UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

[ X ] | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2015

OR

[ ] | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from __________ to ___________

Commission file number 0-19133

FIRST CASH FINANCIAL SERVICES, INC.

(Exact name of registrant as specified in its charter)

Delaware | 75-2237318 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

690 East Lamar Blvd., Suite 400 | 76011 |

Arlington, Texas | (Zip Code) |

(Address of principal executive offices) | |

(817) 460-3947

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class | Name of Exchange on Which Registered |

Common Stock, par value $.01 per share | NASDAQ Global Select Market |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. xYes o No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

oYes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. xYes o No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). xYes o No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

x Large accelerated filer | o Accelerated filer |

o Non-accelerated filer (Do not check if a smaller reporting company) | o Smaller reporting company |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). oYes x No

The aggregate market value of the registrant’s common stock held by non-affiliates of the registrant, based upon the last reported sales price on the NASDAQ Global Select Market on June 30, 2015, is $1,239,130,000.

As of February 12, 2016, there were 28,243,229 shares of common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive Proxy Statement relating to its 2016 Annual Meeting of Stockholders to be held on or about June 7, 2016, is incorporated by reference in Part III, Items 10, 11, 12, 13 and 14 of this Annual Report on Form 10-K.

FIRST CASH FINANCIAL SERVICES, INC.

FORM 10-K

For the Year Ended December 31, 2015

TABLE OF CONTENTS

FORWARD-LOOKING INFORMATION

This annual report contains forward-looking statements about the business, financial condition and prospects of First Cash Financial Services, Inc. and its wholly owned subsidiaries (together, the “Company”). Forward-looking statements, as that term is defined in the Private Securities Litigation Reform Act of 1995, can be identified by the use of forward-looking terminology such as “believes,” “projects,” “expects,” “may,” “estimates,” “should,” “plans,” “targets,” “intends,” “could,” or “anticipates,” or the negative thereof, or other variations thereon, or comparable terminology, or by discussions of strategy or objectives. Forward-looking statements can also be identified by the fact that these statements do not relate strictly to historical or current matters. Rather, forward-looking statements relate to anticipated or expected events, activities, trends or results. Because forward-looking statements relate to matters that have not yet occurred, these statements are inherently subject to risks and uncertainties.

Forward-looking statements in this annual report include, without limitation, the Company’s expectations of earnings per share, earnings growth, expansion strategies, the impact of new or existing regulations, store openings, liquidity (including the availability of capital under existing credit facilities), cash flow, consumer demand for the Company’s products and services, income tax rates, currency exchange rates, future share repurchases and anticipated dividend payments, the price of gold and the impacts thereof, future earnings accretion and related transaction expenses from acquisitions and mergers, the successful completion of expected acquisitions, anticipated debt repayments, the ability to successfully integrate acquisitions and other performance results. These statements are made to provide the public with management’s current assessment of the Company’s business. Although the Company believes the expectations reflected in forward-looking statements are reasonable, there can be no assurances such expectations will prove to be accurate. Security holders are cautioned such forward-looking statements involve risks and uncertainties. Certain factors may cause results to differ materially from those anticipated by the forward-looking statements made in this annual report. Such factors are difficult to predict and many are beyond the control of the Company and may include, without limitation, the following:

• | changes in foreign currency exchange rates and the U.S. dollar to the Mexican peso and Guatemalan quetzal exchange rates in particular; |

• | new federal, state or local legislative initiatives or governmental regulations (or changes to existing laws and regulations) affecting pawn businesses, consumer loan businesses and credit services organizations (in the United States, Mexico, Guatemala and El Salvador), including administrative or legal interpretations thereto; |

• | changes in consumer demand, including purchasing, borrowing and repayment behaviors; |

• | changes in regional, national or international economic conditions, including inflation rates, unemployment rates and energy prices; |

• | changes in pawn forfeiture rates and credit loss provisions; |

• | changes in the market value of pawn collateral and merchandise inventories, including gold prices and the value of consumer electronics and other products; |

• | changes or increases in competition; |

• | the ability to locate, open and staff new stores and successfully integrate acquisitions; |

• | the availability or access to sources of used merchandise inventory; |

• | changes in credit markets, interest rates and the ability to establish, renew and/or extend the Company’s debt financing; |

• | the ability to maintain banking relationships for treasury services and processing of certain consumer lending transactions; |

• | the ability to hire and retain key management personnel; |

• | risks and uncertainties related to foreign operations in Mexico, Guatemala and El Salvador; |

• | changes in import/export regulations and tariffs or duties; |

• | changes in banking, anti-money laundering or gun control regulations; |

• | unforeseen litigation; |

• | changes in tax rates or policies in the U.S., Mexico, Guatemala and El Salvador; |

• | inclement weather, natural disasters and public health issues; |

• | security breaches, cyber attacks or fraudulent activity; |

• | a prolonged interruption in the Company’s operations of its facilities, systems, and business functions, including its information technology and other business systems; |

• | the implementation of new, or changes in the interpretation of existing, accounting principles or financial reporting requirements; and |

• | future business decisions. |

These and other risks, uncertainties and regulatory developments are further and more completely described in Part 1, Item 1A, “Risk Factors.” Many of these risks and uncertainties are beyond the ability of the Company to control, nor can the Company predict, in many cases, all of the risks and uncertainties that could cause its actual results to differ materially from those indicated by the forward-looking statements. The forward-looking statements contained in this annual report speak only as of the date of this annual report, and the Company expressly disclaims any obligation or undertaking to report any updates or revisions to any such statement to reflect any change in the Company’s expectations or any change in events, conditions or circumstances on which any such statement is based, except as required by law.

PART I

Item 1. Business

General

The Company is a leading operator of retail-based pawn stores in the United States and Latin America. As of December 31, 2015, the Company had 1,075 locations, consisting of 338 stores across 14 U.S. states, 705 stores across 29 states in Mexico and 32 stores in Guatemala.

The Company’s primary business is the operation of full-service pawn stores which make small pawn loans secured by personal property such as consumer electronics, jewelry, power tools, household appliances, sporting goods and musical instruments. These pawn stores generate significant retail sales from the merchandise acquired through collateral forfeitures and over-the-counter purchases from customers. In addition, some of the Company’s pawn stores offer small unsecured consumer loans or credit services products. The Company’s strategy is to focus on growing its full-service pawn operations in the United States and Latin America through new store openings and strategic acquisition opportunities as they arise.

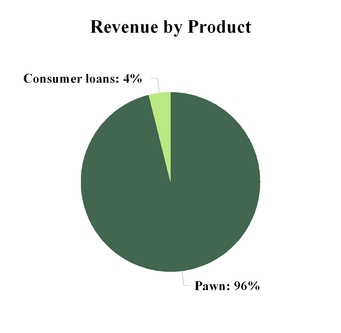

In addition to its pawn stores, the Company operates a small number of stand-alone consumer finance stores in Texas and Mexico. These stores primarily provide consumer financial services products including credit services and small unsecured consumer loans. The Company considers the credit services and consumer loan products to be non-core, non-growth revenue streams, representing 4% of the Company’s total revenues for the year ended December 31, 2015.

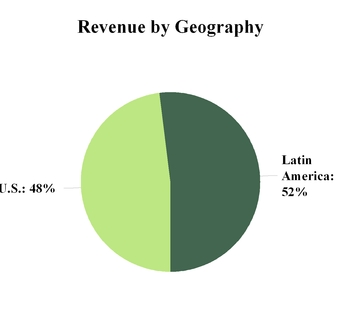

Revenue for the year ended December 31, 2015 was primarily generated from the Company’s pawn operations with 52% derived from Latin America and 48% from the United States. For additional historical information on the composition of revenues from the United States and Latin America, see “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations—Results of Continuing Operations.”

The Company was formed as a Texas corporation in July 1988. In April 1991, the Company reincorporated as a Delaware corporation. The Company’s principal executive offices are located at 690 East Lamar Blvd., Suite 400, Arlington, Texas 76011, and its telephone number is (817) 460-3947.

1

Pawn Industry

Pawn stores are neighborhood-based retail stores that buy and sell popular consumer items such as consumer electronics, jewelry, power tools, appliances, sporting goods and musical instruments. Pawn stores also provide a quick and convenient source of small consumer loans to unbanked, under-banked and credit-challenged customers. These consumers are typically not effectively or efficiently served by traditional lenders such as banks, credit unions, credit card providers or other small loan providers. The Company’s pawn stores directly compete in both the specialty retail and consumer finance industries.

United States

The pawn industry in the United States is well established, with the highest concentration of pawn stores located in the Southeast, Midwest and Southwest regions of the country. The operation of pawn stores is governed primarily by state laws and accordingly, states that maintain regulations most conducive to profitable pawn operations have historically seen the greatest concentration of pawn stores. Management believes the U.S. pawn industry, although mature, remains highly fragmented. The three major publicly traded companies in the pawn industry, which includes the Company, currently operate approximately 1,600 of the estimated 10,000 to 15,000 pawn stores in the United States. The Company believes the majority of pawnshops in the United States are owned by individuals operating five or fewer locations.

Mexico and Other Latin American Markets

Most of the Company’s pawn stores in Mexico are full-service stores lending on a wide array of collateral with a retail sales floor. The full-service pawn industry in Mexico is less developed as compared to the U.S. Of the approximately 6,000 to 8,000 total pawn stores in Mexico, most are limited service, jewelry-focused stores. The jewelry-focused pawn stores in Mexico are much smaller than a typical U.S. pawn store and have limited retail operations, typically offering only pawn loans collateralized by gold jewelry or small consumer electronics. Competition in Mexico for the Company’s full-service pawn stores is limited, as the Company believes there are less than 1,500 of these full-service pawn stores. A large percentage of the population in Mexico and other countries in Latin America are unbanked or under-banked and have limited access to consumer credit. The Company believes there is significant opportunity for future expansion in Mexico and other Latin American countries due to the large potential consumer base and limited competition from other large, full-service pawn store operators.

Business Strategy

The Company’s business plan is to expand its operations by opening new (“de novo”) retail pawn locations, by acquiring existing pawnshops in strategic markets and attempting to increase revenue and operating profits in its existing stores. In pursuing its business strategy, the Company seeks to establish clusters of several stores in specific geographic areas in order to achieve certain economies of scale relative to management and supervision, pricing and purchasing, information and accounting systems and marketing.

The Company has opened or acquired 550 pawn stores in the last five fiscal years. Net store additions have grown at a compound annual store growth rate of 13% over this period. In addition, the Company acquired 166 stores in Mexico in January 2016 and 13 stores in El Salvador in February 2016. The Company intends to open additional stores in locations where management believes appropriate demand and other favorable conditions exist. The following table details stores opened and acquired over the five year period ended December 31, 2015:

2

Year Ended December 31, | ||||||||||||||

2015 | 2014 | 2013 | 2012 | 2011 | ||||||||||

U.S. stores: | ||||||||||||||

New locations opened | — | 8 | 9 | 6 | 10 | |||||||||

Locations acquired | 33 | 25 | 34 | 46 | 11 | |||||||||

Total additions | 33 | 33 | 43 | 52 | 21 | |||||||||

Latin America stores: | ||||||||||||||

New locations opened | 38 | 31 | 60 | 62 | 61 | |||||||||

Locations acquired | 32 | 47 | 8 | 29 | — | |||||||||

Total additions | 70 | 78 | 68 | 91 | 61 | |||||||||

Total: | ||||||||||||||

New locations opened | 38 | 39 | 69 | 68 | 71 | |||||||||

Locations acquired | 65 | 72 | 42 | 75 | 11 | |||||||||

Total additions | 103 | 111 | 111 | 143 | 82 | |||||||||

For additional information on store count activity, see “—Locations and Operations” below.

New Store Openings

The Company plans to continue opening new pawn stores in both Latin America and the U.S. The Company typically opens new stores in under-developed markets, especially where customer demographics are favorable and competition is limited or restricted. After a suitable location has been identified and a lease and material licenses are obtained, a new store can typically be open for business within six to twelve weeks. The investment required to open a new location includes store operating cash, inventory, funds for pawn and consumer loans, leasehold improvements, store fixtures, security systems, computer equipment and other start-up costs.

Acquisitions

Because of the fragmented nature of the pawn industry, the Company believes attractive acquisition opportunities may arise from time to time. Before making an acquisition, management assesses the demographic characteristics of the surrounding area, considers the number, proximity and size of competing stores, and researches state and local regulatory standards. Specific pawn store acquisition criteria include an evaluation of the volume of merchandise sales and pawn transactions, outstanding customer pawn loan balances, historical pawn yields, retail margins and redemption rates, the condition and quantity of inventory on hand, and location, condition and lease terms of the facility.

Enhance Productivity of Existing and Newly Opened Stores

The primary factors affecting the profitability of the Company’s existing store base are the volume and gross profit of merchandise sales, the volume and yield on customer loans outstanding and store expenses. To encourage customer traffic, which management believes is a key determinant to increasing the stores’ profitability, the Company has taken several steps to distinguish its stores and to make customers feel more comfortable. In addition to a clean and secure physical store facility, the stores’ exteriors typically display attractive and distinctive signage similar to those used by contemporary specialty retailers.

The Company has employee-training programs that promote customer service, productivity and professionalism. The Company utilizes a proprietary computer information system that provides fully-integrated functionality to support point-of-sale retail operations, inventory management, customer recordkeeping and loan processing. Each store is connected on a real-time basis to a data center that houses the centralized databases and operating systems. The information systems provide management with the ability to continuously monitor store transactions and operating results. The Company maintains a well-trained internal audit staff that conducts regular store visits to test compliance of financial and operational controls. Management believes the current operating and financial controls and systems are adequate for the Company’s existing store base and can accommodate reasonably foreseeable growth in the near term.

3

Pawn Merchandise Sales

The Company’s pawn merchandise sales are primarily retail sales to the general public from its pawn stores. The items the Company sells generally consist of pre-owned consumer electronics, jewelry, power tools, household appliances, sporting goods and musical instruments. The Company also melts down certain quantities of scrap jewelry and sells the gold, silver and diamonds in commodity markets. Total merchandise sales accounted for approximately 68% of the Company’s revenue during fiscal 2015.

The Company acquires pawn merchandise inventory primarily through forfeited pawn collateral and, to a lesser extent, through purchases of used goods directly from the general public. Merchandise acquired by the Company through forfeited pawn collateral is carried in inventory at the amount of the related pawn loan, exclusive of any accrued service fees. The Company also acquires limited quantities of new or refurbished general merchandise inventories directly from wholesalers and manufacturers.

The Company does not provide direct financing to customers for the purchase of its merchandise, but does permit its customers to purchase merchandise on an interest-free, “layaway” plan. Should the customer fail to make a required payment pursuant to a layaway plan, the item is returned to inventory and previous payments are forfeited to the Company. Interim payments from customers on layaway sales are recorded as deferred revenue and subsequently recorded as income during the period in which final payment is received or when previous payments are forfeited to the Company.

Pawn Lending Activities

The Company’s pawn stores make small secured loans to its customers in order to help them meet short-term cash needs. All pawn loans are collateralized by personal property such as consumer electronics, jewelry, power tools, household appliances, sporting goods and musical instruments. Pawn loans are non-recourse loans and the pledged goods provide the only security to the Company for the repayment of the loan. The Company does not investigate the creditworthiness of the borrower, primarily relying instead on the marketability and sales value of pledged goods as a basis for its credit decision. A customer does not have a legal obligation to repay a pawn loan and the decision to not repay the loan will not affect the customer’s credit score.

At the time a pawn loan transaction is entered into, an agreement, commonly referred to as a “pawn ticket,” is delivered to the borrower for signature that sets forth, among other items, the name and address of the pawnshop, the borrower’s name, the borrower’s identification number from his/her driver’s license or other government issued identification, date, identification and description of the pledged goods, including applicable serial numbers, amount financed, pawn service fee, maturity date, total amount that must be paid to redeem the pledged goods on the maturity date and the annual percentage rate.

Pledged property is held through the term of the loan, unless the loan is paid earlier or renewed. The typical pawn loan term is generally 30 days plus an additional grace period of 15 to 90 days depending on geographical markets and local regulations. Pawn loans may be either paid in full with accrued pawn loan fees and service charges or, where permitted by law, may be renewed or extended by the customer’s payment of accrued pawn loan fees and service charges. If a pawn loan is not repaid prior to the expiration of the automatic extension period, if applicable, the pawn collateral is forfeited to the Company and transferred to inventory at a value equal to the principal amount of the loan, exclusive of accrued interest. The Company does not record pawn loan losses or charge-offs because the amount advanced becomes the carrying cost of the forfeited collateral that is to be recovered through the merchandise sales function described above.

The pawn loan fees are typically calculated as a percentage of the pawn loan amount based on the size and duration of the transaction and generally range from 4% to 25% per month, as permitted by applicable law. As required by applicable law, the amounts of these charges are disclosed to the customer on the pawn ticket. Pawn loan fees accounted for approximately 28% of the Company’s revenue during fiscal 2015.

The amount the Company is willing to finance for a pawn loan is primarily based on a percentage of the estimated retail value of the collateral. There are no minimum or maximum pawn to fair market value restrictions in connection with the Company’s lending activities. In order to estimate the value of the collateral, the Company utilizes its integrated proprietary computer information system to recall recent selling prices of similar merchandise in its own stores. The basis for the Company’s determination of the retail value also includes such sources as precious metals spot markets, catalogs, blue books, online auction sites and retailer advertisements. These sources, together with the employees’ experience in selling similar items of merchandise in particular stores, influence the determination of the estimated retail value of such items. The Company does not utilize a standard or mandated percentage of estimated retail value in determining the amount to be financed. Rather, the employee has the authority to set the percentage for a particular item and to determine the ratio of pawn amount to estimated sale value with the expectation that, if the item is forfeited to the pawnshop, its subsequent sale should yield a gross profit margin consistent with the Company’s historical experience. The recovery of the principal and realization of gross profit on sales of inventory is dependent on the Company’s initial assessment of the property’s estimated retail value. Improper assessment of the retail value of the collateral in the lending

4

function can result in reduced marketability of the property resulting in a reduced gross profit margin. As of December 31, 2015, the Company’s average pawn loan was approximately $99 on a consolidated basis, approximately $169 in the U.S. stores and approximately $63 in the Latin American stores.

Credit Services and Consumer Loan Activities

The Company has significantly reduced its consumer loan activities, primarily from payday lending, over the past several years. The Company closed 23 consumer loan stores in the U.S. during fiscal 2015. As of December 31, 2015, the Company operated 42 stand-alone consumer loan locations in the U.S. and 28 stand-alone consumer loan locations in Mexico. In addition, 138 pawn locations in the U.S. and 49 pawn locations in Mexico also offer consumer loan products.

The Company offers a fee-based credit services organization program (“CSO Program”) to assist consumers in Texas markets in obtaining extensions of credit. The Company’s consumer loan and pawn stores in Texas offer the CSO Program and credit services are also offered via an internet platform for Texas residents. The Company’s CSO Program in Texas is licensed as a Credit Access Business (“CAB”) under Texas Finance Code Chapter 393 and regulated by the Texas Office of the Consumer Credit Commissioner. Under the CSO Program, the Company assists customers in applying for a short-term extension of credit from an independent, non-bank, consumer lending company (the “Independent Lender”) and issues the Independent Lender a letter of credit to guarantee the repayment of the extension of credit. The Company also offers an automobile title lending product under the CSO Program. Total credit services fees accounted for approximately 3% of the Company’s revenue during fiscal 2015.

The Company also offers small, unsecured consumer loans to customers in various states within the U.S. and in Mexico. To qualify for a consumer loan, a customer generally must have proof of steady income, residence and valid identification. At maturity, the customer typically returns to the store to pay off the loan and related fee with cash. If the customer fails to repay the loan, the Company initiates collection procedures. These consumer loan fees accounted for less than 1% of the Company’s revenue during fiscal 2015.

See additional discussion of the credit loss provision and related allowances/accruals in “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations—Critical Accounting Policies.”

Financial Information about Geographic Areas

Financial information regarding the Company’s revenue and long-lived assets by geographic areas is provided in Note 16 of Notes to Consolidated Financial Statements contained herein.

5

Locations and Operations

As of December 31, 2015, the Company had 1,075 locations in 14 U.S. states, 29 states in Mexico and Guatemala, which represents a net store count increase of 7% over the number of stores at December 31, 2014.

The following table details store count activity for the twelve months ended December 31, 2015:

Consumer Loan Locations (2) | Total Locations | |||||||

Pawn Locations (1) | ||||||||

U.S.: | ||||||||

Total locations, beginning of period | 266 | 65 | 331 | |||||

Locations acquired | 33 | — | 33 | |||||

Locations closed or consolidated | (3 | ) | (23 | ) | (26 | ) | ||

Total locations, end of period | 296 | 42 | 338 | |||||

Latin America: | ||||||||

Total locations, beginning of period | 646 | 28 | 674 | |||||

New locations opened | 38 | — | 38 | |||||

Locations acquired | 32 | — | 32 | |||||

Locations closed or consolidated | (7 | ) | — | (7 | ) | |||

Total locations, end of period | 709 | 28 | 737 | |||||

Total: | ||||||||

Total locations, beginning of period | 912 | 93 | 1,005 | |||||

New locations opened | 38 | — | 38 | |||||

Locations acquired | 65 | — | 65 | |||||

Locations closed or consolidated | (10 | ) | (23 | ) | (33 | ) | ||

Total locations, end of period | 1,005 | 70 | 1,075 | |||||

(1) | At December 31, 2015, 138 of the U.S. pawn stores, which are primarily located in Texas, also offered consumer loans or credit services products, while 49 Mexico pawn stores offer consumer loan products. |

(2) | The Company’s U.S. free-standing consumer loan locations offer a credit services product and are all located in Texas. The Mexico locations offer small, short-term consumer loans. |

The Company maintains its primary administrative offices in Arlington, Texas and Monterrey, Mexico.

6

As of December 31, 2015, the Company’s stores were located in the following states:

Consumer Loan Locations | Total Locations | |||||||

Pawn Locations | ||||||||

United States: | ||||||||

Texas | 138 | 42 | 180 | |||||

Colorado | 31 | — | 31 | |||||

Maryland | 29 | — | 29 | |||||

North Carolina | 24 | — | 24 | |||||

South Carolina | 21 | — | 21 | |||||

Kentucky | 15 | — | 15 | |||||

Indiana | 10 | — | 10 | |||||

Missouri | 8 | — | 8 | |||||

Virginia | 6 | — | 6 | |||||

Oklahoma | 4 | — | 4 | |||||

Tennessee | 3 | — | 3 | |||||

District of Columbia | 3 | — | 3 | |||||

Wyoming | 3 | — | 3 | |||||

Nebraska | 1 | — | 1 | |||||

296 | 42 | 338 | ||||||

Mexico: | ||||||||

Estado de. Mexico (State of Mexico) | 86 | — | 86 | |||||

Baja California | 68 | 3 | 71 | |||||

Nuevo Leon | 59 | 2 | 61 | |||||

Jalisco | 54 | 4 | 58 | |||||

Tamaulipas | 50 | 3 | 53 | |||||

Coahuila | 40 | — | 40 | |||||

Puebla | 36 | 4 | 40 | |||||

Chihuahua | 36 | 2 | 38 | |||||

Guanajuato | 28 | 6 | 34 | |||||

Veracruz | 33 | — | 33 | |||||

Sonora | 24 | — | 24 | |||||

Estado de Ciudad de Mexico (State of Mexico City) | 18 | — | 18 | |||||

Sinaloa | 16 | — | 16 | |||||

Queretaro | 12 | 1 | 13 | |||||

Durango | 13 | — | 13 | |||||

Guerrero | 13 | — | 13 | |||||

Aguascalientes | 10 | 3 | 13 | |||||

Morelos | 13 | — | 13 | |||||

San Luis Potosi | 11 | — | 11 | |||||

Michoacan | 11 | — | 11 | |||||

Quintana Roo | 10 | — | 10 | |||||

Hidalgo | 9 | — | 9 | |||||

Baja California Sur | 8 | — | 8 | |||||

Zacatecas | 5 | — | 5 | |||||

Colima | 5 | — | 5 | |||||

7

Consumer Loan Locations | Total Locations | |||||||

Pawn Locations | ||||||||

Mexico (continued): | ||||||||

Chiapas | 3 | — | 3 | |||||

Tabasco | 2 | — | 2 | |||||

Nayarit | 2 | — | 2 | |||||

Yucatan | 2 | — | 2 | |||||

677 | 28 | 705 | ||||||

Guatemala | 32 | — | 32 | |||||

Total | 1,005 | 70 | 1,075 | |||||

Pawn Store Operations

The typical Company pawn store is a freestanding building or part of a retail shopping center with adequate, well-lit parking. Management has established a standard store design intended to distinguish the Company’s stores from the competition. The design consists of a well-illuminated exterior with distinctive signage and a layout similar to other contemporary specialty retailers. The Company’s stores are typically open six to seven days a week from 9:00 a.m. to between 6:00 p.m. and 9:00 p.m.

The Company attempts to attract customers primarily through the pawn stores’ visibility and neighborhood presence. The Company uses seasonal promotions, special discounts for regular customers, prominent display of impulse purchase items such as consumer electronics, jewelry and power tools, tent and sidewalk sales, and a layaway purchasing plan to attract retail shoppers. The Company attempts to attract and retain pawn customers by lending a competitive percentage of the estimated sale value of items presented for pledge and by providing quick financing, renewal and redemption services in an appealing atmosphere.

Each pawnshop employs a manager, one or two assistant managers, and between one and eight sales personnel, depending upon the size, sales volume and location of the store. The store manager is responsible for supervising personnel and assuring the store is managed in accordance with Company guidelines and established policies and procedures. Each manager reports to an area supervisor, who typically oversees four to seven store managers. Area supervisors typically report to a Regional Market Manager, who in turn reports to a Regional Operations Director. Regional Operations Directors report to a Senior Vice President of Operations.

The Company believes the profitability of its pawnshops is dependent, among other factors, upon its employees’ ability to engage in transactions that achieve optimum pawn yields and merchandise sales margins, to be effective sales people and to provide prompt and courteous service. The Company’s computer system permits a store manager or clerk to rapidly recall the cost of an item in inventory and the date it was purchased, as well as the prior transaction history of a particular customer. It also facilitates the timely valuation of goods by showing values assigned to similar goods in the past. The Company has networked its stores to permit the Company’s headquarters to more efficiently monitor each store’s operations, including merchandise sales, service charge revenue, pawns written and redeemed and changes in inventory.

The Company trains its employees through direct instruction and on-the-job pawn and sales experience. New employees are introduced to the business through an orientation and training program that includes on-the-job training in lending practices, layaways, merchandise valuation and general administration of store operations. Certain experienced employees receive training and an introduction to the fundamentals of management to acquire the skills necessary to advance into management positions within the organization. Management training typically involves exposure to income maximization, recruitment, inventory control and cost efficiency. The Company maintains a performance-based compensation plan for all store employees based on sales, gross profit and other performance criteria.

8

Credit Services and Consumer Loan Operations

Similar to the Company’s pawn store operations, the Company’s credit services and consumer loan locations are typically part of a retail strip shopping center with good visibility from a major street and easy access to parking. Management has established a standard store design intended to distinguish the Company’s stores from the competition, which consists of a well-illuminated exterior with lighted signage. The interiors typically feature an ample lobby separated from employee work areas by glass teller windows. The Company’s credit services and consumer loan locations are typically open six to seven days a week from 9:00 a.m. to between 6:00 p.m. and 9:00 p.m.

Competition

The Company encounters significant competition in connection with all aspects of its business operations. These competitive conditions may adversely affect the Company’s revenue, profitability and ability to expand. The Company believes the primary elements of competition in the businesses in which it operates are store location, the ability to lend competitive amounts on pawn and consumer loans, customer service and management of store employees. In addition, the Company competes with financial institutions, such as banks and consumer finance companies, which generally lend on an unsecured as well as a secured basis. Other lenders may and do lend money on terms more favorable than those offered by the Company. Many of these competitors have greater financial resources than the Company.

The Company’s pawn business competes primarily with other pawn store operators, other specialty consumer finance operators, rent-to-own stores and specialty consumer goods retailers. Management believes the pawn industry remains highly fragmented with an estimated 10,000 to 15,000 total pawnshops in the United States and 6,000 to 8,000 pawnshops in Mexico. There are three large publicly-held, U.S.-based pawnshop operators, two of which have pawn operations in the U.S. and Mexico. The Company had the most pawn stores and the largest market capitalization of the peer group as of December 31, 2015, and the Company believes it is the largest public or private operator of full-service pawn stores in Mexico. The pawnshop and other specialty consumer finance industries are characterized by a large number of independent owner-operators, some of whom own and operate multiple locations.

In both its U.S. and Latin American retail pawn operations, the Company’s competitors include numerous retail and wholesale merchants, including jewelry stores, rent-to-own stores, discount retail stores, “second-hand” stores, consumer electronics stores, other specialty retailers, online retailers, online auction sites, online classified advertising sites and other pawnshops. Competitive factors in the Company’s retail operations include the ability to provide the customer with a variety of merchandise items at attractive prices. Many of the retail competitors have significantly greater size and financial resources than the Company.

Intellectual Property

The Company relies on a combination of copyright, trade secret, trademark, and other rights, as well as confidentiality procedures and contractual provisions to protect its proprietary technology, processes and other intellectual property.

The Company’s competitors may develop products that are similar to its technology, such as the Company’s proprietary point of sale software. The Company enters into agreements with its employees, consultants and partners, and through these and other written agreements, the Company attempts to control access to and distribution of its software, documentation and other proprietary technology and information. Despite the Company’s efforts to protect its proprietary rights, third parties may, in an authorized or unauthorized manner, attempt to use, copy or otherwise obtain and market or distribute its intellectual property rights or technology or otherwise develop a product with the same functionality as its solution. Policing all unauthorized use of the Company’s intellectual property rights is nearly impossible. The Company cannot be certain that the steps it has taken or will take in the future will prevent misappropriations of its technology or intellectual property rights.

“First Cash” and “First Cash Pawn” are registered trademarks in the United States. Other significant trade names used by the Company include First Cash Empeno, First Cash Advance, Presta Max, Famous Pawn, Fast Cash Pawn & Gold Center, King Pawn, Mister Money Pawn, Money Man Pawn, Valu + Pawn, Dan’s Discount Jewelry & Pawn, Cash America (in Mexico and Colorado), Quick Cash, Empenos Mexicanos and Realice Empenos.

9

Governmental Regulation

General

The Company is subject to significant regulation of its pawn, consumer lending and general business operations in all of the jurisdictions in which it operates. These regulations are implemented through various laws, ordinances and regulatory pronouncements from federal, state and municipal governmental entities in the United States and Latin America. These regulatory bodies often have broad discretionary authority in the establishment, interpretation and enforcement of such regulations. These regulations are often subject to change, sometimes significantly, as a result of political, economic or social trends, events and media perceptions.

The Company is subject to specific laws, ordinances and regulations primarily concerning its pawn and consumer lending operations. Many statutes and regulations prescribe, among other things, the general terms of the Company’s pawn and consumer loan agreements, including maximum service fees and/or interest rates that may be charged and collected. In many municipal, state and federal jurisdictions, in both the United States and countries in Latin America, the Company must obtain and maintain regulatory operating licenses and comply with regular or frequent regulatory reporting and registration requirements, including reporting and recording of pawn loans, pawned collateral, used merchandise purchased from the general public, retail sales activities, firearm transactions, export, import and transfer of merchandise, and currency transactions, among other things.

In both the United States and Latin America, governmental action to further restrict or even prohibit pawn loans and transactions or small consumer loans, such as payday advances and credit services products, has been advocated over the past few years by elected officials, regulators, consumer advocacy groups and the media. The elected officials, regulators, consumer groups and media typically focus on the aggregated cost to a consumer for pawn and consumer loans, which is typically higher than the interest generally charged by banks, credit unions and credit card issuers to a more creditworthy consumer. They also focus on affordability issues such as the borrower’s ability to repay such loans, real or perceived patterns of sustained or cyclical usage of such lending products and consumer loan collection practices perceived to be unfair or abusive. The elected officials, regulators, consumer groups and media often characterize pawn and payday lending activities as unfair or potentially abusive to consumers. During the last few years, legislation, ordinances and edicts (on federal, state and municipal levels) have been introduced or enacted to prohibit, restrict or further regulate pawn loans and related transactions, including acceptance of pawn collateral, sale of merchandise, payday loans, consumer loans, credit services and related service fees. In addition, public officials and regulatory authorities in various levels of government in the United States and countries in Latin America have and will likely continue to make edicts, proposals or public statements concerning new or expanded regulations that would prohibit or further restrict pawn and consumer lending activities or other related pawn transactions.

The Company is subject to numerous other types of regulations, including but not limited to, regulations related to securities and exchange activities, including financial reporting and internal controls processes, data protection and privacy, tax compliance, labor and employment practices, real estate transactions, electronic banking, credit card transactions, marketing, and advertising and other general business activities.

There can be no assurance that additional local, state or federal statutes, regulations or edicts will not be enacted or that existing laws and regulations will not be amended, decreed or interpreted at some future date that could prohibit or limit the ability of the Company to profitably operate any or all of its services. For example, such regulations could restrict the ability of the Company to offer pawn loans, consumer loans and credit services, significantly decrease the interest rates or service fees for such lending activities, prohibit or more stringently regulate the acceptance of pawn collateral, sale, exportation or importation of pawn merchandise, or processing of consumer loan transactions through the banking system, any of which could have a material adverse effect on the Company’s operations and financial condition. If legislative, regulatory or other arbitrary actions or interpretations are taken at a federal, state or local jurisdiction level in the United States or countries in Latin America which negatively affect the pawn, consumer loan or credit services industries where the Company has a significant number of stores, those actions could have a material adverse effect on the Company’s business operations. There can be no assurance that such regulatory action at any jurisdiction level will not be enacted, or that existing laws and regulations will not be amended, decreed or interpreted in such a way which could have a material adverse effect on the Company’s operations and financial condition.

10

U.S. Federal Regulations

The U.S. government and its agencies have significant regulatory authority over consumer financial services activities. In recent years, additional legislation and regulations have been enacted or proposed which has increased or could continue to increase regulation of the consumer finance industry. These regulations and restrictions are or may be specific to pawn, credit services and consumer loan/payday advance operations.

The Consumer Financial Protection Bureau (the “CFPB”), which was created by Title X of the Dodd Frank Wall Street Reform and Consumer Protection Act of 2010 (the “Dodd-Frank Act”), has broad regulatory, supervisory and enforcement powers over most non-bank providers of consumer credit. The CFPB’s powers include explicit supervisory authority to examine and require registration of providers of consumer financial products and services, including providers of consumer loans, such as the Company, the authority to adopt rules describing specified acts and practices as being “unfair,” “deceptive,” “abusive” and hence “unlawful,” and the authority to impose recordkeeping obligations and promulgate additional compliance requirements.

The CFPB has been systematically gathering data to obtain a complete picture of the consumer loan market and its impact on consumers. The CFPB has also released its Short-Term, Small-Dollar Lending Procedures, which is the field guide CFPB examiners use when examining small-dollar lenders like the Company. The CFPB’s examination authority permits CFPB examiners to inspect the Company’s books and records and ask questions about its business and its practices. The examination procedures include, among other things, specific modules for examining marketing activities, loan application and origination activities, payment processing activities and sustained use by consumers, collections and collection practices, defaults, consumer reporting and third-party or vendor relationships.

In addition to the Dodd-Frank Act’s grant of regulatory and supervisory powers to the CFPB, the Dodd-Frank Act gives the CFPB authority to pursue administrative proceedings or litigation for violations of federal consumer laws (including the CFPB’s own rules). In these proceedings, the CFPB can obtain cease and desist orders (which can include orders for redisclosure, restitution or rescission of contracts, as well as affirmative or injunctive relief) and monetary penalties ranging from $5,000 per day for certain violations of federal consumer laws to $25,000 per day for reckless violations, and $1,000,000 per day for knowing or intentional violations. Also, where a company has been found to have violated consumer laws, the Dodd-Frank Act empowers state attorneys general and state regulators to bring civil actions seeking the same equitable relief available to the CFPB. If the CFPB or one or more state officials believe that the Company has violated any of the applicable laws or regulations, they could exercise their enforcement powers in ways that could have a material adverse effect on the Company or its business.

In March 2015, the CFPB published proposed rules significantly affecting payday loans, vehicle title loans, deposit advance products, high-cost installment and open ended loans, lines of credit and other loans (“Proposed Rules”). The Proposed Rules, among other things, would require additional underwriting criteria, cooling-off periods between certain loans and limitations to prevent the sustained use of certain loans. For example, the Proposed Rules would require lenders to analyze whether consumers can afford and repay the loans without incurring increasing costs, cap loan amounts, limit vehicles as collateral, cap the number of rollovers at two (three loans total) and require that the principal decrease with each rollover loan so that it is repaid after the third loan or provide a no-cost “off-ramp” after the third loan. The Proposed Rules would also restrict lenders from attempting to collect payment from consumers’ bank accounts in ways that cause the consumer to incur excessive bank fees. The CFPB published the Proposed Rules under consideration in preparation for convening a Small Business Review Panel to gather feedback from industry experts, small lenders, and the business community which is the next step in the rule-making process. The Proposed Rules are not final and could change significantly. According to the CFPB, the final rules are expected to be released in the first half of 2016.

The Company does not currently anticipate the Proposed Rules will materially affect its pawn lending activities; however, the Company’s consumer loan, credit services and vehicle title loan products could be negatively affected if they are finally adopted as written. It is not possible to accurately fully predict the scope, extent, nature or effect of the Proposed Rules until further guidance is provided by the CFPB. Further, there can be no assurance that the CFPB will not propose or adopt future rules affecting pawn or short-term lending products, such as payday, title lending and credit services products, making them materially less profitable or even impractical to offer. For fiscal 2015, approximately 48% of the Company’s total revenue was generated from U.S.-based pawn and consumer lending products, consisting of 44% from U.S. pawn products and 4% from U.S. consumer lending products.

The Military Lending Act (“MLA”) which became effective in October 2007, limits the annual percentage rate charged on most consumer loans made to active military personnel or their dependents to 36%. The Company does not have, nor does it intend to develop, any consumer/payday loan or credit services products bearing an effective interest and fee rate of 36% per annum or less, as the Company believes the losses and servicing costs associated with lending to the Company’s traditional customer base would exceed the revenue produced at that rate. As a result, the Company does not have a consumer loan product to offer active military personnel or their dependents.

11

In July 2015, the Department of Defense published a finalized set of new rules (“New MLA Rules”) under the MLA. The Company believes the New MLA Rules expand the scope of the credit products to include certain loans secured by personal property or vehicles and certain unsecured installment loan products to the extent any of such products have an annual percentage rate greater than 36%. Once the New MLA Rules take effect, the Company may not be able to offer any of its current credit products (including pawn loans) to members of the military or their dependents because current product offerings do not conform to the New MLA Rules. The New MLA Rules are scheduled to become effective on October 3, 2016. Compliance with the New MLA Rules could be complex and increase compliance costs; however, the Company currently has a limited number of stores near military bases and does not expect compliance with the New MLA Rules to have a material adverse impact overall on the Company’s financial condition or operating results once the rules take effect.

In addition to the federal laws and frameworks already governing the financial industry, the United States Justice Department (“DOJ” or “Department of Justice”), in conjunction with federal banking regulators, began an initiative in 2013 (“Operation Choke Point”) which was directed at banks in the United States that do business with payment processors, payday lenders, pawn operators and other companies believed to be at higher risk for fraud and money laundering. It is believed the intent of this initiative was to restrict the ability of banks to provide financial services to companies in the targeted industries. In January 2015, the Federal Deposit Insurance Corporation (the “FDIC”) issued a publication encouraging banks to take a risk-based approach in assessing individual customer relationships, rather than declining to provide banking services to entire categories of customers without regard to the risks presented by an individual customer or the financial institution’s ability to manage the risk. While many believe this publication effectively ended Operation Choke Point, reports of the difficulty in securing new banking services and the termination of existing banking services of legal businesses within targeted industries continue. There can be no assurance that Operation Choke Point will not pose a future threat to the Company’s ability to access credit, maintain bank accounts, process payday lending transactions or obtain other banking services needed to operate efficiently and profitably.

In connection with credit services/consumer loan transactions, the Company must comply with the various disclosure requirements under the Federal Truth in Lending Act (and Federal Reserve Regulation Z promulgated thereunder). These disclosures include, among other things, the total amount of the finance charges and annualized percentage rate of the charges associated with consumer loan and credit services transactions.

The credit services/consumer loan business is also subject to various laws, rules and guidelines relating to the procedures and disclosures needed for debiting a debtor’s checking account for amounts due via an ACH transaction. Additionally, the Company is subject to the Federal Fair Debt Collection Practices Act (“FDCPA”) and applicable state collection laws when conducting its collection activities. Furthermore, with respect to online consumer loans, the Company is subject to various state and federal e-signature rules mandating that certain disclosures be made and certain steps be followed in order to obtain and authenticate e-signatures. In addition, some states restrict the advertising content of marketing materials with respect to consumer loans.

Under the Bank Secrecy Act, the U.S. Department of the Treasury (the “Treasury Department”) regulates transactions involving currency in an amount greater than $10,000 and the purchase of monetary instruments for cash in amounts from $3,000 to $10,000 must be recorded. In general, financial institutions, including the Company, must report each deposit, withdrawal, exchange of currency or other payment or transfer, whether by, through or to the financial institution, that involves currency in an amount greater than $10,000. In addition, multiple currency transactions must be treated as single transactions if the financial institution has knowledge that the transactions are by, or on behalf of, any one person and result in either cash in or cash out totaling more than $10,000 during any one business day.

The Money Laundering Suppression Act of 1994 added a section to the Bank Secrecy Act requiring the registration of “money services businesses” that engage in check cashing, currency exchange, money transmission, or the issuance or redemption of money orders, traveler’s checks and similar instruments. The purpose of the registration is to enable governmental authorities to better enforce laws prohibiting money laundering and other illegal activities. The regulations require money services businesses to register with the Treasury Department by filing a form, adopted by the Financial Crimes Enforcement Network of the Treasury Department (“FinCEN”), and to re-register at least every two years thereafter. The regulations also require that a money services business maintain a list of names and addresses of, and other information about, its agents and that the list be made available to any requesting law enforcement agency (through FinCEN). The agent list must be updated annually. Currently, check cashing is the only product offered by the Company which is subject to such money services regulations.

In March 2000, FinCEN adopted additional regulations, implementing the Bank Secrecy Act that also address money services businesses. These regulations require money services businesses, such as the Company, to report suspicious transactions involving at least $2,000 to FinCEN. The regulations generally describe three classes of reportable suspicious transactions - one or more related transactions that the money services business knows, suspects, or has reason to suspect (1) involve funds derived from illegal activity or are intended to hide or disguise such funds; (2) are designed to evade the requirements of the Bank Secrecy Act; or (3) appear to serve no business or lawful purpose.

12

Under the USA PATRIOT Act passed by Congress in 2001 and revised in 2006, the Company is required to maintain an anti-money laundering compliance program. The program must include (1) the development of internal policies, procedures and controls; (2) the designation of a compliance officer; (3) an ongoing employee-training program; and (4) a review function to test the program.

The Gramm-Leach-Bliley Act requires the Company to generally protect the confidentiality of its customers’ nonpublic personal information and to disclose to its customers its privacy policy and practices, including those regarding sharing the customers’ nonpublic personal information with third parties. Such disclosure must be made to customers at the time the customer relationship is established, at least annually thereafter, and if there is a change in the Company’s privacy policy. In addition, the Company is subject to strict document retention and destruction policies.

The federal Equal Credit Opportunity Act (“ECOA”) prohibits discrimination against any credit applicant on the basis of any protected category, such as race, color, religion, national origin, sex, marital status, or age, and requires the Company to notify credit applicants of any action taken on the individual’s credit application. The Company must provide a loan applicant a Notice of Adverse Action (“NOAA”) when the Company denies an application for credit. The NOAA must inform the applicant of (1) the action taken regarding the credit application; (2) a statement of the ECOA’s prohibition on discrimination; (3) the name and address of both the creditor and the federal agency that monitors compliance with the ECOA; and (4) the applicant’s right to learn the specific reasons for the denial of credit and the contact information for the parties the applicant can contact to obtain those reasons. The Company provides NOAA letters and maintains records of all such letters as required by the ECOA and its regulations.

The Company’s consumer loan products are subject to the Fair Credit Reporting Act, which requires the Company to provide certain information to customers whose credit applications are not approved on the basis of a report obtained from a consumer reporting agency and to respond to consumers who inquire regarding any adverse reporting submitted by the Company to the consumer reporting agencies.

The federal Fair and Accurate Credit Transactions Act (“FACTA”) requires the Company to adopt written guidance and procedures for detecting, preventing and responding appropriately to mitigate identity theft and to adopt various coworker policies, procedures, and provide coworker training and materials that address the importance of protecting nonpublic personal information and aid the Company in detecting and responding to suspicious activity, including suspicious activity which may suggest a possible identity theft red flag, as appropriate.

The Company is subject to the Foreign Corrupt Practices Act (“FCPA”) and other laws that prohibit improper payments or offers of improper payments to foreign governments and their officials and political parties by U.S. persons and issuers (as defined by the statute) for the purpose of obtaining or retaining business. It is the Company’s policy to maintain safeguards to discourage these practices by its employees and follow Company standards of conduct for its business throughout the U.S. and Latin America, including the prohibition of any direct or indirect payment or transfer of Company funds or assets to suppliers, vendors, or government officials in the form of bribes, kickbacks or other illegal payoffs.

Each pawn store location that handles pawned firearms or buys and sells firearms must comply with the Brady Handgun Violence Prevention Act (the “Brady Act”). The Brady Act requires that federally licensed firearms dealers conduct a background check in connection with any disposition of handguns. In addition, the Company must comply with the regulations of the U.S. Department of Justice-Bureau of Alcohol, Tobacco and Firearms that require each pawn lending location dealing in guns to obtain a Federal Firearm License (“FFL”) and maintain a permanent written record of all receipts and dispositions of firearms. As of December 31, 2015, the Company had 168 locations in the U.S. with an active FFL.

U.S. State and Local Regulations

The Company operates pawn stores in 14 U.S. states, all of which have licensing and/or fee regulations on pawnshop operations, including Texas, Indiana, Oklahoma, Maryland, Virginia, South Carolina, North Carolina, Washington, D.C., Colorado, Kentucky, Nebraska, Wyoming, Tennessee and Missouri. The Company is licensed in each of the states in which a license is currently required for it to operate as a pawnbroker. Certain jurisdictions restrict or prohibit the Company from transferring and/or relocating its pawn licenses and restrict or prohibit the issuance of new licenses. The Company’s fee structures are at or below the applicable rate ceilings adopted by each of these states. The Company offers its pawn and retail customers an interest free layaway plan which complies with applicable state laws. In addition, the Company is in compliance with the net asset requirements in states where it is required to maintain certain levels of liquid assets for each pawn store it operates in the applicable state.

Under some county and municipal ordinances, pawn stores must provide local law enforcement agencies with reports of all daily transactions involving pawns and over-the-counter merchandise purchases. These daily transaction reports are designed to provide local law enforcement officials with a detailed description of the merchandise involved, including serial numbers, if any, or other

13

specific identifying information, including the name and address of the customer obtained from a valid identification card and photographs of the customers and/or merchandise in certain jurisdictions. Goods held to secure pawns or goods purchased may be subject to mandatory holding periods before they can be resold by the Company. If pawned or purchased merchandise is determined to belong to an owner other than the borrower or seller, it may be subject to confiscation by police for recovery by the rightful owners. Historically, the Company has not found the volume of the confiscations or claims to have a material adverse effect upon results of operations. The Company does not maintain insurance to cover the costs of returning merchandise to its rightful owners but historically has benefited from civil and criminal restitution efforts.

The Company offers a credit services product in the state of Texas and operates as a registered credit services organization as provided under Section 393 of the Texas Finance Code. As a credit services organization, the Company assists customers in applying for a short-term extension of credit from the Independent Lender and issues the Independent Lender a letter of credit to guarantee the repayment of the extension of credit. When a consumer executes a credit services agreement with the Company, the customer agrees to pay a fee to the Company if the Independent Lender approves the extension of credit, and the Company agrees to guarantee the customer’s obligation to repay the extension of credit received by the customer from the Independent Lender if the customer fails to do so. The credit services organization must give a consumer the right to cancel the credit services agreement without penalty within three days after the agreement is signed. In addition, under the provisions of the credit services statute, each credit services location must be registered as a credit services organization and pay a registration fee. In May of 2011, in the state of Texas, legislation was enacted and became effective in 2012 to further regulate credit services businesses in the state, which includes the Company’s CSO Program. The 2011 law creates an expanded regulatory framework under which Credit Access Businesses (“CAB”) may provide credit services products. The regulations provide the CAB be licensed, regulated and audited by the State’s Office of the Consumer Credit Commissioner. The law also provides for enhanced disclosures to customers regarding credit services products.

Primarily as a result of municipal ordinances enacted in several cities in Texas over the past few years which significantly restrict payday and title lending operations, the Company closed 23 stand-alone consumer loan stores during fiscal 2015 and three locations in fiscal 2014. These city ordinances, along with overall deterioration in store-based consumer lending market conditions, have resulted in the Company recording a $7,913,000 goodwill impairment charge during the third quarter of 2015 attributed to its U.S. consumer loan operations reporting unit. As of December 31, 2015, the Company has no remaining goodwill or other intangible assets associated with this reporting unit. During fiscal 2015, the Company’s U.S. consumer and vehicle loan operations represented approximately 4% of the Company’s overall revenues.

It is expected that additional legislation and/or regulations relating to pawn loans, credit services, installment loans and other consumer loan products will be proposed in several state legislatures and/or city councils, including Texas, where the Company has pawn and credit services operations. As an example, the City of Arlington in Texas recently enacted such an ordinance which became effective January 1, 2016. Though the Company cannot accurately predict the scope, extent and nature of future regulations, it is likely that such legislation may address the maximum allowable interest rates on loans, significantly restrict the ability of customers to obtain such loans by limiting the maximum number of consecutive loan transactions that may be provided to a customer, and/or limiting the total loans a customer may have outstanding at any point in time. Any or all of these changes could make offering these products less profitable and could restrict or even eliminate the availability of consumer loan, pawn loan and credit services products in some or all of the states in which the Company offers such products.

Many local government entities also prohibit or restrict pawn and other consumer finance and check cashing activities through zoning ordinances. Such ordinances can significantly prohibit the ability of the Company to move, expand, remodel or relocate store locations, and in some cases cause existing stores to be closed. In some jurisdictions, check cashing companies or money transmission agents are required to meet minimum bonding or capital requirements and are subject to record-keeping requirements.

The Company cannot currently assess the likelihood of any other proposed legislation, regulations or amendments, such as those described above, which could be enacted; however, if such legislation or regulations were enacted in certain jurisdictions, it could have a materially adverse impact on the revenue and profitability of the Company.

Mexico Federal Regulations

Federal law in Mexico provides for administrative regulation of the pawnshop industry by the Federal Consumer Protection Bureau (“PROFECO”), Mexico’s primary federal consumer protection agency, which requires the Company to annually register its pawn stores, locations, loan contracts and disclose the interest rate and fees charged on pawn and consumer loan transactions. In addition, the pawnshop and consumer finance industries in Mexico are subject to various general business regulations in the areas of tax compliance, customs, consumer protections, money laundering, public safety and employment matters, among others, by various federal, state and local governmental agencies.

14

PROFECO regulates the form and terms of pawn loan contracts and defines certain operating standards and procedures for pawnshops, including retail operations, consumer disclosures and establishes reporting requirements. In January 2013, federal legislation conveyed additional regulatory authority to PROFECO regarding the pawn industry and national registration process. The 2013 legislation requires all pawn businesses to register annually with and be approved by PROFECO in order to legally operate. In addition, all operators must comply with additional customer notice and disclosure provisions, bonding requirements to insure against loss or insolvency, reporting of certain types of suspicious transactions, and reporting to state law enforcement officials of certain transactions (or series of transactions) or suspicious transactions. PROFECO continues to implement its process and procedures regarding its registration requirements and the Company has complied and complies in all material respects with this process and registration requirements as administered by PROFECO. There are significant fines and sanctions, including operating suspensions for failure to register and/or comply with PROFECO’s rules and regulations. While there can be no assurance as to the ultimate outcome from the full and final implementation of the 2013 legislation, the Company believes it complies with the rules and regulations, as currently administered, and believes that when fully implemented, these registration requirements should have limited impact on its operations or profitability. In fiscal 2015, approximately 52% of the Company’s revenue was derived from its Mexican operations.

Effective in November 2013, the federal government of Mexico enacted new anti-money laundering regulations, The Federal Law for the Prevention and Identification of Transactions with Funds From Illegal Sources (“Anti-Money Laundering Law”), which requires reporting of certain transactions (or series of transactions) exceeding certain monetary limits, imposed stricter maintenance of customer identification records and controls, and requires reporting of all foreign (non-Mexican) customer transactions. This law affects all industries in Mexico and is intended to detect commercial activities arising from illicit or ill-gotten means though bilateral cooperation between Mexico’s Ministry of Finance and Public Credit (SAT or Hacienda), and Mexico’s Attorney General’s Office (PGR). This law restricts the use of cash in certain transactions associated with high-value assets, and limits, to the extent possible, money laundering activities protected by the anonymity that cash transactions provide. The law empowers Hacienda to oversee and enforce this regime and to follow up on the information received from other agencies in Mexico and abroad. Relevant aspects of the law specifically affecting the pawn industry include monthly reporting by the Company to Hacienda and the PGR on “vulnerable activities,” which encompass pawn transactions (of cash or credit) exceeding $103,000 Mexican pesos, retail transactions of precious metals exceeding $52,000 Mexican pesos, and retail transactions of precious metals exceeding $207,000 Mexican pesos are prohibited. There are significant fines and sanctions for failure to comply with the Anti-Money Laundering Law regulations.

In January 2012, new terms of the Federal Personal Information Protection Act (“Privacy Law”) went into effect, which require companies to protect their customers’ personal information. Specifically, the Privacy Law requires that the Company inform its customers whether the Company shares the customer’s personal information with third parties or transfers personal information to third parties. It also requires public posting (both on-line and in-store) of the Company’s privacy policy, which includes a process for the customer to revoke any previous consent granted to the Company for the use of the customer’s personal information, or limit the use or disclosure of such information.

Mexico State and Local Regulations

Certain state and local governmental entities in Mexico also regulate pawn, other consumer finance and retail businesses through state laws and local zoning and permitting ordinances. For example, the states of Estado de Mexico, Tabasco, Guanajuato, Coahuila, Nuevo Leon, Colima, and Puebla, where the Company operates 268 stores, have enacted legislation which require items such as special operating permits for pawn stores, certification of pawn employees trained in valuation of merchandise, stricter customer identification controls and/or detailed and specified transactional reporting of customers and operations. Additionally, certain municipalities in Mexico have tried to curtail the operation of new and existing pawn stores through additional local business licensing, permitting, and reporting requirements. State and local agencies, including local and state police officials, often have unlimited and discretionary authority to suspend store operations pending an investigation of suspicious pawn transactions or resolution of actual or alleged regulatory, licensing and permitting issues.

Other Latin American Federal and Local Regulations

Similar to Mexico, certain federal, state and local governmental entities in Guatemala and El Salvador also regulate pawn, other consumer finance, including consumer lending and disclosures, and retail businesses. Certain federal laws and local zoning and permitting ordinances require basic commercial business licenses and signage permits. Operating in these countries also subjects the Company to other types of regulations, including but not limited to, regulations related to financial reporting, data protection and privacy, tax compliance, labor and employment practices, real estate transactions, anti-money laundering, commercial and electronic banking restrictions, credit card transactions, marketing, advertising and other general business activities.

15

As the scope of the Company’s international operations increases, the Company may face additional administrative and regulatory costs in managing its business. In addition, unexpected changes, arbitrary or adverse court decisions, administrative interpretations of federal or local requirements or legislation, or public remarks by elected officials could negatively impact the Company’s operations and profitability.

Employees

The Company had approximately 8,600 employees as of December 31, 2015, including approximately 500 persons employed in executive, supervisory, administrative and accounting functions. None of the Company’s employees are covered by collective bargaining agreements. The Company considers its employee relations to be satisfactory.

Insurance

The Company maintains property all-risk coverage and liability insurance for each of its locations in amounts management believes to be adequate. The Company maintains workers’ compensation insurance in Maryland, Missouri, Virginia, South Carolina, Washington, D.C., Oklahoma, Indiana, Wyoming, Nebraska, Kentucky, Tennessee, Colorado and North Carolina. The Company is a non-subscriber under the Texas Workers’ Compensation Act, and therefore maintains employer’s indemnification insurance in Texas.

First Cash Website

The Company’s primary website is at www.firstcash.com. The Company makes available, free of charge, at its corporate website, its annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), as soon as reasonably practicable after they are electronically filed with the Securities and Exchange Commission (“SEC”). The SEC maintains an internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC at www.sec.gov.

Item 1A. Risk Factors

Important risk factors that could cause results or events to differ from current expectations are described below. These factors are not intended to be an all-encompassing list of risks and uncertainties that may affect the operations, performance, development and results of the Company’s business.

The Company’s financial position and results of operations may fluctuate significantly due to fluctuations in currency exchange rates in Latin American Markets.