| Vodafone Group Plc Annual Report on Form 20-F 2023 |

| Contents Strategic report 1 S A new roadmap for Vodafone 2 S About Vodafone 3 S Operating in a rapidly changing industry 4 S Key performance indicators 6 Chair’s message 7 Chief Executive’s statement and strategic roadmap 8 Mega trends 10 Stakeholder engagement 13 Our people strategy 16 Our financial performance 26 S Purpose, sustainability and responsible business 28 Our purpose 29 – Digital Society 30 – Inclusion for All 35 – Planet 39 Contribution to Sustainable Development Goals 40 Responsible business 40 – Protecting data 44 – Protecting people 47 – Business integrity 50 Non-financial information 51 Principal risk factors and uncertainties 57 – Long-term viability statement 58 – TCFD disclosure Governance 60 S Governance at a glance 62 Chair’s governance statement 64 Our Company purpose, values and culture 65 Our Board 68 Our governance structure 69 Our Executive Committee 70 Division of responsibilities 71 Board activities and principal decisions 73 Board effectiveness 74 Nominations and Governance Committee 77 Audit and Risk Committee 83 ESG Committee 85 Remuneration Committee 87 Remuneration Policy 93 Annual Report on Remuneration 107 US listing requirements 108 Directors’ report Welcome to our Annual Report on Form 20-F 2023 This constitutes the Annual Report on Form 20-F of Vodafone Group Plc (the ‘Company’) in accordance with the requirements of the US Securities and Exchange Commission (the ‘SEC’) for the year ended 31 March 2023 and is dated 21 June 2023. This document contains consolidated financial statements set out within the Company’s Annual Report in accordance with International Financial Reporting Standards (‘IFRS’) as issued by the International Accounting Standards Board (‘IASB’). The content of the Group’s website (www.vodafone.com) and any other website referenced in this document is not incorporated into this document and should not be considered to form part of this Annual Report on Form 20-F. Financials 110 Reporting on our financial performance 111 Directors’ statement of responsibility 113 Risk mitigation 119 Report of independent registered public accounting firm 123 Consolidated financial statements and notes 212 This page is intentionally left blank Other information 219 Non-GAAP measures 230 Shareholder information 236 History and development 236 Regulation 242 Form 20-F cross reference guide 245 Forward-looking statements 246 Definition of terms Exhibits Exhibit 2.3 Exhibit 2.4 Exhibit 2.6 Exhibit 4.3 Exhibit 4.20 Exhibit 4.21 Exhibit 4.25 Exhibit 4.26 Exhibit 4.27 Exhibit 4.28 Exhibit 4.29 Exhibit 12 Exhibit 13 Exhibit 15.1 Exhibit 99.1 Exhibit 99.2 |

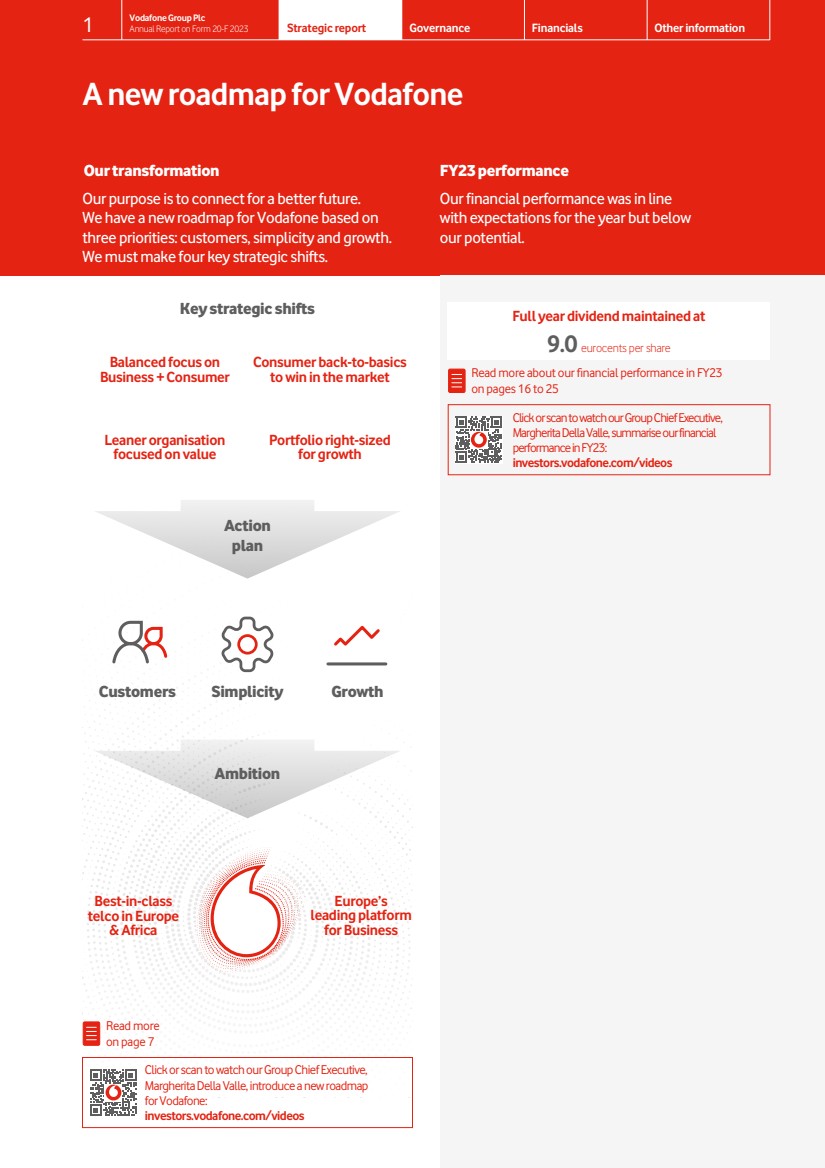

| A new roadmap for Vodafone Our transformation FY23 performance Full year dividend maintained at 9.0 eurocents per share Read more about our financial performance in FY23 on pages 16 to 25 Click or scan to watch our Group Chief Executive, Margherita Della Valle, summarise our financial performance in FY23: investors.vodafone.com/videos Our financial performance was in line with expectations for the year but below our potential. Our purpose is to connect for a better future. We have a new roadmap for Vodafone based on three priorities: customers, simplicity and growth. We must make four key strategic shifts. Read more on page 7 Click or scan to watch our Group Chief Executive, Margherita Della Valle, introduce a new roadmap forVodafone: investors.vodafone.com/videos Key strategic shifts Customers Simplicity Growth Action plan Best-in-class telco in Europe & Africa Europe’s leading platform for Business Balanced focus on Business + Consumer Consumer back-to-basics to win in the market Leaner organisation focused on value Portfolio right-sized for growth Ambition 1 Vodafone Group Plc Annual Report on Form 20-F 2023 Strategic report Governance Financials Other information |

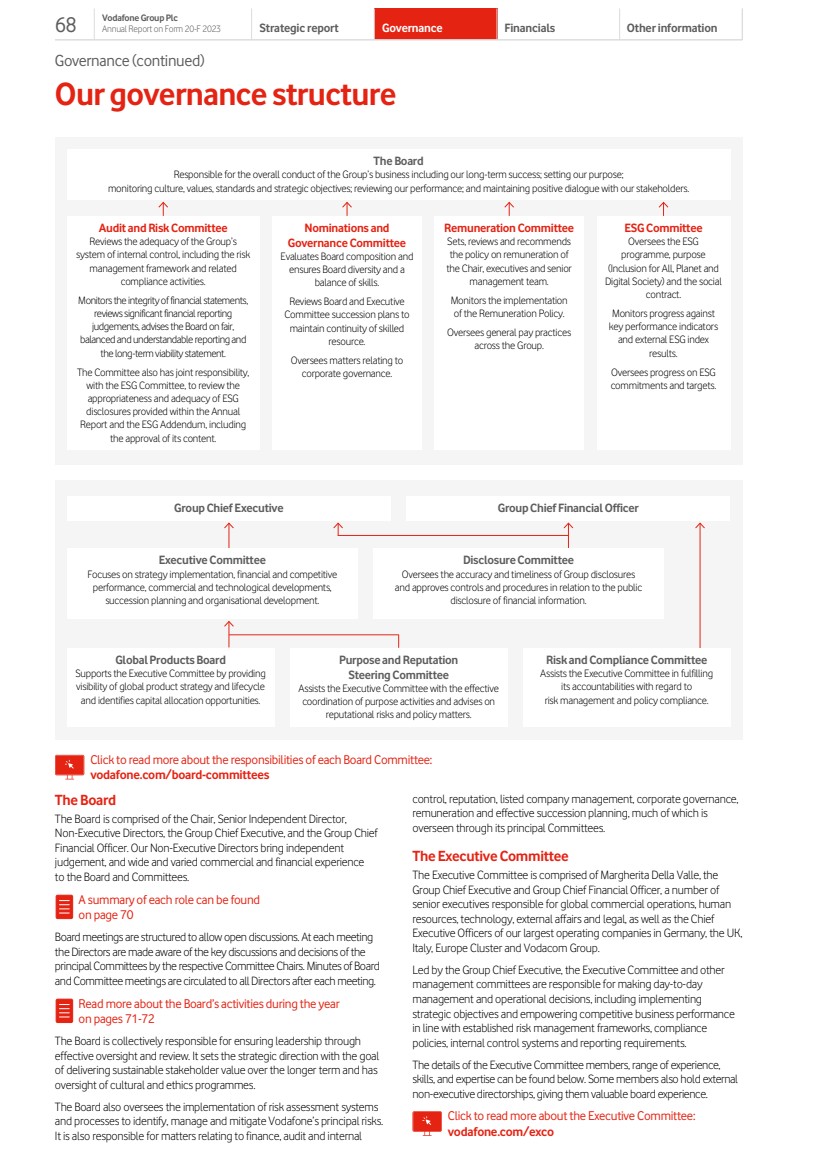

| Our business model About Vodafone How we govern We are a European and African telecommunications company which transforms the way our customers live and work through our innovation, technology, connectivity, platforms, products and services. Our business model is underpinned by our strong governance and risk management framework. Governance The Board held six scheduled meetings this year to discuss key strategic matters, our purpose and culture, our people and stakeholder interests. The Nominations and Governance Committee evaluates the composition and performance of the Board and ensures an appropriate balance of independence, skills, knowledge, experience and diversity. The Audit and Risk Committee provides effective governance over the appropriateness of financial reporting of the Group, including the adequacy of related disclosures, the performance of the internal audit function and the external auditor and oversight of the Group’s systems of internal control, risk management framework and compliance activities. The ESG Committee oversees our Environmental, Social and Governance (‘ESG’) programme, including our purpose pillars, sustainability and responsible business practices, and our contribution to the societies we operate in under our social contract. The Remuneration Committee advises the Board on policies for executive remuneration and reward packages for individual Executive Directors. The Committee also oversees general pay practices across the Group. Read more on pages 74 to 86 Click or scan to watch our Non-Executive Directors speak about their roles in short video interviews: investors.vodafone.com/videos Click or scan to watch our privacy and cyber experts explain how we protect customer data and our networks: investors.vodafone.com/videos Risk management Risks are not static and as the environment changes, so do risks – some diminish or increase, while new risks appear. We continuously review and improve our risk processes in order to ensure that the Company has the appropriate level of support in meeting its strategic objectives. Our risk framework clearly defines roles and responsibilities, and sets out a consistent end-to-end process for identifying and managing risks. We have embedded the risk framework across the Group as this allows us to take a holistic approach and to make meaningful comparisons. Our approach is continuously enhanced, enabling more dynamic risk detection, modelling of risk interconnectedness and the use of data, all of which are improving our risk visibility and our responses. Our Board oversees principal and emerging risks, which are reported to the various management committees and the Board throughout the year. Additionally, risk owners are invited to present in-depth reviews to ensure that risks are managed within the defined tolerance levels. Read more on pages 51 to 59 How we are structured and what we sell1 Our business is comprised of infrastructure assets, shared operations, growth platforms and retail and service operations. Our retail and service operations are split across three broad business lines: Europe Consumer, Vodafone Business and Africa Consumer. Core connectivity products and services in fixed and mobile account for the majority of our revenue. However, our portfolio also includes high return growth areas that leverage and complement our core connectivity business, such as digital services, the Internet of Things (‘IoT’) and financial services. We market and sell through digital and physical channels. Europe Consumer €19bn service revenue We provide a range of market leading mobile and fixed line connectivity services in our European markets. Our converged plans combine these offerings, providing simplicity and better value for our customers. Other value added services include our Consumer IoT propositions, as well as security and insurance products. Vodafone Business €10bn service revenue We serve private and public sector customers of all sizes with a broad range of connectivity services, supported by our dedicated global network. We have unique scale and capabilities, and are expanding our portfolio of products and services into growth areas such as unified communications, cloud & security, and IoT. Africa Consumer2 €6bn service revenue We provide a range of mobile services. The demand for mobile data is growing rapidly driven by the lack of fixed broadband access and by increased smartphone penetration. Together with Vodacom’s VodaPay super-app and the M-Pesa payment platform, we are the leading provider of financial services, as well as business and merchant services in Africa. Where we operate We operate mobile and fixed networks in 17 countries and have stakes in a further five countries through our joint ventures and associates. We also partner with mobile networks in 46 countries outside our footprint. Our portfolio of local markets is supported by corporate services and shared operations, which deliver benefits through scale and standardisation. Notes: 1. Performance across our markets is summarised on pages 16 to 22. 2. Including Turkey. 2 Vodafone Group Plc Annual Report on Form 20-F 2023 Strategic report Governance Financials Other information |

| Operating in a rapidly changing industry The long-term trends that are shaping our industry and driving new growth opportunities. Mega trends We are committed to maintaining good communications and building positive relationships with all of our stakeholders, as we see this as essential to strengthening our sustainable business. Our stakeholders Our customers 323m mobile customers1 28m broadband customers1 21m TV customers1 €45.7bn revenue across 19 operating markets2 Our people 104,000 employees and contractors €5.8bn benefits of job creation Our suppliers 9,000 suppliers €25bn spend, and €8.4bn capital additions Our local communities and non-governmental organisations (‘NGOs’) 98% network coverage recovered within days of earthquakes in Turkey €3m donated in contributions and in-kind services in response to the earthquakes in Turkey and surrounding areas Government and regulators €2.2bn total direct contribution across 62 markets in FY22 €9.9bn total tax and economic contribution in FY22 Our investors 1,000 interactions with institutional investors in FY23 €2.5bn paid in dividends in FY23 and €2.0bn interest paid in FY23 Read more on pages 10 to 12 Read more on pages 8 to 9 Notes: 1. Includes VodafoneZiggo and Safaricom. 2. Including Vodafone Hungary and Vodafone Ghana which were sold in January 2023 and February 2023 respectively. Hybrid Working Connected devices Adoption of cloud technology Digital and green transformation for the private and public sector Digital payments and financial services – Hybrid working is becoming a permanent feature of the modern working environment. – This requires continued investment in reliable, high-speed connections for both business and consumers. – Demand for connected devices, beyond smartphones, is growing rapidly. – The Internet of Things (‘IoT’) is expected to drive huge operational efficiencies, deliver real-time information, and can be employed in a broad range of use cases. – Large technology companies have invested heavily in advanced centralised data storage and processing capabilities that consumers can access remotely via cloud technology. – The cloud is increasingly utilised by businesses and consumers as a more efficient way of sharing capacity and services. – The European Union has launched a series of funding programmes under the banner ‘NextGenerationEU’, including a Recovery and Resilience facility which will also support the European Commission’s digital transformation agenda. – Companies are also increasingly looking to digitalise their operations to become more efficient and reduce their environmental impact. – The trend towards more digital forms of payment is growing, with a broader range of financial services now being delivered through apps and online. – In Africa, the growth in smartphone penetration is allowing consumers access to digital financial services for the first time. Digital services investor briefing Vodafone Business investor briefing Vodafone Business investor briefing Social contract investor briefing Digital services investor briefing 3 Vodafone Group Plc Annual Report on Form 20-F 2023 Strategic report Governance Financials Other information |

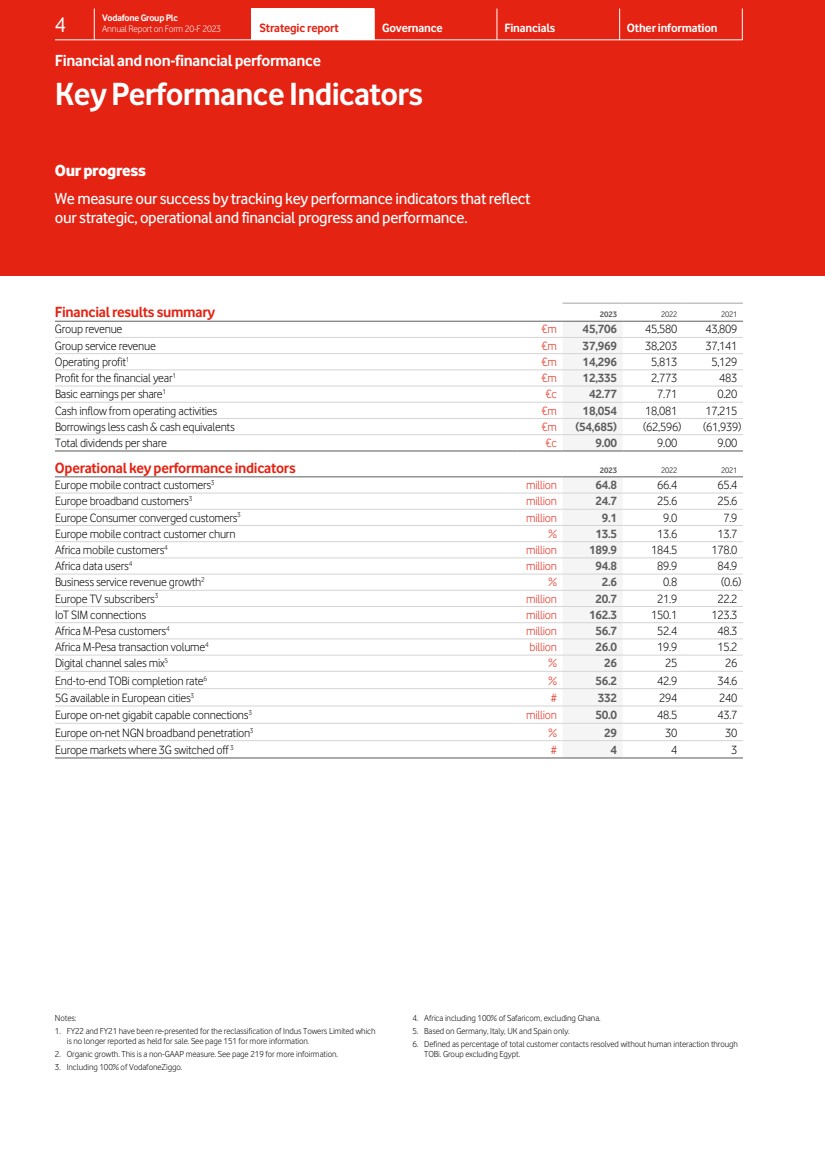

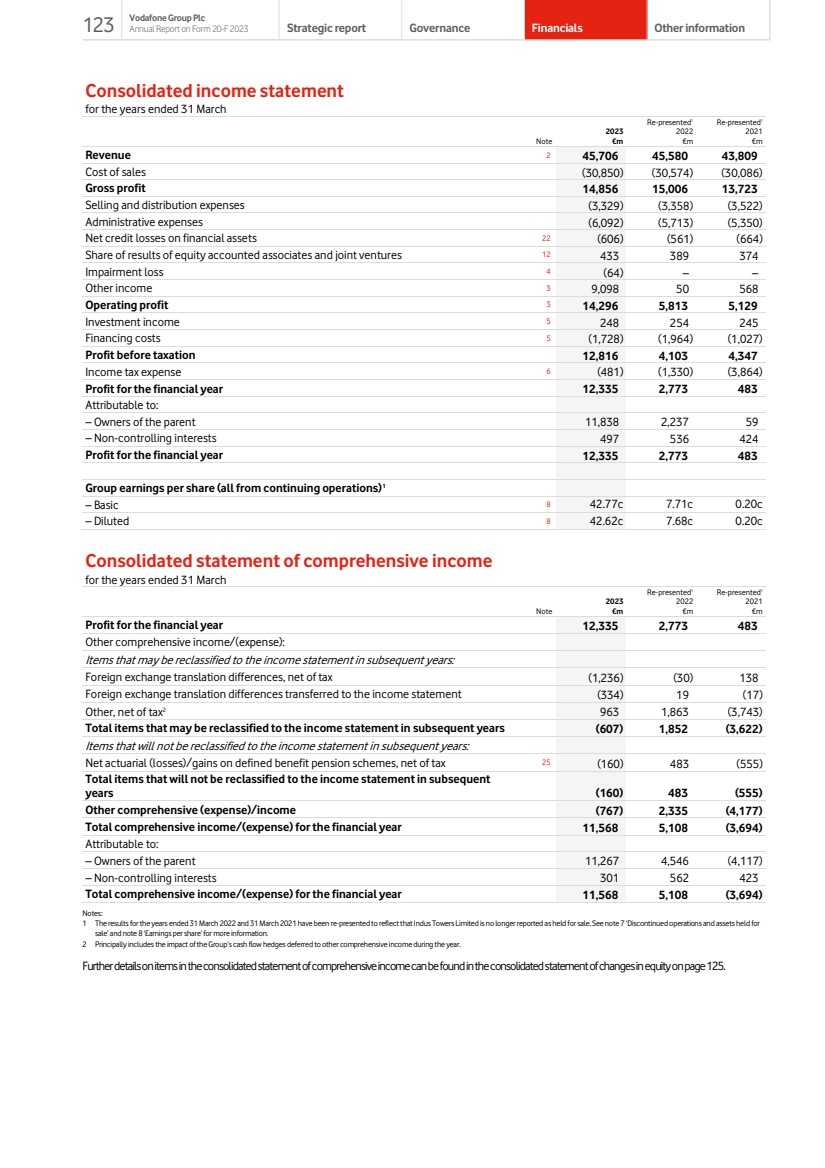

| Our progress Key Performance Indicators Financial and non-financial performance We measure our success by tracking key performance indicators that reflect our strategic, operational and financial progress and performance. Financial results summary 2023 2022 2021 Group revenue €m 45,706 45,580 43,809 Group service revenue €m 37,969 38,203 37,141 Operating profit1 €m 14,296 5,813 5,129 Profit for the financial year1 €m 12,335 2,773 483 Basic earnings per share1 €c 42.77 7.71 0.20 Cash inflow from operating activities €m 18,054 18,081 17,215 Borrowings less cash & cash equivalents €m (54,685) (62,596) (61,939) Total dividends per share €c 9.00 9.00 9.00 Operational key performance indicators 2023 2022 2021 Europe mobile contract customers3 million 64.8 66.4 65.4 Europe broadband customers3 million 24.7 25.6 25.6 Europe Consumer converged customers3 million 9.1 9.0 7.9 Europe mobile contract customer churn % 13.5 13.6 13.7 Africa mobile customers4 million 189.9 184.5 178.0 Africa data users4 million 94.8 89.9 84.9 Business service revenue growth2 % 2.6 0.8 (0.6) Europe TV subscribers3 million 20.7 21.9 22.2 IoT SIM connections million 162.3 150.1 123.3 Africa M-Pesa customers4 million 56.7 52.4 48.3 Africa M-Pesa transaction volume4 billion 26.0 19.9 15.2 Digital channel sales mix5 % 26 25 26 End-to-end TOBi completion rate6 % 56.2 42.9 34.6 5G available in European cities3 # 332 294 240 Europe on-net gigabit capable connections3 million 50.0 48.5 43.7 Europe on-net NGN broadband penetration3 % 29 30 30 Europe markets where 3G switched off 3 # 4 4 3 Notes: 1. FY22 and FY21 have been re-presented for the reclassification of Indus Towers Limited which is no longer reported as held for sale. See page 151 for more information. 2. Organic growth. This is a non-GAAP measure. See page 219 for more infoirmation. 3. Including 100% of VodafoneZiggo. 4. Africa including 100% of Safaricom, excluding Ghana. 5. Based on Germany, Italy, UK and Spain only. 6. Defined as percentage of total customer contacts resolved without human interaction through TOBi. Group excluding Egypt. 4 Vodafone Group Plc Annual Report on Form 20-F 2023 Strategic report Governance Financials Other information |

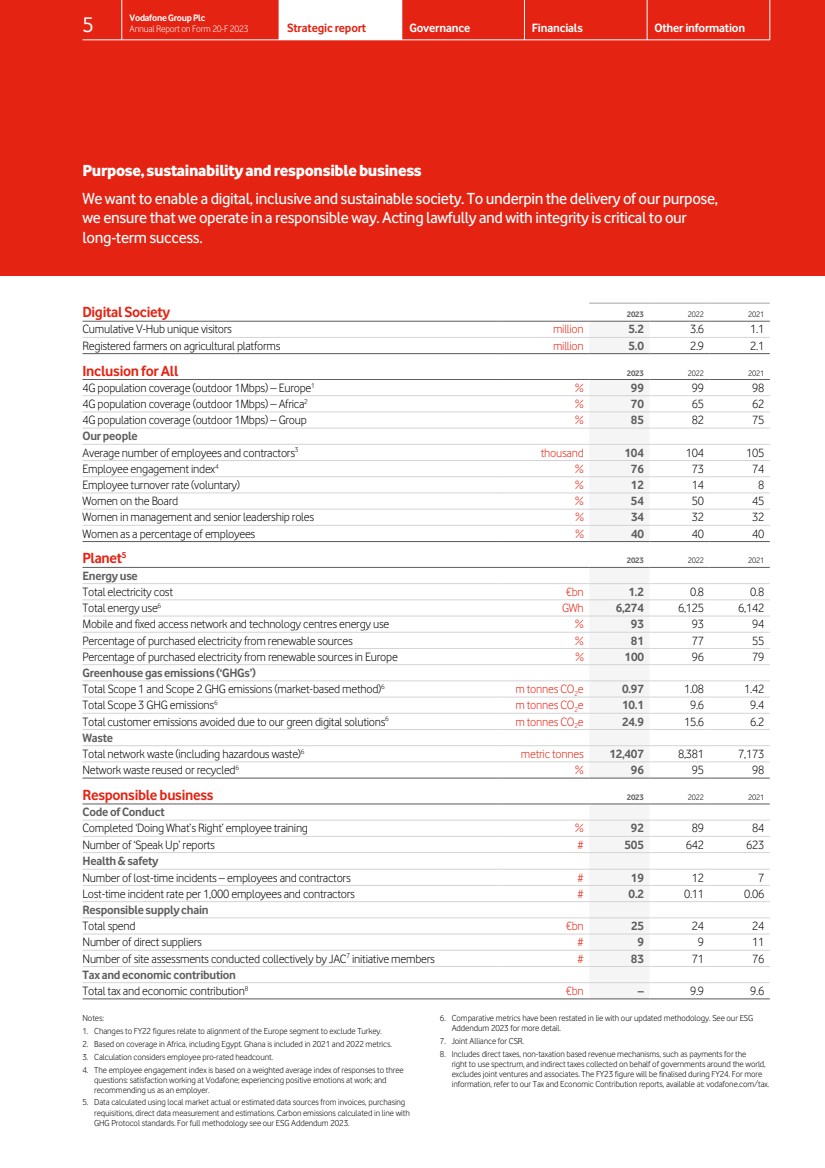

| Purpose, sustainability and responsible business We want to enable a digital, inclusive and sustainable society. To underpin the delivery of our purpose, we ensure that we operate in a responsible way. Acting lawfully and with integrity is critical to our long-term success. Digital Society 2023 2022 2021 Cumulative V-Hub unique visitors million 5.2 3.6 1.1 Registered farmers on agricultural platforms million 5.0 2.9 2.1 Inclusion for All 2023 2022 2021 4G population coverage (outdoor 1Mbps) – Europe1 % 99 99 98 4G population coverage (outdoor 1Mbps) – Africa2 % 70 65 62 4G population coverage (outdoor 1Mbps) – Group % 85 82 75 Our people Average number of employees and contractors3 thousand 104 104 105 Employee engagement index4 % 76 73 74 Employee turnover rate (voluntary) % 12 14 8 Women on the Board % 54 50 45 Women in management and senior leadership roles % 34 32 32 Women as a percentage of employees % 40 40 40 Planet5 2023 2022 2021 Energy use Total electricity cost €bn 1.2 0.8 0.8 Total energy use6 GWh 6,274 6,125 6,142 Mobile and fixed access network and technology centres energy use % 93 93 94 Percentage of purchased electricity from renewable sources % 81 77 55 Percentage of purchased electricity from renewable sources in Europe % 100 96 79 Greenhouse gas emissions (‘GHGs’) Total Scope 1 and Scope 2 GHG emissions (market-based method)6 m tonnes CO2e 0.97 1.08 1.42 Total Scope 3 GHG emissions6 m tonnes CO2e 10.1 9.6 9.4 Total customer emissions avoided due to our green digital solutions6 m tonnes CO2e 24.9 15.6 6.2 Waste Total network waste (including hazardous waste)6 metric tonnes 12,407 8,381 7,173 Network waste reused or recycled6 % 96 95 98 Responsible business 2023 2022 2021 Code of Conduct Completed ‘Doing What’s Right’ employee training % 92 89 84 Number of ‘Speak Up’ reports # 505 642 623 Health & safety Number of lost-time incidents – employees and contractors # 19 12 7 Lost-time incident rate per 1,000 employees and contractors # 0.2 0.11 0.06 Responsible supply chain Total spend €bn 25 24 24 Number of direct suppliers # 9 9 11 Number of site assessments conducted collectively by JAC7 initiative members # 83 71 76 Tax and economic contribution Total tax and economic contribution8 €bn – 9.9 9.6 Notes: 1. Changes to FY22 figures relate to alignment of the Europe segment to exclude Turkey. 2. Based on coverage in Africa, including Egypt. Ghana is included in 2021 and 2022 metrics. 3. Calculation considers employee pro-rated headcount. 4. The employee engagement index is based on a weighted average index of responses to three questions: satisfaction working at Vodafone; experiencing positive emotions at work; and recommending us as an employer. 5. Data calculated using local market actual or estimated data sources from invoices, purchasing requisitions, direct data measurement and estimations. Carbon emissions calculated in line with GHG Protocol standards. For full methodology see our ESG Addendum 2023. 6. Comparative metrics have been restated in lie with our updated methodology. See our ESG Addendum 2023 for more detail. 7. Joint Alliance for CSR. 8. Includes direct taxes, non-taxation based revenue mechanisms, such as payments for the right to use spectrum, and indirect taxes collected on behalf of governments around the world, excludes joint ventures and associates. The FY23 figure will be finalised during FY24. For more information, refer to our Tax and Economic Contribution reports, available at: vodafone.com/tax. 5 Vodafone Group Plc Annual Report on Form 20-F 2023 Strategic report Governance Financials Other information |

| A new roadmap for Vodafone Chair’s message This year has been a challenging one for Vodafone and for many of our customers, following the rise in energy costs and broader inflation. We have taken a number of steps to mitigate the impact of these cost pressures. However, as a Board, we recognise that the Company has also underperformed, and that change is needed. This will require a transformation of the Group, so that Vodafone can realise its full potential. Group Chief Executive succession In December 2022, we announced that Nick Read would step down as Group Chief Executive. The Board and I would like to thank Nick for his commitment and significant contribution to Vodafone throughout his career spanning more than two decades with the Company. The Board has undertaken a rigorous internal and external search to find the best possible candidate, and in April 2023 I was delighted to announce the appointment of Margherita Della Valle as Group Chief Executive. Margherita has a strong track record during her long career at Vodafone in marketing, operational, commercial and financial positions. During her time as interim Group Chief Executive, the Board and I have been impressed with her pace and decisiveness to begin the necessary transformation of the Company. Margherita has the full support of myself and the Board for her plans for Vodafone to provide a better customer experience, become a simpler business and accelerate growth – and deliver value for our shareholders. Board composition As I wrote last year, my ambition for this year was to further enhance the Board’s experience within the telecommunications and technology sectors. I was therefore pleased to welcome four new Non-Executive Directors to the Board this year: Stephen Carter, Delphine Ernotte Cunci, Simon Segars and Christine Ramon. Their appointments bring extensive experience and strong track records of value creation, which will be of great support to the Group. On 10 May 2023, the Board approved the creation of a Technology Committee as a Committee of the Board. The Technology Committee, once established in due course, will oversee the technology strategy and how it supports the overall Company strategy. The creation of a Technology Committee – run by the highly experienced team of Simon Segars, Stephen Carter, Delphine Ernotte Cunci and Deborah Kerr – will be a great additional benefit to the Board and to Vodafone. On the same date, having completed either 9 years or almost 9 years, we also announced that Valerie Gooding, Sir Crispin Davis and Dame Clara Furse would not be seeking re-election at the 2023 Annual General Meeting (‘AGM’). I would like to thank my colleagues for their outstanding service to the Company and look forward to their continuing contribution until the AGM. In light of these retirements and following a review of committee membership, a number of Non-Executive Directors will take on new roles, including David Nish, who will be appointed Senior Independent Director. On 11 May 2023, we announced that we had agreed a strategic relationship with Emirates Telecommunications Group Company PJSC (“e&”). This marks the next phase in a strategic relationship that began last year, and I’m delighted we have strengthened our existing relationship with e&, which will bring additional telecoms experience to our Board in the future. FY23 financial performance Our financial results for FY23 have been in line with expectations for the year. Total revenue increased by 0.3% to €45.7 billion, with Group organic service revenue growing by 2.2% this year1 . This was driven by continued good growth in the UK, Other Europe and Africa, partially offset by declines in Germany, Italy and Spain. Results were impacted by higher energy costs and commercial underperformance in Germany. These factors more than offset the benefits of service revenue growth and a further €0.2 billion of savings from our ongoing European cost efficiency programme. Our reported financials were also impacted by adverse currency movements during the year. Group operating profit increased by 146% to €14.3 billion, largely reflecting a gain on disposal from Vantage Towers, and as a result basic earnings per share increased to 42.77 eurocents. Following the successful disposal of Vodafone Hungary and partial sale of Vantage Towers, our balance sheet position has also improved. The Board has declared a total dividend per share of 9.0 eurocents, implying a final dividend per share of 4.5 eurocents, which will be paid on 4 August 2023 following shareholder approval at our AGM. Taking a leadership role in shaping the future of digital connectivity Over the last few years, we have seen significant shifts in society and the direct role telecoms plays. Digital connectivity is an important priority for governments as it increasingly impacts the relative competitiveness and resilience of countries. Vodafone is firmly committed to supporting Europe and Africa in realising their digital ambitions. However, in order to do so, investment in digital infrastructure is critical. While the European Union has set out a clear vision and Digital Decade targets for a more sustainable and prosperous future, there is currently an estimated €300 billion gap between their ambitions and Europe’s current investment plans. This investment gap is primarily due to the unintended consequences of past policy and regulatory decisions, which have impacted returns for the telecommunications industry. Returns have remained below the cost of capital for over a decade, restricting the appetite for further investment. Whilst we welcome a number of positive reforms towards pro-investment policy, the current pace and magnitude of change is not enough. Further pro-investment policy reform is required to drive growth and scale in the sector. If delivered, it would enable operators to earn a sustainable return and support the much-needed investment required to safeguard Europe and Africa’s global competitiveness. Going forward On behalf of the Board, I would like to thank all of our colleagues across the Group who have continued to work tirelessly to support our customers – keeping them reliably connected. As we enter FY24, the macroeconomic outlook still remains uncertain. I am confident that under Margherita’s leadership we will improve the Company’s performance and drive value for all of our stakeholders. /s/ Jean-François van Boxmeer Jean-François van Boxmeer Chair Notes: 1. Organic growth is a non-GAAP measure. See page 219 for more information. 6 Strategic report Vodafone Group Plc Annual Report on Form 20-F 2023 Governance Financials Other information |

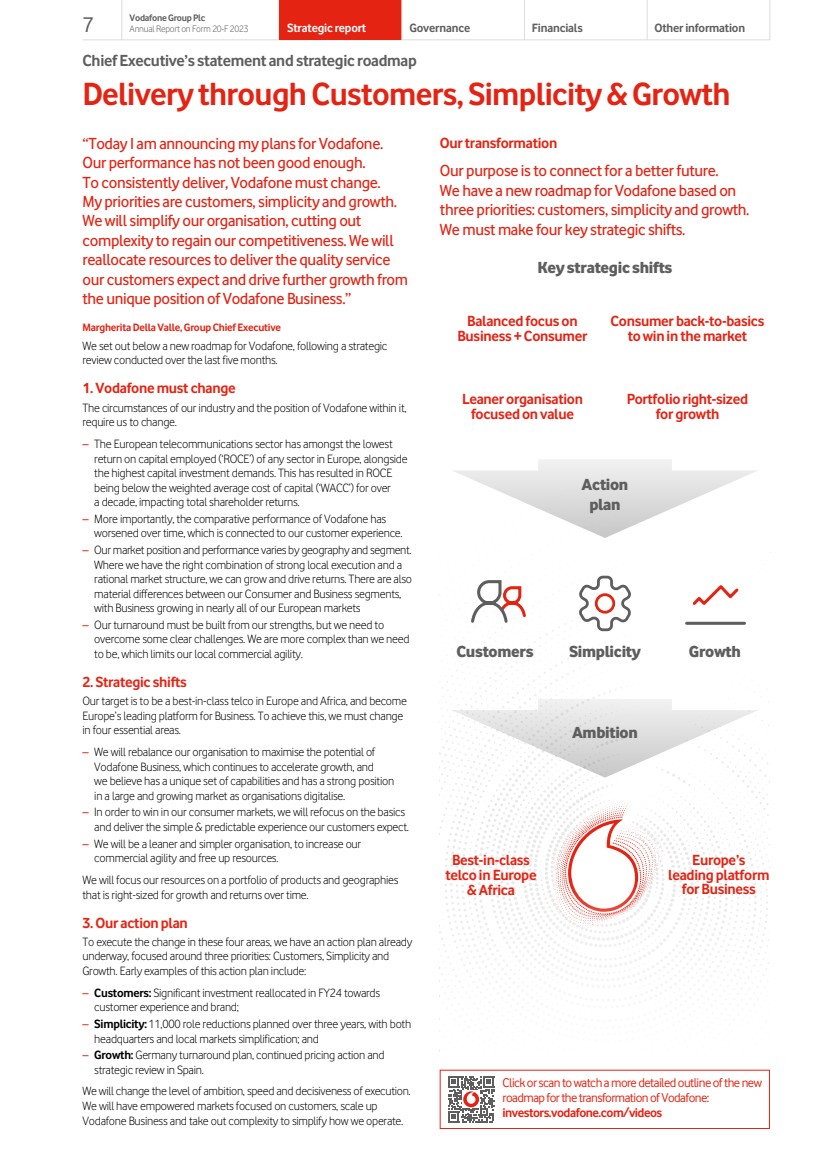

| Chief Executive’s statement and strategic roadmap Delivery through Customers, Simplicity & Growth “Today I am announcing my plans for Vodafone. Our performance has not been good enough. To consistently deliver, Vodafone must change. My priorities are customers, simplicity and growth. We will simplify our organisation, cutting out complexity to regain our competitiveness. We will reallocate resources to deliver the quality service our customers expect and drive further growth from the unique position of Vodafone Business.” Margherita Della Valle, Group Chief Executive We set out below a new roadmap for Vodafone, following a strategic review conducted over the last five months. 1. Vodafone must change The circumstances of our industry and the position of Vodafone within it, require us to change. – The European telecommunications sector has amongst the lowest return on capital employed (‘ROCE’) of any sector in Europe, alongside the highest capital investment demands. This has resulted in ROCE being below the weighted average cost of capital (‘WACC’) for over a decade, impacting total shareholder returns. – More importantly, the comparative performance of Vodafone has worsened over time, which is connected to our customer experience. – Our market position and performance varies by geography and segment. Where we have the right combination of strong local execution and a rational market structure, we can grow and drive returns. There are also material differences between our Consumer and Business segments, with Business growing in nearly all of our European markets – Our turnaround must be built from our strengths, but we need to overcome some clear challenges. We are more complex than we need to be, which limits our local commercial agility. 2. Strategic shifts Our target is to be a best-in-class telco in Europe and Africa, and become Europe’s leading platform for Business. To achieve this, we must change in four essential areas. – We will rebalance our organisation to maximise the potential of Vodafone Business, which continues to accelerate growth, and we believe has a unique set of capabilities and has a strong position in a large and growing market as organisations digitalise. – In order to win in our consumer markets, we will refocus on the basics and deliver the simple & predictable experience our customers expect. – We will be a leaner and simpler organisation, to increase our commercial agility and free up resources. We will focus our resources on a portfolio of products and geographies that is right-sized for growth and returns over time. 3. Our action plan To execute the change in these four areas, we have an action plan already underway, focused around three priorities: Customers, Simplicity and Growth. Early examples of this action plan include: – Customers: Significant investment reallocated in FY24 towards customer experience and brand; – Simplicity: 11,000 role reductions planned over three years, with both headquarters and local markets simplification; and – Growth: Germany turnaround plan, continued pricing action and strategic review in Spain. We will change the level of ambition, speed and decisiveness of execution. We will have empowered markets focused on customers, scale up Vodafone Business and take out complexity to simplify how we operate. Our purpose is to connect for a better future. We have a new roadmap for Vodafone based on three priorities: customers, simplicity and growth. We must make four key strategic shifts. Customers Simplicity Growth Our transformation Best-in-class telco in Europe & Africa Europe’s leading platform for Business Action plan Key strategic shifts Balanced focus on Business + Consumer Consumer back-to-basics to win in the market Leaner organisation focused on value Portfolio right-sized for growth Click or scan to watch a more detailed outline of the new roadmap for the transformation of Vodafone: investors.vodafone.com/videos Ambition 7 Vodafone Group Plc Annual Report on Form 20-F 2023 Strategic report Governance Financials Other information |

| Mega trends Long-term trends shaping our industry Digital services and next-generation connectivity are increasingly central to everything we do – and will be the driving forces that redefine relationships between sectors, employers, employees, customers, and friends and family. There are five ‘mega trends’ that we believe will continue to shape our industry in the years ahead: hybrid working, connected devices, adoption of cloud technology, the digital and green transformation of public and private sectors, and digital payments. Hybrid working Over the past few years we have seen a dramatic shift in working patterns, which are now being maintained following the end of the COVID-19 pandemic. Companies have now moved from largely office-based environments to more ‘hybrid’ working models, thereby providing their employees with much greater flexibility as to how and where they work, whilst still ensuring high or even increased levels of productivity. This change in working patterns will continue to drive increased demand for fast and reliable fixed and mobile networks, as well as a range of supporting services such as cloud-based productivity and communication platforms. The majority of large multinationals already have remote working capabilities; however they are now moving to more efficient technologies. Smaller companies, ranging from corporates to small and medium-sized offices, rely on network operators such as Vodafone to provide secure remote working solutions. These solutions include virtual private networks, unified communication services and the migration of enterprise applications to the cloud. This is vital for business continuity, and it provides network operators with an opportunity to further deepen their customer relationships by offering a broad range of services. Connected devices The world is becoming ever more connected, and it is not just driven by smartphones. A wide range of new devices, across all sectors and applications, are increasingly being connected to the internet. This is driven by continued reductions in the cost of computing components, advances in cross-device operability and software, and the near-ubiquity of networks. For consumers, there is a growing range of applications such as smartwatches, tracking devices for pets, bags and bicycles, and connected vehicles – which can lower insurance premiums and enable a range of advanced in-vehicle solutions. For businesses, the demand for IoT and potential use cases is even more evident. These include solutions such as automated monitoring of energy usage across national grids, tracking consumption in smart buildings and detecting traffic and congestion in cities. In environments that are more localised, such as factories and ports, network operators are building and running Mobile Private Networks (‘MPNs’). MPNs offer corporate customers unparalleled security and bespoke network control. As an example, MPNs enable autonomous factories to connect to thousands of robots, enabling them to work in a synchronised way. Once a product leaves the factory it can also be tracked seamlessly through global supply chain management applications, whether it is delivered through the post, in a vehicle or even via drones. In areas where the same solution can be deployed across multiple sectors, network operators are moving beyond connectivity to provide complex end-to-end hardware and software solutions such as surveillance, smart metering and remote monitoring; it is often more efficient for these solutions to be created in-house. Scaled operators can leverage their unique position to co-create or partner with nimble start-ups at attractive economics. As the number of IoT devices increases, physical assets are also communicating with each other in real-time and new digital markets are being established. This is leading to the Economy of Things, where connected devices securely trade with each other on a user’s behalf, without human intervention. This presents businesses across multiple industries with exciting opportunities to transform goods into tradeable digital assets which can compete in new disruptive online markets. Adoption of cloud technology Over the past decade, large technology companies have invested heavily in advanced centralised data storage and processing capabilities that organisations and consumers can access remotely through connectivity services (commonly termed ‘cloud’ technology). As a result, organisations and consumers are increasingly moving away from using their own expensive hardware and device-specific software to using more efficient shared hardware capacity or services through the cloud. This is popular as it allows upfront capital investment savings, the ability to efficiently scale resources to meet demand, systems that can be easily updated and increased resilience. This is driving demand for fast, reliable and secure connectivity with lower latency. Many small businesses increasingly understand the benefits of cloud technology; however, they lack the technical expertise or direct relationships with large enterprise and cloud specialists. This presents an opportunity for network operators, particularly those with strong existing relationships, as they can effectively help customers navigate their move to the cloud at scale. Click or scan to watch our digital services and experiences investor briefing: investors.vodafone.com/digital-services 8 Strategic report Vodafone Group Plc Annual Report on Form 20-F 2023 Governance Financials Other information |

| Digital and green transformation of the public and private sectors As a part of the fiscal response to the COVID-19 pandemic, the European Union has launched a series of funding programmes with €723.8 billion available under the banner ‘NextGenerationEU’. This includes the Recovery and Resilience facility, which combines €385.5 billion of loans and €338 billion of grants available to European Union Member States. Of these grants, approximately 70% are being allocated to European Union Member States in which Vodafone has an operating presence. The range of funding presents a direct and indirect opportunity given that at least 20% of the total funding is planned to support the European Commission’s digital transformation agenda. The UK and many of our African markets have similar stimulus measures in place. These support measures will help connect schools, hospitals and businesses to gigabit networks and provide hardware, such as tablets, to millions of school children. Similarly, the European Union has committed to be carbon-neutral by 2050. Mobile network operators across Europe will be able to benefit from these funds as they seek to limit their impact on the climate, and help their customers from across the private and public sectors reduce their own energy use and carbon emissions. Small and medium-sized enterprises (‘SMEs’) in Europe can often lag behind in terms of digital adoption. However, under various government-led support mechanisms, SMEs will be eligible for vouchers, grants and loans to transition to eCommerce, upskill employees, and move to cloud-based solutions whilst ensuring they are secure as they do so. SMEs will look to trusted and experienced network operators which can offer a full suite of solutions, whilst also help them navigate technical and regulatory processes. Finally, to ensure the benefits of these projects are spread equitably, funding is also being allocated towards rural inclusion to subsidise the building of network infrastructure where it is currently uneconomical for operators to do so. Read more about our purpose to enable an inclusive and sustainable digital society on pages 35 to 38 Digital payments Businesses in Europe continue to expand and migrate sales channels from physical premises to online channels such as websites and mobile applications. As a result, businesses increasingly transact through mobile-enabled payment services which remove the need for legacy fixed sales terminals. Consequently, businesses demand reliable and secure mobile connectivity. Consumers are also increasingly transitioning away from using cash to digital payment methods conducted directly via mobile phones or smartwatches, further increasing the importance of mobile networks. In Africa, digital payments are primarily conducted via mobile phones through payment networks owned and operated by network operators, and the annual value of mobile money transactions has reached a key milestone in 2021 with one trillion transactions globally1 . Consumers are also moving beyond peer-to-peer transactions as rising smartphone penetration drives the adoption of mobile payment applications. Network operators and a range of FinTech startups are using these applications to sell additional financial services focused products, ranging from advances on mobile airtime and device insurance to more complex offerings such as life insurance, loans and e-commerce marketplaces. This plays a critical role in improving financial inclusion for millions of people across Africa where the traditional banking sector has not been able to reach. Businesses are also increasingly reliant on operator-owned payment infrastructure for consumer-to-business payments and for large business-to-business transfers. These payment networks drive scale benefits for the largest operators by allowing customers to save on transaction fees whilst also driving both business and consumer customers to seek reliable and secure networks. Larger corporates, which may already use the cloud today, are progressively moving away from complex systems based on their own servers or single cloud solutions, to multi-cloud offers sold by network operators and their partners. This approach reduces supplier risk and increases corporate agility and resilience. Large corporates continue to drive higher demand for robust, secure and efficient connectivity services as they transition from their own legacy hardware and services. Cloud providers also recognise the criticality of telecommunications networks. Many cloud providers are partnering with the largest network operators, sometimes through revenue sharing agreements, to develop edge computing solutions which integrate data centres at the edge of telecommunication networks to deliver customers reduced latency. The opportunity is significant as the total addressable market in business-to-business cloud & security is expected to reach €82 billion by 2025 compared to €65 billion today. Consumers use cloud solutions for a variety of reasons, including digital storage, online media consumption or interacting through the metaverse. Consumer hardware can also in some cases be replaced by cloud-first solutions. For example, new cloud-based gaming services allow consumers to stream complex, bandwidth-heavy computer games directly to their phones or tablets, without the need for expensive dedicated hardware. Fast and reliable connectivity will act as a catalyst for further innovation and consumer applications, many of which do not currently exist today. Read more about how Vodafone’s leading gigabit connectivity infrastructure supports the digital society on pages 29 to 30 Click or scan to learn more about our IoT leadership and evolution in our Vodafone Business investor briefing: investors.vodafone.com/vbbriefing Click or scan to watch our digital services and experiences investor briefing: investors.vodafone.com/digital-services Note: 1. GSMA State of the Industry Report on Mobile Money 2022 9 Vodafone Group Plc Annual Report on Form 20-F 2023 Strategic report Governance Financials Other information |

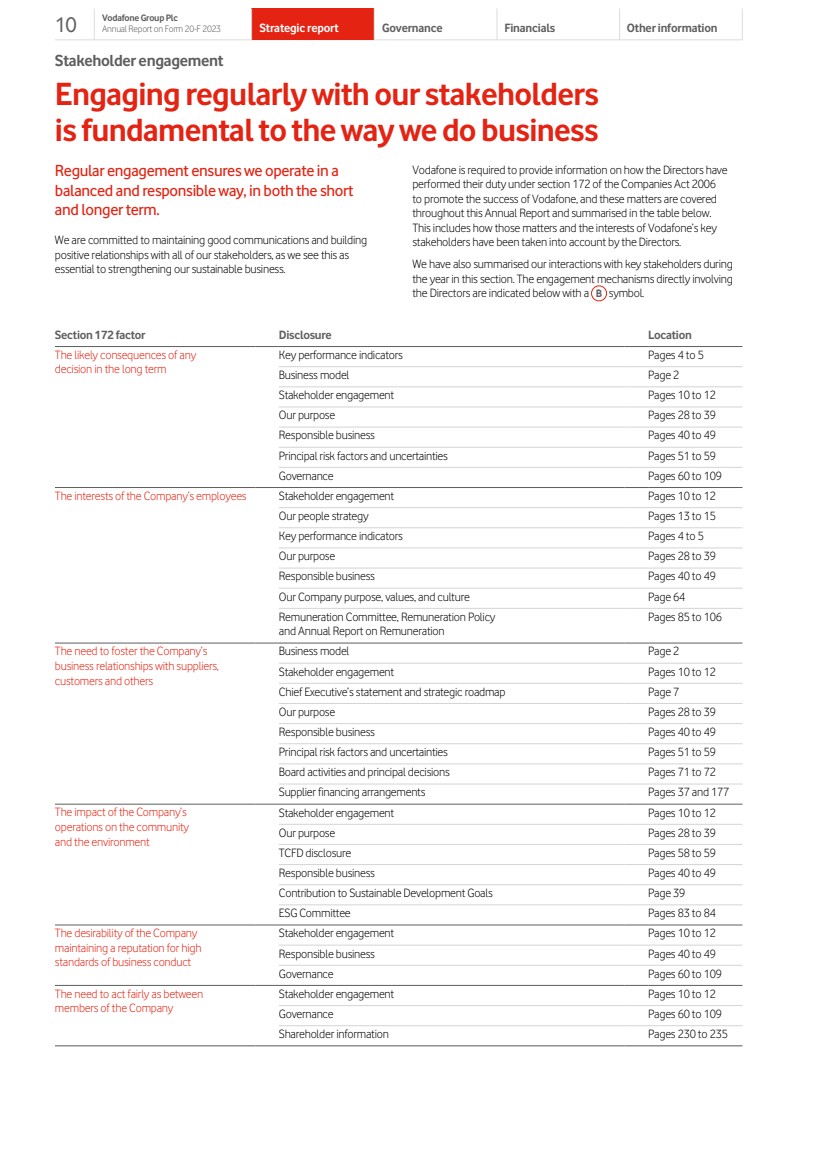

| Stakeholder engagement Engaging regularly with our stakeholders is fundamental to the way we do business Regular engagement ensures we operate in a balanced and responsible way, in both the short and longer term. We are committed to maintaining good communications and building positive relationships with all of our stakeholders, as we see this as essential to strengthening our sustainable business. Section 172 factor Disclosure Location The likely consequences of any decision in the long term Key performance indicators Pages 4 to 5 Business model Page 2 Stakeholder engagement Pages 10 to 12 Our purpose Pages 28 to 39 Responsible business Pages 40 to 49 Principal risk factors and uncertainties Pages 51 to 59 Governance Pages 60 to 109 The interests of the Company’s employees Stakeholder engagement Pages 10 to 12 Our people strategy Pages 13 to 15 Key performance indicators Pages 4 to 5 Our purpose Pages 28 to 39 Responsible business Pages 40 to 49 Our Company purpose, values, and culture Page 64 Remuneration Committee, Remuneration Policy and Annual Report on Remuneration Pages 85 to 106 The need to foster the Company’s business relationships with suppliers, customers and others Business model Page 2 Stakeholder engagement Pages 10 to 12 Chief Executive’s statement and strategic roadmap Page 7 Our purpose Pages 28 to 39 Responsible business Pages 40 to 49 Principal risk factors and uncertainties Pages 51 to 59 Board activities and principal decisions Pages 71 to 72 Supplier financing arrangements Pages 37 and 177 The impact of the Company’s operations on the community and the environment Stakeholder engagement Pages 10 to 12 Our purpose Pages 28 to 39 TCFD disclosure Pages 58 to 59 Responsible business Pages 40 to 49 Contribution to Sustainable Development Goals Page 39 ESG Committee Pages 83 to 84 The desirability of the Company maintaining a reputation for high standards of business conduct Stakeholder engagement Pages 10 to 12 Responsible business Pages 40 to 49 Governance Pages 60 to 109 The need to act fairly as between members of the Company Stakeholder engagement Pages 10 to 12 Governance Pages 60 to 109 Shareholder information Pages 230 to 235 Vodafone is required to provide information on how the Directors have performed their duty under section 172 of the Companies Act 2006 to promote the success of Vodafone, and these matters are covered throughout this Annual Report and summarised in the table below. This includes how those matters and the interests of Vodafone’s key stakeholders have been taken into account by the Directors. We have also summarised our interactions with key stakeholders during the year in this section. The engagement mechanisms directly involving the Directors are indicated below with a B symbol. 10 Strategic report Vodafone Group Plc Annual Report on Form 20-F 2023 Governance Financials Other information |

| Our customers We are focused on deepening our engagement with our customers to develop long-term valuable and sustainable relationships. We have hundreds of millions of customers across Europe and Africa, ranging from individual consumers to large multinational corporates. How did we engage with them? – Digital channels (MyVodafone app, TOBi chatbots, social media interaction and the Vodafone website), and call centres and branded retail stores What were the key topics raised? – Better value offerings and converged solutions for customers – Fast and reliable data networks and wider coverage – Making it simple and quick to deal with us, with prompt feedback and resolution of service-related issues – Managing the challenge of data-usage transparency How did we respond? – Improved efficiency and functionality of MyVodafone app – Expanded our 4G and 5G coverage – Stronger focus on Customer Experience (‘CX’) with new automated satisfaction tracking tools, setting up CX boards in all markets and increasing investments to reduce customer detraction – Continued to leverage our digital channels to support easy access for all of our customers – Enabled free international calling and roaming for our customers following the devastating earthquakes in Turkey and surrounding areas – Supported financially vulnerable customers in the cost of living crisis – Drove inclusion and affordability for smartphones and technology hardware by introducing trade-in & Flex propositions in nine markets – Entered an exclusive three-year partnership with WWF to collect one million phones for the planet to support the circular economy Our people Our people are critical to the successful delivery of our strategy. It is essential that they are engaged and embrace our purpose and values. Throughout the year we focused on a number of areas to ensure that everyone is highly motivated, and we remained focused on wellbeing. How did we engage with them? – Regular meetings with managers – B European Employee Consultative Committee – Inaugural Vodacom Group Employee Engagement Forum – B National Consultative Committee (South Africa) – B Executive Committee discussions – B Internal website and live webinars, newsletters and other digital communications – B Employee Speak Up channel – Global employee surveys, including onboarding and exit surveys What were the key topics raised? – Enhancing performance management and career development – A balanced hybrid working approach – Global and local market communication channels – Global Pulse and Spirit Beat survey actions – Increasing engagement amongst new hires – Importance of manager/employee relationships – Impacts of the macroeconomic environment – Supporting colleagues affected by the earthquakes in Turkey How did we respond? – Launched a new performance management system – Embedded our integrated skills and learning platform – Strengthened our global senior leadership programme – Reviewed our global hybrid ways of working policy – Refreshed manager learning and support guides – Redesigned our global onboarding processes and new starter support – Regular business and trading updates communicated to staff – Provided support for colleagues and their relatives affected by the earthquakes in Turkey; as well as free psychological and wellbeing guidance and matched employee donations Our suppliers Our business is helped by 9,000 suppliers who partner with us. These range from start-ups and small businesses to large multinational companies. Our suppliers provide us with the products and services we need to deliver our strategy and connect our customers. How did we engage with them? – Supplier audits and assessments – Safety forums, events, conferences and site visits – Purpose criteria in tenders relating to planet, diversity and safety What were the key topics raised? – Improving health and safety standards – Driving towards net zero emissions in supply chains – Supplier and product innovation How did we respond? – Held quarterly safety forums – Recognised suppliers through awards for health and safety, diversity and inclusion and planet efforts at our Arch Summit – Collaborated with industry peers and suppliers through the Joint Alliance for CSR (‘JAC’), formerly known as the Joint Audit Cooperation – Launched environmentally-linked supply chain finance programme Our local communities and non-governmental organisations (‘NGOs’) We believe that the long-term success of our business is closely tied to the success of the communities in which we operate. We interact with local communities and NGOs, seeking to be a force for good wherever we operate. How did we engage with them? – Through our products and services – Community and NGO interaction on education, health, agriculture and inclusive finance projects, and on our humanitarian response to global issues including the war in Ukraine – Participation in multi-stakeholder working groups on policy issues at the national and international level What were the key topics raised? – Increasing access to connectivity and digital services, by closing the digital divide, closing the rural gap and connecting SMEs – Human rights topics including digital child rights – Environmental topics including net zero and the circular economy – Delivery of global and national development goals including UN Sustainable Development Goals 11 Vodafone Group Plc Annual Report on Form 20-F 2023 Strategic report Governance Financials Other information |

| How did we respond? – Our previous Group Chief Executive chaired a UN Broadband Commission working group on increasing smartphone access and co-chaired a pillar of the International Telecommunication Union’s Partner2Connect initiative – Participated in partnerships and working groups on human rights – Participated and engaged with key environmental initiatives, including the Science Based Targets initiative and CDP – Launched a response to the earthquakes in Turkey and surrounding areas with NGOs and charities Governments and regulators Our relationship with governments and regulators is important and we hope to work together on policies impacting our industry and customers, while also enabling them to better understand the positive impact we can have on the environment and communities we operate in. How did we engage with them? – B Participation and attendance at company and industry meetings with government and regulators, EU institutions, public forums and parliamentary processes – B Meetings with commissioners, ministers, elected representatives, policy officials and regulators – Hosting and participating in workshops and events to improve sector understanding of connectivity and digitalisation – B Our Chair chairs the European Round Table for Industrialists, which promotes competitiveness and prosperity and engages with European and global institutions, and governments What were the key topics raised? – Regulatory and policy environment and compliance – Responses to COVID-19 and the war in Ukraine – Security and supply chain resilience, and data protection and privacy – Digital societies, digital inclusion, the climate transition and the European Green Deal How did we respond? – Engaged on the digital and green transformation of the EU, and the Digital Decade targets such as the digitalisation of industries and SMEs – Communications on the impact of electromagnetic fields (‘EMF’) – Engaged on network investments, design and deployment, and issues such as the allocation of spectrum and the protection of consumers – Discussed policy and regulatory environment that facilitates investment in technology – Engaged with the EU with respect to the data economy, including data protection, digital principles, and data sharing – Engaged with the UN on digital inclusion via the ITU and UN Broadband Commission, and climate topics via COP27 Click to read more about our social contract in our latest investor briefing. The materials set out why a reset of the European regulatory framework is so important; how through our social contract we have taken a leadership role in improving our relationship with governments and policymakers; and what is need in terms of policy reform: investors.vodafone.com/social-contract Our investors Our investors include individual and institutional shareholders as well as debt investors. We maintain an active dialogue with our investors through our extensive investor relations programme. How did we engage with them? – B Personal meetings, roadshows, conferences – B Annual & interim reports and presentations – B Investor relations website used as primary digital communications tool and is available to all shareholders (institutional and retail), including over 12 hours of dedicated video content covering investor events and interviews with Non-Executive Directors – Stock Exchange News Service (‘SENS’) announcements – B Annual General Meeting (‘AGM’) – B Investor perception study and regular feedback survey – For FY24, further resources will be available to individual shareholders, such as online presentations hosted by the UK Individual Shareholders Society – Our Registrar, Equiniti, operates a portfolio service which provides shareholders with the ability to manage their holdings What were the key topics raised? – Strategy to deliver sustained financial growth and operational priorities – Allocation of capital, deleveraging strategy and dividend policy – Portfolio optimisation – Corporate governance practices – ESG strategy, targets and reporting How did we respond? – We conducted over 1,000 investor interactions through meetings with major institutional shareholders, debt investors, individual shareholder groups and financial analysts, and attended conferences – Meetings were attended by Directors and senior management, including our Chair, Group Chief Executive, Chief Financial Officer, and Executive Committee members Stakeholder engagement (continued) 12 Strategic report Vodafone Group Plc Annual Report on Form 20-F 2023 Governance Financials Other information |

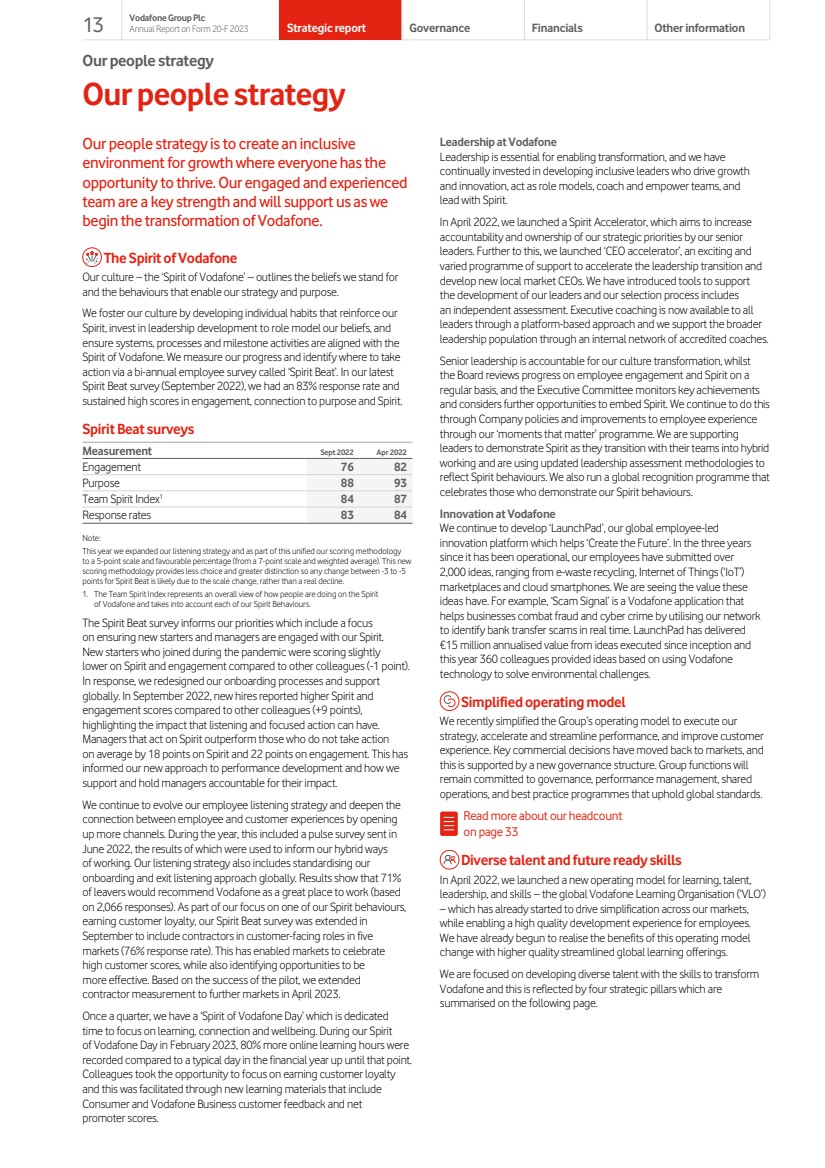

| Our people strategy is to create an inclusive environment for growth where everyone has the opportunity to thrive. Our engaged and experienced team are a key strength and will support us as we begin the transformation of Vodafone. The Spirit of Vodafone Our culture – the ‘Spirit of Vodafone’ – outlines the beliefs we stand for and the behaviours that enable our strategy and purpose. We foster our culture by developing individual habits that reinforce our Spirit, invest in leadership development to role model our beliefs, and ensure systems, processes and milestone activities are aligned with the Spirit of Vodafone. We measure our progress and identify where to take action via a bi-annual employee survey called ‘Spirit Beat’. In our latest Spirit Beat survey (September 2022), we had an 83% response rate and sustained high scores in engagement, connection to purpose and Spirit. Spirit Beat surveys Measurement Sept 2022 Apr 2022 Engagement 76 82 Purpose 88 93 Team Spirit Index1 84 87 Response rates 83 84 Note: This year we expanded our listening strategy and as part of this unified our scoring methodology to a 5-point scale and favourable percentage (from a 7-point scale and weighted average). This new scoring methodology provides less choice and greater distinction so any change between -3 to -5 points for Spirit Beat is likely due to the scale change, rather than a real decline. 1. The Team Spirit Index represents an overall view of how people are doing on the Spirit of Vodafone and takes into account each of our Spirit Behaviours. The Spirit Beat survey informs our priorities which include a focus on ensuring new starters and managers are engaged with our Spirit. New starters who joined during the pandemic were scoring slightly lower on Spirit and engagement compared to other colleagues (-1 point). In response, we redesigned our onboarding processes and support globally. In September 2022, new hires reported higher Spirit and engagement scores compared to other colleagues (+9 points), highlighting the impact that listening and focused action can have. Managers that act on Spirit outperform those who do not take action on average by 18 points on Spirit and 22 points on engagement. This has informed our new approach to performance development and how we support and hold managers accountable for their impact. We continue to evolve our employee listening strategy and deepen the connection between employee and customer experiences by opening up more channels. During the year, this included a pulse survey sent in June 2022, the results of which were used to inform our hybrid ways of working. Our listening strategy also includes standardising our onboarding and exit listening approach globally. Results show that 71% of leavers would recommend Vodafone as a great place to work (based on 2,066 responses). As part of our focus on one of our Spirit behaviours, earning customer loyalty, our Spirit Beat survey was extended in September to include contractors in customer-facing roles in five markets (76% response rate). This has enabled markets to celebrate high customer scores, while also identifying opportunities to be more effective. Based on the success of the pilot, we extended contractor measurement to further markets in April 2023. Once a quarter, we have a ‘Spirit of Vodafone Day’ which is dedicated time to focus on learning, connection and wellbeing. During our Spirit of Vodafone Day in February 2023, 80% more online learning hours were recorded compared to a typical day in the financial year up until that point. Colleagues took the opportunity to focus on earning customer loyalty and this was facilitated through new learning materials that include Consumer and Vodafone Business customer feedback and net promoter scores. Leadership at Vodafone Leadership is essential for enabling transformation, and we have continually invested in developing inclusive leaders who drive growth and innovation, act as role models, coach and empower teams, and lead with Spirit. In April 2022, we launched a Spirit Accelerator, which aims to increase accountability and ownership of our strategic priorities by our senior leaders. Further to this, we launched ‘CEO accelerator’, an exciting and varied programme of support to accelerate the leadership transition and develop new local market CEOs. We have introduced tools to support the development of our leaders and our selection process includes an independent assessment. Executive coaching is now available to all leaders through a platform-based approach and we support the broader leadership population through an internal network of accredited coaches. Senior leadership is accountable for our culture transformation, whilst the Board reviews progress on employee engagement and Spirit on a regular basis, and the Executive Committee monitors key achievements and considers further opportunities to embed Spirit. We continue to do this through Company policies and improvements to employee experience through our ‘moments that matter’ programme. We are supporting leaders to demonstrate Spirit as they transition with their teams into hybrid working and are using updated leadership assessment methodologies to reflect Spirit behaviours. We also run a global recognition programme that celebrates those who demonstrate our Spirit behaviours. Innovation at Vodafone We continue to develop ‘LaunchPad’, our global employee-led innovation platform which helps ‘Create the Future’. In the three years since it has been operational, our employees have submitted over 2,000 ideas, ranging from e-waste recycling, Internet of Things (‘IoT’) marketplaces and cloud smartphones. We are seeing the value these ideas have. For example, ‘Scam Signal’ is a Vodafone application that helps businesses combat fraud and cyber crime by utilising our network to identify bank transfer scams in real time. LaunchPad has delivered €15 million annualised value from ideas executed since inception and this year 360 colleagues provided ideas based on using Vodafone technology to solve environmental challenges. Simplified operating model We recently simplified the Group’s operating model to execute our strategy, accelerate and streamline performance, and improve customer experience. Key commercial decisions have moved back to markets, and this is supported by a new governance structure. Group functions will remain committed to governance, performance management, shared operations, and best practice programmes that uphold global standards. Read more about our headcount on page 33 Diverse talent and future ready skills In April 2022, we launched a new operating model for learning, talent, leadership, and skills – the global Vodafone Learning Organisation (‘VLO’) – which has already started to drive simplification across our markets, while enabling a high quality development experience for employees. We have already begun to realise the benefits of this operating model change with higher quality streamlined global learning offerings. We are focused on developing diverse talent with the skills to transform Vodafone and this is reflected by four strategic pillars which are summarised on the following page. Our people strategy Our people strategy 13 Vodafone Group Plc Annual Report on Form 20-F 2023 Strategic report Governance Financials Other information |

| Our people strategy (continued) 1. Enable a high impact performance & learning culture We continue to support the personal and professional growth of people through online learning initiatives. During the year, our employees accomplished two million hours of learning with an average of 1.7 hours per month. The annual average number of hours per employee has increased by 33% per employee since FY22, with each employee now spending 20 hours on average per annum on their learning. We invested an average of €301 for both mandatory and non-mandatory training for each employee to build future capabilities. To support customer experience, we have launched customer-centric programmes for all employees including a Company-wide customer experience curriculum. In April 2023, we launched a new performance management system and process to increase alignment and prioritisation of goals, enable greater employee ownership, and create a shared understanding of the impact an employee has on outcomes. Performance assessments consider the impact an employee has had on team, business, and customer outcomes and how the Spirit of Vodafone has been harnessed to deliver those outcomes. Reward will be linked to the individual’s impact and underpinned by minimum performance standards, including completion of our Doing What’s Right training, that reinforce our commitment to building an ethical culture. 2. Build the skills for the future This year, we strategically reviewed the skills that we need to support our business strategy. From April 2023 we started to deliver Skill Accelerators across the organisation for critical skill areas such as agile project management, software engineering, automation, and cyber security. In Italy, more than 300 people have been reskilled from contact centres to other internal functions. Large-scale programmes on digital skills have impacted employees in Italy, reflected by more than one million learning hours delivered. We are also introducing a global software engineering reskilling programme. Successful applicants began training in May 2023. As part of our ambition to hire 7,000 software engineers by 2025, we enhanced our employer brand awareness by launching a global recruiting playbook, investing in talent acquisition campaigns, running events across markets, and redesigning the global careers site. So far, we have hired 5,880 software engineers. This year, we also launched a specific ‘Always-on Software Engineer’ attraction campaign in Egypt, Germany, Spain, Turkey, Romania, Portugal and the UK. As a result, we have had 42.8 million impressions. Moreover, last year we were a platinum sponsor at the React Summit, an annual conference gathering thousands of software engineers from around the world. This had a positive impact as 77% of engineers we interacted with had an improved perception of Vodafone as a technology employer following the event. Our technical career path supports the attraction, retention and development of our technical experts and sits alongside a managerial/ leadership career path. The technical career path is designed to provide more formal ways to recognise and reward career progression for technical experts, giving choice in career direction. 3. Drive an efficient engine with the scale and expertise to deliver on our growth ambitions We simplified the operations of the VLO by leveraging vendor partnerships, and launching global product offerings on agile project management, languages and executive coaching. We removed duplicated activities across markets by continuing to expand our _VOIS shared services team. We also conducted global demand planning for our learning, talent, leadership and skills to align our investments with our strategic objectives. 4. Engage and retain diverse talent, and unlock potential through focused succession and people development We reviewed our talent and succession pools across senior roles. These are ultimately discussed and approved at the annual Executive Committee talent review and are also shared with the Board. Gender diversity of the executive succession pools increased to 50% from 38% in the prior year. This year, we also reviewed our commercial capabilities by reviewing the skills we need for the future, assessing the capability of current and future leaders, and developing learning journeys and targeted development actions. We further embedded these assessment tools and strategies into our overall processes for developing and recruiting senior leaders across the business. We continue to invest in youth hiring (5,731 hires, of which 942 were graduates) whilst providing digital learning experiences to 66,036 young people through local work experience programmes and training initiatives. During the year, we also hired 236 apprentices with local programmes that aim to grow future talent and skills in areas such as cyber security, network engineering and software engineering through work-based learning and qualifications. Read more about workplace equality on pages 33 to 34 Digital and personalised experience Future ready ways of working This year, we reviewed our Future Ready Vodafone global policy on hybrid working, which includes the option to work from another country during the year for a maximum of 20 days. To continue our commitment to hybrid ways of working, we believe a minimum of two days in the office is the right balance to achieve the benefits of in-person collaboration and our leaders are expected to clearly role-model this. We are not mandating a fixed day per week at a function or market level as this compromises the principle of flexibility that hybrid working is built on. Underpinning all our hybrid thinking is our continued commitment to the health, safety, and wellbeing of our teams. Office space The shift to hybrid working has redefined the role of the office and inspired us to create a new global office design primarily for collaboration and connection. We experimented in different countries last year, redesigned the Vodafone Turkey headquarters, and opened a new office in Valencia, and a new Innovation Hub in Malaga. These are great examples of the hybrid workplace improving the employees’ experience and being a magnet to attract talent, collaborate, and innovate. A new initiative called ‘Office in a Box’ was implemented to support employees’ wellbeing while working from home, providing a virtual office setup at home following a self-assessment. We are also improving the digital workplace experience with new booking systems for desks and collaboration spaces, access control, video conferencing, and presentation facilities to enhance the employee experience at the office. Click to read our technology employee articles: careers.vodafone.com/life-at-vodafone/projects-stories 14 Strategic report Vodafone Group Plc Annual Report on Form 20-F 2023 Governance Financials Other information |

| To standardise and improve the experience of new joiners, we deployed a new digital onboarding tool in November 2022. It has received an effectiveness score of 86% from new joiners and 83% from hiring managers over a baseline of 80%. We continued to invest in our AI chatbot called, ‘TOBi’, to provide personalised instant responses and process administrative tasks. New features have been piloted in Vodacom Group and _VOIS India, with roll-out plans to UK employees in FY24. In FY23, TOBi resolved 53% of queries that would have been actioned by other support channels. We have also implemented a new quality tool to check and correct HR data against pre-set rules to enable richer and more accurate insights on employee experience. The tool has already fixed 98% of errors. We continue to invest in our data strategy by bringing together and visualising both HR and non-HR data through cloud-based data-lake functionality, and this is reflected in pilots in Greece and _VOIS. Workers’ councils and union engagement We respect freedom of association and recognise the rights of employees to join trade unions and engage in collective bargaining in accordance with local law. We continue to maintain strong relationships with workers’ councils and unions through their representatives and we have almost 23,000 people covered by collective bargaining agreements across our global footprint. As an example, unions in Spain are supported through infrastructure and resources which employees have access to through union halls, digital and physical forums, and regular newsletters. This year, we reached agreements with unions in Spain and Italy on items such as pay, hybrid working and training as we continued to shape the future of work. There were no material disruptions to operations as a result of union activity during the financial year or between the end of the financial year and the date of this Annual Report on Form 20-F. Employee forums We have a number of employee forums where elected employee representatives represent the views of their colleagues. During the year, the Board’s Workforce Engagement Lead, Valerie Gooding, attended employee forums to gather employee views, such as the European Employee Consultative Committee. Key discussion topics from the meetings included talent development, future ready ways of working, cost of living support, and business performance. Read more about the Board’s engagement with the employee voice on pages 62, 64 and 85 Pay and benefits As part of the people experience, we continue to ensure pay, benefits, and wellbeing propositions are competitive and fair. Pay is typically reviewed on an annual basis, with increases aligned to an individual’s level of skills and experience, as well as external factors like market competition and inflation. Our total reward approach also encourages collective performance and ‘in-the-moment’ recognition. For example, 21,335 peer-to-peer ‘Thank You’s’ and 65,258 cash Vodafone Star awards were issued through a digital recognition tool during the year. We continue to apply Fair Pay principles across all markets, working with the Fair Wage Network to ensure a good standard of living in each market. In the UK, our commitment to these principles is reflected in being an Accredited Living Wage employer. Read more about our Fair Pay principles on page 100 Click to read more about Fair Pay at Vodafone: vodafone.com/fair-pay Mental health and wellbeing We remain focused on physical and mental wellbeing, with training and services available in each market, including the provision of employee assistance and psychological support services. Market examples from the year include: – Vodafone Egypt became one of the first companies in the Middle East, as well as in our Vodafone markets, to be verified against ISO 45003:2021 for psychological health and safety at work. – In Italy, we organised awareness and training sessions, including mindfulness sessions, a webinar with a team of psychologists during Mental Health Week, and a session on social welfare services. – In the UK we continued our third year of support for the 245 mental health first aiders across the business. We facilitated six bi-monthly learning sessions across a range of topics on mental health. In May 2022, we delivered a two-hour workshop to 400 employees during UK Mental Health Awareness Week and introduced a new service for people to access professional therapy. – In South Africa, we launched an onsite financial coach and counselling clinic in February 2023 and established the Wellbeing Committee on employee wellbeing needs. We also held 10 wellbeing café sessions on a range of topics including mental health, finance, resilience, anxiety, and trauma (2,235 participants). – Finally in Spain, we launched the rercárgate wellbeing programme, engaging more than 1,260 colleagues in wellbeing programmes. Click to read more about mental health and wellbeing: vodafone.com/wellbeing Digital experience This year, we continued to focus on providing a digital and personalised experience to employees, informed by internal insights, and underpinned by our culture. This has included digitalising our core HR processes, ensuring we have the right tools and data to deliver the people strategy. In 2022, we launched ‘Grow with Vodafone’, an integrated talent acquisition, skills and learning platform that enhances the employee experience, whilst giving employees greater ownership of their learning and career development. The tool is split into three main features: – Grow your skills: Enables individuals to create their unique skills profile enabling personalised learning and career recommendations, as well as providing upskilling opportunities. – Grow your learning: Offers personalised learning recommendations to help each employee achieve their career goals, whilst also driving a culture where growing never stops. – Grow your career: Provides role recommendations based on skills and experience to candidates, and offers optimised recruiter and hiring manager experience by prioritising the most suitable applications. This has had the following impact: – Candidate experience: Job recommendations based on an individual’s skills and experience (driven by an AI role-matching engine). This is facilitated by 66% of roles being auto-calibrated. – Gender diversity: For management roles a higher proportion of women shortlisted, supported by efforts to remove unconscious bias during screening. – Recruiter capability: Increased effectiveness of recruiters, as reflected by a reduction in time-to-hire time by 49%, enabled through AI-based sourcing capabilities. 15 Vodafone Group Plc Annual Report on Form 20-F 2023 Strategic report Governance Financials Other information |

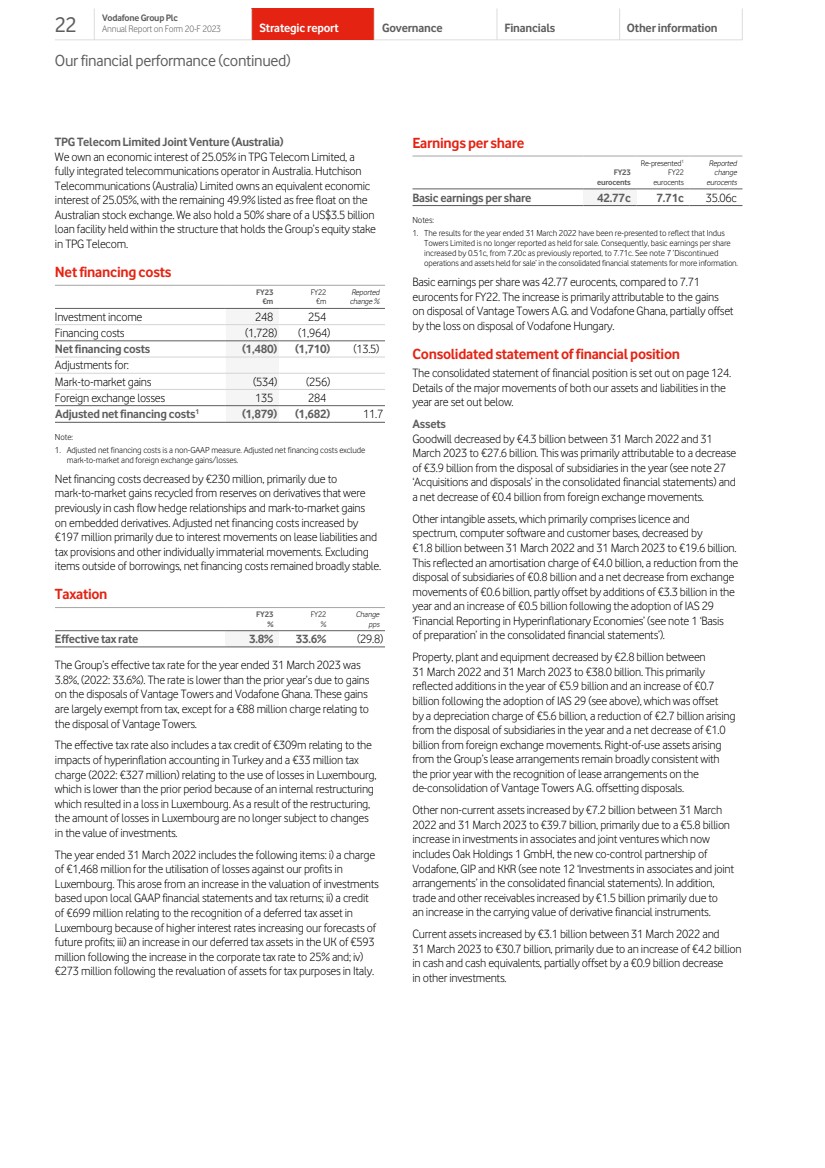

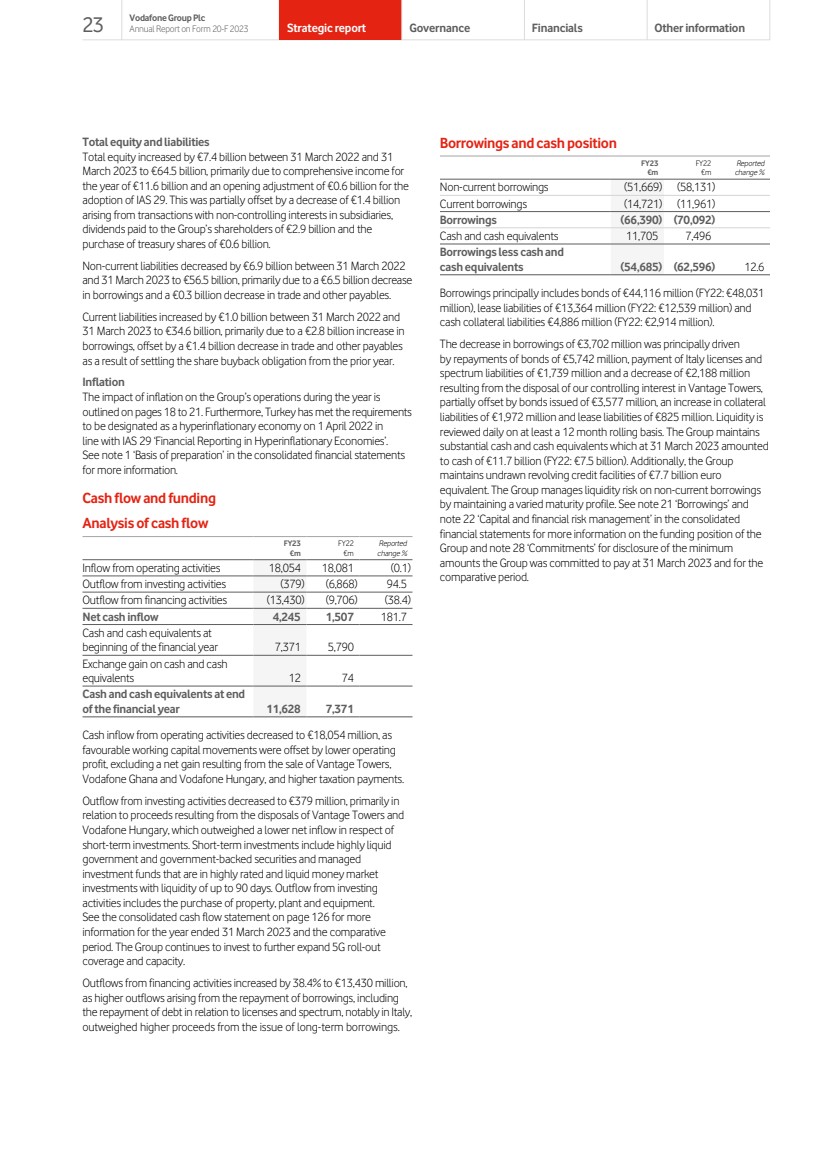

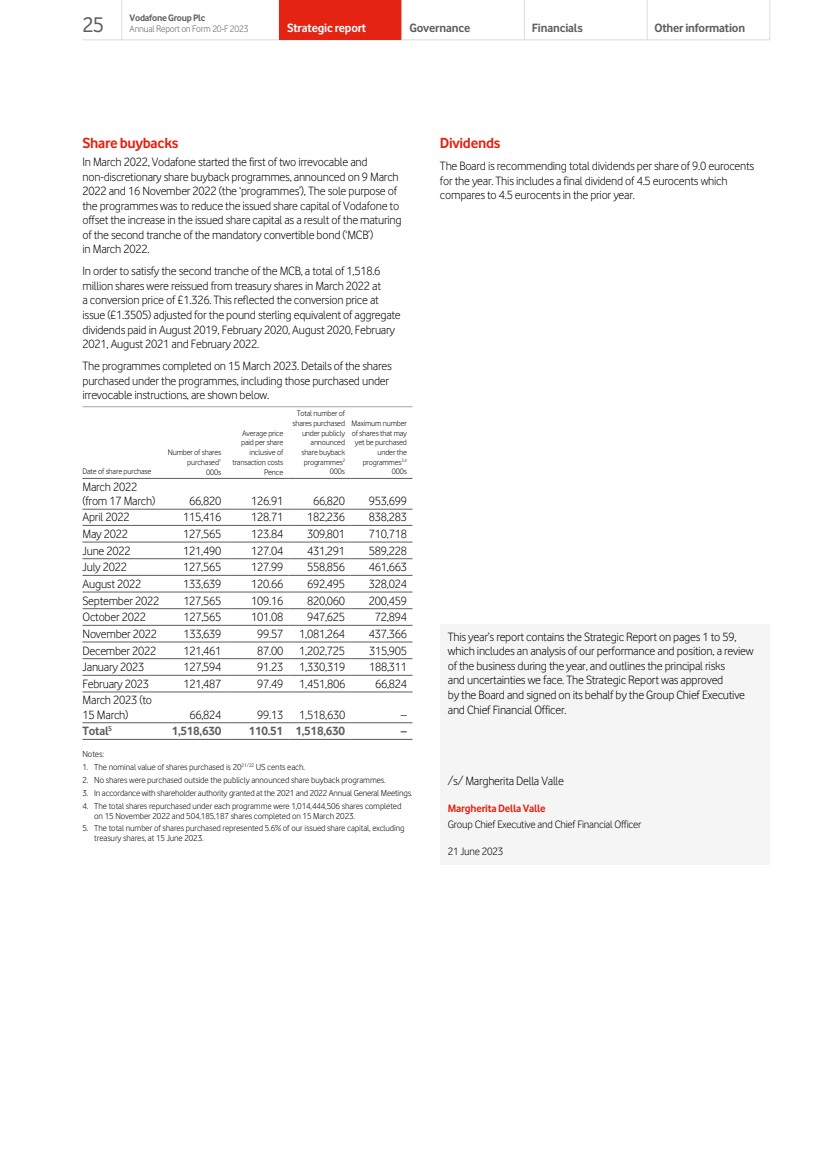

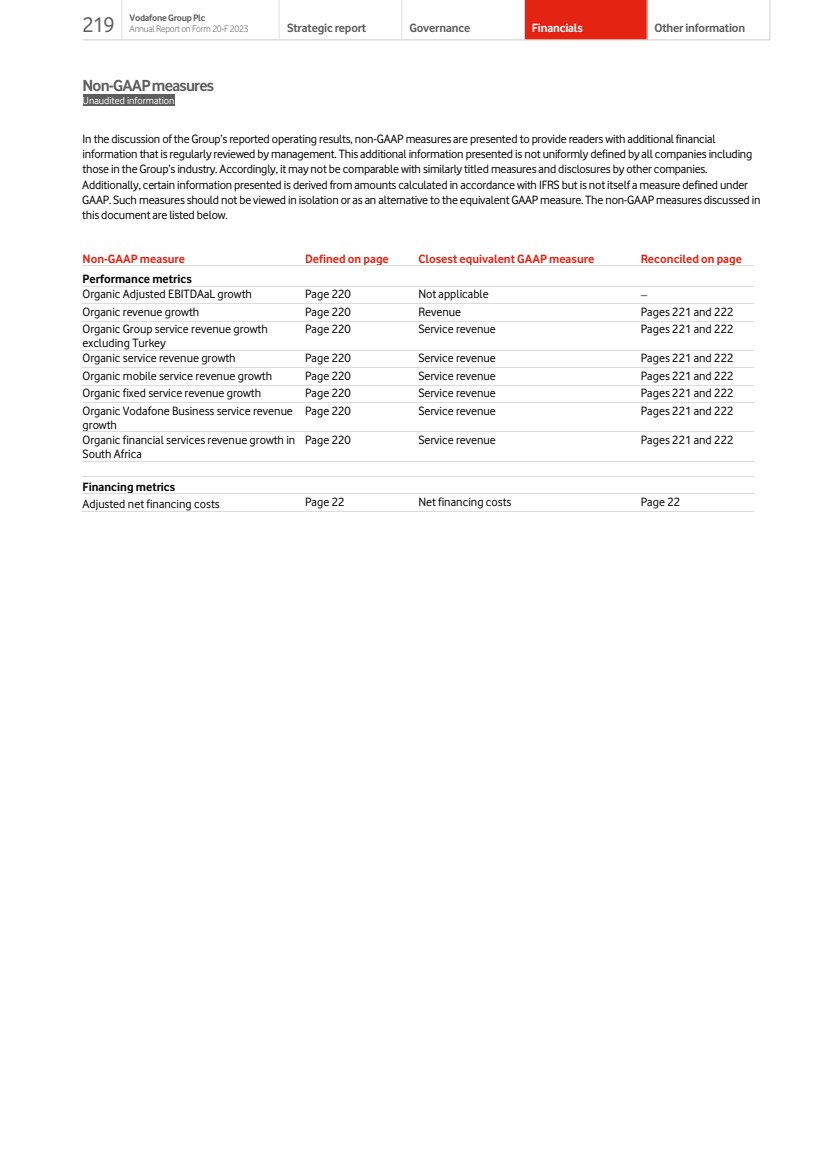

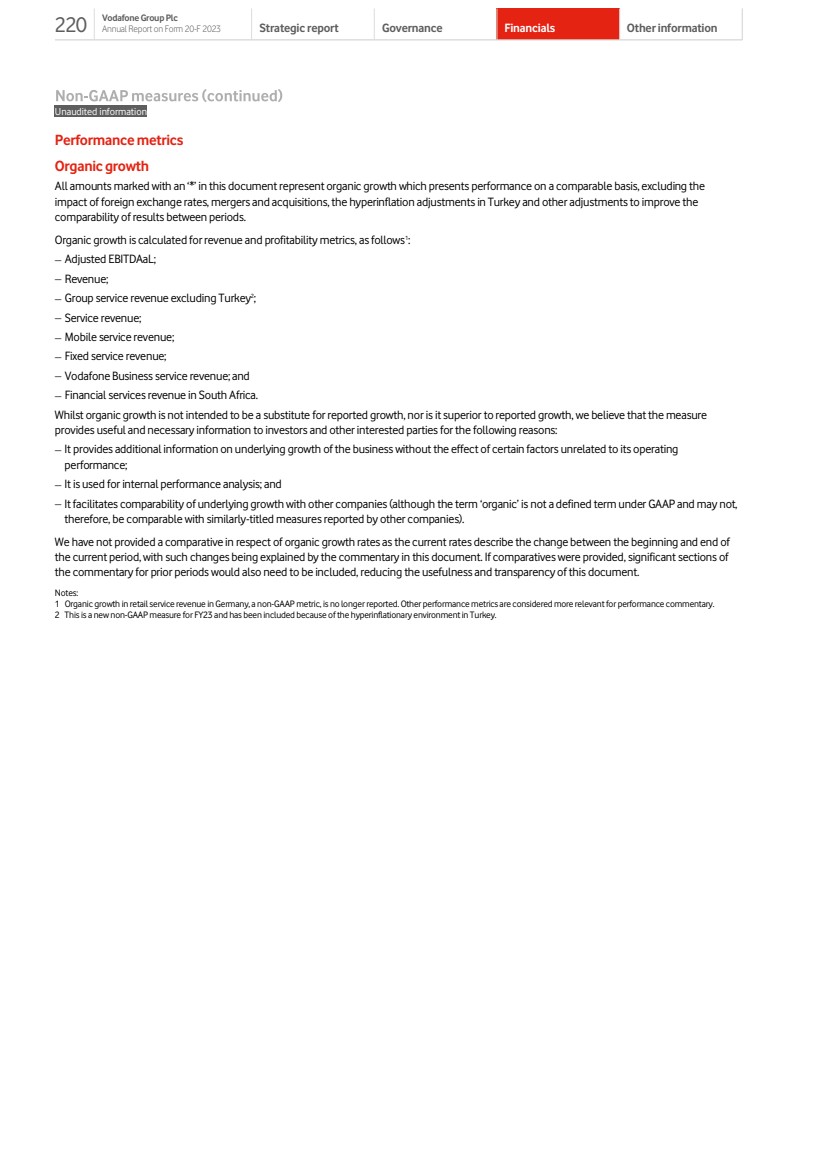

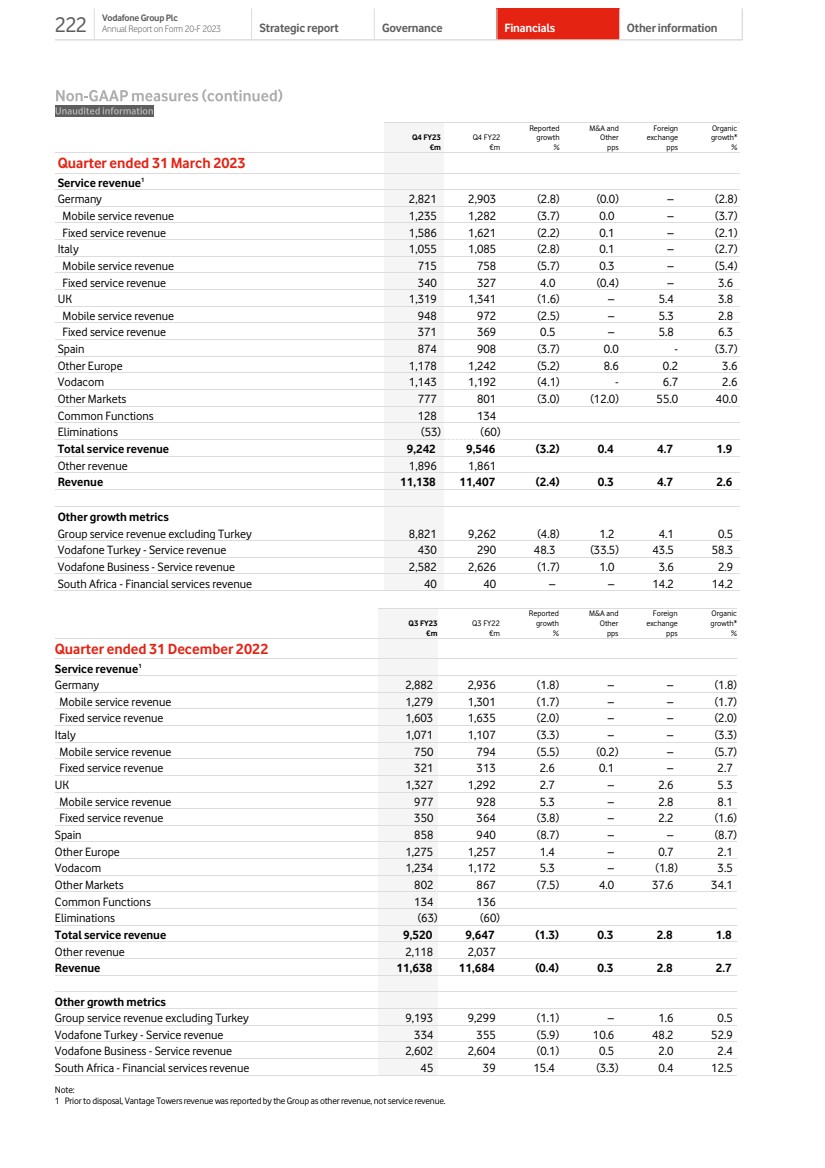

| – Group revenue increased by 0.3% to €45.7 billion driven by growth in Africa and higher equipment sales, offset by lower European service revenue and adverse exchange rate movements. – Group service revenue trend was impacted by a decline in Germany, Italy, and Spain, offset by continued growth in the UK, Other Europe, and Africa. – Service revenue growth in Turkey increased to 47.6%* driven by higher inflation. Group service revenue growth excluding Turkey was 1.0%*. – Operating profit increased from €5.8 billion to €14.3 billion, largely reflecting a gain on disposal of Vantage Towers. – Inflationary cost pressures in Europe were mitigated by our ongoing cost efficiency programme, with a further €0.2 billion of savings in FY23. Financial performance in line with expectations Our financial performance Group financial performance FY231 €m Re-presented2 FY22 €m Reported change % Revenue 45,706 45,580 0.3 – Service revenue 37,969 38,203 (0.6) – Other revenue 7,737 7,377 Operating profit3 14,296 5,813 145.9 Investment income 248 254 Financing costs (1,728) (1,964) Profit before taxation 12,816 4,103 Income tax expense (481) (1,330) Profit for the financial year 12,335 2,773 Attributable to: – Owners of the parent 11,838 2,237 – Non-controlled interests 497 536 Profit for the financial year 12,335 2,773 Basic earnings per share 42.77c 7.71c Notes: 1. The FY23 results reflect average foreign exchange rates of €1:£0.86, €1:INR 83.69, €1:ZAR 17.69, €1:TRY 18.53 and €1: EGP 23.72. 2. The results for the year ended 31 March 2022 have been re-presented to reflect that Indus Towers Limited is no longer reported as held for sale. There is no impact on previously reported revenue. However, operating profit, profit before taxation and profit for the financial year have all increased by €149 million compared to amounts previously reported. Consequently, basic earnings per share increased by 0.51c compared to amounts previously reported. See note 7 ‘Discontinued operations and assets held for sale’ in the consolidated financial statements for more information. 3. Includes a gain on the disposal of Vantage Towers of €8,607 million, a gain on the disposal of Vodafone Ghana of €689 million, slightly offset by a loss on disposal of Vodafone Hungary of €69 million. Organic growth All amounts marked with an ‘*’ in the commentary represent organic growth which presents performance on a comparable basis, excluding the impact of foreign exchange rates, mergers and acquisitions, the hyperinflation adjustments in Turkey and other adjustments to improve the comparability of results between periods. Organic growth figures are non-GAAP measures. Read more about non-GAAP measures on page 219 16 Strategic report Vodafone Group Plc Annual Report on Form 20-F 2023 Governance Financials Other information |

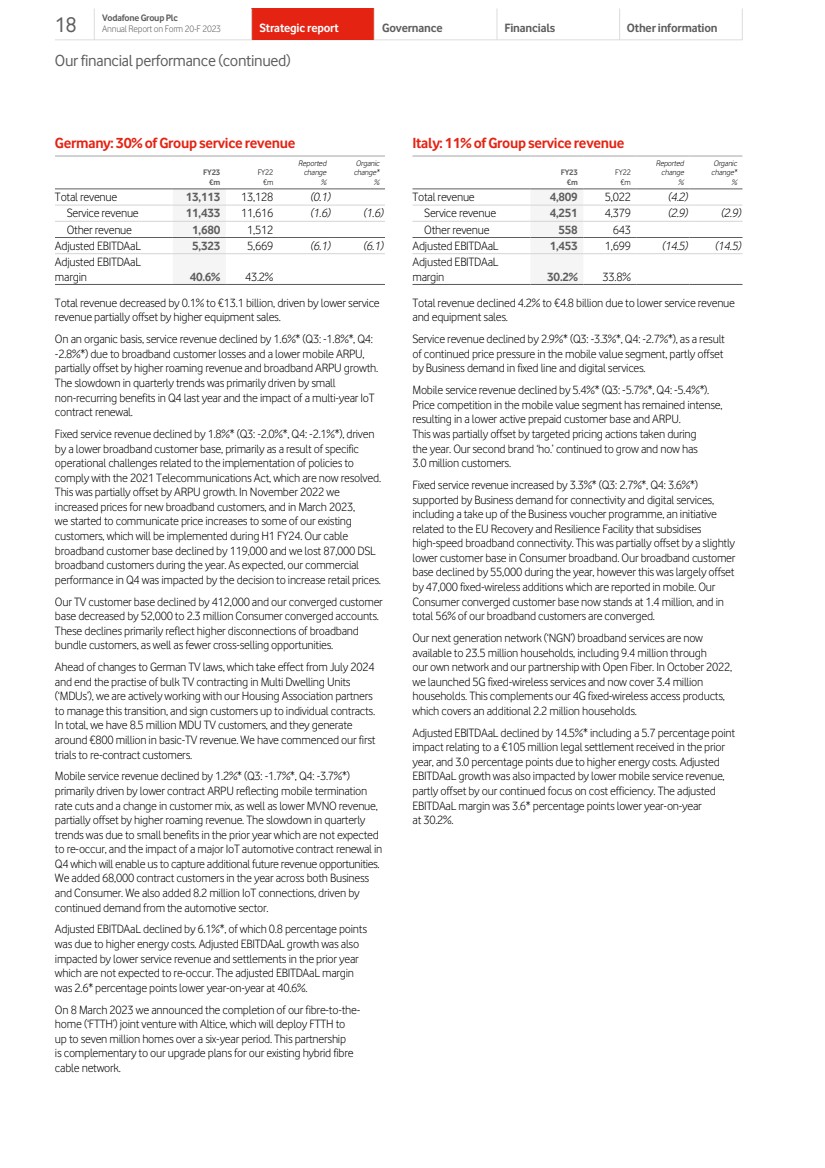

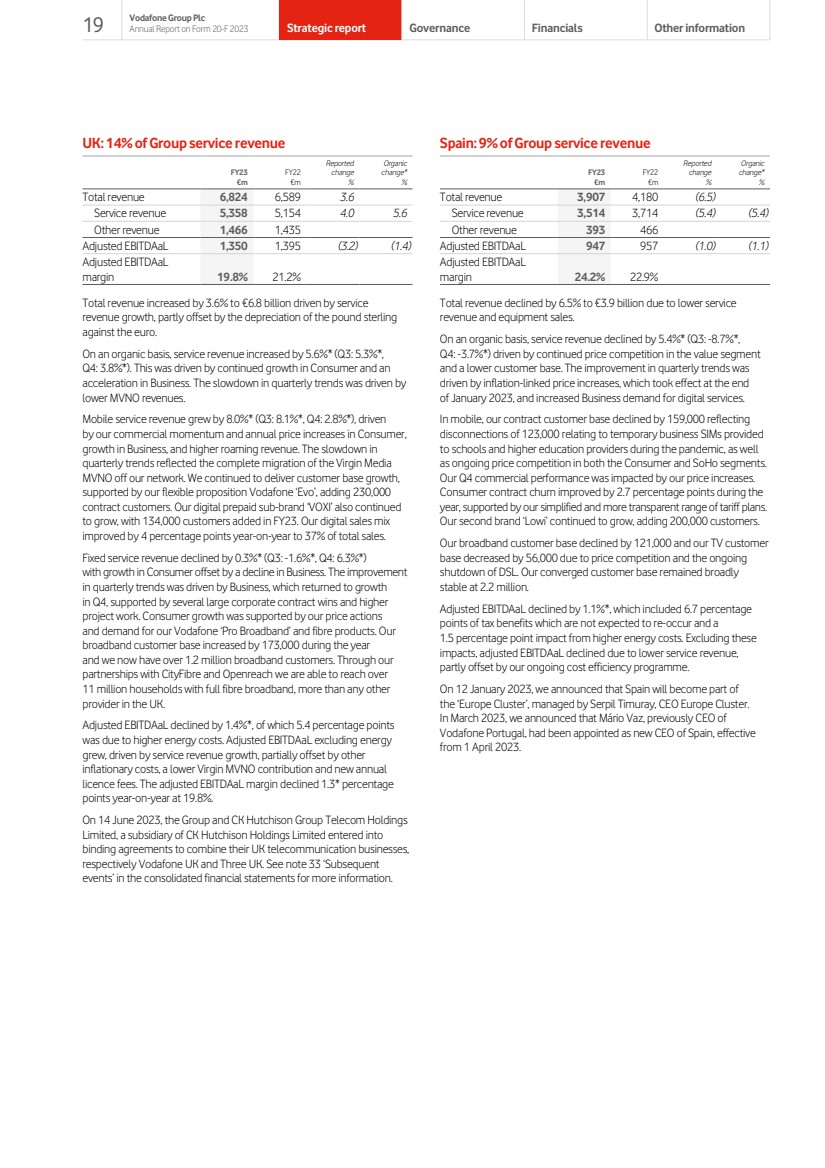

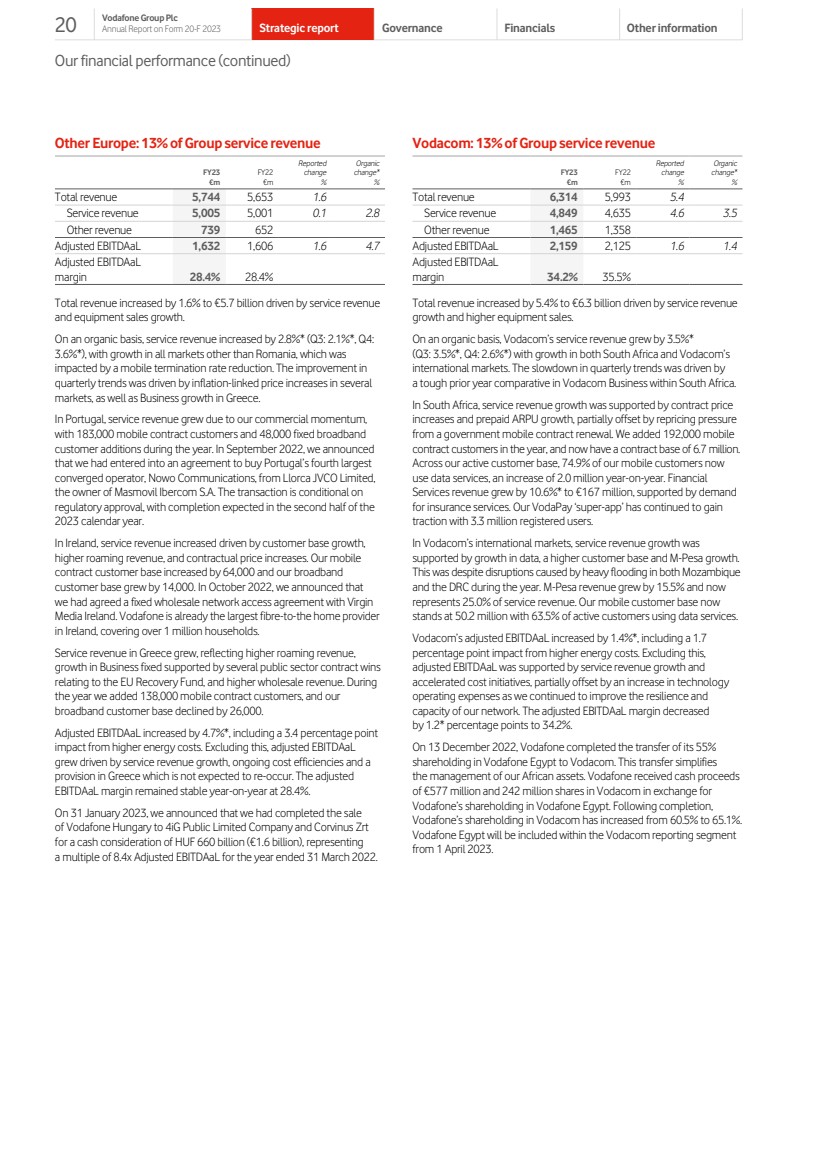

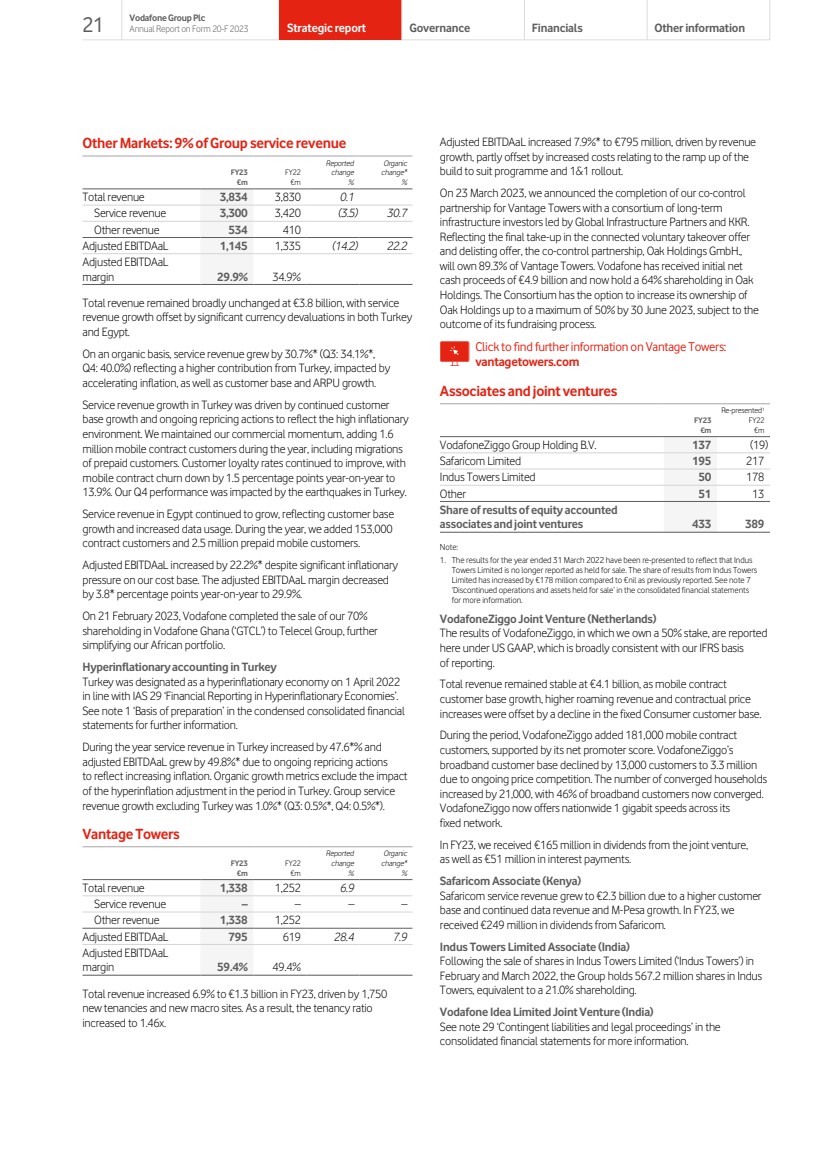

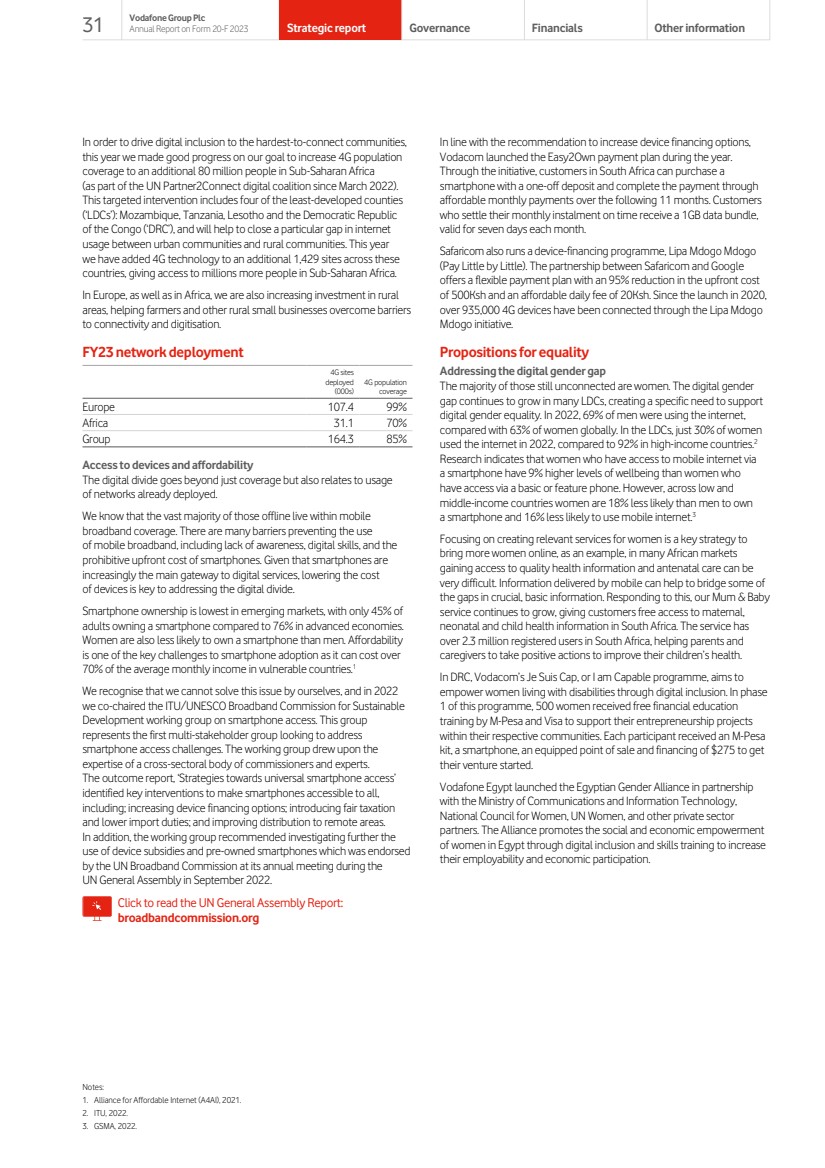

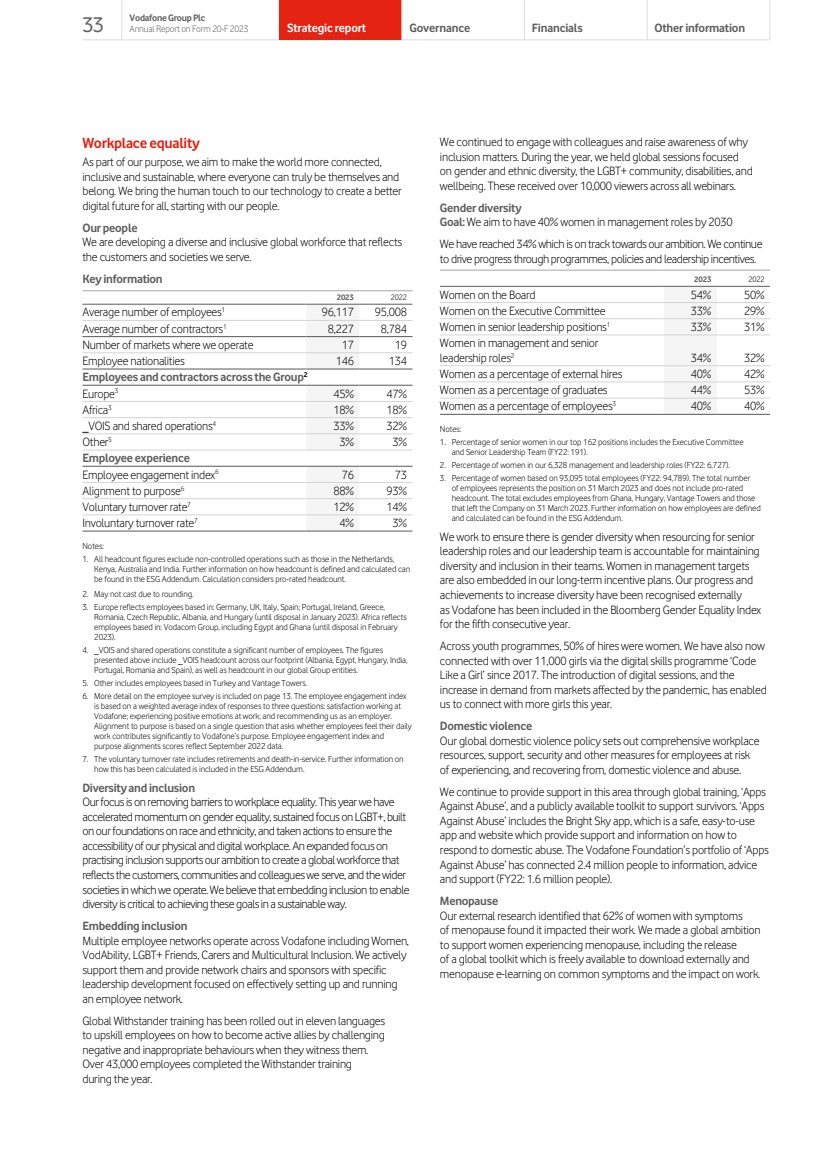

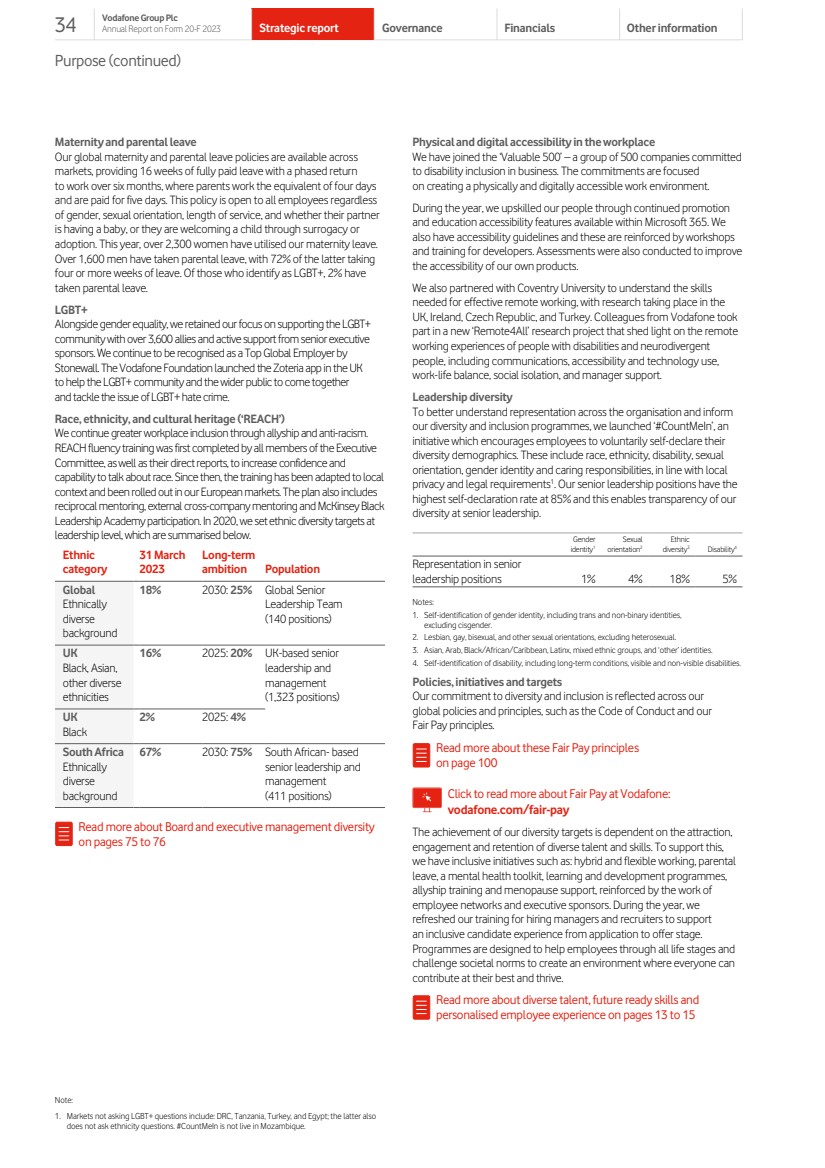

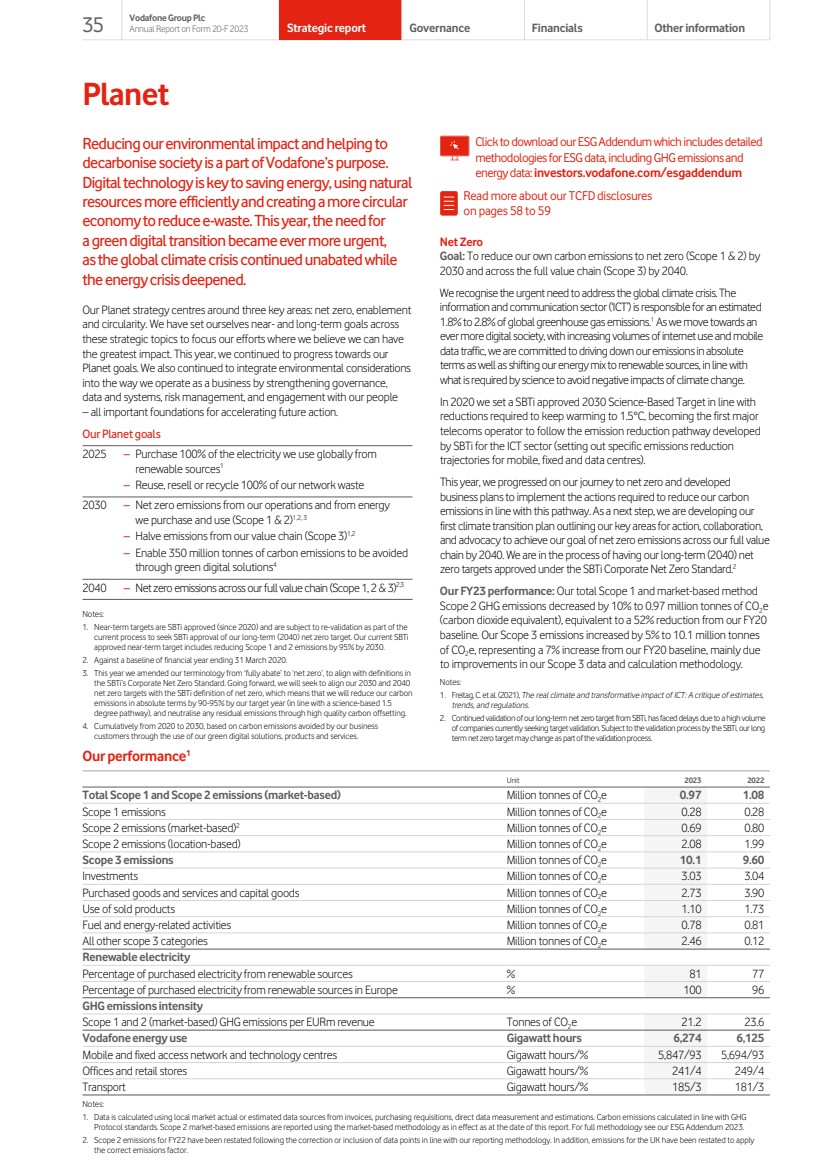

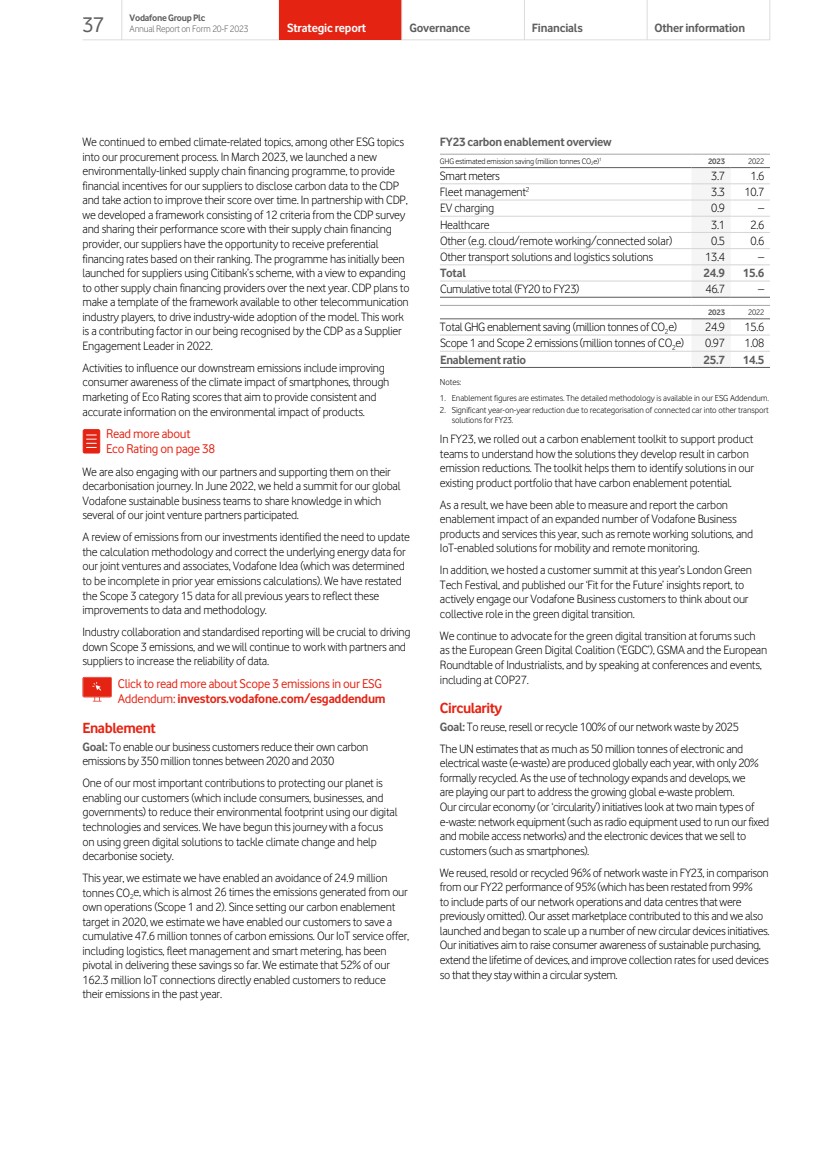

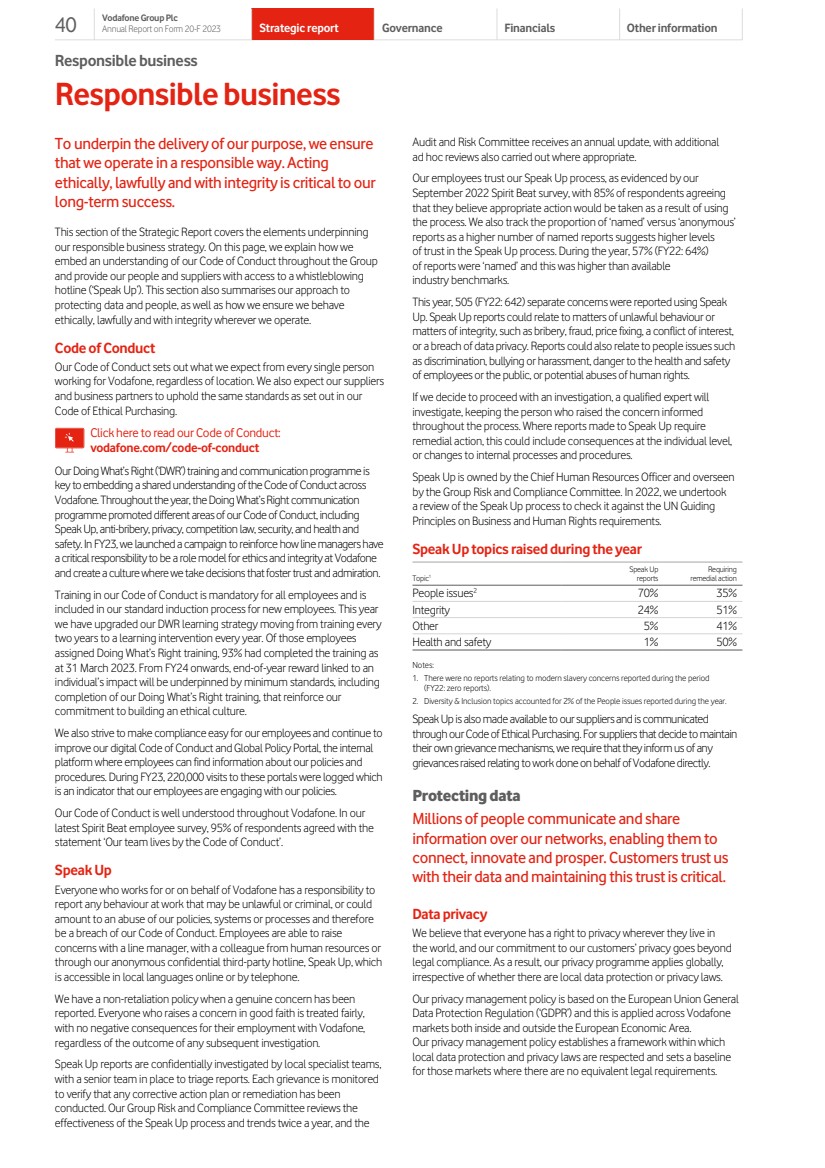

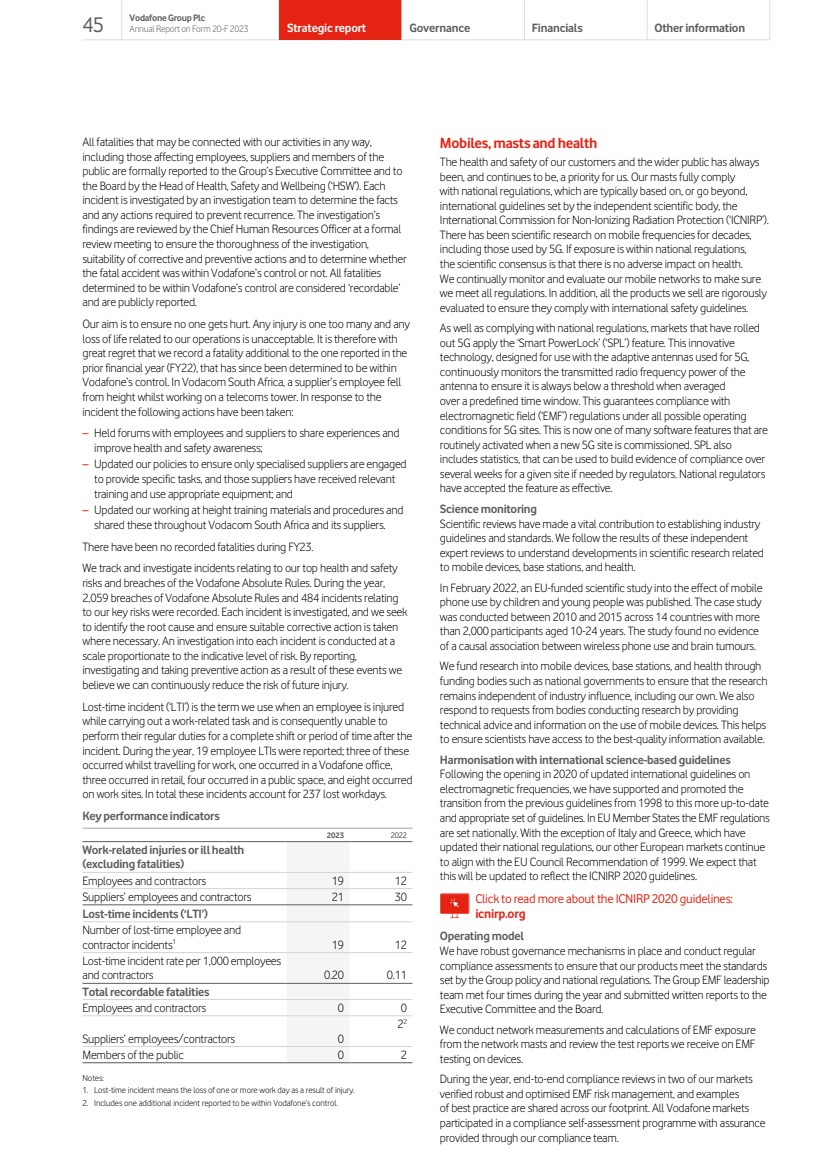

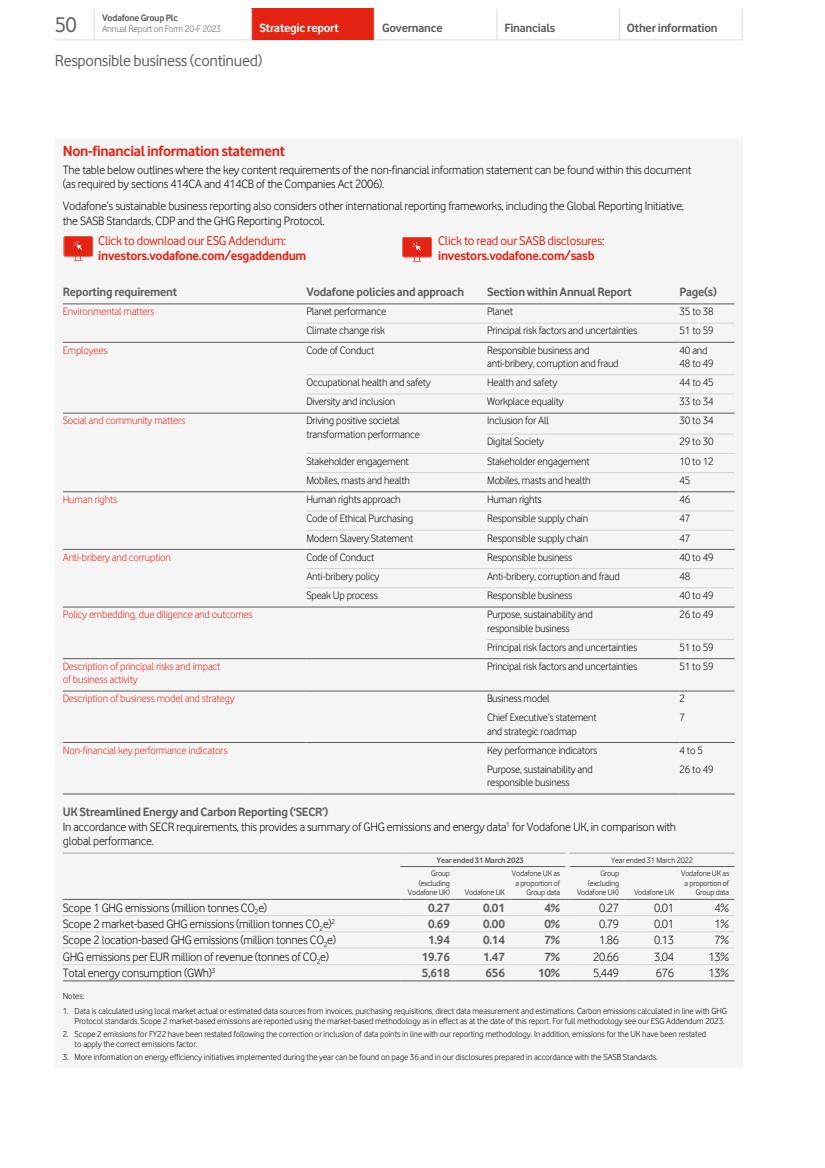

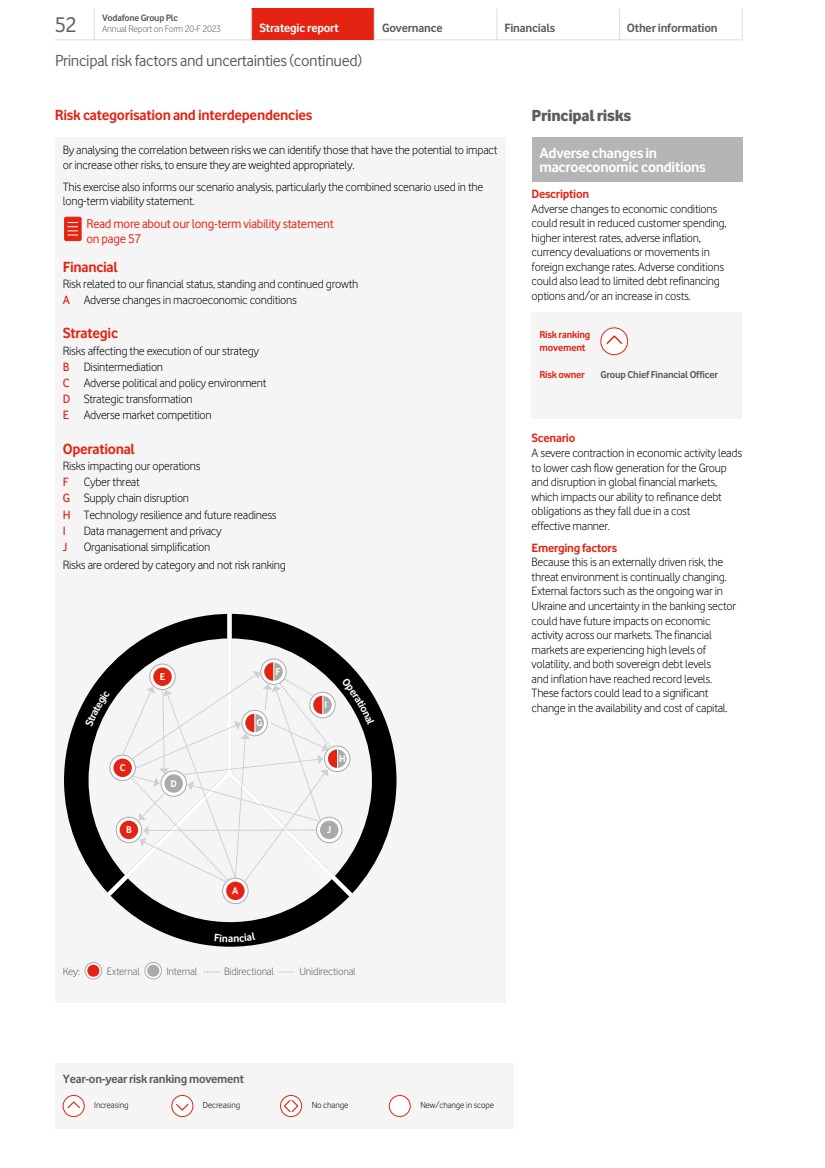

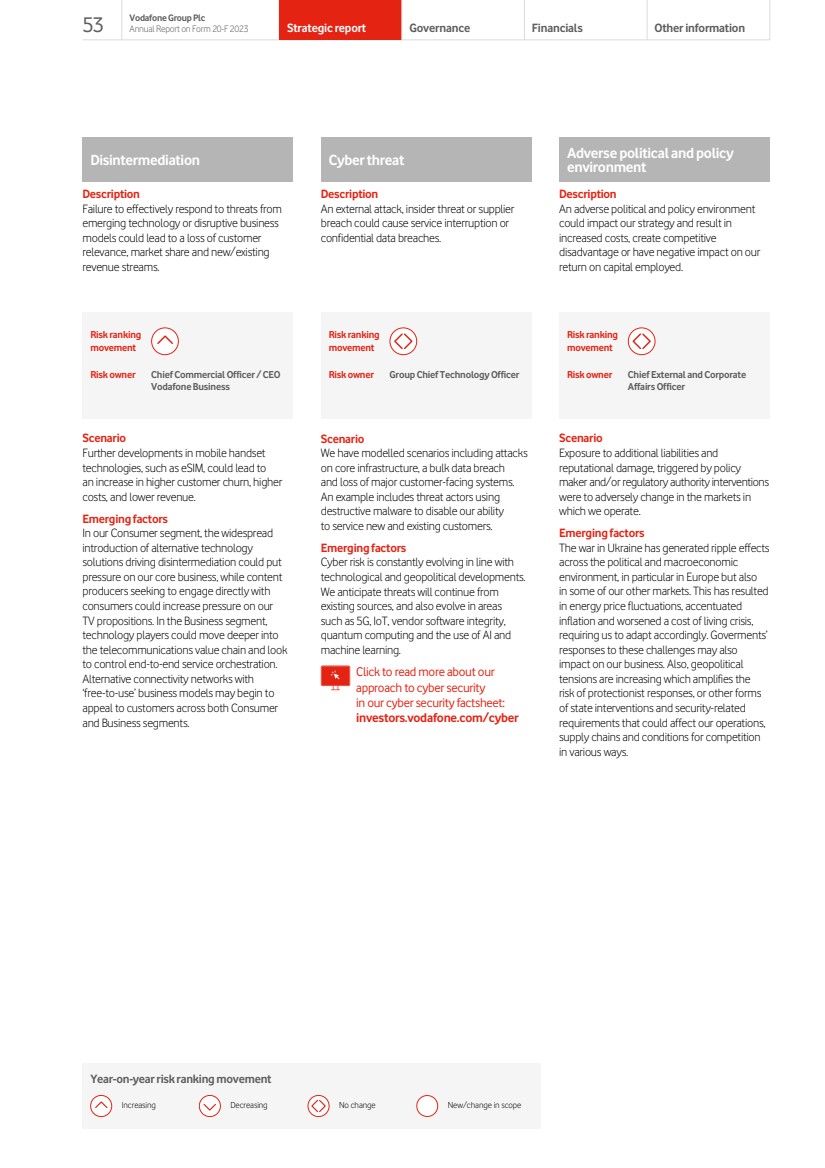

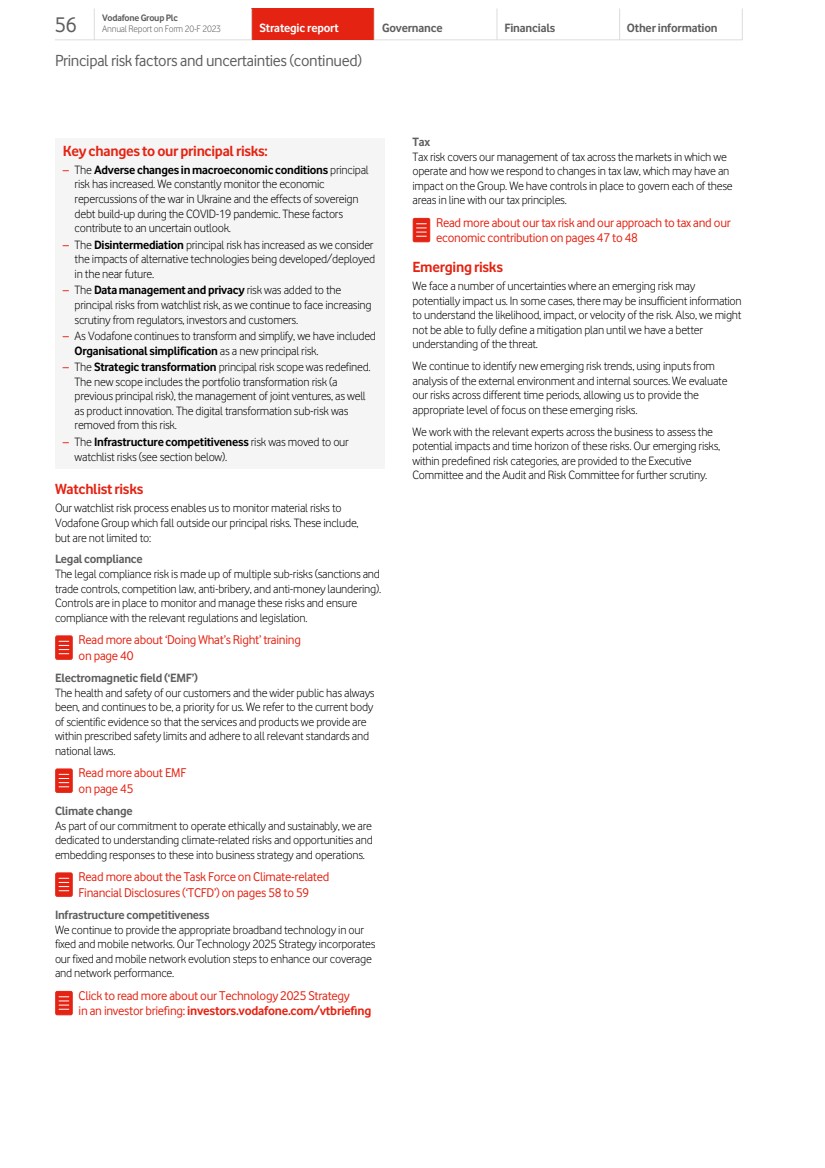

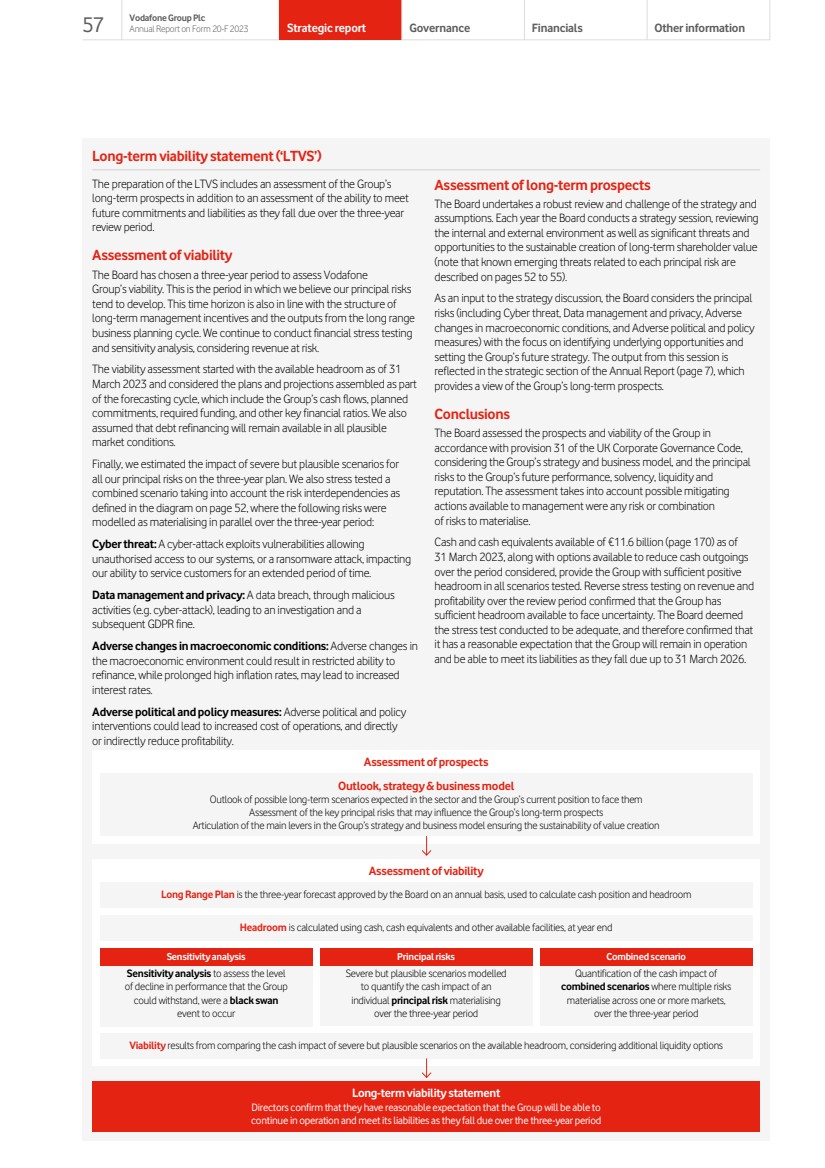

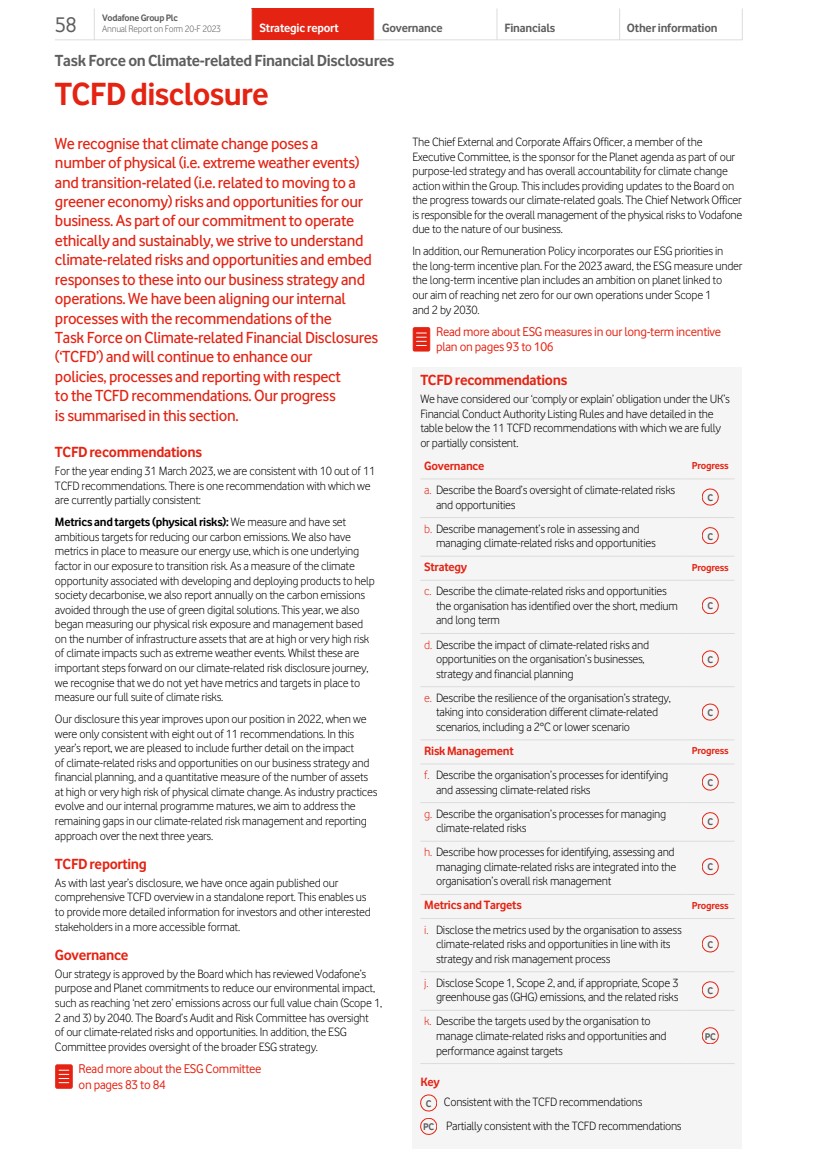

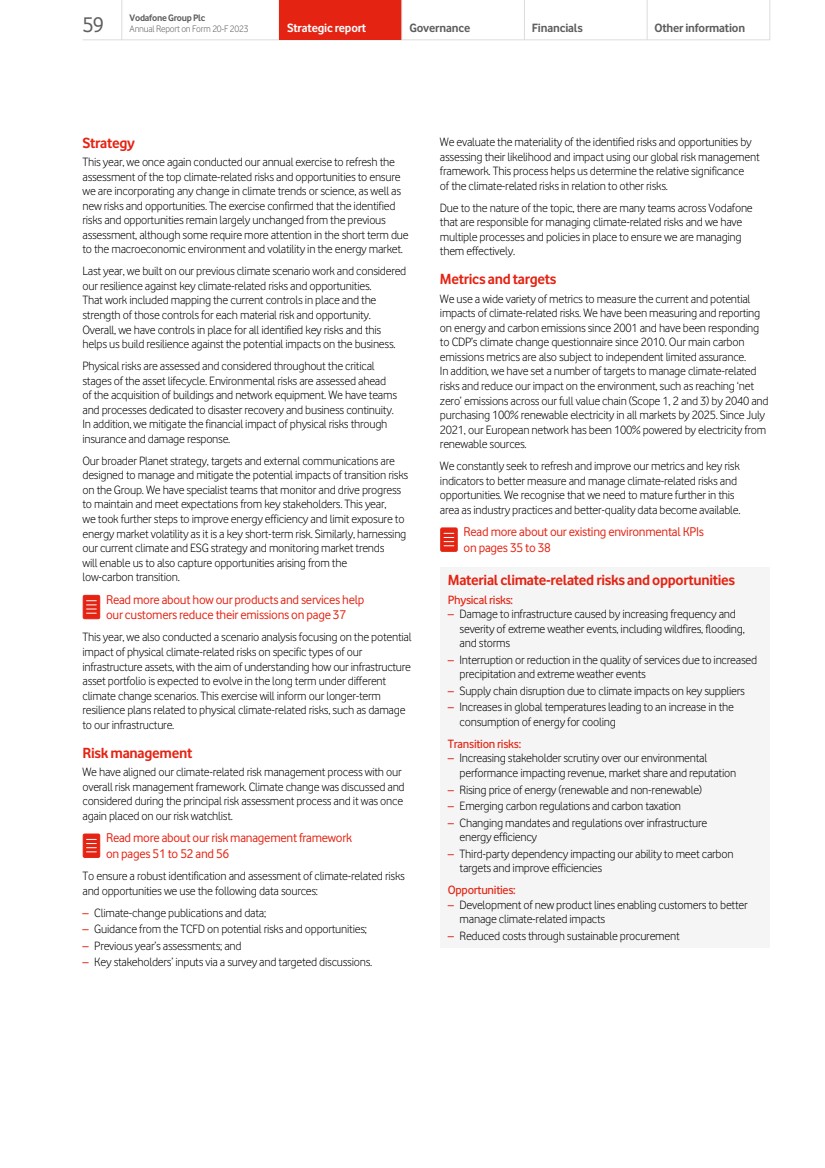

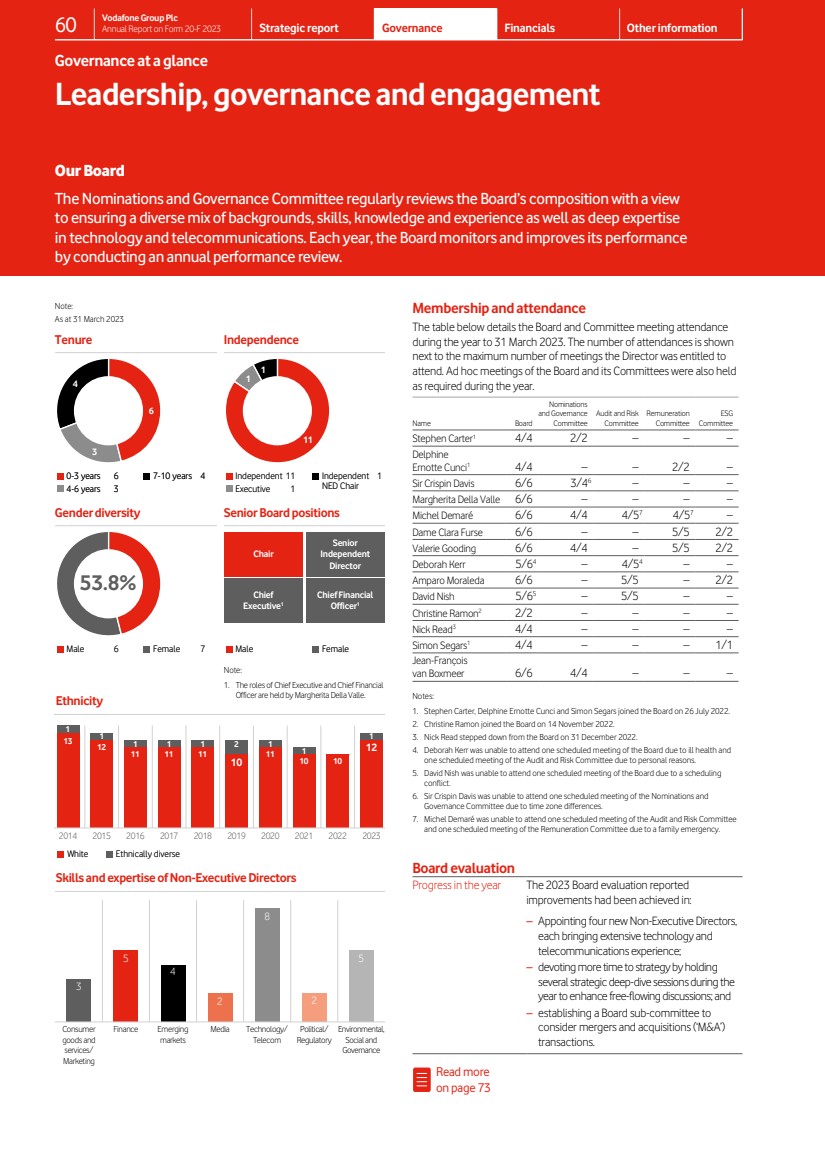

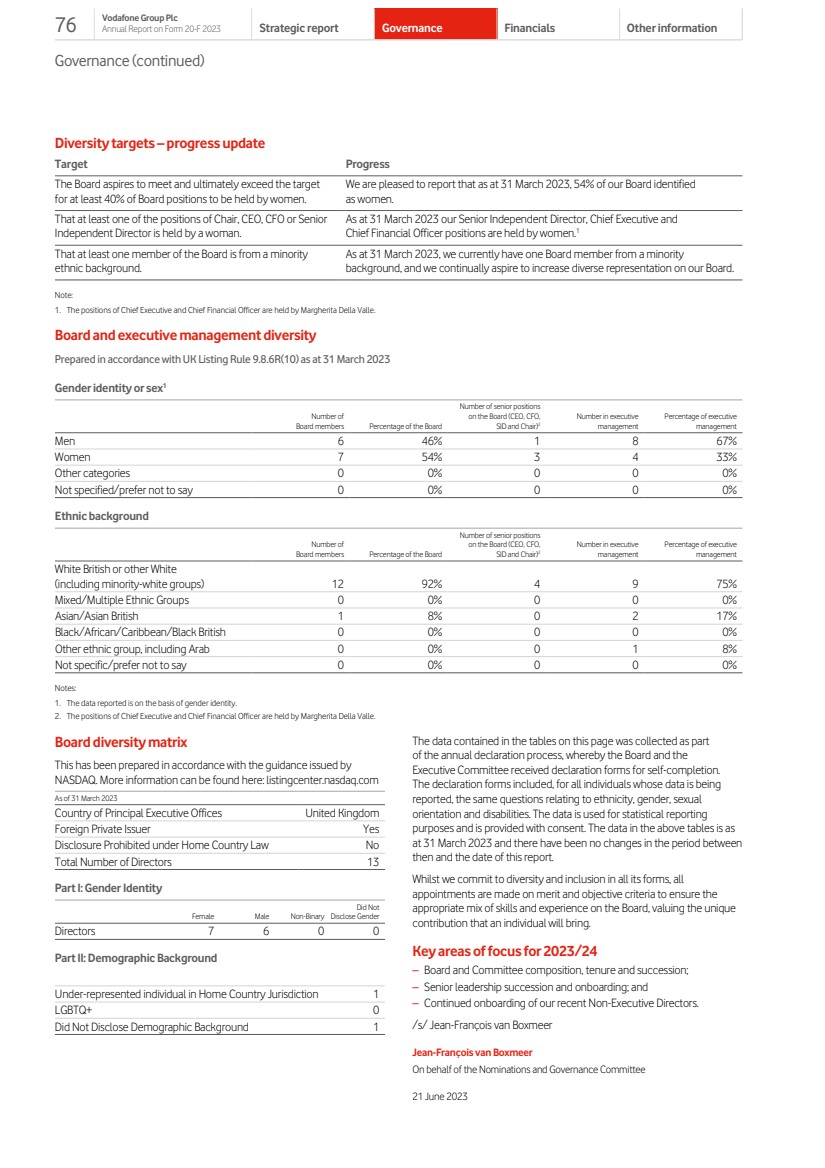

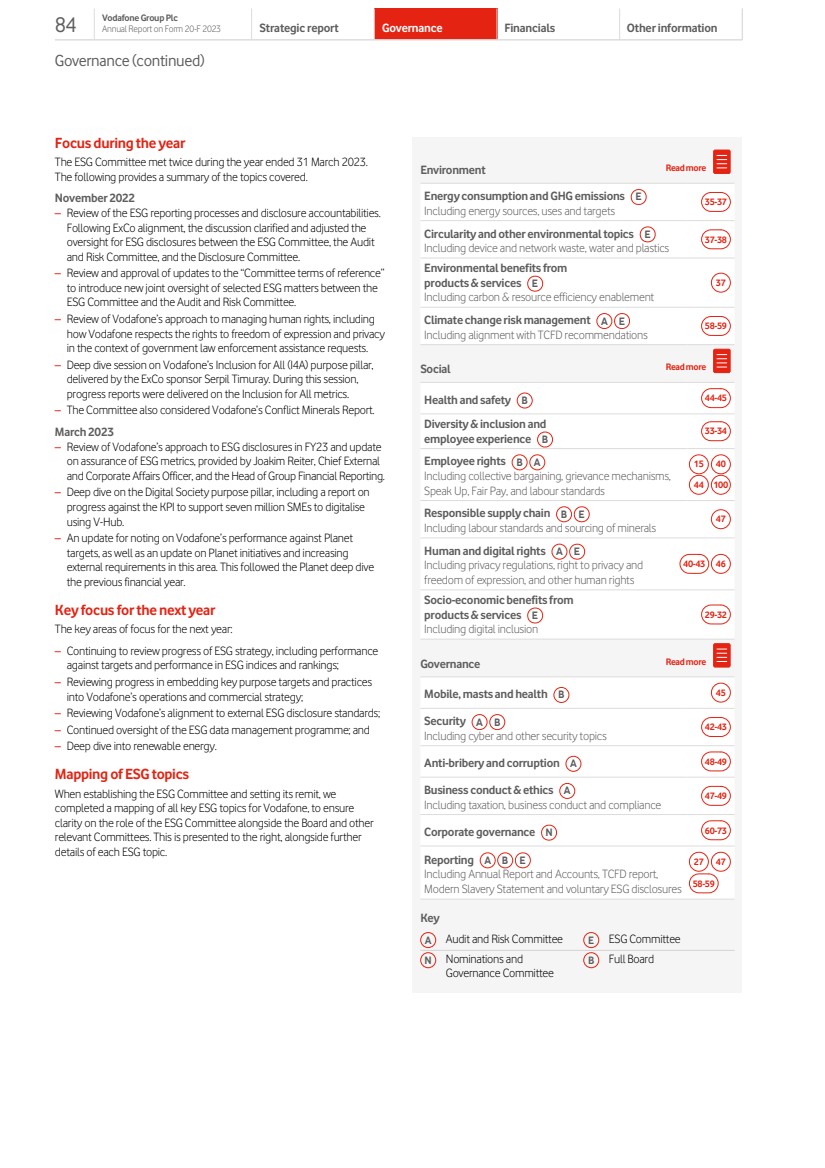

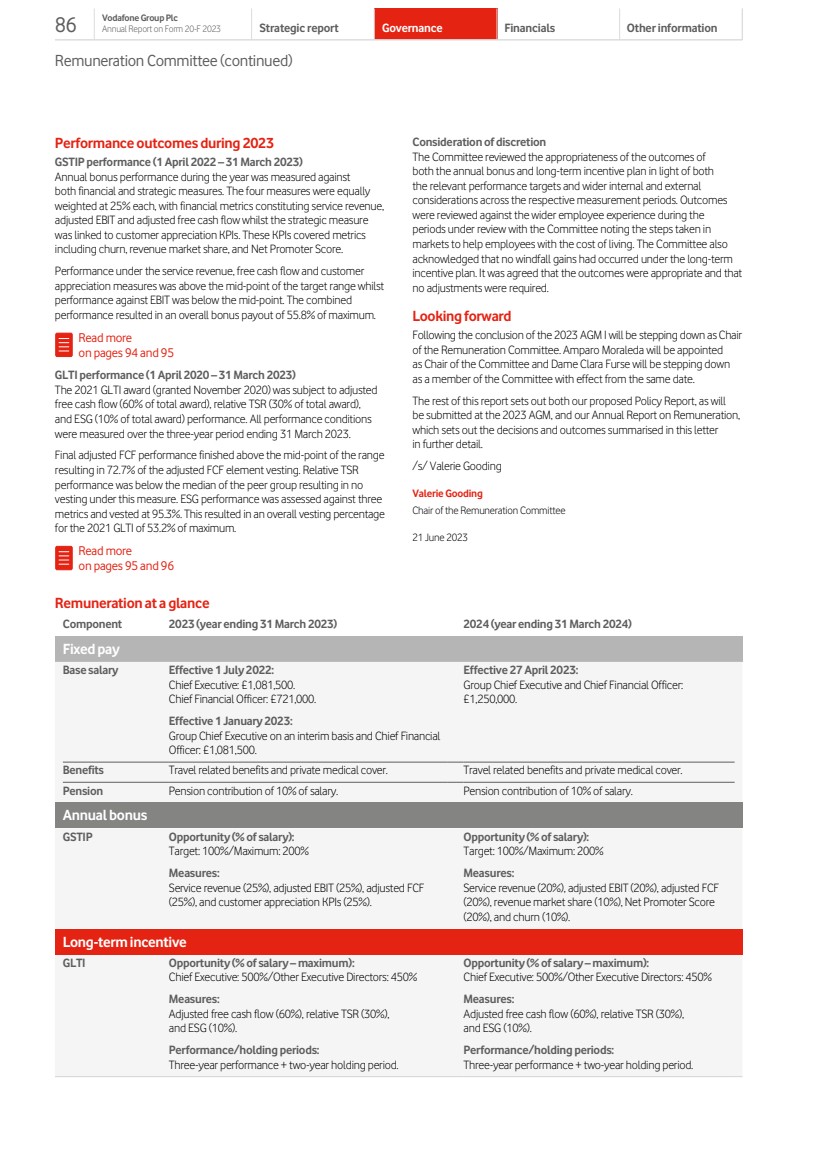

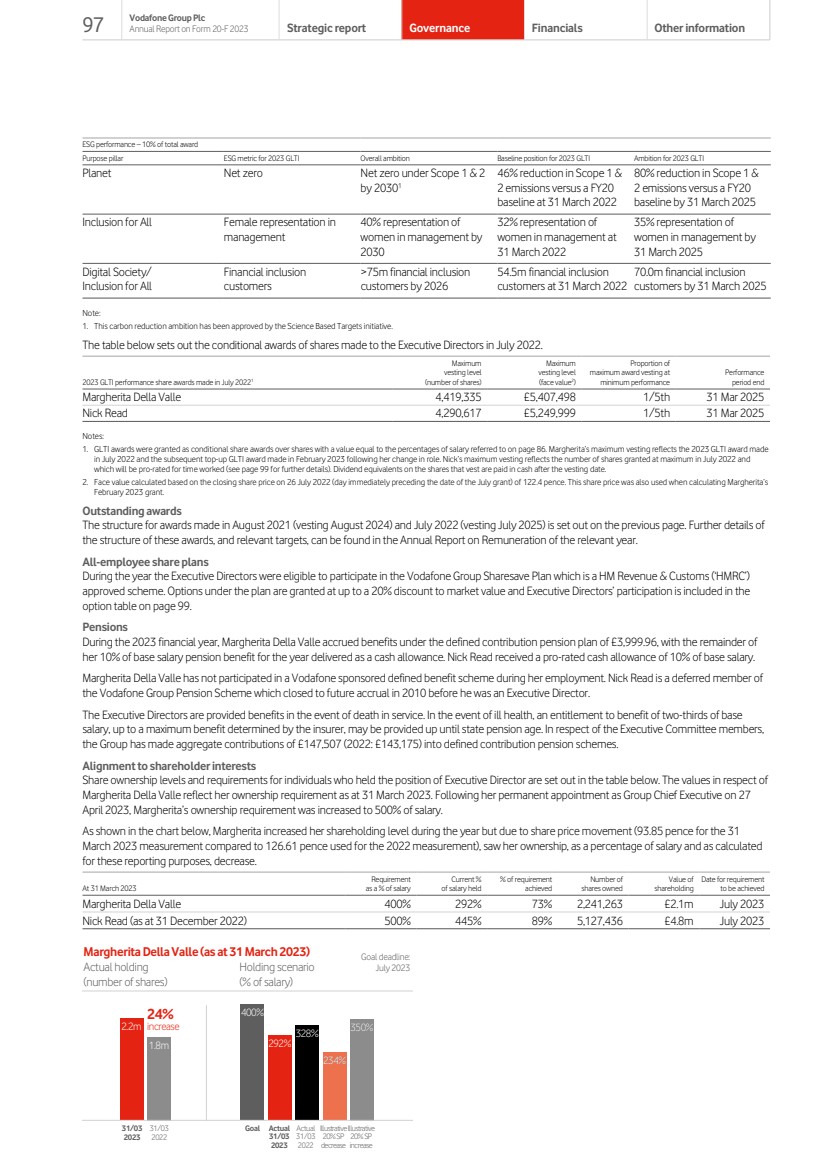

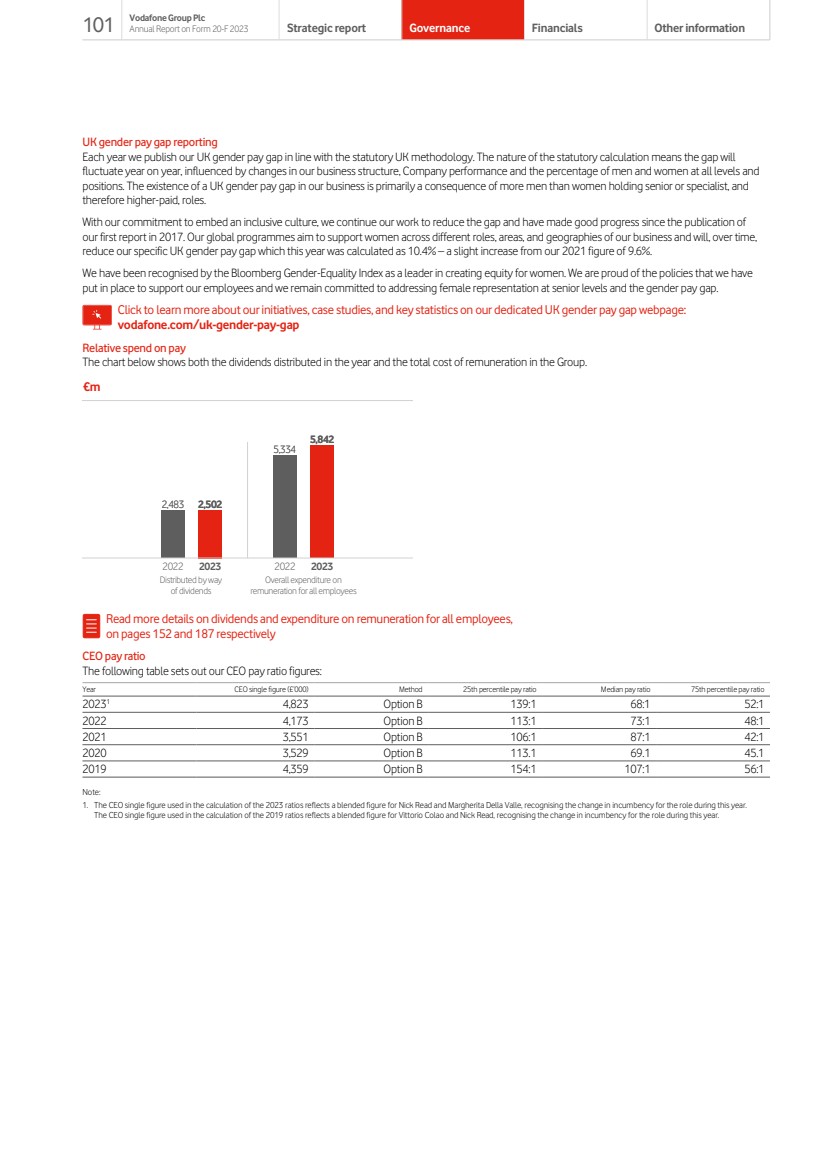

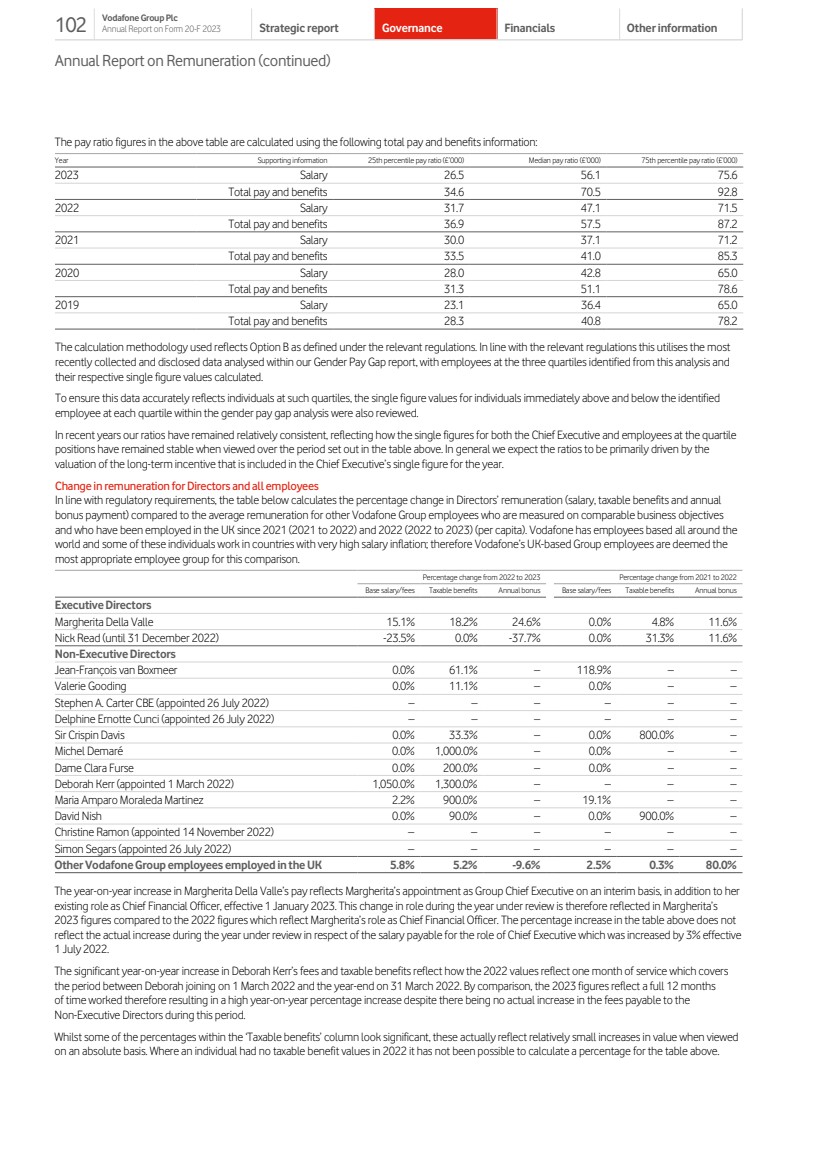

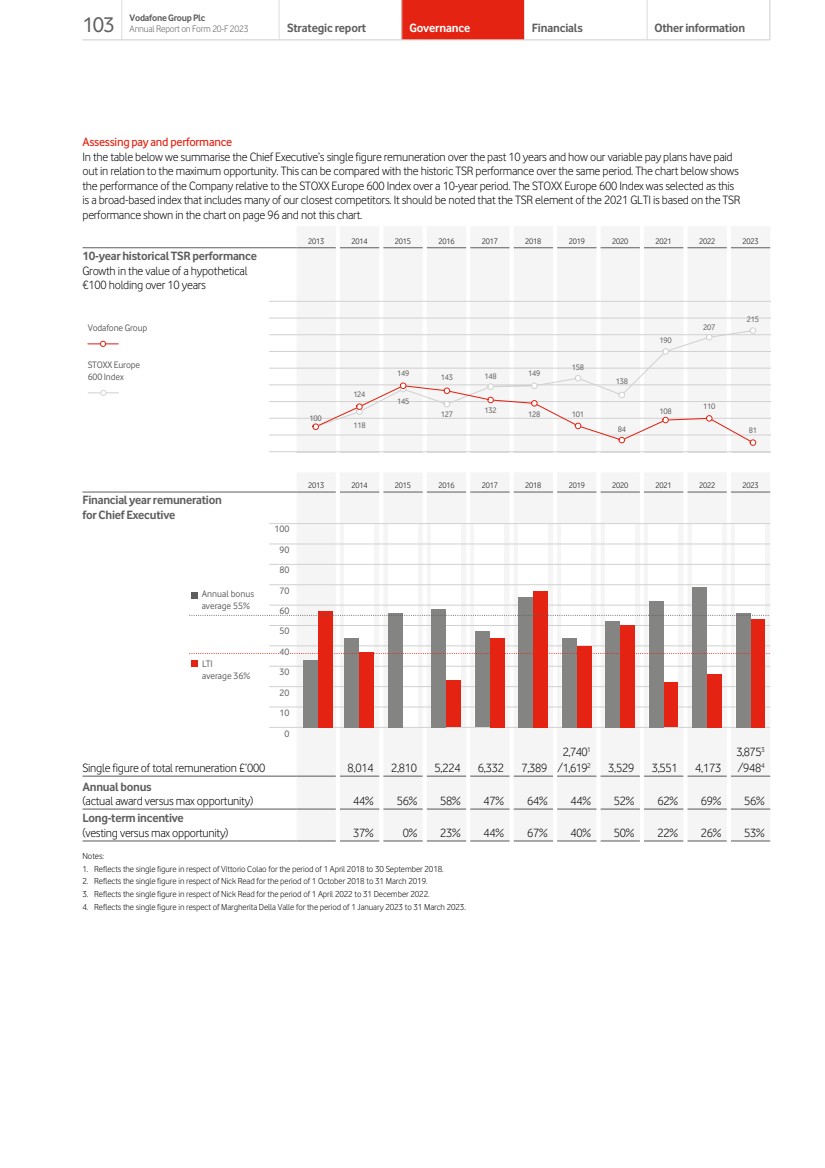

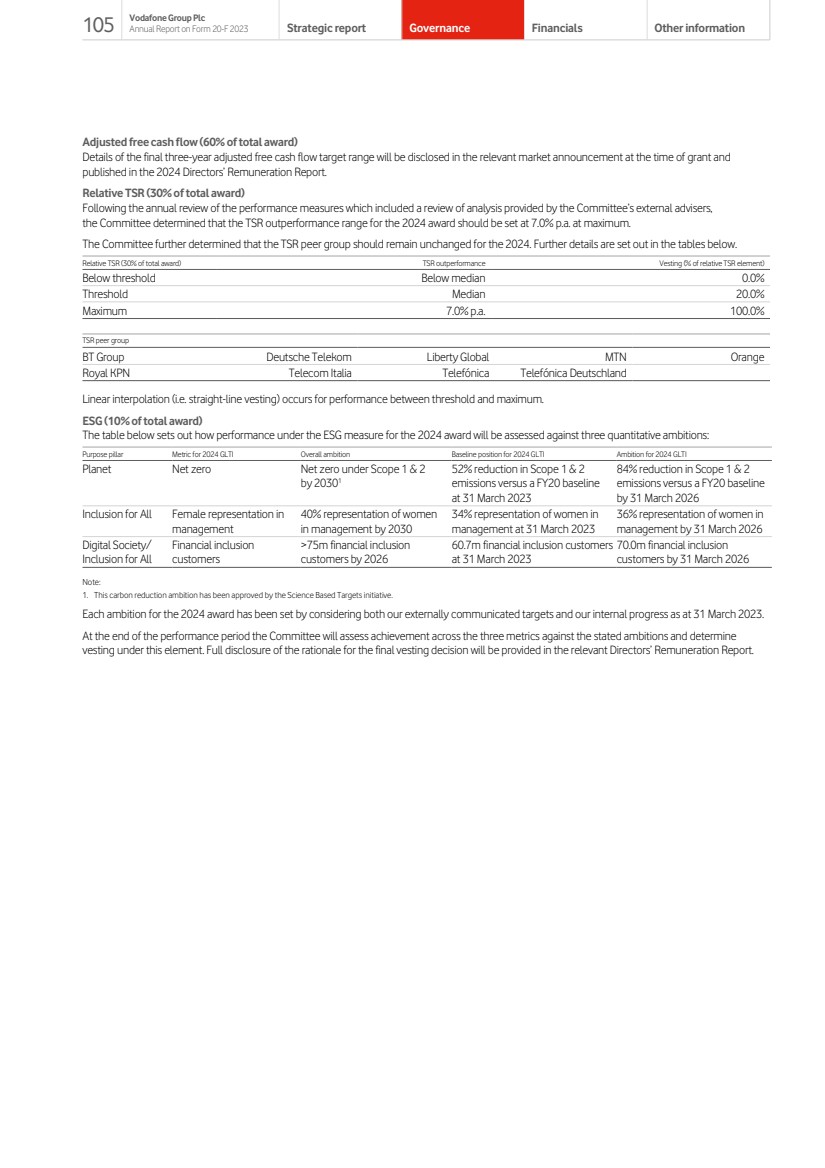

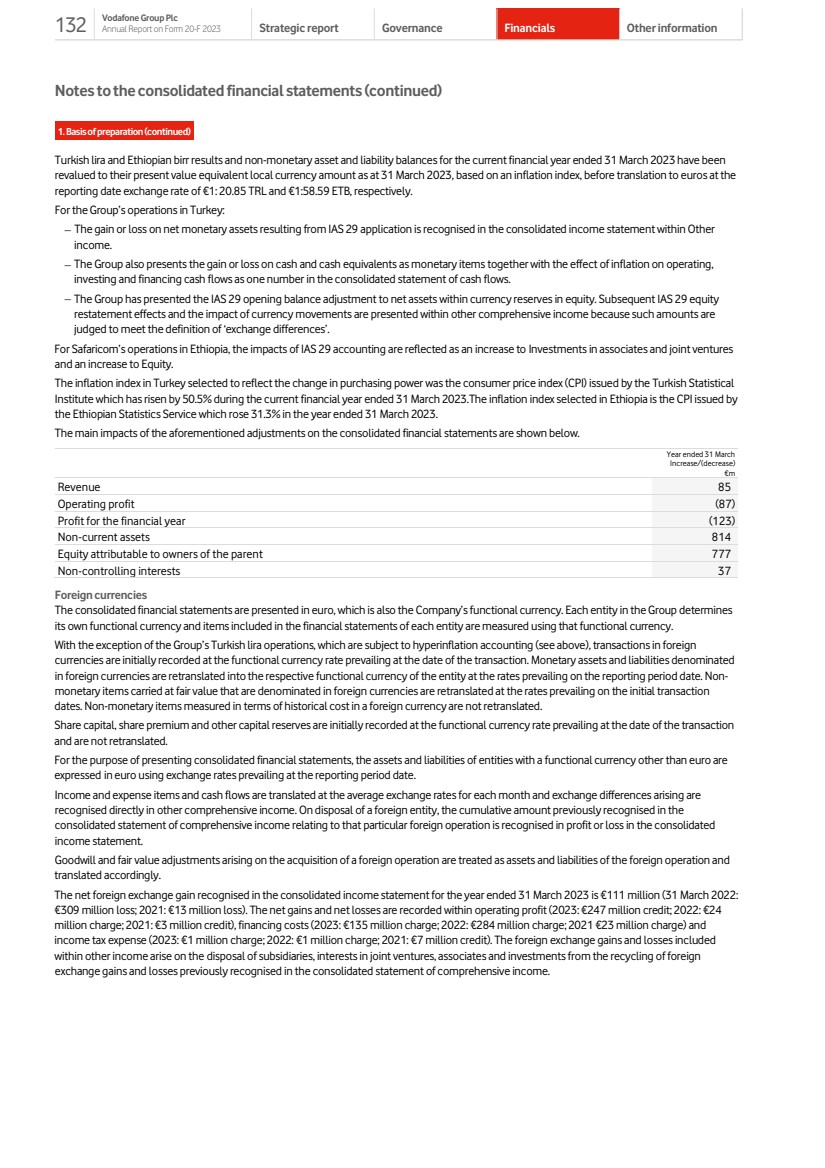

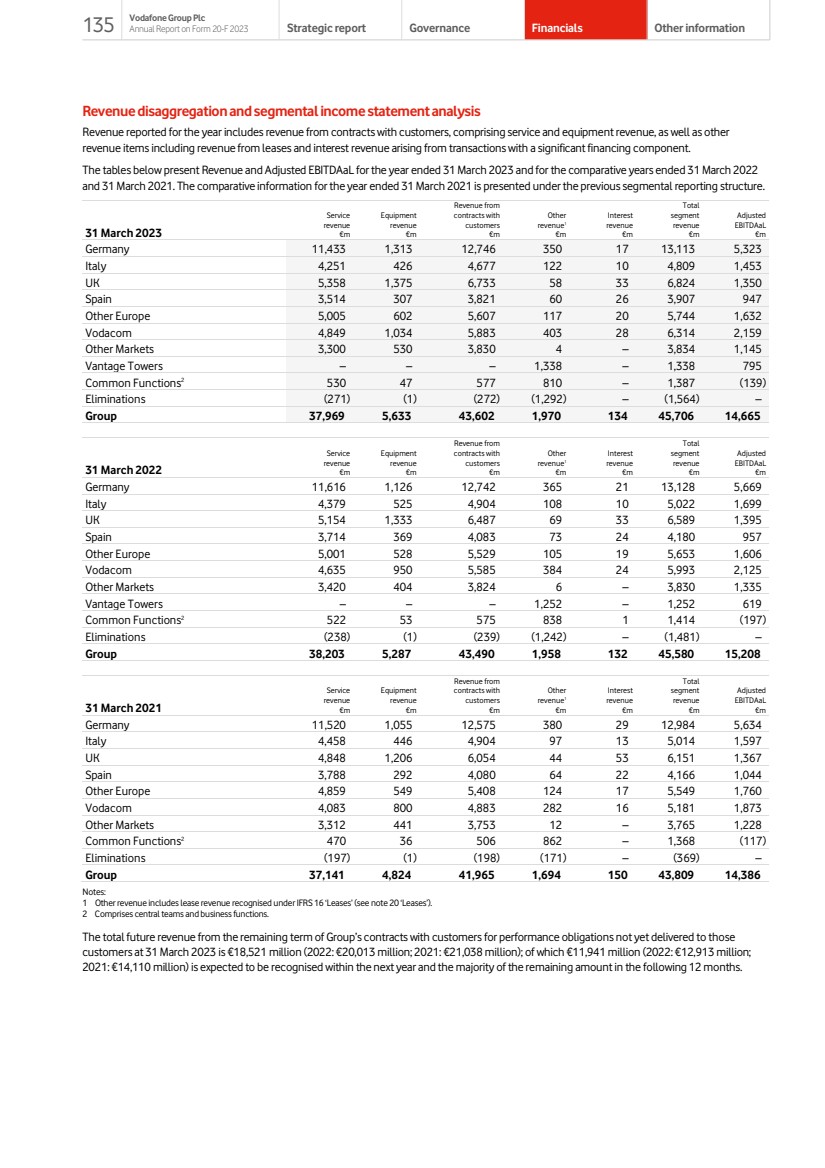

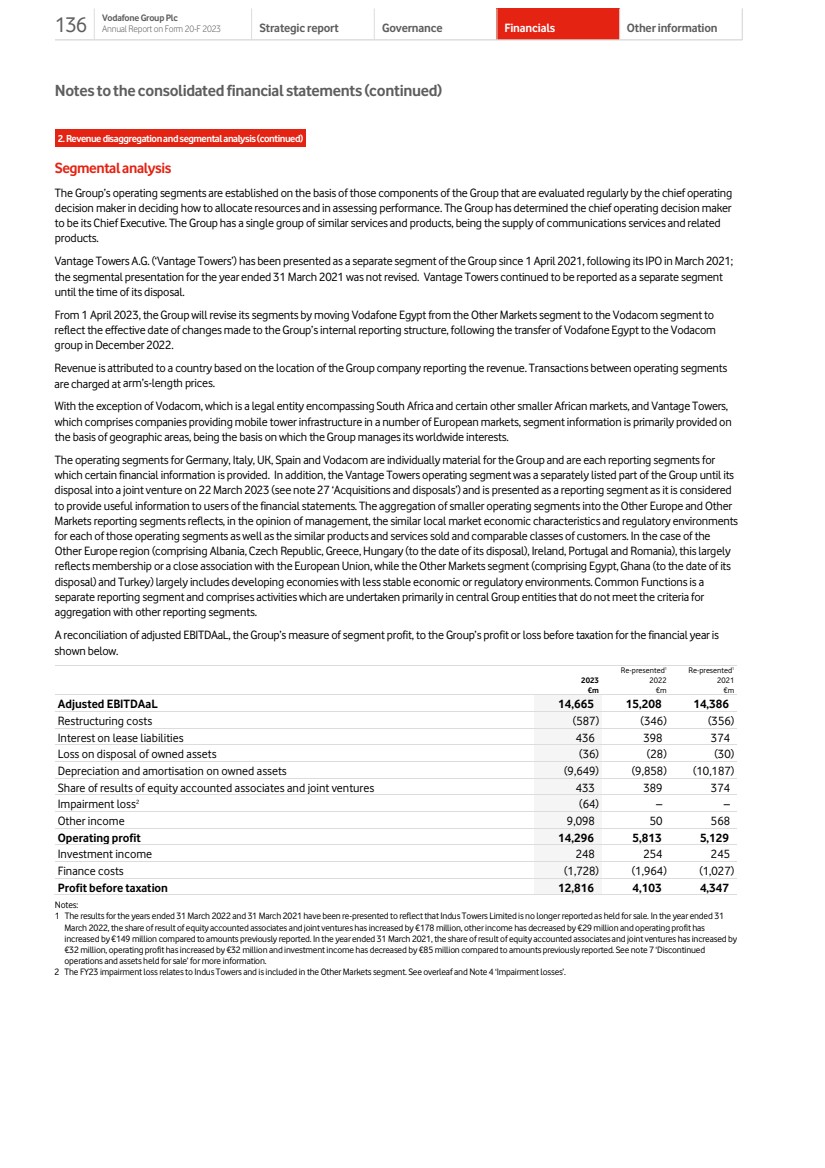

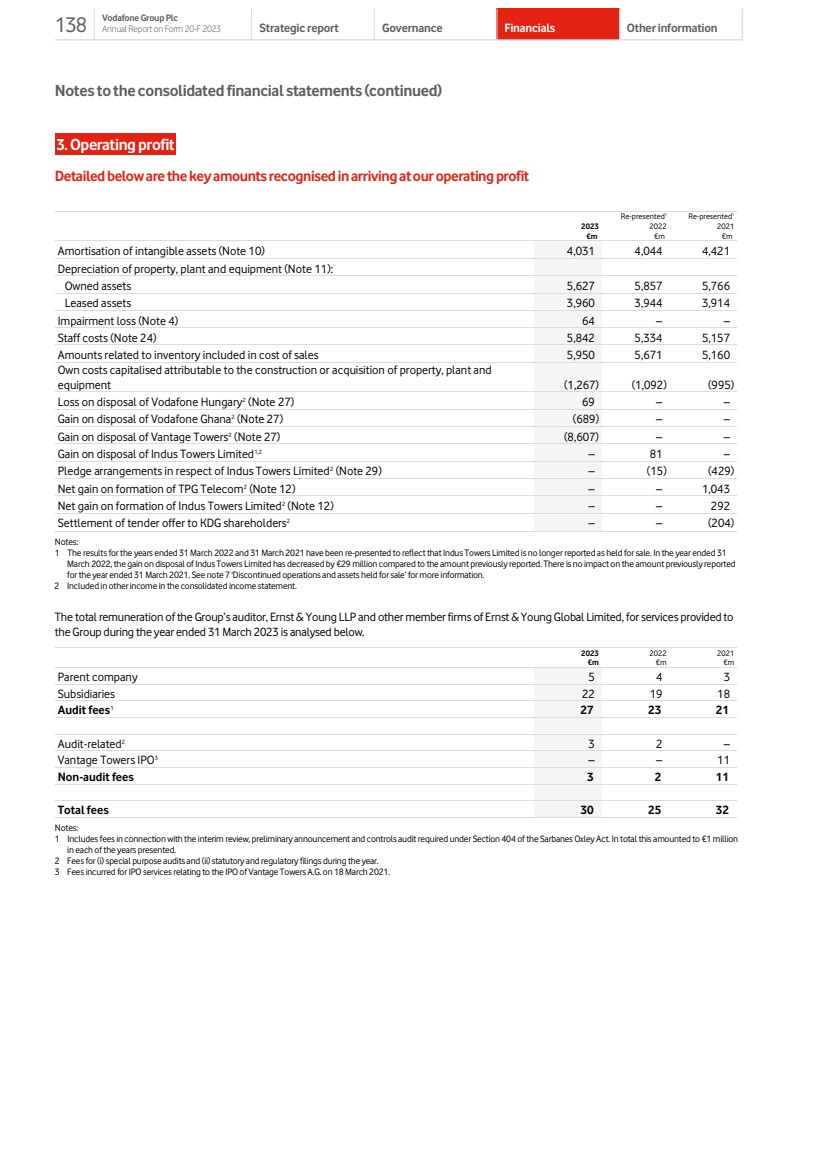

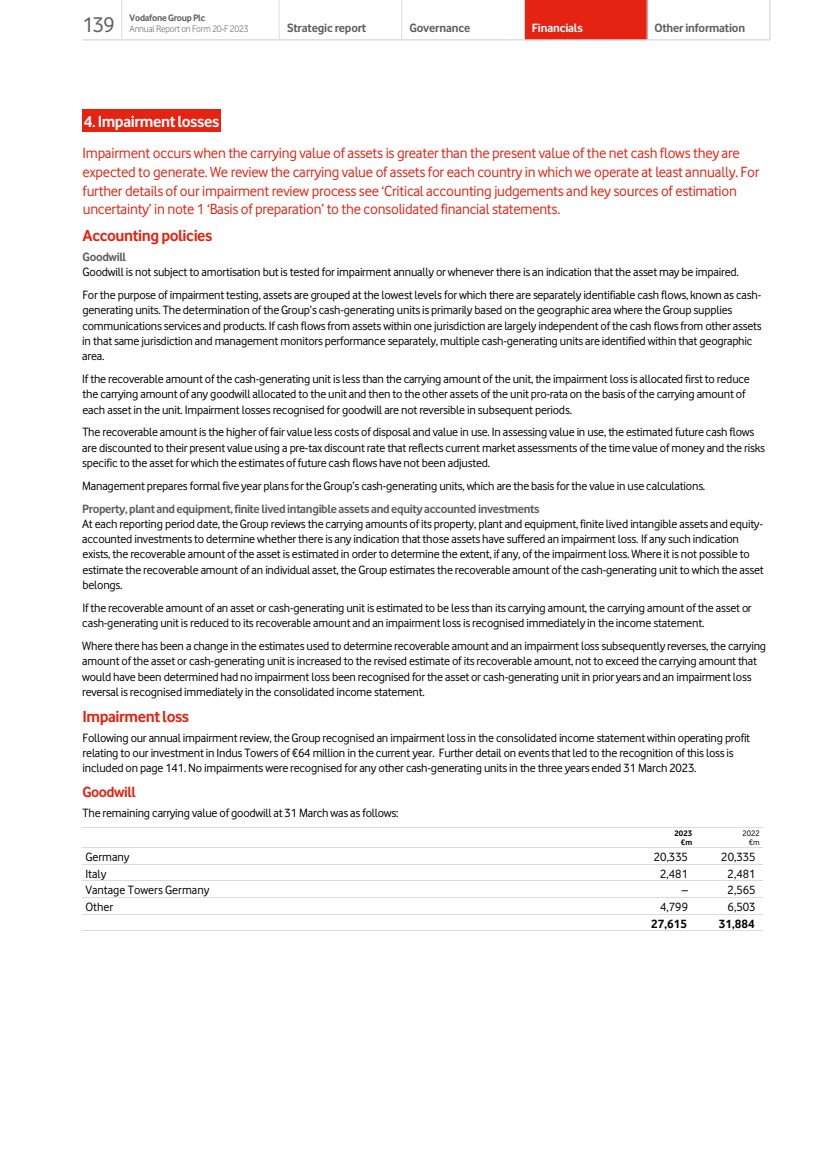

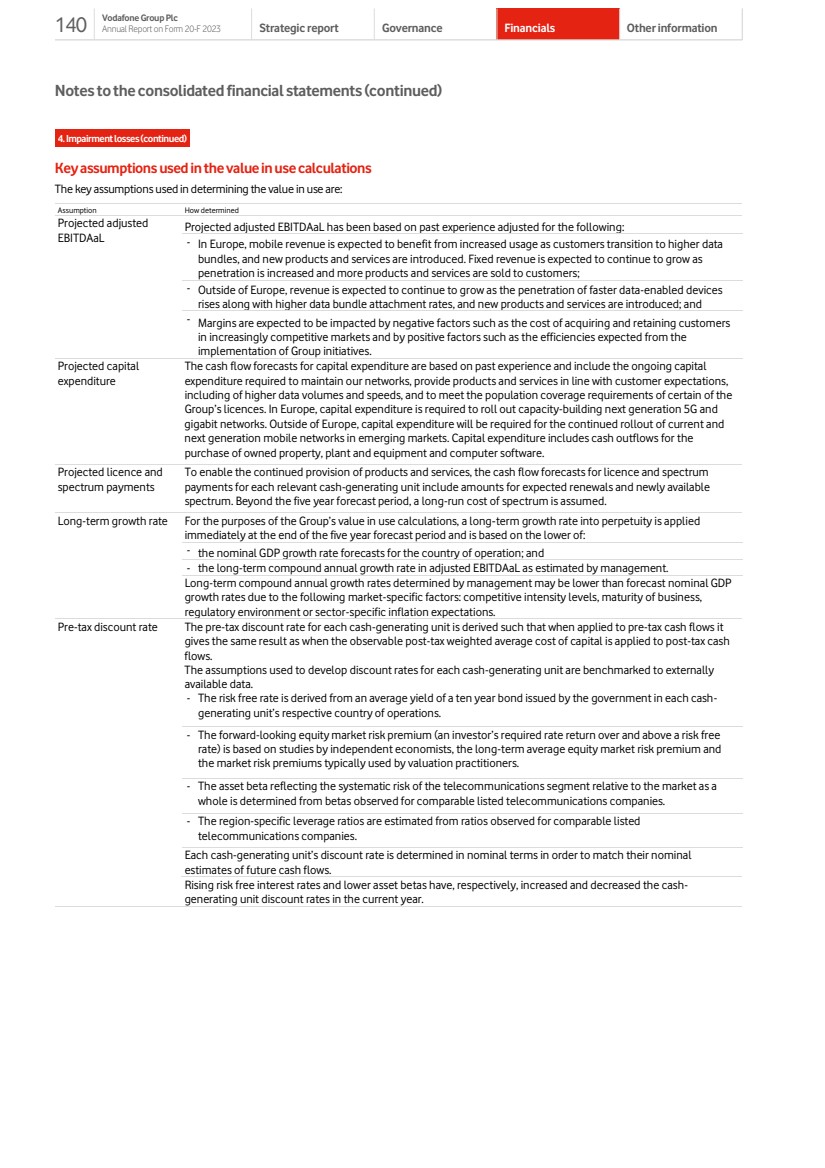

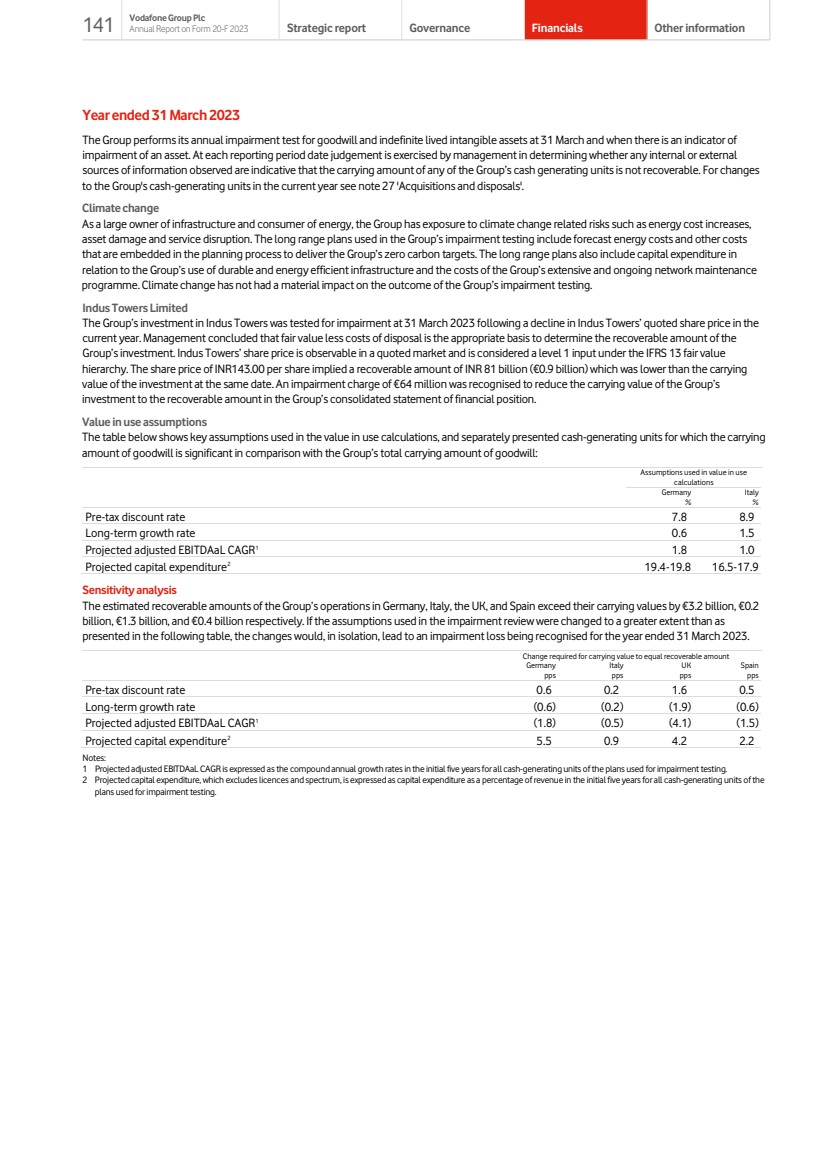

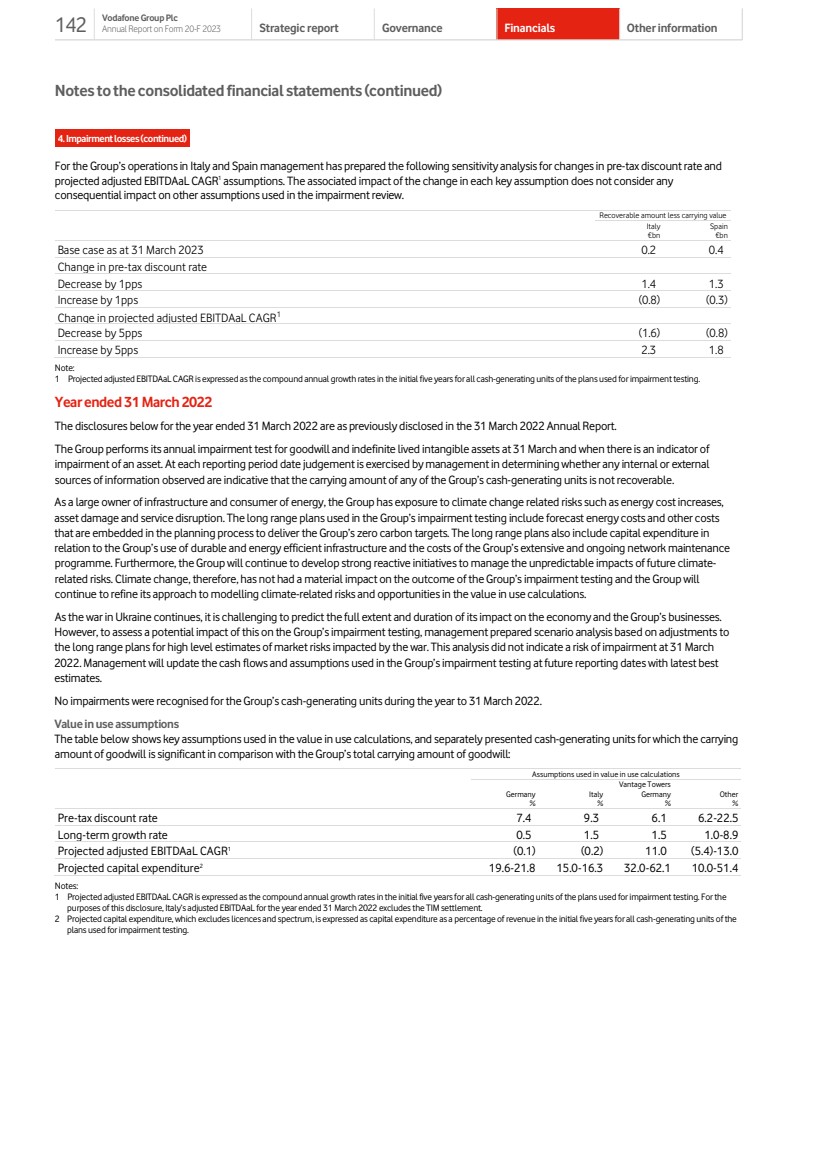

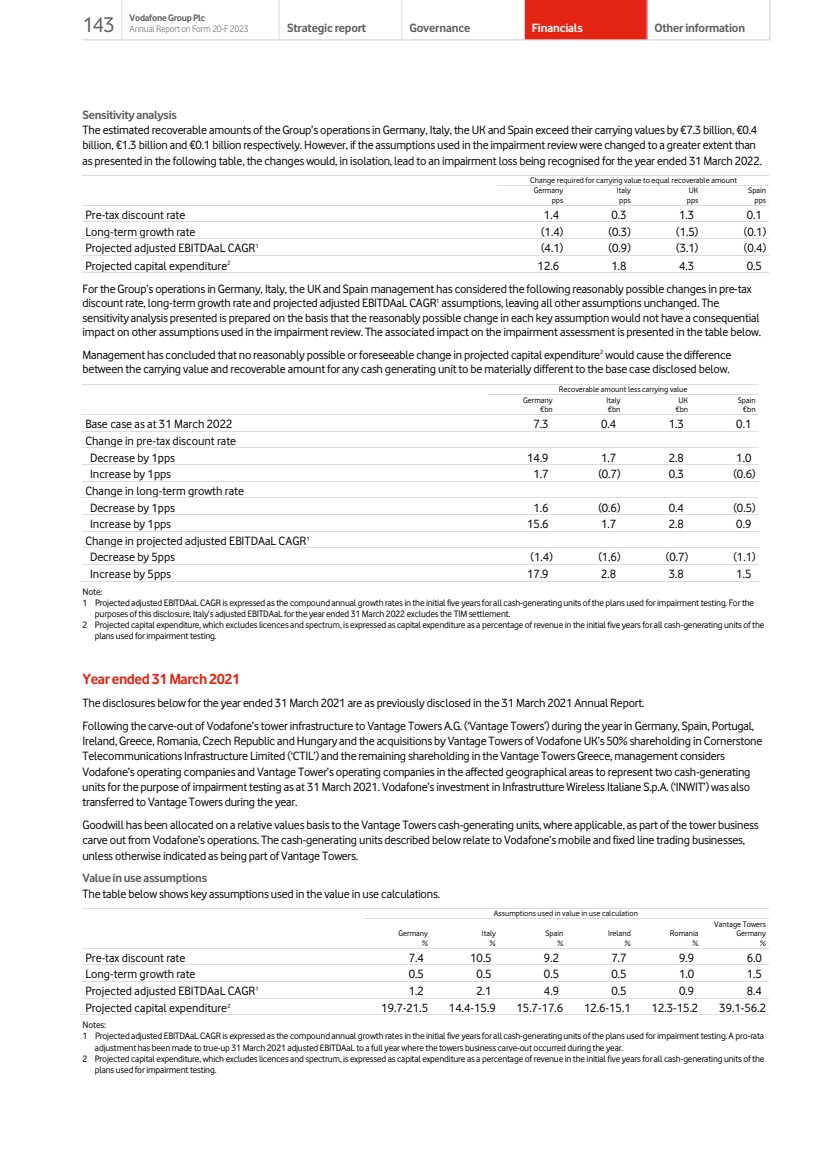

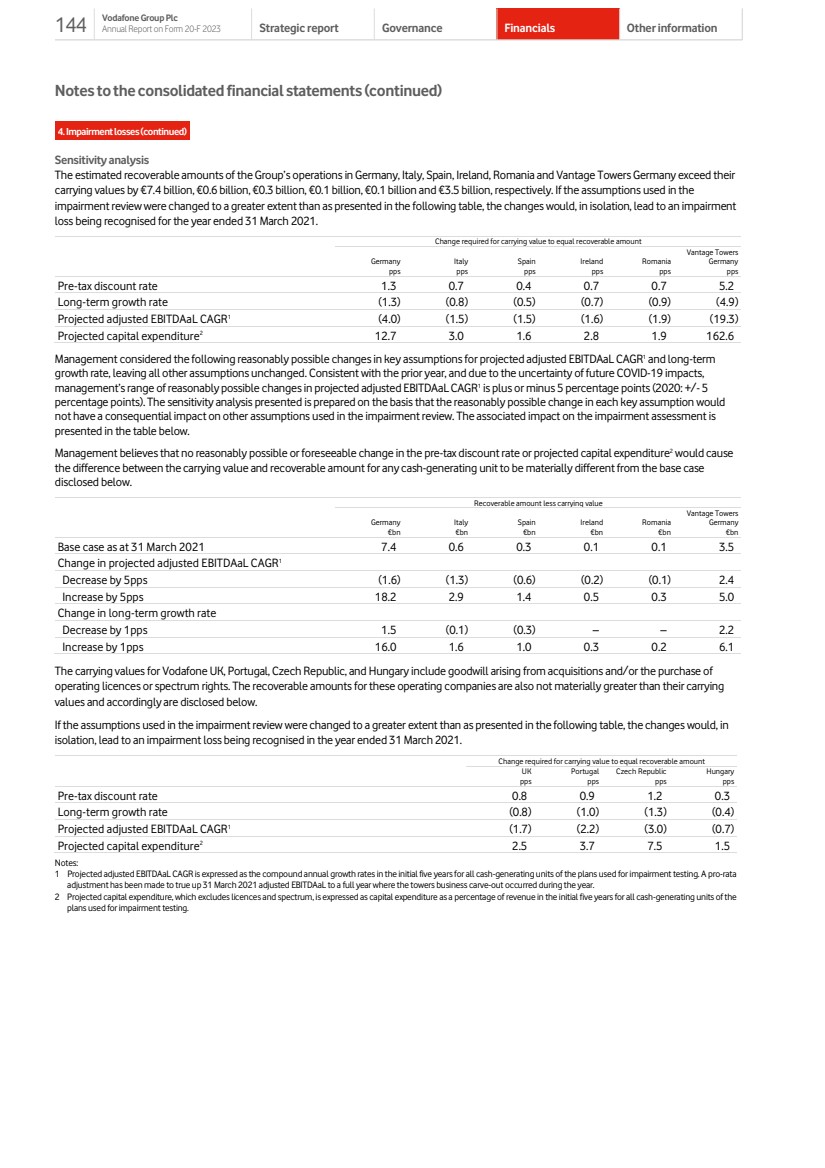

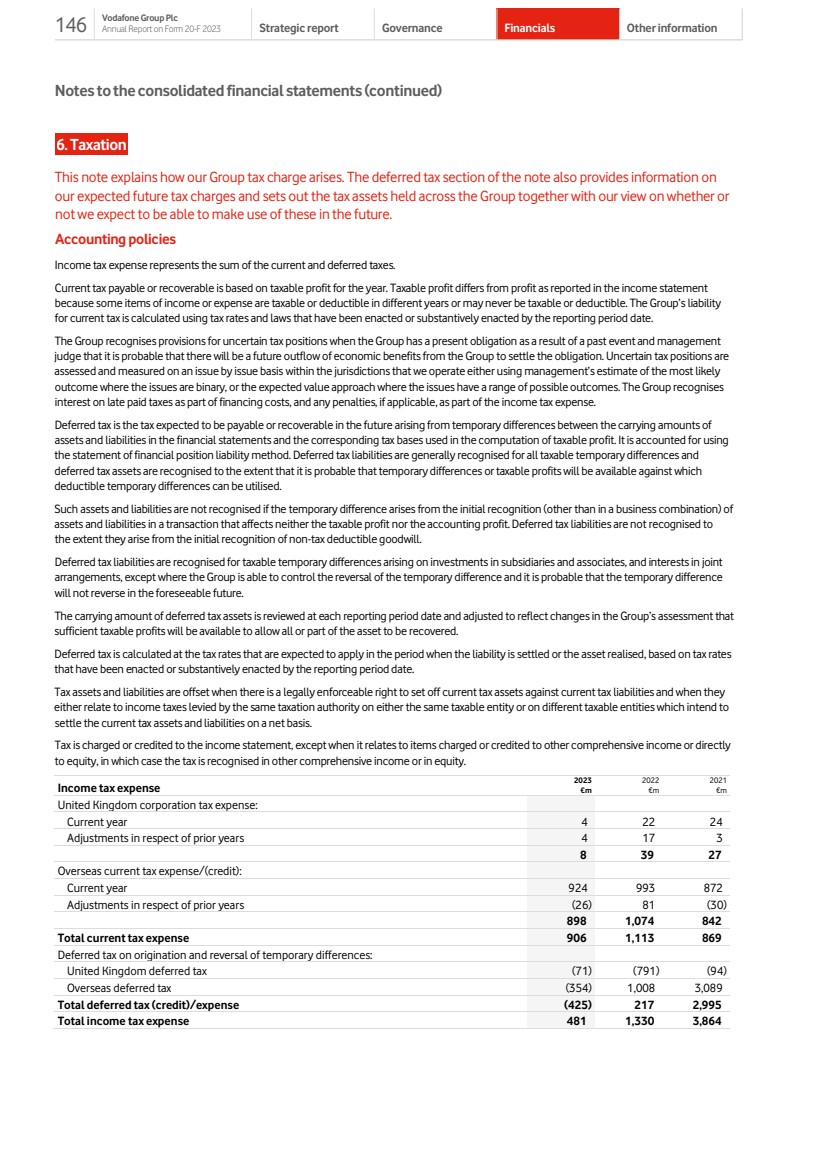

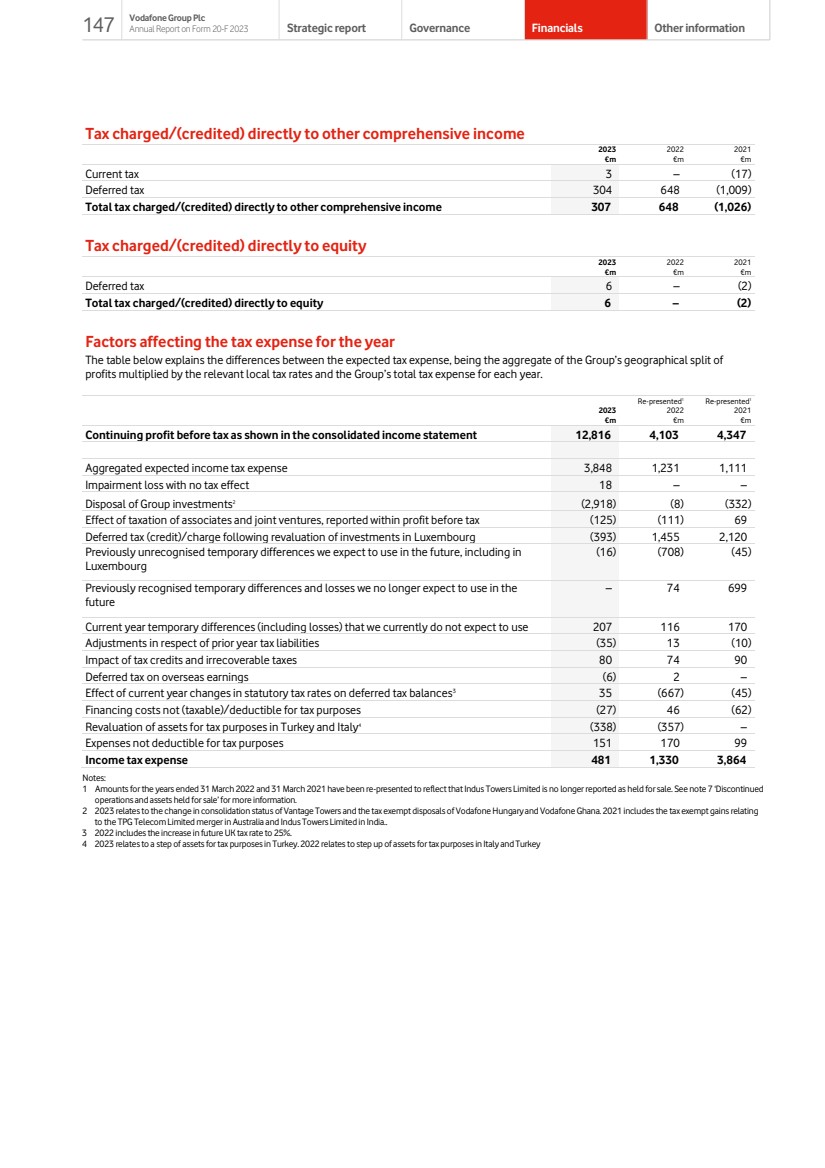

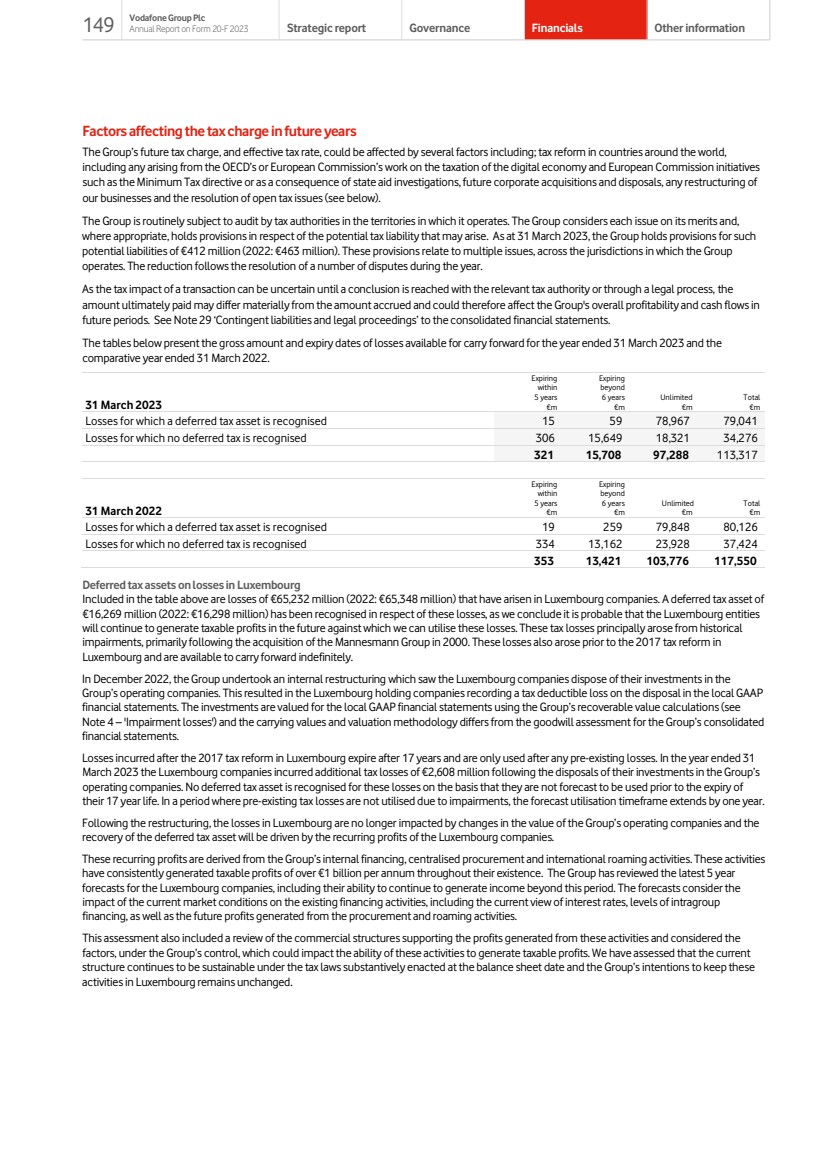

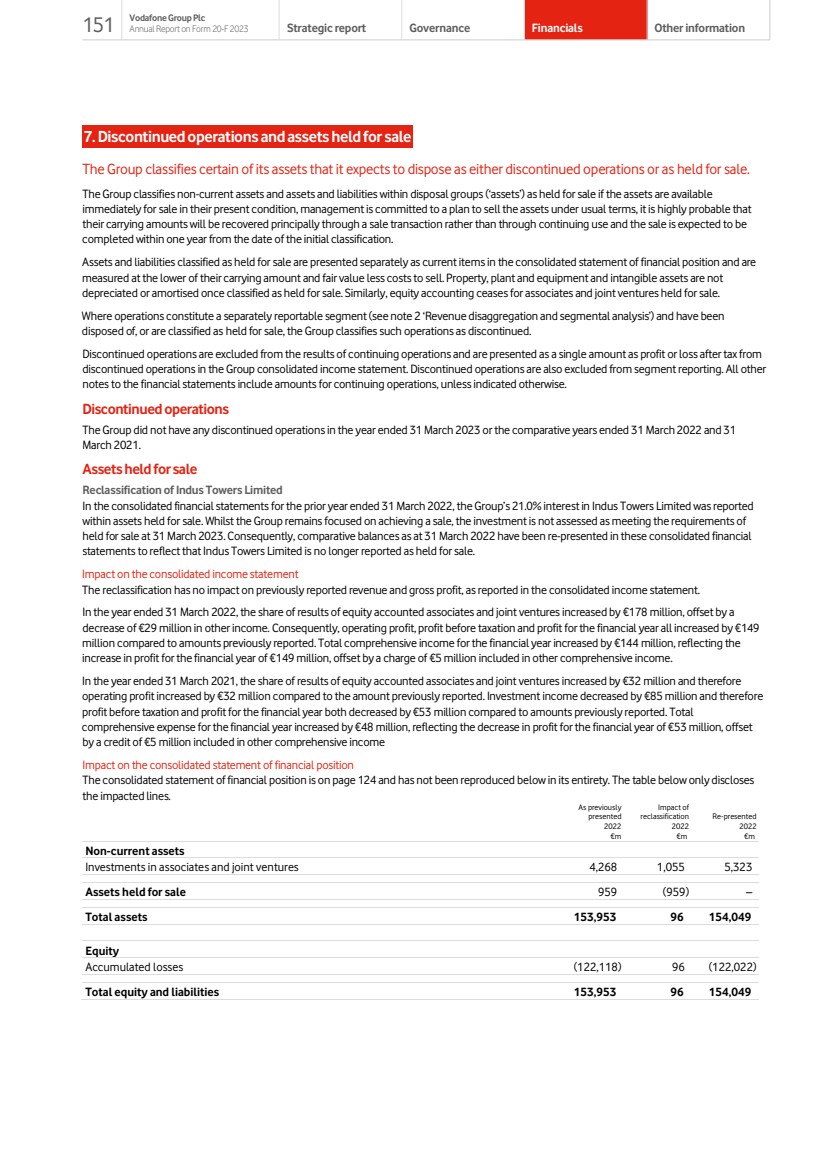

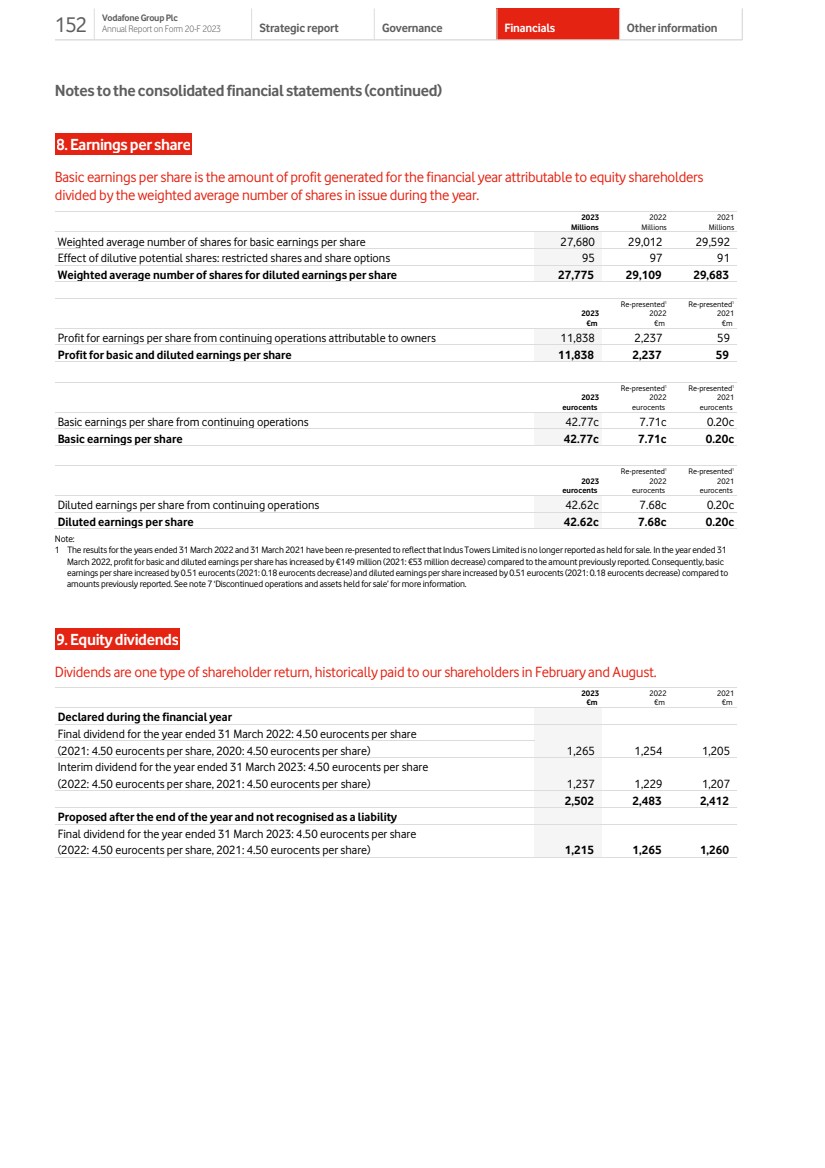

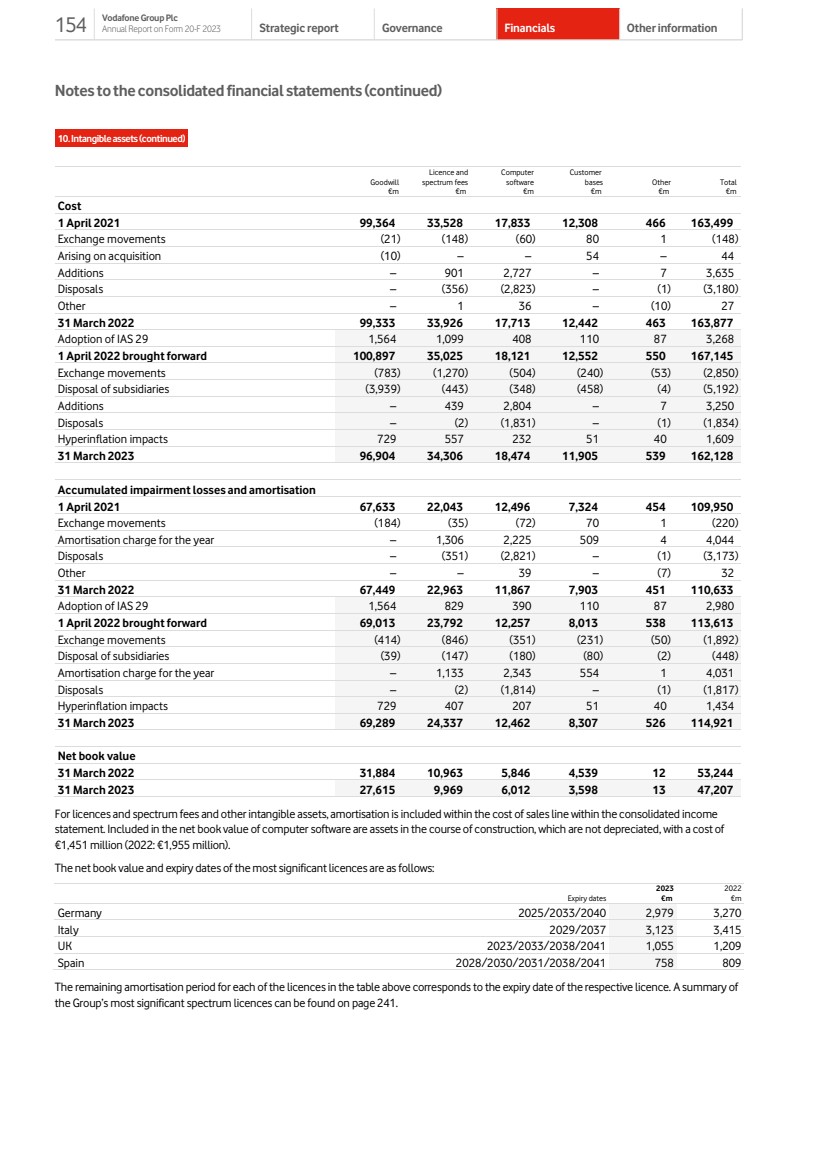

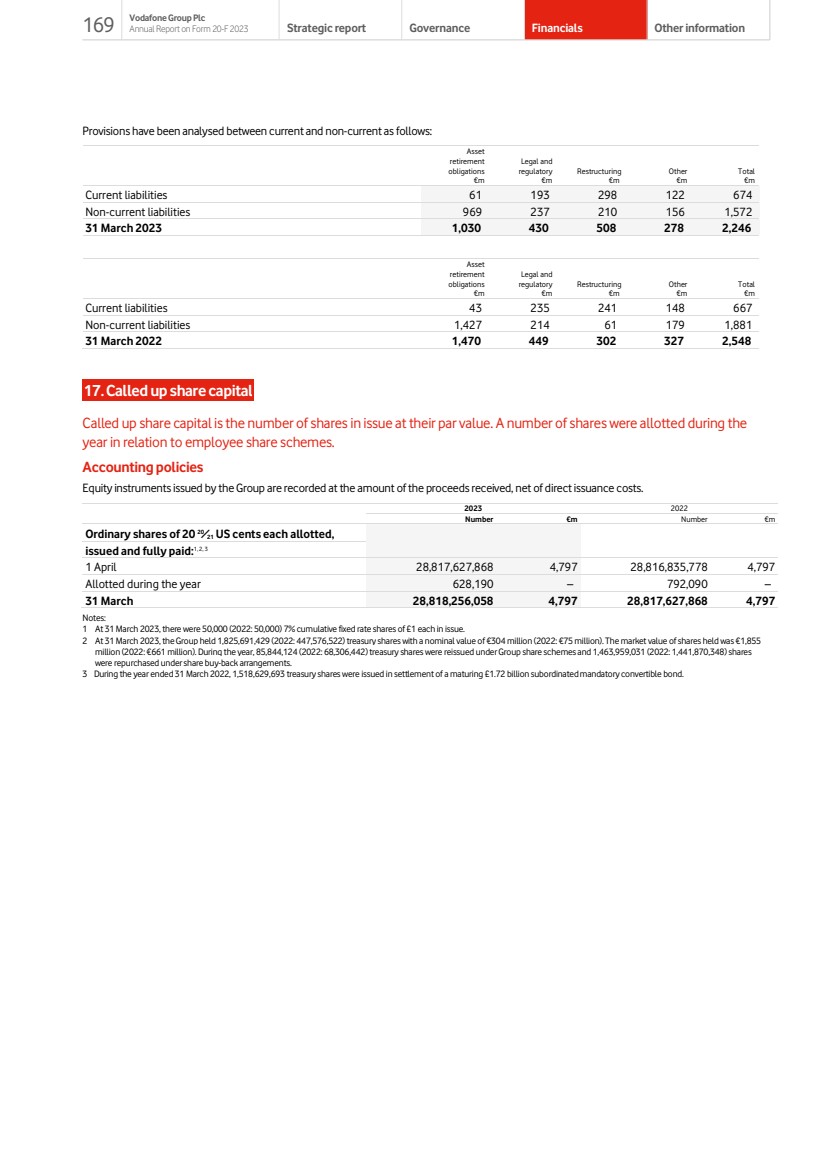

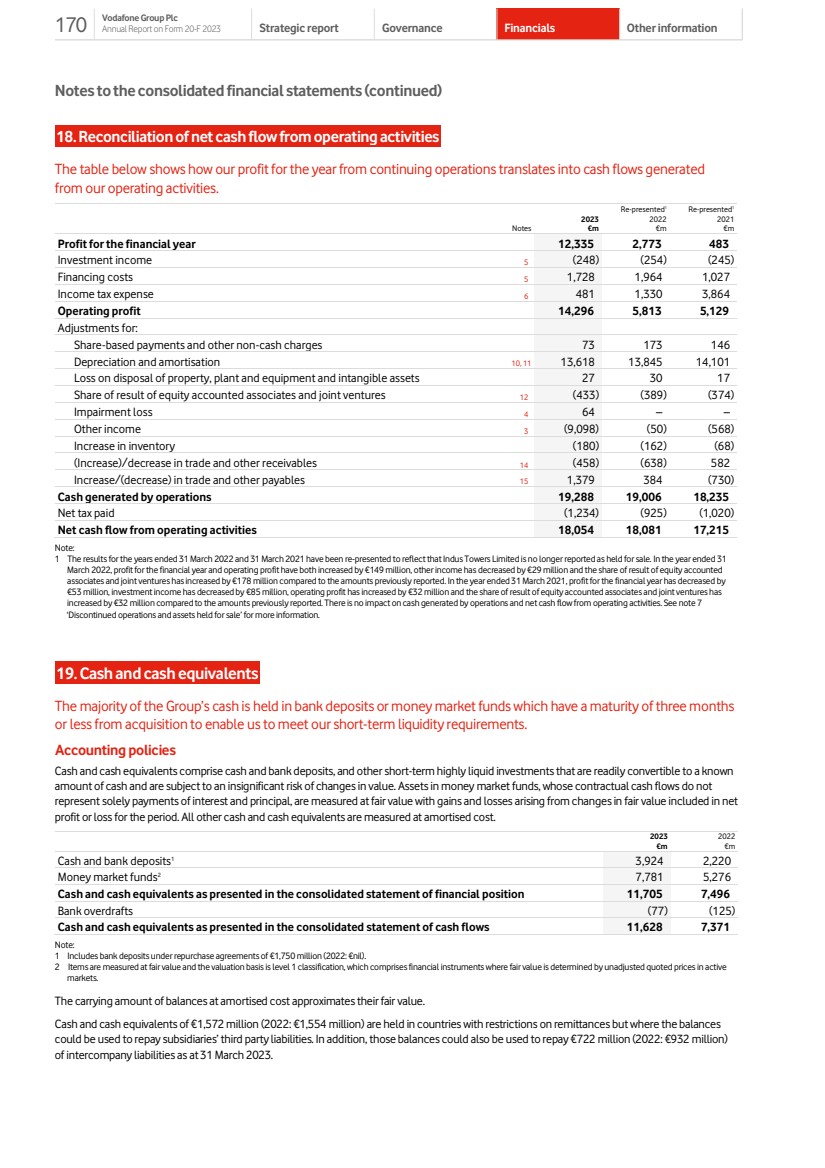

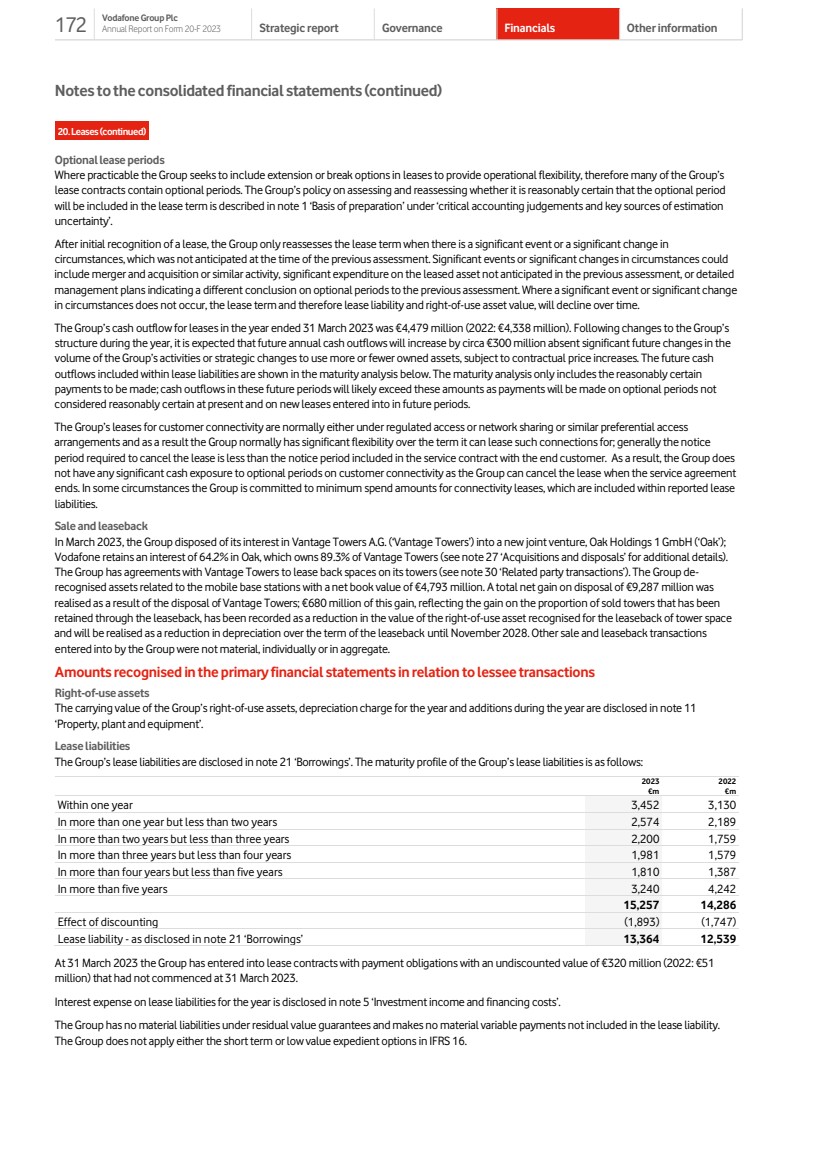

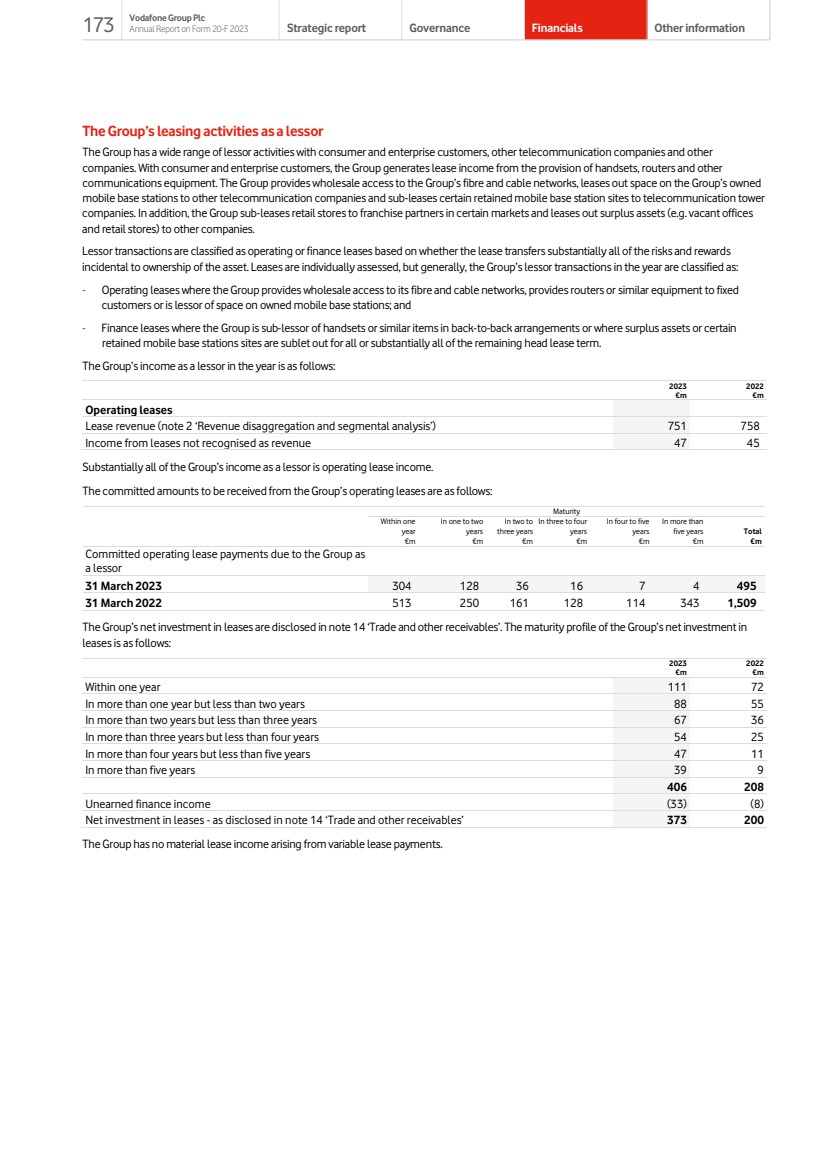

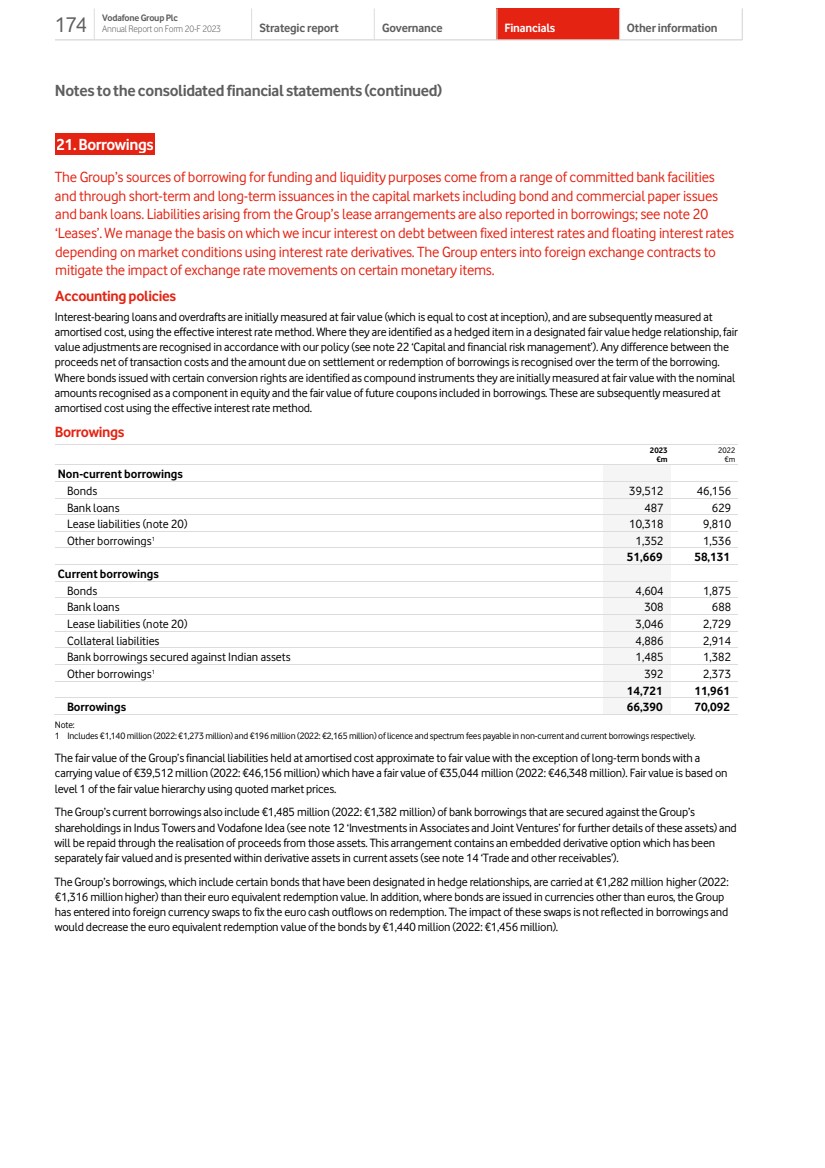

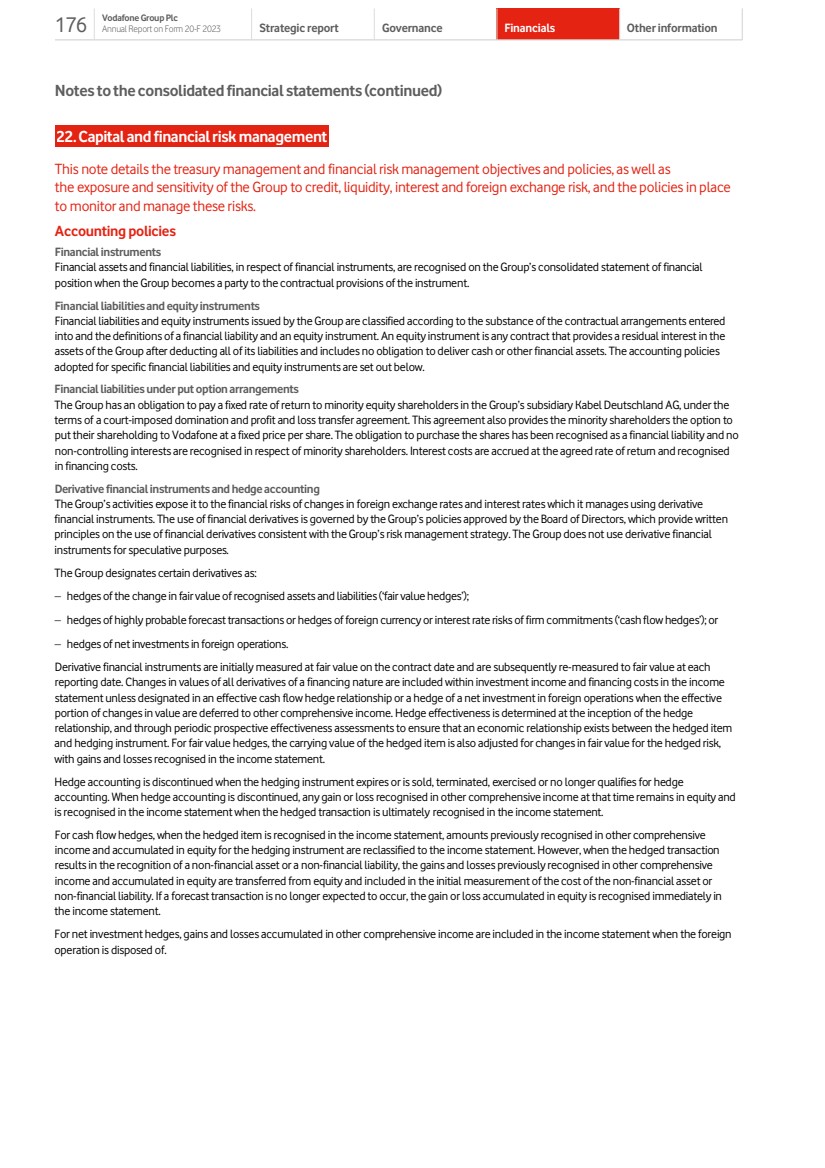

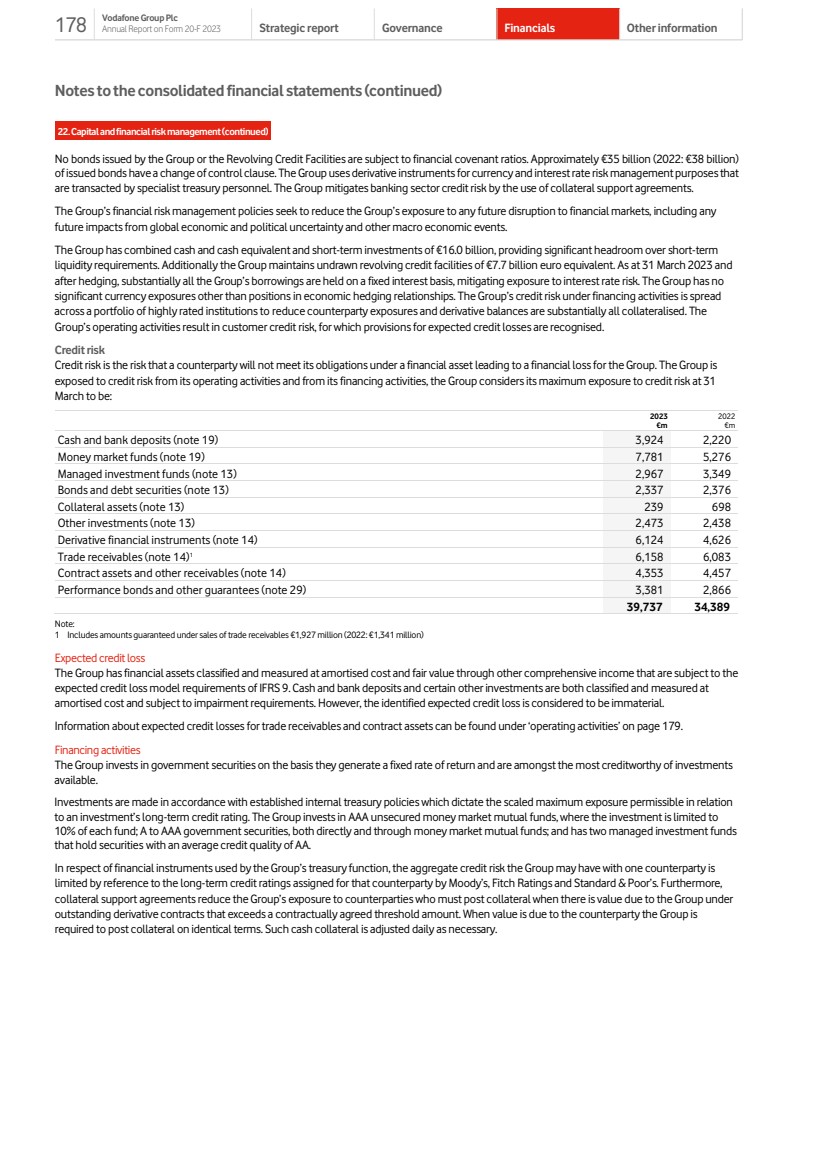

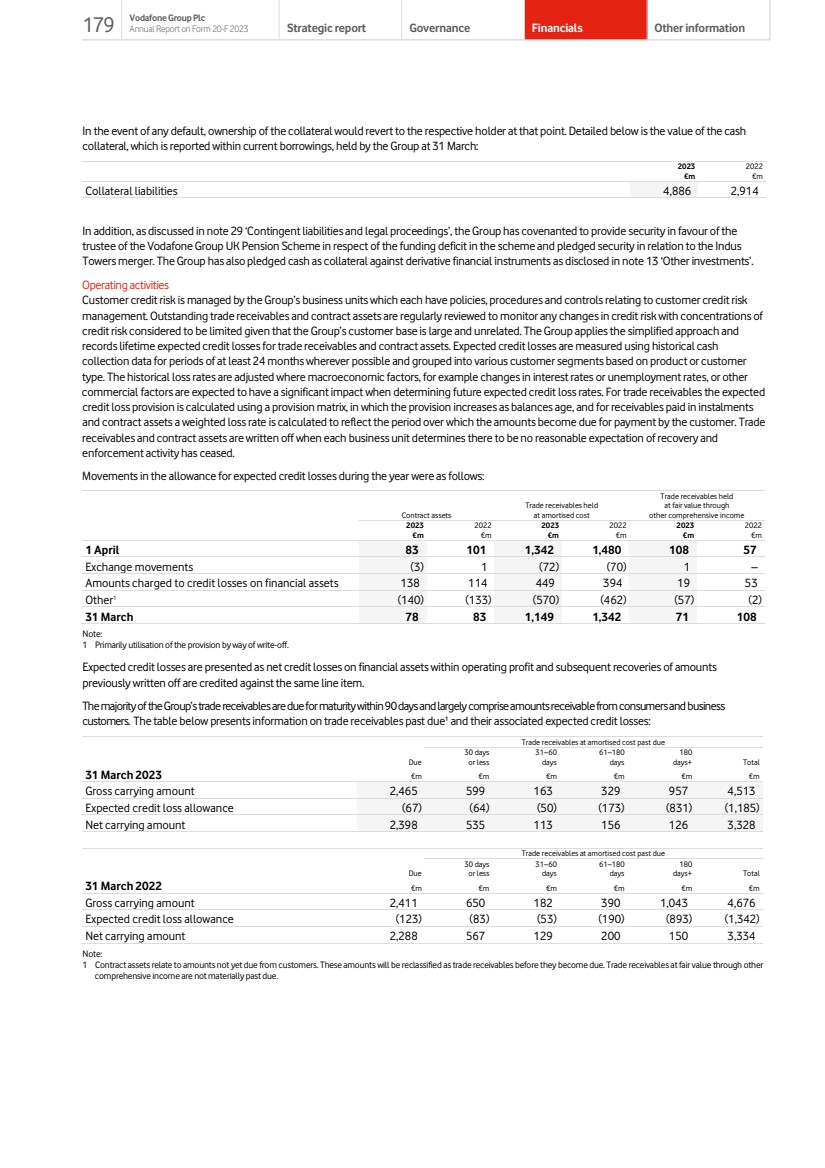

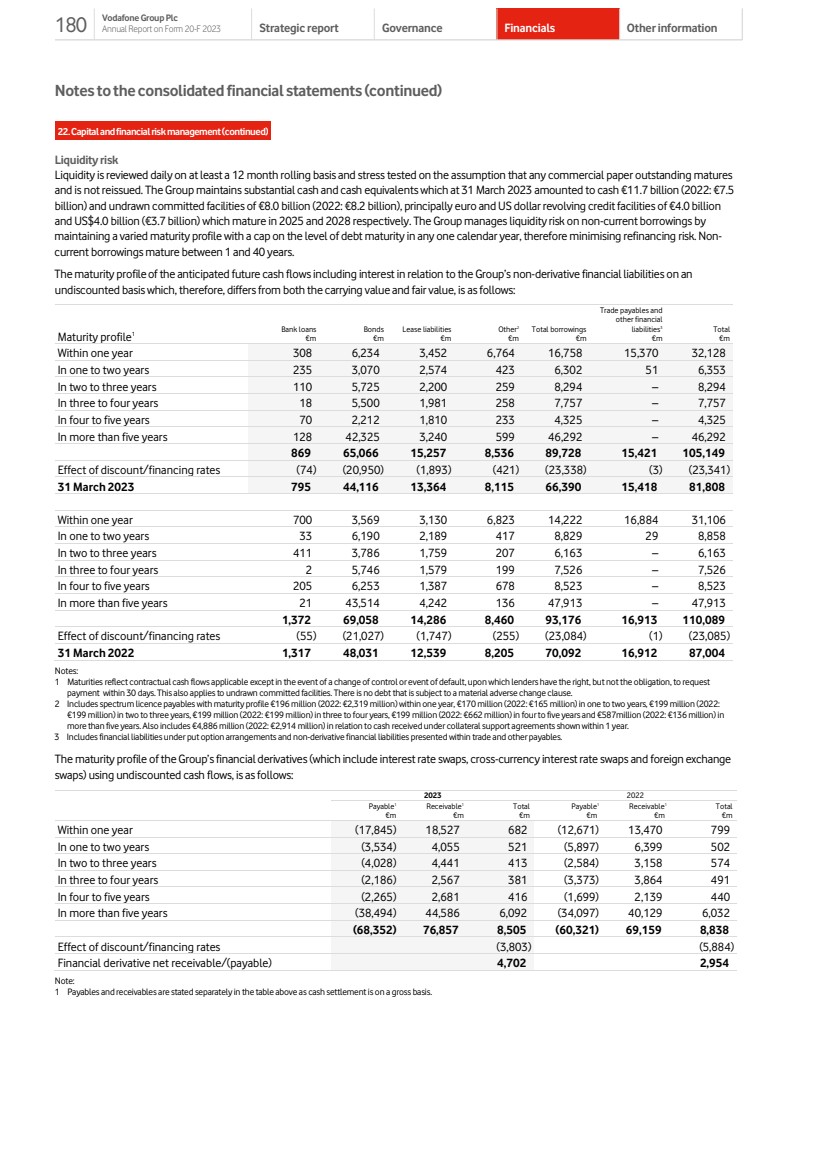

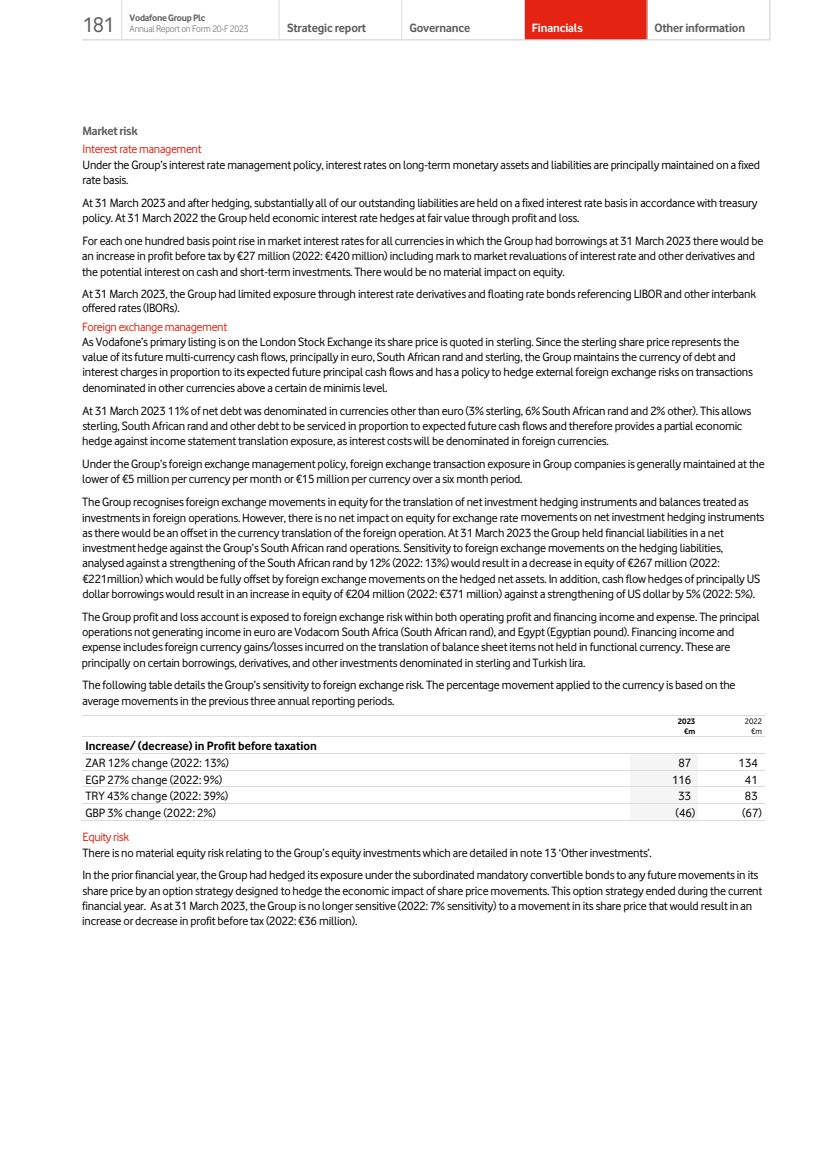

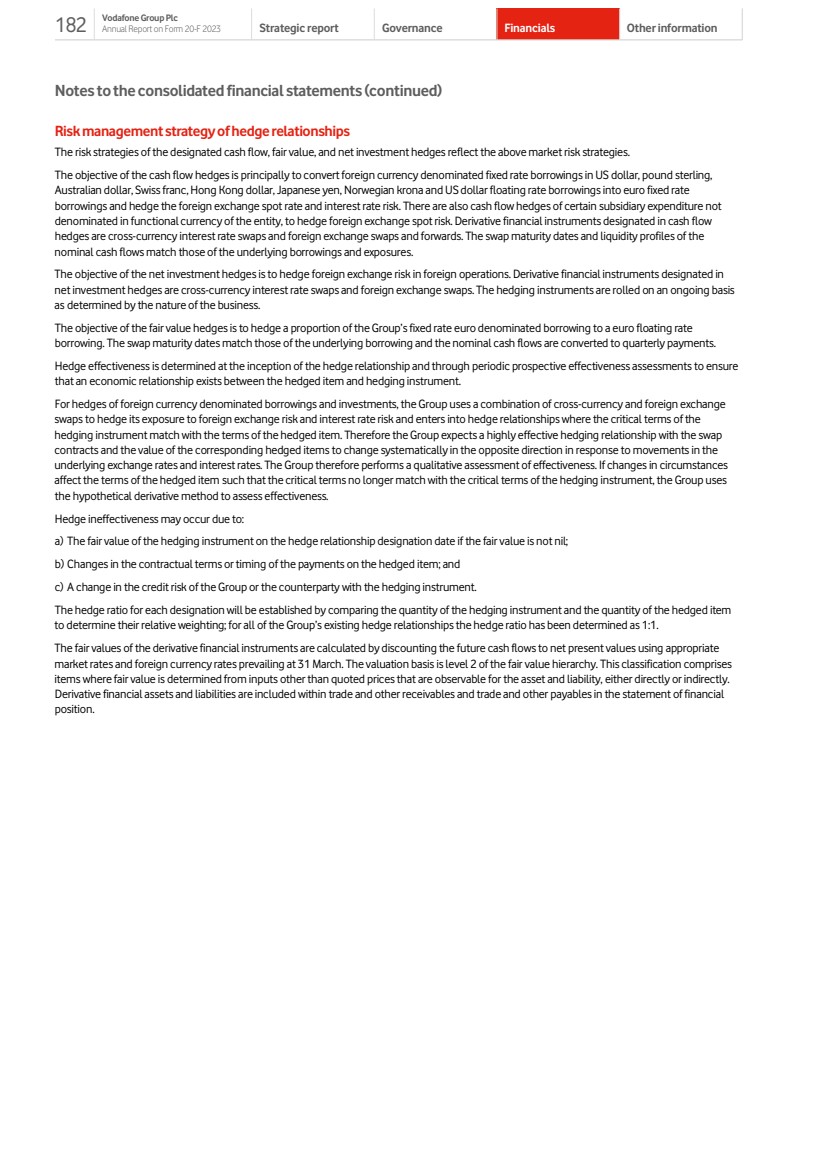

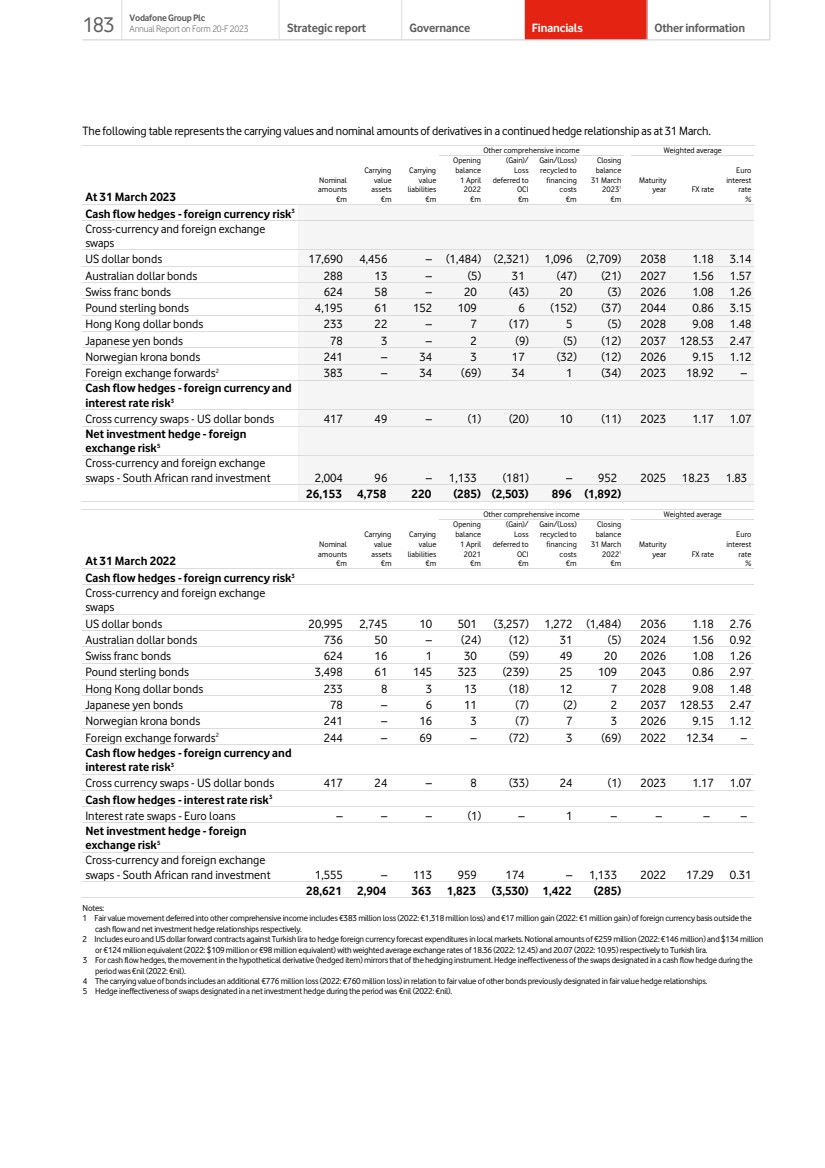

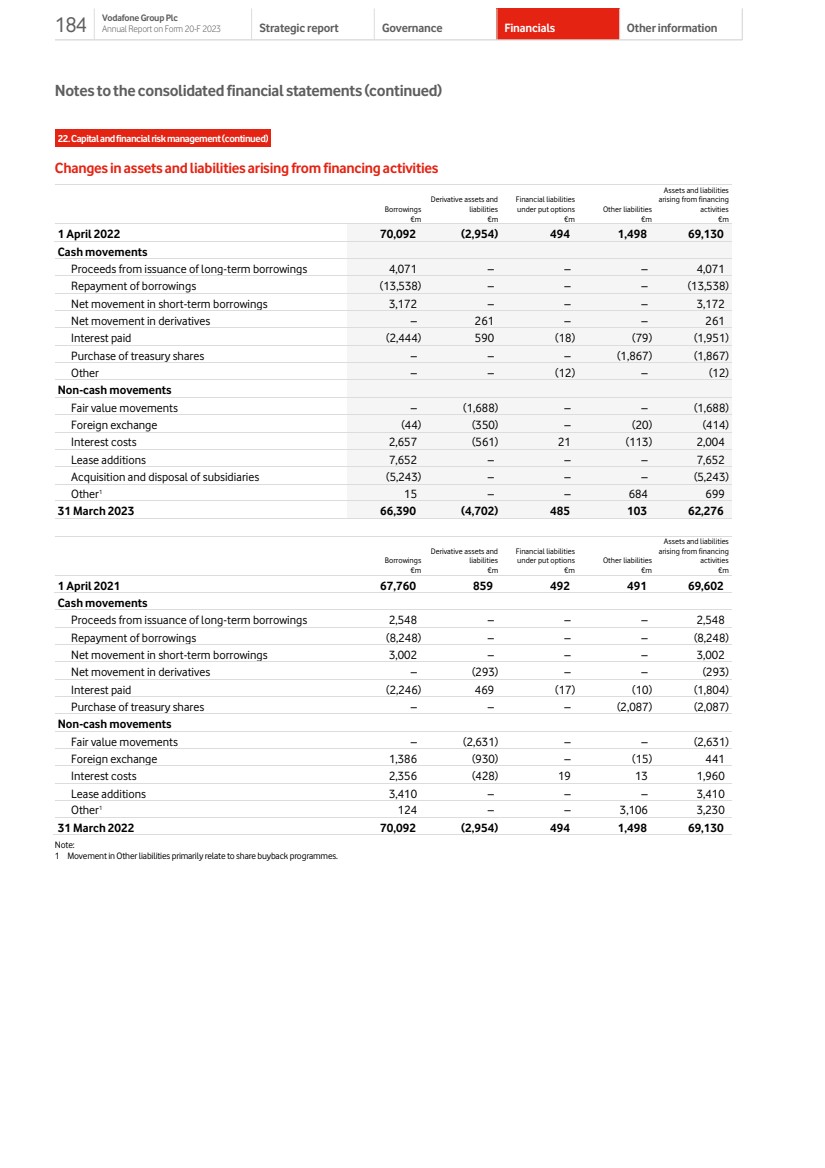

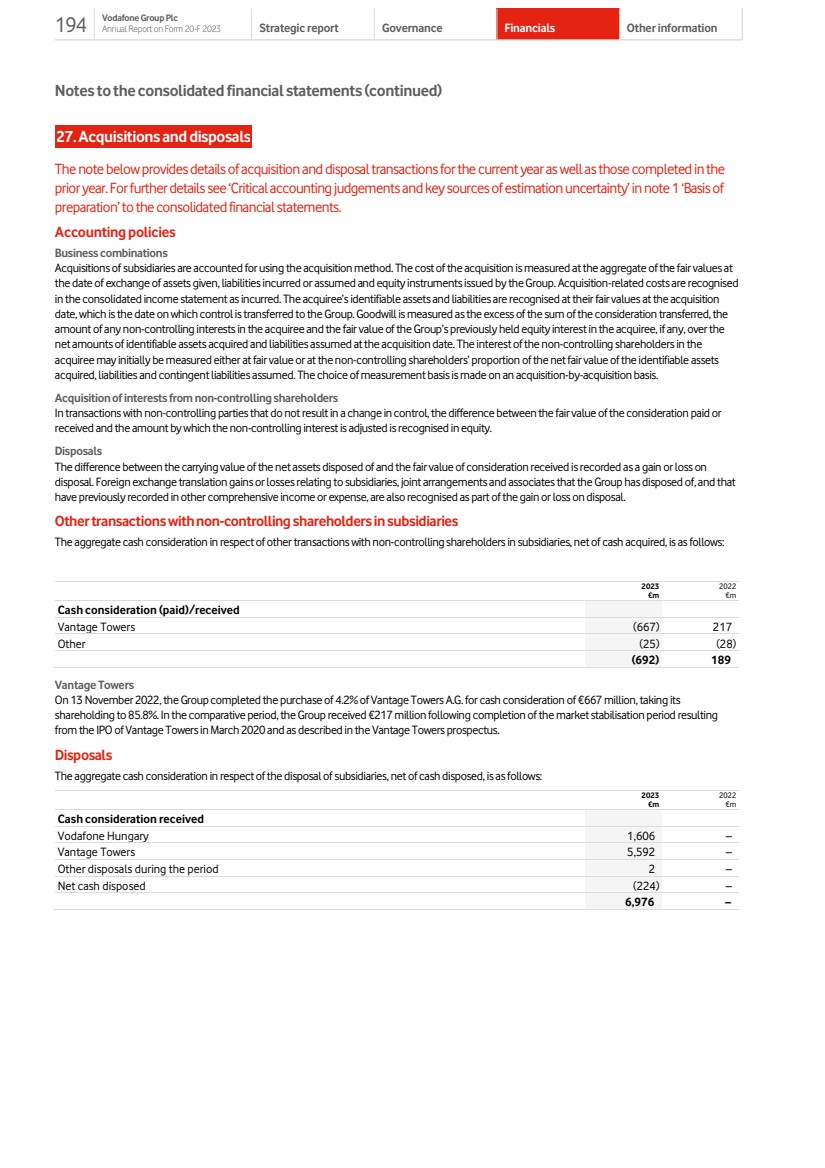

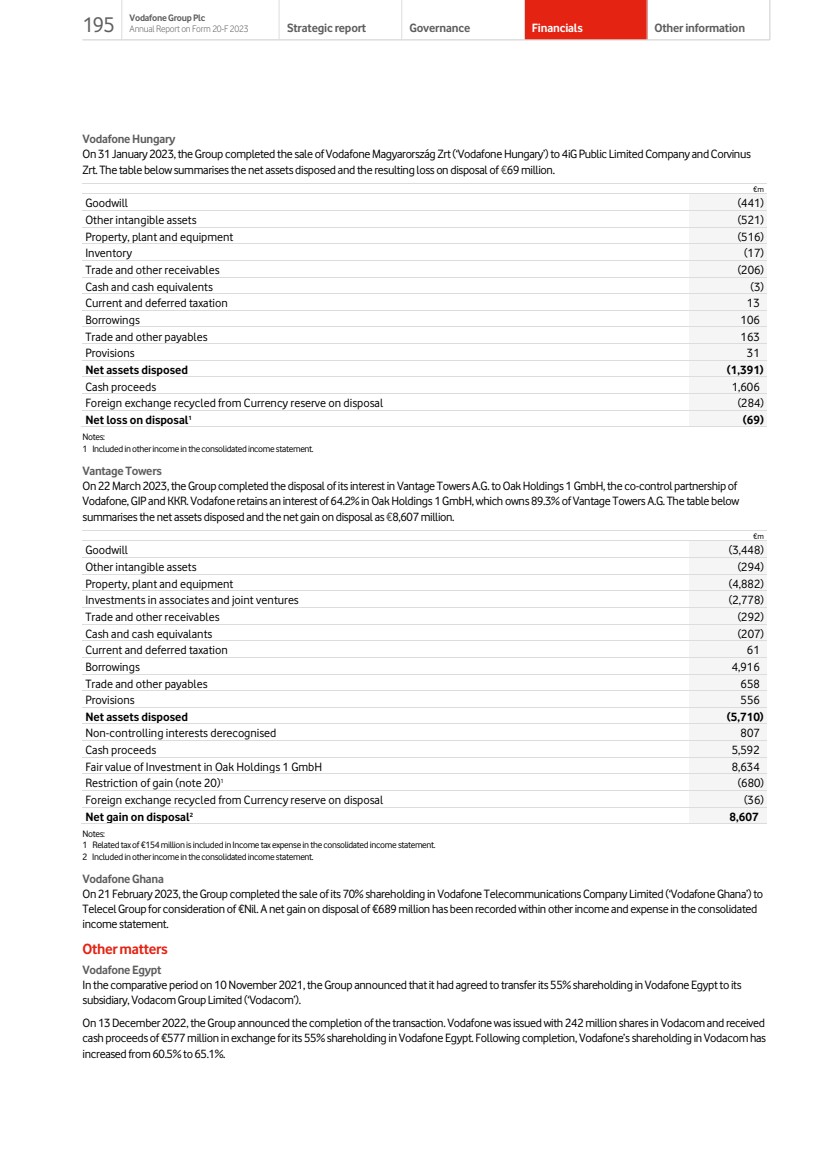

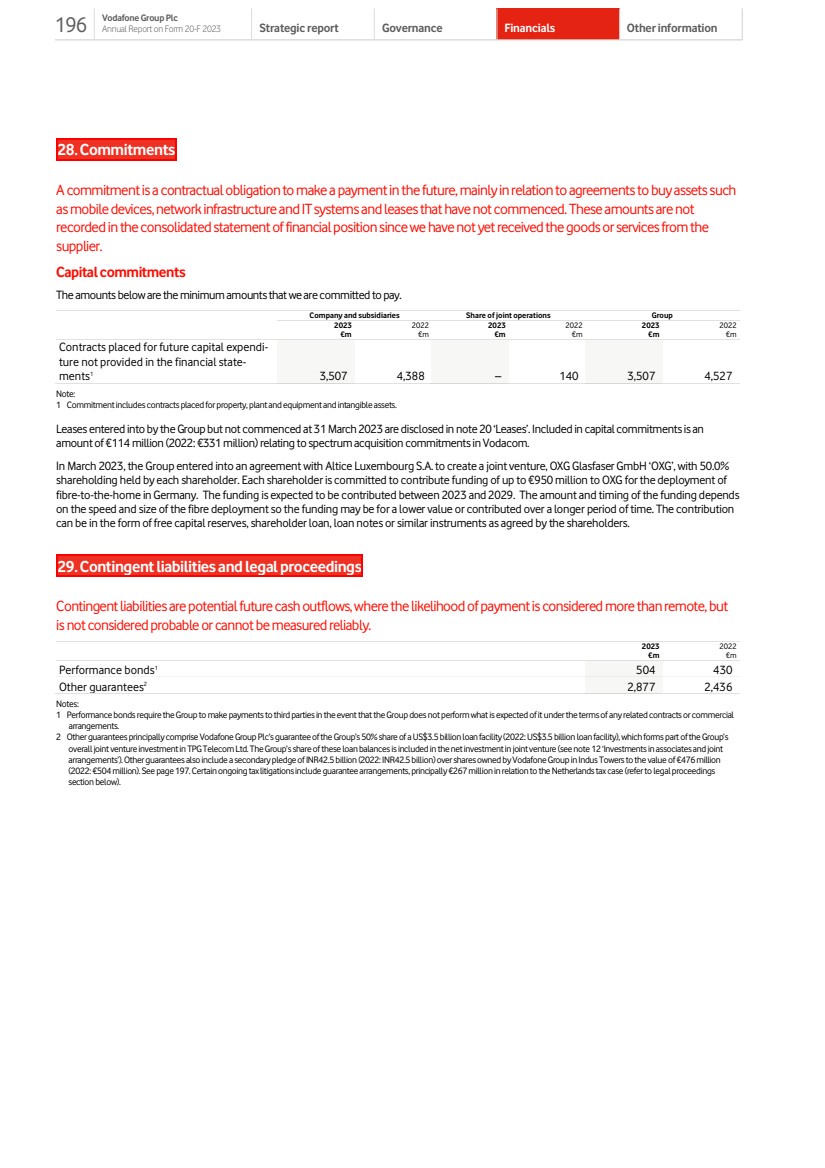

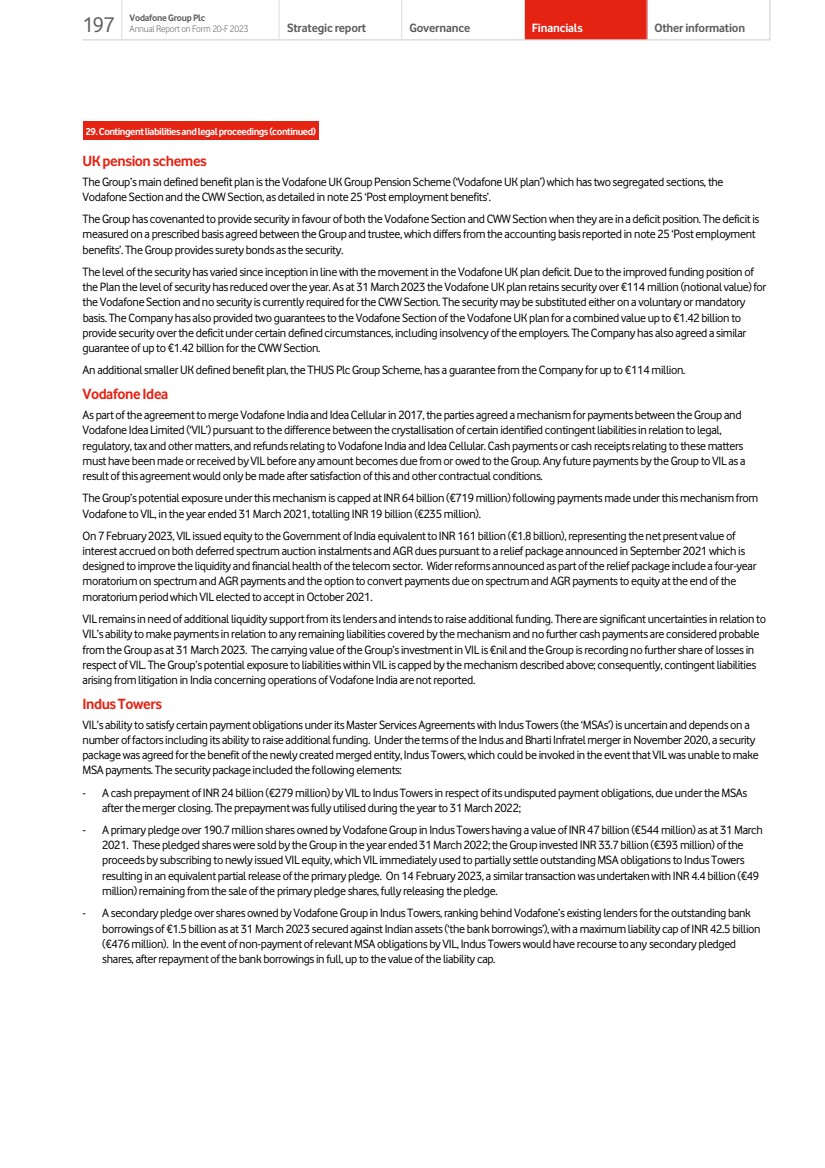

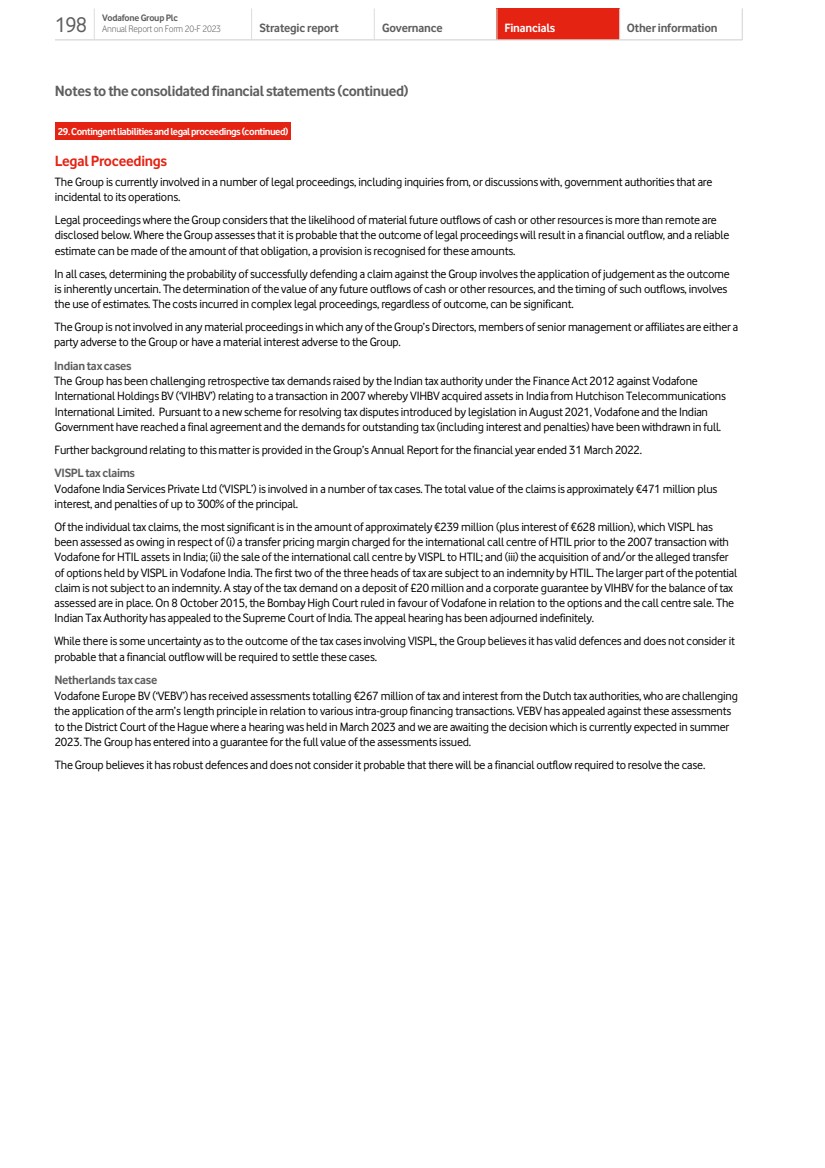

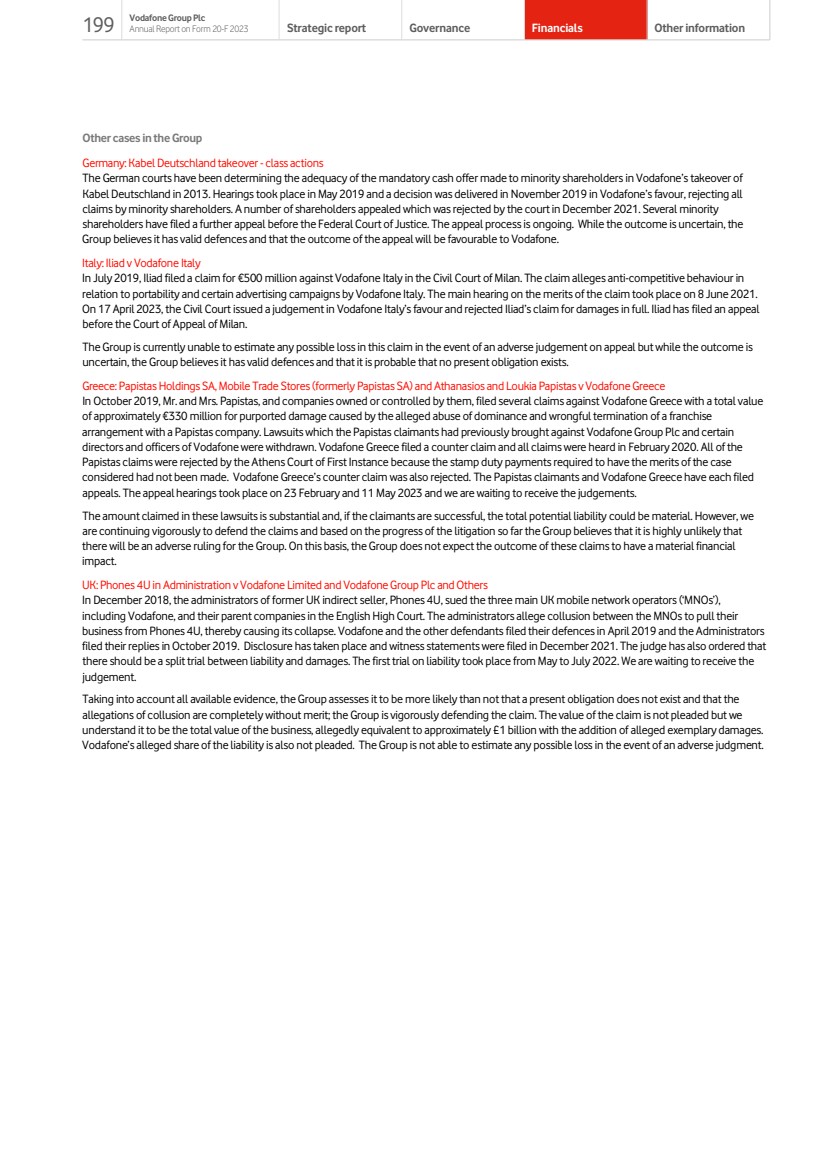

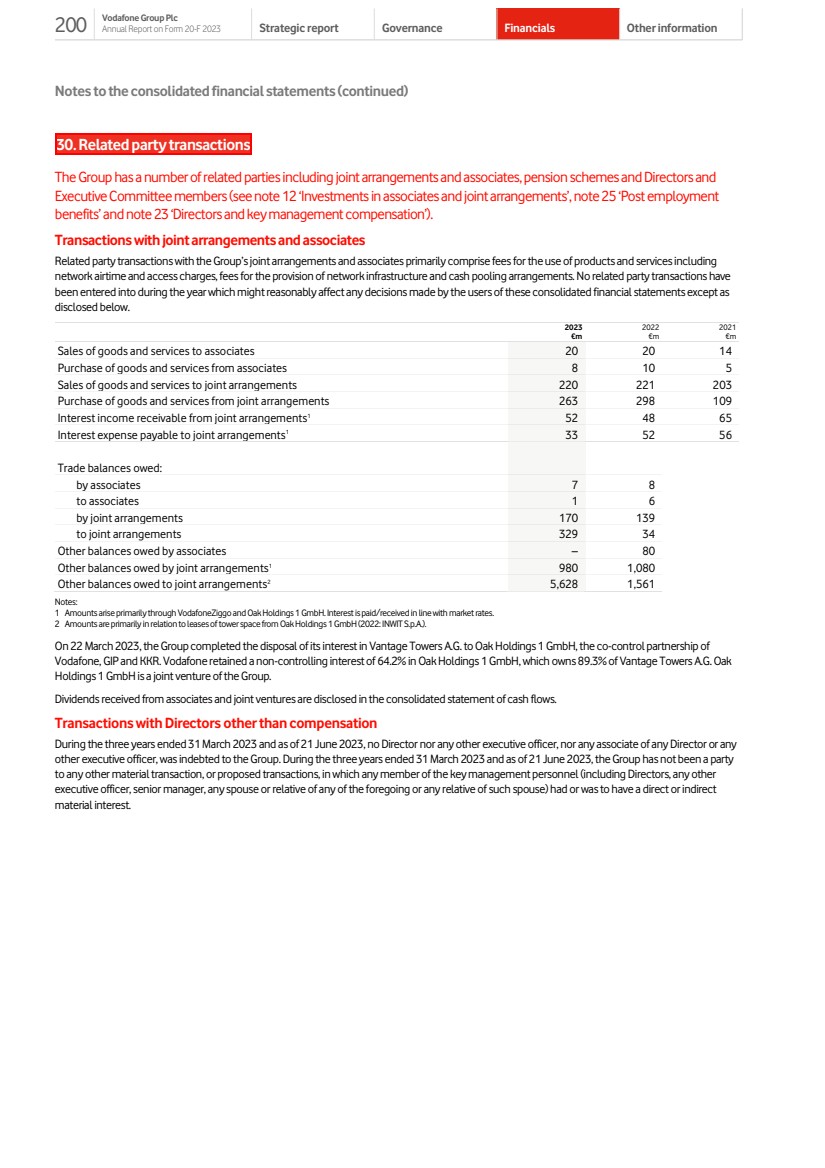

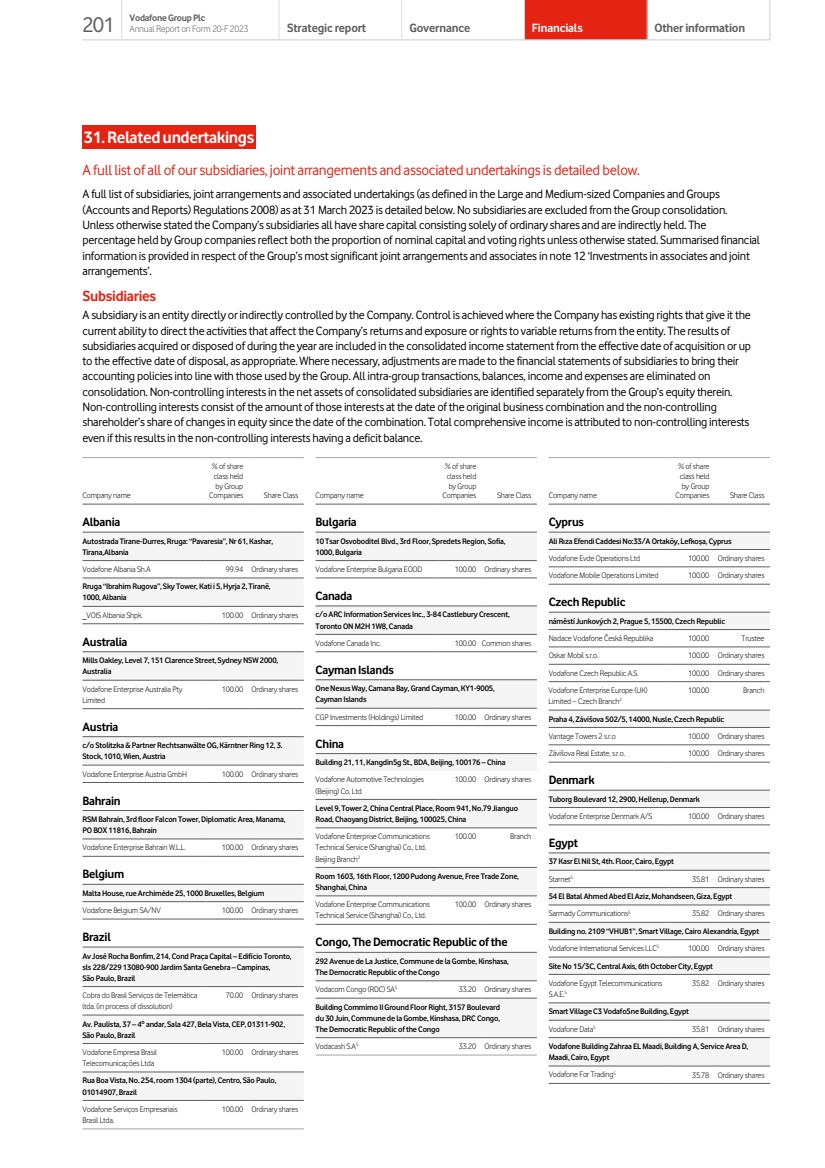

| Geographic performance summary FY23 Germany €m Italy €m UK €m Spain €m Other Europe €m Vodacom €m Other Markets €m Vantage Towers €m Common Functions €m Eliminations €m Group €m Total revenue 13,113 4,809 6,824 3,907 5,744 6,314 3,834 1,338 1,387 (1,564) 45,706 Service revenue 11,433 4,251 5,358 3,514 5,005 4,849 3,300 – 530 (271) 37,969 Adjusted EBITDAaL1 5,323 1,453 1,350 947 1,632 2,159 1,145 795 Adjusted EBITDAaL margin (%) 1 40.6% 30.2% 19.8% 24.2% 28.4% 34.2% 29.9% 59.4% Service revenue growth % Q1 Q2 H1 Q3 Q4 H2 Total Germany (0.5) (1.1) (0.8) (1.8) (2.8) (2.3) (1.6) Italy (2.2) (3.4) (2.8) (3.3) (2.8) (3.0) (2.9) UK 8.3 6.9 7.6 2.7 (1.6) 0.5 4.0 Spain (2.9) (6.1) (4.5) (8.7) (3.7) (6.3) (5.4) Other Europe 2.1 1.9 2.0 1.4 (5.2) (1.8) 0.1 Vodacom 7.8 9.9 8.9 5.3 (4.1) 0.5 4.6 Other Markets (1.8) (1.7) (1.8) (7.5) (3.0) (5.3) (3.5) Group 1.3 0.8 1.0 (1.3) (3.2) (2.2) (0.6) Organic service revenue growth %*1 Q1 Q2 H1 Q3 Q4 H2 Total Germany (0.5) (1.1) (0.8) (1.8) (2.8) (2.3) (1.6) Italy (2.3) (3.4) (2.8) (3.3) (2.7) (3.0) (2.9) UK 6.5 6.9 6.7 5.3 3.8 4.6 5.6 Spain (3.0) (6.0) (4.5) (8.7) (3.7) (6.2) (5.4) Other Europe 2.5 2.9 2.7 2.1 3.6 2.8 2.8 Vodacom 2.9 4.8 3.9 3.5 2.6 3.1 3.5 Other Markets 24.7 26.7 25.7 34.1 40.0 36.8 30.7 Group 2.5 2.5 2.5 1.8 1.9 1.8 2.2 Note: 1. Organic service revenue growth is a non-GAAP measure. See page 219 for more information. 17 Vodafone Group Plc Annual Report on Form 20-F 2023 Strategic report Governance Financials Other information |