|

UNITED STATES

|

|

SECURITIES AND EXCHANGE COMMISSION

|

|

WASHINGTON, D.C. 20549

|

|

FORM 10-K

|

|

T

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

|

|

|

SECURITIES EXCHANGE ACT OF 1934

|

|

|

|

|

|

For the fiscal year ended December 31, 2012

|

|

|

|

|

|

OR

|

|

|

|

|

£

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

|

|

|

SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from ____________ to ____________

Commission File Number: 001-31708

CAPITOL BANCORP LTD.

(Exact name of registrant as specified in its charter)

|

MICHIGAN

|

|

38-2761672

|

|

(State or other jurisdiction of

|

|

(IRS Employer

|

|

incorporation or organization)

|

|

Identification Number)

|

|

|

|

|

|

Capitol Bancorp Center

|

|

|

|

200 N. Washington Square

|

|

|

|

Lansing, Michigan

|

|

48933

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

517-487-6555

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

| Yes o | No x |

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act.

| Yes o | No x |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

| Yes x | No o |

- 1 -

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

| Yes x | No o |

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company (as defined in Rule 12b-2 of the Exchange Act).

|

Large accelerated filer o

|

|

|

Accelerated filer o

|

|

Non-accelerated filer o

|

(Do not check if a smaller reporting company)

|

|

Smaller Reporting Company x

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

| Yes o | No x |

While there is currently no active trading market for the registrant's common stock, as of June 30, 2012, the aggregate market value of the registrant's common stock held by non-affiliates of the registrant was: $4,779,783. (Such amount was computed based on shares held by non-affiliates as of March 14, 2012 and the common stock closing price reported by the OTC Markets Group on June 29, 2012. For purposes of this computation, all executive officers, directors and 5% shareholders have been assumed to be affiliates. Certain of such persons may disclaim that they are affiliates of registrant.)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Exchange Act subsequent to the distribution of securities under a plan confirmed by a court.

| Yes o | No o |

Indicate the number of shares outstanding of each of the issuer's classes of common stock, as of the latest practicable date.

|

Class

|

|

Outstanding at March 15, 2013

|

|

Common Stock, no par value per share

|

|

41,177,479 shares

|

DOCUMENTS INCORPORATED BY REFERENCE

|

Document

|

|

Parts Into Which Incorporated

|

|

Annual Report to Shareholders for the Year Ended

December 31, 2012 (Annual Report)

|

|

Parts I, II and IV

|

- 2 -

CAPITOL BANCORP LTD.

Form 10-K

Fiscal Year Ended: December 31, 2012

Cross Reference Sheet

|

Item of Form 10-K

Part I

|

Incorporation by Reference From:

|

|

Item 1. Business

|

Pages F-10 – F-15, F-30 – F-47, F-61 – F-64, F-92 – F-93

and F-108– F-110, Financial Information Section of Annual Report

|

|

Item 1A. Risk Factors

|

Pages F-50 – F-51, Financial Information Section of Annual Report

|

|

Item 2. Properties

|

Pages F-61 and F-89, Financial Information Section of Annual

Report

|

|

Part II

|

|

|

Item 5. Market for Registrant's Common Equity,

Related Stockholder Matters and Issuer

Purchases of Equity Securities

|

Pages F-2 – F-6, F-93 – F-95 and F-108 – F-110, Financial

Information Section of Annual Report

|

|

Item 6. Selected Financial Data

|

Page F-2, Financial Information Section of Annual Report

|

|

Item 7. Management's Discussion and Analysis of

Financial Condition and Results of

Operations

|

Pages F-10 – F-51, Financial Information Section of Annual Report

|

|

Item 7A. Quantitative and Qualitative Disclosures

About Market Risk

|

Pages F-6 – F-9 and F-43 – F-47, Financial Information Section of

Annual Report

|

|

Item 8. Financial Statements and Supplementary

Data

|

Pages F-2 and F-55 – F-115, Financial Information Section of

Annual Report

|

|

Item 9A. Controls and Procedures

|

Page F-52, Financial Information Section of Annual Report

|

|

Part IV

|

|

|

Item 15. Exhibits and Financial Statement Schedules

|

Pages F-54– F-115, Financial Information Section of Annual Report

|

Key:

| "Annual Report" | means the 2012 Annual Report of Capitol Bancorp Limited ("Capitol") provided to the Commission pursuant to Rule 14a-3(b). Capitol's 2012 Annual Report has a Financial Information Section and is filed as Exhibit 13 with this Form 10-K report. |

| Note: | The page number references herein are based on the paper version of the referenced documents. Accordingly, those page number references may differ from the electronically filed versions of those documents. |

- 3 -

|

CAPITOL BANCORP LTD.

|

|

|

2012 FORM 10-K ANNUAL REPORT

|

|

|

TABLE OF CONTENTS

|

|

|

PART I

|

Page

|

|

8

|

|

|

26

|

|

|

46

|

|

|

46

|

|

|

47

|

|

|

47

|

|

|

PART II

|

|

|

48

|

|

|

48

|

|

|

48

|

|

|

49

|

|

|

49

|

|

|

49

|

|

|

49

|

|

|

49

|

|

|

PART III

|

|

|

50

|

|

|

58

|

|

|

68

|

|

|

69

|

|

|

71

|

|

|

PART IV

|

|

|

72

|

- 4 -

FORWARD-LOOKING STATEMENTS

Some of the statements contained in this document, including Capitol's consolidated financial statements, Management's Discussion and Analysis of Financial Condition and Results of Operations and in documents incorporated into this document by reference that are not historical facts, including, without limitation, statements of future expectations, projections of results of operations and financial condition, statements of future economic performance and other forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, are subject to known and unknown risks, uncertainties and other factors which may cause the actual future results, performance or achievements of Capitol and/or its subsidiaries and other operating units to differ materially from those contemplated in such forward-looking statements. The words "intend," "expect," "project," "estimate," "predict," "anticipate," "should," "could," "believe," "may," "might" and similar expressions also are intended to identify forward-looking statements. Important factors which may cause actual results to differ from those contemplated in such forward-looking statements include, but are not limited to:

· Capitol may not be able to successfully emerge from Chapter 11 bankruptcy and restructure its existing unsecured debt obligations;

· Capitol's ability to continue as a going concern;

· The availability and cost of capital and liquidity on favorable terms, if at all, which may depend in part on Capitol's asset quality, prospects and outlook;

· The risk that Capitol will not be able to complete its various proposed divestitures, mergers and consolidations of certain of its banking subsidiaries or, if completed, realize the anticipated benefits of the proposed transactions;

· The risk of additional future losses if the proceeds Capitol receives upon the liquidation of assets are less than the carrying value of such assets;

· Restrictions or limitations on access to funds from subsidiaries and potential obligations to contribute additional capital to Capitol's subsidiaries, which may restrict its ability to make payments on its obligations;

· Administrative or enforcement actions of banking regulators in connection with any material failure of Capitol or its subsidiary banks to comply with banking laws, rules or regulations or formal enforcement actions with regulatory agencies;

· The costs and effects of litigation, investigations, inquiries or similar matters, or adverse facts and developments related thereto;

· The possibility of the Federal Deposit Insurance Corporation ("FDIC") or an applicable state banking regulator seizing one or more of Capitol's subsidiary banks;

· The possibility of the FDIC assessing Capitol's banking subsidiaries for any cross-guaranty liability;

· Capitol's compliance with the terms of its written agreement with the Federal Reserve Bank, amendments thereto, or subsequent regulatory enforcement actions;

· The current prohibition of Capitol's subsidiary banks to pay dividends to Capitol without prior written authorization from regulatory agencies;

· The risk that the realization of deferred tax assets may not occur;

· The risk that Capitol could have an "ownership change" under Section 382 of the Internal Revenue Code, which could impair its ability to timely and fully utilize its net operating losses for tax purposes and so-called built-in losses that may exist if such an "ownership change" occurs;

· The risks associated with the high concentration of commercial real estate loans within Capitol's consolidated loan portfolio, along with other credit risks associated with individual large loans;

- 5 -

FORWARD-LOOKING STATEMENTS - Continued

· The concentration of Capitol's nonperforming assets by loan type in certain geographic regions and with affiliated borrowing groups;

· The overall adequacy of the allowance for loan losses to absorb the amount of actual losses inherent within the loan portfolio;

· The failure of assumptions underlying estimates for the allowance for loan losses and estimation of values of collateral or cash flow projections related to impaired loans;

· Capitol's ability to manage fluctuations in the value of its assets and liabilities and maintain sufficient capital and liquidity to support its operations;

· Fluctuations in the value of Capitol's investment securities;

· Volatility of interest rate sensitive deposits and the uncertainties of future depositor activity regarding potentially uninsured deposits;

· The ability to successfully acquire deposits for funding and the pricing thereof;

· The continued availability of credit facilities provided by Federal Home Loan Banks to Capitol's banking subsidiaries;

· Management's ability to effectively manage interest rate risk and the impact of interest rates, in general, on the volatility of Capitol's net interest income;

· The ability to successfully execute strategies to increase noninterest income;

· The impact of possible future material impairment charges;

· Capitol's ability to adapt successfully to technological changes to compete effectively in the marketplace;

· Operational risks, including data processing system failures or fraud;

· The ability to retain senior management experienced in banking and financial services;

· A continuation of unprecedented volatility in the capital markets;

· The decline in commercial and residential real estate values and sales volume and the likely potential for continuing illiquidity in the real estate market;

· The uncertainties in estimating the fair value of developed real estate and undeveloped land relating to collateral-dependent loans and other real estate owned in light of decreased demand for such assets, falling prices and continuing illiquidity in the real estate market;

· The impact of negative developments and disruptions in the credit and lending markets on Capitol's business and the businesses of its customers, as well as on other banks and lending institutions with which Capitol has commercial relationships;

· Continued unemployment, the overall continued national economic weakness, rising commodity prices and the impact on Capitol's customers' savings rates and their ability to service debt obligations;

· Changes in the general economic environment, industry conditions, competition or other factors, either nationally or regionally, that could influence loan demand and repayment, deposit inflows and outflows, and the quality of the loan portfolio and loan and deposit pricing;

· The effects of competition from other commercial banks, savings associations, mortgage banking firms, consumer finance companies, credit unions, securities brokerage firms, insurance companies, money market and other mutual funds, and other financial institutions operating in Capitol's market or elsewhere which provide similar services;

- 6 -

FORWARD-LOOKING STATEMENTS - Continued

· Changes in legislation or regulatory and accounting principles, policies, or guidelines affecting the business conducted by Capitol and/or its operating strategy;

· The impact on Capitol's financial results, reputation and business if it is unable to comply with all applicable federal and state regulations and applicable formal enforcement actions, consent orders, other regulatory actions and any related capital requirements;

· The effect of the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, the Emergency Economic Stabilization Act of 2008, the implementation by the Department of the U.S. Treasury and federal banking regulators of a number of programs to address capital and liquidity issues within the banking system and additional programs that may apply to Capitol in the future, all of which may have significant effects on Capitol and the financial services industry;

· Governmental monetary and fiscal policies, as well as legislative and regulatory changes, that may result in the imposition of costs and constraints on Capitol through higher FDIC insurance premiums, significant fluctuations in market interest rates, increases in capital requirements and operational limitations;

· Acts of war or terrorism; and

· Other factors and other information contained in this document and in other reports and filings that Capitol makes with the SEC under the Securities Exchange Act of 1934, as amended, including, without limitation, under the caption "Risk Factors."

For a discussion of these and other risks that may cause actual results to differ from expectations, you should refer to the risk factors and other information in this Annual Report on Form 10-K and Capitol's other periodic filings, including quarterly reports on Form 10-Q and current reports on Form 8-K, that Capitol files from time to time with the SEC. All written or oral forward-looking statements that are made by or are attributable to Capitol are expressly qualified by this cautionary notice. You should not place undue reliance on any forward-looking statements, since those statements speak only as of the date on which the statements are made. Capitol undertakes no obligation to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made to reflect the occurrence of new information or unanticipated events, except as may otherwise be required by law.

[The remainder of this page intentionally left blank]

- 7 -

PART I

a. General development of business:

Incorporated by reference from Pages F-10 – F-15 Financial Information Section of Annual Report, under the captions "Summary and Overview" and "Capitol's Approach to Community Banking," Pages F-37 – F-40, Financial Information Section of Annual Report, under the caption "Certain Regulatory Matters," Pages F-42 – F-43, Financial Information Section of Annual Report, under the caption "Going Concern Considerations," Page F-47, Financial Information Section of Annual Report, under the caption "Divestitures of Banks" and Pages F-61 – F-64, Financial Information Section of Annual Report, under the caption "Note A—Nature of Operations, Basis of Presentation and Principles of Consolidation."

Capitol was incorporated as a Michigan corporation in 1988.

On August 9, 2012, Capitol and its subsidiary, Financial Commerce Corporation ("FCC") filed voluntary petitions for relief under Chapter 11 of the United States Code (the "Bankruptcy Code"). Additional information regarding the bankruptcy filing is incorporated by reference from Pages F-10 – F-12, Financial Information Section of Annual Report, under the caption "Summary and Overview" and Pages F-61 – F-64, Financial Information Section of Annual Report, under the caption "Note A—Nature of Operations, Basis of Presentation and Principles of Consolidation." The bankruptcy filing itself has no direct impact on the operations of Capitol's subsidiary banks.

Capitol Trust I and Capitol Trust XII were formed in 1997 and 2008, respectively; each is a Delaware statutory business trust. The business and affairs of Capitol Trust I and Capitol Trust XII are conducted by their respective property trustee, a Delaware trustee, and administrative trustees who are employees and officers of Capitol. Capitol Trust I and Capitol Trust XII exist for the sole purpose of issuing and selling its preferred securities and common securities, using the proceeds from the sale of those securities to acquire subordinated debentures issued by Capitol and certain related services. During 2001, Capitol formed Capitol Trust II and Capitol Statutory Trust III, in conjunction with private placements of trust preferred securities. Capitol Bancorp Capital Trust IV was similarly formed in 2002, Capitol Trust VI, Capitol Trust VII and Capitol Statutory Trust VIII were formed in 2003, Capitol Trust IX was formed in 2004 and Capitol Bancorp Trust X and Capitol Trust XI were formed in 2007. Each of these securities has similar terms. Additional information regarding trust preferred securities is incorporated by reference from Pages F-92 – F-93, Financial Information Section of Annual Report, under the caption "Note K—Subordinated Debentures."

b. Financial information about segments:

Incorporated by reference from Pages F-15 – F-16, Financial Information Section of Annual Report (excerpt from Management's Discussion and Analysis of Capitol's Business, Financial Condition and Results of Operations) and Pages F-61 – F-64, Financial Information Section of Annual Report, under the caption "Note A—Nature of Operations, Basis of Presentation and Principles of Consolidation."

c. Narrative description of business:

Incorporated by reference from Pages F-10 – F-15, Financial Information Section of Annual Report, under the captions "Summary and Overview" and "Capitol's Approach to Community Banking," Pages F-30 – F-37, Financial Information Section of Annual Report, under the caption "Liquidity, Capital Resources and Capital Adequacy," Page F-36, Financial Information Section of Annual Report, comparative analysis of each banking subsidiaries' regulatory capital position, Pages F-37 – F-40, Financial Information Section of Annual Report, under the caption "Certain Regulatory Matters," Pages F-43 – F-47, Financial Information Section of Annual Report, under the caption "Trends Affecting Operations," Page F-47, Financial Information Section of Annual Report, under the caption "Divestitures of Banks" and Pages F-61 – F-64, Financial Information Section of Annual Report, under the caption "Note A—Nature of Operations, Basis of Presentation and Principles of Consolidation."

- 8 -

Item 1. Business – continued.

At December 31, 2012, Capitol and its subsidiaries employed approximately 580 full time equivalent employees.

Supervision and Regulation:

Incorporated herein by reference from Pages F-37 – F-40 and F-108 – F-110, Financial Information Section of Annual Report, under the caption "Certain Regulatory Matters" and "Capital Requirements and Related Regulatory Matters."

General:

The banking industry is subject to extensive state and federal regulation and continues to undergo significant change, particularly during the recent severe economic recession. Proposals to change the laws and regulations governing the banking industry are currently being discussed in Congress, in state legislatures and before the various bank regulatory agencies. The likelihood and timing of any changes and the impact such changes might have on Capitol are impossible to determine with any certainty. A change in applicable laws or regulations, or a change in the way such laws or regulations are interpreted by regulatory agencies or courts, may have a material impact on Capitol's business, financial position and results of operations. Capitol expects that the financial services industry will remain heavily regulated and that additional laws or regulations may be adopted. The following discussion summarizes certain aspects of the banking laws and regulations that affect Capitol. To the extent that the following information describes statutory or regulatory provisions, it is qualified entirely by reference to the particular statutory or regulatory provision.

Capitol is a bank holding company registered with the Board of Governors of the Federal Reserve and is subject to regulation under the Bank Holding Company Act of 1956, as amended (the "Bank Holding Company Act"). The Bank Holding Company Act requires the Federal Reserve Board's prior approval of an acquisition of assets or of ownership or control of voting shares of any bank or bank holding company, if the acquisition would give the acquiring institution more than 5% of the voting shares of such bank or bank holding company. It also imposes restrictions, summarized below, on the assets or voting shares of nonbanking companies that Capitol may acquire.

Consistent with the requirements of the Bank Holding Company Act, Capitol's community banking subsidiaries provide their customers with banking, trust and other financial services and products. These services include commercial banking, as well as trust services, mortgage origination and servicing, equipment leasing, brokerage and investment advisory services, property and casualty insurance, life insurance and annuity products, and portfolio management services through eleven banking subsidiaries and other subsidiaries.

Under Federal Reserve Board policy, a bank holding company is expected to serve as a source of financial strength to its banking subsidiaries and to stand prepared to commit resources to support each of them. There are no specific quantitative rules on a holding company's potential liability to its banking subsidiaries. In its sole judgment, the Federal Reserve Board could invoke the source-of-strength doctrine and require capital contributions from Capitol to its banking subsidiaries. In addition, and as a separate legal matter, a holding company is required to guarantee the capital plan of an undercapitalized banking subsidiary. See "Capital Adequacy and Prompt Corrective Action" on the next page.

Capitol's banking subsidiaries are subject to the provisions of the banking laws of their respective states of organization, the National Bank Act or national thrift regulations. They are under the supervision of, and are subject to periodic examination by, their respective state banking departments (in the case of state-chartered banks), and the Office of the Comptroller of the Currency (the "OCC") (in the case of national banks or federal savings banks), and are subject to the rules and regulations of the OCC, the Federal Reserve Board and the FDIC. As of December 31, 2012, nine of Capitol's banking subsidiaries were state-chartered banks and, therefore, subject to supervision, regulation and examination by state banking regulators and the FDIC. One of Capitol's depository institution subsidiaries, as of December 31, 2012, was chartered as a federal savings bank, and one banking subsidiary was a national bank, both of which are subject to regulation by the OCC and FDIC. Additionally, nonbank subsidiaries of Capitol are supervised and

- 9 -

Item 1. Business – continued.

examined by the Federal Reserve Board and various other federal and state agencies. As part of the financial and regulatory overhaul for U.S. financial institutions, via certain provisions of the Dodd-Frank Act, the OCC acquired the operations and some employees from the Office of Thrift Supervision in July 2011.

Capitol's insured depository institution subsidiaries are also subject to cross-guaranty liability under federal law. This means that if one FDIC-insured depository institution subsidiary of a multi-institution bank holding company fails or requires FDIC assistance, the FDIC may assess "commonly controlled" depository institutions for the estimated losses suffered by the FDIC. Such liability could have a material adverse effect on the financial condition of any assessed subsidiary institution and on Capitol as the common parent. While the FDIC's cross-guaranty claim is generally junior to the claims of depositors, holders of secured liabilities, general creditors and subordinated creditors, it is generally superior to the claims of shareholders and affiliates.

Payment of Dividends:

There are various statutory restrictions on the ability of Capitol's banking subsidiaries to pay dividends or make other payments to Capitol. Each of the state-chartered banking subsidiaries is subject to dividend limits under the laws of the state in which it is chartered. Federal Reserve Board policy provides that, as a matter of prudent banking, a bank holding company generally should not maintain a rate of cash dividends unless its net income available to common shareholders has been sufficient to fully fund the dividends and the prospective rate of earnings retention appears to be consistent with the holding company's capital needs, asset quality and overall financial condition. Due to operating losses and a written agreement between the Federal Reserve and Capitol, Capitol is currently prohibited from payment of dividends. As of December 31, 2012, Capitol's banking subsidiaries were prohibited from making dividend payments to Capitol without prior regulatory approval.

Capitol has several series of trust preferred securities outstanding which are interest-bearing. Under certain conditions, Capitol may defer payment of interest on the related subordinated debentures for periods of up to five years. In April 2009, Capitol commenced the deferral of interest payments on such subordinated debentures and, pursuant to the written agreement between the Federal Reserve and Capitol, may not make interest payments thereon without prior written approval from the Federal Reserve. The accrual of interest was discontinued as of the August 9, 2012 bankruptcy filing date. The documents governing the trusts restrict Capitol's right to pay a dividend on its common stock under certain circumstances and give holders of the securities preference on liquidation over the holders of Capitol's common stock.

Capital Adequacy and Prompt Corrective Action:

The FDIC Improvement Act of 1991 (the "FDICIA") requires federal regulators to take prompt corrective action against any undercapitalized institution. The FDICIA establishes five capital categories: "well-capitalized," "adequately-capitalized," "undercapitalized," "significantly-undercapitalized" and "critically-undercapitalized." "Well-capitalized" institutions significantly exceed the required minimum level for each capital measure (currently, risk-based and leverage). "Adequately-capitalized" institutions include depository institutions that meet the required minimum level for each capital measure. "Undercapitalized" institutions consist of those that fail to meet the required minimum level for one or more relevant capital measures. "Significantly-undercapitalized" characterizes depository institutions with capital levels significantly below the minimum requirements. "Critically-undercapitalized" refers to depository institutions with minimal capital and at serious risk for government seizure.

Under certain circumstances, a "well-capitalized," "adequately-capitalized" or "undercapitalized" institution may be treated as if the institution were in the next lower capital category. A depository institution is generally prohibited from making capital distributions, including paying dividends or fees to a holding company, if the institution would thereafter be "undercapitalized." Institutions that are adequately but not "well-capitalized" cannot accept, renew or roll over brokered deposits except with a waiver from the FDIC, and are subject to restrictions on the interest rates that can be paid on such deposits. "Undercapitalized" institutions may not accept, renew or roll over brokered deposits.

- 10 -

Item 1. Business – continued.

Most of Capitol's banking subsidiaries are subject to formal enforcement actions which, among other things, preclude classification of the bank at a level higher than "adequately-capitalized."

The banking regulatory agencies are permitted or, in certain cases, required to take certain actions with respect to institutions falling within one of the three undercapitalized categories. Depending on the level of an institution's capital, the agencies' corrective powers include, among other things:

|

·

|

prohibiting the payment of principal and interest on subordinated debt;

|

|

·

|

prohibiting the holding company from obtaining distributions from the institution without prior regulatory approval;

|

|

·

|

placing limits on asset growth and restrictions on activities;

|

|

·

|

placing additional restrictions on transactions with affiliates;

|

|

·

|

restricting the interest rates the institution may pay on deposits;

|

|

·

|

prohibiting the institution from accepting deposits from correspondent banks; and

|

|

·

|

in the most severe cases, appointing a conservator or receiver for the institution.

|

A banking institution that is "undercapitalized" is required to submit a capital restoration plan, and such a plan will not be accepted unless, among other things, the banking institution's holding company guarantees the plan up to a certain specified amount. Any such guarantee from a depository institution's holding company is entitled to a priority of payment in bankruptcy.

Several of Capitol's banking subsidiaries have received Prompt Corrective Action Directives ("PCAD") from the FDIC. These banks are striving to develop and implement capital restoration plans which may be acceptable to the FDIC. Typically, a capital plan is not deemed acceptable by the FDIC until receipt of the planned capital funds is imminent.

The FDICIA also contains a variety of other provisions that may affect Capitol's operations, including reporting requirements, regulatory standards for real estate lending, "truth in savings" provisions, and the requirement that a depository institution give 90 days' prior notice to customers and regulatory authorities before closing any branch.

Information concerning capital adequacy guidelines for Capitol and its banking subsidiaries, including their regulatory capital position at December 31, 2012, is incorporated by reference from Pages F-30 – F-40, Financial Information Section of Annual Report, under the captions "Liquidity, Capital Resources and Capital Adequacy" and "Certain Regulatory Matters" and Pages F-108– F-110 Financial Information Section of Annual Report, under the caption "Note S—Capital Requirements and Related Regulatory Matters."

FDIC Insurance Assessments:

FDIC deposit insurance premium levels remained a significant expense in 2012 ($5.8 million) compared to 2011 ($8.3 million) and 2010 ($12.4 million). Effective April 1, 2011, the FDIC began charging banks insurance premiums based on net assets (defined by the FDIC for assessment purposes as quarter-to-date average daily total assets less the corresponding amount of Tier 1 capital) rather than based on average deposits as they were previously. Initial base assessment rates range from .05% to .35% of "net assets" and may be adjusted for certain factors. Assuming that Capitol's banking subsidiaries remain in their current risk category, this new FDIC assessment methodology may result in a decrease in this expense item in the future.

- 11 -

Item 1. Business – continued.

As of June 30, 2008, the designated reserve ratio was 1.01% of estimated insured deposits at March 31, 2008. As a result of this reduced reserve ratio, in December 2008, the FDIC issued a ruling raising assessment rates uniformly by seven basis points for the first quarter of 2009. During 2009 and 2010, bank failures, coupled with deteriorating economic conditions, significantly reduced the FDIC's insurance fund reserve ratio. The FDIC also modified the way its assessment system differentiates for risk beginning April 1, 2009, resulting in corresponding changes in assessment rates beginning with the second quarter of 2009.

In conjunction with the October 2008 enactment of the Emergency Economic Stabilization Act of 2008 ("EESA"), the limit on FDIC insurance coverage was increased to $250,000 for all accounts. From 2008 through 2012, all noninterest-bearing transaction deposit accounts were fully insured regardless of the amount and account ownership, separate from and in addition to the FDIC insurance coverage provided from the depositors' other accounts.

On June 30, 2009, the FDIC charged a special assessment equal to 10 basis points on assets as of December 31, 2008, payable September 30, 2009. Future special assessments by the FDIC to bolster its insurance fund are possible. As a means to help improve the reserve ratio of the FDIC's insurance fund, it charged many banks, in December 2009, including some of Capitol's banking subsidiaries, an amount approximating three-years' of annual assessments.

In 2006, the FDIC merged the Bank Insurance Fund (the "BIF") and the Savings Association Insurance Fund (the "SAIF") into a single fund called the Deposit Insurance Fund. As a result of the merger, the BIF and the SAIF were abolished. The merger of the BIF and the SAIF into the Deposit Insurance Fund did not affect the authority of the Financing Corporation (the "FICO") to impose and collect, with the approval of the FDIC, assessments for anticipated payments, issuance costs and custodial fees on bonds issued by the FICO in the 1980s to recapitalize the Federal Savings and Loan Insurance Corporation. The bonds issued by the FICO are due to mature in 2017 through 2019. For the quarter ended December 31, 2012, the annualized FICO assessment was equal to 0.660 basis points for each $100 in domestic deposits maintained at an institution.

Temporary Liquidity Guarantee Program:

In November 2008, the FDIC adopted a final rule relating to the Temporary Liquidity Guarantee Program ("TLG Program"). The TLG Program was an initiative to counter the system-wide crisis in the nation's financial sector in 2008. Under the TLG Program, the FDIC (i) guaranteed, through the earlier of maturity or June 30, 2012, certain newly-issued senior unsecured debt issued by participating institutions and (ii) provided full FDIC deposit insurance coverage for noninterest-bearing transaction deposit accounts, Negotiable Order of Withdrawal Accounts (commonly known as NOW accounts) paying less than 0.5% interest per annum and Interest on Lawyers Trust Accounts (commonly known as IOLTAs) held at participating FDIC-insured institutions through December 31, 2009. Coverage under the TLG Program was available for the first 30 days without charge. The fee assessment for coverage of senior unsecured debt ranges from 50 basis points to 100 basis points per annum, depending on the initial maturity of the debt.

The FDIC's TLG Program provided an unlimited guarantee of certain demand deposits and ended effective June 30, 2010. The Dodd-Frank Act was subsequently enacted, which provided a substantially similar unlimited guarantee of all noninterest-bearing deposits through December 31, 2012. The TLG Program expired after December 31, 2012. The full effect of depositor activity upon termination of such unlimited deposit insurance is not determinable.

On July 21, 2010, the Dodd-Frank Wall Street Reform and Consumer Protection Act (the "Dodd-Frank Act") was signed into law, which is significantly impacting the regulation of financial institutions and the financial services industry. The Dodd-Frank Act includes provisions affecting large and small financial institutions, including several provisions that will profoundly affect how community banks, thrifts and smaller bank holding companies will be regulated in the future. Among other things, these provisions abolished the Office of Thrift Supervision and transferred its functions to the other federal banking agencies, relaxed rules regarding interstate branching, allowed financial institutions to pay interest on business checking accounts, changed the scope of FDIC insurance coverage and imposed

- 12 -

Item 1. Business – continued.

new capital requirements on bank holding companies, including the removal of trust preferred securities as a permitted component of a holding company's Tier 1 capital after a three-year phase-in period beginning January 1, 2013. The Dodd-Frank Act also established the Bureau of Consumer Financial Protection as an independent entity within the Federal Reserve, which was given the authority to promulgate consumer protection regulations applicable to all entities offering consumer financial services or products, including banks. Additionally, the Dodd-Frank Act included a series of provisions covering mortgage loan origination standards affecting, among other things, originator compensation, minimum repayment standards and prepayments. Management continues to evaluate provisions of the Dodd-Frank Act and assess its probable impact on its business, financial condition and results of operations. However, the ultimate effect of the Dodd-Frank Act on the financial services industry in general, and on Capitol in particular, currently remains uncertain.

One particularly important aspect of the Dodd-Frank Act (as amended) is that certain trust preferred securities issued by bank holding companies with total assets less than $10 billion, such as Capitol, are permitted to be included as an element of qualifying capital for regulatory capital-adequacy purposes. Accordingly, Capitol's trust preferred securities may be included in regulatory capital measurements in the future, subject to certain limitations, although none of those securities are currently included due to Capitol's Tier 1 capital deficit.

In July 2011, Capitol adopted a Tax Benefits Preservation Plan (the "Plan") designed to preserve substantial tax assets. Capitol's tax attributes include net operating losses that could be utilized in certain circumstances to offset taxable income and reduce federal income tax liability. Capitol's ability to use these tax attributes would be substantially limited if there were an "ownership change" as defined under Section 382 of the Internal Revenue Code and related Internal Revenue Services pronouncements. As part of the Plan, Capitol's board of directors declared a dividend of one preferred share purchase right for each outstanding share of its common stock distributable to shareholders of record as of August 1, 2011, as well as to holders of common stock issued after that date, but this dividend would only be activated if triggered under the Plan.

Future Legislation:

Various legislation affecting financial institutions and the financial industry is, from time to time, introduced in Congress. Such legislation may change banking statutes and the operating environment of Capitol and its subsidiaries in substantial and unpredictable ways and could increase or decrease the cost of doing business, limit or expand permissible activities or affect the competitive balance, depending upon whether any of this potential legislation will be enacted and, if enacted, the effect that it or any implementing regulations would have on the financial condition or results of operations of Capitol or any of its subsidiaries. With the enactments of EESA and the Dodd-Frank Act, the nature and extent of future legislative and regulatory changes affecting financial institutions is very unpredictable.

Interstate Banking:

Under the Riegle-Neal Interstate Banking and Branching Efficiency Act of 1994 (the "Riegle-Neal Act"), as amended, a bank holding company may acquire banks in states other than its home state, subject to any state requirement that the bank has been organized and operating for a minimum period of time (not to exceed five years) and the requirement that the bank holding company not control, prior to or following the proposed acquisition, more than 10% of the total amount of deposits of insured depository institutions nationwide or, unless the acquisition is the bank holding company's initial entry into the state, more than 30% of such deposits in the state, or such lesser or greater amount set by the state. The Riegle-Neal Act also authorizes banks to merge across state lines, thereby creating interstate branches. Banks are also permitted to acquire and to establish de novo branches in other states where authorized under the laws of those states.

- 13 -

Item 1. Business – continued.

Transactions with Affiliates:

Transactions between Capitol's banking subsidiaries and their affiliates are governed by Regulation W of the Federal Reserve Act and substantially similar regulations of the FDIC. The affiliates of the banks include Capitol and any entity controlled by Capitol. Generally, Regulation W (i) limits the extent to which the banking subsidiaries may engage in "covered transactions" with any one affiliate to an amount equal to 10% of such institution's capital stock and surplus, and maintain an aggregate limit on all such transactions with affiliates to an amount equal to 20% of the bank's capital stock and surplus, (ii) requires that a bank's extensions of credit to such affiliates be fully collateralized (with 100% to 130% collateral coverage, depending on the type of collateral), (iii) prohibits a bank from purchasing or accepting as collateral from an affiliate any "low quality assets" (including nonperforming loans) and (iv) requires that all "covered transactions" be on terms substantially the same, or at least as favorable, to the bank or its subsidiary as those provided to a nonaffiliate. The term "covered transaction" includes the making of loans, purchase of assets, issuance of a guarantee and other types of similar transactions.

Loans to Insiders:

The Federal Reserve Act and related regulations impose specific restrictions on loans to directors, executive officers and principal stockholders of banks. Under Section 22(h) of the Federal Reserve Act and its implementing regulations, loans to a director, to an executive officer and to a principal shareholder of a bank, and some affiliated entities of any of the foregoing, may not exceed, together with all other outstanding loans to such person and affiliated entities, the bank's loan-to-one-borrower limit. Loans in the aggregate to insiders and their related interests as a class may not exceed the bank's unimpaired capital and unimpaired surplus. Section 22(h) and its implementing regulations also prohibit loans above amounts prescribed by the appropriate federal banking agency, to directors, executive officers and principal shareholders of a bank or bank holding company, and their respective affiliates, unless such loan is approved in advance by a majority of the board of directors of the bank with any "interested" director not participating in the voting. Section 22(h) generally requires that loans to directors, executive officers and principal shareholders be made on terms and underwriting standards substantially the same as offered in comparable transactions to other persons.

Community Reinvestment Act:

Under the Community Reinvestment Act ("CRA") and related regulations, depository institutions have an affirmative obligation to assist in meeting the credit needs of their market areas, including low and moderate income areas, consistent with safe and sound banking practices. The CRA requires the adoption by each institution of a CRA statement for each of its market areas describing the depository institution's efforts to assist in its community's credit needs. Depository institutions are periodically examined for compliance with CRA and are periodically assigned ratings in this regard. Banking regulators consider a depository institution's CRA rating when reviewing applications to establish new branches, undertake new lines of business, and/or acquire part or all of another depository institution. An unsatisfactory rating can significantly delay or even prohibit regulatory approval of a proposed transaction by a bank holding company or its depository institution subsidiary.

Fair Lending and Consumer Laws:

In addition to the CRA, other federal and state laws regulate various lending and consumer aspects of the banking business. Governmental agencies, including the Department of Housing and Urban Development, the Federal Trade Commission and the Department of Justice, have become concerned that, in some cases, prospective borrowers experience unlawful discrimination in their efforts to obtain loans from depository and other lending institutions. These agencies have brought litigation against some depository institutions alleging discrimination against borrowers. Many of these suits have been settled, in some cases for material sums, short of a full trial.

Those governmental agencies have clarified what they consider to be lending discrimination and have specified various factors that they will use to determine the existence of lending discrimination under the Equal Credit Opportunity Act and the Fair Housing Act. These factors include evidence that a lender discriminated on a prohibited basis, evidence that a lender treated applicants differently based on prohibited factors in the absence of evidence that the treatment was

- 14 -

Item 1. Business – continued.

the result of prejudice or a conscious intention to discriminate, and evidence that a lender applied an otherwise neutral nondiscriminatory policy uniformly to all applicants, but the practice had a discriminatory effect, unless the practice could be justified as a business necessity.

Banks and other depository institutions also are subject to other numerous consumer-oriented laws and regulations. These laws, which include the Truth in Lending Act, the Truth in Savings Act, the Real Estate Settlement Procedures Act and the Electronic Funds Transfer Act require compliance by depository institutions with various disclosure requirements and requirements regulating the availability of funds after deposit or the making of certain loans to customers.

Gramm-Leach Bliley Act of 1999:

The Gramm-Leach-Bliley Act of 1999 (the "GLBA") covers a broad range of issues, including a repeal of most of the restrictions on affiliations among depository institutions, securities firms and insurance companies. The following description summarizes some of its significant provisions.

The GLBA repeals sections 20 and 32 of the Glass-Steagall Act, thus permitting unrestricted affiliations between banks and securities firms. It also permits bank holding companies to elect to become financial holding companies. A financial holding company may engage in or acquire companies that engage in a broad range of financial services, including securities activities such as underwriting, dealing, investment, merchant banking, insurance underwriting, sales and brokerage activities. In order to become a financial holding company, the bank holding company and all of its affiliated depository institutions must be well-capitalized, well-managed and have at least a satisfactory CRA rating. Capitol has decided not to become certified as a financial holding company at this time, but may reconsider this determination in the future.

The GLBA provides that the states continue to have the authority to regulate insurance activities, but prohibits the states in most instances from preventing or significantly interfering with the ability of a bank, directly or through an affiliate, to engage in insurance sales, solicitations or cross-marketing activities. Although the states generally must regulate bank insurance activities in a nondiscriminatory manner, the states may continue to adopt and enforce rules that specifically regulate bank insurance activities in specific areas identified under the law. The federal bank regulatory agencies adopted insurance consumer protection regulations that apply to sales practices, solicitations, advertising and disclosures.

The GLBA repeals the broad exemption of banks from the definitions of "broker" and "dealer" for purposes of the Securities Exchange Act of 1934, as amended. It also identifies a set of specific activities, including traditional bank trust and fiduciary activities, in which a bank may engage without being deemed a "broker," and a set of activities in which a bank may engage without being deemed a "dealer." Additionally, the law makes conforming changes in the definitions of "broker" and "dealer" for purposes of the Investment Company Act of 1940, as amended, and the Investment Advisers Act of 1940, as amended.

The GLBA also contains extensive customer privacy protection provisions. Under these provisions, a financial institution must provide to its customers, both at the inception of the customer relationship and on an annual basis, the institution's policies and procedures regarding the handling of customers' nonpublic personal financial information. The law provides that, except for specific limited exceptions, an institution may not provide such personal information to unaffiliated third parties unless the institution discloses to the customer that such information may be so provided and the customer is given the opportunity to "opt out" of such disclosure. An institution may not disclose to an unaffiliated third party, other than to a consumer reporting agency, customer account numbers or other similar account identifiers for marketing purposes. The GLBA also provides that the states may adopt customer privacy protections that are more strict than those contained in the GLBA.

- 15 -

Item 1. Business – continued.

Anti-Money Laundering and the USA Patriot Act of 2001:

In 2001, Congress enacted the Uniting and Strengthening America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism Act of 2001 (the "Patriot Act"). The Patriot Act is designed to deny terrorists and criminals the ability to obtain access to the United States' financial system and has significant implications for depository institutions, brokers, dealers and other businesses involved in the transfer of money. The Patriot Act mandates that financial services companies implement policies and procedures with respect to additional measures designed to address the following matters: money laundering, terrorist financing, identifying and reporting suspicious activities and currency transactions and currency crimes. The Patriot Act also substantially broadened existing anti-money laundering legislation, imposed new compliance and due diligence obligations, created new crimes and penalties and compelled the production of documents located both inside and outside the United States. The U.S. Treasury Department has issued a number of regulations that apply some of these requirements to financial institutions such as Capitol's banking subsidiaries. The regulations impose new obligations on financial institutions to maintain appropriate policies, procedures and controls to detect, prevent and report money laundering and terrorist financing. Pursuant to the Patriot Act and the related regulations, Capitol and its banking subsidiaries have established anti-money laundering compliance and due diligence programs that include, among other things, the designation of a compliance officer, employee training programs and an independent audit function to review and test the program.

Evolving Legislation and Regulatory Action:

Legislators and regulators in the United States are currently considering a wide range of proposals that, if enacted, could result in major changes to the way banking operations are regulated. Some of these major changes took effect in 2011, and future regulations, particularly as necessary to fully implement the Dodd-Frank Act provisions, could materially impact the profitability of Capitol's banking business, the value of assets Capitol holds or the collateral available for Capitol's banking subsidiaries' loans, require changes to business practices or force Capitol to discontinue businesses and expose the Corporation to additional costs, taxes, liabilities, enforcement actions and reputational risk.

d. Financial information about geographic areas:

Incorporated by reference from Pages F-15 – F-29, Financial Information Section of Annual Report, under the captions "Capitol's Community Banking Regions and Summary Financial Information," "Capitol's Results of Operations" and "Capitol's Financial Position."

e. Available Information:

Capitol maintains an Internet website at http://www.capitolbancorp.com that includes links to Capitol's Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and any amendments to those reports. Capitol files these periodic reports with the SEC, which are available without charge as soon as reasonably practicable following the time they are filed with or furnished to the SEC. Information on Capitol's website is not incorporated into this Form 10-K or Capitol's other securities filings and is not a part of those filings. The public may read and copy any materials Capitol files with the SEC at the SEC's Public Reference Room at 100 F. Street, NE, Washington, DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1‑800‑SEC‑0330. The SEC also maintains an Internet website that contains information regarding issuers that file electronically with the SEC. That address is http://www.sec.gov. In addition, Capitol makes available on its website at http://www.capitolbancorp.com, under the heading "Governance," its: (i) Code of Ethics; (ii) Governance Guidelines; and (iii) the charters of Capitol's board committees, and also intends to disclose any amendments to its Code of Ethics, or waivers of the Code of Ethics on behalf of its Chief Executive Officer and other senior financial officers. These corporate governance materials are also available free of charge in print to shareholders who request them in writing to: Capitol Bancorp Ltd., Attention: Secretary, Capitol Bancorp Center, 200 N. Washington Square, Lansing, Michigan 48933.

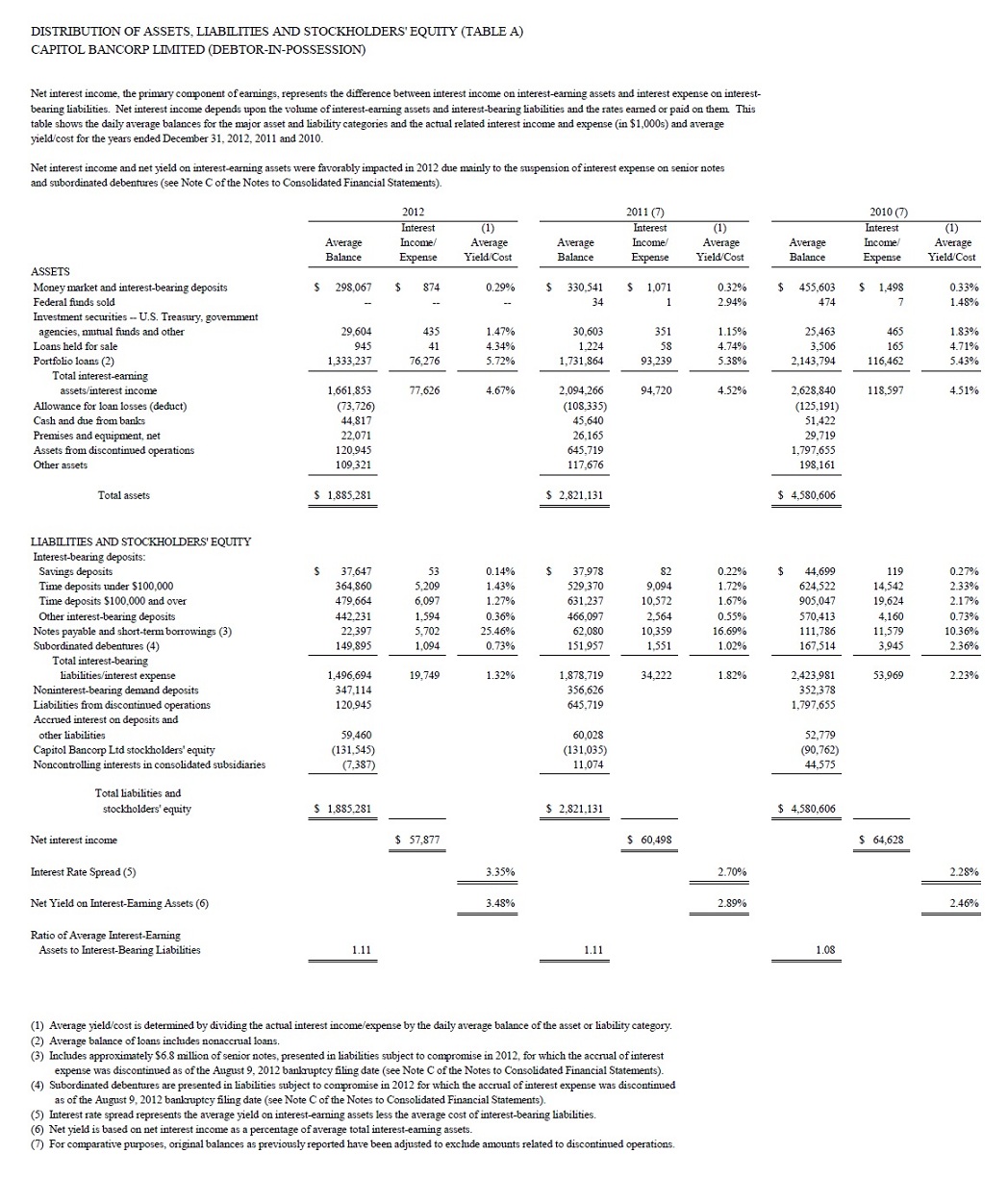

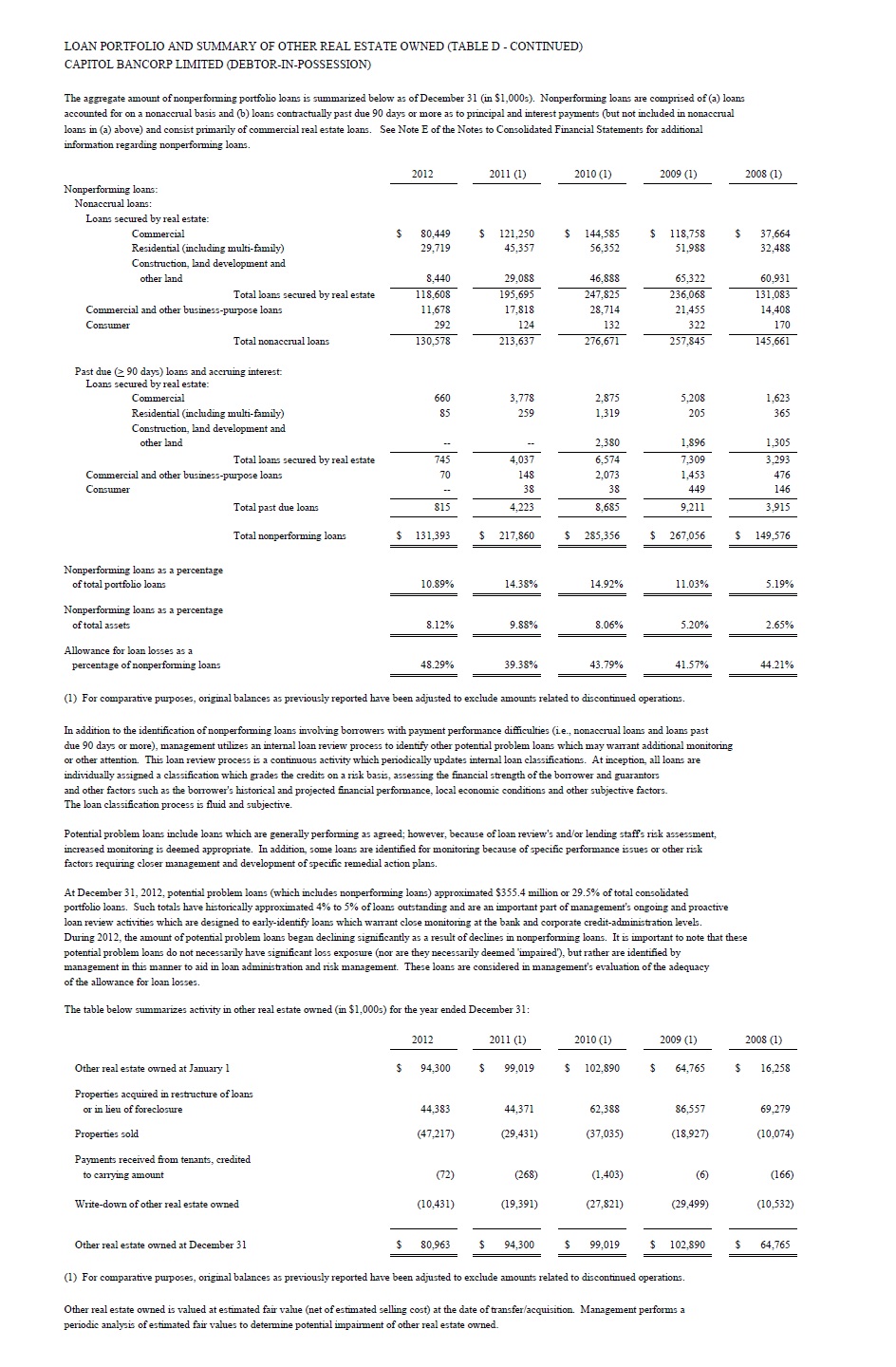

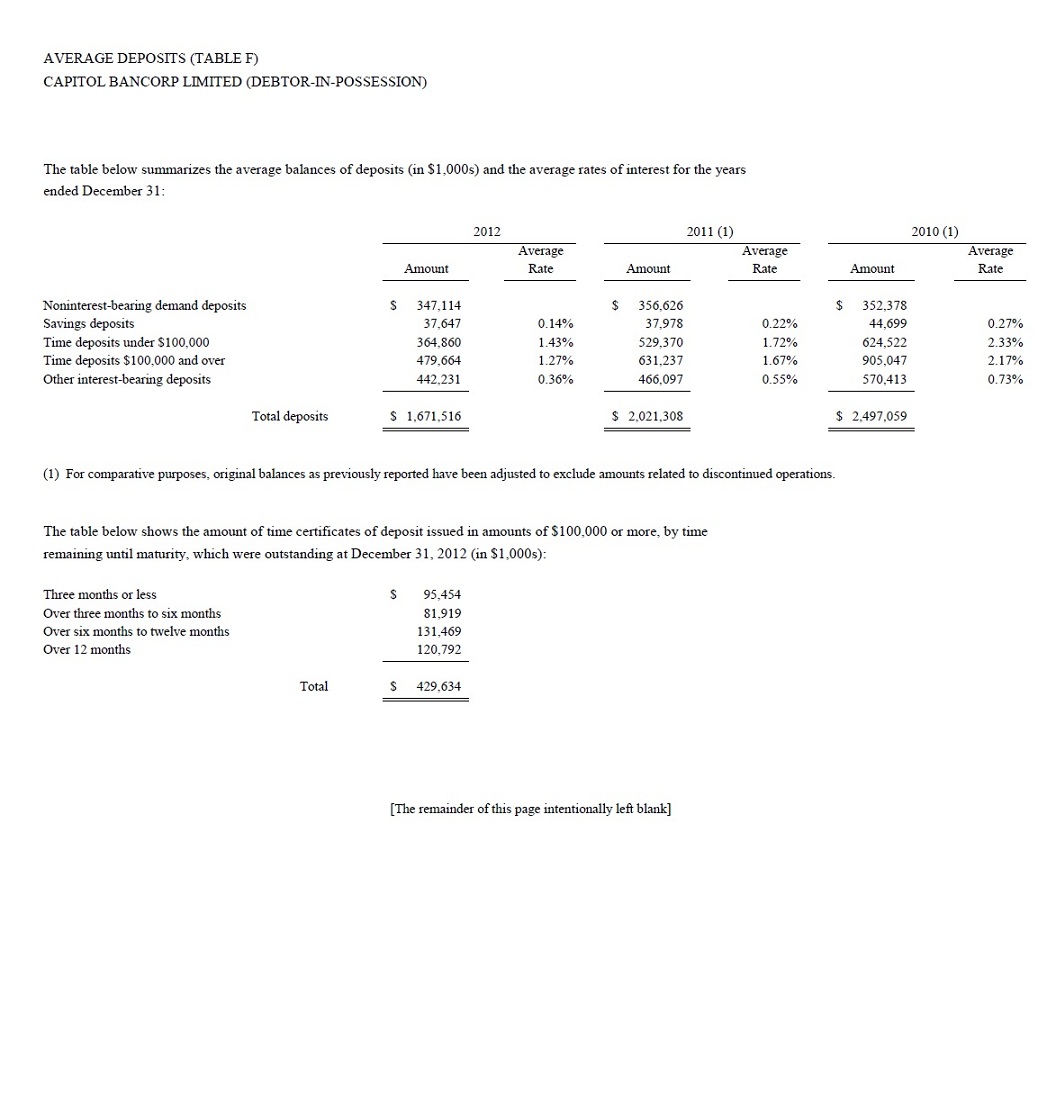

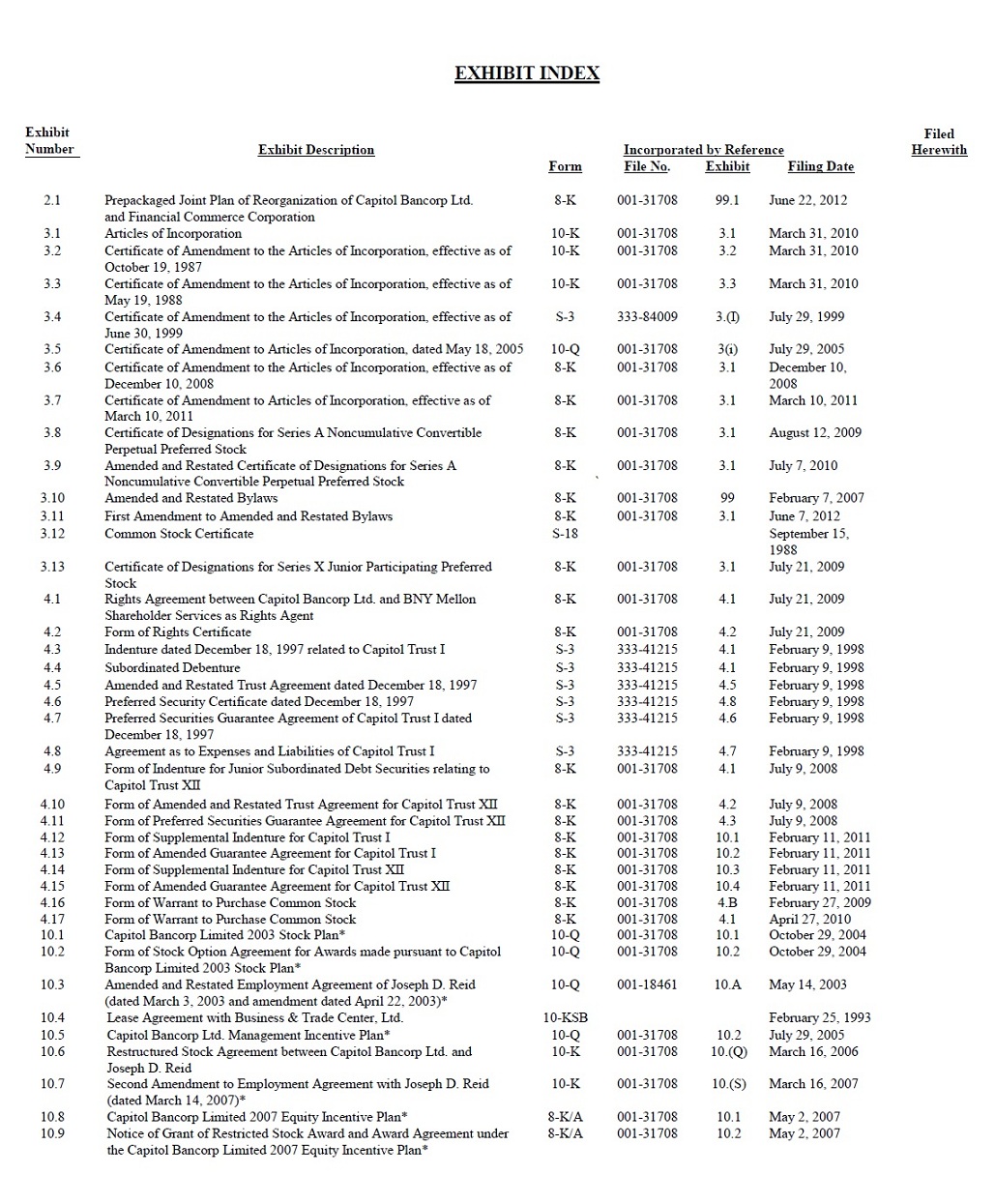

The following tables (Tables A to G, inclusive), present certain statistical information regarding Capitol's business and exclude discontinued operations.

- 16 -

- 17 -

- 18 -

- 19 -

- 20 -

- 21 -

- 22 -

- 23 -

- 24 -

- 25 -

An investment in Capitol's common stock, Series A preferred stock and/or its trust preferred securities is subject to the risks inherent to Capitol's business. The material risks and uncertainties that Capitol believes affect it are described below. The risks and uncertainties described below may not be the only ones it faces. Additional risks and uncertainties that Capitol is not aware of or focused on, or risks currently deemed immaterial, may also impair business operations. This Annual Report on Form 10-K is qualified in its entirety by these risk factors. If any of the following risks actually occur, Capitol's financial condition and results of operations could be materially and adversely affected. If this were to happen, the value of Capitol's common stock could decline significantly, and shareholders could lose all or a portion of their investment.

Capitol's ability to continue as a going concern is uncertain.

Capitol has experienced a significant deterioration in asset quality and incurred significant operating losses, resulting in an equity deficit and a regulatory capital classification as less than "adequately-capitalized." As a result, Capitol and most of its banking subsidiaries have become subject to increased regulatory oversight and compliance requirements. Those factors, among others, raise some level of doubt (potentially substantial doubt) as to Capitol's ability to continue as a going concern. If Capitol becomes unable to operate as a going concern, it is likely that its common shareholders could lose all or substantially all of their investment in Capitol. Such substantial doubt is discussed in the Report of Independent Registered Public Accounting Firm set forth on Page F-54 of the Financial Information Section of the Annual Report.

Capitol's ability to continue to operate as a going concern is contingent upon a number of factors which include, but are not limited to, the following:

|

·

|

Raising significant amounts of new equity capital plan pursuant to the Chapter 11 Plan of Reorganization;

|

|

·

|

Completion of the proposed financial restructuring plan;

|

|

·

|

Ability to raise additional capital to bring its affiliate banks to an "adequately-capitalized" level;

|

|

·

|

Significant proceeds from pending future bank sales to enable timely deployment to improve capital adequacy at remaining bank subsidiaries, in addition to raising additional capital from other sources at the parent-company level;

|

|

·

|

Future abatement of loan losses and losses associated with other nonperforming assets;

|

|

·

|

Future reduction in operating expenses;

|

|

·

|

Future improvement in net interest margin and sources of noninterest income; and

|

|

·

|

Future conversion of nonperforming assets into earning assets.

|

Capitol has incurred net losses of $25.5 million, $45.4 million and $225.2 million during the years ended December 31, 2012, 2011 and 2010, respectively. The losses have largely resulted from provisions for loan losses, higher operating costs related to elevated levels of nonperforming loans and other real estate owned, and a large impairment loss related to goodwill in 2010. Since January 1, 2008, Capitol has recorded total provisions for loan losses of $403.4 million (excluding discontinued operations). While such losses exclude charges to establish and maintain a valuation allowance against the realization of Capitol's deferred tax assets of $190.5 million, which are not deemed more-likely-than-not realizable, these deferred tax related charges would not have been required had Capitol not incurred the losses on loans.

However, substantial risks remain in Capitol's and its banking subsidiaries' loan portfolios. As of December 31, 2012, approximately 99% of Capitol's bank loan portfolio consisted of loans secured by real estate and commercial loans secured by business assets other than real estate. Those types of loans are typically larger than other loans which made up the remaining portion of Capitol's and its banking subsidiaries' portfolio loans. Further, deterioration of any or a few of those loans may lead to a significant increase in nonperforming loans and potential loan losses. Any additional increases in nonperforming loans could result in a decrease in interest income from those loans, an increase in the provision for loan losses and an increase in loan charge-offs, all of which could have a material adverse effect on Capitol's financial condition and results of operations.

- 26 -

Item 1A. Risk Factors – continued.

Capitol has commenced several initiatives and other actions to mitigate these going concern considerations and to improve the Corporation's financial condition, equity, regulatory capital and regulatory compliance. Capitol's ability to continue as a going concern is contingent on the successful achievement of those initiatives. There can be no assurance that the exploration of those capital strategies will result in any transaction, or that any transaction will allow any of Capitol's shareholders to avert a loss of all or substantially all of their investment in Capitol. The pursuit of strategic alternatives may also involve significant expenses and management's time and attention.

Capitol needs to raise additional capital that may not be available.

Regulatory authorities require Capitol and its banking subsidiaries to maintain adequate levels of capital to support their operations. As reported by Capitol, many of its banking subsidiaries were "significantly-undercapitalized" or otherwise classified as less than "adequately-capitalized" as of December 31, 2012 and have an immediate need to raise capital. In addition, even if Capitol succeeds in raising capital, it may need to raise additional capital in the future due to additional losses from operations or regulatory requirements. The ability to raise additional capital, if needed, will depend in part on conditions in the capital markets at that time, which are outside Capitol's control, and will depend on its financial performance. Accordingly, any such additional capital may not be raised, if and when needed, on terms acceptable to Capitol, or at all. If Capitol cannot raise additional capital when needed, its ability to increase its capital ratios could be materially impaired and Capitol could face additional adverse regulatory challenges. In addition, if Capitol issues additional equity capital, it may be at a lower price and the interest of its existing shareholders may be diluted.

Capitol's business has been adversely affected by conditions in the financial markets and economic conditions.

The United States experienced a deep recession that began in December 2007 and continued throughout the first half of 2011. Although the nation is slowly seeing signs of recovery, business activity across a wide range of industries and regions is still greatly reduced, and local governments and many businesses are experiencing serious difficulty due to the lack of consumer spending and the lack of liquidity in the credit markets. Unemployment increased significantly during the recession and remains significantly elevated.

Market conditions have also led to the failure or merger of a number of prominent financial institutions. Financial institution failures or near-failures have resulted in further losses as a consequence of defaults on securities issued by them, and defaults under contracts entered into with such entities as counterparties. Furthermore, declining asset values, defaults on mortgages and consumer loans, and the lack of market and investor confidence, as well as other factors, have all combined to increase credit-default swap spreads, to cause rating agencies to lower credit ratings, and to otherwise increase the cost and decrease the availability of liquidity, despite very significant declines in Federal Reserve borrowing rates and other government actions. Some banks and other lenders, including Capitol, have suffered significant losses and many institutions have become reluctant to lend, even on a secured basis, due to the increased risk of default and the impact of declining asset values on the value of collateral. The foregoing has significantly weakened the strength and liquidity of some financial institutions worldwide. The U.S. government, the Federal Reserve Board and other regulatory agencies have taken numerous steps to increase liquidity and to restore investor confidence, including investing billions in the equity of other banking organizations, but asset values have continued to decline and access to liquidity continues to be very limited.

In response to the adverse economic conditions affecting the banking system and financial markets, and going concern threats to investment banks and other financial institutions, the Emergency Economic Stabilization Act of 2008 (the "EESA") was signed into law in October 2008. Among other things, the EESA authorized the U.S. Treasury (the "Treasury") to spend up to $700 billion to inject capital into financial institutions by purchasing non-voting preferred shares directly from such institutions and to purchase mortgage-backed and other nonperforming assets from financial institutions for the purpose of stabilizing the financial markets. Capitol has not received any so-called "bailout" funds from any governmental sources.

- 27 -

Item 1A. Risk Factors – continued.

Capitol's financial performance generally, and in particular the ability of its banks' borrowers to pay interest on and repay the principal of outstanding loans and the value of collateral securing those loans, is highly dependent on the business environment in the markets where Capitol operates and in the United States as a whole. The recent severe recession was characterized by declines in economic growth, business activity or investor or business confidence; limitations on the availability of, or increases in the cost of, credit and capital; falling commercial and residential real estate values; inactive or nonexistent markets for the sale of real estate; or a combination of these or other factors.

There can be no assurance that weak economic conditions could arise in the near term. Such conditions have and could continue to adversely affect the credit quality of Capitol's loans, results of operations and financial condition.

Capitol's ability to achieve and maintain required capital levels and adequate sources of funding and liquidity may be adversely affected by market conditions.

Capitol is required to maintain certain capital levels in accordance with banking regulations under which Capitol is currently classified as less than "adequately-capitalized." Many of Capitol's banking subsidiaries are also classified as less than "adequately-capitalized." Capitol and its banking subsidiaries must also maintain adequate funding sources in the normal course of business to support their lending and investment operations and repay outstanding liabilities as they become due. Capitol's ability to maintain capital levels, as well as sources of funding and liquidity could be impacted by future adverse operating results and deteriorating economic and market conditions.

Failure by Capitol or its banking subsidiaries to meet any applicable guideline or capital requirement otherwise imposed upon them, or to satisfy certain other regulatory requirements could subject them to further activity restrictions or to a variety of enforcement remedies available to the regulatory authorities that include prohibitions on their ability to pay future dividends, the issuance by regulatory authorities of a capital directive to increase capital and the termination of deposit insurance by the FDIC resulting in closure.

Noncompliance with capital requirements could have a material adverse effect on Capitol's operations and financial position.

Capitol and many of its banking subsidiaries are less than "adequately-capitalized" and regulatory agencies have in some cases required Capitol and/or its individual banking subsidiaries to maintain a higher level of capital than anticipated, which could adversely affect Capitol's liquidity at the parent company level and require it to raise additional capital.

While Capitol must meet certain regulatory requirements on a consolidated basis, regulatory agencies having authority over each of its banking subsidiaries may require that those subsidiaries maintain a higher level of capital than Capitol currently anticipates, which would require that Capitol maintain a consolidated capital position that is well beyond what is presently anticipated and could be in excess of the levels of capital used in the assumptions underlying Capitol's management and estimation of its capital needs. Most of Capitol's banking subsidiaries are currently required to maintain regulatory capital levels in excess of minimum requirements. Further, as a holding company with obligations and expenses separate from its banking subsidiaries, and because many of its banking subsidiaries are currently prohibited from making dividend payments to Capitol, Capitol must maintain a level of liquidity that is sufficient to address those obligations and expenses. The maintenance of adequate liquidity at Capitol may limit its ability to make further capital investments in banking subsidiaries, which could adversely impact Capitol and require it to raise additional capital. Even if Capitol is successful in implementing its current divestiture and charter consolidation initiatives, Capitol and its banking subsidiaries may be required by the regulatory agencies to have a higher level of capital than currently anticipated.

- 28 -

Item 1A. Risk Factors – continued.

At December 31, 2012, Capitol and certain banking subsidiaries were classified as less than "adequately-capitalized" based on their respective regulatory capital ratios. Banks less than "adequately-capitalized" have become subject to increased regulatory enforcement pursuant to the prompt-corrective-action or other provisions of the FDIC and other bank regulatory agencies. Capitol intends to augment the capital levels of those institutions through allocation of proceeds from the further divestiture of some of its banking subsidiaries and by pursuing additional sources of external capital, although there is no assurance that amounts contributed to banking subsidiaries' capital will be sufficient to achieve regulatory compliance.

Capitol's and its banking subsidiaries' allowances for loan losses may prove inadequate to absorb actual loan losses, which may adversely impact results of operations.

Capitol believes that its consolidated allowance for loan losses is maintained at a level adequate to absorb inherent losses in the loan portfolio at the balance-sheet date. Management's determination of the allowance is based on evaluation of the portfolio (including potential impairment of individual loans and concentrations of credit), past loss experience, current economic conditions, the volume, amount and composition of the portfolio and other factors. These estimates are subjective and their accuracy depends on the outcome of future events. Actual future losses may differ from current estimates. Depending on changes in economic, operating and other conditions, including changes in fair value of collateral that are generally beyond Capitol's control, actual loan losses could increase significantly. As a result, such losses could exceed current allowance estimates. No assurance can be provided that the allowance will be sufficient to cover actual future loan losses should such losses be realized. However, Capitol currently has unallocated reserves at several of its banking subsidiaries, including a $20.9 million unallocated reserve at Michigan Commerce Bank, for which Capitol is awaiting regulatory approval to release.

Loan loss experience is helpful in estimating the requirements for the allowance for loan losses at any given balance sheet date. Some of Capitol's banking subsidiaries, particularly those located in the Southeast, Arizona and Nevada, have experienced significantly elevated levels of loan losses due to adverse economic conditions. If it becomes necessary to increase the ratio of the allowance for loan losses to total loans, such increases would be accomplished through higher provisions for loan losses, which may adversely impact results of operations and could result in larger net losses on a consolidated basis.

The domestic economies in the multiple markets in which Capitol's banking subsidiaries operate are coming out of a severe recession and Capitol's levels of nonperforming loans and related loan losses and levels of foreclosed assets and other real estate owned ("OREO") had increased significantly prior to 2011. In 2011 and 2012, the levels of nonperforming loans and related loan losses began to decline. Capitol's level of OREO increased dramatically in 2009 and, although it has begun to decline, it still remains elevated, leading to an increased level of carrying costs and other operating expenses. Continued elevation of OREO could have a material negative impact on Capitol.

In addition, regulatory agencies, as an integral part of their supervisory functions, periodically review the adequacy of the allowance for loan losses. Regulatory agencies may require Capitol or its banking subsidiaries to increase their provision for loan losses or to recognize further loan charge-offs based upon judgments different from those of management. Any increase in the allowance required by regulatory agencies could have a negative impact on Capitol's operating results, capital adequacy and financial position.

Capitol and its banking subsidiaries operate in an environment highly regulated by state and federal government agencies; changes in federal and state banking laws and regulations could have a negative impact on its business.

As a bank holding company, Capitol is regulated primarily by the Federal Reserve Board. Many of Capitol's current bank affiliates are regulated primarily by state banking agencies, the FDIC and the OCC (in the case of one national bank and one federal savings bank subsidiary).

- 29 -

Item 1A. Risk Factors – continued.

Various federal and state laws and regulations govern numerous aspects of the banks' operations, including:

|

·

|

adequate capital and financial condition;

|

|

·

|

permissible types and amounts of extensions of credit and investments;

|

|

·

|

permissible nonbanking activities; and

|

|

·

|

restrictions on dividend payments.

|

Federal and state regulatory agencies have broad discretion and power to prevent or remedy unsafe or unsound practices or violations of law by banks and bank holding companies. Capitol and its banking subsidiaries undergo periodic examinations by one or more regulatory agencies. Following such examinations, Capitol may be required, among other things, to change its asset valuations or the amounts of required loan loss allowances or to restrict bank operations. Those actions would result from the regulators' judgments based on information available to them at the time of their examination, and their estimate of future economic conditions. Judgments of various regulatory agencies vary, and regulatory agencies may change their position and require application of their judgment retroactively, causing institutions to change methodologies for the allowance for loan losses, resulting in restatement of their regulatory financial statements, including their capital position.

Capitol's banking subsidiaries are required to follow a wide variety of state and federal consumer protection and similar statutes and regulations. Federal and state regulatory restrictions limit the manner in which Capitol and its banking subsidiaries may conduct business and obtain financing. Those laws and regulations can and do change significantly from time to time and any such change could adversely affect Capitol and its banking subsidiaries.

Most of Capitol's banking affiliates have entered into formal enforcement actions with their respective regulatory agencies, which impose various additional requirements on those institutions which may further restrict their operations.

The Basel III capital rules may have a material impact on Capitol's operations.