.5%)

|

||||||||

|

Carlisle Cos., Inc.

|

19,000 | 959,310 | ||||||

|