fcfs-2020123100008404892020FYFALSEP3YP3YP3Y00008404892020-01-012020-12-31iso4217:USD00008404892020-06-30xbrli:shares00008404892021-01-2700008404892020-12-3100008404892019-12-31iso4217:USDxbrli:shares00008404892019-01-012019-12-3100008404892018-01-012018-12-310000840489us-gaap:CommonStockMember2019-12-310000840489us-gaap:AdditionalPaidInCapitalMember2019-12-310000840489us-gaap:RetainedEarningsMember2019-12-310000840489us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-12-310000840489us-gaap:TreasuryStockMember2019-12-310000840489us-gaap:AdditionalPaidInCapitalMember2020-01-012020-12-310000840489us-gaap:TreasuryStockMember2020-01-012020-12-310000840489us-gaap:RetainedEarningsMember2020-01-012020-12-310000840489us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-01-012020-12-310000840489us-gaap:CommonStockMember2020-12-310000840489us-gaap:AdditionalPaidInCapitalMember2020-12-310000840489us-gaap:RetainedEarningsMember2020-12-310000840489us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310000840489us-gaap:TreasuryStockMember2020-12-310000840489us-gaap:CommonStockMember2018-12-310000840489us-gaap:AdditionalPaidInCapitalMember2018-12-310000840489us-gaap:RetainedEarningsMember2018-12-310000840489us-gaap:AccumulatedOtherComprehensiveIncomeMember2018-12-310000840489us-gaap:TreasuryStockMember2018-12-3100008404892018-12-310000840489us-gaap:CommonStockMember2019-01-012019-12-310000840489us-gaap:AdditionalPaidInCapitalMember2019-01-012019-12-310000840489us-gaap:TreasuryStockMember2019-01-012019-12-310000840489us-gaap:RetainedEarningsMember2019-01-012019-12-310000840489us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-01-012019-12-310000840489us-gaap:CommonStockMember2017-12-310000840489us-gaap:AdditionalPaidInCapitalMember2017-12-310000840489us-gaap:RetainedEarningsMember2017-12-310000840489us-gaap:AccumulatedOtherComprehensiveIncomeMember2017-12-310000840489us-gaap:TreasuryStockMember2017-12-3100008404892017-12-310000840489us-gaap:CommonStockMember2018-01-012018-12-310000840489us-gaap:AdditionalPaidInCapitalMember2018-01-012018-12-310000840489us-gaap:TreasuryStockMember2018-01-012018-12-310000840489us-gaap:RetainedEarningsMember2018-01-012018-12-310000840489us-gaap:AccumulatedOtherComprehensiveIncomeMember2018-01-012018-12-31fcfs:storefcfs:state0000840489country:US2020-12-310000840489srt:LatinAmericaMember2020-12-31xbrli:pure0000840489country:US2020-04-012020-06-300000840489country:US2020-06-30utr:Rate0000840489currency:MXN2020-12-310000840489currency:USD2020-12-310000840489currency:MXN2019-12-310000840489currency:USD2019-12-310000840489currency:MXN2018-12-310000840489currency:USD2018-12-310000840489currency:GTQ2020-12-310000840489currency:GTQ2019-12-310000840489currency:GTQ2018-12-310000840489currency:COP2020-12-310000840489currency:COP2019-12-310000840489currency:COP2018-12-310000840489srt:MinimumMemberus-gaap:BuildingMember2020-01-012020-12-310000840489us-gaap:BuildingMembersrt:MaximumMember2020-01-012020-12-310000840489srt:MinimumMemberus-gaap:EquipmentMember2020-01-012020-12-310000840489us-gaap:EquipmentMembersrt:MaximumMember2020-01-012020-12-3100008404892020-01-012020-03-3100008404892018-10-012018-12-310000840489country:MX2020-12-310000840489us-gaap:SeriesOfIndividuallyImmaterialBusinessAcquisitionsMember2020-12-310000840489country:US2020-01-012020-12-310000840489srt:LatinAmericaMember2020-01-012020-12-310000840489country:MX2019-12-310000840489country:US2019-12-310000840489srt:MinimumMember2020-12-310000840489srt:MaximumMember2020-12-310000840489fcfs:July252018Member2020-01-012020-12-310000840489fcfs:July252018Member2020-12-310000840489fcfs:October242018Member2020-01-012020-12-310000840489fcfs:October242018Member2020-12-310000840489us-gaap:CarryingReportedAmountFairValueDisclosureMember2020-12-310000840489us-gaap:EstimateOfFairValueFairValueDisclosureMember2020-12-310000840489us-gaap:FairValueInputsLevel1Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2020-12-310000840489us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Member2020-12-310000840489us-gaap:FairValueInputsLevel3Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2020-12-310000840489us-gaap:CarryingReportedAmountFairValueDisclosureMemberfcfs:PawnLoansMember2020-12-310000840489us-gaap:EstimateOfFairValueFairValueDisclosureMemberfcfs:PawnLoansMember2020-12-310000840489us-gaap:FairValueInputsLevel1Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberfcfs:PawnLoansMember2020-12-310000840489us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Memberfcfs:PawnLoansMember2020-12-310000840489us-gaap:FairValueInputsLevel3Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberfcfs:PawnLoansMember2020-12-310000840489us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:LineOfCreditMember2020-12-310000840489us-gaap:LineOfCreditMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2020-12-310000840489us-gaap:FairValueInputsLevel1Memberus-gaap:LineOfCreditMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2020-12-310000840489us-gaap:LineOfCreditMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Member2020-12-310000840489us-gaap:LineOfCreditMemberus-gaap:FairValueInputsLevel3Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2020-12-310000840489us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:SeniorNotesMember2020-12-310000840489us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:SeniorNotesMember2020-12-310000840489us-gaap:FairValueInputsLevel1Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:SeniorNotesMember2020-12-310000840489us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Memberus-gaap:SeniorNotesMember2020-12-310000840489us-gaap:FairValueInputsLevel3Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:SeniorNotesMember2020-12-310000840489us-gaap:CarryingReportedAmountFairValueDisclosureMember2019-12-310000840489us-gaap:EstimateOfFairValueFairValueDisclosureMember2019-12-310000840489us-gaap:FairValueInputsLevel1Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2019-12-310000840489us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Member2019-12-310000840489us-gaap:FairValueInputsLevel3Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2019-12-310000840489us-gaap:CarryingReportedAmountFairValueDisclosureMemberfcfs:PawnLoansMember2019-12-310000840489us-gaap:EstimateOfFairValueFairValueDisclosureMemberfcfs:PawnLoansMember2019-12-310000840489us-gaap:FairValueInputsLevel1Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberfcfs:PawnLoansMember2019-12-310000840489us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Memberfcfs:PawnLoansMember2019-12-310000840489us-gaap:FairValueInputsLevel3Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberfcfs:PawnLoansMember2019-12-310000840489us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:ConsumerPortfolioSegmentMember2019-12-310000840489us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:ConsumerPortfolioSegmentMember2019-12-310000840489us-gaap:FairValueInputsLevel1Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:ConsumerPortfolioSegmentMember2019-12-310000840489us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Memberus-gaap:ConsumerPortfolioSegmentMember2019-12-310000840489us-gaap:FairValueInputsLevel3Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:ConsumerPortfolioSegmentMember2019-12-310000840489us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:LineOfCreditMember2019-12-310000840489us-gaap:LineOfCreditMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2019-12-310000840489us-gaap:FairValueInputsLevel1Memberus-gaap:LineOfCreditMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2019-12-310000840489us-gaap:LineOfCreditMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Member2019-12-310000840489us-gaap:LineOfCreditMemberus-gaap:FairValueInputsLevel3Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2019-12-310000840489us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:SeniorNotesMember2019-12-310000840489us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:SeniorNotesMember2019-12-310000840489us-gaap:FairValueInputsLevel1Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:SeniorNotesMember2019-12-310000840489us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Memberus-gaap:SeniorNotesMember2019-12-310000840489us-gaap:FairValueInputsLevel3Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:SeniorNotesMember2019-12-310000840489us-gaap:LandMember2020-12-310000840489us-gaap:LandMember2019-12-310000840489us-gaap:BuildingMember2020-12-310000840489us-gaap:BuildingMember2019-12-310000840489fcfs:FurnitureFixturesEquipmentAndLeaseholdMember2020-12-310000840489fcfs:FurnitureFixturesEquipmentAndLeaseholdMember2019-12-310000840489us-gaap:LineOfCreditMember2020-12-310000840489us-gaap:LineOfCreditMember2019-12-310000840489fcfs:A5.375SeniorUnsecuredNotesdue2024Memberus-gaap:SeniorNotesMember2020-12-310000840489fcfs:FivePointThreeSevenFivePercentSeniorNotesDue2024Memberus-gaap:SeniorNotesMember2020-12-310000840489fcfs:FivePointThreeSevenFivePercentSeniorNotesDue2024Memberus-gaap:SeniorNotesMember2019-12-310000840489fcfs:A4625SeniorUnsecuredNotesDue2028Memberus-gaap:SeniorNotesMember2020-12-310000840489fcfs:A4625SeniorUnsecuredNotesDue2028Memberus-gaap:SeniorNotesMember2019-12-310000840489us-gaap:LineOfCreditMember2019-12-190000840489us-gaap:LineOfCreditMembersrt:MaximumMember2020-01-012020-12-310000840489us-gaap:LineOfCreditMembersrt:MinimumMember2020-01-012020-12-3100008404892020-11-092020-11-0900008404892020-11-102020-12-3100008404892020-12-312020-12-3100008404892020-11-092020-12-310000840489us-gaap:LineOfCreditMemberus-gaap:LondonInterbankOfferedRateLIBORMember2020-01-012020-12-310000840489us-gaap:LineOfCreditMemberus-gaap:PrimeRateMember2020-01-012020-12-310000840489srt:MinimumMemberus-gaap:LondonInterbankOfferedRateLIBORMember2020-12-310000840489us-gaap:LineOfCreditMember2020-01-012020-12-31iso4217:MXN0000840489us-gaap:LineOfCreditMemberfcfs:RevolvingUnsecuredUncommittedCreditFacilitydue2023Member2020-12-310000840489us-gaap:LineOfCreditMemberfcfs:MexicanCentralBankInterbankEquilibriumRateTIIEMemberfcfs:RevolvingUnsecuredUncommittedCreditFacilitydue2023Member2020-01-012020-12-310000840489fcfs:A4625SeniorUnsecuredNotesDue2028Memberus-gaap:SeniorNotesMember2020-08-260000840489fcfs:A5.375SeniorUnsecuredNotesdue2024Memberus-gaap:SeniorNotesMember2017-05-3000008404892020-08-260000840489fcfs:A5.375SeniorUnsecuredNotesdue2024Memberus-gaap:SeniorNotesMember2020-01-012020-12-3100008404892020-10-012020-12-310000840489country:US2019-01-012019-12-310000840489country:MX2020-01-012020-12-310000840489country:GT2020-01-012020-12-310000840489country:CO2020-01-012020-12-310000840489country:SV2020-01-012020-12-310000840489country:NL2020-01-012020-12-31utr:oz0000840489us-gaap:ForwardContractsMembercurrency:XAU2020-12-31iso4217:USDutr:oz0000840489srt:LatinAmericaMember2019-12-310000840489country:US2018-12-310000840489srt:LatinAmericaMember2018-12-310000840489srt:LatinAmericaMember2019-01-012019-12-310000840489us-gaap:CustomerRelationshipsMember2020-12-310000840489us-gaap:CustomerRelationshipsMember2019-12-310000840489us-gaap:CustomerRelationshipsMember2020-01-012020-12-310000840489us-gaap:GoodwillMember2020-12-310000840489us-gaap:TradeNamesMember2020-12-310000840489us-gaap:TradeNamesMember2019-12-310000840489us-gaap:LicensingAgreementsMember2020-12-310000840489us-gaap:LicensingAgreementsMember2019-12-310000840489us-gaap:FranchiseRightsMember2020-12-310000840489us-gaap:FranchiseRightsMember2019-12-310000840489fcfs:PriortomergerMember2020-12-310000840489srt:MinimumMemberfcfs:A2020PerformanceBasedAwardsMember2020-01-012020-12-310000840489fcfs:A2020PerformanceBasedAwardsMembersrt:MaximumMember2020-01-012020-12-310000840489us-gaap:PerformanceSharesMember2020-01-012020-12-310000840489srt:MinimumMemberfcfs:A2019And2018PerformanceBasedAwardsMember2020-01-012020-12-310000840489srt:MaximumMemberfcfs:A2019And2018PerformanceBasedAwardsMember2020-01-012020-12-310000840489fcfs:TimeBasedSharesMember2019-01-012019-12-310000840489fcfs:TimeBasedSharesMember2020-01-012020-12-310000840489fcfs:TimeBasedSharesMember2018-01-012018-12-310000840489us-gaap:PerformanceSharesMember2019-01-012019-12-310000840489us-gaap:PerformanceSharesMember2018-01-012018-12-310000840489fcfs:PerformanceBasedCanceledMember2020-01-012020-12-310000840489fcfs:PerformanceBasedCanceledMember2019-01-012019-12-310000840489fcfs:PerformanceBasedCanceledMember2018-01-012018-12-310000840489fcfs:PerformanceBasedCanceledMember2020-12-012020-12-310000840489fcfs:NonvestedCommonStockAwardsMember2020-01-012020-12-310000840489fcfs:NonvestedCommonStockAwardsMember2019-01-012019-12-310000840489fcfs:NonvestedCommonStockAwardsMember2018-01-012018-12-310000840489fcfs:NonvestedCommonStockAwardsMember2020-12-310000840489fcfs:StockOptionsAndWarrantsMembersrt:MaximumMember2020-01-012020-12-310000840489fcfs:StockOptionsAndWarrantsMember2019-12-310000840489fcfs:StockOptionsAndWarrantsMember2018-12-310000840489fcfs:StockOptionsAndWarrantsMember2017-12-310000840489fcfs:StockOptionsAndWarrantsMember2020-01-012020-12-310000840489fcfs:StockOptionsAndWarrantsMember2019-01-012019-12-310000840489fcfs:StockOptionsAndWarrantsMember2018-01-012018-12-310000840489fcfs:StockOptionsAndWarrantsMember2020-12-310000840489us-gaap:CommonStockMember2020-12-310000840489us-gaap:EmployeeStockOptionMember2020-01-012020-12-310000840489us-gaap:EmployeeStockOptionMember2019-01-012019-12-310000840489us-gaap:EmployeeStockOptionMember2018-01-012018-12-310000840489srt:MinimumMember2020-01-012020-12-310000840489fcfs:FirstCashMember2020-01-012020-12-31fcfs:segment0000840489us-gaap:CorporationMember2020-01-012020-12-310000840489us-gaap:CorporationMember2020-12-310000840489us-gaap:CorporationMember2019-01-012019-12-310000840489us-gaap:CorporationMember2019-12-310000840489country:US2018-01-012018-12-310000840489srt:LatinAmericaMember2018-01-012018-12-310000840489us-gaap:CorporationMember2018-01-012018-12-310000840489us-gaap:CorporationMember2018-12-310000840489country:MX2019-01-012019-12-310000840489country:MX2018-01-012018-12-310000840489fcfs:OtherLatinAmericaMember2020-01-012020-12-310000840489fcfs:OtherLatinAmericaMember2019-01-012019-12-310000840489fcfs:OtherLatinAmericaMember2018-01-012018-12-310000840489country:MX2018-12-310000840489fcfs:OtherLatinAmericaMember2020-12-310000840489fcfs:OtherLatinAmericaMember2019-12-310000840489fcfs:OtherLatinAmericaMember2018-12-3100008404892020-04-012020-06-3000008404892020-07-012020-09-3000008404892019-01-012019-03-3100008404892019-04-012019-06-3000008404892019-07-012019-09-3000008404892019-10-012019-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| | | | | |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended December 31, 2020

OR

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from __________ to ___________

Commission file number 001-10960

FIRSTCASH, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | | | | |

| Delaware | | 75-2237318 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

1600 West 7th Street, Fort Worth, Texas 76102

(Address of principal executive offices) (Zip code)

(817) 335-1100

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered |

| Common Stock, par value $.01 per share | FCFS | The Nasdaq Stock Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

☒ Yes ☐ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

☐ Yes ☒ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| ☒ | Large accelerated filer | ☐ | Accelerated filer |

| ☐ | Non-accelerated filer | ☐ | Smaller reporting company |

| | ☐ | Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 401(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). ☐ Yes ☒ No

As of June 30, 2020, the aggregate market value of the registrant’s common stock held by non-affiliates of the registrant was approximately $2,420,000,000 based on the closing price as reported on the Nasdaq Stock Market.

As of January 27, 2021, there were 41,038,154 shares of common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive Proxy Statement relating to its 2021 Annual Meeting of Stockholders to be held on or about June 3, 2021, is incorporated by reference in Part III, Items 10, 11, 12, 13 and 14 of this Annual Report on Form 10-K.

FIRSTCASH, INC.

FORM 10-K

For the Year Ended December 31, 2020

TABLE OF CONTENTS

CAUTIONARY STATEMENT REGARDING RISKS AND UNCERTAINTIES THAT MAY AFFECT FUTURE RESULTS

Forward-Looking Information

This annual report contains forward-looking statements about the business, financial condition and prospects of FirstCash, Inc. and its wholly owned subsidiaries (together, the “Company”). Forward-looking statements, as that term is defined in the Private Securities Litigation Reform Act of 1995, can be identified by the use of forward-looking terminology such as “believes,” “projects,” “expects,” “may,” “estimates,” “should,” “plans,” “targets,” “intends,” “could,” “would,” “anticipates,” “potential,” “confident,” “optimistic” or the negative thereof, or other variations thereon, or comparable terminology, or by discussions of strategy, objectives, estimates, guidance, expectations and future plans. Forward-looking statements can also be identified by the fact these statements do not relate strictly to historical or current matters. Rather, forward-looking statements relate to anticipated or expected events, activities, trends or results. Because forward-looking statements relate to matters that have not yet occurred, these statements are inherently subject to risks and uncertainties.

While the Company believes the expectations reflected in forward-looking statements are reasonable, there can be no assurances such expectations will prove to be accurate. Security holders are cautioned that such forward-looking statements involve risks and uncertainties. Certain factors may cause results to differ materially from those anticipated by the forward-looking statements made in this annual report. Such factors may include, without limitation, the risks, uncertainties and regulatory developments (1) related to the COVID-19 pandemic, which include risks and uncertainties related to the current unknown duration and severity of the COVID-19 pandemic, including any variants of the COVID-19 virus, the timing, availability and efficacy of the COVID-19 vaccines in the jurisdictions in which the Company operates, the impact of governmental responses that have been, and may in the future be, imposed in response to the pandemic, including stimulus programs which could adversely impact lending demand and regulations which could adversely affect the Company’s ability to continue to fully operate, potential changes in consumer behavior and shopping patterns which could impact demand for both the Company’s pawn loan and retail products, the deterioration in the economic conditions in the United States and Latin America which potentially could have an impact on discretionary consumer spending, and currency fluctuations, primarily involving the Mexican peso and (2) those discussed and described in this annual report, including the risks described in Part I, Item IA, “Risk Factors” hereof, and other reports filed with the SEC. Many of these risks and uncertainties are beyond the ability of the Company to control, nor can the Company predict, in many cases, all of the risks and uncertainties that could cause its actual results to differ materially from those indicated by the forward-looking statements. The forward-looking statements contained in this annual report speak only as of the date of this annual report, and the Company expressly disclaims any obligation or undertaking to report any updates or revisions to any such statement to reflect any change in the Company’s expectations or any change in events, conditions or circumstances on which any such statement is based, except as required by law.

PART I

Item 1. Business

General

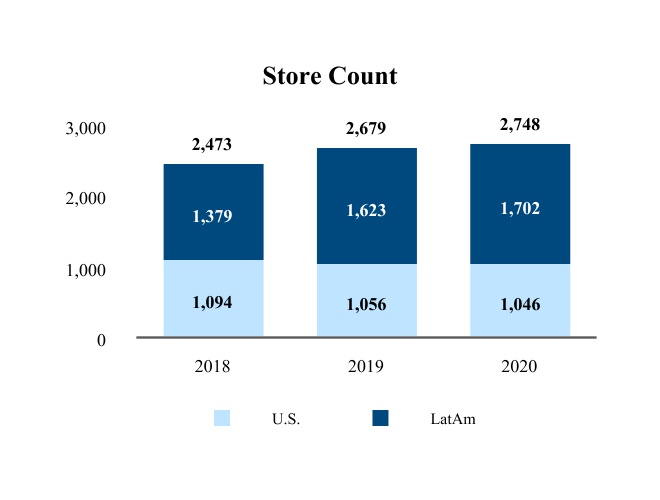

The Company is a leading operator of pawn stores in the U.S. and Latin America. As of December 31, 2020, the Company had 2,748 locations, consisting of 1,046 stores in 24 U.S. states and the District of Columbia, 1,616 stores in all 32 states in Mexico, 59 stores in Guatemala, 14 stores in Colombia and 13 stores in El Salvador.

The Company’s primary business is the operation of retail pawn stores, also known as “pawnshops.” Pawn stores help customers meet small short-term cash needs by providing non-recourse pawn loans and buying merchandise directly from customers. Personal property, such as jewelry, electronics, tools, appliances, sporting goods and musical instruments, is pledged and held as collateral for the pawn loans over the typical 30-day term of the loan. Pawn stores also generate retail sales primarily from the merchandise acquired through collateral forfeitures and over-the-counter purchases from customers.

Effective June 30, 2020, the Company ceased offering domestic payday and installment loans and no longer has any unsecured consumer lending or credit services operations in the U.S. or Latin America.

The Company organizes its operations into two reportable segments. The U.S. operations segment consists of all operations in the U.S. and the Latin America operations segment consists of all operations in Mexico, Guatemala, Colombia and El Salvador. For the year ended December 31, 2020, 66% of total revenues were derived from the U.S. and 34% were derived from Latin America. The Company’s strategy is to grow revenues and income by opening new (“de novo”) retail pawn locations, acquiring existing pawn stores in strategic markets and increasing revenue and operating profits in existing stores.

The Company was formed as a Texas corporation in July 1988. In April 1991, the Company reincorporated as a Delaware corporation. On September 1, 2016, the Company completed a merger with Cash America International, Inc. (“Cash America”), whereby Cash America merged with and into a wholly owned subsidiary of the Company (the “Merger”).

The Company’s principal executive offices are located at 1600 West 7th Street, Fort Worth, Texas 76102, and its telephone number is (817) 335-1100. The Company’s primary website is www.firstcash.com.

Pawn Industry

Pawn stores are neighborhood-based retail locations that buy and sell pre-owned consumer products, such as jewelry, electronics, tools, appliances, sporting goods and musical instruments. Pawn stores also provide a quick and convenient source of small secured consumer loans, also known as pawn loans, to unbanked, under-banked and credit-challenged customers. Pawn loans are safe and affordable non-recourse loans for which the customer has no legal obligation to repay. The Company does not engage in post-default collection efforts, does not take legal actions against its customers for defaulted loans, does not ban its customers for nonpayment, nor does it report any negative credit information to credit reporting agencies, but rather, relies only on the resale of the pawn collateral for recovery. Pawnshop customers are typically value-conscious consumers and/or borrowers who are not effectively or efficiently served by traditional lenders such as banks, credit unions, credit card providers or other small loan providers.

United States

The pawn industry in the U.S. is well established, with the highest concentration of pawn stores located in the Southeast, Midwest and Southwest regions of the country. The operation of pawn stores is governed primarily by state laws and accordingly, states that maintain regulations most conducive to profitable pawn operations have historically seen the greatest concentration of pawn stores. Management believes the U.S. pawn industry, although mature, remains highly fragmented. The two publicly traded companies in the pawn industry, which includes the Company, currently operate approximately 1,600 of the estimated 12,000 to 14,000 pawn stores in the U.S. The Company believes the majority of pawnshops in the U.S. are owned by individuals operating five or fewer locations.

Mexico and Other Latin American Markets

In general, pawn stores in Latin America have limited square footage and focus on providing loans collateralized by gold jewelry or small electronics. In contrast, a majority of the Company’s pawn stores in Latin America are larger format, full-service stores similar to the U.S. stores, which lend on a wide array of collateral and have a larger retail sales floor. Accordingly, competition in Latin America with the Company’s larger format, full-service pawn stores is limited. A large percentage of the population in Mexico and other countries in Latin America is unbanked or under-banked and has limited access to traditional consumer credit. The Company believes there is significant opportunity for further expansion in Mexico and other Latin American countries due to the large potential consumer base and limited competition from other large format, full-service pawn store operators.

Business Strategy

The Company’s long-term business plan is to grow revenues and income by opening new (“de novo”) retail pawn locations, acquiring existing pawn stores in strategic markets and increasing revenue and operating profits in existing stores. In pursuing its business strategy, the Company seeks to establish clusters of several stores in specific geographic areas with favorable regulations and customer demographics and to achieve certain economies of scale relative to management and supervision, pricing and purchasing, information and accounting systems and security/loss prevention.

The Company has opened or acquired 1,952 pawn stores in the last five years, including 815 pawn stores acquired in connection with the Merger, with net store additions growing at a compound annual store growth rate of 21% over this period. The Company intends to open or acquire additional stores in locations where management believes appropriate demand and other favorable conditions exist. The following table details stores opened and acquired over the five-year period ended December 31, 2020:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Year Ended December 31, |

| 2020 | | 2019 | | 2018 | | 2017 | | 2016 |

| U.S. operations segment: | | | | | | | | | |

| Merged Cash America locations | — | | | — | | | — | | | — | | | 815 | |

| New locations opened | — | | | — | | | — | | | 2 | | | — | |

| Locations acquired | 22 | | | 27 | | | 27 | | | 1 | | | 3 | |

| Total additions | 22 | | | 27 | | | 27 | | | 3 | | | 818 | |

| | | | | | | | | |

| Latin America operations segment: | | | | | | | | | |

| | | | | | | | | |

| New locations opened | 75 | | | 89 | | | 52 | | | 45 | | | 41 | |

| Locations acquired | 40 | | | 163 | | | 366 | | | 5 | | | 179 | |

| Total additions | 115 | | | 252 | | | 418 | | | 50 | | | 220 | |

| | | | | | | | | |

| Total: | | | | | | | | | |

| Merged Cash America locations | — | | | — | | | — | | | — | | | 815 | |

| New locations opened | 75 | | | 89 | | | 52 | | | 47 | | | 41 | |

| Locations acquired | 62 | | | 190 | | | 393 | | | 6 | | | 182 | |

| Total additions | 137 | | | 279 | | | 445 | | | 53 | | | 1,038 | |

For additional information on store count activity, see “Locations and Operations” below.

New Store Openings

The Company plans to continue opening new pawn stores, primarily in Latin America. The Company typically opens new stores in under-served markets and neighborhoods, especially where customer demographics are favorable and competition is limited or restricted. After a suitable location has been identified and a lease and the appropriate licenses are obtained, a new store can typically be open for business within six to 12 weeks. The investment required to open a new location includes store operating cash, inventory, funds for pawn loans, leasehold improvements, store fixtures, security systems, computer equipment and other start-up costs.

Acquisitions

Due to the fragmented nature of the pawn industry, the Company believes attractive acquisition opportunities will continue to arise from time to time in both Latin America and the U.S. Before making an acquisition, management assesses the demographic characteristics of the surrounding area, considers the number, proximity and size of competing stores, and researches federal, state and local regulatory standards. Specific pawn store acquisition criteria include an evaluation of the volume of merchandise sales and pawn transactions, outstanding customer pawn loan balances, historical pawn yields, merchandise sales margins, pawn loan redemption rates, the condition and quantity of inventory on hand, licensing restrictions or requirements and the location, condition and lease terms of the facility.

Enhance Productivity of Existing and Newly Opened Stores

The primary factors affecting the profitability of the Company’s existing store base are the volume and gross profit of merchandise sales, the volume of and yield on pawn loans and store operating expenses. To encourage customer traffic, which management believes is a key determinant of a store’s success, the Company has taken several steps to distinguish its stores and to make customers feel more comfortable and secure. In addition to a clean and secure physical store facility, the stores’ exteriors typically display attractive and distinctive signage similar to that used by contemporary specialty retailers.

The Company has employee-training programs that promote customer service, productivity and professionalism. The Company utilizes a proprietary computer information system that provides fully-integrated functionality to support point-of-sale retail operations, real-time merchandise valuations, loan-to-value calculations, inventory management, customer relationship management, loan management, cash management, compliance and control systems and employee compensation. Each store is connected on a real-time basis to a secure data center that houses the centralized databases and operating systems. The information system provides management with the ability to continuously monitor store transactions, assets, loans and operating results.

The Company maintains a well-trained audit and loss prevention staff which conducts regular store visits to verify assets, loans and collateral and test compliance with regulatory, financial and operational controls. Management believes the current operating and financial controls and systems are adequate for the Company’s existing store base and can accommodate reasonably foreseeable growth in the near term.

Response to COVID-19

COVID-19 significantly impacted the Company’s business in 2020 and it expects that it will continue to impact its business throughout 2021. Throughout the COVID-19 pandemic, the Company’s management team and board were focused on managing the Company through the pandemic while prioritizing the health and safety of its employees and customers. The operation of the Company’s stores is critically dependent on the ability of customers and employees to safely conduct transactions at each location. Accordingly, the Company developed and implemented new procedures and protocols to minimize the risk to the health and safety of its employees while allowing the Company to continue to operate its pawnshops and serve its customers. The Company implemented social distancing and mask-wearing protocols in its stores and corporate offices, provided additional cleaning supplies to facilitate the sanitation of high traffic areas, installed plexiglass dividers at store point-of-sale counters and prohibited all domestic and international non-essential travel for all employees, among other things. The Company has consistently been able to meet its customers’ demands for its products, while at the same time making the necessary investments to ensure that the Company prioritizes the health, safety and welfare of its employees. While some of the Company’s pawn stores experienced temporary closures, the Company’s pawn stores were generally able to remain open throughout the pandemic as essential businesses.

For a more detailed discussion of the impact of COVID-19 on the Company’s results of operations please see “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations—Results of Operations.”

Services Offered by the Company

Pawn Merchandise Sales

The Company’s pawn merchandise sales are primarily retail sales to the general public from its pawn store locations. The items sold generally consist of pre-owned consumer products such as jewelry, electronics, tools, appliances, sporting goods and musical instruments. The Company also melts certain quantities of non-retailable scrap jewelry and sells the gold, silver and diamonds in the commodity markets. Merchandise sales accounted for approximately 72% of the Company’s revenue during 2020.

Merchandise inventory is acquired primarily through forfeited pawn loan collateral and, to a lesser extent, through purchases of used goods directly from the general public. The Company also acquires limited quantities of new or refurbished general merchandise inventories directly from wholesalers and manufacturers. Merchandise acquired by the Company through forfeited pawn loan collateral is carried in inventory at the amount of the related pawn loan, exclusive of any accrued service fees, and purchased inventory is carried at cost.

The Company does not provide direct financing to customers for the purchase of its merchandise, but does allow customers to purchase merchandise on an interest-free “layaway” plan. Should the customer fail to make a required payment pursuant to a layaway plan, the item is returned to inventory and all or a portion of previous payments are typically forfeited to the Company. Deposits and interim payments from customers on layaway sales are recorded as deferred revenue and subsequently recorded as retail merchandise sales revenue when the merchandise is delivered to the customer upon receipt of final payment or when previous payments are forfeited to the Company.

Retail sales are seasonally highest in the fourth quarter, associated with holiday shopping and, to a lesser extent, in the first quarter associated with tax refunds in the U.S.

Pawn Lending Activities

The Company’s stores make pawn loans, which are typically small, secured loans, to its customers in order to help them meet instant or short-term cash needs. All pawn loans are collateralized by personal property such as jewelry, electronics, tools, appliances, sporting goods and musical instruments. The pledged collateral provides the only security to the Company for the repayment of the loan. The Company does not investigate the creditworthiness of the borrower, primarily relying instead on the marketability and sales value of pledged goods as a basis for its credit decision. Pawn loans are non-recourse loans and a customer does not have a legal obligation to repay a pawn loan. There is no collections process and the decision to not repay the loan will not affect the customer’s credit score with any credit reporting agency.

At the time a pawn loan transaction is entered into, an agreement or pawn contract, commonly referred to as a “pawn ticket,” is presented to the borrower for signature that includes, among other items, the borrower’s name and identification information, a description of the pledged goods, amount financed, pawn service fee, maturity date, total amount that must be paid to redeem the pledged goods on the maturity date and the annual percentage rate.

The term of a pawn loan is typically 30 days plus an additional grace period of 14 to 90 days, depending on geographic markets and local or state regulations. Pawn loans may be either paid in full with accrued pawn loan fees and service charges or, where permitted by law, may be renewed or extended by the customer’s payment of accrued pawn loan fees and service charges. If a pawn loan is not repaid before the expiration of the grace period, the pawn collateral is forfeited to the Company and transferred to inventory at a value equal to the principal amount of the loan, exclusive of accrued service fees. Pledged property is held in a secured, non-public warehouse area of the pawn store for the term of the loan and the grace period, unless the loan is repaid earlier. The Company does not record pawn loan losses or charge-offs because the amount advanced becomes the carrying cost of the forfeited collateral that is to be recovered through the merchandise sales function described above.

The pawn loan fees are typically calculated as a percentage of the pawn loan amount based on the size, duration and type of collateral of the pawn loan and generally range from 4% to 25% per month, as permitted by applicable law. As required by applicable law, the amounts of these charges are disclosed to the customer on the pawn ticket. Pawn loan fees accounted for approximately 28% of the Company’s revenue during 2020.

The amount the Company is willing to finance for a pawn loan is primarily based on a percentage of the estimated retail value of the collateral. There are no minimum or maximum pawn loan to fair market value restrictions in connection with the Company’s lending activities. In order to estimate the value of the collateral, the Company utilizes its proprietary point-of-sale and loan management system to recall recent selling prices of similar merchandise in its own stores. The basis for the Company’s determination of the retail value also includes such sources as precious metals spot markets, catalogs, blue books, online auction sites and retailer advertisements. These sources, together with the employees’ skills and experience in selling similar items of merchandise in particular stores, influence the determination of the estimated retail value of such items. The Company does not utilize a standard or mandated percentage of estimated retail value in determining the amount to be financed. Rather, the employee has the authority to set the percentage for a particular item and to determine the ratio of pawn loan amount to estimated sales value with the expectation that, if the item is forfeited to the pawnshop, its subsequent sale should yield a gross profit margin consistent with the Company’s historical experience. The recovery of the principal and realization of gross profit on sales of inventory is dependent on the Company’s initial assessment of the property’s estimated retail value. Improper over-assessment of the retail value of the collateral in the lending function can result in reduced gross profit margins from the sale of the merchandise.

The Company typically experiences seasonal growth in its pawn loan balances in the third and fourth quarters following lower balances in the first two quarters due to the typical repayment of pawn loans associated with statutory bonuses received by customers in the fourth quarter in Mexico and with tax refund proceeds typically received by customers in the first quarter in the U.S.

Locations and Operations

As of December 31, 2020, the Company had 2,748 store locations composed of 1,046 stores in 24 U.S. states and the District of Columbia, 1,616 stores in 32 states in Mexico, 59 stores in Guatemala, 14 stores in Colombia and 13 stores in El Salvador.

The following table details store count activity for the twelve months ended December 31, 2020:

| | | | | | | | | | | | | | | | | | | | |

| | U.S. | | Latin America | | |

| | | Operations Segment | | Operations Segment | | Total Locations |

| Total locations, beginning of period | | 1,056 | | | 1,623 | | | 2,679 | |

| New locations opened | | — | | | 75 | | | 75 | |

| Locations acquired | | 22 | | | 40 | | | 62 | |

| | | | | | |

Closure of consumer loan stores (1) | | (13) | | | — | | | (13) | |

Consolidation of existing pawn locations (2) | | (19) | | | (36) | | | (55) | |

| | | | | | |

| Total locations, end of period | | 1,046 | | | 1,702 | | | 2,748 | |

(1)Effective June 30, 2020, the Company ceased offering unsecured consumer lending and credit services products, which include all payday and installment loans, in the U.S.

(2)Store consolidations were primarily acquired locations over the past four years which have been combined with overlapping stores and for which the Company expects to maintain a significant portion of the acquired customer base in the consolidated location.

The Company maintains its primary administrative offices in Fort Worth, Texas, Monterrey, Mexico and Mexico City, Mexico.

As of December 31, 2020, the Company’s stores were located in the following countries and states:

| | | | | | | | | | | | | | |

| Number of Locations |

| U.S. | | Latin America |

| Texas | 423 | | | Mexico: | |

| Florida | 75 | | | Estado de. Mexico (State of Mexico) | 210 | |

| Ohio | 63 | | | Veracruz | 210 | |

| Tennessee | 51 | | | Puebla | 116 | |

| North Carolina | 50 | | | Tamaulipas | 93 | |

| Georgia | 43 | | | Baja California | 82 | |

| Washington | 31 | | | Jalisco | 74 | |

| Maryland | 29 | | | Nuevo Leon | 70 | |

| Colorado | 28 | | | Estado de Ciudad de Mexico (State of Mexico City) | 66 | |

| South Carolina | 28 | | | Chiapas | 63 | |

| Arizona | 27 | | | Oaxaca | 56 | |

| Nevada | 27 | | | Tabasco | 51 | |

| Louisiana | 26 | | | Coahuila | 50 | |

| Illinois | 25 | | | Hidalgo | 47 | |

| Kentucky | 25 | | | Chihuahua | 44 | |

| Indiana | 23 | | | Guanajuato | 44 | |

| Missouri | 23 | | | Sonora | 37 | |

| Oklahoma | 18 | | | Quintana Roo | 33 | |

| Alabama | 8 | | | Sinaloa | 31 | |

| Alaska | 6 | | | Guerrero | 26 | |

| Utah | 6 | | | Michoacan | 24 | |

| Virginia | 6 | | | Morelos | 24 | |

| District of Columbia | 3 | | | San Luis Potosi | 22 | |

| Nebraska | 1 | | | Aguascalientes | 21 | |

| Wyoming | 1 | | | Durango | 19 | |

| U.S. total | 1,046 | | | Campeche | 18 | |

| | | Queretaro | 16 | |

| | | Zacatecas | 16 | |

| | | Yucatan | 14 | |

| | | Tlaxcala | 12 | |

| | | Baja California Sur | 10 | |

| | | Nayarit | 9 | |

| | | Colima | 8 | |

| | | | 1,616 | |

| | | | |

| | | Guatemala | 59 | |

| | | | |

| | | Colombia | 14 | |

| | | | |

| | | El Salvador | 13 | |

| | | | |

| | | Latin America total | 1,702 | |

Pawn Store Operations

The Company’s typical large format pawn store is a freestanding building or part of a retail shopping center with dedicated available parking. The Company also operates smaller stores in Mexico, mostly in dense urban markets, which may not have dedicated parking. Management has established a standard store design intended to attract customers and distinguish the Company’s stores from the competition. The design consists of a well-illuminated exterior with distinctive signage and a layout similar to other contemporary specialty retailers. The Company’s stores are typically open six or seven days a week from 9:00 a.m. to between 6:00 p.m. and 9:00 p.m.

The Company attempts to attract customers primarily through the pawn stores’ visibility, signage and neighborhood presence. The Company uses seasonal promotions, special discounts for regular customers, prominent display of impulse purchase items such as jewelry, electronics, and tools, tent and sidewalk sales and a layaway purchasing plan to attract retail shoppers. The Company attempts to attract and retain pawn customers by lending a competitive loan amount as a percentage of the estimated sales value of items presented for pledge and by providing quick loan processing, funding, renewal and redemption services in an appealing, customer-friendly atmosphere.

Generally, each pawnshop employs a manager, one or two assistant managers, and between two and eight sales personnel, depending upon the size, sales volume and location of the store. The store manager is responsible for customer relations, reviewing pawn transactions and related collateral, inventory management, supervising personnel and assuring the store is managed in accordance with Company guidelines and established policies and procedures which emphasize safeguarding of pledged and Company assets, strict cost containment and financial controls. All material store expenses are paid from corporate administrative offices in order to enhance financial accountability. The Company believes careful monitoring of customer transaction metrics and operational expenses enables it to maintain financial stability and profitability.

Each store manager reports to a district manager, who typically oversees four to seven store managers. District managers report to a regional manager who, in turn, typically reports to a regional operations director. Regional operations directors report to a regional vice president of operations. There is a senior vice president of operations and five regional vice presidents of operations.

The Company believes the profitability of its pawnshops is dependent, among other factors, upon its employees’ skills and ability to engage with customers and provide prompt and courteous service. The Company’s proprietary computer system tracks certain key transactional performance measures, including pawn loan yields and merchandise sales margins, and permits a store manager or clerk to instantly recall the cost of an item in inventory and the date it was purchased, including the prior transaction history of a particular customer. It also facilitates the timely valuation of goods by showing values assigned to similar goods. The Company has networked its stores to allow employees to more accurately determine the retail value of merchandise and to permit the Company’s headquarters to more efficiently monitor, in real time, each store’s operations, including merchandise sales, service charge revenue, pawn loans written and redeemed and changes in inventory.

The Company trains its employees through direct instruction and on-the-job pawn and sales experience. New employees are introduced to the business through an orientation and training program that includes on-the-job training in lending practices, layaways, merchandise valuation, regulatory compliance and general administration of store operations. Certain experienced employees receive training and an introduction to the fundamentals of management to acquire the skills necessary to advance into management positions within the organization. Management training typically involves exposure to overall financial acumen, including revenue and margin generation, cost efficiency, regulatory compliance, recruitment, human resources management and asset and security control. The Company maintains a non-qualified, performance-based profit sharing compensation plan for all store employees based on sales, gross profit and other performance criteria.

Environmental, Social and Governance (ESG)

Pawnshops are neighborhood-based stores which contribute to the modern “circular economy.” Each of the Company’s 2,748 pawn locations provide a quick and convenient source of small, non-recourse pawn loans and a neighborhood-based market for consumers to buy and resell pre-owned and popular consumer products in a safe environment. The Company is committed to environmental sustainability, providing customers with rapid access to capital and operating its business in a manner that results in a positive impact on its employees, communities and the environment.

Environmental Sustainability

The Company’s core business extends the lifecycle and utilization of popular consumer products. Most of the Company’s merchandise inventories are pre-owned items sourced directly from local customers in each store’s immediate geographic neighborhood. In effect, the Company operates a large consumer product recycling business by acquiring pre-owned items, including unwanted or unneeded jewelry, electronics, tools, appliances, sporting goods and musical instruments from individual customers and resells them to other customers desiring such products within the same neighborhood. By being a large reseller of pre-owned items, the Company believes it extends the life of these products and helps reduce demand for newly manufactured and distributed products, thereby reducing carbon emissions and water usage, resulting in a positive impact to the environment.

The Company estimates that it resold approximately 12 million used or pre-owned consumer product items in its retail stores during 2020 with a commercial value of approximately $1.1 billion. In addition, the Company recycles significant volumes of precious metals and diamonds whereby unwanted or broken jewelry is collected and melted/processed by the Company and then resold as a commodity for future commercial use. During 2020, the Company estimates that it recycled over 60,000 ounces of gold and over 35,000 carats of diamonds with a combined market value of approximately $96.2 million. This process helps reduce demand for mined precious metals and diamonds thereby reducing carbon emissions and water usage.

Unlike most brick and mortar or online retailers, the Company does not rely on supply chains or manufacturing of its inventories as it sources the majority of its inventory from forfeited pawn loan collateral and merchandise purchased directly from customers. Accordingly, the Company does not own, operate or contract for any manufacturing, supply chain, warehousing or distribution facilities to support its retail sales or lending operations. Almost all retail sales and pawn loans are made to customers who live or work within a tight geographic radius of the Company’s stores, and only a very small percentage of sales require delivery service. The Company does not own, lease or operate any long-haul trucks to support its 2,748 locations and, other than operating small storefront locations which are typically 5,000 square feet or less, the Company’s operations leave a limited carbon footprint compared to manufacturers and retailers selling new merchandise with extensive supply chain and distribution channels. The Company is working to further reduce energy consumption by retrofitting buildings with LED lighting and reducing corporate travel by utilizing remote work and meeting technologies.

Providing Safe Lending Solutions in Underserved Communities

It is estimated by multiple studies and surveys that approximately 25% of U.S. households remain unbanked or under-banked. In Latin America, the number of unbanked or under-banked consumers can be as much as 75% of the population in countries such as Mexico. As a result, the majority of the Company’s customers have limited access to traditional forms of credit or capital. The Company contributes to its communities by providing these customers with instant access to capital through very small, non-recourse pawn loans or buying merchandise from its customers. The average credit provided to a customer is $198 in the U.S. and $78 in Latin America. Traditional lenders such as banks, credit unions, credit card providers or other small loan providers do not efficiently or effectively offer microcredit products of this size.

Obtaining a pawn loan is simple, requiring only a valid government ID and an item of personal property owned by the customer. The Company does not investigate the creditworthiness of a pawn customer, nor does it matter if the customer has defaulted on a previous pawn loan with the Company. Unlike most credit products, pawn customers are not required to have a bank account, a good credit history or the ability to document their level of income. The process of obtaining a pawn loan is extremely fast, generally taking 15 minutes or less. Loans are funded immediately by giving customers cash.

Pawn loans are highly transparent and responsible products. They are regulated, safe and affordable non-recourse loans for which the customer has no legal obligation to repay. All terms are provided in short, easy to read contracts that allow the Company’s customers to make well-informed decisions before taking out a loan.

Pawn loans differ from most other forms of small dollar lending because the Company does not engage in any post-default collection efforts on delinquent loans, does not take legal actions against its customers for defaulted loans, does not ban its customers for nonpayment, nor does it issue any negative credit information to external credit agencies but rather, relies only on the resale of the pawn collateral for recovery.

The Company promotes a strong corporate culture which emphasizes ethics, accountability and treating customers fairly. This culture is supported by a governance framework with board level oversight of the Company's compliance and internal audit functions and includes the following:

•The Company’s lending operations are licensed and supervised in every jurisdiction in which the Company operates and it is subject to regular regulatory exams in almost all of these jurisdictions.

•A formal compliance management system is maintained by the Company in all markets in which it operates.

•A “single point of contact” issue resolution function is available to all customers.

•Strict data privacy and protection policies are maintained for personal information of customers and employees.

Focus on Social and Corporate Responsibility

The Company has significant operations in Mexico, where the majority of its employees and customers reside. Accordingly, the Company has focused significant time and resources on corporate and social responsibility initiatives in supporting disadvantaged people who live and work in this market.

The Company is certified as an Empresa Socialmente Responsable (“ESR”), or a socially responsible company, in Mexico under the XII Latin American Meeting of Corporate Social Responsibility Framework. This ESR certification is granted to companies that meet a series of criteria that generally cover the economic, social and environmental sustainability of its operations, which include corporate ethics, good governance, the quality of life of the Company’s employees and a proven commitment to the betterment of the community where it operates, including the care and preservation of the environment.

The Company has also established relationships and supports multiple foundations and programs in Mexico, including an exclusive partnership with the JUCONI Foundation, which works with families and children to prevent and help heal the trauma associated with domestic violence in families or children who are living in extreme poverty or are homeless. Additionally, the Company supports or partners with several other foundations and projects, which provide educational scholarships, intern programs, reading initiatives and recycling programs for disadvantaged citizens.

Human Capital Resources

In managing its human capital resources, the Company aims to attract a qualified and diverse workforce through an inclusive and accessible recruiting process that utilizes online recruiting platforms, campus outreach, internships and job fairs. The Company’s workforce is composed primarily of employees who work on an hourly basis, which have historically had high turnover rates. These high turnover rates can lead to increased training, retention and other costs and impair the overall customer service and efficiencies at the Company’s stores. In order to increase retention among its hourly employees, the Company is focused on providing competitive and attractive wages and benefits, which includes a store-level profit-sharing program and extensive training and advancement opportunities as well as fostering a diverse, safe, healthy and secure workplace.

The Company complies with all applicable state, local and international laws governing nondiscrimination in employment in every location in which the Company operates. All applicants and employees are treated with the same high level of respect regardless of their gender, ethnicity, religion, national origin, age, marital status, political affiliation, sexual orientation, gender identity, disability or protected veteran status.

Employee Profile and Diversity

As of December 31, 2020, the Company had approximately 17,000 employees across five countries (the U.S., Mexico, Guatemala, Colombia and El Salvador). The Company employed approximately 6,500 employees in the U.S. as of December 31, 2020, including approximately 500 persons employed in executive, supervisory, administrative and accounting functions. None of the Company’s U.S. employees are covered by collective bargaining agreements. The Company employed approximately 10,500 employees in Latin America as of December 31, 2020, including approximately 900 persons employed in executive, supervisory, administrative and accounting functions. The Company’s Mexico employees are covered by labor agreements as required under Mexico’s Federal Labor Law. None of the Company’s other Latin American employees are covered by collective bargaining agreements.

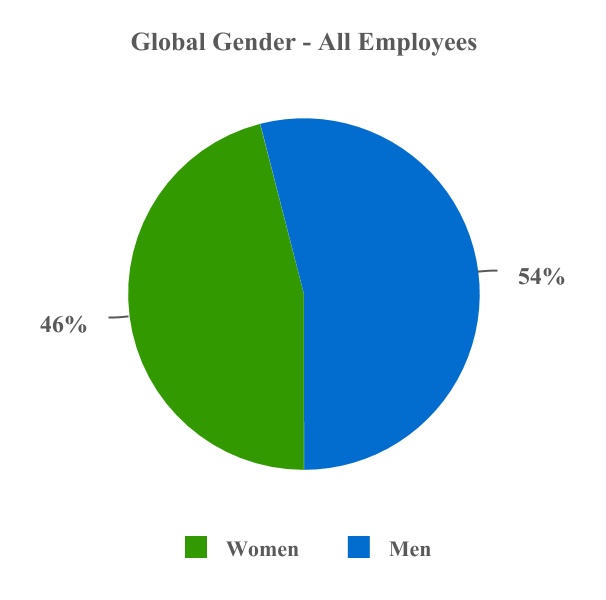

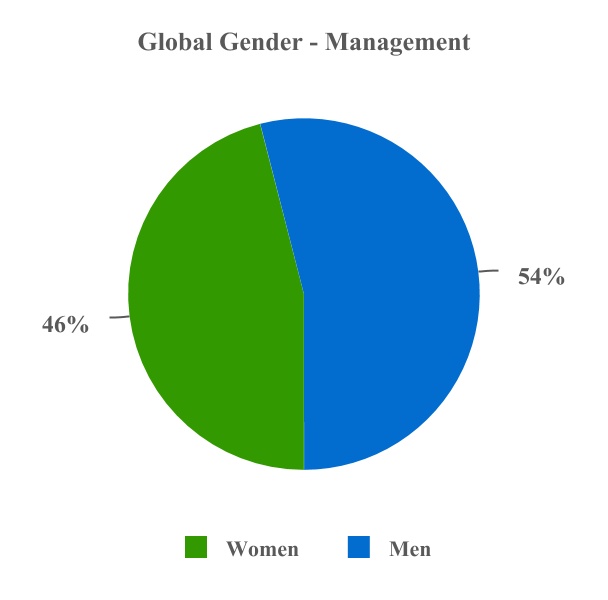

Global Gender Demographics

Among the Company’s global workforce as of December 31, 2020, 46% identify as women and 54% as men. In management positions for our global operations, 46% identify as women and 54% as men as of December 31, 2020.

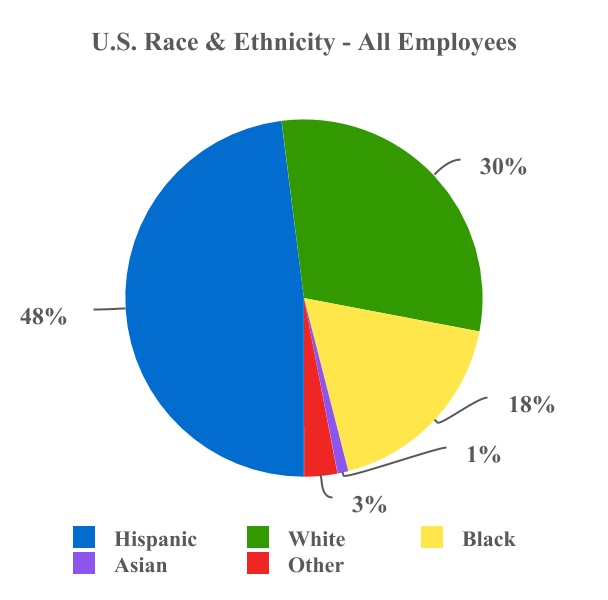

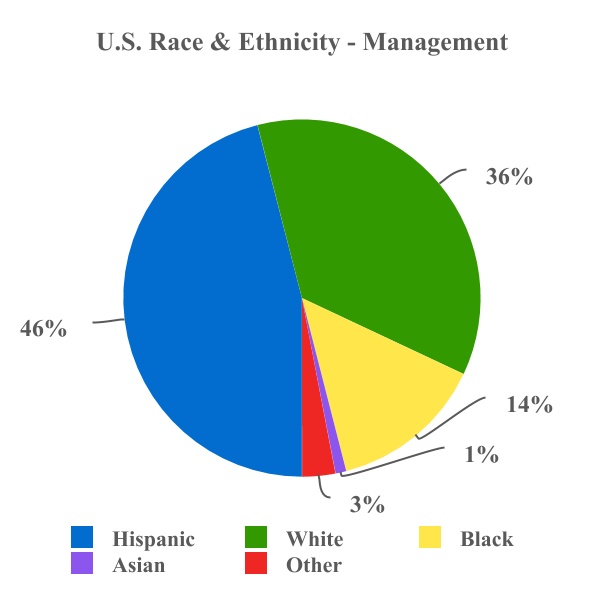

U.S. Race and Ethnicity Demographics

In the U.S.as of December 31, 2020, 48% identify as Hispanic, 18% as Black, 1% as Asian, 3% as two or more races or Other and 30% as White. Among, managers in our U.S. operations, 46% identify as Hispanic, 14% as Black, 1% as Asian, 3% as two or more races or Other and 36% as White as of December 31, 2020.

Employee Empowerment

The Company is committed to creating a safe, trusted and diverse environment in which its employees can thrive. Its employees’ wages are typically above the minimum wage standards in each country in which it operates. The Company also believes in fairly compensating its employees by providing the ability to share in the Company’s profitability. For example, the majority of the Company’s front-line, store-based employees participate in a non-qualified profit sharing program which pays up to 8% of the gross profit an employee personally produced through assigned customer service activities.

The Company also provides its employees with extensive training and advancement opportunities, demonstrated by its long history of employee advancement and promotion from within the organization. The Company maintains robust consumer compliance, anti-money laundering and anti-bribery training programs and requires its managers to adhere to a labor compliance program that meets or exceeds the standards established for coercion and harassment, discrimination and restrictions to freedom of association. The Company’s locations provide a safe, comfortable and healthy work environment and maintain compliance with all occupational safety, wage and hour laws and other workplace regulations.

Health and Safety

The Company is committed to the health, safety and wellness of its employees. The Company provides its employees and their families with access to a variety of flexible and convenient health and wellness programs, including benefits that provide protection and security so they can have peace of mind concerning events that may require time away from work or that impact their financial well-being, that support their physical and mental health by providing tools and resources to help them improve or maintain their health status and encourage engagement in healthy behaviors, and that offer choice where possible so they can customize their benefits to meet their needs and the needs of their families.

The operation of the Company’s stores is critically dependent on the ability of customers and employees to safely conduct transactions at each location. The COVID-19 pandemic presented unprecedented challenges in many parts of the Company’s business and operations, including with respect to keeping employees safe. Accordingly, the Company developed and implemented new procedures and protocols to minimize the risk to the health and safety of its employees while allowing the Company to continue to operate its pawnshops and serve its customers. The Company implemented social distancing and mask-wearing protocols in its stores and corporate offices, provided additional cleaning supplies to facilitate the sanitation of high traffic areas, installed plexiglass dividers at store point-of-sale counters and prohibited all domestic and international non-essential travel for all employees, among other things.

The Company has consistently been able to meet customers’ demands for its products, while at the same time making the necessary investments to ensure that the Company prioritizes the health, safety and welfare of its employees. In addition, during the pandemic, the Company has prioritized the welfare of its employees by maintaining their paid employment status. To date, no employees in the U.S. or Mexico markets have been terminated, laid off or furloughed without pay as a direct result of the pandemic.

Competition

The Company encounters significant competition in connection with all aspects of its business operations. These competitive conditions may adversely affect the Company’s revenue, profitability and ability to expand. The Company believes the primary elements of competition in the businesses in which it operates are store location, customer service, the ability to lend competitive amounts on pawn loans and to sell popular retail merchandise at competitive prices. In addition, the Company competes with other lenders and retailers to attract and retain employees with competitive compensation programs.

The Company’s pawn business competes primarily with other pawn store operators, other specialty consumer finance operators, including online lenders, retail and virtual rent-to-own operators and consumer goods retailers, including online operators. Management believes the pawn industry remains highly fragmented with an estimated 12,000 to 14,000 total pawnshops in the U.S. and 7,000 to 8,000 pawnshops in Mexico. Including the Company, there are two publicly-held, U.S.-based pawnshop operators, both of which have pawn operations in the U.S., Mexico, Guatemala and El Salvador. Of these two, the Company had the most pawn stores and the largest market capitalization, as of December 31, 2020, and believes it is the largest public or private operator of large format, full-service pawn stores in the U.S. and Mexico. The pawnshop and other specialty consumer finance industries are characterized by a large number of independent owner-operators, some of whom own and operate multiple locations. In addition, the Company competes with other non-pawn lenders, such as banks and consumer finance companies, which generally lend on an unsecured as well as a secured basis. Other lenders may and do lend money on terms more favorable than those offered by the Company. Many of these financial institutions have greater financial resources or human capital than the Company’s with which to compete for consumer loans.

In both its U.S. and Latin American retail pawn operations, the Company’s competitors include numerous retail and wholesale merchants, including jewelry stores, rent-to-own operators, discount retail stores, “second-hand” stores, consumer electronics stores, other specialty retailers, online retailers, online auction sites, online classified advertising sites and other pawnshops. Competitive factors in the Company’s retail operations include the ability to provide the customer with a variety of merchandise items at attractive prices. Many of the retail competitors have significantly greater size, financial resources and human capital than the Company.

Intellectual Property

The Company relies on a combination of trademarks, trade dress, trade secrets, proprietary software, website domain names and other rights, including confidentiality procedures and contractual provisions, to protect its proprietary technology, processes and other intellectual property.

The Company’s competitors may develop products that are similar to its technology, such as the Company’s proprietary point-of-sale and loan management software. The Company enters into agreements with its employees, consultants and partners, and through these and other confidentiality or non-compete agreements, the Company attempts to control access to and distribution of its software, documentation and other proprietary technology and information. Despite the Company’s efforts to protect its proprietary rights, third parties may, in an authorized or unauthorized manner, attempt to use, copy or otherwise obtain and market or distribute its intellectual property rights or technology or otherwise develop a product with the same functionality as its solution. Policing all unauthorized use of the Company’s intellectual property rights is nearly impossible. The Company cannot be certain that the steps it has taken or will take in the future will prevent misappropriations of its technology or intellectual property rights.

Governmental Regulation

General

Effective June 30, 2020, the Company ceased offering domestic payday and installment loans and no longer has any unsecured consumer lending or credit services operations in the U.S. or Latin America. The Company remains subject to significant regulation of its pawn and general business operations in all of the jurisdictions in which it operates. These regulations are implemented through various laws, ordinances and regulatory pronouncements from federal, state and municipal governmental entities in the U.S. and Latin America. These regulatory bodies often have broad discretionary authority over the establishment, interpretation and enforcement of such regulations. These regulations are subject to change, sometimes significantly, as a result of political, economic or social trends, events and media perception.

The Company is subject to specific laws, regulations and ordinances primarily concerning its pawn lending operations. Many statutes and regulations prescribe, among other things, the general terms of the Company’s pawn loan agreements, including maximum service fees and/or interest rates that may be charged and collected and mandatory consumer disclosures. In many municipal, state and federal jurisdictions in both the U.S. and countries in Latin America, the Company must obtain and maintain regulatory store operating and employee licenses and comply with regular or frequent regulatory reporting and registration requirements, including reporting and recording of pawn loans and transactions, pawned collateral, used merchandise purchased from the general public, retail sales activities, firearm transactions, export, import and transfer of merchandise, and currency transactions, among other things.

The Company is subject to numerous other types of regulations including, but not limited to, regulations related to securities and exchange activities, including financial reporting and internal controls processes, data protection and privacy, tax compliance, health and safety, labor and employment practices, import/export activities, real estate transactions, credit card transactions, marketing, advertising and other general business activities.

There can be no assurance that the current domestic and international political climate will not change and negatively affect the Company’s business, or that additional local, state or federal statutes, regulations or edicts will not be enacted or that existing laws and regulations will not be amended, decreed or interpreted at some future date that could prohibit or limit the ability of the Company to profitably operate any or all of its services. For example, such regulations could restrict the ability of the Company to offer pawn loans, significantly decrease or cap the interest rates or service fees for such lending activities, prohibit or more stringently regulate the acceptance of pawn collateral or buying used merchandise and the sale, exportation or importation of such pawn merchandise, any of which could have a material adverse effect on the Company’s operations and financial condition. If legislative, regulatory or other arbitrary actions or interpretations are taken at a federal, state or local level in the U.S. or countries in Latin America which negatively affect the pawn industry where the Company has a concentrated or significant number of stores, those actions could have a material adverse effect on the Company’s business operations. There

can be no assurance that such regulatory action at any jurisdiction level will not be enacted, or that existing laws and regulations will not be amended, decreed or interpreted in such a way which could have a material adverse effect on the Company’s operations and financial condition.

U.S. Federal Regulations

The U.S. government and its agencies have significant regulatory authority over consumer financial services activities. In recent years, additional legislation and regulations have been enacted or proposed which have increased or could continue to increase regulation of the consumer finance industry.

The Consumer Financial Protection Bureau (the “CFPB”), created by Title X of the Dodd Frank Wall Street Reform and Consumer Protection Act of 2010 (the “Dodd-Frank Act”), has broad regulatory, supervisory and enforcement powers over certain financial institutions. The CFPB’s examination authority permits examiners to inspect the Company’s books and records and ask questions about its business and its practices relating to unsecured, small dollar loans, like payday loans, which the Company offered before June 30, 2020. The CFPB also has the authority to pursue administrative proceedings or litigation for actual or perceived violations of federal consumer laws (including the CFPB’s own rules). In these proceedings, the CFPB can seek civil investigative demands, consent orders, confidential memorandums of understandings, obtain cease and desist orders (which can include orders for redisclosure, restitution or rescission of contracts, as well as affirmative or injunctive relief) and monetary penalties. Also, where a company has been found to have violated consumer laws, the Dodd-Frank Act (in addition to similar state consumer laws) empowers state attorneys general and state regulators to bring administrative or civil actions seeking the same equitable relief available to the CFPB, in addition to state-led enforcement actions and consent orders. If the CFPB or one or more state officials believe that the Company violated any of the applicable laws or regulations, they could exercise their enforcement powers in ways that could have a material adverse effect on the Company or its business.

On October 5, 2017, the CFPB released its small-dollar loan rule (the “SDL Rule”), which was subsequently revised on July 7, 2020. Traditional possessory, non-recourse pawn loans were not covered under the CFPB’s original 2017 regulation and remain excluded under the revised regulation. Accordingly, the Company believes that the SDL Rule does not directly impact the vast majority of its pawn products, which comprise more than 99% of its total revenues. The SDL Rule does, however, define consumer loan products, both short-term loans and installment loans offered by the Company before June 30, 2020, as loans covered under the rule. Given the Company’s discontinuance of consumer loans and credit services on June 30, 2020, the Company does not believe the SDL Rule will have a material effect, if any, on the Company’s operations and financial condition.

In July 2015, the U.S. Department of Defense published a finalized set of additional requirements and restrictions under the Military Lending Act (“MLA Rule”). The MLA Rule, which went into effect on October 3, 2016, amended requirements for its “safe harbor” (making covered member attestation insufficient on its own to comply with the “safe harbor” provision of the MLA Rule) and expanded the scope of the credit products covered by the MLA to include overdraft lines of credit, pawn loans, or vehicle and certain unsecured installment loan products to the extent any such products have a military annual percentage rate greater than 36%. While the Company does not believe that active members of the U.S. military or their dependents comprise a significant percentage of the historical pawn customer base in most locations, compliance with the MLA Rule, including its safe harbor provisions, is complex, increases compliance risks and related costs and limits the potential customer base of the Company.

The Company must comply with various disclosure requirements under the Federal Truth in Lending Act (and Regulation Z promulgated thereunder). These disclosures include, among other things, the total amount of the finance charges and annualized percentage rate of the charges associated with pawn transactions.

The Financial Crimes Enforcement Network (“FinCEN”) exercises regulatory functions primarily under the Currency and Financial Transactions Reporting Act of 1970, as amended by Title III of the USA PATRIOT Act of 2001 and other legislation, which legislative framework is commonly referred to as the “Bank Secrecy Act” (the “BSA”). The BSA is a comprehensive U.S. federal anti-money laundering (“AML”) and counter-terrorism financing statute. The BSA authorizes the Secretary of the Treasury to issue regulations requiring banks and other financial institutions to take a number of precautions against financial crimes, including the establishment of AML programs and the filing of certain reports. The Secretary of the Treasury has delegated to the Director of FinCEN the authority to implement, administer, and enforce compliance with the BSA and associated regulations, which among other things, regulates the reporting of transactions involving currency in an amount greater than $10,000. As of January 1, 2018, the Company ceased offering fee-based check cashing services and is no longer considered a money services business as defined under federal law. Generally, however, and depending on the service or product, financial institutions, including the Company, must report certain transactions involving currency in an amount greater than $10,000 during a specific period, or transactions deemed suspicious in nature. The Company’s compliance with AML

regulations and reporting requirements is reviewed annually by its director of internal audit who reports all findings directly to the Board of Directors.

The Gramm-Leach-Bliley Act requires the Company to generally protect the confidentiality of its customers’ non-public personal information and to disclose to its customers its privacy policy and practices, including those regarding sharing the customers’ non-public personal information with third parties. Such disclosure must be made to customers at the time the customer relationship is established, at least annually thereafter, and if there is a change in the Company’s privacy policy. In addition, the Company is subject to strict document retention and destruction policies.

The Company’s advertising and marketing activities, in general and depending on the type of product and/or service offered, are subject to additional federal laws and regulations administered by the Federal Trade Commission and the CFPB which prohibit unfair or deceptive acts or practices and false or misleading advertisements.

The Fair and Accurate Credit Transactions Act (“FACTA”) requires the Company to adopt written guidance and procedures for detecting, mitigating, preventing and responding appropriately to identity theft and to adopt various employee policies and procedures, and provide employee training and materials that address the importance of protecting non-public personal information, specifically, personal identifiable information, and aid the Company in detecting and responding to suspicious activity, including suspicious activity which may suggest a possible identity theft red flag, as appropriate.