UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

|

T

|

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

|

|

SECURITIES EXCHANGE ACT OF 1934

|

|

|

For the quarterly period ended March 31, 2011

|

|

|

OR

|

|

|

£

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

|

|

SECURITIES EXCHANGE ACT OF 1934

|

|

|

For the transition period from ________________ to ________________

|

Commission file number: 001-31708

CAPITOL BANCORP LTD.

(Exact name of registrant as specified in its charter)

|

Michigan

|

38-2761672

|

|

|

(State or other jurisdiction of

|

(IRS Employer Identification No.)

|

|

|

incorporation or organization)

|

||

|

Capitol Bancorp Center

|

||

|

Fourth Floor

|

||

|

200 N. Washington Square

|

||

|

Lansing, Michigan

|

48933

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

517-487-6555

(Registrant's telephone number, including area code)

Not applicable

(Former name, former address and former fiscal year, if changed since last report)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

|

Yes T

|

No £

|

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

|

Yes £

|

No £

|

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer £

|

Accelerated filer £

|

||

|

Non-accelerated filer £ (Do not check if a smaller reporting company)

|

Smaller reporting company T

|

||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

|

Yes £

|

No T

|

Indicate the number of shares outstanding of each of the issuer's classes of common stock, as of the latest practicable date.

|

Class

|

Outstanding at April 30, 2011

|

|

|

Common Stock, No par value

|

41,122,057 shares

|

Page 1 of 57

INDEX

PART I. FINANCIAL INFORMATION

Forward-Looking Statements

Some statements contained in this document, including consolidated financial statements of Capitol Bancorp Limited (Capitol or the Corporation), Management's Discussion and Analysis of Financial Condition and Results of Operations and in documents incorporated into this document by reference that are not historical facts, including, without limitation, statements of future expectations, projections of results of operations and financial condition, statements of future economic performance and other forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, are subject to known and unknown risks, uncertainties and other factors which may cause actual future results, performance or achievements of Capitol and/or its subsidiaries and other operating units to differ materially from those contemplated in such forward-looking statements. The words "intend," "expect," "project," "estimate," "predict," "anticipate," "should," "could," "believe," "may," "might," and similar expressions also are intended to identify forward-looking statements. Important factors which may cause actual results to differ from those contemplated in such forward-looking statements include, but are not limited to: (i) the results of Capitol's efforts to implement its business strategy, (ii) changes in interest rates, (iii) legislation or regulatory requirements adversely impacting Capitol's banking business and/or operating strategy, (iv) adverse changes in business conditions or inflation, (v) general economic conditions, either nationally or regionally, which are less favorable than expected and that result in, among other things, a deterioration in credit quality and/or loan performance and collectability, (vi) competitive pressures among financial institutions, (vii) changes in securities markets, (viii) actions of competitors of Capitol's banks and Capitol's ability to respond to such actions, (ix) the cost of and access to capital, which may depend in part on Capitol's asset quality, prospects and outlook, (x) changes in governmental regulation, tax rates and similar matters, (xi) changes in management, (xii) consummation of pending sales of certain bank subsidiaries, (xiii) completion of Capitol's selective bank divestiture activities, (xiv) other risks detailed in Capitol's other filings with the Securities and Exchange Commission (SEC), and (xv) the following, among others:

· Capitol's ability to continue as a going concern;

· The impact on Capitol's financial results, reputation and business if it is unable to comply with all applicable federal and state regulations and applicable formal agreements, consent orders, other regulatory actions and any related capital requirements;

· Management's ability to effectively manage interest rate risk and the impact of interest rates, in general, on the volatility of Capitol's net interest income;

· The effect of the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, Emergency Economic Stabilization Act of 2008, the American Recovery and Reinvestment Act of 2009, the implementation by the Department of the U.S. Treasury and federal banking regulators of a number of programs to address capital and liquidity issues within the banking system and additional programs that may apply to Capitol in the future, all of which may have significant effects on Capitol and the financial services industry;

· The decline in commercial and residential real estate values and sales volume and the likely potential for continuing illiquidity in the real estate market;

· The risks associated with the high concentration of commercial real estate loans within Capitol's portfolio;

· The uncertainties in estimating the fair value of developed real estate and undeveloped land relating to collateral-dependent loans and other real estate owned in light of declining demand for such assets, falling prices and continuing illiquidity in the real estate market;

· Negative developments and disruptions in the credit and lending markets, including the impact of the ongoing credit crisis on Capitol's business and on the businesses of its customers as well as other banks and lending institutions with which Capitol has commercial relationships;

· A continuation of unprecedented volatility in the capital markets;

· The risks associated with implementing Capitol's business strategy, including its ability to preserve and access sufficient capital to execute its strategy;

Page 2 of 57

INDEX – Continued

PART I. FINANCIAL INFORMATION – Continued

Forward-Looking Statements – Continued

· Continued unemployment and its impact on Capitol's customers' savings rates and their ability to service debt obligations;

· Fluctuations in the value of Capitol's investment securities;

· The ability to attract and retain senior management experienced in banking and financial services;

· The sufficiency of the allowance for loan losses to absorb the amount of actual losses inherent within the loan portfolio;

· Capitol's ability to adapt successfully to technological changes to compete effectively in the marketplace;

· Credit risks and risks from concentrations (by geographic area and by industry) within each of Capitol's subsidiary banks' loan portfolio and individual large loans;

· The effects of competition from other commercial banks, thrifts, mortgage banking firms, consumer finance companies, credit unions, securities brokerage firms, insurance companies, money market and other mutual funds, and other financial institutions operating in Capitol's market or elsewhere or providing similar services;

· The failure of assumptions underlying estimates for the allowance for loan losses and estimation of values of collateral or cash flow projections related to collateral-dependent loans;

· Volatility of rate-sensitive deposits;

· Operational risks, including data processing system failures or fraud;

· Liquidity risks;

· The ability to successfully acquire deposits for funding and the pricing thereof;

· The ability to successfully execute strategies to increase noninterest income;

· Changes in the economic environment, competition or other factors that may influence loan demand and repayment, deposit inflows and outflows, and the quality of the loan portfolio and loan and deposit pricing;

· The impact from liabilities arising from legal or administrative proceedings on the financial condition of Capitol;

· The current prohibition of Capitol's subsidiary banks to pay dividends to Capitol without prior written authorization from regulatory agencies;

· The current prohibition of Capitol's payment of cash dividends on its common stock and periodic payments on its trust-preferred securities without prior written regulatory authorization;

· Administrative or enforcement actions of banking regulators in connection with any material failure of Capitol or its subsidiary banks to comply with banking laws, rules or regulations or formal agreements with regulatory agencies;

· Capitol's compliance with the terms of its written agreement with the Federal Reserve Bank, amendments thereto or subsequent regulatory agreements;

· The continued availability of credit facilities provided by Federal Home Loan Banks to Capitol's banking subsidiaries;

Page 3 of 57

INDEX – Continued

PART I. FINANCIAL INFORMATION – Continued

Forward-Looking Statements – Continued

· The uncertainties of future depositor activity regarding potentially uninsured deposits;

· The possibility of the Federal Deposit Insurance Corporation (FDIC) assessing Capitol's banking subsidiaries for any cross-guaranty liability;

· Governmental monetary and fiscal policies, as well as legislative and regulatory changes, that may result in the imposition of costs and constraints on Capitol through higher FDIC insurance premiums, significant fluctuations in market interest rates, increases in capital requirements and operational limitations;

· Changes in general economic or industry conditions, nationally or in the communities in which Capitol conducts business;

· Changes in legislation or regulatory and accounting principles, policies, or guidelines affecting the business conducted by Capitol;

· The impact of possible future material impairment charges;

· Acts of war or terrorism;

· Capitol's ability to manage fluctuations in the value of its assets and liabilities and maintain sufficient capital and liquidity to support its operations;

· The concentration of Capitol's nonperforming assets by loan type in certain geographic regions and with affiliated borrowing groups;

· The risk of additional future losses if the proceeds Capitol receives upon the liquidation of assets are less than the carrying value of such assets;

· Restrictions or limitations on access to funds from subsidiaries and potential obligations to contribute additional capital to Capitol's subsidiaries, which may restrict its ability to make payments on its obligations;

· The availability and cost of capital and liquidity on favorable terms, if at all;

· The risk that the realization of deferred tax assets may not occur;

· The risk that Capitol may not be able to complete its various proposed divestitures, mergers and consolidations of certain of its subsidiary banks or, if completed, realize the anticipated benefits of the proposed mergers and/or consolidations;

· The costs, effects and impact of litigation, investigations, inquiries or similar matters, or adverse facts and developments related thereto;

· The risk that Capitol could have an "ownership change" under Section 382 of the Internal Revenue Code, which could impair its ability to timely and fully utilize its net operating losses for tax purposes and so-called built-in losses that may exist if such an "ownership change" occurs;

· Other factors and other information contained in this document and in other reports and filings that Capitol makes with the SEC under the Exchange Act, including, without limitation, under the caption "Risk Factors"; and

· Other economic, competitive, governmental, regulatory, and technical factors affecting Capitol's operations, products, services and prices.

Page 4 of 57

INDEX – Continued

PART I. FINANCIAL INFORMATION – Continued

Forward-Looking Statements – Continued

For a discussion of these and other risks that may cause actual results to differ from expectations, you should refer to the risk factors and other information in this Form 10-Q and Capitol's other periodic filings, including its 2010 Annual Report on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K, that Capitol files from time to time with the SEC. All written or oral forward-looking statements that are made by or are attributable to Capitol are expressly qualified by this cautionary notice.

Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual outcomes may vary materially from those indicated. All subsequent written or oral forward-looking statements attributable to Capitol or persons acting on its behalf are expressly qualified in their entirety by the foregoing factors. Investors and other interested parties are cautioned not to place undue reliance on such statements, which speak as of the date of such statements. Capitol undertakes no obligation to release publicly any revisions to these forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of unanticipated events.

|

Item 1.

|

Financial Statements (unaudited):

|

Page

|

|

Condensed consolidated balance sheets – March 31, 2011 and December 31, 2010.

|

6

|

|

|

Condensed consolidated statements of operations – Three months ended

March 31, 2011 and 2010.

|

7

|

|

|

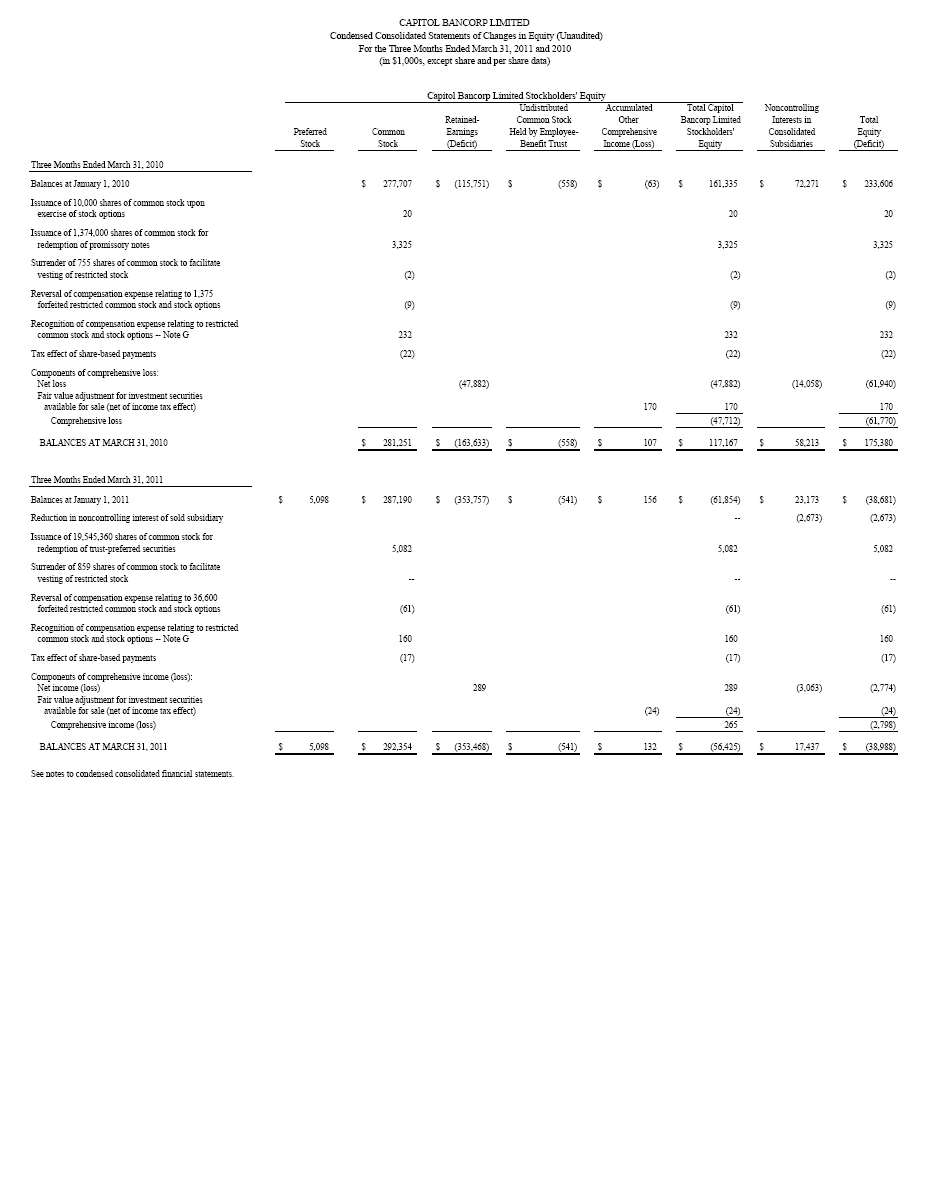

Condensed consolidated statements of changes in equity – Three months ended

March 31, 2011 and 2010.

|

8

|

|

|

Condensed consolidated statements of cash flows – Three months ended March 31,

2011 and 2010.

|

9

|

|

|

Notes to condensed consolidated financial statements.

|

10

|

|

|

Item 2.

|

Management's Discussion and Analysis of Financial Condition and Results of Operations.

|

30

|

|

Item 3.

|

Quantitative and Qualitative Disclosures About Market Risk.

|

49

|

|

Item 4.

|

Controls and Procedures.

|

49

|

|

PART II.

|

OTHER INFORMATION

|

|

|

Item 1.

|

Legal Proceedings.

|

50

|

|

Item 1A.

|

Risk Factors.

|

50

|

|

Item 2.

|

Unregistered Sales of Equity Securities and Use of Proceeds.

|

50

|

|

Item 3.

|

Defaults Upon Senior Securities.

|

50

|

|

Item 4.

|

[Removed and Reserved.]

|

50

|

|

Item 5.

|

Other Information.

|

50

|

|

Item 6.

|

Exhibits.

|

55

|

|

SIGNATURES

|

56

|

|

|

EXHIBIT INDEX

|

57

|

[The remainder of this page intentionally left blank]

Page 5 of 57

|

PART I, ITEM 1

|

|||||||||

|

CAPITOL BANCORP LIMITED

|

|||||||||

|

Condensed Consolidated Balance Sheets

|

|||||||||

|

As of March 31, 2011 and December 31, 2010

|

|||||||||

|

(in $1,000s, except share and per-share data)

|

|||||||||

|

(Unaudited)

|

|||||||||

|

March 31,

|

December 31,

|

||||||||

|

2011

|

2010

|

||||||||

|

ASSETS

|

|||||||||

|

Cash and due from banks

|

$ | 77,008 | $ | 56,709 | |||||

|

Money market and interest-bearing deposits

|

459,002 | 477,639 | |||||||

|

Federal funds sold

|

484 | 413 | |||||||

|

Cash and cash equivalents

|

536,494 | 534,761 | |||||||

|

Loans held for sale

|

1,710 | 6,900 | |||||||

|

Investment securities -- Note C:

|

|||||||||

|

Available for sale, carried at fair value

|

20,954 | 17,482 | |||||||

|

Held for long-term investment, carried at

|

|||||||||

|

amortized cost which approximates fair value

|

2,330 | 2,893 | |||||||

|

Total investment securities

|

23,284 | 20,375 | |||||||

|

Federal Home Loan Bank and Federal Reserve

|

|||||||||

|

Bank stock (carried on the basis of cost) -- Note C

|

17,811 | 17,001 | |||||||

|

Portfolio loans -- Note D:

|

|||||||||

|

Loans secured by real estate:

|

|||||||||

|

Commercial

|

1,346,584 | 1,374,791 | |||||||

|

Residential (including multi-family)

|

497,315 | 518,943 | |||||||

|

Construction, land development and other land

|

216,993 | 230,788 | |||||||

|

Total loans secured by real estate

|

2,060,892 | 2,124,522 | |||||||

|

Commercial and other business-purpose loans

|

350,873 | 375,968 | |||||||

|

Consumer

|

22,066 | 23,375 | |||||||

|

Other

|

16,890 | 15,133 | |||||||

|

Total portfolio loans

|

2,450,721 | 2,538,998 | |||||||

|

Less allowance for loan losses

|

(136,681 | ) | (144,985 | ) | |||||

|

Net portfolio loans

|

2,314,040 | 2,394,013 | |||||||

|

Premises and equipment

|

34,212 | 35,203 | |||||||

|

Accrued interest income

|

8,526 | 8,628 | |||||||

|

Other real estate owned

|

110,829 | 106,835 | |||||||

|

Other assets

|

15,555 | 17,965 | |||||||

|

Assets of discontinued operations -- Note E

|

134,501 | 398,533 | |||||||

|

TOTAL ASSETS

|

$ | 3,196,962 | $ | 3,540,214 | |||||

|

LIABILITIES AND EQUITY

|

|||||||||

|

LIABILITIES:

|

|||||||||

|

Deposits:

|

|||||||||

|

Noninterest-bearing

|

$ | 531,455 | $ | 500,809 | |||||

|

Interest-bearing

|

2,276,515 | 2,373,492 | |||||||

|

Total deposits

|

2,807,970 | 2,874,301 | |||||||

|

Debt obligations:

|

|||||||||

|

Notes payable and other borrowings

|

106,052 | 117,377 | |||||||

|

Subordinated debentures -- Note I

|

149,080 | 167,586 | |||||||

|

Total debt obligations

|

255,132 | 284,963 | |||||||

|

Accrued interest on deposits and other liabilities

|

48,049 | 50,271 | |||||||

|

Liabilities of discontinued operations -- Note E

|

124,799 | 369,360 | |||||||

|

Total liabilities

|

3,235,950 | 3,578,895 | |||||||

|

EQUITY:

|

|||||||||

|

Capitol Bancorp Limited stockholders' equity -- Notes G and L:

|

|||||||||

|

Preferred stock (Series A), 700,000 shares authorized

|

|||||||||

|

($100 per-share liquidation preference); 50,980 shares

|

|||||||||

|

issued and outstanding

|

5,098 | ||||||||

|

Preferred stock (for potential future issuance),

|

|||||||||

|

19,300,000 shares authorized (none issued and outstanding)

|

-- | -- | |||||||

|

Common stock, no par value, 1,500,000,000 shares authorized;

|

|||||||||

| issued and outstanding: 2011 - 41,122,757 shares | |||||||||

| 2010 - 21,614,856 shares | 292,354 | 287,190 | |||||||

|

Retained-earnings deficit

|

(353,468 | ) | (353,757 | ) | |||||

|

Undistributed common stock held by employee-benefit trust

|

(541 | ) | (541 | ) | |||||

|

Fair value adjustment (net of tax effect) for investment securities

|

|||||||||

|

available for sale (accumulated other comprehensive income)

|

132 | 156 | |||||||

|

Total Capitol Bancorp Limited stockholders' equity deficit

|

(56,425 | ) | (61,854 | ) | |||||

|

Noncontrolling interests in consolidated subsidiaries

|

17,437 | 23,173 | |||||||

|

Total equity deficit

|

(38,988 | ) | (38,681 | ) | |||||

|

TOTAL LIABILITIES AND EQUITY

|

$ | 3,196,962 | $ | 3,540,214 | |||||

|

See notes to condensed consolidated financial statements.

|

|||||||||

Page 6 of 57

|

CAPITOL BANCORP LIMITED

|

||||||||

|

Condensed Consolidated Statements of Operations (Unaudited)

|

||||||||

|

For the Three Months Ended March 31, 2011 and 2010

|

||||||||

|

(in $1,000s, except per share data)

|

||||||||

|

|

||||||||

|

2011

|

2010

|

|||||||

|

Interest income:

|

||||||||

|

Portfolio loans (including fees)

|

$ | 34,792 | $ | 41,796 | ||||

|

Loans held for sale

|

29 | 60 | ||||||

|

Taxable investment securities

|

54 | 222 | ||||||

|

Federal funds sold

|

2 | 5 | ||||||

|

Other

|

454 | 485 | ||||||

|

Total interest income

|

35,331 | 42,568 | ||||||

|

Interest expense:

|

||||||||

|

Deposits

|

8,027 | 13,300 | ||||||

|

Debt obligations and other

|

3,113 | 4,428 | ||||||

|

Total interest expense

|

11,140 | 17,728 | ||||||

|

Net interest income

|

24,191 | 24,840 | ||||||

|

Provision for loan losses -- Note D

|

13,467 | 47,364 | ||||||

|

Net interest income (deficiency) after

|

||||||||

|

provision for loan losses

|

10,724 | (22,524 | ) | |||||

|

Noninterest income:

|

||||||||

|

Service charges on deposit accounts

|

905 | 978 | ||||||

|

Trust and wealth-management revenue

|

944 | 1,152 | ||||||

|

Fees from origination of non-portfolio residential

|

||||||||

|

mortgage loans

|

268 | 382 | ||||||

|

Gain on sale of government-guaranteed loans

|

527 | 113 | ||||||

|

Gain on exchange of trust-preferred securities for

|

||||||||

|

common stock -- Note I

|

16,861 | -- | ||||||

|

Gain on exchange of promissory notes for common

|

||||||||

|

stock

|

-- | 1,255 | ||||||

|

Realized gain on sale of investment securities available

|

||||||||

|

for sale

|

-- | 14 | ||||||

|

Other

|

1,887 | 2,330 | ||||||

|

Total noninterest income

|

21,392 | 6,224 | ||||||

|

Noninterest expense:

|

||||||||

|

Salaries and employee benefits

|

15,529 | 18,223 | ||||||

|

Occupancy

|

3,612 | 3,751 | ||||||

|

Equipment rent, depreciation and maintenance

|

2,187 | 2,669 | ||||||

|

Costs associated with foreclosed properties and other

|

||||||||

|

real estate owned

|

7,497 | 11,593 | ||||||

|

FDIC insurance premiums and other regulatory fees

|

3,296 | 4,134 | ||||||

|

Other

|

7,800 | 6,691 | ||||||

|

Total noninterest expense

|

39,921 | 47,061 | ||||||

|

Loss before income tax benefit

|

(7,805 | ) | (63,361 | ) | ||||

|

Income tax benefit

|

(2,135 | ) | (482 | ) | ||||

|

Loss from continuing operations

|

(5,670 | ) | (62,879 | ) | ||||

|

Discontinued operations -- Note E:

|

||||||||

|

Income from operations of bank subsidiaries sold

|

16 | 1,533 | ||||||

|

Gain on sale of bank subsidiaries

|

4,368 | -- | ||||||

|

Less income tax expense

|

1,488 | 594 | ||||||

|

Income from discontinued operations

|

2,896 | 939 | ||||||

|

NET LOSS

|

(2,774 | ) | (61,940 | ) | ||||

|

Net losses attributable to noncontrolling interests in

|

||||||||

|

consolidated subsidiaries

|

3,063 | 14,058 | ||||||

|

NET INCOME (LOSS) ATTRIBUTABLE TO CAPITOL

|

||||||||

|

BANCORP LIMITED

|

$ | 289 | $ | (47,882 | ) | |||

|

NET INCOME (LOSS) PER COMMON SHARE ATTRIBUTABLE

|

||||||||

|

TO CAPITOL BANCORP LIMITED -- Note H

|

$ | 0.01 | $ | (2.75 | ) | |||

|

See notes to condensed consolidated financial statements.

|

||||||||

Page 7 of 57

Page 8 of 57

|

CAPITOL BANCORP LTD.

|

||||||||

|

Condensed Consolidated Statements of Cash Flows (Unaudited)

|

||||||||

|

For the Three Months Ended March 31, 2011 and 2010

|

||||||||

|

(in $1,000s)

|

||||||||

|

2011

|

2010

|

|||||||

|

OPERATING ACTIVITIES

|

||||||||

|

Net loss

|

$ | (2,774 | ) | $ | (61,940 | ) | ||

|

Adjustments to reconcile net loss to net cash provided

|

||||||||

|

by operating activities (including discontinued operations):

|

||||||||

|

Provision for loan losses

|

13,961 | 50,100 | ||||||

|

Depreciation of premises and equipment

|

1,597 | 2,199 | ||||||

|

Amortization of intangibles

|

-- | 61 | ||||||

|

Net amortization of investment security premiums

|

3 | 266 | ||||||

|

Loss on sale of premises and equipment

|

4 | 1 | ||||||

|

Gain on sale of government-guaranteed loans

|

(786 | ) | (462 | ) | ||||

|

Gain on sale of bank subsidiaries

|

(4,368 | ) | -- | |||||

|

Gain on debt extinguishment

|

(16,861 | ) | (1,255 | ) | ||||

|

Realized gain on sale of investment securities available for sale

|

-- | (14 | ) | |||||

|

Loss on sale of other real estate owned

|

134 | 1,774 | ||||||

|

Write-down of other real estate owned

|

4,223 | 8,620 | ||||||

|

Amortization of issuance costs of subordinated debentures

|

25 | 37 | ||||||

|

Share-based compensation expense

|

99 | 223 | ||||||

|

Deferred income tax credit

|

(230 | ) | (267 | ) | ||||

|

Valuation allowance for deferred income tax assets

|

-- | 283 | ||||||

|

Originations and purchases of loans held for sale

|

(9,516 | ) | (29,344 | ) | ||||

|

Proceeds from sales of loans held for sale

|

14,847 | 38,598 | ||||||

|

Decrease in accrued interest income and other assets

|

17,262 | 8,720 | ||||||

|

Increase (decrease) in accrued interest expense on deposits and

|

||||||||

|

other liabilities

|

1,187 | (2,264 | ) | |||||

|

NET CASH PROVIDED BY OPERATING ACTIVITIES

|

18,807 | 15,336 | ||||||

|

INVESTING ACTIVITIES

|

||||||||

|

Proceeds from sales of investment securities available for sale

|

488 | 23,664 | ||||||

|

Proceeds from calls, prepayments and maturities of investment

|

||||||||

|

securities

|

6,766 | 7,164 | ||||||

|

Purchases of investment securities

|

(10,265 | ) | (2,307 | ) | ||||

|

Redemption of Federal Home Loan Bank stock by issuer

|

42 | 225 | ||||||

|

Purchase of Federal Home Loan Bank stock

|

(849 | ) | (87 | ) | ||||

|

Net decrease in portfolio loans

|

40,531 | 66,679 | ||||||

|

Proceeds from sales of government-guaranteed loans

|

11,628 | 10,570 | ||||||

|

Proceeds from sales of premises and equipment

|

50 | 112 | ||||||

|

Purchases of premises and equipment

|

(592 | ) | (254 | ) | ||||

|

Proceeds from sale of bank subsidiaries

|

8,869 | -- | ||||||

|

Payments received on other real estate owned

|

14 | -- | ||||||

|

Proceeds from sales of other real estate owned

|

7,988 | 11,605 | ||||||

|

NET CASH PROVIDED BY INVESTING ACTIVITIES

|

64,670 | 117,371 | ||||||

|

FINANCING ACTIVITIES

|

||||||||

|

Net increase in demand deposits, NOW accounts and savings accounts

|

42,353 | 37,607 | ||||||

|

Net increase (decrease) in certificates of deposit

|

(112,350 | ) | 6,121 | |||||

|

Net borrowings from debt obligations

|

425 | 56 | ||||||

|

Proceeds from Federal Home Loan Bank borrowings

|

91,350 | 271,380 | ||||||

|

Payments on Federal Home Loan Bank borrowings

|

(103,250 | ) | (317,135 | ) | ||||

|

Net proceeds from issuance of common stock

|

-- | 20 | ||||||

|

Tax effect of share-based payments

|

(17 | ) | (22 | ) | ||||

|

NET CASH USED BY FINANCING ACTIVITIES

|

(81,489 | ) | (1,973 | ) | ||||

|

INCREASE IN CASH AND CASH EQUIVALENTS

|

1,988 | 130,734 | ||||||

|

Change in cash and cash equivalents of discontinued operations

|

(255 | ) | (28,947 | ) | ||||

|

Cash and cash equivalents at beginning of period

|

534,761 | 667,881 | ||||||

|

CASH AND CASH EQUIVALENTS AT END OF PERIOD

|

$ | 536,494 | $ | 769,668 | ||||

|

Supplemental disclosures:

|

||||||||

|

Cash paid during the period for interest on deposits and debt obligations

|

$ | 11,914 | $ | 21,387 | ||||

|

Transfers of loans to other real estate owned

|

17,671 | 20,194 | ||||||

|

Surrender of common stock to facilitate vesting of restricted stock

|

-- | 2 | ||||||

| Exchange of common stock for redemption of debt | 5,082 | 3,325 | ||||||

|

See notes to condensed consolidated financial statements.

|

||||||||

Page 9 of 57

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

CAPITOL BANCORP LIMITED

Note A – Basis of Presentation

The accompanying unaudited condensed consolidated financial statements of Capitol Bancorp Limited (Capitol or the Corporation) have been prepared in accordance with generally accepted accounting principles for interim financial information and with the instructions for Form 10-Q. Accordingly, they do not include all information and footnotes necessary for a fair presentation of consolidated financial position, results of operations and cash flows in conformity with accounting principles generally accepted in the United States of America.

The condensed consolidated financial statements do, however, include all adjustments of a normal recurring nature (in accordance with Rule 10-01(b)(8) of Regulation S-X) which Capitol considers necessary for a fair presentation of the interim periods.

The results of operations for the period ended March 31, 2011 are not necessarily indicative of the results to be expected for the year ending December 31, 2011.

The consolidated balance sheet as of December 31, 2010 was derived from audited consolidated financial statements as of that date. Certain 2010 amounts have been reclassified to conform to the 2011 presentation.

Capitol's ability to continue to operate as a going concern is contingent upon a number of factors which are discussed on page 41 of this document, as well as a variety of risk factors discussed elsewhere in this document and Capitol's other filings with the SEC. Capitol's auditors included a going concern qualification in the most recent report on the Corporation's audited consolidated financial statements as of December 31, 2010.

Note B – Accounting Standards Updates

In January 2010, an accounting standards update regarding fair value measurements and disclosures was issued to require more robust disclosures about (1) different classes of assets and liabilities measured at fair value, (2) valuation techniques and inputs used, (3) the activity in Level 3 fair-value measurements and (4) the transfers between Levels 1, 2, and 3 of fair-value estimates. The new disclosures became effective for the Corporation beginning January 1, 2010, except for the disclosures about purchases, sales, issuances and settlements in the rollforward of activity in Level 3 fair-value measurements which became effective beginning January 1, 2011. These new disclosures did not have a material effect on the Corporation's consolidated financial statements upon implementation.

In July 2010, an accounting standards update was issued which requires significant new disclosures on a disaggregated basis about the allowance for loan losses and the credit quality of loans. Under this standards update, a rollforward of the allowance for loan losses with the ending balance further disaggregated on the basis of the impairment methods used to establish loss estimates, along with the related ending loan balances and significant purchases and sales of loans during the period are to be disclosed by portfolio segment or classification used for reporting purposes. Additional disclosures are required by class of loan, including credit quality, aging of past-due loans, nonaccrual status and impairment information. Disclosure of the nature and extent of troubled debt restructurings that occur during the period and their effect on the allowance for loan losses, as well as the effect on the allowance regarding troubled debt restructurings that occur within the prior 12 months that defaulted during the current reporting period, will also be required. The disclosures are to be presented at the level of disaggregation that management uses when assessing and monitoring the loan portfolio's risk and performance.

The majority of the disclosures under this new guidance, which are required as of the end of a reporting period, were first implemented in 2010 and are set forth in Note D. The disclosures about activity that occurs during a reporting period, except for the disclosures related to troubled debt restructurings which were further delayed as noted below, became effective January 1, 2011 and did not have an effect on the Corporation's consolidated financial statements upon implementation except for expanded disclosures therein as set forth in Note D.

Page 10 of 57

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

CAPITOL BANCORP LIMITED – Continued

Note B – Accounting Standards Updates – Continued

In April 2011, an accounting standards update was issued clarifying what constitutes a troubled debt restructuring. When performing the evaluation of whether a loan modification or restructuring constitutes a troubled debt restructuring, a creditor must separately conclude that both of the following exist: (1) the modification constitutes a concession and (2) the debtor is experiencing financial difficulties as defined by the guidance. This guidance also clarifies that a creditor is precluded from using the borrower's effective interest rate test when performing this evaluation. For identification and disclosure purposes, this new guidance is effective beginning in the third quarter of 2011 and is to be applied retrospectively to modifications occurring on or after January 1, 2011 that remain outstanding at September 30, 2011. The guidance requires disclosure of the total recorded investment and allowance for loan losses for newly-identified troubled debt restructurings, based on the new guidance, as of September 30, 2011. The previously-deferred troubled debt restructuring activity related disclosures will be concurrently required. Management has not completed its analysis of this new guidance, however, does not expect the new guidance will have a material effect on the Corporation's consolidated financial statements upon implementation beginning in the third quarter of 2011.

In April 2011, an accounting standards update was issued to improve financial reporting of repurchase agreements and other agreements that both entitle and obligate a transferor to repurchase or redeem financial assets on substantially the agreed upon terms. This standard eliminates consideration of the transferor's ability to fulfill its contractual rights and obligations from the criteria, as well as related implementation guidance (i.e., that it possesses adequate collateral to fund substantially all the cost of purchasing replacement financial assets), in determining effective control, even in the event of default by the transferee. Other criteria applicable to the assessment of effective control are not changed by this new guidance. This new guidance will become effective January 1, 2012 and management does not expect it to have a material effect on the Corporation's results of operations or financial position upon implementation.

Note C – Investment Securities

Investments in Federal Home Loan Bank and Federal Reserve Bank stock are combined and classified separately from investment securities in the condensed consolidated balance sheet, are restricted and may only be resold to, or redeemed by, the issuer.

Investment securities consisted of the following (in $1,000s):

|

March 31, 2011

|

December 31, 2010(1)

|

|||||||||||||||

|

Amortized

Cost

|

Estimated

Fair

Value

|

Amortized

Cost

|

Estimated

Fair

Value

|

|||||||||||||

|

Available for sale:

|

||||||||||||||||

|

United States treasury

|

$ | 4,041 | $ | 4,045 | $ | 503 | $ | 506 | ||||||||

|

United States government agency

|

12,847 | 12,856 | 12,664 | 12,680 | ||||||||||||

|

Mortgage-backed

|

3,518 | 3,676 | 3,758 | 3,918 | ||||||||||||

|

Municipalities

|

370 | 377 | 371 | 378 | ||||||||||||

| 20,776 | 20,954 | 17,296 | 17,482 | |||||||||||||

|

Held for long-term investment:

|

||||||||||||||||

|

Capitol Development Bancorp

Limited III

|

457 | 457 | 463 | 463 | ||||||||||||

|

Corporate

|

1,873 | 1,873 | 2,430 | 2,430 | ||||||||||||

| 2,330 | 2,330 | 2,893 | 2,893 | |||||||||||||

| $ | 23,106 | $ | 23,284 | $ | 20,189 | $ | 20,375 | |||||||||

(1) Excludes amounts related to discontinued operations.

Page 11 of 57

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

CAPITOL BANCORP LIMITED – Continued

Note C – Investment Securities – Continued

Securities held for long-term investment are not subject to the classification and accounting rules relating to most typical investments. In addition, Capitol's corporate investments consist mostly of equity-method investments in non-public enterprises which, accordingly, are outside of the scope of accounting rules for most typical investments which often require use of estimated fair value. Those entities, which are primarily involved in making equity investments in or financing small businesses, use the fair value method of accounting in valuing their investment portfolios. Notwithstanding that those investments are outside the scope of such accounting rules, they are included in Capitol's investment securities for financial reporting purposes to summarize all such investment securities together for reporting purposes.

Gross unrealized gains and losses on investment securities available for sale were as follows (in $1,000s):

|

March 31, 2011

|

December 31, 2010

|

|||||||||||||||

|

Gains

|

Losses

|

Gains

|

Losses

|

|||||||||||||

|

United States treasury

|

$ | 4 | $ | 3 | ||||||||||||

|

United States government agency

|

15 | $ | 6 | 17 | $ | 1 | ||||||||||

|

Mortgage-backed

|

158 | 160 | ||||||||||||||

|

Municipalities

|

7 | 7 | ||||||||||||||

| $ | 184 | $ | 6 | $ | 187 | $ | 1 | |||||||||

The age of gross unrealized losses and carrying value (at estimated fair value) of securities available for sale are summarized below (in $1,000s):

|

March 31, 2011

|

December 31, 2010

|

|||||||||||||||

|

Unrealized

Loss

|

Carrying

Value

|

Unrealized

Loss

|

Carrying

Value

|

|||||||||||||

|

One year or less:

|

||||||||||||||||

|

United States government agency

|

$ | 6 | $ | 5,002 | $ | 1 | $ | 4,794 | ||||||||

Gross realized gains and losses from sales and maturities of investment securities were insignificant for the periods presented.

Scheduled maturities of investment securities held as of March 31, 2011 were as follows (in $1,000s):

|

Amortized

Cost

|

Estimated

Fair Value

|

|||||||

|

Due in one year or less

|

$ | 4,561 | $ | 4,567 | ||||

|

After one year, through five years

|

8,286 | 8,307 | ||||||

|

After five years, through ten years

|

690 | 717 | ||||||

|

After ten years

|

7,239 | 7,363 | ||||||

|

Securities held for long-term investment

|

||||||||

|

without stated maturities

|

2,330 | 2,330 | ||||||

| $ | 23,106 | $ | 23,284 | |||||

Page 12 of 57

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

CAPITOL BANCORP LIMITED – Continued

Note D – Loans

The following tables present the allowance for loan losses and the carrying amount of loans based on management's overall impairment evaluation methodology (in $1,000s), and should not be interpreted as an indication of future charge-offs:

|

March 31, 2011

|

||||||||||||||||||||||||||||

|

Secured by Real Estate

|

||||||||||||||||||||||||||||

|

Commercial

|

Residential

(including

multi-

family)

|

Construction,

Land

Development

and Other

Land

|

Commercial

and Other

Business-

Purpose

Loans

|

Consumer

|

Other

|

Total

|

||||||||||||||||||||||

|

Allowance for loan losses:

|

||||||||||||||||||||||||||||

|

Individually evaluated

|

||||||||||||||||||||||||||||

|

for impairment

|

$ | 10,946 | $ | 5,767 | $ | 5,792 | $ | 6,831 | $ | 29,336 | ||||||||||||||||||

|

Collectively evaluated

|

||||||||||||||||||||||||||||

|

for impairment

|

44,751 | 23,441 | 14,890 | 23,056 | $ | 1,031 | $ | 176 | 107,345 | |||||||||||||||||||

|

Total allowance for

|

||||||||||||||||||||||||||||

|

loan losses

|

$ | 55,697 | $ | 29,208 | $ | 20,682 | $ | 29,887 | $ | 1,031 | $ | 176 | $ | 136,681 | ||||||||||||||

|

Portfolio loans:

|

||||||||||||||||||||||||||||

|

Individually evaluated

|

||||||||||||||||||||||||||||

|

for impairment

|

$ | 171,224 | $ | 59,005 | $ | 56,493 | $ | 24,780 | $ | 22 | $ | 311,524 | ||||||||||||||||

|

Collectively evaluated

|

||||||||||||||||||||||||||||

|

for impairment

|

1,175,360 | 438,310 | 160,500 | 326,093 | 22,044 | $ | 16,890 | 2,139,197 | ||||||||||||||||||||

|

Total portfolio loans

|

$ | 1,346,584 | $ | 497,315 | $ | 216,993 | $ | 350,873 | $ | 22,066 | $ | 16,890 | $ | 2,450,721 | ||||||||||||||

|

December 31, 2010

|

||||||||||||||||||||||||||||

|

Secured by Real Estate

|

||||||||||||||||||||||||||||

|

Commercial

|

Residential

(including

multi-

family)

|

Construction,

Land

Development

and Other

Land

|

Commercial

and Other

Business-

Purpose

Loans

|

Consumer

|

Other

|

Total

|

||||||||||||||||||||||

|

Allowance for loan losses:

|

||||||||||||||||||||||||||||

|

Individually evaluated

|

||||||||||||||||||||||||||||

|

for impairment

|

$ | 10,101 | $ | 5,828 | $ | 6,914 | $ | 6,108 | $ | 28,951 | ||||||||||||||||||

|

Collectively evaluated

|

||||||||||||||||||||||||||||

|

for impairment

|

44,322 | 33,200 | 14,201 | 23,278 | $ | 858 | $ | 175 | 116,034 | |||||||||||||||||||

|

Total allowance for

|

||||||||||||||||||||||||||||

|

loan losses

|

$ | 54,423 | $ | 39,028 | $ | 21,115 | $ | 29,386 | $ | 858 | $ | 175 | $ | 144,985 | ||||||||||||||

|

Portfolio loans:

|

||||||||||||||||||||||||||||

|

Individually evaluated

|

||||||||||||||||||||||||||||

|

for impairment

|

$ | 178,576 | $ | 57,923 | $ | 64,345 | $ | 26,914 | $ | 22 | $ | 327,780 | ||||||||||||||||

|

Collectively evaluated

|

||||||||||||||||||||||||||||

|

for impairment

|

1,196,215 | 461,020 | 166,443 | 349,054 | 23,353 | $ | 15,133 | 2,211,218 | ||||||||||||||||||||

|

Total portfolio loans

|

$ | 1,374,791 | $ | 518,943 | $ | 230,788 | $ | 375,968 | $ | 23,375 | $ | 15,133 | $ | 2,538,998 | ||||||||||||||

Page 13 of 57

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

CAPITOL BANCORP LIMITED – Continued

Note D – Loans – Continued

The allowance for loan losses is maintained at a level believed adequate by management to absorb potential losses inherent in the loan portfolio at the balance-sheet date. Management's determination of the adequacy of the allowance is an estimate based on evaluation of the portfolio (including potential impairment of individual loans and concentrations of credit), past loss experience, current economic conditions, volume, amount and composition of the loan portfolio and other factors. The allowance is increased by provisions for loan losses charged to operations and reduced by net charge-offs. The table below summarizes activity in the allowance for loan losses for the three months ended March 31, 2011 (in $1,000s) by loan type:

|

Secured by Real Estate

|

||||||||||||||||||||||||||||

|

Commercial

|

Residential

(including

multi-

family)

|

Construction,

Land

Development

and Other

Land

|

Commercial

and Other

Business-

Purpose

Loans

|

Consumer

|

Other

|

Total

|

||||||||||||||||||||||

|

Beginning balance

|

$ | 54,423 | $ | 39,028 | $ | 21,115 | $ | 29,386 | $ | 858 | $ | 175 | $ | 144,985 | ||||||||||||||

|

Acquired loan loss reserve

|

1,043 | 117 | 651 | 500 | 68 | 1 | 2,380 | |||||||||||||||||||||

|

Charge-offs

|

(8,753 | ) | (7,341 | ) | (8,434 | ) | (5,325 | ) | (223 | ) | (30,076 | ) | ||||||||||||||||

|

Recoveries

|

995 | 982 | 3,023 | 886 | 38 | 1 | 5,925 | |||||||||||||||||||||

|

Net charge-offs

|

(7,758 | ) | (6,359 | ) | (5,411 | ) | (4,439 | ) | (185 | ) | 1 | (24,151 | ) | |||||||||||||||

|

Provision for loan losses

|

7,989 | (3,578 | ) | 4,327 | 4,440 | 290 | (1 | ) | 13,467 | |||||||||||||||||||

|

Ending balance

|

$ | 55,697 | $ | 29,208 | $ | 20,682 | $ | 29,887 | $ | 1,031 | $ | 176 | $ | 136,681 | ||||||||||||||

[The remainder of this page intentionally left blank]

Page 14 of 57

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

CAPITOL BANCORP LIMITED – Continued

Note D – Loans – Continued

The table below summarizes activity in the allowance for loan losses (in $1,000s) and the ratio of net charge-offs to average portfolio loans outstanding:

|

Three Months Ended

March 31

|

||||||||

|

2011

|

2010(1)

|

|||||||

|

Allowance for loan losses at beginning of period

|

$ | 144,985 | $ | 129,310 | ||||

|

Allowance for loan losses of previously-discontinued

bank subsidiary

|

2,380 | -- | ||||||

|

Loans charged-off:

|

||||||||

|

Loans secured by real estate:

|

||||||||

|

Commercial

|

(8,753 | ) | (10,588 | ) | ||||

|

Residential (including multi-family)

|

(7,341 | ) | (12,126 | ) | ||||

|

Construction, land development and other land

|

(8,434 | ) | (13,777 | ) | ||||

|

Total loans secured by real estate

|

(24,528 | ) | (36,491 | ) | ||||

|

Commercial and other business-purpose loans

|

(5,325 | ) | (7,457 | ) | ||||

|

Consumer

|

(223 | ) | (157 | ) | ||||

|

Total charge-offs

|

(30,076 | ) | (44,105 | ) | ||||

|

Recoveries:

|

||||||||

|

Loans secured by real estate:

|

||||||||

|

Commercial

|

995 | 358 | ||||||

|

Residential (including multi-family)

|

982 | 108 | ||||||

|

Construction, land development and other land

|

3,023 | 1,301 | ||||||

|

Total loans secured by real estate

|

5,000 | 1,767 | ||||||

|

Commercial and other business-purpose loans

|

886 | 688 | ||||||

|

Consumer

|

38 | 19 | ||||||

|

Other

|

1 | -- | ||||||

|

Total recoveries

|

5,925 | 2,474 | ||||||

|

Net charge-offs

|

(24,151 | ) | (41,631 | ) | ||||

|

Additions to allowance charged to expense (provision

|

||||||||

|

for loan losses)

|

13,467 | 47,364 | ||||||

|

Allowance for loan losses at end of period

|

$ | 136,681 | $ | 135,043 | ||||

|

Average total portfolio loans for the period

|

$ | 2,558,053 | $ | 3,215,054 | ||||

|

Ratio of net charge-offs (annualized) to average

portfolio loans outstanding

|

3.78 | % | 5.18 | % | ||||

(1) Excludes amounts related to operations discontinued in 2010 and 2011.

Page 15 of 57

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

CAPITOL BANCORP LIMITED – Continued

Note D – Loans – Continued

Nonperforming loans (i.e., loans which are 90 days or more past due and still accruing interest and loans on nonaccrual status) and other nonperforming assets are summarized below (in $1,000s):

|

March 31,

2011

|

December 31,

2010(1)

|

|||||||

|

Nonaccrual loans:

|

||||||||

|

Loans secured by real estate:

|

||||||||

|

Commercial

|

$ | 146,095 | $ | 153,956 | ||||

|

Residential (including multi-family)

|

53,502 | 60,422 | ||||||

|

Construction, land development and other land

|

51,877 | 59,718 | ||||||

|

Total loans secured by real estate

|

251,474 | 274,096 | ||||||

|

Commercial and other business-purpose loans

|

30,141 | 30,660 | ||||||

|

Consumer

|

538 | 162 | ||||||

|

Total nonaccrual loans

|

282,153 | 304,918 | ||||||

|

Past due (>90 days) loans and accruing interest:

|

||||||||

|

Loans secured by real estate:

|

||||||||

|

Commercial

|

5,049 | 2,875 | ||||||

|

Residential (including multi-family)

|

688 | 1,484 | ||||||

|

Construction, land development and other land

|

2,374 | 2,380 | ||||||

|

Total loans secured by real estate

|

8,111 | 6,739 | ||||||

|

Commercial and other business-purpose loans

|

410 | 2,073 | ||||||

|

Consumer

|

19 | 279 | ||||||

|

Total past due loans

|

8,540 | 9,091 | ||||||

|

Total nonperforming loans

|

$ | 290,693 | $ | 314,009 | ||||

|

Real estate owned and other

repossessed assets

|

111,428 | 107,095 | ||||||

|

Total nonperforming assets

|

$ | 402,121 | $ | 421,104 | ||||

(1) Excludes amounts related to operations discontinued in 2010 and 2011.

[The remainder of this page intentionally left blank]

Page 16 of 57

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

CAPITOL BANCORP LIMITED – Continued

Note D – Loans – Continued

Impaired loans which do not have an allowance requirement include collateral-dependent loans for which direct write-downs have been made to the carrying amount of such loans and, accordingly, no additional allowance requirement or allocation is currently necessary.

Impaired loans are summarized in the following table (in $1,000s), based on loans which either have an allowance for loan losses recorded or no such allowance as of March 31, 2011:

|

Carrying

Value

|

Unpaid

Principal

Balance

|

Related

Allowance

for Loan

Losses

|

||||||||||

|

With an allowance recorded:

|

||||||||||||

|

Loans secured by real estate:

|

||||||||||||

|

Commercial

|

$ | 74,883 | $ | 84,957 | $ | 13,091 | ||||||

|

Residential (including multi-family)

|

28,796 | 30,529 | 7,870 | |||||||||

|

Construction, land development and other land

|

25,170 | 25,766 | 6,530 | |||||||||

|

Total loans secured by real estate

|

128,849 | 141,252 | 27,491 | |||||||||

|

Commercial and other business-purpose loans

|

19,720 | 21,607 | 10,364 | |||||||||

|

Consumer

|

520 | 550 | 121 | |||||||||

| 149,089 | 163,409 | 37,976 | ||||||||||

|

With no related allowance recorded:

|

||||||||||||

|

Loans secured by real estate:

|

||||||||||||

|

Commercial

|

114,794 | 150,893 | ||||||||||

|

Residential (including multi-family)

|

35,056 | 53,372 | ||||||||||

|

Construction, land development and other land

|

35,234 | 58,358 | ||||||||||

|

Total loans secured by real estate

|

185,084 | 262,623 | ||||||||||

|

Commercial and other business-purpose loans

|

13,944 | 21,701 | ||||||||||

|

Consumer

|

18 | 43 | ||||||||||

| 199,046 | 284,367 | |||||||||||

|

Total

|

$ | 348,135 | $ | 447,776 | $ | 37,976 | ||||||

Interest income is recorded on impaired loans if not on nonaccrual status, or may be recorded on a cash basis in some circumstances, if such payments are not credited to principal. For the three months ended March 31, 2011, the average recorded investment in impaired loans and interest income recorded on impaired loans were as follows (in $1,000s):

|

Average

|

Interest

|

|||||||

|

Recorded

|

Income

|

|||||||

|

Investment

|

Recorded

|

|||||||

|

Commercial

|

$ | 189,504 | $ | 558 | ||||

|

Residential (including multi-family)

|

67,160 | 150 | ||||||

|

Construction, land development and other land

|

63,893 | 52 | ||||||

|

Total loans secured by real estate

|

320,557 | 760 | ||||||

|

Commercial and other business-purpose loans

|

34,883 | 100 | ||||||

|

Consumer

|

371 | |||||||

|

Total

|

$ | 355,811 | $ | 860 | ||||

Page 17 of 57

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

CAPITOL BANCORP LIMITED – Continued

Note D – Loans – Continued

Impaired loans are summarized in the following table (in $1,000s), based on loans which either have an allowance for loan losses recorded or no such allowance as of December 31, 2010:

|

Carrying

Value

|

Unpaid

Principal

Balance

|

Related

Allowance

for Loan

Losses

|

||||||||||

|

With an allowance recorded:

|

||||||||||||

|

Loans secured by real estate:

|

||||||||||||

|

Commercial

|

$ | 81,800 | $ | 131,352 | $ | 12,977 | ||||||

|

Residential (including multi-family)

|

39,743 | 47,718 | 10,999 | |||||||||

|

Construction, land development and other land

|

27,150 | 51,117 | 8,554 | |||||||||

|

Total loans secured by real estate

|

148,693 | 230,187 | 32,530 | |||||||||

|

Commercial and other business-purpose loans

|

21,926 | 35,307 | 9,189 | |||||||||

|

Consumer

|

185 | 211 | 104 | |||||||||

| 170,804 | 265,705 | 41,823 | ||||||||||

|

With no related allowance recorded:

|

||||||||||||

|

Loans secured by real estate:

|

||||||||||||

|

Commercial

|

107,531 | 173,018 | ||||||||||

|

Residential (including multi-family)

|

30,724 | 51,005 | ||||||||||

|

Construction, land development and other land

|

40,232 | 64,807 | ||||||||||

|

Total loans secured by real estate

|

178,487 | 288,830 | ||||||||||

|

Commercial and other business-purpose loans

|

14,176 | 23,209 | ||||||||||

|

Consumer

|

18 | 42 | ||||||||||

| 192,681 | 312,081 | |||||||||||

|

Total

|

$ | 363,485 | $ | 577,786 | $ | 41,823 | ||||||

The following tables summarize the aging and amounts of past due loans (in $1,000s):

|

March 31, 2011

|

||||||||||||||||||||||||

|

Past Due Loans

|

Total

|

|||||||||||||||||||||||

|

(based on payment due dates)

|

Amount of

|

|||||||||||||||||||||||

|

Loans on

|

Loans More

|

Loans Either

|

||||||||||||||||||||||

|

More Than

|

Nonaccrual

|

Than 29 Days

|

Current or

|

|||||||||||||||||||||

|

29 Days,

|

More Than

|

Status

|

Past Due or on

|

Less Than

|

Total

|

|||||||||||||||||||

|

and Less Than

|

89 Days

|

(Generally, 90

|

Nonaccrual

|

30 Days

|

Portfolio

|

|||||||||||||||||||

|

90 Days

|

(Accruing)

|

Days or More)

|

Status

|

Past Due

|

Loans

|

|||||||||||||||||||

|

Loans secured by real estate:

|

||||||||||||||||||||||||

|

Commercial

|

$ | 23,853 | $ | 5,049 | $ | 146,095 | $ | 174,997 | $ | 1,171,587 | $ | 1,346,584 | ||||||||||||

|

Residential (including multi-

|

||||||||||||||||||||||||

|

family)

|

8,551 | 688 | 53,502 | 62,741 | 434,574 | 497,315 | ||||||||||||||||||

|

Construction, land development

|

||||||||||||||||||||||||

|

and other land

|

8,758 | 2,374 | 51,877 | 63,009 | 153,984 | 216,993 | ||||||||||||||||||

|

Total loans secured by real

estate

|

41,162 | 8,111 | 251,474 | 300,747 | 1,760,145 | 2,060,892 | ||||||||||||||||||

|

Commercial and other business-

|

||||||||||||||||||||||||

|

purpose loans

|

5,936 | 410 | 30,141 | 36,487 | 314,386 | 350,873 | ||||||||||||||||||

|

Consumer

|

555 | 19 | 538 | 1,112 | 20,954 | 22,066 | ||||||||||||||||||

|

Other

|

16,890 | 16,890 | ||||||||||||||||||||||

|

Total

|

$ | 47,653 | $ | 8,540 | $ | 282,153 | $ | 338,346 | $ | 2,112,375 | $ | 2,450,721 | ||||||||||||

Page 18 of 57

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

CAPITOL BANCORP LIMITED – Continued

Note D – Loans – Continued

|

December 31, 2010

|

||||||||||||||||||||||||

|

Past Due Loans

|

Total

|

|||||||||||||||||||||||

|

(based on payment due dates)

|

Amount of

|

|||||||||||||||||||||||

|

Loans on

|

Loans More

|

Loans Either

|

||||||||||||||||||||||

|

More Than

|

Nonaccrual

|

Than 29 Days

|

Current or

|

|||||||||||||||||||||

|

29 Days,

|

More Than

|

Status

|

Past Due or on

|

Less Than

|

Total

|

|||||||||||||||||||

|

and Less Than

|

89 Days

|

(Generally, 90

|

Nonaccrual

|

30 Days

|

Portfolio

|

|||||||||||||||||||

|

90 Days

|

(Accruing)

|

Days or More)

|

Status

|

Past Due

|

Loans

|

|||||||||||||||||||

|

Loans secured by real estate:

|

||||||||||||||||||||||||

|

Commercial

|

$ | 29,819 | $ | 2,875 | $ | 153,956 | $ | 186,650 | $ | 1,188,141 | $ | 1,374,791 | ||||||||||||

|

Residential (including multi-

|

||||||||||||||||||||||||

|

family)

|

12,470 | 1,484 | 60,422 | 74,376 | 444,567 | 518,943 | ||||||||||||||||||

|

Construction, land development

|

||||||||||||||||||||||||

|

and other land

|

6,467 | 2,380 | 59,718 | 68,565 | 162,223 | 230,788 | ||||||||||||||||||

|

Total loans secured by real

estate

|

48,756 | 6,739 | 274,096 | 329,591 | 1,794,931 | 2,124,522 | ||||||||||||||||||

|

Commercial and other business-

|

||||||||||||||||||||||||

|

purpose loans

|

9,689 | 2,073 | 30,660 | 42,422 | 333,546 | 375,968 | ||||||||||||||||||

|

Consumer

|

560 | 279 | 162 | 1,001 | 22,374 | 23,375 | ||||||||||||||||||

|

Other

|

15,133 | 15,133 | ||||||||||||||||||||||

|

Total

|

$ | 59,005 | $ | 9,091 | $ | 304,918 | $ | 373,014 | $ | 2,165,984 | $ | 2,538,998 | ||||||||||||

Capitol categorizes loans into risk categories based on relevant information about the ability of borrowers to service their debt obligations based on: current financial information, aging analysis, historical payment experience, credit documentation and public information, among other factors. Capitol analyzes loans individually by classifying the loans as to credit risk. This analysis generally includes all loans and is generally performed at least quarterly. Capitol uses the following definitions for its adversely-classified risk ratings:

Watch. Loans classified as watch have a potential weakness that deserves management's close attention. If not improved, those potential weaknesses may result in deterioration of the repayment prospects for the loan in the future.

Substandard. Loans classified as substandard are inadequately protected by the borrower's current net worth, paying capacity of the borrower or the fair value of collateral. Loans so classified have a well-defined weakness or weaknesses that jeopardize the liquidation of the debt obligation by the borrower. These are characterized by the reasonable possibility that some loss will be sustained if the deficiencies are not favorably resolved.

[The remainder of this page intentionally left blank]

Page 19 of 57

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

CAPITOL BANCORP LIMITED – Continued

Note D – Loans – Continued

Loans not meeting the preceding criteria that are analyzed individually as part of management's classification categories described on the preceding page are considered to be loans which are not adversely classified. Based on management's most recent analysis, the risk categories of loans are summarized as follows (in $1,000s):

|

March 31, 2011

|

||||||||||||||||

|

Loans

Not

Adversely

Classified

|

Adversely Classified Loans

|

Total

Portfolio

Loans

|

||||||||||||||

|

Watch

|

Substandard

|

|||||||||||||||

|

Loans secured by real estate:

|

||||||||||||||||

|

Commercial

|

$ | 969,754 | $ | 114,442 | $ | 262,388 | $ | 1,346,584 | ||||||||

|

Residential (including multi-family)

|

356,893 | 41,155 | 99,267 | 497,315 | ||||||||||||

|

Construction, land development and

|

||||||||||||||||

|

other land

|

112,691 | 25,146 | 79,156 | 216,993 | ||||||||||||

|

Total loans secured by real estate

|

1,439,338 | 180,743 | 440,811 | 2,060,892 | ||||||||||||

|

Commercial and other business-purpose

|

||||||||||||||||

|

loans

|

267,633 | 27,348 | 55,892 | 350,873 | ||||||||||||

|

Consumer

|

20,320 | 378 | 1,368 | 22,066 | ||||||||||||

|

Other

|

15,764 | 1,126 | 16,890 | |||||||||||||

|

Total

|

$ | 1,743,055 | $ | 209,595 | $ | 498,071 | $ | 2,450,721 | ||||||||

|

December 31, 2010

|

||||||||||||||||

|

Loans

Not

Adversely

Classified

|

Adversely Classified Loans

|

Total

Portfolio

Loans

|

||||||||||||||

|

Watch

|

Substandard

|

|||||||||||||||

|

Loans secured by real estate:

|

||||||||||||||||

|

Commercial

|

$ | 990,225 | $ | 118,619 | $ | 265,947 | $ | 1,374,791 | ||||||||

|

Residential (including multi-family)

|

377,046 | 42,157 | 99,740 | 518,943 | ||||||||||||

|

Construction, land development and

|

||||||||||||||||

|

other land

|

115,042 | 30,707 | 85,039 | 230,788 | ||||||||||||

|

Total loans secured by real estate

|

1,482,313 | 191,483 | 450,726 | 2,124,522 | ||||||||||||

|

Commercial and other business-purpose

|

||||||||||||||||

|

loans

|

278,739 | 32,220 | 65,009 | 375,968 | ||||||||||||

|

Consumer

|

21,602 | 1,028 | 745 | 23,375 | ||||||||||||

|

Other

|

13,565 | 1,568 | 15,133 | |||||||||||||

|

Total

|

$ | 1,796,219 | $ | 226,299 | $ | 516,480 | $ | 2,538,998 | ||||||||

Page 20 of 57

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

CAPITOL BANCORP LIMITED – Continued

Note E – Discontinued Operations

Through March 31, 2011, Capitol completed the following sales of bank subsidiaries (in $1,000s):

|

Sale

|

|||||||||

|

Date Sold

|

Proceeds

|

Gain

|

|||||||

|

Bank of Tucson – main office(1)

|

January 24, 2011

|

$ | 4,567 | $ | 4,186 | ||||

|

Bank of Fort Bend(2)

|

March 30, 2011

|

4,302 | 1,432 | ||||||

| $ | 8,869 | $ | 5,618 | ||||||

|

|

(1)

|

Previously a wholly-owned subsidiary of Capitol. Sale proceeds represent the net premium received from the

assumption of liabilities and acquisition of assets transaction.

|

|

(2)

|

Previously a majority-owned subsidiary of a bank-development subsidiary controlled by Capitol.

|

On April 19, 2011, the sale of Community Bank of Rowan was completed with aggregate proceeds of $4.8 million and an estimated loss of approximately $1.25 million, which has been reflected in Capitol's first quarter 2011 financial statements against the gain on sale of the above-mentioned bank subsidiaries.

Capitol's consolidated results of operations would not have been materially different if the sales of these banks had occurred at the beginning of the periods presented; however, such sales are reflected on that basis in the pro forma condensed consolidated financial statements on page 46 of this document.

The results of operations of Bank of Fort Bend, Bank of Tucson – main office and Community Bank of Rowan, together with the results of operations of Adams Dairy Bank, Bank of Belleville, Bank of San Francisco, Community Bank of Lincoln, Fort Collins Commerce Bank, Larimer Bank of Commerce, Loveland Bank of Commerce, Napa Community Bank, Ohio Commerce Bank, Southern Arizona Community Bank and USNY Bank which were sold in 2010, are classified as discontinued operations for the periods presented and include the following components (in $1,000s):

|

Three Months Ended

March 31

|

||||||||

|

2011

|

2010

|

|||||||

|

Interest income

|

$ | 1,830 | $ | 14,927 | ||||

|

Interest expense

|

427 | 3,305 | ||||||

|

Net interest income

|

1,403 | 11,622 | ||||||

|

Provision for loan losses

|

494 | 2,736 | ||||||

|

Net interest income after provision for

|

||||||||

|

loan losses

|

909 | 8,886 | ||||||

|

Noninterest income

|

441 | 1,163 | ||||||

|

Gain on sale of bank subsidiaries

|

4,368 | |||||||

|

Noninterest expense

|

1,334 | 8,516 | ||||||

|

Income before income taxes

|

4,384 | 1,533 | ||||||

|

Less income tax expense

|

1,488 | 594 | ||||||

|

Net income from discontinued operations

|

2,896 | 939 | ||||||

|

Net income attributable to noncontrolling

|

||||||||

|

interests in consolidated subsidiaries

|

(60 | ) | (126 | ) | ||||

|

Net income from discontinued operations

|

||||||||

|

attributable to Capitol Bancorp Limited

|

$ | 2,836 | $ | 813 | ||||

|

Net income from discontinued operations

|

||||||||

|

per common share attributable to

|

||||||||

|

Capitol Bancorp Limited

|

$ | 0.09 | $ | 0.05 | ||||

Page 21 of 57

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

CAPITOL BANCORP LIMITED – Continued

Note E – Discontinued Operations – Continued

Assets and liabilities of discontinued operations are summarized below (in $1,000s):

|

March 31,

2011

|

Dec 31,

2010

|

March 31,

2011

|

Dec 31,

2010

|

||||||||||||||

|

Assets:

|

Liabilities:

|

||||||||||||||||

|

Cash and cash equivalents

|

$ | 19,719 | $ | 86,747 |

Noninterest-bearing

|

||||||||||||

|

Investment securities

|

6,682 | 10,664 |

deposits

|

$ | 9,212 | $ | 84,840 | ||||||||||

|

Federal Home Loan Bank

|

Interest-bearing deposits

|

111,468 | 277,677 | ||||||||||||||

|

stock

|

1,065 | 1,912 |

Total deposits

|

120,680 | 362,517 | ||||||||||||

|

Portfolio loans

|

101,219 | 292,047 |

Other liabilities

|

4,119 | 6,843 | ||||||||||||

|

Less allowance for loan

|

|||||||||||||||||

|

losses

|

(1,628 | ) | (4,816 | ) | $ | 124,799 | $ | 369,360 | |||||||||

|

Net portfolio loans

|

99,591 | 287,231 | |||||||||||||||

|

Premises and equipment

|

2,667 | 4,169 | |||||||||||||||

|

Other real estate owned

|

2,099 | 2,226 | |||||||||||||||

|

Other assets

|

2,678 | 5,584 | |||||||||||||||

| $ | 134,501 | $ | 398,533 | ||||||||||||||

Note F – Fair Value

The following is a description of Capitol's valuation methodologies used to measure and disclose the fair values of its assets and liabilities on a recurring or nonrecurring basis:

|

|

Investment securities available for sale: Securities available for sale are recorded at fair value on a recurring basis. Fair value measurement is based on quoted prices, when available. If quoted prices are not available, fair values are measured using independent pricing models.

|

|

|

Mortgage loans held for sale: Mortgage loans held for sale are carried at the lower of aggregate cost or fair value and are measured on a nonrecurring basis. There were no mortgage loans held for sale written down to fair value at March 31, 2011. Fair value is based on independent quoted market prices, where applicable, or the prices for other whole mortgage loans with similar characteristics.

|

|

|

Loans: The Corporation does not record loans at fair value on a recurring basis. However, from time to time, nonrecurring fair value adjustments for collateral-dependent loans are recorded to reflect partial write-downs or specific reserves based on the observable market price, current appraised value of the collateral or other estimates of fair value.

|

|

|