UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

(Mark One) | |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the fiscal year ended | |

or | |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the transition period from to | |

Commission file number

(Exact name of registrant as specified in its charter)

| ||

(State of Incorporation) | (I.R.S. Employer Identification No.) |

| ||

(Address of principal executive offices) | (Zip Code) |

(

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

| Trading Symbol |

| Name of each exchange on which registered |

Securities registered pursuant to section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or emerging growth company. See the definitions of “large accelerated filer”, “accelerated filer” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☐ | Accelerated filer ☐ | Smaller reporting company | |

Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

The aggregate market value of the Common Stock held by non-affiliates of the registrant at June 30, 2022 was approximately $

Documents incorporated by reference: specified portions of Westwater Resources, Inc.’s Definitive Proxy Statement on Schedule 14A relating to its 2023 Annual Meeting of Stockholders are incorporated by reference into Part III where indicated. Westwater Resource, Inc.’s Definitive Proxy Statement will be filed with the U.S. Securities and Exchange Commission within 120 days after the end of the fiscal year to which this report relates.

WESTWATER RESOURCES, INC.

ANNUAL REPORT ON FORM 10-K

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2022

TABLE OF CONTENTS

2

DEFINITIONS

When used in this Form 10-K, the following terms have the meaning indicated.

Term | Meaning |

AGP | Alabama Graphite Products, LLC, an Alabama limited liability company and wholly owned subsidiary of Westwater Resources. |

Alabama Graphite | Alabama Graphite Company, Inc., an Alabama corporation and wholly owned subsidiary of Westwater Resources. |

ASC | FASB Accounting Standards Codification. |

ASU | FASB Accounting Standards Update. |

ATM Offering Agreement | Controlled Equity Offering Sale Agreement between Westwater Resources and Cantor Fitzgerald & Co. dated April 14, 2017. |

Benchmark | Benchmark Mineral Intelligence. |

Cantor | Cantor Fitzgerald & Co. |

Coosa Graphite Deposit | The Company’s graphite mineral deposit located near Rockford, Alabama. |

DFS | The definitive feasibility study for Phase I of the Kellyton Graphite Plant which was completed in the fourth quarter of 2021. |

enCore | enCore Energy Corp. |

EU Critical Raw Minerals List | The list of raw materials that are crucial to the economy of the European Union published by the European Commission. |

Exploration stage property | A property that has no mineral reserves disclosed. |

Graphite | A naturally occurring carbon material with electrical properties that enhance the performance of electrical storage batteries, listed on the U.S. Critical Minerals List and the EU Critical Raw Materials List. |

Gross acres | Total acreage of land under which we have mineral rights. May include unleased fractional ownership. |

Indicated Mineral Resource | That part of a mineral resource for which quantity and grade or quality are estimated on the basis of adequate geological evidence and sampling. The level of geological certainty associated with an indicated mineral resource is sufficient to allow a qualified person to apply modifying factors in sufficient detail to support mine planning and evaluation of the economic viability of the deposit. Because an indicated mineral resource has a lower level of confidence than the level of confidence of a measured mineral resource, an indicated mineral resource may only be converted to a probable mineral reserve. |

Inferred Mineral Resource | That part of a mineral resource for which quantity and grade or quality are estimated on the basis of limited geological evidence and sampling. The level of geological uncertainty associated with an inferred mineral resource is too high to apply relevant technical and economic factors likely to influence the prospects of economic extraction in a manner useful for evaluation of economic viability. Because an inferred mineral resource has the lowest level of geological confidence of all mineral resources, which prevents the application of the modifying factors in a manner useful for evaluation of economic viability, an inferred mineral resource may not be considered when assessing the economic viability of a mining project and may not be converted to a probable mineral reserve. |

3

Initial Assessment | A preliminary technical and economic study of the economic potential of all or parts of mineralization to support the disclosure of mineral resources. The initial assessment must be prepared by a qualified person and must include appropriate assessments of reasonably assumed technical and economic factors, together with any other relevant operational factors, that are necessary to demonstrate at the time of reporting that there are reasonable prospects for economic extraction. An initial assessment is required for disclosure of mineral resources but cannot be used as the basis for disclosure of mineral reserves. |

Kellyton Graphite Plant | The Company’s planned battery-grade graphite processing facility near Kellyton, Alabama. |

Lincoln Park | Lincoln Park Capital Fund, LLC. |

Mineral Reserve | An estimate of tonnage and grade or quality of indicated and measured mineral resources that, in the opinion of the qualified person, can be the basis of an economically viable project. More specifically, it is the economically mineable part of a measured or indicated mineral resource, which includes diluting materials and allowances for losses that may occur when the material is mined or extracted. |

Mineral Resource | A mineralized body which has been delineated by appropriately spaced drilling and/or underground sampling sufficient to support the estimate of tonnages and grade of the mineral deposit. Such a deposit does not qualify as a reserve, until a comprehensive evaluation based upon unit cost, grade, recoveries, and other material factors conclude legal and economic feasibility. |

Ore | Naturally occurring concentration of mineralization from which a mineral or minerals of economic value can be extracted at a reasonable profit. |

PFS | Pre-feasibility level study for Phase II of the Kellyton Graphite Plant. |

Qualified Person | Individual who is: (1) Mineral industry professional with at least five years of relevant experience in the type of mineralization and type of deposit under consideration and in the specific type of activity that person is undertaking on behalf of the registrant; and (2) An eligible member or licensee in good standing of a recognized professional organization at the time the technical report is prepared. For an organization to be a recognized professional organization, it must: a. Be either: i. An organization recognized within the mining industry as a reputable professional association; or ii. A board authorized by U.S. federal, state or foreign statute to regulate professionals in the mining, geoscience or related field; b. Admit eligible members primarily on the basis of their academic qualifications and experience; c. Establish and require compliance with professional standards of competence and ethics; d. Require or encourage continuing professional development; e. Have and apply disciplinary powers, including the power to suspend or expel a member regardless of where the member practices or resides; and f. Provide a public list of members in good standing. |

Roskill | Roskill Information Services Ltd. |

SEC | Securities and Exchange Commission. |

4

SEDAR | System for Electronic Document Analysis and Retrieval used for electronically filing most securities related information with the Canadian securities regulatory authorities. |

SLR | SLR International Corporation. |

SPG Fines | Spherical purified graphite fine material produced from SPG milling. |

Spot price | The price at which a mineral commodity may be purchased for delivery within one year. |

Surety obligations | A bond, letter of credit, or financial guarantee posted by a party in favor of a beneficiary to ensure the performance of its or another party’s obligations, e.g., reclamation bonds, workers’ compensation bond, or guarantees of debt instruments. |

TRS | Technical Report Summary. A report prepared in accordance with Subpart 1300 of Regulation S-K promulgated by the SEC (or SK-1300) that discloses information concerning a registrant’s mineral resources or mineral reserves by one or more qualified persons that, for each material property, identifies and summarizes the scientific and technical information and conclusions reached concerning an initial assessment used to support disclosure of mineral resources, or concerning a preliminary or final feasibility study used to support disclosure of mineral reserves. |

ULTRA-CSPG™ | Coated spherical purified graphite. |

U.S. Critical Minerals List | The list of critical minerals that are crucial to the economy of the United States of America published by the Department of the Interior. |

Vanadium | A rare-earth metal used as a strengthening alloy in steelmaking, and in certain types of batteries, listed on the U.S. Critical Minerals List. |

Westwater Resources | Westwater Resources, Inc. |

2020 Lincoln Park PA | Purchase Agreement dated as of December 4, 2020 between Westwater Resources and Lincoln Park Capital Fund, LLC. |

USE OF NAMES

In this Annual Report on Form 10-K, unless the context otherwise requires, the terms “we”, “us”, “our”, “WWR”, “Westwater”, “Corporation”, or the “Company” refer to Westwater Resources, Inc. and its subsidiaries. The Company changed its name from “Uranium Resources, Inc.” to “Westwater Resources, Inc.” effective August 21, 2017.

CURRENCY

The accounts of the Company are maintained in U.S. dollars. All dollar amounts referenced in this Annual Report on Form 10-K and the consolidated financial statements are stated in U.S. dollars.

5

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

With the exception of historical matters, the matters discussed in this report are forward-looking statements that involve risks and uncertainties that could cause actual results to differ materially from projections or estimates contained herein. We intend such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. Such forward-looking statements include, without limitation, statements regarding the adequacy of funding, liquidity, access to capital, financing activities, the timing or occurrence of any future drilling or production from the Company’s properties, economic conditions, the strategic goals of the business, arbitration matters, costs of Phase I of the Kellyton Graphite Plant and its estimated construction and commissioning timelines and completion dates, the outcome of the feasibility study and start date for the mining of the Coosa Graphite Deposit, and the Company’s anticipated cash burn rate and capital requirements. Words such as “may,” “could,” “should,” “would,” “believe,” “estimate,” “expect,” “anticipate,” “plan,” “forecast,” “potential,” “intend,” “continue,” “project,” “target” and variations of these words, comparable words and similar expressions generally indicate forward-looking statements. You are cautioned not to place undue reliance on forward-looking statements. Actual results may differ materially from those expressed or implied by these forward-looking statements. Factors that could cause actual results to differ materially from these forward-looking statements include, among others:

| ● | the spot price and long-term contract price of graphite (both flake graphite feedstock and purified graphite products) and vanadium, and the world-wide supply and demand of graphite and vanadium; |

| ● | the effects, extent and timing of the entry of additional competition in the markets in which we operate; |

| ● | our ability to obtain contracts or other agreements with customers; |

| ● | available sources and transportation of graphite feedstock; |

| ● | the ability to control costs and avoid cost and schedule overruns during the development, construction and operation of the Kellyton Graphite Plant; |

| ● | the ability to construct and operate the Kellyton Graphite Plant in accordance with the requirements of permits and licenses and the requirements of tax credits and other incentives; |

| ● | the effects of inflation, including labor shortages and supply chain disruptions; |

| ● | rising interest rates and the associated impact on the availability and cost of financing sources; |

| ● | the availability and supply of equipment and materials needed to construct the Kellyton Graphite Plant; |

| ● | stock price volatility; |

| ● | government regulation of the mining and manufacturing industries in the United States; |

| ● | unanticipated geological, processing, regulatory and legal or other problems we may encounter; |

| ● | the results of our exploration activities, and the possibility that future exploration results may be materially less promising than initial exploration results; |

| ● | any graphite or vanadium discoveries not being in high enough concentration to make it economic to extract the metals; |

| ● | our ability to finance growth plans; |

| ● | the potential effects of the continued COVID-19 pandemic; |

6

| ● | currently pending or new litigation or arbitration; and |

| ● | our ability to maintain and timely receive mining, manufacturing, and other permits from regulatory agencies. |

For a more detailed discussion of such risks and other important factors that could cause actual results to differ materially from those in such forward-looking statements and forward-looking information, please see “Item 1A. Risk Factors” below in this Annual Report on Form 10-K. Although we have attempted to identify important factors that could cause actual results to differ materially from those described in forward-looking statements and forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that these statements will prove to be accurate as actual results and future events could differ materially from those anticipated in the statements. The forward-looking statements in this report are made as of the date of this filing, unless an earlier date is specified. Except as required by law, we assume no obligation to publicly update any forward-looking statements and forward-looking information, whether as a result of new information, future events or otherwise.

STATEMENT REGARDING THIRD PARTY INFORMATION

Certain information provided in this report has been provided to us by third parties or is publicly available information published or filed with applicable securities regulatory bodies, including the SEC and SEDAR. WWR has not verified, and is not in a position to verify, and expressly disclaims any responsibility for, the accuracy, completeness or fairness of such third-party information and refers the reader to the information publicly published or filed by the third parties for additional information.

7

PART I

ITEM 1. DESCRIPTION OF BUSINESS.

THE COMPANY

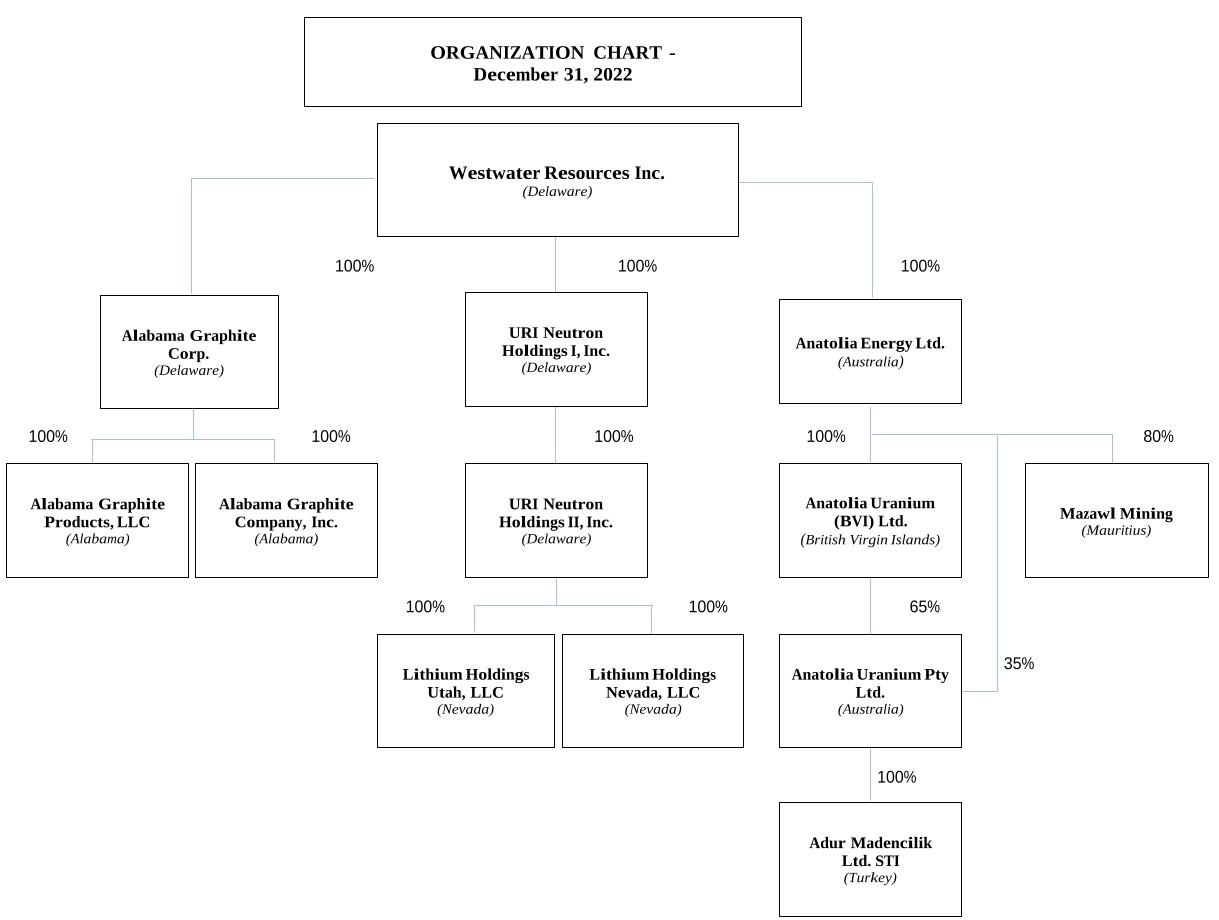

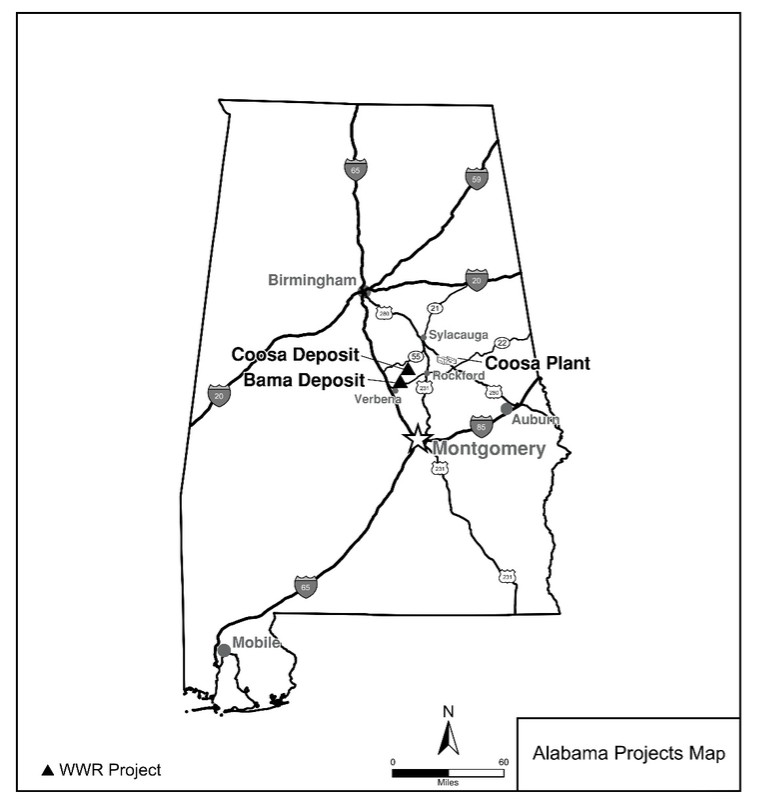

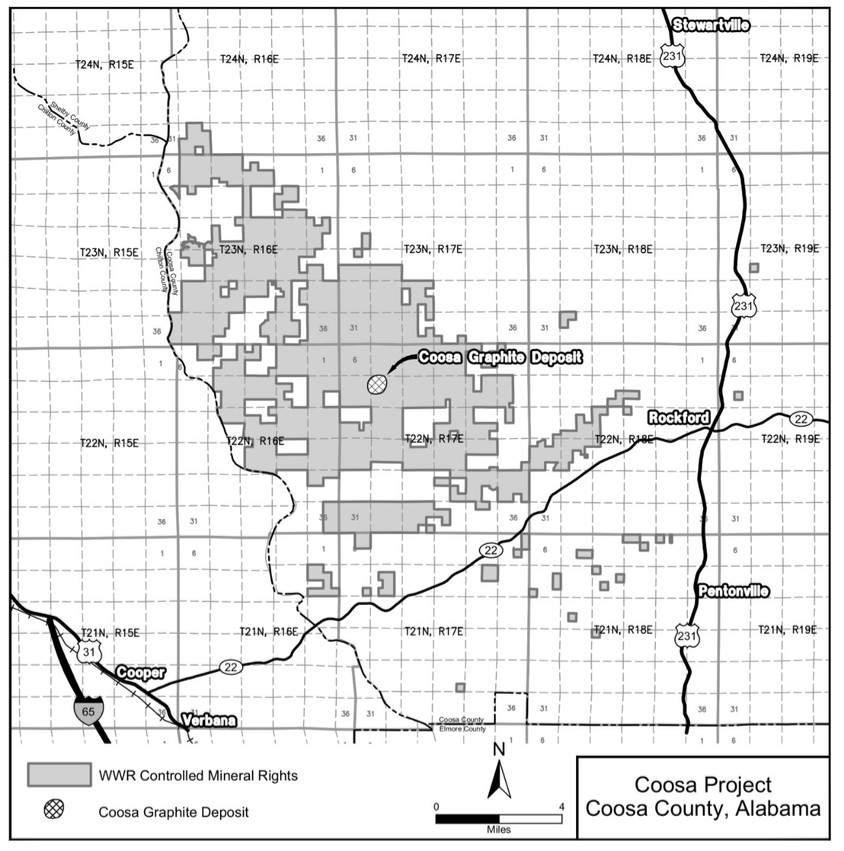

Westwater Resources, Inc., originally incorporated in 1977, is an energy technology company focused on developing battery-grade natural graphite materials after its acquisition of Alabama Graphite in 2018. Alabama Graphite holds mineral rights to explore and potentially mine the Coosa Graphite Deposit. During 2022, AGP, a wholly owned subsidiary of Westwater Resources, continued construction activities related to Phase I of the Kellyton Graphite Plant. In April of 2022, Alabama Graphite completed the initial drilling stage of its exploration program to further investigate the size and extent of graphite mineral concentrations at the Coosa Graphite Deposit. The Coosa Graphite Deposit is located near Rockford Alabama at 32 ° 54’ 30” North and 86 ° 24’ 00” West.

OUR STRATEGY

Our strategy is to increase shareholder value by advancing our battery-grade graphite business. The acquisition of Alabama Graphite in 2018 provides the Company with the opportunity to provide critical raw materials utilized by the growing market for electric automobiles, trucks and buses, consumer electronics, as well as grid-based storage devices. According to Benchmark Intelligence, in 2022, the global battery market demand for both natural and synthetic graphite was estimated at 517,997 tonnes per annum (or tpa) and demand is projected to increase at a compounded annual growth rate (“CAGR”) of 17% over the next 10-year period.

Our goal for the graphite business is to develop a battery-graphite manufacturing business in Alabama that produces low-cost, high-quality, and high-margin graphite products for battery manufacturers. In 2020, we began operation of a pilot program, designed both to manufacture battery-grade graphite materials in quantities suitable for potential customer testing and to inform the DFS. Both the pilot program and DFS were completed during the fourth quarter of 2021, and construction activities on Phase I of the Kellyton Graphite Plant began in the fourth quarter of 2021. In response to increasing customer demand and market conditions, the Company has completed an optimization of the original DFS to increase the expected production for Phase I of the Kellyton Graphite Plant. As a result of this optimization, the Company now expects production capacity for Phase I of the Kellyton Graphite Plant of 16,000 mt per year, and expected CSPG production of 7,500 mt per year. The Company now estimates the total costs for Phase I construction to be approximately $271 million compared to the original estimate of $202 million. Further, the Company now expects to begin testing and commissioning of Phase I in late 2023, and first production to occur in the first half of 2024, subject to securing the additional funding to complete construction. Additionally, we expect to complete the Phase I optimization in the second half of 2024 to increase the expected production capacity of Phase I of the Kellyton Graphite Plant. For additional information regarding the Kellyton Graphite Plant see Item 2, Properties.

We continue to engage with potential customers across a number of markets including automotive companies and lithium-ion battery manufacturers. Based on the positive feedback we have received to date from our potential customers, we continue to provide new or additional samples utilizing our pilot program. We believe that the Inflation Reduction Act, which sets a minimum domestic content threshold for the percentage of the value of applicable critical minerals contained in the battery of the electric vehicles, is beneficial to the domestic graphite industry and will provide additional benefit to the Company as it continues to engage with potential customers. Since the passing of the Inflation Reduction Act in August 2022, the interest of potential customers has intensified as we move towards domestic production of battery-grade natural graphite materials.

Additionally, we hold mineral rights to 41,965 acres for future mining development. The graphite deposit at the Coosa Graphite Deposit is expected to serve as future feedstock for the Kellyton Graphite Plant and provide in-house quality assurance and quality control (“QA/QC”) for raw-material inputs. Subject to further exploration, its own definitive feasibility study, the availability of financing, and regulatory approvals, the Coosa Graphite Deposit and related mining operation is expected by the end of 2028. The Coosa Graphite Deposit also contains vanadium mineral concentrations, which the Company plans to explore and evaluate the technical feasibility of extracting and processing in the future.

8

Currently, the Company is not including any potential benefit related to vanadium in its economic models or resource estimates.

Our project pipeline is prioritized with a goal of achieving sustainable battery-grade graphite production over time to take advantage of rising and/or high price environments for battery materials. We may adjust near-term and long-term business priorities in accordance with market conditions.

We believe our broad base of mining and processing expertise related to graphite, base and precious metals is one of our key competitive advantages. We also believe that Westwater possesses a unique combination of battery-materials knowledge and extensive project-execution experience, coupled with decades of capital markets expertise which makes our business a powerful presence in the new energy marketplace. We intend to advance the Company’s project towards production, while prudently managing our cash and liquidity position for financial flexibility.

KEY BUSINESS AND CORPORATE DEVELOPMENTS IN 2022

Construction Progress on Phase I of the Kellyton Graphite Plant

Construction activities in 2022 consisted of selecting a general contractor, completing earthwork and site grading, and continuing engineering and design work. In 2022, the Company also began installing underground utilities, completed building foundations, and began erecting manufacturing buildings of the Kellyton Graphite Plant. Construction activity during the year also included receipt of certain long-lead equipment items. For full details regarding the Kellyton Graphite Plant see additional details below.

Coosa Graphite Deposit Technical Report Summary

The mineral resource estimate for the Coosa Graphite Deposit, based on 205 drill holes totaling 39,434 ft., was completed by SLR on November 30, 2022 as an Initial Assessment in accordance with Subpart 1300 of Regulation S-K promulgated by the SEC (or S-K 1300). For further information regarding this Technical Report Summary and the Coosa Graphite Deposit, refer to Item 2, Properties, below.

OVERVIEW OF THE BATTERY GRAPHITE INDUSTRY

Graphite is the name given to a common form of the element carbon. Occurring naturally as a mineral in deposits around the world, graphite is used in many industrial applications. These end uses take advantage of graphite’s natural characteristics, which include high lubricity, high resistance to corrosion, the ability to withstand high temperatures while remaining highly stable, and excellent conductivity of heat and electricity.

In recent years, graphite has become an essential component in the production of all types of electrical storage batteries. Graphite’s role will continue to be important as demand for these batteries increases and with the world’s growing electric vehicle and energy-storage needs. Natural battery-ready graphite products are derived from flake graphite that has been transformed through a series of specialty downstream processes into various battery graphite products. These processes include, but are not limited to:

| ● | Micronization (sizing) |

| ● | Purification to battery-grade carbon with graphitic (Cg) content of ≥ 99.95% |

| ● | Spheroidization (shaping) and classification (sorting); and |

| ● | Surface treatment (carbon coating). |

Natural flake graphite is increasingly supplanting or supplementing the use of synthetic graphite in battery applications for cost and performance reasons. Through a series of sophisticated and precise processing steps, flake-

9

graphite concentrates are transformed into high-value end products for the battery industry. Coated spherical purified graphite is used as a graphite anode or anode active material in lithium-ion batteries.

The global battery market demand for natural graphite in 2022 was 221,636 tpa (Benchmark, 2022). The greatest share of this market is made up of four battery-market segments that require advanced battery-grade graphite products:

| ● | Lithium-Ion batteries — these are the most technologically advanced batteries used in everything from mobile phones and hand tools to laptop computers and electric vehicles, particularly because of the rechargeable nature of the batteries. Demand for lithium-ion batteries, related specifically to electric vehicles, accounted for 79% of natural graphite demand in 2022, and is projected to grow to 89% by 2032 (Benchmark, 2022). |

| ● | Alkaline batteries — these are the most popular consumer batteries in the world, with a global market size of approximately $7.8 billion in 2021 and a projected CAGR of 4.9% from 2022 through 2028 (Fortune Business Insights, 2022). |

| ● | Lead Acid batteries — these are the workhorse batteries used in automobiles, backup power supplies, and other energy-storage applications where weight is less important than capacity. The global lead acid battery market was estimated at approximately $83.1 billion in 2021 and a projected CAGR of 2.6% from 2022 through 2030 (Global Market Insights, 2022). |

| ● | Primary Lithium batteries — these are non-rechargeable, lightweight lithium-based batteries, and are typically used in flashlights, smoke detectors, and other small device applications where long life and lightweight matter most. |

Graphite is a critical, non-substitutable constituent in these listed battery segments. According to Benchmark Intelligence, the need for graphite to support the battery market is expected to grow over the next decade. Total graphite demand is expected to reach 2,924,411 tpa in 2032, of which over 1,580,108 tpa are projected to be natural graphite.

Competition between natural and synthetic graphite is expected to continue in lithium-ion batteries with differentiation between the two based on price, performance, and availability. Common precursor materials in the production of synthetic graphite come from either petroleum needle coke, or coal needle coke. However, synthetic graphite and natural graphite blends are becoming popular choices for electric vehicle applications to optimize performance and cost by taking advantage of each graphite attribute, such as cycle life, energy density, and cost. Synthetic graphite consumption by anode manufacturers is expected to grow because of the concentration of the graphite industry in China; however, natural flake graphite demand is forecasted to grow at a higher rate because of natural graphite’s performance and cost efficiencies.

In addition, natural graphite flake and purification costs in China have increased due to environmental factors (hydrofluoric acid handling cost) and China has become one of the major importers of natural graphite flake, relying upon less expensive African sources. China also poses a geopolitical risk, particularly to the EU and U.S. regions.

Overall battery consumption is rising at an accelerated growth rate due to recent and robust developments in electric-automobile markets, personal electronic devices, electrical grid storage, and is an enabling technology for wind and solar power installation. The global shift towards low- and zero-emissions vehicles and power sources is expected to drive increasing demand for graphite-battery materials for the foreseeable future. Recent developments in this sector include:

| ● | The United Kingdom and France have announced a prohibition on the sale of gasoline- and diesel-powered vehicles by 2030 and 2040, respectively. Electric vehicles using battery storage are currently the only viable technology that can satisfy the demands for new cars required by these nations. |

10

| ● | The states of New York and California have adopted regulations requiring all new vehicles sold in those states to be zero emissions by 2035. The requirements would apply to all new cars, pickup trucks, and SUVs. |

| ● | Automobile companies are publicly announcing plans to transition to fully electric vehicles within the next 20 years. Many are developing and distributing electric-based technology to replace internal-combustion engines. |

| ● | Battery manufacturers and major automobile companies have announced plans to develop 14 different battery manufacturing facilities in the United States with more development in the pipeline. |

| ● | Governments around the world, including the United States, continue to incentivize electric vehicle ownership through subsidies and other incentives. |

| ● | The installed base of wind and solar power electrical-generating systems is increasing every year. Grid battery storage is increasing system reliability, and as a result of these catalysts, and according to Roskill, the lithium-ion battery market is expected to grow at a CAGR of over 20%. |

Currently, the primary source of battery-grade graphite is from China, presenting the global battery industry with significant risks, including supply chain management risks, economic risks, geopolitical risks, and environmental sustainability concerns. Also, critical domestic production is lacking in the United States. A Presidential Executive Order signed on September 30, 2020 includes graphite on a list of minerals critical to the safety and security of the United States. With limited current domestic natural graphite production of any kind, the United States is presently required to source most of its battery graphite from China. On February 24, 2021, the President signed another Executive Order that seeks to promote more resilient supply chains, to revitalize and rebuild domestic manufacturing capacity, and maintain America’s competitive edge in research and development. The 2021 Executive Order tasked the Secretary of Energy, as part of a larger study involving several branches of the United States government, to submit a report identifying risks to the supply chain for high-capacity batteries including those that power electric vehicles. On June 8, 2021, the White House released a response to the findings of this study in support of securing an end-to-end domestic supply chain for advanced batteries, including investment in domestic production and processing of critical minerals. Key recommendations in the June 8, 2021 release include, among other things, providing funding and financial incentives to encourage consumer adoption of electric vehicles, providing financing to support advanced battery production, and investing in the development of next-generation batteries.

On March 31, 2022, President Biden invoked the Defense Production Act to encourage the domestic production of critical materials, including graphite, for advanced batteries for electric vehicles and clean energy storage. On August 16, 2022, President Biden signed into law the Inflation Reduction Act (“IRA”). This legislation includes an investment of approximately $370 billion in climate programs. The IRA provides a 10% tax credit for the costs of producing certain critical minerals, including graphite and vanadium. This credit is eligible for direct pay and is also transferable to unrelated taxpayers. In addition, a key provision of the IRA that could indirectly benefit the Company is the Clean Vehicle credit. The IRA eliminates the previous limitation on the number of electric vehicles a manufacturer can sell before the Clean Vehicle credit is phased out or eliminated. Further, the IRA sets a minimum domestic content threshold for the percentage of the value of applicable critical minerals contained in the battery of the electric vehicles. Because Westwater intends to produce battery grade graphite for lithium-ion batteries to be used in electric vehicles in the United States, management believes the domestic content requirement could provide indirect future benefit to the Company.

The State of Alabama and local municipalities have entered into incentive agreements with the Company for the siting of the Company’s proposed graphite processing plant in Coosa County, Alabama. The incentive agreements provide certain tax credits and incentives under the Alabama Jobs Act in connection with the construction of the Kellyton Graphite Plant.

Westwater has developed graphite-purification technology and advanced product-development processes designed to meet the demands of potential customers for battery-grade graphite materials. Westwater is developing methodologies and constructing facilities intended to produce high-purity, battery-grade graphite products at its Kellyton Graphite Plant. These products are designed to serve all major battery sectors. In addition, we believe the processes we

11

intend to use are environmentally sustainable and permittable in the United States, where a robust regulatory environment complements our core values to reliably deliver safe, well-made products to our customers.

Westwater has and will continue to support the efforts by the relevant United States governmental agencies, the State of Alabama and local municipalities to ensure that they remain aware of the importance of natural battery-grade graphite, its importance to the nation’s security, and how the Kellyton Graphite Plant and the Coosa Graphite Deposit fit into the critical minerals-equation.

COMPETITION

In the production and marketing of graphite, there are a number of producing entities globally, some of which are government controlled and several of which have significant capitalization. Approximately 75% of natural graphite global supply comes from China (Benchmark, 2022).

With respect to sales of graphite, the Company expects to compete primarily based on price. We intend to market graphite directly to users of the product. We are in direct competition with supplies available from various sources worldwide. We compete with multiple graphite exploration, development and production companies.

WESTWATER’S GRAPHITE BUSINESS

Kellyton Graphite Plant

On June 22, 2021, AGP entered into incentive agreements with the State of Alabama and local municipalities for the siting of the Kellyton Graphite Plant near Kellyton, Alabama. The incentive agreements provide certain tax credits and incentives under the Alabama Jobs Act in connection with the construction of the Kellyton Graphite Plant.

On July 23, 2021, AGP executed a land lease with the Lake Martin Area Industrial Development Authority, providing AGP rights to approximately 70 acres to construct and operate the Kellyton Graphite Plant. The lease has a term of 10 years, a nominal lease payment, and transfer of title to AGP at the end of the lease term. Further, the lease provides AGP the option to purchase the land for a nominal amount during the term of the lease.

On October 13, 2021, AGP completed the purchase of two buildings that total approximately 90,000 sq. ft. to support the development of the Kellyton Graphite Plant. The build out of one of these building was completed in April of 2022 and is being used for administrative offices and will include a laboratory space as well. The other building is being used for the control room, the maintenance shop, shipping and receiving and as warehousing space. Both buildings are adjacent to the Kellyton Graphite Plant.

Westwater plans to develop the Kellyton Graphite Plant in two phases (Phases I and II).

Phase I: Based upon the Company’s optimization plan, after testing and commissioning is completed, the Kellyton Graphite Plant is now expected to have capacity to produce approximately 16,000 mt per year of two products, ULTRA-CSPG™ and SPG Fines. After processing and purification, the plant is expected to have capacity to produce the two products in the following quantities:

| ● | ULTRA-CSPG™: 7,500 mt per year |

| ● | SPG Fines:8,500 mt per year |

Phase II: Upon completion of the Phase II expansion, the annual capacity of the Kellyton Graphite Plant is now expected to increase to approximately 86,500 mt of two products in the following quantities:

| ● | ULTRA-CSPG™: 40,500 mt per year |

| ● | SPG Fines: 46,000 mt per year |

12

Construction activities for Phase I of the Kellyton Graphite Plant began in the fourth quarter of 2021 and will continue in 2023. The Company expects to begin testing and commissioning of Phase I in late 2023, and first production to occur in the first half of 2024, subject to securing the additional funding to complete construction. Additionally, we expect to complete the Phase I optimization in the second half of 2024 to increase the expected production capacity of Phase I of the Kellyton Graphite Plant. The Company intends to initiate a definitive feasibility study for Phase II upon, or before, the completion of Phase I.

Spheroidization, Purification and Post-Processing Activities

The Company will process natural graphite concentrate at the Kellyton Graphite Plant through a combination of sizing, shaping, spheroidization, and classification. Once completed, the purification is expected to be performed using a proprietary purification process that was developed and tested during our pilot program by Dorfner Anzaplan and other engineering consultants. The process uses a combination of technologies including a caustic bake, acid leach and thermal finishing, a process that allows for a smaller and more sustainable environmental footprint than that of a hydrofluoric acid leaching system as used by other graphite processing companies. Once the graphite is purified to a minimum graphite carbon content of 99.95%, we will then coat the SPG to manufacture the advanced graphite products we intend to sell. This unique application process developed by Westwater is the subject of a patent application that has been filed in the U.S. Patent and Trademark Office.

We currently purchase available graphite flake concentration from a qualified supplier to serve as plant feedstock for the Kellyton Graphite Plant while the Coosa Graphite Deposit is being evaluated, permitted, and developed for future mining operations. Development of a mine at the Coosa Graphite Deposit, expected by the end of 2028, is expected to serve as an in-house source of graphite feedstock and will provide in-house QA/QC for raw-material inputs.

Coosa Graphite Deposit

Westwater acquired Alabama Graphite in 2018 as part of a strategic decision to refocus the Company to supply battery manufacturers with low-cost, high-quality, and high-margin graphite products. As part of that transaction, Westwater became the owner of mineral lease rights over the Coosa Graphite Deposit, located near Rockford, Alabama, 50 miles southeast of Birmingham. For further detail on the Coosa Graphite Deposit refer to Item 2, Properties, below.

Mining Method

The Coosa Graphite Deposit is expected to be mined by conventional small-scale open-pit mining methods.

Concentrate Plant

Mineralized material from the Coosa Graphite Deposit is projected to have an average grade of approximately 3.04% Cg, and is expected to contain impurities consisting of quartz, muscovite, iron oxides and calcite. Most of the impurities are present on the surfaces of the graphite flakes and can be easily removed during a metallurgical process known as flotation. Flotation processing maximizes the removal of these impurities while avoiding degradation of graphite flakes.

Further development work at the Coosa Graphite Deposit is expected to result in the design and construction of a milling and concentration plant.

Products and Business Development

The Company is working to develop products for potential major battery markets. Based on discussions with potential customers, Westwater will focus on the production of ULTRA-CSPG™ and SPG fines during Phase I of the Kellyton Graphite Plant and expects to evaluate the production of additional products in Phase II, subject to market demand and customer interest.

13

The Company plans to focus on supply for several different battery types, including lithium-ion batteries, lead-acid batteries, alkaline batteries, and primary-lithium batteries. The Company has ongoing discussions with multiple potential customers, including battery manufacturers, and automobile manufacturers, with the goal of executing multi-year supply agreements. To date, the Company has executed Non-Disclosure Agreements with potential customers and has executed five letters of intent across multiple product lines, which are subject to customary conditions and quality and packaging specifications to be included in future definitive agreements. The Company has also entered into an agreement with a Tier 1 battery manufacturer for electric vehicles. Under the agreement, the parties will work together to ensure that the ULTRA-CSPG™ that is expected to be produced at the Kellyton Graphite Processing Plant can be used as a high-performance anode material for the customer’s batteries. Subject to those efforts, the parties expect to negotiate another agreement that will allow for the sale of potentially all graphite anode material from the Kellyton Graphite Processing Plant for those batteries.

Regulation

Graphite extraction and processing is regulated by the federal and state governments. Compliance with such regulations has a material effect on the economics of our operations and the timing of project development. Our primary regulatory costs have been, and are expected to relate to, obtaining licenses and operating permits from federal and state agencies before the commencement of production activities, as well as the cost for continuing compliance with licenses and permits once they have been issued. The current environmental and technical regulatory requirements for the graphite extraction and processing industry are well established. However, the regulatory process can make permitting difficult and timing unpredictable.

U.S. regulations pertaining to graphite extraction and processing may evolve in the U.S. However, at this time we do not anticipate any adverse impact from these regulations that would be unique to our operations.

Kellyton Graphite Plant

For construction and operations of the Kellyton Graphite Plant, the Company is required to obtain permits related to air emissions, water discharge, storm water drainage, and possibly other regulated waste. On January 31, 2022, Westwater announced that it had received its National Pollutant Discharge Elimination System (“NPDES”) construction stormwater permit, which was required to commence site grading for the Kellyton Graphite Plant. The NPDES permit has been issued by the State of Alabama under NPDES to ensure Westwater’s construction efforts comply with the Federal Clean Water Act as it relates to regulated disturbances and any stormwater runoff from the Kellyton Graphite Plant site.

In June 2022 and August 2022, the Company received its air permit and its State Indirect Discharge (“SID”) permit for the treatment of wastewater from the Alabama Department of Environmental Management, respectively. Consequently, the Company has all necessary permits to complete the construction of Phase I of the Kellyton Graphite Plant.

Coosa Graphite Deposit

Graphite mining and processing in Alabama requires various permits, including those for any emissions to air, water, or other aspects of the environment. Permits may be required from the State of Alabama, the U.S. Environmental Protection Agency, the Army Corps of Engineers, and other state and federal agencies. Specifically, to mine the Coosa Graphite Deposit, permits may be required in accordance with the Alabama Surface Mining Act of 1969, which is administered by the Alabama Department of Labor (“DoL”). DoL issues mining permits, ensures that mine sites are properly bonded for reclamation purposes, and makes periodic inspections. The Company is currently in the process of determining the requirements for posting surety or negotiable bonds related to the area to be disturbed. Future mining operations at the Coosa Graphite Deposit may be subject to the U.S. National Environmental Policy Act process, with potential review by various federal agencies that may include the U.S. Environmental Protection Agency, the Army Corp of Engineers, and others.

In Alabama, any surface or groundwater withdrawals are managed through the Alabama Water Use Reporting Program. The Alabama Water Resources Act and associated regulations establish the requirements for water withdrawals.

14

The process begins with the submission of an application form called a “Declaration of Beneficial Use” and other required information to the Office of Water Resources (“OWR”) within the Alabama Department of Economic and Community Affairs. Once application information is reviewed and determined to be complete, OWR will issue a Certificate of Use (“COU”) that lists the applicant’s name and information concerning all registered surface and/or groundwater withdrawal points and their withdrawal information. Entities with a capacity to withdraw more than 100,000 gallons per day are required to register with OWR and obtain a COU. The COU certifies that proposed water use will not interfere with existing water use and is beneficial. The Company anticipates evaluating the future need for a COU during its development of a detailed mine plan.

CORE VALUES AND ENVIRONMENT, SOCIAL AND GOVERNANCE (“ESG”) CONSIDERATIONS

Westwater’s core values incorporate ESG principles and drive our business and operations. Westwater’s core values are:

| ● | Safety: |

| ● | Of each other |

| ● | Of our environment |

| ● | Of the communities where we work |

| ● | Of our assets |

| ● | Of our reputation |

| ● | Cost Management |

| ● | Effective and efficient use of our shareholders’ assets |

| ● | Focus on cost performance |

| ● | Reliability and Integrity |

| ● | Highest level of performance every day |

| ● | Improving our processes |

| ● | Conservative promises well kept |

The Company works to be a good corporate citizen and to safeguard our employees, operations, neighbors and the local communities in which our employees and stakeholders live and work.

Further, Westwater intends to report its sustainability in accordance with the applicable guidelines established by the Sustainability Accounting Standards Board (“SASB”). The SASB is an independent, private sector standards-setting organization dedicated to enhancing the efficiency of the capital markets by fostering high-quality disclosure of material sustainability information.

Environmental Criteria and Actions

The DFS for Phase I of the Kellyton Graphite Plant was completed in October 2021. As part of the DFS, we have defined the raw material inputs, energy inputs, product streams, and waste streams, including air, water, solids and heat, for processing our graphite into battery products. Integrated into these input and output streams, we are defining methods of reducing impacts to our environment, including:

| ● | Assessing the origin of our graphite and its impact to the environment. |

| ● | Assessing the supply chain for reagents and their impact to the environment. |

| ● | Assessing the energy forecasted for use in the manufacturing of our products. |

| ● | Performing trade off studies for recycling our reagents and waste streams in an effort to reduce our impact to the communities where we work and where we source our input materials. |

Greenhouse gas emissions: Estimates are being quantified and are expected to be finalized through detailed design work. During the testing and commissioning of Phase I of the Kellyton Graphite Plant, Westwater expects to commence monitoring, measuring, and to begin continuous improvement efforts related to its greenhouse gas emissions.

Air quality: Estimates are being quantified and are expected to be finalized in 2023.

15

Energy consumption: Estimates are being quantified and are expected to be finalized in 2023.

Wastewater management: We expect that the Kellyton Graphite Plant will not have surface water connections to waters of the United States, nor are there any such jurisdictional waters of the United States at the Kellyton Graphite Plant. In August 2022, the Company received its SID permit for the treatment of wastewater from the Alabama Department of Environmental Management. Under the SID, the Company provides an agreed upon wastewater profile to be processed by the local wastewater treatment plant. The Company plans to pretreat the wastewater from the Kellyton Graphite Plant through recycling, neutralizing and filtering to ensure it meets the requirements under the SID.

Social Criteria and Actions

As part of our Kellyton Graphite Plant design and analysis we are evaluating community needs, with input from the local stakeholders, and our ability to support them – whether in education, infrastructure, or in other ways applicable to community needs. Through the Alabama Industrial Training (“AIDT”) program, the Company is eligible to receive a cash reimbursement for the design of a customized plan for the recruitment, screening, and training new employees. In addition to the cash reimbursement for training, AIDT offers in-kind services, which includes items such as assistance with a pre-employment selection system, maintenance assessments, safety assistance and training, and robotic and programable logic controller automation training.

During 2022, Westwater held “townhall” meetings with the local community in Coosa County, Alabama, to maintain open and transparent communication as well as to hear and work to address any concerns of the community. In April, the Company held a groundbreaking ceremony that was attended by state and local government officials and business leaders. In addition, the Company participated in a community service project, in July, to help with general cleanup of a local school. The Company also hosted a first responders luncheon in October that included a tour of the Kellyton Graphite Plant for over 100 first responders and local officials to show appreciation to those helping within the local community.

Westwater has a strong history in social license. The Company spent eight years providing scholarships to family members of the Cebolleta and Juan Tafoya Land Grants in New Mexico, where we previously had operations. We have supported this scholarship effort over the years to ensure that young people are afforded an opportunity to attend colleges and universities. As a result of this work, students in Veterinary Medicine, Mining Engineering, Nursing, Pharmacology, Criminal Justice and Business Management have been able to further their education.

Westwater Team and Culture (Human Capital)

Our team and culture are keys to our success. Management aims to foster a diverse, equitable and inclusive culture. We believe that a diverse workforce provides different viewpoints on business strategy, risk and innovation. We are committed to fostering solid relationships with all members of our workforce based on trust, treating workers fairly and providing them with safe and healthy working conditions. Our team is defined by a commitment to our mission, vision, and values, which includes providing a great place to work for teammates, being a good neighbor in the communities where we work and live, and being a good steward for our investors.

Westwater’s Board of Directors and management team has focused on hiring, succession planning and talent development to produce a strong team. On January 16, 2023, the Board of Directors appointed Frank Bakker as Westwater’s Chief President and Chief Executive Officer. Mr. Bakker is an experienced executive with a proven track record in engineering, project management, and plant construction and operations for large-scale process facilities that produce a wide variety of industrial products. Mr. Bakker has built and operated a number of processing plants that process ammonia, elastomers, methanol, and resins. Since the fall of 2022, Mr. Bakker has been managing the construction activities at the Kellyton Graphite Plant.

On May 10, 2021, after completing a comprehensive search process, Westwater hired Steven M. Cates as Westwater’s Chief Accounting Officer and Controller. On June 23, 2022, following the announced retirement of Jeffrey L. Vigil, Chief Financial Officer and Vice President of Finance of the Company, the Board of Directors elected Mr. Cates

16

Chief Financial Officer and Vice President of Finance effective August 26, 2022, and subsequently promoted Mr. Cates to Senior Vice President of Finance and Chief Financial Officer on January 16, 2023.

Further, on February 26, 2022, the Board of Directors elected John W. Lawrence as the Company’s General Counsel and Corporate Secretary. Mr. Lawrence had been serving, in a contractual capacity, as the Company’s General Counsel since October 2012 and as the Company’s Corporate Secretary since May 2013. On January 16, 2023, Mr. Lawrence was promoted to Chief Administrative Officer while retaining his other roles. Mr. Lawrence has forty years of legal and engineering experience for publicly traded companies.

As of December 31, 2022, 34 people were employed at Westwater.

Consistent with our core value of safety for each other, Westwater offers employment benefits including medical insurance, paid time off, sick leave, and retirement plans for all teammates, and a bonus structure at all salaried levels of the organization. Additionally, we have a history of supporting the professional development of members of our workforce including financial support to those wishing to obtain advance degrees, as well as leadership seminars and training.

Governance Criteria and Factors

Board of Directors

The Company’s business and affairs are overseen by the Board pursuant to the Delaware General Corporation Law and the Company’s charter documents. Members of the Board are kept informed of the Company’s business through discussions with the President and Chief Executive Officer and key members of management, by reviewing materials provided to them and by participating in Board and Committee meetings. All members of the Board are elected annually by the stockholders.

Regular attendance at Board meetings and the Annual Meeting of Stockholders is expected of each director. Our Board held 10 meetings during 2022. All directors attended all meetings of the Board and applicable Committees held during the period that such director served in 2022. The independent directors met in executive session at several of the Board meetings held in 2022. All of the directors in office at the time attended the 2022 Annual Meeting of Stockholders.

Board Leadership Structure

The Company’s governing documents allow the roles of Chairman and Chief Executive Officer to be filled by the same or different individuals. This approach allows the Board flexibility to determine whether the two roles should be separate or combined based upon the Company’s needs and the Board’s assessment of the Company’s leadership from time to time. Currently, Terence J. Cryan serves as Executive Chairman and Frank Bakker serves as Chief Executive Officer.

Safety and Sustainability Committee (previously the Health, Safety, and Environmental Committee)

We have a Safety and Sustainability Committee that reports directly to the entire Board of Directors of Westwater. The Safety and Sustainability Committee held two meetings in 2022. The Committee’s charter reads, in part:

The Committee’s primary purposes are to:

| ● | provide advice, counsel and recommendations to management on: |

| o | health, safety, loss prevention issues and operational security, and |

| o | issues relating to sustainable development, environmental management and affairs, community relations, human rights, government relations and communications; and |

17

| ● | assist the Board in its oversight of: |

| o | health, safety, loss prevention and operational security issues relating to the Company; |

| o | sustainable development, environmental affairs, relations with communities and civil society, government relations, communications issues and human rights relating to the Company; |

| o | the Company’s compliance with regulations and policies that provide processes, procedures and standards to follow in accomplishing the Corporation’s goals and objectives relating to: |

| ◾ | health, safety, loss prevention issues and operational security ,and |

| ◾ | sustainable development, environmental management affairs, community relations, human rights, government relations and communications issues; and |

| o | management of risk related thereto. |

The Safety and Sustainability Committee has direct experience in managing ISO 14001 Environmental Management Systems (“EMS”). These systems are designed to provide for reliable performance in sustainable management of businesses. We are committed to the continual improvement of the EMS, according to compliance obligations, by following the principles and requirement of ISO 14001. After the completion of our Phase I DFS, management has designed ISO 14001 based management systems to facilitate and govern our environmental performance. This effort includes the establishment of a preliminary set of metrics for measuring that performance.

Audit Committee

We have a separately-designated Audit Committee composed solely of independent directors. The Audit Committee held four meetings in 2022.

The Audit Committee’s primary responsibilities are to:

| ● | assist the Board in discharging its responsibilities with respect to the accounting policies, internal controls and financial reporting of the Company; |

| ● | monitor compliance with applicable laws and regulations, standards and ethical business conduct, and the systems of internal controls; |

| ● | assist the Board in its oversight of the qualifications, independence and performance of the registered public accounting firm engaged to be the independent auditor of the Company; and |

| ● | prepare the Audit Committee report required to be included in the Company’s proxy statements. |

Compensation Committee

The Compensation Committee held three meetings and had several informal discussions in 2022. The Compensation Committee is responsible for assisting the Board in setting the compensation of the Company’s directors and executive officers and administering and implementing the Company’s incentive compensation plans and equity-based plans.

18

Nominating and Governance Committee

The Nominating and Corporate Governance Committee held one meeting during 2022, and its duties and responsibilities are to:

| ● | recommend to the Board director nominees for the annual meeting of stockholders; |

| ● | identify and recommend candidates to fill vacancies occurring between annual stockholder meetings; and |

| ● | oversee all aspects of corporate governance of the Company. |

The Nominating and Corporate Governance Committee of the Board identifies director candidates based on input provided by a number of sources, including members of the Nominating and Corporate Governance Committee, other directors, our stockholders, members of management and third parties. The Nominating and Corporate Governance Committee does not distinguish between nominees recommended by our stockholders and those recommended by other parties. Any stockholder recommendation must be sent to the Secretary of Westwater Resources, Inc. at 6950 S. Potomac Street, Suite 300, Centennial, Colorado 80112, and must include detailed background information regarding the suggested candidate that demonstrates how the individual meets the Board membership criteria discussed below. The Nominating and Corporate Governance Committee also has the authority to consult with or retain advisors or search firms to assist in the identification of qualified director candidates.

As part of the identification process, the Nominating and Corporate Governance Committee takes into account each candidate’s business and professional skills, experience serving in management or on the board of directors of companies similar to the Company, financial literacy, independence, personal integrity and judgment. In conducting this assessment, the Nominating and Corporate Governance Committee will, in connection with its assessment and recommendation of candidates for director, consider diversity (including, but not limited to, gender, race, ethnicity, age, experience and skills) and such other factors as it deems appropriate given the then-current and anticipated future needs of the Board and the Company, and to maintain a balance of perspectives, qualifications, qualities and skills on the Board. The Board does not have a formal diversity policy for directors. However, the Board is committed to an inclusive membership. Although the Nominating and Corporate Governance Committee may seek candidates that have different qualities and experiences at different times in order to maximize the aggregate experience, qualities and strengths of the Board members, nominees for each election or appointment of directors will be evaluated using a substantially similar process. Incumbent directors who are being considered for re-nomination are re-evaluated both on their performance as directors and their continued ability to meet the required qualifications.

Board Diversity

Westwater’s Board of Directors is comprised of five directors, three of whom are independent, and currently has diverse gender representation. In 2021, Westwater was acknowledged by, and received an award from, BoardConnect by the Women’s Leadership Foundation for achieving gender balance on its Board of Directors.

Covid-19

The COVID-19 pandemic has not had a significant impact on Westwater’s business activities. Prior to March 1, 2021, Westwater reduced utilization of its offices and instituted remote working arrangements to ensure that some employees were able to work remotely using systems that already were in place. On March 1, 2021, Westwater reopened its Centennial, Colorado corporate officers and allowed employees to return to the office to work together with appropriate health protocols in place. Westwater’s continued focus on the health and safety of employees, the safety of operations, and the safety of the communities in which our employees live and work remains paramount. To that end, Westwater has continued to restrict unnecessary travel, and ensured that employees are permitted to take time off due to illness or the illness of those around them without penalty.

19

AVAILABLE INFORMATION

Our internet website address is www.westwaterresources.net. Our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) of 15(d) of the Exchange Act, are available free of charge through our website under the tab “Investor” as soon as reasonably practicable after they are electronically filed with, or furnished to, the SEC. We also make available on our website copies of materials regarding our corporate governance policies and practices, including our Code of Ethics, Nominating and Governance Committee Charter, Audit Committee Charter and Compensation Committee Charter. You may read and copy any materials we file with the SEC at the SEC’s website at http://www.sec.gov. You may also obtain a printed copy of the foregoing materials at no cost by sending a written request to: Westwater Resources, Inc., 6950 S. Potomac Street, Suite 300, Centennial, Colorado 80112, Attention: Information Request, or by calling 303.531.0516. The information found on our internet website is not part of this or any report filed or furnished to the SEC.

ITEM 1A. RISK FACTORS

Our business activities are subject to significant risks, including those described below. Every investor or potential investor in our securities should carefully consider these risks. If any of the described risks actually occurs, our business, financial position and results of operations could be materially adversely affected. Such risks are not the only ones we face and additional risks and uncertainties not presently known to us or that we currently deem immaterial may also affect our business.

Risks Related to Our Business

There is substantial doubt about our ability to continue as a going concern.

The accompanying consolidated financial statements have been prepared assuming the Company will continue as a going concern. This assumes continuing operations and the realization of assets and liabilities in the normal course of business.

We have incurred significant losses since ceasing production of uranium in 2009 and expect to continue to incur losses as a result of costs and expenses related to maintaining our properties and general and administrative expenses. As of December 31, 2022, we had a net working capital of approximately $51.0 million, cash of approximately $75.2 million and an accumulated deficit of approximately $353.3 million. As a result of our evaluation of the Company’s liquidity for the next twelve months, we have included a discussion about our ability to continue as a going concern in our consolidated financial statements, and our independent auditor’s report for year ended December 31, 2022 includes an explanatory paragraph that expresses substantial doubt about our ability to continue as a “going concern.” Our capital needs have, in recent years, been funded through sales of our debt and equity securities. In the event that we are unable to raise sufficient additional funds, we may be required to delay, reduce or severely curtail our operations or otherwise impede our on-going business efforts, which could have a material adverse effect on our business, operating results, financial condition, long-term prospects and ability to continue as a viable business.

Our business could be negatively impacted by inflationary pressures, which may result in increased costs of operations and negatively impact our ability to access capital.

The U.S. has experienced rising inflation in 2022 and U.S. inflation is currently at a 40-year high. This inflation has resulted in an increase in our costs for labor, services, and materials. Further, our suppliers face inflationary impacts such as the tight labor market and supply chain disruptions, that could increase the costs to construct and commission the Kellyton Graphite Plant, explore and develop the Coosa Graphite Deposit, and conduct our day-to-day operations. The rate and scope of these various inflationary factors may increase our operating costs materially, which may not be readily recoverable, and have an adverse effect on our costs, operating margins, results of operations and financial condition.

Further, sustained inflation has caused and may continue to cause the Federal Reserve Board to raise the target for the federal funds rate, which correspondingly causes an increase in interest rates. Increased interest rates could have a negative effect on the securities markets generally which may, in turn, have a material adverse effect on the Company’s

20

ability to access capital, particularly debt financing, and the market price of equity securities, including the Company’s common stock, which usually decrease as interest rates rise. To the extent that we access debt financing or issue variable interest rate instruments in the future, any increase in interest rates would increase our cost of borrowing and our interest expense.

We are currently operating in a period of economic uncertainty and capital markets disruption, which has been significantly impacted by geopolitical instability and an ongoing military conflict between Russia and Ukraine. Our business, financial condition and results of operations could be materially adversely affected by any negative impact on the global economy and capital markets resulting from the conflict in Ukraine and geopolitical tensions.

The ongoing military conflict in Ukraine has caused broad disruption. Although the length, impact and outcome of that military conflict in Ukraine is highly unpredictable, it could lead to significant market and other disruptions, including significant volatility in commodity prices and supply of energy resources, instability in financial markets, higher inflation, supply chain interruptions, political and social instability, changes in consumer or purchaser preferences as well as increases in cyberattacks and espionage. While we expect any direct impacts to our business to be limited, the indirect impacts on the economy and on the mining industry and other industries in general could negatively affect our business and may make it more difficult for us to raise equity or debt financing. In addition, the impact of other current macro-economic factors on our business, which may be exacerbated by the war in Ukraine - including inflation, supply chain constraints and geopolitical events - is likely to have an adverse effect on our business.

We face a variety of risks related to our planned battery-graphite manufacturing business.

We plan to develop a battery-graphite manufacturing business that produces low-cost, high-quality, and high-margin graphite products for battery manufacturers. The planned battery-graphite manufacturing business is significantly different from our historic mining operations and carries a number of risks, including, without limitation:

| ● | unanticipated liabilities or contingencies, including those related to intellectual property; |

| ● | the need for additional capital and other resources to expand into the battery-graphite manufacturing business; |

| ● | competition from better-funded public and private companies, including from producers of synthetic graphite, and competition from foreign companies that are not subject to the same environmental and other regulations as the Company; |

| ● | difficulty in hiring personnel or acquiring the intellectual property rights and know-how needed for the proposed battery-graphite manufacturing business; and |

| ● | the potential for interruptions in our sources of graphite prior to operation of the Coosa Graphite Deposit due to environmental risks, geopolitical unrest, supply chain disruptions and transportation risks, and regulatory changes. |

Entry into a new line of business may also subject us to new laws and regulations with which we are not familiar and may lead to increased litigation and regulatory risk. Further, our battery-graphite manufacturing business model and strategy are still evolving and are continually being reviewed and revised, and we may not be able to successfully implement our business model and strategy. We may not be able to produce graphite with the characteristics needed for battery production, and we may not be able to attract a sufficiently large number of customers. Although we have gained experience over the past several years, neither the Company nor any member of its management team has directly engaged in producing graphite before, and our lack of this specific experience may result in delays or further complications to the new business. If we are unable to successfully implement our new battery-graphite manufacturing business, our revenue and profitability may not grow as we expect, our competitiveness may be materially and adversely affected, and our reputation and business may be harmed.

21

In developing our planned battery-graphite manufacturing business, we have and will continue to invest significant time and resources. Initial timetables for the development of our battery-graphite manufacturing business may not be achieved. Failure to successfully manage these risks in the development and implementation of our new battery-graphite manufacturing business could have a material adverse effect on our business, results of operations and financial condition.

The construction and operation of the Kellyton Graphite Plant is subject to delays, cost overruns, or may not produce expected benefits.

Construction projects similar to our plant construction are subject to broad and strict government supervision and approval procedures, including but not limited to project approvals and filings; construction, land and project planning approvals; environment protection approvals; pollution discharge permits; work safety approvals; and the completion of inspection and acceptance by relevant authorities. As a result, construction and operation of the Kellyton Graphite Plant may be subject to administrative uncertainty, fines or the suspension of work on such projects. Construction delays related to the Kellyton Graphite Plant or failure to operate the Kellyton Graphite Plant in accordance with agreements with the State of Alabama and local municipalities could result in the loss of otherwise available tax credits and incentives.

Delays or cost overruns could also result from inaccuracies in the estimates and findings in the DFS; difficulties in negotiation of construction contracts; challenges with managing contractors and vendors; subcontractor performance; adverse weather conditions and natural disasters; increased costs, shortages, or inconsistent quality of equipment, materials, and labor; judicial or regulatory action; nonperformance under construction or other agreements; engineering or design problems; negative impacts of the COVID-19 pandemic or future pandemic health events; work stoppages; environmental and geological conditions; or challenges with start-up activities and operational performance.

To the extent we are unable to successfully complete construction on time or at all, our ability to develop the Kellyton Graphite Plant could be adversely affected, which in turn could have a material adverse effect on our business, growth prospects, results of operations and financial condition.

The Company is not producing any products at a commercial scale at this time. As a result, we do not currently have a reliable source of operating cash. If we cannot successfully transition to commercial scale production of graphite and vanadium, partner with another company that has cash resources, find other means of generating and/or access additional sources of private or public capital, we may not be able to remain in business.

We do not have a committed source of financing for the development of our graphite or vanadium projects. While we have spent approximately $55.3 million through December 31, 2022, the remaining capital expenditures to construct Phase I of the Kellyton Graphite Plant are currently estimated at approximately $215.7 million, which amount has increased as a result of the optimization of Phase I of the Kellyton Graphite Plant, and delays in constructing the commercial scale processing facility and other cost overruns may increase that estimate. As of December 31, 2022, we have approximately $75.2 million in cash, and there can be no assurance that we will be able to obtain financing on commercially reasonable terms, if at all, for the remainder of the amount needed to construct Phase I of the Kellyton Graphite Plant or develop our properties. Our inability to construct the Kellyton Graphite Plant or develop our properties would have a material adverse effect on our future operations.